Technical Report for

the

San Martín Silver Mine,

State of Jalisco, México

Prepared for

First Majestic Silver Corp.

January 15,

2009

90535

Prepared by

Pincock, Allen & Holt

Richard Addison,

P.E.

Jack Haptonstall

Leonel López, C.P.G.

1.0 TITLE PAGE

This technical report has been prepared in accordance with the National Instrument 43-101 standards of disclosure for mineral projects (“NI 43-101”) and the contents herein are organized and in compliance with form 43-101F1 contents of the technical report (“43-101F1”). This technical report is an update of Technical Report Amended for the San Martín Silver Mine, State of Jalisco, México; which was prepared for First Majestic Silver Corp. dated July 24, 2007 and published in SEDAR in July 25, 2007. The first two items are the title page and table of contents that are presented previously in this report and are simply mentioned herein to maintain the specific report outline numbering contained in form 43-101F1 contents of the technical report.

| Pincock, Allen & Holt | 1.1 |

| 90535 January 15, 2009 |

2.0 TABLE OF CONTENTS

See discussion in Section 1.

| Pincock, Allen & Holt | 2.1 |

| 90535 January 15, 2009 |

| Pincock, Allen & Holt | i |

| 90535 January 15, 2009 |

| Pincock, Allen & Holt | ii |

| 90535 January 15, 2009 |

| Pincock, Allen & Holt | iii |

| 90535 January 15, 2009 |

TABLES

| Pincock, Allen & Holt | iv |

| 90535 January 15, 2009 |

FIGURES

| Pincock, Allen & Holt | v |

| 90535 January 15, 2009 |

3.0 SUMMARY

Pincock, Allen & Holt (PAH), a division of Runge, Inc. (Runge) was retained by First Majestic Silver Corp. (FMS), to conduct an independent reserve audit, project update, and prepare a Technical Report in accordance with Canadian National Instrument 43-101 for its San Martín Silver Mine (San Martín) operation, as represented and in operation by its wholly-owned Mexican subsidiary, Minera El Pilón, S.A. de C.V. (El Pilón).

Preparation of this Technical Report for FMS by PAH included a site visit (November 2-4, 2008) to review the San Martín mining operation current status, including underground mine, processing plant facilities and present environmental and infrastructure conditions. This Technical Report is also based on the previous “Technical Report for the San Martín Silver Mine, State of Jalisco, México” prepared for First Majestic Silver Corp., dated July 24, 2007 Amended and published in SEDAR on July 25, 2007. The PAH site visit also included a visit to El Pilón administrative and support office at Durango city, where Mr. Ramón Dávila, FMS Chief Operating Officer, provided all requested data on the Company’s financial statements.

The San Martín mine includes underground operations that have opened six main drifts with levels at an approximate 35-meter vertical separation. Each one of the drifts has been developed to a maximum extension of approximately 3,000 meters, with interconnecting ramps between levels, and all have surface access to the Cerro Colorado hillside. Since 1983, when El Pilón initiated operations in the area, to September 30, 2008, about 4.3 million tonnes of silver ore have been extracted and processed, to produce sales of approximately 33.6 million ounces of silver, including some gold and lead. Most of the San Martín ore production has been mined out from the Zuloaga vein, with minor production extracted from the La Blanca, Rosario and Cinco Señores veins.

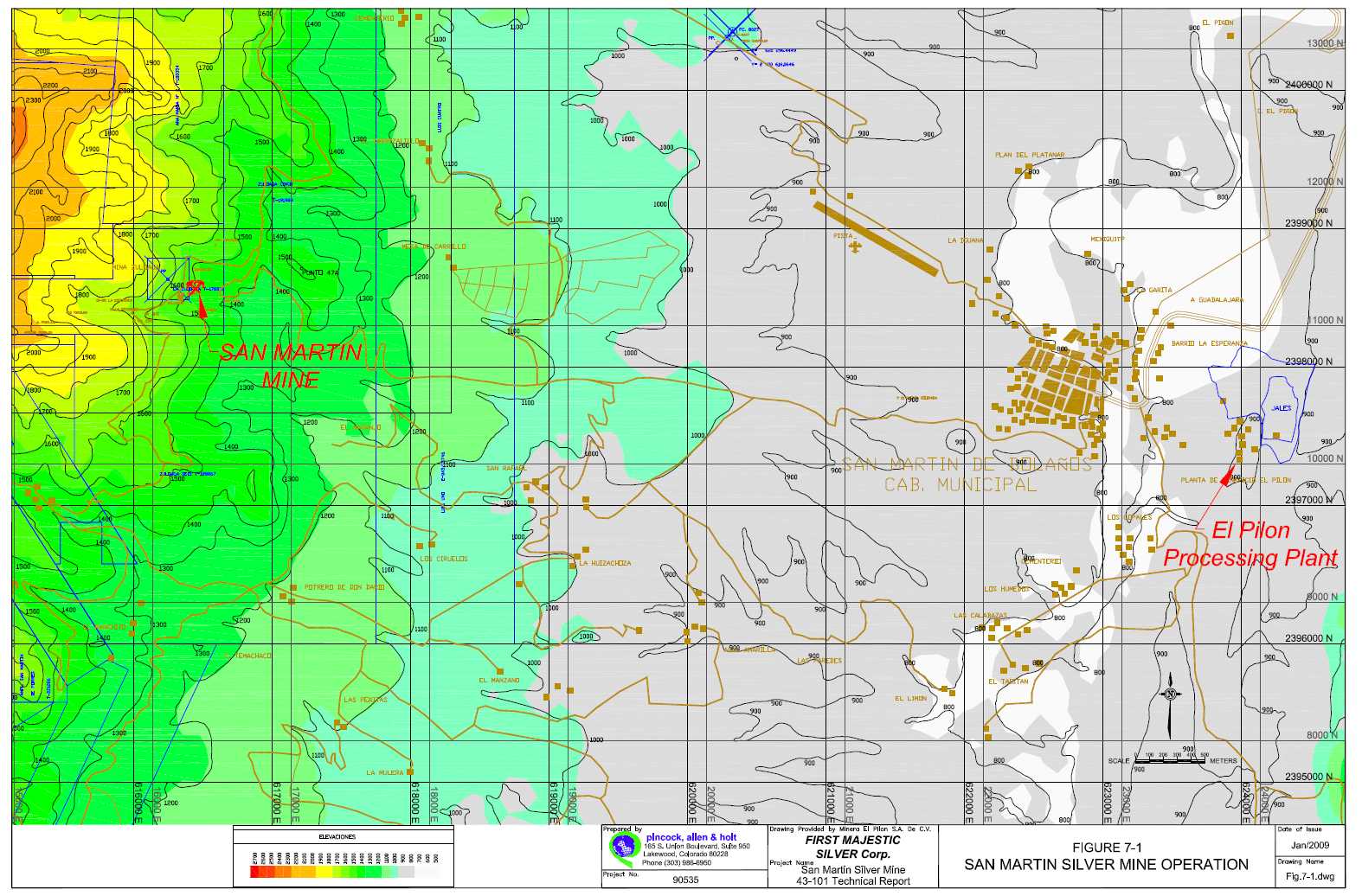

3.1 Location

The San Martín mine is located near the town of San Martín de Bolaños on the Bolaños River valley, in the northern portion of the State of Jalisco, México. The San Martín operation is 150 kilometers by air or 250 kilometers by paved road north from Guadalajara. Driving time is four to five hours and flying time is about 45 minutes by commuter or charter plane. The town of San Martín de Bolaños has a population of about 3,000 and the mine is a major contributor to the economy of the town and area.

The plant is located southeast of the town at an elevation of 850 meters asl. The mine is 10 kilometers northwest of the town at elevations between 1,080 and 1,600 asl. The Distance from the mine to the plant is about 13 km.

UTM coordinates at the central part of the San Martín mine operation area are as follows:

North – 2,375,500; East – 615,000

| Pincock, Allen & Holt | 3.1 |

| 90535 January 15, 2009 |

3.2 Ownership

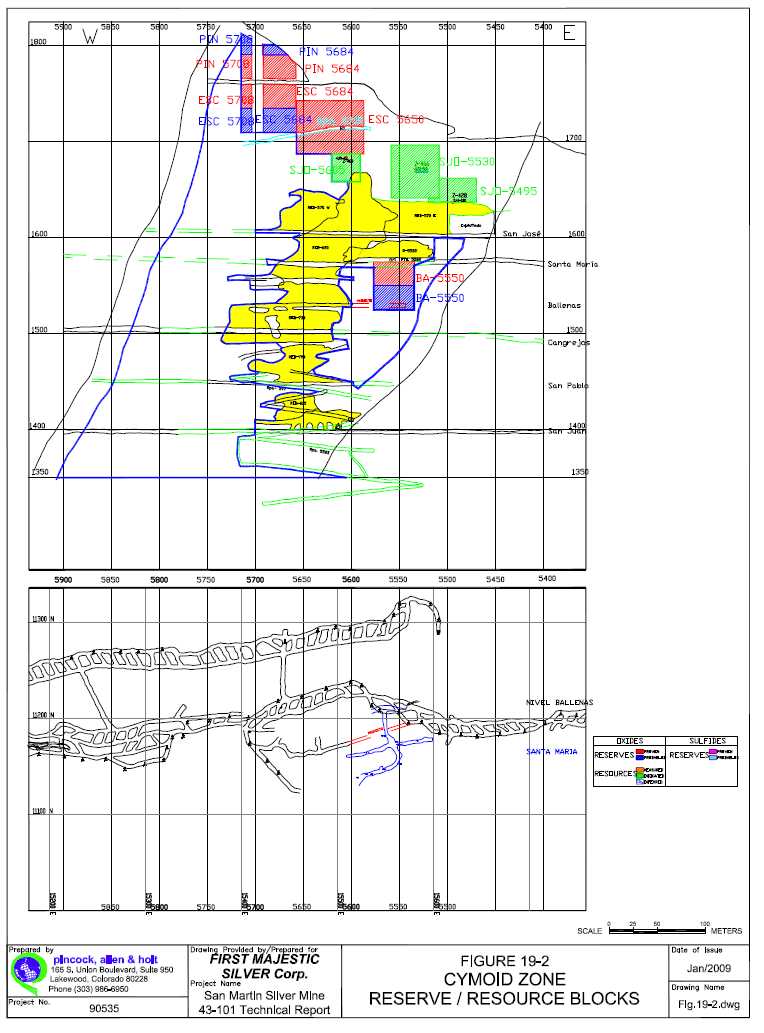

Minera El Pilón S.A. de C.V. (El Pilón) is a wholly owned subsidiary of First Majestic Silver Corp., which is based in Vancouver, British Columbia. El Pilón corporate offices are located in Durango city and operates the San Martín underground silver mine and ore processing facility near the town of San Martín de Bolaños in the State of Jalisco. Oxidized ore is being mined primarily from the Zuloaga vein and from the adjacent La Blanca, Rosario and Cinco Señores Veins. Exploration is on-going on these vein structures, on other sub-parallel, crossing veins and in a recently identified cymoid structure of the Zuloaga vein at the Ballenas level, in the blocks 5,400 and 5,550, as well as on the Rosario-Condesa vein system. Primary mineralization in sulfides with lead, zinc and copper occurs at the deepest levels, San Juan and San Carlos of the Zuloaga vein. FMS has withheld investigations and development of the sulfides mineralization due to currently low metal prices.

El Pilón holds 31 contiguous mining concessions in the San Martín de Bolaños mining district that cover mineral rights for 7,841 hectares.

3.3 Geology and Mineralization

The project area lies in the southern part of the Sierra Madre Occidental, an extensive volcanic terrain starting near the United States-Mexican border and trending southeast into the states of Zacatecas and Jalisco. The terrain is characterized by Tertiary age volcanic rocks that have been divided into a lower andesitic sequence of early Tertiary age (40 to 70 million years) and an upper rhyolitic sequence of middle Tertiary age (20 to 40 million years). Volcanism, structural development and mineralization in the San Martín area occurred during late Miocene, resulting in a complex geologic framework, (Starling, 2001). Two distinct features have been recognized by different authors, the pre and post mineralization rock formations, and the indicator Guásima Formation.

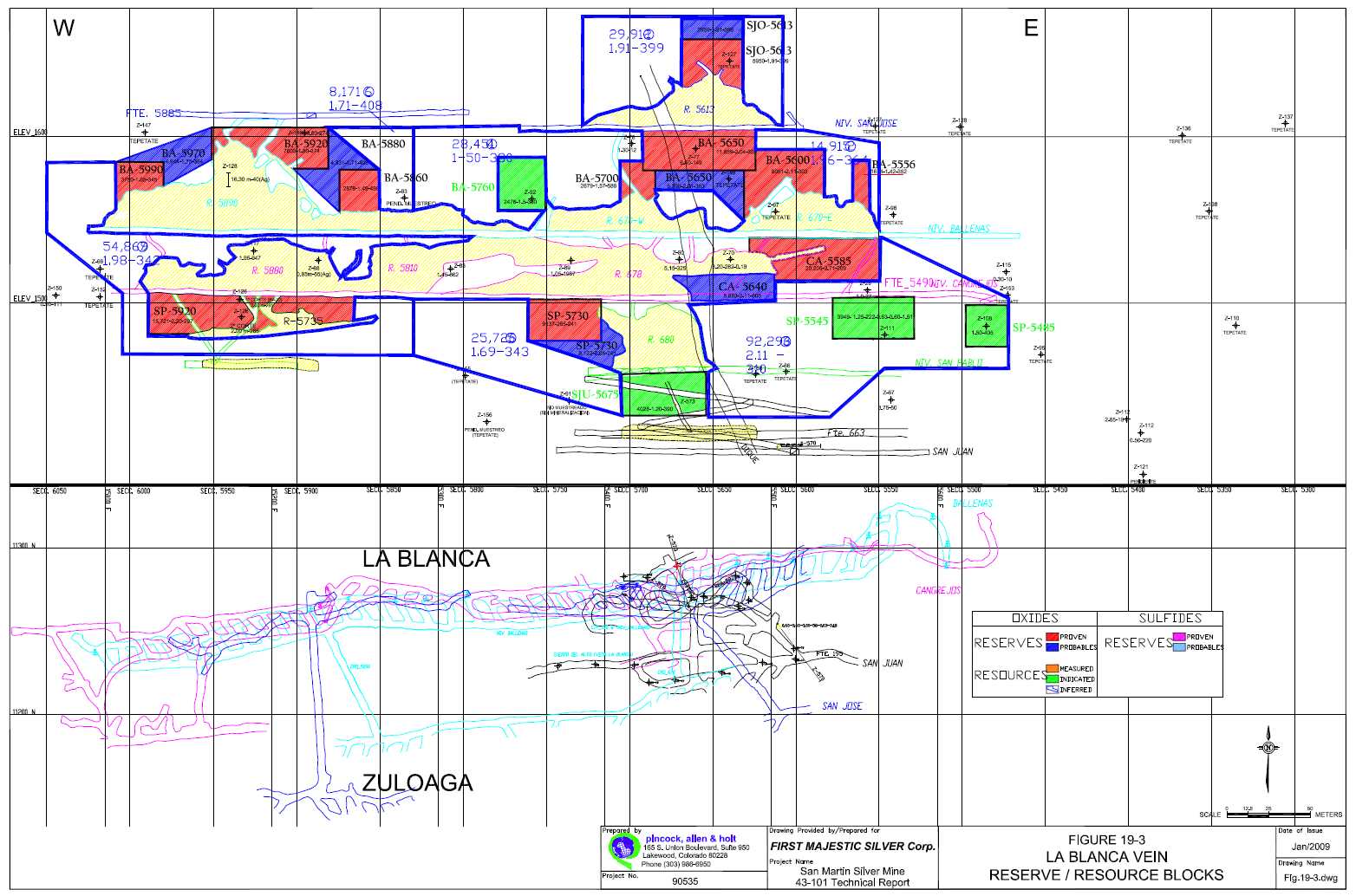

The mine has been developed on the Zuloaga vein, which has by far been the most extensively developed vein in the district, having accounted for about one-half of the silver production in the district. Production also occurs from the La Blanca vein, a vertical split off of the Zuloaga vein. The Zuloaga vein occurs along an east-west trending normal fault zone that dips an average 75 degrees to the north, with the hanging wall of the fault down-dropped 100 to 200 meters relative to the footwall. The vein has been identified over a strike length of 3 kilometers, with a developed vertical extent of about 350 meters. El Pilón is developing exploration and rehabilitation of workings along crosscutting veins to the Zuloaga structure, at the Rebaje 40 Oriente on the Cangrejos Level, and at the Rebaje 1100 on the Ballenas Level; in both cases NS veins intersecting the Zuloaga vein show high grade mineralization in widths of up to 10 meters to the hanging wall of previously mined narrow structures. Recent FMS exploration works have identified a Cymoidal structure of the Zuloaga vein at the mine levels 5,400 to 5,550 and it is preparing access and drilling to evaluate its potential.

