As filed with the Securities and Exchange Commission on August 15, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VIA TRANSPORTATION, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 7372 | 45-5372621 |

(State or other jurisdiction of

incorporation or organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

114 5th Ave, 17th Floor

New York, NY 10011

(917) 877-0915

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel Ramot

Chief Executive Officer

Clara Fain

Chief Financial Officer

Via Transportation, Inc.

114 5th Ave, 17th Floor

New York, NY 10011

(917) 877-0915

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | | | | |

Ryan J. Dzierniejko Yossi Vebman Jeremy Winter Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, NY 10001 (212) 735-3000 | Erin H. Abrams Chief Legal Officer Via Transportation, Inc. 114 5th Ave, 17th Floor New York, NY 10011 (917) 877-0915 | Marc D. Jaffe Nathan Ajiashvili Alison Haggerty Latham & Watkins LLP 1271 Avenue of the Americas New York, NY 10020 (212) 906-1200 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated , 2025

Shares

VIA TRANSPORTATION, INC.

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Via Transportation, Inc. We are offering shares of our Class A common stock and the selling stockholders identified in this prospectus are offering shares of our Class A common stock. We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders. Prior to this offering, there has been no public market for our Class A common stock. We expect the public offering price to be between $ and $ per share. We have applied to list our Class A common stock on the New York Stock Exchange (“NYSE”) under the symbol “VIA.”

We have three classes of authorized common stock: Class A common stock, Class B common stock, and Class C common stock (collectively, our “common stock”). The rights of holders of Class A common stock, Class B common stock, and Class C common stock are identical, except with respect to voting, conversion, and transfer rights. Each share of Class A common stock entitles the holder to one vote. Each share of Class B common stock entitles the holder to 10 votes and is convertible, at the option of the holder, into one share of Class A common stock. Each share of Class C common stock entitles the holder to no voting rights and will convert into one share of Class A common stock following the conversion of all outstanding shares of Class B common stock into shares of Class A common stock.

Upon completion of this offering, all shares of Class B common stock will be held by our Chairman and Chief Executive Officer, Daniel Ramot, and Green Spaces Grantor Retained Annuity Trust No. 1 (the “Ramot Trust”), and Mr. Ramot will hold or have the ability to direct the voting of shares representing approximately % of the voting power of our outstanding capital stock, which voting power may increase over time as certain equity awards held by Mr. Ramot vest and are exercised for or settled into shares of Class A common stock and exchanged for shares of Class B common stock. If all equity awards held by Mr. Ramot had been vested, exercised or settled, and exchanged for shares of Class B common stock as of the date of the completion of this offering, Mr. Ramot would hold or have the ability to direct the voting of shares representing approximately % of the voting power of our outstanding capital stock. See “Principal and Selling Stockholders” and “Description of Capital Stock.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 24 to read about factors you should consider before buying shares of our Class A common stock. Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body or state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| Per Share | | Total |

Initial public offering price | $ | | $ |

Underwriting discounts and commissions(1) | $ | | $ |

Proceeds, before expenses, to us | $ | | $ |

Proceeds, before expenses, to the selling stockholders | $ | | $ |

_______________

(1)See “Underwriting” for a description of the compensation payable to the underwriters.

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional shares of Class A common stock from us at the initial public offering price, less the underwriting discounts and commissions.

The underwriters expect to deliver shares of our Class A common stock against payment in New York, New York on , 2025.

| | | | | | | | | | | | | | | | | | | | |

| Goldman Sachs & Co. LLC | | Morgan Stanley | | Allen & Company LLC | | Wells Fargo Securities |

| | | | | |

| Deutsche Bank Securities | Guggenheim Securities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Citizens Capital Markets | | Needham & Company | | Oppenheimer & Co. | | Raymond James | | William Blair | | Wolfe | Nomura Alliance |

Prospectus dated , 2025

TABLE OF CONTENTS

Through and including , 2025 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We, the selling stockholders and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared or that has been prepared on our behalf or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of Class A common stock offered by this prospectus, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date of this prospectus. Our business, financial condition, and results of operations may have changed since that date.

For investors outside the United States: neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside of the United States. See “Underwriting.”

ABOUT THIS PROSPECTUS

Certain amounts, percentages, and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them.

MARKET AND INDUSTRY DATA

This prospectus includes estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity, and market size, are based on sources including industry publications and surveys, industry reports prepared by consultants, internal surveys, and customer feedback. The market, economic and industry data have primarily been derived and extrapolated from various sources including commissioned studies, reports and publicly available data from the Federal Transit Administration’s National Transit Database (“NTD Reporting”), the American Public Transportation Association (“APTA”), and a major consulting firm.

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets in which we operate. While we believe the estimated market and industry data included in this prospectus is generally reliable, such information is inherently uncertain and imprecise. Market and industry data is subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of such data. In addition, projections, assumptions, and estimates of the future performance of the markets in which we operate are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

TRADEMARKS, SERVICE MARKS, AND TRADENAMES

We own or otherwise have rights to the trademarks, service marks, and tradenames, including those mentioned in this prospectus, used in conjunction with the operation of our business. This prospectus includes our own trademarks, service marks and tradenames which are protected under applicable intellectual property laws, as well as trademarks, service marks and tradenames of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or tradenames to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks, service marks and tradenames referred to in this prospectus may appear without the ®, ™, or ℠ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor to these trademarks, service marks and tradenames.

PROSPECTUS SUMMARY

This summary highlights select information contained elsewhere in this prospectus and does not contain all the information you should consider before making an investment decision. You should read the entire prospectus carefully, including “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the accompanying notes included elsewhere in this prospectus before making an investment decision. Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” the “Company,” “Via,” and similar terms refer to Via Transportation, Inc. and its consolidated subsidiaries.

Overview

Via transforms antiquated and siloed public transportation systems into smart, data-driven, and efficient digital networks.

We are addressing a striking gap in the $545 billion global public transportation market. While billions of people across the globe rely on public transportation, this critical form of mobility has yet to meaningfully benefit from recent advances in technology. Buses still follow fixed routes and schedules planned years, if not decades ago, regardless of actual demand for their service. We can track our pizza from the moment it leaves the oven, but parents of more than 25 million children in the United States have no way of knowing when their child’s school bus will arrive. Some of our most vulnerable citizens, who depend on paratransit to access critical medical care, have no alternative to cumbersome phone reservations that must be made a day or more in advance.

Government agencies and private organizations responsible for providing public transportation operate in a complex and demanding environment. They must maintain reliable and affordable service in the face of continuously changing and difficult to predict traffic and ridership patterns. The industry has historically had no option but to rely on fragmented technology systems with limited functional flexibility, aging infrastructure, and poor end-user experience. Rising operating costs and labor shortages have placed a growing strain on budgets.

Via’s unified platform of cutting-edge software and technology-enabled services replaces fragmented legacy systems and consolidates operations across silos. When our customers adopt our platform, they can leapfrog years of technology neglect and drive meaningful efficiencies in their operations. Public transportation is deeply local in nature; our highly-configurable vertical stack supports the broad and diverse localization requirements of our customers. The use of machine learning and AI is intrinsic to our platform and underlies continuous improvement in the performance of our software. We offer a curated suite of technology-enabled services that enable customers to more easily adopt our software and benefit from lower-cost operations. In turn, the passengers who live in the communities we serve benefit from an improved rider experience and greater access to opportunity.

Our journey to pioneer this category began over a decade ago. We were driven by a simple mission: to create public transportation systems that provide far greater access to jobs, healthcare, and education. Our vision was to reimagine public transit, from a static system of predetermined routes and schedules, to a dynamic network where routes are determined in real time based on passenger demand and data. In 2013, we launched in New York City what was, to our knowledge, the world’s first two-sided marketplace for on-demand shared rides in order to demonstrate the efficacy of this new mode of transportation and begin to build a rich foundation of data to power our algorithms. Out of this marketplace grew a platform so compelling that today it is utilized by hundreds of cities across more than 30 countries. Shaped by feedback from millions of passengers and drivers and informed by data from hundreds of millions of trips, we have developed a proven solution that is reshaping the public transportation landscape.

Our platform has expanded well beyond its origins in on-demand shared rides — a new mode of mass transit now known to the world as microtransit — and today offers a comprehensive, end-to-end public transit solution:

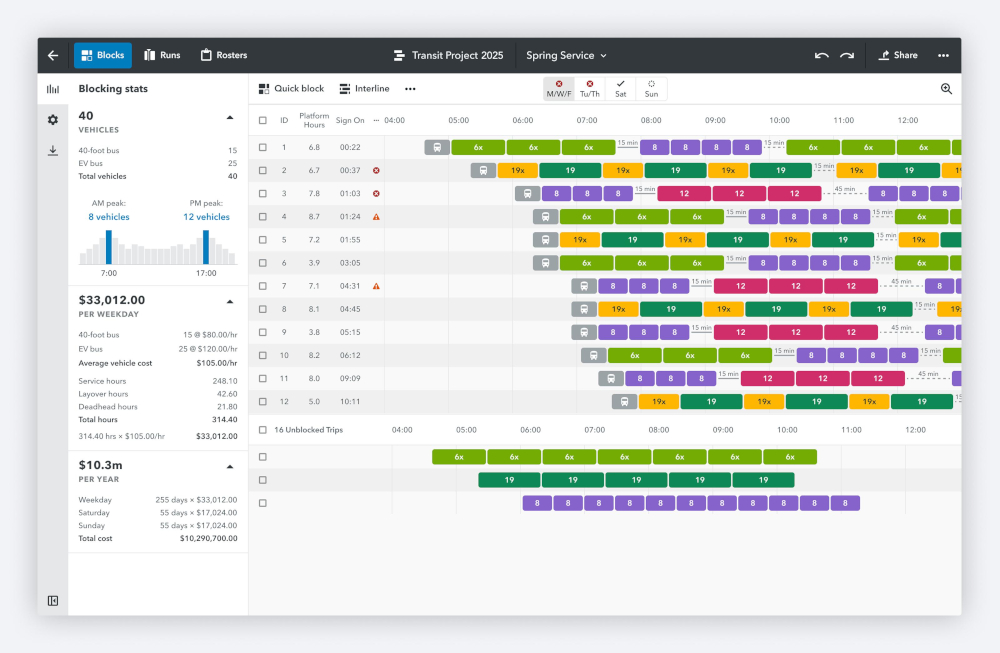

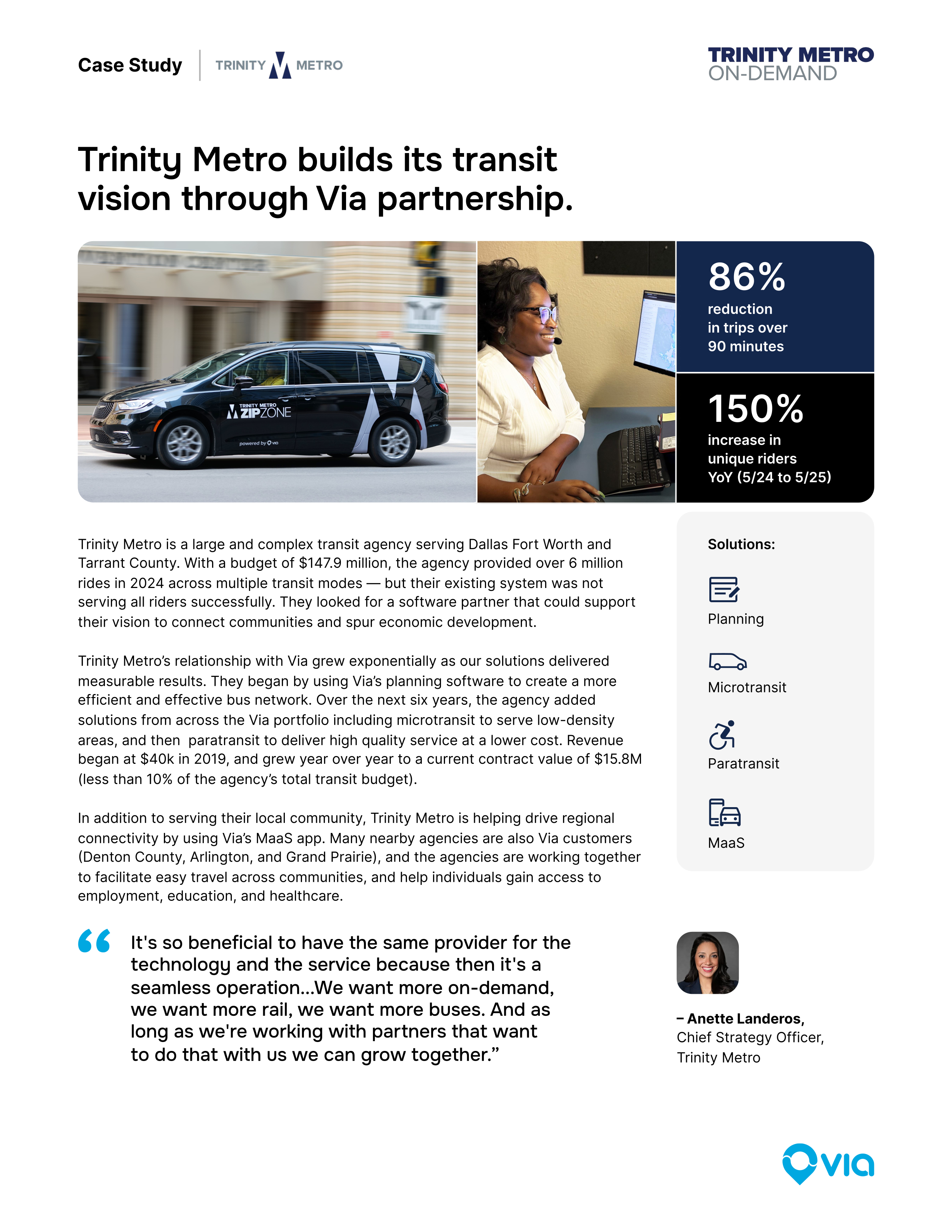

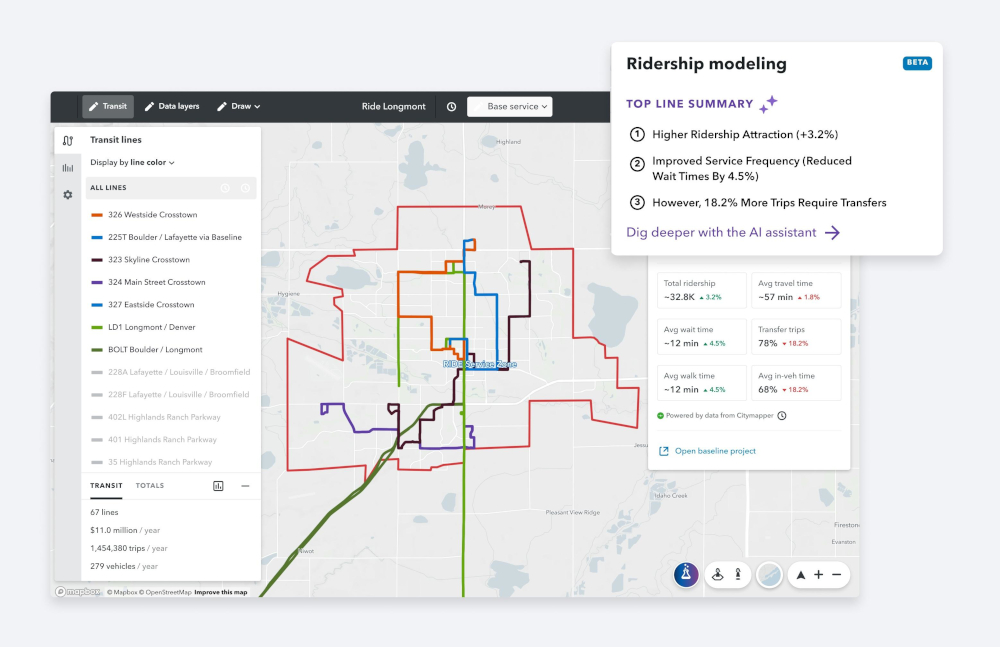

•Planning and scheduling: Our software enables cities to plan smarter transit networks. By combining multiple disparate operational and demographic data sets, and leveraging billions of data points, our tools provide insights that allow city planners to immediately quantify the impact of potential changes to their transit network. In the Dallas suburbs, the Denton County Transit Authority (“DCTA”) was able to use Via’s planning tools to identify underperforming bus lines and replace them with microtransit. This helped DCTA grow their monthly ridership by approximately five times without increasing operating budget.

