As filed with the Securities and Exchange Commission on June 27, 2003.

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2002

Commission file number: 1-15158

Telefónica Móviles, S.A.

(Exact name of Registrant as specified in its charter)

TELEFONICA MOBILES

(Translation of Registrant’s name into English)

Kingdom of Spain

(Jurisdiction of Incorporation or Organization)

Goya, 24

28001 Madrid, Spain

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Ordinary Shares, nominal value €0.50 per share* | New York Stock Exchange | |

| American Depositary Shares, each representing 1 Ordinary Share | New York Stock Exchange |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the New York Stock Exchange. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of outstanding shares of each class of stock of Telefónica Móviles, S.A. as of the close of the period covered by this annual report was:

| Ordinary Shares, nominal value €0.50 per share: 4,330,550,896 |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x |

No ¨ |

Indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ¨ |

Item 18 x |

| 3 | ||||

| 3 | ||||

| 3 | ||||

PART I

i

| Item 10. |

ADDITIONAL INFORMATION | 151 | ||

| 151 | ||||

| 151 | ||||

| 153 | ||||

| 155 | ||||

| 157 | ||||

| 162 | ||||

| 162 | ||||

| 163 | ||||

| 163 | ||||

| Item 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 163 | ||

| Item 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 166 | ||

| PART II | ||||

| Item 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 166 | ||

| Item 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 166 | ||

| Item 15. |

CONTROLS AND PROCEDURES | 167 | ||

| Item 16. |

RESERVED | 167 | ||

| PART III | ||||

| Item 17. |

FINANCIAL STATEMENTS | 167 | ||

| Item 18. |

FINANCIAL STATEMENTS | 167 | ||

| Item 19. |

EXHIBITS | 168 | ||

ii

PRESENTATION OF FINANCIAL INFORMATION

In this annual report, references to “dollars,” “US$,” or “$” are to United States dollars. References herein to “euro” or “€” are to the single currency of the participating member states in the Third Stage of the European and Economic Monetary Union, including Spain, pursuant to the treaty establishing the European Community, as amended from time to time. The combined financial statements and notes to the combined financial statements are presented in euro. The Telefónica Móviles Group previously reported some of this information in Spanish pesetas. The exchange rate at which the Spanish peseta has been irrevocably fixed against the euro is Ptas 166.386 = €1.00. Financial data for periods prior to January 1, 1999 were restated from Spanish pesetas into euro using the irrevocably fixed rate of exchange. Comparative financial data for periods prior to January 1, 1999 reported in euro depict the same trends that would have been presented had we continued to present financial statements in Spanish pesetas. However, financial data for periods prior to January 1, 1999 is not comparable with that of other companies reporting in euro that restated these amounts from a currency other than the Spanish peseta. Certain amounts included herein have been rounded. As a result, some amounts may not sum to the indicated totals.

This annual report contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Safe Harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this annual report and include statements regarding our intent, belief or current expectations with respect to, among other things, trends affecting our business, financial condition and results of operations.

Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors. The accompanying information contained in this annual report, including, without limitation, the information under

| • | “Item 3.D Risk Factors”; |

| • | “Item 4. Information on the Company”; |

| • | “Item 5. Operating and Financial Review and Prospects”; and |

| • | “Item 11. Quantitative and Qualitative Disclosures About Market Risk,” |

identifies important factors that could cause such differences. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date hereof, including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

When we use first person, personal pronouns in this report, such as “we,” “us,” or “our,” or the term “Group,” we mean Telefónica Móviles, S.A. and its consolidated operating companies, unless otherwise indicated or the context otherwise requires.

PART I

| Item 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

3

| Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| Item 3. | KEY INFORMATION |

The following summary selected financial data should be read together with the “Item 5. Operating and Financial Review and Prospects” and our combined financial statements included in this annual report. Our combined financial statements have been prepared in accordance with Spanish GAAP, which differs in certain significant respects from U.S. GAAP. See note 20 to our combined financial statements. The principles of consolidation are described in note 2(c) to our combined financial statements.

Summary Selected Financial Data

| Year ended December 31, |

|||||||||||||||

| 1998 |

1999 |

2000 |

2001 |

2002 |

|||||||||||

| (euro in thousands) | |||||||||||||||

| Statement of Operations Data |

|||||||||||||||

| Spanish GAAP |

|||||||||||||||

| Net revenues from operations |

3,092,130 | 5,015,729 | 6,377,249 | 8,411,064 | 9,139,835 | ||||||||||

| Other revenues |

73,685 | 97,430 | 110,622 | 147,747 | 91,070 | ||||||||||

| Services and goods purchased |

(752,810 | ) | (1,337,895 | ) | (1,559,181 | ) | (1,862,117 | ) | (2,406,039 | ) | |||||

| External services and local taxes |

(956,024 | ) | (1,834,992 | ) | (2,277,186 | ) | (2,603,758 | ) | (2,412,370 | ) | |||||

| Personnel expenses |

(100,026 | ) | (168,235 | ) | (270,696 | ) | (533,831 | ) | (546,381 | ) | |||||

| Depreciation and amortization |

(430,307 | ) | (621,777 | ) | (871,137 | ) | (1,258,159 | ) | (1,316,406 | ) | |||||

| Change in operating provisions |

(75,559 | ) | (101,974 | ) | (129,284 | ) | (225,416 | ) | (130,245 | ) | |||||

| Total operating expenses |

(2,314,726 | ) | (4,064,873 | ) | (5,107,484 | ) | (6,483,281 | ) | (6,811,441 | ) | |||||

| Operating income |

851,089 | 1,048,286 | 1,380,387 | 2,075,530 | 2,419,464 | ||||||||||

| Amortization of goodwill |

(8,907 | ) | (18,415 | ) | (26,420 | ) | (53,802 | ) | (87,096 | ) | |||||

| Income (losses) of associated companies |

10,109 | (3,588 | ) | (94,701 | ) | (119,193 | ) | (159,477 | ) | ||||||

| Financial expense |

(148,624 | ) | (346,784 | ) | (304,471 | ) | (714,869 | ) | (921,983 | ) | |||||

| Financial income |

60,967 | 234,143 | 109,607 | 386,810 | 605,787 | ||||||||||

| Income from ordinary activities |

764,634 | 913,642 | 1,064,402 | 1,574,476 | 1,856,695 | ||||||||||

| Extraordinary income (expense) |

6,503 | (194,992 | ) | (51,241 | ) | (100,705 | ) | 12,075,092 | |||||||

| Corporate income tax |

(224,948 | ) | (210,372 | ) | (347,872 | ) | (628,768 | ) | 2,130,821 | ||||||

| Minority interests |

(57,135 | ) | 31,956 | (20,518 | ) | 48,352 | 4,363,987 | ||||||||

| Net income |

489,054 | 540,234 | 644,771 | 893,355 | (3,724,399 | ) | |||||||||

| Earnings per share |

— | — | 0.18 | 0.22 | (0.87 | ) | |||||||||

| Average outstanding common shares |

— | — | 3,560,966,298 | 4,141,432,815 | 4,290,372,979 | ||||||||||

| U.S. GAAP |

|||||||||||||||

| Net income(1) |

494,535 | 534,093 | 727,483 | 320,447 | (3,647,254 | ) | |||||||||

| Earnings per share |

— | — | 0.20 | 0.08 | (0.85 | ) | |||||||||

| Average outstanding common shares |

— | — | 3,560,966,298 | 4,141,432,815 | 4,290,372,979 | ||||||||||

| (1) | Includes in 2000 the accumulated effect of applying SAB 101 since 1995 in the amount of €132.3 million and the effect of applying SAB 101 for the year ended December 31, 2000 in the amount of €32.2 million. See note 20 to our combined financial statements. |

