Technical Report for the

La Encantada Silver

Mine

Coahuila State, México

Prepared for

First Majestic Silver Corp.

January 12,

2009

90533

AMENDED AND RESTATED

February 26, 2009

Prepared by

Pincock, Allen &

Holt

Richard Addison, P.E.

Leonel

López, C.P.G.

1.0 TITLE PAGE

This technical report has been prepared in accordance with the National Instrument 43-101 standards of disclosure for mineral projects (“NI 43-101”) and the contents herein are organized and in compliance with form 43-101F1 contents of the technical report (“43-101F1”). This technical report is an update of Technical Report Amended for the La Encantada Silver Mine, Coahuila State, México; which was prepared for First Majestic Silver Corp. dated March 19, 2008 and published in SEDAR in March 28, 2008. The first two items are the title page and table of contents that are presented previously in this report and are simply mentioned herein to maintain the specific report outline numbering contained in form 43-101F1 contents of the technical report.

| Pincock, Allen & Holt | REVISED | 1.1 |

| 90533 February 26, 2009 |

2.0 TABLE OF CONTENTS

See discussion in Section 1.

| Pincock, Allen & Holt | REVISED | 2.1 |

| 90533 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | i |

| 90533 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | ii |

| 90533 February 26, 2009 |

TABLES

| Pincock, Allen & Holt | REVISED | iii |

| 90533 February 26, 2009 |

FIGURES

| Pincock, Allen & Holt | REVISED | iv |

| 90533 February 26, 2009 |

| Pincock, Allen & Holt | REVISED | v |

| 90533 February 26, 2009 |

3.0 EXECUTIVE SUMMARY

First Majestic Silver Corp. (FMS) retained Pincock, Allen and Holt (PAH), a division of Australia-based Runge, Inc. to prepare a Technical Report for the silver/lead/zinc deposit of La Encantada Silver Mine located in the Municipality of Ocampo, Coahuila State, and México. This report is an update of Technical Report Amended of March 19, 2008, which was prepared by PAH and published in SEDAR in March 28, 2008. This report is presented to document material change in La Encantada Silver Mine due to an increment of reserves (+183 percent) and resources (measured and indicated -17 percent and inferred +51 percent). This report meets the requirements and is compliant with NI 43-101 and conforms to Form 43-101F1 for technical reports.

La Encantada Silver Mine is owned and operated by Minera La Encantada, S.A. de C.V., wholly-owned Mexican subsidiary of FMS. La Encantada Silver Mine consists of an industrial complex that includes underground silver/lead/zinc mining, a flotation ore processing plant, water wells and pipeline, airport, housing, camp facilities and a new cyanidation plant under construction to process silver tailings. The La Encantada mine was operated by Peñoles for a period of about 25 years, until June 2002. Desmín leased the property from Peñoles and operated the mine and processing plant from July 1, 2004 until November 1, 2006 when Desmín was acquired by FMS. During January to September, 2008 FMS has mined out 178,480 tonnes at an average grade of 297 g/tonne Ag and 2.29 percent Pb.

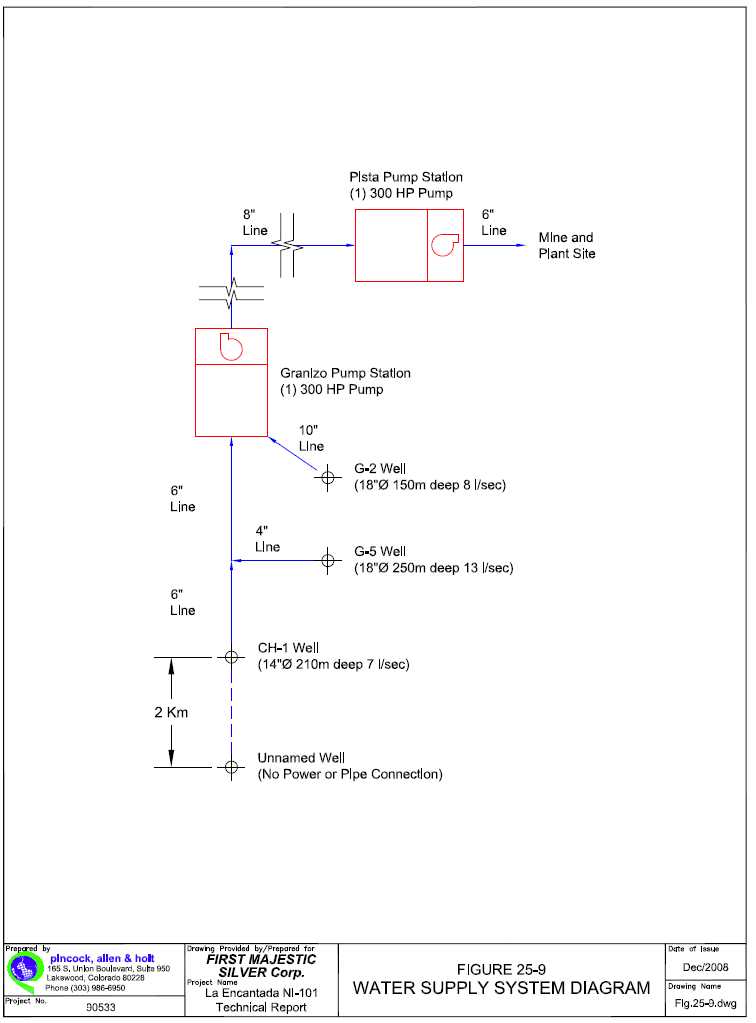

FMS owns mining rights that cover 2,237 hectares (5,227 acres) within 18 titled concessions and 3 approved claim applications, in addition to 2 other applications under review by the Mines Department. Minera La Encantada has acquired, from the Ejido Tenochtitlán, Municipality of Ocampo, under expropriation regulations, surface land ownership of 1,343 hectares (3,319 acres) where mine, plant, housing, camp and associated facilities are installed. It also owns the surface rights, installations and water rights for two water wells at El Granizo, which supply La Encantada water needs.

Estimated proven and probable reserves and measured and indicated resources for La Encantada, as of September 30, 2008, are presented in Table 3-1. These include proven and probable reserves of 5.2 million tonnes at 208 g/tonne (6.7 oz) Ag, and 2.42 percent (53 lb/tonne) Pb, for a total contained silver equivalent, inclusive of Pb credit, of 35.5 million ounces. These reserves include 4 million tonnes of tailings at an average grade of 168 g/tonne silver, estimated at a Cut-off Grade of 111 g/tonne silver.

La Encantada reserves have been estimated at a Cutoff Grade of 250 g/tonne Ag only and 228 g/tonne Ag equivalent net of Pb credit. The La Encantada proven and probable reserves in hard rock include 1.2 million tones at an average grade of 343 g/tonne silver and 2.39 percent lead.

During the period of January through September, 2008 FMS mined 178,480 tonnes of ore, which included 70,000 tonnes from reserves, in addition of other minerals extracted from different areas of the mine for a total of 108,480 tonnes. To September 30, 2008, the La Encantada exploration programs and underground development increased reserves by approximately 183 percent over the 2007 estimates.

| Pincock, Allen & Holt | REVISED | 3.1 |

| 90533 February 26, 2009 |

TABLE 3-1

First Majestic

Silver Corp.

Minera La Encantada, S.A. de

C.V.

La Encantada Mine

Mineral Reserves Prepared by FMS, Reviewed

by PAH as of September 30, 2008 (1)

| Total Reserves Proven plus Probable (3) | ||||||||

| DEPOSIT | CATEGORY | METRIC TONNES | WIDTH | GRADE | METAL CONTAINED (2) | |||

| La Encantada | Reserves | Tonnes | meters | Silver, g/tonne | Lead, % | Zinc, % (4) | Silver (Only) oz. | Silver (Eq) oz. |

| Total | Proven | 683,992 | Over 2.00 | 354 | 2.23 | 0.92 | 7,777,602 | 8,261,401 |

| Total | Probable | 4,511,686 | Over 2.00 | 186 | 2.45 | 2.54 | 26,936,651 | 27,287,462 |

| Total Reserves Proven + Probable | 5,195,677 | Over 2.00 | 208 | 2.42 | 2.33 | 34,714,253 | 35,548,863 | |

| Total Resources Measured plus Indicated (3) | ||||||||

| TOTAL | Measured | 445,650 | Over 2.00 | 399 | 4.15 | 0.65 | 5,710,055 | 6,025,271 |

| TOTAL (5) (6) (7) | Indicated | 4,931,103 | Over 2.00 | 156 | 1.15 | 0.87 | 24,774,263 | 27,082,017 |

| Total Resources Measured + Indicated | 5,376,753 | Over 2.00 | 176 | 1.40 | 0.85 | 30,484,318 | 33,107,288 | |

| TOTAL PROVEN AND PROBABLE RESERVES PLUS MEASURED AND INDICATED RESOURCES | ||||||||

| TOTAL PROVEN PLUS PROBABLE RESERVES AND MEASURED AND INDICATED RESOURCES (8) | 10,572,000 | Over 2.00 | 192 | 1.90 | 1.58 | 65,199,000 | 68,700,000 | |

(1) Cut Off Grade estimated as250 g/tonne Ag only;

and 228 g/tonne Ag eq net of Pb credit. Estimated Reserves are exclusive of

Resources.

(2) Silver equivalent includes Pb credit, at

prices US$12.00/oz -Ag, $0.75/lb -Pb. Pb credit=22 g/tonne -Ag.

(3) Mining dilution is included at over 2.00m width. Estimates do not

include mining recovery.

(4) Zinc is not

recovered.

(5) Dump stockpile is considered as measured

resource because the average grade is below COG - 203 g/tonne Ag only and 186

g/tonne Ageq, however with pre-screening may be processed. It requires of

additional testing.

(6) La Morena sulfide deposit

requires additional metallurgical testwork to prove its economic recovery. La

Encantada mill does not have an operating zinc circuit at this

time.

(7) Tailings are included within Indicated

Resources due to required additional testwork and grade below Cutt Off Grade -

111 g/tonne Ag.

(8) Rounded figures.

| Total Inferred Resources (1) (2) (3) | ||||||||

| Azul y Oro ext. al SW | Inferred | 194,163 | 10.85 | 454 | 0.49 | 0.66 | 2,834,270 | 2,971,423 |

| Azul y Oro | Inferred | 97,164 | 2.27 | 434 | 0.93 | 0.38 | 1,355,502 | 1,424,141 |

| Dk. San Fco | Inferred | 27,065 | 2.06 | 390 | 8.28 | 2.43 | 339,668 | 358,789 |

| Reb 325 | Inferred | 2,196 | 2.03 | 359 | 7.06 | 0.00 | 25,352 | 26,904 |

| Buenos Aires | Inferred | 561,824 | 3.40 | 339 | 0.50 | 0.59 | 6,122,831 | 6,519,825 |

| San Francisco | Inferred | 186,000 | 2.40 | 304 | 0.64 | 0.14 | 1,818,049 | 1,949,492 |

| Sn. Javier. Ext | Inferred | 171,509 | 1.95 | 223 | 4.67 | 3.95 | 1,230,504 | 1,351,736 |

| Bonanza | Inferred | 22,000 | 2.77 | 220 | 1.12 | 1.12 | 155,620 | 171,171 |

| Breccia San Javier | Inferred | 1,015,000 | Over 2.00 | 105 | 0.57 | 0.78 | 3,426,686 | 4,144,392 |

| Intrusivo Milagros | Inferred | 280,000 | 2.00 | 102 | 0.00 | 0.00 | 918,284 | 1,116,274 |

| TOTAL (4) (5) | Inferred | 2,557,000 | Over 2.00 | 220 | 1.00 | 1.00 | 18,226,765 | 20,034,145 |

(1) Cut Off Grade estimated as250 g/tonne Ag only;

and 228 g/tonne Ag eq net of Pb credit. Estimated Reserves are exclusive of

Resources.

(2) Silver equivalent includes Pb credit, at prices US$12.00/oz

-Ag, $0.75/lb -Pb. Pb credit=22 g/tonne -Ag.

(3) Mining dilution is included at over 2.00m width. Estimates do not include

mining recovery.

(4) Zinc is not recovered.

(5) Rounded figures.

| Pincock, Allen & Holt | REVISED | 3.2 |

| 90533 February 26, 2009 |

These were estimated from the following areas: Breccia Milagros, Azul y Oro, Breccia Keylor, Cuerpo 660 E, Cola de Gallo, Bonanza, La Piedra, Breccia San Javier, Dique San Francisco, San Francisco, Jorobada, Rebaje 141, Rebaje and Ojuela Ampliación zones in addition to the Tailings Dam No. 1. Most of these deposit areas remain opened for exploration and development; for instance, Breccia Milagros appears to represent a significant deposit, the full extent of which is still unknown to FMS.

Measured and indicated resources to September 30, 2008 at La Encantada amount to 5.4 million tonnes at 176 g/tonne (5.7 oz) Ag and 1.40 percent (31 lb/tonne) Pb, for a total contained silver equivalent, inclusive of Pb credit, of about 33.1 million ounces. These resources include 1.6 million tonnes of tailings at an average grade of 76 g/tonne (2.4 oz/tonne). Preliminary testwork appears to indicate amenability and probable economic recovery of silver values from the tailings by cyanide leaching processing. Additional bulk testing is recommended to validate and confirm the resource. These resources represent a decrease of about 17 percent over the resources estimated for 2007 in silver equivalent ounces to 33.1 million, due to upgrade of tailings dam No. 2 to probable reserves.

Additional inferred resources have been estimated by FMS at La Encantada. The inferred resources require additional grade and tonnage information before they may be upgraded to indicated or measured resources. They represent geologic potential to be further investigated. La Encantada has estimated inferred resources that amount to about 2.6 million tonnes at an average grade of 220 g/tonne (7.0 oz/tonne) Ag and 1.0 percent (22 lb/tonne) Pb, for a total estimated content of silver equivalent, inclusive of Pb credit, of about 20.0 million ounces. This estimate represents an increment of 51 percent over the reported resources for 2007.

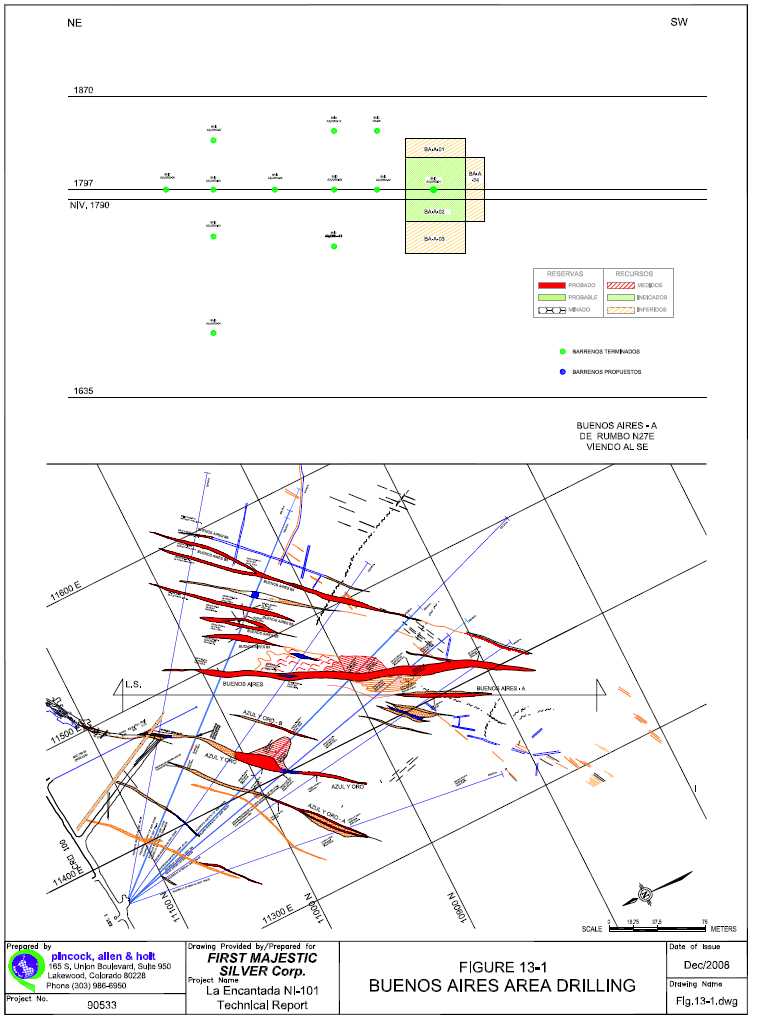

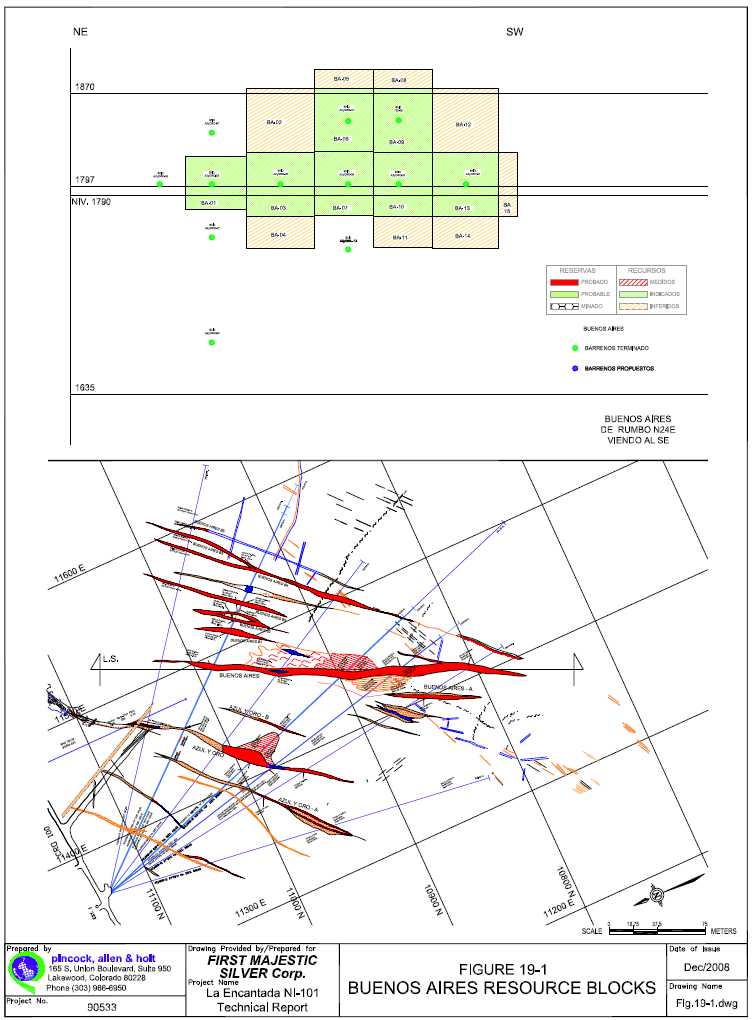

During the La Encantada 2008 exploration drilling program a new mineralized zone was discovered at the 1790 mine level. This zone has been denominated the Buenos Aires zone and delineated with 15 drill holes resulting in about 536,000 tonnes of Indicated Resources at an average grade of 395 g/tonne Ag (7.2 million ounces of silver equivalent) and 560,000 tonnes of Inferred Resources at an average grade of 339 g/tonne Ag (6.5 million ounces of silver equivalent). Silver equivalent includes Pb credits.

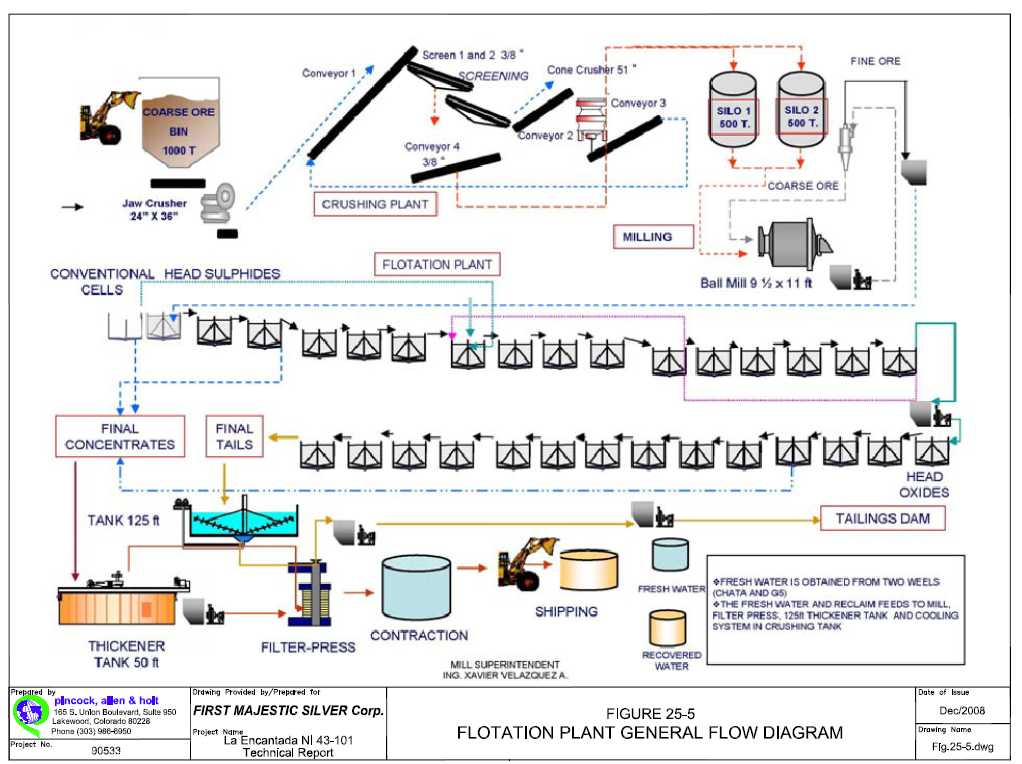

Processing flotation plant facilities have an installed capacity of 800 tonnes per day. It includes all supporting facilities, including laboratory, maintenance, etc. The metallurgical current plant average operating rate is about 800 tonnes per day. About three quarters of the ore comes from the mine and the other quarter from upgraded waste dump rock that has been screened to reject the coarser lower-grade fraction.