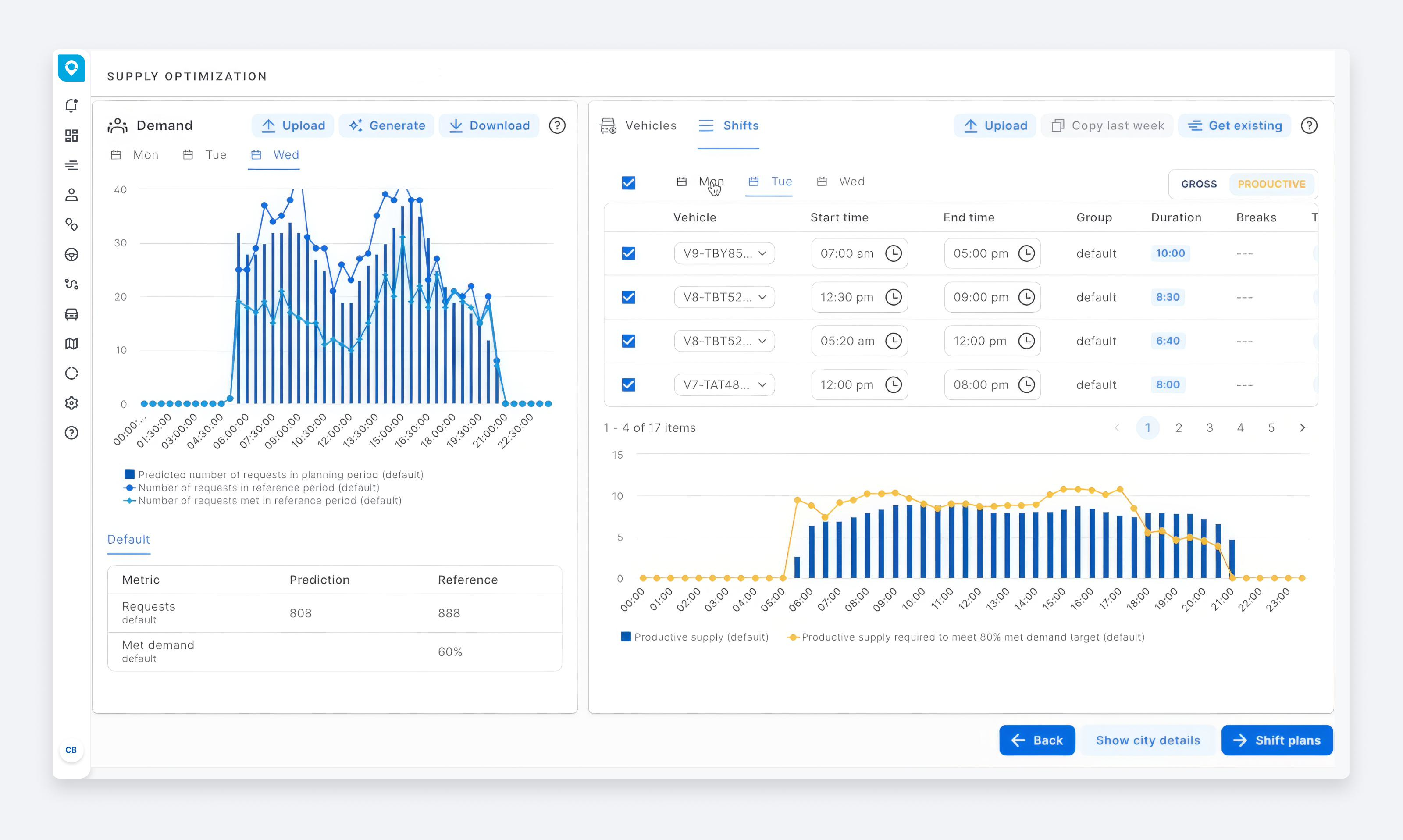

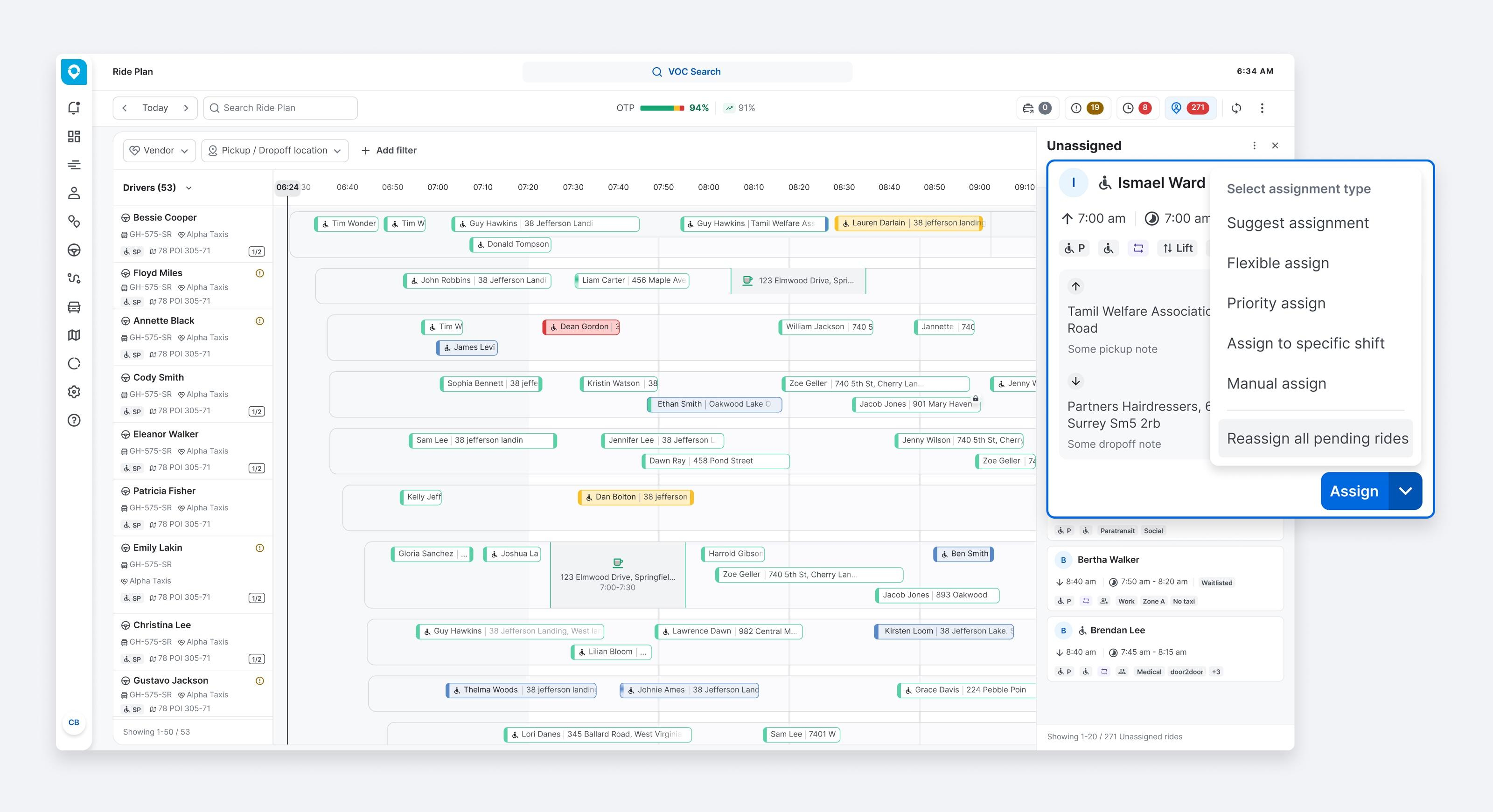

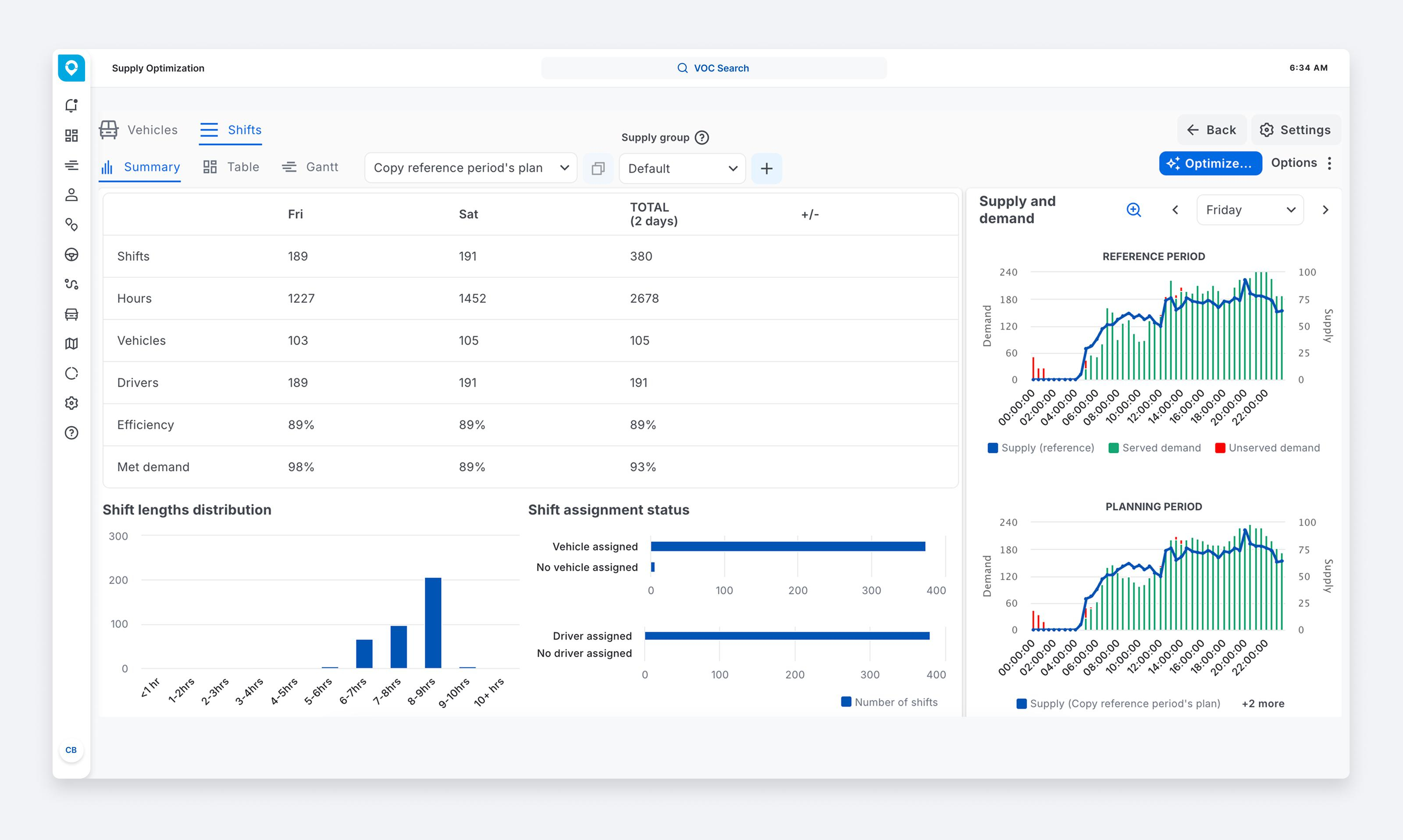

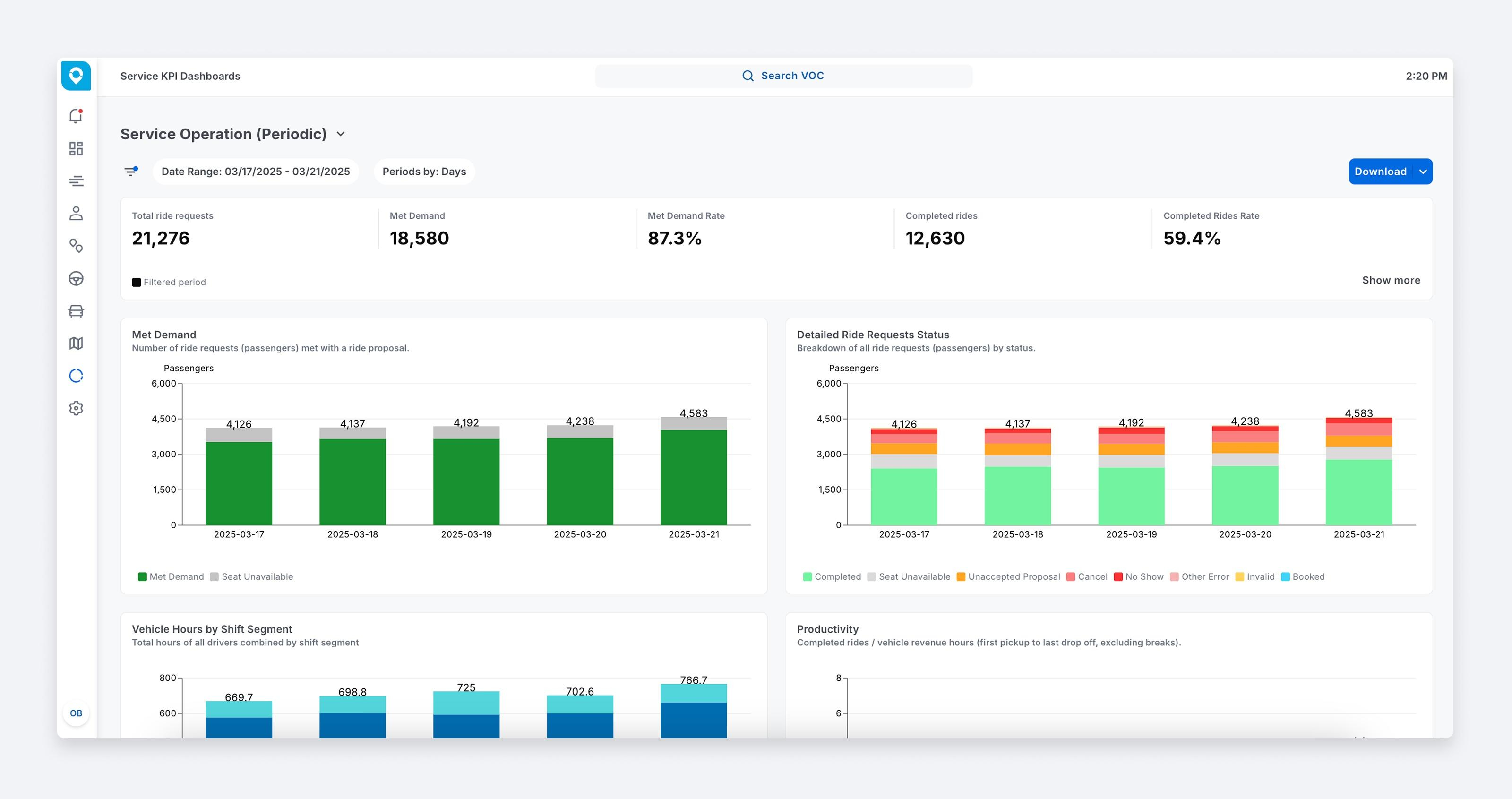

•Operating Software: We provide a deep, cloud-based vertical platform with the necessary range of tools to manage the operations of dynamic and fixed-route forms of mobility, including microtransit, paratransit, school transport, and non-emergency medical transport. Our technology stack offers modules to digitize and automate workstreams across areas such as program eligibility, government reporting and compliance, real-time dispatch and reservations, and customer support. For example, North Carolina’s GoRaleigh was able to reduce driver overtime by approximately 50% once they switched to Via’s software.

•Technology-enabled services: Many of our government customers require additional support in order to adopt modern technology. As a critical part of our go-to-market strategy, we have embedded into our platform a suite of services, vertically integrated into our technology, that complements our powerful software. The services we provide lower barriers to adoption, simplify compliance with complex procurements, support local integration with existing infrastructure, and ultimately meaningfully enhance our ability to deliver successful outcomes. Customers can select from an à la carte menu of services or a full turnkey solution. Examples of services we provide include fleet and driver management, autonomous and electric vehicle management, digital marketing, call center support, and more. In Sarasota, Florida, Breeze Transit used Via to procure a flexible fleet of rental vehicles and independent contractor drivers, allowing them to achieve an approximately 50% reduction in average cost per ride.

