FIRST MAJESTIC SILVER CORP.

2008 ANNUAL REPORT

TSX:FR

FIRST MAJESTIC IS EMERGING AS A WORLD-CLASS SILVER PRODUCER THROUGH THE ACQUISITION AND EXPANSION OF ADVANCED-STAGE SILVER PROJECTS IN MEXICO. WE ARE COMMITTED TO BUILDING LONG-TERM, SUSTAINABLE MINING OPERATIONS THAT ARE BASED ON SOUND ENVIRONMENTAL PRACTICES AND THE WELLBEING OF COMMUNITIES IN WHICH WE OPERATE. |

TRUSTED TO DELIVER. COMMITTED TO GROWTH.

TABLE OF CONTENTS

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 3

IN ONE OF THE MOST TURBULENT ECONOMIC PERIODS IN HISTORY, FIRST MAJESTIC REMAINED FOCUSED ON IMPROVING PRODUCTION CAPACITIES AND EFFICIENCIES, GROWING RESOURCES THROUGH AN AGGRESSIVE AND FOCUSED DRILL PROGRAM, AND BUILDING ONE OF THE SILVER INDUSTRY’S MOST EXPERIENCED AND RESPECTED MANAGEMENT TEAMS.

LETTER TO SHAREHOLDERS

2008 STARTED OFF TO BE A VERY EXCITING YEAR with silver trading at US$20 per ounce in March and the Company’s shares reaching 52-week highs. However, 2008 will not be remembered for this optimism, it will be remembered as a time of global economic crisis. A year when the world changed - we are in uncertain times, there is no doubting it.

There are plenty of reasons to be pessimistic about the state of the world economy, but this is definitely not the case for the precious metals industry. If ever there was a time to be optimistic about silver (& gold), this is most certainly the time.

Unlike so many investments that have recently plummeted in value, such as real estate and oil to name but two, silver and gold remain strong. Precious metals are assets that investors are turning to in these times of uncertainty. Physical demand has consistently outstripped supply in recent years and with many copper and zinc mines shutting down worldwide, silver supplies are being further tightened. For these reasons, we expect silver to outperform gold over the next few years. We feel we are heading into a very exciting time indeed.

Other than our share price and the negative impact on all companies in the fourth quarter due to the dramatic changes that occurred, this past year was another successful year for First Majestic. Our mission remains to become one of North America’s largest silver producers, and we continue to make strong progress towards that goal. We are proud of our team of mining professionals and our workforce of over 1300 people who we owe our successes to.

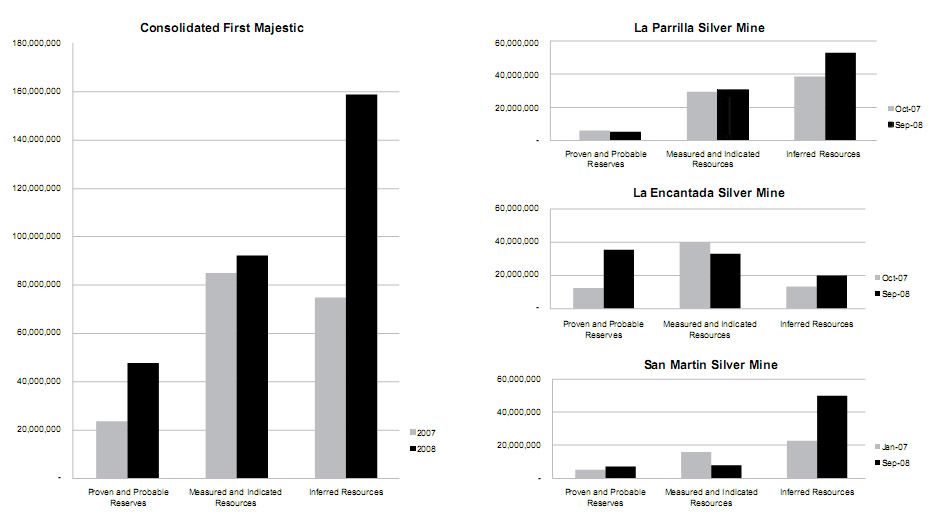

Production growth continued to climb steadily due in large measure to ongoing improvements to our facilities and processes. In addition to our advances in production, we have been rewarded on the exploration and development front as well. On a global consolidated basis, Proven and Probable Reserves increased by 102%, Measured and Indicated Resources increased by 9% and Inferred Resources increased by 110%.

Gross revenues remained strong and grew by 22.4% despite the lower silver price in the fourth quarter.

At the La Encantada Silver Mine, construction began in June 2008 on the new 3500 tpd cyanidation plant. This new plant is scheduled to commence operations in July 2009. We are very excited that once this plant is completed, it is expected to produce over four million ounces of silver annually in the form of doré bars.

As a reflection of our corporate culture, but not reflected in our bottom line, perhaps the two accomplishments in which our team takes the most pride in this year come from our dedication to running a socially and environmentally responsible company. First Majestic received two awards from the Mexican authorities; the Socially Responsible Business Distinction for 2008 and the PROFEPA Clean Industry Certificate for the La Parrilla Silver Mine. Both awards were significant achievements for our company and something we will continue to strive to achieve yearly.

Our primary focus in 2009 is to continue to increase the scale of operations and to shift our mix of production from concentrates to doré bars. This will significantly reduce smelting charges going forward and result in increased net revenues and profits. We are also keenly focused towards ongoing improvements on operating efficiencies and control systems in an effort to realize the benefit of the economies of scale that will ultimately bolster profit and the value of our shares.

Keith Neumeyer

President & CEO

4

HIGHLIGHTS

FIRST MAJESTIC IS DRIVEN TO BECOME ONE OF NORTH AMERICA’S LARGEST SILVER PRODUCERS.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 5

FRIENDLY, SILVER-RICH MEXICO

FRIENDLY, SILVER-RICH MEXICO

WHY MEXICO?

MEXICO IS ONE OF THE MOST ATTRACTIVE REGIONS in the world for mining and exploration. This appeal comes from a variety of factors, including a strong mining culture, excellent geology, political stability and favorable tax and environmental permitting regimes.

Well known for being the world’s largest producer of silver, Mexico remains relatively unexplored. The Fraser Institute says Mexico has more geological potential than any other country as measured by its CMPI index.

In response to a surging demand for gold and silver as investments, Mexico has taken steps to create the right conditions, infrastructure and framework to better accommodate foreign mining companies. There are now around 200 foreign companies exploring and operating in Mexico, and more than 70% are Canadian.

In 2005, the Mexican government approved the restructuring of its Mining Law to deregulate the sector. A large number of free trade agreements further facilitate mining in Mexico, most importantly enabling 100% Foreign Direct Investment (FDI). Interest rates and inflation have been well managed, and most red tape has been reduced or simplified.

Clearly, large-scale mining is a priority for Mexico. Mining is seen as a social and regional development tool, and this is bringing about positive, grassroots changes. There is more access to technology and communications infrastructure than ever before, and access to talented workers has never been better.

6

SOCIAL RESPONSIBILITY

COMMITTED TO OUR COMMUNITIES

FIRST MAJESTIC IS COMMITTED to reaching the highest standard in exemplary corporate citizenship in every community in which we operate. We share common values and strive to make meaningful contributions to community whenever possible.

We focus on both engaging local workforce and on promoting economic sectors beyond our operations. The objective is to create a sustainable economic environment by helping communities to build infrastructure that will avail them new opportunities and a better quality of life. We have launched many social programs that have achieved just that.

Special focus is given to improve and help the local primary and secondary schools. During Christmas, we donate presents to the communities so no child is left without a gift. Working in cooperation with the state governments, we assist in meeting the areas health needs of our communities, compensating local doctors and providing free health services.

We are directly involved with many capital improvement projects, including paving of roadways, construction and upgrades on elementary and high schools, providing clean water to primary schools, assisting with agricultural improvements and construction of a small local clothing factory.

First Majestic is very proud to have been awarded the prestigious Socially Responsible Business Distinction for 2008 by Centro Mexicano para la Filantropia. This milestone for the company recognizes excellence in corporate ethics, quality of work, community citizenship, and environmental responsibility.

First Majestic also remains steadfastly committed to maintaining a clean and safe work environment, and we continue to work with our employees in order to assure that they have the best training, adequate tools, best equipment, and supervision. We were very proud this year to see the La Parrilla Silver Mine receive the prestigious Clean Industry Certificate awarded by Mexican Environmental Authority PROFEPA.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 7

FOCUS ON MANAGEMENT

|

First Majestic, Mexico |

BACK IN 2003, building one of the largest silver producing mining companies in North America was only a vision. From those humble beginnings, First Majestic has grown to over $50 million in gross revenues, employing over 1300 people and affecting the lives of many thousands more in the communities in which we work.