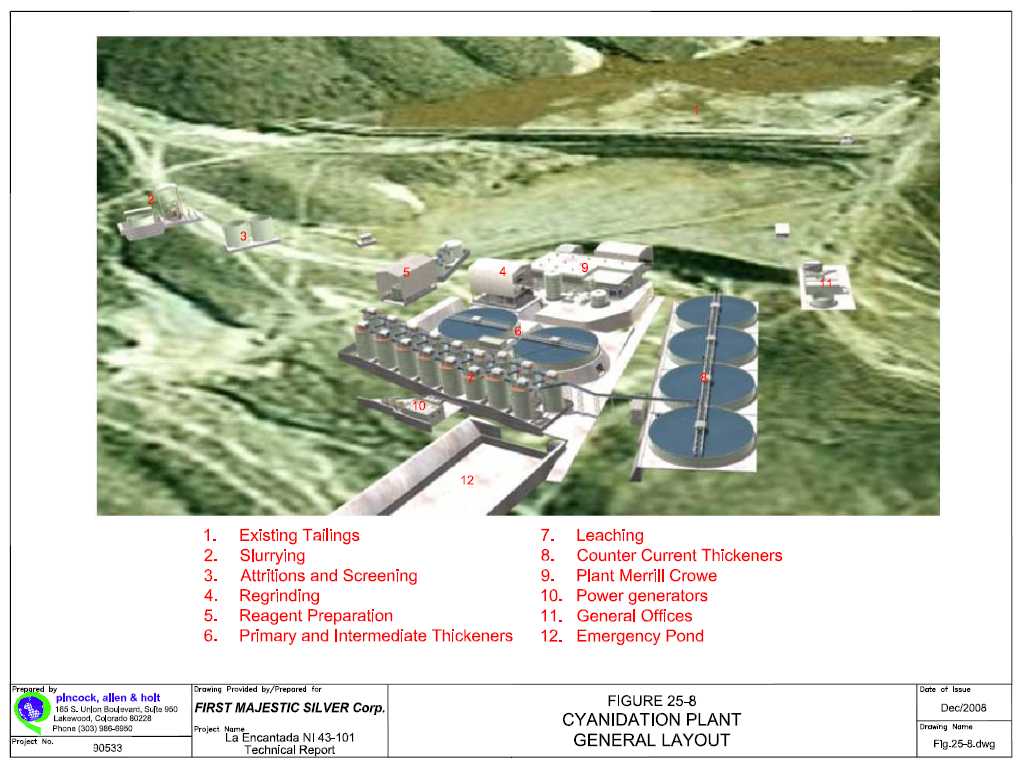

FMS is presently building, on a site about 1-1/2 kilometers from the existing flotation plant, a cyandiation plant with a capacity of 3,500 tonnes per day. The plant will process the ore and waste dump rock that is currently processed through the flotation plant in conjunction with reclaimed tailings. The plant is scheduled to commence operation in April 2009. PAH considers the FMS production and cost projections for this operation optimistic, but these parameters will only be clearly established when it has been in operation for six month or more.

| Pincock, Allen & Holt | REVISED | 3.3 |

| 90533 February 26, 2009 |

The surface rights to La Encantada Silver Mine are mostly owned by Minera La Encantada (a wholly owned subsidiary of FMS). According to La Encantada, there is a good working relationship with people of the Ejido Tenochtitlán from which the surface rights were purchased by La Encantada, and with the town of Múzquiz, since many of the inhabitants are employed in the exploration or mining operations. No labor or access problems have been reported by La Encantada within the area.

La Encantada was declared in suspension of activities by Peñoles in 2003. In April 24, 2007 La Encantada presented a notification of reactivation of operations at the mine to the National Water Commission (C.N.A.), to SEMARNAT, to Secretaría del Trabajo y Previsión Social, and to PROFEPA. In accordance with legal opinion of October 31, 2008 by Mr. Carlos Galván Pastoriza, La Encantada mining operations are currently and have always been conducted in compliance with all applicable laws and regulations.”

PAH is not aware of any environmental liabilities in La Encantada mining district; most of the area covered by La Encantada concessions is mining and prospective land for mineral exploration and mine development. Mr. José Luis Hernández Santibañez, Corporate Manager of Environmental and Permitting for FMS provided PAH with a document dated October 31, 2008 showing the list of Environmental and Operating Permits for La Encantada in current good standing.

PAH believes that La Encantada reserve and resource estimates have been reasonably prepared and conform to acceptable engineering standards for reporting of reserves and resources. PAH believes that the classification of the reserves and resources meets the standards of Canadian National Instrument NI 43-101 and the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

The reserves and resources herein reported by La Encantada were reviewed by PAH and constitute part of an operation by Minera La Encantada, a Mexican subsidiary of FMS. There is no significant technical, legal, environmental, political or other kind of restrictions; therefore, in PAH’s opinion, these reserves and resources are exclusive of each category and may not be materially affected by issues that could prevent their extraction and processing.

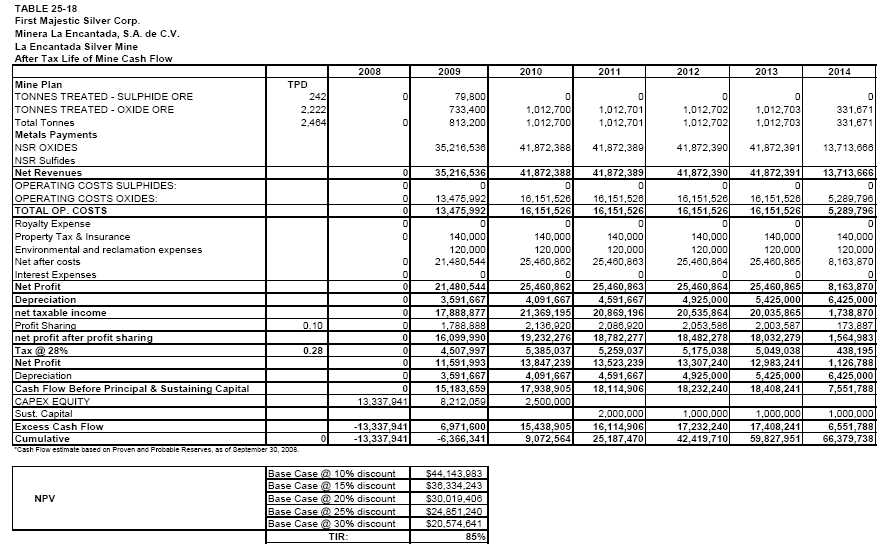

An economic analysis of La Encantada operation shows positive economics as measured by a cash flow model, and thus the postulated reserve position is accepted. La Encantada Silver Mine shows a net present value of $67 million at a 10 percent discounted rate of return. Table 3-2 presents a summary of

TABLE 3-2

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Economic Analysis Results as of September 30, 2008

| DCFRR, Discount, % | Net Present Value, US $ | |

| 10 | $ | 44,143,983.00 |

| 15 | $ | 36,334,243.00 |

| 20 | $ | 30,019,406.00 |

| 25 | $ | 24,851,240.00 |

| 30 | $ | 20,574,641.00 |

| TIR: | 85% |

| Pincock, Allen & Holt | REVISED | 3.4 |

| 90533 February 26, 2009 |

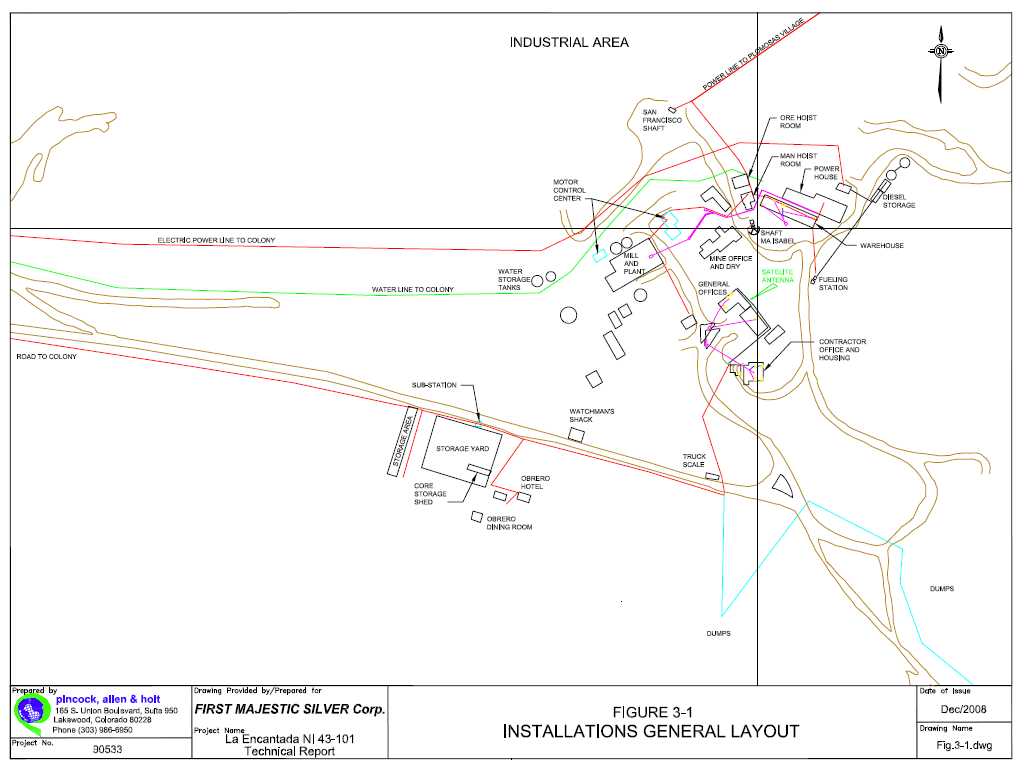

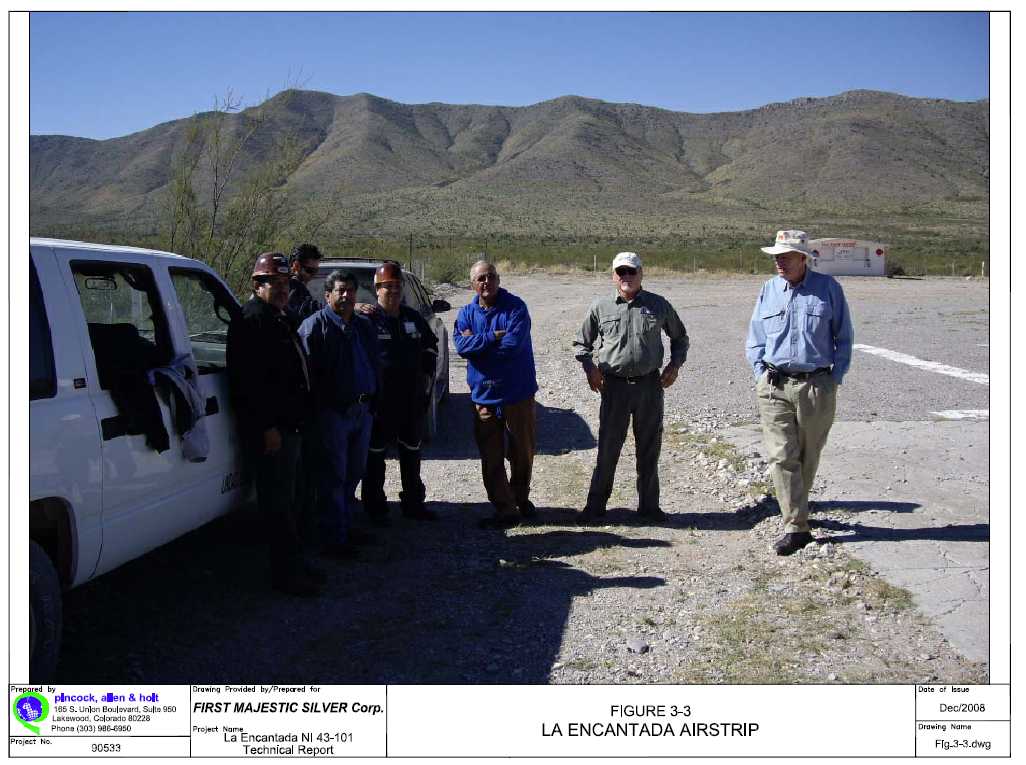

La Encantada cash flow based on current reserves/resources estimates. Figure 3-1 shows the installations general layout, Figure 3-2 shows the underground mine, and Figure 3-3 shows the mines airstrip.

| Pincock, Allen & Holt | REVISED | 3.5 |

| 90533 February 26, 2009 |

4.0 INTRODUCTION

First Majestic Silver Corp. (FMS) retained Pincock, Allen and Holt (PAH) to prepare a Technical Report of exploration activities and results obtained to this date, which represent a material change in the resources and reserves for the silver/lead/zinc deposit of La Encantada Silver Mine located in the Municipality of Ocampo, Coahuila State, México. This report is an update of Technical Report for the La Encantada Silver Mine, Coahuila State, México, prepared for First Majestic Silver Corp. dated March 19, 2008, Amended by Pincock, Allen & Holt, Inc., and was published in SEDAR on March 28, 2008, and it is referred to as Technical Report Amended herein.

The objective of this Technical Report is to provide FMS with a report that will follow existing regulations in Canada. This report presents a material change of the property due a significant increment of reserves including some tailings (+183 percent) and resources (M+I=-17 percent and Inferred=+51 percent) over the estimates reported for 2007. This report meets the requirements and is compliant with NI 43-101 and conforms to Form 43-101F1 for technical reports.

4.1 Qualified Person and Participating Personnel

The principal author of this report is Leonel López, a Certified Professional Geologist (AIPG-CPG-08359), Registered Professional Geologist in the State of Wyoming (PG-2407), a Registered Professional Member of The Society of Mining Engineers (No.1943910) and a PAH Principal Geologist. Mr. López has visited the site during the periods of May 18–23, November 13–18, 2007 and October 28-31, 2008, to review current status of the property. Mr. López also carried out exploration activities for the La Encantada mine as Peñoles Exploration North Division Manager in the 1980s. Mr. López reviewed available information on the La Encantada mine to update the reported areas where material changes have occurred during the period from July 2007 to September 30, 2008 regarding the mining rights, land tenure, history, environmental concerns, and all aspects of the geology, and reviewed drilling core and results, sampling, data verification and projected resources. Mr. López also reviewed drilling, sampling, volume estimates and location of the two tailings deposits that FMS is preparing for re-processing by cyanidation. Dick Addison reviewed methods and processing plant for La Encantada silver/lead/zinc deposit including research results for cyanidation of the silver tailings and plans for on going construction of a cyanidation plant. Other PAH members collaborated in the review of FMS’s tailings deposits modeling to confirm volumes and grade estimates, as well as the reserve estimates, mine planning and safety aspects of the operation.

4.2

Term and Definitions

La Encantada Silver Mine consists of silver/lead/zinc oxidized mineral deposits located in the State of Coahuila, México. La Encantada mine comprises numerous mineral concentrations within the underground development area, including some exhausted deposits and additional geologic potential in other areas. Some of the known deposits within the La Encantada area are the following:

| Pincock, Allen & Holt | REVISED | 4.1 |

| 90533 February 26, 2009 |

In this report:

FMS refers to First Majestic Silver Corp.

Desmín refers to Desmín, S.A. de C.V., a wholly-owned subsidiary of FMS.

PAH refers to Pincock, Allen & Holt, Inc., a Division of Runge, Inc., and its representatives.

Peñoles refers to Industrias Peñoles, S.A. de C.V., MET-MEX Peñoles and Grupo Peñoles.

La Encantada Silver Mine refers to the operating underground mine, processing plant and infrastructure facilities that constitute this industrial complex (also referred to as La Encantada mine or La Encantada).

Technical Report for the La Encantada Silver Mine, Coahuila State, México, prepared for First Majestic Silver Corp. dated March 19, 2008, Amended by Pincock, Allen & Holt, Inc., and was published in SEDAR on March 28, 2008, is referred to as “Technical Report Amended” herein.

Minera La Encantada refers to the operating company and wholly owned subsidiary of First Majestic Silver Corp.

Resource and Reserve definitions are as set forth in the CIM Definitions Standards dated December 15, 2005.

| Pincock, Allen & Holt | REVISED | 4.2 |

| 90533 February 26, 2009 |

4.3

Units

All units are carried in metric units, unless otherwise noted. Grades are described in terms of percent (%) or grams per metric tonne (gptonne, g/tonne), with tonnages stated in metric tonnes. Salable metals are described in terms of tonnes, or troy ounces (precious metals) and percent weight.

Unless otherwise stated, Dollars are US Dollars. The following abbreviations are used in this report:

| Abbreviation | Unit or Term |

| Al2O3 | Alumina |

| ANFO | Ammonium nitrate/fuel oil |

| ASTM | American Society for Testing and Materials |

| Sb | Antimony |

| Ag | Silver |

| As | Arsenic |

| Au | Gold |

| Bi | Bismuth |

| Cd | Cadmium |

| Co | Cobalt |

| Cu | Copper |

| In | Indium |

| Fe | Iron |

| g/t | Grams Per Tonne |

| kcal | Kilocalories |

| kg | Kilograms |

| km | Kilometer |

| k | Thousands |

| Pb | Lead |

| LOM | Life of Mine |

| Mn | Manganese |

| Hg | Mercury |

| m | Meters |

| masl | Meters Above Sea Level |

| mm | Millimeters |

| MT | Million Tonnes |

| mtpd | Metric tonnes per day |

| mtpy | Million tonnes per year |

| NPV | Net Present Value |

| Ni | Nickel |

| Pincock, Allen & Holt | REVISED | 4.3 |

| 90533 February 26, 2009 |

| % | Percent by weight |

| Patio | Yard, court or stocking ground |

| Se | Selenium |

| SiO | Silica |

| Sn | Tin |

| T or t | Metric Tonne (2,204 lbs), tonne |

| Te | Tellurium |

| Ti | Titanium |

| tpa | Tonnes per annum |

| tpy | Tonnes per year |

| tpd | Tonnes per day |

| ug | Underground |

| Wo | Tungsten Oxide |

| Zn | Zinc |

| $ | United States Dollars |

| C$ | Canadian Dollars |

4.4 Source Documents

The source documents for this report are summarized in Section 23.

