Technical Report for the

La Parrilla Silver Mine,

State of Durango,

México

Prepared for

First Majestic Silver Corp.

February 16,

2009

90534

AMENDED AND RESTATED

February 26, 2009

Prepared by

Pincock, Allen &

Holt

Richard Addison, P.E.

Leonel

López, C.P.G.

1.0

TITLE PAGE

This technical report has been prepared in accordance with the National Instrument 43-101 standards of disclosure for mineral projects (“NI 43-101”) and the contents herein are organized and in compliance with form 43-101F1 contents of the technical report (“43-101F1”). This technical report is an update of Technical Reports Amended for the La Parrilla Silver Mine, Durango State, México; which was prepared by Pincock, Allen & Holt, Inc. for First Majestic Silver Corp. dated March 18, 2008 and published in SEDAR in March 19, 2008 and January 25, 2008 and published in SEDAR in January 26, 2008. The first two items are the title page and table of contents that are presented previously in this report and are simply mentioned herein to maintain the specific report outline numbering contained in form 43-101F1 contents of the technical report.

| Pincock, Allen & Holt | REVISED | 1.1 |

| 90534 February 26, 2009 |

2.0 TABLE OF CONTENTS

See discussion in Section 1.

| Pincock, Allen & Holt | REVISED | 2.1 |

| 90534 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | i |

| 90534 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | ii |

| 90534 February 26, 2009 |

TABLES

| Pincock, Allen & Holt | REVISED | iii |

| 90534 February 26, 2009 |

FIGURES

| Pincock, Allen & Holt | REVISED | iv |

| 90534 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | v |

| 90534 February 26, 2009 |

3.0 EXECUTIVE SUMMARY

First Majestic Silver Corp. (FMS) retained Pincock, Allen and Holt (PAH) to prepare a Technical Report covering updated results of operations at La Parrilla Silver Mine (La Parrilla) located in the Municipality of Nombre de Dios, Durango State, México. The objective of this Technical Report is to provide FMS with a report that will comply with existing regulations in Canada. This report meets the requirements for NI 43-101 and conforms to form 43-101F1 for technical reports.

La Parrilla mine is owned and operated by First Majestic Plata, S.A. de C.V. (FMPlata) a wholly-owned subsidiary of FMS through its newly created Mexican holding company, Corporación First Majestic, S.A. de C.V. (CFM) which went into effect on August 14, 2007. La Parrilla Silver Mine was previously operated by First Majestic Resources México, S.A. de C.V.

La Parrilla Silver Mine consists of underground silver/lead/zinc mining operations, and cyanidation and flotation ore processing plants. La Parrilla represents a typical Mexican mining district which was discovered in Colonial times (XVI – XVII centuries) and only developed from outcroppings by following mineralization on the structures, until high grade ore shoots were discovered and depleted at times of high prices of the metals.

FMPlata owns mining rights that cover 53,249.22 hectares (131,581.20 acres). The duration of the mineral rights concessions is 50 years, renewable over similar time periods.

La Parrilla mine consists of underground mine development that includes drifts, ramps, raises, stopes and other old workings along the S-SE-trending Los Rosarios system. This system consists of a 2-km-long mineralized structure that encloses numerous veins that branch out into veinlets and stockwork zones. The Los Rosarios system comprises La Rosa, Rosarios, La Blanca and San José mines and it intersects the NS-trending San Marcos vein. Other mineralized zones are located within the surrounding skarn zone of a regional diorite intrusive stock. These include Quebradillas, Protectora, San Nicolas, San José, Las Vacas, Santa Paula, etc.

Historical production records, plus surveys of old stopes within the La Parrilla district, suggest that approximately 1.37 million tonnes of silver ores were extracted from these mines at an estimated average grade of 310 g/tonne Ag, 1.9 percent Pb and 1.5 percent Zn. This estimate includes production by Mina Los Rosarios between 1978 and 1991 and FMS’s production from 2004 to September 30, 2008. The production amounts to 13.7 million ounces silver, 58.4 million pounds lead and 44.4 million pounds zinc.

FMPlata has developed an on-going aggressive exploration program that includes ramps, drifting and crosscutting into the old working areas of the Los Rosarios system. The exploration budget proposed for the period of 2009 is $5.18M. It includes 97 drill holes totaling 17,200m, geophysical and geochemical surveying, and approximately 5,800m of drifting, crosscutting and ramps development. This program is based on the following premises:

| Pincock, Allen & Holt | REVISED | 3.1 |

| 90534 February 26, 2009 |

Prepare the La Parrilla operation with sufficient mineral reserves to sustain economic production throughout periods of low metals prices.

Plan and develop systematic production and increase operating capacity.

Recover oxides and sulfides mineralization, consolidating mining blocks, and increasing Reserves to support a reasonable production schedule.

Support exploration activities for development, channel sampling and underground drilling.

Carry out an aggressive exploration program including deep drilling from underground and surface sites.

Focus exploration efforts on regional exploration targets.

PAH has reviewed the La Parrilla mine Reserve update of September 30, 2008, along with factors for mining dilution and recovery. In addition, the sampling methods, assaying procedures, compositing methods, data handling, cutoff grade application and grade calculations were reviewed. Several Reserve blocks were cross-checked to track data handling from the initial assays to the final tonnage and grade calculation to ensure that the stated methods and practices were observed.

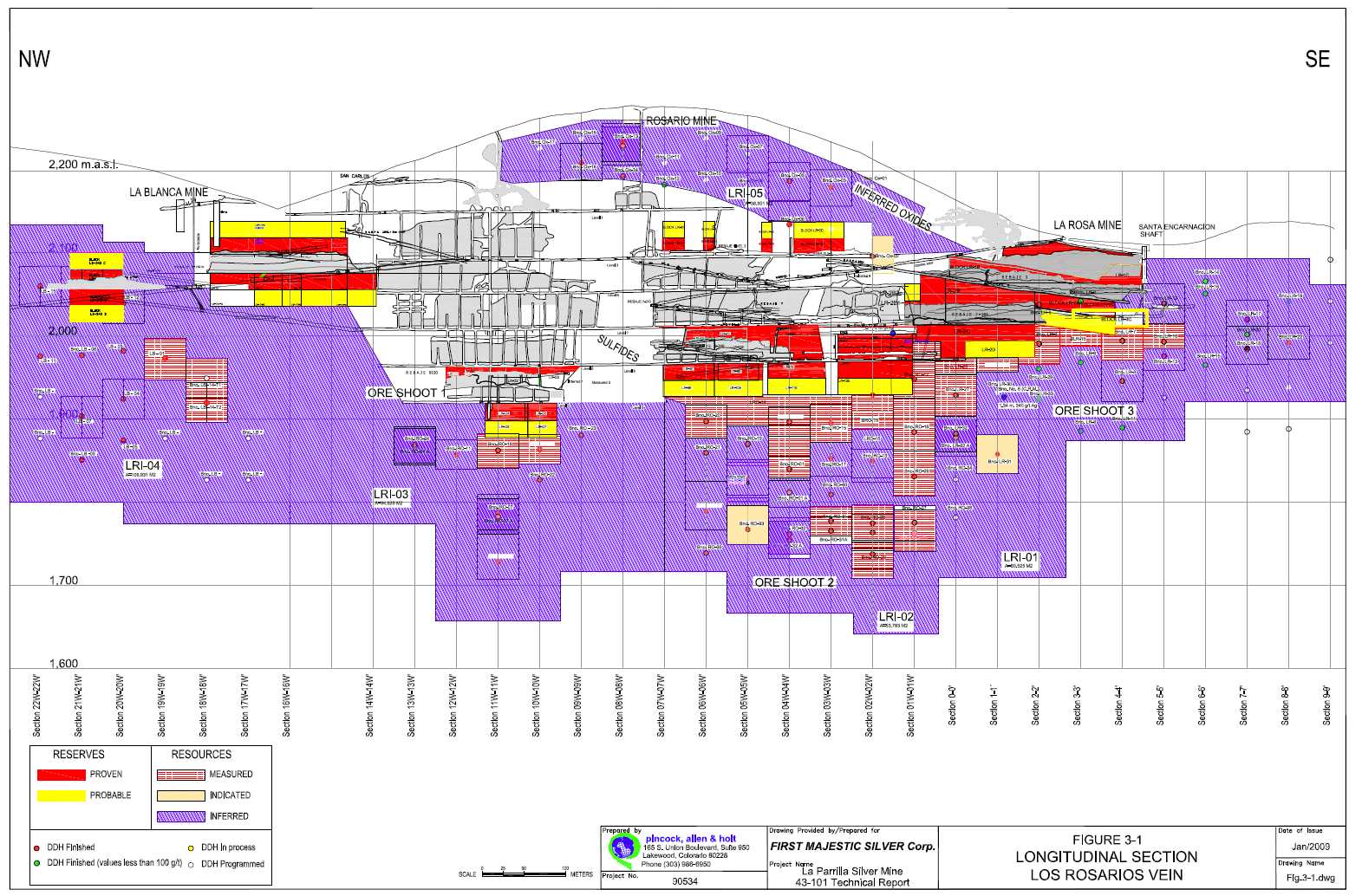

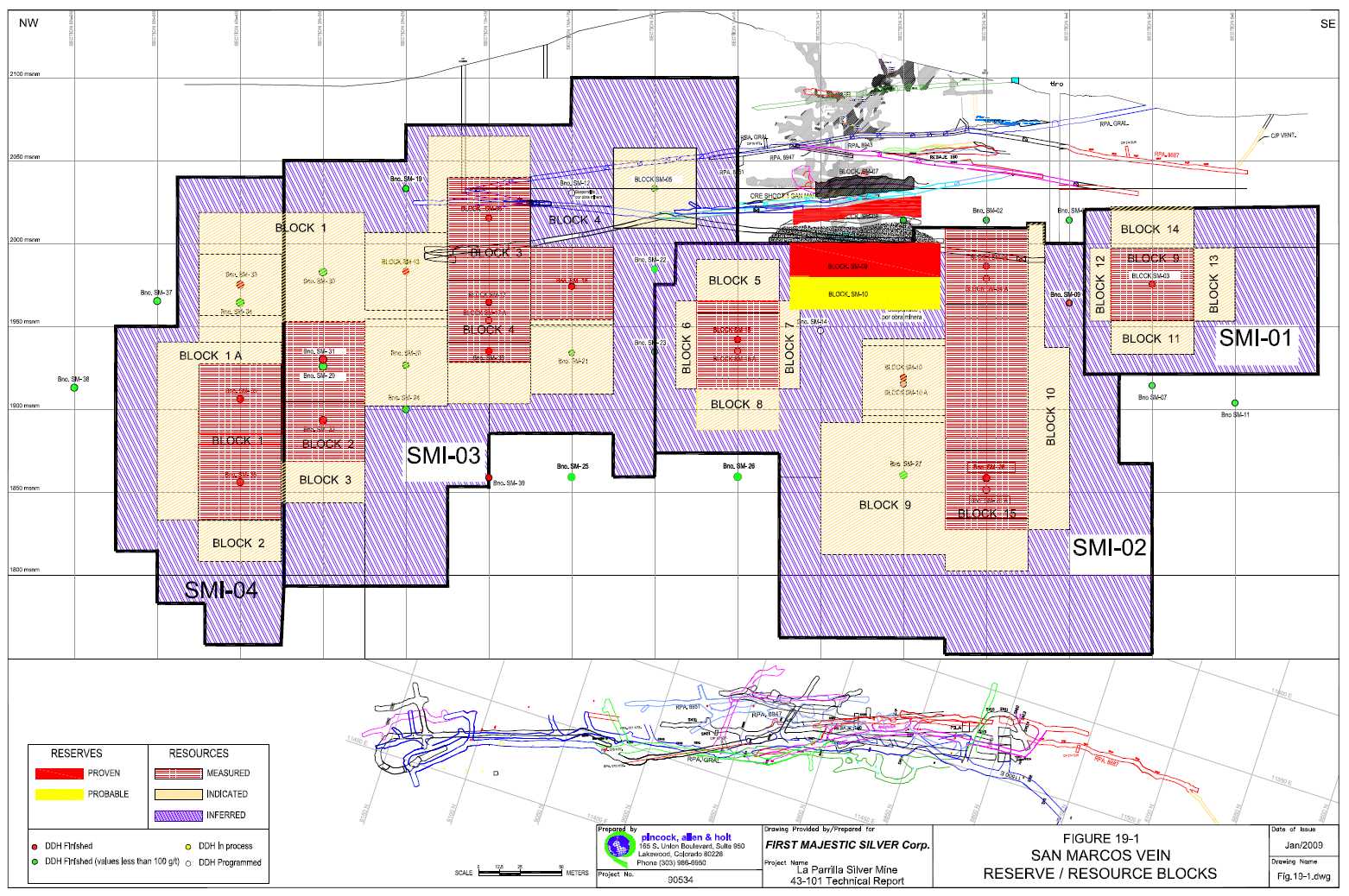

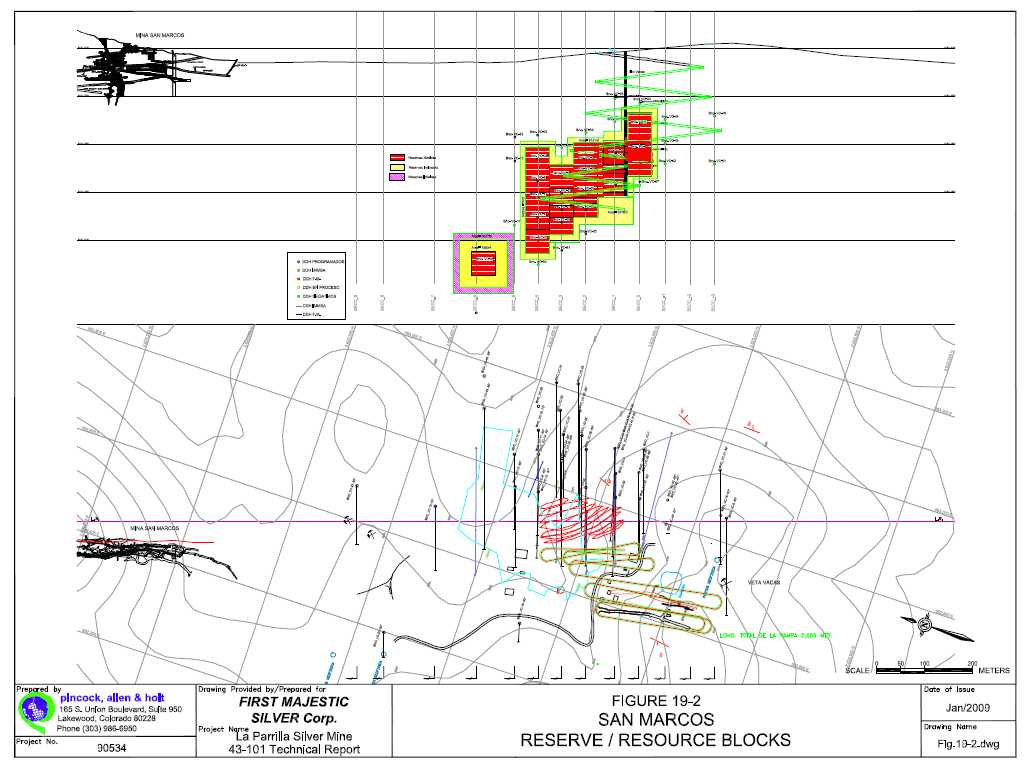

The La Parrilla mine has estimated mineable Reserves for the following deposits:

The Proven ore category has been projected up to 20 meters from the drift sample data, while the Probable ore category is projected another 20 meters beyond the Proven ore. The total “in situ” diluted Proven and Probable Reserves at a minimum mining width of 2.00m, as reviewed by PAH, is 0.50 million tonnes of oxides and sulfides averaging 295 grams per tonne silver, 1.40 percent lead and 1.01 percent zinc, for a total of 4.8 million contained ounces of silver only; or 5.2 million ounces of silver equivalent with gold and lead credits.

Resource calculations by FMPlata at La Parrilla are based on projections of the mineralized zones in the underground mine workings, 20m beyond the areas of Reserves for the Measured Resources, and another 20m beyond the boundaries of the Measured Resources for the blocks of Indicated Resources. Inferred Resources are estimated by projecting up to 50m beyond the Indicated Resource block boundaries along mineralized structures, and another 20m beyond the blocks’ width. La Parrilla mineral resource estimates were applied mostly to diamond drilling intercepts, as well as to some adjacent blocks from the estimated reserves. The grade for these blocks is determined from the grade estimated for the

| Pincock, Allen & Holt | REVISED | 3.2 |

| 90534 February 26, 2009 |

drill hole intercepted grade and from the adjacent Reserve blocks, and sampling in mine workings and drill holes located within the block area.

The Measured and Indicated silver Resources, including oxides and sulfides mineralization, consist of 3.1 million tonnes averaging 255 grams per tonne silver, for a total content of 30.7 million ounces of silver equivalent inclusive of gold credit for oxides and lead and zinc credit for sulfides. The resources grade has been estimated “in situ” above cutoff grade, and the silver equivalent content is inclusive of gold credit in oxides, at 6 g/tonne Ag, and inclusive of lead and zinc credit for sulfides, at 47 g/tonne Ag and 30 g/tonne respectively, for sulfides. This estimate is based on sales and on the following prices: Ag - $12.00/oz, Au - $708/oz, Pb - $0.75/lb and Zn – $0.75/lb.

Table 3-1 presents a summary of the La Parrilla Proven and Probable Reserves and Measured and Indicated Resources, in addition to Inferred Resources at the bottom of the table. These Reserves and Resources are exclusive of each other category. Figure 3-1 shows the Los Rosarios system Reserve/Resource Blocks.

PAH has excluded the zinc mineralization from the Reserve Base. However, zinc may represent a significant value for the La Parrilla operation at better market conditions with higher prices and possibly lower smelter charges. In the current resource grade estimates, the zinc has been considered as part of the block’s grade, and estimated at a 70 percent metallurgical recovery included in the value for silver equivalent calculation.

PAH notes that these Resources are in addition to the previously reported Reserves.

Additional geologic potential exists within the area of La Parrilla to investigate targets that may result in significant resource development for the mining operation. Direct exploration of geophysical anomalies may result in significant target zones for further exploration. FMS has determined anomalous areas of interest for further exploration investigations, which may represent concentrations of sulfides or other conductive minerals.

Other areas representing interesting geologic potential within the FMPlata holdings are the following:

| Pincock, Allen & Holt | REVISED | 3.3 |

| 90534 February 26, 2009 |

TABLE 3-1

First Majestic

Silver Corp.

