As filed with the Securities and Exchange Commission on February 14, 2025

Securities Act Registration Statement No. 033-66528

Investment Company Act File No. 811-07912

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Pre-Effective Amendment | ☐ | ||

| Post-Effective Amendment No. 89 | ☒ |

and/or

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

| Amendment No. 90 | ☒ |

(Check appropriate box or boxes)

(Exact Name of Registrant as Specified in Charter)

103 Bellevue Parkway

Wilmington, DE 19809

(Address of Principal Executive Offices, including Zip Code)

800-607-2200

(Registrant’s telephone number, including area code)

Nicola R. Knight, Esq.

Bessemer Investment Management LLC

1271 Avenue of the Americas

New York, New York 10020

(Name and Address of Agent for Service)

COPY TO:

James V. Catano, Esq.

Dechert LLP

1900 K Street NW

Washington, DC 20006

It is proposed that this filing will become effective (check appropriate box):

| ☐ | Immediately upon filing pursuant to paragraph (b) of Rule 485; or | |

| ☒ | On February 15, 2025 pursuant to paragraph (b) of Rule 485; or | |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) of Rule 485; or | |

| ☐ | On (date) pursuant to paragraph (a)(1) of Rule 485; or | |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) of Rule 485; or | |

| ☐ | On (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Old Westbury Funds, Inc.

Prospectus

Old Westbury All Cap Core Fund OWACX

Old Westbury Large Cap Strategies Fund OWLSX

Old Westbury Small & Mid Cap Strategies Fund OWSMX

Old Westbury Total Equity Fund OWTEX

Old Westbury Credit Income Fund OWCIX

Old Westbury Fixed Income Fund OWFIX

Old Westbury Short-Term Bond Fund OWSBX

Old Westbury Municipal Bond Fund OWMBX

Old Westbury California Municipal Bond Fund OWCAX

Old Westbury New York Municipal Bond Fund OWNYX

BESSEMER INVESTMENT MANAGEMENT LLC

Investment Adviser

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

OLD WESTBURY FUNDS, INC.

Prospectus

February 15, 2025

Bessemer Investment Management LLC—the

Investment Adviser (the “Adviser”) to the Funds listed on the front cover of

this Prospectus (each, a “Fund”

and collectively, the “Funds”)

CONTENTS

FUND SUMMARIES

The Fund’s goal is to seek long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | |

| Other Expenses | |

| Acquired Fund Fees and Expenses | |

| Total Annual Fund Operating Expenses(1) |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund pursues its investment goal by investing in a diversified portfolio of equity and equity-related securities of any market capitalization. The Fund has no restrictions as to the size of the companies in which it invests. The Fund may invest in what generally are considered small-cap stocks, mid-cap stocks and large-cap stocks. The Fund may focus its investments in one of those categories, two of them or all of them, and may change the allocation of its investments at any time.

The Fund invests in a portfolio of securities the Adviser believes has the potential for long-term capital appreciation. The Fund invests primarily in securities listed on securities exchanges or actively traded in over-the-counter markets. The securities may be listed or traded in the form of American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), or other types of depositary receipts (including non-voting depositary receipts) or dual listed securities. The foreign securities in which the Fund may invest may be issued by issuers located in emerging market or developing market countries. The Fund also may invest in exchange-traded funds (“ETFs”) and a variety of derivatives, including futures, options and other derivative instruments, to seek to increase or seek to hedge, or protect, its exposure to, for example, movements in the securities markets.

Principal Risks

All investments carry a certain amount of risk and there is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these strategies may not produce the returns expected by the Adviser, may cause

| 1 |

the Fund’s shares to lose value or may cause the Fund to underperform

other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 2 |

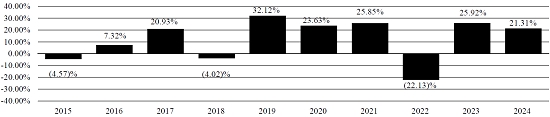

Prior to December 30, 2016, the Fund was named the Old Westbury Large Cap Core Fund and operated under a different investment strategy. The performance information shown below before such date represents the Fund’s prior investment strategies.

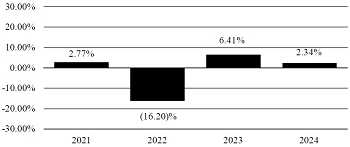

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | 5 Years | 10 Years | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ||||||

| Fund Return After Taxes on Distributions and Sale of Shares | ||||||

| MSCI ACWI Investable Market Index (Net) | ||||||

| 90% MSCI USA Index (Gross) & 10% MSCI ACWI ex USA Index (Net) (reflects no deduction for fees, expenses or income taxes, except foreign withholding taxes for the (Net) index component) |

| 3 |

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers.

Mr. John Alexander Christie, Managing Director of the Adviser and Co-Head of Equities at Bessemer, an affiliate of the Adviser, has managed the Fund since November 16, 2011.

