Articles of Continuance

Business Corporations Act

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 13, 2023

Pyrophyte Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-40957 | N/A | ||

| (State

or incorporation or organization) |

(Commission File Number) | (IRS

Employer Identification No.) |

3262 Westheimer Road Suite 706 Houston, Texas |

77098 | |

| (Address of principal executive offices) | (Zip Code) |

(281) 701-4234

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class registered | Trading Symbol(s) |

Name

of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant | PHYT.U | The New York Stock Exchange | ||

| Class A ordinary shares, par value $0.0001 per share | PHYT | The New York Stock Exchange | ||

| Redeemable warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share | PHYT WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

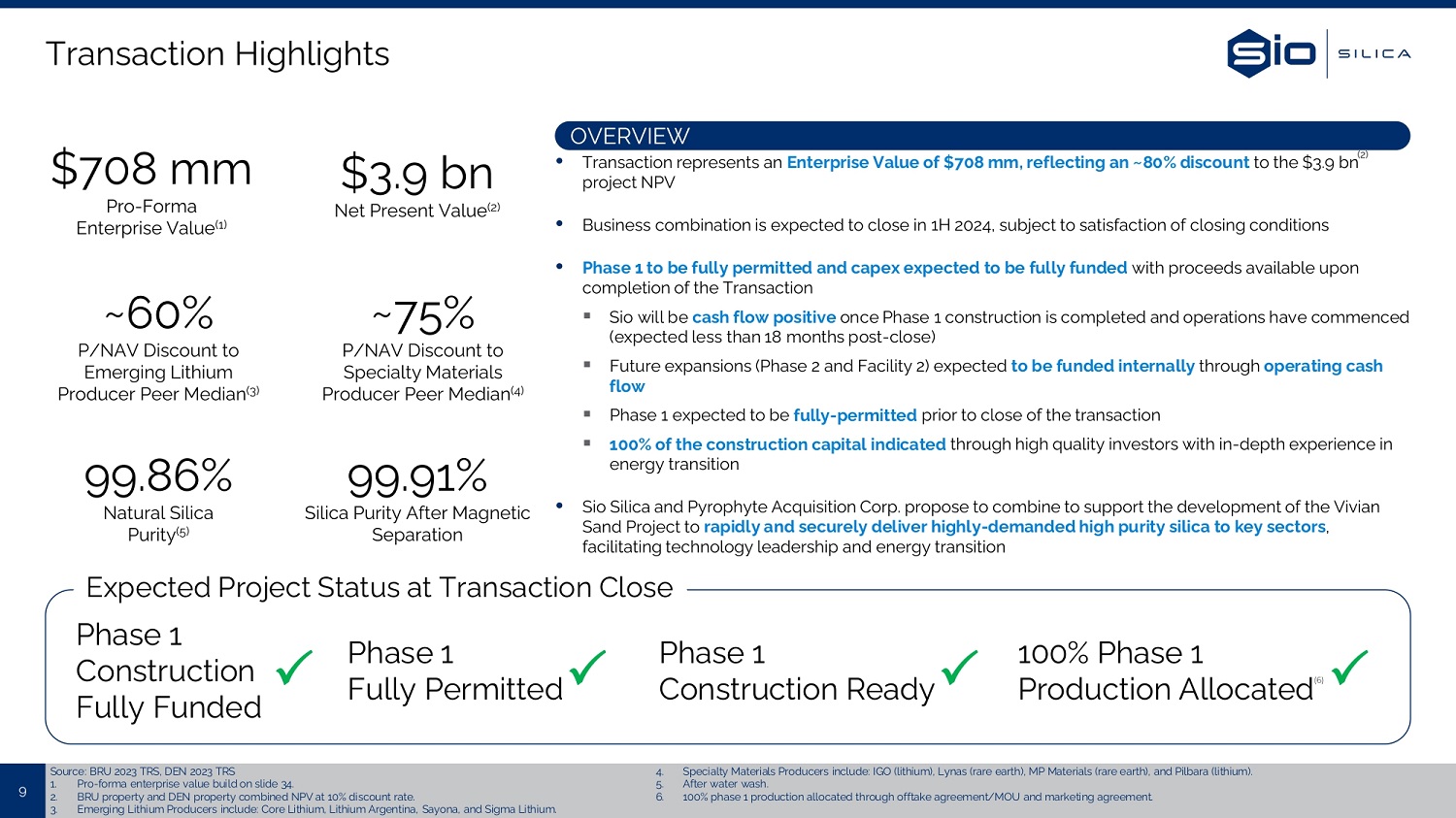

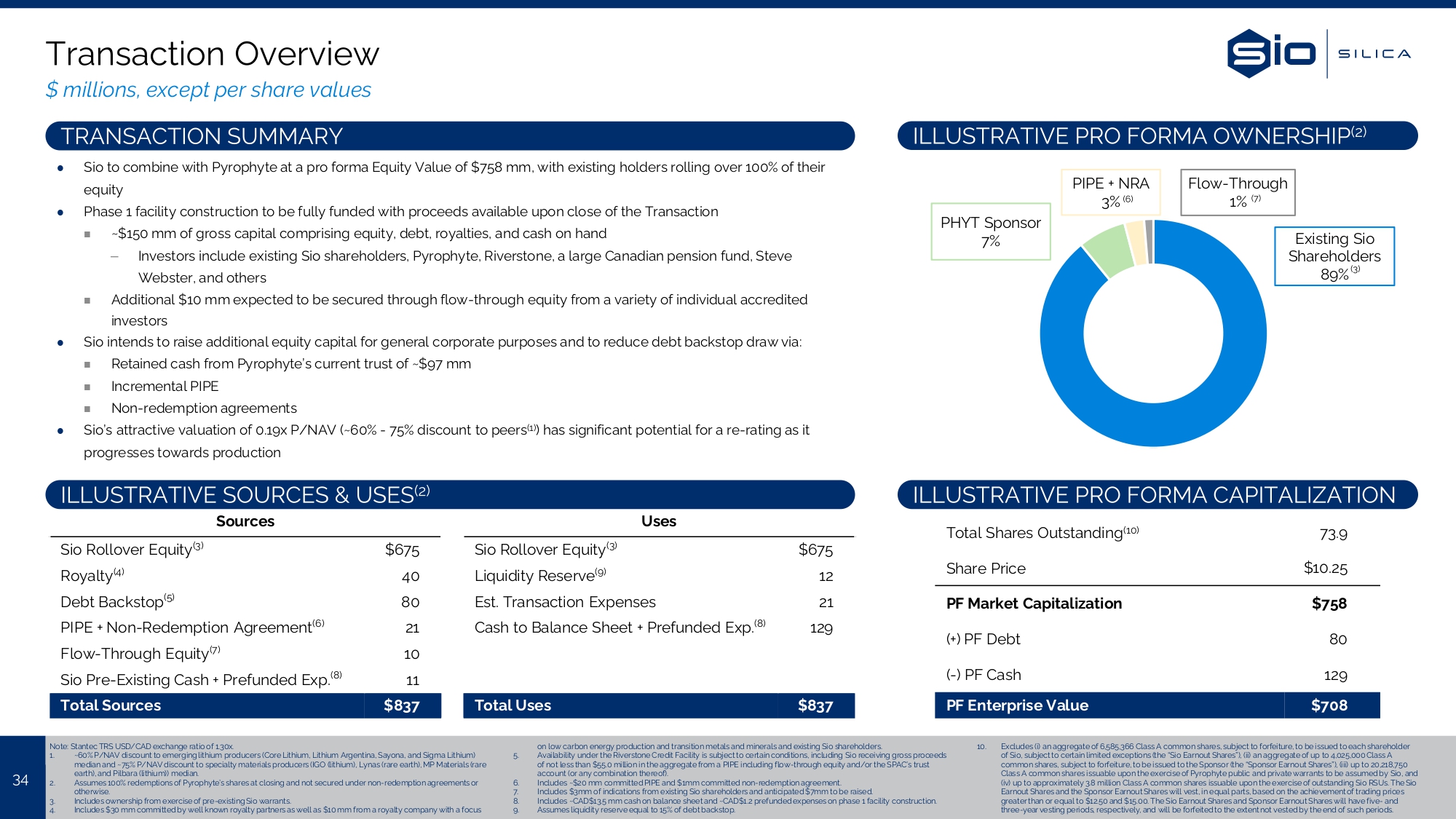

On November 13, 2023, Pyrophyte Acquisition Corp., a Cayman Islands exempted company (“Pyrophyte”), entered into the Business Combination Agreement, as defined and described below, and certain other agreements related thereto, each as described below.

Business Combination Agreement

On November 13, 2023, Pyrophyte, Sio Silica Corporation, an Alberta corporation (“Sio”), Sio Silica Incorporated, a newly-formed Alberta corporation formed solely for the purpose of engaging in the Proposed Transactions (as defined below) and that is wholly owned by Feisal Somji, a nominee (“Nominee”) of Sio (“Sio Newco”), and Snowbank NewCo Alberta ULC, an Alberta unlimited liability corporation and wholly-owned subsidiary of Pyrophyte (“Pyrophyte Newco”), entered into a Business Combination Agreement (the “Business Combination Agreement”), pursuant to which, among other things and subject to the terms and conditions contained therein, (i) Pyrophyte will transfer by way of continuation from the Cayman Islands to Alberta in accordance with the Cayman Islands Companies Act (as revised) (the “Companies Act”) and continue as an Alberta corporation in accordance with the applicable provisions of the Business Corporations Act (Alberta) (the “ABCA”) (such continuation, the “Domestication”), (ii) following the Domestication, Pyrophyte will amalgamate with Sio Newco (the “SPAC Amalgamation”), with Sio Newco surviving the SPAC Amalgamation (“Pubco”) in accordance with the terms of a Plan of Arrangement (the “Plan of Arrangement”), and (iii) Sio and Pyrophyte Newco will amalgamate (the “Sio Amalgamation” and together with the SPAC Amalgamation, the “Amalgamations”), with Sio surviving the Sio Amalgamation as a wholly-owned subsidiary of Pubco and such entity will continue the business operations currently undertaken by Sio. The Amalgamations, together with the other transactions contemplated by the Business Combination Agreement, the Plan of Arrangement and all other agreements, certificates and instruments entered into in connection therewith, are referred to herein as the “Proposed Transactions.”

