As filed with the Securities and Exchange Commission on April 23, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Corsair Components, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3577 | 27-1735357 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

46221 Landing Parkway

Fremont, California 94538

(510) 657-8747

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nicholas B. Hawkins

46221 Landing Parkway

Fremont, California 94538

(510) 657-8747

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Thomas C. DeFilipps Palo Alto, California 94304 Telephone: (650) 565-7000 Telecopy: (650) 565-7100 |

Tad J. Freese Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 Telephone: (650) 328-4600 Telecopy: (650) 463-2600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee | ||

| Common stock, par value $0.0001 per share |

$86,250,000 | $6,150 | ||

| (1) | Includes offering price of shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion dated April 23, 2010

PRELIMINARY PROSPECTUS

Shares

Corsair Components, Inc.

Common Stock

This is the initial public offering of the common stock of Corsair Components, Inc. We are offering shares of our common stock and the selling stockholders identified in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. We estimate that the initial public offering price will be between $ and $ per share.

We intend to apply to list our common stock on the Nasdaq Global Market under the symbol “CRSR.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 13 of this prospectus.

| Per Share | Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discounts and commissions |

$ | $ | ||||

| Proceeds to Corsair, before expenses |

$ | $ | ||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||

We and the selling stockholders have granted the underwriters a 30 day option to purchase a total of up to an additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2010.

| Barclays Capital | Jefferies & Company | |

| Oppenheimer & Co. | RBC Capital Markets | |

The date of this prospectus is , 2010

| Page | ||

| 1 | ||

| 13 | ||

| Special Note Regarding Forward-Looking Statements and Market Data |

40 | |

| 41 | ||

| 42 | ||

| 43 | ||

| 45 | ||

| 48 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |

| 76 | ||

| 92 | ||

| 98 | ||

| 117 | ||

| 120 | ||

| 122 | ||

| 126 | ||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

129 | |

| 133 | ||

| 140 | ||

| 140 | ||

| 140 | ||

| F-1 |

You should rely only on the information contained in this prospectus and in any free writing prospectus that we may provide to you in connection with this offering. Neither we nor any of the selling stockholders or underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor any of the selling stockholders or underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

Until , 2010 (the 25th day after the date of this prospectus), all dealers effecting transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: Neither we nor any of the selling stockholders or underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

This summary highlights some of the information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including “Risk Factors” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Unless otherwise expressly stated or the context otherwise requires, the terms “Corsair,” “our company,” “we,” “us” and “our” and similar references in this prospectus refer to Corsair Components, Inc. and its predecessors (including Corsair Memory, Inc.) and their respective consolidated subsidiaries.

Corsair Components, Inc.

Company Overview

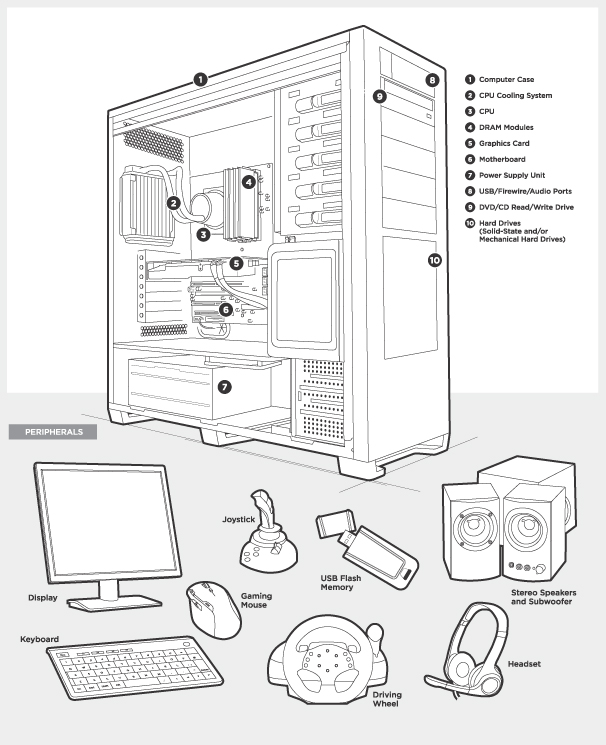

We are a leading designer and supplier of high-performance components to the personal computer, or PC, gaming hardware market. Our products are purchased primarily by PC gaming enthusiasts who build their own high-performance desktop computer systems or buy pre-assembled customized systems in order to achieve the processing speeds and graphics capabilities necessary to fully experience leading edge computer games. According to a report that we commissioned from Jon Peddie Research, a market research firm, sales in the do-it-yourself, or DIY, portion of the worldwide PC gaming hardware market are forecasted to be approximately $10.4 billion in 2010. We believe, based on our management’s estimates, that our current product portfolio addresses approximately one-third of this DIY market segment. We believe that we have a leading brand among PC gaming enthusiasts, reflecting our superior product performance, design and reliability. Over the last four years we have introduced new, higher value added PC gaming components, both leveraging and reinforcing our brand image within our target market. Through our 16 years of operation, we have developed a global, scalable operations infrastructure with extensive marketing and distribution channel relationships with distributors and retailers in Europe, the Americas and the Asia Pacific region.

We have established a strong brand that we believe is widely recognized and respected in the PC gaming hardware market. We believe that our reputation, reinforced by favorable reviews of our products within the PC gaming community, is instrumental to building and maintaining our market leadership, particularly in light of the technical sophistication of many of our end-users. Our products have won numerous awards from computer enthusiast websites, such as hexus.net, hardocp.com, xbitlabs.com, driverheaven.net (now known as hardwareheaven.net) and legitreviews.com. Our products have also been recognized by a variety of publications, such as Maximum PC, a leading PC enthusiast magazine in the United States, which included our high-performance dynamic random access memory, or DRAM, modules in their “Dream Machine” PC in 2007, 2008 and 2009, and Custom PC, a widely distributed computer enthusiast magazine in the United Kingdom, whose readers voted us as the Computer Power Supply Manufacturer of the Year in each of the last three years.

Our products are sold to end-users in more than 60 countries through our customers, primarily retailers and distributors. End-users purchase our products primarily from online and brick-and-mortar retailers, including major retailers such as Newegg.com, TigerDirect.com, Amazon.com and Best Buy in the United States, Media Markt in Germany, PC World in the United Kingdom and Surcouf in France. For the year ended December 31, 2009, despite challenging market conditions, we generated net revenues of $325.6 million, gross profit of $46.7 million, a net loss of $8.7 million and adjusted net income of $7.0 million. Adjusted net income (loss), which is not a financial measure under U.S. generally accepted accounting principles, or GAAP, is equal to net income (loss) plus tax-adjusted stock-based compensation (benefit) expense (which was an expense of $15.7 million in 2009) and is included in this prospectus to provide investors with a supplemental measure of our operating performance. See “Summary Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Measures” below for an explanation of how we compute adjusted net income (loss) and for a reconciliation to net income (loss), the most directly comparable GAAP financial measure.

