UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2022

Commission File Number: 001-39938

Vinci Partners Investments Ltd.

(Exact name of registrant as specified in its charter)

Av. Bartolomeu Mitre, 336

Leblon – Rio de Janeiro

Brazil 22431-002

+55 (21) 2159-6240

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F |

X |

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No |

X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No |

X |

TABLE OF CONTENTS

| EXHIBIT | |

| 99.1 | Press release dated July 28, 2022 – Vinci Partners Announces Launch of New Special Situations Segment With the Acquisition of SPS Capital |

| 99.2 | Presentation dated July 29, 2022 - Vinci Partners & SPS Capital Transaction Overview |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Vinci Partners Investments Ltd. | |||||

| By: | /s/ Sergio Passos Ribeiro | ||||

| Name: | Sergio Passos Ribeiro | ||||

| Title: | Chief Financial Officer | ||||

Date: July 29, 2022

EXHIBIT 99.1

VINCI PARTNERS ANNOUNCES LAUNCH OF NEW SPECIAL SITUATIONS SEGMENT WITH THE ACQUISITION OF SPS CAPITAL

| · | SPS Capital is a leading Special Situations independent asset manager with R$2.0 billion in assets under management, led by a highly experienced and best-in-class team with extensive experience in the sector; |

| · | Transaction strengthens Vinci’s FRE quality, stability, and visibility, due to recurring and high visibility management fee revenues with long-term lockups; |

| · | The new segment, Vinci SPS, is operating in an underpenetrated market, creating substantial future growth opportunities to the platform; |

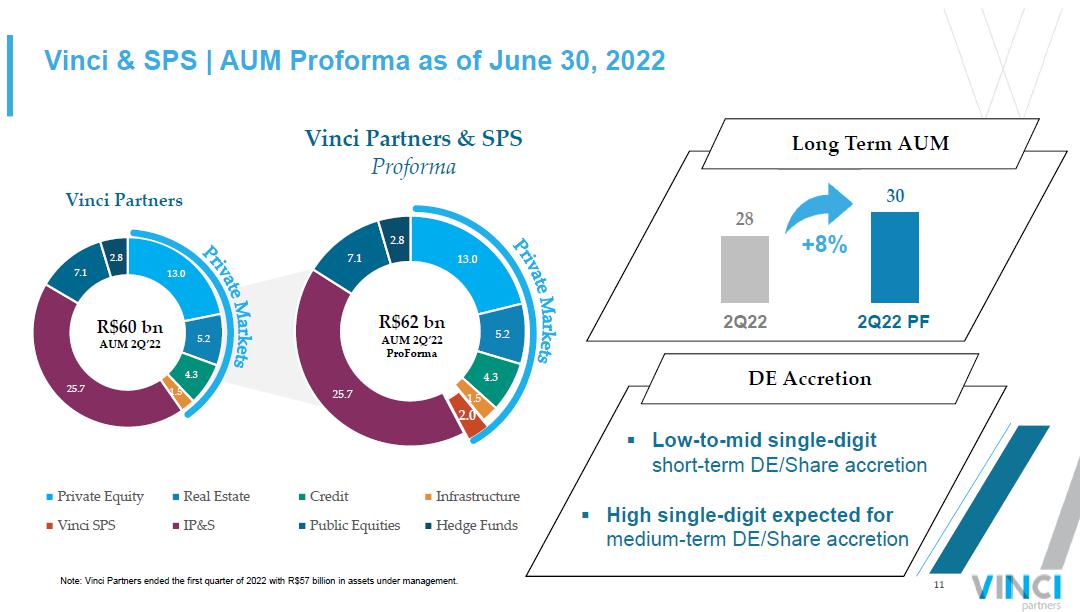

| · | Combined platform will represent R$62 billion in assets under management, considering the 2Q22 AUM Proforma, a result of Vinci’s AUM as of the end of the second quarter of 2022 (R$60 billion1) and the inclusion of SPS Capital (R$2 billion); |

| · | Transaction is immediately accretive to Distributable Earnings per share |

Rio de Janeiro, July 28, 2022 -- Vinci Partners Investments Ltd. (NASDAQ: VINP) ("Vinci Partners,” “Vinci,” "we," "us," or "our"), the controlling company of a leading alternative investment platform in Brazil, announced today an agreement (“Transaction”) to acquire SPS Capital (“SPS,” “Team”), a leading independent alternative asset manager focused on the Special Situations segment in Brazil, with R$2.0 billion in assets under management, distributed across three vintages in its flagship strategy.

“We are extremely happy to welcome SPS to our platform and have high expectations for what we can accomplish together in terms of AUM growth, product offering and solutions to our investors,” said Alessandro Horta, Vinci Partners’ Chief Executive Officer and Director.

“The team at SPS had outstanding success developing their business through successful fundraising of three vintages of their flagship strategy. Our partnership with SPS is the perfect first step for our expansion into the Special Situations market, a sizable and unexplored market in Brazil with a vast pool of asymmetric investment opportunities.

In addition, the complementary investment experiences the SPS team presents will allow us to work on collaborative fashion across our existing Private Market verticals to develop new investment solutions for our clients. This is especially true for the entire Credit universe in Brazil, where the different angle that SPS brings will allow us to further enhance our penetration in this growing segment of the market.

