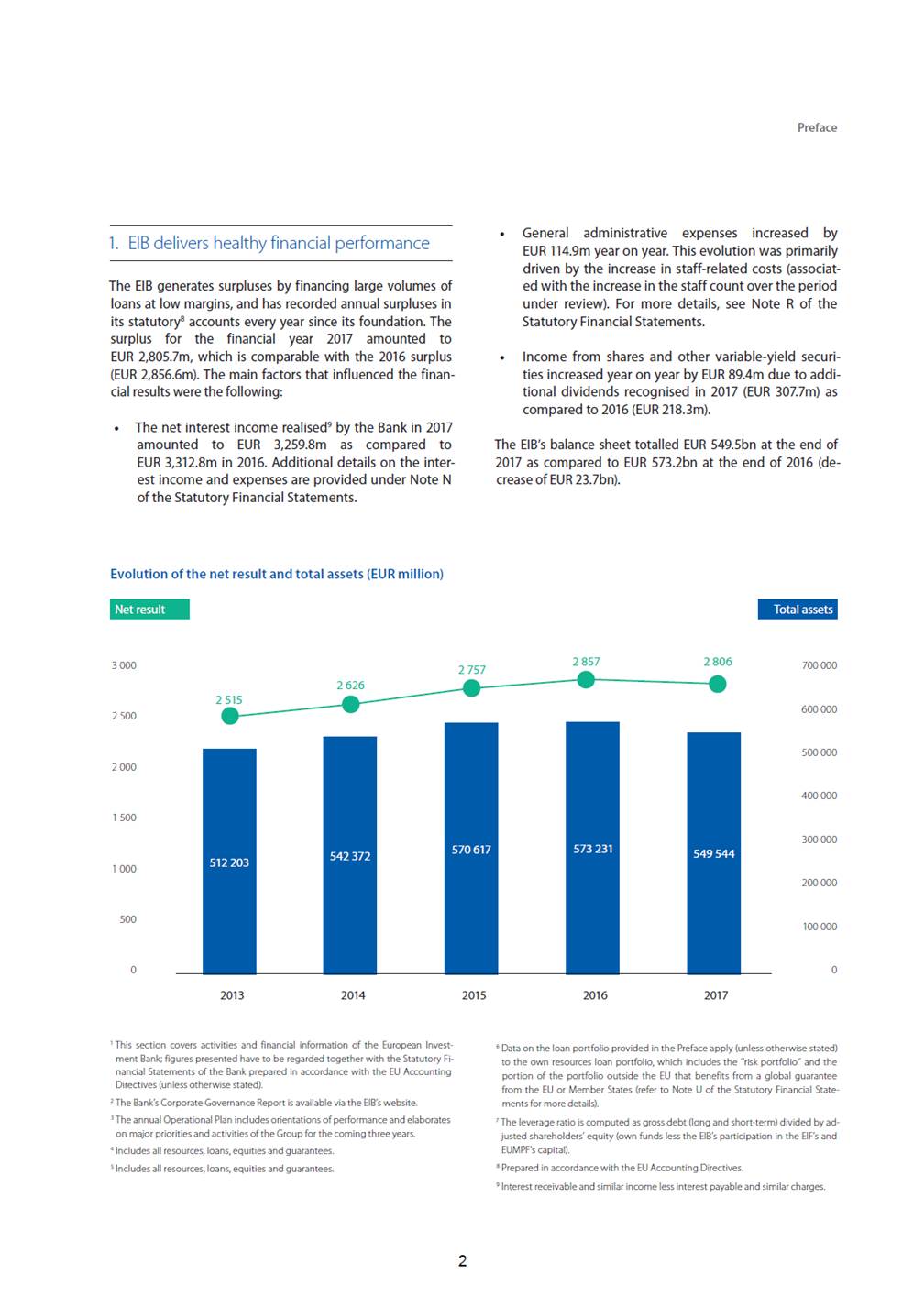

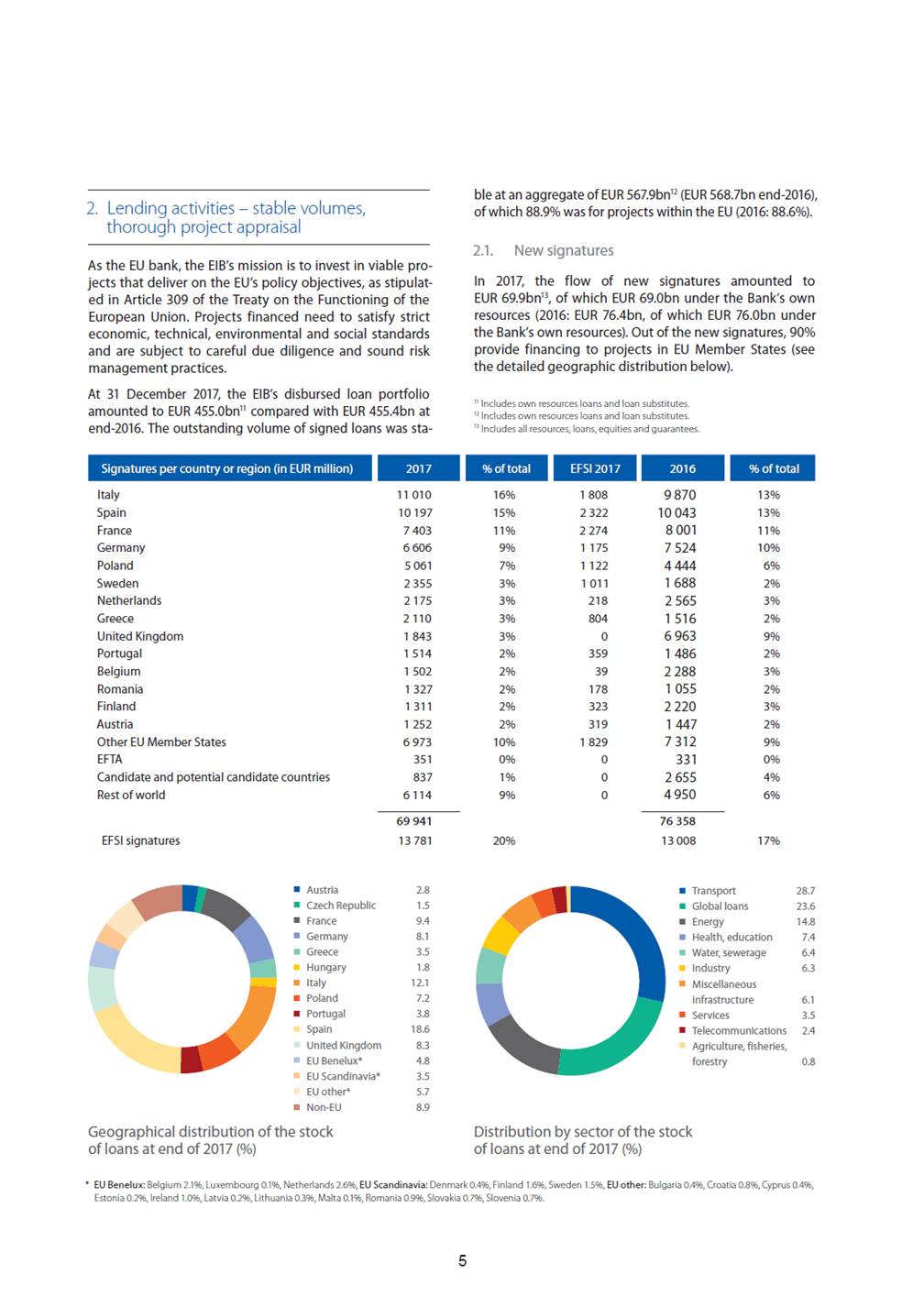

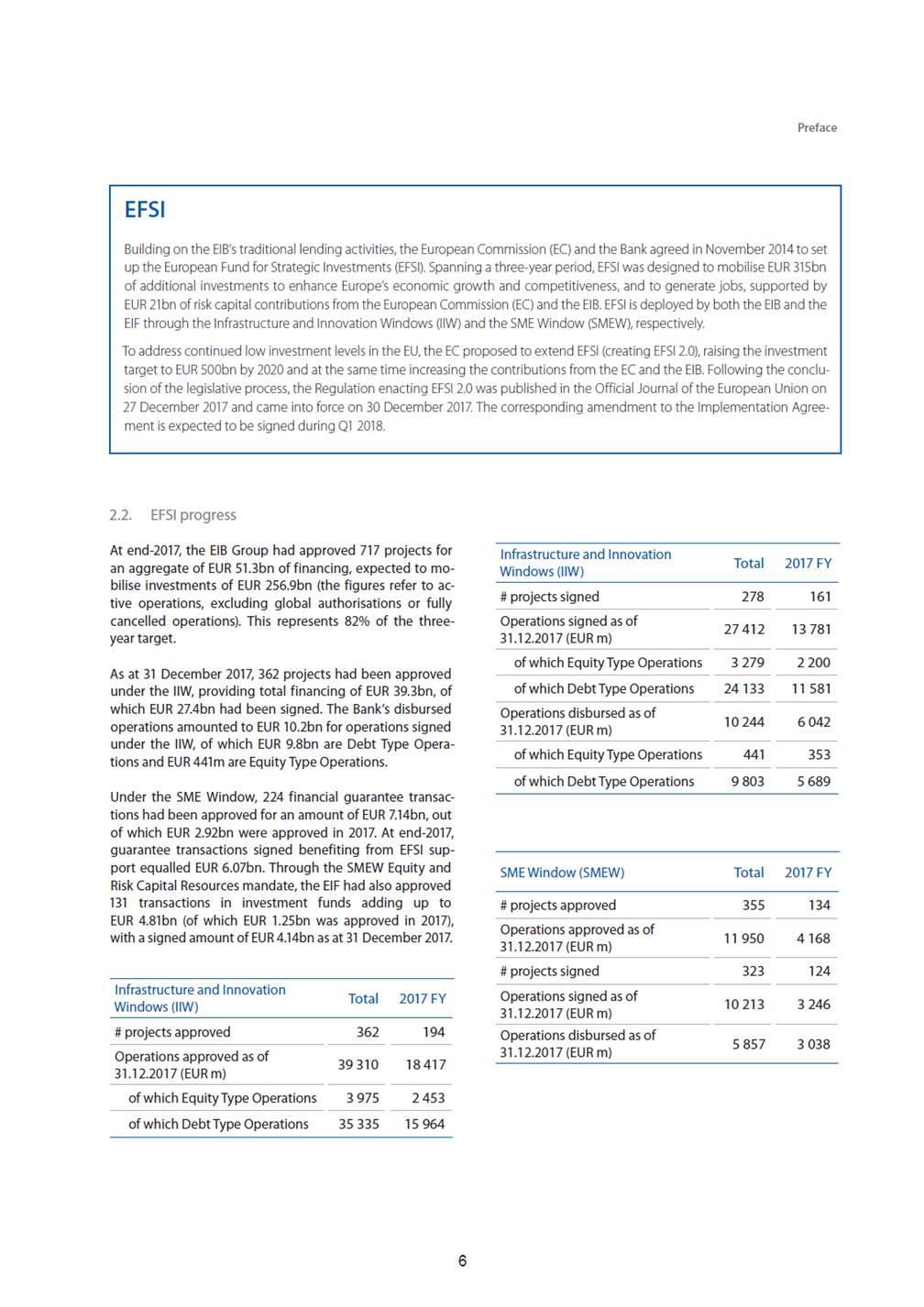

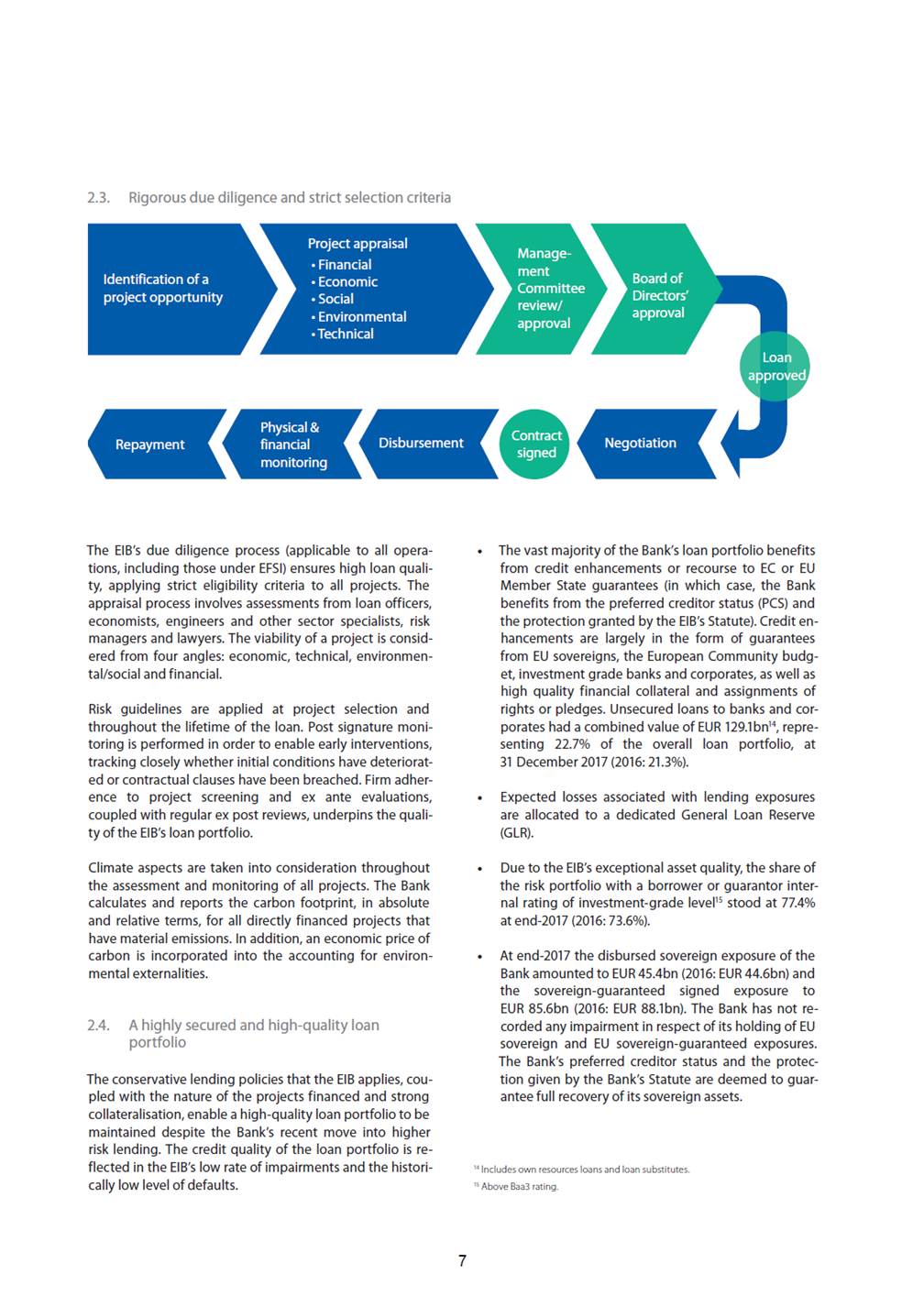

EXHIBIT I Preface Highlights of developments in 20171 The EIB generated healthy financial results in 2017, record-ing an annual net surplus of EUR 2.81bn, roughly in line with the previous year (EUR 2.86bn in 2016). The net result is fully retained, contributing to the Bank’s own funds in support of its long-term financing capacity. This increase in own funds more than offsets a slight increase in RWA, re-sulting in an overall increase in the CET1 ratio to 28.5% from 26.4% the previous year. The leverage ratio7 similarly displayed an improving trend, reducing to 667% in 2017 (742% in 