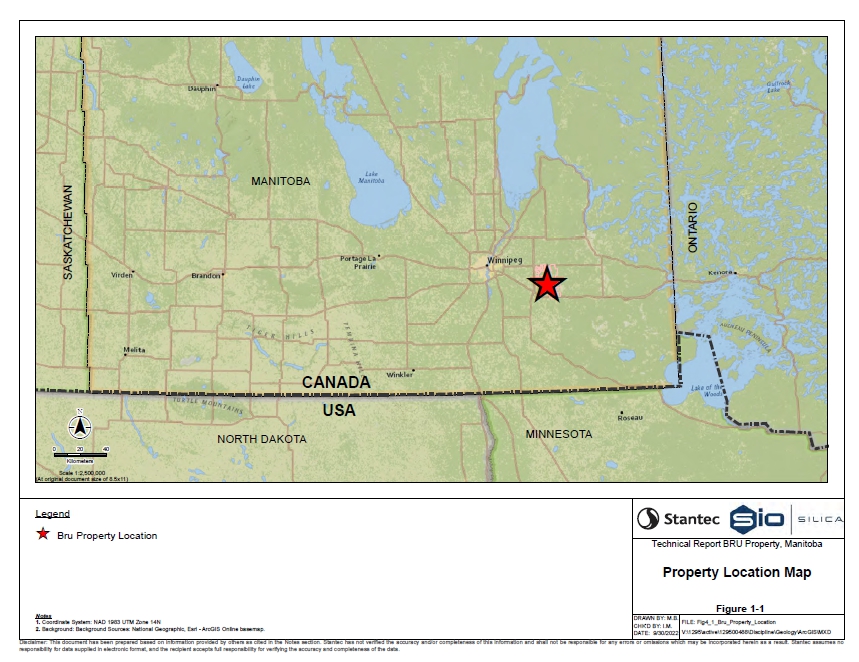

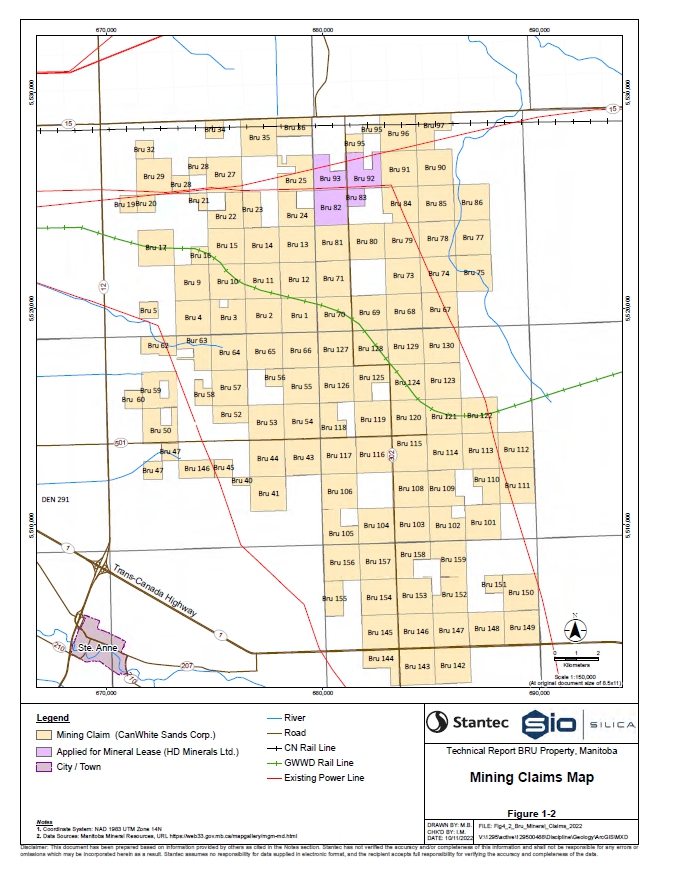

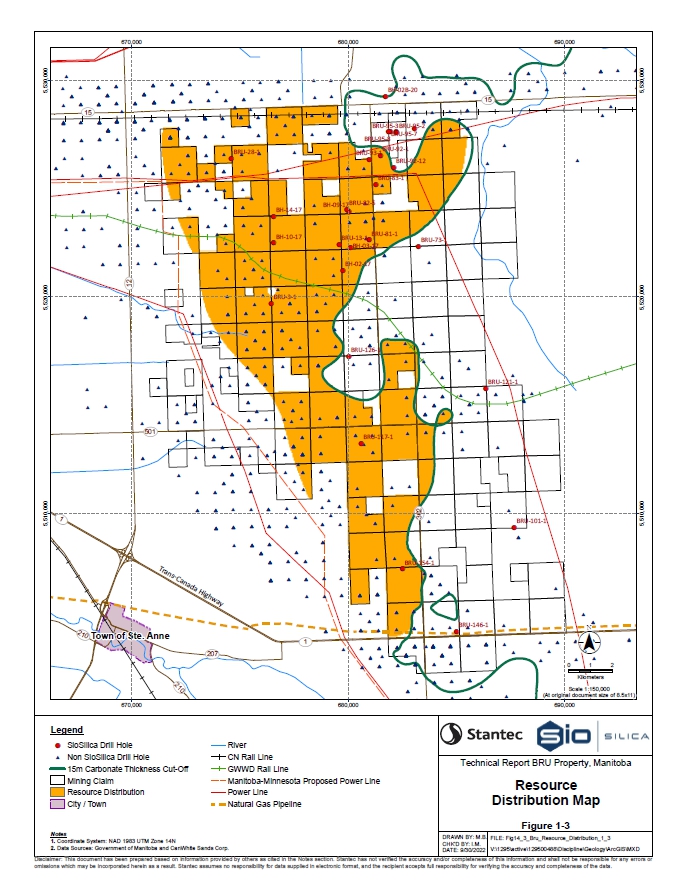

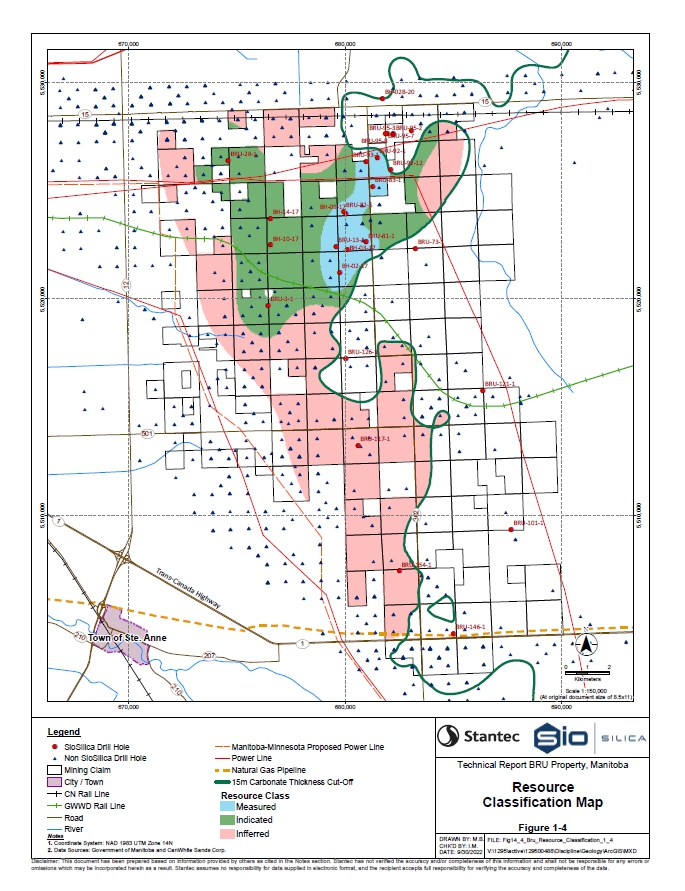

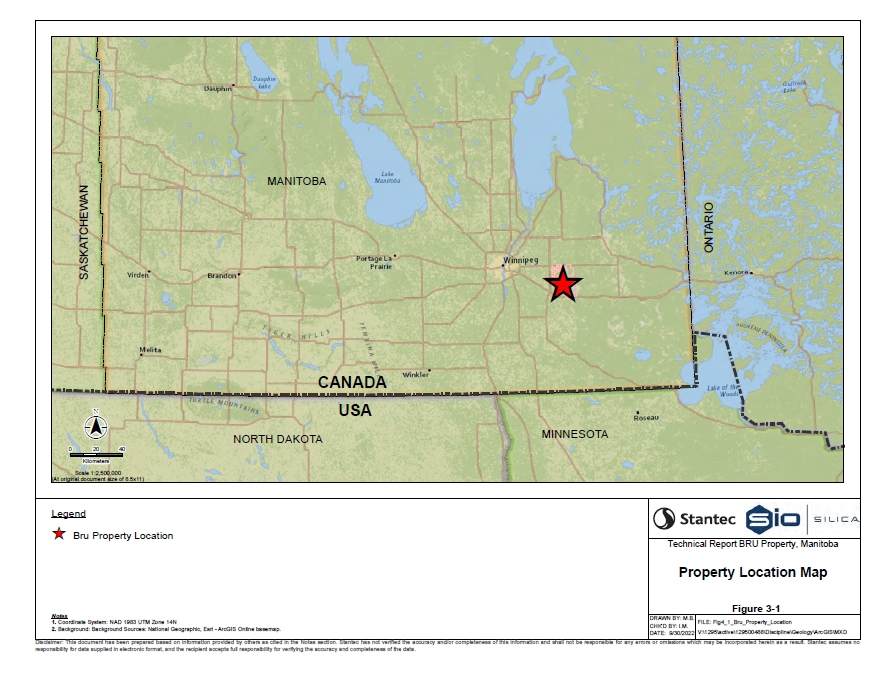

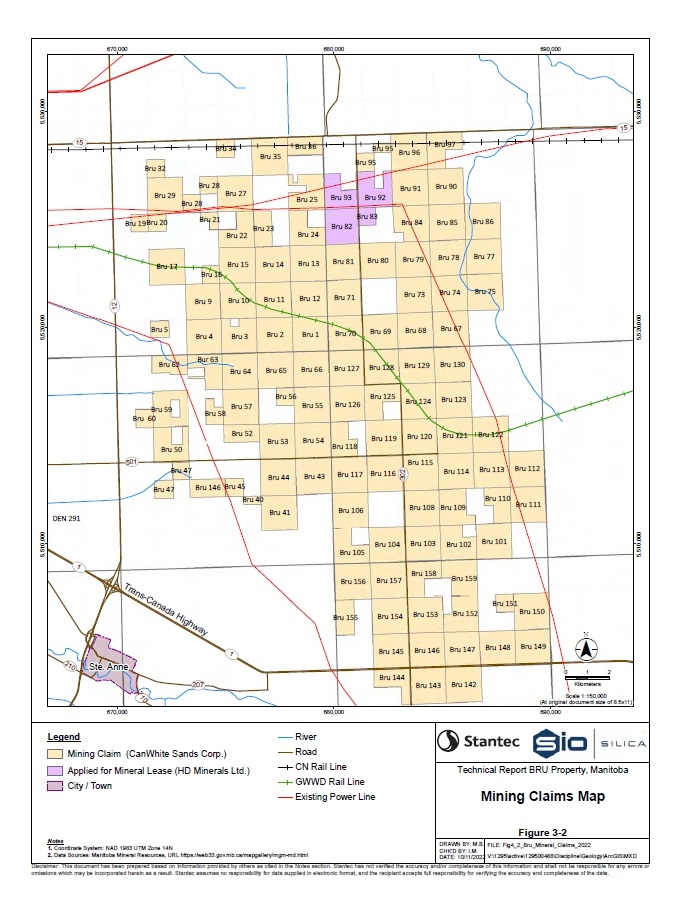

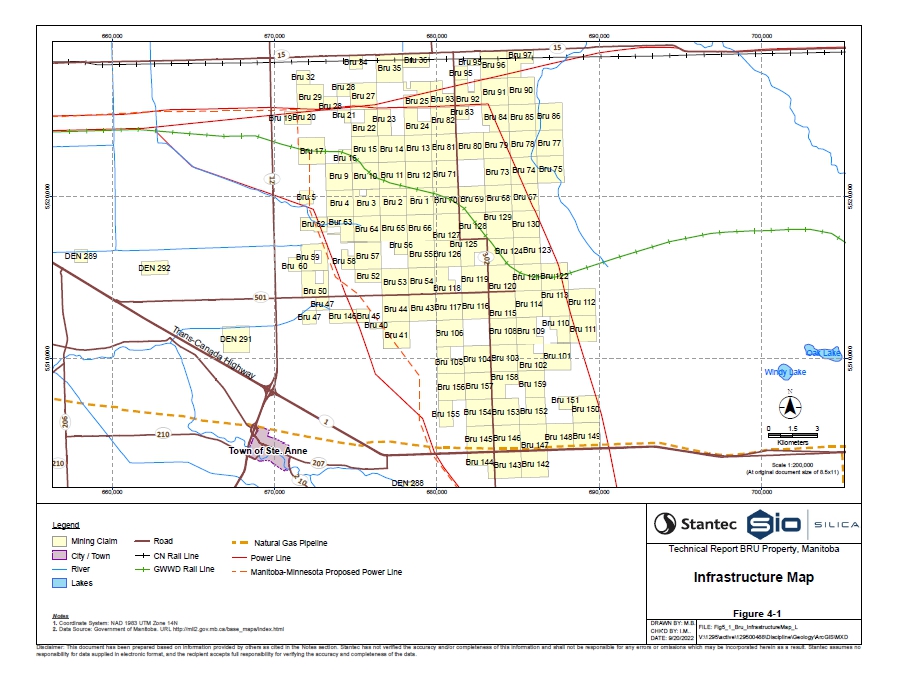

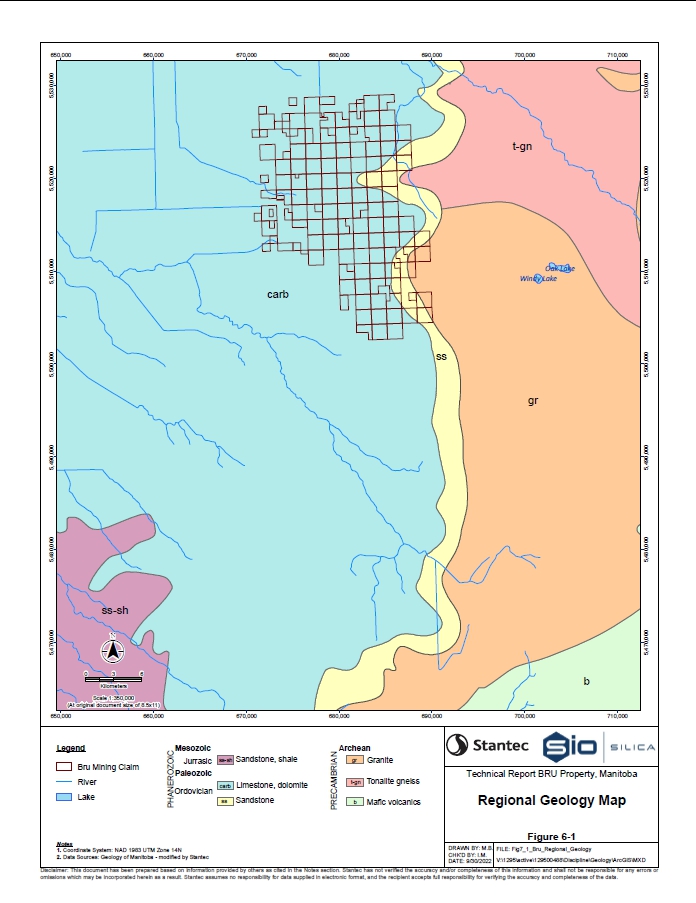

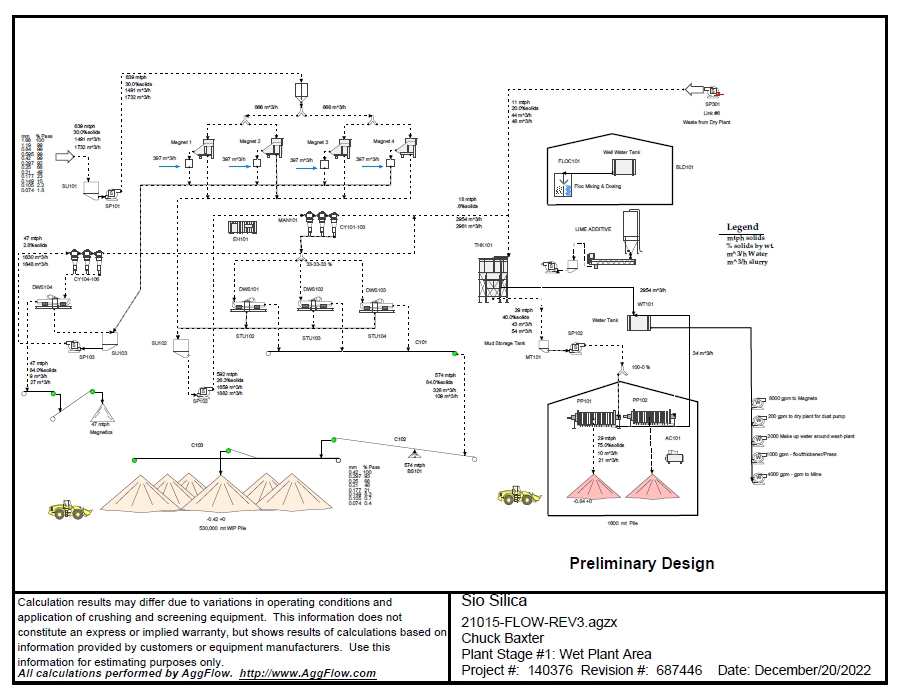

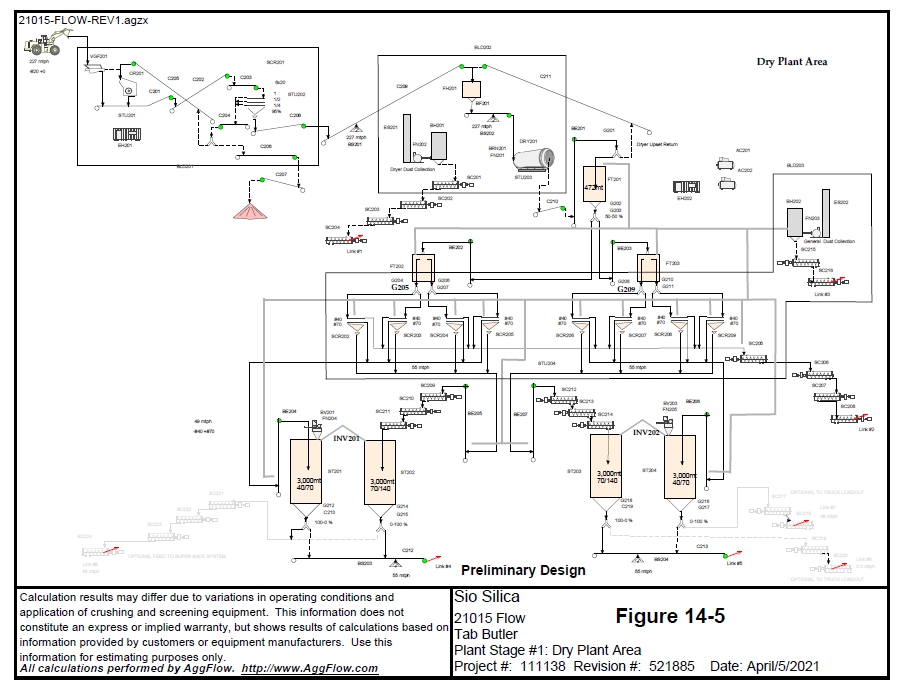

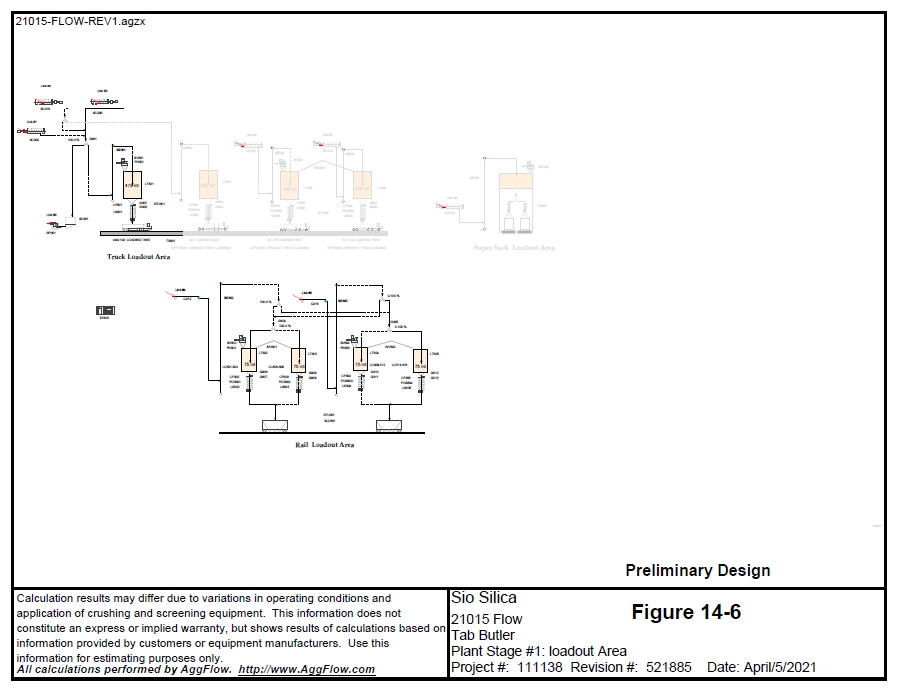

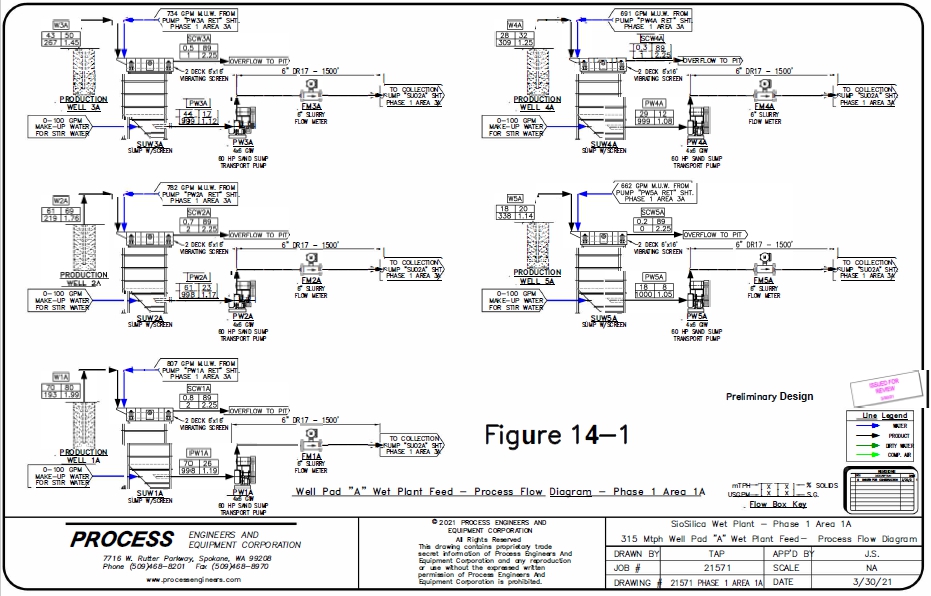

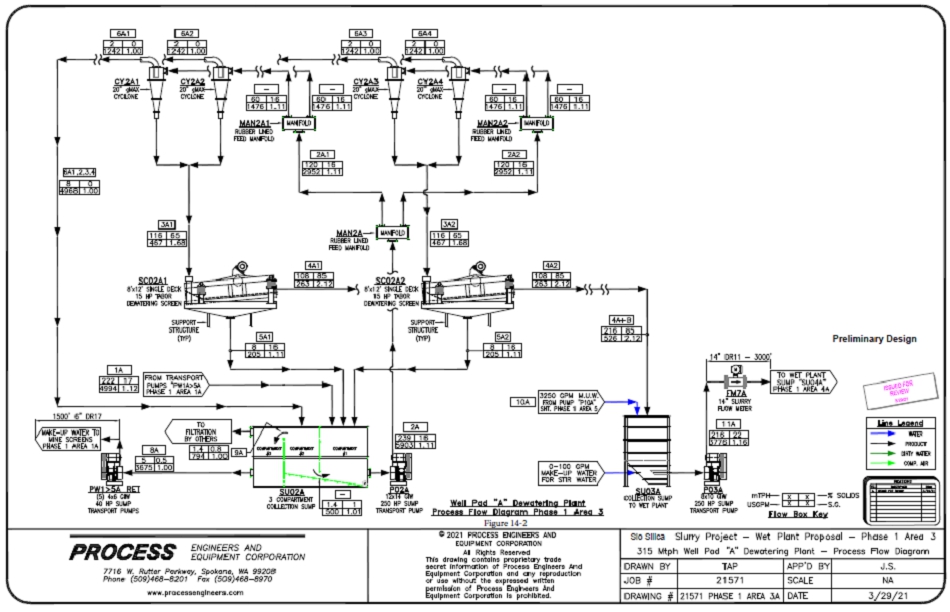

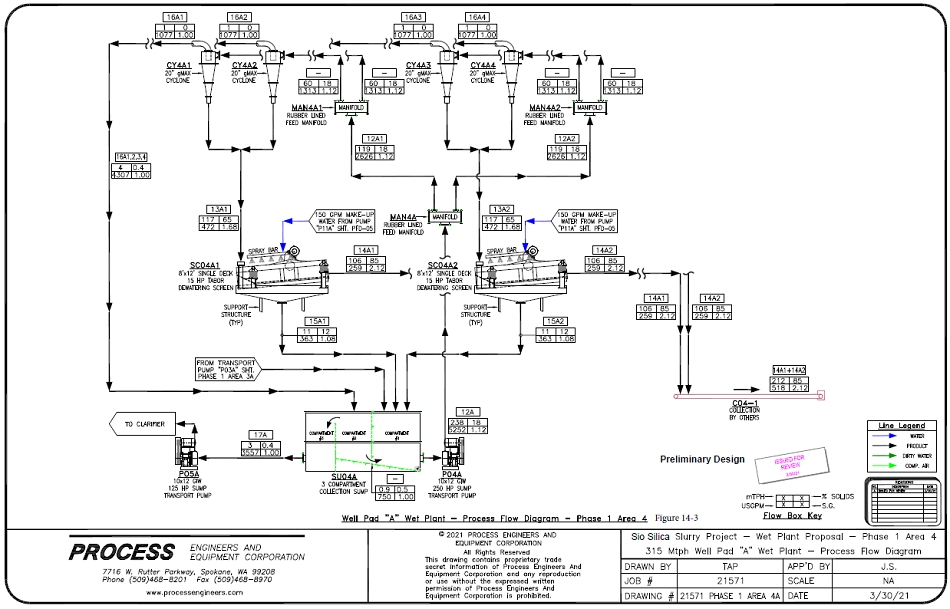

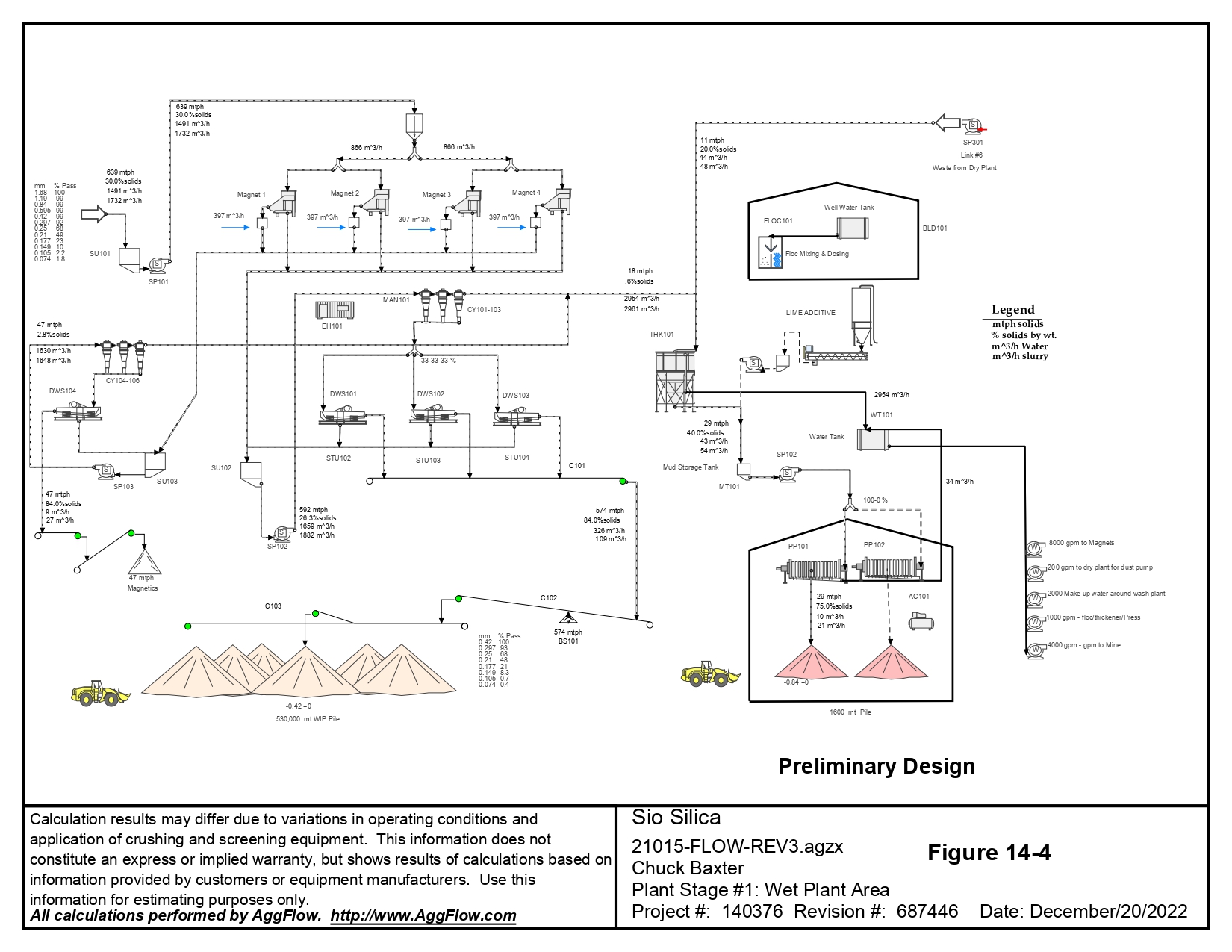

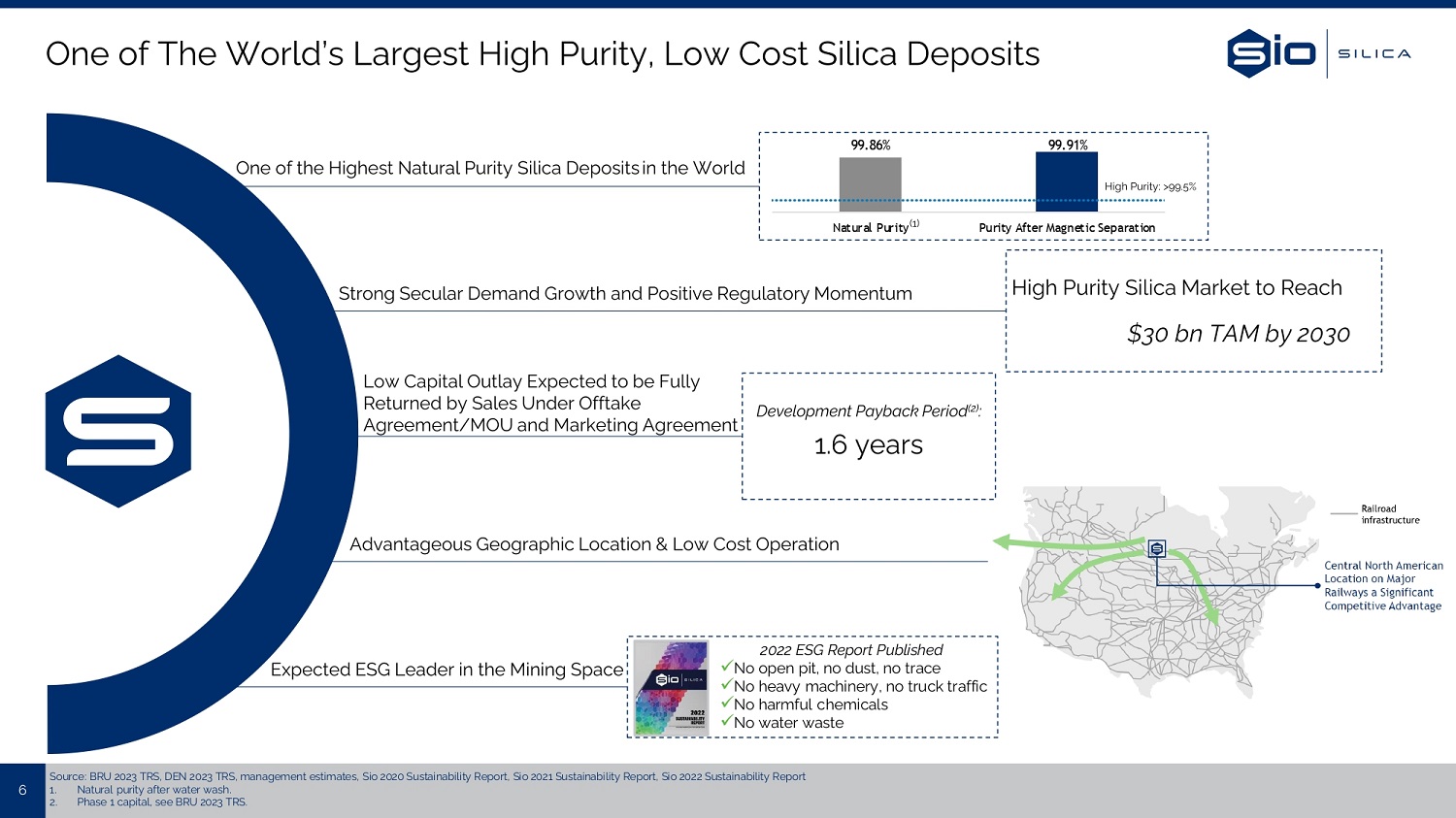

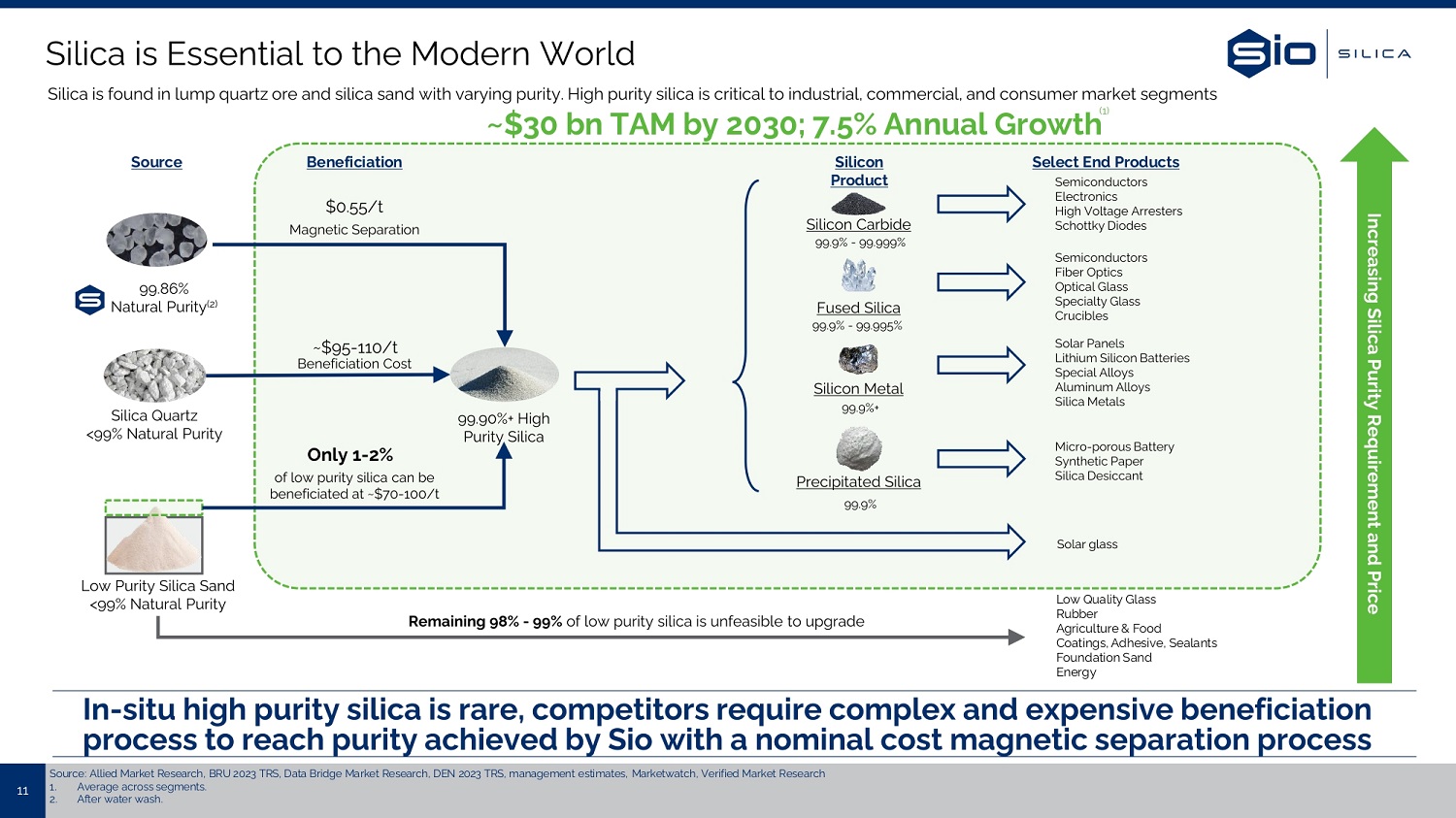

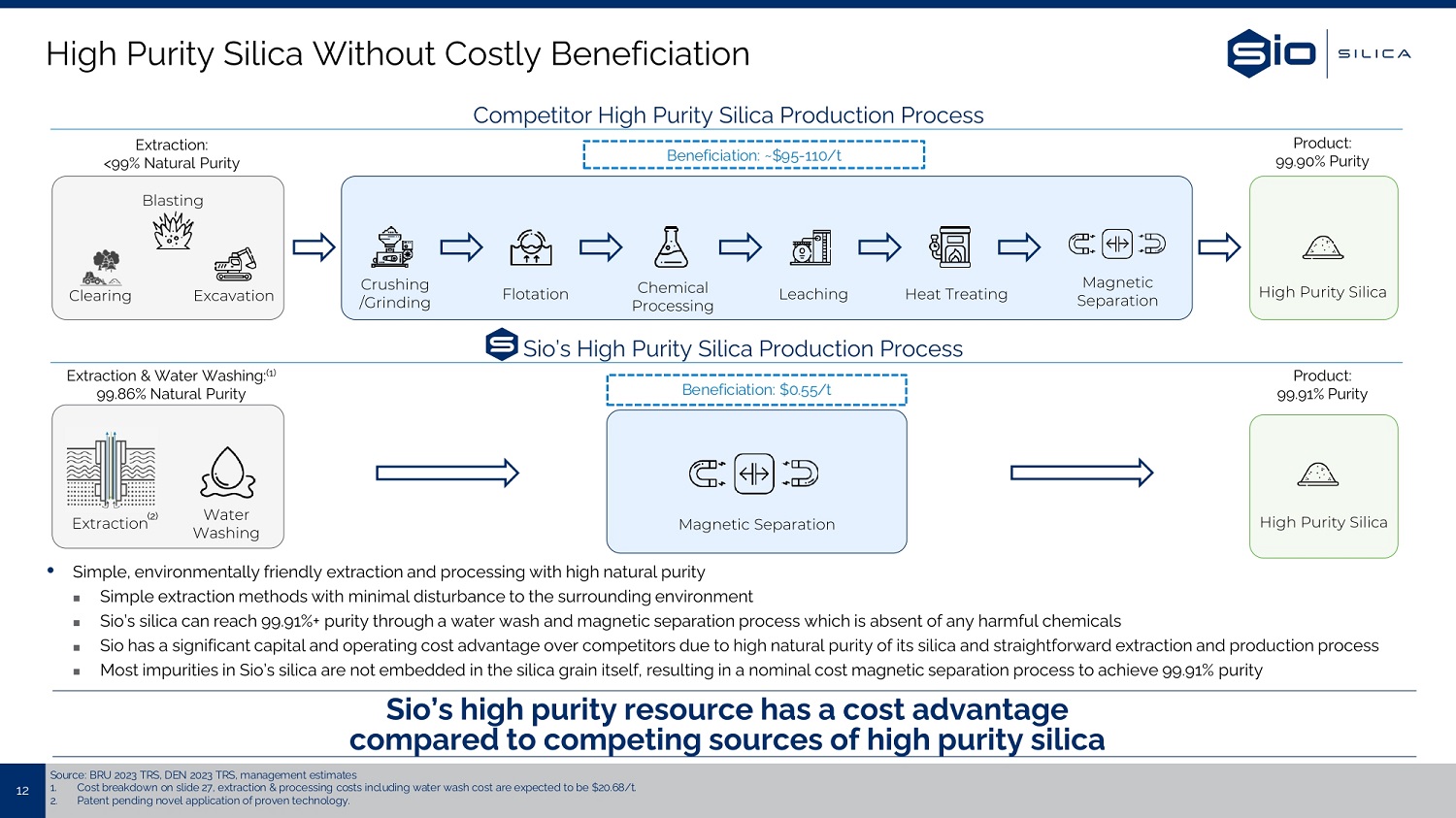

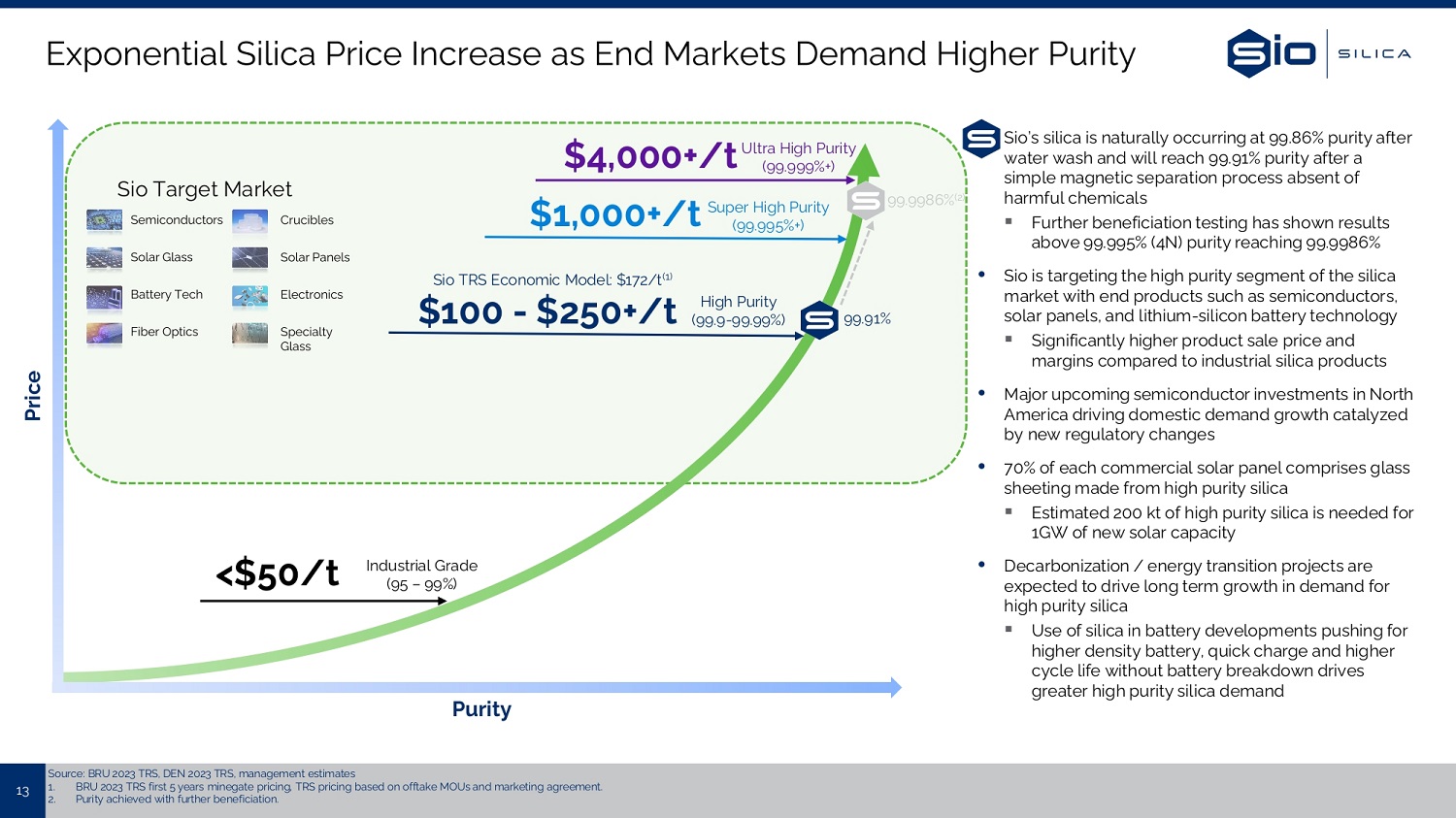

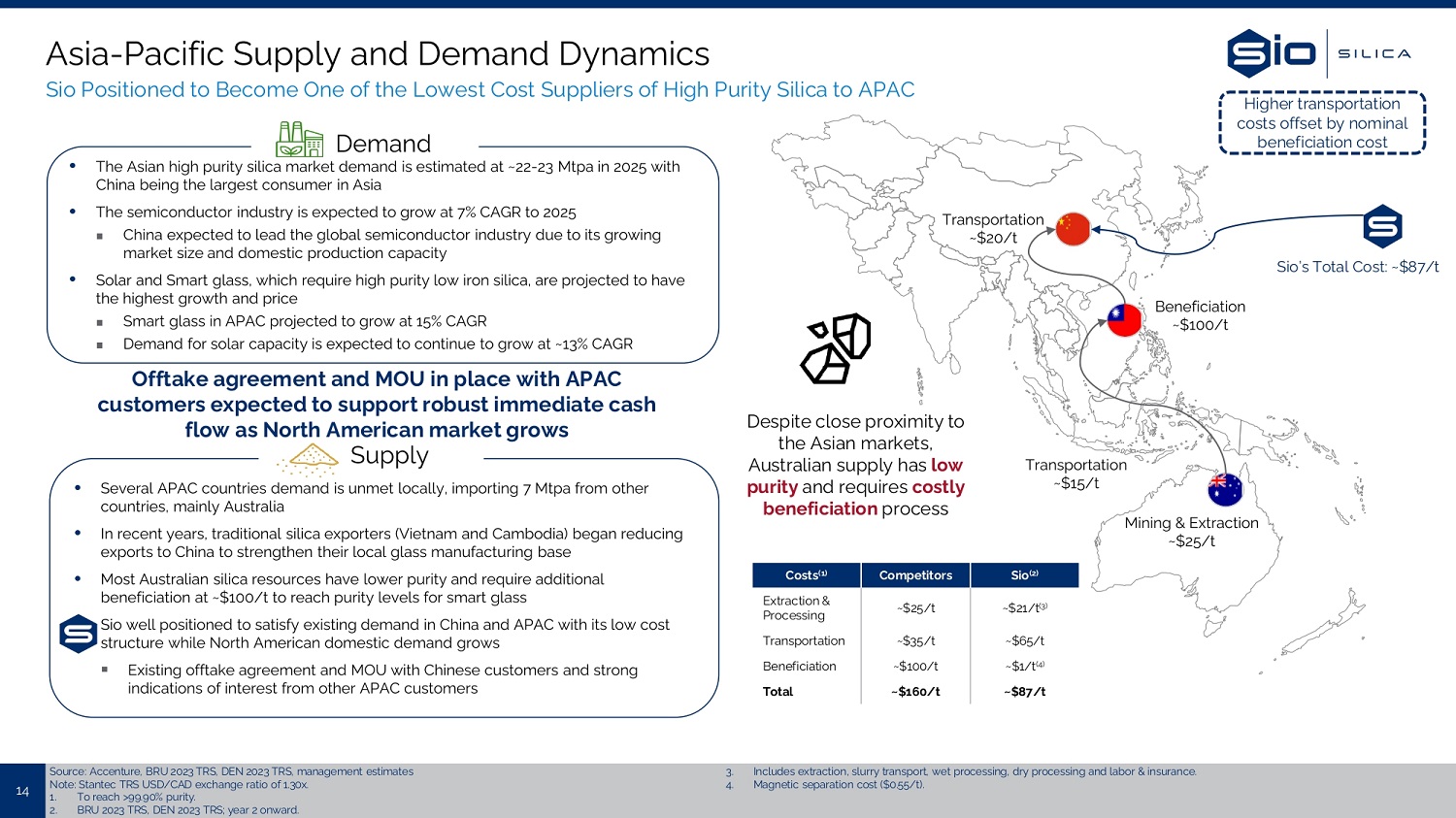

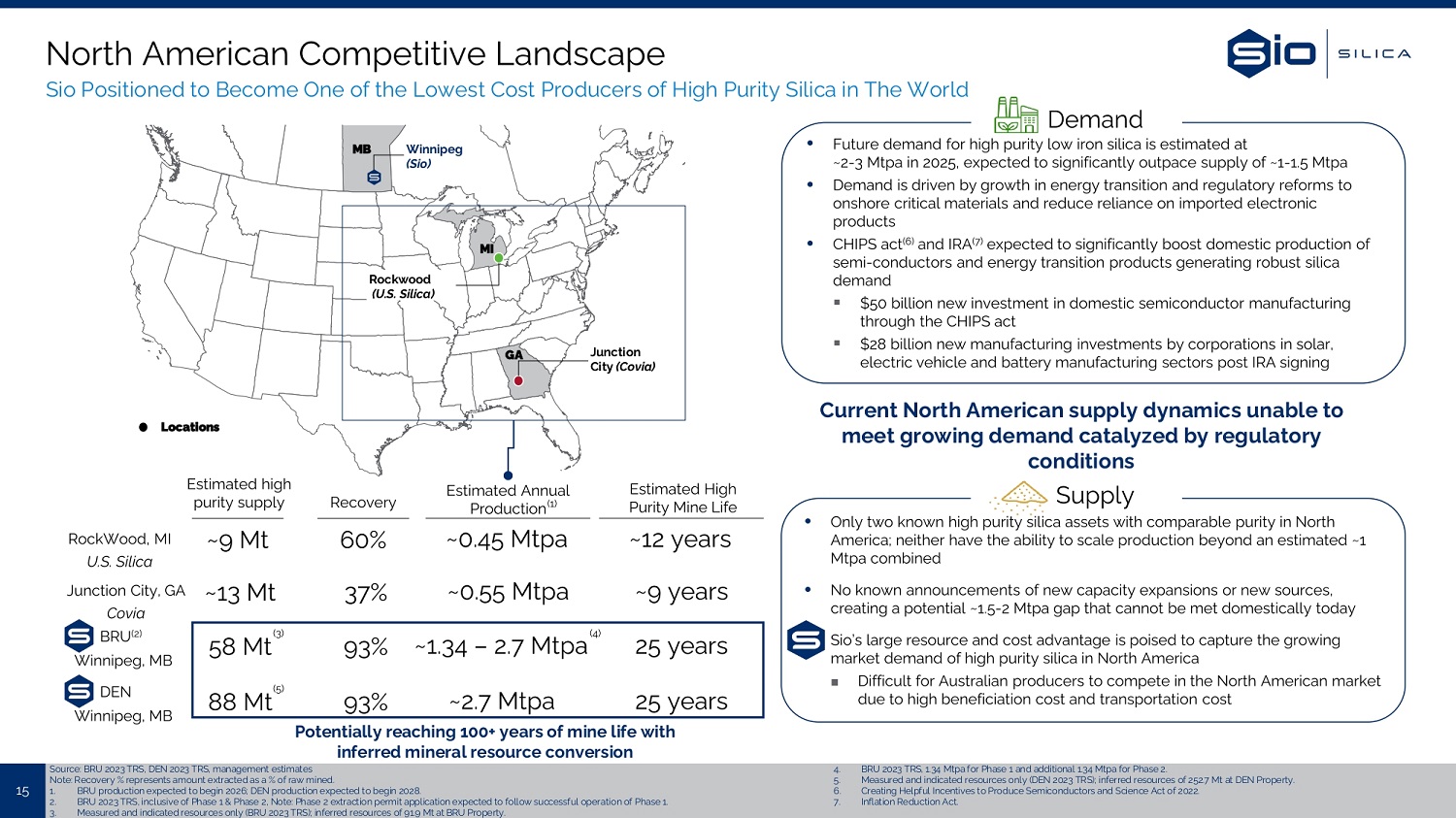

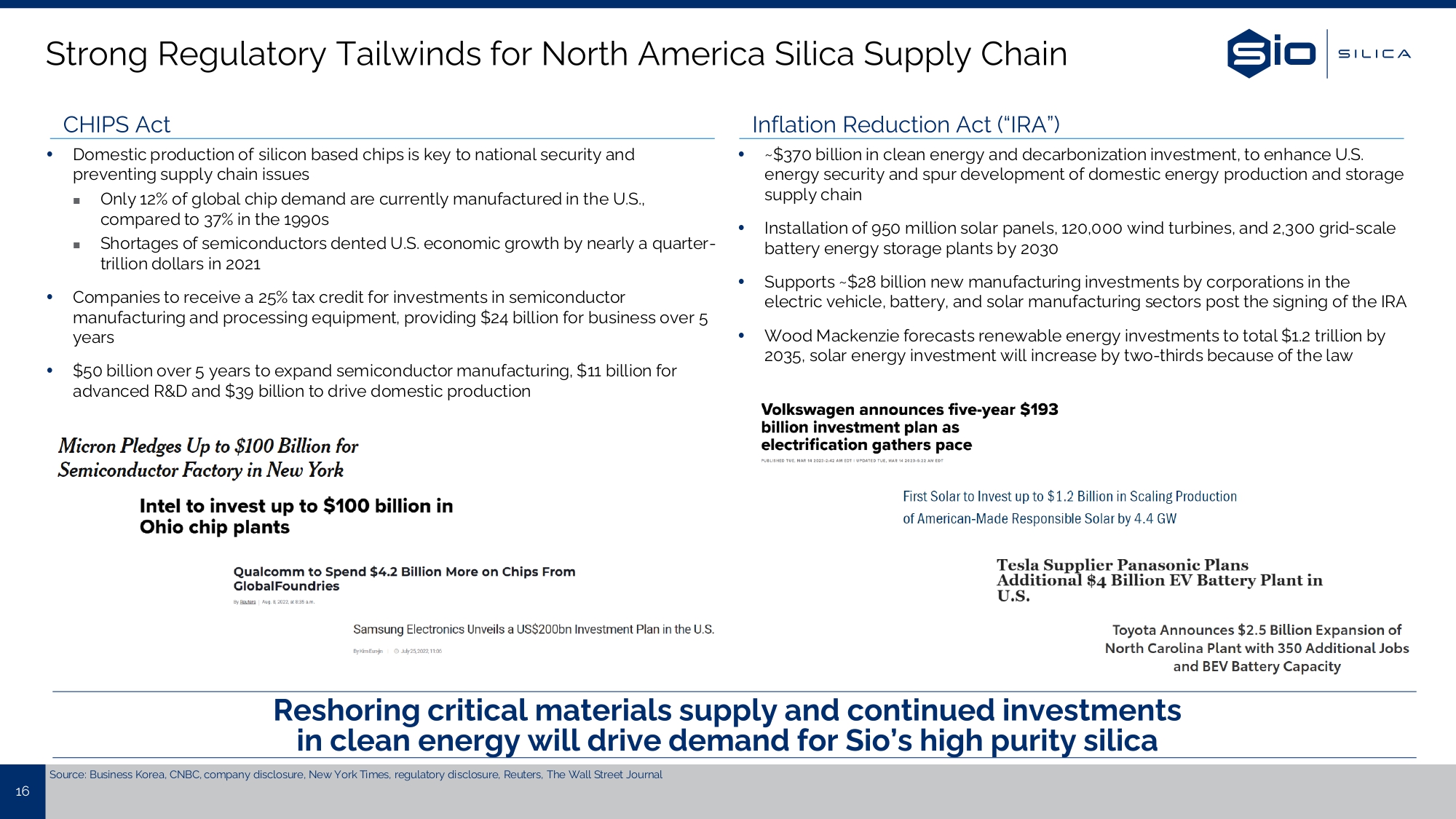

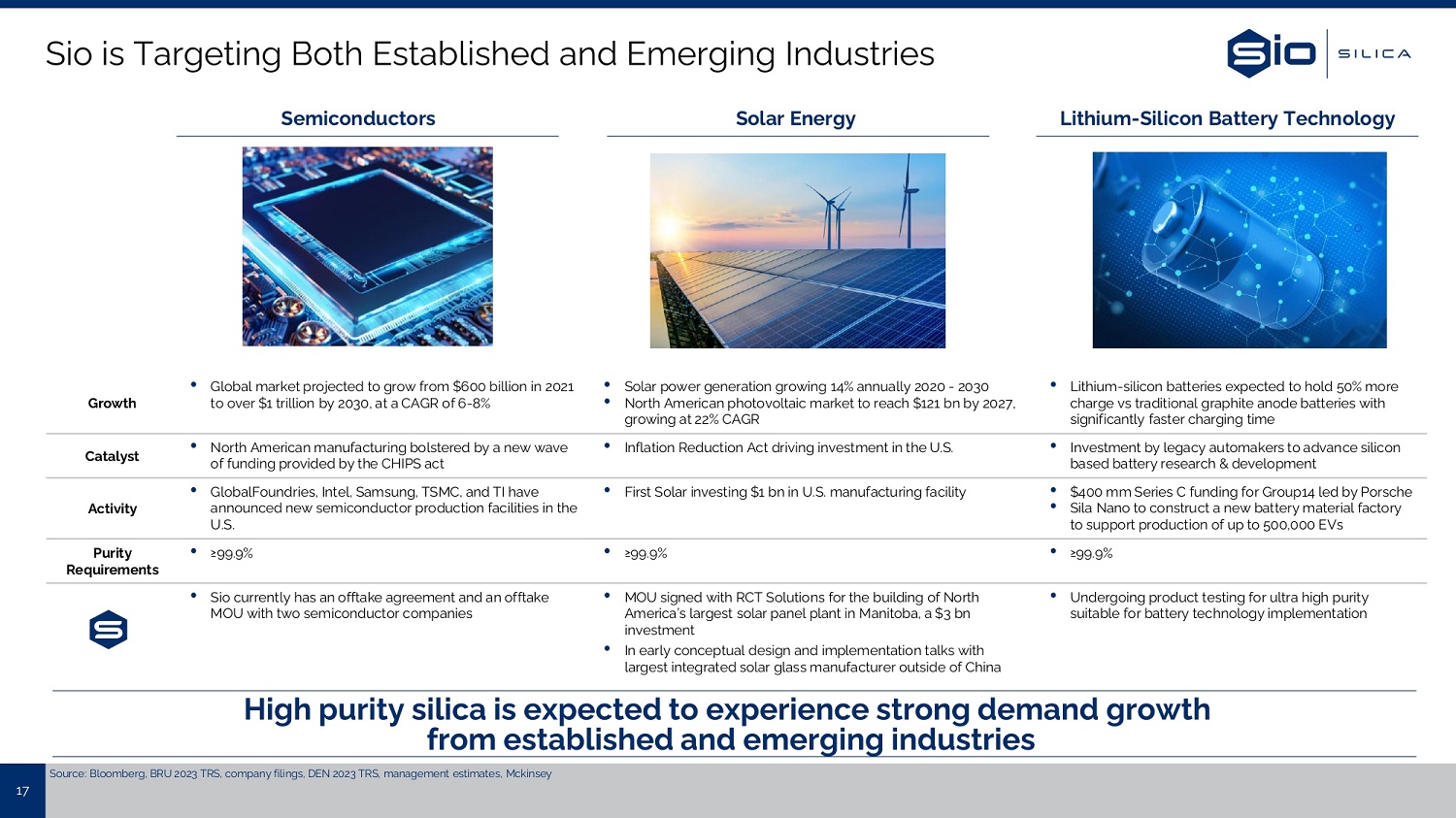

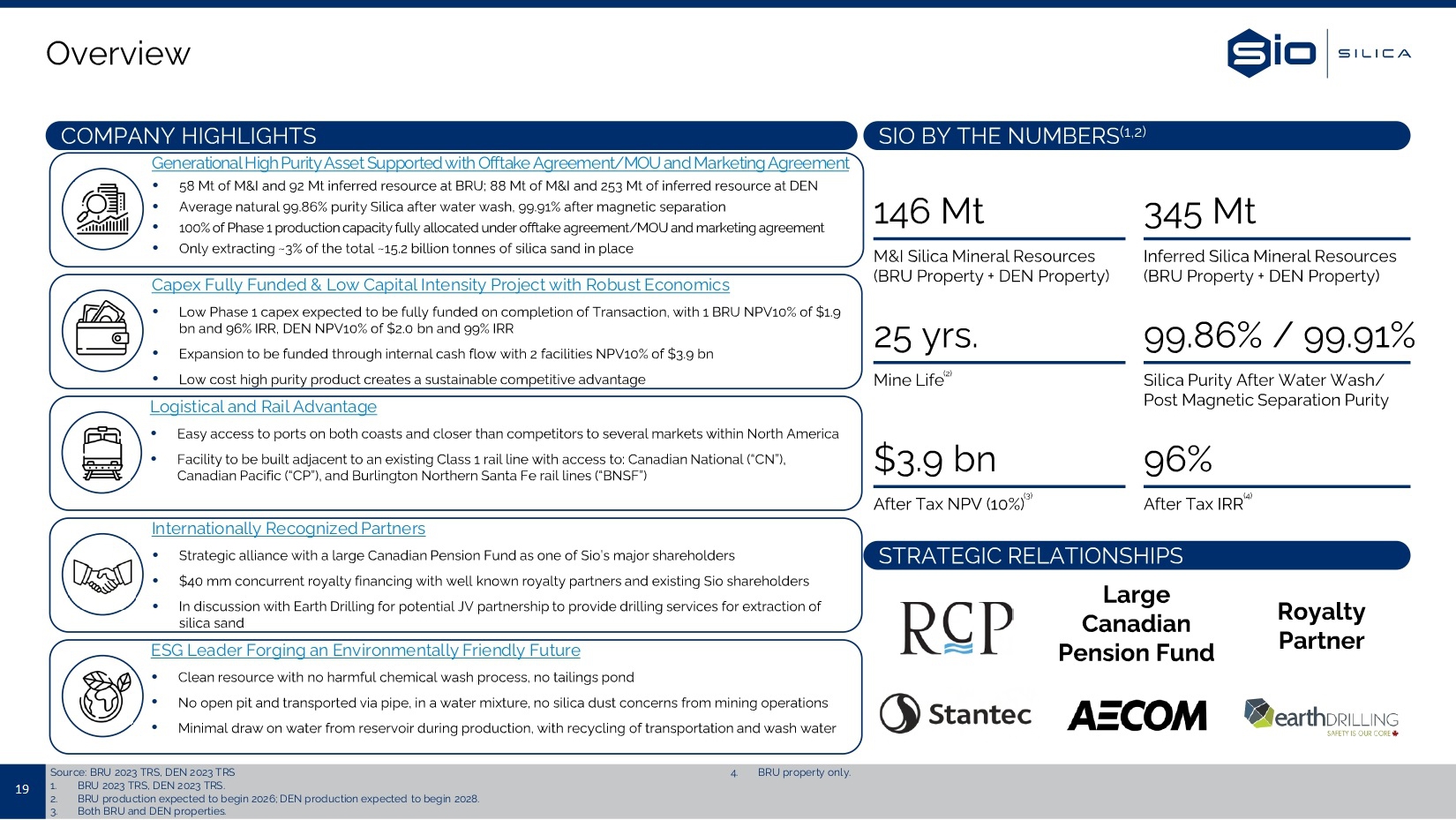

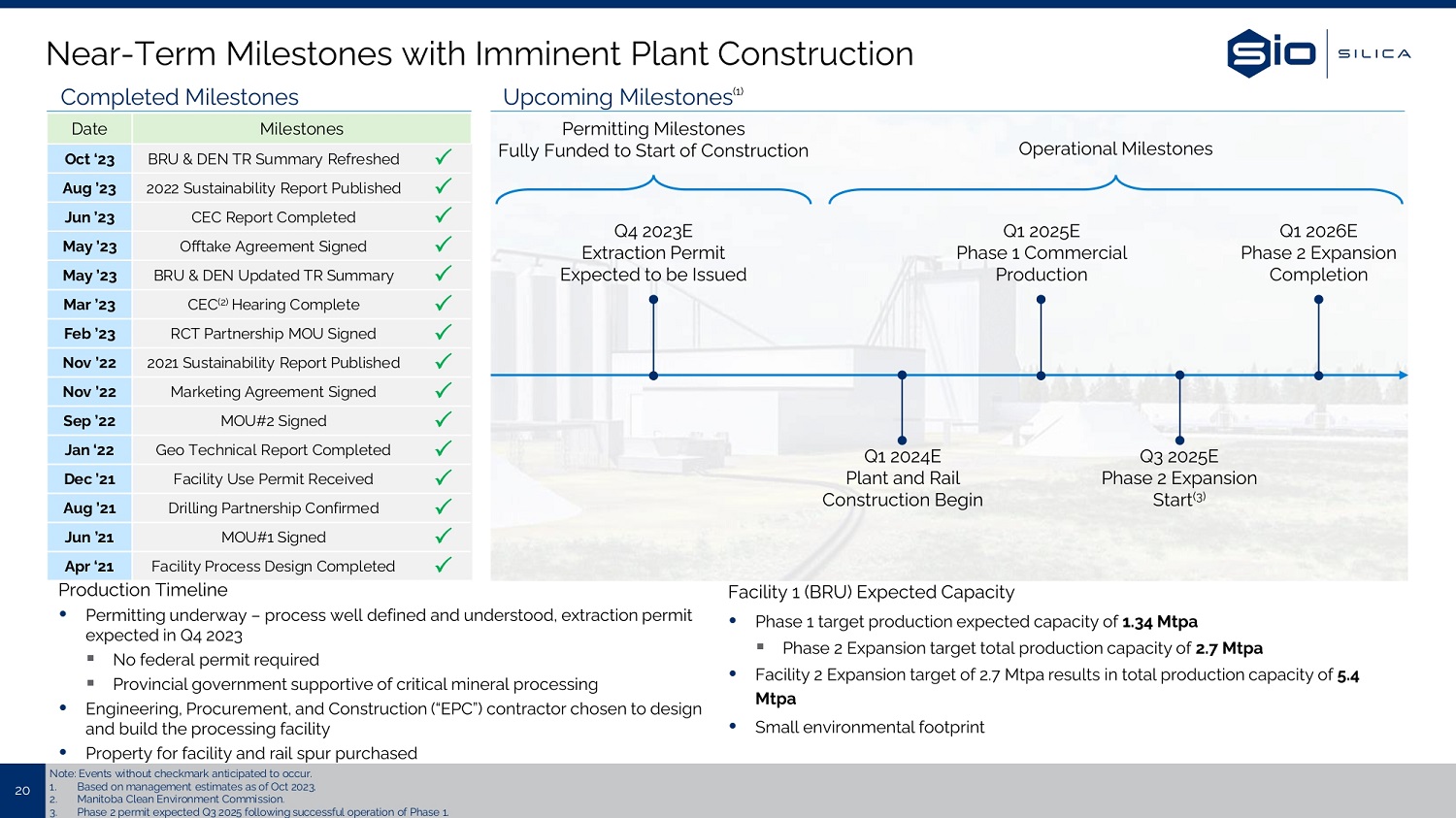

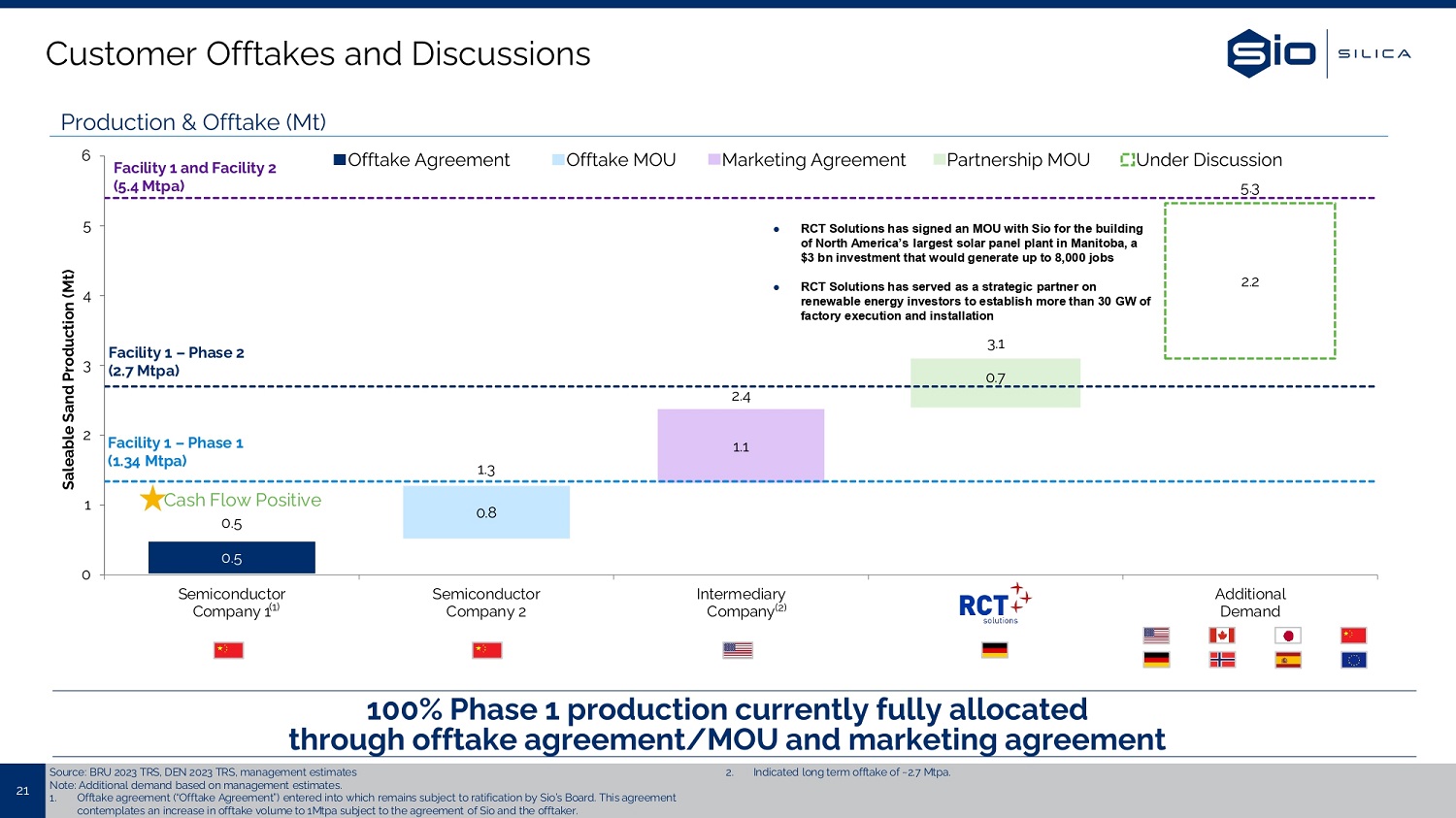

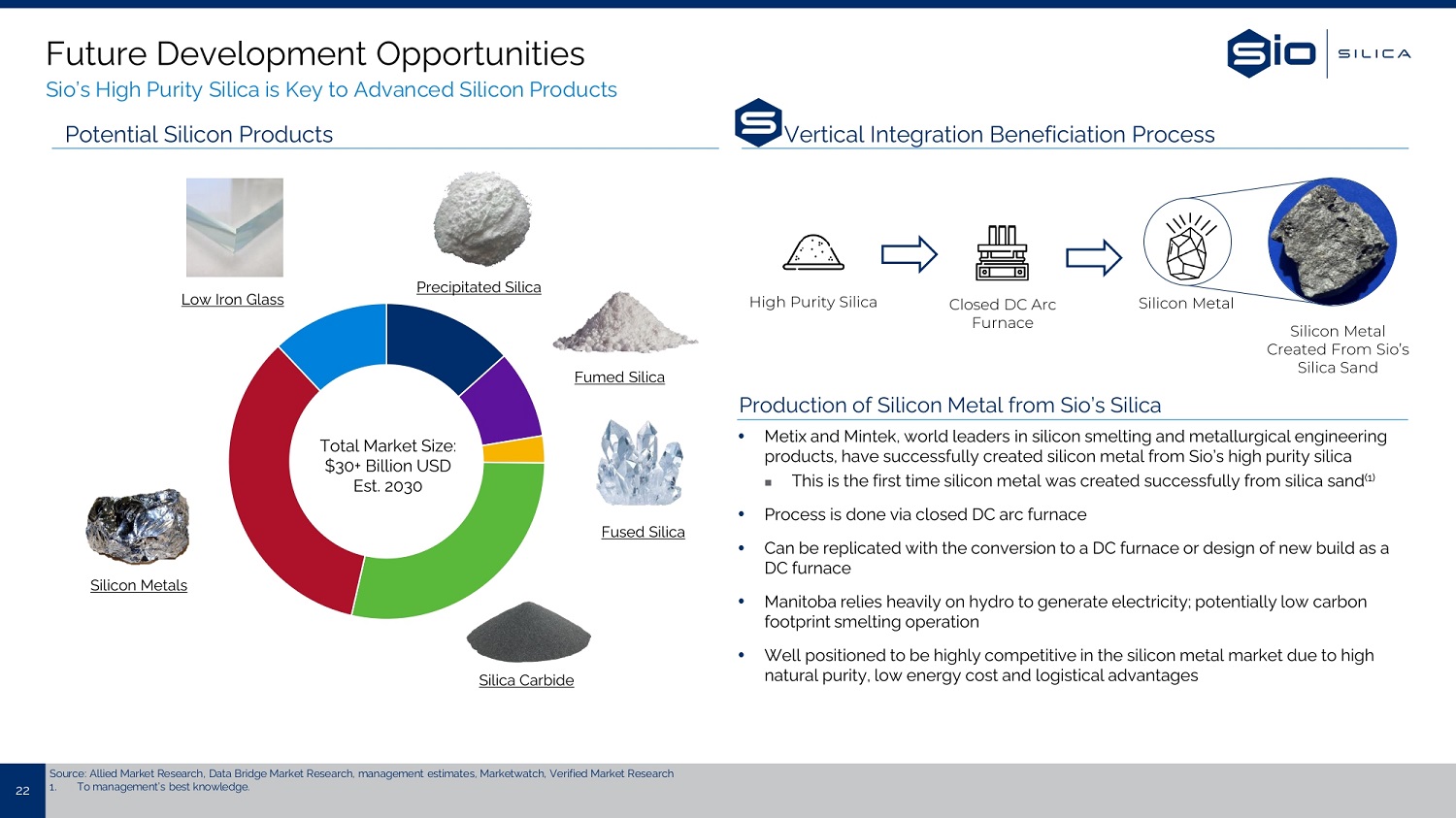

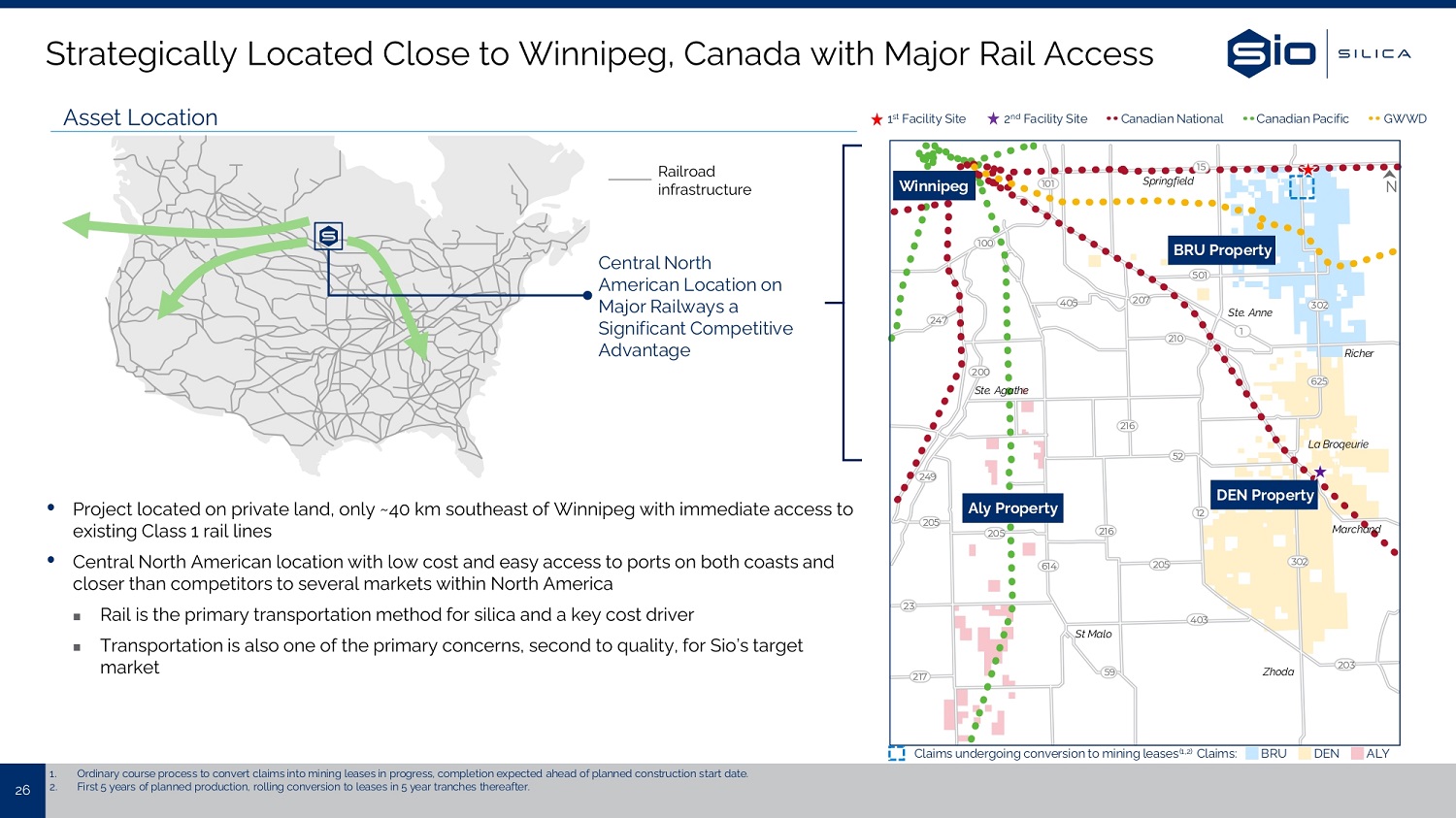

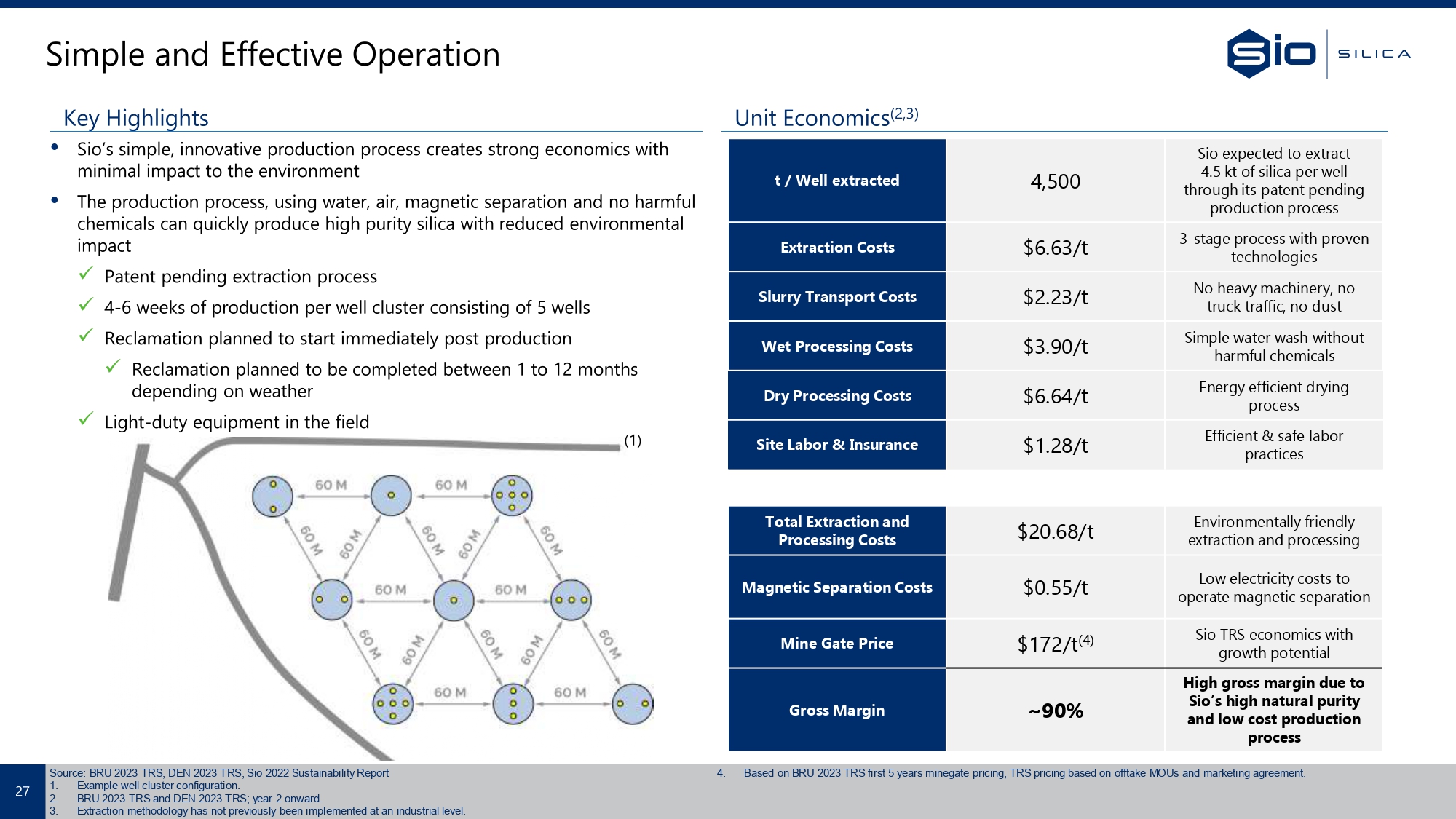

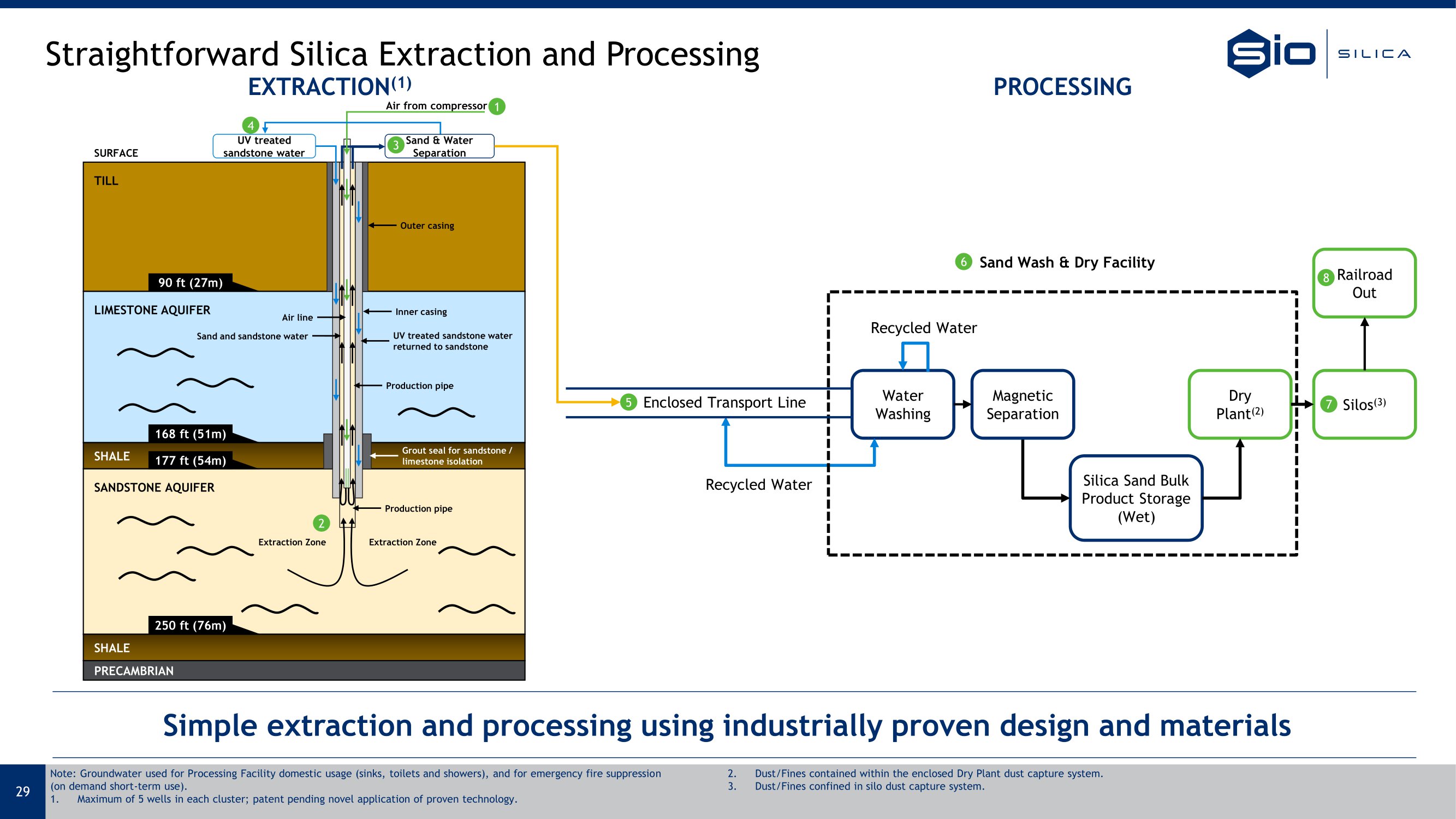

Sio is a Canadian-based company that seeks to become a global leader in the production and supply of environmentally- and ethically-produced high-purity quartz silica. Sio’s extraction of silica is a patent-pending method that does not require truck traffic, surface mining, tunneling, dust generation or chemical cleansing. Combined with its facility using renewable electricity, natural gas, and efficient processing, Sio expects to contribute to a low-carbon future.

Conversion of Securities

Domestication

Pursuant to the Domestication, Pyrophyte will transfer by way of continuation from the Cayman Islands to Alberta in accordance with the Companies Act and continue as an Alberta corporation in accordance with the applicable provisions of the ABCA. In connection with the Domestication, each then-issued and outstanding Class A ordinary share of Pyrophyte, par value $0.0001 per share (the “SPAC Class A Ordinary Shares”), will convert automatically, on a one-for-one basis, into one Class A common share of Pyrophyte (after the Domestication) (the “SPAC Class A Common Shares”) and each of the then-issued and outstanding warrants representing the right to purchase one SPAC Class A Ordinary Share will automatically become a warrant to acquire one SPAC Class A Common Share (the “SPAC Warrants”) in accordance with the terms of the warrant agreement, dated as of October 26, 2021, by and between Pyrophyte and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agreement”).

Concurrently with and as part of the Domestication, Pyrophyte will file articles of incorporation in Canada in substantially the same form as attached as Exhibit B to the Business Combination Agreement.

1

SPAC Amalgamation

Pursuant to the SPAC Amalgamation, which will take place not later than one business day prior to the closing (the “Closing”) of the Proposed Transactions (the “Closing Date”), but after the Domestication, (i) each then-issued and outstanding SPAC Class A Common Share will be exchanged, on a one-for-one basis, for a Class A common share in the authorized share capital of Pubco (the “Pubco Class A Common Shares”), (ii) each then-issued and outstanding SPAC Warrant will become a warrant to acquire one Pubco Class A Common Share (the “Pubco Warrants”) in accordance with the terms of the Warrant Agreement, (iii) each then-issued and outstanding unit of Pyrophyte, comprised of one SPAC Class A Common Share and one-half of one SPAC Warrant (the “SPAC Units”), will be exchanged for a unit of Pubco representing one Pubco Class A Common Share and one-half of one Pubco Warrant (the “Pubco Units”) (each of which will be separated into its component parts in connection with the Closing), (iv) each common share of Sio Newco held by the Nominee (the “Nominee Share”) will be exchanged for one Pubco Class A Common Share, and (v) immediately thereafter, the Pubco Class A Common Share held by the Nominee will be purchased by Sio Newco for cash at the price initially paid by the Nominee for the Nominee Shares and immediately cancelled, in each case upon and subject to the terms and conditions set forth in the Business Combination Agreement, the Plan of Arrangement and in accordance with the provisions of applicable law.

As a result of the SPAC Amalgamation, all holders of then-issued and outstanding SPAC Class A Common Shares will become holders of Pubco Class A Common Shares.

Sio Amalgamation

Pursuant to the Sio Amalgamation, on the Closing Date and following the exercise on a cashless basis of all then-issued and outstanding warrants (the “Sio Warrants”) and options of Sio for common shares in the authorized share capital of Sio (the “Sio Common Shares”) in accordance with the Plan of Arrangement (the “Sio Warrant and Option Settlement”), (i) each then-issued and outstanding Sio Common Share (other than any Sio Common Shares issued by Sio to certain investors during the interim period (the “Sio Interim Common Shares”)) will be exchanged for (x) a number of Pubco Class A Common Shares equal to the Sio Common Share Exchange Ratio (as defined below) and (y) a number of Sio Earnout Shares (as defined below) equal to the Sio Earnout Exchange Ratio (as defined below), (ii) each then-issued and outstanding share award to purchase Sio Common Shares (each, a “Sio RSU”) will become exercisable for a number of Pubco Class A Common Shares (rounded down to the nearest whole share) equal to (a) the number of Sio Common Shares subject to the applicable Sio RSU multiplied by (b) the Sio Common Share Exchange Ratio, (iii) any Sio Warrant that is not exercised pursuant to the Sio Warrant and Option Settlement will remain outstanding and will automatically in accordance with its terms become a warrant to acquire Pubco Class A Common Shares, and (iv) each then-issued and outstanding Sio Interim Common Share will be exchanged for a number of Pubco Class A Common Shares equal to (a) the number of then-issued and outstanding Sio Interim Common Shares multiplied by (b) the Sio Common Share Exchange Ratio, in each case upon and subject to the other terms and conditions set forth in the Business Combination Agreement, the Plan of Arrangement and in accordance with the provisions of applicable law.

As a result of the Amalgamations, Sio will become a wholly-owned subsidiary of Pubco and will continue the business operations currently undertaken by it. Upon the Closing, the Pubco Class A Common Shares and the Pubco Warrants are expected to trade on the New York Stock Exchange under the symbols “SIOS” and “SIOS WS,” respectively.

2

“Sio Common Share Exchange Ratio” means the quotient obtained by (A) dividing (i) Sio’s valuation of $675,000,000 by (ii) $10.25, and then (B) by further dividing the resulting number of Pubco Class A Common Shares established in (A) above by the sum of (x) the number of Sio Common Shares that are issuable upon the exercise of Sio RSUs that are unexpired, issued and outstanding as of immediately prior to the effective of the Sio Amalgamation (the “Sio Amalgamation Effective Time”), (y) the number of Sio Common Shares issued and outstanding immediately prior to the Sio Amalgamation Effective Time, which shall (1) include any Sio Common Shares issued in connection with the Sio Warrant and Option Settlement and (2) exclude any Sio Interim Common Shares, and (z) the number of Sio Common Shares that are issuable upon the exercise of any issued and outstanding warrants to purchase Sio Common Shares that is not exercised pursuant to the Company Warrant and Option Settlement (“Unexercised Company Warrants”) issued and outstanding as of immediately prior to the Sio Amalgamation Effective Time minus a number of Sio Common Shares with a fair market value equal to the aggregate exercise price (determined with reference to the US dollar to the Canadian dollar exchange rate reported by the Bank of Canada at the close of business on the date that is two (2) business days prior to the Closing) of all such Unexercised Company Warrants if they were so exercised (such sum, the “Fully-Diluted Sio Common Shares”).

“Sio Earnout Exchange Ratio” means the quotient obtained by dividing (i) 6,585,366 by (ii) the Fully-Diluted Sio Common Shares.

“Sio Earnout Shares” means the pro rata portion of an aggregate of 6,585,366 Pubco Class A Common Shares (without duplication) issued to each shareholder of Sio (other than holders of any Sio Interim Common Shares) pursuant to the Sio Amalgamation and the Business Combination Agreement (the “Earnout”), valued at the deemed issue price of the Pubco Class A Common Shares in connection with the Earnout, which is $10.25 per Pubco Class A Common Share, which Sio Earnout shares are subject to forfeiture in accordance with the terms of the Business Combination Agreement.

Representations, Warranties and Covenants; Indemnification

The Business Combination Agreement contains customary representations and warranties by the parties thereto, as more particularly set forth in the Business Combination Agreement. The Business Combination Agreement also contains customary pre-Closing covenants of the parties, including the obligation of Pyrophyte and Sio and their respective subsidiaries to conduct their businesses in the ordinary course and to refrain from taking certain specified actions, subject to certain exceptions, without the prior written consent of certain counterparties to the Business Combination Agreement.

The Business Combination Agreement does not provide for indemnification with respect to any of the representations and warranties of the parties thereto. Additionally, Pubco will enter into customary indemnification agreements reasonably satisfactory to Sio and Pubco with the post-Closing directors and officers of Pubco, which indemnification agreements shall continue to be effective following the Closing.

Registration Statement / Proxy Statement

As promptly as reasonably practicable after the date of the Business Combination Agreement, Pyrophyte, Sio and Sio Newco will prepare and Sio Newco will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form F-4 relating to the Proposed Transactions (the “Registration Statement”), which will contain a proxy statement with respect to Pyrophyte’s extraordinary general meeting of its shareholders (the “Pyrophyte Shareholders Meeting”) to be held to consider, among other things, (A) approval of the Domestication, (B) approval of the proposed business combination (including the approval and adoption of the Business Combination Agreement and the Proposed Transactions, including the Plan of Arrangement) and (C) the adoption and approval of any other proposals the parties deem necessary to effectuate the Proposed Transactions, and a prospectus with respect to the securities of Sio Newco to be issued in connection with the Proposed Transactions.

Conditions to the Parties’ Obligations to Consummate the Amalgamations

Under the Business Combination Agreement, the obligations of the parties to consummate the Amalgamations are subject to certain conditions, including (i) the requisite approval by Pyrophyte’s shareholders and Sio’s shareholders having been obtained; (ii) the final order (the “Final Order”) of the Alberta Court of King’s Bench (the “Court”) pursuant to section 193 of the ABCA, approving the Arrangement and not having amended, modified or supplemented the same in a manner unacceptable to the parties; (iii) the absence of specified adverse laws, rules, regulations, judgments, decrees, executive orders or awards making the Proposed Transactions illegal or otherwise prohibiting their consummation; (iv) the Pubco Class A Common Shares having been accepted for listing on the New York Stock Exchange or another national securities exchange mutually agreed to in writing by the parties to the Business Combination Agreement (the “Stock Exchange”); (v) the Registration Statement having been declared effective by the SEC under the Securities Act of 1933, as amended (the “Securities Act”), no stop order suspending the effectiveness of the Registration Statement being in effect, and no proceedings for purposes of suspending the effectiveness of the Registration Statement having been initiated or threatened in writing by the SEC; and (vi) the Domestication and the SPAC Amalgamation having been consummated.

3

The obligations of Pyrophyte and Pyrophyte Newco to consummate the Amalgamations are further subject to additional conditions, including: (i) the truth and accuracy of the representations and warranties of Sio, subject to the materiality standards contained in the Business Combination Agreement; (ii) material compliance by Sio and Sio Newco with their respective covenants under the Business Combination Agreement; (iii) no Company Material Adverse Effect (as defined in the Business Combination Agreement) having occurred; and (iv) receipt of a customary officer’s certificate of Sio, certifying the satisfaction of the conditions listed in clauses (i) through (iii) above.

The obligations of Sio and Sio Newco to consummate the Amalgamations are further subject to additional conditions, including: (i) the truth and accuracy of the representations and warranties of Pyrophyte, subject to the materiality standards contained in the Business Combination Agreement; (ii) material compliance by Pyrophyte and Pyrophyte Newco with their respective covenants under the Business Combination Agreement; (iii) no SPAC Material Adverse Effect (as defined in the Business Combination Agreement) having occurred; (iv) a customary officer’s certificate of Pyrophyte, certifying the satisfaction of the conditions listed in clauses (i) through (iii) above; (v) each officer and director of Pubco having delivered a written resignation in form and substance reasonably satisfactory to Sio, effective as of the Sio Amalgamation Effective Time; and (vi) the Available Closing Cash (as defined below) available at closing (x) being no less than $130,000,000 and (y) having a Debt-to-Other Cash Ratio (defined as the ratio of (a) the available amount under the Credit Agreement to be funded in connection with the Closing, to (b) an amount equal to the sum of (i) Available Closing Cash that results from proceeds of all sources other than in connection with the Credit Agreement and (ii) Transaction Expenses) no greater than 0.5882. “Available Closing Cash” means an amount equal to (a) the funds contained in the Pyrophyte’s trust account as of the Sio Amalgamation Effective Time (prior to the payment of any cash to satisfy the redemption rights exercised by the Pyrophyte shareholders at the Pyrophyte Shareholders Meeting (the “Redemption”)); plus (b) all other cash and cash equivalents of Pyrophyte, including the proceeds of any securities or indebtedness funded in connection with the Closing (excluding, for the avoidance of doubt, any amount already included pursuant to (a) or (e) of this definition); plus (c) the proceeds received on or before the Sio Amalgamation Effective Time from and pursuant to the Royalty Purchase and Sale Agreements plus (d) the proceeds received as a result of the PIPE Investment (as defined below); plus (e) the available amount under the credit agreement to be entered into between Sio and one or more debt financing sources (the “Credit Agreement”); plus (f) the proceeds received as a result of the issuance of any Interim Company Shares or Flow-Through Shares; minus (g) the aggregate amount of cash required to be paid in connection with the Redemption; minus (h) transaction expenses, which include the transaction expenses incurred by each of Sio and Pyrophyte, and all expenses incurred in connection with the Debt Financing (as defined below).