| Pincock, Allen & Holt | REVISED | 4.4 |

| 90533 February 26, 2009 |

5.0 RELIANCE ON OTHER EXPERTS

This report was prepared for First Majestic Silver Corp. (FMS) by the independent consulting firm Pincock, Allen & Holt, Inc. (“PAH”) and is based in part on information prepared by other parties. PAH has relied primarily on information provided as part of the following reports, investigations and operating results:

|

Technical Report for the La Encantada Silver Mine Amended, Coahuila State, México (Technical Report Amended). Prepared for First Majestic Silver Corp. Prepared by Pincock, Allen & Holt, Inc., March 18, 2008, and published in SEDAR on March 28, 2008. | ||

|

Technical Report for the La Encantada Silver Mine Amended, Coahuila State, México (Technical Report Amended). Prepared for First Majestic Silver Corp. Prepared by Pincock, Allen & Holt, Inc., July 24, 2007, and published in SEDAR on July 25, 2007. | ||

|

Resource and Reserve Estimates by FMS for La Encantada Silver Mine. Prepared by FMS staff and reviewed by PAH, October 31, 2007 and September 30, 2008. | ||

|

Resource/Reserve Estimates of the La Encantada Tailings dams No. 1 and 2 based on manual estimations and checked by GEMCOM Geologic modeling. It includes surveying, drilling, cross sections, volumes, tonnage and grade estimates. Prepared by FMS and PAH staff. October and November, 2007 respectively. | ||

|

Peñoles (Largest Silver producer in the World) information as owner and operator of La Encantada mine for a period of 25 years, including public records, operating reports, geological studies, surveying, sampling data, drilling, geologic modeling and resource estimates, production records and historical reserve estimates as of January 2003. It includes the following reports: | ||

|

Plan y Programa de Exploración 2001–2002. Prepared by Ing. Pantaleón Trejo, Manager of Explorations for Mining Operations, Peñoles. June 2002. | ||

|

Desglose de Mineral Probado y Probable por Cuerpos para 2003. Prepared by: Minera La Encantada, S.A. de C.V., Ing. Pantaleón Trejo, Manager of Explorations for Mining Operations, Peñoles. | ||

|

Relación de Fundos Mineros Minera La Encantada, S.A. de C.V., Unidad David Contreras. Prepared by Minera La Encantada, Peñoles. Febrero 2007. This report was updated by FMS including additional claims in May 2007. | ||

|

Database and modeling files for the La Encantada deposits by Peñoles. Provided to FMS in April 2007. | ||

| Pincock, Allen & Holt | REVISED | 5.1 |

| 90533 February 26, 2009 |

|

Legal Opinion–Minera La Encantada, S.A. de C.V., a wholly owned subsidiary of First Majestic Silver Corp. Legal Opinion by Durango-based office of legal advisers, by Mr. Carlos Galván Pastoriza, Abogado, prepared on October 31, 2008. | ||

|

Geochemical and Isotopic Study of Calcite Stockworks at La Encantada Mining District; Relationships with Orebodies and Implications for Exploration. A Thesis submitted to the Faculty of the Department of Mining and Geological Engineering, at the University of Arizona at Tucson, in partial fulfillment of the requirements for the degree of Master of Science with a Major in Geological Engineering. By: Raúl Díaz-Unzueta, 1987. | ||

|

Evaluación Geológica Unidad Minera La Encantada, Municipio de Ocampo, Coahuila, México. Prepared by: Exploraciones Geológico-Mineras de Occidente, S.A. de C.V. Septiembre 2006. | ||

|

Geologic Evaluation of the La Encantada Property, State of Coahuila de Zaragoza, México. Prepared by: J.N. Helsen, Ph.D., P. Geo. December 2006. | ||

|

Data provided by Desmín, S.A. de C.V. as operator of La Encantada under lease from Peñoles, July 1, 2004 to November 1, 2006. | ||

|

Information provided by FMS as owner and operator of La Encantada Silver Mine, including the period from November 2006 to May 2007. | ||

|

Information provided by FMS’s Corporate Manager of Environmental and Permitting, Ing. José Luis Hernández Santibañez, on notifications of mining activities resumption at La Encantada mine and current status of operating permits to: | ||

|

Delegado Federal de la SEMARNAT, Estado de Coahuila. April 24, 2007. | ||

|

Delegado Federal de la STPS (Secretaría de Trabajo y Previsión Social) in the State of Coahuila. April 24, 2007. | ||

|

Director Local de CNA (Comisión Nacional del Agua), Estado de Coahuila. April 24, 2007. | ||

|

Delegado Federal de la PROFEPA (Procuraduría Federal de Protección al Ambiente), Estado de Coahuila. April 24, 2007. | ||

|

PAH observations on site visit during the periods of May 18-23, November 11 – 18, 2007 and October 28-31, 2008. | ||

PAH believes that this information is reliable for use in this report. PAH has reviewed ownership documents for the purchase of Minera La Encantada shares from Peñoles; acquisition of Desmín shares; purchase land rights under expropriation procedure where La Encantada mine, plant, camp and ancillary installations are located; and documents for sampling and applications for renewal of the Permiso Ambiental Unico (environmental permit for operating); as well as copies of the titled concessions for La Encantada mining rights.

| Pincock, Allen & Holt | REVISED | 5.2 |

| 90533 February 26, 2009 |

This information was also reviewed by FMS legal advisers and a legal opinion was provided to PAH by the Durango City-based legal firm of Mr. Carlos Galván Pastoriza in a document issued on October 31, 2008. Therefore, PAH believes all above described documents and information regarding the property current status, legal title and environmental compliance for La Encantada mining–metallurgical operation to be accurate and current in legal standing.

| Pincock, Allen & Holt | REVISED | 5.3 |

| 90533 February 26, 2009 |

6.0 PROPERTY DESCRIPTION AND LOCATION

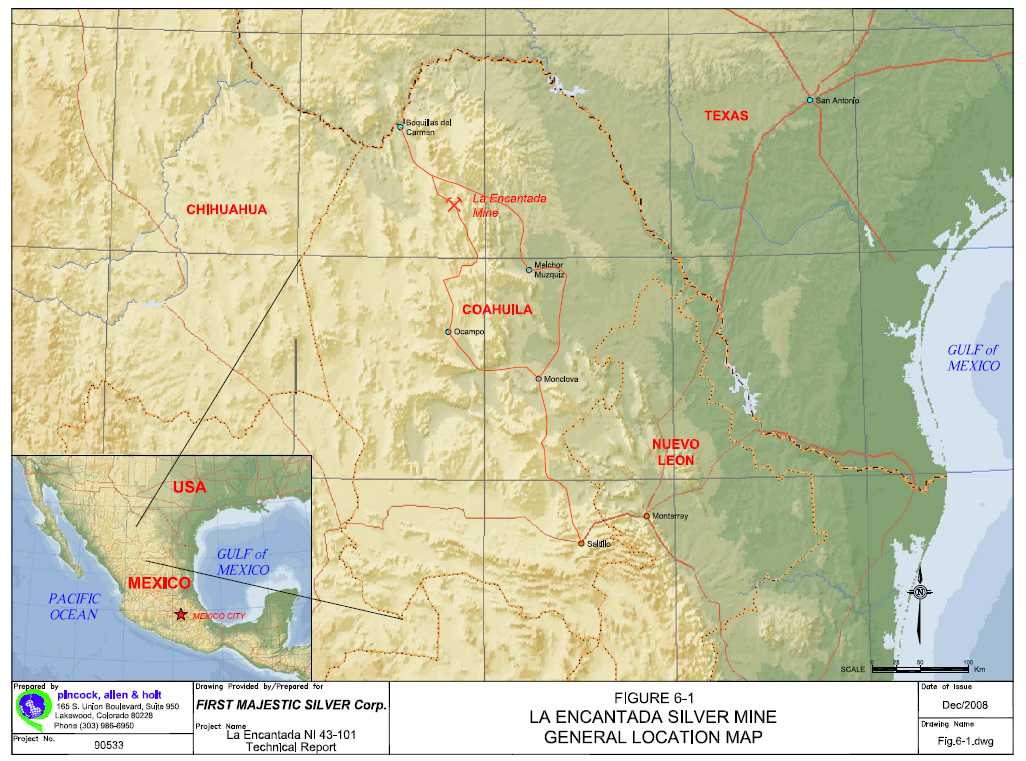

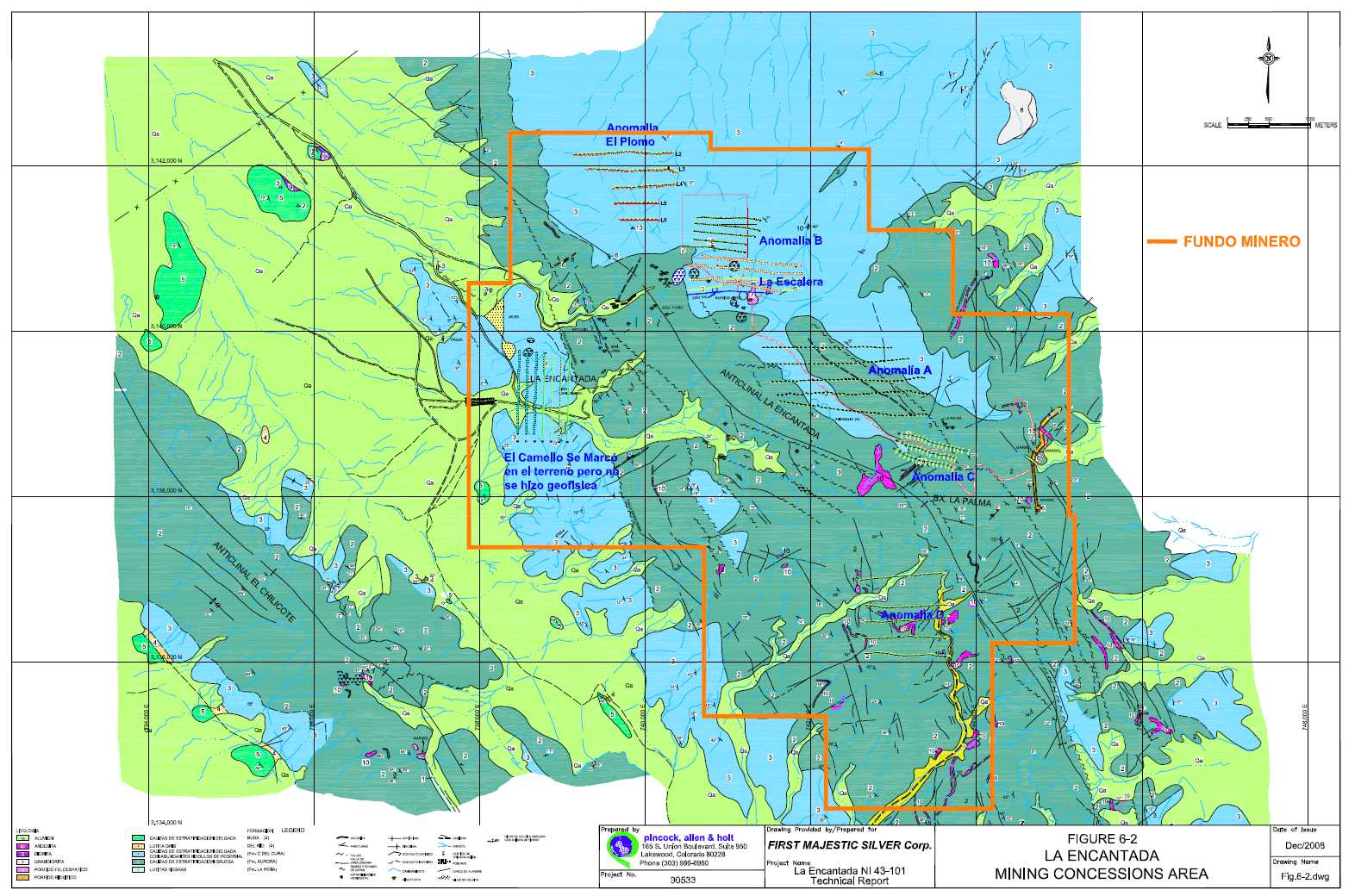

Additional details are presented in Technical Report Amended for La Encantada Silver Mine of March 18, and published in SEDAR on March 28, 2008. Figure 6-1 is a General Location Map and Figure 6-2 is a Mining Concessions Map.

6.1 Property Description

This Technical Report presents an update of La Encantada’s current operating conditions and projections as planned by FMS.

La Encantada Silver Mine property modifications for the period of October, 2007 to September, 30 2008 include the following:

Successful exploration programs have delineated a significant increment of reserves, including some tailings (+183 percent) and resources (M+I - -17 percent and Inf. +51 percent) for 2008 over 2007, at the La Encantada Silver Mine.

The La Encantada mining rights cover 2,237 hectares (5,227 acres) within 21 Mining Concessions including 3 approved Applications which have been accepted by the Dirección General de Minas and are now under the process of registration at the Mines Department (1,250 hectares or 3,089 acres). Two other Concession Applications have presented at the Mines Department and are under review for approval. These Concession Applications cover additional lands within the surrounding area of La Encantada for further protection and exploration potential. No other changes have occurred in total land coverage at La Encantada Silver Mine.

All the Mining Concessions legal status was provided by legal opinion, dated October 31, 2008 from the Durango City-based firm of Mr. Carlos Galván Pastoriza, legal advisers for FMS in México. PAH also requested and received an updated review by legal advisers of the mining concessions current status showing that all mining claims owned by Minera La Encantada, S.A. de C.V. are current in meeting the legal obligations and requirements by Mexican Mining and Environmental Laws and Regulations including assessment works, property taxes and operating permits for the period that covers to December 31, 2008. Table 6-1 shows the List of Mining Concessions at La Encantada.

| Pincock, Allen & Holt | REVISED | 6.1 |

| 90533 February 26, 2009 |

TABLE 6-1

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

List of Mining Concessions

| No. | Name | Title No. | Surface Ha. |

| 1 | Encantada | 143,943 | 75.0000 |

| 2 | El Pajarito | 167,061 | 9.0000 |

| 3 | Montecarlo | 167,062 | 9.0000 |

| 4 | El Tigre | 167,065 | 41.0000 |

| 5 | El Camello | 167,066 | 75.0000 |

| 6 | Los Angeles | 167,067 | 20.0000 |

| 7 | Ampliación de Los Angeles | 167,068 | 27.2300 |

| 8 | El Granizo | 167,069 | 25.0000 |

| 9 | La Presita | 167,070 | 25.0000 |

| 10 | Regalado | 167,071 | 100.0000 |

| 11 | El Golpe 10 | 178,385 | 40.0000 |

| 12 | Rosita No. 19 | 189,752 | 79.9525 |

| 13 | Los Angelitos | 189,758 | 27.2300 |

| 14 | Los Angelitos 2 | 189,759 | 27.2300 |

| 15 | Los Angelitos 3 | 190,341 | 16.0000 |

| 16 | La Presita 10 | 194,878 | 100.0000 |

| 17 | San Javier | 217,855 | 3.0227 |

| 18 | Las Rositas | 227,288 | 287.0000 |

| 19 | Rosita 1* | 232,026 | 50.0000 |

| 20 | Rosita 2* | 232,028 | 350.0000 |

| 21 | Rosita 3* | 232,027 | 850.0000 |

| 22 | Platón (1) | 07 / 16718 | 3,000.0000 |

| 23 | Fracción Platón (2) | 07 / 16718 | 0.0000 |

| TOTAL COVERAGE | 2,236.6652 | ||

(*) Application approved in process of registration.

(1) Mining Application in process. Final coverage will be defined

when the Title is issued. Area NOT INCLUDED.

(2) Fraction of Platón is included in the Paltón claim.

It will be Titled with different No.

| Pincock, Allen & Holt | REVISED | 6.2 |

| 90533 February 26, 2009 |

|

7.0 |

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

La Encantada Silver Mine is located within an isolated mining district in northern México. It is located in the northern part of the physiographic province of the Sierra Madre Oriental in the NW portion of the State of Coahuila. It is located in the municipality of Ocampo, at about 120km to the N60ºW from the city of Múzquiz, and 120km to the N7ºW from the city of Ocampo, Coahuila.

UTM coordinates for La Encantada area are as follows: N–3,139,550; E–739,660.

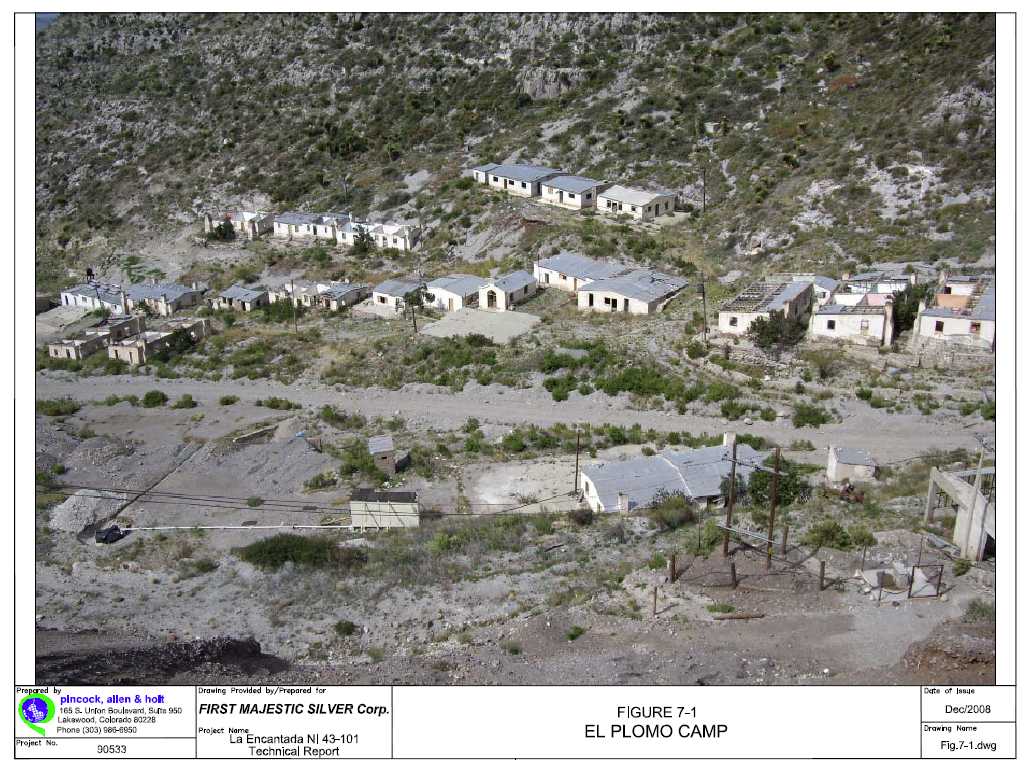

La Encantada mining district consists of two main silver/lead underground mines, the La Encantada and the El Plomo mines. Both of these mine areas have been consolidated into one operation, which is now owned and operated by FMS. Figure 7-1 shows the El Plomo inactive camp.

Additional details on Accessibility, Infrastructure, Climate, Vegetation, Physiography, Hydrology and Local Resources are presented in Technical Report Amended.

| Pincock, Allen & Holt | REVISED | 7.1 |

| 90533 February 26, 2009 |

8.0 HISTORY

In 2003 Peñoles reported proven and probable reserves at the closing of La Encantada mine including 485,000 tonnes at an average grade of 570 g/t Ag and 3.98 percent Pb. FMS’s exploration efforts are directed to explore other areas of interest within the extensive underground workings, validate these historical figures and advance development of additional exploration targets. By June 2007, FMS reported NI 43-101 proven and probable reserves of 633,000 tonnes at an average grade of 315 g/tonne Ag, in addition to measured and indicated resources of 1.4 million tonnes at an average grade of 276 g/tonne Ag, and about 1.5 Million tonnes of inferred resources at an average grade of 200 g/tonne Ag, in Technical Report Amended of July 24, 2007 published in SEDAR.

The La Encantada aggressive exploration and development investments during 2007 resulted in additional proven and probable reserves estimated at 1.2 million tonnes for 2008 at an average grade of 343 g/tonne (11.03 oz/t) and measured and indicated resources estimated at 9.4 million tonnes at an average grade of 173 g/tonne (5.6 oz/t), in addition to inferred resources estimated at 2.6 million tonnes at a grade of about 220 g/tonne (7.0 oz/t). The 2008 reserves and resources represent a significant increment over the 2007 reported reserves (+183 percent) and resources of (M+I -17 and inferred +51 percent). Proven and probable reserves plus measured and indicated resources contain approximately 68.7 million ounces of silver equivalent, while inferred resources may contain about 20.0 million ounces of silver equivalent.

From the period of October, 2007 to September, 2008, FMS has mined and processed 178,480 tonnes of ore from La Encantada Silver mine at an average recovered grade of 297 g/tonne (9.5 oz/tonne) Ag, for a total of 1,704,300 contained ounces. FMS’s 2008 production consisted of about 70,000 tonnes of ore from the proven and probable reserves, in addition to ore extracted from different newly discovered areas during mine preparation and development activities, for a total of 108,480 tonnes. Currently the plant is operating at an average rate of about 800 tonnes per day, while the mine continues to access, prepare new working phases and develop additional reserves and resources.

| Pincock, Allen & Holt | REVISED | 8.1 |

| 90533 February 26, 2009 |

9.0 GEOLOGICAL SETTING

Please refer to Technical Reports Amended dated July 24, 2007 and March 19, 2008 which were published respectively on July 25, 2007 and in March 28, 2008 in SEDAR.

To this date, there are no changes to report regarding the La Encantada Silver Mine geology.

National Instrument 43-101 Standards of Disclosure for Mineral Projects. Form 43-101F1 Technical Report–Instructions (5), December 23, 2005.