4

| At or for the year ended December 31, |

|||||||||||||||

| 1998 |

1999 |

2000 |

2001 |

2002 |

|||||||||||

| (euro in thousands, except as indicated) | |||||||||||||||

| Balance Sheet Data |

|||||||||||||||

| (at period end) |

|||||||||||||||

| Spanish GAAP |

|||||||||||||||

| Property, plant and equipment, net |

2,492,896 | 3,340,551 | 3,820,869 | 5,244,414 | 4,661,729 | ||||||||||

| Total assets |

4,958,168 | 7,104,366 | 21,260,624 | 24,914,086 | 16,231,714 | ||||||||||

| Short-term debt(1) |

274,964 | 513,863 | 4,707,849 | 6,615,828 | 991,596 | ||||||||||

| Long-term debt(2) |

1,869,430 | 2,717,302 | 3,007,622 | 5,279,338 | 7,213,809 | ||||||||||

| Total liabilities |

3,936,640 | 5,913,815 | 15,941,284 | 17,425,434 | 12,984,131 | ||||||||||

| Shareholders’ equity |

1,021,528 | 1,190,551 | 5,319,340 | 7,488,652 | 3,247,583 | ||||||||||

| U.S. GAAP |

|||||||||||||||

| Total assets(3) |

4,991,494 | 7,894,329 | 19,227,998 | 26,935,747 | 15,694,410 | ||||||||||

| Long-term debt |

1,869,430 | 2,934,666 | 2,214,726 | 5,236,446 | 6,677,177 | ||||||||||

| Shareholders’ equity(3) |

1,228,222 | 1,391,042 | 7,940,875 | 9,496,119 | 4,005,739 | ||||||||||

| Other Financial Data |

|||||||||||||||

| Spanish GAAP |

|||||||||||||||

| Cash flow from operating activities |

1,128,387 | 1,449,451 | 5,594,426 | 1,332,485 | 2,156,756 | ||||||||||

| Cash flow from investing activities |

(1,773,564 | ) | (2,337,761 | ) | (12,057,634 | ) | (4,038,059 | ) | (1,756,219 | ) | |||||

| Cash flow from financing activities |

648,661 | 764,829 | 6,455,915 | 2,408,281 | (314,348 | ) | |||||||||

| Capital expenditures |

554,545 | 1,403,063 | 13,620,172 | 2,121,999 | 1,046,596 | ||||||||||

| Cash dividends |

210,354 | 268,672 | 851,616 | — | — | ||||||||||

| Operating Data |

|||||||||||||||

| (in millions at period end) |

|||||||||||||||

| Population in licensed service territories |

88 | 127 | 285 | 372 | 353 | (8) | |||||||||

| Total customers(4) |

6.5 | 12.6 | 19.2 | 28.0 | 39.4 | ||||||||||

| Proportionate customers(5) |

5.3 | 10.3 | 16.7 | 24.6 | 28.6 | ||||||||||

| Pre-paid customers(6) |

28 | % | 55 | % | 64 | % | 69 | % | 71 | % | |||||

| Short messages(7) |

134 | 539 | 2,276 | 6,300 | 8,400 | ||||||||||

| (1) | Consists of short-term debt payable to banks and other financial institutions, short-term marketable debt securities and short-term debt payable to Telefónica Group companies. Short-term debt excludes interest payable and trade payables. |

| (2) | Consists of long-term debt payable to banks and other institutions, long-term debt payable to Telefónica Group companies and as of December 31, 2001 long-term debt incurred in connection with the acquisition of UMTS licenses included under “Other liabilities” on the combined balance sheet. |

| (3) | Includes at December 31, 2000 the accumulated effect of applying SAB 101 since 1995 in the amount of €132.3 million and the effect of applying SAB 101 at such date in the amount of €32.2 million. See note 20 to our combined financial statements. |

| (4) | Represents total number of customers of all companies in which we have an interest, including subsidiaries, companies carried by the equity method and other companies carried as an investment. As of December 2002 we also include Brasilcel’s customers. |

| (5) | Represents total number of customers of all companies in which we have an interest multiplied by our economic ownership interest in those companies. |

| (6) | Represents total pre-paid customers as a percentage of total customers at period-end. |

| (7) | Represents the total number of short messages, which are a form of wireless data transmission, carried through our network in Spain during the year or period. |

| (8) | Excludes the populations of Germany, Italy, Austria and Switzerland. |

5

Exchange Rate Information

The following table sets forth certain information concerning the Noon Buying Rate for dollars expressed in pesetas per $1.00:

| Noon Buying Rate | ||||||||

| Year ended December 31, |

Period End |

Average(1) |

High |

Low | ||||

| 1998 |

142.15 | 149.42 | 157.41 | 136.80 | ||||

| 1999 (through January 15, 1999) |

143.55 | 142.84 | 144.26 | 140.86 | ||||

Source: Federal Reserve Bank of New York.

| (1) | The average of the Noon Buying Rates on the last day of each full month during the relevant period. |

Effective January 1, 1999, the following 11 European Union member states adopted the euro as a common currency: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, The Netherlands, Portugal and Spain. They also established fixed conversion rates between their respective sovereign currencies and the euro. On January 1, 2001, Greece joined the European Economic and Monetary Union. The exchange rate at which the Spanish peseta has been irrevocably fixed against the euro is 166.386 = €1.00. On January 1, 2002, the participating member states began issuing new euro-denominated bills and coins for use in cash transactions. As of March 1, 2002, the participating member states have withdrawn the bills and coins denominated in their respective currencies from circulation, and they are no longer legal tender for any transactions.

The Federal Reserve Bank of New York no longer quotes a Noon Buying Rate for the currencies of any of the participating member states, including Spain. The Noon Buying Rate for the euro on June 26, 2003 was $1.1429 = €1.00. The equivalent exchange rate in pesetas, translated at the irrevocably fixed exchange rate of Ptas 166.386 = €1.00, was approximately Ptas 190.16 = $1.00.

The following tables describe, for the periods and dates indicated, information concerning the Noon Buying Rate for the euro. Amounts are expressed in U.S. dollars per €1.00.

| Noon Buying Rate | ||||||||

| Year ended December 31, |

Period End |

Average(1) |

High |

Low | ||||

| 1999 (January 16, 1999 through December 31, 1999) |

1.0070 | 1.0588 | 1.1812 | 1.0016 | ||||

| 2000 |

0.9388 | 0.9207 | 1.0335 | 0.8270 | ||||

| 2001 |

0.8901 | 0.8909 | 0.9535 | 0.8370 | ||||

| 2002 |

1.0485 | 0.9495 | 1.0485 | 0.8594 | ||||

Source: Federal Reserve Bank of New York.

| (1) | The average of the Noon Buying Rates for the euro on the last day of each month during the relevant period. |

| Month |

Period End |

High |

Low | |||

| Month ended December 31, 2002 |

1.0485 | 1.0485 | 0.9927 | |||

| Month ended January 31, 2003 |

1.0739 | 1.0861 | 1.0361 | |||

| Month ended February 28, 2003 |

1.0779 | 1.0875 | 1.0708 | |||

| Month ended March 31, 2003 |

1.0900 | 1.1062 | 1.0545 | |||

| Month ended April 30, 2003 |

1.1180 | 1.1180 | 1.0621 | |||

| Month ended May 31, 2003 |

1.1766 | 1.1853 | 1.1200 | |||

| (June 1 through June 26, 2003) |

1.1429 | 1.1870 | 1.1429 |

Monetary policy within the members of the euro zone is set by the European Central Bank. The European Central Bank has set itself the objective of containing inflation and will adjust interest rates in line with this policy without taking account of other economic variables such as the rate of unemployment. It has further declared that it will not set an exchange rate target for the euro.

6

The Madrid stock exchange quotes share prices, including those of Telefónica Móviles, in euro. Currency fluctuations may affect the dollar equivalent of the euro price of our shares listed on the Spanish stock exchanges and, as a result, the market price of our ADSs, which are listed on the New York Stock Exchange. Currency fluctuations may also affect the dollar amounts received by holders of ADRs on conversion by the Depositary of cash dividends (if any) paid in euro on the underlying shares.