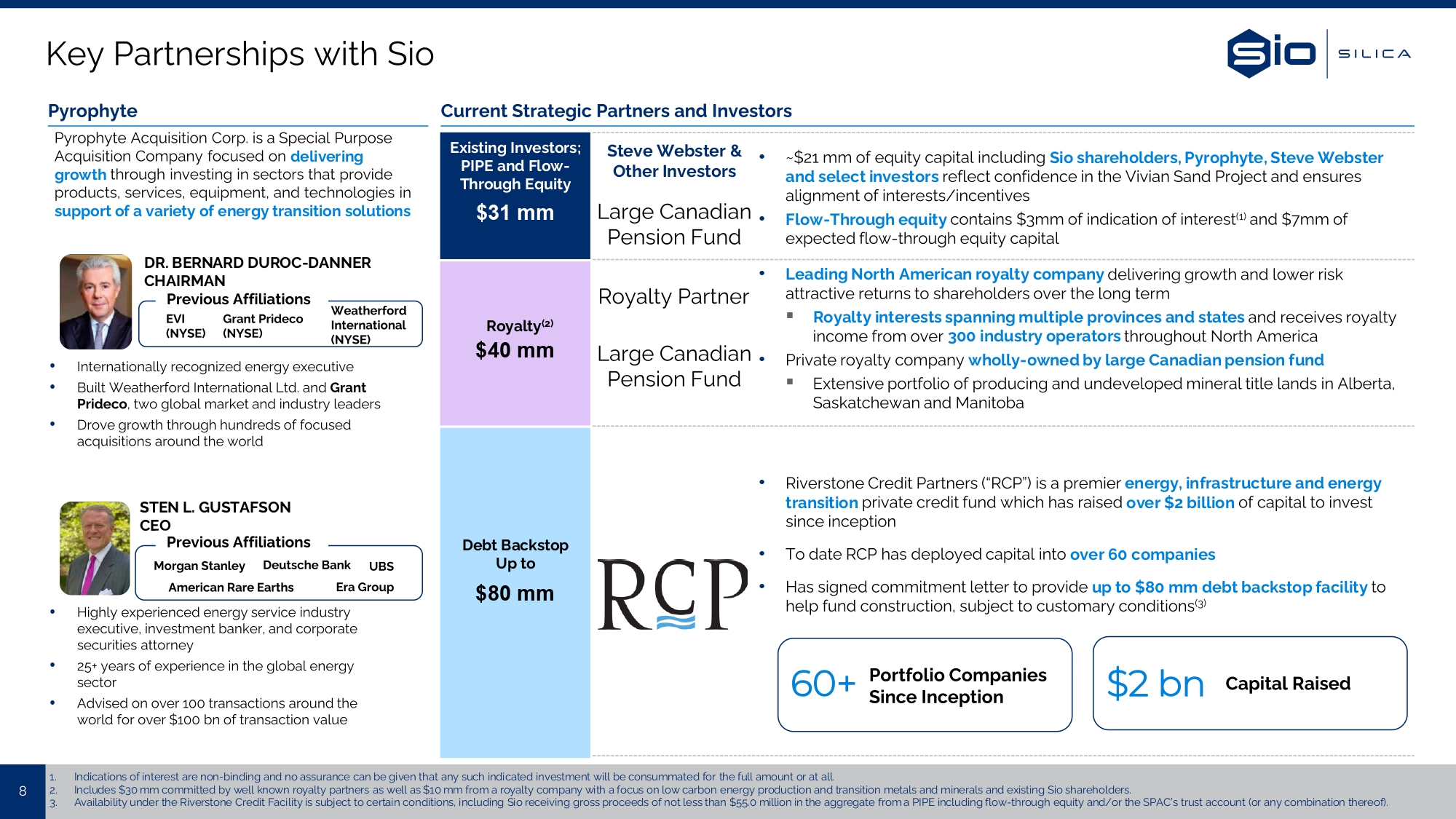

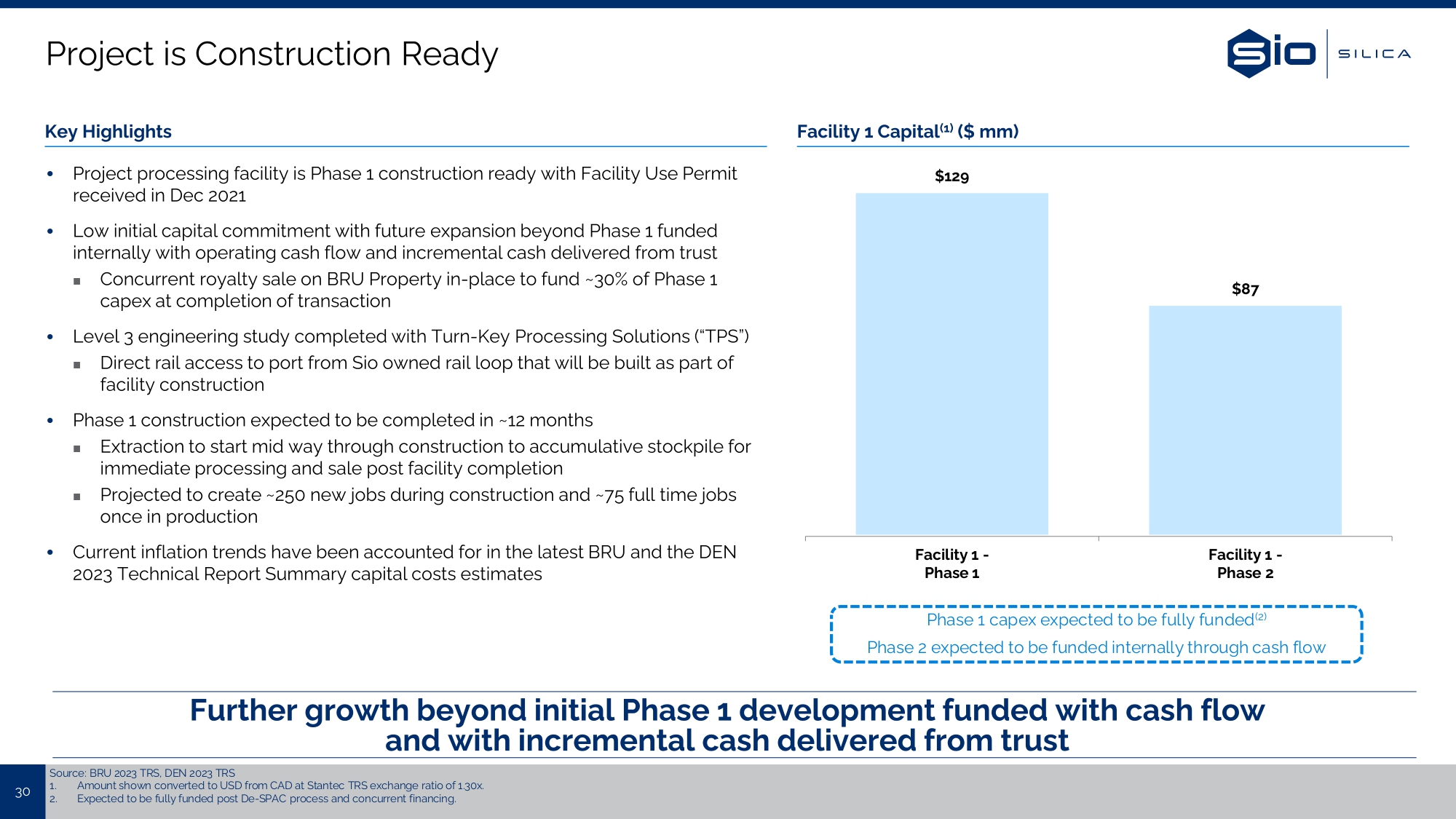

Financing

The Business Combination Agreement contemplates (a) the delivery and execution of the Credit Agreement on the Closing Date and the debt financing pursuant to such Credit Agreement (“Debt Financing”) becoming available, (b) the receipt on the Closing Date of approximately $40,000,000 in aggregate sales proceeds pursuant to the Royalty Purchase and Sale Agreements between Sio and the agreement counterparties, pursuant to which Sio covenants to sell to each of the agreement counterparties an overriding royalty (in the form of an undivided percentage interest in and to all marketable naturally occurring minerals or mineral bearing material mined or otherwise recovered from Sio’s BRU Property) for a specified cash purchase price, which purchase price is to be used by Sio solely to fund the development of its BRU Property, and (c) the PIPE Investment. Availability of the Debt Financing is subject to certain conditions, including Sio receiving gross proceeds of not less than $55,000,000 in the aggregate from any PIPE financing and any remaining cash in Pyrophyte’s trust account after the Redemption (or any combination thereof).

4

Termination Rights

The Business Combination Agreement may be terminated at any time prior to the Closing (i) by mutual written consent of Pyrophyte and Sio; (ii) by Pyrophyte or Sio upon the occurrence of any of the following: (a) if the Closing has not occurred prior to November 13, 2024 (the “Outside Date”), which may be extended by either party pursuant to written notice given to the other party for an additional sixty-five (65) days if the SEC has not declared the Registration Statement effective by the date which is sixty (60) days prior to the Outside Date, provided however, that the Business Combination Agreement may not be terminated by or on behalf of any party that is either directly or indirectly through its affiliates in breach or violation of any representation, warranty, covenant, agreement or obligation contained in the Business Combination Agreement and such breach is the cause of the failure of a condition to the parties’ obligation to close; (b) by Pyrophyte or Sio if any governmental entity has enacted, issued, promulgated, enforced or entered any injunction, order, decree or ruling which has become final and nonappealable and has the effect of permanently restraining, enjoining or otherwise prohibiting the Proposed Transactions, except that such termination right will not apply as a result of the refusal of the Court to issue a Final Order in respect of the Plan of Arrangement; or (c) by Pyrophyte or Sio if the requisite approvals are not obtained from Pyrophyte’s shareholders or Sio’s shareholders, except that such termination right will not be available to any party to the Business Combination Agreement whose failure to fulfill any of its obligations or breach of any its representations and warranties under the Business Combination Agreement has been the cause of, or results in, failure to obtain such requisite approvals; (iii) by Pyrophyte in the event any representation, warranty, covenant or agreement by Sio or Sio Newco has been breached or has become untrue such that the conditions to Closing would not be satisfied; provided, however, that Pyrophyte has not waived such breach and that Pyrophyte or Sio Newco is not then in material breach of its representations, warranties, covenants or agreements under the Business Combination Agreement; provided, further, that, if such breach is curable by Sio or Sio Newco, Pyrophyte may not terminate for so long as Sio or Sio Newco continues to exercise its reasonable efforts to cure such breach, unless such breach is not cured by the earlier of 30 days after notice of such breach and the Outside Date, and that Pyrophyte may not terminate pursuant to this clause (iii) if it has materially breached the Business Combination Agreement, which breach has not been cured; (iv) by Sio in the event any representation, warranty, covenant or agreement by Pyrophyte or Pyrophyte Newco has been breached or has become untrue such that the conditions to Closing would not be satisfied; provided, however, that Sio has not waived such breach and that Sio or Sio Newco is not then in material breach of their representations, warranties, covenants or agreements under the Business Combination Agreement; provided, further, that, if such breach is curable by Pyrophyte or Pyrophyte Newco, Sio may not terminate for so long as Pyrophyte or Pyrophyte Newco continue to exercise their reasonable efforts to cure such breach, unless such breach is not cured by the earlier of 30 days after notice of such breach and the Outside Date, and that Sio may not terminate pursuant to this clause (iv) if it has materially breached the Business Combination Agreement, which breach has not been cured; or (v) by Sio at any time prior to Pyrophyte receiving the requisite approval of its shareholders, if Pyrophyte or Pyrophyte’s board of directors effects a Change in Recommendation (as defined in the Business Combination Agreement).

Effect of Termination

If the Business Combination Agreement is terminated, the agreement will become void, and there will be no liability under the Business Combination Agreement on the part of any party thereto, except as set forth in the Business Combination Agreement. The Business Combination Agreement provides that no such termination shall affect any liability on the part of any party for fraud or a willful and material breach of the Business Combination Agreement.

A copy of the Business Combination Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference. The foregoing description of the Business Combination Agreement and the Proposed Transactions does not purport to be complete and is qualified in its entirety by reference to the full text of the Business Combination Agreement filed with this Current Report on Form 8-K. The Business Combination Agreement is included to provide security holders with information regarding its terms. It is not intended to provide any other factual information about Sio, Pyrophyte Newco, Pyrophyte or Sio Newco. In particular, the assertions embodied in representations and warranties by Sio, Pyrophyte Newco, Pyrophyte and Sio Newco contained in the Business Combination Agreement are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement, including being qualified by confidential information in the disclosure schedules provided by the parties in connection with the execution of the Business Combination Agreement, and are subject to standards of materiality applicable to the contracting parties that may differ from those applicable to security holders. The confidential disclosures contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Business Combination Agreement. Moreover, certain representations and warranties in the Business Combination Agreement were used for the purpose of allocating risk between the parties, rather than establishing matters as facts. Accordingly, security holders should not rely on the representations and warranties in the Business Combination Agreement as characterizations of the actual state of facts about Sio, Pyrophyte Newco, Pyrophyte or Sio Newco. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in Pyrophyte’s public disclosures.

5

Subscription Agreements

Concurrently with the execution of the Business Combination Agreement, Pyrophyte, Sio and Sio Newco entered into subscription agreements with (i) a certain accredited investor (the “Non-Insider PIPE Investor”) and (ii) certain other accredited investors who are existing shareholders of Sio or Pyrophyte (the “Insider PIPE Investors” and, together with the Non-Insider PIPE Investor, the “PIPE Investors”), pursuant to which, among other things, Sio Newco agreed to issue and sell, in a private placement to close concurrently with and conditioned upon the effectiveness of the consummation of the Proposed Transactions, an aggregate of 3,114,258 Pubco Class A Common Shares (the “PIPE Investment”) to the PIPE Investors for an aggregate purchase price equal to $20,122,474.

The foregoing description of the PIPE Investment does not purport to be complete and is qualified in its entirety by the terms and conditions of (i) the form of subscription agreement entered into with the Non-Insider PIPE Investors (the “Non-Insider Subscription Agreement”) and (ii) the form of subscription agreement entered into with the Insider PIPE Investors (the “Insider Subscription Agreement” and, together with the Non-Insider Subscription Agreement, the “Subscription Agreements”), as applicable, copies of which are filed as Exhibits 10.1 and 10.2, respectively, hereto and are incorporated by reference herein.

Non-Redemption Agreement

Concurrently with the execution of the Business Combination Agreement, Pyrophyte and Sio Newco entered into a non-redemption agreement (the “Non-Redemption Agreement”) with a Pyrophyte shareholder with respect to 100,000 SPAC Class A Ordinary Shares held by such shareholder (the “Non-Redemption SPAC Shares”), pursuant to which, among other things, Pyrophyte agreed to issue 58,570 SPAC Class A Ordinary Shares to such shareholder in consideration of such shareholder’s commitment not to redeem the Non-Redemption SPAC Shares held by it in connection with the approval of the Proposed Transactions by Pyrophyte’s shareholders (the “Non-Redemption Transaction”).

The foregoing description of the Non-Redemption Transaction and the Non-Redemption Agreement does not purport to be complete and is qualified in its entirety by the full text of the Non-Redemption Agreement, a copy of which is filed as Exhibit 10.3 hereto and is incorporated by reference herein.

Sponsor Support Agreement

Concurrently with the execution of the Business Combination Agreement, Pyrophyte Acquisition LLC, a Delaware limited liability company (the “Sponsor”), entered into a letter agreement (the “Sponsor Support Agreement”) with Sio, Sio Newco, Pyrophyte and the directors and officers (or otherwise a part of the management team) of Pyrophyte, solely for purposes of amending certain of the terms of the letter agreement signed by them in connection with Pyrophyte’s initial public offering, pursuant to which, among other things, the Sponsor agreed to (i) appear at the Pyrophyte Shareholders Meeting or otherwise cause the Covered Shares (as defined below) to be counted as present thereat for the purposes of establishing a quorum, (ii) vote all SPAC Class A Ordinary Shares, or any securities convertible into, exercisable or exchangeable for SPAC Class A Ordinary Shares, held by it or acquired after the date of the Sponsor Support Agreement (the “Covered Shares”) at the Pyrophyte Shareholders Meeting (or execute and deliver a written consent, if applicable, causing to be voted) (v) in favor of any circumstances upon which a consent or other approval is required under the organizational documents of Pyrophyte or otherwise sought in furtherance of the Proposed Transactions, (w) in favor of the adoption and approval of the Proposed Transactions and each other proposal related to the Proposed Transactions necessary or reasonably requested by Pyrophyte for the consummation of the Proposed Transactions, (x) against any alternative transactions or actions reasonably expected to impede, interfere with, delay, postpone or adversely impact the Proposed Transaction or result in a breach of any covenant, representation or warranty of Pyrophyte under the Business Combination Agreement or result in any of the closing conditions of the Business Combination Agreement not being fulfilled, (y) against any change in the dividend policy or capitalization of, including the voting rights of, any class of shares of Pyrophyte, and (z) against any change in business, management or the board of directors of the Pyrophyte, in each of clause (y) and (z) other than in connection with the Proposed Transactions, (iii) not transfer the SPAC Class A Ordinary Shares until the earlier of (a) termination of the Business Combination Agreement and (b) termination of the Sponsor Support Agreement upon mutual written agreement of the parties thereto, (iv) not redeem any Covered Shares owned by it in connection with approval of the Proposed Transactions by Pyrophyte’s shareholders, (v) not transfer any Covered Shares (other than Pubco Class A Common Shares issued upon exercise of any private placement warrants held by the Sponsor) until the earlier of (A) one year after the Closing, (B) the first day the last sale price of Pubco Class A Common Shares equals or exceeds $12.00 per share for any 20 trading days within a 30-day trading period commencing at least 150 days after the Closing or (C) after the Closing, the date on which Pubco completes a liquidation, amalgamation, share exchange or similar transaction resulting in the shareholders of Pubco having the right to exchange their shares for consideration, and (vi) not transfer any private placement warrants (or Pubco Class A Common Shares issued or issuable upon exercise of such warrants) held by it until 30 days after the Closing.

6

In addition, the Sponsor has agreed to subject a number of SPAC Class A Ordinary Shares held by it on the date of execution of the Sponsor Support Agreement (“Restricted Owned Shares”) to certain restrictions, to the extent such shares are used to obtain any additional PIPE Financing or other financing arrangements in connection with consummation of the Proposed Transactions; provided that in no event shall the aggregate number of Restricted Owned Shares equal more than 4,025,000 SPAC Class A Ordinary Shares (the “Maximum Restricted Owned Shares”). If, prior to the Closing, the sum of all Available Closing Cash raised from the PIPE Investment, any non-redemption agreements (including the Non-Redemption Agreement) and any other cash and cash equivalents of Pyrophyte (including the proceeds of any securities funded in connection with the Closing but excluding, for the avoidance of doubt, (I) the Royalty Agreement Proceeds (as defined in the Business Combination Agreement), (II) proceeds received from any flow-through common shares (other than to the extent that any incentive equity interests are issued in connection with such issuance) and (III) any Indebtedness (as defined in the Business Combination Agreement) funded in connection with the Closing) (collectively, the “SPAC Proceeds”) is less than $70,000,000, then (i) the number of Restricted Owned Shares shall be equal to the actual number of SPAC Class A Ordinary Shares that were used to secure such SPAC Proceeds, up to (but not exceeding) an amount equal to the Maximum Restricted Owned Shares (the “Incentive Owned Shares”), and (ii) a number of SPAC Class A Ordinary Shares owned by Sponsor equal to (x) 4,025,000 minus (y) the number of Incentive Owned Shares shall be automatically forfeited and deemed transferred to Pyrophyte for cancellation for no consideration. If, prior to Closing, the sum of the Available Closing Cash raised from the SPAC Proceeds is equal to or greater than $70,000,000, then the number of Restricted Owned Shares shall be equal to the Incentive Owned Shares.