1

Industry Overview

Consumers desire increasing realism in videogames and game publishers have responded with games that incorporate enhanced live-action, movie-like graphics, sophisticated game play and multi-player interactivity. Although videogames can be played on consoles, smartphones and dedicated handheld gaming devices, the most advanced games require the processing and graphics power of a high-performance gaming PC for optimal performance. The emergence of advanced, multiplayer online videogames, such as World of Warcraft, Need for Speed and Crysis, has also placed increased demands on processing speed and power by giving an inherent competitive performance advantage to players with faster systems. Moreover, gaming enthusiasts often utilize multiple large format video displays and game specific controllers, such as steering wheels and joysticks, for a more immersive experience. This increased complexity of games, along with the use of multiple displays and interface devices, require increased memory, faster processing speeds and superior graphics for optimal performance, which we believe drives the purchase of high-performance PC gaming systems and components.

The worldwide installed base of consumer PCs that could be used to play games was estimated to be approximately 228 million in 2008 and is projected to increase to more than 600 million by 2013, according to the PC Gaming Alliance, a computer gaming industry trade association. According to an independent research report by Jon Peddie Research, the worldwide PC gaming hardware market (including systems, accessories and upgrades) was estimated to be approximately $20.8 billion in sales in 2009 and is projected to grow to approximately $35.2 billion in sales in 2013, reflecting a compound annual growth rate of approximately 14.0%. In the separate report that we commissioned, Jon Peddie Research forecasts that sales in the DIY segment of the worldwide PC gaming hardware market will be approximately $10.4 billion in 2010.

Our Competitive Strengths

We are a leading provider of high-performance PC gaming hardware. We believe that we have a strong position in our target market as a result of the following competitive strengths:

| • | Strong Brand Recognition and Customer Loyalty. We have been shipping high-performance DRAM modules for over 10 years and believe that we have established ourselves as a leading brand among computer gaming enthusiasts. We deliver high-performance and reliable products that have consistently met our targeted and advertised product specifications. This has helped us create a strong brand that we believe is widely recognized and respected in the PC gaming hardware market, as well as a loyal customer base among gaming enthusiasts. |

| • | Broad and Expanding Product Portfolio. We have demonstrated the ability to grow our business by successfully expanding our product portfolio. In late 2006, we launched our first line of non-memory components by introducing high-performance power supply units and in 2009 we launched three additional product categories: solid-state drives, cooling systems and computer cases. As of March 31, 2010, these four new product categories constituted our gaming components and peripherals segment, which experienced growth in net revenues from approximately $17.3 million in 2007 to approximately $82.5 million in 2009, reflecting a compound annual growth rate of approximately 118%. |

| • | Rapid and Effective Product Development. We leverage the active online community of gaming enthusiasts to understand better the needs of our end-users, with whom we continuously communicate through forums, blogs, customer surveys, social networking websites and other media. Our website, corsair.com, which includes forums, blogs and on-line tutorials, had a monthly average of over 700,000 visits in the fourth quarter of 2009. We believe that our proactive efforts to solicit and integrate end-user feedback into our product designs enhance our ability to deliver new products within a relatively short time frame and provide us with significant competitive advantages. |

| • | Global Sales and Distribution Network. In over 16 years of operation, we have developed a comprehensive global marketing and distribution network with representation in major markets |

2

| worldwide. We currently ship to more than 60 countries and to major retailers including Newegg.com, TigerDirect.com, Amazon.com and Best Buy in the United States, Media Markt in Germany, PC World in the United Kingdom and Surcouf in France. |

| • | Scalable and Efficient Operating Model. We maintain a highly scalable and efficient operating model designed to manage the global supply chain of an increasingly diverse mix of products. As we have expanded our product portfolio, we have developed increasingly sophisticated tools for forecasting and managing our supply chain, freight costs and inventory in a variety of economic environments. |

Our Growth Strategy

We intend to maintain and extend our position as a leading provider of high-performance PC gaming hardware by pursuing the following growth strategies:

| • | Increase Product Sales to our Core Gaming Enthusiast Market. Our goal is to be the leading provider of high-performance components for the PC gaming enthusiast. Our strategy is to maintain and strengthen our position as a leading provider of DRAM modules to the PC gaming market, while growing the market share of our newer product categories. |

| • | Expand our Served Market. We seek to expand our end-user base and end markets by introducing new peripheral products intended to appeal to consumers in the significantly larger mainstream PC gaming market. We intend to leverage our brand and apply our expertise with existing technologies, our product development capabilities and our knowledge of customer requirements in order to enter product categories such as audio products, which we are currently developing, and input/output devices that are designed to appeal to both mainstream and enthusiast PC gamers. |

| • | Leverage our Scalable Operating and Business Model. We intend to continue to leverage our flexible operating model, which has allowed us to limit our operating expenses and deploy our capital efficiently, despite sometimes challenging market conditions. We believe that our global and scalable operations infrastructure and outsourced manufacturing model can support meaningful growth with modest incremental capital investment. |

| • | Build on our Existing Infrastructure to Address Growing Opportunities in the Asia Pacific Region. For the year ended December 31, 2009, sales to the Asia Pacific markets generated 12.7% of our net revenues, with most of our sales in that region coming from Australia and Japan. We believe that there are significant opportunities in China, India and other Asian markets with substantial populations as consumer spending on PC gaming hardware increases with growth in disposable income. |

| • | Pursue Selective Complementary Acquisitions. The markets for some of our products are highly fragmented, with a number of relatively small suppliers, some of which may lack the necessary resources to market and distribute their products effectively. We plan to evaluate, and may pursue, acquisitions that diversify our product offerings and broaden our end-user base or expand our geographic presence. |

Risks Affecting Us

Our business is subject to numerous risks, including those described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks represent challenges to the implementation of our strategy and to the success of our business. These risks include the following:

| • | integrated circuits account for most of the cost of producing our DRAM modules, USB flash drives and solid-state drives and fluctuations in the market price of integrated circuits may have a material impact on our net revenues and gross profit; |

3

| • | the majority of our net revenues is generated by sales of DRAM modules and any significant decrease in the average selling prices of our DRAM modules would have a material adverse effect on our business, results of operations and financial condition; |

| • | our gross profit can vary significantly depending on fluctuations in the market price of DRAM modules, product mix and other factors, many of which are beyond our control; |

| • | our competitive position depends to a significant degree upon our ability to maintain the strength of our brand among PC gaming enthusiasts; |

| • | our success and growth depend on our ability to continuously develop and successfully market new products and improvements; |

| • | we depend on the introduction and success of new high-performance computer hardware, particularly microprocessors and graphics cards, and sophisticated new computer games to drive sales of our products; |

| • | we face intense competition and the markets we serve are characterized by continuous and rapid technological developments and change; |

| • | our results of operations are subject to substantial quarterly and annual fluctuations, which may adversely affect the market price of our common stock; |

| • | we do not own any manufacturing facilities, we do not have any guaranteed sources of supply of products or components, and we depend upon a small number of manufacturers, some of which are single-source suppliers, to supply our products, which may result in product and component shortages, delayed deliveries and quality control problems; and |

| • | your ability to influence matters that require approval of our stockholders will be limited because a small group of our existing stockholders will own a substantial portion of our outstanding common stock immediately after this offering. |

Corporate Information

We were founded in 1994 as a California corporation. We reincorporated in the State of Delaware in 2007. Our executive offices are located at 46221 Landing Parkway, Fremont, California 94538 and our telephone number is (510) 657-8747. Our website address is www.corsair.com. Information contained on, or accessible through, our website is not incorporated by reference into this prospectus and should not be considered to be part of this prospectus.

