ANNUAL INFORMATION FORM

For the year ended December 31, 2008

Date: March 31, 2009

2

TABLE OF CONTENTS

3

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (“AIF”) of First Majestic Silver Corp. (“First Majestic” or the “Company”) is as of March 31, 2009.

Financial Information

All financial information in this AIF is prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”).

Forward-looking Information

Certain statements contained in this AIF, and in certain documents incorporated by reference herein, constitute forward-looking statements. These statements relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to, statements with respect to commercial mining operations, anticipated mineral recoveries, protected quantities of future mineral production, interpretation of drill results, anticipated production rates and mine life, operating efficiencies, capital budgets, costs and expenditures and conversion of mineral resources to proven and probable mineral reserves, analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

All statements other than statements of historical fact may be forward-looking statements. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and in the case of mineral resources or proven and probable mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect, “forecast”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “outlook” and similar expressions) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Company believes that the expectations reflected in those forward looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this AIF should not be unduly relied upon. These statements speak only as of the date of this AIF or as of the date specified in the documents incorporated by reference into this AIF, as the case may be. The Company does not intend, and does not assume any obligation, to update these forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among other things, results of exploration and development activities, the Company’s historical experience with development-stage mining operations, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and, particularly, silver prices, actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations and unanticipated environmental impacts on operations. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, risk factors incorporated by reference herein. See “Risk Factors”.

4

Cautionary Notes to U.S. Investors Concerning Reserve and Resource Estimates

The definitions of Proven and Probable Reserves used in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7. Under SEC Guide 7 standards, a “Final” or “Bankable” feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into Reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Documents Incorporated By Reference

Information has been incorporated by reference in this AIF from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from First Majestic’s head office at Suite 1805 –925 W. Georgia Street, Vancouver, British Columbia, V6C 3L2 (telephone: (604) 688-3033) or by accessing the disclosure documents available through the internet on the System for Electronic Document Analysis and Retrieval (“SEDAR”) which can be accessed at www.sedar.com.

The following documents of the Company are specifically incorporated by reference in this AIF:

| (a) |

the technical report prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of Pincock Allen & Holt entitled “Technical Report for the La Parrilla Silver Mine, Durango State, México” dated February 16, 2009, as amended and restated on February 26, 2009 and filed on SEDAR on February 27, 2009. See “Mineral Projects – La Parrilla Silver Mine, México”; |

| (b) |

the technical report prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of Pincock Allen & Holt entitled “Technical Report for the San Martín Silver Mine, State of Jalisco, México” dated January 15, 2009, as amended and restated on February 26, 2009 and filed on SEDAR on February 27, 2009. See “Mineral Projects – San Martín Silver Mine, México”; |

5

| (c) |

the technical report prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of Pincock Allen & Holt entitled “Technical Report for the La Encantada Silver Mine, Coahuila State, México” dated January 12, 2009, as amended and restated on February 26, 2009 and filed on SEDAR on February 27, 2009. See “Mineral Projects-La Encantada Silver Mine, México”; and |

| (d) |

the technical report prepared by Leonel Lopez, C.P.G. of Pincock Allen & Holt entitled “Technical Report for the Del Toro Silver Mine, Zacatecas State, México” dated October 9, 2008 and filed on SEDAR on October 9, 2008. See “Mineral Projects-Del Toro Silver Mine, México”. |

Currency

All dollar amounts in this AIF are expressed in Canadian dollars unless otherwise indicated.

6

CORPORATE STRUCTURE

Name, Address and Incorporation

First Majestic was incorporated under the Company Act (British Columbia) (the “Company Act”) on September 26, 1979 by registration of its Memorandum and Articles, under the name Brandy Resources Inc.

On September 5, 1984, the Company changed its name to Vital Pacific Resources Ltd. and consolidated its share capital on a two for one basis.

On May 26, 1987 the Company continued out of British Columbia and was continued as a federal company pursuant to the Canada Business Corporations Act.

On August 27, 1987, the Company was extra provincially registered under the Company Act.

On August 21, 1998, the Company continued out of Canada and was continued into the jurisdiction of the Commonwealth of the Bahamas under the Companies Act (Bahamas).

On January 2, 2002, the Company continued out of the Commonwealth of the Bahamas under the Companies Act (Bahamas) and was continued to the Yukon Territory pursuant to the Business Corporations Act (Yukon). On January 3, 2002, the Company completed a consolidation of its share capital on a 1 new for 10 old basis and changed its name to First Majestic Resource Corp.

On January 17, 2005, the Company continued out of the Yukon Territory and was continued to British Columbia pursuant to the Business Corporations Act (British Columbia).

On November 22, 2006, the Company changed its name to First Majestic Silver Corp.

The Company’s head office is located at Suite 1805 – 925 W. Georgia Street, Vancouver, British Columbia, Canada, V6C 3L2 and its registered office is located at #1100 - 888 Dunsmuir Street, Vancouver, British Columbia, V6C 3K4.

The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia and Newfoundland.

Intercorporate Relationships

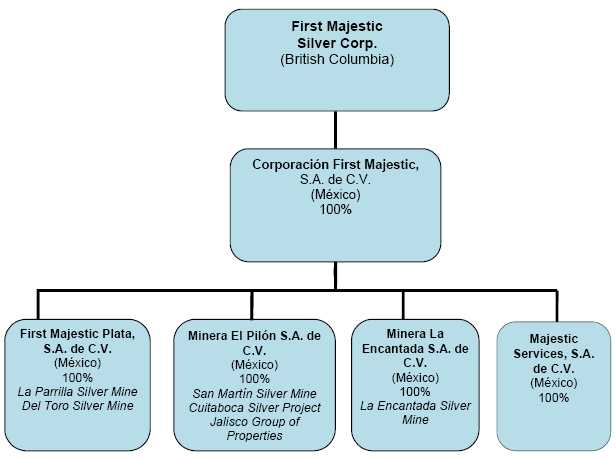

The chart set out below illustrates the corporate structure of the Company and its material subsidiaries, the jurisdictions of incorporation, the percentage of voting securities held and their respective interests in various mineral projects and mining properties.

7

GENERAL DEVELOPMENT OF THE BUSINESS

History

Since inception, First Majestic has been in the business of acquisition, development and exploration of mineral properties. During the fiscal year ended June 30, 2004, the Company became focused on the acquisition, development and exploration of mineral properties in México with an emphasis on silver projects.

On January 12, 2004, the Company entered into an agreement to purchase the La Parrilla Silver Mine located approximately 65 kilometres south-east of the city of Durango, México. The purchase price of US$3 million (paid) included all properties, assets and equipment and all mining concessions consisting of 280 hectares. See “Mineral Projects – La Parrilla Silver Mine, México”. The La Parrilla Silver Mine was operated from 1956 to 1999 by the previous owners when it was put on a care and maintenance program in 1999 due to low silver prices. Total tonnage mined during that period is estimated at approximately 700,000 tonnes with an average grade of 300 grams per tonne (“g/t”) silver, 1.5% lead and 1.5% zinc.

Between March 2004 and August 2005, the Company entered into a number of agreements to acquire mining concessions located in Chalchihuites, Zacatecas, México which are located approximately 45 kilometres southeast of the La Parrilla Silver Mine. During the period ended December 31, 2006 and the year ended June 30, 2006, the Company wrote off acquisition and exploration costs totalling $688,766 and $384,930, respectively, relating to certain of the Chalchihuites Group Properties, the remaining properties are now referred to as the Del Toro Silver Mine. The Company paid an aggregate of US$5,825,000 over a four-year period to complete the remaining options.

