ALPS GLOBAL OPPORTUNITY PORTFOLIO |

ALPS VARIABLE INVESTMENT TRUST |

Ticker: Class I (N/A) and Class III (AVPEX) |

Summary Prospectus May 1, 2025 |

Before you invest, you may want to review the Portfolio’s prospectus, which contains more information about the Portfolio and its risks. You can find the Portfolio's prospectus, reports to shareholders, and other information about the Portfolio, including the statement of additional information, online at https://www.alpsfunds.com/variable-insurance-trusts/avpex. You can also get this information at no cost by calling 1-866-432-2926, by sending an e-mail request to redrocksportfolio@alpsfunds.com, or by contacting your insurance company. The Portfolio’s prospectus and statement of additional information, each dated May 1, 2025, along with the Portfolio’s most recent annual report to shareholders dated December 31, 2024, are incorporated by reference into this summary prospectus.

Investment Objective

The investment objective of the Portfolio is to seek to maximize total return, which consists of appreciation on its investments and a variable income stream.

Fees and Expenses of the Portfolio

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Portfolio. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. The table does not reflect expenses incurred from investing through a separate account or qualified plan and does not reflect variable annuity or life insurance contract charges. If it did, the overall fees and expenses would be higher.

Annual Fund Operating Expenses |

Class I |

Class III |

Management Fee |

0.90% |

0.90% |

Distribution and/or Service (12b-1) Fees |

0.00% |

0.25% |

Total Other Expenses |

0.46% |

0.56% |

Shareholder Service Fee |

0.15% |

0.25% |

Other Portfolio Expenses |

0.31% |

0.31% |

Acquired Fund Fees and Expenses |

0.93% |

0.93% |

Total Annual Fund Operating Expenses(1)(2) |

2.29% |

2.64% |

Fee Waiver/Expense Reimbursement(3) |

-0.26% |

-0.26% |

Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursements |

2.03% |

2.38% |

|

(1) |

The operating expenses in this fee table will not correlate to the expense ratio in the Portfolio’s financial statements (or the financial highlights in its prospectus) because the financial statements include only the direct operating expenses incurred by the Portfolio, not the indirect costs of investing in the acquired funds. |

|

(2) |

Total Annual Fund Operating Expenses have been restated to reflect current fees. |

|

(3) |

ALPS Advisors, Inc. (the “Adviser”) has contractually agreed to reimburse Portfolio expenses and/or waive a portion of the investment advisory and other fees that the Adviser is entitled to receive to the extent necessary such that Total Annual Fund Operating Expenses (excluding distribution and/or service (Rule 12b-1) fees, shareholder service fees, acquired fund fees and expenses, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.95% of the Portfolio’s Class I or Class III shares average daily net assets through April 29, 2026. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the letter agreement described above to the extent that the Portfolio’s expenses in later periods fall below the annual rates set forth in the above-described agreement or in previous letter agreements. The Portfolio’s fee waiver/expense reimbursement arrangements with the Adviser permit the Adviser to recapture only if any such recapture payments do not cause the Portfolio’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. The Portfolio will not be obligated to pay any such deferred fees and expenses more than three years after the end of the fiscal year in which the fee and expenses were deferred. This agreement may only be terminated during the period by the Board of Trustees of ALPS Variable Investment Trust. |

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, you reinvest all dividends and capital gains distributions and that the Portfolio’s operating expenses remain the same. After one year, the Example does not take into consideration the Adviser’s agreement to waive fees and/or reimburse expenses. The Example does not include expenses incurred from investing through a separate account or qualified plan. If the Example included these expenses, the figures shown would be higher.

Although your actual |

1 Year |

3 Years |

5 Years |

10 Years |

Class I |

$206 |

$690 |

$1,201 |

$2,602 |

Class III |

$241 |

$796 |

$1,376 |

$2,950 |

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s turnover rate was 31% of the average value of the Portfolio.

1 |

ALPS GLOBAL OPPORTUNITY PORTFOLIO

Principal Investment Strategies

To achieve its objective, the Portfolio will invest at least 80% of its net assets in securities of U.S. and non-U.S. companies, including those in emerging markets, listed on a national securities exchange, or foreign equivalent, that have a majority of their assets invested in or exposed to private companies or have as their stated intention to have a majority of their assets invested in or exposed to private companies (“Listed Private Equity Companies”). Although the Portfolio does not invest directly in private companies, it will be managed with a similar approach: identifying and investing in long-term, high-quality Listed Private Equity Companies. The Fund will typically invest in securities issued by companies domiciled in at least three countries, including the United States. The Fund will invest a significant portion of its total assets (at least 40% under normal market conditions) at the time of purchase in securities issued by companies that are domiciled outside the United States. Domicile is determined by where the company is organized, located, has the majority of its assets, or receives the majority of its revenue.

