UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023

Commission File Number: 001-40398

HIVE Digital Technologies Ltd.

(Translation of registrant's name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 855 -789 West Pender Street

Vancouver, BC

V6C 1H2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

[ ] Form 20-F [X] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

EXHIBIT INDEX

| SIGNATURES | ||

| HIVE DIGITAL TECHNOLOGIES LTD. | ||

| By: | /s/ Darcy Daubaras | |

| Name: Darcy Daubaras | ||

| Title: Chief Financial Officer | ||

Date: August 10, 2023

HIVE Digital Technologies Ltd.

(formerly, HIVE Blockchain Technologies Ltd.)

Condensed Interim Consolidated Financial Statements

For the three months ended June 30, 2023 and 2022

(Expressed in US dollars)

(Unaudited)

| HIVE Digital Technologies Ltd. (formerly, HIVE Blockchain Technologies Ltd.) Condensed Interim Consolidated Statements of Financial Position (Expressed in US dollars unless otherwise indicated) (Unaudited) |

| June 30, | March 31, | ||||||

| Notes | 2023 | 2023 | |||||

| Assets | |||||||

| Current assets | |||||||

| Cash | $ | 4,519,855 | $ | 4,372,837 | |||

| Amounts receivable and prepaids | 5 | 8,967,346 | 9,353,875 | ||||

| Investments | 4 | 2,231,807 | 2,866,181 | ||||

| Digital currencies | 6 | 59,547,361 | 65,899,449 | ||||

| 75,266,369 | 82,492,342 | ||||||

| Plant and equipment | 7 | 86,058,372 | 87,228,302 | ||||

| Long term receivable | 5 | 5,973,323 | 5,814,779 | ||||

| Deposits, net of provision | 8 | 10,697,280 | 9,541,822 | ||||

| Right of use asset | 14 | 10,375,258 | 10,973,183 | ||||

| Intangible assets | 9 | - | 67,119 | ||||

| Total assets | $ | 188,370,602 | $ | 196,117,547 | |||

| Liabilities and equity | |||||||

| Current liabilities | |||||||

| Accounts payable and accrued liabilities | 11 | $ | 8,617,613 | $ | 9,353,631 | ||

| Current portion of convertible loan - liability component | 10 | 1,277,460 | 1,174,397 | ||||

| Current portion of lease liability | 14 | 2,344,867 | 2,330,341 | ||||

| Term loan | 13 | 6,867,816 | 7,138,945 | ||||

| Loans payable | 12 | 1,335,000 | 1,224,102 | ||||

| Current income tax liability | 3,678,283 | 1,846,102 | |||||

| 24,121,039 | 23,067,518 | ||||||

| Convertible loan - liability component | 10 | 3,193,469 | 3,554,287 | ||||

| Convertible loan - derivative component | 10 | 624,878 | 481,998 | ||||

| Loans payable | 12 | 11,400,539 | 11,853,946 | ||||

| Lease liability | 14 | 7,450,158 | 8,138,067 | ||||

| Deferred tax liability | - | 206,000 | |||||

| Total liabilities | 46,790,083 | 47,301,816 | |||||

| Equity | |||||||

| Share capital | 17 | 421,126,066 | 419,213,365 | ||||

| Equity reserve | 20,764,734 | 18,863,725 | |||||

| Accumulated other comprehensive income | 12,606,691 | 7,404,497 | |||||

| Accumulated deficit | (312,916,972 | ) | (296,665,856 | ) | |||

| Total equity | 141,580,519 | 148,815,731 | |||||

| Total liabilities and equity | $ | 188,370,602 | $ | 196,117,547 | |||

| Nature of operations (Note 1) | |||||||

| Commitments and contingencies (Note 15) | |||||||

| Subsequent events (Note 27) |

| The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements |

| Page 1 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Condensed Interim Consolidated Statements of (Loss) Income and Comprehensive (Loss) Income (Expressed in US dollars unless otherwise indicated) (Unaudited) |

| Three months ended June 30, | |||||||

| 2023 | 2022 | ||||||

| Notes | Revised - Note 25 | ||||||

| Revenue from digital currency mining | 6 | $ | 23,344,086 | $ | 44,178,526 | ||

| Other revenue | 221,057 | - | |||||

| 23,565,143 | 44,178,526 | ||||||

| Cost of sales | |||||||

| Operating and maintenance costs | (15,584,848 | ) | (17,161,751 | ) | |||

| Depreciation | 7,9,14 | (16,482,986 | ) | (25,752,181 | ) | ||

| (8,502,691 | ) | 1,264,594 | |||||

| Revaluation of digital currencies | 6 | - | (70,699,828 | ) | |||

| Loss on sale of digital currencies | 6 | (575,186 | ) | (22,300,418 | ) | ||

| Expenses | |||||||

| General and administrative | 20 | (2,766,838 | ) | (3,365,316 | ) | ||

| Foreign exchange gain (loss) | 1,444,797 | (3,656,510 | ) | ||||

| Share-based compensation | 17 | (1,972,791 | ) | (953,362 | ) | ||

| (3,294,832 | ) | (7,975,188 | ) | ||||

| Unrealized loss on investments | 4 | (664,864 | ) | (8,683,081 | ) | ||

| Change in fair value of derivative liability | 10 | (142,880 | ) | 4,371,195 | |||

| Impairment of equipment | 7 | - | (6,336,558 | ) | |||

| Impairment of deposits | 8 | - | (4,678,000 | ) | |||

| Loss on sale of equipment | (266,847 | ) | - | ||||

| Other expenses | (110,504 | ) | - | ||||

| Finance expense | 19 | (879,312 | ) | (989,514 | ) | ||

| Net loss before tax for the period | (14,437,116 | ) | (116,026,798 | ) | |||

| Tax expense | (1,814,000 | ) | - | ||||

| Net loss for the period | $ | (16,251,116 | ) | $ | (116,026,798 | ) | |

| Other comprehensive (loss) income | |||||||

| Other comprehensive (loss) income to be reclassified to profit or loss in subsequent periods: | |||||||

| Revaluation of digital currencies | 6 | $ | 4,367,621 | $ | - | ||

| Translation adjustment | 834,573 | 1,100,484 | |||||

| Net loss and comprehensive loss for the period | $ | (11,048,922 | ) | $ | (114,926,314 | ) | |

| Basic loss per share | $ | (0.19 | ) | $ | (1.41 | ) | |

| Diluted loss per share | $ | (0.19 | ) | $ | (1.41 | ) | |

| Weighted average number of common shares outstanding | |||||||

| Basic | 18 | 84,244,374 | 82,241,988 | ||||

| Diluted | 18 | 84,244,374 | 82,241,988 | ||||

| The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements |

| Page 2 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Condensed Interim Consolidated Statements of Changes in Equity (Expressed in US dollars unless otherwise indicated) (Unaudited) |

| Share capital | Accumulated other | |||||||||||||||||

| Equity | comprehensive | Accumulated | Total | |||||||||||||||

| Shares issued | Amount | reserve | income | deficit | equity | |||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| At March 31, 2022 | 82,241,988 | 413,660,484 | 12,236,169 | 23,399,468 | (60,243,556 | ) | 389,052,565 | |||||||||||

| Share-based compensation | - | - | 886,461 | - | - | 886,461 | ||||||||||||

| Vesting of restricted stock units | - | - | 66,901 | - | - | 66,901 | ||||||||||||

| Loss for the period | - | - | - | - | (116,026,798 | ) | (116,026,798 | ) | ||||||||||

| Translation adjustment | - | - | - | 1,100,484 | - | 1,100,484 | ||||||||||||

| Realized loss on digital currencies | - | - | - | (15,110,953 | ) | - | (15,110,953 | ) | ||||||||||

| At June 30, 2022 (revised - Note 25) | 82,241,988 | 413,660,484 | 13,189,531 | 9,388,999 | (176,270,354 | ) | 259,968,660 | |||||||||||

| At March 31, 2023 | 84,172,711 | 419,213,365 | 18,863,725 | 7,404,497 | (296,665,856 | ) | 148,815,731 | |||||||||||

| Share-based compensation | - | - | 1,972,791 | - | - | 1,972,791 | ||||||||||||

