ANNUAL INFORMATION FORM

For the year ended December 31, 2009

Date: March 29, 2010

2

TABLE OF CONTENTS

- 1 -

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (“AIF”) of First Majestic Silver Corp. (“First Majestic” or the “Company”) is as of March 29, 2010.

Financial Information

All financial information in this AIF is prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”).

Forward-looking Information

Certain statements contained in this AIF, and in certain documents incorporated by reference herein, constitute forward-looking statements. These statements relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to, statements with respect to commercial mining operations, anticipated mineral recoveries, protected quantities of future mineral production, interpretation of drill results, anticipated production rates and mine life, operating efficiencies, capital budgets, costs and expenditures and conversion of mineral resources to proven and probable mineral reserves, analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

All statements other than statements of historical fact may be forward-looking statements. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and in the case of mineral resources or proven and probable mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect, “forecast”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “outlook” and similar expressions) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Company believes that the expectations reflected in those forward looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this AIF should not be unduly relied upon. These statements speak only as of the date of this AIF or as of the date specified in the documents incorporated by reference into this AIF, as the case may be. The Company does not intend, and does not assume any obligation, to update these forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among other things, results of exploration and development activities, the Company’s historical experience with development-stage mining operations, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and, particularly, silver prices, actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations and unanticipated environmental impacts on operations. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, risk factors incorporated by reference herein. See “Risk Factors”.

- - 2 -

Cautionary Notes to U.S. Investors Concerning Reserve and Resource Estimates

The definitions of Proven and Probable Reserves used in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7. Under SEC Guide 7 standards, a “Final” or “Bankable” feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into Reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Currency

All dollar amounts in this AIF are expressed in Canadian dollars unless otherwise indicated.

- - 3 -

CORPORATE STRUCTURE

Name, Address and Incorporation

First Majestic was incorporated under the Company Act (British Columbia) (the “Company Act”) on September 26, 1979 by registration of its Memorandum and Articles, under the name Brandy Resources Inc.

On September 5, 1984, the Company changed its name to Vital Pacific Resources Ltd. and consolidated its share capital on a two for one basis.

On May 26, 1987 the Company continued out of British Columbia and was continued as a federal company pursuant to the Canada Business Corporations Act.

On August 27, 1987, the Company was extra provincially registered under the Company Act.

On August 21, 1998, the Company continued out of Canada and was continued into the jurisdiction of the Commonwealth of the Bahamas under the Companies Act (Bahamas).

On January 2, 2002, the Company continued out of the Commonwealth of the Bahamas under the Companies Act (Bahamas) and was continued to the Yukon Territory pursuant to the Business Corporations Act (Yukon). On January 3, 2002, the Company completed a consolidation of its share capital on a 1 new for 10 old basis and changed its name to First Majestic Resource Corp.

On January 17, 2005, the Company continued out of the Yukon Territory and was continued to British Columbia pursuant to the Business Corporations Act (British Columbia).

On November 22, 2006, the Company changed its name to First Majestic Silver Corp.

The Company’s head office is located at Suite 1805 – 925 W. Georgia Street, Vancouver, British Columbia, Canada, V6C 3L2 and its registered office is located at #2610 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1.

The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia, Newfoundland and Quebec.

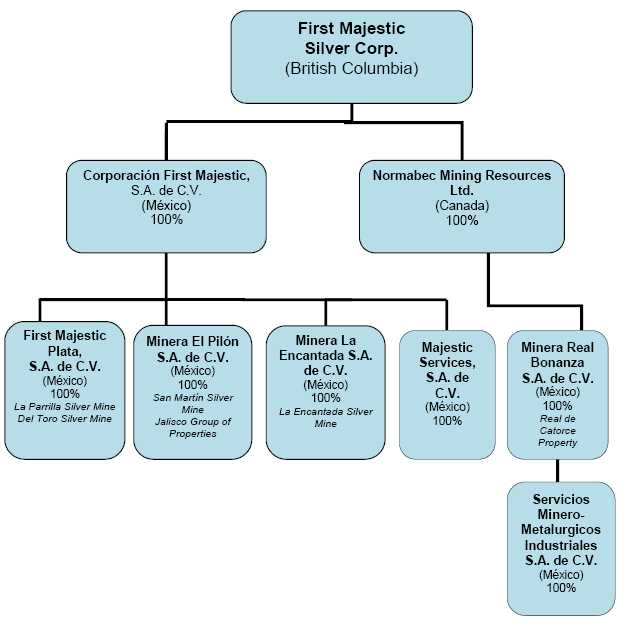

Intercorporate Relationships

The chart set out below illustrates the corporate structure of the Company and its material subsidiaries, the jurisdictions of incorporation, the percentage of voting securities held and their respective interests in various mineral projects and mining properties.

- - 4 -

GENERAL DEVELOPMENT OF THE BUSINESS

History

Since inception, First Majestic has been in the business of acquisition, development and exploration of mineral properties. During the fiscal year ended June 30, 2004, the Company became focused on the acquisition, development and exploration of mineral properties in México with an emphasis on silver projects.

- - 5 -

On January 12, 2004, the Company entered into an agreement to purchase the La Parrilla Silver Mine located approximately 65 kilometres south-east of the city of Durango, México. The purchase price of US$3 million (paid) included all properties, assets and equipment and all mining concessions consisting of 280 hectares. See “Mineral Projects – La Parrilla Silver Mine, México”. The La Parrilla Silver Mine was operated from 1956 to 1999 by the previous owners when it was put on a care and maintenance program in 1999 due to low silver prices. Total tonnage mined during that period is estimated at approximately 700,000 tonnes with an average grade of 300 grams per tonne (“g/t”) silver, 1.5% lead and 1.5% zinc.

Between March 2004 and August 2005, the Company entered into a number of agreements to acquire mining concessions located in Chalchihuites, Zacatecas, México which are located approximately 45 kilometres southeast of the La Parrilla Silver Mine. During the period ended December 31, 2006 and the year ended June 30, 2006, the Company relinquished its options relating to certain of the Chalchihuites Group Properties and wrote off acquisition and exploration costs relating to those options totalling $688,766 and $384,930, respectively. The remaining properties are now referred to as the Del Toro Silver Mine. The Company paid an aggregate of US$5,825,000 over a four-year period to complete the remaining options.

In December 2004, the Company entered into agreements for the purchase of the Candameña Mining District properties located in the Western Sierra Madre Mountain range between Hermosillo and Chihuahua in east central Sonora, México. On August 14, 2007, the Company entered into an agreement with Prospector Consolidated Resources Inc. (“Prospector”) whereby Prospector had the right to acquire 100% interest in the Company’s option to the Candameña Mining District property by paying $50,000 and issuing two million of its common shares to the Company. The Company received $50,000 in August 2007 and Prospector assumed all option commitments to the underlying property vendors effective August 2007. Prospector received regulatory approval and the Company received two million shares of Prospector in March 2008. See “Past Three Years” below.

In September 2005, the Company acquired a 100% interest in the La Encarnación and San Ignacio Dos mining claims consisting of 16 hectares adjacent to the Company’s La Parrilla Silver Mine for consideration of $40,000 and 200,000 common shares of the Company.

First Majestic entered into an irrevocable share purchase agreement dated for reference April 3, 2006 to purchase approximately 63% of the issued and outstanding shares of First Silver Reserve Inc. (“First Silver”) from the major shareholder of First Silver (the “Shareholder”). First Silver’s primary business was silver mining and the acquisition, exploration and development of mineral claims with a primary focus on silver properties in México. First Silver’s wholly owned subsidiary, El Pilon, is the sole owner of the San Martín Silver Mine in Jalisco State, México.