8

On November 18, 2004, the Company entered into an agreement to acquire the Dios Padre Silver Project located in the western Sierra Madre Mountain Range and midway between Hermosillo and Chihuahua in east central Sonora, México which was amended on December 17, 2004 and June 13, 2005. The acquisition included all properties, assets and equipment and all mining concessions consisting of 285 hectares. The Company was required to pay an aggregate of US$6,500,000 over a four-year period and issue a total of 500,000 common shares upon the completion of specific phases of exploration. During calendar 2006, the Company completed an exploration program which consisted of 17 diamond drill holes totalling 2,216 metres, a review of historical geological data, mapping and resource definition. In addition, a geologic survey of the 285 hectare property surrounding the main mine area was completed to evaluate four different geologic anomalies to determine the possibility of the existence of other mineralized bodies that may increase the potential of the property. The program was not definitive in outlining sufficient economic resources in order to make a positive production decision. During the year ended December 31, 2006, management elected not to proceed with the acquisition of the Dios Padre Silver Project and acquisition and exploration costs totalling $1,899,789 were expensed.

In December 2004, the Company entered into agreements for the purchase of the Candameña Mining District properties located in the Western Sierra Madre Mountain range between Hermosillo and Chihuahua in east central Sonora, México. The Company was required to pay an aggregate of US$7,600,000 over a four-year period. The purchase price included all properties, assets and equipment and all mining concessions consisting of 5,215 hectares. The payment schedule to one of the agreements was amended on May 24, 2005, November 30, 2006 and March 26, 2007 and a 1% NSR, payable up to a maximum of US$4,000,000, was cancelled on November 30, 2006. On August 14, 2007, the Company entered into an agreement with Prospector Consolidated Resources Inc. (“Prospector”) whereby Prospector had the right to acquire 100% interest in the Company’s option to the Candameña Mining District Property by paying $50,000 and issuing two million of its common shares to the Company. The Company received $50,000 in August 2007 and Prospector assumed all option commitments to the underlying property vendors effective August 2007. Prospector received regulatory approval and the Company received two million shares of Prospector in March 2008. See “Past Three Years” below.

In September 2005, the Company acquired a 100% interest in the La Encarnación and San Ignacio Dos mining claims consisting of 16 hectares adjacent to the Company’s La Parrilla Silver Mine for consideration of $40,000 and 200,000 common shares of the Company.

On October 10, 2005, the Company entered into an agreement with Compañia Minera Rio Frio, S.A. de C.V. (“Compañia”) to purchase the La Candelaria Silver Project, Jalisco, México. After completing a due diligence program, a revised agreement with Compañia was entered into on April 26, 2006. Under the revised terms of the agreement, First Majestic was required to make a payment of US$110,000 and issue 100,000 common shares to the vendor upon confirmation of re-registration of the mining claims. Additional payments totalling US$2,090,000 were to be paid over a period of twenty-four months. During the year ended December 31, 2006, management elected not to proceed with the acquisition of the La Candelaria Silver Project and acquisition and exploration costs totalling $292,753 were expensed.

9

Past Three Years

First Majestic entered into an irrevocable share purchase agreement dated for reference April 3, 2006 to purchase approximately 63% of the issued and outstanding shares of First Silver from the major shareholder of First Silver (the “Shareholder”). First Silver’s primary business was silver mining and the acquisition, exploration and development of mineral claims with a primary focus on silver properties in México. First Silver’s wholly owned subsidiary, El Pilon, was the sole owner of the San Martín Silver Mine in Jalisco State, México.

First Majestic purchased 24,649,200 common shares of First Silver (the “Acquisition”) at a price of $2.165 per share for an aggregate purchase price of $53,365,519 payable to the Shareholder in three instalments.

The first instalment of $26,682,759 represented 50% of the purchase price and was paid on closing of the Acquisition on May 30, 2006. A second instalment of $13,341,380, representing 25% of the purchase price, was paid on May 30, 2007. A final instalment of $13,341,380 was payable on May 30, 2008. An interest amount of 6% per annum is payable quarterly on the outstanding payment. Pending the outcome of the litigation referred to in the section entitled “Legal Proceedings” of this Annual Information Form, the Company has withheld payment of quarterly instalments of interest due on November 30, 2007, February 29, 2008 and May 30, 2008. The Company is withholding payment of the final instalment of $13,341,380 due May 30, 2008 and the above interest payments, an amount totalling $13,940,237. On July 22, 2008, the Company posted an irrevocable Letter of Credit with the Supreme Court of British Columbia pending the outcome of such litigation which is not anticipated for at least one year.

On June 5, 2006, First Majestic and First Silver entered into a letter agreement whereby the parties agreed to enter into a business combination such that First Majestic would acquire all of the outstanding securities of First Silver and First Silver would become a wholly owned subsidiary of First Majestic. The business combination was structured as a plan of arrangement (the “Arrangement”) which was formalized in a combination agreement with the parties dated August 9, 2006. On September 14, 2006, First Majestic acquired all of the issued and outstanding First Silver shares which it did not already own for an aggregate of 6,712,159 common shares of First Majestic and an aggregate cash payment of $777,672 paid at closing and $388,836 due on each of September 14, 2007 (which was paid) and September 14, 2008 (which was paid), with interest payable quarterly and compounded annually at 6.0% per annum on the unpaid balances from the closing of the Arrangement.

The Arrangement was approved at a special meeting of shareholders of First Silver on September 7, 2006 and closed on September 14, 2006. At closing, 12,500 stock options exercisable at a price of $3.28 per share expiring on June 13, 2009 and 550,000 stock options exercisable at a price of $4.30 per share expiring on June 19, 2011 were granted by the Company in exchange for 25,000 stock options of First Silver exercisable at a price of $1.64 per share expiring on June 13, 2009 and 1,100,000 stock options of First Silver exercisable at a price of $2.15 per share expiring on June 19, 2011. The common shares of First Silver were delisted from the Toronto Stock Exchange at the close of business on September 18, 2006.

Any certificate formerly representing First Silver shares not duly surrendered on or prior to September 14, 2012 shall cease to represent a claim or interest of any kind or nature, including a claim for dividends or other distributions against First Majestic or First Silver by a former First Silver shareholder. After such date, all First Majestic shares to which the former First Silver shareholder was entitled shall be deemed to have been cancelled.

10

In May 2006, through the acquisition of First Silver and its wholly owned subsidiary, El Pilon, the Company acquired an option to acquire the Cuitaboca Silver Project which consists of a 5,134 hectare land package. The Company presently has an option dated November 25, 2004 with Consorcio Minero Latinamericano, SA de CV, a private Mexican company owned by a former director of First Silver, for the purchase of a 100% interest in seven mining claims covering 3,718 hectares located in the State of Sinaloa, México. To purchase the claims, the Company must pay a total of US$2,500,000 in staged cash payments through November 25, 2010. As at December 31, 2008, a total of US$925,000 had been paid. During the year ended December 31, 2008, the Company paid US$375,000 related to mineral property options. A 2.5% NSR on the claims may be purchased for an additional US$500,000 at any time during the term of the agreement or for a period of 12 months thereafter.

In August 2006, the Company entered into three agreements to acquire the Quebradillas and Viboras Silver Mines and a contiguous land package of 3,126 hectares of mining concessions located in the La Parrilla Mining District in Durango State, México. The Company has the right to purchase all the mining concessions, the mines, the data of past diamond drill programs and the assets located within the mine areas for a total purchase price of US$3,000,000 payable over a period of two years of which an aggregate of US$2,251,000 had been paid as of December 31, 2008. During the year ended December 31, 2008, the Company amended payment terms to the optionor regarding the outstanding payments as at December 31, 2008. The Company has agreed to make a series of payments in 2009 totalling US$1,121,160 which includes interest calculated at a rate of the three month LIBOR plus 3%. There is a net smelter royalty of 1.5% (“NSR”) of sales revenue to a maximum of US$2,500,000 and the Company has the option to purchase the NSR at any time for US$2,000,000. The Company has paid US$69,000 relating to royalties.

