UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Registrant is making a filing for 8 of its series: Allspring CoreBuilder Shares-Series EM, Allspring Emerging Markets Equity Fund, Allspring Emerging Markets Equity Income Fund, Allspring Global Long/Short Equity Fund, Allspring International Equity Fund, Allspring Special Global Small Cap Fund, Allspring Special International Small Cap Fund, and Allspring U.S. Long/Short Equity Fund.

Date of reporting period: October 31, 2023

ITEM 1. REPORT TO STOCKHOLDERS

| Notice to Shareholders |

| Beginning in July 2024, the Fund will be required by the

Securities and Exchange Commission to send shareholders a paper copy of a

new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance

information and fund statistics. If you wish to receive this new tailored shareholder

report electronically, please follow the instructions on the back cover

of this report. |

| Other information that is currently included in the shareholder

report, such as the Fund’s financial statements, will be available

online and upon request, free of charge, in paper or electronic format. |

| Investment objective |

The Fund seeks to achieve long-term capital appreciation and current income. |

| Manager |

Allspring Funds Management, LLC |

| Subadviser |

Allspring Global Investments, LLC |

| Portfolio manager |

Alison Shimada, Elaine Tse |

| Average annual total returns (%) as of October 31, 2023 | ||||

| |

|

|

Expense ratios1 (%) | |

| |

Inception date |

Since inception |

Gross |

Net2 |

| Allspring Managed Account CoreBuilder® Shares - Series EM (ACBEX) |

11-16-2022 |

0.66 |

0.21 |

0.00 |

| MSCI EM Index (Net) (USD)3 |

– |

-0.31

* |

– |

– |

| | |

| * |

Based on the Fund’s inception date. |

| 1 |

Reflects the expense ratios as stated in the most recent prospectus. The expense ratios shown are subject to change and may differ from the annualized expense ratios

shown in the Financial Highlights of this report. |

| 2 |

Generally, no ordinary fees or expenses are charged to the Fund. Allspring Funds Management, LLC has contractually committed to irrevocably absorb and pay or

reimburse all ordinary operating expenses of the Fund, except portfolio

transactions or other investment related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses and other expenses not incurred in the ordinary course of the

Fund’s business. This commitment has an indefinite term. |

| 3 |

The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to

measure the equity market performance of emerging markets. Source: MSCI. MSCI makes no express or implied warranties

or representations and shall have no liability whatsoever with respect to

any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

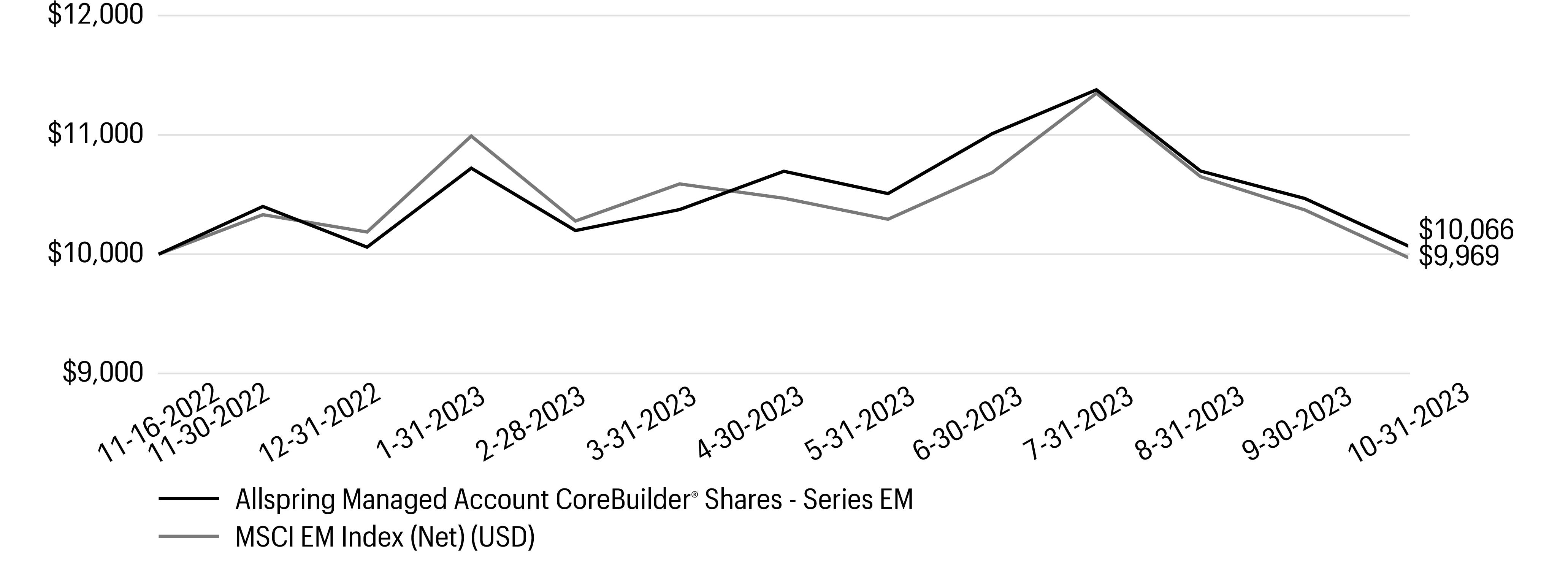

| Growth of $10,000 investment as of October 31, 20231 |

| 1 |

The chart compares the performance of the Fund since inception with the MSCI EM Index (Net) (USD). The chart assumes a hypothetical investment of $10,000

investment and reflects all operating expenses of the Fund.

