UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10027

STATE FARM MUTUAL FUND TRUST

(Exact name of registrant as specified in charter)

| One State Farm Plaza | 61710-0001 | |

| Bloomington, IL | ||

| (Address of principal executive offices) | (Zip code) | |

| Paul J. Smith | Alan Goldberg | |

| One State Farm Plaza | Stradley Ronon Stevens & Young | |

| Bloomington, Illinois 61710-0001 | 191 North Wacker Dr., Suite 1601 | |

| Chicago, Illinois 60606 | ||

(Names and addresses of agents for service)

Registrant’s telephone number, including area code: 1-800-447-4930

Date of fiscal year end: 12/31/2017

Date of reporting period: 06/30/2017

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Before investing, consider the Funds’ investment objectives, risks, charges and expenses. Contact State Farm VP Management Corp. (1-800-447-4930) for a prospectus or summary prospectus containing this and other information. Read it carefully.

Investing involves risk, including potential for loss.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, and information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, are available without charge upon request at 1-800-447-4930 and at sec.gov.

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Funds make the information on Form N-Q available to shareholders upon request without charge at 1-800-447-4930.

Any website referenced in this report is an inactive textual reference only, and information contained in or otherwise accessible through that website does not form a part of, and is not incorporated by reference into, this report.

The Funds may send one copy of each annual report, semi-annual report, prospectus, and proxy statement to an address shared by more than one shareholder, a practice commonly referred to as “householding” delivery of these documents. If the Fund documents you receive are being householded but you would like to receive individual copies of these documents, contact us to request individual delivery by writing to State Farm Investment Management Corp., P.O. Box 219548, Kansas City, Missouri 64121-9548 or by calling us at 1-800-447-4930. We will begin sending individual copies within 30 days after we receive notice that you have revoked your consent.

State Farm LifePath Funds are target-date portfolios that provide a diversified exposure to equities, fixed income, and/or cash for those investors who have a specific date in mind (in this case years 2020, 2030, 2040, or 2050) for retirement or another goal. The target date is the approximate date when investors plan to start withdrawing assets. The investment objectives of each LifePath Fund are adjusted over time to become more conservative as the target date approaches. The principal value of the LifePath Fund(s) is not guaranteed at any time, including at the target date.

Automatic Investment Plan (AIP)1

State Farm Mutual Funds allow you to make regular investments in a Fund with an Automatic Investment Plan through an electronic transfer of funds from your bank/credit union account. If you wish to begin an Automatic Investment Plan, the minimum amount required for initial investment is $1,000 per Fund and subsequent investments is $50. Please consider signing up today for AIP by calling 1-800-447-4930 for assistance.

Electronic Delivery

As a State Farm Mutual Funds shareholder, we wish to remind you that you can elect to have future Annual Reports, Semi-Annual Reports, Prospectuses, statements, and tax forms delivered electronically rather than receiving large, bulky paper reports through the mail. This is a great way to help reduce internal fund costs related to printing and mailing these materials as well as a way to be environmentally friendly. Please consider signing up for electronic delivery today by going on statefarm.com or by calling 1-800-447-4930 for assistance.

Service is only a phone call away

Fund prices are available to you 24 hours a day, 7 days a week.

Representatives are available 8 a.m.—6 p.m. Central Time Monday through Friday (except holidays)

1-800-447-4930

Visit our website at statefarm.com

State Farm VP Management Corp.

(Underwriter and Distributor of Securities Products)

One State Farm Plaza

Bloomington, Illinois 61710-0001

1-800-447-4930

| 1 | Automatic investment plans do not assure a profit or protect against loss. |

Message to Shareholders of State Farm Mutual Fund Trust

Dear Shareholders,

Thank you for investing with State Farm Mutual Funds®. Enclosed is the Semi-Annual Report for the 6-month period ended June 30, 2017, for the State Farm Mutual Fund Trust (“the Trust”). We encourage your review and consideration of this entire report.

State Farm Investment Management Corp. has consistently maintained a long-term, disciplined approach to managing investment risk and providing competitive investment products that can help you, our valued shareholder, with your investment goals.1 We believe that remaining focused on your long-term goals and maintaining an appropriate asset allocation mix are important elements in pursuing investment success.2

Market Review

During the 6-month period ended June 30, 2017, U.S. equity and fixed income markets experienced positive returns, while international equities generated even stronger gains.

Beginning the calendar year at a period low of 2,238, U.S. equity markets (as represented by the S&P 500® Index3) staged a series of uneven climbs before ending June 2017 at 2,423. Along the way, the S&P 500 Index set multiple closing price highs, including a new record of 2,453 on June 19. During this 6-month timeframe, U.S. equities entered the ninth year of their current bull market run while posting a 9.34% total return, including dividends.