In Mexico, we have built one of the most respected and knowledgeable operational teams in the country. Our reputation for supporting our employees both personally and professionally, and the care we show for the environment and our communities, has allowed us to attract the country’s finest talent. Collectively, our top 40 executives have over 600 years of mining and management experience.

OUR TEAM IN MEXICO is led by Ramon Davila, Chief Operating Officer, who runs all operations in Mexico out of our Mexican head office in Durango. Our senior management team in Durango includes Francisco Garza, Vice President Finance and Administration, Sergio Ramirez, Regional General Manager of Operations, Florentino Muñoz, Regional General Manager of Exploration, Mario Maldonado, Manager of Human Resources and Oscar Melgar, Manager of Purchasing.

In 2008, our team in Mexico successfully implemented major expansion projects and upgrades at each operation. In addition, improvements to our processes have been continuously implemented, providing better controls and reporting which, in turn, has and will continue to lower costs.

Not only are we committed to the professional development of our existing employees, we are committed to our future ones as well.

8

| First Majestic, Vancouver |  |

Through the Chamber of Mines, First Majestic provides scholarships to students at various schools, including University of Guanajuato, University of Zacatecas, University of San Luis Potosi and several others.

THE VANCOUVER HEAD OFFICE is responsible for regulatory, accounting and investor relations functions. All accounting functions and financial reporting requirements are run by Raymond Polman our Chief Financial Officer and all other regulatory functions are directed by Connie Lillico, Corporate Secretary.

A very close relationship exists between our Vancouver and Mexican offices, and both Raymond and Connie are in touch with Mexico continually to manage their respective areas of the business.

Possibly the most unique thing in the Vancouver office this year was an initiative implemented by Keith Neumeyer, President and CEO respecting yoga classes for the staff. He requests that each employee attend a yoga class twice per week on company time and once per week on their own time. First Majestic has also sponsored the Vancouver 10km Sun Run and all our Vancouver staff are offered Spanish speaking lessons weekly. It’s obviously not all play, but these are healthy parts of our business that help bring more value to shareholders.

The First Majestic family of energetic, talented people in both Mexico and Canada are all focused on one common vision: to be one of the biggest silver producers in North America. The heart of our mines is silver, but the heart of our success is our people.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 9

SILVER COIN, BULLION SALES

|

|

IN 2008, FIRST MAJESTIC began minting and selling silver coins, ingots and bars. Our intention was first to be able to supply silver to our shareholders who were requesting physical silver. This interesting side-business grew very quickly and is expected to continue as demand remains extremely strong.

Within a few short months, we were inundated with requests to supply larger quantities to shareholders and other investors. In response, we launched the sale of silver on our website that allows people to buy coins and bars directly from First Majestic online.

Our silver is shipped from Mexico in the form of dore bars and then sent to the refinery where it is purified into .999 fine silver.

10

.999 |

PURE SILVER |

| THERE’S NO SUBSTITUTE FOR SILVER! AS CAN BE SEEN BY THE AVERAGE TRADING PRICE FOR SILVER IN THE LAST FEW YEARS. 2008 SAW THE AVERAGE SILVER PRICE ATTAINING $14.97 COMPARED TO $13.38 IN 2007 and $11.50 in 2006. | |

From there, the silver is shipped to the mint where it is melted into several different forms of finished products. Sales of these products have recently exceeded 10% of First Majestic’s total monthly production.

Online sales are beginning to represent a significant portion of our sales and profits. These sales are a very efficient revenue source because we own the silver and are able to realize higher than normal margins when we sell directly.

This innovative approach of selling our silver directly to investors is allowing First Majestic to tap into a new revenue source. More importantly, we are supplying physical silver to individuals who may otherwise find it difficult due to the tightness in the marketplace.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 11

LA ENCANTADA SILVER MINE A MAJOR EXPANSION PROGRAM IS UNDERWAY AT LA ENCANTADA TO DRAMATICALLY INCREASE SILVER PRODUCTION. |

|

|

|

12

LA ENCANTADA SILVER MINE is a producing underground mine located 120km from the city of Múzquiz in the northwest corner of the State of Coahuila in Mexico. The property is easily accessible by road.

The property covers 2,826 hectares (6,982 acres) of mining claims , the mine, a 1000 tonnes per day flotation mill, associated facilities including a laboratory, maintenance buildings, water wells, airstrip, 180 houses, mine office, warehouses, a clubhouse, guest houses, restaurant and recreational facilities.

La Encantada is First Majestic’s highest grade mine and lowest cost producer. The mill is undergoing a US$21.6 million expansion program, which was launched in July 2008. The first part of the expansion program involved expanding the capacity of the current flotation mill from 800 tpd to 1000 tpd.This was successfully completed in December 2008. The second and larger part of the expansion program, scheduled for completion in mid-2009, will add a 3,500 tpd cyanidation plant enabling the production of doré bars versus concentrates.

The mill is presently operating at approximately 950 tpd and produces a silver rich lead concentrate. Once the expansion program is complete, it is anticipated that silver production will reach over 4.0 million ounces of silver doré on an annual basis.

During the 2008 exploration program a new mineralized zone was discovered at the 1790 mine level. This zone has been named the Buenos Aires zone and was defined with 15 drill holes resulting in defining approximately 850,000 tonnes of Resources at an average grade of 339 grams per tonne of silver. These additional Resources of approximately 13.4 million ounces of silver equivalent were added to the new NI 43-101 Report which was released in December 2008.

Total Reserves / Resources (all catagories) increased to 88.7 million equivalent ounces of silver.

| LOCATION - COAHUILA, MÉXICO | |

| Ownership: 100% | 2008 Production (Silver Equiv.):1.6 million ounces |

| Monthly Capacity (Tonnes): 30,000 | 2008 Production Costs ($US per Tonne): $45.93 |

| Employment: 352 | 2008 Cash Costs ($US, excl. smelting): $3.59 |

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 13

LA PARRILLA SILVER MINE MAJOR DISCOVERY AT LAS VACAS NOW UNDER DEVELOPMENT FOR PRODUCTION IN 2010 |

|

|

|

14

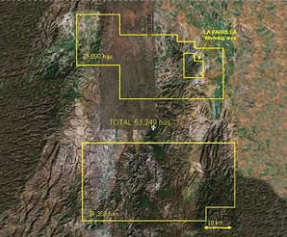

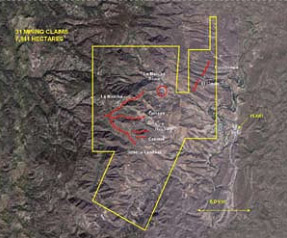

THE LA PARRILLA SILVER MINE is located approximately 75 km southeast of the city of Durango in central Mexico. Excellent infrastructure exists in the area with the mine only 4 km away from the main highway, which links Durango and Zacatecas.

La Parrilla was the first mine developed by First Majestic. It began commercial silver production in October 2004 and its operations have been scaled up continually from 180 tpd in early 2005 to the 840 tpd it is presently operating at.

The plant processes both oxide and sulphide silver ores in two separate 425 tpd parallel circuits. Both doré metal bars and flotation concentrates are being produced.

The Company’s mining claims surrounding the main mine and mill complex cover a very large, 53,249 hectare (131,558 acres) land package consisting of several known areas of mineralization, such as: the Los Rosarios, La Rosa and La Blanca/San José vein system (Los Rosarios System); San Marcos; Quebradillas; Las Vacas; San Nicolas; Las Animas, and numerous other targets for exploration along several known structures and projected intersections, such as Milagros, La Víbora and Sacramento.

Since acquisition of La Parrilla, the mine has proven to be much larger than originally thought. The company has spent the past five years improving the operations through a variety of mechanical improvements, modernizations, underground development, mill expansion, and resource definition.

Exploration at La Parrilla to September 2008 has included 310 drill holes for a total drilled depth of 72,084 meters (72.1 kms); 274 km of geophysical surveying (IP/AR); 36 sq km of aeromagnetic investigations; and about 4,100 samples for geochemical research; in addition to 17,540 metres (17.5 kms) of underground development. The most significant mining area currently under development is the Las Vacas mine, which is being prepared for production in 2010.