La Blanca vein is a near-vertical split off of the Zuloaga vein that cuts upward through the Zuloaga hanging wall. La Blanca vein is typically irregular and narrow, but where mineralized, has higher silver and zinc grades.

| Pincock, Allen & Holt | 3.2 |

| 90535 January 15, 2009 |

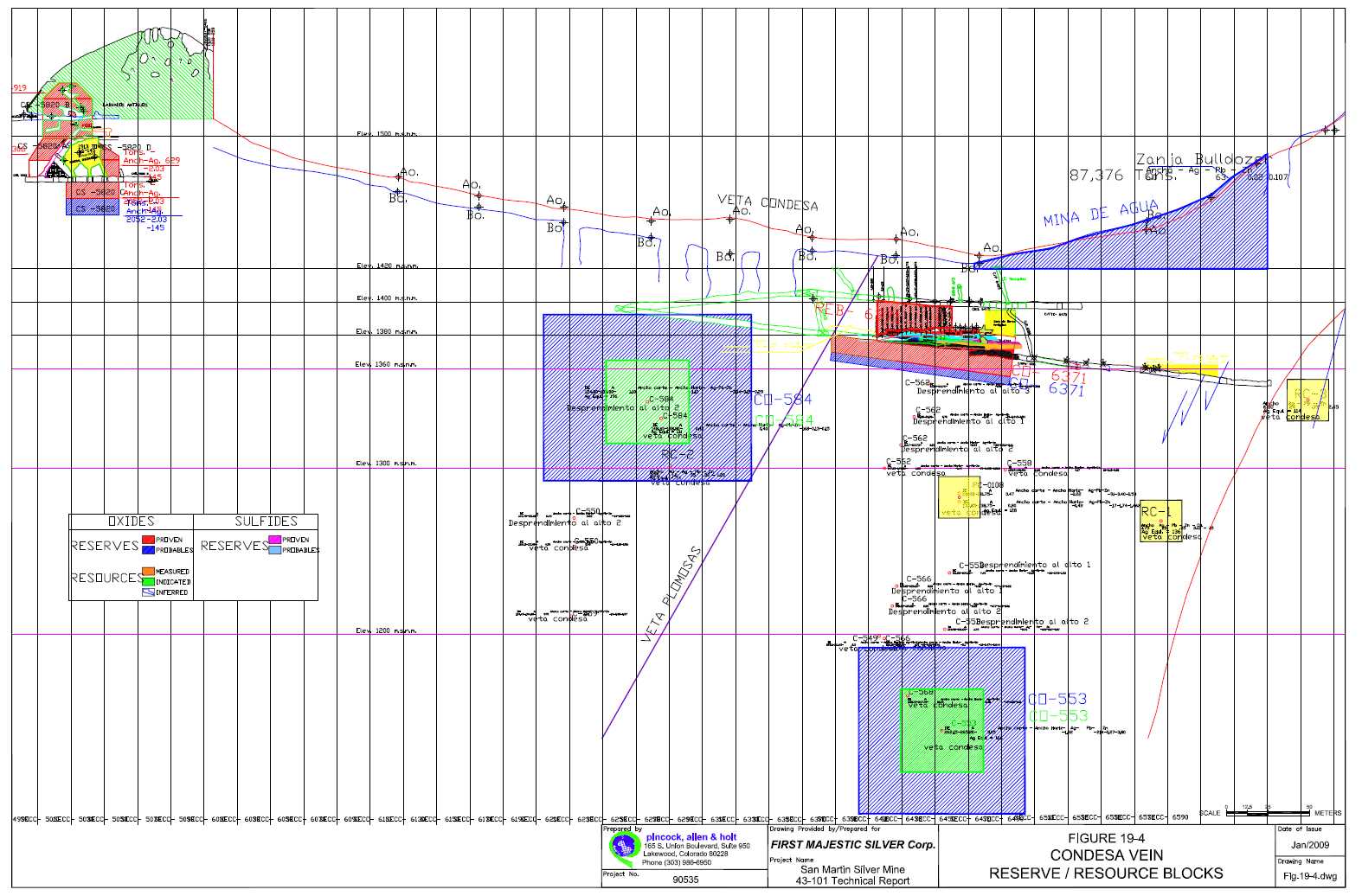

Two additional veins, the Condesa and Rosario, occur to the southwest and have northwest trends. Access to these veins is from the town of San Martín via an 11.4 kilometer gravel road. The Condesa structure strikes N 40° W and dips 81° SW. The Condesa workings show mineralization over 150 meters along strike, with mineralized zone ranging from 1.5 to 2.0 meters in width and occurring in a quartz-cemented andesitic breccia. The Rosario mine is located within the Santa Rosa arroyo at an elevation of 1,600 meters. The Rosario mine is 11.7 kilometers from the town of San Martín on the same gravel road leading to the Condesa mine. These vein trends intersect the Zuloaga vein in an area below mineralized surface outcrops of the vein and represent a potential exploration target.

3.4 Exploration and Project Data

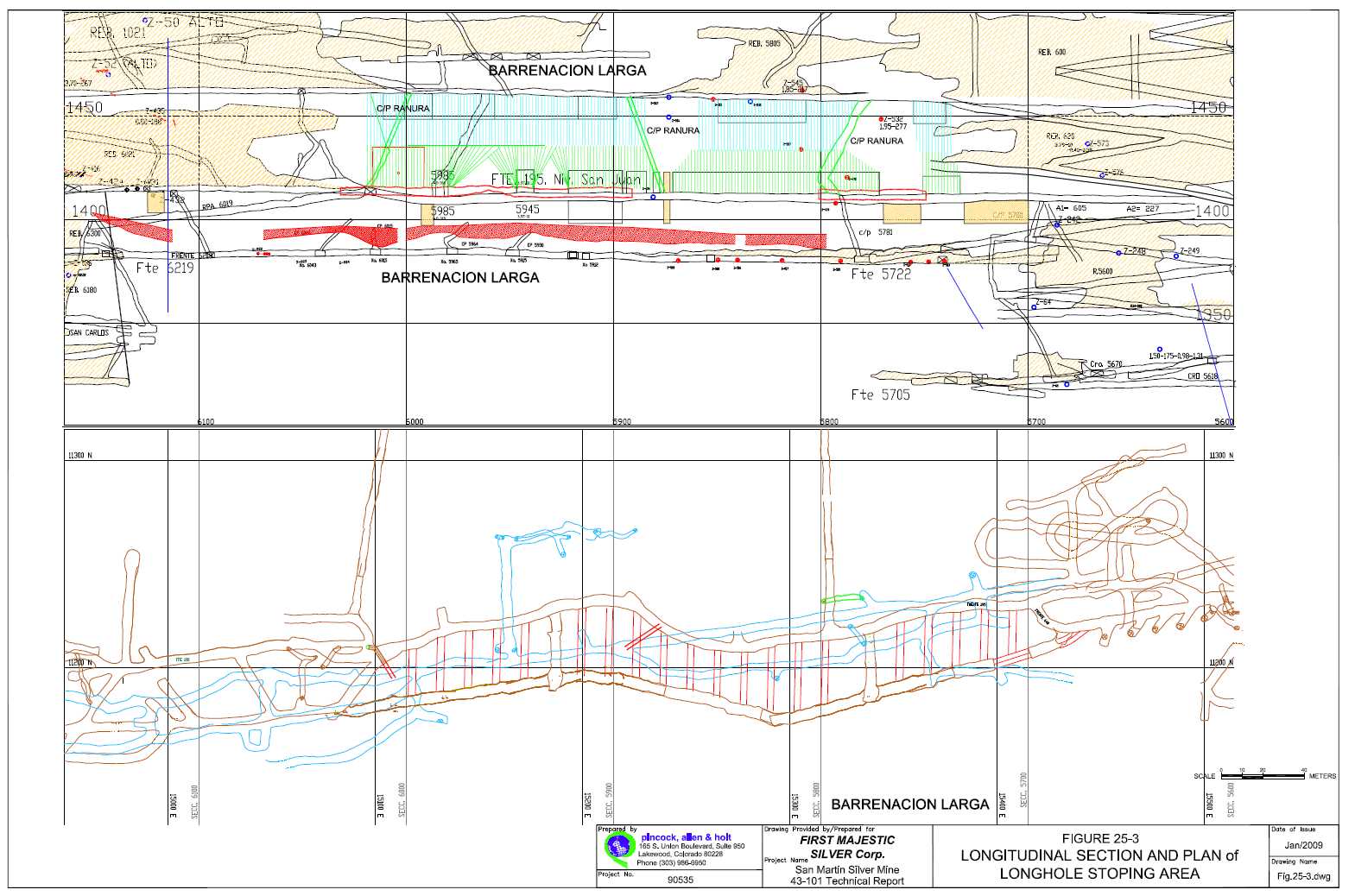

Exploration potential for finding and developing new resources/reserves in the San Martín district appears to be promising. Ore bodies in the mine are typically indicated at depth beneath zones of alteration on the surface expression of the Zuloaga vein. The Zuloaga vein projections from developed mine levels towards its outcropping is under development, since it may hold a significant amount of oxides mineralization. Access to the zone is difficult due to topographic constrains; however, FMS is developing access from the La Escondida level, at the Pinolea level. The vein outcroppings show alteration zones that may be correlated to indicate ore concentrations in the upper portion of the Zuloaga vein.

Direct exploration development is integrated into the mine preparation programs, and for vein deposits this has proven to be the most effective method of exploration. For the year 2007, the El Pilón’s drilling program completed 3,900 meters from underground access, while for the year 2008, the program of exploration included drilling 15,719 meters from underground workings, in addition to about 3,770 meters of underground development in drifts and crosscuts for exploration and drill site access.

The 2009 drilling program designed for the San Martín mine includes 93 drill holes to explore the La Escondida level, Rosario, Condesa, Providencia, La Esperanza, Cymoid and other areas below the known ore shoots on the Zuloaga vein. These 93 drill holes with a total of 13,400 meters are directed to investigate areas of resources with the objective to increase reserves, and if it is successful, the program should result in additional resources for the mine. Due to current market conditions at the time of writing this report, FMS has delayed this program; however, the estimated investment of drilling from underground workings is US$1.80 million.

Exploration sampling for reserve delineation in the San Martín mine is conducted by drifting along the mineralized zone so that channel samples can be taken and diamond drilling can be conducted. Channel samples are the primary means of sampling in the mine and are taken perpendicular to the vein structure, across the back of the drift. Sampling crews take channel samples at irregular intervals, typically with one sample every 2 to 3.5 meters along new openings (drifts, crosscuts, ramps, stopes, etc.) and every day from stope development muck piles.

Core drilling is conducted locally to test the upward and downward projections of the structural zone at a distance from the drifts. Core samples are BQ size, 36 millimeters in diameter, and holes are reportedly of generally good recovery (90 percent), with the remaining bad ground having modest recovery (50 to 60 percent).