Stocks rose sharply over the first two months of the year — the S&P 500 Index delivered 1.90% and 3.97% total returns in January and February, respectively — as investors digested news of expanding fourth-quarter (October — December) corporate profits, rising consumer confidence levels, and an acceleration in global growth. However, with March came signs of market headwinds. Congressional Republicans failed to pass a health care plan to replace the Affordable Care Act, raising questions regarding the new administration’s ability to achieve its other pro-growth policy goals. Pockets of anxiety regarding the health of the U.S. economy also appeared during this time, as did a sense of increased geopolitical uncertainty around the world. Together, these concerns put downward pressure on stocks, with the S&P 500 Index pulling back as it moved into early April. However, U.S. equities soon rebounded, charting a generally upward

| 1 | Investing involves risk, including potential for loss. |

| 2 | Asset allocation cannot guarantee a profit or protect against a loss in a declining market. |

| 3 | Source: Standard and Poor’s. The S&P 500 Index is a capitalization-weighted measure of common stocks of 500 large U.S. companies. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 4 | Source: Bloomberg. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities of the Russell 1000 Index based on a combination of their market cap and current index membership. The Russell Midcap represents approximately 31% of the total market capitalization of the Russell 1000 companies. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 5 | Source: Bloomberg. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities of the Russell 3000 Index based on a combination of their market cap and current index membership. The stocks of small companies are more volatile than the stocks of larger, more established companies. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

1

Message to Shareholders of State Farm Mutual Fund Trust (continued)

course through period end. During this time, stocks were buoyed by news of robust first-quarter (January — March) corporate earnings, a strong April jobs report, and an unemployment rate that ticked down to 4.3% in May, its lowest level since 2001.

Results were even stronger in the international equity markets. Signs of improving economic growth around the world and continued monetary stimulus measures helped to make global stocks — especially in emerging market countries — attractive to investors. Through June 2017, the MSCI EAFE Free® Index, MSCI All Country World Index (ACWI) ex-U.S. Index and MSCI Emerging Markets Index provided total returns of 13.81%, 14.10% and 18.43%, respectively.6 Within the MSCI EAFE Free Index, Austria paced top performers with a 32.76% return, while Norway turned in the lowest at 5.60%. Emerging markets extended the gains registered last year — the MSCI Emerging Markets Index ended with an 11.19% total return for calendar year 2016 — as Poland and Turkey led that Index through the first six months of 2017 with 33.78% and 32.21% returns, respectively. Meanwhile, after Russia’s stock market surged in late 2016 — in part on the prospect of the Trump U.S. administration lifting economic sanctions — the first six months of 2017 provided a different narrative. Through June 2017, Russia’s –14.18% return ended as the weakest among emerging market countries, as hopes diminished through the period for a sanctions reprieve and crude oil prices remained relatively low.7

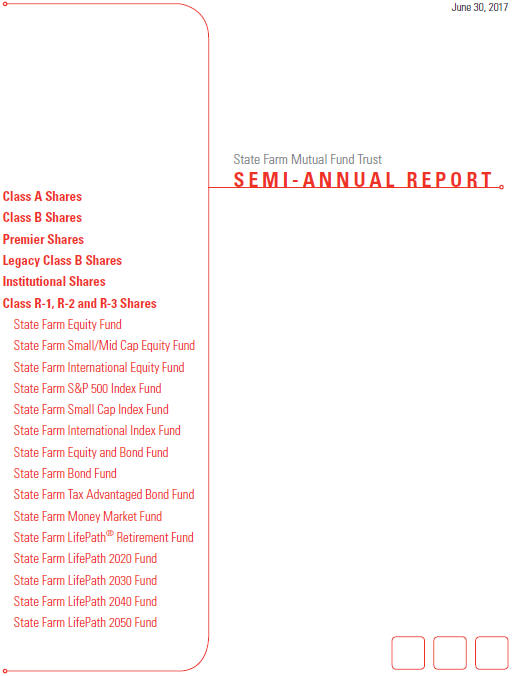

Among major fixed income indices, the Bloomberg Barclays U.S. Aggregate Bond Index and the Bloomberg Barclays Municipal Bond Index posted total returns of 2.27% and 3.57%, respectively, as price increases added to bond coupon income.8 The U.S. Treasury yield curve flattened as shorter-term (3-month and 2-year) yields rose over the period while longer-term (10-year) yields decreased. Following on the heels of the Federal Reserve’s (the “Fed”) December 2016 interest rate increase, 3-month U.S. Treasury yields began the period at 0.51% and remained relatively stable through February, ranging between a period low of 0.50% and 0.55%.9 Those yields surged almost 0.20% within the first week of March alone, however, when better-than-anticipated economic news raised investors’ expectations for another Fed rate hike. As the Fed subsequently announced its second (March) and third (June) increases in seven months — ultimately raising its key interest rate target range to 1.00% — 1.25% — yields on 3-month Treasuries navigated a gradual ascent through June to end the 6-month period at 1.03%. Similarly, after starting January at 1.20% and moving between 1.12% and 1.27% over the first two months of the year, 2-year Treasury yields increased in early March, reaching a period high of 1.40% later that month before eventually settling at 1.38% on June 30, 2017.