The latest NI 43-101 Report published in January 2009 resulted in a 19.79% increase in overall resources at the La Parrilla. Total Reserves / Resources (all categories) have reached 88.75 million equivalent ounces of silver.

| LOCATION - JALISCO, MÉXICO | |

| Ownership: 100% | 2008 Production (Silver Equiv.):1.0 million ounces |

| Monthly Capacity (Tonnes): 28,500 | 2008 Production Costs ($US per Tonne): $38.90 |

| Employment: 310 | Cash Costs ($US, excl. smelting): $10.12 |

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 15

SAN MARTIN SILVER MINE WITH RENEWED INVESTMENT AND MINING APPROACH THE SAN MARTIN CONTINUES TO PRODUCE SUBSTANTIAL OUNCES OF SILVER |

|

|

|

16

THE SAN MARTIN SILVER MINE is located in the Bolaños river valley, a 250 kilometre drive by paved road north from Guadalajara. The San Martín consists of a 950 tpd cyanide and flotation mill, along with all buildings, housing, restaurant, lab and ancillary facilities, including 7840 hectares (19,370 acres) of mining claims.

The San Martin mine and mill has been in operation since 1983 and is a major contributor to the economy of the town of San Martin de Bolaños, which has a population of around 3,000 people. For much of 2008, the mill has been operating at 750 tpd, producing a total of 1.0 million ounces of silver for the year. An expansion program launched in June 2008 resulted in the mill capacity reaching the current 950 tpd in December 2008. The upgrades included the construction of a new thickener, new clarifiers and new filter presses to complete the expansion of the cyanidation process to current levels.

The expansion program also resulted in many improvements to the facilities, including the repair and reinforcing of the older leaching tanks and construction of spill containment systems. These improvements are part of the process of achieving a “Clean Industry Certification” from PROFEPA for the San Martin operation.

Until recently, the area has never been explored using modern exploration techniques. First Majestic’s drill program from January 1, 2007 to September 30, 2008 included 127 drill holes with a total depth of 19,619 metres of core, in addition to about 3906 metres of underground development for mining, drill sites and access preparations.

During this exploration program, new mineralized zones were discovered in the Zuloaga (Pinolea and Ballenas levels and Cymoid zone), La Blanca, Rosario-Condesa, La Mancha, Huichola and La Hedionda veins.

The most recent NI 43-101 Report published in January 2009, showed a significant increase in overall Reserves and Resources which now stand at 64.6 million ounces of silver equivalent (all categories).

| LOCATION - JALISCO, MÉXICO | |

| Ownership: 100% | 2008 Production (Silver Equiv.):1.0 million ounces |

| Monthly Capacity (Tonnes): 28,500 | 2008 Production Costs ($US per Tonne): $38.90 |

| Employment: 310 | Cash Costs ($US, excl. smelting): $10.12 |

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 17

DEL TORO SILVER MINE DEL TORO TO BECOME FIRST MAJESTIC’S FOURTH PRODUCING MINE PERMITTING UNDERWAY |

|

|

|

18

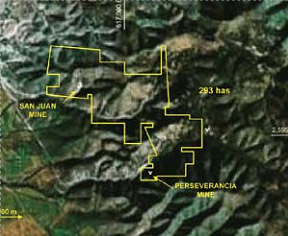

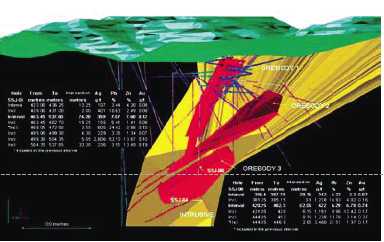

THE DEL TORO SILVER MINE is located 60 km to the southeast from First Majestic’s La Parrilla Silver Mine and consists of a 320 contiguous hectares (791 acres) of mining claims which covers the old Perseverancia mine and the San Juan mine.

Del Toro is an advanced stage development project that has undergone an aggressive drilling program since 2005 to explore the various areas of interest within the Del Toro property holdings. The program has been highly successful in delineating a significant resource base within a short period of time. In October 2008, First Majestic released the first Resource definition on Del Toro, which far exceeded management’s expectations. The Measured and Indicated Resources represented approximately 21 million ounces of silver equivalent and approximately 36 million ounces of silver equivalent were estimated in the Inferred Resource category for a total resource of over 56 million equivalent ounces of silver.

Ore is being extracted from the Del Toro mine and shipped to the La Parrilla mill for mixing into La Parrilla’s production and for batch metallurgical testing.

Permitting is presently underway for the construction of a new mill at Del Toro. Assuming all permitting is completed by mid-year 2009, and funds are available for the project, a new 500 tpd mill is anticipated to be operating in the first half of 2010. All infrastructure, including electricity and water and people are currently available.

LOCATION - ZACATECAS, MÉXICO Ownership: 100% |

DEL TORO’S SAN JUAN OREBODIES  |

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 19

|

1805, 925 West Georgia Street Vancouver, B.C. Canada V6C 3L2 Phone: 604.688.3033 Fax: 604.639.8873 Toll Free: 1.866.529.2807 info@firstmajestic.com www.firstmajestic.com |

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING

The consolidated financial statements of First Majestic Silver Corp. (the “Company”) are the responsibility of the Company’s management. The consolidated financial statements are prepared in accordance with accounting principles generally accepted in Canada and reflect management’s best estimates and judgment based on information currently available.

Management has developed and maintains a system of internal controls to ensure that the Company’s assets are safeguarded, transactions are authorized and properly recorded, and financial information is reliable.

The Board of Directors is responsible for ensuring management fulfills its responsibilities. The Audit Committee reviews the results of the audit and the annual consolidated financial statements prior to their submission to the Board of Directors for approval.

The consolidated financial statements have been audited by Deloitte & Touche LLP and their report outlines the scope of their examination and gives their opinion on the financial statements.

|

|

| Keith Neumeyer | Raymond Polman |

| President & CEO | Chief Financial Officer |

| March 25, 2009 | March 25, 2009 |

20

|

Deloitte & Touche LLP |

Auditors’ report

To the Shareholders of

First Majestic Silver Corp.

We have audited the consolidated balance sheets of First Majestic Silver Corp. as at December 31, 2008, and 2007, and the consolidated statements of loss, shareholders’ equity and comprehensive income (loss), and cash flows for the years ended December 31, 2008 and 2007. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2008 and 2007, and the results of its operations and its cash flows for the years ended December 31, 2008 and 2007 in accordance with Canadian generally accepted accounting principles.

![]()

Chartered Accountants

March 31, 2009

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 21

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED BALANCE SHEETS |

| AS AT DECEMBER 31, 2008 AND 2007 |

| (Expressed in Canadian dollars) |

| 2008 | 2007 | |||

| $ | $ | |||

| ASSETS | ||||

| CURRENT ASSETS | ||||

| Cash and cash equivalents (Note 5) | 17,424,123 | 12,835,183 | ||

| Marketable securities | 50,375 | - | ||

| Accounts receivable | 2,116,325 | 3,365,054 | ||

| Other receivables (Note 6) | 7,212,693 | 6,600,195 | ||

| Inventories (Note 7) | 4,941,340 | 2,908,880 | ||

| Prepaid expenses and other (Note 8) | 2,123,881 | 1,044,753 | ||

| 33,868,737 | 26,754,065 | |||

| MINING INTERESTS (Note 9) | ||||

| Producing properties | 49,933,735 | 25,167,945 | ||

| Exploration properties | 102,760,230 | 102,462,552 | ||

| Plant and equipment | 42,127,380 | 28,903,950 | ||

| 194,821,345 | 156,534,447 | |||

| CORPORATE OFFICE EQUIPMENT (Note 9) | 483,050 | 432,309 | ||

| DEPOSITS ON LONG-TERM ASSETS AND OTHER (Note 11) | 1,986,517 | 1,282,030 | ||

| 231,159,649 | 185,002,851 | |||

| LIABILITIES | ||||

| CURRENT LIABILITIES | ||||

| Accounts payable and accrued liabilities | 17,324,823 | 8,532,702 | ||

| Unearned revenue on silver bullion sales | 110,258 | - | ||

| Vendor liability and interest (Note 10) | 13,940,237 | 13,541,125 | ||

| Vendor liability on mineral property (Note 9(b)) | 1,372,973 | - | ||

| Current portion of arrangement liability | - | 388,836 | ||

| Current portion of capital lease obligations (Note 19) | 1,584,477 | 2,061,464 | ||

| Employee profit sharing payable (Note 22) | 14,801 | 177,624 | ||

| Income and other taxes payable (Note 17) | 557,634 | 926,946 | ||

| 34,905,203 | 25,628,697 | |||

| FUTURE INCOME TAXES (Note 17) | 30,690,087 | 31,848,682 | ||

| CAPITAL LEASE OBLIGATIONS (Note 19) | 1,898,396 | 1,245,194 | ||

| OTHER LONG TERM LIABILITIES (Note 18) | 832,769 | 1,207,332 | ||

| ASSET RETIREMENT OBLIGATIONS (Note 20) | 5,304,369 | 2,290,313 | ||

| 73,630,824 | 62,220,218 | |||

| SHAREHOLDERS' EQUITY | ||||

| SHARE CAPITAL (Note 13) | 196,648,345 | 145,699,783 | ||

| SHARE CAPITAL TO BE ISSUED (Note 13(d)) | 276,495 | 9,286,155 | ||

| CONTRIBUTED SURPLUS | 23,297,258 | 17,315,001 | ||

| ACCUMULATED OTHER COMPREHENSIVE LOSS | (23,216,390 | ) | (15,186,207 | ) |

| DEFICIT | (39,476,883 | ) | (34,332,099 | ) |

| 157,528,825 | 122,782,633 | |||

| 231,159,649 | 185,002,851 | |||

CONTINUING OPERATIONS (Note 1)

