| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

The number of shares outstanding with respect to each of the classes of common stock of Constellation Brands, Inc., as of April 13, 2023, is set forth below: | |||||

| Class | Number of Shares Outstanding | ||||

| Class A Common Stock, par value $.01 per share | |||||

| Class 1 Common Stock, par value $.01 per share | |||||

| Page | ||||||||

| FORWARD-LOOKING STATEMENTS | ||||||||

| DEFINED TERMS | ||||||||

| PART I | ||||||||

| Item 1. | Business | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 1B. | Unresolved Staff Comments | NA | ||||||

| Item 2. | Properties | |||||||

| Item 3. | Legal Proceedings | |||||||

| Item 4. | Mine Safety Disclosures | NA | ||||||

| PART II | ||||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |||||||

| Item 6. | [Reserved] | NA | ||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 8. | Financial Statements and Supplementary Data | |||||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | NA | ||||||

| Item 9A. | Controls and Procedures | |||||||

| Item 9B. | Other Information | NA | ||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | NA | ||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers, and Corporate Governance | |||||||

| Item 11. | Executive Compensation | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | Exhibits and Financial Statement Schedules | |||||||

| Item 16. | Form 10-K Summary | |||||||

| INDEX TO EXHIBITS | ||||||||

| SIGNATURES | ||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I i | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I ii | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I iii | ||||

| Term | Meaning | ||||

| $ | U.S. dollars | ||||

| 2.65% November 2017 Senior Notes | $700.0 million principal amount of 2.65% senior notes issued in November 2017 and redeemed in August 2021, prior to maturity | ||||

| 2.70% May 2017 Senior Notes | $500.0 million principal amount of 2.70% senior notes issued in May 2017 and redeemed in August 2021, prior to maturity | ||||

| 3.20% February 2018 Senior Notes | $600.0 million principal amount of 3.20% senior notes issued in February 2018, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 4.25% May 2013 Senior Notes | $1,050.0 million principal amount of 4.25% senior notes issued in May 2013, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 2018 Authorization | authority to repurchase up to $3.0 billion of our publicly traded common stock, authorized in January 2018 by our Board of Directors and fully utilized during Fiscal 2023 | ||||

| 2020 Credit Agreement | ninth amended and restated credit agreement, dated as of March 26, 2020, provided for an aggregate revolving credit facility of $2.0 billion, now superseded by the 2022 Credit Agreement | ||||

| 2020 Restatement Agreement | restatement agreement, dated as of March 26, 2020, that amended and restated our eighth amended and restated credit agreement, dated as of September 14, 2018, which was our then-existing senior credit facility | ||||

| 2020 Term Credit Agreement | amended and restated term credit agreement, dated as of March 26, 2020, now repaid in full | ||||

| 2020 Term Loan Restatement Agreement | restatement agreement, dated as of March 26, 2020, that amended and restated our then-existing term credit agreement, resulting in the March 2020 Term Credit Agreement | ||||

| 2020 U.S. wildfires | significant wildfires that broke out in California, Oregon, and Washington states which affected the 2020 U.S. grape harvest | ||||

| 2021 Authorization | authority to repurchase up to $2.0 billion of our publicly traded common stock, authorized in January 2021 by our Board of Directors | ||||

| 2022 Credit Agreement | tenth amended and restated credit agreement, dated as of April 14, 2022, provides for an aggregate revolving credit facility of $2.25 billion | ||||

| 2022 Restatement Agreement | restatement agreement, dated as of April 14, 2022, that amended and restated the 2020 Credit Agreement, dated as of March 26, 2020, which was our then-existing senior credit facility as of February 28, 2022 | ||||

| 2022 Wine Divestiture | sale of certain mainstream and premium wine brands and related inventory | ||||

| 2023 Canopy Promissory Note | C$100.0 million principal amount of 4.25% promissory note issued to us by Canopy in April 2023 | ||||

| 3-tier | distribution channel where products are sold to a distributor (wholesaler) who then sells to a retailer; the retailer sells the products to a consumer | ||||

| 3-tier eCommerce | digital commerce experience for consumers to purchase beverage alcohol from retailers | ||||

| ABA | alternative beverage alcohol | ||||

| Acreage | Acreage Holdings, Inc. | ||||

| Acreage Financial Instrument | a call option for Canopy to acquire up to 100% of the shares of Acreage | ||||

| Acreage Transaction | Canopy’s intention to acquire Acreage, subject to certain conditions | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I iv | ||||

| Term | Meaning | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for applicable senior credit facilities and term loan credit agreements | ||||

| Amended and Restated By-Laws | our amended and restated by-laws which became effective at the Effective Time | ||||

| Amended and Restated Charter | our amended and restated certificate of incorporation which effectuated the Reclassification at the Effective Time | ||||

| AOCI | accumulated other comprehensive income (loss) | ||||

| April 2022 Term Credit Agreement | June 2021 Term Credit Agreement, inclusive of amendment dated as of April 14, 2022 | ||||

| ASR | accelerated share repurchase agreement with a third-party financial institution | ||||

| August 2022 Term Credit Agreement | term loan credit agreement, dated as of August 9, 2022, that provided for a $1.0 billion unsecured delayed draw three-year term loan facility | ||||

| Austin Cocktails | we made an initial investment in the Austin Cocktails business and subsequently acquired the remaining ownership interest | ||||

| Ballast Point Divestiture | sale of Ballast Point craft beer business, including a number of its associated production facilities and brewpubs | ||||

| BRG(s) | business resource group(s) | ||||

| C$ | Canadian dollars | ||||

| Canopy | we made an investment in Canopy Growth Corporation, an Ontario, Canada-based public company | ||||

| Canopy Amendment | a proposed resolution authorizing amending Canopy’s share capital to create Exchangeable Shares and providing for the conversion of Canopy common shares into Exchangeable Shares on a one-for-one basis at any time and at the option of the holder of such shares | ||||

| Canopy Debt Securities | debt securities issued by Canopy in June 2018, as amended in June 2022 to remove Canopy's right to settle such debt securities on conversion into Canopy common shares | ||||

| Canopy Equity Method Investment | November 2017 Canopy Investment, November 2018 Canopy Investment, May 2020 Canopy Investment, and July 2022 Canopy Investment, collectively | ||||

| Canopy Strategic Transaction(s) | any potential acquisition, divestiture, investment, or other similar transaction made by Canopy, including but not limited to the Acreage Transaction and the Canopy Transaction | ||||

Canopy Transaction | proposed corporate transaction by Canopy, including the creation of Exchangeable Shares, designed to consolidate its U.S. cannabis assets into Canopy USA | ||||

| Canopy USA | a new U.S. holding company formed by Canopy | ||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act | ||||

CB International | CB International Finance S.à r.l., a wholly-owned subsidiary of ours | ||||

| Class 1 Stock | our Class 1 Convertible Common Stock, par value $0.01 per share | ||||

| Class A Stock | our Class A Common Stock, par value $0.01 per share | ||||

| Class B Stock | our Class B Convertible Common Stock, par value $0.01 per share, eliminated on November 10, 2022, pursuant to the Reclassification | ||||

| CODM | chief operating decision maker | ||||

| Comparable Adjustments | certain items affecting comparability that have been excluded by management | ||||