|

| Ten largest holdings (%) as of October 31, 20231 | |

| Samsung Electronics Co. Ltd., Preferred stock |

6.33 |

| Samsung Electronics Co. Ltd. |

6.28 |

| Mahindra & Mahindra Ltd. |

5.91 |

| ICICI Bank Ltd. |

4.89 |

| HDFC Bank Ltd. |

4.84 |

| Reliance Industries Ltd. GDR |

4.44 |

| Midea Group Co. Ltd. Class A |

3.57 |

| Dr. Reddy’s Laboratories Ltd. |

3.45 |

| Arabian Drilling Co. |

2.15 |

| Bank Polska Kasa Opieki SA |

2.15 |

| 1 |

Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

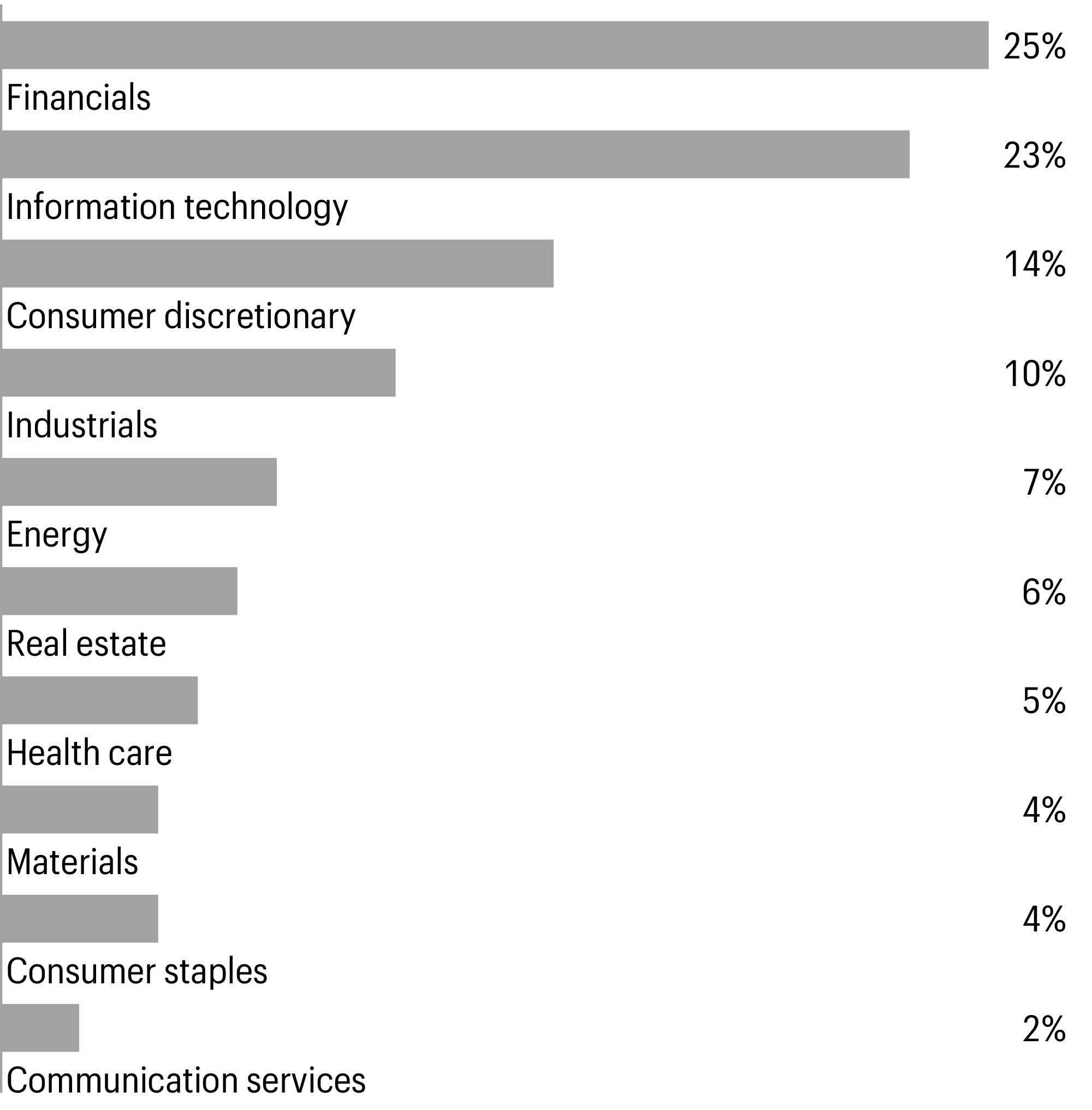

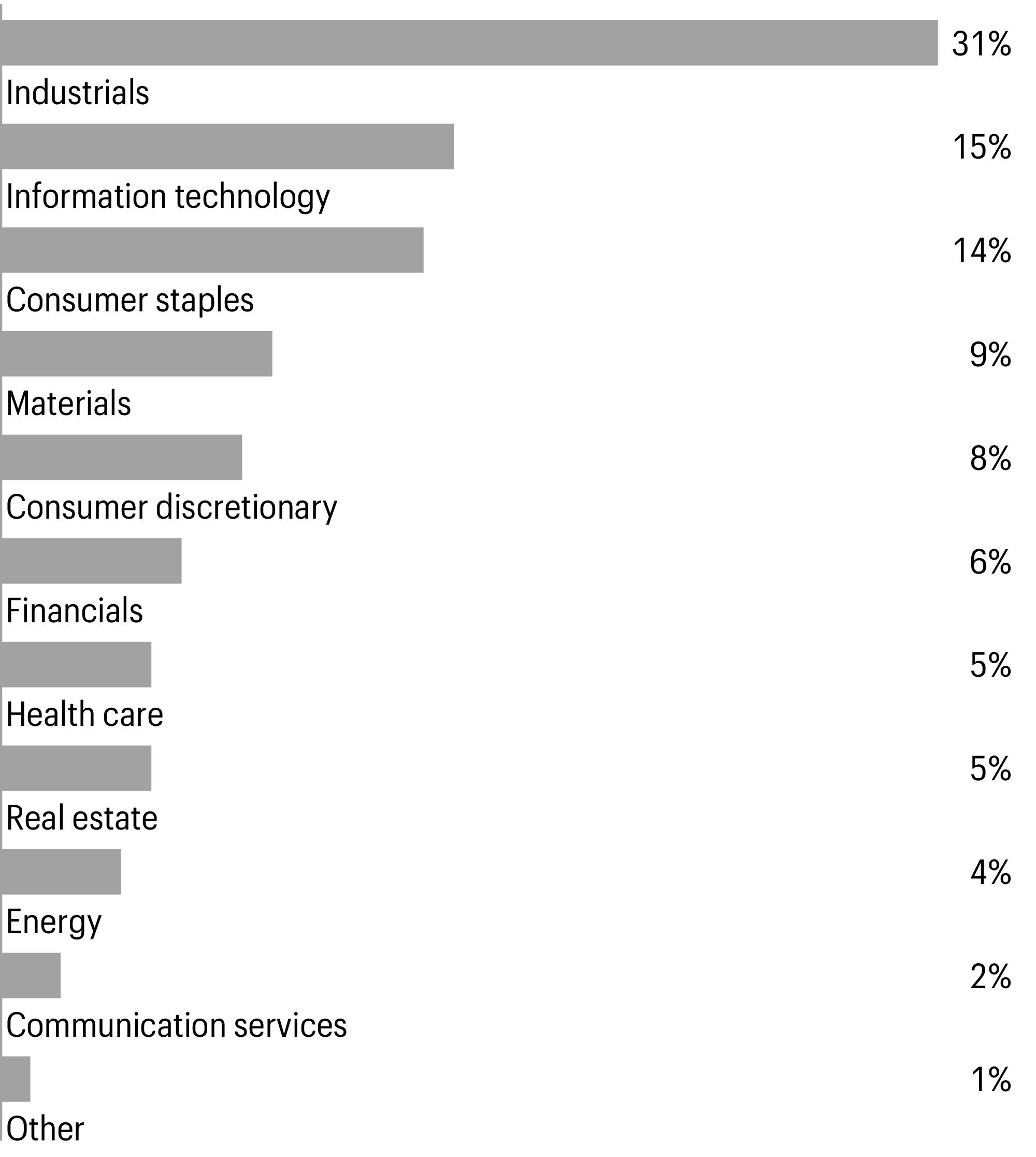

| Sector allocation as of October 31, 20231 |

| 1 |

Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

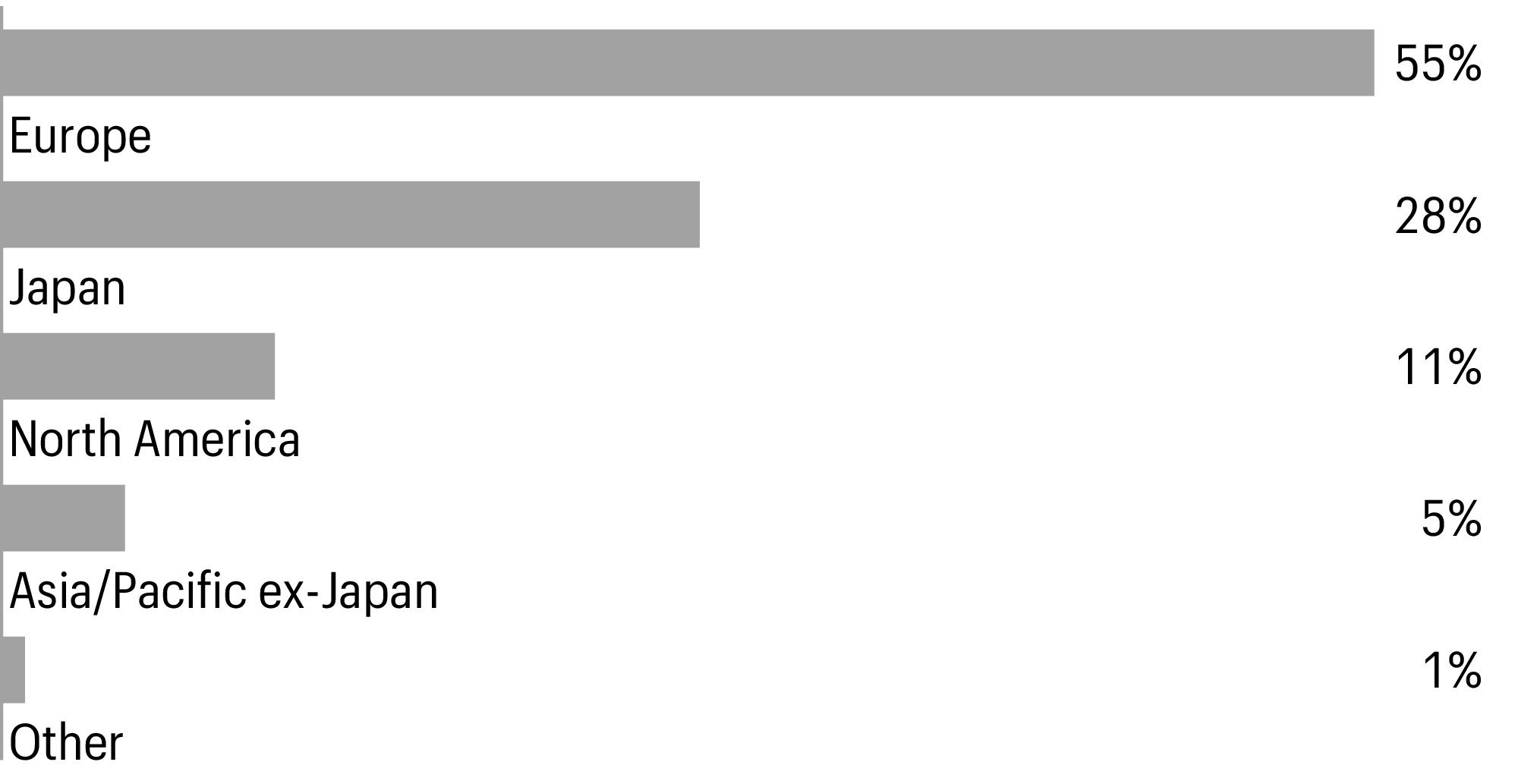

| Geographic allocation as of October 31, 20231 |

| 1 |

Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

| |

Beginning

account value

5-1-2023 |

Ending

account value

10-31-2023 |

Expenses

paid during

the period1 |

Annualized net

expense ratio |

| Actual |

$1,000.00 |

$941.15 |

$0.00 2 |

0.00

%2 |

| Hypothetical (5% return before expenses) |

$1,000.00

|

$1,025.21

|

$0.00

2 |

0.00 %2 |

| 1 |

Expenses paid is equal to the annualized net expense ratio multiplied by the average account value over the period, multiplied by 184 divided by 365 (to reflect the

one-half-year period). |

| 2 |

Generally, no ordinary fees or expenses are charged to the Fund. Allspring Funds Management, LLC has contractually committed to irrevocably absorb and pay or

reimburse all ordinary operating expenses of the Fund, except portfolio

transactions or other investment related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses and other expenses not incurred in the ordinary course of the

Fund’s business. This commitment has an indefinite term. |

| |

|

|

|

Shares |

Value | |

| Common stocks: 90.09% |

|

|

|

|

|

|

| Brazil: 3.42% |

|

|

|

|

|

|

| B3 SA - Brasil Bolsa Balcao (Financials, Capital markets) |

|

|

|

|

31,800 |

$70,011 |

| Banco BTG Pactual SA (Financials, Capital markets) |

|

|

|

|

14,400 |

84,542 |

| |

|

|

|

|

|

154,553 |

| Chile: 1.03% |

|

|

|

|

|

|

| Cencosud SA (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

28,608 |

46,348 |

| China: 14.79% |

|

|

|

|

|

|

| Baoshan Iron & Steel Co. Ltd. Class A (Materials, Metals & mining) |

|

|

|

|

50,500 |

43,199 |

| China Communications Services Corp. Ltd. Class H (Industrials, Construction & engineering) |

|

|

|

|

126,000 |

51,537 |

| China Resources Land Ltd. (Real estate, Real estate management & development) |

|

|

|

|

16,000 |

59,890 |

| China State Construction International Holdings Ltd. (Industrials, Construction & engineering) |

|

|

|

|

75,410 |

80,775 |

| China Tower Corp. Ltd. Class H (Communication services, Diversified telecommunication services)144A |

|

|

|

|

742,000 |

69,192 |

| Hengli Petrochemical Co. Ltd. Class A (Materials,

Chemicals)† |

|

|

|

|

37,600 |

75,322 |

| Inner Mongolia Yili Industrial Group Co. Ltd. Class A (Consumer staples, Food products) |

|

|

|

|

18,600 |

69,728 |

| Midea Group Co. Ltd. Class A (Consumer discretionary, Household durables) |

|

|

|

|

22,300 |

161,319 |

| Zhejiang NHU Co. Ltd. Class A (Health care, Pharmaceuticals) |

|

|

|

|

25,600 |

56,603 |

| |

|

|

|

|

|

667,565 |

| Greece: 2.48% |

|

|

|

|

|

|

| Hellenic Telecommunications Organization SA (Communication services, Diversified telecommunication services) |

|

|

|

|

3,043 |

42,652 |

| National Bank of Greece SA (Financials, Banks)† |

|

|

|

|

12,090 |

69,244 |

| |

|

|

|

|

|

111,896 |

| India: 23.53% |

|

|

|

|

|

|

| Dr. Reddy’s Laboratories Ltd. ADR (Health care, Pharmaceuticals) |

|

|

|

|

2,393 |

155,856 |

| HDFC Bank Ltd. ADR (Financials, Banks) |

|

|

|

|

3,863 |

218,453 |

| ICICI Bank Ltd. ADR (Financials, Banks) |

|

|

|

|

9,956 |

220,924 |

| Mahindra & Mahindra Ltd. GDR (Consumer discretionary, Automobiles) |

|

|

|

|

15,085 |

267,004 |

| Reliance Industries Ltd. GDR (Energy, Oil, gas & consumable

fuels)144A |

|

|

|

|

3,665 |

200,248 |

| |

|

|

|

|

|

1,062,485 |

| Indonesia: 1.68% |

|

|

|

|

|

|

| Bank Negara Indonesia Persero Tbk PT (Financials, Banks) |

|

|

|

|

251,800 |

75,990 |

| Malaysia: 0.94% |

|

|

|

|

|

|

| RHB Bank Bhd (Financials, Banks) |

|

|

|

|

36,278 |

42,493 |

| Mexico: 0.99% |

|

|

|

|

|

|

| Fibra Uno Administracion SA de CV (Real estate, Diversified REITs) |

|

|

|

|

29,400 |

44,698 |

| Philippines: 1.17% |

|

|

|

|

|

|

| Bank of the Philippine Islands (Financials, Banks) |

|

|

|

|

29,828 |

52,832 |

| |

|

|

|

Shares |

Value | |

| Poland: 2.58% |

|

|

|

|

|

|

| Bank Polska Kasa Opieki SA (Financials, Banks) |

|

|

|

|

3,191 |

$96,965 |

| LPP SA (Consumer discretionary, Textiles, apparel & luxury goods) |

|

|

|

|

6 |

19,316

|

| |

|

|

|

|

|

116,281 |

| Qatar: 1.13% |

|

|

|

|

|

|

| Industries Qatar QSC (Industrials, Industrial conglomerates) |

|

|

|

|

15,141 |

50,864 |

| Saudi Arabia: 4.90% |

|

|

|

|

|

|

| Al Rajhi Bank (Financials, Banks) |

|

|

|

|

2,534 |

45,360 |

| Arabian Drilling Co. (Energy, Energy equipment &

services)† |

|

|

|

|

2,077 |

97,107 |

| Saudi Awwal Bank (Financials, Banks) |

|

|

|

|

4,721 |

42,154 |

| United International Transportation Co. (Industrials, Ground transportation) |

|

|

|

|

2,050 |

36,774

|

| |

|

|

|

|

|

221,395 |

| Singapore: 4.72% |

|

|

|

|

|

|

| BOC Aviation Ltd. (Industrials, Trading companies &

distributors)144A |

|

|

|

|

8,900 |

54,736 |

| Capitaland India Trust (Real estate, Real estate management & development) |

|

|

|

|

121,000 |

84,841 |

| Yangzijiang Shipbuilding Holdings Ltd. (Industrials, Machinery) |

|

|

|

|

69,500 |

73,669

|

| |

|

|

|

|

|

213,246 |

| South Korea: 9.70% |

|

|

|

|

|

|

| Doosan Bobcat, Inc. (Industrials, Machinery) |

|

|

|

|

1,446 |

41,545 |

| Fila Holdings Corp. (Consumer discretionary, Textiles, apparel & luxury goods) |

|

|

|

|

1,939 |

51,343 |

| Kia Corp. (Consumer discretionary, Automobiles) |

|

|

|

|

1,071 |

61,188 |

| Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) |

|

|

|

|

5,699 |

283,667

|

| |

|

|

|

|

|

437,743 |

| Taiwan: 12.99% |

|

|

|

|

|

|

| Advanced Energy Solution Holding Co. Ltd. (Industrials, Electrical equipment) |

|

|

|

|

2,000 |

38,083 |

| Advantech Co. Ltd. (Information technology, Technology hardware, storage & peripherals) |

|

|

|

|

4,399 |

45,177 |

| Cathay Financial Holding Co. Ltd. (Financials,

Insurance)† |

|

|

|

|

46,000 |

62,424 |

| Chroma ATE, Inc. (Information technology, Electronic equipment, instruments & components) |

|

|

|

|

13,000 |

87,849 |

| E Ink Holdings, Inc. (Information technology, Electronic equipment, instruments & components) |

|

|

|

|

11,340 |

59,003 |

| MediaTek, Inc. (Information technology, Semiconductors & semiconductor equipment)† |

|

|

|

|

3,000 |

78,298 |

| momo.com, Inc. (Consumer discretionary, Broadline retail) |

|

|

|

|

2,760 |

45,503 |

| Realtek Semiconductor Corp. (Information technology, Semiconductors & semiconductor equipment) |

|

|

|

|

5,000 |

62,314 |

| Tripod Technology Corp. (Information technology, Electronic equipment, instruments & components) |

|

|

|

|

10,000 |

51,196 |

| Vanguard International Semiconductor Corp. (Information technology, Semiconductors & semiconductor equipment) |