During the period, further increases in the yields on both short- and long-term Treasuries were moderated by continued strong market demand. With the European Central Bank, Bank of Japan, and other foreign central banks maintaining their respective monetary stimulus measures, global bond yields remained low through June 2017. Consequently, fixed income investors continued to seek out the relatively higher returns found in U.S. Treasuries, exerting downward pressure on their yields. Longer-term U.S. Treasury yields were also negatively impacted by some concern — particularly in the latter half of the period — around the pace of U.S. economic growth and level of inflation. As a result, yields on 10-year Treasuries began January 2017 at 2.45% and after tracking within a relatively tight range of 2.14% (period low) and 2.62% (period high), ended June 2017 lower at 2.31%.

| 6 | Source: Bloomberg. The MSCI Europe, Australasia and Far East Free (EAFE Free) Index currently measures the performance of stock markets of Europe, Australia, New Zealand, Israel, and the Far East. The MSCI All Country World Index (ex-U.S.) (MSCI ACWI ex-U.S. Index) is a free float adjusted market capitalization index that is designed to measure equity market performance in global developed and emerging markets, excluding the United States. As of June 30, 2017, the MSCI ACWI ex-U.S. Index consisted of 45 developed and emerging market country indices. The MSCI Emerging Markets Index is a float-adjusted market capitalization index designed to measure equity market performance in global emerging markets. Foreign securities involve risks not normally associated with investing in the U.S., including higher trading and custody costs, less stringent accounting, legal and reporting practices, potential for political and economic instability, and the fluctuation and potential regulation of currency exchange and exchange rates, all of which are magnified in emerging markets. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 7 | Returns are reported in U.S. dollar terms for the MSCI EAFE Free Index, MSCI ACWI ex-US Index, and MSCI Emerging Markets Index. |

| 8 | Source: Bloomberg. The Bloomberg Barclays U.S. Aggregate Bond Index represents debt securities in the U.S. investment grade fixed rate taxable bond market, including government and corporate debt securities, mortgage pass-through debt securities and asset-backed debt securities with maturities greater than one year. The Bloomberg Barclays Municipal Bond Index is representative of the tax-exempt bond market and is made up of investment grade municipal bonds issued after 12/31/90 having a remaining maturity of at least one year. Bonds have historically been less volatile than stocks, but are sensitive to changes in interest rates. It is not possible to invest directly in an index. Past performance does not guarantee future results. |

| 9 | Source: The U.S. Department of the Treasury. A 3-month U.S. Treasury Bill is a debt obligation issued by the U.S. Treasury that has a term of 92 days or less.A 2-year U.S. Treasury Note and a 10-year U.S. Treasury Note are debt obligations issued by the U.S. Treasury with maturities of 2 and 10 years, respectively, and that pay interest every six months. U.S. Treasury securities are backed by the full faith and credit of the U.S. government and are guaranteed only as to the prompt payment of principal and interest, and are subject to market risks if sold prior to maturity. Bonds have historically been less volatile than stocks, but are sensitive to changes in interest rates. Past performance does not guarantee future results. |

2

Message to Shareholders of State Farm Mutual Fund Trust (continued)

Source: The U.S. Department of the Treasury (treasury.gov)

Look for a detailed discussion of factors that impacted the performance of the Funds during the time frame of January 1, 2017, through December 31, 2017, in the State Farm Mutual Fund Trust Annual Report.

On behalf of the entire State Farm Mutual Funds team, thank you for your continued business and allowing us to help serve your investment needs.

| Sincerely, |

|

|

| Joe R. Monk Jr. |

| Senior Vice President |

| State Farm Investment Management Corp. |

3

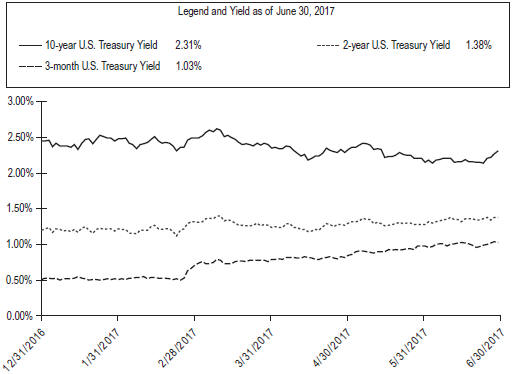

State Farm Equity Fund

Fund Composition*

(unaudited)

| * | Illustrated by sector and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

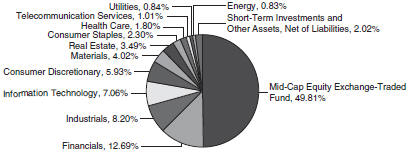

State Farm Small/Mid Cap Equity Fund

Fund Composition*

(unaudited)

| * | Illustrated by sector and security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

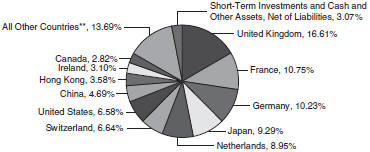

State Farm International Equity Fund

Fund Composition*

(unaudited)

| * | Illustrated by country and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Represents 13 other countries, each of which represents less than 2% of net assets. |

4

Portfolio Summary (continued)

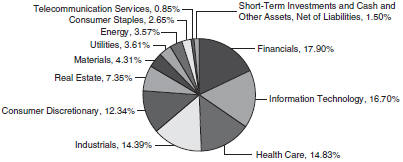

State Farm S&P 500 Index Fund

Fund Composition*

(unaudited)

| * | Illustrated by sector and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