Concentrate Business Divestiture | sale of certain brands used in our concentrates and high-color concentrate business, and certain intellectual property, inventory, interests in certain contracts, and other assets | ||||

| Consent Agreement | an agreement between Canopy and (i) Greenstar Canada Investment Limited Partnership and (ii) CBG Holdings LLC, our indirect, wholly-owned subsidiaries | ||||

| Copper & Kings | Copper & Kings American Brandy Company, acquired by us | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I v | ||||

| Term | Meaning | ||||

| CPG | consumer packaged goods | ||||

| Crown | Crown Imports LLC, a wholly-owned subsidiary of ours | ||||

| CSR | corporate social responsibility | ||||

| current Mexican breweries | the Nava Brewery and the Obregon Brewery, collectively | ||||

| Daleville Facility | production facility located in Roanoke, Virginia | ||||

| DEI | diversity, equity, and inclusion | ||||

| Depletions | represent U.S. domestic distributor shipments of our respective branded products to retail customers, based on third-party data | ||||

| DGCL | General Corporation Law of the State of Delaware | ||||

| Digital Business Acceleration | a phased initiative by the Company to create a cohesive digital strategy and build an advanced digital business in the coming years | ||||

| DTC | direct-to-consumer inclusive of (i) a digital commerce experience for consumers to purchase directly from brand websites with inventory coming straight from the supplier and (ii) consumer purchases at hospitality locations (tasting rooms and tap rooms) from the supplier | ||||

| Effective Time | the time that the Amended and Restated Charter was duly filed with the Secretary of State of the State of Delaware on November 10, 2022 | ||||

| EHS | Environmental, Health, & Safety | ||||

| Empathy Wines | Empathy Wines business, including a digitally-native wine brand, acquired by us | ||||

| Employee Stock Purchase Plan | the Company’s 1989 Employee Stock Purchase Plan, under which 9,000,000 shares of Class A Stock may be issued | ||||

| ERP | enterprise resource planning system | ||||

| ESG | environmental, social, and governance | ||||

| Exchangeable Shares | proposed new class of non-voting and non-participating exchangeable shares in Canopy which will be convertible into Canopy common shares | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| FASB | Financial Accounting Standards Board | ||||

| February 2023 Senior Notes | $500.0 million aggregate principal amount of senior notes issued in February 2023 | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein | ||||

| Fiscal 2020 | the Company’s fiscal year ended February 29, 2020 | ||||

| Fiscal 2021 | the Company’s fiscal year ended February 28, 2021 | ||||

| Fiscal 2022 | the Company’s fiscal year ended February 28, 2022 | ||||

| Fiscal 2023 | the Company’s fiscal year ended February 28, 2023 | ||||

| Fiscal 2024 | the Company’s fiscal year ending February 29, 2024 | ||||

| Fiscal 2025 | the Company’s fiscal year ending February 28, 2025 | ||||

| Fiscal 2026 | the Company’s fiscal year ending February 28, 2026 | ||||

| Fiscal 2027 | the Company’s fiscal year ending February 28, 2027 | ||||

| Fiscal 2028 | the Company’s fiscal year ending February 29, 2028 | ||||

| Five-Year Term Facility | a five-year term loan facility under the April 2022 Term Credit Agreement | ||||

| Form 10-K | this Annual Report on Form 10-K for Fiscal 2023 unless otherwise specified | ||||

| Gallo | E. & J. Gallo Winery | ||||

| GHG | greenhouse gas | ||||

| GILTI | global intangible low-taxed income | ||||

| Glass Plant | glass production plant in Nava operated through an equally-owned joint venture with Owens-Illinois | ||||

| Incremental Facilities | one or more tranches of additional term loans under our senior credit facility | ||||

| IRA | Inflation Reduction Act of 2022, signed into law in the U.S. on August 16, 2022 | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I vi | ||||

| Term | Meaning | ||||

| IT | information technology | ||||

| July 2022 Canopy Investment | in July 2022, we received 29.2 million common shares of Canopy through the exchange of C$100.0 million principal amount of our Canopy Debt Securities | ||||

| June 2021 Term Credit Agreement | March 2020 Term Credit Agreement, inclusive of amendment dated as of June 10, 2021 | ||||

| Lender | Bank of America, N.A., as lender for the April 2022 Term Credit Agreement | ||||

| LIBOR | London Interbank Offered Rate | ||||

| Lingua Franca | Lingua Franca, LLC business, acquired by us | ||||

| Long-Term Stock Incentive Plan | a stockholder-approved omnibus incentive plan that provides the ability to grant various types of equity and cash awards to eligible plan participants | ||||

| March 2020 Term Credit Agreement | amended and restated term loan credit agreement, dated as of March 26, 2020, that provided for aggregate facilities of $491.3 million, consisting of the Five-Year Term Facility | ||||

| May 2020 Canopy Investment | in May 2020, we made an incremental investment for 18.9 million common shares of Canopy through the exercise of warrants obtained in November 2017 | ||||

| May 2022 Senior Notes | $1,850.0 million aggregate principal amount of senior notes issued in May 2022 | ||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part II — Item 7. of this Form 10-K | ||||

Mexicali Brewery | canceled brewery construction project located in Mexicali, Baja California, Mexico | ||||

| Mexico Beer Projects | expansion, optimization, and/or construction activities at the Obregon Brewery, Nava Brewery, and Veracruz Brewery | ||||

| Mission Bell | Mission Bell Winery in Madera, California | ||||

| M&T | Manufacturers and Traders Trust Company | ||||

| My Favorite Neighbor | we made an initial investment in My Favorite Neighbor, LLC and subsequently acquired the remaining ownership interest | ||||

| NA | not applicable | ||||

| Nasdaq | The Nasdaq Global Select Market | ||||

| Nava | Nava, Coahuila, Mexico | ||||

| Nava Brewery | brewery located in Nava | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Nobilo Wine Divestiture | sale of New Zealand-based Nobilo Wine brand and certain related assets | ||||

| Note(s) | notes to the consolidated financial statements under Item 8. of this Form 10-K | ||||

| November 2017 Canopy Investment | in November 2017, we made an initial investment for 18.9 million common shares of Canopy | ||||

| November 2017 Canopy Warrants | warrants which gave us the option to purchase 18.9 million common shares of Canopy, exercised May 1, 2020 | ||||

| November 2018 Canopy Investment | in November 2018, we made an incremental investment for 104.5 million common shares of Canopy | ||||

| November 2018 Canopy Warrants | Tranche A Warrants, Tranche B Warrants, and Tranche C Warrants, collectively | ||||

| NPD | new product development | ||||

| Obregon | Obregon, Sonora, Mexico | ||||

Obregon Brewery | brewery located in Obregon | ||||

| OCI | other comprehensive income (loss) | ||||

| October 2022 Credit Agreement Amendments | amendments dated as of October 18, 2022, to the 2022 Credit Agreement, the April 2022 Term Credit Agreement, and the August 2022 Term Credit Agreement | ||||

| Owens-Illinois | O-I Glass, Inc., the ultimate parent of the company with which we have an equally-owned joint venture to operate the Glass Plant | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I vii | ||||

| Term | Meaning | ||||

| Paul Masson Divestiture | sale of Paul Masson Grande Amber Brandy brand, related inventory, and interests in certain contracts | ||||

| Pre-issuance hedge contracts | treasury lock and/or swap lock contracts designated as cash flow hedges entered into to hedge treasury rate volatility on future debt issuances | ||||

| Proxy Statement | Proxy Statement for Fiscal 2023 to be issued in connection with the 2023 Annual Meeting of Stockholders of our Company | ||||

| Reclassification | the reclassification, exchange, and conversion of the Company’s common stock to eliminate the Class B Stock pursuant to the terms and conditions of the Reclassification Agreement | ||||

| Reclassification Agreement | reclassification agreement in support of the Reclassification, dated June 30, 2022, among the Company and the Sands Family Stockholders | ||||

| Registration Rights Agreement | Registration Rights Agreement, dated as of November 10, 2022, by and among the Company and the Sands Family Stockholders | ||||

Registration Statement on Form S-4 | our Registration Statement on Form S-4, including our proxy statement/prospectus, in connection with the Reclassification declared effective by the SEC on September 21, 2022 | ||||

| RTD | ready-to-drink | ||||

| Sands Family Stockholders | RES Master LLC, RES Business Holdings LP, SER Business Holdings LP, RHT 2015 Business Holdings LP, RSS Master LLC, RSS Business Holdings LP, SSR Business Holdings LP, RSS 2015 Business Holdings LP, RCT 2015 Business Holdings LP, RCT 2020 Investments LLC, NSDT 2009 STZ LLC, NSDT 2011 STZ LLC, RSS Business Management LLC, SSR Business Management LLC, LES Lauren Holdings LLC, MES Mackenzie Holdings LLC, Abigail Bennett, Zachary Stern, A&Z 2015 Business Holdings LP (subsequently liquidated), Marilyn Sands Master Trust, MAS Business Holdings LP, Sands Family Foundation, Richard Sands, Robert Sands, WildStar, Astra Legacy LLC, AJB Business Holdings LP, and ZMSS Business Holdings LP | ||||

| Scope 1 | direct GHG emissions from sources that are owned or controlled by a company, such as emissions associated with furnaces or vehicles | ||||

| Scope 2 | indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling | ||||

| SEC | Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

SOFR | secured overnight financing rate administered by the Federal Reserve Bank of New York | ||||

| SOX | Section 404 of the Sarbanes-Oxley Act of 2002 | ||||

| Specified Time | such time as the domestic sale of marijuana could not reasonably be expected to violate the Controlled Substances Act, the Civil Asset Forfeiture Reform Act (as it relates to violation of the Controlled Substances Act), and all related applicable anti-money laundering laws | ||||

| Term Loan Restatement Agreement | restatement agreement, dated as of March 26, 2020, that amended and restated our term credit agreement dated as of September 14, 2018, resulting in the 2020 Term Credit Agreement | ||||

| Tranche A Warrants | warrants which give us the option to purchase 88.5 million common shares of Canopy expiring November 1, 2023 | ||||

| Tranche B Warrants | warrants which give us the option to purchase 38.4 million common shares of Canopy expiring November 1, 2026 | ||||

| Tranche C Warrants | warrants which give us the option to purchase 12.8 million common shares of Canopy expiring November 1, 2026 | ||||

