|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

|

|

Toronto Stock Exchange

|

|

(in thousands of US$)

|

Year ended December 31, 2022

|

Year ended December 31, 2021

|

||||||

|

Audit fees (note 1)

|

$ | 1,065 | $ | 1,177 | ||||

|

Audit-related fees (note 2)

|

65 | 11 | ||||||

|

Tax fees (note 3)

|

36 | 31 | ||||||

|

All other fees (note 4)

|

104 | 102 | ||||||

| $ | 1,270 | $ | 1,321 | |||||

|

1.

|

Refers to the aggregate fees billed by the Registrant's external auditor for audit services relating to the audit of the Registrant and statutory audits required by subsidiaries.

|

|

2.

|

Refers to the aggregate fees billed for assurance and related services by the Registrant's external auditor that are reasonably related to the performance of the audit or review of the Registrant's financial statements and are not reported under (1) above, including professional services rendered by the Registrant's external auditor for accounting consultations on proposed transactions and consultations related to accounting and reporting standards. Such fees included amounts incurred in respect of: due diligence and other work related to the disposition and acquisition of businesses, such work being unrelated to the audit of the Registrant's financial statements; accounting consultations with respect to proposed transactions, as well as other audit-related services.

|

|

3.

|

Refers to the aggregate fees billed for professional services rendered by the Registrant's external auditor for tax compliance, tax advice and tax planning.

|

|

4.

|

Refers to fees for licensing and subscriptions to accounting and tax research tools, as well as administration and out-of-pocket expenses.

|

|

A.

|

Undertaking

|

|

B.

|

Consent to Service of Process

|

|

FIRSTSERVICE CORPORATION

|

||

|

Date: February 23, 2023

|

By:

|

/s/ Jeremy Rakusin

|

|

Name:

|

Jeremy Rakusin

|

|

|

Title:

|

Chief Financial Officer

|

|

|

No.

|

Document

|

|

|

101

|

Interactive Data File.

|

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

|

|

EXHIBIT 1

FIRSTSERVICE CORPORATION

ANNUAL INFORMATION FORM

For the year ended December 31, 2022

February 23, 2023

TABLE OF CONTENTS

| 2 | |

| 2 | |

| 2 | |

| 3 | |

| 3 | |

| 4 | |

| 8 | |

| 8 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 9 | |

| 10 | |

| 10 | |

| 11 | |

| 11 | |

| 15 | |

| 16 | |

| 16 | |

| 18 | |

| 23 | |

| 23 | |

| 25 | |

| 25 | |

| 26 | |

| 26 | |

| 27 | |

This is the annual information form of FirstService Corporation for the year ended December 31, 2022 (the “AIF”). In this AIF, unless otherwise specified or the context otherwise requires, reference to “we”, “us”, “our”, “Company” or “FirstService” includes reference to the subsidiaries of, and other equity interests held by, FirstService Corporation and its subsidiaries.

Certain historical information contained in this AIF has been provided by, or derived from information provided by, certain third parties. Although we have no knowledge that would indicate that any such information is untrue or incomplete, we assume no responsibility for the completeness or accuracy of such information or the failure by such third parties to disclose events which may have occurred or may affect the completeness or accuracy of such information, but which are unknown to us.

Unless otherwise specified, all dollar amounts referred to in this AIF are expressed in United States dollars and all references to “$” or “US$” are to United States dollars and all references to “C$” are to Canadian dollars. Unless otherwise indicated, all financial information included in, or incorporated by reference into, this AIF is derived from consolidated financial statements that are prepared using generally accepted accounting principles as in effect in the United States (“GAAP”) and presented as at December 31, 2022.

This AIF contains, and incorporates by reference, “forward looking statements” which reflect the current expectations, estimates, forecasts and projections of management regarding our future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as “may,” “would,” “could,” “will,” “anticipate,” “believe,” “plan,” “expect,” “intend,” “estimate,” “aim,” “endeavour” and similar expressions have been used to identify these forward-looking statements. These statements reflect management’s current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, without limitation, those listed in the “Risk Factors” section of this AIF. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this AIF. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in, or incorporated by reference into, this AIF are based upon what management currently believes to be reasonable assumptions, we cannot assure readers that actual results, performance or achievements will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this AIF and, unless otherwise required by applicable securities laws, we do not intend, nor do we undertake any obligation, to update or revise any forward-looking statements contained in this AIF to reflect subsequent information, events, results or circumstances or otherwise.

FIRSTSERVICE CORPORATION

ANNUAL INFORMATION FORM

(February 23, 2022)

We were formed under the Business Corporations Act (Ontario) as “New FSV Corporation” pursuant to Articles of Incorporation effective on October 6, 2014. On June 1, 2015, our predecessor, FirstService Corporation (“Old FSV”), completed a plan of arrangement (the “Spin-off”) which separated Old FSV into two independent publicly traded companies – FirstService and Colliers International Group Inc. Under the spin-off, Old FSV shareholders received one FirstService share and one Colliers International Group Inc. share of the same class as each Old FSV share previously held, Old FSV amalgamated with a wholly-owned subsidiary and changed its name to Colliers International Group Inc., and FirstService’s name was changed to “FirstService Corporation”.

On May 10, 2019, we settled the Restated Management Services Agreement, including the long-term incentive arrangement therein, between FirstService, Jay S. Hennick and Jayset Management FSV Inc. and eliminated FirstService’s dual class share structure. On that date, FirstService also effected an amendment to its articles that eliminated the multiple voting shares and the “blank cheque” preference shares as part of the authorized capital of FirstService, and re-classified its subordinate voting shares as common shares. This transaction is further described in FirstService’s management information circular dated March 25, 2019 relating to the annual and special meeting of shareholders held on May 3, 2019 under “Business of the Meeting – Approval of Transaction” and “Business of the Meeting – Approval of Amendment to the Articles”.

Our head and registered office is located at 1255 Bay Street, Suite 600, Toronto, Ontario, M5R 2A9. Our fiscal year-end is December 31.

Intercorporate Relationships

We have the following principal subsidiaries which have total assets or revenues which exceed 10% of our total consolidated assets or revenues as at and for the year ended December 31, 2022:

|

Name of subsidiary |

Percentage of voting securities owned |

Jurisdiction of incorporation, continuance, formation or organization |

|

FirstService CAM Holdings, Inc. |

100.0% |

Delaware |

|

FirstService Residential, Inc. |

100.0% |

Delaware |

|

FirstService Residential Florida, Inc. |

100.0% |

Florida |

|

FirstService Restoration, Inc. |

100.0% |

Delaware |

|

Bellwether FOS Holdco, Inc. |

89.2% |

Delaware |

|

FirstOnSite USA Holdings, Inc. |

100.0% |

Delaware |

|

Interstate Restoration LLC |

100.0% |

Colorado |

|

FS Brands, Inc. |

97.2% |

Delaware |

|

Century Fire Holdings, LLC |

94.8% |

Delaware |

The voting securities of the above noted subsidiaries not controlled by FirstService are owned by operating management of each respective subsidiary. The above table does not include all of the subsidiaries of FirstService. The assets and revenues of our unnamed subsidiaries did not exceed 20% of our total consolidated assets or total consolidated revenues as at and for the year ended December 31, 2022.

General development of the business

FirstService is the North American leader in residential property management and other essential property services to residential and commercial customers. We began independent operations on June 1, 2015 following the completion of the Spin-off, which included, among other things, the transfer to us of the FirstService Residential and FirstService Brands divisions of Old FSV, and the assets and liabilities referable thereto, as operated by Old FSV prior to June 1, 2015. Prior to completion of the Spin-off, we did not carry on any active business and did not issue any shares.

