Form 10-Q: 0001227025-22-000127 compared to 0001227025-22-000046FALSE2022Q1Q2000122702512/31P3Mhttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrent2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrent2022#AccruedLiabilitiesCurrent00012270252022-01-012022-0306-313000012270252022-0407-2218xbrli:shares00012270252022-0306-3130iso4217:USD00012270252021-12-31iso4217:USDxbrli:shares00012270252021-01-012021-03-312022-04-012022-06-3000012270252021-04-012021-06-3000012270252021-01-012021-06-300001227025us-gaap:CommonStockMember2022-03-310001227025us-gaap:AdditionalPaidInCapitalMember2022-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001227025us-gaap:RetainedEarningsMember2022-03-3100012270252022-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001227025us-gaap:RetainedEarningsMember2022-04-012022-06-300001227025us-gaap:CommonStockMember2022-04-012022-06-300001227025us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001227025us-gaap:CommonStockMember2022-06-300001227025us-gaap:AdditionalPaidInCapitalMember2022-06-300001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001227025us-gaap:RetainedEarningsMember2022-06-300001227025us-gaap:CommonStockMember2021-03-310001227025us-gaap:AdditionalPaidInCapitalMember2021-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001227025us-gaap:RetainedEarningsMember2021-03-3100012270252021-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001227025us-gaap:RetainedEarningsMember2021-04-012021-06-300001227025us-gaap:CommonStockMember2021-04-012021-06-300001227025us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001227025us-gaap:CommonStockMember2021-06-300001227025us-gaap:AdditionalPaidInCapitalMember2021-06-300001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001227025us-gaap:RetainedEarningsMember2021-06-3000012270252021-06-300001227025us-gaap:CommonStockMember2021-12-310001227025us-gaap:AdditionalPaidInCapitalMember2021-12-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001227025us-gaap:RetainedEarningsMember2021-12-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-0306-31300001227025us-gaap:RetainedEarningsMember2022-01-012022-0306-31300001227025us-gaap:CommonStockMember2022-01-012022-0306-31300001227025us-gaap:AdditionalPaidInCapitalMember2022-01-012022-0306-310001227025us-gaap:CommonStockMember2022-03-310001227025us-gaap:AdditionalPaidInCapitalMember2022-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001227025us-gaap:RetainedEarningsMember2022-03-31300001227025us-gaap:CommonStockMember2020-12-310001227025us-gaap:AdditionalPaidInCapitalMember2020-12-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001227025us-gaap:RetainedEarningsMember2020-12-3100012270252020-12-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-0306-31300001227025us-gaap:RetainedEarningsMember2021-01-012021-0306-31300001227025us-gaap:CommonStockMember2021-01-012021-0306-31300001227025us-gaap:AdditionalPaidInCapitalMember2021-01-012021-0306-310001227025us-gaap:CommonStockMember2021-03-310001227025us-gaap:AdditionalPaidInCapitalMember2021-03-310001227025us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001227025us-gaap:RetainedEarningsMember2021-03-3100012270252021-03-31300001227025us-gaap:CustomerConcentrationRiskMembernptn:ThreeCustomersMemberus-gaap:SalesRevenueNetMembernptn:ThreeCustomersMember2022-0104-012022-0306-3130xbrli:pure0001227025us-gaap:CustomerConcentrationRiskMembernptn:TopFiveCustomersMemberus-gaap:SalesRevenueNetMember2022-01-012022-03-31us-gaap:SalesRevenueNetMembernptn:TopFiveCustomersMember2022-04-012022-06-300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembernptn:ThreeCustomersMember2021-04-012021-06-300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembernptn:TopFiveCustomersMember2021-04-012021-06-300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembernptn:ThreeCustomersMember2022-01-012022-06-300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembernptn:TopFiveCustomersMember2022-01-012022-06-300001227025nptn:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-0306-31300001227025us-gaap:CustomerConcentrationRiskMembernptn:TopFiveCustomersMemberus-gaap:SalesRevenueNetMembernptn:TopFiveCustomersMember2021-01-012021-0306-31300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembernptn:ThreeCustomersMember2022-01-012022-0306-31300001227025us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembernptn:ThreeCustomersMember2021-01-012021-12-31000122702520202021-0710-012020-12-312021-12-310001227025nptn:HighSpeedMember2022-04-012022-06-300001227025nptn:HighSpeedMember2021-04-012021-06-300001227025nptn:HighSpeedMember2022-01-012022-0306-31300001227025nptn:HighSpeedMember2021-01-012021-03-3106-300001227025nptn:NetworkProductsandSolutionMember2022-04-012022-06-300001227025nptn:NetworkProductsandSolutionMember2021-04-012021-06-300001227025nptn:NetworkProductsandSolutionMember2022-01-012022-0306-31300001227025nptn:NetworkProductsandSolutionMember2021-01-012021-03-3106-300001227025country:CN2022-04-012022-06-300001227025country:CN2021-04-012021-06-300001227025country:CN2022-01-012022-0306-31300001227025country:CN2021-01-012021-03-3106-300001227025srt:AmericasMember2022-04-012022-06-300001227025srt:AmericasMember2021-04-012021-06-300001227025srt:AmericasMember2022-01-012022-0306-31300001227025srt:AmericasMember2021-01-012021-03-3106-300001227025nptn:OtherMember2022-04-012022-06-300001227025nptn:OtherMember2021-04-012021-06-300001227025nptn:OtherMember2022-01-012022-0306-31300001227025nptn:OtherMember2021-01-012021-03-3106-300001227025us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001227025us-gaap:EmployeeStockOptionMember2021-04-012021-06-300001227025us-gaap:EmployeeStockOptionMember2022-01-012022-0306-31300001227025us-gaap:EmployeeStockOptionMember2021-01-012021-03-3106-300001227025us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001227025us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-06-300001227025us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-0306-31300001227025us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-3106-300001227025nptn:MarketbasedRestrictedStockUnitsMember2022-04-012022-06-300001227025nptn:MarketbasedRestrictedStockUnitsMember2021-04-012021-06-300001227025nptn:MarketbasedRestrictedStockUnitsMember2022-01-012022-0306-31300001227025nptn:MarketbasedRestrictedStockUnitsMember2021-01-012021-03-3106-300001227025nptn:PerformanceBasedRestrictedStockUnitsMember2022-04-012022-06-300001227025nptn:PerformanceBasedRestrictedStockUnitsMember2021-04-012021-06-300001227025nptn:PerformanceBasedRestrictedStockUnitsMember2022-01-012022-0306-31300001227025nptn:PerformanceBasedRestrictedStockUnitsMember2021-01-012021-03-3106-300001227025us-gaap:EmployeeStockMember2022-04-012022-06-300001227025us-gaap:EmployeeStockMember2021-04-012021-06-300001227025us-gaap:EmployeeStockMember2022-01-012022-0306-31300001227025us-gaap:EmployeeStockMember2021-01-012021-0306-31300001227025srt:SubsidiariesMembernptn:NeoPhotonicsTechnicsLLCMember2022-01-012022-0306-31300001227025us-gaap:MoneyMarketFundsMember2022-0306-31300001227025us-gaap:MoneyMarketFundsMember2021-12-310001227025us-gaap:ShortTermInvestmentsMember2022-0306-31300001227025us-gaap:ShortTermInvestmentsMember2021-12-31nptn:investment0001227025us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-0306-31300001227025us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-0306-31300001227025us-gaap:MoneyMarketFundsMemberFairValueInputsLevel3Memberus-gaap:FairValueInputsLevel3MemberMoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-0306-31300001227025us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-0306-31300001227025us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001227025us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001227025us-gaap:MoneyMarketFundsMemberFairValueInputsLevel3Memberus-gaap:FairValueInputsLevel3MemberMoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001227025us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-03-310001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-03-310001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueInputsLevel1Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2022-03-3106-300001227025us-gaap:FairValueInputsLevel2Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001227025us-gaap:FairValueInputsLevel3Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2022-0306-31300001227025us-gaap:FairValueInputsLevel1Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001227025us-gaap:FairValueInputsLevel2Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueInputsLevel3Membernptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001227025nptn:MutualFundsHeldInRabbiTrustMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001227025us-gaap:FairValueMeasurementsRecurringMember2022-0306-31300001227025us-gaap:FairValueMeasurementsNonrecurringMemberFairValueMeasurementsRecurringMember20222021-0312-310001227025us-gaap:FairValueMeasurementsNonrecurringMember2021-12-310001227025us-gaap:FairValueMeasurementsNonrecurringMember2022-06-300001227025nptn:PatentsAndDevelopedTechnologyMember2022-0306-31300001227025nptn:PatentsAndDevelopedTechnologyMember2021-12-310001227025us-gaap:CustomerRelationshipsMember2022-0306-31300001227025us-gaap:CustomerRelationshipsMember2021-12-310001227025nptn:LeaseholdInterestMember2022-0306-31300001227025nptn:LeaseholdInterestMember2021-12-310001227025nptn:PatentsAndDevelopedTechnologyMember2022-01-012022-0304-012022-06-300001227025nptn:PatentsAndDevelopedTechnologyMember2021-04-012021-06-300001227025nptn:PatentsAndDevelopedTechnologyMember2022-01-012022-06-31300001227025nptn:PatentsAndDevelopedTechnologyMember2021-01-012021-0306-31300001227025us-gaap:EmployeeSeveranceMember2021-12-310001227025us-gaap:OtherRestructuringMember2021-12-310001227025us-gaap:EmployeeSeveranceMember2022-01-012022-0306-31300001227025us-gaap:OtherRestructuringMember2022-01-012022-0306-31300001227025us-gaap:EmployeeSeveranceMember2022-0306-31300001227025us-gaap:OtherRestructuringMember2022-0306-31300001227025us-gaap:LineOfCreditMembernptn:NotePayableToShanghaiPudongDevelopmentBankMember2022-0306-31300001227025us-gaap:LineOfCreditMembernptn:NotePayableToShanghaiPudongDevelopmentBankMember2021-12-310001227025nptn:RelatedPartyTermLoanWithLumentumHoldingsIncMemberus-gaap:LineOfCreditMember2022-0306-31300001227025nptn:RelatedPartyTermLoanWithLumentumHoldingsIncMemberus-gaap:LineOfCreditMember2021-12-310001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2022-0306-31300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMember2022-06-300001227025us-gaap:NotesPayableToBanksMember2022-03srt:MinimumMembernptn:MitsubishiBankLoansMember2022-06-300001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMembersrt:MaximumMember2022-06-300001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMember2021-12-310001227025nptn:MitsubishiBankLoansMemberus-gaap:NotesPayableToBanksMembersrt:MinimumMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMember20222021-0312-310001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMembersrt:MaximumMemberus-gaap:NotesPayableToBanksMember20222021-0312-310001227025nptn:MitsubishiBankLoansMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansAndYamanashiChuoBankLoansMember2022-06-300001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansAndYamanashiChuoBankLoansMember2021-12-310001227025nptn:MitsubishiBankLoansMembersrt:MinimumMemberus-gaap:NotesPayableToBanksMember2021-12-310001227025nptn:MitsubishiBankLoansMembersrt:MaximumMemberus-gaap:NotesPayableToBanksMember2021-12-310001227025nptn:MitsubishiBankLoansAndYamanashiChuoBankLoansMemberus-gaap:NotesPayableToBanksMember2022-03-310001227025nptn:MitsubishiBankLoansAndYamanashiChuoBankLoansMemberus-gaap:NotesPayableToBanksMember2021-12-310001227025srt:SubsidiariesMembernptn:NeoPhotonicsChinaCoLtdMemberCreditLineAgreementMembersrt:SubsidiariesMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNNeoPhotonicsChinaCoLtdMember2021-06-30iso4217:CNY0001227025srt:SubsidiariesMembernptn:CreditLineAgreementMembernptn:NeoPhotonicsDongguanCoLtdMembersrt:SubsidiariesMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNnptn:NeoPhotonicsDongguanCoLtdMember2021-06-300001227025srt:SubsidiariesMembernptn:CreditLineAgreementMembernptn:NeoPhotonicsDongguanCoLtdMembersrt:SubsidiariesMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNnptn:NeoPhotonicsDongguanCoLtdMember2022-0306-31300001227025us-gaap:NotesPayableOtherPayablesMembersrt:MinimumMembercountry:CNsrt:MinimumMemberus-gaap:NotesPayableOtherPayablesMember2022-01-012022-0306-31300001227025country:CNus-gaap:NotesPayableOtherPayablesMembercountry:CNsrt:MaximumMember2022-01-012022-0306-31300001227025nptn:CreditLineAgreementMembersrt:SubsidiariesMembernptn:NeoPhotonicsChinaCoLtdMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNNeoPhotonicsChinaCoLtdMember2022-0306-31300001227025nptn:CreditLineAgreementMembersrt:SubsidiariesMembernptn:NeoPhotonicsChinaCoLtdMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNNeoPhotonicsChinaCoLtdMember2021-12-310001227025srt:SubsidiariesMembernptn:CreditLineAgreementMembernptn:NeoPhotonicsDongguanCoLtdMembersrt:SubsidiariesMembercountry:CNus-gaap:NotesPayableOtherPayablesMembernptn:CreditLineAgreementMembercountry:CNnptn:NeoPhotonicsDongguanCoLtdMember2021-12-310001227025us-gaap:BankersAcceptanceMember2022-06-300001227025us-gaap:BankersAcceptanceMember2021-12-310001227025us-gaap:BankersAcceptanceMember2022-03-310001227025nptn:AmendedAndRestatedCreditAgreementMemberus-gaap:LineOfCreditMembernptn:AmendedAndRestatedCreditAgreementMember2021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2021-06-300001227025nptn:WellsFargoCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMembersrt:MinimumMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMembersrt:MaximumMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2021-06-012021-06-300001227025us-gaap:LondonInterbankOfferedRateLIBORMembernptn:WellsFargoCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMembersrt:MaximumMemberus-gaap:PrimeRateMembersrt:MinimumMemberus-gaap:LineOfCreditMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:PrimeRateMemberus-gaap:LineOfCreditMembersrt:MinimumMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:PrimeRateMembersrt:MaximumMemberus-gaap:LineOfCreditMemberMaximumMember2021-06-012021-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2022-01-14130001227025us-gaap:LondonInterbankOfferedRateLIBORMembernptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2022-03-3101-140001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-06-300001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2022-0104-012022-0306-31300001227025nptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:SubordinatedDebtMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMember2022-01-140001227025nptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:SubordinatedDebtMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMember2022-01-142022-01-140001227025nptn:WellsFargoCreditFacilityMemberus-gaap:LineOfCreditMember2021-01-130001227025nptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:LineOfCreditMember2022-01-140001227025us-gaap:SubordinatedDebtMemberDebtInstrumentRedemptionPeriodOneMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:DebtInstrumentRedemptionPeriodOneMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberSubordinatedDebtMember2022-01-142022-01-140001227025nptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SubordinatedDebtMember2022-01-142022-01-140001227025nptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SubordinatedDebtMember2022-01-142022-01-140001227025us-gaap:SubordinatedDebtMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2022-01-142022-01-140001227025us-gaap:SubordinatedDebtMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMembernptn:LumentumUnsecuredSubordinatedDelayedDrawTermLoanFacilityMember2022-01-142022-01-140001227025NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankTermLoanAMemberus-gaap:NotesPayableToBanksMember2015-02-25iso4217:JPY0001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankTermLoanBMemberus-gaap:NotesPayableToBanksMember2015-02-250001227025nptn:TokyoInterbankOfferRateMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankLoansMemberTokyoInterbankOfferRateMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoansMember2015-02-252015-02-250001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankTermLoanBMemberus-gaap:NotesPayableToBanksMember2015-02-252015-02-250001227025nptn:TokyoInterbankOfferRateMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankTermLoanBMemberTokyoInterbankOfferRateMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankTermLoanBMember2015-02-252015-02-250001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankLoansMemberus-gaap:NotesPayableToBanksMember2015-02-250001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankTermLoanAMemberus-gaap:NotesPayableToBanksMember2018-01-012018-01-310001227025nptn:MitsubishiBankMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankLoan2015Member2022-0306-31300001227025nptn:MitsubishiBankLoan2017Memberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoan2017Member2017-03-310001227025us-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMembernptn:MitsubishiBankLoan2017Membernptn:TokyoInterbankOfferRateMembernptn:MitsubishiBankMemberus-gaap:NotesPayableToBanksMember2017-03-012017-03-310001227025nptn:MitsubishiBankLoan2017Memberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoan2017Member2017-03-012017-03-310001227025nptn:MitsubishiBankLoan2017Memberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankMemberus-gaap:NotesPayableToBanksMembernptn:MitsubishiBankLoan2017Member2022-0306-31300001227025nptn:MitsubishiBankandTheTamanashiChouBanLtd.Membernptn:TermLoanCMember2018-01-310001227025nptn:TokyoInterbankOfferRateMembernptn:MitsubishiBankandTheTamanashiChouBanLtd.Membernptn:TermLoanCMembernptn:TokyoInterbankOfferRateMember2018-01-012018-01-310001227025nptn:MitsubishiBankandTheTamanashiChouBanLtd.Membernptn:TermLoanCMember2018-01-012018-01-310001227025nptn:MitsubishiBankandTheTamanashiChouBanLtd.Membernptn:TermLoanCMember2022-0306-31300001227025srt:MinimumMember2022-0306-31300001227025srt:MaximumMember2022-0306-31300001227025country:JP2022-0306-31300001227025country:JP2021-12-310001227025nptn:APATOEMembernptn:ApatOptoelectronicsComponentsCoArbitrationMembernptn:NeoChinaMember2020-10-272020-10-270001227025nptn:APATHongKongMembernptn:ApatOptoelectronicsComponentsCoArbitrationMember2020-10-272020-10-270001227025nptn:APATOEMembernptn:ApatOptoelectronicsComponentsCoArbitrationMember2020-10-272020-10-270001227025nptn:APATOEMembernptn:ApatOptoelectronicsComponentsCoArbitrationMember2022-032022-06-31300001227025nptn:APATOEMembernptn:ApatOptoelectronicsComponentsCoArbitrationMember2021-12-310001227025us-gaap:EmployeeStockOptionMember2022-0306-31300001227025us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001227025us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetTransitionAssetObligationMember2021-12-310001227025us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-0306-31300001227025us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetTransitionAssetObligationMember2022-01-012022-0306-31300001227025us-gaap:AccumulatedTranslationAdjustmentMember2022-0306-31300001227025us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetTransitionAssetObligationMember2022-0306-313000012270252021-01-012021-12-310001227025us-gaap:CashMember2022-0306-31300001227025us-gaap:CashMember2021-12-310001227025nptn:EarningsRestrictionsandAllocationofDiscretionalPortionsMember2022-0306-31300001227025nptn:EarningsRestrictionsandAllocationofDiscretionalPortionsMember2021-12-310001227025nptn:MinimumNetAssetsRequiredMember2022-0306-31300001227025nptn:MinimumNetAssetsRequiredMember2021-12-310001227025us-gaap:CostOfSalesMember2022-01-012022-0304-012022-06-300001227025us-gaap:CostOfSalesMember2021-04-012021-06-300001227025us-gaap:CostOfSalesMember2022-01-012022-06-31300001227025us-gaap:CostOfSalesMember2021-01-012021-03-3106-300001227025us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001227025us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300001227025us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-0306-31300001227025us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-03-3106-300001227025us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001227025us-gaap:SellingAndMarketingExpenseMember2021-04-012021-06-300001227025us-gaap:SellingAndMarketingExpenseMember2022-01-012022-0306-31300001227025us-gaap:SellingAndMarketingExpenseMember2021-01-012021-03-3106-300001227025us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001227025us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012021-06-300001227025us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-0306-31300001227025us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-0306-31300001227025us-gaap:InventoriesMember2022-01-012022-0306-31300001227025us-gaap:InventoriesMember2021-01-012021-12-310001227025us-gaap:EmployeeStockOptionMember2021-12-310001227025us-gaap:RestrictedStockUnitsRSUMember2021-12-310001227025us-gaap:EmployeeStockOptionMember2022-01-012022-0306-31300001227025us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-0306-31300001227025us-gaap:RestrictedStockUnitsRSUMember2022-0306-31300001227025nptn:MarketbasedRestrictedStockUnitsMember2022-0306-31300001227025nptn:MarketbasedRestrictedStockUnitsMember2022-01-012022-0306-31300001227025nptn:PerformanceBasedRestrictedStockUnitsMembernptn:April2020Member2020-04-012020-04-300001227025nptn:PerformanceBasedRestrictedStockUnitsMembernptn:April2020Member2022-01-012022-0306-31300001227025nptn:PerformanceBasedRestrictedStockUnitsMembernptn:July2021Member2021-07-012021-07-310001227025nptn:PerformanceBasedRestrictedStockUnitsMembernptn:July2021Member2022-01-012022-0306-31300001227025nptn:StockAppreciationUnitsSAUsMember2021-01-012021-03-3106-300001227025nptn:StockAppreciationUnitsSAUsMember2022-04-012022-06-300001227025nptn:StockAppreciationUnitsSAUsMember2022-01-012022-03-3106-300001227025nptn:StockAppreciationUnitsSAUsMember2021-04-012021-06-300001227025nptn:StockAppreciationUnitsSAUsMember2022-0306-31300001227025nptn:StockAppreciationUnitsSAUsMember2021-12-310001227025nptn:Amended2020EquityIncentivePlanMember2021-06-012021-06-010001227025nptn:Amended2020EquityIncentivePlanMember2021-06-010001227025nptn:BluGlassIncMember2022-03-232022-03-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended MarchJune 3130, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35061

