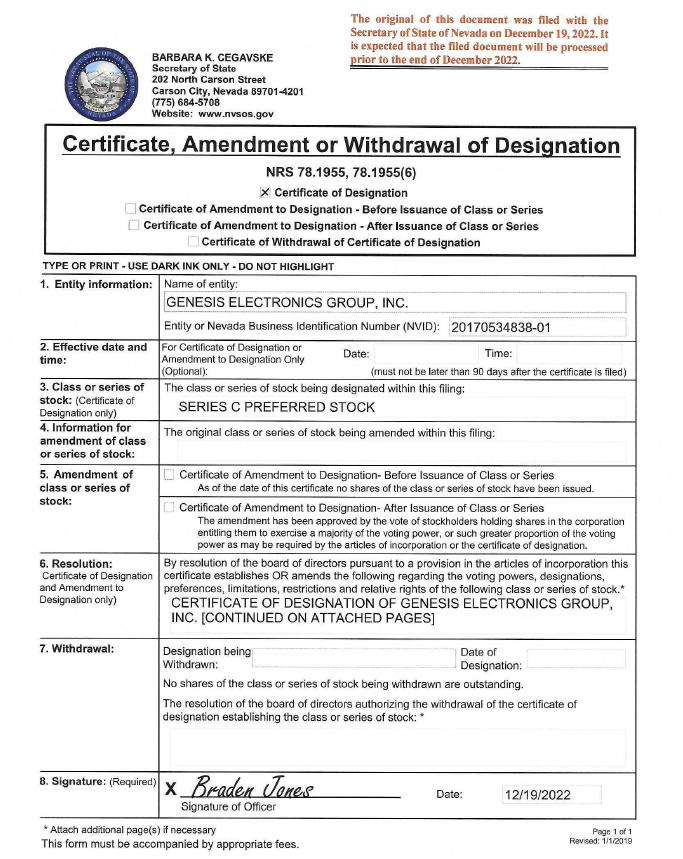

Exhibit 2.5

Filed in the Office of Secretary of State State Of Nevada Business Number C5889 - 1998 Filing Number 20222826873 Filed On 12/20/2022 8:00:00 AM Number of Pages 6

| 1 |

GENESIS ELECTRONICS GROUP, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES, RIGHTS AND LIMITATIONS

OF

SERIES C PREFERRED STOCK

PURSUANT TO SECTION 78.1955 OF THE

NEVADA REVISED STATUTES

Pursuant to Section 78.1955 of the Nevada Revised Statutes, the undersigned does hereby certify, on behalf of Genesis Electronics Group, Inc., a Nevada corporation (the "Company"), that the following resolution was duly adopted by the Board of Directors of the Company.

WHEREAS, the Articles of Incorporation of the Company, as amended (the "Articles of Incorporation"), authorize the issuance of up to 1,000,000 shares of preferred stock, par value $0.001 per share, of the Company (the "Preferred Stock") in one or more series, which Preferred Stock shall have such distinctive designation or title,voting powers or no voting powers, and such preferences, rights, qualifications, limitations or restrictions, as shall be stated in such resolution or resolutions providing for the issuance of such class or series of Preferred Stock as may be adopted from time to time by the Board prior to the issuance of any shares thereof; and

WHEREAS, it is the desire of the Board of Directors to establish and fix the number of shares to be included in a new series of Preferred Stock and the designation, rights, preferences, powers, restrictions and limitations of the shares of such new series.

NOW, THEREFORE, IT IS RESOLVED, that the Board of Directors does hereby provide for the issue of a series of Preferred Stock and does hereby in this Certificate of Designation (this "Certificate of Designation") establish and fix and herein state and express the designation, rights, preferences, powers, restrictions, and limitations of such series of Preferred Stock as follows:

TERMS OF SERIES C PREFERRED STOCK

Section 1. Designation, Amount and Par Value. The series of Preferred Stock shall be designated as Series C Preferred Stock (the "Series C Preferred Stock") and the number of shares so designated shall be Twenty Thousand (20,000).

Section 2. Stated Value. The Series C Preferred Stock shall have a stated value of $100.00 per share (the "Stated Value").

Section 3. Fractional Shares. The Series C Preferred Stock may be issued in fractional shares.

Section 4. Voting Rights. The Series C Preferred Stock shall vote on an"as-converted" basis, together with the outstanding shares of Company common stock.