| Shares offering | 534,400 | 1,966,050 | - | - | - | 1,966,050 | ||||||||||||

| Vesting of restricted stock units | 14,900 | 71,782 | (71,782 | ) | - | - | - | |||||||||||

| Issuance costs | - | (125,131 | ) | - | - | - | (125,131 | ) | ||||||||||

| Loss for the period | - | - | - | - | (16,251,116 | ) | (16,251,116 | ) | ||||||||||

| Translation adjustment | - | - | - | 834,573 | - | 834,573 | ||||||||||||

| Revaluation gain on digital currencies | - | - | - | 4,367,621 | - | 4,367,621 | ||||||||||||

| At June 30, 2023 | 84,722,011 | 421,126,066 | 20,764,734 | 12,606,691 | (312,916,972 | ) | 141,580,519 | |||||||||||

| The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements |

| Page 3 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Condensed Interim Consolidated Statements of Cash Flows (Expressed in US dollars unless otherwise indicated) (Unaudited) |

| For the three months ended June 30, | ||||||

| 2023 | 2022 | |||||

| Revised - Note 25 | ||||||

| Operating activities | ||||||

| Net loss for the period: | $ | (16,251,116 | ) | $ | (116,026,798 | ) |

| Adjusted for: | ||||||

| Revenue recognized from digital currency mined | (23,344,086 | ) | (44,178,526 | ) | ||

| Depreciation and amortization | 16,482,986 | 25,752,181 | ||||

| Unrealized loss on investments | 664,864 | 8,683,081 | ||||

| Change in fair value of derivative liability | 142,880 | (4,371,195 | ) | |||

| Impairment of equipment | - | 6,336,558 | ||||

| Impairment of deposits | - | 4,678,000 | ||||

| Loss on sale of equipment | 266,847 | - | ||||

| Accretion on convertible debt | 490,190 | 777,409 | ||||

| Tax expense | 1,814,000 | - | ||||

| Share-based compensation | 1,972,791 | 953,362 | ||||

| Interest expense | 239,180 | 218,770 | ||||

| Foreign exchange | 314,573 | 323,830 | ||||

| Changes in non-cash working capital items: | ||||||

| Amounts receivable and prepaids | 227,985 | 277,585 | ||||

| Taxes payable | - | (126,803 | ) | |||

| Digital currencies | 34,063,795 | 127,714,078 | ||||

| Accounts payable and accrued liabilities | (923,837 | ) | 3,929,189 | |||

| Cash provided by operating activities | 16,161,052 | 14,940,721 | ||||

| Investing activities | ||||||

| Deposits on equipment | (4,749,458 | ) | (2,711,483 | ) | ||

| Proceeds on disposal of equipment | 26,760 | - | ||||

| Purchase of equipment | (11,258,214 | ) | (11,058,200 | ) | ||

| Cash used in investing activities | (15,980,912 | ) | (13,769,683 | ) | ||

| Financing activities | ||||||

| Shares offering, net of issuance costs | 1,840,919 | - | ||||

| Repayment of loan | (423,214 | ) | (583,387 | ) | ||

| Repayment of debenture | (747,945 | ) | (974,158 | ) | ||

| Lease payments made | (691,377 | ) | (679,570 | ) | ||

| Cash used in financing activities | (21,617 | ) | (2,237,115 | ) | ||

| Effect of exchange rate changes on cash | (11,505 | ) | (233,298 | ) | ||

| Net change in cash during the period | 147,018 | (1,299,375 | ) | |||

| Cash, beginning of period | 4,372,837 | 5,318,922 | ||||

| Cash, end of period | $ | 4,519,855 | $ | 4,019,547 | ||

| Supplemental disclosures: | ||||||

| Interest paid | $ | 592,681 | $ | 809,599 | ||

| The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements |

| Page 4 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

1. Nature of Operations

HIVE Digital Technologies Ltd. (the "Company") was incorporated in the province of British Columbia on June 24, 1987. The Company is a reporting issuer in each of the Provinces and Territories of Canada and is listed for trading on the TSXV, under the symbol "HIVE.V", as well on the Nasdaq's Capital Markets Exchange under "HIVE", and on the Open Market of the Frankfurt Stock Exchange under "YO0.F". On July 12, 2023 the Company completed a name change from HIVE Blockchain Technologies Ltd. to HIVE Digital Technologies Ltd. The Company's head office is located at Suite 855, 789 Pender Street, Vancouver, BC, V6C 1H2, and the Company's registered office is located at Suite 2500, 700 West Georgia Street, Vancouver, BC, V7Y 1B3.

In connection with the Company's change of business filed in September 2017 ("Change of Business"), the Company acquired digital currency mining data center equipment in Iceland. Following the initial acquisition, the Company acquired additional data center equipment in Iceland and Sweden throughout fiscal 2018. Phases one and two of Sweden commenced operations on January 15, 2018 and March 31, 2018 respectively, while phase three commenced operations on April 30, 2018. On April 9, 2020 the Company acquired a data center in Quebec, Canada, and on April 15, 2021 the Company acquired a data center in New Brunswick, Canada. The Company is in the business of providing infrastructure solutions, including the provision of computational capacity to distributed networks, in the blockchain industry. The Company's operations are focused on the mining and sale of digital currencies to upgrade, expand and scale up its mining operations. Digital currencies are subject to risks unique to the asset class and different from traditional assets. Additionally, the Company may at times hold assets by third party custodians or exchanges that are limited in oversight by regulatory authorities.

On May 24, 2022, the Company affected the consolidation of its common shares (Note 17) based on one post-consolidation common share for each five pre-consolidated common shares. The impact was reflected and adjusted such that all common shares and per share amounts have been retroactively restated to reflect the consolidation.

The negative impact on the global supply chain related to the COVID-19 pandemic has presented challenges to the Company including increased shipping costs and delaying obtaining equipment from China on a timely basis. Additionally, the Company continues to face uncertainty in the availability of equipment from suppliers as it relates to the Company's ASIC equipment.

2. Basis of Presentation and Material Accounting Policies

(a) Statement of Compliance

These unaudited condensed interim consolidated financial statements have been prepared in accordance with IAS 34, "Interim Financial Reporting of the International Financial Reporting Standards" ("IFRS") as issued by the International Accounting Standards Board ("IASB") and follow the same accounting policies and methods of application as the Company's March 31, 2023, annual audited financial statements, unless otherwise noted. These condensed interim consolidated financial statements do not include all the information required for full annual financial statements and accordingly, they should be read in conjunction with the Company's most recent annual statements.

The condensed interim consolidated financial statements have been prepared on a cost basis except for the convertible loan - derivative component and digital assets that have been measured at fair value. In addition, these condensed interim consolidated financial statements have been prepared using the accrual basis of accounting, except for cash flow information. The consolidated financial statements are presented in U.S. dollars, except where otherwise indicated.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

2. Basis of Presentation and Material Accounting Policies (continued…)

(a) Statement of Compliance (continued...)

The Company is in the business of the mining and sale of digital currencies to upgrade, expand, and scale up its mining operations, many aspects of which are not specifically addressed by current IFRS guidance. The Company is required to make judgements as to the application of IFRS and the selection of accounting policies. The Company has disclosed its presentation, recognition and de-recognition, and measurement of digital currencies, and the recognition of revenue as well as significant assumptions and judgements; however, if specific guidance is enacted by the IASB in the future, the impact may result in changes to the Company's earnings and financial position as presented.

These unaudited condensed interim consolidated financial statements were approved and authorized for issuance by the Board of Directors on August 10, 2023.

(b) New accounting standards adopted by the Company

Amendment to IAS 12 - deferred tax related to assets and liabilities arising from a single transaction

In May 2021, the IASB issued Deferred Tax related to Assets and Liabilities arising from a Single Transaction (Amendments to IAS 12). The amendments narrowed the scope of the initial recognition exemption to exclude transactions that give rise to equal and offsetting temporary differences. The amendments are effective for annual periods beginning on or after January 1, 2023, with early adoption permitted.