We use various trademarks and trade names in our business, including Corsair, Dominator, Dominator GT, Dominator GTX, XMS, Value Select, DHX, DHX+, Flash Voyager, Flash Voyager GT, Flash Voyager GTR, Flash Voyager Mini, Flash Voyager Port, Flash Survivor, Flash Survivor GT, Flash Padlock, Corsair Professional Series, Corsair Enthusiast Series, Corsair Builder Series, Corsair Obsidian Series, Corsair Air Series, Corsair Hydro Series, Corsair Ice Series, Corsair Storage Solutions, Corsair Performance Series, Corsair Extreme Series, Corsair Reactor Series and Corsair Nova Series, some of which appear in this prospectus, as well as the sail logo appearing on the cover page of this prospectus. All other trademarks and trade names appearing in this prospectus are the property of their respective owners.

4

The Offering

| Total common stock offered |

shares |

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Total common stock to be outstanding immediately after this offering |

shares |

| Use of proceeds |

We estimate that the net proceeds we receive from the sale of common stock in this offering will be approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional shares of common stock in full), in each case assuming an initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this preliminary prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds that we receive from the sale of shares of our common stock in this offering for general corporate purposes, which may include working capital, capital expenditures and possible acquisitions of other businesses, products, assets or technologies. Although one of our strategies is to grow through acquisitions, we have no present commitments or agreements to make any acquisitions. We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” |

| Proposed Nasdaq Global Market symbol |

We intend to apply to list our common stock on the Nasdaq Global Market under the symbol “CRSR.” |

The total number of shares of our common stock to be outstanding immediately after this offering as set forth above is based on the number of shares outstanding as of March 31, 2010 (assuming that the Holding Company Formation referred to below had occurred as of that date) and excludes:

| • | 38,524,482 shares of our common stock issuable upon the exercise of options outstanding under our equity incentive plans as of March 31, 2010 at a weighted average exercise price of $0.38 per share; |

| • | shares of our common stock that will be issuable upon exercise of options we intend to grant prior to the closing of this offering under our 2010 Equity Incentive Plan at an exercise price equal to $ per share; |

| • | additional shares of our common stock that will be available for future awards under our 2010 Equity Incentive Plan, plus automatic annual increases in the number of shares of common stock available for future awards under that plan, as more fully described in “Executive Compensation—Equity Incentive Plans”; |

| • | additional shares of our common stock that will be available for future awards under our 2010 Employee Stock Purchase Plan, as more fully described in “Executive Compensation—Equity Incentive Plans”; and |

5

| • | shares of our common stock issuable upon the exercise of outstanding warrants at an exercise price of $0.55 per share (subject to adjustment as provided in the warrants). The number of shares of our common stock issuable upon exercise of the warrants is equal to the sum of (a) 1,942,827 shares of common stock plus (b) the number of shares of common stock equal to 2% of the total number of shares of common stock of all classes issued by us (other than shares of common stock issued in this offering) during the period beginning on and including April 1, 2010 to but excluding the closing date of this offering, calculated as of the date of exercise on a fully-diluted basis after giving effect to the exercise of all other warrants, options and rights to acquire any shares of our common stock issued by us, and the conversion of any convertible securities issued by us, during the period beginning on and including April 1, 2010 to but excluding the closing date of this offering. |

Unless otherwise expressly stated or the context otherwise requires, the information in this prospectus gives effect to and assumes the following:

| • | the completion of the Holding Company Formation described below, which will occur prior to the closing of this offering; |

| • | no exercise of outstanding options or warrants; |

| • | the effectiveness of our amended and restated certificate of incorporation, which we sometimes refer to as our certificate of incorporation, and of our amended and restated bylaws, which we sometimes refer to as our bylaws, which will occur prior to the closing of this offering; |

| • | the effectiveness of a for reverse split of our common stock and the amendment of some of the terms of our outstanding warrants, both of which will occur prior to the closing of this offering; and |

| • | no exercise by the underwriters of their option to purchase a total of additional shares of common stock on the terms and conditions set forth on the cover page of this prospectus if the underwriters sell more than shares of common stock in this offering, consisting of up to shares that may be purchased from us and a total of up to shares that may be purchased from the selling stockholders. |

The Holding Company Formation and Repurchase Right Termination

Corsair Components, Inc., or Corsair Components, the issuer of the common stock to be sold in this offering, was incorporated in Delaware in January 2010. Our business was in the past conducted through Corsair Memory, Inc., or Corsair Memory, and its predecessors and their respective subsidiaries. Prior to the closing of this offering, Corsair Memory will effect a corporate reorganization, which we sometimes refer to as the Holding Company Formation, pursuant to which Corsair Memory will become a wholly-owned subsidiary, and all of our other subsidiaries will become direct or indirect subsidiaries, of Corsair Components. In connection with the Holding Company Formation, the outstanding shares of Corsair Memory’s common stock will be converted into shares of Corsair Components’ common stock and outstanding options and warrants to purchase Corsair Memory’s common stock will become options or warrants, as the case may be, to purchase shares of Corsair Components’ common stock. Accordingly, our consolidated financial statements and other financial information included in this prospectus as of dates and for periods prior to date of the Holding Company Formation reflect the results of operations and financial position of Corsair Memory and its consolidated subsidiaries, and our consolidated financial statements and other financial information, if any, as of dates and for periods from and after the date of the Holding Company Formation reflect the results of operations and financial condition of Corsair Components and its consolidated subsidiaries, in each case unless otherwise expressly stated or the context otherwise requires.

6

The terms of our employee stock ownership plan, or ESOP, currently provide that ESOP participants have the right, for a specified period of time, to require us to repurchase shares of our common stock that are distributed to them by the ESOP. As a result, the shares of common stock held by the ESOP are reflected in our consolidated balance sheet in a line item (called “redeemable ESOP shares”) below liabilities and above stockholders’ (deficit) equity and in an offsetting line item (also called “redeemable ESOP shares”) that is a component of stockholders (deficit) equity. We plan to terminate this repurchase right, which we sometimes refer to as the ESOP Repurchase Right Termination, upon the closing of this offering, whereupon this accounting treatment for the ESOP shares will be discontinued.