First Majestic Plata, S.A. de

C.V.

La Parrilla Silver Mine

Mineral Reserves and Resources Prepared

by FMPlata, Reviewed by PAH as of September

30, 2008

| CATEGORY | Mineralization | Metric | Width | Au | Ag | Pb | Zn | Contained Metal | |

| Type | Tonnes | Meters | g/tonne | g/tonne | % | % | Ag (only) oz | Ag eq oz | |

| MINERAL RESERVES | |||||||||

| Total Proven | Oxides | 127,778 | 3.09 | 301 | 1,235,695 | 1,260,344 | |||

| Total Proven | Sulfides | 160,690 | 2.72 | 302 | 1.36 | 0.93 | 1,561,792 | 1,804,608 | |

| PROVEN | Oxides plus Sulfides | 288,468 | 2.88 | 302 | 1.36 | 0.93 | 2,797,487 | 3,064,952 | |

| Total Probable | Oxides | 112,391 | 3.11 | 283 | 1,023,170 | 1,044,851 | |||

| Total Probable | Sulfides | 104,669 | 2.78 | 291 | 1.45 | 1.12 | 978,988 | 1,137,152 | |

| PROBABLE | Oxides plus Sulfides | 217,060 | 2.95 | 287 | 1.45 | 1.12 | 2,002,158 | 2,182,002 | |

| PROVEN PLUS PROBABLE | Oxides plus Sulfides | 505,528 | 2.91 | 295 | 1.40 | 1.01 | 4,799,645 | 5,246,954 | |

| MINERAL RESOURCES | |||||||||

| Total Measured | Oxides | 554,630 | 4.42 | 0.15 | 320 | 5,702,839 | 5,809,830 | ||

| Total Measured | Sulfides | 1,640,818 | 6.58 | 0.08 | 245 | 2.59 | 4.54 | 12,934,778 | 16,996,798 |

| MEASURED | Oxides plus Sulfides | 2,195,448 | 6.04 | 0.10 | 264 | 2.59 | 4.54 | 18,637,618 | 22,806,628 |

| Total Indicated | Oxides | 428,445 | 3.06 | 0.22 | 298 | 4,107,289 | 4,189,938 | ||

| Total Indicated | Sulfides | 433,043 | 4.59 | 0.05 | 192 | 3.46 | 6.07 | 2,678,396 | 3,750,441 |

| INDICATED | Oxides plus Sulfides | 861,488 | 3.83 | 0.13 | 245 | 3.46 | 6.07 | 6,785,685 | 7,940,379 |

| MEASURED PLUS INDICATED (8) | Oxides plus Sulfides | 3,100,000 | 5.41 | 0.11 | 255 | 2.84 | 4.97 | 25,400,000 | 30,700,000 |

| INFERRED RESOURCES | |||||||||

| Total Inferred (6) | Oxides | 4,600,000 | 3.37 | 0.03 | 162 | 0.01 | 0.00 | 23,900,000 | 24,800,000 |

| Total Inferred | Sulfides | 3,400,000 | 4.86 | 0.12 | 179 | 2.05 | 3.51 | 20,000,000 | 28,000,000 |

| INFERRED RESOURCES (8) | Oxides plus Sulfides | 8,000,000 | 4.00 | 0.07 | 169 | 0.87 | 1.49 | 43,900,000 | 52,800,000 |

(1) Estimates by First Majestic Plata, reviewed

by PAH. Estimates based on Minimum Mining Width >2.00m. No mine recovery

included.

(2) Silver equivalent based on sales. Prices used for evaluation:

Ag - $12/oz; Au - $708/oz; Pb - $0.75/lb; Zn - $0.75/lb.

(3) Oxides Ag equivalent includes gold credit based on FMPlata

sales. Au Credit = 6 g/tonne Ag.

(4) Sulfides Ag equivalent includes Pb credit = 47 g/tonne Ag.

Zinc is considered at 70% met. recovery = 30 g/tonne Ag.

(5) Cut Off Grade estimated as 184 g/tonne Ag net of Au credit

in oxide ores; and 246 g/tonne Ag net of Pb credit in sulfide ores. Zinc not

onsidered in COG estimates.

(6) Preliminary Quebradillas Block Model estimate at COG>50

g/tonne Ag.

(7) Reserves and resources in this report are exclusive of each

other.

(8) Rounded figures.

| Pincock, Allen & Holt | REVISED | 3.4 |

| 90534 February 26, 2009 |

Additional Inferred Resources have been projected in Rosarios, Quebradillas, and San Marcos zones.

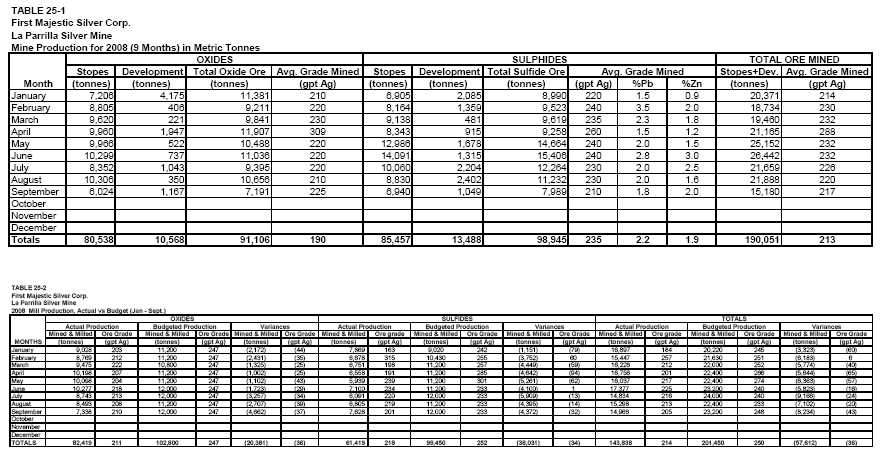

FMS operates three mines in La Parrilla area. The Rosa/Rosario and La Blanca, the San Marcos, and Quebradillas operations, all are separate mines within an area of about 10 km2. The production from the mines during 2008 has been about 143,838 tonnes at an average grade of 213 g/tonne Ag. This production includes about 24,000 tonnes of ore extracted from development workings. Oxide ore mined was about 82,419 tonnes, while sulfide ore mined was about 61,419 tonnes.

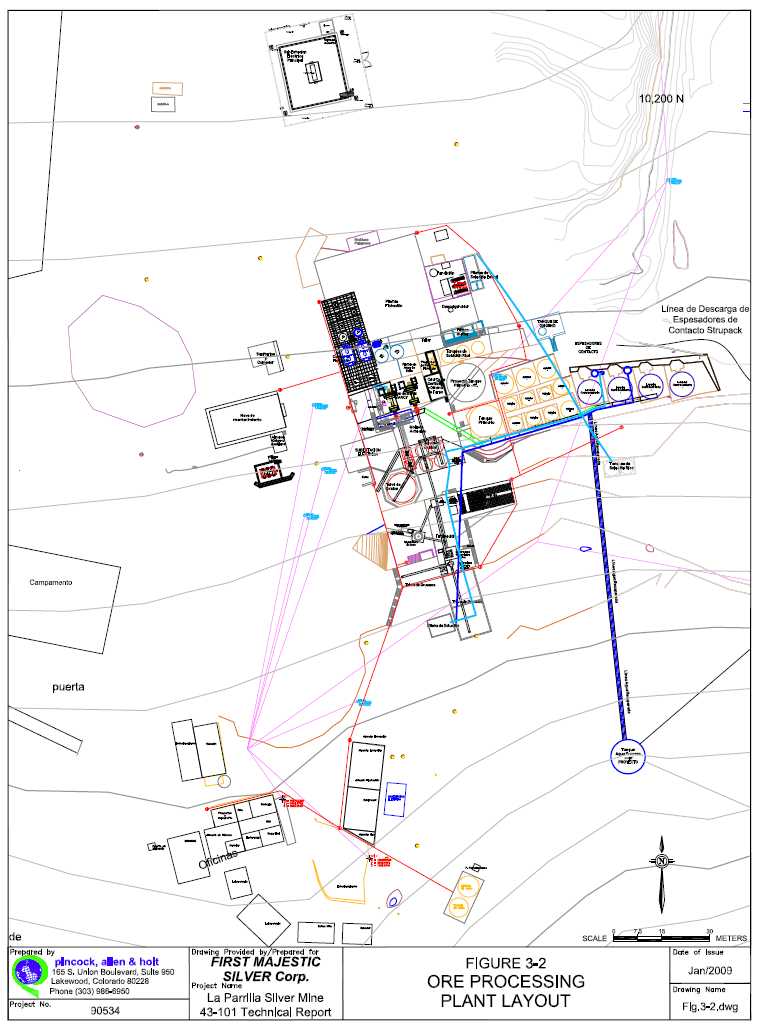

The La Parrilla processing plant has both an oxide recovery circuit and sulfide recovery circuit; therefore both doré metal bars and flotation concentrates are produced. Products are marketed to Met-Mex Peñoles’ smelter and refineries, located in Torreón, Coahuila. The tonnes milled during the first 9 months of 2008 totaled 143,838 tonnes. Silver production for the first 9 months was about 731,259 equivalent ounces of silver. The company’s 5-Year Plans requires improvements in production rates, ore head grades and mill recoveries to achieve about 1.94 million ounces of silver equivalent production per year by the end of 2009.

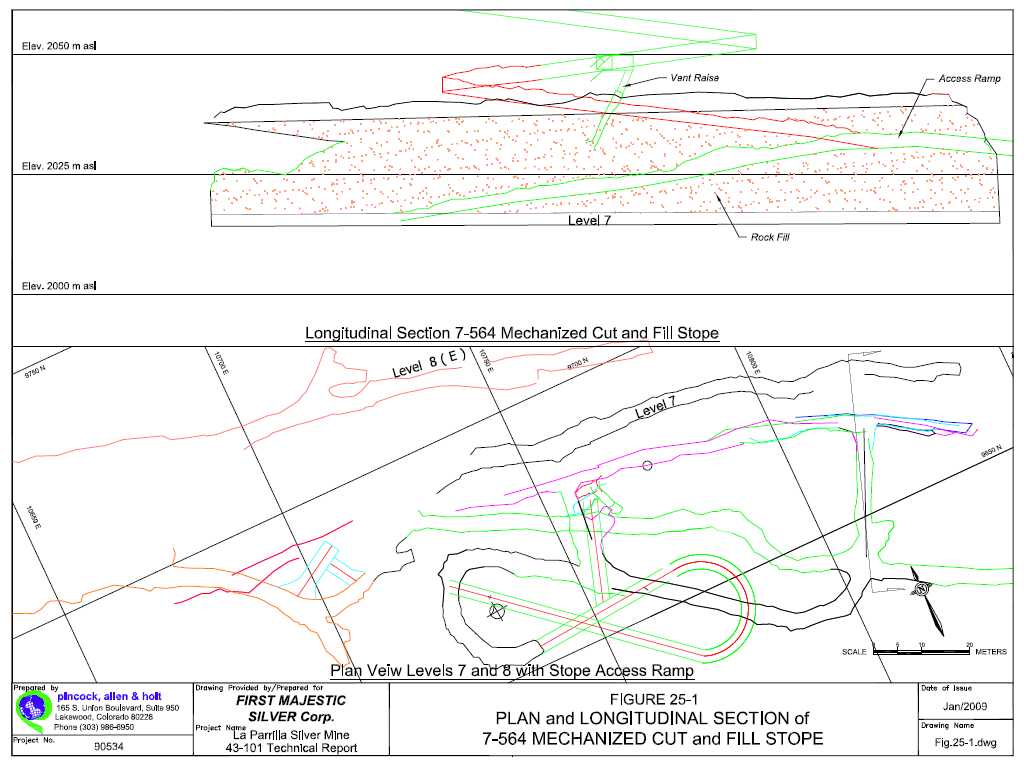

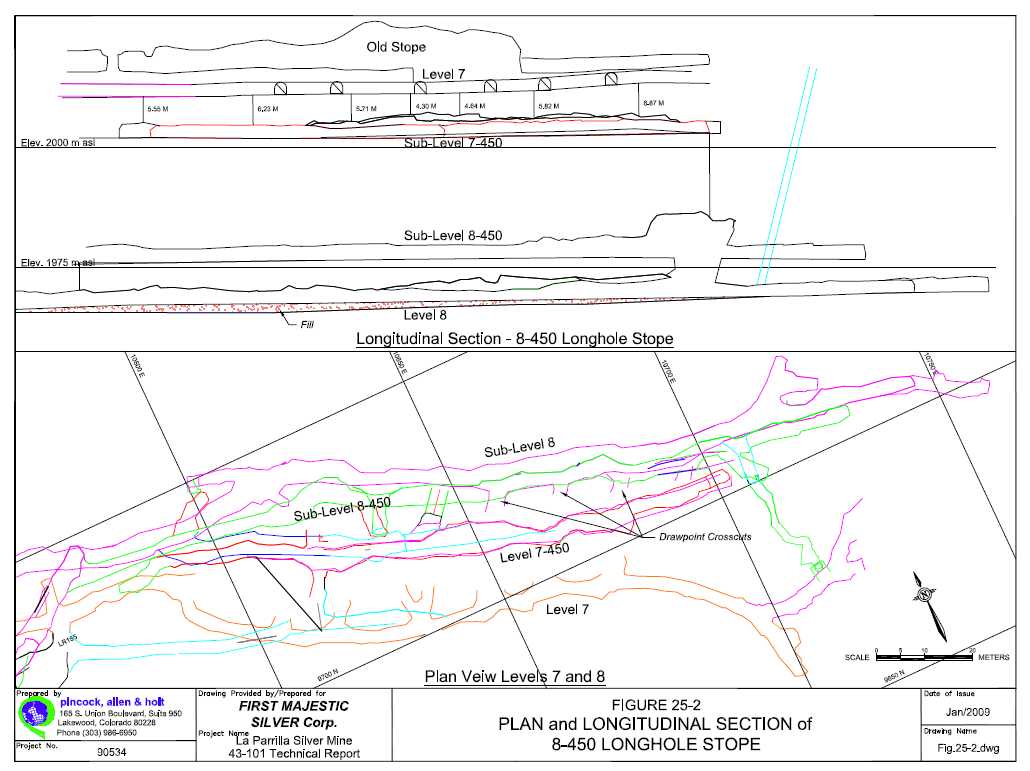

Mining is semi mechanized with trackless loading and hauling. Some drilling is done with a 2-boom and 1-boom electro-hydraulic drill jumbo, but most development and production drilling is accomplished with hand-held jackleg drills. The principal stoping method for the near-vertical veins of La Parrilla is overhand cut and fill, with backfill mainly obtained from development waste. However, the operators are currently experimenting with long-hole open stoping. Drifting and ramping is all trackless, and at times old drifts and other workings that are used in the modern La Parrilla operations are slashed out to accommodate the trackless equipment. Raising is mainly done conventionally as “bald-headed raises,” but some major raises, ventilation, orepasses, etc, are done with contracted raise boring equipment.

The mines are dry and very little water handling is required. Ventilation is primarily by natural flow, and the operators are in the process of boring exhaust ventilation raises for the mines. Compressed air is provided from surface compressor stations in all three operations.

The ore processing plant at La Parrilla processes both oxide and sulfide silver ore in two separate parallel circuits. The oxide circuit has a process capacity of 420 tonnes per day of which during 2008, an average of 300 tonnes per day of ore from La Parrilla containing 211 grams per tonne of silver and recovers about 65 percent of the contained silver as silver bars. The sulfide circuit has a 420 tonnes per day capacity of which during 2008 an of average of 230 tonnes per day of ore were from La Parrilla containing about 218 grams per tonne silver and 2.0 percent lead and recovers about 65 percent of the silver and about 55 percent of the lead into a concentrate containing about 4.0 kilograms per tonne silver and 28 percent lead.

The plant was extensively expanded and modified in 2006 to allow processing of both oxide and sulfide ore at a rate of 420 tonnes per day each. Metal recoveries are expected to gradually rise to 70 percent, and may, perhaps, improve further as the mineral processed is extracted from other areas of the mine outside of the transition zone. In addition to the plant, the tailing containment area with 10 years of life has been built. Figure 3-2 shows the Ore Processing Plant Layout.

| Pincock, Allen & Holt | REVISED | 3.6 |

| 90534 February 26, 2009 |

Infrastructure for the operation is well established with adequate roads, buildings and utility systems. Power and water supply systems were expanded in 2006 to mine and process ore at a higher rate than in the past.

PAH is not aware of any environmental liabilities within the La Parrilla mining district. FMS applied for modifications to the previous operating permits (“Permiso Unico Ambiental”) to accommodate the expansion for the processing plant installations. This was granted on March 23, 2006.

The mine operations are contracted to outside contractors, and surface ore and waste haulage is also contracted. The administration, beneficiation plant and ancillary functions are all accomplished with company personnel. The total personnel on site at the end of September 2008 totaled 509 people of which 458 were outside contractors. The overall efficiencies achieved to date (September 30) in 2008 were about 1.1 tonnes per man-shift, while that for the mine operation only, were about 2.3 tonnes per man-shift.

Site operating costs have averaged about $47 per tonne mined and milled for the nine-month period of 2008. The all-in costs including mining, milling and downstream processing have averaged about $50 per tonne for oxides and $67 per tonne for sulfides. The mining costs were an average of about $18 per tonne, milling costs were about $24 for oxide ores and $21 for sulfide ores per tonne and site G&A costs averaged about $6.30 per tonne. A summary of the 2008 operating costs is shown in Table 3-2.

TABLE 3-2

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Summary of Operating Costs

| Concept Area | Type of Ore | |

| Oxides | Sulfides | |

| Mine | 18.50 | 17.52 |

| Mill | 23.50 | 20.81 |

| Site G&A | 6.32 | 6.32 |

| Marketing, SR, Freights, etc. | 1.55 | 22.29 |

| Total OC for Cutoff | $49.87 | $66.94 |

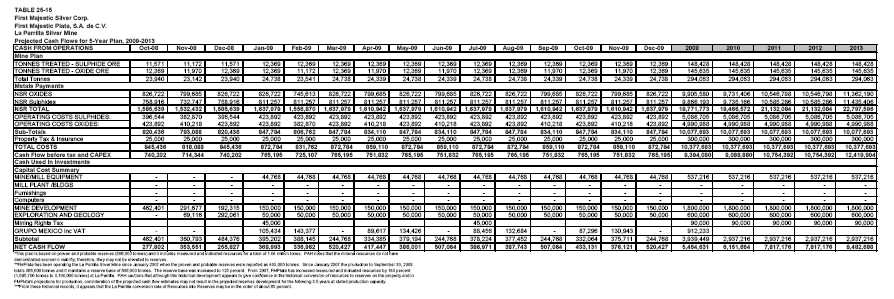

Capital expenditures are estimated at about $6.8 million in 2008, including $3.2 million for exploration and mine development. Projected capital expenditures budgets decrease to $3.9 million in 2009 and are at about $2.9 million per year for the remaining three years of the 5-Year Plan. The detail of the capital costs is found in Table 3-3.

