EFFECTIVE MATURITY DIVERSIFICATION

(% of Fund's net assets)

|

||

|

Days

|

||

1-7

|

||

8-30

|

||

31-60

|

||

61-90

|

||

91-180

|

||

>180

|

||

|

|

||

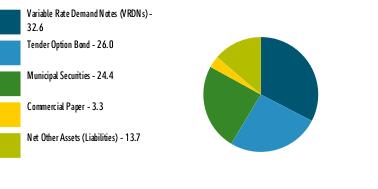

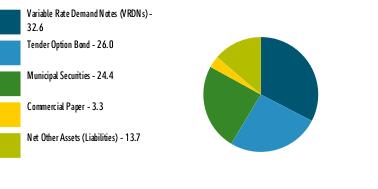

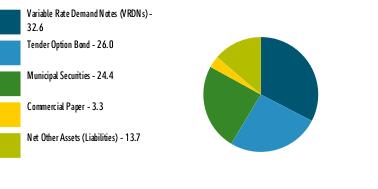

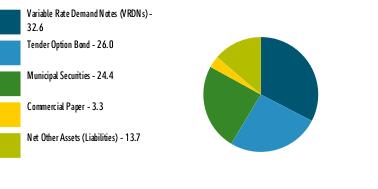

ASSET ALLOCATION (% of Fund's net assets)

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06453

Fidelity Court Street Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | November 30 |

Date of reporting period: | November 30, 2024 |

Item 1.

Reports to Stockholders

ANNUAL SHAREHOLDER REPORT | AS OF

|

||

|

|

||

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

||

Institutional Class

|

$

|

KEY FACTS

|

||

Fund Size

|

$

|

|

Number of Holdings

|

||

Total Advisory Fee

|

$

|

EFFECTIVE MATURITY DIVERSIFICATION

(% of Fund's net assets)

|

||

|

Days

|

||

1-7

|

||

8-30

|

||

31-60

|

||

61-90

|

||

91-180

|

||

>180

|

||

|

|

||

ASSET ALLOCATION (% of Fund's net assets)

|

|

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved.

|

||

|

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec

1.9914087.100 1870-TSRA-0125

|

|

ANNUAL SHAREHOLDER REPORT | AS OF

|

||

|

|

||

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

||

Fidelity® New Jersey Municipal Money Market Fund

|

$

|

KEY FACTS

|

||

Fund Size

|

$

|

|

Number of Holdings

|

||

Total Advisory Fee

|

$

|

EFFECTIVE MATURITY DIVERSIFICATION

(% of Fund's net assets)

|

||

|

Days

|

||

1-7

|

||

8-30

|

||

31-60

|

||

61-90

|

||

91-180

|

||

>180

|

||

|

|

||

ASSET ALLOCATION (% of Fund's net assets)

|

|

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved.

|

||

|

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec

1.9914089.100 6960-TSRA-0125

|

|

ANNUAL SHAREHOLDER REPORT | AS OF

|

||

|

|

||

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

||

Premium Class

|

$

|

KEY FACTS

|

||

Fund Size

|

$

|

|

Number of Holdings

|

||

Total Advisory Fee

|

$

|

EFFECTIVE MATURITY DIVERSIFICATION

(% of Fund's net assets)

|

||

|

Days

|

||

1-7

|

||

8-30

|

||

31-60

|

||

61-90

|

||

91-180

|

||

>180

|

||

|

|

||

ASSET ALLOCATION (% of Fund's net assets)

|

|

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved.

|

||

|

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec

1.9914088.100 423-TSRA-0125

|

|

Item 2.

Code of Ethics

As of the end of the period, November 30, 2024, Fidelity Court Street Trust II (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Laura M. Bishop is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Ms. Bishop is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Fidelity New Jersey Municipal Money Market Fund (the “Fund”):

Services Billed by PwC

November 30, 2024 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity New Jersey Municipal Money Market Fund | $39,200 | $3,000 | $2,100 | $1,300 |

November 30, 2023 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity New Jersey Municipal Money Market Fund | $42,300 | $3,100 | $4,200 | $1,300 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by PwC

November 30, 2024A | November 30, 2023A | |

Audit-Related Fees | $9,701,800 | $8,881,200 |

Tax Fees | $61,000 | $1,000 |

All Other Fees | $35,000 | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by PwC for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

Billed By | November 30, 2024A | November 30, 2023A |

PwC | $15,297,500 | $14,394,900 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its(their) audit of the Fund(s), taking into account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Contents

Variable Rate Demand Note - 32.6%

|

|||

Principal

Amount (a)

|

Value ($)

|

||

Alabama - 0.3%

|

|||

Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 3.15% 12/6/24, VRDN (b)(c)

|

900,000

|

900,000

|

|

West Jefferson Indl. Dev. Board Solid Waste Disp. Rev. (Alabama Pwr. Co. Plant Miller Proj.) Series 2023, 3.6% 12/6/24, VRDN (b)(c)

|

3,000,000

|

3,000,000

|

|

TOTAL ALABAMA

|

3,900,000

|

||

Arizona - 0.0%

|

|||

Maricopa County Poll. Cont. Rev. (Arizona Pub. Svc. Co. Palo Verde Proj.) Series 2009 A, 3.38% 12/6/24, VRDN (b)

|

400,000

|

400,000

|

|

Arkansas - 0.0%

|

|||

Blytheville Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1998, 3.15% 12/6/24, VRDN (b)(c)

|

300,000

|

300,000

|

|

Florida - 1.9%

|

|||

Broward County Indl. Dev. Rev. (Florida Pwr. & Lt. Co. Proj.):

|

|||

Series 2015, 3.05% 12/6/24, VRDN (b)(c)

|

7,100,000

|

7,100,000

|

|

Series 2018 B, 3% 12/6/24, VRDN (b)(c)

|

200,000

|

200,000

|

|

Lee County Indl. Dev. Auth. Rev. (Florida Pwr. & Lt. Co. Proj.) Series 2016 A:

|

|||

2.95% 12/6/24, VRDN (b)(c)

|

300,000

|

300,000

|

|

3.05% 12/6/24, VRDN (b)(c)

|

1,100,000

|

1,100,000

|

|

Miami-Dade County Indl. Dev. Auth. Rev.:

|

|||

Series 2024 A, 3% 12/6/24, VRDN (b)(c)

|

7,300,000

|

7,300,000

|

|

Series 2024 B, 3.33% 12/6/24, VRDN (b)(c)

|

7,800,000

|

7,800,000

|

|

TOTAL FLORIDA

|

23,800,000

|

||

Iowa - 0.4%

|

|||

Iowa Fin. Auth. Solid Disp. Waste Rev. (MidAmerican Energy Co. Proj.) Series 2008 A, 3.05% 12/6/24, VRDN (b)(c)

|

200,000

|

200,000

|

|

Iowa Fin. Auth. Solid Waste Facilities (MidAmerican Energy Co. Proj.) Series 2017, 3.1% 12/6/24, VRDN (b)(c)

|

4,800,000

|

4,800,000

|

|

TOTAL IOWA

|

5,000,000

|

||

Kansas - 0.2%

|

|||

Burlington Envir. Impt. Rev. (Kansas City Pwr. and Lt. Co. Proj.):