We believe the Transaction solidifies Vinci’s position as the player of choice for alternative investments in Brazil, with a full-suite of sophisticated and complementary business segments.”

Founded in 2017, SPS Capital is one of the top independent Special Situations asset managers in Brazil, with an extensive track record across three vintages that represent R$2.0 billion in assets under management. SPS is focused on investment strategies that deliver equity like returns, through debt downside protected structures. The Team manages its capital pools through closed-end fund structures,

1 Vinci Partners had R$57 billion in assets under management as of the first quarter of 2022 and has ended the second quarter of 2022 with R$60 billion in assets under management.

with lockups of up to eight years. In November 2021, SPS raised its latest vintage, SPS Capital III, with R$1.1 billion in capital commitments.

“SPS and Vinci are an excellent cultural and business fit, sharing the same values and principles based on reputation, first-class human capital and alignment of interest with our LPs,” said Marcelo Mifano, co-founding partner of SPS. “We are excited for the next chapter and delighted to be part of such established and well-recognized platform. We believe joining forces with Vinci’s robust platform and entire network of distribution capabilities will leverage SPS’ growth into new and adjacent products additional to our flagship strategy and will help us expand the business throughout the next years.”

Transaction Overview

The acquisition of SPS Capital strengthens Vinci’s FRE quality, stability, and visibility for future earnings results and enriches Distributable Earnings’ composition, due to the recurring and high-visibility nature of SPS’ revenue stream, coming from funds with long-term lockups and a typical private market fee structure.

We expect low-to-mid single-digit short term accretion in Distributable Earnings per share with the Transaction, with upside to high single-digit medium term accretion as current funds are deployed, and a new flagship vintage is launched.

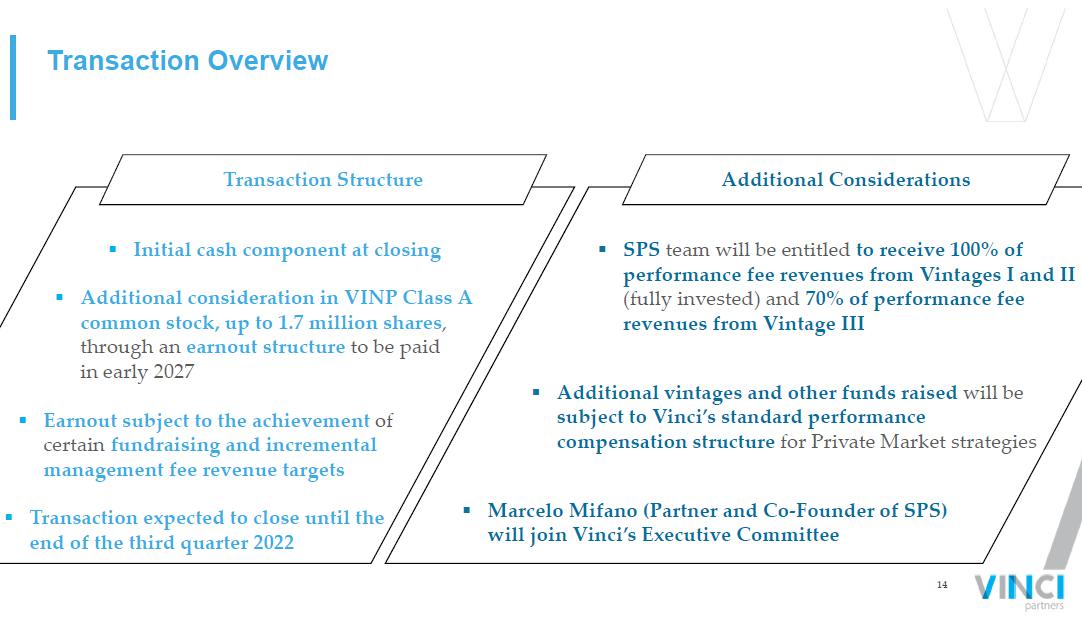

The Transaction will have an initial cash component at closing, with an additional consideration in VINP’s Class A common stock through an earnout structure to be paid in 2027, up to a maximum number of 1.7 million shares, subject to the achievement of certain fundraising and incremental management fee revenue targets. Transaction is expected to close until the end of the third quarter of 2022.

Webcast and Earnings Conference Call

Vinci Partners will host a conference call on Friday, July 29, 2022 at 9:00 am (Eastern Time) to discuss the Transaction. A detailed presentation of the Transaction will be posted to Vinci’s IR website and on the SEC website at www.sec.gov on Friday morning in advance of the conference call.

To access the webcast and presentation please visit the Events & Presentations’ section of the Company's website at: www.ir.vincipartners.com/news-and-events/events-and-presentations. For those unable to listen to the live broadcast, there will be a webcast replay on the same section of the website.

To access the conference call through dial in, please register at Dial in Registration to obtain the conference number and access code.

About Vinci Partners

Vinci Partners is a leading alternative investment platform in Brazil, established in 2009. Vinci Partners' business segments include private equity, public equities, real estate, credit, infrastructure, hedge funds, and investment products and solutions, each managed by dedicated investment teams with an independent investment committee and decision-making process. We also have a financial advisory business, focusing mostly on pre-initial public offering, or pre-IPO, and merger and acquisition, or M&A, advisory services for Brazilian middle-market companies.