Amendments to IAS 1, Practice statement 2 and IAS 8

Presentation of Financial Statements was amended to clarify that the classification of liabilities as current or non-current is based on rights that are in existence at the end of the reporting period and specifies that classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of a liability. The amendments are effective January 1, 2023 with early application permitted. The amendments are required to be adopted retrospectively.

Amendments to IAS 1, Presentation of financial statements', on classification of liabilities

In February 2021, the IASB issued Definition of Accounting Estimates (Amendments to IAS 8). The amendments introduced a definition of accounting estimates and included other amendments to help entities distinguish changes in accounting estimates from changes in accounting policies. The amendments are effective for annual periods beginning on or after January 1, 2023, with early adoption permitted.

Amendments to IAS 1 Amendments to IAS 1 clarify how to classify debt and other liabilities as current or non-current.

The amendments help to determine whether, in the consolidated financial statements, debt and other liabilities with an uncertain settlement date should be classified as current (due or potentially due to be settled within one year) or non-current. The amendments also include clarifying the classification requirements for debt an entity might settle by converting it into equity. Amendments to IAS 1 specify that covenants to be complied with after the reporting date do not affect the classification of debt as current or non-current at the reporting date. Instead, the amendments require to disclose information about these covenants in the notes to the financial statements.

The adoption of the amendments listed above did not have a significant impact on the Company's condensed interim consolidated financial statements.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

2. Basis of Presentation and Material Accounting Policies (continued…)

(c) Future accounting standards

The Company continues to review changes to IFRS standards. There are no other pending IFRSs or IFRIC interpretations that are expected to be relevant to the Company's condensed interim consolidated financial statements.

3. Significant Estimates and Judgements

The preparation of the unaudited condensed interim consolidated financial statements necessitates management to make various judgments, estimates, and assumptions regarding the recognition and measurement of assets, liabilities, income, and expenses. These judgments and estimates are based on management's best understanding of future events, circumstances, and potential actions taken by the Company. It should be noted that the actual results may deviate from these assumptions and estimates.

The assessments and underlying assumptions are regularly reviewed. If any revisions are made to the assumptions or estimates and they only affect the current period, they are recognized in that particular period. However, if the revisions impact both the current and future periods, they are recognized in the period of the revision and in subsequent periods.

The significant judgments made by management while applying the Company's accounting policies and the primary sources of estimation uncertainty remain consistent with those outlined in the audited annual consolidated financial statements for the year ended March 31, 2023.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

4. Investments

As at June 30, 2023 the Company holds a number of non-material investments in both private and public companies. The Company's investment holdings that are not traded in active markets by the Company are considered investments. Investments are accounted for as financial assets which are initially recognized at fair value and subsequently measured through fair value through profit or loss.

The continuity of investments was as follows:

| Investments | |||

| Balance, March 31, 2022 | $ | 17,000,742 | |

| Unrealized loss on investments | (13,431,910 | ) | |

| Foreign exchange | (702,651 | ) | |

| Balance, March 31, 2023 | $ | 2,866,181 | |

| Unrealized loss on investments | (664,864 | ) | |

| Foreign exchange | 30,490 | ||

| Balance, June 30, 2023 | $ | 2,231,807 |

5. Amounts Receivable and Prepaids

| June 30, 2023 | March 31, 2023 | ||||||

| Sales tax receivable ** | $ | 8,415,175 | $ | 8,693,836 | |||

| Prepaid expenses and other receivables | 4,709,530 | 4,658,854 | |||||

| Receivable on sale of subsidiary* | 1,815,964 | 1,815,964 | |||||

| Total | $ | 14,940,669 | $ | 15,168,654 | |||

| Less: current portion | (8,967,346 | ) | (9,353,875 | ) | |||

| Long term portion | $ | 5,973,323 | $ | 5,814,779 | |||

* Receivable is conditional upon ruling by the by the Swedish Tax Authority related to an ongoing value added tax process. If the ruling is favourable; amounts will be received; otherwise, the amounts will not be collectible. Management has assessed the collectability using a probability model under a range of scenarios and this receivable reflects the results of that process.

** Includes VAT receivable of $4,157,359 (March 31, 2023 - $3,998,815) which is conditional upon ruling by the Swedish Tax Authority related to an ongoing value added tax process. If the ruling is favourable; amounts will be received; otherwise, the amounts will not be collectible. If the ruling of the Swedish Tax Authority goes against the Company, then the full amount may be payable including other items such as interest and penalties. See Note 15.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

6. Digital Currencies

Digital currencies are recorded at their fair value on the date they are received as income from digital currency mining and are revalued to their current market value less costs to sell at each reporting date.

The Company's holdings of digital currencies consist of the following:

| June 30, 2023 | March 31, 2023 | |||||

| Bitcoin | $ | 59,339,912 | $ | 65,772,170 | ||

| Ethereum Classic | 116,514 | 117,281 | ||||

| Other coins | 90,935 | 9,998 | ||||

| Total | $ | 59,547,361 | $ | 65,899,449 |

The continuity of digital currencies was as follows:

| Bitcoin | Amount | Number of coins | ||||

| Digital currencies, March 31, 2022 | $ | 117,669,390 | 2,596 | |||

| Digital currency mined | 77,482,265 | 3,258 | ||||

| Digital currency sold | (70,996,517 | ) | (3,522 | ) | ||

| Revaluation adjustment | (58,382,968 | ) | - | |||

| Digital currencies, March 31, 2023 | 65,772,170 | 2,332 | ||||

| Digital currency mined | 23,326,983 | 834 | ||||

| Digital currency sold | (34,063,795 | ) | (1,209 | ) | ||

| Revaluation adjustment | 4,304,554 | - | ||||

| Digital currencies, June 30, 2023 | $ | 59,339,912 | 1,957 | |||

| Ethereum | Amount | Number of coins | ||||

| Digital currencies, March 31, 2022 | $ | 52,301,707 | 16,165 | |||

| Digital currency mined | 28,424,318 | 14,984 | ||||

| Digital currency sold | (68,257,041 | ) | (31,149 | ) | ||

| Revaluation adjustment | (12,468,984 | ) | - | |||

| Digital currencies, March 31, 2023 and June 30, 2023 | $ | - | - | |||

| Ethereum Classic | Amount | Number of coins | ||||

| Digital currencies, March 31, 2022 | $ | 29,315 | 625 | |||

| Digital currency mined | 171,914 | 6,180 | ||||

| Digital currency sold | (45,317 | ) | (1,087 | ) | ||

| Revaluation adjustment | (38,631 | ) | - | |||

| Digital currencies, March 31, 2023 | 117,281 | 5,718 | ||||

| Digital currency mined | 461 | 25 | ||||

| Digital currency sold | - | - | ||||

| Revaluation adjustment | (1,228 | ) | - | |||

| Digital currencies, June 30, 2023 | $ | 116,514 | 5,743 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

6. Digital Currencies (continued…)

During the period ended June 30, 2023, the Company sold digital currencies for proceeds totalling $33,487,349 (June 30, 2022 - $34,519,966) with a cost of $34,062,535 (June 30, 2022 - $56,820,384) and recorded a loss on sale of $575,186 (June 30, 2022 - loss on sale of $22,300,418).

The Company reclassified a surplus of $nil from accumulated other comprehensive income (June 30, 2022 - $15,110,953) in connection to the revaluation gain on its digital currencies.