|

|||

Series 2007 A, 3.2% 12/6/24, VRDN (b)

|

100,000

|

100,000

|

|

Series 2007 B, 3.2% 12/6/24, VRDN (b)

|

300,000

|

300,000

|

|

St. Mary's Kansas Poll. Cont. Rev. (Kansas Gas and Elec. Co. Proj.) Series 1994, 2.95% 12/6/24, VRDN (b)

|

1,100,000

|

1,100,000

|

|

Wamego Kansas Poll. Cont. Rfdg. Rev.:

|

|||

(Kansas Gas & Elec. Co. Proj.) Series 1994, 2.95% 12/6/24, VRDN (b)

|

100,000

|

100,000

|

|

(Western Resources, Inc. Proj.) Series 1994, 2.95% 12/6/24, VRDN (b)

|

500,000

|

500,000

|

|

TOTAL KANSAS

|

2,100,000

|

||

Kentucky - 0.3%

|

|||

Daviess County Exempt Facilities Rev. (Kimberly-Clark Tissue Co. Proj.) Series 1999, 2.95% 12/6/24 (Kimberly-Clark Corp. Guaranteed), VRDN (b)(c)

|

1,800,000

|

1,800,000

|

|

Meade County Indl. Bldg. Rev. (Nucor Steel Brandenburg Proj.):

|

|||

Series 2020 B1, 3.45% 12/2/24, VRDN (b)(c)

|

325,000

|

325,000

|

|

Series 2021 A1, 3.8% 12/2/24, VRDN (b)(c)

|

1,300,000

|

1,300,000

|

|

Series 2021 B1, 3.45% 12/2/24, VRDN (b)(c)

|

100,000

|

100,000

|

|

TOTAL KENTUCKY

|

3,525,000

|

||

Nebraska - 0.0%

|

|||

Stanton County Indl. Dev. Rev. Series 1998, 3.15% 12/6/24, VRDN (b)(c)

|

100,000

|

100,000

|

|

New Jersey - 26.6%

|

|||

New Jersey Econ. Dev. Auth. Rev. (Cooper Health Sys. Proj.) Series 2008 A, 3.18% 12/6/24, LOC TD Banknorth, NA, VRDN (b)

|

49,100,000

|

49,100,000

|

|

New Jersey Health Care Facilities Fing. Auth. Rev.:

|

|||

(AHS Hosp. Corp. Proj.):

|

|||

Series 2008 B, 3.13% 12/6/24, LOC Bank of America NA, VRDN (b)

|

79,105,000

|

79,105,000

|

|

Series 2008 C, 3.13% 12/6/24, LOC JPMorgan Chase Bank, VRDN (b)

|

58,285,000

|

58,285,000

|

|

(Virtua Health Proj.):

|

|||

Series 2004, 2.68% 12/6/24, LOC Wells Fargo Bank NA, VRDN (b)

|

30,325,000

|

30,325,000

|

|

Series 2009 B, 2.25% 12/2/24, LOC JPMorgan Chase Bank, VRDN (b)

|

14,310,000

|

14,310,000

|

|

Series 2009 C, 2.2% 12/2/24, LOC JPMorgan Chase Bank, VRDN (b)

|

8,205,000

|

8,205,000

|

|

Series 2009 D, 3% 12/6/24, LOC TD Banknorth, NA, VRDN (b)

|

44,230,000

|

44,230,000

|

|

Series 2009 E, 2.3% 12/6/24, LOC TD Banknorth, NA, VRDN (b)

|

6,550,000

|

6,550,000

|

|

Union County Poll. Cont. Fing. Auth. Poll. Cont. Rev. (Exxon Mobil Proj.) Series 1994, 2.85% 12/2/24 (Exxon Mobil Corp. Guaranteed), VRDN (b)

|

28,300,000

|

28,300,000

|

|

FHLMC Essex County Impt. Auth. Multi-family Hsg. Rev. (Fern Sr. Hsg. Proj.) Series 2010, 3.18% 12/6/24, LOC Freddie Mac, VRDN (b)

|

11,300,000

|

11,300,000

|

|

TOTAL NEW JERSEY

|

329,710,000

|

||

New York And New Jersey - 2.0%

|

|||

Port Auth. of New York & New Jersey:

|

|||

Series 1992 2, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN (b)(d)(e)

|

6,400,000

|

6,400,000

|

|

Series 1995 3, SIFMA Municipal Swap Index + 0.080% 3.26% 12/30/24, VRDN (b)(c)(d)(e)

|

4,800,000

|

4,800,000

|

|

Series 1995 4, SIFMA Municipal Swap Index + 0.080% 3.26% 12/30/24, VRDN (b)(c)(d)(e)

|

6,600,000

|

6,600,000

|

|

Series 1997 1, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN (b)(d)(e)

|

4,400,000

|

4,400,000

|

|

Series 1997 2, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN (b)(d)(e)

|

3,100,000

|

3,100,000

|

|

TOTAL NEW YORK AND NEW JERSEY

|

25,300,000

|

||

North Carolina - 0.5%

|

|||

Hertford County Indl. Facilities Poll. Cont. Fing. Auth. (Nucor Corp. Proj.) Series 2000 A, 3% 12/6/24, VRDN (b)(c)

|

6,400,000

|

6,400,000

|

|

South Carolina - 0.2%

|

|||

Berkeley County Indl. Dev. Rev.:

|

|||

(Nucor Corp. Proj.):

|

|||

Series 1995, 3.15% 12/6/24, VRDN (b)(c)

|

100,000

|

100,000

|

|

Series 1997, 3.15% 12/6/24, VRDN (b)(c)

|

300,000

|

300,000

|

|

Series A, 3.07% 12/6/24, VRDN (b)(c)

|

1,500,000

|

1,500,000

|

|

Darlington County Indl. Dev. Rev. (Nucor Corp. Proj.) Series 2003 A, 3.07% 12/6/24, VRDN (b)(c)

|

200,000

|

200,000

|

|

TOTAL SOUTH CAROLINA

|

2,100,000

|

||

Tennessee - 0.0%

|

|||

Memphis-Shelby County Indl. Dev. Board Facilities Rev. Series 2007, 3.15% 12/6/24, VRDN (b)(c)

|

50,000

|

50,000

|

|

Wyoming - 0.2%

|

|||

Converse County Envir. Impt. Rev. Series 1995, 3.15% 12/6/24, VRDN (b)(c)

|

500,000

|

500,000

|

|

Sweetwater County Env Imp Rev. (Pacificorp Proj.) Series 1995, 3.35% 12/2/24, VRDN (b)(c)

|

1,300,000

|

1,300,000

|

|

TOTAL WYOMING

|

1,800,000

|

||

|

TOTAL VARIABLE RATE DEMAND NOTE

(Cost $404,485,000)

|

404,485,000

|

||

Tender Option Bond - 26.0%

|

|||

Principal

Amount (a)

|

Value ($)

|

||

Alaska - 0.0%

|

|||

Mizuho Floater / Residual Trust V Participating VRDN Series MIZ 92 01, 3.5% 1/3/25 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(d)(f)(g)

|

200,000

|

200,000

|

|

Colorado - 0.2%

|

|||

Colorado Health Facilities Auth. Rev. Bonds Participating VRDN Series 2023, 3.48% 1/3/25 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

