EXHIBIT 99p2

PERSONAL INVESTING

SUMMARY

All Mercer colleagues are subject

to the Marsh & McLennan Companies (“MMC”) Code of Conduct – The Greater Good. The Greater Good sets out standards for colleagues dealing with potentially complex ethical decisions.

It also provides basic information to colleagues regarding MMC’s procedures for reporting conflicts of interest and raising

other issues of concern.

MMC has supplemented The Greater Good with specific restrictions

on all colleagues who engage in personal investment activities. As described in the MMC Trading Securities Ethically policy, colleagues

are subject to certain restrictions when trading MMC securities and are prohibited from, among other things, engaging in “insider

trading” (i.e., trading securities when in possession of material non-public information about those securities or the companies

that issue those securities).

In addition to The Greater Good and Trading Securities Ethically

policy, certain Mercer colleagues are subject to restrictions and reporting obligations under federal securities laws applicable

to investment advisers registered with the U.S. Securities and Exchange Commission (“SEC”). In addition to these policies,

this Personal Investing policy is designed to enable Mercer Investments LLC (“Mercer”) to comply with Rule 204A-1 under

the Investment Advisers Act of 1940 (“Rule 204A-1”), which requires investment advisers, such as Mercer, to adopt a

code of ethics that includes certain minimum standards of business conduct, as well as reporting of certain brokerage accounts,

personal securities transactions and securities holdings. This policy also conforms to the requirements of Rule 17j-1 under the

Investment Company Act of 1940 (“Rule 17j-1”), which applies to Mercer when it serves as an investment adviser to SEC-registered

investment companies. Lastly, this policy is designed to comply with federal securities laws which prohibit the trading of securities

while in the possession of material non-public information about such securities and/or otherwise communicating such information.

SCOPE

This policy applies to all directors, officers and employees

of Mercer, as well as outside consultants and temporary employees in certain circumstances described below.

Policy statement

Mercer expects colleagues to adhere to the following principles

related to personal investing:

| • | Client interests come first. Colleagues must scrupulously avoid serving personal interests ahead of the interests of Mercer’s

clients. |

|

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time. |

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

| • | Avoid taking advantage. Colleagues may not make personal investment decisions based on knowledge of a client’s holdings

or transactions. The most common example of this is “front running,” or knowingly engaging in a personal transaction

ahead of a client with the expectation that the client’s transaction will cause a favorable move in the market. |

| • | Avoid conflicts of interest. All personal investing, including personal securities transactions, should be conducted in such

manner so as to avoid any actual or potential conflict of interest or any abuse of a colleague’s position of trust and responsibility. |

| • | Compliance with applicable law. Colleagues must comply with Rule 204A-1, Rule 17j-1 and other federal securities laws that

govern Mercer’s business. |

| • | Strict prohibition on insider trading (i.e. trading while in possession of material nonpublic information). |

| • | In connection with personal investing, it is unlawful for colleagues: |

| ─ | To employ any device, scheme or artifice to defraud a client; |

| ─ | To make any untrue statement of a material fact to a client or omit to state a material fact necessary in order to make the

statements made to a client, in light of the circumstances under which they are made, not misleading; |

| ─ | To engage in any act, practice or course of business that operates or would operate as a fraud or deceit on a client; or |

| ─ | To engage in any manipulative practice with respect to a client. |

Mercer has many important assets, perhaps the most valuable of

which is its established and unquestioned reputation for integrity. An important element of Mercer’s commitment to integrity

is its philosophy of always putting Mercer’s clients’ interests ahead of its own. This requires that colleagues manage

or avoid actual, perceived or potential conflict of interest with a client. It also requires that colleagues use the knowledge

and/or opportunities gained at Mercer in a manner that is consistent with Mercer’s fiduciary duty to its clients. This policy

is designed to provide a framework for colleagues to conduct personal investment activities in a manner that is consistent with

placing the interest of Mercer’s clients first.

COLLEAGUE RESPONSIBILITIES

WHICH COLLEAGUES ARE COVERED BY THIS POLICY?

This policy governs personal investment activities of all Mercer

“supervised persons,” which includes directors and officers of Mercer (or other persons occupying a similar status

or performing similar functions); employees of Mercer; outside consultants and temporary employees; and any other person who provides

advice on behalf of Mercer and is subject to Mercer’s supervision and control.

Certain restrictions and reporting obligations described below

apply only to Mercer colleagues who have been designated as “access persons” by Mercer’s compliance department.

The following colleagues are considered “access persons” for purposes of this policy:

| • | Any supervised person: (A) who has access to non-public information regarding any clients’ purchase or sale of securities,

or nonpublic information regarding the portfolio holdings of any investment fund |

| |

|

2 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

managed by Mercer; or (B) who is involved in making

securities recommendations to clients or investment funds, or who has access to such recommendations that are nonpublic; and

| • | Outside consultants and other temporary colleagues hired for a period of 30 days or more and other Mercer colleagues who have

access to non-public information regarding the investment advice provided to clients or investment funds, or who are involved in

making securities recommendations for clients or investment funds, or have access to such recommendations that are non-public. |

Upon the determination that a colleague must comply with this

policy, Legal & Compliance (“L&C”) will provide the colleague with a copy of this policy and inform them

of their reporting obligations.

WHAT DO COLLEAGUES NEED TO DO?

All colleagues who are supervised persons are required to certify

that they have read and understand this policy, including amendments thereto, and recognize that they are subject to its provisions.

This certification is due within 10 calendar days of becoming a supervised person. In addition, colleagues must certify annually

that they have read and understand this policy and that they have complied with its requirements during the prior year, including

disclosing all transactions, holdings and/or accounts that they were required to disclose. Colleagues who are access persons must

comply with the Personal Investing Reporting Requirements described below.

PROHIBITION ON INSIDER

TRADING

No Mercer colleague may trade, either personally or on behalf

of others (such as investment funds and private accounts managed by Mercer), while in the possession of material, nonpublic information,

nor may any Mercer colleague communicate material, nonpublic information to others except as permitted by law.

| 1. | What is Material Information? |

Information is material where there is a substantial

likelihood that a reasonable investor would consider it important in making his or her investment decisions. Generally, this includes

any information the disclosure of which will have a substantial effect on the price of a company’s securities. No simple

test exists to determine when information is material; assessments of materiality involve a highly fact-specific inquiry. Material

information often relates to a company’s results and operations, including, for example, dividend changes, earnings results,

changes in previously released earnings estimates, significant merger or acquisition proposals or agreements, major litigation,

liquidation problems, and extraordinary management developments.

Material information also may relate to the market

for a company’s securities. Information about a significant order to purchase or sell securities may, in some contexts, be

material. Prepublication information regarding reports in the financial press also may be material.

| |

|

3 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

Material nonpublic information relates not only to

issuers of securities but also to Mercer’s securities recommendations and client securities holdings and transactions.

| 2. | What is Nonpublic Information? |

Information is “public” when it has been

disseminated broadly to investors in the marketplace. For example, information is public after it has become available to the general

public through a public filing with the SEC or some other government agency, news wire releases, widely available broadcasts on

television or radio, publication in widely available newspapers or news websites or other publication of general circulation and

after sufficient time has passed so that the information has been disseminated widely. You must notify L&C immediately if you

have any questions regarding whether information should be considered non-public.

| 3. | Identifying Inside Information |

Before executing any trade for yourself or others,

including investment funds or private accounts managed by Mercer (“Client Accounts”), you must determine whether you

have access to material, nonpublic information. If you think that you might have access to material, nonpublic information, you

should take the following steps:

| • | Report the information and proposed trade immediately to L&C. |

| • | Do not purchase or sell the securities on behalf of yourself or others, including investment funds or private accounts managed

by Mercer. |

| • | Do not communicate the information inside or outside Mercer, other than to L&C. |

| 4. | Contacts with Public Companies |

Contacts with public companies may represent an important

part of our research efforts. The firm may make investment decisions on the basis of conclusions formed through such contacts and

analysis of publicly available information. Difficult legal issues arise, however, when, in the course of these contacts, a supervised

person of Mercer or other person subject to this policy becomes aware of material, nonpublic information. To protect yourself,

your clients and Mercer, you should contact L&C immediately if you believe that you may have received material, nonpublic information.