In connection with the Closing, each Restricted Owned Share will be exchanged on a one-for-one basis for Pubco Class A Common Shares pursuant to the Business Combination and the Plan of Arrangement and such shares will be subject to forfeiture or release as follows: (i) half of the Restricted Owned Shares will be released to the Sponsor on the first day that the Trading Price (as defined in the Business Combination Agreement) is at least $12.50, (ii) the other half of the Restricted Owned Shares will be released from forfeiture on the first day that the Trading Price is at least $15.00, in each case during the period commencing on the Closing Date and ending on the date that is three (3) years after the Closing Date (the “End Date”), and (iii) after the End Date, any Restricted Owned Shares that have not been released to the Sponsor pursuant to clauses (i) or (ii) above will be automatically forfeited for no consideration.

The foregoing description of the Sponsor Support Agreement is qualified in its entirety by reference to the full text of the Sponsor Support Agreement, a copy of which is included as Exhibit 10.5 to this Current Report on Form 8-K and is incorporated herein by reference.

7

Sio Securityholder Support Agreements

In connection with the execution of the Business Combination Agreement, on November 13, 2023, Pyrophyte, Sio, and certain securityholders of Sio entered into support agreements (the “Sio Securityholder Support Agreements”), pursuant to which, among other things, such shareholders agreed to vote (or cause to be voted) all of their Sio shares and other voting securities of Sio (“Subject Securities”) in favor of the special resolution of Sio shareholders in respect of the Plan of Arrangement, to be considered at Sio’s shareholders meeting to approve the Proposed Transaction. Additionally, such shareholders have agreed, among other things, not to, prior to the Closing, (a) transfer any of their Subject Securities (or enter into any agreement, arrangement or understanding in connection therewith other than pursuant to the Plan of Arrangement), subject to certain customary exceptions, or (b) enter into any voting arrangement that is inconsistent with the Sio Securityholder Support Agreements. Sio covenants in the Business Combination Agreement that it will use commercially reasonable efforts to obtain Sio Securityholder Support Agreements from at least 66 ⅔% of its shareholders as promptly as possible, but in any event, within five days of the execution date of the Business Combination Agreement.

The foregoing description of the Sio Securityholder Support Agreements is qualified in its entirety by reference to the full text of the form of Sio Securityholder Support Agreements Support Agreement, a copy of which is included as Exhibit 10.6 to this Current Report on Form 8-K and is incorporated herein by reference.

Amended and Restated Registration Rights Agreement

Concurrently with the Closing, Pyrophyte will amend and restate its registration rights agreement, dated October 26, 2021 (as amended and restated, the “Registration Rights Agreement”), pursuant to which Pubco will agree that, within 15 business days after the Closing, Pubco will file with the SEC (at Pubco’s sole cost and expense) a registration statement registering the resale of certain securities held by or issuable to certain existing shareholders of Pyrophyte (the “Resale Registration Statement”), and Pubco will use its commercially reasonable efforts to have the Resale Registration Statement declared effective as soon as reasonably practicable after the filing thereof. In certain circumstances, the holders can demand Pubco’s assistance with underwritten offerings and block trades. The holders will be entitled to customary piggyback registration rights.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the form of Registration Rights Agreement, a copy of which is included as Exhibit G to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Lock-Up Agreement

On the Closing Date, existing shareholders of Sio owning 1% or more of the Sio Common Shares outstanding immediately prior to the Sio Amalgamation will enter into a Lock-Up Agreement (the “Lock-Up Agreement”) with Pubco pursuant to which they will agree, subject to certain customary exceptions, not to (i) effect any sale of, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidation with respect to or decrease a call equivalent position within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations of the SEC promulgated thereunder with respect to, any securities of Pubco, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any securities of Pubco, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise or (iii) make any public announcement of any intention to effect any transaction specified in clause (i) or (ii), until the earlier of (a) six months after the Closing or (b) the date that the last sale price of the Pubco Class A Common Shares equals or exceeds $12.00 per share (as adjusted for share subdivisions, share dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-day trading period provided, however, that the restrictions set forth in each of (i), (ii), and (iii) shall not apply to 10% of the aggregate amount of securities held by such shareholders on the Closing Date.

The foregoing description of the form of Lock-Up Agreement is qualified in its entirety by reference to the full text of the form of Lock-Up Agreement, a copy of which is filed as Exhibit 10.4 to this Current Report on Form 8-K and is incorporated herein by reference.

8

Item 3.02 Unregistered Sales of Equity Securities

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein. The SPAC Class A Ordinary Shares issuable in connection with the Non-Redemption Agreement and the Pubco Class A Common Shares issuable in connection with the PIPE Investment will not be registered under the Securities Act, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