TSX | Toronto Stock Exchange | ||||

| U.S. | United States of America | ||||

| U.S. GAAP | generally accepted accounting principles in the U.S. | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I viii | ||||

| Term | Meaning | ||||

| Veracruz | Heroica Veracruz, Veracruz, Mexico | ||||

| Veracruz Brewery | a new brewery being constructed in Veracruz | ||||

VWAP Exercise Price | volume-weighted average of the closing market price of Canopy’s common shares on the TSX for the five trading days immediately preceding the exercise date | ||||

| WildStar | WildStar Partners LLC | ||||

Wine and Spirits Divestiture | sale of a portion of our wine and spirits business, including lower-margin, lower-growth wine and spirits brands, related inventory, interests in certain contracts, wineries, vineyards, offices, and facilities | ||||

Wine and Spirits Divestitures | Wine and Spirits Divestiture and the Nobilo Wine Divestiture, collectively | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I ix | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 1 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| Date | Strategic Contribution | ||||||||||||||||

| Wine and Spirits segment | |||||||||||||||||

| 2022 Wine Divestiture | October 2022 | Divestiture of certain of our mainstream and premium wine brands and related inventory; supported our focus on consumer-led premiumization trends. | ||||||||||||||

| Austin Cocktails | April 2022 | Acquisition of a portfolio of small batch, RTD cocktails; supported our focus on meeting the evolving needs of consumers. | ||||||||||||||

| Lingua Franca | March 2022 | Acquisition of a collection of Oregon-based luxury wines, a vineyard, and a production facility; supported our focus on consumer-led premiumization trends and meeting the evolving needs of consumers. | ||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 2 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

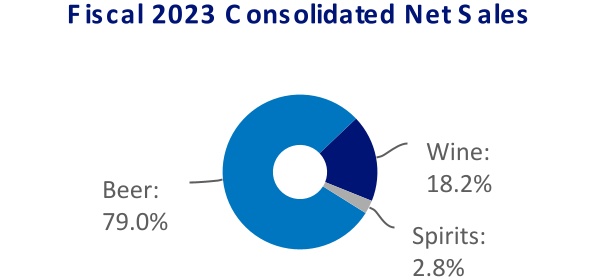

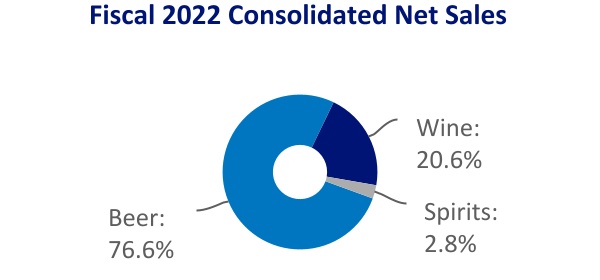

| For the Years Ended | |||||||||||

| February 28, 2023 | February 28, 2022 | ||||||||||

| (in millions) | |||||||||||

| Beer | $ | 7,465.0 | $ | 6,751.6 | |||||||

| Wine and Spirits: | |||||||||||

| Wine | 1,722.7 | 1,819.3 | |||||||||

| Spirits | 264.9 | 249.8 | |||||||||

| Total Wine and Spirits | 1,987.6 | 2,069.1 | |||||||||

| Canopy | 339.3 | 444.3 | |||||||||

| Consolidation and Eliminations | (339.3) | (444.3) | |||||||||

| Consolidated Net Sales | $ | 9,452.6 | $ | 8,820.7 | |||||||

| Corona Brand Family | Modelo Brand Family | Victoria Brand Family | Other Import Brand | ||||||||||||||||||||

Corona Extra | Corona Light | Modelo Especial | Victoria | Pacifico | |||||||||||||||||||

Corona Premier | Corona Refresca | Modelo Negra | Vicky Chamoy | ||||||||||||||||||||

Corona Familiar | Corona Hard Seltzer | Modelo Chelada | |||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 3 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 4 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| Wine Brands | Wine Portfolio of Brands | Spirits Brands | ||||||||||||||||||

Cook’s California Champagne | Mount Veeder | My Favorite Neighbor | Casa Noble | Mi CAMPO | ||||||||||||||||

Kim Crawford | Ruffino | Robert Mondavi Winery | Copper & Kings | Nelson’s Green Brier | ||||||||||||||||

Meiomi | SIMI | Schrader | High West | SVEDKA | ||||||||||||||||

The Prisoner Wine Company | ||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 5 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| Beer | Anheuser-Busch InBev, The Boston Beer Company, Heineken, Mark Anthony, Molson Coors | ||||

| Wine | Deutsch Family Wine & Spirits, Duckhorn Portfolio, E. & J. Gallo Winery, Ste. Michelle Wine Estates, Treasury Wine Estates, Trinchero Family Estates, The Wine Group | ||||

| Spirits | Bacardi USA, Beam Suntory, Brown-Forman, Diageo, Fifth Generation, Pernod Ricard, Sazerac Company | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 6 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 7 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 8 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 9 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 10 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 11 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 12 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| $11.9 million | ||

Fiscal 2023 corporate charitable contributions, including company match of employee donations | ||

| William A. Newlands, age 64, is the President and Chief Executive Officer of the Company. He has served as Chief Executive Officer of the Company and as a director since March 2019 and as President since February 2018. He served as Chief Operating Officer from January 2017 through February 2019 and as Executive Vice President of the Company from January 2015 until February 2018. From January 2016 to January 2017 he performed the role of President, Wine & Spirits Division and from January 2015 through January 2016 he performed the role of Chief Growth Officer. Mr. Newlands joined the Company in January 2015. Prior to that he served from October 2011 until August 2014 as Senior Vice President and President, North America of | ||||

Beam Inc., as Senior Vice President and President, North America of Beam Global Spirits & Wine, Inc. from December 2010 to October 2011, and as Senior Vice President and President, USA of Beam Global Spirits & Wine, Inc. from February 2008 to December 2010. Beam Inc., a producer and seller of branded distilled spirits products, merged with a subsidiary of Suntory Holding Limited, a Japanese company, in 2014. Prior to October 2011, Beam Global Spirits & Wine, Inc. was the spirits operating segment of Fortune Brands, Inc., which was a leading consumer products company that made and sold branded consumer products worldwide in the distilled spirits, home and security, and golf markets. | |||||

BRG sponsorship - ECP supporting our early career professionals | |||||

| James O. Bourdeau, age 58, is the Executive Vice President and Chief Legal Officer of the Company, having served in the role since December 2017 and as the Company’s Secretary since April 2017. Prior to that, he served as the Company’s Senior Vice President and General Counsel, Corporate Development, having performed that role from September 2014 until December 2017. Before joining the Company in September 2014, Mr. Bourdeau was an attorney with the law firm of Nixon Peabody LLP from July 2000 through September 2014, and a partner from February 2005 through September 2014. Mr. Bourdeau was associated with another law firm from 1995 to 2000. | ||||

BRG sponsorship - Stellar PRIDE supporting our LGBTQ+ community | |||||

| K. Kristann Carey, age 53, is the Executive Vice President and Chief Human Resources Officer of the Company, having served in the role since May 2022. Prior to that, she served as the Company’s Senior Vice President, Human Resources, Beer Division, having performed that role from February 2019 until May 2022. From July 2018 until December 2020, she performed the role of Chief Diversity Officer. From July 2017 until January 2019, she served as Chief Compliance Officer and from November 2015 until January 2019, she served as Senior Vice President and General Counsel, Beer Division. From June 2013 until November 2015, she served as Vice President and Associate General Counsel, Beer Division. Before joining the Company, Ms. Carey | ||||

served in roles of increasing responsibility with McDonald’s Corporation from January 2005 until June 2013, most recently as Senior Counsel. Prior to joining McDonald’s Corporation, she worked at the law firms of Seyfarth Shaw LLP from January 2003 through January 2005 and Cassiday, Schade & Gloor LLP from October 1998 until January 2003. | |||||