First Majestic purchased 24,649,200 common shares of First Silver (the “Acquisition”) at a price of $2.165 per share for an aggregate purchase price of $53,365,519 payable to the Shareholder in three instalments.

The first instalment of $26,682,759 represented 50% of the purchase price and was paid on closing of the Acquisition on May 30, 2006. A second instalment of $13,341,380, representing 25% of the purchase price, was paid on May 30, 2007. A final instalment of $13,341,380 was payable on May 30, 2008. An interest amount of 6% per annum was payable quarterly on the outstanding payment. Pending the outcome of the litigation referred to in the section entitled “Legal Proceedings” of this Annual Information Form, the Company has withheld payment of quarterly instalments of interest due on November 30, 2007, February 29, 2008 and May 30, 2008. The Company was withholding payment of the final instalment of $13,341,380 due May 30, 2008 and the above interest payments, an amount totalling $13,940,237.

On July 16, 2009, an Order was granted by the Court, with the consent of all parties, under which the Defendant obtained a judgment in the amount of $14,881,912. The Company agreed to pay out $14,258,332 to the Defendant’s lawyers trust account (the “Trust Funds”) in partial payment of the judgment. The consent order requires that the Trust Funds be held in trust pending the outcome of the litigation. If the trial has not commenced by June 30, 2011, the Trust Funds can be released on that date to the Defendant, unless otherwise ordered by the Court. At present time, the trial is scheduled to commence in the Supreme Court of British Columbia, Vancouver, British Columbia in February, 2011. The Consent Order does not affect the standing of the Company’s claims for relief against the Defendant in the Action.

- - 6 -

On June 5, 2006, First Majestic and First Silver entered into a letter agreement whereby the parties agreed to enter into a business combination such that First Majestic would acquire all of the outstanding securities of First Silver and First Silver would become a wholly owned subsidiary of First Majestic. The business combination was structured as a plan of arrangement (the “Arrangement”) which was formalized in a combination agreement with the parties dated August 9, 2006. On September 14, 2006, First Majestic acquired all of the issued and outstanding First Silver shares which it did not already own for an aggregate of 6,712,159 common shares of First Majestic and an aggregate cash payment of $777,672 paid at closing and $388,836 due on each of September 14, 2007 (which was paid) and September 14, 2008 (which was paid), with interest payable quarterly and compounded annually at 6.0% per annum on the unpaid balances from the closing of the Arrangement.

In addition, upon closing of the Arrangement, 12,500 stock options exercisable at a price of $3.28 per share expiring on June 13, 2009 and 550,000 stock options exercisable at a price of $4.30 per share expiring on June 19, 2011 were granted by the Company in exchange for 25,000 stock options of First Silver exercisable at a price of $1.64 per share expiring on June 13, 2009 and 1,100,000 stock options of First Silver exercisable at a price of $2.15 per share expiring on June 19, 2011. The common shares of First Silver were delisted from the Toronto Stock Exchange at the close of business on September 18, 2006.

Any certificate formerly representing First Silver shares not duly surrendered on or prior to September 14, 2012 shall cease to represent a claim or interest of any kind or nature, including a claim for dividends or other distributions against First Majestic or First Silver by a former First Silver shareholder. After such date, all First Majestic shares to which the former First Silver shareholder was entitled shall be deemed to have been cancelled.

In August 2006, the Company entered into three agreements to acquire the Quebradillas and Viboras Silver mines and a contiguous land package of 3,126 hectares of mining concessions located in the La Parrilla Mining District in Durango State, México, which now forms part of the Company’s La Parrilla Silver Mine. The Company acquired the right to purchase all the mining concessions, the mines, the data of past diamond drill programs and the assets located within the mine areas for a total purchase price of US$3,000,000 payable over a period of two years of which an aggregate of US$2,251,000 had been paid as of December 31, 2008. During the year ended December 31, 2008, the Company amended payment terms to the optionor regarding the outstanding payments as at December 31, 2008. The Company paid the balance of US$749,000 for concession payments in monthly instalments during 2009. As of December 31, 2009, no further payments were due. There is a net smelter royalty of 1.5% (“NSR”) of sales revenue to a maximum of US$2,500,000 and the Company has the option to purchase the NSR at any time for US$2,000,000. For the year ended December 31, 2009, the Company paid US$135,363 (December 31, 2008 – US$69,000) relating to royalties.

In August 2006, the Company entered into a letter agreement pursuant to which the Company acquired 100% of the issued and outstanding shares of Desmin S.A. de C. V. (“Desmin”), a privately held Mexican mining company for the purchase price of US$1.5 million (the final payment having been made on April 30, 2007), resulting in Desmin becoming a wholly owned subsidiary of the Company. Desmin’s primary asset was an exploitation contract which entitled Desmin to operate the La Encantada Silver Mine located in Coahuila State in Northern México. The exploitation contract provided Desmin an option to acquire all properties within the 697 hectare land package, including the operations of the mine and mill and all the auxiliary installations and associated equipment. The Company purchased the operations of Desmin effective November 1, 2006 and took over the operations of the La Encantada Silver Mine. In addition, Desmin had an option agreement to acquire the La Encantada Silver Mine, including the mill and surrounding mining claims.

- - 7 -

In December 2006, the Company signed a letter of agreement to acquire 100% of the issued and outstanding shares of Minera La Encantada S.A. de C.V. (“La Encantada”), a Mexican mining company owned by Minas Peñoles S.A. de C.V. and Industrias Peñoles S.A de C.V. for the purchase price of US$3,250,000 and a 4% NSR. La Encantada’s primary asset is the La Encantada Silver Mine in Coahuila State, Mexico. A non-refundable deposit of US$1,000,000 was made on the date of the agreement and the balance was paid upon closing the acquisition on March 20, 2007. Pursuant to the terms of the agreement, the Company exercised its option to acquire the 4% NSR in exchange for 382,582 common shares at a value of $5.32 per share and 191,291 warrants exercisable at a price of $6.81 per share for a two-year period.

The Company changed its financial year from June 30 to December 31, effective for the financial period July 1, 2006 to December 31, 2006. The decision to change the Company’s fiscal year end was made so that the Company would have the same fiscal year end as its operating subsidiaries in México. To facilitate the change, the Company reported a one-time, six-month transition year covering the period from July 1, 2006 to December 31, 2006. Subsequent to the transition year, the first full financial year covered the period January 1, 2007 to December 31, 2007.

Past Three Years

In January 2007, the Company completed the acquisition of the San Juan silver mine which forms part of the Del Toro Silver Mine (formerly referred to as the Chalchihuites Group of Properties) by making the final payments of US$500,000 and US$150,000 due January 7, 2007 and July 7, 2007, respectively, pursuant to the agreement. In connection therewith, a finder’s fee in the amount of $77,808 (US$68,422) was paid to a director of the Company.

In March 2007, the Company acquired all of the issued and outstanding shares of Minera La Encantada S.A. de C.V. (“Minera La Encantada”), a Mexican mining company owned by Industrias Peñoles, S.A. de C.V. (“Peñoles”) for a total purchase price of US$3,250,000 and an NSR of 4%. The Company also acquired the underlying 4% NSR through the issuance of 382,582 shares and 191,291 warrants, each warrant entitling Peñoles to purchase one additional share at a price of $6.81 which expired on March 20, 2009. Desmin paid a sliding-scale royalty to Peñoles pursuant to the terms of its exploitation contract. As a result of the Company’s purchase of Minera La Encantada, all royalties were cancelled at closing on March 20, 2007. On January 1, 2008, Desmin amalgamated with Minera La Encantada S.A. de C.V.