Section 5. Dividends. The Series C Preferred Stock shall be treated pari passu with the Company's common stock, except that the dividend on each share of Series C Preferred Stock shall be equal to the amount of the dividend declared and paid on each share of the common stock (the "Common Stock") of the Company multiplied by the Conversion Price, as that term is defined in Section 7(a).

| 2 |

Section 6. Liquidation. Upon any liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, payments to the holders (each, a "Holder," collectively, the "Holders") of Series C Preferred Stock shall be treated pari passu with the Company's common stock, except that the payment on each share of Series C Preferred Stock shall be an amount equal to One Hundred Dollars ($100.00) for each such share of the outstanding Series C Preferred Stock held by such Holder (as adjusted for any combinations, consolidations, stock distributions or stock dividends with respect to such shares), plus all dividends, if any, declared and unpaid thereon as of the date of such distribution, before any payment shall be made or any assets distributed to the holders of the Common Stock, and, after such payment, the remaining assets of the Company shall be distributed to the holders of the Common Stock.

Section 7. Conversion and Adjustments.

(a) Conversion Price. The Series C Preferred Stock shall be convertible into shares of the Company's common stock, as follows:

Holders of Series C Preferred Stock may convert shares of Series C Preferred Stock held by them into shares of the Common Stock. The conversion price shall be $0.008 per share (the "Conversion Price"), subject to adjustments described in Section 5. The number of shares of Common Stock receivable upon conversion of one share of Series C Preferred Stock equals the Stated Value divided by the then-Conversion Price. A conversion notice (the "Conversion Notice") may be delivered to Company by the method of the Holder's choice (including, but not limited to, email, facsimile, mail, overnight courier, or personal delivery), and all conversions shall be cashless and not require further payment from the Holder. If no objection is delivered from the Company to the Holder, with respect to any variable or calculation reflected in the Conversion Notice within 48 hours of delivery of the Conversion Notice, the Company shall have been thereafter deemed to have irrevocably confirmed and irrevocably ratified such Conversion Notice and waived any objection thereto. The Company shall deliver the shares of Common Stock from any conversion to the Holder within three (3) business days of Conversion Notice delivery. If the Company is participating in the Depository Trust Company ("DTC") Fast Automated Securities Transfer ("FAST") program, then, upon request of the Holder, and provided that the shares to be issued are eligible for transfer under Rule 144 of the Securities Act of 1933, as amended (the "Securities Act"), or are effectively registered under the Securities Act, the Company shall cause its transfer agent to electronically issue the Common Stock issuable upon conversion to the Holder through the DTC Direct Registration System ("DRS"). If the Company is not participating in the DTC FAST program, then the Company agrees in good faith to apply and cause the approval for participation in the DTC FAST program.

(b) Limitation on Conversions. In no event shall the Holder be entitled to convert any Series C Preferred Stock, such that the conversion of which the sum of (1) the number of shares of Common Stock beneficially owned by the Holder and the Holder's affiliates (other than shares of Common Stock which may be deemed beneficially owned through the ownership of the unconverted portion of this Series C Preferred Stock or the unexercised or unconverted portion of any other security of the Company subject to a limitation on conversion or exercise analogous to the limitations contained herein) and (2) the number of shares of Common Stock issuable upon conversion of Series C Preferred Stock with respect to which the determination of this proviso is being made, would result in beneficial ownership by the Holder and the Holder's affiliates of more than 4.99% of the outstanding shares of Common Stock. For purposes of the proviso of the immediately preceding sentence, beneficial ownership shall be determined in accordance with Section 13(d) of the Securities Exchange Act of 1934 and Regulations 13D- G thereunder, except as otherwise provided in clause 0 of such proviso, provided, further, however, that the limitations on conversion may be waived by the Holder upon, at the election of the Holder, not less than 61 days' prior notice to the Company, and the provisions of the conversion limitation shall continue to apply until such 61st day (or such later date, as determined by the Holder, as may be specified in such notice of waiver).

(c) Adjustment to Conversion Price for Stock Dividends, Consolidations and Subdivisions. In case the Company at any time after the first issuance of a share of the Series C Preferred Stock shall declare or pay on the Common Stock any dividend in shares of Common Stock, or effect a subdivision of the outstanding shares of the Common Stock into a greater number of shares of the Common Stock (by reclassification or otherwise than by payment of a dividend payable in shares of the Common Stock), or shall combine or consolidate the outstanding shares of the Common Stock into a lesser number of shares of the Common Stock (by reclassification or otherwise), then, and in each such case, the Conversion Price (as previously adjusted) in effect immediately prior to such declaration, payment, subdivision, combination or consolidation shall, concurrently with the effectiveness of such declaration, payment, subdivision, combination or consolidation, be proportionately adjusted.