NeoPhotonics Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | | |

| Delaware | | 94-3253730 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

3081 Zanker Road

San Jose, California 95134

(Address of principal executive offices, zip code)

(408) 232-9200

(Registrant’s telephone number, including area code) | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | |

| Title of each class: | | Trading symbol(s): | | Name of each exchange on which registered |

| Common Stock, $0.0025 par value | | NPTN | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐☐ No ☒☒

As of AprilJuly 2218, 2022, there were approximately 53,473688,745898 shares of the registrant’s Common Stock outstanding.

NEOPHOTONICS CORPORATION

For the Quarter Ended MarchJune 3130, 2022

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| | As of |

| (In thousands, except par value data) | June 30, 2022 | | December 31, 2021 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 77,079 | | | $ | 77,833 | |

| Short-term investments | 27,720 | | | 27,675 | |

| Restricted cash | 38 | | | 87 | |

| Accounts receivable, net | 68,460 | | | 55,324 | |

| Inventories | 65,510 | | | 52,896 | |

| Prepaid expenses and other current assets | 18,927 | | | 16,246 | |

| Total current assets | 257,734 | | | 230,061 | |

| Property, plant and equipment, net | 49,191 | | | 54,190 | |

| Operating lease right-of-use assets | 12,091 | | | 13,201 | |

| Purchased intangible assets, net | 787 | | | 844 | |

| Goodwill | 1,115 | | | 1,115 | |

| Other long-term assets | 5,636 | | | 6,156 | |

| Total assets | $ | 326,554 | | | $ | 305,567 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 69,685 | | | $ | 58,125 | |

| Short-term borrowing, net | — | | | 14,914 | |

| Current portion of long-term debt | 2,449 | | | 2,928 | |

| Accrued and other current liabilities | 29,327 | | | 30,008 | |

| Total current liabilities | 101,461 | | | 105,975 | |

| Long-term debt, net of current portion | 23,945 | | | 25,753 | |

| Related party long-term debt | 29,954 | | | — | |

| Operating lease liabilities, noncurrent | 12,107 | | | 13,441 | |

| Other noncurrent liabilities | 6,813 | | | 7,437 | |

| Total liabilities | 174,280 | | | 152,606 | |

| Commitments and contingencies (Note 11) | | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.0025 par value, 10,000 shares authorized, no shares issued or outstanding | — | | | — | |

Common stock, $0.0025 par value, 100,000 shares authorized; at June 30, 2022, 53,568 shares issued and outstanding; at December 31, 2021, 53,113 shares issued and outstanding | 134 | | | 133 | |