About SPS Capital

SPS Capital is a leading special situations independent asset manager in Brazil, established in 2017. SPS Capital operates through an all-weather approach, with exposure to assets in different stages of the economic cycle and sectors, in five different strategies including funding for primary and secondary market, legal claims, litigation finance and credit platforms. The flagship strategy holds three vintages and represents R$2.0 billion in assets under management.

Forward-Looking Statements

This press release contains forward-looking statements that can be identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. By their nature, forward-looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside of our control. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements and there can be no assurance that such forward-looking statements will prove to be correct. The forward-looking statements included herein speak only as at the date of this press release and we do not undertake any obligation to update these forward-looking statements. Past performance does not guarantee or predict future performance. Moreover, neither we nor our affiliates, officers, employees and agents undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release. Further information on these and other factors that could affect our financial results is included in filings we have made and will make with the U.S. Securities and Exchange Commission from time to time.

USA Media Contact

Nick Lamplough / Kate Thompson / Katie Villany

Joele Frank, Wilkinson Brimmer Katcher

+1 (212) 355-4449

Brazil Media Contact

Danthi Comunicações

Carla Azevedo (carla@danthicomunicacoes.com.br)

+55 (21) 3114-0779

Investor Contact

ShareholderRelations@vincipartners.com

NY: +1 (646) 559-8040

RJ: +55 (21) 2159-6240

EXHIBIT 99.2

1 Vinci Partners & SPS Capital Transaction Overview 29 July 2022

Disclaimer This presentation contains forward - looking statements that can be identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others . By their nature, forward - looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside of our control . Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward - looking statements and there can be no assurance that such forward - looking statements will prove to be correct . Accordingly, you should not place undue reliance on forward - looking statements . The forward - looking statements included herein speak only as at the date of this presentation and we do not undertake any obligation to update these forward - looking statements . Past performance does not guarantee or predict future performance . Moreover, neither we nor our affiliates, officers, employees and agents undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward - looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation . Further information on these and other factors that could affect our financial results is included in filings we have made and will make with the U . S . Securities and Exchange Commission (the “SEC”) from time to time, including in the section titled “Risk Factors” in our latest fillings with the SEC . These documents are available on the SEC Filings section of the investor relations section of our website at : https : //ir . vincipartners . com/financials/sec - filings . We have prepared this presentation solely for informational purposes . The information in this presentation does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any of our securities or securities of our subsidiaries or affiliates, not should it or any part of it form the basis of, or be relied on, in connection with any contract to purchase or subscribe for any of our securities or securities of any of our subsidiaries or affiliates, nor shall it or any part of it form the basis of, or be relied on, in connection with any contract or commitment whatsoever . This presentation also includes certain non - GAAP financial information . We believe that such information is meaningful and useful in understanding the activities and business metrics of our operations . We also believe that these non - GAAP financial measures reflect an additional way of viewing aspects of our business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting our business . Further, investors regularly rely on non - GAAP financial measures to assess operating performance and such measures may highlight trends in our business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS . We also believe that certain non - GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in our industry, many of which present these measures when reporting their results . The non - GAAP financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements . The non - GAAP measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results . As other companies may determine or calculate this non - GAAP financial information differently, the usefulness of these measures for comparative purposes is limited . A reconciliation of such non - GAAP financial measures to the nearest GAAP measure is included in this presentation . 2

3 Presenters Alessandro Horta Chief Executive Officer Sergio Passos Chief Operating Officer & Chief Financial Officer Bruno Zaremba Private Equity Chairman & Head of Investor Relations

4 Vinci Partners announces launch of new Special Situations segment with the acquisition of SPS Capital ▪ SPS Capital is led by a highly - experienced and top performing team with extensive experience in Special Situations investments in Brazil ▪ Transaction will increase Vinci's product offering in Private Market strategies , by filling a strategic gap in our platform, on which we can build and grow into synergistic and complementary additional funds ▪ We are combining Vinci's proprietary distribution capabilities and complementary business strategies with SPS' extensive trac k r ecord in special situations to leverage fundraising efforts for SPS Vintage IV and new products ▪ Founded in 2017, SPS Capital is one of the top independent Special Situations asset managers in Brazil , with R$2.0 billion in AUM and an extensive track record in a sizable and unexplored segment of the market Vinci Partners & SPS Capital: a top - notch and complementary partnership First M&A transaction since the IPO Transaction strengthens FRE growth with attractive near and medium - term DE/Share accretion Presence in Private Markets SPS strengthens Vinci's position as a leading asset manager for Private Market strategies in Brazil

5 A solid start to Vinci’s expansion into Special Situations Vinci brand recognition Capital allocation flexibility allows strategy to have adequate risk return across all stages of macroeconomic cycle Complexity vs. Eligibility Traditional credit markets are not open to debtors due to complex nature of transactions Brazilian Market still unexplored, with a limited number of players with experience Why Special Situations? Differentiated Origination N etwork First Class Track Record Investment Team with Best - in - Class Reputation Why SPS ? Sizable and unexplored addressable market, with opportunities for asymmetries and arbitrage

