UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

[X] REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ______________

Commission File Number ______________

FIRST MAJESTIC SILVER CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 1041 | Not Applicable |

| (Province or other jurisdiction | (Primary Standard Industrial | (I.R.S. Employer |

| of incorporation or | Classification Code Number) | Identification Number) |

| organization) |

Suite 1805 – 925 West Georgia Street

Vancouver,

British Columbia V6C 3L2 Canada

(604) 688-3033

(Address and telephone number of Registrant’s principal executive offices)

| Copies to: | |

| National Registered Agents, Inc. | Stewart L. Muglich |

| 1090 Vermont Avenue N.W. | Clark Wilson LLP |

| Suite 910 | 800 – 885 West Georgia Street |

| Washington D.C. 20005 | Vancouver, BC V6C 3H1 |

| (202) 371-8090 | (604) 891-7701 |

| Name, address (including zip code) | |

| and telephone number (including | |

| area code) of agent for service in | |

| the United States |

- 2 -

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of exchange on which registered: |

| Common Shares, no par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Not Applicable

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form.

[ ] Annual information form [ ] Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Not Applicable

Indicate by check mark whether the Registrant by filing the

information contained in this Form is also thereby furnishing the information to

the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934 (the “Exchange Act”). If “yes” is marked, please indicate the filing number

assigned to the Registration in connection with such Rule.

[ ]

Yes [X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

[ ] Yes [X]

No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the Registrant was required to submit and post such files).

[ ] Yes [X] No

- 3 -

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

First Majestic Silver Corp. (the “Registrant”) prepares its financial statements, which are filed with this report on Form 40-F in accordance with Canadian generally accepted accounting practices (“GAAP”), and are subject to Canadian auditing and auditor independence standards. They may not be comparable to financial statements of United States companies. The Registrant is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. Significant differences between Canadian GAAP and United States GAAP as pertains to the Registrant for the years ended December 31, 2009, 2008 and 2007 are described in Exhibit 99.9 to this Registration Statement.

FORWARD-LOOKING STATEMENTS

This Registration Statement and the Exhibits incorporated by reference into it contain “forward-looking statements.” Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, and other similar words, or statements that certain events or conditions “may” or “will” or “can” occur. Forward-looking statements are based on the opinions and estimates of management on the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the exploration, development, and mining of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project cost overruns or unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future, as well as those factors discussed in the section entitled “Description of the Business - Risk Factors” in the Annual Information Form of the Registrant filed as Exhibit 99.2 to this Registration Statement. Although the Registrant has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Forward-looking statements contained in the Exhibits incorporated by reference into this Registration Statement are made as of the respective dates set forth in such Exhibits and the Registrant disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

RESOURCE AND RESERVES ESTIMATES

The terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) CIM Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”) under the Securities Act of 1933. The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

- 4 -

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this report and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

DOCUMENTS FILED PURSUANT TO GENERAL INSTRUCTIONS

In accordance with General Instruction B.(1) of Form 40-F, the Registrant hereby incorporates by reference Exhibits 99.1 through 99.8, Exhibits 99.10 through 99.129 and Exhibits 99.135 through 99.139, inclusive, as set forth in the Exhibit Index attached hereto.

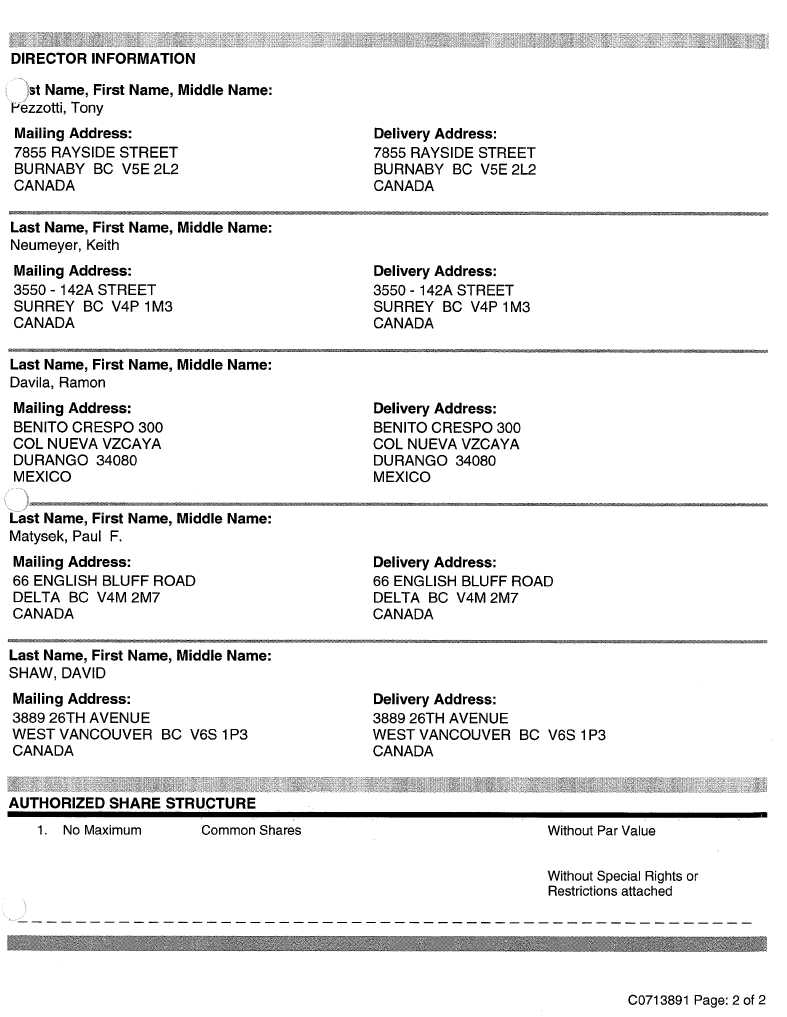

In accordance with General Instruction B.(2) of Form 40-F, the Registrant hereby makes reference to the sections entitled “Authorized Share Structure” on page 3 of the Notice of Articles of the Registrant filed as Exhibit 99.135 and on page 2 of the Notice of Articles of the Registrant filed as Exhibit 99.136, as set forth in the Exhibit Index attached hereto.

In accordance with General Instruction C.(2) of Form 40-F, the Registrant hereby incorporates by reference (i) Exhibits 99.4 and 99.7, the Audited Consolidated Financial Statements of the Registrant for the years ended December 31, 2009, 2008 and 2007; (ii) Exhibits 99.3 and 99.6, Management’s Discussion and Analysis of Financial Condition and Results of Operation for the period ended December 31, 2009 and December 31, 2008, respectively; and (iii) Exhibit 99.9, Reconciliation to United States Generally Accepted Accounting Principles for years ended December 31, 2009, 2008 and 2007.

- 5 -

In accordance with General Instruction D.(9) of Form 40-F, the Registrant has filed written consents of certain experts named in the foregoing Exhibits as Exhibit 99.130 through Exhibit 99.134, inclusive, as set forth in the Exhibit Index attached hereto.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant has no off-balance sheet arrangements.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table lists, as of December 31, 2009, information with respect to the Registrant’s known contractual obligations.

| Payment due by period | |||||

| Contractual Obligations | Total | Less than 1 year |

1-3 years | 3-5 years | More than 5 years |

| Long-Term Debt Obligations | 4,309,159 | 1,095,672 | 1,676,605 | 1,536,882 | - |

| Capital (Finance) Lease Obligations | 2,807,636 | 2,139,352 | 668,284 | - | - |

| Metal Prepayment Obligation | 450,940 | 450,940 | - | - | - |

| Property Purchase Obligations | 1,261,200 | 1,261,200 | - | - | - |

| Construction Contract Obligations | 2,071,102 | 2,071,102 | - | - | - |

| Other Long-Term Liabilities Reflected on the Registrant’s Balance Sheet under GAAP of the primary financial statements – Asset Retirement Obligations | 4,336,088 | - | - | - | 4,336,088 |

Total |

15,236,125 |

7,018,266 |

2,344,889 |

1,536,882 |

4,336,088 |

UNDERTAKINGS

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

Concurrently with the filing of this Registration Statement on Form 40-F, the Registrant will file with the Commission an Appointment of Agent for Service of Process and Undertaking on Form F-X.

Any change to the name or address of the Registrant’s agent for service shall be communicated promptly to the Commission by amendment to Form F-X referencing the file number of the Registrant.

- 6 -

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereto duly authorized.

Date: November 23, 2010

FIRST MAJESTIC SILVER CORP.

| By: | /s/ Raymond Polman | |

| Name: Raymond Polman | ||

| Title: Chief Financial Officer |

- 7 -

EXHIBIT INDEX

Annual Information

Quarterly Information

- 8 -

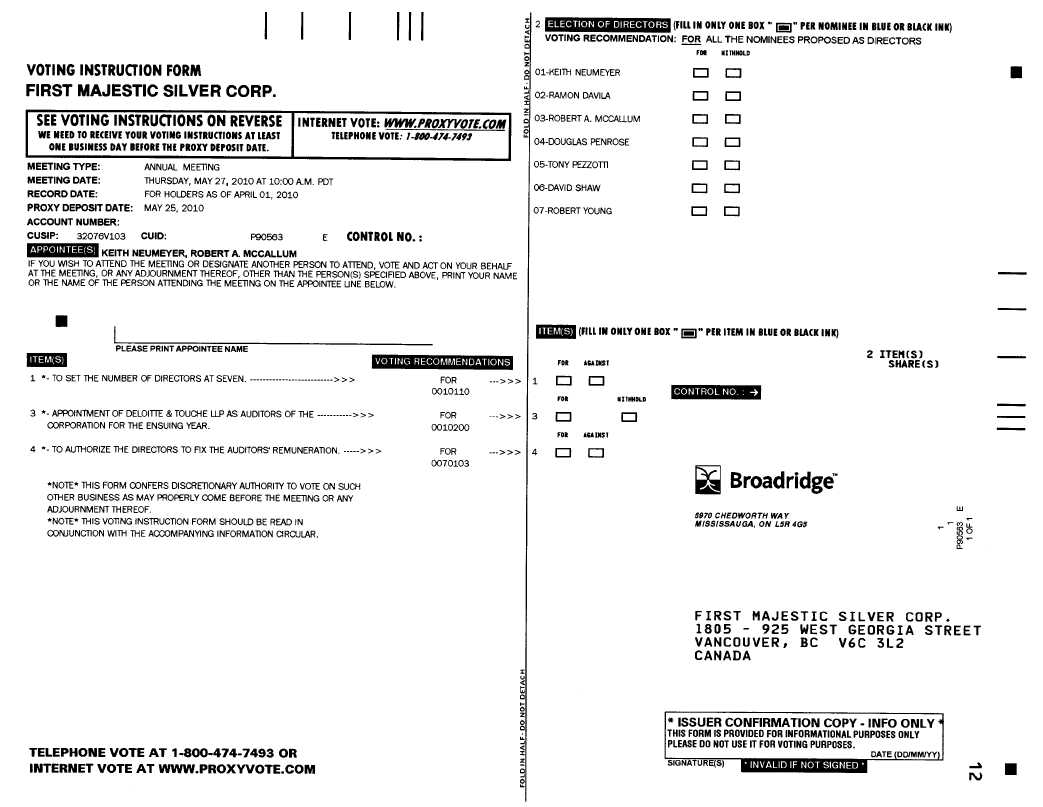

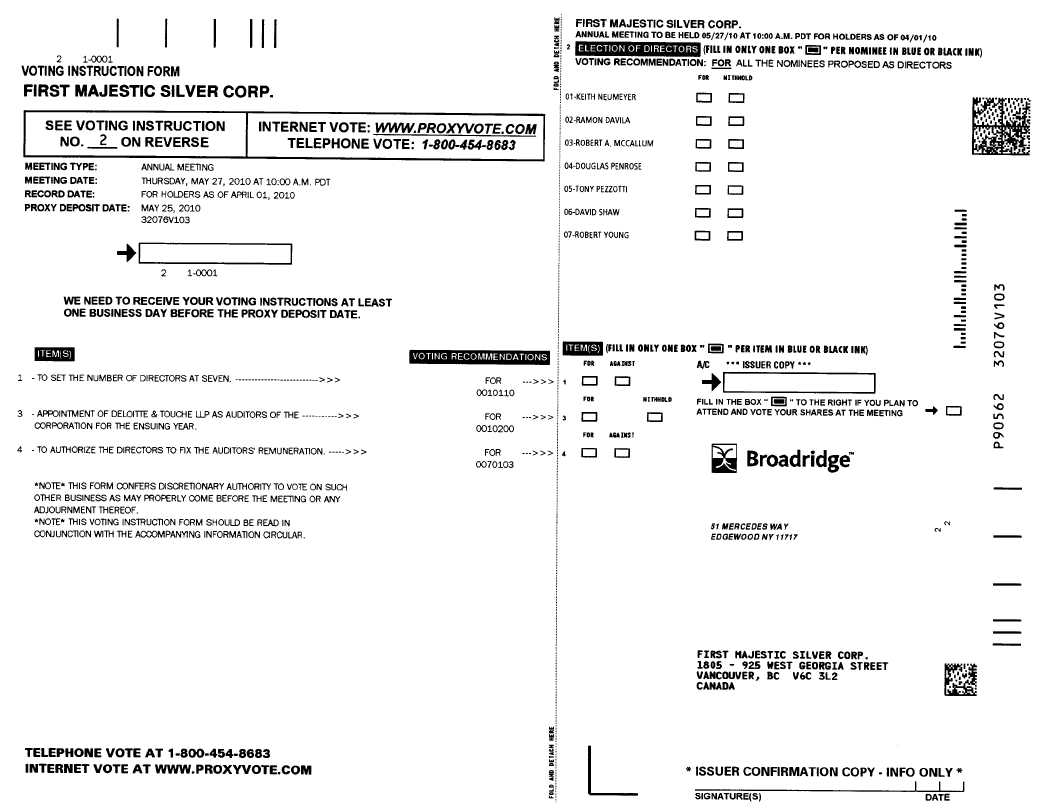

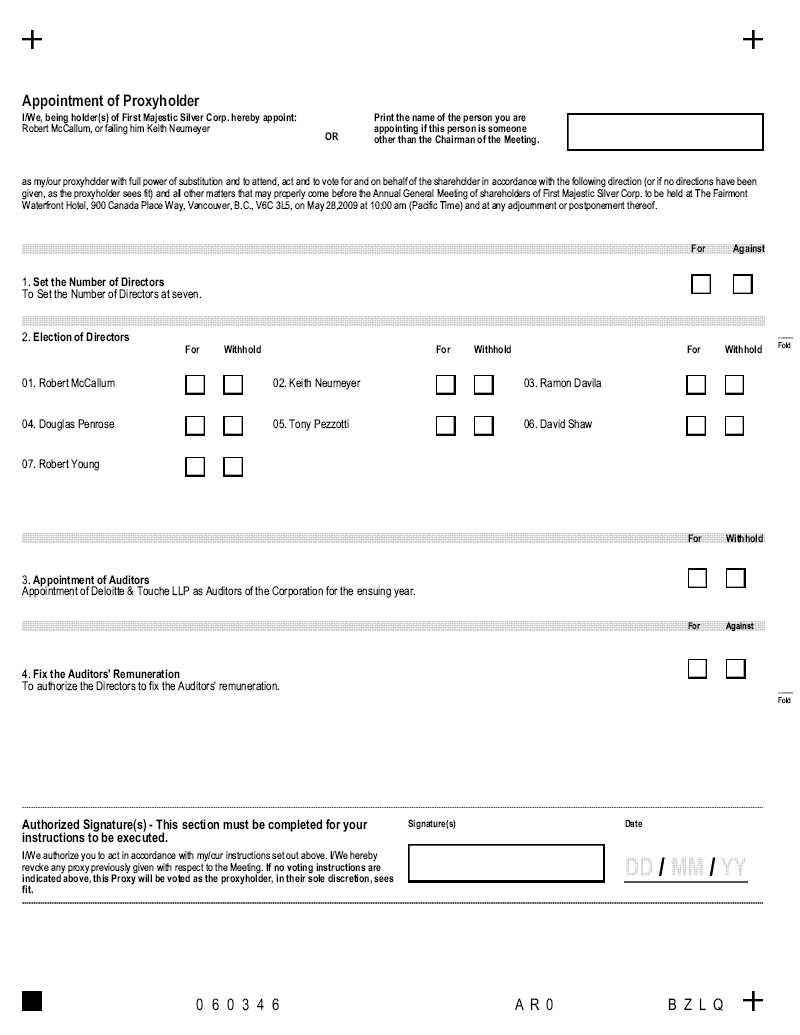

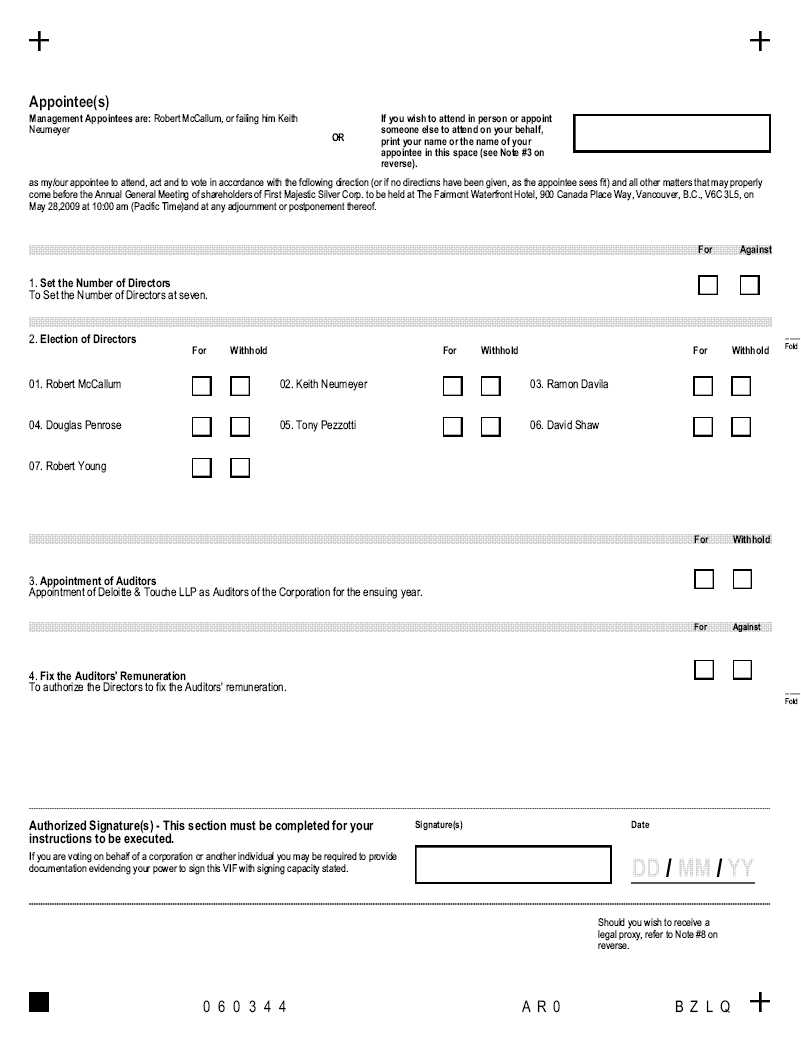

Shareholder Meeting Materials

- 9 -

Material Change Reports

| 99.36. | |

| 99.37. | |

| 99.38. | |

| 99.39. | |

| 99.40. | |

| 99.41. | |

| 99.42. | |

| 99.43. | |

| 99.44. | |

| 99.45. | |

| 99.46. | |

| 99.47. | |

| 99.48. | |

| 99.49. | |

| 99.50. | |

| 99.51. | |

| 99.52. | |

| 99.53. | |

| 99.54. | |

| 99.55. | |

| 99.56. | |

| 99.57. | |

| 99.58. |

- 10 -

| 99.59. | |

| 99.60. | |

| 99.61. | |

| 99.62. | |

| 99.63. | |

| 99.64. | |

| 99.65. | |

| 99.66. | |

| 99.67. | |

| 99.68. | |

| 99.69. | |

| 99.70. | |

| 99.71. |

News Releases

| 99.72. | |

| 99.73. | |

| 99.74. | |

| 99.75. | |

| 99.76. | |

| 99.77. | |

| 99.78. | |

| 99.79. | |

| 99.80. | |

| 99.81. |

- 11 -

- 12 -

Technical Reports

- 13 -

Consents

Constating Documents

| 99.135. | |

| 99.136. | |

| 99.137. | |

| 99.138. |

Material Contracts

| 99.139. | Arrangement Agreement dated September 11, 2009 |

FIRST MAJESTIC SILVER CORP.

2009 ANNUAL REPORT

TSX:FR

IT’S WHAT’S INSIDE THAT COUNTS

|

|

| FIRST MAJESTIC IS A WORLD-CLASS SILVER PRODUCER FOCUSED ON THE ACQUISITION AND EXPANSION OF ADVANCED-STAGE SILVER PROJECTS IN MEXICO. WE ARE COMMITTED TO BUILDING SUSTAINABLE MINING OPERATIONS BASED ON SOUND SOCIAL AND ENVIRONMENTAL PRACTICES. | |

Steadfastly driven to become one of North America’s top silver producers, First Majestic has had a remarkable year in 2009 highlighted by profitability, major improvements to its facilities, a strategic acquisition, and more industry recognition for its exemplary corporate citizenship. |

|

TABLE OF CONTENTS

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 3

MESSAGE FROM THE |

|

LETTER TO SHAREHOLDERS

2009 HAS BEEN A TREMENDOUSLY EXCITING YEAR for First Majestic. We continued to aggressively execute our strategy to become a senior silver producer through the development of our existing assets and through the acquisition of additional assets. This was realized by completing a major expansion at the La Encantada Silver Mine and by acquiring Normabec Mining Resources Ltd. the owner of the exciting Real de Catorce Silver Project.

Gross revenues were very strong at $71.5 million growing by over 27%. We also experienced an 18% increase in shipments resulting in net income of $6.3 million, compared to a net loss of $5.1 million in 2008. We also invested over $33 million into our existing assets and reduced our liabilities by over $20 million.

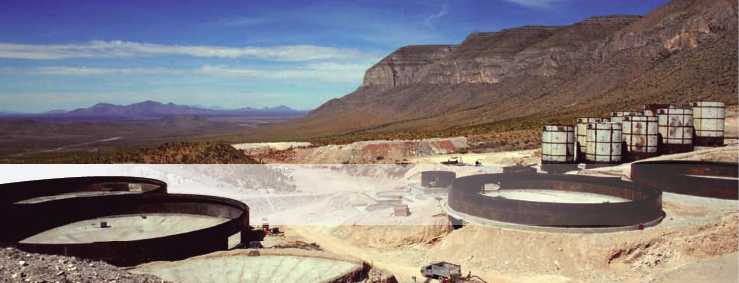

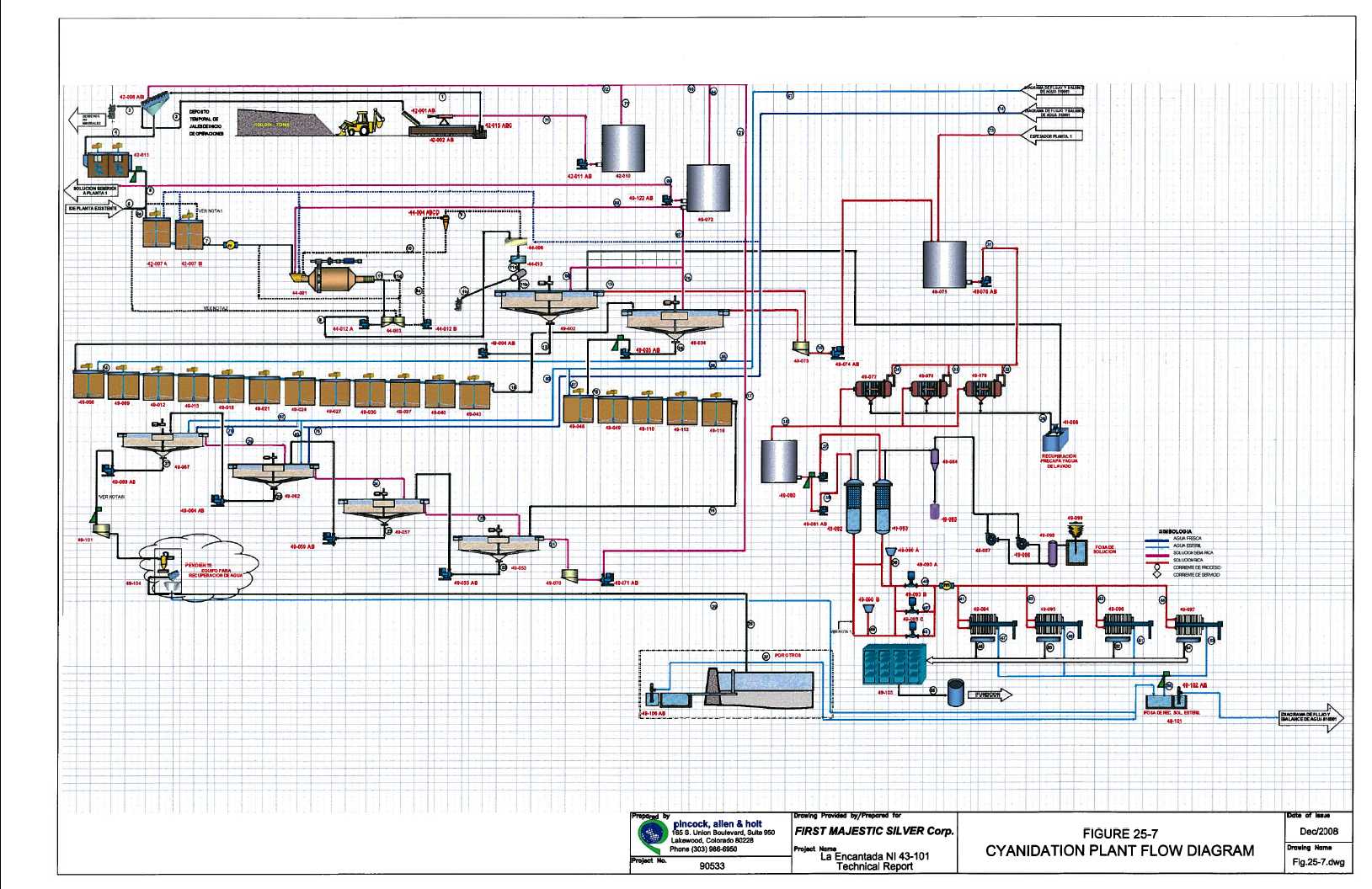

First Majestic’s largest operation, the La Encantada, has undergone a $33 million facelift with the addition of a new cyanidation plant. When fully operational in Q2, 2010, this upgrade will result in the La Encantada’s silver production to be in the form of silver Doré bars instead of concentrates. At full production, La Encantada will contribute over four million ounces of silver annually.

GROSS REVENUES REMAINED STRONG AND GREW BY 27.5%.

The other significant event in 2009 was the acquisition of the Real de Catorce Silver Project. This project added over 47 million ounces of silver to First Majestic’s asset base and, at the same time, has given the Company ownership of a 6000 hectare prolific silver district that is under explored and under developed.

At the Del Toro Silver Mine in Zacatecas, preparations are underway for our next major construction project. Breaking ground for the construction of our fourth operation is slated to begin in late 2010, with a planned opening in late 2011.

To the credit of our team in Mexico, First Majestic was recognized for the second year running for our commitment and dedication to operating a socially and environmentally responsible company. First Majestic received an award from the Mexican authorities for the 2nd consecutive year —the Socially Responsible Business Distinction Award for 2009.

First Majestic’s year ended on a very positive note, with the fourth quarter results being the strongest in our history. It is noteworthy that these results in 2009 can be primarily credited to the La Parrilla and San Martin operations as the La Encantada expansion project was commissioned in November and had not delivered significant production increases by year end.

We are confident that 2010 will be an even better year financially for First Majestic due to increases in production and profitability expected from the recent expansion at La Encantada.

Our top priority is to continue to increase the scale of operations and continually make ongoing improvements as necessary. This strategy has proven successful to date and is expected to drive profits higher and ultimately translate to increasing the value of the Company for the benefit of all shareholders.

Keith Neumeyer

President & CEO

4

MESSAGE FROM |

|

THANKS TO THE HARD WORK of our dedicated team in Mexico, we are proud that La Parrilla and San Martin mines now have a significantly improved productivity and efficiency in their operations. La Encantada is in the final stage of its upgrade and is expected to be at full capacity in the second quarter of 2010.

WE ARE CONFIDENT OUR EFFORTS WILL GREATLY IMPROVE OUR RESULTS IN 2010

We are working daily to improve our performance in all key areas of operations: hitting our production targets with special focus on metallurgical recoveries, maintaining our cost levels, providing safe and environmentally sound operations, and modernizing our facilities with new equipment and technologies. We are confident our efforts will greatly improve our results in 2010, and we look forward to advancing our Del Toro and Real de Catorce projects.

Our success over the last five years is the result of an exceptionally hard-working team of people. I wish to thank our Board of Directors, the management team for their support of the operations, and our committed team of employees who have worked so diligently over the years. Our partners and consultants also deserve our gratitude for the tremendous support they have given our operations. To our exploration team, who discovered and upgraded our resources, and to our administrative team, I say thank you. With their ongoing effort and dedication, we can rely on them to continue to drive our growth for many years to come.

Ramon Davila, Ing

Chief Operating Officer

HIGHLIGHTS RELENTLESS DRIVE TO BECOME ONE OF NORTH AMERICA’S LARGEST

SILVER PRODUCERS |

|

| • | Gross revenue up 27.5% to $71.5M |

| • | Total production up 2.5% to 4,337,103 ounces of silver equivalents |

| • | Completed construction of $33 million upgrade at La Encantada |

| • | Continued focus on reduction of costs |

| • | Generated net income of $6.3 million (EPS of $0.08) |

| • | Invested over $33 million into existing properties |

| • | Acquired the Real de Catorce Silver Project |

| • | Company recognition for Distinction of Socially Responsible Business |

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 5

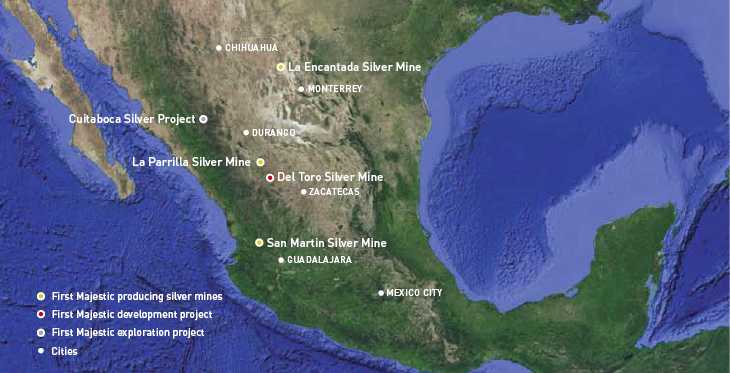

WELCOME TO SILVER-RICH MEXICO

Mexico remains one of the world’s most attractive regions for mining and exploration. As one of the largest silver producing nations in the world, Mexico provides a strong mining culture, excellent geology, political stability, free trade agreements, a skilled workforce and efficient permitting regimes. Mexico is ranked in the 5th position – just below Australia, Canada, Chile and USA – as a low risk country, according to the 2009 study of the Behre Dolbear group’s “ranking countries for mining investment.”

A large number of free trade agreements further facilitate mining in Mexico, most importantly enabling 100% foreign direct investment (FDI). Interest rates and inflation have been well managed, and bureaucratic hurdles have been minimized.

First Majestic’s growth continues to be driven by acquisitions, continued development and exploration, and a firm commitment to the country.

6

COMMUNITY SUPPORT FROM THE GROUND UP

COMMUNITY SUPPORT FROM THE GROUND UP

First Majestic is committed to the highest possible standard in corporate citizenship. We believe in supporting our communities from the ground up.

We take pride in making meaningful contributions to the communities we are active in wherever possible. We engage local workforces and stimulate well-being beyond our operations.

We are actively involved in improving and aiding in a variety of essential areas: healthcare services including supporting doctors, paramedics and ambulance services, supplying clean water to primary schools, paving of roads, providing funding for parks and recreation, upgrading of elementary and high schools, and assisting with agricultural subsidies and capital improvement projects.

In both 2008 & 2009, this commitment was recognized by the Centro Mexicano para la Filantropia with a Socially Responsibility Business Distinction award. This Distinction recognizes excellence in corporate ethics, quality of work, community citizenship, and environmental responsibility. We are particularly proud to have been recognized within the Mexican community two years running.

WE SUPPORT OUR LOCAL COMMUNITIES

In addition to the many things we do as a Company to assist the local populations, we also provide academic scholarships towards university degrees focused in geology and engineering, All of these efforts are simply reflections of the manner in which First Majestic operates.

First Majestic remains dedicated to maintaining a clean and safe work environment, and we continue to engage and work with our employees to provide the best training, tools, equipment and supervision on our worksites.

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 7

THERE’S NO SUBSTITUTE FOR SILVER |

|

8

| SILVER |  |

The diversity of silver uses in critical applications makes silver one of the most compelling investments today. As mankind becomes more reliant on technology, we become more reliant on silver. This trend seems to have no end in sight.

As an investment, the outlook for silver is expected to remain strong for many years. Silver has benefitted from being both an industrial metal and a cheap precious metal. Industrial metals have rallied strongly as the economic recovery has taken hold, while at the same time, precious metals have done well as investors and world banks have been divesting away from the US dollar. Jewellery demand has also been strong.

Given the diverse nature of silver demand, prices are expected to perform well. (Source: ScotiaMocatta, Silver Forecast 2010)

SOME OF THE KEY SILVER USES IN THE MARKET TODAY, ARE:

| • Pharmaceuticals |

| • Anti-Bacterial Applications |

| • Electric Wiring |

| • Chemical Catalyst |

| • Reflectants |

| • Printed Circuitry |

| • Superconductors |

| • Electroplating |

| • Brazing & Soldering |

| • Coins & Bars for investment |

| • Photography (incl. X-Ray’s) |

| • Silverware & Jewellery |

| • Mirrors & Window Coatings |

| • Solar Energy |

| • Water Purification |

FIRST MAJESTIC’S SILVER BARS & BULLION

FIRST MAJESTIC CONTINUES TO INNOVATE WITH THE INTRODUCTION OF AN ONLINE BULLION E-STORE

After many months of development, First Majestic recently launched our online E-store for the sale of our own silver coins and bars. Online sales now represent a significant portion of our sales.

This unique approach to selling our silver directly to investors gives First Majestic a new revenue source, higher than normal margins and more importantly, provides access for individuals who may otherwise find it difficult to source physical silver at reasonable prices. The company is pleased to continue to provide this opportunity for bullion investors, and are happy to hear that often these investors become shareholders.

First Majestic continues to strive to fill customer demand resulting in the introduction of a new 50 ounce free-poured bar to its product line. These innovative 50-ounce bars are hand-poured and marked the old-fashioned way, resulting in a rustic look that makes each bar a unique work of art.

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 9

THE KEY TO OUR TREMENDOUS GROWTH HAS BEEN THE STRENGTH AND COMMITMENT OF OUR PEOPLE. IN JUST SEVEN SHORT YEARS, FIRST MAJESTIC HAS GROWN TO OVER $70 MILLION IN GROSS REVENUES, EMPLOYING OVER 1500 PEOPLE, WHICH INCLUDES ONE OF THE MOST RESPECTED OPERATIONAL TEAMS IN MEXICO.

COLLECTIVELY OUR TOP 40 EXECUTIVES HAVE OVER 600 YEARS OF MINING AND MANAGEMENT EXPERIENCE.

THE FIRST MAJESTIC TEAM OF ENERGETIC, TALENTED PEOPLE IN BOTH MEXICO AND CANADA ARE ALL FOCUSED ON ONE COMMON VISION-TO BE ONE OF THE LARGEST SILVER PRODUCERS IN NORTH AMERICA.

10

DRIVEN BY DEDICATED PROFESSIONALS

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 11

OUR TEAM VANCOUVER OFFICE Raymond L. Polman, B.Sc (Econ), CA Mr. Polman has over 25 years of public accountancy and corporate finance experience in the Canadian and US financial markets. Mr. Polman has a Bachelor of Science (Economics) Degree from the University of Victoria and is a member of the Institute of Chartered Accountants of British Columbia. Mr. Polman served as a CA with Deloitte & Touche, LLP, for eight years prior to leaving public practice and heading up Finance for Rescan Consulting. He has also served as a Chief Financial Officer for a group of junior and growth stage public companies in the high tech sector. Connie Lillico, B.A. Ms. Lillico has worked in public company management and administration since 2000. She was previously the Corporate Secretary of several publicly traded mining and oil & gas companies for three years, prior to which she was a Paralegal with a publicly traded software company for two-and-a-half years. Ms. Lillico also worked in corporate and securities law as a Paralegal with a large national legal firm for eight years. She has a Bachelor of Arts degree from Simon Fraser University and a Paralegal certification from Capilano College. MEXICO OFFICE Francisco Garza, CP Mr. Garza is a Chartered Public Accountant with over 42 years of experience during which he held positions with Grupo Mexico, San Luis Corporación, and Silver Eagle. Previous positions held by Mr. Garza include CFO, VP of Finance and Administration, and President of Auto Parts Division in the San Luis Group (LUISMIN). |

|

||

|

|||

| 1. |

Raymond L. Polman | ||

| 2. |

Connie Lillico | ||

| 3. |

Francisco Garza | ||

12

Sergio Ramírez, Ing Mr. Ramírez is a mining engineer with over 42 years of experience. He spent over 32 years in several key positions within Grupo Mexico and prior to that with the Mexican Government. In his five years with First Majestic, Mr. Ramírez has held several senior management positions within our operations. Previous positions held by Mr. Ramírez, include: Chief of Engineering, Chief of Planning, Mine Superintendent, Assistant Mine Manager, Mine Manager and Operations Director. Florentino Muñoz, Ing Mr. Muñoz is a Geological Engineer who holds a Masters Degree in Economic Geology. Mr Muñoz’s 36 years of experience includes positions with Grupo Mexico, Luismin and Exploraciones Geologicas de Occidente. Mr. Muñoz also worked as an independent consultant. Mr. Muñoz’s prior positions include Chief Geologist, Geology Superintendent, Chief of Petrography and Mineragraphy, and Regional Exploration Manager. Mario Maldonado, Lic. Mr. Maldonado holds a Bachelor Degree in Industrial Administration and has over 32 years of experience working in Human Resources for various firms. Mr. Maldonado has held positions with Industrias Peñoles, Refrescos del Norte, Embotelladora Aga, Jugos del Valle, and Casas Geo. Some of Mr. Maldonado’s earlier positions include Chief of Organization Development and Corporate Manager of Human Resources. Oscar Melgar, Ing Mr. Melgar is a Mechanical Engineer who holds a Masters Degree in Metallurgy and has over 35 years of experience. Mr. Melgar has held positions with Movisa, Minera San Francisco del Oro, Industrias Peñoles, Minera Maple, Svedala-Metso, Weir Envirotech, and Gammon Lake. Previous positions held by Mr. Melgar include Design Engineer, Assistant Maintenance Superintendent, Maintenance Superintendent, Manager of Spare Parts, and Purchasing Manager. |