Our consolidated results are affected by fluctuations between the euro and the currencies in which the revenues and expenses of our consolidated subsidiaries are denominated, principally the Brazilian real and the Argentine peso. See “Item 11. Quantitative and Qualitative Disclosures About Market Risk.”

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

Risks Related to Telefónica Móviles’ Business

We face intense competition in most of our markets, which could result in decreases in current and potential customers, revenues and profitability.

We face significant competition in all of our markets, typically from at least two other wireless providers, and increasingly from multiple providers, including some of the leading global wireless operators. Governmental authorities in many countries also continue to auction or sell additional bands of spectrum for wireless use and to grant licenses and concessions to new entrants, which will create new competitors in some of our markets.

In addition to other wireless providers, we experience competition from fixed-line telephone companies and, to an increasing extent, from the cable, utility, paging, internet and satellite industries. We expect that competition will continue to intensify in all of our existing markets, both from existing competitors and new entrants. These competitors could:

| • | offer lower prices, more attractive calling plans or better services and features; |

| • | provide increased handset subsidies; |

| • | bundle offerings of fixed-line telephone services with other services; |

| • | develop and deploy more rapidly new or improved wireless technologies, services and products; or |

| • | expand and enhance their networks faster. |

The wireless communications industry has been experiencing significant consolidation, and we expect that this consolidation trend will continue. Acquisitions, mergers or joint ventures have created large, well-capitalized competitors with substantial financial, technical, marketing and other resources to compete with our service and product offerings.

We expect competition among wireless providers, including new entrants, to continue to drive prices for services and handsets lower. In addition, portability requirements, which enable customers to switch wireless providers without changing their wireless telephone numbers, have been introduced in some of the markets in which we operate and may be introduced in other markets in the future. All of these developments could lead to greater movement of customers among competitors, known as customer churn, which could increase our

7

marketing, distribution and administrative costs, slow growth in customers and reduce revenues. Our market position will also depend on effective marketing initiatives and on our ability to anticipate and respond to various competitive factors affecting the industry, including new services, pricing strategies by competitors, changes in consumer preferences and economic, political and social conditions. Any material failure by us to compete effectively or any aggressive competitive behavior by our competitors in pricing their services or acquiring new customers would have a material adverse effect on our revenues and overall results of operations.

We may require substantial capital resources in order to meet existing obligations under our licenses and continue to develop and expand our business.

The operation, expansion and upgrade of our networks, as well as the marketing and distribution of our services and products, require substantial financing. Achieving the minimum coverage requirements under our licenses could require additional financing. These requirements have increased as a result of our decision to launch digital Global System for Mobile Communications, or GSM, operations in Mexico from 2003. If we do not meet the minimum coverage requirements by the date set in our licenses, the respective regulatory authorities could impose penalties or suspend, change or revoke the terms of the licenses. Moreover, our liquidity and capital resource requirements may further increase if we make acquisitions in other countries. Our company also has major capital resource requirements relating to, among other things, the following:

| • | acquisition or construction of networks and of additional network capacity for existing networks; |

| • | development of distribution channels in new countries of operation; and |

| • | development and implementation of new wireless technologies. |

Historically, we have relied, in large measure, on the Telefónica Group to satisfy our liquidity and capital resource requirements through loans and from time to time capital contributions. We plan to continue to rely upon Telefónica, S.A. and other Telefónica Group companies to satisfy most of these requirements. We may, however, need to incur significant amounts of debt from sources other than Telefónica, S.A. to support the ongoing development and expansion of our business. In addition, as in 2000 when a portion of our liquidity and capital resource requirements were satisfied by issuing securities in our initial public offering in November 2000, we could, in the future, issue additional equity securities to satisfy our liquidity and capital resource requirements.

We cannot assure you that our company will be able to arrange any needed additional financing to fund its capital resource requirements on acceptable terms, or at all.

Increased levels of debt could have negative effects on our company, including:

| • | high debt-service costs that adversely affect our results of operations; |

| • | allocation of increasing amounts of cash flow for debt service; |

| • | increased difficulty in obtaining future financing; |

| • | reduction of any credit ratings issued by rating agencies in respect of any debt we issue in the future; |

| • | exposure to interest and exchange rate fluctuations; |

| • | restrictions on our company’s capital resources or operations imposed by lenders; and |

| • | reduced flexibility to take advantage of, or pursue, other business opportunities. |

Any failure to satisfy our substantial liquidity and capital resource requirements would impede our ability to take advantage of promising but capital-intensive opportunities in our industry. In addition, our results of operations may be negatively affected if we are unable to upgrade our networks or respond to competitive initiatives of competitors that may be less capital-constrained or as we incur increased financial expense due to higher levels of indebtedness.

8

We have engaged in a strategic review of our asset portfolio which has led us to fully write down our investments in Germany, Austria and Switzerland. We may also in the future have to further adjust the value of our investments in Italy.

In 2002, we commissioned independent experts to assess the business plans of our UMTS operations in Germany, Austria, Switzerland and Italy. After taking into account the independent assessments, we updated the valuations of our business plans for these operators in order to reflect the additional delays expected by the sector regarding commercial availability of the UMTS technology and the consequent delay in revenue generation. In this context, we decided to fully write down the book value of our investments in Germany, Austria and Switzerland.

With respect to our investment in Italy, we also adjusted the value of our investment in IPSE 2000. Given the differences in the regulatory environment, both with regard to compliance with coverage requirements included in the license and flexibility shown by the regulators, we estimate the value of IPSE 2000’s assets at €300 million, €136 million of which represents our investment in IPSE 2000. This value estimated by us could be different in case other assumptions and estimates were made. We will perform a regular review of the value and assumptions of our investment in our UMTS operations in Italy. There can be no assurance that a change of strategy or changes in the telecommunications industry will not require us to further adjust, or fully write down, the value of our investment in Italy in the future, which could adversely affect our business, financial condition or results of operation.

Accordingly, at December 31 2002, a net loss of €5,049.8 million was recorded in our combined financial statements associated with the write-down of assets and the restructuring of operations in these four countries. For further information on the write-down of our assets in Germany, Austria, Switzerland and Italy please see “Item 4.B Business Overview—Rest of Europe.”

We have recorded an impairment charge to goodwill and may be required to make additional write offs in the future.

Goodwill represents the purchase price of an acquisition in excess of the fair value of the assets acquired less liabilities assumed. We have generated substantial amounts of goodwill from some of our acquisitions.

In December 2002, we performed an analysis of projected discounted cash flows from Iobox Oy, an internet portal we acquired in July 2000, and other companies as a result of which we determined that such projected cash flows were not adequate to support the value of goodwill related to these companies both under Spanish and U.S. GAAP. Accordingly, the goodwill arising on the acquisition of Iobox Oy was written down by €154 million, due to the dissolution of Iobox Oy and the closure of its subsidiaries.

We cannot be certain that we will be able to recover all of the goodwill that we now carry as an asset or that we will not have to write off additional goodwill in the future under U.S. GAAP or Spanish GAAP. We could be forced to write off goodwill because of rapid technological change, intense competition, adverse regulatory measures, significant declines in sales, earnings or cash flows and other factors that in the future indicate that the fair value of our acquisitions is not worth their carrying value.

There may be insufficient demand for the new products and services we have invested in and developed.

As an element of our strategy, we have invested in and developed new wireless services, such as wireless internet and data services. In order for our customers to better access these services, we will need to upgrade our customer base with new handsets enabled with MMS, cameras, color screens and other capabilities. This can increase our cost base while demand for data services and products may not materialize. We cannot assure you that demand for these services will be as high as expected, or that these initiatives will be profitable. If they are not, our growth could be impaired and we could lose our capital investments in these new services. These initiatives could fail for a number of reasons, such as technological developments or competitive factors. Our

9

ability to introduce new services also depends on whether and on what terms new services are permitted by applicable regulations.

