File No. 024-______________

As filed with the Securities and Exchange Commission on December ___, 2022

PART II - INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering Circular dated December ___, 2022

An offering statement pursuant to Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”). Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

Genesis Electronics Group, Inc.

400,000,000 Shares of Common Stock

By this Offering Circular, Genesis Electronics Group, Inc., a Nevada corporation, is offering for sale a maximum of 400,000,000 shares of its common stock (the “Offered Shares”), at a fixed price of $_____[0.001-0.005] per share (the price to be fixed by a post-qualification supplement), pursuant to Tier 1 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). A minimum purchase of $5,000 of the Offered Shares is required in this offering; any additional purchase must be in an amount of at least $1,000. This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments.

Please see the “Risk Factors” section, beginning on page 4, for a discussion of the risks associated with a purchase of the Offered Shares.

We estimate that this offering will commence within two days of the SEC’s qualification of the Offering Statement of which this Offering Circular forms a part; this offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

|

Title of Securities Offered |

Number of Shares |

Price to Public |

Commissions (1) |

Proceeds to Company (2) |

||||||||

| Common Stock | 400,000,000 | $_____[0.001-0.005] | $-0- | $_____[400,000-2,000,000] | ||||||||

| (1) | We do not intend to offer and sell the Offered Shares through registered broker-dealers or utilize finders. However, should we determine to employ a registered broker-dealer of finder, information as to any such broker-dealer or finder shall be disclosed in an amendment to this Offering Circular. | |||||||||||

| (2) | Does not account for the payment of expenses of this offering estimated at $20,000. See “Plan of Distribution.” | |||||||||||

Our common stock is quoted in the over-the-counter under the symbol “GEGI” in the OTC Pink marketplace of OTC Link. On December 19, 2022, the closing price of our common stock was $0.0016 per share.

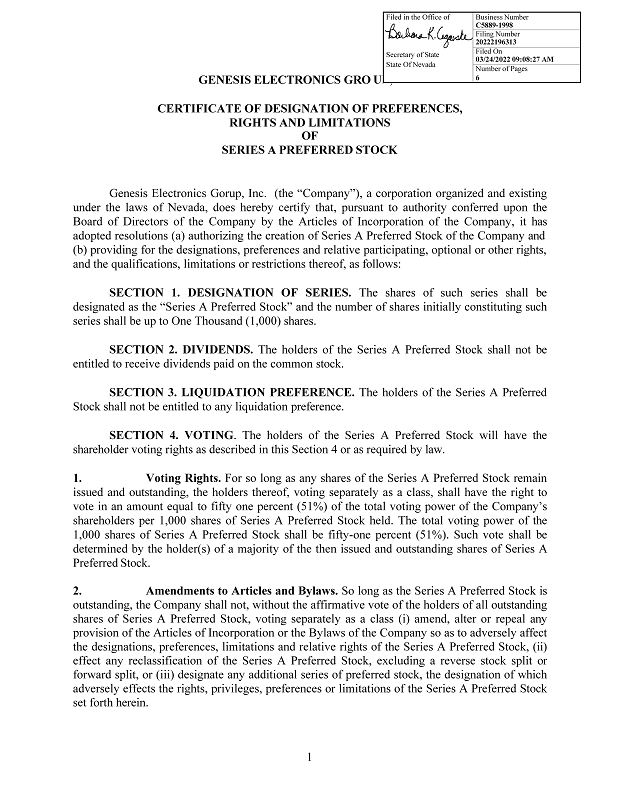

Investing in the Offered Shares is speculative and involves substantial risks, including the superior voting rights of our outstanding shares of Series A Preferred Stock, which preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders. Our Chief Executive Officer, as the owner of all outstanding shares of the Series A Preferred Stock will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares”).

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Offered Shares.

No sale may be made to you in this offering if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption and Offerings to Qualified Purchasers” (page ___). Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is ______, 2022.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes, continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| 1 |

The following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and the unaudited consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms we, us and our refer and relate to Genesis Electronics Group, Inc., a Nevada corporation, including its subsidiaries.