History

The business lines of FirstService were part of the foundation of our predecessor company, Old FSV, originally launched in 1989 by Jay S. Hennick, our founder and Chairman, with a Toronto-based commercial swimming pool and recreational facility management business which he founded as a teenager in 1972. Over the past 30 years, the businesses of FirstService have grown their operations “one step at a time” both through internal growth and acquisitions. In addition to the Spin-off, the following chart summarizes key milestones in the evolution of the Company:

|

Year |

Event |

|

|

1989 |

Jay S. Hennick established Old FSV with a Toronto-based swimming pool management company Old FSV acquired College Pro Painters franchise system and established FirstService Brands |

|

|

1994 |

D. Scott Patterson joined Old FSV as Vice President, Corporate Development and soon thereafter became Chief Financial Officer |

|

|

1996 |

Old FSV established the FirstService Residential platform by acquiring two Florida-based property management firms, with follow-on acquisitions in the New York City and Northeast U.S. regions shortly thereafter |

|

|

1997 |

FirstService Brands acquired Paul Davis Restoration |

|

|

1997 |

FirstService Financial was established as part of the FirstService Residential platform service offering |

|

|

1998 |

FirstService Brands acquired California Closets |

|

|

2005 |

FirstService Brands exceeded 1,000 franchises |

|

|

2007 |

FirstService Brands exceeded $1 billion in system-wide sales |

|

|

2008 |

FirstService adopted Net Promoter System (NPS) across all of its businesses |

|

|

2009 |

FS Energy was launched to add to FirstService Residential’s comprehensive services |

|

|

2010 |

FirstService Residential expanded into Canada |

|

|

2013 |

FirstService Residential national brand was established from the rebranding of 18 regional brands |

|

|

2016 |

FirstService acquired Century Fire Protection |

|

|

2019 |

FirstService acquired Global Restoration (legally known as Bellwether FOS Holdco, Inc.) and completed a public offering of common shares for gross proceeds of approximately US$200 million |

|

|

2020 |

FirstService completed a private placement sale of common shares for gross proceeds of approximately US$150 million. |

|

|

2021 |

First Onsite Restoration national brand was established from the rebranding of Global Restoration |

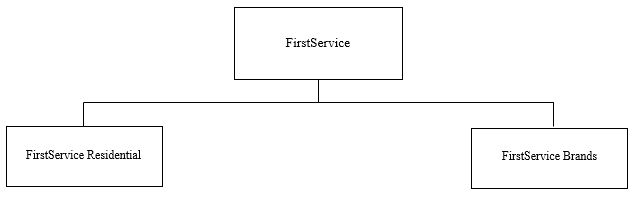

FirstService is a North American leader in the essential outsourced property services sector, serving its customers through two operating divisions: FirstService Residential, North America’s largest manager of residential communities, and FirstService Brands, one of North America’s largest providers of essential property services delivered through individually branded franchise systems and company-owned operations. With the completion of the acquisition of Global Restoration in 2019 (subsequently rebranded as First Onsite Restoration in early 2021), FirstService Brands significantly expanded its scale and capabilities in commercial and large loss property restoration in North America. See “– FirstService Brands Segment – First Onsite Restoration”.

FirstService Residential and FirstService Brands both rely on the same operational foundations for success – a core competency in managing and growing market-leading, value-added outsourced essential property services businesses; a focus on client service excellence; economies of scale that are leveraged wherever possible to create more value for clients; and strong brand recognition. These pillars provide our businesses with competitive advantages that are difficult to replicate. Our two business lines also have similar highly attractive financial profiles, including a high proportion of recurring revenue streams, low capital expenditure and working capital requirements, high free cash flow generation, and significant financial strength to grow both organically and through consolidation of highly fragmented industries.

We conduct our business and report our financial performance through two operating segments as shown below:

The following charts summarize the revenues, operating earnings and adjusted EBITDA of our two operating segments over the past two fiscal years.

|

Revenues by operating segment |

Year ended December 31 |

|||||||

|

(in thousands of US$) |

2022 |

2021 |

||||||

|

FirstService Residential |

1,772,258 | 1,585,431 | ||||||

|

FirstService Brands |

1,973,577 | 1,663,641 | ||||||

|

Total |

$ | 3,745,835 | $ | 3,249,072 | ||||

|

Operating earnings (loss) by operating segment |

Year ended December 31 |

|||||||

|

(in thousands of US$) |

2022 |

2021 |

||||||

|

FirstService Residential |

138,873 | 127,297 | ||||||

|

FirstService Brands |

111,638 | 106,579 | ||||||

|

Corporate |

(31,485 | ) | (32,234 | ) | ||||

| Total | $ | 219,026 | $ | 201,642 | ||||

|

Adjusted EBITDA1 by operating segment |

Year ended December 31 |

|||||||

|

(in thousands of US$) |

2022 |

2021 |

||||||

|

FirstService Residential |

168,637 | 156,718 | ||||||

|

FirstService Brands |

196,277 | 187,882 | ||||||

|

Corporate |

(13,182 | ) | (17,224 | ) | ||||

| Total | $ | 351,732 | $ | 327,376 |

|

|||

__________________________

1 Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. For a reconciliation of this and other non-GAAP financial measures, see “Reconciliation of non-GAAP financial measures” in this AIF.

FirstService Residential Segment

FirstService Residential is North America’s largest manager of private residential communities, offering a full range of services across multiple geographies to a wide variety of clients, including condominiums (high and low-rise), co-operatives, homeowner associations, master-planned communities, active adult and lifestyle communities, and a variety of other residential developments governed by common interest or multi-unit residential community associations. Our approximately 20,000 employees in approximately 100 offices across 25 U.S. states and 3 Canadian provinces manage approximately 8,700 communities, representing more than 4 million residents. Our operational and client coverage footprint is extensive, with a presence in major markets that constitute over 70% of the North American population.

Typically, owners of residential units within these communities are required to pay monthly or quarterly fees to cover all expenses to operate and maintain the common areas of the communities. Resident owners elect volunteer homeowners to serve on a board of directors to oversee the operations of the community association. Historically, decision-making for the day-to-day operations of the communities was delegated to these volunteer board members, although, increasingly, these boards outsource this responsibility to professional property management companies like FirstService Residential.

There are two types of professional property management companies within the industry – traditional or full-service:

|

● |

Traditional property management: Traditional property managers focus principally on administrative and governance property management functions on behalf of community association clients, including advising homeowner boards on matters relating to the operation of their communities, collection of monthly maintenance fees, sourcing and payments to suppliers, financial statement preparation, and outsourcing of support services. |

|

● |

Full service property management: Full service property managers provide all of the traditional functions, plus a range of ancillary services including, among other things, on-site staffing (in areas such as building engineering and maintenance, full-service amenity management, security and concierge/front desk), banking and insurance products, energy conservation and management solutions, and resale processing services. |

Only a small number of industry participants have the expertise and capital to provide full-service property management services comparable to FirstService Residential. We have the scale, highly recognized brand, geographic footprint, resources, operating expertise and innovation to deliver a full-service offering. We combine our advantages of size and national presence with a local touch and dedication focusing on service excellence, which solidifies our client relationships and market-leading reputation.

As a full-service property manager, FirstService Residential provides a full range of ancillary services, including on-site staffing for building engineering and maintenance, full-service swimming pool and amenity management, security and concierge/front desk. In most markets, we provide financial services (cash management, other banking transaction-related services, and specialized property insurance brokerage), energy management solutions and advisory services, and resale processing services, utilizing the scale of our operations to economically benefit clients.