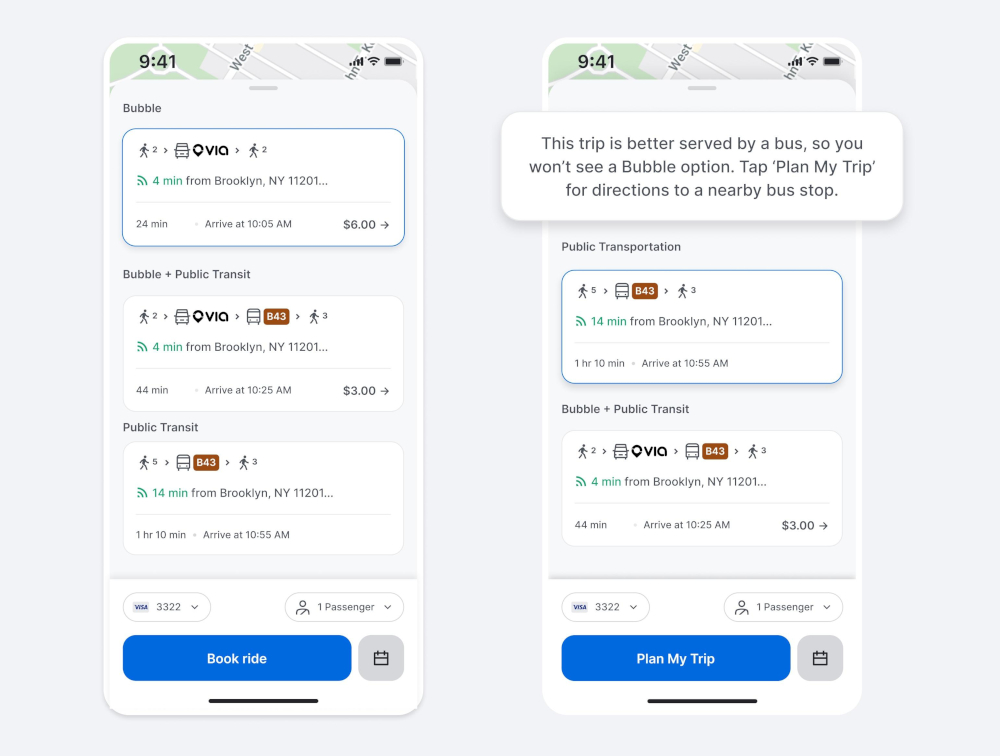

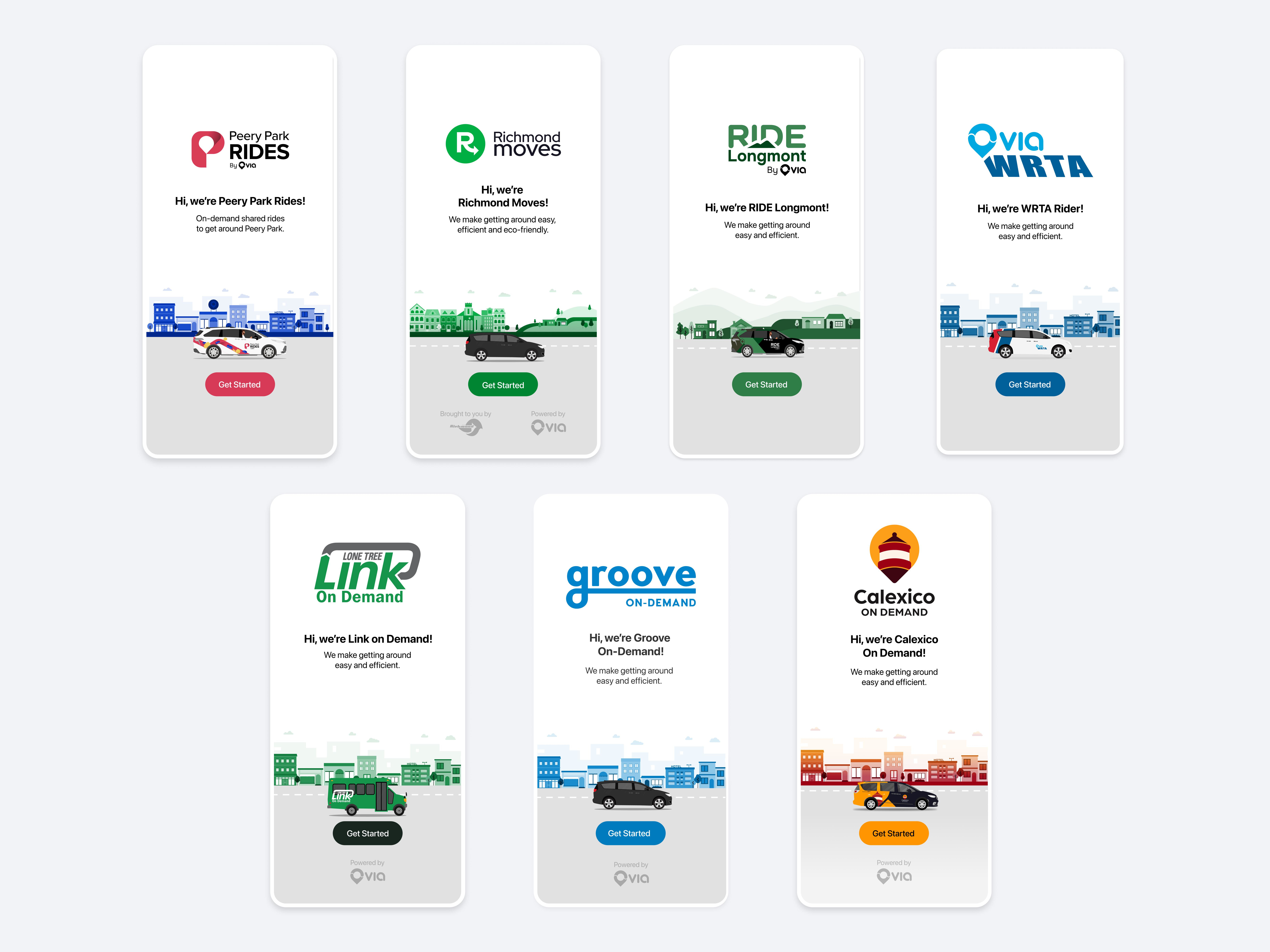

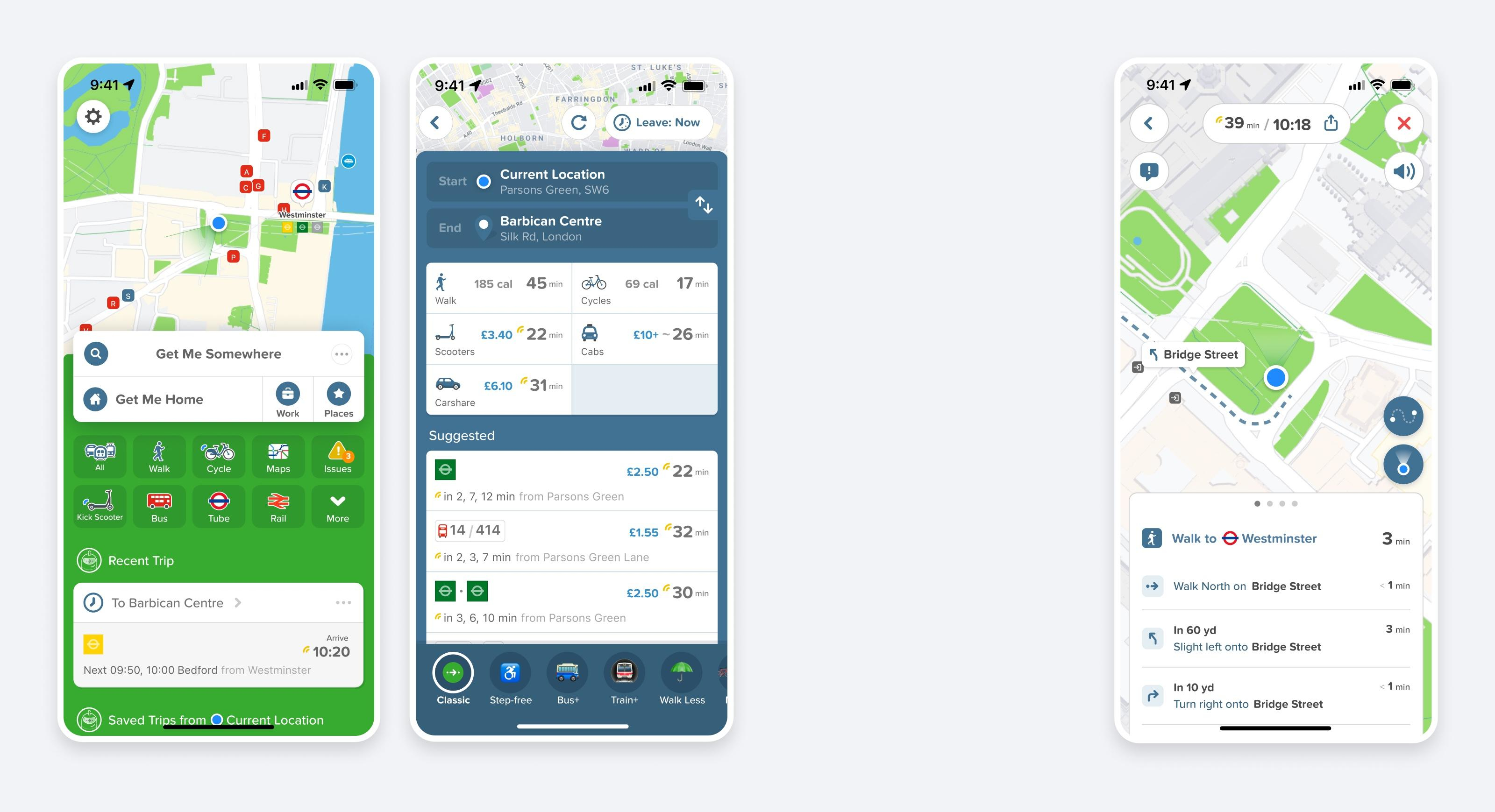

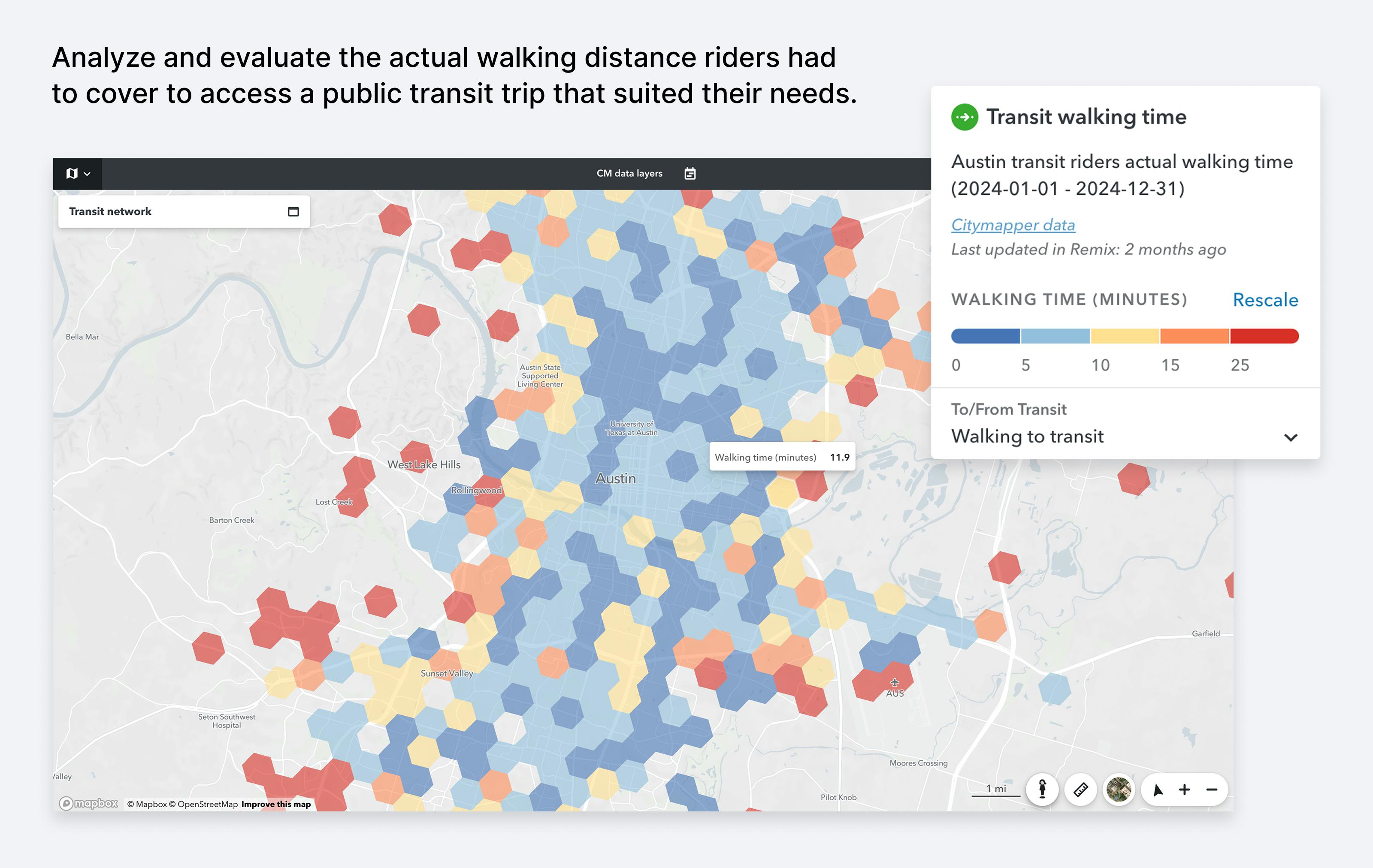

•Passenger tools: We provide consumer-grade applications for passengers to seamlessly plan, book, and pay for their transit journeys. Our customers have a choice of passenger facing tools. Using Via’s white-labeled apps, governments can engage local audiences with best-in-class, frictionless user experience that faithfully represents their brand. We also offer Citymapper, one of the world’s premier journey planning MaaS (Mobility-as-a-Service) apps, which is used by millions globally. Citymapper achieves arrival / departure time estimates that are, on average, 15% more accurate than industry norms.

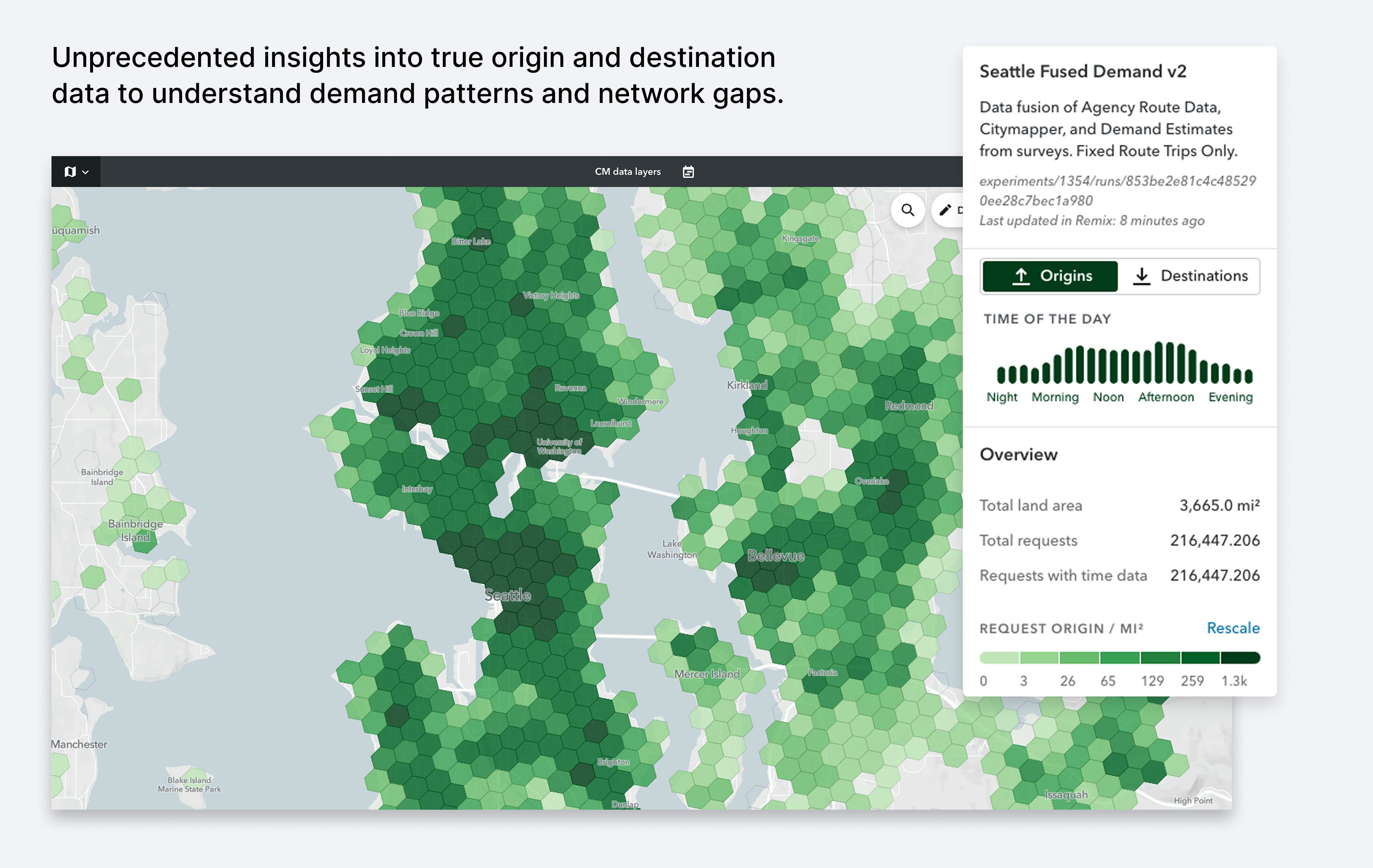

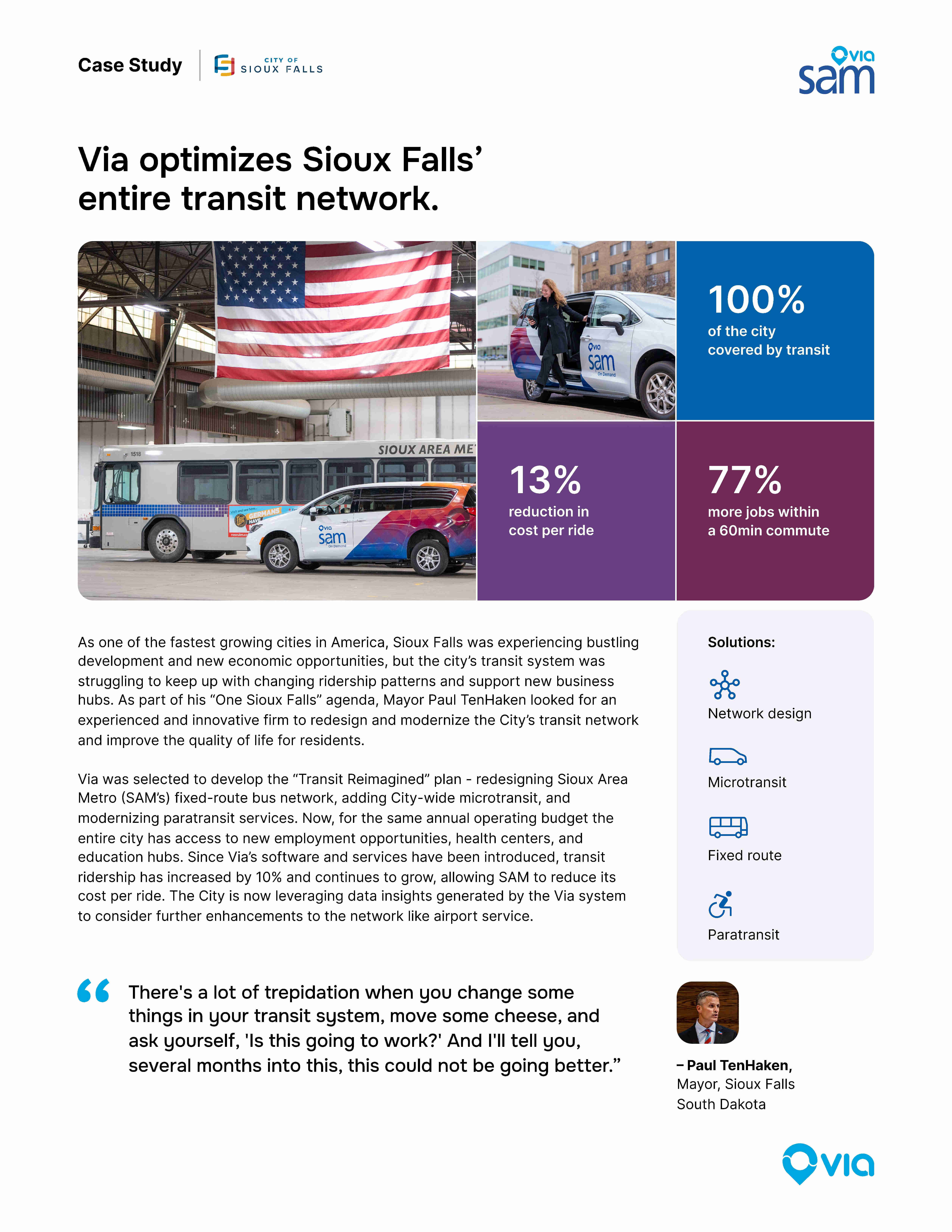

•Data and insights: We are often able to unlock unprecedented data insights for our customers, allowing them, for example, to understand changing demand patterns and rapidly adapt operational plans to performance reality. Our integrated planning, operating, and passenger tools provide the end-to-end data necessary for the holistic optimization of entire transit systems. Sioux Area Metro was able to increase ridership by 10% while reducing average cost per ride by 13% by leveraging Via’s platform to optimize their network.

We are in the early innings of transforming an enormous addressable market. For the quarter ended June 30, 2025, we provided solutions for 689 customers in over 30 countries. This represents approximately 1% of the total addressable market in North America and Western Europe, which we estimate to be approximately 63,000 customers, based on a report commissioned by us from