BRG sponsorship - ¡SALUD! supporting Hispanic and Latinx employees and communities | |||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 13 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| Garth Hankinson, age 55, is the Executive Vice President and Chief Financial Officer of the Company, having served in the role since January 2020. Prior to that, he served as the Company’s Senior Vice President, Corporate Development, a position he had been in since February 2016, where he was responsible for leading all of the Company’s financial planning, reporting, and analysis activities, as well as all efforts related to mergers, acquisitions, ventures investments, and strategic alliances. From October 2009 until February 2016, he served as the Vice President, Corporate Development of the Company. From October 2007 until October 2009, Mr. Hankinson served as the Vice President, Business Development for Constellation’s prior | ||||

Canadian business, Constellation Brands Canada, Inc., which was a Canadian subsidiary of the Company during that time. From March 2004 until October 2007, he served as the Director of Corporate Development. | |||||

BRG sponsorship - Valor supporting veterans, service members, first responders, and their families | |||||

| Robert Hanson, age 60, is the Executive Vice President and President, Wine & Spirits Division of the Company, having served in the role since June 2019. Prior to that, he served as Chief Executive Officer of John Hardy Global Limited, a luxury jewelry brand, from August 2014 to June 2019. He continued to serve as its Chairman of the Board until July 2020. He served as Chief Executive Officer and a Director of American Eagle Outfitters, Inc., a leading global specialty retailer of clothing, accessories, and personal care products from January 2012 to January 2014. He served Levi Strauss & Co. from 1988 to 2011 in a variety of important leadership roles across multiple brands where he led cross-functional teams, including merchandising, product | ||||

development, multi-channel operations, marketing and creative teams, in addition to a full support staff. Mr. Hanson’s roles at Levi’s included serving as Global President of the Levi’s Brand from 2010 to 2011; President, Levi’s Strauss Americas/North America from 2006 to 2010; President, Levi’s Brand U.S. from 2001 to 2006; and President/Vice President, Levi’s Europe/Africa/Middle East from 1998 to 2001. | |||||

BRG sponsorship - WISE supporting our female community | |||||

| Michael McGrew, age 49, has been an Executive Vice President of the Company since April 2020. Beginning December 2020, Mr. McGrew has performed the role of Executive Vice President, and Chief Communications, CSR, and Diversity Officer of the Company. Mr. McGrew joined Constellation Brands in 2014 as Senior Director, Communications for the Company’s Beer Division. He was promoted to Vice President, Communications – Beer Division in 2016 and assumed the role of Vice President, Corporate Communications in 2017. Prior to joining Constellation Brands, he held a number of roles with increasing responsibility at Grainger, then a $9 billion global provider of industrial supplies and equipment. While at Grainger, from 2011 to | ||||

2013 Mr. McGrew served as Director, U.S. Business Communications, from January 2013 to October 2013 he served as Senior Director, U.S. Business & Global Supply Chain Communications and from October 2013 to September 2014 he served as Senior Director, Communications – Americas, among other roles of increasing responsibility. | |||||

BRG sponsorships - ASIAA supporting employees and communities of Asian descent SAGE supporting experienced career professionals | |||||

| Mallika Monteiro, age 44, has been an Executive Vice President of the Company since October 2019. Beginning March 2021, Ms. Monteiro has performed the role of Executive Vice President, and Chief Growth, Strategy, and Digital Officer. From October 2019 to February 2021 she performed the role of Executive Vice President, Chief Growth and Strategy Officer and from October 2018 to September 2019, she performed the role of Senior Vice President, Chief Growth Officer. She joined Constellation in October 2016 as Vice President, Beer Innovation and was given additional responsibilities as Chief of Staff to the Company's Executive Management Committee in July 2018. Prior to joining Constellation, from July 2014 to September 2016, | ||||

Ms. Monteiro was a Senior Marketing Director at Anheuser Busch InBev. Prior to joining Anheuser Busch InBev, she served in roles of increasing responsibility with Beam Suntory Inc., including as Associate Brand Manager - Jim Beam from July 2007 to June 2009, Brand Manager - Cognac from July 2009 to December 2011, and Senior Brand Manager - Vodka, from January 2012 to June 2014. | |||||

BRG sponsorship - CPN supporting parents and caregivers | |||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 14 | ||||

| PART I | ITEM 1. BUSINESS | Table of Contents | ||||||

| James A. Sabia, Jr., age 61, is the Company’s Executive Vice President and President, Beer Division as well as President of Crown, having performed these roles since January 2022 and February 2022, respectively. He has been an Executive Vice President of the Company since May 2018. From March 2021 through January 2022 he served as Executive Vice President, Managing Director, Beer Division. From May 2018 through March 2021 he performed the role of Executive Vice President, Chief Marketing Officer. He joined the Company in August 2007 as Vice President, Marketing for the Company’s spirits business. Since then, he has served in roles of increasing responsibility with the Company. Since 2009, he has served as the Chief Marketing | ||||

Officer of the Company’s Beer Division. From 2009 to June 2013, Mr. Sabia was employed by Crown, of which the Company owned a 50% interest and was the Company’s beer business during that period. In June 2013, the Company acquired the remaining 50% of Crown, which became a wholly-owned indirect subsidiary of the Company on that date. Prior to joining the Company, Mr. Sabia was with Molson Coors Brewing Company for 17 years. | |||||

BRG sponsorship - AASCEND supporting Black and African American employees and communities | |||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 15 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 16 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 17 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 18 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 19 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 20 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 21 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 22 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 23 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 24 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 25 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 26 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 27 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 28 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 29 | ||||

| PART I | ITEM 1A. RISK FACTORS | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 30 | ||||

| PART I | OTHER KEY INFORMATION | Table of Contents | ||||||

| Beer |  | Wine and Spirits | ||||||||

Breweries •Nava Brewery in Nava, Coahuila, Mexico •Obregon Brewery in Obregon, Sonora, Mexico Production facility •Glass Plant in Nava, Coahuila, Mexico | Wineries •Gonzales Winery in Gonzales, California, U.S. •Mission Bell Winery in Madera, California, U.S. •Woodbridge Winery in Acampo, California, U.S. •Kim Crawford Winery in Marlborough, South Island, New Zealand Warehouse, distribution, and other production facilities •Lodi Distribution Center in Lodi, California, U.S. •Pontassieve Winery in Florence, Italy | ||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 31 | ||||

| PART II | OTHER KEY INFORMATION | Table of Contents | ||||||

| Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of a Publicly Announced Program | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program (1) | ||||||||||||||||||||||

| (in millions, except share and per share data) | ||||||||||||||||||||||||||

| December 1 – 31, 2022 | — | $ | — | — | $ | 1,163.1 | ||||||||||||||||||||

| January 1 – 31, 2023 | 1,326,692 | $ | 218.68 | 1,326,692 | $ | 872.9 | ||||||||||||||||||||

| February 1 – 28, 2023 | 41,801 | $ | 227.27 | 41,801 | $ | 863.4 | ||||||||||||||||||||

| Total | 1,368,493 | $ | 218.94 | 1,368,493 | ||||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 32 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 33 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 34 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 35 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 36 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 37 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Fiscal 2023 | Fiscal 2022 | ||||||||||

| (in millions) | |||||||||||

| Cost of product sold | |||||||||||

| Settlements of undesignated commodity derivative contracts | $ | (76.7) | $ | (35.9) | |||||||

| Net gain (loss) on undesignated commodity derivative contracts | (15.0) | 109.9 | |||||||||

| Flow through of inventory step-up | (4.5) | (0.1) | |||||||||

| Strategic business development costs | (1.2) | (2.6) | |||||||||

| Net flow through of reserved inventory | 1.2 | 12.1 | |||||||||

| Recovery of (loss on) inventory write-down | 0.2 | (1.0) | |||||||||

| Comparable Adjustments, Cost of product sold | (96.0) | 82.4 | |||||||||

| Selling, general, and administrative expenses | |||||||||||

| Impairments of assets | (66.5) | — | |||||||||

| Costs associated with the Reclassification | (37.8) | — | |||||||||

| Transition services agreements activity | (20.5) | (19.2) | |||||||||

| Restructuring and other strategic business development costs | (9.9) | 0.6 | |||||||||

| Transaction, integration, and other acquisition-related costs | (1.4) | (1.4) | |||||||||

| Gain (loss) on sale of business | 15.0 | 1.7 | |||||||||

Other gains (losses) | 23.3 | (2.3) | |||||||||

| Comparable Adjustments, Selling, general, and administrative expenses | (97.8) | (20.6) | |||||||||

| Impairment of brewery construction in progress | — | (665.9) | |||||||||

| Comparable Adjustments, Operating income (loss) | $ | (193.8) | $ | (604.1) | |||||||

