| 2022 FINANCIAL REPORT OVERVIEW1 Since 1958, the European Investment Bank (EIB, or the Bank) has been promoting the policies and priorities of the European Union, while standing ready to scale up its support during exceptional times of crisis. Russia’s invasion of Ukraine in February 2022 has brought additional challenges to a global economy still dealing with the aftermath of the coronavirus pandemic. The European Union has adapted its policies in response, redirecting substantial resources, including political, financial and humanitarian assistance to Ukraine and the unfolding energy crisis. The EIB stands by the government and the people of Ukraine. In March 2022, the Bank, in agreement with the European Commission, provided a EUR 668 million financial support package to help Ukraine meet its most immediate and urgent financial needs. In July 2022, the EIB proposed a second support package of EUR 1.59 billion, to help the country fix damaged infrastructure, restart municipal services, and support urgent energy efficiency measures in preparation for the cold season. Disbursements under both packages benefit from guarantees from the European Union and complement other initiatives announced by EU institutions and the Member States of the European Union (EU Member States). The Bank also provided a EUR 4.0 billion package for the EU Member States hosting Ukrainian refugees, financing key infrastructure and services for refugees and host communities. The EIB continues to work on new initiatives to assist Ukraine over the short- and medium-term and to support its long-term goal of acceding to the European Union. The war in Ukraine and its impact on energy exports have also triggered a shock to the EU economy with significant challenges to the security and affordability of our energy supplies. This crisis adds a new strategic rationale to the European Union’s decarbonisation goal and calls for an acceleration of the clean energy transition already underway. In this context, the EIB welcomes the REPowerEU plan proposed by the European Commission and strongly supports the objective of phasing out the European Union’s dependency on Russian gas, oil and coal imports as soon as possible. With this objective in mind, the EIB and the European Investment Fund (EIF and together, the EIB Group) announced in October 2022 a financing package of an additional EUR 30 billion over the next five years for renewables, energy efficiency, grids and storage, electric-vehicle charging infrastructure, and breakthrough technologies, such as low-carbon hydrogen. Through the second year of implementation of its Climate Bank Roadmap, introduced in 2020, the EIB Group has remained strongly committed to financing projects supporting climate action and environmental sustainability. In 2022, the EIB signed EUR 36.6 billion of finance supporting climate action and environmental sustainability globally (58% of the Bank’s total financing, compared to 51% in 2021)2 .. This represents an increase of approximately EUR 10 billion compared with 2021, driven to a large degree by an increase in renewable energy, energy efficiency and innovation in support. During COP27, the United Nations Climate Conference in Egypt, the Bank stepped up its efforts for the protection, restoration and sustainable use of nature, with the introduction of its Environment Framework, which promotes a green, resilient, equitable and inclusive development approach. The new Environment Framework consolidates the EIB’s efforts and activities contributing to environmental sustainability. It supports the EIB’s putting into action of its commitment, taken at the COP26, the United Nations Climate Conference in Glasgow, along with other multilateral development banks, to step up 1. This section covers the activities and financial information of the European Investment Bank. The figures presented have to be viewed together with the Statutory Financial Statements of the Bank prepared in accordance with the EU Accounting Directives (unless otherwise stated). 2. 2022 data under the Bank’s own resources are preliminary and unaudited. 1 |

| Overview efforts towards the protection, restoration and sustainable use of nature. The EIB remains dedicated to its statutory mission of supporting the European Union’s economic and social cohesion and contributing to innovation and digitalisation investment, as well as to the European Union’s competitiveness. In 2022 alone, EIB financing to the European Union’s cohesion priority regions amounted to EUR 24.8 billion, equivalent to 45.9% of the Bank's total signatures in the European Union (compared to EUR 19.8 billion or 41% in 2021). The EIB Group continues to support a transition towards environmentally sustainable economies and societies, for example, by helping regions that depend greatly on coal, oil and other fossil fuels to make the switch towards low-carbon and resilient economies. As in previous crises, the EIB Group is acting as a countercyclical force, supporting investment and growth in the European Union and beyond. Since the start of the coronavirus pandemic, the EIB Group has mobilised its resources to counter the disease and the economic fallout of the pandemic. In 2022, the EIB Group signed EUR 8.6 billion in new support related to its pandemic response programmes. Moreover, in light of the additional burdens weighing on the recovery from the pandemic, the allocation period for the guarantee products under the EIB pan-European Guarantee Fund (EGF), launched in 2020, was extended until the end of 2022. Delivering on EU mandates in the context of the 2021-2027 Multiannual Financial Framework (MFF) was an important part of the EIB Group’s activity in 2022. In March 2022, the EIB Group signed the InvestEU Guarantee Agreement and the InvestEU Advisory Hub Agreement, each with the European Commission. InvestEU is a key pillar of the European Union’s largest ever stimulus package, designed to support recovery from the pandemic and help build a greener, more digital and more resilient European economy. The EIB Group is proud to be the privileged partner in the InvestEU scheme, implementing 75% of the EU budget guarantee (EUR 19.7 billion) to support finance and investment operations. The EIB continues to support the EU Member States by helping them leverage the resources of the Recovery and Resilience Facility, the European Union’s centrepiece to address the medium and long-term negative economic effects of the COVID-19 crisis and facilitate the implementation of new investment projects. EIB Global was launched in January 2022 as a direct response to the request by the Council of the European Union to strengthen the impact of EIB operations beyond the European Union based on dedicated strategies, stronger partnerships and an inclusive association of development policy makers. As such, it is an integral part of the European Union’s external and development financing toolbox. EIB Global benefits from the engagement and support of the EU Member States, the European Commission and increasing cooperation with development stakeholders. It supports the delivery and works within the parameters of EU external action policies in partner and candidate countries and is strengthening its presence at the country level within EU delegations. EIB Global is well placed to contribute to the EU global and geopolitical agenda and deploy its unique expertise in financing the green and digital transitions. It stands ready to provide a key contribution to addressing the extraordinary challenges many countries beyond the European Union are facing. In 2022, new financing signed by the Bank amounted to EUR 65.1 billion3 (of which EUR 62.6 billion under the Bank’s own resources), close to the upper end of the target range set in the 2022-24 Operational Plan4 (compared to EUR 65.4 billion, of which EUR 54.3 billion under the Bank’s own resources in 2021). Total disbursements reached EUR 57.6 billion5 in 2022 (of which EUR 56.7 billion under the Bank’s own resources). In 2021, total disbursements amounted to EUR 41.4 billion (of which EUR 40.4 billion under the Bank’s own resources). 3. Includes all resources: loans, equities and guarantees. 4. The annual Operational Plan includes performance orientations and elaborates on major priorities and activities of the EIB Group for the coming three years. 5. Includes all resources: loans, equities and guarantees. 2 |