CONTINGENT LIABILITIES (Note

21)

COMMITMENTS (Note 22)

|

Director |  |

Director |

The accompanying notes are an integral part of these consolidated financial statements

22

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF LOSS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

| (Expressed in Canadian dollars, except share amounts) |

| 2008 | 2007 | |||

| $ | $ | |||

| Revenue (Note 14) | 44,324,887 | 42,924,920 | ||

| Cost of sales | 30,419,415 | 26,989,300 | ||

| Amortization and depreciation | 3,169,226 | 2,402,262 | ||

| Depletion | 3,034,137 | 6,317,134 | ||

| Accretion of reclamation obligation | 200,477 | 208,448 | ||

| Mine operating earnings | 7,501,632 | 7,007,776 | ||

| General and administrative | 7,549,079 | 7,460,903 | ||

| Stock-based compensation | 3,680,111 | 3,865,689 | ||

| 11,229,190 | 11,326,592 | |||

| Operating loss | (3,727,558 | ) | (4,318,816 | ) |

| Interest and other expenses | (1,372,768 | ) | (1,169,935 | ) |

| Investment and other income | 1,180,742 | 1,358,166 | ||

| Foreign exchange loss | (3,144,654 | ) | (11,299 | ) |

| Write off of mineral properties | - | (1,703,591 | ) | |

| Loss before taxes | (7,064,238 | ) | (5,845,475 | ) |

| Income tax - current | 136,533 | 259,392 | ||

| Income tax (recovery) - future | (2,055,987 | ) | 1,125,255 | |

| Income tax (recovery) expense | (1,919,454 | ) | 1,384,647 | |

| NET LOSS FOR THE PERIOD | (5,144,784 | ) | (7,230,122 | ) |

| Other Comprehensive Income | ||||

| Effect of changing translation | ||||

| adjustment method (Note 2) | - | (3,244,350 | ) | |

| Translation adjustment | (7,616,671 | ) | (19,852,359 | ) |

| Unrealized loss on available for sale securities | (413,512 | ) | - | |

| COMPREHENSIVE LOSS FOR THE PERIOD | (13,174,967 | ) | (30,326,831 | ) |

| LOSS PER COMMON SHARE | ||||

| BASIC & DILUTED | $ (0.07 | ) | $ (0.13 | ) |

| WEIGHTED AVERAGE SHARES OUTSTANDING | ||||

| BASIC | 71,395,164 | 56,720,099 | ||

| DILUTED | 83,336,455 | 68,457,839 |

The accompanying notes are an integral part of these consolidated financial statements

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 23

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF SHAREHOLDER’S EQUITY AND COMPREHENSIVE LOSS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

| (Expressed in Canadian dollars, except share amounts) |

| Accumulated | |||||||||||||||||||

| Other | |||||||||||||||||||

| Comprehensive | Total | ||||||||||||||||||

| Share capital | Special | Contributed | Income (Loss) | AOCI | |||||||||||||||

| Shares | Amount | To be issued | Warrants | Surplus | ("AOCI") (1) | Deficit | and deficit | Total | |||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||

| Balance at December 31, 2006 | 51,698,630 | 103,466,619 | 9,294,020 | - | 11,720,436 | 7,910,502 | (27,101,977 | ) | (19,191,475 | ) | 105,289,600 | ||||||||

| Net loss | - | - | - | - | - | - | (7,230,122 | ) | (7,230,122 | ) | (7,230,122 | ) | |||||||

| Other comprehensive loss: | |||||||||||||||||||

| Exchange translation adjustment of changing consolidation method for First Majestic Plata | - | - | - | - | - | (3,244,350 | ) | - | (3,244,350 | ) | (3,244,350 | ) | |||||||

| Translation adjustment | - | - | - | - | - | (19,852,359 | ) | - | (19,852,359 | ) | (19,852,359 | ) | |||||||

| Total comprehensive loss | (30,326,831 | ) | (30,326,831 | ) | |||||||||||||||

| Adjustment relating to Minera El Pilon transaction | - | - | - | - | (417,317 | ) | - | - | - | (417,317 | ) | ||||||||

| Shares issued for: | |||||||||||||||||||

| Exercise of options | 1,407,500 | 3,022,400 | - | - | - | - | - | - | 3,022,400 | ||||||||||

| Exercise of warrants | 2,668,823 | 6,876,102 | - | - | - | - | - | - | 6,876,102 | ||||||||||

| First Silver arrangement | 1,625 | 7,865 | (7,865 | ) | - | - | - | - | - | - | |||||||||

| Acquisition of La Encantada | 382,582 | 2,000,904 | - | - | - | - | - | - | 2,000,904 | ||||||||||

| Conversion of special warrants | 6,883,000 | 29,221,643 | - | (32,138,643 | ) | 2,917,000 | - | - | - | - | |||||||||

| Special warrants issued | - | - | - | 32,138,643 | - | - | - | - | 32,138,643 | ||||||||||

| Stock option expense during the period | - | - | - | - | 3,865,689 | - | - | - | 3,865,689 | ||||||||||

| Wa rrants issued during the period | - | - | - | - | 333,443 | - | - | - | 333,443 | ||||||||||

| Transfer of contributed surplus upon exercise of stock options | - | 1,104,250 | - | - | (1,104,250 | ) | - | - | - | - | |||||||||

| Balance at December 31, 2007 | 63,042,160 | 145,699,783 | 9,286,155 | - | 17,315,001 | (15,186,207 | ) | (34,332,099 | ) | (49,518,306 | ) | 122,782,633 | |||||||

| Balance at December 31, 2007 | 63,042,160 | 145,699,783 | 9,286,155 | - | 17,315,001 | (15,186,207 | ) | (34,332,099 | ) | (49,518,306 | ) | 122,782,633 | |||||||

| Net income | - | - | - | - | - | - | (5,144,784 | ) | (5,144,784 | ) | (5,144,784 | ) | |||||||

| Other comprehensive loss: | |||||||||||||||||||

| Translation adjustment | - | - | - | - | - | (7,616,671 | ) | - | (7,616,671 | ) | (7,616,671 | ) | |||||||

| Unrealized loss on marketable securities | - | - | - | - | - | (413,512 | ) | - | (413,512 | ) | (413,512 | ) | |||||||

| Total comprehensive loss | (13,174,967 | ) | (13,174,967 | ) | |||||||||||||||

| Shares issued for: | |||||||||||||||||||

| Exercise of options | 436,650 | 1,398,566 | - | - | - | - | - | - | 1,398,566 | ||||||||||

| Exercise of warrants | 7,500 | 31,875 | - | - | - | - | - | - | 31,875 | ||||||||||

| First Silver arrangement | 1,861,500 | 9,009,660 | (9,009,660 | ) | - | - | - | - | - | - | |||||||||

| Public offering, net of issue costs | 8,500,000 | 40,144,471 | - | - | - | - | - | - | 40,144,471 | ||||||||||

| Stock option expense, net of deferred compensation | - | - | - | - | 3,609,247 | - | - | - | 3,609,247 | ||||||||||

| Warrants issued during the period | - | - | - | - | 2,737,000 | - | - | - | 2,737,000 | ||||||||||

| Transfer of contributed surplus upon exercise of stock options | - | 363,990 | - | - | (363,990 | ) | - | - | - | - | |||||||||

| Balance at December 31, 2008 | 73,847,810 | 196,648,345 | 276,495 | - | 23,297,258 | (23,216,390 | ) | (39,476,883 | ) | (62,693,273 | ) | 157,528,825 | |||||||

| (1) | AOCI consists of the cumulative translation adjustment on self sustaining subsidiaries, except for the unrealized losses of $413,512 on marketable securities classified as "available for sale". |

The accompanying notes are an integral part of these consolidated financial statements