We generally provide residential property management and recurring ancillary services under contract, with a fixed monthly fee. These contracts typically range in duration from one to three years, yet are generally cancellable by either party with 30 to 90 days’ notice. Historically, a significant proportion of our revenue is recurring due to the nature of our contracts, which have a mid-90% retention rate, and therefore have a long-term tenure.

FirstService Brands Segment

FirstService Brands is a leading North American operator and provider of essential property services to residential and commercial customers. The principal brands in this division include Paul Davis Restoration, First Onsite Restoration, Century Fire Protection, CertaPro Painters, California Closets, Pillar to Post Home Inspectors, and Floor Coverings International.

Franchised Operations

We own and operate five franchise networks as follows:

|

(i) |

Paul Davis Restoration is a franchisor of residential and light commercial restoration services serving the insurance industry in the United States and Canada through 338 franchises. Paul Davis provides full service water, fire and mold cleanup, construction rebuild and restoration services for property damaged by natural or man-made disasters. Royalties are earned from franchisees based on a percentage of franchisee gross revenues. |

|

(ii) |

CertaPro Painters is the largest provider of residential and commercial painting services in North America. CertaPro has 364 franchises operating in major markets across the United States and Canada. CertaPro Painters focuses on high-end residential and commercial painting and decorating work. CertaPro completes more than 125,000 projects in a typical year. Royalties are earned based on a percentage of franchisee gross revenues or a fixed monthly fee, plus administrative fees for various ancillary services. |

|

(iii) |

California Closets is North America's largest provider of custom-designed and installed closet and home storage solutions. California Closets has 87 franchises in the United States and Canada. There are currently approximately 138 branded California Closets retail showrooms in operation in North America which are used by franchisees to demonstrate and sell the product. California Closets franchise and corporate locations typically install more than 70,000 jobs annually across North America. Royalties are earned based on a percentage of franchisee gross revenues. |

|

(iv) |

Pillar to Post Home Inspectors is one of North America’s largest home inspection service providers. Services are provided through a network of approximately 700 home inspectors in 496 franchises. Through its proprietary inspection model, Pillar to Post Home Inspectors can assess many categories or items inside and outside the home as part of its evaluation process. Pillar to Post Home Inspectors typically inspects more than $50 billion in residential real estate each year. Royalties are earned on a percentage of franchisee gross revenues. |

|

(v) |

Floor Coverings International is a residential and commercial floor coverings design and installation franchise system operating in North America with 239 franchises. Royalties are earned based on a percentage of franchisee gross revenues. |

The aggregate system-wide revenues of our 1,524 franchisees were approximately $2.6 billion for 2022. Franchise agreements are for terms of five or ten years. Royalties are reported and paid to us monthly in arrears. All franchise agreements contain renewal provisions that can be invoked by FirstService Brands at little or no cost.

The franchised property services industry is highly fragmented, consisting principally of a large number of smaller, single-service or single-concept companies. Due to the large size of the overall market for these services, dominant market share is not considered necessary for becoming a major player in the industry. However, because of the low barriers to entry in this segment, we believe that brand name recognition among consumers is a critical factor in achieving long-term success in the businesses we operate.

Franchise businesses are subject to U.S. Federal Trade Commission regulations and state and provincial laws that regulate the offering and sale of franchises. Presently, we are authorized to sell franchises in 50 U.S. states, in all Canadian provinces and in several other countries around the world. In all jurisdictions, we endeavor to have our franchises meet or exceed regulatory standards.

Company-Owned Operations

FirstService Brands owns 21 California Closets operations, 14 Paul Davis Restoration operations and 1 CertaPro Painters operation in major metropolitan markets in the United States and Canada. The California Closets, Paul Davis Restoration and CertaPro Painters operations were acquired from franchisees with the goal of accelerating revenue growth and realizing operating margin expansion potential.

Century Fire Protection

Century Fire Protection is one of the largest full-service fire protection companies in the Southeastern United States. Century Fire Protection adds an important service capability to FirstService’s portfolio of essential property services. Headquartered in Duluth, Georgia, Century Fire Protection provides end-to-end fire protection solutions, including design, fabrication, installation, maintenance, repair, service and inspection services for commercial, residential, industrial and institutional clients. Century Fire Protection employs approximately 1,700 staff operating out of 34 offices throughout Georgia, Alabama, Maryland, North Carolina, South Carolina, Tennessee, Texas, Florida, Missouri, Virginia, Kansas and Kentucky.

First Onsite Restoration

In June 2019, we completed the acquisition of Global Restoration, the second largest commercial and large loss property restoration firm in North America. This acquisition expanded FirstService’s scale and capabilities in the property restoration sector and complements our Paul Davis Restoration franchised and company-owned operations, which collectively are a leading player in the residential segment of the industry. In the first quarter of 2021, we brought our eight commercial restoration brands together under the First Onsite Restoration name with a single purpose and vision. The new brand has assisted in enhancing our culture-building initiatives and accelerating organic growth. Headquartered in Denver, Colorado and founded in 1998, First Onsite provides integrated end-to-end solutions encompassing mitigation, restoration and reconstruction services on behalf of blue chip, national clients which include large, multi-location commercial customers, property owners and insurance companies. First Onsite employs approximately 2,600 staff operating out of approximately 110 regional offices throughout North America.

Certain segments of the Company’s operations are subject to seasonal variations. This seasonality results in variations in quarterly revenues and operating margins. Variations can also be caused by acquisitions or dispositions, which alter the consolidated service mix.

Our trademarks are important for the advertising and brand awareness of all of our businesses and franchises. We take precautions to defend the value of our trademarks by maintaining legal registrations and by litigating against alleged infringements, if necessary.

The FirstService Residential operating division operates under the FirstService Residential trademark. This common branding creates a unified North American market presence signifying our market leadership, to showcase our commitment to service excellence and to leverage our strengths to the benefit of current and future clients. No value has been ascribed to the FirstService Residential trademark in our consolidated financial statements.

In our FirstService Brands division, our Century Fire business and two franchise systems – California Closets and Paul Davis Restoration – have trademarks to which value has been ascribed in our consolidated financial statements. The value of these trademarks is derived from the recognition they enjoy among the target audiences for the respective property services. These trademarks have been in existence for many years, and their prominence among consumers has grown over time through the addition of locations and/or franchisees and the ongoing marketing programs conducted by franchisees and FirstService. No value has been ascribed to the First Onsite trademark in our consolidated financial statements.

We maintain leadership positions in the residential property management and residential and commercial property services industries, offering a full complement of services to a wide range of customers. We have an established track record of expanding our business through both organic and acquisition growth. Our growth plan involves five primary drivers: (i) capitalizing on our scale advantages to win new business; (ii) continuing to emphasize retention of our existing customer base, and leveraging referrals from past and existing customers; (iii) continuing to expand our ancillary services; (iv) realizing operational efficiencies; and (v) selectively pursuing strategic acquisitions.

We compete in the essential property services industry as one of the largest providers of such services to residential and commercial customers in North America.

FirstService Residential is the North American leader in residential property management with an estimated 6% market share. We operate in a highly fragmented market, with an estimated 8,000 local and regional management companies across North America. Only a relatively small number of our competitors are able to deliver the expertise and investment capital to compete broadly on a professional platform. Our primary competitors are smaller independent regional players. Our competitive position varies across geographies, property types, and services provided.

The essential property services industry in which FirstService Brands participates is highly fragmented and consists predominantly of small “mom & pop” businesses and, for restoration, emergency response and related services, a few national restoration companies. Each of our service lines within FirstService Brands has professionalized its business category, and has a leading position within each market served. FirstService Brands competes primarily with local, regional and family-owned and operated enterprises or franchise businesses.

We have approximately 27,000 employees.