|

|

|

|

26,000 |

56,465

|

| |

|

|

|

|

|

586,312 |

| Thailand: 1.03% |

|

|

|

|

|

|

| Thai Beverage PCL (Consumer staples, Beverages) |

|

|

|

|

118,100 |

46,647 |

| |

|

|

|

Shares |

Value | |

| United Arab Emirates: 3.01% |

|

|

|

|

|

|

| Abu Dhabi Commercial Bank PJSC (Financials, Banks) |

|

|

|

|

19,903 |

$43,512 |

| Aldar Properties PJSC (Real estate, Real estate management & development) |

|

|

|

|

65,178 |

92,275 |

| |

|

|

|

|

|

135,787 |

| Total common stocks (Cost $4,158,812) |

|

|

|

|

|

4,067,135 |

| |

|

Dividend rate |

|

|

| |

| Preferred stocks: 7.67% |

|

|

|

|

|

|

| South Korea: 7.67% |

|

|

|

|

|

|

| LG Chem Ltd. (Materials, Chemicals) |

|

7.40 |

|

|

291 |

60,777 |

| Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) |

|

0.27 |

|

|

7,154 |

285,622 |

| Total preferred stocks (Cost $395,575) |

|

|

|

|

|

346,399 |

| |

|

Yield |

|

|

| |

| Short-term investments: 1.79% |

|

|

|

|

|

|

| Investment companies: 1.79% |

|

|

|

|

|

|

| Allspring Government Money Market Fund Select

Class♠∞ |

|

5.29 % |

|

|

80,580 |

80,580 |

| Total short-term investments (Cost $80,580) |

|

|

|

|

|

80,580 |

| Total investments in securities (Cost $4,634,967) |

99.55 % |

|

|

|

|

4,494,114 |

| Other assets and liabilities, net |

0.45 |

|

|

|

|

20,505 |

| Total net assets |

100.00 % |

|

|

|

|

$4,514,619 |

| 144A |

The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of

1933. |

| † |

Non-income-earning security |

| ♠ |

The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ |

The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| ADR |

American depositary receipt |

| GDR |

Global depositary receipt |

| REIT |

Real estate investment trust |

| |

Value, beginning of period |

Purchases |

Sales

proceeds |

Net

realized

gains

(losses) |

Net

change in

unrealized

gains

(losses) |

Value,

end of

period |

Shares,

end

of period |

Income

from

affiliated

securities |

| Short-term investments |

|

|

|

|

|

|

|

|

| Allspring Government Money Market Fund Select Class |

$0 |

$6,440,966 |

$(6,360,386 ) |

$0 |

$0 |

$80,580 |

80,580 |

$12,565 |

| Assets |

|

| Investments in unaffiliated securities, at value (cost $4,554,387) |

$4,413,534 |

| Investments in affiliated securities, at value (cost $80,580) |

80,580 |

| Foreign currency, at value (cost $4,664) |

4,648 |

| Receivable for investments sold |

23,612 |

| Receivable for dividends |

4,971 |

| Receivable from manager |

703 |

| Prepaid expenses and other assets |

6,062 |

| Total assets |

4,534,110 |

| Liabilities |

|

| Payable for investments purchased |

19,378 |

| Accrued expenses and other liabilities |

113 |

| Total liabilities |

19,491 |

| Total net assets |

$4,514,619 |

| Net assets consist of |

|

| Paid-in capital |

$4,612,628 |

| Total distributable loss |

(98,009

) |

| Total net assets |

$4,514,619 |

| Computation of net asset value per share |

|

| Net assets |

$4,514,619 |

| Shares outstanding1

|

230,126 |

| Net asset value per share |

$19.62

|

| Investment income |

|

| Dividends (net of foreign withholdings taxes of $19,480) |

$123,950 |

| Income from affiliated securities |

12,565 |

| Interest |

10 |

| Total investment income |

136,525 |

| Expenses |

|

| Custody and accounting fees |

7,552 |

| Professional fees |

83,141 |

| Registration fees |

52,850 |

| Shareholder report expenses |

5,494 |

| Trustees’ fees and expenses |

23,902 |

| Other fees and expenses |

3,940 |

| Total expenses |

176,879 |

| Less: Fee waivers and/or expense reimbursements |

(176,879

) |

| Net expenses |

0 |

| Net investment income |

136,525 |

| Realized and unrealized gains (losses) on investments |

|

| Net realized gains (losses) on |

|

| Unaffiliated securities |

37,758 |

| Foreign currency and foreign currency translations |

(7,724 ) |

| Net realized gains on investments |

30,034 |

| Net change in unrealized gains (losses) on |

|

| Unaffiliated securities |

(140,853

) |

| Foreign currency and foreign currency translations |

3 |

| Net change in unrealized gains (losses) on investments |

(140,850

) |

| Net realized and unrealized gains (losses) on investments |

(110,816

) |

| Net increase in net assets resulting from operations |

$25,709 |

| |

year ended October 31, 20231

| |

| Operations |

|

|

| Net investment income |

|

$136,525 |

| Net realized gains on investments |

|

30,034 |

| Net change in unrealized gains (losses) on investments |

|

(140,850 ) |

| Net increase in net assets resulting from operations |

|

25,709 |

| Distributions to shareholders from |

|

|

| Net investment income and net realized gains |

|

(123,718 ) |

| Capital share transactions |

Shares |

|

| Proceeds from shares sold |

224,911 |

4,502,070 |

| Reinvestment of distributions |

5,215 |

110,558 |

| Net increase in net assets resulting from capital share transactions |

|

4,612,628 |

| Total increase in net assets |

|

4,514,619 |

| Net assets |

|

|

| Beginning of period |

|

0 |

| End of period |

|

$4,514,619 |

| |

Year ended October 31 |

| |

20231 |

| Net asset value, beginning of period |

$20.00 |

| Net investment income |

0.61

2 |

| Net realized and unrealized gains (losses) on investments |

(0.44 ) |

| Total from investment operations |

0.17 |

| Distributions to shareholders from |

|

| Net investment income |

(0.55 ) |

| Net asset value, end of period |

$19.62 |

| Total

return3 |

0.66 % |

| Ratios to average net assets (annualized) |

|

| Gross expenses |

3.95 % |

| Net expenses |

0.00

%4 |

| Net investment income |

3.05 % |

| Supplemental data |

|

| Portfolio turnover rate |

92 % |

| Net assets, end of period (000s omitted) |

$4,515

|

| 1 |

For the period from November 16, 2022 (commencement of operations) to October 31, 2023 |

| 2 |

Calculated based upon average shares outstanding |

| 3 |

Returns for periods of less than one year are not annualized. |

| 4 |

The manager has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other

investment-related costs (e.g., commissions), fees payable for services

provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses, and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term. |

| Gross unrealized gains |

$183,619 |

| Gross unrealized losses |

(336,004 ) |

| Net unrealized losses |

$(152,385

) |

| |

Quoted prices

(Level 1) |

Other significant

observable inputs

(Level 2) |

Significant

unobservable inputs

(Level 3) |

Total |

| Assets |

|

|

|

|

| Investments in: |

|

|

|

|

| Common stocks |

|

|

|

|

| Brazil |

$154,554

|

$0

|

$0 |

$154,554

|

| Chile |

46,348 |

0 |

0 |

46,348 |

| China |

0 |

667,565 |

0 |

667,565 |

| Greece |

0 |

111,896 |

0 |

111,896 |

| India |

862,237 |

200,248 |

0 |

1,062,485 |

| Indonesia |

0 |

75,990 |

0 |

75,990 |

| Malaysia |

0 |

42,493 |

0 |

42,493 |

| Mexico |

44,698 |

0 |

0 |

44,698 |

| Philippines |

52,832 |

0 |

0 |

52,832 |

| Poland |

19,316 |

96,965 |

0 |

116,281 |

| Qatar |

0 |

50,864 |

0 |

50,864 |

| Saudi Arabia |

97,107 |

124,288 |

0 |

221,395 |

| Singapore |

84,841 |

128,404 |

0 |

213,245 |

| South Korea |

0 |

437,743 |

0 |

437,743 |

| Taiwan |

0 |

586,312 |

0 |

586,312 |

| Thailand |

0 |

46,647 |

0 |

46,647 |

| United Arab Emirates |

135,787 |

0 |

0 |

135,787 |

| Preferred stocks |

|

|

|

|

| South Korea |

0 |

346,399 |

0 |

346,399 |

| Short-term investments |

|

|

|

|

| Investment companies |

80,580 |

0 |

0 |

80,580 |

| Total assets |

$1,578,300 |

$2,915,814 |

$0 |

$4,494,114 |

| Undistributed

ordinary

income |

Unrealized

losses |

| $54,373 |

$(152,382 ) |

| Creditable

foreign taxes

paid |

Per share

amount |

Foreign

income as % of

ordinary income

distributions |

| $147,513 |

$0.0741 |

100 % |

| Name and

year of birth |

Position held and

length of service |

Principal occupations during past five years or

longer |

Current other

public company

or

investment

company

directorships |

| William R.

Ebsworth

(Born 1957) |

Trustee,

since 2015 |

Retired. From 1984 to 2013, equities analyst, portfolio manager, research

director and chief investment officer at Fidelity

Management and Research Company in Boston, Tokyo, and Hong

Kong, and retired in 2013 as Chief Investment Officer of Fidelity

Strategic Advisers, Inc. where he led a team of investment

professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International

Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire

Fidelity Investments Life Insurance Company. Audit

Committee Chair and Investment Committee Chair of the Vincent

Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA

charterholder. |

N/A |

| Jane A.

Freeman

(Born 1953) |

Trustee,

since 2015;

Chair Liaison,

since 2018 |

Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of

Scientific Learning Corporation. From 2008 to 2012, Ms.

Freeman provided consulting services related to strategic

business projects. Prior to 1999, Portfolio Manager at Rockefeller &

Co. and Scudder, Stevens & Clark. Board member of the

Harding Loevner Funds from 1996 to 2014, serving as both Lead

Independent Director and chair of the Audit Committee. Board member of

the Russell Exchange Traded Funds Trust from 2011 to 2012

and the chair of the Audit Committee. Ms. Freeman is also an

inactive Chartered Financial Analyst. |

N/A |

| Isaiah

Harris, Jr.

(Born 1952) |

Trustee,

since 2009;

Audit Committee

Chair,

since 2019 |

Retired. Member of the Advisory Board of CEF of East Central Florida.

Chairman of the Board of CIGNA Corporation from 2009 to

2021, and Director from 2005 to 2008. From 2003 to 2011,

Director of Deluxe Corporation. Prior thereto, President and CEO of

BellSouth Advertising and Publishing Corp. from 2005 to

2007, President and CEO of BellSouth Enterprises from 2004 to

2005 and President of BellSouth Consumer Services from 2000 to 2003.

Emeritus member of the Iowa State University Foundation

Board of Governors. Emeritus Member of the Advisory board of

Iowa State University School of Business. Advisory Board Member, Palm

Harbor Academy (private school). Advisory Board Member,

Fellowship of Christian Athletes. Mr. Harris is a certified public

accountant (inactive status). |

N/A |

| David F.

Larcker

(Born 1950) |

Trustee,

since 2009 |

Distinguished Visiting Fellow at the Hoover Institution since 2022. James

Irvin Miller Professor of Accounting at the Graduate School

of Business (Emeritus), Stanford University, Director of the

Corporate Governance Research Initiative and Senior Faculty of The Rock

Center for Corporate Governance since 2006. From 2005 to

2008, Professor of Accounting at the Graduate School of

Business, Stanford University. Prior thereto, Ernst & Young Professor

of Accounting at The Wharton School, University of Pennsylvania

from 1985 to 2005. |

N/A |

| Olivia S.

Mitchell

(Born 1953) |

Trustee,

since 2006;

Nominating and

Governance

Committee Chair,

since 2018 |

International Foundation of Employee Benefit Plans Professor since 1993,

Wharton School of the University of Pennsylvania. Director

of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic

Research. Previously taught at Cornell University from 1978 to 1993.

|

N/A |

| Timothy J.

Penny

(Born 1951) |

Trustee,

since 1996;

Chair,

since 2018 |

President and Chief Executive Officer of Southern Minnesota Initiative

Foundation, a non-profit organization, since 2007. Vice

Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of

NorthStar Education Finance, Inc., a non-profit organization, from

2007-2022. Senior Fellow of the University of Minnesota Humphrey

Institute from 1995 to 2017. |

N/A |

| Name and

year of birth |

Position held and

length of service |

Principal occupations during past five years or

longer |

Current other

public company

or

investment

company

directorships |

| James G.

Polisson

(Born 1959) |

Trustee,

since 2018 |

Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from

2015 to 2017. From 2012 to 2015, Principal of The Polisson

Group, LLC, a management consulting, corporate advisory and

principal investing company. Chief Executive Officer and Managing

Director at Russell Investments, Global Exchange Traded

Funds from 2010 to 2012. Managing Director of Barclays

Global Investors from 1998 to 2010 and Global Chief Marketing Officer for

iShares and Barclays Global Investors from 2000 to 2010.

Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust

from 2011 to 2012. Director of Barclays Global Investors Holdings

Deutschland GmbH from 2006 to 2009. Mr. Polisson is an

attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. |

N/A |

| Pamela Wheelock (Born 1959) |

Trustee, since January 2020; previously Trustee from January 2018 to July 2019 |

Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit

sectors. Interim President and CEO, McKnight Foundation, 2020. Interim

Commissioner, Minnesota Department of Human Services, 2019.

Chief Operating Officer, Twin Cities Habitat for Humanity,

2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive

Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008.

Commissioner, Minnesota Department of Finance, 1999-2002.

Chair of the Board of Directors of Destination Medical Center

Corporation. Board member of the Minnesota Wild Foundation. |

N/A |

| Name and

year of birth |

Position held and

length of

service |

Principal occupations during past five years or

longer |

| Andrew Owen

(Born 1960) |

President,

since 2017 |

President and Chief Executive Officer of Allspring Funds Management, LLC

since 2017 and Head of Global Fund Governance of Allspring

Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated

Managers, Allspring Global Investments, from 2014 to 2019 and Executive

Vice President responsible for marketing, investments and product

development for Allspring Funds Management, LLC, from 2009 to 2014. |

| Jeremy DePalma

(Born 1974) |

Treasurer,

since 2012

(for certain funds in

the Fund Complex);

since 2021 (for

the remaining funds

in the Complex) |

Senior Vice President of Allspring Funds Management, LLC since 2009.

Senior Vice President of Evergreen Investment Management

Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010.

|

| Christopher Baker

(Born 1976) |

Chief Compliance

Officer,

since 2022 |

Global Chief Compliance Officer for Allspring Global Investments since

2022. Prior thereto, Chief Compliance Officer for State

Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015

Vice President, Global Head of Investment and Marketing Compliance for State

Street Global Advisors. |

| Matthew Prasse (Born 1983) |

Chief Legal Officer, since 2022; Secretary, since 2021 |

Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department

from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018.

Prior to joining Barings, Associate at Morgan, Lewis & Bockius

LLP from 2008 to 2015. |

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| 18 | |

| 20 | |

| 22 | |

| 23 | |

| 28 | |

| 34 | |

| 35 |

| Notice to Shareholders |

| Beginning in July 2024, the Fund will be required by the

Securities and Exchange Commission to send shareholders a paper copy of a

new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance

information and fund statistics. If you wish to receive this new tailored shareholder

report electronically, please follow the instructions on the back cover

of this report. |

| Other information that is currently included in the shareholder

report, such as the Fund’s financial statements, will be available

online and upon request, free of charge, in paper or electronic format. |

| Investment objective |

The Fund seeks long-term capital appreciation. |

| Manager |

Allspring Funds Management, LLC |

| Subadviser |

Allspring Global Investments, LLC |

| Portfolio managers |

Derrick Irwin, CFA, Richard Peck, CFA, Yi (Jerry) Zhang, Ph.D.,

CFA |

| Average annual total returns (%) as of October 31, 2023 | |||||||||

| |

|

Including sales charge |

Excluding sales charge |

Expense ratios1 (%) | |||||

| |

Inception date |

1 year |

5 year |

10 year |

1 year |

5 year |

10 year |

Gross |

Net2 |

| Class A (EMGAX) |

9-6-1994 |

3.37 |

-0.02 |

-0.08 |

9.67 |

1.17 |

0.51 |

1.53 |

1.43 |

| Class C (EMGCX) |

9-6-1994 |

7.77 |

0.44 |

-0.08 |

8.77 |

0.44 |

-0.08 |

2.28 |

2.18 |

| Class R6 (EMGDX) |

6-28-2013 |

– |

– |

– |

10.09 |

1.60 |

0.95 |

1.11 |

1.01 |

| Administrator Class (EMGYX) |

9-6-1994 |

– |

– |

– |

9.70 |

1.47 |

0.72 |

1.46 |

1.36 |

| Institutional Class (EMGNX) |

7-30-2010 |

– |

– |

– |

10.01 |

1.52 |

0.88 |

1.21 |

1.11 |

| MSCI EM Index (Net) (USD)3 |

– |

– |

– |

– |

10.80 |

1.59 |

1.19 |

– |

– |

| | |

| 1 |

Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios

shown in the Financial Highlights of this report. |

| 2 |

The manager has contractually committed through February 29, 2024 (February 28, 2025 for Class A and C), to waive fees and/or reimburse expenses to the extent

necessary to cap total annual fund operating expenses after fee waivers at

1.43% for Class A, 2.18% for Class C, 1.01% for Class R6, 1.36% for Administrator Class and 1.11% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded

from the expense caps. Prior to or after the commitment expiration date,

the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio

(the total annual fund operating expenses after fee waivers) as stated in the

prospectuses. |

| 3 |

The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to

measure the equity market performance of emerging markets. Source: MSCI. MSCI makes no express or implied warranties

