MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

Forward-Looking Statements

Certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “forecast”, “ project”, ”intend”, ”believe”, ”anticipate”, “outlook” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates of management at the dates the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the po ssibility of project cost overruns or unanticipated costs and expenses, uncertainties related to the availability of and costs of financing needed in the future and other factors described in the Company’s Annual Information Form under the heading “Risk Factors”. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements.

PRELIMINARY INFORMATION

First Majestic Silver Corp. (“First Majestic” or “the Company”) is in the business of producing, developing, exploring and acquiring mineral properties with a focus on silver in México. The Company’s shares and warrants trade on the Toronto Stock Exchange under the symbols “FR”, “FR.WT.A” and “FR.WT.B”, respectively. The common shares are also quoted on the “Grey Market” (Pink Sheets) in the U.S. under the symbol “FRMSF” and on the Frankfurt, Berlin, Munich and Stuttgart Stock Exchanges under the symbol “FMV”. Silver producing operations of the Company are carried out through three operating mines: the La Parrilla, La Encantada, and San Martin mines.

The following Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2008 and 2007. Additional information on the Company, including the Company’s Annual Information Form, is also available on SEDAR at www.sedar.com.

This MD&A relates to the consolidated operations of the Company and its two wholly owned direct subsidiaries: Corporación First Majestic, S.A. de C.V. (“CFM”), and First Silver Reserve Inc (“First Silver”), as well as the indirect wholly owned subsidiaries of CFM: First Majestic Plata, S.A. de C.V. (“FM Plata”), Mineral El Pilón, S.A. de C.V. (“El Pilón”), and Minera La Encantada, S.A. de C.V. (“La Encantada”). First Silver underwent a wind up and distribution of assets and liabilities to the Company in December 2007; however, First Silver has not been dissolved pending the outcome of litigation described herein.

QUALIFIED PERSONS

Unless otherwise indicated, Leonel Lopez, C.P.G., P.G. of Pincock Allen & Holt is the Qualified Person for the Company and has reviewed the technical information herein. National Instrument 43-101 technical reports regarding the La Parrilla Silver Mine, the La Encantada Silver Mine, the San Martin Silver Mine and the Del Toro Silver Mine can be found on the Company’s web site at www.firstmajestic.com or on SEDAR at www.sedar.com.

All financial information in this MD&A is prepared in accordance with Canadian GAAP, and all dollar amounts are expressed in Canadian dollars unless otherwise indicated. All information contained in this MD&A is current as of March 31, 2009, unless otherwise stated.

1

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

FINANCIAL PERFORMANCE AND HIGHLIGHTS

|

Total annual production for 2008 increased by 18% to 4,229,998 ounces of silver equivalents, including 3,654,698 ounces of silver, 1,661 ounces of gold, 7,457,707 pounds of lead and 425,710 pounds of zinc. This compares to the 3,584,265 ounces of silver equivalents produced in 2007 consisting of 3,170,139 ounces of silver, 2,049 ounces of gold and 2,924,146 pounds of lead. | |

|

Gross revenue for 2008, prior to smelting charges, was $56.1 million compared to $45.8 million in 2007, an increase of 22.4%. In 2008 the Company shipped 3,590,202 ounces of silver equivalent at an average price of $15.63 per ounce (US$14.66) compared to 3,461,560 ounces in 2007 at an average price of $13.24 (US$12.33). | |

|

Due to low metal prices in the latter half of 2008, the Company elected to carry 553,923 ounces of equivalent silver in inventory over the year end from its annual production. The inventory at year end consisted of 429,652 ounces in stockpiles, 101,755 ounces of finished product and 22,516 ounces in process. These ounces are expected to be sold throughout 2009. | |

|

Sales revenue (after smelting, refining and transportation charges) for the year ended December 31, 2008 was $44.3 million; an increase of 3% compared to $42.9 million for the year ended December 31, 2007. Smelting, refining and transportation charges increased from $2.9 million in 2007 to $11.8 million in 2008. A primary focus of the Company in 2009 is to increase its scale of operations and to shift its mix of production from concentrates toward doré production to reduce its smelting charges and increase net revenues. Average smelting and transportation charges for doré in 2008 were US$0.39 per equivalent ounce whereas for concentrates were US$4.78 per equivalent ounce (see Non-GAAP measures below). | |

|

Direct cash costs per ounce of silver (see Non-GAAP measures below) for the year ended December 31, 2008 decreased to US$5.87 per ounce of silver, compared to US$7.06 per ounce of silver for the year ended December 31, 2007 and US$6.37 per ounce of silver for the fourth quarter of 2008 compared to US$7.97 per ounce of silver for the fourth quarter of 2007 due to higher silver ounces produced in 2008. | |

|

Effective December 1, 2008, smelting and refining charges were reduced. In addition, in February 2009, the Company entered into two new smelting agreements which further reduced smelting charges for doré and concentrate smelting which have positively impacted costs for 2009. | |

|

At the La Encantada Silver Mine, construction began in June 2008 on the new US$21.6 million cyanidation plant which will have a capacity of 3,500 tonnes per day (“tpd”) once completed. The plant is scheduled to commence operations in July 2009. Once completed, the new plant is anticipated to produce over four million ounces of silver annually in the form of doré bars. | |

|

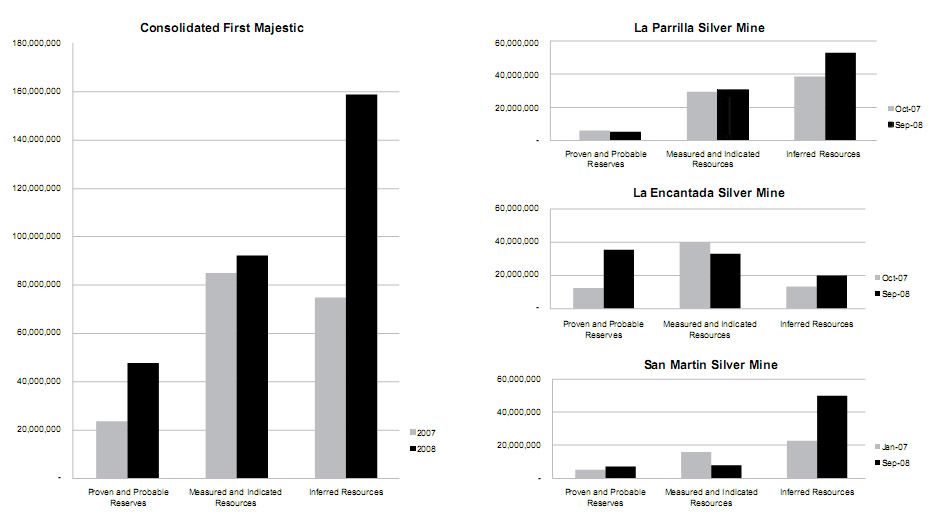

Reserve and Resource development was a high priority for the Company in 2008, leading to substantial increases in Reserves and Resources at all of its operating mines. On a consolidated basis, Proven and Probable Reserves increased by 102% to 47.8 million equivalent ounces of silver, compared to 23.7 million equivalent ounces of silver at the end of 2007. Measured and Indicated Resources increased by 9% to 92.3 million equivalent ounces of silver in 2008, compared to 85.1 million equivalent ounces of silver at the end of 2007. Inferred Resources increased by 113% to 158.8 million equivalent ounces of silver in 2008, compared to 74.7 million equivalent ounces of silver at the end of 2007. | |

|

During 2008, the Company invested $30.1 million in capital expenditures on its mineral properties, and a further $18.0 million on additions to plant and equipment. | |

|

Mine operating earnings for the year ended December 31, 2008 was $7.5 million, an increase of 7% compared to mine operating earnings of $7.0 million for the year ended December 31, 2007. | |

|

The Company reduced its operating loss for 2008 to $3.7 million, a 14% reduction compared to an operating loss of $4.3 million for the year ended December 31, 2007. | |

|

The Company incurred a net loss after taxes of $5.1 million for the year ended December 31, 2008, compared to a net loss after taxes of $7.2 million for the year ended December 31, 2007. The net loss after taxes for this year was after deducting a non-cash stock-based compensation expense of $3.7 million (2007 - $3.9 million) and recording a recovery for future income taxes of $2.1 million. | |

|

Subsequent to December 31, 2008, the Company completed a public offering with a syndicate of underwriters who purchased 8,487,576 units at an issue price of $2.50 per unit for gross proceeds to the Company of $21,218,940. The Company plans to use $15.5 million of the net proceeds of the offering for mill construction and mine improvements at the La Encantada Silver Mine, including the completion of the 3,500 tonne-per-day cyanidation plant, and the remainder for general working capital. |

2

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

The subsidiaries, mines, mills and properties in México are as follows:

| Subsidiaries | Mine and Mill | Exploration Properties |

| First Majestic Plata, S.A. de C.V. | La

Parrilla Silver Mine Del Toro Silver Mine |

La

Parrilla properties Del Toro properties (formerly referred to as the Chalchihuites Group of Properties) |

| Minera El Pilón, S.A. de C.V. | San Martin Silver Mine | San

Martin property Cuitaboca Silver Project Jalisco Group of Properties |

| Minera La Encantada, S.A. de C.V. | La Encantada Silver Mine | La Encantada property |

| Majestic Services,

S.A. de C.V. (a labour services company) |

(all of the above) | (all of the above) |

| Corporación First

Majestic, S.A. de C.V. (holding company for the above) |

(holding company for the above) | (holding company for the above) |

Certain financial results in this MD&A, regarding operations, cash costs, and average realized revenues, are presented in the Mine Operations Results table below to conform with industry peer company presentation standards, which are generally presented in U.S. dollars. U.S. dollar results are translated using the U.S. dollar rates on the dates on which the transactions occurred.