The holders of our outstanding warrants to purchase shares of our common stock have the right to require us to repurchase those warrants or the shares of common stock issued on exercise of those warrants on June 18, 2012 and under other specified circumstances. As a result, the warrants are reflected as a liability on our consolidated balance sheet. The holder of the warrants has agreed to terminate this repurchase right, which we sometimes refer to as the Warrant Repurchase Right Termination, upon the closing of this offering, which means that the outstanding warrants will then be reflected in stockholders’ (deficit) equity on our consolidated balance sheet.

A significant number of our outstanding employee based awards are subject to repurchase rights that, combined with our past practices of repurchasing shares, caused such awards to be reflected as a stock compensation liability on our consolidated balance sheet. We expect that these repurchase rights will be terminated in connection with this offering, which means the amount previously reflected as stock compensation liability will then be reflected in stockholders’ (deficit) equity in our consolidated balance sheet. We sometimes refer to this repurchase right termination, the ESOP Repurchase Right Termination and the Warrant Repurchase Right Termination, collectively, as the Repurchase Right Termination.

7

Summary Consolidated Financial Data

We derived the following summary consolidated statement of operations data and other financial and operating data (other than units sold) for the years ended December 31, 2007, 2008 and 2009 and the following summary historical consolidated balance sheet data as of December 31, 2009 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the following summary consolidated statement of operations data and other financial and operating data (other than units sold) for the year ended December 31, 2005 from our unaudited restated consolidated financial statements for that year and for the year ended December 31, 2006 from our audited consolidated financial statements for that year, which financial statements are not included in this prospectus. Our results of operations and financial condition presented below do not purport to be indicative of our results of operations or financial condition as of any future date or for any future period. You should read the following information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Consolidated Financial Data” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||||||||||

| Restated 2005(3) |

2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| (in thousands except per share amounts) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Net revenues |

$ | 275,950 | $ | 378,050 | $ | 379,718 | $ | 341,072 | $ | 325,633 | ||||||||||

| Cost of revenue(1) |

254,776 | 350,830 | 343,337 | 305,505 | 278,976 | |||||||||||||||

| Gross profit |

21,174 | 27,220 | 36,381 | 35,567 | 46,657 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Product development(1) |

6,704 | 8,748 | 1,736 | 87 | 13,514 | |||||||||||||||

| Sales and marketing(1) |

9,912 | 10,969 | 15,751 | 17,534 | 23,780 | |||||||||||||||

| General and administrative(1) |

15,724 | 12,734 | 11,039 | 4,668 | 20,201 | |||||||||||||||

| Total operating expenses(2) |

32,340 | 32,451 | 28,526 | 22,289 | 57,495 | |||||||||||||||

| Income (loss) from operations |

(11,166 | ) | (5,231 | ) | 7,855 | 13,278 | (10,838 | ) | ||||||||||||

| Interest expense, net |

(1,019 | ) | (2,388 | ) | (3,267 | ) | (2,543 | ) | (1,730 | ) | ||||||||||

| Loss on revaluation of common stock warrants |

— | — | — | — | (1,722 | ) | ||||||||||||||

| Other income (expense), net |

21 | 154 | 70 | (90 | ) | 310 | ||||||||||||||

| Income (loss) before income taxes |

(12,164 | ) | (7,465 | ) | 4,658 | 10,645 | (13,980 | ) | ||||||||||||

| Income tax expense (benefit) |

702 | 1,296 | 67 | (557 | ) | (5,290 | ) | |||||||||||||

| Net income (loss) |

$ | (12,866 | ) | $ | (8,761 | ) | $ | 4,591 | $ | 11,202 | $ | (8,690 | ) | |||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | (0.23 | ) | $ | (0.15 | ) | $ | 0.08 | $ | 0.19 | $ | (0.14 | ) | |||||||

| Diluted |

$ | (0.23 | ) | $ | (0.15 | ) | $ | 0.00 | $ | (0.03 | ) | $ | (0.14 | ) | ||||||

| Weighted average shares used in computing net income (loss) per share: |

||||||||||||||||||||

| Basic |

55,464 | 57,976 | 58,494 | 59,643 | 61,251 | |||||||||||||||

| Diluted |

55,464 | 57,976 | 79,783 | 75,579 | 61,251 | |||||||||||||||

8

| (1) | Includes stock-based compensation (benefit) expense as follows: |

| Year Ended December 31, | ||||||||||||||||||||

| Restated 2005(3) |

2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue |

$ | 1,924 | $ | 1,033 | $ | (476 | ) | $ | (1,674 | ) | $ | 448 | ||||||||

| Product development |

4,488 | 2,895 | (1,672 | ) | (4,353 | ) | 8,389 | |||||||||||||

| Sales and marketing |

1,866 | 1,477 | (398 | ) | (1,389 | ) | 7,878 | |||||||||||||

| General and administrative |

5,509 | 3,604 | (1,984 | ) | (5,407 | ) | 11,289 | |||||||||||||

| Total |

$ | 13,787 | $ | 9,009 | $ | (4,530 | ) | $ | (12,823 | ) | $ | 28,004 | ||||||||

| (2) | For years prior to 2007, we had a bonus plan under which the bonus payouts were significantly larger than under our current bonus plan. In 2005, our total bonus expense was approximately $3.6 million compared to adjusted EBIT of approximately $2.6 million and adjusted EBIT before bonus expense of approximately $6.2 million. In 2006, our total bonus expense was approximately $7.3 million compared to adjusted EBIT of approximately $3.8 million and adjusted EBIT before bonus expense of approximately $11.1 million. Adjusted EBIT is a non-GAAP financial measure that we include in this prospectus to provide investors with a supplemental measure of our operating performance. For a definition of adjusted EBIT and reconciliation to net income (loss), the most directly comparable GAAP measure, see note (1) on the following page. |

| (3) | We restated our consolidated financial statements as of December 31, 2005 primarily to correct the accounting treatment for stock options under variable accounting. The net effects of the restatement resulted in a net loss of $12.9 million instead of previously reported net income of $1.5 million for the year ended December 31, 2005 after adjusting for the stock-based compensation expense of $13.8 million and $0.6 million of other items. |

9

| Year Ended December 31, | ||||||||||||||||

| Restated 2005(4) |

2006 | 2007 | 2008 | 2009 | ||||||||||||

| (dollars and units in thousands) | ||||||||||||||||

| Other Financial and Operating Data: |

||||||||||||||||

| Adjusted EBIT(1) |

$ | 2,621 | $ | 3,778 | $ | 3,325 | $ | 455 | $ | 17,166 | ||||||

| Adjusted net income (loss)(1) |

$ | 921 | $ | 248 | $ | 61 | $ | (1,621 | ) | $ | 7,022 | |||||

| Gross profit:(2) |

||||||||||||||||

| High-performance memory components |

$ | — | $ | — | $ | — | $ | — | $ | 30,167 | ||||||

| Gaming components and peripherals |

$ | — | $ | — | $ | — | $ | — | $ | 16,490 | ||||||

| Total |

$ | 21,174 | $ | 27,220 | $ | 36,381 | $ | 35,567 | $ | 46,657 | ||||||

| Gross margin:(2)(3) |

||||||||||||||||

| High-performance memory components |

— % | — % | — % | — % | 12.4% | |||||||||||

| Gaming components and peripherals |

— % | — % | — % | — % | 20.0% | |||||||||||

| Total |

7.7% | 7.2% | 9.6% | 10.4% | 14.3% | |||||||||||

| Total units sold |

4,947 | 6,560 | 9,314 | 10,700 | 9,083 | |||||||||||

| (1) | We present adjusted EBIT and adjusted net income (loss) in this prospectus to provide investors with supplemental measures of our operating performance. Adjusted EBIT and adjusted net income (loss) are non-GAAP financial measures. We define adjusted EBIT as net income (loss) less other income (expense), net, plus interest expense, net, loss on revaluation of common stock warrants, income tax expense (benefit) and stock-based compensation (benefit) expense. We define adjusted net income (loss) as net income (loss) plus tax-adjusted stock-based compensation (benefit) expense. |

