As filed with the U.S. Securities and Exchange

Commission on

File No. 333-123467

File No. 811-21732

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☑ | |

| Pre-Effective Amendment No. __ | ☐ | |

| Post-Effective Amendment No. 50 | ☑ |

and/or

REGISTRATION STATEMENT

UNDER

| THE INVESTMENT COMPANY ACT OF 1940 | ☑ | |

| Amendment No. 52 | ☑ |

(Check appropriate box or boxes.)

(Exact Name of Registrant as Specified in Charter)

|

99 High Street Boston, Massachusetts 02110 |

| (Address of Principal Executive Offices) |

Registrant’s Telephone Number: (617) 747-9500

Colin J. Dean, Esq.

Mercer Investments LLC

99 High Street

Boston, Massachusetts 02110

(Name and Address of Agent for Service)

Please send copies of all communications to:

Patrick W. D. Turley, Esq.

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

(202) 261-3300

It is proposed that this filing will become effective (check appropriate box):

| ☐ | immediately upon filing pursuant to paragraph (b) | |

| ☑ | on | |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) | |

| ☐ | on (date) pursuant to paragraph (a)(1) | |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) | |

| ☐ | on (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

MERCER FUNDS™

| Mercer

US Large Cap Equity Fund (Adviser Class: MLCDX) (Class I: MLCSX) (Class Y-2: MLCYX) (Class Y-3: MLCGX) |

| Mercer

US Small/Mid Cap Equity Fund (Adviser Class: MSCJX) (Class I: MSCQX) (Class Y-2: MSCWX) (Class Y-3: MSCGX) |

| Mercer

Non-US Core Equity Fund (Adviser Class: MNCDX) (Class I: MNCSX) (Class Y-2: MNCYX) (Class Y-3: MNCEX) |

| Mercer

Emerging Markets Equity Fund (Adviser Class: MEMVX) (Class I: MEMSX) (Class Y-2: MEMWX) (Class Y-3: MEMQX) |

| Mercer

Global Low Volatility Equity Fund (Adviser Class: MGLPX) (Class I: MGLSX) (Class Y-2: MGLYX) (Class Y-3: MGLVX) |

| Mercer

Core Fixed Income Fund (Adviser Class: MCFVX) (Class I: MCFQX) (Class Y-2: MCFWX) (Class Y-3: MCFIX) |

| Mercer

Opportunistic Fixed Income Fund (Adviser Class: MOFAX) (Class I: MOFTX) (Class Y-2: MOFYX) (Class Y-3: MOFIX) |

Prospectus

This prospectus offers Adviser Class, Class I, Class Y-2 and Class Y-3 shares in the seven series (each a “Fund,” and together, the “Funds”) of the Mercer Funds (the “Trust”). This prospectus contains information about the Adviser Class, Class I, Class Y-2 and Class Y-3 shares of the Funds that you should read carefully before you invest.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

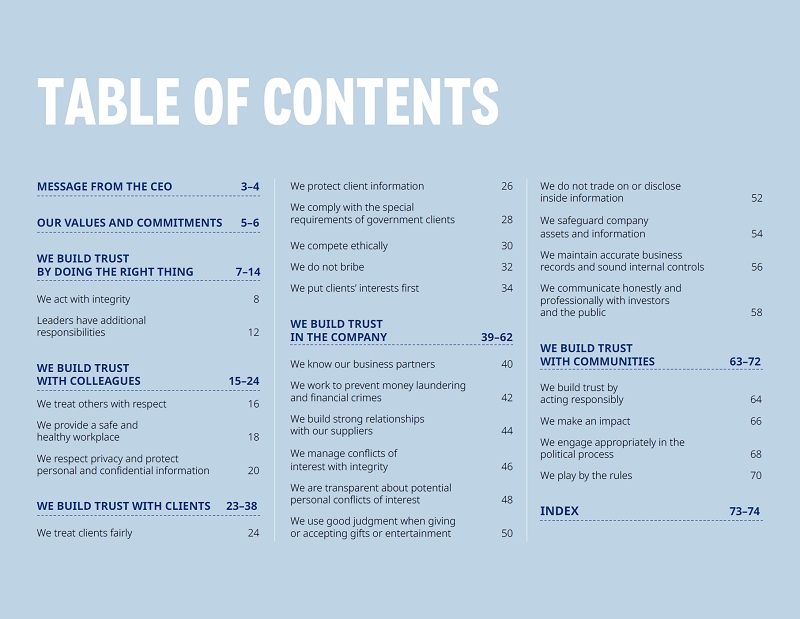

Contents

| ii |

| iii |

Summary of the Funds

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income.

These tables summarize the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Redemption Fee on shares owned less than 30 days (as a % of total redemption proceeds) | % | % | % | % | ||||||||||||

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Management Fees(1) | % | % | % | % | ||||||||||||

| Distribution (12b-1) Fees | % | | ||||||||||||||

| Non-Distribution Shareholder Administrative Services Fees | % | % | % | |||||||||||||

| Other Expenses(2) | | % | | % | | % | | % | ||||||||

| Total Annual Fund Operating Expenses | % | % | % | % | ||||||||||||

| Less Fee Waivers(1) | ( | % | ( | % | ( | % | ( | % | ||||||||

| Net Annual Fund Operating Expenses | % | % | % | % | ||||||||||||

| (1) |

| (2) |

The example below is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods shown, that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same as shown above (taking into account the contractual expense limitation being in effect for the one-year period ending July 31, 2023).

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Adviser Class | $ | $ | $ | |

$ | |||||||||||

| Class I | $ | $ | $ | $ | ||||||||||||

| Class Y-2 | $ | $ | $ | $ | ||||||||||||

| Class Y-3 | $ | $ | $ | $ | ||||||||||||

| 1 |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may increase transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio

turnover rate was

The Fund invests principally in equity securities (such as common stock) issued by large capitalization U.S. companies. The Fund employs a “core equity” investment strategy that seeks to meet the Fund’s investment objective by investing in both growth- and value-oriented equity securities. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in the equity securities of large capitalization U.S. companies. (If the Fund changes this investment policy, the Fund will notify shareholders at least 60 days in advance of the change.) For purposes of the 80% test, equity securities include securities such as common stock, preferred stock, and other securities that are not debt securities, cash or cash equivalents. For purposes of this investment policy, the Fund considers “large capitalization U.S. companies” to be U.S. companies with market capitalizations greater than $4 billion at the time of investment. The Fund may invest in derivative instruments, such as exchange-listed equity futures contracts, to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

The principal risks that could adversely affect the

value of the Fund’s shares and the total return on your investment include the following, which appear in the order of magnitude.

An investment in the Fund is not a bank deposit and is not guaranteed by the Federal Deposit Insurance Corporation or any other governmental

agency.

Equity Securities Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. U.S. and global stock markets have experienced periods of substantial price volatility in the past and may do so in the future.

Market Risk. The value of the securities in which the Fund invests may be adversely affected by fluctuations in the financial markets, regardless of how well the companies in which the Fund invests perform. The market as a whole may not favor the types of investments the Fund makes. Also, there is the risk that the price(s) of one or more of the securities or other instruments in the Fund’s portfolio will fall, or will fail to rise. Many factors can adversely affect a security’s performance, including both general financial market conditions and factors related to a specific company, government, industry, country, or geographic region. Extraordinary events, including extreme economic or political conditions, natural disasters, epidemics and pandemics, and other factors can lead to volatility in local, regional, or global markets, which can result in market losses that may be substantial. The impact of one of these types of events may be more pronounced in certain regions, sectors, industries, or asset classes in which the Fund invests, or it may be pervasive across the global financial markets. The timing and occurrence of future market disruptions cannot be predicted, nor can the impact that government interventions, if any, adopted in response to such disruptions may have on the investment strategies of the Fund or the markets in which the Fund invests.

