UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2022

NOYACK LOGISTICS INCOME REIT II, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 024-11850

Maryland |

87-4640183 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

2 Blue Slip, Suite 7J Brooklyn,

New York |

11222 | |

| (Address of principal executive offices) | (Zip Code) |

(813)

438-6452

Registrant’s telephone number, including area code

Common

Stock

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

Part II.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report on Form 1-K (“Annual Report”) that are forward-looking statements within the meaning of the federal securities laws. The words “outlook,” “believe,” “estimate,” “potential,” “projected,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “could” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| ● | the uncertainty and economic impacts of pandemics, epidemics or other health emergencies or the fear of such events, such as the renewal of COVID-19 outbreak; | |

| ● | the competitive environment in which we operate; | |

| ● | real estate risks, including fluctuations in real estate values and the general economic climate in local markets and competition for transactions in such markets; | |

| ● | decreased rental rates or increased vacancy rates and potential defaults on or non-renewal of leases by tenants; | |

| ● | the impact of our structure on our financial condition and results of operations; | |

| ● | acquisition risks, including failure of such acquisitions to perform in accordance with projections; | |

| ● | our ability to retain and hire necessary employees and appropriately staff our operations; | |

| ● | our financial condition; | |

| ● | legislative or regulatory changes impacting our business or our assets (including changes in the Securities and Exchange Commission (“SEC”) guidance related to Regulation A (“Regulation A”) of the Securities Act of 1933, as amended (the “Securities Act”), or the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”)); | |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; | |

| ● | any necessary compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940, as amended (the “Advisers Act”), the Investment Company Act and other laws; and | |

| ● | changes to U.S. generally accepted accounting principles (“U.S. GAAP”). |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

| 1 |

| Item 1. | Business |

General

Noyack Logistics Income REIT II, Inc. (“NLI REIT II” or the “Company”), a recently formed Maryland corporation, focuses, either directly or through special purpose entities or joint ventures with other entities, including affiliates of the Company, on the acquisition, renovation, leasing and management of a diversified portfolio of commercial real estate properties that encompass the supply chain and logistics infrastructure of North America, including dry warehouses, cold storage warehouses, life science buildings and structured parking garages (collectively, the “Properties”).

NLI REIT II intends to qualify as a real estate investment trust, or REIT, commencing with its taxable year ending December 31, 2023, and is structured as an umbrella partnership REIT, commonly called an “UPREIT.” As an UPREIT, NLI REIT II will own substantially all of its assets and conduct substantially all of its operations through NL REIT II OP, LP, its Operating Partnership. NLI REIT II, as the sole general partner of the Operating Partnership, has exclusive control over the Operating Partnership. NLI REIT II is externally managed, meaning its day-to-day operations are managed by its external manager, Noyack Capital LLC.

NLI REIT II’s Logistics and Infrastructure Targets

Mobility Hubs: Defining a Space in the New Mobility Ecosystem

For decades, the US parking market has been relatively stable, but we believe the parking space, which hasn’t changed since the dawn of the automobile, will be fundamentally redefined in the next ten years due to emerging trends in mobility, connectivity and commerce. NLI REIT II plans to pioneer this change by pursuing value-add opportunities to repurpose structured parking for the future of mobility.

NLI REIT II’s investment strategy is to acquire large structures in great locations. These assets will provide material downside protection, assuring preservation of capital, while simultaneously maximizing opportunities to pursue new revenue sources due to their central location.

NLI REIT II does not expect the advent of autonomous vehicles to remake the parking industry overnight, but the technology is arriving sooner than most traditional operators appreciate. NLI REIT II’s thesis is that the future of mobility will increase the terminal value of structured parking, creating a favorable exit environment within NLI REIT II’s operating lifetime.

Attractive Cap Rates Relative to Other Asset Classes

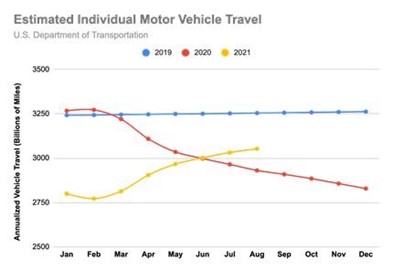

Many parking facility operators are still suffering the adverse economic impact from the pandemic. Parking demand fell by as much as 95% during the early days of the pandemic, according to SpotHero, and individual vehicle travel has yet to recover to 2019 levels. As a result, parking facilities are trading at attractive cap rates relative to other asset classes, 4.5 – 8%.1

By capitalizing on the once-in-a-lifetime convergence of technological disruption and underpriced assets, NLI REIT II intends to bring thought leadership to the parking industry.

1 Altus Group, “The Paved Paradise: Appraising a Parking Lot”; JLL, “Parking industry: strategic considerations for investors.”

| 2 |

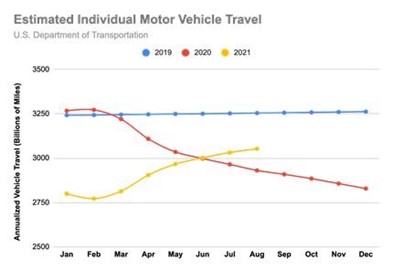

Optimal Occupancy Creates Space for Other Uses

Structured parking garages can maximize revenue at only 50% occupancy, according to a study conducted by researchers at UCLA2. This pricing dynamic creates space for additional uses such as autonomous car storage, electric vehicle charging, micro-fulfillment depots and even cloud kitchen facilities, all while preserving parking revenues.

Parking Garages can Maximize Revenue at Only 50% Occupancy (Pierce et al.):

Covered-Land Play

Structured parking has emerged as a compelling covered land play through conversion of existing infrastructure to other uses. For example, Jones Lang LaSalle recently provided $35 million in financing for the redevelopment of a parking structure into a Class-A, climate-controlled self-storage facility in New York City’s Flatiron District.3

2 Pierce et al. (2015). Optimizing the use of public garages: Pricing parking by demand. Transport Policy. 44. 89-95.

3 Real Estate Weekly, “Developer bags $35M to turn Flatiron lot into self-storage.”

| 3 |

Micro-Fulfillment & Distribution: Navigating the Transition from Parking Structure to Mobility Hub

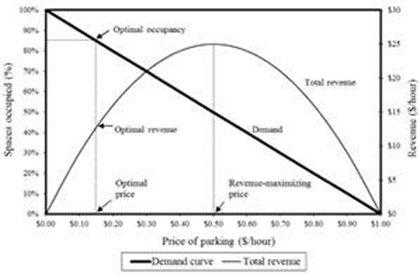

Over the past five years, digital commerce has grown 140% to a $2.4 trillion market opportunity, according to CBRE. Consumers now take it for granted that orders will arrive on their doorstep within 48 hours, but most fail to appreciate the revolution in the distribution of goods required to make two-day delivery possible. In a world where consumers no longer go to the goods, but the goods go to the consumers, who is really paying for delivery?

In traditional brick-and-mortar retail, consumers travel to a central location, e.g., a grocery store, and incur the full cost of last-mile transportation. The delivery model effectively transfers the cost of last-mile transportation from consumers to retailers because most people aren’t willing to pay for shipping. This dynamic creates an enormous economic incentive for retailers to channel distribution through a central Mobility Hub—where consumers’ cars are already sitting idle for multiple hours every day.