We believe that adjusted EBIT and adjusted net income (loss) assist our board of directors, management and investors in comparing our operating performance from period to period on a consistent basis because, in the case of adjusted EBIT, it removes the impact of stock-based compensation (benefit) expense (which is a non-cash item that can vary substantially from period to period), loss on revaluation of our outstanding common stock warrants (which is a non-cash item), other income (expense), net (which consists primarily of items, such as foreign currency gain or loss and income from scrap sales, that we do not consider indicative of our operating performance) and variations in our capital structure (affecting interest expense, net) and tax position (such as the impact of changes in effective tax rates) and because, in the case of adjusted net income (loss), it removes the impact of tax-adjusted stock-based compensation (benefit) expense. We also use adjusted EBIT as a performance measure in determining management bonuses. The use of adjusted EBIT and adjusted net income (loss) have limitations and you should not consider these performance measures in isolation from or as an alternative to GAAP measures such as net income (loss). For further information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Measures.”

The following table provides a reconciliation of adjusted EBIT to net income (loss), the most directly comparable GAAP financial measure, for the following periods:

| Year Ended December 31, | ||||||||||||||||||||

| Restated 2005(4) |

2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income (loss) |

$ | (12,866 | ) | $ | (8,761 | ) | $ | 4,591 | $ | 11,202 | $ | (8,690 | ) | |||||||

| Less: other income (expense), net |

21 | 154 | 70 | (90 | ) | 310 | ||||||||||||||

| Plus: |

||||||||||||||||||||

| Interest expense, net |

1,019 | 2,388 | 3,267 | 2,543 | 1,730 | |||||||||||||||

| Loss on revaluation of common stock warrants |

— | — | — | — | 1,722 | |||||||||||||||

| Income tax expense (benefit) |

702 | 1,296 | 67 | (557 | ) | (5,290 | ) | |||||||||||||

| Stock-based compensation (benefit) expense |

13,787 | 9,009 | (4,530 | ) | (12,823 | ) | 28,004 | |||||||||||||

| Adjusted EBIT |

$ | 2,621 | $ | 3,778 | $ | 3,325 | $ | 455 | $ | 17,166 | ||||||||||

(Footnote continued on next page)

10

| (1) | (cont.) The following table provides a reconciliation of adjusted net income (loss) to net income (loss), the most directly comparable GAAP financial measure, for the following periods. The tax adjustment in the following table reflects the increase in income tax expense or decrease in income tax benefit, as the case may be, that would have been reflected in our consolidated statement of operations for the applicable period if stock-based compensation (benefit) expense was not deducted or added, as the case may be, in computing net income (loss). |

| Year Ended December 31, | ||||||||||||||||||||

| Restated 2005(4) |

2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income (loss) |

$ | (12,866 | ) | $ | (8,761 | ) | $ | 4,591 | $ | 11,202 | $ | (8,690 | ) | |||||||

| Plus stock-based compensation (benefit) expense |

13,787 | 9,009 | (4,530 | ) | (12,823 | ) | 28,004 | |||||||||||||

| Less tax adjustment |

— | — | — | — | 12,292 | |||||||||||||||

| Adjusted net income (loss) |

$ | 921 | $ | 248 | $ | 61 | $ | (1,621 | ) | $ | 7,022 | |||||||||

| (2) | Our business has two operating segments: high-performance memory components and gaming components and peripherals. Prior to 2009, we evaluated the performance of our two operating segments based on net revenues; accordingly, information relating to cost of revenue and gross profit for each operating segment is not available for periods prior to 2009. Starting in 2009, we began evaluating the performance of our two operating segments based on cost of revenue and gross profit, in addition to net revenues. |

| (3) | Gross margin is gross profit as a percentage of net revenues. |

| (4) | We restated our consolidated financial statements as of December 31, 2005 primarily to correct the accounting treatment for stock options under variable accounting. The net effects of the restatement resulted in a net loss of $12.9 million instead of previously reported net income of $1.5 million for the year ended December 31, 2005 after adjusting for the stock-based compensation expense of $13.8 million and $0.6 million of other items. |

11

| As of December 31, 2009 | ||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) | ||||||||

| (in thousands) | ||||||||||

| Consolidated Balance Sheet Data: |

||||||||||

| Cash |

$ | 1,367 | $ | 1,367 | $ | |||||

| Total assets |

100,637 | 100,637 | ||||||||

| Short-term debt and current portion of long-term debt and capital lease obligations |

25,986 | 25,986 | ||||||||

| Long-term debt and capital lease obligations (less current portion) |

— | — | ||||||||

| Stock compensation liability |

31,072 | — | ||||||||

| Common stock warrant liability |

1,895 | — | ||||||||

| Redeemable ESOP shares |

14,298 | — | ||||||||

| Total stockholders’ (deficit) equity |

(25,106 | ) | 22,159 | |||||||

| (1) | The pro forma balance sheet data in the table above gives effect to the Repurchase Right Termination and the pro forma as adjusted balance sheet data in the table above gives effect to the Repurchase Right Termination and the sale of shares of our common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this preliminary prospectus, and our receipt of the estimated net proceeds from the sale of the shares sold by us, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, as if these transactions had occurred as of December 31, 2009. None of this data gives effect to our application of those net proceeds. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this preliminary prospectus, would increase (decrease) our pro forma as adjusted cash, total assets and total stockholders’ equity by approximately $ million, assuming that the number of shares of common stock sold by us, as set forth on the cover page of this preliminary prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. A 100,000 share increase (decrease) in the number of shares of common stock sold by us in this offering would increase (decrease) our pro forma as adjusted cash, total assets and total stockholders’ equity by approximately $ million, assuming an initial public offering price per share equal to the midpoint of the estimated price range set forth on the cover page of this preliminary prospectus and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information set forth above is provided for illustrative purposes only and our actual consolidated balance sheet data after this offering will be determined in part by the actual public offering price and number of shares sold by us and other terms of this offering. |

12

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with the risks and uncertainties described elsewhere in this prospectus, including in our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business

Integrated circuits account for most of the cost of producing our DRAM modules, USB flash drives and solid-state drives and fluctuations in the market price of integrated circuits may have a material impact on our net revenues and gross profit.