In August 2006, the Company entered into a letter agreement pursuant to which the Company acquired 100% of the issued and outstanding shares of Desmin S.A. de C. V. (“Desmin”), a privately held Mexican mining company for the purchase price of US$1.5 million (the final payment having been made on April 30, 2007), resulting in Desmin becoming a wholly owned subsidiary of the Company. Desmin’s primary asset was an exploitation contract which entitled Desmin to operate the La Encantada Silver Mine located in Coahuila State in Northern México. The exploitation contract provided Desmin an option to acquire all properties within the 985 hectare land package, including the operations of the mine and mill and all the auxiliary installations and associated equipment. The Company purchased the operations of Desmin effective November 1, 2006 and took over the operations of the La Encantada Silver Mine. In addition, Desmin had an agreement to purchase the La Encantada Silver Mine, including the mill and surrounding mining claims.

The Company changed its financial year from June 30 to December 31, effective for the financial period July 1, 2006 to December 31, 2006. The decision to change the Company’s fiscal year end was made so that the Company would have the same fiscal year end as its operating subsidiaries in México. To facilitate the change, the Company reported a one-time, six-month transition year covering the period from July 1, 2006 to December 31, 2006. Subsequent to the transition year, the first full financial year covered the period January 1, 2007 to December 31, 2007.

In January 2007, the Company completed the acquisition of the San Juan Silver Mine which forms part of the Del Toro Silver Mine, formerly referred to as the Chalchihuites Group of Properties by making the final payments of US$500,000 and US$150,000 due January 7, 2007 and July 7, 2007, respectively, pursuant to the agreement. In connection therewith, a finder’s fee in the amount of $77,808 (US$68,422) was paid to a director of the Company.

11

In March 2007, the Company acquired all of the issued and outstanding shares of Minera La Encantada S.A. de C. V. (“Minera La Encantada”), a Mexican mining company owned by Industrias Peñoles, S.A. de C.V. (“Peñoles”) for a total purchase price of US$3,250,000 and an NSR of 4%. The Company also acquired the underlying 4% NSR through the issuance of 382,582 shares and 191,291 warrants, each warrant entitling Peñoles to purchase one additional share at a price of $6.81 expiring March 20, 2009. Desmin paid a sliding-scale royalty to Peñoles pursuant to the terms of its exploitation contract. As a result of the Company’s purchase of Minera La Encantada, all royalties were cancelled at closing on March 20, 2007. On January 1, 2008, Desmin amalgamated with Minera La Encantada S.A. de C.V.

On May 10, 2007, the Company completed a private placement of special warrants for gross proceeds of $34,415,000. A total of 6,883,000 special warrants were sold at a price of $5.00 per special warrant through Cormark Securities Inc. and CIBC World Markets Inc., as co-lead underwriters, and Blackmont Capital Inc. Each special warrant was automatically exercised for one common share of the Company and one half of a common share purchase warrant on July 25, 2007 (the date the Company obtained a final receipt for a prospectus qualifying the underlying securities). Each whole share purchase warrant was exercisable at a price of $6.50. The warrants expired on November 10, 2008, none of which were exercised prior to expiry. The underwriters received a commission of 5.5% of the gross proceeds of the offering at closing.

On July 31, 2007, the Company incorporated a new wholly owned Mexican subsidiary, Corporación First Majestic, S.A. de C.V., (“CFM”) and effected a corporate restructuring of Desmin, La Encantada and First Majestic Plata, on August 14, 2007, such that Desmin and La Encantada were amalgamated and the Company now holds the shares of FM Plata, Minera El Pilon and La Encantada, through CFM, which is a Mexican holding company for Mexican tax consolidation purposes.

In August 2007, the Company entered into an agreement with Prospector whereby Prospector had the right to acquire a 100% interest in the Company’s option to acquire the Candameña Mining District Property by paying $50,000 within five business days following the execution of the agreement (paid) and issuing 2,000,000 of its shares to the Company within five business days of regulatory approval or September 7, 2007, whichever is earlier. As Prospector had not received regulatory approval by September 7, 2007, it paid an additional US$150,000 to the Company on October 19, 2007 to satisfy an option commitment to the underlying vendor. In March 2008, the Company received 2,000,000 common shares from Prospector In August 2008, the Company after having made numerous unsuccessful attempts to assist Prospector in the transfer of the rights to the Candameña property, and having advised Prospector that the underlying agreements with the Candameña property owners were in breach and likely to revert to their underlying owners, the Company negotiated the full return of the mining rights to their respective property owners.

The Company’s common shares and warrants were listed and commenced trading on the Toronto Stock Exchange effective January 15, 2008.

On March 25, 2008, the Company completed a public offering with a syndicate of underwriters led by CIBC World Markets Inc. and including Blackmont Capital Inc., Cormark Securities Inc. and GMP Securities L.P., who purchased 8,500,000 units of the Company at a price of $5.35 per unit. Each unit consisted of one common share in the capital of the Company and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one additional common share at a price of $7.00 for a period of 24 months from the closing of the offering. The underwriters also received an over-allotment option, exercisable up until 30 days following the closing of the offering to purchase up to an additional 1,275,000 common shares at a price of $5.07 per share and up to an additional 637,500 share purchase warrants at a price of $0.56 per warrant. On April 4, 2008, the Company completed the issuance of an aggregate of 637,500 warrants pursuant to the exercise of the over-allotment option.

12

On July 6, 2008, the Company entered into an agreement to acquire the Fatima mining concession consisting of 46 hectares of mining concessions located in the Zacatecas State, México and forms part of the Del Toro Silver Mine. The Company has the right to purchase all the mining concessions, for a total purchase price of US$387,500 payable over a period of 30 months, of which an aggregate of US$62,500 had been paid as of December 31, 2008.

Subsequent to December 31, 2008

On March 5, 2009, the Company completed a public offering with a syndicate of underwriters led by CIBC World Markets Inc. and including Blackmont Capital Inc., GMP Securities L.P. and Thomas Weisel Partners, who purchased 8,487,576 units of the Company at a price of $2.50 per unit for gross proceeds to the Company of $21,218,940. Each unit consisted of one common share in the capital of the Company and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one additional common share at a price of $3.50 for a period of 24 months from the closing of the offering. The underwriters also received an over-allotment option, exercisable up until 30 days following the closing of the offering to purchase up to an additional 1,273,136 common shares at a price of $2.40 per share and up to an additional 636,568 share purchase warrants at a price of $0.20 per warrant.

DESCRIPTION OF BUSINESS

General

The Company is in the business of the production, development, exploration and acquisition of mineral properties focusing on silver in México. The common shares and warrants of the Company trade on the Toronto Stock Exchange under the symbols “FR”, “FR.WT.A” and “FR.WT.B”. The common shares are also quoted on the Pink Sheets in the U.S. under the symbol “FRMSF” and on the Frankfurt, Berlin, Munich and Stuttgart Stock Exchanges under the symbol “FMV”.

The Company has an interest in three principal properties in México: the La Parrilla Silver Mine in Durango State, the San Martín Silver Mine in Jalisco State and the La Encantada Silver Mine in Coahuila State. The Company also has interests in an advanced stage development project, the Del Toro Silver Mine, formerly referred to as the Chalchihuites Group Properties in Zacatecas, and in several exploration properties in various states in México including the Cuitaboca Silver Project in Sinaloa.