Comparable Adjustments, Income (loss) from unconsolidated investments | $ | (1,907.7) | $ | (1,488.2) | |||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 38 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 39 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Beer | $ | 7,465.0 | $ | 6,751.6 | $ | 713.4 | 11 | % | |||||||||||||||

| Wine and Spirits: | |||||||||||||||||||||||

| Wine | 1,722.7 | 1,819.3 | (96.6) | (5 | %) | ||||||||||||||||||

| Spirits | 264.9 | 249.8 | 15.1 | 6 | % | ||||||||||||||||||

| Total Wine and Spirits | 1,987.6 | 2,069.1 | (81.5) | (4 | %) | ||||||||||||||||||

| Canopy | 339.3 | 444.3 | (105.0) | (24 | %) | ||||||||||||||||||

| Consolidation and eliminations | (339.3) | (444.3) | 105.0 | 24 | % | ||||||||||||||||||

| Consolidated net sales | $ | 9,452.6 | $ | 8,820.7 | $ | 631.9 | 7 | % | |||||||||||||||

| Beer segment | |||||||||||||||||||||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | |||||||||||||||||||||||

| (in millions, branded product, 24-pack, 12-ounce case equivalents) | ||||||||||||||||||||||||||

| Net sales | $ | 7,465.0 | $ | 6,751.6 | $ | 713.4 | 11 | % | ||||||||||||||||||

| Shipments | 389.2 | 364.2 | 6.9 | % | ||||||||||||||||||||||

| Depletions | 7.5 | % | ||||||||||||||||||||||||

| Wine and Spirits segment | |||||||||||||||||||||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | |||||||||||||||||||||||

| (in millions, branded product, 9-liter case equivalents) | ||||||||||||||||||||||||||

| Net sales | $ | 1,987.6 | $ | 2,069.1 | $ | (81.5) | (4 | %) | ||||||||||||||||||

| Shipments | ||||||||||||||||||||||||||

Total | 27.1 | 29.9 | (9.4 | %) | ||||||||||||||||||||||

Organic (1) | 27.1 | 29.4 | (7.8 | %) | ||||||||||||||||||||||

U.S. Domestic | 23.5 | 26.3 | (10.6 | %) | ||||||||||||||||||||||

Organic U.S. Domestic (1) | 23.5 | 25.9 | (9.3 | %) | ||||||||||||||||||||||

Depletions (1) | (3.0 | %) | ||||||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 40 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Canopy segment Our ownership interest in Canopy allows us to exercise significant influence, but not control, and, therefore, we account for our investment in Canopy under the equity method. Amounts included for the Canopy segment represent 100% of Canopy’s reported results on a two-month lag. Accordingly, we recognized our share of Canopy’s earnings (losses) from January through December 2022, in our Fiscal 2023 results and January through December 2021, in our Fiscal 2022 results. Although we own less than 100% of the outstanding shares of Canopy, 100% of its results are included and subsequently eliminated to reconcile to our consolidated financial statements. See “Income (loss) from unconsolidated investments” below for a discussion of Canopy’s net sales, gross profit (loss), selling, general, and administrative expenses, and operating income (loss). This discussion is based on information Canopy has publicly disclosed. | ||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Beer | $ | 3,937.8 | $ | 3,677.0 | $ | 260.8 | 7 | % | |||||||||||||||

| Wine and Spirits | 927.2 | 947.9 | (20.7) | (2 | %) | ||||||||||||||||||

| Canopy | (125.7) | (18.6) | (107.1) | NM | |||||||||||||||||||

| Consolidation and eliminations | 125.7 | 18.6 | 107.1 | NM | |||||||||||||||||||

| Comparable Adjustments | (96.0) | 82.4 | (178.4) | NM | |||||||||||||||||||

| Consolidated gross profit | $ | 4,769.0 | $ | 4,707.3 | $ | 61.7 | 1 | % | |||||||||||||||

| The increase in Beer gross profit is primarily due to the $279.7 million favorable impact from pricing and $253.0 million of shipment volume growth, partially offset by $233.2 million of higher cost of product sold and $40.7 million of unfavorable product mix. The higher cost of product sold is largely due to (i) $185.1 million of higher materials costs, including aluminum, glass, malt, cartons, lumber, corn, and steel, driven by inflation and supply chain constraints, (ii) a $42.5 million increase in brewery costs primarily driven by increased utilities, administrative costs, and maintenance, (iii) $40.7 million of higher depreciation, (iv) $34.1 million of increased transportation costs, and (v) $18.3 million of supporting costs, including increased compensation and benefits, IT expenses, and travel, partially offset by (i) $71.9 million of decreased obsolescence primarily from excess inventory of hard seltzers resulting from a slowdown in the overall category in early Fiscal 2022 and (ii) $26.8 million of favorable fixed cost absorption related to increased production levels as compared to Fiscal 2022. | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 41 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| The decrease in Wine and Spirits gross profit is due to a decrease of $29.3 million from the 2022 Wine Divestiture, partially offset by an $8.6 million increase in organic gross profit. The increase in organic gross profit is driven by (i) $62.6 million of favorable product mix, (ii) $22.7 million of higher non-branded gross profit, (iii) a $5.0 million favorable foreign currency translation impact, and (iv) the $4.1 million favorable impact from pricing, partially offset by (i) a $78.8 million decline in branded wine and spirits shipment volume and (ii) $7.0 million of higher cost of product sold, driven by inflation and global supply chain constraints. The increase in cost of product sold was largely attributable to (i) $30.5 million of increased transportation and warehousing costs, including ocean freight shipping, and (ii) $10.8 million of higher material costs, including glass and packaging materials, largely offset by (i) $22.3 million of net favorable fixed cost absorption and (ii) $12.0 million of cost saving initiatives, primarily resulting in lower grape costs. | ||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Beer | $ | 1,076.3 | $ | 973.7 | $ | 102.6 | 11 | % | |||||||||||||||

| Wine and Spirits | 474.1 | 477.2 | (3.1) | (1 | %) | ||||||||||||||||||

| Corporate Operations and Other | 277.9 | 238.2 | 39.7 | 17 | % | ||||||||||||||||||

| Canopy | 1,980.2 | 611.5 | 1,368.7 | NM | |||||||||||||||||||

| Consolidation and eliminations | (1,980.2) | (611.5) | (1,368.7) | NM | |||||||||||||||||||

| Comparable Adjustments | 97.8 | 20.6 | 77.2 | NM | |||||||||||||||||||

| Consolidated selling, general, and administrative expenses | $ | 1,926.1 | $ | 1,709.7 | $ | 216.4 | 13 | % | |||||||||||||||

| The increase in Beer selling, general, and administrative expenses is primarily due to $54.7 million of higher marketing spend and $47.8 million of increased general and administrative expenses. The higher marketing spend was driven by increased sports-related partnerships and planned investments to support the growth of our Mexican beer portfolio. The increase in general and administrative expenses was primarily driven by (i) compensation and benefits, primarily related to incremental headcount to support the growth of our Mexican beer portfolio, (ii) higher travel and meeting costs as compared to Fiscal 2022, and (iii) Mexico Beer Projects strategic asset relocation, partially offset by favorable foreign currency impact. | ||||