Through reduced shipping costs, decreased package theft, improved convenience, and minimized vehicle emissions, Mobility Hubs are a win–win–win for retailers, consumers and the environment.

The Advent of Autonomous: Autonomous Vehicles Will Revolutionize Not Only How We Drive, But Also How We Park

On August 24, 2021, Waymo began offering autonomous rides to the public in San Francisco. By 2040, more than half of the miles traveled in the United States could occur in shared autonomous vehicles, according to Deloitte.4

When Cars Park Themselves

Self-parking and self-summoning cars have the potential to drastically improve the driving experience by dropping drivers off directly at their location, eliminating the parking space search altogether and preventing fender-benders. For Mobility Hubs, self-parking cars are expected to more than double parkable space—and revenue—by eliminating the buffer on either side of the vehicle for opening doors.

While self-parking cars are a far cry from fully autonomous vehicles, the technology is already here thanks to Tesla’s Autopark feature. Within the next five years, we forecast that vehicle-to-infrastructure (V2I) software will become widely available to parking facility operators, enabling structures to communicate in real time with vehicles to convey dropoff and pickup information, direct self-parking vehicles to underutilized spaces such as those in the back of the structure, and provide charging as a value-added service. The seamless driver experience that mobility hubs will be able to deliver as a result of these advances will become a key point of differentiation and premiumization versus government-controlled on-street parking, which has historically been slow to adopt new technology.

Increased Structure Utilization

Ever since the rapid growth of ride-hailing services, conventional wisdom has been that Uber is killing the parking structure. Nevertheless, NLI REIT II is adopting a contrarian view. We believe ride-hailing services will become a significant tailwind for off-street parking, not a competitive threat, as Uber et al. will require robust infrastructure for fleet management to charge and maintain autonomous vehicles.

4 Deloitte, “Future of Mobility.”

| 4 |

Fleet management has potential to drastically increase off-peak structure utilization as Mobility Hubs provide office capacity during the day, short-term and event parking in the evening, and fleet management services when structures have historically remained nearly empty.

Dry Storage Industrial Buildings

Surging Demand for Industrial Properties

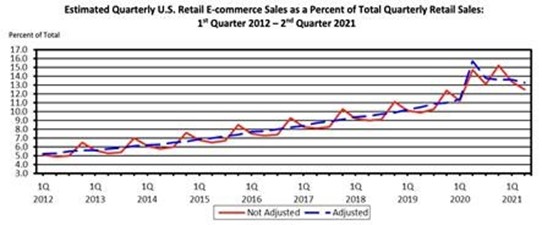

During the pandemic, e-commerce sales grew 39% year-over-year from the first quarter of 2020 to the first quarter of 2021, and the trend shows no sign of abating as e-commerce sales in the most recent quarter rose 9.3% from a year ago despite the explosion of activity during the early months of the pandemic.

Quarterly Retail E-Commerce Sales (U.S. Department of Commerce):

Industrial capacity to satisfy this surging demand for distribution and fulfillment centers simply doesn’t exist. As a result, industrial vacancy fell to 4.5% in the most recent quarter, tying the previous all-time low. Vacancy rates now sit 180 basis points below their 10-year historical average of 6.3% and rents have risen 5.4% to an average of $6.42psf, according to Cushman & Wakefield.5

Automation as a Value-Added Service

For retailers to continue to improve delivery times and inventory management to compete with Amazon, properties with installed technology and automation services will likely become critical to achieving operational efficiencies. Most retailers cannot afford to make these large capital investments and are fearful of straying from their core sales competency. By working in partnership with these businesses to build out automated improvements, NLI REIT II expects to build a differentiated portfolio of logistics assets while increasing property values.

Transitioning to Intermodal

The rapid reorganization of the consumer-packaged goods supply chain will be a boon for intermodal assets as the volume of deliveries and destinations proliferates with the increasing adoption of e-commerce as the primary mode of consumption.

Balance Sheet Flexibility for Distribution and Micro-Fulfillment Companies

In a recent interview, Steve Hornyak, Chief Commercial Officer at Fabric, an automated logistics startup, stated:

“When Amazon announces it’s providing free same-day deliveries of $1 items, that becomes the consumer expectation—and the faster the delivery, the more complicated and expensive it is,” he added. “Our aim is to enable all other retailers to stay relevant and competitive in this world that Amazon has created, providing the operational, strategic and financial infrastructure they need to meet consumer expectations profitably, sustainably and at scale in an on-demand world.”

5 Cushman & Wakefield, “Marketbeat U.S. National Industrial: Q2 2021.”

| 5 |

Hornyak’s interview underscores a key sourcing strategy NLI REIT II will pursue to acquire user-occupied dry storage assets by serving as channel partner to logistics companies expanding at breakneck speed to capture as much share as possible but who may lack the balance sheet flexibility to finance property acquisitions internally.

Climate-Controlled and Freezer (aka Cold Storage) Industrial Buildings

Smaller, Closer, Colder: The Big Bet on Micro-Fulfillment for Grocery Retail

Grocery E-commerce Market Penetration to Reach 22% by 2024

Grocery delivery has long lagged behind other product types due to the perishable nature and variable quality of goods, but the pandemic has drastically altered consumer behavior. According to the Food Industry Association, 49% of grocery shoppers purchased online at the height of the pandemic, 43% of who did so for the first time.6 UBS estimates that grocery e-commerce sales will reach 22% in 2024 from 4% 2019, continuing robust growth from 2020 when it was the fastest growing category in e-commerce.

Groceries have a massive addressable market of approximately $1 trillion, according to Cowen, meaning that even a 1% shift in the distribution channel represents a $10 billion sales opportunity.

Increased “Share of Stomach” Due to the Pandemic

Grocers substantially increased their “share of stomach” during 2020 due to widespread restaurant closures. But even with restaurants reopening, grocers are expected to maintain a higher share of consumption as work-from-home has shifted where consumers eat, driving up the demand for cold storage assets.

Robust Network Effects of Cold Storage Micro-Fulfillment

Grocers are aggressively pursuing e-commerce market share as there is a robust network effect and economies of scale around distribution and fulfillment. With the growing realization that despite robust sales grocery trips are only at 35% of pre-pandemic levels and unlikely to fully recover, grocers are pursuing micro-fulfillment out of existential concern.7 8 Given the large capital outlays required to build out a new distribution model, micro-fulfillment is only economically viable at scale when distribution costs are spread among the broadest possible customer base. This creates a winner-take-all dynamic that will edge out all but the very largest players and has spurred frenzied investment activity since the onset of the pandemic that is expected to continue throughout the current market cycle.

Transition from In-Store Pickup to Off-Premises Model

Given the lack of logistics assets in place to absorb excess demand from the rapid shift to e-commerce fulfillment, many grocers have relied upon in-store pickup to address their online sales channel, which reached 26% penetration as of the second quarter 2020 and is forecasted to grow to 35% by year end.8 9

NLI REIT II believes repurposing brick-and-mortar locations as pseudo-fulfillment centers has led to operational inefficiencies and a poor customer experience for traditional shoppers. As a result, we expect fulfillment to transition to an off-premises model as the supply of cold storage assets increases.