The Company’s business is not materially affected by intangibles such as licences, patents and trademarks, nor is it affected by seasonal changes. The Company is not aware of any aspect of its business which may be affected in the current financial year by renegotiation or termination of contracts.

At December 31, 2008, the Company had 11 employees based in its Vancouver corporate office, one employee in the United Kingdom and approximately 1,236 employees, contractors and other personnel in México. Additional consultants are also retained from time to time for specific corporate business, development and exploration programs.

13

Risk Factors

The Company, and thus the securities of the Company, should be considered a highly speculative investment and investors should carefully consider all of the information disclosed in this AIF prior to making an investment in the Company. In addition to the other information presented in this AIF, the following risk factors should be given special consideration when evaluating an investment in the Company’s securities.

Operating Hazards and Risks

The operation and development of a mine or mineral property involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include:

These occurrences could result in environmental damage and liabilities, work stoppages and delayed production, increased production costs, damage to, or destruction of, mineral properties or production facilities, personal injury or death, asset write downs, monetary losses and other liabilities. Liabilities that First Majestic incurs may exceed the policy limits of its insurance coverage or may not be insurable, in which event First Majestic could incur significant costs that could adversely impact its business, operations or profitability.

Uncertainty in the Calculation of Mineral Reserves, Resources and Silver Recovery

There is a degree of uncertainty attributable to the calculation of mineral Reserves and mineral Resources and corresponding grades being mined or dedicated to future production. Until mineral Reserves or mineral Resources are actually mined and the processed, the quantity of minerals and grades must be considered estimates only. In addition, the quantity of mineral Reserves and mineral Resources may vary depending on, among other things, metal prices. Any material change in the quantity of mineral Reserves, mineral Resources, grade or minimum mining thickness may affect the economic viability of First Majestic’s properties. In addition, there can be no assurance that silver recoveries or other metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production, or that the existing known and experienced recoveries will continue.

Substantial Decommissioning and Reclamation Costs

During the year ended December 31, 2008, the Company reassessed its reclamation obligations at each of its mines based on updated mine life estimates, rehabilitation and closure plans. The total undiscounted amount of estimated cash flows required to settle the Company’s estimated obligations is $7.27 million (US$5.94 million), which has been discounted using a credit adjusted risk free rate of 8.5%, of which $2.46 million of the reclamation obligation relates to the La Parrilla Silver Mine, $2.31 million of the obligation relates to the San Martín Silver Mine, and $2.51 million relates to the La Encantada Silver Mine. The present value of the reclamation liabilities may be subject to change based on management’s current estimates, changes in the remediation technology or changes to the applicable laws and regulations. Such changes will be recorded in the accounts of the Company as they occur.

14

The costs of performing the decommissioning and reclamation must be funded by the Company’s operations. These costs can be significant and are subject to change. The Company cannot predict what level of decommissioning and reclamation may be required in the future by regulators. If the Company is required to comply with significant additional regulations or if the actual cost of future decommissioning and reclamation is significantly higher than current estimates, this could have an adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition.

Obtaining Future Financing

The further development and exploration of mineral properties in which the Company holds interests or which the Company acquires may depend upon its ability to obtain financing through joint ventures, debt financing, equity financing or other means. There is no assurance that the Company will be successful in obtaining required financing as and when needed. Volatile precious metals markets may make it difficult or impossible for the Company to obtain debt financing or equity financing on favourable terms or at all. The Company currently has $32.2 million of cash in treasury. As a result of the $21,218,940 public offering mentioned above, and in addition to the Company’s ability to earn cash flow from its ongoing operations, the Company considers that it has sufficient capital to support its current operating requirements provided it can continue to generate cash from its operations and that its capital projects are not materially over their projected costs. There is a risk that commodity prices decline and that the Company is unable to continue generating sufficient cash flow from operations or that the Company requires significant additional cash to fund expansions and potential acquisitions. Failure to obtain additional financing on a timely basis may cause the Company to postpone acquisitions, major expansion and development plans, or reduce its operations.

Key Personnel

Recruiting and retaining qualified personnel is critical to First Majestic’s success. The number of persons skilled in mining, exploration and development of mining properties is limited and competition for such persons is intense. As First Majestic’s business activity grows, First Majestic will require additional key financial, administrative and mining personnel as well as additional operations staff. Although the Company believes it will be successful in attracting, training and retaining qualified personnel, there can be no assurance of such success. If the Company is not successful in attracting and training qualified personnel, the efficiency of First Majestic’s operations could be affected, which could have an adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition.

Factors Beyond the Company’s Control

There are also a number of factors beyond the Company’s control. These factors include government regulation, high levels of volatility in market prices, availability of markets, availability of adequate transportation and smelting facilities and the imposition of new or amendments to existing taxes and royalties. The effects of these factors cannot be accurately predicted.

Uninsured Risks

First Majestic’s mineral properties are subject to the risks normally inherent in mineral properties, including but not limited to environmental hazards, industrial accidents, flooding, periodic or seasonal interruptions due to climate and hazardous weather conditions and unusual or unexpected geological formations. Such risks could result in damages, delays and possible legal liability. The Company may become subject to liability for pollution and other hazards against which it cannot insure or against which it may elect not to insure due to high premium costs or other reasons. The payments for any such liabilities would reduce the funds available for exploration and development activities and may have a material impact on First Majestic’s financial position.

15

Foreign Operations

The Company’s mining, exploration and development projects are located in México. Such projects could be adversely affected by exchange controls, currency fluctuations, taxation and laws or policies of México or Canada affecting foreign trade, investment or taxation.

Changes in mining or investment policies or shifts in political attitude in México may adversely affect the Company’s business. Operations may be affected by governmental regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The effect, if any, of these factors cannot be accurately predicted.

Foreign Currency

The Company carries on its primary business activity outside of Canada. Accordingly, it is subject to the risks associated with the fluctuation of the rate of exchange of the Canadian dollar and foreign currencies, in particular the Mexican peso, the currency of México, and the United States dollar, the currency for calculating the Company’s sales of silver based on the world’s commodity markets. Financial instruments that impact the Company’s net earnings or other comprehensive income due to currency fluctuations include: Mexican peso denominated cash and cash equivalents, accounts receivable, accounts payable, and investments in mining interests. Such currency fluctuations may materially affect the Company’s financial position and results of operations.

Title to Properties

Although the Company has obtained title opinions with respect to certain of its properties and has taken reasonable measures to ensure proper title to its properties, there is no guarantee that title to any of its properties will not be challenged or impugned. Third parties may have valid claims underlying portions of the Company’s interest.

Property Interests

The La Parrilla Silver Mine consists of various option agreements pursuant to which the Company holds its rights and mineral claims in certain of adjacent properties which provide that the Company must make a series of cash payments related to some of the properties over certain time periods. If the Company fails to make such payments in a timely manner, the Company may lose selective interest in those properties. The payments consist of US$1,121,160 in fiscal 2009.

The option agreement relating to the Cuitaboca Silver Project pursuant to which the Company holds its rights in certain of the properties provide that the Company must make a series of cash payments over certain time periods. If the Company fails to make such payments in a timely manner, the Company may lose some or all of its interest in this project. The payments consist of US$525,000 in fiscal 2009 and US$1,050,000 in fiscal 2010 and beyond.