|

||

|

|||

| 4. | Sergio Ramírez |

||

| 5. | Florentino Muñoz |

||

| 6. | Mario Maldonado |

||

| 7. | Oscar Melgar |

||

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 13

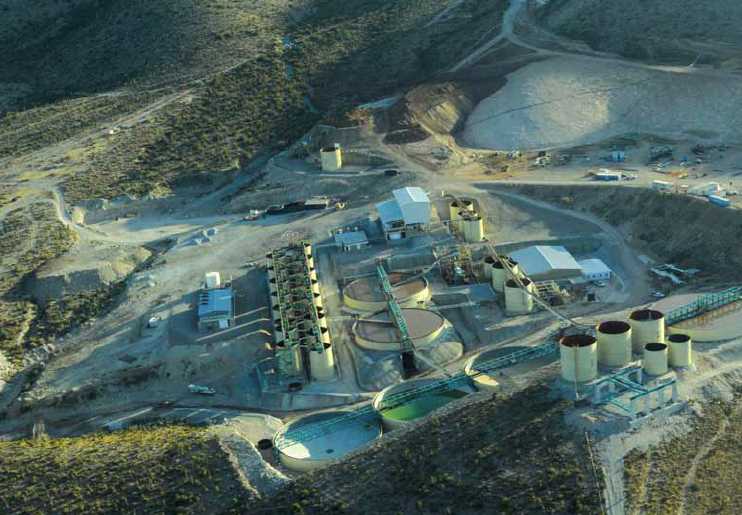

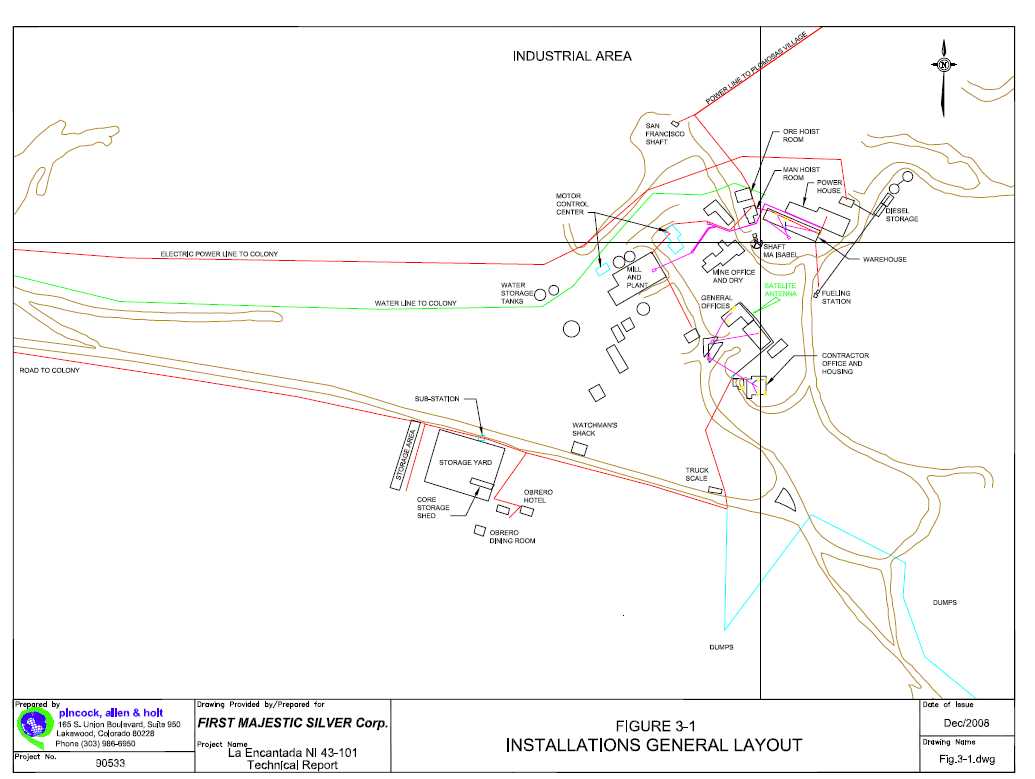

LA ENCANTADA SILVER MINE, COAHUILA, MEXICO

MAJOR EXPANSION COMPLETED IN 2009 WILL DRAMATICALLY INCREASE PRODUCTION

| LOCATION: COAHUILA, MÉXICO | |||||||

| 100% OWNERSHIP |

96,250 MONTHLY CAPACITY (TONNES) |

641 EMPLOYEES |

1,446,660 2009 PRODUCTION (SILVER EQ. OZ.) |

US$6.10 2009 DIRECT CASH COSTS PER OUNCE |

US$10.20 2009 CASH COSTS PER OUNCE (ALL IN) |

US$45.59 2009 TOTAL COSTS PER TONNE |

3,500,000 2010 PROJECTED SILVER EQ. OZ. PRODUCTION |

14

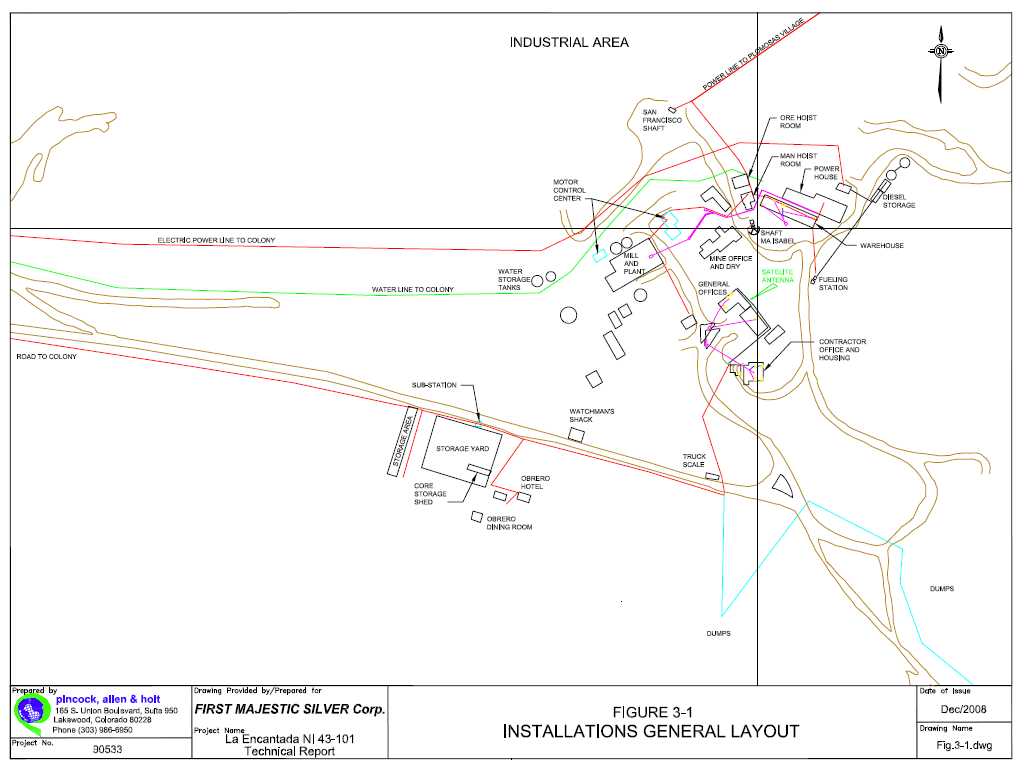

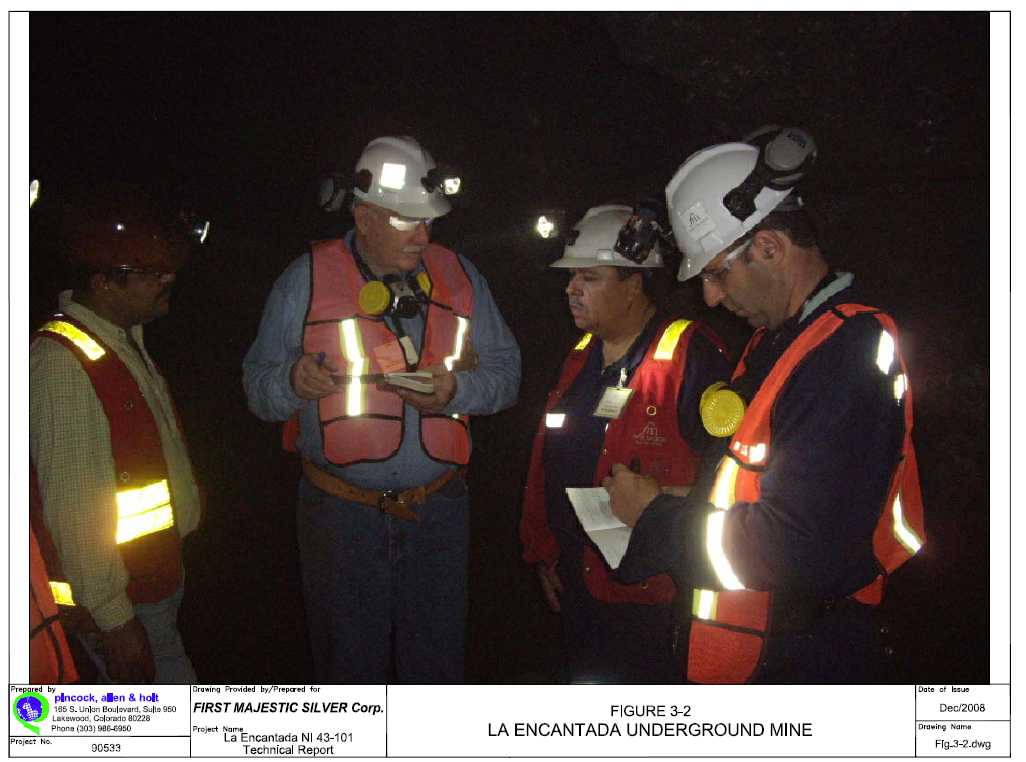

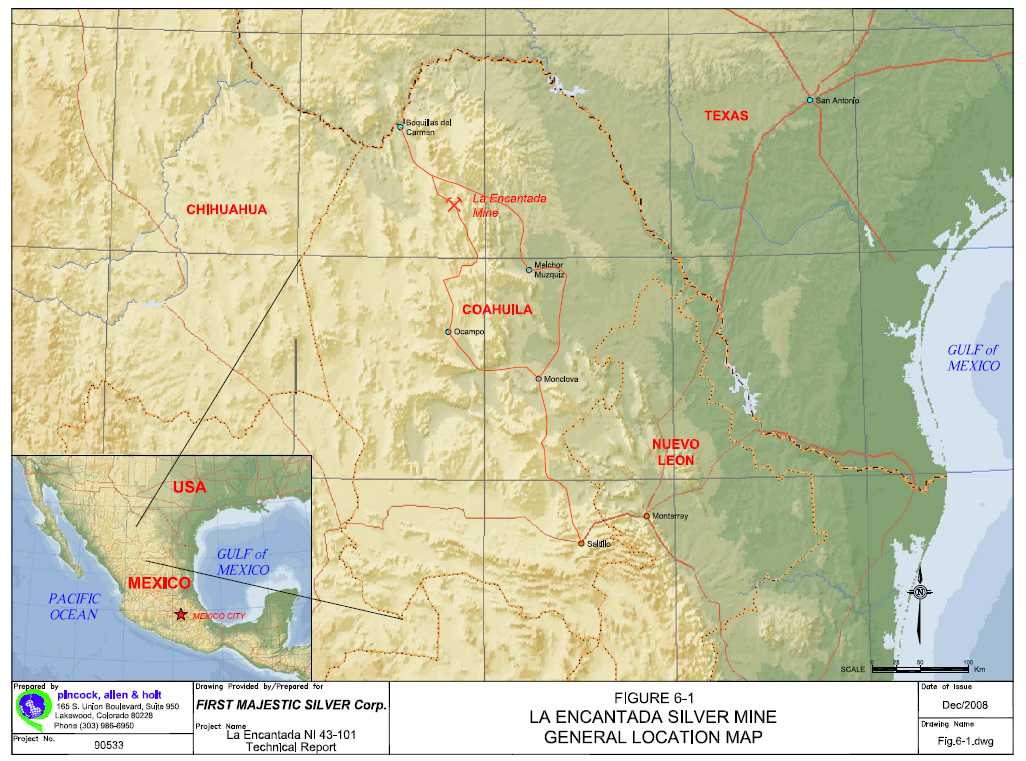

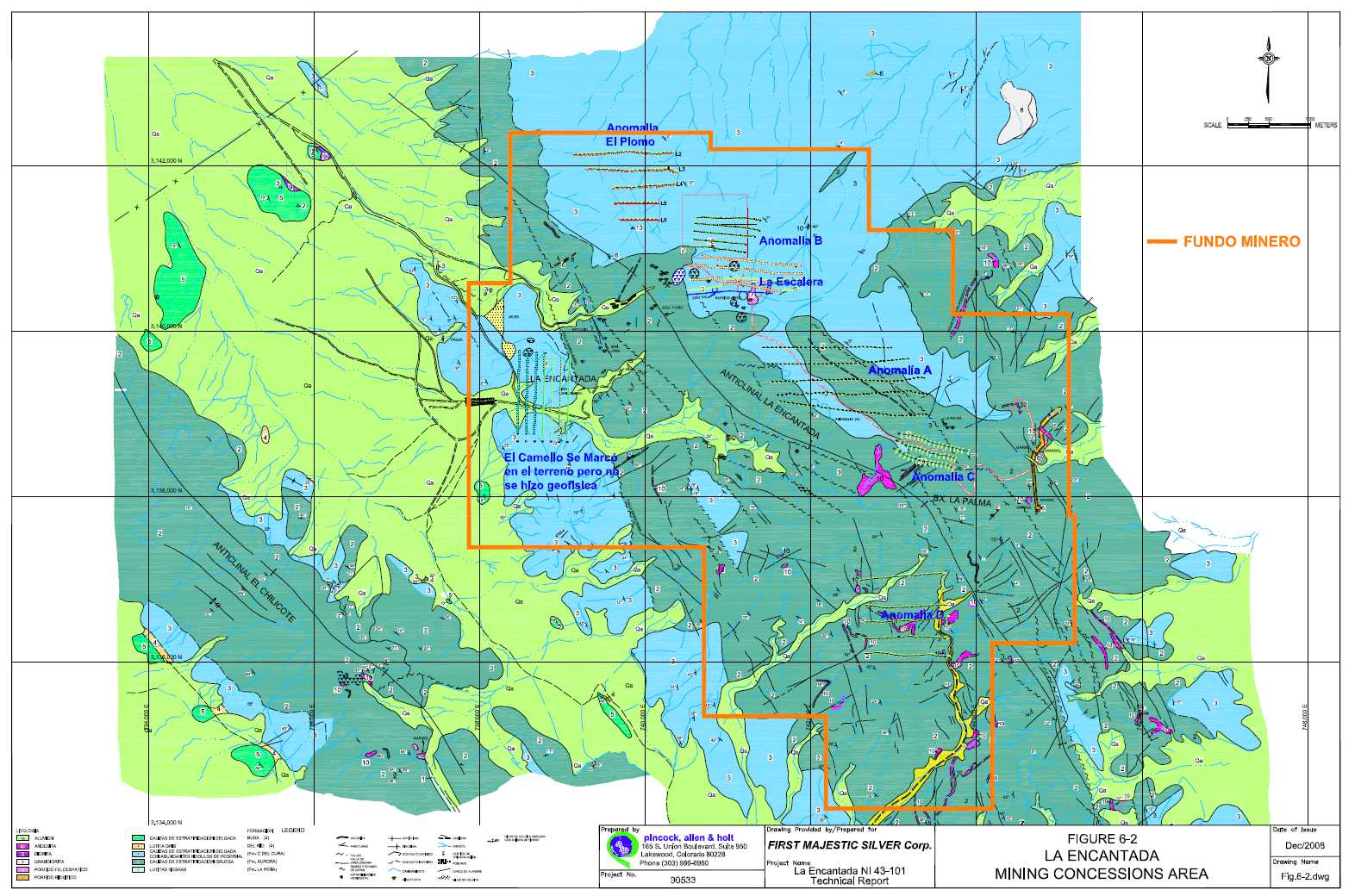

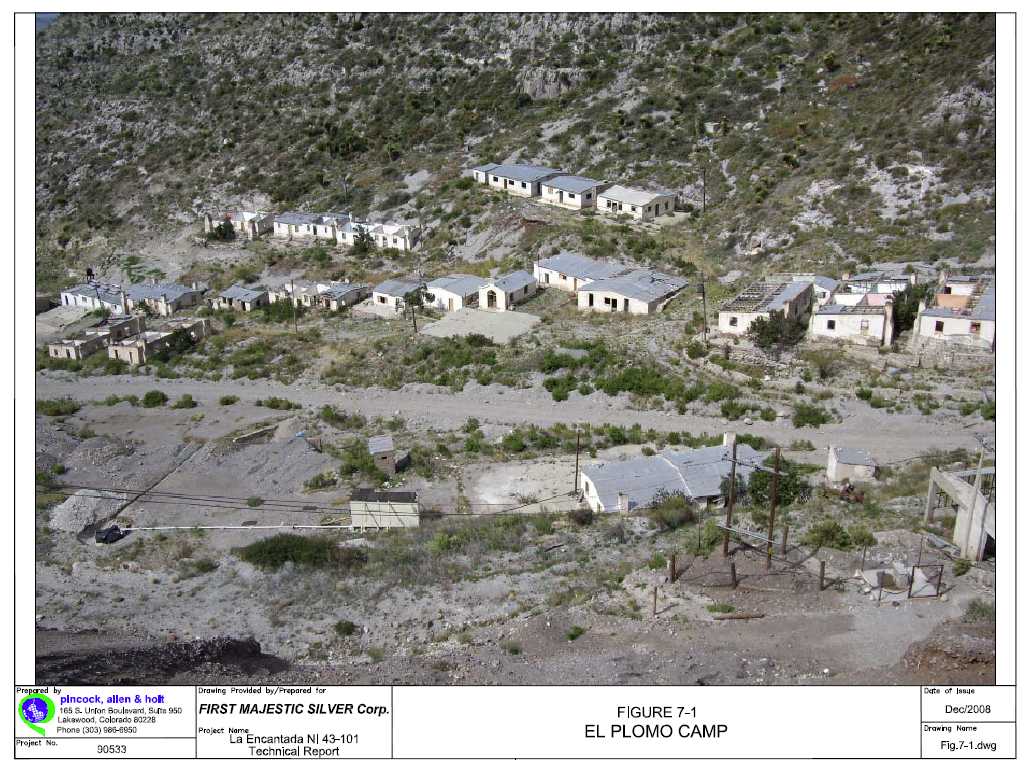

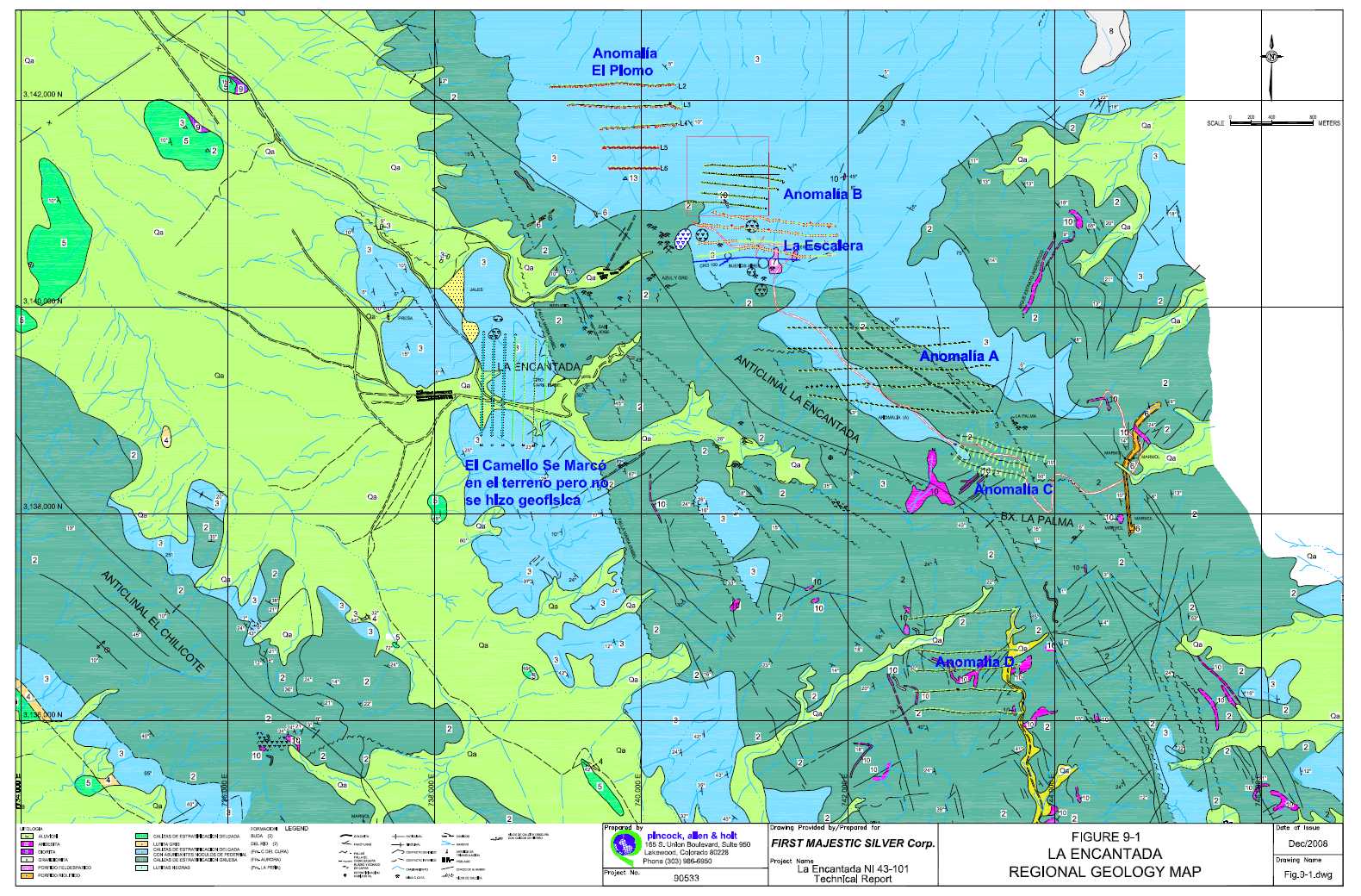

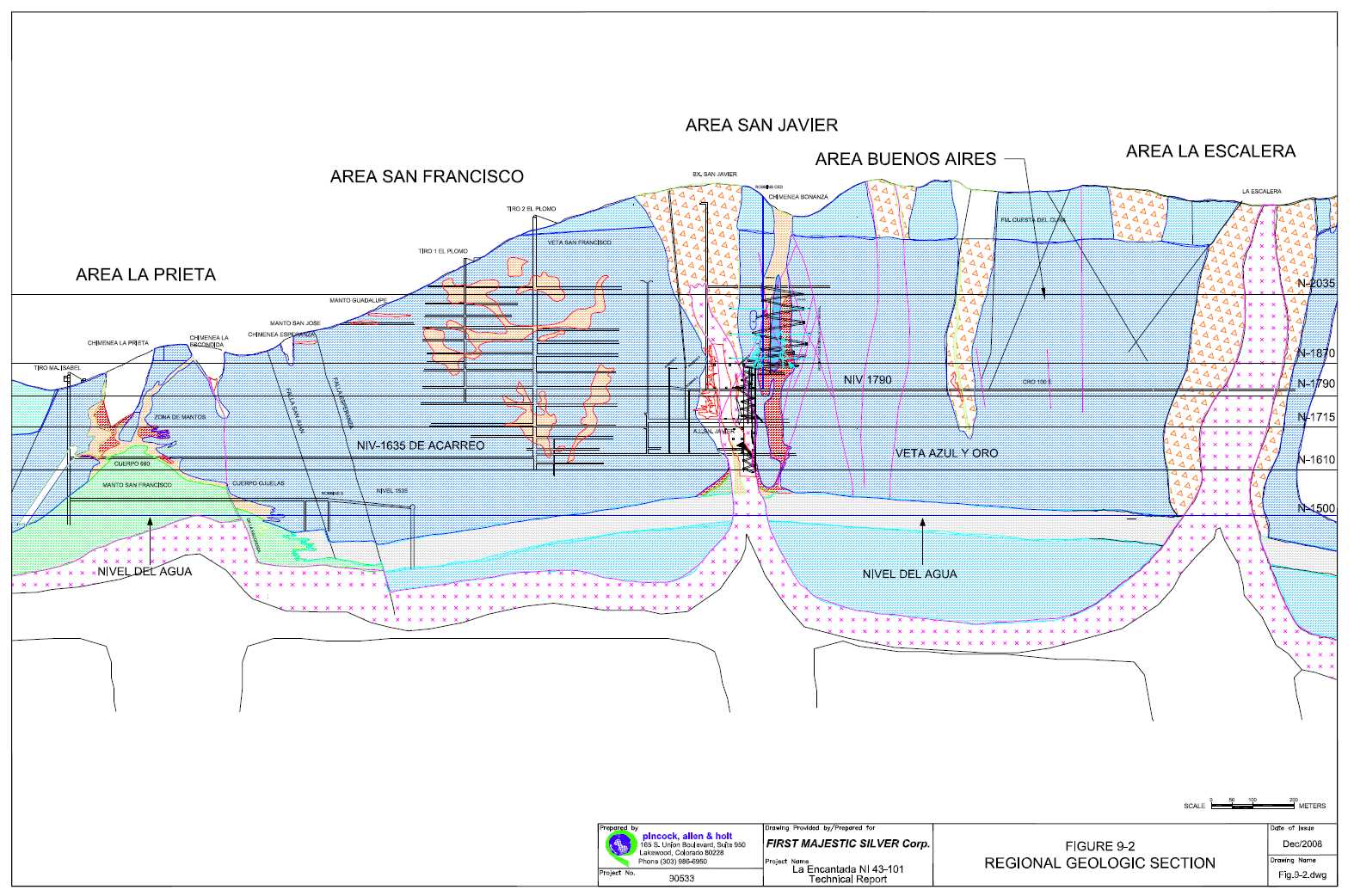

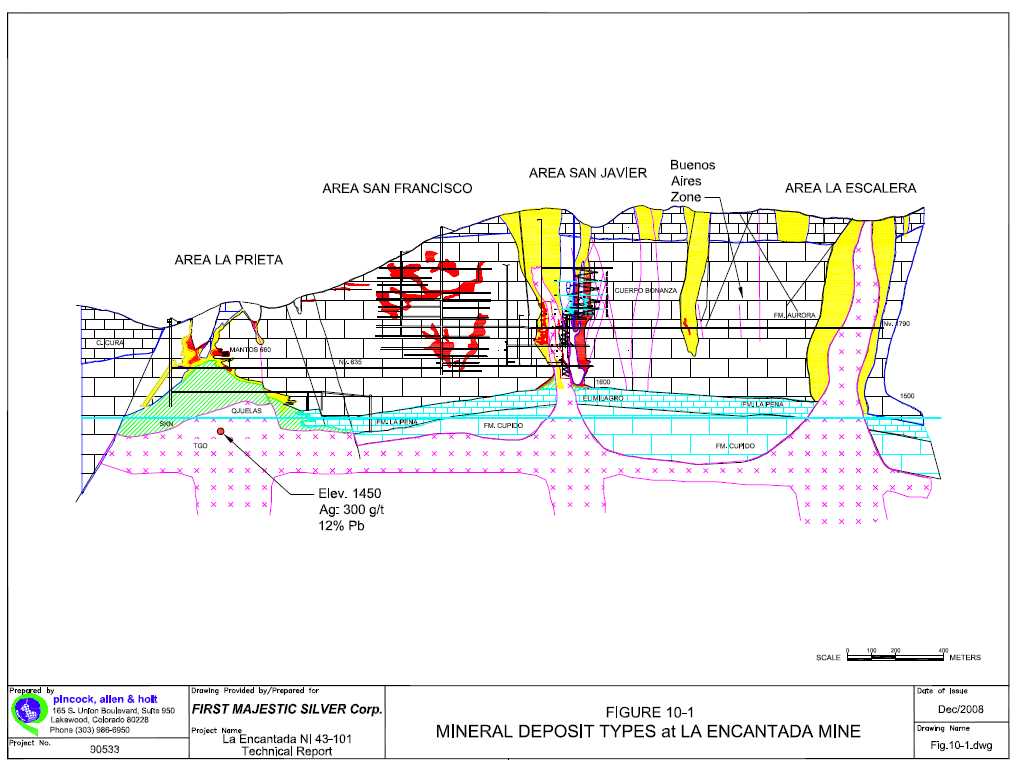

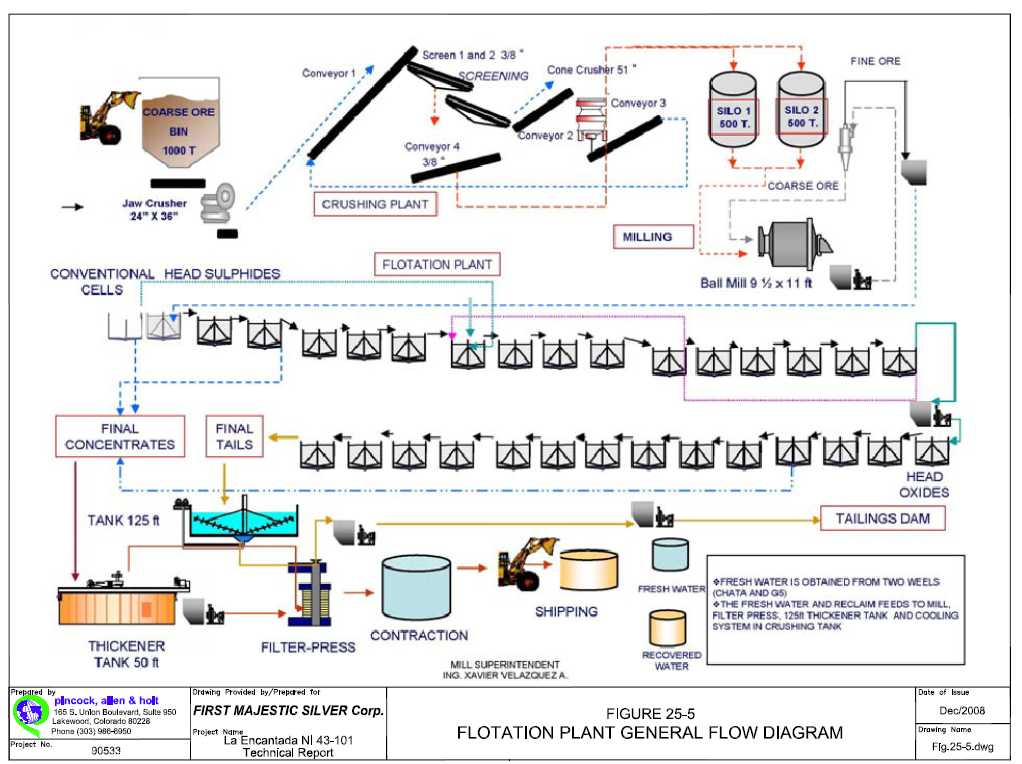

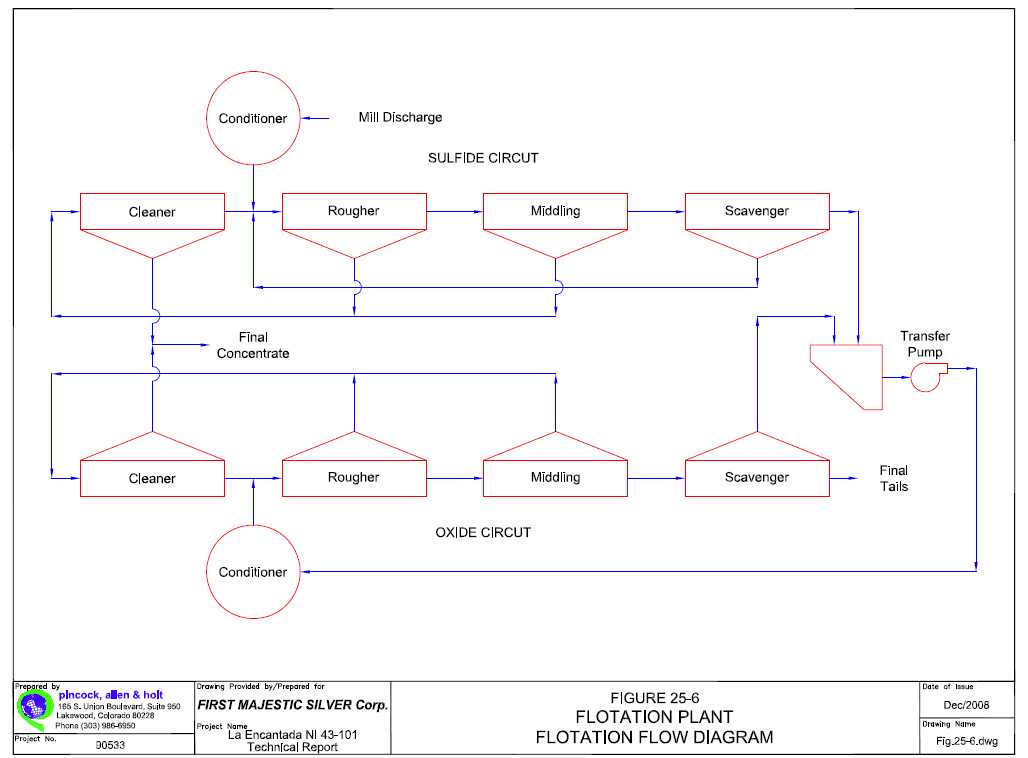

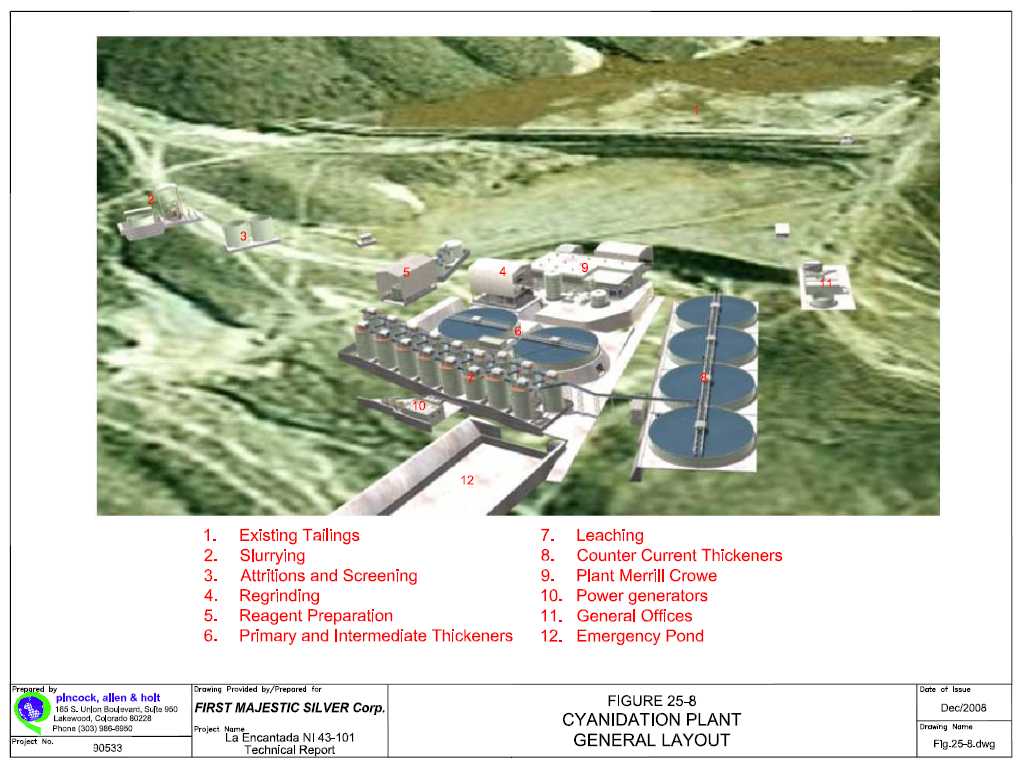

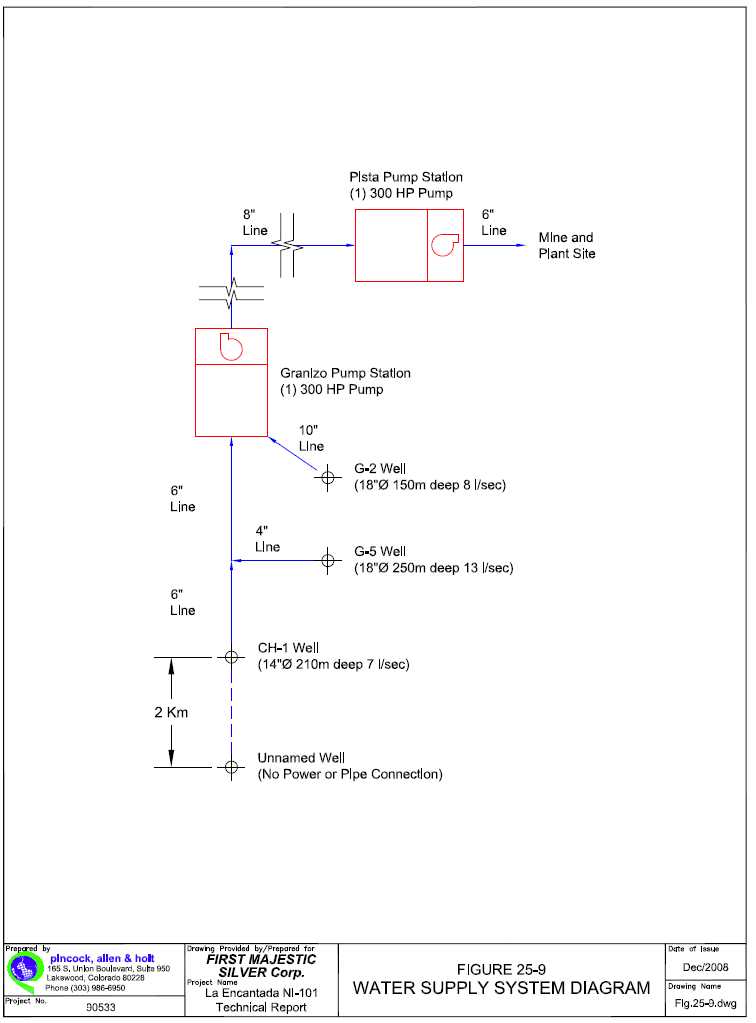

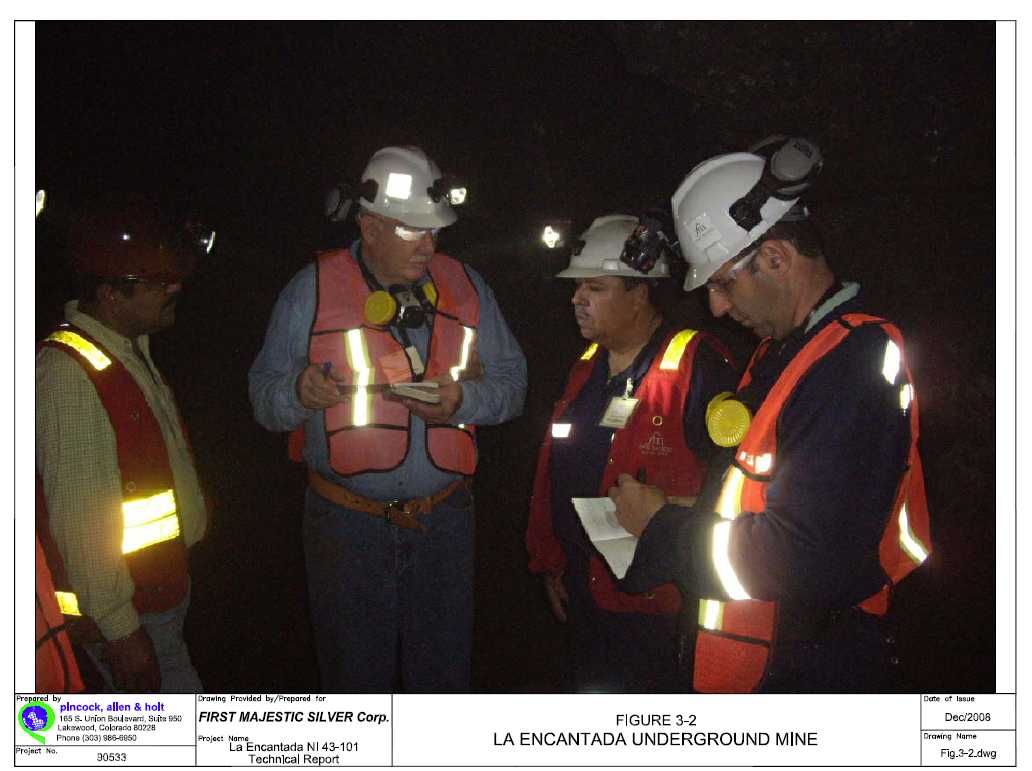

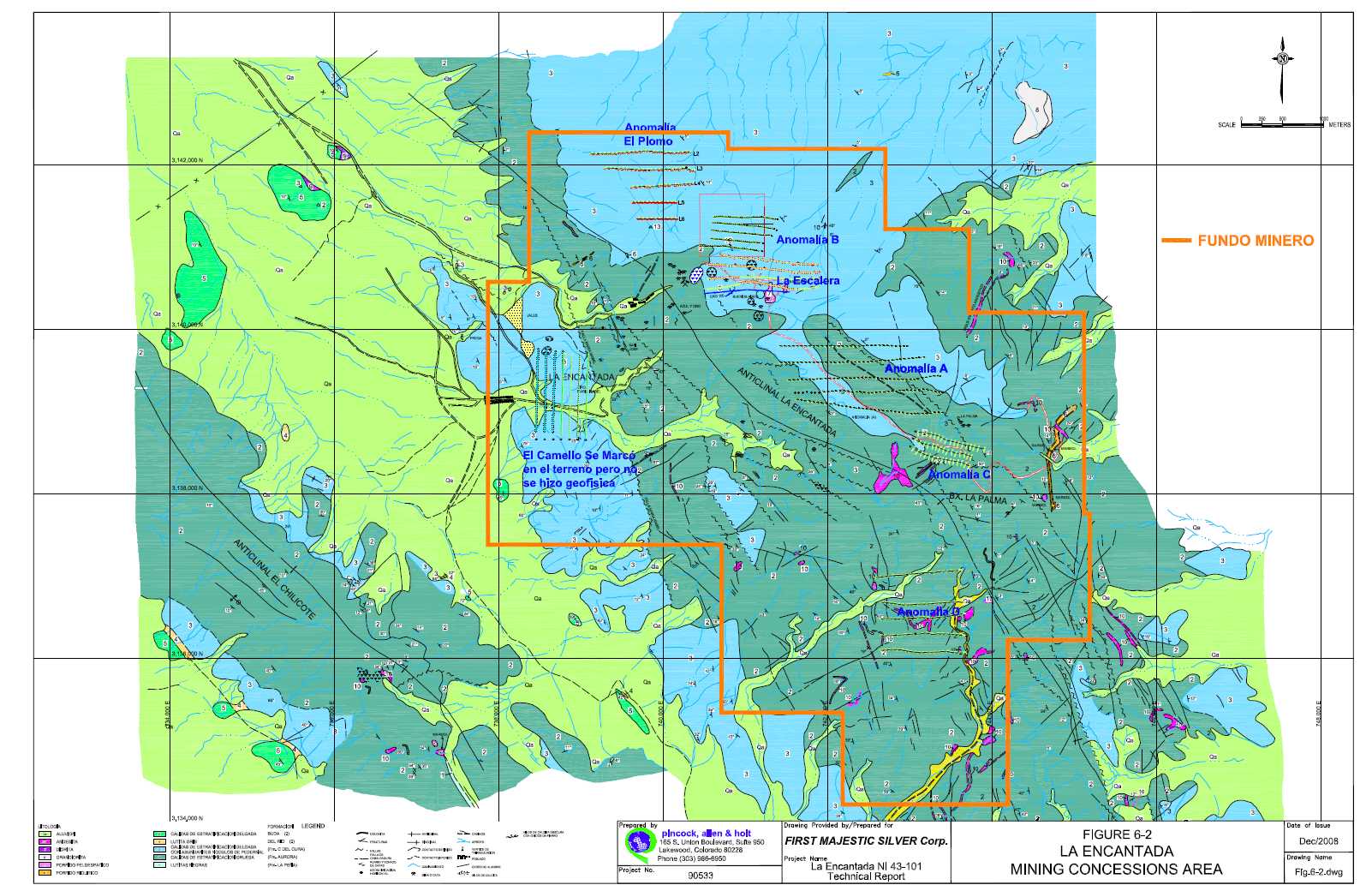

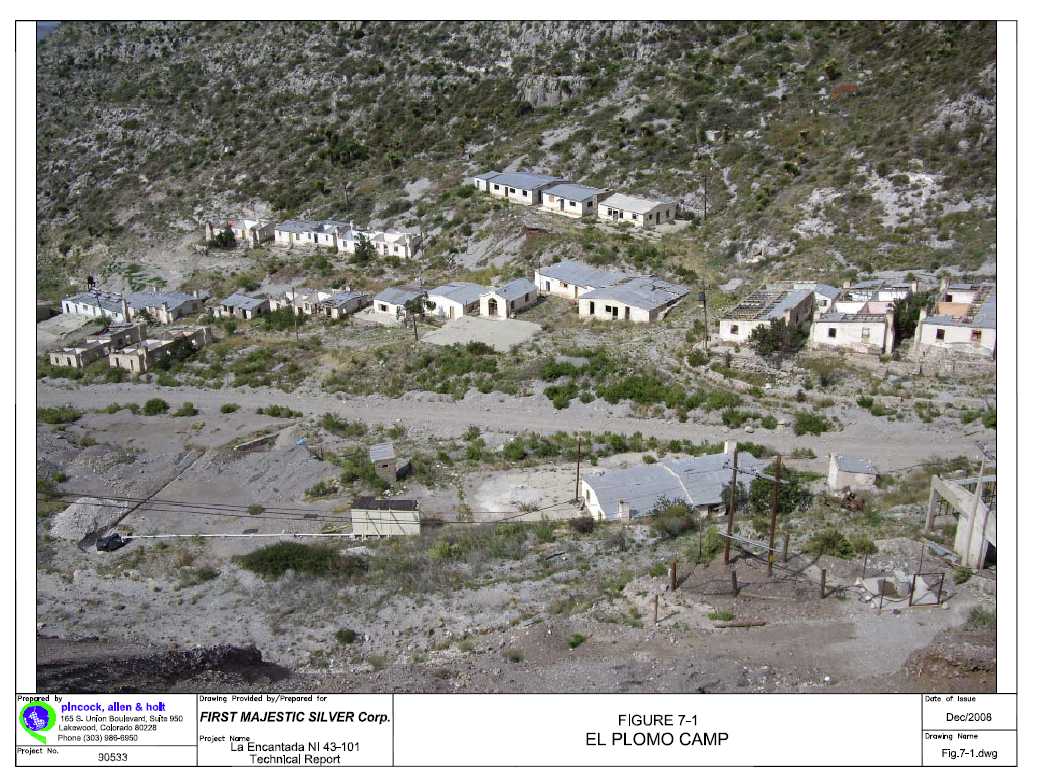

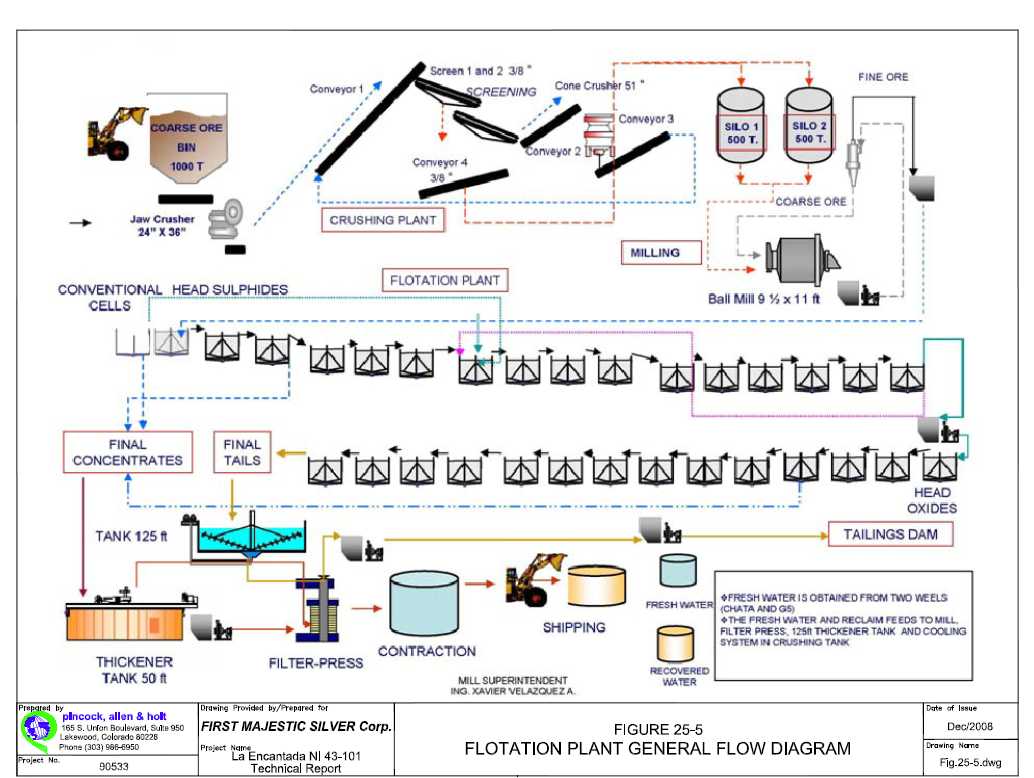

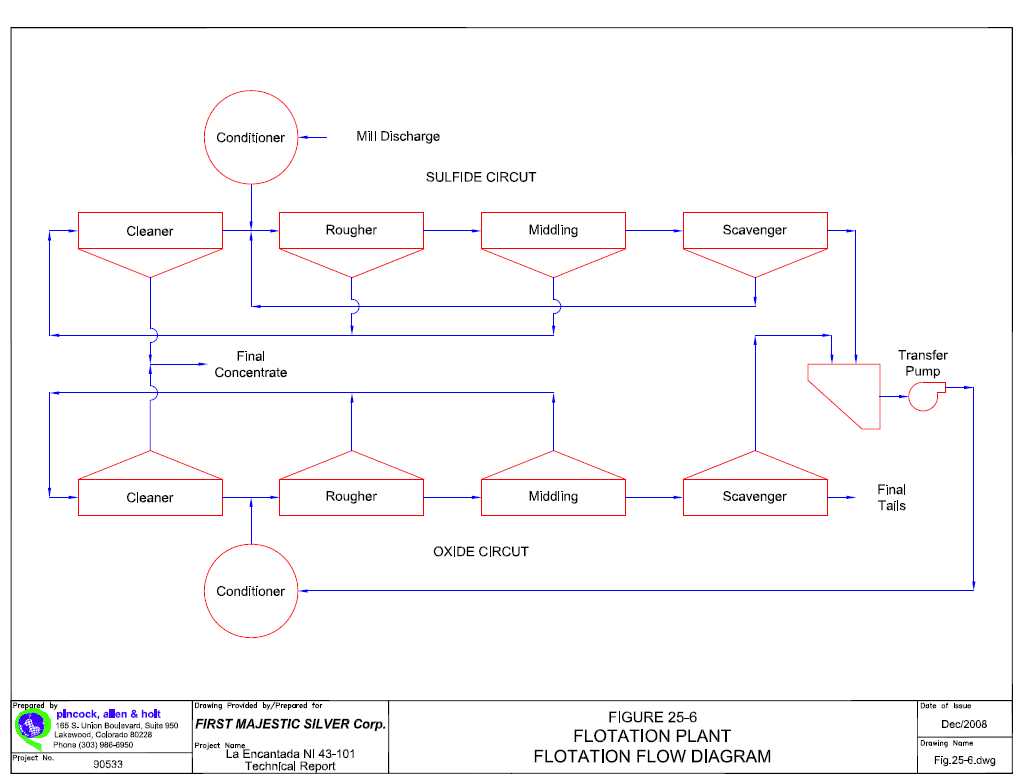

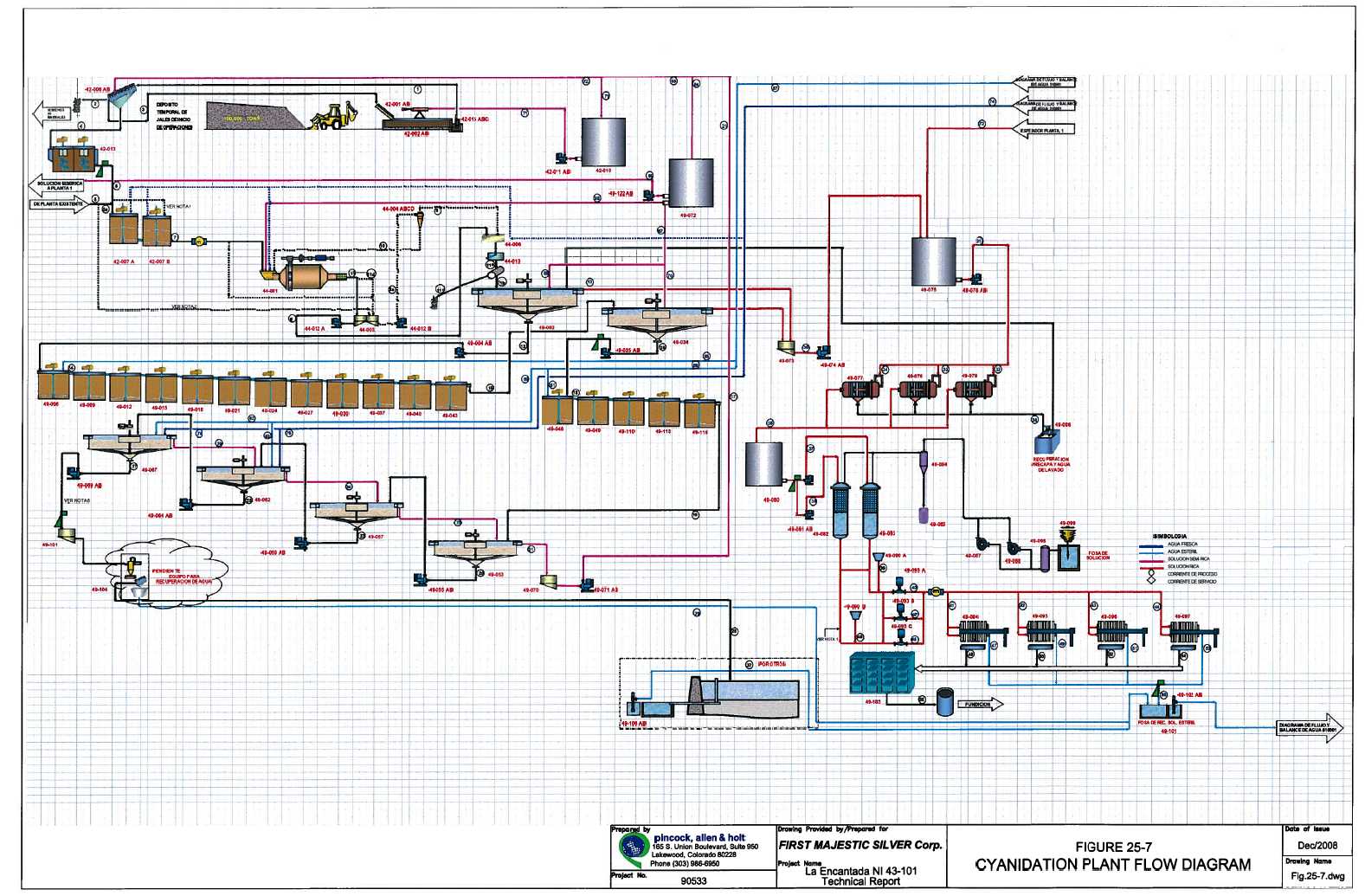

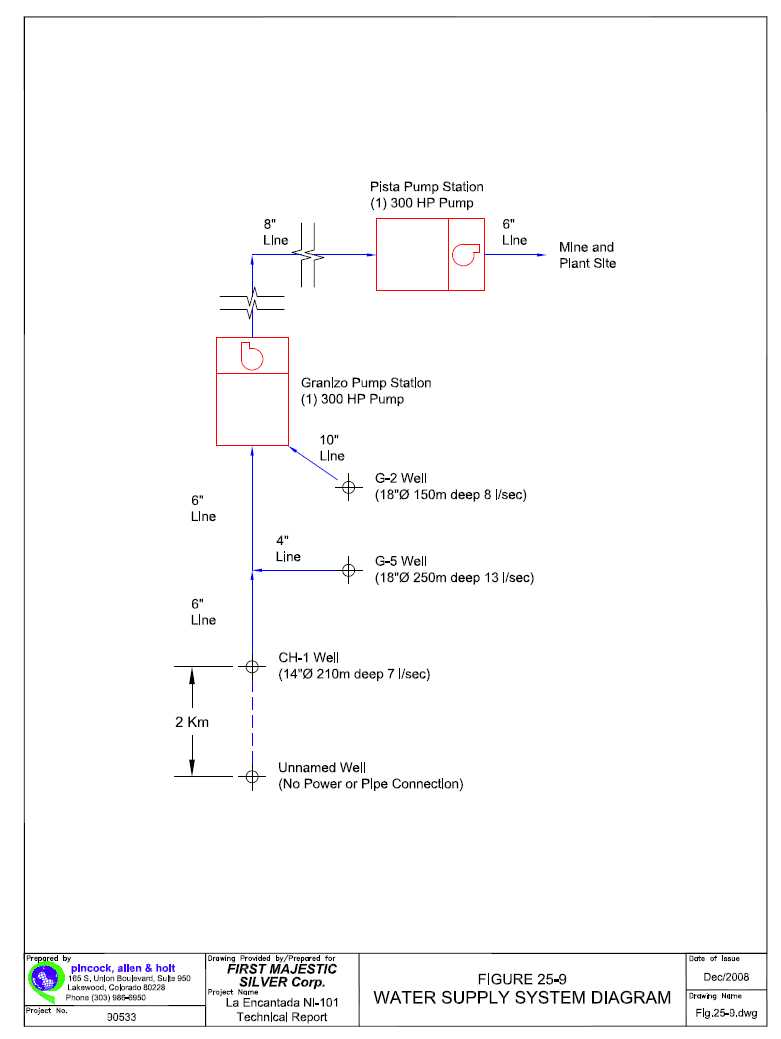

LA ENCANTADA SILVER MINE is First Majestic’s highest-grade mine and lowest-cost producer. It is located in the Coahuila State in Northern Mexico, easily accessible by road, and approximately an hour and half by plane from the city of Torreon. The mine site comprises of 4,076 hectares of mining rights and 1,343 hectares of surface land ownership. The closest city is Melchor Muzquiz. The mine consists of a complete 3,500 tpd cyanidation plant and a 1,000 tpd flotation plant including all related facilities and infrastructure; a mining camp with 180 houses, administrative offices, laboratory, recreation centre, schools, church, general store and a private airstrip. First Majestic owns 100% of the La Encantada Silver Mine. WE ARE CONVINCED THAT THE NEXT YEARS WILL BE A GREAT SUCCESS FOR ALL OF US AT FIRST MAJESTIC. During 2009, a major expansion was completed at the La Encantada which resulted in the commissioning of a new 3500 tpd cyanidation plant. This new plant is currently in the ramp-up stage. Commercial production was achieved on April 1st, 2010 and full capacity is anticipated later in Q2 2010. The expansion is projected to add over 2.0 million ounces to the Company’s production in 2010, while bringing total production to over 4.0 million ounces in the form of Doré bars annually. “The positive results of exploration and development of the high-grade area within the mine, including completing the learning curve on the new cyanidation plant, will allow the La Encantada to be one of the leading producers of low-cost silver in Mexico. We are in the process of ramping up the new plant and the challenge is very exciting for all of us. We are convinced that the next years will be a great success for all of us at First Majestic.”

Miguel Riós, Ing Mr. Riós is a Mining Engineer with more than 28 years of experience during which he has worked with several mining groups such as Peñoles and Pan American Silver (Plata Panamericana). His previous positions include Mine Foreman, Mine and Planning Superintendent, Mine Superintendent, and General Manager. Mr. Riós has been with First Majestic for five years and has been the manager at each of the Company’s operations. He is currently the General Manager of the La Encantada mine. |