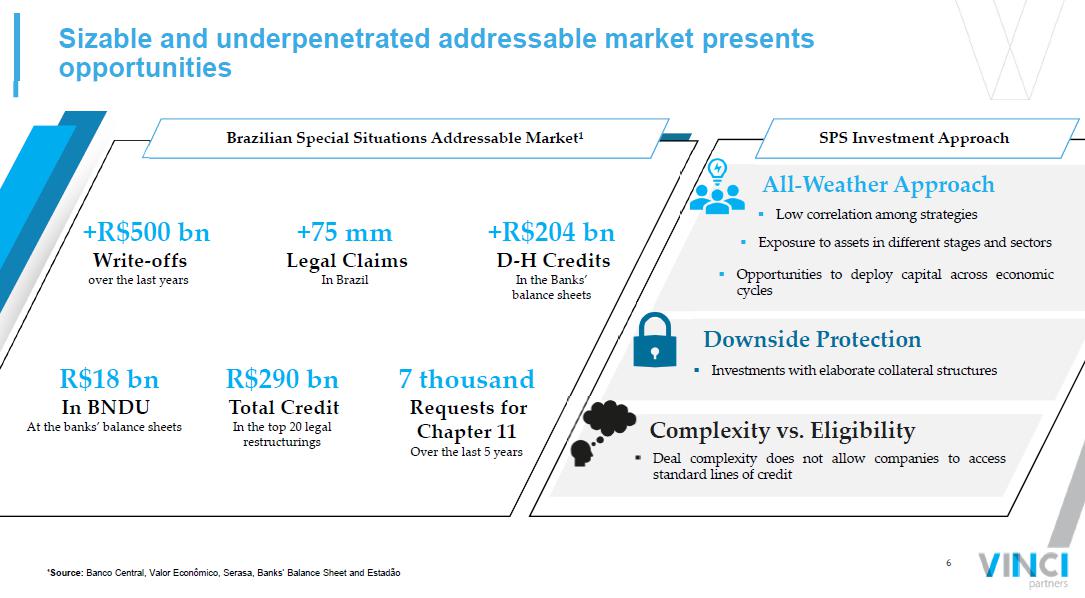

6 Vinci brand recognition Brazilian Special Situations Addressable Market¹ Sizable and underpenetrated addressable market presents opportunities ¹Source: Banco Central, Valor Econômico, Serasa, Banks’ Balance Sheet and Estadão +R$500 bn Write - offs over the last years +75 mm Legal Claims In Brazil +R$204 bn D - H Credits In the Banks’ balance sheets R$18 bn In BNDU At the banks’ balance sheets R$290 bn Total Credit In the top 20 legal restructurings 7 thousand Requests for Chapter 11 Over the last 5 years SPS Investment Approach All - Weather Approach ▪ Low correlation among strategies ▪ Exposure to assets in different stages and sectors ▪ Opportunities to deploy capital across economic cycles Downside Protection ▪ Investments with elaborate collateral structures Complexity vs . Eligibility ▪ Deal complexity does not allow companies to access standard lines of credit