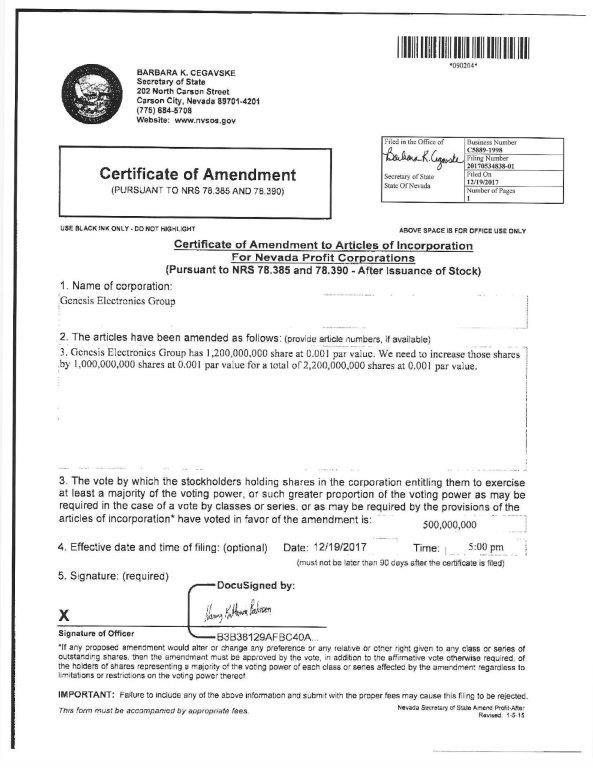

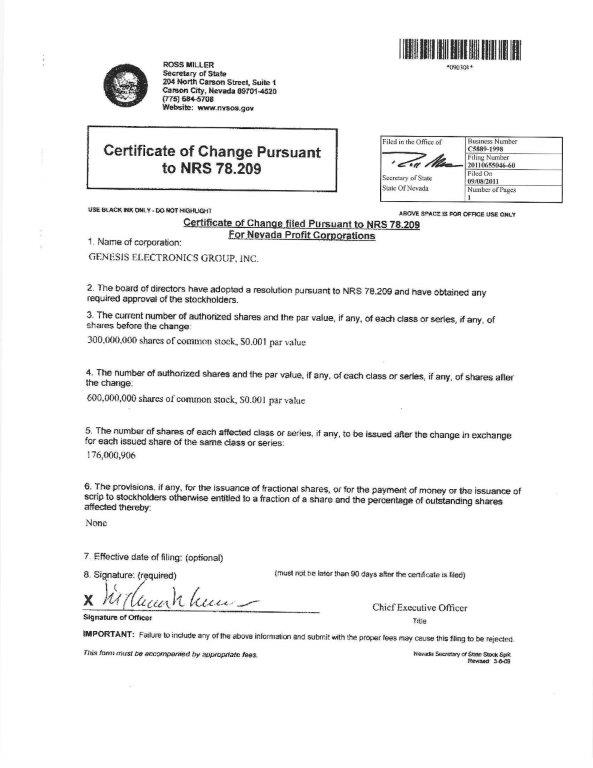

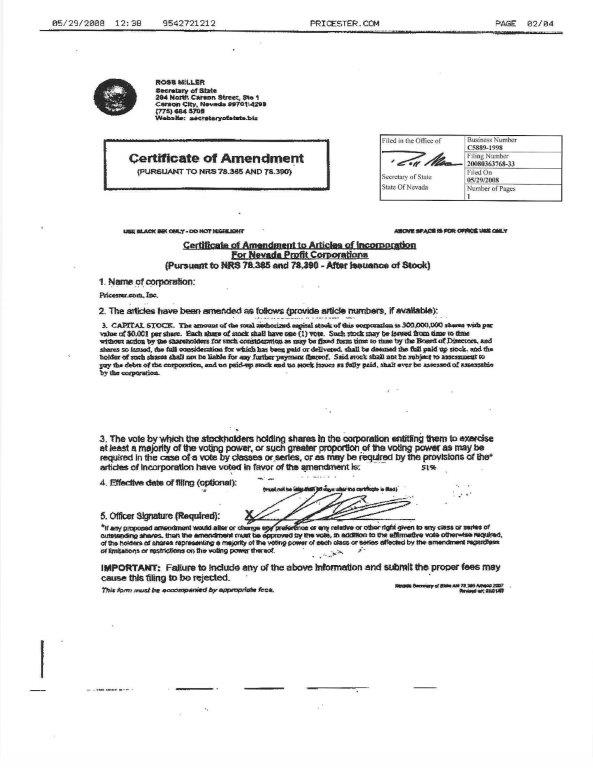

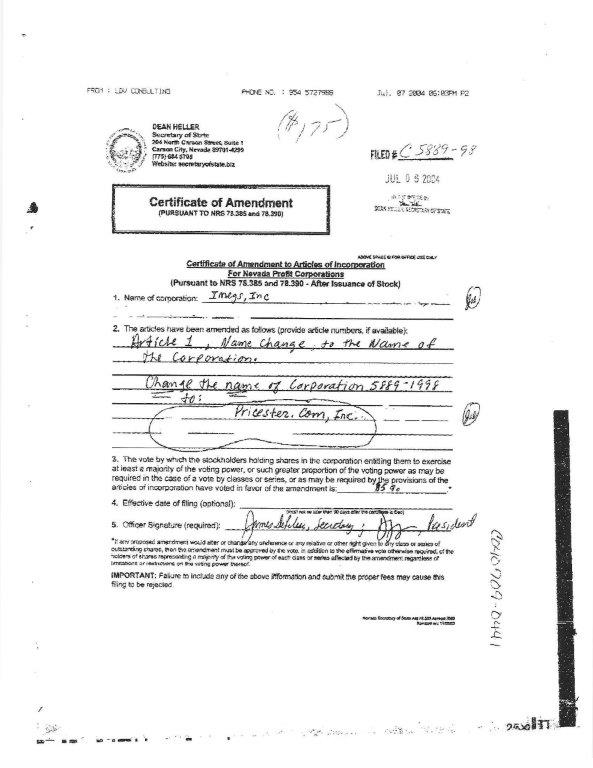

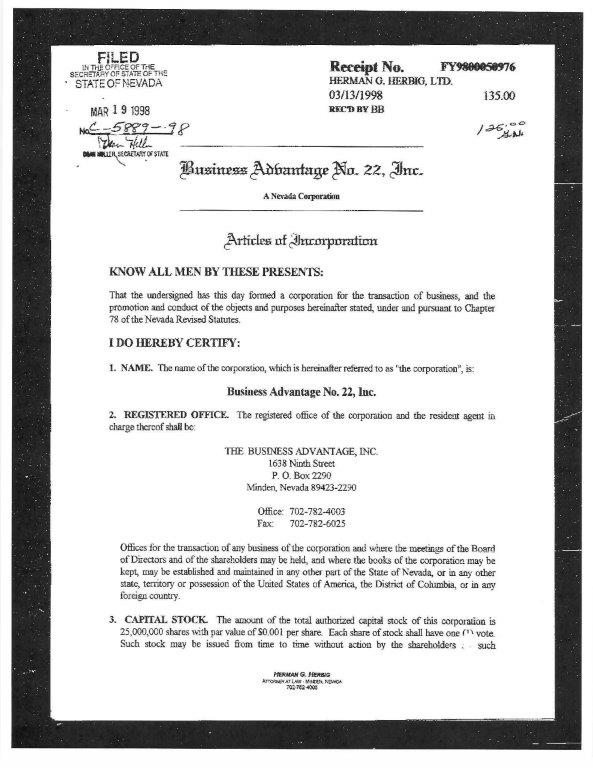

Our Company

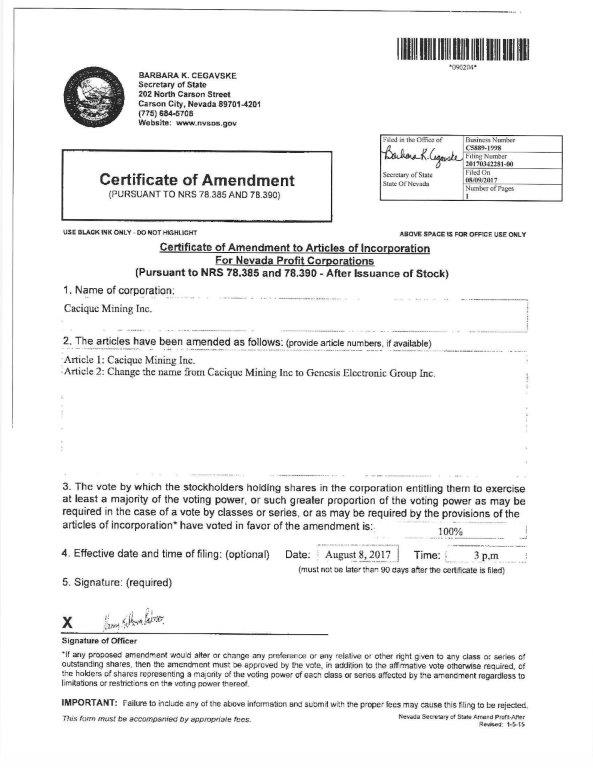

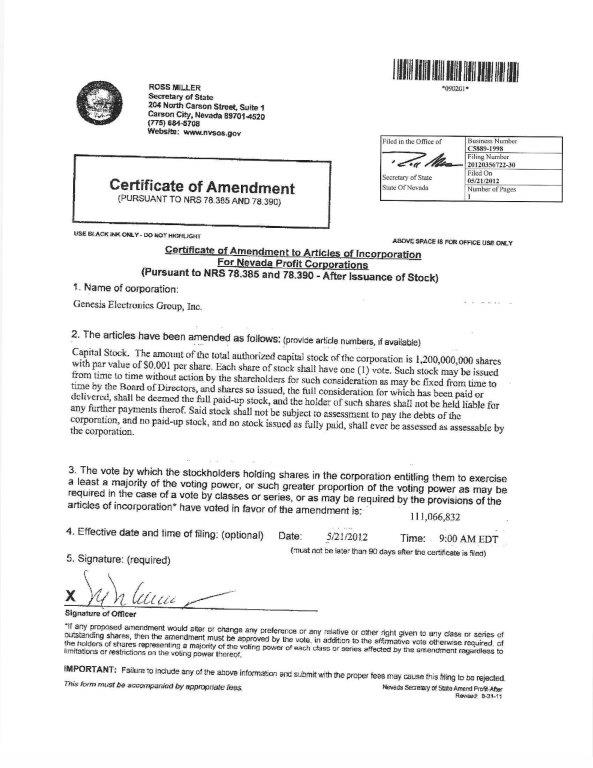

We were incorporated on March 19, 1998, under the name Business Advantage No. 22, Inc. On August 23, 2000, our corporate name changed to IMEGS, Inc.. On July 6, 2004, our corporate name changed to Pricester.com, Inc. On February 24, 2009, our corporate name changed to Genesis Electronics Group, Inc. On June 22, 2017, our corporate name changed to Cacique Mining Inc. On August 9, 2017, our corporate name changed to Genesis Electronic Group Inc. On August 10, 2017, our corporate name changed to Genesis Electronics Group, Inc.

Effective October 24, 2022, we acquired Glīd LLC (pronounced Glide). With patent-pending technology, our company, through our Glīd subsidiary, has begun to establish an electric and autonomous trucking company, with the overall goal of reducing operational costs in the trucking industry. (See “Business”).