| The decrease in Wine and Spirits selling, general, and administrative expenses is due to $20.3 million of lower marketing spend and a $6.2 million decrease in selling expenses, partially offset by $23.4 million of increased general and administrative expenses. The increase in general and administrative expenses was primarily driven by compensation and benefits, primarily related to higher headcount from our continued focus on expanding into DTC channels and higher-end brands, higher travel as compared to Fiscal 2022, and expenses associated with an initiative to improve our marketing effectiveness, partially offset by favorable foreign currency impact. For Fiscal 2024, we expect marketing spend to be 8% of net sales. | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 42 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| The increase in Corporate Operations and Other selling, general, and administrative expenses is largely due to approximately (i) a $36 million increase in third-party services, primarily driven by our Digital Business Acceleration investments, and (ii) a $9 million increase in compensation and benefits, partially offset by a decrease of approximately $8 million resulting from the completion of an ERP implementation in Fiscal 2022. The increase in compensation and benefits was primarily driven by (i) a Fiscal 2022 reversal of stock-based compensation for a performance award tied to earnings from our investment in Canopy that did not achieve a threshold level of performance and (ii) increased headcount to support our Digital Business Acceleration initiative, partially offset by lower incentive accruals as compared to Fiscal 2022. | ||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Beer | $ | 2,861.5 | $ | 2,703.3 | $ | 158.2 | 6 | % | |||||||||||||||

| Wine and Spirits | 453.1 | 470.7 | (17.6) | (4 | %) | ||||||||||||||||||

| Corporate Operations and Other | (277.9) | (238.2) | (39.7) | (17 | %) | ||||||||||||||||||

| Canopy | (2,105.9) | (630.1) | (1,475.8) | NM | |||||||||||||||||||

| Consolidation and eliminations | 2,105.9 | 630.1 | 1,475.8 | NM | |||||||||||||||||||

| Comparable Adjustments | (193.8) | (604.1) | 410.3 | NM | |||||||||||||||||||

| Consolidated operating income (loss) | $ | 2,842.9 | $ | 2,331.7 | $ | 511.2 | 22 | % | |||||||||||||||

| The increase in Beer operating income is largely attributable to the favorable pricing impact, strong shipment volume growth within our Mexican beer portfolio, decreased obsolescence, and favorable fixed cost absorption, partially offset by higher operational and logistics costs, marketing spend, and general and administrative expenses, as discussed above, and the unfavorable product mix shift. | ||||

| The decrease in Wine and Spirits operating income is largely attributable to the decline in branded wine and spirits shipment volume, the 2022 Wine Divestiture, and increases in general and administrative expenses and cost of product sold, as described above, partially offset the favorable product mix shift, increase in non-branded net sales, lower marketing spend, and the favorable pricing impact. | ||||

| As previously discussed, the Corporate Operations and Other increase in operating loss is largely due to Fiscal 2023 Digital Business Acceleration investments and increased compensation and benefits, as discussed above, partially offset by the decrease in ERP-related consulting services. | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 43 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | Percent Change | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Impairment of Canopy Equity Method Investment | $ | (1,060.3) | $ | — | $ | (1,060.3) | NM | ||||||||||||||||

| Unrealized net gain (loss) on securities measured at fair value | (45.9) | (1,644.7) | 1,598.8 | 97 | % | ||||||||||||||||||

Equity in earnings (losses) from Canopy and related activities (1) | (949.3) | (73.6) | (875.7) | NM | |||||||||||||||||||

| Equity in earnings (losses) from other equity method investees and related activities | 19.1 | 31.8 | (12.7) | (40 | %) | ||||||||||||||||||

Net gain (loss) on sale of unconsolidated investment (2) | — | 51.0 | (51.0) | NM | |||||||||||||||||||

| $ | (2,036.4) | $ | (1,635.5) | $ | (400.9) | (25 | %) | ||||||||||||||||

| Canopy segment Canopy net sales decreased to $339.3 million for Fiscal 2023 from $444.3 million for Fiscal 2022. This decrease of $105.0 million, or 24%, is largely attributable to lower cannabis sales, partially offset by growth in their BioSteel Sports Nutrition Inc. business. The decline in cannabis sales primarily resulted from decreases in (i) Canadian adult-use cannabis sales volume, largely driven by the continuing impacts of price compression resulting from increased competition, and (ii) medicinal sales driven by the January 2022 divestiture of C3, an international pharmaceutical business. Additionally, other consumer products sales in Fiscal 2023 as compared to Fiscal 2022 decreased driven by declines in their Storz & Bickel GmbH & Co. KG and This Works Products Limited businesses. Canopy gross profit (loss) decreased to $(125.7) million for Fiscal 2023 from $(18.6) million for Fiscal 2022. This decrease of $107.1 million is primarily driven by (i) a net increase in inventory write-downs and other charges associated with Canopy’s restructuring actions as compared to Fiscal 2022, (ii) decreased net sales and price compression in the Canadian adult-use channel, (iii) unfavorable product mix shift, and (iv) a decrease in payroll subsidies received from the Canadian government in Fiscal 2022 pursuant to a COVID-19 relief program. Canopy selling, general, and administrative expenses increased $1,368.7 million largely driven by a $1,353.2 million goodwill impairment related to their cannabis operations, restructuring costs, and asset impairments for Fiscal 2023, partially offset by a continued focus on reducing costs and the closure of certain research and development facilities in Fiscal 2022. The combination of these factors were the main contributors to the $1,475.8 million increase in operating loss. | ||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 44 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 45 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | |||||||||||||||

| (in millions) | |||||||||||||||||

| Net cash provided by (used in): | |||||||||||||||||

| Operating activities | $ | 2,756.9 | $ | 2,705.4 | $ | 51.5 | |||||||||||

| Investing activities | (999.4) | (1,035.8) | 36.4 | ||||||||||||||

| Financing activities | (1,819.9) | (1,929.5) | 109.6 | ||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (3.5) | (1.3) | (2.2) | ||||||||||||||

| Net increase (decrease) in cash and cash equivalents | $ | (65.9) | $ | (261.2) | $ | 195.3 | |||||||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | |||||||||||||||

| (in millions) | |||||||||||||||||

| Net income (loss) | $ | (38.5) | $ | 1.0 | $ | (39.5) | |||||||||||

| Unrealized net (gain) loss on securities measured at fair value | 45.9 | 1,644.7 | (1,598.8) | ||||||||||||||

| Deferred tax provision (benefit) | 207.8 | 84.8 | 123.0 | ||||||||||||||

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | 971.8 | 61.6 | 910.2 | ||||||||||||||

| Impairment of Canopy Equity Method Investment | 1,060.3 | — | 1,060.3 | ||||||||||||||

| Impairment of long-lived assets | 53.5 | 665.9 | (612.4) | ||||||||||||||

| Other non-cash adjustments | 730.6 | 433.0 | 297.6 | ||||||||||||||

| Change in operating assets and liabilities, net of effects from purchase and sale of business | (274.5) | (185.6) | (88.9) | ||||||||||||||

| Net cash provided by (used in) operating activities | $ | 2,756.9 | $ | 2,705.4 | $ | 51.5 | |||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 46 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Acquisitions | Divestitures | |||||||||||||

| Fiscal 2023 | ||||||||||||||

•Lingua Franca | •2022 Wine Divestiture | |||||||||||||

•Austin Cocktails | ||||||||||||||

| Fiscal 2022 | ||||||||||||||

•My Favorite Neighbor | •Corporate investment | |||||||||||||

| Fiscal 2023 | Fiscal 2022 | Dollar Change | |||||||||||||||

| (in millions) | |||||||||||||||||

| Net proceeds from (payments of) debt, current and long-term, and related activities | $ | 1,991.3 | $ | (81.3) | $ | 2,072.6 | |||||||||||

| Dividends paid | (587.7) | (573.0) | (14.7) | ||||||||||||||

| Purchases of treasury stock | (1,700.2) | (1,390.5) | (309.7) | ||||||||||||||

| Net cash provided by stock-based compensation activities | 32.0 | 167.8 | (135.8) | ||||||||||||||

| Distributions to noncontrolling interests | (55.3) | (52.5) | (2.8) | ||||||||||||||

| Payment to holders of Class B Stock in connection with the Reclassification | (1,500.0) | — | (1,500.0) | ||||||||||||||

| Net cash provided by (used in) financing activities | $ | (1,819.9) | $ | (1,929.5) | $ | 109.6 | |||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 47 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