State Farm Small Cap Index Fund

Fund Composition*

(unaudited)

| * | Illustrated by sector and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

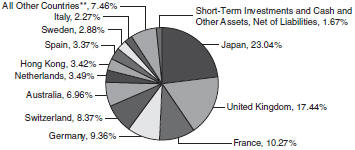

State Farm International Index Fund

Fund Composition*

(unaudited)

| * | Illustrated by country and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Represents 10 other countries, each of which represents less than 2% of net assets. |

5

Portfolio Summary (continued)

State Farm Equity and Bond Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

State Farm Bond Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

State Farm Tax Advantaged Bond Fund

Fund Composition*

(unaudited)

| * | Illustrated by maturity and based on total investments as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

| ** | Includes a 0.43% allocation to the JPMorgan U.S. Government Money Market Fund Capital Shares. |

6

Portfolio Summary (continued)

State Farm Money Market Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

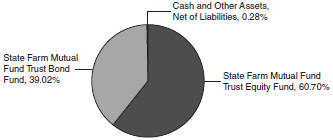

State Farm LifePath Retirement Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

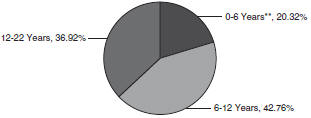

State Farm LifePath 2020 Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

7

Portfolio Summary (continued)

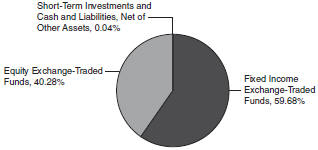

State Farm LifePath 2030 Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

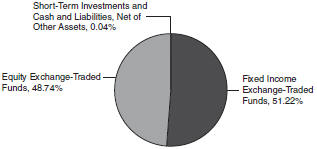

State Farm LifePath 2040 Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

State Farm LifePath 2050 Fund

Fund Composition*

(unaudited)

| * | Illustrated by security type and based on total net assets as of June 30, 2017. Please refer to the Schedule of Investments later in this report for details concerning Fund holdings. |

8

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and certain redemptions; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; shareholder servicing fees; and other Fund expenses. The Example in the following table for each Fund below is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as stated in the table for each Fund.

Actual Expenses

The Actual information in the table under each Fund name below provides information about actual account values and actual expenses for each Class of shares. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value for a Fund Class by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual information line under the heading entitled “Expenses Paid During Period” for the applicable Fund Class to estimate the expenses you paid on your account for that Fund Class during the period. If your account has multiple Fund positions, add up the results calculated for each Fund position by Class within your account to estimate the expenses you paid on your total account value. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account holding Class A, Class B, Premier, Legacy Class B or Institutional shares (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The Hypothetical information in the table under each Fund name below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio by Class and an assumed rate of return of 5% per year before expenses, which is not the actual return of the Class indicated. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A potential account fee of $10 per calendar quarter is not included in the expenses shown in the table. This fee will be charged to an account holding Class A, Class B, Premier, Legacy Class B or Institutional shares (other than a SEP IRA, SIMPLE IRA, Archer Medical Savings Account, Tax Sheltered Account under §403(b)(7) of the Internal Revenue Code or an account held under other employer-sponsored qualified retirement plans) if the balance in the account falls below $5,000 at the close of business on the second business day of the last month of the calendar quarter, unless the account has been open for less than a year as of the second business day of the last month of the calendar quarter. You should consider any account fee that you incurred when estimating the total ongoing expenses paid over the period and the impact of this fee on your ending account value. This additional fee has the effect of increasing the costs of investing.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) applicable to Class A, Class B, Premier, and Legacy Class B shares. Therefore, the Hypothetical information in the table under each Fund name is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

State Farm Equity Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,092.67 | 1.02 | % | $ | 5.29 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,090.32 | 1.37 | % | $ | 7.10 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,092.59 | 0.92 | % | $ | 4.77 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,090.72 | 1.24 | % | $ | 6.43 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,093.25 | 0.90 | % | $ | 4.67 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,091.59 | 1.22 | % | $ | 6.33 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,091.79 | 1.11 | % | $ | 5.76 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,093.15 | 0.97 | % | $ | 5.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,019.74 | 1.02 | % | $ | 5.11 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,018.00 | 1.37 | % | $ | 6.85 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,020.23 | 0.92 | % | $ | 4.61 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,018.65 | 1.24 | % | $ | 6.21 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,020.33 | 0.90 | % | $ | 4.51 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,018.74 | 1.22 | % | $ | 6.11 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,019.29 | 1.11 | % | $ | 5.56 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,019.98 | 0.97 | % | $ | 4.86 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Small/Mid Cap Equity Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,025.77 | 1.17 | % | $ | 5.88 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,023.49 | 1.52 | % | $ | 7.63 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,026.34 | 1.07 | % | $ | 5.38 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,024.12 | 1.37 | % | $ | 6.88 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,025.83 | 1.04 | % | $ | 5.22 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,024.67 | 1.36 | % | $ | 6.83 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,025.66 | 1.26 | % | $ | 6.33 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,025.33 | 1.11 | % | $ | 5.57 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,018.99 | 1.17 | % | $ | 5.86 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,017.26 | 1.52 | % | $ | 7.60 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,019.49 | 1.07 | % | $ | 5.36 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,018.00 | 1.37 | % | $ | 6.85 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,019.64 | 1.04 | % | $ | 5.21 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,018.05 | 1.36 | % | $ | 6.80 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,018.55 | 1.26 | % | $ | 6.31 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,019.29 | 1.11 | % | $ | 5.56 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