Our ability to deploy and deliver some of the new services is dependent upon new technologies. These technologies may not be developed in a timely manner or, if developed, may not perform as expected or favorably in comparison to competing technologies, which could negatively affect customer demand. In addition, we may not be able to deliver these services on an economic basis, particularly in comparison to competing technologies.

Our growth prospects could be adversely affected if we are not able to develop our operations in Mexico successfully.

We have made substantial investments to establish a presence in Mexico and additional investments will be required over the next several years to build our nationwide GSM network, expand our customer base and gain market share in the country.

We consider Mexico a highly competitive market, where we face various operators at a national level. After several years in competition, new entrants in the telecommunication market have not been able to gain significant market share and Mexican incumbent operators, both in fixed and wireless telephony, maintain their leadership positions despite facing competition from well-known international players.

Any material failure by us to compete effectively, or any aggressive competitive behavior by our major competitor in Mexico, could adversely affect our future revenue growth, financial conditions or results of operations.

We could lose customers and revenues if we fail to upgrade our existing networks.

We must continue to upgrade our existing wireless networks on a timely and satisfactory basis in order to retain and expand our customer base, provide an adequate and updated portfolio of products and services in each of our markets, and satisfy regulatory requirements. Among other things, we must:

| • | upgrade the functionality of our networks to permit increased customization of services; |

| • | fill in coverage gaps and increase capacity in some of our markets; |

| • | expand and maintain customer care, network management and administrative systems; and |

| • | upgrade systems as new technologies become available. |

We cannot assure you that we will be able to execute successfully all of these tasks, many of which are not entirely under our control, on a timely basis or at all. If we fail to successfully execute these tasks, we also may be less attractive to new customers and lose existing customers to our competitors, which would adversely affect our revenues and overall results of operations. The provision of wireless internet-based content and wireless electronic commerce, which is commonly called m-commerce, may become subject to increased regulation, which could increase our costs or delay growth in demand for our wireless data and internet services.

Our strategy may call for the acquisition and integration of new operations, services and technologies, which may be costly, difficult and time consuming.

We may pursue acquisitions of new operations. We may face technological, administrative and other challenges involved in integrating acquired operations, new services and technologies into our existing networks and operations. Remedial actions could prove costly and time consuming. Any failure to expand and improve our service and product offerings through acquisitions may place us at a competitive disadvantage relative to other wireless communications providers. Customers may choose these competitors over our company, which could adversely affect our ability to increase our revenues and leverage our cost base.

10

Our business could be adversely affected if major suppliers fail to provide us with needed equipment and services on a timely basis.

Although we have not been materially affected by supply problems in the past, handsets and network infrastructure suppliers may, among other things, extend delivery times, raise prices and limit supply due to their own shortages and business requirements. If these suppliers fail to deliver products and services on a timely basis, or fail to develop and deliver to us handsets that satisfy our customers’ demands, we could be negatively affected. Similarly, interruptions in the supply of telecommunications equipment for our networks could impede network development and expansion. Although these equipment supply risks are no longer significant in relation to our existing networks, they could be substantial in relation to the build-out of our GSM network in Mexico.

The development of our business could be hindered if we fail to maintain satisfactory working relationships with our partners, especially with respect to Portugal Telecom, our joint venture partner in Brasilcel.

Some of our operations, such as Brasilcel, our co-managed joint venture with Portugal Telecom in Brazil, are conducted through joint ventures in which we do not have absolute control over the operations of the venture. In our joint venture with Portugal Telecom, cooperation is necessary to implement and expand Brasilcel’s business strategies and finance and manage its operations. Should there be disagreements with Portugal Telecom, we may not realize the benefits from the joint venture, including economies of scale and opportunities to realize potential synergies and cost savings.

In addition, in other cases where we own a majority of a venture, we may still be subject to provisions in shareholders’ agreements restricting our control over the venture. The particular corporate governance provisions affecting our company vary from venture to venture, and often depend upon the size of our investment relative to that of other investors, our experience as a wireless operator compared to that of other investors and the preferences or requirements of foreign governments that local owners hold an interest in licensed telecommunications operators.

The risk of disagreement or deadlock is inherent in jointly controlled entities and there is the risk that a decision against our interests will be made. Our joint venture partners may choose not to continue their partnerships. In addition, our arrangements with our joint venture partners may expose us to additional investment requirements, to capital expenditure and additional financing requirements or to obligations to buy or sell our interests.

In Italy we participate in a consortium with local shareholders. The success of this consortium will depend, in part, upon the cooperation of the partners and will be subject to risks comparable to those affecting our other joint ventures.

We face risks associated with litigation.

We are party to lawsuits and other legal proceedings in the ordinary course of our business. An adverse outcome in, or any settlement of, these or other lawsuits could result in significant costs to us. In addition, we may be required to devote substantial time to these lawsuits which they could otherwise devote to our business. For a more detailed description of these lawsuits, see “Item 8.A Consolidated Statements and Other Financial Information—Legal Proceedings.”

Risks Related to Telefónica Móviles’ Organizational Structure

Our historical financial statements are carve-out financial statements, and our historical results of operations may have been different if we had been a stand-alone enterprise.

The combined financial statements included in this annual report have been prepared as if we had been in existence at all dates and during all the periods presented and and include the accounts of the operating companies and interests and investments in other wireless companies transferred to us by Telefónica, S.A. prior

11

to December 31, 2002. Because some of these wireless operations were historically held through Telefónica, S.A. holding companies, the assets, liabilities, revenues, costs and cash flows relating solely to the wireless operations of these companies have been “carved-out” from the accounts of these companies. The combined financial statements reflect, in particular, historical accounts of our wireless operations in Spain, Brazil, El Salvador and Guatemala, carved-out and combined accounts of our holding companies for investments outside of Spain and carved-out and equity method reported accounts of our wireless operators in Morocco. The combined financial statements also include the accounts of Telefónica Móviles Mexico, including as of July 1, 2001, the accounts of our Northern Mexico operators acquired in 2001, and as of September 2002 the operations of Pegaso Telecomunicaciones, S.A. de C.V., or Pegaso. In addition, as of January 1, 2002, our combined financial statements include Tele Leste Celular Participações S.A., or Tele Leste Celular on a fully consolidated basis and our wireless operations in Argentina and Peru as of October 1, 2000 and January 1, 2001, respectively, the effective dates for accounting purposes of the transfer of these operations to us. For further information on the presentation of our combined accounts, please see “Item 5.A Operating Results—Presentation of Financial Information—Basis of Presentation of Combined Financial Statements.” The combined financial statements may not necessarily be indicative of our future results of operations, financial condition and cash flows or of what our results of operations, financial condition and cash flows would have been had we been operated at the dates and during the periods covered by these financial statements as a separate, stand-alone, integrated wireless group rather than as separate parts of integrated telecommunications companies within the Telefónica Group.

We have recently undertaken a series of major initiatives and actions which will materially affect comparability of historical and future financial performance and which may not be fully captured in our historical financial statements included in this annual report.

In order to achieve our overall strategy of enhancing our position as one of the leading global wireless operators and achieving superior growth and profitability, we took several major initiatives during 2000, 2001, 2002 and early 2003. These initiatives and actions include, among others, the following:

| • | the increase in our ownership interest in our Brazilian operations (2000–2002); |

| • | the acquisition of our UMTS licenses in Western Europe in (2000–2001); |

| • | the consummation of Brasilcel N.V., our joint venture with Portugal Telecom in Brazil (2002); |

| • | the acquisition by Brasilcel of Tele Centro Oeste Participaçoes (2003); |

| • | the acquisition by us of four wireless operators in Mexico (2001) and the acquisition by us of a 65% interest in the Mexican wireless operator Pegaso Telecomunicaciones, S.A. de C.V. and its integration with our Northern Mexican operations (2002); |

| • | the acquisition by us of the Telefónica Group’s wireless operations in Peru and Argentina (2001); and |

| • | allocation of additional Telefónica Group assets and debts (2000). |

None of these transactions are reflected in all of the periods covered by the combined financial statements, and transactions that had not been consummated by December 31, 2002 are not reflected in the combined financial statements at all. All of these items will affect the comparability of our historical and future results of operations and financial condition. For further information on the items described above please see “Item 5A. Operating Results—Presentation of Financial Information—Events Affecting Comparability of Historical and Future Results of Operations and Financial Condition.” We anticipate that future results of operations and financial condition will be different from our results of operations and financial condition reflected in our combined financial statements, after taking into account these developments and any other future material developments.