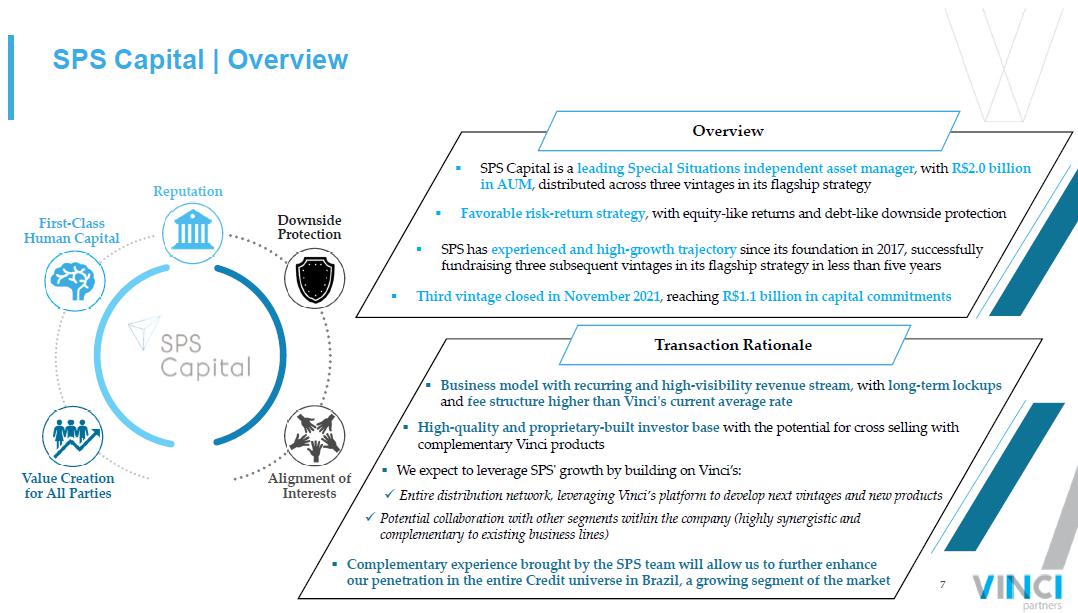

7 SPS Capital | Overview Reputation First - Class Human Capital Value Creation for All Parties Alignment of Interests Downside Protection Overview Transaction Rationale ▪ SPS Capital is a leading Special Situations independent asset manager , with R$2.0 billion in AUM , distributed across three vintages in its flagship strategy ▪ Favorable risk - return strategy , with equity - like returns and debt - like downside protection ▪ SPS has experienced and high - growth trajectory since its foundation in 2017, successfully fundraising three subsequent vintages in its flagship strategy in less than five years ▪ Third vintage closed in November 2021 , reaching R$1.1 billion in capital commitments ▪ Business model with recurring and high - visibility revenue stream , with long - term lockups and fee structure higher than Vinci's current average rate ▪ High - quality and proprietary - built investor base with the potential for cross selling with complementary Vinci products ▪ We expect to leverage SPS' growth by building on Vinci’s: x Entire distribution network, leveraging Vinci’s platform to develop next vintages and new products x Potential collaboration with other segments within the company (highly synergistic and complementary to existing business lines) ▪ Complementary experience brought by the SPS team will allow us to further enhance our penetration in the entire Credit universe in Brazil, a growing segment of the market

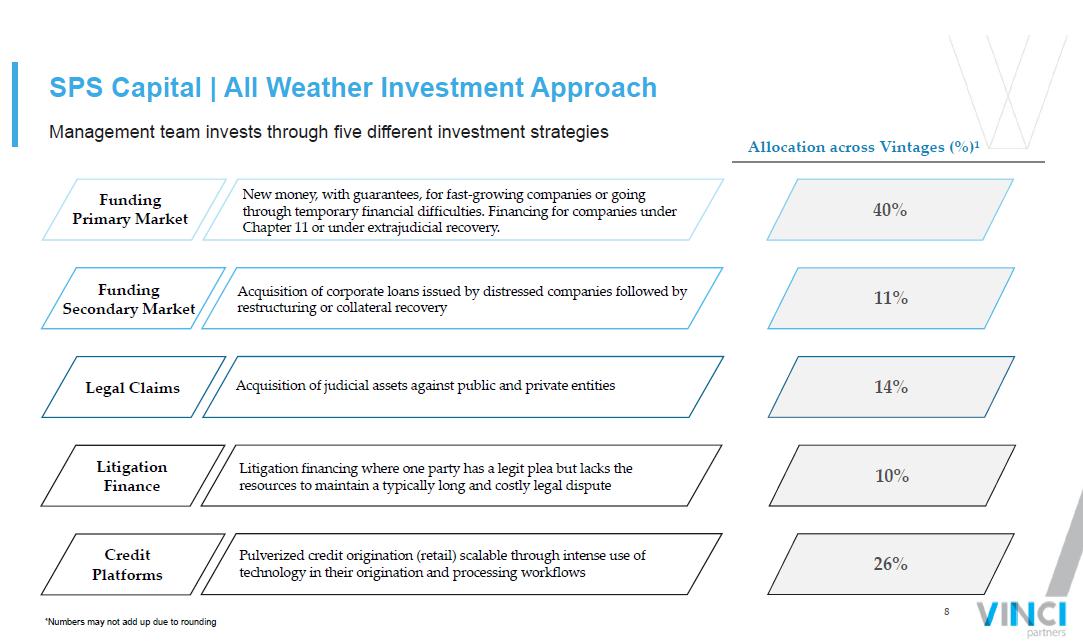

8 Management team invests through five different investment strategies SPS Capital | All Weather Investment Approach Allocation across Vintages (%)¹ Funding Primary Market Funding Secondary Market Legal Claims 40% New money, with guarantees, for fast - growing companies or going through temporary financial difficulties. Financing for companies under Chapter 11 or under extrajudicial recovery. Acquisition of corporate loans issued by distressed companies followed by restructuring or collateral recovery Acquisition of judicial assets against public and private entities Litigation financing where one party has a legit plea but lacks the resources to maintain a typically long and costly legal dispute Litigation Finance Pulverized credit origination (retail) scalable through intense use of technology in their origination and processing workflows Credit Platforms 11% 14% 10% 26% ¹Numbers may not add up due to rounding