24

| FIRST MAJESTIC SILVER CORP. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

| (Expressed in Canadian dollars) |

| 2008 | 2007 | |||

| $ | $ | |||

| OPERATING ACTIVITIES | ||||

| Net income (loss) for the period | (5,144,784 | ) | (7,230,122 | ) |

| Adjustment for items not affecting cash | ||||

| Depletion | 3,034,137 | 6,317,134 | ||

| Depreciation | 3,169,226 | 2,402,262 | ||

| Stock-based compensation | 3,680,111 | 3,865,689 | ||

| Accretion of reclamation obligation | 200,477 | 208,448 | ||

| Unrealized gain on futures contracts | (81,307 | ) | - | |

| Write-down of other assets | 240,000 | - | ||

| Write-down of mineral property interests | - | 1,703,591 | ||

| Future income taxes | (2,055,987 | ) | 1,125,255 | |

| Other long-term liabilities | (209,085 | ) | - | |

| Unrealized foreign exchange | 1,800,823 | 290,487 | ||

| 4,633,611 | 8,682,744 | |||

| Net change in non-cash working capital items | ||||

| Decrease (increase) in accounts receivable and other receivables | 1,517,537 | (2,164,592 | ) | |

| Increase in inventories | (1,571,118 | ) | (1,220,429 | ) |

| Increase in prepaid expenses and advances | (588,697 | ) | (983,728 | ) |

| Increase in accounts payable and accrued liabilities | 1,218,517 | 147,418 | ||

| Increase in unearned revenue | 110,258 | - | ||

| Decrease in employee profit sharing payable | (162,823 | ) | (116,365 | ) |

| Decrease in taxes receivable and payable | (369,312 | ) | (173,839 | ) |

| Increase in vendor liability and interest | 399,112 | - | ||

| Increase in vendor liability on mineral property | 1,372,973 | - | ||

| 6,560,058 | 4,171,209 | |||

| INVESTING ACTIVITIES | ||||

| Expenditures on mineral property interests (net of accruals) | (24,485,036 | ) | (18,895,126 | ) |

| Additions to plant and equipment (net of accruals) | (14,921,672 | ) | (11,841,594 | ) |

| Increase in derivative financial instruments | (127,153 | ) | - | |

| Increase in silver futures contract deposits | (363,278 | ) | - | |

| Increase in deposits on long term assets and other | (704,487 | ) | - | |

| Increase in restricted cash securitizing vendor liability (Note 10) | (13,940,237 | ) | - | |

| Acquisition costs of Minera La Encantada less cash acquired | - | (3,798,900 | ) | |

| (54,541,863 | ) | (34,535,620 | ) | |

| FINANCING ACTIVITIES | ||||

| Issuance of common shares and warrants net of issue costs | 41,574,912 | 11,002,752 | ||

| Issuance of special warrants, net of issue costs | - | 29,221,643 | ||

| Payment of short-term vendor liability | - | (13,341,380 | ) | |

| Payment of short-term Arrangement liability | (388,836 | ) | (388,836 | ) |

| Payment of capital lease obligations | (2,551,752 | ) | - | |

| Payment of liability for acquisition of Desmin | - | (1,165,300 | ) | |

| 38,634,324 | 25,328,879 | |||

| DECREASE IN CASH AND CASH EQUIVALENTS | (9,347,481 | ) | (5,035,532 | ) |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH HELD IN FOREIGN CURRENCY | (3,816 | ) | - | |

| CASH AND CASH EQUIVALENTS - BEGINNING OF THE PERIOD | 12,835,183 | 17,870,715 | ||

| UNRESTRICTED CASH | 3,483,886 | 12,835,183 | ||

| RESTRICTED CASH (Note 10) | 13,940,237 | - | ||

| CASH AND CASH EQUIVALENTS - END OF THE PERIOD | 17,424,123 | 12,835,183 | ||

| CASH AND CASH EQUIVALENTS IS COMPRISED OF: | - | |||

| Cash | 495,168 | 521,201 | ||

| Short-term deposits | 2,988,718 | 12,313,982 | ||

| Restricted cash | 13,940,237 | - | ||

| 17,424,123 | 12,835,183 | |||

| Interest paid | 883,307 | 1,039,418 | ||

| Income taxes paid | 135,847 | - | ||

| NON-CASH FINANCING AND INVESTING ACTIVITIES (NOTE 23) |

The accompanying notes are an integral part of these consolidated financial statements

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 25

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

1. DESCRIPTION OF BUSINESS AND CONTINUING OPERATIONS

First Majestic Silver Corp. (the “Company” or “First Majestic”) is in the business of production, development, exploration, and acquisition of mineral properties with a focus on silver in México. The Company’s shares and warrants trade on the Toronto Stock Exchange under the symbols “FR”, “FR.WT.A” and “FR.WT.B”, respectively.

These consolidated financial statements have been prepared on the going concern basis which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. During the latter part of the year ended December 31, 2008, there was a significant decline in the spot and forward prices of silver and other commodities and access to the capital markets significantly tightened. In 2009, there has been some recovery in the silver price and on March 5, 2009, the Company completed a public offering with a syndicate of underwriters who purchased 8,487,576 units at an issue price of $2.50 per unit for gross proceeds to the Company of $21,218,940 (Note 24(c)). In addition, $13.9 million of the Company’s cash is restricted pending the outcome of the litigation described in Note 10. Ultimately, the Company’s ability to continue as a going concern is dependent on maintaining sustained profitable operations and/or obtaining funds from other sources as required for capital developments. If the Company were unable to continue as a going concern, then material adjustments would be required to the carrying value of assets and liabilities and the balance sheet classifications used.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements of the Company have been prepared by management in accordance with Canadian generally accepted accounting principles (“GAAP”).

The consolidated financial statements include the accounts of the Company and its direct wholly-owned subsidiaries: Corporación First Majestic, S.A. de C.V. (“CFM”) and First Silver Reserve Inc. (“First Silver”), as well as its indirect wholly-owned subsidiaries: First Majestic Plata, S.A. de C.V., (“First Majestic Plata”), Minera El Pilon, S.A. de C.V., (“El Pilon”), and Minera La Encantada, S.A. de C.V. (“La Encantada”). The prior balances of Desmin, S.A. de C.V. were amalgamated into La Encantada on January 1, 2008, with no gain or loss on the amalgamation. First Silver underwent a wind up and distribution of assets and liabilities to the Company in December 2007 but First Silver has not been dissolved for legal purposes pending the outcome of litigation described in Note 10. Inter-company balances and transactions are eliminated on consolidation.

Measurement Uncertainties

The preparation of consolidated financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities as at the date of the financial statements, and the reported amounts of revenues and expenses during the reported period. Significant areas where management judgment is applied include, among others, the expected economic lives and the future operating results and net cash flows expected to result from exploitation of resource properties and related assets, the amount of proven and probable mineral reserves, income tax provisions, stock-based compensation, the determination of the fair value of assets acquired in business combinations and the amount of future site reclamation costs and asset retirement obligations. Actual results could differ from those reported.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and money market instruments with terms to maturity not exceeding 90 days at date of issue. The Company does not believe it is exposed to significant credit or interest rate risk although cash and cash equivalents are held in excess of federally insured limits with major financial institutions. Cash and cash equivalents include $13.9 million of restricted cash as described in Note 10.

Inventories

Finished product, ore in process and stockpile are valued at the lower of cost and net realizable value. Cost is determined as the average production cost of saleable silver and metal by-product. Materials and supplies are valued at the lower of cost and net realizable value.

Mineral Property Interests

The acquisition, development and deferred exploration costs are depleted on a units-of-production basis over the estimated economic life of the ore body following commencement of production.

Mineral property costs and exploration, development and field support costs directly relating to mineral properties are deferred until the property to which they directly relate is placed into production, sold, abandoned or subject to a condition of impairment. The deferred costs are amortized over the useful life of the ore body following commencement of production, or written off if the property is sold or abandoned. Administration costs and other exploration costs that do not relate to any specific property are expensed as incurred.

26

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

The Company reviews and evaluates its mining properties for impairment at least annually or when events and changes in circumstances indicate that the related carrying amounts may not be recoverable. Impairment is considered to exist if the total estimated future undiscounted cash flows are less than the carrying amount of the assets. Estimated undiscounted future net cash flows for properties in which a mineral resource has been identified are calculated using estimated future production, commodity prices, operating and capital costs and reclamation and closure costs. Undiscounted future cash flows for exploration stage mineral properties are estimated by reference to the timing of exploration and development work, work programs proposed, the exploration results achieved to date and the likely proceeds receivable if the Company sold specific properties to third parties. If it is determined that the future net cash flows from a property are less than the carrying value, then an impairment loss is recorded to write down the property to fair value.