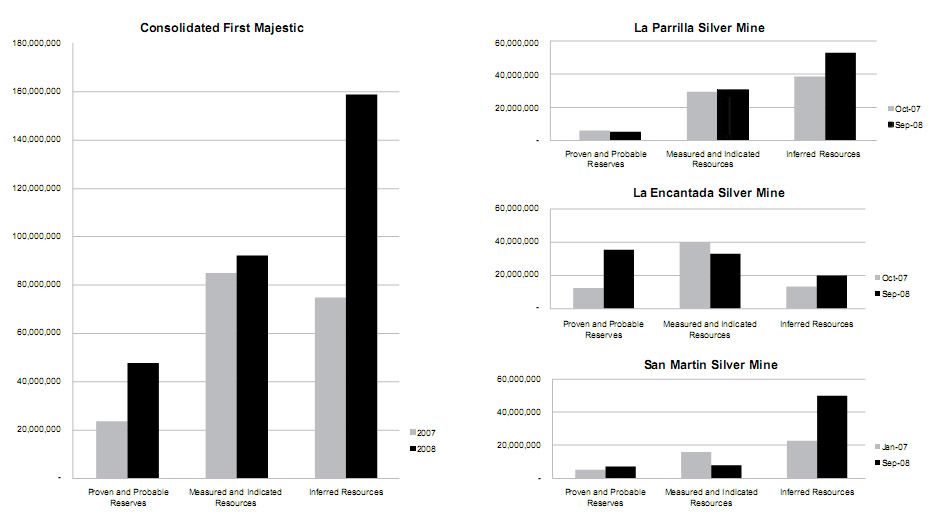

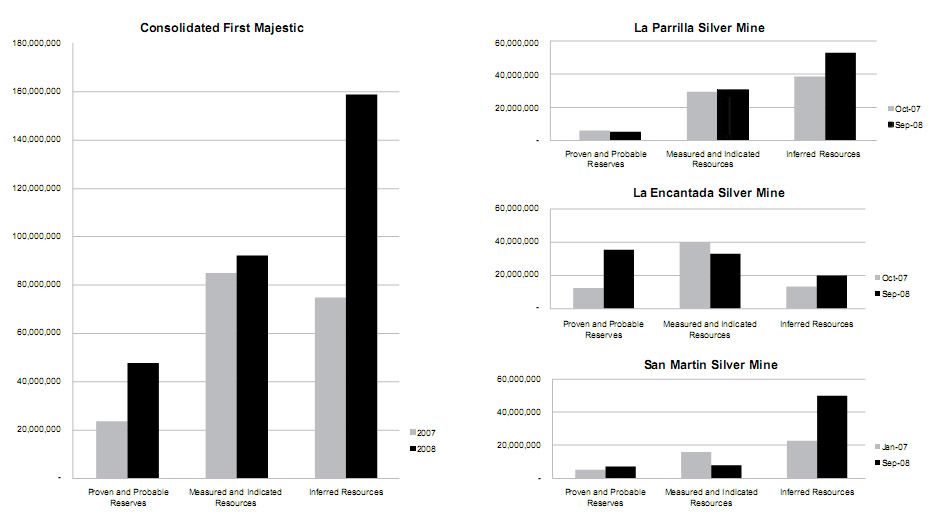

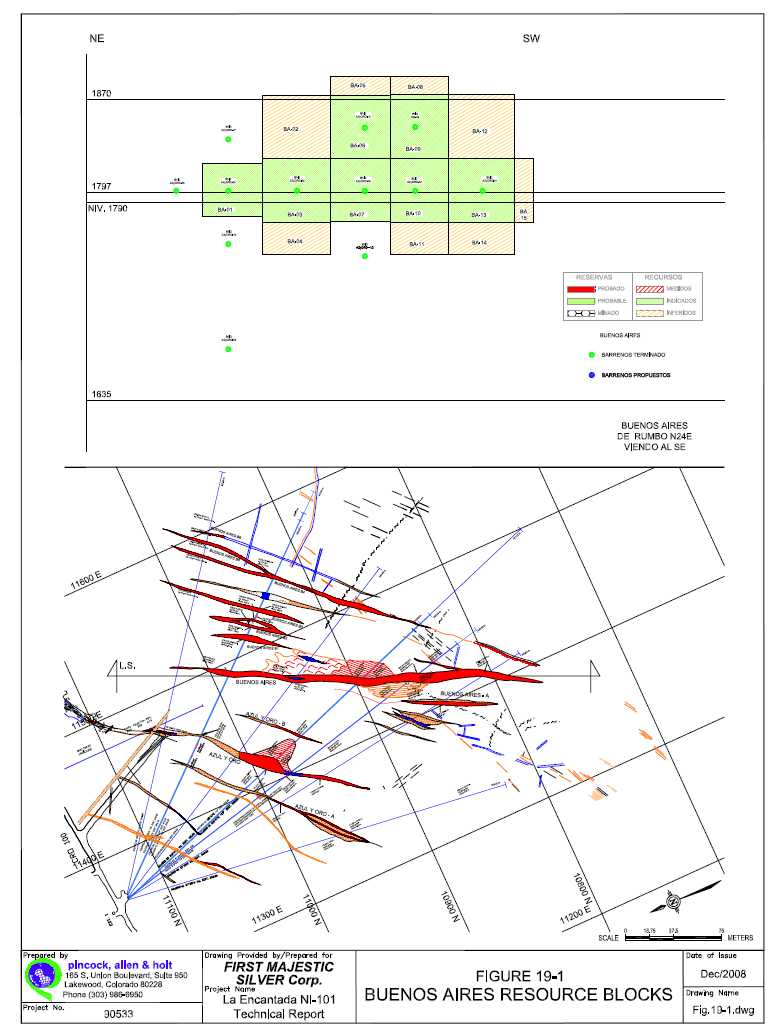

NI 43-101 CHART - see pg. 23

|

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 15

LA PARRILLA SILVER MINE, DURANGO, MEXICO

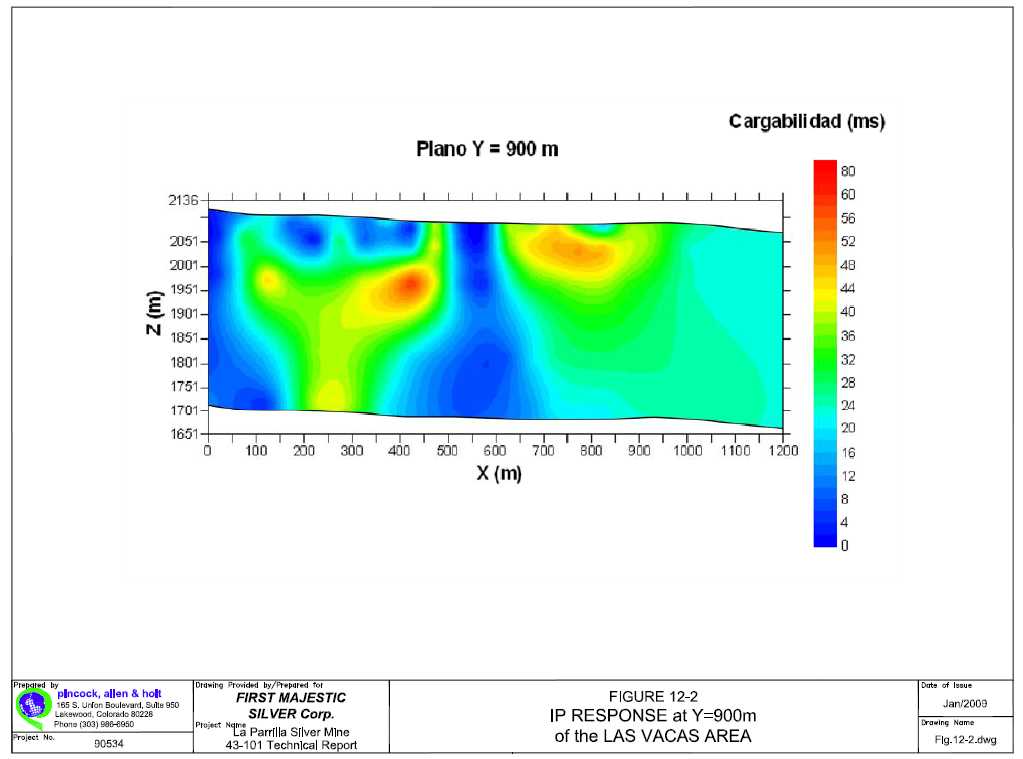

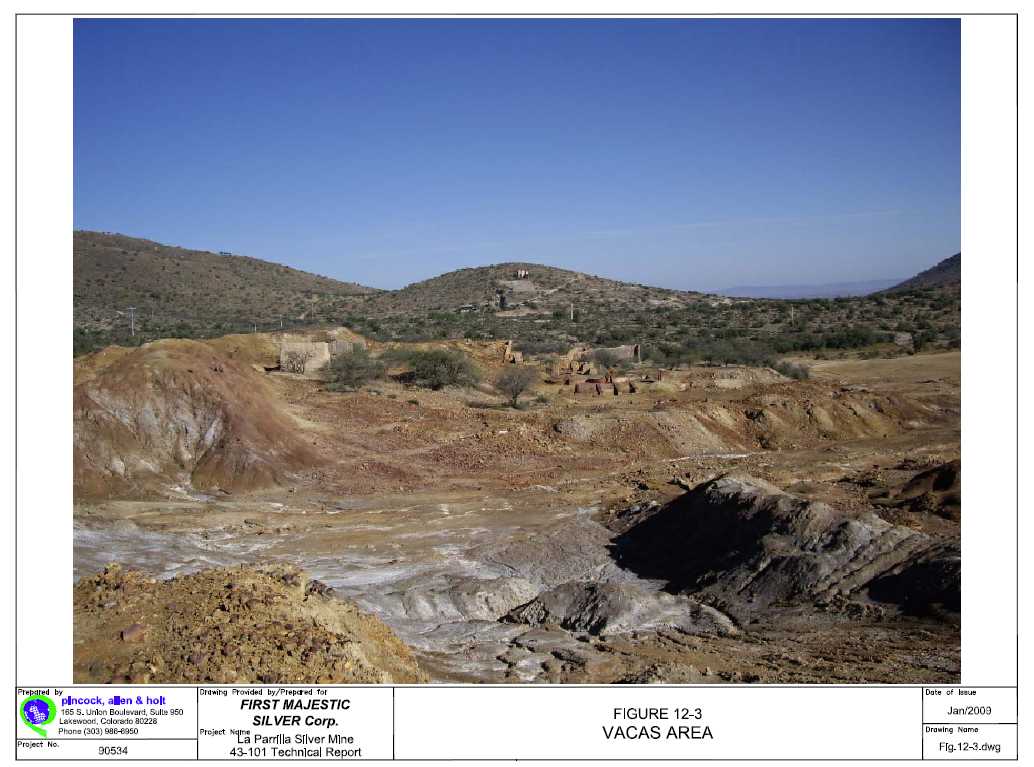

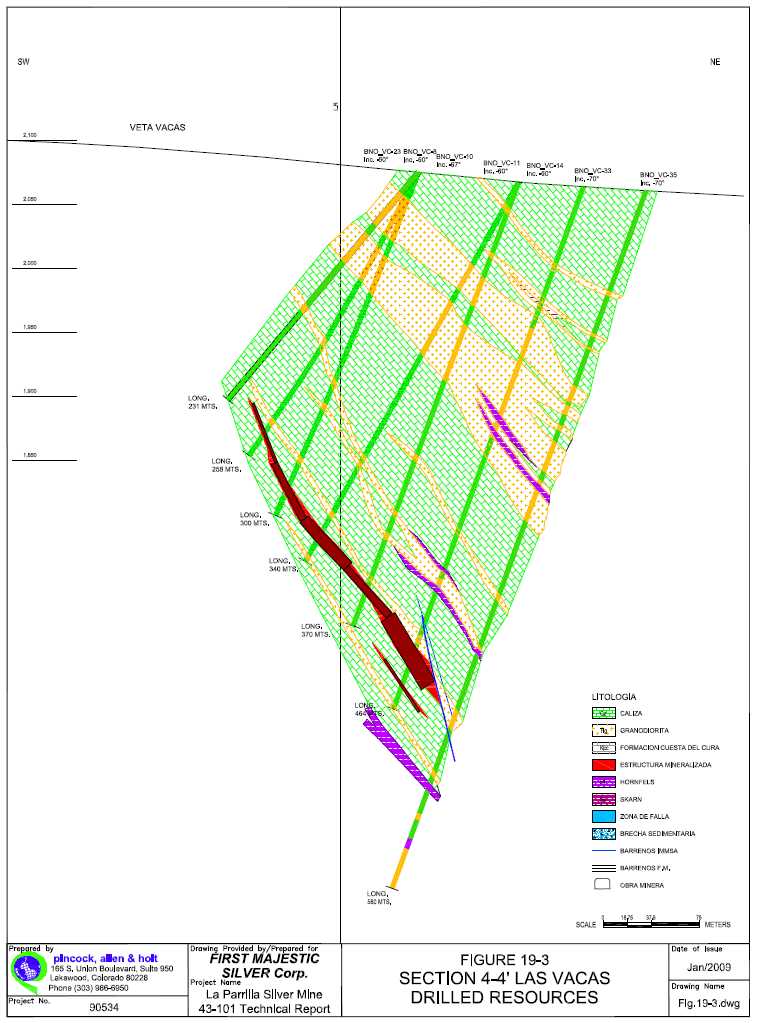

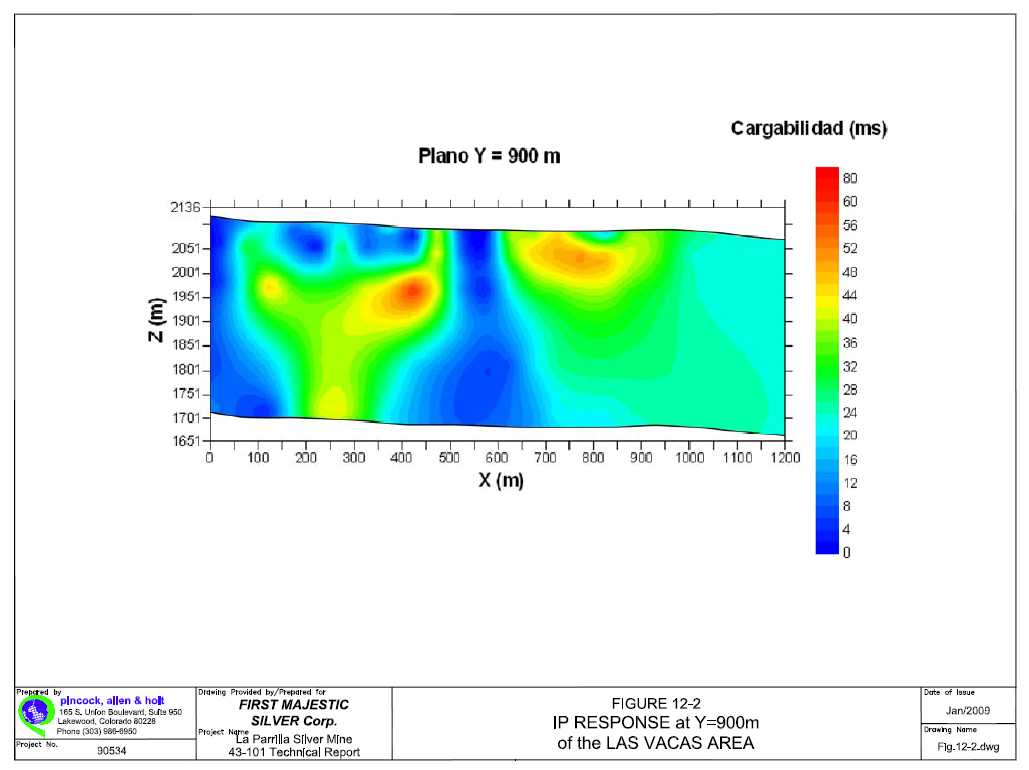

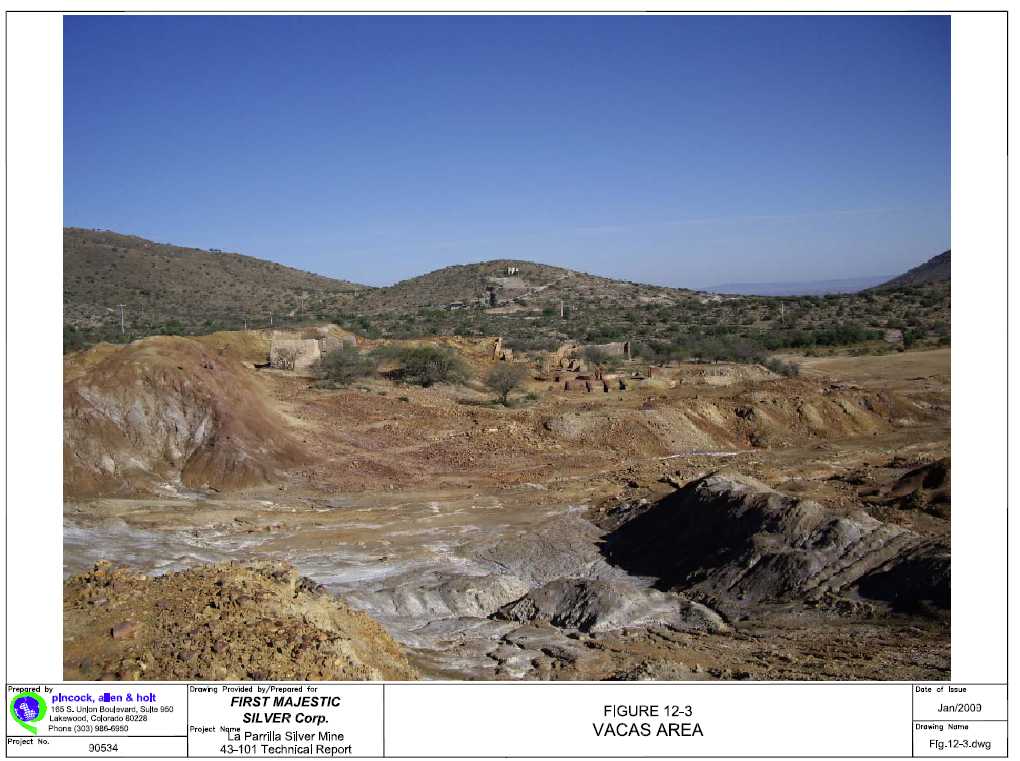

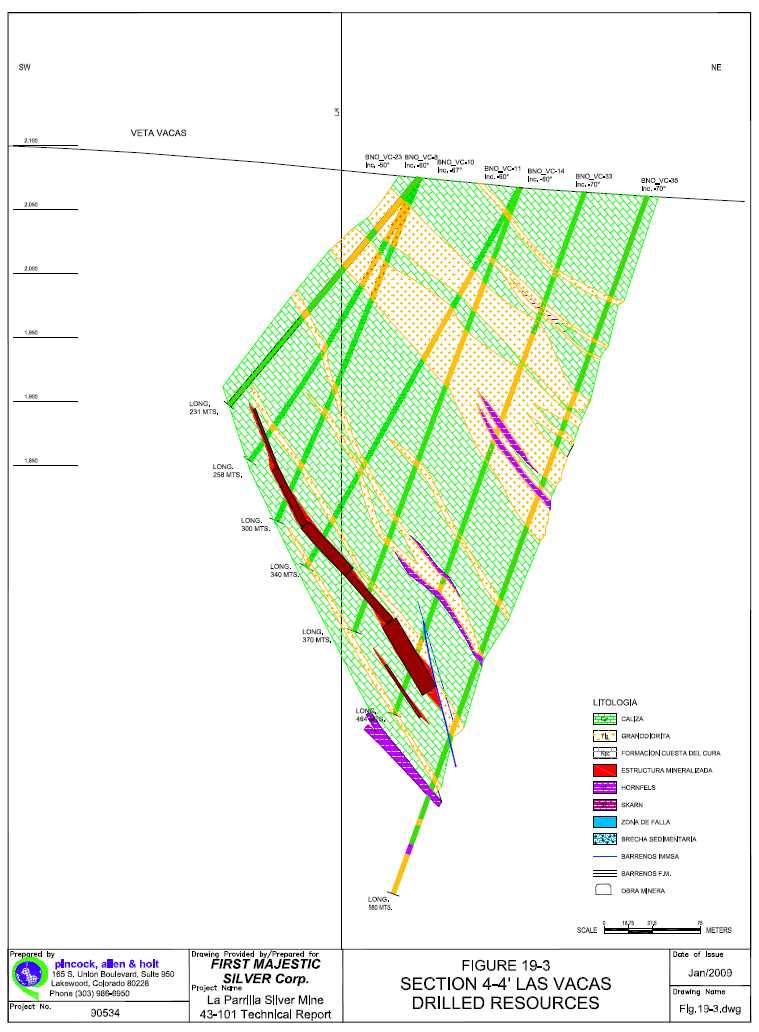

DISCOVERY AT LAS VACAS, UNDER DEVELOPMENT FOR PRODUCTION IN 2011

| LOCATION: DURANGO, MEXICO | |||||||

| 100% OWNERSHIP |

23,375 MONTHLY CAPACITY (TONNES) |

423 EMPLOYEES |

1,643,207 2009 PRODUCTION (SILVER EQ. OZ.) |

US$4.26 2009 DIRECT CASH COSTS PER OUNCE |

US$7.84 2009 CASH COSTS PER OUNCE (ALL IN) |

US$38.60 2009 TOTAL COSTS PER TONNE |

1,600,000 2010 PROJECTED SILVER EQ. OZ. PRODUCTION |

16

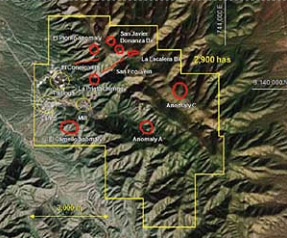

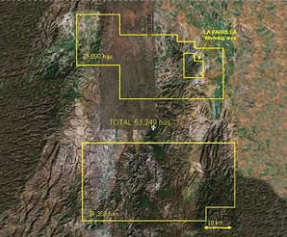

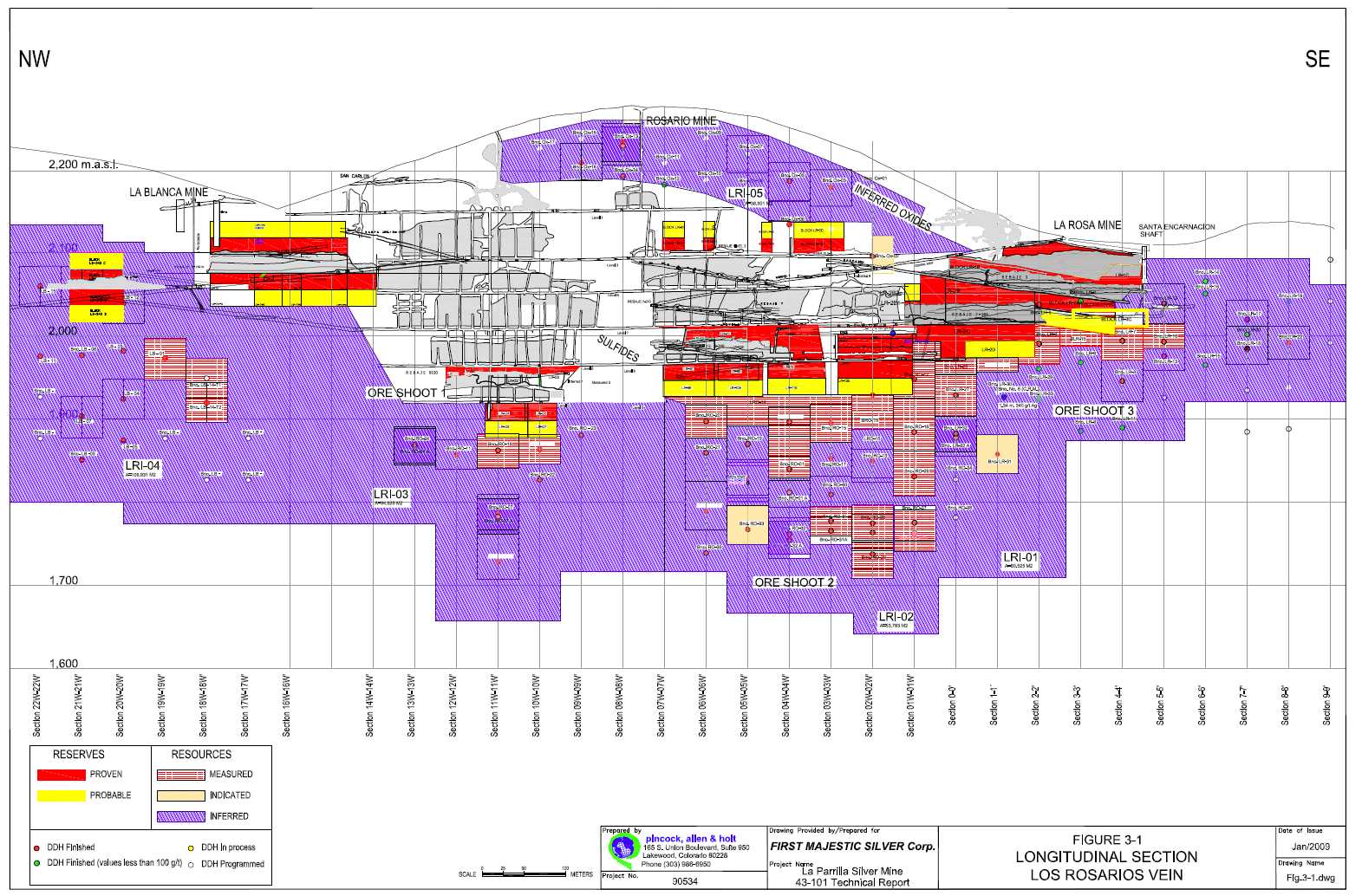

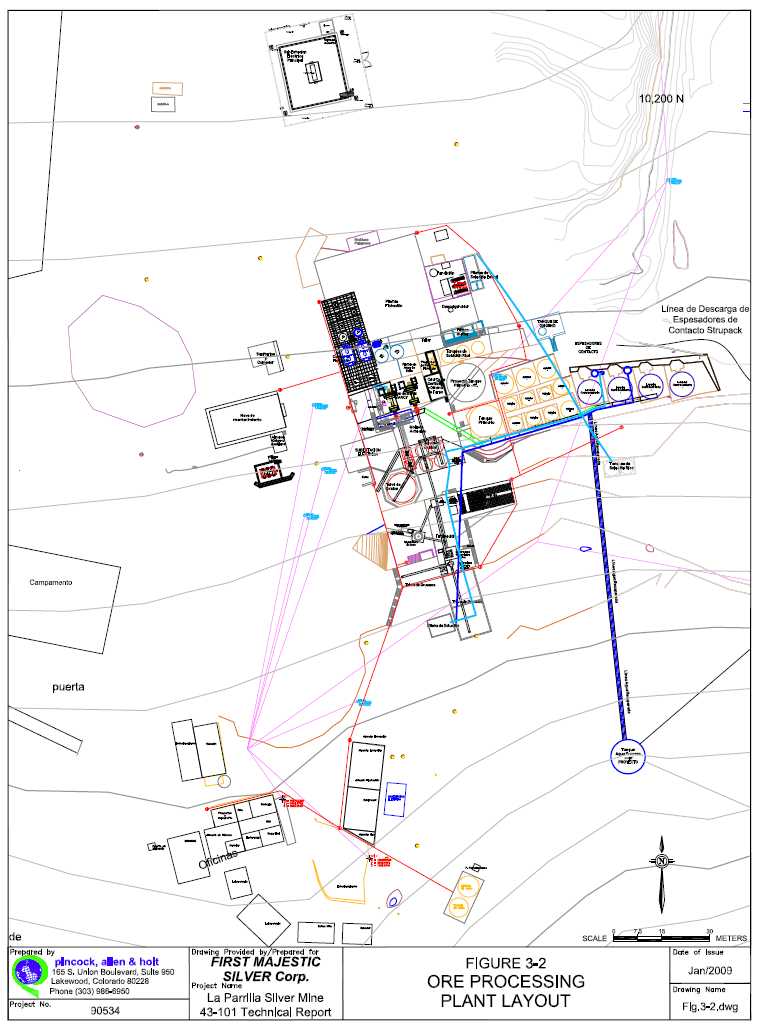

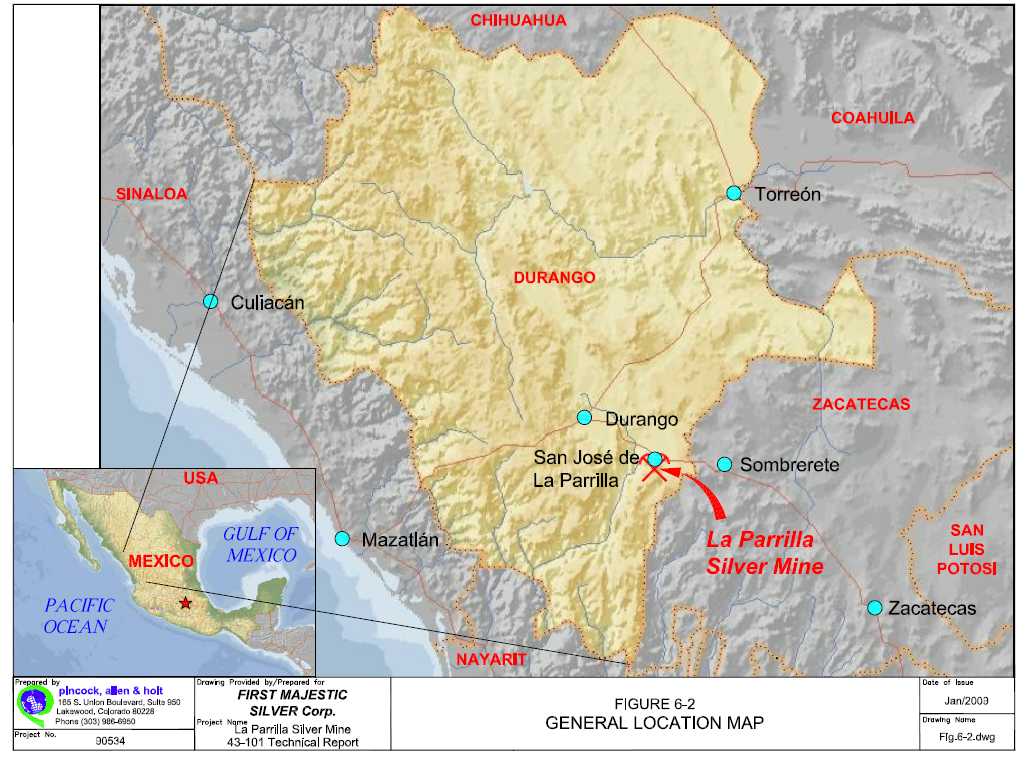

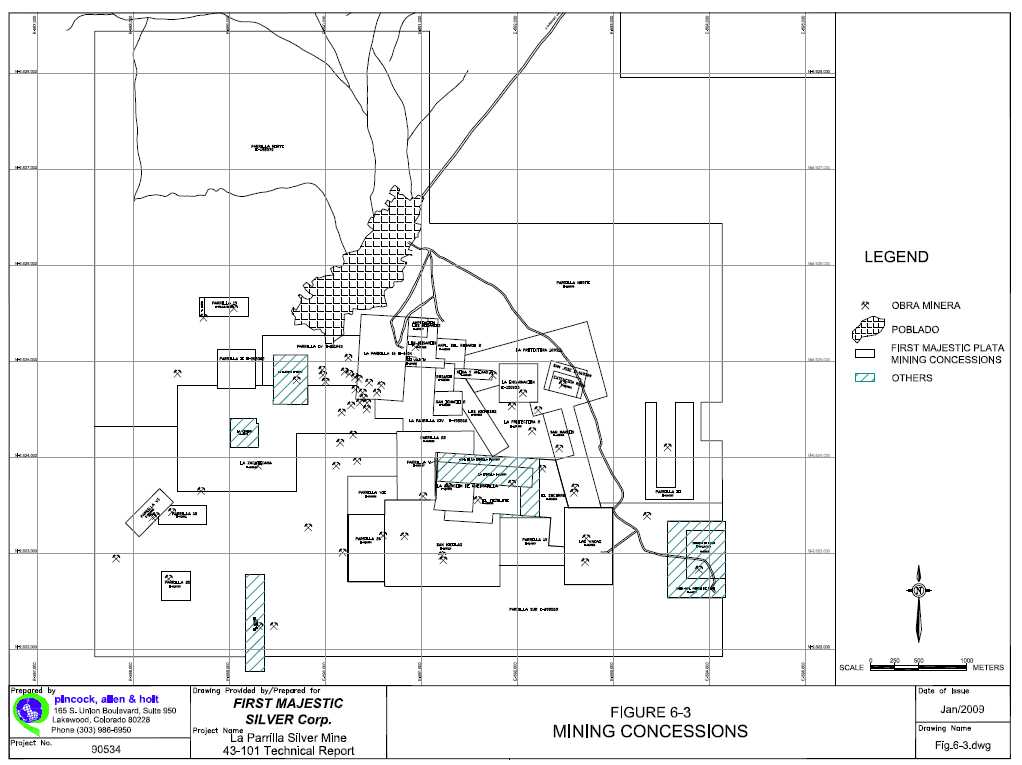

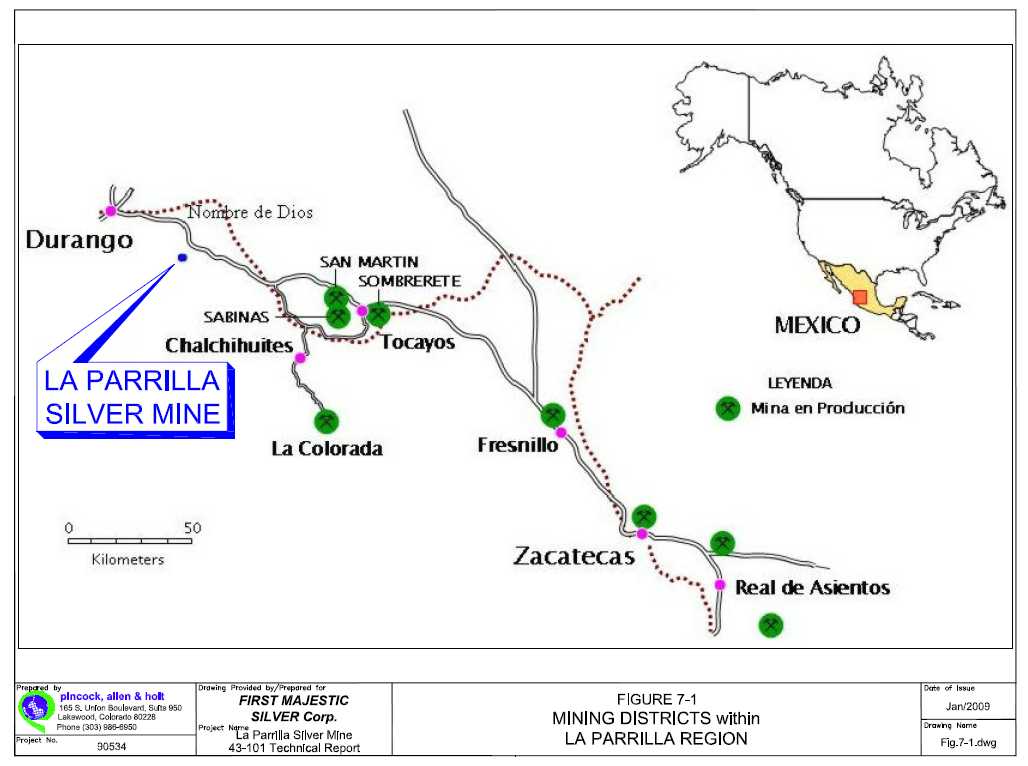

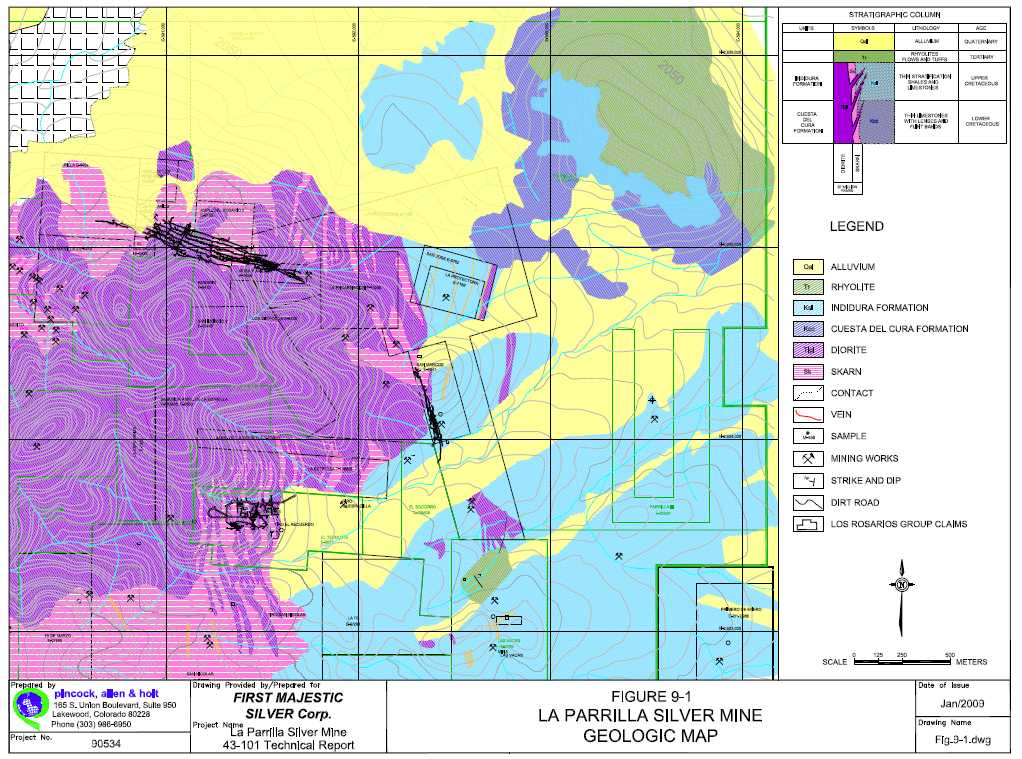

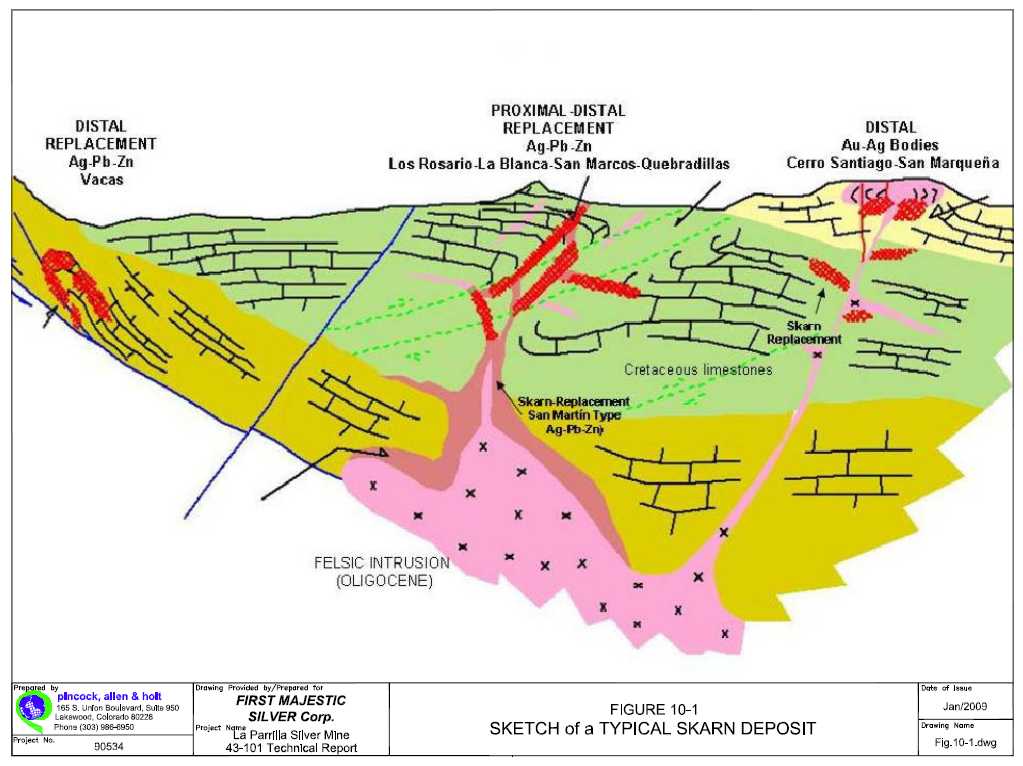

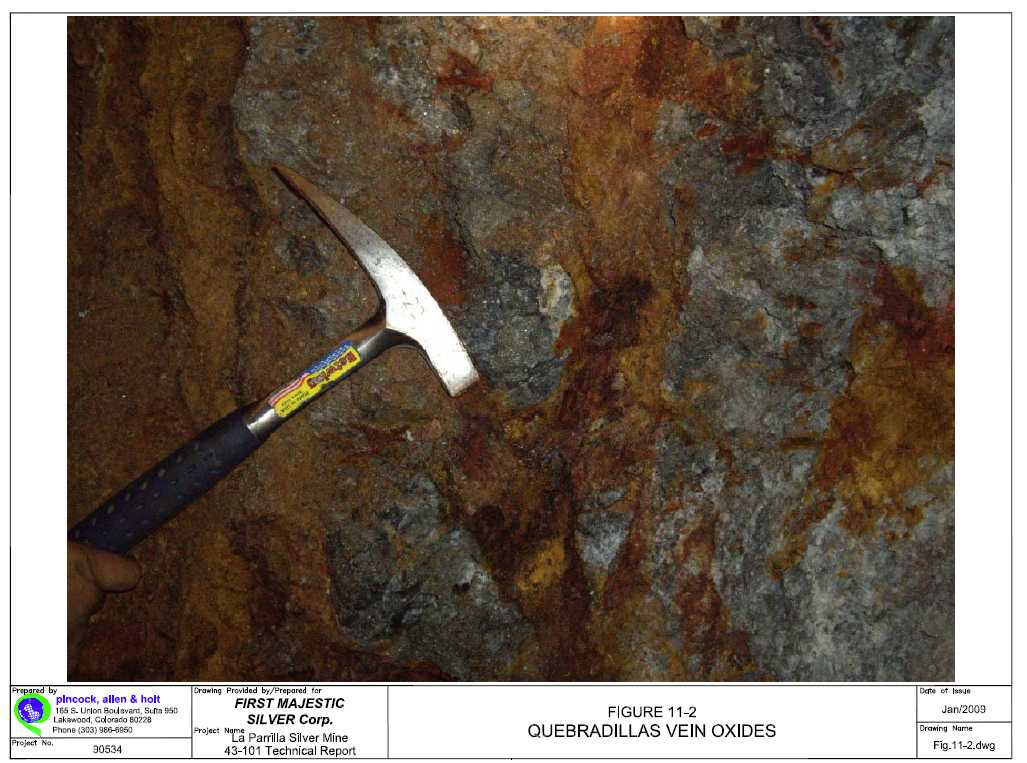

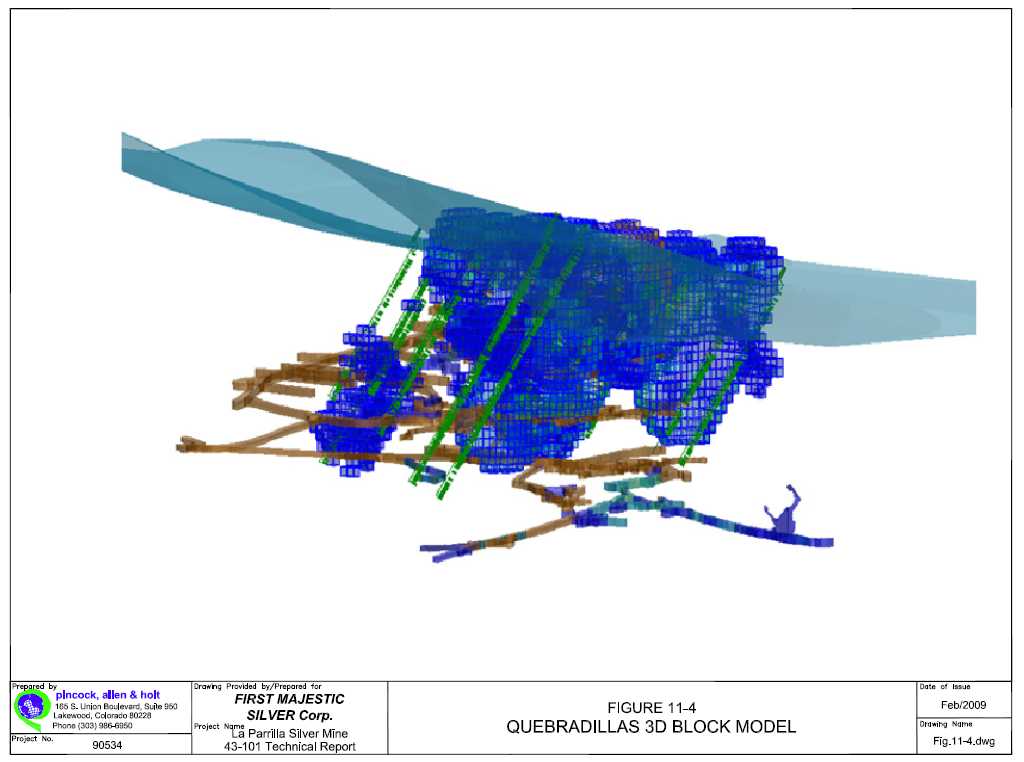

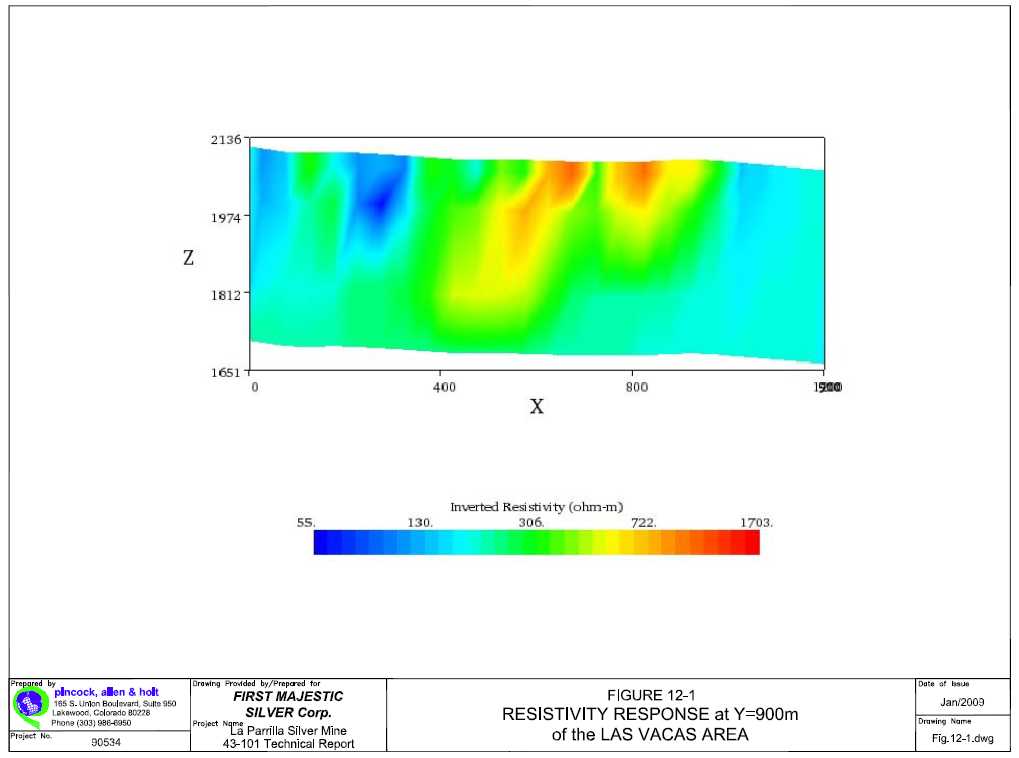

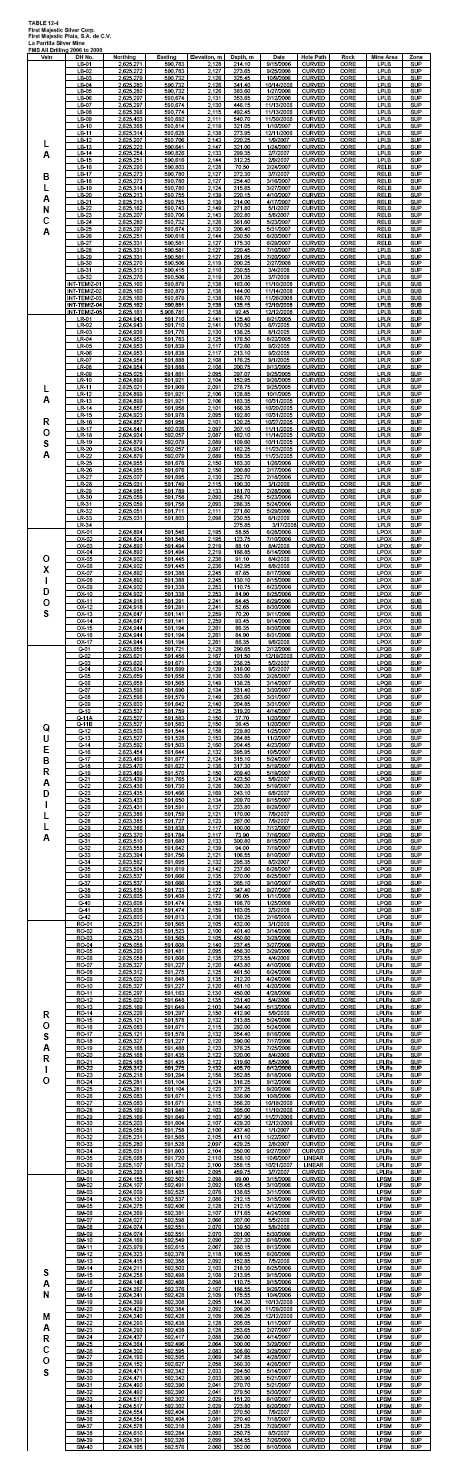

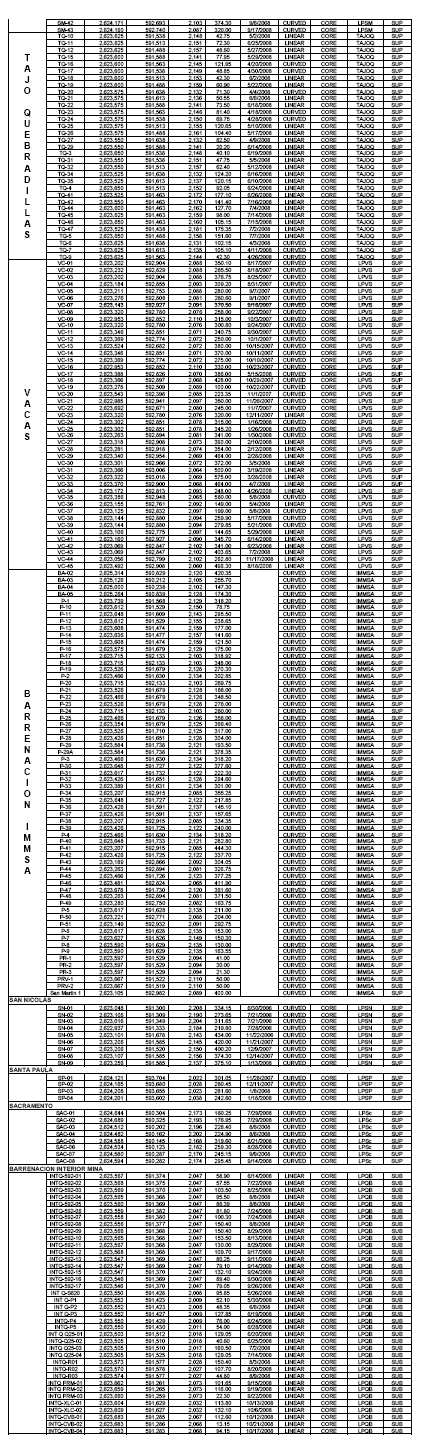

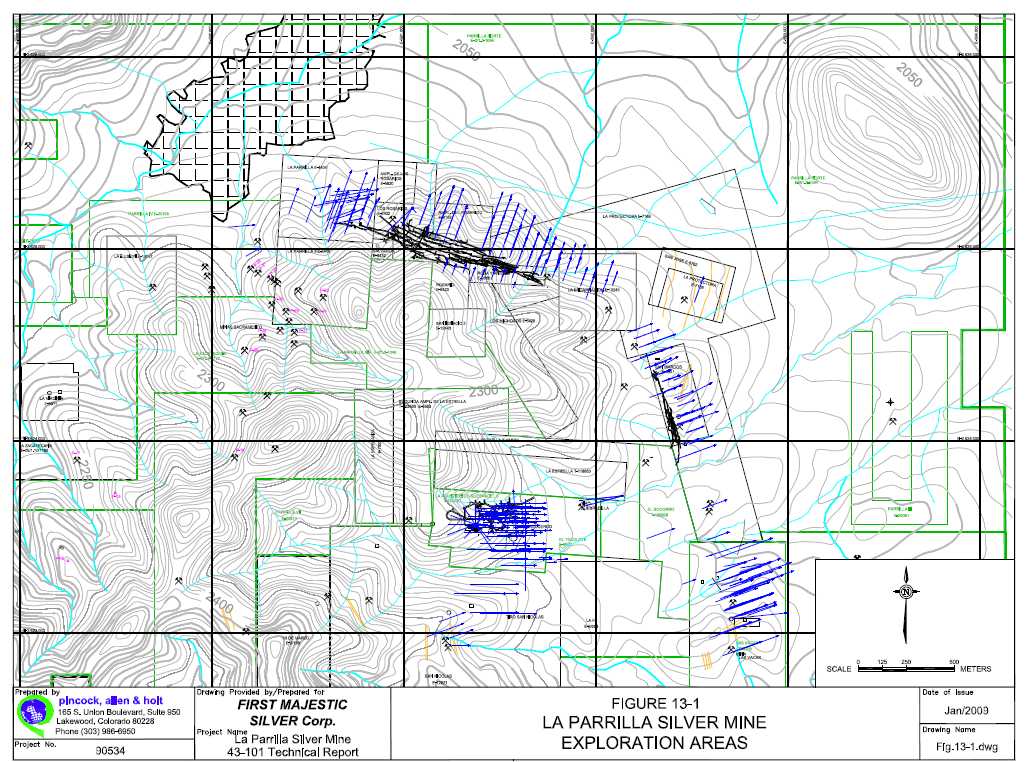

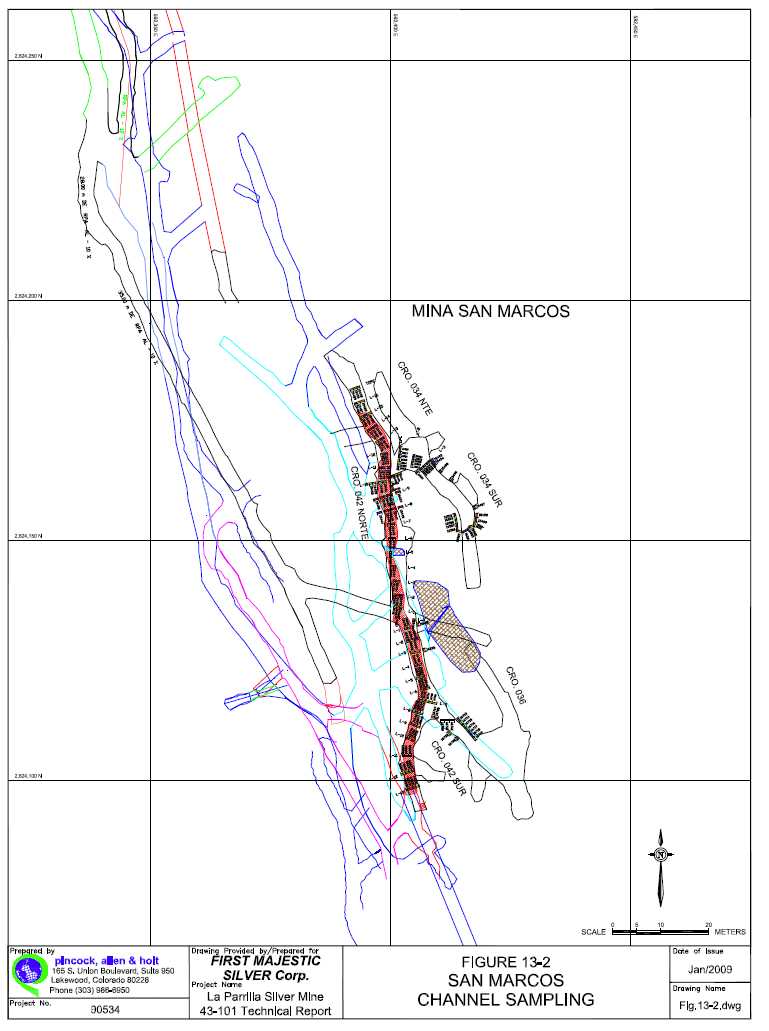

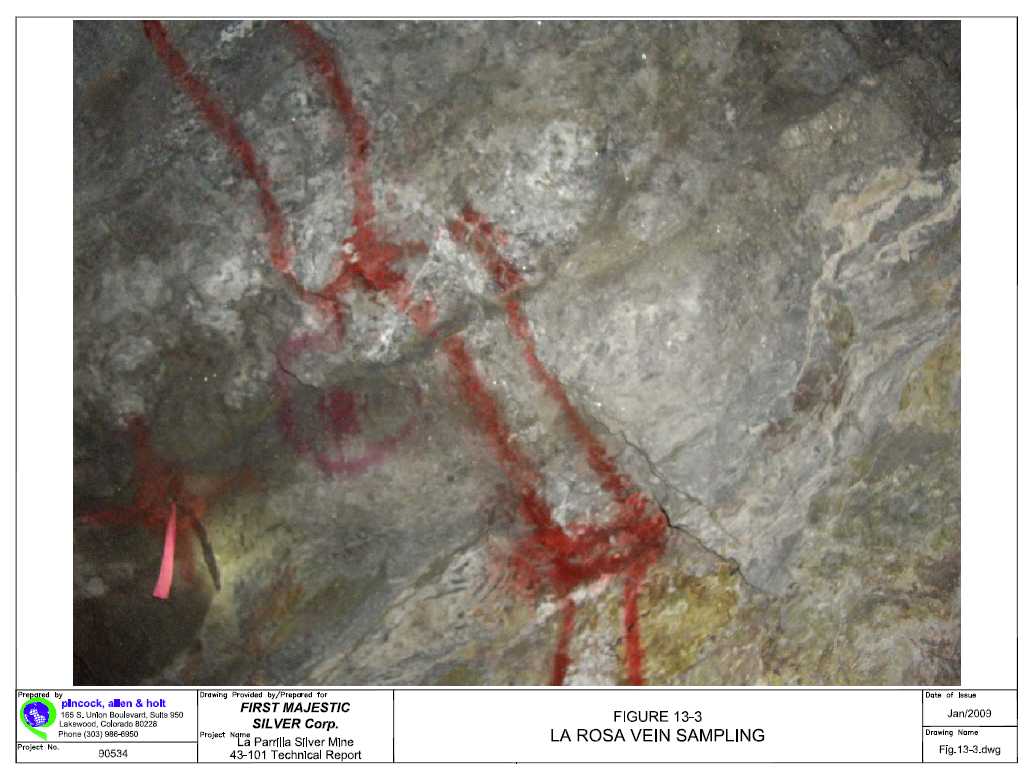

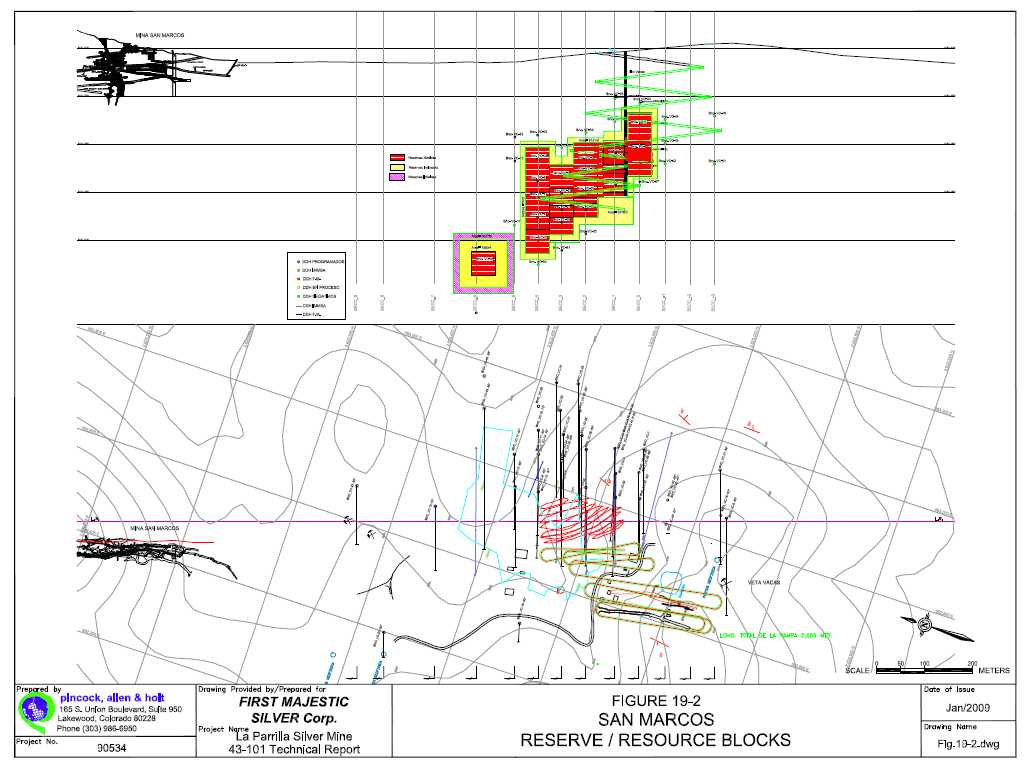

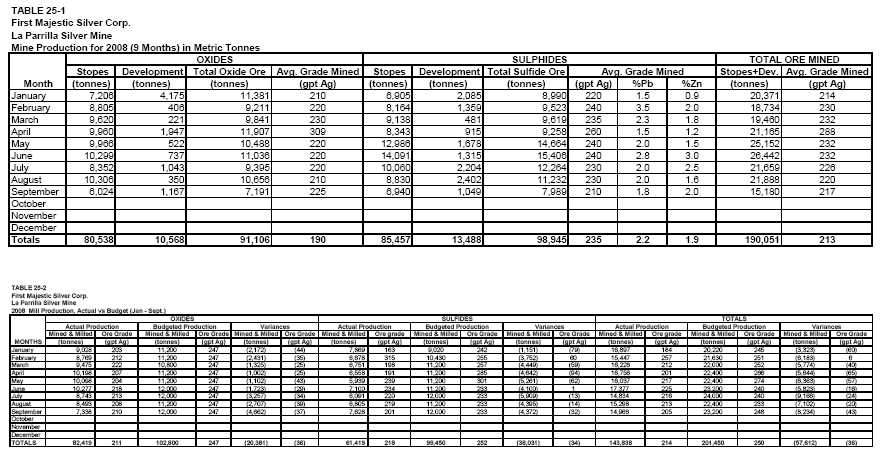

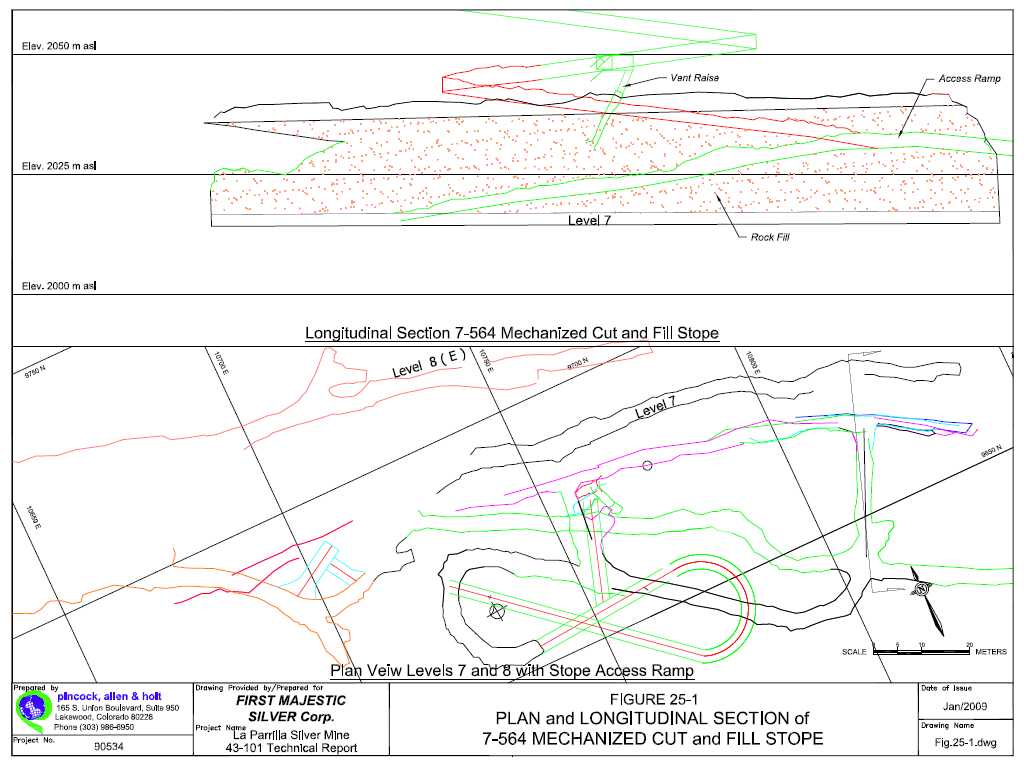