| Pincock, Allen & Holt | 3.3 |

| 90535 January 15, 2009 |

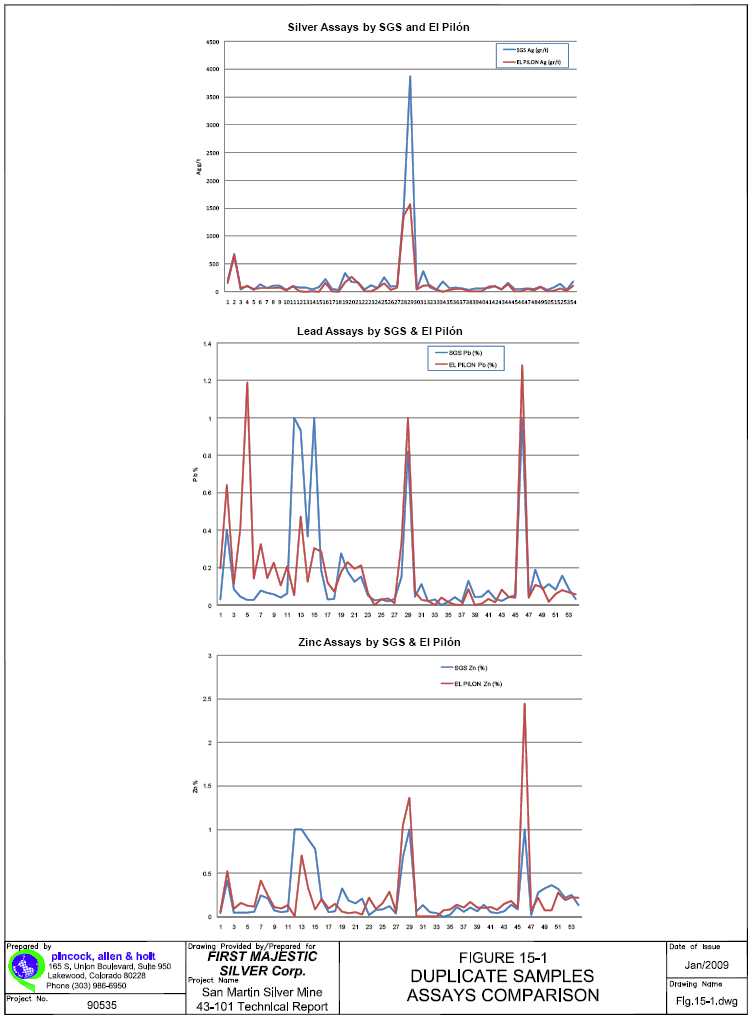

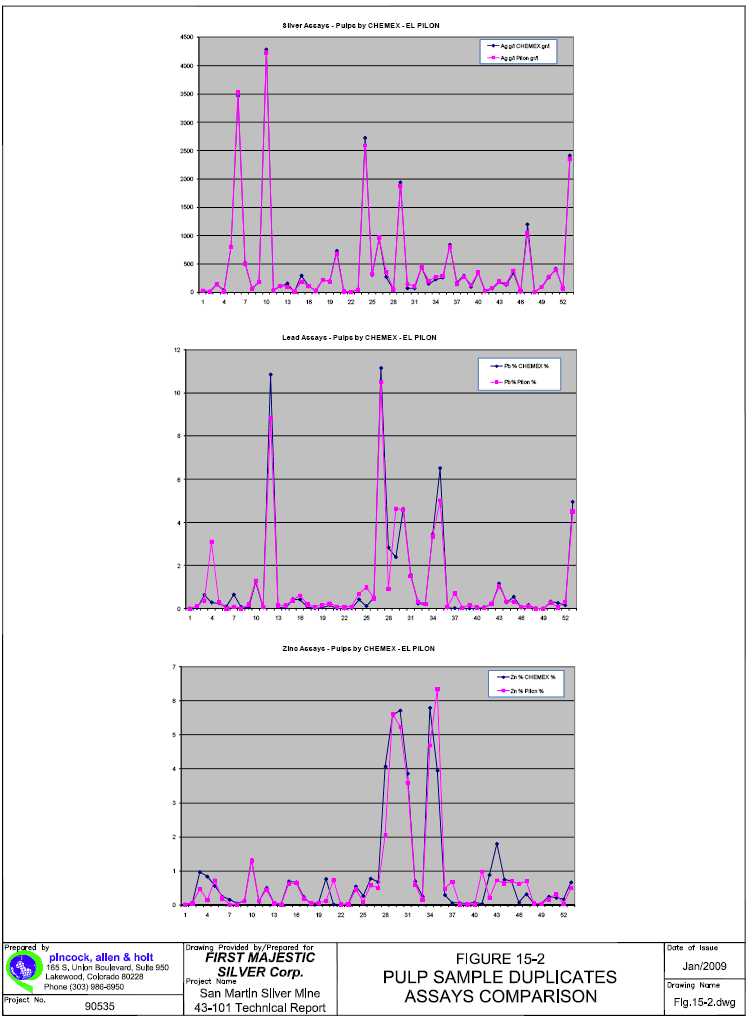

Channel, exploration, mine development and production, and plant samples are sent to San Martin’s on site laboratory for chemical analysis of silver and gold. In more recent years additional analyses by atomic absorption for lead and zinc in geology samples have become routine. To evaluate sample quality control, San Martin performs multiple assays, up to three times on some samples, and periodic check analyses on samples. Since 2004, the San Martin mine has sent about 10 pulp samples each month to ALS Chemex Laboratories, amount of duplicate samples to SGS Labs in Guadalajara city, for duplicate analysis, obtaining good correlation in silver values and poor correlation in gold assays. The latter is probably a consequence of the very low gold content of the samples.

3.5 Mining Methods

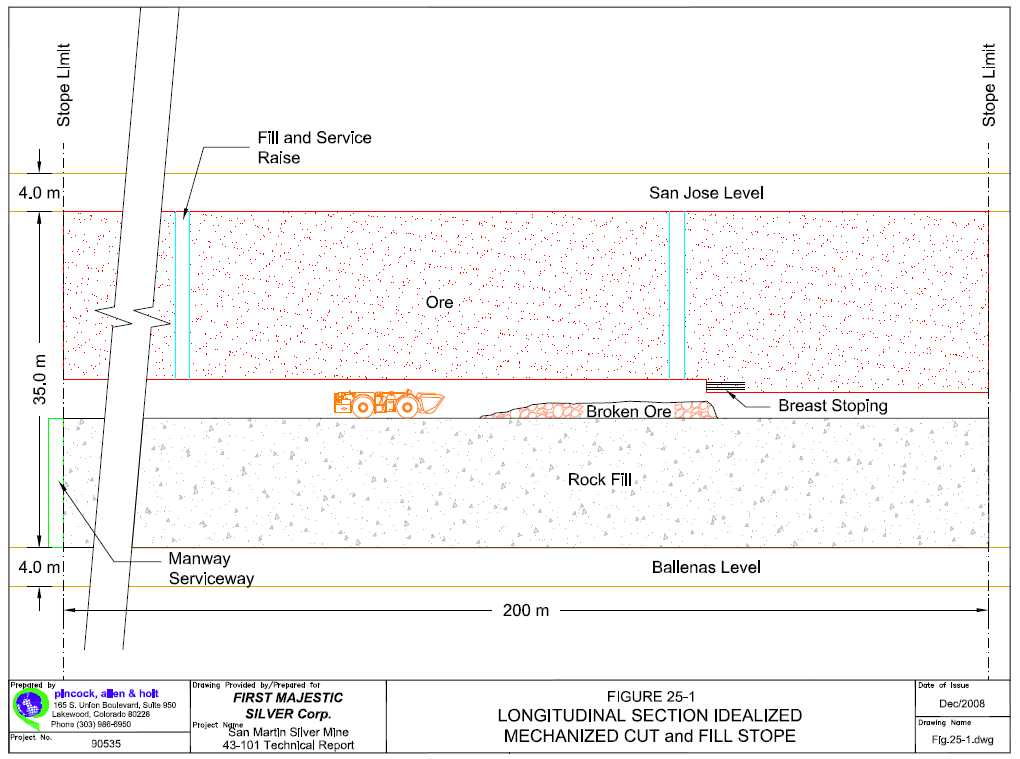

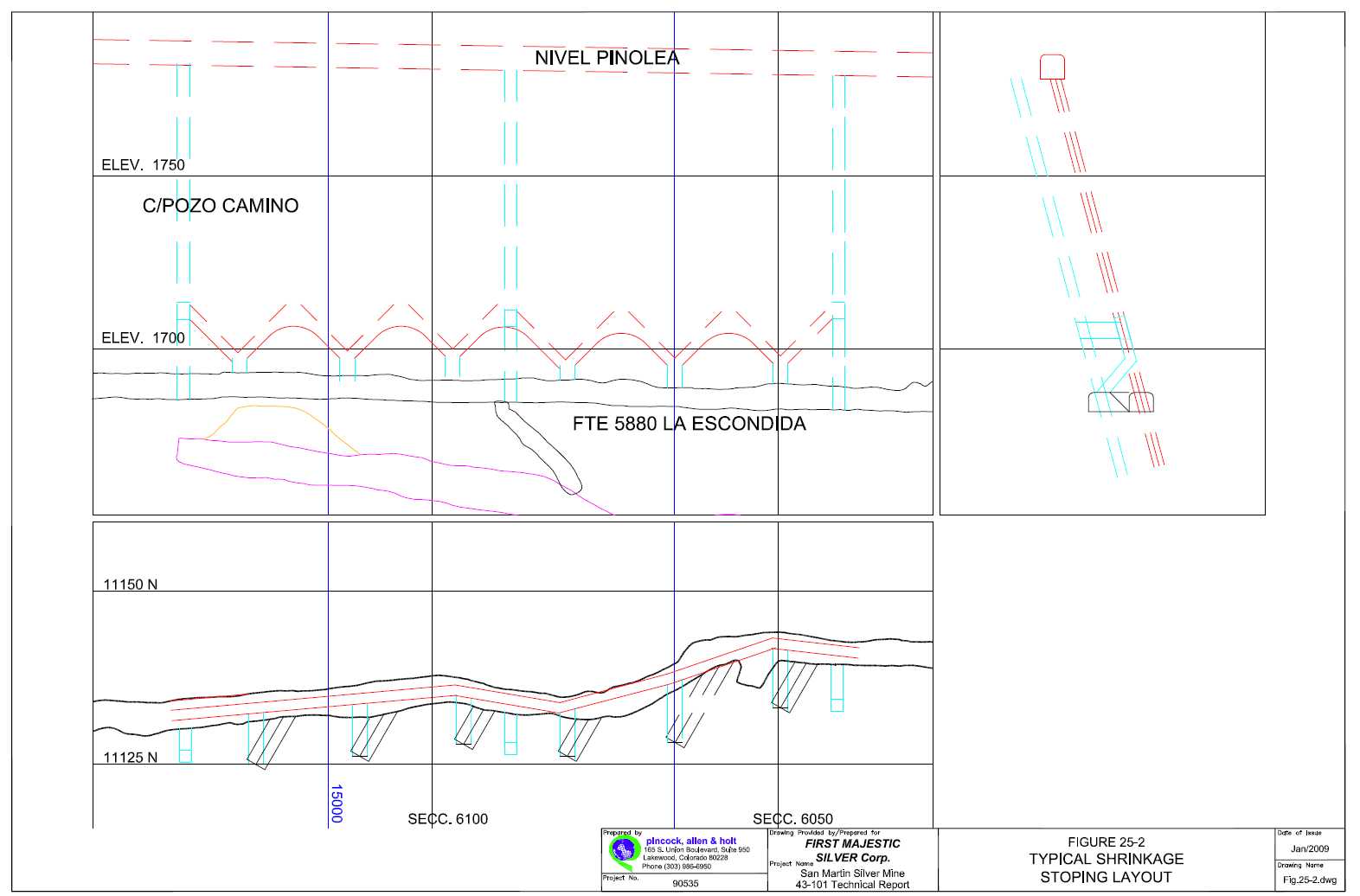

Current mine production has been averaging about 775 tonnes per day (tpd) from stopes located on La Escondida, San José, Ballenas, Congrejos, San Pablo, San Juan, Santa Elena, and San Carlos levels. Underground drilling is performed using jackleg drills, and blasting is accomplished with ANFO explosives. Underground loading and haulage is performed with 2 cy, 3 cy and 5 cy LHD's (scooptrams) and 10 to 13 tonne-capacity trucks. Opening sizes are driven at 4.0 meters by 3.5 meters. Ramp inclinations are generally limited to about 12 percent. Typically, the total advance for drifting, ramping and raising is about 550 meters per month. The average productivity in headings is 0.7 meters per manshift, which is in the normal range for this type of development.

Mechanized, cut and fill stopes now account for 100 percent of the production, and these are developed either directly on the vein or by first driving a drift on the vein and then driving a parallel drift about 8 meters away, leaving a pillar between the drifts. Crosscuts are then driven about every 10 meters from the parallel drift through the pillar to the vein for ore extraction. Raises are driven as needed to provide access, services and ventilation.

Ore is trammed to surface with LHD’s or low-profile dump trucks and stockpiled at surface dump sites. On the surface, the ore is loaded from stockpiles into 22-tonne trucks for transport to the mill some 13 kilometers away over a gravel road. The ore haulage from the mine to the mill is performed by a contractor.