Offering Summary

| Securities Offered | 400,000,000 shares of common stock, par value $0.001 (the Offered Shares). | |

| Offering Price | $_____[0.001-0.005] per Offered Share. | |

|

Shares Outstanding Before This Offering |

1,723,775,755 shares issued and outstanding as of the date hereof. | |

|

Shares Outstanding After This Offering |

2,123,775,755 shares issued and outstanding, assuming the sale of all of the Offered Shares hereunder. | |

|

Minimum Number of Shares to Be Sold in This Offering |

None | |

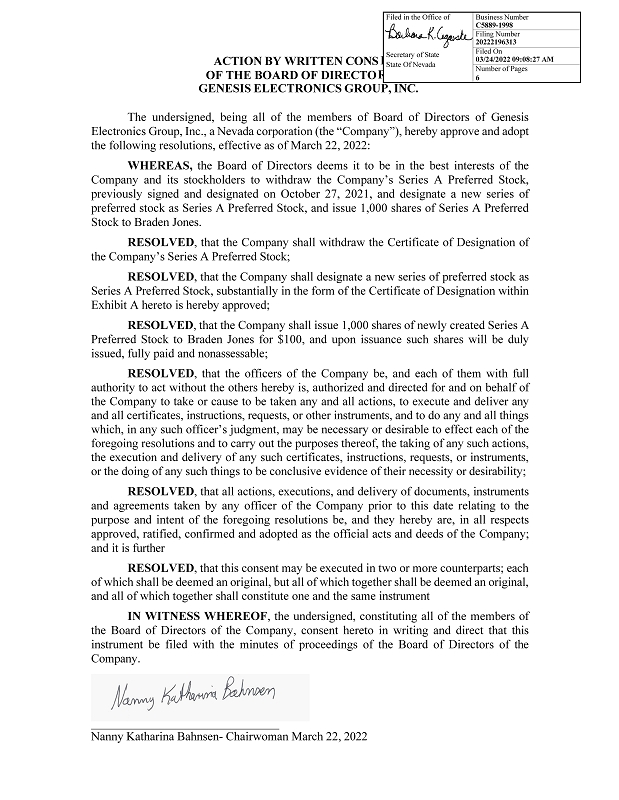

| Disparate Voting Rights | The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders. Our outstanding shares of Series A Preferred Stock possess superior voting rights, which preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders. Our Chief Executive Officer, Braden Jones, is the owner of all of the outstanding shares of the Series A Preferred Stock and will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and (“Security Ownership of Certain Beneficial Owners and Management”). | |

| Investor Suitability Standards | The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings. | |

| Market for our Common Stock | Our common stock is quoted in the over-the-counter market under the symbol “GEGI” in the OTC Pink marketplace of OTC Link. | |

| Termination of this Offering | This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. | |

| Use of Proceeds | We will apply the proceeds of this offering for prototype development, software development, safety testing, general and administrative expenses and working capital. (See “Use of Proceeds”). | |

| Risk Factors | An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. | |

| Corporate Information | Our principal executive offices are located at 26 South Rio Grande Street, #2072, Salt Lake City, Utah 84101; our telephone number is 800-390-1302; our corporate website is located at www.genesis-electronics.com. No information found on our company’s website is part of this Offering Circular. |

| 2 |

Continuing Reporting Requirements Under Regulation A

As a Tier 1 issuer under Regulation A, we will be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering. We will not be required to file any other reports with the SEC following this offering.

However, during the pendency of this offering and following this offering, we intend to file quarterly and annual financial reports and other supplemental reports with OTC Markets, which will be available at www.otcmarkets.com.

All of our future periodic reports, whether filed with OTC Markets or the SEC, will not be required to include the same information as analogous reports required to be filed by companies whose securities are listed on the NYSE or NASDAQ, for example.

| 3 |

An investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Associated with the COVID-19 Pandemic

It is possible that the Coronavirus (“COVID-19”) pandemic could cause long-lasting stock market volatility and weakness, as well as long-lasting recessionary effects on the United States and/or global economies. Should the negative economic impact caused by the COVID-19 pandemic result in continuing long-term economic weakness in the United States and/or globally, our ability to expand our business would be severely negatively impacted. It is possible that our company would not be able to sustain during any such long-term economic weakness. The COVID-19 pandemic has, to date, had minimal impact on our operations.

Risks Related to Our Company

We have incurred losses in prior periods, and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows. We have incurred losses in prior periods. For the nine months ended September 30, 2022, we incurred a net loss of $114,857 (unaudited) and, as of that date, we had an accumulated deficit of $12,745,570 (unaudited). For the year ended December 31, 2021, we incurred a net loss of $5,348,604 (unaudited) and, as of that date, we had an accumulated deficit of $3,418,333 (unaudited). Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

Our financial statements are not independently audited, which could result in errors and/or omissions in our financial statements if proper standards are not applied. We are not required to have our financial statements audited by a firm that is certified by the Public Company Accounting Oversight Board (“PCAOB”). As such, we do not have a third party reviewing the accounting. We may also not be up to date with all publications and releases released by the PCAOB regarding accounting standards and treatments. This circumstance could mean that our unaudited financials may not properly reflect up to date standards and treatments resulting misstated financials statements.

There is doubt about our ability to continue as a viable business. We have not earned a profit from our operations during recent financial periods. There is no assurance that we will ever earn a profit from our operations in future financial periods.

We may be unable to obtain sufficient capital to implement our full plan of business. Currently, we do not have sufficient financial resources with which to establish our business strategies. There is no assurance that we will be able to obtain sources of financing, including in this offering, in order to satisfy our working capital needs.

| 4 |

We do not have a successful operating history. For the year ended December 31, 2021, and the nine months ended September 30, 2022, we generated no revenues and reported a net loss from operations, which makes an investment in the Offered Shares speculative in nature. Because of this lack of operating success, it is difficult to forecast our future operating results. Additionally, our operations will be subject to risks inherent in the implementation of new business strategies, including, among other factors, efficiently deploying our capital, developing and implementing our marketing campaigns and strategies and developing greater awareness. Our performance and business prospects will suffer if we are unable to overcome the following challenges, among others:

| · | our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to continue as a going concern; | |

| · | our ability to execute our business strategies; | |

| · | our ability to manage our expansion, growth and operating expenses; | |

| · | our ability to finance our business; | |

| · | our ability to compete and succeed in a highly competitive industry; and | |

| · | future geopolitical events and economic crisis. |

We have limited operational history in an emerging industry, making it difficult to predict and forecast accurately business operations. As we have limited operations in our business and have yet to generate revenue, it is extremely difficult to make accurate predictions and forecasts on our finances. This is compounded by the fact that we intend to operate in the transportation industry, which is a rapidly transforming and highly competitive industry. There is no assurance that we will be able to establish our road-to-rail transportation business.

We may not be successful in establishing our electric or autonomous road to rail transportation business model. We are unable to offer assurance that we will be successful in establishing our electric and autonomous road-to-rail transportation business model. Should we fail to do so, you can expect to lose your entire investment in the Offered Shares.

There are risks and uncertainties encountered by under-capitalized companies. As an under-capitalized company, we are unable to offer assurance that we will be able to overcome our lack of capital, among other challenges.

We may never earn a profit in future financial periods. Because we lack a successful operating history, we are unable to offer assurance that we will ever earn a profit in future financial periods.

If we are unable to manage future expansion effectively, our business may be adversely impacted. In the future, we may experience rapid growth in our operations, which could place a significant strain on our company’s infrastructure, in general, and our internal controls and other managerial, operating and financial resources, in particular. If we are unable to manage future expansion effectively, our business would be harmed. There is, of course, no assurance that we will enjoy rapid development in our business.

We currently depend on the efforts of our Chief Executive Officer; the loss of this executive could disrupt our operations and adversely affect the further development of our business. Our success in establishing implementing our real estate business strategies will depend, primarily, on the continued service of our Chief Executive Officer, Braden Jones. The loss of service of Mr. Goiodman, for any reason, could seriously impair our ability to execute our business plan, which could have a materially adverse effect on our business and future results of operations. We have not entered into an employment agreement with Mr. Jones. We have not purchased any key-man life insurance.

If we are unable to recruit and retain key personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business may be harmed. Our failure to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees could adversely affect our long-term strategic planning and execution.

| 5 |

Our planned electric and autonomous road-to-rail transportation business is not based on independent market studies. We have not commissioned any independent market studies with respect to the electric and autonomous transportation industry. Rather, our plans for implementing our electric and autonomous transportation business and achieving profitability are based on the experience, judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in establishing our business.

Servicing our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our debt. Our ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness, including the outstanding convertible notes, depends on our future performance, which is subject to economic, financial, competitive and other factors beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations.

Our operating expenses could increase without a corresponding increase in revenues. Our operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on our consolidated financial results and on an investment in the Offered Shares. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

Changes in the economy could have a detrimental impact on our company. Changes in the general economic climate could have a detrimental impact on transportation expenditure and, therefore, on our future revenue, if any. It is possible that recessionary pressures and other economic factors may adversely affect overall business confidence and willingness to sustain or increase expenditures. Any of such events or occurrences could have a material adverse effect on our financial results and on your investment in the Offered Shares.

Our lack of adequate directors and officers liability insurance may also make it difficult for us to retain and attract talented and skilled directors and officers. In the future, we may be subject to litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance, the amounts we would pay to indemnify our officers and directors, should they be subject to legal action based on their service to our company, could have a material adverse effect on our financial condition, results of operations and liquidity. Further, our lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business.