The carrying value of exploration stage mineral property interests represent costs incurred to date. The Company is in the process of exploring its other mineral properties interests and has not yet determined whether they contain ore reserves that are economically recoverable. Accordingly, the recoverability of these capitalized costs is dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete their exploration and development, and upon future profitable production.

Although the Company has taken steps to verify ownership and legal title to mineral properties in which it has an interest, according to the usual industry standards for the stage of mining, development and exploration of such properties, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects. Management is not aware of any such agreements, transfers or defects.

From time to time, the Company acquires or disposes of properties pursuant to the terms of option agreements. Options are exercisable entirely at the discretion of the optionee and, accordingly, are recorded as mineral property costs or recoveries when the payments are made or received.

Asset Retirement Obligations and Reclamation Costs

Future costs to retire an asset including dismantling, remediation and ongoing treatment and monitoring of the site are recognized and recorded as a liability at fair value at the date the liability is incurred. The liability is accreted over time to the amount ultimately payable through periodic charges to earnings. Future site restoration costs are capitalized as part of the carrying value of the related mineral property at their initial value and amortized over the mineral property’s useful life based on a units-of-production method.

Translation of Foreign Currencies

(i) Foreign Currency Transactions

The currency of measurement for the Company’s Mexican operating subsidiaries is the Mexican peso. Transaction amounts denominated in foreign currencies (currencies other than the Mexican peso) are translated into Mexican pesos at exchange rates prevailing on the transaction dates. Carrying value of foreign currency denominated monetary assets and liabilities are translated into the currency of measurement at the exchange rate in effect at the balance sheet date and non-monetary assets and liabilities are translated at the exchange rates in effect at the time of acquisition or issue. Revenues and expenses are translated at the exchange rates in effect at the time of the transactions. Exchange gains and losses arising from the translation of these items are included in operations.

(ii) Subsidiary Financial Statements

The financial statements of Mexican subsidiaries are translated to Canadian dollars using the current rate method. In August 2007, the Company changed the method by which it translated the accounts of First Majestic Plata. The operations of First Majestic Plata changed from integrated to self-sustaining and commercial operations of the La Parrilla Silver Mine experienced a change in the functional currency from the Canadian dollar to the Mexican peso. As a result, the current rate method was adopted and replaced the temporal method. The translation loss of $3,244,350 attributable to current rate translation of non-monetary items as of the date of the change is included as an element of the exchange gains and losses and as a separate component of accumulated other comprehensive income.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Under this method, income tax liabilities and assets are recognized for the estimated tax consequences attributable to differences between the amounts reported in the financial statements and their respective tax bases (temporary differences), using substantively enacted income tax rates. The effect of a change in income tax rates on future income tax liabilities and assets is recognized in income in the period that the change occurs. Future income tax assets are recognized to the extent that they are considered more likely than not to be realized.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost less accumulated depreciation applied from the commencement of operations, calculated using the straight line method over the following useful lives:

| Computer equipment | 3 years straight-line |

| Automobile | 5 years straight-line |

| Office equipment | 5 years straight-line |

| Mine and mill equipment | 10 years straight-line |

| Buildings | 20 years straight-line |

Construction in progress costs are not amortized until the related asset is complete, ready for use and utilized in commercial production.

Revenue Recognition

Revenue from the sale of silver is recorded in the Company’s accounts when title transfers to the customer, which generally occurs on the date the shipment is received, when collection is reasonably assured, and when the price is reasonably determinable. Revenue is recorded in the statement of operations net of treatment and refining costs paid to counterparties. Revenue from the sale of silver is subject to adjustment upon final settlement of estimated metal prices, weights and assays. Adjustments to revenue for metal price changes are recorded on final settlement. By-product revenue is included as a component of sales.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 27

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

Unearned Revenue

Unearned revenue is recorded when cash has been received from customers prior to shipping of the related silver coins, ingots and bullion products.

Impairment of Long-Lived Assets

Long-lived assets are assessed for impairment at least annually, and when events and circumstances warrant. The carrying value of a long-lived asset is impaired when the carrying amount exceeds the estimated undiscounted net cash flow from use or disposal. In the event that a long-lived asset is determined to be impaired, the amount by which the carrying value exceeds its fair value is charged to earnings.

Loss Per Share

Basic loss per share is computed by dividing the loss available to common shareholders by the weighted average number of common shares outstanding during the period. The computation of diluted earnings per share assumes the conversion, exercise or contingent issuance of securities only when such conversion, exercise or issuance would have a dilutive effect on earnings per share. The dilutive effect of convertible securities is reflected in diluted earnings per share by application of the “if converted” method. The dilutive effect of outstanding options and warrants and their equivalents is reflected in diluted earnings per share by application of the treasury stock method. The effects of potential issuances of shares under options and warrants would be anti-dilutive, and therefore basic and diluted loss per share are the same.

Stock-based Compensation

The Company uses the fair value method for recording compensation for all awards made to directors, employees and non-employees including stock appreciation rights, direct awards of stock and stock-based awards that call for settlement in cash or other assets. The compensation expense is determined as the fair value of the option at the date of grant and is calculated using the Black-Scholes Option Pricing Model. The contributed surplus balance is reduced as the options are exercised and the amount initially recorded is transferred to share capital. The effect of forfeitures of stock-based compensation is recorded as an adjustment to stock-based compensation expense in the period the option is forfeited.

Derivatives

The Company may periodically use foreign exchange and commodity contracts to manage exposure to fluctuations in foreign exchange rates and commodity prices. Derivative financial instruments are recorded on the Company’s balance sheet at their fair values with changes in fair values recorded in the results of operations during the period in which the change occurred.

Comprehensive Income

Comprehensive income consists of net income and other comprehensive income (“OCI”). OCI represents changes in shareholders’ equity during a period arising from transactions other than changes related to transactions with owners. OCI includes unrealized gains and losses on financial assets classified as available-for-sale, changes in the fair value of the effective portion of derivative instruments included in cash flow hedges and currency translation adjustments on the Company’s net investment in self-sustaining foreign operations.

Cumulative changes in OCI are included in accumulated other comprehensive income (“AOCI”).

28

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

Financial Instruments – Recognition and Measurement and Hedges

Financial assets and liabilities, including derivatives, are recognized on the consolidated balance sheet when the Company becomes a party to the contractual provisions of the financial instrument. All financial instruments are required to be measured at fair value on initial recognition except for certain related party transactions. Measurement in subsequent periods depends on whether the financial instrument has been classified as held-for-trading, available-for-sale, held-to-maturity, loans and receivables, or other financial liabilities. Transaction costs are expensed as incurred for financial instruments classified as held-for-trading. For financial instruments classified as other than held-for-trading, transaction costs are added to the carrying amount of the financial asset or liability on initial recognition and amortized using the effective interest method.

Financial assets and financial liabilities held-for-trading are measured at fair value with changes in those fair values recognized in the statement of loss. Loans and receivables and other financial liabilities are measured at amortized cost using the effective interest method. Available-for-sale financial assets are presented in available-for-sale securities in the Company’s consolidated balance sheet and measured at fair value with unrealized gains and losses, including changes in foreign exchange rates, recognized in OCI. Other than temporary unrealized losses on available-for-sale, financial assets are recognized in the statement of income or loss. Investments in equity instruments classified as available-for-sale that do not have a quoted market price in an active market are measured at cost.

Derivative instrument are recorded on the consolidated balance sheet at fair value, including those derivatives that are embedded in financial or non-financial contracts that are not closely related to the host contracts. Changes in the fair values of derivative instruments are recognized in net income with the exception of derivatives designated as effective cash flow hedges.

The Company has designated its financial assets and liabilities as follows:

| • | Cash and cash equivalents | Held-for-trading |

| • | Marketable securities | Available-for-sale |

| • | Accounts receivable and other receivables | Loans and receivables |

| • | Derivative financial instruments | Held-for-trading |

| • | Accounts payable and accrued liabilities | Other financial liabilities |

| • | Vendor liabilities | Other financial liabilities |

| • | Employee profit sharing | Other financial liabilities |

| • | Debt obligations | Other financial liabilities |

| • | Capital lease obligations | Other financial liabilities |

Comparative Figures

Certain comparative figures have been reclassified to conform with the classifications used in 2008.

Significant Changes in Accounting Policies

Capital Disclosures and Financial Instruments - Disclosures and Presentation

Effective January 1, 2008, the Company adopted three new presentation and disclosure standards that were issued by the Canadian Institute of Chartered Accountants: Handbook Section 1535, Capital Disclosures (“Section 1535”), Handbook Section 3862, Financial Instruments – Disclosures (“Section 3862”) and Handbook Section 3863, Financial Instruments – Presentation (“Section 3863”).