a major consulting firm. Our potential for growth is further evidenced by our current penetration: at our current revenue, we capture less than 1% of our Serviceable Addressable Market (“SAM”) in our two core geographies of North America and Western Europe. See “Business—Our Market Opportunity.” More than 90% of our revenue comes from government customers, in most cases represented by a municipality or a

local transit agency or authority. We also serve blue-chip corporate and university customers who leverage Via’s platform to power campus transportation solutions.

Our founder-led executive team is unique in its long tenure and alignment of mission. We deeply understand the technical and operational challenges that our customers and their end-users face every day.

Thanks to our deep knowledge of the complex needs of government customers, we have developed a go-to-market strategy that allows us to efficiently and effectively sell to our customers at scale. We employ a consultative sales process, leveraging our technology to model the impact of our solutions to our customers, allowing them to gain confidence that change can be low-risk and high reward. When customers adopt our platform, the measurable increase in efficiency and ridership can generate a virtuous cycle that leads to growth in contract scope and value over time. Our Platform Net Revenue Retention Rate averaged over 120% in each of the last two years. And, as transit agencies are in many cases part of collaborative multi-government coalitions such as regional planning authorities, customer references are a major driver of our growth. We often see the adoption of our platform by one city or agency quickly leading to adoption by similar customers in the surrounding area.