or representations and shall have no liability whatsoever with respect to

any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

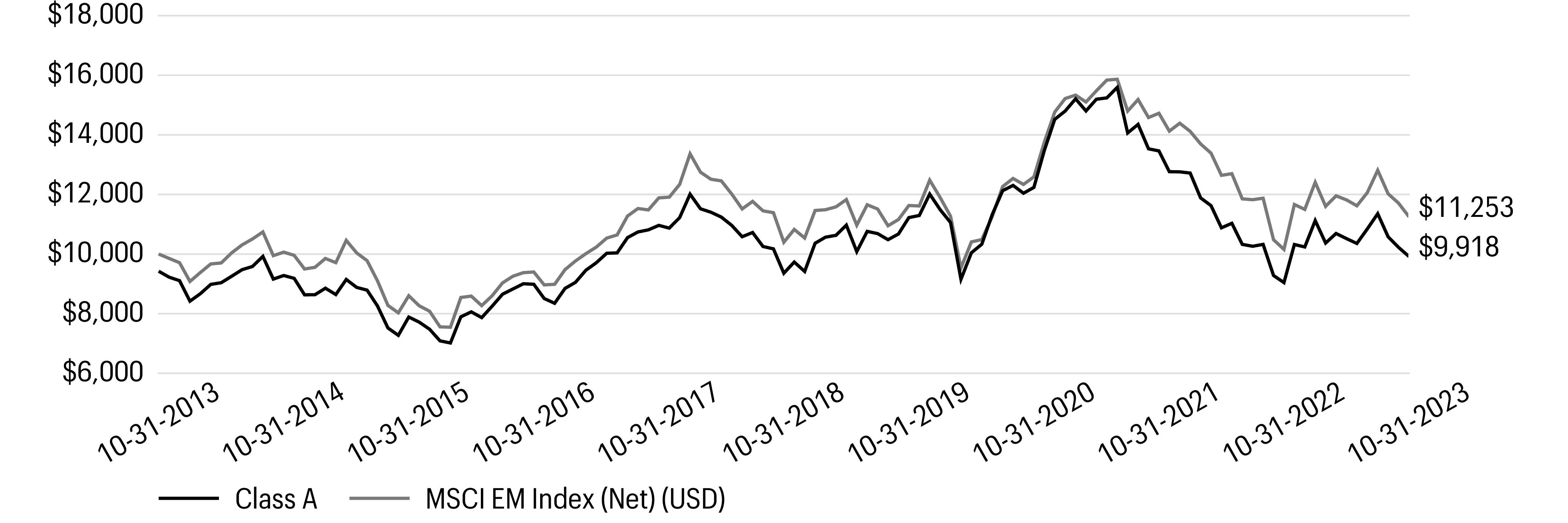

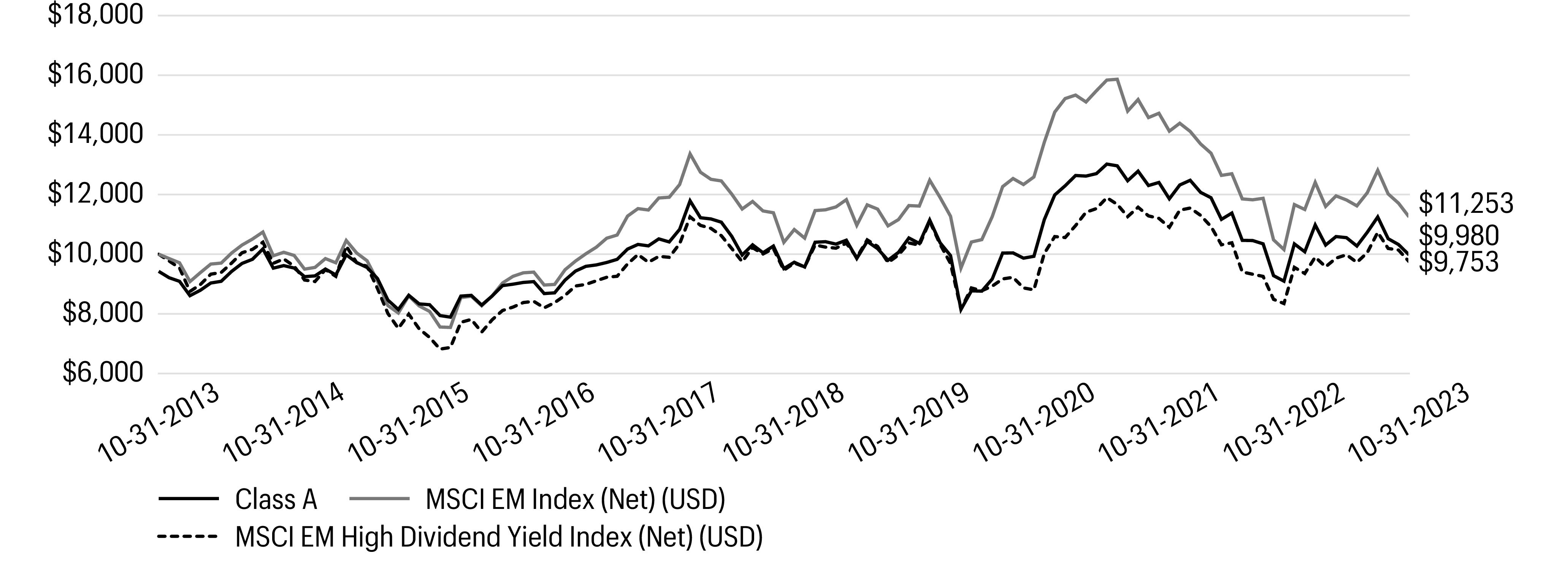

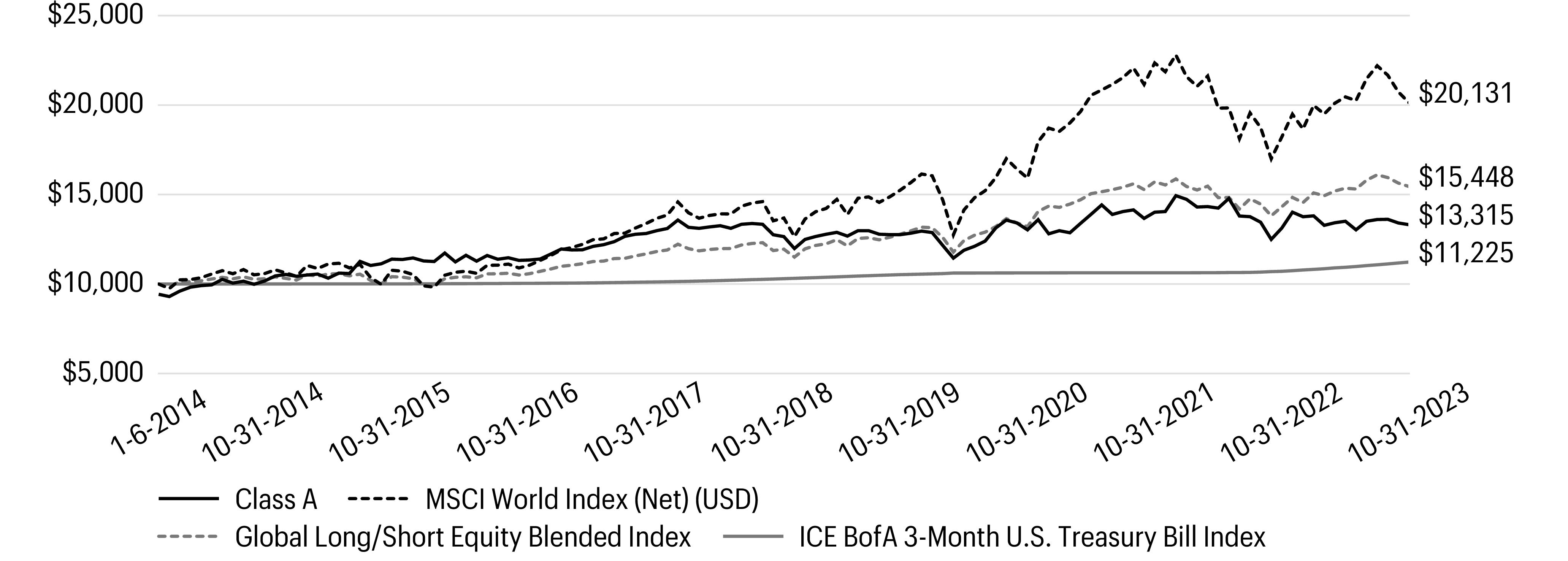

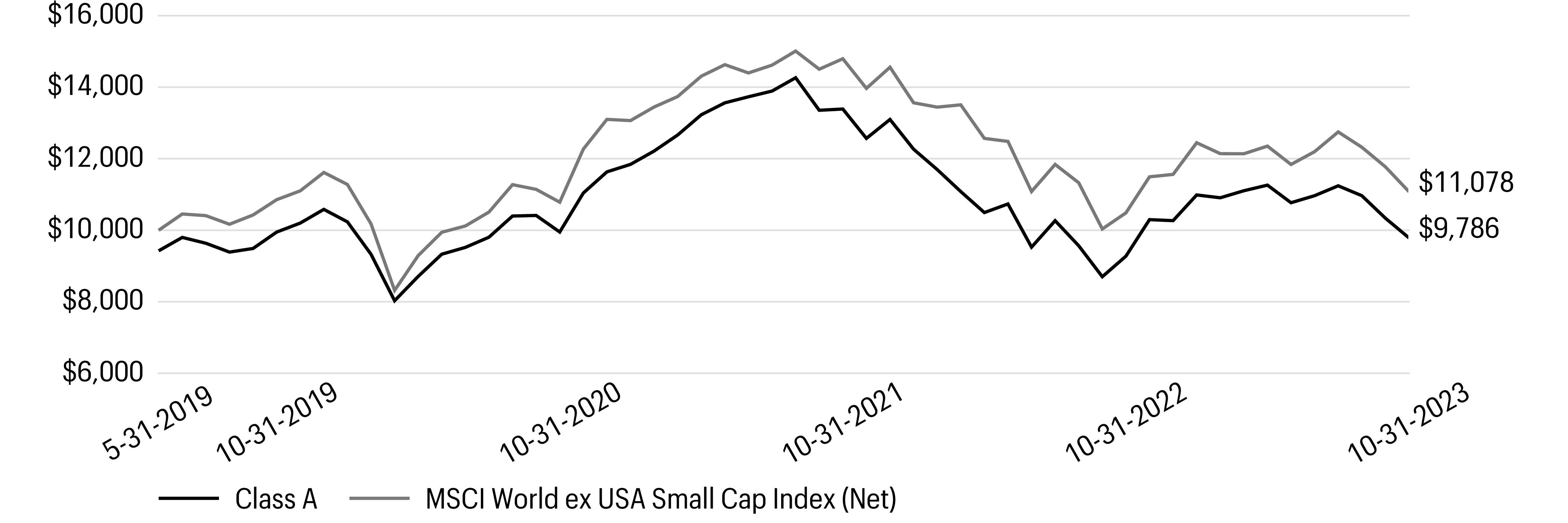

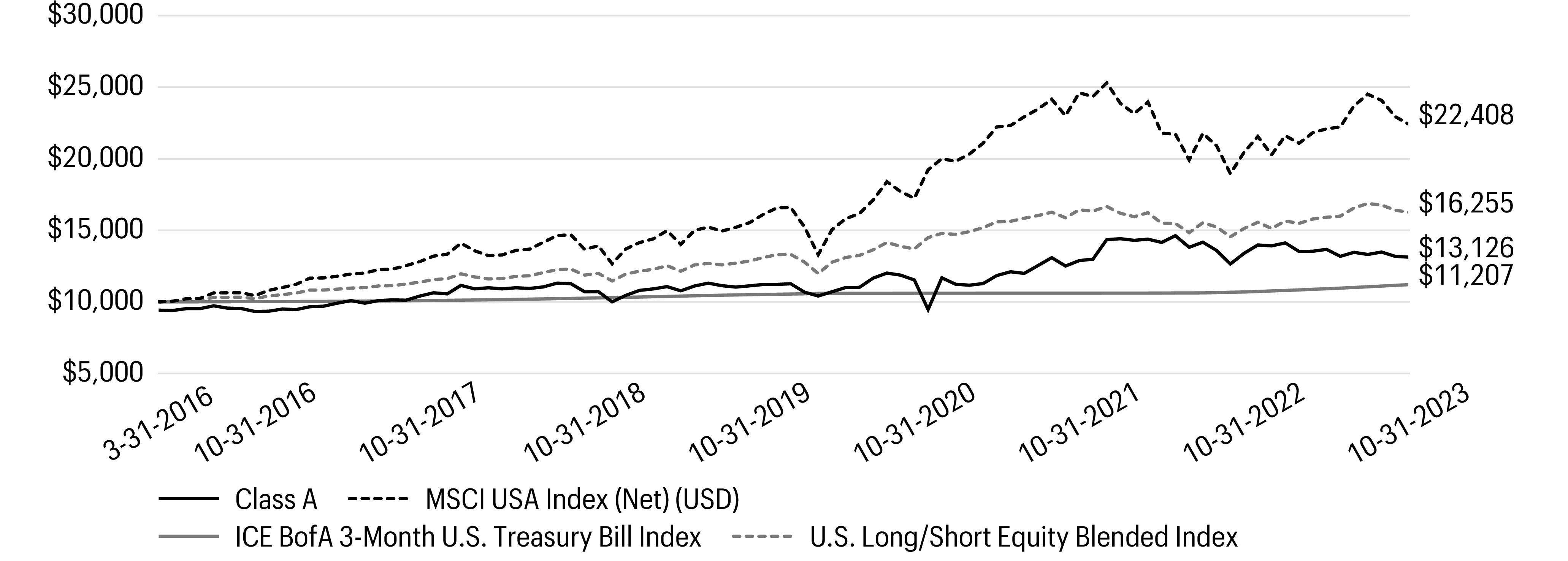

| Growth of $10,000 investment as of October 31, 20231 |

| 1 |

The chart compares the performance of Class A shares for the most recent ten years with the MSCI EM Index (Net) (USD). The chart assumes a hypothetical investment of