Tender offers represent a particular concern in the

law of insider trading for two reasons: First, tender offer activity often produces extraordinary movement in the price of the

target company’s securities. Trading during this time period is more likely to attract regulatory attention (and produces

a disproportionate percentage of insider trading cases). Second, the SEC has adopted a rule which expressly forbids trading and

“tipping” while in the possession of material, nonpublic information

| |

|

4 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

regarding a tender offer received from the tender

offeror, the target company or anyone acting on behalf of either.

While it is unlikely colleagues would obtain such

information given Mercer’s business, Supervised persons of Mercer and others subject to this policy should exercise extreme

caution any time they become aware of nonpublic information relating to a tender offer.

PERSONAL INVESTING

– REPORTING REQUIREMENTS

All colleagues designated as access persons must disclose to

L&C:

| • | All reportable accounts and all reportable securities, as defined below. These holding reports are due within 10 calendar days

of becoming a Mercer access person and annually thereafter. The information that is reported must be current as of a date no more

than 45 calendar days prior to the date of the report. |

| • | On a quarterly basis, all transactions in reportable securities and any new reportable accounts. This report is due within

30 days after the end of each calendar quarter. |

WHAT SECURITIES AND ACCOUNTS ARE REPORTABLE?

Only securities and accounts in which the colleague has beneficial

ownership are reportable. “Beneficial ownership” is interpreted in the same manner as it would be under Rule 16a-1(a)(2)

under the Securities Exchange Act of 1934 in determining whether a person is the beneficial owner of a security for purposes of

Section 16 of such Act and the rules and regulations thereunder, including but not limited to, securities or accounts owned by

a colleague as well as those owned by any member of a colleague’s immediate family that share the colleague’s household.

If a colleague is unclear about whether he or she has beneficial ownership over an account or a security for purposes of this policy,

he or she should consult with L&C.

“Reportable securities” are securities that are beneficially

owned by an access person, including stocks, bonds, and other instruments that might not ordinarily be thought of as securities,

such as:

| • | Any form of limited partnerships; |

| • | Private investment funds, hedge funds and investment clubs (these require pre-approval prior to acquiring interests therein); |

| • | Open-end mutual funds that are managed or advised by Mercer. |

The following securities are NOT reportable securities:

| • | Direct obligations of the United States government (note that securities issued by agencies or instrumentalities of the U.S.

government are reportable); |

| |

|

5 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

| • | Bank certificates of deposit; |

| • | High quality short-term debt instruments, including repurchase agreements; |

| • | Shares of open-end mutual funds that are not managed or advised by Mercer; and |

| • | Shares issued by unit investment trusts that are invested exclusively in one or more open-end funds that are not managed or

advised by Mercer. |

“Reportable accounts” include all accounts in which

any reportable securities can be held even if no reportable securities are currently held in that account. They include:

| • | Accounts held at a broker-dealer, bank, transfer agent, investment adviser or other financial services firm. |

| • | IRAs, certain HSA accounts, and 401(k) accounts held at MMC or another employer. |

| • | Brokerage accounts established by MMC on behalf of a colleague for purposes of holding MMC equity received in connection with

a bonus deferral, long-term-incentive award, or other incentive program; and |

| • | Any account in which the colleague has a beneficial interest. |

Please note that 529 plans are not considered reportable accounts.

Any questions about which accounts and securities are reportable

should be directed to L&C.

HOW DO COLLEAGUES REPORT?

The reporting of accounts and securities must occur through Mercer’s

Schwab CT system, including certifications, initial holdings reports and quarterly transaction reports.

Holdings reports must include, at a minimum, the title and type

of security, the exchange ticker symbol or CUSIP number, number of shares and principal amount of each reportable security, the

name of any broker, dealer or bank and the date the report is submitted.

To satisfy the initial and annual holdings reports, colleague

may provide duplicate copies of their account statements provided it includes all required reporting information. Such statement

must include information that is current as of a date no more than 45 calendar days prior to the date of the report.

Quarterly transaction reports must include, at a minimum, the

date of the transaction, the title, the exchange ticker symbol or CUSIP number, interest rate and maturity date, number of shares

and principal amount of each reportable security; the nature of the transaction (i.e., purchase, sale or other type of acquisition

or disposition); the price of the security at which the transaction was effected; the name of the broker, dealer or bank with or

through which the transaction was effected; and the date the access person submits the report. Quarterly reports are due within

30 days after the end of each calendar quarter for all reportable accounts.

| |

|

6 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

To satisfy the quarterly transaction reporting requirement, colleagues

must direct their brokers to provide duplicate copies of confirmations of transactions in reportable securities and duplicate copies

of all periodic statements related to their account(s) to Mercer. Such instructions must be made promptly (within 10 days) upon

becoming an access person and as new accounts are established. Upon request, L&C will facilitate the process for obtaining

duplicate confirmations and statements.

Colleagues that are unable to arrange for duplicate confirmations

and account statements to be sent to Mercer in a timely manner, must immediately notify L&C and request an exemption from the

requirement to provide confirmations and periodic account statements. If L&C grants the request, the colleague must submit

a quarterly report on the form provided by L&C. Colleagues must report any securities transactions that are not reported on

a brokerage or other account statement using the form provided by L&C.

Initial and annual holdings reports and quarterly transactions

reports are not required for accounts over which a colleague has no direct or indirect influence or control. A colleague’s

direct or indirect influence or control over an account is a facts and circumstances evaluation. For instance, accounts that are

managed on a discretionary basis by a third party discretionary manager would not, by itself, establish a basis that such colleague

has no direct or indirect influence or control over the account. Accounts that are set up as discretionary or where a trustee has

management authority over the account require reporting if the colleague is able to:

| • | Suggest purchases or sales of investments to the trustee or third-party discretionary manager; |

| • | Direct purchases or sales of investments; or |

| • | Consult with the trustee or third-party discretionary manager as to the particular allocation of investments to be made in

the account. |

Colleagues must consult L&C to evaluate whether a colleague

may have direct or indirect influence or control. If an exemption from reporting is granted, Colleagues may be required to complete

initial and periodic certifications related to the exemption. Further, L&C may impose special reporting requirements related

to such exempted accounts. It is important to note that where a colleague has demonstrated they have no direct or indirect influence

or control over an account and are exempted from the holdings and quarterly transaction reports with respect to such account, such

accounts must nevertheless be reported in Schwab CT; it is important for Mercer and L&C to be informed of these accounts for

purposes of monitoring compliance with this policy and federal securities regulations.

PRE-APPROVAL OF CERTAIN

TRANSACTIONS

Colleagues must obtain prior written approval from L&C before

acquiring direct or indirect beneficial ownership (through purchase or otherwise) of (i) a security in an initial public offering,

or (ii) a security in a limited offering (generally meaning a private placement, such as a hedge fund or private equity fund).

To initiate pre-approval, colleagues must provide to L&C full details of the proposed transaction and include a written certification

that the investment opportunity did not arise by virtue of the colleague’s activities on

| |

|

7 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

behalf of the client. If the transaction is approved, it will

be subject to continuous monitoring for possible future conflicts.

Colleagues may be subject to additional policies and procedures

through other regulated MMC companies. For instance, those colleagues that hold securities licenses through a broker dealer are

subject to the broker dealer’s policies and procedures. Such policies and procedures may have separate and distinct requirements

that should be reviewed prior to engaging in personal investing activities.

RESTRICTED TRADING

PERIODS

To help avoid even the appearance that colleagues might be trading

on the basis of nonpublic information, Mercer may impose periodic trading prohibitions on specified colleagues such as through

the adoption of a restricted list or pre-clearance list. For example, Mercer may impose trading prohibitions on investment management

colleagues for specified periods before and after a client or manager transition. L&C will notify affected colleagues of any

such situational restricted trading periods.