7. Plant and Equipment

| Cost | Equipment | Land | Building and Leaseholds |

Total | ||||||||

| Balance, March 31, 2022 | $ | 306,802,142 | $ | 662,910 | $ | 17,537,720 | $ | 325,002,772 | ||||

| Disposals | (9,587,018 | ) | - | - | (9,587,018 | ) | ||||||

| Additions | 55,352,672 | - | 10,296,373 | 65,649,045 | ||||||||

| Impairment | (119,032,683 | ) | - | - | (119,032,683 | ) | ||||||

| Foreign exchange on translation | (4,347,913 | ) | - | (1,307,231 | ) | (5,655,144 | ) | |||||

| Balance, March 31, 2023 | $ | 229,187,200 | $ | 662,910 | $ | 26,526,862 | $ | 256,376,972 | ||||

| Disposals | (1,557,332 | ) | - | - | (1,557,332 | ) | ||||||

| Additions | 13,352,440 | - | 20,054 | 13,372,494 | ||||||||

| Foreign exchange on translation | 1,634,673 | - | 598,000 | 2,232,673 | ||||||||

| Balance, June 30, 2023 | $ | 242,616,981 | $ | 662,910 | $ | 27,144,916 | $ | 270,424,807 | ||||

| Accumulated depreciation and impairment | Equipment | Land | Building and Leaseholds |

Total | ||||||||

| Balance, March 31, 2022 | $ | 146,669,579 | $ | - | $ | 790,449 | $ | 147,460,028 | ||||

| Disposals | (6,250,009 | ) | - | - | (6,250,009 | ) | ||||||

| Depreciation | 76,738,743 | - | 2,212,751 | 78,951,494 | ||||||||

| Impairment | (48,623,077 | ) | - | - | (48,623,077 | ) | ||||||

| Foreign exchange on translation | (2,300,370 | ) | - | (89,396 | ) | (2,389,766 | ) | |||||

| Balance, March 31, 2023 | $ | 166,234,866 | $ | - | $ | 2,913,804 | $ | 169,148,670 | ||||

| Disposals | (1,247,634 | ) | - | - | (1,247,634 | ) | ||||||

| Depreciation | 15,170,289 | - | 558,248 | 15,728,537 | ||||||||

| Foreign exchange on translation | 701,741 | - | 35,121 | 736,862 | ||||||||

| Balance, June 30, 2023 | $ | 180,859,262 | $ | - | $ | 3,507,173 | $ | 184,366,435 | ||||

| Carrying amount | ||||||||||||

| Balance, March 31, 2023 | $ | 62,952,334 | $ | 662,910 | $ | 23,613,058 | $ | 87,228,302 | ||||

| Balance, June 30, 2023 | $ | 61,757,719 | $ | 662,910 | $ | 23,637,743 | $ | 86,058,372 |

During the period ended June 30, 2022, the Company recorded an impairment on miner equipment of $6,336,558. The impairment was based on an assessment of the performance of the equipment in relation to prevailing replacement costs. There were no indicators of impairment at the period ended June 30,2023.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

8. Deposits

The deposits relate to required amounts on account with electricity providers in Sweden and deposit for equipment purchases, consisting of:

| Description | June 30, 2023 | March 31, 2023 | ||||

| Bodens Energi | $ | 208,533 | $ | 217,153 | ||

| Equipment Deposits | 21,443,350 | 35,430,727 | ||||

| Vattenfall AB | 1,176,596 | 1,225,229 | ||||

| 22,828,479 | 36,873,109 | |||||

| Equipment deposit provision | 12,131,199 | (27,331,287 | ) | |||

| Total | $ | 10,697,280 | $ | 9,541,822 |

The Company is exposed to counterparty risk through the advances made for certain mining equipment ("Deposits") it places with its suppliers in order to secure orders over a set delivery schedule. The risk of a supplier failing to meet its contractual obligations may result in late deliveries and/or the value of the deposits is not realised from non delivery of equipment or delivery of equipment with reduced quality. The Company attempts to mitigate this risk by procuring mining hardware from the established suppliers and with whom the Company has existing relationships and knowledge of their reputation in the market.

During the period ended June 30, 2023, the Company recorded impairment on the equipment deposits of $nil (June 30, 2022 - $4,678,000). The impairments are based on the counterparty risk of delivery, efficiency of machines expected use of the machines and the expected quantity and quality of the equipment to be received.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

9. Intangible Assets

| Intangible Assets | |||

| Balance, March 31, 2022 | $ | 335,594 | |

| Amortization | (268,475 | ) | |

| Balance, March 31, 2023 | $ | 67,119 | |

| Amortization | (67,119 | ) | |

| Balance, June 30, 2023 | $ | - |

The Company amortized its intangible assets over its expected useful life and recorded $67,119 of amortization to costs of sales (June 30, 2022 - $67,119).

10. Convertible Loan

On January 12, 2021, the Company closed its non-brokered private placement of unsecured debentures (the "Debentures"), for aggregate gross proceeds of $15,000,000 with U.S. Global Investors, Inc. ("U.S. Global"). The Executive Chairman of the Company is a director, officer and controlling shareholder of U.S. Global.

The Debentures mature on the date that is 60 months from the date of issuance, bearing interest at a rate of 8% per annum. The Debentures will be issued at par, with each Debenture being redeemable by the Company at any time, and convertible at the option of the holder into common shares (each, a "Share") in the capital of the Company at a conversion price of CAD$15.00 per Share. Interest will be payable monthly and principal will be payable quarterly. In addition, U.S. Global was issued 5.0 million common share purchase warrants (the "Warrants"). Each five whole Warrant entitles U.S. Global to acquire one common at an exercise price of CAD$15.00 per Share for a period of three years from closing.

The Company determined that the Convertible Loan contained an embedded derivative, and that the conversion feature does not qualify as equity as it does not satisfy the "fixed for fixed" requirement as the number of potential common shares to be issued is contingent on a variable carrying amount for the financial liability. The financial liability is variable because the functional currency of Hive Digital Technologies Ltd. is Canadian dollars and the Convertible Loan is denominated in US dollars, therefore the number of common shares to be issued depends on the foreign exchange rate at the date of settlement. Consequently, the conversion feature is classified as a derivative liability.

The Company allocated the proceeds of $15,000,000 first to the derivative component for $8,560,630, with the residual value to the liability component for $6,439,370. The derivative component was valued on initial recognition using the Black-Scholes option pricing model with the following assumptions: a risk-free interest rate of 0.69%; an expected volatility of 105%; an expected life of 2.71 years; a forfeiture rate of zero; and an expected dividend of zero.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

10. Convertible Loan (continued…)

Liability Component

| Balance, March 31, 2022 | $ | 5,599,007 | |

| Principal payment | (3,000,000 | ) | |

| Interest payment | (817,336 | ) | |

| Accretion and interest | 2,947,013 | ||

| Balance, March 31, 2023 | 4,728,684 | ||

| Principal payment | (747,945 | ) | |

| Interest payment | (166,376 | ) | |

| Accretion and interest | 656,566 | ||

| Balance, June 30, 2023 | 4,470,929 | ||

| Less: Current portion | (1,277,460 | ) | |

| Non-current portion | $ | 3,193,469 |

Derivative Component

| Balance, March 31, 2022 | $ | 4,986,354 | |

| Change in fair value of liability | (4,504,356 | ) | |

| Balance, March 31, 2023 | 481,998 | ||

| Change in fair value of liability | 142,880 | ||

| Balance, June 30, 2023 | $ | 624,878 |

The derivative component is re-valued each reporting period. As at June 30, 2023, the derivative component was revalued at $624,878 (March 31, 2023 - $481,998) using the Black-Scholes option pricing model with the following assumptions: share price of C$6.14 (March 31, 2023 - C$4.46) an expected weighted average risk-free interest rate of 4.75% (March 31, 2023 - 3.71%); an expected weighted average volatility of 88% (March 31, 2023 - 97%); and an expected weighted average life of 1.48 years (March 31, 2023 - 1.61 years). For the period ended June 30, 2023, the Company recorded a change in the fair value of the derivative liability of $142,880 (June 30, 2022 - $4,371,195).

11. Accounts Payable and Accrued Liabilities

The components of accounts payable and accrued liabilities are as follows:

| June 30, 2023 | March 31, 2023 | |||||

| Accounts payable | $ | 6,546,249 | $ | 6,858,814 | ||

| Accrued liabilities | 2,052,732 | 2,361,599 | ||||

| Other payable | 18,632 | 133,218 | ||||

| Total | $ | 8,617,613 | $ | 9,353,631 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

12. Loans Payable

On March 31, 2021, as part of the sale of the net assets in Boden Technologies AB, the Company incurred a loan payable. The facility bears interest at the Swedish government borrowing rate plus 1% per annum and has a maturity date of December 31, 2035. Principal payment plus interest is payable annually. The loan payable is contingently forgiven based on a favourable ruling from the Swedish Tax Authority on the ongoing value tax assessment.