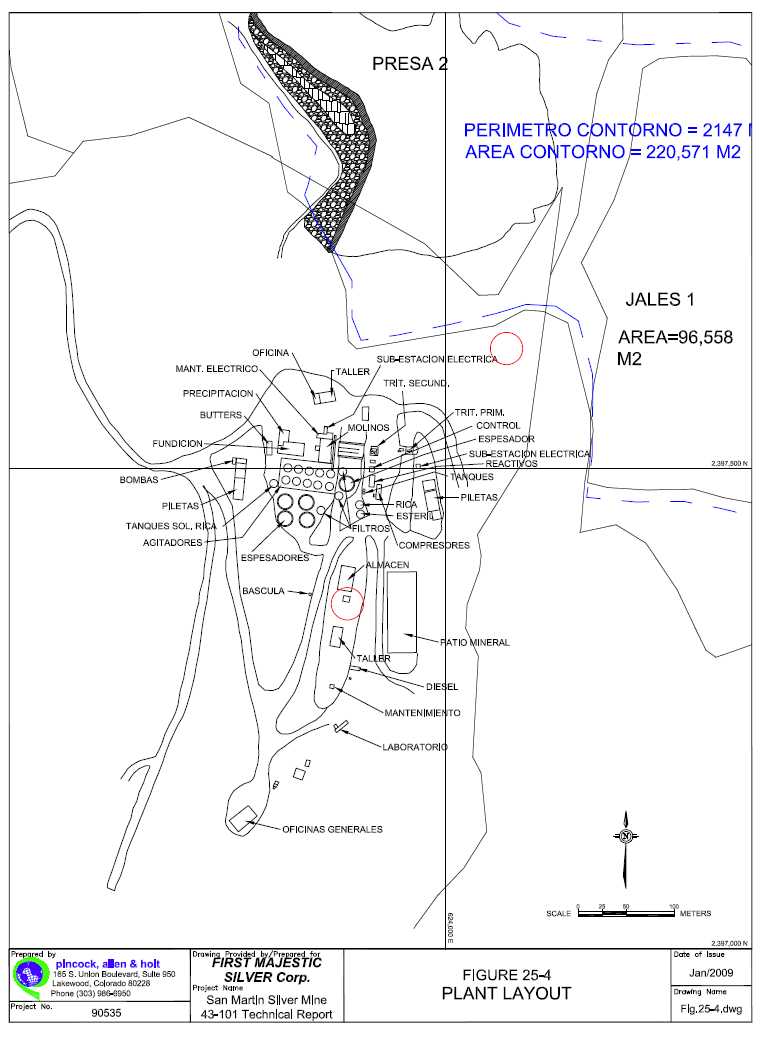

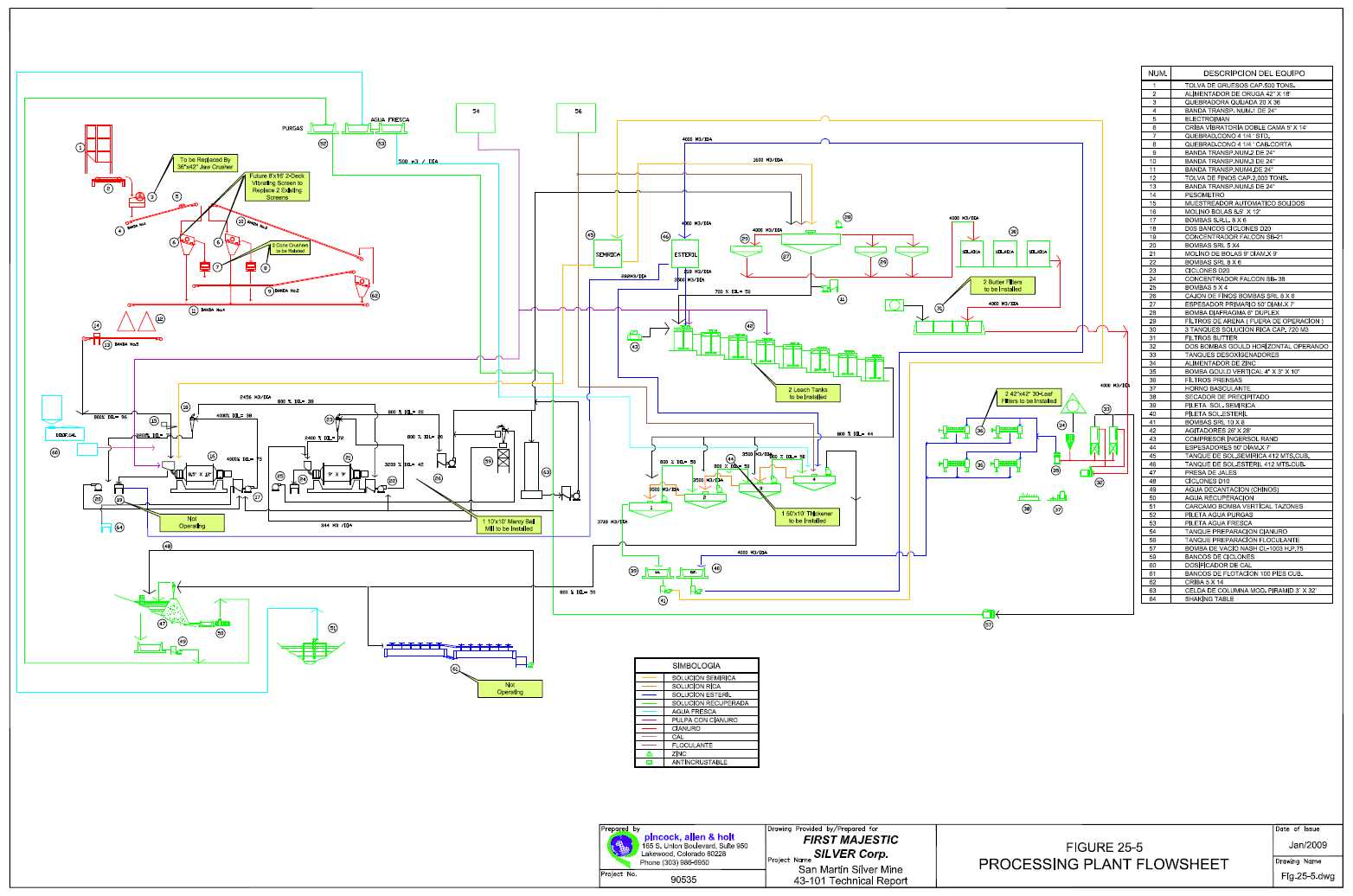

3.6 Processing Facilities

The San Martín processing plant has been in operation since 1983 at an increasing capacity that has reached 750 tonnes per day and is currently being expanded to 1000 tonnes per day. Silver ore is processed by conventional cyanidation, using agitation in tanks, counter-current decantation (CCD) thickening, and precipitation of the dissolved silver and gold by cementation with zinc dust in the Merrill-Crow process. The precipitate is then smelted to produce doré for shipment to commercial refineries. In addition to the cyanidation system, the plant also produces a gravity concentrate which is sold to a smelter; the gravity system recovers about 1 percent of the silver and 3 percent of the gold in the ore.

| Pincock, Allen & Holt | 3.4 |

| 90535 January 15, 2009 |

Since 1983, the San Martin mine has produced more than 33.3 million ounces of silver together with small amounts of gold.

Plant statistics indicate that during the first three quarters of 2008 plant feed rock (a combination of mine ore and fines screened from waste dumps) averaged 131 g/t silver and about 0.23 g/t gold. Silver and gold recovery into Doré and gravity concentrates for the first three quarters of 2008 were 76.39 and 54.91 percent, respectively. FMS built a 500 tpd flotation circuit which was commissioned during the year and is not in operation due to the low lead and zinc prices and higher smelter costs.

3.7 Mineral Reserves/Resources

The San Martin mine uses conventional, manual methods, assisted by computer databases, to calculate the tonnage and average grades of the mineable reserves. Reserves are calculated annually, at the end of each calendar year. For this report, PAH has reviewed the reserve dated September 30, 2008 (referred to subsequently as the September 30, 2008 Reserve).

Table 3-1 shows a summary of Mineral Reserves and Resources for the San Martín Silver Mine to September 30, 2008.

3.7.1 Reserve Estimates

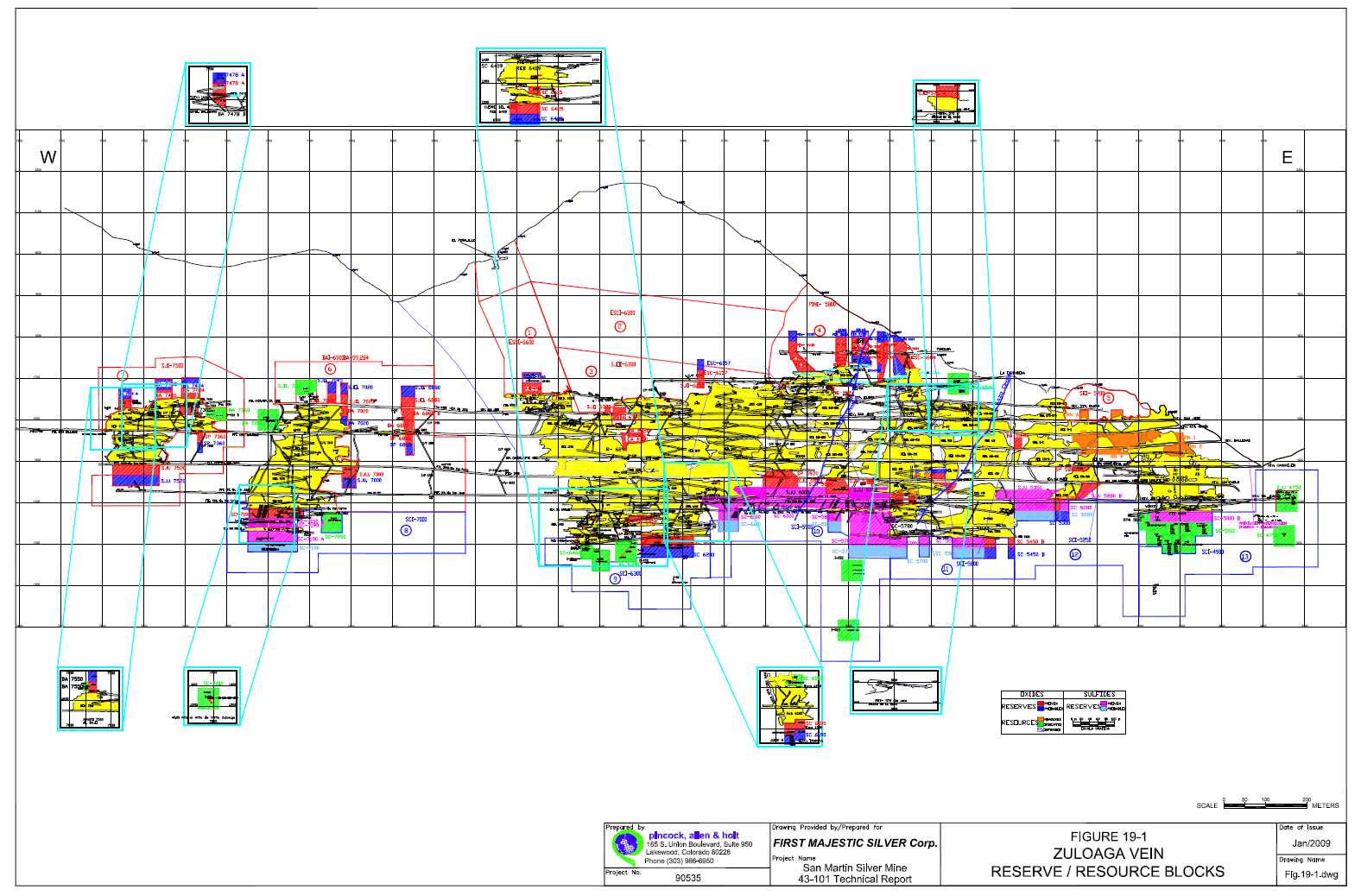

Reserve blocks have been defined at the various drift levels in the mine where sampling has found economically mineable mineralization within the Zuloaga, La Blanca and two NS newly-accessed veins. The reserve tonnage and grade are based largely on channel samples, locally with some influence from drill core samples. Reserve blocks range from 10 to 50 meters in length along the vein trend, with proven reserve blocks projected up to 25 meters from the drift in which the channel samples were taken, and probable blocks extending another 25 meters beyond the proven blocks.

For the present (September 30, 2008) mineable reserve, PAH’s economic breakeven cutoff grade calculation was based (Gag), solely on a projected $12.00 per ounce for silver, and the total 2008 operating cost and process recoveries as follows:

Gag= $43.09/( $12.00 x 0.775 X 0.99 ) = 4.68 oz/tonne or 146 g Ag/tonne

All 2007 and 2008 production has come from the mechanized cut and fill mining.

The gold contained in Doré and concentrates was 19,770 grams (635 ounces), which would indicate a recovered grade of about 0.14 g/t. For each ounce of silver paid there were 0.001 ounces of gold paid (635 ounces Au/724,239 ounces Ag). At a gold price of US$708/oz, this represents a contribution of US$0.62 per ounce of silver.

| Pincock, Allen & Holt | 3.5 |

| 90535 January 15, 2009 |

TABLE 3-1

First Majestic

Silver Corp.

Minera El Pilón, S.A. de C.V.

San

Martín Silver Mine

Mineral Reserves Prepared by FMS, Reviewed

by PAH as of September 30, 2008

| CATEGORY | Mineralization | Metric | Width | Ag | Pb | Zn | METAL CONTAINED | |

| Proven Reserves | Type | Tonnes | m | g/tonne | % | % | Silver (Only) oz. | Silver Eq oz. |

| SUBTOTAL - 1 | Oxides | 527,373 | 2.72 | 273 | 4,636,211 | 4,805,765 | ||

| Probable Reserves | ||||||||

| SUBTOTAL - 2 | Oxides | 243,091 | 2.56 | 276 | 2,154,571 | 2,232,727 | ||

| Proven and Probable Reserves | ||||||||

| TOTAL | Oxides | 770,464 | 2.67 | 274 | 6,790,782 | 7,038,492 | ||

| Mineral Resources | ||||||||

| Measured Resources | ||||||||

| SUBTOTAL - 3 | Oxides | 122,404 | 4.95 | 233 | 915,774 | 955,128 | ||

| SUBTOTAL - 4 | Sulfides | 415,771 | 3.23 | 97 | 0.87 | 2.07 | 1,292,213 | 1,292,213 |

| Indicated Resources | ||||||||

| SUBTOTAL - 5 | Oxides | 294,361 | 4.49 | 288 | 2,729,201 | 2,823,840 | ||

| SUBTOTAL - 6 | Sulfides | 670,684 | 4.95 | 116 | 0.94 | 1.64 | 2,498,639 | 2,498,639 |

| Measured and Indicated Resources | ||||||||

| TOTAL | Oxides plus Sulfides | 1,503,220 | 4.38 | 154 | 0.91 | 1.80 | 7,435,827 | 7,569,820 |

| Proven and Probable Reserves plus Measured and Indicated Resources. | ||||||||

| TOTAL RESERVES AND RESOURCES | Oxides plus Sulfides | 2,273,684 | 3.80 | 195 | 0.91 | 1.80 | 14,226,609 | 14,608,312 |

(1) Estimated Reserves are exclusive of

Resources.

(2) Cut Off estimates as 146 g/tonne Ag for

mined oxides, and 87 g/tonne Ag for dump recovered oxides; Ageq=Au/Pb credits =

10g/tonne Ag.

(3) Metal prices at $708/oz-Au, $12.00/oz

- -Ag, $0.75/lb -Pb, $0.50/lb -Zn.

(4) Mine dilution is

included at a minimum mining width of 2.00m. Estimates do not

include mining recovery .

(5) Base metals, Lead and Zinc are not recovered due to low market

prices.

| Inferred Resources | ||||||||

| Inferred Resources | ||||||||

| TOTAL (6) | Oxides plus Sulfides | 8,200,000 | 5.33 | 185 | 1.40 | 1.60 | 48,900,000 | 50,000,000 |

(1) Estimated Reserves are exclusive of Resources.

(2) Inferred Resources are especulative in nature and may not become

Reserves.

(3) Metal prices at $708/oz-Au, $12.00/oz -Ag, $0.75/lb -Pb, $0.50/lb

-Zn.

(4) Mine dilution is included at a minimum mining width of 2.00m. Estimates

do not include mining recovery .

(5) Base metals, Lead and Zinc are not recovered due to low market

prices.

(6) Rounded figures.

| Pincock, Allen & Holt | 3.6 |

| 90535 January 15, 2009 |

In addition to the Doré sales, a gravity concentrate is produced. During 2008, 43.6 tonnes of concentrate were sold that contained 4,400 kilograms (9,698 lbs) of lead in the concentrates. For each ounce of silver sold, approximately 0.013 kilograms (0.03 lbs) of lead were sold. At US$0.75/lb of lead, this contributes another US$0.02 per ounce of silver.

This would indicate a total contribution of gold and lead of US$0.64 per ounce of silver.

The silver equivalent breakeven cutoff grade (Gag eq), considering the gold/lead contribution, converted to an equivalent silver grade, would be as follows. Since the metal quantities and values shown in the gold/lead contribution include process recoveries, they are not repeated in the cutoff estimation.

Gag eq = $43.09/(( $12.00 x0.775 X 0.99) + $0.64)) = 4.38 oz Ag eq./tonne, or about 136 grams Ag eq/tonne.

Most of the January through September 2008 production has been derived from the mechanized cut and fill mining of oxide ores, however, a small amount was obtained from the recovery of old dumps at the mine site. Possible resources of dump material remain, and PAH also calculated a cutoff grade for this material as follows:

CAg= $25.63/( $12.00 X 0.775 X 0.99) = 2.78 oz Ag/tonne or 87 g Ag/tonne

Milled oxide ore production for the first 9 months of 2008 was 145,592 tonnes, at an average grade of 131 g Ag/t, and 0.25 g Au/t. Milling of oxide ore from the underground mine totaled 132,043 tonnes at an average grade of 133 g/t Ag, and that from the mine dump recovery totaled 13,549 tonnes at an average grade of 111 g/t Ag. Gold is present in payable quantities in many areas and lead in some. In the cutoff grade calculation the small gold and lead credits are already included as an operating cost deduction (see Table 25-6).

There was a significant tonnage of sulfide material (57,072 tonnes) extracted from the mine and transported to the mill patios during the first 9 months of 2008, however, only small amounts of this material were processed in the new flotation plant, as test material. The sulfide material remains stockpiled on the mill patios and will not be processed until market conditions improve for lead and zinc, nor will any additional sulfides be extracted from the mine. In view of the foregoing, PAH has not calculated a cutoff grade for San Martín sulfide material.