$10,000 in Class A shares and reflects all operating expenses and assumes the

maximum initial sales charge of 5.75%. |

| Ten largest holdings (%) as of October 31, 20231 | |

| Samsung Electronics Co. Ltd. |

6.20 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR |

4.94 |

| Tencent Holdings Ltd. |

4.23 |

| Fomento Economico Mexicano SAB de CV |

3.81 |

| Reliance Industries Ltd. GDR |

3.56 |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

3.20 |

| AIA Group Ltd. |

2.19 |

| Alibaba Group Holding Ltd. |

2.17 |

| Fibra Uno Administracion SA de CV |

2.13 |

| WH Group Ltd. |

2.12 |

| 1 |

Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

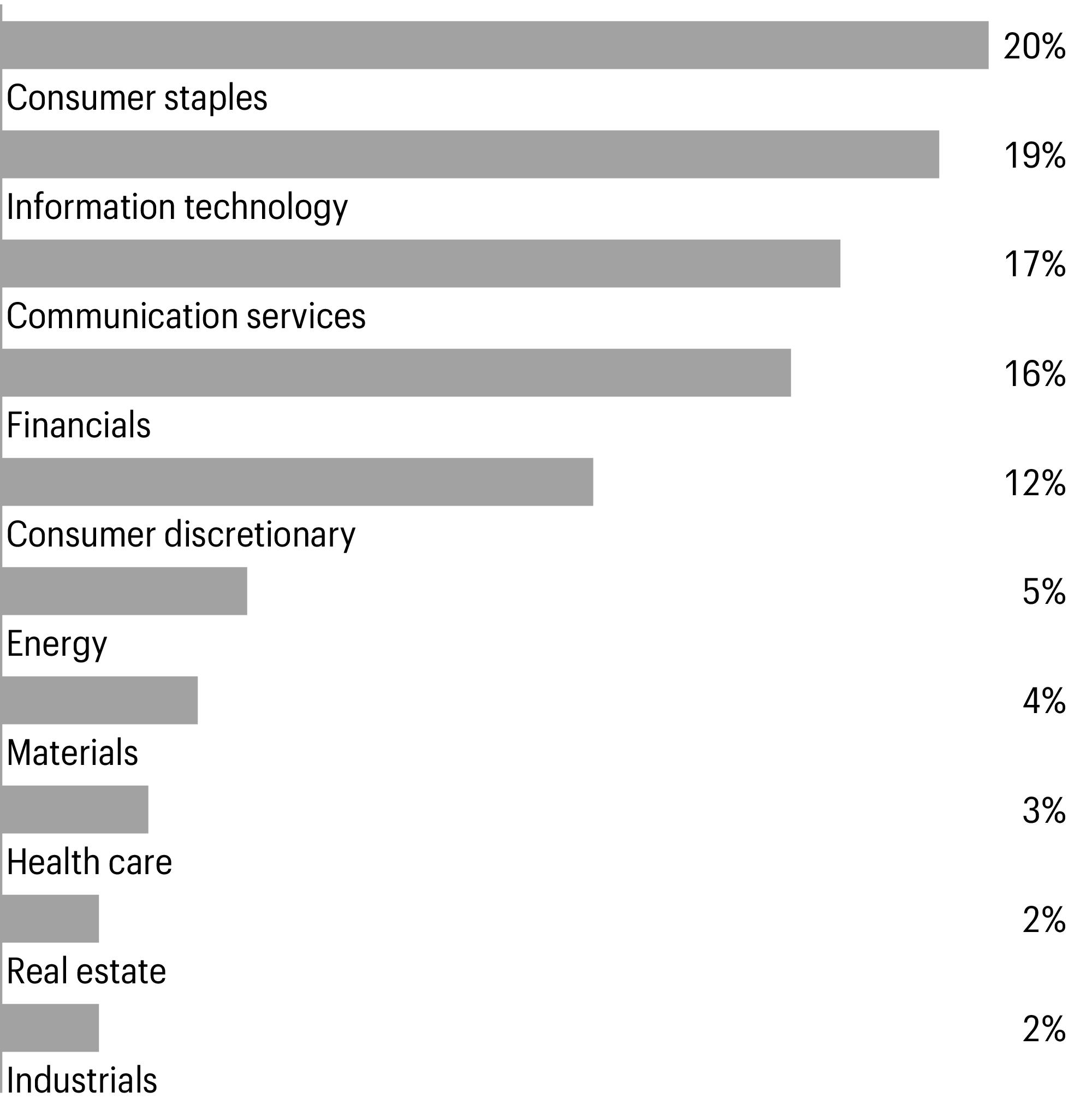

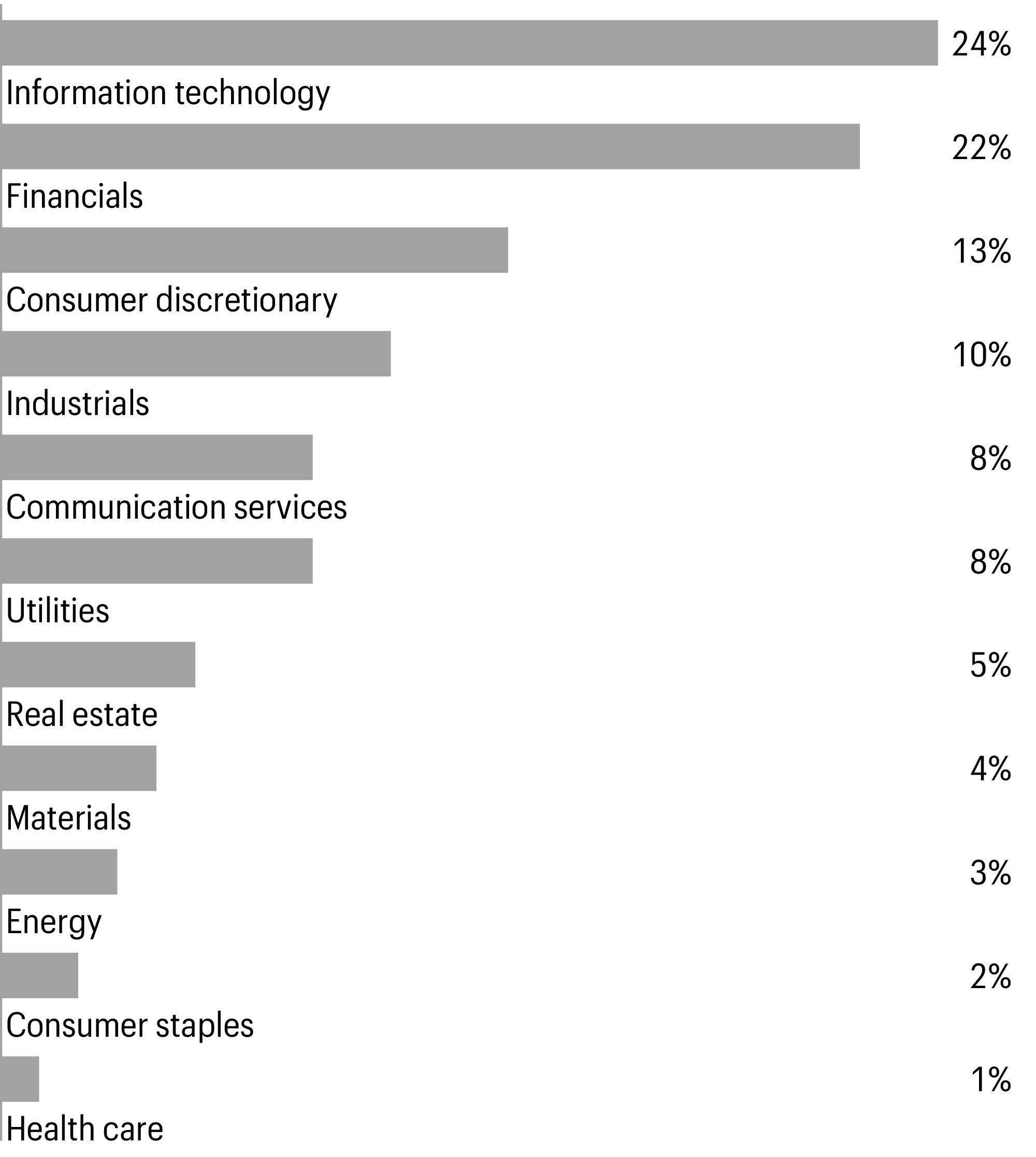

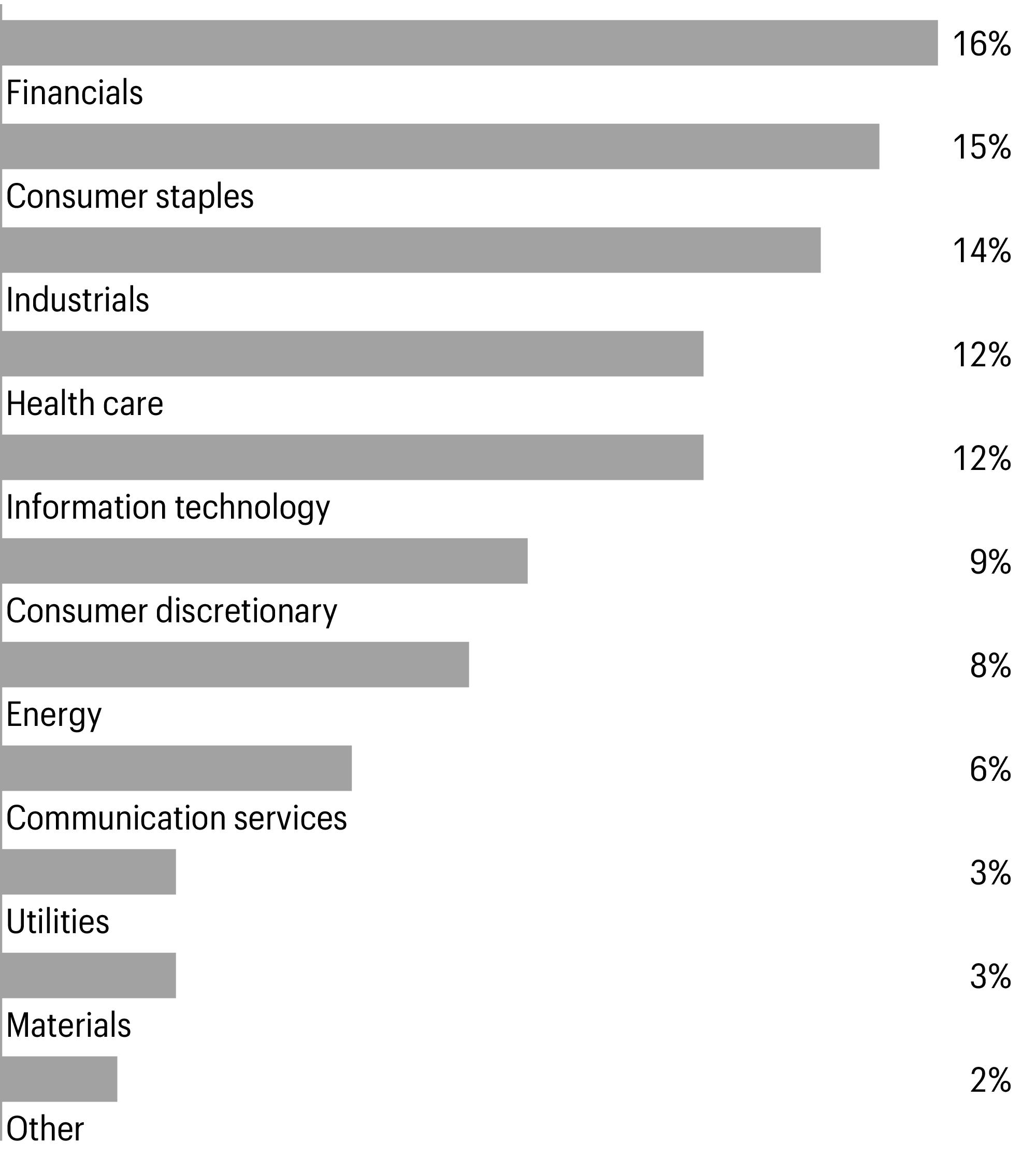

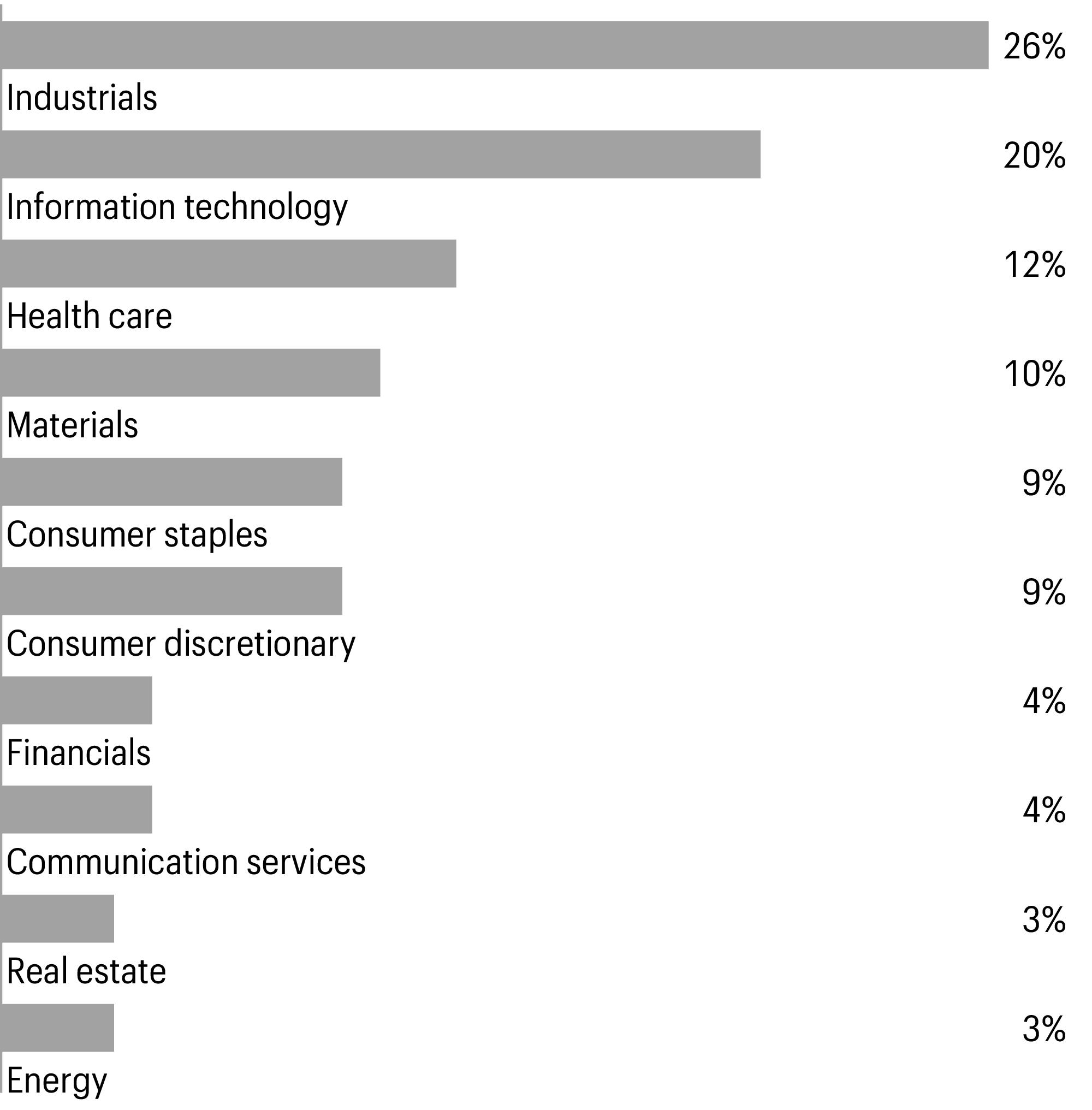

| Sector allocation as of October 31, 20231 |

| 1 |

Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

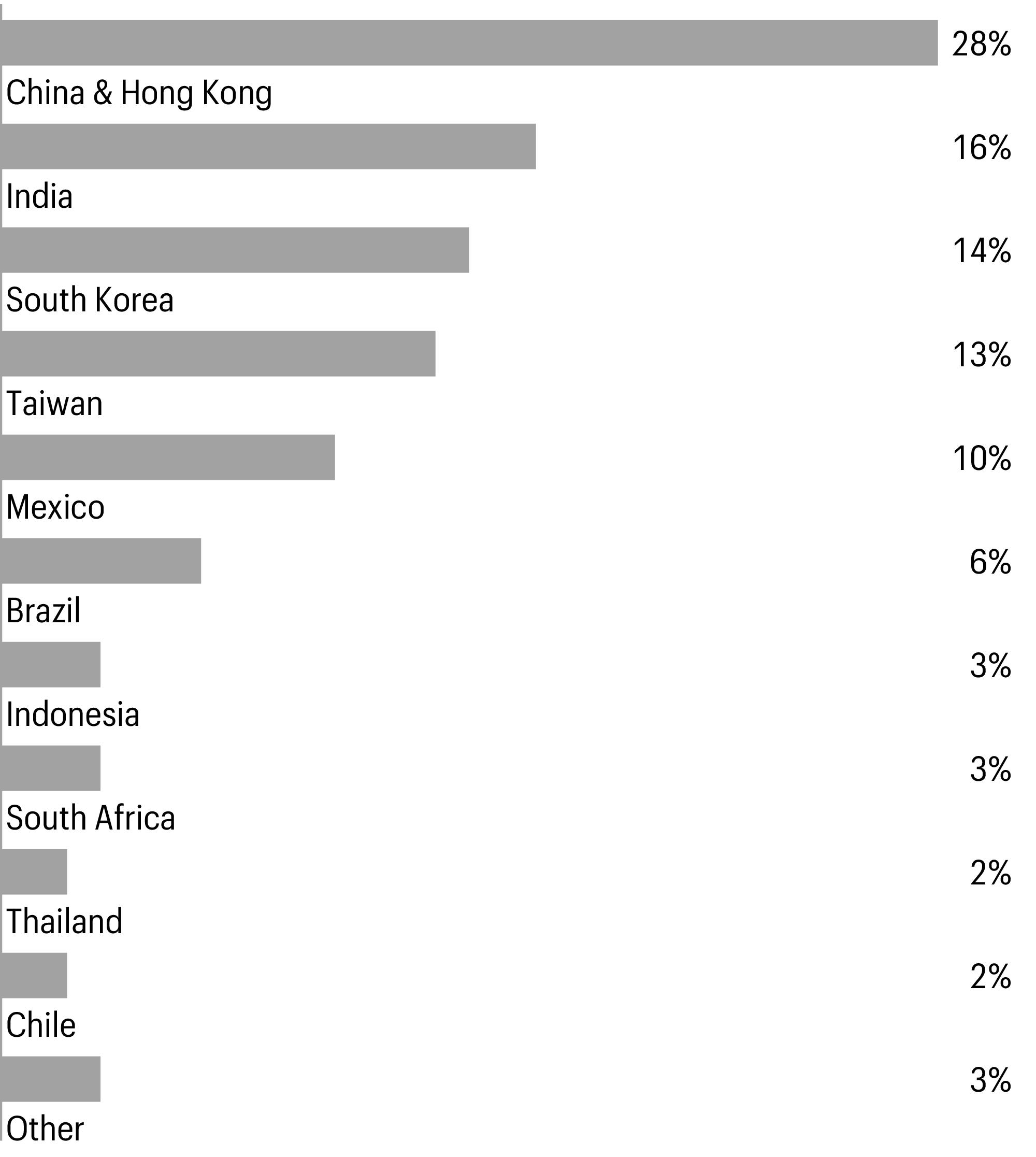

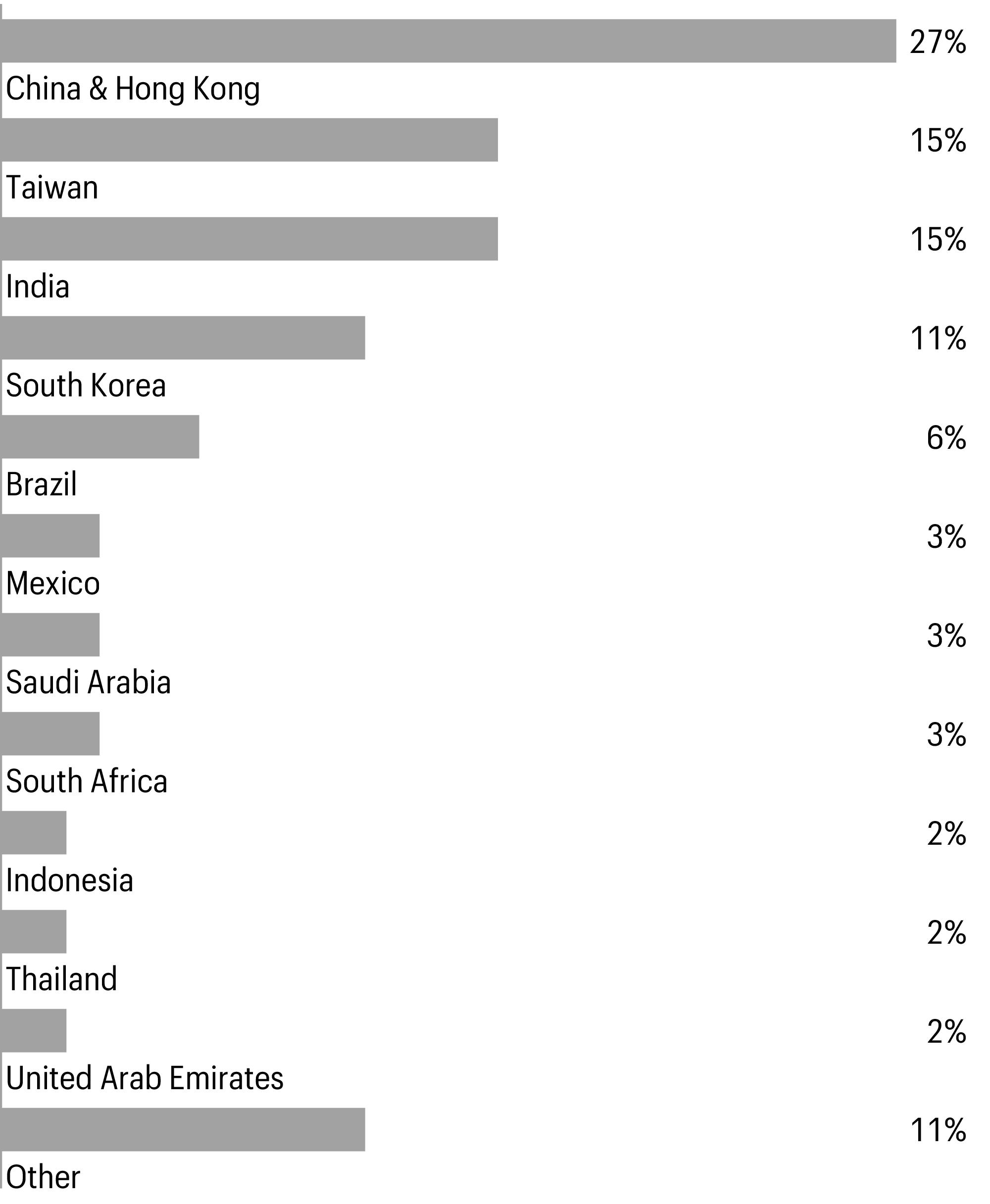

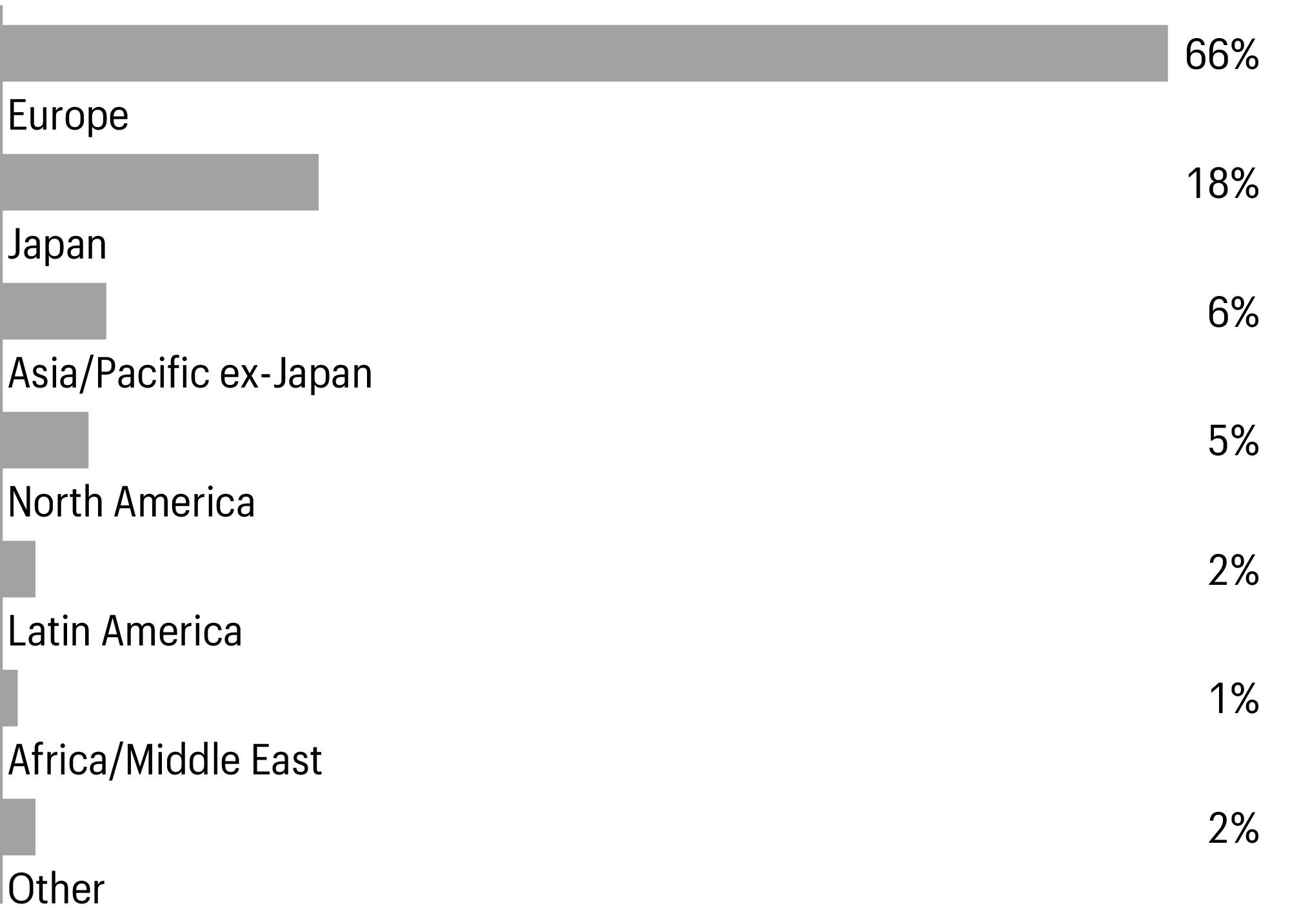

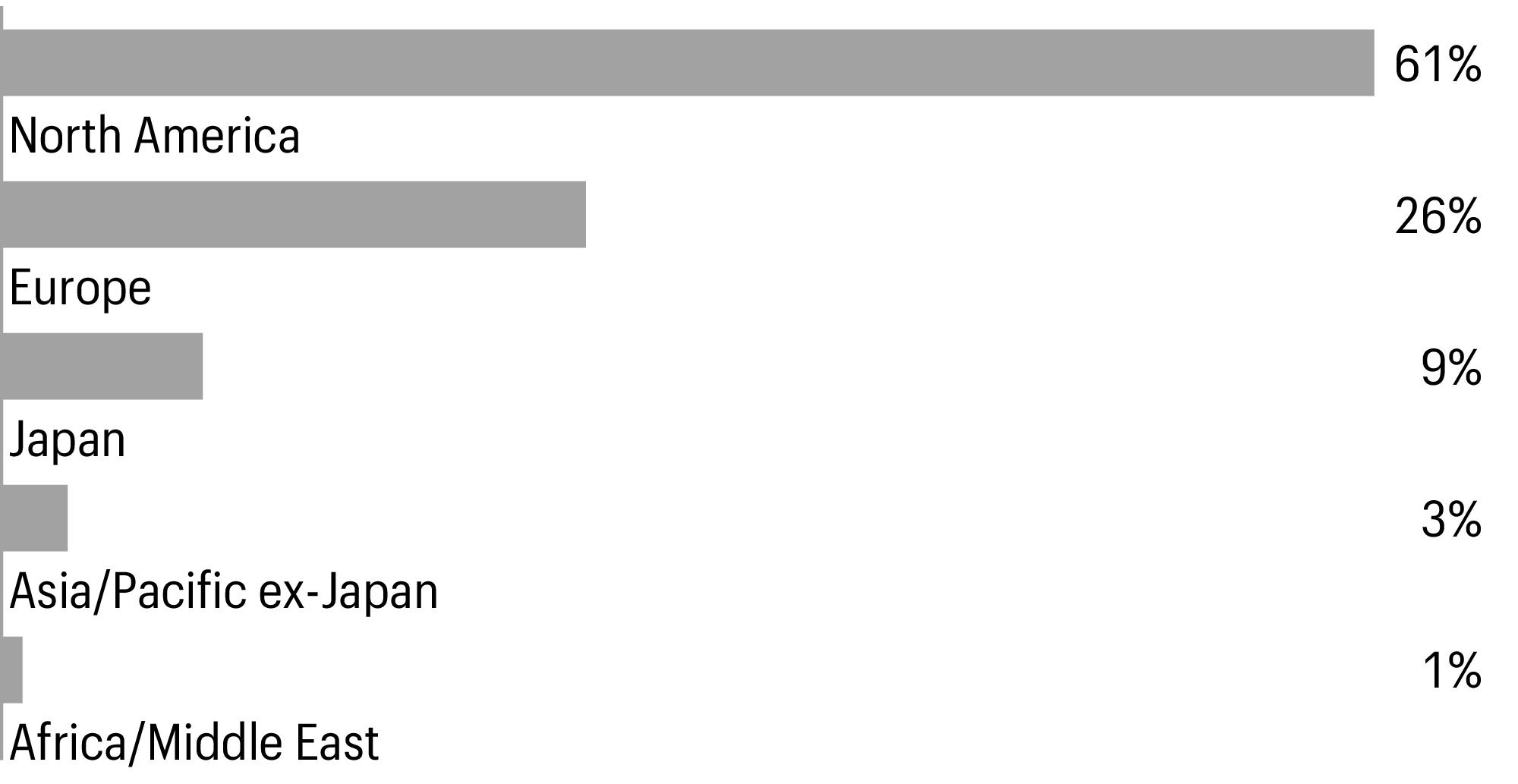

| Country allocation as of October 31, 20231 |

| 1 |

Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

| |

Beginning account value 5-1-2023 |

Ending account value 10-31-2023 |

Expenses paid during the period1

|

Annualized net expense ratio |

| Class A |

|

|

|

|

| Actual |

$1,000.00 |

$942.89 |

$6.86 |

1.40 % |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,018.15 |

$7.12 |

1.40 % |

| Class C |

|

|

|

|

| Actual |