16

The option agreement relating to the Del Toro Silver Mine pursuant to which the Company holds its rights in certain of the properties provide that the Company must make a series of cash payments over certain time periods. If the Company fails to make such payments in a timely manner, the Company may lose some or all of its interest in this property. The payments consist of US$100,000 in fiscal 2009 and US$225,000 in fiscal 2010 and beyond.

Permits and Licenses

The operations of the Company may require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects.

Metal Prices

There are global economic factors beyond the control of the Company that may affect the marketability of minerals already discovered and minerals to be discovered. Metal prices have historically fluctuated widely and are affected by numerous factors beyond the Company’s control, including international, economic and political trends, expectations for inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and worldwide production levels. Movements in the spot price of silver have a direct and immediate impact on the Company’s income. The Company does not use other derivative instruments to hedge its commodity price risk. The effect of these factors cannot accurately be predicted.

Price Volatility of Other Commodities

The Company’s profitability is also affected by the market prices of commodities which are consumed or otherwise used in connection with the operations, such as diesel fuel, natural gas, electricity and cement. Prices of such commodities are also subject to volatile price movements over short periods of time and are affected by factors that are beyond the Company’s control.

Competition

The mining industry is highly competitive in all its phases. The Company competes with a number of companies which are more mature or in later stages of production. These companies may possess greater financial resources, more significant investments in capital equipment and mining infrastructure for the ongoing development, exploration and acquisition of mineral interests, as well as for the recruitment and retention of qualified employees.

17

Environmental Regulations

The Company’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibition of spills, release or emission of various substances related to mining industry operations, which could result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require submissions to and approval of environmental impact assessments. Environmental legislation is evolving in a manner, which means stricter standards and enforcement, and fines and penalties for non-compliance are becoming more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations. The Company intends to fully comply with all environmental regulations.

Conflicts of Interest

Certain directors of the Company are also directors or officers or shareholders of other companies that are similarly engaged in the business of acquiring, developing and exploiting natural resource properties. Such associations may give rise to conflicts of interest from time to time. The directors of the Company are required by law to act honestly and in good faith with a view to the best interests of the Company and to disclose any interest, which they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict will disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

History of Losses

The Company has a history of losses including a net loss of $5,144,784 for the year ended December 31, 2008. At December 31, 2008, the Company had an accumulated deficit of $39,476,883. The Company anticipates that its net losses will be reduced in 2009 as operating earnings from its mines increase due to the scaling up of operations. The Company is focusing its efforts on reducing its mine operating costs as well as its general and administrative costs as it attempts to achieve break even or profitable operations in the current year.

Shares Reserved for Future Issuance

There are stock options and share purchase warrants of the Company outstanding pursuant to which common shares may be issued in the future. Pursuant to the Arrangement between First Majestic and First Silver, there are also shares of First Silver that may be tendered for shares of First Majestic until September 14, 2012. As of the date of this AIF, there are 114,254 shares of First Silver outstanding that may be tendered for 57,127 shares of First Majestic. Options and share purchase warrants are likely to be exercised when the market price of the Company’s common shares exceeds the exercise price of such options or warrants. The exercise of such options or warrants and the subsequent resale of such common shares in the public market could adversely affect the prevailing market price and the Company’s ability to raise equity capital in the future at a time and price which it deems appropriate. The Company may also enter into commitments in the future which would require the issuance of additional common shares and the Company may grant additional share purchase warrants and stock options. Any share issuances from the Company’s treasury will result in immediate dilution to existing shareholders.

18

Volatility of Share Price

The price of the shares of resource companies tends to be volatile. Fluctuations in the world price of precious metals and many other elements beyond the control of the Company could materially affect the price of the Company’s common shares.

Credit Risk

Credit risk is the risk of financial loss if a customer or counterparty fails to meet its contractual obligations. The Company’s credit risk relates primarily to trade receivables in the ordinary course of business and value added tax and other receivables. The Company has smelting and refining agreements with four parties and and has lessened its dependency on the primary relationship its prior sole smelting relationship Payments are received from a small number of large customers, the receipts involve significant advance payments, scheduled final settlements, routine and received final receipts within sixty days of submission; therefore, the balance of overdue trade receivables owed to the Company in the ordinary course of business is not significant. The Company has a Mexican value added tax receivable of $6.1 million as at December 31, 2008, a significant portion of which is past due. The Company expects to recover the full amount. The Company believes it is not exposed to significant credit risk and overall the Company’s credit risk has not changed significantly from the prior year.

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they arise. The Company has in place a planning and budgeting process to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis and its expansion plans. The Company does not have any committed loan facilities to meet its business requirements. As at December 31, 2008, the Company has outstanding accounts payable and accrued liabilities of $17.3 million which are generally payable in 90 days or less.

On March 5, 2009, the Company completed a public offering with a syndicate of underwriters who purchased 8,487,576 units at an issue price of $2.50 per unit for gross proceeds to the Company of $21,218,940. Although the Company does not have a history of operating profits, the Company believes it has sufficient cash on hand to meet operating requirements as they arise.

The Company has an obligation regarding its purchase of First Silver Reserve (“FSR”) to make a final instalment payment of $13,341,380, due on May 30, 2008, and to make simple interest payments at 6% per annum, payable quarterly on the outstanding vendor balance. In November 2007, an action was commenced by the Company and FSR against the previous majority shareholder of FSR (“Majority Shareholder”), who was a previous director, President & Chief Executive Officer of FSR, and a company he controls, whereby the Company and FSR allege that while holding the positions of director, President and Chief Executive Officer of FSR, he engaged in a course of deceitful and dishonest conduct in breach of his fiduciary and statutory duties owed to FSR, which resulted in FSR not acquiring a mine. Management believes that there are substantial grounds to this claim, however, the outcome of this litigation is not presently determinable.

Pending resolution of the litigation set out above the Company has withheld payment of quarterly instalments of interest due on November 30, 2007, February 29, 2008 and May 30, 2008 totalling $598,857 to the previous Majority Shareholder, and has maintained a reserve of cash in the amount of such instalments. The Company has withheld payments of the final instalment and interest, combined to a total of $13,940,237 due May 30, 2008 until such litigation has been resolved, and such date is presently not determinable. The Company filed on July 22, 2008 an irrevocable Letter of Credit with the Supreme Court of British Columbia as security for this matter.

19

The Company has an ongoing vendor liability regarding its acquisition of the Quebradillas mine and capital lease obligations regarding outstanding lease payments for equipment the Company acquired in 2007 and 2008. The vendor liability for Quebradillas is $1,372,973 in intermittent payments throughout the 2009 year. The capital lease obligation amounts to $3,814,049 in principal and interest, payable in 24 monthly payments beginning in February 2009 and completing in January 2011.

Interest Rate Risk

The Company is exposed to interest rate risk on its short term investments. The Company monitors its exposure to interest rates and has not entered into any derivative contracts to manage this risk.

The Company’s interest-bearing financial assets comprise cash and cash equivalents which bear interest at a mixture of variable and fixed rates for pre-set periods of time. The Company’s interest-bearing financial liabilities comprise fixed rate debt instruments and capital leases with terms to maturity ranging up to three years.

Future Exploration and Development Activities

Exploration and development of mineral properties involve significant financial risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling, constructing mining and processing facilities at a site, developing metallurgical processes and extracting precious metals from ore. The Company cannot ensure that its current exploration and development programs will result in profitable commercial mining operations. Also, substantial expenses may be incurred on exploration projects which are subsequently abandoned due to poor exploration results or the inability to define reserves which can be mined economically.

The economic feasibility of development projects is based upon many factors, including the accuracy of reserve estimates, metal recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting and environmental protection; and precious metal prices, which are highly volatile. Development projects are also subject to the successful completion of feasibility studies, issuance of necessary governmental permits and availability of adequate financing.