2016) due primarily to the increase of own funds and the appreciation of the euro. Overview In 2017 the EIB successfully achieved its objectives, imple-menting EU policy in line with its mission2 and as detailed in its Operational Plan3. The Bank’s lending signatures for the year amounted to EUR 69.9bn4 (out of which EUR 69.0bn under the Bank’s own resources) and total dis-bursements reached EUR 58.4bn5 (out of which EUR 57.9bn under the Bank’s own resources). While the overall vol-umes are slightly lower than in 2016 (EUR 76.4bn signed out of which EUR 76.0bn under the Bank’s own resources; EUR 60.4bn disbursed out of which EUR 59.5bn under the Bank’s own resources), they are within the 10% flexibility margin foreseen in the Operational Plan. The 2017 funding programme was completed as planned, taking into account the prefunding of end-2016. In 2017 the EIB raised EUR 56.4bn in the international capital mar-kets to finance lending activities and other cashflow needs. The total of borrowings and commercial paper amounted to EUR 449.6bn at end-2017, compared to EUR 470.9bn at end-2016, representing a decrease of EUR 21.3bn or 4.5%. The quality of the Bank’s loan portfolio remains remarkably high, despite increased lending in higher risk projects due to the EIB’s role in the European Fund for Strategic Invest-ments (EFSI). The overall loan portfolio6 remained stable, with only 0.3% impaired at end-2017 (0.3% end-2016). The portion of payments overdue by more than 90 days re-mains very low, totalling EUR 180.0m at end-2017 (EUR 89.6m end-2016) and representing only 0.04% of the risk portfolio. Specific provisions on loans decreased to EUR 463.3m from EUR 538.7m at end-2016. Rigorous risk management policies and thorough project due diligence underpin the Bank’s credit standing. The Bank has a prudent approach to liquidity management, focusing on liquid and very high quality investments. Treas-ury assets amounted to EUR 72.1bn at the end of 2017 (EUR 83.5bn in 2016). The Bank’s liquidity ratios remain well within limits, covering 74% of 2018 projected net cash out-flows (compared to 75% in 2016). Importantly, the EIB’s access to the Eurosystem’s refinancing facility provides additional protection in circumstances of extreme liquidity distress. 1