Mr. Michael Morrisroe, Managing Director of the Adviser, has managed the Fund since December 30, 2016.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 4 |

The Fund’s goal is to seek long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | |

| Other Expenses | |

| Total Annual Fund Operating Expenses |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund pursues its investment goal by investing in a diversified portfolio of equity and equity-related securities throughout the world, including in emerging markets. Under normal circumstances, the Fund invests at least 80% of its net assets, including any borrowings for investment purposes, in securities of large capitalization companies. The Adviser currently defines large capitalization companies as companies having, at the time of initial investment, a market capitalization equal to or greater than the largest 70% by market capitalization of the companies that comprise the MSCI ACWI Investable Market Index (IMI). The Fund may continue to hold securities of companies whose market capitalizations fall below the foregoing threshold subsequent to the Fund’s investment in such securities. As of December 31, 2024, the smallest market capitalization in this group was $31.2 billion. This capitalization range will change as the size of the companies in the index changes with market conditions and the composition of the index.

The Fund employs multiple investment strategies which the Adviser believes are complementary. The Fund invests in securities the Adviser believes have potential for above average returns and active currency strategies. The Fund invests primarily in securities listed on securities exchanges or actively traded in over-the-counter markets either within or outside the issuer’s domicile country. The securities may be listed or traded in the form of American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”) and Global Depositary Receipts (“GDRs”), or other types of depositary receipts (including non-voting depositary receipts) or dual listed securities. The Fund may also invest in government fixed income securities, other investment companies, including exchange-traded funds (“ETFs”), and a variety of derivatives, including futures, options, swaps, and other derivative instruments, to seek to increase or seek to hedge, or protect, its exposure to, for example, currency value fluctuations or movements in the securities markets. In addition, the Fund may engage in short sales. The foreign securities in which the Fund may invest may be issued by issuers located in emerging market or developing market countries. Fixed income securities held by the Fund may be of any maturity.

The Fund may employ a quantitative strategy. Under a quantitative strategy, the Fund may invest in U.S. and non-U.S. equity securities with a minimum market capitalization of $250 million. The Fund may, to a lesser extent, also employ quantitative strategies focused on one or more industries.

| 5 |

The Adviser has engaged sub-advisers to make the day-to-day investment decisions for portions of the Fund’s portfolio.

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser and sub-advisers use the Fund’s principal investment

strategies and other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser

and sub-advisers in using these strategies may not produce the returns expected by the Adviser and sub-advisers, may cause the Fund’s

shares to lose value or may cause the Fund to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 6 |

| 7 |

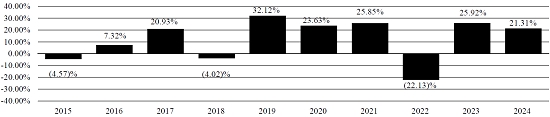

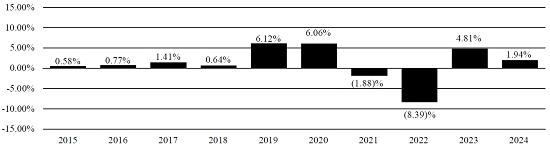

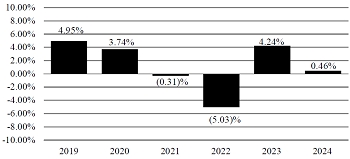

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | 5 Years | 10 Years | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ||||||

| Fund Return After Taxes on Distributions and Sale of Shares | ||||||

| MSCI ACWI Investable Market Index (Net) | ||||||

| MSCI ACWI Large Cap Index (Net) (reflects no deduction for fees, expenses or income taxes, except foreign withholding taxes) |

*

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers and Sub-Advisers.

Mr. John Hall, Managing Director of the Adviser and Co-Head of Equities at Bessemer, an affiliate of the Adviser, has managed the Fund since January 15, 2019.

Dr. Edward N. Aw, DBA, Managing Director of the Adviser and Head of Quantitative Strategies at Bessemer, an affiliate of the Adviser, has managed the Fund since January 15, 2016.

Ms. Nancy Sheft, Managing Director of the Adviser and Head of External Managers at Bessemer, an affiliate of the Adviser, has managed the Fund since October 25, 2016

Mr. Jeffrey A. Rutledge, Managing Director of the Adviser, has managed the Fund since October 1, 2018.

Sands Capital Management, LLC (“Sands Capital”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Messrs. David Levanson, Perry Williams, Brian Christiansen and Daniel Pilling are the portfolio managers of Sands Capital’s portion of the Fund. Mr. Levanson has been a portfolio manager of Sands Capital’s portion of the Fund since November 16, 2011. Mr. Williams has been a portfolio manager of Sands Capital’s portion of the Fund since June 1, 2013. Mr. Christiansen has been a portfolio manager of Sands Capital’s portion of the Fund since January 31, 2020. Mr. Pilling has been a portfolio manager of Sands Capital’s portion of the Fund since July 1, 2024.