Growth Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Companies with strong growth potential (both domestic and foreign) tend to have higher than average price-to-earnings ratios, meaning that these stocks are more expensive than average relative to the companies’ earnings. The market prices of equity securities of growth companies are often quite volatile, since the prices may be particularly sensitive to economic, market, or company developments and may present a greater degree of risk of loss.

Issuer Risk. The issuer of a security may perform poorly and the value of its stocks or bonds may decline as a result. An issuer of securities held by the Fund could become bankrupt or could default on its issued debt or have its credit rating downgraded.

Large Capitalization Stock Risk. Large-capitalization stocks as a group could fall out of favor with the market, causing the Fund to underperform investments that focus on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies.

Management Techniques Risk. The investment strategies, techniques, and risk analyses employed by the subadvisers, while designed to enhance potential returns, may not produce the desired results or expected returns, which may cause the Fund to not meet its investments objective, or underperform its benchmark index or funds with similar investment objectives and strategies. The subadvisers may be incorrect in their assessments of the values of securities or their assessments of market trends, which can result in losses to the Fund.

| 2 |

Quantitative Model Risk. One or more subadvisers to the Fund follows a quantitative model strategy to manage its allocated portion of the Fund. Quantitative models (both proprietary models developed by a quantitative-focused subadviser, and those supplied by third parties) and information and data supplied by third parties can be incorrect, misleading or incomplete, and any decisions made in reliance thereon can expose the Fund to potential risks of loss. In addition, the use of predictive models can also expose the Fund to potential risks of loss. For example, such models may incorrectly forecast future behavior, leading to potential losses on a cash flow and/or a mark-to-market basis. In addition, in unforeseen or certain low-probability scenarios (often involving a market disruption of some kind), such models may produce unexpected results, which can result in losses for the Fund.

If the assumptions made by quantitative-focused subadvisers in their underlying models are unrealistic, inaccurate or become unrealistic or inaccurate and are not promptly adjusted to account for changes in the overall market environment, it is likely that profitable trading signals will not be generated. If and to the extent that the models do not reflect certain factors, and a quantitative-focused subadviser does not successfully address such omission through its testing and evaluation, and modify the models accordingly, the Fund may experience losses. In addition, because of the complexity of quantitative-focused investment strategy programming and modeling, there is a risk that the finished model may contain an error; one or more of such errors could adversely affect the Fund’s performance.

To the extent that a quantitative-focused subadviser is not able to develop sufficiently differentiated models, the Fund’s investment objective may not be met, irrespective of whether the models are profitable in an absolute sense, as a result of “crowding” or “convergence” of the model’s output with actions taken by other market participants. In addition, to the extent a quantitative subadviser’s model focuses on identifying a certain type of stock (e.g., high relative profitability stocks), those stocks may perform differently from the market as a whole, which could cause the Fund to underperform.

The models and proprietary research of a quantitative subadviser are largely protected by the subadviser through the use of policies, procedures, agreements, and similar measures designed to create and enforce robust confidentiality, non-disclosure, and similar safeguards. However, aggressive position-level public disclosure obligations (or disclosure obligations to exchanges or regulators with insufficient privacy safeguards) could lead to opportunities for competitors to reverse-engineer a subadviser’s models and data, and thereby impair the relative or absolute performance of the Fund.

Value Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Value stocks represent companies that tend to have lower than average price to book value ratios, price to earnings ratios, or other financial ratios. These companies may have relatively weak balance sheets and, during economic downturns, these companies may have insufficient cash flow to pay their debt obligations and difficulty finding additional financing needed for their operations. A particular value stock may not increase in price, as anticipated by a subadviser, if other investors fail to recognize the stock’s value or the catalyst that the subadviser believes will increase the price of the stock does not affect the price of the stock in the manner or to the degree that the subadviser anticipates. Also, cyclical stocks tend to increase in value more quickly during economic upturns than non-cyclical stocks, but also tend to lose value more quickly in economic downturns. The stocks of companies that a subadviser believes are undervalued compared to their intrinsic value can continue to be undervalued for long periods of time, may not realize their expected value, and can be volatile.

Custody Risk. There are risks involved in dealing with the custodians or brokers who settle Fund trades. Securities and other assets deposited with custodians or brokers may not be clearly or constantly identified as being assets of the Fund, and hence the Fund may be exposed to a credit risk with regard to such parties. The Fund may be an unsecured creditor of its broker in the event of bankruptcy or administration of such broker. Further, there may be practical or time problems associated with enforcing the Fund’s rights to its assets in the case of an insolvency of any such party.

Derivatives Risk. The Fund may engage in a variety of transactions involving derivatives, such as options, futures, forwards and swap agreements. Derivatives are financial instruments, the values of which depend upon, or are derived from, the value of something else, such as one or more underlying investments, pools of investments, indices, or currencies. A subadviser may use derivatives both for hedging and non-hedging purposes, although it is anticipated that the use of derivatives by the Fund will generally be limited to maintaining exposure to certain market segments or asset classes, increasing or decreasing currency exposure, or facilitating certain portfolio transactions. A subadviser may also use derivatives such as exchange-listed equity futures contracts, swaps and currency forwards to equitize cash held in the portfolio. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the ability of a subadviser to manage these sophisticated instruments. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility of the Fund’s share price. Certain derivatives

| 3 |

are subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations, and risks arising from margin requirements, which include the risk that the Fund will be required to pay additional margin or set aside additional collateral to maintain open derivative positions. Certain derivatives are subject to mandatory central clearing and exchange-trading. Central clearing is intended to reduce counterparty credit risk, but central clearing does not make derivatives transactions risk-free Exchange-trading is intended to increase liquidity, but there is no guarantee the Fund could consider exchange-traded derivatives to be liquid. Some derivatives are more sensitive to interest rate changes and market movements than other instruments. The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Certain derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of the Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Leverage Risk. If the Fund makes investments in options, futures, forwards, swap agreements and other derivative instruments, these derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of a Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Sector Risk. While the Fund does not have a principal investment strategy to focus its investments in any particular sector, the Fund from time to time may have significant exposure to one or more sectors. The Fund may have little or no exposure to certain other sectors. There are risks associated with having significantly overweight or underweight allocations to certain sectors, such as that an individual sector may be more volatile than the broader market, or could perform differently, and that the stocks of multiple companies within a sector could simultaneously rise or decline in price because of, for example, investor perceptions, an event that affects the entire sector or other factors.

The Fund is not intended to serve as a complete investment program.

The Fund offers four different classes of shares

in this prospectus: Adviser Class shares, Class I shares, Class Y-2 shares and Class Y-3 shares.