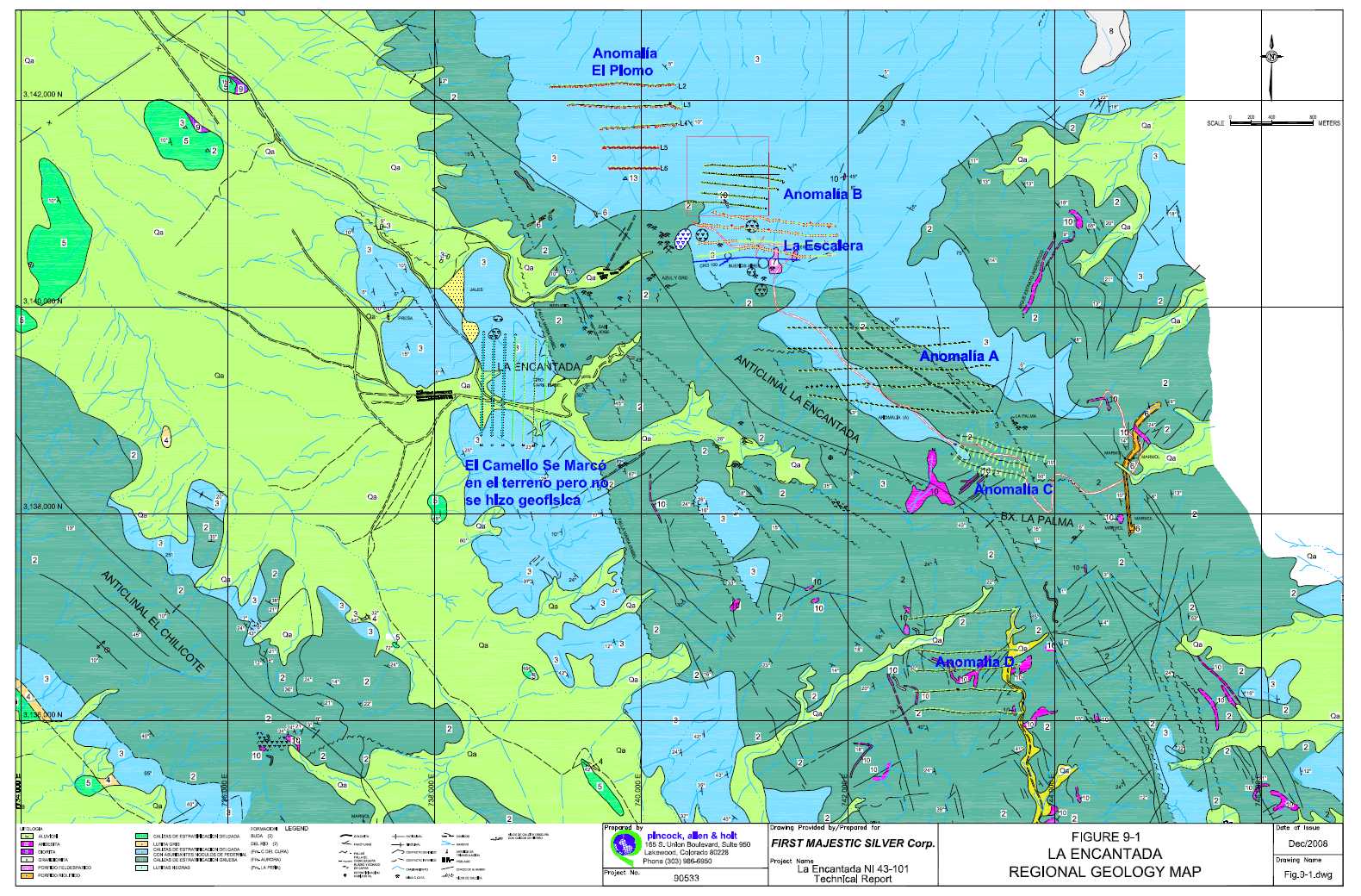

Figure 9-1 shows the La Encantada Regional Geologic Map.

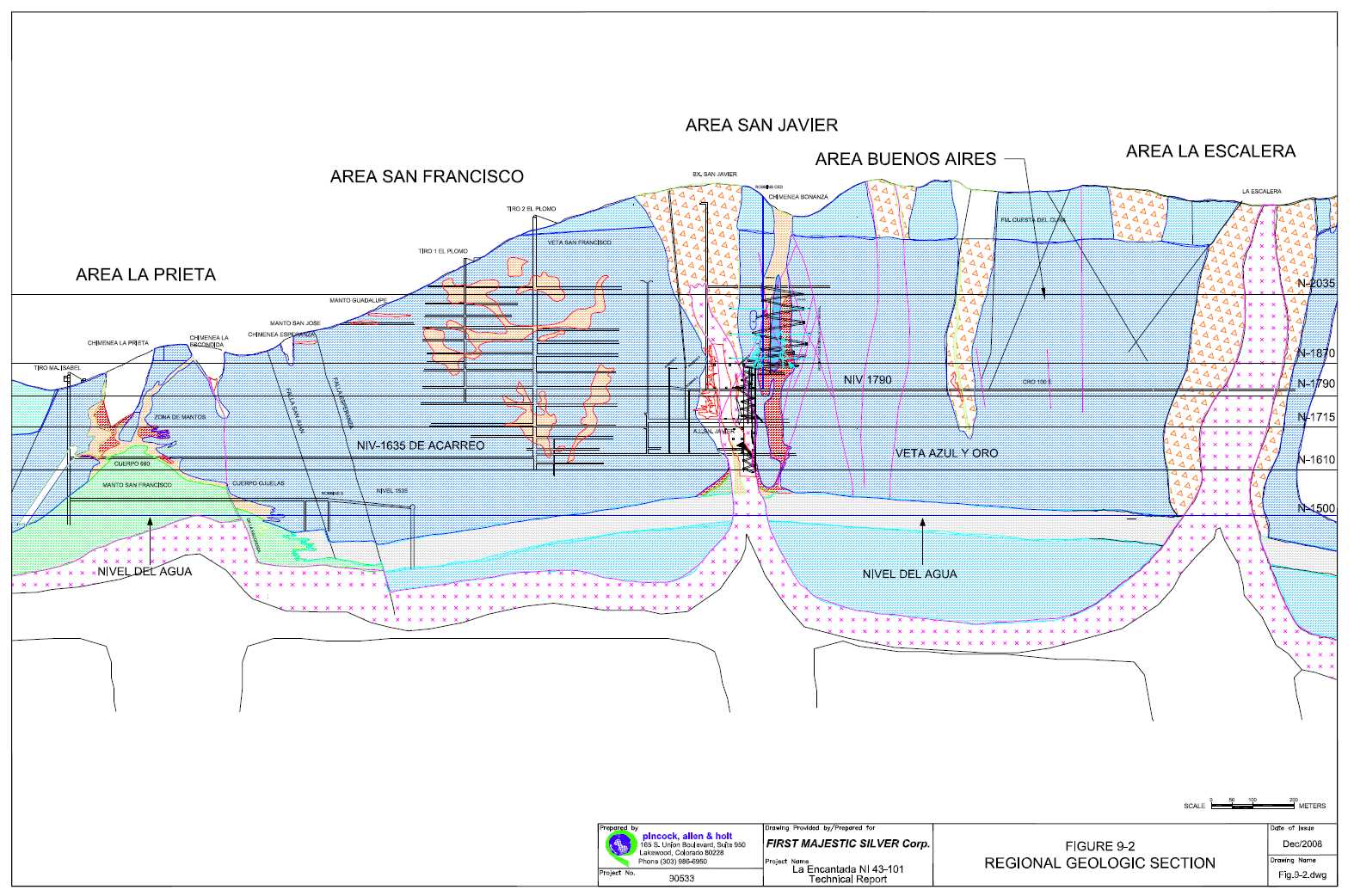

Figure 9-2 shows La Encantada Silver Mine Geologic Cross Section.

| Pincock, Allen & Holt | REVISED | 9.1 |

| 90533 February 26, 2009 |

10.0 DEPOSIT TYPES

There are no changes to report regarding geologic and mineral deposit concepts for the La Encantada Silver Mine.

Please refer to Technical Report Amended dated July 24, and published in SEDAR on July 25, 2007.

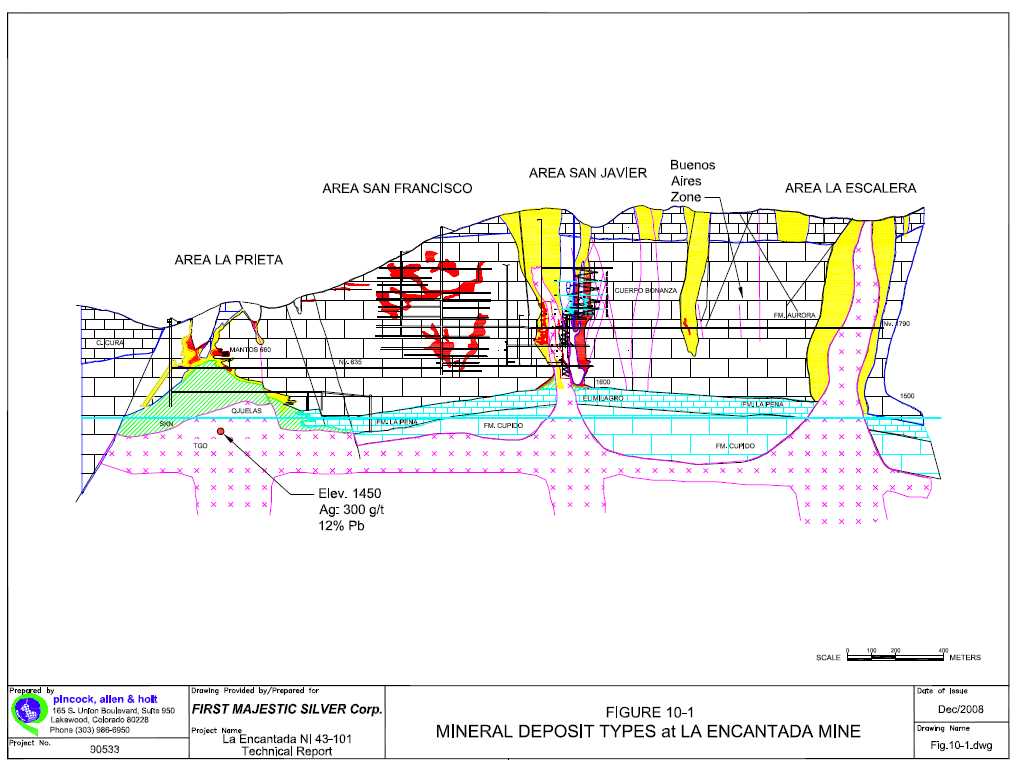

Figure 10-1 shows Types of Mineral Deposits at La Encantada.

| Pincock, Allen & Holt | REVISED | 10.1 |

| 90533 February 26, 2009 |

11.0 MINERALIZATION

For details on mineralization at La Encantada Silver Mine please refer to Technical Report Amended of July 24 and published in SEDAR on July 25, 2007.

No changes regarding mineralization characteristics of the La Encantada Silver Mine have occurred since last publication in Technical Report Amended. However, the mineralized zones of the La Encantada mine have been further increased by discovery of a new mineralized zone denominated Buenos Aires.

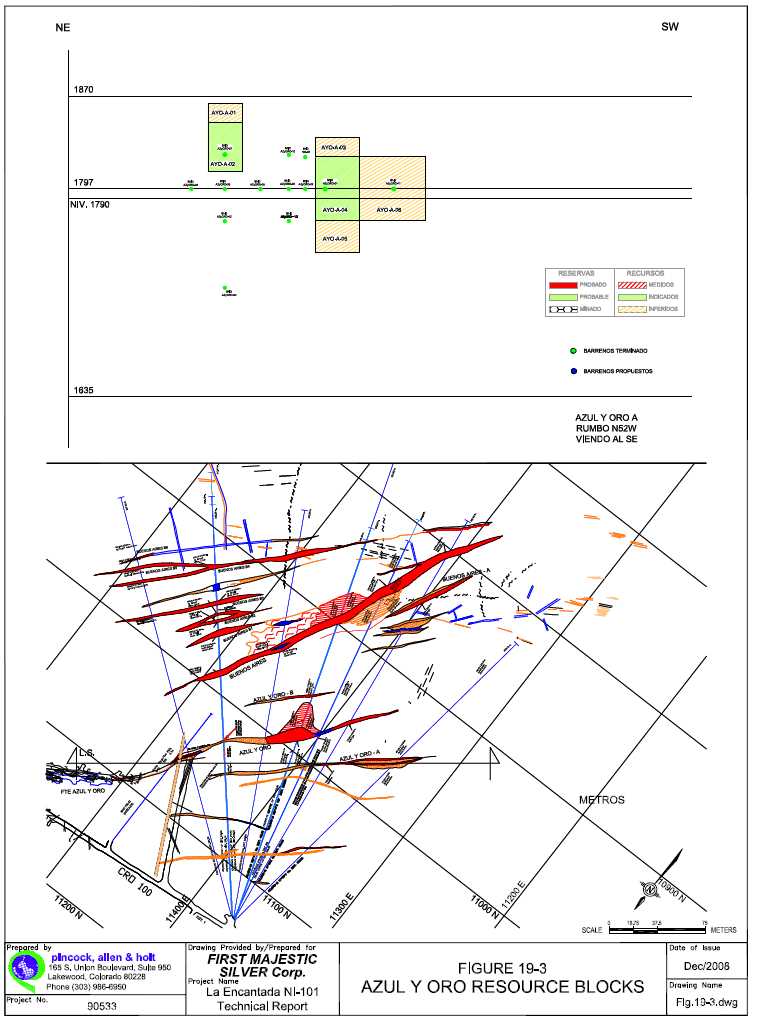

FMS exploration drilling program to investigate the Azul y Oro deposit resulted in interception of an unknown mineralized zone which comprises a series of NW-SE oriented veins and mineralized breccia zones containing high grade silver mineralization with lead and zinc. These structures show variable widths of up to eight meters. The Buenos Aires zone is located between the Azul y Oro and La Escalera breccia zones within the northeastern portion of the mine.

Currently known projections of the Buenos Aires zone have been drilled from the mine levels 1870, 1790 and 1635. Preliminary drilling has determined some blocks of indicated and inferred resources which enclose approximately 850,000 tonnes containing some estimated 13 million ounces of silver equivalent in oxides.

FMS is preparing underground access to the zone and additional drilling to upgrade the Buenos Aires resource base.

Figure 11-1 shows Duplicate Channel Sample at Breccia San Javier.

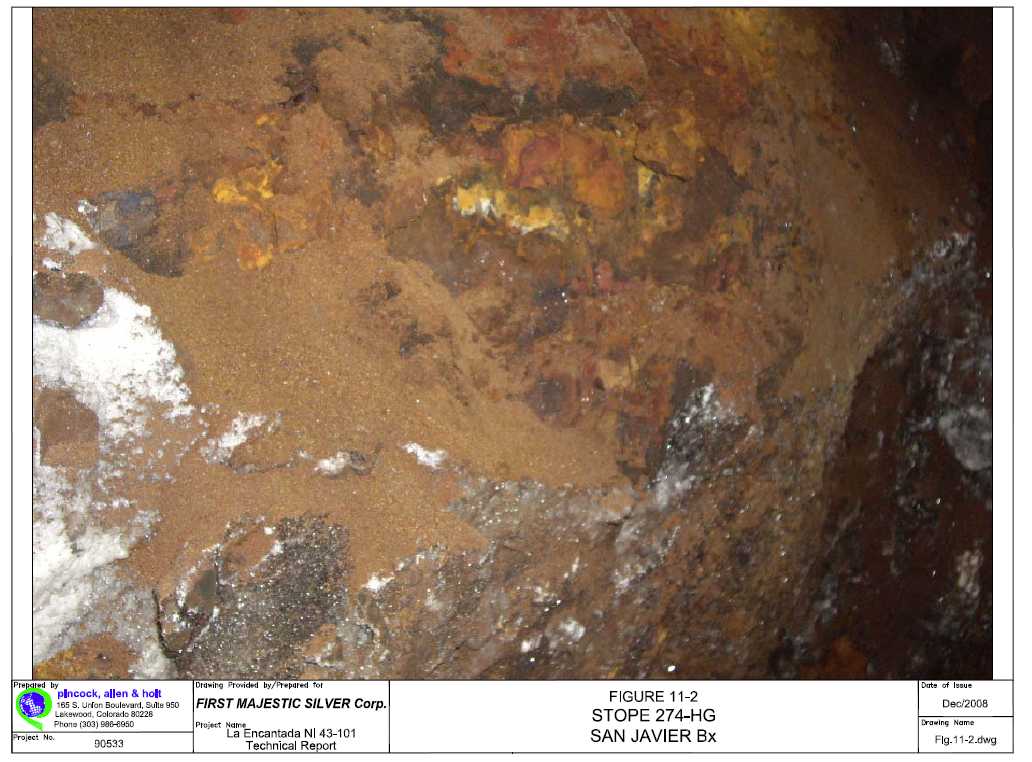

Figure 11-2 shows stope 274 High Grade Silver at Breccia San Javier.

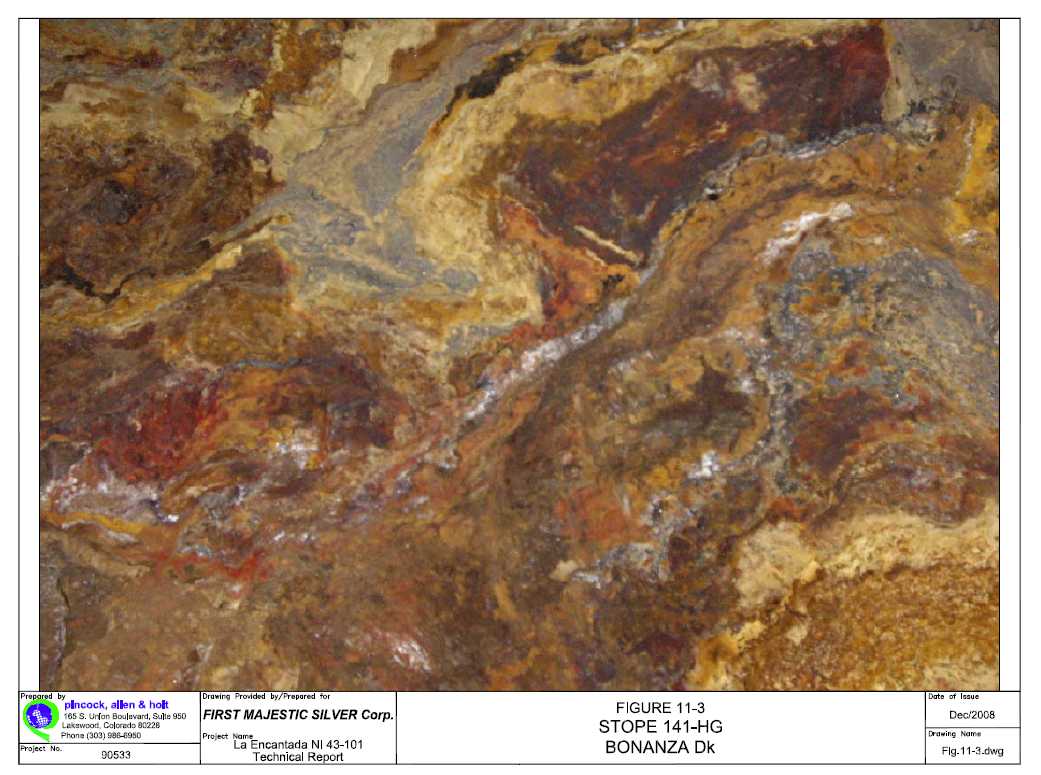

Figure 11-3 shows the Stope 141 – El Chamaco High Grade zone at the Bonanza Dike.

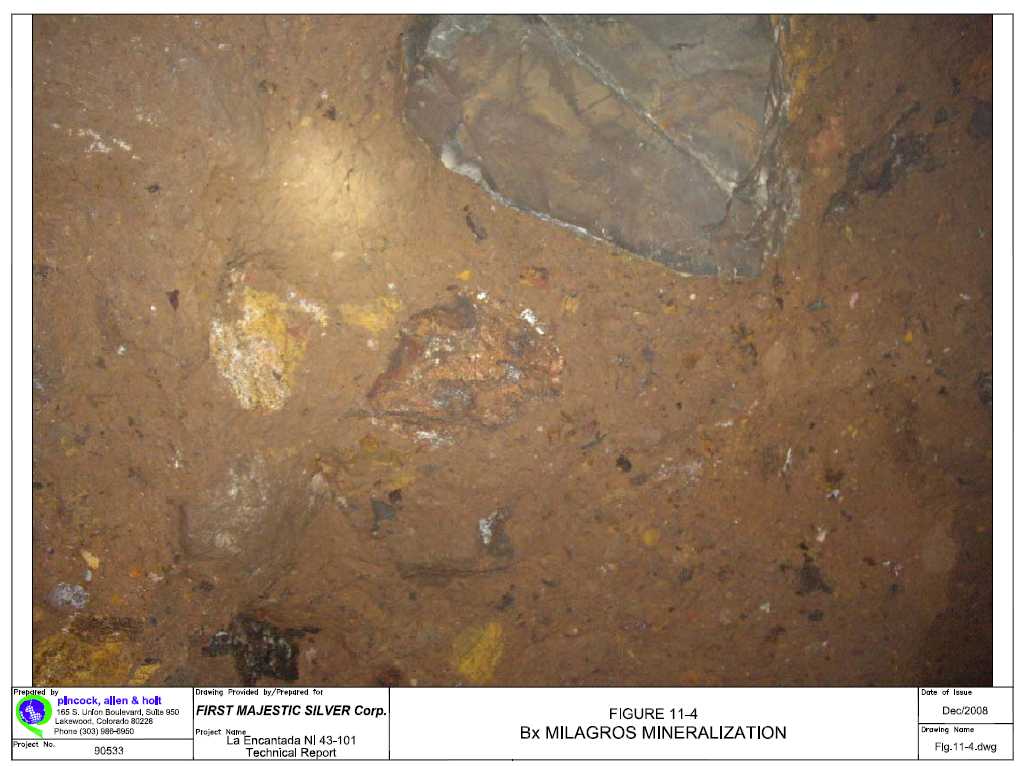

Figure 11-4 shows Breccia Milagros mineralization.

| Pincock, Allen & Holt | REVISED | 11.1 |

| 90533 February 26, 2009 |

12.0 EXPLORATION

12.1 Introduction

La Encantada Silver Mine has been subjected to exploration programs from its discovery in the 1950s, by prospectors in the early stages and by Peñoles since the late 1960s to 2003. FMS has developed an aggressive program of explorations including mine development and preparations for drilling from underground sites. Additional diamond drilling is planned from surface locations, as well as geophysical surveying to investigate areas of interest and confirm other previously identified exploration areas.