$1,000.00 |

$938.80 |

$10.65 |

2.18 % |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,014.22 |

$11.07 |

2.18 % |

| Class R6 |

|

|

|

|

| Actual |

$1,000.00 |

$944.31 |

$4.95 |

1.01 % |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,020.11 |

$5.14 |

1.01 % |

| Administrator Class |

|

|

|

|

| Actual |

$1,000.00 |

$942.85 |

$6.61 |

1.35 % |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,018.40 |

$6.87 |

1.35 % |

| Institutional Class |

|

|

|

|

| Actual |

$1,000.00 |

$944.31 |

$5.44 |

1.11 % |

| Hypothetical (5% return before expenses) |

$1,000.00

|

$1,019.61

|

$5.65

|

1.11 % |

| 1 |

Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 184 divided by 365 (to

reflect the one-half-year period). |

| |

|

|

|

Shares |

Value | |

| Common stocks: 97.02% |

|

|

|

|

|

|

| Brazil: 5.18% |

|

|

|

|

|

|

| Atacadao SA (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

8,727,000 |

$15,526,591 |

| B3 SA - Brasil Bolsa Balcao (Financials, Capital markets) |

|

|

|

|

20,185,515 |

44,440,763 |

| Banco Bradesco SA ADR (Financials, Banks) |

|

|

|

|

5,976,276 |

16,673,810 |

| BRF SA ADR (Consumer staples, Food products)† |

|

|

|

|

3,969,115 |

8,216,068 |

| Cia Brasileira de Aluminio (Materials, Metals & mining) |

|

|

|

|

4,652,600 |

3,506,695 |

| Diagnosticos da America SA (Health care, Health care providers & services) |

|

|

|

|

3,700,673 |

7,112,515 |

| Hapvida Participacoes e Investimentos SA (Health care, Health care providers & services)144A† |