We are controlled by Telefónica, S.A., whose interests may conflict with those of our company.

Telefónica, S.A. currently owns, directly or indirectly, approximately 92.44% of our shares and controls our company. As a result, Telefónica, S.A. has the power to determine the composition of our board of directors and to influence major business and corporate decisions, including, for example, extraordinary corporate transactions, strategic initiatives and dividend policy. Telefónica, S.A. also is able to direct our day-to-day management and operations.

12

The Telefónica Group could have conflicts of interest in business transactions with us, or take advantage of business opportunities otherwise available to us, which could reduce our revenues or increase our costs.

We regularly enter into business transactions and contractual arrangements with companies in the Telefónica Group and plan to continue to do so. Although we believe that prior and existing transactions and arrangements have been fair to us in all material respects and that their terms have reflected market conditions, it is possible that we could have obtained better terms from third parties. We could also face competition from other companies within the Telefónica Group that are not part of our company. Consequently, we could be impeded from pursuing some future business opportunities or obligated to pursue them in conjunction with other companies in the Telefónica Group. Because Telefónica, S.A. is a party to business transactions and contractual arrangements with our company and companies of the Telefónica Group are active in businesses that overlap with ours, there is potential for conflicts of interest between Telefónica, S.A. and its affiliates, on the one hand, and our company, on the other, in circumstances where our interests and those of Telefónica, S.A. are not aligned.

Other Telefónica Group companies could negatively affect the image of the Telefónica brand used by us.

We share the Telefónica brand name with other Telefónica Group companies. If any other Telefónica Group company were to take any action that harmed the quality or image associated with this brand, we could suffer a decrease in revenues due to a loss of customers, which would hurt our results of operations.

Our shareholders will not be able to realize the financial benefits of any proposed acquisition of our company or of our Spanish operating company without the consent of the Spanish government.

A third-party will not be able to acquire us, and our shareholders will not be able to receive the financial benefits of any proposed acquisition of us, without the consent of the Spanish government. In March 1995, in connection with the privatization of some public sector companies, the Spanish government adopted a requirement of prior government authorization for specified fundamental corporate transactions affecting these companies. This prior authorization requirement, which is known as the “golden share,” was imposed on Telefónica, S.A. in January 1997 and is applicable to our company and our Spanish operating company, Telefónica Móviles España, S.A. through Telefónica, S.A.’s ownership of our shares. In the case of our company and our Spanish operating company, the transactions requiring Spanish government approval include, among others:

| • | a voluntary dissolution, spin-off or merger; |

| • | any other transaction that would decrease Telefónica, S.A.’s interest in us or our interest in our Spanish operating company to less than 50%; |

| • | the sale, transfer or encumbrance of our material assets; |

| • | the acquisition by a third-party of 10% or more of our or Telefónica Móviles España’s share capital; and |

| • | any amendment to our by-laws affecting the above provisions. |

The Spanish government is currently empowered to exercise these prior authorization rights until 2007. In addition, if a third-party acquires 10% or more of our capital stock or that of our Spanish operating company without prior government approval, such third-party will not have voting rights in respect of the shares acquired until the Spanish government approves the acquisition. Although the circumstances in which this authorization concept is valid has been substantially limited by the European Court of Justice, we cannot assure you that the Spanish government will exercise its prior authorization rights in a manner favorable to the interests of other shareholders of our company or that the government will be compelled to relinquish these rights in the future.

13

We will be obligated to adopt new accounting standards in 2005 that may have a considerable impact on our accounts.

In June 2002, the European Union (“EU”) adopted new regulations requiring all listed EU companies, including us, to apply International Financial Reporting Standards (“IFRS”) (previously known as International Accounting Standards or “IAS”) in their financial statements by no later than January 1, 2005.

Because IFRS emphasizes the measure of the fair value of a company’s assets and liabilities, it may have a considerable impact on a number of important areas of accounts, including, among others, goodwill and intangibles and derivative instruments.

IFRS will therefore affect the valuation methods that analysts use to measure and evaluate our performance. In addition, the treatment of our business combinations and hybrid financial instruments may change. The wider implications of IFRS could have an effect on our debt covenants and other legal documentation.

Risks Related to Telefónica Móviles’ Industry

We operate in a highly regulated industry and could become subject to more burdensome regulation, which could adversely affect our businesses.

The licensing, construction, operation and interconnection arrangements of wireless communications systems are regulated to varying degrees by national, state, regional or local and supra-national authorities, such as the European Union. These authorities could adopt regulations or take other actions that could adversely affect us and our companies. Our operating companies require licenses or concessions from the governmental authorities of the countries in which they operate. These licenses and concessions specify the types of services permitted to be offered by our operating companies and the spectrum that may be utilized for these purposes. The continued existence and terms of our licenses and concessions are subject to review by regulatory authorities in each country and to interpretation, modification or termination by these authorities. The terms of our licenses and concessions generally range from 15 to 25 years. Although these licenses and concessions generally are renewable upon expiration, we cannot assure you that they will be renewed or that any renewal will be on acceptable terms.

The rules of some of the government regulatory authorities having jurisdiction over our operating companies require us to meet specified network build-out requirements and schedules. In addition, our wireless licenses and concessions typically also require satisfaction of various obligations, including minimum specified quality, service, coverage criteria and capital investment. Failure to comply with these obligations in a given license area could result in the imposition of fines or the revocation or forfeiture of the license for that area. In addition, the need to meet scheduled deadlines may cause our company to expend more resources than otherwise budgeted for a particular network build-out. We cannot assure you that our operating companies will be able to fully comply with the terms and conditions of these licenses and concessions.

Increased or significant changes in the regulation of the activities of our operating companies, including the regulation of rates that may be charged to customers for services or termination fees, could have a material adverse effect on our company. New regulations could also increase the costs of regulatory compliance.

Our operating companies also typically require governmental permits, including permits for the construction and operation of cell sites. We do not believe that compliance with these permit requirements should have a material adverse effect on our company. However, if we fail to comply with these permit requirements, we could become subject to claims or regulatory actions.

Our results in Brazil may be affected in the medium or long term as a result of the new SMP rules.

Our Brazilian operating subsidiaries all held concessions prior to the introduction of the SMP regime. Subsequent to its introduction, they have migrated to the new SMP regime.

14

Under the SMP regime, we will no longer receive payment from our customers for outbound long distance traffic, but will receive payment for the use of our network, in accordance with the network usage remuneration plan. However, there is no assurance that the interconnection fees that we will receive from long distance operators will compensate us for the revenues that we would have received from our customers for outbound long distance traffic.

The SMP regime establishes free negotiation of the network usage fee among telecommunication service providers or a confirmation, until June 30, 2004, of the maximum fee by Anatel. After that date, negotiation of that fee will be the rule.

We cannot assure you that the new rules will not affect negatively our revenues and results of operations.

We are subject to evolving regulatory policies which favor increased competition and which could expose us to additional competition in our markets.

Regulatory policies of many of the countries in which we operate generally favor increasing competition in the wireless services industry, including by granting new licenses in existing licensed territories in order to permit the entry of new competitors. Since 2002, Spanish regulation allows for the introduction of mobile virtual network operators, according to an “allow and not oblige” principle. These and similar regulatory policies could have the effect, over time, of reducing our market shares in the service territories in which we currently operate.

Because we hold leading market shares in many of the countries in which we have operations, we could face regulatory actions by national or, in the case of Europe, EU antitrust or competition authorities if it is determined that we have prevented, restricted or distorted competition.