DRAM integrated circuits, or ICs, account for most of the cost of producing our DRAM modules and NAND flash memory ICs account for most of the cost of producing our USB flash drives and solid-state drives. The market for these ICs is highly competitive and cyclical. Prices of DRAM ICs and NAND flash memory ICs have been volatile and subject to significant fluctuations in the past over relatively short periods of time due to a number of factors, including excess supply of ICs due to manufacturing overcapacity and imbalances in supply and demand. Prices for DRAM ICs and NAND flash memory ICs may fluctuate substantially in the future over relatively short periods of time, which may materially affect our net revenues and gross profit.

A majority of our net revenues is generated by sales of DRAM modules and any significant decrease in the average selling prices of our DRAM modules would have a material adverse effect on our business, results of operations and financial condition.

A majority of our net revenues is generated by sales of DRAM modules. In particular, net revenues of our high-performance memory segment, most of which are generated by sales of DRAM modules, accounted for a total of 95.4%, 86.7% and 74.7% of our consolidated net revenues in 2007, 2008 and 2009, respectively. As a result, any significant decrease in average selling prices of our DRAM modules, whether as a result of declining market prices of DRAM ICs or for any other reason, would have a material adverse effect on our business, results of operations and financial condition. Selling prices for our DRAM modules tend to increase or decrease with increases or decreases, respectively, in market prices of DRAM ICs and average selling prices of DRAM modules declined substantially in 2008, which had a material adverse effect on our results of operations for that year. Furthermore, while sales of USB flash drives and solid-state drives generate substantially smaller percentages of our total net revenues than sales of DRAM modules, declines in average selling prices of our USB flash drives and solid-state drives, whether as a result of declining prices of NAND flash memory ICs or for other reasons, may adversely affect our business, results of operations and financial condition. Similarly, declines in average selling prices of DRAM modules and, to a lesser extent, USB flash drives and solid-state drives could affect the valuation of our inventory and may lead to inventory write-downs. Declines in average selling prices of DRAM modules could also allow original equipment manufacturers to pre-install higher capacity DRAM modules into new computers at existing price points, which could reduce the demand for our DRAM modules in the retail market.

Our gross profit and gross margin can vary significantly depending on changes in product mix, fluctuations in the market price of DRAM ICs and other factors, many of which are beyond our control.

Our gross profit, which we define as net revenues minus cost of revenue, can vary substantially due to consumer demand, competition, product life cycles, new product introductions, fluctuations in average selling prices for our products (including fluctuations resulting from changes in the market price of DRAM and NAND flash memory ICs), unit volumes and manufacturing, freight and distribution costs. In particular, if we are not able to introduce new products in a timely manner, if our product, freight or other costs exceed our expectations, if demand for our products is less than we anticipate, or if there are product pricing, marketing and other

13

initiatives by our competitors to which we need to react by lowering our selling prices or increasing promotional and marketing expenditures, our gross profit may be materially adversely affected. In addition, because we carry inventories of both DRAM ICs and DRAM modules at our facility in Taiwan, as well as inventories of DRAM modules at our shipping hubs, fluctuations in the market price of DRAM ICs can also have an effect on our gross margins, which we define as gross profit as a percentage of net revenues. For example, if prices of DRAM ICs and DRAM modules decrease, this has in the past tended to have a negative short-term impact on gross margins of our DRAM modules (reflecting the relatively higher cost of DRAM modules held in our inventory). As a result, our gross profit and gross margin may vary materially from quarter to quarter due to changes in prices of DRAM ICs.

In addition, our gross margins may vary significantly by product line. For example, due to price competition in the market for DRAM modules and solid-state drives and, to a lesser extent, USB flash drives, these products generally have lower gross margins than our power supply units, cooling systems and computer cases. Should the mix of products sold shifts from higher margin products to lower margin products, our overall gross margins may be adversely affected.

Our competitive position depends to a significant degree upon our ability to maintain the strength of our brand among PC gaming enthusiasts.

We regard our brand as one of our most valuable assets and we consider it essential to both maintaining and strengthening our brand that we be perceived by the computer gaming market as a leading supplier of cutting-edge, high-performance products. This requires that we constantly innovate by introducing new and enhanced high-performance products that achieve high levels of acceptance among computer gamers. We also need to spend substantial amounts of money on, and devote substantial resources to, advertising, marketing and other efforts to create and maintain brand recognition and loyalty among end-users. Product development, marketing and other brand promotion activities may not yield increased revenues and, even if they do, any increased revenues may not offset the expenses incurred in building our brand. If we fail to maintain and build our brand, or if we incur substantial expenses in an unsuccessful attempt to maintain and build our brand, it may have a material adverse effect on our business and revenues. Our brand may also be damaged by events such as product recalls, perceived declines in quality or reliability, product shortages and other events, some of which are beyond our control.

Our success and growth depend on our ability to continuously develop and successfully market new products and improvements.

The products we sell are characterized by short product life cycles, frequent new product introductions, rapidly changing technology and evolving industry standards. In addition, average selling prices of our products tend to decline as they mature. As a result, we must continually anticipate and respond to changing customer requirements, innovate in our current and emerging product categories, introduce new product lines and products, and enhance existing products in order to remain competitive and execute our growth strategy.

The success of our products depends on many factors, including our ability to:

| • | identify new features or product opportunities; |

| • | anticipate technological developments and market trends; |

| • | develop innovative and reliable new products and enhancements to our existing products in a cost-effective and timely manner; |

| • | quickly develop, manufacture and ship new products to take advantage of developments in enabling technologies and the introduction of new computer hardware (such as new generations of microprocessors and more powerful graphics cards) and computer games that drive demand for our products; and |

| • | distinguish our products from those of our competitors. |

14

If we do not execute on these factors successfully, demand for our current products may decline and any new products that we may introduce may not gain widespread acceptance, adversely affecting our business and operating results. In addition, if we do not continue to distinguish our products through distinctive, technologically advanced features and designs, as well as continue to build and strengthen our brand recognition and our access to distribution channels, our business could be harmed.

We depend on the introduction and success of new high-performance computer hardware, particularly microprocessors and graphics cards, and sophisticated new computer games to drive sales of our products.

We believe that the introduction of more powerful central processing units, or CPUs, graphics cards and similar computer hardware that place increased demands on other system components, such as memory, power supply or cooling, has a significant effect on the demand for our products. As a result, our operating results can be materially affected by the frequency with which new high-performance hardware products are introduced, whether these products achieve widespread consumer acceptance and whether additional memory, enhanced power supply units or cooling systems, solid-state drives, new computer cases or other peripheral devices are necessary to support those products. Although we believe that, historically, new generations of high-performance CPUs and graphics cards have positively affected the demand for our products, we cannot assure you that this will be the case in the future. For example, the introduction of a new generation of highly efficient CPUs and graphics cards that require less power or that generate less heat than prior generations may reduce the demand for both our power supply units and cooling systems. In the past, semiconductor and computer hardware companies have typically introduced new products annually, generally in the second calendar quarter, which has tended to drive our sales in the following two quarters. If computer hardware companies do not continue to regularly introduce new and enhanced CPUs, graphics cards and other products that place increasing demands on system memory and processing speed, require larger power supply units or cooling systems or that otherwise drive demand for computer cases, USB flash drives and other peripherals, or if consumers do not accept those products, it would likely have a material adverse effect on our business, results of operations and financial condition.