Aikya Investment Management Limited (“Aikya”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Aikya’s portion of the Fund has been managed by Messrs. Ashish Swarup, Rahul Desai, and Thomas Allen since February 6, 2024.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

| 8 |

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 9 |

The Fund’s goal is to seek long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Acquired Fund Fees and Expenses | % | |

| Total Annual Fund Operating Expenses(1),(2) | % | |

| Less Fee Waiver(2) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(2) | % |

| (1) | |

| (2) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund invests in a broad, diversified portfolio of securities of small and medium capitalization companies traded on a principal U.S. exchange or U.S. over-the-counter market, and securities of small and medium capitalization non-U.S. companies in foreign countries, including emerging market countries. Under normal circumstances, the Fund invests at least 80% of its net assets, including borrowings for investment purposes, in securities of small and medium capitalization companies. The Adviser currently defines small and medium capitalization companies as companies having, at the time of initial investment, a market capitalization not greater than the smallest 40% by market capitalization of the companies that comprise the MSCI ACWI Investable Market Index (IMI). The Fund may continue to hold securities whose market capitalizations exceed the foregoing threshold subsequent to the Fund’s investment in such securities. As of December 31, 2024, the largest market capitalization in this group was $55.8 billion. This capitalization range will change as the size of the companies in the index changes with market conditions and the composition of the index.

The Fund may employ a quantitative strategy. Under a quantitative strategy, the Fund may invest in U.S. and non-U.S. equity securities with a minimum market capitalization of $250 million.

| 10 |

The Fund invests primarily in securities listed on securities exchanges or actively traded in over-the-counter markets either within or outside the issuer’s domicile country. The securities may be listed or traded in the form of American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”) and Global Depositary Receipts (“GDRs”), or other types of depositary receipts (including non-voting depositary receipts) or dual listed securities. The Fund also may invest in government fixed income securities, exchange-traded funds (“ETFs”), real estate investment trusts (“REITs”) and REIT-like entities, corporate bonds, and a variety of derivatives, including futures, options, swaps and other derivative instruments, to seek to increase return, seek to hedge, or protect, its exposure to, for example, interest rate movements, movements in the commodities or securities markets and currency value fluctuations. Fixed income securities held by the Fund may be of any maturity or quality, including investment grade securities, below investment grade rated securities (sometimes referred to as “junk bonds”) and unrated securities determined by the Adviser or sub-advisers to be of comparable quality.

The Adviser has engaged sub-advisers to make the day-to-day investment decisions for portions of the Fund’s portfolio.

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser and sub-advisers use the Fund’s principal investment

strategies and other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser

and sub-advisers in using these strategies may not produce the returns expected by the Adviser or sub-advisers, may cause the Fund’s

shares to lose value or may cause the Fund to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 11 |

| 12 |

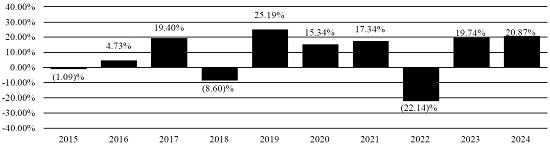

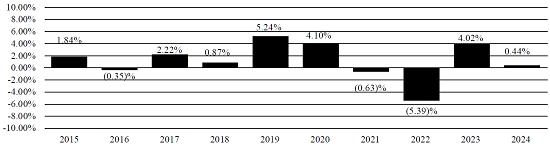

SMID Cap Index (Net) is the Fund’s additional index and

is generally more representative of the Fund’s investment universe than the regulatory index. The Net performance

figures of each index reflect no deductions for fees, expenses or income taxes, except foreign withholding taxes.

Prior to December 30, 2016, the Fund was named the Old Westbury Small & Mid Cap Fund and operated under a different investment strategy. The performance information shown below before such date represents the Fund’s prior investment strategies.

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | 5 Years | 10 Years | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ||||||

| Fund Return After Taxes on Distributions and Sale of Shares | ||||||

| MSCI ACWI Investable Market Index (Net) | ||||||

| MSCI ACWI SMID Cap Index (Net) (reflects no deduction for fees, expenses or income taxes, except foreign withholding taxes) |

*

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers and Sub-Advisers.

Ms. Nancy Sheft, Managing Director of the Adviser and Head of External Managers at Bessemer, an affiliate of the Adviser, has managed the Fund since October 25, 2016.

Dr. Edward N. Aw, DBA, Managing Director of the Adviser and Head of Quantitative Strategies at Bessemer, an affiliate of the Adviser, has managed the Fund since June 2016.

| 13 |

Mr. Michael Morrisroe, Managing Director of the Adviser, has managed the Fund since February 28, 2014.

Ms. Andrea Tulcin, Managing Director of the Adviser, has managed the Fund since June 27, 2022.

Champlain Investment Partners, LLC (“Champlain”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Champlain’s portion of the Fund has been managed by a team of investment professionals led by Mr. Scott T. Brayman since January 1, 2006. The team includes Corey N. Bronner, Joseph M. Caligiuri, Joseph J. Farley, Robert D. Hallisey, and Ms. Jacqueline W. Williams. Mr. Corey N. Bronner and Mr. Joseph M. Caligiuri have been members of Champlain’s investment team since 2010. Mr. Joseph J. Farley has been a member of Champlain’s investment team since 2014. Mr. Robert D. Hallisey has been a member of Champlain’s investment team since 2016. Ms. Jacqueline W. Williams has been a member of Champlain’s investment team since 2019.