The provision of wireless internet-based content and m-commerce may become subject to increased regulation, which could increase our costs or delay growth in demand for our wireless data and internet services.

The provision of internet-based content and m-commerce has not to date been materially restricted by regulation in the markets in which we operate or intend to operate. The legal and regulatory environment relating to internet content and m-commerce is uncertain, however, and may change. New laws and regulations may be adopted for internet service offerings. Existing laws may be applied to the forms of m-commerce in which we expect to engage. Uncertainty and new regulations could increase our costs and could also slow the growth of m-commerce. New and existing laws could delay growth in demand for our wireless data and internet services and thereby limit the growth of our revenues.

Our company’s technology could fail to be competitive with other technologies or compatible with the next generation technology.

Our operating companies offer both analog and digital cellular services in their markets. Our digital networks in different countries use different standards. Although there is some ability to roam on analog networks, the digital transmission standards are not fully compatible with one another. Our use of these multiple technologies may limit some of our anticipated economies of scale as we seek to further integrate the businesses of our multiple operating companies. Significant capital investments may not be recouped and revenues could decline as current and potential customers select alternative providers and technologies. In addition, alternative technologies may develop for the provision of wireless services to customers that may prove superior to those currently projected. We cannot assure you that unforeseen technological developments will not render our services unpopular with customers or obsolete.

The wireless industry may be harmed by reports suggesting that radio frequency emissions cause health problems and interfere with medical devices.

Media and other reports have suggested that radio frequency emissions from wireless handsets and base stations may cause health problems. If consumers harbor health-related concerns, they may be discouraged from

15

using wireless handsets. These concerns could have an adverse effect on the wireless communications industry and, possibly, expose wireless providers, including us, to litigation. We cannot assure you that further medical research and studies will refute a link between the radio frequency emissions of wireless handsets and base stations and these health concerns. Government authorities could increase regulation of wireless handsets and base stations as a result of these health concerns or wireless companies, including us, could be held liable for costs or damages associated with these concerns, which could have an adverse effect on our business. In Spain, for example, we are required by law to test and certify the emissions of our base stations in or close to populated areas. For the year ended 2002, such tests have confirmed lower emission levels than those required by regulations. If in the future we fail to comply fully with these standards, we could be subject to claims or regulatory actions.

Risks Related to Latin America

Adverse Latin American economic, political and social conditions could affect our financial performance.

The portion of our revenues and profits deriving from Latin American operations will be increasing due mainly to the development of our operations in Brazil and Mexico. Our financial performance in the region is affected by economic, political and social conditions in Latin America. These conditions are volatile due to, among other factors, the following:

| • | significant governmental influence over local economies; |

| • | substantial fluctuations in economic growth; |

| • | historically high levels of inflation; |

| • | devaluation or depreciation, or over-valuation of local currencies; |

| • | exchange controls or restrictions on expatriation of earnings; |

| • | high domestic interest rates; |

| • | wage and price controls; |

| • | changes in governmental economic or tax policies; |

| • | imposition of trade barriers; |

| • | unexpected changes in governmental regulation; |

| • | social unrest; and |

| • | overall political and economic instability, such as the recent situation in Peru. |

Many or all of these factors have occurred at various times in the last two decades, in most Latin American markets, including Argentina, Brazil, Peru and Mexico. Adverse economic, political and social conditions in Latin America may inhibit wireless usage and create uncertainty regarding our operating environment and, more generally, may have a material adverse effect on our company and the market price for our ordinary shares or ADSs.

We face similar risks in Morocco.

Latin American currencies have been subject to fluctuations, including the devaluation of the Argentine peso, which could adversely affect revenues and expenses for our operations in this geographic region.

Although our reporting currency is the euro, most of our revenues and expenses relating to our Latin American operations are denominated in local currencies or the U.S. dollar. The currencies of many Latin American countries, including Argentina, Brazil and Peru, have experienced substantial devaluations and

16

volatility in recent years, and our revenues from customers will decline in value if the local currencies depreciate relative to the euro.

For example, we have been affected by the economic situation in Argentina and the devaluation of the Argentine peso. As of December 31, 2002 and 2001, our exposure from our Argentine operations amounted to €122 million and €494 million, respectively, including the asset value assignable to those holdings and the internal financing provided. The impact of the devaluation of the Argentine peso resulted in an adverse impact on consolidated earnings of €37 million and €42 million in 2002 and 2001, respectively. As a result of the current macroeconomic conditions in Argentina, Telefónica Comunicaciones Personales pursuant to Argentinian law (Decree 214/2002), is currently in a negative net asset position. Notwithstanding the above, Argentine law allows companies to maintain this negative net asset position up to December 2003, without the need to establish a positive net asset position. It is uncertain whether the government of Argentina will extend this exception beyond December 2003. For further information on the devaluation of the Argentine peso please see “Item 5.A Operating Results—Presentation of Financial Information—Argentina” and note 2 to our combined financial statements.

Our business, financial condition and results of operations may be adversely affected by declines in the value of the currencies of the Latin American countries where we operate. Our hedging strategies may not prove effective to address the effects of foreign currency exchange movements on our financial condition or performance. In addition, our exposure to foreign currency exchange losses may be increased if we become subject to exchange control regulations that restrict our ability to convert local currencies into euro or U.S. dollars. Because our strategy involves increasing our revenues from our Latin American operations and because of the increasing importance of Brazil and Mexico to our operations, our exposure to foreign currency movements is likely to increase over time.

Risks Related to Telefónica Móviles’ Ordinary Shares

The market prices for our shares or ADSs may be subject to significant volatility.

The market price of our ordinary shares and ADSs may be significantly affected by, among others, the following factors:

| • | our actual or anticipated results of operations and financial condition; |

| • | investor perceptions of investments relating to Latin America and other less developed geographic regions in which we now operate or may conduct operations; |

| • | new services or products offered by our company or our competitors; |

| • | changes in, or our failure to meet, securities analysts’ expectations; |

| • | changes in investors’ preferences and expectations with respect to the technology, media and telecommunications industry; |

| • | developments affecting the regulation of the wireless industry; |

| • | technological innovations relevant to the wireless communications industry; and |

| • | general market conditions and other factors beyond our control. |

Securities markets have periodically experienced significant price and volume fluctuations that have especially affected the market prices of ordinary shares and ADSs of telecommunications and other technology-related companies. These changes have often been unrelated to the financial performance of particular companies. These broad market developments may also adversely affect the market price of our ordinary shares and ADSs.

17

Forward-looking statements contained in this annual report may not be realized.

We have made forward-looking statements in this annual report that are subject to risks and uncertainties. These forward-looking statements relate to, among other things:

| • | management strategy; |

| • | synergies; |

| • | efficiencies; |

| • | cost savings; |

| • | general market and similar data relating to the wireless communications industry in Spain, Latin America and other geographic areas; |

| • | strategic partnerships and relationships and joint ventures; |

| • | capital expenditures; |

| • | timing for the introduction or enhancement of our services and products; and |

| • | possible bids for additional licenses or concessions. |

Forward-looking statements also may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. The sections of this annual report which contain forward looking statements include:

“Item 3.D Risk Factors”;

“Item 4. Information on the Company”;

“Item 5. Operating and Financial Review and Prospects”; and

“Item 11. Quantitative and Qualitative Disclosures About Market Risk.”

These statements reflect our current expectations. They are subject to a number of risks and uncertainties, including, but not limited to, changes or delays in the development of technology and changes in regulation and the global wireless communications marketplace. In light of the many risks and uncertainties surrounding this marketplace, you should understand that we cannot assure you that the forward-looking statements contained in this annual report will be realized. You are cautioned not to put undue reliance on any forward-looking information.

| Item 4. | INFORMATION ON THE COMPANY |

A. HISTORY AND DEVELOPMENT OF THE COMPANY

Background of Our Company

We are a limited liability company duly organized and existing under the laws of the Kingdom of Spain. We were incorporated in February 14, 2000. Our principal executive offices are located at Goya 24, 28001 Madrid, Spain and our telephone number is +(34) 91 423-4004.