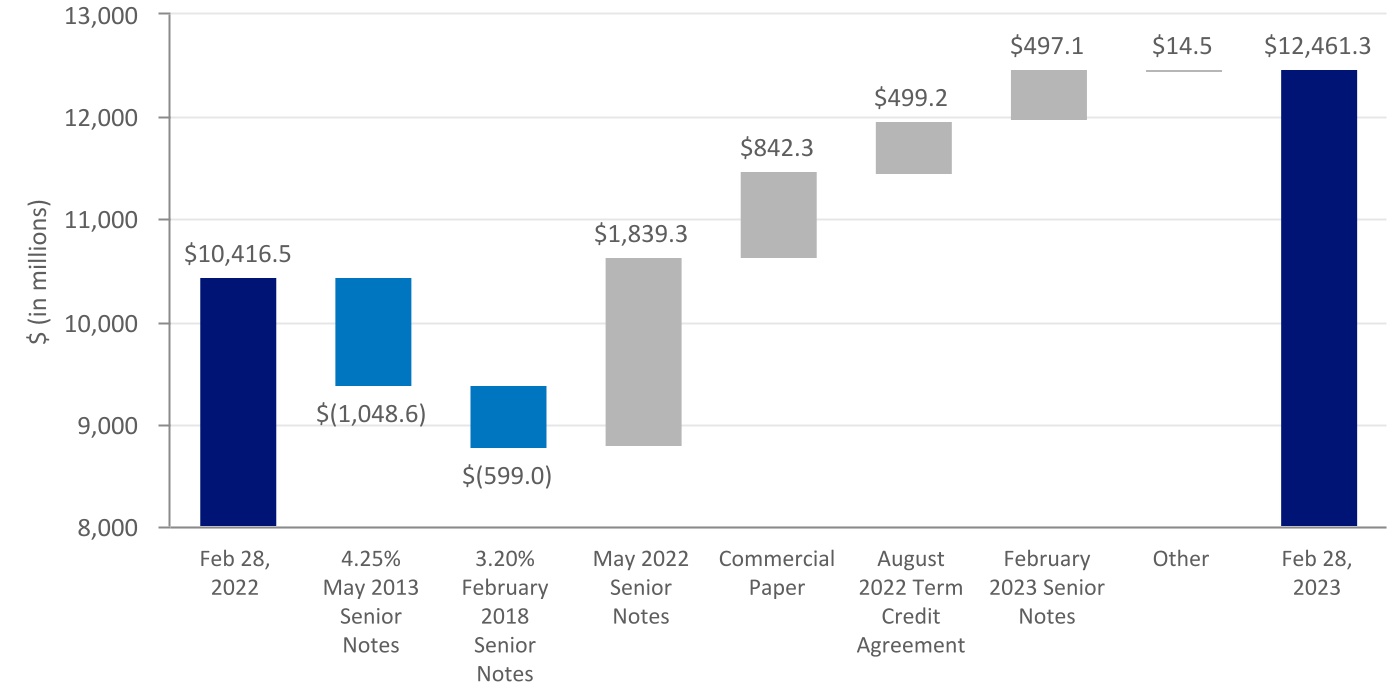

| Debt repayment | Debt issuance (1) | ||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 48 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| February 28, 2023 | April 13, 2023 | ||||||||||

| (in millions) | |||||||||||

Revolving credit facility (1) | $ | 1,068.5 | $ | 1,234.4 | |||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 49 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 50 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Class A Common Shares | |||||||||||||||||

| Repurchase Authorization | Dollar Value of Shares Repurchased | Number of Shares Repurchased | |||||||||||||||

| (in millions, except share data) | |||||||||||||||||

| 2018 Authorization | $ | 3,000.0 | $ | 3,000.0 | 13,331,156 | ||||||||||||

| 2021 Authorization | $ | 2,000.0 | $ | 1,136.6 | 4,831,910 | ||||||||||||

| Short-term payments | Long-term payments | Total | |||||||||||||||

| (in millions) | |||||||||||||||||

| Contractual obligations: | |||||||||||||||||

| Short-term borrowings | $ | 1,165.3 | $ | — | $ | 1,165.3 | |||||||||||

| Interest payments on short-term debt | $ | 4.2 | $ | — | $ | 4.2 | |||||||||||

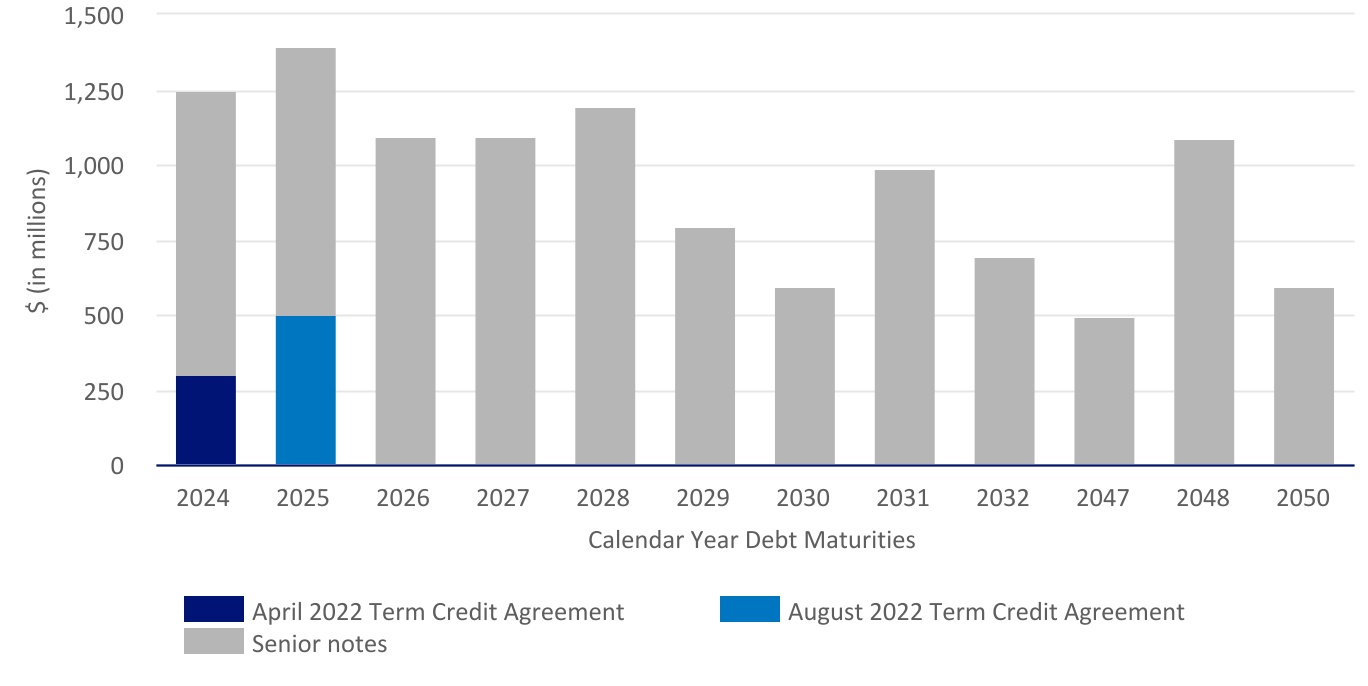

| Long-term debt (excluding unamortized debt issuance costs and unamortized discounts) | $ | 10.4 | $ | 11,365.8 | $ | 11,376.2 | |||||||||||

Interest payments on long-term debt (1) | $ | 457.6 | $ | 3,848.5 | $ | 4,306.1 | |||||||||||

| Operating leases | $ | 96.3 | $ | 503.4 | $ | 599.7 | |||||||||||

Other long-term liabilities (2) | $ | 99.7 | $ | 299.5 | $ | 399.2 | |||||||||||

| Purchase obligations | |||||||||||||||||

| Raw materials and supplies | $ | 597.3 | $ | 1,633.3 | $ | 2,230.6 | |||||||||||