We also believe that sales of our products are driven by conditions in the computer gaming industry. In particular, we believe that our business depends on the introduction and success of computer games with sophisticated graphics that place greater demands on system processing speed and capacity and therefore require more powerful CPUs or graphics cards, which in turn drives demand for our high-performance DRAM modules, power supply units, cooling systems and other components and peripheral drives. Likewise, we believe that the continuing introduction and market acceptance of new or enhanced versions of computer games helps sustain consumer interest in computer gaming generally. The demand for our products would likely decline, perhaps substantially, if computer game companies and developers do not introduce and successfully market sophisticated new and improved games that require increasingly high levels of system and graphics processing power on an ongoing basis or if demand for computer games among computer gaming enthusiasts or conditions in the computer gaming industry deteriorate for any reason. As a result, our sales and other operating results fluctuate due to conditions in the market for computer games and downturns in this market may materially adversely affect our business, results of operations and financial condition.

We face intense competition and, if we do not compete effectively, demand for our products could decline and our business and operating results could suffer.

We face intense competition in the markets for all of our products. We operate in markets that are characterized by rapid technological change, constant price pressure, rapid product obsolescence, evolving industry standards and new demands for features and performance. We experience aggressive price competition and other promotional activities by competitors, including in response to declines in consumer demand and excess product supply or as competitors seek to gain market share.

In recent years, we have added new product categories and we intend to introduce new product categories in the future. To the extent we are successful in adding new product categories, we will confront new competitors,

15

many of which may have more experience, better known brands and greater distribution capabilities in the new product categories and markets than we do. In addition, because of the continuing convergence of the markets for computing devices and consumer electronics, we expect greater competition in the future from well-established consumer electronics companies. Many of our current and potential competitors, some of which are large, multi-national businesses, have substantially greater financial, technical, sales, marketing, personnel and other resources and greater brand recognition than we have. In addition, some of our competitors are small or mid-sized specialty companies, which may enable them to react to changes in industry trends or consumer preferences or to introduce new or innovative products more quickly than we can.

Our primary competitors in the markets for DRAM modules and USB flash drives include Adata, GSkill, Kingston Technology, Micron Technology through its Crucial division, OCZ Technology and SanDisk. Our primary competitors in the market for solid-state drives include Intel, Micron Technology through its Crucial division, OCZ Technology, Patriot, and Super Talent. In that regard, we face the risk that established semiconductor companies, such as Intel, Micron Technology, Samsung and SanDisk, which both manufacture DRAM or NAND flash memory ICs and incorporate them into the DRAM modules, USB flash drives or solid-state drives they sell, or established disk drive companies, such as Seagate or Western Digital, that sell solid-state drives, will use their lower cost structures, widely recognized brands and other resources to price their products substantially below ours and capture market share from us. Our primary competitors in the market for our power supply units, cooling systems and computer cases include Antec, Coolermaster and Thermaltake.

In addition, we are developing audio products and are considering a number of other new computer hardware product categories and, to the extent we introduce products in new categories, we will likely experience substantial competition from additional companies, which may include large computer peripherals and consumer electronics companies with global brand recognition and significant resources. The principal competitive factors in our market include the following:

| • | performance; |

| • | reliability; |

| • | brand and associated style and image; |

| • | price; |

| • | time to market with new emerging technologies; |

| • | early identification of emerging opportunities; |

| • | interoperability of products; and |

| • | responsive customer support on a worldwide basis. |

Computer games may be subject to significant competition from dedicated video game consoles, such as Microsoft’s Xbox, Nintendo’s Wii and Sony’s PlayStation, to the extent that the processing and graphics power of those consoles increase substantially. Our products are not designed for use in video game consoles. As a result, our net revenues and other operating results may suffer to the extent that consumer spending on video game consoles and related games increases, whether as a result of the introduction of new games or improved gaming consoles or for other reasons.

If we do not compete effectively, demand for our products could decline, our net revenues and gross margin could decrease and we could lose market share.

If we lose or are unable to attract and retain key management, our financial performance could suffer.

Our performance depends to a significant degree upon the continued individual and collective contributions of our management team, particularly Andrew J. Paul, our Chief Executive Officer and President and one of our co-founders. If we lose the services of one or more of our key executives, we may not be able to successfully

16

manage our business or achieve our growth objectives. To the extent that our business grows, we will need to attract and retain additional qualified management personnel in a timely manner and we may not be able to do so.

We rely on highly-skilled personnel and if we are unable to attract, retain or motivate key personnel or hire qualified personnel, we may not be able to grow or our business may contract.

Our performance is largely dependent on the talents and efforts of highly-skilled individuals, particularly our electrical engineers, mechanical engineers and computer professionals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly-skilled personnel and, if we are unable to hire and train a sufficient number of qualified employees for any reason, we may not be able to implement our current initiatives or grow, or our business may contract and we may lose market share. Moreover, certain of our competitors or other technology businesses may seek to hire our employees. Although we have granted stock-based incentives to employees in the past and intend to continue doing so, there is no assurance that stock-based compensation will provide adequate incentives to attract, retain and motivate employees in the future, particularly if the market price of our common stock does not increase or declines. If we do not succeed in attracting, retaining and motivating highly qualified personnel, our business will suffer.

Our results of operations are subject to substantial quarterly and annual fluctuations, which may adversely affect the market price of our common stock.

Our results of operations have in the past fluctuated, sometimes substantially, from period to period, and we expect that these fluctuations will continue. A number of factors, many of which are outside our control, may cause or contribute to significant fluctuations in our quarterly and annual net revenues and other operating results. These fluctuations may make financial planning and forecasting more difficult. In addition, these fluctuations may result in unanticipated decreases in our available cash, which could negatively impact our business and prospects. These fluctuations also could both increase the volatility and adversely affect the market price of our common stock. Factors that may cause or contribute to fluctuations in our operating results include:

| • | changes in the frequency with which new high-performance computer hardware, particularly CPUs and graphics cards, and sophisticated new computer games that drive demand for additional DRAM modules, larger power supplies, enhanced cooling systems and other peripherals are introduced; |

| • | fluctuations in average selling prices of and demand for our products, particularly DRAM modules; |

| • | changes in demand for our lower margin products relative to demand for our higher margin products; |

| • | loss of significant customers, cancellations or reductions of orders and product returns; |

| • | a delay, reduction or cessation of deliveries from one or more of the third parties that manufacture our products; |

| • | uncertainty in economic conditions, either globally or in specific countries or regions; |

| • | competitive pressures resulting in, among other things, lower selling prices or loss of market share; |