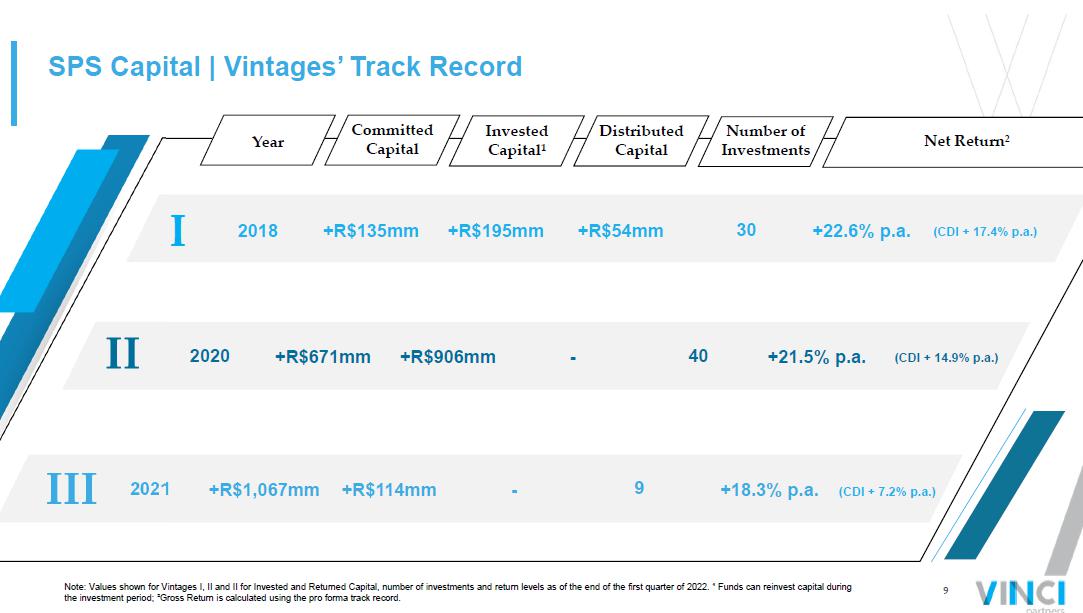

9 SPS Capital | Vintages’ Track Record Year Committed Capital Invested Capital¹ Distributed Capital Number of Investments Net Return² I II III +R$135mm +22.6% p.a. +R$195mm 30 2018 +R$54mm +R$671mm +21.5% p.a. +R$906mm 40 2020 - +R$1,067mm +18.3% p.a. +R$114mm 9 2021 - Note: Values shown for Vintages I, II and II for Invested and Returned Capital, number of investments and return levels as of th e end of the first quarter of 2022. ¹ Funds can reinvest capital during the investment period; ²Gross Return is calculated using the pro forma track record. (CDI + 17.4% p.a.) (CDI + 14.9% p.a.) (CDI + 7.2% p.a.)

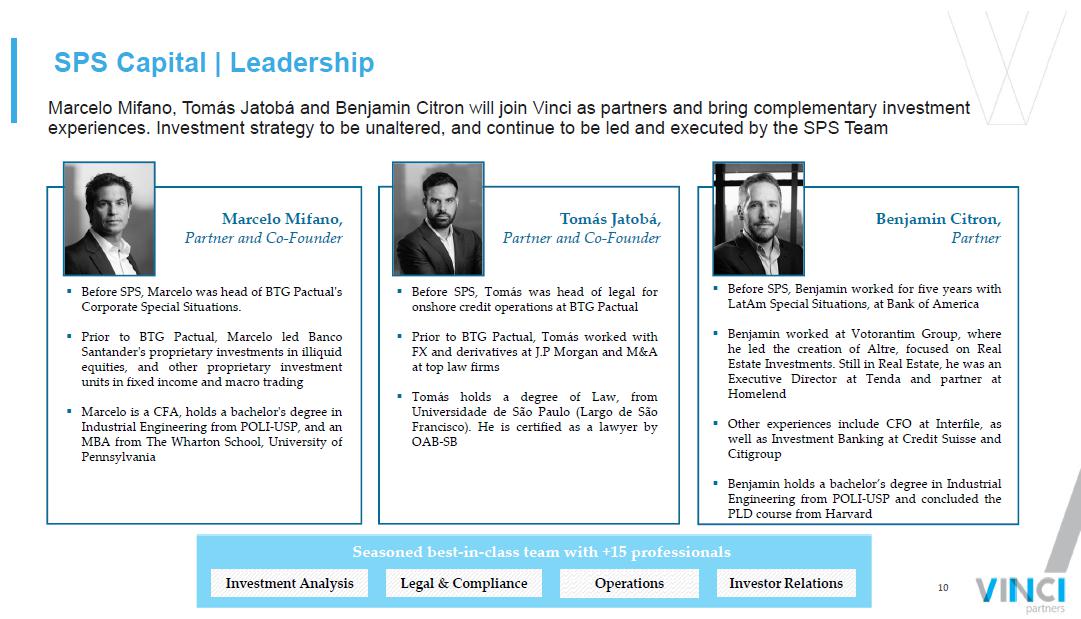

10 Marcelo Mifano, Tomás Jatobá and Benjamin Citron will join Vinci as partners and bring complementary investment experiences. Investment strategy to be unaltered, and continue to be led and executed by the SPS Team Marcelo Mifano, Partner and Co - Founder ▪ Before SPS, Marcelo was head of BTG Pactual's Corporate Special Situations . ▪ Prior to BTG Pactual, Marcelo led Banco Santander's proprietary investments in illiquid equities, and other proprietary investment units in fixed income and macro trading ▪ Marcelo is a CFA, holds a bachelor's degree in Industrial Engineering from POLI - USP, and an MBA from The Wharton School, University of Pennsylvania Tomás Jatobá, Partner and Co - Founder ▪ Before SPS, Tomás was head of legal for onshore credit operations at BTG Pactual ▪ Prior to BTG Pactual, Tomás worked with FX and derivatives at J . P Morgan and M&A at top law firms ▪ Tomás holds a degree of Law, from Universidade de São Paulo (Largo de São Francisco) . He is certified as a lawyer by OAB - SB SPS Capital | Leadership Benjamin Citron, Partner ▪ Before SPS, Benjamin worked for five years with LatAm Special Situations, at Bank of America ▪ Benjamin worked at Votorantim Group, where he led the creation of Altre , focused on Real Estate Investments . Still in Real Estate, he was an Executive Director at Tenda and partner at Homelend ▪ Other experiences include CFO at Interfile, as well as Investment Banking at Credit Suisse and Citigroup ▪ Benjamin holds a bachelor’s degree in Industrial Engineering from POLI - USP and concluded the PLD course from Harvard Seasoned best - in - class team with +15 professionals Investment Analysis Legal & Compliance Operations Investor Relations