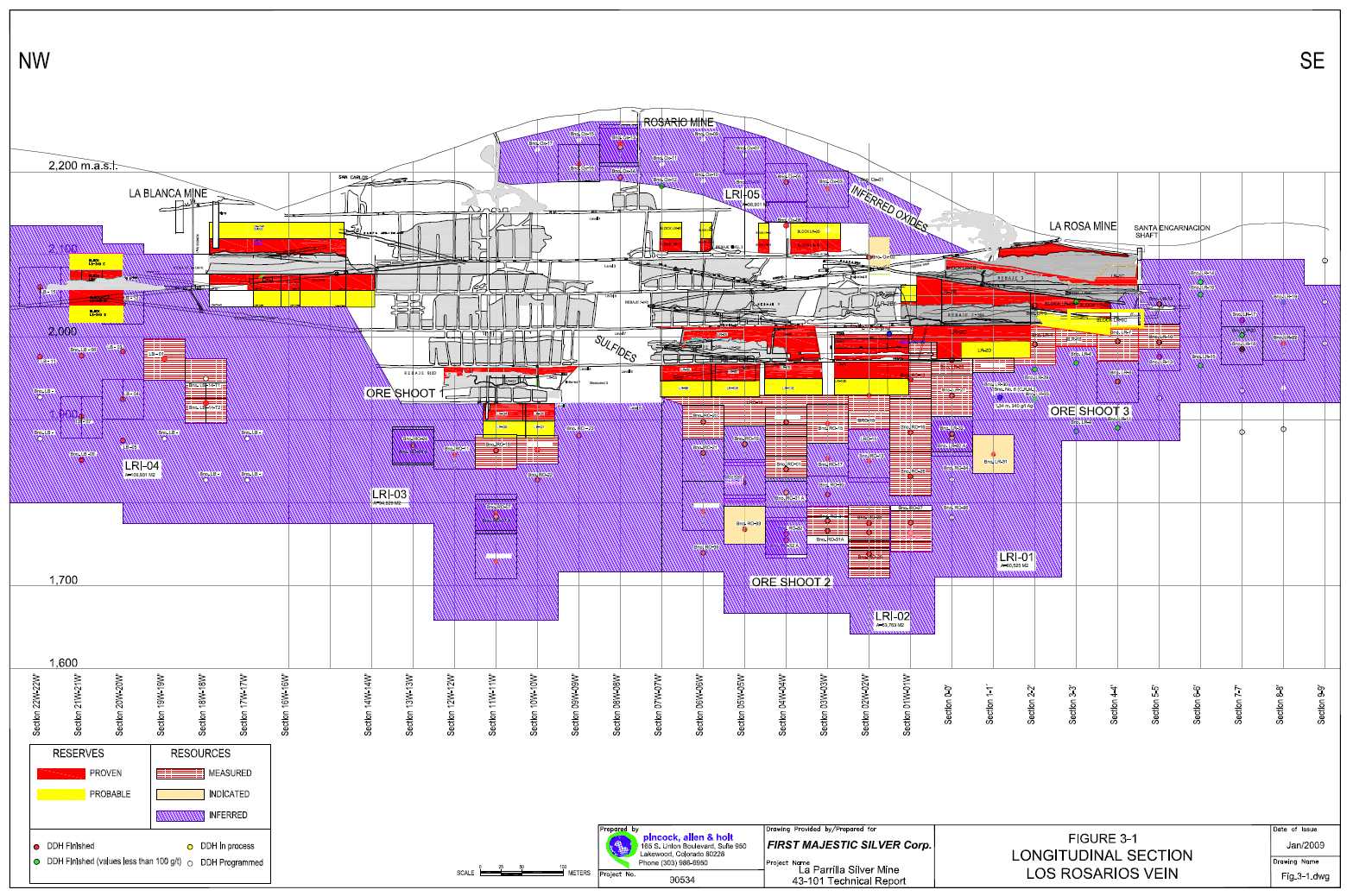

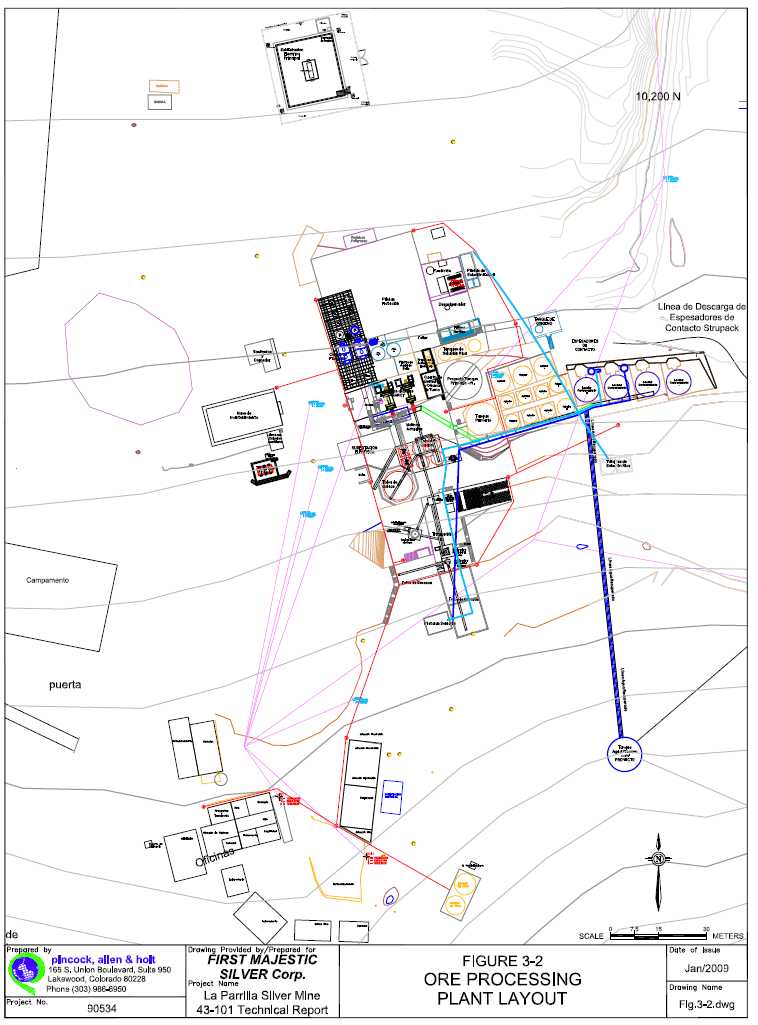

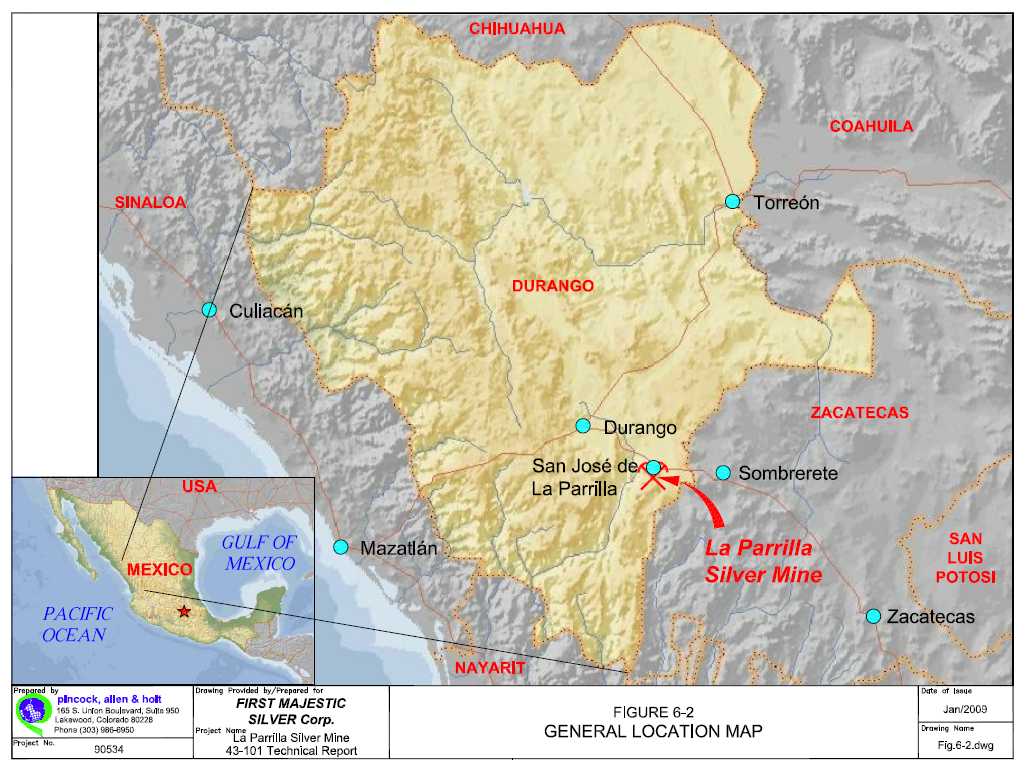

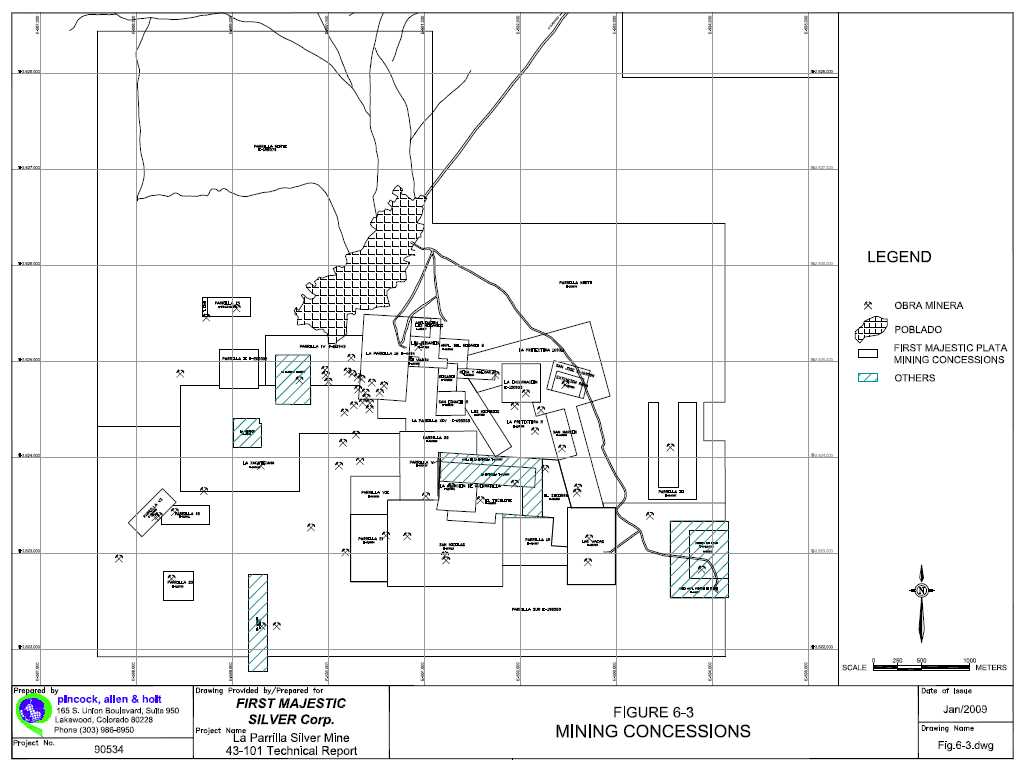

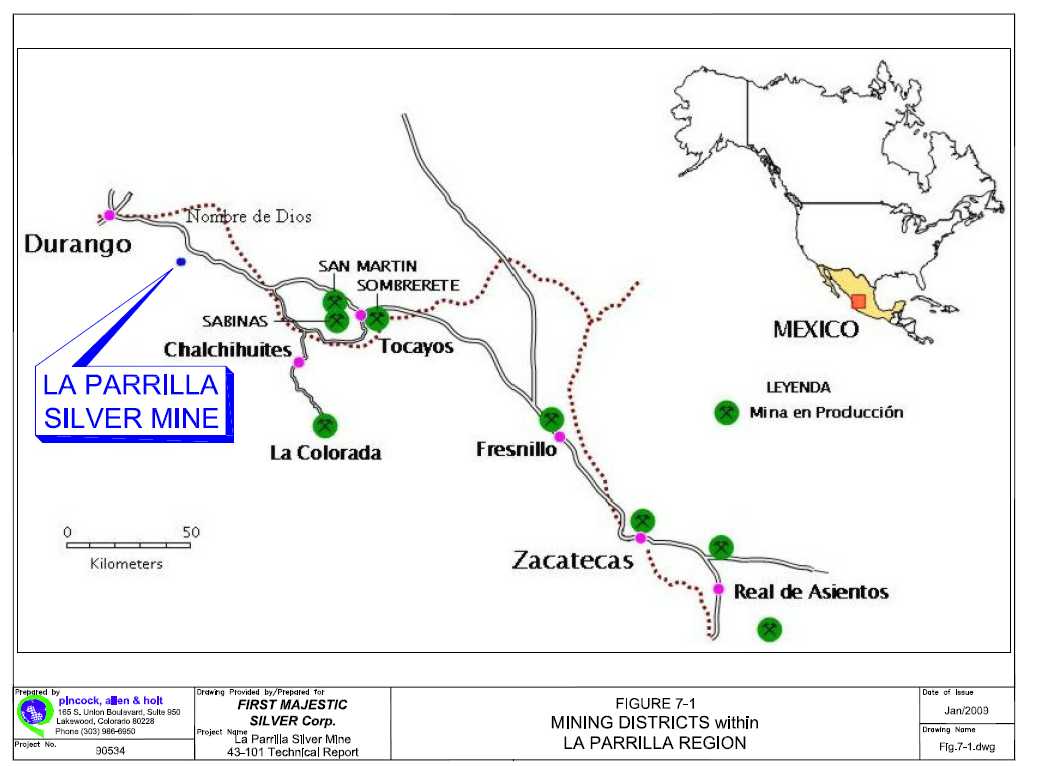

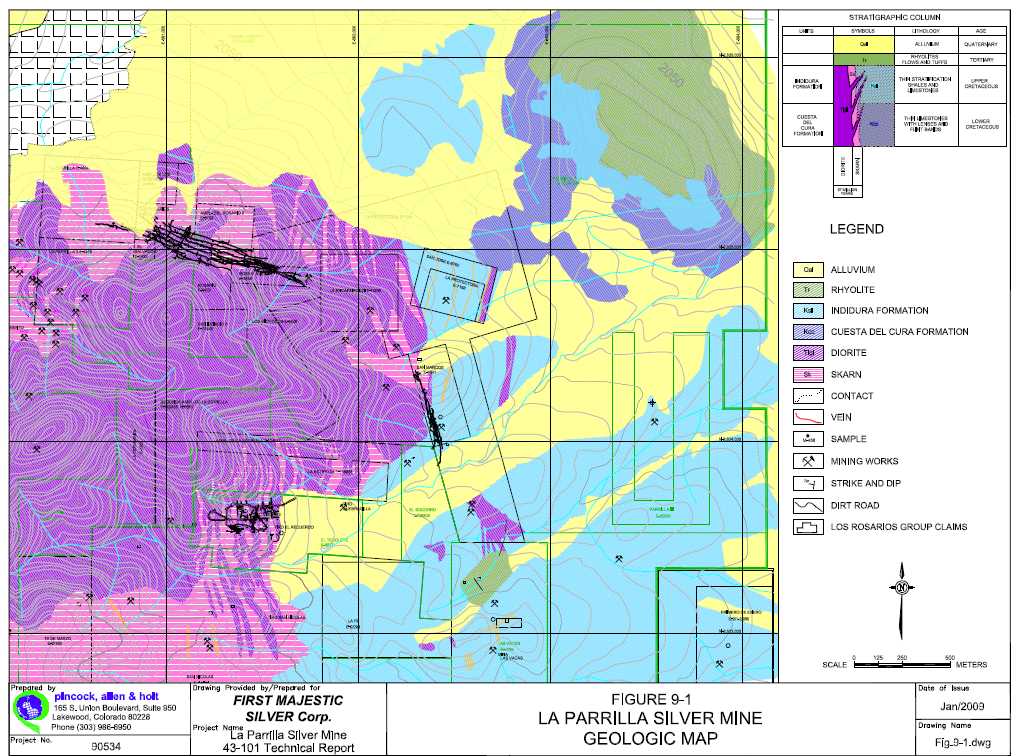

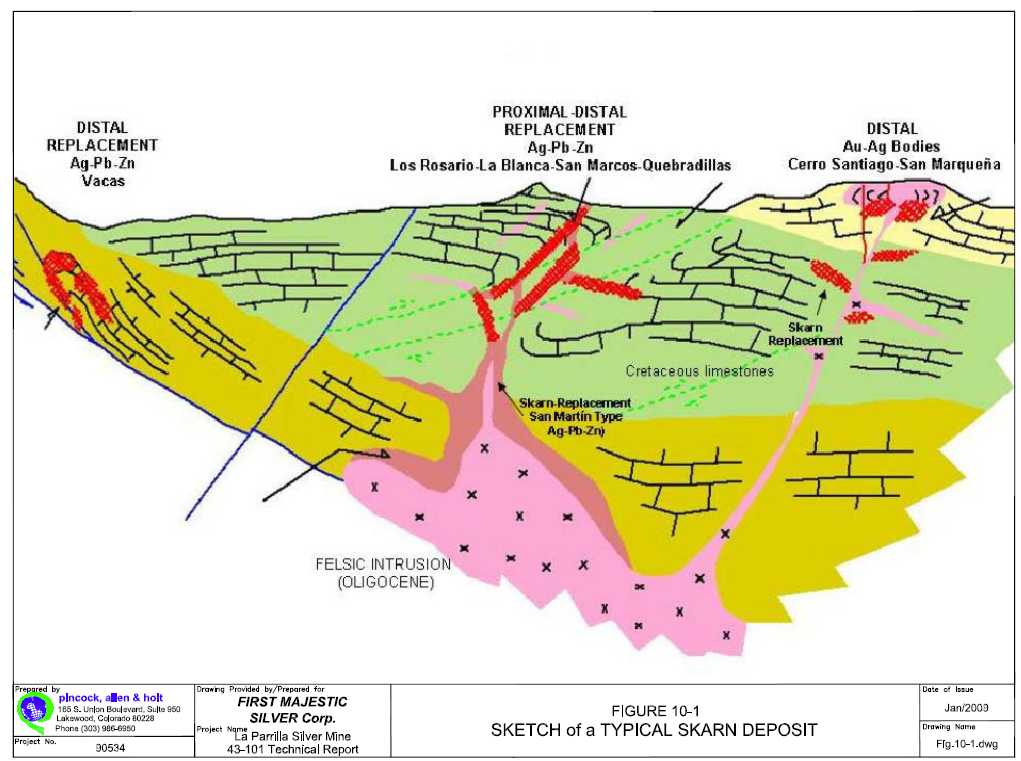

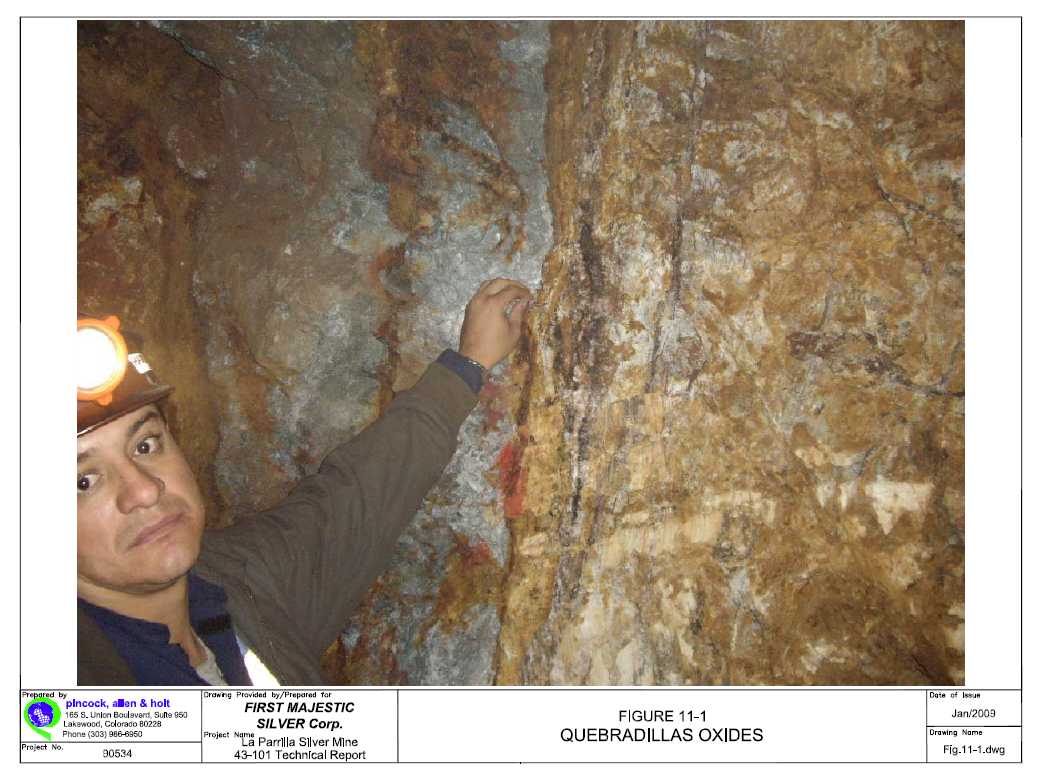

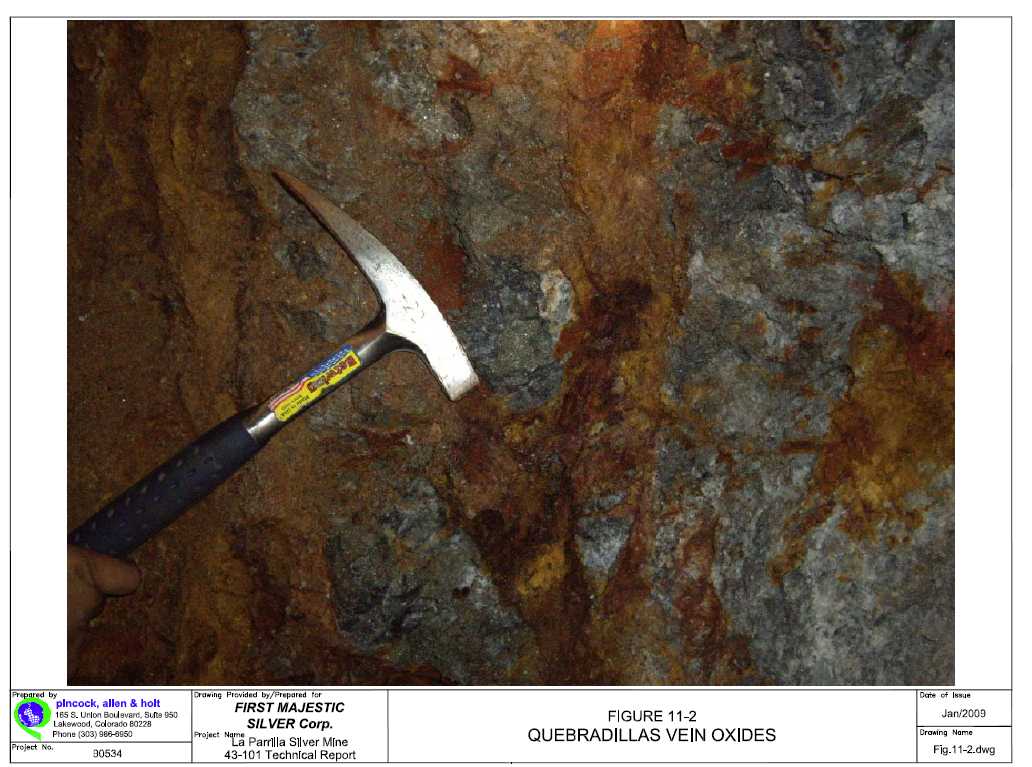

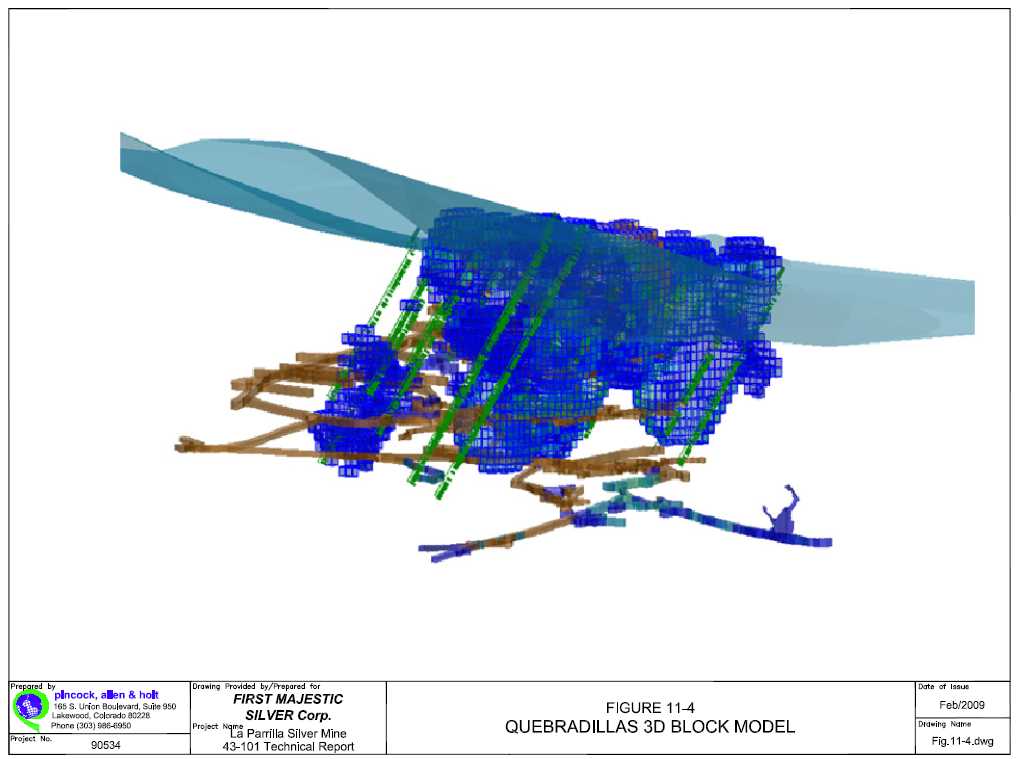

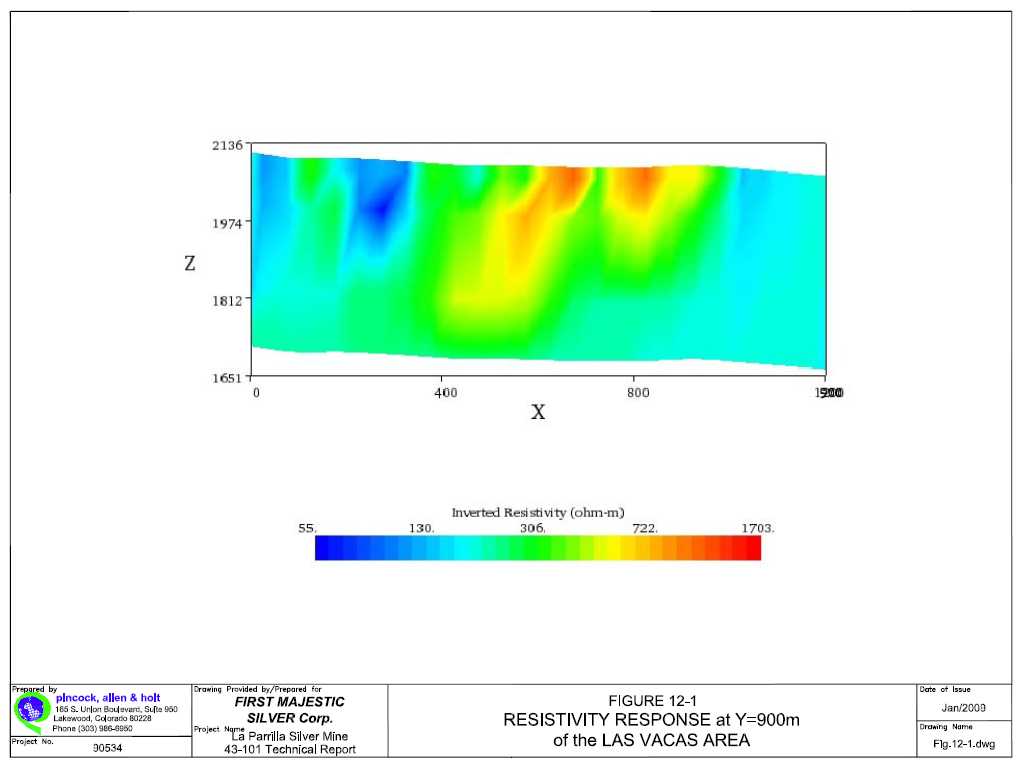

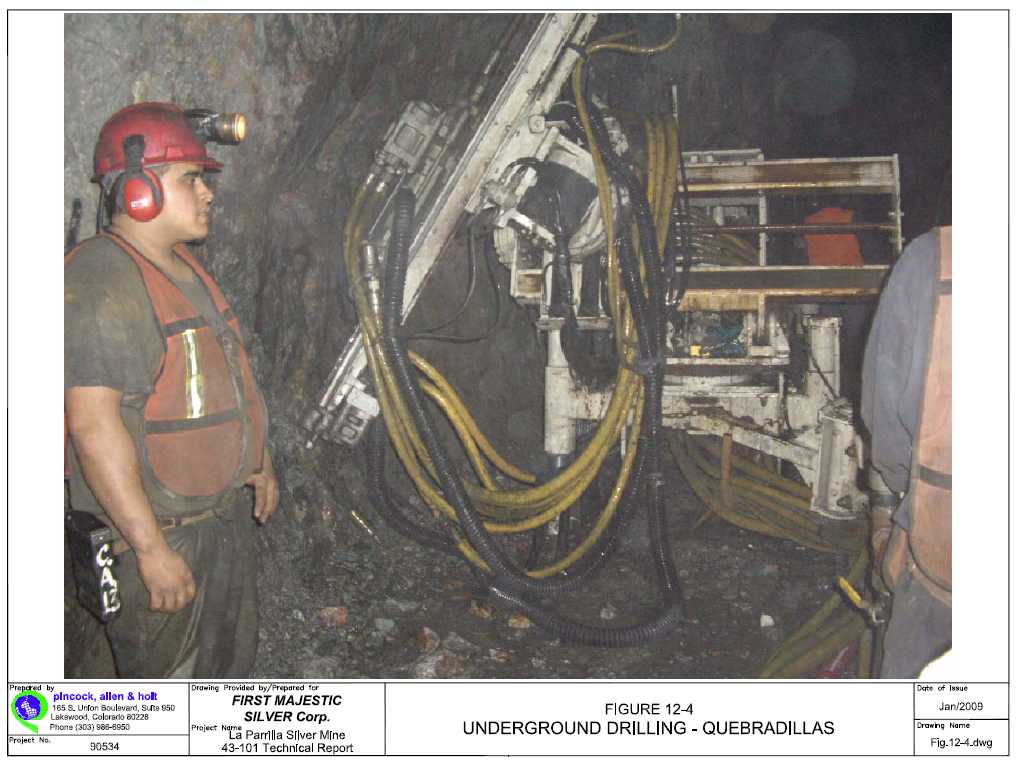

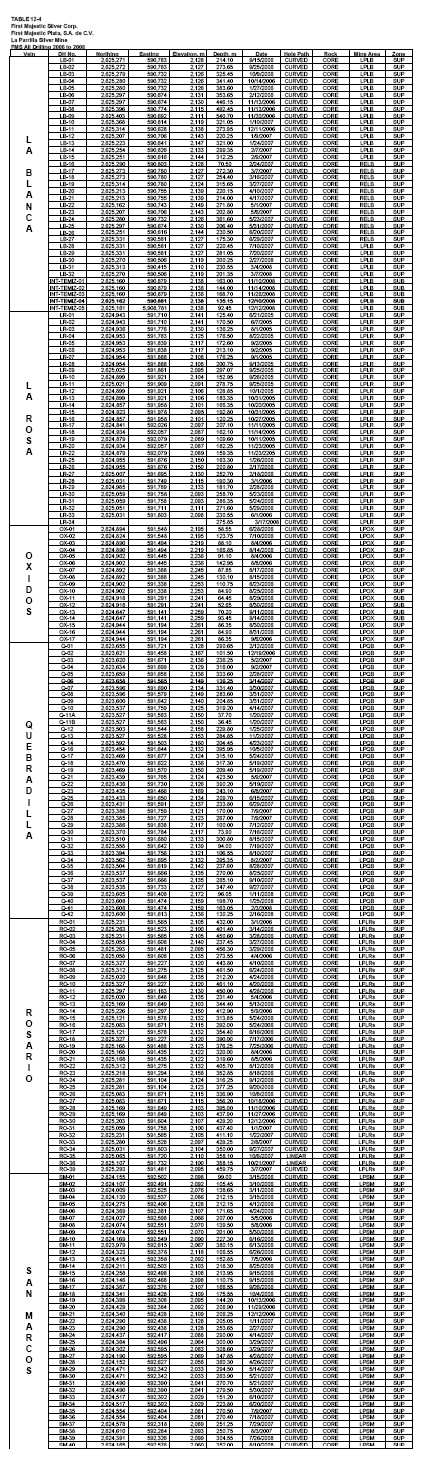

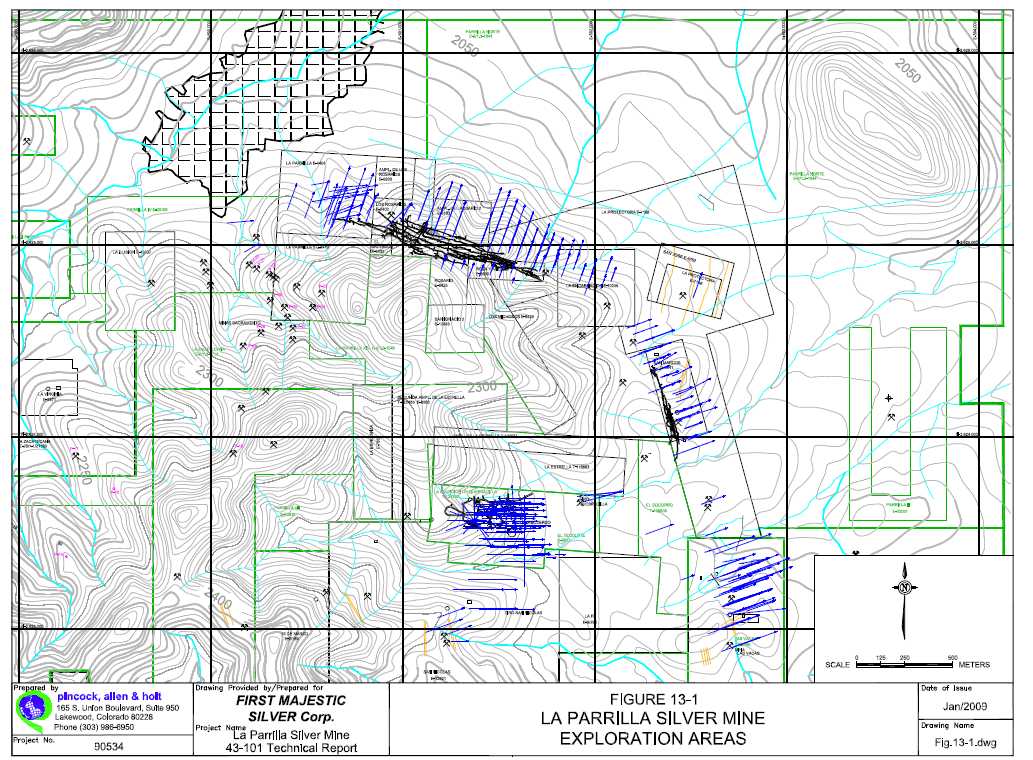

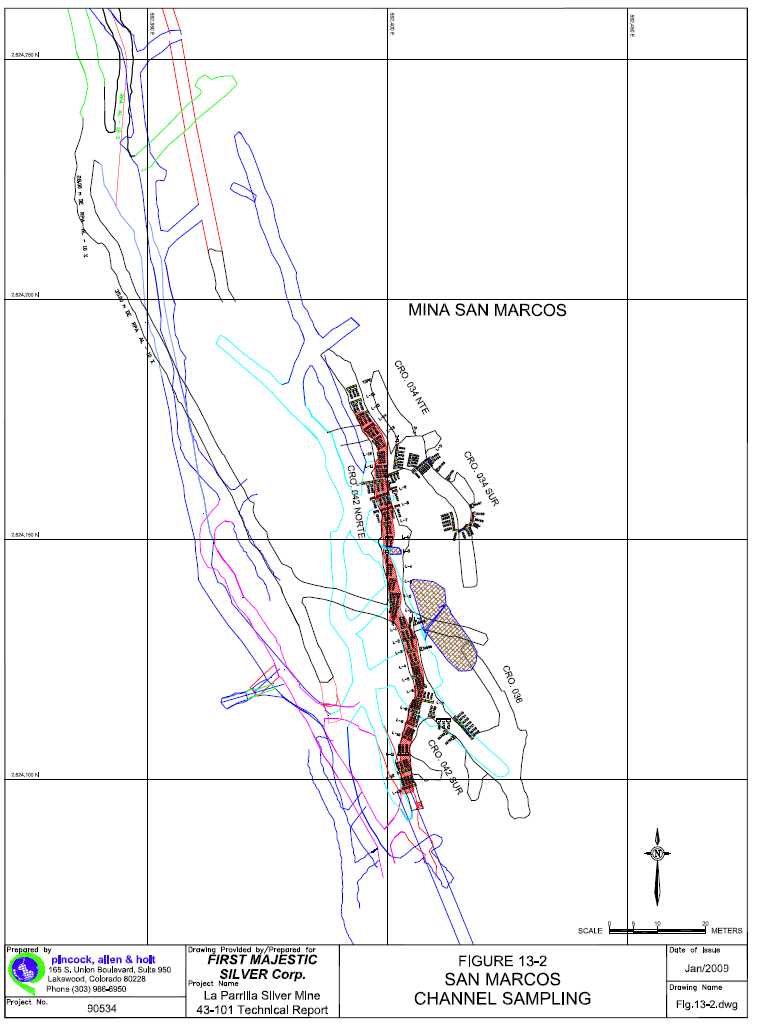

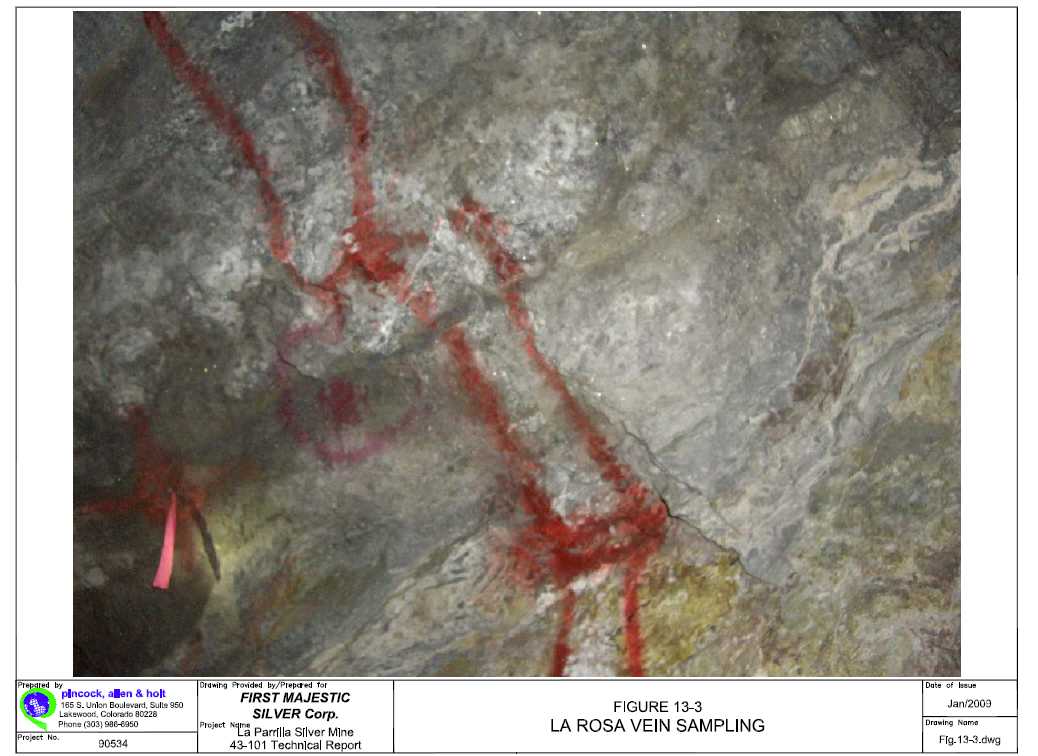

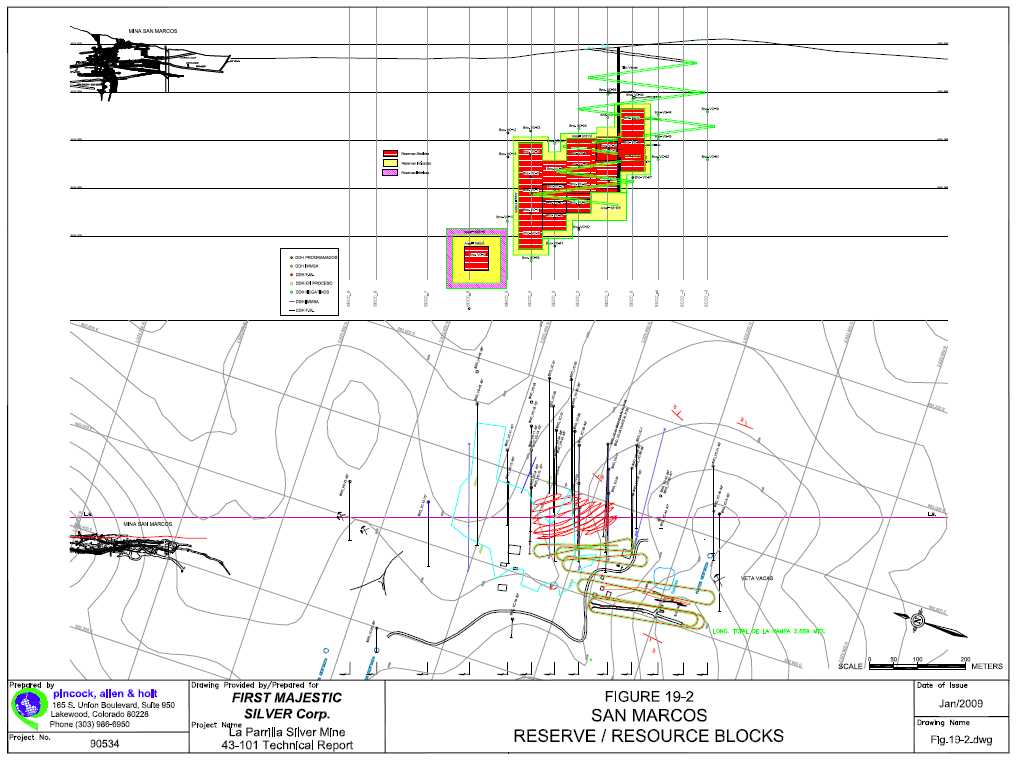

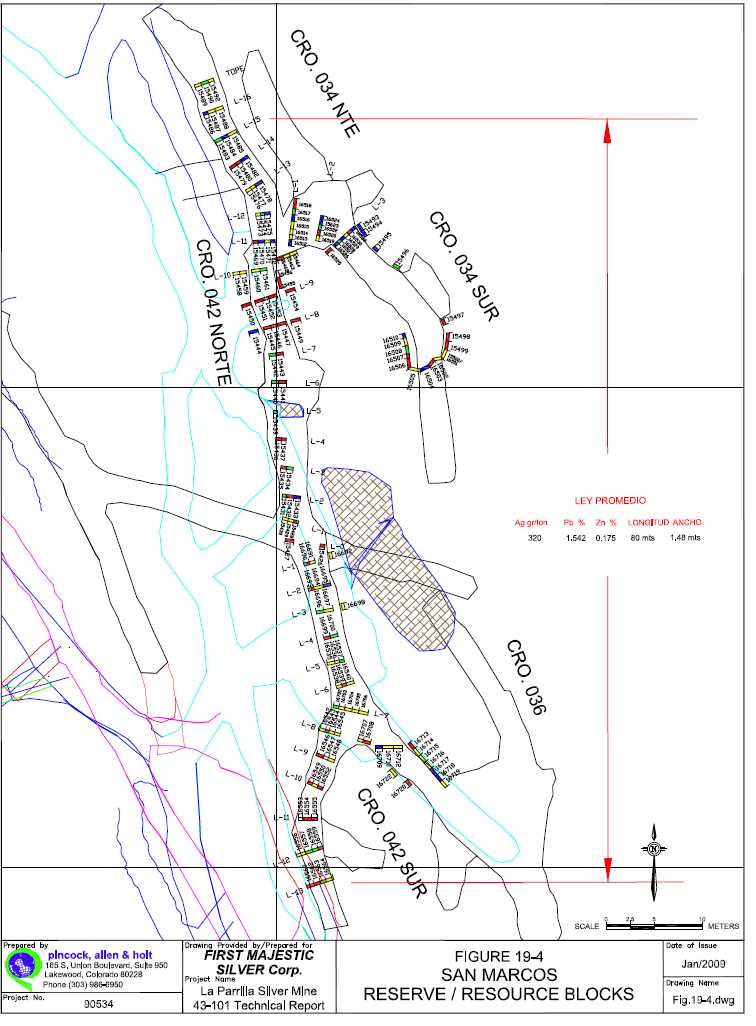

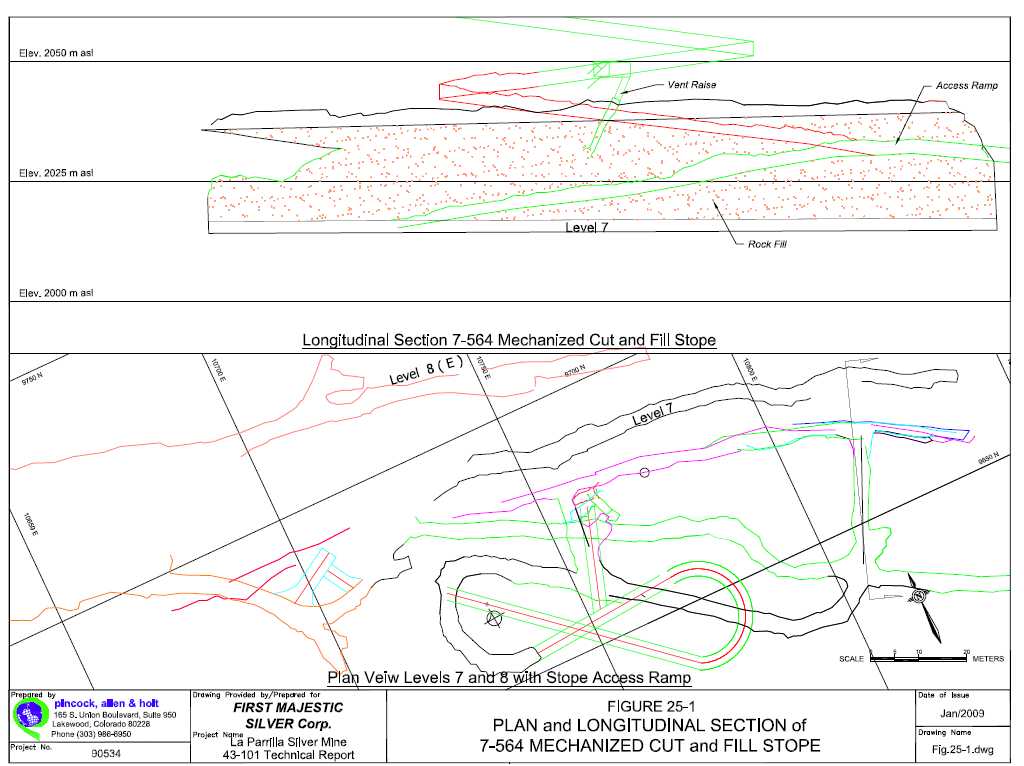

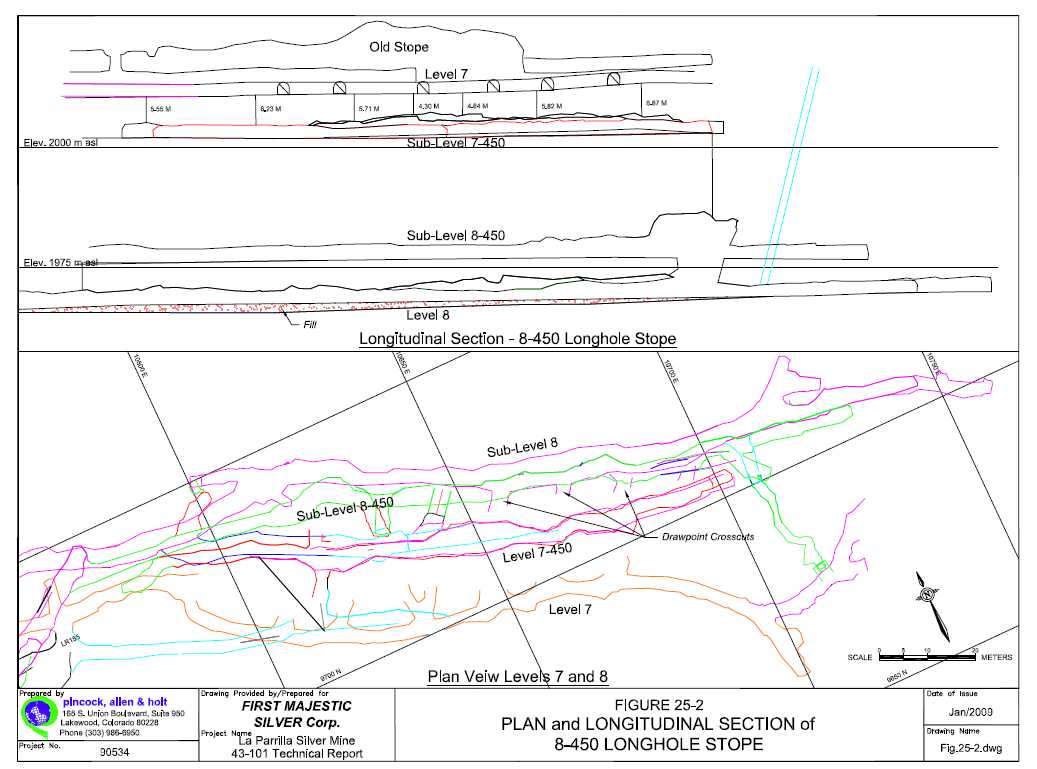

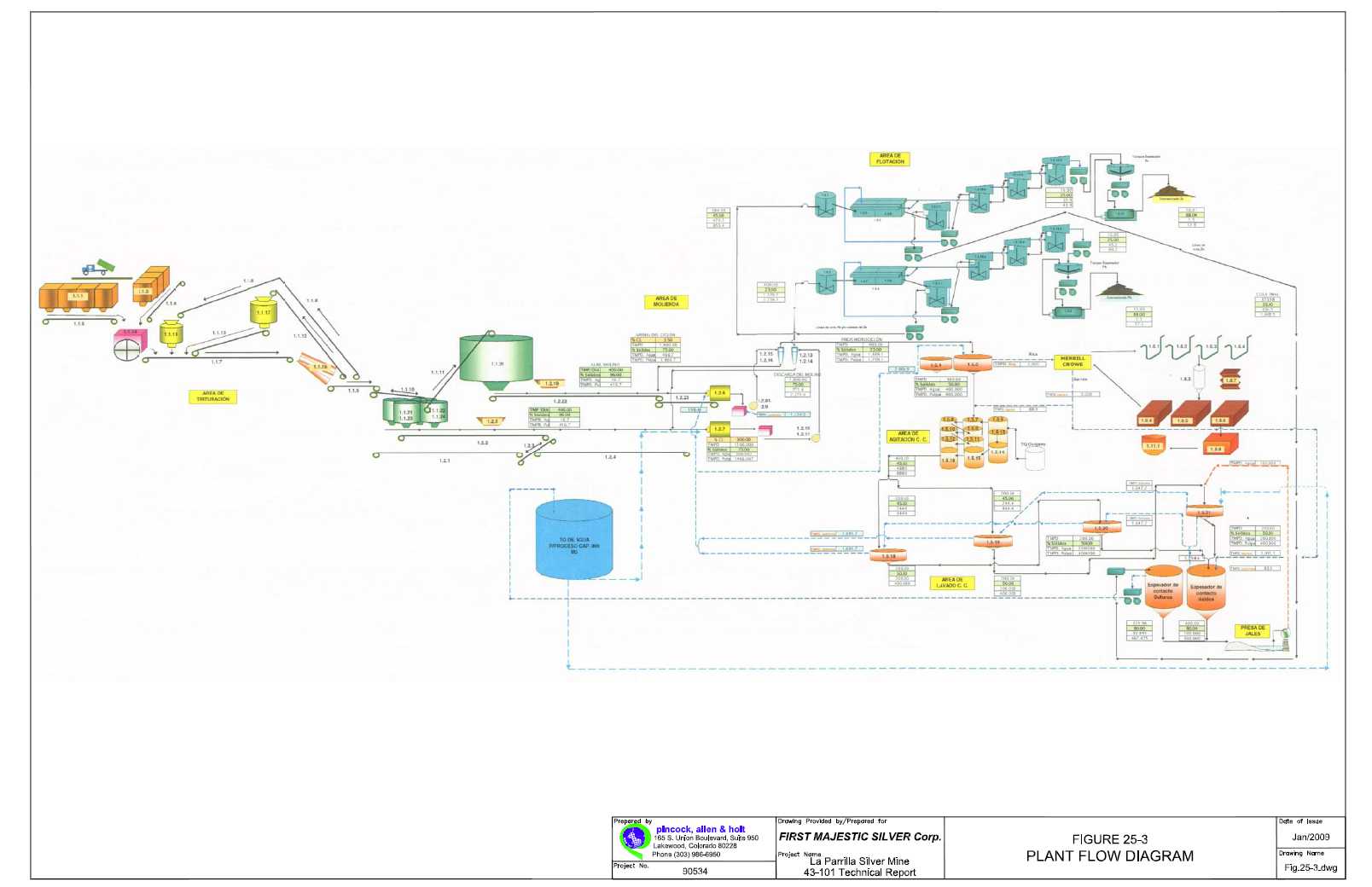

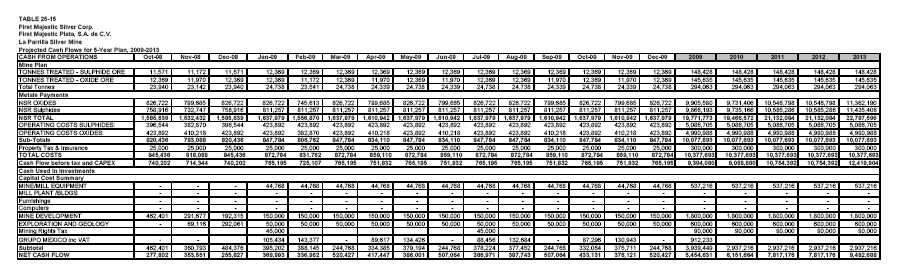

LA PARRILLA was the first mine developed by First Majestic. It began commercial silver production in October 2004 and its operations have been scaled up continually from 180 tpd in early 2005 to the current capacity of 850 tpd. The La Parrilla Silver Mine is located approximately 75 km southeast of the city of Durango in Central Mexico. Excellent infrastructure exists in the area with the mine only 4 km away from a major highway. First Majestic owns 100% of the La Parrilla mine. The plant processes both oxide and sulphide silver ores in two separate 425 tpd parallel circuits. Both Doré metal bars and flotation concentrates are being produced. The Company’s mining claims surrounding the main mine and mill complex cover a very large, 53,249 hectare (131,558 acres) land package consisting of several known areas of mineralization, such as: the Los Rosarios, La Rosa and