10

State Farm International Equity Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,204.61 | 1.36 | % | $ | 7.43 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,202.67 | 1.69 | % | $ | 9.23 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,204.37 | 1.25 | % | $ | 6.83 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,203.44 | 1.55 | % | $ | 8.47 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,205.36 | 1.24 | % | $ | 6.78 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,203.44 | 1.55 | % | $ | 8.47 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,204.02 | 1.45 | % | $ | 7.92 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,205.56 | 1.31 | % | $ | 7.16 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,018.05 | 1.36 | % | $ | 6.80 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,016.41 | 1.69 | % | $ | 8.45 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,018.60 | 1.25 | % | $ | 6.26 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,017.11 | 1.55 | % | $ | 7.75 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,018.65 | 1.24 | % | $ | 6.21 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,017.11 | 1.55 | % | $ | 7.75 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,017.60 | 1.45 | % | $ | 7.25 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,018.30 | 1.31 | % | $ | 6.56 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm S&P 500 Index Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,090.37 | 0.52 | % | $ | 2.70 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,088.48 | 0.88 | % | $ | 4.56 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,091.07 | 0.42 | % | $ | 2.18 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,089.46 | 0.74 | % | $ | 3.83 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,091.34 | 0.39 | % | $ | 2.02 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,089.45 | 0.71 | % | $ | 3.68 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,089.87 | 0.61 | % | $ | 3.16 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,090.96 | 0.46 | % | $ | 2.38 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.22 | 0.52 | % | $ | 2.61 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.71 | 0.42 | % | $ | 2.11 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,021.12 | 0.74 | % | $ | 3.71 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.86 | 0.39 | % | $ | 1.96 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,021.27 | 0.71 | % | $ | 3.56 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,022.51 | 0.46 | % | $ | 2.31 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

11

State Farm Small Cap Index Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,046.97 | 0.60 | % | $ | 3.05 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,046.43 | 0.88 | % | $ | 4.47 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,048.02 | 0.50 | % | $ | 2.54 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,046.77 | 0.81 | % | $ | 4.11 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,048.38 | 0.48 | % | $ | 2.44 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,046.51 | 0.80 | % | $ | 4.06 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,046.97 | 0.70 | % | $ | 3.55 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,047.76 | 0.55 | % | $ | 2.79 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.32 | 0.50 | % | $ | 2.51 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.78 | 0.81 | % | $ | 4.06 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.41 | 0.48 | % | $ | 2.41 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.83 | 0.80 | % | $ | 4.01 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.32 | 0.70 | % | $ | 3.51 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm International Index Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,142.72 | 0.72 | % | $ | 3.83 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,140.61 | 1.05 | % | $ | 5.57 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,142.99 | 0.62 | % | $ | 3.29 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,142.07 | 0.91 | % | $ | 4.83 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,143.39 | 0.60 | % | $ | 3.19 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,141.54 | 0.91 | % | $ | 4.83 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,142.06 | 0.81 | % | $ | 4.30 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,143.25 | 0.67 | % | $ | 3.56 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.22 | 0.72 | % | $ | 3.61 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,019.59 | 1.05 | % | $ | 5.26 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,021.72 | 0.62 | % | $ | 3.11 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.28 | 0.91 | % | $ | 4.56 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.28 | 0.91 | % | $ | 4.56 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,020.78 | 0.81 | % | $ | 4.06 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,021.47 | 0.67 | % | $ | 3.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

State Farm Equity and Bond Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,063.39 | 0.12 | % | $ | 0.61 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,061.62 | 0.47 | % | $ | 2.40 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,064.50 | 0.02 | % | $ | 0.10 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,062.46 | 0.32 | % | $ | 1.64 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,063.90 | 0.00 | % | $ | 0.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,062.34 | 0.32 | % | $ | 1.64 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,062.77 | 0.22 | % | $ | 1.13 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,064.39 | 0.07 | % | $ | 0.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,024.20 | 0.12 | % | $ | 0.60 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.46 | 0.47 | % | $ | 2.36 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,024.70 | 0.02 | % | $ | 0.10 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,023.21 | 0.32 | % | $ | 1.61 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,024.79 | 0.00 | % | $ | 0.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,023.21 | 0.32 | % | $ | 1.61 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,023.70 | 0.22 | % | $ | 1.10 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,024.45 | 0.07 | % | $ | 0.35 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Bond Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,019.52 | 0.53 | % | $ | 2.65 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,018.53 | 0.73 | % | $ | 3.65 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,020.02 | 0.43 | % | $ | 2.15 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,019.41 | 0.75 | % | $ | 3.76 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,021.06 | 0.40 | % | $ | 2.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,018.54 | 0.71 | % | $ | 3.55 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,019.05 | 0.62 | % | $ | 3.10 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,020.70 | 0.47 | % | $ | 2.35 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.17 | 0.53 | % | $ | 2.66 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,021.17 | 0.73 | % | $ | 3.66 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.66 | 0.43 | % | $ | 2.16 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,021.08 | 0.75 | % | $ | 3.76 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.81 | 0.40 | % | $ | 2.01 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,021.27 | 0.71 | % | $ | 3.56 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.72 | 0.62 | % | $ | 3.11 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,022.46 | 0.47 | % | $ | 2.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