Polunin Capital Partners Limited (“Polunin”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Polunin’s portion of the Fund has been managed by Mr. Douglas Polunin since September 5, 2017. Mr. Polunin is supported by a team of investment professionals.

Acadian Asset Management LLC (“Acadian”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Acadian’s portion of the Fund has been managed by a team of investment professionals led by Mr. Brendan Bradley since July 19, 2018 and Ms. Fanesca Young since April 17, 2023.

Artisan Partners Limited Partnership (“Artisan Partners”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Artisan Partners’ portion of the Fund is managed by Rezo Kanovich. Mr. Kanovich has been portfolio manager of Artisan Partners’ portion of the Fund since July 28, 2020.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 14 |

The Fund’s goal is to seek long-term capital appreciation.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses(1) | % | |

| Total Annual Fund Operating Expenses | % | |

| Less Fee Waiver(2) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(2) | % |

(1)

(2)

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | |

| $ |

$ |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. Because the Fund is newly organized, no portfolio turnover rate is available.

The Fund pursues its investment goal by investing in a diversified portfolio of equity and equity-related securities of any market capitalization. Equity and equity-related securities include, without limitation, common stocks and derivatives that provide investment exposure to equity securities. The Fund has no restrictions as to the size of the companies in which it invests. The Fund may focus its investments in any market capitalization range, and may change the allocation of its investments at any time.

Under normal circumstances, the Fund invests at least 80% of its net assets, including any borrowings for investment purposes, in equity securities. Equity securities are common stocks, preferred securities, warrants, rights, convertible securities and depositary receipts.

The Fund invests in a portfolio of securities the Adviser or the applicable sub-adviser believes has the potential for long-term capital appreciation. The Fund invests primarily in securities listed on securities exchanges or actively traded in over-the-counter markets. The securities may be listed or traded in the form of American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), or other types of depositary receipts (including non-voting depositary receipts) or dual listed securities.

| 15 |

Securities in which the Fund may invest may be issued by issuers, in any sector, located in developed, emerging market or developing market countries. The Fund also may invest in other investment companies, including exchange-traded funds (“ETFs”), and a variety of derivatives, including futures, options and other derivative instruments, to seek to increase or seek to hedge, or protect, its exposure to, for example, currency value fluctuation or movements in the securities markets.

The Fund employs multiple investment strategies which the Adviser believes are complementary. The Fund’s portfolio is constructed by combining the investment styles and strategies of the Adviser and sub-advisers that have been engaged by the Fund and the Adviser.

The Fund may employ a quantitative strategy. Under a quantitative strategy, the Fund may invest in U.S. and non-U.S. equity securities with a minimum market capitalization of $250 million.

The Adviser makes the day-to-day investment decisions for portions of the Fund’s portfolio. In addition, each sub-adviser manages its allocated portion of the Fund’s portfolio by providing a model portfolio to the Adviser on an ongoing basis. The model portfolio of each sub-adviser represents such sub-adviser’s recommendation as to the securities to be purchased, sold or retained by the Fund and the recommended weightings of such securities. The Adviser then implements the investment recommendations of the sub-advisers and constructs a portfolio for the Fund that represents the aggregation of the Adviser’s portions of the Fund’s portfolio and the model portfolios of the sub-advisers, with the weighting of each sub-adviser’s model in the total portfolio determined by the Adviser.

Each sub-adviser will use its research and securities selection processes in constructing its model portfolio. The Adviser will generally invest in the component securities of the model portfolio provided by the sub-adviser and will generally invest in such securities in the same proportion as the model portfolio, which model portfolio is subject to change from time to time. However, the Adviser, in its discretion, may vary from the model portfolios under certain circumstances, such as when the Adviser believes that the securities or weightings are not appropriate for seeking to achieve the Fund’s investment objective, for tax or risk management purposes, based on overall portfolio characteristics, limitations (regulatory or otherwise) or other factors or to seek trading cost efficiencies, portfolio rebalancing or other portfolio construction objectives.

The Adviser may adjust the weighting of Fund assets allocated to each sub-adviser’s model at any time.

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser and sub-advisers use the Fund’s principal investment

strategies and other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser

(and model portfolios provided by the sub-advisers) in using these strategies may not produce the returns expected by the Adviser or sub-advisers,

may cause the Fund’s shares to lose value or may cause the Fund to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 16 |

| 17 |

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers and Sub-Advisers.

Mr. John Alexander Christie, Managing Director of the Adviser and Co-Head of Equities at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Mr. Michael Morrisroe, Managing Director of the Adviser, has managed the Fund since its inception.

| 18 |

Mr. John Hall, Managing Director of the Adviser and Co-Head of Equities at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Dr. Edward N. Aw, DBA, Managing Director of the Adviser and Head of Quantitative Strategies at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Ms. Nancy Sheft, Managing Director of the Adviser and Head of External Managers at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Mr. Jeffrey A. Rutledge, Managing Director of the Adviser, has managed the Fund since its inception.

Ms. Andrea Tulcin, Managing Director of the Adviser, has managed the Fund since its inception.