La Blanca/San Jose vein system (Rosarios System); San Marcos; Quebradillas; Las Vacas; San Nicolas; Las Animas, and numerous other targets for exploration along several known structures and projected intersections, such as Milagros, La Vibora and Sacramento. During 2009, a key focus of the development program underway at La Parrilla was to reach the lower levels of the La Rosa/Rosarios vein. During the year, the 8th and 9th levels were developed, allowing the mine to increase the Proven and Probable Reserves and improve the quality of the resources that are located in these areas. At Quebradillas, the development work was focused on reaching a high-volume deeper ore body. This development proved successful, and the area is currently being prepared for production for 2010. “La Parrilla is at a crucial stage due to the high mining potential both at the Rosarios System and at the Quebradillas mine, which will give us the opportunity to increase production in the near future. I feel very proud to work with a team of professionals that have a firm commitment with our Company. First Majestic has had a vision to acquire new projects with high potential, which has positioned the Company as one of the most important silver producers in Mexico. I am glad to be a part of it, and it is a privilege to work for First Majestic.”  Mario Valdez, Ing Mr. Valdez is a mining engineer with over 28 years of experience during which he has worked with several Mexican and Canadian mining companies such as Minera Autlan, Compañía Minera del Norte, Grupo Mexico, Baramin, Silver Eagle, Dia Bras, and Gammon Lake. Positions held include Mine Foreman, Chief of Engineering and Planning, Mine Superintendent, Mine Manager, Operations Manager, and Planning and Engineering Director. |