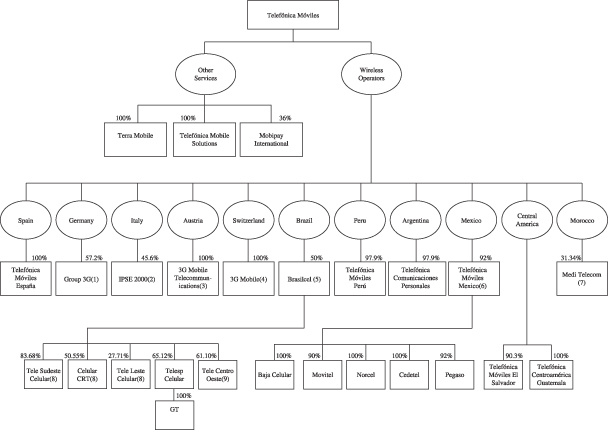

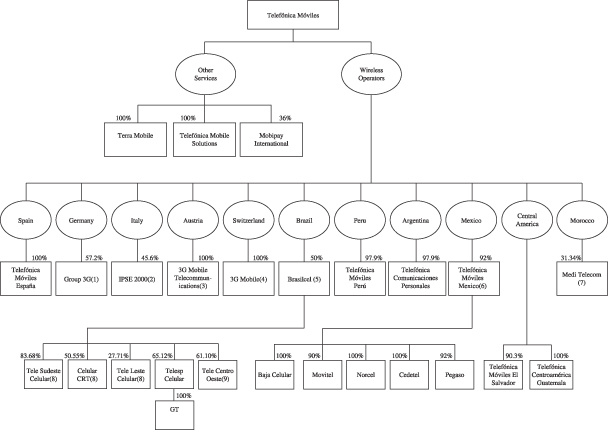

We are a holding company that conducts its wireless operations through subsidiaries and investments in Spain, Morocco, and Latin America. The following is a brief summary of key steps in the development of our company:

| • | Spain: The Telefónica Group began to offer wireless services in Spain in 1982. In 1995 Telefónica Group’s wireless services were transferred to Telefónica Servicios Móviles, a wholly-owned subsidiary |

18

| of Telefónica, S.A. that was subsequently renamed Telefónica Móviles España, S.A. As part of the reorganization of the Telefónica Group, Telefónica, S.A. transferred to our company all of the shares of Telefónica Móviles España in exchange for ordinary shares of our company. Telefónica Móviles España is a direct wholly-owned subsidiary of our company and constitutes our most significant subsidiary in terms of its contribution to our revenues and profitability. In December 2001, we merged Telefónica Móviles Intercontinental, S.A into Telefónica Móviles España, S.A. Telefónica Móviles Intercontinental, S.A held our interests in Germany, Switzerland, Austria, Italy and Morocco. |

| • | Brazil: The Telefónica Group has had operations in Brazil since 1996 when it acquired a 7.9% beneficial interest in Companhia Riograndense de Telecomunicações S.A., or Celular CRT, at that time an integrated telecommunications operator in the state of Rio Grande do Sul. In 1998, through its participation in the privatization of Telebrás, the former Brazilian government-controlled telecommunications monopoly, the Telefónica Group acquired several interests in the wireless sector, including a 15.9% interest in Tele Sudeste Celular Participações S.A., located in the region covering the states of Rio de Janeiro and Espírito Santo, and a 7.3% interest in Tele Leste Celular Participações S.A., located in the region covering the states of Bahia and Sergipe. The Telefónica Group subsequently increased its interest in Celular CRT, Tele Sudeste Celular and Tele Leste Celular in several transactions. In October 2000, each of Telefónica, S.A. and Telefónica Internacional, S.A. transferred to our company its interests in these companies in exchange for ordinary shares of our company. |

In May 2002, we acquired from Telefónica, S.A. its interests in TBS Celular Participações, S.A. (which owns an interest in Celular CRT Participações), Tele Leste Celular Participações, S.A., Tele Sudeste Celular Participações, S.A. and Sudestecel Participações, S.A. (which owns an interest in Tele Sudeste Participações) as well as shares of the Brazilian company Iberoleste Participações, S.A., which owns interest in Tele Leste Celular Participações, S.A. On October 17, 2002, we also acquired from Telefónica, S.A. a 0.63% holding in Celular CRT Participações, S.A., bringing our direct and indirect investment in Celular CRT Participações, S.A. to 40.90%. Additionally, on October 21, 2002 we acquired from Portugal Telecom SGPS, S.A., or Portugal Telecom, for approximately €200 million a 14.68% holding in Telesp Celular Participações, S.A., a company that provides wireless services in the Brazilian states of São Paolo, Paraná and Santa Catarina.

On October 17, 2002, we, Portugal Telecom, and its subsidiary PT Moveis SGPS, S.A., or PT Moveis, entered into a Shareholders’ Agreement and Subscription Agreement that implemented a joint venture framework agreement signed in January 2001 among us, Telefónica, S.A., Portugal Telecom and PT Moveis. Following the agreements entered into with the Portugal Telecom Group on October 17, 2002 and after having obtained the necessary authorization from the Brazilian authorities on December 27, 2002, we and PT Moveis contributed to Brasilcel, N.V., a joint venture that is 50% owned by each company, all the shares directly or indirectly held by the two groups in their wireless communications companies in Brazil, as set out below:

| % Contributed |

Ownership Interest of December 31, 2002 |

Total customers at December 31, 2002 | ||||||||||||||

| Company |

State |

Telefónica Móviles |

PT Moveis |

Total Equity |

Voting equity |

|||||||||||

| (millions) | ||||||||||||||||

| Tele Sudeste Celular |

|

83.56 | % | — | 83.56 | % | 80.50 | % | 3.5 | |||||||

| Celular CRT |

Rio Grande do Sul | 40.90 | % | 7.58 | % | 48.48 | % | 86.94 | % | 2.1 | ||||||

| Tele Leste Celular |

Bahia and Sergipe | 27.71 | % | — | 27.71 | % | 58.42 | % | 1.0 | |||||||

| Telesp Celular |

|

14.68 | % | 50.44 | % | 65.12 | % | 93.66 | % | 7.2 | ||||||

19

The value of the contribution to Brasilcel of the wireless assets owned by us was €1,898 million. For further information see “Item 4.B Business Overview—Latin America—Brazil—Acquisition of Interests in Brazil—Joint Venture with Portugal Telecom.”

Our share ownership in Tele Sudeste and Celular CRT has been modified since December 31, 2002, due to a capital increase made during the first quarter of 2003. The ownerships interests indicated in the table above are equal to the percentages contributed to Brasilcel as of December 31, 2002. For information on our ownership interest in Brasilcel, and its operators, as of June 27, 2003 please refer to our organizational structure found in “Item 5.A Operating Results—Overview.”