1,700,000

|

1,700,000

|

|

Illinois - 0.0%

|

|||

Illinois Fin. Auth. Rev. Participating VRDN Series Floaters 017, 3.48% 1/3/25 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

300,000

|

300,000

|

|

Missouri - 0.0%

|

|||

Missouri Health & Edl. Facilities Rev. Bonds Series 2023 G 121, 3.06%, tender 12/2/24 (Liquidity Facility Royal Bank of Canada) (b)(f)(g)

|

300,000

|

300,000

|

|

New Jersey - 21.6%

|

|||

Gloucester County Impt. Auth. Rev. Participating VRDN Series XG 05 57, 3.21% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(f)(g)

|

1,660,000

|

1,660,000

|

|

Middlesex County Impt. Auth. Rutgers Univ. Gen. Oblig. Participating VRDN:

|

|||

Series XF 31 23, 3.19% 12/6/24 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(f)(g)

|

15,000,000

|

15,000,000

|

|

Series XG 04 92, 3.21% 12/6/24 (Liquidity Facility Toronto-Dominion Bank) (b)(f)(g)

|

3,200,000

|

3,200,000

|

|

Series XG 04 93, 3.21% 12/6/24 (Liquidity Facility Toronto-Dominion Bank) (b)(f)(g)

|

3,110,000

|

3,110,000

|

|

New Jersey Econ. Dev. Auth. Participating VRDN:

|

|||

Series 2022 YX 12 56, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

2,985,000

|

2,985,000

|

|

Series XF 28 65, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

4,500,000

|

4,500,000

|

|

Series XL 03 95, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

3,750,000

|

3,750,000

|

|

New Jersey Econ. Dev. Auth. Rev. Participating VRDN:

|

|||

Series Floaters XF 10 48, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

8,985,000

|

8,985,000

|

|

Series Floaters XF 23 93, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

3,600,000

|

3,600,000

|

|

Series Floaters XF 25 38, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

2,810,000

|

2,810,000

|

|

Series Floaters XL 00 52, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

1,100,000

|

1,100,000

|

|

Series XF 23 40, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

750,000

|

750,000

|

|

Series YX 12 87, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

8,165,000

|

8,165,000

|

|

New Jersey Edl. Facilities Auth. Rev. Participating VRDN:

|

|||

Series XL 04 70, 3.21% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(f)(g)

|

5,190,000

|

5,190,000

|

|

Series XL 05 35, 3.3% 12/2/24 (Liquidity Facility JPMorgan Chase Bank) (b)(f)(g)

|

9,600,000

|

9,600,000

|

|

New Jersey Edl. Facility Participating VRDN Series Floaters XF 27 56, 3.21% 12/6/24 (Liquidity Facility JPMorgan Chase Bank) (b)(f)(g)

|

3,400,000

|

3,400,000

|

|

New Jersey Health Care Facilities Fing. Auth. Rev. Participating VRDN Series 2022 043, 2.9% 12/2/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

7,985,000

|

7,985,000

|

|

New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev. Participating VRDN Series XF 09 57, 3.25% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(c)(f)(g)

|

715,000

|

715,000

|

|

New Jersey Hsg. & Mtg. Fin. Agcy. Participating VRDN Floater BAML 24, 3.1% 12/2/24 (Liquidity Facility Bank of America NA) (b)(f)(g)

|

6,807,500

|

6,807,500

|

|

New Jersey Hsg. & Mtg. Fin. Agcy. Multi-family Rev. Participating VRDN:

|

|||

Series Floater 2024, 3.43% 1/3/25 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

10,100,000

|

10,100,000

|

|

Series YX 13 14, 3.2% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(c)(f)(g)

|

6,510,000

|

6,510,000

|

|

New Jersey Hsg. & Mtg. Fin. Agcy. Rev. Participating VRDN:

|

|||

Series Floaters XG 02 28, 3.21% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(f)(g)

|

4,965,000

|

4,965,000

|

|

Series YX 13 33, 3.2% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

8,015,000

|

8,015,000

|

|

New Jersey Tpk. Auth. Tpk. Rev. Participating VRDN:

|

|||

Series 2022 XF 04 09, 3.21% 12/6/24 (Liquidity Facility Wells Fargo Bank NA) (b)(f)(g)

|

10,400,000

|

10,400,000

|

|

Series 2022 YX 12 46, 3.21% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

7,880,000

|

7,880,000

|

|

Series XG 05 69, 2.89% 12/6/24 (Liquidity Facility JPMorgan Chase Bank) (b)(f)(g)

|

6,800,000

|

6,800,000

|

|

Series XM 10 96, 2.91% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(f)(g)

|

22,800,000

|

22,800,000

|

|

Series ZF 31 72, 3.21% 12/6/24 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(f)(g)

|

5,000,000

|

5,000,000

|

|

New Jersey Trans. Trust Fund Auth. Participating VRDN:

|

|||

Series Floaters XG 02 05, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

700,000

|

700,000

|

|

Series XF 16 75, 3.22% 12/6/24 (Liquidity Facility Toronto-Dominion Bank) (b)(f)(g)

|

8,300,000

|

8,300,000

|

|

Series YX 12 68, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

8,300,000

|

8,300,000

|

|

Series YX 12 70, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

9,295,000

|

9,295,000

|

|

Series YX 12 83, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

7,870,000

|

7,870,000

|

|

RIB Floater Trust Various States Participating VRDN Series 2024, 3.2% 12/2/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

52,400,000

|

52,400,000

|

|

Union County Util. Auth. Solid Waste Facilities Lease Rev. Participating VRDN Series ZF 24 79, 2.87% 12/6/24 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(f)(g)

|

5,845,000

|

5,845,000

|

|

TOTAL NEW JERSEY

|

268,492,500

|

||

Pennsylvania, New Jersey - 1.0%

|

|||

Delaware River Port Auth. Pennsylvania & New Jersey Rev. Participating VRDN Series YX 12 14, 3.22% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(f)(g)

|

12,265,000

|

12,265,000

|

|

New York And New Jersey - 3.1%

|

|||

Port Auth. of New York & New Jersey Participating VRDN:

|

|||

Series 2023 G, 3.24% 12/6/24 (Liquidity Facility Royal Bank of Canada) (b)(c)(f)(g)

|

1,800,000

|

1,800,000

|

|

Series BC 22 023, 2.9% 12/2/24 (Liquidity Facility Barclays Bank PLC) (b)(c)(f)(g)

|

6,515,000

|

6,515,000

|

|

Series Floater 2023-0009, 3.21% 12/6/24 (Liquidity Facility Citibank NA) (b)(c)(f)(g)

|

1,800,000

|

1,800,000

|

|

Series MS 3321, 2.93% 12/6/24 (Liquidity Facility Toronto-Dominion Bank) (b)(c)(f)(g)

|

4,970,000

|

4,970,000

|

|

Series X3 03 37, 3.24% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

3,935,000

|

3,935,000

|

|

Series XF 15 79, 3% 12/2/24 (Liquidity Facility JPMorgan Chase Bank) (b)(f)(g)

|

1,500,000

|

1,500,000

|

|

Series XF 16 22, 3.21% 12/6/24 (Liquidity Facility Bank of America NA) (b)(f)(g)

|

400,000

|

400,000

|

|

Series XF 31 84, 3.21% 12/6/24 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(c)(f)(g)