Section 1535 requires the disclosure of both qualitative and quantitative information that enables users of financial statements to evaluate (i) an entity’s objectives, policies and processes for managing capital; (ii) quantitative data about what the entity regards as capital; (iii) whether the entity has complied with any capital requirements; and (iv) if it has not complied, the consequences of such non-compliance.

Sections 3862 and 3863 replace Handbook Section 3861, Financial Instruments – Disclosure and Presentation, revising and enhancing its disclosure requirements and carrying forward unchanged its presentation requirements for financial instruments. Sections 3862 and 3863 place increased emphasis on disclosures about the nature and extent of risks arising from financial instruments and how the entity manages those risks.

Inventories

The Company adopted CICA Section 3031, Inventories, on January 1, 2008. This section provides further guidance on the measurement and disclosure requirements for inventories. Specifically, the new pronouncement requires inventories to be measured at the lower of cost and net realizable value, and provides guidance on the determination of cost and its subsequent recognition as an expense, including any write-down to net realizable value. The adoption of the new standard did not have a material impact on the Company’s results of operations or financial position.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 29

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

Recent Pronouncements

The Company has assessed new and revised accounting pronouncements that have been issued but that are not yet effective and determined that the following may have a significant impact on the Company.

| (i) | The CICA issued the new Handbook Section 3064, “Goodwill and Intangible Assets”, which establishes revised standards for the recognition, measurement, presentation and disclosure of goodwill and intangible assets. The new standard also provides guidance for the treatment of preproduction and start- up costs and requires that these costs be expensed as incurred. The new standard is effective for the Company beginning January 1, 2009. The Company is currently assessing the impact of this new standard on its consolidated financial statements. |

| (ii) | The CICA issued the new Handbook Section 1582, “Business Combinations”, Section 1601 “Consolidations” and Section 1602 “Non-controlling Interests” to harmonize with International Financial Reporting Standards (“IFRS”). Section 1582 specifies a number of changes including: an expanded definition of a business, a requirement to measure all business acquisitions at fair value, a requirement to measure non-controlling interests at fair value, and a requirement to recognize acquisition related costs as expenses. Section 1601 establishes the standards for preparing consolidated financial statements. Section 1602 specifies that non-controlling interests be treated as a separate component of equity, not as a liability or other item outside of equity. These new standards become effective beginning on or after January 1, 2011, but early adoption is permitted. The Company is currently assessing the impact of these new standards. |

International Financial Reporting Standards (“IFRS”)

In 2006, the Canadian Accounting Standards Board (“AcSB”) published a strategic plan that will significantly affect financial reporting requirements for Canadian companies. The AcSB strategic plan outlines convergence of Canadian GAAP with IFRS over an expected five year transitional period. In February 2008, the AcSB announced that 2011 is the changeover date for public companies to commence using IFRS, replacing Canada’s own GAAP. The transition date is for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011. The transition date of January 1, 2011 will require the restatement for comparative purposes of amounts reported by the Company for all the periods ended after January 1, 2010.

We have begun planning our transition to IFRS but the impact on our consolidated financial position and results of operations has not yet been determined. The Company is presently undergoing a diagnostic assessment of its current accounting policies systems and processes in order to identify differences between current Canadian GAAP and IFRS treatment. The Company will continue to monitor changes in IFRS during implementation process and intends to update the critical accounting policies and procedures to incorporate the changes required by converting to IFRS and the impact of these changes on its financial reporting.

3. MANAGEMENT OF CAPITAL RISK

The Company’s objective when managing capital is to maintain its ability to continue as a going concern while at the same time maximizing growth of its business and providing returns on its shareholders’ investments. The Company’s overall strategy with respect to capital risk management remains unchanged from the prior year ended December 31, 2007.

The Company’s capital structure consists of shareholders’ equity, comprising of issued capital, share capital to be issued, contributed surplus, retained earnings (deficit) and accumulated other comprehensive loss.

In order to facilitate the management of its capital requirements, the Company prepares annual expenditure budgets that are updated as necessary depending on various factors, including successful capital deployment and general industry conditions. The annual and updated budgets are approved by the Company’s Board of Directors.

The Company’s investment policy is to invest its cash in highly liquid short term interest bearing investments with maturities of 90 days or less, selected with regards to the expected timing of expenditures from continuing operations. As a result of the funding received subsequent to year end, the Company expects that the capital resources available to it will be sufficient to carry out its development plans and operations for at least the next twelve months.

4. FINANCIAL INSTRUMENTS AND RISKS

The Company thoroughly examines the various financial instruments and risks to which it is exposed and assesses the impact and likelihood of those risks. These risks may include credit risk, liquidity risk, currency risk, commodity price risk, and interest rate risk. Where material, these risks are reviewed and monitored by the Board of Directors.

30

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

Credit Risk

Credit risk is the risk of financial loss if a customer or counterparty fails to meet its contractual obligations. The Company’s credit risk relates primarily to trade receivables in the ordinary course of business and value added tax and other receivables. The Company sells its silver primarily to one international organization with a strong credit rating, payments of receivables are scheduled, routine and received within sixty days of submission; therefore, the balance of overdue trade receivables owed to the Company in the ordinary course of business is not significant. The Company has a Mexican value added tax receivable of $6.1 million as at December 31, 2008, a significant portion which is past due. The Company expects to recover the full amount.

The carrying amount of financial assets recorded in the financial statements represents the Company’s maximum exposure to credit risk. The Company believes it is not exposed to significant credit risk and overall, the Company’s credit risk has not changed significantly from the prior year.

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they arise. The Company has in place a planning and budgeting process to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis and to support its expansion plans. The Company does not have any committed loan facilities. As at December 31, 2008, the Company has outstanding accounts payable and accrued liabilities of $17.3 million which are generally payable in 90 days or less.

On March 5, 2009, the Company completed a public offering with a syndicate of underwriters who purchased 8,487,576 units at an issue price of $2.50 per unit for gross proceeds to the Company of $21,218,940 (see Note 24(c)). Although, the Company does not have a history of operating profits, the Company believes it has sufficient cash on hand to meet operating requirements as they arise for at least the next twelve months.

The Company has an obligation regarding its purchase of First Silver Reserve (“FSR”) to make a final installment payment of $13,341,380, due on May 30, 2008, and to make simple interest payments at 6% per annum, payable quarterly on the outstanding vendor balance. In November 2007, an action was commenced by the Company and FSR against the previous majority shareholder of FSR (“Majority Shareholder”), who was a previous director, President and Chief Executive Officer of FSR, and a company he controls, whereby the Company and FSR allege that while holding the positions of director, President and Chief Executive Officer of FSR, he engaged in a course of deceitful and dishonest conduct in breach of his fiduciary and statutory requirements owed to FSR, which resulted in FSR not acquiring a mine. Management believes that there are substantial grounds to this claim, however, the outcome of this litigation is not presently determinable.

Pending resolution of the litigation set out above, the Company has withheld payment of quarterly installments of interest due on November 30, 2007, February 29, 2008 and May 30, 2008 totaling $598,857 to the previous Majority Shareholder, and has maintained a reserve of cash in the amount of such installments. The Company has withheld payments of the final installment and interest, combined to a total of $13,940,237 due May 30, 2008 until such litigation has been resolved, and such date is presently not determinable. The Company filed on July 22, 2008 an irrevocable Letter of Credit with the Supreme Court of British Columbia as security for this matter.

The Company’s liabilities have contractual maturities which are summarized below:

| Payments Due By Period | |||||||||||||||

| Total | Less than | 1- 3 | 4 - 5 | After 5 | |||||||||||

| 1 year | years | years | years | ||||||||||||

| Capital Lease Obligations | $ | 3,814,049 | $ | 1,815,197 | $ | 1,998,852 | $ | - | $ | - | |||||

| Purchase Obligations (1) | 5,984,323 | 5,984,323 | - | - | - | ||||||||||

| Vendor Liability on Mineral Property (2) | 1,372,973 | 1,372,973 | - | - | - | ||||||||||

| Total Contractual Obligations (3) | $ | 11,171,345 | $ | 9,172,493 | $ | 1,998,852 | $ | - | $ | - | |||||

| (1) | Contract commitments for construction materials and equipment for the La Encantada Mill Expansion Project. |

| (2) | Vendor liability on mineral property totalling US$1,121,160 on the Quebradillas Mine at La Parrilla. |

| (3) | Amounts a bove do not include payments related to the Company's future asset retirement obligations (see Note 20), nor do they i nclude a ccounts payable a nd accrued liabilities of $17.3 million. |

Currency Risk

Financial instruments that impact the Company’s net earnings or other comprehensive income due to currency fluctuations include Mexican peso denominated cash and cash equivalents, accounts receivable, investments in mining interests and accounts payable. The sensitivity of the Company’s net earnings and other comprehensive income due to changes in the exchange rate between the Mexican peso and the Canadian dollar is included in the table below.