Sourcing Strategy

A key sourcing strategy for NLI REIT II will be to support regional grocers and mid-sized fulfillment companies as they expand by freeing up their balance sheets through sale-leasebacks of cold storage warehouses. NLI REIT II also plans to pursue properties with multiple users as we believe this market segment is underserved and offers greater yield potential because small- and medium-sized companies lack the capability, credit or desire for single-occupant solutions. Grocers are poorly suited to real estate management and lack the funds for expansion at scale due to the capital-intensive nature of cold storage facilities. Thus, NLI REIT II’s approach will be to support regional grocers and mid-sized fulfillment companies with efficient real estate solutions that will free up their balance sheets for potential future expansion. For example, Instacart recently announced its plan to open grocery fulfillment centers to meet the rising demand for online grocery.

6 The Food Industry Association, “U.S. Grocery Shopper Trends: The Impact of COVID-19.”

7 McKinsey & Co., “The state of grocery in North America.”

8 Winsight Grocery Business, “New Data Pegs Online Grocery Penetration Soaring Past 20%.”

| 6 |

Additionally, there is an interesting crossover effect between our structured parking facilities and cold storage initiatives. We expect significant value-add opportunities as we convert portions of large-structured parking garages we own and plan to acquire into on-demand cold storage fulfillment centers.

Healthcare & Life Sciences

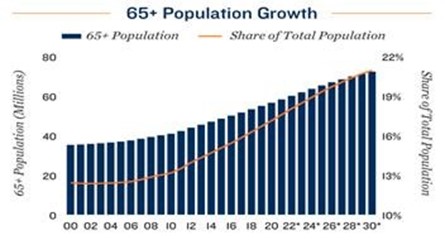

Strong 65+ Cohort Growth

As the fastest growing demographic in the country, seniors are expected to serve as strong secular tailwinds within healthcare and life sciences from now until 2040.

65+ Population Growth (Marcus & Millichap, 2021 Medical Office Outlook):

Low Vacancy Relative to Traditional Office

Medical office has compared favorably to traditional office during the pandemic. According to Colliers, vacancy rates for medical offices stood at 8.6% at the end of 2020, significantly below the 13.2% vacancy of the traditional office sector.

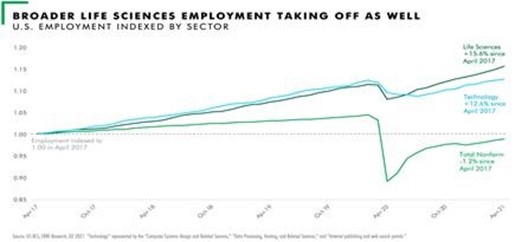

Robust Hiring & Capital Investment

Strong hiring and investor interest in life sciences have driven consistent demand for office and lab space. As a result, net absorption has outpaced supply for the past three years, according to CBRE.9

9 CBRE, “2021 U.S. Life Science Mid-Year Report.”

| 7 |

Drug Delivery Logistics

The low-temperature requirements of vaccines and biopharmaceuticals has created an opportunity for a niche, highly regulated, GMP-compliant, “cold chain” fulfillment solution within the healthcare and life sciences industries. Pharmaceutical cold-chain logistics accounted for 12% of total cold storage demand in 2020, according to Property Week. These assets tend to produce higher yields given the complexity, small scale and highly regulated nature of healthcare.

Simultaneously, companies such as DoorDash are pursuing delivery of pharmaceuticals with broader temperature delivery requirements that have lower barriers to entry but would still benefit from a purpose-built warehouse solution.

Sourcing and NOI Growth Strategy

NLI REIT II believes that healthcare and life sciences facilities will continue to divest their real estate holdings to bolster available cash, reduce debt and improve their credit ratings. Characteristic hospital real estate strategies could include: (i) the sale of non-strategic real estate holdings; (ii) the sale and leaseback of occupied or developed medical offices and/or outpatient facilities; (iii) the refinancing of hospital real estate assets; and (iv) the sale/leaseback of adjacent parking facilities. For these transactions, speed and ability to close is often more important than price, and NLI REIT II plans to aggressively pursue these opportunities.

Investment opportunities targeted by NLI REIT II are expected to include:

| 1. | Medical office buildings (MOBs) with strong positive cash flow that are undervalued due to (i) temporary market illiquidity; (ii) inefficient capital structure; (iii) poor management and/or leasing capabilities; (iv) ownership by capital-constrained developers that are pressured to sell or financial institutions which have time-sensitive disposition requirements; (v) deferred maintenance and required spending for upgrade; or (vi) a combination of any of the foregoing factors where a capital infusion, deleveraging, more aggressive management or redevelopment offers potential for improved performance and asset quality. NLI REIT II believes that today’s marketplace provides significant opportunities to inject redevelopment capital into such assets and create an investment at or below replacement cost. | |

| 2. | Acquisition and management of hospital-owned parking structures. | |

| 3. | Sale/leaseback of existing MOBs and ambulatory care facilities with a creditworthy hospital or healthcare provider as the anchor tenant |

NLI REIT II’S Use of Data and Potential for Artificial Intelligence is Unique in Commercial Real Estate

NOYACK MarketQuotient™

NOYACK MarketQuotient™ (NMQ) is our proprietary underwriting methodology to identify the top acquisition markets for all our asset classes using a large multitude of data points organized in our algorithm. Our analysts focus on the future demand of high growth cities and areas across North America by tracking traffic data and municipal parking revenue per capita. Target markets are continuously ranked utilizing our constantly updating NOYACK MarketQuotient™. A data-intensive approach to prospective markets will be central to the Manager’s sourcing strategy.

| 8 |

The Manager creates a composite NMQ Score for every urban center by weighing the proprietary list of data.

NOYACK PropertyQuotient™

NOYACK PropertyQuotient™ (NPQ) is even more customized to effectively score potential acquisition targets across several asset classes in differing markets. Our proprietary NPQ algorithm has been built drawing on our Managing Principal’s decades of experience back testing successful acquisitions in the target asset classes. Some of the large number of proprietary points utilized in our NPQ are as follows:

| (1) | Long-term rent growth potential | |

| (2) | Asking cap rate | |

| (3) | Population Growth | |

| (4) | IRR for applicable period | |

| (5) | Three-year Weighted Average Stability | |

| (6) | Lease Terms | |

| (7) | Proximity to Applicable Facilities | |

| (8) | Market Liquidity |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements. You should not place undue reliance on forward-looking statements, and you should consider carefully the statements made in “Risk Factors” and elsewhere in this offering circular that identify important factors that could cause actual outcomes to differ from those expressed or implied in our forward-looking statements, and that could materially and adversely affect our business, operating results and financial condition.

This Management’s Discussion and Analysis should be read together with the financial statements and notes thereto, included elsewhere in this offering circular.

Overview

The Company was formed on January 20, 2022, and has conducted no operations other than those related to our organization and the preparation of the offering of its common stock (the “Offering”) pursuant to an offering statement filed with the Securities and Exchange Commission. The Company’s business will consist of the ownership and operation of the Properties. As of December 31, 2022, the Company has not generated any revenues and has relied on the Manager to provide funding for its operations to date. The Company’s lack of operating history makes it difficult for potential investors to evaluate the potential success of its business and to assess its future viability.