|

2,600,000

|

2,600,000

|

|

Series XG 03 79, 3.24% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

1,140,000

|

1,140,000

|

|

Series XG 03 94, 3.24% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

3,325,000

|

3,325,000

|

|

Series XG 04 38, 3.24% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

655,000

|

655,000

|

|

Series XG 04 71, 3.03% 12/2/24 (Liquidity Facility JPMorgan Chase Bank) (b)(c)(f)(g)

|

3,940,000

|

3,940,000

|

|

Series XG 05 26, 3.24% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

2,200,000

|

2,200,000

|

|

Series XL 05 36, 3.23% 12/6/24 (Liquidity Facility JPMorgan Chase Bank) (b)(c)(f)(g)

|

1,000,000

|

1,000,000

|

|

Series YX 11 78, 3.23% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(c)(f)(g)

|

1,400,000

|

1,400,000

|

|

Series ZF 16 99, 3.22% 12/6/24 (Liquidity Facility Bank of America NA) (b)(c)(f)(g)

|

1,000,000

|

1,000,000

|

|

Series ZL 02 70, 3.23% 12/6/24 (Liquidity Facility Barclays Bank PLC) (b)(c)(f)(g)

|

600,000

|

600,000

|

|

TOTAL NEW YORK AND NEW JERSEY

|

38,780,000

|

||

Pennsylvania - 0.1%

|

|||

Mizuho Floater / Residual Trust V Participating VRDN Floater MIZ 91 77, 3.18% 1/3/25 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(d)(f)(g)

|

700,000

|

700,000

|

|

|

TOTAL TENDER OPTION BOND

(Cost $322,737,500)

|

322,737,500

|

||

Other Municipal Security - 27.7%

|

|||

Principal

Amount (a)

|

Value ($)

|

||

Delaware, New Jersey - 0.3%

|

|||

Delaware River & Bay Auth. Rev. Bonds:

|

|||

Series 2022, 5% 1/1/25

|

1,000,000

|

1,001,838

|

|

Series 2024 B, 5% 1/1/25

|

2,025,000

|

2,027,868

|

|

TOTAL DELAWARE, NEW JERSEY

|

3,029,706

|

||

Michigan - 0.0%

|

|||

Kent Hosp. Fin. Auth. Hosp. Facilities Rev. Bonds (Spectrum Health Sys. Proj.) Series 2015 A, SIFMA Municipal Swap Index + 0.250% 3.43%, tender 6/27/25 (b)(e)

|

300,000

|

300,000

|

|

New Jersey - 27.0%

|

|||

Avalon Borough Gen. Oblig. BAN Series 2024, 3.75% 2/6/25

|

22,382,000

|

22,407,445

|

|

Bergen County Impt. Auth. Rev. RAN Series 2024, 4% 10/16/25 (Bergen County Gen. Oblig. Guaranteed)

|

100,000

|

100,670

|

|

Berkely Township BAN Series 2024 A, 4.25% 3/20/25

|

10,772,000

|

10,802,192

|

|

Burlington County Gen. Oblig. BAN Series 2024 A, 4.5% 6/18/25

|

10,200,000

|

10,241,819

|

|

Chatham Boro Gen. Oblig. BAN Series 2024, 4.5% 5/16/25

|

7,188,000

|

7,208,127

|

|

Cranford Township Gen. Oblig. BAN Series 2024, 4.5% 7/18/25

|

9,700,000

|

9,730,390

|

|

East Brunswick Township Gen. Oblig. BAN Series 2024 A, 4.5% 7/15/25

|

7,000,000

|

7,039,745

|

|

Essex County Gen. Oblig. BAN Series 2024, 4.25% 7/10/25

|

775,000

|

779,197

|

|

Essex County Impt. Auth. BAN (Essex County Family Court Bldg. Proj.) Series 2024, 5% 6/18/25 (Essex County Gen. Oblig. Guaranteed)

|

515,000

|

519,254

|

|

Evesham Township BAN Series 2024 A, 4% 9/16/25

|

2,000,000

|

2,012,576

|

|

Hamilton Township Mercer County BAN Series 2024 A, 5% 5/14/25

|

1,560,000

|

1,569,358

|

|

Hazlet Township NJ BAN Series 2024 A, 4% 11/6/25

|

9,623,000

|

9,692,286

|

|

Hoboken Gen. Oblig. BAN Series 2024 A, 4% 3/12/25

|

5,690,000

|

5,703,926

|

|

Hudson County Gen. Oblig.:

|

|||

BAN Series 2024, 4% 2/28/25

|

12,146,000

|

12,169,725

|

|

Bonds Series 2014, 5% 12/1/24

|

330,000

|

330,000

|

|

Hudson County Impt. Auth. Rev. BAN Series 2024 A1, 4.25% 3/25/25 (Hudson County Gen. Oblig. Guaranteed)

|

6,485,000

|

6,504,337

|

|

Livingston Township Gen. Oblig. BAN:

|

|||

Series 2023, 5% 12/10/24

|

6,135,000

|

6,137,284

|

|

Series 2024, 4% 12/5/25 (h)

|

7,000,000

|

7,070,560

|

|

Mercer County Gen. Oblig. Bonds Series 2022, 4% 2/1/25

|

100,000

|

100,099

|

|

Monmouth County Impt. Auth. Rev.:

|

|||

BAN Series 2024, 4% 3/14/25 (Monmouth County Guaranteed)

|

26,860,000

|

26,909,209

|

|

Bonds Series 2019 B, 5% 12/1/24 (Monmouth County Guaranteed)

|

390,000

|

390,000

|

|

Monroe Township Middlesex County Gen. Oblig. Bonds Series 2021, 4% 1/15/25

|

1,005,000

|

1,006,379

|

|

Morris Township Gen. Oblig. BAN Series 2024, 4% 9/25/25

|

12,051,000

|

12,170,641

|

|

New Jersey Econ. Dev. Auth. Bonds Series 2023 RRR, 5% 3/1/25

|

1,000,000

|

1,003,666

|

|

New Jersey Econ. Dev. Auth. Lease Rev. Bonds Series 2018 C, 4% 6/15/25

|

440,000

|

441,180

|

|

New Jersey Econ. Dev. Auth. Rev. Bonds:

|

|||

Series 2013 I, 4.43% 9/1/25 (b)(e)

|

600,000

|

599,017

|

|

Series 2017 DDD, 5% 6/15/25

|

210,000

|

211,819

|

|

New Jersey Edl. Facilities Auth. Rev.:

|

|||

Bonds Series 2024 A, 5% 5/15/25 (h)

|

4,000,000

|

4,031,040

|

|

Series 2024 A, 2.5% 2/18/25, CP

|

41,000,000

|

41,000,000

|

|

New Jersey Gen. Oblig. Bonds:

|

|||

Series 2014, 5% 6/1/25 (Pre-Refunded to 6/1/25 @ 100)

|

200,000

|

201,355

|

|

Series 2020 A, 5% 6/1/25

|

285,000

|

287,374

|

|

New Jersey Health Care Facilities Fing. Auth. Rev. Bonds:

|

|||

Series 2016 A, 5% 7/1/25

|

285,000

|

287,868

|

|

Series 2019 B2, 5%, tender 7/1/25 (b)