POLICY COMPLIANCE

L&C will review on a regular basis the reports filed pursuant

to this policy. In this regard, L&C will give special attention to evidence, if any, of potential violations of the antifraud

provisions of the federal securities laws or the procedural requirements or ethical standards set forth in this policy.

In addition, colleagues must report violations of this policy

to L&C immediately. Colleagues must recognize that this policy is a condition of employment with Mercer. Violations will be

addressed by senior management. Since many provisions of this policy also reflect provisions of the U.S. securities laws, colleagues

should be aware that violations could also lead to regulatory enforcement action resulting in suspension or expulsion from the

securities business, fines, penalties, or imprisonment.

If it is determined that a colleague has violated this policy,

L&C will report the violation to senior management. Senior management, in consultation with L&C, will determine the appropriate

sanctions. Sanctions may range from a verbal or written reprimand to suspension or termination of employment. They may also include

fines and the disgorgement of profits or other benefit realized.

POLICY RECORDS

L&C shall maintain and cause to be maintained in a readily

accessible place the following records:

| • | A copy of any code of ethics adopted by the firm pursuant to Advisers Act Rule 204A-1 which is or has been in effect during

the past five years; |

| • | A record of any violation of Mercer’s code and any action that was taken as a result of such violation for a period of five

years from the end of the fiscal year in which the violation occurred; |

| |

|

8 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

|

COMPLIANCE POLICY:

PERSONAL INVESTING

MARCH 29, 2019

|

|

| • | A record of all written acknowledgements of receipt of the code and amendments thereto for each person who is currently, or

within the past five years was, a supervised person which shall be retained for five years after the individual ceases to be a

supervised person of Mercer; |

| • | A copy of each report made pursuant to Advisers Act Rule 204A-1, including any brokerage confirmations and account statements

made in lieu of these reports; |

| • | A list of all persons who are, or within the preceding five years have been, access persons; |

| • | A record of any decision and reasons supporting such decision to approve a supervised person’s acquisition of securities in

any IPOs or limited offerings within the past five years after the end of the fiscal year in which such approval is granted. |

POLICY REVIEW AND

APPROVAL

L&C shall periodically review the Policy and related policies

and update as necessary.

resources

Please contact your L&C representative if you have questions.

■

| |

|

9 |

|

INTERNAL USE ONLY

This policy supersedes and replaces any previous Mercer policies on this subject. Mercer reserves the right to modify, suspend or terminate this policy at any time.