Aikya Investment Management Limited (“Aikya”) manages its allocated portion of the Fund’s portfolio by providing a model portfolio to the Adviser on an ongoing basis, subject to the oversight of the Adviser. Aikya’s portion of the Fund has been managed by Messrs. Ashish Swarup, Rahul Desai, and Thomas Allen since the Fund’s inception.

Polunin Capital Partners Limited (“Polunin”) manages its allocated portion of the Fund’s portfolio by providing a model portfolio to the Adviser on an ongoing basis, subject to the oversight of the Adviser. Polunin’s portion of the Fund has been managed by Messrs. Omar Hegazi and Aleksandrs Babikovs since the Fund’s inception.

Sands Capital Management, LLC (“Sands Capital”) manages its allocated portion of the Fund’s portfolio by providing a model portfolio to the Adviser on an ongoing basis, subject to the oversight of the Adviser. Sands Capital’s portion of the Fund has been managed by Messrs. David Levanson, Perry Williams, Brian Christiansen and Daniel Pilling since the Fund’s inception.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus

| 19 |

The Fund’s primary investment objective is income.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Acquired Fund Fees and Expenses | % | |

| Total Annual Fund Operating Expenses(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund may invest in debt or debt linked instruments of any credit rating, and there are no limits on the Fund’s investments in high-yield (“junk”) bonds. The Fund defines credit instruments broadly to include any debt or debt linked instrument, including corporate and sovereign bonds, leveraged loans (or bank loans), municipal securities, preferred securities, convertible securities, and securitized instruments (including mortgage- and asset-backed securities). The Fund, under normal market circumstances invests at least 80% of its net assets (including any borrowing for investment purposes) in credit instruments and derivative instruments that are linked to, or provide investment exposure to, credit instruments, including short exposure. Additionally, the Adviser, as part of the Fund’s overall portfolio construction, may invest in various securities with an aim of managing risk and overall volatility similar to the ICE BofA 1-10 Year U.S. Corporate Index over a business cycle. There is no limit on the Fund’s investments in securities issued by foreign issuers, including issuers in emerging markets, although the Fund’s overall net exposure to non-U.S. currencies through direct holdings and derivatives is normally limited to 25% of its net assets. The Fund may invest up to 20% of its net assets in long and short positions in equity securities, including common stocks, warrants, and other equity securities in addition to derivatives that provide exposure to equity securities.

High yield instruments are rated below investment grade (BB and lower, or an equivalent rating), and tend to provide higher income relative to investment-grade debt instruments in an effort to compensate investors for their higher risk of default, which is the failure to make required interest or principal payments. High yield instruments in which the Fund may invest include bonds, leveraged loans, and securities in default. The Fund may invest in debt instruments of any maturity or duration, although the Fund expects to normally maintain an effective duration between 2 and 8 years. Duration is an estimate of a security’s (or portfolio of securities) sensitivity to

| 20 |

changes in prevailing interest rates, with securities with a longer duration generally tending to be more sensitive to changes in prevailing interest rates.

The Adviser employs sub-advisers for some asset classes, or segments of specific asset classes, and allocates the Fund’s portfolio investments and assets on an opportunistic basis intended to achieve attractive relative returns among asset classes and investments. The Adviser’s investment process consists of fundamental research as well as the use of proprietary quantitative models that evaluate a universe of securities based on factors such as credit quality, maturity, valuation, revenues, earnings, capital discipline, financial leverage and volatility.

The Fund’s investment approach provides the Fund the flexibility to invest across a wide variety of global credit instruments without constraints to particular benchmarks, asset classes, or sectors. Through this flexibility, and the use of active risk management and hedging positions, the Fund attempts to benefit from the upsides of the fixed income credit markets while avoiding some of the downsides over a full market cycle.

When deciding whether to adjust allocations among the various sectors and asset classes (such as high yield corporate bonds, mortgage- and asset-backed securities, international bonds, sovereign bonds, municipal securities, and leveraged loans) or duration (which measures the Fund’s price sensitivity to interest rate changes), the Adviser may consider factors such as expected interest rate movements and currency valuations, the outlook for inflation and the economy, and the yield advantage and potential for increased returns that lower rated bonds may offer over investment-grade bonds.

The Fund may purchase or sell mortgage-backed securities on a delayed delivery or forward commitment basis through the “to-be-announced” (TBA) market. With TBA transactions, the particular securities to be delivered are not identified at the trade date but the delivered securities must meet specified terms and standards.

Bank loans represent amounts generally borrowed by banks and leveraged loans represent amounts generally borrowed by companies and other entities. These loans have floating interest rates that reset periodically (typically quarterly or monthly) and are often rated below investment grade (sometimes referred to as “junk bonds”). In many cases, the borrowing companies have significantly more debt than equity and the loans have been issued in connection with recapitalizations, acquisitions, leveraged buyouts, or refinancings. Leveraged loans may be acquired directly through an agent acting on behalf of the lenders participating in the loan, as an assignment from another lender who holds a direct interest in the loan, or as a participation interest in another lender’s portion of the loan.