| 4 |

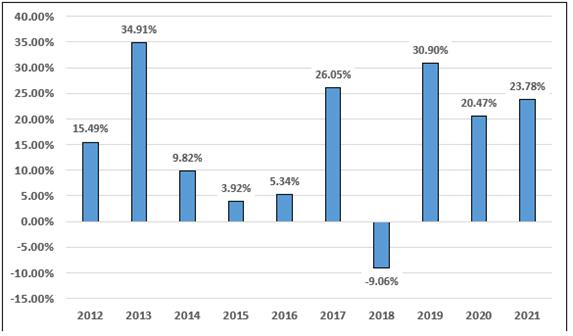

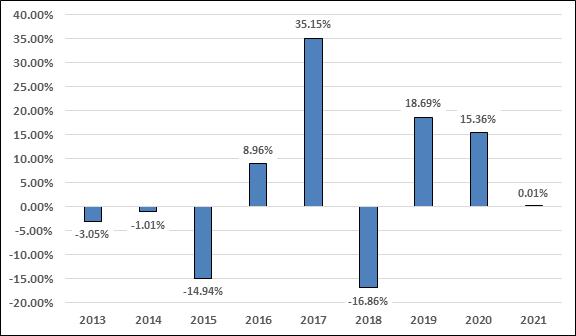

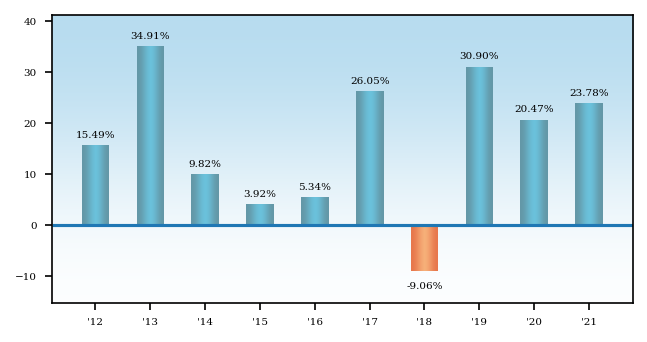

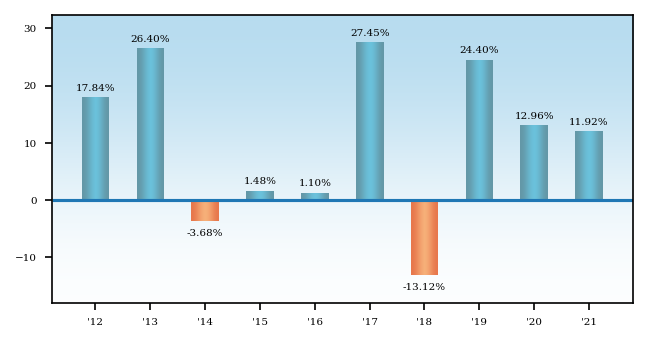

The Fund’s calendar

The Fund’s

The Fund’s

| 1 Year | 5 Years | 10 Years | ||||||||||

| Mercer US Large Cap Equity Fund – Class Y-3 Shares | ||||||||||||

| Return Before Taxes | % | % | % | |||||||||

| Return After Taxes on Distributions | % | % | % | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | % | % | % | |||||||||

| Russell 1000® Index(1) | | % | | % | | % | ||||||

| (1) |

Fund Management

Investment Adviser:

Mercer Investments LLC

| 5 |

Subadvisers and Portfolio Managers:

The individuals listed below are jointly and primarily responsible for the day-to-day management of their allocated portions of the Fund’s portfolio.

Brandywine Global Investment Management, LLC (“Brandywine”)

| ● | Patrick Kaser, Portfolio Manager and Co-lead of the Large Cap Value Equity Strategy, joined Brandywine in 1998. Mr. Kaser began managing Brandywine’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. Kaser managed Brandywine’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2011. |

| ● | James Clarke, Portfolio Manager of the Large Cap Value Equity Strategy, rejoined the Firm in 2008. Mr. Clarke began managing Brandywine’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. Clarke managed Brandywine’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2011. |

| ● | Celia Rodgers, Portfolio Manager and Co-lead of the Large Cap Value Equity Strategy, joined Brandywine in 2018. Ms. Rodgers began managing Brandywine’s allocated portion of the Mercer US Large Cap Value Equity Fund in December 2020. |

Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust (“Macquarie”)

| ● | Nikhil G. Lalvani, CFA, Managing Director, Senior Portfolio Manager and Team Leader, joined Macquarie in 1997. Mr. Lalvani began managing Macquarie’s allocated portion of the Fund’s portfolio in July 2019. |

| ● | Kristen E. Bartholdson, Managing Director and Senior Portfolio Manager, joined Macquarie in 2006. Ms. Bartholdson, began managing Macquarie’s allocated portion of the Fund’s portfolio in July 2019. |

| ● | Robert A. Vogel Jr., CFA, Managing Director and Senior Portfolio Manager, joined Macquarie in 2004. Mr. Vogel, began managing Macquarie’s allocated portion of the Fund’s portfolio in July 2019. |

| ● | Erin Ksenak, Senior Vice President and Portfolio Manager, joined Macquarie in May 2017. Ms. Ksenak began managing Macquarie’s allocated portion of the Fund in December 2020. |

Jennison Associates LLC (“Jennison”)

| ● | Blair A. Boyer, Managing Director, Co-Head of Large Cap Growth Equity and Large Cap Growth Equity Portfolio Manager, joined Jennison in 1993. Mr. Boyer began managing Jennison’s allocated portion of the Fund’s portfolio in April 2019. |

| ● | Rebecca Irwin, Managing Director, Large Cap Growth Equity Portfolio Manager and Research Analyst, joined Jennison in 2006. Ms. Irwin, began managing Jennison’s allocated portion of the Fund’s portfolio in April 2019. |

| ● | Natasha Kuhlkin, CFA, Managing Director, Large Cap Growth Equity Portfolio Manager and Research Analyst, joined Jennison in 2004. Ms. Kuhlkin, began managing Jennison’s allocated portfolio of the Fund’s portfolio in April 2019. |

| ● | Kathleen A. McCarragher, Managing Director, Head of Growth Equity, and Large Cap Growth Equity Portfolio Manager, joined Jennison in 1998. Ms. McCarragher began managing Jennison’s allocated portfolio of the Fund’s portfolio in April 2019. |

O’Shaughnessy Asset Management, LLC (“O’Shaughnessy”)

| ● | James O’Shaughnessy, Chairman, Co-Chief Investment Officer, and Portfolio Manager of O’Shaughnessy since 2007, began managing O’Shaughnessy’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. O’Shaughnessy managed O’Shaughnessy’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2010. |

| ● | Patrick O’Shaughnessy, Chief Executive Officer, and Portfolio Manager of O’Shaughnessy since 2007, began managing O’Shaughnessy’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. O’Shaughnessy managed O’Shaughnessy’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2010. |

| ● | Christopher Meredith, Co-Chief Investment Officer, Portfolio Manager and Director of Research of O’Shaughnessy since 2007, began managing O’Shaughnessy’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. Meredith managed O’Shaughnessy’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2010. |

| ● | Scott Bartone, Chief Operating Officer since 2020 and Portfolio Manager since 2008 of O’Shaughnessy, began managing O’Shaughnessy’s allocated portion of the Fund’s portfolio in June 2016. Prior to that, Mr. O’Shaughnessy managed O’Shaughnessy’s allocated portion of the Mercer US Large Cap Value Equity Fund since 2010. |

Parametric Portfolio Associates LLC (“Parametric”)

| ● | Zach Olsen, CFA, Portfolio Manager, joined Parametric in 2017. Mr. Olsen began managing Parametric’s allocated portion of the Fund’s portfolio in May 2022. |

| ● | Ricky Fong, CFA, Portfolio Manager, joined The Clifton Group in 2010, which was acquired by Parametric in 2012. Mr. Fong began managing Parametric’s allocated portion of the Fund’s portfolio in February 2015. |

| 6 |

Polen Capital Management, LLC (“Polen”)

| ● | Dan Davidowitz, Portfolio Manager and Analyst, joined Polen in 2005. Mr. Davidowitz began managing Polen’s allocated portion of the Fund’s portfolio in April 2019. |

| ● | Brandon Ladoff, Director of Sustainable Investing and Portfolio Manager, joined Polen in 2013. Mr. Ladoff began managing Polen’s allocated portion of the Fund’s portfolio in April 2019. |

Tax Information

The Fund’s distributions generally are taxable as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an Individual Retirement Account, in which case you may be subject to federal income tax upon withdrawal from the tax-deferred account.

For important information about purchase and sale of Fund shares and financial intermediary compensation, please turn to “Important Additional Information” on page 52 of this prospectus.

| 7 |

The investment objective of the Fund is to provide long-term total return, comprised primarily of capital appreciation.