We own a majority interest in substantially all of our operations, while operating management of each non-wholly-owned subsidiary owns the remaining shares. This structure was designed to maintain control at FirstService while providing significant risks and rewards of equity ownership to management at the operating businesses. In almost all cases, we have the right to “call” management’s shares, usually payable at our option with any combination of common shares of FirstService (the “Common Shares”) or cash. We may also be obligated to acquire certain of these non-controlling interests in the event of death, disability or cessation of employment or if the shares are “put” by the holder, subject to annual limitations on these puts imposed by the relevant shareholder agreements. These arrangements provide significant flexibility to us in connection with management succession planning and shareholder liquidity matters.

Dividend policy

Our board of directors has adopted a dividend policy pursuant to which we intend to make quarterly cash dividends to holders of Common Shares of record at the close of business on the last business day of each calendar quarter. The current quarterly dividend rate is $0.225 per Common Share (a rate of $0.90 per annum), which has increased several times since the Spin-off in 2015 when the quarterly dividend rate was $0.10 per Common Share (a rate of $0.40 per annum). Each quarterly dividend is paid within 30 days after the applicable record date. For the purposes of the Income Tax Act (Canada) and any similar provincial legislation, all dividends on the Common Shares will be eligible dividends unless indicated otherwise.

The terms of our dividend policy remain, among other things, at the discretion of our board of directors. Future dividends on the Common Shares, if any, will depend on the results of our operations, cash requirements, financial condition, contractual restrictions, business opportunities, provisions of applicable law and other relevant factors. Under the terms of our second amended and restated credit agreement dated as of February 17, 2022 (the “Credit Agreement”), our amended and restated note and guarantee agreement (the “Senior Note Agreement”) governing our senior notes (the “Senior Notes”), our master note agreement dated as of September 29, 2022 (the “NYL Note Agreement”) with NYL Investors LLC for private placement issuances of up to US$150 million of senior unsecured notes (“NYL Notes”) and our note purchase and private shelf agreement dated as of September 29, 2022 (the “Prudential Note Agreement”) with PGIM Private Capital for private placement issuances of up to US$300 million of senior unsecured notes (“Prudential Notes”), we are not permitted to pay dividends, whether in cash or in specie, in the circumstances of an event of default thereunder occurring and continuing or an event of default occurring as a consequence thereof. See “Material contracts” and “Risk factors” below.

Dividend history

The aggregate cash dividends declared per Common Share for the years ended December 31, 2022, 2021 and 2020 were US$0.81, US$0.73 and US$0.66, respectively.

Authorized and issued capital

Our authorized capital consists of an unlimited number of Common Shares, of which, as at the date hereof, there were 44,546,167 Common Shares issued and outstanding.

Common Shares

Holders of Common Shares are entitled to receive: (i) notice of, to attend and speak at and to vote at any meeting of the shareholders of FirstService, and at such meeting holders of Common Shares have one vote for each Common Share held; (ii) dividends as may be declared thereon by our board of directors; and (iii) our remaining property and assets, in equal amounts per share on all Common Shares at the time outstanding without preference or distinction, upon our liquidation, dissolution or winding up, or other distribution of our assets among our shareholders for the purposes of winding-up our affairs. The holders of Common Shares do not have any right to vote separately upon any proposal to amend our articles to increase any maximum number of authorized shares of any class or series having rights or privileges equal or superior to the Common Shares or to create a new class of shares equal or superior to the Common Shares. The Common Shares are not redeemable nor retractable but are, subject to applicable law, able to be purchased for cancellation by FirstService in the open market, by private contract or otherwise.

Stock Option Plan

FirstService has a stock option plan (the “Option Plan”) pursuant to which options to acquire Common Shares are granted to directors, officers and full-time employees of FirstService or its subsidiaries (other than Jay S. Hennick). A summary of the terms of the Option Plan is set out in the section entitled “Executive Compensation – Incentive Award Plans of FirstService – FirstService Stock Option Plan” contained in our Management Information Circular filed in connection with our meeting of shareholders held on April 6, 2022 (the “Meeting Circular”), which section is incorporated by reference herein and is available under our SEDAR profile at www.sedar.com. The maximum number of Common Shares subject to grants of options under the Option Plan is limited to 5,413,500, of which, as at the date hereof: (i) options exercisable for 2,575,749 Common Shares have been granted and are outstanding as at the date hereof; and (ii) options which were exercisable for 2,837,751 Common Shares have been exercised or expired as at the date hereof, leaving no options available for grant for Common Shares.

The outstanding Common Shares are listed and posted for trading on the Toronto Stock Exchange (“TSX”) and the NASDAQ Global Select Market (“Nasdaq”) under the symbol “FSV”. No other securities of FirstService are listed for trading on any marketplace. The following table sets forth the reported high and low trading prices and the aggregate volume of trading of the Common Shares on Nasdaq (in United States dollars) and on the TSX (in Canadian dollars) for each month during 2022:

|

Nasdaq |

TSX |

|||||

|

Month |

High Price (US$) |

Low Price (US$) |

Volume Traded |

High Price (C$) |

Low Price (C$) |

Volume Traded |

|

January 2022 |

$199.07 |

$150.16 |

1,975,933 |

251.57 |

190.11 |

2,504,060 |

|

February 2022 |

$162.00 |

$134.35 |

1,974,820 |

205.48 |

171.98 |

2,408,640 |

|

March 2022 |

$148.31 |

$130.56 |

1,827,633 |

185.25 |

166.76 |

2,740,872 |

|

April 2022 |

$146.55 |

$121.51 |

1,565,645 |

183.00 |

155.86 |

1,564,726 |

|

May 2022 |

$128.28 |

$115.33 |

1,416,799 |

162.93 |

149.93 |

2,124,921 |

|

June 2022 |

$132.92 |

$112.64 |

1,258,230 |

162.39 |

145.76 |

1,629,299 |

|

July 2022 |

$135.59 |

$119.93 |

1,322,524 |

173.98 |

154.18 |

1,311,369 |

|

August 2022 |

$139.85 |

$124.00 |

1,053,192 |

179.46 |

162.35 |

1,541,543 |

|

September 2022 |

$131.09 |

$112.44 |

1,470,738 |

170.28 |

152.30 |

1,598,306 |

|

October 2022 |

$131.17 |

$114.80 |

1,420,025 |

181.97 |

159.94 |

1,393,780 |

|

November 2022 |

$130.77 |

$118.14 |

1,561,641 |

174.60 |

160.65 |

1,846,167 |

|

December 2022 |

$131.95 |

$118.12 |

1,359,859 |

177.46 |

160.72 |

1,529,241 |

Transfer agents and registrars

The transfer agent and registrar for the Common Shares is TSX Trust Company, 301 – 100 Adelaide Street West, Toronto, Ontario M5H 4H1.