From the 145,592 tonnes of production, the silver sold in Doré and concentrates during the first 9 months of 2008 was 22.5 million grams (724,239 ozs.). The gold sold in Doré and concentrates during the 9-month period of 2008 was 19,770 grams (635 ounces). The estimated process recovery for gold was 55.4 percent. For each ounce of silver paid there were 0.001 ounces of gold paid (635 ounces Au/ 724,239 oz. Ag). At a gold price of US$708/oz, this represents a contribution of US$0.62 per ounce of silver.

| Pincock, Allen & Holt | 3.7 |

| 90535 January 15, 2009 |

In addition to the Doré sales, a gravity concentrate is produced. During 2008, 43.6 tonnes of gravity concentrates were sold that contained silver, gold and lead values, and the payable lead content was approximately 4,400 kilos of lead. For each ounce of silver sold, approximately 0.01 kilograms (0.02 lbs) of lead were sold. At a price of $0.75/lb of lead, this contributes another $0.02 per ounce of silver.

This would indicate a total contribution of gold and lead of $0.64 per ounce of silver, which have been included a by-product credit to operating costs (see Table 25-6).

This cutoff estimate was the basis that PAH used to calculate the September 2008 Reserves. PAH notes that that the reserve is in addition to the material considered as resources.

PAH believes that these reserve estimates have been reasonably prepared and conform to acceptable engineering standards for reporting of reserves. PAH believes that the classification of the reserves meets the standards of Canadian National Instrument NI 43-101 and the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

3.7.2 Resource Estimates

The resource calculations by FMS are based on projections of the mineralized zones of 50 meters beyond the areas of the reserves for the measured resources, and another 50 meters beyond the boundaries of the measured resources for the blocks of indicated resources. The grade for these blocks is determined from the grade estimated for the adjacent reserve blocks, and sampling in mine workings and drill holes located within the block area.

In addition to the reserves, FMS has estimated resources in blocks along the Zuloaga, La Blanca, Plomosa – Rosario, and Rosario – Condesa veins, and in two other NS newly accessed veins that cross the main mineralized structure. These blocks were estimated in the same manner as that described previously for the reserve blocks, with the additional calculation of lead and zinc assays where they are available. During the period of 2006, the San Martin generated production of lead and gold in gravity concentrates adding some contributions for these metals to the silver recovery and sales. The estimated contribution for these metals was approximately 8 percent for the year; therefore, it is reasonable to add that value to the estimated silver grade, but with no additional contribution of zinc.

FMS’s estimated resource blocks do not include the estimated reserve blocks since these have been projected at distances that are adjacent and beyond the reserve blocks boundaries.

Mineral resources do not include development details for underground mine accessibility and mine planning; therefore, in PAH’s opinion these resources are appropriately reported as resources, with estimated tonnage and grade calculated from available data on an “in-situ” basis.

Based on these assumptions, and in the mine’s silver COG, PAH reviewed FMS’s estimates, resulting in measured and indicated resources of silver equivalent, which includes credit for lead and gold at projected prices for the silver US$12/oz, for lead $0.75/lb and for zinc $0.50/lb, which equates to about 10 grams of silver per tonne of ore. These estimates do not take in consideration mine dilution nor mine and metallurgical recoveries, or S&R charges. The resources are estimated as “In Situ” material as shown in Table 3-1. At the current rate of San Martín’s production, the resources may add about five more years of life to the mine, with additional potential of inferred resources.

| Pincock, Allen & Holt | 3.8 |

| 90535 January 15, 2009 |

The mineral resources estimated by FMS and reviewed by PAH are presented in Table 3-1. PAH notes that these resources are in addition to the previously reported reserve.

PAH believes that these resource estimates have been reasonably prepared and conform to acceptable engineering standards for reporting of resources. PAH believes that the classification of the resources meets the standards of Canadian National Instrument NI 43-101 and the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

The reserves and resources herein reported by FMS for the San Martín Silver Mine were reviewed by PAH and constitute part of the San Martin mining operation. There are no significant technical, legal, environmental, political or other kind of restrictions; therefore, in PAH’s opinion these reserves and resources may not be materially affected by issues that could prevent their extraction and processing.

3.8 Environmental

The San Martín mine has been operating since 1983 with the necessary land-use and water extraction permits in effect for the operation. El Pilón has purchase the land surface rights where the mine and plant installations are located to better manage the property. Through the years and changes in regulatory framework, El Pilón has been required to update the necessary operation permits.

PAH’s environmental and safety review consisted of discussions with site management and supervision Ing. Juan Francisco Díaz de León V., Mine Manager of Security and Environmental, and the site visit to observe the current site safety and environmental conditions and to identify any potential liabilities having significant economic impacts. Our assessment is not intended as an environmental and safety compliance audit, although prudent practices were considered in our review. In PAH’s opinion, the San Martin mine is in compliance with the required permits and authorizations.

Periodic regulatory inspections of the site by SEMARNAP and the Mines Department are being performed to observe compliance. PAH has reviewed permits and authorizations for the San Martín operation and believes it is in compliance with applicable regulations and obtains permits as required.

3.9 Conclusions

The San Martín Silver Mine is a modest-sized underground operation that has utilized used equipment, whenever possible, and expensed its replacement equipment to a large extent. However, according to a new FMS policy, new equipment has been purchased as part of the capital expenditure program. This program of equipment replacement by FMS has been in place for the last two years, including 7 scoop trams, 5 underground trucks and 1 jumbo.

| Pincock, Allen & Holt | 3.9 |

| 90535 January 15, 2009 |

Capital forecast for San Martín during the last quarter of 2008 and 2009 is presented in Table 25-9 and totals $1.6 million and $2.1 million. An amount of $150,000 has been estimated for portal closures (ten at $10,000 each) and for tailings pond reclamation. Salvage of plant equipment is forecast to just equal dismantling.

A summary of production including oxides and sulfides is presented in Table 3-2. Production costs for the mine in January to September, 2008 are provided in Table 25-6, based on mine accounting records. A total of US$7.9 million was expended during the 9-months period to produce roughly 184,440 tonnes of ore, containing saleable silver amounting to 796,524 ounces. On a unit basis, cash production costs were $40.87/tonne of ore, and $10.40/oz of silver produced. Unit costs of $41.30/tonne of ore are projected for the rest of 2008 and subsequent years.

TABLE 3-2

First Majestic Silver

Corp.

Cia. Minera El Pilón, S.A. de C.V.

San Martín Silver

Mine

Summary of Economic Analysis - Sensitivity

| Case | Discount | NPV, US$ M |

| Base | 12 % | 15.00 |

| Increase Silver price | 10 % | 18.60 |

| Decrease Silver price | 10 % | 11.60 |

| Increase Operating costs | 10 % | 13.40 |

| Decrease Operating costs | 10 % | 16.80 |

| Increase Capital costs | 10 % | 14.80 |

| Decrease Capital costs | 10 % | 15.30 |

A simplified cash flow forecast has been prepared and is presented as Table 25-10. The economics covers the period through December 2011, at which time the known proven/probable reserves will be exhausted. In the interim, of course, it is expected that underground exploration will be advanced through both diamond drilling and drifting, and that reserves will continually be added over time from the strong resource base of the mine. FMS has allocated a high capital investment for San Martín to develop reserves and extend the mine life.

Basic premises for the cash flow involve silver prices, which are taken at $12/ounce for 2008, 2009 and 2010 and $13/ounce thereafter. Gold sales are presented at a percentage of silver revenues and are predicated on historical returns in the past. Operating costs and expenses are projected to be decreased by 24 percent annually. Reclamation expenditures are considered spent in the remaining months of 2008. It can be seen from the table that a net present value for the project at a 12-percent discount rate is approximately $15.00 million.

As expected, the operation exhibits the greatest sensitivity to metal prices, followed by operating costs, and finally by capital costs. Any variances in grade or metallurgical recovery will be equivalent to similar changes in metal prices, since all three factors impact the revenue stream equally. In all cases, however, the San Martín mine shows positive economics as measured by a cash flow exercise, and thus the postulated reserve position is accepted.

| Pincock, Allen & Holt | 3.10 |

| 90535 January 15, 2009 |

4.0 INTRODUCTION

4.1 Terms of Reference

Pincock, Allen & Holt (PAH), a division of Runge, Inc. (Runge) was retained by First Majestic Silver Corp. (FMS), to conduct an independent reserve audit and project update, and prepare a Technical Report in accordance with Canadian National Instrument 43-101 for its San Martín Silver Mine operation, as represented by its wholly-owned Mexican subsidiary, Minera El Pilón, S.A. de C.V., (El Pilón).

FMS of Vancouver, British Columbia (traded as FR on the Toronto Stock Exchange and as FMV on the Frankfurt Stock Exchange) has been operating the San Martín mine since its acquisition in June 2006, while the mine has been in continuous production since 1983. Total recorded production from the San Martín mine to September 2008, is 33.6 million troy ounces of silver including some gold and lead from 4.3 million tonnes of ore. The operation consists of an underground silver mine and an 800-metric-tonne-per-day (tpd) capacity processing plant that produces Doré and gravity concentrates for shipment to Met-Mex Peñoles (Met-Mex) smelter in Torreón, Coahuila, México. During the first 9 months of 2008, San Martin processed 184,440 tonnes of ore and shipped Doré product that contained 724,240 troy ounces of silver and 691 troy ounces of gold. El Pilón also shipped 43.6 tonnes of gravimetric concentrates to Met-Mex smelter that contained 4,400 kilograms of lead, for a total production of 796,524 ounces of silver equivalent.

4.2 Purpose of the Technical Report

Preparation of this Technical Report for FMS by PAH included a site visit to review the San Martín mining operation current status, including underground mine, processing plant facilities and present environmental and infrastructure conditions. PAH site visit also included a visit to San Martín administrative and support office at Durango city, where Mr. Ramón Dávila, FMS Chief Operating Officer provided all requested data on the Company’s financial statements.

During the site visit to San Martín, PAH’s personal had the opportunity to interview technical and operative personal for the mine, plant, laboratory, administration, and from other areas of responsibility within the operation. PAH greatly appreciates the support and cooperation provided by FMS Ing. Florentino Muñoz and Ing. Ricardo Flores during the trip and other employees and administrators, including Ing. J. Miguel Ríos G., Mine Manager of Operations, Ing. Rafael Romo Gaucin, Mine Chief Geologist, and Ing. Sergio Oliva, Plant Superintendent, Ing. Cristóbal Jiménez, Geologist, and many others.

The San Martín mining operation is protected by the mineral rights of 31 valid concessions that cover 7,841 hectares (19,375 acres). PAH has not reviewed the legal status of the mineral concessions; however, in title opinion provided to FMS by the legal firm of Carlos Galván Pastoriza from Durango City, dated September 30, 2008, is stated that “all mining rights described in Table 6-1 hereto have been validly issued and recorded properly in the Public Registry of Mining when required by law and are in full force and effect.” This Technical Report was completed to meet the requirements of Canada National Instrument 43-101.

| Pincock, Allen & Holt | 4.1 |

| 90535 January 15, 2009 |

4.2.1 Sources of Information

Technical data on the San Martín mining operation was provided by FMS and or its subsidiary’s to PAH, including information, maps, and reports generated by its own personnel, as well as reports prepared on behalf of FMS. A list of reports and files is presented in Section 21.0, References.

In addition to the above indicated sources of information, PAH’s own references included various Technical Reports (public information) on behalf of FMS, including Technical Report for the San Martín Silver Mine, State of Jalisco, México Amended prepared for First Majestic Silver Corp. dated July 24, 2007 and published at SEDAR on July 25, 2007.

Previous studies by PAH in the San Martín mining district included geologic and exploration investigations of the Bolaños mine, which is located at about 20 kilometers to the North, within the same San Martín mining district.

4.3 Site Visit

The San Martín mine was visited from November 2-4, 2008, by PAH team members Leonel López, Jack Haptonstall and Richard Addison, as PAH representatives, as Independent Engineers and Qualified Persons for the purpose of auditing the reserves, observing the operation of the mine and process facilities, inspecting the condition of support facilities and infrastructure, and observing the general site environmental conditions.

PAH previously visited the San Martín mine to perform independent reserve audits and project updates in late 2001, February 1999, in February 1998, in early 1997, and in 1996 to prepare a valuation of El Pilón’s operation prior to First Silver Reserve’s acquisition of the company in early 1997, and on behalf of FSR during the period of May 16–19, 2005 and January 23-26, 2007. Personnel assigned for this study includes the following:

4.4 Terms and Definitions

FMS refers to First Majestic Silver Corp.

FSR refers to First Silver Reserve Inc. A wholly owned subsidiary of FMS since September 2006.

| Pincock, Allen & Holt | 4.2 |

| 90535 January 15, 2009 |

INEGI refers to Instituto Nacional de Estadística, Geografía e Informática.

Ing. refers to engineer, a University professional graduate.

PAH refers to Pincock, Allen and Holt, Inc., a division of Runge, Inc.

Peñoles or Met-Mex refers to Metalúrgica Mexicana Met-Mex Peñoles, S.A. de C.V.

El Pilón refers to Minera El Pilón, S.A. de C.V., a Mexican corporation wholly-owned subsidiary of First Majestic Silver Corp.

San Martín, San Martín mine or San Martín operation refers to the San Martín Silver Mine and mining operation sometimes referred to in other publications as the San Martín de Bolanos Silver Mine, which includes underground mine, processing plant and ancillary installations, and operated by Minera El Pilón, S.A. de C.V.

Zuloaga mine also refers to San Martín mine, which is developed on the Zuloaga vein.

TSX refers to Toronto Stock Exchange.

RC refers to reverse circulation drilling.

COG refers to Cutoff Grade.

g/t Ag or g/tonne Ag refer to grams per metric tonne.

g/t Au refers to grams per metric tonne.

Pb (%) refers to the grade of lead in percent.

Zn (%) refers to the grade of zinc in percent.

tpd refers to metric tonnes per day.

m refers to meter.

km refers to kilometers, 1,000 meters.

mm refers to millimeters.

asl refers to elevations above sea level.

SEMARNAP refers to Secretaría del Medio Ambiente, Recursos Naturales y Pesca.

| Pincock, Allen & Holt | 4.3 |

| 90535 January 15, 2009 |

CAN$ refers to Canadian currency.

$ refers to US currency, and

$ Pesos refers to Mexican currency.

4.5 Units

Units in this report are metric unless otherwise noted.

Tonnage figures are dry, metric tonnes, unless otherwise stated.

Precious metal content is reported in grams per metric tonne (g/t) or grams (g), except where otherwise stated.

Elevations reported as meters above mean sea level (asl).

All coordinates used for location and elevations referenced on maps and text in this report are based on newly obtained Universal Transverse Mercator and have been referred to by project personnel as the Global UTM system, and they are based on the Map Datum NAD27-México.

| Pincock, Allen & Holt | 4.4 |

| 90535 January 15, 2009 |

5.0 RELIANCE ON OTHER EXPERTS

This Technical Report was prepared for First Majestic Silver Corp. (FMS) by the independent consulting firm of Pincock, Allen & Holt (PAH), to report the results of a review performed on its San Martín Silver Mine operations. The mine is operated by FMS through its wholly-owned Mexican subsidiary, Minera El Pilón, S.A. de C.V.