Exploration efforts carried out during the second half of 2007 through 2008 were primarily focused in proving and developing additional reserves and resources for La Encantada mine. These resulted in a significant increment of both resources and reserves. Major efforts were developed in the areas of Breccia Milagros, Bonanza, San Francisco, Intrusivo Milagros, Azul y Oro, and Cuerpo de Zinc at mine level N-1535 and in the sampling of the old dumps. A long term exploration program was initiated to investigate the promising target at the La Escalera breccia zone. A new exploration target was identified during the course of explorations to define the Azul y Oro mineralized zone. The newly discovered zone, denominated Buenos Aires, is located between the Azul y Oro and the La Escalera breccia zones. FMS exploration efforts have resulted in a material change of the La Encantada reserve/resource base. These results, in addition to some tailings, show an increment of about 183 percent in proven and probable Reserves and a decrement of about 17 percent in measured and indicated resources over previously reported reserves and resources of October 31, 2007. Additional inferred resources have resulted in an increment of about 51 percent. These results have increased the ounces of silver equivalent contained for the La Encantada mine to about 69 million in proven and probable reserves plus measured and indicated resources. Additional exploration may upgrade the inferred resources, currently estimated at about 20 million ounces of silver equivalent.

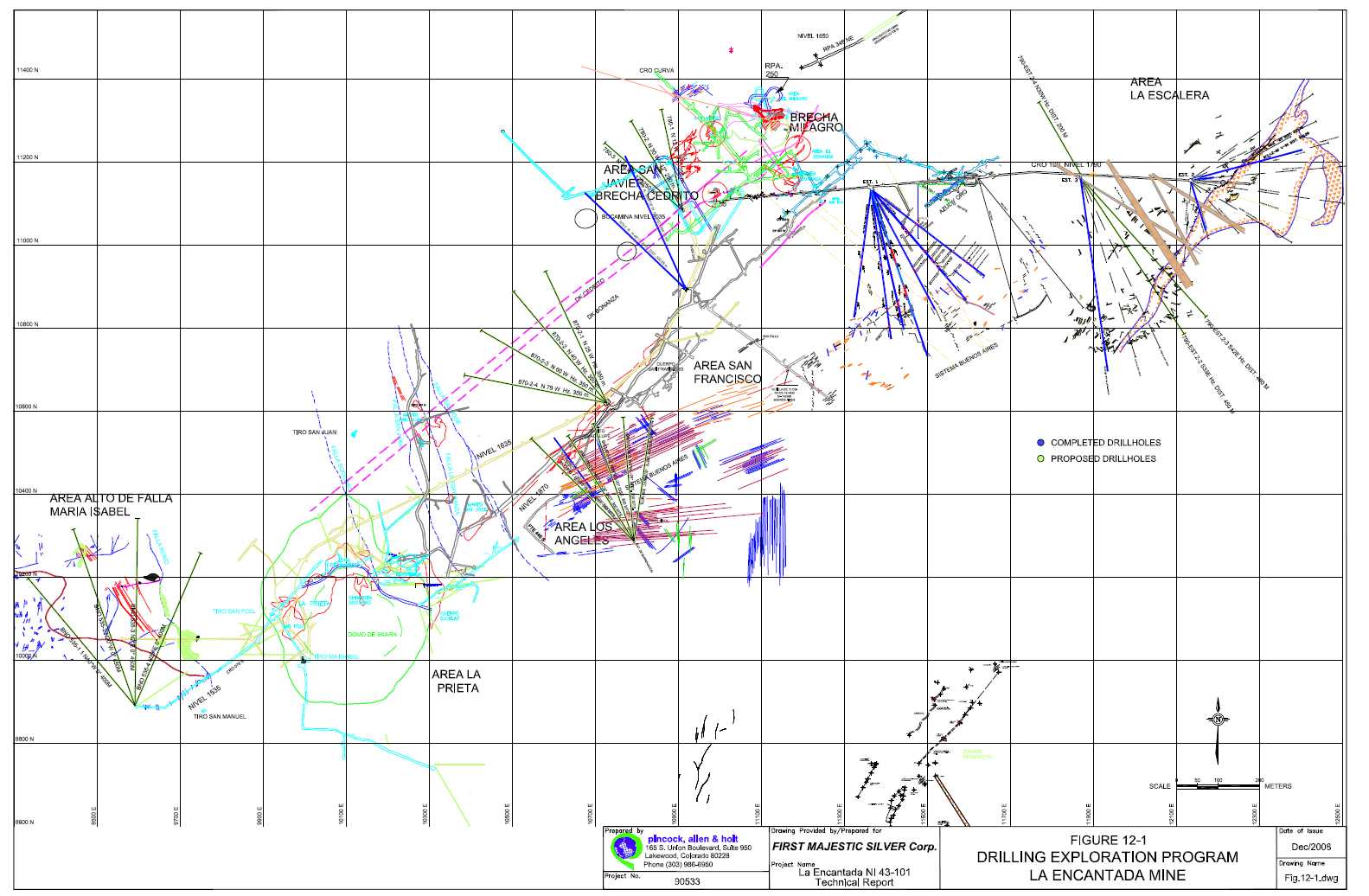

Sampling of old dumps was also advanced and about 150,000 tonnes of screened material was measured, sampled and indicated during the period, in addition to screening and processing about 42,000 tonnes. Screening recovery of the dumps is about 40 percent in tonnage and grade enrichment from about 120 g/tonne Ag to about 160 g/tonne Ag. Figure 12-1 shows the La Encantada Exploration Program.

12.2 Exploration Programs

FMS’s program of underground exploration was designed to investigate the Milagros and San Javier breccia zones, as well as the San Francisco bedded deposits and the Bonanza area where numerous veins occur associated with the Bonanza dike. The La Escalera breccia zone appears to be a significant target for exploration.

| Pincock, Allen & Holt | REVISED | 12.1 |

| 90533 February 26, 2009 |

During the period of September 2007, to September 30, 2008, a total of about 6,660 meters of core drilling was completed. During the period of January to June, 2008 underground workings for exploration purposes were developed at the La Encantada mine, including about 1,490 meters of access ramps, drifts, and crosscuts, and about 850 meters of exploration tunneling for drill sites access. This development resulted in a significant increment of resources and reserves at the various mine levels of the La Encantada Silver Mine, within the Stope 141, Stope 325, Breccia Milagros, Bonanza, Dique San Francisco, San Francisco, Jorobada, San Javier Extensión and Alto del Dique La Escondida areas.

12.2.1 Geophysical

Exploration

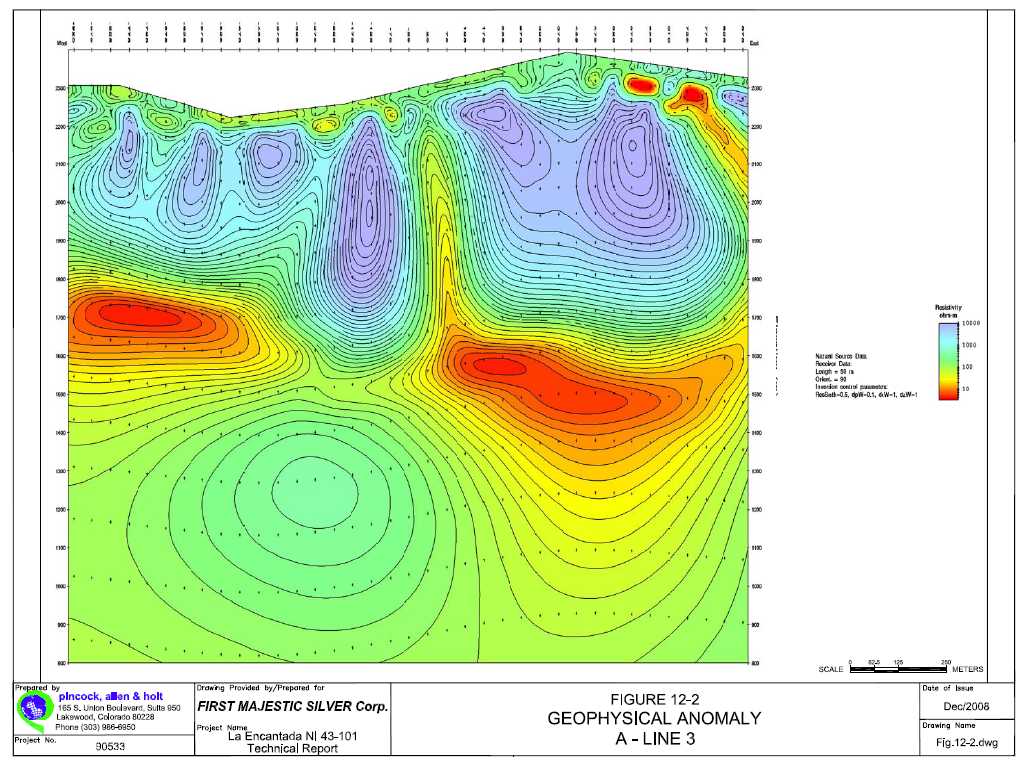

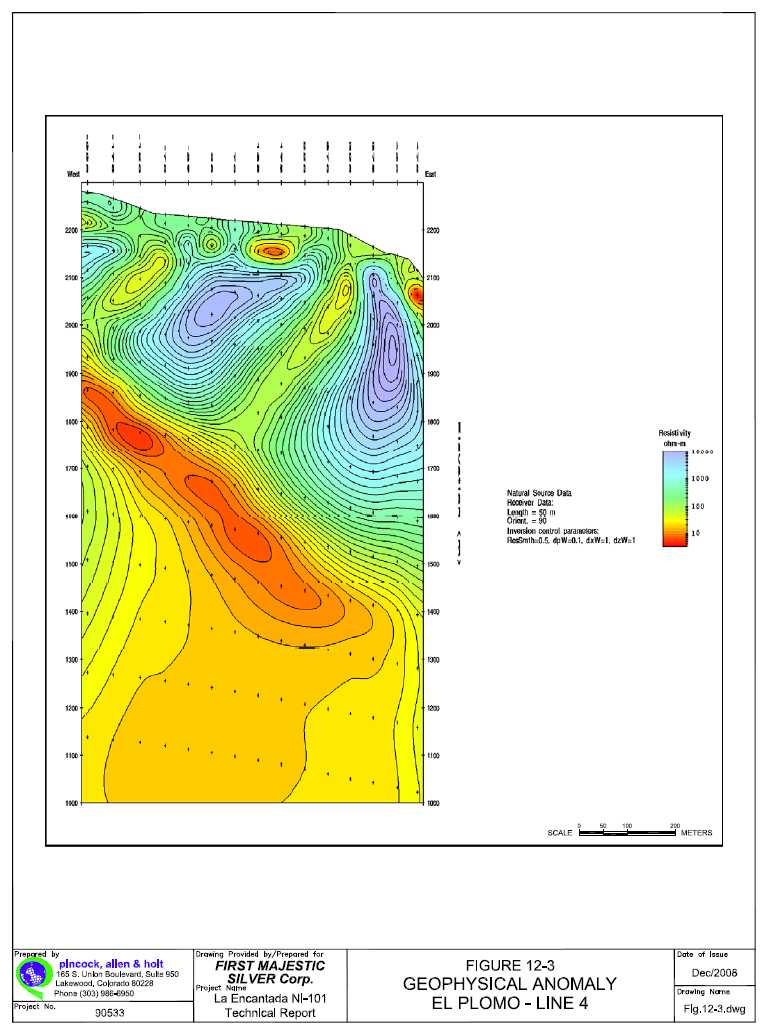

FMS has designed an extensive 2008 program of exploration based on geophysical surveying to investigate the various identified anomaly areas, and to confirm other indicated potential zones. This program was completed during the period of January to October, 2008, and includes about 50 km of lines to be measured by Natural Source Audio-frequency Magnetotelluric methods (NSAMT). Readings were carried out along lines at 100m and 50m spacing according to geologic conditions, at 25m and 50m stations along the lines. This geophysical method takes reading of resistivity and conductivity parameters. The survey was conducted by Zonge Engineering and Research Organization from Tucson, Arizona. The Report is in progress. Some exploration targets have been identified and confirmed from previous research, including the most outstanding targets for investigation, such as the El Plomo, La Escalera Breccia zone and the Anomalous areas “A”, “B”, “C” and “D”. Figure 12-2 shows Geophysical Anomaly A – Line 3. Figure 12-3 shows Geophysical Anomaly El Plomo – Line 4.

12.2.2 Geochemical Exploration

No geochemical sampling has taken place at La Encantada during 2008; however, FMS has designed a 2009 exploration program that includes sampling for geochemical investigations in the areas of the geophysical anomalies. This program is estimated to include about 500 samples.

12.3 Drilling

Drilling programs at La Encantada have been limited since the best exploration results may have been obtained through underground development. Additionally, topographic conditions at the mine and irregular morphology of mineral concentrations make it difficult to plan for drilling. Therefore, drilling from underground sites and mine workings has proven to be the most effective combination for exploration at La Encantada.

During the period from September, 2007 to September 30, 2008, the La Encantada exploration team completed drilling from underground sites totaling 6,660 meters to investigate continuity and depth of the Azul y Oro, Breccia San Javier, and La Escalera mineralized structures. These drill holes resulted in discovery of the Buenos Aires mineralized zone, extension and confirmation of some of San Francisco and Azul y Oro mineralized zones.

| Pincock, Allen & Holt | REVISED | 12.3 |

| 90533 February 26, 2009 |

Additional drilling was developed at the old Peñoles tailings dams to determine volume and grade of the two tailings dams. Metallurgical testwork was carried out in some of the drilled tailings. Grade, tonnage and metallurgical recovery estimates have resulted in additional resources for the La Encantada Silver Mine, since some of the silver contained by the tailings appears to be amenable for economic recovery by Cyanide Leaching processing methods. The tailings drilling program included 15 drill holes totaling 168 meters at the Tailings Dam No. 1, and 34 drill holes for a total drilled depth of 576 meters in Tailings Dam No. 2. Trenches and surveying delimited additional tailings volume at the Presa No. 3. Figure 12-4 shows tailing samples.

12.3.1 Exploration Drilling

FMS exploration activities for La Encantada mine include three drill rigs for drilling from underground sites. The program completed during 2008, consisted of a total underground development of 2,340m including drifts, crosscuts, raises, ramps and stopes development in addition to 5,000m of development carried out during the second semester of 2007. Numerous drill sites have been prepared during 2008.

Details of the exploration program developed and completed during 2008 are included in Table 12-1. This program resulted in a material change with significant additional Resources for the La Encantada mine. Table 12-1 shows the exploration program completed during 2008.

TABLE 12-1

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Completed Exploration Program for the Period November, 2007 to September,

2008

| Exploration Activities | Objective | Area | Total Development |

| Underground Development | Access ramps, drifts, crosscuts, raises, drill sites, etc | Access to La Escalera, Brccia Milagros, Azul y Oro, Bonanza, Jsan Javier, etc | 6,144 meters |

| Underground Drilling | Exploration, Resource Blocks upgrade, investigate extension zones, etc | Azaul y Oro, La Escalera, Bonanza, San Javier, etc | 6,660 meters |

| Geophysics | Confirm previously defined anomalies |

La Encantada coverage | Approximately 50km of geophysical lines |

The FMS exploration program for La Encantada includes an aggressive underground and drilling plan that has a high probability of success given the geological conditions of the mineralization at the mine. In PAH’s opinion the combination of direct exploration methods, drilling and underground development represents a good balance for exploration at La Encantada. The program is directed to access projected known areas of mineralization as well as to investigate other adjacent and new promising areas that may result in an increment of the resource base and a higher level of reserves for the mine. This has been proven positive during the period of 2008 since the new Buenos Aires zone was discovered and resulted in additional resources containing approximately 13 million ounces of silver equivalent.

| Pincock, Allen & Holt | REVISED | 12.6 |

| 90533 February 26, 2009 |

The exploration program suggested by FMS for the La Encantada Silver Mine for implementation during the period of calendar year 2009 is presented in Table 22-1 including estimated costs. This program consists of 7,195 meters of drilling, including 23 drill holes from underground sites, and 10,807 meters of underground drifting. Table 12-2 shows the La Encantada exploration program for 2009.

TABLE 12-2

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Exploration Program for the Period October-December, 2008, January-September,

2009

| Exploration Activities | Objective | Area | Total Development |

| Underground Drilling | Explore extensions, confirm and delineate Resource blocks | Azul y Oro, Buenos Aires, La Escalera, Cedrito, Bonanza, Falla María Isabel | 23 DH - 7,195 meters |

| Underground Development | Crosscuts, drifts, ramps and drill sites | 1790 Mine Level, Buenos Aires zone, San Francisco, Bonanza and Azul y Oro | 11,807 meters |

In PAH’s opinion, FMS’s exploration program at La Encantada represents an aggressive exploration program with a high probability of success to upgrade the mine’s reserve and resource base, and with high probability for discovery of additional mineralized zones, which would lengthen the mine’s life. PAH recommends implementation of the suggested program at an estimated cost of about $2.5 million.

| Pincock, Allen & Holt | REVISED | 12.8 |

| 90533 February 26, 2009 |

13.0 DRILLING

FMS continued with an aggressive drilling program at La Encantada during the period from September, 2007 to September, 2008. FMS has three drilling rigs to carry out the exploration drilling from underground sites. FMS’s program for 2009 includes 7,195 meters of core drilling from underground sites to investigate the La Escalera breccia, Buenos Aires and Azul y Oro targets from the 1870, 1970 and 1535 mine levels. Exploration drilling requires access and drill site preparation, which for the underground exploration is estimated to be approximately 10,800 meters of ramps, drifts, crosscuts and drill site construction.

During the period of January through September 2008, drilling at La Encantada completed 29 drill holes for a total depth of 6,660 meters from underground locations. This program resulted in additional total estimated tonnage of 850,000 tonnes of indicated and inferred resources at an average grade of about 340 g/tonne (about 11 oz/tonne) Ag in oxides mineralization with lead and zinc.

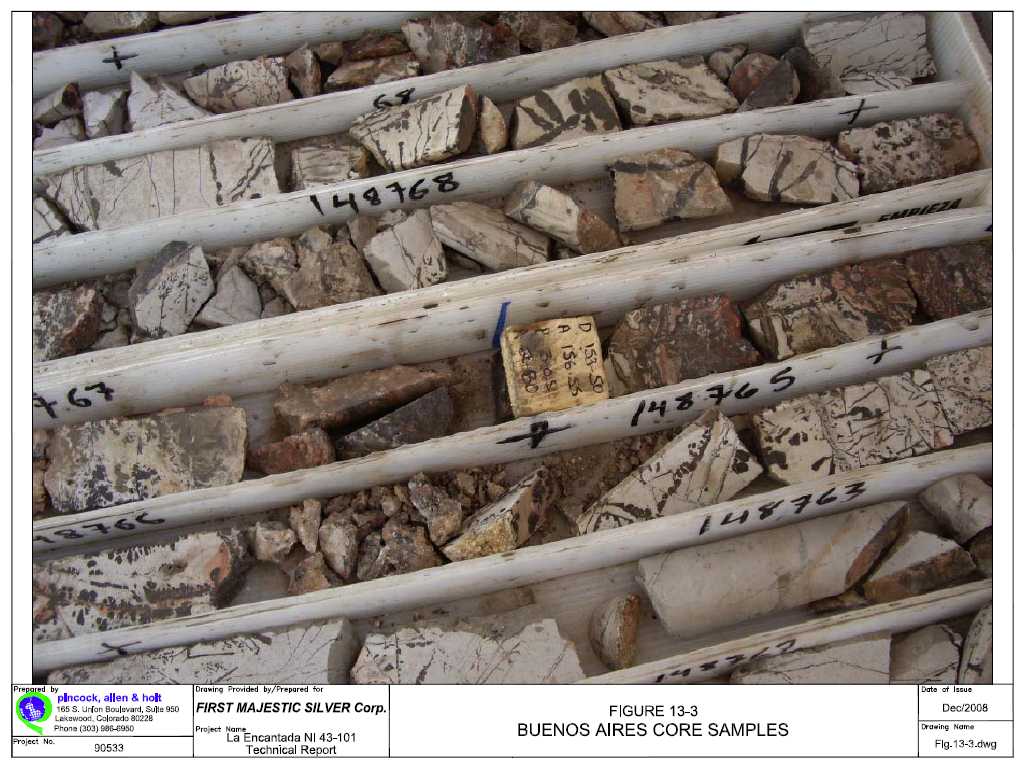

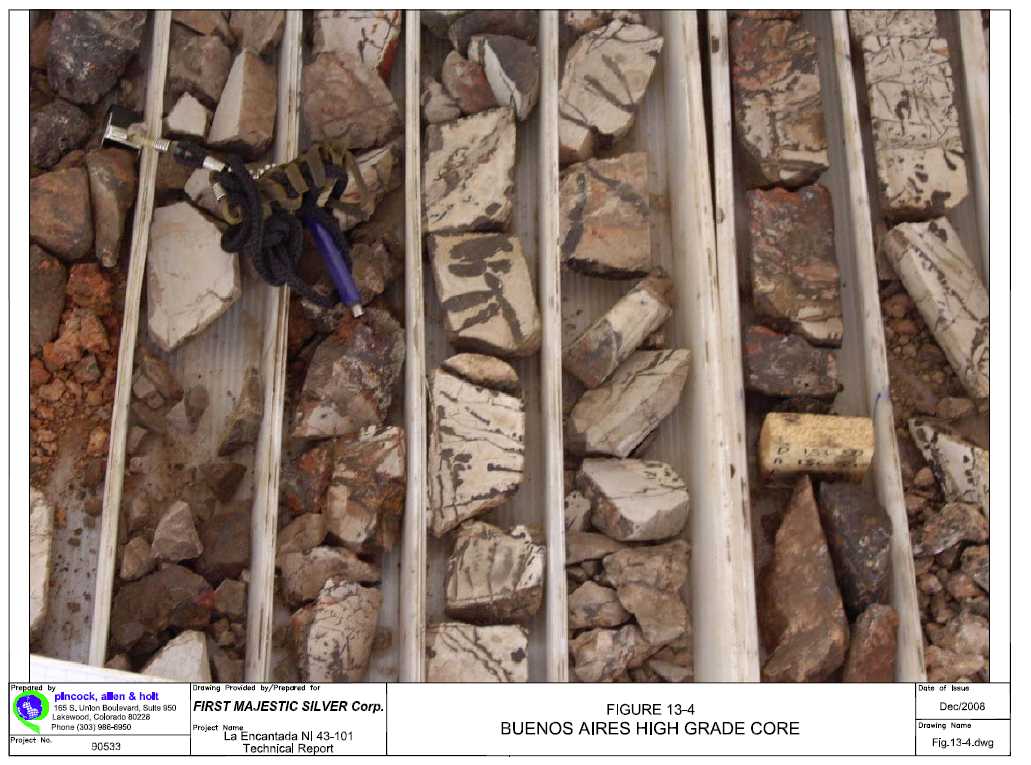

Fifteen drill holes were completed from underground access to investigate the Azul y Oro mineralized structure. These drill holes also intercepted a new mineralized zone denominated Buenos Aires. Some of these drill holes intersected some of the mineralized structures of the Azul y Oro zone confirming geologic continuity of the mineralization. Additional resource and some reserve blocks were confirmed by the program. Figure 13-1 shows the Buenos Aires Drilling and Figure 13-2 shows Underground Drilling for Azul y Oro and Buenos Aires zones.