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 31

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

Commodity Price Risk

Commodity price risk is the risk that movements in the spot price of silver have a direct and immediate impact on the Company’s income or the value of its related financial instruments. The Company also derives by-product revenue from the sale of gold, lead and zinc. The Company’s sales are directly dependent on commodity prices that have shown volatility and are beyond the Company’s control.

The Company does not use other derivative instruments to hedge its commodity price risk.

Interest Rate Risk

The Company is exposed to interest rate risk on its short term investments. The Company monitors its exposure to interest rates and has not entered into any derivative contracts to manage this risk.

The Company’s interest bearing financial assets comprise of cash and cash equivalents which bear interest at a mixture of variable and fixed rates for pre-set periods of time. The Company’s interest bearing financial liabilities comprise fixed rate debt instruments and capital leases with terms to maturity ranging up to three years.

The sensitivity analyses below have been determined based on the undernoted risks at December 31, 2008.

|

Reasonably possible changes |

|||||||||||

|

|

$US Denominated Silver Commodity Price |

|

$US /Peso |

|

Peso/$CDN |

|

Market interest rate |

|

|||

Impact on Annual Operations |

|

+/- 10% |

|

+/- 10% |

|

+/- 10% |

|

+/- 25 basis points |

|

|||

Net Income (1) |

$ |

5,196,932 |

$ |

2,604,453 |

$ |

2,557,372 |

$ |

43,560 |

|

|||

Other Comprehensive Income(1) |

$ |

- |

$ |

- |

$ |

440,923 |

$ |

- |

|

|||

| (1) | These sensitivities are hypothetical and should be used with caution, favourable hypothetical changes in the assumptions result in an increased amount and unfavourable hypothetical changes in the assumptions result in a decreased amount of net income and/or other comprehensive income. |

Fair Value Estimation

The Company’s financial instruments are comprised of cash and cash equivalents, marketable securities, accounts receivables, other receivables, derivative financial instruments, accounts payable and accrued liabilities, employee profit sharing payable, capital lease obligations and vendor liability.

Marketable securities and derivative instruments are carried at fair value. The fair values of accounts receivable, other receivables, accounts payable and accrued liabilities, unearned revenue, employee profit sharing payable and capital lease obligations approximate their carrying value due to the short term nature of these items. The fair value of the vendor liability and interest payable is not readily determinable due to the uncertainty with respect to the outcome of the litigation described in Note 10.

5. RESTRICTED CASH

On July 22, 2008, the Company secured its outstanding vendor liability (Note 10) by entering into a Letter of Credit facility for $13,940,237, secured by cash and liquid short term investments. The Letter of Credit is revolving with annual expiry on July 22. The cash and short term investments earn market rates of interest from which the 0.5% per annum cost of the Letter of Credit is deducted and the net interest remitted to the Company. The Restricted Cash is segregated from operating cash as the funds are not accessible by the Company pending the litigation described in Note 10.

6. OTHER RECEIVABLES

Details of the components of other receivables are as follows:

| 2008 | 2007 | |||

| $ | $ | |||

| Value added ta xes recoverable | 6,109,943 | 4,467,782 | ||

| Other taxes recoverable | 406,536 | 1,286,967 | ||

| Interest receivable | 188,111 | 16,325 | ||

| Advances to employees | 67,240 | 11,288 | ||

| Advances to s uppliers | 440,863 | 421,535 | ||

| Other | - | 396,298 | ||

| 7,212,693 | 6,600,195 |

32

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

7. INVENTORIES

Inventories consist of the following:

| 2008 | 2007 | |||

| $ | $ | |||

| Silver coins and bullion | 247,368 | - | ||

| Finished product - Doré and concentrates | 1,342,550 | 1,321,004 | ||

| Ore in process | 196,169 | 246,289 | ||

| Stockpile | 1,631,625 | - | ||

| Materials and supplies | 1,523,628 | 1,341,587 | ||

| 4,941,340 | 2,908,880 |

8. PREPAID EXPENSES AND OTHER

As at December 31, 2008, the Company had futures contracts for the receipt of 100,000 ounces of silver at a price of US$10.305 per ounce and sold call options for 50,000 ounces at US$13.00 per ounce. The Company provides deposits in connection with these contracts. The fair value of these contracts and deposits at December 31, 2008 was $490,431 (2007-$nil).

9. MINING INTERESTS

Expenditures incurred on mining interests, net of accumulated depletion, are as follows:

| 2008 | 2007 | |||||||||||

| Accumulated | Accumulated | |||||||||||

| depreciation | depreciation | |||||||||||

| and | and | |||||||||||

| Cost | depletion | Net | Cost | depletion | Net | |||||||

| $ | $ | $ | $ | $ | $ | |||||||

| Mining properties | 167,130,756 | 14,436,791 | 152,693,965 | 138,832,672 | 11,202,175 | 127,630,497 | ||||||

| Plant and equipment | 48,271,432 | 6,144,052 | 42,127,380 | 31,133,655 | 2,229,705 | 28,903,950 | ||||||

| 215,402,188 | 20,580,843 | 194,821,345 | 169,966,327 | 13,431,880 | 156,534,447 | |||||||

A summary of the net book value of mining properties is as follows:

| 2008 | 2007 | |||||||||||

| Non- | Plant and | |||||||||||

| Depletable | Depletable | Subtotal | Equipment | Total | Total | |||||||

| MEXICO | $ | $ | $ | $ | $ | $ | ||||||

| Producing properties | ||||||||||||

| La Encantada (a) | 6,645,503 | - | 6,645,503 | 18,320,120 | 24,965,623 | 10,086,394 | ||||||

| La Parrilla (b) | 16,606,554 | - | 16,606,554 | 16,022,373 | 32,628,927 | 24,517,121 | ||||||

| San Martin (c) | 26,681,678 | - | 26,681,678 | 7,784,887 | 34,466,565 | 19,468,380 | ||||||

| 49,933,735 | - | 49,933,735 | 42,127,380 | 92,061,115 | 54,071,895 | |||||||

| Exploration properties | ||||||||||||

| La Encantada (a) | - | 2,858,043 | 2,858,043 | - | 2,858,043 | 1,728,689 | ||||||

| La Parrilla (b) | - | 8,722,897 | 8,722,897 | - | 8,722,897 | 4,717,254 | ||||||

| San Martin (c) (1) | - | 77,582,247 | 77,582,247 | - | 77,582,247 | 87,749,359 | ||||||

| Candamena | - | - | - | - | - | 700,000 | ||||||

| Del Toro (d) (2) | - | 11,881,557 | 11,881,557 | - | 11,881,557 | 6,804,780 | ||||||

| Cuitaboca (e) | - | 1,715,486 | 1,715,486 | - | 1,715,486 | 762,470 | ||||||

| - | 102,760,230 | 102,760,230 | - | 102,760,230 | 102,462,552 | |||||||

| 49,933,735 | 102,760,230 | 152,693,965 | 42,127,380 | 194,821,345 | 156,534,447 | |||||||

| (1) | This includes properties acquired from First Silver and held by Minera El Pilon. The properties are located in the San Martin de Bolaños region, as well as in Jalisco State (the Jalisco Group of Properties). |

| (2) | The ore from Del Toro is processed via the La Parrilla Silver Mine. |

FIRST MAJESTIC SILVER CORP. 2008 ANNUAL REPORT | 33

| FIRST MAJESTIC SILVER CORP. |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 |

A summary of plant and equipment is as follows:

| 2008 | 2007 | |||||||||||

| Accumulated | Net Book | Accumulated | Net Book | |||||||||

| Cost | Depreciation | Value | Cost | Depreciation | Value | |||||||

| $ | $ | $ | $ | $ | $ | |||||||

| La Encantada Silver Mine | 19,541,421 | 1,221,301 | 18,320,120 | 9,451,422 | 301,669 | 9,149,753 | ||||||

| La Parrilla Silver Mine | 18,590,746 | 2,568,373 | 16,022,373 | 14,763,264 | 1,063,330 | 13,699,934 | ||||||

| San Martin Silver Mine | 10,139,265 | 2,354,378 | 7,784,887 | 6,918,969 | 864,706 | 6,054,263 | ||||||

| Used in Mining Operations | 48,271,432 | 6,144,052 | 42,127,380 | 31,133,655 | 2,229,705 | 28,903,950 | ||||||

| Corporate office equipment | 712,525 | 229,475 | 483,050 | 528,865 | 96,556 | 432,309 | ||||||