Our Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegates such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operations.

| 6 |

Risks Related to Our Electric and Autonomous Road-to-Rail Business

We may not be able to compete effectively in the electric or autonomous trucking or rail transportation markets. The trucking and rail industries are dominated by many large conglomerate companies and many tech companies with deep pockets are entering into the electric and autonomous trucking industry. Tesla, Einride and XOS Trucks are among the most well-known of our competitors. Many of our competitors possess substantially greater resources, financial and otherwise, than does our company. No assurances can be given that we will be able to compete successfully in the electric and autonomous trucking industry.

Our long-term success will be dependent upon our ability to achieve market acceptance of our Glīd road-to-rail transportation services. There is no guarantee that our Glīd road-to-rail transportation services, once established, will be successfully accepted by businesses utilizing transportation services. There is no guarantee that we will be able to achieve such market acceptance.

Introduction of new products and services by competitors could harm our competitive position and results of operations. The market for our planned electric and autonomous road to rail transportation service is characterized by intense competition, evolving industry standards, evolving business and distribution models, price cutting, with resulting downward pressure on gross margins, and price sensitivity on the part of consumers. Our future success will depend on our ability to gain recognition of Glīd’s road-to-rail transportation services and customer loyalty, as well as our being able to anticipate and respond to emerging standards and other unforeseen changes. If we fail to satisfy such standards of operation, our operating results could suffer. Further, intra-industry consolidations may result in stronger competitors and may, therefore, also harm our future results of operations.

If our efforts to attract and retain customers to our business model is not successful, our business will be adversely affected. Our ability to attract, and to continue to attract, customers to our electric and autonomous road-to-rail transportation business will depend, in part, on our ability consistently to provide customers with affordable and reliable service. If customers do not perceive our service to be of value, we may not be able to attract and retain customers. If we do not grow as expected, we may not be able to adjust our expenditures commensurate with the lowered growth rate such that our margins, liquidity and results of operation may be adversely impacted. If we are unable to compete successfully with current and new competitors in both retaining existing subscribers and attracting new subscribers, our business will be adversely affected.

Changes in competitive offerings for electric or autonomous road to rail transportation solutions, could adversely impact our business. Technology is rapidly advancing in the realms of electric vehicles and autonomous technologies. New technologies, electric battery production restrictions or other regulations could adversely impact our business.

New entrants may enter the market or existing providers may adjust their services with unique offerings or approaches to providing road-to-rail transportation solutions. Companies also may enter into business combinations or alliances that strengthen their competitive positions. If we are unable to compete successfully or profitably with current and new competitors, our business will be adversely affected, and we may not be able to increase or maintain market share, revenues or profitability.

If we fail to maintain a positive reputation with customers concerning our planned road to rail transportation services, we may not be able to attract or retain customers, and our operating results may be adversely affected. We believe that a positive reputation with consumers concerning our planned road to rail transportation services, once launched, is highly important in attracting and retaining customers who have a number of choices from which to obtain transportation services. To the extent Glīd’s products or services are perceived as low quality, unreliable or otherwise not compelling to customers, our ability to establish and maintain a positive reputation may be adversely impacted.

| 7 |

Any significant disruption in, or unauthorized access to, our computer management systems or those of third parties utilized in our operations, including those relating to cybersecurity or arising from cyber-attacks, could result in a loss or degradation of service, unauthorized disclosure of data, including customer information, or theft of intellectual property, which could adversely impact our business. Our reputation and ability to attract, retain and serve customers is dependent upon the reliable performance and security of our computer systems and those of third parties utilized in our operations. These systems may be subject to damage or interruption from earthquakes, adverse weather conditions, other natural disasters, terrorist attacks, power loss, telecommunications failures and cybersecurity risks. Interruptions in these systems, or with the internet in general, could make our services unavailable or degraded or otherwise hinder our ability to deliver to our customers. Service interruptions, errors in software or the unavailability of computer systems used in operations could diminish the overall attractiveness of our company to existing and potential customers.

Our computer systems and those of third parties used in our operations are vulnerable to cybersecurity risks, including computer viruses, physical or electronic break-ins and similar disruptions. Any attempt by hackers to obtain our data or intellectual property, disrupt our operations, or otherwise access to our systems, or those of associated third parties, if successful, could harm our business, be expensive to remedy and damage our reputation. We will implement certain systems and processes to thwart hackers and protect our data and systems. Any significant disruption to our business operations could result in a loss of customes and adversely affect our business and results of operation.

If government regulations relating to the transportation or other areas of our business change or are increased, we may need to alter the manner in which we conduct our business, or incur greater operating expenses. The adoption or modification of laws or regulations relating to electric and/or autonomous vehicles or other areas of our business could limit or otherwise adversely affect the manner in which we currently conduct our business, once established. In addition, the continued growth and development of the market for electric batteries may cause shortages, which may lead to slower production time lines or decreased capacities.

Privacy concerns could limit our ability to collect and leverage our customer data and disclosure of customer data could adversely impact our business and reputation. In the ordinary course of business, we will collect and utilize data supplied our customers and their shipments. We currently face certain legal obligations regarding the manner in which we treat such information. Increased regulation of data utilization practices, including self-regulation or findings under existing laws that limit its ability to collect, transfer and use data, could have an adverse effect on our business.

Our reputation and our relationships with customers would be harmed if customer data, particularly transportation logs or shipping manifests, were to be accessed by unauthorized persons. We will maintain certain customer data, including names and billing data, and shipping manifest information. Initially, this data will be maintained on third-party systems. With respect to billing data, such as credit card numbers, we will rely on licensed encryption and authentication technology to secure such information. Measures will be taken to protect against unauthorized intrusion into our company’s customers’ data. Despite these measures, our third-party payment processing services could experience an unauthorized intrusion into our customers’ data. Additionally, we could face legal claims or regulatory fines or penalties for such a breach. The costs relating to any data breach could be material, and we do not expect to carry insurance against the risk of a data breach for the foreseeable future. For these reasons, should an unauthorized intrusion into customers’ data occur, our business could be adversely affected.

If our trademarks and other proprietary rights are not adequately protected to prevent use or appropriation by competitors, the value of the our brand or intellectual property may be diminished, and our business adversely affected. We rely, and expect to continue to rely, on a combination of confidentiality and license agreements with employees, consultants and third parties with whom we have relationships, as well as trademark, copyright, patent and trade secret protection laws, to protect our proprietary rights. If the protection of our intellectual property rights is inadequate to prevent use or misappropriation by third parties, the value of our company may be diminished, competitors may be able to more effectively mimic our technologies and methods of operations, the perception of our business and service to customers and potential customers may become confused in the marketplace, and our ability to attract customers may be adversely affected.

| 8 |

Our success will depend on external factors within the transportation industry. The success of our planned services will depend on our ability to establish our Glīder technology from which to provide our planned services. Thereafter, the success of our business will also depend upon:

| · | creating effective distribution channels and brand awareness; | |

| · | critical reviews; | |

| · | the availability of alternatives; | |

| · | general economic conditions; and | |

| · | other tangible and intangible factors. |

Risks Related to Securities Compliance and Regulation

We will not have reporting obligations under Sections 14 or 16 of the Securities Exchange Act of 1934, nor will any shareholders have reporting requirements of Regulation 13D or 13G, nor Regulation 14D. So long as our common shares are not registered under the Exchange Act, our directors and executive officers and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange Act. Section 16(a) of the Exchange Act requires executive officers and directors and persons who beneficially own more than 10% of a registered class of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our directors, executive officers and beneficial holders will only be available through periodic reports we file with OTC Markets.

Our common stock is not registered under the Exchange Act and we do not intend to register our common stock under the Exchange Act for the foreseeable future; provided, however, that we will register our common stock under the Exchange Act if we have, after the last day of any fiscal year, more than either (1) 2,000 persons; or (2) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act.

Further, as long as our common stock is not registered under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders and filing with the SEC a proxy statement and form of proxy complying with the proxy rules.

The reporting required by Section 14(d) of the Exchange Act provides information to the public about persons other than the company who is making the tender offer. A tender offer is a broad solicitation by a company or a third party to purchase a substantial percentage of a company’s common stock for a limited period of time. This offer is for a fixed price, usually at a premium over the current market price, and is customarily contingent on shareholders tendering a fixed number of their shares.