MINING OPERATING RESULTS

Consolidated First Majestic

| Quarter Ended December 31, | RESULTS | Year to Date December 31, | ||

| 2008 | 2007 | 2008 | 2007 | |

| 215,646 | 146,798 | Ore processed/tonnes milled | 758,338 | 604,756 |

| 207 | 241 | Average silver grade (g/tonne) | 219 | 222 |

| 65% | 77% | Recovery (%) | 68% | 73% |

| 930,120 | 868,354 | Silver ounces produced | 3,654,698 | 3,170,139 |

| 403 | 490 | Gold ounces produced | 1,661 | 2,049 |

| 31,650 | 27,239 | Equivalent ounces from gold | 100,496 | 106,046 |

| 2,093,988 | 1,107,154 | Pounds of lead produced | 7,457,707 | 2,924,146 |

| 93,239 | 112,706 | Equivalent ounces from lead | 450,423 | 308,079 |

| 24,413 | - | Pounds of zinc produced | 425,710 | - |

| 1,403 | - | Equivalent ounces from zinc | 24,381 | - |

| 1,056,219 | 1,008,299 | Total production - ounces silver equivalent | 4,229,998 | 3,584,265 |

| 827,845 | 908,688 | Ounces of silver equivalents sold | 3,590,202 | 3,461,560 |

| 6.37 | 7.97 | Total US cash cost per ounce(1)(2) | 5.87 | 7.06 |

| 5,845 | 5,346 | Underground development (m) | 27,890 | 20,279 |

| 4,194 | 8,122 | Diamond drilling (m) | 61,440 | 35,655 |

| 37.57 | 50.30 | Total US production cost per tonne (2) | 43.08 | 42.96 |

| (1) | The Company reports non-GAAP measures which include

Direct Costs Per Tonne, Direct Cash Cost per ounce of payable silver

(prior to smelting charge), and smelting charges per ounce of

silver in order to manage and evaluate operating performance at each of

the Company’s mines. These measures are widely used in the silver

mining industry as a benchmark for performance, but do not have a

standardized meaning, and are not GAAP measures. See Reconciliation

to GAAP below |

| (2) | Cash Costs do not include smelting; production costs per tonne include smelter charges. |

3

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

LA ENCANTADA SILVER MINE

| Quarter Ended December 31, | RESULTS | Year to Date December 31, | ||

| 2008 | 2007 | 2008 | 2007 | |

| 79,480 | 37,657 | Ore processed/tonnes milled | 257,960 | 185,549 |

| 281 | 370 | Average silver grade (g/tonne) | 283 | 306 |

| 59% | 78% | Recovery (%) | 62% | 68% |

| 427,753 | 341,709 | Silver ounces produced | 1,442,566 | 1,238,316 |

| - | - | Gold ounces produced | - | - |

| - | - | Equivalent ounces from gold | - | - |

| 1,195,557 | 298,269 | Pounds of lead produced | 3,312,869 | 1,091,902 |

| 56,299 | 30,933 | Equivalent ounces from lead | 193,675 | 128,061 |

| - | - | Pounds of zinc produced | - | - |

| - | - | Equivalent ounces from zinc | - | - |

| 484,053 | 372,642 | Total production - ounces silver equivalent | 1,636,242 | 1,366,377 |

| 450,063 | 303,056 | Ounces of silver equivalents sold | 1,529,301 | 1,272,810 |

| 3.82 | 4.22 | Total US cash cost per ounce (1) (2) | 3.59 | 3.35 |

| 3,075 | 1,587 | Underground development (m) | 8,463 | 5,647 |

| 2,107 | 532 | Diamond drilling (m) | 8,048 | 1,474 |

| 32.98 | 44.26 | Total US production cost per tonne (2) | 45.93 | 33.85 |

LA PARRILLA SILVER MINE

| Quarter Ended December 31, | RESULTS | Year to Date December 31, | ||

| 2008 | 2007 | 2008 | 2007 | |

| 66,395 | 53,138 | Ore processed/tonnes milled | 246,166 | 179,411 |

| 206 | 222 | Average silver grade (g/tonne) | 234 | 204 |

| 70% | 70% | Recovery (%) | 70% | 68% |

| 305,685 | 261,931 | Silver ounces produced | 1,291,210 | 802,603 |

| 297 | 142 | Gold ounces produced | 864 | 427 |

| 15,899 | 7,884 | Equivalent ounces from gold | 47,139 | 22,435 |

| 897,031 | 801,746 | Pounds of lead produced | 3,979,046 | 1,782,220 |

| 36,864 | 81,024 | Equivalent ounces from lead | 245,056 | 175,785 |

| 24,414 | - | Pounds of zinc produced | 24,414 | - |

| 1,403 | - | Equivalent ounces from zinc | 1,403 | - |

| 359,851 | 350,838 | Total production - ounces silver equivalent | 1,584,808 | 1,000,823 |

| 228,661 | 336,405 | Ounces of silver equivalents sold | 1,282,340 | 986,390 |

| 6.68 | 8.95 | Total US cash cost per ounce (1) (2) | 5.39 | 8.70 |

| 1,557 | 1,477 | Underground development (m) | 10,457 | 6,414 |

| 668 | 6,869 | Diamond drilling (m) | 37,944 | 30,481 |

| 47.01 | 46.05 | Total US production cost per tonne (2) | 44.42 | 42.91 |

| (1) | The Company reports non-GAAP measures which include

Direct Costs Per Tonne, Direct Cash Cost per ounce of payable silver

(prior to smelting charge), and smelting charges per ounce of

silver in order to manage and evaluate operating performance at each of

the Company’s mines. These measures are widely used in the silver

mining industry as a benchmark for performance, but do not have a

standardized meaning, and are not GAAP measures. See Reconciliation

to GAAP below |

| (2) | Cash Costs do not include smelting; production costs per tonne include smelter charges. |

4

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

SAN MARTIN SILVER MINE

| Quarter Ended December 31, | RESULTS | Year to Date December 31, | ||

| 2008 | 2007 | 2008 | 2007 | |

| 69,771 | 56,003 | Ore processed/tonnes milled | 254,211 | 239,796 |

| 124 | 171 | Average silver grade (g/tonne) | 141 | 171 |

| 71% | 86% | Recovery (%) | 80% | 84% |

| 196,681 | 264,714 | Silver ounces produced | 920,921 | 1,129,220 |

| 106 | 348 | Gold ounces produced | 797 | 1,622 |

| 15,751 | 19,355 | Equivalent ounces from gold | 53,357 | 83,611 |

| 1,399 | 7,409 | Pounds of lead produced | 165,792 | 50,024 |

| 75 | 749 | Equivalent ounces from lead | 11,691 | 4,233 |

| - | - | Pounds of zinc produced | 401,297 | - |

| - | - | Equivalent ounces from zinc | 22,979 | - |

| 212,315 | 284,819 | Total production - ounces silver equiv. | 1,008,948 | 1,217,065 |

| 149,121 | 269,227 | Ounces of silver equivalents sold | 778,561 | 1,202,360 |

| 11.43 | 11.83 | Total US cash cost per ounce (1)(2) | 10.12 | 9.92 |

| 1,214 | 2,282 | Underground development (m) | 8,971 | 8,218 |

| 1,419 | 721 | Diamond drilling (m) | 15,448 | 3,700 |

| 33.82 | 58.40 | Total US production cost per tonne (2) | 38.90 | 50.05 |

| (1) | The Company reports non-GAAP measures which

include Direct Costs Per Tonne, Direct Cash Cost per ounce of payable

silver (prior to smelting charge) and smelting charges per ounce

of silver in order to manage and evaluate operating performance at each of

the Company’s mines. These measures are widely used in the silver

mining industry as a benchmark for performance, but do not have a

standardized meaning, and are not GAAP measures. See Reconciliation

to GAAP below. |

| (2) | Cash Costs do not include smelting; production costs per tonne include smelter charges. |