On May 10, 2007, the Company completed a private placement of special warrants for gross proceeds of $34,415,000. A total of 6,883,000 special warrants were sold at a price of $5.00 per special warrant through Cormark Securities Inc. and CIBC World Markets Inc., as co-lead underwriters, and Blackmont Capital Inc. Each special warrant was automatically exercised for one common share of the Company and one half of a common share purchase warrant on July 25, 2007 (the date the Company obtained a final receipt for a prospectus qualifying the underlying securities). Each whole share purchase warrant was exercisable at a price of $6.50. The warrants expired on November 10, 2008, none of which were exercised prior to expiry. The underwriters received a commission of 5.5% of the gross proceeds of the offering at closing.

On July 31, 2007, the Company incorporated a new wholly owned Mexican subsidiary, Corporación First Majestic, S.A. de C.V., (“CFM”) and effected a corporate restructuring of Desmin, La Encantada and First Majestic Plata, on August 14, 2007, such that Desmin and La Encantada were amalgamated and the Company now holds the shares of FM Plata, Minera El Pilon and La Encantada, through CFM, which became a Mexican holding company for Mexican tax consolidation purposes.

- - 8 -

In August 2007, the Company entered into an agreement with Prospector whereby Prospector had the right to acquire a 100% interest in the Company’s option to acquire the Candameña Mining District Property by paying $50,000 within five business days following the execution of the agreement (paid) and issuing 2,000,000 of its shares to the Company within five business days of regulatory approval or September 7, 2007, whichever is earlier. As Prospector had not received regulatory approval by September 7, 2007, it paid an additional US$150,000 to the Company on October 19, 2007 to satisfy an option commitment to the underlying vendor. In March 2008, the Company received 2,000,000 common shares from Prospector. In August 2008, the Company after having made numerous unsuccessful attempts to assist Prospector in the transfer of the rights to the Candameña property, and having advised Prospector that the underlying agreements with the Candameña property owners were in breach the Company was required to return the mining rights to their respective underlying property owners.

The Company’s common shares and warrants were listed and commenced trading on the Toronto Stock Exchange effective January 15, 2008.

On March 25, 2008, the Company completed a public offering with a syndicate of underwriters led by CIBC World Markets Inc. and including Blackmont Capital Inc., Cormark Securities Inc. and GMP Securities L.P., who purchased 8,500,000 units of the Company at a price of $5.35 per unit. Each unit consisted of one common share in the capital of the Company and one-half of one common share purchase warrant. Each whole common share purchase warrant entitled the holder to acquire one additional common share at a price of $7.00 for a period of 24 months from the closing of the offering. The underwriters also received an over-allotment option, exercisable up until 30 days following the closing of the offering to purchase up to an additional 1,275,000 common shares at a price of $5.07 per share and up to an additional 637,500 share purchase warrants at a price of $0.56 per warrant. On April 4, 2008, the Company completed the issuance of an aggregate of 637,500 warrants pursuant to the exercise of the over-allotment option.

On July 6, 2008, the Company entered into an agreement to acquire the Fatima mining concession consisting of 46 hectares of mining concessions located in the Zacatecas State, México which forms part of the Del Toro Silver Mine. The Company has the right to purchase all the mining concessions, for a total purchase price of US$387,500 payable over a period of 30 months, of which an aggregate of US$162,500 had been paid as of December 31, 2009.

On March 5, 2009, the Company completed a public offering with a syndicate of underwriters led by CIBC World Markets Inc. and including Blackmont Capital Inc., GMP Securities L.P. and Thomas Weisel Partners, who purchased 8,487,576 units of the Company at a price of $2.50 per unit for gross proceeds to the Company of $21,218,940. Each unit consisted of one common share in the capital of the Company and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one additional common share at a price of $3.50 for a period of 24 months from the closing of the offering. The underwriters also received an over-allotment option, exercisable up until 30 days following the closing of the offering to purchase up to an additional 1,273,136 common shares at a price of $2.40 per share and up to an additional 636,568 share purchase warrants at a price of $0.20 per warrant.

On August 20, 2009, the Company completed the first tranche of a non-brokered private placement consisting of 3,499,000 units at a price of $2.30 per unit for gross proceeds of $8,047,700. Each unit consisted of one common share and one-half of one common share purchase warrant, with each full warrant entitling the holder to purchase one additional common share of the Company at an exercise price of $3.30 per warrant share for a period of two years after the closing of the offering. A finder’s fee in the amount of $101,016 cash and 50,000 finder’s warrants were paid in respect to a portion of this private placement. The finder’s warrants are subject to the same terms and conditions as those issued to the subscribers.

- - 9 -

On August 20, 2009, the Company also settled certain current liabilities amounting to $822,053 by the issuance of 357,414 common shares of the Company at a deemed price of $2.30 per common share.

On September 16, 2009, the Company completed the second and final tranche of the non-brokered private placement consisting of 668,478 units at a price of $2.30 per unit for gross proceeds of $1,537,500. Each unit consisted of one common share and one-half of one common share purchase warrant, with each full warrant entitling the holder to purchase one additional common share of the Company at an exercise price of $3.30 per warrant share for a period of two years after the closing of the offering.

On September 18, 2009, the Company settled certain current liabilities amounting to $1,919,209 by the issuance of 834,438 common shares of the Company at a deemed price of $2.30 per common share.

On November 13, 2009, the Company announced the closing of a plan of arrangement (the “Normabec Arrangement”) to acquire all of the issued and outstanding shares of Normabec Mining Resources Ltd. (“Normabec”) a publicly traded mining company listed on the TSX Venture Exchange in exchange for the issuance of 4,652,778 common shares of the Company. In addition, the Company issued warrants to purchase an aggregate of 260,965 common shares of the Company in exchange for all outstanding share purchase warrants of Normabec, all of which expired by January 2, 2010. Normabec’s primary asset is the Real de Catorce Silver Project located 25 km west of the town of Matehuala in San Luis Potosi State, Mexico. The Real de Catorce property consists of 22 mining concessions covering 6,327 hectares. Real de Catorce is an historic mining region, with estimated historical production of 230 million ounces between the years 1773 and 1990.

Concurrent with the completion of the Normabec Arrangement, the non-Mexican assets of Normabec were divested to a newly formed entity named Brionor Resources Inc. (“Brionor”) Holders of Normabec shares also received 0.25 Brionor shares for each Normabec common share. The Company also purchased, via private placement, 2,115,195 common shares of Brionor for an aggregate purchase price of $300,000, representing a price per share of approximately $0.1418. These shares represented 9.9% of the total issued and outstanding shares of Brionor upon completion of the transaction at November 13, 2009. Brionor is a public company listed on the TSX Venture Exchange.

Through the acquisition of Normabec and its wholly owned subsidiary, Mineral Real de Bonanza SA de CV, the Company owns 100% of the Real de Catorce Silver Project. Upon commencement of commercial production on the property, the Company has agreed to pay an amount of US$200,000. The property is subject to a 3% net smelter return royalty, of which 1.75% may be acquired in increments of 0.25% for a price of US$250,000 per increment for the first five years from the date of the first payment and at a price of US$300,000 per increment for the following five years.

In addition, the Company has agreed to acquire the surface rights forming part of the property, including the buildings located thereon and covering the location of the previous mining operations, in consideration for a single payment of US$1,000,000 to be made in December 2010. The Company has also agreed to make a payment of US$200,000 on December 10, 2010 for all technical and geological information collected over the area. Such payment is not related to the acquisition of the mining concessions or the surface rights and buildings agreement.