Directors and executive officers

Directors

Our board of directors is currently comprised of nine members. The following information is provided with respect to the directors of FirstService as at the date hereof:

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Yousry Bissada1 Ontario, Canada |

62 |

Director since April 6, 2022 |

Mr. Bissada is the President and Chief Executive Officer of Home Capital Group Inc. Mr. Bissada has more than three decades of experience in financial services and the mortgage industry. Prior to joining Home Capital Group, Mr. Bissada was President and CEO of Kanetix Ltd., an insurance and financial products company, President and CEO of Filogix, Senior Vice President, Real Estate Secured Lending Products at TD Canada Trust and CFO of Firstline Trust. Mr. Bissada has also served on the boards of companies in the mortgage and financial services industries, such as Chair of Canadiana Financial Corp. and Paradigm Quest Inc. and as a director of Propel Holdings Inc., Street Capital Financial Corp. and Equity Financial Holdings Inc. (now Haventree Bank). Mr. Bissada is a CPA, CGA and an Accredited Mortgage Professional (AMP). |

|

Bernard I. Ghert1,2 Ontario, Canada |

83 |

Director since June 1, 2015 |

Mr. Ghert was previously President and Chief Executive Officer of the Cadillac Fairview Corporation Limited from 1981 to 1987 and President of Stelworth Investments Inc. from 1987 to 1992. In 2002, Mr. Ghert was appointed a member of the Order of Canada. He is also a recipient of Queen Elizabeth II’s Golden Jubilee Medal and Queen Elizabeth II’s Diamond Jubilee Medal. Mr. Ghert has been a director of many organizations in the private and public sectors, including Cadillac Fairview, Stelworth, CT Financial and Canada Trust, Wellington Insurance and the Canada Deposit Insurance Corporation. Mr. Ghert has served as Director of the Managers of several Middlefield Funds, President of the Canadian Institute of Public Real Estate Companies and was a former member of the Advisory Board of the Office of the Superintendent of Financial Institutions. Mr. Ghert currently is Chairman of the Independent Review Committee of Middlefield Fund Management Limited, President of the B.I. Ghert Family Foundation, President of Coppi Holdings Ltd., a Director Emeritus on Sinai Health System’s Board and Past Chair of the Mount Sinai Hospital Board of Directors. Mr. Ghert holds a Master of Business Administration degree. |

|

Elizabeth Carducci Ontario, Canada |

57 |

Director since June 30, 2022 |

Ms. Carducci is recognized as a visionary leader in the customer and employee experience industry. She is currently an advisor and investor in early stage companies, having recently retired from a 21 year career at Medallia, a leading software company in the customer experience space. As a member of the founding team, Ms. Carducci joined Medallia in 2001 as employee number three and helped build the company into an industry leader with 2,000 employees and more than $500 million in annual revenue. She was part of the management team that took Medallia public in 2019, and through a subsequent $6.4 billion buyout in 2021 by private equity firm, Thoma Bravo. Ms. Carducci held numerous operational roles during her tenure at Medallia, culminating in her position as Chief Revenue Officer. Under her stewardship, Medallia became the leading provider of customer experience management solutions across a wide variety of industries, including the hospitality, retail and financial services sectors. Before Medallia, Ms. Carducci led the global contact center organization for Starwood Hotels, with prior roles at ITT Sheraton, and Deloitte. Ms. Carducci holds an MBA from Stanford University and a Bachelor of Science in Electrical Engineering from the Massachusetts Institute of Technology. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Steve H. Grimshaw3 Texas, USA |

58 |

Director since May 11, 2021 |

Mr. Grimshaw is the full time Executive Chairman of Caliber, Inc., one of the largest automotive service companies in the U.S. Since joining as CEO in 2009, Caliber has grown from 68 locations in two states to over 1,550 company owned locations in 42 states across the U.S. Caliber’s family of brands now include Caliber Collision, Caliber Auto Glass, Caliber Auto Care, and Protech Electronics. Caliber’s revenues have increased from $284 million to over $4.0+ billion during his tenure. Prior to joining Caliber, Mr. Grimshaw served as Executive Vice President & General Manager at Safety-Kleen Systems, one of the largest environmental services companies in the U.S. with additional operations in Canada, Mexico, Japan, China, and South Korea. Under Mr. Grimshaw’s inspirational leadership, Caliber’s philanthropic efforts are tightly woven into the fabric of the Caliber culture, including the annual Rhythm Restoration Food Drive with more than 20 million meals collected for children in need of nutritious meals and the Caliber Recycled Rides program which has donated more than 250 vehicles to military and first responder families in need of reliable transportation. Mr. Grimshaw received the 2016 Ernst & Young Southwest Entrepreneur of the Year Award in the services category and was a National Finalist. Mr. Grimshaw was Chair of the Board for the Dallas Division of the American Heart Association until June 2020 and currently serves on the AHA Board for the Southwest Region. Mr. Grimshaw chaired the 2016 Côtes du Coeur event with his wife raising a record $4 million to fight heart disease and stroke. Mr. Grimshaw was also appointed to the American Heart Association CEO Roundtable as one of 40 CEOs from some of America’s largest companies dedicated to disseminating evidence-based approaches to workplace health. Mr. Grimshaw also sits on the board of Premise Health, the nation’s leading direct healthcare provider based in Nashville, TN and Apple Roofing, a residential and commercial roofing company based in Southlake, TX. Mr. Grimshaw is a graduate of the University of South Carolina where he currently serves as a Trustee for the Business Partnership Foundation for the Darla Moore Business School. Previous board participation includes Mavis Discount Tire, Amegy Bank Dallas Advisory Board and 22Kill (focused on ending veteran suicide). |

|

Jay S. Hennick2 Ontario, Canada |

66 |

Director and Chairman of the Board since June 1, 2015 |

Mr. Hennick is the global Chairman, CEO and controlling shareholder of Colliers International. Jay is also the Founder, Chairman and the largest individual shareholder of FirstService and was the former CEO from 1988 to 2015. He is also the Chairman of Hennick & Company, a private family investment firm. In 1998, Mr. Hennick was awarded Canada's Entrepreneur of the Year, and in 2001 he was named Canada's CEO of the Year by Canadian Business Magazine. In 2011, Jay received an Honorary Doctorate of Laws from York University and in 2014, an Honorary Doctorate from the University of Ottawa. In 2019, Mr. Hennick was appointed as a member of the Order of Canada and received the International Horatio Alger Award. Mr. Hennick also served as past Chairman of the Board of Directors of the Sinai Health System and Mount Sinai Hospital, in Toronto. Jay and his wife Barbara are also active philanthropists establishing the Hennick Family Foundation to support important causes in healthcare, education and the arts, the largest of which include: a $50 million donation to the Royal Ontario Museum in support of their revitalization and new vision plans; a $36 million donation to name Hennick Bridgepoint Hospital, the largest complex care and rehabilitation hospital in Canada; a $10 million donation to the World Holocaust Remembrance Centre (Yad Vashem) in Jerusalem, Israel; and smaller but significant benefactions include those to Osgoode Hall Law School and the Schulich School of Business at York University and to the University of Ottawa. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Frederick F. Reichheld3 Massachusetts, USA |

71 |

Director since June 1, 2015 |

Since 1977, Mr. Reichheld has been employed at Bain & Company, Inc., a global business consulting firm, and was elected to the partnership at Bain in 1982. Mr. Reichheld is the creator of the Net Promoter® system of management and founded Bain’s Loyalty practice, which helps clients achieve superior results through improvements in customer, employee, partner and investor loyalty and has also served in a variety of other roles, including as a member of Bain & Company’s Worldwide Management, Nominating, and Compensation Committees. In January 1999, he was elected by the firm to become the first Bain Fellow. Mr. Reichheld is a frequent speaker to major business forums and groups of CEOs and senior executives worldwide and has authored several books, including The Loyalty Effect: The Hidden Force Behind Growth, Profits, and Lasting Value (Harvard Business School Press, 1996), Loyalty Rules!: How Today’s Leaders Build Lasting Relationships (Harvard Business School Press 2003), The Ultimate Question (Harvard Business School Press, 2006), The Ultimate Question 2.0 (Harvard Business School Press 2011) and Winning on Purpose (Harvard Business Review Press 2021). Mr. Reichheld received his BA from Harvard College and his MBA from Harvard Business School. |