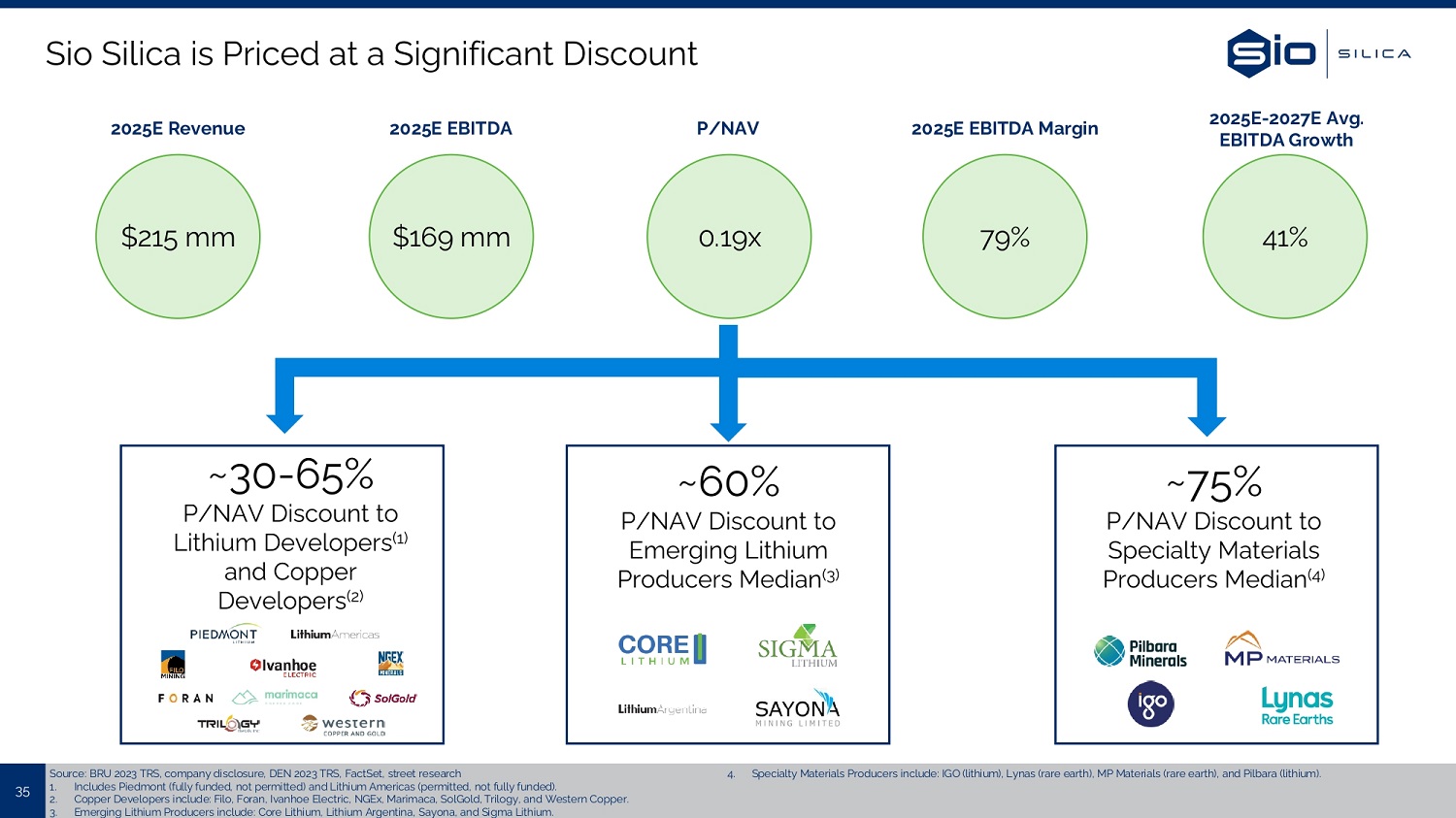

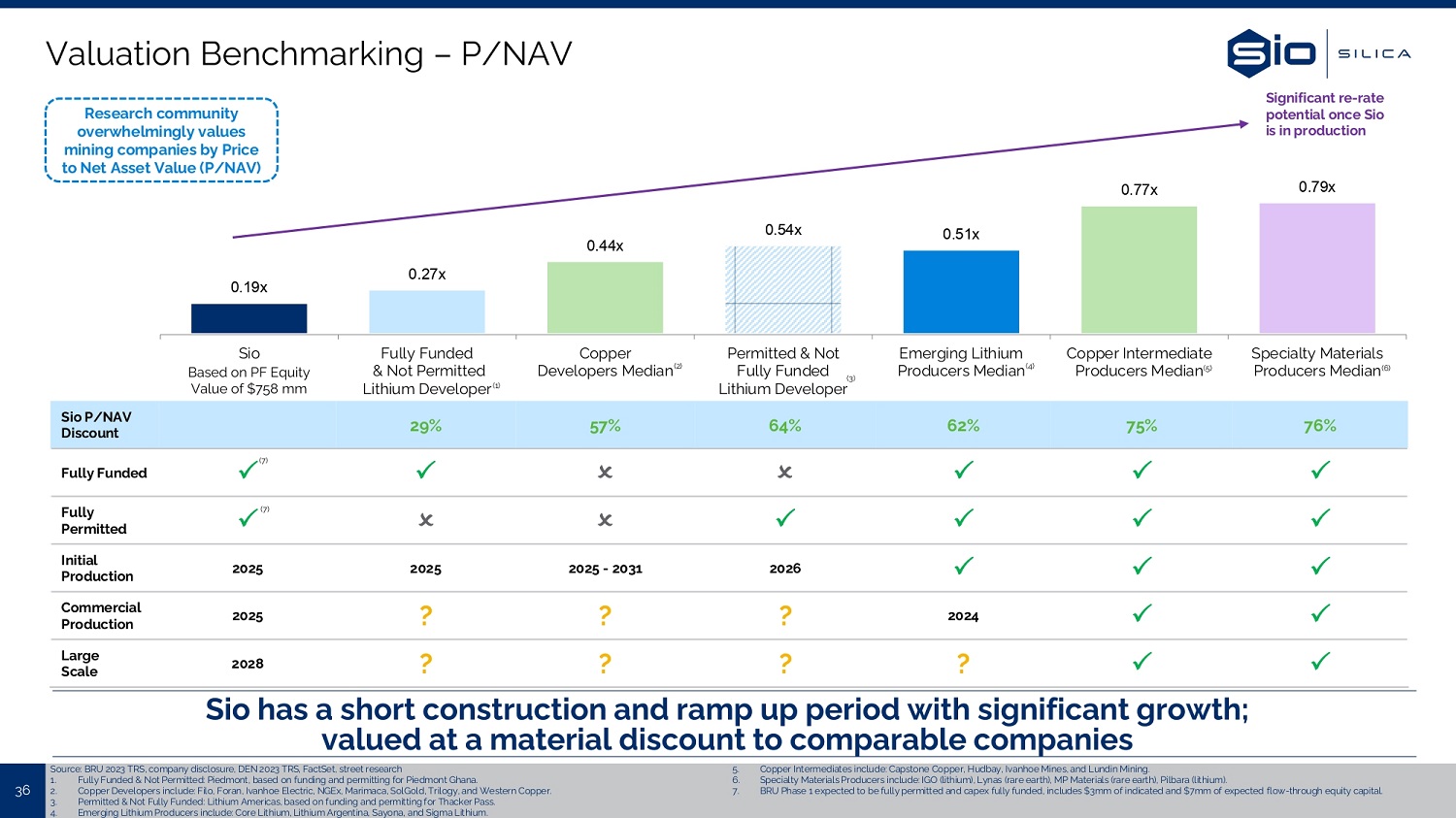

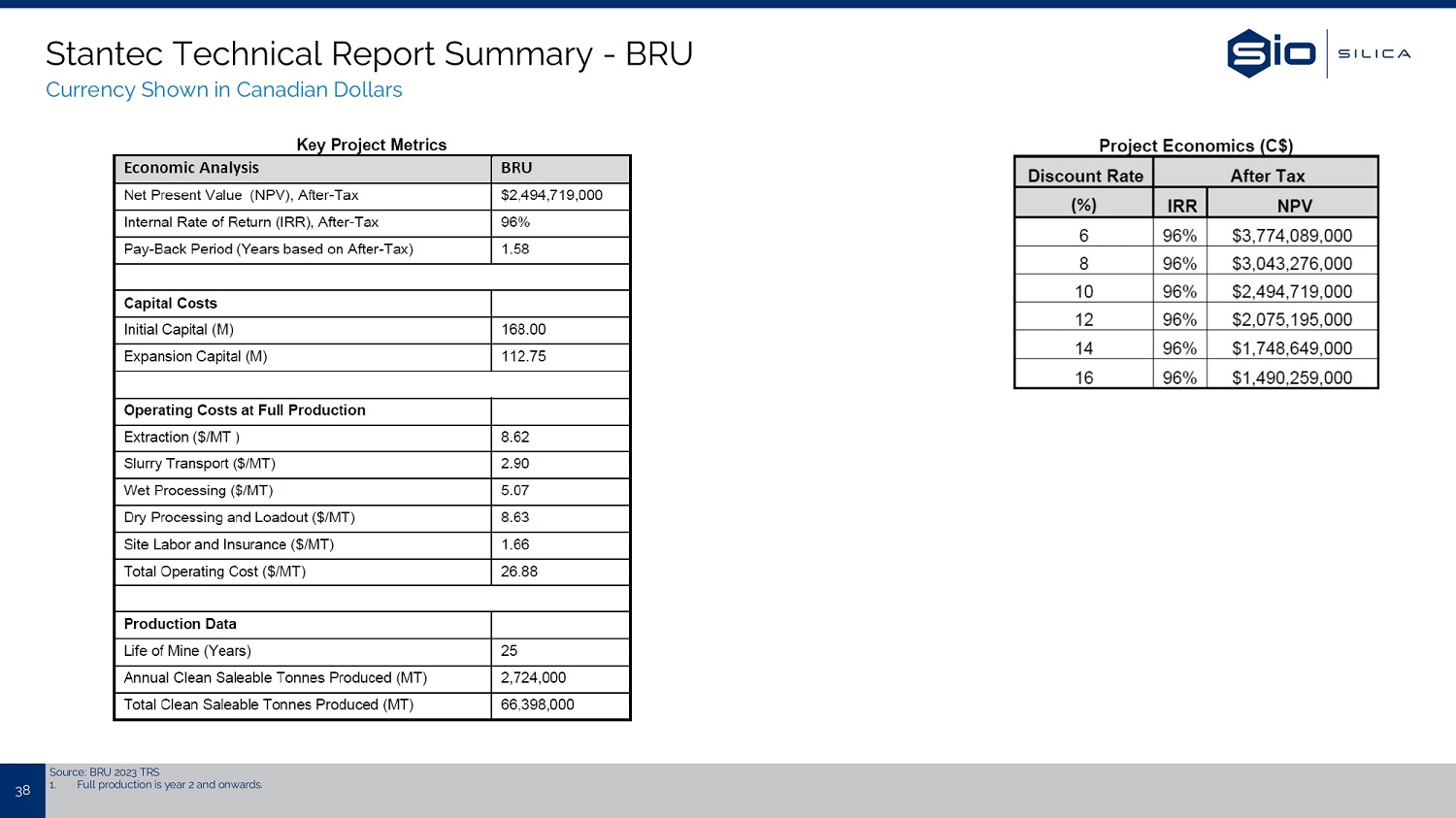

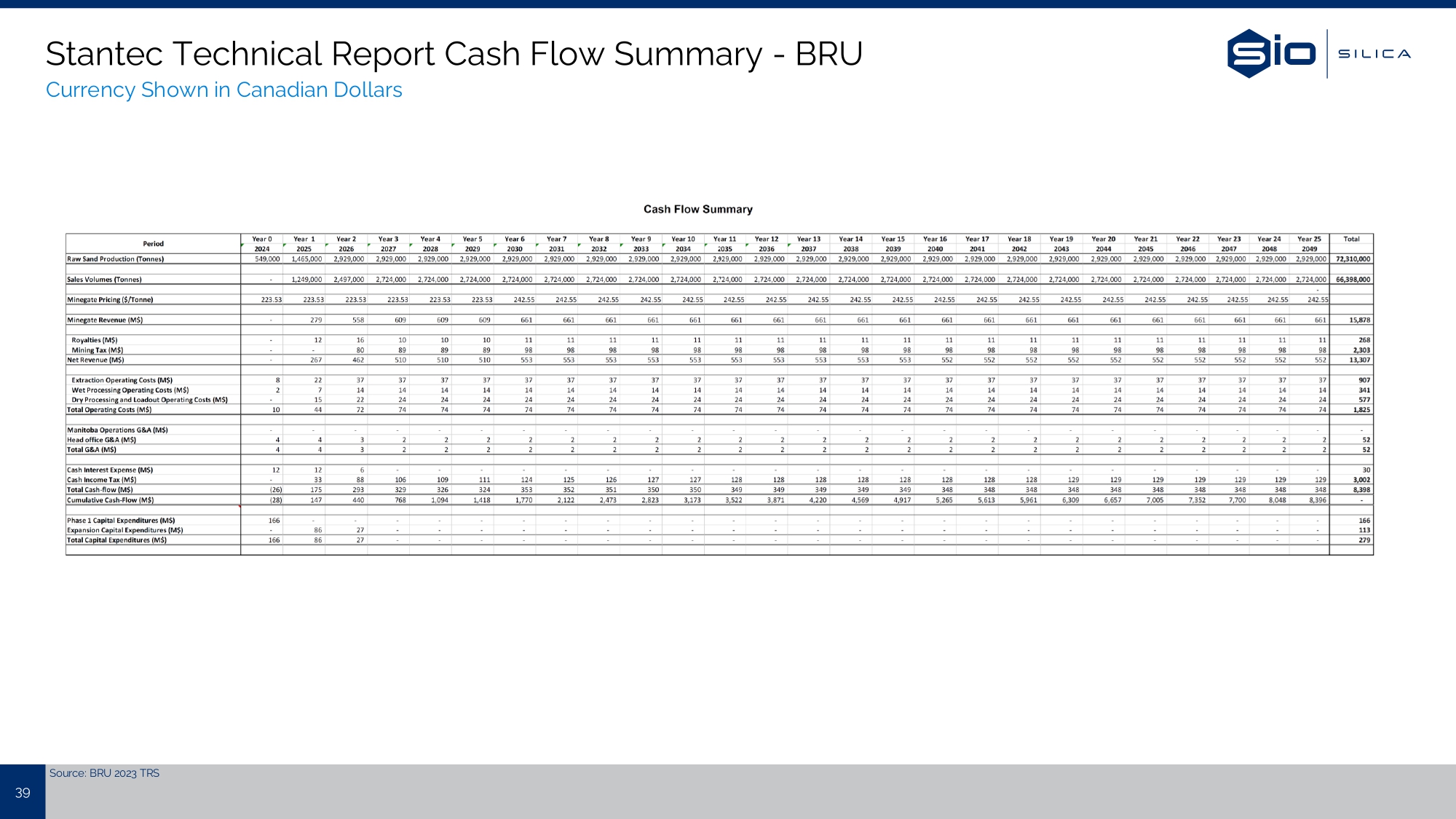

Item 7.01 Regulation FD Disclosure

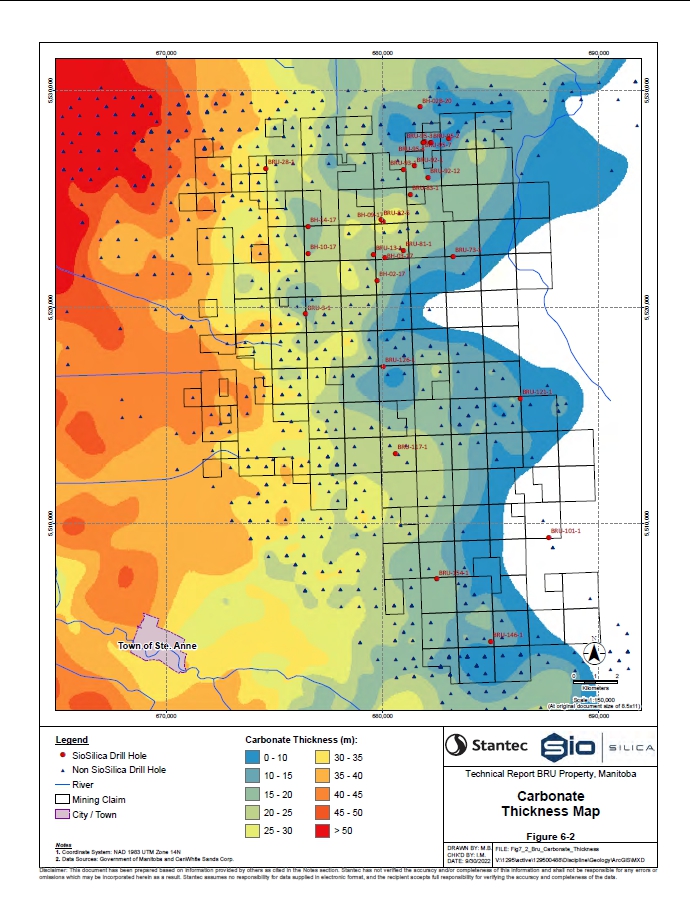

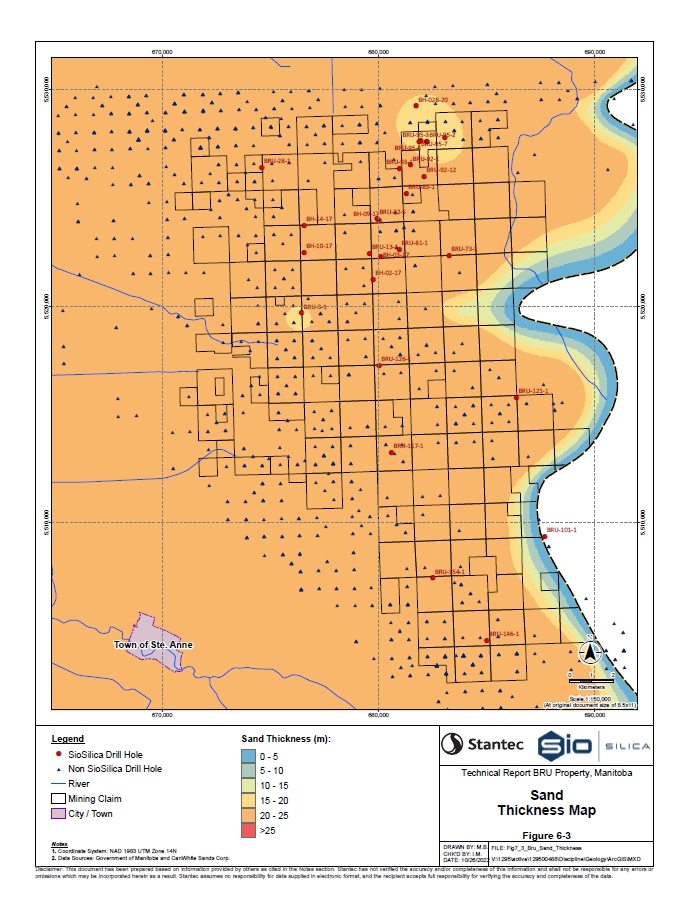

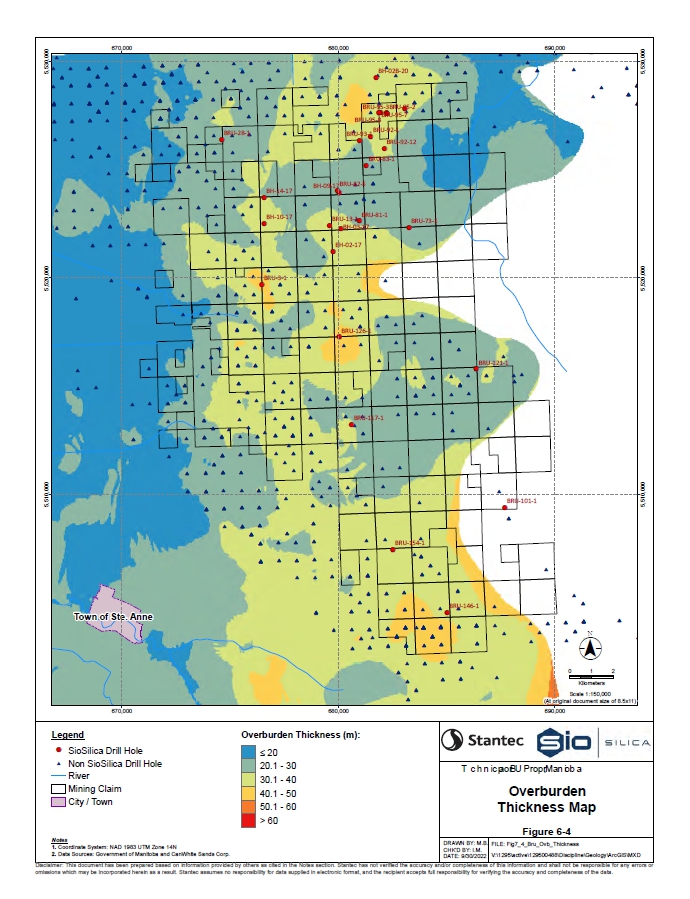

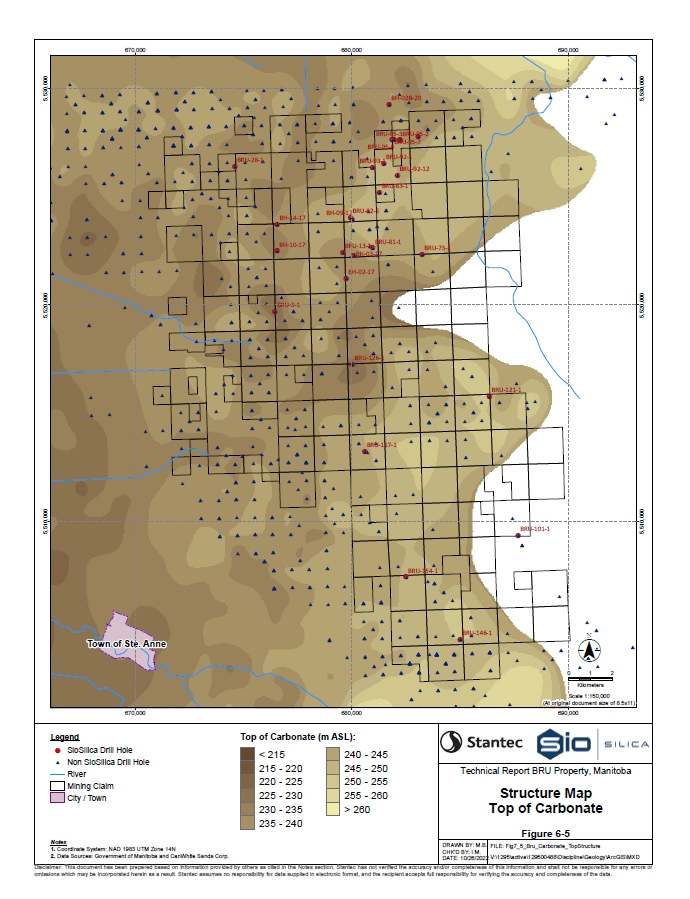

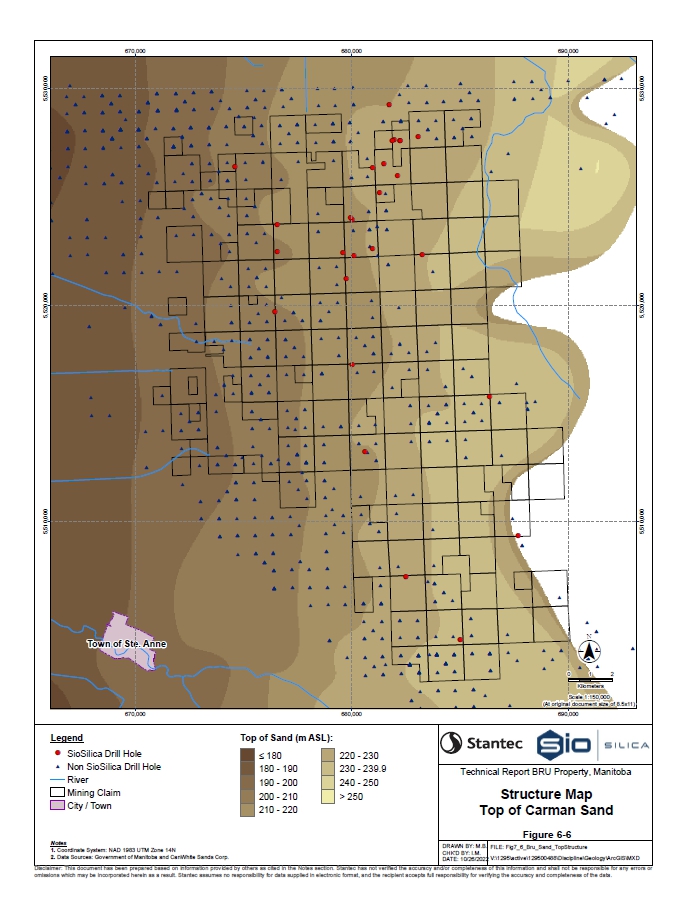

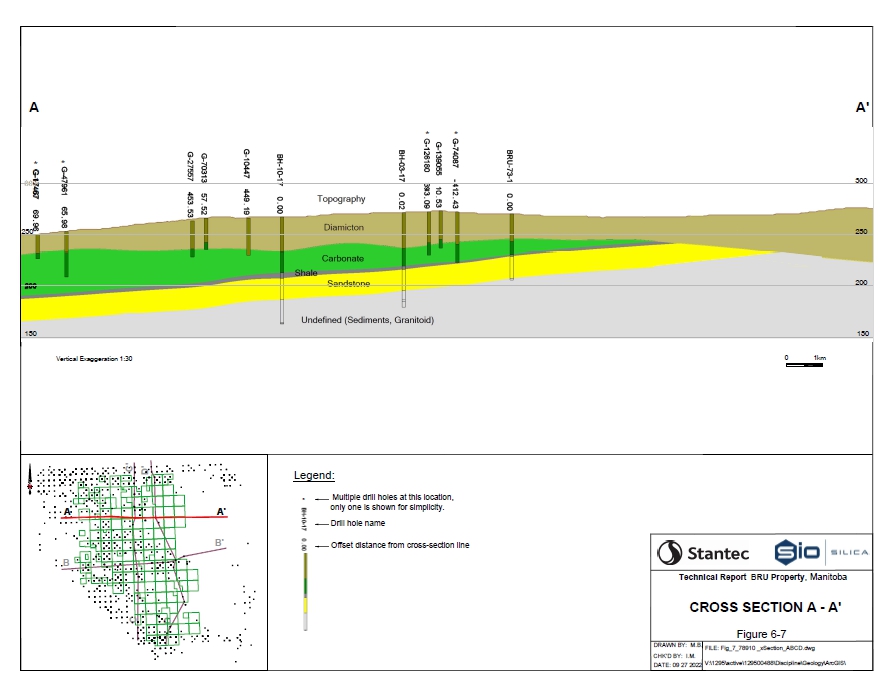

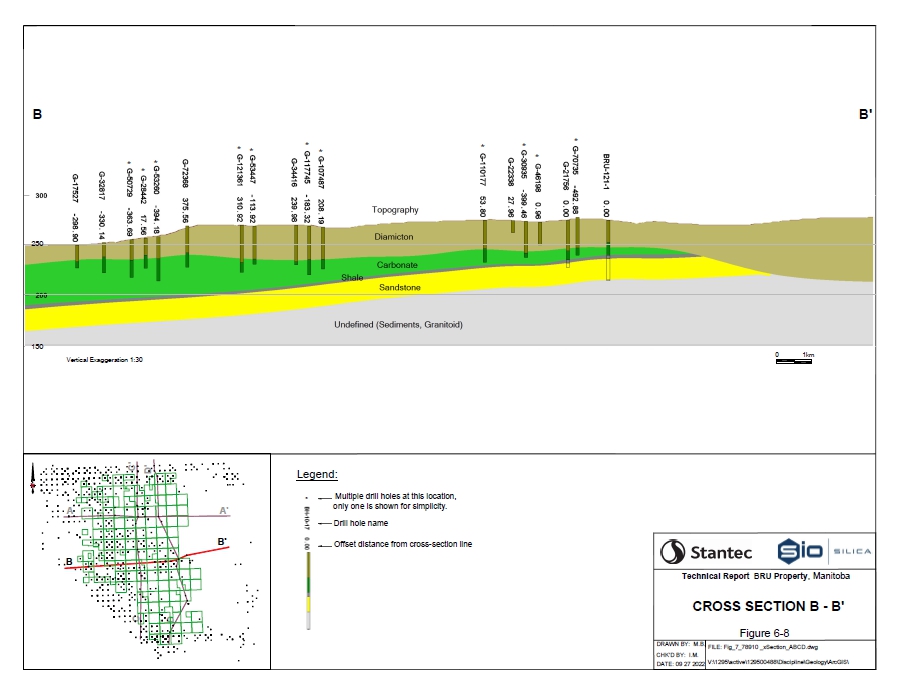

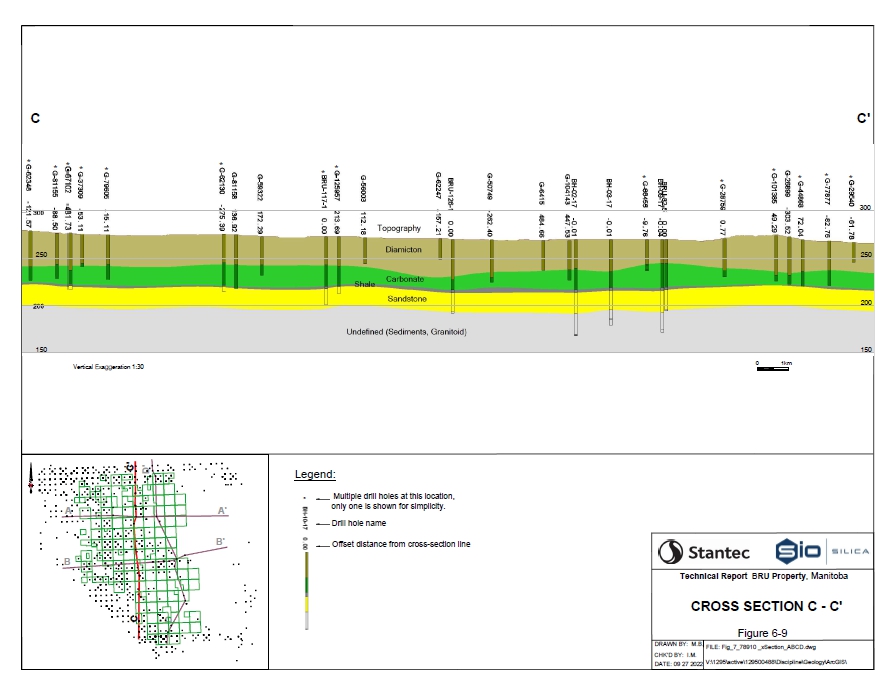

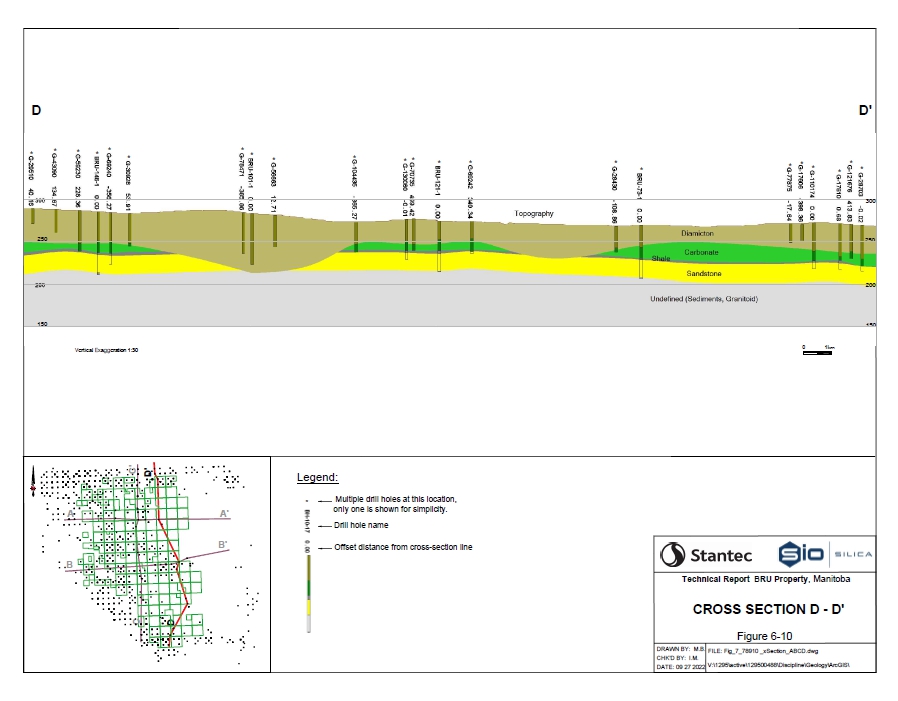

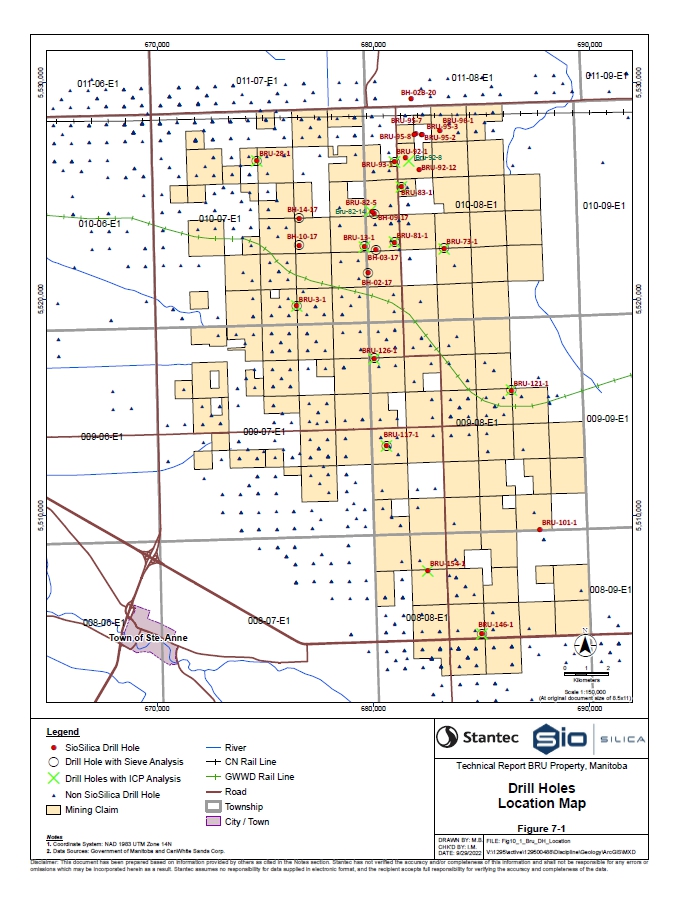

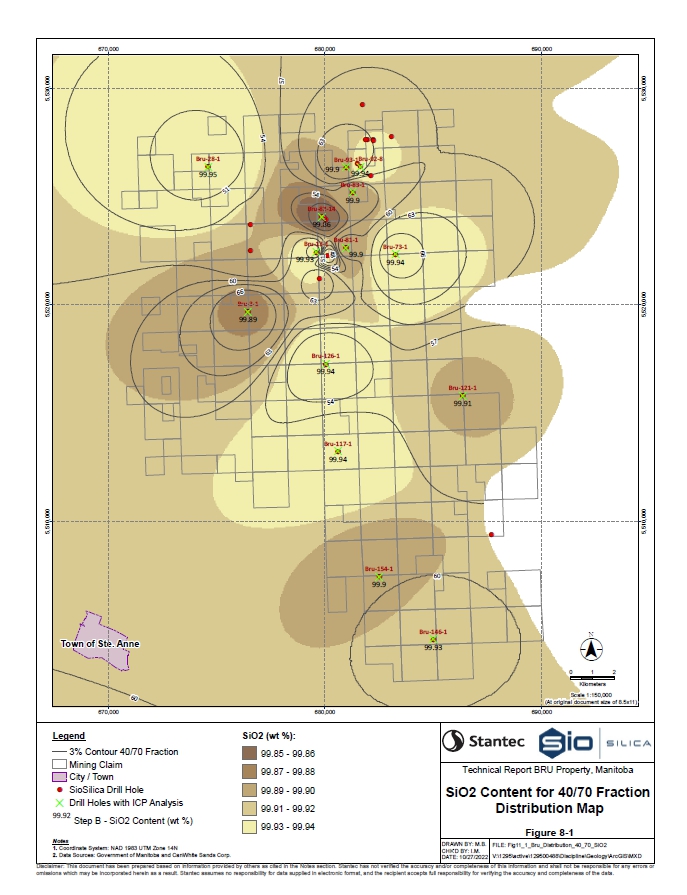

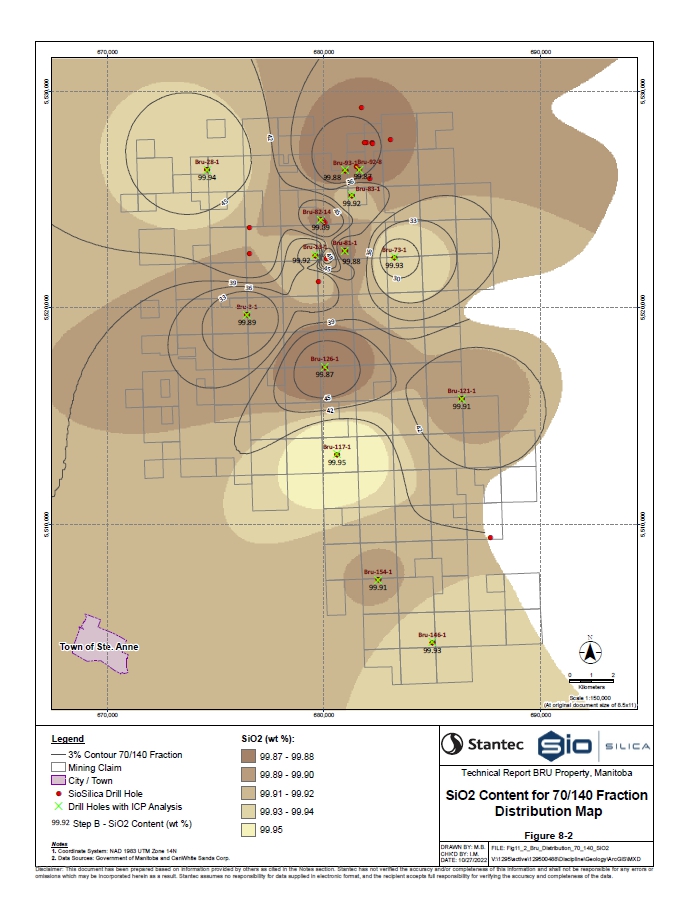

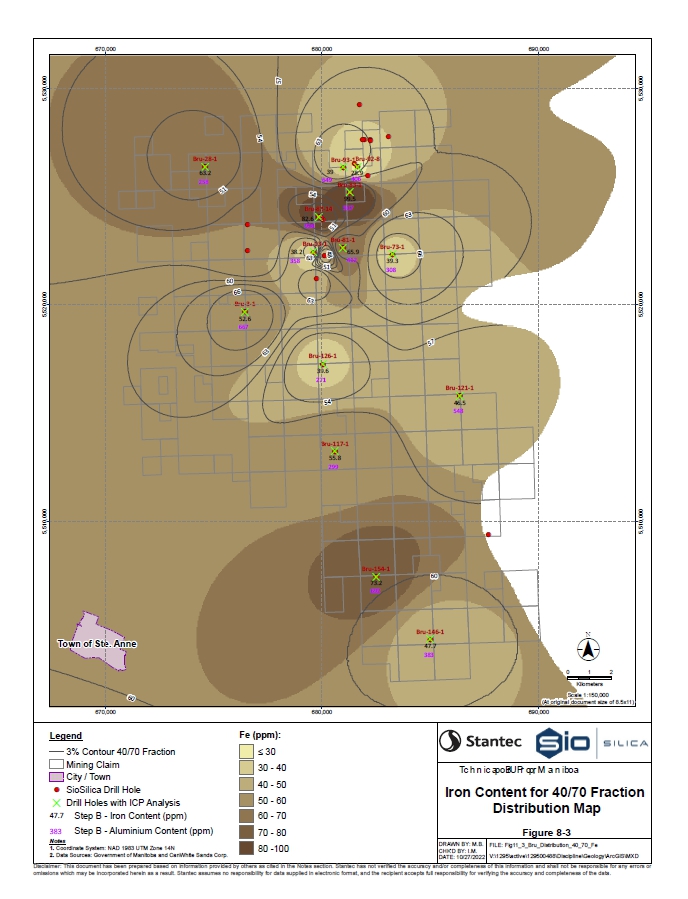

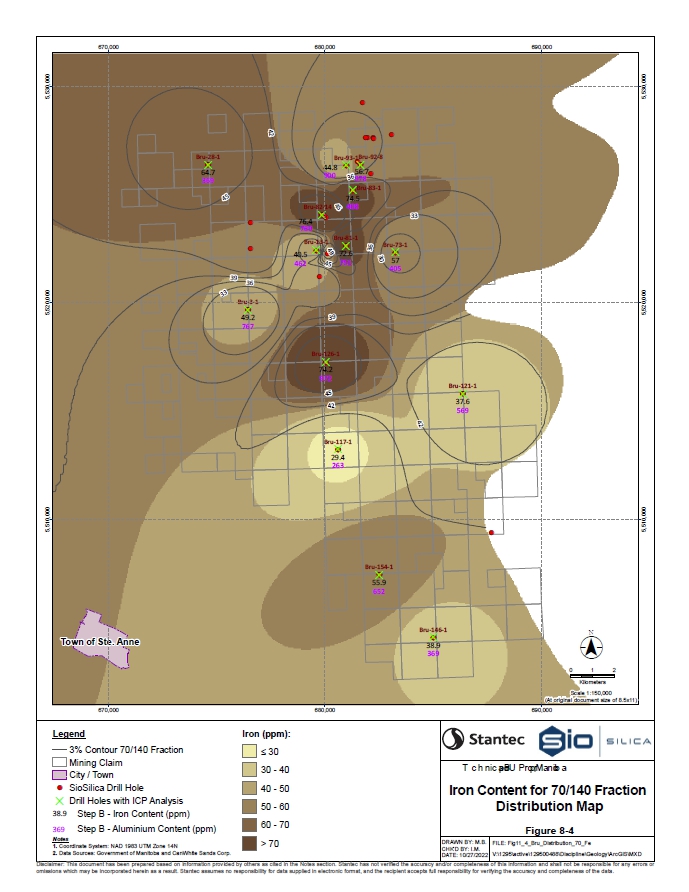

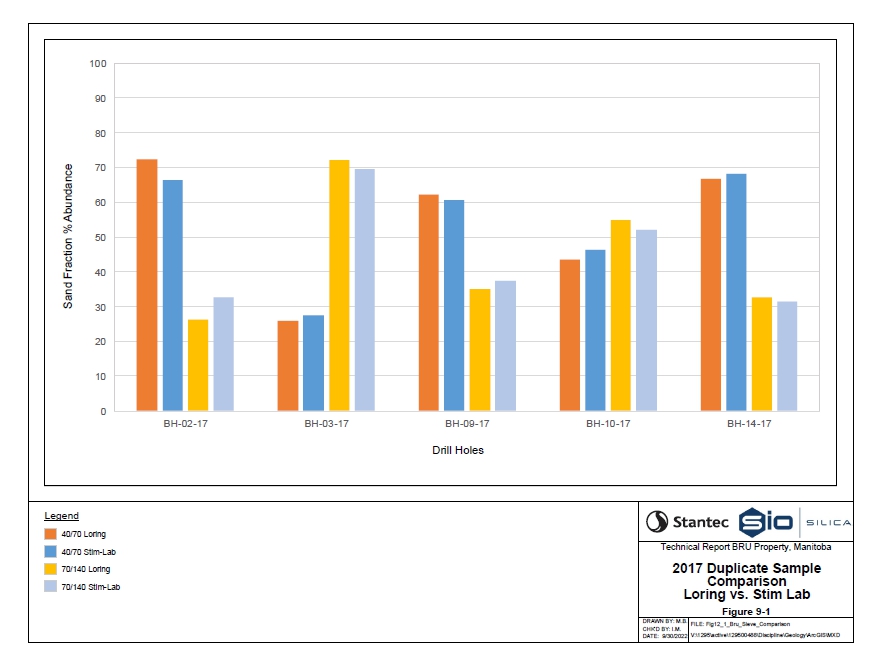

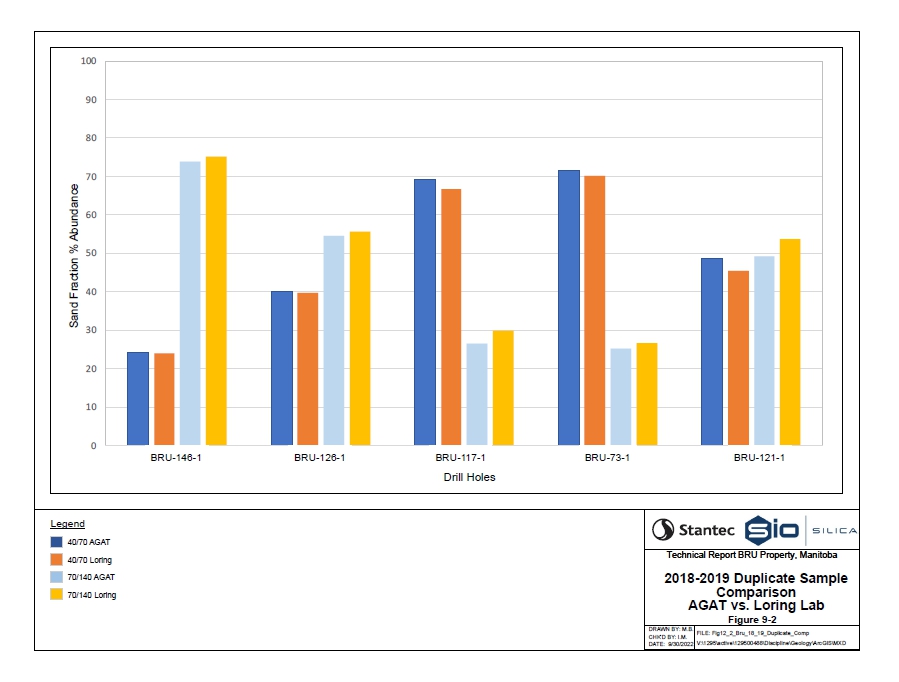

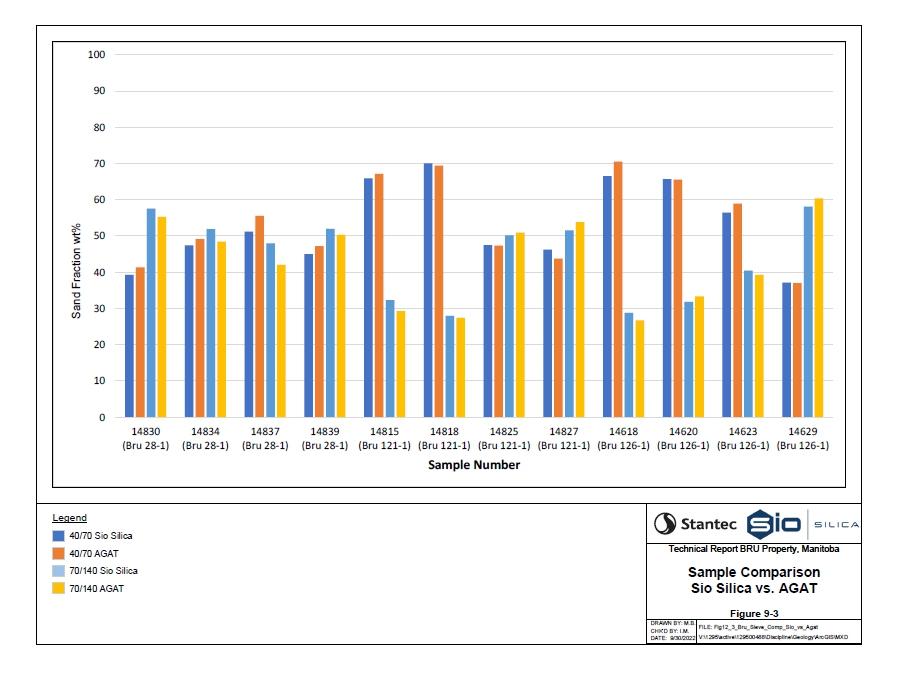

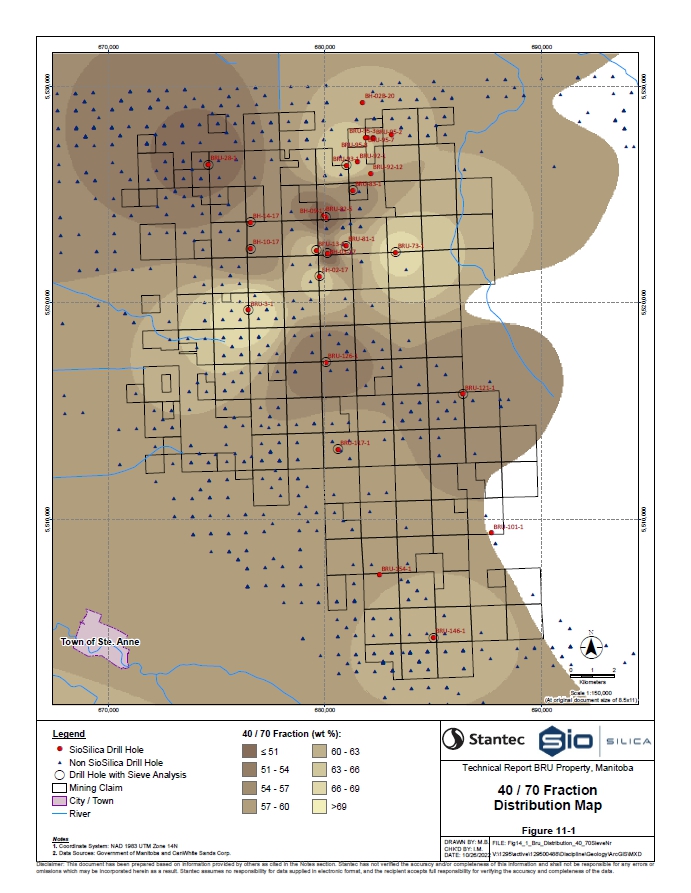

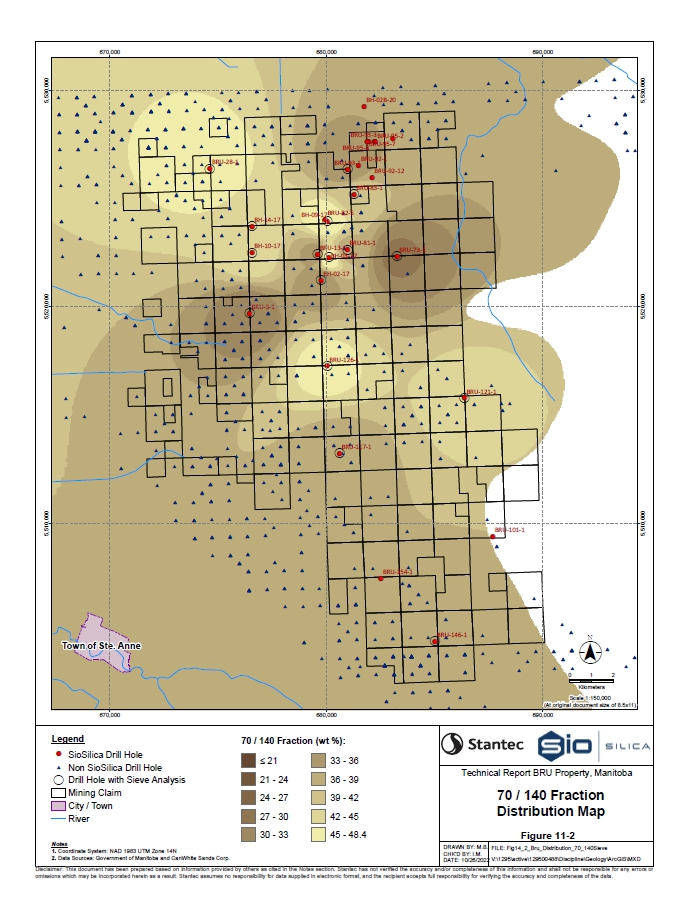

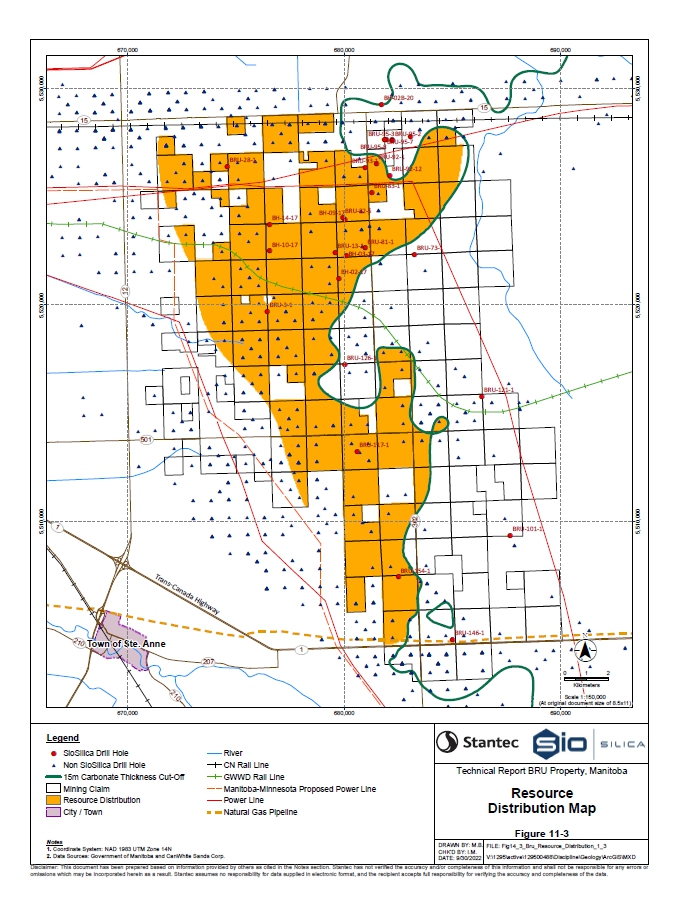

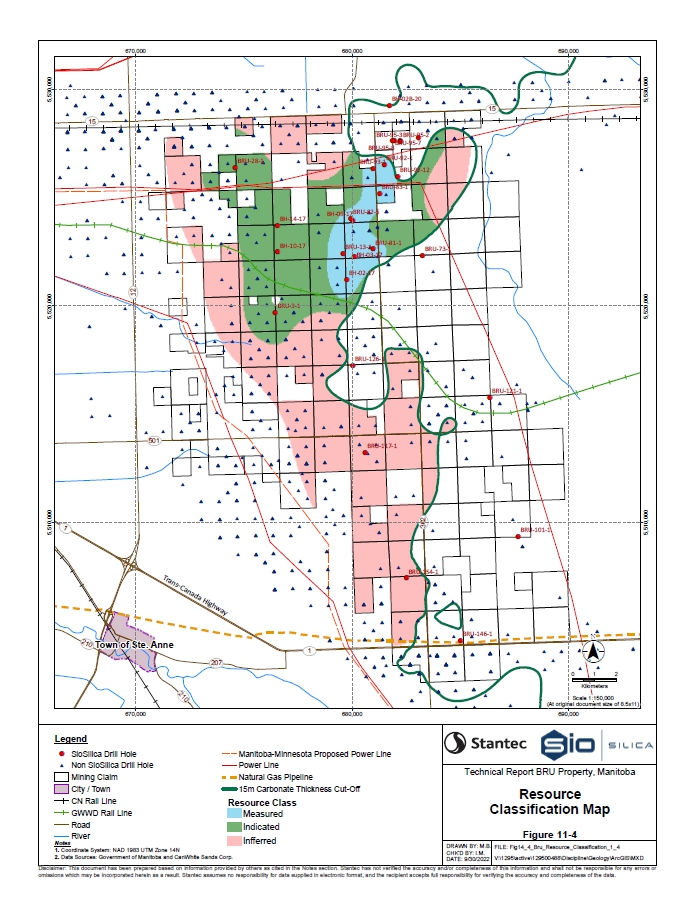

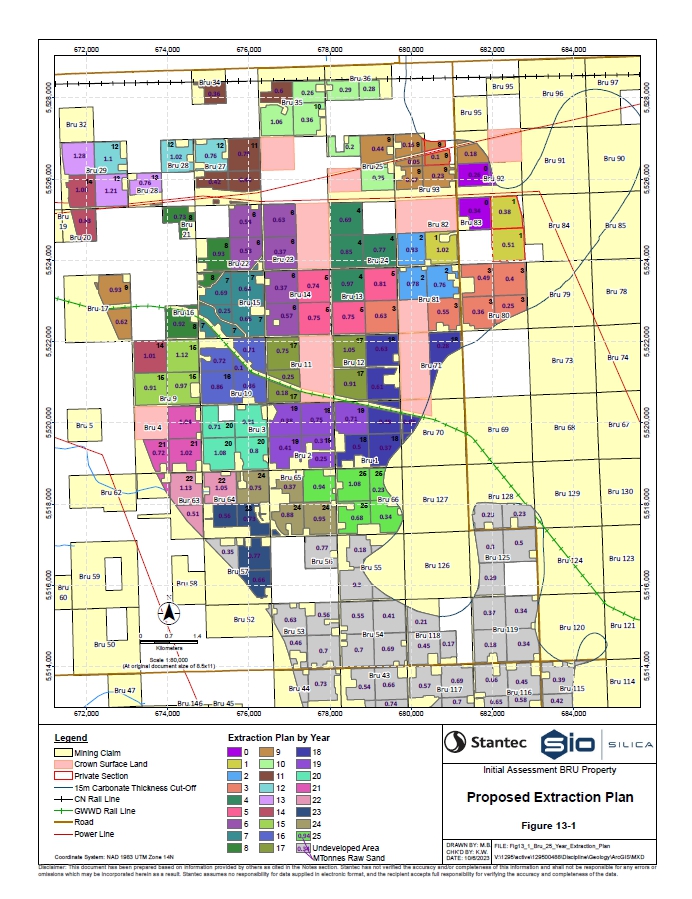

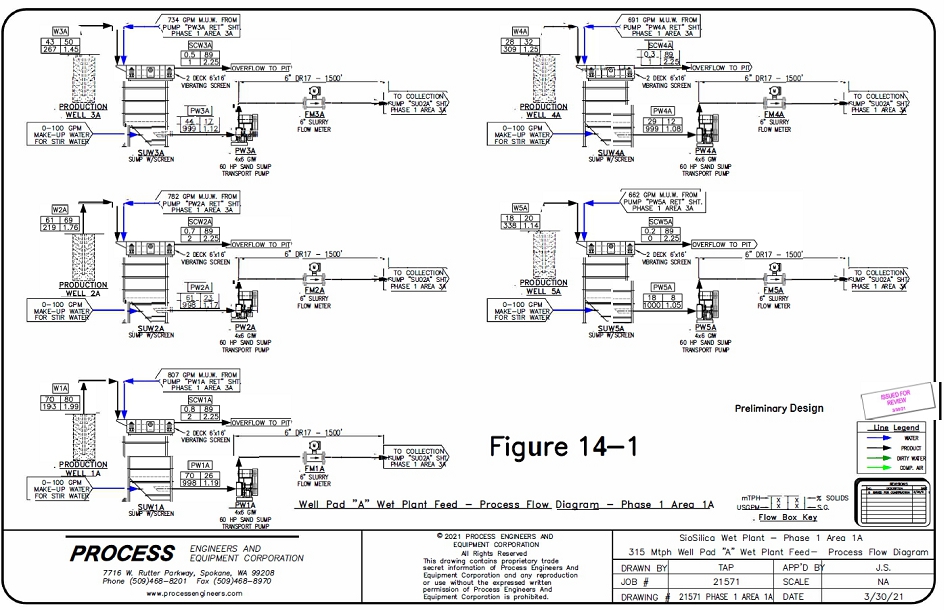

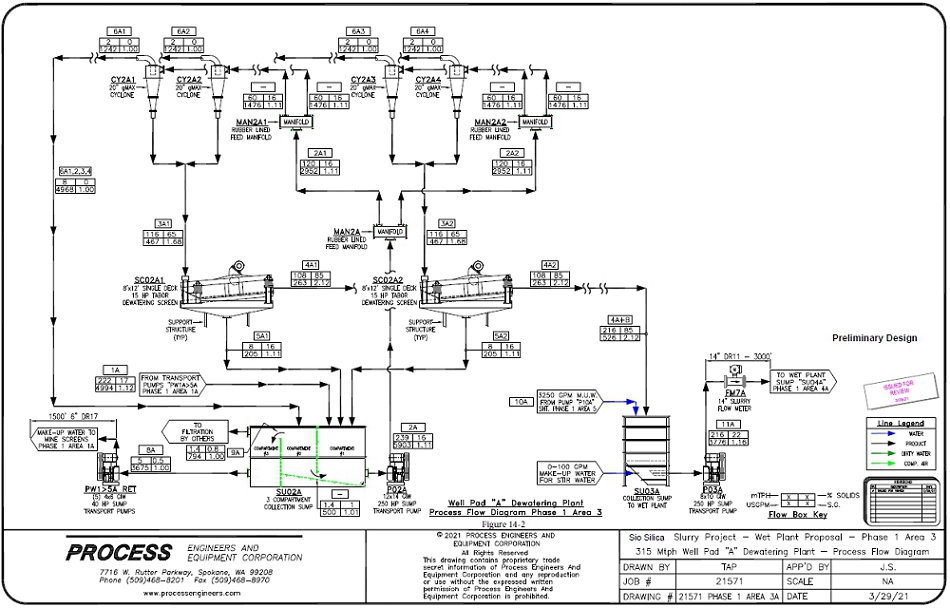

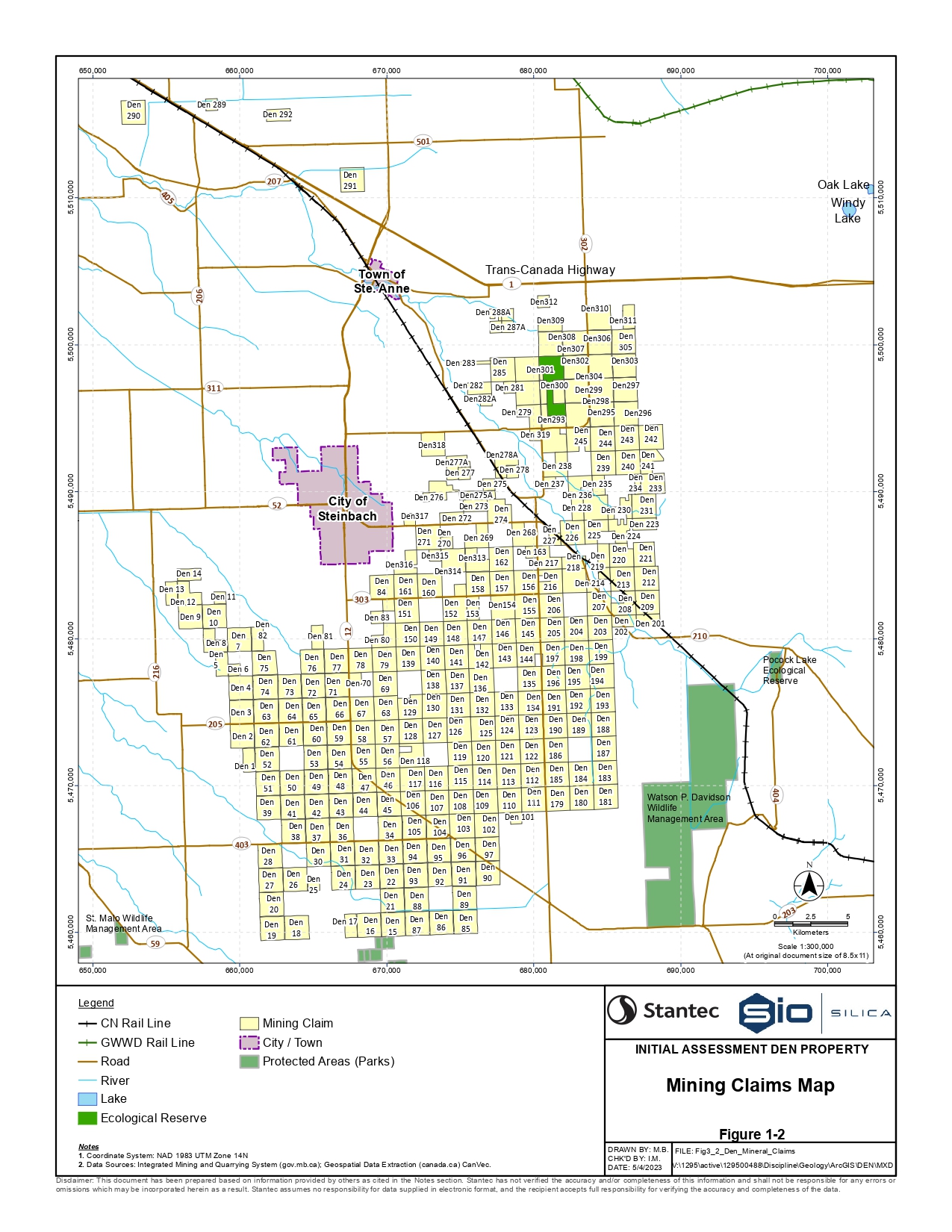

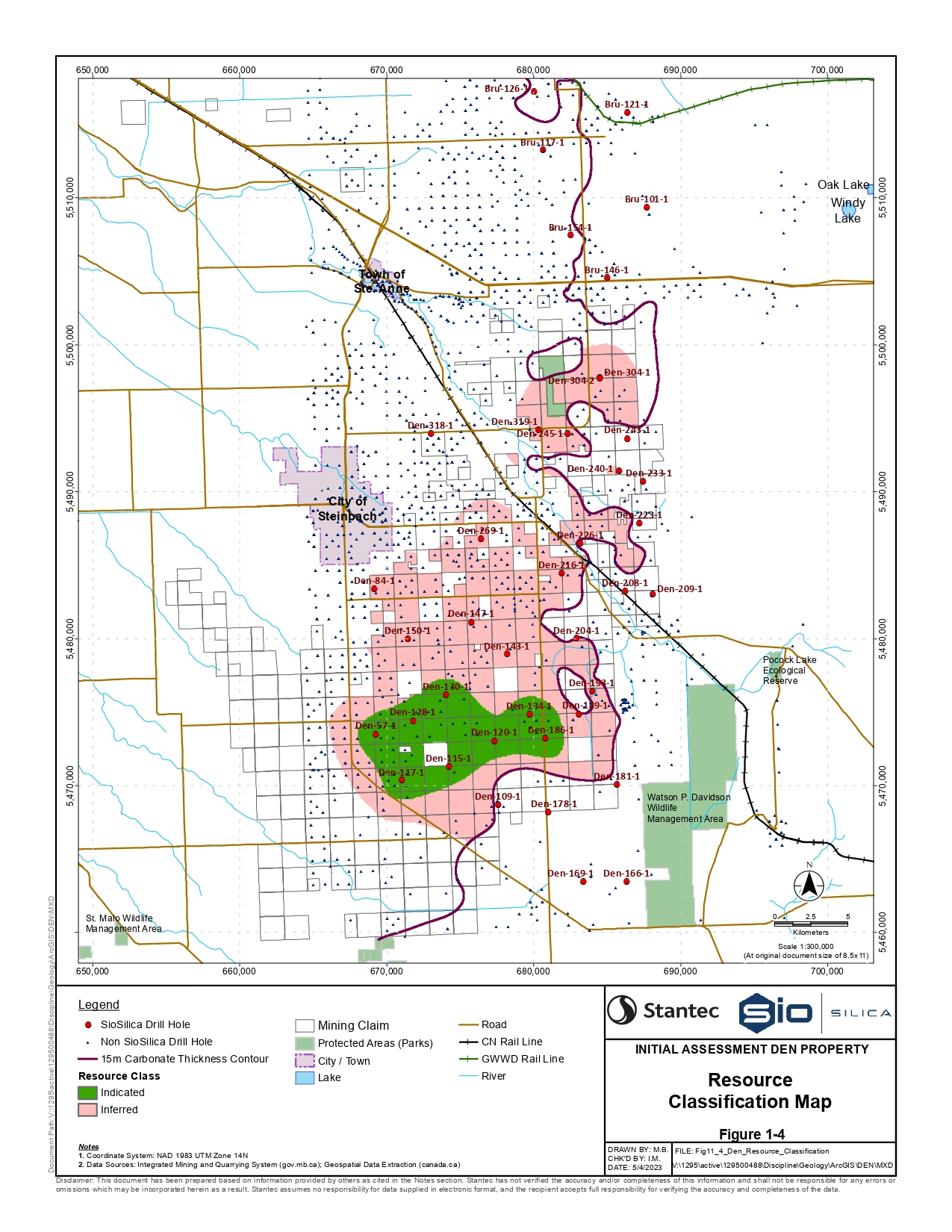

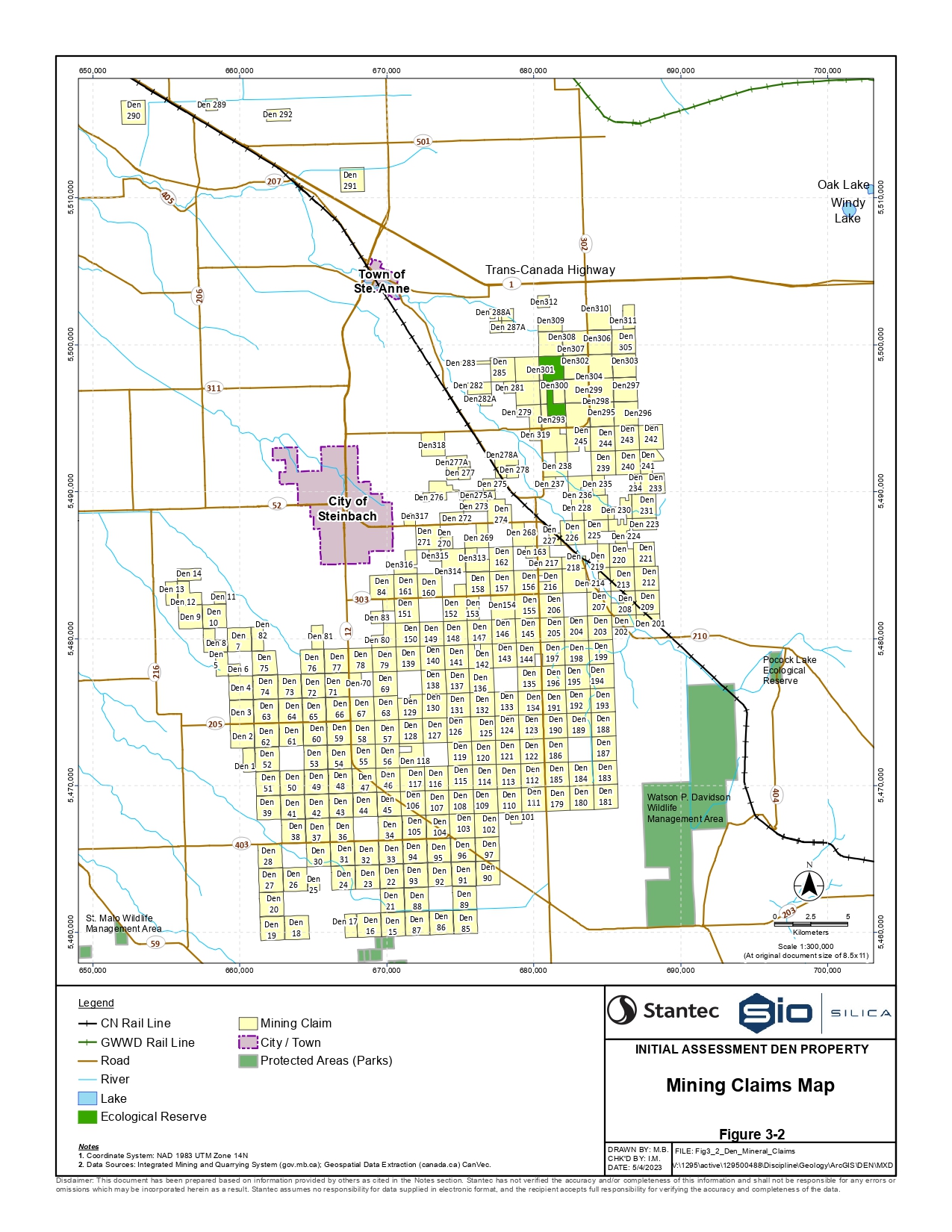

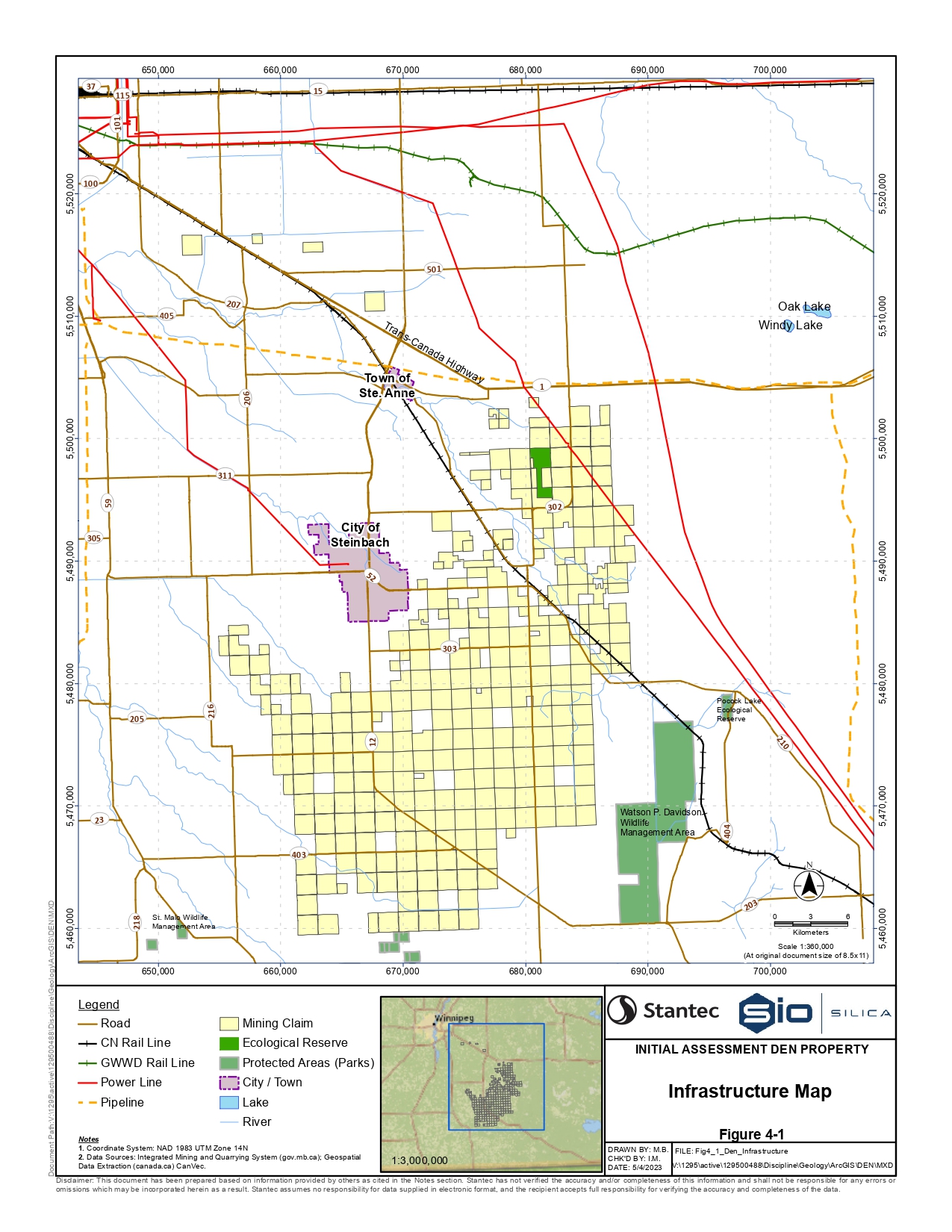

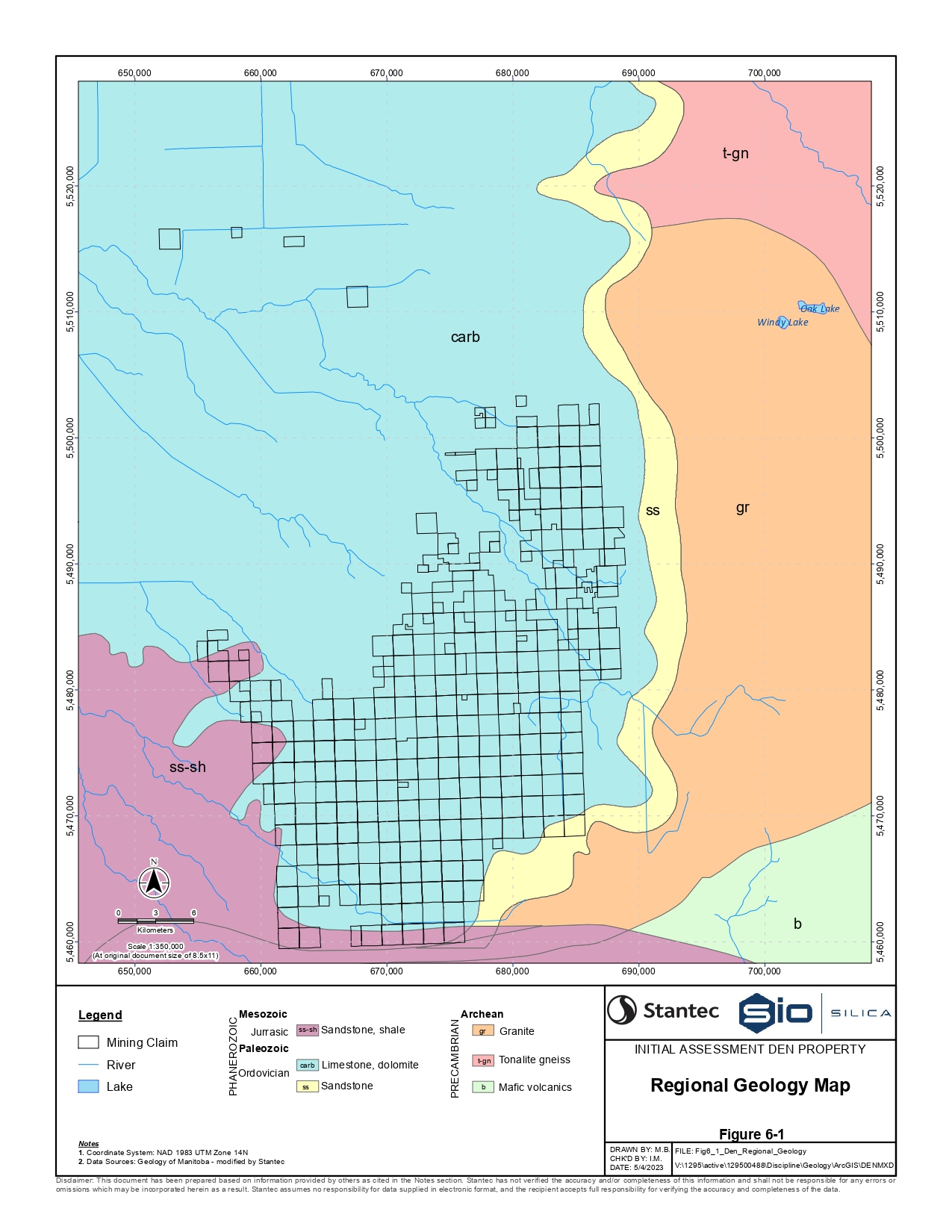

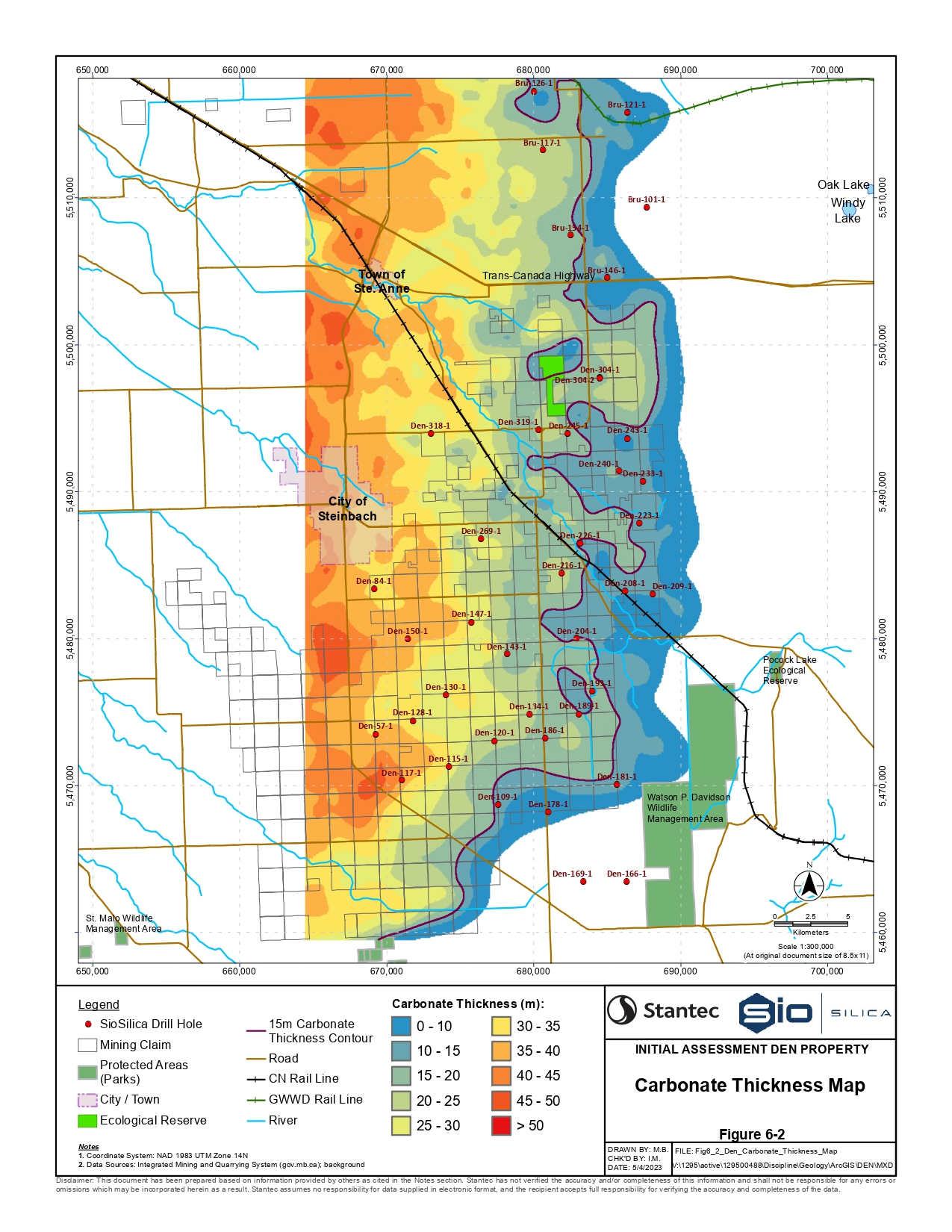

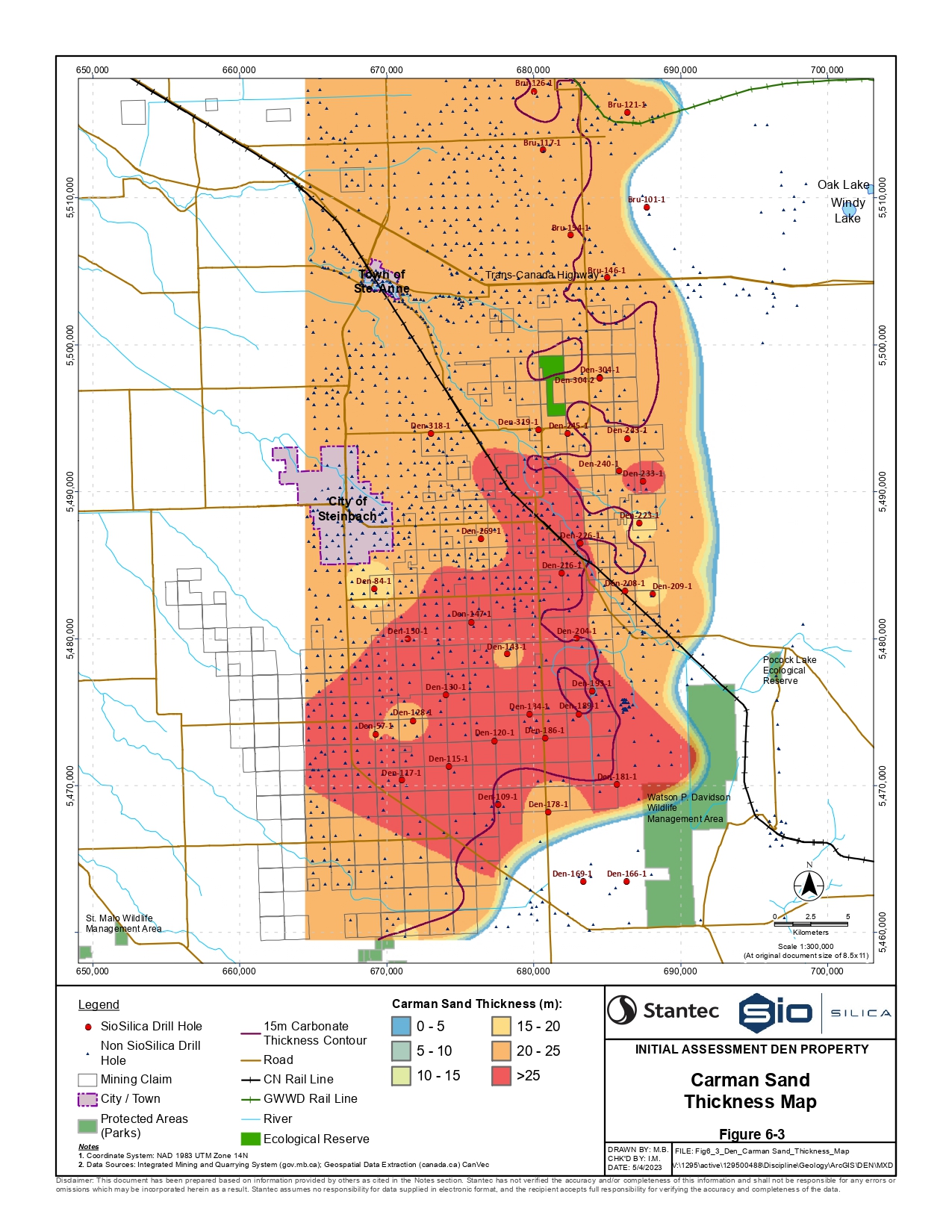

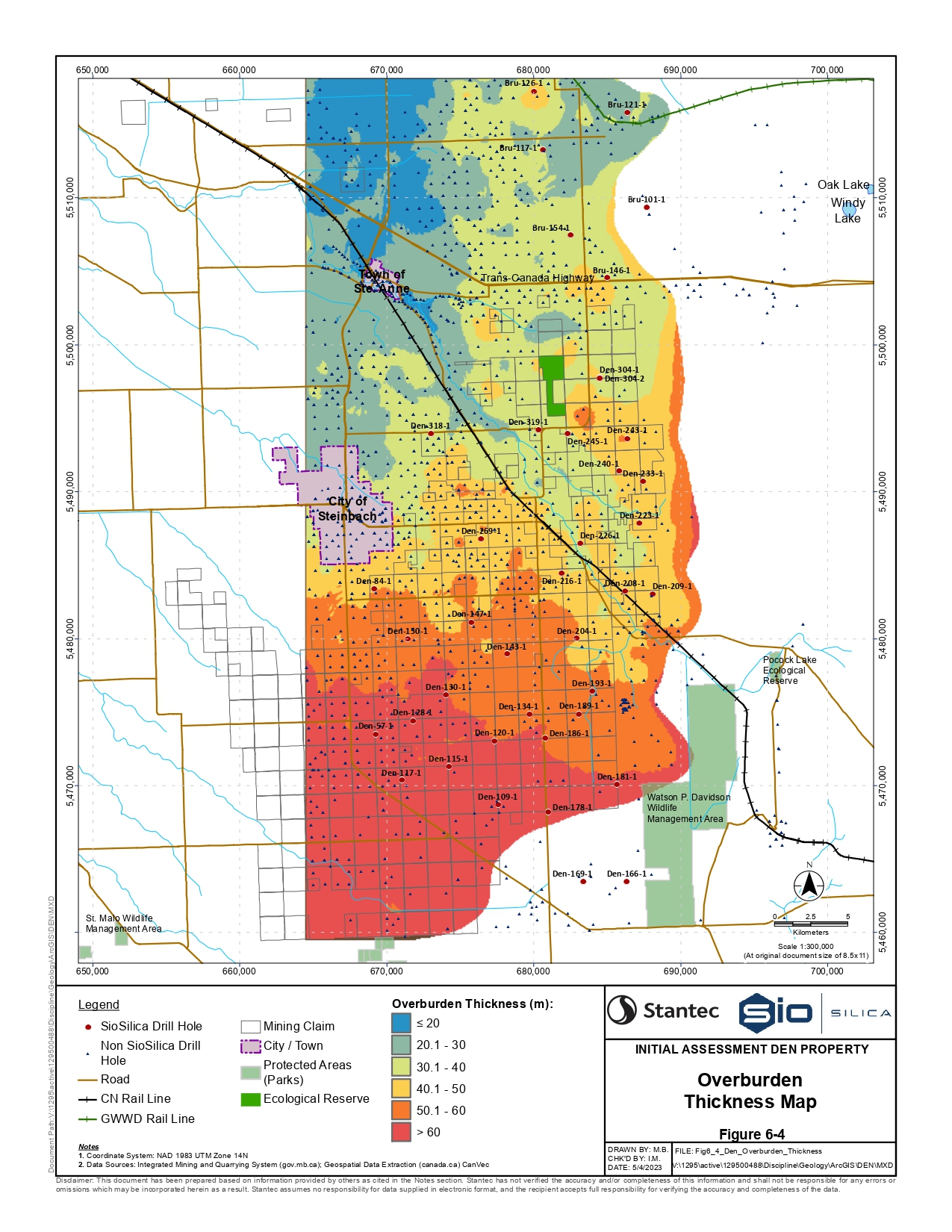

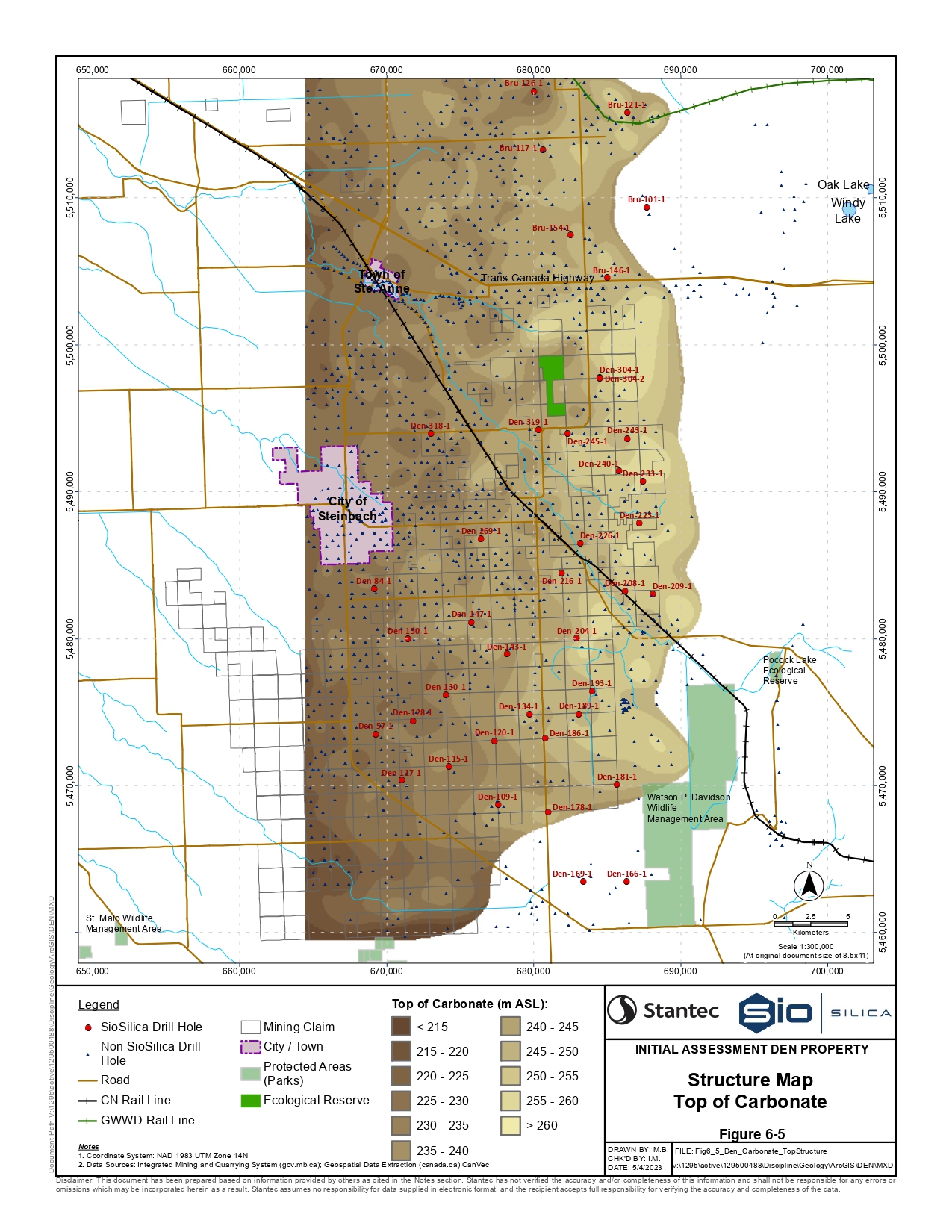

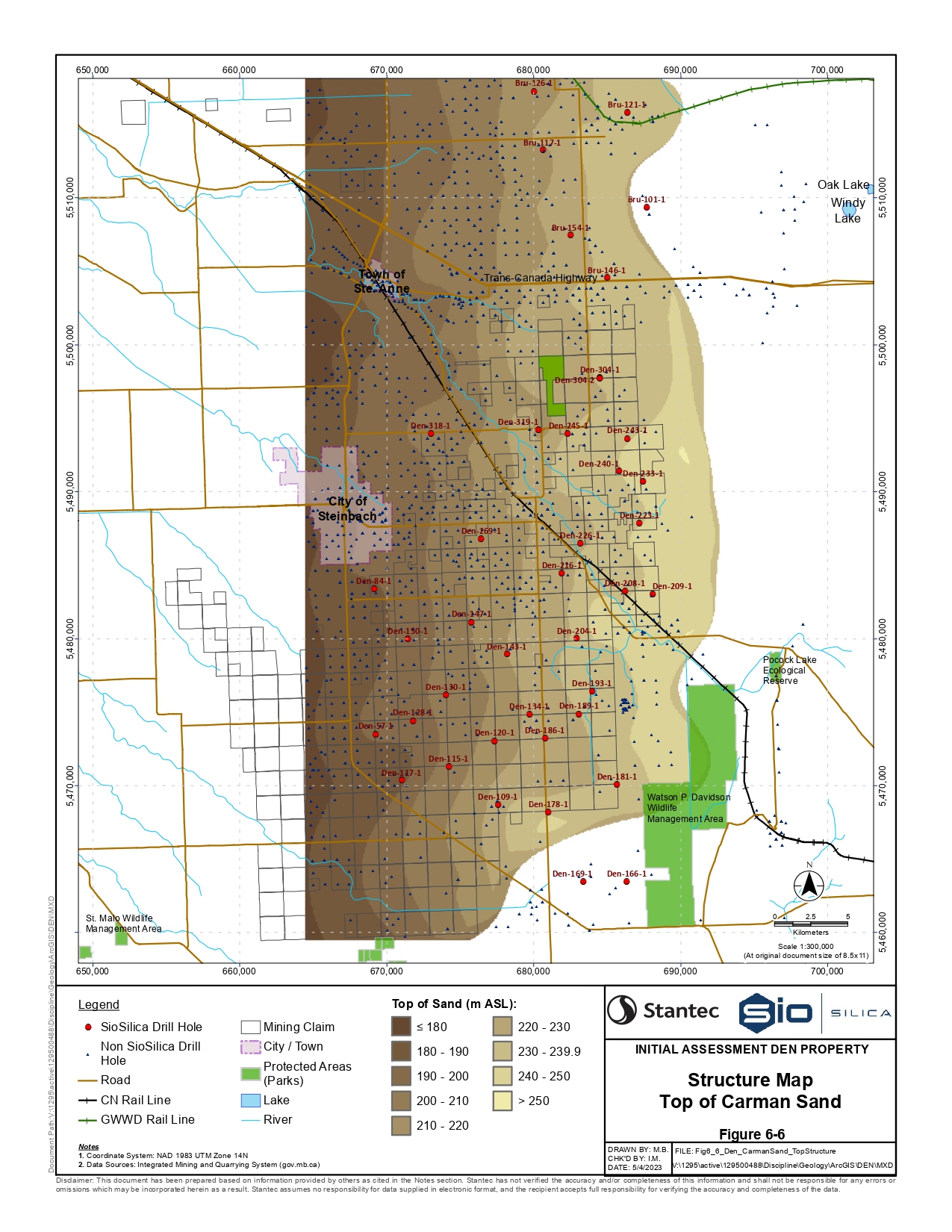

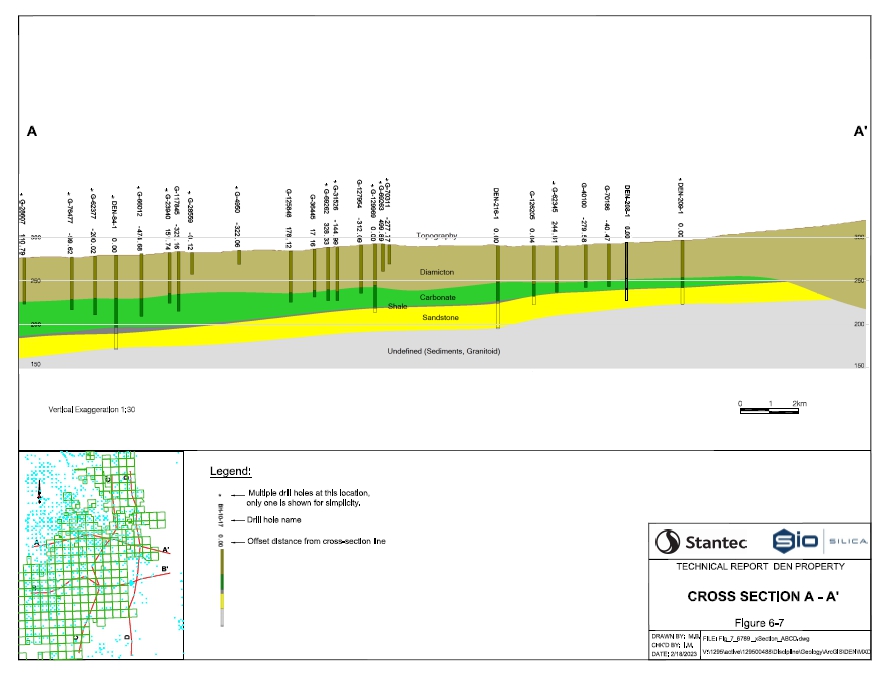

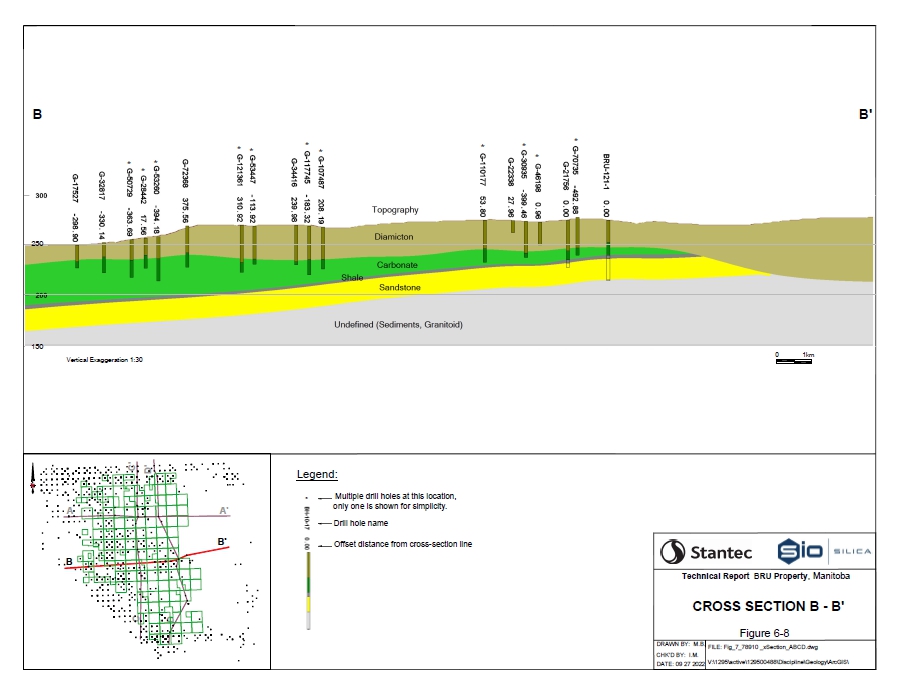

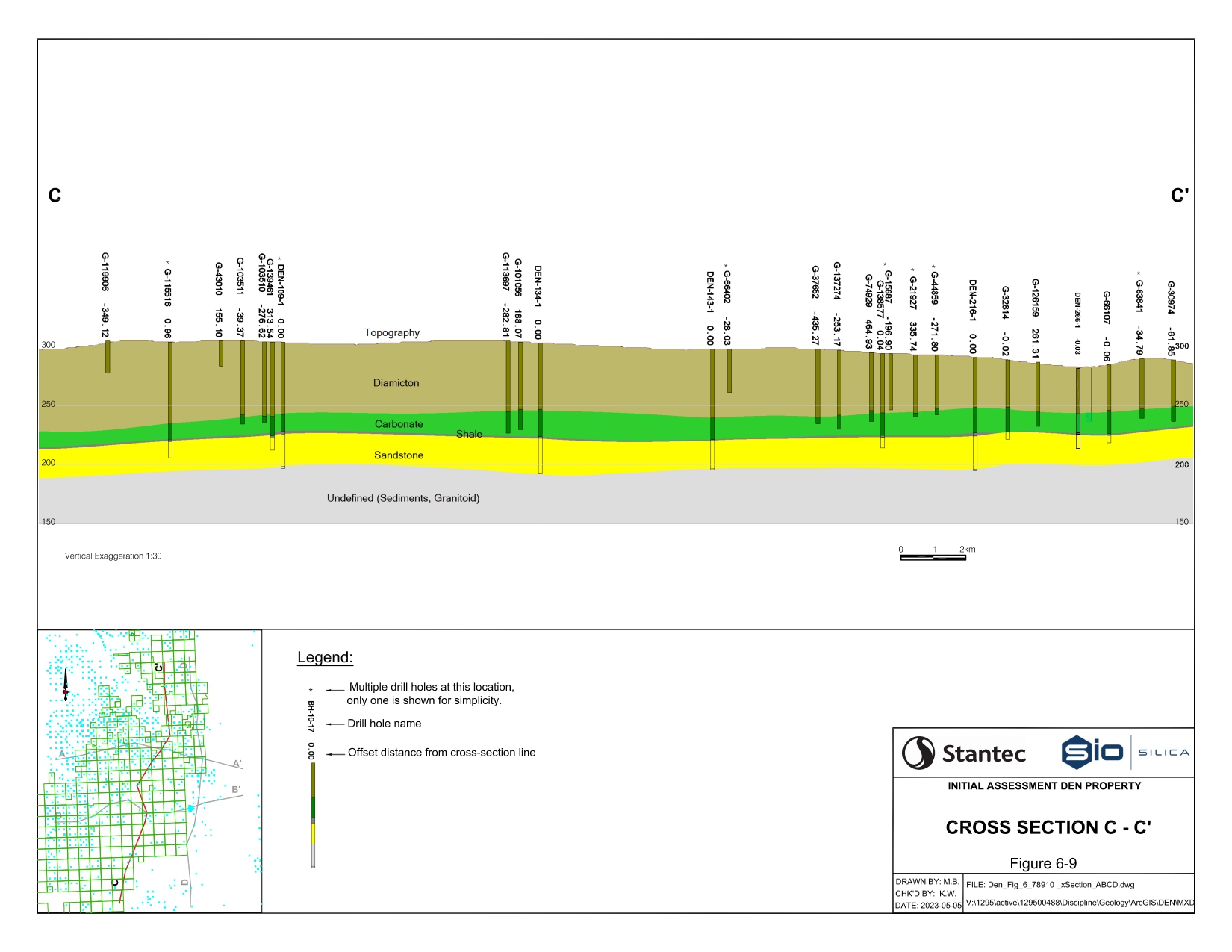

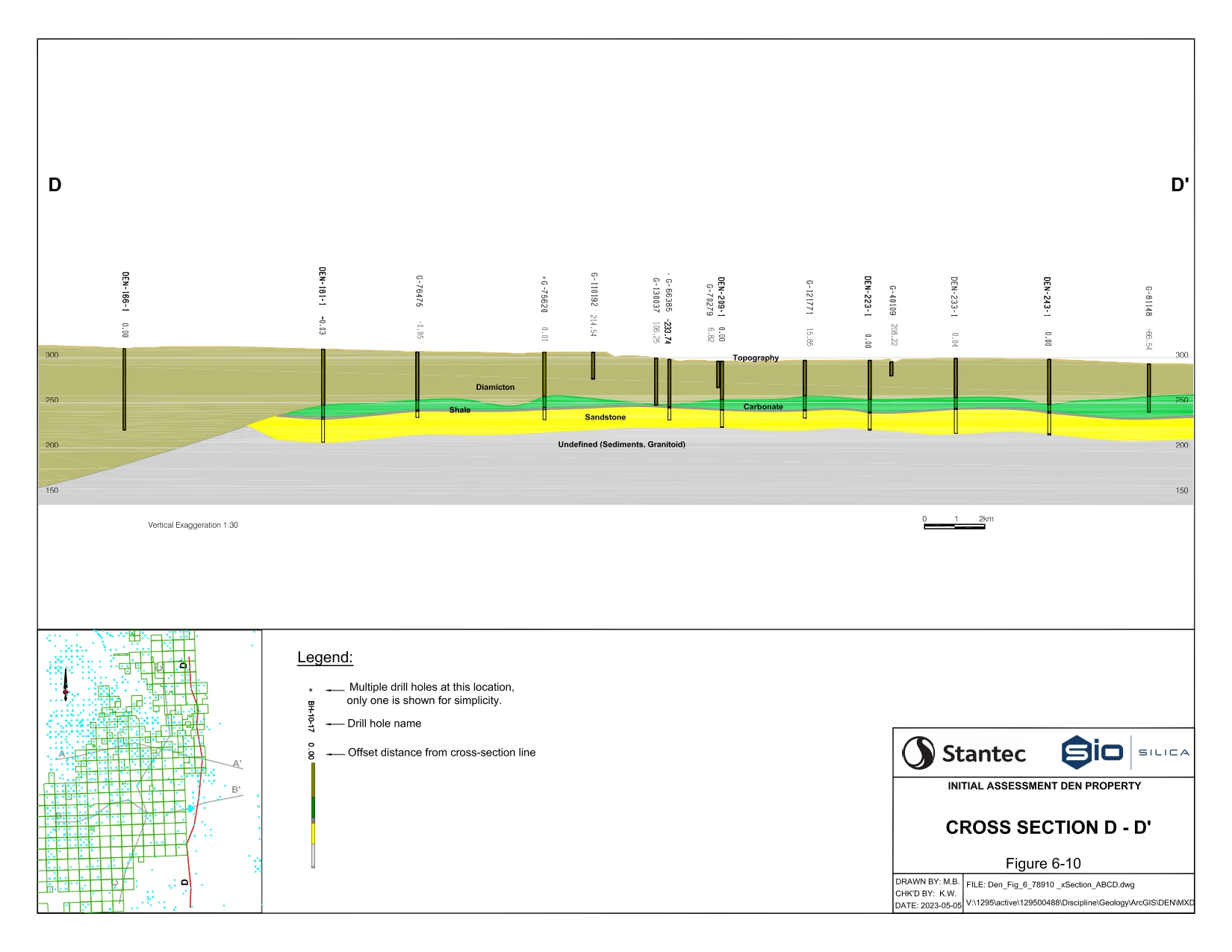

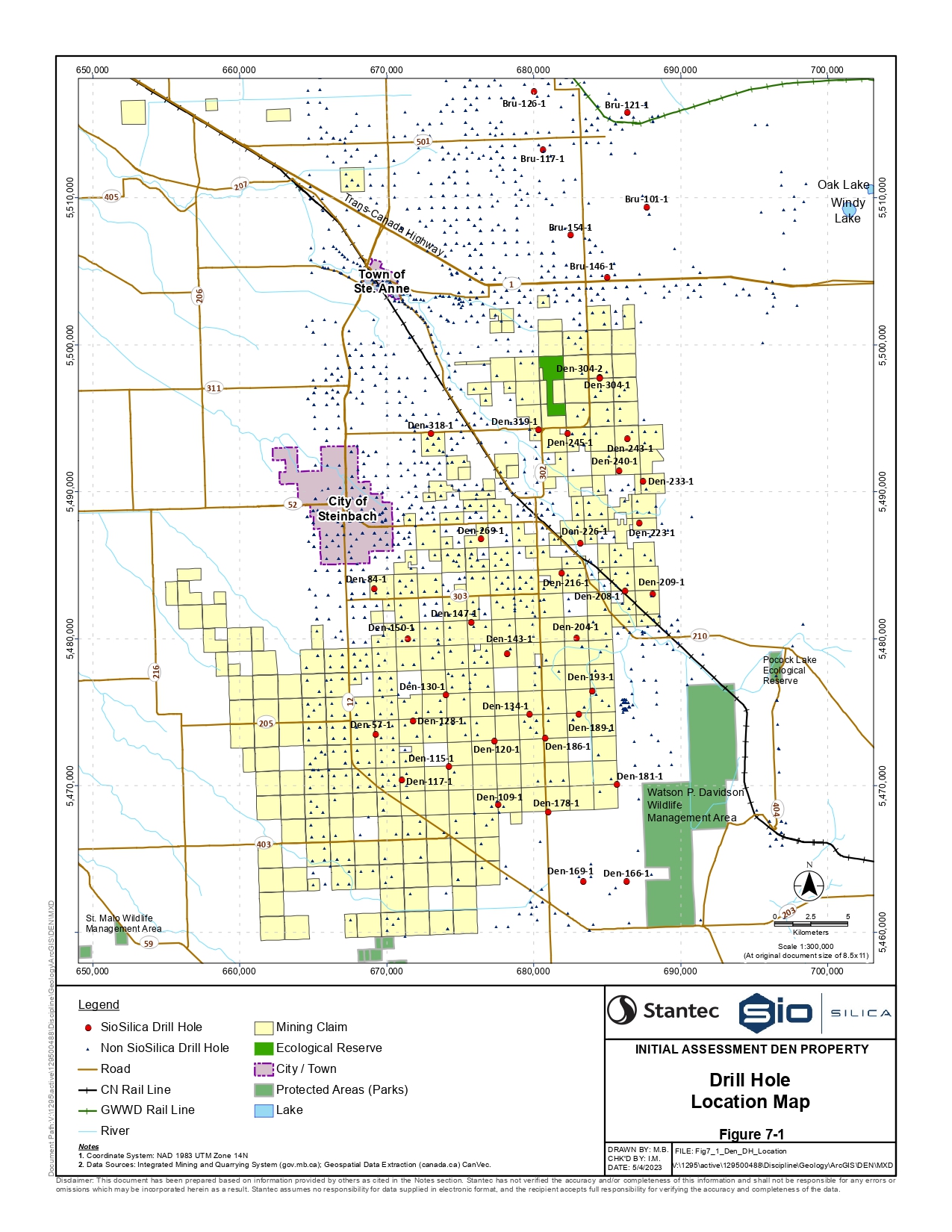

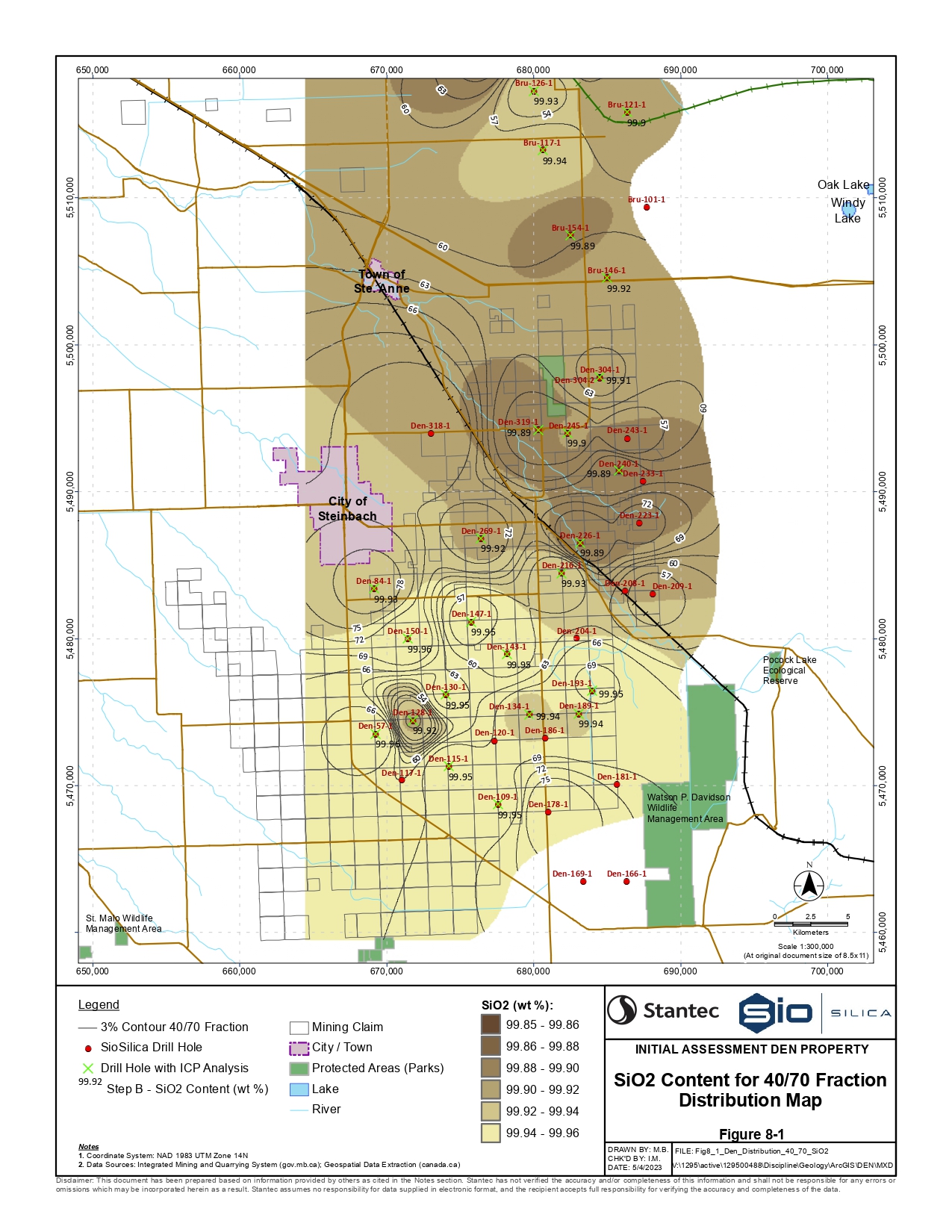

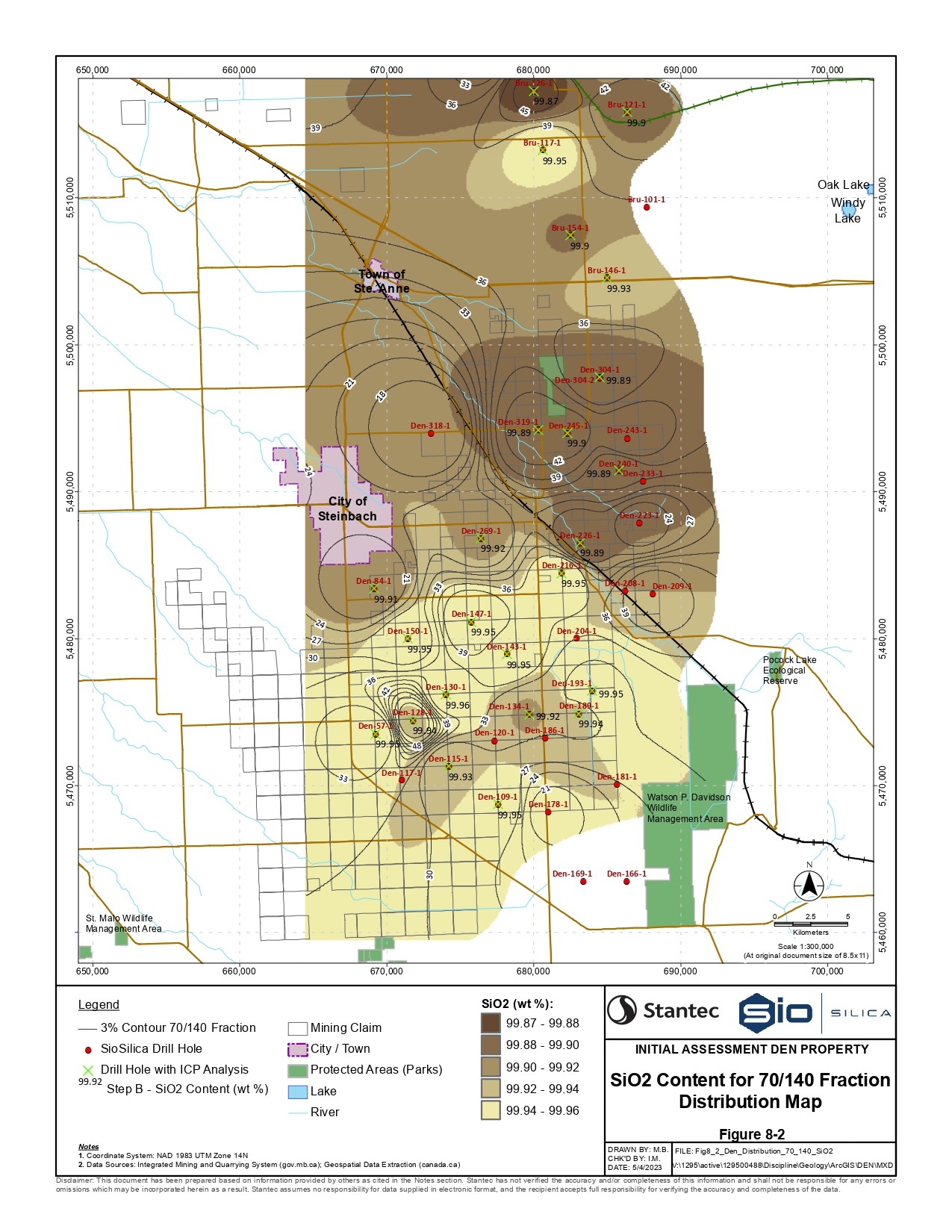

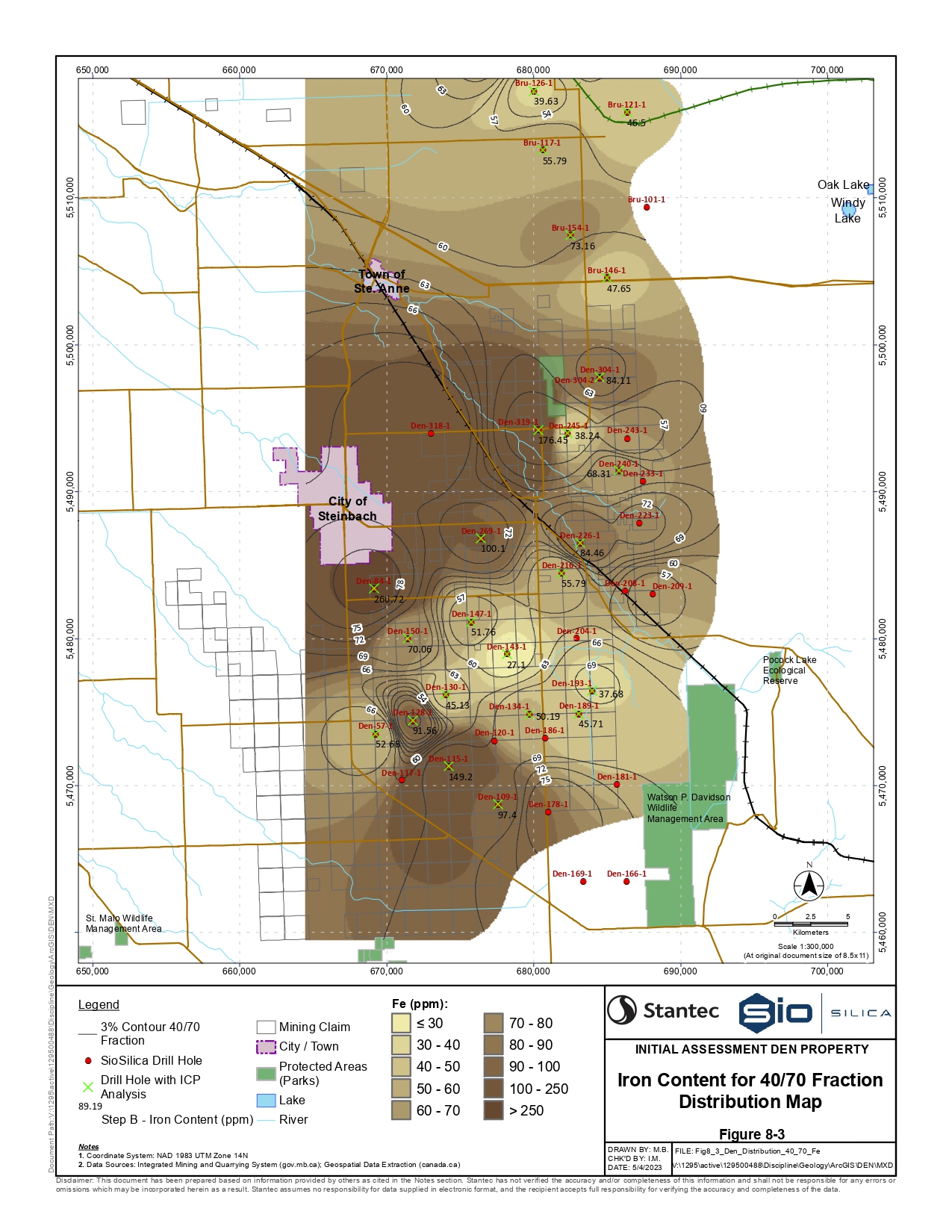

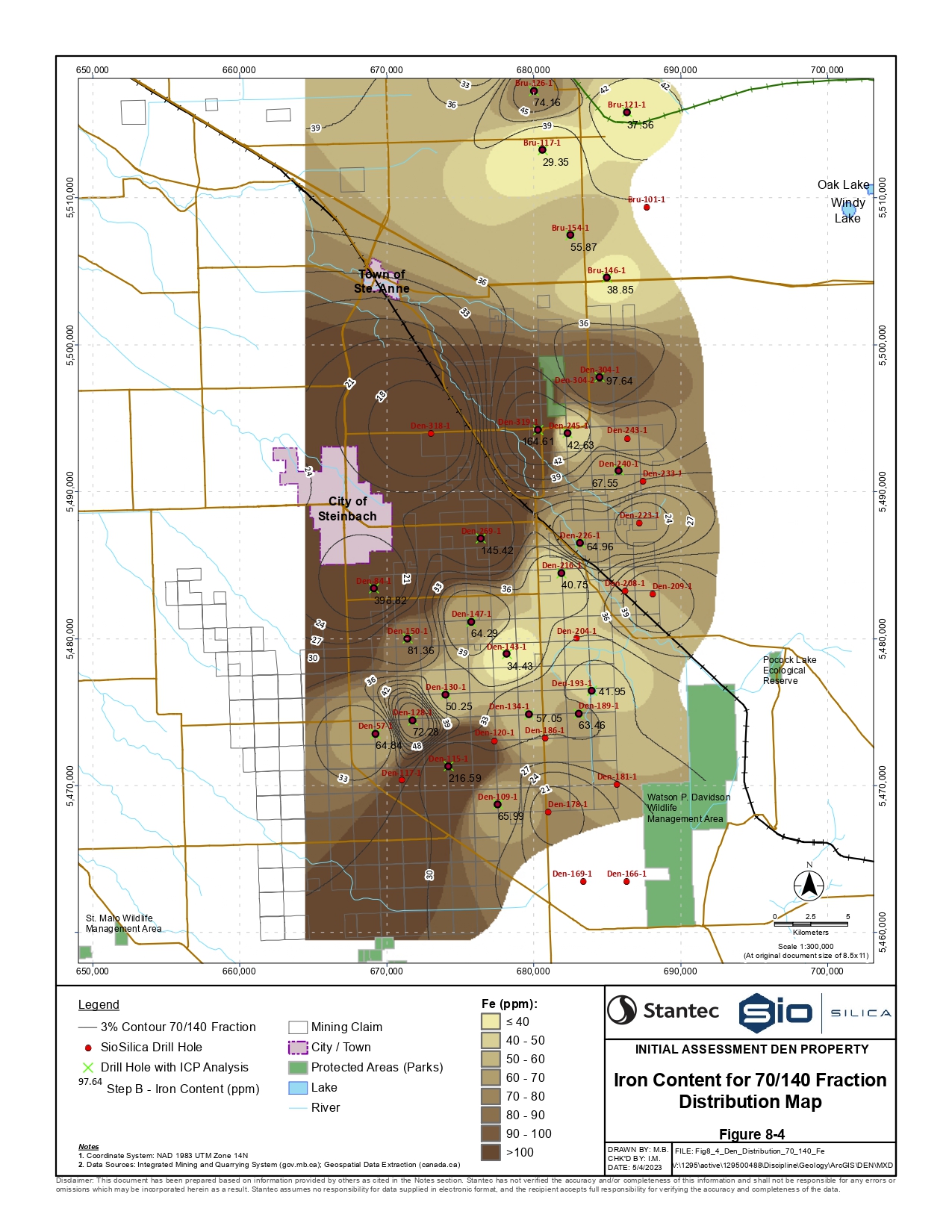

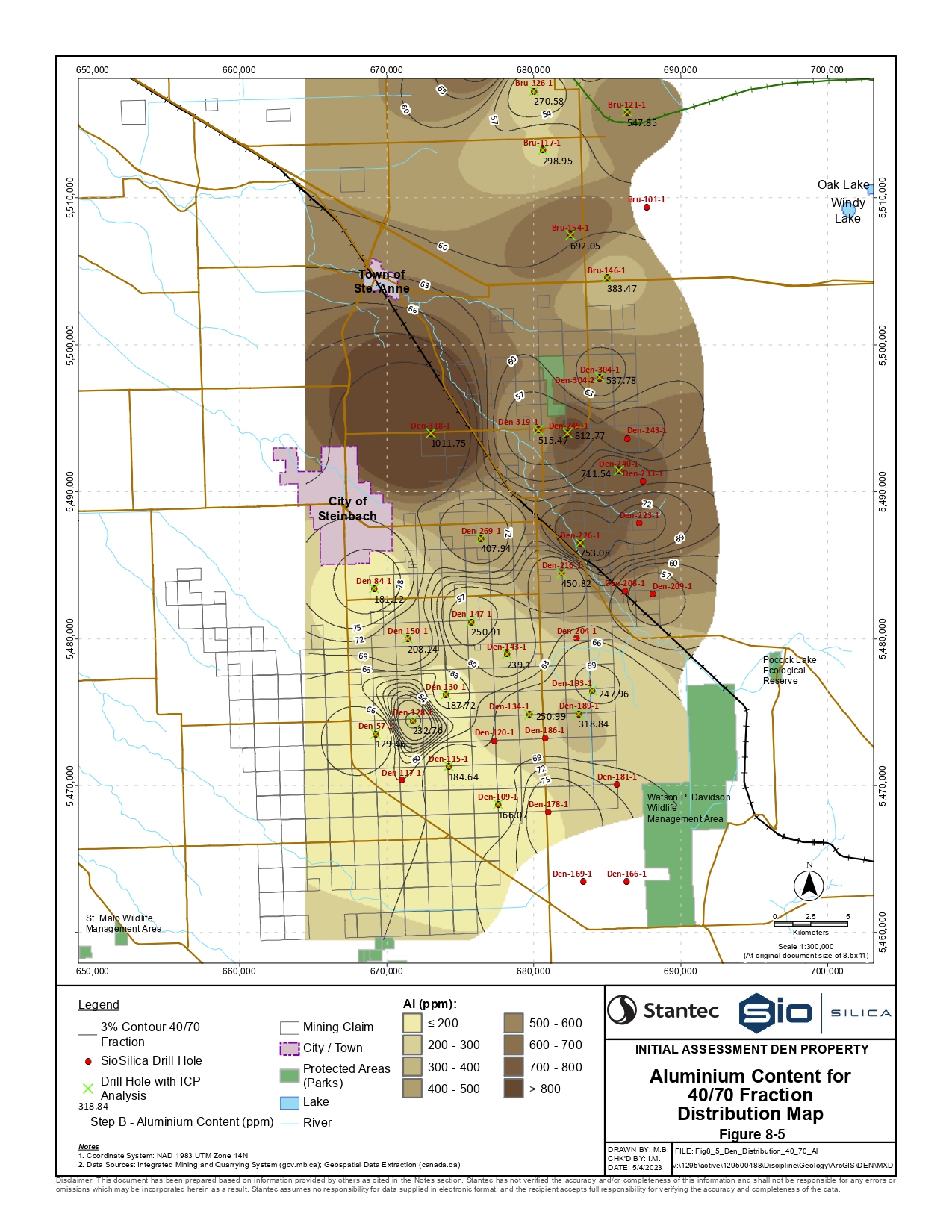

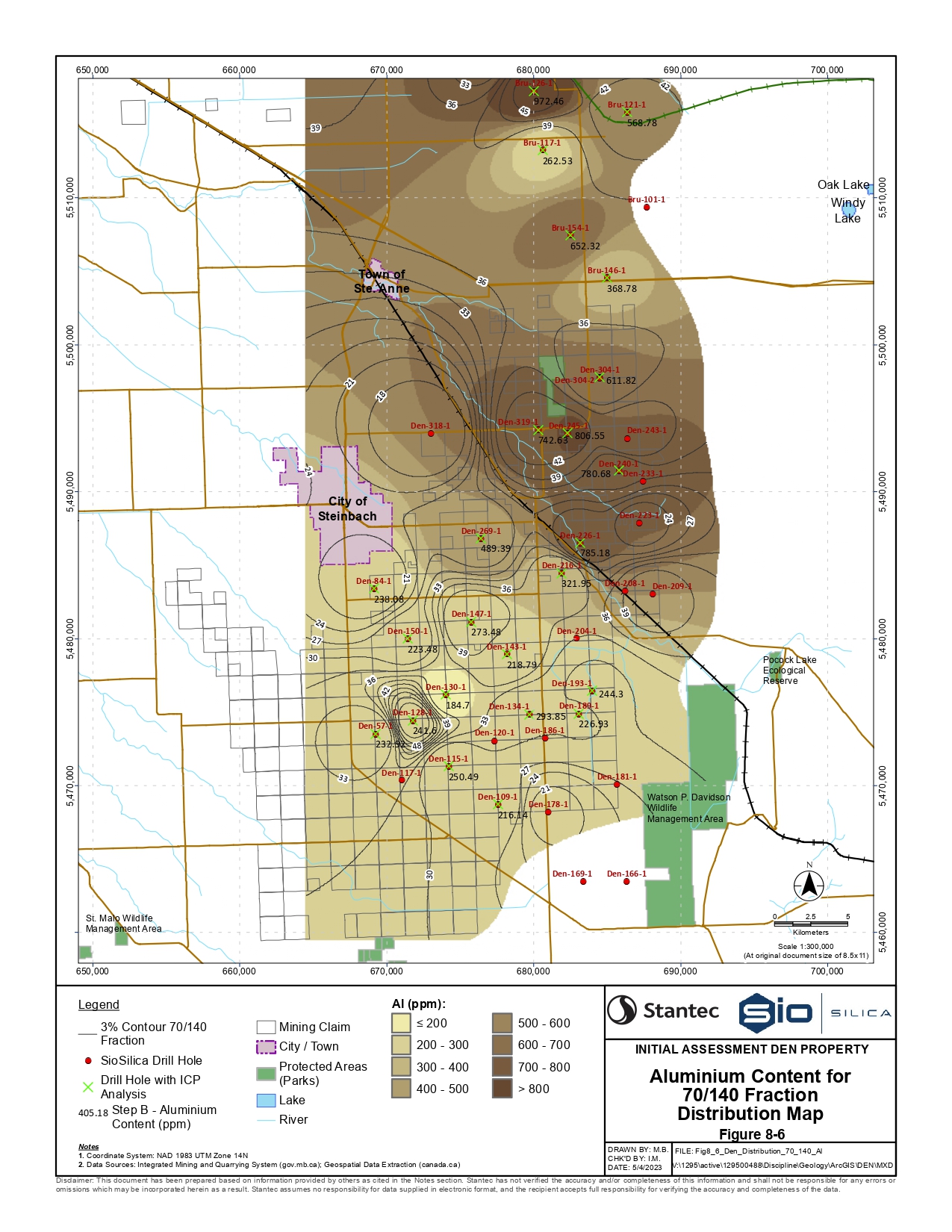

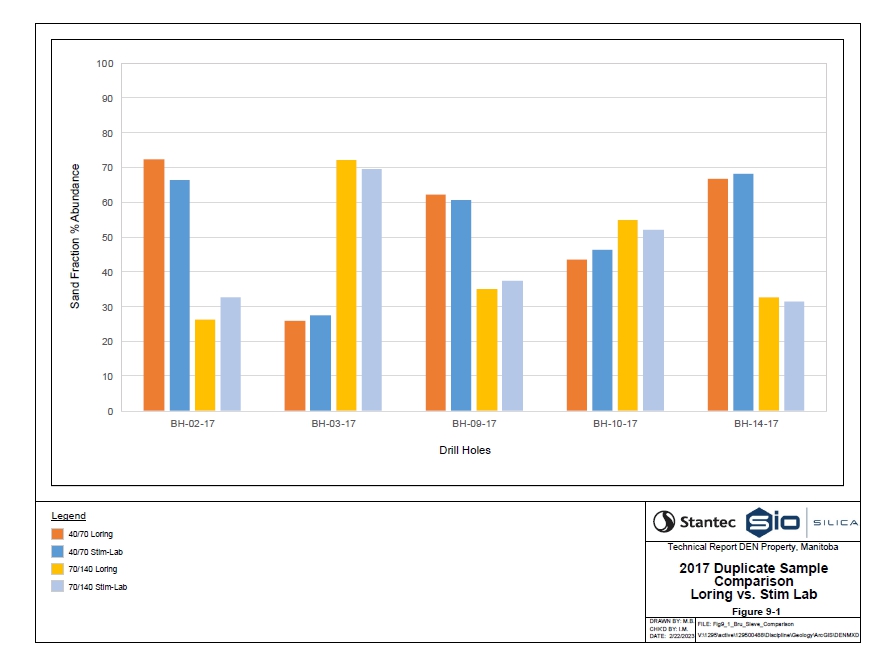

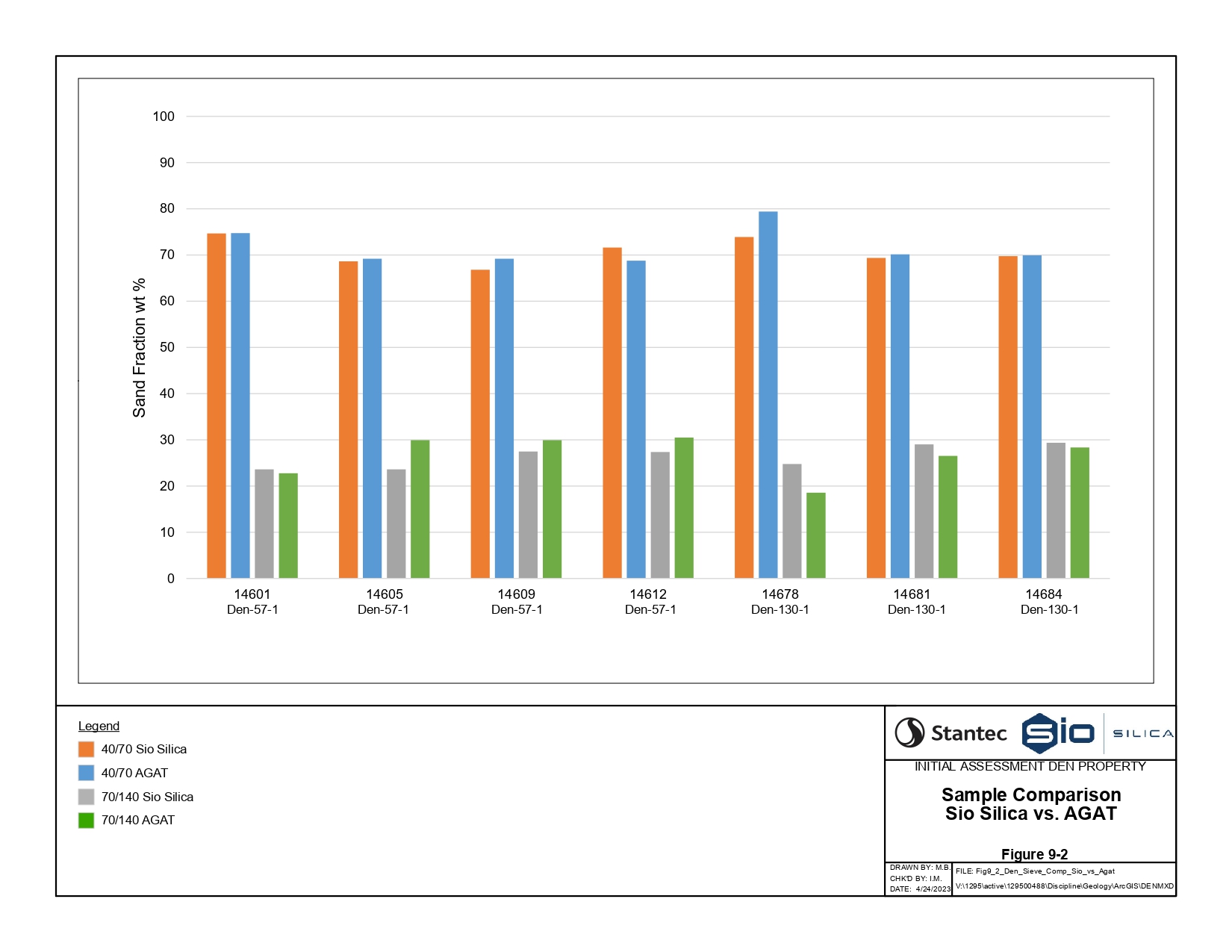

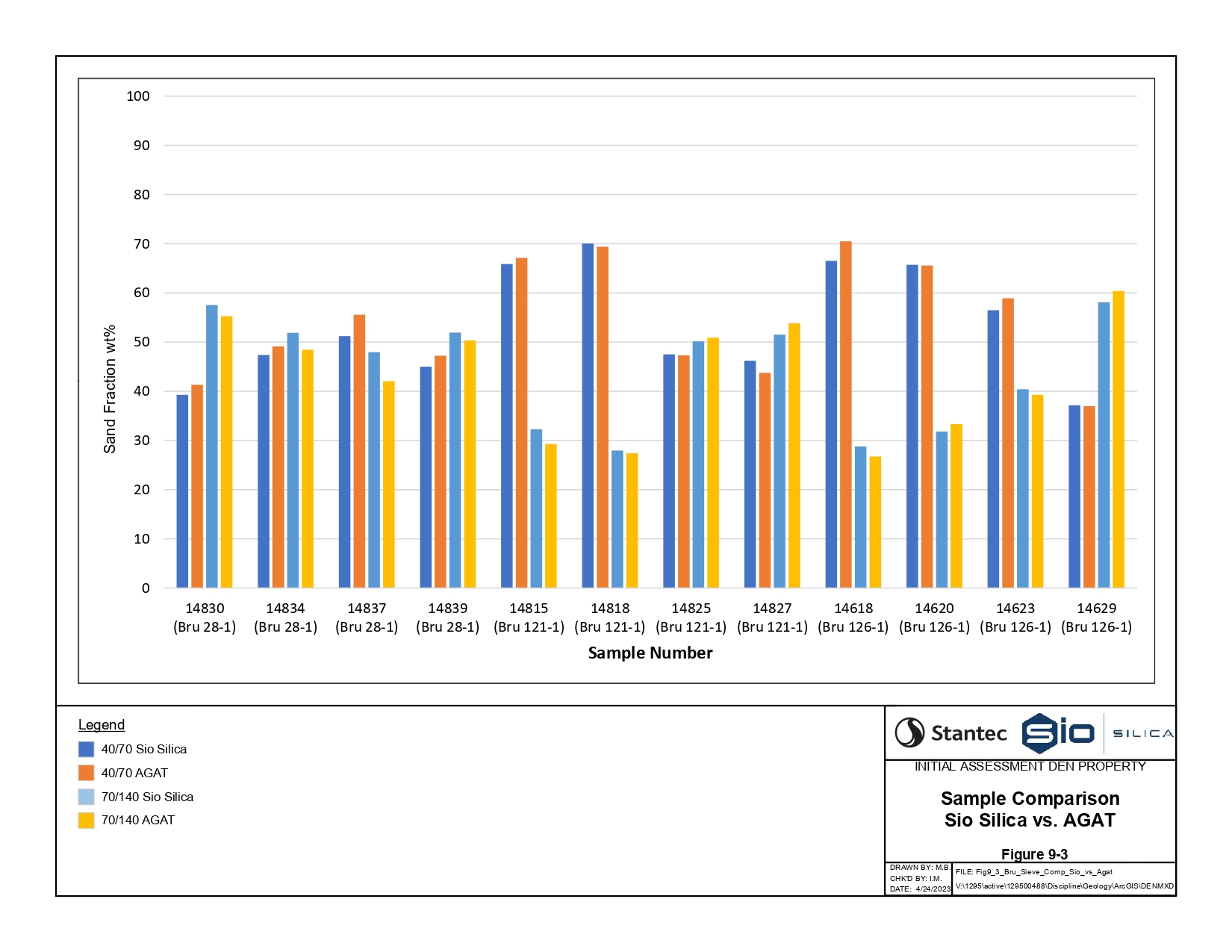

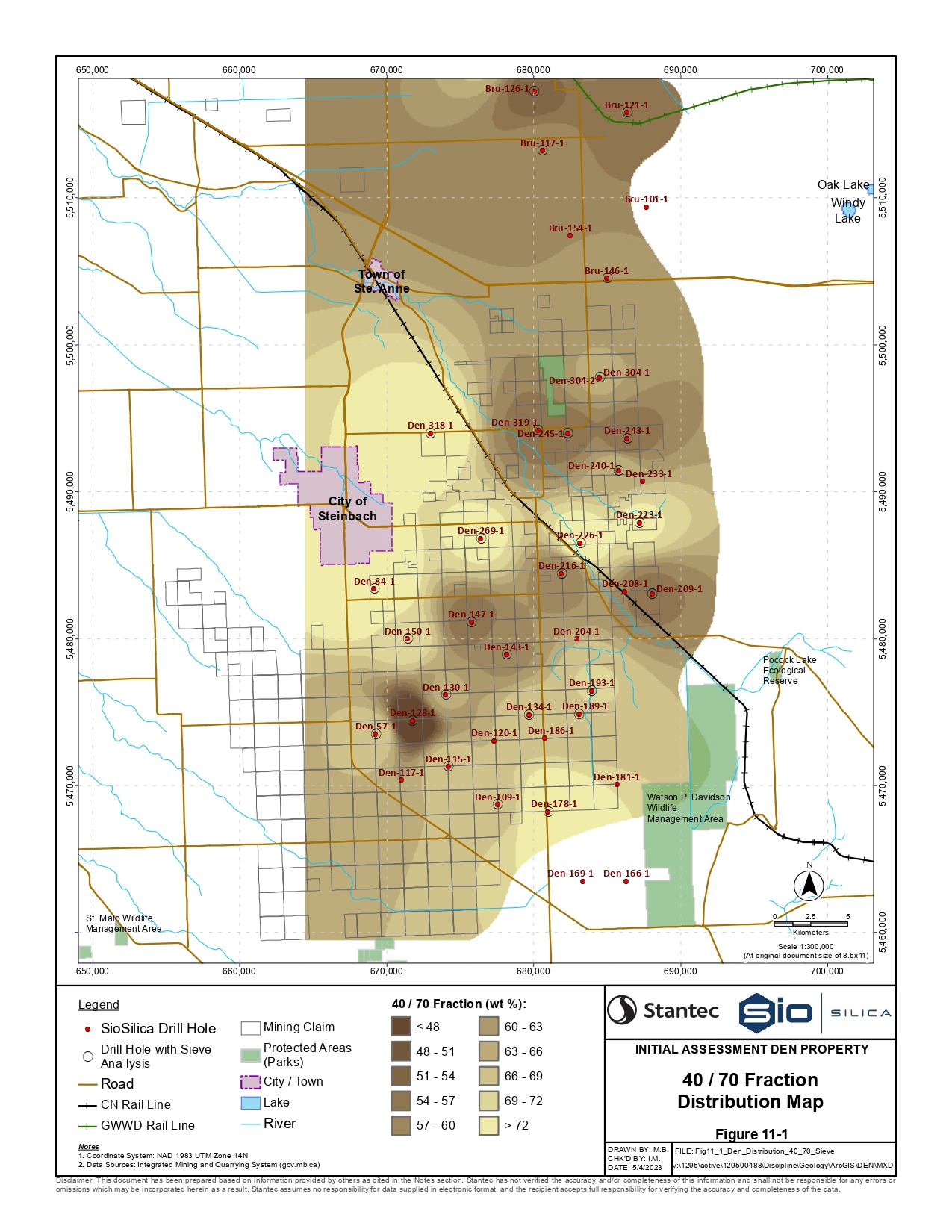

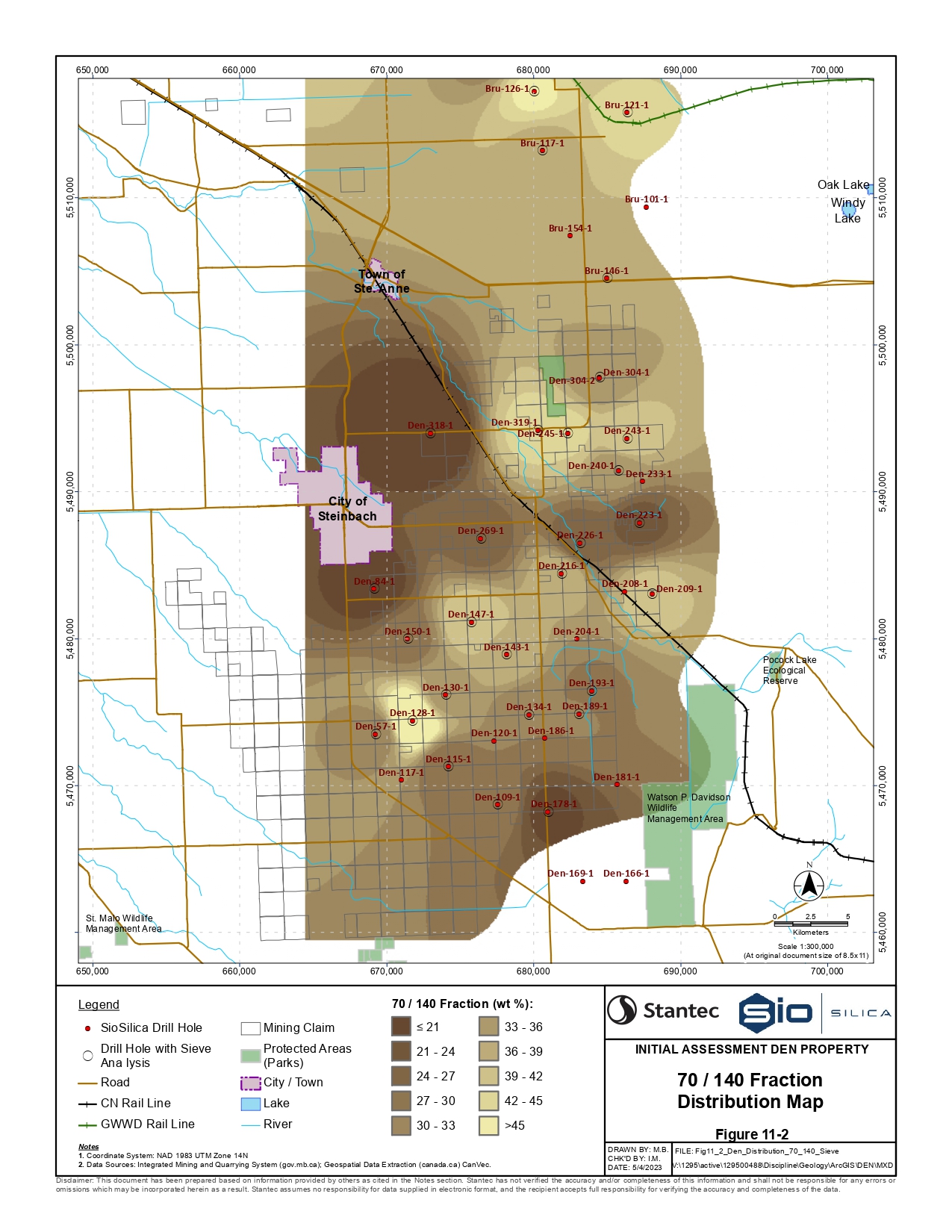

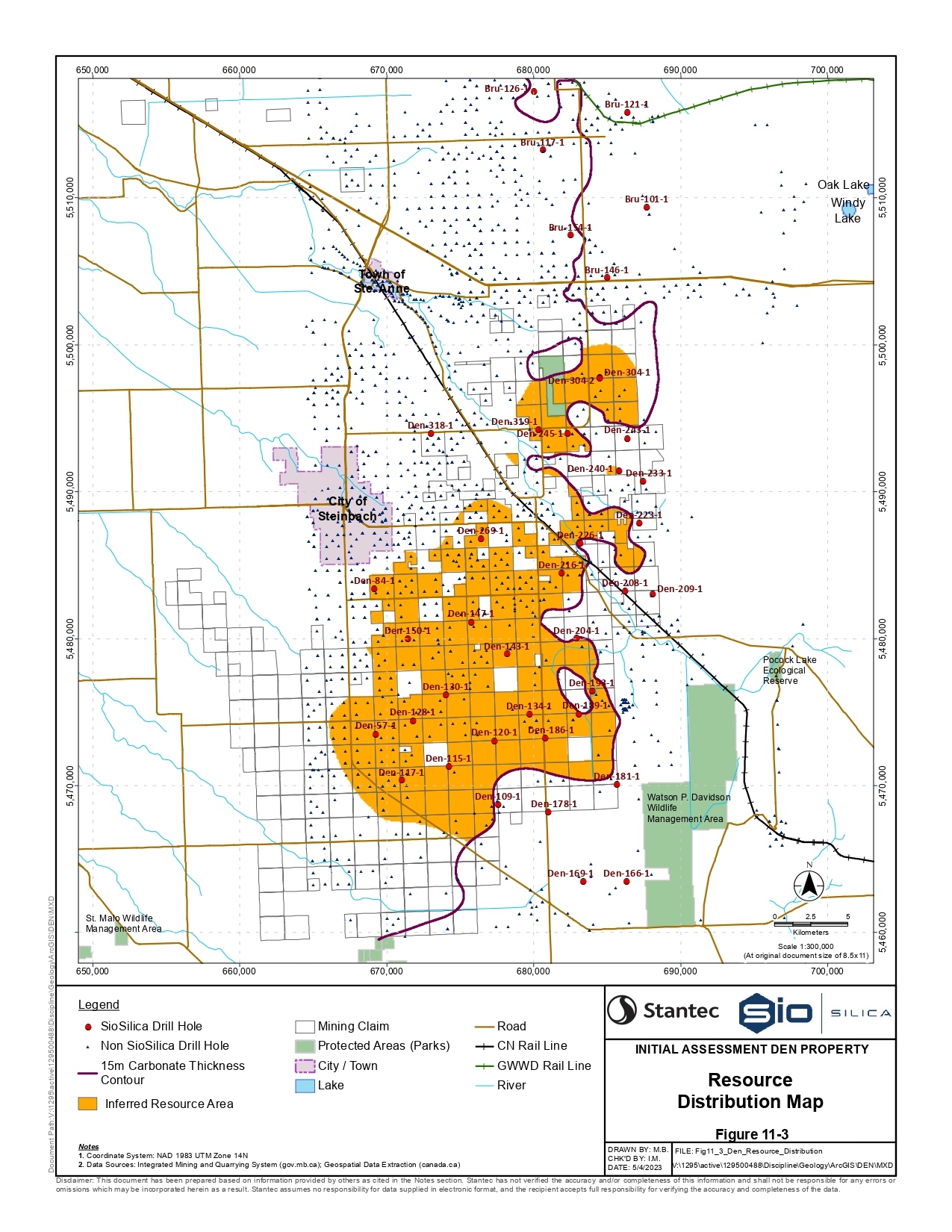

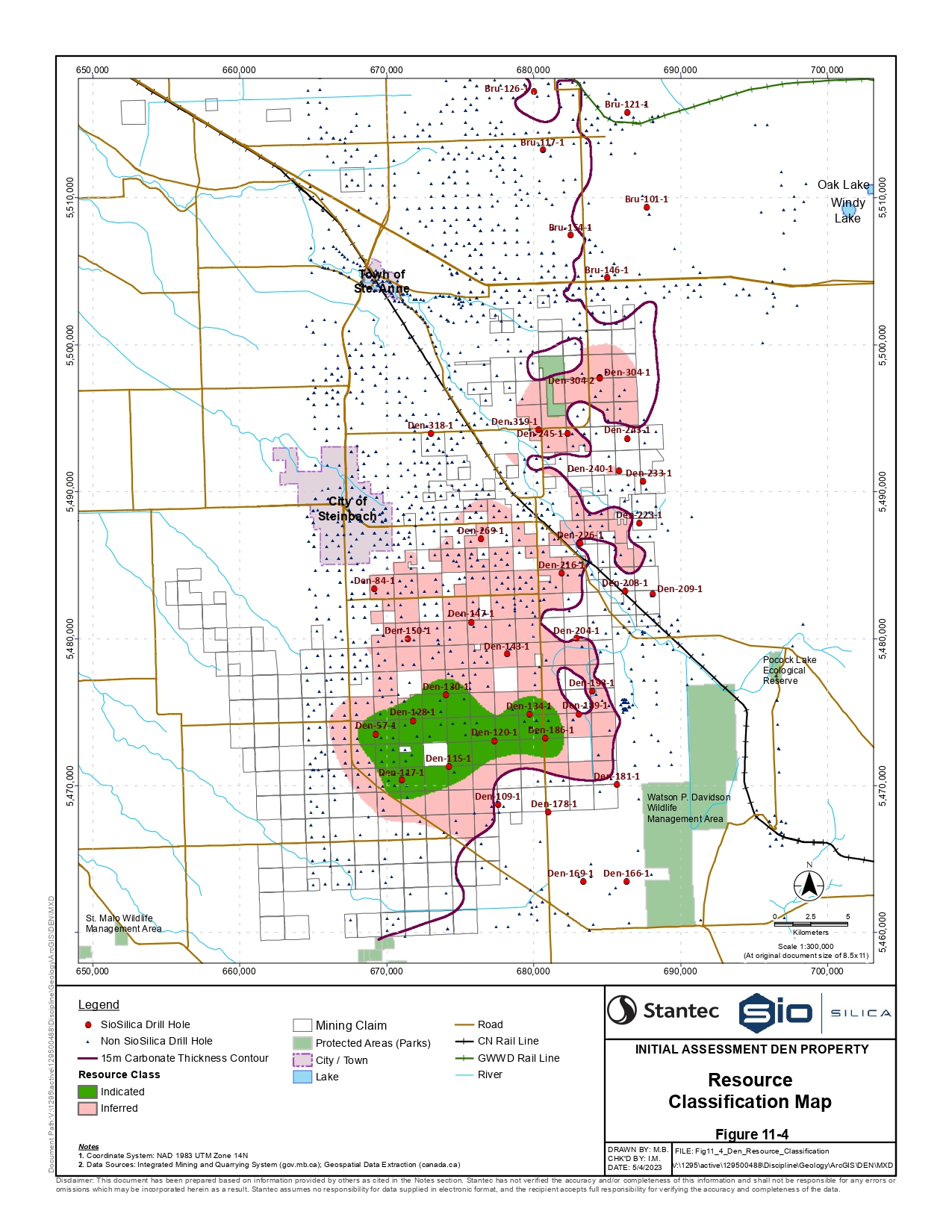

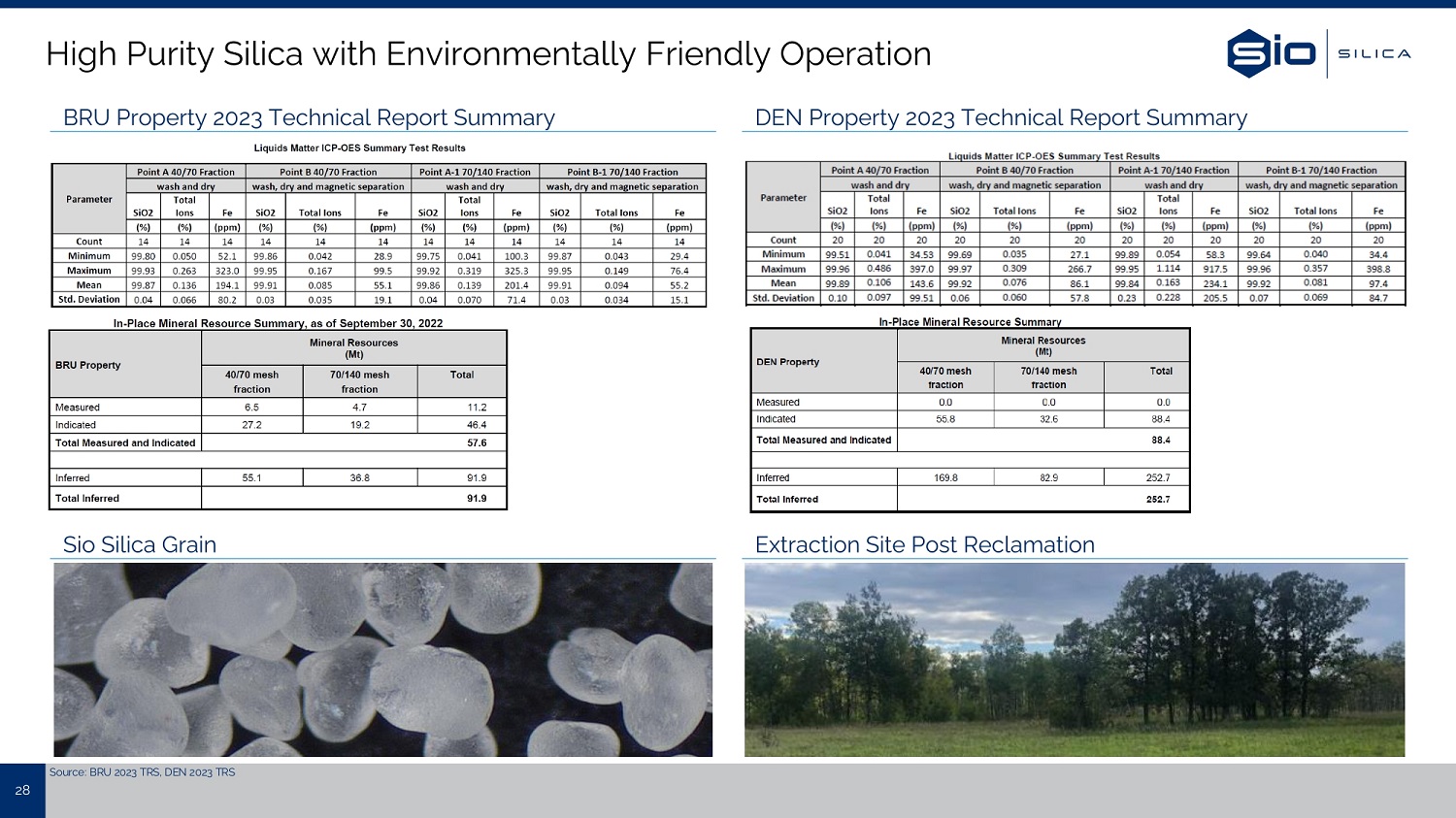

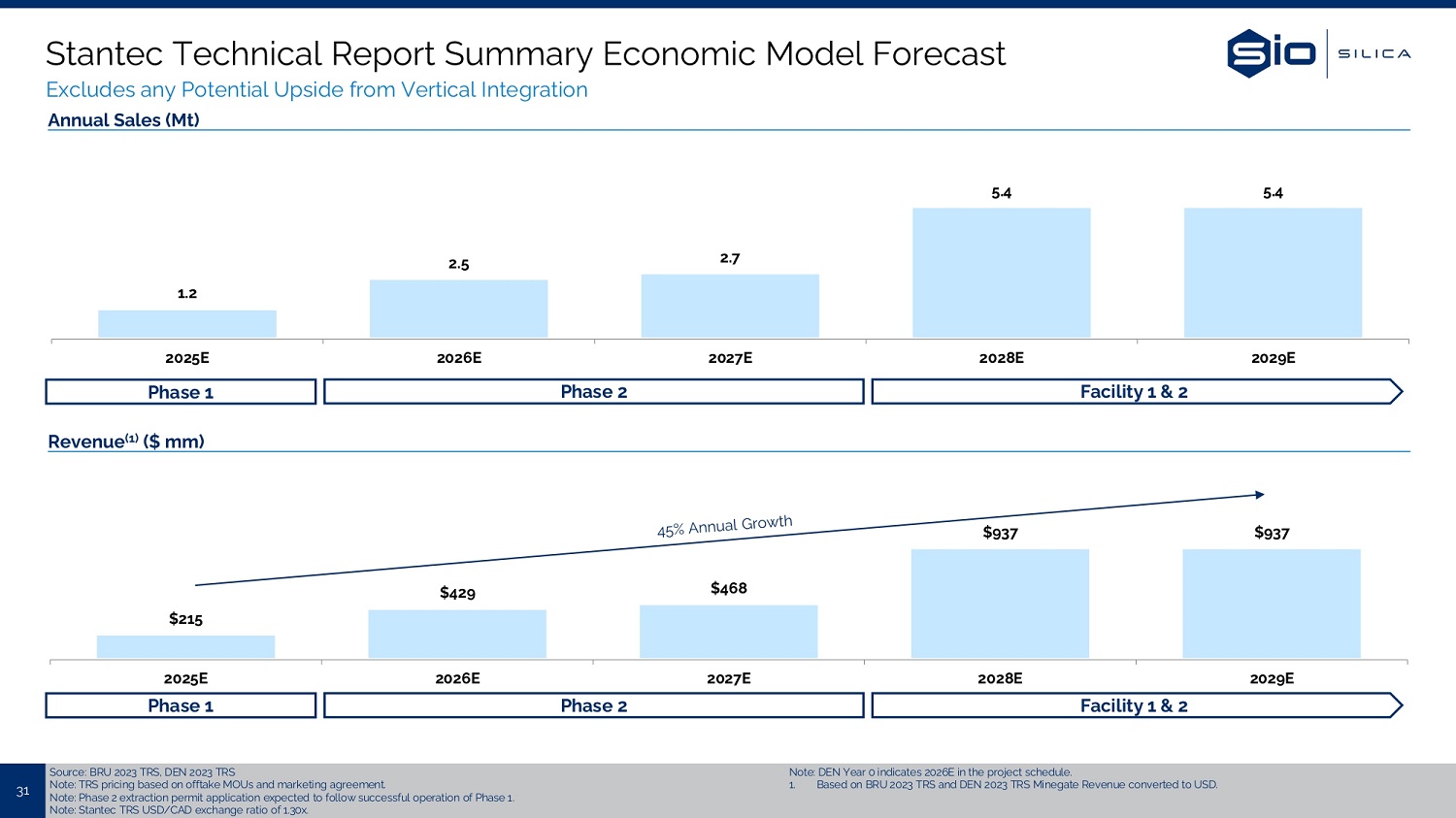

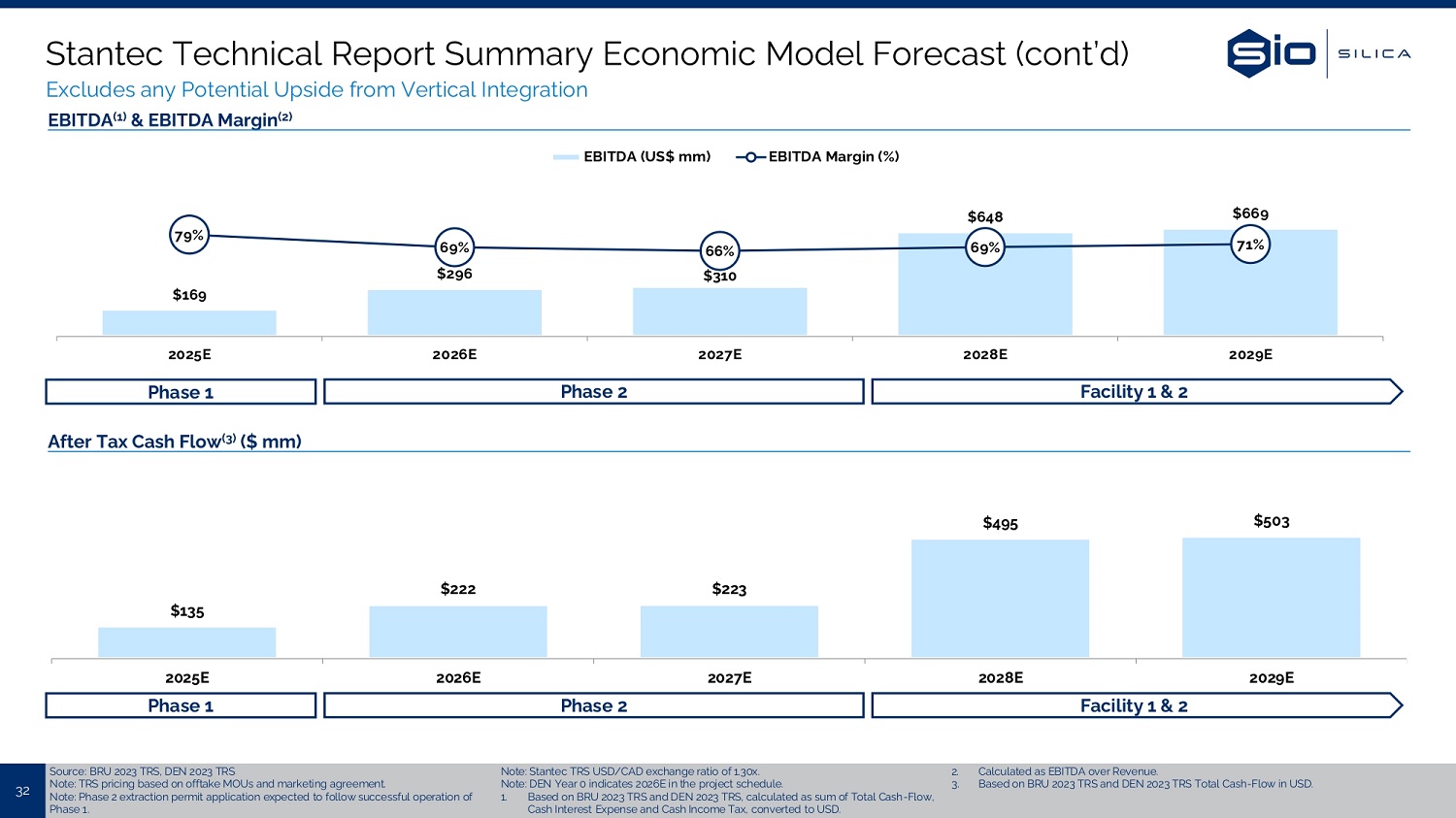

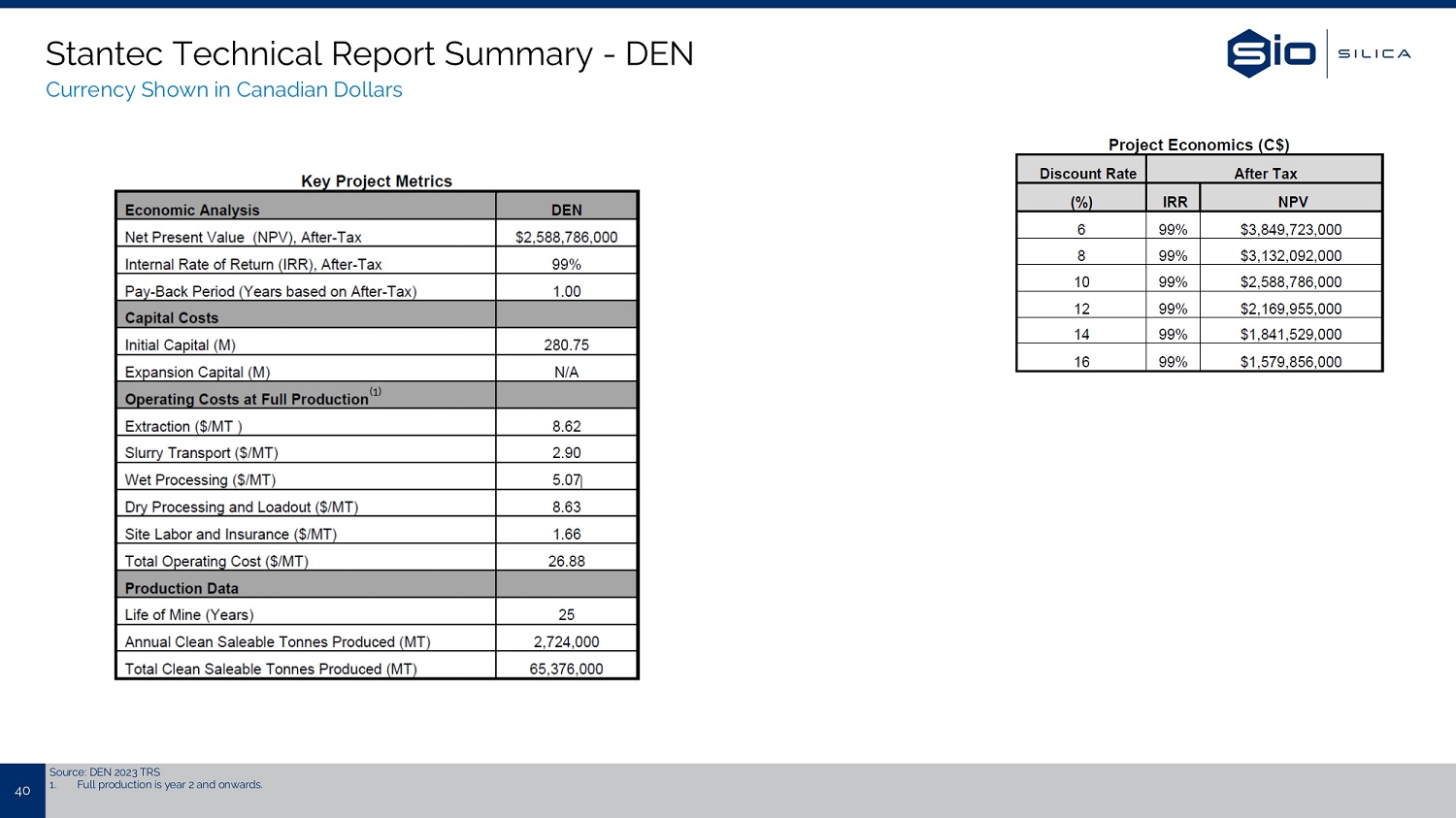

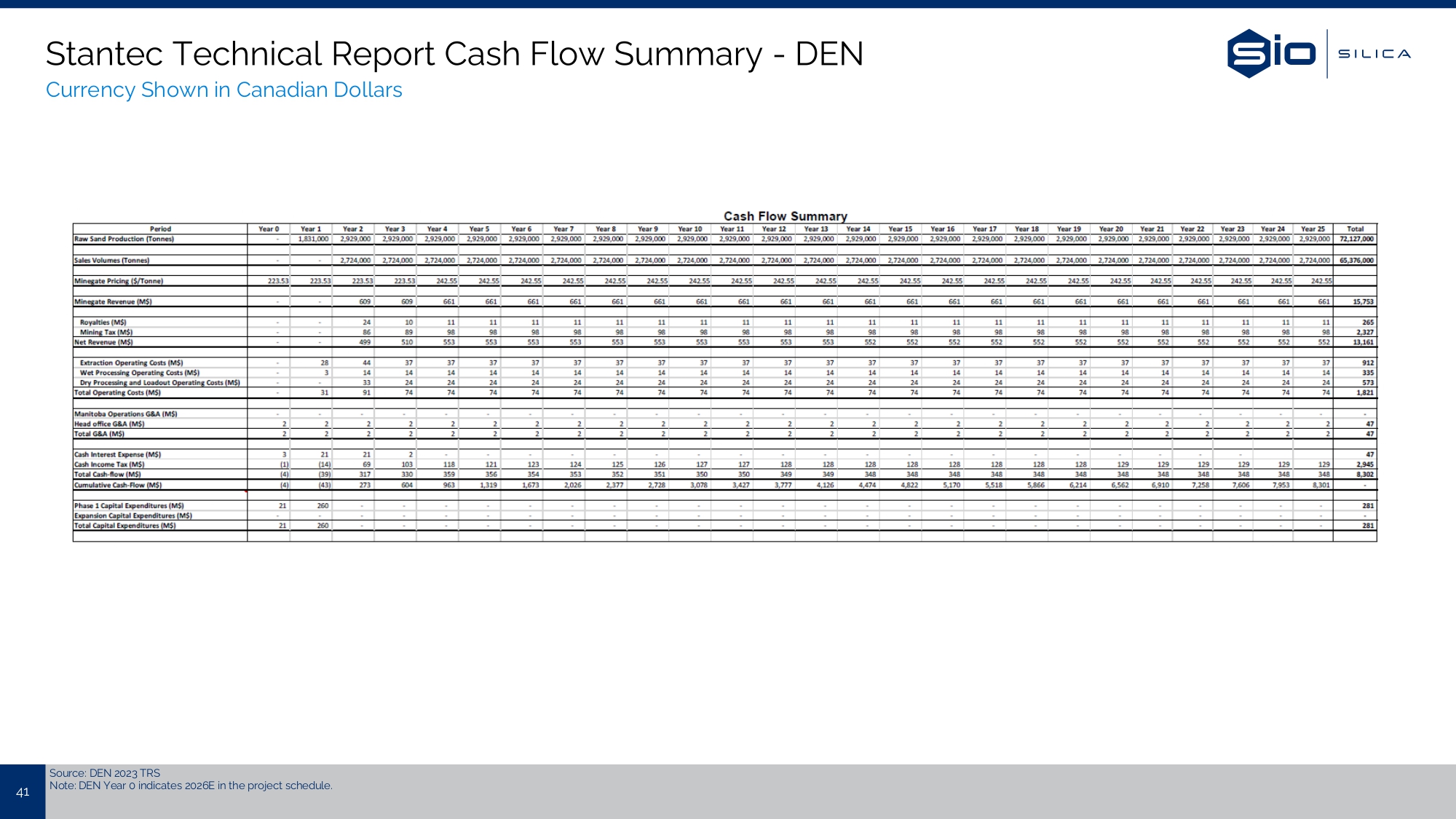

Attached as Exhibits 96.1 and 96.2 hereto and incorporated by reference herein are copies of the technical report summaries for Sio’s BRU Property and DEN Property, each dated October 6, 2023 (collectively, the “Technical Report Summaries”), which were prepared in accordance with Subpart 1300 of Regulation S-K (“S-K 1300”) by qualified persons of Stantec Consulting Ltd. The Technical Report Summaries are based on mineral resources. Unlike mineral reserves, mineral resources do not have demonstrated economic viability. The economic analysis in the Technical Report Summaries includes inferred mineral resources that are considered too speculative geologically to have modifying factors applied to them that would enable them to be categorized as mineral reserves. There is no certainty that such economic assessments will be realized.

On November 13, 2023, Pyrophyte and Sio issued a joint press release announcing the execution of the Business Combination Agreement.

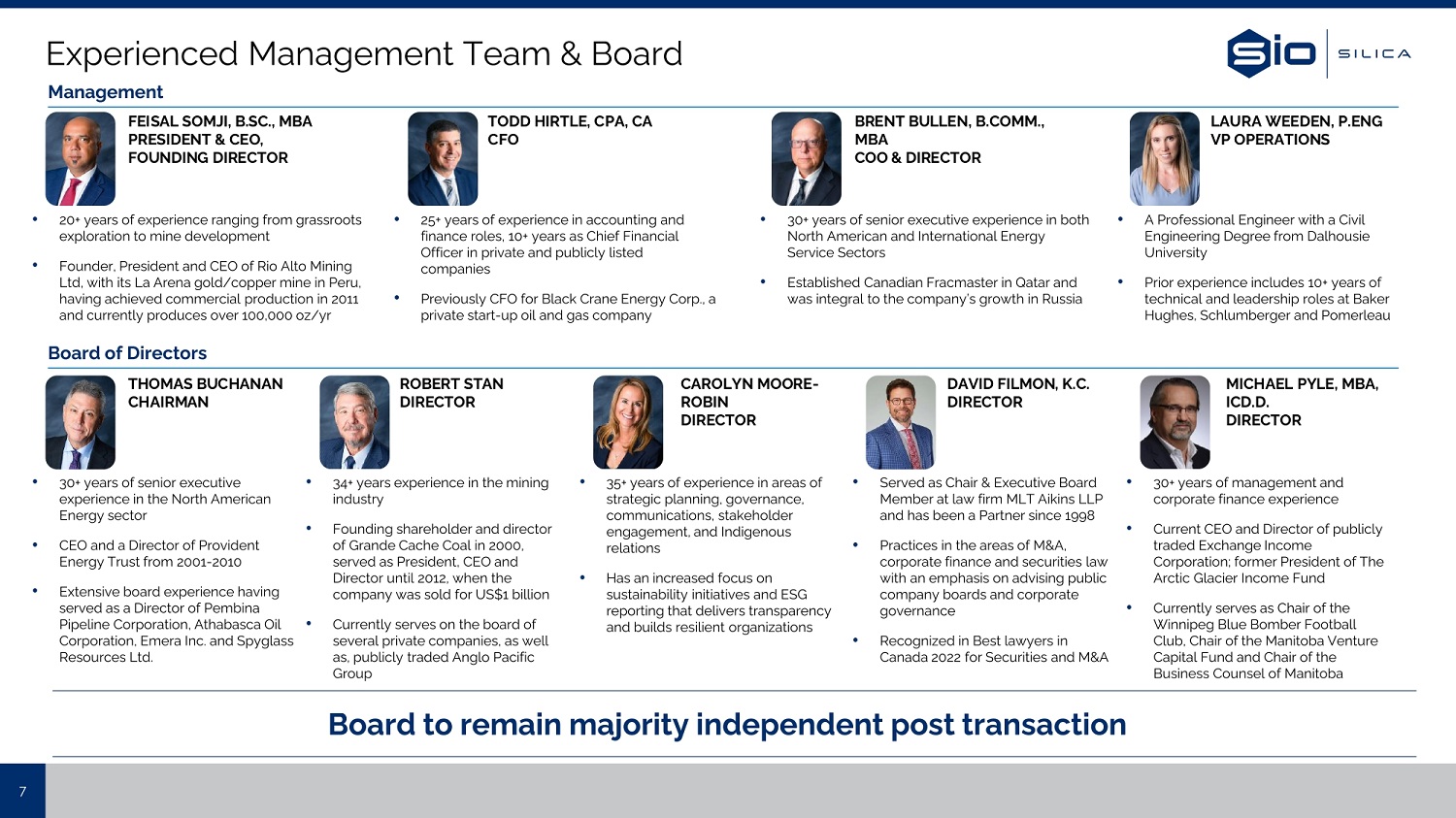

In addition, attached as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation, dated November 2023, that will be used by Pyrophyte and Sio with respect to the Business Combination.

The information in this Item 7.01, including Exhibits 96.1, 96.2, 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of Pyrophyte under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibits 96.1, 96.2, 99.1 and 99.2.

Additional Information about the Proposed Transactions and Where to Find It

In connection with the Proposed Transactions, Sio Newco intends to file the Registration Statement, which will include a preliminary proxy statement of Pyrophyte and a preliminary prospectus of Sio Newco, and after the Registration Statement is declared effective, Pyrophyte will mail the definitive proxy statement/prospectus relating to the Proposed Transactions to Pyrophyte’s shareholders as of a record date to be established for voting on the Proposed Transactions. The Registration Statement, including the proxy statement/prospectus contained therein, will contain important information about the Proposed Transactions and the other matters to be voted upon at Pyrophyte Shareholders Meeting. This communication does not contain all the information that should be considered concerning the Proposed Transactions and other matters and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. Pyrophyte and Sio Newco may also file other documents with the SEC regarding the Proposed Transactions. Pyrophyte’s shareholders and other interested persons are advised to read, when available, the Registration Statement, including the preliminary proxy statement/prospectus contained therein, and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the Proposed Transactions, as these materials will contain important information about Pyrophyte, Sio, Pyrophyte Newco, Pubco and the Proposed Transactions.

9

Pyrophyte’s shareholders and other interested persons will be able to obtain copies of the Registration Statement, including the preliminary proxy statement/prospectus contained therein, the definitive proxy statement/prospectus and other documents filed or that will be filed with the SEC, free of charge, by Pyrophyte and Sio Newco through the website maintained by the SEC at www.sec.gov.

Participants in Solicitation

Pyrophyte, Sio, Sio Newco and their respective directors and officers may be deemed participants in the solicitation of proxies of Company shareholders in connection with the Proposed Transactions. More detailed information regarding the directors and officers of Pyrophyte, and a description of their interests in Pyrophyte, is contained in Pyrophyte’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on April 12, 2023, and is available free of charge at the SEC’s website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Pyrophyte’s shareholders in connection with the Proposed Transactions and other matters to be voted upon at the Company Shareholders Meeting will be set forth in the Registration Statement for the Proposed Transactions when available.

Forward-Looking Statements

This Current Report on Form 8-K includes certain statements that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the Pyrophyte or Sio’s ability to effectuate the Proposed Transactions discussed in this document; the benefits of the Proposed Transactions; the future financial performance of Pubco (which will be the go-forward public company following the completion of the business combination) following the transactions; changes in Sio’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. These forward-looking statements are based on information available as of the date of this document, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing Pyrophyte, Sio or Pubco’s views as of any subsequent date, and none of Pyrophyte, Sio or Pubco undertakes any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Neither Pubco nor Pyrophyte gives any assurance that either Pubco or Pyrophyte will achieve its expectations. You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, Pubco’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: (i) the timing to complete the Proposed Transactions by Pyrophyte’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Pyrophyte; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreements relating to the Proposed Transactions; (iii) the outcome of any legal, regulatory or governmental proceedings that may be instituted against Pubco, Pyrophyte, Sio or any investigation or inquiry following announcement of the Proposed Transactions, including in connection with the Proposed Transactions; (iv) the inability to complete the Proposed Transactions due to the failure to obtain approval of Pyrophyte’s or Sio’s shareholders; (v) Sio’s and Pubco’s success in retaining or recruiting, or changes required in, its officers, key employees or directors following the Proposed Transactions; (vi) the ability of the parties to obtain the listing of Pubco’s common shares and warrants on the Stock Exchange upon the Closing; (vii) the risk that the Proposed Transactions disrupts current plans and operations of Sio; (viii) the ability to recognize the anticipated benefits of the Proposed Transactions; (ix) unexpected costs related to the Proposed Transactions; (x) the amount of redemptions by Pyrophyte’s public shareholders being greater than expected; (xi) the management and board composition of Pubco following completion of the Proposed Transactions; (xii) limited liquidity and trading of Pubco’s securities; (xiii) geopolitical risk and changes in applicable laws or regulations; (xiv) the possibility that Sio or Pyrophyte may be adversely affected by other economic, business, and/or competitive factors; (xv) operational risks; (xvi) litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on Sio’s resources; (xvii) the risk that the consummation of the Proposed Transactions is substantially delayed or does not occur; and (xix) other risks and uncertainties indicated from time to time in the Registration Statement, including those under “Risk Factors” therein, and in Pyrophyte’s other filings with the SEC.