An economic analysis of the project, at a discount rate of 10 percent, resulted in a net present value of $13.65M with an Internal Rate of Return of 205 percent. These values show La Parrilla’s current conditions, which are based on mining lower tonnage at lower grades due to mine preparation developments, and lower metallurgical recoveries due to processing ores from the oxides/sulfides transition zone.

| Pincock, Allen & Holt | REVISED | 3.8 |

| 90534 February 26, 2009 |

TABLE 3-3

First Majestic Silver

Corp

First Majestic Plata, S.A de C.V.

La Parrilla Silver

Mine

Projected Capital Expenditures, 2009 through 2013 ($U.S)

| AREA | 2008 | 2009 | 010 | 2011 | 2012 | 2013 | TOTALS |

| Mine | |||||||

| Exploration | 5,103,135 | 600,000 | 600,000 | 600,000 | 600,000 | 600,000 | 8,103,135 |

| Mine Development | 3,725,198 | 1,800,000 | 1,800,000 | 1,800,000 | 1,800,000 | 1,800,000 | 12,725,198 |

| Mine Equipment and Other | 2,372,080 | 525,000 | 525,000 | 530,000 | 530,000 | 530,000 | 5,012,080 |

| Sub-total | 11,200,413 | 2,925,000 | 2,925,000 | 2,930,000 | 2,930,000 | 2,930,000 | 25,840,413 |

| Plant | |||||||

| Equipment & Installations | 980,202 | 980,202 | |||||

| Sub-total | 980,202 | 980,202 | |||||

| Other G&A, Infrastructure | |||||||

| Equipment & Installations | 733,821 | 62,216 | 62,216 | 7216 | 7216 | 7216 | 879,901 |

| Grupo Mexico Inc. VAT | 912,233 | 912,233 | |||||

| Sub-total | 733,821 | 974,449 | 62,216 | 7216 | 7216 | 7216 | 1,792,134 |

| TOTALS | 12,914,436 | 3,899,449 | 2,987,216 | 2,937,216 | 2,937,216 | 2,937,216 | 28,612,749 |

These conditions are also affected by high capital and operating costs generated by equipment acquisitions, an aggressive exploration program and mine preparation investments. In PAH’s opinion the La Parrilla mill and process plant will likely reach planned throughput rates in 2009 as shown in Table 3-4.

TABLE 3-4

First Majestic Silver

Corp.

First Majestic Plata, S.A de C.V.

La Parrilla Silver

Mine

Economic Analysis Results for 5-year Plan

ECONOMIC EVALUATION |

Discount Rate (%) |

NPV ($US) |

NPVs |

10% 15% 20% 25% |

13,655,502 11,628,858 9,982,165 8,629,095 |

| IRR | 176% | |

PAH believes that the La Parrilla Reserve and Resource estimates have been reasonably prepared and conform to acceptable engineering standards for reporting of Reserves and Resources. PAH believes that the classification of the Reserves and Resources meets the standards of Canadian National Instrument NI 43-101 and the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

The Reserves and Resources herein reported by FMPlata for the La Parrilla Silver Mine were reviewed by PAH and constitute part of an operation by FMS. There are no significant technical, legal, environmental, political or other kind of restrictions; therefore, in PAH’s opinion these Reserves and Resources may not be materially affected by issues that could prevent their extraction and processing.

An economic analysis of the La Parrilla operation shows positive economics as measured by a cash flow exercise, and thus the postulated Reserve position is accepted.

| Pincock, Allen & Holt | REVISED | 3.9 |

| 90534 February 26, 2009 |

4.0 INTRODUCTION

First Majestic Silver Corp. (FMS) retained Pincock, Allen and Holt (PAH) to prepare a Technical Report covering the La Parrilla Silver Mine (La Parrilla) located in the Municipality of Nombre de Dios, Durango State, México. This report is an update of Technical Reports for the La Parrilla Silver Mine, Durango State, México, prepared for First Majestic Silver Corp. dated July 24, 2007, Amended by Pincock, Allen & Holt, Inc., and was published in SEDAR on July 25, 2007, and Technical Report for the La Parrilla Silver Mine, Durango State, México, dated January 25, 2008, and published in SEDAR in January 29, 2008, and Technical Report Amended dated March 18, 2008 and published in SEDAR in March 19, 2008, and they are referred to as Technical Reports herein.

The objective of this Technical Report is to provide FMS with an updated report that will follow existing regulations in Canada. This report meets the requirements for NI 43-101 and conforms to form 43-101F1 for technical reports.

4.1 Qualified Person and Participating Personnel

The principal author of this report is Leonel López, a Certified Professional Geologist (AIPG-C.P.G.-08359), Registered Professional Geologist in the State of Wyoming (PG-2407), a Registered Professional Member of The Society of Mining Engineers (No.1943910) and a PAH Principal Geologist. Mr. López has visited the site during the periods of May 15–18 and November 13-18, 2007 to review current status of the property. Another team of PAH professionals visited La Parrilla Silver Mine to review environmental, mine, plant and safety issues during the period of April 13–15, 2007. Mr. López’s prior visit to La Parrilla Silver Mine was in June 21, 2006 as part of a PAH team of professionals to review the operations. Mr. López and Mr. Richard Addison visited the property during the period of October 30 to November 1, 2008 to review available information on La Parrilla Silver Mine and has assembled the location, tenure, history, environmental considerations, and all aspects of the geology, and reviewed the sampling, data verification, drilling and project resources. Other PAH members collaborated in the review of reserve estimates, mine and processing, operations and operating and capital costs for La Parrilla Silver Mine and operation.

4.2 Terms and Definitions

La Parrilla consists of silver/lead/zinc oxidized and sulfides mineral deposits located in the State of Durango, México. La Parrilla comprises numerous mineralized structures, vein, breccia zones and metasomatic mineral concentrations within the area, including additional geologic potential to discover other projected concentrations along regional and local structures and their projected intersections. Some of the known deposits within the La Parrilla area are the following:

| Pincock, Allen & Holt | REVISED | 4.1 |

| 90534 February 26, 2009 |

In this report:

FMS refers to First Majestic Silver Corp.

CFM refers to Corporación First Majestic, S.A. de C.V. a Mexican holding company wholly owned subsidiary of FMS, which was incorporated on July 31, 2007 and effected corporate restructuring on August 14, 2007 by which CFM now holds all ownership, including all shares of La Encantada, El Pilon and FMPlata. FMS Press Release of November 29, 2007 published on SEDAR site.

FMPlata refers to First Majestic Plata, S.A. de C.V. a wholly owned subsidiary of Corporación First Majestic, S.A. de C.V. It was incorporated on July 31, 2007 to hold the La Parrilla Silver Mine mineral rights, ownership and obligations held through First Majestic Resources México, S.A. de C.V. including all FMRM shares and acquisitions from Industrial Minera México, S.A. de C.V., its subsidiaries and other third parties. All changes were effected on August 14, 2007.

FMRM refers to First Majestic Resources México, S.A. de C.V., a wholly-owned Mexican subsidiary of FMS held under the Mexican holding company CFM, and operator of La Parrilla Silver Mine. FMRM ownership and rights were transferred to FMPlata on August 14, 2007.

PAH refers to Pincock, Allen & Holt, Inc., a Division of Runge, Inc., and its representatives.

Peñoles refers to Industrias Peñoles, S.A. de C.V., MET-MEX Peñoles and Grupo Peñoles.

La Parrilla Silver Mine, La Parrilla mine, La Parrilla district or La Parrilla refers to the operating underground mines, processing plants and infrastructure facilities that form this industrial complex and all the surrounding ground owned by FMPlata.

Mina Los Rosarios, S.A. de C.V. is a Mexican mining company owned by Mr. José Antonio Gámiz Quiñones and Family, former operator of the La Parrilla mine and plant. FMRM acquired the rights to La Parrilla from this company.

Grupo México refers to the corporation that holds ownership of ASARCO, former ASARCO Mexicana, and a group of Mexican Companies, subsidiaries of Industrial Minera México, S.A. de C.V., including Minera Montana, S. de R.L. de C.V., Mexicana del Arco, S.A. de C.V. and Minerales Metálicos del Norte, S.A. de C.V., from which FMRM has purchased mining concessions and properties within La Parrilla area.

| Pincock, Allen & Holt | REVISED | 4.2 |

| 90534 February 26, 2009 |

Resource and Reserve definitions are as set forth in the CIM Definitions Standards dated December 15, 2005.

Resource definitions are as set forth in an appendix to Companion Policy 43-101CP, “Canadian Institute of Mining, Metallurgy and Petroleum – Definitions Adopted by CIM Council, August 20, 2000.”

CFM refers to Comisión de Fomento Minero, a Mexican Federal Entity responsible for support and promoting mining activities, including financing and exploration, mining and processing through contracting by small-scale miners (gambusinos). It was shut down by the Mexican Federal Government. All former CFM activities were transferred to other Federal Institutions as Fideicomiso de Fomento Minero (FIFOMI) and Servicio Geológico Mexicano (SGM).

4.3 Units

All units are carried in metric units, also unless otherwise noted. Grades are described in terms of percent (%) or grams per metric tonne (gptonne or g/tonne), with tonnages stated in metric tonnes. Salable metals are described in terms of tonnes, or troy ounces (precious metals) and percent weight.

Unless otherwise stated, Dollars are US Dollars. The following abbreviations are used in this report:

| Abbreviation | Unit or Term |

| Al2O3 | Alumina |

| ANFO | Ammonium nitrate/fuel oil |

| ASTM | American Society for Testing and Materials |

| Sb | Antimony |

| Ag | Silver |

| As | Arsenic |

| Au | Gold |

| Bi | Bismuth |

| Cd | Cadmium |

| Co | Cobalt |

| Cu | Copper |

| In | Indium |

| Fe | Iron |

| g/tonne (gptonne) | Grams per tonne |

| ha | Hectare (10,000 m2) |

| kcal | Kilocalories |

| kg | Kilograms |

| km | Kilometer |

| k | Thousands |

| Pb | Lead |

| Pincock, Allen & Holt | REVISED | 4.3 |

| 90534 February 26, 2009 |

| LOM | Life of Mine |

| Mn | Manganese |

| Hg | Mercury |

| m | Meters |

| masl | Meters Above Sea Level |

| mm | Millimeters |

| M | Million |

| Mt | Million Tonnes |

| mtpd | Metric tonnes per day |

| Mtpy | Million tonnes per year |

| NPV | Net Present Value |

| Ni | Nickel |

| oz | Ounces |

| % | Percent by weight |

| Patio | refers to yard, court or stocking ground |

| Se | Selenium |

| SiO | Silica |

| Sn | Tin |

| T or t | Metric Tonne (2,204 lbs) |

| Te | Tellurium |

| Ti | Titanium |

| tpa | Tonnes per annum |

| tpy | Tonnes per year |

| tpd | Tonnes per day |

| ug | Underground |

| WO | Tungsten Oxide |

| Zn | Zinc |

| $ | United States Dollars |

| MX$ | Pesos, New Mexican Pesos |

| CA$ | Canadian Dollars |

4.4 Source Documents

The source documents for this report are summarized in Section 22.

| Pincock, Allen & Holt | REVISED | 4.4 |

| 90534 February 26, 2009 |

5.0 RELIANCE ON OTHER EXPERTS

This report was prepared for First Majestic Silver Corp. (FMS) by the independent consulting firm Pincock, Allen & Holt, Inc. (“Consultant”) and is based in part on information prepared by other parties. PAH has relied primarily on information provided as part of the following reports, investigations and operating results:

| • |

Resource and Reserve Estimates by FMS for La Parrilla Silver Mine. Prepared by FMPlata and FMRM staff and reviewed by PAH. September 30, 2008. | |

| • |

Technical Report for the La Parrilla Silver Mine Amended, Durango State, México (Technical Report Amended). Prepared for First Majestic Silver Corp. Prepared by Pincock, Allen & Holt, Inc., March 18, 2008, and published in SEDAR in March 19, 2008. | |

| • |

Technical Report for the La Parrilla Silver Mine Amended, Durango State, México (Technical Report Amended). Prepared for First Majestic Silver Corp. Prepared by Pincock, Allen & Holt, Inc., July 24, 2007, and published in SEDAR on July 25, 2007. | |

| • |

La Parrilla Geologic Report, Durango, México. Prepared by the consulting firm of Exploraciones Geológico-Mineras de Occidente, S.A. de C.V., Ing. Florentino Muñoz Cabral, April 2004. | |

| • |

Legal Opinion – First Majestic Plata, S.A. de C.V., a wholly owned subsidiary of Corporación First Majestic, S.A. de C.V. wholly owned subsidiary of First Majestic Silver Corp. Legal Opinion by Durango-based office of legal advisers, by Mr. Carlos Galván Pastoriza, Abogado, prepared on September 30, 2008. | |

| • |

Geological Evaluation of the La Parrilla Property, State of Durango, México. Prepared by: J.N. Helsen, Ph.D., P.Geo. March 27, 2006. | |

| • |

Information provided by FMRM and FMS as owners and operators of La Parrilla mine, including data from January to September 2008. | |

| • |

Information provided by FMS Corporate Manager of Environmental and Permitting, on Permits and Environmental Requirements compliance on behalf of the La Parrilla mining operation. This document of statement and list of permits and requirements was provided to PAH by FMS Corporate Manager of Environmental and Permitting, Mr. José Luis Hernández Santibañez, dated on October 31, 2008. It includes the following: | |

| • |

Delegación Federal de la SEMARNAT, Estado de Durango, Unidad de Gestión Ambiental. April 17, 2006. Authorization to change the “Licencia Ambiental Unica No. LAU-10/016-2005” dated March 16, 2005 to updated terms due to increment of operating capacity at La Parrilla, registration No. “FMR141001611” dated April 17, 2006. | |

| Pincock, Allen & Holt | REVISED | 5.1 |

| 90534 February 26, 2009 |

| • |

Delegación Federal de la SEMARNAT, Estado de Durango, Unidad de Gestión Ambiental on resolution to authorize construction and use of Tailings dam “Parrilla II”. Document No. SG/130.2.1.1/000897. Dated April 16, 2007. It includes other documents in which FMRM is authorized to change the use of the land, etc. | ||

| • |

State Manager of CNA (Comisión Nacional del Agua), Estado de Durango. Official notification of Concesión Title No. 03DGO102200/11IMGE06 for the use of water at La Parrilla, dated December 18, 2006. Registration of title rights on October 26, 2006. | ||

| • |

Delegación Federal de la SEMARNAT, Estado de Durango. Permit as industry that uses and handles dangerous substances, including the use of Sodium Cyanide. Dated June 15, 2006. | ||

| • |

Delegación Federal Durango, Subdelegación de Gestión para la Protección Ambiental y Recursos Naturales, Unidad de Aprovechamiento y Restauración de Recursos Naturales. Document No. SG/130.2.2./000979. Authorization to change the use of land for the project construction and operation of the La Parrilla II Tailings Dam of the La Parrilla Mining Operation. Dated on Durango city April 27, 2007. | ||

| • |

Program of Environmental Audit has been presented to SEMARNAT with pending resolution for approval. | ||

| • |

Permit for the use of explosives. | ||

| • |

Permit to allow discharge of fluids. | ||

| • |

Annual Operating Permit. | ||

| • |

Risk Analysis for the Plant. | ||

| • |

Program of Accidents Prevention. | ||

| • |

The following studies have been completed on behalf of the La Parrilla Silver Mine operation: | ||

|

- |

Dust in surrounding areas, May – 2005, August 2007 and July 2008. | ||

|

- |

Sampling and analysis of tailings for cyanide and arsenic, May 2005 and Jun 2008. | ||

|

- |

Sampling and analysis of water from domestic water wells, May 2005, July 2007 and June 2008. | ||

|

- |

Program of Environmental Audit in application since February 2006. | ||

|

- |

Risks study, February 2006. | ||

| Pincock, Allen & Holt | REVISED | 5.2 |

| 90534 February 26, 2009 |

|

- |

Program of Accidents Prevention, February 2006. | ||

|

- |

Study of noises in the surrounding areas, May 2006 and July 2008. | ||

|

- |

Study of noises in the working areas, April 2007. | ||

|

- |

Termic conditions study in working areas, April 2007. | ||

|

- |

Study of illumination conditions in working areas, April 2007. | ||

|

- |

Study of the presence of dust in working areas, April 2007. | ||

|

- |

Study on characterization of soils and tailings, August 2007. | ||

| • |

PAH’s observations during site visits on the periods of June 20-25, 2006; April 13-15, 2007; May 15–18, 2007 and November 13–18, 2007. | ||

PAH believes that this information is reliable for use in this report. Environmental review of documents, permits and studies for the La Parrilla Silver Mine were provided to PAH by the FMS Corporate Manager of Environmental and Permitting, Mr. José Hernández Santibañez in document dated October 31, 2008.

This information was also reviewed by FMPlata legal advisers and a legal opinion was provided to PAH by the Durango City-based Lawyers Firm of Mr. Carlos Galván Pastoriza, dated September 30, 2008. Therefore, PAH believes all above described documents and information regarding the property current status, legal title and environmental compliance for the La Parrilla Silver Mine mining – metallurgical operation to be accurate and current in legal standing.

| Pincock, Allen & Holt | REVISED | 5.3 |

| 90534 February 26, 2009 |

6.0 PROPERTY DESCRIPTION AND LOCATION

La Parrilla Silver Mine is owned and operated by First Majestic Plata, S.A. de C.V. (FMPlata) a wholly-owned subsidiary of Corporación First Majestic, S.A. de C.V., a Mexican holding company wholly owned by First Majestic Silver Corp. of Vancouver, Canada (FMS).