Assuming the successful completion of the Offering, all of the Company’s revenues will be comprised of revenues generated from the operation of the Properties.

Liquidity and Capital Resources

The Company is dependent on the proceeds from the Offering to acquire the Properties. As of December 31, 2022, the Company’s assets are nominal, and it has limited cash on hand. As of the date of this offering circular, the Manager has paid for initial organizational expenses and certain expenses related to this offering and will continue to fund any expenses in excess of the total placement fee.

| 9 |

As indicated in the financial statements included elsewhere in this Annual Report, as of December 31, 2022, the Company had $10,000 in cash, representing the Manager’s contribution to the Company’s initial capitalization.

We will be required to obtain the capital required to purchase the Properties and conduct our operations from the sale of the shares of our common stock pursuant to the Offering and from revenue generated from the ownership and operation of the Properties.

| Item 3. | Directors and Officers |

MANAGEMENT

Board of Directors

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. Our board of directors has retained the Manager to direct the management of our business and affairs, manage our day-to-day affairs and implement our investment strategy, subject to the board of directors’ supervision. The sole member of the board is Charles J. Follini, but the Company intends to add additional directors as its portfolio of assets expands.

All members of our board of directors will serve annual terms. Upon the expiration of their terms as of the dates of the Company’s annual meetings, directors will be elected to serve a term of one year and until his or her successor is elected and qualified. With respect to the election of directors, each candidate nominated for election to our board of directors must receive a plurality of the votes cast, in person or by proxy, in order to be elected.

Our current director is also an executive officer of the Manager. In order to ameliorate the risks created by conflicts of interest, our board of directors, when necessary, will appoint an independent representative (the “Independent Representative”) to address any potential conflicts. The Independent Representative will act upon conflicts of interest matters, including transactions between us and the Manager.

Although the number of directors may be increased or decreased, a decrease may not have the effect of shortening the term of any incumbent director. Any director may resign at any time or may be removed for fraud, gross negligence or willful misconduct as determined by non-appealable decision of a court of competent jurisdiction, or by the stockholders upon the affirmative vote of at least two-thirds of all the votes entitled to be cast at a meeting called for the purpose of the proposed removal. The notice of the meeting will indicate that the purpose, or one of the purposes, of the meeting is to determine if the director will be removed.

Our charter and bylaws provide that any and all vacancies on our board of directors may be filled only by the affirmative vote of a majority of the remaining directors in office, even if the remaining directors do not constitute a quorum, and any individual elected to fill such vacancy will serve for the remainder of the full term of the class in which the vacancy occurred and until a successor is duly elected and qualifies.

Our charter and bylaws provide that any action required or permitted to be taken at any meeting of the stockholders may be taken without a meeting with the unanimous consent, in writing or by electronic transmissions, of each stockholder entitled to vote on the matter.

Our general investment and borrowing policies are set forth in this Memorandum. Our directors may establish further written policies on investments and borrowings and will monitor our administrative procedures, investment operations and performance to ensure that our executive officers and the Manager follow these policies and that these policies continue to be in the best interests of our stockholders. Unless modified by our directors, we will follow the policies on investments and borrowings set forth in this Memorandum.

| 10 |

Executive Officers and Directors

We have provided below certain information about our directors and executive officers.

| Name | Age | Position Held | ||

| Charles J. (CJ) Follini | 56 | Chief Executive Officer | ||

| Sam Suechting | 27 | Chief Operating Officer | ||

| Stephen Robie | 54 | Chief Financial Officer | ||

| David Merrill | 41 | Head of Digital Marketing |

Currently, all of our directors and executive officers are also officers of the Manager and may serve as officers and managers of other entities managed by the Manager. The address of each director and executive officer listed is 2 Blue Slip, Suite 7J, Brooklyn, New York 11222.

CJ Follini, Chief Executive Officer

CJ Follini has more than 38 years of investment experience in commercial real estate and venture capital. Mr. Follini’s real estate career began in his teens when he was handed the management and disposition of his family’s eight figure industrial portfolio and successfully yielded in excess of 20% IRR.

Since 1990, Mr. Follini has become a leading investment expert on alternative real estate assets including healthcare, cold storage logistics, structured parking, media infrastructure, and Qualified Opportunity Zone development.

A few of Mr. Follini’s real estate career highlights include:

| (1) | Development of a 400-acre site into the first-ever Foreign Trade Zone in a joint venture with Rockefeller Group Properties known as the International Trade Center in Mount Olive, New Jersey | |

| (2) | Creation and disposition of a $300 million healthcare real estate portfolio yielding over 23% IRR for its family office investors | |

| (3) | Creation and development of the content production infrastructure known as Gun For Hire Production Centers, consisting of over 700,000 square feet of digital media production studios in Miami, Vancouver, Toronto, Austin, Los Angeles, and New York. Mr. Follini was awarded the 1998 Crain’s Magazine Small Business Award | |

| (4) | Brownfield redevelopment of 15 waterfront acres in the NYC borough of Queens, the largest privately-owned waterfront parcel in NYC, achieving 3x returns for its investors in four years | |

| (5) | Transacted 12 acres of industrial-zoned land in Bronx, New York at the highest per square foot price ever recorded in that Borough. | |

| (6) | Winner of Real Estate Forum’s 2021 INDUSTRIAL INFLUENCER award. |

Ten years ago, Mr. Follini expanded his single-family office into a multi-family office (“MFO”) investing a majority of its discretionary assets under management in alternative real estate; concurrently he expanded the family office allocation into early-stage venture capital supporting female founders. He sits on several Boards related to these investments. Mr. Follini has also significantly expanded the multi-family office’s investments in Consumer Packaged Goods (“CPG”) and e-sports.

Mr. Follini speaks at conferences, domestic and abroad, on commercial real estate, alternative asset investing and family office strategy.

Mr. Follini holds a B.S., magna cum laude, in Econometrics from Tufts University, a General Course Degree in Game Theory from the London School of Economics, and a Degree in Executive Management from Harvard Business School. Mr. Follini has also served on boards as Chairperson of the HERE Arts Center & Chashama Arts.

| 11 |

Sam Suechting, Chief Operating Officer

Prior to joining NOYACK, Sam Suechting worked in numerous roles in the venture capital and private equity industries. At SilverHaze Partners, Mr. Suechting worked with the founder to source, analyze, structure, and manage investments in early-stage companies.

| (1) | Mr. Suechting facilitated a joint venture between the Qatar Investment Authority, Doha Venture Capital, and Balbec KPL, a South Korean Asset Management firm led by the former Deputy Prime Minister, to structure transnational investments in breakthrough innovations. | |

| (2) | Mr. Suechting consulted with Nectar, a commerce platform powered by ultrasonic Smart Caps, on business development opportunities in CPG and the global chemical industry, and worked with the CEO, Aayush Phumbhra, founder of Chegg (NYSE: CHGG), to develop go-to-market strategy. | |

| (3) | Mr. Suechting created the financial forecast, investor presentation, and accretion/dilution model for CommuniKids, a venture-backed, for-profit, language immersion preschool growing rapidly in the Washington, D.C. area. |

Mr. Suechting serves as the Director of Product & Platform Strategy for Chefs-à-Porter, a fine-dining platform based in Bengaluru, India. He graduated with a B.S. in Quantitative Economics from Tufts University.