5

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

| Reconciliation of Cash Costs to GAAP | Three Months Ended

December 31, 2008 |

Year ended December 31, 2008 | |||||||

| San Martin | La Parrilla (1) | La Encantada | Q42008 | San Martin | La Parrilla (1) | La Encantada | 2008 | ||

| DIRECT MINING EXPENSES(MMI) | US$ | 2,437,236 | 2,642,802 | 2,175,866 | 7,255,903 | 10,332,232 | 11,048,812 | 7,558,285 | 28,939,328 |

| PROFIT SHARING | US$ | - | - | - | - | - | - | - | - |

| OTHER SELLING COSTS | |||||||||

| (TRANSPORT, ETC.) | US$ | (1,272) | 72,397 | 46,234 | 117,359 | 78,930 | 247,807 | 235,831 | 562,568 |

| THIRD PARTY SMELTING | US$ | 110,772 | 1,080,074 | 988,885 | 2,179,732 | 571,209 | 3,977,916 | 6,667,136 | 11,216,262 |

| BYPRODUCT CREDITS | US$ | (187,427) | (673,849) | (589,497) | (1,450,773) | (1,094,506) | (4,339,639) | (2,613,425) | (8,047,570) |

| LESS PROFIT SHARING | US$ | - | - | - | - | - | - | - | - |

| TOTAL CASH COSTS | US$ | 2,359,309 | 3,121,425 | 2,621,488 | 8,102,221 | 9,887,866 | 10,934,898 | 11,847,827 | 32,670,588 |

| CASH COST PER OUNCE | |||||||||

| PRODUCED | US$/OZ | 12.00 | 10.21 | 6.13 | 8.71 | 10.74 | 8.47 | 8.21 | 8.94 |

| SMELTING/REFINING/ | |||||||||

| TRANSPORTATION | |||||||||

| COST PER OUNCE | US$/OZ | (0.56) | (3.53) | (2.31) | (2.34) | (0.62) | (3.08) | (4.62) | (3.07) |

| DIRECT MINING EXPENSES | |||||||||

| CASH COST | US$/OZ | 11.43 | 6.68 | 3.82 | 6.37 | 10.12 | 5.39 | 3.59 | 5.87 |

| TONNES PRODUCED | TONNES | 69,771 | 66,396 | 79,479 | 215,646 | 254,211 | 246,167 | 257,960 | 758,338 |

| OUNCES OF SILVER PRODUCED | OZ | 196,682 | 305,685 | 427,753 | 930,121 | 920,921 | 1,291,211 | 1,442,566 | 3,654,699 |

| OUNCES OF SILVER EQ PRODUCED | OZ EQ | 15,633 | 62,771 | 62,250 | 140,654 | 88,027 | 302,203 | 199,626 | 589,856 |

| TOTAL OZ OF SILVER EQ PRODUCED | OZ EQ | 212,315 | 359,850 | 484,053 | 1,056,218 | 1,008,948 | 1,584,808 | 1,636,242 | 4,229,998 |

| MINING | $/Tonne | 13.18 | 17.96 | 11.69 | 14.10 | 17.88 | 18.20 | 11.03 | 15.65 |

| MILLING | $/Tonne | 13.84 | 18.50 | 9.77 | 13.78 | 12.93 | 21.30 | 7.16 | 13.69 |

| INDIRECT | $/Tonne | 7.91 | 3.34 | 5.91 | 5.77 | 9.88 | 5.43 | 11.14 | 8.86 |

| SELLING AND TRANSPORT COSTS | $/Tonne | (0.02) | 1.09 | 0.58 | 0.54 | 0.31 | 1.01 | 0.91 | 0.74 |

| SMELTING AND REFINING COSTS | $/Tonne | 1.59 | 16.27 | 12.44 | 10.11 | 2.25 | 16.16 | 25.85 | 14.79 |

| BY PRODUCT CREDITS | $/Tonne | (2.69) | (10.15) | (7.42) | (6.73) | (4.31) | (17.63) | (10.13) | (10.61) |

| DIRECT COST PER TONNE | $/Tonne | 33.82 | 47.01 | 32.98 | 37.57 | 38.90 | 44.42 | 45.93 | 43.08 |

| RECONCILIATION: | |||||||||

| Cash Cost | US$ | 2,359,309 | 3,121,425 | 2,621,488 | 8,102,221 | 9,887,866 | 10,934,898 | 11,847,826 | 32,670,589 |

| Inventory changes | US$ | (305,899) | 196,454 | (176,063) | (285,508) | (893,499) | (466,693) | 293,719 | (1,066,473) |

| Byproduct credits | US$ | 187,427 | 673,849 | 589,497 | 1,450,773 | 1,094,506 | 4,339,639 | 2,613,425 | 8,047,570 |

| Smelting and refining | US$ | (110,772) | (1,080,074) | (988,885) | (2,179,732) | (571,209) | (3,977,917) | (6,667,136) | (11,216,263) |

| Other | US$ | - | (503,377) | - | (503,377) | - | (278,966) | - | (278,966) |

| Cost of sales - Calculated | US$ | 2,130,065 | 2,408,276 | 2,046,036 | 6,584,377 | 9,517,664 | 10,550,960 | 8,087,833 | 28,156,457 |

| Average CDN/US Exchange Rate | 0.8279 | 0.8229 | 0.8461 | 0.8316 | 0.9438 | 0.9300 | 0.9390 | 0.9372 | |

| Booked Cost of Sales - CDN$ | CDN$ | 2,572,773 | 2,926,679 | 2,418,181 | 7,917,633 | 10,083,947 | 11,345,291 | 8,613,007 | 30,042,245 |

Note 1: Does not include cost of sales on the intercompany transfers of doré from La Parrilla to parent company in the amount of Cdn$377,170.

| Reconciliation of Cash Costs to GAAP | Three Months Ended December 31, 2008 |

Year ended

December 31, 2008 | |||||||||

| INVENTORY RECONCILIATION (2): | San Martin | La Parrilla | La Encantada | Vancouver | Q42008 | San Martin | La Parrilla | La Encantada | Vancouver | 2008 | |

| Opening inventory | OZ EQ | 207,691 | 334,847 | 115,714 | 11,668 | 669,920 | 15,592 | 31,590 | 31,264 | 20,650 | 99,096 |

| Production - silver equivalent ounces | OZ EQ | 212,315 | 359,851 | 484,053 | - | 1,056,219 | 1,008,948 | 1,584,808 | 1,636,242 | - | 4,229,998 |

| Shipments - silver equivalent ounces | OZ EQ | (149,121) | (228,661) | (450,063) | (16,463) | (844,308) | (778,561) | (1,282,340) | (1,529,301) | (24,607) | (3,614,809) |

| Reduction of stockpile | OZ EQ | - | (123,384) | (37,352) | - | (160,736) | - | (123,384) | (37,352) | - | (160,736) |

| Inventory adjustments | OZ EQ | (27,853) | 21,840 | 13,730 | 47,248 | 54,965 | (50,779) | 11,382 | 35,814 | 46,410 | 42,827 |

| Shipment adjustments | OZ EQ | (47,832) | (142,437) | 10,585 | - | (179,684) | - | - | - | - | - |

| Ending inventory | OZ EQ | 195,200 | 222,056 | 136,667 | 42,453 | 596,376 | 195,200 | 222,056 | 136,667 | 42,453 | 596,376 |

| Value of ending inventory | CDN$ | 1,203,178 | 1,013,558 | 628,829 | 572,147 | 3,417,712 | 1,203,178 | 1,013,558 | 628,829 | 572,147 | 3,417,712 |

Note 2: The inventory reconciliation above consists of silver coins, bullion, doré, concentrates, ore in process and stockpile but excludes materials and supplies.

6

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

REVIEW OF MINING OPERATING RESULTS

The Company turned its focus toward operating efficiencies in the final quarter of 2008, scaling up its mine operations in its three primary mines in an effort to realize economies of scale. Expansions began in July of 2008 at each of the operating mines culminating in higher capacities in the fourth quarter. At the La Parrilla Silver Mine, mill capacity was expanded from 800 tpd and reached 850 tpd in November 2008. At the La Encantada Silver Mine, several improvements were made within the current flotation mill which resulted in overall capacity reaching 1,000 tpd in November 2008. At the San Martin Silver Mine, expansion of the mill was completed in December resulting in an increase in capacity from 800 tpd to 950 tpd. Total capacity has increased from 2,400 tpd to 2,800 tpd, a 17% increase. The impact of the increased scale of production was also aided by a weakening Mexican peso and the net result has been a reduction of the cost per tonne from US$50.30 in the fourth quarter of 2007 to US$37.57 per tonne in the fourth quarter of 2008 (See “Non-GAAP Measures”).

Silver production increased from 3,584,265 equivalent ounces of silver for the year ended December 31, 2007 to 4,229,998 equivalent ounces of silver for the year ended December 31, 2008, an increase of 18%. This can be attributed to an increase of mill throughput tonnage, from 604,756 tonnes in 2007 to 758,338 tonnes in 2008, an increase of 25%. Lead production increased by 155%, from 2,924,146 pounds in 2007 to 7,457,707 pounds in 2008. Gold production decreased by 19%, from 2,049 ounces in 2007 to 1,661 ounces in 2008.

Due to a sharp decline in silver, lead and zinc prices in late 2008, cash management was a priority for the Company. The Company revised its exploration and development plans in late 2008 as it had achieved its targets for Reserves and Resource development resulting in an increase in mine life now equalling more than 20 years.

The Company’s revised mine development plan for 2008 included the completion of 25,000 metres of underground development across its operations and projects, a reduction from its prior target of 46,000 metres; however, a total of 27,890 metres were completed during the year ended December 31, 2008, representing an increase of 38% when compared with the 20,279 metres completed in the previous year.

The Company’s revised plan for diamond drilling in 2008 included a reduction from 82,000 metres to the completion of 60,000 metres of diamond drilling across its operations and projects. Diamond drilling increased by 72%, from 35,655 metres in 2007 to 61,440 metres in 2008.