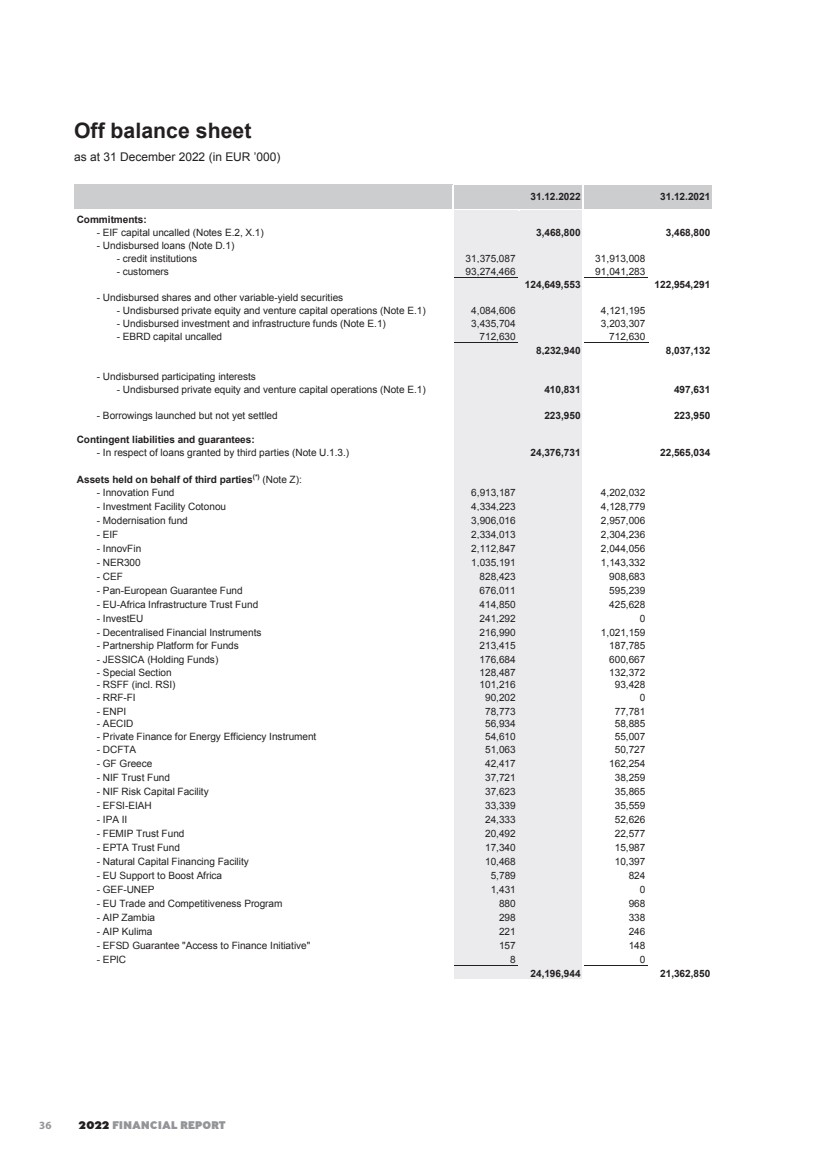

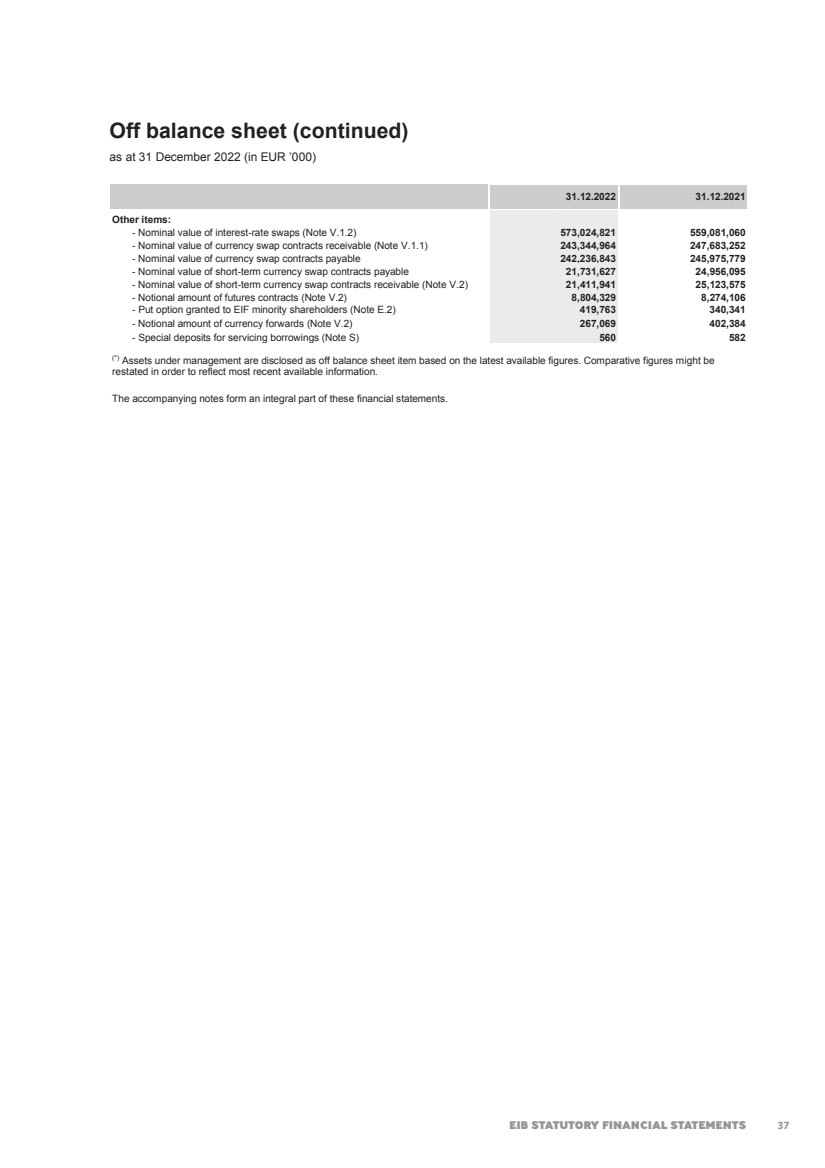

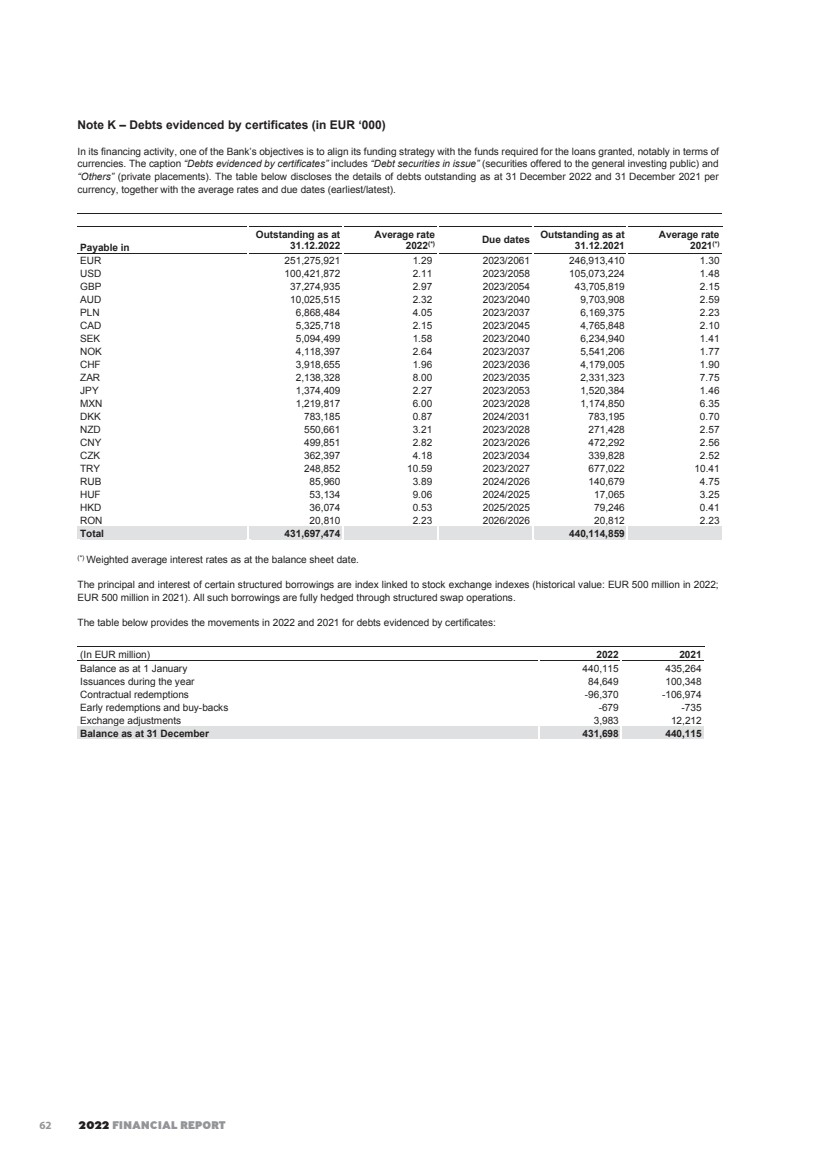

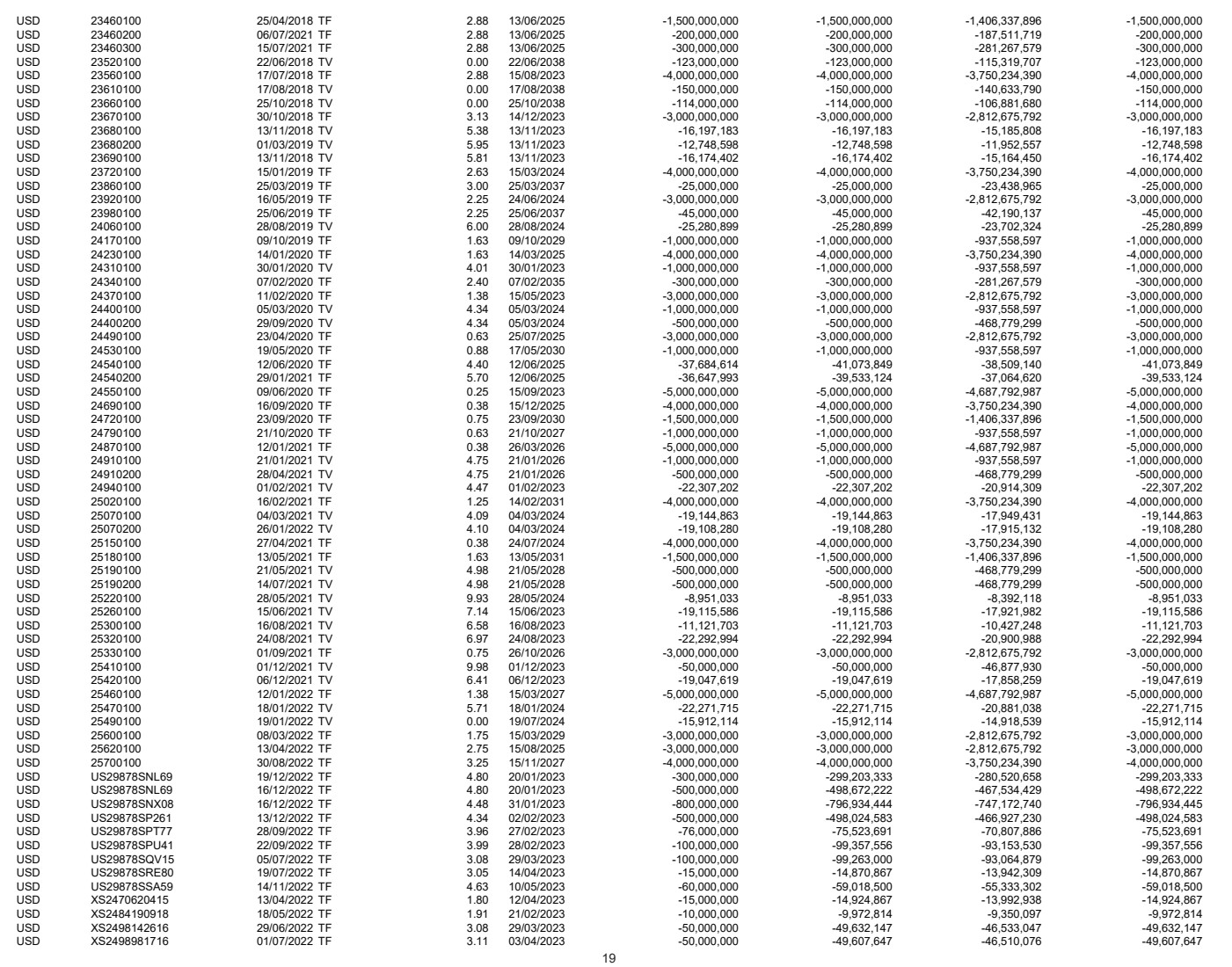

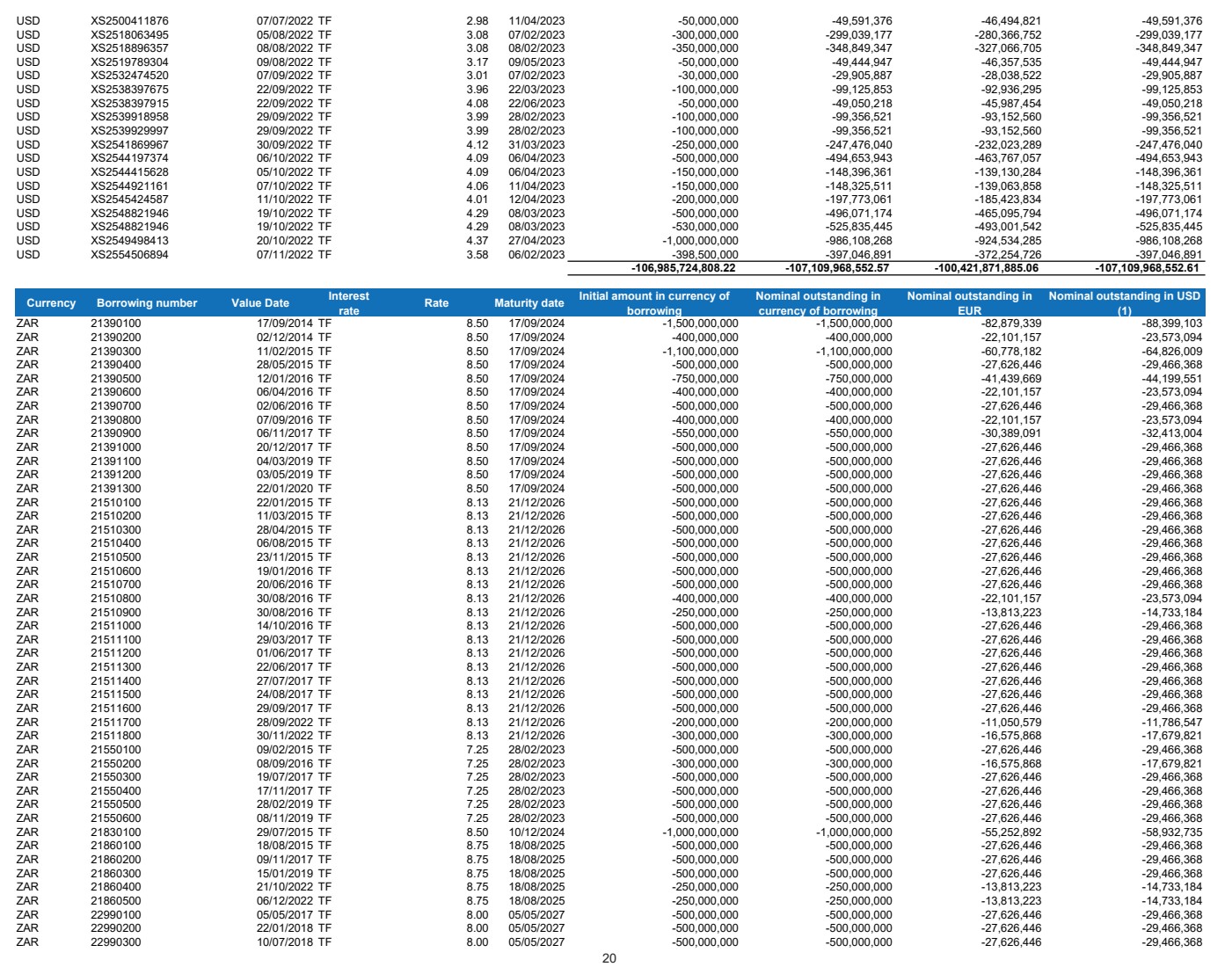

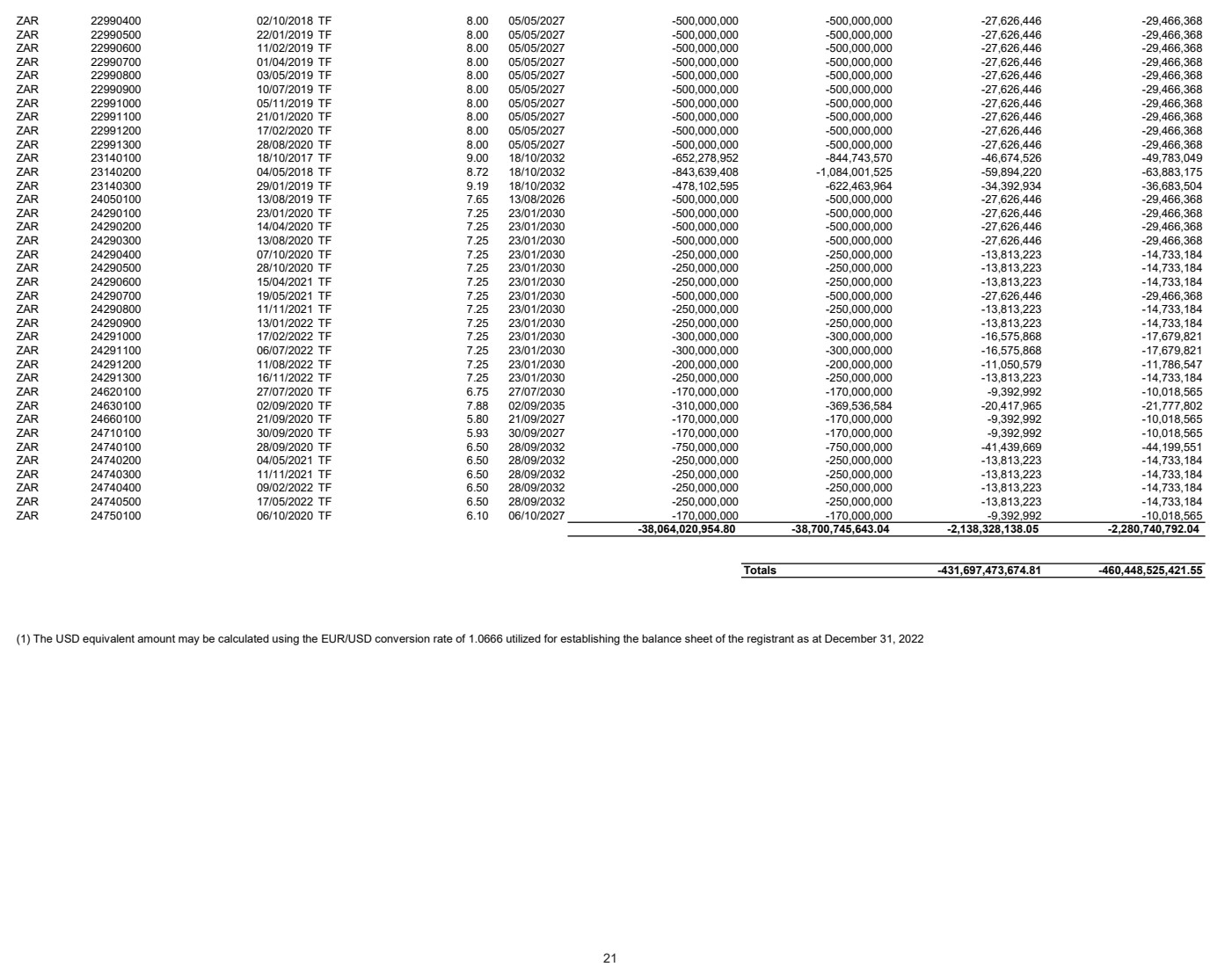

| 2022 FINANCIAL REPORT Over the course of 2022, the Bank raised EUR 44.3 billion on the international capital markets, to finance lending activities and other cashflow needs. The EIB is a leading issuer in the sovereigns, supranationals and agencies (SSA) segment, and actively contributes to innovation and development in the capital markets, promoting cutting-edge standards. The EIB reaffirmed its presence in the global climate and sustainability bond markets, having issued a record EUR 19.9 billion in Climate and Sustainability Awareness Bonds (CABs and SABs) in 2022. The EIB increased the climate and sustainability funding share in its total funding from 21% in 2021 to a record 45% in 2022. The growth of climate action and environmental sustainability lending facilitated substantial growth in climate and sustainability funding, including the first benchmark-sized climate and sustainability issues by the Bank. This led to a significant increase of benchmark issuances in the total funding. The EIB also continued to spearhead developments in the digitalisation of capital markets with the issuance of EUR-denominated digital bonds on a private blockchain in November 2022. Outstanding borrowings and commercial paper amounted to EUR 431.6 billion at the end of 2022, compared to EUR 440.1 billion at the end of 2021. The EIB has a prudent approach to liquidity management, focusing on liquid and very high-quality investments. Treasury assets totalled EUR 77.5 billion at the end of 2022 (compared to EUR 105.6 billion at the end of 2021). The Bank’s total liquidity ratio remains well within internal limits, covering 95.4% of 2023 projected net cash outflows (compared to 117.2% at the end of 2021), while the liquidity coverage ratio stood at 348.0% and the net stable funding ratio (NSFR) amounted to 124.6% (compared to 564.9% and 130.0% respectively in ‘2021). Importantly, the EIB’s access to the Eurosystem’s refinancing facility provides additional protection in circumstances of extreme liquidity stress. The EIB's risk management strategy is based on a robust due diligence process, adequate levels of security and guarantees, as well as standard protective clauses included in its loan agreements. The level of loan impairments is only 0.4% at the end of 2022 (0.3% at the end of 2021) supported by securities, guarantees and portfolio credit enhancements in place. The portion of payments overdue by more than 90 days remains very low, totalling EUR 77.7 million at the end of 2022 (EUR 118.7 million at the end of 2021) and representing only 0.02% of the risk portfolio. Provisions on loans decreased from EUR 443.9 million at the end of 2021 to EUR 402.5 million at the end of 2022. The latter includes the recording of a collective provision to reflect the potential effects of the Russian invasion of Ukraine on the loan portfolio. In 2022, the EIB generated positive financial results, booking an annual surplus of EUR 2.4 billion as compared to EUR 2.6 billion in 2021. The annual surplus is fully retained, contributing to the Bank’s own funds and supporting its long-term financing capacity. The EIB Common Equity Tier 1 (CET1) ratio increased from 32.3% at the end of 2021 to 35.1% at the end of 2022, essentially due to the positive development of the stock and the retained annual surplus. The Capital Requirement Regulation II leverage ratio increased from 10.9% to 11.8% during 2022, mainly due to the increase in Tier 1 capital from the annual surplus accumulation. 3 |