Stephen Robie, Chief Financial Officer

Stephen Robie joined NOYACK in October 2021 as Chief Financial Officer. Mr. Robie has over thirty years of global real estate finance and accounting experience managing the financial operations of high-growth public real estate investment trusts (“REITs”), private real estate companies, and start-up, entrepreneurial ventures. From 2008 to October 2021, Mr. Robie founded and served as Managing Partner of SIR Holdings, LLC, an entrepreneurial investment firm with focus on venture capital, real estate, and advisory services. From 2015 to 2019, Mr. Robie also served as a Senior Principal and Senior Vice President – Finance and Operations at Veneto Capital Management, LLC, a privately-held commercial real estate investment management company. From 2011 to 2012, Mr. Robie served as Chief Financial Officer, Treasurer, and Secretary of Cornerstone Core Properties REIT, Inc. (“CCP REIT” and now Summit Healthcare REIT, Inc.), a publicly registered, non-traded industrial REIT, which he strategically repositioned into healthcare real estate. Mr. Robie also served as the Chief Operating Officer and Chief Financial Officer, Healthcare Real Estate Group of Cornerstone Ventures, Inc., an affiliate of CCP REIT’s advisor. From 2004 to 2008, Mr. Robie served as Senior Vice President – Financial Planning and Analysis at HCP, Inc. (now Healthpeak Properties, Inc. (NYSE:PEAK)), an S&P 500 healthcare REIT. From 1997 to 2004, Mr. Robie worked for General Electric Company (NYSE:GE) and its commercial real estate division, GE Real Estate, where he served as Manager of Finance for GE Real Estate’s North America Equity Investments. Prior to his affiliation with General Electric Company, Mr. Robie spent over six years in public accounting at Arthur Andersen LLP, including serving as a Manager for private and publicly traded real estate companies. Mr. Robie graduated magna cum laude with a Bachelor of Arts Degree in Economics from Tufts University and earned a Master of Business Administration Degree, with Distinction, in Finance and Accounting from the Leonard N. Stern School of Business at New York University. Mr. Robie is a Certified Public Accountant in the State of New York, a Chartered Global Management Accountant, and a member of the AICPA.

David Merrill, Head of Digital Marketing

David Merrill is a brand strategist, technology enthusiast and digital marketing professional. Mr. Merrill’s experience includes managing multi-million-dollar media plans as well as creating go-to-market strategy for start-ups and Fortune 500 companies. After receiving a Bachelor’s degree from Connecticut College and receiving his MBA from Fordham University, Mr. Merrill launched Camisado Marketing, a digital marketing agency for small businesses. Mr. Merrill has also worked for both Omnicom and Publicis agencies in business development and brand management and led all marketing efforts for the Employee Engagement SaaS at Imminent Digital.

| 12 |

Gus Ackley, Director of Accredited Equity Sales

Gus Ackley serves as the Director of Accredited Equity Sales for NOYACK where he leads all fundraising efforts and manages accredited investor relationships. Prior to joining NOYACK, Mr. Ackley worked at Stifel, serving in various business development positions. Most recently, Mr. Ackley was a member of the Private Equity Advisory Group, providing capital raising advisory to general partners of private equity funds. While at Stifel, Mr. Ackley and his team raised hundreds of millions of dollars for private real estate funds. His team advised on billions of dollars of funds raised across the space including private equity, venture capital, and private credit funds. Mr. Ackley’s responsibilities also included fund selection and analysis, due diligence, and relationship management. Mr. Ackley started his career working as an investment banking analyst focusing on the healthcare sector. Mr. Ackley is a graduate of Trinity College where he studied economics and played football and lacrosse.

Compensation of Directors

Our board of directors has the authority to fix the compensation of all officers that it selects and may pay compensation to directors for services rendered to us in any other capacity. However, we currently do not intend to pay our board members or officers any compensation for serving as members of our board of directors and as officers, respectively.

A member of our board of directors who is also an employee of the Manager is referred to as an executive director. Executive directors will not receive compensation for serving on our board of directors. Our board of directors has the authority to fix the compensation of any non-executive directors that may serve on our board of directors in the future. Our board of directors may pay compensation to directors for services rendered to us in any other capacity. We will also reimburse each of our directors for their travel expenses incurred in connection with their attendance at board of directors and committee meetings, if any. We have not made any payments to any of our directors to date.

Compensation of Executive Officers

We do not currently have any employees, nor do we currently intend to hire any employees who will be compensated directly by us. Each of our executive officers also serves as an executive officer of the Manager. Each of these individuals receives compensation for his or her services, including services performed for us on behalf of the Manager, from the Manager. As executive officers of the Manager, these individuals will serve to manage our day-to-day affairs, oversee the review, selection and recommendation of investment opportunities, service acquired investments and monitor the performance of these investments to ensure that they are consistent with our investment objectives. Although we will indirectly bear some of the costs of the compensation paid to these individuals, through fees we pay to the Manager, we do not intend to pay any compensation directly to these individuals.

| 13 |

The Manager and the Management Agreement

The Manager

We operate under the direction of the Manager, which is responsible for directing the management of our business and affairs, managing our day-to-day affairs, and implementing our investment strategy. The Manager and its officers and managers are not required to devote all of their time to our business and are only required to devote such time to our affairs as their duties require.

The Manager performs its duties and responsibilities pursuant to a management agreement between it and NLI REIT II. The Manager maintains a contractual, as opposed to a fiduciary relationship, with us and our stockholders. Furthermore, we have agreed to limit the liability of the Manager and to indemnify it against certain liabilities.

Responsibilities of the Manager

The responsibilities of the Manager include:

Property Advisory, Origination and Acquisition Services

| (1) | approve and oversee our overall investment strategy, which will consist of elements such as investment selection criteria, diversification strategies and asset disposition strategies; | |

| (2) | serve as our investment manager with respect to sourcing, underwriting, acquiring, financing, investing in and managing a diversified portfolio of supply chain and logistics properties; | |

| (3) | adopt and periodically review our investment guidelines; | |

| (4) | structure the terms and conditions of our acquisitions, sales and joint ventures; | |

| (5) | enter into service contracts for the Properties and other investments; | |

| (6) | approve and oversee our debt financing strategies; | |

| (7) | approve joint ventures, limited partnerships and other such relationships with third parties; | |

| (8) | approve any potential liquidity transaction; | |

| (9) | obtain market research and economic and statistical data in connection with our investments and investment objectives and policies; | |

| (10) | oversee and conduct the due diligence process related to prospective investments; | |

| (11) | prepare reports regarding prospective investments that include recommendations and supporting documentation necessary for the board of directors to evaluate the proposed investments; and | |

| (12) | negotiate and execute approved investments and other transactions. |

Offering Services

| (1) | the development of this offering, including the determination of its specific terms; | |

| (2) | preparation and approval of all marketing materials to be used by us relating to this offering; | |

| (3) | the negotiation and coordination of the receipt, collection, processing and acceptance of subscription agreements, commissions, and other administrative support functions; | |

| (4) | creation and implementation of various technology and electronic communications related to this offering; and | |

| (5) | all other services related to this offering. |

| 14 |

Asset Management Services

| (1) | investigate, select, and, on our behalf, engage and conduct business with such persons as the Management deems necessary to the proper performance of its obligations under the management agreement, including, without limitation, consultants, accountants, lenders, technical managers, attorneys, corporate fiduciaries, escrow agents, depositaries, custodians, agents for collection, insurers, insurance agents, developers, construction companies and any and all persons acting in any other capacity deemed by the Manager to be necessary or desirable for the performance of any of the services under the management agreement; | |

| (2) | monitor applicable markets and obtain reports (which may be prepared by the Manager or its affiliates) where appropriate, concerning the value of our investments; | |

| (3) | monitor and evaluate the performance of our investments, provide daily management services to us and perform and supervise the various management and operational functions related to our investments; | |

| (4) | formulate and oversee the implementation of strategies for the administration, promotion, management, operation, maintenance, improvement, financing and refinancing, marketing, leasing and disposition of investments on an overall portfolio basis; and | |

| (5) | coordinate and manage relationships between us and any joint venture partners. |