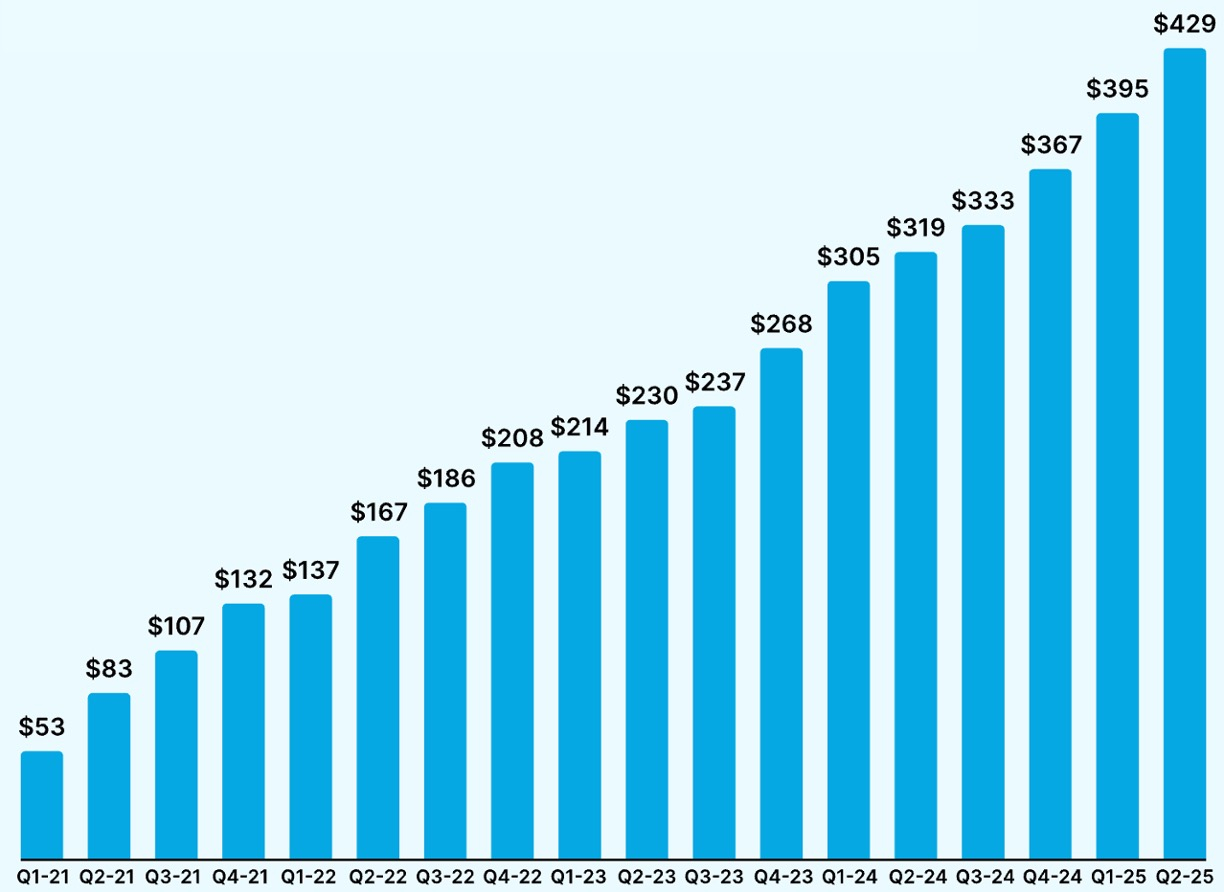

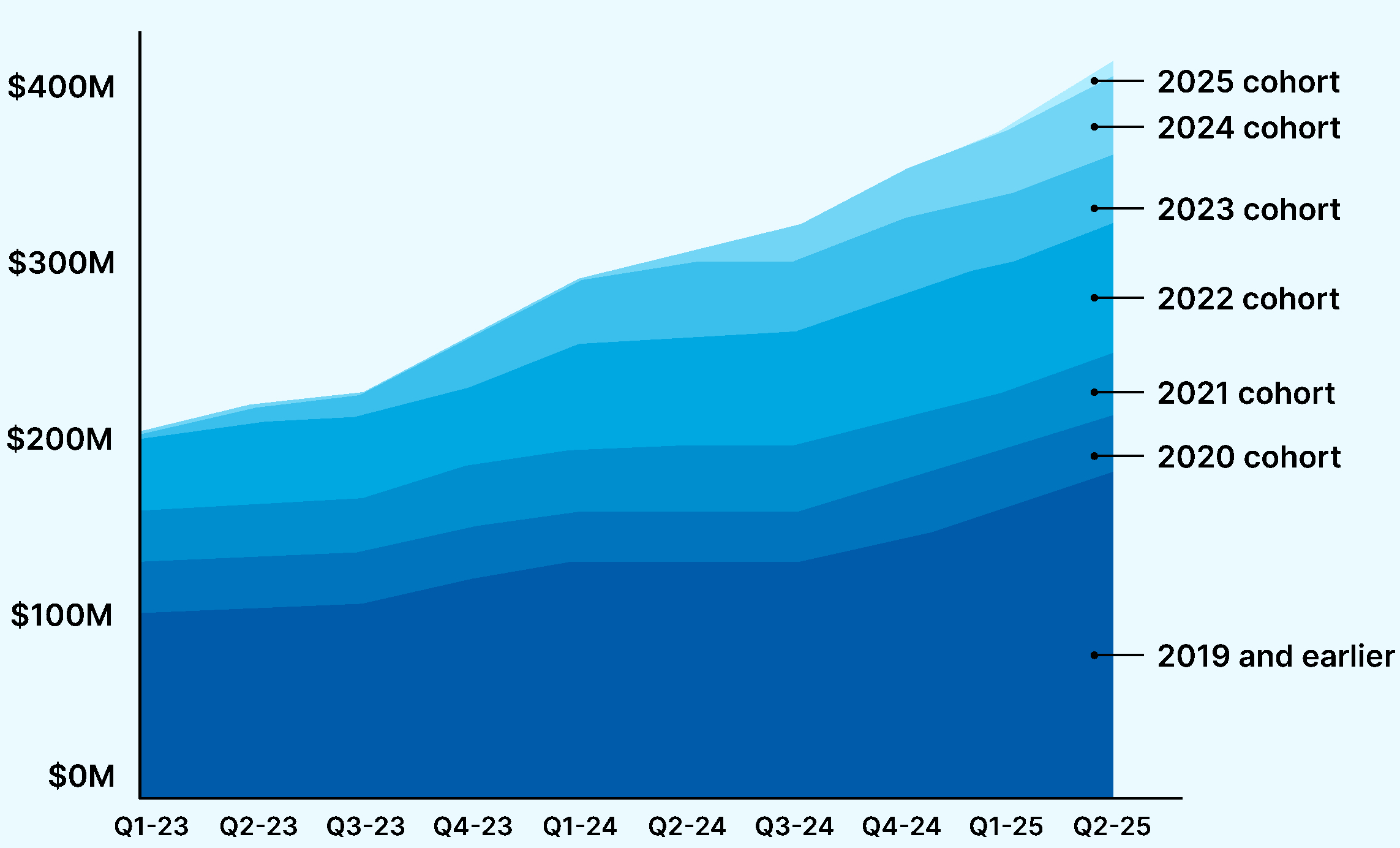

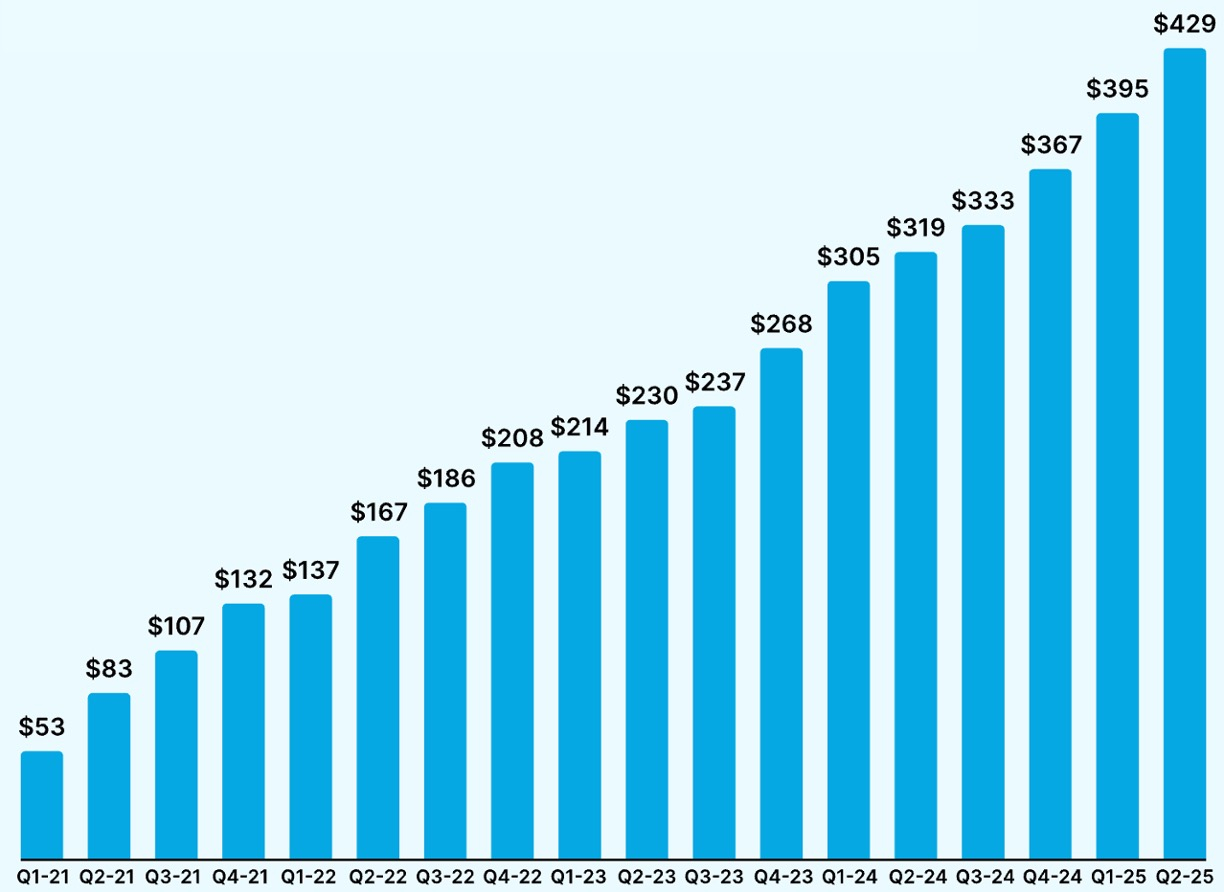

The unique value of our platform is demonstrated by our rapid and sustained growth. From 2021 to 2024, our revenue grew from $100.0 million to $337.6 million, representing a compound annual growth rate of 50%. Our revenue was $248.9 million and $337.6 million for the years ended December 31, 2023 and 2024, respectively, representing a year-over-year increase of 36%. For the six months ended June 30, 2025, our revenue was $205.8 million.

Our Platform revenue was $237.3 million and $330.8 million in the year ended December 31, 2023 and 2024, respectively, representing a year-over-year increase of 39%. For the six months ended June 30, 2025, our Platform revenue was $205.8 million. Our Platform segment represented 95%, 98% and 100% of our revenue in the years ended December 31, 2023 and 2024, and the six months ended June 30, 2025, respectively. In addition to our Platform segment, we have one legacy operating segment (which we refer to as our Legacy segment). The Legacy segment had included our historical on-demand shared rides marketplace, which we ceased to operate in 2021, and includes a legacy operational contract, which terminated in June 2024. We no longer earn any revenue from our Legacy segment.

Our Platform Annual Run-Rate Revenue of $366.7 million as of December 31, 2024 represented an increase of 37% from December 31, 2023. Our Platform Annual Run-Rate Revenue of $428.5 million as of June 30, 2025 represented an increase of 34% from June 30, 2024. Platform Annual Run-Rate Revenue as of the last date in any quarter represents our Platform revenue for that quarter multiplied by four.

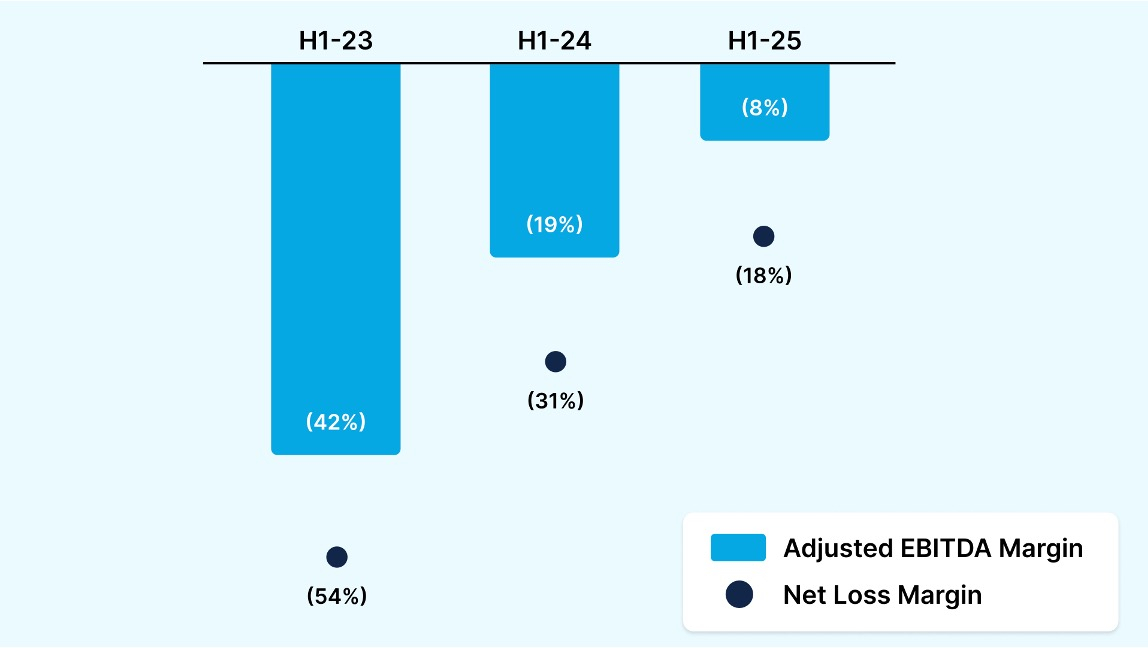

While generating rapid and consistent revenue growth, we have benefited from significant operating leverage in the business resulting in a continuous reduction in losses. Our net loss margin and Adjusted EBITDA Margin has significantly improved over the past ten quarters. Our net loss margin and Adjusted EBITDA Margin improved from (58)% and (43)%, respectively, in the quarter ended March 31, 2023, to (20)% and (8)%, respectively, in the quarter ended June 30, 2025. In the years ended December 31, 2023 and 2024, we incurred a net loss of $117.0 million and $90.6 million, respectively, with losses of $92.0 million and $54.4 million in Adjusted EBITDA, respectively, representing net loss margin of (47)% and (27)%, respectively, and Adjusted EBITDA margin of (37)% and (16)%, respectively. For the six months ended June 30, 2025, we incurred a net loss of $37.5 million with a loss of $17.3 million in Adjusted EBITDA, representing net loss margin of (18)%, respectively, and Adjusted EBITDA margin of (8)%.

Our year-over-year improvement was driven by significant operating leverage in the business. For more information on our financial performance, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” For a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to net loss and net loss margin, the most directly comparable GAAP financial metrics, see

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Metrics.”

Industry Background

Public transportation is antiquated, fragmented, and siloed

The dearth of modern technology solutions tailored to local government needs and a tradition of operating transportation in siloed verticals have made it difficult for governments to benefit from advancements in the broader technology sector.

•Static, fixed routes & schedules: Around the world transit agencies operate static routes and schedules planned years ago, regardless of actual demand for their service. COVID-19 further amplified the challenges faced by rigid transit systems. The pandemic upended the traditional travel patterns that these old systems were designed to serve and exposed the extent to which they are no longer able to meet the evolving needs of their communities.