|

1,950,000

|

1,966,955

|

|

New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev. Bonds:

|

|||

Series 2015 1A, 5% 12/1/24 (c)

|

6,610,000

|

6,610,000

|

|

Series 2017 1A, 5% 12/1/24 (c)

|

3,750,000

|

3,750,000

|

|

Series 2018 B, 5% 12/1/24 (c)

|

1,400,000

|

1,400,000

|

|

Series 2019 A, 5% 12/1/24

|

4,190,000

|

4,190,000

|

|

Series 2021 B, 5% 12/1/24 (c)

|

570,000

|

570,000

|

|

Series 2022 A, 5% 12/1/24 (c)

|

650,000

|

650,000

|

|

Series 2022 B, 5% 12/1/24 (c)

|

1,395,000

|

1,395,000

|

|

New Jersey Tpk. Auth. Tpk. Rev. Bonds:

|

|||

Series 2014 C, 5% 1/1/25

|

495,000

|

495,567

|

|

Series 2017 E, 5% 1/1/25

|

1,000,000

|

1,001,251

|

|

New Jersey Trans. Trust Fund Auth. Bonds:

|

|||

Series 2006 C:

|

|||

0% 12/15/24

|

1,075,000

|

1,073,561

|

|

0% 12/15/24 (Escrowed to Maturity)

|

570,000

|

569,231

|

|

Series 2008, 0% 12/15/24 (Escrowed to Maturity)

|

290,000

|

289,606

|

|

Series 2018 A, 5% 12/15/24 (Escrowed to Maturity)

|

6,080,000

|

6,083,456

|

|

Series 2022 AA, 5% 6/15/25

|

3,375,000

|

3,403,840

|

|

Series A, 5% 12/15/24 (Escrowed to Maturity)

|

4,050,000

|

4,052,244

|

|

North Arlington BAN Series 2024, 4.5% 8/1/25

|

8,030,000

|

8,068,598

|

|

North Brunswick Township Gen. Oblig. BAN Series 2024 A, 5% 7/8/25

|

310,000

|

312,851

|

|

Old Bridge Township Gen. Oblig. BAN Series 2024, 4% 9/5/25

|

3,000,000

|

3,019,126

|

|

Plainsboro Township Gen. Oblig. BAN Series 2024, 4.25% 7/24/25

|

11,000,000

|

11,063,032

|

|

Rahway Gen. Oblig. BAN Series 2024, 4.5% 7/24/25

|

100,000

|

100,814

|

|

Ridgefield Park BAN Series 2024, 4.5% 4/4/25

|

6,462,000

|

6,477,211

|

|

Ringwood Boro Gen. Oblig. BAN Series 2024, 4.5% 4/4/25

|

8,509,000

|

8,536,924

|

|

River Edge N J BAN Series 2024, 4.5% 6/18/25

|

9,000,000

|

9,033,057

|

|

Rockaway Township Gen. Oblig. BAN Series 2023, 4.75% 12/13/24

|

9,235,130

|

9,238,312

|

|

Rutgers State Univ. Rev. Bonds Series 2016 M, 5% 5/1/25

|

350,000

|

352,237

|

|

Tenafly BAN Series 2024, 4.5% 5/22/25

|

4,000,000

|

4,015,272

|

|

Verona Township Gen. Oblig. BAN Series 2024 B, 4% 10/22/25

|

9,858,800

|

9,932,829

|

|

West Caldwell Township BAN Series 2024, 4% 9/3/25

|

10,923,325

|

10,991,325

|

|

Wood-Ridge Gen. Oblig. BAN Series 2024, 4.5% 2/25/25

|

8,200,000

|

8,220,480

|

|

Woolwich Township BAN Series 2024, 4.5% 5/21/25

|

265,000

|

266,408

|

|

TOTAL NEW JERSEY

|

335,787,725

|

||

New York And New Jersey - 0.4%

|

|||

Port Auth. of New York & New Jersey Bonds:

|

|||

Series 2023 242, 5% 12/1/24 (c)

|

2,250,000

|

2,250,000

|

|

Series 2024 246, 5% 9/1/25 (c)

|

3,100,000

|

3,139,755

|

|

TOTAL NEW YORK AND NEW JERSEY

|

5,389,755

|

||

|

TOTAL OTHER MUNICIPAL SECURITY

(Cost $344,507,186)

|

344,507,186

|

||

Investment Company - 11.7%

|

|||

Shares

|

Value ($)

|

||

Fidelity Municipal Cash Central Fund 2.98% (i)(j)

(Cost $145,006,573)

|

144,978,744

|

145,006,573

|

|

|

TOTAL INVESTMENT IN SECURITIES - 98.0%

(Cost $1,216,736,259)

|

1,216,736,259

|

NET OTHER ASSETS (LIABILITIES) - 2.0%

|

25,291,420

|

NET ASSETS - 100.0%

|

1,242,027,679

|

BAN

|

-

|

BOND ANTICIPATION NOTE

|

CP

|

-

|

COMMERCIAL PAPER

|

RAN

|

-

|

REVENUE ANTICIPATION NOTE

|

VRDN

|

-

|

VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

|

(a)

|

Amount is stated in United States dollars unless otherwise noted.

|

(b)

|

Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

|

(c)

|

Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

|

(d)

|

Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $26,200,000 or 2.1% of net assets.

|

(e)

|

Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

|

(f)

|

Provides evidence of ownership in one or more underlying municipal bonds. Coupon rates are determined by re-marketing agents based on current market conditions.

|

(g)

|

Coupon rates are determined by re-marketing agents based on current market conditions.

|

(h)

|

Security or a portion of the security purchased on a delayed delivery or when-issued basis.

|

(i)

|

Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

|

(j)

|

Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

|

Additional information on each restricted holding is as follows:

|

||

Security

|

Acquisition Date

|

Cost ($)

|

Mizuho Floater / Residual Trust V Participating VRDN Floater MIZ 91 77, 3.18% 1/3/25 (Liquidity Facility Mizuho Cap. Markets LLC)

|

6/20/24

|

700,000

|

Mizuho Floater / Residual Trust V Participating VRDN Series MIZ 92 01, 3.5% 1/3/25 (Liquidity Facility Mizuho Cap. Markets LLC)

|

11/21/24

|

200,000

|

Port Auth. of New York & New Jersey Series 1992 2, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN

|

2/14/92

|

6,400,000

|

Port Auth. of New York & New Jersey Series 1995 3, SIFMA Municipal Swap Index + 0.080% 3.26% 12/5/24, VRDN

|

9/15/95

|

4,800,000

|

Port Auth. of New York & New Jersey Series 1995 4, SIFMA Municipal Swap Index + 0.080% 3.26% 12/5/24, VRDN

|

8/09/02

|

6,600,000

|

Port Auth. of New York & New Jersey Series 1997 1, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN

|

8/09/02

|

4,400,000

|

Port Auth. of New York & New Jersey Series 1997 2, SIFMA Municipal Swap Index + 0.050% 3.23% 12/30/24, VRDN

|

9/15/97

|

3,100,000

|

Affiliate

|

Value,

beginning

of period ($)

|

Purchases ($)

|

Sales

Proceeds ($)

|

Dividend

Income ($)

|

Realized

Gain (loss) ($)

|

Change in

Unrealized

appreciation

(depreciation) ($)