Development projects have no operating history upon which to base estimates of future cash flow. Estimates of Proven, Probable Reserves and Measured, Indicated and Inferred Resources are, to a large extent, based upon detailed geological and engineering analysis.

Mineral Projects

To satisfy the reporting requirements of National Instrument 51-102F2 with respect to the Company’s mineral projects, the Company has opted, as allowed by the Instrument, to reproduce the summaries from the technical reports on the respective material properties.

20

La Parrilla Silver Mine, México

The following summary is extracted from a technical report titled “Technical Report for the La Parrilla Silver Mine, Durango State, México” prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of Pincock Allen & Holt (“PAH”) and dated February 16, 2009, as amended and restated on February 26, 2009. Mr. Addison and Mr. Lopez are independent Qualified Persons for the purposes of NI 43-101. The complete report can be viewed on SEDAR at www.sedar.com. The detailed disclosure contained in the above mentioned report is incorporated by reference into this AIF.

La Parrilla Silver Mine is owned and operated by First Majestic Plata, S.A. de C.V. (FMPlata) a wholly-owned indirect subsidiary of the Company through its Mexican holding company, Corporación First Majestic, S.A. de C.V. (“CFM”). La Parrilla Silver Mine was previously operated by First Majestic Resources México, S.A. de C.V.

La Parrilla Silver Mine consists of underground silver/lead/zinc mining operations, and cyanidation and flotation ore processing plant. La Parrilla was discovered in Colonial times (XVI – XVII centuries) and only developed from outcroppings by following mineralization on the structures, until high grade ore shoots were discovered and depleted at times of high prices of the metals.

FMPlata owns mining rights that cover 53,249.22 hectares (131,581.20 acres). The duration of the mineral rights concessions is 50 years, renewable over similar time periods.

La Parrilla mine consists of underground mine development that includes drifts, ramps, raises, stopes and other old workings along the S-SE-trending Los Rosarios system. This system consists of a 2-km-long mineralized structure that encloses numerous veins that branch out into veinlets and stockwork zones. The Los Rosarios system comprises La Rosa, Rosarios, La Blanca and San José mines and it intersects the NS-trending San Marcos vein. Other mineralized zones are located within the surrounding skarn zone of a regional diorite intrusive stock. These include Quebradillas, Protectora, San Nicolas, San José, Las Vacas, Santa Paula, etc.

Historical production records, plus surveys of old stopes within the La Parrilla district, suggest that approximately 1.37 million tonnes of silver ores were extracted from these mines at an estimated average grade of 310 g/tonne silver, 1.9 percent lead and 1.5 percent zinc. This estimate includes production by Mina Los Rosarios between 1978 and 1991, and the Company’s production from 2004 to September 30, 2008. The production amounts to 13.7 million ounces silver, 58.4 million pounds lead and 44.4 million pounds zinc.

FMPlata has developed an on-going aggressive exploration program that includes ramps, drifting and crosscutting into the old working areas of the Los Rosarios system. The exploration budget proposed for 2009 is US$5.18 million. It includes 97 drill holes totaling 17,200m, geophysical and geochemical surveying, and approximately 5,800m of drifting, crosscutting and ramps development. This program is based on the following premises:

21

PAH has reviewed the La Parrilla mine Reserve update of September 30, 2008, along with factors for mining dilution and recovery. In addition, the sampling methods, assaying procedures, compositing methods, data handling, cutoff grade application and grade calculations were reviewed. Several Reserve blocks were cross-checked to track data handling from the initial assays to the final tonnage and grade calculation to ensure that the stated methods and practices were observed.

The La Parrilla mine has estimated mineable Reserves for the following deposits:

The Proven ore category has been projected up to 20 metres from the drift sample data, while the Probable ore category is projected another 20 metres beyond the Proven ore. The total “in situ” diluted Proven and Probable Reserves at a minimum mining width of 2.00m, as reviewed by PAH, is 0.50 million tonnes of oxides and sulfides averaging 295 grams per tonne silver, 1.40 percent lead and 1.01 percent zinc, for a total of 4.8 million contained ounces of silver only; or 5.2 million ounces of silver equivalent with gold and lead credits.

Resource calculations by FMPlata at La Parrilla are based on projections of the mineralized zones in the underground mine workings, 20 metres beyond the areas of Reserves for the Measured Resources, and another 20 metres beyond the boundaries of the Measured Resources for the blocks of Indicated Resources. Inferred Resources are estimated by projecting up to 50 metres beyond the Indicated Resource block boundaries along mineralized structures, and another 20 metres beyond the blocks’ width. La Parrilla mineral resource estimates were applied mostly to diamond drilling intercepts, as well as to some adjacent blocks from the estimated reserves. The grade for these blocks is determined from the grade estimated for the drill hole intercepted grade and from the adjacent Reserve blocks, and sampling in mine workings and drill holes located within the block area.

The Measured and Indicated silver Resources, including oxides and sulfides mineralization, consist of 3.1 million tonnes averaging 255 grams per tonne silver, for a total content of 30.7 million ounces of silver equivalent inclusive of gold credit for oxides and lead and zinc credit for sulfides. The resources grade has been estimated “in situ” above cutoff grade, and the silver equivalent content is inclusive of gold credit in oxides, at 6 g/tonne silver, and inclusive of lead and zinc credit for sulfides, at 47 g/tonne silver and 30 g/tonne respectively, for sulfides. This estimate is based on sales and on the following prices: silver - US$12.00/oz, Au - US$708/oz, lead - US$0.75/lb and zinc – US$0.75/lb.

22

Table 1-1 presents a summary of the La Parrilla Proven and Probable Reserves and Measured and Indicated Resources, in addition to Inferred Resources at the bottom of the table. These Reserves and Resources are exclusive of each other category.

PAH has excluded the zinc mineralization from the Reserve Base. However, zinc may represent a significant value for the La Parrilla operation at better market conditions with higher prices and possibly lower smelter charges. In the current resource grade estimates, the zinc has been considered as part of the block’s grade, and estimated at a 70 percent metallurgical recovery included in the value for silver equivalent calculation.

These Resources are in addition to the previously reported Reserves.

Additional geologic potential exists within the area of La Parrilla to investigate additional targets. Direct exploration of geophysical anomalies may result in significant target zones for further exploration. The Company has determined anomalous areas of interest for further exploration investigations, which may represent concentrations of sulfides or other conductive minerals.