•Siloed services: Today, nearly every transportation vertical — bus, microtransit, paratransit and school transport, etc — operates on a separate software platform with separate fleets, drivers, and operational teams. This creates disjointed operational practices, with inefficient redundancies in areas such as vehicle and driver supply.

•Fragmented and legacy technology: Each transit vertical typically relies on multiple technology components for its operation. These components are themselves siloed and rarely integrate into other systems in the network. The result is a fragmented software and data infrastructure that constrains the ability to operate the network in a coordinated fashion or gain a holistic view of its performance. In addition, these legacy software solutions, many of which are hosted on-premise, rely on antiquated and unscalable data models and architectures. This limits their ability to incorporate many of the latest performance-enhancing technologies that can drive efficiency, including AI.

•Aging Infrastructure: Existing fleets and accompanying hardware are dated and unable to support modern needs and changing consumer preferences. Maintaining these older fleets is cost prohibitive as they require more frequent maintenance and higher repair and parts costs.

Driving government change is arduous and complex

Government customers are complex organizations with a diverse set of stakeholders requiring a unique approach to change, even when the need is well-known. Additionally, government services are mission critical with very high stakes for operators, communities and local political stakeholders. It requires deep expertise and credibility to be able to drive transformation in this sector.

•Complex funding structures: Transportation services are often funded by a disparate mix of local, regional, and national funding streams. According to historical APTA data, approximately 80% of public transit funding in the United States is derived from state and local sources. Understanding all the available funding structures, and how they can be applied by a particular government entity, is crucial to driving new opportunities and sustained expansion of existing customer relationships. Historically, government funding was largely allocated towards large-scale capital expenditures which created incentives for agencies to prioritize buying large vehicles over investing in technology. More recently, supported by positive regulatory changes, we have experienced increasing allocation of budgets to technology and digital infrastructure.

•Byzantine procurement: Government procurement is in most cases a complex and bespoke process, requiring the submission of dozens of separate documents and adherence to narrowly-specified requirements. In addition, the process is designed by its very nature to solicit bids for highly tailored solutions. Even when governments expressly set out to procure a commercial,

streamlined product, it is not atypical to see a list of hundreds of mandatory features and specifications. A highly specialized sales strategy and expert team are required to efficiently navigate the procurement process at scale as dozens of these unique and complex RFP documents must be reviewed and responded to on a weekly basis.

•Political stakeholders: While transit consistently enjoys bipartisan support, procurement of critical government services rightly attracts the attention of mayors, city council members, and community advocacy groups. Understanding the local political dynamic and effectively engaging with all stakeholders within the customer organization and the broader political landscape is crucial to enable long term growth and success.

•Sensitive change management: Public transportation systems serve passengers who are highly sensitive to change and require support to adopt new technologies, such as the elderly, passengers with disabilities, and schoolchildren. Detailed and thoughtful plans for successfully transitioning passengers to new services and ensuring that no rider is left behind are a critical part of any successful deployment of our technology.

Public transportation services are highly local

For government transit agencies to effectively serve their passengers, they must be able to provide solutions that meet their specific local needs.

•Payment, ticketing, currency: Passengers must be able to pay for trips in their local currency, and automatically have the system calculate and remit the exact fare they owe, even when taking trips that span multiple different transit modes. Integrations with local ticketing systems allow for frictionless transfers between service providers and transit modes.

•Journey planning: The system must have the ability to ingest data from all local and regional transit feeds in order to enable seamless end-to-end journey planning that leverages all available transit modes.

•Regulatory & reporting: Transit services supported by government funding must adhere to rigid and in some cases extensive compliance, reporting, and audit requirements. These regulatory requirements vary city to city, county to county, state to state, and country to country, requiring a highly configurable solution that can easily conform to the exact local requirements.

•Integrated operations: The software must be integrated with existing tools and practices of the government customer and any local operators that participate in the service. For example, to ensure that drivers are paid timely and correctly, integration into existing local backend payroll systems may be required.

Our Approach

We have spent the past decade building a comprehensive technology platform and sophisticated go-to-market strategy designed to accelerate the adoption of our software and drive the success of our customers.

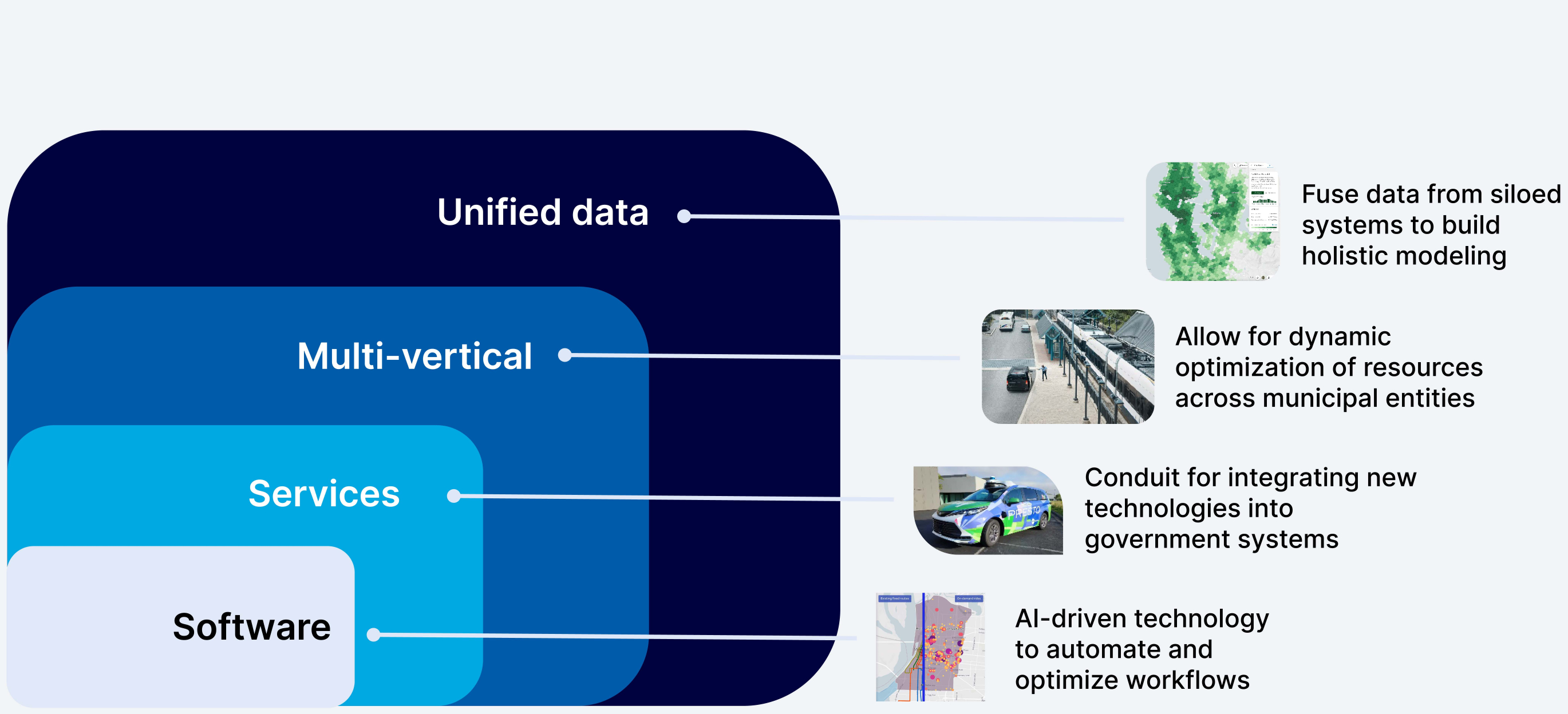

End-to-end modular platform

Via’s end-to-end platform replaces fragmented legacy systems and consolidates operations across silos. Our unified software platform creates a virtuous cycle of planning, operating, and optimizing networks across multiple transportation verticals. In breaking down silos, our customers can drive meaningful operational efficiencies by leveraging fleet, driver, and staffing resources more effectively, and data streams can be unified to allow for performance optimization that spans the entire network.

•Highly configurable software: Our highly-configurable software supports the diverse localization requirements of our customers, meaningfully reducing or eliminating the need for custom

development. We designed our software to meet the diverse needs of our customers’ passengers: from tech-savvy commuters to those without smartphone access to riders with disabilities. The broad extensibility of our platform allows us to seamlessly integrate a long list of local technology partners required to provide a holistic solution; from payment processors, to local ticketing systems, to providers of real-time multi-agency transit data. Robust configuration tools enable our customers to put highly local touches on their service with the click of a button.

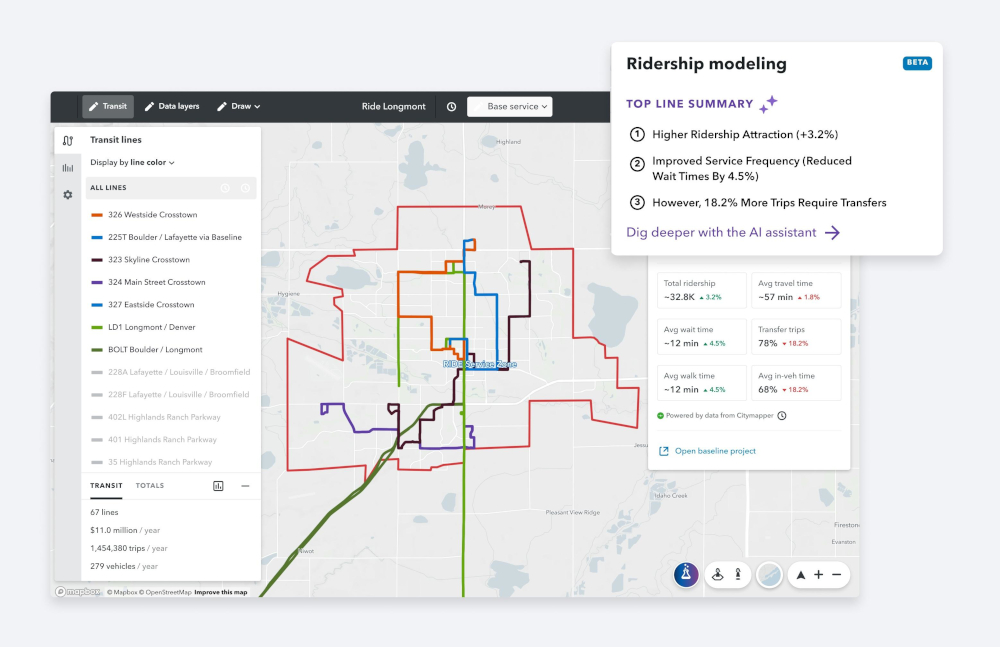

•Software powered by over a decade of proprietary data, ML algorithms, and AI: Our innovative network design, algorithms, and AI technology generate remarkable efficiency and customer satisfaction that drive superior outcomes. In bringing AI-powered technology to government users, our platform automates workflows and optimizes performance. Our ability to capture billions of data points, where previously there was little to no visibility, and to unify data across previously siloed operations enables us to generate actionable insights for our customers that dramatically improve the passenger experience and network efficiency.

Our algorithms leverage the data from hundreds of millions of transit trips, which allow customers to continuously improve system efficiency and the overall customer and passenger experience. Our use of AI technologies such as digital twins and generative-AI can allow cities to accurately predict costs and travel times of never-before travelled routes. The tools leverage this data to offer recommendations to planners on the most efficient transit plans across modes based on the data from thousands of “alike” cities worldwide. The scale and breadth of data over years of operation, and our continued expansion, contribute to a data advantage that strengthens as we continue to grow.

•Technology-enabled services: To facilitate the adoption of our software, we offer a menu of services: lowering barriers to adoption, simplifying procurement, and accelerating the localization of our platform. Our ability to offer these services is a critical piece of our strategy. It accelerates our go-to-market timelines and drives performance outcomes for our customers. These services which can either be provided by us or by a curated ecosystem of third-party providers, include driver and fleet management, customer support, marketing services, and more, plugging the gaps in our customers’ operations where they lack the modern infrastructure or capabilities to leverage our solution to its full potential. The capabilities provided by these services are fully integrated into our software. For example, integrations between the Via platform and driver management CRM solutions like Salesforce allow for the seamless flow of critical information. If a driver’s license is expired in Salesforce, they will automatically be marked as ineligible to be scheduled for and unable to log in and start a shift in the Via system.

Our platform of software and services allows us to create a multi-vertical operational infrastructure, unify data across transportation verticals, and create a virtuous cycle for continuous optimization.

Highly Sophisticated Go-To-Market Strategy

As government services like transportation are mission critical with uniquely high stakes, barriers to adoption are extremely high. Our knowledge of the complex needs of our customers has allowed us to develop a go-to-market strategy that enables us to efficiently and effectively sell at scale.

•Technology-enabled consultative sales motion: We employ a consultative sales process, leveraging the AI-power of our technology to model to our customers the impact of our solutions, allowing them to gain confidence that change can be low-risk and high reward. Our full-service in-house transit planning and consulting agency employs our proprietary simulation technology, which leverages data from hundreds of millions of transit trips to guide our customers through complex service planning exercises and feasibility studies. Our software allows us to generate the required in-depth financial modeling and cost-benefit analysis our customers require in order to build consensus for change. Our public procurement team utilizes generative-AI language

learning models to draw from our expansive library of content to seamlessly automate draft documents which can be enhanced with data from our simulation tools.

•Experienced team with deep government expertise: From the White House to running major metropolitan transit agencies, our sales, consulting, and public procurement teams represent some of the world’s preeminent experience in consulting, transit planning, and government. We look for candidates with the ability to collaborate with our customers in tailoring the right combination of modules on our platform to create a bespoke solution to meet their unique needs. We value individuals who prioritize selling the “right” solution, not just any solution.

•Sophisticated sales and public procurement teams: We have structured our sales efforts through two go-to-market strategies: direct sales and public procurements. Our direct sales team manages our sales efforts from opportunity creation to contract signing, working collaboratively with multiple teams to onboard new customers and expand with our existing customers as their needs evolve and their scope of Via solutions grows. Our public procurement efforts are led by our business development team, which focuses on writing responses to RFPs. Our sales motion coordinates between several key teams including our direct salesforce, business development, strategy, marketing, customer success, expansion, and consulting.

Our Market Opportunity

The public transportation market is large and significantly underpenetrated by technology due to decades of underinvestment in software, siloed transit systems and operations, and sub-scale, fragmented solutions. In the United States alone, nearly 8 billion public transit trips occur annually. We believe many cities across the globe are poised to upgrade their transit infrastructure in the coming years, and digitization will be a crucial part of the strategy to modernize these networks.