No Offer or Solicitation

This communication relates to a Proposed Transactions between Sio and Pyrophyte. This document does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Transactions. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any offer, sale or exchange of securities in any state or jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

10

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

| * | Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request. |

11

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PYROPHYTE ACQUISITION CORP. | |||

| Date: November 13, 2023 | By: | /s/ Sten Gustafson | |

| Name: | Sten Gustafson | ||

| Title: | Chief Financial Officer | ||

12

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by and among

PYROPHYTE ACQUISITION CORP.,

SIO SILICA CORPORATION,

SNOWBANK NEWCO ALBERTA ULC,

and

SIO SILICA INCORPORATED

Dated as of November 13, 2023

Table of Contents

| Page | ||

| Article I DEFINITIONS | 4 | |

| Section 1.01 | Certain Definitions | 4 |

| Section 1.02 | Further Definitions | 19 |

| Section 1.03 | Construction | 22 |

| Article II THE ARRANGEMENT; THE TRANSACTIONS; CLOSING | 23 | |

| Section 2.01 | The Arrangement | 23 |

| Section 2.02 | The Interim Order | 23 |

| Section 2.03 | The Company Shareholders Meeting | 24 |

| Section 2.04 | Company Information Circular | 24 |

| Section 2.05 | The Final Order | 25 |

| Section 2.06 | Court Proceedings | 26 |

| Section 2.07 | Transactions | 26 |

| Section 2.08 | Payment Schedule | 28 |

| Section 2.09 | Exchange Agent | 28 |

| Section 2.10 | Company Earnout Shares | 28 |

| Section 2.11 | Intentionally Omitted | 30 |

| Section 2.12 | Withholding | 30 |

| Article III REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 31 | |

| Section 3.01 | Organization and Qualification; Subsidiaries | 31 |

| Section 3.02 | Organizational Documents | 31 |

| Section 3.03 | Capitalization | 31 |

| Section 3.04 | Authority Relative to this Agreement | 32 |

| Section 3.05 | No Conflict; Required Filings and Consents | 33 |

| Section 3.06 | Permits; Compliance | 33 |

| Section 3.07 | Financial Statements | 34 |

| Section 3.08 | Absence of Certain Changes or Events | 34 |

| Section 3.09 | Absence of Litigation | 35 |

| Section 3.10 | Employee Benefit Plans | 35 |

| Section 3.11 | Labor and Employment Matters | 36 |

| Section 3.12 | Interest in Properties and Mineral Rights | 38 |

| Section 3.13 | Rights-of-Way | 41 |

| Section 3.14 | Intellectual Property | 41 |

| Section 3.15 | Taxes | 43 |

| Section 3.16 | Environmental Matters | 45 |

| Section 3.17 | Material Contracts | 45 |

| Section 3.18 | Insurance | 47 |

| Section 3.19 | Board Approval; Vote Required. | 48 |

| Section 3.20 | Certain Business Practices | 48 |

| Section 3.21 | Interested Party Transactions | 49 |

| Section 3.22 | Exchange Act | 49 |

| Section 3.23 | Brokers | 49 |

| Section 3.24 | Sexual Harassment and Misconduct | 49 |

| Section 3.25 | Solvency | 50 |

| Section 3.26 | Records | 50 |

| Section 3.27 | Company’s and Sio NewCo’s Reliance | 50 |

| Section 3.28 | Exclusivity of Representations and Warranties | 50 |

i

| Page | ||

| Article IV REPRESENTATIONS AND WARRANTIES OF SPAC | 51 | |

| Section 4.01 | Corporate Organization | 51 |

| Section 4.02 | Organizational Documents | 51 |

| Section 4.03 | Capitalization | 51 |

| Section 4.04 | Authority Relative to This Agreement | 52 |

| Section 4.05 | No Conflict; Required Filings and Consents | 52 |

| Section 4.06 | Compliance | 53 |

| Section 4.07 | SEC Filings; Financial Statements; Sarbanes-Oxley | 53 |

| Section 4.08 | Absence of Certain Changes or Events | 55 |

| Section 4.09 | Absence of Litigation | 55 |

| Section 4.10 | Board Approval; Vote Required | 55 |

| Section 4.11 | Brokers | 56 |

| Section 4.12 | SPAC Trust Account | 56 |

| Section 4.13 | Employees | 56 |

| Section 4.14 | Taxes | 57 |

| Section 4.15 | Registration and Listing | 59 |

| Section 4.16 | Business Activities; Assets | 59 |

| Section 4.17 | Material Contracts | 59 |

| Section 4.18 | Certain Business Practices | 60 |

| Section 4.19 | Interested Party Transactions | 61 |

| Section 4.20 | Solvency | 61 |

| Section 4.21 | Sexual Harassment and Misconduct | 61 |

| Section 4.22 | Records | 61 |

| Section 4.23 | Insurance | 62 |

| Section 4.24 | SPAC’s and NewCo’s Independent Investigation and Reliance | 62 |

| Section 4.25 | Investment Canada Act | 62 |

| Article V CONDUCT OF BUSINESS | 63 | |

| Section 5.01 | Conduct of Business by the Company | 63 |

| Section 5.02 | Conduct of Business by SPAC | 66 |

| Section 5.03 | Conduct of Business by NewCo and Sio NewCo | 68 |

| Section 5.04 | Domestication | 68 |

| Section 5.05 | Claims Against Trust Account | 68 |

| Section 5.06 | Change of Name | 69 |

| Article VI ADDITIONAL AGREEMENTS | 69 | |

| Section 6.01 | Registration Statement / Proxy Statement | 69 |

| Section 6.02 | SPAC Shareholders Meeting | 71 |

| Section 6.03 | Access to Information; Confidentiality | 72 |

| Section 6.04 | Exclusivity | 72 |

| Section 6.05 | Employee Matters | 73 |

| Section 6.06 | Directors’ and Officers’ Indemnification | 74 |

| Section 6.07 | Notification of Certain Matters | 75 |

| Section 6.08 | Further Action; Reasonable Best Efforts | 76 |

| Section 6.09 | Public Announcements | 76 |

| Section 6.10 | Stock Exchange Listing | 76 |

ii

| Page | ||

| Section 6.11 | Trust Account | 77 |

| Section 6.12 | Certain Actions | 77 |

| Section 6.13 | Intended Tax Treatment | 77 |

| Section 6.14 | Post-Closing Officers and Directors | 78 |

| Section 6.15 | NewCo and Sio NewCo Shareholder Approvals | 78 |

| Section 6.16 | Transferred Information | 78 |

| Section 6.17 | Additional SPAC Extension | 79 |

| Section 6.18 | PFIC Status | 79 |

| Section 6.19 | GRA | 79 |

| Section 6.20 | Tax Matters | 79 |

| Section 6.21 | Alternative Financing | 79 |

| Section 6.22 | Financing Cooperation | 80 |

| Section 6.23 | Extraction Permit | 80 |

| Section 6.24 | Support Agreements | 80 |

| Article VII CONDITIONS TO THE TRANSACTIONS | 81 | |

| Section 7.01 | Conditions to the Obligations of Each Party | 81 |

| Section 7.02 | Conditions to the Obligations of SPAC and NewCo | 82 |

| Section 7.03 | Conditions to the Obligations of the Company | 83 |

| Article VIII TERMINATION, AMENDMENT AND WAIVER | 84 | |

| Section 8.01 | Termination | 84 |

| Section 8.02 | Effect of Termination | 85 |

| Section 8.03 | Expenses | 85 |

| Section 8.04 | Amendment | 85 |

| Section 8.05 | Waiver | 85 |

| Article IX GENERAL PROVISIONS | 86 | |

| Section 9.01 | Notices | 86 |

| Section 9.02 | Nonsurvival of Representations, Warranties and Covenants | 86 |

| Section 9.03 | Severability | 87 |

| Section 9.04 | Entire Agreement; Assignment | 87 |

| Section 9.05 | Parties in Interest | 87 |

| Section 9.06 | Governing Law | 87 |

| Section 9.07 | Waiver of Jury Trial | 87 |

| Section 9.08 | Headings | 88 |

| Section 9.09 | Counterparts | 88 |

| Section 9.10 | Specific Performance | 88 |

| Section 9.11 | No Recourse | 88 |

EXHIBITS

Exhibit A – Form of PIPE Subscription Agreement

Exhibit B – Form of Domestication Articles

Exhibit C – Form of New SPAC Articles

Exhibit D – Form of Company Closing Articles

Exhibit E – Form of Lock-Up Agreement

Exhibit F – Form of New SPAC Closing Articles

Exhibit G – Form of Registration Rights Agreement

Exhibit H – Form of Plan of Arrangement

iii

This BUSINESS COMBINATION AGREEMENT, dated as of November 13, 2023 (this “Agreement”), is by and among Pyrophyte Acquisition Corp., a Cayman Islands exempted company (“SPAC”), Sio Silica Corporation, an Alberta corporation (the “Company”), Snowbank NewCo Alberta ULC, an Alberta unlimited liability corporation (“NewCo”), and Sio Silica Incorporated, an Alberta corporation (“Sio NewCo” and, together with SPAC, the Company and NewCo, collectively, the “Parties”). Capitalized terms used but not otherwise defined herein have the meanings set forth in Article I.