|

D. Scott Patterson Ontario, Canada |

62 |

Director and Chief Executive Officer since June 1, 2015 |

Mr. Patterson is the CEO of FirstService. Pre-spin-off, Mr. Patterson was the President and Chief Operating Officer of former FirstService Corporation from 2003 to 2015. He joined former FirstService Corporation in 1995 as Vice President Corporate Development, and was its Chief Financial Officer from February 1995 until September 2003. Prior to joining former FirstService Corporation, Mr. Patterson was an investment banker at Bankers Trust. Mr. Patterson qualified as a Chartered Accountant in 1985 and began his career at PricewaterhouseCoopers. Mr. Patterson holds a Bachelor of Arts degree in Business Administration from the University of Western Ontario. |

|

Joan Eloise Sproul1 Ontario, Canada |

66 |

Director since May 15, 2018 |

Ms. Sproul was most recently the Executive Vice President, Finance (CFO) & Chief Administrative Officer of the Sinai Health System in Toronto, Canada. In addition to serving more than 20 years in various finance and corporate-related roles at Mount Sinai Hospital, she previously held a number of senior financial positions in the hospitality industry. Ms. Sproul was named to the list of Canada's Most Powerful Women, Women's Executive Network, 2013. Ms. Sproul holds a Chartered Professional Accountant (CPA) designation, having qualified as a Chartered Accountant in 1981 and began her career at Ernst & Whinney. Ms. Sproul holds a Bachelor of Commerce degree from the University of Toronto. |

|

Erin J. Wallace2,3 Colorado, USA |

63 |

Director since October 8, 2015 |

Ms. Wallace is the former Chief Operating Officer at Great Wolf Resorts, Inc., a role she held from 2016 through 2019. In this role she was responsible for leading more than 9,000 Pack Member employees at 18 lodges throughout the United States. Great Wolf Resorts, Inc. is America’s largest family of indoor water park resorts and has over 7.0 million guests a year. Before joining Great Wolf Resorts, Inc., Ms. Wallace was the Chief Operating Officer of Learning Care Group, Inc. from February 2015 to August 2016, where she led more than 16,000 Learning Care Group employees in delivering operational excellence to the families served at more than 900 schools throughout its umbrella of 5 brands. Prior to that, Ms. Wallace’s 30 year career at the Walt Disney Company spanned many roles in Theme Parks and Resorts concluding with Executive Vice President of Operations Strategy, Planning, Revenue Management and Decision Sciences, encompassing all of Disney Parks’ domestic and international sites. After joining Disney as an industrial engineer in 1985, Ms. Wallace’s roles included Senior Vice President of Walt Disney World Operations – where she oversaw the largest and most popular resort destination in the world, Vice President of Walt Disney World’s Magic Kingdom® and general manager for Disney’s Animal Kingdom® and Disney’s All-Star Resort. Ms. Wallace graduated with honors from the University of Florida and earned her MBA from the Crummer School of Business at Rollins College. She is currently a Trustee at Rollins College and a director of Ardent Leisure Group Limited. |

Notes:

|

1. |

Member of Audit Committee |

|

2. |

Member of Executive Compensation Committee |

|

3. |

Member of Nominating and Corporate Governance Committee |

Each director remains in office until the following annual shareholders’ meeting of FirstService or until the election or appointment of his or her successor, unless he or she resigns, his or her office becomes vacant or he or she becomes disqualified to act as a director. All directors stand for election or re-election annually.

Further background information regarding the directors of FirstService are set out in the Meeting Circular, the relevant sections of which are incorporated by reference herein and which is available under our SEDAR profile at www.sedar.com.

Officers

The following information is provided with respect to the executive and other key officers of FirstService as at the date hereof:

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

D. Scott Patterson Ontario, Canada |

62 |

Chief Executive Officer since June 2015 |

See description above under “Directors”. |

|

Jeremy Rakusin Ontario, Canada |

54 |

Chief Financial Officer since June 2015 |

Mr. Rakusin is the CFO of FirstService, and he is responsible for the overall financial management of FirstService, including external and internal financial reporting, budgeting, and capital market activities, including managing investor and lender relationships. Mr. Rakusin is also closely involved with all corporate communications and capital allocation decision making. Mr. Rakusin joined FirstService in September 2012 as Vice President, Strategy & Corporate Development and was responsible for sourcing and executing the company’s acquisition strategy, as well as leading other corporate strategic and growth initiatives. Prior to joining FirstService, Mr. Rakusin was Mergers & Acquisitions Head at Raymond James Ltd. with responsibility for leading the firm’s domestic and cross-border M&A practice. Mr. Rakusin’s investment banking and corporate finance experience also includes more than 10 years at Bank of America, Merrill Lynch and TD Securities. Other career experience includes positions as a portfolio manager at a Toronto-based discretionary investment firm and as a securities and corporate lawyer at Toronto-based Goodmans LLP. Mr. Rakusin earned his joint MBA and Law degrees from the University of Toronto. He also received his Chartered Financial Analyst designation. |

|

Douglas G. Cooke Ontario, Canada |

63 |

Senior Vice President, Corporate Controller and Corporate Secretary since June 2015 |

Mr. Cooke is the Senior Vice President, Corporate Controller and Corporate Secretary of FirstService, and he is responsible for FirstService’s external and internal corporate reporting and cash management functions. Mr. Cooke joined FirstService in 1995 as Controller, later assuming the position of Corporate Controller and Treasurer. In 2019, Mr. Cooke was appointed Senior Vice President. Prior to joining FirstService, Mr. Cooke was Senior Internal Auditor for Unilever Canada, a subsidiary of Unilever PLC, one of the world’s largest consumer product companies. Previously, Mr. Cooke has held senior financial reporting positions within the retail and financial sectors. Mr. Cooke is both a Chartered Professional Accountant and Chartered Financial Analyst, beginning his career with KPMG. |

|

Alex Nguyen Ontario, Canada |

40 |

Senior Vice President, Strategy and Corporate Development, since June 2015 |

Mr. Nguyen is the Senior Vice President, Strategy and Corporate Development, of FirstService. In this role, Mr. Nguyen is responsible for driving acquisition growth across all of FirstService’s business platforms. Mr. Nguyen is also closely involved in the formulation and execution of the Company’s corporate strategy and growth initiatives. In 2019, Mr. Nguyen was appointed Senior Vice President. Prior to FirstService, Mr. Nguyen worked at the Ontario Teachers’ Pension Plan, one of the largest institutional investors in the world, where he was responsible for the execution and management of private equity investments. Formerly, Mr. Nguyen worked at RBC Capital Markets and CIT. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Roger Thompson Ontario, Canada |

44 |

Vice President, Strategy and Effectiveness, since January 2017 |

Mr. Thompson serves as Vice President Strategy and Effectiveness for FirstService. In this role, Mr. Thompson is responsible for driving strategic initiatives across all of FirstService’s business platforms. Additionally, Mr. Thompson is focused on developing our social purpose programs for our people, our communities and our environment. Since joining FirstService in 2007, Mr. Thompson has held many progressive roles within the organization, with the latest as Executive Vice President of FirstService Residential Ontario, the condominium management arm of FirstService. Mr. Thompson is a MBA graduate from the University of Toronto’s Rotman School of Management and holds various degrees/diplomas/certifications from Western University, York University, CAGBC, USGBC, and D’Youville College in New York. |

|

Steve Carpenter |

47 |

Senior Vice President, Technology and Sustainability and Information Services, since January 2022 |