11 13.0 5.2 4.3 1.5 2.0 25.7 7.1 2.8 Private Equity Real Estate Credit Infrastructure Vinci SPS IP&S Public Equities Hedge Funds 13.0 5.2 4.3 1.5 25.7 7.1 2.8 R$60 bn AUM 2Q’22 R$62 bn AUM 2Q’22 ProForma Vinci Partners Vinci Partners & SPS Proforma 28 30 Vinci & SPS | AUM Proforma as of June 30, 2022 Note: Vinci Partners ended the first quarter of 2022 with R$57 billion in assets under management. Long Term AUM 2Q22 2Q22 PF +8% DE Accretion ▪ Low - to - mid single - digit short - term DE/Share accretion ▪ High single - digit expected for medium - term DE/Share accretion

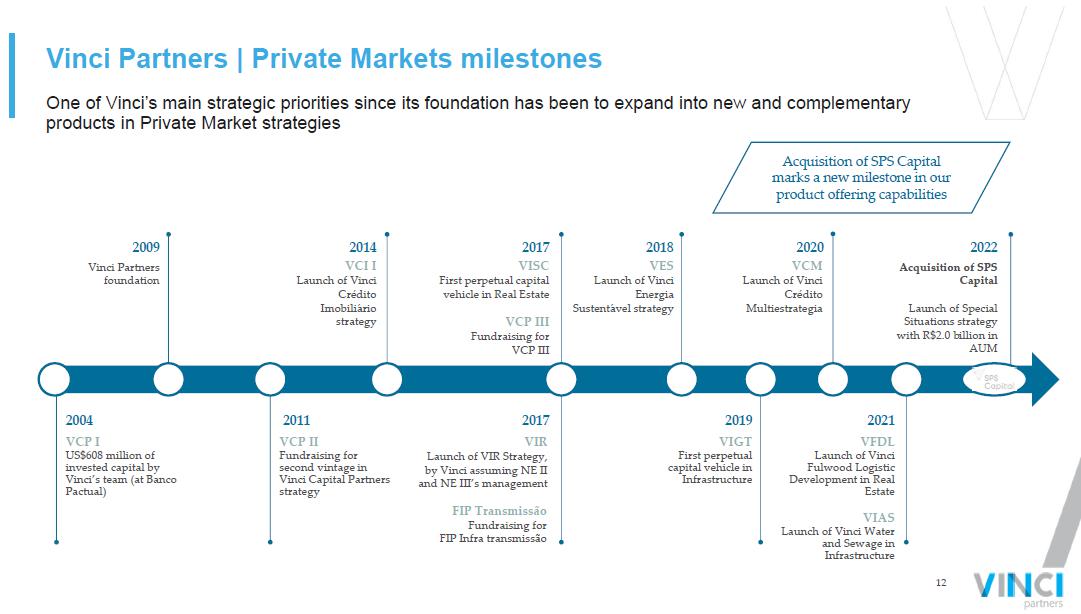

12 One of Vinci’s main strategic priorities since its foundation has been to expand into new and complementary products in Private Market strategies Vinci Partners | Private Markets milestones Vinci Partners foundation 2009 VISC First perpetual capital vehicle in Real Estate VCP III Fundraising for VCP III 2017 VCI I Launch of Vinci Crédito Imobiliário strategy 2014 2018 VCP II Fundraising for second vintage in Vinci Capital Partners strategy 2017 2021 VFDL Launch of Vinci Fulwood Logistic Development in Real Estate VIAS Launch of Vinci Water and Sewage in Infrastructure 2004 VCP I US$608 million of invested capital by Vinci’s team (at Banco Pactual) Acquisition of SPS Capital Launch of Special Situations strategy with R$2.0 billion in AUM 2022 2011 VIR Launch of VIR Strategy, by Vinci assuming NE II and NE III’s management FIP Transmissão Fundraising for FIP Infra transmissão VES Launch of Vinci Energia Sustentável strategy 2020 VCM Launch of Vinci Crédito Multiestrategia 2019 VIGT First perpetual capital vehicle in Infrastructure Acquisition of SPS Capital marks a new milestone in our product offering capabilities