The fourth quarter of 2008 was impacted by the cut backs that occurred in late 2008. Development decreased by 34%, from 8,876 metres of development completed in the third quarter to 5,845 metres in the fourth quarter. The diamond drilling program saw a reduction of 84%, from 26,666 metres drilled in the third quarter to 4,194 metres drilled in the fourth quarter.

Production increased by 26%, from 840,918 equivalent ounces of silver in the third quarter to 1,056,219 equivalent ounces of silver in the fourth quarter of 2008; however, the results of the third quarter of 2008 were negatively impacted by heavy rains. Silver production increased by 29% from 719,399 ounces in the third quarter to 930,120 ounces in the fourth quarter. Lead production also increased by 38% from 1,518,271 pounds in the third quarter to 2,093,988 pounds in the fourth quarter. Production of gold decreased by 25%, from 536 ounces in the third quarter to 403 ounces in the fourth quarter. The fourth quarter of 2008 also saw an increase of 5% over the equivalent ounces of silver produced in the fourth quarter of 2007.

During the fourth quarter, the overall recoveries of silver from the three mills reflected a decrease from 67% to 65%; however, the overall average silver head grade increased from 196 grams per tonne (“g/t”) of silver in the third quarter to 207 g/t of silver in the fourth quarter.

The Company also reviewed its unfulfilled orders for mining equipment and cancelled pending orders of new equipment. Its original agreement for 20 pieces of equipment in 2008 was scaled back to the nine pieces which had been delivered. Also, the Company restructured its remaining US$2.9 million in equipment lease payments to provide for two years of level monthly payments and accrued interest, commencing February 1, 2009.

Management believes strongly in responsible, sustainable growth and contributing to its people and the communities in which it operates. In March 2009, the Company was awarded the prestigious Socially Responsible Business Distinction for 2008 (Distintivo Empressa Socialmente Responsable 2008) by Centro Mexicano para la Filantropia (CEMEFI). To receive this award, the Company demonstrated responsibility, transparency and sustainability within its operations and projects in México.

7

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

RESERVES AND RESOURCES UPDATE

Reserve and Resource development was a high priority for the Company in 2008, leading to substantial increases in Reserves and Resources at all of its operating mines. The Company’s management set a target to expand its total Reserves and Resources to 300 million equivalent silver ounces of all combined categories by the end of 2008. Based on updated NI 43-101 reports published between October 2008 and February 2009, the Company defined a total of 140.2 million ounces of silver equivalent in Proven and Probable Reserves and Measured and Indicated Resources, in addition to 158.8 million ounces of silver equivalent in Inferred Resources.

| In October 2008, the Company released an updated NI 43-101 compliant resource estimate for the Del Toro Silver Mine. This mineral resource estimate, with a cut-off date of July 31, 2008, included Measured and Indicated Resources of 20.9 million ounces of silver equivalent and Inferred Resources of 36.0 million ounces of silver equivalent. | |

| In December 2008, the Company released an updated NI 43-101 compliant resource estimate for the La Encantada Silver Mine. This mineral resource estimate, with a cut-off date of September 30, 2008, included Proven and Probable Reserves of 35.5 million ounces of silver equivalent, Measured and Indicated Resources of 33.1 million ounces of silver equivalent and Inferred Resources of 20.0 million ounces of silver equivalent. | |

| In January 2009, the Company released an updated NI 43-101 compliant resource estimate for the San Martin Silver Mine. This mineral resource estimate, with a cut-off date of September 30, 2008, included Proven and Probable Reserves of 7.0 million ounces of silver equivalent, Measured and Indicated Resources of 7.6 million ounces of silver equivalent and Inferred Resources of 50.0 million ounces of silver equivalent. | |

| In February 2009, the Company released an updated NI 43-101 compliant resource estimate for the La Parrilla Silver Mine. This mineral resource estimate, prepared with a cut-off date of September 30, 2008, included Proven and Probable Reserves of 5.2 million ounces of silver equivalent, Measured and Indicated Resources of 30.7 million ounces of silver equivalent and Inferred Resources of 52.8 million ounces of silver equivalent. |

Shareholders and interested parties are encouraged to read these reports which can be viewed on SEDAR (www.sedar.com) and the Company’s web site at www.firstmajestic.com.

Reserves and Resources data follows:

Note: The 2008 Reserve and Resource estimates for the La Encantada Silver Mine, the La Parrilla Silver Mine and the San Martin Silver Mine are as of September 30, 2008, respectively. The 2008 Resource estimate for the Del Toro Silver Mine is as of July 31, 2008. The 2007 Reserve and Resource estimates for the La Encantada Silver Mine, the La Parrilla Silver Mine and the San Martin Silver Mine are as of October 31, 2007, October 31, 2007 and January 1, 2007 respectively. Measurement is shown in ounces of silver equivalent.

8

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

RESERVES AND RESOURCES - 2007 AND 2008

| Ag Eq Oz. | ||||

| % | ||||

| Consolidated First Majestic | 2007 | 2008 | Increase | |

| (Decrease) | ||||

| Proven and Probable Reserves | 23,690,775 | 47,834,309 | 24,143,534 | 101.91% |

| Measured and Indicated Resources | 85,083,804 | 92,320,108 | 7,236,304 | 8.50% |

| Total Proven + Probable Reserves | ||||

| and Measured + Indicated Resources | 108,774,579 | 140,154,417 | 31,379,838 | 28.85% |

| Inferred Resources | 74,732,705 | 158,804,145 | 84,071,440 | 112.50% |

| La Encantada Silver Mine | 2007 | 2008 | Increase | % |

| (Decrease) | ||||

| Proven and Probable Reserves | 12,620,835 | 35,548,863 | 22,928,028 | 181.67% |

| Measured and Indicated Resources | 40,122,659 | 33,107,288 | (7,015,371) | (17.48%) |

| Total Proven + Probable Reserves | ||||

| and Measured + Indicated Resources | 52,743,494 | 68,656,151 | 15,912,657 | 30.17% |

| Inferred Resources | 13,428,000 | 20,034,145 | 6,606,145 | 49.20% |

| La Parrilla Silver Mine | 2007 | 2008 | Increase | % |

| (Decrease) | ||||

| Proven and Probable Reserves | 6,107,551 | 5,246,954 | (860,597) | (14.09%) |

| Measured and Indicated Resources | 29,336,405 | 30,700,000 | 1,363,595 | 4.65% |

| Total Proven + Probable Reserves | ||||

| and Measured + Indicated Resources | 35,443,956 | 35,946,954 | 502,998 | 1.42% |

| Inferred Resources | 38,639,050 | 52,800,000 | 14,160,950 | 36.65% |

| San Martin Silver Mine | 2007 | 2008 | Increase | % |

| (Decrease) | ||||

| Proven and Probable Reserves | 4,962,389 | 7,038,492 | 2,076,103 | 41.84% |

| Measured and Indicated Resources | 15,624,740 | 7,569,820 | (8,054,920) | (51.55%) |

| Total Proven + Probable Reserves | ||||

| and Measured + Indicated Resources | 20,587,129 | 14,608,312 | (5,978,817) | (29.04%) |

| Inferred Resources | 22,665,655 | 50,000,000 | 27,334,345 | 120.60% |

| Del Toro Silver Mine | 2007 | 2008 | Increase | % |

| (Decrease) | ||||

| Proven and Probable Reserves | - | - | - | n/a |

| Measured and Indicated Resources | - | 20,943,000 | 20,943,000 | n/a |

| Total Proven + Probable Reserves | ||||

| and Measured + Indicated Resources | - | 20,943,000 | 20,943,000 | n/a |

| Inferred Resources | - | 35,970,000 | 35,970,000 | n/a |

Note: The 2008 Reserve and Resource estimates for the La Encantada Silver Mine, the La Parrilla Silver Mine and the San Martin Silver Mine are as of September 30, 2008, respectively. The 2008 Resource estimate for the Del Toro Silver Mine is as of July 31, 2008. The 2007 Reserve and Resource estimates for the La Encantada Silver Mine, the La Parrilla Silver Mine and the San Martin Silver Mine are as of October 31, 2007, October 31, 2007 and January 1, 2007 respectively. Measurement is shown in ounces of silver equivalent.

9

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

MINE UPDATES

La Encantada Silver Mine

| Location: Coahuila, México | Ownership: 100% |

| Reserves/Resources (PP&MI): 68.7 million ounces | Monthly Capacity (Tonnes): 30,000 |

| Employment: 352 | 2008 Production (Silver Equiv.):1.6 million ounces |

| 2008 Production Costs ($US per Tonne): $45.93 | 2008 Cash Costs/Oz. ($US, excl. smelting): $3.59 |

The La Encantada Silver Mine is a producing underground mine located in Northern México in Coahuila State approximately a 1.5 hour flight from Torreon and comprises 4,076 hectares of mining rights and surface land ownership of 1,343 hectares. The closest city is, Melchor Muzquiz, is 225 kilometres away via 45 kilometres of gravel road and 180 kilometres in paved road. The La Encantada Silver Mine consists of a 1,000 tpd flotation plant, an airstrip, and other facilities, including a mining village with 180 houses as well as administrative offices. The Company owns 100% of the La Encantada Silver Mine.