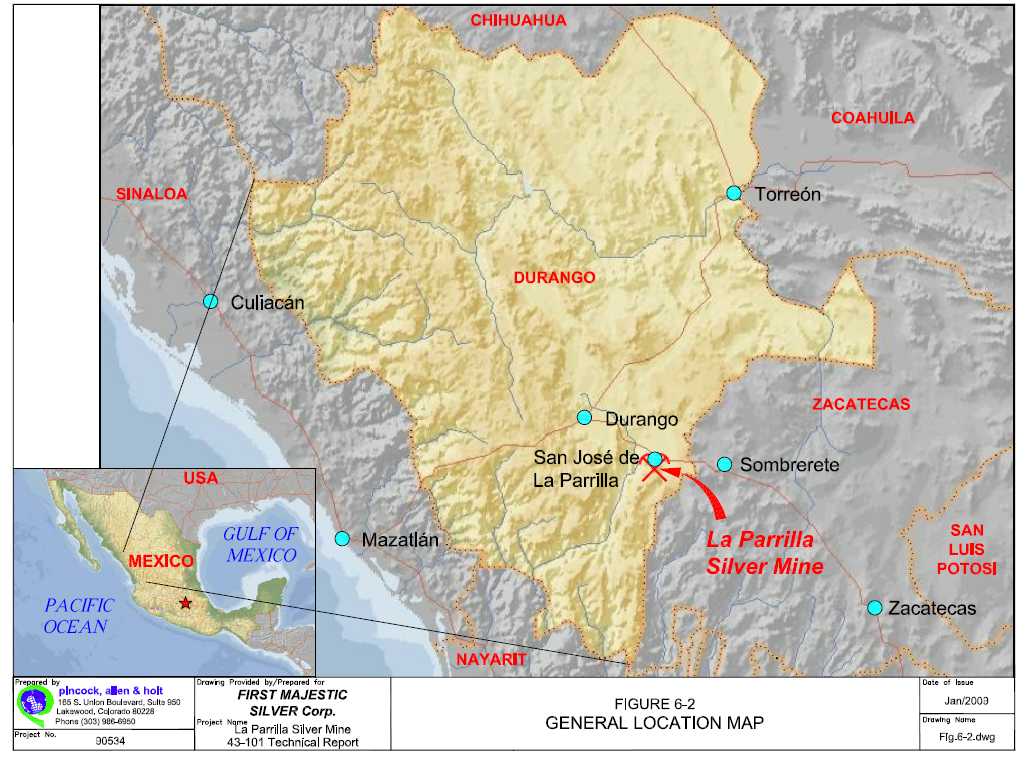

Additional details of property description and location are presented in Technical Report Amended for La Parrilla Silver Mine of March 18, 2008 and published in SEDAR on March 19, 2008 and in Technical Report Amended of July 24, 2007 and published in SEDAR on July 25, 2007. Figure 6-1 presents a general site map and Figure 6-2 is a general location map.

Location coordinates to approximate center of La Parrilla Silver Mine are as follows:

| Geographic | UTM |

| North 23º 44’ 16” | North 2,625,000 |

| West 104º 06’ 26” | East 591,500 |

6.1 Property Description

This Technical Report presents an update of La Parrilla’s current operating conditions and projections as planned by FMS. La Parrilla property modifications for the period of January to September, 2008 include the following:

The La Parrilla mining rights covered by First Majestic Resources México, S.A. de C.V. a wholly owned subsidiary of FMS have been transferred to the newly founded First Majestic Plata, S.A. de C.V. a corporation owned by the newly created Mexican holding company Corporación First Majestic, S.A. de C.V. which consolidates all shares and ownership of the Mexican operations by First Majestic Silver Corp. of Vancouver, BC.

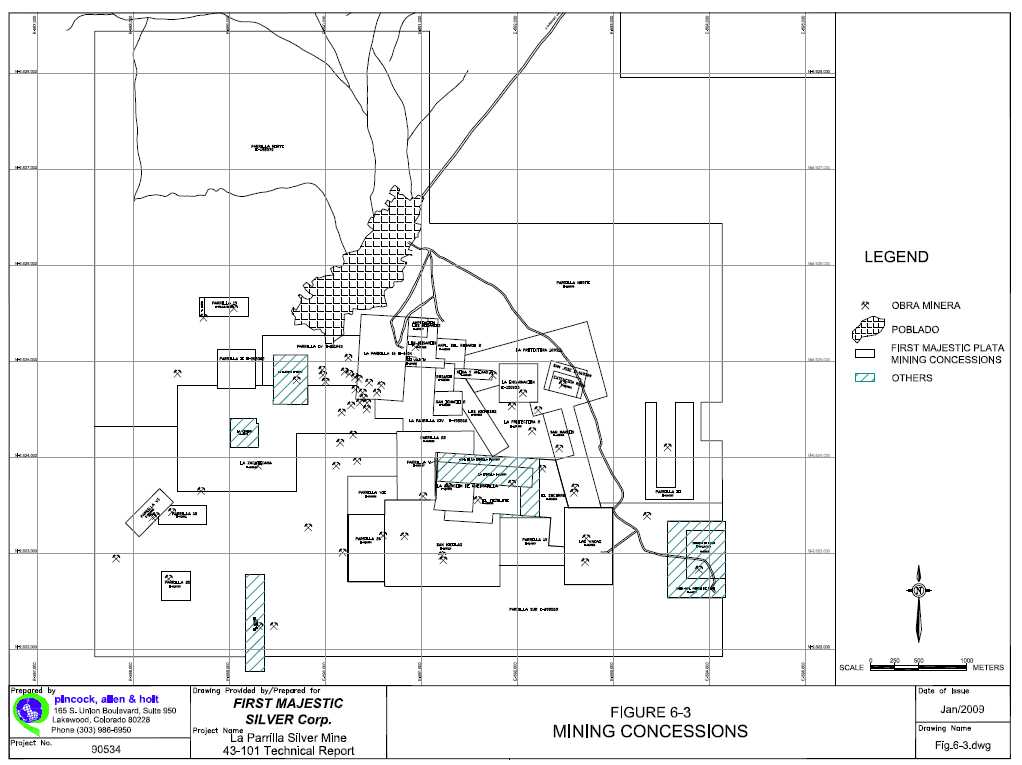

All the Mining Concessions legal status was provided by legal opinion, dated September 30, 2008 from the Durango City based firm of Mr. Carlos Galván Pastoriza, legal advisers for FMS in México. PAH also requested and received an updated review by legal advisers of the mining concessions current status showing that all mining claims owned by FMPlata are current in meeting the legal obligations and requirements by Mexican Mining and Environmental Laws and Regulations including assessment works, property taxes and operating permits for the period that covers to December 31, 2008. Figure 6-3 is a mining concessions map.

La Parrilla consists of 38 contiguous mining concessions in the La Parrilla mining district that cover mineral rights for 53,249.21 hectares (131,581.20 acres). All these mining concessions hold exploitation rights for 50 years from the date of registration.

| Pincock, Allen & Holt | REVISED | 6.1 |

| 90534 February 26, 2009 |

Table 6-1 presents a list of La Parrilla Silver Mine concessions.

TABLE 6-1

First Majest Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Mining Concessions

| No. | Name | Title No. | Surface Ha. | Ownership |

| 1 | Protectora 2 | 169,302 | 32.3560 | FMPlata |

| 2 | Extensión Rosa | 169,303 | 6.0000 | FMPlata |

| 3 | Rosa y Anexas | 169,304 | 4.0000 | FMPlata |

| 4 | Rosario | 169,305 | 5.3670 | FMPlata |

| 5 | El Salvador | 169,306 | 1.0000 | FMPlata |

| 6 | Ampliación Los Rosarios | 169,307 | 4.0000 | FMPlata |

| 7 | Los Michosos | 169,308 | 15.9673 | FMPlata |

| 8 | San José | 169,309 | 6.0000 | FMPlata |

| 9 | San Marcos | 169,310 | 10.0000 | FMPlata |

| 10 | La Protectora | 169,311 | 83.8767 | FMPlata |

| 11 | Ampliación del Rosario 2 | 169,312 | 7.5000 | FMPlata |

| 12 | San Nicolás | 169,313 | 95.4983 | FMPlata |

| 13 | Los Rosarios | 171,082 | 11.0000 | FMPlata (2) |

| 14 | La Encarnación | 150,935 | 16.0000 | FMPlata (2) |

| 15 | San Ignacio Dos | 158,205 | 8.9286 | FMPlata (2) |

| 16 | Parrilla II | 203,302 | 16.0000 | FMPlata (2) |

| 17 | Parrilla V | 203,987 | 0.4088 | FMPlata (2) |

| 18 | El Tecolote | 121,256 | 20.0000 | FMPlata (2) |

| 19 | Las Vacas | 122,739 | 40.0000 | FMPlata (2) |

| 20 | La Asunción de Quebradillas | 124,290 | 12.0000 | FMPlata (2) |

| 21 | El Socorro | 136,808 | 15.3702 | FMPlata (2) |

| 22 | Parrilla 18 | 210,061 | 9.2208 | FMPlata (2) |

| 23 | Parrilla 16 | 214,003 | 44.4244 | FMPlata (2) |

| 24 | Parrilla 19 | 214,557 | 30.0068 | FMPlata (2) |

| 25 | Parrilla 21 | 216,554 | 26.8962 | FMPlata (2) |

| 26 | Parrilla 20 | 216,723 | 9.0000 | FMPlata (2) |

| 27 | Parrilla 22 | 219,888 | 53.9870 | FMPlata (2) |

| 28 | Parrilla XIV | 198,568 | 33.1581 | FMPlata (2) |

| 29 | Parrilla Sur | 198,569 | 874.6880 | FMPlata (2) |

| 30 | Parrilla Norte | 198,570 | 1,742.3879 | FMPlata (2) |

| 31 | Parrilla III | 204,357 | 32.5267 | FMPlata (2) |

| 32 | Parrilla VI | 204,358 | 10.0000 | FMPlata (2) |

| 33 | Parrilla VII | 204,520 | 20.8434 | FMPlata (2) |

| 34 | Parrilla IV | 211,943 | 38.1396 | FMPlata (2) |

| 35 | Parrilla 15 | 212,351 | 8.9420 | FMPlata (2) |

| 36 | La Zacatecana | 217,646 | 88.0107 | FMPlata (2) |

| 37 | Michis | 230,602 | 31,350.0000 | FMPlata |

| 38 | La Providencia | 229,493 | 18,465.7120 | FMPlata |

| Total Hectares | 53,249.2165 |

| (1) |

All concessions have been transferred to FMPlata |

| (2) |

Concessions with provisions to pay royalties |

| Pincock, Allen & Holt | REVISED | 6.5 |

| 90534 February 26, 2009 |

6.2 Mineral Tenure

FMS acquisition rights of La Parrilla claims purchased from Grupo México include a Net Smelter Return (NSR) of 1.5 percent royalty payments that may be acquired by FMPlata for a total of US$2,000,000. There are no other encumbrances on La Parrilla mining concessions. FMPlata has recently negotiated a lease on the land where the second tailings dam has being built and is now operating; this includes a yearly payment to the Ejido San José de La Parrilla.

6.3 Environmental

All mining and environmental activities in México are regulated by the Dirección General de Minas and by the SEMARNAP from México City, under the corresponding Laws and Regulations. All minerals below surface rights lie with the State; while surface rights are owned by “ejidos” (communities) or private individuals, allowing them the right of access and use of their land.

La Parrilla area is located, within the Ejido San José de la Parrilla and also within private property. La Parrilla has made an Agreement for the surface rights from Ejido San José de La Parrilla under the provisions included in the Mexican Mining Law to permit the use of surface rights for development of projects that are of general economic interest, including mining operations.

PAH is not aware of any pending environmental liabilities within the La Parrilla area of operations. A list and statement of all operating permits and their current status was provided to PAH by FMS Corporate Manager of Environmental and Permitting regarding the La Parrilla, dated October 31, 2008. Environmental Permits and Requirements are current.

| Pincock, Allen & Holt | REVISED | 6.6 |

| 90534 February 26, 2009 |

| 7.0 |

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

La Parrilla Silver Mine is located in the south-eastern part of the state of Durango, at about 60km to the southeast from the capital city of Durango. It is located in the municipality of Nombre de Dios, at about 1km to the SE of the village of San José de la Parrilla.

Geographic coordinates for the central part of the La Parrilla area are as follows:

N – 2,625,000; E – 591,500

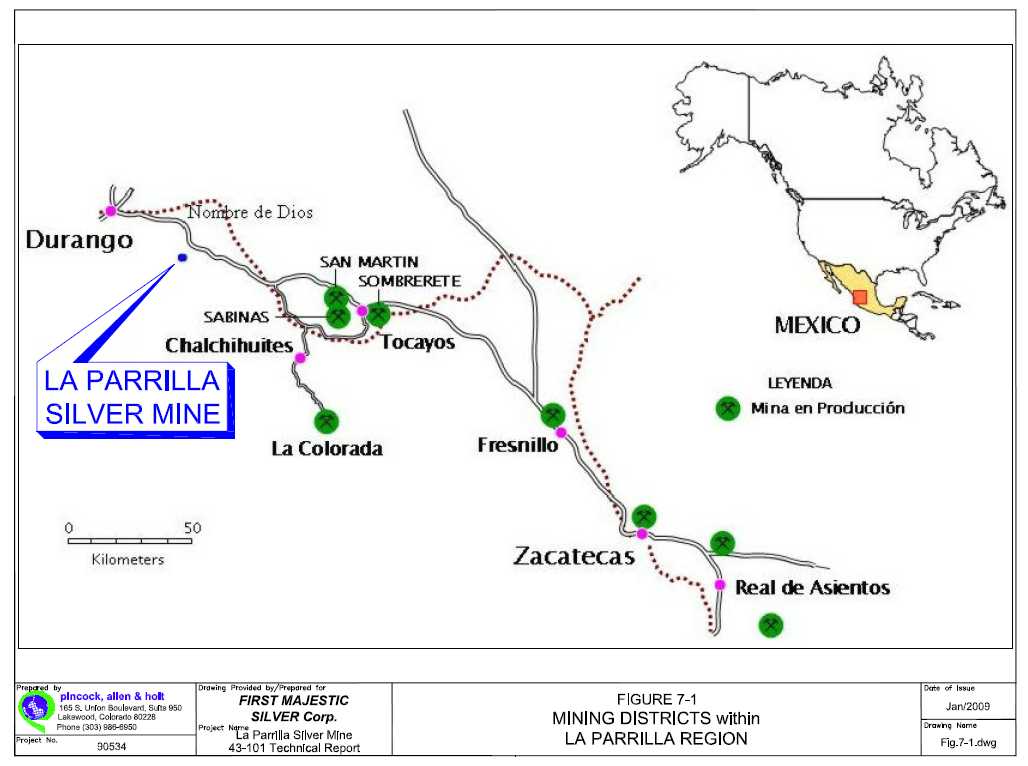

La Parrilla district consists of numerous silver/gold/lead/zinc underground mines, Los Rosarios, La Rosa, San José, La Blanca, San Marcos, Las Vacas, Quebradillas, Las Víboras, San Marqueña, Sacramento, Cerro Santiago, Santa Paula and other small workings. FMS has consolidated the district into the La Parrilla Silver Mine operation.

Additional details on Accessibility, Infrastructure, Climate, Vegetation, Physiography, Hydrology and Local Resources are presented in Technical Reports. A project access map is shown in Figure 7-1.

| Pincock, Allen & Holt | REVISED | 7.1 |

| 90534 February 26, 2009 |

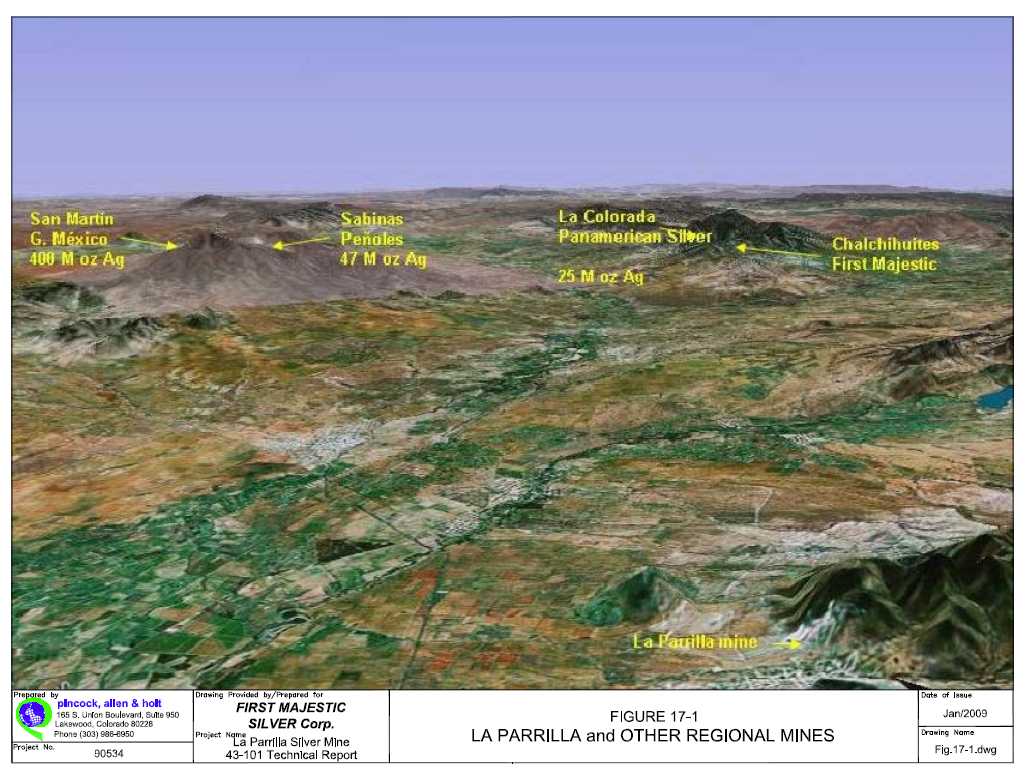

8.0 HISTORY

La Parrilla mining district was discovered during the Spanish Colonial Times of the XVI century, when mining activity began in the region. Mining districts that are still in operation within this region include mines at Fresnillo, San Martín, Sombrerete, La Colorada, Cerro del Mercado, and others.

La Parrilla consists of underground silver-gold-lead mines with a processing facility that was originally constructed in 1956. The mine and plant were operated until 1999, when operations were shut down due to low silver prices. In 1960, the mining claims were acquired by Minera Los Rosarios, S.A. de C.V. who operated the mine until 1999. The Comisión de Fomento Minero (CFM), a Mexican Federal Entity responsible for promoting and supporting mining, constructed a 180 tpd flotation plant at La Parrilla, which operated as a custom mill, processing ores from nearby areas, such as Chalchihuites, Sombrerete, Zacatecas, etc. This plant was purchased in 1990 by Minera Los Rosarios from CFM. Subsequently, in 2004, FMS acquired the mining rights and the plant from Minera Los Rosarios and in 2006 successfully negotiated the acquisition of the mineral rights held by Grupo México which surrounded the original La Parrilla mine. Today FMS has consolidated ownership of the plant and all the land surrounding La Parrilla, where numerous mineral occurrences and mineral deposits are being investigated.