13 Transaction with SPS fills a strategic gap within our Private Markets product offering Vinci Partners & SPS | Consolidating Private Markets Vinci SPS SPS Capital will join Vinci Partners’ Private Markets as a new business line, with three vintages in its flagship strategy Equity Investments Closed - end funds seeking exposure to equity investments to real assets across Private Equity, Real Estate and Infrastructure strategies Perpetual Capital Vehicles Yield - focused vehicles listed on the Brazilian stock exchange, with exposure to Real Estate and Infrastructure assets or Credit securities Private Market Strategies Vinci Capital Partners (VCP) Vinci Impact and Return (VIR) Vinci Fullwood Logistic Dev. (VFDL) Vinci Water & Sewage (VIAS) Vinci Shopping Centers (VISC) Vinci Logística (VILG) Vinci Offices (VINO) Vinci Instrumentos Financeiros (VIFI) Vinci Imóveis Urbanos (VIUR) Vinci Energia (VIGT) Vinci Credit Securities (VCRI) High - Grade Private Credit Debentures to finance infrastructure projects, senior loans, mortgage - backed securities, securitization facilities and structured - credit transactions. Vinci Real Estate Credit (VCI) Vinci Multistrategies Credit (VCM) Vinci Infrastructure Credit (VES) We believe SPS will leverage Vinci’s platform and distribution capabilities to launch new and different strategies, additional to fundraising for a fourth vintage in its current flagship. FIP Infra Transmissão

14 Transaction Overview Transaction Structure ▪ Initial cash component at closing ▪ Additional consideration in VINP Class A common stock, up to 1.7 million shares , through an earnout structure to be paid in early 2027 Additional Considerations ▪ SPS team will be entitled to receive 100% of performance fee revenues from Vintages I and II (fully invested) and 70% of performance fee revenues from Vintage III ▪ Additional vintages and other funds raised will be subject to Vinci’s standard performance compensation structure for Private Market strategies ▪ Marcelo Mifano (Partner and Co - Founder of SPS) will join Vinci’s Executive Committee ▪ Earnout subject to the achievement of certain fundraising and incremental management fee revenue targets ▪ Transaction expected to close until the end of the third quarter 2022

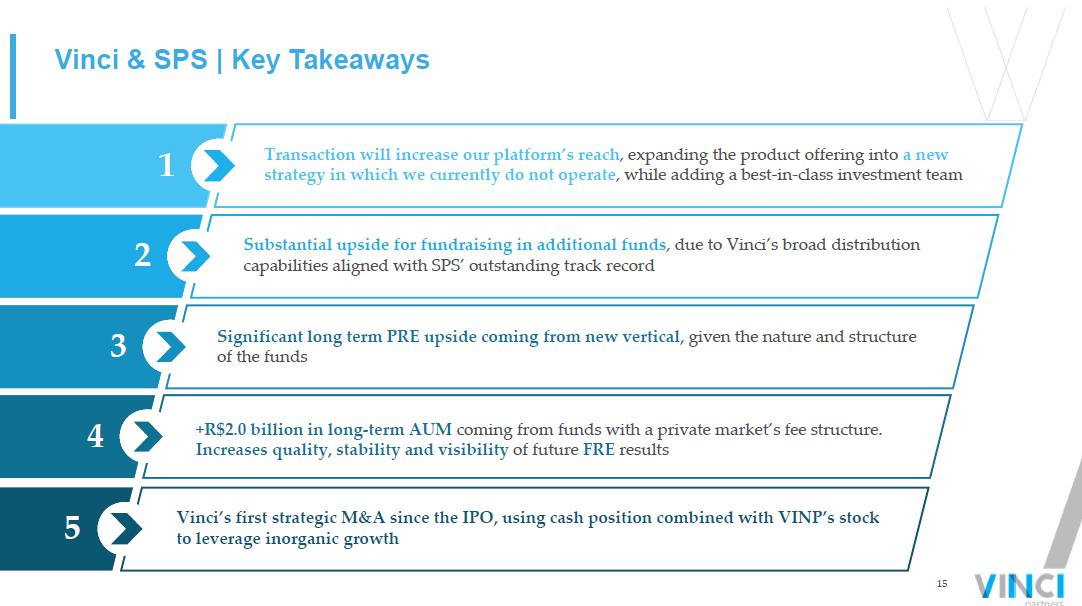

15 Transaction will increase our platform’s reach , expanding the product offering into a new strategy in which we currently do not operate , while adding a best - in - class investment team 1 2 Significant long term PRE upside coming from new vertical, given the nature and structure of the funds 3 +R$2.0 billion in long - term AUM coming from funds with a private market’s fee structure . Increases quality, stability and visibility of future FRE results 4 Substantial upside for fundraising in additional funds , due to Vinci’s broad distribution capabilities aligned with SPS’ outstanding track record Vinci’s first strategic M&A since the IPO, using cash position combined with VINP’s stock to leverage inorganic growth 5 Vinci & SPS | Key Takeaways

16 Rio de Janeiro 55 21 2159 6000 Av. Bartolomeu Mitre, 336 Leblon - 22431 - 002 São Paulo 55 11 3572 3700 Av. Brigadeiro Faria Lima, 2.277 14 o andar Jardim Paulistano - 01452 - 000 Recife 55 81 3204 6811 Av. República do Líbano, 251 - Sala 301 Torre A - Pina - 51110 - 160 Nova York 1 646 559 8000 780 Third Avenue, 25 th Floor - 10017