We estimate the total addressable market for public transportation solution providers across all transit verticals in North America and Europe, our core markets, to be $250 billion, based on a report commissioned by us from a major consulting firm. Based on this report, when evaluating the global market, inclusive of Asia, Latin America and Africa, we estimate a $545 billion global opportunity, with expectations of consistent 5% annual market growth over the next five years, driven by increasing public transit investment per capita.

Our global market opportunity is measured utilizing a total addressable market (“TAM”) analysis that leverages a bottom up approach. The analysis calculates the estimated spend by transportation vertical and solution based on network size and estimated pricing. This was correlated with a top down approach that reviews publicly available data on public transit spending.

We estimate that our serviceable addressable market (“SAM”) in North America alone is a $38 billion opportunity, based on a report commissioned by us from a major consulting firm. SAM is calculated using the same methodology as described above, focusing on geographies core to our business including the United States, Canada, France, Germany, and the United Kingdom. The SAM analysis includes networks of traditional buses with less than 250 vehicle fleets, microtransit and paratransit (all fleet sizes), school buses to serve the special needs community, non-emergency medical transportation (all fleet sizes), and end-user technology centered around passenger apps which we define as mobility-as-a-service (“MaaS”). The SAM analysis excludes certain transportation verticals that are not fully addressed yet by our platform including large transportation systems over 250 vehicles and standard school bus operations. In Western Europe where public transit networks are highly developed and receive more significant annual investments, our SAM is estimated at $44 billion and mainly consists of solutions to extend transit to areas and hours not well-served by existing fixed-route networks (e.g., city suburbs, night hours) and drive fixed-route ridership by enabling first and last-mile connections. Combined, our total SAM across North America and Western Europe represents an $82 billion opportunity.

We have a history of expanding the addressable market of our platform through continuous innovation and the extension of our platform into larger networks. We estimate the total addressable

market for public transportation solution providers across all transit verticals in North America and Europe, our core markets, to be $250 billion, based on a report commissioned by us from a major consulting firm. This figure includes the networks in our SAM as well as bus networks of greater than 250 vehicle fleets, standard school buses, and end-user technologies centered around ticketing. In the near term, we intend to continue to grow our presence in Europe and in North America and eventually pursue our global TAM opportunity.

Our Value Proposition

Newfound Visibility and Improved Operational Efficiency for Cities

Our platform allows organizations to design, operate, and monitor their entire transit network through a single cloud-based interface; enhancing operational efficiency, automating workflows, and driving continuous optimization with real-time data insights.

•Digital Optimization of Networks: Customers can use our software to unify their fleets and optimize ride assignments across multiple transportation verticals. For example, vehicles that primarily serve a commuter use case during peak hours can easily be redeployed to serve paratransit trips during off-peak hours. This allows supply to be more efficiently matched to demand across the entire network, reducing the number of drivers and vehicles required to deliver the same, or improved, level of service. Network unification also allows for multi- and inter-modal trip planning, where passengers can be directed to the optimal mix across multiple modes of transport (e.g., existing fixed-route buses, metro services, and on-demand transport). In addition, our transit planning software allows our customers to easily plan their entire transportation network in one place, leveraging a wealth of data which our software has accumulated from billions of datapoints including ridership, origin-destination data, vehicle speeds data, and custom mapping data. This gives planners the ability to quantify the impact of changes to their network in a scalable and automated manner.

•Workflow Automation and Reduction of Operating Costs: Our software streamlines service management, allowing our customers’ booking and dispatch staff to perform most functions with a few clicks. It enables dispatchers to increase on-time performance with precise, real-time notifications and automated interventions that preempt delays and performance issues. For example, our software will automatically reassign a rider to an alternative vehicle if the original vehicle is unable to reach the pickup on time. This reduces the number of missed and delayed trips without any manual intervention. App and web booking and tracking reduces the number of customer support staff required to manage the booking process. Increased efficiencies derived from an integrated network covering multiple transportation verticals allow for savings in vehicle, driver, and fuel costs.

•Real-Time Decision-Making Tools and Analytics: Our software provides customers with real-time visibility into the performance of their operations. Easy-to-use operating applications enable dispatchers to preempt issues such as a delayed pick up or an unexpected extra passenger. Our platform also includes comprehensive reporting tools that generate insights into operational metrics and deployment performance. These reports highlight areas for improvement in the customer’s operations and enable the customer to seamlessly comply with regulatory and funding reporting requirements.

Enhanced Quality of Service for our Customers’ Passengers

Our platform provides numerous benefits to passengers such as improving access to transportation, delivering a more reliable transit experience, and introducing modern on-demand conveniences.

•Increased Access to Jobs, Healthcare, and Education: In the United States, 45% of Americans have no access to public transit, according to APTA. A typical job is only available to about 27% of its metropolitan workforce by fixed-route public transit in 90 minutes or less, according to the

U.S. DOT. The algorithms that power our software allow for any street corner to serve as a “virtual bus stop.” This gives customers the ability to replace or supplement static fixed-route transit with fully dynamic and on-demand shuttles. By filling the gaps in the fixed-route network, our platform creates a denser and wider grid without the need to add expensive and inefficient fixed-route infrastructure. This provides residents with greater flexibility and benefits previously underserved communities by increasing access to transit. For example, in Birmingham, AL, after launching our platform, nearly 80% more of the city’s jobs became accessible within a 30 minute commute by public transportation than with fixed-route transit alone.

•Reduced Trip Durations: Our software leverages real-time and historic traffic and speed data to dynamically optimize routing and trip allocation, allowing for multiple passengers to share a vehicle without adding lengthy detours and delays. Suffolk County Bus Corporation switched to our technology from a legacy solution to power their paratransit service across the 1,200 square miles off Suffolk County, New York. They were able to reduce trip durations for their passengers by nearly 30% immediately after implementing our solution.

•Flexible and Modern Booking and Payments: Our platform offers a range of fare payment options including credit cards, cash cards, digital wallets (e.g., Apple Pay, Google Pay and PayPal) and vouchers, while maintaining the option for onboard payments with cash and integrations with local transit passes. Our rider apps and web-booking portals allow passengers to book pre-scheduled and same-day rides, track their vehicles and journeys in real time, pay for rides, troubleshoot any issues that may arise and submit feedback. Our platform also supports phone bookings in multiple languages for passengers who are unable to book using an app.

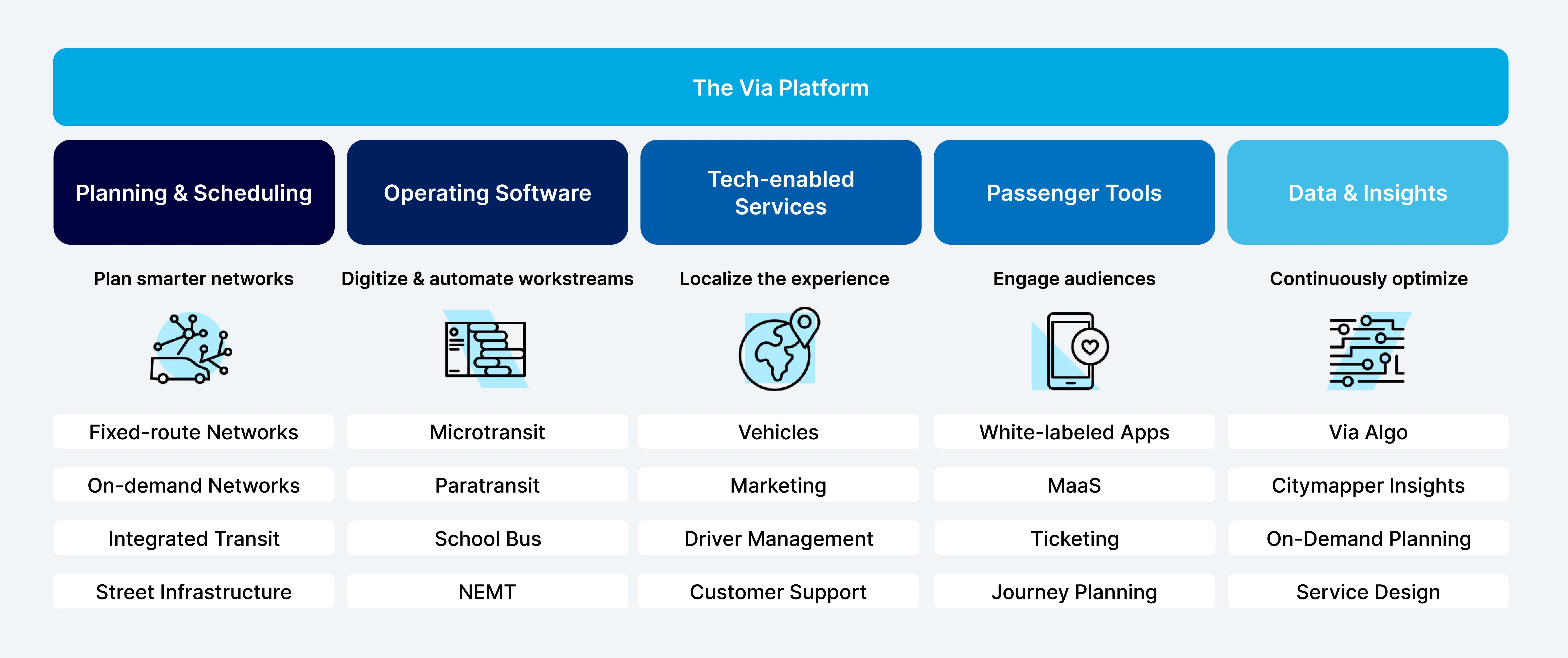

The Via Platform

Via’s modular platform transforms global transportation systems into efficient digital networks. Our vertically integrated platform is designed to comprehensively address key workflows for the end-to-end management of transit networks. This includes planning and scheduling, operating software, tech-enabled services, passenger tools, and data and insights.

Our platform:

•Helps to design and plan better transit systems and street networks;

•Serves as the daily workflow management system for our customers’ operations;

•Unifies the operational network for our customers across their vehicles, drivers and passengers, regardless of transportation vertical;

•Generates deep data insights communicated in a clear and digestible format that enables our customers to continuously optimize and report their performance; and

•Eliminates the need for costly on-premise solutions by offering a cloud-based platform.

Planning and Scheduling

Our transit planning and scheduling software allows transportation planners to build more livable cities by considering transit demands, street design, and public mobility across all modes of transit. It’s a one-stop shop where cities can leverage millions of data points to simulate and rapidly quantify the impact of changes to their network: from microtransit, to bus routes, to bike lanes.

Operating Software

Our operating software is designed to manage every aspect of our customer’s daily workflows as they manage their transit networks. The Via Operations Console provides sophisticated automations that minimize the amount of manual intervention necessary by dispatchers.

Technology-Enabled Services

Many of our customers require additional support in order to adopt modern technology. As a critical part of our go-to-market strategy, we have embedded into our platform a suite of vertically integrated services that complements our powerful software. Customers can opt to include these services on an à la carte basis or as a full turnkey solution.

Passenger Tools

We provide a host of consumer-grade applications to allow passengers to seamlessly plan, book, and pay for their end-to-end transit journeys. Our customers can select from a choice of passenger facing tools depending on their needs.

Data and Insights

The Via platform is designed to allow for the continuous optimization of operational performance. Where formerly siloed, customers can now in real-time compare performance across their vendors, drivers, vehicles, and other key variables. Our algorithms leverage ML to ingest learnings from hundreds of millions of data points and continuously improve system efficiency and the overall customer and rider experience, automatically becoming smarter over time.

Our Competitive Advantage

Our Vertical Software Breaks Down Operational Silos and Drives Network Efficiencies

We believe that we are the only company in our industry that has developed an end-to-end and easily configurable cloud-based and vertically integrated software solution.

Our Highly Modular Platform Meets the Needs of our Diverse Customer Base

We offer a customer-centric highly adaptable business model that combines software with technology-enabled services providing a bespoke solution for any sized city, transit agency, or organization, domestic or international.

Our Data Advantage Generates Actionable Insights for Customers

We have spent more than a decade cultivating billions of data points from the hundreds of millions of trips powered on our platform to drive the ML and AI that powers our software. This allows our algorithms to become smarter over time; planning better, routing more efficiently, automating more tasks, and offering better predictive modeling to generate suggestions for efficiency. This creates a flywheel effect for our customers as the cost savings generated from running more efficient operations allows them to invest in further service expansions or enhancements to serve more passengers.

Our Government Domain Expertise and High Specialized Go-to-Market Strategy

Our sales efforts are centered around selling subscriptions to our platform directly through a sales force with expertise in government sales and public procurements. We believe that our ability to understand and sell efficiently to our unique set of customers is a key driver of our rapid growth.

Our Brand Recognition and Reputation has Established Us as the Category Leader

With hundreds of government customers, we believe that our brand recognition and reputation has created broad awareness of us and our platform amongst our prospective customers. We anticipate that we will be able to leverage our position as the category leader to accelerate the growth of this emerging category.

Our Expert and Mission-Driven Team is Highly Specialized in Building for Governments

We are committed to building and nurturing an outstanding team of employees that reflects the best expertise in their fields. We pride ourselves on our culture which values exceptionalism, collaboration, optimism, diversity, and a commitment to our mission. Our management team represents a wealth of experience across business, financial, and government sectors.

We Serve as the Conduit to Connect Autonomous Vehicles to Public Transportation Networks

Our software has been designed to effectively allow autonomous fleets to be deployed as part of public transit networks while supporting the unique requirements of government customers. As autonomous vehicles become more widely accepted, reliable, and cost effective, we believe we are poised to grow off of our early success, as we have already begun piloting the deployment of autonomous vehicles as part of public transportation fleets for dozens of our customers around the globe.

Our Growth Strategies

Winning New Customers

We believe that our platform can be adapted to meet the needs of any city or government agency in charge of public transportation networks around the world. Our customer count grew from 597 as of December 31, 2023 to 689 as of June 30, 2025.

Growing our Existing Customer Relationships

Our ability to expand our relationships with our customers is often driven by the operational success and economic impact of our solutions. We estimate that we capture less than 1% of our SAM in our two core geographies, North America and Western Europe, leaving significant room for growth. While we initially focus on acquiring new customers with one solution (most often planning or microtransit), we rapidly work to grow our relationships with our customers by expanding the scale of our contracts (through volume usage), upselling to new solutions or transportation verticals (such as paratransit, scheduling, or school transport), and introducing new modules (such as tech-enabled services, passenger apps, service design consulting, or data and insights).

Expanding Internationally

We have primarily focused our sales efforts on North America and Europe, and have initiated sales efforts in the Middle East, Australia, New Zealand, Japan, and Latin America. For the year ended December 31, 2024 and the six months ended June 30, 2025, we generated approximately 70% of our revenue from our customers in North America, however, public transportation is a global market and we plan to invest significantly in our sales efforts and marketing programs to grow new geographies across the globe.