Production records by ASARCO and Consejo de Recursos Minerales, plus surveying volumes of old stopes within La Parrilla district, suggest that approximately 1.37 million tonnes of silver ores have been extracted from the various mines that make up this industrial complex at an estimated grade of 310 g/tonne Ag, 1.9 percent Pb and 1.5 percent Zn.

FMS’s production from the La Parrilla area (June 2004 to September 2008) amounts to 443,340 tonnes with recovered average grade of 215 g/tonne Ag and 1.05 percent Pb. These are included in total production within the mining district. Table 8-1 summarizes the La Parrilla district’s historical production.

TABLE 8-1

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Historical Mineral Production (*)

| Mine | Metric Tonnes | Average Grade | ||

| Silver g/tonne | Pb % | Zn % | ||

| Los Rosarios | 530,000 | 450 | 2.60 | 2.80 |

| San Marcos | 100,000 | 250 | 2.20 | 0.50 |

| San José | 50,000 | 125 | 2.00 | 0.80 |

| La Rosa | 20,000 | 350 | 2.50 | 2.00 |

| Mina Los Rosarios, SA de CV | 231,000 | 235 | 1.89 | 1.74 |

| FMPlata production (2) | 443,000 | 215 | 1.05 | - |

| Total Estimated Recovered Production | 1,374,000 | 310 | 1.93 | 1.47 |

| Total (ounces, lbs, lbs) = | 13,705,219 | 58,416,698 | 44,443,816 | |

(*) Data provided by FMS from ASARCO, Consejo de Recursos Minerales

and FMPlata.

(1) reported production by Mina Los Rosarios, S.A. de C.V. (1978 - 1991). Rounded

figures.

(2) FMS production from Jun 2004 to Sep 2008, including 16,589 tonnes of reprocessed

dumps.

| Pincock, Allen & Holt | REVISED | 8.1 |

| 90534 February 26, 2009 |

FMS has consolidated ownership of the La Parrilla concessions and property under First Majestic Resources, SA de CV and newly renamed (July 31, 2007) the operating company First Majestic Plata, S.A. de C.V. (FMPlata). This operating company is held under FMS’s newly created wholly owned Mexican Holding Company, Corporación First Majestic, S.A. de C.V. (CFM). These changes have been incorporated as of August 14, 2007.

FMS resumed operations at La Parrilla in June, 2004, with plans to improve and expand operations. In 2006 FMS initiated construction of a flotation plant within the cyanidation plant facilities, for total production capacity of 800 tonnes per day, including 400 tpd of oxide ore and 400 tpd of sulfide ore. This flexibility allows for a more efficient processing of the ores extracted from the various mines within the La Parrilla land holdings.

FMPlata has been developing an aggressive exploration program in the area to increase the La Parrilla Resources and Reserves. This program included drilling with six surface drilling rigs operating in the area. During the third quarter of 2008 the drilling activity was reduced to four drill rigs and by September 2008 only one drilling machine was left in operation for underground investigations. The recommended drilling program for 2009 includes 97 drill holes with a total depth of 17,200 meters.

| Pincock, Allen & Holt | REVISED | 8.2 |

| 90534 February 26, 2009 |

9.0 GEOLOGICAL SETTING

Please refer to La Parrilla Silver Mine Technical Reports dated July 24, 2007 and March 18, 2008, which were published on July 25, 2007 and March 19, 2008 respectively in SEDAR.

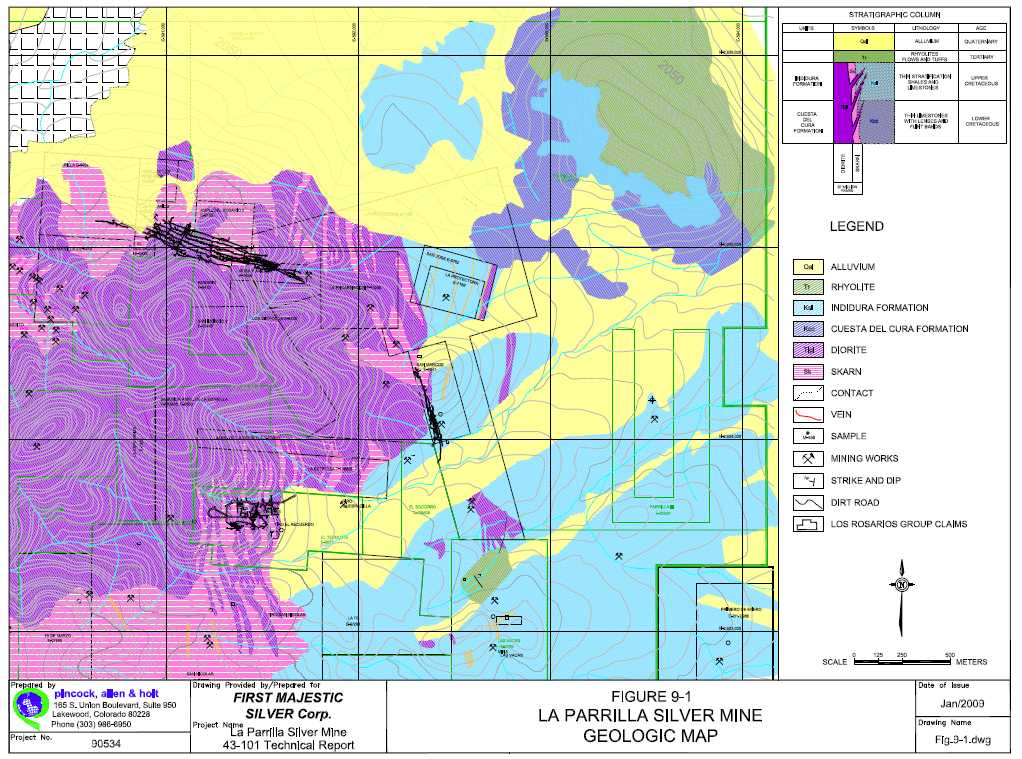

La Parrilla Silver Mine district is located in the border zone between the physiographic provinces of the Sierra Madre Occidental and the Mesa Central, within the sub-province of Sierras y Llanuras de Durango. La Parrilla Silver Mine is located in the northern side of a contact zone between a dioritic intrusive stock and a sequence of Cretaceous sedimentary rocks. Figure 9-1 shows La Parrilla Silver Mine Regional Geologic Map.

To this date, there are no changes to report regarding the La Parrilla geology.

National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Form 43-101F1 Technical Report – Instructions (5), December 23, 2005.

| Pincock, Allen & Holt | REVISED | 9.1 |

| 90534 February 26, 2009 |

10.0 DEPOSIT TYPES

La Parrilla Silver Mine mineral deposits consist of structurally-controlled mineral concentrations of silver/gold/lead/zinc and other secondary minerals. These occur associated and partly enclosed by the metasomatic zone created by a stock of dioritic composition intruding a sequence of calcareous rocks of Cretaceous age.

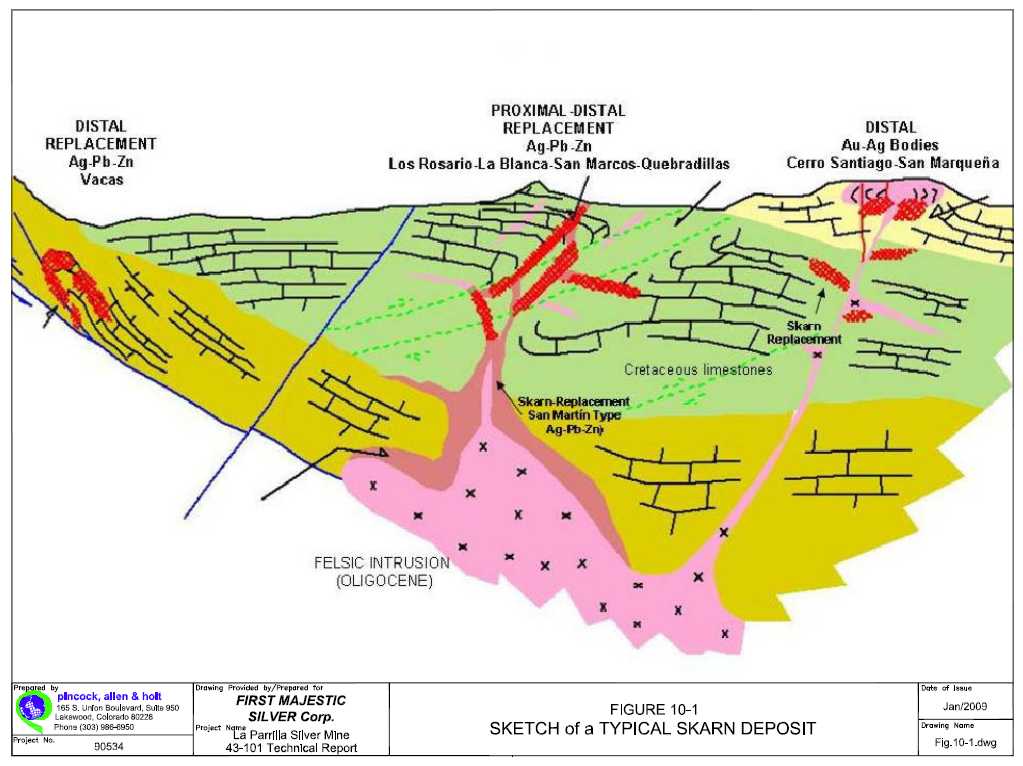

The plutonic cycle originated uplifting and intense faulting and fracturing of the pre-existing sedimentary rocks. A broad zone of metasomatic alteration was developed around the outer zone of the intrusive and into the sedimentary rocks, which may reach up to about 2km in the southern part of the outcropping contact zone at the La Parrilla Silver Mine area. Figure 10-1 shows a sketch of a typical skarn deposit.

To this date, there are no changes to report regarding the La Parrilla Silver Mine geology.

For additional details on the deposit types at La Parrilla Silver Mine, please refer to La Parrilla Silver Mine Technical Report Amended dated July 24, 2007, which was prepared by Pincock, Allen & Holt, Inc. for First Majestic Silver Corp. and published on July 25, 2007 in SEDAR.

National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Form 43-101F1 Technical Report – Instructions (5), December 23, 2005.

| Pincock, Allen & Holt | REVISED | 10.1 |

| 90534 February 26, 2009 |

11.0 MINERALIZATION

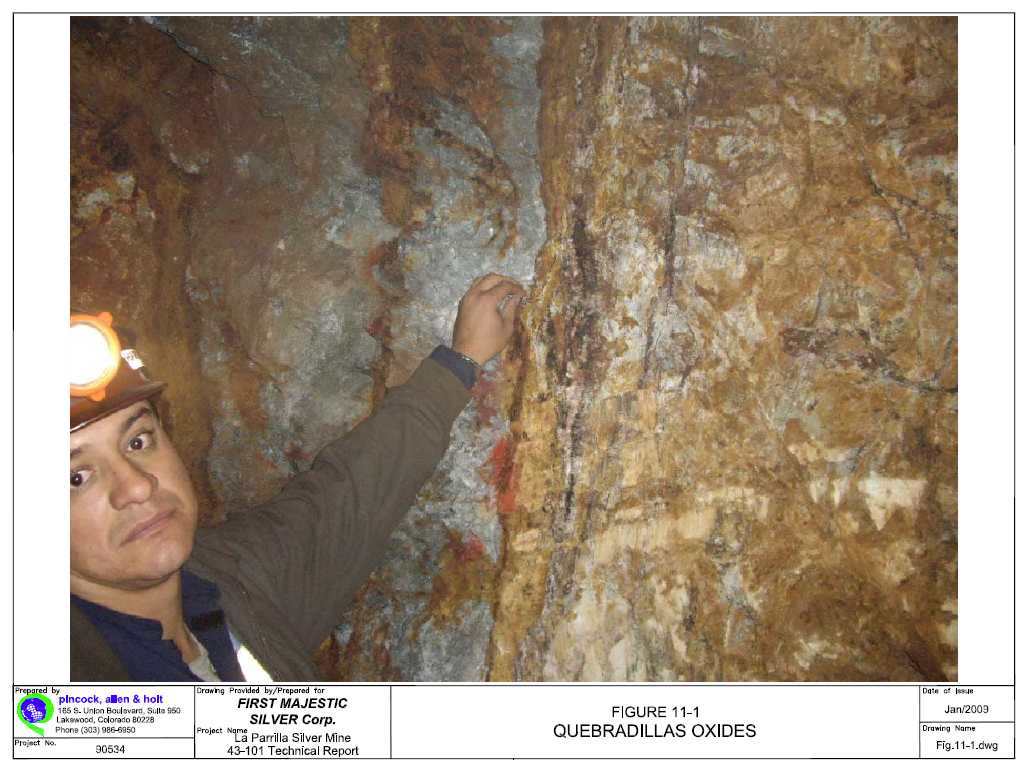

Mineralization at La Parrilla Silver Mine is a typical assemblage of metasomatic deposit and hydrothermal vein deposits with a high content of silver. These mineral assemblages have been affected by processes of oxidation and secondary enrichment. They mainly consist of pyrite, sphalerite, galena, some chalcopyrite, argentite and other silver sulfosalts associated with calcite and quartz as gangue minerals. Oxidation and secondary enrichment of these sulfides makes up the mineral concentrations in the upper parts of the deposits, which consists of sulfosalts (ceragyrite, pyrargyrite, stephanite) carbonates (cerussite, hydrozincite, hemimorphite), sulfates (anglesite, willemite), and iron oxides, hematite, limonite, etc. Figure 11-1 Quebradillas mine High Grade oxides mineralization.

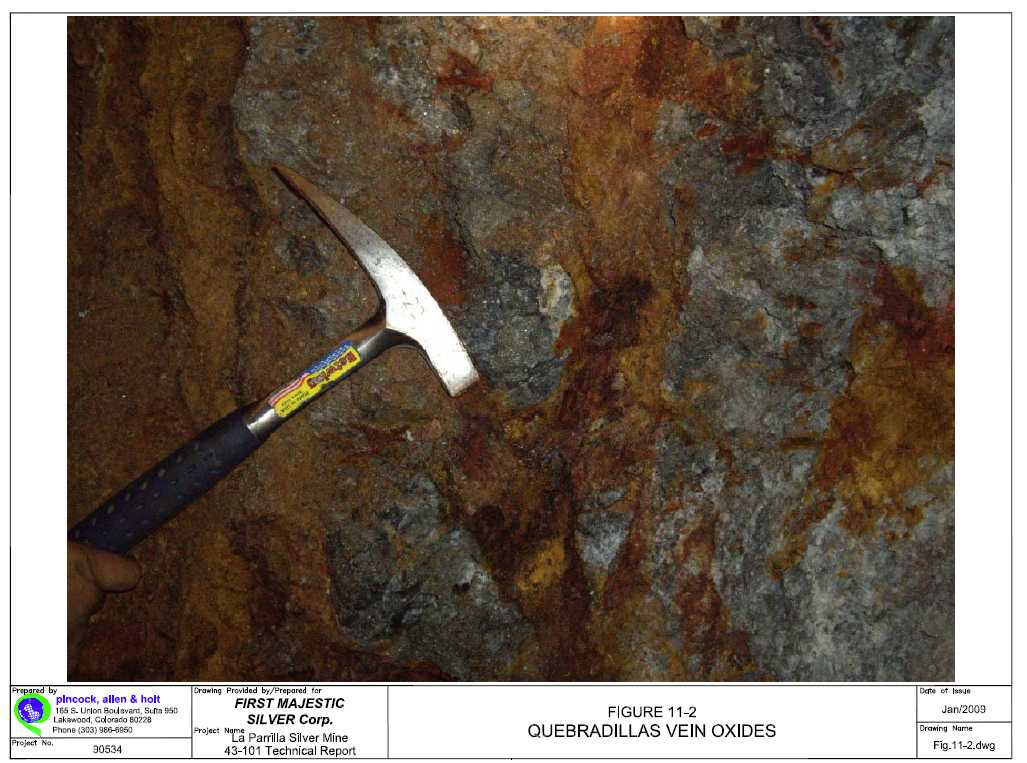

Silver mineralization occurs as argentite and native silver. Lead mineralization is present as carbonates (cerussite) and sulfates (anglesite) and other oxides. Figure 11-2 shows High Grade oxides at Quebradillas vein, Stope 538. Figure 11-3 shows exploration drilling at Stope 7564 of La Rosa vein.

The La Parrilla Silver Mine mineralization occurs along a vertical range of about 600m in vertical extension (2,300m to 1,700m above sea level). This extension is known through underground development and drill holes and it is still open to depth. Known longitudinal extensions vary from about 1,200 meters at the Los Rosarios system, 500 meters at the San Marcos vein system, and about 400 meters at the Quebradillas area; however some of these systems may be continuous, such as Los Rosarios System and San Marcos.