Other areas representing interesting geologic potential within the FMPlata holdings are the following:

23

TABLE 1-1

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Mineral Reserves and Resources Prepared by FMPlata, Reviewed by PAH as of September 30, 2008

| CATEGORY | Mineralization | Metric | Width | Au | Ag | Pb | Zn | Contained Metal | |

| Type | Tonnes | Meters | g/tonne | g/tonne | % | % | Ag (only) oz | Ag eq oz | |

| MINERAL RESERVES | |||||||||

| Total Proven | Oxides | 127,778 | 3.09 | 301 | 1,235,695 | 1,260,344 | |||

| Total Proven | Sulfides | 160,690 | 2.72 | 302 | 1.36 | 0.93 | 1,561,792 | 1,804,608 | |

| PROVEN | Oxides plus Sulfides | 288,468 | 2.88 | 302 | 1.36 | 0.93 | 2,797,487 | 3,064,952 | |

| Total Probable | Oxides | 112,391 | 3.11 | 283 | 1,023,170 | 1,044,851 | |||

| Total Probable | Sulfides | 104,669 | 2.78 | 291 | 1.45 | 1.12 | 978,988 | 1,137,152 | |

| PROBABLE | Oxides plus Sulfides | 217,060 | 2.95 | 287 | 1.45 | 1.12 | 2,002,158 | 2,182,002 | |

| PROVEN PLUS PROBABLE | Oxides plus Sulfides | 505,528 | 2.91 | 295 | 1.40 | 1.01 | 4,799,645 | 5,246,954 | |

| MINERAL RESOURCES | |||||||||

| Total Measured | Oxides | 554,630 | 4.42 | 0.15 | 320 | 5,702,839 | 5,809,830 | ||

| Total Measured | Sulfides | 1,640,818 | 6.58 | 0.08 | 245 | 2.59 | 4.54 | 12,934,778 | 16,996,798 |

| MEASURED | Oxides plus Sulfides | 2,195,448 | 6.04 | 0.10 | 264 | 2.59 | 4.54 | 18,637,618 | 22,806,628 |

| Total Indicated | Oxides | 428,445 | 3.06 | 0.22 | 298 | 4,107,289 | 4,189,938 | ||

| Total Indicated | Sulfides | 433,043 | 4.59 | 0.05 | 192 | 3.46 | 6.07 | 2,678,396 | 3,750,441 |

| INDICATED | Oxides plus Sulfides | 861,488 | 3.83 | 0.13 | 245 | 3.46 | 6.07 | 6,785,685 | 7,940,379 |

| MEASURED PLUS INDICATED (8) | Oxides plus Sulfides | 3,100,000 | 5.41 | 0.11 | 255 | 2.84 | 4.97 | 25,400,000 | 30,700,000 |

| INFERRED RESOURCES | |||||||||

| Total Inferred (6) | Oxides | 4,600,000 | 3.37 | 0.03 | 162 | 0.01 | 0.00 | 23,900,000 | 24,800,000 |

| Total Inferred | Sulfides | 3,400,000 | 4.86 | 0.12 | 179 | 2.05 | 3.51 | 20,000,000 | 28,000,000 |

| INFERRED RESOURCES (8) | Oxides plus Sulfides | 8,000,000 | 4.00 | 0.07 | 169 | 0.87 | 1.49 | 43,900,000 | 52,800,000 |

| (1) |

Estimates by First Majestic Plata, reviewed by PAH. Estimates based on Minimum Mining Width >2.00m. No mine recovery included. |

| (2) |

Silver equivalent based on sales. Prices used for evaluation: Ag - $12/oz; Au - $708/oz; Pb - $0.75/lb; Zn - $0.75/lb. |

| (3) |

Oxides Ag equivalent includes gold credit based on FMPlata sales. Au Credit = 6 g/tonne Ag. |

| (4) |

Sulfides Ag equivalent includes Pb credit = 47 g/tonne Ag. Zinc is considered at 70% met. recovery = 30 g/tonne Ag. |

| (5) |

Cut Off Grade estimated as 184 g/tonne Ag net of Au credit in oxide ores; and 246 g/tonne Ag net of Pb credit in sulfide ores. Zinc not considered in COG estimates. |

| (6) |

Preliminary Quebradillas Block Model estimate at COG>50 g/tonne Ag. |

| (7) |

Reserves and resources in this report are exclusive of each other. |

| (8) |

Rounded figures. |

24

Additional Inferred Resources have been projected in Rosarios, Quebradillas, and San Marcos zones.

The Company operates three mines in La Parrilla area. The Rosa/Rosario and La Blanca, the San Marcos, and Quebradillas operations, all are separate mines within an area of about 10 km2. The production from the mines during 2008 has been about 143,838 tonnes at an average grade of 213 g/tonne silver. This production includes about 24,000 tonnes of ore extracted from development workings. Oxide ore mined was about 82,419 tonnes, while sulfide ore mined was about 61,419 tonnes.

The La Parrilla processing plant has both an oxide recovery circuit and sulfide recovery circuit; therefore both Doré metal bars and flotation concentrates are produced. Products are marketed to Met-Mex Peñoles’ smelter and refineries, located in Torreón, Coahuila. The tonnes milled during the first 9 months of 2008 totaled 143,838 tonnes. Silver production for the first 9 months was about 731,259 equivalent ounces of silver. The Company’s 5-Year Plans requires improvements in production rates, ore head grades and mill recoveries to achieve about 1.94 million ounces of silver equivalent production per year by the end of 2009.

Mining is semi mechanized with trackless loading and hauling. Some drilling is done with a 2-boom and 1-boom electro-hydraulic drill jumbo, but most development and production drilling is accomplished with hand-held jackleg drills. The principal stoping method for the near-vertical veins of La Parrilla is overhand cut and fill, with backfill mainly obtained from development waste. However, the operators are currently experimenting with long-hole open stoping. Drifting and ramping is all trackless, and at times old drifts and other workings that are used in the modern La Parrilla operations are slashed out to accommodate the trackless equipment. Raising is mainly done conventionally as “bald-headed raises,” but some major raises, ventilation, orepasses, etc, are done with contracted raise boring equipment.

The mines are dry and very little water handling is required. Ventilation is primarily by natural flow, and the operators are in the process of boring exhaust ventilation raises for the mines. Compressed air is provided from surface compressor stations in all three operations.

The ore processing plant at La Parrilla processes both oxide and sulfide silver ore in two separate parallel circuits. The oxide circuit has a process capacity of 420 tonnes per day of which during 2008, an average of 300 tonnes per day of ore from La Parrilla containing 211 grams per tonne of silver and recovers about 65 percent of the contained silver as silver bars. The sulfide circuit has a 420 tonnes per day capacity of which during 2008 an of average of 230 tonnes per day of ore were from La Parrilla containing about 218 grams per tonne silver and 2.0 percent lead and recovers about 65 percent of the silver and about 55 percent of the lead into a concentrate containing about 4.0 kilograms per tonne silver and 28 percent lead.

The plant was extensively expanded and modified in 2006 to allow processing of both oxide and sulfide ore at a rate of 420 tonnes per day each. Metal recoveries are expected to gradually rise to 70 percent, and may, perhaps, improve further as the mineral processed is extracted from other areas of the mine outside of the transition zone. In addition to the plant, the tailing containment area with 10 years of life has been built.

Infrastructure for the operation is well established with adequate roads, buildings and utility systems. Power and water supply systems were expanded in 2006 to mine and process ore at a higher rate than in the past.

25

The Company applied for modifications to the previous operating permits (“Permiso Unico Ambiental”) to accommodate the expansion for the processing plant installations. This was granted on March 23, 2006.

The mine operations are contracted to outside contractors, and surface ore and waste haulage is also contracted. The administration, beneficiation plant and ancillary functions are all accomplished with company personnel. The total personnel on site at the end of September 2008 totaled 509 people of which 458 were outside contractors. The overall efficiencies achieved to date (September 30) in 2008 were about 1.1 tonnes per man-shift, while that for the mine operation only, were about 2.3 tonnes per man-shift.

Site operating costs have averaged about US$47 per tonne mined and milled for the nine-month period of 2008. The all-in costs including mining, milling and downstream processing have averaged about US$50 per tonne for oxides and US$67 per tonne for sulfides. The mining costs were an average of about US$18 per tonne, milling costs were about US$24 for oxide ores and US$21 for sulfide ores per tonne and site G&A costs averaged about US$6.30 per tonne. A summary of the 2008 operating costs is shown in Table 1-2.