These tables summarize the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Redemption Fee on shares owned less than 30 days (as a % of total redemption proceeds) | % | % | % | % | ||||||||||||

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Management Fees(1) | % | % | % | % | ||||||||||||

| Distribution (12b-1) Fees | % | |||||||||||||||

| Non-Distribution Shareholder Administrative Services Fees | % | % | % | |||||||||||||

| Other Expenses(2) | % | % | % | % | ||||||||||||

| Acquired Fund Fees and Expenses | % | % | % | % | ||||||||||||

| Total Annual Fund Operating Expenses(3) | % | % | % | % | ||||||||||||

| Less Fee Waivers(1) | ( | % | ( | % | ( | % | ( | % | ||||||||

| Net Annual Fund Operating Expenses(3) | % | % | % | % | ||||||||||||

| (1) |

| (2) |

| (3) |

The example below is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods shown, that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same as shown above (taking into account the contractual expense limitation being in effect for the one-year period ending July 31, 2023).

| 8 |

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Adviser Class | $ | $ | $ | $ | ||||||||||||

| Class I | $ | $ | $ | $ | ||||||||||||

| Class Y-2 | $ | $ | $ | $ | ||||||||||||

| Class Y-3 | $ | $ | $ | $ | ||||||||||||

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may increase transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio

turnover rate was

The Fund invests principally in equity securities (such as common stock) issued by small-to-medium capitalization U.S. companies. The Fund employs a “core equity” investment strategy that seeks to meet the Fund’s investment objective by investing in both growth- and value-oriented equity securities. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in the equity securities of small-to-medium capitalization U.S. companies. (If the Fund changes this investment policy, the Fund will notify shareholders at least 60 days in advance of the change.) For purposes of the 80% test, equity securities include securities such as common stock, preferred stock, and other securities that are not debt securities, cash or cash equivalents. For purposes of this investment policy, the Fund considers “small to medium capitalization U.S. companies” to be U.S. companies with market capitalizations between $25 million and the largest company included in the Russell 2500® Index (as of June 30, 2022, $17.8 billion). The Fund may invest in derivative instruments, such as exchange-listed equity futures contracts, to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

The principal risks that could adversely affect the

value of the Fund’s shares and the total return on your investment include the following, which appear in the order of magnitude.

An investment in the Fund is not a bank deposit and is not guaranteed by the Federal Deposit Insurance Corporation or any other governmental

agency.

Equity Securities Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. U.S. and global stock markets have experienced periods of substantial price volatility in the past and may do so in the future.

Market Risk. The value of the securities in which the Fund invests may be adversely affected by fluctuations in the financial markets, regardless of how well the companies in which the Fund invests perform. The market as a whole may not favor the types of investments the Fund makes. Also, there is the risk that the price(s) of one or more of the securities or other instruments in the Fund’s portfolio will fall, or will fail to rise. Many factors can adversely affect a security’s performance, including both general financial market conditions and factors related to a specific company, government, industry, country, or geographic region. Extraordinary events, including extreme economic or political conditions, natural disasters, epidemics and pandemics, and other factors can lead to volatility in local, regional, or global markets, which can result in market losses that may be substantial. The impact of one of these types of events may be more pronounced in certain regions, sectors, industries, or asset classes in which the Fund invests, or it may be pervasive across the global financial markets. The timing and occurrence of future market disruptions cannot be predicted, nor can the impact that government interventions, if any, adopted in response to such disruptions may have on the investment strategies of the Fund or the markets in which the Fund invests.

Issuer Risk. The issuer of a security may perform poorly and the value of its stocks or bonds may decline as a result. An issuer of securities held by the Fund could become bankrupt or could default on its issued debt or have its credit rating downgraded.

Small and Medium Capitalization Stock Risk. The securities of companies with small and medium capitalizations may involve greater investment risks than securities of companies with large capitalizations. Small and medium capitalization companies may have an unproven or narrow technological base and limited product lines, distribution channels, and market and financial resources, and the small and medium capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals. As a result, the prices of securities of small and medium capitalization companies may be subject to more abrupt or erratic movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Securities of small and medium capitalization companies also may pay no, or only small, dividends.

| 9 |

Real Estate Investment Trusts (“REITs”) Risk. REITs may be affected by changes in the value of the underlying properties owned by the trusts and by the quality of any credit extended. Further, REITs are dependent upon specialized management skills and cash flows, and may have their investments in relatively few properties, or in a small geographic area or a single property type. Failure of a company to qualify as a REIT under federal tax law may have adverse consequences to the Fund. In addition, to the extent that the Fund invests in REITs, the Fund must bear the REIT’s expenses in addition to the expenses of its own operation and is subject to risks associated with extended vacancies of properties or defaults by borrowers or tenants, particularly during periods of disruptions to business operations or an economic downturn.

Custody Risk. There are risks involved in dealing with the custodians or brokers who settle Fund trades. Securities and other assets deposited with custodians or brokers may not be clearly or constantly identified as being assets of the Fund, and hence the Fund may be exposed to a credit risk with regard to such parties. The Fund may be an unsecured creditor of its broker in the event of bankruptcy or administration of such broker. Further, there may be practical or time problems associated with enforcing the Fund’s rights to its assets in the case of an insolvency of any such party.

Growth Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Companies with strong growth potential (both domestic and foreign) tend to have higher than average price-to-earnings ratios, meaning that these stocks are more expensive than average relative to the companies’ earnings. The market prices of equity securities of growth companies are often quite volatile, since the prices may be particularly sensitive to economic, market, or company developments and may present a greater degree of risk of loss.

Value Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Value stocks represent companies that tend to have lower than average price to book value ratios, price to earnings ratios, or other financial ratios. These companies may have relatively weak balance sheets and, during economic downturns, these companies may have insufficient cash flow to pay their debt obligations and difficulty finding additional financing needed for their operations. A particular value stock may not increase in price, as anticipated by a subadviser, if other investors fail to recognize the stock’s value or the catalyst that the subadviser believes will increase the price of the stock does not affect the price of the stock in the manner or to the degree that the subadviser anticipates. Also, cyclical stocks tend to increase in value more quickly during economic upturns than non-cyclical stocks, but also tend to lose value more quickly in economic downturns. The stocks of companies that a subadviser believes are undervalued compared to their intrinsic value can continue to be undervalued for long periods of time, may not realize their expected value, and can be volatile.

Derivatives Risk. The Fund may engage in a variety of transactions involving derivatives, such as options, futures, forwards and swap agreements. Derivatives are financial instruments, the values of which depend upon, or are derived from, the value of something else, such as one or more underlying investments, pools of investments, indices, or currencies. A subadviser may use derivatives both for hedging and non-hedging purposes, although it is anticipated that the use of derivatives by the Fund will generally be limited to maintaining exposure to certain market segments or asset classes, increasing or decreasing currency exposure, or facilitating certain portfolio transactions. A subadviser may also use derivatives such as exchange-listed equity futures contracts, swaps and currency forwards to equitize cash held in the portfolio. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the ability of a subadviser to manage these sophisticated instruments. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility of the Fund’s share price. Certain derivatives are subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations, and risks arising from margin requirements, which include the risk that the Fund will be required to pay additional margin or set aside additional collateral to maintain open derivative positions. Certain derivatives are subject to mandatory central clearing and exchange-trading. Central clearing is intended to reduce counterparty credit risk, but central clearing does not make derivatives transactions risk-free Exchange-trading is intended to increase liquidity, but there is no guarantee the Fund could consider exchange-traded derivatives to be liquid. Some derivatives are more sensitive to interest rate changes and market movements than other instruments. The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Certain derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of the Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Management Techniques Risk. The investment strategies, techniques, and risk analyses employed by the subadvisers, while designed to enhance potential returns, may not produce the desired results or expected returns, which may cause the Fund to not meet its

| 10 |

investments objective, or underperform its benchmark index or funds with similar investment objectives and strategies. The subadvisers may be incorrect in their assessments of the values of securities or their assessments of market trends, which can result in losses to the Fund.