The Technical Report is based on information available and provided to PAH at the time of the report, largely including data by FMS and its subsidiary’s and to a lesser extent including information by third parties and generated by PAH. PAH believes that the information contained herein will be reliable under the conditions and subject to the limitations set forth herein. For mineral rights legal title, as well as assessment works and permits required by Mexican Mining and Environmental Laws, PAH has only relied on previous public reports, Legal Opinions, verbal assessments and confirmations by FMS personnel and consultants who are experienced professionals.

According to the Durango-based Legal Firm of Carlos Galván Patoriza, “San Martín mining operations are currently and have always been conducted, in compliance with all applicable laws and regulations of the jurisdiction in which the property is located or in which San Martín mining operations are conducted”, dated September 30, 2008.

Some parts of this Technical Report have not been included to avoid duplication of information that has not been modified or changed from previous Technical Reports prepared by PAH for First Silver Reserves Inc. regarding the same mining operation of San Martín de Bolaños dated June 23, 2005 and published at SEDAR on July 5, 2005 and Technical Report for the San Martín de Bolaños Silver Mine, State of Jalisco, México Amended dated July 24, 2007 and published in SEDAR on July 25, 2007 prepared by PAH on behalf of FMS.

| Pincock, Allen & Holt | 5.1 |

| 90535 January 15, 2009 |

6.0 PROPERTY DESCRIPTION AND LOCATION

6.1 Property Description

First Majestic Silver Corp. operates the San Martín Silver Mine that consists of a predominantly silver mine and processing plant through its wholly owned Mexican subsidiary Minera El Pilón, S.A. de C.V. (El Pilón), the project is located near the town of San Martín de Bolaños, in the State of Jalisco, México.

The San Martín mine includes underground operations that have opened six main drifts with levels at an approximate 35-meter vertical separation. Each one of the drifts has been developed to a maximum extension of approximately 3,000 meters, with interconnecting ramps between levels, and all have surface access to the Cerro Colorado hillside. Since 1983, when El Pilón initiated operations in the area, to September 2008, over 4.3 million tonnes of silver ore have been extracted and processed, for sales of approximately 33.6 million ounces of silver, including some gold and lead. Most of the San Martín ore production has been mined from the Zuloaga vein, with only minor production extracted from the La Blanca, Rosario, Cinco Señores and Condesa veins.

The San Martín ore is transported via a 13-kilometer dirt road from the mine installations to the processing plant from an elevation of 1,080-meter above-sea-level (asl), to about 850. The processing plant consists of crushing, grinding and conventional cyanidation by agitation in tanks. Silver and gold values in solution are then precipitated by the Merrill-Crow method, by adding zinc dust and smelting the resulting precipitates into Doré bars for shipment to a smelter. A gravity separation circuit, consisting of two Falcon concentrators and one vibrating Wilffley table has been added to the processing system to recuperate coarse grains of gold and silver and some sulfides that are not recovered in the cyanidation circuit.

Other installations include laboratory facilities, offices, dining room, and some housing for key employees.

In addition to the mineral rights covered by 31 mining concessions that include 7,841 hectares (19,375 acres), El Pilón has purchased the surface rights for 1,295.81 hectares (3,202 acres) of land that include the mine and mine installations, part of the access roads, and surrounding areas. Additionally, El Pilón has acquired the surface rights of 159.52 hectares (394 acres) of land where the plant installations and camp are located.

El Pilón’s corporate activities are maintained within FMS’s head Mexican offices located in the capital city of Durango, State of Durango, where purchasing, legal and accounting administrative functions provide support to each of FMS’s subsidiary’s and mining operations.

6.2 Location

The San Martín mine is located near the town of San Martín de Bolaños on the Bolaños River valley, in the northern portion of the State of Jalisco, México. The San Martín operation is 150 kilometers by air or 250 kilometers by paved road north from Guadalajara city. Driving time is four to five hours and flying time is about 45 minutes by charter plane. The town of San Martín de Bolaños has a population of about 3,000 and the mine is a major contributor to the economy of the town and area.

| Pincock, Allen & Holt | 6.1 |

| 90535 January 15, 2009 |

The plant is located southeast of the town at an elevation of 850 meters asl. The mine is 10 kilometers northwest of the town at elevations between 1,080 and 1,190 asl. Figure 6-1 shows a general location map.

UTM coordinates at the central part of the San Martín mine area are as follows:

North – 2,375,500

East – 615,000

6.3 Property Ownership

Minera El Pilón was a wholly owned subsidiary of First Silver Reserve Inc. which was acquired in September 2006 by First Majestic Silver Corp. and subsequently delisted from the Toronto Stock Exchange. FMS is based in Vancouver, British Columbia. El Pilón’s corporate offices are located in Durango, México. El Pilón operates the San Martín silver mine, an underground silver mine and ore processing facility near San Martín de Bolaños. Ore is being mined primarily from the Zuloaga Vein. Exploration is on-going on the Zuloaga vein and in other sub-parallel and crossing veins that have been uncovered recently on the San Carlos level, as well as on the Rosario-Condesa vein system. Figure 6-2 depicts El Pilón’s San Martín general layout.

El Pilón holds 31 contiguous mining concessions in the San Martín mining district that cover mineral rights for 7,840.5692 hectares. These include 31 mining concessions with exploitation rights.

The process to acquire mineral rights from the Mining Department in México (Dirección General de Minas) is initiated by surveying the area of coverage. The applicant must present a location map of the area requested for mineral rights, which includes description of local prominent features and relative position with regards to other adjacent and nearby pre-existing claims. If the claimed area is free at the time of presenting the application, then a Mining Concession is granted for a 50-year term, which may be renewed for similar duration. The Dirección General de Minas issued new Regulations, by Presidential decree, regarding mining concessions in April 26, 2005, to be applied from January 1, 2006, whereby all the Exploration and Exploitation mining claims were transformed to a unique type of Mining Concession for a renewable duration of 50 years. Previous mining claims were automatically adjusted to a 50 year- term from the date of their registration in the Mining Public Registry. The El Pilón title records are maintained in Guadalajara, the state capital city of Jalisco, at the Mining Agency (Agencia de Minería), and at the Central Mining Registry in México City (Dirección General de Minas).

According to El Pilón’s concession title dates, mineral rights are due for the earliest titled concessions in the year 2035 (Ampl. Patricia), and most other claims have expiration dates to the years 2050s; these however, may be renewed for another 50 years. PAH reviewed the legal opinion on the current legal status of the properties, which was issued by the legal firm of Carlos Galván Pastoriza from Durango City, where the concessions legal status is confirmed as in good legal standing. Table 6-1 presents a list of El Pilón’s mining concessions. Figure 6-3 shows San Martín mining concessions map.

| Pincock, Allen & Holt | 6.2 |

| 90535 January 15, 2009 |

6.4 Mineral Tenure

According to El Pilón’s personal and Mr. Carlos Galván Pastoriza’s legal opinion, all mineral concessions are current in assessment work, property taxes and other obligations required by Mexican Mining and Environmental Laws and Regulations.

No royalties or any other encumbrances are due on El Pilón mining concessions.

El Pilón also reported that it owns two lots that cover 1,295.8163 hectares (3,202 acres) of surface land surrounding the mine, and owns another 159.520 hectares (394 acres) of surface land in five lots that include the plant site, camp and tailings areas.

All mining and environmental activities in México are regulated by the Dirección General de Minas and by the SEMARNAP from México City, under the corresponding Laws and Regulations. All minerals below-surface rights lie with the State; while surface rights are owned by “ejidos” (communities) or private individuals, allowing them the right of access and use of their land.

At the San Martín and nearby areas there are no “ejidos;” most land is privately owned.

Provisions are included in the Mexican Mining Law to permit expropriation of surface rights for development of projects that are of general economic interest, including mining operations.

6.5 Surface Land Ownership

The surface rights to the San Martín mine are mostly owned by El Pilón and only part of the access roads are in land of other private owners. El Pilón has negotiated surface rights agreements with some individual owners for parts of the road of access. An important consideration is the traditional use of land, which in fact, recognizes that mining is the preferred use of the land in and around old mining workings, as well as current conditions for the proper use of the land. In fact, the right of way provisions allow for free access to mining claims despite land ownership. Topographic conditions at the San Martín mine area do not allow for proper development of other economic activities for the use of the land.

According to FMS, there is a good working relationship with people of the town of San Martín de Bolaños, since many of the inhabitants are necessarily employed in the exploration or mining operations. No labor or access problems have been reported by FMS within the area.

| Pincock, Allen & Holt | 6.5 |

| 90535 January 15, 2009 |

TABLE 6-1

First Majestic Silver

Corp.

Minera El Pilón, S.A de C.V.

San Martín Silver

Mine

Mining Concessions - September 30, 2008

| No. | Concession Name | Title No. | Surface Ha. |

| 1 | La Zuloaga | 178831 | 9.0000 |

| 2 | La Mancha | 172212 | 270.0000 |

| 3 | Polo | 178829 | 88.0000 |

| 4 | San Judas | 179604 | 140.0000 |

| 5 | Santitos | 179605 | 69.4479 |

| 6 | Zuloaga Dos | 185281 | 168.8724 |

| 7 | Pinalillo Dos | 185284 | 79.7712 |

| 8 | Zuloaga Tres | 185307 | 220.0000 |

| 9 | Zuloaga Cuatro | 188862 | 282.5180 |

| 10 | Zuloaga Cinco | 191989 | 245.0970 |

| 11 | Zuloaga Seis | 188867 | 425.2678 |

| 12 | Zuloaga Siete | 218104 | 2,102.2937 |

| 13 | Pinalillo | 181758 | 37.9645 |

| 14 | La Esperanza | 175485 | 12.5631 |

| 15 | San Eduardo | 206208 | 51.2962 |

| 16 | Luis Tres | 218872 | 1,091.9181 |

| 17 | Ampl. Verónica | 218866 | 148.6571 |

| 18 | Ampl San Martín de Porres | 221206 | 17.2641 |

| 19 | Ampl A San Eduardo | 186428 | 71.0181 |

| 20 | San Martín de Porres | 160810 | 91.4350 |

| 21 | San Judas Tadeo | 160811 | 94.8922 |

| 22 | Ampl Patricia | 187325 | 150.0000 |

| 23 | Santa Elena | 216187 | 322.7636 |

| 24 | Luis Dos | 220312 | 459.0367 |

| 25 | Los Cinco Metros | 185282 | 0.1479 |

| 26 | El Pilón Fracc.I | 124219 | 4.2244 |

| 27 | El Pilón Fracc.II | 220480 | 187.1202 |

| 28 | La Condesa | 221189 | 300.0000 |

| 29 | La Providencia | 221137 | 100.0000 |

| 30 | Luis Uno | 226108 | 300.0000 |

| 31 | Luis Cuatro | 226447 | 300.0000 |

| TOTAL AREA SAN MARTIN UNIT | 7,840.5692 |

6.6 Environmental and Permitting

PAH is not aware of any environmental liabilities in the San Martín mining district; most of the area covered by El Pilón concessions is mining and prospective land for mineral exploration and mine development. Local topographic conditions are rough. The San Martin mine consists of underground workings, and relatively small waste dumps have been constructed near the mine portals. Mining operations throughout the District present only minor surface disturbances. Most of the mine operations are located within land holdings owned by El Pilón. The San Martín underground operation has been developed on the Zuloaga vein, which strike intersects the western slope of the Cerro Colorado hill, extracting selected ores, and only relatively small waste dumps have been formed during the long history of production. Currently San Martin operates in part with Cut-and-Fill mining methods to avoid accumulation of large waste dumps on surface.

| Pincock, Allen & Holt | 6.6 |

| 90535 January 15, 2009 |

PAH’s environmental and safety review consisted of discussions with site management. Personnel interviewed include Ings. J. Miguel Ríos G., Mine Manager of Operations, and Ing. Rafael Romo Gaucin, Mine Chief Geologist and other plant personnel. PAH also observed the current site safety and environmental conditions to identify any potential liabilities that may have significant economic impacts. A brief review was made of file records provided us during the site visit. Other public references have reported full compliance by El Pilón in Mining and Environmental Regulations (Peter Megaw, May 2003). Our assessment is not intended as an environmental and safety compliance audit, although prudent practices were considered in our review. In PAH’s opinion, the San Martin mine is in compliance with the safety and environmental laws and regulations.

PAH has received a copy of document dated October 27, 2008 that presents a list of the permits and authorizations for the San Martín operation and believes that El Pilón is in compliance with applicable regulations and obtains permits as required. Environmental permits in the state of Jalisco are issued by the Subdelegación de Gestión para la Protección Ambiental y Recursos Naturales, Unidad de Gestión Ambiental located in Guadalajara City. This Institution has recently renewed, on November 6, 2006, the Licencia Ambiental Unica No. 14/LU-117/11/06 on behalf of Minera El Pilón, S.A. de C.V. for operating the San Martín mine. The Licencia Ambiental Unica is issued for the duration of the operation, and is subject to compliance with existing regulations and some other requirements. Periodic site inspections by regulators are being performed by Mexican Official Inspectors to observe site safety and environmental conditions.

Environmental studies developed and reported by El Pilón include the following:

| Pincock, Allen & Holt | 6.8 |

| 90535 January 15, 2009 |

|

7.0 |

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

7.1 Topography and Accessibility

The San Martín Silver Mine is located on the eastern slopes of the Sierra Madre Occidental, alongside the Bolaños River valley, in the northern portion of the State of Jalisco. It is located within the jurisdiction of the municipality of San Martín de Bolaños. The village of San Martín de Bolaños is located by the Bolaños River, at an elevation of 820 meters asl, while the San Martín processing plant is at about 850 meters and the mine portals at 1,080 to 1,600 meters. The Bolaños River has established a 10 to 15 km broad valley that runs north-south and presents abrupt escarpments of volcanic rocks on both sides. Figure 6-2 shows a topographic map of the area.

Access to the San Martín mine area is from Guadalajara city by a 250-km paved road or by air in small aircraft to the San Martín de Bolaños airstrip located to the northwest of the village. Driving time from Guadalajara city to the mine is approximately four to five hours, and flying time is 45 minutes from the International Airport at Guadalajara city. Please refer to Figure 6-1 that shows a general location and access map of the area.

Access from the mine to the plant is by a 13.5 -km road, built and maintained by El Pilón, which includes a concrete pad at the part that crosses the village, and is constantly irrigated to avoid dust generation.

7.2 Climate and Physiography

The San Martín mine is located at the coordinates 21° 45’ North latitude, and 103° 45’ West longitude, by the Bolaños river valley. Climate in this area is, according to INEGI (Instituto Nacional de Geografía y Estadística de México) generally warm and semi-wet with rain in the summer season. It presents an average temperature of about 22°C, with the lowest monthly average (19.7°C) in February, and highest in May (30.5° C). Annual freezing temperatures in the region are recorded, mostly during the month of February, from 0 to 20 days, while hail occurs during the rainy season on less than five days per year. Yearly accumulated rainfall in San Martín de Bolaños is registered as 592.1 mm, most of which occurs during June through October. The highest rate of precipitation is recorded at 197.0 mm during the month of October.