The La Encantada mine is the Company’s lowest cost producer, and has the highest Reserve / Resource position. This mine is undergoing a US$21.6 million expansion, to be completed in mid-2009, to convert the mill into a 3,500 tpd cyanidation by agitated leaching process, thereby becoming a producer of doré bars. The mill is presently operating at approximately 950 tpd and produces a silver rich lead concentrate.

During the fourth quarter of 2008, construction continued on the 3,500 tpd cyanidation plant. Earth and rock removal at the site preparation are 95% complete, foundations for the leaching tanks are 100% complete and assembly is proceeding with eight of the leaching tanks. The foundations of the primary and intermediate thickeners are complete and the assembly of the primary and intermediate thickeners is progressing well. Also, the construction work for the new tailings dam is in process. Eighty percent of the equipment has been acquired and is in the process of being delivered. To date, the Company has spent US$10.5 million on the plant and the Company estimates commissioning to commence in mid-2009.

At the La Encantada mill, several modifications were completed to increase the mill capacity from 800 to 1,000 tpd, which was completed in November 2008. Production in the fourth quarter was 79,480 tonnes showing an increase of 27% when compared with the 62,406 tonnes produced in the third quarter of 2008. The average head grade was 281 g/t, an increase of 15% when compared to the 244 g/t achieved in the previous quarter due to larger tonnage of high grade ore coming from the mine. A total of 484,053 equivalent ounces of silver were produced during the fourth quarter, which represents an increase of 45% from the 334,595 equivalent ounces of silver in the third quarter. Silver production consisted of 427,753 ounces of silver, an increase of 49% versus the 287,668 ounces in the previous quarter and 1,195,557 pounds of lead, an increase of 54% from the 777,099 pounds in the previous quarter due to better lead recoveries at the flotation plant.

Underground mine development continued with a total of 3,075 metres of development completed in the fourth quarter aimed at several targets including the San Javier/Milagros Breccias, Azul y Oro and the new Buenos Aires areas and a new developed area between the 660 and the Ojuelas ore bodies. This compares to 2,232 metres of development completed in the previous quarter showing an increase of 38%. The purpose of the ongoing underground development program is to prepare for increased production levels in 2009, to confirm additional Reserves and Resources, and for exploration and exploitation purposes going forward. Underground diamond drilling continued with a total of 2,107 metres compared with 2,662 metres drilled in the previous quarter. During the fourth quarter of 2008, the Company decided to substantially reduce the diamond drill and development programs, reducing from three rigs to only one rig operating underground, with the rig engaged in production and operations activities only.

La Parrilla Silver Mine

| Location: Durango, México | Ownership: 100% |

| Reserves/Resources (PP&MI): 35.9 million ounces | Monthly Capacity (Tonnes): 25,500 |

| Employment: 332 | 2008 Production (Silver Equiv.):1.6 million ounces |

| 2008 Production Costs ($US per Tonne): $44.42 | 2008 Cash Costs/Oz. ($US, excl. smelting): $5.39 |

The La Parrilla Silver Mine is a group of producing underground mines consisting of the La Rosa/Rosarios/La Blanca mines which are connected through underground workings, the San Marcos mine and the Quebradillas mine, located approximately 65 kilometres southeast of the city of Durango, México. It includes an 850 tpd mill consisting of a 425 tpd cyanidation circuit and a 425 tpd flotation circuit, buildings, offices and infrastructure and mining concessions covering an area of 53,000 hectares of which the Company owns 100 hectares of surface rights. The Company owns 100% of the La Parrilla Silver Mine, which began commercial silver production in October 2004.

This is the first mine developed by the Company and its operations have been scaled up continually from a 180 tpd operation in early 2005, to the current average throughput of 840 tpd. This mill produces doré bars and both silver-rich lead and zinc concentrates.

An expansion program of the mill was launched in July 2008 to expand this operation up to 1,000 tpd by April 2009. However, due to market conditions that affected the entire mining sector in the fourth quarter of 2008, the expansion program was suspended resulting in the current mill capacity of 850 tpd.

10

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

During the fourth quarter of 2008, the diamond drilling and development activity for both preparation and exploration decreased. As well, capital expenditures and operating costs were reduced to a minimum in order to compensate for the lower silver and lead prices realized in the fourth quarter.

The most important activities undertaken in the year were the continued underground development at the different areas within the La Parrilla property. This included the preparation of Levels 7 and 8 at the Rosarios/La Rosa area where the new long hole drilling method using a new Stopemate machine began operations in the early part of the year with good results in increasing the productivity. In order to reduce dilution, bolting in the hanging wall was completed and achieved good results. At Quebradillas, development continued to focus on accessing the sulphides areas in the lower levels. At San Marcos and at the San Jose/La Blanca areas, development continued to access new production areas at the lower levels within the mines.

Production from the La Parrilla mill increased from 51,822 tonnes in the third quarter of 2008 to 66,395 tonnes in the fourth quarter of 2008, an increase of 28%. The average head grade of silver at the mill decreased from 213 g/t in the third quarter of 2008 to 206 g/t in the fourth quarter, a decrease of 3%. Recoveries of silver increased from 65% in the third quarter to 70% in the fourth quarter of 2008.

Total silver production from the mill increased from 300,461 ounces of silver equivalent in the third quarter of 2008 to 359,851 ounces of silver equivalent in the fourth quarter of 2008, a 20% increase. The composition of the silver equivalent production in the fourth quarter of 2008 included 305,685 ounces of silver, 297 ounces of gold and 897,031 pounds of lead.

Diamond drilling and underground development continued to define additional Reserves and Resources at the different areas of the La Parrilla property. Due to the lower silver and lead prices, the number of drill rigs that were active during the year were reduced in the fourth quarter, from seven to one. As a result, the total metres of diamond drilling decreased from 18,160 metres in the third quarter of 2008 to 668 metres in the fourth quarter of 2008, a reduction of 96%. However, total metres drilled during the year increased by 24%, from 30,481 metres in 2007 to 37,944 metres in 2008. In addition to the ongoing diamond drill program, a total of 1,557 metres of underground development was completed in the fourth quarter of 2008 which when compared with the 4,347 metres in the third quarter of 2008 shows a decrease of 64%. During the year, a total of 10,457 metres were developed which compared with a total of 6,414 metres completed in 2007 shows an increase of 63%. Underground development in the fourth quarter focused on the La Rosa/Rosario, La Blanca, San Marcos, Quebradillas and San José areas, with the objective of increasing total Reserves and developing new production areas.

In February 2009, the Mexican Environmental Authority PROFEPA (Procuradoria Federal Proteccion al Ambiente) awarded a Clean Industry Certificate to the La Parrilla Silver Mine. This Certificate was achieved after twenty nine months of voluntary environmental audit work, which demonstrates the Company’s sustained focus in complying with international and Mexican mining standards.

San Martin Silver Mine

| Location: Jalisco, México | Ownership: 100% |

| Reserves/Resources (PP&MI): 14.6 million ounces | Monthly Capacity (Tonnes): 28,500 |

| Employment: 310 | 2008 Production (Silver Equiv.):1.0 million ounces |

| 2008 Production Costs ($US per Tonne): $38.90 | 2008 Cash Costs/Oz. ($US, excl. smelting): $10.12 |

The San Martin Silver Mine is a producing underground mine located adjacent to the town of San Martin de Bolaños, in Northern Jalisco State, México. The mine comprises approximately 7,840 hectares of mineral rights, approximately 1,300 hectares of surface land rights surrounding the mine and another 104 hectares of surface land rights where the 1,000 tpd cyanidation mill and 500 tpd flotation circuit, mine buildings and offices are located. The Company owns 100% of the San Martin Silver Mine, having acquired it in two transactions in May and September 2006. The mill has historically produced 100% doré bars and continues to do so to this day. In early 2008, a 500 tpd flotation circuit was completed to take advantage of the large sulphide Resource at this mine, however, due to low base metal prices and high concentrate smelting charges this circuit is presently not being operated.

During the fourth quarter, in order to reduce operating costs, the Company temporarily reduced the production of ore from the main Zuloaga vein, eliminating all the external contractors and focusing on a combination of ore from the mine and stockpile inventory to feed the cyanidation process. Also, due to the high cost of smelting charges and the low prices of lead and zinc, the operation of the flotation circuit was suspended.

Expansion of the mill commenced in July 2008. The program included adding additional leaching tanks, thickeners and the addition of a third ball mill. The plan was to expand this mill from the historic 800 tpd to 1,200 tpd by April 2009. However, due to market conditions and the need to preserve cash, the expansion program was suspended in November 2008 resulting in the mill running at the current 950 tpd since December 2008. The upgrades included the construction of a new thickener, new clarifiers and new filter presses to complete the expansion of the cyanidation process. Other upgrades completed included the pouring of cement floors around the leaching and thickeners areas and the repair and reinforcement of the older leaching tanks. These improvements are part of the process of achieving a “Clean Industry Certification” from PROFEPA.

11

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

Production at the San Martin mine increased from 56,071 tonnes in the third quarter of 2008 to 69,771 tonnes in the fourth quarter, an increase of 24% increase. The average head grade decreased slightly, from 127 g/t in the third quarter to 124 g/t during the current quarter, representing a 3% decrease from during the previous quarter.