In addition, as long as our common stock is not registered under the Exchange Act, our company will not be subject to the reporting requirements of Regulation 13D and Regulation 13G, which require the disclosure of any person who, after acquiring directly or indirectly the beneficial ownership of any equity securities of a class, becomes, directly or indirectly, the beneficial owner of more than 5% of the class.

There may be deficiencies with our internal controls that require improvements. Our company is not required to provide a report on the effectiveness of our internal controls over financial reporting. We are in the process of evaluating whether our internal control procedures are effective and, therefore, there is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared to issuers that have conducted such independent evaluations.

| 9 |

Risks Related to Our Organization and Structure

As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including the requirements for independent board members. As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements that an issuer conducting an offering on Form S-1 or listing on a national stock exchange would be. Accordingly, we are not required to have (a) a board of directors of which a majority consists of independent directors under the listing standards of a national stock exchange, (b) an audit committee composed entirely of independent directors and a written audit committee charter meeting a national stock exchange’s requirements, (c) a nominating/corporate governance committee composed entirely of independent directors and a written nominating/ corporate governance committee charter meeting a national stock exchange’s requirements, (d) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements of a national stock exchange, and (e) independent audits of our internal controls. Accordingly, you may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of a national stock exchange.

Risks Related to a Purchase of the Offered Shares

The outstanding shares of our Series A Preferred Stock preclude current and future owners of our common stock from influencing any corporate decision. Our Chief Executive Officer, Braden Jones, owns all of the outstanding shares of our Series A Preferred Stock. The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders. Our outstanding shares of Series A Preferred Stock possess superior voting rights, which preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders. Our Chief Executive Officer, Braden Jones, is the owner of all of the outstanding shares of the Series A Preferred Stock and will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Security Ownership of Certain Beneficial Owners and Management”).

We have outstanding convertible debt instruments that could negatively affect the market price of our common stock. Certain of our outstanding convertible debt instruments could negatively affect the market price of our common stock, should their respective exercise prices, at the time of exercise, be lower than the then-market price of our common stock. We are unable, however, to predict the actual effect that the conversion of any such convertible debt instruments would have on the market price of our common stock. (See “Description of Securities—Convertible Promissory Notes”).

There is no minimum offering and no person has committed to purchase any of the Offered Shares. We have not established a minimum offering hereunder, which means that we will be able to accept even a nominal amount of proceeds, even if such amount of proceeds is not sufficient to permit us to achieve any of our business objectives. In this regard, there is no assurance that we will sell any of the Offered Shares or that we will sell enough of the Offered Shares necessary to achieve any of our business objectives. Additionally, no person is committed to purchase any of the Offered Shares.

We may seek additional capital that may result in shareholder dilution or that may have rights senior to those of our common stock. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders to experience dilution.

| 10 |

You may never realize any economic benefit from a purchase of Offered Shares. Because the market for our common stock is volatile, there is no assurance that you will ever realize any economic benefit from your purchase of Offered Shares.

We do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines can be allocated to dividends.

Our shares of common stock are Penny Stock, which may impair trading liquidity. Disclosure requirements pertaining to penny stocks may reduce the level of trading activity in the market for our common stock and investors may find it difficult to sell their shares. Trades of our common stock will be subject to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, broker-dealers must make a special suitability determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale. The SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

Our common stock is thinly traded and its market price may become highly volatile. There is currently only a limited market for our common stock. A limited market is characterized by a relatively limited number of shares in the public float, relatively low trading volume and a small number of brokerage firms acting as market makers. The market for low-priced securities is generally less liquid and more volatile than securities traded on national stock markets. Wide fluctuations in market prices are not uncommon. No assurance can be given that the market for our common stock will continue. The price of our common stock may be subject to wide fluctuations in response to factors such as the following, some of which are beyond our control:

| · | quarterly variations in our operating results; | |

| · | operating results that vary from the expectations of investors; | |

| · | changes in expectations as to our future financial performance, including financial estimates by investors; | |

| · | reaction to our periodic filings, or presentations by executives at investor and industry conferences; | |

| · | changes in our capital structure; | |

| · | announcements of innovations or new services by us or our competitors; | |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; | |

| · | lack of success in the expansion of our business operations; | |

| · | announcements by third parties of significant claims or proceedings against our company or adverse developments in pending proceedings; | |

| · | additions or departures of key personnel; | |

| · | asset impairment; | |

| · | temporary or permanent inability to offer our products and services; and | |

| · | rumors or public speculation about any of the above factors. |

| 11 |

The terms of this offering were determined arbitrarily. The terms of this offering were determined arbitrarily by us. The offering price for the Offered Shares does not necessarily bear any relationship to our company’s assets, book value, earnings or other established criteria of valuation. Accordingly, the offering price of the Offered Shares should not be considered as an indication of any intrinsic value of such securities. (See “Dilution”).

Our common stock is subject to price volatility unrelated to our operations. The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our company’s competitors or our company itself. In addition, the over-the-counter stock market is subject to extreme price and volume fluctuations in general. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

You will suffer dilution in the net tangible book value of the Offered Shares you purchase in this offering. If you acquire any Offered Shares, you will suffer immediate dilution, due to the lower book value per share of our common stock compared to the purchase price of the Offered Shares in this offering. (See “Dilution”).

As an issuer of penny stock, the protection provided by the federal securities laws relating to forward looking statements does not apply to us. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

| 12 |

Ownership Dilution

The information under “Investment Dilution” below does not take into account the potential conversion of (a) the outstanding shares of Series B Preferred Stock into at a total of 500,000,000 shares of our common stock and (b) the outstanding shares of Series C Preferred Stock into at a total of 250,000,000 shares of our common stock. The conversion of the outstanding shares of Series B Preferred Stock and the Series C Preferred Stock into shares of our common stock would cause holders of our common stock, including the Offered Shares, to incur significant dilution in their ownership of our company. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares,” “Description of Securities” and “Security Ownership of Certain Beneficial Owners and Management”).

Investment Dilution

Dilution in net tangible book value per share to purchasers of our common stock in this offering represents the difference between the amount per share paid by purchasers of the Offered Shares in this offering and the net tangible book value per share immediately after completion of this offering. In this offering, dilution is attributable primarily to our negative net tangible book value per share.

If you purchase Offered Shares in this offering, your investment will be diluted to the extent of the difference between your purchase price per Offered Share and the net tangible book value of our common stock after this offering. Our net tangible book value as of September 30, 2022, was $(591,747) (unaudited), or $(0.0004) per share. Net tangible book value per share is equal to total assets minus the sum of total liabilities and intangible assets divided by the total number of shares outstanding.

The tables below illustrate the dilution to purchasers of Offered Shares in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Offered Shares are sold.

| Assuming the Sale of 100% of the Offered Shares | |||||

|

Assumed offering price per share Net tangible book value per share as of September 30, 2022 (unaudited) Increase in net tangible book value per share after giving effect to this offering Pro forma net tangible book value per share as of September 30, 2022 (unaudited) Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$__[0.001-0.005] $(0.0004) $__[0.0003-0.0011] $__[(0.0001)-0.0007] $__[0.0011-0.0043] |

||||

| Assuming the Sale of 75% of the Offered Shares | |||||

|

Assumed offering price per share Net tangible book value per share as of September 30, 2022 (unaudited) Increase in net tangible book value per share after giving effect to this offering Pro forma net tangible book value per share as of September 30, 2022 (unaudited) Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$__[0.001-0.005] $(0.0004) $__[0.0003-0.0008] $__[(0.0001)-0.0004] $__[0.0011-0.0046] |

||||

| Assuming the Sale of 50% of the Offered Shares | |||||

|

Assumed offering price per share Net tangible book value per share as of September 30, 2022 (unaudited) Increase in net tangible book value per share after giving effect to this offering Pro forma net tangible book value per share as of September 30, 2022 (unaudited) Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$__[0.001-0.005] $(0.0004) $__[0.0002-0.0006] $__[(0.0002)-0.0002 $__[0.0012-0.0048] |

||||

| Assuming the Sale of 25% of the Offered Shares | |||||

|

Assumed offering price per share Net tangible book value per share as of September 30, 2022 (unaudited) Increase in net tangible book value per share after giving effect to this offering Pro forma net tangible book value per share as of September 30, 2022 (unaudited) Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$__[0.001-0.005] $(0.0004) $__[0.0002-0.0003] $__[(0.0002)-(0.0001)] $__[0.0012-0.0051] |

||||

| 13 |

The table below sets forth the estimated proceeds we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares and assuming the payment of no sales commissions or finder’s fees. There is, of course, no guaranty that we will be successful in selling any of the Offered Shares in this offering.

| Assumed Percentage of Offered Shares Sold in This Offering | |||||||||||||||

| 25% | 50% | 75% | 100% | ||||||||||||

| Offered Shares sold | 100,000,000 | 200,000,000 | 300,000,000 | 400,000,000 | |||||||||||

| Gross proceeds | $ | [100,000-500,000] | $ | [200,000-1,000,000] | $ | [300,000-1,500,000] | $ | [400,000-2,000,000] | |||||||

| Offering expenses | 20,000 | 20,000 | 20,000 | 20,000 | |||||||||||

| Net proceeds | $ | [80,000-480,000] | $ | [180,000-980,000] | $ | [280,000-1,480,000] | $ | [380,000-1,980,000] | |||||||

The table below sets forth the manner in which we intend to apply the net proceeds derived by us in this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares. All amounts set forth below are estimates.