|

|

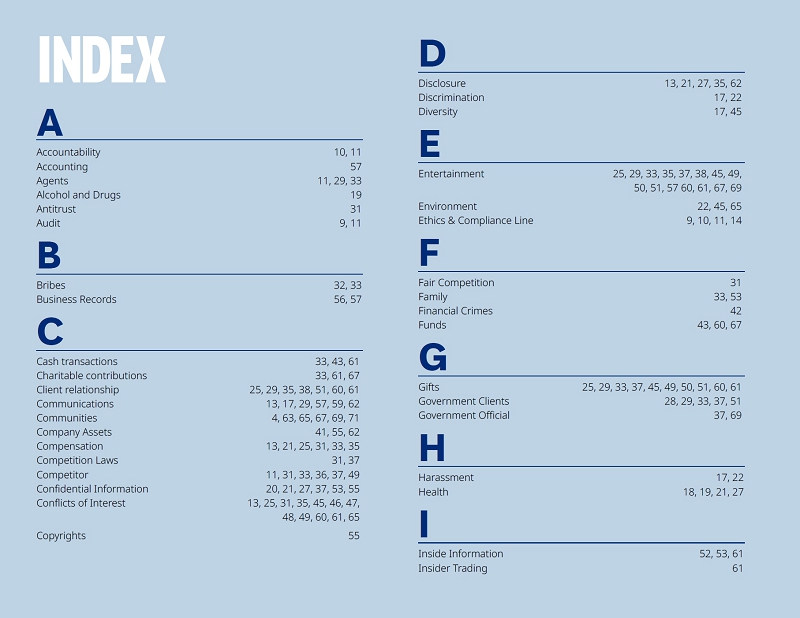

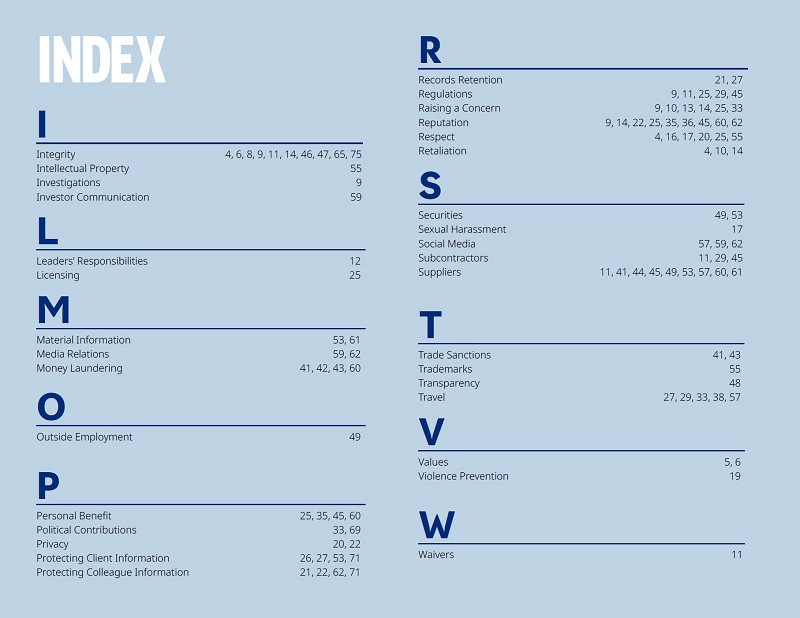

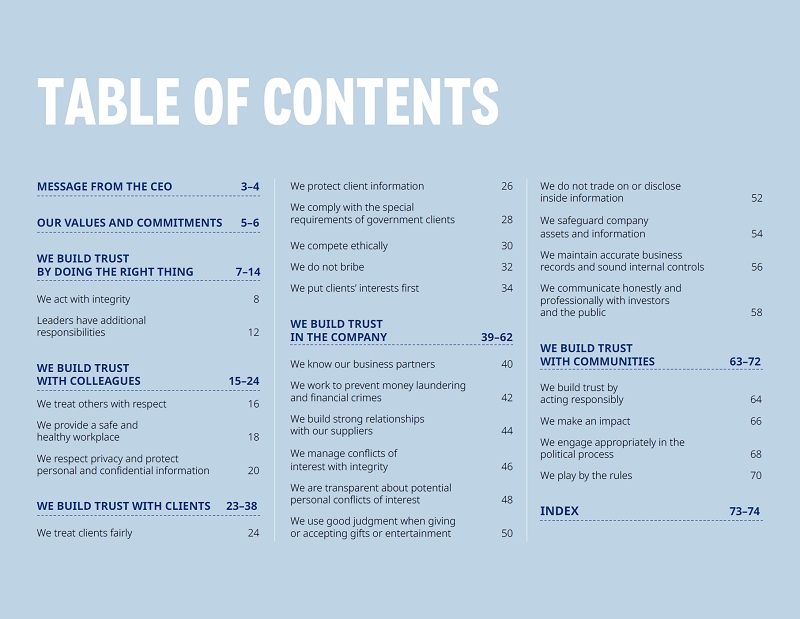

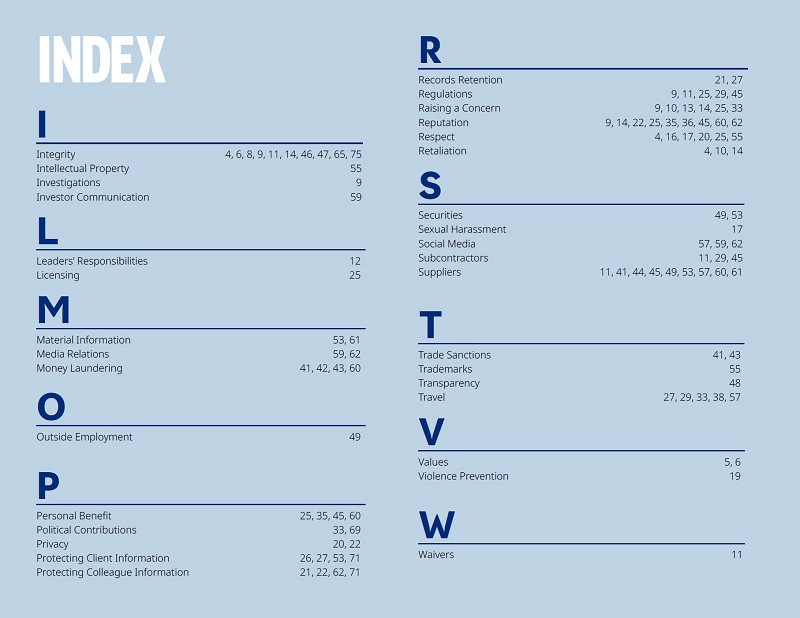

The Greater Good Our Code of Conduct

Table of contents MESSAGE FROM THE CEO 3–4 OUR VALUES AND COMMITMENTS 5–6 WE BUILD TRUST BY DOING THE RIGHT THING

7–14 We act with integrity 8 Leaders have additional responsibilities 12 WE BUILD TRUST WITH COLLEAGUES 15–24

We treat others with respect 16 We provide a safe and healthy workplace 18 We respect privacy and protect personal and confidential

information 20 WE BUILD TRUST WITH CLIENTS 23–38 We treat clients fairly 24 We protect client information 26 We comply

with the special requirements of government clients 28 We compete ethically 30 We do not bribe 32 We put clients’ interests

first 34 WE BUILD TRUST IN THE COMPANY 39–62 We know our business partners 40 We work to prevent money laundering and

financial crimes 42 We build strong relationships with our suppliers 44 We manage conflicts of interest with integrity 46

We are transparent about potential personal conflicts of interest 48 We use good judgment when giving or accepting gifts or

entertainment 50 We do not trade on or disclose inside information 52 We safeguard company assets and information 54 We maintain

accurate business records and sound internal controls 56 We communicate honestly and professionally with investors and the

public 58 WE BUILD TRUST WITH COMMUNITIES 63–72 We build trust by acting responsibly 64 We make an impact 66 We engage

appropriately in the political process 68 We play by the rules 70 INDEX 73–74

Message from the CEO

Our Code

of Conduct, The Greater Good, is foundational to how we do business at Marsh McLennan. We strive to create a culture that is

respectful, collaborative and inclusive. We are committed to earning the trust of our colleagues, clients, shareholders and

the communities we call home. We call this living The Greater Good. Our colleagues are Marsh McLennan, and we are only as

strong as our weakest link. It is up to all of us to protect the reputation of trust and integrity that we and those who came

before us have built over the past 150 years. In order to preserve and strengthen that reputation, each of us must abide by

these three pillars and live The Greater Good: 1. WIN WITH INTEGRITY We compete vigorously and fairly. Work that might harm

the reputation of the firm is simply not worth it. 2. YOU ARE NEVER ALONE The only mistake you can make at our company is the

mistake that you make alone. When in doubt, reach out. To your manager. To Compliance. To HR. To a colleague. We are all in

this together. 3. SPEAK UP If something does not feel right, speak up. You are not doing a service to anyone by keeping

quiet. You have a right to raise concerns and, indeed, an obligation to do so. Marsh McLennan exists to help clients address

their greatest challenges. We make a difference in the moments that matter. As we navigate real life situations and

challenges towards that mission, I encourage you to read and refer to The Greater Good. DEAR COLLEAGUES, Dan Glaser President

and Chief Executive Officer Marsh McLennan Companies The Greater Good | Message from the CEO 4

Our values and commitments

The

Greater Good is foundational to how we conduct business at Marsh McLennan. As a Company, we have committed to:

SUCCEEDING TOGETHER We are in business to expand what’s possible for our clients and each other. ACCELERATING IMPACT We

embrace change and create enduring client value. ADVANCING GOOD We strive to serve the greater good. At the core of each of these commitments is our Code of Conduct, The Greater Good. We expect every colleague to act with integrity,

to raise your hand when you are unsure of what to do and to speak up when you witness conduct that may not align with the

values of The Greater Good. The Greater Good | Our values and commitments 6

We build trust

by doing the

right thing

We act

with integrity. The Greater Good | We build trust by doing the right thing 8

Each one of us must take individual responsibility for acting with integrity at all times, even when this means making difficult

choices. This is the bedrock principle of acting for The Greater Good. MAKE SURE YOU Follow all laws and regulations that apply to your work. Take all required training to understand your responsibilities. Understand

and adhere to the letter and spirit of this Code and Company policy. Act honestly in all your business dealings. Speak up

if you have a concern about any work-related behavior that may be a violation of the law, this Code or Company policy. Raise

concerns with your managers at any level, or with Legal and Compliance or Human Resources, or through the Ethics & Compliance

Line. Cooperate in internal and external audits and investigations by fully and truthfully providing information and by preserving

all materials that might be relevant. AS YOU MAKE A BUSINESS DECISION, ASK YOURSELF Is it legal, ethical and socially responsible? Is it consistent with the spirit of the Code and Company policy? Is it based

on a thorough understanding of the risks involved? Will it maintain trust with clients, shareholders, regulators and colleagues?

Would it maintain our good reputation if the behavior were to become known internally or publicly? If the answer to any of

these questions is no, stop and speak up. The Greater Good | We build trust by doing the right thing 9

SPEAKING

UP You and your colleagues are certain to encounter difficult choices, and everyone makes mistakes from time to time. At

Marsh McLennan, we are dedicated to choosing our actions with care and fixing mistakes promptly. You are never alone. Do not

hesitate to raise concerns or seek guidance. Your fast action helps all of us retain and build trust. The Company will act

promptly to investigate allegations of violations of this Code or the law. As an alternative to raising concerns with or

seeking guidance from a manager, Legal and Compliance or Human Resources, you may use the Ethics & Compliance Line. The

Ethics & Compliance Line gives you the option of raising a concern or seeking guidance online or with a phone call. If

you wish, you may remain anonymous (except in a small number of countries where the law does not allow an anonymous call).

Please go to EthicsComplianceLine.com for detailed instructions. NO RETALIATION We will not tolerate retaliation against any

colleague who raises a good-faith concern about a potential violation of the law, this Code or Company policy. Examples of

retaliation may include termination, a reduction in pay, a negative change in job responsibilities, intimidation or any other

material change in a colleague’s conditions of employment. Reporting a concern does not relieve a colleague of

accountability for misconduct. The Greater Good | We build trust by doing the right thing 10

ACCOUNTABILITY

This Code applies to all directors, officers, employees, contingent workers and temporary

employees (“colleagues”) of the Company and its subsidiaries worldwide. We also hold our agents, subcontractors

and suppliers to high standards of integrity by requiring them to comply with relevant aspects of our compliance policies.

No colleague may use a third party to do something prohibited by this Code. Colleagues who violate the law, this Code or

Company policy are subject to disciplinary action in accordance with local laws and internal procedure. Marsh McLennan will

waive application of the policies in this Code only if the Company decides that it is justified by the circumstances. A

waiver will be granted only under limited circumstances. Only the Audit Committee of the Marsh McLennan Board of Directors

may approve a waiver of this Code for the Company’s directors and senior executive officers. Waivers must be properly

disclosed as required under applicable laws or regulations. IF LAWS CONFLICT Because we operate in many countries, laws will

sometimes conflict with each other or with this Code or Company policy. If you encounter such a conflict, consult with Legal

before deciding how to act. WATCH OUT FOR We will inevitably face difficult situations in our work. Under the heading

“Watch Out For,” most of the sections of this Code list temptations, pressures or “red flags.” These

things to “Watch Out For” should alert you to the potential problems inherent in the choices you are facing and

signal the need to speak up or seek guidance. For example, WATCH OUT FOR: Temptations to compromise integrity for revenue.