| • | introduction or enhancement of products by us and our competitors, and market acceptance of these new or enhanced products; |

| • | delays or problems in our introduction of new products or in the delivery of products; |

| • | changes in purchasing patterns by the distributors and retailers to which we sell our products; |

| • | discounts and price reductions offered by our competitors; |

| • | rapid, wholesale changes in technology in the markets in which we compete; |

| • | increased costs or shortages of our products or components used in our products; |

| • | changes in freight costs; |

17

| • | fluctuations in currency exchange rates; |

| • | seasonal electronics product purchasing patterns by our customers and consumers; |

| • | the impact of political instability, natural disasters, war and/or events of terrorism; |

| • | changes in business cycles that affect the markets in which we sell our products; |

| • | the effect of fluctuations in interest rates on consumer disposable income; |

| • | cost and adverse outcomes of litigation, governmental proceedings or any proceedings to protect our brand or other intellectual property; and |

| • | the potential success of cloud computing. |

One or more of the foregoing or other factors may cause our expenses to be disproportionately higher or lower or may cause our net revenues and other operating results to fluctuate significantly in any particular quarterly or annual period. Our results of operations in one or more future quarters or years may fail to meet the expectations of investment research analysts or investors, which could cause an immediate and significant decline in the market price of our common stock.

Conditions in the retail and consumer electronics markets may significantly affect our business, and the global economic downturn has harmed and could continue to harm our operating results.

We derive most of our revenue from higher priced products sold through online and brick-and-mortar retailers to end-users, and we are vulnerable to declines in consumer spending due to, among other things, depressed economic conditions, reductions in disposable income and other factors that affect the retail and consumer electronics markets generally. In addition, most of our revenues are attributable to sales of high-performance DRAM modules, USB flash drives, power supply units, solid-state drives, cooling systems and computer cases, all of which are products that are geared to the computer gaming market which, like other consumer electronic markets, is susceptible to the adverse effects of poor economic conditions.

The downturn in worldwide economic conditions, particularly in retail markets, has had a negative effect on our business. To the extent that these adverse economic conditions continue or worsen, they will likely continue to have a number of negative effects on our business, operating results and financial condition, which may include the following:

| • | downward pressure on our product prices; |

| • | limited growth or reductions in our sales, reflecting lower consumer demand for our products as well as a shift in consumer buying patterns toward lower priced products and away from the relatively higher priced products that we sell; |

| • | limited growth or reductions in worldwide sales of products that incorporate DRAM modules, such as PCs, resulting in excess supply in the worldwide DRAM market; |

| • | reduced demand for our products from our customers as they limit or lower their inventory levels; |

| • | reduced cash flow due to delays in customer payments and increased risk of customer bankruptcy or business failures, resulting in increases in bad debt write-offs and receivables reserves; |

| • | higher costs for promotions, customer incentive programs and other initiatives used to stimulate demand; |

| • | increased risk of excess and obsolete inventories, which may require write-downs or impairment charges; and |

| • | financial distress or bankruptcy of key suppliers or third-party manufacturers, resulting in insufficient product quantities to meet demand or increases in the cost of producing our products. |

18

A continuation or worsening of depressed global economic conditions, or the occurrence of similar conditions in the future, could have a material adverse effect on our results of operations and financial condition.

We do not own any manufacturing facilities, we have no guaranteed sources of supply of products or components, and we depend upon a small number of manufacturers, many of which are single-source suppliers, to supply our products, which may result in product or component shortages, delayed deliveries and quality control problems.

We do not have any manufacturing facilities and we depend entirely on third parties to manufacture and supply the products we sell and the components used in our products. Our products are generally produced by only one or a limited number of manufacturers. For example, our Obsidian 800D and 700D computer cases are produced by a single manufacturer, each model of our power supply units, cooling systems and solid-state drives is produced by a single manufacturer, and our USB flash drives are produced by two manufacturers. Likewise, there are a limited number of companies capable of producing the advanced DRAM ICs required for our high-performance DRAM modules and NAND flash memory ICs required for our USB flash drives and solid-state drives. We do not have any long-term supply agreements with any of our manufacturers or suppliers. This reliance on a limited number of manufacturers and suppliers exposes us to numerous risks, including the following:

| • | our manufacturers or suppliers may cease or reduce production or deliveries, raise prices or renegotiate other terms; |

| • | we may be slower than our competitors in introducing new products due to production or delivery delays by our third-party manufacturers or suppliers; |

| • | we carry very limited inventories of our products and the loss of one or more of these manufacturers or suppliers, or a significant decline in production or deliveries by any of them, could significantly limit our shipments of the product in question or prevent us from shipping that product entirely; |

| • | if one of our single source manufacturers were to stop production, we may be unable to locate a suitable replacement on terms we consider acceptable and there would likely be significant delays before we were able to transition production to a new manufacturer and potential significant costs associated with that transition; |

| • | the supply of products from these manufacturers and suppliers may be interrupted or delayed and we may be unable to obtain sufficient quantities because, among other things, these manufacturers or suppliers may experience financial difficulties, be affected by natural disasters or may have limited production facilities; |

| • | our manufacturers or suppliers may provide us with products or components that do not perform reliably, do not meet our quality standards or performance specifications, are susceptible to early failure or contain other defects, which may harm our reputation, increase our warranty and other costs or lead to product returns and recalls; and |

| • | lead times for the delivery of products being manufactured for us can vary significantly and depend on many factors outside of our control, such as demand for manufacturing capacity and availability of components. |

From time to time we have experienced product shortages due to both disruptions in supply from the third parties that manufacture or supply our products and our inability or the inability of these third-party manufacturers to obtain necessary components, and we may experience similar shortages in the future. For example, from time to time our industry experiences shortages in DRAM ICs and NAND flash memory ICs which have resulted in placing companies, including us, on component allocation. Because sales of DRAM modules account for a majority of our net revenues, a shortage of DRAM ICs, particularly high-speed DRAM ICs, could have a material adverse effect on our net revenues and cash flow. Moreover, procurement of the other

19

components used in our products is generally the responsibility of the third parties that manufacture our products and we therefore have limited or no ability to control or influence the procurement process or to monitor the quality of components.

Any disruption in or termination of our relationship with any of our manufacturers or suppliers or our inability to develop relationships with new manufacturers or suppliers as and when required would cause delays, disruptions or reductions in product shipment and may require product redesigns, all of which could damage relationships with our customers, harm our brand, increase our costs and otherwise materially adversely affect our business. Likewise, shortages or interruptions in the supply of products or components, or any inability to procure these products or components from alternate sources at acceptable prices in a timely manner, could delay shipments to our customers and increase our costs, any of which could materially adversely affect our business and operating results.

We rely on manufacturers in Taiwan to supply a significant portion of our DRAM modules, most of our USB flash drives and some of our solid-state drives, we rely on manufacturers in China to produce all of our power supply units, cooling systems and computer cases, and the facility where we perform testing and packaging of most of our DRAM modules is located in Taiwan, which exposes us to risks.