Combined recoveries of silver in the quarter were 71%, compared to 89% in the previous quarter, resulting in total production of 212,315 equivalent ounces of silver, which is 3% higher than the 205,862 equivalent ounces of silver in the third quarter of 2008. The equivalent ounces of silver consisted of 196,681 ounces of silver, 106 ounces of gold, and 1,399 pounds of lead.

During the fourth quarter of 2008, a total of 1,419 metres of diamond drilling was completed. This is compared to 5,844 metres drilled in the third quarter amounting to a 76% decrease due to the decrease in exploration corporate wide.

During the fourth quarter, a total of 1,214 metres of underground development was completed compared with 2,297 metres of underground development in the third quarter. An important part of this development continues to be focused on access to the upper levels in the mine where oxide ores are present. During the fourth quarter, work continued at the new zone in the Rosario area where old workings continue to be rehabilitated with additional exploration work and some direct underground development. This activity is ongoing with the purposes of grade control; the development of additional Reserves and Resources; and exploration to define additional targets for future mine expansion.

Del Toro Silver Mine, Zacatecas, México (previously referred to as Chalchihuites Group of Properties)

| Location: Zacatecas, México | Ownership: 100% |

| Resources (MI): 20.9 million ounces | Employment: 50 |

The Del Toro Silver Mine is located 60 km to the southeast from the Company’s La Parrilla Silver Mine and consists of a 320 contiguous hectare land package which covers the old Perseverancia mine and the San Juan mine. In 2004, the Company entered into a number of option agreements and, based on encouraging exploration results in 2005 and 2006, in January 2007, the Company exercised its option to acquire the San Juan silver mine, and in June 2007 exercised its option to acquire the Perseverancia silver mine. During the year ended December 31, 2007, the Company acquired 100 hectares of surface rights covering the area surrounding the San Juan mine.

The Del Toro is an advanced stage development project that has undergone an aggressive drilling program since 2005 to explore the various areas of interest within the Del Toro property holdings. The Company has been extracting development ore from the mine and shipping it to its La Parrilla mill for mixing into La Parrilla’s production and for batch metallurgical testing.

On October 28, 2008, the Company announced drill results from hole SSJ-08 and the ongoing drilling program at the Del Toro. Holes SSJ-04 and SSJ-08 represent the discovery of a third deeper massive sulphide ore body which is 25 metres below the two other ore bodies discovered by previous drilling. Drill Hole SSJ-08 cut 62.05 metres (203.58 Ft) of 422 g/t Ag, 6.29% Pb, 6.78% Zn & 0.74 g/t Au.

The Perseverancia area is presently being upgraded and rehabilitated to increase production from the high grade chimney areas. During the fourth quarter, the upgrade of the shaft continued and construction and installation of a new 200 tpd head frame and new hoist was completed which will allow for an increase in production from this area in the following months.

Presently permitting is underway for the construction of a new mill at Del Toro. Assuming all permitting is completed by mid 2009, and funds are available for this project, a new 500 tpd mill is anticipated to be operating in the first half of 2010.

EXPLORATION PROPERTY UPDATES

Cuitaboca Silver Project, Sinaloa, México

The Company has an option to purchase a 100% interest in the Cuitaboca Silver Project, consisting of 5,134 hectares located in the State of Sinaloa, México, which contains at least six well known veins with sulphide mineralization carrying high grade silver. The veins within the property are known as the La Lupita, Los Sapos, Chapotal, Colateral-Jesus Maria, Mojardina and Santa Eduwiges. In October 2008, in an effort to reduce costs, the Company temporarily halted its activities at the Cuitaboca project. Further exploration and development consisting of 2,000 metres of direct drifting along the vein and a diamond drill program at both the Colateral and Mojardina veins is being deferred until silver commodity prices recover and/or funds can be allocated to this project. Road construction for access to the La Lupita, Los Sapos, Chapotal, and Santa Eduwiges veins was also deferred.

Jalisco Group of Properties, Jalisco, México

The Company acquired a group of mining claims totalling 5,131 hectares located in various mining districts located in Jalisco State, México. During 2008, surface geology and mapping began with the purpose of defining future drill targets; however, exploration has been discontinued pending an improvement in market conditions.

12

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

SELECTED ANNUAL INFORMATION

| Year ended

December 31 2008 $ |

Year ended

December 31 2007 $ |

Transitional year

Six months ended December 31, 2006 $ (1) |

||||

| Revenue | 44,324,887 | (2) | 42,924,920 | (2) | 12,754,965 | (2) |

| Mine operating earnings (loss) | 7,501,632 | 7,007,776 | (1,492,118) | |||

| Net loss for the period | (5,144,784) | (3) | (7,230,122) | (7,588,192) | ||

| Basic and diluted loss per share | (0.07) | (0.13) | (0.17) | |||

| Total assets | 231,159,649 | (4) | 185,002,851 | 185,361,654 | ||

| Total long term liabilities | 38,725,621 | (5) | 36,591,521 | (5) | 55,930,797 | (5) |

| (1) |

The Company changed its fiscal year end in 2006, from June 30 to December 31. The results disclosed for December 31, 2006, are for the six months then ended, as is required by Canadian GAAP. | |

| (2) |

During the year ended December 31, 2008, revenues increased by $1.4 million due to the ramping up of production at the La Parrilla and La Encantada Silver Mines. During the year ended December 31, 2007, revenues increased by $30.2 million over the revenues for the six month transitional year ended December 31, 2006. This increase is primarily due to the difference in volumes of production, and the comparison of one year to a six month period. In the year ended December 31, 2008, the Company shipped 3,590,202 ounces of silver equivalent compared to 3,461,650 ounces of silver equivalent during the year ended December 31, 2007. Increased production of silver has resulted from the ramping up of the La Parrilla mill, and the acquisition of San Martin in June 2006, and La Encantada in November, 2006. In the six months ended December 31, 2006, total silver revenues were attributed to 1,016,583 ounces of silver equivalent. | |

|

La Parrilla Silver Mine – During the year ended December 31, 2008, a total 246,166 tonnes of ore were processed with an average head grade of 234 grams per tonne of silver resulting in a total of 1,584,808 equivalent ounces of silver produced and 1,282,340 ounces of silver equivalent shipped. During the year ended December 31, 2007, a total of 179,411 tonnes of ore were processed with an average head grade of 204 grams per tonne of silver resulting in a total of 1,000,823 equivalent ounces of silver produced, and 986,390 ounces of silver equivalent shipped. During the six month period ended December 31, 2006, a total of 29,057 tonnes of ore were processed with an average head grade of 172 grams per tonne of silver resulting in a total of 110,114 equivalent ounces of silver produced. | ||

|

San Martin Silver Mine – During the year ended December 31, 2008, a total of 254,211 tonnes of ore were processed with an average head grade of 141 grams per tonne of silver resulting in a total of 1,008,948 equivalent ounces of silver produced and 778,561 ounces of silver equivalents shipped. For the year ended December 31, 2007, a total of 239,796 tonnes of ore was processed with an average grade of 171 grams per tonne of silver resulting in 1,217,065 ounces of silver equivalents, and 1,202,360 ounces of silver equivalents shipped. The San Martin mine and mill, over the six month period ended December 31, 2006, processed 128,175 tonnes of ore with an average grade of 192 grams per tonne of silver resulting in 725,055 ounces of silver equivalent. | ||

|

La Encantada Silver Mine – During the year ended December 31, 2008, 257,960 tonnes of ore were processed with an average head grade of 283 grams per tonne of silver resulting in a total of 1,636,242 equivalent ounces of silver produced and 1,529,301 ounces of silver equivalents shipped. During the year ended December 31, 2007, 1,366,377 equivalent ounces of silver were produced, and 1,272,810 ounces of silver equivalent were shipped, compared to 181,413 equivalent ounces of silver in the prior six month period ended December 31, 2006, which included production only for the months of November and December 2006. Net losses in these periods included non-cash stock based compensation expenses of $3,680,111 for the year ended December 31, 2008 compared to $3,865,689 for the year ended December 31, 2007 and $1,558,892 for the six month transition year ended December 31, 2006. | ||

| (3) |

There was a net income tax recovery of $1,919,454 in the year ended December 31, 2008 compared to a tax expense of $1,384,647 in the year ended December 31, 2007, attributed primarily to an increase in future income tax benefits as well as a reduction of non-allowable tax deductions. | |

| (4) |

During the year ended December 31, 2008, the increase in total assets consists primarily of approximately $5 million in cash and cash equivalents, $38 million on mining interests and plant and equipment, net of depletion, depreciation and translation adjustments. | |

| (5) |

During the year ended December 31, 2006, the Company paid $13.3 million for its 25% annual vendor liability to the majority shareholder of First Silver, and the final payment of $13.3 million was due on May 30, 2008 but the payment has been withheld pending resolution of the litigation further described herein (see Liquidity Risk below). | |

The Company has not paid any dividends since incorporation and it presently has no plans to pay dividends.