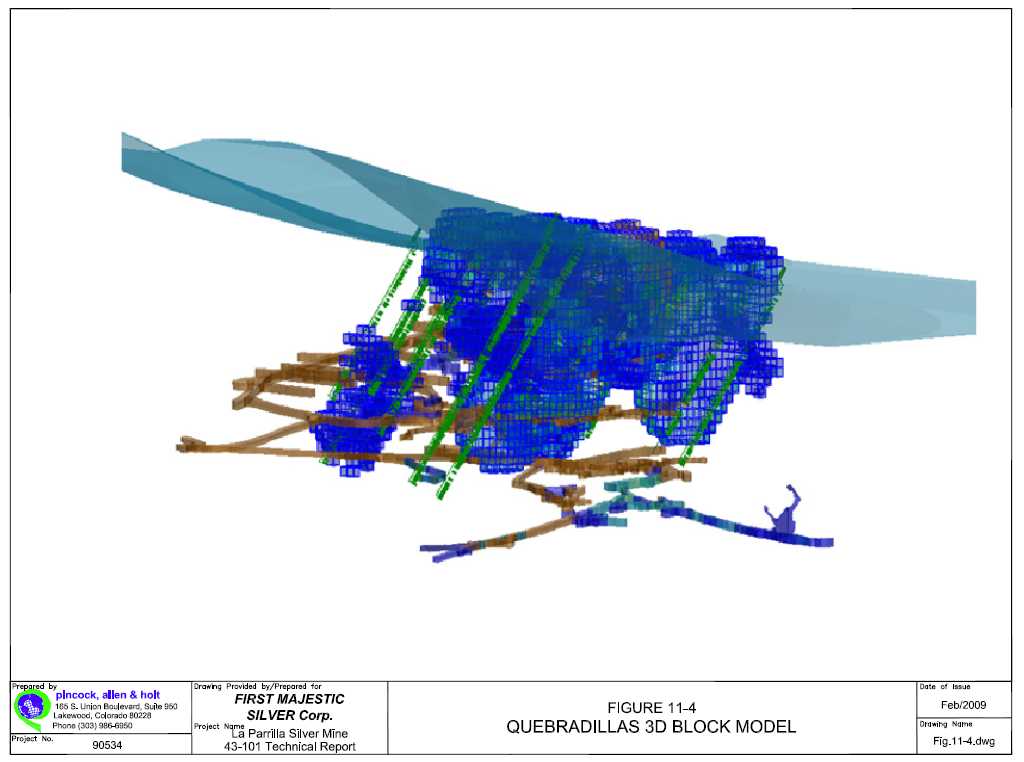

FMS has delineated an area of approximately 200m by 200m for possible open pit mining. Preliminary estimates based on 33 drill holes with a total depth of 2,905m has indicated 3.3m tones at an average grade of 100 g/tonne Ag in oxides mineralization. Figure 11-4 shows the Quebradillas outcropping 3D Block Model representation.

To this date, there are no changes to report regarding the La Parrilla Silver Mine mineralization.

For additional details on the deposit types at La Parrilla Silver Mine, please refer to La Parrilla Silver Mine Technical Report Amended dated July 24, 2007, which was prepared by Pincock, Allen & Holt, Inc. for First Majestic Silver Corp. and published on July 25, 2007 in SEDAR.

National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Form 43-101F1 Technical Report – Instructions (5), December 23, 2005.

| Pincock, Allen & Holt | REVISED | 11.1 |

| 90534 February 26, 2009 |

12.0 EXPLORATION

12.1 Introduction

La Parrilla Silver Mine represents a typical Mexican mining district which was discovered in Colonial times (XVI – XVII centuries) and only developed from outcroppings by following mineralization along the structures, until high grade ore shoots were discovered and depleted at times of high metals prices. Common practice in these districts’ development was to mine out high grade ores, for the most part, by direct exploration development.

For additional details on the deposit types at La Parrilla Silver Mine, please refer to La Parrilla Silver Mine Technical Report Amended dated July 24, 2007, which was prepared by Pincock, Allen & Holt, Inc. for First Majestic Silver Corp. and published on July 25, 2007 in SEDAR.

FMS through its wholly-owned Mexican subsidiary FMPlata continues development of an aggressive exploration program that includes underground workings, such as ramps of access, drifting and crosscutting into the old working areas of the Los Rosarios System including La Blanca, San Marcos, Quebradillas and Vacas areas. It also includes, for 2009 the completion of investigations for the potential development of the Quebradillas outcroppings area by open pit methods. This program is based on the following premises:

Prepare the La Parrilla Silver Mine operation with sufficient mineral Reserves to sustain economic production throughout periods of low metals prices.

Plan and develop systematic production and increasing operating capacity.

Recover oxides and sulphides mineralization consolidating mining blocks and increasing Reserves to support reasonable production schedule.

Support exploration activities for development, channel sampling and underground drilling.

Carry out an aggressive exploration program including deep drilling from underground and surface sites, and

Focus exploration efforts into regional exploration targets.

FMPlata is focusing exploration efforts on large volume targets while mining small to medium size volume mineral concentrations that were left within blocks and accessible areas along the workings. Part of the efforts during 2008 focused on the probable development of the Quebradillas outcroppings area by open pit methods. Table 12-1 shows the exploration programs at La Parrilla Silver Mine for 2009.

| Pincock, Allen & Holt | REVISED | 12.1 |

| 90534 February 26, 2009 |

TABLE 12-1

First Majestic

Silver Corp.

First Majestic Plata, S.A. de

C.V.

La Parrilla Silver

Mine

Exploration Program 2009

Exploration Activites |

Objective |

Area |

Unit |

Quantity |

Total Estimated Cost US$ |

| Geophysical Survey IP | Define Areas for Drilling | Cerro Santiago | Km | 15 | 45,000 |

| La Cruz | " | 15 | 45,000 | ||

| 30 | 90,000 | ||||

| Geochemical Survey | Define Areas for Drilling | Cerro Santiago | Samples | 250 | 10,000 |

| Providencia | " | 250 | 10,000 | ||

| La Cruz | " | 100 | 8,000 | ||

| Michis | " | 300 | 12,000 | ||

| Assays DDH | " | 1,000 | 40,000 | ||

| 1,900 | 80,000 | ||||

| Surface Diamond Drilling | Develop Resources | Quebradillas | 20 Drill holes, m | 3,000 | 300,000 |

| Vacas | 4 Drill holes, m | 1,000 | 100,000 | ||

| Cerro Santiago | 4 Drill holes, m | 1,000 | 200,000 | ||

| Sacramento | 15 Drill holes, m | 5,000 | 500,000 | ||

| 10,000 | 1,100,000 | ||||

| Underground Diamond Drilling | Develop Resources at Depth | La Rosa Rosarios | 2 Drill holes, m | 500 | 50,000 |

| Quebradillas | 29 Drill holes, m | 4,200 | 420,000 | ||

| San Marcos | 8 Drill holes, m | 500 | 50,000 | ||

| La Blanca | 15 Drill holes, m | 2,000 | 200,000 | ||

| 7,200 | 720,000 | ||||

| Underground Development Ramps, Drifts, Crosscuts | Develope Reserves and Resources | Quebradillas-Vacas (ramp) | Meters | 5,800 | 3,190,000 |

| Total US$ | 5,180,000 |

| Pincock, Allen & Holt | REVISED | 12.2 |

| 90534 February 26, 2009 |

12.2 Exploration Programs

FMPlata exploration programs for the La Parrilla district during 2009 are designed to investigate principally two types of targets:

To increase La Parrilla Reserve/Resource base within currently producing areas. These targets include mine workings and drilling for confirmation of blocks and areas in the Los Rosarios System, La Blanca, San Marcos, Quebradillas, Las Vacas, etc.

To investigate geophysical, geochemical and structural targets that may indicate significant concentrations of minerals. These target areas may represent large-volume exploration targets. These areas are generally associated with the contact zone between the regional intrusive stock and sedimentary formations, or with dykes and sills that may indicate favorable zones for mineral concentrations. Geophysical investigations are programmed for the Cerro Santiago and La Cruz areas. Geochemical sampling is scheduled for Cerro Santiago, Providencia, La Cruz, Michis and additional assays of drill core.

Access, prepare and develop old mine workings such as Quebradillas, Las Vacas, San Marcos, etc.

FMPlata has considered a significant budget for investment in exploration at La Parrilla. This budget includes programs of exploration that have already shown positive results by indicating an important Reserve/Resource base for the mine. It appears that, at no other time during the life of the mine, La Parrilla has shown the Reserves and Resources currently estimated by FMPlata. Estimated budget for exploration during 2009 is shown in Table 12-1. Due to current market conditions, at the time of writing this report, this program is presently on hold.

12.2.1 Geophysical Exploration

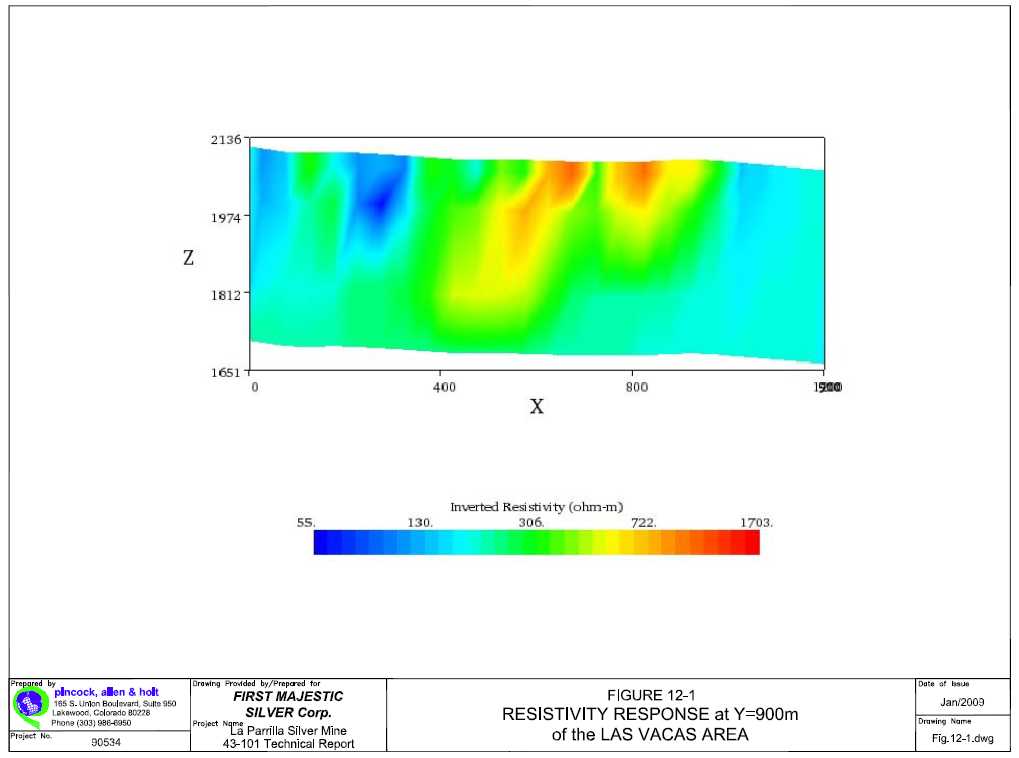

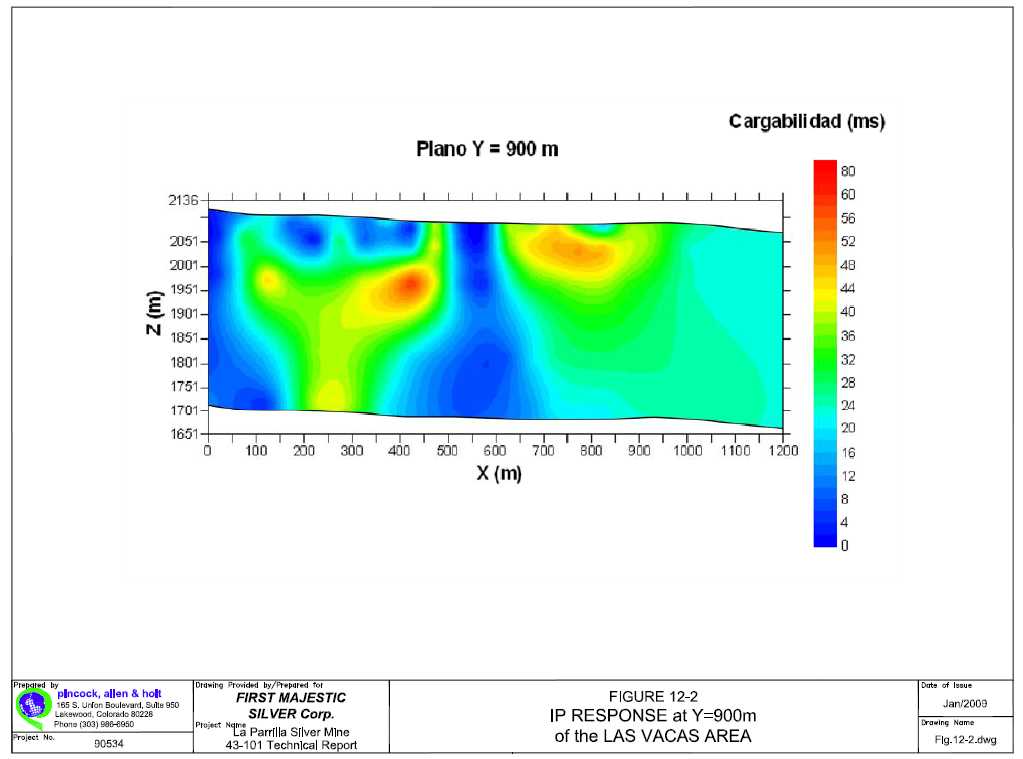

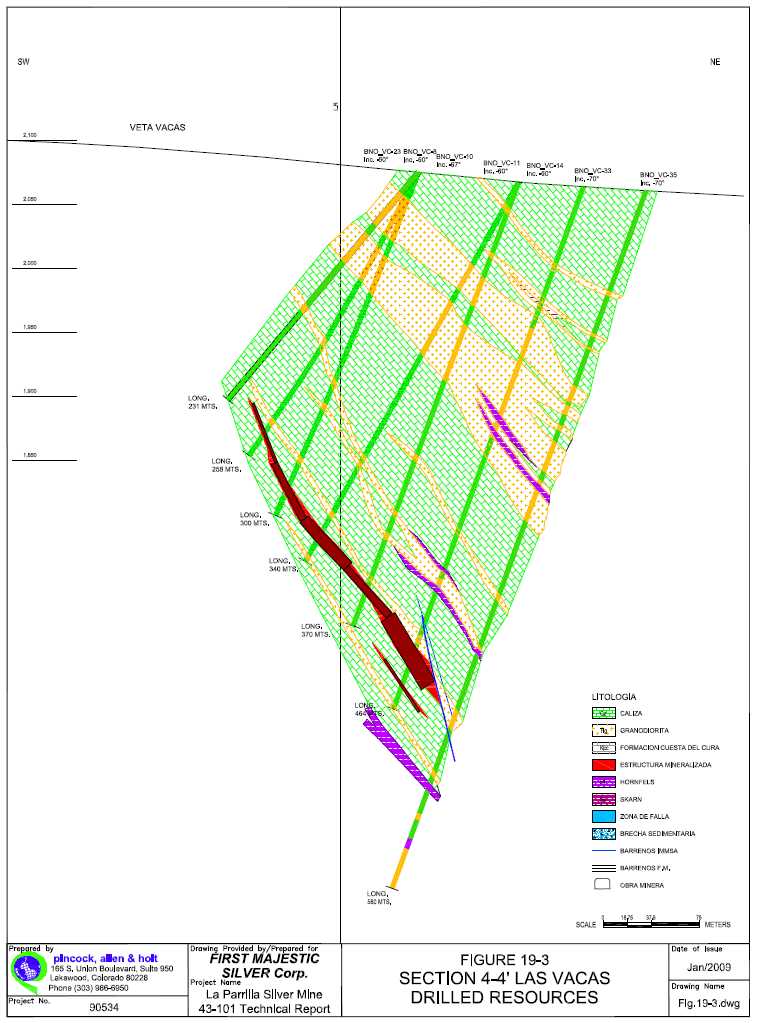

FMPlata carried out geophysical investigations during the period of April to June, 2007 to confirm previous studies within the areas of Quebradillas, Sacramento, Las Vacas, and Santa Paula (formerly Los Perros). These investigations have confirmed the presence of Induced Polarization and Resistivity anomalies which will be further investigated by direct methods, such as drilling and underground access where possible. Figure 12-1 shows Resistivity Profile of Line Y-900 at Las Vacas area.

The geophysical survey was developed by Geolinsa, a Monterrey city based geophysical company. Methodology and results were described in Report dated August 30, 2007, Informe Técnico Exploración Geofísica en La Parrilla, Durango. This Surrey consisted in measuring electric resistivity and induced polarization (IP). The data was processed by EarthImager 3D Software including topographic information.

| Pincock, Allen & Holt | REVISED | 12.3 |

| 90534 February 26, 2009 |

The resulting interpretation was presented in plan view to show anomalous zones and projected cross sections indicating electrical resistivity and induced polarization (chargeability) in 2D vertical representation. The survey was completed for the following Areas:

The IP survey was developed by the Dipole – Dipole method with readings at 100m along the lines. The topographic survey included location of control points at 50m spacing along the lines.

The geophysical survey resulted in prospective anomalous zones showing high resistivity and high chargeability. Drill sites were recommended to investigate the most outstanding anomalies as indicated above. Figure 12-2 shows Induced Polarization response at Profile Y-900 at the Las Vacas area.

FMPlata has included in 2009 additional exploration programs for IP and Resistivity surveying at the Cerro Santiago and La Cruz areas. Total estimated length of IP surveying is 30km.

12.2.2 Geochemical Exploration

FMPlata exploration program for 2009 includes geochemical investigations to complement exploration investigations by geophysical methods at the Cerro Santiago, Providencia, La Cruz and Michis areas. This program includes about 800 samples to detail, confirm or evaluate some of the geophysically anomalous areas. Additional geochemical sampling has been scheduled to assay about 1,000 representative samples of drill core to investigate probable geochemical signatures. This core sampling is intended to establish a database that may help to make future interpretations of other target zones within the mining district. FMPlata exploration program for La Parrilla during 2009 include geologic mapping and geochemical sampling of the Quebradillas and Víboras areas.

12.3 Drilling

Drilling programs at La Parrilla Silver Mine have been limited by past operations, since the best exploration results may have been obtained through underground development. However, FMPlata has obtained positive results by increasing drilling to define and evaluate new mineralized zones as well as to investigate continuity of ore shoots for development.

FMPlata initiated an aggressive drilling program to explore the various areas of interest within La Parrilla holdings in 2005. The entire program through to September 30, 2008, has consisted of 310 diamond drill holes completed by FMPlata for a total drilled depth of 72,084m at an average depth of 233m per drill

| Pincock, Allen & Holt | REVISED | 12.5 |

| 90534 February 26, 2009 |

hole. FMPlata completed drilling program was developed to investigate 13 areas within the mining district. Table 12-2 shows completed drilling at La Parrilla Silver Mine by FMS through September 2008.

TABLE 12-2

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

FMPlata Drilling Programs through September 2008

| Area | Drilling | |

| No. Drill Holes | Meters | |

| La Blanca | 31 | 9,153 |

| La Rosa | 36 | 6,668 |

| Los Rosarios System | 39 | 11,440 |

| Oxidos | 17 | 1,565 |

| Quebradillas | 42 | 9,042 |

| Tajo Quebradillas | 34 | 2,923 |

| San José | 4 | 740 |

| San Marcos | 41 | 9,480 |

| San Nicolás | 9 | 3,143 |

| Las Vacas | 45 | 14,995 |

| Santa Paula | 4 | 1,107 |

| Sacramento | 6 | 1,315 |

| Víboras | 2 | 513 |

| Total | 310 | 72,084 |

| Average drilled depth | 233 | |

FMPlata contracted and operated six drill rigs to carry out the 2008 program that included 24,700m of drilling in the Quebradillas, Vacas, San Marcos, Santa Paula, Cerro Santiago, Sacramento and Michis areas. At the time of PAH’s visit, four drill rigs were operating, including one underground. Currently, the La Parrilla Silver Mine drilling program comprises one underground drill rig.