|

Value,

end

of period ($)

|

% ownership,

end

of period

|

Fidelity Municipal Cash Central Fund 2.98%

|

95,313,423

|

403,390,100

|

353,690,187

|

4,755,828

|

(6,763)

|

-

|

145,006,573

|

4.2%

|

Total

|

95,313,423

|

403,390,100

|

353,690,187

|

4,755,828

|

(6,763)

|

-

|

145,006,573

|

|

Statement of Assets and Liabilities

|

||||

As of November 30, 2024

|

||||

Assets

|

||||

Investment in securities, at value - See accompanying schedule:

|

||||

Unaffiliated issuers (cost $1,071,729,686)

|

$

|

1,071,729,686

|

||

Fidelity Central Funds (cost $145,006,573)

|

145,006,573

|

|||

Total Investment in Securities (cost $1,216,736,259)

|

$

|

1,216,736,259

|

||

Cash

|

27,302,836

|

|||

Receivable for fund shares sold

|

471,620

|

|||

Interest receivable

|

11,809,810

|

|||

Distributions receivable from Fidelity Central Funds

|

385,196

|

|||

Receivable from investment adviser for expense reductions

|

25,895

|

|||

Other receivables

|

3,556

|

|||

Total assets

|

1,256,735,172

|

|||

Liabilities

|

||||

Payable for investments purchased

|

||||

Regular delivery

|

$

|

2,000,000

|

||

Delayed delivery

|

11,101,600

|

|||

Payable for fund shares redeemed

|

1,095,563

|

|||

Distributions payable

|

226,572

|

|||

Accrued management fee

|

203,811

|

|||

Other affiliated payables

|

79,947

|

|||

Total liabilities

|

14,707,493

|

|||

Net Assets

|

$

|

1,242,027,679

|

||

Net Assets consist of:

|

||||

Paid in capital

|

$

|

1,241,990,133

|

||

Total accumulated earnings (loss)

|

37,546

|

|||

Net Assets

|

$

|

1,242,027,679

|

||

Net Asset Value and Maximum Offering Price

|

||||

Fidelity New Jersey Municipal Money Market Fund :

|

||||

Net Asset Value, offering price and redemption price per share ($21,706,142 ÷ 21,712,168 shares)

|

$

|

1.00

|

||

Institutional Class :

|

||||

Net Asset Value, offering price and redemption price per share ($595,763,529 ÷ 595,310,399 shares)

|

$

|

1.00

|

||

Premium Class :

|

||||

Net Asset Value, offering price and redemption price per share ($624,558,008 ÷ 623,857,260 shares)

|

$

|

1.00

|

||

Statement of Operations

|

||||

|

Year ended November 30, 2024

|

||||

Investment Income

|

||||

Interest

|

$

|

32,122,465

|

||

Income from Fidelity Central Funds

|

4,755,828

|

|||

Total income

|

36,878,293

|

|||

Expenses

|

||||

Management fee

|

$

|

2,188,597

|

||

Transfer agent fees

|

865,116

|

|||

Independent trustees' fees and expenses

|

2,813

|

|||

Miscellaneous

|

3,085

|

|||

Total expenses before reductions

|

3,059,611

|

|||

Expense reductions

|

(259,113)

|

|||

Total expenses after reductions

|

2,800,498

|

|||

Net Investment income (loss)

|

34,077,795

|

|||

Realized and Unrealized Gain (Loss)

|

||||

Net realized gain (loss) on:

|

||||

Investment Securities:

|

||||

Unaffiliated issuers

|

27,175

|

|||

Fidelity Central Funds

|

(6,763)

|

|||

Total net realized gain (loss)

|

20,412

|

|||

Net increase in net assets resulting from operations

|

$

|

34,098,207

|

||

Statement of Changes in Net Assets

|

||||

Year ended

November 30, 2024

|

Year ended

November 30, 2023

|

|||

Increase (Decrease) in Net Assets

|

||||

Operations

|

||||

Net investment income (loss)

|

$

|

34,077,795

|

$

|

24,894,259

|

Net realized gain (loss)

|

20,412

|

73,022

|

||

Net increase in net assets resulting from operations

|

34,098,207

|

24,967,281

|

||

Distributions to shareholders

|

(34,057,749)

|

(24,877,748)

|

||

Share transactions - net increase (decrease)

|

310,049,285

|

146,856,659

|

||

Total increase (decrease) in net assets

|

310,089,743

|

146,946,192

|

||

Net Assets

|

||||

Beginning of period

|

931,937,936

|

784,991,744

|

||

End of period

|

$

|

1,242,027,679

|

$

|

931,937,936

|

Fidelity® New Jersey Municipal Money Market Fund |

Years ended November 30,

|

2024

|

2023

|

2022 A

|

|||

Selected Per-Share Data

|

||||||

Net asset value, beginning of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Income from Investment Operations

|

||||||

Net investment income (loss) B

|

.030

|

.027

|

.003

|

|||

Net realized and unrealized gain (loss)

|

(.001) C

|

- D

|

- D

|

|||

Total from investment operations

|

.029

|

.027

|

.003

|

|||

Distributions from net investment income

|

(.029)

|

(.027)

|

(.003)

|

|||

Total distributions

|

(.029)

|

(.027)

|

(.003)

|

|||

Net asset value, end of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Total Return E,F

|

2.99 % |

2.76%

|

.32%

|

|||

Ratios to Average Net Assets B,G,H

|

||||||

Expenses before reductions

|

.42%

|

.42%

|

.42% I

|

|||

Expenses net of fee waivers, if any

|

.42 % |

.42%

|

.42% I

|

|||

Expenses net of all reductions

|

.42%

|

.42%

|

.42% I

|

|||

Net investment income (loss)

|

2.95%

|

2.73%

|

1.61% I

|

|||

Supplemental Data

|

||||||

Net assets, end of period (000 omitted)

|

$

|

21,706

|

$

|

9,456

|

$

|

1,614

|

Fidelity® New Jersey Municipal Money Market Fund Institutional Class |

Years ended November 30,

|

2024

|

2023

|

2022

|

2021

|

2020

|

|||||

Selected Per-Share Data

|

||||||||||

Net asset value, beginning of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Income from Investment Operations

|

||||||||||

Net investment income (loss) A

|

.032

|

.029

|

.008

|

- B

|

.005

|

|||||

Net realized and unrealized gain (loss) B

|

-

|

-

|

-

|

-

|

-

|

|||||

Total from investment operations

|

.032

|

.029

|

.008

|

- B

|

.005

|

|||||

Distributions from net investment income

|

(.032)

|

(.029)

|

(.008)

|

- B

|

(.005)

|

|||||

Total distributions

|

(.032)

|

(.029)

|

(.008)

|

- B

|

(.005)

|

|||||

Net asset value, end of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Total Return C

|

3.22 % |

2.99%

|

.79%

|

.01%

|

.52%

|

|||||

Ratios to Average Net Assets A,D,E

|

||||||||||

Expenses before reductions

|

.25%

|

.25%

|

.25%

|

.25%

|

.25%

|

|||||

Expenses net of fee waivers, if any

|

.20 % |

.20%

|

.18%

|

.10%

|

.20%

|

|||||

Expenses net of all reductions

|

.20%

|

.20%

|

.18%

|

.10%

|

.20%

|

|||||

Net investment income (loss)