Capital expenditures (3) | $ | 243.7 | $ | 407.3 | $ | 651.0 | |||||||||||

| Contract services | $ | 168.7 | $ | 402.8 | $ | 571.5 | |||||||||||

| In-process and finished goods inventories | $ | 30.1 | $ | 56.9 | $ | 87.0 | |||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 51 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

| Short-term payments | Long-term payments | Total | |||||||||||||||

| (in millions) | |||||||||||||||||

| Other: | |||||||||||||||||

Investments in businesses (4) | $ | 4.4 | $ | 110.2 | $ | 114.6 | |||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 52 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 53 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 54 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 55 | ||||

| PART II | ITEM 7. MD&A | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 56 | ||||

| PART II | ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES | Table of Contents | ||||||

| Aggregate Notional Value | Fair Value, Net Asset (Liability) | Increase (Decrease) in Fair Value – Hypothetical 10% Adverse Change | |||||||||||||||||||||||||||||||||

| February 28, 2023 | February 28, 2022 | February 28, 2023 | February 28, 2022 | February 28, 2023 | February 28, 2022 | ||||||||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||||||||

| Foreign currency contracts | $ | 2,801.2 | $ | 2,360.8 | $ | 232.3 | $ | 38.6 | $ | (175.8) | $ | (145.1) | |||||||||||||||||||||||

| Commodity derivative contracts | $ | 416.5 | $ | 291.1 | $ | (2.0) | $ | 90.1 | $ | 34.5 | $ | (35.1) | |||||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 57 | ||||

| PART II | ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES | Table of Contents | ||||||

| Aggregate Notional Value | Fair Value Net Asset (Liability) | Increase (Decrease) in Fair Value – Hypothetical 1% Rate Increase | |||||||||||||||||||||||||||||||||

| February 28, 2023 | February 28, 2022 | February 28, 2023 | February 28, 2022 | February 28, 2023 | February 28, 2022 | ||||||||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||||||||

| Fixed interest rate debt | $ | 10,576.2 | $ | 9,869.9 | $ | (9,436.8) | $ | (10,045.3) | $ | (586.3) | $ | (709.7) | |||||||||||||||||||||||

| Pre-issuance hedge contracts | $ | — | $ | 100.0 | $ | — | $ | (0.4) | $ | — | $ | (8.6) | |||||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 58 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

| Page | |||||||||||

| Management’s Annual Report on Internal Control Over Financial Reporting | |||||||||||

Reports of Independent Registered Public Accounting Firm (PCAOB ID | |||||||||||

| Consolidated Balance Sheets | |||||||||||

| Consolidated Statements of Comprehensive Income (Loss) | |||||||||||

| Consolidated Statements of Changes in Stockholders’ Equity | |||||||||||

| Consolidated Statements of Cash Flows | |||||||||||

| Notes to Consolidated Financial Statements | |||||||||||

| 1. | Description of Business, Basis of Presentation, and Summary of Significant Accounting Policies | ||||||||||

| 2. | Acquisitions and Divestitures | ||||||||||

| 3. | Inventories | ||||||||||

| 4. | Prepaid Expenses and Other | ||||||||||

| 5. | Property, Plant, and Equipment | ||||||||||

| 6. | Derivative Instruments | ||||||||||

| 7. | Fair Value of Financial Instruments | ||||||||||

| 8. | Goodwill | ||||||||||

| 9. | Intangible Assets | ||||||||||

| 10. | Equity Method Investments | ||||||||||

| 11. | Other Accrued Expenses and Liabilities | ||||||||||

| 12. | Borrowings | ||||||||||

| 13. | Income Taxes | ||||||||||

| 14. | Deferred Income Taxes and Other Liabilities | ||||||||||

| 15. | Leases | ||||||||||

| 16. | Commitments and Contingencies | ||||||||||

| 17. | Stockholders' Equity | ||||||||||

| 18. | Stock-Based Employee Compensation | ||||||||||

| 19. | Net Income (Loss) Per Common Share Attributable to CBI | ||||||||||

| 20. | Accumulated Other Comprehensive Income (Loss) | ||||||||||

| 21. | Significant Customers and Concentration of Credit Risk | ||||||||||

| 22. | Business Segment Information | ||||||||||

| 23. | Selected Quarterly Financial Information (unaudited) | ||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 59 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 60 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 61 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 62 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 63 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 64 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

| February 28, 2023 | February 28, 2022 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable | |||||||||||

| Inventories | |||||||||||

| Prepaid expenses and other | |||||||||||

| Total current assets | |||||||||||

| Property, plant, and equipment | |||||||||||

| Goodwill | |||||||||||

| Intangible assets | |||||||||||

| Equity method investments | |||||||||||

| Securities measured at fair value | |||||||||||

| Deferred income taxes | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings | $ | $ | |||||||||

| Current maturities of long-term debt | |||||||||||

| Accounts payable | |||||||||||

| Other accrued expenses and liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt, less current maturities | |||||||||||

| Deferred income taxes and other liabilities | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (Note 16) | |||||||||||

| CBI stockholders’ equity: | |||||||||||

Preferred Stock, $ | |||||||||||

Class A Stock, $ | |||||||||||

Class B Stock, $ | |||||||||||

Class 1 Stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ||||||||||

| Less: Treasury stock – | |||||||||||

Class A Stock, at cost, | ( | ( | |||||||||

Class B Stock, at cost, | ( | ||||||||||

| ( | ( | ||||||||||

| Total CBI stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 65 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

| For the Years Ended | |||||||||||||||||

| February 28, 2023 | February 28, 2022 | February 28, 2021 | |||||||||||||||

| Sales | $ | $ | $ | ||||||||||||||

| Excise taxes | ( | ( | ( | ||||||||||||||

| Net sales | |||||||||||||||||

| Cost of product sold | ( | ( | ( | ||||||||||||||

| Gross profit | |||||||||||||||||

| Selling, general, and administrative expenses | ( | ( | ( | ||||||||||||||

| Impairment of brewery construction in progress | ( | ||||||||||||||||

| Operating income (loss) | |||||||||||||||||

| Income (loss) from unconsolidated investments | ( | ( | |||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Loss on extinguishment of debt | ( | ( | ( | ||||||||||||||

| Income (loss) before income taxes | |||||||||||||||||

| (Provision for) benefit from income taxes | ( | ( | ( | ||||||||||||||

| Net income (loss) | ( | ||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Net income (loss) attributable to CBI | $ | ( | $ | ( | $ | ||||||||||||

| Net income (loss) per common share attributable to CBI: | |||||||||||||||||

| Basic – Class A Stock | $ | ( | $ | ( | $ | ||||||||||||

| Basic – Class B Stock | $ | ( | $ | ( | $ | ||||||||||||

| Diluted – Class A Stock | $ | ( | $ | ( | $ | ||||||||||||

| Diluted – Class B Stock | $ | ( | $ | ( | $ | ||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||

| Basic – Class A Stock | |||||||||||||||||

| Basic – Class B Stock | |||||||||||||||||

| Diluted – Class A Stock | |||||||||||||||||

| Diluted – Class B Stock | |||||||||||||||||

| Cash dividends declared per common share: | |||||||||||||||||

| Class A Stock | $ | $ | $ | ||||||||||||||

| Class B Stock | $ | $ | $ | ||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | |||||||||||||

| Other comprehensive income (loss), net of income tax effect: | |||||||||||||||||

| Foreign currency translation adjustments | ( | ( | |||||||||||||||

| Unrealized gain (loss) on cash flow hedges | ( | ( | |||||||||||||||

| Pension/postretirement adjustments | ( | ||||||||||||||||

| Share of other comprehensive income (loss) of equity method investments | ( | ( | |||||||||||||||

| Other comprehensive income (loss), net of income tax effect | ( | ( | |||||||||||||||

| Comprehensive income (loss) | ( | ||||||||||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | $ | ( | $ | |||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 66 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

| Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock | Non-controlling Interests | Total | |||||||||||||||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance at February 29, 2020 | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | |||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2021 | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2022 | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | |||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification payment | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Retirement of treasury shares | — | ( | — | ( | — | — | |||||||||||||||||||||||||||||||||||||||||

| Conversion of common shares | ( | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2023 | $ | $ | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||

Constellation Brands, Inc. FY 2023 Form 10-K | #WORTHREACHINGFOR I 67 | ||||

| PART II | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Table of Contents | ||||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) | |||||||||||||||||

| For the Years Ended | |||||||||||||||||

| February 28, 2023 | February 28, 2022 | February 28, 2021 | |||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | |||||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||||||||

| Unrealized net (gain) loss on securities measured at fair value | ( | ||||||||||||||||

| Deferred tax provision (benefit) | |||||||||||||||||

| Depreciation | |||||||||||||||||

| Stock-based compensation | |||||||||||||||||

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | |||||||||||||||||

| Noncash lease expense | |||||||||||||||||

| Impairment and amortization of intangible assets | |||||||||||||||||

| Amortization of debt issuance costs and loss on extinguishment of debt | |||||||||||||||||

| Net (gain) loss on sale of unconsolidated investment | ( | ||||||||||||||||

| Impairment of Canopy Equity Method Investment | |||||||||||||||||

| Impairment of long-lived assets | |||||||||||||||||

| Loss on inventory and related contracts associated with business optimization | |||||||||||||||||