Pressures to get things done before knowing the risks involved or what the law, this Code or Company policy require. Excuses

for sacrificing integrity, such as, “Our competitors do it.” Assumptions that someone else will address a problem

or that management already knows about it. When you come across a red flag, speak up. Talk to a manager, Legal and Compliance

or Human Resources, or submit a report through the Ethics & Compliance Line. RELATED POLICIES AND GUIDANCE Colleagues can

visit The Greater Good website at integrity.mmc.com to find Compliance policies and materials listed under the “Policy

Hub” heading. The Greater Good | We build trust by doing the right thing 11

Leaders

have additional responsibilites. The Greater Good | We build trust by doing the right thing 12

If you

manage others, you must lead by example. Hold yourself to the highest standards of conduct and make those standards clear to

those who report to you. Create an atmosphere that inspires open and honest communication. Take an active role

in understanding the risks inherent in your colleagues’ work and give effective guidance when needed. MAKE SURE YOU

Communicate the letter and spirit of this Code to those who report to you and to your other colleagues. Make sure that

your teams understand Company policies and procedures. Take an active role in assuring the quality of the work product of

your teams and the fairness and honesty of their communications with clients, colleagues and other business partners. Use

adherence to this Code and Company policy as a factor when you evaluate and recommend compensation for your teams.

Communicate to your teams that your door is always open for them to report a mistake, raise a concern or discuss a difficult

business choice. At the same time, make it clear that they are free to report concerns through other channels as well.

Respond quickly and effectively to concerns colleagues raise. Take prompt remedial action when mistakes or misconduct

are discovered or brought to your attention. Notify Legal and Compliance when you encounter a potential violation of the

law, this Code or Company policy. Make appropriate disclosure to clients and other business partners when mistakes occur or

when conflicts of interest arise, after consulting with a manager or with Legal and Compliance. The Greater Good | We build

trust by doing the right thing 13

Q: My manager recently notified me that something I was doing was in violation of the Code. I had no idea I was doing something

wrong. Can I be held accountable even though I was unaware of the rule? A: Yes, you can be held accountable. You are expected

to read, understand and follow the principles in the Code and all Company policies. Whenever you encounter something in the

Code or a policy that seems unclear or difficult to carry out, you must seek guidance from a manager or Legal and Compliance

or Human Resources. Our reputation for integrity is our most valuable asset. To protect that asset, it is essential that you

follow the principles set out in the Code and the policies. Q: I have a problem: I believe a colleague is doing something

in violation of the Code, but I’m reluctant to say anything about it to my manager because my colleague and my manager

are friends. I’m also worried I will be branded an “informer” by my colleagues. What should I do? A: You

have a duty and obligation to speak up when you are aware of a violation of the Code. This may be one of the times when it

would be appropriate to raise the concern with someone other than your manager. You can make a confidential call (or send

a confidential email) to our Ethics & Compliance Line. Go to EthicsComplianceLine.com for instructions. You may keep your

call or message anonymous if you wish (except in a small number of countries where anonymity is not permitted by law). Remember:

The Company will not tolerate retaliation in any form against a colleague who speaks up in good faith. Q: I’m a manager. If I observe misconduct in an area not within my responsibility, should I raise a concern? A: Yes.

All Company colleagues must speak up if they have a concern about any work-related behavior that may be a violation of the

law, the Code or Company policy. All colleagues, including managers, may raise concerns with their managers at any level with

Legal and Compliance or Human Resources or through the Ethics & Compliance Line. Q: My manager says that we should always

bring our concerns directly to her and has suggested she will “make problems” for anyone who reports “over

her head.” Is that OK? A: No. She is in violation of Company policy if she is trying to prevent you from using other

reporting channels. While it is often best to raise an issue with your manager first, you may sometimes be unable to do so,

or believe doing so is inappropriate. You are free to communicate the concern to another manager, Legal and Compliance or

Human Resources, or by using our Ethics & Compliance Line. If your manager disciplines you, assigns you unpleasant work

or otherwise treats you differently because you chose to report through another channel, then she may be in violation of our

anti-retaliation policy and you should report that behavior. The Greater Good | We build trust by doing the right thing 14

We build trust with colleagues

We treat

others with respect. The Greater Good | We build trust bwyit dh ocionlgle tahgeu reisght thing 16

Marsh McLennan is committed to maintaining a diverse,

inclusive, equal-opportunity culture that empowers all colleagues and business partners. We believe that every

colleague’s unique contribution is fundamental to the overall success of the Company. MAKE SURE YOU Treat others

respectfully and professionally, always. Promote diversity and inclusion in hiring and other employment decisions. Report

comments, jokes, behavior or communications that may be offensive. Do not discriminate against or harass a colleague on the

basis of gender or gender identity, race, color, religion, national origin, age, disability, military service,

marital status, sexual orientation, genetic predisposition or any other characteristic protected by law or Company policy. Do

not sexually harass a colleague. Sexual harassment includes sexual advances, inappropriate references to sex or

gender, inappropriate touching of a sexual nature, conduct of a sexual nature or other offensive conduct or language. Do not

verbally abuse, threaten, taunt, intimidate or bully a colleague. WATCH OUT FOR Comments, jokes or materials, including

emails, that others might find offensive. RELATED POLICIES AND GUIDANCE Diversity at Marsh McLennan The Greater Good | We build trust with colleagues 17

We provide a safe and

healthy workplace. The Greater Good | We build trust with colleagues 18

Marsh

McLennan is committed to providing a safe and healthy workplace for colleagues and visitors to our facilities. Each of us is

responsible for acting in a way that protects ourselves and others. MAKE SURE YOU Observe the safety, security and health

rules and practices that apply to your role. Do not touch anyone in a violent or unwelcome manner in the workplace or while

conducting Company business. Never sell, possess or use illegal drugs in the workplace or while conducting Company business.

Do not come to work or conduct Company business while intoxicated or under the influence of illegal drugs. Immediately

address and report risks to safety and security and any workplace accident or injury to a member of management, Human

Resources or Global Security. WATCH OUT FOR Unsafe practices or work conditions, such as using handheld devices while

driving. Lax enforcement of security standards, such as facility entry procedures and password protocols. RELATED POLICIES

AND GUIDANCE Workplace Violence Prevention Policy Global Security at Marsh McLennan The Greater Good | We build trust with colleagues 19

We

respect privacy and protect personal and confidential information. The Greater Good | We build trust with colleagues 20

Colleagues place their

trust in each other. We safeguard our colleagues’ personal and confidential information. This includes information we

collect and process for Human Resources, recruiting, compensation, training, managing individual performance, administering

benefits and providing occupational health and safety. MAKE SURE YOU Understand and adhere to the law and Company policy on

the use, protection and retention of information about colleagues. Learn about the types of information given heightened

protection by the law and Company policy (such as personal information, including personal identification numbers, bank

account numbers and health data) and protect them through appropriate means (such as encryption or other types of access

restrictions). Consult Legal and Compliance or Human Resources if a law enforcement or regulatory authority or any other

person outside the Company requests colleague information. Immediately report any loss or inadvertent disclosure of colleague

information to your local IT Help Desk, or to Legal and Compliance. WATCH OUT FOR Unintentional exposure of confidential colleague information in public settings, such as during phone calls or while working

on your laptop. RELATED POLICIES AND GUIDANCE Handling Information Appropriately Policy The Greater Good | We build trust with colleagues 21

Q: While on a business trip, a colleague repeatedly asked me out for drinks and commented several times on my appearance in

a way that disturbed me. Is this an issue, since we weren’t in the office when it happened? A: This type of conduct

is not tolerated in any work-related situation, including business trips. You should report the problem to Human Resources

or a manager. Also, if you feel comfortable doing so, you could tell your colleague you find his or her actions inappropriate

and unwelcome. Q: One of my coworkers sends emails containing sex jokes and comments that make fun of certain nationalities.