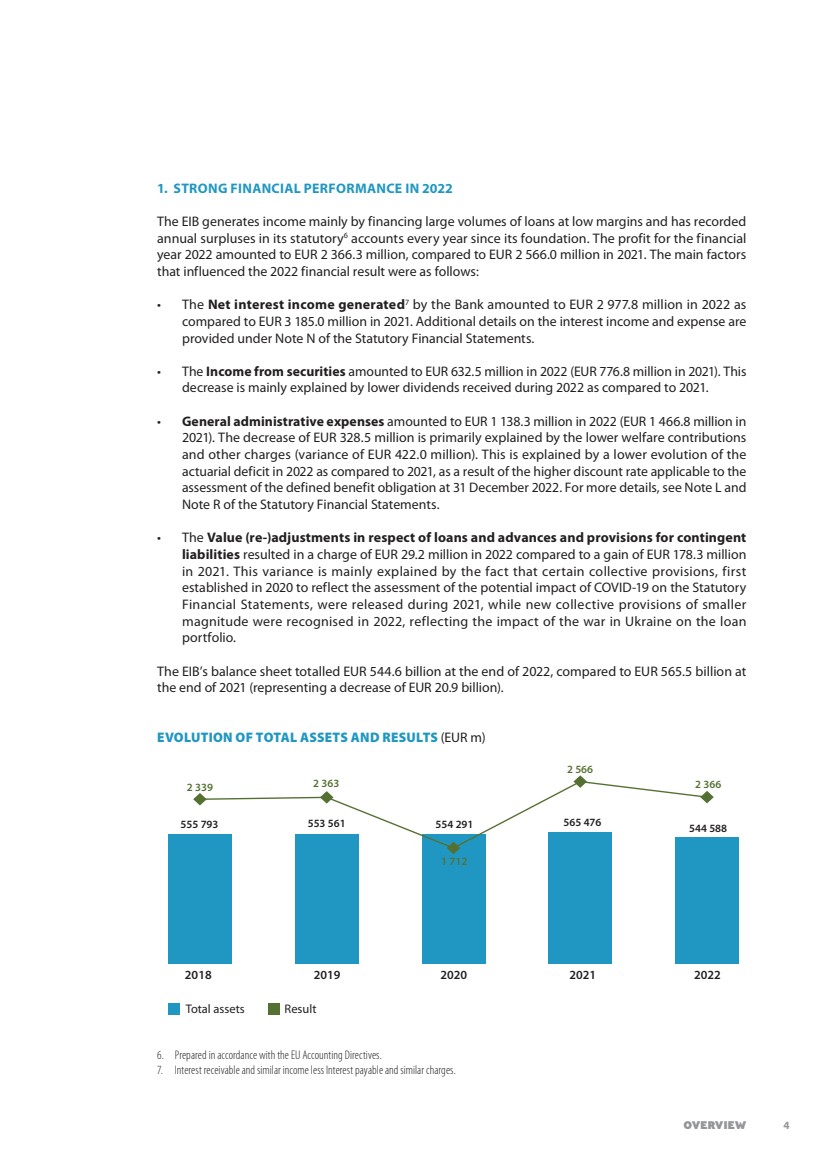

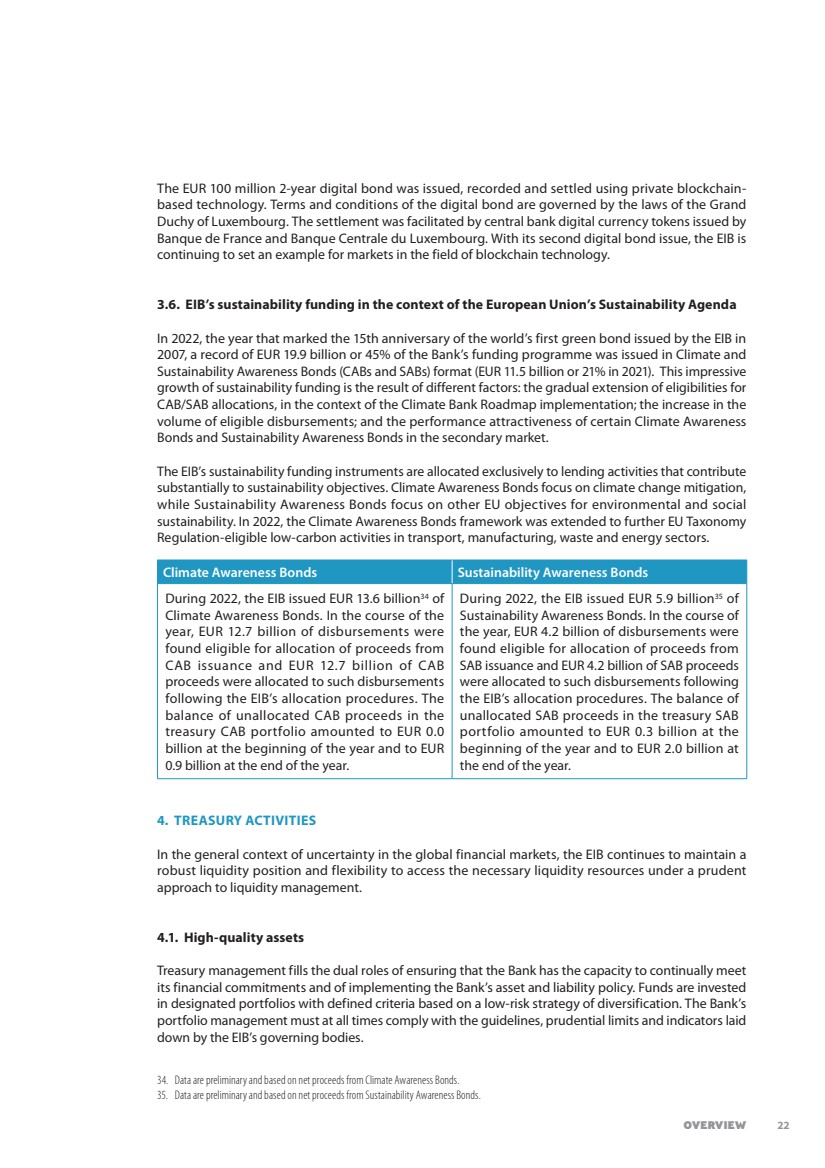

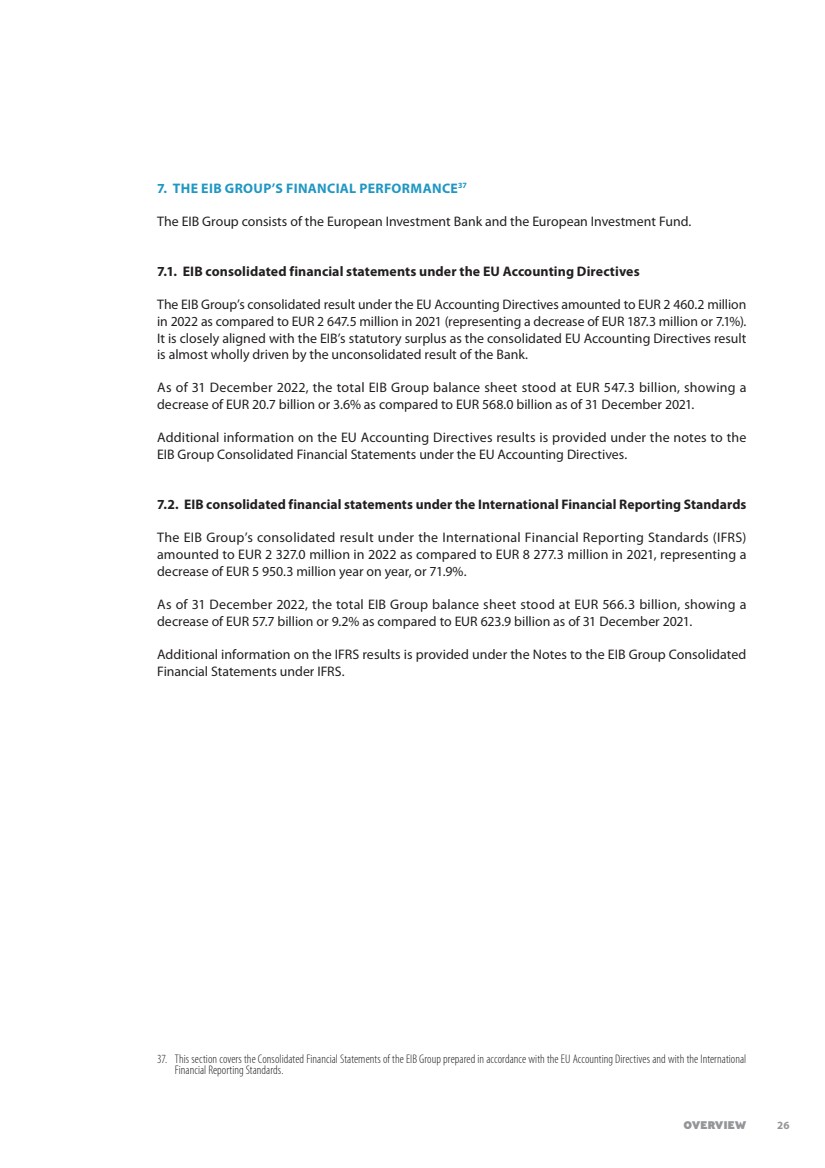

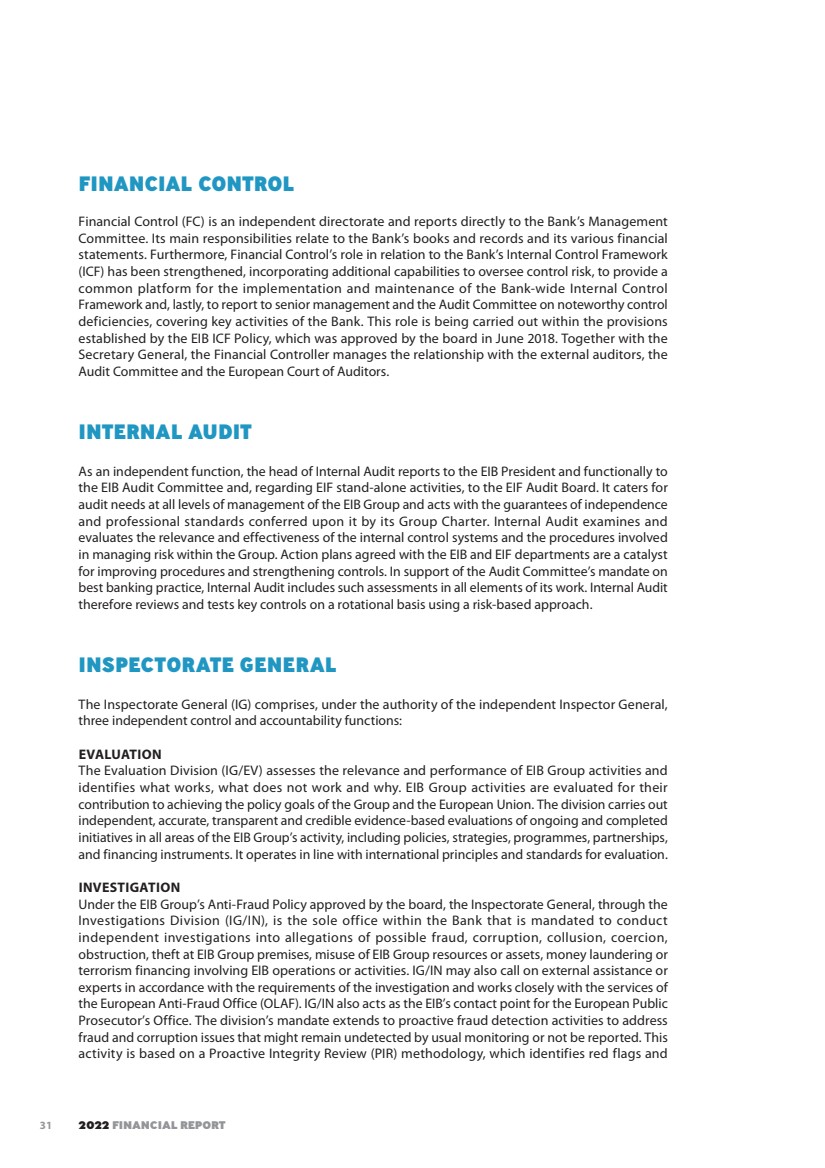

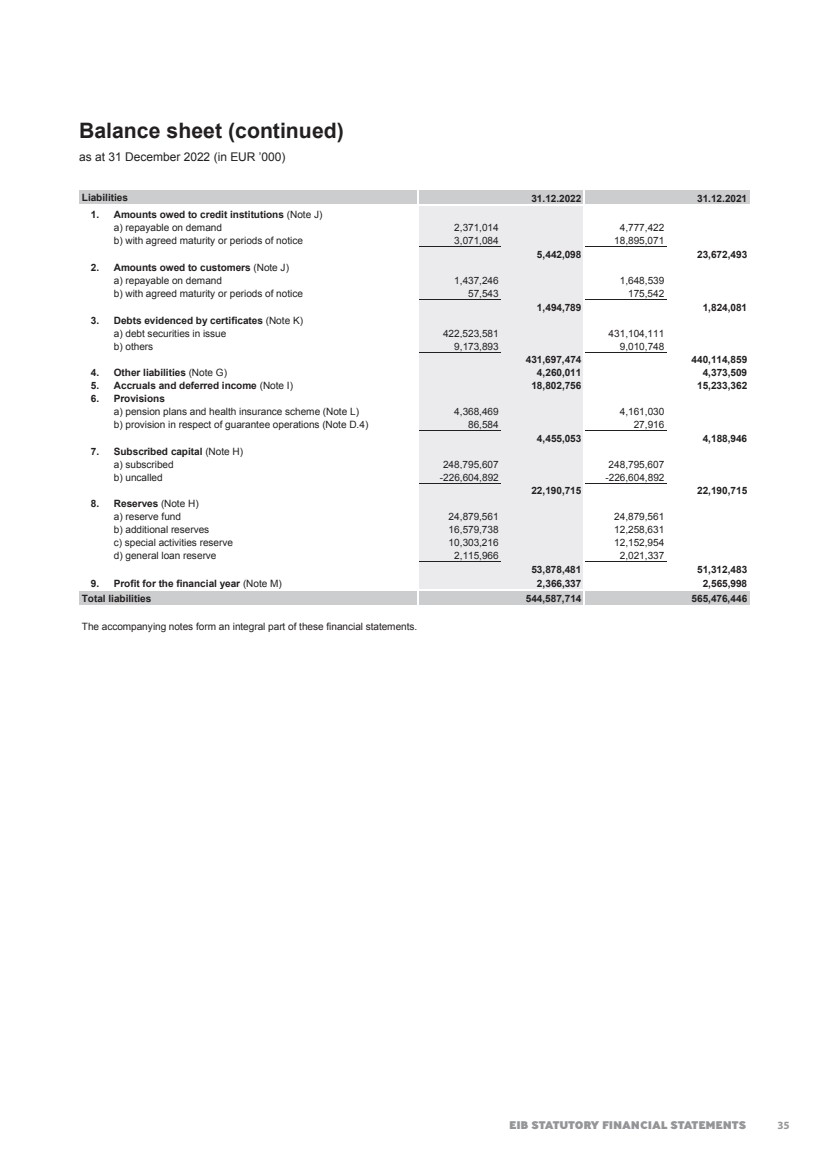

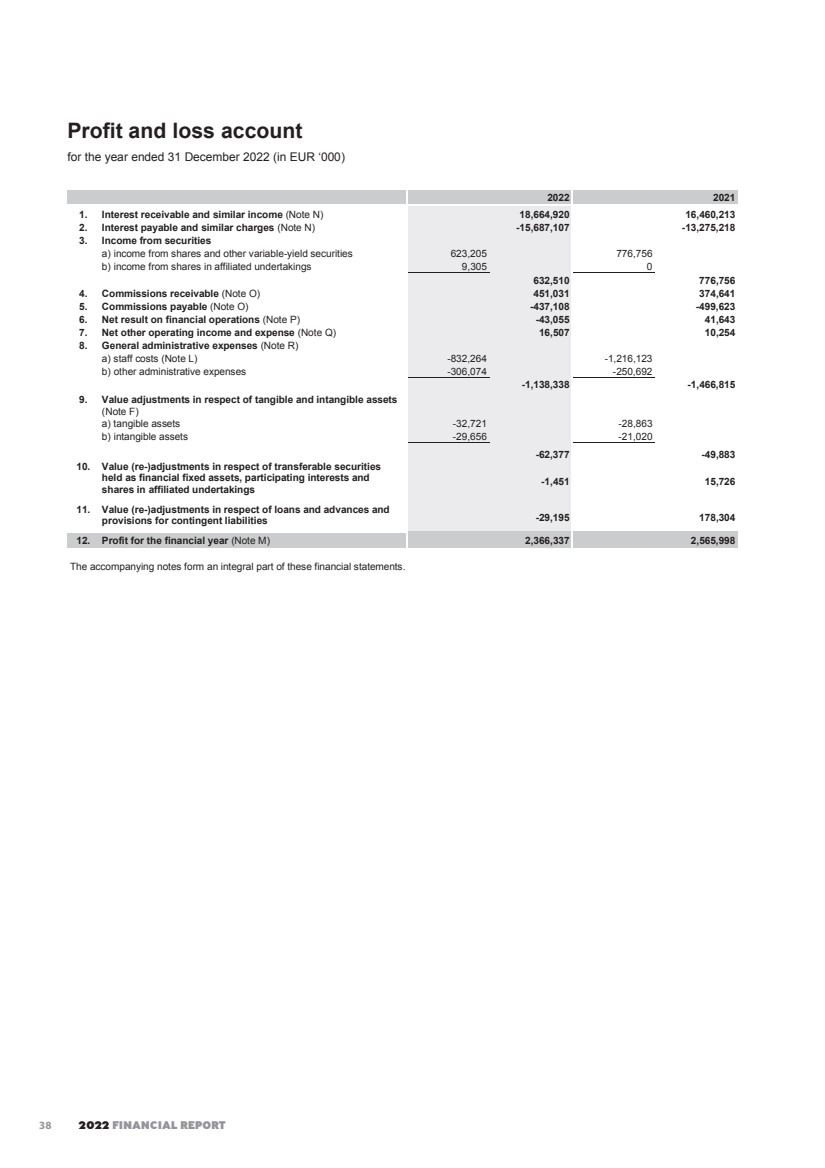

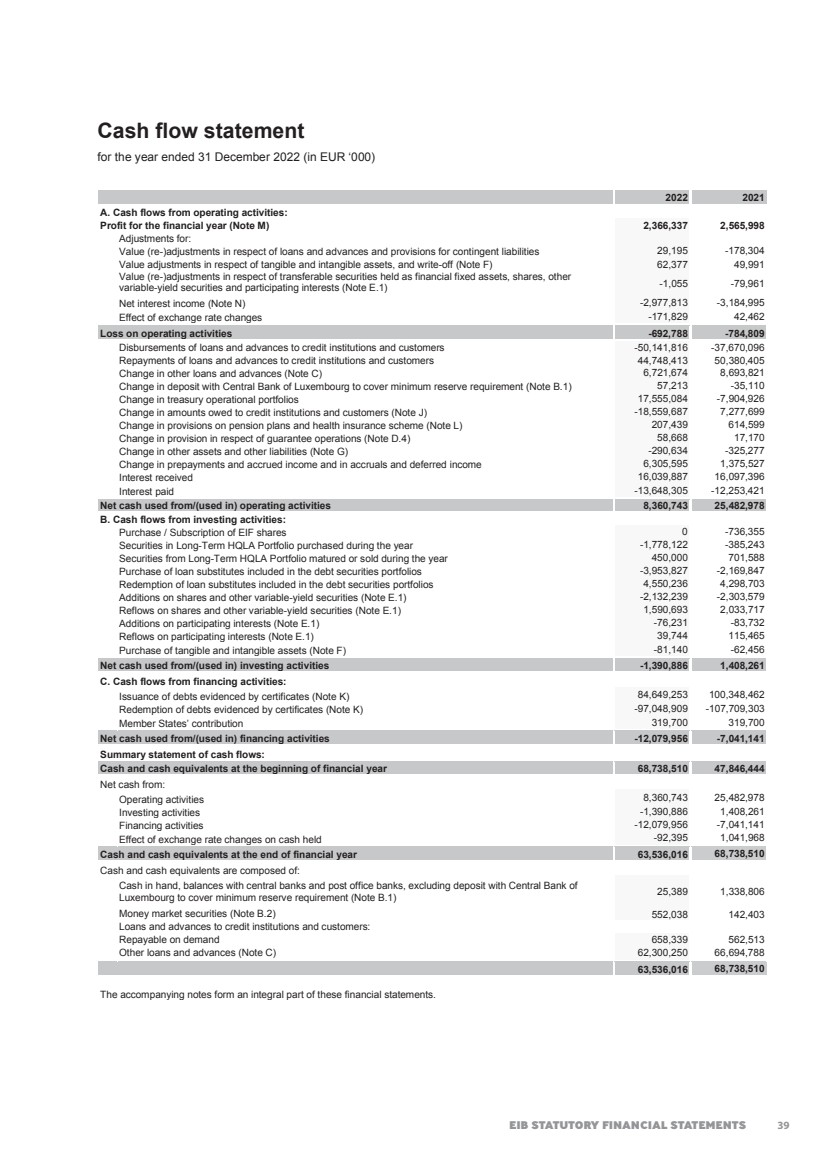

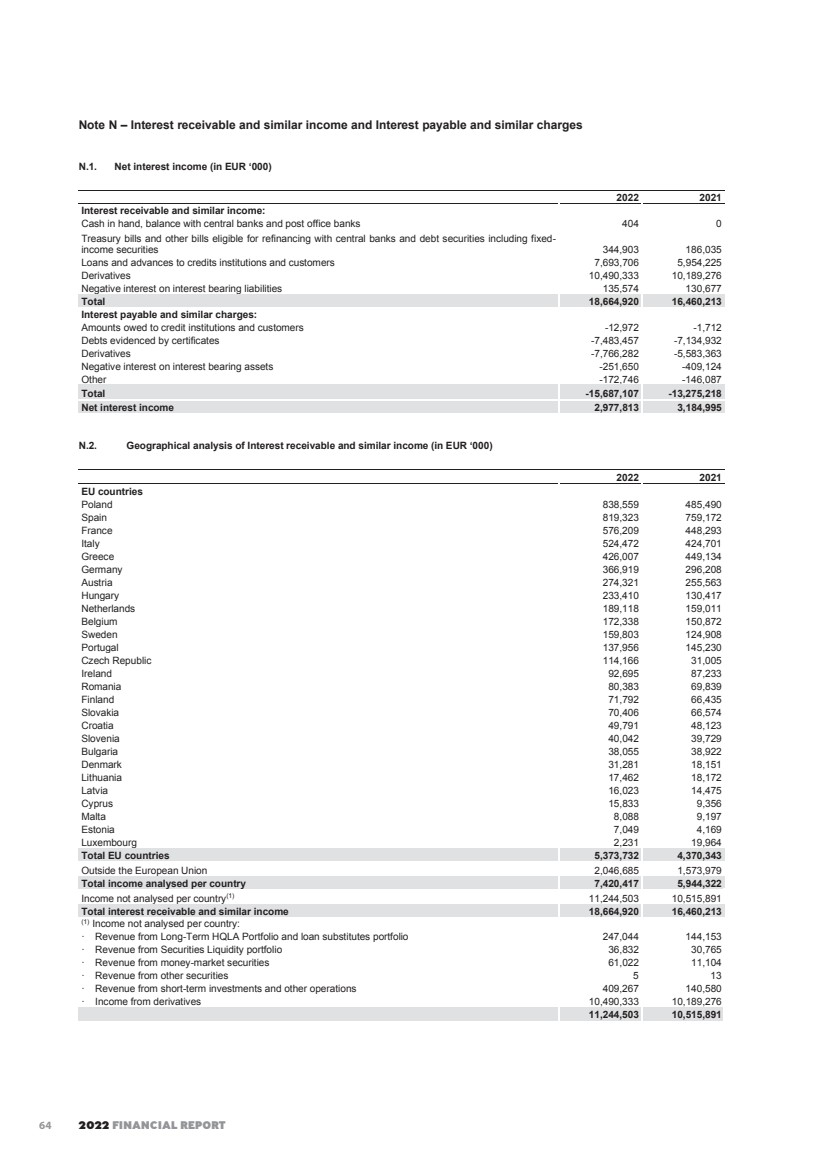

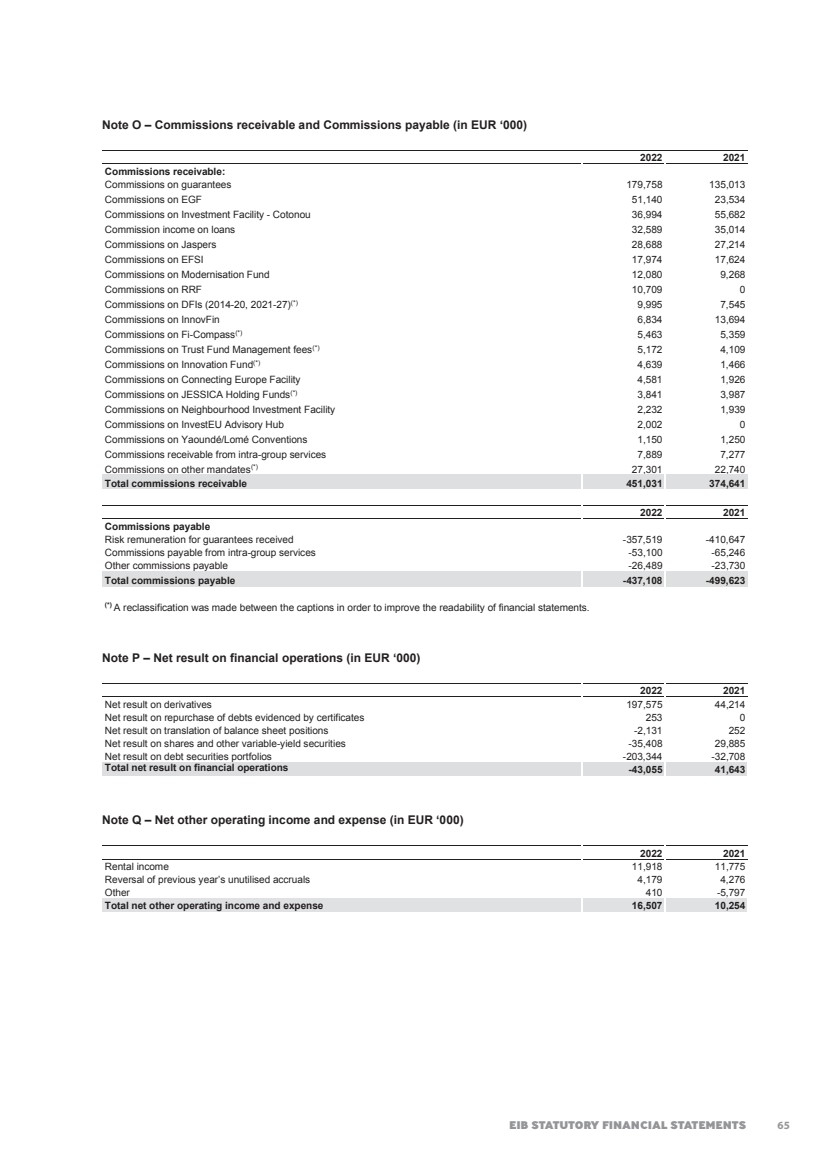

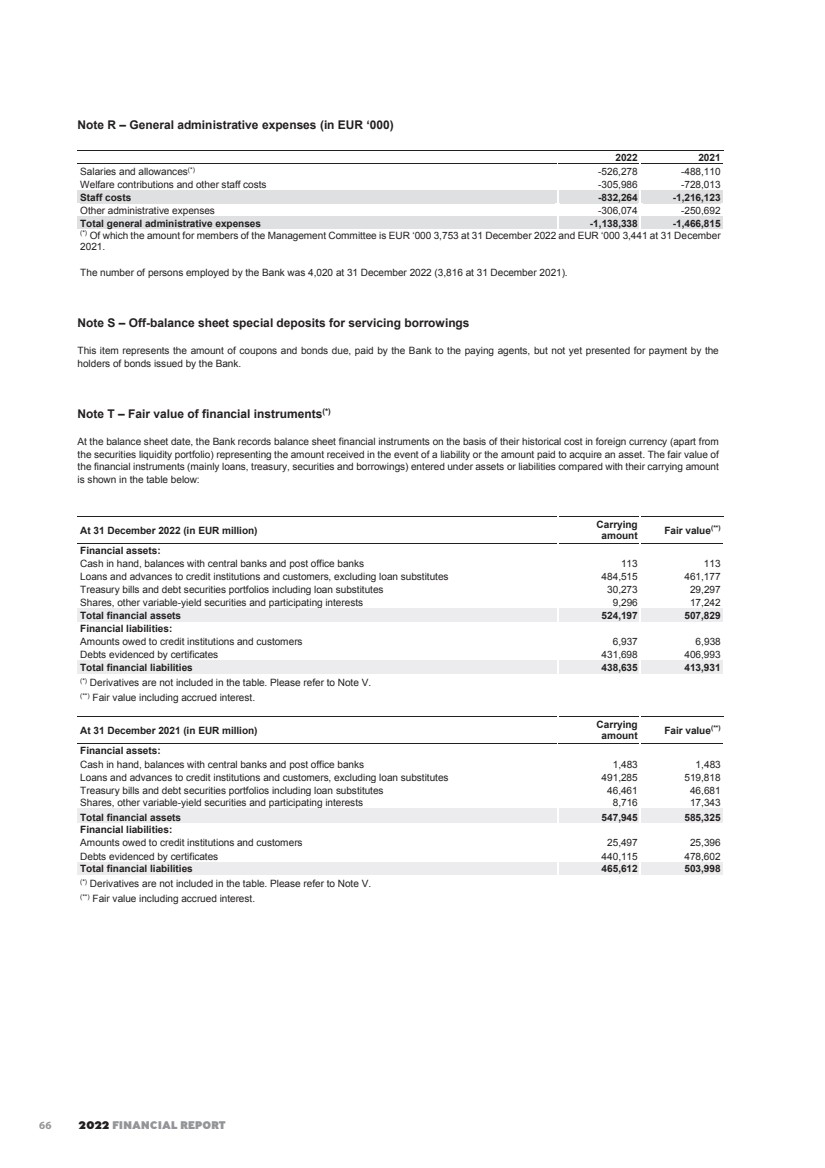

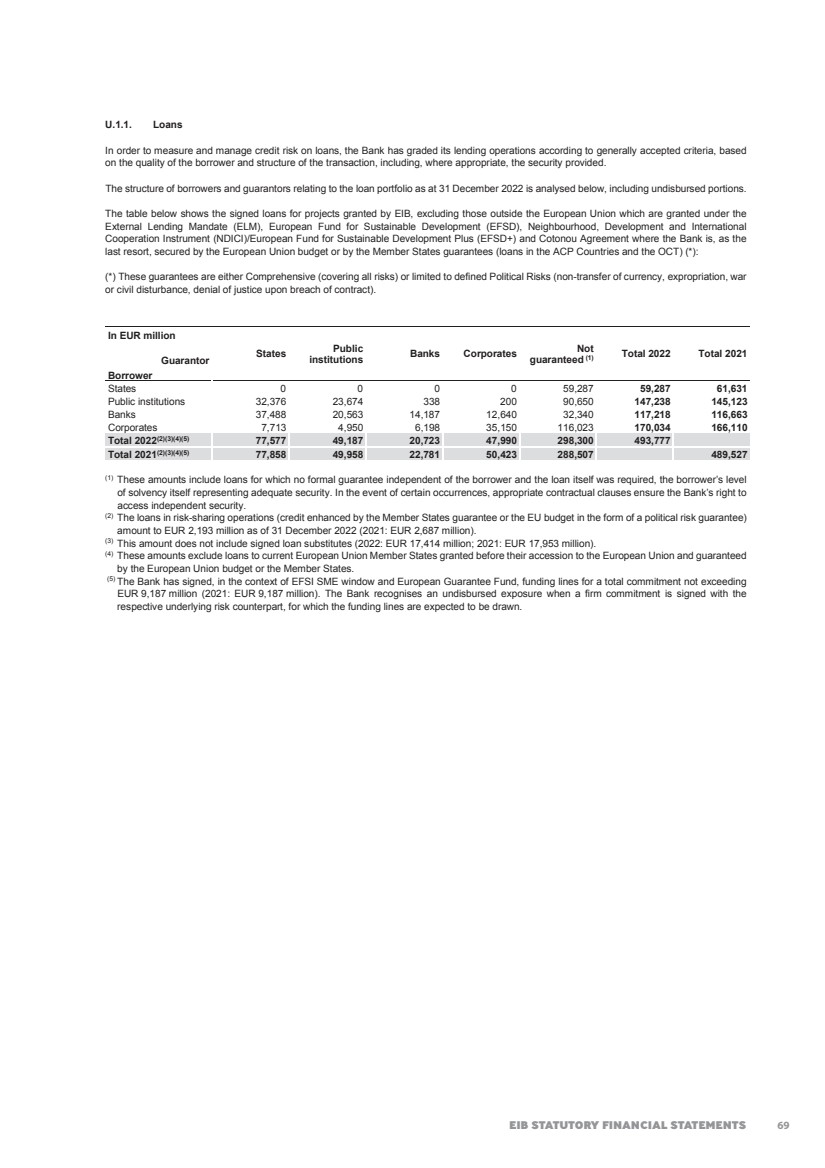

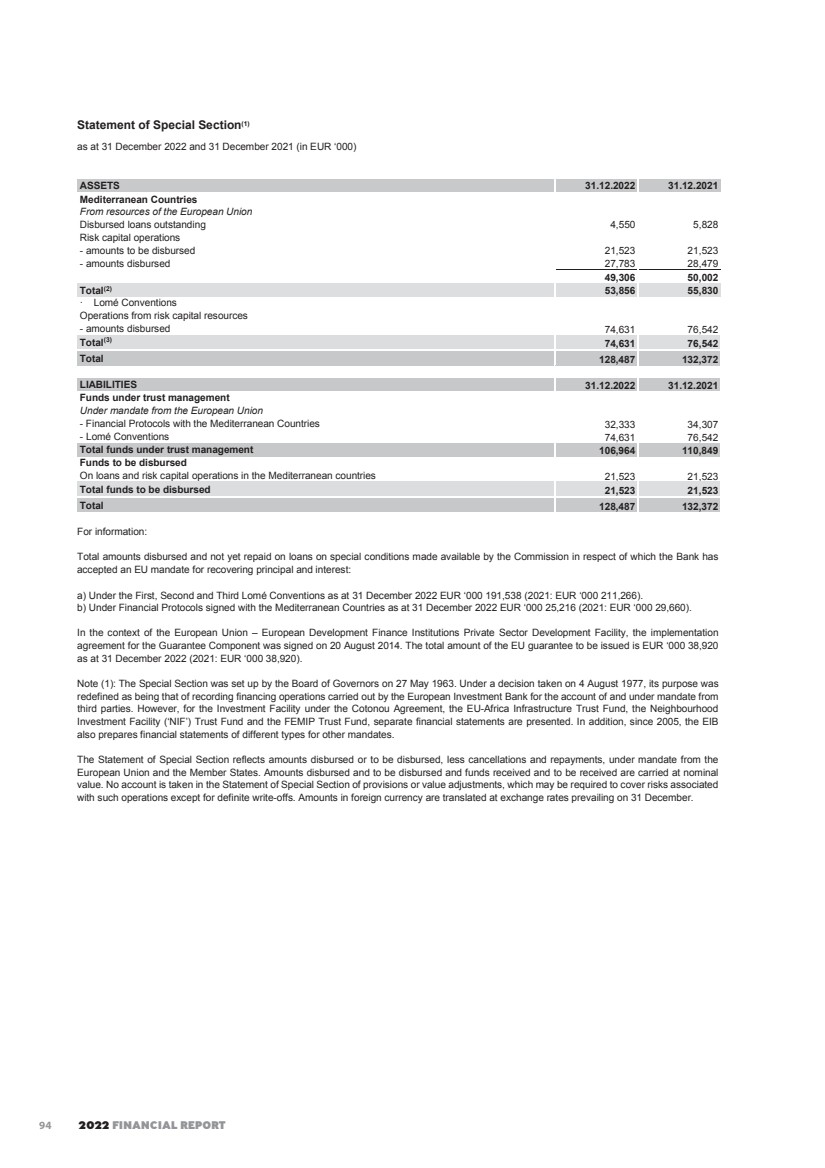

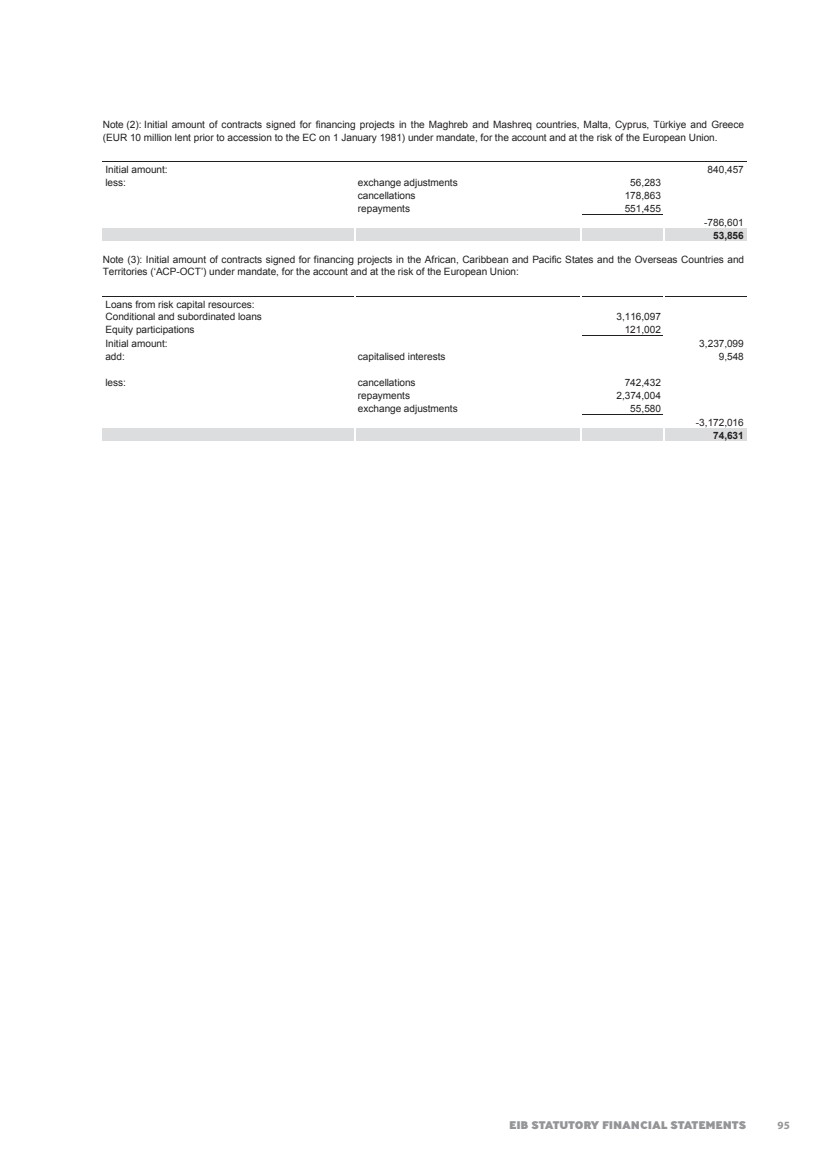

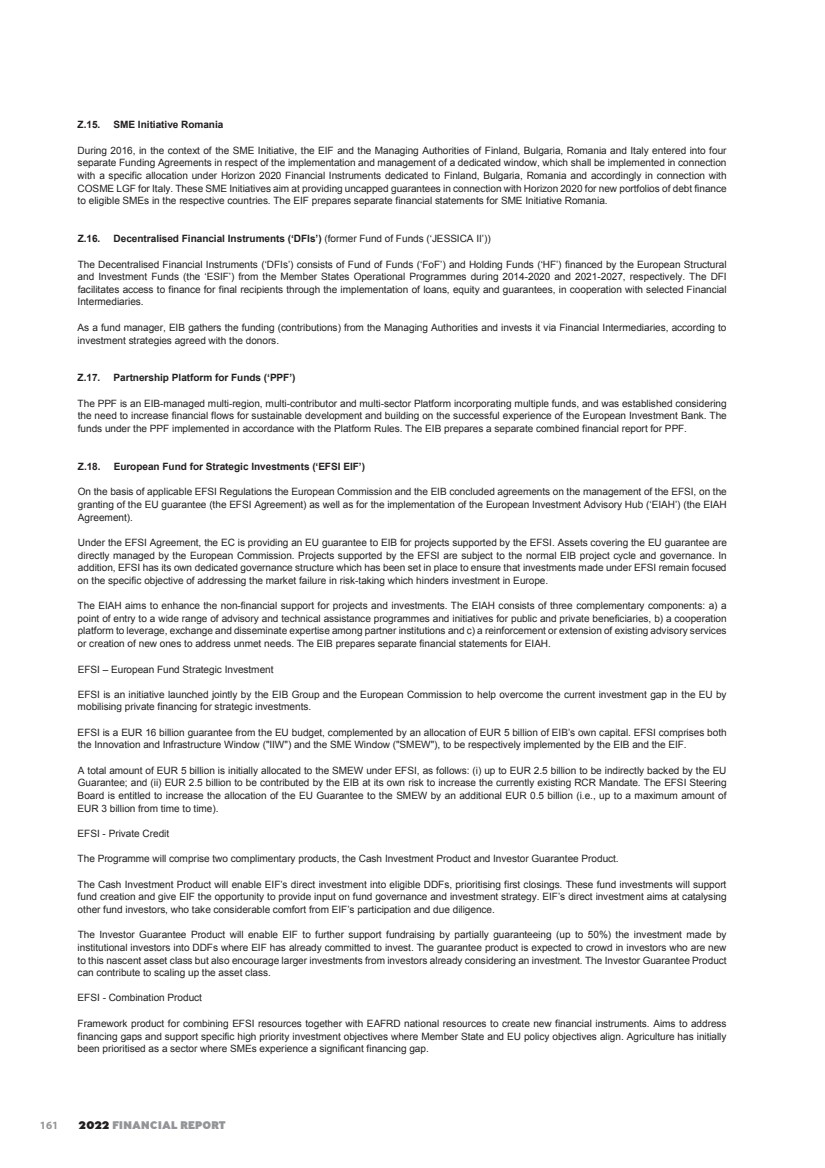

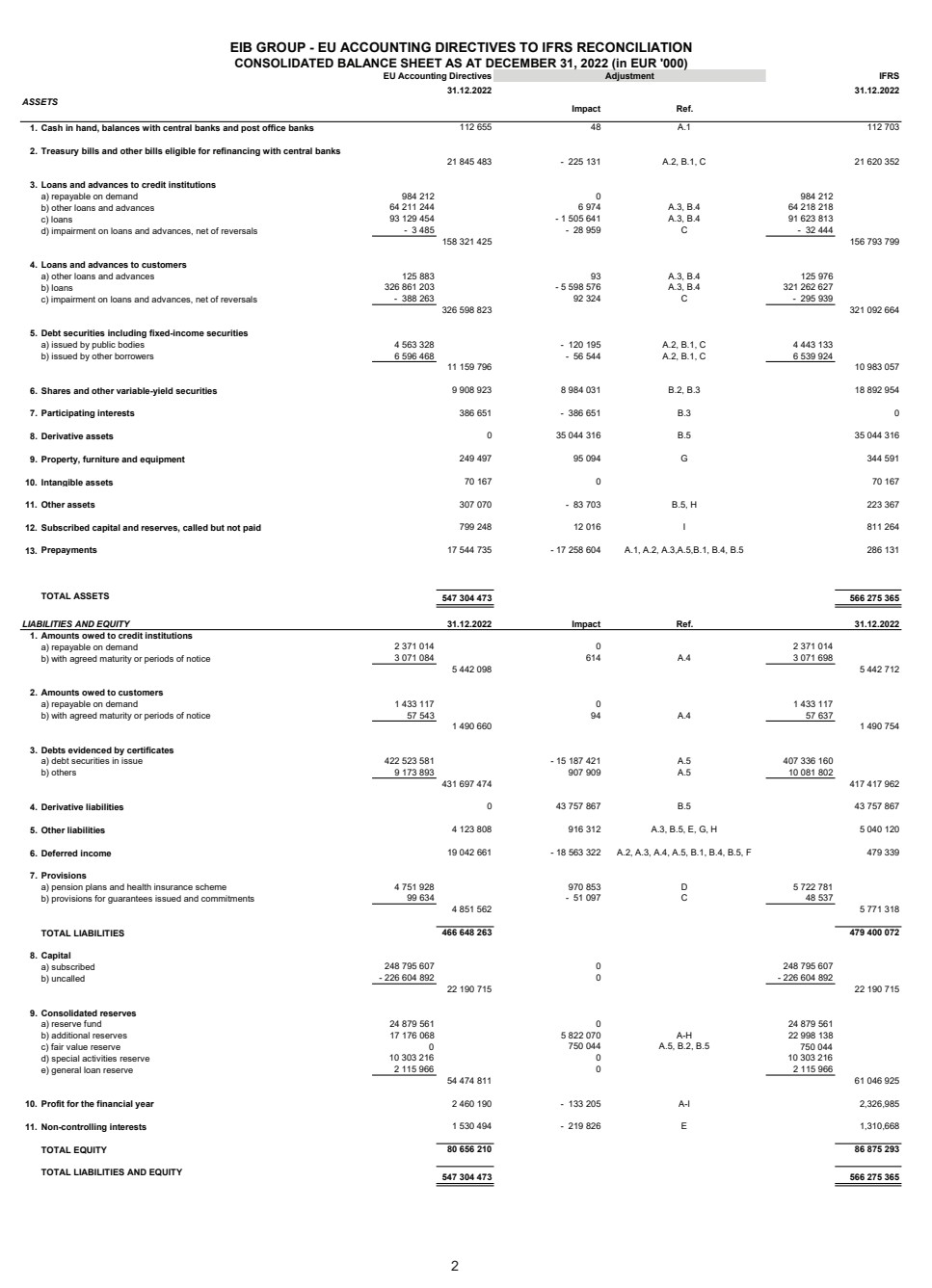

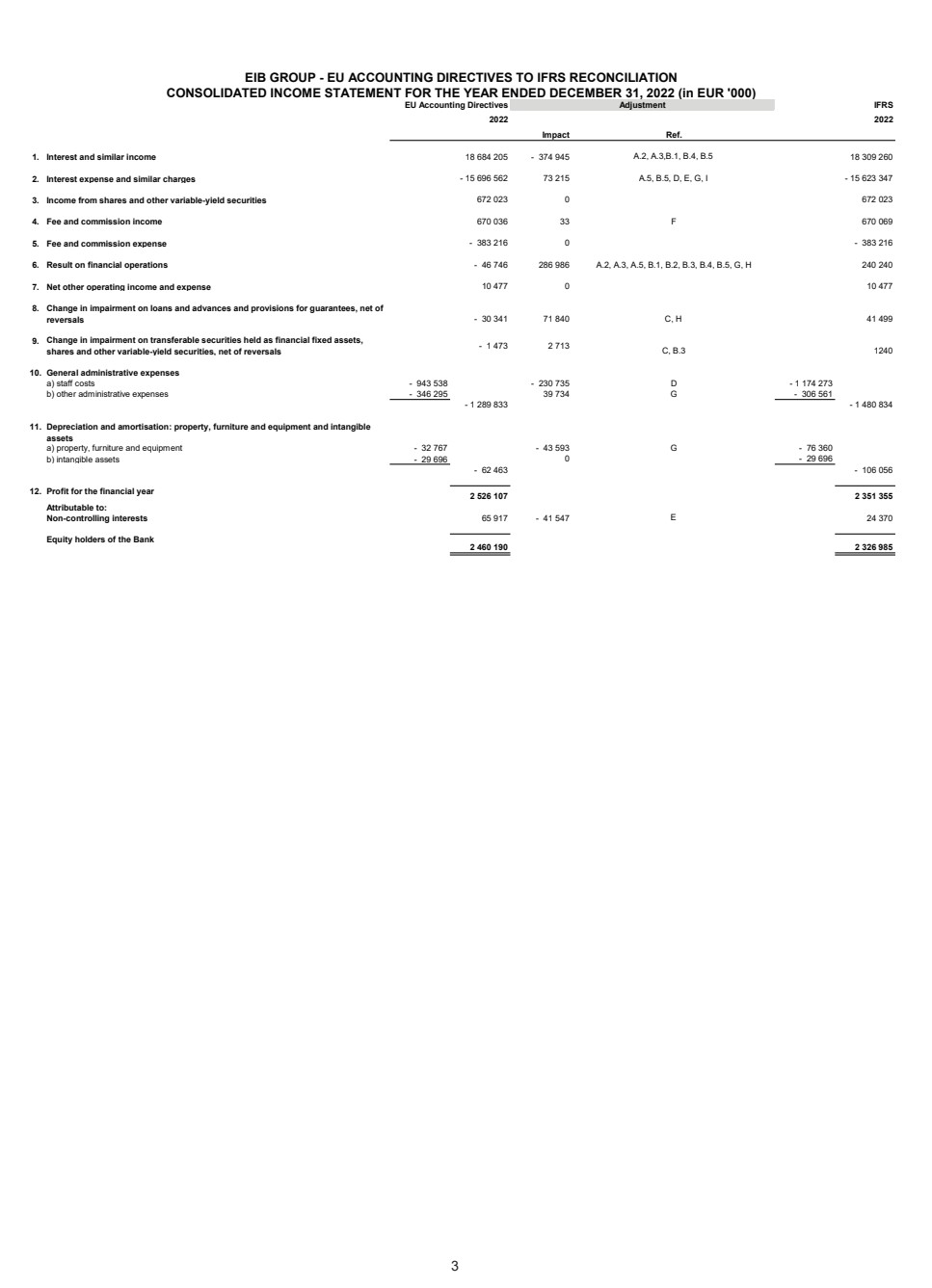

| Overview 1. STRONG FINANCIAL PERFORMANCE IN 2022 The EIB generates income mainly by financing large volumes of loans at low margins and has recorded annual surpluses in its statutory6 accounts every year since its foundation. The profit for the financial year 2022 amounted to EUR 2 366.3 million, compared to EUR 2 566.0 million in 2021. The main factors that influenced the 2022 financial result were as follows: • The Net interest income generated7 by the Bank amounted to EUR 2 977.8 million in 2022 as compared to EUR 3 185.0 million in 2021. Additional details on the interest income and expense are provided under Note N of the Statutory Financial Statements. • The Income from securities amounted to EUR 632.5 million in 2022 (EUR 776.8 million in 2021). This decrease is mainly explained by lower dividends received during 2022 as compared to 2021. • General administrative expenses amounted to EUR 1 138.3 million in 2022 (EUR 1 466.8 million in 2021). The decrease of EUR 328.5 million is primarily explained by the lower welfare contributions and other charges (variance of EUR 422.0 million). This is explained by a lower evolution of the actuarial deficit in 2022 as compared to 2021, as a result of the higher discount rate applicable to the assessment of the defined benefit obligation at 31 December 2022. For more details, see Note L and Note R of the Statutory Financial Statements. • The Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities resulted in a charge of EUR 29.2 million in 2022 compared to a gain of EUR 178.3 million in 2021. This variance is mainly explained by the fact that certain collective provisions, first established in 2020 to reflect the assessment of the potential impact of COVID-19 on the Statutory Financial Statements, were released during 2021, while new collective provisions of smaller magnitude were recognised in 2022, reflecting the impact of the war in Ukraine on the loan portfolio. The EIB’s balance sheet totalled EUR 544.6 billion at the end of 2022, compared to EUR 565.5 billion at the end of 2021 (representing a decrease of EUR 20.9 billion). 6. Prepared in accordance with the EU Accounting Directives. 7. Interest receivable and similar income less Interest payable and similar charges. 2 339 555 793 553 561 2018 2019 2020 2021 2022 554 291 565 476 544 588 2 363 1 712 2 566 2 366 Total assets Result EVOLUTION OF TOTAL ASSETS AND RESULTS (EUR m) 4 |

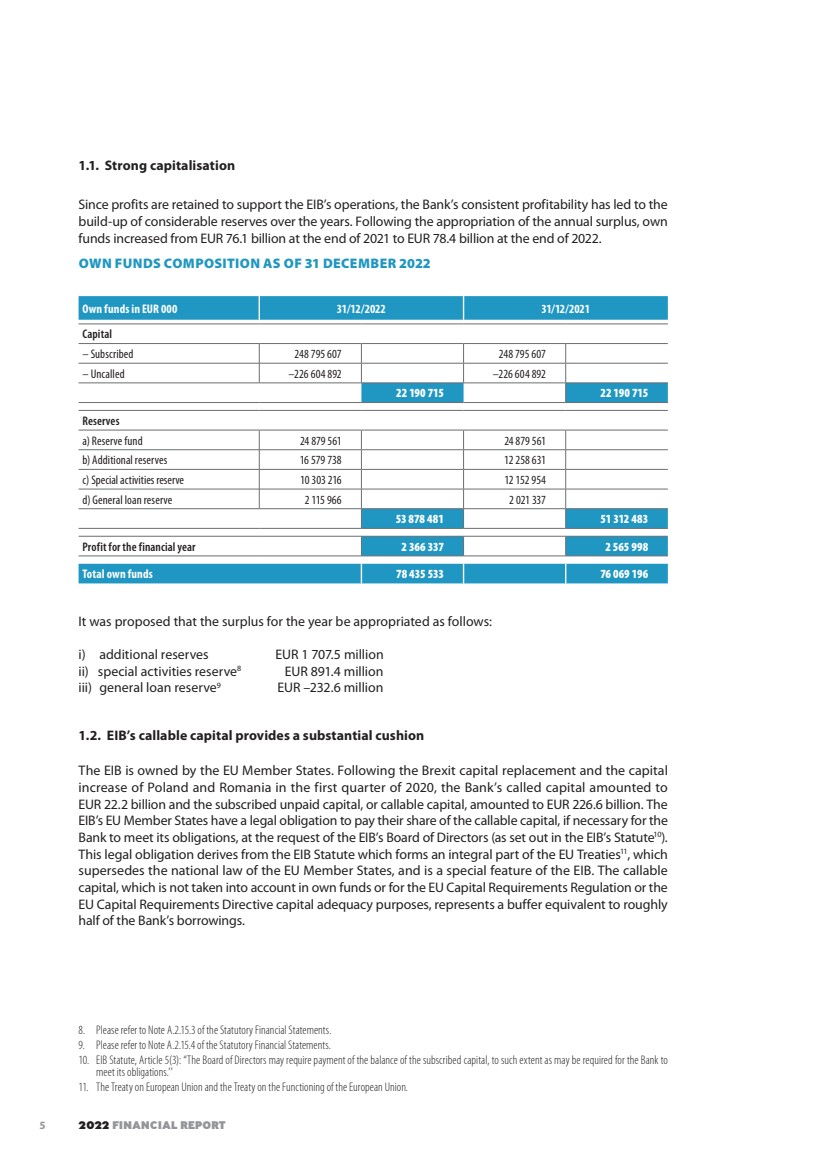

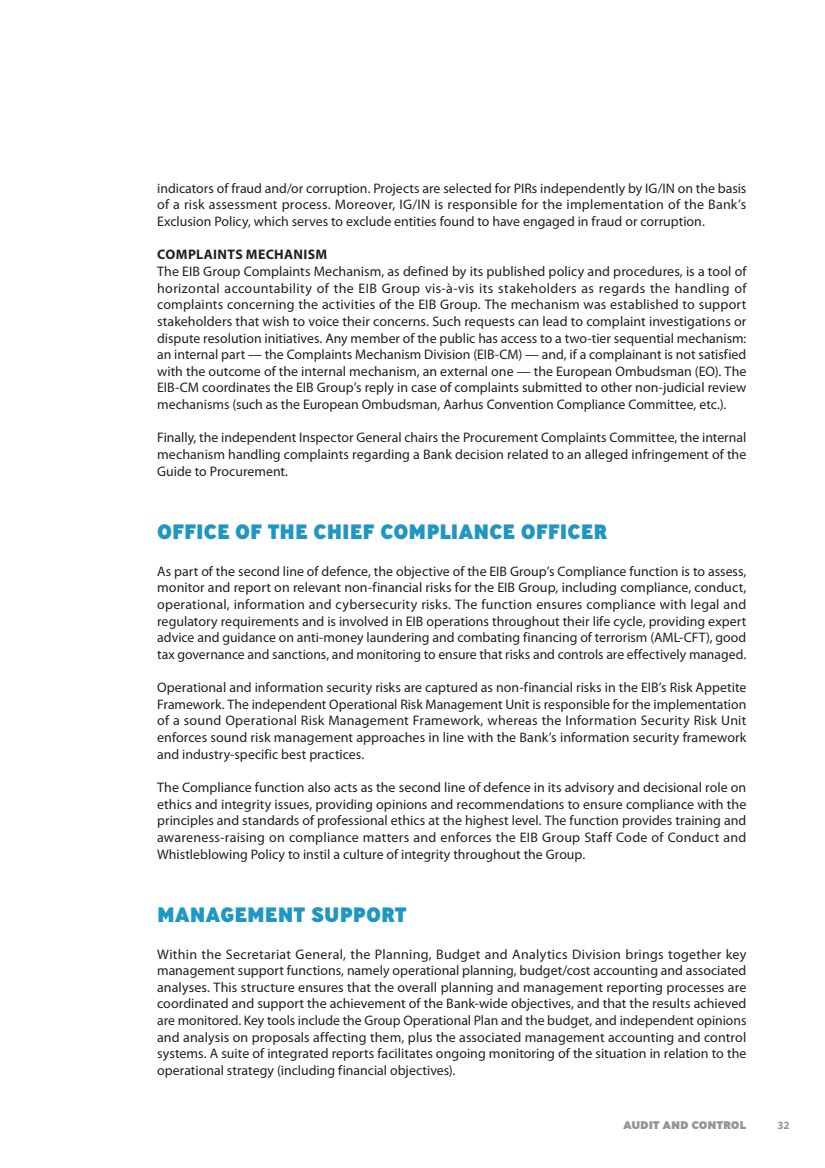

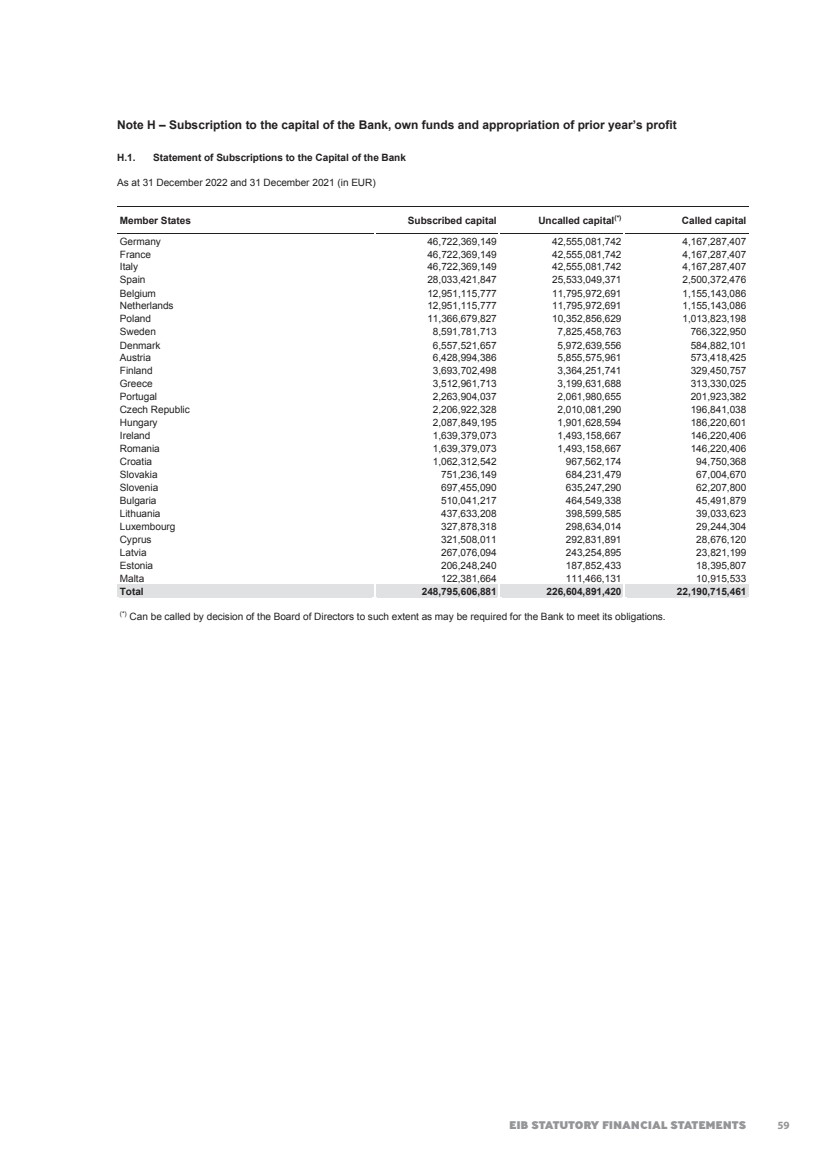

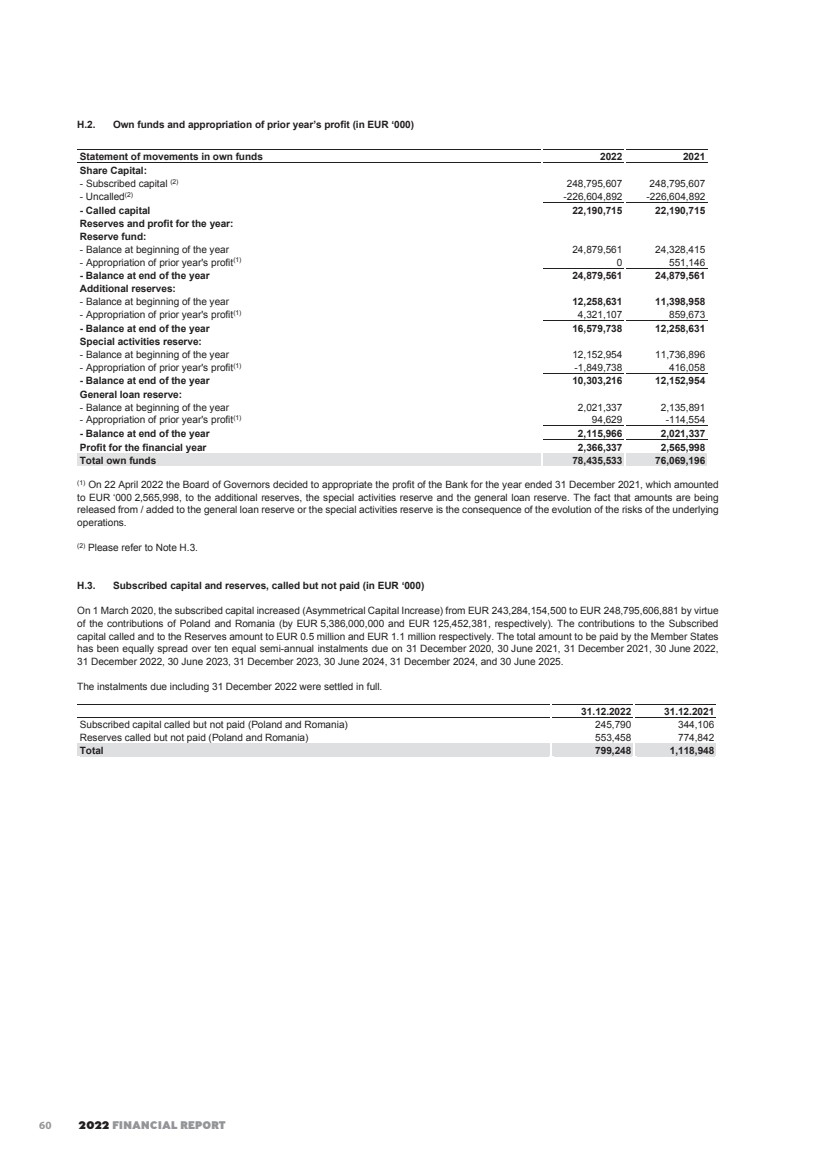

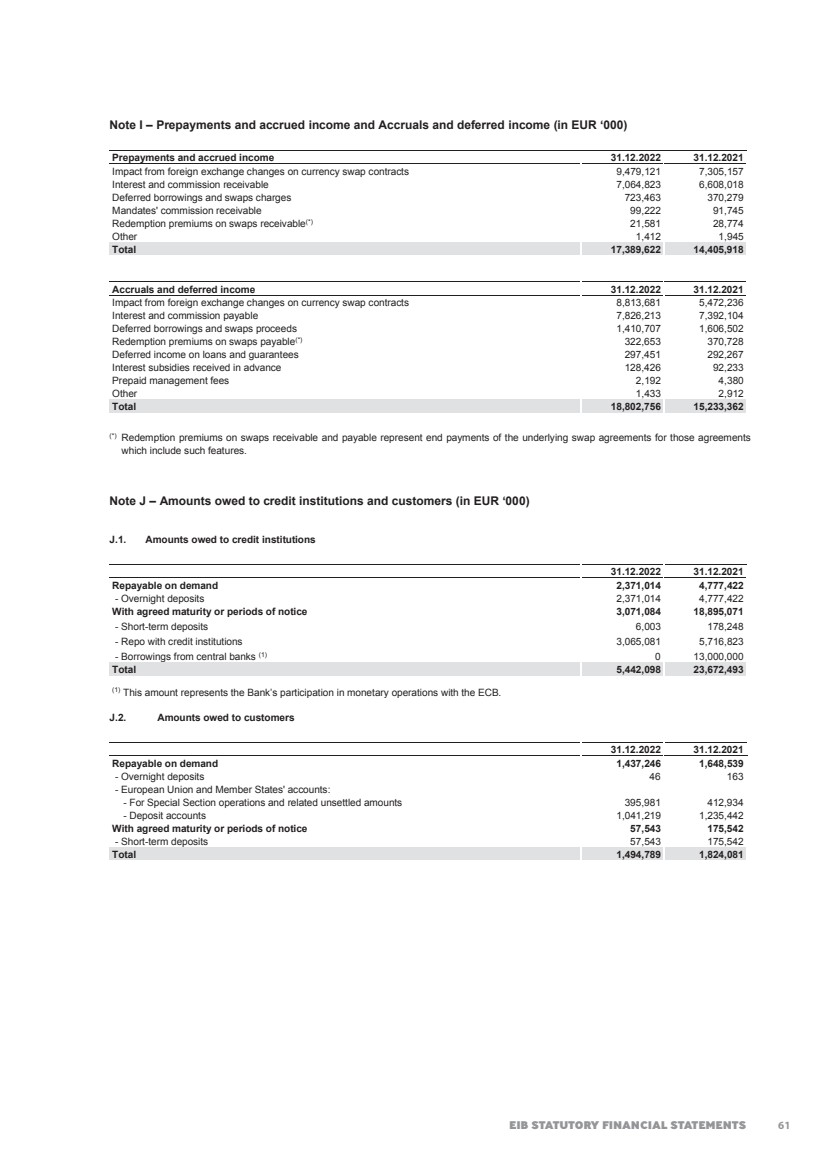

| 2022 FINANCIAL REPORT 1.1. Strong capitalisation Since profits are retained to support the EIB’s operations, the Bank’s consistent profitability has led to the build-up of considerable reserves over the years. Following the appropriation of the annual surplus, own funds increased from EUR 76.1 billion at the end of 2021 to EUR 78.4 billion at the end of 2022. It was proposed that the surplus for the year be appropriated as follows: i) additional reserves EUR 1 707.5 million ii) special activities reserve8 EUR 891.4 million iii) general loan reserve9 EUR –232.6 million 1.2. EIB’s callable capital provides a substantial cushion The EIB is owned by the EU Member States. Following the Brexit capital replacement and the capital increase of Poland and Romania in the first quarter of 2020, the Bank’s called capital amounted to EUR 22.2 billion and the subscribed unpaid capital, or callable capital, amounted to EUR 226.6 billion. The EIB’s EU Member States have a legal obligation to pay their share of the callable capital, if necessary for the Bank to meet its obligations, at the request of the EIB’s Board of Directors (as set out in the EIB’s Statute10). This legal obligation derives from the EIB Statute which forms an integral part of the EU Treaties11, which supersedes the national law of the EU Member States, and is a special feature of the EIB. The callable capital, which is not taken into account in own funds or for the EU Capital Requirements Regulation or the EU Capital Requirements Directive capital adequacy purposes, represents a buffer equivalent to roughly half of the Bank’s borrowings. 