Details of FMS’s 2008 and 2009 drilling program are presented in Tables 12-1 and Table 12-2. Estimated costs for the 2009 program are presented in Table 22-1.

FMS has defined future targets of exploration for drilling from surface. These include confirmation of geophysical and structural anomalies, such as:

Exploration drilling from underground drill sites includes:

| Pincock, Allen & Holt | REVISED | 13.1 |

| 90533 February 26, 2009 |

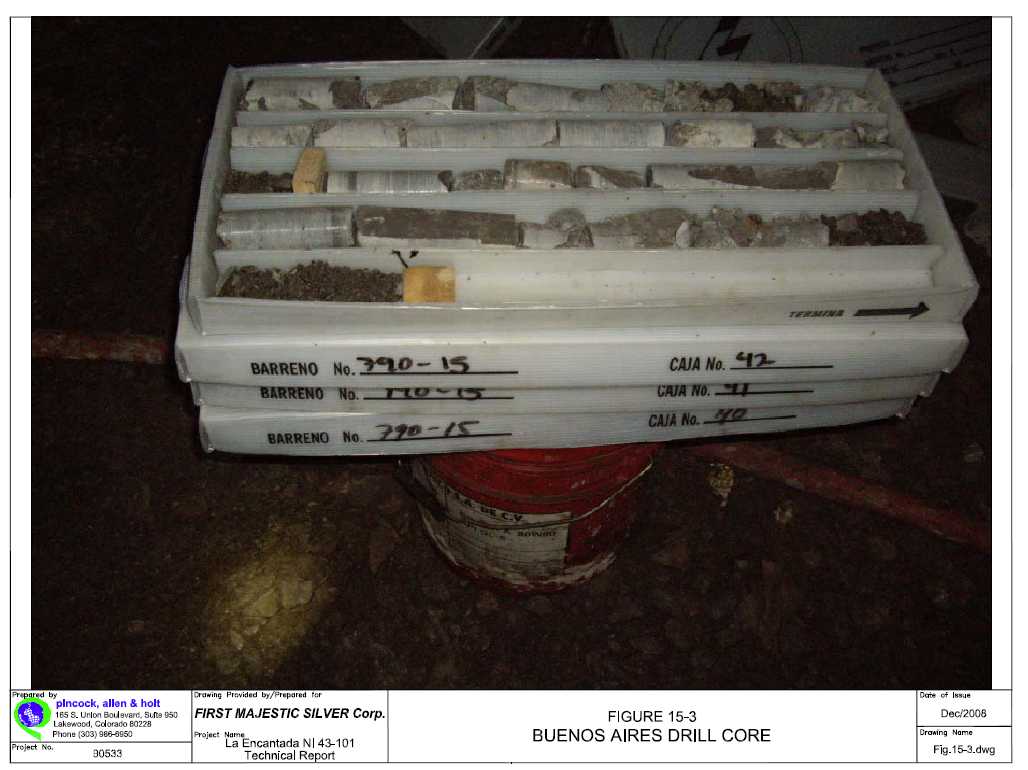

PAH believes that this drilling program from surface and underground workings, in combination with underground development, is appropriate and well designed to explore promising targets. Geologic potential exists to discover additional mineralized zones along the development workings. Estimated budget for this program is included in Section 22 of this Report - Recommendations. PAH recommends implementation of this program. Figure 13-3 shows Buenos Aires Drill Core Intercept. Figure 13-4 shows Buenos Aires High Grade Core.

| Pincock, Allen & Holt | REVISED | 13.4 |

| 90533 February 26, 2009 |

14.0 SAMPLING METHOD AND APPROACH

PAH reviewed La Encantada’s sampling program for the preparation of the Technical Report Amended dated July 24, 2007. Full description of sampling method and approach by La Encantada’s geologic crews is presented in the Technical Report Amended July 24, 2007. Additionally, PAH also reviewed the La Encantada sampling procedures for this Technical Report and did not notice changes in protocols that may affect the results, other than improving in some areas, such as QA/QC with increasing number of filed duplicates for drilling and reserve blocks samples.

The samples are brought into the La Encantada laboratory for preparation and assaying. Duplicate samples are sent to Inspectorate Lab for assay checks. Additional representative samples are sent to the La Encantada laboratory for density determinations. For the period of 2008 FMS has assayed 38 duplicate samples and 26 pulp samples at Inspectorate Lab in Reno, Nevada for comparison with assay results from the La Encantada lab. A total of 28 representative samples for density were sent to the La Encantada Lab from the El Plomo, Bonanza, Breccia Milagros, San Javier and San Francisco zones.

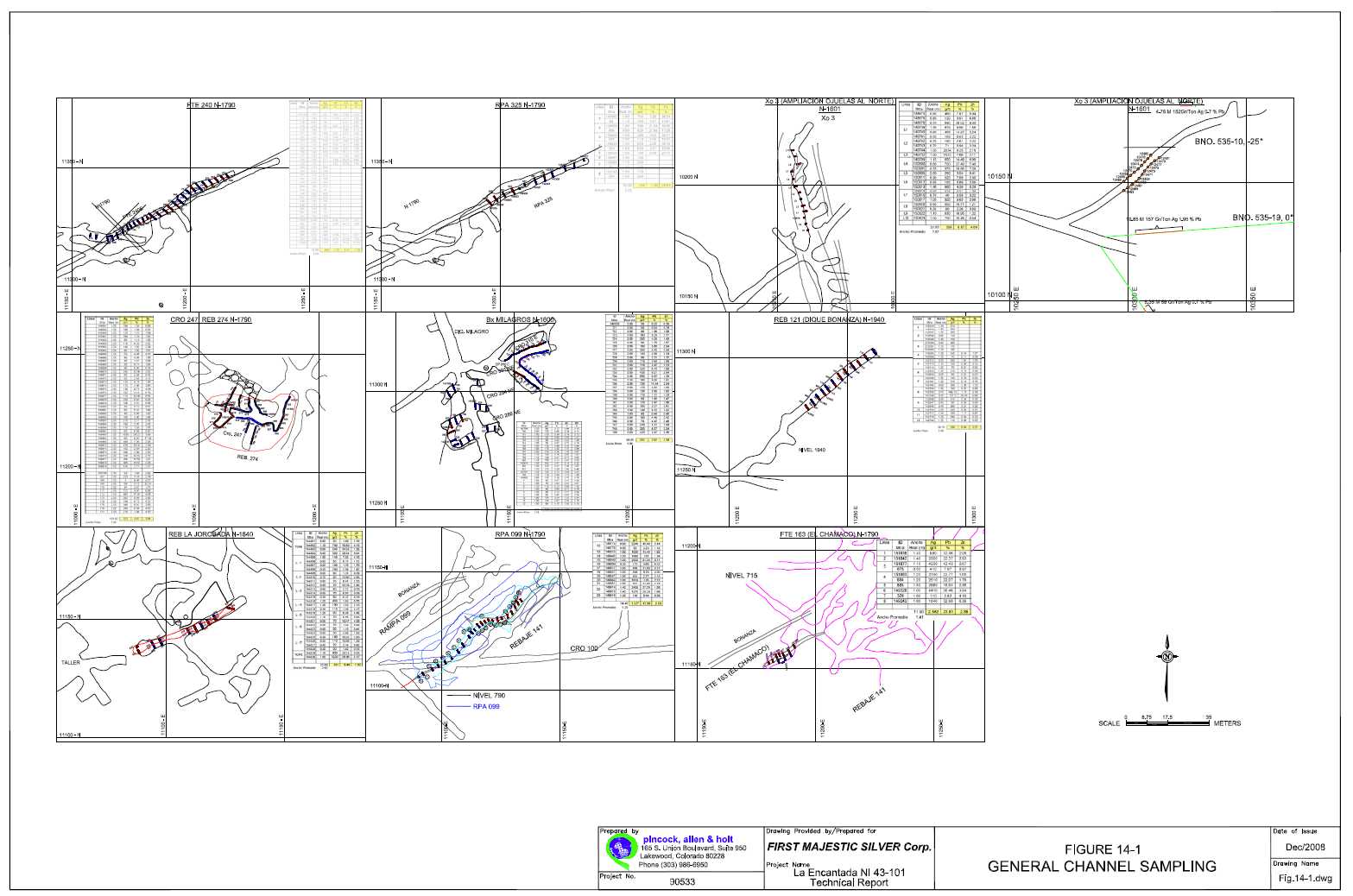

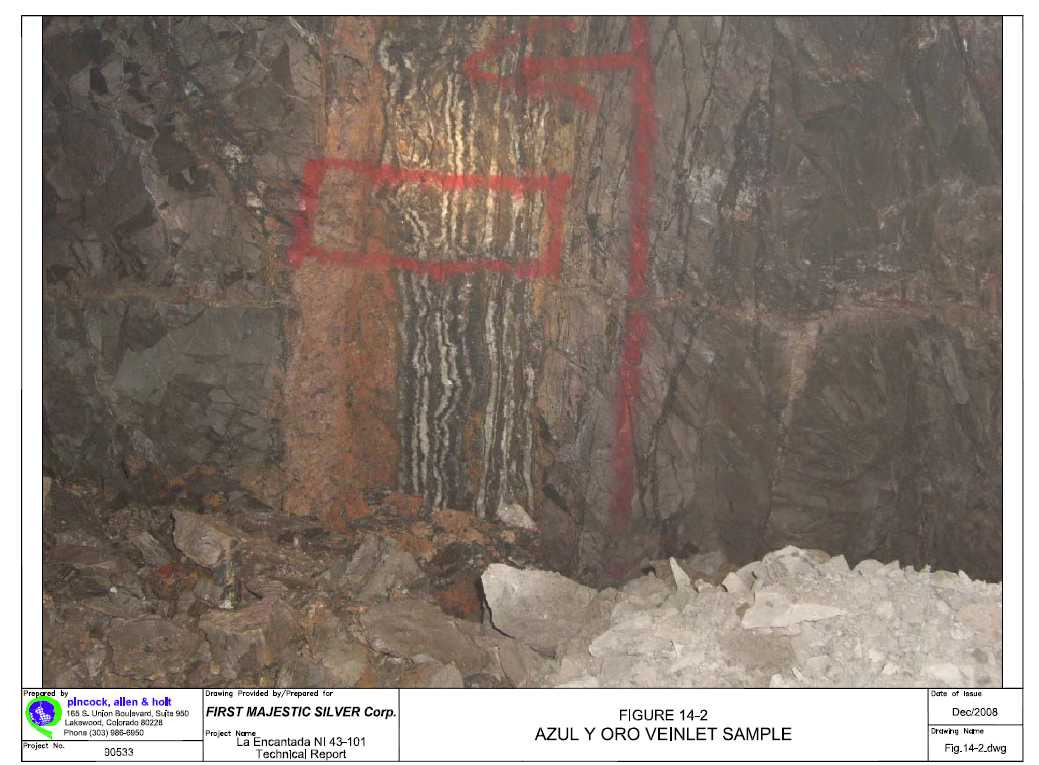

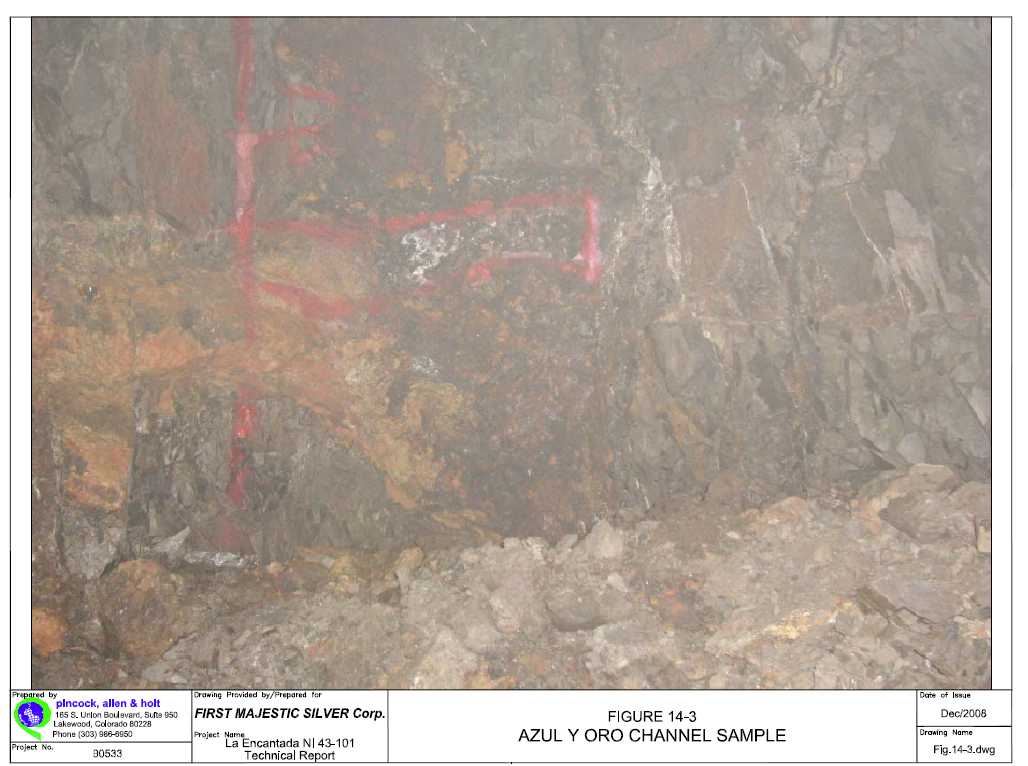

In PAH’s opinion, the channel and core sampling and methods applied by La Encantada exploration and mining crews is done carefully and responsibility by well trained samplers. The sampling appears to reconcile with silver/lead head assays for the processing plant, as well as with production and sales by Minera La Encantada. The channel and core samples appear to properly represent the mineralization of La Encantada various deposits; therefore, they are acceptable for resource and reserve estimates. Figure 14-1 shows channel sampling. Figure 14-2 shows a channel sample of Azul y Oro Veinlet. Figure 14-3 shows a channel Sample of Azul y Oro at Level 1790.

| Pincock, Allen & Holt | REVISED | 14.1 |

| 90533 February 26, 2009 |

15.0 SAMPLE PREPARATION, ANALYSIS AND SECURITY

15.1 Sample Preparation

PAH reviewed the La Encantada sample preparation for the Technical Report Amended dated March 18, 2008. FMS has not modified the sample preparation methods and procedures. Details are presented in the Technical Report Amended.

15.2 Laboratory Facilities

PAH notes that the La Encantada laboratories generally appear to be adequate, with reasonable cleaning and organization. The laboratory currently conducts about 800 samples by fire assay and AA per month, including exploration samples, development samples, and mill samples.

More details on laboratory facilities are presented in Technical Report Amended of July 24, 2007.

FMS’s procedure for quality controls is by sending drill core, mine samples and/or pulps to an outside laboratory, usually Inspectorate Labs in Reno, Nevada. Samples of concentrates are regularly sent to Peñoles for check assays. The laboratory duplicates pulp assays at about 1 sample for every 20 and it includes field duplicates, standard samples and introduction of blank samples.

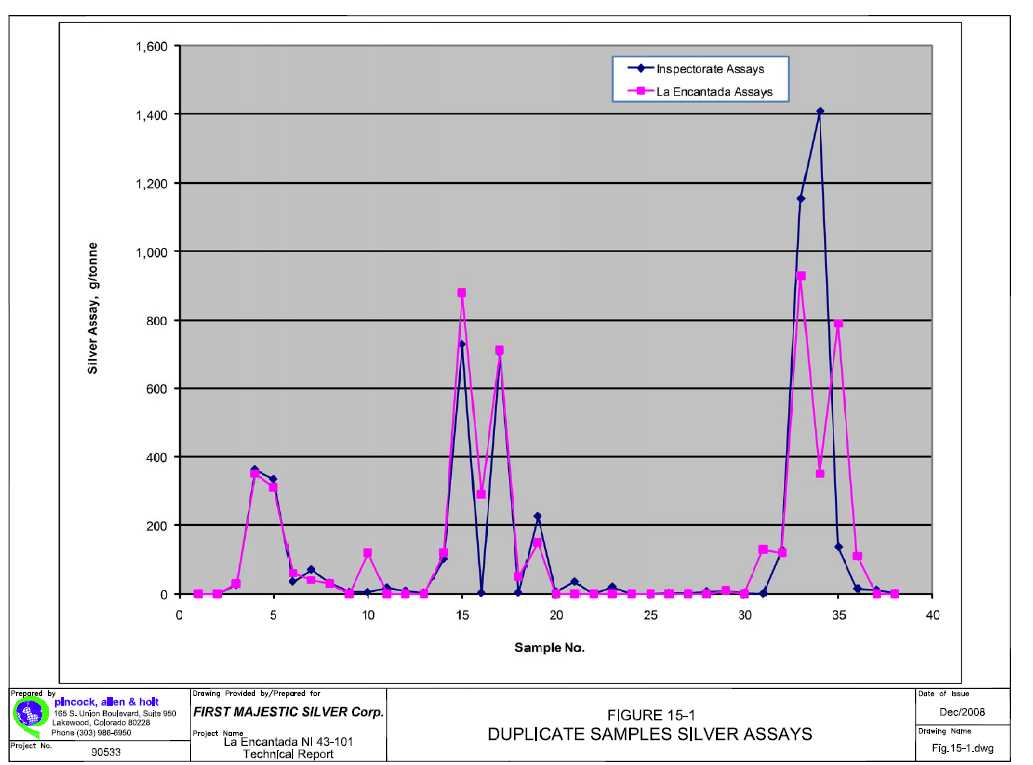

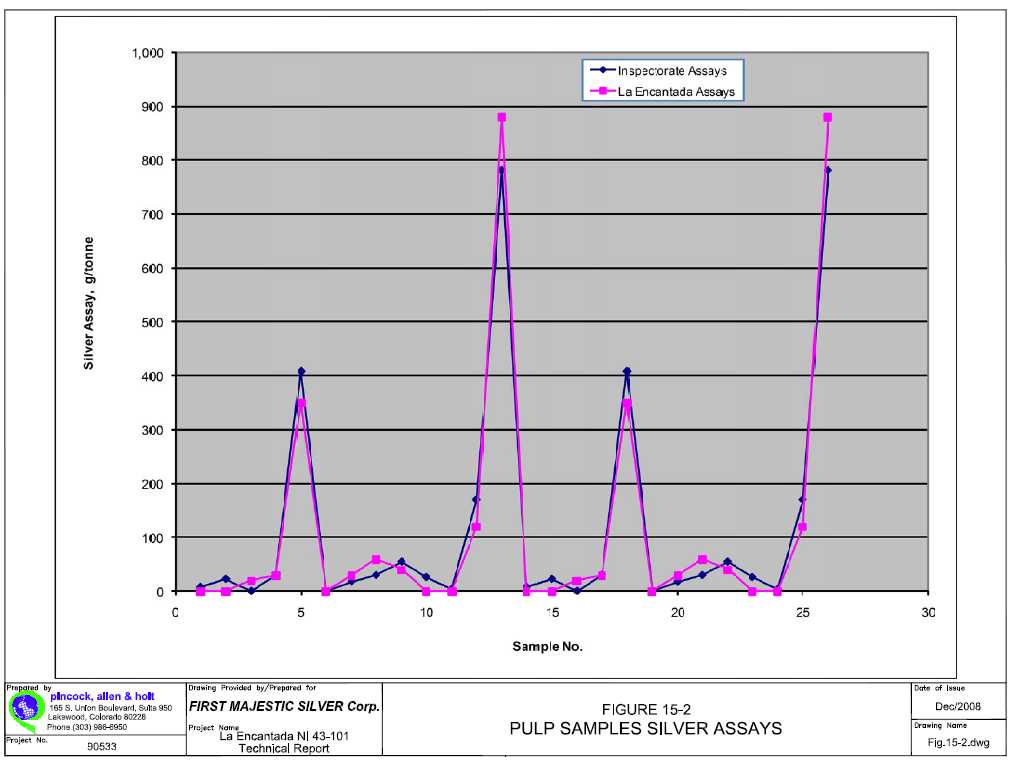

15.3 Check Assaying

To evaluate sample quality control, the La Encantada personnel perform periodic check analyses on samples. For the period from November, 2007 to September, 2008, La Encantada has sent 64 samples to Inspectorate Laboratories, an independent commercial laboratory in Reno, Nevada for duplicate analysis. These include 38 channel samples from reserve blocks in addition to 26 core duplicates of pulps from the reserve blocks. Results of the assays and graphs are presented in the following tables and graphs. La Encantada Silver Mine is mining and processing mineralization contained in oxides, which presents highly variable metal concentrations due to its inherent genetic characteristics. In this type of mineral occurrence, the comparison of assays may present high variations, depending on the mineral content of each sample. High grade silver assays may present differences of up to 80 percent due probably to some nugget effect, while the middle range grade samples usually result in close assays. In overall comparison, however, within a range of assays that represent very low to very high grades, the correlation is acceptable at an average of 74 percent for silver, and 100 percent for lead. While the duplicates of pulp samples show a better correlation of 99 percent for silver and 98 percent for lead.