BACKGROUND

NewCo is a newly formed Alberta unlimited liability corporation formed solely for the purposes of engaging in the Transactions and wholly owned by SPAC.

Sio NewCo is a newly formed Alberta corporation formed solely for the purposes of engaging in the Transactions and wholly owned by Feisal Somji, a nominee of the Company (the “Nominee”).

Concurrently with the execution of this Agreement, Riverstone Credit Partners II – Direct, L.P. (“Lender”) is executing and delivering a debt financing commitment letter (the “Commitment Letter”) in favor of the Company, pursuant to which Lender has committed to provide, subject only to the terms and conditions set forth therein, the full amount of the debt financing stated therein (the “Debt Financing”).

Concurrently with the execution of this Agreement, certain accredited investors (collectively, the “PIPE Investors”) are entering into subscription agreements, substantially in the form attached hereto as Exhibit A (the “PIPE Subscription Agreements”), pursuant to which, among other things, each PIPE Investor is agreeing to subscribe for and purchase on the Closing Date, and Sio NewCo is agreeing to issue and sell to each such PIPE Investor on the Closing Date (after giving effect to the SPAC Amalgamation (as defined below)), the number of New SPAC Class A Common Shares (as defined below) set forth in the applicable Subscription Agreement in exchange for the purchase price set forth therein (such equity financing, the “PIPE Financing”), in each case, on the terms and subject to the conditions set forth therein, for an aggregate purchase price of $20,122,474.

Prior to or concurrently with the execution of this Agreement, the Company is entering into royalty agreements (the “Royalty Agreements”) with the Persons identified on Section 1.01(d) of the Company Disclosure Schedules for aggregate proceeds of approximately $40,000,000 (the “Royalty Agreement Proceeds”).

On or prior to the SPAC Amalgamation, SPAC is entering into a non-redemption agreement with a holder of SPAC Class A Ordinary Shares (the “Non-Redemption Agreement”).

Prior to the SPAC Amalgamation and subject to the terms and conditions of this Agreement, SPAC shall transfer by way of continuation from the Cayman Islands to Alberta in accordance with the Cayman Islands Companies Act (as revised) (the “Companies Act”) and continue as an Alberta corporation in accordance with the applicable provisions of the Business Corporations Act (Alberta) (the “ABCA”) (such transfer by way of continuation and domestication, including all matters necessary or ancillary in order to effect such transfer by way of continuation and domestication, the “Domestication”).

Concurrently with and as part of the Domestication, SPAC shall file articles in substantially the form attached hereto as Exhibit B hereto (the “Domestication Articles”).

Following the Domestication and subject to the terms and conditions of this Agreement, (i) SPAC shall amalgamate with Sio NewCo (the “SPAC Amalgamation”) to form one corporate entity (“New SPAC”), except that the legal existence of Sio NewCo will not cease and Sio NewCo will survive the SPAC Amalgamation as New SPAC, (ii) the articles of New SPAC will be the articles substantially in the form attached hereto as Exhibit C (the “New SPAC Articles”), (iii) the officers and directors of SPAC shall become the officers and directors of New SPAC, and (iv) New SPAC shall assume the SPAC Warrant Agreement and enter into such amendments thereto as are necessary to give effect to the SPAC Amalgamation, in each case upon and subject to the other terms and conditions set forth in this Agreement, the Plan of Arrangement, the PIPE Subscription Agreements, the SPAC Warrant Agreement and in accordance with the provisions of applicable Law.

1

Pursuant to the SPAC Amalgamation, (i) each then issued and outstanding SPAC Class A Common Share shall be exchanged, on a one-for-one basis, for a Class A common share in the authorized share capital of New SPAC (the “New SPAC Class A Common Shares”), (ii) each then issued and outstanding SPAC Warrant shall be exchanged for a warrant to acquire one New SPAC Class A Common Share pursuant to the SPAC Warrant Agreement (the “New SPAC Warrants”), (iii) each then issued and outstanding SPAC Unit shall be exchanged for a unit of New SPAC representing one New SPAC Class A Common Share and one-half of one New SPAC Warrant (the “New SPAC Units”), (iv) each common share of Sio NewCo held by the Nominee will be exchanged for one New SPAC Class A Common Share, and (v) immediately thereafter, the New SPAC Class A Common Share held by the Nominee will be purchased for cancellation for cash equal to the subscription price for the common share of Sio NewCo, in each case upon and subject to the other terms and conditions set forth in this Agreement, the Plan of Arrangement and in accordance with the provisions of applicable Law.

On the Closing Date, prior to the Company Amalgamation and subject to the terms and conditions of this Agreement, the Company Warrants and Company Options shall be exercised on a cashless basis for Company Common Shares in accordance with the Plan of Arrangement (the “Company Warrant and Option Settlement”).

On the Closing Date, following the Company Warrant and Option Settlement, and subject to the terms and conditions of this Agreement, (i) the Company and NewCo shall amalgamate (the “Company Amalgamation” and, together with the SPAC Amalgamation, the “Amalgamations”) to form one corporate entity (the “Amalgamated Company”), except that the legal existence of the Company will not cease and the Company will survive the Company Amalgamation as the Amalgamated Company, (ii) the articles of the Amalgamated Company will be the articles substantially in the form attached hereto as Exhibit D (the “Company Closing Articles”), and (iii) the directors and officers of the Amalgamated Company shall be designated by the Company, all in accordance with the terms of the Plan of Arrangement.

Pursuant to the Company Amalgamation, (i) each then issued and outstanding Company Common Share (other than the Interim Company Shares) shall be exchanged for (x) a number of New SPAC Class A Common Shares equal to the Company Common Share Exchange Ratio and (y) a number of Company Earnout Shares equal to the Company Earnout Exchange Ratio, (ii) each then issued and outstanding Company RSU shall become exercisable for a number of New SPAC Class A Common Shares (rounded up or down to the nearest whole share) equal to the number of Company Common Shares subject to the applicable Company RSU multiplied by the Company Common Share Exchange Ratio, (iii) each Unexercised Company Warrant shall remain outstanding and shall automatically in accordance with its terms become a warrant to acquire New SPAC Class A Common Shares, and (iv) each then issued and outstanding Interim Company Share shall be exchanged for a number of New SPAC Class A Common Shares equal to the Company Common Share Exchange Ratio.

On the Closing Date, New SPAC shall issue and sell to each PIPE Investor the number of New SPAC Class A Common Shares set forth in the applicable PIPE Subscription Agreement in exchange for the purchase price set forth therein.

On the Closing Date, the Company and one or more Debt Financing Sources shall enter into a credit agreement on substantially the terms described in or contemplated by the Commitment Letter (the “Credit Agreement”) and such Debt Financing Source(s) shall fund the amounts contemplated thereby to be available at Closing subject to the terms and conditions of the Credit Agreement and funded in whole or in part at Closing.

2

On the Closing Date, the counterparties to the Royalty Agreements shall fund the Royalty Agreement Proceeds to the Company.

New SPAC and each of the Lock-Up Shareholders shall become bound by a lock-up agreement in substantially the form attached hereto as Exhibit E hereto (the “Lock-Up Agreement”) in accordance with the terms of the Plan of Arrangement.

Concurrently with the Company Amalgamation, (i) the New SPAC Articles shall be replaced with the articles in substantially the form attached hereto as Exhibit F (the “New SPAC Closing Articles”) in accordance with the terms of the Plan of Arrangement, (ii) the directors of the New SPAC immediately prior to the Company Amalgamation will resign and be replaced by seven (7) individuals to be designated in the manner set forth in the New SPAC Closing Articles prior to the Closing (the “Post-Closing Directors”), and (iii) the officers of New SPAC immediately prior to the Company Amalgamation will resign and be replaced by the officers of the Company prior to the Closing (collectively with the Post-Closing Directors, the “Post-Closing Officers and Directors”).