Quantitative Model Risk. One or more subadvisers to the Fund follows a quantitative model strategy to manage its allocated portion of the Fund. Quantitative models (both proprietary models developed by a quantitative-focused subadviser, and those supplied by third parties) and information and data supplied by third parties can be incorrect, misleading or incomplete, and any decisions made in reliance thereon can expose the Fund to potential risks of loss. In addition, the use of predictive models can also expose the Fund to potential risks of loss. For example, such models may incorrectly forecast future behavior, leading to potential losses on a cash flow and/or a mark-to-market basis. In addition, in unforeseen or certain low-probability scenarios (often involving a market disruption of some kind), such models may produce unexpected results, which can result in losses for the Fund.

If the assumptions made by quantitative-focused subadvisers in their underlying models are unrealistic, inaccurate or become unrealistic or inaccurate and are not promptly adjusted to account for changes in the overall market environment, it is likely that profitable trading signals will not be generated. If and to the extent that the models do not reflect certain factors, and a quantitative-focused subadviser does not successfully address such omission through its testing and evaluation, and modify the models accordingly, the Fund may experience losses. In addition, because of the complexity of quantitative-focused investment strategy programming and modeling, there is a risk that the finished model may contain an error; one or more of such errors could adversely affect the Fund’s performance.

To the extent that a quantitative-focused subadviser is not able to develop sufficiently differentiated models, the Fund’s investment objective may not be met, irrespective of whether the models are profitable in an absolute sense, as a result of “crowding” or “convergence” of the model’s output with actions taken by other market participants. In addition, to the extent a quantitative subadviser’s model focuses on identifying a certain type of stock (e.g., high relative profitability stocks), those stocks may perform differently from the market as a whole, which could cause the Fund to underperform.

The models and proprietary research of a quantitative subadviser are largely protected by the subadviser through the use of policies, procedures, agreements, and similar measures designed to create and enforce robust confidentiality, non-disclosure, and similar safeguards. However, aggressive position-level public disclosure obligations (or disclosure obligations to exchanges or regulators with insufficient privacy safeguards) could lead to opportunities for competitors to reverse-engineer a subadviser’s models and data, and thereby impair the relative or absolute performance of the Fund.

Leverage Risk. If the Fund makes investments in options, futures, forwards, swap agreements and other derivative instruments, these derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of a Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Sector Risk. While the Fund does not have a principal investment strategy to focus its investments in any particular sector, the Fund from time to time may have significant exposure to one or more sectors. The Fund may have little or no exposure to certain other sectors. There are risks associated with having significantly overweight or underweight allocations to certain sectors, such as that an individual sector may be more volatile than the broader market, or could perform differently, and that the stocks of multiple companies within a sector could simultaneously rise or decline in price because of, for example, investor perceptions, an event that affects the entire sector or other factors.

The Fund is not intended to serve as a complete investment program.

The Fund offers four different classes of shares in

this prospectus: Adviser Class shares, Class I shares, Class Y-2 shares and Class Y-3 shares.

| 11 |

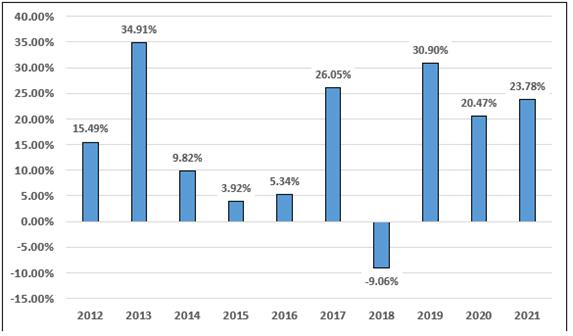

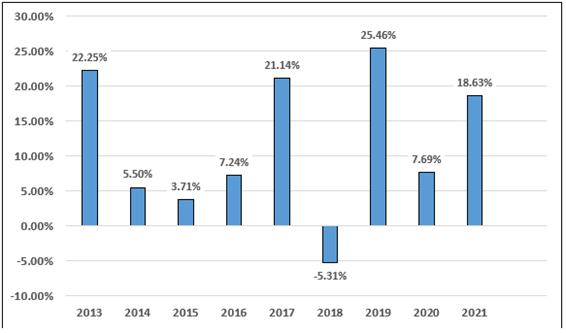

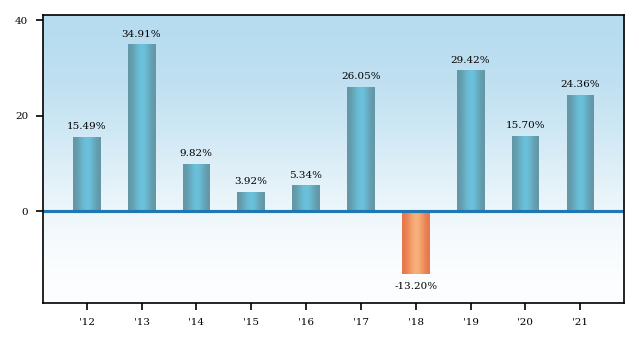

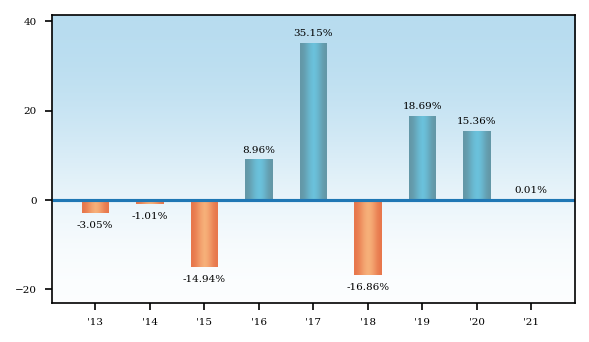

The Fund’s calendar

The Fund’s

The Fund’s

For the Periods Ended December

31, 2021

| 1 Year | 5 Years | 10 Years | ||||||||||

| Mercer US Small/Mid Cap Equity Fund – Class Y-3 Shares | ||||||||||||

| Return Before Taxes | % | % | % | |||||||||

| Return After Taxes on Distributions | % | % | % | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | % | % | % | |||||||||

| Russell 2500® Index(1) | % | % | % | |||||||||

| 12 |

| (1) |

Fund Management

Investment Adviser:

Mercer Investments LLC

Subadvisers and Portfolio Managers:

The individuals listed below are jointly and primarily responsible for the day-to-day management of their allocated portions of the Fund’s portfolio.

GW&K Investment Management, LLC (“GW&K”)

| ● | Daniel L. Miller, CFA, Partner, Director of Equities, joined GW&K in 2008. Mr. Miller began managing GW&K’s allocated portion of the Fund’s portfolio in June 2016. |

| ● | Jeffrey W. Thibault, CFA, Partner, Portfolio Manager, joined GW&K in 2004. Mr. Thibault began managing GW&K’s allocated portion of the Fund’s portfolio in June 2016. |

Loomis, Sayles & Company, L.P. (“Loomis Sayles”)

| ● | Mark F. Burns, CFA, Vice President since 1999, began managing Loomis Sayles’ allocated portion of the Fund’s portfolio in June 2016. Prior to that Mr. Burns managed Loomis Sayles’ allocated portion of the Mercer US Small/Mid Cap Growth Equity Fund since April 2016. |

| ● | John J. Slavik, CFA, Vice President since 2005, began managing Loomis Sayles’ allocated portion of the Fund’s portfolio in June 2016. Prior to that Mr. Slavik managed Loomis Sayles’ allocated portion of the Mercer US Small/Mid Cap Growth Equity Fund since April 2016. |