The Company had an option dated November 25, 2004 with Consorcio Minero Latinamericano, SA de CV, a private Mexican company owned by a former director of First Silver, for the purchase of a 100% interest in seven mining claims referred to as the Cuitaboca Silver Project covering 3,718 hectares located in the State of Sinaloa, México. To purchase the claims, the Company was required to pay a total of US$2,500,000 in staged cash payments through November 25, 2010. Subsequent to acquiring Normabec and during the year ended December 31, 2009, the Company elected not to proceed with the acquisition of the Cuitaboca Silver Project. Accordingly, the historical investment including exploration totalling $2,589,824 was written off during the year ended December 31, 2009.

- - 10 -

DESCRIPTION OF BUSINESS

General

The Company is in the business of the production, development, exploration and acquisition of mineral properties focusing on silver in México. The common shares and certain warrants of the Company trade on the Toronto Stock Exchange under the symbols “FR” and “FR.WT.B”. The common shares are also quoted on the OTCQX in the U.S. under the symbol “FRMSF” and on the Frankfurt, Berlin, Munich and Stuttgart Stock Exchanges under the symbol “FMV”.

The Company has ownership of three producing properties in México: the La Encantada Silver Mine in Coahuila State, the La Parrilla Silver Mine in Durango State, and the San Martin Silver Mine in Jalisco State. The Company also owns two advanced stage development silver project, the Del Toro Silver Mine, formerly referred to as the Chalchihuites Group Properties in Zacatecas State, and the Real de Catorce Silver Project in San Luis Potosi State, and has an interest in several exploration properties in various states in México.

The Company’s business is not materially affected by intangibles such as licences, patents and trademarks, nor is it affected by seasonal changes. The Company is not aware of any aspect of its business which may be affected in the current financial year by renegotiation or termination of contracts.

At December 31, 2009, the Company had 13 employees based in its Vancouver corporate office, one employee in the United Kingdom and approximately 1,449 employees, contractors and other personnel in México. Additional consultants are also retained from time to time for specific corporate activities, development and exploration programs.

Risk Factors

The Company, and thus the securities of the Company, should be considered a speculative investment and investors should carefully consider all of the information disclosed in this AIF prior to making an investment in the Company. In addition to the other information presented in this AIF, the following risk factors should be given special consideration when evaluating an investment in the Company’s securities.

Operating Hazards and Risks

The operation and development of a mine or mineral property involves many risks which a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include:

These occurrences could result in environmental damage and liabilities, work stoppages and delayed production, increased production costs, damage to, or destruction of, mineral properties or production facilities, personal injury or death, asset write downs, monetary losses and other liabilities. Liabilities that First Majestic incurs may exceed the policy limits of its insurance coverage or may not be insurable, in which event First Majestic could incur significant costs that could adversely impact its business, operations or profitability.

- - 11 -

Uncertainty in the Calculation of Mineral Reserves, Resources and Silver Recovery

There is a degree of uncertainty attributable to the calculation of mineral Reserves and mineral Resources and corresponding grades being mined or dedicated to future production. Until mineral Reserves or mineral Resources are actually mined and processed, the quantity of minerals and grades must be considered estimates only. In addition, the quantity of mineral Reserves and mineral Resources may vary depending on, among other things, metal prices. Any material change in the quantity of mineral Reserves, mineral Resources, grade or minimum mining widths may affect the economic viability of First Majestic’s properties. In addition, there can be no assurance that silver recoveries or other metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production, or that the existing known and experienced recoveries will continue.

Substantial Decommissioning and Reclamation Costs

During the year ended December 31, 2009, the Company reassessed its reclamation obligations at each of its mines based on updated mine life estimates, rehabilitation and closure plans. The total undiscounted amount of estimated cash flows required to settle the Company’s estimated obligations is $6.1 million, which has been discounted using a credit adjusted risk free rate of 8.5%, of which $1.65 million of the reclamation obligation relates to the La Parrilla Silver Mine, $1.99 million of the obligation relates to the San Martin Silver Mine, and $2.49 million relates to the La Encantada Silver Mine. The present value of the reclamation liabilities may be subject to change based on management’s current estimates, changes in the remediation technology or changes to the applicable laws and regulations. Such changes will be recorded in the accounts of the Company as they occur.

The costs of performing the decommissioning and reclamation must be funded by the Company’s operations. These costs can be significant and are subject to change. The Company cannot predict what level of decommissioning and reclamation may be required in the future by regulators. If the Company is required to comply with significant additional regulations or if the actual cost of future decommissioning and reclamation is significantly higher than current estimates, this could have an adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition.

Obtaining Future Financing

The further development and exploration of mineral properties in which the Company holds interests or which the Company acquires may depend upon its ability to obtain financing through joint ventures, debt financing, equity financing or other means. There is no assurance that the Company will be successful in obtaining required financing as and when needed. Volatile precious metals markets may make it difficult or impossible for the Company to obtain debt financing or equity financing on favourable terms or at all.

The Company currently has $5.9 million of cash in treasury. As a result of the Company’s ability to earn cash flow from its ongoing operations, the Company considers that it has sufficient capital to support its current operating requirements provided it can continue to generate cash from its operations and that its capital projects are not materially over their projected costs. There is a risk that commodity prices decline and that the Company is unable to continue generating sufficient cash flow from operations or that the Company requires significant additional cash to fund expansions and potential acquisitions. Failure to obtain additional financing on a timely basis may cause the Company to postpone acquisitions, major expansion and development plans.

- - 12 -

Key Personnel

Recruiting and retaining qualified personnel is critical to First Majestic’s success. The number of persons skilled in mining, exploration and development of mining properties is limited and competition for such persons is intense. As First Majestic’s business activity grows, First Majestic will require additional key financial, administrative and mining personnel as well as additional operations staff. Although the Company believes it will be successful in attracting, training and retaining qualified personnel, there can be no assurance of such success. If the Company is not successful in attracting and training qualified personnel, the efficiency of First Majestic’s operations could be affected, which could have an adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition.

Factors Beyond the Company’s Control

There are also a number of factors beyond the Company’s control. These factors include government regulation, high levels of volatility in market prices, availability of markets, availability of adequate transportation and smelting facilities and the imposition of new or amendments to existing taxes and royalties. The effects of these factors cannot be accurately predicted.

Uninsured Risks

First Majestic’s mineral properties are subject to the risks normally inherent in mineral properties, including but not limited to environmental hazards, industrial accidents, flooding, periodic or seasonal interruptions due to climate and hazardous weather conditions and unusual or unexpected geological formations. Such risks could result in damages, delays and possible legal liability. The Company may become subject to liability for pollution and other hazards against which it cannot insure or against which it may elect not to insure due to high premium costs or other reasons. The payments for any such liabilities would reduce the funds available for exploration and development activities and may have a material impact on First Majestic’s financial position.

Foreign Operations

The Company’s mining, exploration and development projects are located in México. Such projects could be adversely affected by exchange controls, currency fluctuations, changes in taxation and corporate laws or policies of México or Canada affecting foreign trade, investment or repatriation of financial assets.

Changes in mining or investment policies or shifts in political attitude in México may adversely affect the Company’s business. Operations may be affected by governmental regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The effect, if any, of these factors cannot be accurately predicted.

Foreign Currency

The Company carries on its primary business activity outside of Canada. Accordingly, it is subject to the risks associated with fluctuation of the rate of exchange of other foreign currencies, in particular the Mexican peso, the currency of México, and the United States dollar, the currency for calculating the Company’s sales of silver based on the world’s commodity markets. Financial instruments that impact the Company’s net earnings or other comprehensive income due to currency fluctuations include: Mexican peso denominated cash and cash equivalents, accounts receivable, accounts payable, and investments in mining interests. Such currency fluctuations may materially affect the Company’s financial position and results of operations.