|

|

|

|

33,701,316 |

24,665,613 |

| Lojas Renner SA (Consumer discretionary, Specialty retail) |

|

|

|

|

8,956,892 |

21,780,433 |

| Magazine Luiza SA (Consumer discretionary, Broadline

retail)† |

|

|

|

|

22,599,800 |

5,961,766 |

| Multiplan Empreendimentos Imobiliarios SA (Real estate, Real estate management & development) |

|

|

|

|

1,696,906 |

8,326,762 |

| Petroleo Brasileiro SA ADR (Energy, Oil, gas & consumable fuels) |

|

|

|

|

562,079 |

8,431,185 |

| Raia Drogasil SA (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

2,046,720 |

10,473,621 |

| Suzano SA (Materials, Paper & forest products) |

|

|

|

|

646,000 |

6,607,670 |

| Zamp SA (Consumer discretionary, Hotels, restaurants &

leisure)† |

|

|

|

|

2,855,794 |

3,596,825 |

| |

|

|

|

|

|

185,320,317 |

| Chile: 1.67% |

|

|

|

|

|

|

| Banco Santander Chile ADR (Financials, Banks) |

|

|

|

|

1,190,492 |

20,714,561 |

| Falabella SA (Consumer discretionary, Broadline retail)†

|

|

|

|

|

19,096,599 |

38,901,310 |

| |

|

|

|

|

|

59,615,871 |

| China: 22.02% |

|

|

|

|

|

|

| Agora, Inc. ADR (Information technology, Software)†

|

|

|

|

|

1,224,765 |

3,600,809 |

| Alibaba Group Holding Ltd. (Consumer discretionary, Broadline retail)† |

|

|

|

|

2,930,000 |

30,164,563 |

| Alibaba Group Holding Ltd. ADR (Consumer discretionary, Broadline retail)† |

|

|

|

|

940,837 |

77,656,686 |

| Bilibili, Inc. ADR (Communication services,

Entertainment)† |

|

|

|

|

2,098,150 |

28,178,154 |

| China Literature Ltd. (Communication services, Media)144A† |

|

|

|

|

4,716,168 |

15,881,600 |

| China Meidong Auto Holdings Ltd. (Consumer discretionary, Specialty retail) |

|

|

|

|

12,373,400 |

6,635,743 |

| FinVolution Group ADR (Financials, Consumer finance) |

|

|

|

|

4,401,985 |

20,821,389 |

| GreenTree Hospitality Group Ltd. ADR (Consumer discretionary, Hotels, restaurants & leisure)† |

|

|

|

|

2,531,768 |

11,190,415 |

| Hua Medicine (Health care, Pharmaceuticals)144A† |

|

|

|

|

8,733,136 |

1,754,914 |

| Kingdee International Software Group Co. Ltd. (Information technology, Software)† |

|

|

|

|

14,400,000 |

19,106,896 |

| Li Ning Co. Ltd. (Consumer discretionary, Textiles, apparel & luxury goods) |

|

|

|

|

10,365,207 |

31,763,172 |

| Meituan Class B (Consumer discretionary, Hotels, restaurants & leisure)144A† |

|

|

|

|

4,709,070 |

66,751,087 |

| Shandong Weigao Group Medical Polymer Co. Ltd. Class H (Health care, Health care equipment & supplies) |

|

|

|

|

35,410,600 |

32,867,825 |

| |

|

|

|

Shares |

Value | |

| China(continued) |

|

|

|

|

|

|

| Tencent Holdings Ltd. (Communication services, Interactive media & services)† |

|

|

|

|

4,092,700 |

$151,465,630 |

| Tencent Music Entertainment Group ADR (Communication services, Entertainment)† |

|

|

|

|

4,556,603 |

33,080,938 |

| Tongdao Liepin Group (Communication services, Interactive media & services)† |

|

|

|

|

1,636,260 |

1,202,205 |

| Trip.com Group Ltd. ADR (Consumer discretionary, Hotels, restaurants & leisure)† |

|

|

|

|

945,178 |

32,136,052 |

| Tsingtao Brewery Co. Ltd. Class H (Consumer staples, Beverages) |

|

|

|

|

5,122,500 |

38,846,615 |

| Vipshop Holdings Ltd. ADR (Consumer discretionary, Broadline retail)† |

|

|

|

|

3,018,967 |

43,050,469 |

| Want Want China Holdings Ltd. (Consumer staples, Food products) |

|

|

|

|

76,125,800 |

47,301,485 |

| Weibo Corp. ADR (Communication services, Interactive media & services)† |

|

|

|

|

2,101,212 |

24,857,338 |

| Wuxi Biologics Cayman, Inc. (Health care, Life sciences tools & services)144A† |

|

|

|

|

3,493,500 |

21,721,668 |

| Xiaomi Corp. Class B (Information technology, Technology hardware, storage & peripherals)144A† |

|

|

|

|

20,471,900 |

36,706,582 |

| Zepp Health Corp. ADR (Information technology, Electronic equipment, instruments & components)♠† |

|

|

|

|

2,439,291 |

2,512,470 |

| Zhou Hei Ya International Holdings Co. Ltd. (Consumer staples, Food products)144A† |

|

|

|

|

25,612,726 |

8,451,605 |

| |

|

|

|

|

|

787,706,310 |

| Colombia: 0.35% |

|

|

|

|

|

|

| Bancolombia SA ADR (Financials, Banks) |

|

|

|

|

499,100 |

12,667,158 |

| Hong Kong: 4.95% |

|

|

|

|

|

|

| AIA Group Ltd. (Financials, Insurance) |

|

|

|

|

9,017,500 |

78,306,192 |

| Johnson Electric Holdings Ltd. (Consumer discretionary, Automobile components) |

|

|

|

|

4,183,050 |

5,189,087 |

| Sun Art Retail Group Ltd. (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

84,455,400 |

17,829,374 |

| WH Group Ltd. (Consumer staples, Food products)144A |

|

|

|

|

126,938,195 |

75,811,670 |

| |

|

|

|

|

|

177,136,323 |

| India: 15.28% |

|

|

|

|

|

|

| Axis Bank Ltd. (Financials, Banks) |

|

|

|

|

3,301,923 |

38,962,053 |

| Bajaj Finance Ltd. (Financials, Consumer finance) |

|

|

|

|

153,281 |

13,798,268 |

| Bharti Airtel Ltd. (Communication services, Wireless telecommunication services) |

|

|

|

|

5,019,052 |

55,122,278 |

| Bharti Airtel Ltd. (Partly Paid) (Communication services, Wireless telecommunication services) |

|

|

|

|

347,789 |

2,240,699 |

| Dalmia Bharat Ltd. (Materials, Construction materials) |

|

|

|

|

624,658 |

15,793,652 |

| Fortis Healthcare Ltd. (Health care, Health care providers & services)† |

|

|

|

|

5,334,970 |

20,695,484 |

| HDFC Bank Ltd. (Financials, Banks) |

|

|

|

|

4,074,376 |

72,297,887 |

| HDFC Bank Ltd. ADR (Financials, Banks) |

|

|

|

|

368,752 |

20,852,926 |

| IDFC First Bank Ltd. (Financials, Banks)† |

|

|

|

|

9,124,275 |

9,067,265 |

| |

|

|

|

Shares |

Value | |

| India(continued) |

|

|

|

|

|

|

| Indus Towers Ltd. (Communication services, Diversified telecommunication services)† |

|

|

|

|

2,043,851 |

$4,229,487 |

| ITC Ltd. (Consumer staples, Tobacco) |

|

|

|

|

13,732,027 |

70,686,165 |

| JM Financial Ltd. (Financials, Capital markets) |

|

|

|

|

8,071,429 |

7,924,087 |

| Kotak Mahindra Bank Ltd. (Financials, Banks) |

|

|

|

|

1,027,262 |

21,474,734 |

| Max Financial Services Ltd. (Financials, Insurance)†

|

|

|

|

|

895,389 |

9,834,304 |

| Reliance Industries Ltd. (Energy, Oil, gas & consumable fuels) |

|

|

|

|

450,000 |

12,374,000 |

| Reliance Industries Ltd. GDR (Energy, Oil, gas & consumable fuels)144A |

|

|

|

|

2,332,274 |

127,430,789 |

| SBI Life Insurance Co. Ltd. (Financials, Insurance)144A |

|

|

|

|

964,273 |

15,837,449 |

| UltraTech Cement Ltd. (Materials, Construction materials) |

|

|

|

|

274,000 |

27,729,887 |

| |

|

|

|

|

|

546,351,414 |

| Indonesia: 3.07% |

|

|

|

|

|

|

| Astra International Tbk PT (Industrials, Industrial conglomerates) |

|

|

|

|

79,651,000 |

28,975,405 |

| Bank Central Asia Tbk PT (Financials, Banks) |

|

|

|

|

62,747,500 |

34,568,890 |

| Telkom Indonesia Persero Tbk PT (Communication services, Diversified telecommunication services) |

|

|

|

|

73,500,000 |

16,112,356 |

| Telkom Indonesia Persero Tbk PT ADR (Communication services, Diversified telecommunication services) |

|

|

|

|

1,377,471 |

30,304,362 |

| |

|

|

|

|

|

109,961,013 |

| Luxembourg: 0.61% |

|

|

|

|

|

|

| InPost SA (Industrials, Air freight & logistics)†

|

|

|

|

|

2,222,122 |

21,987,435 |

| Mexico: 10.05% |

|

|

|

|

|

|

| America Movil SAB de CV ADR (Communication services, Wireless telecommunication services) |

|

|

|

|

3,667,304 |

60,877,246 |

| Becle SAB de CV (Consumer staples, Beverages) |

|

|

|

|

14,809,921 |

26,204,253 |

| Cemex SAB de CV ADR (Materials, Construction materials)†

|

|

|

|

|

3,865,872 |

23,079,256 |

| Fibra Uno Administracion SA de CV (Real estate, Diversified REITs) |

|

|

|

|

49,968,804 |

75,968,990 |

| Fomento Economico Mexicano SAB de CV ADR (Consumer staples, Beverages) |

|

|

|

|

1,202,387 |

136,362,709 |

| Grupo Financiero Banorte SAB de CV Class O (Financials, Banks) |

|

|

|

|

2,383,566 |

19,308,881 |

| Sitios Latinoamerica SAB de CV (Communication services, Diversified telecommunication services)† |

|

|

|

|

4,152,304 |

1,450,969 |

| Wal-Mart de Mexico SAB de CV (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

4,472,900 |

16,026,920 |

| |

|

|

|

|

|

359,279,224 |

| Nigeria: 0.07% |

|

|

|

|

|

|

| IHS Holding Ltd. (Communication services, Diversified telecommunication services)† |

|

|

|

|

493,367 |

2,427,366 |

| Peru: 0.15% |

|

|

|

|

|

|

| Cia de Minas Buenaventura SAA ADR (Materials, Metals & mining) |

|

|

|

|

677,263 |

5,485,830 |

| Philippines: 0.66% |

|

|

|

|

|

|

| ACEN Corp. (Utilities, Independent power and renewable electricity producers) |

|

|

|

|

1,884,654 |

176,374 |

| |

|

|

|

Shares |

Value | |

| Philippines(continued) |

|

|

|

|

|

|

| Ayala Corp. (Industrials, Industrial conglomerates) |

|

|

|

|

837,624 |

$8,955,675 |

| San Miguel Food & Beverage, Inc. (Consumer staples, Food products) |

|

|

|

|

3,495,810 |

3,136,001 |

| SM Investments Corp. (Industrials, Industrial

conglomerates)† |

|

|

|

|

812,873 |

11,488,568 |

| |

|

|

|

|

|

23,756,618 |

| Russia: 0.00% |

|

|

|

|

|

|

| LUKOIL PJSC (Acquired 4-9-2002, cost $16,145,227) (Energy, Oil, gas & consumable fuels)♦†˃ |

|

|

|

|

340,179 |

0 |

| Ozon Holdings PLC ADR (Acquired 11-24-2020, cost $2,412,000) (Consumer discretionary, Broadline retail)♦‡†˃« |

|

|

|

|

80,400 |

0 |

| Sberbank of Russia PJSC (Acquired 8-18-2011, cost $17,232,150) (Financials, Banks)♦†˃ |

|

|

|

|

6,000,456 |

0

|

| |

|

|

|

|

|

0 |

| Singapore: 0.42% |

|

|

|

|

|

|

| Sea Ltd. ADR (Communication services, Entertainment)†

|

|

|

|

|

357,740 |

14,917,758 |

| South Africa: 2.97% |

|

|

|

|

|

|

| MTN Group Ltd. (Communication services, Wireless telecommunication services) |

|

|

|

|

4,988,543 |

24,351,852 |

| Shoprite Holdings Ltd. (Consumer staples, Consumer staples distribution & retail) |

|

|

|

|

3,571,500 |

45,766,940 |

| Standard Bank Group Ltd. (Financials, Banks) |

|

|

|

|

2,147,090 |

21,069,419 |

| Tiger Brands Ltd. (Consumer staples, Food products) |

|

|

|

|

1,631,933 |

15,108,665 |

| |

|

|

|

|

|

106,296,876 |

| South Korea: 13.15% |

|

|

|

|

|

|

| KT Corp. (Communication services, Diversified telecommunication services) |

|

|

|

|

335,000 |

8,104,374 |

| KT Corp. ADR (Communication services, Diversified telecommunication services) |