8. Please refer to Note A.2.15.3 of the Statutory Financial Statements. 9. Please refer to Note A.2.15.4 of the Statutory Financial Statements. 10. EIB Statute, Article 5(3): “The Board of Directors may require payment of the balance of the subscribed capital, to such extent as may be required for the Bank to meet its obligations.’’ 11. The Treaty on European Union and the Treaty on the Functioning of the European Union. Own funds in EUR 000 31/12/2022 31/12/2021 Capital – Subscribed 248 795 607 248 795 607 – Uncalled –226 604 892 –226 604 892 22 190 715 22 190 715 Reserves a) Reserve fund 24 879 561 24 879 561 b) Additional reserves 16 579 738 12 258 631 c) Special activities reserve 10 303 216 12 152 954 d) General loan reserve 2 115 966 2 021 337 53 878 481 51 312 483 Profit for the financial year 2 366 337 2 565 998 Total own funds 78 435 533 76 069 196 OWN FUNDS COMPOSITION AS OF 31 DECEMBER 2022 5 |

| Overview 1.3. Outlook The EIB Group Operational Plan 2023-202512 was approved by the EIB’s Board of Directors on 14 December 2022 and was published on 2 February 2023. In addition to the EIB Group's backing for Ukraine’s reconstruction efforts, the financing programme for 2023-2025 presents how the EIB Group intends to focus on accelerating the green and digital transitions, innovation, and investing in the European Union’s strategic autonomy. The EIB Group remains committed to supporting growth, employment and economic prosperity in the European Union and beyond. The Operational Plan summarises the major priorities and activities to deliver the EIB Group’s strategy for the next three years. It also proposes financing targets using the EIB Group's own and third party resources. The EIB Group’s signature volume target for 2023 is EUR 80.4 billion13, of which EUR 60.0 billion is by the EIB inside the European Union, EUR 8.5 billion by EIB Global (that is, by the EIB outside of the European Union) and EUR 13.0 billion by the EIF. The EIB Group disbursement target range for 2023 is EUR 47.6 billion to EUR 56.1 billion. The Operational Plan foresees an overall increase of financing volumes in response to the emerging policy priorities and it has been calibrated to optimise additionality and impact while ensuring the EIB Group’s longer-term financial sustainability. Higher risk and mandate activities are expected to grow, with increased amounts of own higher risk activity to complement the limited capacity available under the MFF 2021-2027. In view of persisting uncertainties in the market environment, the Operational Plan incorporates a flexibility margin of +15%/-10% for signatures. The EIB Group will continue to review its activities throughout the year to account for developments related to the impacts of Russia‘s war on Ukraine, as well as the unfolding energy and food crises, external market demand for new EIB Group financing and the actual pace of project origination and signature. The EIB Group’s financing remains focused on its public policy goals, which are aligned with the European Union’s political priorities, namely: • sustainable cities and regions • sustainable energy and natural resources • innovation, digital and human capital • financing of small and medium firms and mid-caps. In addition, the EIB has two transversal indicators of climate action and environmental sustainability, and EU economic and social cohesion and convergence. The 2023-2025 planning period also encompasses the EIB Group’s contribution to REPowerEU, to help accelerate the green transition towards the goal of net-zero emissions and reduced dependency on Russian fossil fuels. The Operational Plan envisages an ambitious level of signatures and disbursements for EIB Global within the planning period with the overarching objective of strengthening the impact of the Bank’s operations beyond the European Union, and to turn the European Union’s policy initiatives and priorities into solutions on the ground. The funding programme outlined in the Operational Plan reflects the anticipated borrowings needed to achieve the operational targets. The EIB’s Board of Directors approved a global borrowing authorisation of up to EUR 50 billion for 2023 and the Bank announced an expected funding programme amounting to EUR 45 billion. The Bank’s high credit standing is key to its business model. Therefore, the EIB accepts credit, market and liquidity risk in line with its risk appetite and public mission. By pursuing a prudent financial policy, the Bank seeks to self finance its growth in the long term. 12. The annual Operational Plan includes performance orientations and elaborates on the major priorities and activities of the Group (link) 13. Total Group signatures avoid double counting of joint transactions (for example. EIF operations back-to-back guaranteed by EIB) for EUR 1.1 billion 6 |