13

State Farm Tax Advantaged Bond Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,027.22 | 0.53 | % | $ | 2.66 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,026.20 | 0.74 | % | $ | 3.72 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,027.73 | 0.43 | % | $ | 2.16 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,026.19 | 0.74 | % | $ | 3.72 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.17 | 0.53 | % | $ | 2.66 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,021.12 | 0.74 | % | $ | 3.71 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.66 | 0.43 | % | $ | 2.16 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,021.12 | 0.74 | % | $ | 3.71 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Money Market Fund 3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,000.62 | 0.50 | % | $ | 2.48 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,000.49 | 0.53 | % | $ | 2.63 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,001.13 | 0.40 | % | $ | 1.98 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,000.49 | 0.53 | % | $ | 2.63 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,000.01 | 0.42 | % | $ | 2.08 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,000.37 | 0.55 | % | $ | 2.73 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,000.37 | 0.55 | % | $ | 2.73 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,000.67 | 0.49 | % | $ | 2.43 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.32 | 0.50 | % | $ | 2.51 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.17 | 0.53 | % | $ | 2.66 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.81 | 0.40 | % | $ | 2.01 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.17 | 0.53 | % | $ | 2.66 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.71 | 0.42 | % | $ | 2.11 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,022.36 | 0.49 | % | $ | 2.46 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

14

State Farm LifePath Retirement Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,049.33 | 0.67 | % | $ | 3.40 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,047.43 | 1.03 | % | $ | 5.23 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,050.28 | 0.57 | % | $ | 2.90 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,049.05 | 0.88 | % | $ | 4.47 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,050.41 | 0.54 | % | $ | 2.75 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,048.99 | 0.87 | % | $ | 4.42 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,049.94 | 0.76 | % | $ | 3.86 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,050.08 | 0.61 | % | $ | 3.10 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.47 | 0.67 | % | $ | 3.36 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,019.69 | 1.03 | % | $ | 5.16 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,021.97 | 0.57 | % | $ | 2.86 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.48 | 0.87 | % | $ | 4.36 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.03 | 0.76 | % | $ | 3.81 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm LifePath 2020 Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,057.29 | 0.66 | % | $ | 3.37 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,055.39 | 1.02 | % | $ | 5.20 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,057.58 | 0.56 | % | $ | 2.86 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,057.04 | 0.88 | % | $ | 4.49 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,057.89 | 0.54 | % | $ | 2.76 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,056.89 | 0.86 | % | $ | 4.39 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,056.85 | 0.76 | % | $ | 3.88 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,058.01 | 0.61 | % | $ | 3.11 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.52 | 0.66 | % | $ | 3.31 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,019.74 | 1.02 | % | $ | 5.11 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.02 | 0.56 | % | $ | 2.81 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.53 | 0.86 | % | $ | 4.31 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.03 | 0.76 | % | $ | 3.81 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

15

State Farm LifePath 2030 Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,076.18 | 0.66 | % | $ | 3.40 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,075.76 | 0.77 | % | $ | 3.96 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,076.82 | 0.56 | % | $ | 2.88 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,074.98 | 0.88 | % | $ | 4.53 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,077.03 | 0.54 | % | $ | 2.78 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,075.28 | 0.86 | % | $ | 4.43 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,076.39 | 0.75 | % | $ | 3.86 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,076.29 | 0.61 | % | $ | 3.14 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.52 | 0.66 | % | $ | 3.31 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.98 | 0.77 | % | $ | 3.86 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.02 | 0.56 | % | $ | 2.81 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.53 | 0.86 | % | $ | 4.31 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.08 | 0.75 | % | $ | 3.76 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm LifePath 2040 Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,092.04 | 0.67 | % | $ | 3.48 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,091.69 | 0.77 | % | $ | 3.99 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,092.99 | 0.56 | % | $ | 2.91 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,091.80 | 0.88 | % | $ | 4.56 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,093.16 | 0.54 | % | $ | 2.80 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,091.81 | 0.86 | % | $ | 4.46 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,092.17 | 0.76 | % | $ | 3.94 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,092.78 | 0.61 | % | $ | 3.17 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.47 | 0.67 | % | $ | 3.36 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.98 | 0.77 | % | $ | 3.86 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.02 | 0.56 | % | $ | 2.81 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.53 | 0.86 | % | $ | 4.31 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.03 | 0.76 | % | $ | 3.81 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