LSV Asset Management (“LSV”)

| ● | Josef Lakonishok, Ph.D., CEO, CIO, Partner and portfolio manager of LSV since its founding in 1994, began managing LSV’s allocated portion of the Fund’s portfolio in June 2016. |

| ● | Menno Vermeulen, CFA, has served as a portfolio manager for LSV since 1995 and a Partner since 1998 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2016. |

| ● | Puneet Mansharamani, CFA, has served as a Partner and portfolio manager for LSV since 2006 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2016. |

| ● | Greg Sleight, has served as a Quantitative Analyst of LSV since 2006, a Partner since 2012 and portfolio manager since 2014 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2016. |

| ● | Guy Lakonishok, CFA, has served as a Quantitative Analyst of LSV since 2009, a Partner since 2013 and portfolio manager since 2014 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2016. |

Parametric Portfolio Associates LLC (“Parametric”)

| ● | Zach Olsen, CFA, Portfolio Manager, joined Parametric in 2017. Mr. Olsen began managing Parametric’s allocated portion of the Fund’s portfolio in May 2022. |

| ● | Ricky Fong, CFA, Portfolio Manager, joined The Clifton Group in 2010, which was acquired by Parametric in 2012. Mr. Fong began managing Parametric’s allocated portion of the Fund’s portfolio in February 2015. |

| 13 |

River Road Asset Management, LLC (“River Road”)

| ● | J. Justin Akin, Vice President & Senior Portfolio Manager, joined River Road in 2005 and began managing River Road’s allocated portion of the Fund’s portfolio in April 2019. |

| ● | R. Andrew Beck, Chief Executive Officer & Senior Portfolio Manager, joined River Road in 2005 and began managing River Road’s allocated portion of the Fund’s portfolio in April 2019. |

| ● | James C. Shircliff, CFA, Senior Portfolio Manager, joined River Road in 2005 and began managing River Road’s allocated portion of the Fund’s portfolio in April 2019. |

Westfield Capital Management Company, L.P. (“Westfield”)

| ● | William A. Muggia, Chief Executive Officer, Chief Investment Officer, President, and Managing Partner, joined Westfield in 1994, and has been managing Westfield’s allocated portion of the Fund’s portfolio since inception in 2005. |

| ● | Richard D. Lee, CFA, Managing Partner and Deputy Chief Investment Officer, joined Westfield in 2004 and has been managing Westfield’s allocated portion of the Fund’s portfolio since inception in 2005. |

| ● | Ethan J. Meyers, CFA, Managing Partner and Director of Research, joined Westfield in 1999 and has been managing Westfield’s allocated portion of the Fund’s portfolio since inception in 2005. |

| ● | John M. Montgomery, Managing Partner, Portfolio Strategist and COO, joined Westfield in 2006 and began managing Westfield’s allocated portion of the Fund’s portfolio in 2006. |

Tax Information

The Fund’s distributions generally are taxable as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an Individual Retirement Account, in which case you may be subject to federal income tax upon withdrawal from the tax-deferred account.

For important information about purchase and sale of Fund shares and financial intermediary compensation, please turn to “Important Additional Information” on page 52 of this prospectus.

| 14 |

The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income.

These tables summarize the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Redemption Fee on shares owned less than 30 days (as a % of total redemption proceeds) | % | % | % | % | ||||||||||||

| Adviser Class | Class I | Class Y-2 | Class Y-3 | |||||||||||||

| Management Fees(1) | % | % | % | % | ||||||||||||

| Distribution (12b-1) Fees | % | |||||||||||||||

| Non-Distribution Shareholder Administrative Services Fees | % | % | % | |||||||||||||

| Other Expenses(2) | % | % | % | % | ||||||||||||

| Total Annual Fund Operating Expenses | % | % | % | % | ||||||||||||

| Less Fee Waivers(1) | ( | % | ( | % | ( | % | ( | % | ||||||||

| Net Annual Fund Operating Expenses | % | % | % | % | ||||||||||||

| (1) |

| (2) |

The example below is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods shown, that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same as shown above (taking into account the contractual expense limitation being in effect for the one-year period ending July 31, 2023).

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Adviser Class | $ | $ | $ | $ | ||||||||||||

| Class I | $ | $ | $ | $ | ||||||||||||

| Class Y-2 | $ | $ | $ | $ | ||||||||||||

| Class Y-3 | $ | $ | $ | $ | ||||||||||||

| 15 |

The Fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may increase transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio

turnover rate was

The Fund invests principally in equity securities (such as common stock) issued by non-U.S. companies of any capitalization, located in the world’s developed and emerging capital markets. The Fund employs a “core equity” investment strategy that seeks to meet the Fund’s investment objective by investing in both growth- and value-oriented equity securities. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in the equity securities of non-U.S. companies. (If the Fund changes this investment policy, the Fund will notify shareholders at least 60 days in advance of the change.) For purposes of the 80% test, equity securities include securities such as common stock, preferred stock, and other securities that are not debt securities, cash or cash equivalents.

Certain subadvisers may employ a quantitative investment process in seeking to achieve the Fund’s investment objective, which may lead to higher than expected portfolio turnover for the Fund.

Securities of non-U.S. companies generally include all securities included in the Fund’s benchmark index. In addition, securities of non-U.S. companies may include: (a) securities of companies that are organized under the laws of, or maintain their principal places of business in, countries other than the United States; (b) securities for which the principal trading market is in a country other than the United States; (c) securities issued or guaranteed by the government of a country other than the United States, such government’s agencies or instrumentalities, or the central bank of such country; (d) securities denominated in the currency issued by a country other than the United States; (e) securities of companies that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in countries other than the United States or have at least 50% of their assets in countries other than the United States; (f) equity securities of companies in countries other than the United States, in the form of depositary receipts; or (g) securities issued by pooled investment vehicles that invest primarily in securities or derivative instruments that derive their value from securities of non-U.S. companies. The Fund may invest in derivative instruments, such as forward contracts and exchange-listed equity futures contracts, to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs or to increase or decrease currency exposure. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

The principal risks that could adversely affect the

value of the Fund’s shares and the total return on your investment include the following, which appear in the order of magnitude.

An investment in the Fund is not a bank deposit and is not guaranteed by the Federal Deposit Insurance Corporation or any other governmental

agency.

Equity Securities Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. U.S. and global stock markets have experienced periods of substantial price volatility in the past and may do so in the future.

Market Risk. The value of the securities in which the Fund invests may be adversely affected by fluctuations in the financial markets, regardless of how well the companies in which the Fund invests perform. The market as a whole may not favor the types of investments the Fund makes. Also, there is the risk that the price(s) of one or more of the securities or other instruments in the Fund’s portfolio will fall, or will fail to rise. Many factors can adversely affect a security’s performance, including both general financial market conditions and factors related to a specific company, government, industry, country, or geographic region. Extraordinary events, including extreme economic or political conditions, natural disasters, epidemics and pandemics, and other factors can lead to volatility in local, regional, or global markets, which can result in market losses that may be substantial. The impact of one of these types of events may be more pronounced in certain regions, sectors, industries, or asset classes in which the Fund invests, or it may be pervasive across the global financial markets. The timing and occurrence of future market disruptions cannot be predicted, nor can the impact that government interventions, if any, adopted in response to such disruptions may have on the investment strategies of the Fund or the markets in which the Fund invests.

Foreign Investments Risk. Investing in foreign securities typically involves more risks than investing in U.S. securities. These risks can increase the potential for losses in the Fund and affect its share price. Generally, securities of many foreign issuers may be less liquid, and their prices may be more volatile, than the securities of comparable U.S. issuers. Transaction costs for foreign securities generally are higher than for comparable securities issued in the United States. Foreign securities may be subject to foreign taxes. Many foreign governments may supervise and regulate their financial markets less stringently than the U.S. government does. In addition, foreign issuers generally are not subject to the same types of accounting, auditing, or financial reporting standards as those

| 16 |

that are applicable to U.S. issuers. As a result, with respect to foreign issuers, there may be less publicly available information regarding their operations and financial conditions, and the information that is available may be less reliable. To the extent that the Fund’s investments in a single country or a limited number of countries represent a large percentage of the Fund’s assets, the Fund may be adversely affected by the economic, political, and social conditions in those countries.