Accounting and Other Administrative Services

| (1) | manage and perform the various administrative functions necessary for our day-to-day operations; | |

| (2) | provide or arrange for administrative services, legal services, office space, office furnishings, personnel and other overhead items necessary and incidental to our business and operations; | |

| (3) | provide financial and operational planning services and portfolio management functions; | |

| (4) | maintain accounting data and any other information concerning our activities as will be required to prepare and to file all periodic financial reports and returns required to be filed with any regulatory agency, including annual financial statements; | |

| (5) | maintain all appropriate company books and records; | |

| (6) | oversee tax and compliance services and risk management services and coordinate with appropriate third parties, including independent accountants and other consultants, on related tax matters; | |

| (7) | supervise the performance of such ministerial and administrative functions as may be necessary in connection with our daily operations; | |

| (8) | provide us with all necessary cash management services; | |

| (9) | evaluate and obtain adequate insurance coverage based upon risk management determinations; | |

| (10) | provide timely updates related to the overall regulatory environment affecting us, as well as managing compliance with regulatory matters; | |

| (11) | evaluate our corporate governance structure and appropriate policies and procedures related thereto; and | |

| (12) | oversee all reporting, record keeping, internal controls and similar matters in a manner to allow us to comply with applicable law. |

| 15 |

Stockholder Services

| (1) | determine our distribution policy and authorizing distributions from time to time; | |

| (2) | manage communications with our stockholders, including answering phone calls, preparing and sending written and electronic reports and other communications; and | |

| (3) | establish technology infrastructure to assist in providing stockholder support and services. |

Financing Services

| (1) | identify and evaluate potential financing and refinancing sources, engaging a third-party broker if necessary; | |

| (2) | negotiate terms of, arrange and execute financing agreements; | |

| (3) | manage relationships between us and our lenders, if any; and | |

| (4) | monitor and oversee the service of our debt facilities and other financings, if any. |

Disposition Services

| (1) | evaluate and approve potential asset dispositions, sales or liquidity transactions; and | |

| (2) | structure and negotiate the terms and conditions of transactions pursuant to which our assets may be sold. |

Allocation of Property Opportunities

For more information regarding the factors that the Manager may consider in allocating investment opportunities among our additional similar programs, please see “Conflicts of Interest – Our Affiliates’ Interests in Other Entities – Allocation of Property Opportunities”.

Executive Officers of the Manager

As of the date of this Memorandum, the executive officers of the Manager and their positions and offices are as follows:

| Name | Age | Position Held | ||

| Charles J. (CJ) Follini | 56 | Managing Principal | ||

| Sam Suechting | 27 | Chief Operating Officer | ||

| Stephen Robie | 54 | Chief Financial Officer | ||

| David Merrill | 41 | Head of Digital Marketing |

Biographical information for each of the Manager’s executive officers may be found in “Management – Executive Officers and Directors.”

Limited Liability and Indemnification of the Manager and Others

Subject to certain limitations, the management agreement limits the liability of the Manager, its officers, members and affiliates for monetary damages and provides that we will indemnify and pay or reimburse reasonable expenses in advance of final disposition of a proceeding to the Manager, its officers, members and affiliates.

| 16 |

The management agreement provides that to the fullest extent permitted by applicable law the Manager, its officers, members and affiliates will not be liable to us. In addition, pursuant to the management agreement, we have agreed to indemnify the Manager, its officers, members and affiliates to the fullest extent permitted by law, against all expenses and liabilities (including judgments, fines, penalties, interest, amounts paid in settlement with the approval of NLI REIT II and attorney’s fees and disbursements) arising from the performance of any of their obligations or duties in connection with their service to us or the management agreement, including in connection with any civil, criminal, administrative, investigative or other action, suit or proceeding to which any such person may hereafter be made party by reason of being or having been the Manager or one of the Manager’s managers or officers.

Term and Removal of the Manager

The management agreement provides that the Manager will serve for an indefinite term, but that the Manager may be removed by us, or may choose to withdraw as manager, under certain circumstances.

Our board of directors may only remove the Manager at any time with 30 days’ prior written notice for “cause.” “Cause” is defined as:

| (1) | The Manager’s continued breach of any material provision of the management agreement following a period of 30 days after written notice thereof (or 45 days after written notice of such breach if the Manager, under certain circumstances, has taken steps to cure such breach within 30 days of the written notice); | |

| (2) | the commencement of any proceeding relating to the bankruptcy or insolvency of the Manager, including an order for relief in an involuntary bankruptcy case or the Manager authorizing or filing a voluntary bankruptcy petition; | |

| (3) | the Manager committing fraud against us, misappropriating or embezzling our funds, or acting, or failing to act, in a manner constituting bad faith, willful misconduct, gross negligence or reckless disregard in the performance of its duties under the management agreement; provided, however, that if any of these actions is caused by an employee, personnel and/or officer of the Manager or one of its affiliates and the Manager (or such affiliate) takes all necessary and appropriate action against such person and cures the damage caused by such actions within 30 days of the Manager’s actual knowledge of its commission or omission, then the Manager may not be removed; or | |

| (4) | the dissolution of the Manager. |

Unsatisfactory financial performance does not constitute “cause” under the management agreement.

In the event of the removal of the Manager, it will use reasonable efforts to cooperate with us and take all reasonable steps to assist in making an orderly transition of the management function. The Manager will determine whether any succeeding management possesses sufficient qualifications to perform the management function.

| Item 4. | Security Ownership of Management and Certain Securityholders |

The following table cites the beneficial ownership of the Shares as of the date of this offering circular for each person or group that holds more than 5% of the Shares, for each executive officer and directors and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with SEC rules and generally includes sole or shared voting or investment power with respect to voting securities. Affiliates of the Company and the Manager may purchase Shares in this offering, but only at the same price and on the same terms as other investors in this offering. We will not reserve any portion of the Shares being offered for sale in this offering for sale to any of the foregoing or any other person.