A continuity of the loan balances are as follows:

| Boden | |||

| Balance, March 31, 2022 | $ | 15,692,339 | |

| Interest | 223,119 | ||

| Repayment | (1,271,535 | ) | |

| Foreign exchange movement | (1,565,875 | ) | |

| Balance, March 31, 2023 | 13,078,048 | ||

| Interest | 94,307 | ||

| Foreign exchange movement | (436,816 | ) | |

| Balance, June 30, 2023 | 12,735,539 | ||

| Less: Current portion | (1,335,000 | ) | |

| Non-current portion | $ | 11,400,539 |

13. Term Loan

As part of the Atlantic acquisition, the Company acquired a $10,978,065 (C$13,639,249) term loan. The facility bears interest at 3.33% per annum and a maturity date of June 30, 2024. Principal payments of C$189,434 plus interest is payable monthly.

The term loan has financial ratios and minimum tangible asset covenants that must be maintained by Hive Atlantic Datacentres Ltd. As at June 30, 2023, the covenant to maintain a ratio of total debt to tangible net worth equal to or less than 2:1 was not met. The outstanding balance is presented as a currently liability as at June 30, 2023. The lender has not requested early repayment of the loan as of the date when these financial statements were approved by the Board of Directors. The term loan includes an unlimited guarantee from the Company.

| Balance, March 31, 2022 | $ | 9,375,244 | |

| Interest | 272,765 | ||

| Repayment | (1,990,988 | ) | |

| Foreign exchange movement | (518,076 | ) | |

| Balance, March 31, 2023 | $ | 7,138,945 | |

| Interest | 58,313 | ||

| Repayment | (481,527 | ) | |

| Foreign exchange movement | 152,085 | ||

| Balance, June 30, 2023 | $ | 6,867,816 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

14. Right of Use Asset and Lease Liability

The Company has lease agreements for its offices, and buildings for its datacenters in Sweden and Quebec, Canada, in addition to electrical equipment in Sweden.

During the period ended June 30, 2023, the Company recognized interest expense on the lease liability of $144,873 (June 30, 2022 - $171,194) which was recorded within finance expense.

| Cost | Right of Use Assets | ||

| Balance, March 31, 2022 | $ | 17,758,451 | |

| Additions | 249,989 | ||

| Lease extension | 174,191 | ||

| Adjustment for change in variable payments based on rate or index | 474,132 | ||

| Foreign exchange | (1,353,799 | ) | |

| Balance, March 31, 2023 | $ | 17,302,964 | |

| Foreign exchange | 144,448 | ||

| Balance, June 30, 2023 | $ | 17,447,412 | |

| Accumulated Depreciation | |||

| Balance, March 31, 2022 | $ | (5,170,569 | ) |

| Depreciation | (2,510,224 | ) | |

| Foreign exchange | 1,351,012 | ||

| Balance, March 31, 2023 | $ | (6,329,781 | ) |

| Depreciation | (687,330 | ) | |

| Foreign exchange | (55,043 | ) | |

| Balance, June 30, 2023 | $ | (7,072,154 | ) |

| Carrying Amount | |||

| Balance, March 31, 2023 | $ | 10,973,183 | |

| Balance, June 30, 2023 | $ | 10,375,258 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

14. Right of Use Asset and Lease Liability (continued…)

| Lease Liability | |||

| Balance, March 31, 2022 | $ | 12,649,194 | |

| Lease payments made | (2,674,182 | ) | |

| Additions | 249,989 | ||

| Lease extension | 174,191 | ||

| Adjustment for change in variable payments based on rate or index | 474,132 | ||

| Interest expense on lease liabilities | 663,768 | ||

| Foreign exchange | (1,068,684 | ) | |

| Balance, March 31, 2023 | $ | 10,468,408 | |

| Lease payments made | (691,377 | ) | |

| Interest expense on lease liabilities | 144,873 | ||

| Foreign exchange | (126,879 | ) | |

| 9,795,025 | |||

| Less: current portion | (2,344,867 | ) | |

| Balance, June 30, 2023 | $ | 7,450,158 | |

| Lease Disclosures | |||

| Interest expense on lease liabilities | $ | 144,873 | |

| Total cash outflow for leases | $ | 691,377 | |

| Maturity Analysis - Undiscounted Contractual Payments | |||

| Less than 1 year | $ | 2,838,125 | |

| 1 to 2 years | 2,812,933 | ||

| 2 to 3 years | 2,707,399 | ||

| 3 to 4 years | 1,588,893 | ||

| 4 to 5 years | 1,013,224 | ||

| $ | 10,960,574 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

15. Commitments and Contingencies

(a) Service agreements

The Company has a service agreement with an unrelated third party to operate and maintain their data center computing equipment for the purpose of mining crypto currency in Canada, Sweden and Iceland. As part of the arrangement, proprietary software is installed on the Company's computing equipment to assist in optimizing the use of the equipment.

(b) Power purchase agreement

The Company entered into a supplemental power pricing arrangement that provides a fixed price of electricity consumption each month at the Company's Bikupa Datacenter AB and Bikupa Datacenter 2 AB location in Sweden. The fixed price agreement was assessed and is being accounted for as an executory contract; electricity costs are expensed as incurred.

(c) Obligations on Mining equipment

The Company had purchase commitments of $1,277,457 at the period ended June 30, 2023 (March 31, 2023 - $8,947,944).

Contingencies

(a) Contingent VAT Liability to the Swedish Tax Authority ("STA")

The Company's wholly owned subsidiaries located in Sweden (Bikupa Datacenter AB ("Bikupa") and Bikupa Datacenter 2 AB ("Bikupa 2") received decision notice of assessments ("the decision(s)"), on December 28, 2022 and February 14, 2023 for Bikupa and Bikupa 2 respectively, from the Swedish Tax Authority in connection with the application of VAT and its ability to recover input VAT against certain equipment and other charges in a total amount of SEK 337.9 million or approximately $32.4 million. The assessments covered the period December 2020 to June 2022 for Bikupa, and the period April 2021 to June 2022 for Bikupa 2, expressing the intent to reject the recovery of all the VAT for the periods under assessment and repayment of amounts previously received plus applicable interest.

The Company filed a formal appeal in connection with the Bikupa decision on February 9, 2023; however, there can be no guarantee that the Company will achieve a favourable outcome in its appeal. A formal appeal for Bikupa 2 in relation to the February 14, 2023 decision was filed on March 10, 2023 by the Company. The Company engaged an independent legal firm in Sweden with expertise in these matters to assist in the appeal process. The Company does not believe that the decision has merit because in management's opinion and those of the Company's independent advisors, the decision is not compatible with the current applicable law and therefore the amount claimed to be owed by the Company is not probable. According to general principles regarding the placement of the burden of proof, it is up to the Swedish Tax Agency to provide sufficient evidence in support of its decision. It is the Company's opinion, the Swedish Tax Agency has not substantiated their claim. We are not aware of any precedent cases, authoritative literature, or other statement that supports the Swedish Tax Agency's position. The formal appeals are still pending review by the Swedish Tax Authority.

It is not yet known when this dispute will be resolved; the due process following appeals and the court ruling could extend beyond a year. Furthermore, given that the industry is rapidly developing, there can be no guarantee that changes to the laws or policies of Sweden will not have a negative impact on the Company's tax position with respect to the eligibility of the claimed VAT. (Note 21 Uncertain Tax Positions).

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

15. Commitments and Contingencies (continued…)

(a) Contingent VAT Liability to the Swedish Tax Authority (continued…)

If the Company is unsuccessful in its appeal, the full amount could be payable including other items such as penalties and interest that may accrue to the Company. The Company will continue to assess these matters. At the year end the Company has not recorded any amounts payable to the STA in connection with the decisions.

(b) Litigation

From time to time, the Company is involved in routine litigation incidental to the Company's business. Management believes that adequate provisions have been made where required and the ultimate resolution with respect to any claim will not have a material adverse effect on the financial position or results of the operations of the Company.

16. Related Party Transactions

The Company entered into the following related party transactions not otherwise disclosed in these consolidated financial statements:

a) As at June 30, 2023, the Company had $2,559 (March 31, 2023 - $11,778) due to officers for the reimbursement of expenses included in accounts payable and accrued liabilities.

b) As at June 30, 2023, the Company had $nil (March 31, 2023 - $nil) due to a company controlled by a director of the Company included in accounts payable and accrued liabilities. For the period ended June 30, 2023, the Company paid $79,668 (June 30, 2022 - $96,558) to this company for marketing services.