NI 43-101 CHART - see pg. 22

|

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 17

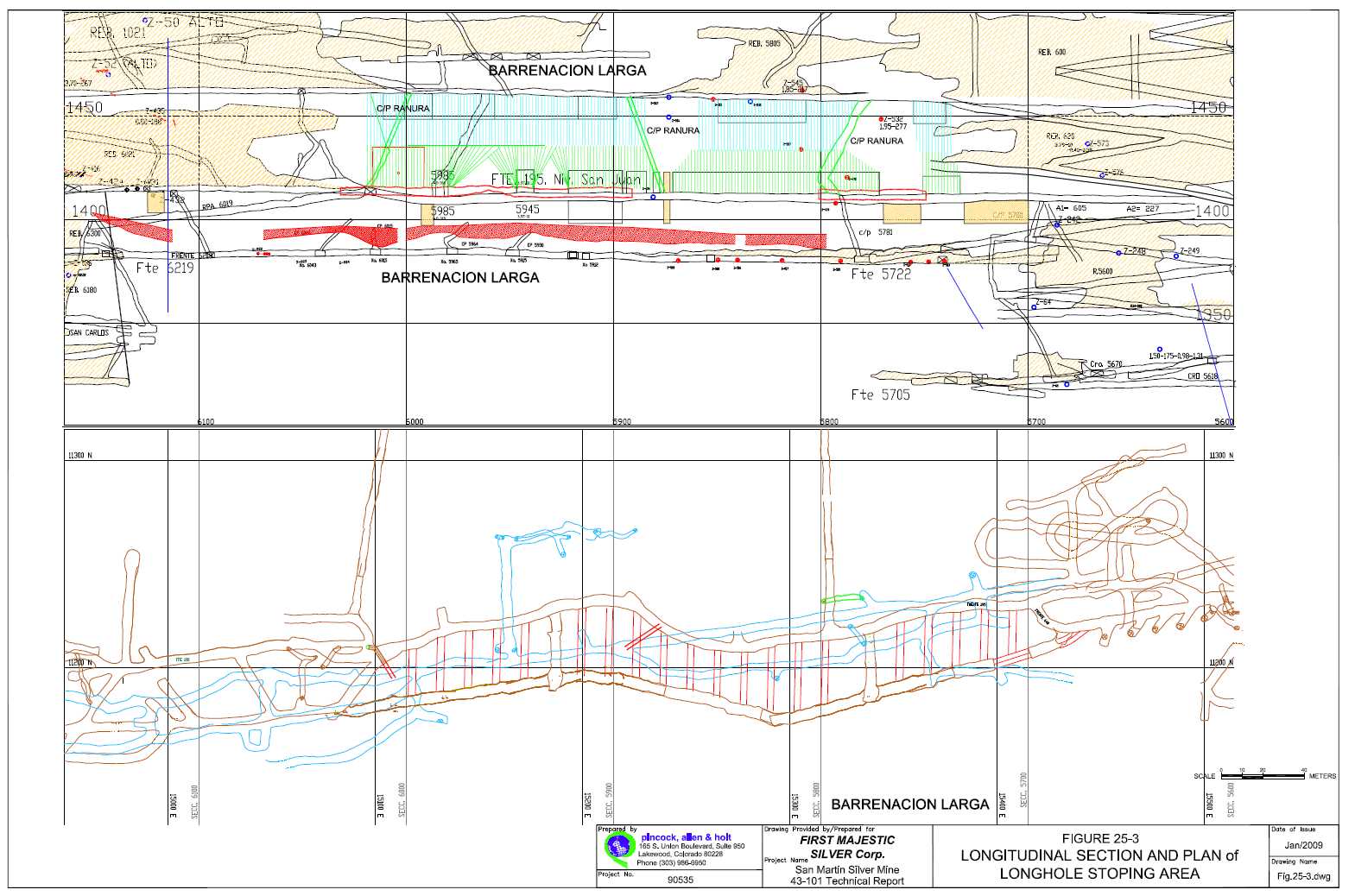

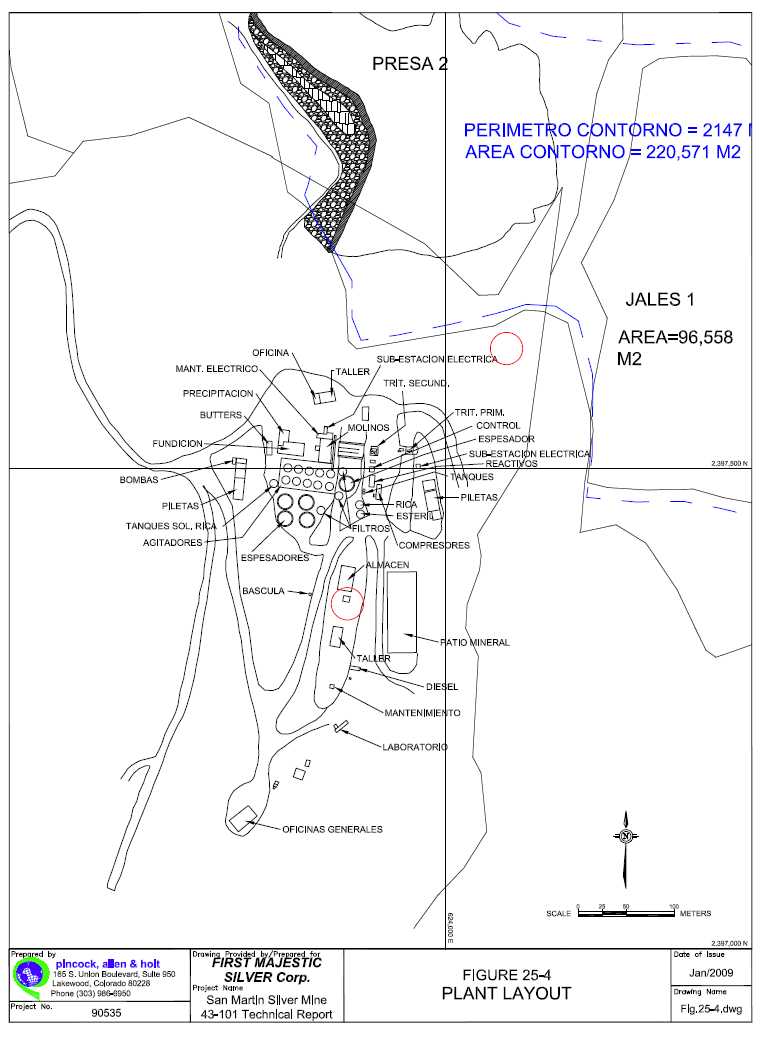

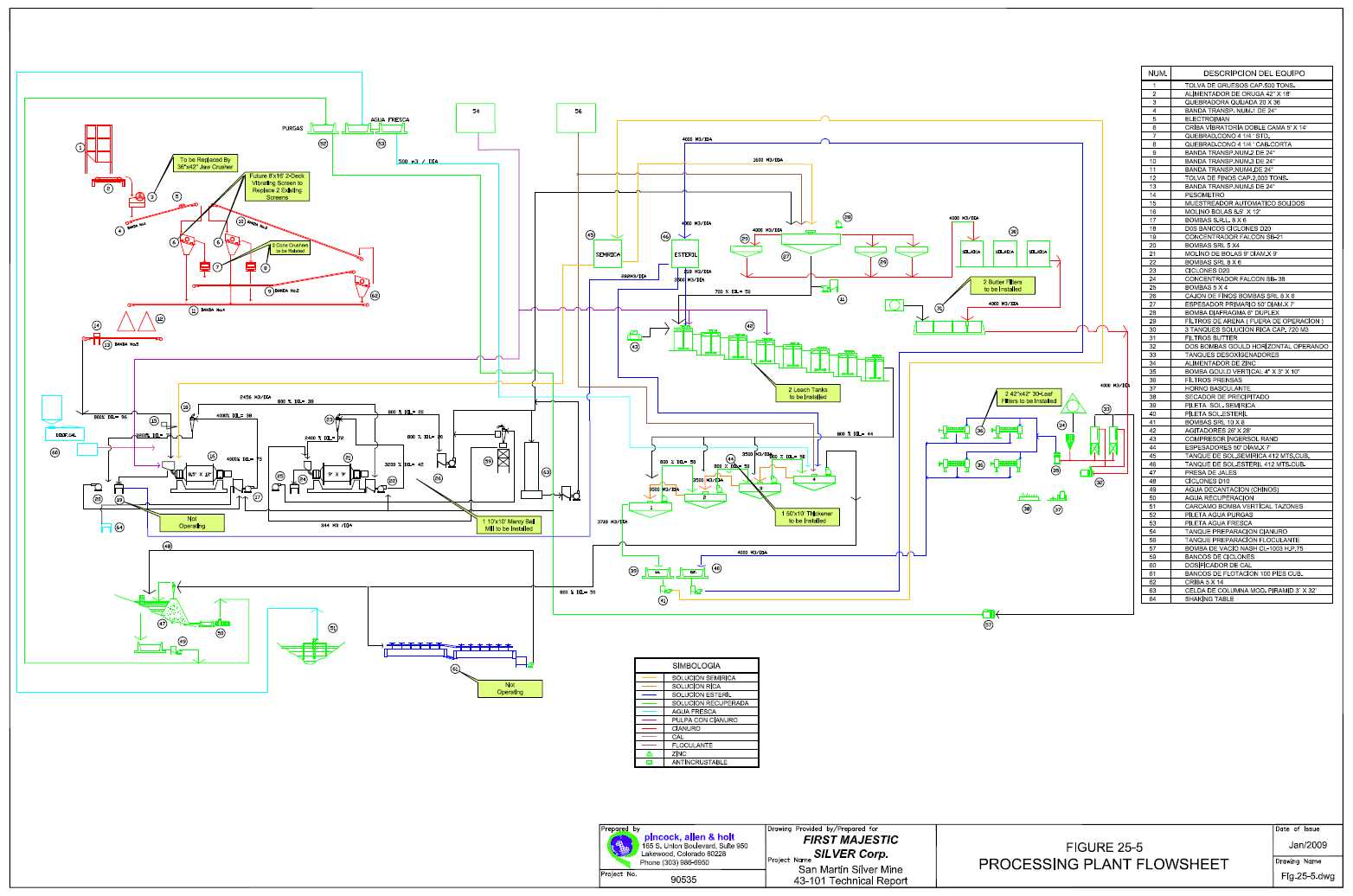

SAN MARTIN SILVER MINE, JALISCO, MEXICO

SAN MARTIN CONTINUES TO PRODUCE SUBSTANTIAL OUNCES OF SILVER

| LOCATION: JALISCO, MEXICO | |||||||

| 100% OWNERSHIP |

26,125 MONTHLY CAPACITY (TONNES) |

342 EMPLOYEES |

1,247,236 PRODUCTION (SILVER EQ. OZ.) |

US$6.71 2009 DIRECT CASH COSTS PER OUNCE |

US$7.35 2009 CASH COSTS PER OUNCE (ALL IN) |

US$28.06 2009 TOTAL COSTS PER TONNE |

1,250,000 2010 PROJECTED SILVER EQ. OZ. PRODUCTION |

18

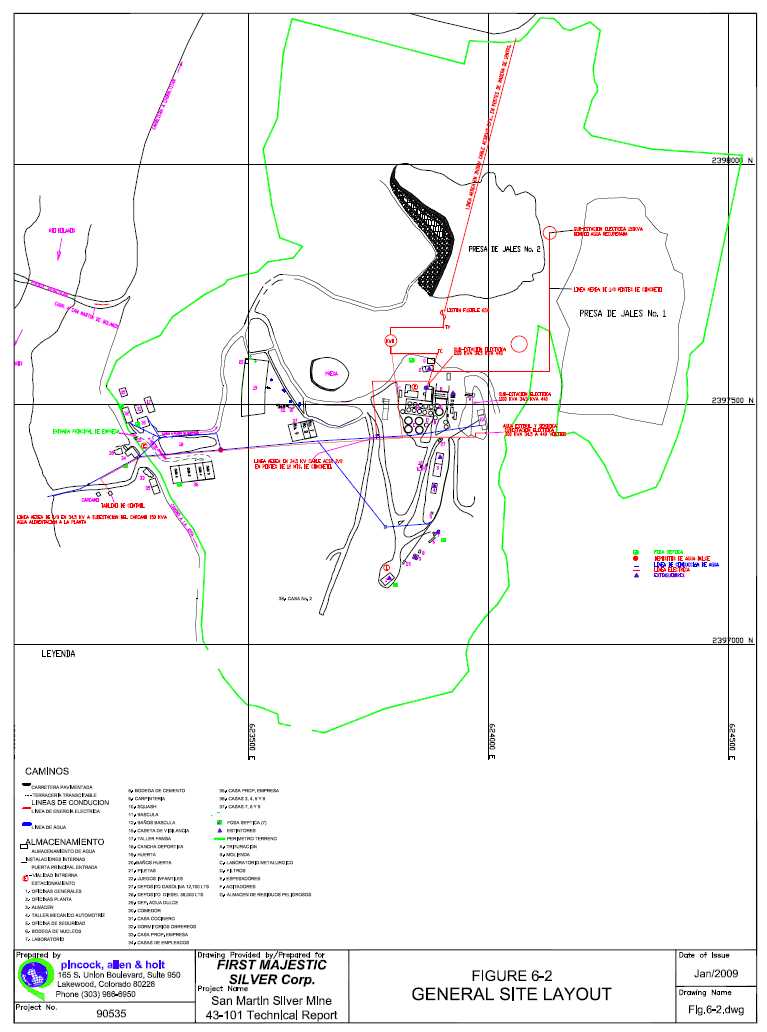

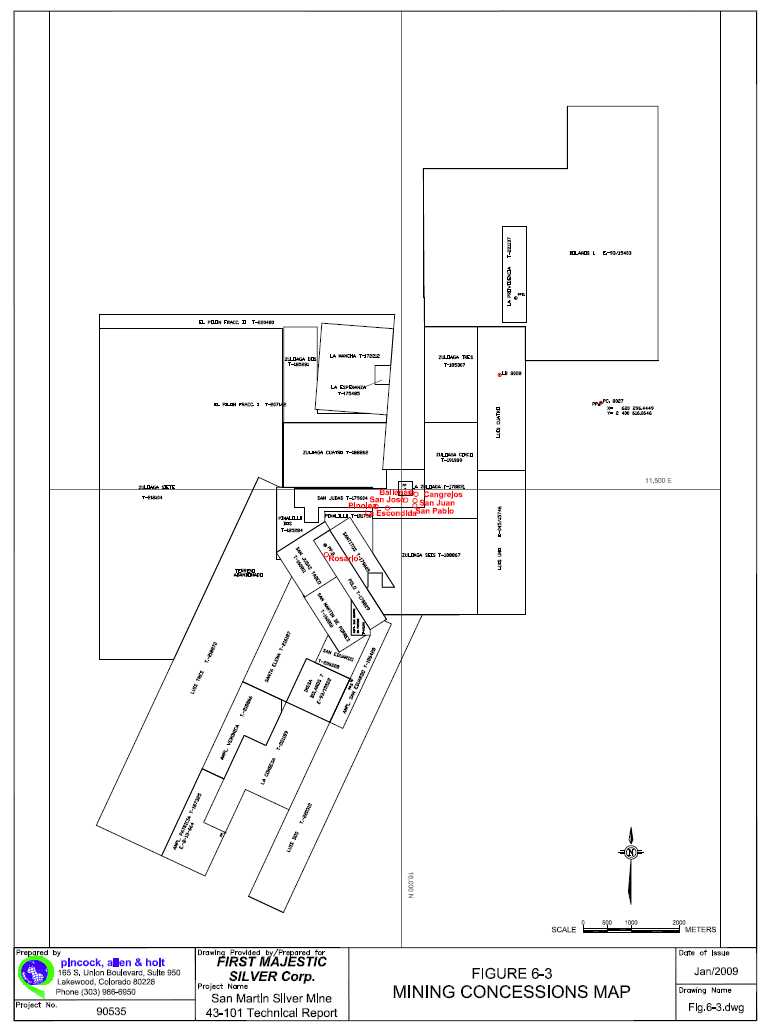

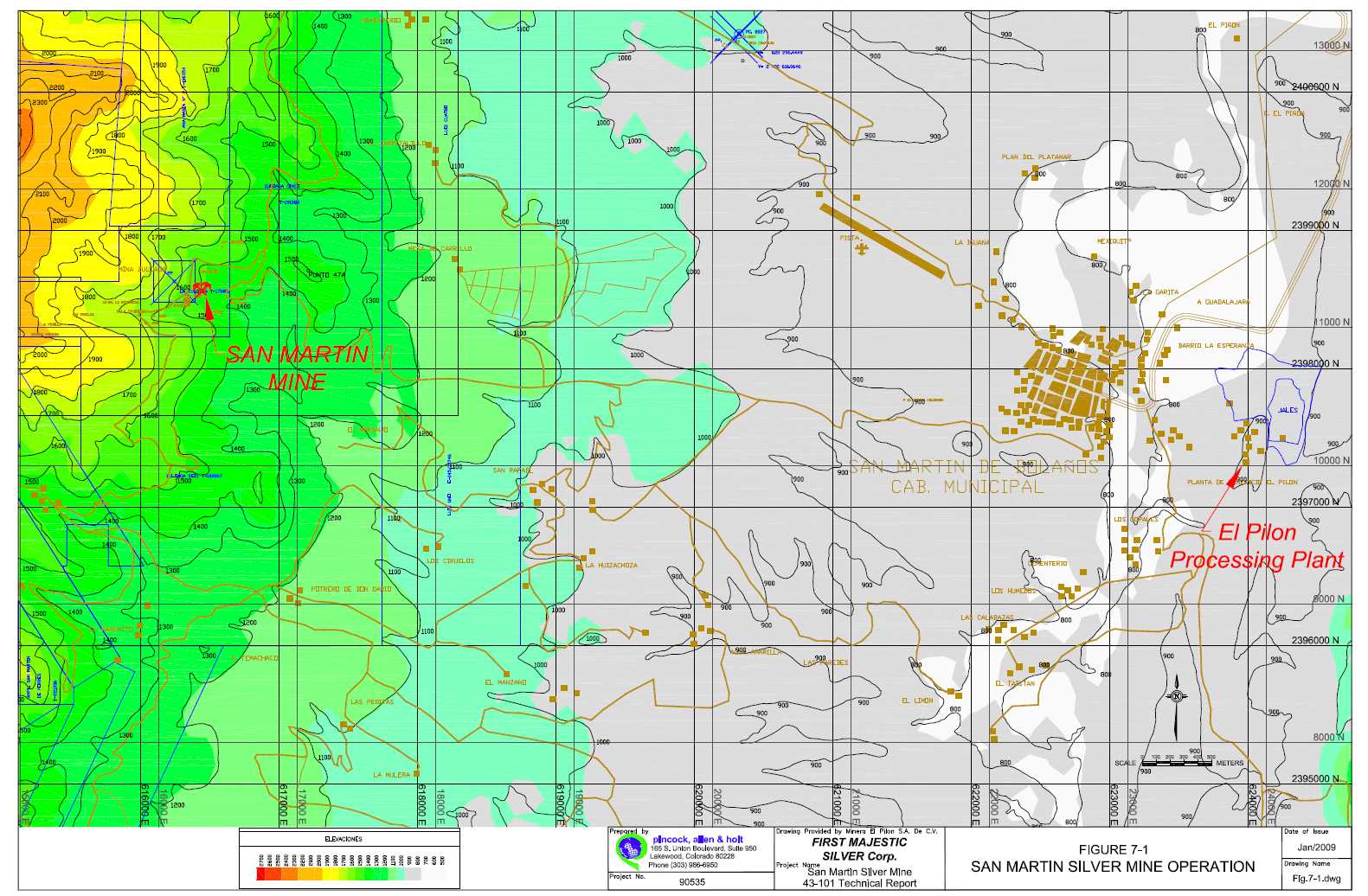

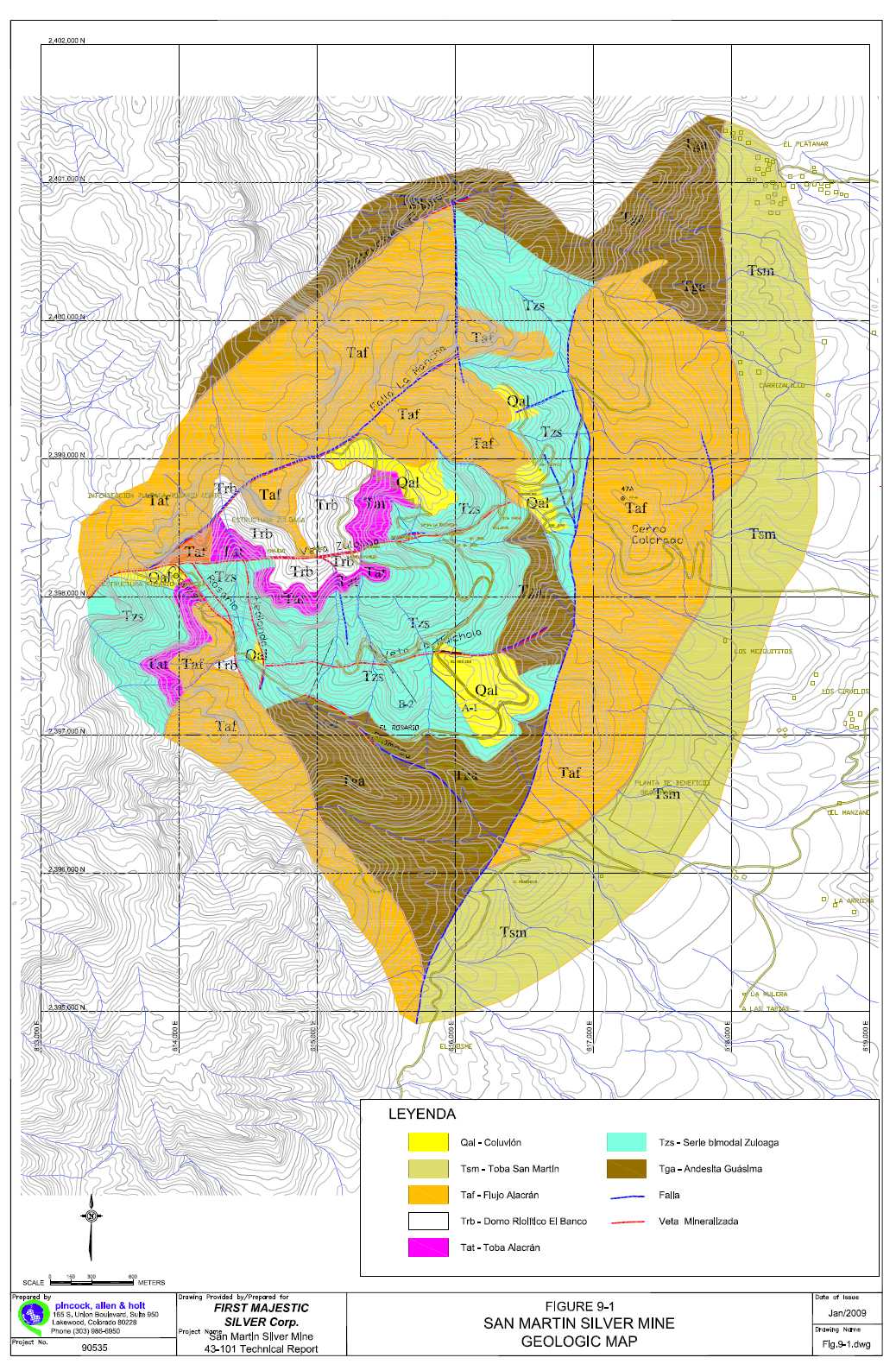

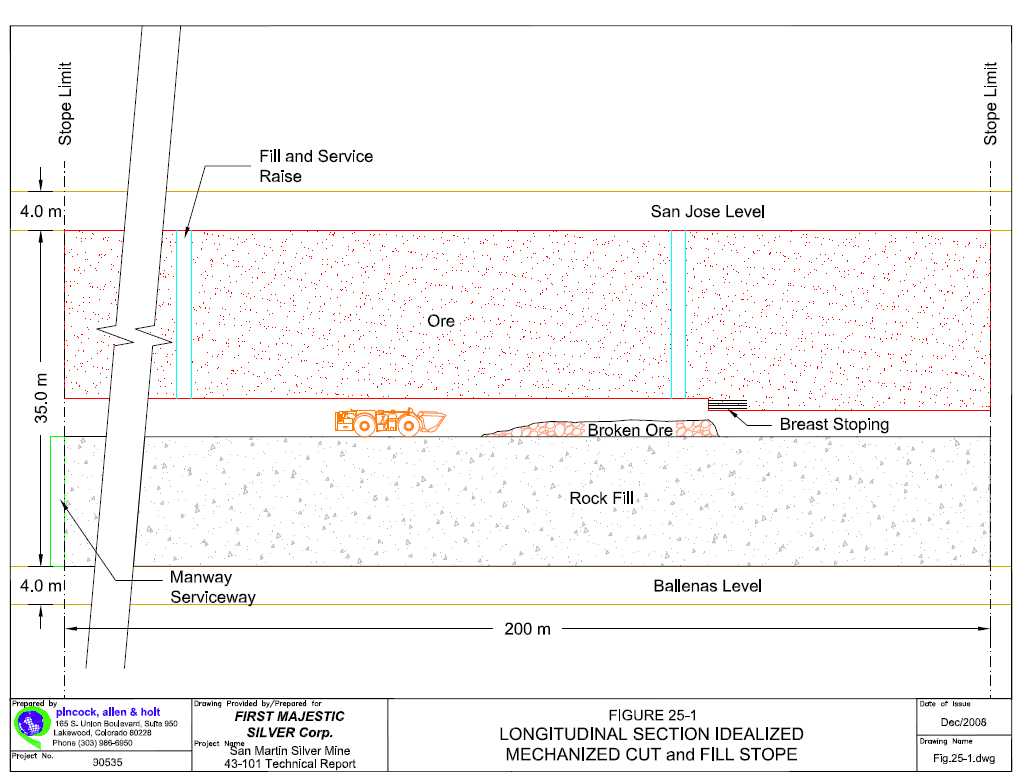

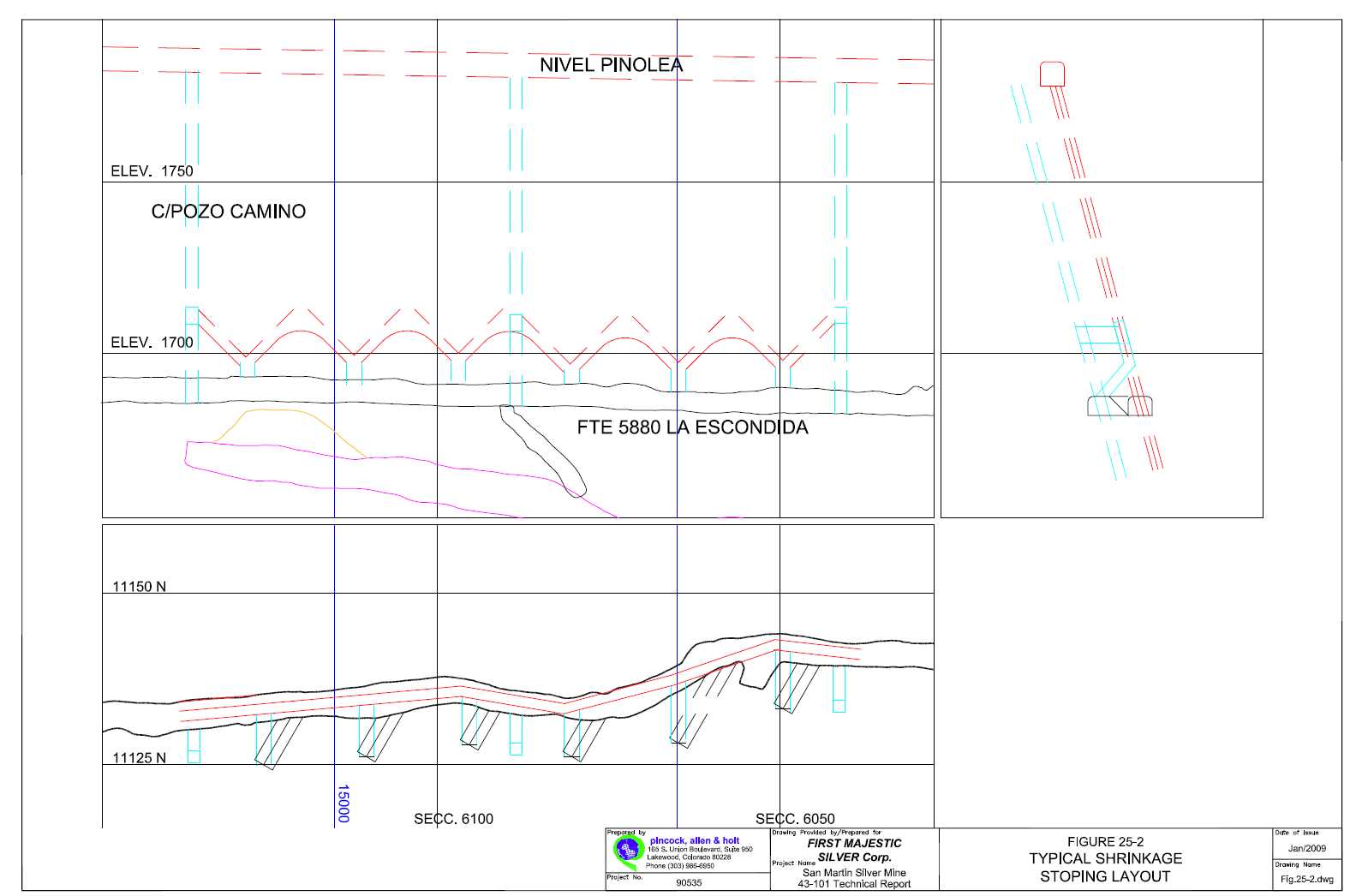

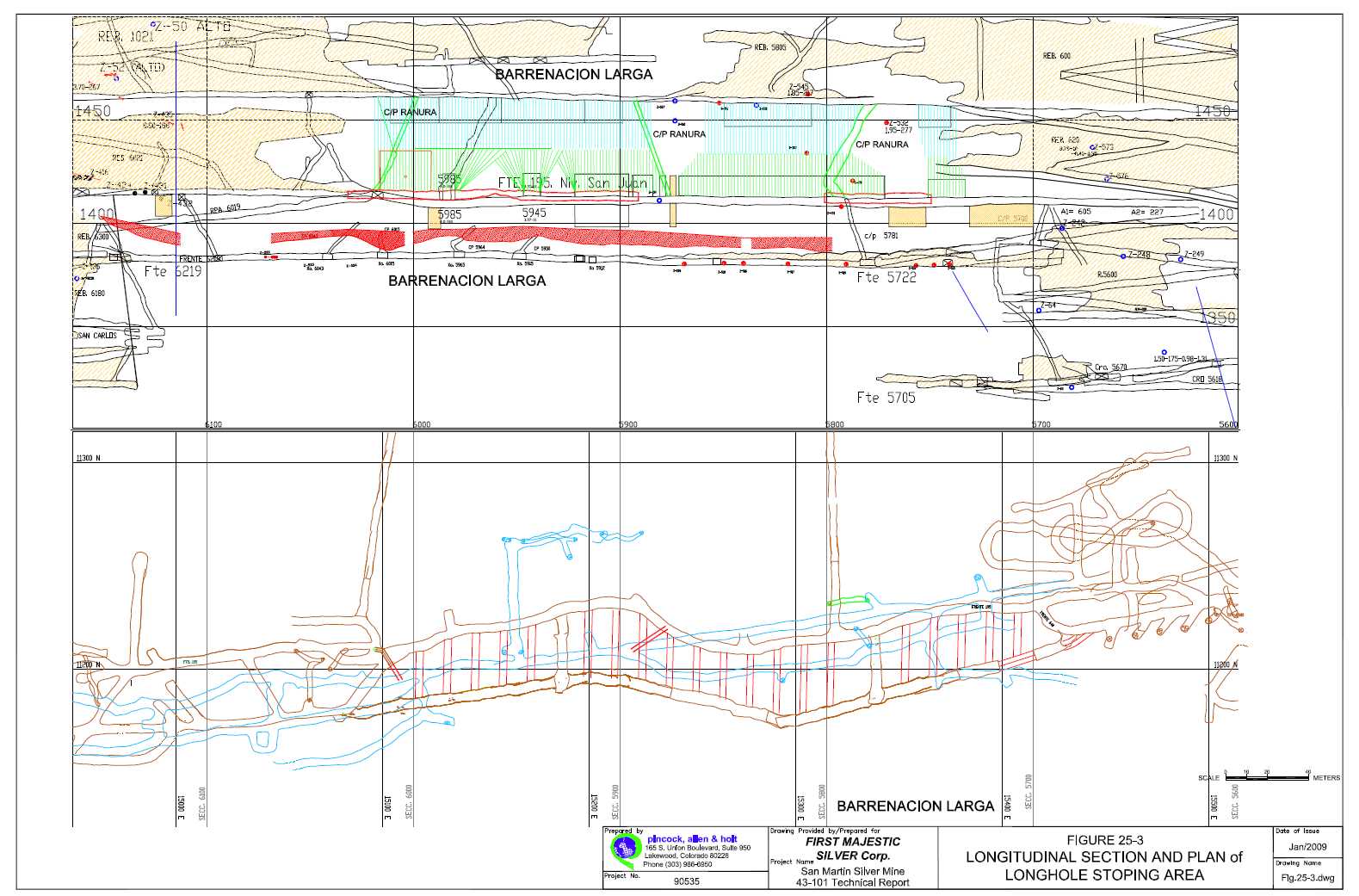

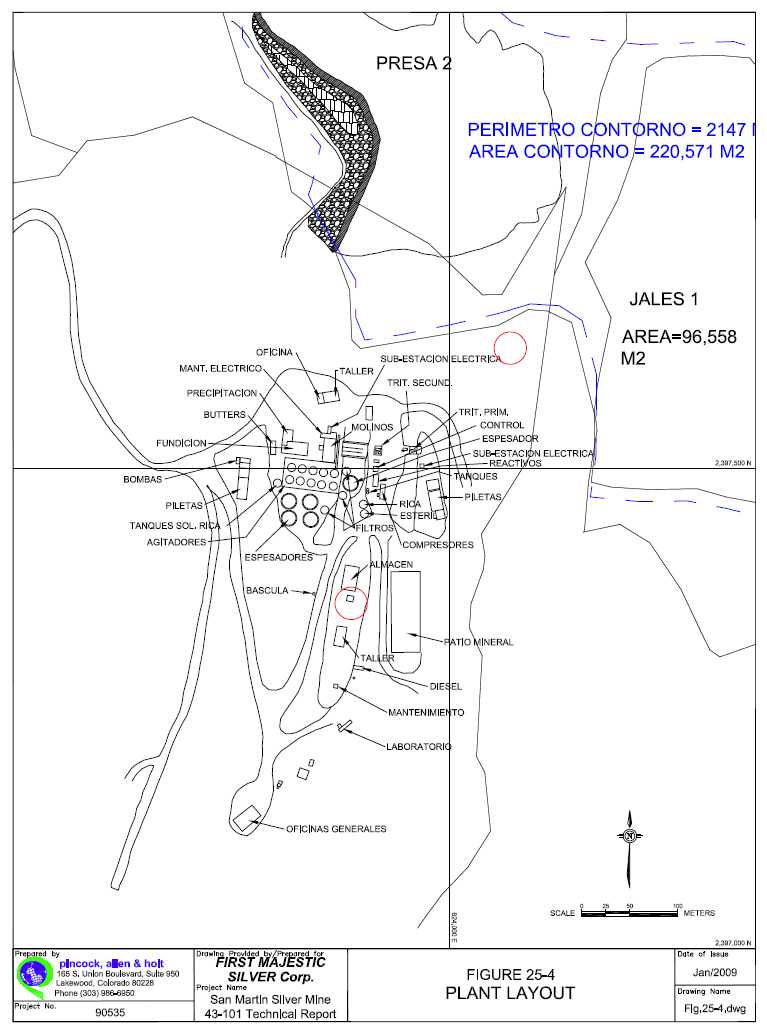

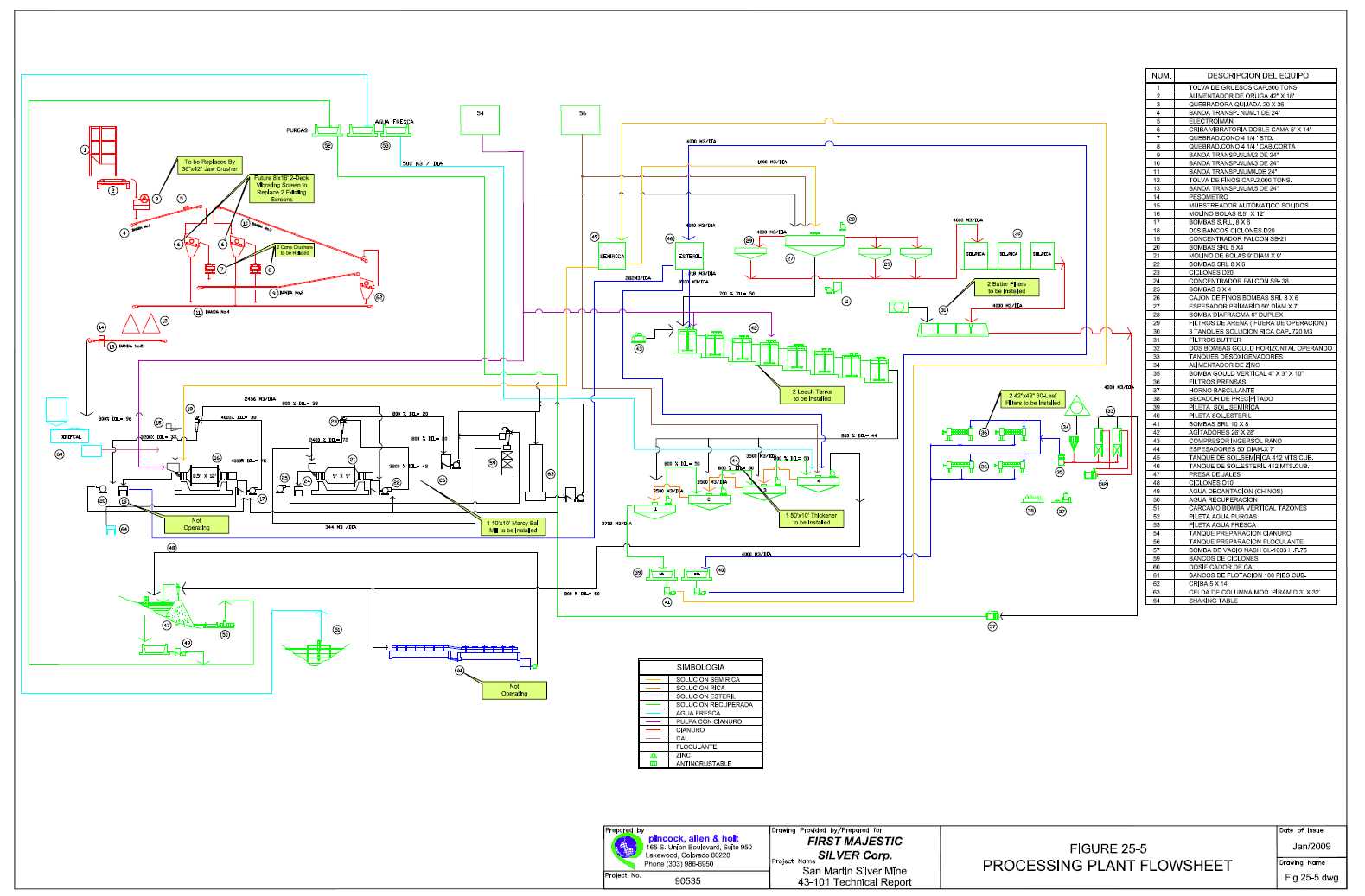

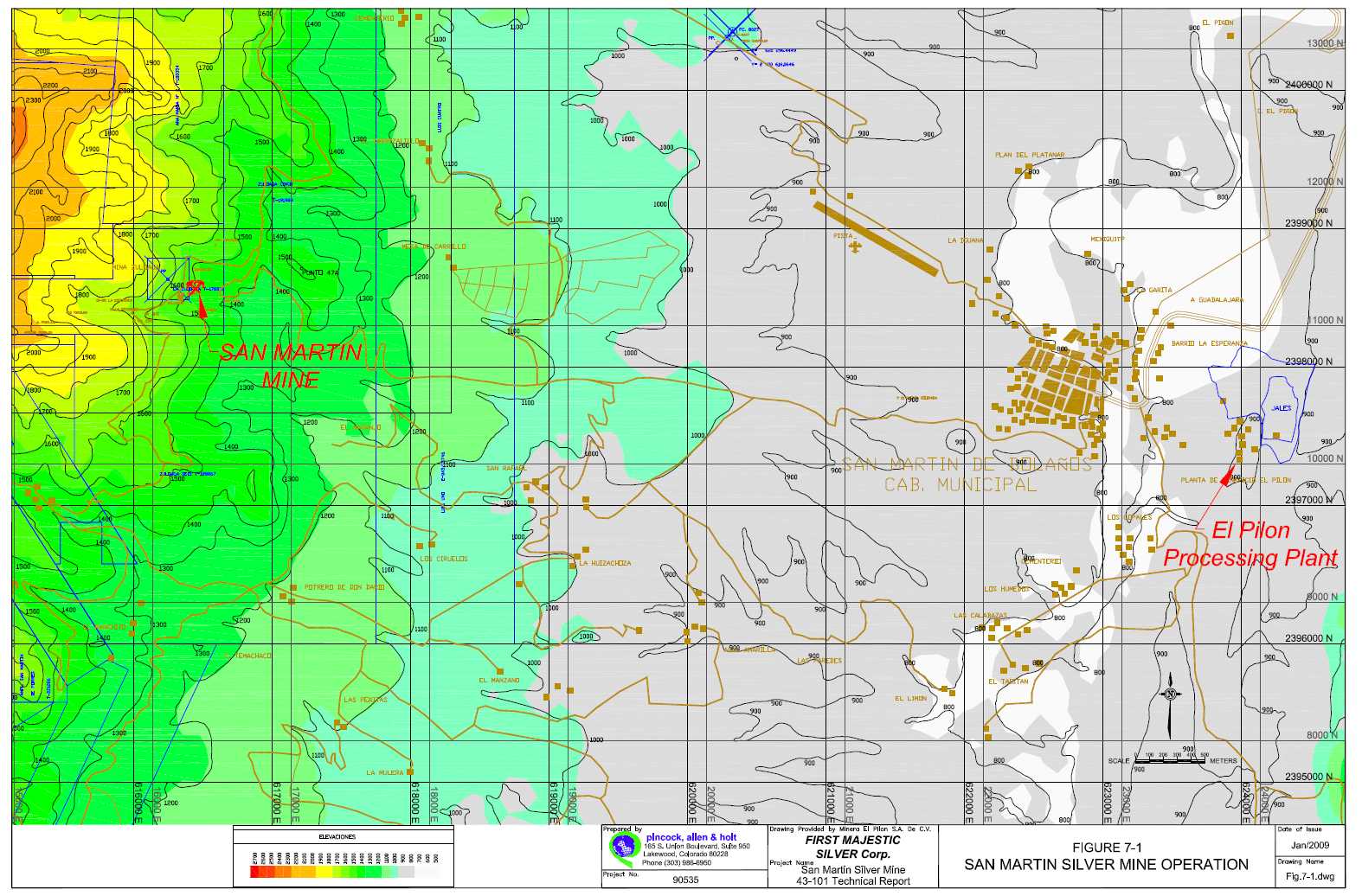

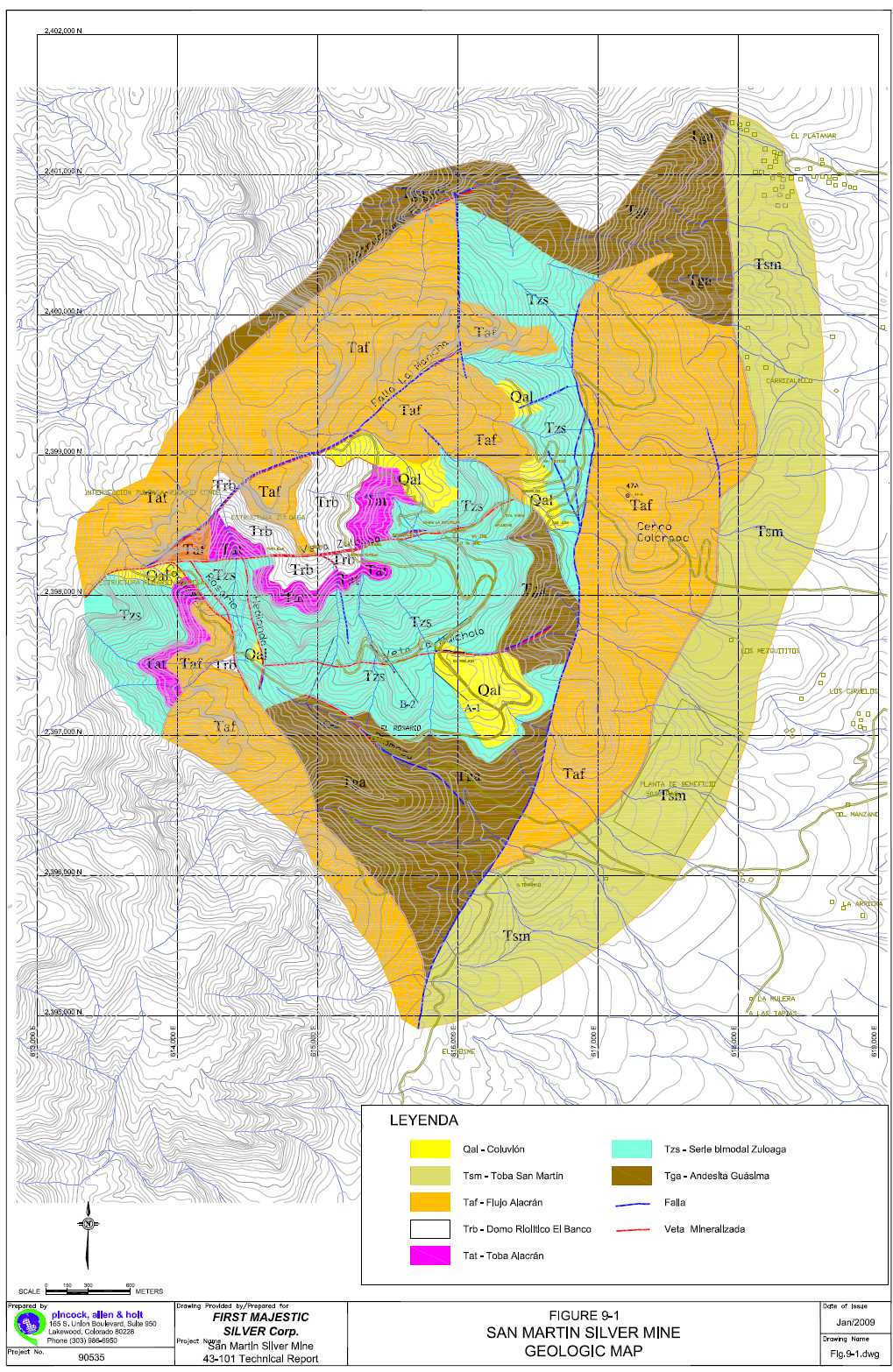

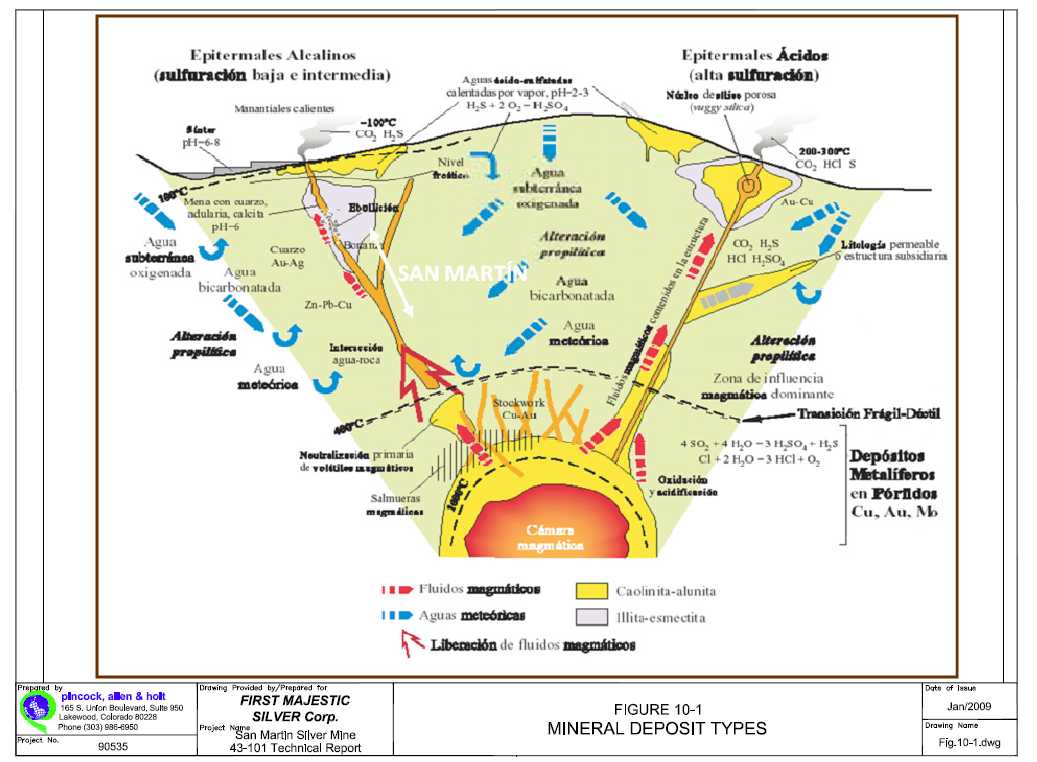

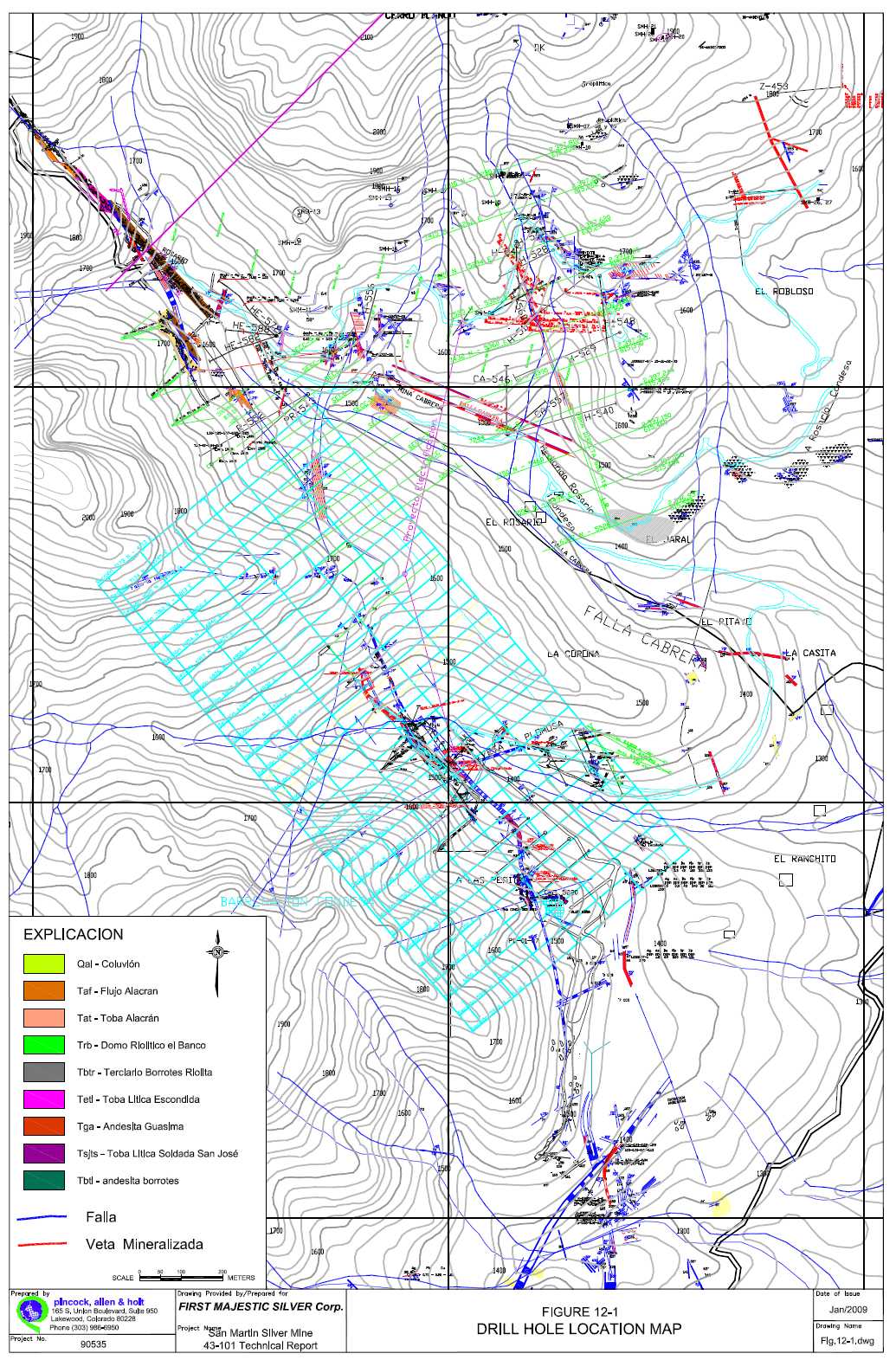

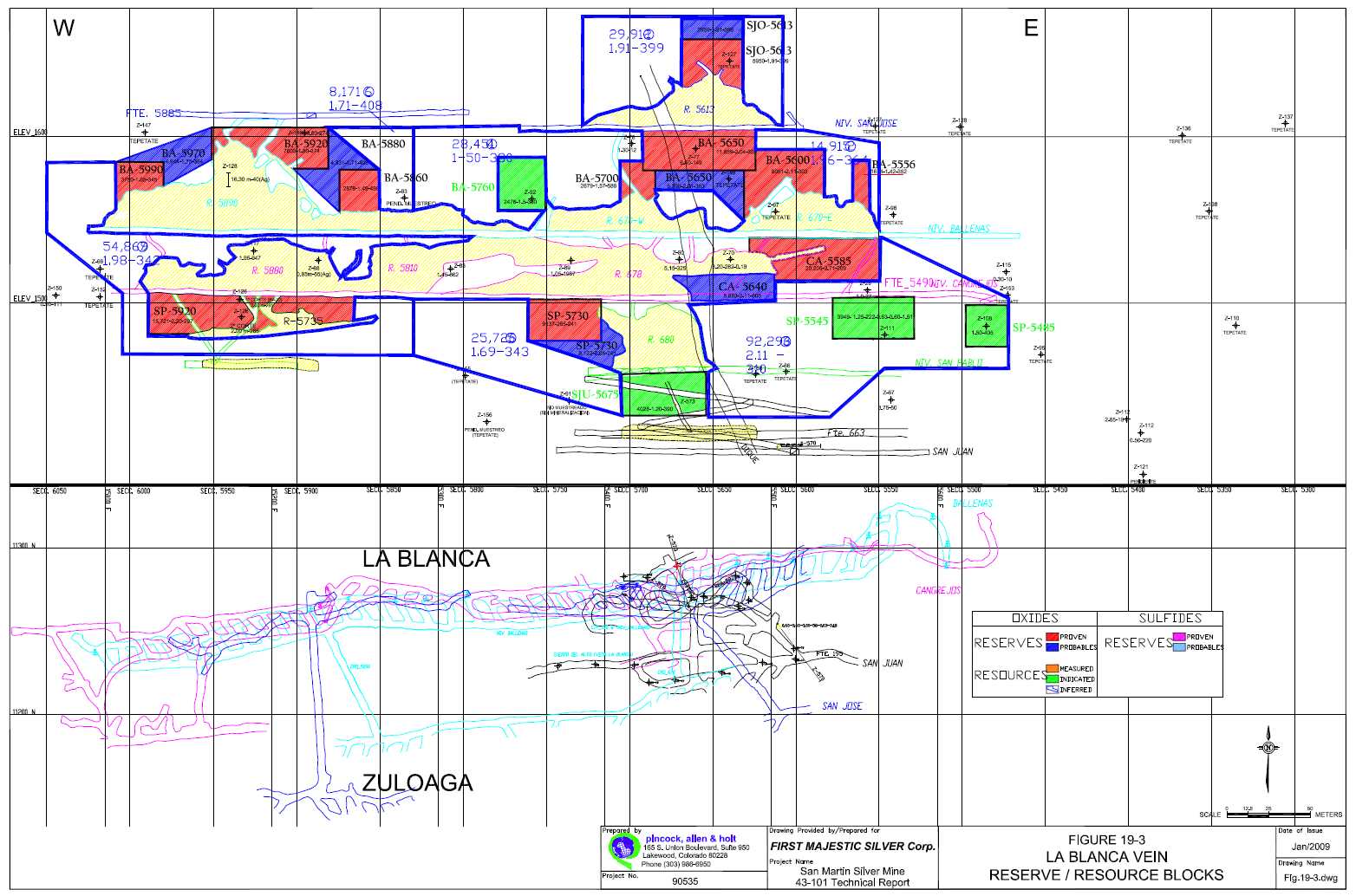

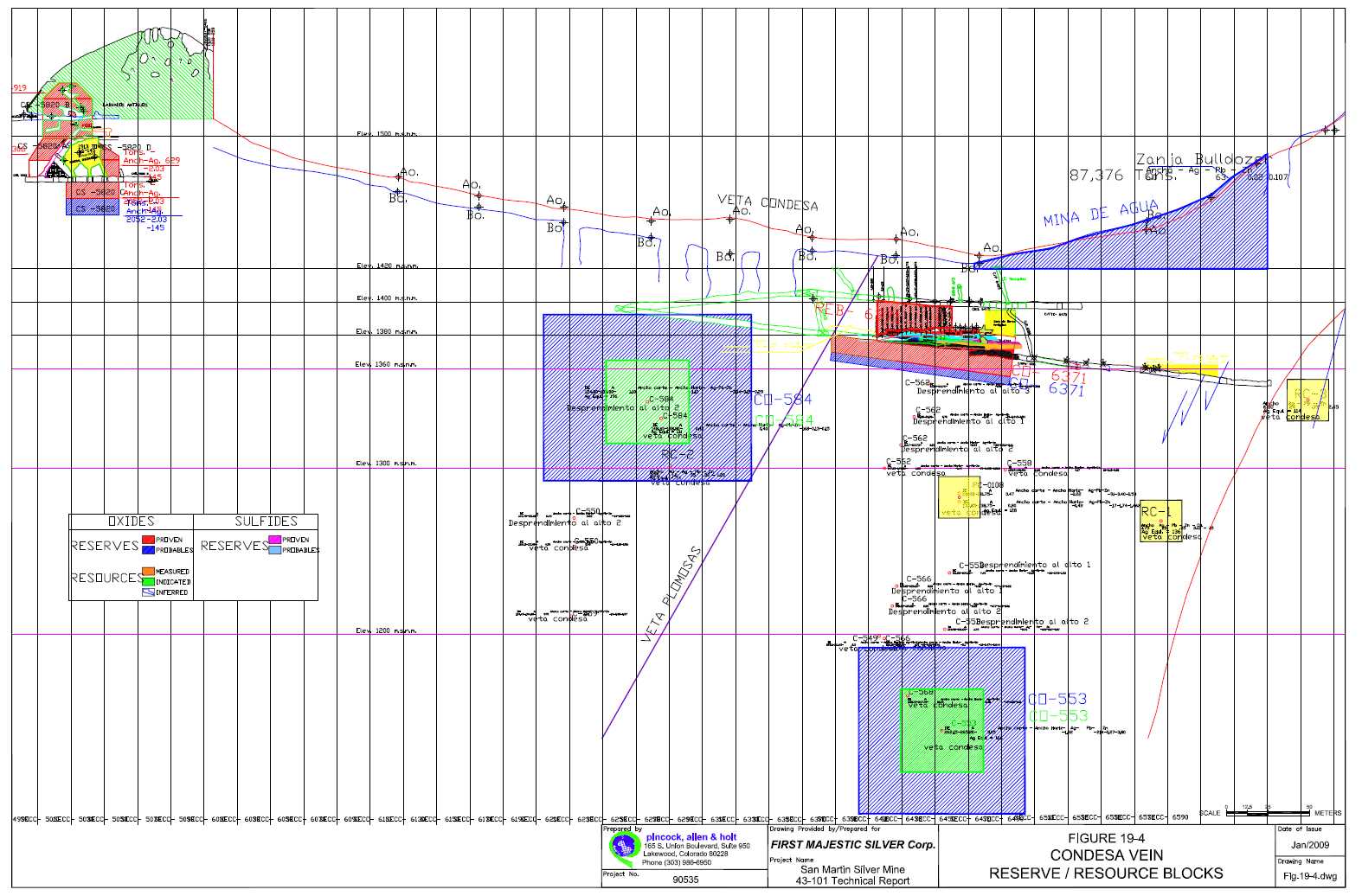

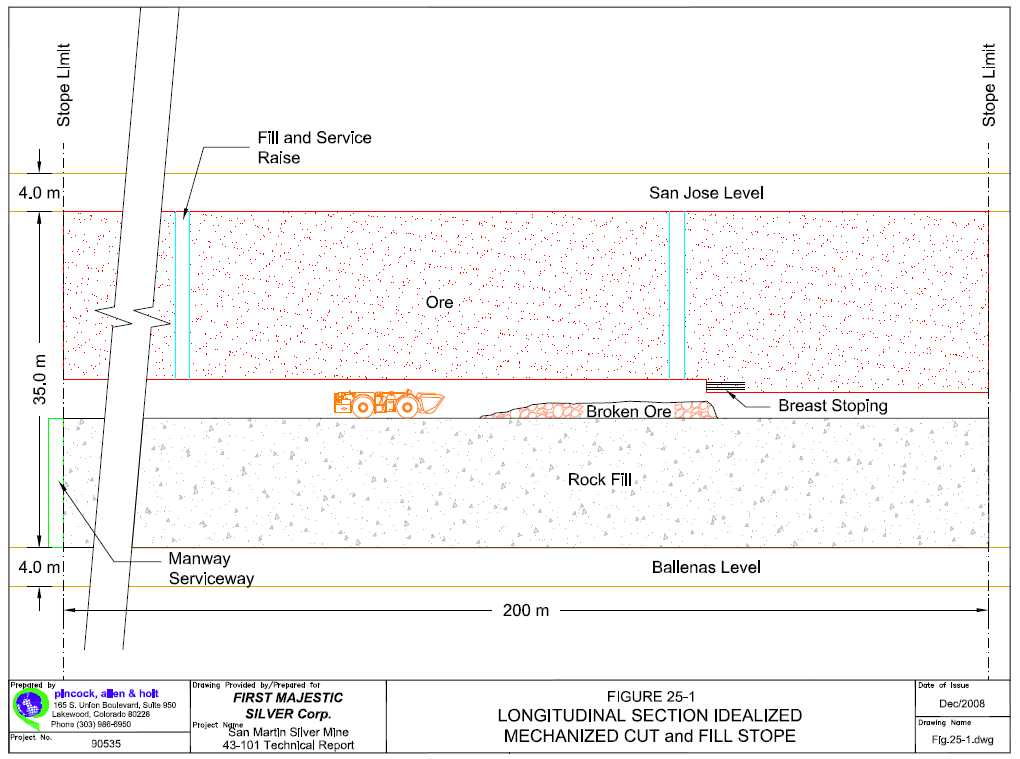

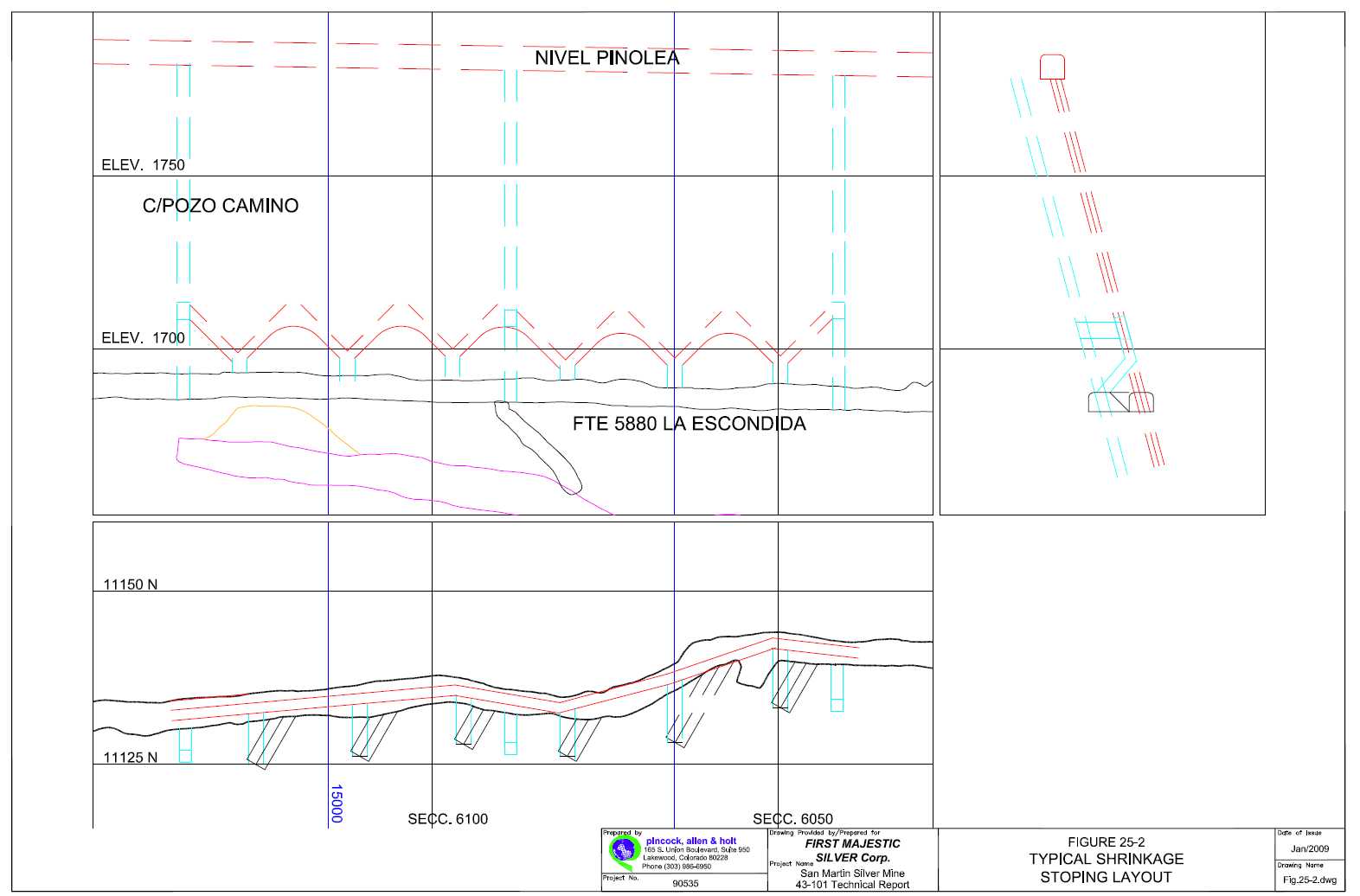

SAN MARTIN SILVER MINE is located in the Bolanos river valley, a 250 km drive north of Guadalajara, adjacent to the town of San Martin de Bolaños, in Northern Jalisco State, Mexico. The mine and mill has been in continuous operation since 1983 and is a major contributor to the economy of the town of San Martin de Bolanos, which has a population of approximately 3,000 people. The mine comprises approximately 7,840 hectares of mineral rights, approximately 1,300 hectares of surface land rights surrounding the mine, and another 104 hectares of surface land rights where the 950 tpd cyanidation mill and 500 tpd flotation circuit, mine buildings and offices are located. First Majestic has been focused on increasing its silver reserves/resources in Oxides while at the same time maintaining production at present levels. The mill has historically produced 100% Doré bars and continues to do so. First Majestic owns 100% of the San Martin Silver Mine. A mill expansion program was launched in 2008 and completed in 2009 resulting in the current mill capacity. The upgrades included the construction and addition of a new thickener, new clarifiers and new filter presses. The expansion program also resulted in many improvements to the facilities, including the repair and reinforcing of the older leaching tanks and construction of spill containment systems. During 2009, additional development was completed in a new area at the San Martin mine, referred to as the San Pedro area, which is located at the footwall of the Zuloaga vein. This development program has enabled access to higher grade ores and additional tonnage of reserves. An underground drill program is currently underway that is completing short horizontal holes into the footwall and hanging way. This program was responsible for discovering the San Pedro area and is anticipated to discover other similar areas. “The potential for increasing the reserves and thus the life of the mine is great; we just began working in a new vein called La Esperanza in which we have very high expectations. The team that is working at the San Martin mine is excellent and we are working very hard to meet our targets.”

Alfredo Flores, Ing Mr. Flores is a mining engineer with over 31 years of experience during which he has worked with several different Mexican and Canadian mining companies such as Compañia Fresnillo, Industrias Peñoles, Luismin, and Excellon. Positions held include: Mine Foreman, Development Foreman, Assistant of Mine Superintendent, Mine Superintendent, Mine Manager, Operations Manager, and Regional Manager. |