- - 13 -

Title to Properties

Although the Company has obtained title opinions with respect to certain of its properties and has taken reasonable measures to ensure proper title to its properties, there is no guarantee that title to any of its properties will not be challenged or impugned. Third parties may have valid claims underlying portions of the Company’s interest.

Property Interests

The option agreement relating to the Del Toro Silver Mine pursuant to which the Company holds its rights in certain of the properties provide that the Company must make a series of cash payments over certain time periods. If the Company fails to make such payments in a timely manner, the Company may lose some or all of its interest in the Fatima mining concession portion of this property which covers 46 hectares of a total of 393 hectares. The payments consist of US$62,500 due June 10, 2010 and US$162,500 due October 10, 2010.

Permits and Licenses

The operations of the Company may require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects.

Metal Prices

There are global economic factors beyond the control of the Company that may affect the marketability of minerals already discovered and any future minerals to be discovered. Metal prices have historically fluctuated widely and are affected by numerous factors beyond the Company’s control, including international, economic and political trends, expectations for inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and worldwide production levels. Movements in the spot price of silver have a direct and immediate impact on the Company’s income. The Company does not use derivative instruments to hedge its silver commodity price risk, but the Company forward sells its lead production between one and six months ahead. The effect of these price variation factors cannot accurately be predicted.

Price Volatility of Other Commodities

The Company’s profitability is also affected by the market prices of commodities which are consumed or otherwise used in connection with the Company’s operations, such as diesel fuel, natural gas, electricity and cement. Prices of such commodities are also subject to volatile price movements over short periods of time and are affected by factors that are beyond the Company’s control.

Competition

The mining industry is highly competitive in all its phases. The Company competes with a number of companies which are more mature or in later stages of production. These companies may possess greater financial resources, more significant investments in capital equipment and mining infrastructure for the ongoing development, exploration and acquisition of mineral interests, as well as for the recruitment and retention of qualified employees.

- - 14 -

Environmental Regulations

The Company’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibition of spills, release or emission of various substances related to mining industry operations, which could result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require submissions to and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards and enforcement, and fines and penalties for non-compliance are becoming more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations. The Company intends to fully comply with all environmental regulations. On February 25, 2009, the Mexican Environmental Authority PROFEPA (Procuradoria Federal Proteccion al Ambiente) awarded a CLEAN INDUSTRY CERTIFICATE to one of the Company's wholly owned subsidiaries, First Majestic Plata, SA de CV., regarding its activities at the La Parrilla Silver Mine.

Conflicts of Interest

Certain directors of the Company are also directors or officers or shareholders of other companies that are similarly engaged in the business of acquiring, developing and exploiting natural resource properties. Such associations may give rise to conflicts of interest from time to time. The directors of the Company are required by law and the Company’s policies to act honestly and in good faith with a view to the best interests of the Company and to disclose any interest, which they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict is required to disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

History of Losses

The Company has a history of losses including a net loss of $5,144,784 for the year ended December 31, 2008; however, for the year ended December 31, 2009, the Company had net income of $6,205,822. At December 31, 2009, the Company had an accumulated deficit (net loss) of $33,271,061.

Shares Reserved for Future Issuance

There are stock options and share purchase warrants of the Company outstanding pursuant to which common shares may be issued in the future. Pursuant to the Arrangement between First Majestic and First Silver, there are also shares of First Silver that may be tendered for shares of First Majestic until September 14, 2012. As of the date of this AIF, there are 114,254 shares of First Silver outstanding that may be tendered for 57,127 shares of First Majestic. Options and share purchase warrants are likely to be exercised when the market price of the Company’s common shares exceeds the exercise price of such options or warrants. The exercise of such options or warrants and the subsequent resale of such common shares in the public market could adversely affect the prevailing market price and the Company’s ability to raise equity capital in the future at a time and price which it deems appropriate. The Company may also enter into commitments in the future which would require the issuance of additional common shares and the Company may grant additional share purchase warrants and stock options. Any share issuances from the Company’s treasury will result in immediate dilution to existing shareholders.

- - 15 -

Volatility of Share Price

The price of the shares of resource companies tends to be volatile. Fluctuations in the world price of precious metals and many other elements beyond the control of the Company could materially affect the market price of the Company’s common shares.

Credit Risk

Credit risk is the risk of financial loss if a customer or counterparty fails to meet its contractual obligations. The Company’s credit risk relates primarily to trade receivables in the ordinary course of business and value added tax refunds and other receivables. The Company sells and receives payment upon delivery of its silver doré and byproducts primarily through one international organization. Additionally, silver concentrates and related base metal by-products are sold primarily through one international organization with a good credit rating, payments receivables are scheduled, routine and received within sixty days of submission; therefore, the balance of overdue trade receivables owed to the Company in the ordinary course of business is not significant. The Company has a Mexican value added tax receivable of $6.0 million as at December 31, 2009, a significant portion of which is past due. The Company is proceeding through a lengthy and slow review process with Mexican tax authorities, but the Company expects to fully recover these amounts. The carrying amount of financial assets recorded in the financial statements represents the Company’s maximum exposure to credit risk.

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they arise. The Company has in place a planning and budgeting process to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis and its expansion plans. As at December 31, 2009, the Company had a loan facility with the Mexican Mining Development Trust – Fideicomiso de Fomento Minero (“FIFOMI”) amounting to $4.3 million repayable over a five-year period. As at December 31, 2009, the Company has outstanding accounts payable and accrued liabilities of $11.3 million which are generally payable in 90 days or less.

Although the Company does not have a long-term history of operating profits, the Company believes it has sufficient cash on hand to meet operating requirements as they arise for at least the next twelve months.

Interest Rate Risk

The Company is exposed to interest rate risk on its short term investments. The Company monitors its exposure to interest rates and has not entered into any derivative contracts to manage this risk.

The Company’s interest-bearing financial assets comprise cash and cash equivalents which bear interest at a mixture of variable and fixed rates for pre-set periods of time. The Company’s interest-bearing financial liabilities comprise a floating rate loan with FIFOMI and a floating rate operating line, plus fixed rate debt instruments and capital leases with terms to maturity ranging up to three years. The FIFOMI loans are floating at 7.51% and 7.31% over the Mexican Interbank Rate which is currently at 4.91% .

Future Exploration and Development Activities

Exploration and development of mineral properties involve significant financial risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling, constructing mining and processing facilities at a site, developing metallurgical processes and extracting precious metals from ore. The Company cannot ensure that its current exploration and development programs will result in profitable commercial mining operations. Also, substantial expenses may be incurred on exploration projects which are subsequently abandoned due to poor exploration results or the inability to define reserves which can be mined economically.

- 16 -

The economic feasibility of development projects is based upon many factors, including the accuracy of reserve estimates, metal recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting and environmental protection; and precious metal prices, which are highly volatile. Development projects are also subject to the successful completion of economic evaluations or feasibility studies, issuance of necessary governmental permits and availability of adequate financing.

Development projects have no operating history upon which to base estimates of future cash flow. Estimates of Proven and Probable Reserves and Measured, Indicated and Inferred Resources are, to a large extent, based upon detailed geological and engineering analysis.

Mineral Projects

Pursuant to National Instrument 51-102 - Continuous Disclosure Obligations (“NI 51-102”), the following properties and projects have been identified by First Majestic as being material: the La Parrilla Silver Mine, the San Martin Silver Mine, the La Encantada Silver Mine and the Del Toro Silver Mine.