Steve Carpenter joined FirstService in 2015 and has served as California Closets CIO and FirstService Brands CIO prior to moving to the FirstService Corporate team in 2022. Prior to joining FirstService, he served as Director of Hosted Operations for one of the largest global contact center companies. In that role he was responsible for hosted services provided to numerous Fortune 100 companies. Previously, Steve held multiple IT leadership positions over a ten plus year period with a North American multi-brand home services provider; where he focused on providing technology solutions that improved customer experience, employee productivity, and overall life cycle management. Steve has over twenty years of IT leadership experience in selecting, sourcing, designing, implementing, and running all aspects of information technology. Steve attended Murray State University and is a United States Army veteran, he currently resides in the Ozark Mountain area of Arkansas. |

|

David Diestel Florida, USA |

53 |

Chief Executive Officer, FirstService Residential, since August 2021 |

Mr. Diestel is CEO of FirstService Residential, a role he assumed in 2021 after serving as President of the company’s South Region since 2014. During his time leading the South, his focus on corporate culture and operating discipline transformed the region and led the team to deliver significant increases in revenue and profitability along with entry into new markets. Mr. Diestel joined FirstService Residential in 2005 as the company's Senior Vice President, Operations. In this role, he was responsible for launching the FirstService Residential brand and many of the foundational operational practices that today drive the company’s focus on associate and client experience as well as growth initiatives. Before joining FirstService Residential, Mr. Diestel held the position of Director of Strategy and Operations at FirstService, which he joined in 2002. Mr. Diestel earned a bachelor’s degree in Engineering from McGill University and an MBA from the Rotman School of Management at the University of Toronto. He earned his certification as a LEED AP (Leadership in Energy and Environmental Design) from the U.S. Green Building Council. |

|

Charlie E. Chase Pennsylvania, USA |

63 |

President and Chief Executive Officer, FirstService Brands, since 2010 |

Mr. Chase is the President and CEO of FirstService Brands. Prior to his role as CEO, Mr. Chase served as the President of the Consumer Franchises of The Franchise Company and prior to that he was CEO of CertaPro Group. Throughout his 30 years with FirstService Brands he has held numerous roles, starting as a Franchise owner in 1982 at College Pro Painters. Believing that there was an opportunity to create a successful and significant full time painting company, in 1992 he became the founding President of CertaPro Painters. |

Ownership

As of the date hereof, the directors and executive/key officers of FirstService, as a group, own, or control or direct, directly or indirectly, 5,561,420 Common Shares, which represents 12.5% of the total Common Shares outstanding.

Legal proceedings and regulatory actions

There are no legal proceedings to which FirstService is a party to, or in respect of which, any of the property of FirstService is the subject of, which is or was material to FirstService during 2022, and FirstService is not aware of any such legal proceedings that are contemplated. In the normal course of operations, FirstService is subject to routine immaterial claims and litigation incidental to its business. Litigation currently pending or threatened against FirstService includes disputes with former employees and commercial liability claims related to services provided by FirstService. FirstService believes resolution of such proceedings, combined with amounts set aside, will not have a material impact on FirstService’s financial condition or the results of operations.

During 2022, there were no penalties or sanctions imposed against FirstService by a court relating to provincial and territorial securities legislation or by a securities regulatory authority, nor were there any other penalties or sanctions imposed by a court or regulatory body against FirstService and, during 2022, FirstService did not enter into any settlement agreements before a court relating to provincial and territorial securities legislation or with a securities regulatory authority.

The following chart provides a summary of the properties occupied by FirstService and its subsidiaries as at December 31, 2022:

|

(square feet) |

United States (leased) |

United States (owned) |

Canada (leased) |

Canada (owned) |

International (leased) |

International (owned) |

||||||||||||||||||

|

FirstService Residential |

931,000 | 36,000 | 102,000 | – | – | – | ||||||||||||||||||

|

FirstService Brands |

2,246,000 | 47,000 | 528,000 | – | – | – | ||||||||||||||||||

|

Corporate |

- | - | 8,000 | – | – | – | ||||||||||||||||||

Reconciliation of non-GAAP financial measures

In this AIF, we make reference to “adjusted EBITDA” and “adjusted EPS,” which are financial measures that are not calculated in accordance with GAAP.

Adjusted EBITDA is defined as net earnings, adjusted to exclude: (i) income tax; (ii) other expense (income); (iii) interest expense; (iv) depreciation and amortization; (v) acquisition-related items; and (vi) stock-based compensation expense. The Company uses adjusted EBITDA to evaluate its own operating performance and its ability to service debt, as well as an integral part of its planning and reporting systems. Additionally, this measure is used in conjunction with discounted cash flow models to determine the Company’s overall enterprise valuation and to evaluate acquisition targets. Adjusted EBITDA is presented as a supplemental measure because the Company believes such measure is useful to investors as a reasonable indicator of operating performance because of the low capital intensity of its service operations. The Company believes this measure is a financial metric used by many investors to compare companies, especially in the services industry. This measure is not a recognized measure of financial performance under GAAP in the United States, and should not be considered as a substitute for operating earnings, net earnings from operations or cash flow from operating activities, as determined in accordance with GAAP. The Company’s method of calculating adjusted EBITDA may differ from other issuers and accordingly, this measure may not be comparable to measures used by other issuers. A reconciliation of net earnings (loss) from operations to adjusted EBITDA appears below.

|

Year ended |

||||||||

|

(in thousands of US$) |

December 31 |

|||||||

|

2022 |

2021 |

|||||||

|

Net earnings |

$ | 145,007 | $ | 156,130 | ||||

|

Income tax |

48,974 | 52,875 | ||||||

|

Other income, net |

(146 | ) | (23,399 | ) | ||||

|

Interest expense, net |

25,191 | 16,036 | ||||||

|

Operating earnings |

219,026 | 201,642 | ||||||

|

Depreciation and amortization |

110,140 | 98,965 | ||||||

|

Acquisition-related items |

4,520 | 12,023 | ||||||

|

Stock-based compensation expense |

18,046 | 14,746 | ||||||

|

Adjusted EBITDA |

$ | 351,732 | $ | 327,376 | ||||

|

A reconciliation of segment operating earnings to segment Adjusted EBITDA appears below. |

||||||||||||

|

(in thousands of US$) |

||||||||||||

| Year ended December 31, 2022 |

FirstService |

FirstService |

||||||||||

|

Residential |

Brands |

Corporate |

||||||||||

|

Operating earnings (loss) |

$ | 138,873 | $ | 111,638 | $ | (31,485 | ) | |||||

|

Depreciation and amortization |

28,611 | 81,439 | 90 | |||||||||

|

Acquisition-related items |

1,153 | 3,200 | 167 | |||||||||

|

Stock-based compensation expense |

- | - | 18,046 | |||||||||

|

Adjusted EBITDA |

$ | 168,637 | $ | 196,277 | $ | (13,182 | ) | |||||

| Year ended December 31, 2021 |

FirstService |

FirstService |

||||||||||

|

Residential |

Brands |

Corporate |

||||||||||

|

Operating earnings (loss) |

$ | 127,297 | $ | 106,579 | $ | (32,234 | ) | |||||

|

Depreciation and amortization |

28,470 | 70,404 | 91 | |||||||||

|

Acquisition-related items |

951 | 10,899 | 173 | |||||||||

|

Stock-based compensation expense |

- | - | 14,746 | |||||||||

|

Adjusted EBITDA |

$ | 156,718 | $ | 187,882 | $ | (17,224 | ) | |||||

Adjusted EPS is defined as diluted net earnings (loss) per share, adjusted for the effect, after income tax, of: (i) the non-controlling interest redemption increment; (ii) acquisition-related items; (iii) amortization of intangible assets recognized in connection with acquisitions; and (iv) stock-based compensation expense. The Company believes this measure is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company and enhances the comparability of operating results from period to period. Adjusted EPS is not a recognized measure of financial performance under GAAP, and should not be considered as a substitute for diluted net earnings per Common Share from operations, as determined in accordance with GAAP. The Company’s method of calculating this non-GAAP measure may differ from other issuers and, accordingly, this measure may not be comparable to measures used by other issuers. A reconciliation of diluted net earnings (loss) per Common Share from operations to adjusted EPS appears below.