Use of Proceeds for Assumed Percentage of Offered Shares Sold in This Offering | |||||||||||||||

| 25% | 50% | 75% | 100% | ||||||||||||

| Prototype Development | $ | [50,000-300,000] | $ | [100,000-600,000] | $ | [150,000-900,000] | $ | [200,000-1,200,000] | |||||||

| Software Development | [10.000-60,000] | [25,000-100,000] | [25,000-100,000] | [40,000-200,000] | |||||||||||

| Safety Testing | [0-20,000] | [5,000-50,000] | [25,000-100,000] | [25,000-150,000] | |||||||||||

| General and Administrative | [10,000-50,000] | [25,000-115,000] | [40,000-190,000] | [57,500-215,000] | |||||||||||

| Working Capital | [10,000-50,000] | [25,000-115,000] | [40,000-190,000] | [57,500-215,000] | |||||||||||

| Total Net Proceeds | $ | [80,000-480,000] | $ | [180,000-980,000] | $ | [280,000-1,480,000] | $ | [380,000-1,980,000] | |||||||

We reserve the right to change the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made with respect to the industry in which we operate, general economic conditions and our future revenue and expenditure estimates.

Investors are cautioned that expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing funds. Currently, we do not have any committed sources of financing.

| 14 |

In General

Our company is offering a maximum of 400,000,000 Offered Shares on a best-efforts basis, at a fixed price of $[0.001-0.005] per Offered Share; any funds derived from this offering will be immediately available to us for our use. There will be no refunds. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

There is no minimum number of Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will be immediately available for use by us, in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular. No funds will be placed in an escrow account during the offering period and no funds will be returned, once an investor’s subscription agreement has been accepted by us.

We intend to sell the Offered Shares in this offering through the efforts of our Chief Executive Officer, Braden Jones. Mr. Jones will not receive any compensation for offering or selling the Offered Shares. We believe that Mr. Jones is exempt from registration as a broker-dealers under the provisions of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934 (the Exchange Act). In particular, Mr. Jones:

| · | is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and | |

| · | is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and | |

| · | is not an associated person of a broker or dealer; and | |

| · | meets the conditions of the following: | |

| · | primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and | |

| · | was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and | |

| · | did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

As of the date of this Offering Circular, we have not entered into any agreements with selling agents for the sale of the Offered Shares. However, we reserve the right to engage FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to 8% of the gross offering proceeds from their sales of the Offered Shares. In connection with our appointment of a selling broker-dealer, we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our non-exclusive sales agent in consideration of our payment of commissions of up to 8% on the sale of Offered Shares effected by the broker-dealer.

Procedures for Subscribing

If you are interested in subscribing for Offered Shares in this offering, please submit a request for information by e-mail to Mr. Jones at: braden@genesis-electronics.com; all relevant information will be delivered to you by return e-mail.

Thereafter, should you decide to subscribe for Offered Shares, you are required to follow the procedures described therein, which are:

| · | Electronically execute and deliver to us a subscription agreement; and | |

| · | Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank account. |

Right to Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred to us, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

| 15 |

Acceptance of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Offered Shares subscribed. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

This Offering Circular will be furnished to prospective investors upon their request via electronic PDF format and will be available for viewing and download 24 hours per day, 7 days per week on our company’s page on the SEC’s website: www.sec.gov.

An investor will become a shareholder of our company and the Offered Shares will be issued, as of the date of settlement. Settlement will not occur until an investor’s funds have cleared and we accept the investor as a shareholder.

By executing the subscription agreement and paying the total purchase price for the Offered Shares subscribed, each investor agrees to accept the terms of the subscription agreement and attests that the investor meets certain minimum financial standards. (See “State Qualification and Investor Suitability Standards” below).

An approved trustee must process and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

Minimum Purchase Requirements

You must initially purchase at least $10,000 of the Offered Shares in this offering. If you have satisfied the minimum purchase requirement, any additional purchase must be in an amount of at least $1,000.

State Law Exemption and Offerings to Qualified Purchasers

State Law Exemption. This Offering Circular does not constitute an offer to sell or the solicitation of an offer to purchase any Offered Shares in any jurisdiction in which, or to any person to whom, it would be unlawful to do so. An investment in the Offered Shares involves substantial risks and possible loss by investors of their entire investments. (See “Risk Factors”).

The Offered Shares have not been qualified under the securities laws of any state or jurisdiction. Currently, we plan to sell the Offered Shares in Colorado, Connecticut, Delaware, Georgia, Nevada, Puerto Rico and New York. However, we may, at a later date, decide to sell Offered Shares in other states. In the case of each state in which we sell the Offered Shares, we will qualify the Offered Shares for sale with the applicable state securities regulatory body or we will sell the Offered Shares pursuant to an exemption from registration found in the applicable state’s securities, or Blue Sky, law.

Certain of our offerees may be broker-dealers registered with the SEC under the Exchange Act, who may be interested in reselling the Offered Shares to others. Any such broker-dealer will be required to comply with the rules and regulations of the SEC and FINRA relating to underwriters.

Investor Suitability Standards. The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings.

Issuance of the Offered Shares

Upon settlement, that is, at such time as an investor’s funds have cleared and we have accepted an investor’s subscription agreement, we will either issue such investor’s purchased Offered Shares in book-entry form or issue a certificate or certificates representing such investor’s purchased Offered Shares.

| 16 |

Transferability of the Offered Shares

The Offered Shares will be generally freely transferable, subject to any restrictions imposed by applicable securities laws or regulations.

Advertising, Sales and Other Promotional Materials

In addition to this Offering Circular, subject to limitations imposed by applicable securities laws, we expect to use additional advertising, sales and other promotional materials in connection with this offering. These materials may include information relating to this offering, articles and publications concerning industries relevant to our business operations or public advertisements and audio-visual materials, in each case only as authorized by us. In addition, the sales material may contain certain quotes from various publications without obtaining the consent of the author or the publication for use of the quoted material in the sales material. Although these materials will not contain information in conflict with the information provided by this Offering Circular and will be prepared with a view to presenting a balanced discussion of risk and reward with respect to the Offered Shares, these materials will not give a complete understanding of our company, this offering or the Offered Shares and are not to be considered part of this Offering Circular. This offering is made only by means of this Offering Circular and prospective investors must read and rely on the information provided in this Offering Circular in connection with their decision to invest in the Offered Shares.

| 17 |

General

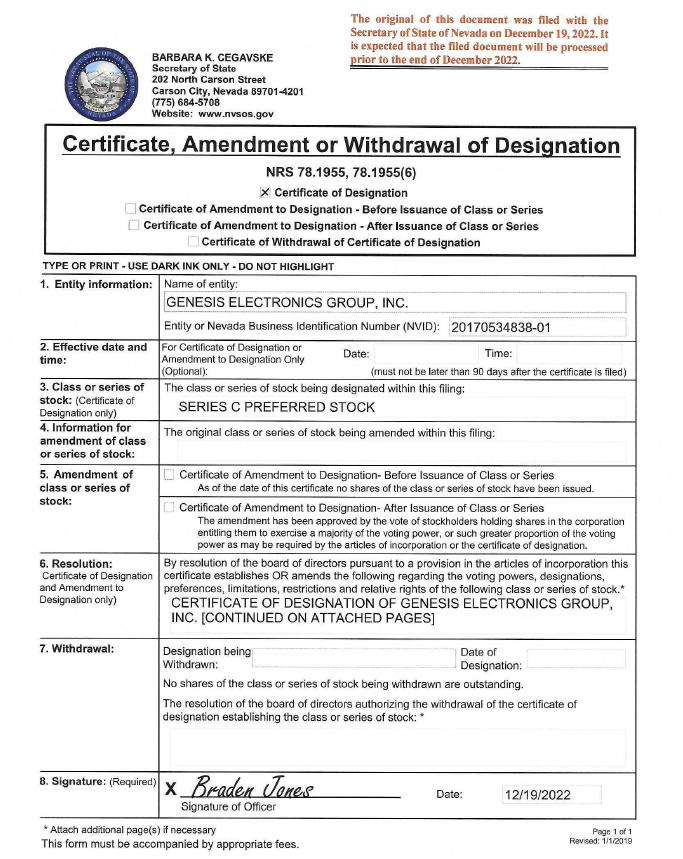

Our authorized capital stock consists of (a) 5,000,000,000 shares of common stock, $.001 par value per share; and (b) 1,000,000 shares of preferred stock, $.001 par value per share, of which (1) 1,000 shares are designated Series A Preferred Stock, (2) 500,000 shares are designated Series B Preferred Stock and (3) 20,000 shares are designated Series C Preferred Stock.