They make me uncomfortable, but no one else has spoken up about them. What should I do? A: You should speak up immediately

to a manager or to Human Resources, as sending such jokes may violate Company standards on harassment and discrimination and

our policies about the use of Company systems. By doing nothing, you could be condoning discrimination or tolerating beliefs

that can seriously erode the team environment we have all worked hard to create. Q: I think a colleague who works near me

has been coming to work drunk. What should I do? A: This may be a performance or a safety issue, and could impact the reputation

of the organization. The best thing that you can do for everyone, including your coworker, is to report your concern to your

manager or to Human Resources. Q: I saw two colleagues in another area having an argument, and one threatened the other with violence. A friend of mine from

that area says that’s just how they deal with each other on that team. I’m uncomfortable speaking up, but the

emotions seemed pretty real to me. Should I report the threat or not? A: Report the threat immediately to your manager or

to Human Resources. When safety is at issue, err on the side of caution. Q: My best friend happens to work in the Company’s

payroll department and has access to colleagues’ personal information. I’m planning a party and would like to

send invitations to the homes of several coworkers. Can I ask her to get me their addresses? A: No. This is a violation of

privacy and could result in disciplinary action for both you and your friend. You should look up the addresses on the internet

or ask the coworkers directly. The Greater Good | We build trust with colleagues 22

We build trust with clients

We treat clients fairly. The Greater Good | We build trust with clients 24

We work to understand and meet our clients’ business needs, while always remaining true to our own ethical standards.

We tell the truth about our services, capabilities and compensation. We do not make promises we cannot keep. In short, we

treat our clients as we would want to be treated. MAKE SURE YOU Treat each client fairly and honestly. Document the terms of client relationships and engagements according to your business

procedures. Develop and deliver products and services according to your business procedures, including appropriate reviews

to ensure high quality. Promptly raise any concern about a potential error, omission, missed deadline or defect in quality

with a manager or Legal. Report actual or potential legal claims, lawsuits and errors and comissions to Legal by using your

“Report to Counsel” form. Promptly raise any potential conflict of interest between clients, or between a client

and the Company, with a manager or with Legal and Compliance. Comply with all licensing and other legal requirements that apply to your work. Never follow a client’s request to do

something unethical or unlawful. If you are uncertain of the right course, consult a manager or Legal and Compliance. WATCH OUT FOR Any request by an employee of a client for an arrangement that personally benefits the employee rather than

the client itself. Any client’s request for an arrangement that is not clearly legal or that could harm the Company’s

reputation. Pressures from colleagues or managers to cut corners on quality or delivery standards. Temptations to tell clients

what you think they want to hear rather than the truth. If a situation is unclear, present a fair and accurate picture to

the client as a basis for decision. Any request by a client or third party to share our revenues if doing so would violate

local licensing or other laws or regulations. Comments or behavior from clients that may be considered offensive or disrespectful

to others. RELATED POLICIES AND GUIDANCE Resolving Conflicts of Interest Policy Giving and Receiving: Gifts, Entertainment and Contributions

Policy The Greater Good | We build trust with clients 25

We protect client information. The Greater Good | We build trust with clients 26

Clients place their trust in us. In the course of developing a

client’s business or providing services to our clients, we are routinely provided with confidential, personal,

proprietary, non-public or trade-secret information. When this occurs, we securely maintain and safeguard this information so

that it is not improperly used or disclosed. MAKE SURE YOU Understand and adhere to the law, Company policy and client

agreements on the use, protection and retention of information from or about clients. Learn about the types of information

given heightened protection by the law and Company policy, such as personal information (including Social Security numbers,

bank account numbers and health data), and protect them through appropriate means such as encryption or other types of access

restrictions. Use and disclose client information only for legitimate business purposes in accordance with the client

contract and the Company’s Handling Information Appropriately policy Immediately consult Legal and Compliance if a law

enforcement or regulatory authority or any other person outside the Company requests client information or documents. Only

share client information within the Company if you have made sure it is permissible and will be appropriately protected.

Follow our Handling Information Appropriately policy to protect client information, Company information and equipment

(laptops, phones, tablets, etc.). Protect your passwords and secure portable devices while traveling. Immediately report all

incidents involving the suspected or actual loss, theft, unauthorized disclosure or inappropriate use of client information

to your local IT help desk or to Legal and Compliance. WATCH OUT FOR Requests by clients for information about other clients.

Unintentional exposure of client information in public settings, such as on phone calls or while working on your laptop.

RELATED POLICIES AND GUIDANCE Handling Information Appropriately Policy The Greater Good | We build trust with clients 27

We comply with the special requirements of government clients. The Greater Good | We build trust with clients 28

The Company is committed to meeting the many special legal, regulatory and contractual requirements that apply to government-related

work around the world. These requirements may apply to bidding, invoicing, employment practices, contract performance, gifts

and entertainment and other matters. The Company may also be obligated to impose these requirements on any agents or subcontractors

we bring in to help with the work. Legal and Compliance can help you understand these rules and establish processes to ensure

they are followed. MAKE SURE YOU Determine in every case whether the client you are working with is owned or controlled by a government. Follow all laws, regulations,

contractual provisions and other rules applicable to the business relationship between the Company and each government client

you work with. Understand the rules about gifts, entertainment, travel and lodging of each government client you work with,

as they may differ from other clients’. Clearly communicate any special requirements of government clients to all colleagues,

agents, subcontractors and other business partners involved in the work. Understand and adhere to Company policies and guidance in this area, including Giving and Receiving: Gifts, Entertainment

and Contributions and Working with Third Party Providers, Governments and Vendors. WATCH OUT FOR Businesses such as transportation providers, energy companies, financial institutions, telecommunications providers and others

which may be owned or controlled by a government, in whole or in part, and subject to special rules. Laws, regulations or

rules governing the Company’s relationship with a government client, which sometimes are not readily accessible. Whenever

possible, ask the government client to inform you of requirements of this kind. The temptation to provide otherwise reasonable

entertainment to a government client—such as a business meal—before learning that client’s rules on entertainment.

Some government clients have rules that prohibit or limit all entertainment. RELATED POLICIES AND GUIDANCE Giving and Receiving: Gifts, Entertainment and Contributions Policy Working with Third Party Providers, Governments and Vendors

Policy The Greater Good | We build trust with clients 29

We compete ethically. The Greater Good | We build trust with clients 30

Marsh McLennan is committed to competing vigorously and fairly

for business by providing superior products and services—not by engaging in improper or anti-competitive practices. We

comply with all laws related to competition, antitrust and obtaining competitive information in the countries in which we do

business. Do not engage in anti-competitive behavior, particularly including: MAKE SURE YOU Collusion—when companies

secretly communicate or agree on how they will compete. This may include agreements or exchanges of information on pricing,

terms, wages or allocations of clients or market segments. Bid-rigging—when competitors manipulate bidding to undermine

fair competition. This may include comparing bids, agreeing not to bid or knowingly submitting noncompetitive bids.