The Bolaños River constitutes one of the most important water flows in the State; it forms the Bolaños Hydrological basin that covers approximately 5,100 sq. km. within three States, Aguascalientes, Jalisco, and Nayarit. The Bolaños River discharges its waters into the Santiago River to the south, which drains into the Pacific Ocean. Figure 7-1 shows the San Martin Silver Mine operations.

Climate and topographical conditions in the San Martín de Bolaños area may only support farming and cattle by the river valley; however, in the surrounding areas, only sparse to moderately dense desert vegetation of bushes and shrubs cover the hill slopes. Within the mine area, is a transition zone that changes from the desert grasses in the lower elevations to evergreens, pines and oaks and other types of trees at higher elevations.

| Pincock, Allen & Holt | 7.1 |

| 90535 January 15, 2009 |

7.3 Local Resources and Infrastructure

The town of San Martín de Bolaños constitutes the commercial center for the population living in the region around the San Martín de Bolaños mining district. San Martín de Bolaños offers retail, medical (including General and Seguro Social hospitals), educational (including Jr. and High School), and communications facilities; however, major facilities, including International Airport, are located in the cities of Guadalajara, Zacatecas and Aguascalientes.

The municipality of San Martín de Bolaños holds 5,400 inhabitants according to INEGI’s 2000 census data, in a range of 0-10 inhabitants per sq. km. The town includes approximately 3,000 people, with El Pilón probably being the largest employer. The town is connected to the national power grid (Comisión Federal de Electricidad - CFE), and it has standard telephone lines and satellite communications. Water for the town inhabitants’ consumption is pumped from wells.

Most of the people living in nearby villages or other small congregations within the area, and mostly along the Bolaños river valley, depend on small scale farming, raising livestock, and growing fruit.

The San Martín mine is also connected to the CFE power grid through a substation located at about 20 km to the north, at the Bolaños mine. Mine and plant are connected to the national power grid. Water source for the processing plant is the Bolaños River, a permanent flow. Mine and plant installations, including camp facilities, tailings storage and waste disposal areas required for the mining and milling operation of San Martín are located on land owned by El Pilón.

The infrastructure on site includes the support facilities for the operations, which are located near the plant and include the main administrative offices, warehouse, assay laboratory, tailings facilities, maintenance buildings, cafeteria and other employee housing. The Maintenance Department operates from the extensive shops and warehouses located at the plant site. Maintenance personnel are supplied for mine and plant requirements from this department. A large fleet of mobile equipment consisting of track type tractors (bulldozers), wheel loaders and road graders are available for feeding ore to the crushing circuit and site and road maintenance.

Power is supplied by the grid at 33 kva and 60 cycle. Two 1,000-volt transformers supply power to the plant. Diesel generators are located at the plant for emergency and stand-by power in case of power interruptions. Air compressors are located at the plant to supply low-pressure air to the leach tanks.

| Pincock, Allen & Holt | 7.2 |

| 90535 January 15, 2009 |

8.0 HISTORY

8.1 Property History

The San Martín mining district is located in the southern portion of the Bolaños District, which consists of a geologic setting (graben) that includes, 20 km to the north of San Martín, the old Bolaños mine. Most of the historical mining production from the area was extracted since colonial times, from the Bolaños mine, which was developed by Kennecott, Cyprus and other operators, into a 1,500 tpd underground mining and processing operation in recent times (1980s). At the San Martín area, past mining developments included underground workings and partial discoveries of the Zuloaga, Blanca, Condesa, Cinco Señores, and Rosario veins, with some drifting at the Ballenas, Mancha, Plomosa, Melón and Hedionda among other smaller mine developments. Reportedly over 33.6 million ounces of silver have been extracted from about 4.3 million tonnes of silver ore of the Zuloaga and adjacent veins to September 30, 2008.

8.2 Exploration Programs

At San Martin, traditional exploration programs implemented have been based on direct development workings and complemented with limited drilling. This allows for mine preparation at the same time as the exploration advances along the mineralized structures. Topographic characteristics in the mine area do not permit easy drilling from surface access due to the vein’s strike and dip into the mountain range. However, in recent years, and particularly since the year 2002 when the prices of the precious metals have improved a more aggressive program has been carried out consisting of exploration based on diamond drilling, both from underground accesses and surface sites.

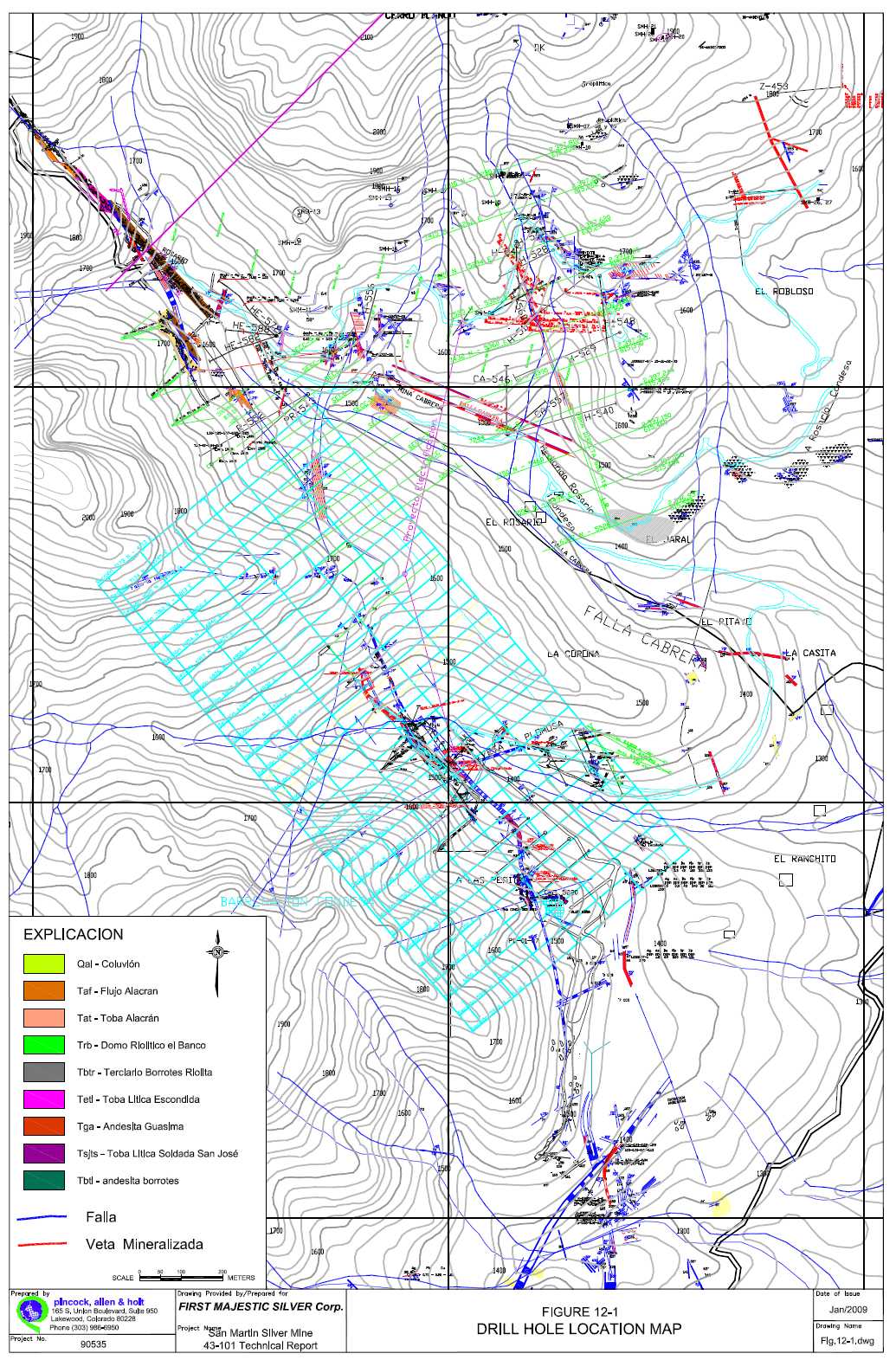

To date, September 30, 2008, drilling has totaled 570 diamond drill holes with a total depth of 61,132 meters, at an average depth per hole of about 107.3 meters. All of the drill core has been kept after logging and sampling.

FMS’s staff prepares yearly reports of the San Martín mine silver ore reserves in order to keep accurate accounting records. These reports have been reviewed by PAH since 1996 to 2001, 2005, 2007, and in 2008. PAH’s reviews the reserve estimates, including past audits as well as this last visit of November 2008, have concluded that these were prepared in a reasonable manner, and in conformance to acceptable engineering standards for reporting of reserves, and meet the standards for classification of reserves established by Canadian National Instrument 43-101, and the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum. Table 8-1 shows San Martín reserve history.

For 2007 and 2008, an aggressive program of exploration based on direct underground exploration/development and diamond drilling at an estimated cost of about $5,000,000 were executed. This program is an on-going effort, and included approximately 19,600 meters of diamond drilling, and 3,900 meters of crosscuts and drifts. As a consequence, the results are advancing resources to reserves and opening other areas for further exploration and development, such as the Cymoid zone of the Zuloaga vein at the La Escondida mine Level 5900, at the Ballenas mine Level 5550, at the La Blanca vein Stope 5735 and at the San Pablo Stope 5920, where sampling and development works have shown high grade silver mineralization. FMS’s geological staff at the San Martin includes 8 active and experienced geologists and other company geologist’s active throughout FMS’s other operations within Mexico with full support from Management, to carry out and supervise the exploration efforts in addition to 19 samplers and contractors for field work.

| Pincock, Allen & Holt | 8.1 |

| 90535 January 15, 2009 |

TABLE 8-1

First Majestic Silver

Corp.

Minera El Pilón, S.A de C.V.

San Martín Silver

Mine

Proven and Probable Reserves

| Year | Silver Ore | Average Grade Rec. Silver/MT |

| Metric Tonnes | ||

| 1994 | 790,889 | 396 |

| 1995 | 1,020,044 | 361 |

| 1996 | 1,271,495 | 355 |

| 1997 | 1,421,578 | 358 |

| 1998 | 1,322,437 | 336 |

| 1999 | 811,695 | 346 |

| 2000 | 1,350,615 | 343 |

| 2001 | 634,555 | 421 |

| 2002 | 614,419 | 384 |

| 2003 | 397,403 | 305 |

| 2004 | 676,000 | 273 |

| 2005 | 619,480 | 277 |

| 2006 | 414,879 | 302 |

| 2007 | 492,022 | 314 |

| 2008 | 770,464 | 274 |

(*) Minera El Pilón data. PAH Feb 12, 2007

8.3 San Martín Silver Production

In 1981, Mr. Héctor Dávila Santos purchased the San Martín property, developed the mine, constructed the process plant, and then began production in 1983. In 1997 First Silver Reserve, Inc. (FSR) by way of reverse takeover, acquired all the shares of the Mexican company Minera El Pilón, S.A. de C.V., owner and operator of the San Martín Silver Mine. In April 2006 First Majestic Resource Corp. entered into an irrevocable share purchase agreement to acquire majority shares of First Silver Reserve Inc. FMS took control of FSR and the San Martin mine in June 2006 and subsequently a business combination was arranged and approved on September 14, 2006. Upon acquisition of First Silver Reserve Inc. by First Majestic Resource Corp. the name was changed to First Majestic Silver Corp. To September 30, 2008, El Pilón has recorded a production of 33.6 million ounces of silver from 4.3 million tonnes of ore. Table 8-2 presents the San Martín mines historical silver production

| Pincock, Allen & Holt | 8.2 |

| 90535 January 15, 2009 |

TABLE 8-2

First Majestic Silver

Corp.

Minera El Pilon, S.A. de C.V.

San Martín Silver

Mine

Historical Silver Production

| Year | Silver Ore | Silver Ounces

Sold |

Average Grade

Rec. Silver oz/Tonne |

| Metric Tonnes | |||

| 1984 | 110,468 | 566,726 | 5.13 |

| 1985 | 104,707 | 517,265 | 4.94 |

| 1986 | 108,837 | 579,022 | 5.32 |

| 1987 | 106,958 | 412,844 | 3.86 |

| 1988 | 105,419 | 244,554 | 2.32 |

| 1989 | 88,987 | 206,304 | 2.32 |

| 1990 | 99,947 | 484,704 | 4.85 |

| 1991 | 89,816 | 669,121 | 7.45 |

| 1992 | 72,105 | 563,868 | 7.82 |

| 1993 | 71,777 | 548,337 | 7.64 |

| 1994 | 77,313 | 812,650 | 10.51 |

| 1995 | 135,690 | 1,684,508 | 12.41 |

| 1996 | 171,099 | 2,148,719 | 12.56 |

| 1997 | 206,770 | 2,258,759 | 10.92 |

| 1998 | 257,924 | 2,337,123 | 9.06 |

| 1999 | 273,791 | 2,288,608 | 8.36 |

| 2000 | 262,768 | 2,315,143 | 8.81 |

| 2001 | 260,660 | 2,393,186 | 9.18 |

| 2002 | 258,219 | 2,399,494 | 9.29 |

| 2003 | 234,539 | 2,291,955 | 9.77 |

| 2004 | 266,592 | 2,312,745 | 8.68 |

| 2005 | 249,239 | 1,957,645 | 7.85 |

| 2006 | 261,834 | 1,688,564 | 6.45 |

| 2007 | 239,796 | 1,129,220 | 5.50 |

| 2008(1) | 184,440 | 796,525 | 4.30 |

| TOTAL | 4,299,695 | 33,607,559 | 7.82 |

(1) January - September 30, 2008

(*) From 2004 Silver ounces equivalent, including gold.

| Pincock, Allen & Holt | 8.3 |

| 90535 January 15, 2009 |

9.0 GEOLOGICAL SETTING

This section describes the geology for the San Martín mine and is based on reports provided by El Pilón, previous Technical Reports and observations made during site visits. A discussion of the regional and deposit geology has been previously published in a report entitled “Geology, Tectonic Environment and Structural Controls in the San Martín de Bolaños District, Jalisco, Mexico” by F. R. Scheubel, et. al., published in Economic Geology, Vol. 83, 1988, p. 1703-1720.