13

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

RESULTS OF OPERATIONS

Year ended December 31, 2008 compared to the Year ended December 31, 2007

Gross revenue (prior to smelting, refining and transportation costs) increased from $45.8 million for the year ended December 31, 2007 to $56.1 million for the year ended December 31, 2008, an increase of $10.3 million or 22%. Most of the increase was due to higher average silver prices, from US$12.33 per ounce in 2007 to US$14.66 per ounce in 2008, an increase of 19%, as shipments were only up marginally. Due to low metal prices at the end of 2008, the Company inventoried 554,000 ounces of production to be sold in 2009. Net revenue increased from $42.9 million for the year ended December 31, 2007 to $44.3 million for the year ended December 31, 2008, an increase of $1.4 million or 3%. The increase in commodity prices was not fully realized in 2008 net revenues due to a significant increase in smelter and refining charges, predominantly affecting concentrates sold to the Peñoles smelter.

Effective December 1, 2008, smelting and refining charges were substantially reduced. Subsequently, in February 2009, the Company entered into two new smelting agreements which further reduced smelting charges for doré and concentrate smelting. The Company is also shifting its mix of production toward doré production with the anticipated completion of the La Encantada cyanidation plant, which will reduce the overall smelting charges for the Company due to the significantly lower refining charges for doré compared to concentrates. Production for the year consisted of production from the mines and the mills including production which is inventoried in the form of doré, concentrates, ore in process and stockpile.

Mine operating earnings for the year ended December 31, 2008 was $7,501,632, an increase of 7% over the $7,007,776 of mine operating earnings for the year ended December 31, 2007 and is primarily due to the increase of 128,642 equivalent silver ounces sold in 2008 compared to 2007. Though there was an overall increase in average silver prices in 2008 compared to 2007, this was offset by the increase in smelter and refining charges and an increase in operating costs. There was an increase in depreciation and amortization expenses of $766,964 in 2008 compared to 2007 which were normal charges on plant and equipment related to capital expansions at all three operating mines. Also contributing to the increase in mine operating earnings is a reduction of $3,282,997 in depletion expense for 2008 due to the increase in life of mine from the updated NI 43-101 reports with larger mine reserves and a reduction of depletion due to the effect of inventorying a portion of depletion due to the adoption of the new Canadian GAAP inventory guidelines per CICA HB section 3031.

An operating loss of $3,727,558 was incurred after general and administrative costs and stock-based compensation, for the year ended December 31, 2008 compared to a loss of $4,318,816 for the year ended December 31, 2007 which is a 14% decrease from the prior year. Most of the decrease is attributed to the increase in mine operating earnings as described above and a decrease in stock-based compensation of $185,578 or 5%.

Interest and other expenses increased by $202,833 or 17% compared to the prior year and is primarily attributed to additional interest on capital leases. Investment and other income decreased by $177,424 or 13% from prior year due to declining interest rates on short term investments. There was a significant increase in foreign exchange loss, primarily in the fourth quarter, due to the effect of a strengthening US dollar on outstanding US dollar denominated liabilities, which has had a negative effect on net income for the year.

The income tax benefit recorded in 2008 was $1,919,454 which is the tax benefit attributable to the loss generated by the Company during the year. This compares to an income tax provision of $1,384,647 for 2007, based on the taxable income generated in that year.

The net loss for the year after taxes is $5,144,784 or $0.07 per common share in 2008 compared to $7,230,122 or $0.13 per common share in 2007, for a decrease of $2,085,338 and is primarily due to increased mine earnings in 2008 and to the write off of $1,703,591 in the prior year.

Fourth Quarter of 2008 compared to the Fourth Quarter of 2007

| Q4 2008 | Q4 2007 | |||

| $ | $ | |||

| Revenue | 9,106,605 | 11,631,477 | ||

| Mine operating (loss) earnings | (1,126,697 | ) | 3,229,142 | |

| Operating loss | (3,787,419 | ) | (345,596 | ) |

| Loss before taxes | (8,053,990 | ) | (524,397 | ) |

| Income tax (recovery) expense | (2,515,084 | ) | 768,234 | |

| Net loss for the quarter | (5,538,906 | ) | (1,292,631 | ) |

Sales revenue declined by 22% to $9,106,605, compared to $11,631,477 in the fourth quarter of 2007. In the fourth quarter of 2008, the Company also experienced declining silver prices, higher smelting and refining charges and negative sales adjustments related to provisionally priced sales in the previous quarter, as doré settles in one month and concentrates settle in two months from the time of delivery to the smelter. In the fourth quarter of 2008, the average gross revenue per ounce sold was US$11.67 while in the fourth quarter of 2007, it was US$13.85.

14

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

Mine operating loss for the fourth quarter of 2008 was $1,126,697 compared to mine operating earnings of $3,229,142 in the fourth quarter of 2007. Cost of sales increased to $8,294,803 in the fourth quarter of 2008, compared to $6,335,226 in the fourth quarter of 2007 due to the processing of lower grade ore and lower recoveries at all three mines. Amortization and depreciation expense increased by $408,189 to $1,049,767 in the fourth quarter of 2008, compared to $641,578 in the fourth quarter of 2007 due to increased investments in plant and equipment. There was a $636,626 reduction in depletion, which was $825,185 in the fourth quarter of 2008 compared to $1,461,811 in the fourth quarter of 2007, due to longer mine life related to updated NI 43-101 reports and the inventory effect of inventorying a portion of depletion due to the adoption of the new Canadian GAAP inventory rules per CICA HB section 3031.

General and administrative expenses decreased by $332,610 to $1,795,307 in the fourth quarter of 2008, compared to $2,127,917 in the fourth quarter of 2007, as the Company took measures to reduce expenditures and preserve cash. Stock-based compensation decreased by $581,406 to $865,415 in the fourth quarter of 2008, compared $1,446,821 in the fourth quarter of 2007, due to a lower number of options granted in the fourth quarter of 2008.

Operating loss was $3,787,419 in the fourth quarter of 2008 compared to $345,596 in the fourth quarter of 2007. This increased operating loss is primarily due to lower mine operating earnings for 2008 compared to 2007.

Loss before income tax was $8,053,990 for the fourth quarter of 2008, compared to $524,397 for the fourth quarter of 2007. Foreign exchange loss increased by $3,534,738, from $215,766 in the fourth quarter of 2007 to $3,750,504 in the fourth quarter of 2008, due to strengthening U.S. dollar relative to the Mexican peso and Canadian dollar. Interest and other expenses increased by $375,696, from $207,734 in the fourth quarter of 2007 to $583,430 in the fourth quarter of 2008, due to higher capital lease obligations in 2008. Lower interest on short-term investments gave rise to a $177,336 reduction in investment and other income, from $244,699 in the fourth quarter of 2007 to $67,363 in the fourth quarter of 2008.

The income tax benefit recorded in the fourth quarter of 2008 was $2,515,084 which is the tax benefit attributable to the loss generated by the Company during the period. This compares to an income tax provision of $768,234 for the fourth quarter of 2007, based on the taxable income generated in that period.

The net loss after taxes was $5,538,906 or $0.08 per share for the fourth quarter of 2008 compared to a net loss of $1,292,631 or $0.03 per share in the fourth quarter of 2007.

SUMMARY OF QUARTERLY RESULTS

The following table presents selected financial information for each of the last eight quarters.

| Quarter | Net sales revenues $ |

Net income (loss) after taxes $ |

Basic and diluted net income (loss) per common share $ |

Stock based compensation(1) $ |

Property write downs $ |

Note | |

| Year ended December 31, 2008 | Q4 | 9,106,605 | (5,538,906) | (0.08) | 865,415 | - | 2 |

| Q3 | 10,817,211 | (374,245) | (0.01) | 1,035,864 | - | ||

| Q2 | 11,436,889 | (296,956) | 0.00 | 670,616 | - | 3 | |

| Q1 | 12,964,182 | 1,065,323 | 0.02 | 1,108,216 | - | ||

| Year ended December 31, 2007 | Q4 | 11,631,477 | (1,292,631) | (0.03) | 1,446,821 | - | |

| Q3 | 10,288,478 | (2,070,082) | (0.04) | 723,992 | 1,703,591 | 4 | |

| Q2 | 10,846,344 | (729,658) | (0.01) | 775,532 | - | ||

| Q1 | 10,158,621 | (3,137,751) | (0.06) | 919,344 | - |

Notes:

| (1) |

Stock-based Compensation - the net losses are affected significantly by varying stock based compensation amounts in each quarter. Stock based compensation results from the issuance of stock options in any given period, as well as factors such as vesting and the volatility of the Company’s stock, and is a calculated amount based on the Black-Scholes Option Pricing Model of estimating the fair value of stock option issuances. |

| (2) |

In the quarter ended December 31, 2008, net sales revenue was negatively affected by declining silver prices and losses on final metals settlements, for which provisional payments had already been received. While the average gross revenue per ounce was US$14.66 for the year ended December 31, 2008, the average gross revenue per ounce for the fourth quarter of 2008 was US$11.67 per ounce. In addition, the strengthening U.S. dollar relative to the Mexican peso and Canadian dollar gave rise to a foreign exchange loss of $3.7 million in the fourth quarter of 2008. |

| (3) |

In the quarter ended June 30, 2008, the Company had a revision to its smelting charges imposed, resulting in an incremental charge and reduction of net sales of $1.9 million (US$1,852,830) in the quarter. Effective December 1, 2008, smelting and refining charges were reduced. In addition, in February 2009, the Company entered into two new smelting agreements which further reduced smelting charges for doré and concentrate. |