| • | Peru: The Telefónica Group has had operations in Peru since 1994 when it acquired control of two integrated telecommunications companies. Wireless operations were commenced in Peru in 1991. In accordance with the resolution of the shareholders of Telefónica del Perú S.A.A. to divide the company along business lines, Telefónica del Perú S.A.A. spun off in June 2001 its wireless operations in the form of shares of Telefónica Móviles S.A.C. Following this spin-off and share exchanges and additional share purchases, we hold indirectly a 97.97% interest in Telefónica Móviles S.A.C. The former minority shareholders of Telefónica del Perú S.A.A. own the remaining minority interest in Telefónica Móviles S.A.C. |

| • | Argentina: The Telefónica Group has had operations in Argentina since 1990 and commenced wireless operations in that country in 1993. In accordance with a resolution of the shareholders of Telefónica de Argentina S.A. to divide the company along business lines, in November 2001 Telefónica de Argentina S.A. spun off its wireless operations in the form of shares of Telefónica Comunicaciones Personales S.A. and its data operations. Following the spin-off and share exchanges, we indirectly hold a 97.93% interest in Telefónica Comunicaciones Personales S.A. and do not hold an interest in the data operations or Telefónica de Argentina S.A. The former minority shareholders of Telefónica de Argentina S.A. own the remaining minority interest in Telefónica Comunicaciones Personales S.A. |

| • | Mexico: In July 2001 we acquired from Telefónica, S.A. its interest in four wireless operators in Mexico acquired by it from Motorola, Inc. in June 2001. The companies operate in four of the nine wireless regions of Mexico and began operations in 1990. The interests acquired include the following: |

| Ø | 100% of Baja Celular Mexicana, S.A. de C.V., or Bajacel, which has licenses to operate in the Mexican States of Baja California, Baja California Sur, and parts of Sonora; |

| Ø | 90% of Movitel del Noroeste, S.A. de C.V., or Movitel, which has licenses to operate in the Mexican States of Sinaloa and parts of Sonora; |

| Ø | 100% of Telefonía Celular del Norte, S.A. de C.V., or Norcel, which has licenses to operate in the Mexican States of Chihuahua, Durango, and parts of Coahuila; and |

| Ø | 100% of Celular de Telefonía, S.A. de C.V., or Cedetel, which has licenses to operate in the Mexican States of Nuevo Leon, Tampaulipas, and parts of Coahuila. |

The purchase price paid by Telefónica, S.A. for these wireless operators was an aggregate of US$1,835.5 million in shares of Telefónica, S.A. and US$10.5 million in cash. Telefónica, S.A. transferred the wireless operators to us in exchange for our ordinary shares of equivalent value, based upon our initial public offering price. Accordingly, we transferred approximately 203 million ordinary shares to Telefónica, S.A.

On April 26, 2002, we signed agreements to purchase 65.23% of Pegaso from Sprint, Leap Wireless, Qualcomm and other financial investors. Pegaso owns licenses to operate on a nationwide basis. In connection with this agreement, we also agreed with the Burillo Group, who held a 34.77% interest in Pegaso at the time of our acquisition, to contribute our interests in Pegaso and our other Mexican operators with the Burillo Group’s interest in Pegaso into a new company, Telefónica Móviles Mexico.

On September 10, 2002, having obtained authorization from the relevant Mexican authorities, we acquired a 65.23% holding in Pegaso for €92.9 million. In accordance with our agreement with the Burillo Group, on

20

September 10, 2002 we contributed our interests in Pegaso and our other Mexican operators (Bajacel, Movitel, Norcel and Cedetel) to Telefónica Móviles Mexico. On the same date the Burillo Group contributed its wireless interests to Telefónica Móviles Mexico. We hold a 92% interest in Telefónica Móviles Mexico and the Burillo Group owns the remaining 8%.

| • | Central America: The Telefónica Group commenced operations in El Salvador in December 1998 and in Guatemala in October 1999. Telefónica Internacional, S.A. transferred all of its shares in the two Central American holding companies, TES Holdings, S.A. and TCG Holdings S.A., to us in 2000 in exchange for ordinary shares of our company. TES Holdings, S.A. holds a 90.3% interest in Telefónica Móviles El Salvador, S.A. de C.V., or Telefónica Móviles El Salvador, and TCG Holding, S.A. holds a 100% interest in Telefónica Centroamérica Guatemala, S.A de C.V., or Telefónica Centroamérica Guatemala. |

We owned 51% of TES Holdings, S.A. and TCG Holding, S.A., and Mesoamérica Telecom, a private fund of Central American investors, owned the remaining 49% interest in the companies through its subsidiary Mesotel de Costa Rica, S.A. In August 2001, we entered into an agreement with Mesotel de Costa Rica, S.A. to acquire its direct and indirect interests in Telefónica Móviles El Salvador, Telefónica Centroamérica Guatemala, Telca Gestión, S.A. and Telca Gestión Guatemala, S.A., and other companies in which we had shared holdings in exchange for approximately 21.9 million of our ordinary shares. In January 2002 we amended this agreement and acquired one-third of Mesotel de Costa Rica, S.A.’s interests in exchange for 7.3 million of our ordinary shares. The remaining two-thirds were transferred by Group Mesotel in July 2002 for the remaining 14.6 million of our ordinary shares. We subsequently hold through TES Holdings, S.A. and TCG Holdings S.A. a 90.3% indirect interest in Telefónica Móviles El Salvador and a 100% indirect interest in Telefónica Centroamérica Guatemala. Telefónica Móviles El Salvador, S.A. de C.V. and Telefónica Centroamérica Guatemala, S.A. have principally wireless operations, but also fixed-line operations. We consider our ownership of fixed-line operations to be outside the scope of our overall business.

| • | Morocco: The Telefónica Group commenced wireless operations in Morocco in March 2000 through Medi Telecom, S.A. The Group has a 31.34% equity interest in Medi Telecom and also shares management responsibility for that company through an agreement providing for joint corporate governance with Portugal Telecom, which holds a 31.34% equity interest. Telefónica, S.A. transferred to our company a 30.5% interest in Medi Telecom in exchange for ordinary shares of our company. The additional percentage was acquired through a capital increase of Medi Telecom in 2002 in which only we and Portugal Telecom participated. |

| • | Europe: In 2000 and 2001, we obtained third-generation wireless telephony (UMTS) licenses in Germany, Italy, Austria and Switzerland. The financial, technological, competitive and regulatory changes that have taken place in the market since then resulted in our reviewing our European strategy. Accordingly, in July 2002 we decided to halt our commercial activities in Germany as a GSM/GPRS mobile virtual operator network (MVNO) and updated the assumptions of the business plans of our subsidiaries in Austria, Germany, Italy and Switzerland. As a result, at December 31 2002, a net loss of €5,049.8 million was recorded in our combined financial statements associated with the write-down of assets and the restructuring of operations in these four countries. For further information see “—Business Overview—Rest of Europe.” |

| • | Puerto Rico: The Telefónica Group plans to transfer to us its investment in NewComm Wireless Services, Inc., a Puerto Rican wireless operator with approximately 169 thousand customers at December 31, 2002. This investment has been made through several convertible notes in an aggregate amount of US$54.0 million that are convertible into up to 49.9% of the capital stock of NewComm Wireless, subject to receipt of necessary U.S. regulatory authorizations. Any conversion of the convertible notes into NewComm Wireless’ capital stock that would result in a noteholder acquiring more than 25% of such stock requires the approval of the U.S. Federal Communication Commission, or FCC. Telefónica, S.A.’s interest in NewComm Wireless is held indirectly, through Telefónica Larga Distancia. |

21

The transfer of the convertible notes from the Telefónica Group to us is expected to be completed in 2003 subject to the approval of the FCC. Once the convertible notes have been transferred, we plan to convert the notes into 49.9% of the capital stock of NewComm Wireless. In addition, the Telefónica Group, with a view to holding a controlling interest in NewComm Wireless Services, has entered into an agreement with ClearComm to purchase a further 0.2% interest in NewComm Wireless Services. It is also intended that this right to purchase an additional 0.2% interest will be transferred to us. We currently manage the day-to-day operations of NewComm Wireless on behalf of Telefónica, S.A. For further information see “—Business Overview—Latin America—Pending Acquisitions in Latin America—Puerto Rico.”

We have also undertaken the following strategic initiative that we believe is complementary to our core wireless communications activities.

| • | Alliance with T-Mobile and TIM: In April 2003 we entered into an agreement with T-Mobile International and Telecom Italia Mobile, or TIM, to set up an strategic alliance to provide our customers with a unified and superior offering of products and services thereby strengthening the operators’ ability to compete in all the markets where they have a presence. The alliance will be open to the possible incorporation of other wireless operators interested in contributing to the enhancement of the different areas of collaboration. Recently, Orange has also announced its plan to join the alliance. |

Overview

We are part of the Telefónica Group, whose parent company is Telefónica, S.A., estimated as one of the ten largest diversified telecommunications companies in the world based upon stock market capitalization.