While most assets are typically invested in bonds and other debt instruments, the Fund also may use credit default swaps (on both indexes and specific bonds or issuers), total return swaps (on both indexes and specific bonds or issuers), interest rate futures, interest rate swaps, forward currency exchange contracts, and options on such instruments. The Fund intends to buy or sell credit default and total return swaps in order to seek to generate returns, adjust the Fund’s overall credit quality, or protect the value of certain portfolio holdings, as well as to seek to profit from expected deterioration in the credit quality of an issuer or the widening of credit spreads. Total return swaps may also be used in order to seek to obtain a short position with respect to a particular instrument. Interest rate futures and interest rate swaps are primarily used to seek to manage the Fund’s exposure to interest rate changes and to seek to limit overall volatility by adjusting the portfolio’s duration and extending or shortening the overall maturity of the Fund. Forward currency exchange contracts may be used to seek to limit overall volatility by protecting the Fund’s non-U.S. dollar-denominated holdings from adverse currency movements relative to the U.S. dollar or to seek to generate returns by gaining long or short exposure to certain currencies expected to increase or decrease in value relative to other currencies. In addition, the Fund may take a short position in a currency, which means that the Fund could sell a currency in excess of its assets denominated in that currency (or the Fund might sell a currency even if it doesn’t own any assets denominated in the currency).

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser and sub-advisers use the Fund’s principal investment

strategies and other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser

and sub-advisers in using these strategies may not produce the returns expected by the Adviser or sub-advisers, may cause the Fund’s

shares to lose value or may cause the Fund to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the

| 21 |

Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 22 |

| 23 |

| 24 |

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | Since Commencement of Operations ( | ||||

| Fund Return Before Taxes | ( | |||||

| Fund Return After Taxes on Distributions | ( | |||||

| Fund Return After Taxes on Distributions and Sale of Shares | ( | |||||

| ICE BofA U.S. Broad Market Index | ( | |||||

| ICE BofA 1-10 Year U.S. Corporate Index (reflects no deduction for fees, expenses, or income and withholding taxes) |

*

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers and Sub-Advisers.

Mr. David W. Rossmiller, Managing Director of the Adviser and Chief of Portfolio Management at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Mr. Jared B. Olivenstein, Managing Director of the Adviser, has managed the Fund since its inception.

Dr. Qiang Jiang, PhD, Managing Director of the Adviser and Director of Investment Quantitative R&D at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Mr. Anthony Wile, Principal of the Adviser, has managed the Fund since its inception.

BlackRock Financial Management, Inc. (“BlackRock”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Messrs. Ibrahim Incoglu and Saffet Ozbalci have been portfolio managers of BlackRock’s portion of the Fund since its inception.

| 25 |

Muzinich & Co., Inc. (“Muzinich”) is responsible for the day-to-day management of a portion of the Fund’s portfolio subject to the oversight of the Adviser. Messrs. Michael McEachern, Warren Hyland, Thomas Samson, Torben Ronberg, Anthony DeMeo and Joseph Galzerano have been portfolio managers of Muzinich’s portion of the Fund since its inception.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 26 |

The Fund’s goal is to seek total return (consisting of current income and capital appreciation).

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Total Annual Fund Operating Expenses(1) | % | |

| Less Fee Waiver(1) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund invests primarily in a diversified portfolio of investment-grade bonds and notes of any maturity. The Fund invests at least 80% of its net assets, plus borrowings for investment purposes, in investment-grade fixed income securities including corporate, asset-backed, mortgage-backed, and U.S. Government securities. The Adviser attempts to manage the Fund’s “total return” (which includes both changes in principal value of the Fund’s securities and income earned) by lengthening or shortening the average maturity of the Fund’s securities according to whether the Adviser expects market interest rates to rise or decline. The Fund may also engage in futures and options transactions, both to seek to increase return and/or to seek to hedge, or protect, its exposure to, for example, interest rate movements, movements in the commodities or securities markets and currency value fluctuations. In addition, the Fund may invest in exchange-traded funds (“ETFs”), convertible securities, municipal securities, and inflation-protected securities such as Treasury Inflation-Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States. Fixed income securities held by the Fund may be of any maturity.

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and

other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these

strategies may not produce the returns expected by the Adviser, may cause the Fund’s shares to lose value or may cause the Fund

to underperform other funds with a similar investment goal.

| 27 |

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 28 |

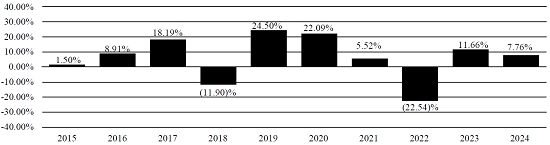

During the periods shown in the bar chart, the

| 29 |

(for the periods ended 12/31/2024) | 1 Year | 5 Years | 10 Years | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ( | |||||

| Fund Return After Taxes on Distributions and Sale of Shares | ( | |||||

| ICE BofA U.S. Broad Market Index | ( | |||||

| ICE BofA 1-10 Year AAA-A U.S. Corporate & Government Index (reflects no deduction for fees, expenses, or income and withholding taxes) |

*

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers.

Mr. David W. Rossmiller, Managing Director of the Adviser and Chief of Portfolio Management at Bessemer, an affiliate of the Adviser, has managed the Fund since November 30, 2012.