16

State Farm LifePath 2050 Fund 2,3

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 20171 |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,098.19 | 0.69 | % | $ | 3.59 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,099.43 | 0.59 | % | $ | 3.07 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,098.00 | 0.88 | % | $ | 4.58 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,097.91 | 0.78 | % | $ | 4.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.37 | 0.69 | % | $ | 3.46 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,021.87 | 0.59 | % | $ | 2.96 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.43 | 0.88 | % | $ | 4.41 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,020.93 | 0.78 | % | $ | 3.91 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | Expenses are equal to the applicable Fund’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 2 | The expense examples do not reflect acquired fund fees and expenses. |

| 3 | Restated Expense Example Tables: Effective April 1, 2017, for each Fund, State Farm VP Management Corp. agreed to waive all distribution and service (12b-1) fees for Class A, Class B, Premier, Legacy Class B, Class R-1 and Class R-2 shares. In addition, effective May 1, 2017, State Farm Investment Management Corp. agreed to waive 0.29% of management fees for the State Farm Small/Mid Cap Equity Fund. The restated examples reflect expenses as if (1) the 12b-1 fee waiver had been in effect for all Funds, and (2) the management fee waiver had been in effect for the State Farm Small/Mid Cap Equity Fund, throughout the entire period from January 1, 2017 to June 30, 2017 as follows: |

State Farm Equity Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,093.35 | 0.90 | % | $ | 4.67 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,092.87 | 0.90 | % | $ | 4.67 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,093.27 | 0.80 | % | $ | 4.15 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,092.47 | 0.90 | % | $ | 4.67 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,092.94 | 0.97 | % | $ | 5.03 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,092.60 | 0.97 | % | $ | 5.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,020.33 | 0.90 | % | $ | 4.51 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.33 | 0.90 | % | $ | 4.51 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,020.83 | 0.80 | % | $ | 4.01 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.33 | 0.90 | % | $ | 4.51 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,019.98 | 0.97 | % | $ | 4.86 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,019.98 | 0.97 | % | $ | 4.86 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

State Farm Small/Mid Cap Equity Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,027.38 | 0.85 | % | $ | 4.27 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,026.86 | 0.85 | % | $ | 4.27 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,027.95 | 0.75 | % | $ | 3.77 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,026.74 | 0.85 | % | $ | 4.27 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,026.81 | 0.85 | % | $ | 4.27 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,026.91 | 0.92 | % | $ | 4.62 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,027.40 | 0.92 | % | $ | 4.62 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,026.30 | 0.92 | % | $ | 4.62 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,020.58 | 0.85 | % | $ | 4.26 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.58 | 0.85 | % | $ | 4.26 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,021.08 | 0.75 | % | $ | 3.76 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,020.58 | 0.85 | % | $ | 4.26 | ||||||||

| Institutional Shares |

$ | 1,000.00 | $ | 1,020.58 | 0.85 | % | $ | 4.26 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,020.23 | 0.92 | % | $ | 4.61 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,020.23 | 0.92 | % | $ | 4.61 | ||||||||

| Class R-3 Shares |

$ | 1,000.00 | $ | 1,020.23 | 0.92 | % | $ | 4.61 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm International Equity Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,205.36 | 1.24 | % | $ | 6.78 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,205.49 | 1.24 | % | $ | 6.78 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,205.11 | 1.14 | % | $ | 6.23 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,205.37 | 1.24 | % | $ | 6.78 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,204.92 | 1.31 | % | $ | 7.16 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,204.91 | 1.31 | % | $ | 7.16 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,018.65 | 1.24 | % | $ | 6.21 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,018.65 | 1.24 | % | $ | 6.21 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,019.14 | 1.14 | % | $ | 5.71 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,018.65 | 1.24 | % | $ | 6.21 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,018.30 | 1.31 | % | $ | 6.56 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,018.30 | 1.31 | % | $ | 6.56 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

18

State Farm S&P 500 Index Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,091.04 | 0.39 | % | $ | 2.02 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,091.03 | 0.39 | % | $ | 2.02 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,091.74 | 0.29 | % | $ | 1.50 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,091.21 | 0.39 | % | $ | 2.02 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,090.79 | 0.46 | % | $ | 2.38 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,090.68 | 0.46 | % | $ | 2.38 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.86 | 0.39 | % | $ | 1.96 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.86 | 0.39 | % | $ | 1.96 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,023.36 | 0.29 | % | $ | 1.45 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.86 | 0.39 | % | $ | 1.96 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,022.51 | 0.46 | % | $ | 2.31 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,022.51 | 0.46 | % | $ | 2.31 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Small Cap Index Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,047.61 | 0.48 | % | $ | 2.44 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,048.49 | 0.48 | % | $ | 2.44 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,048.67 | 0.38 | % | $ | 1.93 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,048.45 | 0.48 | % | $ | 2.44 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,047.80 | 0.55 | % | $ | 2.79 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,047.74 | 0.55 | % | $ | 2.79 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.41 | 0.48 | % | $ | 2.41 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.41 | 0.48 | % | $ | 2.41 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.91 | 0.38 | % | $ | 1.91 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.41 | 0.48 | % | $ | 2.41 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