Unless otherwise indicated below, each person or entity has an address in care of our principal executive offices at 2 Blue Slip, Suite 7J, Brooklyn, New York 11222.

| Name of Owner | Number of Shares Owned | Percent of All Shares | ||||||

| Noyack Capital LLC | 500 | 100 | % | |||||

| All directors and executive officers as a group (5 persons) | 0 | 0 | % | |||||

| Item 5. | Interest of Management and Others in Certain Transactions |

For further details, please see Note 3 “Related-party Transactions,” in Item 7, Financial Statements.

| Item 6. | Other Information |

None

| 17 |

| Item 7. | Financial Statements |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

CONSOLIDATED FINANCIAL STATEMENTS

For the Period from January 20, 2022 (Inception) through December 31, 2022

(With Independent Auditors’ Report Thereon)

| 18 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

For the Period from January 20, 2022 (Inception) through December 31, 2022

| Page | |

| Independent Auditors’ Report | 20 |

| CONSOLIDATED FINANCIAL STATEMENTS: | |

| Consolidated Statement of Financial Condition | 22 |

| Consolidated Statement of Operations | 23 |

| Consolidated Statement of Stockholder’s Deficit | 24 |

| Consolidated Statement of Cash Flows | 25 |

| Notes to Consolidated Financial Statements | 26 |

| 19 |

To the Board of Directors and Stockholders

Noyack Logistics Income REIT, II, Inc.

Opinion

We have audited the accompanying consolidated financial statements of Noyack Logistics Income REIT, II, Inc and subsidiary (a Maryland corporation, collectively the “Company”), which comprise the consolidated statement of financial condition as of December 31, 2022, and the related consolidated statements of operations, changes in Stockholders’ deficit, and cash flows for the period from January 20, 2022 (Inception) to December 31, 2022, and the related notes to the financial statements (collectively referred to as the “financial statements”).

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2022, and the results of its operations and its cash flows for the period then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are available to be issued.

| 20 |

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements, including omissions, are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with generally accepted auditing standards, we:

| ● | Exercise professional judgment and maintain professional skepticism throughout the audit. | |

| ● | Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. | |

| ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. | |

| ● | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. | |

| ● | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

| /s/ dbbmckennon | |

| Newport Beach, California | |

| April 26, 2023 |

| 21 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

CONSOLIDATED STATEMENT OF FINANCIAL CONDITION

December 31, 2022

| ASSETS | ||||

| Cash and cash equivalents | $ | 10,000 | ||

| Prepaid expenses | 523 | |||

| Total assets | $ | 10,523 | ||

| LIABILITIES AND DEFICIT | ||||

| Due to affiliate | $ | 15,127 | ||

| Total liabilities | 15,127 | |||

| Commitments and contingencies (Note 3) | ||||

| Stockholder’s deficit | ||||

| Preferred stock, $0.01 par value: 5,000,000 shares authorized; 0 shares issued and outstanding | - | |||

| Common stock, $0.01 par value: 95,000,000 shares authorized; 500 shares issued and outstanding | 5 | |||

| Additional paid-in capital | 9,995 | |||

| Accumulated deficit | (14,604 | ) | ||

| Total stockholder’s deficit | (4,604 | ) | ||

| Total liabilities and deficit | $ | 10,523 | ||

See accompanying notes to consolidated financial statements.

| 22 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

CONSOLIDATED STATEMENT OF OPERATIONS

For the Period from January 20, 2022 (Inception) through December 31, 2022

| Revenues: | $ | - | ||

| Expenses: | ||||

| General and administrative | 14,604 | |||

| Total expenses | 14,604 | |||

| Net loss | $ | (14,604 | ) | |

| Net loss per common share: | ||||

| Basic | $ | (30.81 | ) | |

| Diluted | $ | (30.81 | ) | |

| Weighted average number of common shares outstanding: | ||||

| Basic | 474 | |||

| Diluted | 474 |

See accompanying notes to consolidated financial statements.

| 23 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

CONSOLIDATED STATEMENT OF STOCKHOLDER’S DEFICIT

For the Period from January 20, 2022 (Inception) through December 31, 2022

| Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Total Stockholder’s | ||||||||||||||||||||||||

| Shares | Amounts | Shares | Amounts | Capital | Deficit | Deficit | ||||||||||||||||||||||

| Balance, January 20, 2022 (Inception) | - | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Issuance of common stock | - | - | 500 | 5 | 9,995 | - | 10,000 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (14,604 | ) | (14,604 | ) | |||||||||||||||||||

| Balance, December 31, 2022 | - | $ | - | 500 | $ | 5 | $ | 9,995 | $ | (14,604 | ) | $ | (4,604 | ) | ||||||||||||||

See accompanying notes to consolidated financial statements.

| 24 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

CONSOLIDATED STATEMENT OF CASH FLOWS

For the Period from January 20, 2022 (Inception) through December 31, 2022

| Cash flows from operating activities: | ||||

| Net loss | $ | (14,604 | ) | |

| Changes in operating assets and liabilities: | ||||

| Prepaid expenses | (523 | ) | ||

| Due to affiliate | 15,127 | |||

| Net cash provided by operating activities | - | |||

| Cash flows from investing activities: | ||||

| Net cash provided by investing activities | - | |||

| Cash flows from financing activities: | ||||

| Issuance of common stock | 10,000 | |||

| Net cash provided by financing activities | 10,000 | |||

| Net increase in cash and cash equivalents | 10,000 | |||

| Cash and cash equivalents, January 20, 2022 (Inception) | - | |||

| Cash and cash equivalents, December 31, 2022 | $ | 10,000 | ||

| Supplemental disclosures of cash flow information: | ||||

| Cash paid for interest | $ | - | ||

| Cash paid for income taxes | $ | - |

See accompanying notes to consolidated financial statements.

| 25 |

NOYACK LOGISTICS INCOME REIT II, INC.

(A Maryland Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

For the Period from January 20, 2022 (Inception) through December 31, 2022

The use of the words “we”, “us” or “our” refers to Noyack Logistics Income REIT II, Inc. and its wholly owned subsidiary, NL REIT II OP, LP, except where the context otherwise requires.

| 1. | Organization and Description of Business |

Noyack Logistics Income REIT II, Inc. (“NLI REIT II” or the “Company”), a Maryland corporation, was incorporated on January 20, 2022. We were initially capitalized on February 7, 2022 and we intend to offer and sell to the public up to 3,750,000 shares of our $0.01 par value common stock for $20.00 per share. We intend to focus, either directly or through special purpose entities or joint ventures with other entities on the acquisition, renovation, leasing and management of a diversified portfolio of commercial real estate properties that encompass the supply chain and logistics infrastructure of North America, including dry warehouses, cold storage warehouses, life science buildings and structured parking garages. We generally will seek investments that produce current income. We intend to elect to be treated as a real estate investment trust, or REIT, for federal income tax purposes for our taxable year ending December 31, 2022, or the first year in which we commence material operations. Our board of directors may extend such date until the taxable year ending December 31, 2023.

NLI REIT II is structured as an umbrella partnership REIT, commonly called an “UPREIT”. As an UPREIT, NLI REIT II will own substantially all of its assets and conduct substantially all of its operations through NL REIT II OP, LP, its operating partnership and wholly owned subsidiary as of December 31, 2022. NLI REIT II will be the sole general partner of the operating partnership and will have exclusive control over the operating partnership. NLI REIT II is externally managed by its manager, Noyack Capital LLC (the “Manager”) pursuant to a management agreement between us and the Manager. The Manager will supervise and manage our day-to-day operations and select the properties and real estate-related investments we acquire, subject to the oversight by our board of directors. The Manager will also provide marketing, sales and client services on our behalf. The Manager is affiliated with us in that we and the Manager have common officers, some of whom also own a direct or indirect equity interest in the Manager. The Manager will engage affiliated entities to provide various services to us.