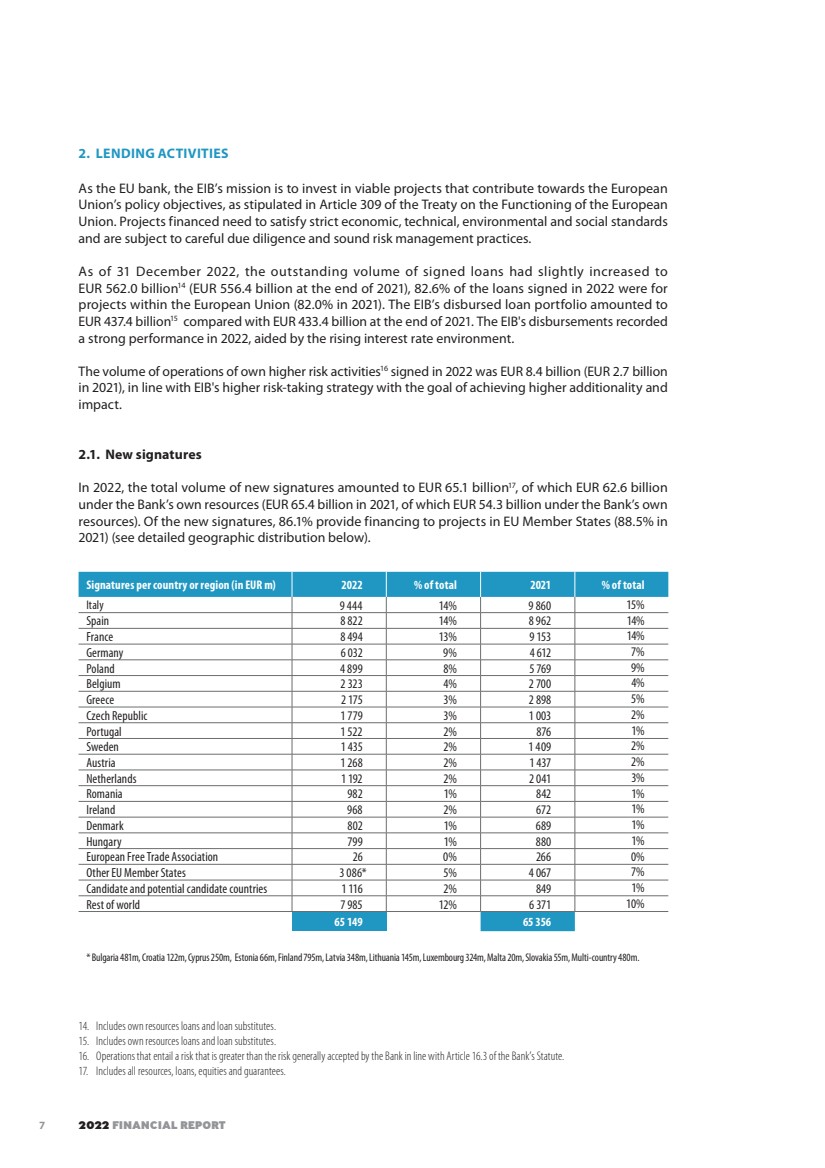

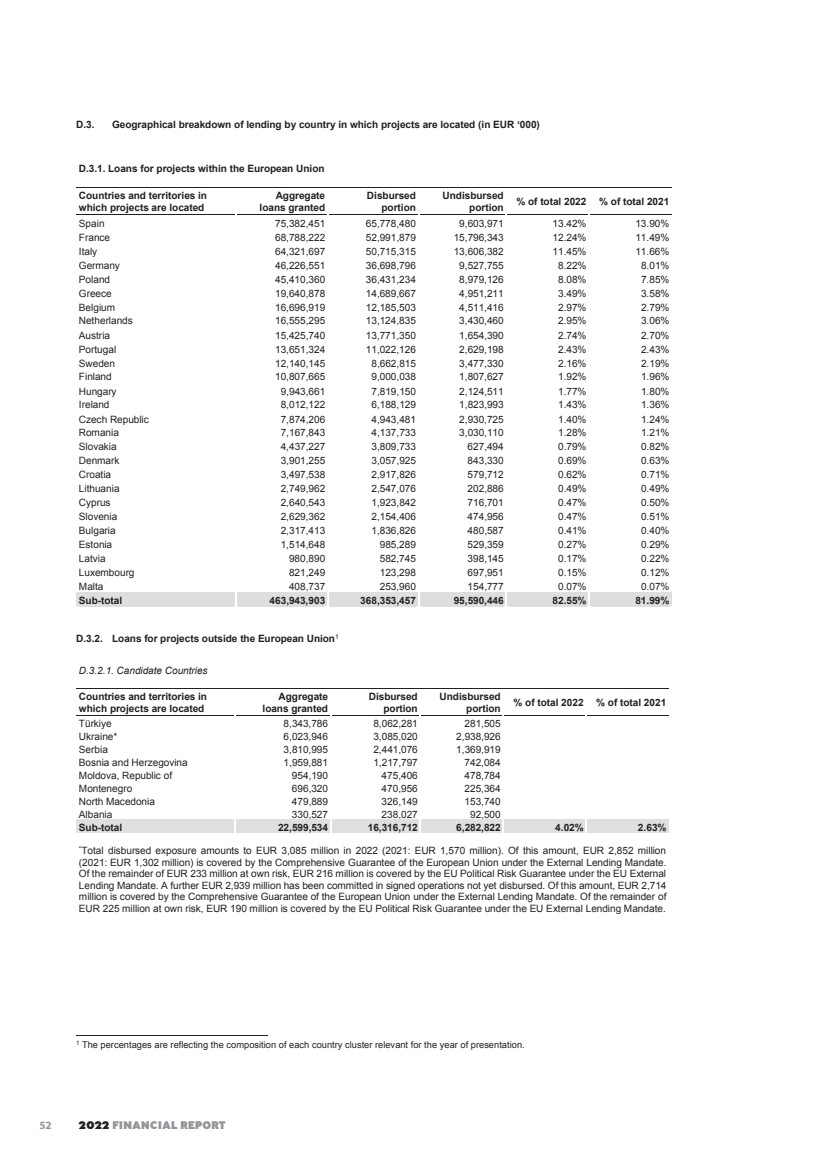

| 2022 FINANCIAL REPORT 2. LENDING ACTIVITIES As the EU bank, the EIB’s mission is to invest in viable projects that contribute towards the European Union’s policy objectives, as stipulated in Article 309 of the Treaty on the Functioning of the European Union. Projects financed need to satisfy strict economic, technical, environmental and social standards and are subject to careful due diligence and sound risk management practices. As of 31 December 2022, the outstanding volume of signed loans had slightly increased to EUR 562.0 billion14 (EUR 556.4 billion at the end of 2021), 82.6% of the loans signed in 2022 were for projects within the European Union (82.0% in 2021). The EIB’s disbursed loan portfolio amounted to EUR 437.4 billion15 compared with EUR 433.4 billion at the end of 2021. The EIB's disbursements recorded a strong performance in 2022, aided by the rising interest rate environment. The volume of operations of own higher risk activities16 signed in 2022 was EUR 8.4 billion (EUR 2.7 billion in 2021), in line with EIB's higher risk-taking strategy with the goal of achieving higher additionality and impact. 2.1. New signatures In 2022, the total volume of new signatures amounted to EUR 65.1 billion17, of which EUR 62.6 billion under the Bank’s own resources (EUR 65.4 billion in 2021, of which EUR 54.3 billion under the Bank’s own resources). Of the new signatures, 86.1% provide financing to projects in EU Member States (88.5% in 2021) (see detailed geographic distribution below). 14. Includes own resources loans and loan substitutes. 15. Includes own resources loans and loan substitutes. 16. Operations that entail a risk that is greater than the risk generally accepted by the Bank in line with Article 16.3 of the Bank’s Statute. 17. Includes all resources, loans, equities and guarantees. Signatures per country or region (in EUR m) 2022 % of total 2021 % of total Italy 9 444 14% 9 860 15% Spain 8 822 14% 8 962 14% France 8 494 13% 9 153 14% Germany 6 032 9% 4 612 7% Poland 4 899 8% 5 769 9% Belgium 2 323 4% 2 700 4% Greece 2 175 3% 2 898 5% Czech Republic 1 779 3% 1 003 2% Portugal 1 522 2% 876 1% Sweden 1 435 2% 1 409 2% Austria 1 268 2% 1 437 2% Netherlands 1 192 2% 2 041 3% Romania 982 1% 842 1% Ireland 968 2% 672 1% Denmark 802 1% 689 1% Hungary 799 1% 880 1% European Free Trade Association 26 0% 266 0% Other EU Member States 3 086* 5% 4 067 7% Candidate and potential candidate countries 1 116 2% 849 1% Rest of world 7 985 12% 6 371 10% 65 149 65 356 * Bulgaria 481m, Croatia 122m, Cyprus 250m, Estonia 66m, Finland 795m, Latvia 348m, Lithuania 145m, Luxembourg 324m, Malta 20m, Slovakia 55m, Multi-country 480m. 7 |

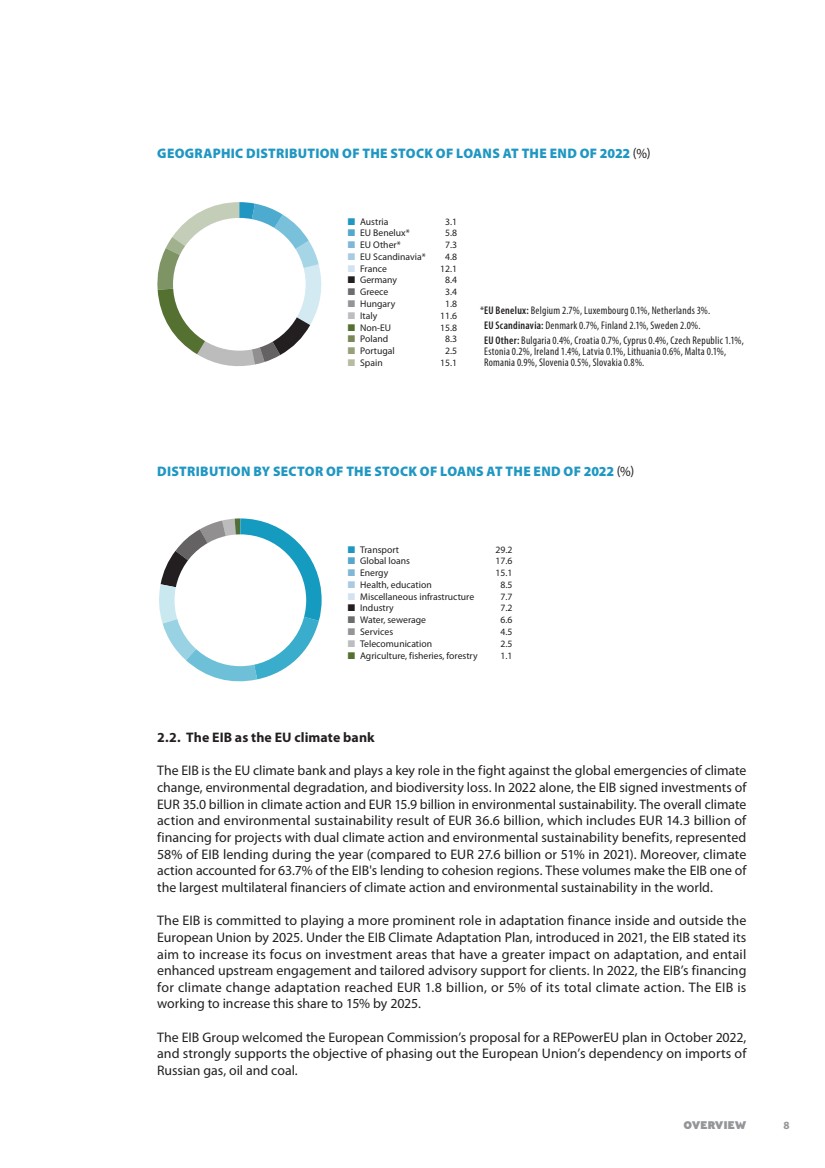

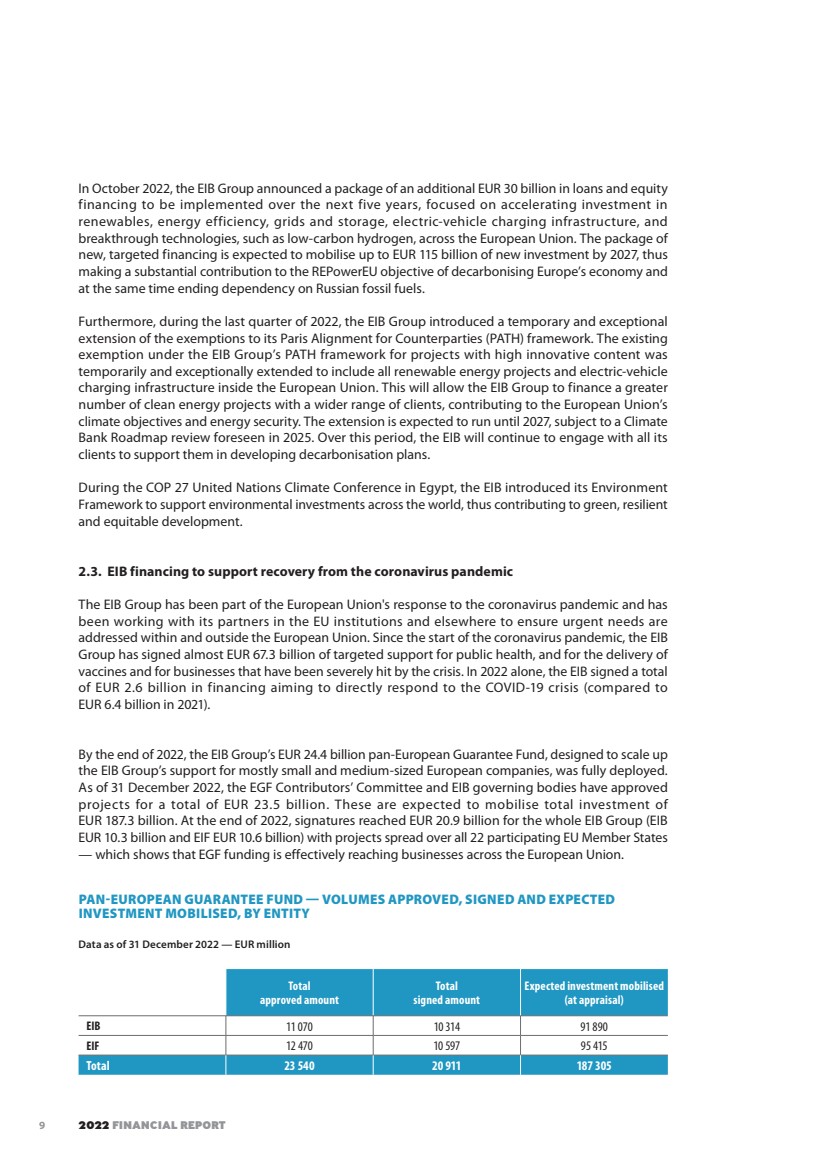

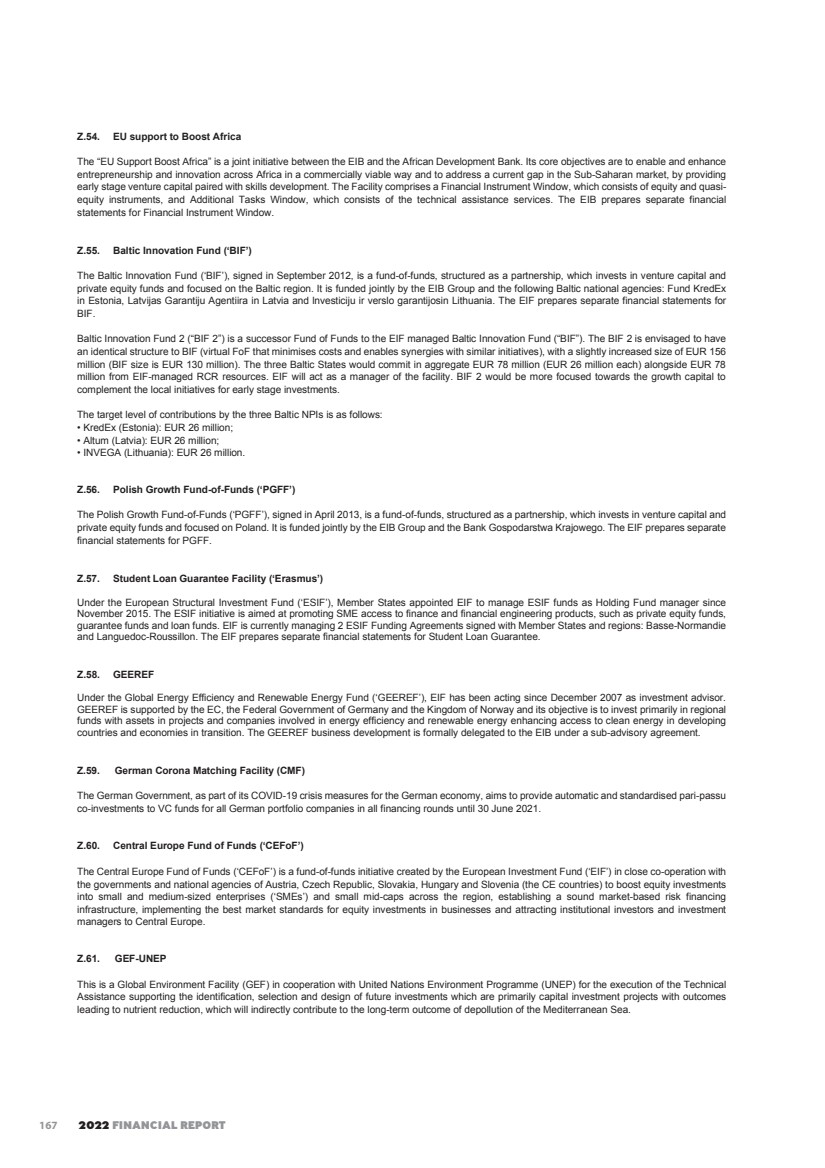

| Overview 2.2. The EIB as the EU climate bank The EIB is the EU climate bank and plays a key role in the fight against the global emergencies of climate change, environmental degradation, and biodiversity loss. In 2022 alone, the EIB signed investments of EUR 35.0 billion in climate action and EUR 15.9 billion in environmental sustainability. The overall climate action and environmental sustainability result of EUR 36.6 billion, which includes EUR 14.3 billion of financing for projects with dual climate action and environmental sustainability benefits, represented 58% of EIB lending during the year (compared to EUR 27.6 billion or 51% in 2021). Moreover, climate action accounted for 63.7% of the EIB's lending to cohesion regions. These volumes make the EIB one of the largest multilateral financiers of climate action and environmental sustainability in the world. The EIB is committed to playing a more prominent role in adaptation finance inside and outside the European Union by 2025. Under the EIB Climate Adaptation Plan, introduced in 2021, the EIB stated its aim to increase its focus on investment areas that have a greater impact on adaptation, and entail enhanced upstream engagement and tailored advisory support for clients. In 2022, the EIB’s financing for climate change adaptation reached EUR 1.8 billion, or 5% of its total climate action. The EIB is working to increase this share to 15% by 2025. The EIB Group welcomed the European Commission’s proposal for a REPowerEU plan in October 2022, and strongly supports the objective of phasing out the European Union’s dependency on imports of Russian gas, oil and coal. Austria 3.1 EU Benelux* 5.8 EU Other* 7.3 EU Scandinavia* 4.8 France 12.1 Germany 8.4 Greece 3.4 Hungary 1.8 Italy 11.6 Non-EU 15.8 Poland 8.3 Portugal 2.5 Spain 15.1 Transport 29.2 Global loans 17.6 Energy 15.1 Health, education 8.5 Miscellaneous infrastructure 7.7 Industry 7.2 Water, sewerage 6.6 Services 4.5 Telecomunication 2.5 Agriculture, fisheries, forestry 1.1 *EU Benelux: Belgium 2.7%, Luxembourg 0.1%, Netherlands 3%. EU Scandinavia: Denmark 0.7%, Finland 2.1%, Sweden 2.0%. EU Other: Bulgaria 0.4%, Croatia 0.7%, Cyprus 0.4%, Czech Republic 1.1%, Estonia 0.2%, Ireland 1.4%, Latvia 0.1%, Lithuania 0.6%, Malta 0.1%, Romania 0.9%, Slovenia 0.5%, Slovakia 0.8%. GEOGRAPHIC DISTRIBUTION OF THE STOCK OF LOANS AT THE END OF 2022 (%) DISTRIBUTION BY SECTOR OF THE STOCK OF LOANS AT THE END OF 2022 (%) 8 |