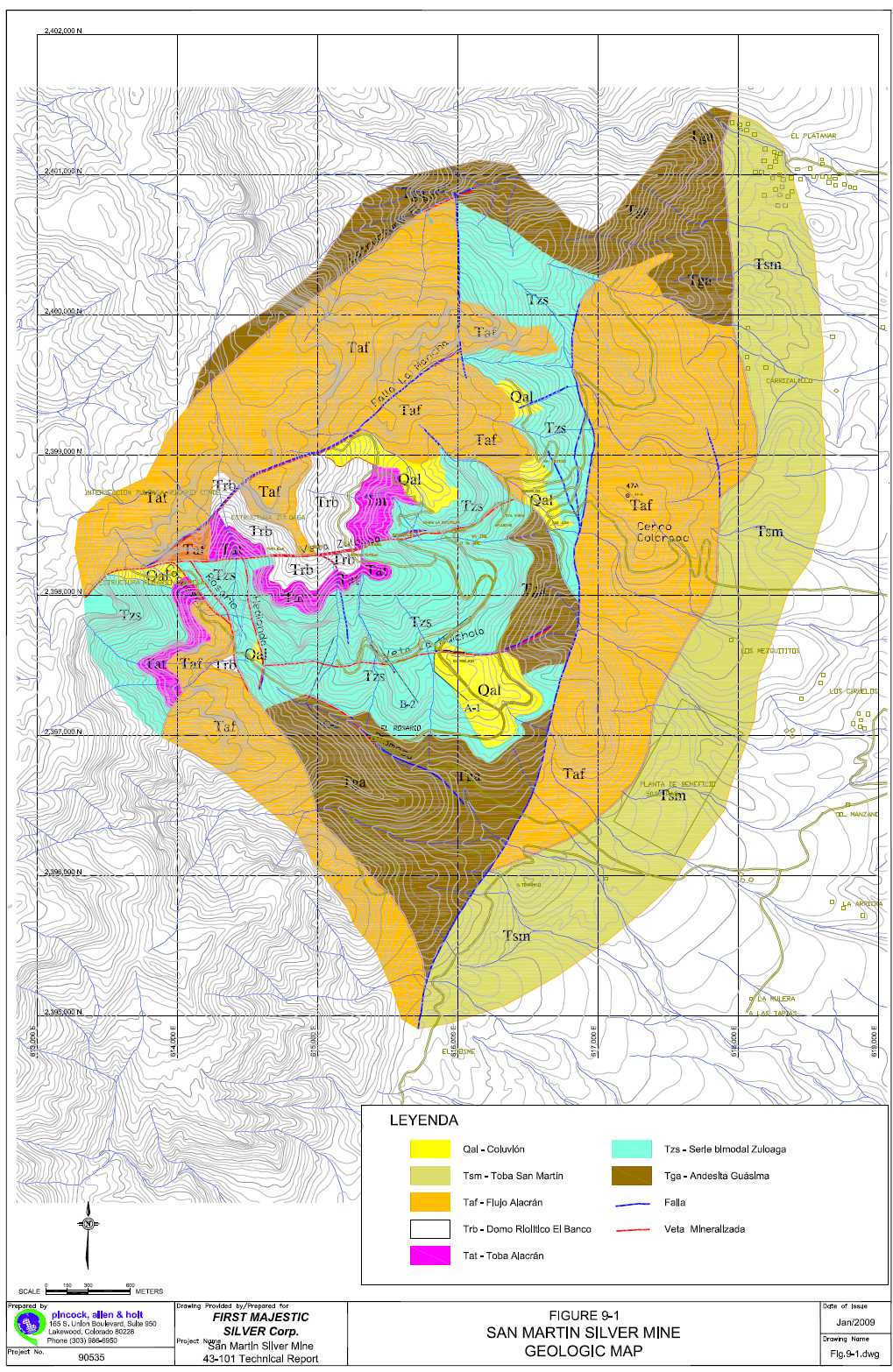

On the first Technical Report for the San Martín Silver Mine, State of Jalisco, México prepared by PAH for First Silver Reserve Inc., dated June 23, 2005 as project PAH-9161.01, which was published on the SEDAR web site in July 5, 2005 and also, on the SM 43-101 made for FMS by PAH on March 06, 2007 and Amended on July 24, 2007 contain descriptions of the San Martín mine Geological Setting, including District Regional Geology, Bolaños Regional Stratigraphy, Bolaños Regional Structure, and the San Martín deposit Geology, which have not changed since publication of the Technical Report; therefore, PAH does not consider it necessary to repeat these sections. Figure 9-1 shows the Regional Geological Map.

9.1 Bolaños Mining District Regional Geology

Please refer to Technical Report Amended July 24, 2007, published in SEDAR on July 25, 2007.

9.2 Bolaños Regional Stratigraphy

Please refer to Technical Report Amended July 24, 2007, published in SEDAR on July 25, 2007.

9.3 Bolaños Regional Structure

Please refer to Technical Report Amended July 24, 2007, published in SEDAR on July 25, 2007.

9.4 San Martín Deposit Geology

Please refer to Technical Report Amended July 24, 2007, published in SEDAR on July 25, 2007.

| Pincock, Allen & Holt | 9.1 |

| 90535 January 15, 2009 |

10.0 DEPOSIT

TYPES

For a more detailed description of this Report’s section please refer to Technical Reports dated June 23, 2005, published in SEDAR on July 5, 2005 and July 24, 2007, published in SEDAR on July 25, 2007.

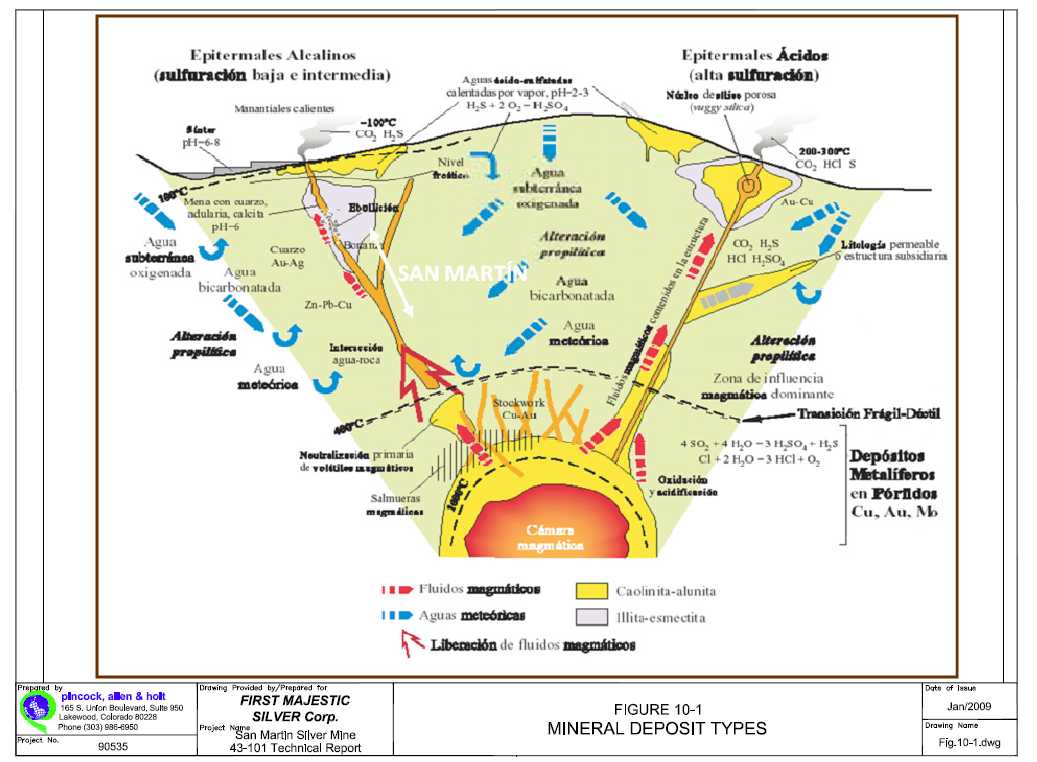

Most of the ore extracted from San Martín’s Zuloaga vein includes oxidized mineralization with native silver, secondary acanthite and chlorargyrite; however, at the deepest levels, such as San Juan and San Carlos, some primary sulfides occur associated within the transition zone, such as galena, sphalerite and pyrite. No typical mineral zoning has been defined at the San Martín mine due to the structural complexity of the area. Gold is present in minor amounts in the upper parts of the mine and shows poor correlation with silver, with typical ratios that range from 1:300 to 1:800, averaging about 1:600. Figure 10-1 shows the Deposit Types.

| Pincock, Allen & Holt | 10.1 |

| 90535 January 15, 2009 |

11.0 MINERALIZATION

Mineralization at the San Martín mining area is exposed in three main structural systems that include sup-parallel veins and faults. Mineralization at San Martín is enclosed by the rhyolites of the formation Zuloaga, with projected base to the top of the andesites of the Guásima formation; meanwhile, the high grade concentrations of silver mineralization encountered at the San Martin mine is capped by the base of the Guásima formation. This may indicate that there is a high possibility to uncover important mineral concentrations under the Guásima formation at San Martín.

Descriptions of the San Martín mineralized structures are taken from the Technical Report for the San Martín de Bolaños Silver Mine, State of Jalisco, México was prepared by PAH for First Silver Reserve Inc., dated June 23, 2005 as project PAH-9161.01 and published in the SEDAR site in July 5, 2005 and Technical Report for the San Martín Silver Mine, State of Jalisco, México Amended prepared by PAH for First Majestic Silver Corp. dated July 24, 2007 and published in SEDAR on July 25, 2007.

11.1 Zuloaga System (EW)

The Zuloaga system includes the La Huichola, La Mancha and El Melón veins. These mineralized structures are oriented mostly EW (from N60ºE to EW), although the La Mancha tends to joint the Zuloaga vein at their western extension. These mineralized structures present recognized outcroppings of 2.5 to 4.0 km, excepting the El Melón which only appears to be mineralized in the fault’s NE extension (500 m). Some blind veins may be associated to these structures, as is the case of the La Blanca vein which splits off the Zuloaga’s hangingwall in underground workings, and the parallel vein to hangingwall off Zuloaga at the Rebaje 40 Oriente. This system is the most important in San Martín due to its development along the Zuloaga vein, and it offers important future potential for exploration in the other veins within the system, as well as to depth. Geological reinterpretations of some the Zuloaga vein areas have resulted in identification of the Cymoid zone, which occurs vertically along the Zuloaga vein from the mine Levels of San Juan at 1,400 masl to above the San José Level, with extension along strike from the 5450 E to the 5700 E sections.

11.2 Rosario – Condesa System (NS)

This system consists of NS-trending faults and mineralized structures. It has been partially developed along the Rosario, Condesa and Hedionda veins. Mineralization generally occurs in these structures for about 1,000 m, although the fault zones extend to over 4,000 m in the Rosario-Condesa vein (the SE extension of the structure where the two veins form one structure). Other semi parallel structures within this system include Plomosa and a series of faults in the central and eastern parts of the mine area. Some other NS blind veins have been uncovered in the Zuloaga underground workings, such as the vein at Sección 6195 at San Carlos level, and the vein at Crucero 6231 also at the San Carlos level. These NS structures appear to be narrow veins with high-grade silver mineralization. Some of the most important faults within the mining district are oriented NS.

| Pincock, Allen & Holt | 11.1 |

| 90535 January 15, 2009 |

11.3 Plomosa System (NW)

The Plomosa system consists of NW-trending fault zones and veins. Generally this system shows lower intensity of mineralization with only partial exposure in the Plomosa structure. The SE extension of the Rosario-Condesa occurs parallel to this system, as well as numerous unnamed faults located in the north zone of the mine area.

The surface geologic map appears to indicate a structural window at the San Martín mining area, by showing older rocks of the Toba Alacrán as being pushed up by the Porphyry Rhyolite stock. Strong fracturing, alteration and disseminated mineralization are associated with the Porphyry Rhyolitic stock that occurs in the central portion of the San Martín mining area. This stock has also been identified in the underground workings, by the Section 6405 in the San Carlos level, where it occurs as a mineralized breccia with disseminated sulfides, pyrite, galena and sphalerite, as well as strong propylitic alteration. NS vein structures associated to this stock have shown high grade silver mineralization (350 to 400 grams) in considerable vein widths or brecciated zones. This area is known at the mine as Plutonic Breccia.

Silver occurs in the veins primarily as argentite and was deposited after the base metals. Native silver and possibly chlorargyrite occurs below the surface outcrops and in the upper workings, a product of surficial oxidation of the sulfide mineralization. Gold is only present in minor amounts and shows no correlation with silver, suggesting different mineralizing events. Silver to gold ratios typically range from 300:1 to 800:1 and average about 650:1 for recent production.

Alteration consists predominantly of limited silicification around and next to the veins, with argillic or kaolinization alteration in the surrounding area and a propyllitic halo that extends up to 400 meters from the mineralized zones (Scheubel and others, 1988). X-ray and petrographic investigations (Albison, 2002) concluded that the propyllitic alteration is composed of chlorite-epidote-adularia-calcite with an increase in iron-rich chlorite to the west and depth. It was also concluded that the argillic alteration along vein segments containing high-grade mineralization is dominated by Illite-smectite, and to a lesser degree, kaolinite clays.

El Pilón has commissioned several fluid inclusion studies that show a typical epithermal range of temperatures for the ore formation, from 200ºC to 300ºC, with 1-10 weight percent NaCl equivalent.

Table 11-1 presents a summary of the known extent of the various veins and faults in the San Martín mine area.

| Pincock, Allen & Holt | 11.2 |

| 90535 January 15, 2009 |

TABLE 11-1

First Majestic Silver Corp.

Minera El Pilon, S.A. de C.V.

San Martín Silver

Mine

General Veins and Faults Systems

| System | Veins and Faults | Estimated Extension |

| Zuloaga | Zuloaga (*) | 3,500 m; w-0.1 to 10.0 m; depth-+400 m |

| (EW) | La Mancha | 4,000 m |

| El Melón (Three veins) | (500 m) – 3,000 m; w-1.-0 to 2.0 m each. | |

| La Huichola | 2,500 m | |

| La Blanca (Blind vein) | Unknown | |

| Cymoid Zone | From 5450 E to 5700 E and San Juan to San José Mine Levels. | |

| Other Blind veins | Unknown | |

| Rosario – Condesa | Condesa | 1,000 m; w-1.5 to 2.0 m |

| (NS) | Rosario | 1,000 m; w – 1.5 to 2.0 m |

| Hedionda | 1,000 m; w – 1.0 to 2.0 m | |

| Two Faults in central zone (South of Zuloaga) | 1,000 m each | |

| NS vein off Zuloaga (Blind vein) Rebaje 40 Oriente | Unknown | |

| NS Rebaje 6231 San Carlos (Blind vein) | Unknown | |

| Section 6195 San Carlos (Blind vein) | Unknown | |

| Faults to the East of mine area | 1,000 to 2,000 m | |

| East limiting faults | 5,000 to 7,000 m | |

| Plomosa | Plomosa | (1,000 m) – 2,000 m; w – 1.0 to 2.0 m |

| (NW) | Rosario-Condesa | 3,000 m; w – 1.5 to 2.0 m |

| North and East zones of mine area | 1,000 to 2,000 m |

(*) The Zuloaga vein has been developed to a depth of approximately 400 meter and it remains open to depth and along strike. All other known veins are undeveloped to depth and strike.

| Pincock, Allen & Holt | 11.3 |

| 90535 January 15, 2009 |

12.0 EXPLORATION