TABLE 1-2

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Summary of Operating Costs

| Type of Ore | ||

| Concept Area | Oxides | Sulfides |

| Mine | 18.50 | 17.52 |

| Mill | 23.50 | 20.81 |

| Site G&A | 6.32 | 6.32 |

| Marketing, SR, Freights, etc. | 1.55 | 22.29 |

| Total OC for Cutoff | $49.87 | $66.94 |

Capital expenditures are estimated at about US$6.8 million in 2008, including US$3.2 million for exploration and mine development. Projected capital expenditures budgets decrease to US$3.9 million in 2009 and are at about US$2.9 million per year for the remaining three years of the 5-Year Plan. The detail of the capital costs is found in Table 1-3.

An economic analysis of the project, at a discount rate of 10 percent, resulted in a net present value of US$13.65 million with an Internal Rate of Return of 205 percent. These values show La Parrilla’s current conditions, which are based on mining lower tonnage at lower grades due to mine preparation developments, and lower metallurgical recoveries due to processing ores from the oxides/sulfides transition zone.

26

TABLE 1-3

First Majestic Silver

Corp

First Majestic Plata, S.A de C.V.

La Parrilla Silver

Mine

Projected Capital Expenditures, 2009 through 2013

($U.S.)

| AREA | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | TOTALS |

| Mine | |||||||

| Exploration | 5,103,135 | 600,000 | 600,000 | 600,000 | 600,000 | 600,000 | 8,103,135 |

| Mine Development | 3,725,198 | 1,800,000 | 1,800,000 | 1,800,000 | 1,800,000 | 1,800,000 | 12,725,198 |

| Mine Equipment and Other | 2,372,080 | 525,000 | 525,000 | 530,000 | 530,000 | 530,000 | 5,012,080 |

| Sub-total | 11,200,413 | 2,925,000 | 2,925,000 | 2,930,000 | 2,930,000 | 2,930,000 | 25,840,413 |

| Plant | |||||||

| Equipment & Installations | 980,202 | 980,202 | |||||

| Sub-total | 980,202 | 980,202 | |||||

| Other G&A, Infrastructure | |||||||

| Equipment & Installations | 733,821 | 62,216 | 62,216 | 7216 | 7216 | 7216 | 879,901 |

| Grupo México Inc. VAT | 912,233 | 912,233 | |||||

| Sub-total | 733,821 | 974,449 | 62,216 | 7216 | 7216 | 7216 | 1,792,134 |

| TOTALS | 12,914,436 | 3,899,449 | 2,987,216 | 2,937,216 | 2,937,216 | 2,937,216 | 28,612,749 |

These conditions are also affected by high capital and operating costs generated by equipment acquisitions, an aggressive exploration program and mine preparation investments.

San Martín Silver Mine, México

The following summary is extracted from a technical report titled “Technical Report for the San Martín Silver Mine, State of Jalisco, México” prepared by Richard Addison, P.E. and Leonel Lopez, C.P.G. of PAH and dated January 15, 2009, as amended and restated on February 26, 2009. Mr. Addison and Mr. Lopez are independent Qualified Persons for the purposes of NI 43-101. The complete report can be viewed on SEDAR at www.sedar.com. The detailed disclosure contained in the above mentioned report is incorporated by reference into this AIF.

Ownership

Minera El Pilón S.A. de C.V. (El Pilón) is a wholly owned indirect subsidiary of the Company, through its Mexican holding company, CFM. El Pilón corporate offices are located in Durango city and operates the San Martín underground silver mine and ore processing facility near the town of San Martín de Bolaños in the State of Jalisco. Oxidized ore is being mined primarily from the Zuloaga vein and from the adjacent La Blanca, Rosario and Cinco Señores Veins. Exploration is on-going on these vein structures, on other sub-parallel, crossing veins and in a recently identified cymoid structure of the Zuloaga vein at the Ballenas level, in the blocks 5,400 and 5,550, as well as on the Rosario-Condesa vein system. Primary mineralization in sulfides with lead, zinc and copper occurs at the deepest levels, San Juan and San Carlos of the Zuloaga vein. The Company has withheld investigations and development of the sulfides mineralization due to currently low metal prices.

El Pilón holds 31 contiguous mining concessions in the San Martín de Bolaños mining district that cover mineral rights for 7,841 hectares.

27

Geology and Mineralization

The project area lies in the southern part of the Sierra Madre Occidental, an extensive volcanic terrain starting near the United States-Mexican border and trending southeast into the states of Zacatecas and Jalisco. The terrain is characterized by Tertiary age volcanic rocks that have been divided into a lower andesitic sequence of early Tertiary age (40 to 70 million years) and an upper rhyolitic sequence of middle Tertiary age (20 to 40 million years). Volcanism, structural development and mineralization in the San Martín area occurred during late Miocene, resulting in a complex geologic framework, (Starling, 2001). Two distinct features have been recognized by different authors, the pre and post mineralization rock formations, and the indicator Guásima Formation.

The mine has been developed on the Zuloaga vein, which has by far been the most extensively developed vein in the district, having accounted for about one-half of the silver production in the district. Production also occurs from the La Blanca vein, a vertical split off of the Zuloaga vein. The Zuloaga vein occurs along an east-west trending normal fault zone that dips an average 75 degrees to the north, with the hanging wall of the fault down-dropped 100 to 200 metres relative to the footwall. The vein has been identified over a strike length of 3 kilometers, with a developed vertical extent of about 350 metres. El Pilón is developing exploration and rehabilitation of workings along crosscutting veins to the Zuloaga structure, at the Rebaje 40 Oriente on the Cangrejos Level, and at the Rebaje 1100 on the Ballenas Level; in both cases NS veins intersecting the Zuloaga vein show high grade mineralization in widths of up to 10 metres to the hanging wall of previously mined narrow structures. Recent the Company exploration works have identified a Cymoidal structure of the Zuloaga vein at the mine levels 5,400 to 5,550 and it is preparing access and drilling to evaluate its potential.

La Blanca vein is a near-vertical split off of the Zuloaga vein that cuts upward through the Zuloaga hanging wall. La Blanca vein is typically irregular and narrow, but where mineralized, has higher silver and zinc grades.

Two additional veins, the Condesa and Rosario, occur to the southwest and have northwest trends. Access to these veins is from the town of San Martín via an 11.4 kilometer gravel road. The Condesa structure strikes N 40° W and dips 81° SW. The Condesa workings show mineralization over 150 metres along strike, with mineralized zone ranging from 1.5 to 2.0 metres in width and occurring in a quartz-cemented andesitic breccia. The Rosario mine is located within the Santa Rosa arroyo at an elevation of 1,600 metres. The Rosario mine is 11.7 kilometers from the town of San Martín on the same gravel road leading to the Condesa mine. These vein trends intersect the Zuloaga vein in an area below mineralized surface outcrops of the vein and represent a potential exploration target.

Exploration and Project Data

Exploration potential for finding and developing new resources/reserves in the San Martín district appears to be promising. Ore bodies in the mine are typically indicated at depth beneath zones of alteration on the surface expression of the Zuloaga vein. The Zuloaga vein projections from developed mine levels towards its outcropping is under development, since it may hold a significant amount of oxides mineralization. Access to the zone is difficult due to topographic constrains; however, the Company is developing access from the La Escondida level, at the Pinolea level. The vein outcroppings show alteration zones that may be correlated to indicate ore concentrations in the upper portion of the Zuloaga vein.

Direct exploration development is integrated into the mine preparation programs, and for vein deposits this has proven to be the most effective method of exploration. For the year 2007, El Pilón’s drilling program completed 3,900 metres from underground access, while for the year 2008, the program of exploration included drilling 15,719 metres from underground workings, in addition to about 3,770 metres of underground development in drifts and crosscuts for exploration and drill site access.

28