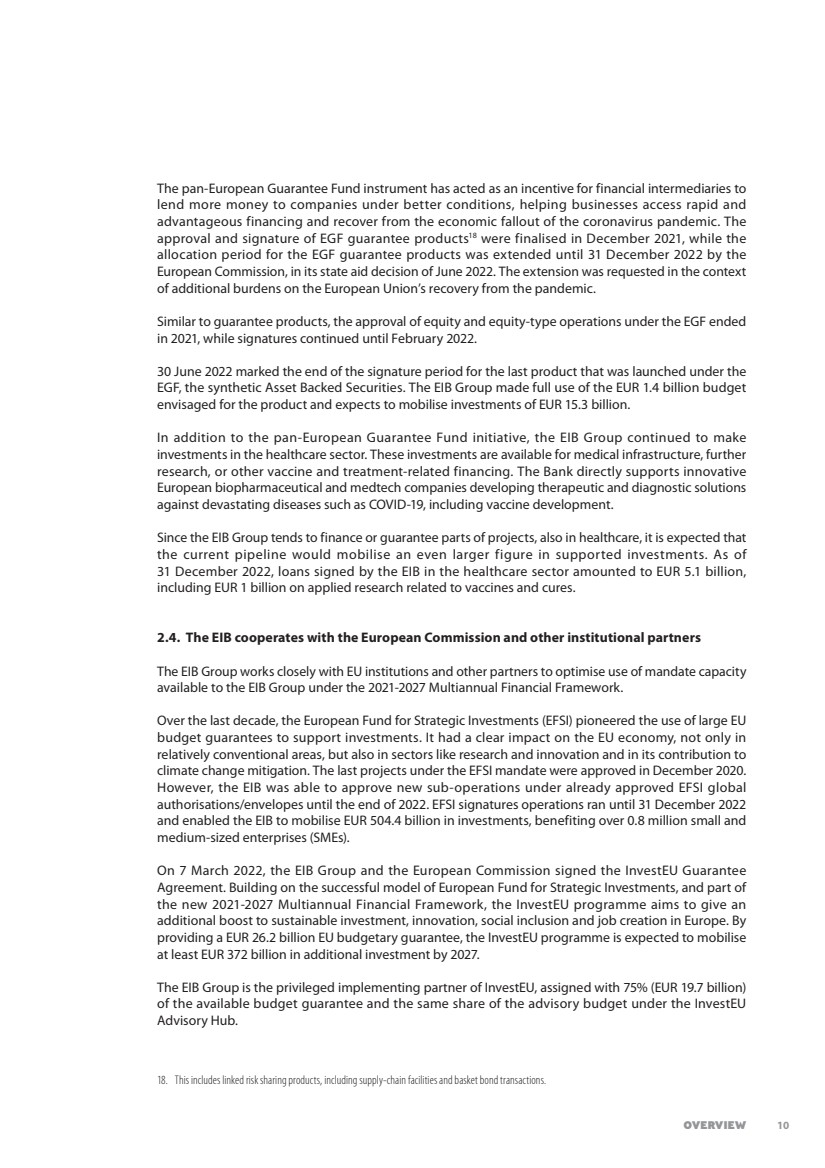

| 2022 FINANCIAL REPORT In October 2022, the EIB Group announced a package of an additional EUR 30 billion in loans and equity financing to be implemented over the next five years, focused on accelerating investment in renewables, energy efficiency, grids and storage, electric-vehicle charging infrastructure, and breakthrough technologies, such as low-carbon hydrogen, across the European Union. The package of new, targeted financing is expected to mobilise up to EUR 115 billion of new investment by 2027, thus making a substantial contribution to the REPowerEU objective of decarbonising Europe’s economy and at the same time ending dependency on Russian fossil fuels. Furthermore, during the last quarter of 2022, the EIB Group introduced a temporary and exceptional extension of the exemptions to its Paris Alignment for Counterparties (PATH) framework. The existing exemption under the EIB Group’s PATH framework for projects with high innovative content was temporarily and exceptionally extended to include all renewable energy projects and electric-vehicle charging infrastructure inside the European Union. This will allow the EIB Group to finance a greater number of clean energy projects with a wider range of clients, contributing to the European Union’s climate objectives and energy security. The extension is expected to run until 2027, subject to a Climate Bank Roadmap review foreseen in 2025. Over this period, the EIB will continue to engage with all its clients to support them in developing decarbonisation plans. During the COP 27 United Nations Climate Conference in Egypt, the EIB introduced its Environment Framework to support environmental investments across the world, thus contributing to green, resilient and equitable development. 2.3. EIB financing to support recovery from the coronavirus pandemic The EIB Group has been part of the European Union's response to the coronavirus pandemic and has been working with its partners in the EU institutions and elsewhere to ensure urgent needs are addressed within and outside the European Union. Since the start of the coronavirus pandemic, the EIB Group has signed almost EUR 67.3 billion of targeted support for public health, and for the delivery of vaccines and for businesses that have been severely hit by the crisis. In 2022 alone, the EIB signed a total of EUR 2.6 billion in financing aiming to directly respond to the COVID-19 crisis (compared to EUR 6.4 billion in 2021). By the end of 2022, the EIB Group’s EUR 24.4 billion pan-European Guarantee Fund, designed to scale up the EIB Group’s support for mostly small and medium-sized European companies, was fully deployed. As of 31 December 2022, the EGF Contributors’ Committee and EIB governing bodies have approved projects for a total of EUR 23.5 billion. These are expected to mobilise total investment of EUR 187.3 billion. At the end of 2022, signatures reached EUR 20.9 billion for the whole EIB Group (EIB EUR 10.3 billion and EIF EUR 10.6 billion) with projects spread over all 22 participating EU Member States — which shows that EGF funding is effectively reaching businesses across the European Union. PAN-EUROPEAN GUARANTEE FUND — VOLUMES APPROVED, SIGNED AND EXPECTED INVESTMENT MOBILISED, BY ENTITY Data as of 31 December 2022 — EUR million Total approved amount Total signed amount Expected investment mobilised (at appraisal) EIB 11070 10314 91890 EIF 12470 10597 95415 Total 23 540 20 911 187 305 9 |

| Overview The pan-European Guarantee Fund instrument has acted as an incentive for financial intermediaries to lend more money to companies under better conditions, helping businesses access rapid and advantageous financing and recover from the economic fallout of the coronavirus pandemic. The approval and signature of EGF guarantee products18 were finalised in December 2021, while the allocation period for the EGF guarantee products was extended until 31 December 2022 by the European Commission, in its state aid decision of June 2022. The extension was requested in the context of additional burdens on the European Union’s recovery from the pandemic. Similar to guarantee products, the approval of equity and equity-type operations under the EGF ended in 2021, while signatures continued until February 2022. 30 June 2022 marked the end of the signature period for the last product that was launched under the EGF, the synthetic Asset Backed Securities. The EIB Group made full use of the EUR 1.4 billion budget envisaged for the product and expects to mobilise investments of EUR 15.3 billion. In addition to the pan-European Guarantee Fund initiative, the EIB Group continued to make investments in the healthcare sector. These investments are available for medical infrastructure, further research, or other vaccine and treatment-related financing. The Bank directly supports innovative European biopharmaceutical and medtech companies developing therapeutic and diagnostic solutions against devastating diseases such as COVID-19, including vaccine development. Since the EIB Group tends to finance or guarantee parts of projects, also in healthcare, it is expected that the current pipeline would mobilise an even larger figure in supported investments. As of 31 December 2022, loans signed by the EIB in the healthcare sector amounted to EUR 5.1 billion, including EUR 1 billion on applied research related to vaccines and cures. 2.4. The EIB cooperates with the European Commission and other institutional partners The EIB Group works closely with EU institutions and other partners to optimise use of mandate capacity available to the EIB Group under the 2021-2027 Multiannual Financial Framework. Over the last decade, the European Fund for Strategic Investments (EFSI) pioneered the use of large EU budget guarantees to support investments. It had a clear impact on the EU economy, not only in relatively conventional areas, but also in sectors like research and innovation and in its contribution to climate change mitigation. The last projects under the EFSI mandate were approved in December 2020. However, the EIB was able to approve new sub-operations under already approved EFSI global authorisations/envelopes until the end of 2022. EFSI signatures operations ran until 31 December 2022 and enabled the EIB to mobilise EUR 504.4 billion in investments, benefiting over 0.8 million small and medium-sized enterprises (SMEs). On 7 March 2022, the EIB Group and the European Commission signed the InvestEU Guarantee Agreement. Building on the successful model of European Fund for Strategic Investments, and part of the new 2021-2027 Multiannual Financial Framework, the InvestEU programme aims to give an additional boost to sustainable investment, innovation, social inclusion and job creation in Europe. By providing a EUR 26.2 billion EU budgetary guarantee, the InvestEU programme is expected to mobilise at least EUR 372 billion in additional investment by 2027. The EIB Group is the privileged implementing partner of InvestEU, assigned with 75% (EUR 19.7 billion) of the available budget guarantee and the same share of the advisory budget under the InvestEU Advisory Hub. 18. This includes linked risk sharing products, including supply-chain facilities and basket bond transactions. 10 |

| 2022 FINANCIAL REPORT The operations benefiting from the EU budgetary guarantee finance investments in four policy areas to support the European Union’s goals in sustainability, scientific excellence and social inclusion. These four policy areas include: • sustainable infrastructure • research, innovation and digitalisation • small and medium firms and small mid-caps • social investment and skills. At least 30% of all the investments are expected to be made in areas directly supporting Europe's green transition. With the benefit of the InvestEU Advisory Hub, the EIB draws together financial and technical expertise to provide an integrated response across the project cycle. Advisory services provide targeted support across all four of the InvestEU policy windows to public and private sector promoters. The services also support the identification, preparation and implementation of InvestEU-guaranteed investment projects and investment platforms across the European Union. The InvestEU programme also includes an EU Member State compartment, in which EU countries have the possibility to contribute a part of their shared management funds to the InvestEU Fund. The first projects under InvestEU were approved in March 2022, and total approvals reached almost EUR 9.1 billion by the end of December 2022. An amount of almost EUR 2.4 billion was signed and EUR 726.0 million was disbursed by the end of December 2022. In November 2022, the EIB Group signed a new contractual framework with Greece for the EIF to manage an additional EUR 400 million of Recovery and Resilience Facility investments to help small and medium-sized businesses in the country. This is on top of the EUR 5 billion in Recovery and Resilience Facility funds already entrusted to the EIB. In March 2022, the EIB’s Board of Directors approved the Strategic European Security Initiative (SESI), which aims to mobilise investment in support of Europe’s dual-use security and defence systems by backing Europe’s technology industry and security of civilian infrastructure. In particular, SESI may include dual-use Research, Development and Innovation (RDI) projects, such as development of dual-use aviation platforms or of satellite constellations, modernisation of non-core security and defence infrastructure, and development of cybersecurity technologies. SESI does not change what is eligible for EIB financing or modify the definition of the EIB’s excluded activities or excluded sectors. The EIB will not invest in ammunition or weaponry and the EIB cannot finance investments in core defence. SESI projects must be dual-use, meaning they need to be primarily motivated by their civil applications. As part of SESI, the EIB intends to strengthen institutional partnerships, such as with the European Commission, the European Space Agency and the EU Agency for the Space Programme. SESI is expected to make available financing of up to EUR 6 billion for eligible projects between 2022 and 2027. In 2022, the value of the financing provided by the Bank to investment projects under SESI amounted to around EUR 1.5 billion. The EIB Group’s cooperation with the European Commission is essential to uphold and promote the European Union’s values, principles and geopolitical interests worldwide. The implementation of EIB Global’s business outside the European Union is underpinned by EU mandates. It is also the key implementing partner in the Neighbourhood, Development and International Cooperation Instrument (NDICI) – Global Europe and a participant in its governance as a member of the European Fund for Sustainable Development Plus (EFSD+) Strategic Board. NDICI – Global Europe establishes the overall framework for EIB operations outside the European Union under the 2021-2027 Multiannual Financial Framework. It streamlines and simplifies the structure of the funding architecture for the European Union’s external actions. 11 |

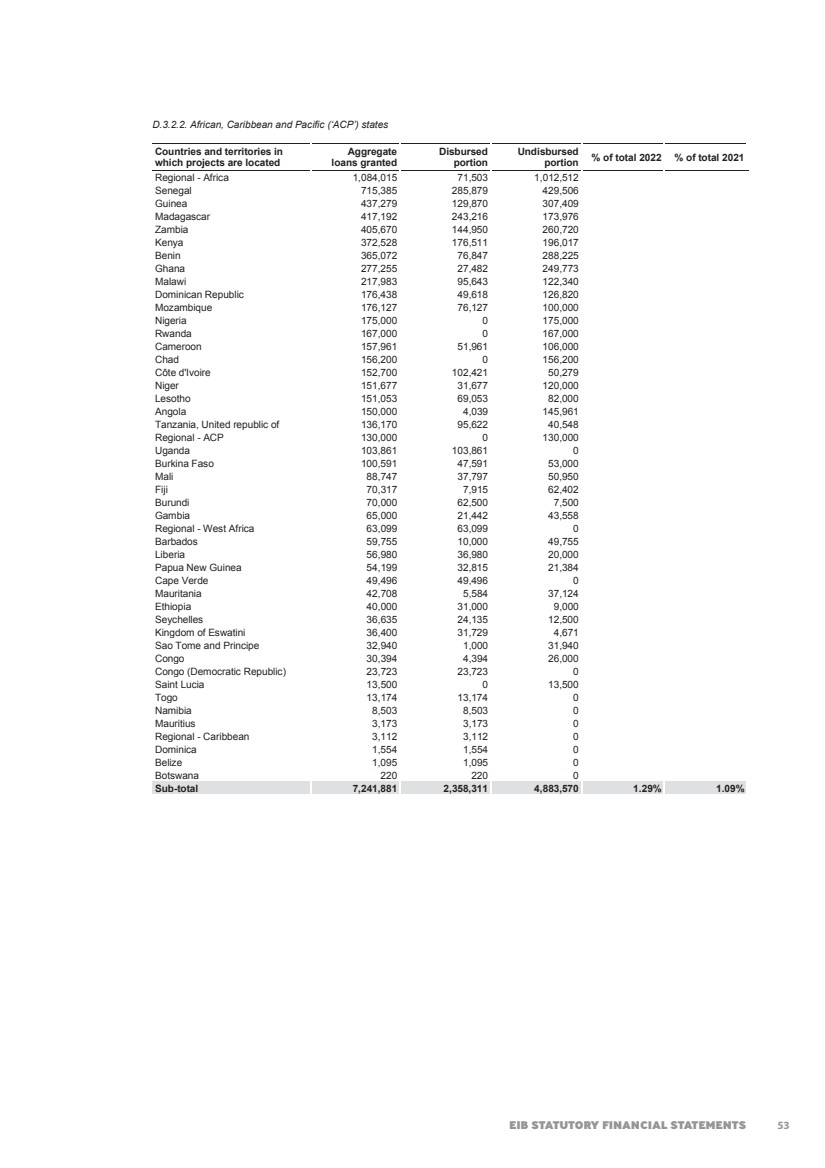

| Overview On 29 April 2022, the EIB and the European Commission signed a guarantee agreement in the context of the EFSD+ framework, through which the European Commission will support up to EUR 26.7 billion of EIB financial operations to enable crucial public investments in sectors like clean energy, digital and transport infrastructure, health, and education over the next seven years. This supports the implementation of the European Union’s Global Gateway strategy, which is set to mobilise up to EUR 300 billion of investments between 2021 and 2027 in new sustainable infrastructure worldwide. 2.5. Operations outside the European Union19 The EIB has decades of experience as a leading multilateral development bank, actively contributing to the European Union’s external policy objectives for nearly 60 years. Over the last ten years, the Bank has provided over EUR 70 billion in more than 100 low and middle-income countries. Nonetheless, it is ultimately not the financing volumes that matter but the impact: real positive change in people’s lives. The Bank uses its Additionality and Impact Measurement (AIM) system to assess and track the results and impact of its operations as well as the added benefit that comes from EIB involvement. Since the start of 2022, the EIB’s development finance role has moved forward and intensified through the establishment of EIB Global, the Bank’s development branch focused on activities outside the European Union. EIB Global brings the resources of the EIB to bear on our operations outside the European Union through an integrated and impact-driven product offering while reinforcing and deepening our upstream policy dialogue and cooperation with partner countries, clients, EU Member States, development finance institutions, UN agencies, civil society and other partners. EIB Global is an internal organisational unit within the EIB, operating under the Bank’s current legal framework. It brings together EIB development staff under a dedicated management. The branch has a dedicated capital allocation provided annually by the EIB’s Board of Directors under the EIB Group Operational Plan, and benefits from a dedicated Board Advisory Group involving European development stakeholders. It has flexibility to establish its own policies and strategies and develop its own products. The branch nonetheless operates fully within EIB Group-wide financial policies on areas such as risk management, as determined by the EIB’s Board of Directors. As part of its operating model, EIB Global maintains a strong local presence on the ground through a network of 30 external representations located in partner countries, with further openings and more staff being planned where needs are the greatest and where local presence will have the greatest impact by bringing the Bank closer to its clients. Recently, the Nairobi office in Kenya was upgraded into a regional hub to provide more direct support to the East Africa region. Demand outside the European Union remained high, with EUR 98.1 billion worth of projects signed, of which EUR 9.1 billion of signatures in 2022. In addition to these amounts, EIB Global repurposed EUR 1.7 billion of existing loans signed in 2022 as immediate support to Ukraine. Most of EIB Global’s outstanding portfolio is covered by guarantees from the European Union (the EU External Lending Mandate) which include comprehensive guarantees (the EU Comprehensive Guarantees) and political risk guarantees (the EU Political Risk Guarantees), or guarantees from the EU Member States within the Cotonou Agreement framework. Under the current EU long term budget (MFF), EIB Global’s business implementation will continue to rely on the new generation of EU mandates within the NDICI – Global Europe framework to deliver on key priorities as the EU bank within Team Europe.20 19. Figures presented under this section include own resources loans and loans substitutes unless otherwise stated. 20. Team Europe is the EU initiative first launched to support partner countries in the fight against the coronavirus pandemic, and that combines resources from the European Union, the EU Member States, as well as the EIB and the European Bank for Reconstruction and Development (EBRD). 12 |

| 2022 FINANCIAL REPORT These mandates most notably include the European Union’s Global Gateway initiative where EIB Global, as a key implementing partner, supports greater connectivity and mutual benefits through sustainable infrastructure investment around the world, as well as support to a transition in partner countries towards sustainable, resource-efficient and low-carbon neutral economies under the external dimension of the EU Green Deal.21 21. Approved in 2020, the EU Green Deal is a set of policy initiatives by the European Commission with the overarching aim of making the EU climate neutral in 2050. EIB support for Ukraine and countries affected by war The EIB started operations in Ukraine in 2005 with the signing of a framework agreement, and the first operations were signed in 2007. The Bank’s financing in the country has been focused on social and economic infrastructure, development of the private sector and climate action. In response to Russia’s invasion of Ukraine, which has inflicted immense human and economic suffering on the people of Ukraine, the EIB disbursed EUR 668 million of the ‘Ukraine Solidarity Urgent Response’ in March 2022 to help Ukrainian authorities meet their most urgent financial needs. • In April 2022, the Bank launched a EUR 4.0 billion programme, designed to help EU cities and regions affected by the conflict, during 2022-2023. It aims to provide financing for key infrastructure and services for refugees and host communities, such as housing, schools, hospitals and access to jobs. EUR 2.0 billion has been allocated to Poland, where more than one million Ukrainian refugees have fled, as a specific support to the country’s national Aid Fund, established to address the humanitarian crisis. • In addition, the EIB approved a second package of EUR 1.59 billion of support to Ukraine in July 2022, of which EUR 1.05 billion is dedicated to immediate financial assistance and was disbursed in September and October 2022. It will cover high priority short-term financing needs, support strategic state-owned companies, ensure urgent repairs of damaged infrastructure, resume provision of disrupted municipal services, and support urgent energy and energy efficiency measures in preparation for the winter. The remaining funds are reserved for resuming EIB-financed projects in Ukraine, covering energy, energy efficiency, roads, transport, education and infrastructure, as well as reconstruction and recovery programmes. • As detailed below, the EIB’s disbursed exposure in Ukraine is predominantly covered by the EU Comprehensive Guarantees and the EU Political Risk Guarantees under the EU External Lending Mandate. As of 31 December 2022, total disbursed exposure on loans granted to borrowers located in Ukraine amounted to EUR 3 085.0 million (EUR 1 570.1 million in 2021). Of this amount, EUR 2 852.4 million (EUR 1 301.8 million in 2021) is covered by the EU Comprehensive Guarantees. Out of the remaining EUR 232.6 million (EUR 268.3 million in 2021), EUR 216.0 million (EUR 251.3 million in 2021) is covered by the EU Political Risk Guarantees. A further EUR 2 938.9 million has been committed in signed operations not yet disbursed. Of this amount, EUR 2 714.4 million is covered by the EU Comprehensive Guarantees and EUR 189.7 million by the EU Political Risk Guarantees. The remaining EUR 34.9 million is at own risk. In addition, the Bank also granted financial guarantees to counterparties located in Ukraine for a signed amount of EUR 478.8 million at the end of 2022 (EUR 459.1 million in 2021). This is fully covered by the EU Comprehensive Guarantees. The EIB remains committed to supporting the reconstruction of Ukraine by financing new critical economic and social infrastructure as needed, as soon as conditions permit it. 13 |

| Overview Russia The Bank has restricted its lending activities in Russia since 2014 to stay consistent with the overall objectives of EU common foreign and security policy, including applicable sanctions. The Bank has robust compliance controls, including a dedicated Sanctions Compliance Programme, which ensures that its activities that relate to Russia, even indirectly, comply with all applicable sanctions, and will continue to comply with any new ones, that may be imposed on Russia. The EIB’s remaining disbursed debt exposure in Russia amounted to EUR 13.8 million as of the end of 2022 (EUR 16.1 million in 2021) with no debt exposure at the EIB’s own risk. Belarus The EIB’s total disbursed exposure in Belarus is rather limited and consists of three operations for an amount of EUR 45.2 million at the end of 2022 (EUR 173.3 million in 2021), of which EUR 36.3 million, or 80% (EUR 163.3 million in 2021) is secured by the EU Comprehensive Guarantees. One operation related to the private sector is guaranteed by an EU-based bank and benefits from the supplementary EU Political Risk Guarantees. The Bank has been observing developments in Belarus with great concern. The EIB stopped signatures in Belarus following the country’s disputed presidential elections in August 2020 and will continue to maintain the same stance, in line with EU policy and existing applicable sanctions. Türkiye The EIB’s total disbursed exposure in Türkiye amounted to EUR 7.8 billion at the end of 2022 (EUR 9.1 billion in 2021). Of this amount, EUR 5.5 billion, or 71% (EUR 5.9 billion in 2021) is covered by the EU Comprehensive Guarantees while EUR 2.3 billion, or 29% (EUR 3.2 billion in 2021) is at the EIB’s own risk. A further EUR 0.3 billion has been committed in signed operations not yet disbursed, of which EUR 0.2 billion is secured by the EU Comprehensive Guarantees. Lebanon The credit standing of Lebanese counterparties has been impacted by the political and economic turbulence in the country. The EIB’s total disbursed exposure in Lebanon amounted to EUR 294.9 million at the end of 2022 (EUR 407.8 million in 2021), of which EUR 258.8 million, or 88% (EUR 356.4 million in 2021) is secured by the EU Comprehensive Guarantees. A further EUR 792.2 million has been committed in signed operations not yet disbursed, which are fully secured by the EU Comprehensive Guarantees. Tunisia Tunisia is experiencing a protracted period of political and economic uncertainty since the second half of 2021. The country’s situation has been exacerbated by the COVID-19 pandemic, the impact of the war in Ukraine and the possibility of enduring delays in reform-dependent funding. The EIB’s total disbursed exposure in Tunisia amounted to EUR 1 582.1 million at the end of 2022 (EUR 1 717.3 million in 2021), of which EUR 1 436.7 million (EUR 1 537.1 million in 2021), or 91%, is secured by the EU Comprehensive Guarantees. A further EUR 1 035.4 million has been committed in signed operations not yet disbursed, of which only EUR 9.0 million is expected to be at the EIB’s own risk. The Bank is closely monitoring the evolving situation and reviewing the need for further specific provisions on its risk portfolio. 14 |