Geographic Focus Risk. To the extent that the Fund focuses its investments in a particular geographic region or country, the Fund may be subject to increased currency, political, regulatory and other risks relating to such region or country. As a result, the Fund may be subject to greater price volatility and risk of loss than a fund holding more geographically diverse investments.

Currency Exchange Rate Risk. Foreign securities may be issued and traded in foreign currencies. As a result, the values of foreign securities may be affected by changes in exchange rates between foreign currencies and the U.S. dollar, as well as between currencies of countries other than the United States. For example, if the value of the U.S. dollar increases relative to a particular foreign currency, an investment denominated in that foreign currency will decrease in value because the investment will be worth fewer U.S. dollars.

Political and Economic Risk. The political, legal, economic, and social structures of certain foreign countries may be less stable and more volatile than those in the United States. Investments in these countries may be subject to the risks of internal and external conflicts, currency devaluations, changes in currency exchange rates or exchange control regulations (including limitations on currency movements and exchanges), and the imposition of trade sanctions.

Small and Medium Capitalization Stock Risk. The securities of companies with small and medium capitalizations may involve greater investment risks than securities of companies with large capitalizations. Small and medium capitalization companies may have an unproven or narrow technological base and limited product lines, distribution channels, and market and financial resources, and small and medium capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals. As a result, the prices of securities of small and medium capitalization companies may be subject to more abrupt or erratic movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Foreign companies with large capitalizations may be relatively small by U.S. standards and may be subject to risks that are similar to the risks that may affect small and medium capitalization U.S. companies. Securities of small and medium capitalization companies also may pay no, or only small, dividends.

Custody Risk. There are risks involved in dealing with the custodians or brokers who settle Fund trades. Securities and other assets deposited with custodians or brokers may not be clearly or constantly identified as being assets of the Fund, and hence the Fund may be exposed to a credit risk with regard to such parties. The Fund may be an unsecured creditor of its broker in the event of bankruptcy or administration of such broker. Further, there may be practical or time problems associated with enforcing the Fund’s rights to its assets in the case of an insolvency of any such party.

Growth Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Companies with strong growth potential (both domestic and foreign) tend to have higher than average price-to-earnings ratios, meaning that these stocks are more expensive than average relative to the companies’ earnings. The market prices of equity securities of growth companies are often quite volatile, since the prices may be particularly sensitive to economic, market, or company developments and may present a greater degree of risk of loss.

Issuer Risk. The issuer of a security may perform poorly and the value of its stocks or bonds may decline as a result. An issuer of securities held by the Fund could become bankrupt or could default on its issued debt or have its credit rating downgraded.

Large Capitalization Stock Risk. Large-capitalization stocks as a group could fall out of favor with the market, causing the Fund to underperform investments that focus on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies.

Value Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Value stocks represent companies that tend to have lower than average price to book value ratios, price to earnings ratios, or other financial ratios. These companies may have relatively weak balance sheets and, during economic downturns, these companies may have insufficient cash flow to pay their debt obligations and difficulty finding additional financing needed for their operations. A particular value stock may not increase in price, as anticipated by a subadviser, if other investors fail to recognize the stock’s value or the catalyst that the subadviser believes will increase the price of the stock does not affect the price of the stock in the manner or to the degree that the subadviser anticipates. Also, cyclical stocks tend to increase in value more quickly during economic upturns than non-cyclical stocks, but also tend to lose value more quickly in economic downturns. The stocks of companies that a subadviser believes are undervalued compared to their intrinsic value can continue to be undervalued for long periods of time, may not realize their expected value, and can be volatile.

| 17 |

Derivatives Risk. The Fund may engage in a variety of transactions involving derivatives, such as options, futures, forwards and swap agreements. Derivatives are financial instruments, the values of which depend upon, or are derived from, the value of something else, such as one or more underlying investments, pools of investments, indices, or currencies. A subadviser may use derivatives both for hedging and non-hedging purposes, although it is anticipated that the use of derivatives by the Fund will generally be limited to maintaining exposure to certain market segments or asset classes, increasing or decreasing currency exposure, or facilitating certain portfolio transactions. A subadviser may also use derivatives such as exchange-listed equity futures contracts, swaps and currency forwards to equitize cash held in the portfolio. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the ability of a subadviser to manage these sophisticated instruments. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility of the Fund’s share price. Certain derivatives are subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations, and risks arising from margin requirements, which include the risk that the Fund will be required to pay additional margin or set aside additional collateral to maintain open derivative positions. Certain derivatives are subject to mandatory central clearing and exchange-trading. Central clearing is intended to reduce counterparty credit risk, but central clearing does not make derivatives transactions risk-free Exchange-trading is intended to increase liquidity, but there is no guarantee the Fund could consider exchange-traded derivatives to be liquid. Some derivatives are more sensitive to interest rate changes and market movements than other instruments. The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Certain derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of the Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Emerging Markets Investments Risk. Emerging markets securities involve unique risks, such as exposure to economies that are less diverse and mature than those of the United States or more established foreign markets. Also, emerging markets securities are subject to the same risks as foreign investments, described above. Generally, these risks are more severe for issuers in countries with emerging capital markets. Also, economic or political instability may cause larger price changes in emerging markets securities than in other foreign investments. Additionally, companies in emerging market countries may not be subject to accounting, auditing, financial reporting and recordkeeping requirements that are as robust as those in more developed countries and therefore, material information about a company may be unavailable or unreliable, and U.S. regulators may be unable to enforce a company’s regulatory obligations.

Liquidity Risk. The Fund may not be able to purchase or sell a security in a timely manner or at desired prices or achieve its desired weighting in a security. The market for certain investments may become illiquid due to specific adverse changes in the conditions of a particular issuer or under adverse market or economic conditions independent of the issuer, including, for example, during periods of rising interest rates. In addition, dealer inventories of certain securities—an indication of the ability of dealers to engage in “market making”—are at, or near, historic lows in relation to market size, which could potentially lead to decreased liquidity.

Quantitative Model Risk. One or more subadvisers to the Fund follows a quantitative model strategy to manage its allocated portion of the Fund. Quantitative models (both proprietary models developed by a quantitative-focused subadviser, and those supplied by third parties) and information and data supplied by third parties can be incorrect, misleading or incomplete, and any decisions made in reliance thereon can expose the Fund to potential risks of loss. In addition, the use of predictive models can also expose the Fund to potential risks of loss. For example, such models may incorrectly forecast future behavior, leading to potential losses on a cash flow and/or a mark-to-market basis. In addition, in unforeseen or certain low-probability scenarios (often involving a market disruption of some kind), such models may produce unexpected results, which can result in losses for the Fund.

If the assumptions made by quantitative-focused subadvisers in their underlying models are unrealistic, inaccurate or become unrealistic or inaccurate and are not promptly adjusted to account for changes in the overall market environment, it is likely that profitable trading signals will not be generated. If and to the extent that the models do not reflect certain factors, and a quantitative-focused subadviser does not successfully address such omission through its testing and evaluation, and modify the models accordingly, the Fund may experience losses. In addition, because of the complexity of quantitative-focused investment strategy programming and modeling, there is a risk that the finished model may contain an error; one or more of such errors could adversely affect the Fund’s performance.

To the extent that a quantitative-focused subadviser is not able to develop sufficiently differentiated models, the Fund’s investment objective may not be met, irrespective of whether the models are profitable in an absolute sense, as a result of “crowding” or “convergence” of the model’s output with actions taken by other market participants. In addition, to the extent a quantitative subadviser’s model focuses on identifying a certain type of stock (e.g., high relative profitability stocks), those stocks may perform differently from the market as a whole, which could cause the Fund to underperform.

| 18 |

The models and proprietary research of a quantitative subadviser are largely protected by the subadviser through the use of policies, procedures, agreements, and similar measures designed to create and enforce robust confidentiality, non-disclosure, and similar safeguards. However, aggressive position-level public disclosure obligations (or disclosure obligations to exchanges or regulators with insufficient privacy safeguards) could lead to opportunities for competitors to reverse-engineer a subadviser’s models and data, and thereby impair the relative or absolute performance of the Fund.