| 3 |

(d) Adjustments for Reclassifications and Certain Reorganizations. In case the Company at any time after the first issuance of a share of the Series C Preferred Stock shall reclassify or otherwise change the outstanding shares of the Common Stock, whether by capital reorganization, reclassification or otherwise, or shall consolidate with or merge with or into any other corporation where the Company is not the surviving corporation but not otherwise, then, and in each such case, each outstanding share of the Series C Preferred Stock shall, immediately after the effectiveness of such reclassification, other change, consolidation or merger, be convertible into the type and amount of stock and other securities or property which the holder of that number of shares of the Common Stock into which such share of the Series C Preferred Stock would have been convertible before the effectiveness of such reclassification, other change, consolidation or merger would be entitled to receive in respect of such shares of the Common Stock as the result of such reclassification, other change, consolidation or merger.

(e) Reservation of Stock Issuable Upon Conversion. The Company shall at all times reserve and keep available out of its authorized but unissued shares of the Common Stock, solely for the purpose of effecting the conversion of the Series C Preferred Stock, such number of shares of the Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of the Series C Preferred Stock (the "Reserve Shares"); and if at any time the number of authorized but unissued shares of the Common Stock shall not be sufficient to effect the conversion of all outstanding shares of the Series C Preferred Stock, the Company will take such corporate action as is necessary to increase its authorized by unissued shares of the Common Stock to such number of shares as shall be sufficient for such purpose. The Holder shall have the right to directly instruct the Company's transfer agent to explicitly reserve the Reserve Shares from the Company's authorized shares of Common Stock, solely for satisfying the conversion of the Series C Preferred Stock.

(f) Transfer Agent Instructions. The Holder shall have the right to directly instruct the Company's transfer agent to explicitly reserve the Reserve Shares from the Company's authorized shares of Common Stock, solely for satisfying the conversion of the Series C Preferred Stock. In the event that an opinion of counsel, such as but not limited to a Rule 144 opinion, is needed for any matter related to this Series C Preferred Stock or the Common Stock, the Holder has the right to have any such opinion provided by its own counsel.

Section 8. Protection Provisions. So long as any shares of Series C Preferred Stock are outstanding, the Company shall not, without first obtaining the unanimous written consent of the holders of Series C Preferred Stock, alter or change the rights, preferences or privileges of the Series C Preferred Stock so as to affect adversely the holders of Series C Preferred Stock.

The Company hereby covenants and agrees that the Company will not, by amendment of its Articles of Incorporation, bylaws or through any reorganization, transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Certificate of Designation, and will at all times carry out all the provisions of this Certificate of Designation and take all action as may be required to protect the rights of the Holders of the Series C Preferred Stock.

Section 9. Status of Converted Stock. In the event any shares of the Series C Preferred Stock shall be converted pursuant to Section 7 above, the shares so converted shall be cancelled and shall revert to the Company's authorized but unissued Preferred Stock.

Section 10. Transferability. This Series C Preferred Stock shall be transferable and may be assigned by the Holders, to anyone of their choosing without the Company's approval subject to applicable securities laws. Each Holder of the Series C Preferred Stock covenants not to engage in any unregistered public distribution of the Series C Preferred Stock when making any assignments.

Section 11. Notices. Any notice required hereby to be given to the Holders of shares of the Series C Preferred Stock shall be deemed given if sent by email or deposited in the United States mail, postage prepaid, and addressed to each holder of record at his, her or its address appearing on the books of the Company.

| 4 |

Section 12. Miscellaneous.

(a) The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall not affect the interpretation of any of the provisions of this Certificate of Designation.

(b) Whenever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under applicable law and publish policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

(c) Except as may otherwise be required by law, the shares of the Series C Preferred Stock shall not have any powers, designations, preferences or other special rights, other than those specifically set forth in this Certificate of Designation.

Section 13. Waiver. Any of the rights, powers or preferences of the holders of the Series C Preferred Stock may be waived by the affirmative consent or vote of the holders of at least a majority of the shares of Series C Preferred Stock then outstanding.

Section 14. No Other Rights or Privileges. Except as specifically set forth herein, the holder(s) of the shares of Series C Preferred Stock shall have no other rights, privileges or preferences with respect to the Series C Preferred Stock.

RESOLVED, FURTHER, that the president or any vice-president, and the secretary or any assistant secretary, of the Company be and they hereby are authorized and directed to prepare and file this Certificate of Designation of Preferences, Rights and Limitations in accordance with the foregoing resolution and the provisions of the Nevada Revised Statutes.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Designation this 25th day of October, 2022.

| GENESIS ELECTRONICS GROUP, INC. | |

| By: /s/ Braden Jones | |

| Braden Jones | |

| Chief Executive Officer |

| 5 |