As of the date of this Offering Circular, there were (w) 1,723,775,755 shares of our common stock issued and outstanding held by 531 holders of record; (x) 1,000 shares of Series A Preferred Stock were issued and outstanding held by one (1) holder of record; (y) 50,000 shares of Series B Preferred Stock were issued and outstanding held by two holders of record; and (z) 20,000 shares of Series C Preferred Stock were issued and outstanding held by two holders of record.

Common Stock

General. The holders of our common stock currently have (a) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by our Board of Directors; (b) are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of our company; (c) do not have preemptive, subscriptive or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (d) are entitled to one non-cumulative vote per share on all matters on which shareholders may vote. Our Bylaws provide that, at all meetings of the shareholders for the election of directors, a plurality of the votes cast shall be sufficient to elect. On all other matters, except as otherwise required by Nevada law or our Articles of Incorporation, as amended, a majority of the votes cast at a meeting of the shareholders shall be necessary to authorize any corporate action to be taken by vote of the shareholders.

Non-cumulative Voting. Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

Pre-emptive Rights. As of the date of this Offering Circular, no holder of any shares of our capital stock has pre-emptive or preferential rights to acquire or subscribe for any unissued shares of any class of our capital stock not otherwise disclosed herein.

Series A Preferred Stock

Voting Rights. The Series A Preferred Stock has the following voting rights: as a class, the Series A Preferred Stock shall have the right to vote in an amount equal to 51% of the total voting power of our company’s shareholders.

100% of our Series A Preferred Stock is owned by our Chief Executive Officer, Braden Jones. Due to the superior voting rights of the Series A Preferred Stock, Mr. Jones will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Security Ownership of Certain Beneficial Owners and Management” and “Certain Transactions”).

Dividends. The shares of Series A Preferred Stock shall be entitled to no dividends.

| 18 |

Liquidation Preference. In the event of liquidation, dissolution or winding up of our company, either voluntary or involuntary,

the holder(s) of the Series A Preferred Stock will not be entitled to receive any of the assets of our company.

Conversion Rights. The Series A Preferred Stock has no voting rights.

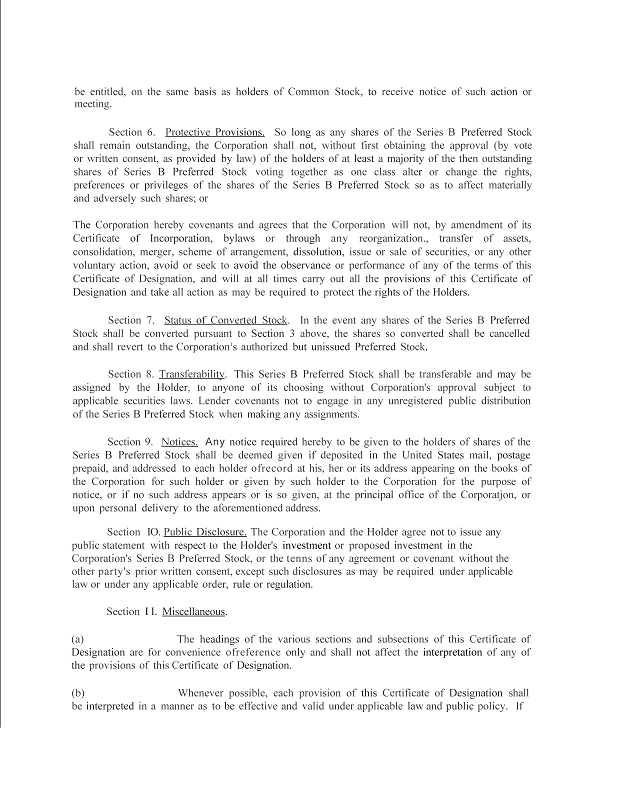

Series B Preferred Stock

Voting Rights. The Series B Preferred Stock has the following voting rights: with respect to each matter submitted to a vote of our shareholders, each holder of Series B Preferred Stock shall be entitled to cast that number of votes which is equivalent to the number of shares of Series B Preferred Stock owned by such holder.

Dividends. The shares of Series B Preferred Stock shall be entitled to dividends as may be declared by our Board of Directors.

Liquidation Preference. In the event of any liquidation, dissolution or winding up of our company, either voluntary or involuntary, the holder of each outstanding share of the Series B Preferred Stock shall be entitled to receive, out of our assets available for distribution to our shareholders upon such liquidation, whether such assets are capital or surplus of any nature, an amount equal to Ten Dollars ($10.00) for each such share of the Series B Preferred Stock (as adjusted for any combinations, consolidations, stock distributions or stock dividends with respect to such shares), plus all dividends, if any, declared and unpaid thereon as of the date of such distribution, before any payment shall be made or any assets distributed to the holders of our common stock, and, after such payment, the remaining assets of our company shall be distributed to the holders of common stock.

Conversion Rights. Each share of Series B Preferred Stock is convertible into a number of shares of common stock that is equal to the Share Value, $10.00, divided by the per share Conversion Price, $0.001, or 10,000 shares of common stock; provided, however, that, in no event shall the holder of shares of Series B Preferred Stock be entitled to convert any Series B Preferred Stock, such that, upon conversion, such holder’s ownership of common stock would exceed 4.99% of the then-outstanding shares of common stock.

Series C Preferred Stock

Stated Value. The Series C Preferred Stock has a Stated Value of $100.00 per share.

Voting Rights. The Series C Preferred Stock shall vote on an “as-converted” basis, together with the outstanding shares of our common stock.

Dividends. The Series C Preferred Stock shall be treated pari passu with the our common stock, except that the dividend on each share of Series C Preferred Stock shall be equal to the amount of the dividend declared and paid on each share of our common stock multiplied by the then-applicable Conversion Price.

Conversion Rights. Each share of Series C Preferred Stock is convertible into a number of shares of common stock that is equal to the Stated Value, $100.00, divided by the per share Conversion Price, $0.008, or 12,500 shares of common stock.