Listed Private Equity Companies may include, among others, business development companies, investment holding companies, publicly traded limited partnership interests (common units), publicly traded venture capital funds, publicly traded venture capital trusts, publicly traded private equity funds, publicly traded private equity investment trusts, publicly traded closed-end funds, publicly traded financial institutions that lend to or invest in privately held companies and any other publicly traded vehicle whose purpose is to invest in privately held companies. The determination of whether a company is a Listed Private Equity Company will be made at the time of purchase and a portfolio company’s status will not vary solely as a result of fluctuations in the value of its assets or as a result of the progression of its holdings through the normal stages of a private equity company, including the exit stage. A portfolio company is considered to have a stated intention of investing primarily in private companies if it meets the criteria above under normal circumstances, notwithstanding temporary fluctuations in the public/private values of its private equity portfolio. The inclusion of a company in a recognized Listed Private Equity index will be considered a primary factor in the determination of whether a company is a Listed Private Equity Company.

The Adviser selects investments from the Listed Private Equity Company universe pursuant to a proprietary selection methodology using quantitative and qualitative historical results and commonly used financial measurements such as: price-to-book, price-to-sales, price-to-earnings, return on equity and balance sheet analysis. In addition, the Adviser observes the depth and breadth of company management, including management turnover. Lastly, the Adviser looks to allocate the Portfolio directly and indirectly amongst industry sectors, geographic locations, stage of investment and the year in which the private equity firm or fund makes a commitment or an investment in a fund, asset or business (“vintage year”).

The Portfolio’s policy to invest, at least 80% of its net assets in Listed Private Equity Companies, under normal market conditions, may not be changed without written notification to shareholders at least sixty (60) days prior to any change in such policy.

Principal Risks of Investing in the Portfolio

The main risks of investing in the Portfolio are below. Like all investments in securities, you risk losing money by investing in the Portfolio. An investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Additional Information on the Portfolio’s Principal Investment Risks can be found on page 53 in the prospectus.

Currency Risk. Fluctuations in exchange rates between the U.S. dollar and non-U.S. currencies may cause the value of the Portfolio’s investments to decline in terms of U.S. dollars. Additionally, certain of the Portfolio’s foreign currency transactions may give rise to ordinary income or loss to the extent such income or loss results from fluctuations in the value of the foreign currency. To the extent the Portfolio invests in securities denominated in, or receives revenues in, non-U.S. currencies it is subject to this risk.

Emerging Markets Risk. To the extent that the Portfolio invests in issuers located in emerging markets, the risk may be heightened by political changes and changes in taxation or currency controls that could adversely affect the values of these investments. Emerging markets have been more volatile than the markets of developed countries with more mature economies.

Managed Portfolio Risk. Any failure by the Adviser to accurately measure market risk and appropriately react to current and developing market trends may result in significant losses in the Portfolio’s investments, which can also result in possible losses overall for the Portfolio.

Market Risk. Market risk refers to the risk that the value of securities held by the Portfolio may decline due to daily fluctuations in the securities markets that are generally beyond the Adviser’s control, including inflation, supply chain disruptions, real or perceived adverse economic or political conditions throughout the world, war or political unrest, changes in the general outlook for corporate earnings, changes in interest or currency rates, natural disasters, the spread of infectious illness, including COVID-19 and its variants, or other public issues or adverse investor sentiment generally affect the securities and derivatives markets. The market value of a security or instrument also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. In a declining stock market, stock prices for all companies (including those in the Portfolio’s portfolio) may decline, regardless of their long-term prospects.

Non-U.S. Securities Risk. Investments in securities of non-U.S. issuers involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers. Non-U.S. securities exchanges, brokers and companies may be subject to less government supervision and regulation than exists in the U.S. Dividend and interest income may be subject to withholding and other non-U.S. taxes, which may adversely affect the net return on such investments. There may be difficulty in obtaining or enforcing a court judgment abroad. In addition, it may be difficult to effect repatriation of capital invested in certain countries. When investing in securities issued by non-U.S. issuers, there is also the risk that the value of such an investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates.

2 |

PFIC Tax Risk. The Portfolio may own shares in foreign investment entities that constitute “passive foreign investment companies” (“PFICs”) for U.S. tax purposes. In order to avoid U.S. federal income tax and an additional interest charge on any “excess distribution” from PFICs or gain from the disposition of shares of a PFIC, the Portfolio may elect to “mark-to-market” annually its investments in a PFIC, which will result in the Portfolio being taxed as if it had sold and repurchased all the PFIC stock at the end of each year. Alternatively, in order to avoid the “excess distribution” rules, the Portfolio may elect to treat a PFIC as a “qualified electing fund” (a “QEF election”), which would require the Portfolio to include in taxable income its allocable share of the PFIC’s income and net capital gains annually, regardless of whether it receives distributions from the PFIC. Amounts included in income under a QEF election are qualifying dividend income for a RIC if either (i) the earnings attributable to the inclusions are distributed in the taxable year of the inclusion, or (ii) such earnings are derived with respect to the RIC’s business of investing in stock, securities or currencies.