|

3.17%

|

2.96%

|

1.01%

|

.01%

|

.54%

|

|||||

Supplemental Data

|

||||||||||

Net assets, end of period (000 omitted)

|

$

|

595,764

|

$

|

401,895

|

$

|

290,546

|

$

|

209,900

|

$

|

260,192

|

Fidelity® New Jersey Municipal Money Market Fund Premium Class |

Years ended November 30,

|

2024

|

2023

|

2022

|

2021

|

2020

|

|||||

Selected Per-Share Data

|

||||||||||

Net asset value, beginning of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Income from Investment Operations

|

||||||||||

Net investment income (loss) A

|

.031

|

.028

|

.007

|

- B

|

.004

|

|||||

Net realized and unrealized gain (loss) B

|

-

|

-

|

-

|

-

|

-

|

|||||

Total from investment operations

|

.031

|

.028

|

.007

|

- B

|

.004

|

|||||

Distributions from net investment income

|

(.031)

|

(.028)

|

(.007)

|

- B

|

(.004)

|

|||||

Total distributions

|

(.031)

|

(.028)

|

(.007)

|

- B

|

(.004)

|

|||||

Net asset value, end of period

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

$

|

1.00

|

Total Return C

|

3.12 % |

2.89%

|

.72%

|

.01%

|

.44%

|

|||||

Ratios to Average Net Assets A,D,E

|

||||||||||

Expenses before reductions

|

.30%

|

.30%

|

.30%

|

.30%

|

.30%

|

|||||

Expenses net of fee waivers, if any

|

.30 % |

.30%

|

.27%

|

.10%

|

.27%

|

|||||

Expenses net of all reductions

|

.30%

|

.30%

|

.27%

|

.10%

|

.27%

|

|||||

Net investment income (loss)

|

3.07%

|

2.86%

|

.92%

|

.01%

|

.47%

|

|||||

Supplemental Data

|

||||||||||

Net assets, end of period (000 omitted)

|

$

|

624,558

|

$

|

520,586

|

$

|

492,831

|

$

|

127,495

|

$

|

139,392

|

Fidelity Central Fund

|

Investment Manager

|

Investment Objective

|

Investment Practices

|

Expense RatioA

|

Fidelity Money Market Central Funds

|

Fidelity Management & Research Company LLC (FMR)

|

Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity.

|

Short-term Investments

|

Less than .005%

|

Gross unrealized appreciation

|

$-

|

Gross unrealized depreciation

|

-

|

Net unrealized appreciation (depreciation)

|

$-

|

Tax Cost

|

$1,216,736,259

|

Undistributed tax-exempt income

|

$16,619

|

Undistributed ordinary income

|

$6,918

|

Undistributed long-term capital gain

|

$15,532

|

Net unrealized appreciation (depreciation) on securities and other investments

|

$-

|

November 30, 2024

|

November 30, 2023

|

|

Tax-exempt Income

|

$34,057,749

|

$24,877,748

|

Amount ($)

|

% of Class-Level Average Net Assets

|

|

Fidelity New Jersey Municipal Money Market Fund

|

34,677

|

.22

|

Institutional Class

|

249,505

|

.05

|

Premium Class

|

580,934

|

.10

|

865,116

|

Purchases ($)

|

Sales ($)

|

Realized Gain (Loss)($)

|

|

Fidelity New Jersey Municipal Money Market Fund

|

9,699,141

|

7,865,000

|

-

|

Year ended

November 30, 2024

|

Year ended

November 30, 2023

|

|

Fidelity New Jersey Municipal Money Market Fund

|

||

Distributions to shareholders

|

||

Fidelity New Jersey Municipal Money Market Fund

|

$461,285

|

$145,486

|

Institutional Class

|

15,780,049

|

10,799,761

|

Premium Class

|

17,816,415

|

13,932,501

|

Total

|

$34,057,749

|

$24,877,748

|

Shares

|

Shares

|

Dollars

|

Dollars

|

|

Year ended

November 30, 2024

|

Year ended

November 30, 2023

|

Year ended

November 30, 2024

|

Year ended

November 30, 2023

|

|

Fidelity New Jersey Municipal Money Market Fund

|

||||

Shares sold

|

40,405,756

|

15,256,176

|

$40,405,756

|

$15,256,176

|

Reinvestment of distributions

|

433,989

|

134,419

|

433,989

|

134,419

|

Shares redeemed

|

(28,584,576)

|

(7,547,905)

|

(28,584,576)

|

(7,547,905)

|

Net increase (decrease)

|

12,255,169

|

7,842,690

|

$12,255,169

|

$7,842,690

|

Institutional Class

|

||||

Shares sold

|

786,451,896

|

571,573,076

|

$786,451,896

|

$571,573,076

|

Reinvestment of distributions

|

13,937,857

|

9,650,499

|

13,937,857

|

9,650,499

|

Shares redeemed

|

(606,569,783)

|

(469,969,391)

|

(606,569,783)

|

(469,969,391)

|

Net increase (decrease)

|

193,819,970

|

111,254,184

|

$193,819,970

|

$111,254,184

|

Premium Class

|

||||

Shares sold

|

341,261,292

|

285,874,277

|

$341,261,292

|

$285,877,771

|

Reinvestment of distributions

|

16,682,506

|

13,015,481

|

16,682,506

|

13,015,481

|

Shares redeemed

|

(253,969,652)

|

(271,133,467)

|

(253,969,652)

|

(271,133,467)

|

Net increase (decrease)

|

103,974,146

|

27,756,291

|

$103,974,146

|

$27,759,785

|

|

Item 8.

Changes in and Disagreements with Accountants for Open-End Management Investment Companies

See Item 7.

Item 9.

Proxy Disclosures for Open-End Management Investment Companies

See Item 7.

Item 10.

Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies

See Item 7.

Item 11.

Statement Regarding Basis for Approval of Investment Advisory Contract

See Item 7.

Item 12.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 13.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 14.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 15.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the trust’s Board of Trustees.

Item 16.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the trust’s internal control over financial reporting.

Item 17.

Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable.

Item 18.

Recovery of Erroneously Awarded Compensation

(a)

Not applicable.

(b)

Not applicable.

Item 19.

Exhibits

| (a) | (1) | Code of Ethics pursuant to Item 2 of Form N-CSR is filed and attached hereto as EX-99.CODE ETH. |

| (a) | (2) | |

| (a) | (3) | Not applicable. |

| (b) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Court Street Trust II

| By: | /s/Laura M. Del Prato |

| | Laura M. Del Prato |

| | President and Treasurer (Principal Executive Officer) |

| | |

| Date: | January 22, 2025 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/Laura M. Del Prato |

| | Laura M. Del Prato |

| | President and Treasurer (Principal Executive Officer) |

| | |

| Date: | January 22, 2025 |

| By: | /s/Stephanie Caron |

| | Stephanie Caron |

| | Chief Financial Officer (Principal Financial Officer) |

| | |

| Date: | January 22, 2025 |

Fidelity Investments

FIDELITY FUNDS’

CODE OF ETHICS

FOR PRESIDENT, TREASURER

AND PRINCIPAL ACCOUNTING OFFICER

2023

FIDELITY FUNDS’ CODE OF ETHICS FOR

PRESIDENT, TREASURER AND PRINCIPAL ACCOUNTING OFFICER

I. Purposes of the Code/Covered Officers

This document constitutes the Code of Ethics (Code) adopted by the Fidelity Funds (Funds) pursuant to Section 406 of the Sarbanes-Oxley Act of 2002. The Code applies to the Fidelity Funds’ President and Treasurer, and Chief Financial Officer (Covered Officers). Fidelity’s Ethics Office, within Enterprise Compliance, administers the Code.