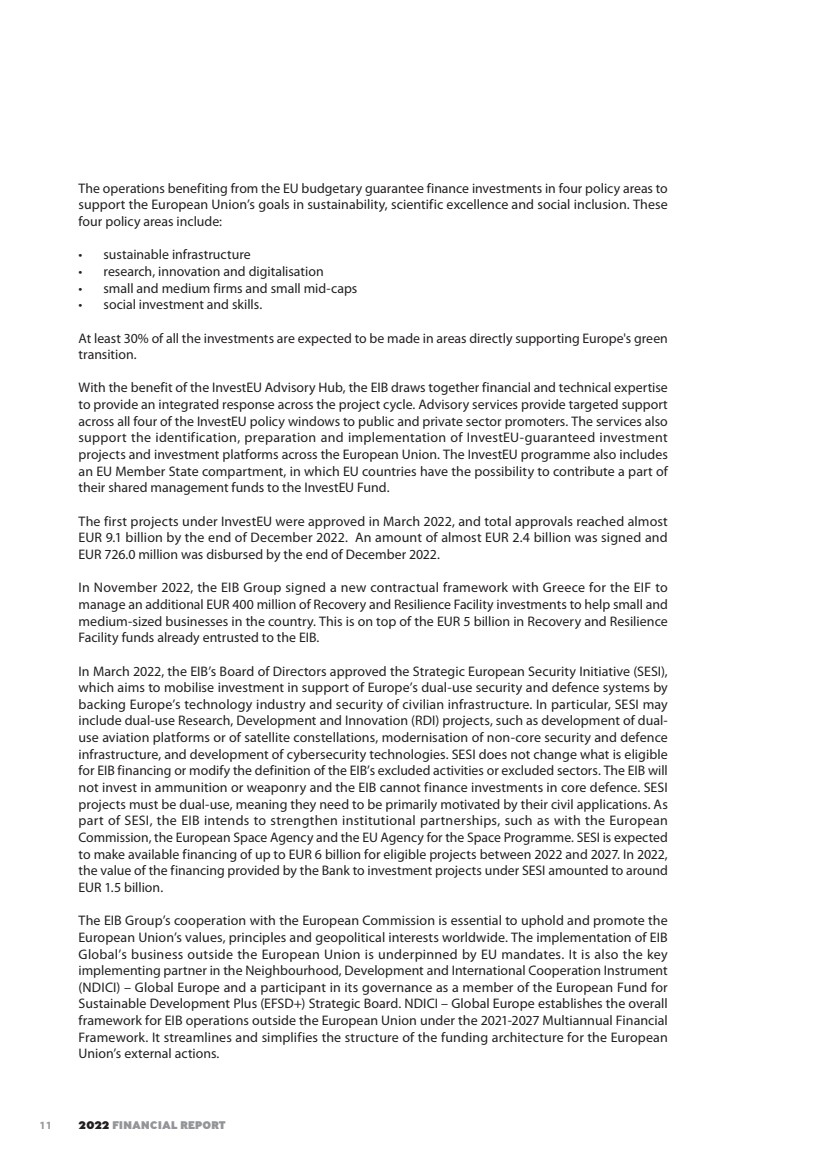

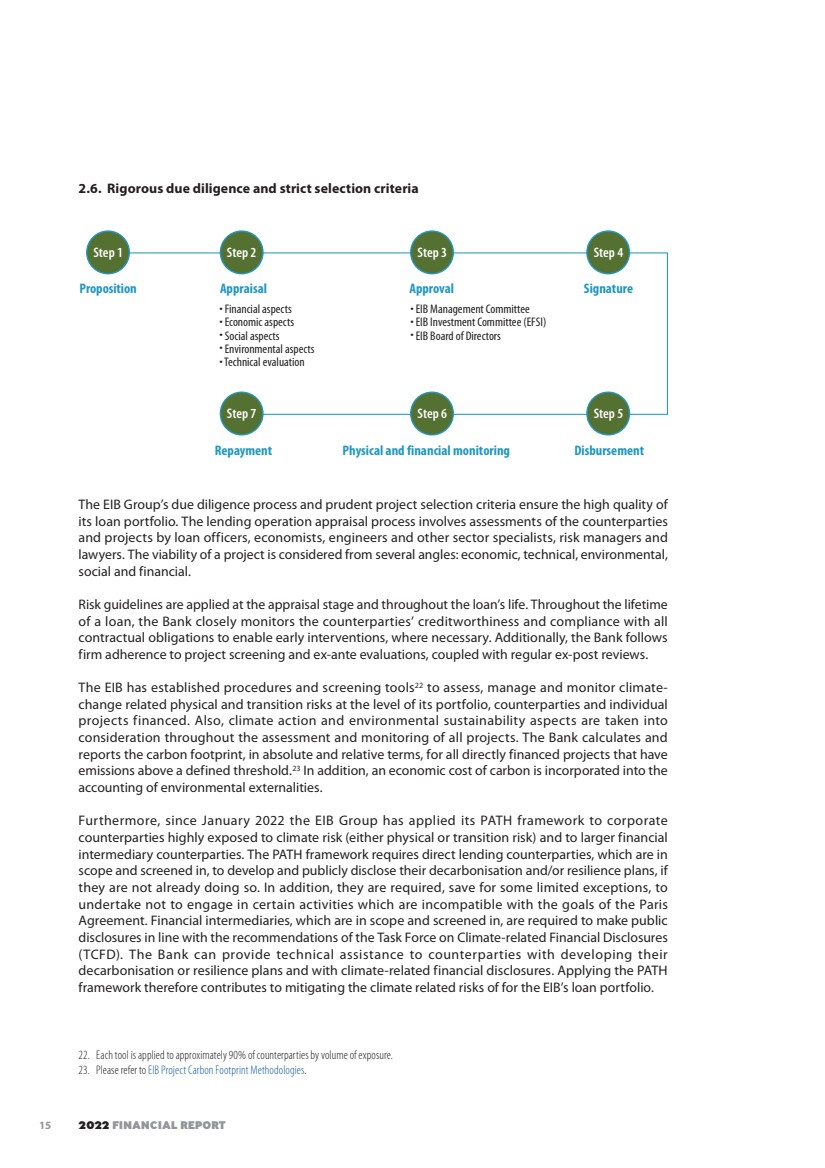

| 2022 FINANCIAL REPORT 2.6. Rigorous due diligence and strict selection criteria Step 1 Proposition Appraisal Repayment Approval • EIB Management Committee • EIB Investment Committee (EFSI) • EIB Board of Directors • Financial aspects • Economic aspects • Social aspects • Environmental aspects • Technical evaluation Physical and financial monitoring Signature Disbursement Step 2 Step 7 Step 3 Step 6 Step 4 Step 5 The EIB Group’s due diligence process and prudent project selection criteria ensure the high quality of its loan portfolio. The lending operation appraisal process involves assessments of the counterparties and projects by loan officers, economists, engineers and other sector specialists, risk managers and lawyers. The viability of a project is considered from several angles: economic, technical, environmental, social and financial. Risk guidelines are applied at the appraisal stage and throughout the loan’s life. Throughout the lifetime of a loan, the Bank closely monitors the counterparties’ creditworthiness and compliance with all contractual obligations to enable early interventions, where necessary. Additionally, the Bank follows firm adherence to project screening and ex-ante evaluations, coupled with regular ex-post reviews. The EIB has established procedures and screening tools22 to assess, manage and monitor climate-change related physical and transition risks at the level of its portfolio, counterparties and individual projects financed. Also, climate action and environmental sustainability aspects are taken into consideration throughout the assessment and monitoring of all projects. The Bank calculates and reports the carbon footprint, in absolute and relative terms, for all directly financed projects that have emissions above a defined threshold.23 In addition, an economic cost of carbon is incorporated into the accounting of environmental externalities. Furthermore, since January 2022 the EIB Group has applied its PATH framework to corporate counterparties highly exposed to climate risk (either physical or transition risk) and to larger financial intermediary counterparties. The PATH framework requires direct lending counterparties, which are in scope and screened in, to develop and publicly disclose their decarbonisation and/or resilience plans, if they are not already doing so. In addition, they are required, save for some limited exceptions, to undertake not to engage in certain activities which are incompatible with the goals of the Paris Agreement. Financial intermediaries, which are in scope and screened in, are required to make public disclosures in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The Bank can provide technical assistance to counterparties with developing their decarbonisation or resilience plans and with climate-related financial disclosures. Applying the PATH framework therefore contributes to mitigating the climate related risks of for the EIB’s loan portfolio. 22. Each tool is applied to approximately 90% of counterparties by volume of exposure. 23. Please refer to EIB Project Carbon Footprint Methodologies. 15 |

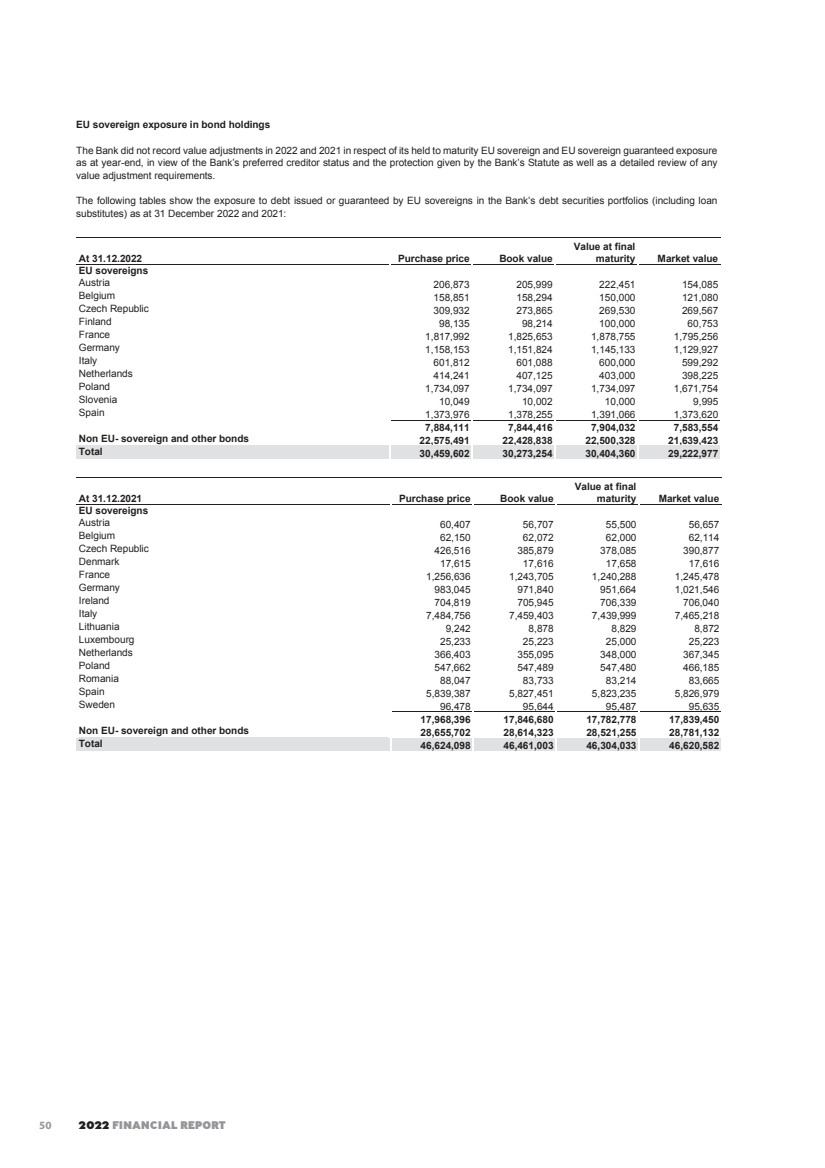

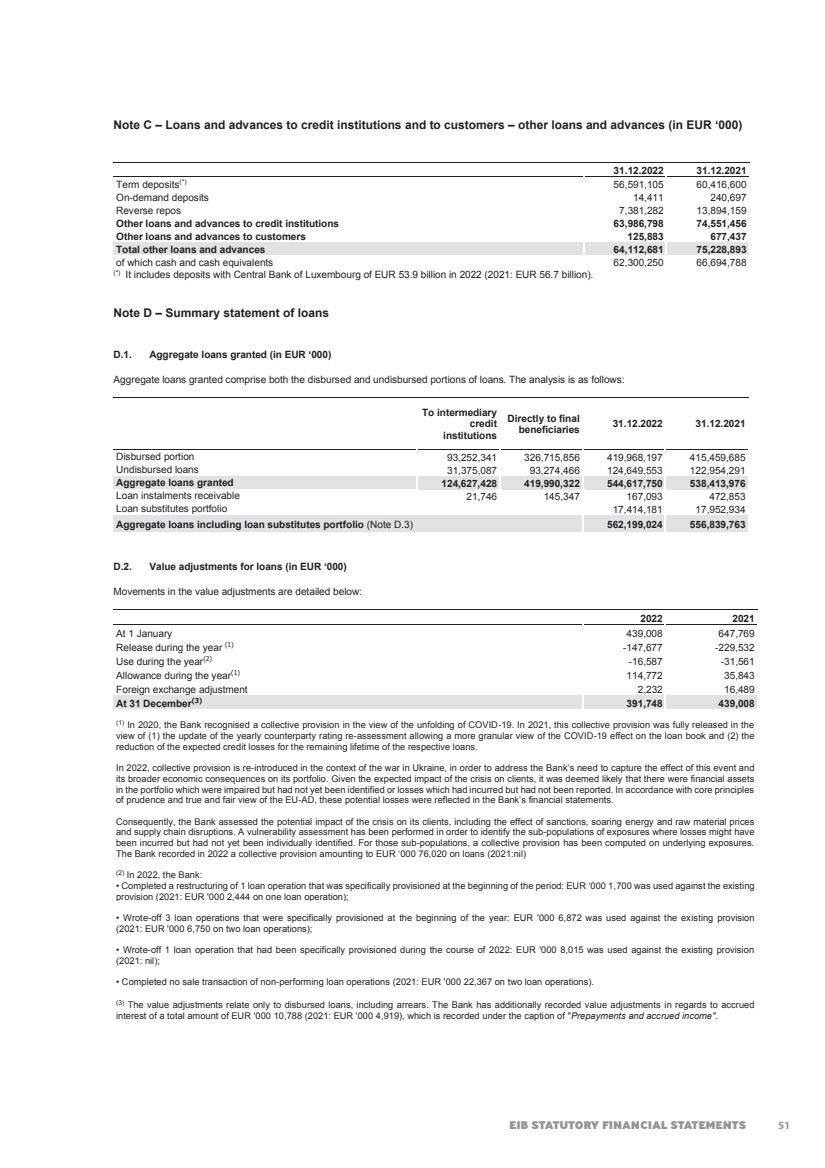

| Overview In February 2022, the EIB published its updated Environmental and Social Standards, promoting an integrated approach to impact assessment and risk management by ensuring that environmental, climate, social and human rights considerations are addressed and taken into account in the decision-making processes. These Standards outline promoters’ responsibilities for assessing and managing environmental, climate and social impacts and risks in EIB-financed projects. As part of the update, the ten earlier environmental and social standards were revised and a new standard, on intermediated finance, was added. 2.7. A highly secured and high-quality loan portfolio Despite the general context of uncertainty and various risks resulting from the Russian invasion of Ukraine, the credit quality of the loan portfolio is deemed stable at present. A significant portion of the Bank’s loan portfolio benefits from credit enhancements or recourse to EU or EU Member State guarantees. Credit enhancements are largely in the form of portfolio guarantees from EU sovereigns, the EU budget, investment grade banks and corporates and high-quality financial collateral and assignments of rights or pledges at transaction level. Unsecured loans24 to banks and corporates had a combined value of EUR 151.1 billion25, representing 29.6% of the risk portfolio at the end of 2022 (EUR 140.6 billion and 27.7% as the end of 2021). The asset quality of the EIB’s risk portfolio is high. The share of best of borrower or guarantor internal ratings of investment-grade level26 stood at 84.0%27 of the Bank’s risk portfolio at the end of 2022 (83.5% at the end of 2021). At the end of 2022 the disbursed sovereign exposure28 of the Bank amounted to EUR 45.3 billion (EUR 45.5 billion in 2021) and the sovereign-guaranteed signed exposure29 was EUR 79.3 billion (EUR 78.4 billion in 2021). The Bank has not recorded any impairment in respect of its holding of EU sovereign and EU sovereign-guaranteed exposures. The Bank’s preferred creditor status and the protection given by its Statute are deemed to guarantee full recovery of these EU sovereign assets. The EIB follows the non-performing exposure30 regulatory requirements in the context of its Best Banking Practice Guiding Principles. The level of non-performing signed exposure31 in the risk portfolio stood at EUR 2.9 billion at the end of 2022 (EUR 3.2 billion at the end of 2021), while disbursed exposure amounted to EUR 2.6 billion (EUR 2.9 billion at the end of 2021). The non-performing exposures are assessed based on the situation of the counterparty, disregarding any collateral arrangements or portfolio guarantees. Of the non-performing exposure, there was impaired loan exposure subject to specific provisions of EUR 1.8 billion (EUR 1.5 billion in 2021). These operations represent 0.4% of the total loan portfolio (0.4 % in 2021), for which the Bank has specific provisions for gross exposure (disbursed exposures, accrued interest and exposures in arrears) of EUR 326.5 million (EUR 443.9 million in 2021). The level of specific provisions is relatively low in view of the security, guarantees and portfolio credit enhancements in place. 24. Unsecured loans refer to lending operations where the EIB has no genuine recourse to an independent third party. 25. Includes own resources loans and loan substitutes. 26. Above Baa3 rating. 27. Includes own resources loans and loan substitutes. 28. Includes own resources loans and loan substitutes. 29. Includes own resources loans and loan substitutes. 30. Non-performing exposure is defined as material exposures which are more than 90 days past-due or unlikely to pay regardless of the existence of any past-due amount based on methodology for identification and management of deterioration in the portfolio during the entire loan cycle. 31. Including loans, (incl. quasi-equities), loan substitutes and guarantees. 16 |

| 2022 FINANCIAL REPORT As a result of the war in Ukraine, the Bank assessed the potential impact of the crisis on clients, including the effect of sanctions, soaring energy and raw material prices and supply chain disruptions. In that context, additional provisions were recorded in the Statutory Financial Statements in December 2022, amounting to EUR 76.0 million in the form of collective provisions on loans. At the end of 2022, arrears32 over 90 days amounted to EUR 77.7 million (EUR 118.7 million in 2021). 3. FUNDING ACTIVITIES The EIB raises long term funds through bond issuance on the international capital markets to meet its lending needs. Funding activities aim to reach set volume targets with a maturity structure suitable for the Bank’s asset and liability management, and to optimise cost on a sustainable basis. Diversification of sources and tenors of funding support the flexibility of the Bank, which maintains a regular presence in different funding markets. Funding in 2022 faced fresh challenges from global fixed income market conditions, characterised by rising yields and increased volatility, amid persistent economic disruptions linked to the exit from the coronavirus pandemic and onset of war in Ukraine. The EIB completed 2022 with a total issuance equivalent of EUR 44.3 billion in 17 currencies (EUR 55.3 billion in 21 currencies in 2021), in line with the announced funding programme of EUR 45 billion and the borrowing authorisation of up to EUR 50 billion. The 2022 funding target factored in the pre-funding already secured in 2021 (EUR 0.8 billion) and took into consideration the Bank’s lending targets, debt service and prudent liquidity requirements. Net issuance33 was negative by EUR 6.0 billion in 2022, but slightly less than in 2021 (net negative by EUR 9.7 billion). The Bank's funding strategy relies on the issuance of large and liquid benchmark transactions in the world’s main currencies, complemented by targeted issuance (plain vanilla and structured), the latter usually driven by reverse inquiries. Benchmark transactions represented about 70% of funding in 2022. Such transactions helped to secure volume and manage cost and duration against the volatile backdrop. Also, the growth of climate action and environmental sustainability lending facilitated substantial growth in climate and sustainability funding, which reached a record share of 45% of the funding programme in 2022 amounting to EUR 19.9 billion (EUR 11.5 billion and 21% in 2021), including the first benchmark- sized climate and sustainability issues by the EIB. As in previous years, the Bank frontloaded its funding activities at the beginning of the year, when issuance activity on the capital markets worldwide was at its peak. In January 2022, the EIB opened up the sovereigns, supranationals and agencies (SSA) US dollar market with its USD 5.0 billion 5-year Global Bond issue, which recorded the EIB’s second-largest USD Global Bond order-book ever. This was followed by the first public, syndicated Kangaroo Sustainability Awareness Bond (SAB), the largest single SSA Kangaroo tranche ever launched for AUD 1.5 billion (EUR 1.0 billion). Moreover, in February 2022, the Bank registered its largest 5-year order-book on record for a new EIB Euro Area Reference Note (EARN), which was significantly oversubscribed. Funding highlights in 2022 also included the first ever EARN to be issued in Climate Awareness Bond format in May 2022, and a well-received USD 3.0 billion 7 year Global Bond issue on 1 March 2022, in spite of the markets’ gyrations that followed the unfolding crisis in Ukraine. A remarkable innovation in 2022 was the issuance of digital bonds on a private blockchain platform in November 2022. 32. For more details on arrears over 90 days on the loan portfolio, please refer to Note U of the Statutory Financial Statements. 33. Gross issuance minus redemption and repayment during 2022. 17 |