Tying—when a company with significant market power forces customers to buy products or services they do not want in

order to receive those that they do want. “No Poach” Agreements—when competitors agree not to pursue each

other’s employees. Also refrain from: Discussing or agreeing with competitors on inappropriate matters, including fee

and commission levels, strategic plans and how we win business. Obtaining competitively sensitive information from a

competitor. Coordinating employee compensation with a competitor. Sharing the Company’s competitively sensitive

information with a competitor. Sharing competitively sensitive information of clients or third parties with their

competitors. Inappropriately coordinating or discouraging bidding among insurance and reinsurance markets for a

client’s business. Facilitating collusion among companies competing for a client’s business. WATCH OUT FOR Formal

or informal agreements with competitors about whether and how we compete for clients (e.g., an understanding not to pursue

each other’s clients). Collecting data from inappropriate sources (such as competitors, new hires or candidates for

employment). This can be, or appear to be, an improper exchange of competitively sensitive information. Participation in a

trade, industry or professional group that becomes a forum for reaching unlawful agreements or improperly

exchanging competitively sensitive information. RELATED POLICIES AND GUIDANCE Competing Ethically Policy Resolving Conflicts

of Interest Policy The Greater Good | We build trust with clients 31

We do not bribe. The Greater Good | We build trust with clients 32

Improper influence may take many forms. Cash, gifts,

meals, travel, entertainment, loans, charitable contributions, political contributions or offers of employment may all be

used inappropriately in attempts to influence business decisions or government action. Regardless of the form, we do not

bribe or use any other means to improperly influence the decisions of clients, potential clients or government employees. We

do not offer or provide bribes directly or through a third party. We do not bribe even where it might be a generally

accepted practice, when competitors do so or for any other reason. MAKE SURE YOU Do not give or offer anything of value to a

client, prospective client or government employee unless it is legal, reasonable and free of any intent or understanding that

it will influence a business decision or government action. Follow our rigorous due diligence processes when engaging agents

who represent us or third parties who introduce clients to us, and oversee their activity for the duration of any

agreement. Raise a concern if you know or suspect that a colleague, third party or other agent of the Company may be

attempting to improperly influence a decision of a client, potential client or government employee. Never record, or allow a

colleague to record, a transaction in a way that disguises its true nature, such as booking the cost of entertaining a client

as a “consulting fee” or a “training expense.” Carefully review the accuracy of the expense reports

you approve. WATCH OUT FOR Requests for payments to a country or a party unrelated to a transaction, or for payments in cash.

Third parties or agents who are deemed valuable for their personal ties rather than for their services, or who request

compensation out of proportion to the value of their services. Requests to engage third parties or agents without a written

contract, or without completing the documentation required by the Company’s due diligence process. Requests from

colleagues not to record agreements or payments. Client requirements to engage specific third parties. Client requests for

favors, such as job interviews or internships for family members. Entertainment or meals that could be seen as lavish or

inappropriate. The appearance of impropriety, especially when dealing with government employees. RELATED POLICIES AND GUIDANCE Giving and Receiving: Gifts, Entertainment and Contributions Policy Working with Third Party

Providers, Governments and Vendors Policy The Greater Good | We build trust with clients 33

We put clients’ interests first. The Greater Good | We build trust with clients 34

We are often called upon to help clients choose

between business partners. Some of our most important services involve helping our clients select (re)insurance markets and investment

service providers for pension and benefit plan assets. Within the bounds of applicable law, regulation and Company policy, we

always put our clients’ interests first when helping them choose business partners of any kind. MAKE SURE YOU Help

clients choose business partners based on the quality of their products and services and the competitiveness of their prices and

other terms and conditions. Help clients choose business partners who are well qualified and financially responsible and avoid

business partners who have engaged in unlawful or unethical conduct, or who could damage client reputations. Disclose to your

manager any actual or potential conflict of interest, or any personal relationship with a prospective business partner if you

are involved in choosing the business partner. Avoid any gift, entertainment or favor from a business partner or potential business

partner which might create the appearance of personal benefit to you from the choice of business partner WATCH OUT FOR Any

relationship between the Company and a business partner, or between a colleague and a business partner, that could be perceived

as a conflict of interest. If any such relationship exists, discuss it with a manager or Legal and Compliance. RELATED POLICIES

AND GUIDANCE Resolving Conflicts of Interest Policy Business procedures for compensation disclosure The Greater Good |

We build trust with clients 35

Q&A Q: One of my clients is asking me to go

way outside the scope of our engagement agreement. They’re a very important client, and I want to keep them happy. What should

I do? A: Significant changes in the scope of work should be documented and approved by the client. Of course, if the requests

are for something illegal or inappropriate, you must not help, even if it “keeps them happy.” Q: I’m on

a tight deadline preparing a report for a client. The report includes some information we collected. I’ve reviewed most of

it, and it seems fine. Can I just assume the rest of it is OK so I have a chance of meeting the deadline? A: Your reputation

and ours are tied to everything we deliver to clients. When you inform them that the information you’re providing is accurate,

you must be certain that it is. Failing to do so could lead to harm for both you and the Company. Q: I’ve discovered

that I made an error in billing my time to a client. It’s a minor error, given the scope of the project, and it will make

us look bad if I point it out. Can I just adjust future billings accordingly? A: You should notify the Finance Department

and the client and agree how to correct the error. This is the right thing to do, complies with Company policies and may in fact

build trust because of our honesty. Q: I walked past a coworker’s desk this morning. She was in a meeting in the conference

room, but highly confidential information about one of her clients was open on her desk. This isn’t the first time she’s

done that. What should I do? A: You should talk to her or your manager about it. Safeguarding confidential information is

everybody’s responsibility. Q: My client has asked me for information about one of her competitors, who happens to

be another client of the Company. What should I tell her? A: You must politely but firmly say we cannot discuss anything

about one client with another client. Beware of the temptation to discuss things you believe are widely known. Put yourself in

the shoes of the Company’s other client and ask yourself whether it would build trust with that client if he or she became

aware you had been discussing the client’s business with a competitor. The Greater Good | We build trust with clients

36

Q&A Q: I’m in a meeting with government clients, which is running longer than planned, and

they’ve missed their flight back home. There are no more flights for a number of hours. Can I buy them dinner since we’re

still working in the Company’s offices? A: When dealing with government clients, you must become familiar with all

special rules relating to our service for those clients. This includes any special rules the client may have, or the law may require,

about providing meals or other gifts, entertainment or hospitality. If you find yourself in a situation like the one in the question

and you don’t know what the rules are, ask the client directly whether providing the meal is permissible. In any event, use

good judgment, and if you choose to provide a modest meal, report it promptly afterward to Compliance in accordance with our Giving

and Receiving: Gifts, Entertainment and Contributions Policy. Q: An acquaintance at a competitor just phoned me to ask that

I meet him for drinks to discuss “opportunities to support each other.” Is it OK for me to go if I go just to listen?

A: Before agreeing to meet, you should talk to Legal and Compliance, who can give you guidance on the subject areas that

would be prohibited under competition laws. While competitors generally cooperate in ways that are legal, you need to be aware

of the possibility the competitor will direct the conversation into areas that are not permissible. Q: I used to work for

a competitor. My team members have asked me to brief them on my former company’s proposal strategies. Is this OK? A: If

the proposal strategies are not a matter of public record, you may be improperly divulging the competitor’s confidential

proprietary information. In order to understand the boundaries between what you can and cannot talk about, contact Legal and Compliance

to discuss the matter. Q: We are considering the use of a prominent businessman as a consultant to help us open a new market

for our services in a particular country. The agent is asking for a budget of a few thousand Euros to ensure that all the proper

officials think highly of us. He says this is the way business is done in his country. Should I agree? A: No. It is clear

the agent intends to make improper payments that violate the Code and our Giving and Receiving: Gifts, Entertainment and Contributions

Policy— and, probably, the law. You cannot allow this to occur, and you cannot turn a blind eye simply because the improper

acts would be done by an agent rather than by you or a Company colleague. The Greater Good | We build trust with clients

37

Q&A Q: I sent a visa application to an embassy. It has been there for a long time and I now need

to travel to that country. I have been told that the embassy may expedite my application if I pay one of its employees a modest

amount. Can I go ahead with such payment? A: No. The payment is to an individual, not to the embassy. This is a “facilitating”

payment, which is not acceptable under the Code and illegal in almost all of the countries in which we operate. However, if there

is an expediting fee that is a standard way the embassy operates, and the fee goes to the embassy, not to an individual employee,

it might be acceptable to pay—check with Legal and Compliance. Q: I have a client in another country whose insurance

manager is about to come to my city for three days of business meetings with me and the insurance companies who underwrite the

client’s coverages. The manager has asked me to arrange for our Company to organize and pay for a day of sightseeing for

him during his trip. Is this something I should discuss with Legal and Compliance? A: Yes. Striking the right balance between

business meetings and entertainment often requires a careful understanding of the anticorruption laws applicable to our Company.