|

|

|

|

4,534,713 |

54,779,333 |

| KT&G Corp. (Consumer staples, Tobacco) |

|

|

|

|

352,091 |

22,211,056 |

| LG Chem Ltd. (Materials, Chemicals) |

|

|

|

|

62,109 |

20,355,733 |

| NAVER Corp. (Communication services, Interactive media & services) |

|

|

|

|

248,500 |

34,741,079 |

| Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) |

|

|

|

|

4,454,800 |

221,737,127 |

| Samsung Life Insurance Co. Ltd. (Financials, Insurance) |

|

|

|

|

710,337 |

38,030,955 |

| SK Hynix, Inc. (Information technology, Semiconductors & semiconductor equipment) |

|

|

|

|

553,500 |

48,067,101 |

| SK Telecom Co. Ltd. (Communication services, Wireless telecommunication services) |

|

|

|

|

424,000 |

15,461,979 |

| SK Telecom Co. Ltd. ADR (Communication services, Wireless telecommunication services) |

|

|

|

|

340,000 |

6,888,400 |

| |

|

|

|

|

|

470,377,137 |

| Taiwan: 12.53% |

|

|

|

|

|

|

| 104 Corp. (Industrials, Professional services)† |

|

|

|

|

1,655,000 |

10,179,513 |

| |

|

|

|

Shares |

Value | |

| Taiwan(continued) |

|

|

|

|

|

|

| MediaTek, Inc. (Information technology, Semiconductors & semiconductor equipment)† |

|

|

|

|

1,910,881 |

$49,872,756 |

| President Chain Store Corp. (Consumer staples, Consumer staples distribution & retail)† |

|

|

|

|

3,220,000 |

25,613,002 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Information technology, Semiconductors & semiconductor equipment) |

|

|

|

|

7,005,224 |

114,412,863 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Information technology, Semiconductors & semiconductor equipment) |

|

|

|

|

2,045,552 |

176,551,593 |

| Uni-President Enterprises Corp. (Consumer staples, Food products) |

|

|

|

|

34,012,368 |

71,356,171 |

| |

|

|

|

|

|

447,985,898 |

| Thailand: 2.43% |

|

|

|

|

|

|

| PTT Exploration & Production PCL (Energy, Oil, gas & consumable fuels) |

|

|

|

|

1,933,139 |

8,828,311 |

| PTT PCL (Energy, Oil, gas & consumable fuels) |

|

|

|

|

22,759,000 |

20,938,503 |

| SCB X PCL (Financials, Banks) |

|

|

|

|

8,405,100 |

22,886,445 |

| Thai Beverage PCL (Consumer staples, Beverages) |

|

|

|

|

86,427,000 |

34,136,945 |

| |

|

|

|

|

|

86,790,204 |

| United States: 1.46% |

|

|

|

|

|

|

| MercadoLibre, Inc. (Consumer discretionary, Broadline

retail)† |

|

|

|

|

25,116 |

31,162,426 |

| Southern Copper Corp. (Materials, Metals & mining) |

|

|

|

|

282,191 |

20,007,342 |

| Uxin Ltd. Class A (Consumer discretionary, Specialty

retail)♦† |

|

|

|

|

23,979,831 |

975,188 |

| |

|

|

|

|

|

52,144,956 |

| Total common stocks (Cost $3,066,162,503) |

|

|

|

|

|

3,470,207,708 |

| |

|

Interest rate |

Maturity date |

Principal |

| |

| Convertible Debentures: 0.00% |

|

|

|

|

|

|

| Brazil: 0.00% |

|

|

|

|

|

|

| Lupatech SA Series 1 (Energy, Oil & gas

services)♦† |

|

6.50 % |

4-15-2049 |

$ |

303,000 |

0 |

| Total convertible debentures (Cost $160,691) |

|

|

|

|

|

0 |

| |

|

Dividend rate |

|

Shares |

| |

| Preferred stocks: 0.24% |

|

|

|

|

|

|

| Brazil: 0.24% |

|

|

|

|

|

|

| Petroleo Brasileiro SA (Energy, Oil, gas & consumable fuels) |

|

0.12 |

|

|

1,272,900 |

8,770,872 |

| Total preferred stocks (Cost $7,897,430) |

|

|

|

|

|

8,770,872 |

| |

|

|

Expiration

date |

Shares |

Value | |

| Warrants: 0.00% |

|

|

|

|

|

|

| Brazil: 0.00% |

|

|

|

|

|

|

| Diagnosticos da America SA (Health care, Health care providers & services)♦† |

|

|

4-30-2025 |

|

72,020 |

$16,999 |

| Total warrants (Cost $0) |

|

|

|

|

|

16,999 |

| |

|

Yield |

|

|

| |

| Short-term investments: 2.89% |

|

|

|

|

|

|

| Investment companies: 2.89% |

|

|

|

|

|

|

| Allspring Government Money Market Fund Select

Class♠∞ |

|

5.29 % |

|

|

103,234,358 |

103,234,358 |

| Total short-term investments (Cost $103,234,358) |

|

|

|

|

|

103,234,358 |

| Total investments in securities (Cost $3,177,454,982) |

100.15 % |

|

|

|

|

3,582,229,937 |

| Other assets and liabilities, net |

(0.15 ) |

|

|

|

|

(5,445,161 ) |

| Total net assets |

100.00 % |

|

|

|

|

$3,576,784,776 |

| † |

Non-income-earning security |

| 144A |

The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of

1933. |

| ♠ |

The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ♦ |

The security is fair valued in accordance with procedures approved by the Board of Trustees. |

| ˃ |

Restricted security as to resale, excluding Rule 144A securities. The Fund held restricted securities with an aggregate current value of $0 (original an aggregate

cost of $35,789,377), representing 0.00% of its net assets as of period

end. |

| ‡ |

Security is valued using significant unobservable inputs. |

| « |

This security is on loan pending return from the lending agent. |

| ∞ |

The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| ADR |

American depositary receipt |

| GDR |

Global depositary receipt |

| REIT |

Real estate investment trust |

| |

Value, beginning of period |

Purchases |

Sales

proceeds |

Net

realized

gains

(losses) |

Net

change in

unrealized

gains

(losses) |

Value,

end of

period |

Shares,

end

of period |

Income

from

affiliated

securities |

| Common stocks |

|

|

|

|

|

|

|

|

| Zepp Health Corp. ADR† |

$3,000,328 |

$0 |

$0 |

$0 |

$(487,858 ) |

$2,512,470 |

2,439,291 |

$0 |

| Short-term investments |

|

|

|

|

|

|

|

|

| Allspring Government Money Market Fund Select Class |

113,703,486 |

420,516,493 |

(430,985,621 ) |

0 |

0 |

103,234,358 |

103,234,358 |

5,446,935 |

| Investments in affiliates no longer held at end of period |

|

|

|

|

|

|

|

|

| Securities Lending Cash Investments LLC |

38,056,633 |

225,700,376 |

(263,757,266 ) |

257 |

0 |

0 |

0 |

987,949 1 |

| |

|

|

|

$257 |

$(487,858

) |

$105,746,828 |

|

$6,434,884 |

| † |

Non-income-earning security |

| 1 |

Amount shown represents income before fees and rebates. |

| Assets |

|

| Investments in unaffiliated securities, at value (cost $3,049,201,711) |

$3,476,483,109 |

| Investments in affiliated securities, at value (cost $128,253,271) |

105,746,828 |

| Cash |

7,081 |

| Cash collateral for securities on loan |

1,386,900 |

| Foreign currency, at value (cost $8,536,153) |

7,307,740 |

| Receivable for investments sold |

4,567,300 |

| Receivable for Fund shares sold |

4,356,974 |

| Receivable for dividends |

3,737,177 |

| Prepaid expenses and other assets |

218,417 |

| Total assets |

3,603,811,526 |

| Liabilities |

|

| Contingent tax liability |

16,088,489 |

| Payable for Fund shares redeemed |

3,532,572 |

| Management fee payable |

2,883,879 |

| Custody and accounting fees payable |

1,730,316 |

| Payable upon receipt of securities loaned |

1,386,400 |

| Payable for investments purchased |

872,128 |

| Administration fees payable |

377,770 |

| Distribution fee payable |

2,862 |

| Accrued expenses and other liabilities |

152,334 |

| Total liabilities |

27,026,750 |

| Total net assets |

$3,576,784,776 |

| Net assets consist of |

|

| Paid-in capital |

$3,641,831,259 |

| Total distributable loss |

(65,046,483

) |

| Total net assets |

$3,576,784,776 |

| Computation of net asset value and offering price per share |

|

| Net assets–Class A |

$140,305,794 |

| Shares outstanding–Class A1

|

6,389,624 |

| Net asset value per share–Class A |

$21.96 |

| Maximum offering price per share – Class A2 |

$23.30 |

| Net assets–Class C |

$4,372,606 |

| Shares outstanding–Class C1

|

241,531 |

| Net asset value per share–Class C |

$18.10 |

| Net assets–Class R6 |

$371,407,765 |

| Shares outstanding–Class R61

|

16,223,151 |

| Net asset value per share–Class R6 |

$22.89 |

| Net assets–Administrator Class |

$36,100,547 |

| Shares outstanding–Administrator

Class1 |

1,551,981 |

| Net asset value per share–Administrator Class |

$23.26 |

| Net assets–Institutional Class |

$3,024,598,064 |

| Shares outstanding–Institutional

Class1 |

132,161,976 |

| Net asset value per share–Institutional Class |

$22.89

|

| Investment income |

|

| Dividends (net of foreign withholdings taxes of $12,908,207) |

$93,403,525 |

| Income from affiliated securities |

5,648,939 |

| Interest (net of foreign withholding taxes of $58) |

37,173 |

| Total investment income |

99,089,637 |

| Expenses |

|

| Management fee |

39,778,556 |

| Administration fees |

|

| Class A |

319,912 |

| Class C |

11,070 |

| Class R6 |

122,107 |

| Administrator Class |

57,415 |

| Institutional Class |

4,279,716 |

| Shareholder servicing fees |

|

| Class A |

387,037 |

| Class C |

13,299 |

| Administrator Class |

108,736 |

| Distribution fee |

|

| Class C |

39,853 |

| Custody and accounting fees |

2,659,720 |

| Professional fees |

154,836 |

| Registration fees |

160,815 |

| Shareholder report expenses |

667,472 |

| Trustees’ fees and expenses |

19,975 |

| Other fees and expenses |

149,716 |

| Total expenses |

48,930,235 |

| Less: Fee waivers and/or expense reimbursements |

|

| Fund-level |

(5,075,907

) |

| Class A |

(38,207

) |

| Class C |

(130 ) |

| Class R6 |

(26,052

) |

| Administrator Class |

(2,756 ) |

| Institutional Class |

(220,626

) |

| Net expenses |

43,566,557 |

| Net investment income |

55,523,080 |

| Realized and unrealized gains (losses) on investments |

|

| Net realized gains (losses) on |

|

| Unaffiliated securities |

$(283,377,767 ) |

| Affiliated securities |

257 |

| Foreign currency and foreign currency translations |

(344,540

) |

| Net realized losses on investments |

(283,722,050

) |

| Net change in unrealized gains (losses) on |

|

| Unaffiliated securities (net of deferred foreign capital gains tax of $2,622,375) |

601,652,696 |

| Affiliated securities |

(487,858

) |

| Foreign currency and foreign currency translations |

(73,832

) |

| Net change in unrealized gains (losses) on investments |

601,091,006

|

| Net realized and unrealized gains (losses) on investments |

317,368,956

|

| Net increase in net assets resulting from operations |

$372,892,036 |

| |

Year ended October 31, 2023 |

Year ended October 31, 2022 | ||

| Operations |

|

|

|

|

| Net investment income |

|

$55,523,080 |

|

$49,464,076 |

| Net realized losses on investments |

|

(283,722,050 ) |

|

(157,619,252 ) |

| Net change in unrealized gains (losses) on investments |

|

601,091,006 |

|

(1,751,750,563

) |

| Net increase (decrease) in net assets resulting from operations |

|

372,892,036 |

|

(1,859,905,739 ) |

| Distributions to shareholders from |

|

|

|

|

| Net investment income and net realized gains |

|

|

|

|

| Class A |

|

(1,206,336 ) |

|

(523,337 ) |

| Class R6 |

|

(5,221,911 ) |

|

(3,926,921 ) |

| Administrator Class |

|

(408,773 ) |

|

(226,378 ) |

| Institutional Class |

|

(38,037,723 ) |

|

(29,592,408 ) |

| Total distributions to shareholders |

|

(44,874,743

) |

|

(34,269,044 ) |

| Capital share transactions |

Shares |

|

Shares |

|

| Proceeds from shares sold |

|

|

|

|

| Class A |

526,956 |

12,429,497 |

522,651 |

13,494,450 |

| Class C |

10,989 |

211,779 |

16,918 |

350,881 |

| Class R6 |

2,816,191 |

68,449,429 |

4,238,704 |

110,361,263 |

| Administrator Class |

169,953 |

4,205,464 |

238,489 |

6,392,265 |

| Institutional Class |

26,992,809 |

652,959,509 |

40,883,064 |

1,076,015,019 |

| |

|

738,255,678 |

|

1,206,613,878 |

| Reinvestment of distributions |

|

|

|

|

| Class A |

48,589 |

1,102,474 |

17,202 |

485,624 |

| Class R6 |

185,248 |

4,366,293 |

113,499 |

3,332,328 |

| Administrator Class |

16,841 |

404,511 |

7,483 |

223,655 |

| Institutional Class |

1,598,910 |

37,718,277 |

998,541 |

29,327,151 |

| |

|

43,591,555 |

|

33,368,758 |

| Payment for shares redeemed |

|

|

|

|

| Class A |

(1,123,006 ) |

(25,992,556 ) |

(1,332,931 ) |

(33,898,169 ) |

| Class C |

(103,550 ) |

(1,984,353 ) |

(174,207 ) |

(3,663,650 ) |

| Class R6 |

(4,292,148 ) |

(105,617,539 ) |

(3,896,910 ) |

(101,644,199 ) |

| Administrator Class |

(557,436 ) |

(13,911,202 ) |

(772,810 ) |

(20,890,449 ) |

| Institutional Class |

(37,538,966 ) |

(911,083,142 ) |

(70,531,121 ) |

(1,854,111,980

) |

| |

|

(1,058,588,792

) |

|

(2,014,208,447 ) |

| Net decrease in net assets resulting from capital share transactions |

|

(276,741,559

) |

|

(774,225,811

) |

| Total increase (decrease) in net assets |

|

51,275,734 |

|

(2,668,400,594 ) |

| Net assets |

|

|

|

|

| Beginning of period |

|

3,525,509,042 |

|

6,193,909,636 |

| End of period |

|

$3,576,784,776 |

|

$3,525,509,042 |

| |