Key Management Compensation

Key management personnel include those persons having authority and responsibility for planning, directing and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of members of the Company's Board of Directors and corporate officers.

For the period ended June 30, 2023, key management compensation includes salaries and wages paid to key management personnel and directors of $261,216 (June 30, 2022 - $225,972) and share-based payments of $1,546,972 (June 30, 2022 - $312,891).

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

17. Equity

(a) Authorized

Unlimited common shares without par value

Unlimited preferred shares without par value

(b) Issued and fully paid common shares

On May 24, 2022, the Company proceeded with the consolidation of its common shares on the basis of five (5) pre-Consolidation Common Shares for one (1) post-Consolidation Common Shares. The common shares, options, warrants and RSU's have been retroactively adjusted for impact of the share consolidation by the Company.

During the period ended June 30, 2023, the Company:

(c) Stock options

The Company has established a rolling Stock Option Plan (the "Plan"). Under the Plan, the number of shares reserved for issuance may not exceed 10% of the total number of issued and outstanding shares and, to any one optionee, may not exceed 5% of the issued shares on a yearly basis. The maximum term of each option shall not be greater than 10 years. The exercise price of each option shall not be less than the market price of the Company's shares at the date of grant. Options granted to consultants performing investor relations activities shall vest over a minimum of 12 months with no more than a quarter of such options vesting in any 3-month period. All other options vest at the discretion of the Board of Directors.

Following is a summary of changes in stock options outstanding for the period ended June 30, 2023:

| Weighted average | ||||||

| Outstanding | exercise price | |||||

| Balance, March 31, 2022 | 2,846,515 | C$ | 6.31 | |||

| Granted | 415,200 | 5.66 | ||||

| Expired | (133,300 | ) | 1.50 | |||

| Forfeited | (55,000 | ) | 18.97 | |||

| Balance, March 31, 2023 | 3,073,415 | C$ | 6.20 | |||

| Forfeited | (200,000 | ) | 25.00 | |||

| Balance, June 30, 2023 | 2,873,415 | C$ | 4.89 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

17. Equity (continued…)

(c) Stock options (continued...)

The stock options outstanding and exercisable as at June 30, 2023, are as follows:

| Outstanding | Exercisable | Exercise price | Expiry date |

| 2,000 | 2,000 | 15.70 | February 11, 2026 |

| 10,000 | 10,000 | 14.95 | June 4, 2026 |

| 415,200 | 173,000 | 5.66 | August 26, 2027 |

| 1,000,000 | 1,000,000 | 1.50 | September 14, 2027 |

| 24,615 | 24,615 | 10.00 | October 11, 2027 |

| 50,000 | 50,000 | 10.00 | March 26, 2028 |

| 400,000 | 400,000 | 3.10 | September 18, 2028 |

| 100,000 | 100,000 | 1.35 | December 21, 2028 |

| 500,000 | 500,000 | 1.45 | February 10, 2030 |

| 20,000 | 20,000 | 1.90 | May 29, 2030 |

| 1,600 | 1,600 | 10.80 | December 24, 2030 |

| 30,000 | 30,000 | 25.15 | April 6, 2031 |

| 60,000 | 60,000 | 18.35 | April 29, 2031 |

| 180,000 | 63,000 | 18.50 | October 7, 2031 |

| 60,000 | 30,000 | 25.35 | November 10, 2031 |

| 20,000 | 15,000 | 21.00 | December 9, 2031 |

| 2,873,415 | 2,479,215 |

(d) Warrants

Following is a summary of changes in warrants outstanding for the period ended June 30, 2023:

| Warrants | Weighted average | |||||

| outstanding | exercise price | |||||

| Balance, March 31, 2022 and 2023 | 3,573,727 | C$ | 22.92 | |||

| Expired | (250,000 | ) | 6.20 | |||

| Balance, June 30, 2023 | 3,323,727 | C$ | 24.18 |

The warrants outstanding and exercisable as at June 30, 2023, are as follows:

| Outstanding | Exercisable | Exercise price | Expiry date | |

| 300,000 | * | 300,000 | C$ 15.55 | July 12, 2023 |

| 1,000,000 | 1,000,000 | C$ 15.00 | January 12, 2024 | |

| 1,917,050 | 1,917,050 | C$ 30.00 | May 30, 2024 | |

| 106,677 | ** | 106,677 | C$ 30.00 | September 15, 2024 |

| 3,323,727 | 3,323,727 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

17. Equity (continued…)

(d) Warrants (continued...)

* For the year ended March 31, 2022, the Company issued 300,000 warrants as consideration for mining equipment. Each full warrant entitles the holder to acquire one common share for C$15.55 for a period of 2 years. The warrants were valued at $2,030,045 using the Black-Scholes option pricing model with the following assumptions: a risk-free interest rate of 0.46%; an expected volatility of 105%; an expected life of 2.00 years; a forfeiture rate of zero; and an expected dividend of zero. Subsequent to the period ended June 30, 2023, these warrants have expired unexercised.

** On December 1, 2021, the Company issued 106,677 warrants as consideration for an investment in Titan.io. Each Warrant is exercisable for one share on or before September 15, 2024, at an exercise price of C$30.00 per Share.

On November 30, 2021, the Company completed an agreement with Stifel GMP as lead underwriter and sole book runner to include a syndicate of underwriters (the "Underwriters"), whereby the Underwriters will purchase, on a bought-deal basis, 3,834,100 special warrants of the Company (the "Special Warrants") at a price of C$30.00 per Special Warrant for aggregate gross proceeds to the Company of C$115,023,000 (the "Offering").

On January 12, 2022, each Special Warrant was deemed to be exercised into one Unit comprised of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant being a "Warrant"). Each Warrant is exercisable for one share on or before May 30, 2024, at an exercise price of C$30.00 per Share.

(e) Restricted share-units

The Company has established a Restricted Share Unit Plan (the "RSU Plan"). Under the RSU Plan, together with any other share compensation arrangement, the number of shares reserved for issuance may not exceed 10% of the total number of issued and outstanding shares and, to any one optionee, may not exceed 5% of the issued shares on a yearly basis. Currently, the RSU Plan has a limit of 2 million shares, which is not rolling. The Board may in its own discretion, at any time, and from time to time, grant RSUs to any employee, director or consultant of the Company or its subsidiaries (collectively, "Eligible Person"), other than persons conducting investor relations activities, from time to time by the Board, subject to the limitations set forth in the RSU Plan. The Board may designate one or more performance periods under the RSU Plan. In respect of each designated performance period and subject to the terms of the RSU Plan, the Board may from time to time establish the grant date and grant to any Eligible Person one or more RSUs as the Board deems appropriate.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

17. Equity (continued…)

(e) Restricted share-units (continued...)

The fair value of restricted shares units (RSUs) is generally measured as the grant date price of the Company's share.

Following is a summary of changes in restricted share units outstanding for the period ended June 30, 2023:

| Outstanding | |||

| Balance, March 31, 2022 | 61,500 | ||

| Granted | 2,641,280 | ||

| Cancelled | (150,000 | ) | |

| Exercised | (624,250 | ) | |

| Balance, March 31, 2023 | 1,928,530 | ||

| Exercised | (14,900 | ) | |

| Balance, June 30, 2023 | 1,913,630 |

(f) Share-based compensation

During the period ended June 30, 2023, $390,663 (June 30, 2022 - $886,461) of share-based compensation expense was recognized in relation to the vesting of options, and $1,582,128 (June 30, 2022 - $66,901) of share-based compensation expense was recognized in relation to the vesting of RSUs.

During the period ended June 30, 2023, the Company did not grant any stock options or RSUs.

18. Loss per Share

Income per common share represents net income for the year divided by the weighted average number of common shares outstanding during the period.