The purposes of the Code are to deter wrongdoing and to promote, on the part of the Covered Officers:

·

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

·

full, fair, accurate, timely and understandable disclosure in reports and documents that the Fidelity Funds submit to the Securities and Exchange Commission (SEC), and in other public communications by a Fidelity Fund;

·

compliance with applicable laws and governmental rules and regulations;

·

the prompt internal reporting to an appropriate person or persons identified in the Code of violations of the Code; and

·

accountability for adherence to the Code.

Each Covered Officer should adhere to a high standard of business ethics and should be sensitive to situations that may give rise to actual as well as apparent conflicts of interest.

II.

Covered Officers Should Handle Ethically

Actual and Apparent Conflicts of Interest

Overview. A “conflict of interest” occurs when a Covered Officer’s private interest interferes with the interests of, or their service to, the Fidelity Funds. For example, a conflict of interest would arise if a Covered Officer, or a member of their family, receives improper personal benefits as a result of their position with the Fidelity Funds.

Certain conflicts of interest arise out of the relationships between Covered Officers and the Fidelity Funds and already are subject to conflict of interest provisions in the Investment Company Act of 1940 (Investment Company Act) and the Investment Advisers Act of 1940 (Investment Advisers Act). For example, Covered Officers may not individually engage in certain transactions (such as the purchase or sale of securities or other property) with a Fidelity Fund because of their status as “affiliated persons” of the Fund. Separate compliance programs and procedures of the Fidelity Funds, Fidelity Management & Research Company (FMR) and the other Fidelity companies are designed to prevent, or identify and correct, violations of these provisions. This Code does not, and is not intended to, repeat or replace these programs and procedures, and such conflicts fall outside of the parameters of this Code.

Although typically not presenting an opportunity for improper personal benefit, conflicts arise from, or as a result of, the contractual relationship between the Fidelity Funds and FMR (or another Fidelity company) of which the Covered Officers are also officers or employees. As a result, this Code recognizes that the Covered Officers will, in the normal course of their duties (whether formally for the Fidelity Funds, FMR or another Fidelity company), be involved in establishing policies and implementing decisions that have different effects on the Fidelity Funds, FMR and other Fidelity companies. The participation of the Covered Officers in such activities is inherent in the contractual relationship between the Fidelity Funds and FMR (or another Fidelity company) and is consistent with the performance by the Covered Officers of their duties as officers of the Fidelity Funds. Thus, if performed in conformity with the provisions of the Investment Company Act and the Investment Advisers Act, such activities will be deemed to have been handled ethically. In addition, it is recognized by the Funds’ Board of Trustees (Board) that the Covered Officers also may be officers or employees of one or more other Fidelity Funds covered by this Code.

Other conflicts of interest are covered by the Code, even if such conflicts of interest are not subject to provisions in the Investment Company Act and the Investment Advisers Act. The following list provides examples of conflicts of interest under the Code, but Covered Officers should keep in mind that these examples are not exhaustive. The overarching principle is that the personal interest of a Covered Officer should not be placed improperly before the interest of a Fidelity Fund.

* * *

Each Covered Officer must:

·

not use their personal influence or personal relationships improperly to influence investment decisions or financial reporting by any Fidelity Fund whereby the Covered Officer would benefit personally to the detriment of any Fidelity Fund;

·

not cause a Fidelity Fund to take action, or fail to take action, for the individual personal benefit of the Covered Officer rather than the benefit of the Fidelity Fund;

·

not engage in any outside business activity, including serving as a director or trustee, that prevents the Covered Officer from devoting appropriate time and attention to the Covered Officer’s responsibilities with the Fidelity Funds;

·

not have a consulting or employment relationship with any of the Fidelity Funds’ service providers that are not affiliated with Fidelity; and

·

not retaliate against any employee or Covered Officer for reports of actual or potential misconduct, which are made in good faith.

With respect to other fact patterns, if a Covered Officer is in doubt, other potential conflict of interest situations should be described immediately to the Fidelity Ethics Office for resolution. Similarly, any questions a Covered Officer has generally regarding the application or interpretation of the Code should be directed to the Fidelity Ethics Office immediately.

III. Disclosure and Compliance

·

Each Covered Officer should familiarize themself with the disclosure requirements generally applicable to the Fidelity Funds.

·

Each Covered Officer should not knowingly misrepresent, or cause others to misrepresent, facts about any Fidelity Fund to others, whether within or outside Fidelity, including to the Board and auditors, and to governmental regulators and self-regulatory organizations;

·

Each Covered Officer should, to the extent appropriate within their area of responsibility, consult with other officers and employees of the Fidelity Funds, FMR and the Fidelity service providers, and with the Board’s Compliance Committee, with the goal of promoting full, fair, accurate, timely and understandable disclosure in the reports and documents the Fidelity Funds file with, or submit to, the SEC and in other public communications made by the Fidelity Funds; and

·

It is the responsibility of each Covered Officer to promote compliance with the standards and restrictions imposed by applicable laws, rules and regulations.

IV. Reporting and Accountability

Each Covered Officer must:

·

upon receipt of the Code, and annually thereafter, submit to the Fidelity Ethics Office an acknowledgement stating that they have received, read, and understand the Code; and

·

notify the Fidelity Ethics Office promptly if they know of any violation of the Code. Failure to do so is itself a violation of this Code.

The Fidelity Ethics Office shall take all action it considers appropriate to investigate any actual or potential violations reported to it. Upon completion of the investigation, if necessary, the matter will be reviewed with senior management or other appropriate parties, and a determination will be made as to whether any action should be taken as detailed below. The Covered Officer will be informed of any action determined to be appropriate. The Fidelity Ethics Office will inform the Personal Trading Committee of all Code violations and actions taken in response. Without implied limitation, appropriate remedial, disciplinary or preventive action may include a written warning, a letter of censure, suspension, dismissal or, in the event of criminal or other serious violations of law, notification of the SEC or other appropriate law enforcement authorities. Additionally, other legal remedies may be pursued.

The policies and procedures described in the Code do not create any obligations to any person or entity other than the Fidelity Funds. The Code is intended solely for the internal use by the Fidelity Funds and does not constitute a promise, contract or an admission by or on behalf of any Fidelity Fund as to any fact, circumstance, or legal conclusion. The Fidelity Funds, the Fidelity companies and the Fidelity Head of Ethics retain the discretion to decide whether the Code applies to a specific situation, and how it should be interpreted.

V. Oversight

Material violations of this Code will be reported promptly by FMR (or another Fidelity company) to the Board’s Compliance Committee. In addition, at least once each year, FMR (or another Fidelity company) will provide a written report to the Board, which describes any issues arising under the Code since the last report to the Board, including, but not limited to, information about material violations of the Code and action taken in response to the material violations.

VI. Other Policies and Procedures