Additional paid-in capital | 614,553 | | | 610,085 | |

| Accumulated other comprehensive income (loss) | (8,782) | | | 2,376 | |

Accumulated deficit | (453,631) | | | (459,633) | |

| Total stockholders’ equity | 152,274 | | | 152,961 | |

| Total liabilities and stockholders’ equity | $ | 326,554 | | | $ | 305,567 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | |

| (In thousands, except per share data) | 2022 | | 2021 | | 2022 | | 2021 |

| Revenue | $ | 95,006 | | | $ | 65,010 | | | $ | 184,274 | | | $ | 125,935 | |

| Cost of goods sold | 61,935 | | | 55,135 | | | 123,914 | | | 102,721 | |

Gross profit | 33,071 | | | 9,875 | | | 60,360 | | | 23,214 | |

| Operating expenses: | | | | | | | |

Research and development | 14,736 | | | 15,410 | | | 29,834 | | | 28,508 | |

Sales and marketing | 3,742 | | | 3,362 | | | 7,428 | | | 7,227 | |

General and administrative | 9,228 | | | 7,398 | | | 19,022 | | | 14,692 | |

| Acquisition and asset sale related costs | 638 | | | (36) | | | 1,543 | | | 127 | |

| Restructuring charges | — | | | 22 | | | — | | | 22 | |

| Asset impairment charges | 30 | | | — | | | 443 | | | — | |

| Facility shut down related costs | 209 | | | — | | | 509 | | | — | |

| Litigation settlements | (12) | | | — | | | 37 | | | — | |

| Gain on asset sale | (1,866) | | | — | | | (1,980) | | | — | |

Total operating expenses | 26,705 | | | 26,156 | | | 56,836 | | | 50,576 | |

| Income (loss) from operations | 6,366 | | | (16,281) | | | 3,524 | | | (27,362) | |

Interest income | 147 | | | 140 | | | 218 | | | 245 | |

Interest expense | (510) | | | (220) | | | (865) | | | (447) | |

| Other income (expense), net | 5,823 | | | (880) | | | 6,218 | | | 263 | |

| Total interest and other income (expense), net | 5,460 | | | (960) | | | 5,571 | | | 61 | |

| Income (loss) before income taxes | 11,826 | | | (17,241) | | | 9,095 | | | (27,301) | |

| Income tax provision | (2,521) | | | (192) | | | (3,093) | | | (823) | |

| Net income (loss) | $ | 9,305 | | | $ | (17,433) | | | $ | 6,002 | | | $ | (28,124) | |

| | | | | | | |

| Basic net income (loss) per share | $ | 0.17 | | | $ | (0.34) | | | $ | 0.11 | | | $ | (0.55) | |

| Diluted net income (loss) per share | $ | 0.17 | | | $ | (0.34) | | | $ | 0.11 | | | $ | (0.55) | |

| Weighted average shares used to compute basic net income (loss) per share | 53,488 | | | 51,634 | | | 53,318 | | | 51,178 | |

| Weighted average shares used to compute diluted net income (loss) per share | 56,095 | | | 51,634 | | | 55,999 | | | 51,178 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | |

| (in thousands) | 2022 | | 2021 | | 2022 | | 2021 |

| Net income (loss) | $ | 9,305 | | | $ | (17,433) | | | $ | 6,002 | | | $ | (28,124) | |

| Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments, net of zero tax | (10,150) | | | 2,031 | | | (11,158) | | | (312) | |

| Total other comprehensive income (loss) | (10,150) | | | 2,031 | | | (11,158) | | | (312) | |

| Comprehensive income (loss) | $ | (845) | | | $ | (15,402) | | | $ | (5,156) | | | $ | (28,436) | |

See accompanying Notes to Condensed Consolidated Financial Statements.

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 | Common stock | | Additional paid-in capital | | Accumulated other comprehensive income (loss) | | Accumulated deficit | | Total stockholders’ equity |

| (In thousands) | Shares | | Amount | | | | |

| Balances at March 31, 2022 | 53,210 | | | $ | 133 | | | $ | 612,946 | | | $ | 1,368 | | | $ | (462,936) | | | $ | 151,511 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (10,150) | | | 9,305 | | | (845) | |

| Issuance of common stock upon exercise of stock options | 40 | | | — | | | 167 | | | — | | | — | | | 167 | |

| Issuance of common stock for vested restricted stock units | 395 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Tax withholding related to vesting of restricted stock units | (77) | | | — | | | (1,171) | | | — | | | — | | | (1,171) | |

| Stock-based compensation costs | — | | | — | | | 2,612 | | | — | | | — | | | 2,612 | |

| Balances at June 30, 2022 | 53,568 | | | $ | 134 | | | $ | 614,553 | | | $ | (8,782) | | | $ | (453,631) | | | $ | 152,274 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2021 | Common stock | | Additional paid-in capital | | Accumulated other comprehensive income (loss) | | Accumulated deficit | | Total stockholders’ equity |

| (In thousands) | Shares | | Amount | | | | |

| Balances at March 31, 2021 | 51,009 | | | $ | 128 | | | $ | 599,744 | | | $ | (608) | | | $ | (429,605) | | | $ | 169,659 | |

| Comprehensive income (loss) | — | | | — | | | — | | | 2,031 | | | (17,433) | | | (15,402) | |

| Issuance of common stock upon exercise of stock options | 199 | | | — | | | 1,045 | | | — | | | — | | | 1,045 | |

| Issuance of common stock under employee stock purchase plan | 235 | | | 1 | | | 1,548 | | | — | | | — | | | 1,549 | |

| Issuance of common stock for vested restricted stock units | 802 | | | 2 | | | (2) | | | — | | | — | | | — | |

| Tax withholding related to vesting of restricted stock units | (165) | | | (1) | | | (1,846) | | | — | | | — | | | (1,847) | |

| Stock-based compensation costs | — | | | — | | | 2,388 | | | — | | | — | | | 2,388 | |

| Balances at June 30, 2021 | 52,080 | | | $ | 130 | | | $ | 602,877 | | | $ | 1,423 | | | $ | (447,038) | | | $ | 157,392 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See accompanying Notes to Condensed Consolidated Financial Statements.

7

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 | Common stock | | Additional paid-in capital | | Accumulated other comprehensive income (loss) | | Accumulated deficit | | Total stockholders’ equity |

| (In thousands) | Shares | | Amount | | | | |

| Balances at December 31, 2021 | 53,113 | | | $ | 133 | | | $ | 610,085 | | | $ | 2,376 | | | $ | (459,633) | | | $ | 152,961 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (11,158) | | | 6,002 | | | (5,156) | |

| Issuance of common stock upon exercise of stock options | 114 | | | — | | | 534 | | | — | | | — | | | 534 | |

| Issuance of common stock for vested restricted stock units | 421 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Tax withholding related to vesting of restricted stock units | (80) | | | — | | | (1,219) | | | — | | | — | | | (1,219) | |

| Stock-based compensation costs | — | | | — | | | 5,154 | | | — | | | — | | | 5,154 | |

| Balances at June 30, 2022 | 53,568 | | | $ | 134 | | | $ | 614,553 | | | $ | (8,782) | | | $ | (453,631) | | | $ | 152,274 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2021 | Common stock | | Additional paid-in capital | | Accumulated other comprehensive income (loss) | | Accumulated deficit | | Total stockholders’ equity |

| (In thousands) | Shares | | Amount | | | | |

| Balances at December 31, 2020 | 50,457 | | | $ | 126 | | | $ | 597,460 | | | $ | 1,735 | | | $ | (418,914) | | | $ | 180,407 | |

| Comprehensive loss | — | | | — | | | — | | | (312) | | | (28,124) | | | (28,436) | |

| Issuance of common stock upon exercise of stock options | 398 | | | 1 | | | 2,154 | | | — | | | — | | | 2,155 | |

| Issuance of common stock under employee stock purchase plan | 235 | | | 1 | | | 1,548 | | | — | | | — | | | 1,549 | |

| Issuance of common stock for vested restricted stock units | 1,305 | | | 3 | | | (3) | | | — | | | — | | | — | |

| Tax withholding related to vesting of restricted stock units | (315) | | | (1) | | | (3,682) | | | — | | | — | | | (3,683) | |

| Stock-based compensation costs | — | | | — | | | 5,400 | | | — | | | — | | | 5,400 | |

| Balances at June 30, 2021 | 52,080 | | | $ | 130 | | | $ | 602,877 | | | $ | 1,423 | | | $ | (447,038) | | | $ | 157,392 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See accompanying Notes to Condensed Consolidated Financial Statements.

NEOPHOTONICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| |

| (In thousands) | 2022 | | 2021 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 6,002 | | | $ | (28,124) | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

Depreciation and amortization | 7,524 | | | 12,486 | |

Stock-based compensation expense | 5,224 | | | 5,617 | |

Deferred taxes | 1,002 | | | 989 | |

Others | 245 | | | 171 | |

Gain on sale of assets and other write-offs | (1,980) | | | (14) | |

| Allowance for doubtful accounts | — | | | (1) | |

Write-down of inventories | 3,708 | | | 6,096 | |

Amortization of operating lease right-of-use assets | 1,028 | | | 1,025 | |

Foreign currency remeasurement | (7,462) | | | (129) | |

Change in operating assets and liabilities: | | | |

Accounts receivable | (13,137) | | | (2,532) | |

Inventories | (19,198) | | | (3,836) | |

Prepaid expenses and other assets | (4,198) | | | 4,058 | |

Accounts payable | 13,545 | | | 2,294 | |

Accrued and other liabilities | (2,380) | | | (19,775) | |

| Net cash used in operating activities | (10,077) | | | (21,675) | |

| Cash flows from investing activities | | | |

Purchase of property, plant and equipment | (5,202) | | | (5,461) | |

Proceeds from sale of property, plant and equipment and other assets | 2,029 | | | 1,013 | |

Purchase of marketable securities | (25,045) | | | (22,504) | |

Proceeds from sale of marketable securities | 25,416 | | | 22,501 | |

Net cash used in investing activities | (2,802) | | | (4,451) | |

| Cash flows from financing activities | | | |

Proceeds from exercise of stock options and issuance of stock under ESPP | 605 | | | 4,143 | |

Tax withholding on restricted stock units | (1,219) | | | (3,683) | |

| Proceeds from related party term loan, net of debt issuance costs | 29,942 | | | — | |

Repayment of bank loans | (15,987) | | | (2,662) | |

Repayment of finance lease liabilities | (50) | | | (46) | |

| Net cash provided by (used in) financing activities | 13,291 | | | (2,248) | |

Effect of exchange rates on cash, cash equivalents and restricted cash | (1,215) | | | 99 | |

| Net decrease in cash, cash equivalents and restricted cash | (803) | | | (28,275) | |

Cash, cash equivalents and restricted cash at the beginning of the period | 77,920 | | | 95,606 | |

Cash, cash equivalents and restricted cash at the end of the period | $ | 77,117 | | | $ | 67,331 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Unpaid property, plant and equipment in accounts payable | $ | 1,132 | | | $ | 1,952 | |

| Right-of-use asset in exchange for a lease liability | $ | — | | | $ | 1,645 | |

| | | |

See accompanying Notes to Condensed Consolidated Financial Statements.

NeoPhotonics Corporation Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. The Company, basis of presentation and significant accounting policies

Basis of Presentation and Consolidation

The condensed consolidated financial statements of NeoPhotonics Corporation (“NeoPhotonics” or the “Company”) as of MarchJune 3130, 2022 and for the three and six months ended MarchJune 3130, 2022 and 2021, have been prepared in accordance with the instructions on Form 10-Q pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). In accordance with those rules and regulations, the Company has omitted certain information and notes normally provided in the Company’s annual consolidated financial statements. In the opinion of management, the condensed consolidated financial statements contain all adjustments, consisting only of normal recurring items, except as otherwise noted, necessary for the fair presentation of the Company’s financial position and results of operations for the interim periods. These condensed consolidated financial statements do not include all disclosures required by U.S. generally accepted accounting principles (“U.S. GAAP”) and should be read in conjunction with the Consolidated Financial Statements and Notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021. The results of operations for the three and six months ended MarchJune 3130, 2022 are not necessarily indicative of the results expected for the entire fiscal year. All intercompany accounts and transactions have been eliminated.

Proposed Merger with Lumentum Holdings Inc.

On November 3, 2021, we the Company entered into an Agreement and Plan of Merger with Lumentum Holdings Inc., a Delaware corporation (“Lumentum”) and Neptune Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Lumentum (“Merger Sub”), (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, wethe Company will be acquired by Lumentum through a merger of Merger Sub with and into usthe Company (the “Merger”), with NeoPhotonics Corporation surviving the Merger as a wholly owned subsidiary of Lumentum.

Consummation of the Merger is subject to customary closing conditions, including (1) the absence of certain legal impediments, the expiration or termination of the required waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (“HSR Act”), and (2) approval by the holders of a majority of the outstanding shares of our common stock. The waiting period under the HSR Act expired as of January 21, 2022 and the required approval from our stockholders was obtained on February 1, 2022. The remaining requirements for closure of the Merger are (3) customary closing conditions set forth in the Merger Agreement and (4) approval from the State Administration for Market Regulation of the People’s Republic of China ("SAMR"). The Merger is expectedwhich the parties hope to closereceive in the second half of calendar year 2022, as previously announced.

Certain Significant Risks and UncertaintiesIf the Merger is not completed by August 3, 2022, the Merger Agreement termination date will be automatically extended until November 3, 2022 and will automatically be extended again to February 3, 2023 if the closing is delayed due to certain closing conditions related to antitrust laws not being satisfied but all other conditions to the closing being satisfied or satisfiable at the closing. The parties may also terminate the Merger Agreement under certain other circumstances, including by mutual written consent of both parties.

Certain Significant Risks and Uncertainties

The Company operates in a dynamic industry, and accordingly, can be affected by a variety of factors. For example, any of the following areas could have a negative effect on the Company in terms of its future financial position, results of operations or cash flows: the general state of the U.S., China and world economies and inflation levels; the highly cyclical nature of the industries the Company serves; successful and timely completion of product design efforts; the ability of the Company to sell its new products into new market segments; trade restrictions by the United States against the Company's customers in China, as well

as potential retaliatory trade actions taken by China; the loss of any of its larger customers; restrictions on the Company's ability to sell to foreign customers due to additional U.S. or new China trade laws, regulations and requirements; disruptions of the supply chain of components needed for its products; ability to obtain additional financing; inability to meet certain debt covenants; fundamental changes in the technology underlying the Company’s products; the hiring, training and retention of key employees; and new product design introductions by competitors. The inputs into the Company’s judgments and estimates consider the economic implications of the Covid-19 pandemic and supply chain implications as the Company knows them, on its critical and significant accounting estimates. The extent to which the Covid-19 pandemic may impact its business will depend on future developments, which are highly uncertain, such as the duration of the outbreak, travel restrictions, governmental mandates issued to mitigate the spread of the disease, business closures, economic disruptions, and the effectiveness of actions taken to contain and treat the virus. Accordingly, future adverse developments with respect to the Covid-19 pandemic, persistent inflation and economic uncertainty and the impacts of semiconductor supply shortages may have a negative impact on its sales, supply chain and results of operations. The inputs into the Company's judgments and estimates also consider the Department of Commerce Entities List restrictions on Huawei Technologies effective September 2020 for the Company and loss of business from Huawei Technologiesresults of operations.

Concentration

In the three months ended MarchJune 3130, 2022, twothree customers were each greater than 10% of the Company’s total revenue, representing 5971% of total revenue, and the Company's top five customers represented approximately 7983% of the Company’s total revenue. In the three months ended March 31June 30, 2021, three customers each were greater than 10% of revenue, representing 61% of total revenue, and the Company's top five customers during this period represented 77% of total revenue.

In the six months ended June 30, 2022, three customers were each greater than 10% of the Company’s total revenue, representing 69% of total revenue, and the Company's top five customers represented approximately 81% of the Company’s total revenue. In the six months ended June 30, 2021, four customers each were greater than 10% of revenue, representing 7466% of total revenue, and ourthe Company's top five customers during this period represented 80% of total revenue. 76% of total revenue.

As of MarchNotes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

As of June 3130, 2022, three customers accounted for a total of 65% of the Company’s total accounts receivable. As of December 31, 2021, three customers accounted for a total of 35% of the Company’s total accounts receivable.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported revenue and expenses during the reporting period. Significant estimates made by management include: the useful lives and recoverability of long-lived assets; valuation allowances for deferred tax assets; valuation of excess and obsolete inventories; warranty reserves; and recognition of stock-based compensation, among others. Actual results could differ from these estimates.

Long-lived Assets

The Company assesses the impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss would be recognized when the sum of the future net cash flows expected to result from the use of the asset and its eventual disposition is less than its carrying amount. The estimated future cash flows are based upon, among other things, assumptions about expected future operating performance and may differ from actual cash flows.