The following table shows the total tonnage mined from each of the Company’s three producing properties during 2009, including total ounces of silver and silver equivalent ounces produced from each property and the tonnage mined from delineated reserves and resources at each such property.

| San Martin | La Parrilla | La Encantada | Total | ||

| TONNES OF ORE PROCESSED | TONNES | 291,339 | 277,917 | 279,536 | 848,792 |

| OUNCES OF SILVER PRODUCED | OZ | 1,112,698 | 1,367,742 | 1,249,377 | 3,729,817 |

| OUNCES OF SILVER EQ PRODUCED | OZ EQ | 134,538 | 275,465 | 129,257 | 539,260 |

| TOTAL OZ OF SILVER EQ PRODUCED | OZ EQ | 1,247,236 | 1,643,207 | 1,378,634 | 4,269,077 |

| TONNES MINED FROM 43-101 | TONNES | 64,514 | 214,443 | 169,733 | 448,690 |

| TONNES MINED OUTSIDE OF 43-101 | TONNES | 226,825 | 63,474 | 109,803 | 400,102 |

La Parrilla Silver Mine, México

Certain of the information on the La Parrilla Silver Mine is based on the technical report prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of Pincock Allen & Holt (“PAH”) entitled, “Technical Report for the La Parrilla Silver Mine, Durango State, Mexico” dated February 16, 2009, as amended and restated on February 26, 2009 (in this section, the “Current Technical Report”) and has been updated as necessary. Mr. Addison and Mr. Lopez are independent Qualified Persons for the purposes of NI 43-101. The Current Technical Report has been filed with securities regulatory authorities in each province of Canada. Portions of the following information are based in assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the full text of the Current Technical Report which is available for review on SEDAR located at www.sedar.com.

- - 17 -

Property Description and Location

La Parrilla Silver Mine is a producing underground silver mine and processing facility in Durango State, Mexico. The mine is wholly owned and operated by First Majestic Plata, S.A. de C.V. (“FM Plata”) a wholly-owned indirect subsidiary of the Company through its Mexican holding company, Corporación First Majestic, S.A. de C.V.

La Parrilla consists of 38 contiguous mining concessions in the La Parrilla mining district of Durango State which provide mineral rights which cover an area of 53,249.21 hectares (131,581.20 acres). All of these mining concessions convey exploitation rights for 50 years from the date of registration.

Certain of the La Parrilla claims were purchased from Grupo México and include a net smelter return of 1.5% payable to Grupo México. This net smelter return may be acquired by FM Plata for a total payment of US$2,000,000. In the event that FM Plata does not acquire the net smelter royalty, the royalties payable thereunder will be capped at US$2,500,000. To date a total of US$229,233 had been paid by the Company under the net smelter royalty. There are no other encumbrances on La Parrilla mining concessions.

The La Parrilla area is located partly within Ejido San José de la Parrilla and partly within private property. The Comisión de Fomento Minero (the “CFM”) executed a lease agreement on the surface rights from Ejido San José de la Parrilla to permit the use of surface rights for development of projects that are of general economic interest, including mining operations. In 1990 the Gamiz Family acquired the surface rights and mill from CFM and reconfirmed the lease agreement with the Ejido. Subsequently, First Majestic acquired the surface rights and the mill from the Gamiz Family. First Majestic updated the lease agreement with the Ejido and negotiated a lease to extend the surface rights to a total of 100 hectares where the second tailings dam has been built and is now operating; this includes a yearly payment to the Ejido San José de La Parrilla. First Majestic also has a lease agreement for 100 hectares with a private land owner where the Quebradillas, and San Marcos mines are located. First Majestic also owns surface land of 38 hectares which was acquired from Grupo México where the Vacas mine is located.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The La Parrilla Silver Mine is located in the south-eastern part of the state of Durango, about 60 kilometres from the capital city of Durango. The La Parrilla mine is connected to various communities within distances of 10 kilometres to 20 kilometres, such as Nombre de Dios and Vicente Guerrero. Most of La Parrilla’s workers are transported from these towns to work at the mine. To access more specialized resources such as universities and private and public hospitals the cities of Durango and Zacatecas are within easy driving distances from La Parrilla. International flights by commercial airlines to cities in the United States and to most major cities in Mexico are available from Durango and/or Zacatecas.

Access to the La Parrilla mine is by Federal Highway No. 45 from Durango to Zacatecas. A four kilometre detour at the 75 kilometre marker leads to La Parrilla and the mine and plant through the village of San José de la Parrilla. La Parrilla is connected to the San José de la Parrilla village by a one kilometre dirt road.

Power supply to the camp is provided by the national power grid. Potable water supply is provided from a water well, and from the Quebradillas shaft. Telephone communications at the mine are integrated into the national telecommunications grid. Satellite and ISDN copper connections provide internet communications capabilities to the La Parrilla. Hand held radios are carried by all supervisors, managers and all vehicle operators for local ground communications. Most of the suppliers and labourers required for the operation are brought in from the cities of Vicente Guerrero, Durango and Zacatecas.

- - 18 -

The climate at La Parrilla is semi-dry with annual average temperatures that vary from 12º Celsius to 26º Celsius, with an annual average of about 18º Celsius. The annual average rainfall is about 580 millimetres with most of the rain occurring during the summer months, with only occasional rains during the winter months. Occasional rain storms may partially interrupt the La Parrilla operations.

Vegetation in the area consists of desert bush and shrub, including small mesquite, cacti, and grasses. At higher elevations there are pine, cedar and oak trees. Farming is mostly developed in the areas neighbouring the population centers in the Mesa Central flatlands, and the principal crops are corn, beans and some wheat. Apple and peach trees are also grown in the region.

The La Parrilla area is located within the physiographic sub-province of Sierras y Llanuras de Durango, which borders between the Sierra Madre Occidental and the Mesa Central in north-western México. This physiographic sub-province presents elevations of about 1,600 metres above sea level in the Mesa Central and up to 3,000 metres above sea level in the mountain peaks of the Sierra Madre Occidental. Topography in the La Parrilla area is dominated by either isolated mountains or north-west oriented mountain chains, all surrounded by the plateaus and flat lands of the Mesa Central. The La Parrilla (San José) mine portal is located at an elevation of 2,100 metres above sea level.

History

Mining activity in La Parrilla mining district began during colonial times. La Parrilla consists of underground silver-gold-lead mines with a processing facility that was originally constructed in 1956. In 1960, the mining claims were acquired by Minera Los Rosarios, S.A. de C.V. (“Minera Los Rosarios”) who operated the mine until 1999 when operations were shut down due to low silver prices. The CFM, a Mexican federal entity responsible for promoting and supporting mining, constructed a 180 tonnes per day flotation plant at La Parrilla, which operated as a custom mill, processing ores from nearby areas, such as Chalchihuites, Sombrerete and Zacatecas. This plant was purchased in 1990 by Minera Los Rosarios from CFM.

In 2004, First Majestic acquired the mining rights and the plant from Minera Los Rosarios and, in 2006, successfully negotiated the acquisition of the mineral rights held by Grupo México which surrounded the original La Parrilla mine. Today First Majestic has consolidated ownership of the plant and all the mining rights of the land surrounding La Parrilla, where numerous mineral occurrences and mineral deposits are being investigated.

Geological Setting

La Parrilla mining district is located in the border zone between the physiographic provinces of the Sierra Madre Occidental and the Mesa Central, within the sub-province of Sierras y Llanuras de Durango. La Parrilla is located in the northern side of a contact zone between a dioritic intrusive stock and a sequence of Cretaceous sedimentary rocks.

La Parrilla’s mineral deposits are associated to geologic structures, which appear related to the intrusive stock, dikes and sills. Structural intersections have also originated breccia zones that caused favorable conditions for mineralization emplacement as stockwork zones. The contact zone between the intrusive stock and sedimentary rocks has also originated metasomatic deposits.