The Parties intend that: (a) for U.S. federal and applicable state and local income Tax purposes, (i) the Domestication and the SPAC Amalgamation each qualify as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code, (ii) the Company Amalgamation qualify as a “reorganization” within the meaning of Section 368(a) of the Code and the Company be the surviving entity of the “reorganization”, and (iii) this Agreement and the Plan of Arrangement constitute, and are hereby adopted as, a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) (collectively, the “Intended U.S. Tax Treatment”), and (b) for Canadian income Tax purposes, each of the Amalgamations are intended to (i) qualify as an amalgamation within the meaning of section 87 of the Canadian Tax Act and for the purposes of the ABCA, and (ii) be governed by subsections 87(1), 87(2), 87(4), 87(5) and 87(9) of the Canadian Tax Act (collectively, the “Intended Canadian Tax Treatment” and together with the Intended U.S. Tax Treatment, the “Intended Tax Treatment”).

The Board of Directors of the Company (the “Company Board”) has unanimously (i) determined that the Transactions are in the best interests of the Company and are fair to the Company Shareholders, (ii) approved this Agreement, the Ancillary Agreements to which the Company is or will be a party and the Transactions and (iii) resolved to recommend that the Company Shareholders vote in favor of the Arrangement Resolution.

The Board of Directors of SPAC (the “SPAC Board”) has unanimously (i) determined that the Transactions are in the commercial interests of SPAC and are fair to the SPAC Shareholders, (ii) approved this Agreement, the Ancillary Agreements to which SPAC is or will be a party and the Transactions and (iii) directed that the Transaction Proposals be submitted for consideration by the SPAC Shareholders at the SPAC Shareholders Meeting and recommended that SPAC Shareholders approve and adopt each of the Transaction Proposals at the SPAC Shareholders Meeting.

The Board of Directors of Sio NewCo (the “Sio NewCo Board”) has unanimously (i) determined that the Transactions are in the best interests of Sio NewCo, (ii) approved this Agreement, the Ancillary Agreements to which Sio NewCo is or will be a party and the Transactions and (iii) recommended the approval of this Agreement, the Ancillary Agreements to which Sio NewCo is or will be a party and the Transactions by the sole shareholder of Sio NewCo.

The Board of Directors of NewCo (the “NewCo Board”) has unanimously (i) determined that the Transactions are in the best interests of NewCo, (ii) approved this Agreement, the Ancillary Agreements to which NewCo is or will be a party and the Transactions and (iii) recommended the approval of this Agreement, the Ancillary Agreements to which NewCo is or will be a party and the Transactions by the sole shareholder of NewCo.

3

Concurrently with the execution and delivery of this Agreement, the Sponsor, NewCo and the Company are entering into a letter agreement, dated as of the date hereof (the “Sponsor Letter”), pursuant to which, among other things, (i) the Sponsor has agreed to waive the anti-dilution rights set forth in SPAC’s Amended and Restated Memorandum and Articles of Association adopted on October 26, 2021 (the “SPAC Memorandum and Articles of Association”) with respect to Sponsor Shares that may be triggered by the Transactions; (ii) the Sponsor has agreed to vote all Sponsor Shares held by it in favor of each of the Transaction Proposals; and (iii) the Sponsor has agreed to subject certain of the Sponsor Shares to restrictions until the occurrence of certain conditions.

SPAC, the Company, and the Key Company Shareholders will use commercially reasonable efforts, as promptly as possible (and in any event, within five days of the date of this Agreement) following the date of this Agreement, to enter into agreements (the “Support Agreements”), pursuant to which, among other things, each such Key Company Shareholder will agree to support and vote in favor of the Arrangement Resolution.

Concurrently with the Closing, New SPAC and certain Company Shareholders and SPAC Shareholders shall enter into a registration rights agreement in substantially the form attached hereto as Exhibit G hereto (the “Registration Rights Agreement”).

The Parties intend to complete the Amalgamations and the other Transactions pursuant to the Plan of Arrangement.

AGREEMENT

In consideration of the foregoing and the mutual covenants and agreements herein contained, the Parties hereto hereby agree as follows:

Article

I

DEFINITIONS

Section 1.01 Certain Definitions. For purposes of this Agreement:

“Affiliate” of a specified Person means a Person who, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified Person.

“Ancillary Agreements” means the Plan of Arrangement, the Support Agreements, the Sponsor Letter, the Lock-Up Agreement, the Registration Rights Agreement, the PIPE Subscription Agreements, the Royalty Agreements, the Non-Redemption Agreement, the Commitment Letter, the Credit Agreement and all other agreements, certificates and instruments executed and delivered by SPAC, NewCo, Sio NewCo or the Company in connection with the Transactions and specifically contemplated by this Agreement.

“Anti-Corruption Laws” means: (i) the U.S. Foreign Corrupt Practices Act of 1977, as amended (“FCPA”); (ii) the UK Bribery Act 2010 (“UKBA”); (iii) the Corruption of Foreign Publics Official Act (Canada), the Criminal Code (Canada), and the Extractive Sector Transparency Measures Act (Canada); (iv) Laws adopted in furtherance of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions; and (v) all other applicable, similar or equivalent anti-corruption or anti-bribery Laws of any jurisdiction.

4

“Anti-Money Laundering Laws” means financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970 (also known as the Bank Secrecy Act), as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), the anti-money laundering statutes of all applicable jurisdictions (defined by virtue of such entity’s jurisdiction of incorporation or its conduct of business operations), the rules and regulations thereunder, and any related or similar rules or regulations, issued, administered or enforced by any governmental agency.

“Arrangement” means an arrangement under section 193 of the ABCA on the terms and subject to the conditions set forth in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of this Agreement and the Plan of Arrangement or made at the directions of the Court in the Interim Order or Final Order with the prior written consent of SPAC and the Company, such consent not to be unreasonably withheld, conditioned or delayed.

“Arrangement Resolution” means (i) in the case of the Company, the special resolution of the Company Shareholders in respect of the Arrangement to be considered at the Company Shareholders Meeting, and (ii) in the case of SPAC, the special resolution of SPAC Shareholders to be considered at the SPAC Shareholders Meeting; in each case, including any amendments or variations thereto made in accordance with the Agreement or made at the direction of the Court in the Interim Order, with the consent of the Company and SPAC, each acting reasonably.

“As-Converted Company Options” means the number of Company Common Shares that are issuable upon the exercise of Company Options that are unexpired, issued and outstanding as of immediately prior to the Company Amalgamation Effective Time minus a number of Company Common Shares with a fair market value equal to the aggregate exercise price (determined with reference to the US dollar to the Canadian dollar exchange rate reported by the Bank of Canada at the close of business on the date that is two (2) Business Days prior to the Closing Date) of all Company Options if they were so exercised, in each case, assuming that the fair market value of one Company Common Share equals (x) the Company Common Share Exchange Ratio multiplied by (y) $10.25.

“As-Converted Company RSUs” means the number of Company Common Shares that are issuable upon the exercise of Company RSUs that are unexpired, issued and outstanding as of immediately prior to the Company Amalgamation Effective Time.

“As-Converted Company Warrants” means the number of Company Common Shares that are issuable upon the exercise of any Unexercised Company Warrants issued and outstanding as of immediately prior to the Company Amalgamation Effective Time minus a number of Company Common Shares with a fair market value equal to the aggregate exercise price (determined with reference to the US dollar to the Canadian dollar exchange rate reported by the Bank of Canada at the close of business on the date that is two (2) Business Days prior to the Closing Date) of all such Unexercised Company Warrants if they were so exercised.