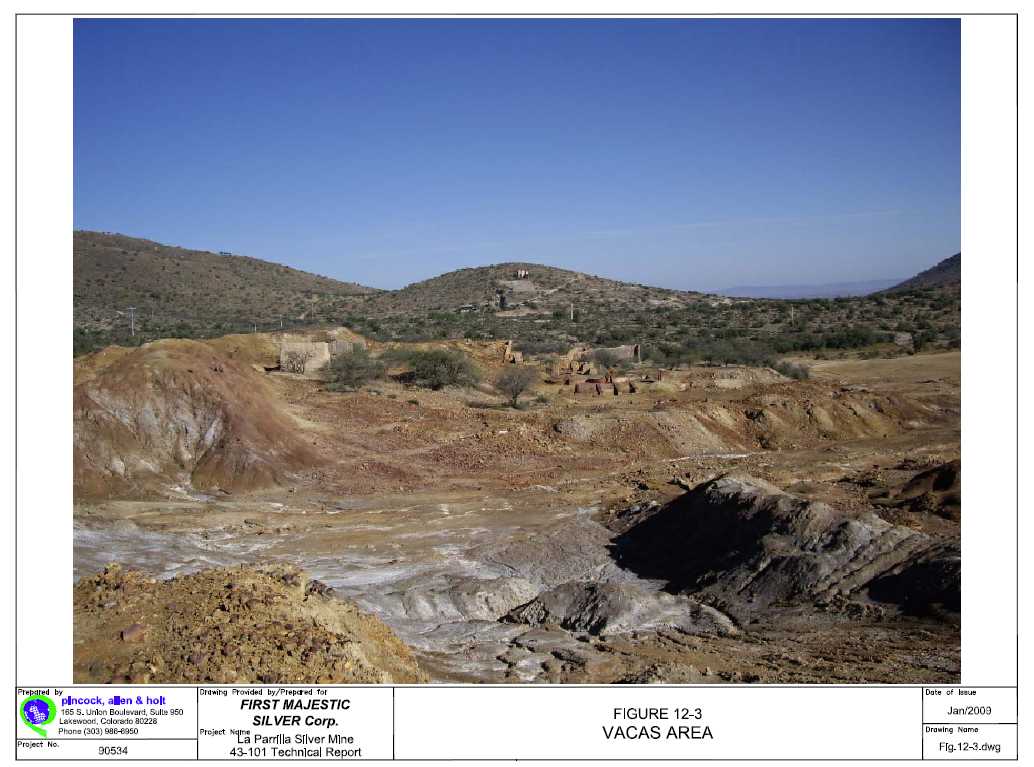

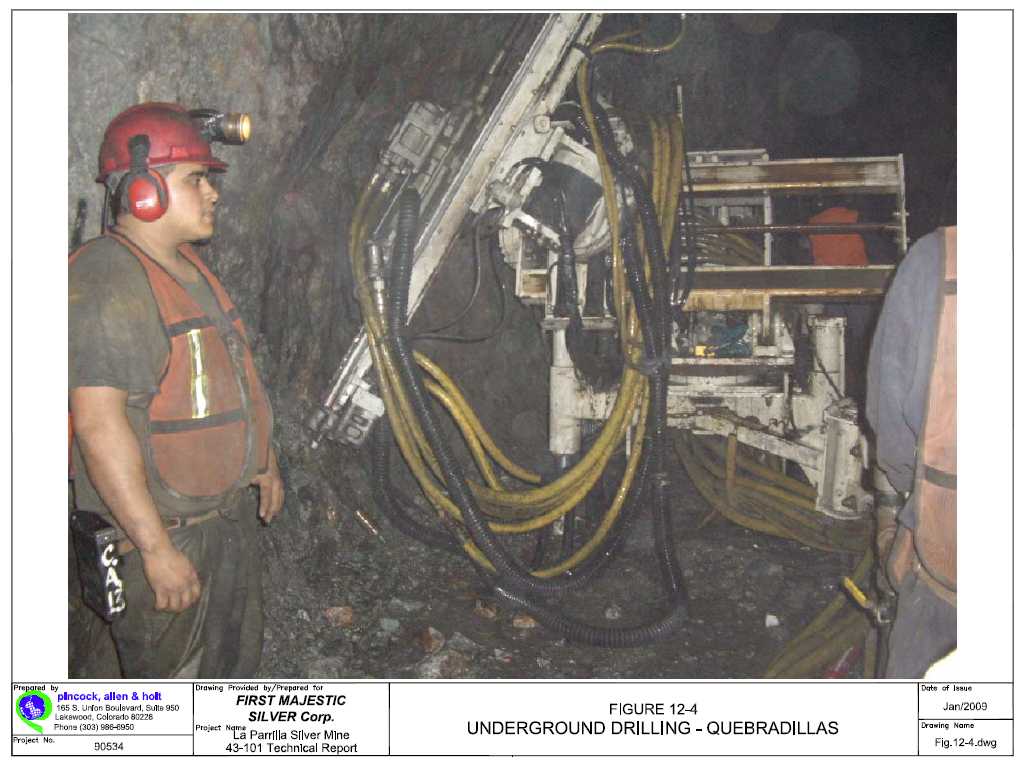

Table 12-3 shows exploration programs completed by FMS at La Parrilla through 2007. In addition to these investigation FMS has completed diamond drilling during 2008 as shown in Table 12-2. Figure 12-3 shows the Vacas area surface expression. Figure 12-4 Underground Drilling at Quebradillas vein.

TABLE 12-3 First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Exploration Programs Through 2007

| Area | Studies | Drilling | Total | UG Development Workings m | Total | |||

| No. Drill Holes | Grupo México m | First Majestic m | m |

Grupo México m |

First Majestic m | m |

||

| Rosarios | Geology/Geochemistry | 35 | 13,126 | 13,126 | 5776 | 5,776 | ||

| La Rosa | " | 30 | 5,748 | 5,748 | - | |||

| Rosarios Oxidos | " | 17 | - | 1,623 | 1,623 | - | ||

| San Marcos | " | 38 | - | 8,317 | 8,317 | 1097 | 1,097 | |

| La Blanca | 29 | 8,416 | 8,416 | 1153 | 1,153 | |||

| Quebradillas | 36 | 8,674 | 8,674 | 2580 | 2,580 | |||

| Quebradillas/Vacas/Others (G.M) | 85 | 15,563 | 15,563 | 1,663 | 1,663 | |||

| Vacas | IP-1200m - 10 Sec. | 22 | 6,745 | 6,745 | - | |||

| Santa Paula | IP-1000m - 4 Sec. | 1 | - | 300 | 300 | - | ||

| San Nicolás | IP-1000m - 7 Sec. | 5 | - | 1,364 | 1,364 | - | ||

| Sacramento A | IP-2000m - 9 Sec. | - | - | |||||

| Sacramento B | IP-1000m - 5 Sec. | - | - | |||||

| Parrilla District | Airborne magnetometry | - | - | |||||

| Total | 298 | 15,563 | 54,313 | 69,875 | 1,663 | 10,606 | 12,269 | |

| Pincock, Allen & Holt | REVISED | 12.7 |

| 90534 February 26, 2009 |

12.4 Opinion

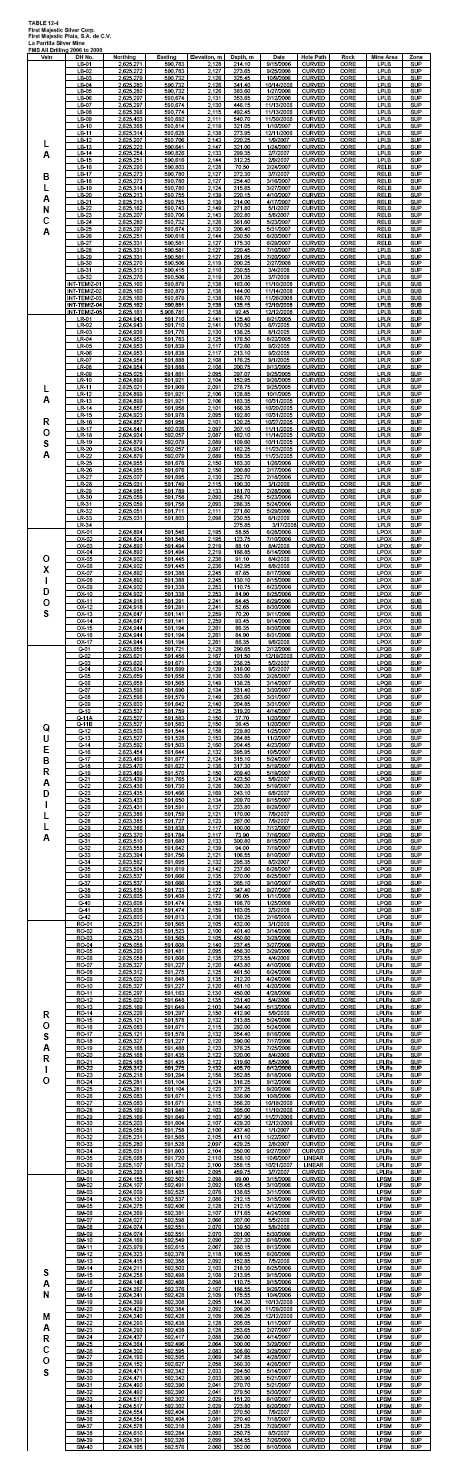

In PAH’s opinion the exploration programs developed by FMPlata within the La Parrilla Silver Mine district have been successful in testing exploration targets, increasing the mine’s Reserve/Resource base and indicating new targets of exploration within the mining district. FMPlata has assembled an experienced and enthusiastic team of exploration professionals to cover all facets of the exploration requirements. In PAH’s opinion FMPlata exploration programs have established a significant Resource/Reserve base for La Parrilla Silver Mine to sustain continued operation during a significant period of time. Table 12-4 presents FMS all drilling at La Parrilla Silver Mine from 2006 to 2008.

| Pincock, Allen & Holt | REVISED | 12.10 |

| 90534 February 26, 2009 |

13.0 DRILLING

FMPlata has been drilling at La Parrilla Silver Mine since June 2005, shortly after acquisition of the Project took place. FMPlata is currently drilling with one drill rig from underground sites, and has contracted four drill rigs with Cau S.A. de C.V. (“Causa”). Causa is a Gómez Palacio, Durango, México based drilling company. This program includes drilling from surface and underground sites.

FMPlata’s 2009 exploration drilling program, even though it is presently on hold due to market conditions, includes a total of 97 holes planned for a total depth of 17,200m distributed for exploration within the following areas: Quebradillas, Vacas, San Marcos, La Blanca, Cerro Santiago, and Sacramento. This program has been outlined in Table 12-1.

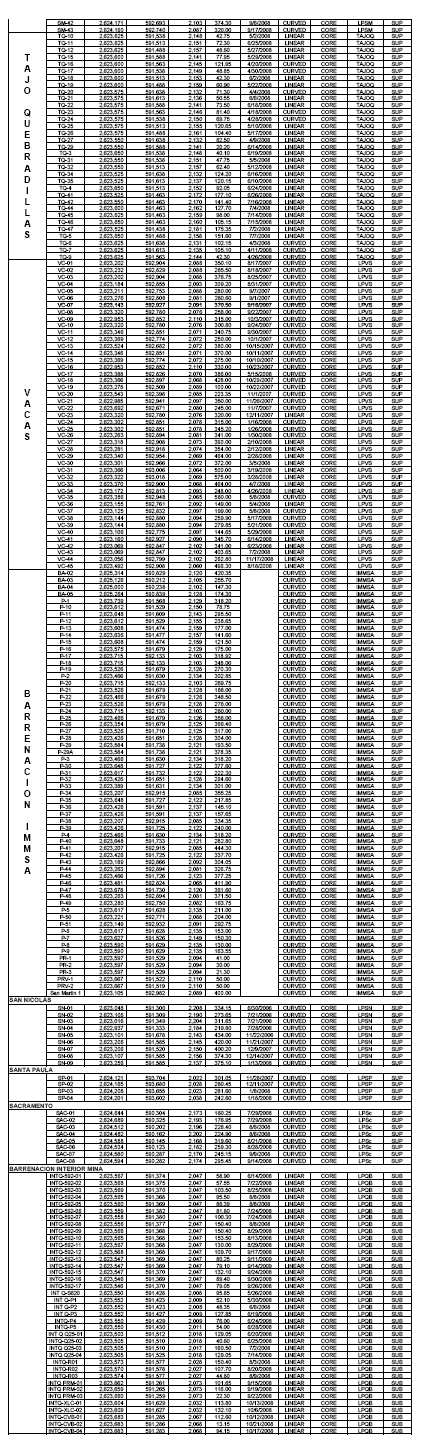

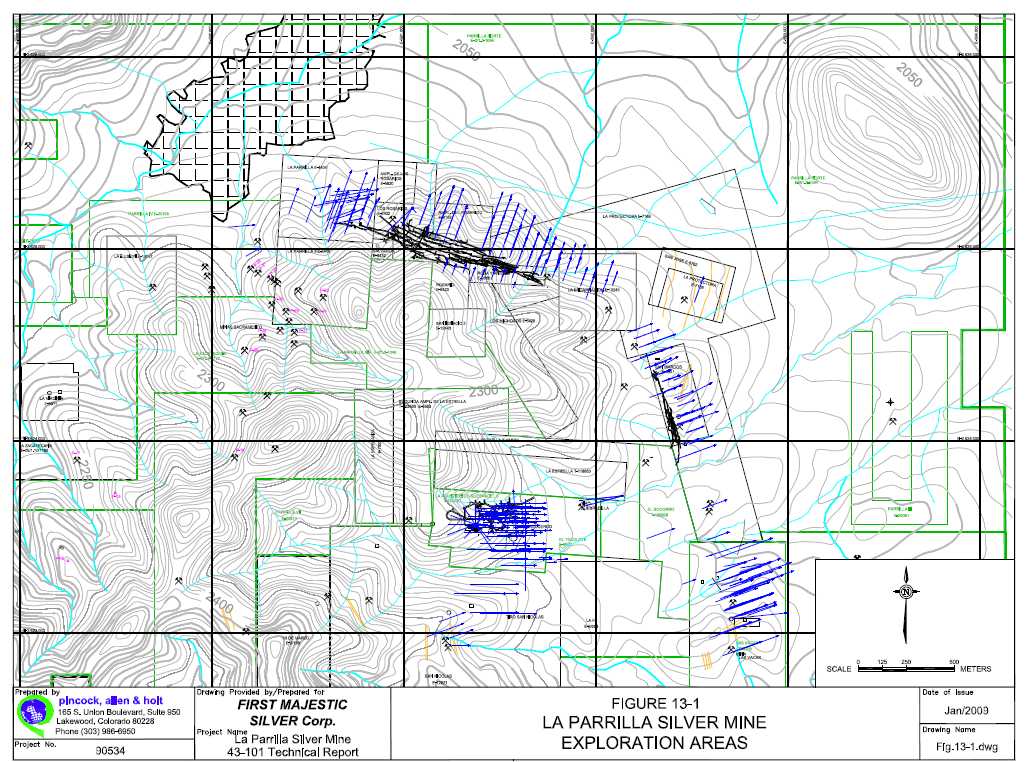

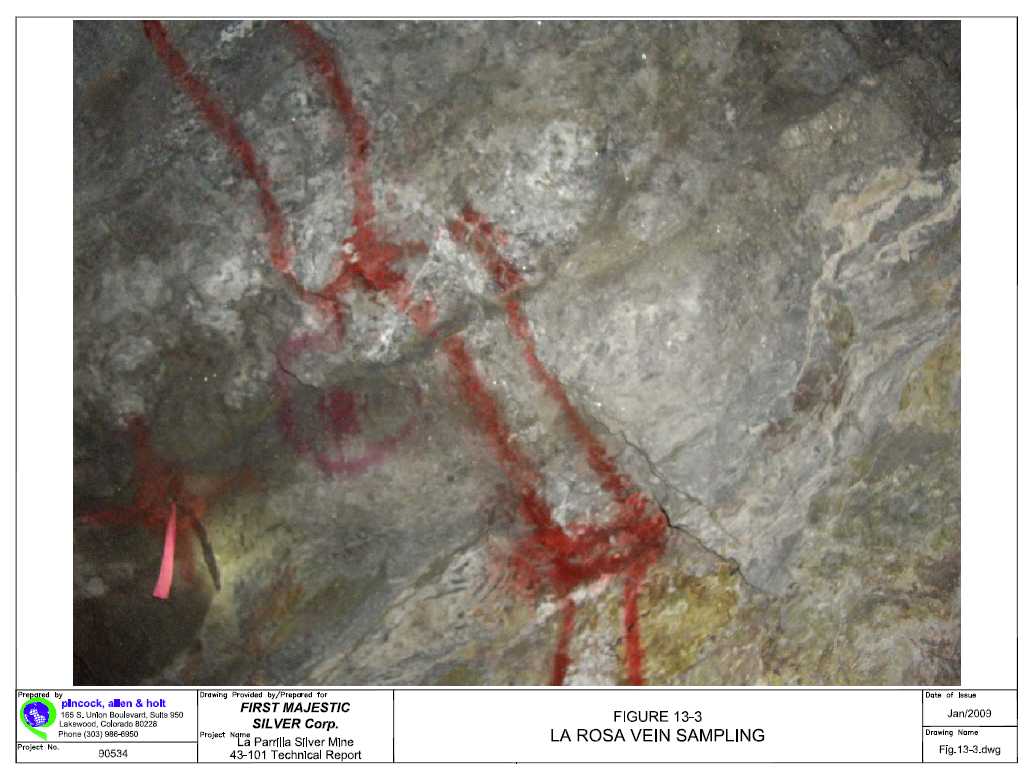

Figure 13-1 shows the La Parrilla general map showing all the areas under exploration within the mining district. Figure 13-2 shows channel sampling at San Marcos Drift 042-N. Figure 13-3 shows channel sampling at La Rosa vein, L-8450.