Entering New Verticals

Our platform creates a unified digital infrastructure for cities, government agencies, universities and corporations. We have a strong track record of successfully launching new solutions both organically and through acquisitions. For example, paratransit and school transport solutions were added organically to the platform, while our planning and MaaS and insights solutions were added through the Remix and Citymapper acquisitions, respectively. Our long-term success will be driven in part by our ability to expand into new verticals and continue to digitize legacy government systems. We firmly believe that cutting-edge technology will help create more efficient cities and evolve to encompass all aspects of transportation systems and cities’ infrastructure. Therefore, we will continue to invest in research and development and sales and marketing to address new verticals and support our mission.

Continuing to Invest in Innovation

As pioneers of dynamic transit, we have a long history of product innovation. We plan to continue to invest in new products and features to enhance the capabilities of our platform and maintain our competitive advantage.

Evaluating Acquisitions in a Fragmented Market

Our competitive landscape is highly fragmented and siloed with large, legacy players lacking in product and technology expertise and numerous technology point solutions which are vertically focused and not operating at significant scale. Because of this, acquisition or strategic partnership opportunities may arise. Acquisitions, such as Remix and Citymapper, have proven to help enhance our platform, expand our geographical reach, and accelerate our market penetration.

Summary Risk Factors

Our business is subject to a number of risks and uncertainties, as more fully described under “Risk Factors” in this prospectus. These risks could materially and adversely impact our business, financial condition, and results of operations, which could cause the trading price of our Class A common stock to decline and could result in a loss of all or part of your investment. Some of these risks include:

•we have a history of net losses and we may not be able to achieve or maintain profitability in the future;

•our rapid growth and financial performance in recent periods may not be indicative of future performance, and if we fail to grow at the rate we currently expect, we may not be able to achieve and maintain profitability;

•a significant portion of our business depends on contracting with government entities and other heavily regulated organizations, and we face a number of challenges and risks unique to such business;

•increases in the cost of fuel, vehicle supply and labor related to inflation or other operational factors could adversely affect our business, financial condition, and results of operations;

•natural disasters, public health crises, economic downturns, or other unexpected geopolitical events could adversely affect our business, financial condition, and results of operations;

•we are subject to a wide range of laws and regulations, many of which are constantly evolving;

•changes in domestic and international laws or regulations relating to data privacy, data security, data protection, or the collection, use, protection, disclosure, or transfer of personal data, or any failure by us to comply with such laws and regulations could adversely affect our business;

•we face risks related to protection of our intellectual property and cybersecurity threats;

•we may fail to accurately predict the rate of customer contract renewals or the long-term revenue from our customer contracts;

•our industry is highly competitive and we face pressure from existing and new companies;

•if we are unable to successfully develop and deploy new software and technology applications and features for our platform (including those incorporating the latest advances in artificial intelligence (“AI”)), we may fail to retain and attract customers;

•conditions in Israel, including Israel’s conflicts with Hamas, Iran and other parties in the region, as well as ongoing political and economic instability, may adversely affect our engineering

operations and our research and development efforts, which could lead to a decrease in revenues or increase in operating expenses; and

•issues raised by the incorporation of AI (including large language models and machine learning (“ML”)) into our platform and business may result in reputational harm or liability.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

•we are only required to include two years of audited consolidated financial statements in this prospectus, in addition to any required interim financial statements, and are only required to provide reduced disclosure in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”;

•we are not required to engage an auditor to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”);

•we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes”; and

•we are not required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to our median employee compensation.

We may take advantage of these provisions until the last day of the fiscal year following the fifth anniversary of the completion of this offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest of (a) the last day of the first fiscal year in which our annual gross revenue is $1.235 billion or more, (b) the date on which we have, during the previous rolling three-year period, issued more than $1.0 billion in non-convertible debt securities, and (c) the last day of the fiscal year in which the market value of our Class A common stock held by non-affiliates exceeded $700 million as of June 30 of such fiscal year.

Under the JOBS Act, emerging growth companies also can delay adopting new or revised accounting standards until such time as those standards would otherwise apply to private companies. We currently intend to take advantage of this exemption.

For risks related to our status as an emerging growth company, see “Risk Factors—Risks Relating to this Offering and Ownership of our Class A Common Stock—We qualify as an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies.”

Corporate Information

We were incorporated in the State of Delaware on May 29, 2012. Our principal executive offices are located at 114 5th Ave, 17th Floor, New York, NY 10011. Our telephone number is (917) 877-0915 and our website address is www.ridewithvia.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus; we have included this website address solely as an inactive textual reference.

Channels for Disclosure of Information

Following the closing of this offering, we intend to announce material information to the public through filings with the SEC, the investor relations page on our website (www.ridewithvia.com), press releases, public conference calls, and public webcasts.

Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

THE OFFERING

| | | | | | | | |

| Class A common stock offered by us | | shares |

Class A common stock offered by the selling stockholders | | shares |

| | |

Option to purchase additional shares of Class A common stock from us | | The underwriters have an option to purchase up to an aggregate of additional shares of Class A common stock from us at the initial public offering price, less the underwriting discounts and commissions. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. See “Underwriting.” |

| | |

| Class A common stock to be outstanding upon the completion of this offering | | shares (or shares if the underwriters exercise their option to purchase additional shares of Class A common stock from us in full). |

| | |

| Class B common stock to be outstanding upon the completion of this offering | | shares |

| | |

| Class C common stock to be outstanding upon the completion of this offering | | None |

| | |

Total Class A common stock, Class B common stock, and Class C common stock to be outstanding upon the completion of this offering | | shares (or shares if the underwriters exercise their option to purchase additional shares of Class A common stock from us in full). |

| | |

| Voting and conversion rights | | We have three classes of authorized common stock: Class A common stock, Class B common stock, and Class C common stock. The rights of holders of Class A common stock, Class B common stock, and Class C common stock are identical, except with respect to voting, conversion, and transfer rights. Each share of Class A common stock entitles the holder to one vote. Each share of Class B common stock entitles the holder to 10 votes and is convertible, at the option of the holder, into one share of Class A common stock. Upon completion of this offering, all shares of Class B common stock will be held by our Chairman and Chief Executive Officer, Daniel Ramot, and the Ramot Trust, and Mr. Ramot will hold or have the ability to direct the voting of shares representing approximately % of the voting power of our outstanding capital stock, |

| | | | | | | | |

| | which voting power may increase over time as certain equity awards held by Mr. Ramot vest and are exercised for or settled into shares of Class A common stock and exchanged for shares of Class B common stock. If all such equity awards held by Mr. Ramot had been vested, exercised or settled, and exchanged for shares of Class B common stock as of the date of the completion of this offering, Mr. Ramot would hold or have the ability to direct the voting of shares representing approximately % of the voting power of our outstanding capital stock. See “Principal and Selling Stockholders” and “Description of Capital Stock—Common Stock—Voting Rights.” All shares of Class B common stock will convert automatically into shares of Class A common stock on the earliest to occur of (1) the 15 year anniversary of the date of the completion of this offering, (2) the date fixed by our board of directors that is no less than 61 days and no more than 180 days following the date of the death or disability of Mr. Ramot, (3) the date fixed by our board of directors that is no less than 61 days and no more than 180 days following the date that the number of shares of Class B common stock or securities convertible into or exchangeable for Class B common stock represents less than 65% of the number of such shares or securities immediately following the completion of this offering or (4) the date fixed by our board of directors that is no less than 61 days and no more than 180 days following the date that Mr. Ramot is no longer providing services to us as an officer, employee, director or consultant for a continuous period of more than 90 days (the “Final Conversion Date”). Each share of Class C common stock entitles the holder to no voting rights and will convert into one share of Class A common stock following the conversion of all outstanding shares of Class B common stock into shares of Class A common stock. |

| | |

| Use of proceeds | | We estimate that the net proceeds to us from the sale of the shares of our Class A common stock in this offering will be approximately $ (or approximately $ if the underwriters exercise their option to purchase additional shares of Class A common stock from us in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders. |

| | |

| | | | | | | | |

| | The principal purpose of this offering is to increase our capitalization and financial flexibility and facilitate an orderly distribution of shares for the selling stockholders. We intend to use the net proceeds that we receive from this offering for general corporate purposes, including operating expenses, sales and marketing, working capital, research and development for the continued development and extension of our platform, expansion into additional geographic markets and capital expenditures. We may also use a portion of the proceeds to acquire or invest in businesses, products, services, strategic partnerships, and technologies; however, we do not have agreements or commitments for any material acquisitions or investments at this time. See “Use of Proceeds.” |

| | |

| Dividend policy | | We have never declared or paid any dividends on any class of our common stock. We do not currently anticipate paying dividends on our Class A common stock, Class B common stock, or Class C common stock. Any declaration and payment of future dividends to holders of our Class A common stock, Class B common stock, or Class C common stock will be at the sole discretion of our board of directors and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends, and other considerations that our board of directors deems relevant. In addition, the terms of our Credit Agreement (as defined below) currently limit our ability to pay dividends and future agreements governing our indebtedness may similarly limit our ability to pay dividends. See “Dividend Policy.” |

| | |

| Listing | | We have applied to list our Class A common stock on NYSE under the symbol “VIA.” |

| | |

| Risk factors | | See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

Unless otherwise indicated or the context otherwise requires, the number of shares of our Class A common stock, Class B common stock, and Class C common stock to be outstanding after completion of this offering is based on shares of our Class A common stock outstanding, shares of our Class B common stock outstanding, and no shares of our Class C common stock outstanding as of June 30, 2025, which excludes:

•an aggregate of shares of Class A common stock issuable upon exercise of stock options outstanding under our 2012 Equity Incentive Plan and our 2018 Equity Incentive Plan (together, the “Current Equity Plans”) as of June 30, 2025 and held by individuals other than our Chairman and Chief Executive Officer at a weighted average exercise price of $ per share (after giving effect to the Option Exercise);

•an aggregate of shares of Class A common stock issuable upon the exercise of stock options outstanding under our Current Equity Plans as of June 30, 2025 and held by our Chairman and Chief Executive Officer at a weighted average exercise price of $ per share, and an aggregate of shares of Class B common stock issuable pursuant to the Equity Award Exchange Agreement (as defined below) upon the exchange of such shares of Class A common stock;

•2,051,945 shares of Class A common stock issuable in connection with the settlement of the CEO Stock Price Award (as defined under “Executive and Director Compensation—CEO Stock Price Award”);

•an aggregate of shares of Class A common stock issuable in connection with the settlement of the CFO Stock Price Award (as defined under “Executive and Director Compensation—CFO Stock Price Award”), based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus;

•362,108 shares of Class A common stock issuable in connection with the settlement of the CEO Service Award (as defined under “Executive and Director Compensation—CEO Service Award”), and 362,108 shares of Class B common stock issuable pursuant to the Equity Award Exchange Agreement upon the exchange of such shares of Class A common stock;

•an aggregate of shares of Class A common stock issuable in connection with the settlement of the Executive Service Awards (as defined under “Executive and Director Compensation—Executive Service Awards”), based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus; and

•an aggregate of 7,263,418 shares of Class A common stock reserved for future issuance under the Via Transportation, Inc. 2025 Omnibus Incentive Plan (the "2025 Omnibus Incentive Plan") (which number includes the CEO Stock Price Award, the CFO Stock Price Award, the CEO Service Award and the Executive Service Awards and excludes any potential future increases pursuant to the terms of the 2025 Omnibus Incentive Plan), which will become effective immediately prior to the effectiveness of the registration statement of which this prospectus forms a part.

The 2025 Omnibus Incentive Plan also provides for automatic annual increases in the number of shares of our Class A common stock reserved thereunder, as more fully described in “Executive and Director Compensation—2025 Omnibus Incentive Plan.”

Following the completion of this offering, and pursuant to an equity award exchange agreement (the “Equity Award Exchange Agreement”) to be entered into between us and Daniel Ramot, our Chairman and Chief Executive Officer, Mr. Ramot shall have a right (but not an obligation) to exchange any shares of Class A common stock received by him upon the exercise of options or the settlement of restricted stock units (“RSUs”) for an equivalent number of shares of Class B common stock. This right applies only to shares of Class A common stock received by Mr. Ramot upon the exercise of options that were outstanding immediately prior to the completion of this offering or the settlement of RSUs that were granted pursuant to the CEO Service Award. This right does not apply to shares of Class A common stock received by Mr. Ramot upon settlement of stock price-based restricted stock units (“PSUs”) that were granted pursuant to the CEO Stock Price Award. See “Executive and Director Compensation” and “Certain Relationships and Related Party Transactions.”

Unless otherwise indicated or the context otherwise requires, all information in this prospectus assumes or gives effect to:

•the conversion of all of our outstanding Series A preferred stock, Series B preferred stock, Series C preferred stock, Series D preferred stock, Series E preferred stock, Series F preferred

stock, Series G preferred stock and Series G-1 preferred stock into shares of our Class A common stock (the “Existing Preferred Stock Conversion”), which will take place immediately prior to the completion of this offering;

•the conversion of $50.0 million in aggregate principal amount of convertible notes (the “Convertible Notes”) into shares of our Class A common stock (the “Note Conversion”), based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, which will take place immediately prior to the completion of this offering;

•the exercise of stock options to purchase shares of our Class A common stock at a weighted average exercise price of $ per share for total gross proceeds to us of approximately $ by certain selling stockholders set forth in “Principal and Selling Stockholders” in connection with the sale of all or a portion of such shares by such selling stockholders in this offering (the “Option Exercise”);

•the reclassification of all shares of common stock into shares of Class A common stock (the “Share Reclassification”), which will take place immediately prior to the completion of this offering;

•the exchange by Daniel Ramot and the Ramot Trust of shares of Class A common stock for an equivalent number of shares of our Class B common stock (the “Founder Share Exchange”), which will take place immediately prior to the completion of this offering pursuant to the terms of an exchange agreement between us, Mr. Ramot and the Ramot Trust (the “Founder Share Exchange Agreement”);

•no exercise of the outstanding stock options described above, except for the Option Exercise;

•no settlement of the RSUs or PSUs described above;

•an initial public offering price of $ per share of Class A common stock, which is the midpoint of the price range set forth on the cover page of this prospectus;

•no exercise by the underwriters of their option to purchase up to an additional shares of our Class A common stock from us; and

•the filing and effectiveness of our amended and restated certificate of incorporation (our “New Charter”) and the adoption and effectiveness of our amended and restated bylaws (our “New Bylaws”), each of which will occur immediately prior to the completion of this offering.