Due to the additional restrictions imposed by the U.S. Bureau of Industry and Security ("BIS"), an agency of the U.S. Department of Commerce, which became effective in September 2020, and the expected loss of business from Huawei, the Company performed a recoverability test in the fourth quarter of 2021 and determined there was no impairment of long-lived assets.

Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use ("ROU") assets, other current liabilities and operating lease liabilities on the Company's condensed consolidated balance sheets. Finance leases are included in property, plant and equipment, current portion of long-term debt and long-term debt, net of current portion on the condensed consolidated balance sheets.

Operating lease ROU assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As most of the Company's leases do not provide an implicit rate, the Company uses an estimate of its incremental borrowing rate based on observed market data and other information available at the lease commencement date. The operating lease ROU assets also include any lease payments made and exclude lease incentives. Lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise such options. The Company does not record leases on the condensed consolidated balance sheet with a term of one year or less. The Company does not separate lease and non-lease components but rather account for each separate component as a single lease component for all underlying classes of assets. Variable lease payments are expensed as incurred and are not included within the operating lease ROU asset and lease liability calculation. Variable lease payments primarily include reimbursements of costs incurred by lessors for common area maintenance and utilities. Lease expense for minimum operating lease payments is recognized on a straight-line basis over the lease term.

Accounting Pronouncements Recently Adopted

In December 2019, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes (ASU 2019-12), which simplifies the accounting for income taxes. This guidance became effective for fiscal years beginning after December 15, 2020. The Company adopted this ASU in the first quarter of 2021 and the adoption of this standard did not have a material impact on the Company's consolidated financial statements.

Recent Accounting Pronouncements Not Yet Effective

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 amends existing guidance on the impairment of financial assets and adds an impairment model that is based on expected losses rather than incurred losses and requires an entity to recognize as an allowance its estimate of expected credit losses for its financial assets. An entity will apply this guidance through a cumulative-effect adjustment to retained earnings upon adoption (a modified-retrospective approach) while a prospective transition approach is required for debt securities for which an other-than-temporary impairment had been recognized before the effective date. In November 2019, the FASB issued ASU 2019-10, according to which, the new standard is effective for smaller reporting companies (“SRC”) as defined by the SEC, for fiscal years beginning after December 15, 2022 including interim periods within those fiscal years. The Company is in the process of evaluating the impact and timing of the adoption on its consolidated financial statements and related disclosures.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Note 2. Revenue

Product revenue

The Company develops, manufactures and sells lasers and other high-speed optoelectronic products that transmit, receive, modify and switch high-speed digital optical signals for communications networks. Revenue is derived primarily from the sale of optoelectronic laser, component and module hardware products. The Company sells its products worldwide, primarily to leading network equipment manufacturers.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Revenue recognition

Revenue is recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those products or services. The Company generally bears all costs, risk of loss or damage and retains title to the goods up to the point of transfer of control of promised products to customer. Revenue related to the sale of consignment inventories at customer vendor managed locations is not recognized until the products are pulled from consignment inventories by customers. In instances where acceptance of the product or solutions is specified by the customer, revenue is deferred until such required acceptance criteria have been met. Shipping and handling costs are included in the cost of goods sold. The Company presents revenue net of sales taxes and any similar assessments.

The Company’s performance obligations relate to contracts with a duration of less than one year. The Company elected to apply the practical expedient provided in Accounting Standard Codification Topic 606, “Revenue from Contracts with Customers” and, therefore, is not required to disclose the aggregate amount of the transaction price allocated to performance obligations that are unsatisfied or partially unsatisfied at the end of the reporting period.

Nature of products

Revenue from the sale of hardware products is recognized upon transfer of control to the customer. The performance obligation for the sale of hardware products is satisfied at a point in time. The Company has aligned its products in two groups - High Speed Products and Network Products and Solutions. The following presents revenue by product group (in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| High Speed Products | $ | 88,999 | | | $ | 61,032 | | | $ | 172,580 | | | $ | 118,305 | |

| Network Products and Solutions | 6,007 | | | 3,978 | | | 11,694 | | | 7,630 | |

| Total revenue | $ | 95,006 | | | $ | 65,010 | | | $ | 184,274 | | | $ | 125,935 | |

The following table presents the Company's revenue information by geographical region. Revenue is classified based on the ship to location requested by the customer. Such classification recognizes that for many customers, including those in North America or in Europe, designated shipping points are often in China or elsewhere in Asia (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| China | $ | 16,389 | | $ | 24,940 | | $ | 36,417 | | $ | 40,183 |

| Americas | 12,959 | | 5,997 | | 26,654 | | 11,188 |

| Rest of world | 65,658 | | 34,073 | | 121,203 | | 74,564 |

| Total revenue | $ | 95,006 | | $ | 65,010 | | $ | 184,274 | | $ | 125,935 |

Deferred revenue

The Company records deferred revenue when cash payments are received or due in advance of the Company's performance. The deferred revenue balances were immaterial as of MarchJune 3130, 2022 and December 31, 2021.

Contract assets

Contract assets are rights to consideration in exchange for goods or services that the Company has transferred to a customer when such right is conditional on something other than the passage of time. Contract assets exclude any amounts presented as an accounts receivable. There were no contract assets balances as of MarchJune 3130, 2022 and December 31, 2021.

Refund liabilities

The Company recognizes a refund liability if the Company receives consideration from a customer and expects to refund some or all of that consideration to the customer. The refund liabilities as of MarchJune 3130, 2022 and December 31, 2021 were immaterial.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Note 3. Net income (loss) per share

The following table sets forth the computation of the basic and diluted net income (loss) per share for the periods indicated (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Numerator: | | | | | | | |

| Net income (loss) | $ | 9,305 | | | $ | (17,433) | | | $ | 6,002 | | | $ | (28,124) | |

| Denominator: | | | | | | | |

| Weighted average shares used to compute per share amount: | | | | | | | |

| Basic | 53,488 | | | 51,634 | | | 53,318 | | | 51,178 | |

| Diluted | 56,095 | | | 51,634 | | | 55,999 | | | 51,178 | |

| | | | | | | |

| Basic net income (loss) per share | $ | 0.17 | | | $ | (0.34) | | | $ | 0.11 | | | $ | (0.55) | |

| Diluted net income (loss) per share | $ | 0.17 | | | $ | (0.34) | | | $ | 0.11 | | | $ | (0.55) | |

The Company has excluded the impact of the following outstanding employee stock options and restricted stock units as well as the shares that were expected to be issued under its employee stock purchase plan from the computation of diluted net income (loss) per share, as their effect would have been antidilutive (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Employee stock options | 5 | | | 1,734 | | | 5 | | | 1,734 | |

| Restricted stock units | 1 | | | 2,465 | | | 1 | | | 2,465 | |

| Market-based restricted stock units | — | | | 265 | | | — | | | 265 | |

| Performance-based restricted stock units | 240 | | | 75 | | | 240 | | | 75 | |

| Employee stock purchase plan | — | | | 132 | | | — | | | 132 | |

| | 246 | | | 4,671 | | | 246 | | | 4,671 | |

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Note 4. Cash, cash equivalents, short-term investments and restricted cash

The following table summarizes the Company’s cash, cash equivalents and restricted cash (in thousands):

| | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Cash and cash equivalents | $ | 77,079 | | | $ | 77,833 | |

| Restricted cash | 38 | | | 87 | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | $ | 77,117 | | | $ | 77,920 | |

As a result of sanctions imposed by the U.S. Treasury on the country of Russia's financial institutions in February 2022, the total cash balance held in ourthe Company's Russian subsidiary NeoPhotonics Technics LLC, of $0.3 million, was written off to Asset impairment charges during the threesix months ended MarchJune 3130, 2022.