Management Techniques Risk. The investment strategies, techniques, and risk analyses employed by the subadvisers, while designed to enhance potential returns, may not produce the desired results or expected returns, which may cause the Fund to not meet its investments objective, or underperform its benchmark index or funds with similar investment objectives and strategies. The subadvisers may be incorrect in their assessments of the values of securities or their assessments of market trends, which can result in losses to the Fund.

Leverage Risk. If the Fund makes investments in options, futures, forwards, swap agreements and other derivative instruments, these derivative instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If a subadviser uses leverage through purchasing derivative instruments, the Fund has the risk of capital losses that exceed the net assets of the allocable portion of the Fund managed by that subadviser. The net asset value of a Fund employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Sector Risk. While the Fund does not have a principal investment strategy to focus its investments in any particular sector, the Fund from time to time may have significant exposure to one or more sectors. The Fund may have little or no exposure to certain other sectors. There are risks associated with having significantly overweight or underweight allocations to certain sectors, such as that an individual sector may be more volatile than the broader market, or could perform differently, and that the stocks of multiple companies within a sector could simultaneously rise or decline in price because of, for example, investor perceptions, an event that affects the entire sector or other factors.

The Fund is not intended to serve as a complete investment program.

The Fund offers four different classes of shares in

this prospectus: Adviser Class shares, Class I shares, Class Y-2 shares and Class Y-3 shares.

| 19 |

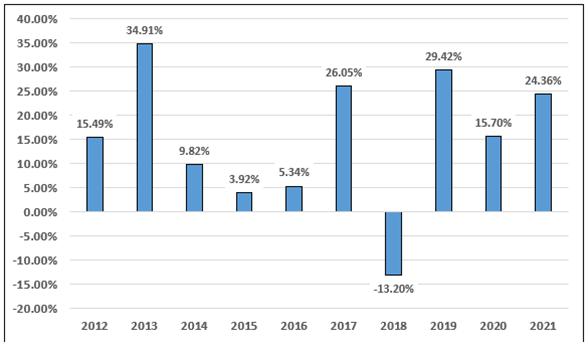

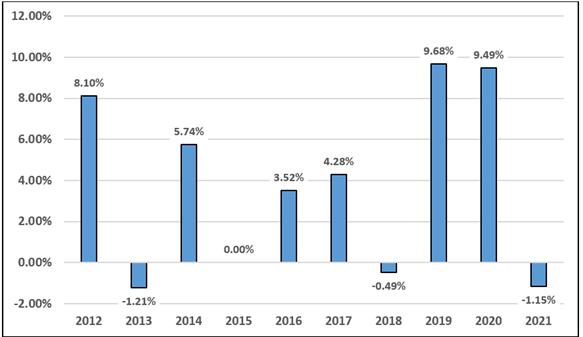

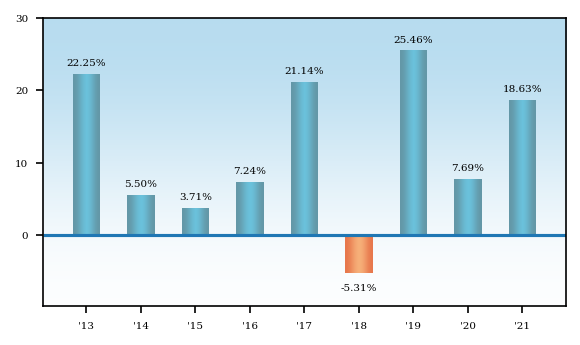

The Fund’s calendar

The Fund’s

The Fund’s

| 1 Year | 5 Years | 10 Years | ||||||||||

| Mercer Non-US Core Equity Fund – Class Y-3 Shares | ||||||||||||

| Return Before Taxes | % | % | % | |||||||||

| Return After Taxes on Distributions | % | % | % | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | % | % | % | |||||||||

| MSCI EAFE® Index(1) (net dividends) | % | % | % | |||||||||

| (1) |

Fund Management

Investment Adviser:

Mercer Investments LLC

| 20 |

Subadvisers and Portfolio Managers:

The individuals listed below are jointly and primarily responsible for the day-to-day management of their allocated portions of the Fund’s portfolio.

American Century Investment Management, Inc. (“American Century”)

| ● | Rajesh Gandhi, CFA, Vice President and Senior Portfolio Manager, joined American Century in 2002. Mr. Gandhi began managing American Century’s allocated portion of the Fund’s portfolio in 2013. |

| ● | Jim Zhao, Vice President and Portfolio Manager, joined American Century in 2009. Mr. Zhao began managing American Century’s allocated portion of the Fund’s portfolio in 2018. |

Arrowstreet Capital, Limited Partnership (“Arrowstreet”)

| ● | Peter Rathjens, Ph.D., Partner, Chief Investment Officer, joined Arrowstreet in 1999. Mr. Rathjens began managing Arrowstreet’s allocated portion of the Fund’s portfolio in 2010. |

| ● | Manolis Liodakis, Ph.D., Partner, Portfolio Management, joined Arrowstreet in 2012. Mr. Liodakis began managing Arrowstreet’s allocated portion of the Fund’s portfolio in 2012. |

| ● | Derek Vance, CFA, Partner, Co-Head of Research, joined Arrowstreet in 2008. Mr. Vance began managing Arrowstreet’s allocated portion of the Fund’s portfolio in 2018. |

| ● | Christopher Malloy, PhD, Manager, Research, joined Arrowstreet in 2019. Mr. Malloy began managing Arrowstreet’s allocated portion of the Fund’s portfolio in 2019. |

LSV Asset Management (“LSV”)

| ● | Josef Lakonishok, Ph.D., CEO, CIO, Partner and portfolio manager of LSV since its founding in 1994, began managing LSV’s allocated portion of the Fund’s portfolio in June 2015. |

| ● | Menno Vermeulen, CFA, has served as a portfolio manager for LSV since 1995 and a Partner since 1998 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2015. |

| ● | Puneet Mansharamani, CFA, has served as a Partner and portfolio manager for LSV since 2006 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2015. |

| ● | Greg Sleight, has served as a Quantitative Analyst of LSV since 2006, a Partner since 2012 and portfolio manager since 2014 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2015. |

| ● | Guy Lakonishok, CFA, has served as a Quantitative Analyst of LSV since 2009, a Partner since 2013 and portfolio manager since 2014 and began managing LSV’s allocated portion of the Fund’s portfolio in June 2015. |

Massachusetts Financial Services Company (“MFS”)

| ● | Benjamin Stone, Investment Officer, joined MFS in 2005, and began managing MFS’ allocated portion of the Fund’s portfolio in 2009. |

| ● | Philip Evans, Investment Officer, joined MFS in 2011, and began managing MFS’ allocated portion of the Fund’s portfolio in 2020. |

Parametric Portfolio Associates LLC (“Parametric”)

| ● | Zach Olsen, CFA, Portfolio Manager, joined Parametric in 2017. Mr. Olsen began managing Parametric’s allocated portion of the Fund’s portfolio in May 2022. |

| ● | Ricky Fong, CFA, Portfolio Manager, joined The Clifton Group in 2010, which was acquired by Parametric in 2012. Mr. Fong began managing Parametric’s allocated portion of the Fund’s portfolio in February 2015. |

Tax Information

The Fund’s distributions generally are taxable as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an Individual Retirement Account, in which case you may be subject to federal income tax upon withdrawal from the tax-deferred account.