19

State Farm International Index Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,143.43 | 0.60 | % | $ | 3.19 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,143.28 | 0.60 | % | $ | 3.19 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,143.69 | 0.50 | % | $ | 2.66 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,143.90 | 0.60 | % | $ | 3.19 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,142.94 | 0.67 | % | $ | 3.56 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,142.91 | 0.67 | % | $ | 3.56 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.32 | 0.50 | % | $ | 2.51 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,021.47 | 0.67 | % | $ | 3.36 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.47 | 0.67 | % | $ | 3.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Equity and Bond Fund **

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,064.04 | 0.00 | % | $ | 0.00 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,064.11 | 0.00 | % | $ | 0.00 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,065.15 | -0.10 | % | -$ | 0.51 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,064.16 | 0.00 | % | $ | 0.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,063.65 | 0.07 | % | $ | 0.36 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,063.56 | 0.07 | % | $ | 0.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,024.79 | 0.00 | % | $ | 0.00 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,024.79 | 0.00 | % | $ | 0.00 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,025.29 | -0.10 | % | -$ | 0.50 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,024.79 | 0.00 | % | $ | 0.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,024.45 | 0.07 | % | $ | 0.35 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,024.45 | 0.07 | % | $ | 0.35 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

20

State Farm Bond Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,020.15 | 0.40 | % | $ | 2.00 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,020.16 | 0.40 | % | $ | 2.00 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,020.65 | 0.30 | % | $ | 1.50 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,021.05 | 0.40 | % | $ | 2.00 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,019.80 | 0.47 | % | $ | 2.35 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,019.81 | 0.47 | % | $ | 2.35 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.81 | 0.40 | % | $ | 2.01 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.81 | 0.40 | % | $ | 2.01 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,023.31 | 0.30 | % | $ | 1.51 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.81 | 0.40 | % | $ | 2.01 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,022.46 | 0.47 | % | $ | 2.36 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,022.46 | 0.47 | % | $ | 2.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm Tax Advantaged Bond Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,027.86 | 0.41 | % | $ | 2.06 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,027.85 | 0.41 | % | $ | 2.06 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,028.37 | 0.31 | % | $ | 1.56 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,027.84 | 0.41 | % | $ | 2.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.76 | 0.41 | % | $ | 2.06 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.76 | 0.41 | % | $ | 2.06 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,023.26 | 0.31 | % | $ | 1.56 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.76 | 0.41 | % | $ | 2.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

21

State Farm Money Market Fund

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,000.82 | 0.42 | % | $ | 2.08 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,000.69 | 0.42 | % | $ | 2.08 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,001.50 | 0.32 | % | $ | 1.59 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,000.69 | 0.42 | % | $ | 2.08 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,000.40 | 0.49 | % | $ | 2.43 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,000.40 | 0.49 | % | $ | 2.43 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.71 | 0.42 | % | $ | 2.11 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.71 | 0.42 | % | $ | 2.11 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,023.21 | 0.32 | % | $ | 1.61 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.71 | 0.42 | % | $ | 2.11 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,022.36 | 0.49 | % | $ | 2.46 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,022.36 | 0.49 | % | $ | 2.46 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm LifePath Retirement Fund **

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,049.98 | 0.54 | % | $ | 2.74 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,049.89 | 0.54 | % | $ | 2.74 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,050.92 | 0.44 | % | $ | 2.24 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,050.73 | 0.54 | % | $ | 2.75 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,050.29 | 0.61 | % | $ | 3.10 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,050.72 | 0.61 | % | $ | 3.10 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.61 | 0.44 | % | $ | 2.21 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

22

State Farm LifePath 2020 Fund **

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,057.94 | 0.54 | % | $ | 2.76 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,057.87 | 0.54 | % | $ | 2.76 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,058.23 | 0.44 | % | $ | 2.25 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,058.73 | 0.54 | % | $ | 2.76 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,058.20 | 0.61 | % | $ | 3.11 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,057.63 | 0.61 | % | $ | 3.11 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.61 | 0.44 | % | $ | 2.21 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,021.77 | 0.61 | % | $ | 3.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

State Farm LifePath 2030 Fund **

| Beginning Account Value January 1, 2017 |

Ending Account Value June 30, 2017 |

Annualized Expense Ratio Based on the Period January 1, 2017 to June 30, 2017 |

Expenses Paid During Period January 1, 2017 to June 30, 2017* |

|||||||||||||

| Actual |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,076.85 | 0.54 | % | $ | 2.78 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,076.95 | 0.54 | % | $ | 2.78 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,077.48 | 0.44 | % | $ | 2.27 | ||||||||

| Legacy Class B Shares |

$ | 1,000.00 | $ | 1,076.71 | 0.54 | % | $ | 2.78 | ||||||||

| Class R-1 Shares |

$ | 1,000.00 | $ | 1,076.60 | 0.61 | % | $ | 3.14 | ||||||||

| Class R-2 Shares |

$ | 1,000.00 | $ | 1,077.19 | 0.61 | % | $ | 3.14 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Class B Shares |

$ | 1,000.00 | $ | 1,022.12 | 0.54 | % | $ | 2.71 | ||||||||

| Premier Shares |

$ | 1,000.00 | $ | 1,022.61 | 0.44 | % | $ | 2.21 | ||||||||