Private Equity Risk. There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately–held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision. In addition to the risks associated with the Portfolio’s direct investments, the Portfolio is also subject to the underlying risks which affect the Listed Private Equity Companies in which the Portfolio invests. Listed Private Equity Companies are subject to various risks depending on their underlying investments, which could include, but are not limited to, additional liquidity risk, industry risk, non-U.S. security risk, currency risk, valuation risk, credit risk and managed portfolio risk.

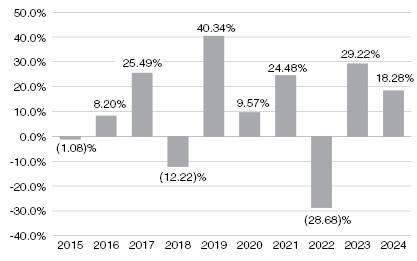

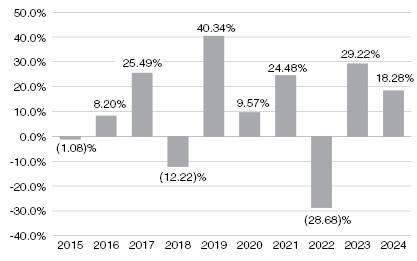

Performance

The bar charts and tables on the following pages provide an indication of the risk of investing in the Portfolio by showing changes in the Portfolio’s Class I performance from year to year and by showing how the Portfolio’s average annual returns for one year and since inception compared with those of a widely recognized, unmanaged index of securities, as appropriate. The Morningstar Developed Markets Index is the Portfolio’s primary benchmark.

Class III shares and Class I shares would have similar annual returns because all Classes of shares are invested in the same portfolio of securities, although annual returns will differ to the extent the Classes do not have the same expenses. Currently, the annual expense ratio of the Class I shares is lower than the estimated expense ratio of the Class III shares. Accordingly, performance would have been lower if Class III expenses were reflected. The bar charts and performance tables assume reinvestment of dividends and distributions. Returns do not reflect separate account, insurance contract or qualified plan fees and/or charges. If such fees and charges were taken into account, returns would be lower. The Portfolio’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Best Quarter and Worst Quarter figures apply only to the period covered by the chart. Updated performance information is available on the Portfolio’s website at www.alpsfunds.com or by calling 1-866-432-2926.

ALPS Global Opportunity Portfolio – Class I

Best Quarter: |

06/30/2020 |

20.75% |

Worst Quarter: |

03/31/2020 |

-30.58% |

Average Annual Total Returns

(for the periods ended December 31, 2024)

|

1 Year |

5 Years |

10 Years |

ALPS Global Opportunity Portfolio – Class I |

18.28% |

8.25% |

9.42% |

ALPS Global Opportunity Portfolio – Class III |

18.01% |

7.91% |

9.07% |

Morningstar Developed Markets Index* |

17.55% |

10.49% |

9.59% |

Red Rocks Global Listed Private Equity Index (reflects no deduction for fees, expenses or taxes)** |

17.88% |

8.58% |

9.54% |

|

* |

Broad-based securities market index. |

|

** |

Additional index. |

Investment Adviser

ALPS Advisors, Inc. (“Adviser”) is the investment adviser to the Portfolio.

Portfolio Managers

Andrew Drummond, Vice President and Portfolio Manager of the Adviser. Mr. Drummond has been portfolio manager of the Portfolio since March 2017. Mr. Drummond has primary responsibility for the day-to-day management of the Portfolio’s portfolio.

3 |

ALPS GLOBAL OPPORTUNITY PORTFOLIO

Tax Information

The Portfolio’s distributions are generally not taxable if you are investing through a tax-deferred arrangement, such as a variable insurance contract. Withdrawals from tax-deferred arrangements are subject to special tax rules. If the Portfolio’s distributions are made to arrangements that do not provide for non-taxable earnings or tax-deferral (e.g., certain registered and unregistered separate accounts), the distributions will generally be taxed as ordinary income, capital gains, qualified dividend income or Section 199A dividends. For information regarding the tax consequences of insurance contract ownership, you should consult the prospectus for the particular insurance contract you own.

Financial Intermediary Compensation

This Portfolio is only offered as an underlying investment option for variable insurance contracts and to qualified plans. The Portfolio and its related companies may make payments to sponsoring insurance companies, their affiliates or other financial intermediaries for distribution and/or other services. These payments may create a conflict of interest by influencing insurance companies to include the Portfolio as an underlying investment option in a variable insurance contract. In addition, these payments may be a factor that another financial intermediary considers in including the Portfolio as an investment option under a qualified plan. The prospectus or other offering documents for variable insurance contracts or plans may also contain additional information about these payments.

4 |