NI 43-101 CHART - see pg. 24

|

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 19

DEVELOPMENT PROJECTS

20

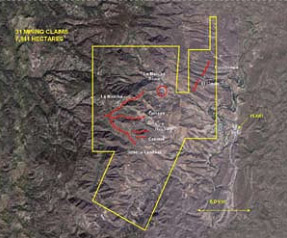

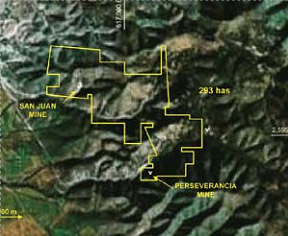

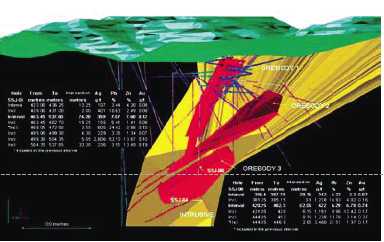

DEL TORO SILVER MINE, ZACATECAS, MEXICO THE DEL TORO SILVER MINE is located 60 km southeast of the Company’s La Parrilla Silver Mine. The Del Toro operation represents the consolidation of two old silver mines: the Perseverancia and San Juan mines, which are approximately one kilometre apart. Del Toro consists of mining rights that cover 393 hectares within 21 titled concessions plus an additional 100 hectares of surface rights covering the area surrounding the San Juan mine entrance. Access to the properties is through the nearby Interstate 45 highway and the state roads which connect the Chalchihuites Town and several country and trail roads. Local infrastructure, including electricity, water and telephones, and accommodations are excellent. Exploration efforts at Del Toro have been highly successful in delineating a significant Resource base within a short period of time and at relatively low cost. All necessary permits for the construction of a 1,000 tpd flotation mill were granted in Q4 2009 and Q1 2010 by the Mexican authorities. No immediate plans are in place to commence construction, although the Company anticipates a final decision to proceed later in 2010. |

NI 43-101 CHART - see pg. 25

|

|

REAL DE CATORCE SILVER PROJECT, SAN LUIS POTOSÍ, MEXICO THE REAL DE CATORCE SILVER PROJECT is located approximately 25 km west of the town of Matehuala in the San Luis Potosí state of México, which lies about 259 km to the south of the industrial city of Saltillo and about 170 km north of the city of San Luis Potosí. The Real de Catorce was acquired on November 13, 2009, with the all-share acquisition of Normabec Mining Resources. The Real de Catorce property consists of 22 mining concessions covering 6,327 hectares, with historical production of 230 million ounces between 1773 and 1990. First Majestic owns 100% of the Real de Catorce Silver Project. In 2010, First Majestic plans to reconfirm the existing geological information and launch an aggressive drilling and exploration program in the latter half of the year. |

NI 43-101 CHART - see pg. 25 |

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 21

LA PARRILLA SILVER MINE

NI 43-101 RESOURCES DATED

SEPTEMBER 30, 2008

TOTAL PROVEN + PROBABLE MINERAL RESERVES (1,2,3,4,5)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (4) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Proven Reserves (Oxides plus Sulphides) |

288,468 | 302 | 1.36 | 0.93 | 2,797,487 | 3,064,952 |

| Probable Reserves (Oxides plus Sulphides) |

217,060 | 287 | 1.45 | 1.12 | 2,002,158 | 2,182,002 |

| Total Proven Plus Probable Reserves |

505,528 | 295 | 1.40 | 1.01 | 4,799,645 | 5,246,954 |

TOTAL MEASURED + INDICATED RESOURCES

| CATEGORY | TONNES |

GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC % |

SILVER ONLY

OZ. |

SILVER (OZ.)

INCLUDING LEAD CREDIT | ||

| Measured Resources (Oxides plus Sulphides) |

2,195,448 | 264 | 2.59 | 4.54 | 18,637,618 | 22,806,628 |

| Indicated Resources (Oxides Plus Sulphides) |

861,488 | 245 | 3.46 | 6.07 | 6,785,685 | 7,940,379 |

| Total Measured Plus Indicated Resources (Oxides plus Sulphides)(6) |

3,100,000 | 255 | 2.84 | 4.97 | 25,400,000 | 30,700,000 |

TOTAL INFERRED RESOURCES

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (4) % |

SILVER ONLY

OZ. |

SILVER (OZ.)