Diluted income per share is calculated by dividing the applicable net income by the sum of the weighted average number of common shares outstanding and all additional common shares that would have been outstanding if potentially dilutive common shares had been issued during the period.

| Three months ended June 30, 2023 |

Three months ended June 30, 2022 |

|||||

| Basic weighted average number of common shares outstanding | 84,244,374 | 82,241,988 | ||||

| Effect of dilutive stock options and warrants | - | - | ||||

| Effect of convertible loan | - | - | ||||

| Diluted weighted average common shares outstanding | 84,244,374 | 82,241,988 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

19. Finance Expense

Finance expenses were comprised of the following for the period ended:

| June 30, 2023 | June 30, 2022 | |||||

| Interest and accretion on convertible loan | $ | 656,566 | $ | 770,744 | ||

| Interest on lease liabilities | 144,873 | 47,576 | ||||

| Interest on loans payable | 77,873 | 171,194 | ||||

| Total | $ | 879,312 | $ | 989,514 |

20. General and Administrative Expenses

General and administrative expenses were comprised of the following for the period ended:

| June 30, 2023 | June 30, 2022 | |||||

| Management fees, salaries and wages | $ | 647,245 | $ | 786,485 | ||

| Marketing | 306,700 | 198,471 | ||||

| Office, administration, and regulatory | 921,673 | 1,432,799 | ||||

| Professional fees, advisory, and consulting | 891,220 | 947,561 | ||||

| Total | $ | 2,766,838 | $ | 3,365,316 |

21. Financial Instruments and Risk Management

The fair values of investments were measured using the cost, market or income approaches. The investments measured at fair value are classified into one of the three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values, with the designation based upon the lowest level of input that is significant to the fair value measurement. The three levels of the fair value hierarchy are:

Level 1 Inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date.

Level 2 Inputs: Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities in markets that are not active, or other observable inputs other than quoted prices.

Level 3 Inputs: Unobservable inputs for the asset or liability (Unobservable inputs reflect management's assumptions on how market participants would price the asset or liability based on the information available).

Valuation of Assets that use Level 2 Inputs ("Level 2 Assets"). The fair value of Level 2 Assets would use the quoted price from the exchanges which the Company most frequently uses, with no adjustment.

The Company is exposed, in varying degrees, to a variety of financial related risks. The fair value of the Company's financial instruments, including cash, amounts receivable, and accounts payable approximates their carrying value due to their short-term nature. The type of risk exposure and the way in which such exposure is managed is provided as follows:

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

21. Financial Instruments and Risk Management (continued…)

At the year end the Company classified its financial assets into the following levels:

| June 30, 2023 | As at March 31, 2023 | |||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | ||||||||||||

| Cash | $ | - | $ | 4,519,855 | $ | - | $ | - | $ | 4,372,837 | $ | - | ||||||

| Digital currencies | - | 59,547,361 | - | - | 65,899,449 | - | ||||||||||||

| Investments | 892,656 | - | 1,339,151 | 1,307,255 | - | 1,558,926 | ||||||||||||

| $ | 892,656 | $ | 64,067,216 | $ | 1,339,151 | $ | 1,307,255 | $ | 70,272,286 | $ | 1,558,926 | |||||||

| Liabilities | ||||||||||||||||||

| Convertible loan -derivative component | $ | - | $ | - | $ | 624,878 | $ | - | $ | - | $ | 481,998 | ||||||

| $ | - | $ | - | $ | 624,878 | $ | - | $ | - | $ | 481,998 | |||||||

Valuation of Assets / Liabilities that use Level 1 Inputs ("Level 1 Assets / Liabilities"). Consists of the Company's investments in common stock, where quoted prices in active markets are available.

Valuation of Assets / Liabilities that use Level 2 Inputs ("Level 2 Assets / Liabilities"). Consists of the Company's digital currencies, where quoted prices in active markets are available. The fair value is determined by the volume-weighted average of prices across principal exchanges as of 12:00 AM UTC, per coinbase.com.

Valuation of Assets / Liabilities that use Level 3 Inputs ("Level 3 Assets / Liabilities"). Consists of the Company's investments in preferred stock, convertible notes and common stock. For the Company's common stock investments:

A verified prior transaction is initially given 100% weighting in a fair value conclusion (if completed at arm's length), but subsequently such weighting is adjusted based on the merits of newly observed data. As a result, in the absence of disconfirming data, an unadjusted prior transaction price may not be considered "stale" for months or, in some cases, years.

Level 3 Continuity

The following is a reconciliation of Level 3 assets and liabilities:

| Fair value at | Change | Fair Value at, | |||||||||||||

| Level 3 Continuity | March 31, 2023 | Additions | Disposals | in fair value | June 30, 2023 | ||||||||||

| Assets | |||||||||||||||

| Investments | $ | 1,558,926 | $ | - | $ | - | $ | (219,775 | ) | $ | 1,339,151 | ||||

| $ | 1,558,926 | $ | - | $ | - | $ | (219,775 | ) | $ | 1,339,151 | |||||

| Liabilities | |||||||||||||||

| Convertible loan -derivative component | $ | 481,998 | $ | - | $ | - | $ | 142,880 | $ | 624,878 | |||||

| $ | 481,998 | $ | - | $ | - | $ | 142,880 | $ | 624,878 |

The carrying values of the Company's cash, amounts receivable, accounts payable and accrued liabilities, term loan and loans payable approximate fair value due to their short maturities. The carrying value of the Company's lease liability is measured as the present value of the discounted future cash flows.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

21. Financial Instruments and Risk Management (continued…)

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Company's primary exposure to credit risk is on its cash held in bank accounts as at June 30, 2023. The majority of cash is deposited in bank accounts held primarily with one major bank in Canada so there is a concentration of credit risk. This risk is managed by using a major bank that is a high credit quality financial institution as determined by rating agencies.

For the security of its digital currencies, the Company uses the services of two institutions through custodial agreements, one located in Liechtenstein and another in the United States.

The Company is exposed to credit risk related to amounts receivable from the Swedish government related to VAT filings. These receivables are currently being withheld by the STA as a result of the decision notice of assessments received for both Bikupa and Bikupa 2 (Note 15). The uncertainty surrounding the resolution of the dispute gives rise to potential credit risk, as there is the possibility that the Company may not be able to fully collect the outstanding amounts from the Swedish government. Refer to Note 5 for the at risk balances.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk by maintaining cash balances to ensure that it is able to meet its short term and long-term obligations as and when they fall due. The Company manages company-wide cash projections centrally and regularly updates projections for changes in business and fluctuations caused by digital currency prices and exchange rates.

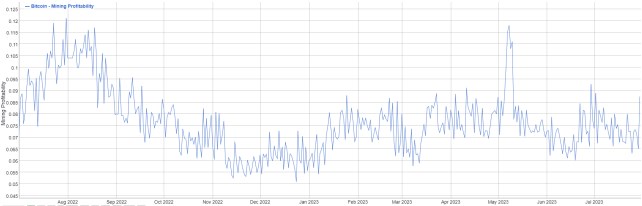

HIVE is primarily engaged in the cryptocurrency mining industry, a highly volatile market with significant inherent risk. Declines in the market prices of cryptocurrencies, an increase in the difficulty of cryptocurrency mining, delays in the delivery of mining equipment, changes in the regulatory environment and other adverse changes in the industry can significantly and negatively impact the Company's operations and cash flows and its ability to maintain sufficient liquidity to meet its financial obligations. Adverse changes to the factors mentioned above have impacted the recoverability of the Company's digital assets and property, and equipment, resulting in impairment losses being recorded.

The Company currently settles its financial obligations out of cash and digital assets. The Company has a planning and budgeting process to help determine the funds required to support the Company's normal spending requirements on an ongoing basis and its expansionary plans. At current BTC prices, the Company's existing cash resources and the proceeds from any sale of its treasury and mined BTC will be sufficient to fund its capital investments and support its growth objectives. If the BTC price declines significantly, the Company would be required to raise additional funds from external sources to meet these requirements. Refer to details in Note 17 for the Company's ATM Equity Program.