Tables 15-1, 15-2 and Figures 15-1 and 15-2 show the assay results and graphs for samples of the La Encantada reserve blocks as duplicate samples and as duplicate pulp samples. The comparison is between assays by the La Encantada mine’s lab and Inspectorate Laboratories. Figure 15-3 shows the Buenos Aires drill core.

| Pincock, Allen & Holt | REVISED | 15.1 |

| 90533 February 26, 2009 |

TABLE 15-1

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Sample Assay Checks

Reserve Duplicate Samples

(1)

| INSPECTORATE LAB | LA ENCANTADA LAB | Sample Type | ||||||||

| DUPLICATE SAMPLES | DUPLICATE SAMPLES | |||||||||

| Sample No. | Ag gr/tonne | Pb % | Fe % | Zn % | Sample No. | Ag gr/tonne | Pb % | Fe % | Zn % | |

| 143348 | 0 | 0.01 | 0.01 | 0.80 | 146541 | 0 | 0.15 | 2.13 | 0.01 | BNO. 790-ESC-2 |

| 143349 | 0 | 0.00 | 0.00 | 0.41 | 146552 | 0 | 0.11 | 9.00 | 0.02 | BNO. 790-ESC-2 |

| 146012 | 26 | 0.01 | 0.91 | 12.70 | 146373 | 30 | 0.08 | 13.68 | 0.82 | SN FCO. 641 |

| 146013 | 363 | 1.45 | 0.43 | 8.90 | 146384 | 350 | 1.18 | 11.83 | 0.53 | SN FCO. 641 |

| 146014 | 334 | 20.50 | 0.09 | 26.80 | 146395 | 310 | 23.94 | 32.91 | 0.11 | SN FCO. 660 |

| 146015 | 36 | 1.27 | 0.09 | 41.30 | 146949 | 60 | 0.91 | 41.67 | 0.08 | SN FCO. 660 |

| 146016 | 71 | 2.55 | 0.16 | 42.20 | 146960 | 40 | 3.20 | 47.88 | 0.11 | SN FCO. 660 |

| 146044 | 32 | 0.07 | 0.14 | 0.78 | 146595 | 30 | 0.23 | 1.15 | 0.04 | BNO. 790-8 |

| 146045 | 5 | 0.09 | 0.03 | 3.48 | 143379 | 0 | 0.18 | 0.79 | 0.09 | BNO. 790-8 |

| 146046 | 6 | 0.04 | 0.13 | 0.47 | 140038 | 120 | 0.32 | 4.71 | 0.29 | BNO. 790-8 |

| 146047 | 18 | 0.01 | 0.05 | 0.41 | 143396 | 0 | 0.10 | 0.65 | 0.02 | BNO. 790-8 |

| 147901 | 9 | 0.02 | 0.08 | 0.54 | 147811 | 0 | 0.28 | 1.45 | 0.09 | BNO. 790-9 |

| 147902 | 3 | 0.01 | 0.05 | 0.38 | 147822 | 0 | 0.09 | 0.99 | 0.02 | BNO. 790-9 |

| 147903 | 102 | 0.06 | 0.18 | 0.32 | 147833 | 120 | 0.08 | 0.63 | 0.12 | BNO. 790-9 |

| 147904 | 727 | 0.56 | 0.65 | 4.40 | 147844 | 880 | 0.34 | 6.88 | 0.69 | BNO. 790-9 |

| 147905 | 3 | 0.02 | 0.01 | 0.19 | 147855 | 290 | 0.70 | 2.49 | 0.46 | BNO. 790-9 |

| 147906 | 703 | 0.11 | 0.28 | 0.85 | 147866 | 710 | 0.17 | 1.58 | 0.20 | BNO. 790-9 |

| 147907 | 4 | 0.01 | 0.03 | 0.22 | 147877 | 50 | 0.24 | 6.24 | 0.19 | BNO. 790-9 |

| 147908 | 226 | 0.22 | 0.45 | 1.21 | 147899 | 150 | 1.00 | 0.00 | 0.17 | BNO. 790-10 |

| 147919 | 6 | 0.02 | 0.04 | 0.40 | 148920 | 0 | 0.10 | 0.85 | 0.02 | BNO. 790-9 |

| 147920 | 36 | 0.02 | 0.02 | 0.19 | 148930 | 0 | 0.06 | 0.39 | 0.00 | BNO. 790-9 |

| 147921 | 1 | 0.01 | 0.01 | 0.20 | 148940 | 0 | 0.08 | 0.69 | 0.01 | BNO. 790-9 |

| 147922 | 21 | 0.03 | 0.22 | 0.85 | 148954 | 0 | 0.05 | 1.10 | 0.07 | BNO. 790-12 |

| 147923 | 1 | 0.01 | 0.02 | 0.21 | 148965 | 0 | 0.04 | 0.56 | 0.01 | BNO. 790-12 |

| 147924 | 2 | 0.01 | 0.00 | 0.10 | 148976 | 0 | 0.06 | 0.51 | 0.01 | BNO. 790-12 |

| 147925 | 3 | 0.02 | 0.09 | 0.94 | 148987 | 0 | 0.07 | 1.52 | 0.00 | BNO. 790-12 |

| 147926 | 2 | 0.01 | 0.02 | 0.32 | 148998 | 0 | 0.38 | 3.05 | 0.00 | BNO. 790-12 |

| 147927 | 7 | 0.02 | 0.13 | 0.78 | 148710 | 0 | 0.10 | 1.00 | 0.00 | BNO. 790-12 |

| 147928 | 10 | 0.01 | 0.05 | 0.40 | 148721 | 10 | 0.11 | 1.06 | 0.01 | BNO. 790-12 |

| 147929 | 3 | 0.01 | 0.01 | 0.19 | 148732 | 0 | 0.07 | 0.52 | 0.00 | BNO. 790-12 |

| 147930 | 1 | 0.01 | 0.02 | 0.16 | 148753 | 130 | 0.07 | 1.88 | 0.01 | BNO. 790-13 |

| 147931 | 128 | 0.18 | 0.55 | 1.73 | 148764 | 120 | 0.28 | 3.67 | 0.37 | BNO. 790-13 |

| 147932 | 1,155 | 0.06 | 0.85 | 3.72 | 148775 | 930 | 0.09 | 4.82 | 0.58 | BNO. 790-13 |

| 147934 | 1,409 | 0.48 | 2.05 | 6.78 | 148786 | 350 | 0.11 | 9.18 | 0.13 | BNO. 790-13 |

| 147935 | 137 | 0.10 | 0.59 | 1.97 | 148797 | 790 | 0.73 | 15.98 | 1.85 | BNO. 790-13 |

| 147936 | 15 | 0.01 | 0.03 | 0.16 | 149208 | 110 | 0.14 | 13.10 | 0.70 | BNO. 790-13 |

| 147937 | 11 | 0.01 | 0.04 | 0.36 | 149219 | 0 | 0.09 | 0.29 | 0.01 | BNO. 790-13 |

| 147938 | 2 | 0.01 | 0.02 | 0.15 | 149230 | 0 | 0.10 | 0.95 | 0.01 | BNO. 790-13 |

| Min. | 0.20 | 0.00 | 0.00 | 0.10 | 0.00 | 0.04 | 0.00 | 0.00 | ||

| Max | 1,409 | 21 | 2 | 42 | 930 | 24 | 48 | 2 | ||

| Average | 148 | 1 | 0 | 4 | 147 | 1 | 7 | 0 | ||

| Stdev. | 323 | 3 | 0 | 10 | 259 | 4 | 11 | 0 | ||

| Correlation. | 0.74 | 1.00 | 0.11 | 0.03 | ||||||

(1) Data by FMS, formatted by PAH

| Pincock, Allen & Holt | REVISED | 15.2 |

| 90533 February 26, 2009 |

TABLE 15-2

First Majestic Silver Corp.

Minera

La Encantada, S.A. de C.V.

La Encantada Silver Mine

Sample

Assay Checks

Reserve Duplicate of Pulp Samples (1)

| INSPECTORATE LAB | LA ENCANTADA LAB | Sample Type | ||||||

| PULP SAMPLES | PULP SAMPLES | |||||||

| Sample No. | Ag gr/tonne | Pb % | Zn % | Sample No. | Ag gr/tonne | Pb % | Zn % | |

| 143379 | 8 | 0.06 | 0.21 | 143379 | 0 | 0.18 | 0.09 | BNO. 790-8 |

| 143396 | 23 | 0.02 | 0.05 | 143396 | 0 | 0.10 | 0.02 | BNO. 790-8 |

| 146341 | 1 | 0.01 | 0.01 | 146341 | 20 | 0.09 | 0.02 | AyO N-850 |

| 146373 | 31 | 0.07 | 0.91 | 146373 | 30 | 0.08 | 0.82 | SN FCO. 641 |

| 146384 | 408 | 1.65 | 0.71 | 146384 | 350 | 1.18 | 0.53 | SN FCO. 641 |

| 146552 | 1 | 0.01 | 0.00 | 146552 | 0 | 0.11 | 0.02 | BNO. 790-ESC-2 |

| 146595 | 18 | 0.15 | 0.08 | 146595 | 30 | 0.23 | 0.04 | BNO. 790-8 |

| 146949 | 30 | 0.95 | 0.12 | 146949 | 60 | 0.91 | 0.08 | SN FCO. 660 |

| 146960 | 55 | 3.15 | 0.16 | 146960 | 40 | 3.20 | 0.11 | SN FCO. 660 |

| 147811 | 26 | 0.03 | 0.22 | 147811 | 0 | 0.28 | 0.09 | BNO. 790-9 |

| 147822 | 4 | 0.03 | 0.04 | 147822 | 0 | 0.09 | 0.02 | BNO. 790-9 |

| 147833 | 170 | 0.10 | 0.22 | 147833 | 120 | 0.08 | 0.12 | BNO. 790-9 |

| 147844 | 781 | 0.37 | 0.80 | 147844 | 880 | 0.34 | 0.69 | BNO. 790-9 |

| 143379 | 8 | 0.06 | 0.21 | 143379 | 0 | 0.18 | 0.09 | Channel |

| 143396 | 23 | 0.02 | 0.05 | 143396 | 0 | 0.10 | 0.02 | Channel |

| 146341 | 1 | 0.01 | 0.01 | 146341 | 20 | 0.09 | 0.02 | Channel |

| 146373 | 31 | 0.07 | 0.91 | 146373 | 30 | 0.08 | 0.82 | Channel |

| 146384 | 408 | 1.65 | 0.71 | 146384 | 350 | 1.18 | 0.53 | Channel |

| 146552 | 1 | 0.01 | 0.00 | 146552 | 0 | 0.11 | 0.02 | Channel |

| 146595 | 18 | 0.15 | 0.08 | 146595 | 30 | 0.23 | 0.04 | Channel |

| 146949 | 30 | 0.95 | 0.12 | 146949 | 60 | 0.91 | 0.08 | Channel |

| 146960 | 55 | 3.15 | 0.16 | 146960 | 40 | 3.20 | 0.11 | Channel |

| 147811 | 26 | 0.03 | 0.22 | 147811 | 0 | 0.28 | 0.09 | Channel |

| 147822 | 4 | 0.03 | 0.04 | 147822 | 0 | 0.09 | 0.02 | Channel |

| 147833 | 170 | 0.10 | 0.22 | 147833 | 120 | 0.08 | 0.12 | Channel |

| 147844 | 781 | 0.37 | 0.80 | 147844 | 880 | 0.34 | 0.69 | Channel |

| Min. | 0.70 | 0.01 | 0.00 | 0.00 | 0.08 | 0.02 | ||

| Max. | 781 | 3 | 0.91 | 880 | 3.20 | 0.82 | ||

| Average | 120 | 1 | 0.27 | 118 | 0.53 | 0.20 | ||

| Stdev. | 224 | 1 | 0.31 | 243 | 0.86 | 0.27 | ||

| Correlation | 0.99 | 0.98 | 0.99 | |||||

(1) Data by FMS, formatted by PAH.

| Pincock, Allen & Holt | REVISED | 15.3 |

| 90533 February 26, 2009 |

The reserve duplicate samples mineral content range includes assays that vary from 0.2 to 1,409 g/tonne Ag. The average correlation coefficient of the silver grades is acceptable for the set of samples, at 74 percent, with slightly lower assays by the La Encantada lab. The reserve pulp duplicate samples, for the set of duplicate samples, range in silver values from 0.7 to 781 g/tonne Ag with an average correlation of 99 percent and slightly lower silver assays for the La Encantada Lab and average correlation of 98 and 99 percent respectively for lead and zinc. Therefore, pulp duplicate samples assays show good sample preparation procedures at La Encantada. PAH believes that the reproducibility of silver grades is acceptable, and it represents acceptable procedures and practices in the sampling preparation processes.

La Encantada Silver Mine has implemented a strict program of Quality Control by introduction of blank and standard samples, as well as the insertion of field duplicate samples and pulp duplicates to keep a close control of the assay results. PAH recommends continuing with current sample preparation and shipping processes, which show acceptable differences in assay checks.

15.4 Conclusion

Overall, PAH found that the results from the check assaying are excellent and acceptable for pulp duplicates, the mineralization in oxides may cause larger differences in assays due to its nature. It is PAH’s opinion that the sample methods and analyses are representative of the deposits at La Encantada mine, and that most of La Encantada’s data was generated by procedures that were carried out according to accepted industry standards using accepted practices.

PAH finds that the exploration, sampling, and laboratory analysis for La Encantada operation is being conducted by FMS in a reasonable manner consistent with standard industry practices. In PAH’s opinion the sampling results appear to be reasonably representative of the deposits mineralization and believes that they may be used with acceptable confidence in the estimation of the mineable reserves.

| Pincock, Allen & Holt | REVISED | 15.7 |

| 90533 February 26, 2009 |

16.0 DATA VERIFICATION

PAH has not taken independent samples from the surface or underground exposures of the mineral concentrations at La Encantada mine, as other Qualified Persons have previously sampled the mineralization as discussed in this report, and the production records are the most reliable data of mineralization contained in the ore deposits under development at the mine. Peñoles developed and operated La Encantada mine for over 25 years producing over 80 million ounces of silver. Peñoles is one of the leading Mexican mining companies and the world’s largest silver producer.

FMS has established in a short operating period a systematic procedure to verify data and quality control which is proving effective and accurate. Assay data and information generated by the operation is transmitted manually; however, the entire paper trail is accessible and available for inspection.

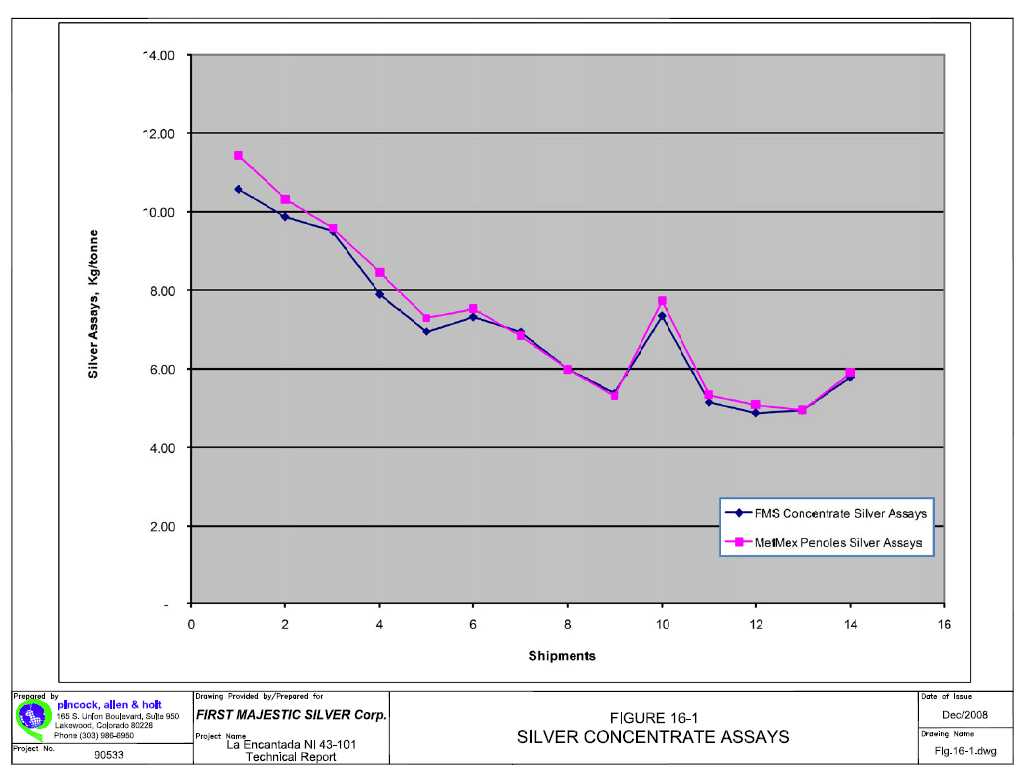

FMS initiated effective control of La Encantada operations since November 2006 when it took control of the mining operation. La Encantada has established an active program of assay checks for samples and pulps of exploration, production and concentrates at the mine’s lab in comparison to assays performed by Inspectorate Laboratories of Durango city and Reno, Nevada, and concentrate sampling and assaying program by a sales representative in the city of Torreón, Coahuila to check the assays reported by the MET-MEX Peñoles smelter.

Table 16-1 presents a summary of concentrate assays for July, 2008 of shipments to MET-MEX Peñoles. This summary presents a comparison of assays by La Encantada lab and MetMex Peñoles.

TABLE 16-1

First Majestic Silver

Corp.

Minera la Encantada, S.A. de C.V.