The following table summarizes the Company’s unrealized gains and losses related to its short-term investments in marketable securities designated as available-for-sale (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2022 | | As of December 31, 2021 |

| | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Loss | | Fair Value | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Loss | | Fair Value |

| Marketable securities: | | | | | | | | | | | | | | | |

| Money market funds | $ | 27,720 | | | $ | — | | | $ | — | | | $ | 27,720 | | | $ | 27,675 | | | $ | — | | | $ | — | | | $ | 27,675 | |

| Reported as: | | | | | | | | | | | | | | | |

| Short-term investments | | | | | | | $ | 27,720 | | | | | | | | | $ | 27,675 | |

As of MarchJune 3130, 2022 and December 31, 2021, maturities of marketable securities were less than one year. There were nono realized gains and losses on the sale of marketable securities during the three and six months ended MarchJune 31, 2022 and 2021. The Company did not recognize any impairment losses on its marketable securities during the three30, 2022 and 2021. The Company did not recognize any impairment losses on its marketable securities during the three and six months ended MarchJune 3130, 2022 or 2021. As of MarchJune 3130, 2022, the Company did not have any investments in marketable securities that were in an unrealized loss position for a period in excess of 12 months.

Note 5. Fair value disclosures

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table presents the Company's assets that are measured at fair value on a recurring basis (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2022 | | As of December 31, 2021 |

| | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | | | | | | | | | |

| Short-term investments: | | | | | | | | | | | | | | | |

| Money market funds | $ | 27,720 | | | $ | — | | | $ | — | | | $ | 27,720 | | | $ | 27,675 | | | $ | — | | | $ | — | | | $ | 27,675 | |

| Other long-term assets: | | | | | | | | | | | | | | | |

| Mutual funds held in Rabbi Trust | $ | 706 | | | $ | — | | | $ | — | | | $ | 706 | | | $ | 894 | | | $ | — | | | $ | — | | | $ | 894 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The Company offers a Non-Qualified Deferred Compensation Plan (“NQDC Plan”) to a select group of its highly compensated employees. The NQDC Plan provides participants the opportunity to defer payment of certain compensation as defined in the NQDC Plan. A Rabbi Trust has been established to fund the NQDC Plan obligation, which was fully funded at MarchJune 3130, 2022. The assets held by the Rabbi Trust are substantially in the form of exchange traded mutual funds and are included in the Company’s other long-term assets on its condensed consolidated balance sheets as of MarchJune 3130, 2022 and December 31, 2021.

There were nono liabilities that are measured at fair value on a recurring basis as of MarchJune 30, 2022 and December 31, 20222021.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

As of MarchJune 3130, 2022 and December 31, 2021 the Company had no assets or liabilities required to be measured at fair value on a nonrecurring basis.

Assets and Liabilities Not Measured at Fair Value

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The carrying values of accounts receivable, accounts payable and short-term borrowings approximate their fair values due to the short-term nature and liquidity of these financial instruments.

Note 6. Balance sheet components

Accounts receivable, net

Accounts receivable, net, consists of the following (in thousands): | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Accounts receivable | $ | 68,460 | | | $ | 55,324 | |

| Allowance for doubtful accounts | — | | | — | |

| | $ | 68,460 | | | $ | 55,324 | |

Inventories

Inventories consist of the following (in thousands):

| | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Raw materials | $ | 41,471 | | | $ | 32,809 | |

| Work in process | 13,910 | | | 14,851 | |

Finished goods(1) | 10,129 | | | 5,236 | |

| | $ | 65,510 | | | $ | 52,896 | |

________________________________________________________

(1)Finished goods inventory at customer vendor managed inventory locations was $4.1.8 million and $1.8 million as of MarchJune 3130, 2022 and December 31, 2021, respectively.

Prepaid expenses and other current assets

Prepaid expenses and other current assets consist of the following (in thousands):

| | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| | | |

| Prepaid taxes and taxes receivable | $ | 4,150 | | | $ | 5,825 | |

| Receivables due from suppliers | 10,771 | | | 6,728 | |

| Deposits and other prepaid expenses | 2,986 | | | 2,682 | |

| Other receivable | 1,020 | | | 1,011 | |

| | $ | 18,927 | | | $ | 16,246 | |

Purchased intangible assets, net

Purchased intangible assets, net, consist of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| | Gross

Assets | | Accumulated

Amortization | | Net

Assets | | Gross

Assets | | Accumulated

Amortization | | Net

Assets |

| Technology and patents | $ | 37,189 | | | $ | (37,189) | | | $ | — | | | $ | 37,814 | | | $ | (37,814) | | | $ | — | |

| Customer relationships | 15,110 | | | (15,110) | | | — | | | 15,535 | | | (15,535) | | | — | |

| Leasehold interest | 1,271 | | | (484) | | | 787 | | | 1,339 | | | (495) | | | 844 | |

| | $ | 53,570 | | | $ | (52,783) | | | $ | 787 | | | $ | 54,688 | | | $ | (53,844) | | | $ | 844 | |

For the three months ended MarchJune 3130, 2022 and 2021, amortization expense relating to technology and patents is included within cost of goods sold and totaled $0.0 million and $0.2 million in each period, respectively. For the six months ended June 30, 2022 and 2021, amortization expense relating to technology and patents is included within cost of goods sold and totaled $0.0 and $0.3 million in each period, respectively.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The estimated future amortization expense of purchased intangible assets as of MarchJune 3130, 2022, was as follows (in thousands): | | | | | |

| 2022 (remaining six months) | $ | 14 | |

| 2023 | 29 | |

| 2024 | 29 | |

| 2025 | 29 | |

| 2026 | 29 | |

| Thereafter | 657 | |

| | $ | 787 | |

Accrued and other current liabilities

Accrued and other current liabilities consist of the following (in thousands):

| | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Employee-related | $ | 15,966 | | | $ | 14,956 | |

| Transition services agreement payable (refer to Note 11) | — | | | 823 | |

| Operating lease liabilities, current | 2,456 | | | 2,356 | |

| Income and other taxes payable | 4,024 | | | 2,703 | |

| Accrued warranty | 670 | | | 977 | |

| Other accrued expenses | 6,211 | | | 8,193 | |

| | $ | 29,327 | | | $ | 30,008 | |

Warranty accrual

The table below summarizes the movement in the warranty accrual, which is included in accrued and other current liabilities (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Beginning balance | $ | 966 | | | $ | 1,096 | | | $ | 977 | | | $ | 1,111 | |

| Warranty accruals | 39 | | | 4 | | | 103 | | | 65 | |

| Settlements | (335) | | | (197) | | | (410) | | | (273) | |

| Ending balance | $ | 670 | | | $ | 903 | | | $ | 670 | | | $ | 903 | |

Other noncurrent liabilities

Other noncurrent liabilities consist of the following (in thousands):

| | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Pension and other employee-related | $ | 2,713 | | | $ | 3,266 | |

| Asset retirement obligations | 3,535 | | | 3,508 | |

| | | |

| | | |

| Government grant | 565 | | | 369 | |

| Other | — | | | 294 | |

| | $ | 6,813 | | | $ | 7,437 | |

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Note 7. Restructuring Charges

A summary of the current period activity in accrued restructuring costs is as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| | Employee Severance | | Other | | Total |

| Restructuring obligations December 31, 2021 | $ | 302 | | | $ | — | | | $ | 302 | |

| Recoveries | (18) | | | — | | | (18) | |

| Cash payments | (284) | | | — | | | (284) | |

| Restructuring obligations June 30, 2022 | $ | — | | | $ | — | | | $ | — | |

For the threesix months ended MarchJune 3130, 2022, the restructuring recoveries related to accrual adjustments for severance and were included within cost of goods sold.

In a second phase of restructuring actions taken in 2020, related to reducing operating expenses and manufacturing costs while maintaining the Company's focus on its core capabilities, in December 2021 the Company exercised its early exit right to terminate the facility lease in Fremont, California. The remaining lease commitment will end in April 2022As of June 30, 2022, the Company was in the process of completing final requirements for closure of the lease commitments.