The most important known deposits at La Parrilla occur as vein deposits that pinch and swell along strike as well as downdip. These are enclosed by three main systems within the mining district. The first structural system may be related in orientation to the regional intrusive stock. Its general strike is north east 60º south west, dipping nearly vertical. It cuts through all regional rock units and it does not appear to represent economic significance.

- - 19 -

The second structural system occurs with a general orientation of north 45º - 75º west dipping approximately 50º to 85º to the north east. It cuts through limestone, diorite and skarn zones. It encloses several mineral deposits in the area including Los Rosarios, El Cármen, San Cayetano and San José.

The third regional structural system is oriented north-south and dips to the east from 45º top vertical. It is generally concordant with the stratification and it encloses mineral concentrations, such as San Marcos, Quebradillas and San Nicolas.

Exploration

La Parrilla was discovered in colonial times and developed from outcroppings by following mineralization along the structures until high grade ore shoots were discovered and depleted. Common practice in these districts’ development was to mine out high grade ores, for the most part, without exploration efforts.

The Company carried out geophysical investigations during the period of April to June, 2007 to confirm previous studies within the areas of Quebradillas, Sacramento, Las Vacas, and Santa Paula (formerly Los Perros). These investigations have confirmed the presence of Induced Polarization (“IP”) and Resistivity anomalies which may be further investigated by direct methods, such as drilling and underground access where possible.

This survey consisting of measuring electric resistivity and induced polarization was completed in the following areas:

The geophysical survey resulted in prospective anomalous zones showing high resistivity and high chargeability. Drill sites were recommended to further investigate the most outstanding anomalies.

Drilling

Drilling programs at La Parrilla have been limited by past operations, since the best exploration results have been obtained through underground development. However, FM Plata has obtained positive results by increasing drilling to define and evaluate new mineralized zones as well as to investigate continuity of ore shoots for development. The Company initiated a drilling program to explore the various areas of interest within La Parrilla in 2005. The drill program covered by the Current Technical Report, covering the entire period up to September 30, 2008, consisted of 310 diamond drill holes completed by the Company for a total drilled depth of 72,084 meters at an average depth of 233 meter per drill hole. The FM Plata drilling program was developed to investigate 13 areas within the mining district. In addition to this drill program an extensive underground development program commenced in 2004 and to September 30, 2008 consisted of 9,157 meters of which approximately 50% was mining exploration and 50% mine development to access and connect the different mines of La Rosa, Rosarios, San Marcos and Quebradillas.

Since the Current Technical Report, mining activities have continued and have required the continuation of ongoing drilling and development programs. Since September 30, 2008, an additional 1,905 metres have been drilled from underground. Furthermore, an additional 8,891 metres of underground development was completed to the end of December 31, 2009.

- - 20 -

FM Plata’s drill hole database is compiled in electronic format, which contains collar, assay intervals, lithology, and assay information with gold/silver/lead/zinc values. Most of the holes are drilled at an angle to intersect vein or mineralized structures that generally dip at near vertical angles. Based on geologic interpretations, no apparent deviation has been detected in drill holes. FM Plata has established a surveying procedure which is performed during the drilling due to the fact that most of the holes are now longer than 150 meters. Deviation is defined with one survey reading at the bottom for holes of 150 meters in depth and two survey readings for holes longer than 150 meters; one reading at the middle and one reading at the bottom of the hole.

Logging is performed by the project geologist in each of the areas being investigated. The project geologist also determines the sample intervals. Trained assistants are in charge of core splitting and sampling as per the project geologist’s indications.

Mineralization

Mineralization at La Parrilla Silver Mine is a typical assemblage of metasomatic deposit and hydrothermal vein deposits with a high content of silver. These mineral assemblages have been affected by processes of oxidation and secondary enrichment. They mainly consist of pyrite, sphalerite, galena, some chalcopyrite, argentite and other silver sulfosalts associated with calcite and quartz as gangue minerals. Oxidation and secondary enrichment of these sulfides makes up the mineral concentrations in the upper parts of the deposits, which consist of sulfosalts (ceragyrite, pyrargyrite, stephanite) carbonates (cerussite, hydrozincite, hemimorphite), sulfates (anglesite, willemite), and iron oxides, hematite, limonite, etc. Silver mineralization occurs as argentite and native silver. Lead mineralization is present as carbonates (cerussite) and sulfates (anglesite) and other oxides.

The La Parrilla Silver Mine mineralization occurs along a vertical range of about 600 meters in vertical extension (2,300 meters to 1,700 meters above sea level). This extension is known through underground development and drill holes and it is still open to depth. Known longitudinal extensions vary from about 1,200 meters at the Los Rosarios system, 500 meters at the San Marcos vein system, and about 400 meters at the Quebradillas area; however, some of these systems may be continuous, such as Los Rosarios System and San Marcos.

First Majestic has delineated an area of approximately 200 meters by 200 meters for possible open pit mining. Preliminary estimates based on 33 drill holes with a total depth of 2,905 meters has indicated 3.3 metric tonnes at an average grade of 100 gram per tonne Ag in oxides mineralization.

Sampling and Analysis

(a) Sample Preparation

Exploration, mine development, production, and plant samples are sent to First Majestic’s on-site laboratory for chemical analysis of silver/gold/lead/zinc and copper. Silver and gold assays are carried out by fire assaying methods, while the rest of the elements are assayed by atomic absorption.

A typical channel sample received by the laboratory, weighing approximately four kilograms, is passed through a jaw crusher to reduce it to a 1.3 -centimeter (1/2”) size. A 500 gram split is taken and passed through gyratory or disk crushers to reduce it to a 10-mesh (1/8”) size. A 200 to 300 gram split is taken and placed in a drying oven at 120 degrees Celsius. After drying, the material is put into two pulverizers, one disk pulverizer and one ring pulverizer, to grind the rock to minus 100 mesh. The resulting pulp is homogenized and ten grams taken for fire assay analysis of silver and gold for geology samples and for concentrates; 20 grams are taken for head samples; and one gram is required for precipitate samples.

- - 21 -

The ten gram pulps are placed in fusion crucibles and placed into an electric furnace for fusion into lead buttons. The lead buttons are placed in cupellation cupels and placed into an electric furnace for cupellation into a silver-gold bead. The bead is weighed and then put into nitric acid to dissolve away the silver and then the remaining gold bead is weighed again. The microbalance used has a sensitivity of + 1 per 10,000 (equivalent to an actual grade of +0.1 gram per tonne), while the gold beads commonly range in weight from 100 milligrams down to less than 1 milligram. As a result, the determination of the smaller bead weight is at or below the detection limits of the microbalance.

(b) Check Assaying

To evaluate sample quality control, First Majestic performs periodic check analyses on samples. For the period to September 30, 2008, First Majestic sent 119 samples to BSI Inspectorate Laboratories, an independent commercial laboratory in Reno, Nevada for duplicate analysis. All core samples are sent to the BSI Inspectorate lab for assaying; therefore, the assay check was also performed by the same lab.

No gold assays are performed at First Majestic’s lab. The correlation for silver assays of core samples is excellent at 99 percent while the pulp duplicates correlation is acceptable at 91 percent. The correlation for assays of lead is 97 percent and 81 percent respectively. The correlation for zinc assays is 97 percent for duplicate samples and 40 percent for pulp sample duplicates. The poor correlation for zinc pulp samples is probably due to presence of oxidizes within the mineralization. The range of silver values is from 0 to 1,137 grams per tonne, with an average grade of 119 gram per tonne, while the range for lead is 0 to 22 percent with an average of 2.44 percent and for zinc is 0 to 19 percent with an average grade of 4.12 percent.