15

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

| (4) |

Write downs of mineral properties – net losses are impacted by managements’ decision not to pursue certain mineral properties. In the quarter ended September 30, 2007, management elected not to proceed with the acquisitions of the Candameña Mining District and accordingly, included a $1,703,591 one time write down of the carrying value of the Candameña mineral property to its estimated proceeds from disposal. |

Revenues Per Canadian GAAP (expressed in CDN$)

As required by Canadian GAAP, revenues are presented as the net invoiced revenues for delivered shipments of silver doré bars, and silver concentrates, including metal by-products of gold, lead and zinc, after having deducted refining and smelting charges. The following analysis provides the gross revenues prior to refining and smelting charges, and shows deducted smelting and refining charges to arrive at the net reportable revenue for the period per Canadian GAAP. Gross revenues are deducted by shipped ounces of equivalent silver to calculate the average realized price per ounce of silver sold.

| Quarter Ended | Year Ended | |||

| December 31, | December 31, | |||

| Revenue Analysis | 2008 | 2007 | 2008 | 2007 |

| $ | $ | $ | $ | |

| Gross revenues - silver dore bars and concentrates | 11,712,165 | 12,357,792 | 56,102,459 | 45,837,983 |

| Less: refining, smelting and transportation charges | (2,605,560) | (726,316) | (11,777,572) | (2,913,063) |

| Net revenue | 9,106,605 | 11,631,476 | 44,324,887 | 42,924,920 |

| Equivalent ounces of silver sold | 827,845 | 908,688 | 3,590,202 | 3,461,560 |

| Average gross revenue per ounce sold ($CDN) | 14.15 | 13.60 | 15.63 | 13.24 |

| Average exchange rate in the period ($US/$CDN) | 1.2123 | 0.9818 | 1.0660 | 1.0740 |

| Average gross revenue per ounce sold ($US) | 11.67 | 13.85 | 14.66 | 12.33 |

LIQUIDITY

At December 31, 2008, the Company had a working capital deficiency of $1,036,466 and cash and cash equivalents of $17,424,123 compared to working capital of $1,125,368 and cash and cash equivalents of $12,835,183 at December 31, 2007. Current liabilities at December 31, 2008 include the long-term vendor liability and associated interest relating to the acquisition of First Silver in the amount of $13,940,237. On July 22, 2008, the Company secured its outstanding vendor liability by entering into a Letter of Credit facility for $13,940,237, secured by cash and liquid short term investments. The Letter of Credit is revolving with annual expiry on July 22. The cash and short term investments earn market rates of interest from which the 0.5% per annum cost of the Letter of Credit is deducted and the net interest remitted to the Company. The Restricted Cash is segregated from operating cash as the funds are not accessible by the Company pending the litigation described in Liquidity Risk below. Also included in current liabilities at December 31, 2008 is the current portion of capital lease obligations of $1,584,477.

On March 25, 2008, the Company completed a public offering with a syndicate of underwriters issuing 8,500,000 Units at an issue price of $5.35 per Unit for net proceeds to the Company of $40,144,471. Each Unit consisted of one common share in the capital of the Company and one-half of one Common Share purchase warrant. Each whole Common Share purchase warrant entitles the holder to acquire one additional Common Share at a price of $7.00 expiring March 25, 2010. In addition, the Company received $1,398,566 pursuant to the exercise of 436,650 stock options and $31,875 pursuant to the exercise of 7,500 share purchase warrants during the year ended December 31, 2008.

During the year ended December 31, 2008, the Company made investments on its mineral properties of $24.5 million (2007 - $18.9 million), and on plant and equipment further expenditures of $14.9 million (2007 - $11.8 million) on a cash basis. In the fourth quarter of 2008, the Company took actions to reduce its rate of spending on exploration and development expenditures, reducing the number of drill rigs deployed from 22 early in the year to four by the end of the year. Although the Company has expended approximately US$10.5 million to date on its capital expansion at La Encantada, this is expected to be a US$21.6 million capital expansion that would increase capacity to 3,500 tonnes per day.

On March 5, 2009, the Company completed a public offering with a syndicate of underwriters who purchased 8,487,576 units at an issue price of $2.50 per unit for gross proceeds to the Company of $21,218,940. Each unit consisted of one common share in the capital of the Company and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one additional common share at a price of $3.50 until March 5, 2011. The underwriters have an option, exercisable up until 30 days following closing of the offering, to purchase up to an additional 1,273,136 common shares at a price of $2.40 per share and up to an additional 636,568 warrants at a price of $0.20 per warrant. The Company plans to use $15.5 million of the net proceeds of the offering for mill construction and mine improvements at the La Encantada Silver Mine and the remainder for general working capital.

Funds surplus to the Company’s short-term operating needs are invested in highly liquid short-term investments with maturities of three months or less. The funds are not exposed to any liquidity risk and there are no restrictions on the ability of the Company to meet its obligations. The Company has no exposure and has not invested any of its treasuries in any asset backed commercial paper securities. See “Liquidity Risk” below.

16

FIRST MAJESTIC SILVER CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND THE FOURTH QUARTER ENDED DECEMBER 31, 2008

2009 OUTLOOK

This section of the MD&A provides management’s production and costs forecasts for 2009. We also discuss the major capital projects planned for the La Encantada mine in 2009. These are forward-looking estimates and subject to the cautionary note regarding the risks associated with forward looking statements at the beginning of this MD&A.

| PRODUCTION DATA | La Encantada | La Parrilla | San Martin | Consolidated |

| Tonnes Milled | 611,800 | 275,358 | 307,753 | 1,194,911 |

| Silver head grades (grams/tonne) | 212 | 250 | 150 | 205 |

| Silver recoveries | 60% | 75% | 80% | 68% |

| Silver ounces | 2,572,301 | 1,604,776 | 1,187,470 | 5,364,547 |

| Gold ounces | 15 | 465 | 1,187 | 1,667 |

| Lead tonnes | 944 | 1,322 | - | 2,266 |

| Silver equivalent ounces (1) | 2,668,627 | 1,769,154 | 1,266,625 | 5,704,406 |

| AVERAGE COSTS | ||||

| Production costs per ounce (US$) | 4.71 | 6.83 | 9.10 | 6.40 |

| Smelting/refining per ounce (US$) | 1.38 | 1.23 | 0.28 | 1.09 |

| Transport and marketing per ounce (US$) | 0.17 | 0.18 | 0.16 | 0.17 |

| Production costs per tonne (US$) | 21.72 | 39.79 | 35.10 | 28.84 |

(1) Pricing assumptions for equivalents – Au = US$800/oz., Pb = US$0.55/oz. , Zn = US$0.50/oz.

Silver production is expected to increase in mid 2009 when the La Encantada plant expansion is completed and plant capacity has been increased from 1,000 tpd to 3,500 tpd. The Company expects to gradually bring the new cyanidation plant into production beginning with production of 1,000 tpd in the first month, 2,000 tpd in the second month, 3,000 tpd in the third month, and achieving full capacity of 3,500 tpd in the fourth month of production.

Capital expenditures at the La Encantada mine are expected to amount to US$21.6 million upon completion in mid-2009.

Cash costs are expected to remain constant due to foreign exchange translation effects on domestic peso based costs which when translated into US dollars have shown a decrease from earlier in 2008. The Company estimates that 65% of the production costs are in pesos, and 35% are denominated in U.S. dollars.

Smelting and refining charges are expected to decrease in 2009 due to new refining and smelting agreements entered into in February 2009 for doré and concentrate production. With the shift in production at the La Encantada mine, the mix of doré to concentrate production will increase from 49% to 92% by the fourth quarter of 2009.

Sales of coins, ingots and bullion will increase in the year from 5% of production in Q1/09, to approximately 10% by the end of Q2/09 and will remain at that level for the balance of 2009. These sales result in approximately a 10% increase in selling price over normal quoted selling prices in any quarter. Additional information on the Company’s silver coins, ingots and bullion, including how to place an order, may be found on the Company’s website at www.firstmajestic.com.

OFF-BALANCE SHEET ARRANGEMENTS

At December 31, 2008, the Company had no material off-balance sheet arrangements such as guarantee contracts, contingent interest in assets transferred to an entity, derivative instruments obligations or any obligations that generate financing, liquidity, market or credit risk to the Company, other than those disclosed in this MD&A and the audited consolidated financial statements and the related notes.

RELATED PARTY TRANSACTIONS

During the year ended December 31, 2008, the Company:

| (a) |

incurred $248,025 (2007 - $197,696) for management services provided by the President & CEO and/or a corporation controlled by the President & CEO of the Company pursuant to a consulting agreement. |

| (b) |

incurred $310,920 (2007 - $478,206) to a director and Chief Operating Officer for management and other services related to the mining operations of the Company in México pursuant to a consulting agreement. |

| (c) |

incurred $8,010,843 (2007 - $1,728,222) of service fees with a mining services company sharing our premises in Durango México. This related party provides management services and pays mining contractors who provide services at the Company’s mines in México. Of the fees incurred, $3,122,130 was unpaid at December 31, 2008 (December 31, 2007 - $94,724). This relationship was terminated in February 2009. |

| (d) |

incurred $7,365 (2007- $254,742) to a director of the Company as finder’s fees upon the completion of certain option agreements relating to the Del Toro Silver Mine. |

| (e) |