Legal and Compliance can assist you in understanding what the limits are so you can plan a client visit that will both enhance

the client relationship and comply with the law. The Greater Good | We build trust with clients 38

We build trust in the Company

We know our business partners. The Greater Good |

We build trust ibny tdhoei nCgo mthpea rnigyht thing 40

Marsh McLennan is committed to compliance with trade sanctions,

anti-terrorist financing, export controls, anti-human trafficking and anti-boycott laws. These laws designate countries, companies

and persons with which we may not do business. Be aware of the possibility that a client, prospect or other business partner could

be located in a sanctioned country or could itself be a sanctioned entity. MAKE SURE YOU Enter all required information

into the systems provided by your business for onboarding and managing clients, suppliers and third parties before you begin work

on a new matter or engage a new business partner. These systems screen business partners and protect the Company from violating

trade sanctions laws. Do not engage in “facilitation”—for example, helping someone else do an act you are not

permitted to do yourself. If you are not legally allowed to perform an action yourself, you are also prohibited from helping someone

else perform the action. Seek advice from Legal and Compliance when you find any conflict between the sanctions laws of different

countries. WATCH OUT FOR Third parties acting on behalf of sanctioned countries, companies or persons. Any money or other

assets in our Company’s possession in which a sanctioned country, company or person may have an interest. RELATED POLICIES

AND GUIDANCE Understanding Trade Sanctions and Anti-Money Laundering Policy The Greater Good | We build trust in the

Company 41

We work to prevent money laundering and financial crimes.

The Greater Good | We build trust ibny tdhoei nCgo mthpea rnigyht thing 42

Marsh McLennan is committed to compliance with anti-money laundering

laws. Money laundering is conduct designed to conceal the origin or nature of the proceeds of criminal activity. You must follow

the anti-money laundering requirements of your business, including know-your-client procedures, and restrictions on forms of payment.

Learn about and keep alert for possible money laundering “red flags.” If a red flag should appear in the course of

a transaction, before you go further, speak with your manager or Legal and Compliance. MAKE SURE YOU Follow your business’s

know-your-client business procedures. Follow your business procedures relating to acceptable forms of payment in situations where

you are involved with receiving or handling funds. Some forms of payment, such as cash or third-party checks, present heightened

money laundering risks. Follow applicable laws on filing suspicious activity reports, by notifying Legal and Compliance about activity

that could be a sign of money laundering. Never tell or “tip off” a client about money laundering suspicions you may

have. In some countries, “tipping off” is a criminal offense. WATCH OUT FOR A client or prospect who: Has been

the subject of financial crime or money laundering allegations; Has an ownership structure that obscures its true owners; Refuses

to properly document a transaction or relationship; or Makes or requests payment in cash, to or from a third party or to or from

a country not related to the transaction. Also look for: Transactions that seem to lack a business purpose or consistency with

a party’s business strategy. Duplicate payments or overpayments that are not easily explained as simple mistakes. RELATED

POLICIES AND GUIDANCE Understanding Trade Sanctions and Anti-Money Laundering Policy The Greater Good | We build trust

in the Company 43

We build strong relationships with our suppliers. The

Greater Good | We build trust ibny tdhoei nCgo mthpea rnigyht thing 44

Engaging suppliers and subcontractors who provide the Company

with superior service on reasonable terms is important to our success. MAKE SURE YOU Choose suppliers, third-party providers

and contractors based on the quality of their products and services and the competitiveness of their prices and other terms and

conditions. Choose suppliers and third-party providers who are well qualified and financially responsible, and avoid suppliers

who have engaged in unlawful or unethical conduct, who do not meet our data-protection standards or who could damage our reputation.

Disclose to your manager any actual or potential conflict of interest or any personal relationship with a prospective supplier

if you are involved in choosing the supplier. Avoid any gift, entertainment or other favor from a supplier or potential supplier

that might create the appearance of improper influence or a personal benefit to you from the choice of supplier. Encourage suppliers

from diverse backgrounds to compete for our business. WATCH OUT FOR Any relationship or dealings between you and a supplier

that could be perceived as a conflict of interest. Pressures to choose a supplier that does not offer competitive products, services,

prices or terms only because it is also a client or prospective client of the Company. Supplier practices that could jeopardize

our reputation, such as violations of human rights, environmental regulations or data-protection regulations. RELATED POLICIES

AND GUIDANCE Working with Third Party Providers, Governments and Vendors Policy Giving and Receiving: Gifts, Entertainment

and Contributions Policy Resolving Conflicts of Interest Policy Vendor Management Program The Greater Good | We build trust

in the Company 45

We manage conflicts of interest with integrity. The

Greater Good | We build trust ibny tdhoei nCgo mthpea rnigyht thing 46

Given our broad client base and diverse business offerings, we will face situations where the interests of one client may conflict with the interests of another, or even with the interests of the Company itself. We will identify such situations promptly, resolve them with integrity and treat our clients fairly. MAKE SURE YOU Follow your business’s screening procedures by properly entering account-opening and new-opportunity information into your client management system. Update the information as required. Identify potential business conflicts of interest promptly. Work with Legal and Compliance to determine an appropriate course of action to manage the conflict. Potential resolutions for a conflict are: Disclosing the relationships to the relevant parties; Obtaining consent from the party at risk; Establishing information barriers (ethical walls); or Declining the engagement. WATCH OUT FOR Situations where a revenue opportunity for the Company is not in the best interests of a client. Situations where one client is in litigation with another client. Services that could involve one business investigating, offering an opinion on or questioning the work of a sister company. RELATED POLICIES AND GUIDANCE Resolving Conflicts of Interest Policy The Greater Good | We build trust in the Company 47

We are transparent

about potential

personal conflicts

of interest. The Greater Good | We build trust in the Company 48

Each of us owes a duty of loyalty to the Company and its shareholders. We must avoid or disclose conflicts of interest between the Company and ourselves. We may only accept a directorship or other position with a for-profit or nonprofit business or organization outside the Company if it would not impair our ability to fulfill our duties to Marsh McLennan. MAKE SURE YOU Avoid conflicts of interest whenever possible and, if you find yourself facing a potential conflict of interest, disclose it to your manager and Legal and Compliance. Do not do any outside work or accept any outside employment, leadership or directorship positions that could harm the Company, such as: Work for a competitor; Outside work that would interfere with your work for the Company; or Outside work that could embarrass the Company or give the appearance of a conflict. Also make sure you: Do not pursue business opportunities for yourself that would be appropriate opportunities for the Company. Avoid any investments that are material to you (or greater than 1% of such company’s publicly traded securities) in any company that competes or does business with our Company without prior written approval of your manager. WATCH OUT FOR Common conflicts of interest, such as: Proposing a close friend or relative as a supplier or contractor without disclosing the relationship; Proposing a company in which you have a financial interest as a supplier or contractor without disclosing the relationship; Doing work in your personal capacity for a supplier or client; Allowing a supplier or contractor to do work for you in your personal capacity, whether paid or unpaid; Receiving gifts, entertainment or other favors from a supplier or contractor that could create the appearance of improper influence. RELATED POLICIES AND GUIDANCE Giving and Receiving: Gifts, Entertainment and Contributions Policy Working with Third Party Providers, Governments and Vendors Policy Resolving Conflicts of Interest policy The Greater Good | We build trust in the Company 49

We use good

judgement

when giving or

accepting gifts

or entertainment. The Greater Good | We build trust in the Company 50