|

Year ended |

||||||||

|

(in US$) |

December 31 |

|||||||

|

2022 |

2021 |

|||||||

|

Diluted net earnings per share |

$ | 2.72 | $ | 3.05 | ||||

|

Non-controlling interest redemption increment |

0.33 | 0.30 | ||||||

|

Acquisition-related items |

0.10 | 0.26 | ||||||

|

Amortization of intangible assets, net of tax |

0.79 | 0.71 | ||||||

|

Stock-based compensation expense, net of tax |

0.30 | 0.25 | ||||||

|

Adjusted EPS |

$ | 4.24 | $ | 4.57 | ||||

We believe that the presentation of adjusted EBITDA and adjusted EPS, which are non-GAAP financial measures, provides important supplemental information to management and investors regarding financial and business trends relating to the Company’s financial condition and results of operations. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other issuers. We use these non-GAAP financial measures to assist management and investors in understanding our operating performance, our ability to service debt, to assist in determining our overall enterprise valuation and to evaluate acquisition targets, and such measures are an integral part of our planning and reporting systems. We provide non-GAAP financial measures because we believe such measures are useful to investors as a reasonable indicator of our operating performance given the low capital intensity of our service operations and provide a supplemental way to understand our underlying operating performance that enhances the comparability of operating results from period to period, and such measures are commonly used by many investors to compare companies, especially in the services industry. We have also chosen to provide such measures to investors so they can analyze our operating results in the same way that management does and use such measures in their assessment of our core business and valuation. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs or benefits associated with the operations of our business as determined in accordance with GAAP. As a result, investors should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP.

Readers should carefully consider the following risks, as well as the other information contained in this AIF and our management’s discussion and analysis for the year ended December 31, 2022. If any of the following risks actually occurs, our business could be materially harmed. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those of which we are currently unaware or we currently deem immaterial, may also adversely affect our business, and past performance is no guarantee of future performance.

Risks relating to our Business

Public health crises, and its related impact on global, regional and local economic conditions, and in particular its impact on client demand for our services, our ability to deliver services and ensure the health and productivity of our employees

FirstService’s business, operations and financial condition could be materially adversely affected by the outbreak of epidemics or pandemics or other health crises beyond our control. Many governments may declare that an outbreak, or one or more waves or an outbreak, constitutes an emergency in their jurisdictions. Reactions to the spread of an outbreak, or the worsening of an outbreak from time to time, may lead to, among other things, significant restrictions on travel, business closures, quarantines, social distancing and other containment measures and a general reduction in consumer activity. While these effects may be temporary, the duration of any business disruptions and related financial impact cannot be reasonably estimated, and may be instituted, terminated and re-instituted from time to time as an outbreak worsens, waves of an outbreak occur or new variants of the virus arise from time to time.

Such public health crises can also result in volatility and disruptions in the supply and demand for various products and services (including the products and services offered by FirstService), global supply chains and financial markets, as well as declining trade and market sentiment and reduced mobility of people, all of which could affect interest rates, credit ratings, credit risk and inflation. The risks to FirstService of such public health crises also include risks to employee health and safety and a slowdown or temporary suspension of operations in geographic locations impacted by an outbreak.

Economic conditions, especially as they relate to credit conditions and consumer spending and demand for managed residential property

During periods of economic slowdown or contraction, our business is impacted directly. Consumer spending directly impacts our FirstService Brands operations businesses because as consumers spend less on property services, our revenues decline. These factors could also negatively impact the timing or the ultimate collection of accounts receivable, which would negatively impact our operating revenues, profitability and cash flow.

Residential real estate property values, resale rates and general conditions of financial liquidity for real estate transactions

We provide various services at residential properties in our FirstService Residential and FirstService Brands operating divisions. Property values and consumer confidence are strongly correlated with demand for our services, including painting, closet installation, general maintenance, collections and resale processing.

Extreme weather conditions impacting demand for our services or our ability to perform those services

Natural disasters, such as hurricanes, can have a direct impact in our FirstService Residential and FirstService Brands operations. These events damage property, which require various services that our companies offer, such as restoration. They may also harm our employees, facilities and franchisees, resulting in an inability to serve clients and generate revenues.

Economic deterioration impacting our ability to recover goodwill and other intangible assets

Expectations of future earnings drive the recoverability of goodwill and other intangible assets, which are tested, at least, on an annual basis. A future deterioration of operating performance may necessitate additional non-cash impairment charges.

A decline in our ability to generate cash from our businesses to fund future acquisitions and meet our debt obligations

We rely on our businesses to generate the necessary cash to service our financial obligations. As at December 31, 2022, we had $734.5 million of debt outstanding ($598.2 million net of cash) that, on December 31, 2022, was required to be refinanced or repaid over the next 4 years. We also had $382 million of available un-drawn credit at December 31, 2022. To date, we have been able to meet all of our debt obligations, however with a decline in performance in some of our businesses, surplus cash may not be available to be remitted which may result in the inability to meet a debt repayment.

An important component of our growth strategy is strategic and selective acquisitions, which we tend to complete with cash. Although we have a revolving credit facility available to us under the Credit Agreement and potential future private placement issuances of NYL Notes and/or Prudential Notes under the NYL Note Agreement and Prudential Note Agreement, respectively, as noted elsewhere in this AIF, we also rely on surplus cash on hand to fund acquisitions. If cash on hand is not available and our revolving credit facility is fully utilized, then future acquisitions may not be possible.

The effects of changes in foreign exchange rates in relation to the U.S. dollar on our Canadian dollar denominated revenues and expenses

We generate approximately 12% of our revenues outside the United States. Consequently, a portion of our consolidated results are impacted directly by fluctuations in the relative strength of the U.S. dollar versus the Canadian dollar currency. In the future, we may acquire additional international operations. In such event, the impact of foreign currency exchange rate fluctuations may increase.

Competition in the markets served by FirstService

We operate in highly competitive markets. Changes in the source and intensity of competition in the markets served by us impact the demand for our services and may result in additional pricing pressures. The relatively low capital cost of entry to certain of our businesses has led to strong competitive markets, including regional and local owner-operated companies. Regional and local competitors operating in a limited geographic area may have lower labour, benefits and overhead costs. The principal methods of competition in our businesses include name recognition, quality and speed of service, pricing, customer satisfaction and reputation. No assurance can be given that we will be able to compete successfully against current or future competitors and that the competitive pressures that we face will not result in reduced market share or negatively impact our financial performance.

Labour shortages or increases in wage and benefit costs

As a services company, our primary asset is the human capital that comprises our workforce. In particular, we rely on property managers, franchisees and other skilled staff to generate revenues. A shortage, or increase in wage and benefit costs, of this human capital could reduce our revenues and profitability.

The effects of changes in interest rates on our cost of borrowing

As at December 31, 2022, we had $573 million of debt at variable interest rates. As a result, changes in base rates such as SOFR affect our interest expense as these base rates fluctuate. On our fixed rate debt, we have from time-to-time entered into fixed-for-floating interest rate swaps, where advantageous, to convert the fixed interest payments to floating. These swaps are intended to manage interest rate sensitivity and reduce overall interest costs. The Company has one interest rate swap in place to exchange the floating interest rate on $100 million of debt under its Credit Agreement for a fixed rate.

A decline in our performance impacting our continued compliance with the financial covenants under our debt agreements, or our ability to negotiate a waiver of certain covenants with our lenders