Management’s Plans

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company is a business that has not commenced planned principal operations, expects to incur costs in pursuit of its capital financing plans, and has not generated any revenues or profits through December 31, 2022. For the next twelve months, the Company plans to receive financing from its Manager to cover operational costs, and the Manager is committed to providing funds on an as needed basis. The Company also anticipates raising funds under a Regulation A offering, which if and when received, will allow the Company to start executing its business plan. Prior to receiving Regulation A funds, costs to continue operating the business are minimal and management believes the Manager will continue to cover such costs. Accordingly, management believes substantial doubt about the Company’s ability to continue as a going concern is alleviated.

| 26 |

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying consolidated financial statements and related notes have been prepared on the accrual basis of accounting and conform to accounting principles generally accepted in the United States of America (“U.S. GAAP”) and Article 8 of Regulation S-X of the rules and regulations of the SEC. The consolidated financial statements include the accounts of NLI REIT II and its wholly owned subsidiary, as defined in Note 1. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the consolidated financial statements, in conformity with U.S. GAAP, requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Risks and Uncertainties

The Company has a limited operating history. The Company’s business and operations are sensitive to general business and economic conditions in the United States. A host of factors beyond the Company’s control could cause fluctuations in these conditions. These adverse conditions could affect the Company’s financial condition and the results of its operations.

Cash and Cash Equivalents

The Company considers all highly liquid holdings with maturities of three months or less at the time of purchase to be cash equivalents. The Company had no cash equivalents as of December 31, 2022.

Since Inception, we have maintained cash balances within federally insured limits. We have not experienced any losses in such accounts and believe we are not exposed to any significant financial and/or cash management risk.

Real Estate Held for Investment

As of December 31, 2022, we have neither purchased nor contracted to purchase any investments. The Manager has not identified any real estate or real estate-related investments in which it is probable that we will invest.

| 27 |

Real estate assets will be stated at the lower of depreciated cost or fair value, if deemed impaired. Major replacements and betterments are capitalized and depreciated over their estimated useful lives. Depreciation is computed on a straight-line basis over the useful lives of the properties. We will continually evaluate the recoverability of the carrying value of our real estate assets using the methodology prescribed in ASC Topic 360, “Property, Plant and Equipment.” Factors considered by management in evaluating impairment of its existing real estate assets held for investment include significant declines in property operating profits, annually recurring property operating losses and other significant adverse changes in general market conditions that are considered permanent in nature. Under ASC Topic 360, a real estate asset held for investment is not considered impaired if the undiscounted, estimated future cash flows of an asset (both the annual estimated cash flow from future operations and the estimated cash flow from the theoretical sale of the asset) over its estimated holding period are in excess of the asset’s net book value at the balance sheet date. If any real estate asset held for investment is considered impaired, a loss is provided to reduce the carrying value of the asset to its estimated fair value.

Real Estate Held for Sale

We may periodically classify real estate assets as held for sale. An asset is classified as held for sale after the approval of management and after an active program to sell the asset has commenced. Upon the classification of a real estate asset as held for sale, the carrying value of the asset is reduced to the lower of its net book value or its estimated fair value, less costs to sell the asset. Subsequent to the classification of assets as held for sale, no further depreciation expense is recorded.

Cost Capitalization

A variety of costs are incurred in the acquisition and development of properties such as costs of acquiring a property, development costs, construction costs, interest costs, real estate taxes, salaries and related costs, and other costs incurred during the period of development. After determination is made to capitalize a cost, it is allocated to the specific component of a project that is benefited. Determination of when a development project is substantially complete, and capitalization must cease, involves a degree of judgment. Our capitalization policy on development properties is guided by ASC Topic 835-20 “Interest - Capitalization of Interest” and ASC Topic 970 “Real Estate - General.” We cease capitalization of costs upon completion.

Deferred Offering Costs

The Company complies with the requirements of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 340-10-S99-1 with regards to offering costs. Prior to the completion of an offering, offering costs are capitalized. The deferred offering costs are charged to stockholder’s deficit upon the completion of an offering or to expense if the offering is not completed. The Company will reimburse the Manager for any offering costs incurred by the Manager from the proceeds from the offering. As of December 31, 2022, no offering costs have been capitalized.

Income Taxes

We intend to make an election to be taxed as a REIT, under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code, and we intend to be taxed as such beginning with our taxable year ending December 31, 2022, or the first year in which we commence material operations. Our board of directors may extend such date until the taxable year ending December 31, 2023. As of December 31, 2022, we have not yet qualified as a REIT. To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to currently distribute at least 90.0% of our ordinary taxable income to stockholders. As a REIT, we generally will not be subject to federal income tax on taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will then be subject to federal income taxes on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the IRS grants us relief under certain statutory provisions. Such an event could materially adversely affect our net income and net cash available for distribution to stockholders.

| 28 |

Revenue Recognition

ASC Topic 606, “Revenue from Contracts with Customers,” establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers.

Revenues will be recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements: 1) identify the contract with a customer; 2) identify the performance obligations in the contract; 3) determine the transaction price; 4) allocate the transaction price to performance obligations in the contract; and 5) recognize revenue as the performance obligation is satisfied.

No revenue has been earned or recognized through December 31, 2022.

Recent Accounting Pronouncements

Management does not believe that any recently issued, but not yet effective, accounting standards could have a material effect on the accompanying consolidated financial statements. As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances.

| 3. | Commitments and Contingencies |

Litigation

We are not presently subject to any material litigation nor, to our knowledge, is any material litigation threatened against us, which if determined unfavorably to us, would have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Organization and Offering Expenses

Our organization and offering expenses are being paid by the Manager or its affiliates on our behalf. These organization and offering expenses include formation costs and all expenses to be paid by us in connection with our offering. As of December 31, 2022, the Manager and its affiliates have incurred organization expenses of $10,535 on our behalf, which is recognized as a component of general and administrative expenses on the consolidated statement of operations. No offering expenses have been recorded in our consolidated statement of financial condition as of December 31, 2022. As disclosed in Note 2, offering costs are capitalized prior to the completion of an offering. The deferred offering costs are charged to stockholder’s deficit upon the completion of an offering or to expense if the offering is not completed. The Company will reimburse the Manager for any offering costs incurred by the Manager from the proceeds from the offering.

| 29 |

| 4. | Related Party Transactions |

Initial Contribution

On February 7, 2022, the Manager purchased 500 shares of common stock for total cash consideration of $10,000 and was admitted as the initial stockholder. We will use the proceeds from the sale of shares of our common stock to the Manager to make such capital contribution to our operating partnership.

On April 27, 2022, we made an initial capital contribution of $5,000 to our operating partnership. On June 8, 2022, we made a second capital contribution of $5,000 to our operating partnership.

Compensation to the Manager and its Affiliates

As of December 31, 2022, $15,127 was due to the Manager. Such amounts are non-interest bearing and due on demand.

The Manager and its affiliates are entitled to receive fees, compensation and distributions as set forth below.