Note 8. Debt

The table below summarizes the carrying amounts and weighted average interest rates of the Company’s debt (in thousands, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| | Carrying

Amount | | Interest

Rate | | Carrying

Amount | | Interest

Rate |

| Short-term borrowing: | | | | | | | |

| Note payable to Shanghai Pudong Development Bank | $ | — | | | — | % | | $ | 15,000 | | | 0.60 | % |

| | | | | | | |

| | | | | | | |

| Unaccreted discount and issuance costs | — | | | | | (86) | | | |

| Short-term borrowing, net | $ | — | | | | | $ | 14,914 | | | |

| | | | | | | |

| Long-term debt, current and noncurrent: | | | | | | | |

| Related party term loan with Lumentum Holdings Inc. | $ | 30,000 | | | 4.00 | % | | $ | — | | | — | % |

| Borrowing under Wells Fargo Credit Facility | 20,571 | | | 3.12 | % | | 20,338 | | | 1.94 | % |

| Mitsubishi Bank loans | 3,438 | | | 1.06%-1.46% | | 5,000 | | | 1.06%-1.46% |

| Mitsubishi Bank and Yamanashi Chuo Bank loan | 2,454 | | | 1.07 | % | | 3,429 | | | 1.06 | % |

| Finance lease liability | 43 | | | | | 94 | | | |

| Total long-term debt | 56,506 | | | | | 28,861 | | | |

| Unaccreted discount and issuance costs | (158) | | | | | (180) | | | |

| Total long-term debt, net of unaccreted discount and issuance costs | $ | 56,348 | | | | | $ | 28,681 | | | |

| Reported as: | | | | | | | |

| Current portion of long-term debt | $ | 2,449 | | | | | $ | 2,928 | | | |

| Long-term debt, net of current portion | 23,945 | | | | | 25,753 | | | |

| Related party long-term debt | 29,954 | | | | | — | | | |

| Total long-term debt, net of unaccreted discount and issuance costs | $ | 56,348 | | | | | $ | 28,681 | | | |

Notes payable and short-term borrowing

In June 2021, NeoPhotonics (China) Co., Ltd., ("NeoPhotonics China"), a subsidiary of the Company, entered into a credit line agreement with Shanghai Pudong Development Bank Shenzhen Branch (“SPDB”) providing for a line of credit to NeoPhotonics China in an amount of RMB 120,000,000 (approximately $1817.9 million) for short-term loans at varying interest rates. The line of credit facility expired on February 23, 2022.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

In June 2021, NeoPhotonics Dongguan Co., Ltd (“NeoPhotonics Dongguan”), also a subsidiary of the Company, entered into a credit line agreement with SPDB providing for a line of credit to NeoPhotonics Dongguan in an amount of RMB 30,000,000 (approximately $4.75 million) for short-term loans at varying interest rates. As of MarchJune 3130, 2022, there was not an amount outstanding under this credit facility. The line of credit facility expired on February 23, 2022.

The Company regularly issues notes payable to its suppliers in China. These notes are supported by non-interest bearing bank acceptance drafts issued under the Company’s existing line of credit facilities and are due three to six months after issuance. As a condition of the notes payable arrangements, the Company is required to keep a compensating balance at the issuing banks that is a percentage of the total notes payable balance until the amounts are settled.

As of MarchJune 3130, 2022 and December 31, 2021, there was $0 and $15 million outstanding under the NeoPhotonics China credit facility, respectively. The note payable bore interest at 3.0% (2.4% of which was charged to NeoPhotonics China as a loan fee and paid in the fourth quarter of 2021) and was repaid in March 2022.

There was no amount outstanding under the NeoPhotonics Dongguan line of credit as of MarchJune 3130, 2022 and December 31, 2021.

As of MarchJune 3130, 2022 and December 31, 2021, there were no bank acceptance drafts issued in connection under the NeoPhotonics China and the NeoPhotonics Dongguan credit facility.

There were no compensating balances relating to these credit facilities as of MarchJune 3130, 2022 and December 31, 2021, respectively. Compensating balances are classified as restricted cash on the Company’s condensed consolidated balance sheets.

Credit facilities

In June 2021, the Company entered into an Amended and Restated Credit Agreement (the “A&R Credit Agreement”) with Wells Fargo Bank, National Association ("Wells Fargo"), as administrative agent for a lender group. The A&R Credit Agreement amends and restates in full that certain Credit Agreement dated as of September 8, 2017 (as amended, the "Former Credit Agreement"), by and among the Company and Wells Fargo. The A&R Credit Agreement provides for continuation of the $50 million revolving credit facility (the "Credit Facility").

The A&R Credit FacilityAgreement provides for borrowings equal to the lower of (a) a maximum revolver amount of $50.0 million, or (b) an amount up to 80% - 90% of eligible accounts receivable plus 100% of qualified cash balances up to $15.0 million, less certain discretionary adjustments ("Borrowing Base"). The maximum revolver amount may be increased by up to $25.0 million, subject to certain conditions.

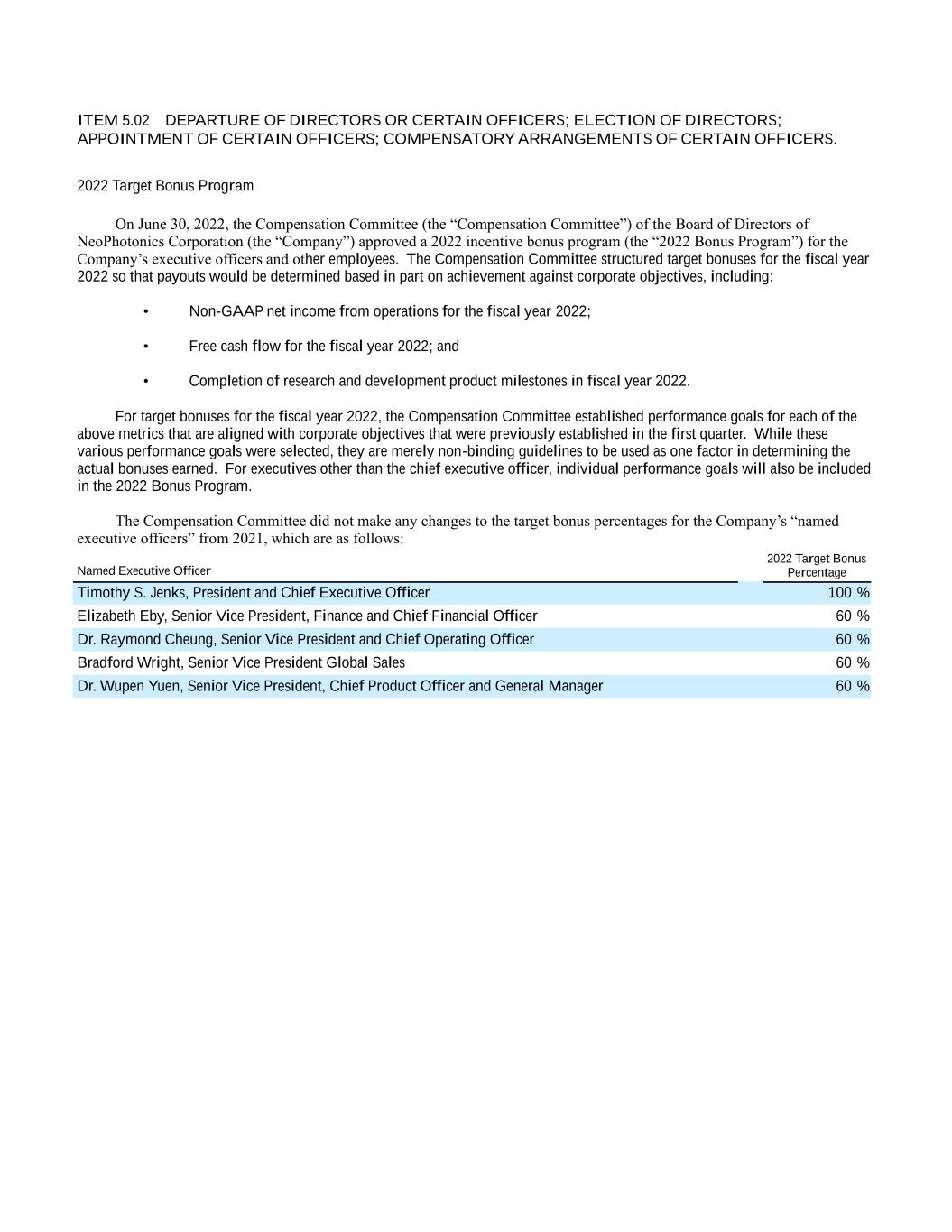

The A&R Credit FacilityAgreement matures on June 30, 2026 and borrowings bear interest, at the Company's option, at an interest rate of either (a) the LIBOR rate, plus an applicable margin ranging from 1.50% to 1.75% per annum, based upon the average excess availability (as defined in the Credit Facility), or (b) the prime lending rate, plus an applicable margin ranging from 0.50% to 0.75% per annum, based upon the average excess availability. The Company is also required to pay a commitment fee equal to 0.25% of the unused portion of the Credit Facility, monthly, in arrears.