INCLUDING LEAD CREDIT | ||

| Total Inferred Resources (Oxides Plus Sulphides) (6) |

8,000,000 | 169 | 0.87 | 1.49 | 43,900,000 | 52,800,000 |

| 1. |

Estimates by First Majestic reviewed by PAH. Estimates based on Minimum Mining Width >2.00m. No mine recovery included. |

| 2. |

Silver equivalent based on sales. Prices used for evaluation: Ag - $12/oz; Au - $708/oz; Pb - $0.75/lb; Zn - $0.75/lb. |

| 3. |

Oxides Ag equivalent includes gold credit based on sales. Au Credit = 6 g/tonne Ag. |

| 4. |

Sulphides Ag equivalent includes Pb credit = 47 g/tonne Ag. Zinc is considered at 70% met. Recovery = 30 g/tonne Ag. |

| 5. |

Cut-off grade estimated as 184 g/tonne Ag net of Au credit in oxide ores; and 246 g/tonne Ag net of Pb credit in sulphide ores. Zinc not considered in COG estimates. |

| 6. |

Rounded figures. |

22

LA ENCANTADA SILVER MINE

NI 43-101 RESOURCES

DATED SEPTEMBER 30, 2008

TOTAL PROVEN + PROBABLE MINERAL RESERVES (MINEABLE RESERVES) (4)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (5) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Proven Reserves | 683,992 | 354 | 2.23 | 0.92 | 7,777,602 | 8,261,401 |

| Probable Reserves | 4,511,686 | 186 | 2.45 | 2.54 | 26,936,651 | 27,287,462 |

| Total Proven + Probable Reserves |

5,195,677 | 208 | 2.42 | 2.33 | 34,714,253 | 35,548,863 |

TOTAL MEASURED + INDICATED RESOURCES (4)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (5) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Measured Resources | 445,650 | 399 | 4.15 | 0.65 | 5,710,055 | 6,025,271 |

| Indicated Resources (6, 7, 8) |

4,931,103 | 156 | 1.15 | 0.87 | 24,774,263 | 27,082,017 |

| Total Measured + Indicated Resources |

5,376,753 | 176 | 1.40 | 0.85 | 30,484,318 | 33,107,288 |

| Total Proven and Probable Reserves plus Measured and Indicated Resources (9) |

10,572,000 | 192 | 1.90 | 1.58 | 65,199,000 | 68,700,000 |

TOTAL INFERRED RESOURCES (1, 2, 3, 4)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (5) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Total Inferred Resources (5, 9) | 2,557,000 | 220 | 1.00 | 1.00 | 18,226,765 | 20,034,145 |

| 1. |

Cut Off Grade (COG) estimated as 250 g/tonne Ag only; and 228g/tonne Ag eqv net of Pb credit. |

| 2. |

Estimated Reserves are exclusive of Resources. |

| 3. |

Silver equivalent includes Pb credit, at prices US$12.00/oz-Ag, US$0.75/lb-Pb. Pb credit=22 g/tonne-Ag. |

| 4. |

Mining dilution is included at over 2.00m width. Estimates do not include mining recovery. |

| 5. |

Zinc is not recovered. |

| 6. |

Dump stockpile is considered as Measured Resource because the average grade is below COG -- 203 g/tonne Ag only and 186 g/tonne Ag eqv however with pre-screening may be processed. |

| 7. |

La Morena sulphide deposit requires additional metallurgical test work to prove its economic recovery. La Encantada mill does not have an operating zinc circuit at this time. |

| 8. |

Tailings are included within the Indicated Resources due to required additional test work and grade below Cut-off grade - 111 g/tonne Ag. |

| 9. |

Rounded figures |

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 23

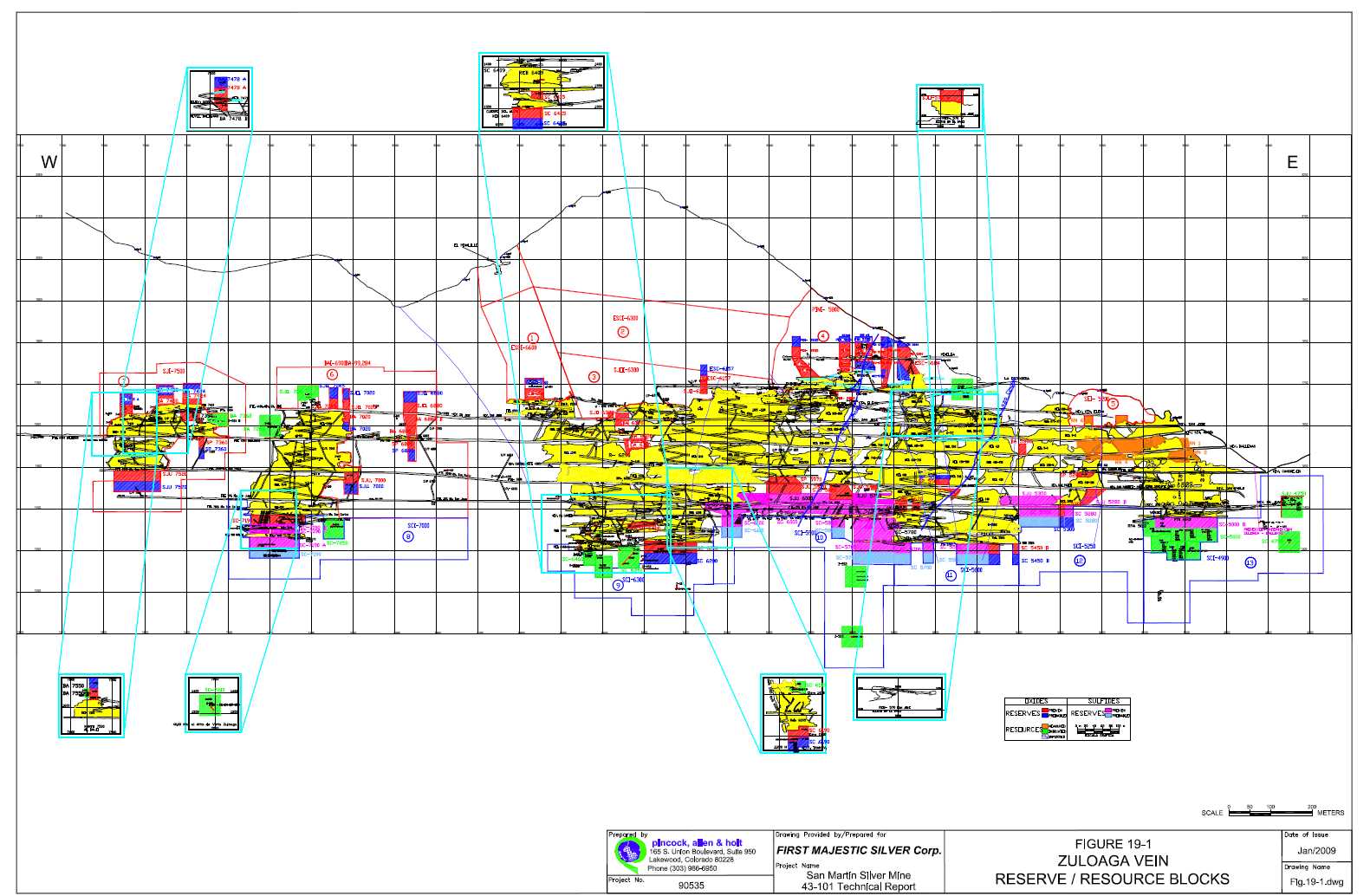

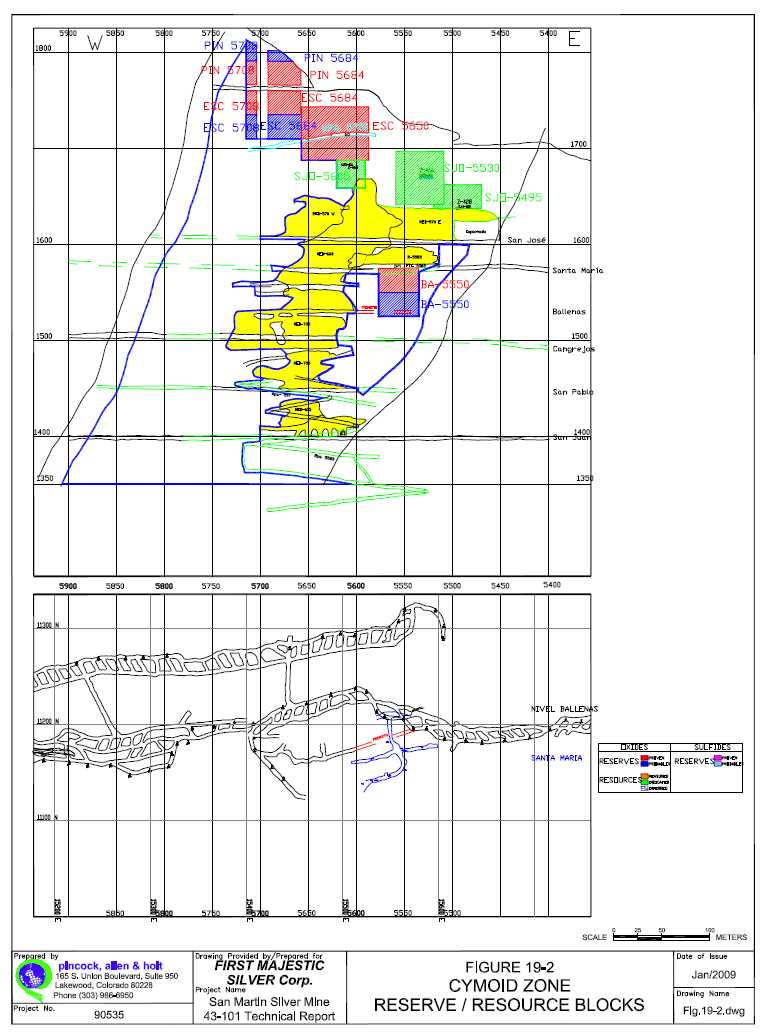

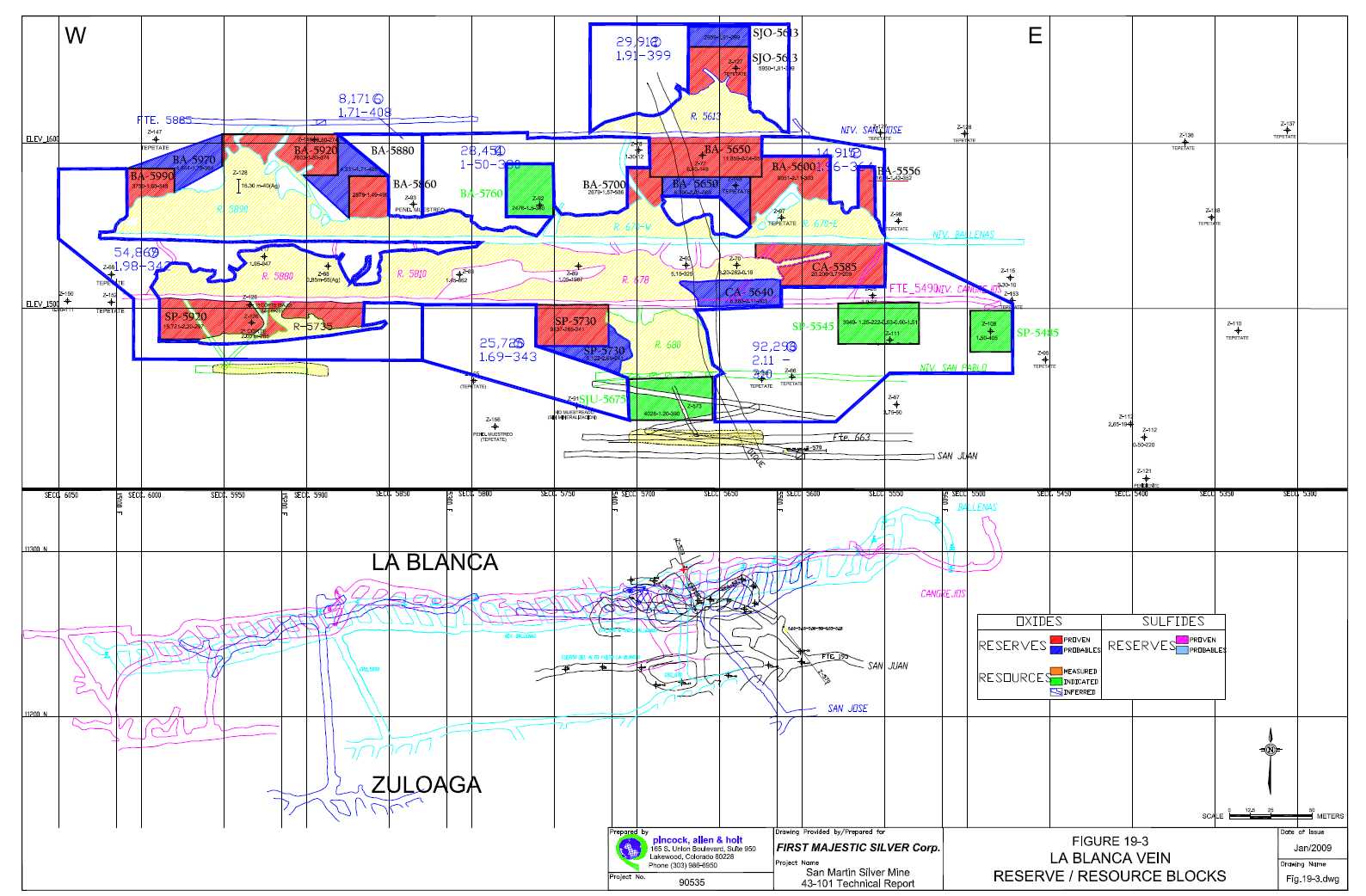

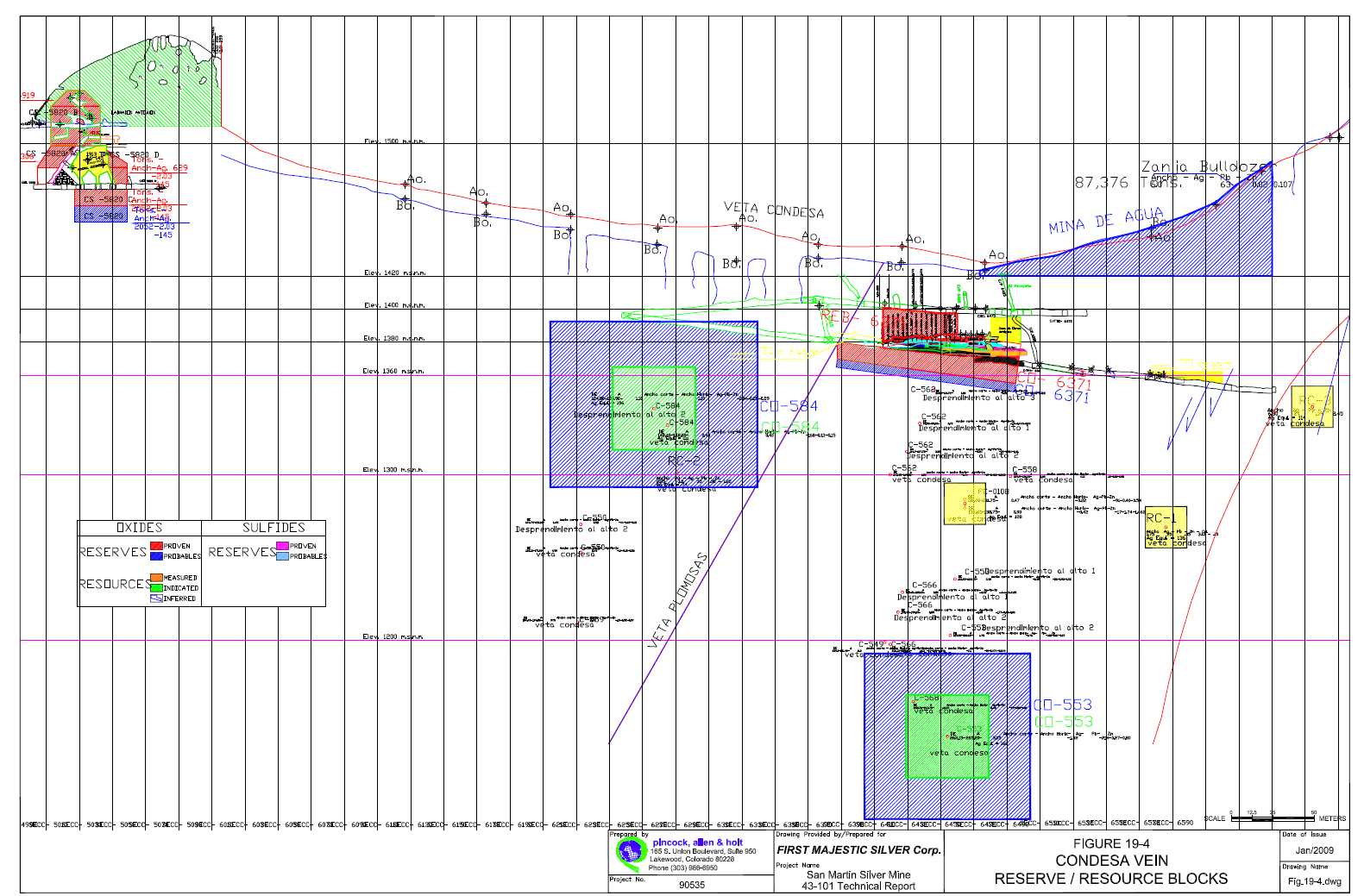

SAN MARTIN SILVER MINE

NI 43-101 RESOURCES DATED SEPTEMBER 30, 2008

TOTAL PROVEN + PROBABLE MINERAL RESERVES (MINEABLE RESERVES) (1, 2, 3, 4, 5)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (4) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Proven Reserves (Oxides) | 527,373 | 273 | 4,636,211 | 4,805,765 | ||

| Probable Reserves (Oxides) | 243,091 | 276 | 2,154,571 | 2,232,727 | ||

| Total Proven and Probable Reserves | 770,464 | 274 | 6,790,782 | 7,038,492 | ||

TOTAL MEASURED + INDICATED RESOURCES (2, 3, 5)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (4) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Measured Resources (Oxides) |

122,404 | 233 | 915,774 | 955,128 | ||

| Measured Resources (Sulfides) |

415,771 | 97 | 0.87 | 2.07 | 1,292,213 | 1,292,213 |

| Indicated Resources (Oxides) |

294,361 | 288 | 2,729,201 | 2,823,840 | ||

| Indicated Resources (Sulfides) |

670,684 | 116 | 0.94 | 1.64 | 2,498,639 | 2,498,639 |

| Total Measured and Indicated Resources (Oxides plus Sulfides) |

1,503,220 | 154 | 0.91 | 1.80 | 7,435,827 | 7,569,820 |

| Proven and Probable Reserves Plus Measured and Indicated Resources |

2,273,684 | 195 | 0.91 | 1.80 | 14,226,609 | 14,608,312 |

TOTAL INFERRED RESOURCES (2, 3, 5)

| CATEGORY | TONNES | GRADE | METAL CONTAINED | |||

| SILVER

G/TONNE |

LEAD % |

ZINC (4) % |

SILVER ONLY

OZ. |

SILVER (OZ.) INCLUDING

LEAD CREDIT | ||

| Total Inferred Resources (Oxides plus Sulfides) | 8,200,000 | 185 | 1.40 | 1.60 | 48,900,000 | 50,037,365 |

1. Estimated Reserves are exclusive of Resources.

2. Cut Off

estimates as 146 g/tonne Ag for oxides, and 87 g/tonne Ag for dump recovered;

Ageq=Au/Pb credits= 10g/tonne Ag

3. Metal prices at $708/oz-Au, $12.00/oz

- -Ag, $0.75/lb -Pb, $0.50/lb -Zn.

4. Mine dilution is included at a minimum

mining width of 2.00m. Estimates do not include mining recovery.

5. Base

metals, Lead and Zinc are not recovered due to low market prices.

To download the entire San Martin 43-101 Technical Report - Click here to view (PDF, 9.34 MB)

24

DEL TORO SILVER MINE

NI 43-101 RESOURCES

ESTIMATE DATED JULY 31, 2008

| CATEGORY | TONNES | GRADE | CONTAINED SILVER EQV. OUNCES | ||

| SILVER

G/TONNE |

LEAD % |

ZINC % | |||

| Measured + Indicated - Oxides | 728,444 | 194 | 2.45 | 2.71 | 2,947,000 |

| Measured + Indicated - Sulphides | 649,528 | 353 | 7.20 | 7.14 | 17,996,000 |

| Total Measured + Indicated Resources | 1,377,972 | 269 | 4.69 | 4.80 | 20,943,000 |

| Total Inferred Resources | 1,831,738 | 306 | 5.77 | 5.94 | 35,970,000 |

| 1. |

Resource estimated “in situ” |

| 2. |

Price considerations $12.70/oz Ag, $0.90/lb-Pb and $0.85/lb-Zn. |

| 3. |

Mill recovery estimated: Oxides -- Ag 65%: Sulphides -- Ag 85%, Pb 85% and Zn 80%. |

| 4. |

Minimum mining width -- 2.00 m. |

| 5. |

Rounded figures. |

REAL DE CATORCE SILVER PROJECT

NI 43-101 RESOURCES

ESTIMATE DATED JULY 25, 2008

Update Resource Calculation November 10,

2008

| CATEGORY | TONNES (6,7,8) |

GRADE | METAL CONTAINED (2,5) SILVER (OZ.) | ||

| SILVER G/TONNE (3,4) |

LEAD % |

ZINC % | |||

| Measured Resources (oxides) | 2,656,428 | 222 | 0.08 | 0.06 | 18,938,779 |

| Indicated Resources (sulphides) | 1,052,170 | 316 | 0.73 | 0.74 | 10,675,742 |

| Measured in Tailings | 1,403,233 | 90 | 4,075,305 | ||

| Total Measured and Indicated Resources | 5,111,831 | 205 | 0.27 | 0.25 | 33,689,826 |

TOTAL INFERRED RESOURCES

| CATEGORY | TONNES (6,7,8) |

GRADE | METAL CONTAINED (2,5) SILVER (OZ.) | ||

| SILVER G/TONNE (3,4) |

LEAD % |

ZINC % | |||

| Total Inferred Resources | 1,854,963 | 220 | 0.22 | 0.17 | 13,097,701 |

| 1. |

Estimated are exclusive of Resources. |

| 2. |

Metal contained is Silver only. |

| 3. |

Grade capping at 605 g/t Ag for oxides and 1500 g/t Ag for sulphides. |

| 4. |

Cut Off Grade (COG) estimated as 100 g/tonne Ag. |

| 5. |

Metal contained not include credits derived from the lead and zinc. |

| 6. |

Mining dilution is included at over 1.50 m width. Estimates do not include mining recovery. |

| 7. |

The datebase for resource estimate consist of diamond drilling (surface grid 50 x 50 m-underground) and surface channel sampling. |

| 8. |

Method; polygons maximum radius 50 m. |

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 25

|

1805, 925 West Georgia Street Vancouver, B.C. Canada V6C 3L2 Phone: 604.688.3033 Fax: 604.639.8873 Toll Free: 1.866.529.2807 info@firstmajestic.com www.firstmajestic.com |

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING

The consolidated financial statements of First Majestic Silver Corp. (the “Company”) are the responsibility of the Company’s management. The consolidated financial statements are prepared in accordance with accounting principles generally accepted in Canada and reflect management’s best estimates and judgment based on information currently available.

Management has developed and maintains a system of internal controls to ensure that the Company’s assets are safeguarded, transactions are authorized and properly recorded, and financial information is reliable.

The Board of Directors is responsible for ensuring management fulfills its responsibilities. The Audit Committee reviews the results of the audit and the annual consolidated financial statements prior to their submission to the Board of Directors for approval.

The consolidated financial statements have been audited by Deloitte & Touche LLP and their report outlines the scope of their examination and gives their opinion on the financial statements.

|

|

| Keith Neumeyer | Raymond Polman, CA |

| President & CEO | Chief Financial Officer |

| March 19, 2010 | March 19, 2010 |

26

|

Deloitte & Touche LLP 2800 - 1055 Dunsmuir Street 4 Bentall Centre P.O. Box 49279 Vancouver, BC Canada V7X 1P4 Tel: 604-669-4466 Fax: 604-685-0395 www.deloitte.ca |

AUDITORS’ REPORT

To the Shareholders of

First Majestic Silver Corp.

We have audited the consolidated balance sheets of First Majestic Silver Corp. as at December 31, 2009 and 2008, and the consolidated statements of income (loss), shareholders’ equity and comprehensive income (loss), and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2009 and 2008, and the results of its operations and its cash flows for the years then ended in accordance with Canadian generally accepted accounting principles.

![]()

Chartered Accountants

Vancouver, Canada

March 19, 2010

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 27

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED BALANCE SHEETS |

| AS AT DECEMBER 31, 2009 AND 2008 |

| (Expressed in Canadian dollars) |

| 2009 | 2008 | |||

| $ | $ | |||

| ASSETS | ||||

| CURRENT ASSETS | ||||

| Cash and cash equivalents (Note 5) | 5,889,793 | 17,424,123 | ||

| Accounts receivable | 2,174,848 | 2,116,325 | ||

| Other receivables (Note 6) | 6,725,989 | 7,212,693 | ||

| Inventories (Note 7) | 3,812,460 | 4,941,340 | ||

| Prepaid expenses and other (Note 8) | 1,467,759 | 2,174,256 | ||

| 20,070,849 | 33,868,737 | |||

| MINING INTERESTS (Note 9) | ||||

| Producing properties | 57,144,477 | 49,933,735 | ||

| Exploration properties | 109,255,696 | 102,760,230 | ||

| Plant and equipment | 60,388,530 | 42,127,380 | ||

| 226,788,703 | 194,821,345 | |||

| CORPORATE OFFICE EQUIPMENT (Note 9) | 409,281 | 483,050 | ||

| DEPOSITS ON LONG-TERM ASSETS (Note 12) | 4,306,419 | 1,986,517 | ||

| 251,575,252 | 231,159,649 | |||

| LIABILITIES | ||||

| CURRENT LIABILITIES | ||||

| Accounts payable and accrued liabilities | 11,304,170 | 17,339,624 | ||

| Unearned revenue on silver bullion sales | 158,147 | 110,258 | ||

| Current portion of debt facilities (Note 11) | 1,546,612 | - | ||

| Vendor liability and interest (Notes 5 and 10) | - | 13,940,237 | ||

| Vendor liability on mineral property | - | 1,372,973 | ||

| Current portion of capital lease obligations (Note 20) | 2,139,352 | 1,584,477 | ||

| Income and other taxes payable | 117,844 | 557,634 | ||

| 15,266,125 | 34,905,203 | |||

| FUTURE INCOME TAXES | 28,417,011 | 30,690,087 | ||

| CAPITAL LEASE OBLIGATIONS (Note 20) | 668,284 | 1,898,396 | ||

| LONG-TERM PORTION OF DEBT FACILITIES (Note 11) | 3,213,487 | - | ||

| OTHER LONG TERM LIABILITIES (Note 19) | 753,657 | 832,769 | ||

| ASSET RETIREMENT OBLIGATIONS (Note 21) | 4,336,088 | 5,304,369 | ||

| 52,654,652 | 73,630,824 | |||

| SHAREHOLDERS' EQUITY | ||||

| SHARE CAPITAL (Note 14(a)) | 244,241,006 | 196,648,345 | ||

| SHARE CAPITAL TO BE ISSUED (Note 14(d)) | 276,495 | 276,495 | ||

| CONTRIBUTED SURPLUS | 27,808,671 | 23,297,258 | ||

| ACCUMULATED OTHER COMPREHENSIVE LOSS | (40,238,914 | ) | (23,216,390 | ) |

| DEFICIT | (33,166,658 | ) | (39,476,883 | ) |

| 198,920,600 | 157,528,825 | |||

| 251,575,252 | 231,159,649 | |||

CONTINUING OPERATIONS (Note 1)

CONTINGENT LIABILITIES (Note

22)

COMMITMENTS (Note 23)

|

Director |  |

Director |

The accompanying notes are an integral part of these consolidated financial statements

28

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF INCOME (LOSS) |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

| (Expressed in Canadian dollars, except share amounts) |

| 2009 | 2008 | |||||

| $ | $ | |||||

| Revenues (Note 15) | 59,510,669 | 44,324,887 | ||||

| Cost of sales | 34,351,853 | 30,419,415 | ||||

| Amortization and depreciation | 3,504,065 | 3,169,226 | ||||

| Depletion | 2,748,709 | 3,034,137 | ||||

| Accretion of reclamation obligation (Note 21) | 445,090 | 200,477 | ||||

| Mine operating earnings | 18,460,952 | 7,501,632 | ||||

| General and administrative | 8,089,087 | 7,549,079 | ||||

| Stock-based compensation | 3,302,780 | 3,680,111 | ||||

| Write-down of mineral properties (Note 9 (f)) | 2,589,824 | - | ||||

| 13,981,691 | 11,229,190 | |||||

| Operating income (loss) | 4,479,261 | (3,727,558 | ) | |||

| Interest and other expenses | (2,101,862 | ) | (1,372,768 | ) | ||

| Investment and other income | 1,129,527 | 1,180,742 | ||||

| Impairment of marketable securities | (390,467 | ) | - | |||

| Foreign exchange loss | (36,426 | ) | (3,144,654 | ) | ||

| Income (loss) before taxes | 3,080,033 | (7,064,238 | ) | |||

| Income tax expense - current | 85,786 | 136,533 | ||||

| Income tax (recovery) - future | (3,315,978 | ) | (2,055,987 | ) | ||

| Income tax recovery (Note 18) | (3,230,192 | ) | (1,919,454 | ) | ||

| NET INCOME (LOSS) FOR THE YEAR | 6,310,225 | (5,144,784 | ) | |||

| EARNINGS (LOSS) PER COMMON SHARE | ||||||

| BASIC | $ | 0.08 | $ | (0.07 | ) | |

| DILUTED | $ | 0.07 | $ | (0.07 | ) | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | ||||||

| BASIC | 83,389,253 | 71,395,164 | ||||

| DILUTED | 85,913,487 | 71,395,164 |

The accompanying notes are an integral part of these consolidated financial statements

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 29

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME (LOSS) |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

| (Expressed in Canadian dollars, except share amounts) |

| Accumulated | |||||||||||||||||

| Other | |||||||||||||||||

| Comprehensive | Total | ||||||||||||||||

| Share capital | Contributed | Income (Loss) | AOCI | ||||||||||||||

| Shares | Amount | To be issued | Surplus | ("AOCI") (1) | Deficit | and deficit | Total | ||||||||||

| $ | $ | $ | $ | $ | $ | $ | |||||||||||

| Balance at December 31, 2007 | 63,042,160 | 145,699,783 | 9,286,155 | 17,315,001 | (15,186,207 | ) | (34,332,099 | ) | (49,518,306 | ) | 122,782,633 | ||||||

| Net loss | - | - | - | - | - | (5,144,784 | ) | (5,144,784 | ) | (5,144,784 | ) | ||||||

| Other comprehensive loss: | |||||||||||||||||

| Translation adjustment | - | - | - | - | (7,616,671 | ) | - | (7,616,671 | ) | (7,616,671 | ) | ||||||

| Unrealized loss on marketable securities | - | - | - | - | (413,512 | ) | - | (413,512 | ) | (413,512 | ) | ||||||

| Total comprehensive loss | (13,174,967 | ) | (13,174,967 | ) | |||||||||||||

| Shares issued for: | |||||||||||||||||

| Exercise of options | 436,650 | 1,398,566 | - | - | - | - | - | 1,398,566 | |||||||||

| Exercise of warrants | 7,500 | 31,875 | - | - | - | - | - | 31,875 | |||||||||

| First Silver arrangement | 1,861,500 | 9,009,660 | (9,009,660 | ) | - | - | - | - | - | ||||||||

| Public offering, net of issue costs (Note 14(a)(iv)) | 8,500,000 | 40,144,471 | - | - | - | - | - | 40,144,471 | |||||||||

| Stock option expense, net of deferred compensation | - | - | - | 3,609,247 | - | - | - | 3,609,247 | |||||||||

| Warrants issued during the year | - | - | - | 2,737,000 | - | - | - | 2,737,000 | |||||||||

| Transfer of contributed surplus upon exercise of stock options | - | 363,990 | - | (363,990 | ) | - | - | - | - | ||||||||

| Balance at December 31, 2008 | 73,847,810 | 196,648,345 | 276,495 | 23,297,258 | (23,216,390 | ) | (39,476,883 | ) | (62,693,273 | ) | 157,528,825 | ||||||

| Net income | - | - | - | - | - | 6,310,225 | 6,310,225 | 6,310,225 | |||||||||

| Other comprehensive loss: | |||||||||||||||||

| Translation adjustment | - | - | - | - | (17,411,904 | ) | - | (17,411,904 | ) | (17,411,904 | ) | ||||||

| Impairment of marketable securities | - | - | - | - | 390,467 | - | 390,467 | 390,467 | |||||||||

| Unrealized loss on marketable securities | - | - | - | - | (1,087 | ) | - | (1,087 | ) | (1,087 | ) | ||||||

| Total comprehensive loss | (10,712,299 | ) | (10,712,299 | ) | |||||||||||||

| Shares issued for: | |||||||||||||||||

| Exercise of options | 36,250 | 97,963 | - | (29,125 | ) | - | - | - | 68,838 | ||||||||

| Exercise of warrants | 50,000 | 165,000 | - | - | - | - | - | 165,000 | |||||||||

| Public offering, net of issue costs (Note 14(a)(i)) | 8,487,576 | 18,840,890 | - | 848,758 | - | - | - | 19,689,648 | |||||||||

| Private placements, net of issue costs (Note 14(a )(i i)) | 4,167,478 | 9,051,069 | - | 389,000 | - | - | - | 9,440,069 | |||||||||

| Debt settlements (Note 14(a )(iii)) | 1,191,852 | 2,741,260 | - | - | - | - | - | 2,741,260 | |||||||||

| Acquisition of Normabec (Note 13) | 4,867,778 | 16,696,479 | - | - | - | - | - | 16,696,479 | |||||||||

| Stock option expense during the year | - | - | - | 3,302,780 | - | - | - | 3,302,780 | |||||||||

| Balance at December 31, 2009 | 92,648,744 | 244,241,006 | 276,495 | 27,808,671 | (40,238,914 | ) | (33,166,658 | ) | (73,405,572 | ) | 198,920,600 | ||||||

(1) AOCI consists of the cumulative translation adjustment on self sustaining subsidiaries which primarily affects the mining interests, except for the unrealized loss of $1,087 (2008 - unrealized loss of $391,000) on marketable securities classified as "available for sale".

The accompanying notes are an integral part of these consolidated financial statements

30

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

| (Expressed in Canadian dollars) |

| 2009 | 2008 | |||

| $ | $ | |||

| OPERATING ACTIVITIES | ||||

| Net income (loss) for the year | 6,310,225 | (5,144,784 | ) | |

| Adjustment for items not affecting cash | ||||

| Depletion | 2,748,709 | 3,034,137 | ||

| Depreciation | 3,504,065 | 3,169,226 | ||

| Stock-based compensation | 3,302,780 | 3,680,111 | ||

| Accretion of reclamation obligation | 445,090 | 200,477 | ||

| Write-down of other assets | - | 240,000 | ||

| Write-down of mineral property interests | 2,589,824 | - | ||

| Write-down of marketable securities | 390,467 | - | ||

| Future income taxes | (3,315,978 | ) | (2,055,987 | ) |

| Other income from derivative financial instruments | (1,002,780 | ) | - | |

| Unrealized foreign exchange loss and other | 566,553 | 1,510,431 | ||

| 15,538,955 | 4,633,611 | |||

| Net change in non-cash working capital items | ||||

| (Decrease) Increase in accounts receivable and other receivables | (960,183 | ) | 1,517,537 | |

| Decrease (Increase) in inventories | 365,964 | (1,571,118 | ) | |

| Increase in prepaid expenses and other | (1,144,849 | ) | (588,697 | ) |

| (Decrease) Increase in accounts payable and accrued liabilities | (5,813,014 | ) | 1,055,694 | |

| Increase in unearned revenue | 47,889 | 110,258 | ||

| Decrease in taxes receivable and payable | (89,190 | ) | (369,312 | ) |

| Increase in vendor liability and interest | - | 399,112 | ||

| (Decrease) Increase in vendor liability on mineral property | (1,242,543 | ) | 1,372,973 | |

| 6,703,029 | 6,560,058 | |||

| INVESTING ACTIVITIES | ||||

| Expenditures on mineral property interests (net of accruals) | (14,025,158 | ) | (24,485,036 | ) |

| Additions to plant and equipment (net of accruals) | (19,365,209 | ) | (14,921,672 | ) |

| Increase in derivative financial instruments | - | (127,153 | ) | |

| Decrease (increase) in silver futures contract deposits | 1,355,163 | (363,278 | ) | |

| Investment in marketable securities | (300,000 | ) | - | |

| Increase in deposits on long term assets and other | (2,508,617 | ) | (704,487 | ) |

| Acquisition of Normabec, less cash acquired | (531,419 | ) | - | |

| (35,375,240 | ) | (40,601,626 | ) | |

| FINANCING ACTIVITIES | ||||

| Issuance of common shares and warrants, net of issue costs | 29,363,555 | 41,574,912 | ||

| Payment of capital lease obligations | (2,708,513 | ) | (2,551,752 | ) |

| Prepayment facility, net of repayments | 415,632 | - | ||

| Payment of restricted cash into trust account | (14,258,332 | ) | - | |

| Payment of short-term Arrangement liability | - | (388,836 | ) | |

| Proceeds from FIFOMI debt facility | 4,309,159 | - | ||

| 17,121,501 | 38,634,324 | |||

| (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (11,550,710 | ) | 4,592,756 | |

| EFFECT OF EXCHANGE RATE ON CASH HELD IN FOREIGN CURRENCY | 16,380 | (3,816 | ) | |

| CASH AND CASH EQUIVALENTS - BEGINNING OF THE YEAR | 17,424,123 | 12,835,183 | ||

| CASH AND CASH EQUIVALENTS - END OF THE YEAR | 5,889,793 | 17,424,123 | ||

| CASH AND CASH EQUIVALENTS IS COMPRISED OF: | - | |||

| Cash | 5,296,059 | 495,168 | ||

| Short-term deposits | 593,734 | 2,988,718 | ||

| Restricted cash (Notes 5 and 10) | - | 13,940,237 | ||

| 5,889,793 | 17,424,123 | |||

| Interest paid | 636,950 | 883,307 | ||

| Income taxes paid | - | 135,847 | ||

| NON-CASH FINANCING AND INVESTING ACTIVITIES (NOTE 24) |

The accompanying notes are an integral part of these consolidated financial statements

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 31

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

1. DESCRIPTION OF BUSINESS AND CONTINUING OPERATIONS

First Majestic Silver Corp. (the “Company” or “First Majestic”) is in the business of production, development, exploration, and acquisition of mineral properties with a focus on silver in Mexico. The Company’s shares and warrants trade on the Toronto Stock Exchange under the symbols “FR”, “FR.WT.A” and “FR.WT.B”, respectively.

These consolidated financial statements have been prepared on the going concern basis which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company’s ability to continue as a going concern is dependent on the price of silver in global commodity markets, and on maintaining profitable operations or obtaining sufficient funds from alternative sources as required to augment operations and for ongoing capital developments. If the Company were unable to continue as a going concern, material adjustments may be required to the carrying value of assets and liabilities and the balance sheet classifications used.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements of the Company have been prepared by management in accordance with Canadian generally accepted accounting principles (“GAAP”).

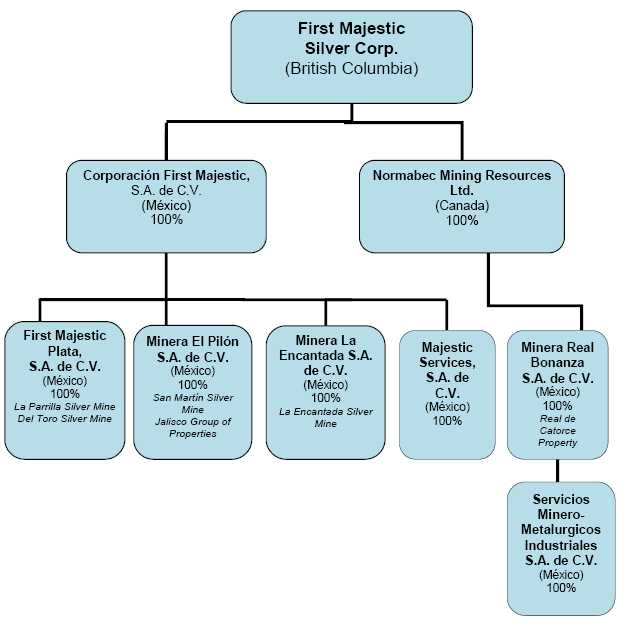

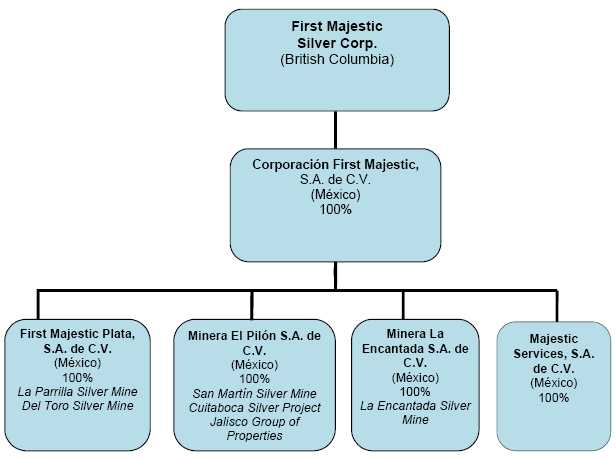

The consolidated financial statements include the accounts of the Company and its direct wholly-owned subsidiaries: Corporación First Majestic, S.A. de C.V. (“CFM”), First Silver Reserve Inc. (“First Silver”) and Normabec Mining Resources Ltd. (“Normabec”) as well as its indirect wholly-owned subsidiaries: First Majestic Plata, S.A. de C.V. (“First Majestic Plata”), Minera El Pilon, S.A. de C.V. (“El Pilon”), Minera La Encantada, S.A. de C.V. (“La Encantada”), Majestic Services S.A. de C.V. (“Majestic Services”), Minera Real Bonanza, S.A. de C.V. (“MRB”) and Servicios Minero-Metalurgicos e Industriales, S.A. de C.V. (“Servicios”). First Silver underwent a wind up and distribution of its assets and liabilities to the Company in December 2007 but First Silver has not been dissolved for legal purposes pending the outcome of litigation described in Note 10. Intercompany balances and transactions are eliminated on consolidation.

Variable Interest Entities (“VIEs”) as defined by the Accounting Standards Board in Accounting Guideline 15 “Consolidation of Variable Interest Entities” are entities in which equity investors do not have the characteristics of a “controlling financial interest” or there is not sufficient equity at risk for the entity to finance its activities without additional subordinated financial support. VIEs are subject to consolidation by the primary beneficiary who will absorb the majority of the entities expected losses and/or expected residual returns. The Company has determined that it has no VIEs.

Measurement Uncertainties

The preparation of consolidated financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities as at the date of the financial statements, and the reported amounts of revenues and expenses during the reported period. Significant areas where management judgment is applied include, among others, the expected economic lives and the future operating results and net cash flows expected to result from exploitation of resource properties and related assets, the amount of proven and probable mineral reserves, accounting for income tax provisions, stock-based compensation, the determination of the fair value of assets acquired in business combinations and the amount of future site reclamation costs and asset retirement obligations. Actual results could differ from those reported.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and money market instruments with terms to maturity not exceeding 90 days at date of issue. The Company does not believe it is exposed to significant credit or interest rate risk although cash and cash equivalents are held in excess of federally insured limits with major financial institutions. In 2008, cash and cash equivalents included restricted cash of $13.9 million as described in Note 5.

Inventories

Silver coins and bullion, finished products of silver doré and silver concentrates, ore in process and stockpile (unprocessed ore) are valued at the lower of cost and net realizable value. Cost is determined as the average production cost of saleable silver and metal by-product. Materials and supplies are valued at the lower of cost and net replacement cost.

32

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Mineral Property Interests

Mineral property costs and exploration, development and field support costs directly relating to mineral properties are deferred until the property to which they directly relate is placed into production, sold, abandoned or subject to a condition of impairment. The deferred costs are amortized over the useful life of the ore body following commencement of production, or written off if the property is sold or abandoned. Administration costs and other exploration costs that do not relate to any specific property are expensed as incurred.

The acquisition, development and deferred exploration costs are depleted on a units-of-production basis over the estimated economic life of the ore body following commencement of production.

The Company reviews and evaluates its mining properties for impairment at least annually or when events and changes in circumstances indicate that the related carrying amounts may not be recoverable. Impairment is considered to exist if the total estimated future undiscounted cash flows are less than the carrying amount of the assets. Estimated undiscounted future net cash flows for properties in which a mineral resource has been identified are calculated using estimated future production, commodity prices, operating and capital costs and reclamation and closure costs. Undiscounted future cash flows for exploration stage mineral properties are estimated by reference to the timing of exploration and development work, work programs proposed, the exploration results achieved to date and the likely proceeds receivable if the Company sold specific properties to third parties. If it is determined that the future net cash flows from a property are less than the carrying value, then an impairment loss is recorded to write down the property to fair value.

The carrying value of exploration stage mineral property interests represent costs incurred to date. The Company is in the process of exploring its other mineral property interests and has not yet determined whether they contain ore reserves that are economically recoverable. Accordingly, the recoverability of these capitalized costs is dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete their exploration and development, and upon future profitable production.

Although the Company has taken steps to verify ownership and legal title to mineral properties in which it has an interest, according to the usual industry standards for the stage of mining, development and exploration of such properties, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects. Management is not aware of any such agreements, transfers or defects.

From time to time, the Company acquires or disposes of properties pursuant to the terms of option agreements. Options are exercisable entirely at the discretion of the optionee and, accordingly, are recorded as mineral property costs or recoveries when the payments are made or received.

Impairment of Long-Lived Assets

Long-lived assets are assessed for impairment at least annually, and when events and circumstances warrant. The carrying value of a long-lived asset is impaired when the carrying amount exceeds the estimated undiscounted net cash flow from use or disposal. In the event that a long-lived asset is determined to be impaired, the amount by which the carrying value exceeds its fair value is charged to earnings.

Asset Retirement Obligations and Reclamation Costs

Future costs to retire an asset including dismantling, remediation and ongoing treatment and monitoring of the site are recognized and recorded as a liability at fair value at the date the liability is incurred. The liability is accreted over time to the amount ultimately payable through periodic charges to earnings. Future site restoration costs are capitalized as part of the carrying value of the related mineral property at their initial value and amortized over the mineral property’s useful life based on a units-of-production method.

Translation of Foreign Currencies

(i) Foreign Currency Transactions

The currency of measurement for the Company’s Mexican operating subsidiaries is the Mexican peso. Transaction amounts denominated in foreign currencies (currencies other than the Mexican peso) are translated into Mexican pesos at exchange rates prevailing on the transaction dates. Carrying values of foreign currency denominated monetary assets and liabilities are translated into the currency of measurement at the exchange rate in effect at the balance sheet date and non-monetary assets and liabilities are translated at the exchange rates in effect at the time of acquisition or issue. Revenues and expenses are translated at the historical exchange rates in effect at the time of the transactions. Exchange gains and losses arising from the translation of these foreign currency denominated monetary assets and liabilities are included in operations.

FIRST MAJESTIC SILVER CORP. 2009 ANNUAL REPORT | 33

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

(ii) Subsidiary Financial Statements

The financial statements of Mexican self-sustaining subsidiaries that are measured in Mexican pesos are translated into Canadian dollars using the current rate method. Translation gains and losses related to current rate translation of non-monetary items as at the reporting date are included as an element of the exchange gains and losses and included as a separate component of accumulated other comprehensive income.