Ms. Beatriz M. Cuervo, Managing Director of the Adviser and Head of Taxable Fixed Income at Bessemer, an affiliate of the Adviser, has managed the Fund since February 28, 2014.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 30 |

The Fund’s primary investment objective is income.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Total Annual Fund Operating Expenses | % | |

| Less Fee Waiver(1) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the period from February 29, 2024 (commencement of operations)

through October 31, 2024, the Fund’s portfolio turnover rate was

The Fund invests primarily in a diversified portfolio of short- and intermediate-term investment-grade bonds and notes. The Fund invests at least 80% of its net assets, plus borrowings for investment purposes, in investment-grade fixed income securities including sovereign, corporate, asset-backed, money market securities, bank obligations, foreign securities (including securities of issuers in emerging markets and non-U.S. dollar-denominated securities), and U.S. Government securities. The Fund only invests in investment-grade debt obligations, rated at the time of purchase by at least one major rating agency or, if unrated, determined by the Adviser to be of comparable quality. After purchase, a debt obligation may cease to be rated or may have its rating downgraded below investment grade. In such cases, the Adviser will consider whether to continue to hold the debt obligation. The Fund may hold debt obligations of any credit rating or no rating. The dollar-weighted average portfolio effective maturity of the Fund is expected to be more than one year but less than three years during normal market conditions. The Fund may invest in debt obligations of all maturities.

The Fund may also engage in futures, forwards and options transactions, both to seek to increase return and/or to seek to hedge, or protect, its exposure to, for example, interest rate movements, movements in the commodities or securities markets and currency value fluctuations. In addition, the Fund may invest in exchange-traded funds (“ETFs”), municipal securities, and inflation-protected securities such as Treasury Inflation-Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States.

| 31 |

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and

other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these

strategies may not produce the returns expected by the Adviser, may cause the Fund’s shares to lose value or may cause the Fund

to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 32 |

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers.

Mr. David W. Rossmiller, Managing Director of the Adviser and Chief of Portfolio Management at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception.

Mr. Peter D. Hayward, Principal of the Adviser, has managed the Fund since its inception.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

| 33 |

Tax Information

The Fund will distribute to its shareholders substantially all of the Fund’s net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 34 |

The Fund’s goal is to seek total return (consisting of current income that is exempt from regular federal income tax and capital appreciation).

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Total Annual Fund Operating Expenses(1) | % | |

| Less Fee Waiver(1) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund invests primarily in a diversified portfolio of investment-grade municipal securities, which include tax-free debt securities of states, territories, and possessions of the U.S. and political subdivisions and taxing authorities of these entities, with a goal of seeking total return (consisting of current income that is exempt from regular federal income tax and capital appreciation). The Fund invests, as a fundamental policy, at least 80% of its net assets plus investment borrowings, under normal circumstances, in investments the income from which is exempt from federal income tax, but not necessarily the federal alternative minimum tax. The Fund invests, as a non-fundamental policy, under normal circumstances, at least 80% of its net assets, plus borrowings for investment purposes, in municipal bonds. The Fund may also engage in futures and options transactions, both to seek to increase return and/or to seek to hedge, or protect, its exposure to, for example, interest rate movements. In addition, the Fund may invest in exchange-traded funds (“ETFs”), U.S. Treasury securities, securities subject to the federal alternative minimum tax, taxable municipal bonds, and inflation-protected securities such as Treasury Inflation Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States. Fixed income securities held by the Fund may be of any maturity.

| 35 |

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and

other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these

strategies may not produce the returns expected by the Adviser, may cause the Fund’s shares to lose value or may cause the Fund

to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 36 |

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | 5 Years | 10 Years | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ||||||

| Fund Return After Taxes on Distributions and Sale of Shares | ||||||

| ICE BofA U.S. Municipal Securities Index | ||||||

| ICE BofA 1-12 Year AAA-AA Municipal Securities Index (reflects no deduction for fees, expenses or income and withholding taxes) |

*

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers.

Mr. David W. Rossmiller, Managing Director of the Adviser and Chief of Portfolio Management at Bessemer, an affiliate of the Adviser, has managed the Fund since February 28, 2020.

| 37 |

Mr. Kevin Akinskas, Managing Director of the Adviser and Head of Municipal Bonds at Bessemer, an affiliate of the Adviser, has managed the Fund since February 24, 2020.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of its net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Distributions of the Fund’s net investment income from tax-exempt securities, if any, generally will not be subject to federal income tax, although a portion of such distributions may be subject to the federal alternative minimum tax. Other distributions from the Fund generally will be taxed as described in the paragraph above. For additional information, see the section entitled “Taxes” on page 73 of this Prospectus.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 38 |

The Fund’s goal is to seek total return (consisting of current income that is exempt from regular federal and California income tax and capital appreciation).