La Encantada Silver

Mine

Concentrate Checks for July, 2008 Shipments

| Concentrates | First Majestic Silver Corp. | Met Mex Peñoles SA de CV | |||||||||

| Shipment | Date | Weight | Assays | Content | Weight | Assays | Content | ||||

| No. | (Tonnes) | Silver | lead | Silver | Lead | Tonnes | Silver | Lead | Silver | Lead | |

| Kg/tonne | % | Kg | Tonnes | Kg/tonne | % | Kg | Tonnes | ||||

| DES- 2008 - 101 | 7/1/2008 | 31.80 | 10.57 | 39.37 | 336.12 | 12.52 | 32.71 | 11.438 | 37.42 | 374.15 | 12.24 |

| DES- 2008 - 102 | 7/4/2008 | 30.57 | 9.87 | 39.94 | 301.71 | 12.21 | 30.98 | 10.318 | 34.08 | 319.66 | 10.56 |

| DES- 2008 - 103 | 7/7/2008 | 32.82 | 9.50 | 31.16 | 311.80 | 10.23 | 33.53 | 9.582 | 29.65 | 321.25 | 9.94 |

| DES- 2008 - 104 | 7/9/2008 | 22.81 | 7.90 | 28.63 | 180.20 | 6.53 | 23.42 | 8.453 | 24.69 | 197.97 | 5.78 |

| DES- 2008 - 105 | 7/10/2008 | 32.88 | 6.95 | 27.08 | 228.50 | 8.90 | 33.37 | 7.29 | 23.65 | 243.38 | 7.89 |

| DES- 2008 - 106 | 7/13/2008 | 31.83 | 7.32 | 27.44 | 233.01 | 8.73 | 32.89 | 7.53 | 25.71 | 247.68 | 8.46 |

| DES- 2008 - 107 | 7/15/2008 | 32.54 | 6.95 | 24.31 | 226.16 | 7.91 | 32.52 | 6.85 | 22.28 | 222.62 | 7.25 |

| DES- 2008 - 108 | 7/17/2008 | 31.39 | 6.00 | 13.73 | 188.19 | 4.31 | 31.96 | 5.99 | 20.58 | 191.38 | 6.58 |

| DES- 2008 - 109 | 7/18/2008 | 32.73 | 5.39 | 24.41 | 176.43 | 7.99 | 32.59 | 5.30 | 17.72 | 172.81 | 5.77 |

| DES- 2008 - 110 | 7/21/2008 | 30.15 | 7.35 | 16.84 | 221.57 | 5.08 | 30.80 | 7.74 | 16.75 | 238.21 | 5.16 |

| DES- 2008 - 111 | 7/23/2008 | 30.66 | 5.15 | 18.63 | 157.89 | 5.71 | 31.35 | 5.34 | 18.14 | 167.48 | 5.69 |

| DES- 2008 - 112 | 7/27/2008 | 30.19 | 4.88 | 11.82 | 147.32 | 3.57 | 30.70 | 5.09 | 11.50 | 156.16 | 3.53 |

| DES- 2008 - 113 | 7/29/2008 | 31.28 | 4.95 | 11.69 | 154.83 | 3.66 | 31.84 | 4.96 | 11.48 | 157.85 | 3.66 |

| DES- 2008 - 114 | 7/29/2008 | 30.30 | 5.79 | 16.19 | 175.44 | 4.91 | 30.93 | 5.91 | 16.31 | 182.64 | 5.04 |

| Total | 432 | 7.036 | 331 | 3,039 | 102 | 440 | 101.779 | 310 | 3,193 | 98 | |

| Average | 31 | 0.503 | 24 | 31 | 7.270 | 22 | |||||

| Max | 33 | 10.570 | 40 | 34 | 11.438 | 37 | |||||

| Min | 23 | 4.880 | 12 | 23 | 4.957 | 11 | |||||

| Correlation | 0.99 | 1.00 | 0.95 | ||||||||

| Pincock, Allen & Holt | REVISED | 16.1 |

| 90533 February 26, 2009 |

The coefficient of correlation is excellent for all determinations, including weight (99 percent), silver (100 percent) and lead (95 percent).

Figure 16-1 shows correlation between silver assays of both laboratories.

PAH believes that an adequate amount of checking has been conducted and that the results are representative of the mineralization and concentrates produced at La Encantada and shipped to the smelter.

PAH’s conclusion is that the results from check assaying are reasonable, including appropriate preparation procedures that the sampling results appear to be reasonably representative of the deposit mineralization and concentrates, and should be usable with acceptable confidence in the estimation of the mineable reserves.

| Pincock, Allen & Holt | REVISED | 16.2 |

| 90533 February 26, 2009 |

17.0 ADJACENT PROPERTIES

No adjacent properties exist within the surrounding area of La Encantada. The El Plomo mine was operated as an independent mine for a period of time during the early stages of La Encantada development; however, in 1983 it was purchased by Minera La Encantada and it has been part of La Encantada mine since then. Underground developments of La Encantada and El Plomo were connected and established as one underground system. No other mine exists nearby the La Encantada area.

La Encantada mine is located at about 100km from the cities of Ocampo and Muzquiz, in Coahuila, México.

La Encantada mine housing facilities include 180 single family houses, events center, hotel and three restaurants, elementary school facilities, secondary school by teleconferences, sport facilities for soccer, squash and bowling, apart from the administration offices and warehouses, etc. Refurbishing of required facilities is in progress.

FMS has consolidated ownership of the La Encantada mine area by acquiring all mining claims and additional concessions around the property. Surface rights have also been acquired by La Encantada from the local “Ejido” (land community) under expropriation proceedings in accordance with the Mining Laws.

| Pincock, Allen & Holt | REVISED | 17.1 |

| 90533 February 26, 2009 |

18.0 METALLURGICAL TESTING AND MINERAL PROCESSING

The ore processed at La Encantada is a complex mixture of oxide and sulfide minerals and is consequently difficult to process efficiently. The principal economic minerals are as follows:

The gangue is principally limestone and hematite with minor amounts of quartz, manganese, and zinc.

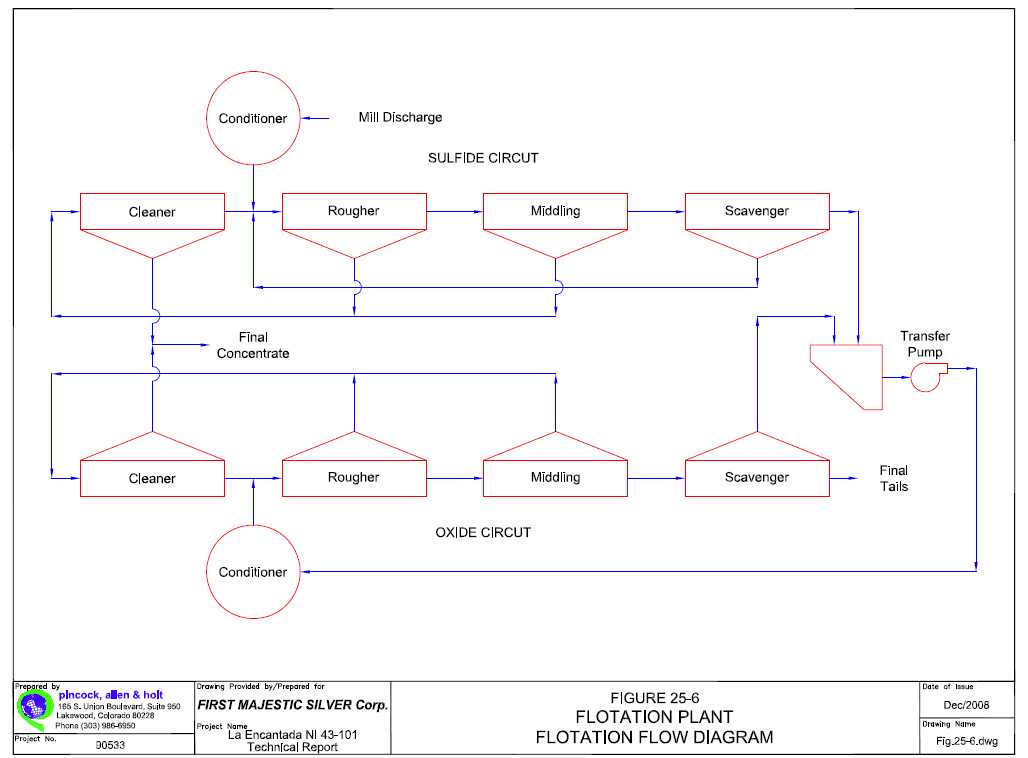

The ore is relatively soft and friable making for easy crushing and grinding. The ore processing method consists of crushing and grinding followed by two sequential flotation steps, the first consists of sulfide mineral flotation and the second is oxide mineral flotation. The reason for floating the ore in two stages is because the reagents used for oxide flotation are detrimental to sulfide flotation. Recoveries are poor, a reflection of the difficult mineralogy of the rock.

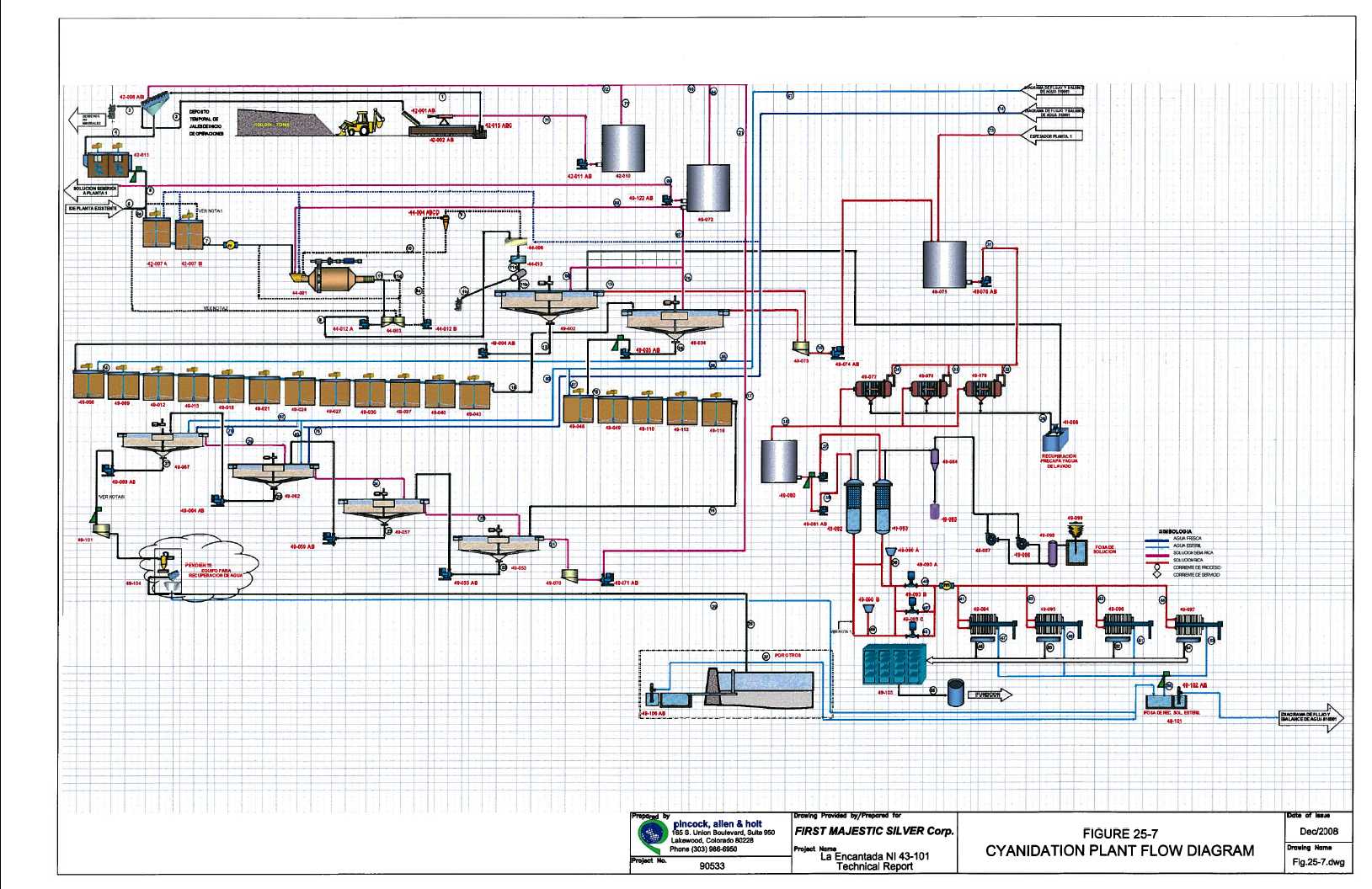

A cyanide leach plant is currently under construction at La Encantada and plans are to place it in operation in April 2009. The plant will process ore from the mine and waste dumps and from the three existing tailings containments: No. 1, No. 2 and No. 3.

Metallurgical testwork has been conducted on cyanide leaching of old tailings and of flotation concentrate. Results of the testwork are presented in Table 18-1 and 18-2, respectively.

Table 18-1 shows that cyanide leaching achieves relatively good recovery, averaging 59 percent, from the lower-grade, lower-tonnage No. 1 Tailings, and relatively poor recovery, averaging 40 percent, from the higher-grade, higher-tonnage No. 2 Tailings. Recovery from the composite sample, a mixture of fresh ore and Tailings No. 1 and No. 2, was good at 67 percent, though the sample is not particularly representative of what will be fed to the plant.

Table 18-2 shows that cyanide leaching of one sample of flotation concentrate gave very good recovery, at 98 percent. When the cyanide leach plant becomes operational, one option for the future plans is to eliminate flotation and instead, cyanide leach the ore and waste dump rock in the new plant following crushing and grinding in the existing mill. Direct cyanide leaching the ore and waste dump rock is projected to be 78 percent in the FMS Cash Flow Model, which appears reasonable based on the results of leaching concentrate and old tailings; however, the testwork is limited but the results were comfirmed with historic testworks made by Penoles.

One area of concern in the cyanide leaching plant is that the process water used at La Encantada is slightly saline and testwork conducted thus far has been with standard potable water. It may well be that the use of plant process water will be of no consequence but, until this is tested, this uncertainty remains.

| Pincock, Allen & Holt | REVISED | 18.1 |

| 90533 February 26, 2009 |

TABLE 18-1

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Cyanide Leach Testwork, Tailings and Ore/Tailings Composite

| Parameter | Units | Jales 1 | Jales 2 | Composite* |

| FMS Cash Flow Model | ||||

| Resource | tonnes | 900,375 | 4,015,711 | |

| Silver Grade | grams/tonne | 72 | 168 | 187 |

| Projected Recovery | percent | 52 | 48 | 59 |

| Laboratory Results | ||||

| Silver Grade | ||||

| June 22, 2007 | grams/tonne | 89 | 163 | |

| July 12, 2008 | grams/tonne | 163 | 231 | |

| March 14, 2008 | grams/tonne | 103 | 104 | |

| Cyanide Consumption | ||||

| June 22, 2007 | grams/tonne | |||

| July 12, 2008 | grams/tonne | 4.3 | 4.0 | |

| March 14, 2008 | grams/tonne | 3.3 | 3.4 | |

| Silver Recovery | ||||

| June 22, 2007 | percent | 59 | 43 | |

| July 12, 2008 | percent | 46 | 67 | |

| March 14, 2008 | percent | 59 | 31 | |

| Average | percent | 59 | 40 |

* Made up of 37.5% mine ore, 31.25% Tailings No. 1, and 31.25% Tailings No. 2

TABLE 18-2

First Majestic Silver

Corp.

Minera La Encantada, S.A. de C.V.

La Encantada Silver

Mine

Cyanide Leach Testwork, Flotation Concentrate

| Parameter | Units | Value |

| Head Grade | ||

| Silver | grams/tonne | 9,350 |

| Lead | percent | 35.13 |

| Zinc | percent | 1.77 |

| Iron | percent | 6.65 |

| Manganese | percent | 0.44 |

| Test Conditions | ||

| Weight of sample | kilograms | 13 |

| Cyanide additon | grams | 699.2 |

| Lime adition | grams | 132.8 |

| Water addition | liters | 26 |

| Cyanide strength | grams/liter | 27 |

| pH | 11.5 | |

| Slurry density | weight percent | 33 |

| Leach time | hours | 24 |

| Test Results * | ||

| Cyanide addition rate | kilograms/tonne | 54 |

| Lime addition rate | kilograms/tonne | 10 |

| Silver recovery | percent | 97.53 |

*Note: Residual concentrations of cyanide and lime

could not be determined because of the strong yellow

color of the leach solution.

| Pincock, Allen & Holt | REVISED | 18.2 |

| 90533 February 26, 2009 |

19.0 MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

La Encantada uses conventional, manual methods, assisted by computer databases, to calculate the tonnage and average grades of the mineral resources and reserves. FMS has initiated the compilation of all data to incorporate it into a database and create a geologic model in SURPAC software which has been acquired by the company. FMS has reviewed and calculated resources and reserves for La Encantada to assess the current status of the property and to use it as a basis for future updated estimates. FMS assumed control of La Encantada Silver Mine operation from November 2006. FMS estimated the first resource/reserve base for the La Encantada mine as of May 31, 2007. This estimate is an update of October 31, 2007, resource/reserve base and it incorporates exploration and underground development results for the mine. During the current period, November, 2007 to September 2008, La Encantada mined a total of about 205,000 tonnes of ore, from which only 90,000 tonnes were mined out of the previously reported reserves and also increased the reserves during the period to about 5.2 million tones, including 4.0 million tones of tailings to be processed by cyanidation. This resource/reserve update calculation has been estimated as of September 30, 2008.

19.1 Introduction

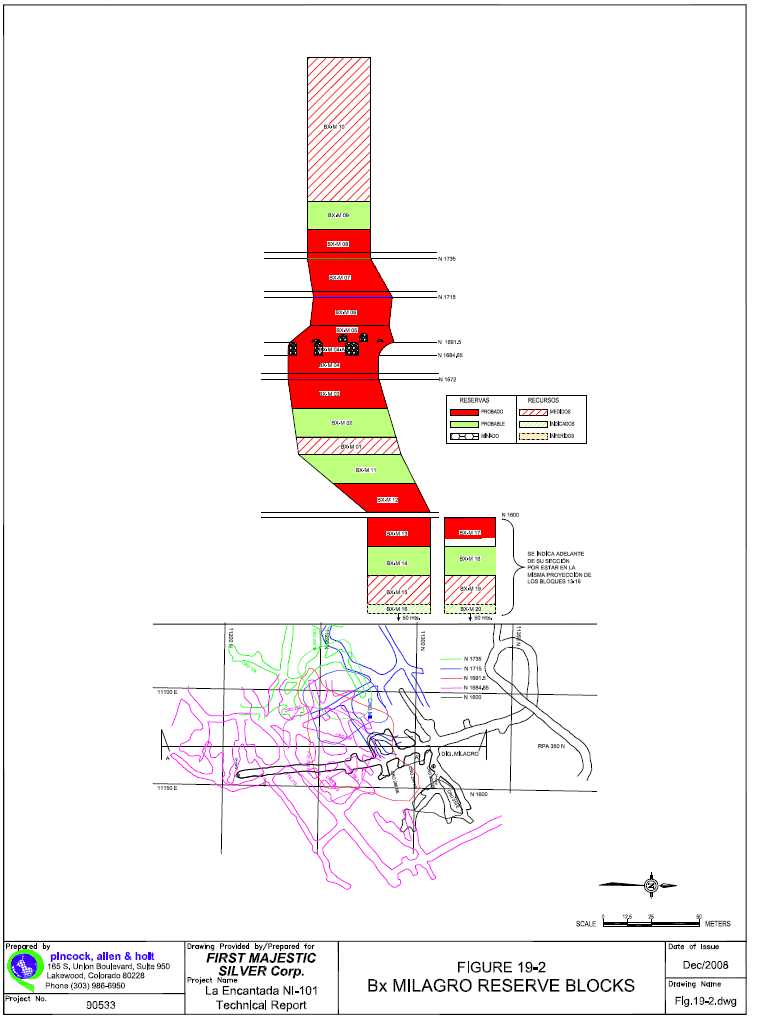

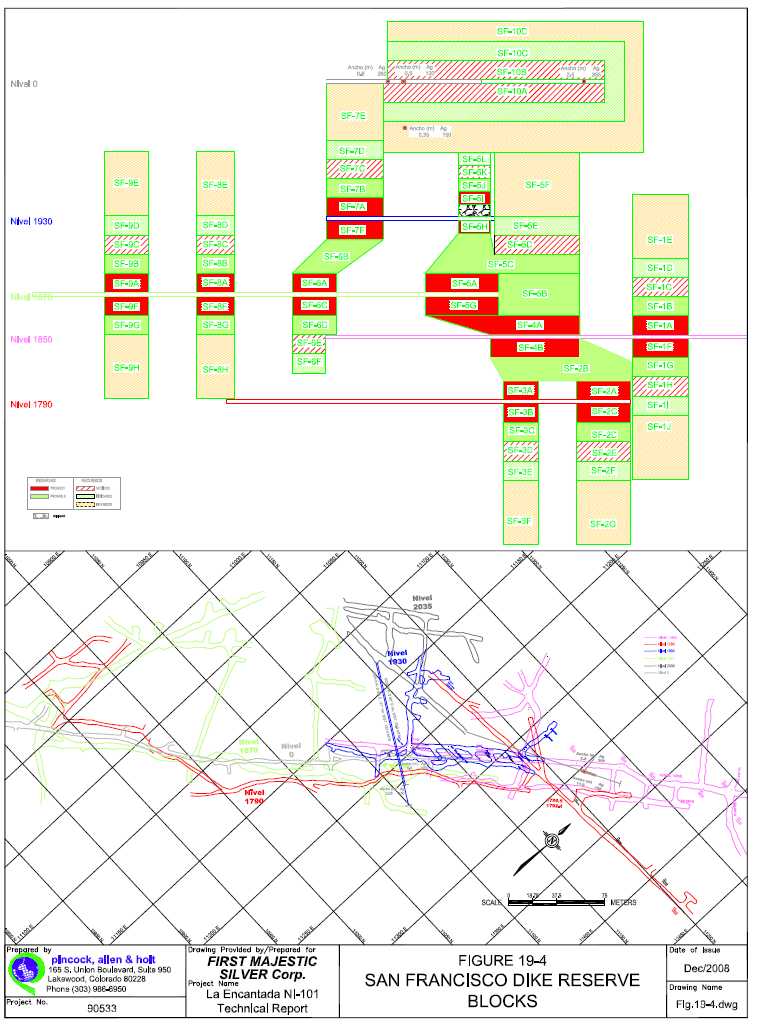

FMS estimated proven and probable reserves, as of October 31, 2007, amounted to 1.2 million tonnes at an average grade of 312 g/tonne Ag and 1.77 percent Pb. Cutoff grade was estimated as 256 g/tonne Ag only, and 241 g/tonne Ag equivalent net of Pb credit. The estimated reserves were included in the deposits of: Breccia Milagros, Azul y Oro, Breccia Keylor, Cuerpo 660, Mantos 314, Chicotón Stope, San Francisco, La Piedra, Cola Gallo deposits and some dumps.