As at June 30, 2023, the contractual maturities of financial and other liabilities, including estimated interest payments, are as follows:

| Contractual cash flows |

within 1 year | 1 to 3 years | 3 to 5 years | 5+ years | |||||||||||

| Accounts payable | $ | 6,564,881 | $ | 6,564,881 | $ | - | $ | - | $ | - | |||||

| Term loan | 6,867,816 | 6,867,816 | - | - | - | ||||||||||

| Convertible loan | 8,438,103 | 3,526,888 | 4,911,215 | - | - | ||||||||||

| Lease commitments | 10,960,574 | 2,838,125 | 5,520,332 | 2,602,117 | - | ||||||||||

| Loans payable and interest | 15,133,077 | 1,334,887 | 3,834,276 | 2,414,199 | 7,549,715 | ||||||||||

| Total | $ | 47,964,451 | $ | 21,132,597 | $ | 14,265,823 | $ | 5,016,316 | $ | 7,549,715 |

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

21. Financial Instruments and Risk Management (continued…)

Foreign currency risk

Currency risk relates to the risk that the fair values or future cash flows of the Company's financial instruments will fluctuate because of changes in foreign exchange rates. Exchange rate fluctuations affect the costs that the Company incurs in its operations as well as the currency in which the Company has historically raised capital.

The Company's presentation currency is the US dollar, major purchases are transacted in US dollars, while financing to date has been completed in Canadian and US dollars. As the Company operates in an international environment, some of the Company's financial instruments and transactions are denominated in currencies other than an entity's functional currency. A portion of the Company's general and administrative costs are incurred mainly in currencies separate from each entity's functional currency, such as Swiss Francs, the Euro, the Swedish Krona, and Icelandic Krona. The fluctuation of these currencies in relation to the US dollar will consequently impact the profitability of the Company and may also affect the value of the Company's assets and liabilities and the amount of shareholders' equity.

The Company's net monetary position in the significant foreign currencies as of June 30, 2023 is summarized below with the effect on earnings before tax of a 10% fluctuation of each currency relative to the functional currency of the entity holding it to the US dollar:

| Net Monetary Position June 30, 2023 (USD$ equivalent) |

Impact of 10% variance in foreign exchange rate (in foreign currency) |

|

| US Dollars | 1,123,745 | 102,159 |

| Canadian Dollars | (193,548) | 13,238 |

| Euro Dollars | 147,405 | 14,532 |

| Swiss Francs | 3,457 | 349 |

| Swedish Krona | 2,633,395 | 22,258 |

| Icelandic Krona | 319,156 | 213 |

Interest rate risk

Interest rate risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company's exposure to interest rate risk is limited and only relates to its ability to earn interest income on cash balances at variable rates. Changes in short term interest rates will not have a significant effect on the fair value of the Company's cash account. The interest rate on the Company's loans is fixed in nature and have limited exposure to changes in interest rates.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

21. Financial Instruments and Risk Management (continued…)

Price risk

Price risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate due to changes in market prices, other than those arising from interest rate risk or foreign currency risk. The Company is not exposed to any significant price risks with respect to its financial instruments.

Loss of access risk

The loss of access to the private keys associated with the Company's digital currency holdings may be irreversible and could adversely affect an investment. Digital currencies are controllable only by an individual that possesses both the unique public key and private key or keys relating to the "digital wallet" in which the digital currency is held. To the extent a private key is lost, destroyed or otherwise compromised and no backup is accessible the Company may be unable to access the digital currencies.

Irrevocability of transactions

Digital currency transactions are irrevocable and stolen or incorrectly transferred digital currencies may be irretrievable. Once a transaction has been verified and recorded in a block that is added to the blockchain, an incorrect transfer or theft generally will not be reversible, and the Company may not be capable of seeking compensation.

Regulatory oversight risk

Regulatory changes or actions may restrict the use of digital currencies or the operation of digital currency networks or exchanges in a manner that adversely affects investments held by the Company.

Digital asset risk

Digital currencies are measured at fair value less cost to sell. Digital currency prices are affected by various forces including global supply and demand, interest rates, exchanges rates, inflation or deflation and the political and economic conditions. Further, digital currencies have no underlying backing or contracts to enforce recovery of invested amounts. The profitability of the Company is related to the current and future market price of digital currencies; in addition, the Company may not be able to liquidate its holdings of digital currencies at its desired price if necessary. Investing in digital currencies is speculative, prices are volatile and market movements are difficult to predict. Supply and demand for such currencies change rapidly and are affected by a variety of factors, including regulation and general economic trends. Digital currencies have a limited history, their fair values have historically been volatile and the value of digital currencies held by the Company could decline rapidly. A decline in the market prices of digital currencies could negatively impact the Company's future operations. Historical performance of digital currencies is not indicative of their future performance.

Many digital currency networks are online end-user-to-end-user networks that host a public transaction ledger (blockchain) and the source code that comprises the basis for the cryptographic and algorithmic protocols governing such networks. In many digital currency transactions, the recipient or the buyer must provide its public key, which serves as an address for a digital wallet, to the seller. In the data packets distributed from digital currency software programs to confirm transaction activity, each party to the transaction must sign transactions with a data code derived from entering the private key into a hashing algorithm, which signature serves as validation that the transaction has been authorized by the owner of the digital currency. This process is vulnerable to hacking and malware and could lead to theft of the Company's digital wallets and the loss of the Company's digital currency.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |

21. Financial Instruments and Risk Management (continued…)

While the Company does not store cryptocurrency on an exchange, the public failure of cryptocurrency exchanges appears to affect the value of cryptocurrencies and the cryptocurrency and crypto mining industries as a whole. As noted above, digital currency transactions are irrevocable. There are no governmental bodies that backstop the security of cryptocurrencies against theft or loss. A general loss of confidence in the technology that underlies the cryptocurrency industry, or a loss of confidence in the industry, itself, could substantially devalue our Bitcoin holdings and threaten the viability of our cryptocurrency mining business.

Digital currencies are loosely regulated and there is no central marketplace for exchange. Supply is determined by a computer code, not a central bank. Additionally, exchanges may suffer from operational issues, such as delayed execution, that could have an adverse effect on the Company.

Additionally, to the extent that the digital asset exchanges representing a substantial portion of the volume in digital asset trading are involved in fraud or experience security failures or other operational issues, such digital asset exchanges' failures may result in loss or less favorable prices of digital currencies, or may adversely affect the Company, its operations and its investments.

Safeguarding of digital assets

The Company utilizes the Fireblocks platform which provides the Company a secure medium to access its digital wallets and transact with reputable, exchanges on sales of its digital assets. At the year end the Company utilised the Fireblocks platform for 98% of its digital currencies associated with its operations. Fireblocks, with locations in New York and Tel Aviv, utilizes a secure hot vault and secure transfer environment to help establish connections between the Company's wallets and exchanges. Fireblocks utilizes multi-party computation ("MPC") protection layers to distribute private key secrets across multiple locations to ensure there is no single point of failure associated with the private keys. The use of MPC ensures private key shards are never concentrated to a single device at any point in time. The Company utilizes the Fireblocks Policy Engine to designate transaction approval policies for digital assets held within the Fireblocks portal. As such, administrators configure automated rules to ensure all transactions are disbursed based on the asset sent, total value of the transaction, source and destination of funds and signor requirements. All transactions initiated from Fireblocks that fail to meet the Company's predefined criteria per the engine policy are automatically rejected. All internal wallets owned by the Company and external wallets for addresses of the Company's counterparties require multiple approvals in accordance with our whitelisting policy. As such, the Company settles with counterparties or entities without the risk of losing funds due to deposit address attacks or errors. Fireblocks is SOC 2 Type II certified for the defined period and undergoes a SOC 2 review on an annual basis. The Company reviews the Fireblocks SOC 2 report to ensure they maintain a secure technology infrastructure and that their systems are designed and operating effectively. Additionally, the Company reviews its own complementary user entity controls in conjunction with the Fireblocks controls to ensure that applicable trust services criteria can be met. Fireblocks maintains an insurance policy which has coverage for technology, cyber, and professional liability and is rated "A" by A.M. Best based on the strength of the policy and has had no known security breaches or incidents reported to date.

| HIVE Digital Technologies Ltd. formerly, HIVE Blockchain Technologies Ltd.) Notes to the Condensed Interim Consolidated Financial Statements For the three months ended June 30, 2023, and 2022 (Expressed in US dollars unless otherwise indicated) (Unaudited) |