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Total Annual Fund Operating Expenses(1) | % | |

| Less Fee Waiver(1) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund invests primarily in a non-diversified portfolio of investment-grade municipal securities, which include tax-free debt securities issued by the State of California, its political subdivisions and taxing authorities, with a goal of seeking total return consisting of current income that is exempt from regular federal and California income tax and capital appreciation. The Fund invests, as a fundamental policy, at least 80% of its net assets plus investment borrowings, under normal circumstances, in investments the income from which is exempt from federal income tax and California income tax, but not necessarily the federal alternative minimum tax. The Fund may also engage in futures and options transactions, both to seek to increase return and/or to seek to hedge, or protect, its exposure to, for example, interest rate movements. In addition, the Fund may invest in exchange-traded funds (“ETFs”), U.S. Treasury securities, securities subject to the federal alternative minimum tax, taxable municipal bonds, and inflation-protected securities such as Treasury Inflation-Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States. Fixed income securities held by the Fund may be of any maturity.

| 39 |

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and

other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these

strategies may not produce the returns expected by the Adviser, may cause the Fund’s shares to lose value or may cause the Fund

to underperform other funds with a similar investment goal.

The following are the principal risks of investing in the Fund. The relative significance of each principal risk summarized below may change over time and you should review each risk carefully because any one or more of these risks may result in losses to the Fund. Please see “Additional Information About the Funds” for an additional discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund.

| 40 |

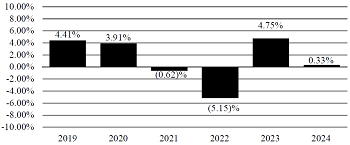

During the periods shown in the bar chart, the

(for the periods ended 12/31/2024) | 1 Year | 5 Years | Since Commencement of Operations ( | |||

| Fund Return Before Taxes | ||||||

| Fund Return After Taxes on Distributions | ||||||

| Fund Return After Taxes on Distributions and Sale of Shares | ||||||

| ICE BofA U.S. Municipal Securities Index | ||||||

| ICE BofA 3-7 Year AAA-AA Municipal Securities Index (reflects no deduction for fees, expenses, or income and withholding taxes) |

*

| 41 |

Management of the Fund

Investment Adviser. Bessemer Investment Management LLC, a wholly-owned subsidiary of Bessemer Trust Company, N.A. (“Bessemer”), is located at 1271 Avenue of the Americas, New York, New York 10020.

Portfolio Managers.

Mr. David W. Rossmiller, Managing Director of the Adviser and Chief of Portfolio Management at Bessemer, an affiliate of the Adviser, has managed the Fund since its inception on December 1, 2018.

Mr. Kevin Akinskas, Managing Director of the Adviser and Head of Municipal Bonds at Bessemer, an affiliate of the Adviser, has managed the Fund since February 24, 2020.

Purchase and Sale of Fund Shares

For important information about the purchase and sale of Fund shares, please turn to the section entitled “Purchase and Sale of Fund Shares” on page 47 of this Prospectus.

Tax Information

The Fund will distribute to its shareholders substantially all of its net investment income and realized net capital gains, if any. Distributions from the Fund’s ordinary income and net short-term capital gain, if any, generally will be taxable to you as ordinary income. Distributions from the Fund’s net long-term capital gain, if any, generally will be taxable to you as long-term capital gain.

Distributions of the Fund’s net investment income from tax-exempt securities, if any, generally will not be subject to federal income tax, although a portion of such distributions may be subject to the federal alternative minimum tax. Other distributions from the Fund generally will be taxed as described in the paragraph above. For additional information, see the section entitled “Taxes” on page 73 of this Prospectus.

Financial Intermediary Compensation

For important information about financial intermediary compensation, please turn to the section entitled “Financial Intermediary Compensation” on page 47 of this Prospectus.

| 42 |

The Fund’s goal is to seek total return (consisting of current income that is exempt from regular federal and New York income tax and capital appreciation).

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or example below.

| Management Fees | % | |

| Other Expenses | % | |

| Total Annual Fund Operating Expenses(1) | % | |

| Less Fee Waiver(1) | ( | )% |

| Total Annual Fund Operating Expenses After Fee Waiver(1) | % |

| (1) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated below and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual fee waiver for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transactions

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the Fund’s

portfolio turnover rate was

The Fund invests primarily in a non-diversified portfolio of investment-grade municipal securities, which include tax-free debt securities issued by the State of New York, its political subdivisions and taxing authorities, with a goal of seeking total return consisting of current income that is exempt from regular federal and New York income tax and capital appreciation. The Fund invests, as a fundamental policy, at least 80% of its net assets plus investment borrowings, under normal circumstances, in investments the income from which is exempt from federal income tax and New York income tax, but not necessarily the federal alternative minimum tax. The Fund may also engage in futures and options transactions, both to seek to increase return and/or to seek to hedge, or protect, its exposure to, for example, interest rate movements. In addition, the Fund may invest in exchange-traded funds (“ETFs”), U.S. Treasury securities, securities subject to the federal alternative minimum tax, taxable municipal bonds, and inflation-protected securities such as Treasury Inflation-Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States. Fixed income securities held by the Fund may be of any maturity.

| 43 |

Principal Risks

All investments carry a certain amount of risk and there

is no assurance that the Fund will achieve its investment goal. The Adviser uses the Fund’s principal investment strategies and

other investment strategies to seek to achieve the Fund’s investment goal. Investment decisions made by the Adviser in using these