Liquidation Preference. Upon any liquidation, dissolution or winding up of our company, whether voluntary or involuntary, payments to the holders of Series C Preferred Stock shall be treated pari passu with our common stock, except that the payment on each share of Series C Preferred Stock shall be an amount equal to $100.00 for each such share of the outstanding Series C Preferred Stock held by such holder, plus all dividends, if any, declared and unpaid thereon as of the date of such distribution, before any payment shall be made or any assets distributed to the holders of our common stock, and, after such payment, our remaining assets shall be distributed to the holders of our common stock.

| 19 |

Convertible Promissory Notes

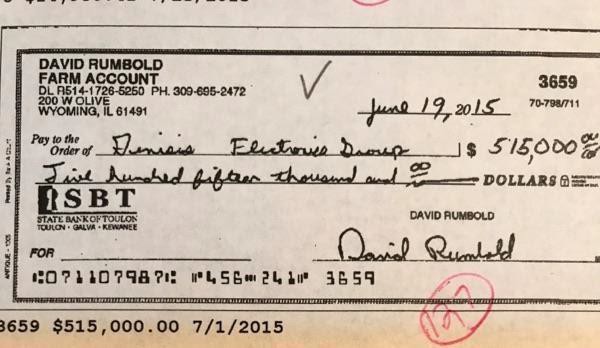

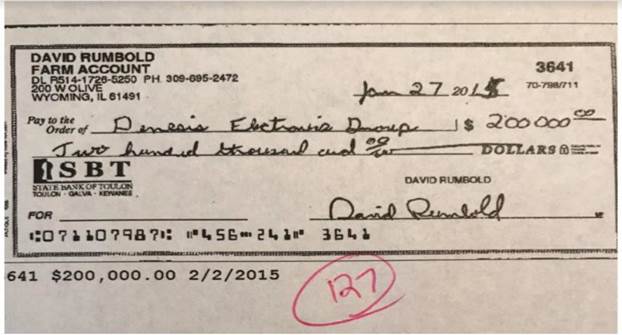

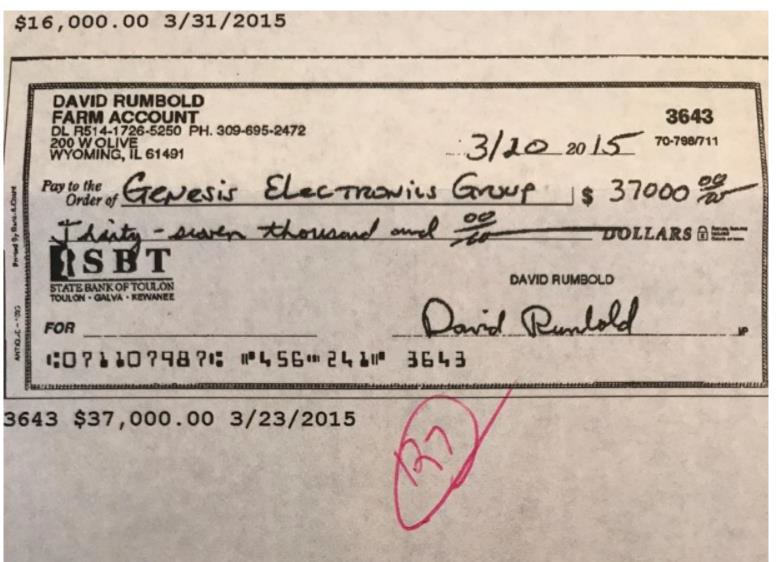

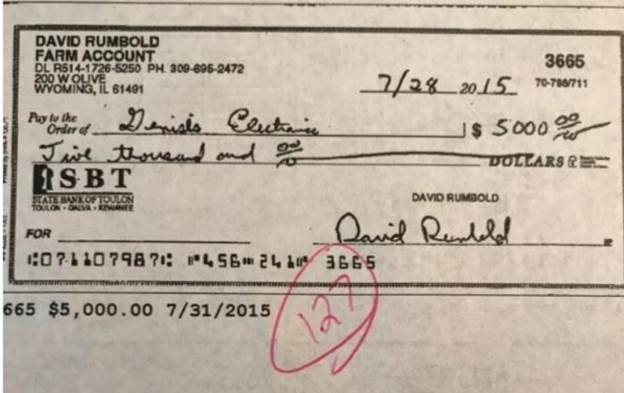

As of September 30, 2022, we had outstanding the notes indicated in the table below.

|

Date of Note Issuance |

Outstanding Balance |

Principal Amount at Issuance |

Accrued Interest |

Maturity Date |

Conversion Terms |

Name of Noteholder |

Reason for Issuance |

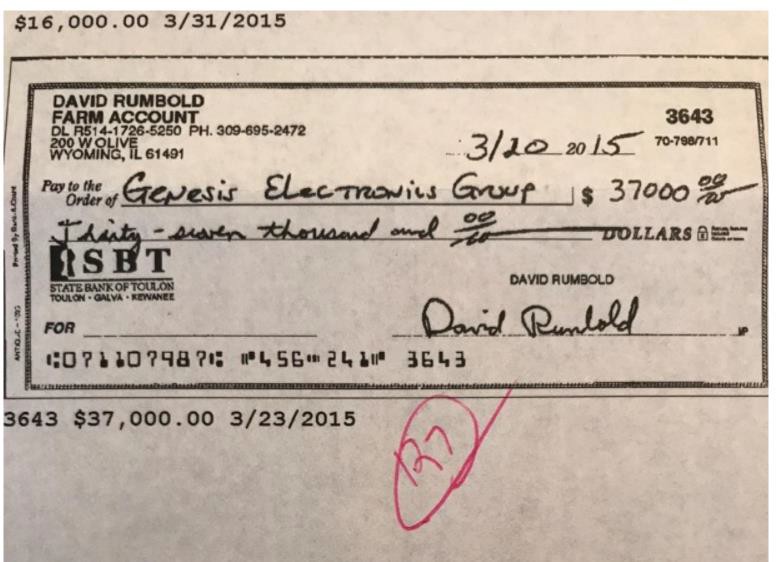

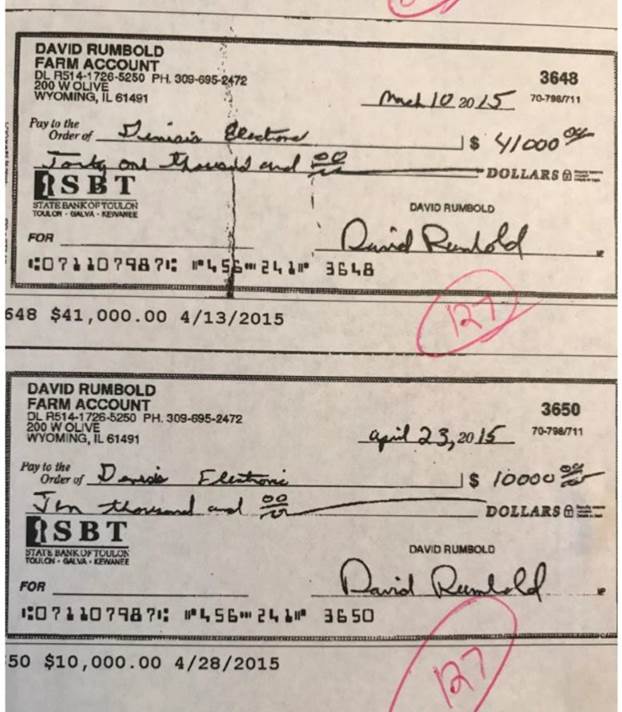

| 04/20/2022 | $10,223 | $10,000 | $223 | 04/20/2022 | Conversion Price: N/A | Altus Advisors, LLC (Brian Kessigner) | Loan |

|

05/23/2022

|

$514,309 | $500,000 | $14,309 | 05/23/2022 | Conversion Price: $0.001 per share | Loyal Technologies, LLC (Chad MacKay) | Exchanged for court judgments |

| 08/11/2022 | $11,645 | $11,550 | $95 | 08/11/2022 | Conversion Price: 50% of the 10-day VWAP | Newpath Capital, LLC (Dennis Wynn) | Purchase of Rubold Note |

|

08/17/2022

|

$9,972 | $9,900 | $72 | 08/17/2022 | Conversion Price: 50% of the 10-day VWAP | Andrew Van Noy | Purchase of Rubold Note |

| 08/19/2022 | $20,000 | $20,000 | $-0- | 08/19/2022 | Convertible at fixed price in any future Regulation A offering | Synnestvedt Retirement Trust (Ben Oates) | Loan |

|

08/26/2022

|

$100,575 | $100,000 | $575 | 08/26/2022 | Conversion Price: 50% of the 10-day VWAP | South Coastal Investments, LLC (Tru Le) | Purchase of Rubold Note |

| 09/15/2022 | $61,853 | $61,600 | $253 | 09/15/2022 | Conversion Price: 45% of 30-day lowest price | Boot Capital, LLC (Peter Rosten) | Loan |

Subsequent to September 30, 2022, we issued a convertible promissory note in connection with our acquisition of Glīd LLC, which is described in the table below.

|

Date of Note Issuance |

Outstanding Balance |

Principal Amount at Issuance |

Accrued Interest |

Maturity Date |

Conversion Terms |

Name of Noteholder |

Reason for Issuance |

| 10/25/2022 | $2,022,000 | $2,000,000 | $22,000 | 10/25/2023 | Conversion Price: $.005 per share | Glid LLC (Andrew Van Noy and Braden Jones) | Issued in acquisition of Glid LLC |

Dividend Policy

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Shareholder Meetings