FMPlata’s drill hole database is compiled in electronic format, which contains collar, assay intervals, lithology, and assay information with gold/silver/lead/zinc values. Most of the holes are drilled at an angle to intersect vein or mineralized structures that generally dip at near vertical angles. According to FMPlata, based on geologic interpretations, no apparent deviation has been detected in drill holes. FMPlata has established a surveying procedure which is performed during the drilling due to the fact that most of the holes are now longer than 150 meters. Deviation is defined with one survey reading at the bottom for holes of 150 meters in depth and 2 survey readings for holes longer than 150 meters; one reading at the middle and one reading at the bottom of the hole.

Logging is performed by the project geologist in each of the areas being investigated. The project geologist also determines the sample intervals. Trained assistants are in charge of core splitting and sampling as per the project’s geologist indications.

PAH believes that FMPlata’s drilling program from surface and underground sites, in combination with underground development, is appropriate and well designed to explore promising targets and ore deposits continuity. Table 13-1 Drilling and mine development for exploration, 2007 – 2008.

Geologic potential exists to discover additional mineralized zones along the development workings.

In PAH’s opinion FMPlata’s exploration drilling program is well designed and is justified as an investment as it has consistently developed additional Reserves/Resources for La Parrilla Silver Mine. The estimated budget for the next program anticipated for 2009 is included in Section 22 of this Report - Recommendations.

| Pincock, Allen & Holt | REVISED | 13.1 |

| 90534 February 26, 2009 |

TABLE 13-1

First Majestic Silver

Corp.

First Majestic Plata, S.A. de C.V.

La Parrilla Silver

Mine

Drilling and Mine Development Programs, 2007 and 2008

| Month | Drilling, m | UG Development, m | ||

| 2007 | 2008 | 2007 | 2008 | |

| January | 2,345 | 1,690 | 74 | 336 |

| February | 2,884 | 2,478 | 94 | 99 |

| March | 1,988 | 2,803 | 189 | 199 |

| April | 2,163 | 1,632 | 138 | 174 |

| May | 3,029 | 2,197 | 6 | 112 |

| June | 2,974 | 2,354 | 144 | 182 |

| July | 2,712 | 2,791 | 84 | 152 |

| August | 2,733 | 2,490 | 115 | 213 |

| September | 2,866 | 1,646 | 113 | 183 |

| October | 2,964 | 0 | 114 | |

| November | 2,293 | 0 | 176 | |

| December | 1,530 | 0 | 239 | |

| TOTAL | 30,481 | 20,081 | 1,486 | 1,651 |

| Pincock, Allen & Holt | REVISED | 13.5 |

| 90534 February 26, 2009 |

14.0 SAMPLING METHOD AND APPROACH

PAH reviewed La Parrilla Silver Mine’s sampling program for the preparation of this Technical Report. La Parrilla Silver Mine’s current sampling team consists of three sampling crews with three employees each for underground sampling, one sampler for drill core, and one sampling supervisor. This process is managed by the mine geologists.

14.1 Channel Sampling

Exploration sampling for Reserve delineation at La Parrilla Silver Mine is conducted by drifting along the mineralized zones so that channel samples can be taken. Channel samples are the primary means of sampling in the mine and are taken perpendicular to the vein structures, across the back of the drift and across the drifts and workings, generally from the footwall towards the hanging wall of the mineralized structure. Sampling crews take channel samples at regular intervals of 2m to 3m, typically with several samples along every sampling channel on new openings (drifts, crosscuts, ramps, stopes, etc.) and every day from stope development muck piles. Channel samples are taken in consecutive lengths of less than 1.50m along the channel, depending on geologic features. Channel samples are taken with chisel and hammer, collected in a canvas tarp and deposited in numbered bags for transportation to the laboratory.

A channel “line” typically consists of two or more individual samples taken to reflect changes in geology and/or mineralogy across the structural zone. Each sample weighs approximately 4kg. All channels for sampling are painted by the geologist and numbered on the drift’s walls for proper orientation and identification.

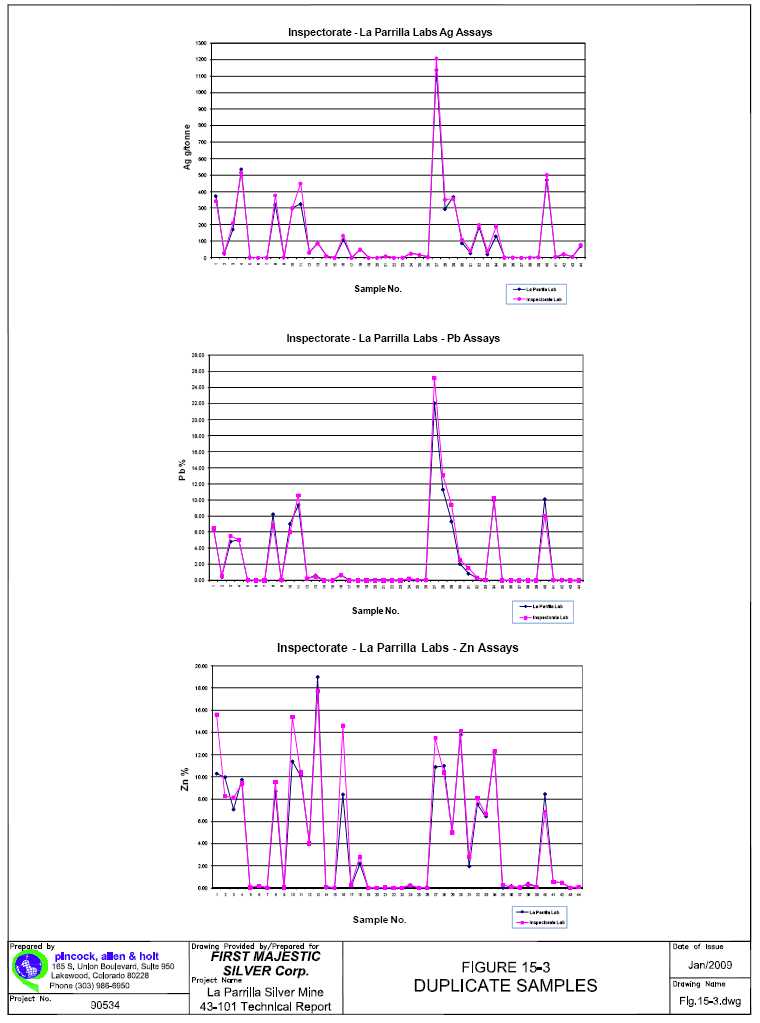

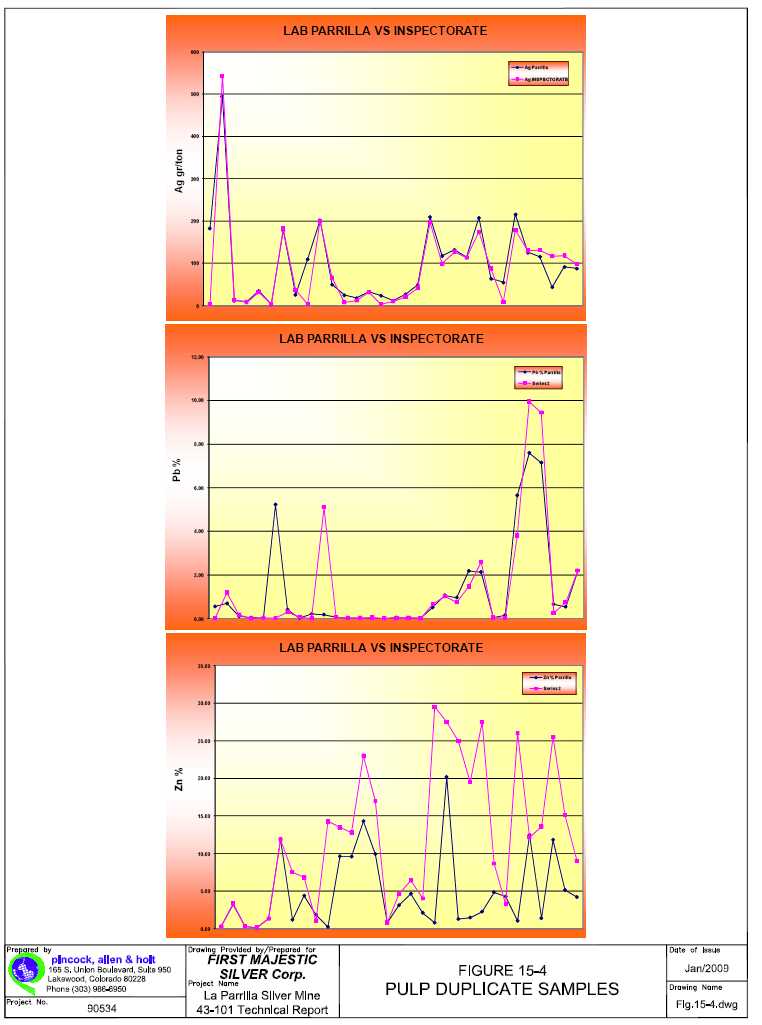

The La Parrilla sampling quality control program consists of checking the assays of one duplicate sample for every 20 regular samples from pulp samples. La Parrilla also includes duplicate drill core samples, at a rate of about 1 duplicate for every 40 samples, to confirm the sample preparation and assaying methods.

La Parrilla Silver Mine’s duplicate samples for this period included 44 samples from drill core samples of exploration areas. Additionally the program included assays of 31 duplicate pulp samples.

All samples are assayed at La Parrilla Silver Mine’s lab, while duplicate samples are sent to BSI-Inspectorate laboratory a US lab located in Reno, Nevada with representation and sampling preparation facilities in Durango City, México.

14.2 Drill Core Samples

FMPlata exploration drilling is performed by the contractor firm of Causa. This company is based in the city of Gómez Palacio, Durango State, Mexico and at the time of the PAH visit, presently is operating four drilling rigs within the La Parrilla Silver Mine area.

| Pincock, Allen & Holt | REVISED | 14.1 |

| 90534 February 26, 2009 |

Sampling of the drill core is made after the core has been logged by the mine geologists. The geologist marks the core on the basis of geologic and mineralization features. Then the sampling crew splits the core with diamond saw, as indicated by the geologist and one half of the core is placed in a numbered bag and sent to Inspectorate lab in Durango City. Generally the samples represent core lengths of less than 1.50m. All the core samples are sent for assaying by Inspectorate. The core samples are crushed and pulverized at Inspectorate in Durango City and 250g pulp samples are sent to Reno, Nevada for assaying.

Duplicate core samples are taken by FMPlata crew from the remaining half of the core, by again splitting the core to a one quarter size. Therefore, one quarter of the core still remains in the box for future reference. Duplicate samples are taken at a rate of approximately one duplicate sample from every twenty regular samples. Figure 14-1 shows core samples of the La Blanca Vein, LB-13.

Drill hole data are included in the Resource/Reserve calculations, and are generally applied by La Parrilla Silver Mine in the resource projections. Drilling results are applied in the grade calculations giving more weight to the larger-size channel sample data.

PAH’s opinion regarding the channel sampling applied by FMPlata’s exploration and mining crews, is that it is done carefully and responsibly by well trained samplers. The sampling appears to reconcile with silver production and sales by FMPlata. The channel samples appear to properly represent the mineralization of the various La Parrilla Silver Mine deposits; therefore, they are acceptable for Resource and Reserve estimates.

| Pincock, Allen & Holt | REVISED | 14.2 |

| 90534 February 26, 2009 |

15.0 SAMPLE PREPARATION, ANALYSIS AND SECURITY

15.1 Sample Preparation

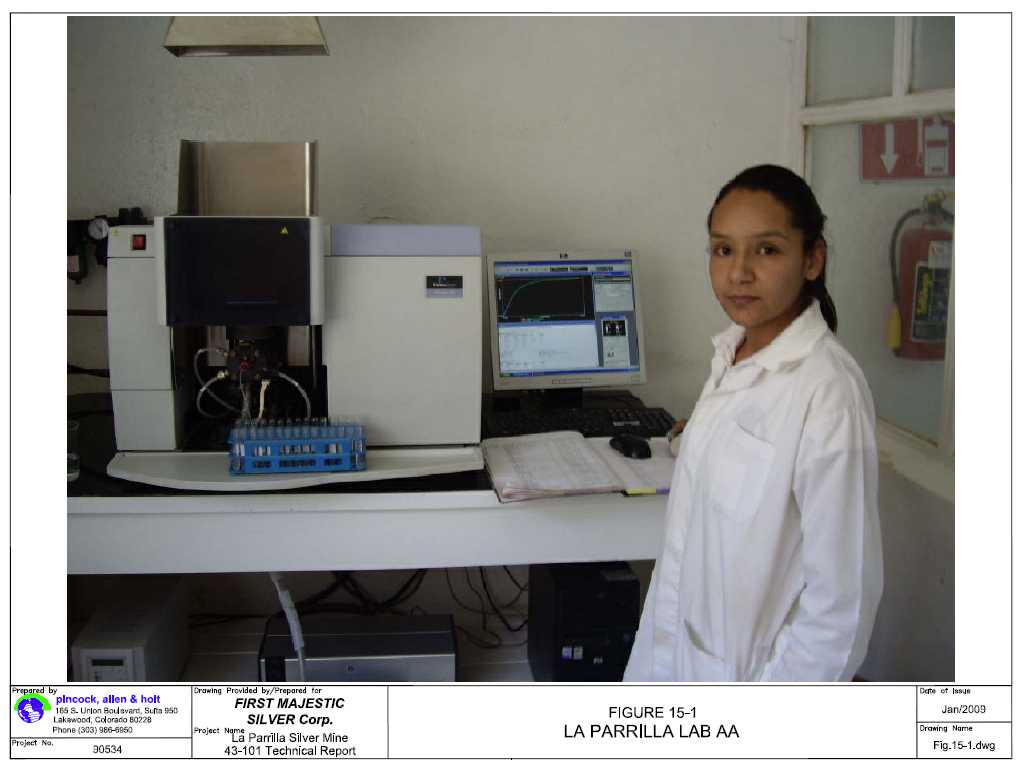

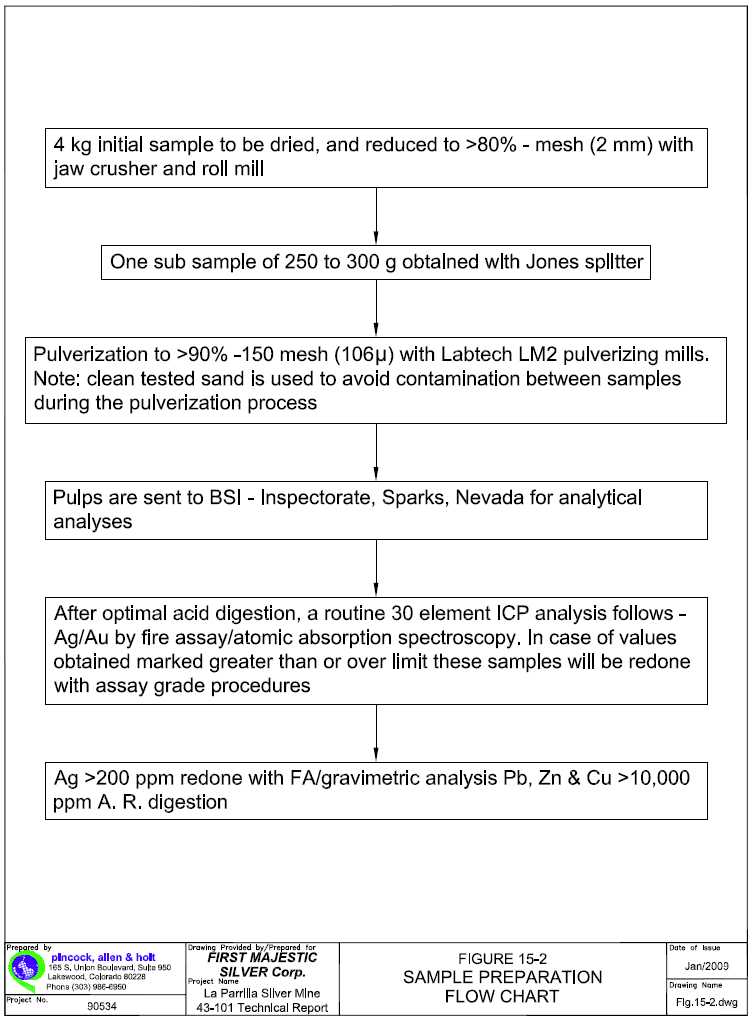

La Parrilla FMPlata’s sample preparation descriptions were presented in previous PAH’s Technical Reports as follows: “Exploration, mine development, production, and plant samples are sent to FMPlata’s on-site laboratory for chemical analysis of silver/gold/lead/zinc and copper. Silver and gold assays are carried out by fire assaying methods, while the rest of the elements are assayed by atomic absorption (AA)”.

A typical channel sample received by the laboratory, weighing approximately 4 kilograms, is passed through a jaw crusher to reduce it to a 1.3 - -centimeter (1/2”) size. A 500-gram split is taken and passed through gyratory or disk crushers to reduce it to a 10-mesh (1/8”) size. A 200 to 300 gram split is taken and placed in a drying oven at 120 degrees Centigrade. After drying, the material is put into two pulverizers, one disk pulverizer and one ring pulverizer, to grind the rock to minus 100 mesh. The resulting pulp is homogenized and 10 grams taken for fire assay analysis of silver and gold for geology samples and for concentrates; 20 grams are taken for head samples; and 1 gram is required for precipitate samples.

The 10-gram pulps are placed in fusion crucibles and placed into an electric furnace for fusion into lead buttons. The lead buttons are placed in cupellation cupels and placed into an electric furnace for cupellation into a silver-gold bead. The bead is weighed and then put into nitric acid to dissolve away the silver and then the remaining gold bead is weighed again. The microbalance used has a sensitivity of + 1 per 10,000 (equivalent to an actual grade of +0.1 gram per tonne), while the gold beads commonly range in weight from 100 milligrams down to less than 1 milligram. As a result, the determination of the smaller bead weight is at or below the detection limits of the microbalance.” Figure 15-1 shows AA unit at La Parrilla Lab. Figure 15-2 shows La Parrilla sample preparation flow chart.

15.2 Laboratory Facilities

PAH notes that the La Parrilla FMPlata laboratories generally appear to be adequate, with reasonable cleaning and organization. The laboratory currently processes about 250 samples by fire assay and by AA per day, including exploration samples, development samples, and mill samples. Laboratory personnel include five sample preparation operators, one Chief Chemist/AA and one Assistant Operator in fire assay and AA, and one person who weigh samples and reports results. La Parrilla Silver Mine supports students under scholarship programs for practicing at the laboratory during the summer months.