Channel sample checks are performed by analyzing random sample pulps at the La Parrilla lab with assay checking by the SGS de México lab at Durango. The assays include silver, lead and zinc.

(c) Security of Samples and Data Verification

The Company’s quality control procedure consists of sending mine samples and/or pulps to an outside laboratory, usually BSI-Inspectorate Labs in Reno, Nevada. Samples of concentrates are regularly sent to Peñoles for check assays. The laboratory duplicates pulp assays at one sample for every 20. Drill samples are duplicated as one sample for every twenty regular samples. The standard samples are analyzed at the SGS Laboratory located in Durango, Mexico.

Mineral Resource and Mineral Reserve Estimate

The La Parrilla mine has estimated mineable reserves for the following deposits:

- - 22 -

The total “in situ” diluted proven and probable reserves at a minimum mining width of two meters, is 0.50 million tonnes of oxides and sulfides averaging 295 grams per tonne silver, 1.40 percent lead and 1.01 percent zinc, for a total of 4.8 million contained ounces of silver only; or 5.2 million ounces of silver equivalent with gold and lead credits.

The proven ore category has been projected up to 20 meters from the drift sample data, while the probable ore category is projected another 20 meters beyond the proven ore. Resource calculations at La Parrilla are based on projections of the mineralized zones in the underground mine workings 20 meters beyond the areas of reserves for the measured resources, and another 20 meters beyond the boundaries of the measured resources for the blocks of indicated resources. Inferred resources are estimated by projecting up to 50 meters beyond the indicated resource block boundaries along mineralized structures, and another 20 meters beyond the blocks’ width. La Parrilla mineral resource estimates were applied mostly to diamond drilling intercepts, as well as to some adjacent blocks from the estimated reserves. The grade for these blocks is determined from the grade estimated for the drill hole intercepted grade and from the adjacent reserve blocks, and sampling in mine workings and drill holes located within the block area.

Table 1 presents a summary of the La Parrilla Proven and Probable Reserves and Measured and Indicated Resources, as at September 30, 2008 in addition to Inferred Resources at the bottom of the table, all as reported in the Current Technical Report. No further external Resource or Reserve estimates have been conducted since such date. It should be noted that since the cutoff date of September 30, 2008, 344,313 tonnes grading 214 grams per tonne Ag have been mined from the La Parrilla’s various deposits of which 246,106 tonnes where mined from the Reserves and 98,207 tonnes where mined from areas that were not included in any previous NI 43-101 estimates.

- 23 -

TABLE 1

La Parrilla Silver Mine

Mineral Reserves and Resources as of September 30, 2008

| CATEGORY | Mineralization | Metric | Width | Au | Ag | Pb | Zn | Contained Metal | |

| Type | Tonnes | Meters | g/tonne | g/tonne | % | % | Ag (only) oz | Ag eq oz | |

| MINERAL RESERVES | |||||||||

| Total Proven | Oxides | 127,778 | 3.09 | 301 | 1,235,695 | 1,260,344 | |||

| Total Proven | Sulfides | 160,690 | 2.72 | 302 | 1.36 | 0.93 | 1,561,792 | 1,804,608 | |

| PROVEN | Oxides plus Sulfides | 288,468 | 2.88 | 302 | 1.36 | 0.93 | 2,797,487 | 3,064,952 | |

| Total Probable | Oxides | 112,391 | 3.11 | 283 | 1,023,170 | 1,044,851 | |||

| Total Probable | Sulfides | 104,669 | 2.78 | 291 | 1.45 | 1.12 | 978,988 | 1,137,152 | |

| PROBABLE | Oxides plus Sulfides | 217,060 | 2.95 | 287 | 1.45 | 1.12 | 2,002,158 | 2,182,002 | |

| PROVEN PLUS PROBABLE | Oxides plus Sulfides | 505,528 | 2.91 | 295 | 1.40 | 1.01 | 4,799,645 | 5,246,954 | |

| MINERAL RESOURCES | |||||||||

| Total Measured | Oxides | 554,630 | 4.42 | 0.15 | 320 | 5,702,839 | 5,809,830 | ||

| Total Measured | Sulfides | 1,640,818 | 6.58 | 0.08 | 245 | 2.59 | 4.54 | 12,934,778 | 16,996,798 |

| MEASURED | Oxides plus Sulfides | 2,195,448 | 6.04 | 0.10 | 264 | 2.59 | 4.54 | 18,637,618 | 22,806,628 |

| Total Indicated | Oxides | 428,445 | 3.06 | 0.22 | 298 | 4,107,289 | 4,189,938 | ||

| Total Indicated | Sulfides | 433,043 | 4.59 | 0.05 | 192 | 3.46 | 6.07 | 2,678,396 | 3,750,441 |

| INDICATED | Oxides plus Sulfides | 861,488 | 3.83 | 0.13 | 245 | 3.46 | 6.07 | 6,785,685 | 7,940,379 |

| MEASURED PLUS INDICATED (8) | Oxides plus Sulfides | 3,100,000 | 5.41 | 0.11 | 255 | 2.84 | 4.97 | 25,400,000 | 30,700,000 |

| INFERRED RESOURCES | |||||||||

| Total Inferred (6) | Oxides | 4,600,000 | 3.37 | 0.03 | 162 | 0.01 | 0.00 | 23,900,000 | 24,800,000 |

| Total Inferred | Sulfides | 3,400,000 | 4.86 | 0.12 | 179 | 2.05 | 3.51 | 20,000,000 | 28,000,000 |

| INFERRED RESOURCES (8) | Oxides plus Sulfides | 8,000,000 | 4.00 | 0.07 | 169 | 0.87 | 1.49 | 43,900,000 | 52,800,000 |

| (1) |

Estimates based on Minimum Mining Width >2.00m. No mine recovery included. |

| (2) |

Silver equivalent based on sales. Prices used for evaluation: Ag - $12/oz; Au - $708/oz; Pb - $0.75/lb; Zn - $0.75/lb. |

| (3) |

Oxides Ag equivalent includes gold credit based on FMPlata sales. Au Credit = 6 g/tonne Ag. |

| (4) |

Sulfides Ag equivalent includes Pb credit = 47 g/tonne Ag. Zinc is considered at 70% met. recovery = 30 g/tonne Ag. |

| (5) |

Cut-Off Grade estimated as 184 g/tonne Ag net of Au credit in oxide ores; and 246 g/tonne Ag net of Pb credit in sulfide ores. Zinc not considered in COG estimates. |

| (6) |

Preliminary Quebradillas Block Model estimate at COG>50 g/tonne Ag. |

| (7) |

Reserves and resources in this report are exclusive of each other. |

| (8) |

Rounded figures. |

- - 24 -

Since the date of the mineral Reserve and Resource estimate contained in Table 1, approximately 2,003,057 ounces of silver equivalent have been extracted from the La Parrilla Silver Mine of which 473,562 came out of the current delineated Reserves/Resources.

Mining Operations

The Company operates three mines in La Parrilla area: the La Rosa/Rosario/La Blanca, the San Marcos, and Quebradillas operations. All are separate mines within an area of about 10 square kilometres. The production from the mines during 2009 was approximately 277,917 tonnes at an average grade of 214 grams per tonne silver. This production includes about 46,797 tonnes of ore extracted from development workings. Oxide ore mined was about 146,979 tonnes, while sulphide ore mined was about 130,938 tonnes. Silver production for 2009 was 1,643,206 equivalent ounces of silver. The Company’s five year plan requires improvements in production rates, ore head grades and mill recoveries to achieve up to 1.94 million ounces of silver equivalent annually. Production for the period of October 1st 2008 to December 31, 2009 was 2,003,057 ounces of silver equivalents.