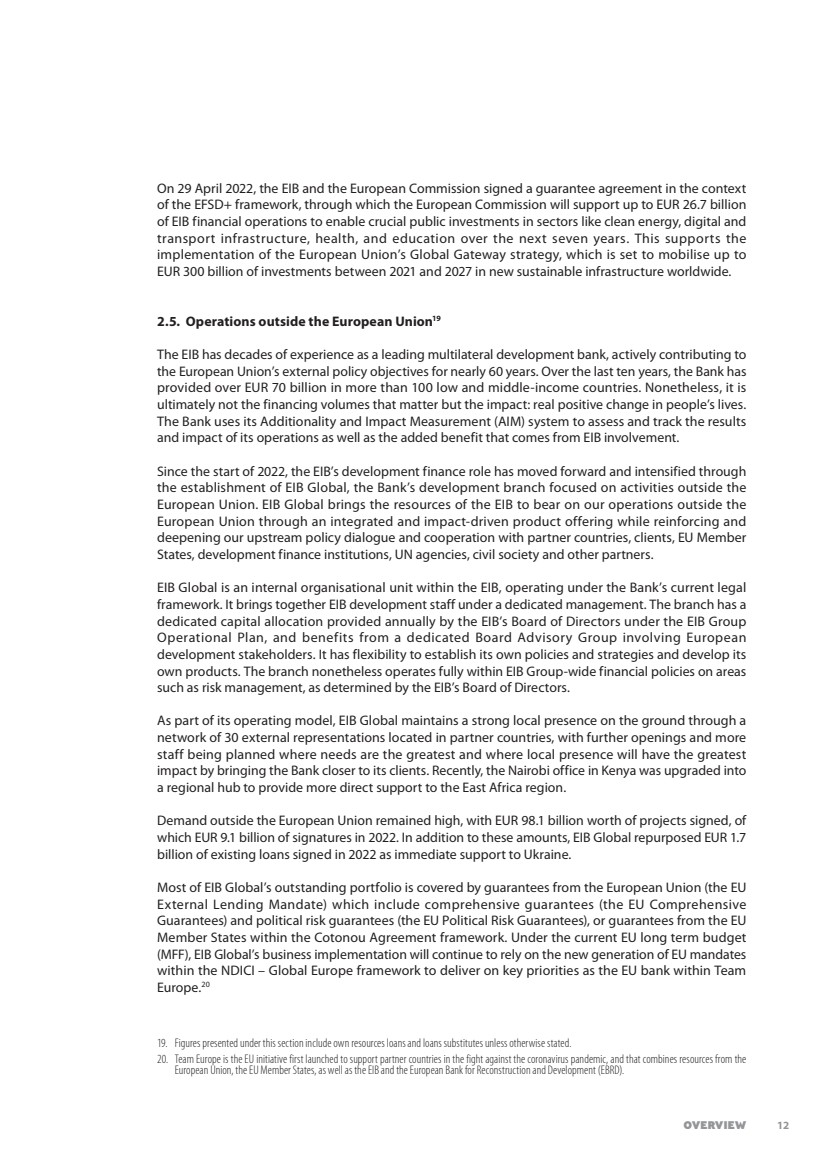

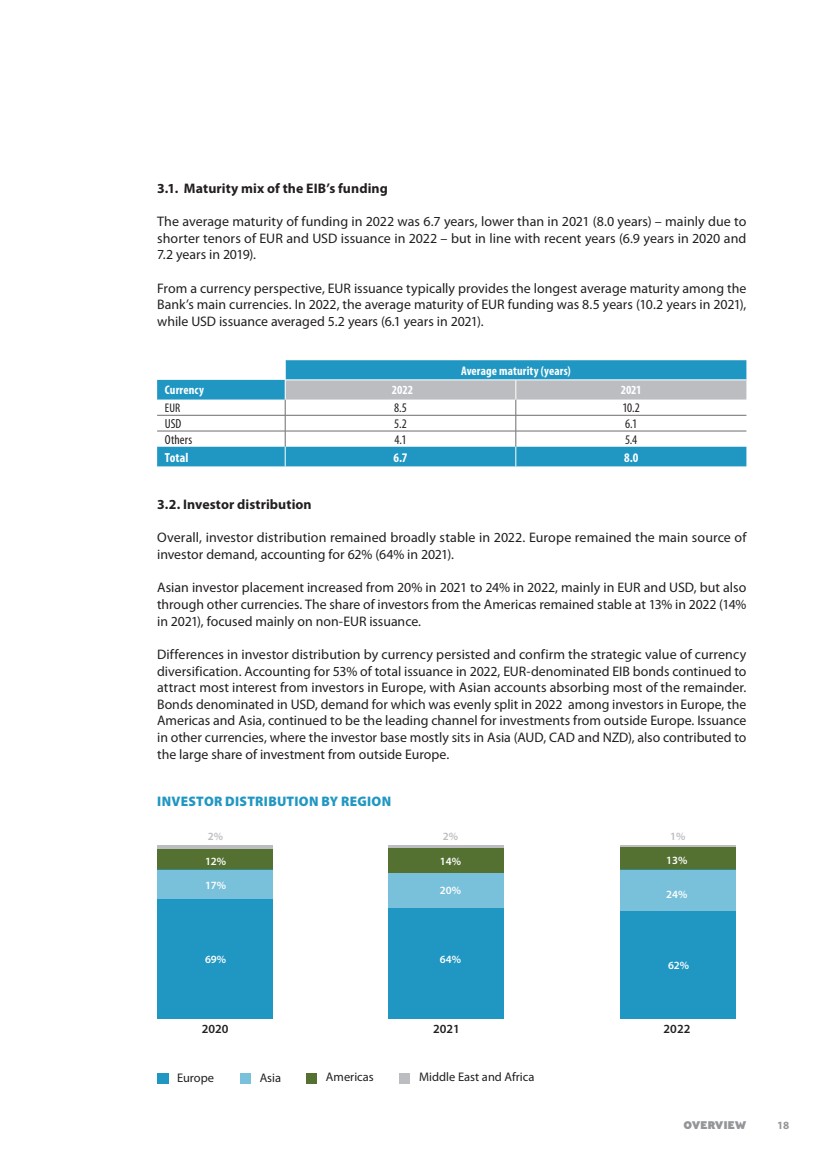

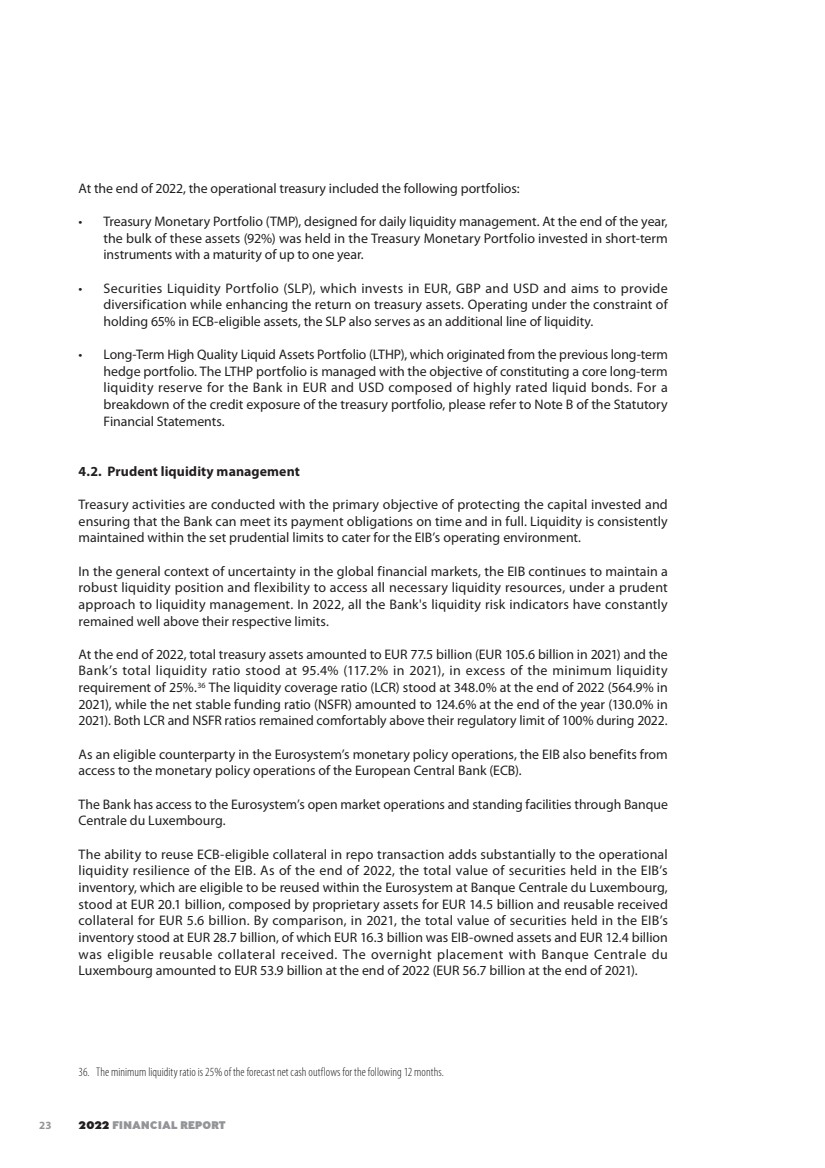

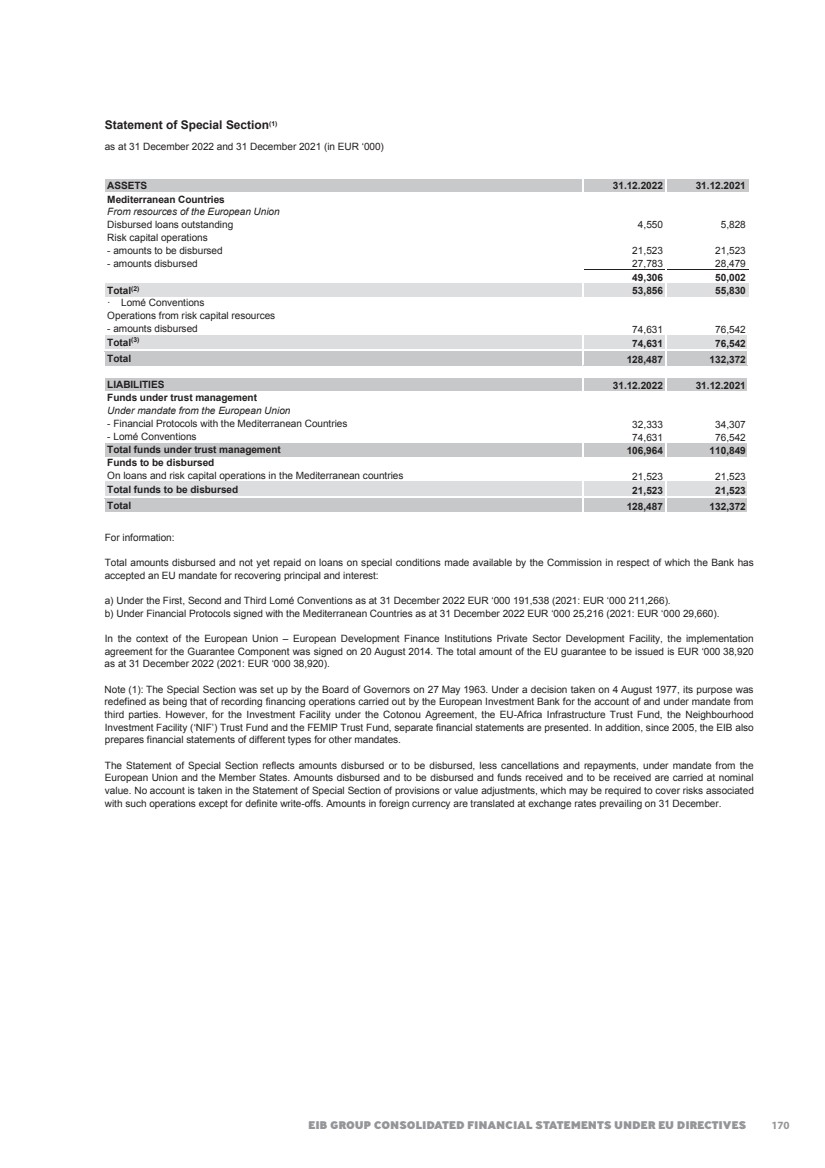

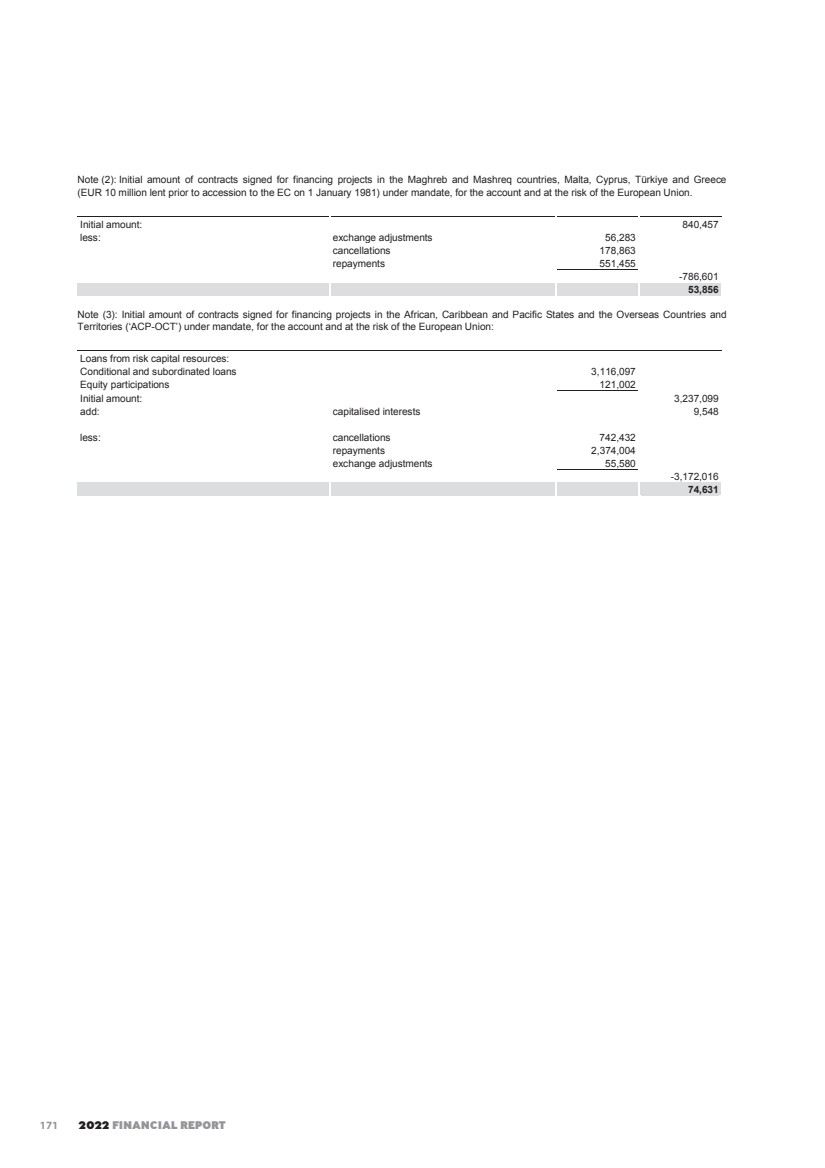

| Overview 2020 2021 2022 Europe Asia Americas Middle East and Africa 69% 17% 12% 2% 64% 62% 20% 14% 2% 24% 13% 1% 3.1. Maturity mix of the EIB’s funding The average maturity of funding in 2022 was 6.7 years, lower than in 2021 (8.0 years) – mainly due to shorter tenors of EUR and USD issuance in 2022 – but in line with recent years (6.9 years in 2020 and 7.2 years in 2019). From a currency perspective, EUR issuance typically provides the longest average maturity among the Bank’s main currencies. In 2022, the average maturity of EUR funding was 8.5 years (10.2 years in 2021), while USD issuance averaged 5.2 years (6.1 years in 2021). Average maturity (years) Currency 2022 2021 EUR 8.5 10.2 USD 5.2 6.1 Others 4.1 5.4 Total 6.7 8.0 3.2. Investor distribution Overall, investor distribution remained broadly stable in 2022. Europe remained the main source of investor demand, accounting for 62% (64% in 2021). Asian investor placement increased from 20% in 2021 to 24% in 2022, mainly in EUR and USD, but also through other currencies. The share of investors from the Americas remained stable at 13% in 2022 (14% in 2021), focused mainly on non-EUR issuance. Differences in investor distribution by currency persisted and confirm the strategic value of currency diversification. Accounting for 53% of total issuance in 2022, EUR-denominated EIB bonds continued to attract most interest from investors in Europe, with Asian accounts absorbing most of the remainder. Bonds denominated in USD, demand for which was evenly split in 2022 among investors in Europe, the Americas and Asia, continued to be the leading channel for investments from outside Europe. Issuance in other currencies, where the investor base mostly sits in Asia (AUD, CAD and NZD), also contributed to the large share of investment from outside Europe. INVESTOR DISTRIBUTION BY REGION 18 |

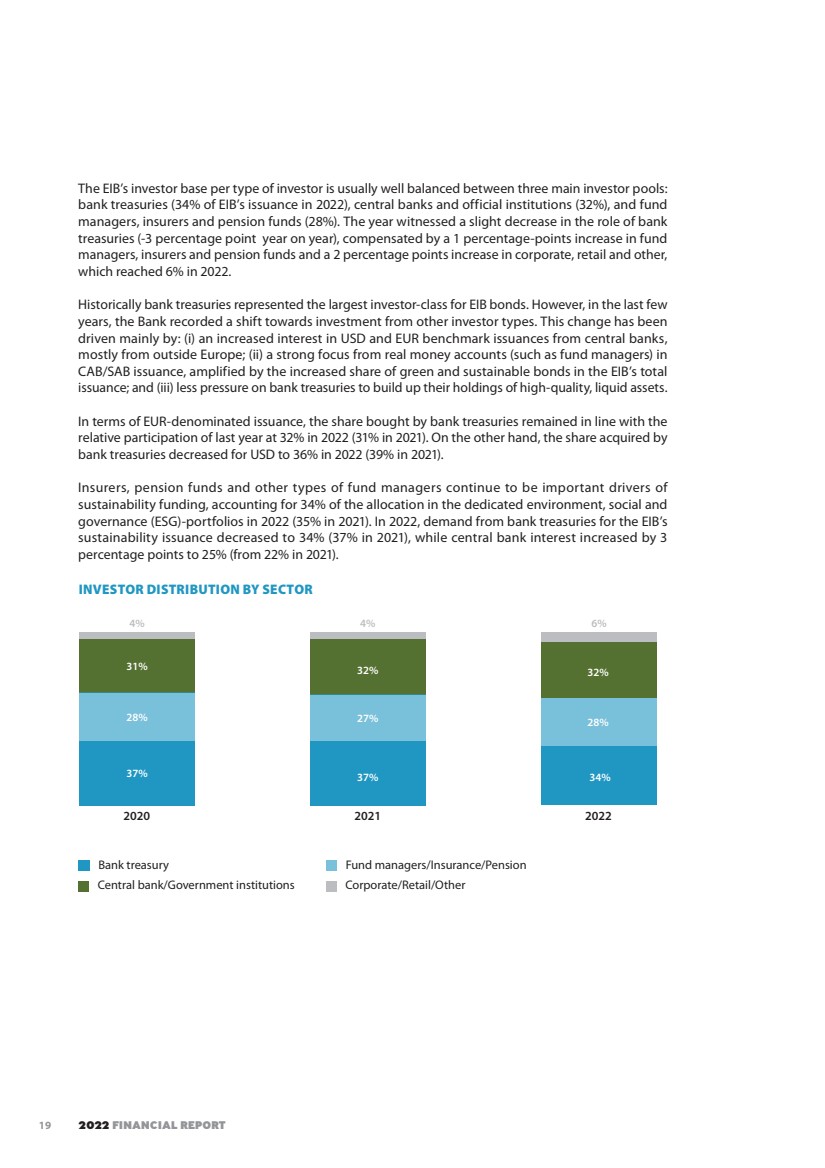

| 2022 FINANCIAL REPORT The EIB’s investor base per type of investor is usually well balanced between three main investor pools: bank treasuries (34% of EIB’s issuance in 2022), central banks and official institutions (32%), and fund managers, insurers and pension funds (28%). The year witnessed a slight decrease in the role of bank treasuries (-3 percentage point year on year), compensated by a 1 percentage-points increase in fund managers, insurers and pension funds and a 2 percentage points increase in corporate, retail and other, which reached 6% in 2022. Historically bank treasuries represented the largest investor-class for EIB bonds. However, in the last few years, the Bank recorded a shift towards investment from other investor types. This change has been driven mainly by: (i) an increased interest in USD and EUR benchmark issuances from central banks, mostly from outside Europe; (ii) a strong focus from real money accounts (such as fund managers) in CAB/SAB issuance, amplified by the increased share of green and sustainable bonds in the EIB’s total issuance; and (iii) less pressure on bank treasuries to build up their holdings of high-quality, liquid assets. In terms of EUR-denominated issuance, the share bought by bank treasuries remained in line with the relative participation of last year at 32% in 2022 (31% in 2021). On the other hand, the share acquired by bank treasuries decreased for USD to 36% in 2022 (39% in 2021). Insurers, pension funds and other types of fund managers continue to be important drivers of sustainability funding, accounting for 34% of the allocation in the dedicated environment, social and governance (ESG)-portfolios in 2022 (35% in 2021). In 2022, demand from bank treasuries for the EIB’s sustainability issuance decreased to 34% (37% in 2021), while central bank interest increased by 3 percentage points to 25% (from 22% in 2021). 2020 2021 2022 Bank treasury Fund managers/Insurance/Pension Central bank/Government institutions Corporate/Retail/Other 37% 28% 31% 4% 37% 34% 27% 32% 4% 28% 32% 6% INVESTOR DISTRIBUTION BY SECTOR 19 |

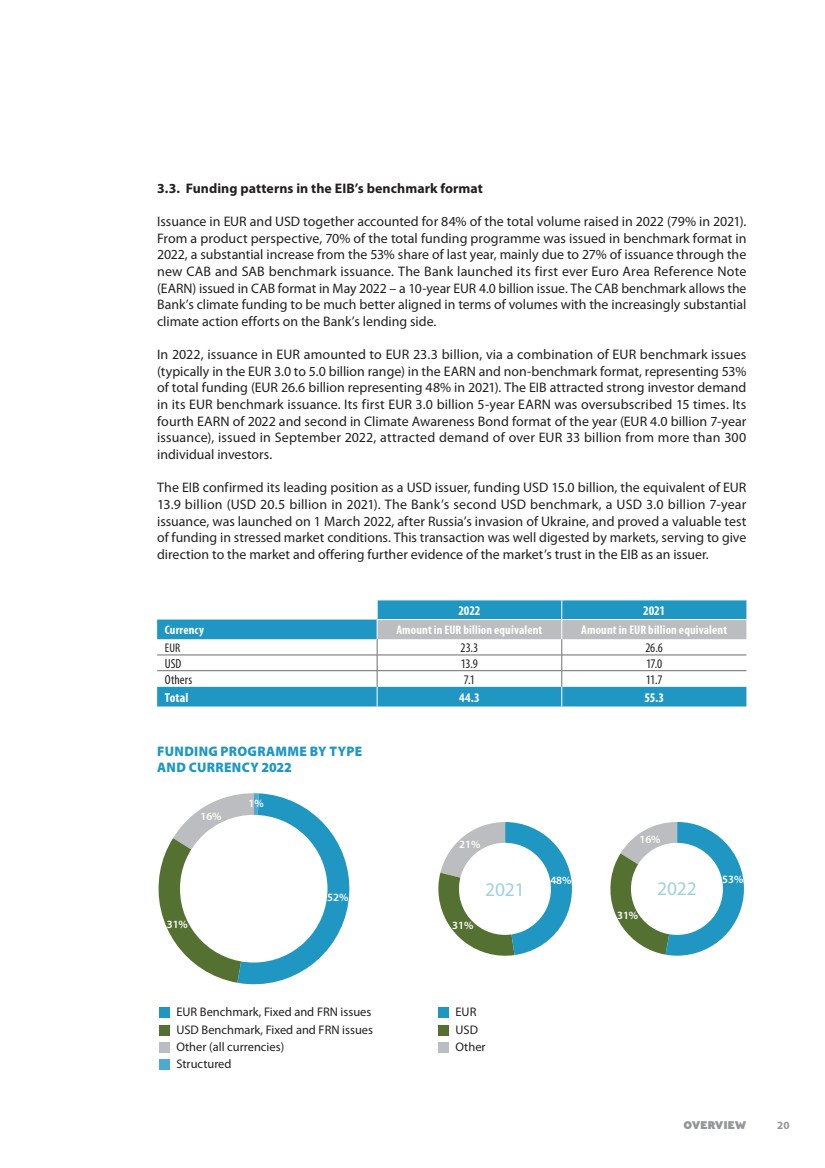

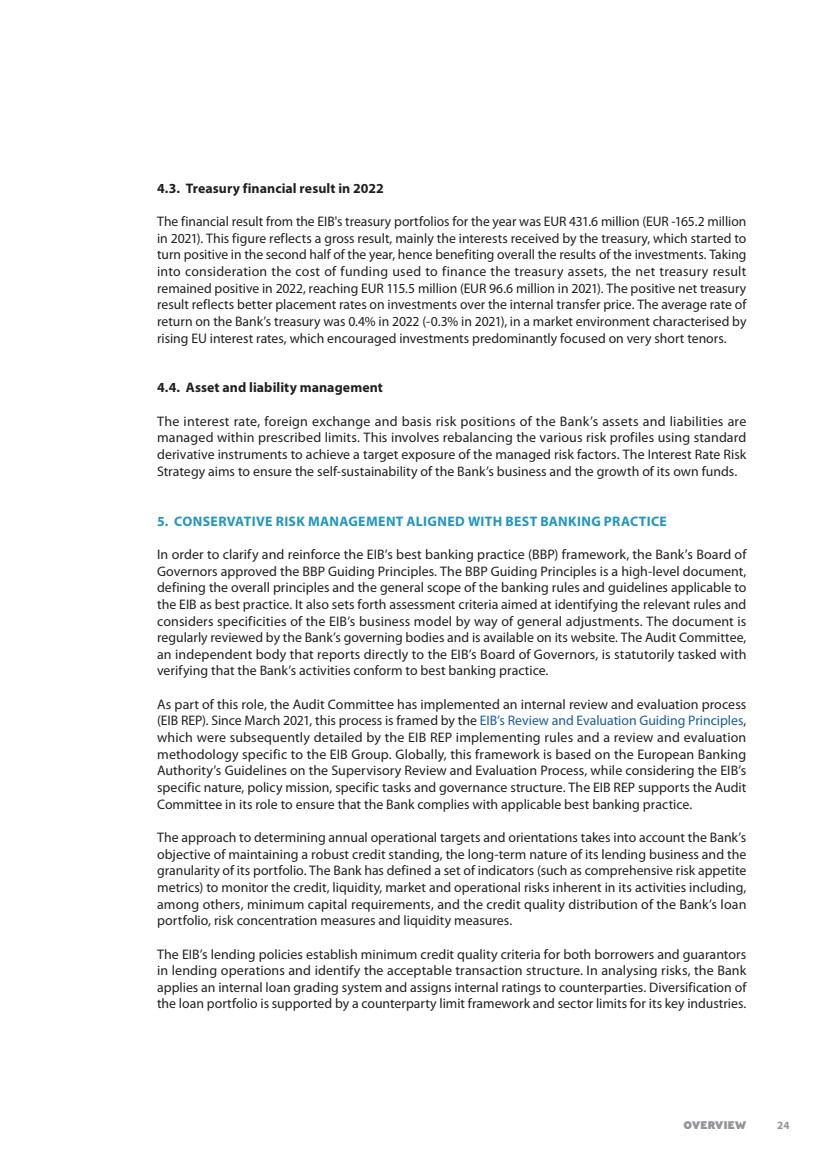

| Overview 3.3. Funding patterns in the EIB’s benchmark format Issuance in EUR and USD together accounted for 84% of the total volume raised in 2022 (79% in 2021). From a product perspective, 70% of the total funding programme was issued in benchmark format in 2022, a substantial increase from the 53% share of last year, mainly due to 27% of issuance through the new CAB and SAB benchmark issuance. The Bank launched its first ever Euro Area Reference Note (EARN) issued in CAB format in May 2022 – a 10-year EUR 4.0 billion issue. The CAB benchmark allows the Bank’s climate funding to be much better aligned in terms of volumes with the increasingly substantial climate action efforts on the Bank’s lending side. In 2022, issuance in EUR amounted to EUR 23.3 billion, via a combination of EUR benchmark issues (typically in the EUR 3.0 to 5.0 billion range) in the EARN and non-benchmark format, representing 53% of total funding (EUR 26.6 billion representing 48% in 2021). The EIB attracted strong investor demand in its EUR benchmark issuance. Its first EUR 3.0 billion 5-year EARN was oversubscribed 15 times. Its fourth EARN of 2022 and second in Climate Awareness Bond format of the year (EUR 4.0 billion 7-year issuance), issued in September 2022, attracted demand of over EUR 33 billion from more than 300 individual investors. The EIB confirmed its leading position as a USD issuer, funding USD 15.0 billion, the equivalent of EUR 13.9 billion (USD 20.5 billion in 2021). The Bank’s second USD benchmark, a USD 3.0 billion 7-year issuance, was launched on 1 March 2022, after Russia’s invasion of Ukraine, and proved a valuable test of funding in stressed market conditions. This transaction was well digested by markets, serving to give direction to the market and offering further evidence of the market’s trust in the EIB as an issuer. 2022 2021 Currency Amount in EUR billion equivalent Amount in EUR billion equivalent EUR 23.3 26.6 USD 13.9 17.0 Others 7.1 11.7 Total 44.3 55.3 FUNDING PROGRAMME BY TYPE AND CURRENCY 2022 Structured EUR Benchmark, Fixed and FRN issues USD Benchmark, Fixed and FRN issues Other (all currencies) 52% 31% 16% 1% EUR USD Other 31% 21% 48% 2021 31% 16% 53% 2022 20 |

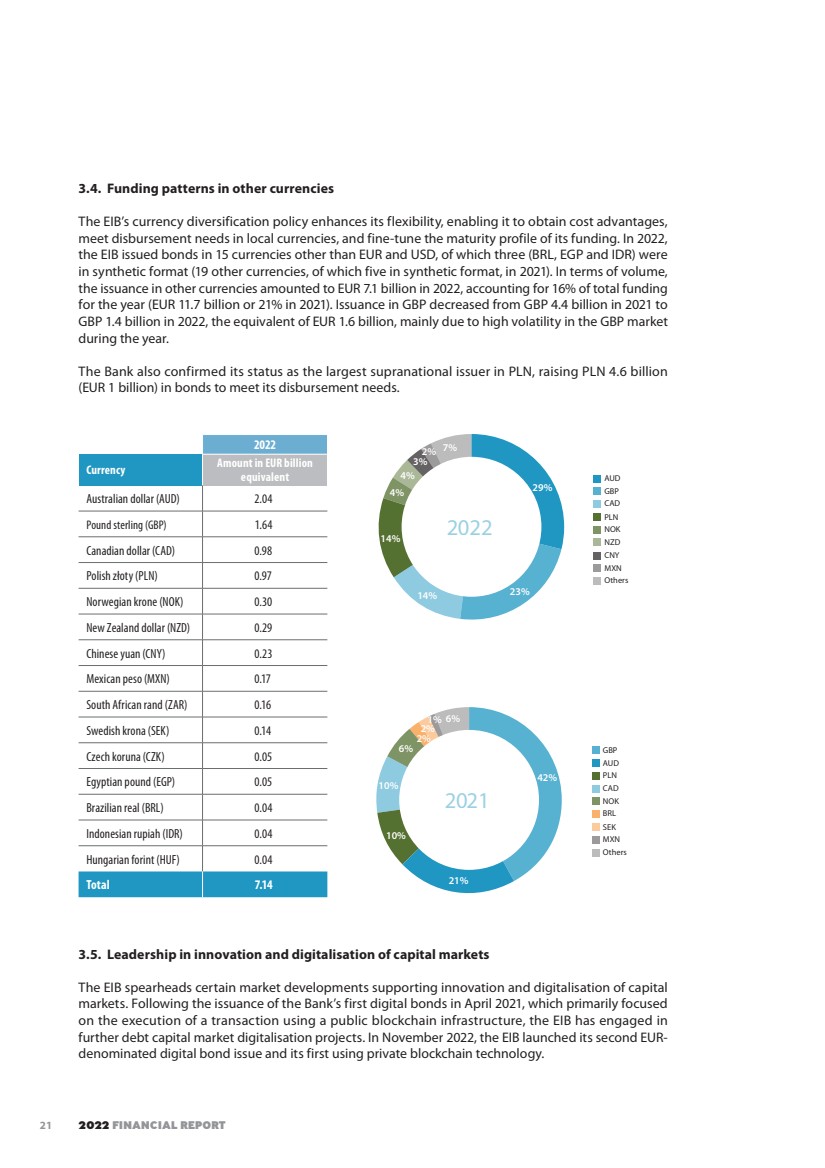

| 2022 FINANCIAL REPORT 3.4. Funding patterns in other currencies The EIB’s currency diversification policy enhances its flexibility, enabling it to obtain cost advantages, meet disbursement needs in local currencies, and fine-tune the maturity profile of its funding. In 2022, the EIB issued bonds in 15 currencies other than EUR and USD, of which three (BRL, EGP and IDR) were in synthetic format (19 other currencies, of which five in synthetic format, in 2021). In terms of volume, the issuance in other currencies amounted to EUR 7.1 billion in 2022, accounting for 16% of total funding for the year (EUR 11.7 billion or 21% in 2021). Issuance in GBP decreased from GBP 4.4 billion in 2021 to GBP 1.4 billion in 2022, the equivalent of EUR 1.6 billion, mainly due to high volatility in the GBP market during the year. The Bank also confirmed its status as the largest supranational issuer in PLN, raising PLN 4.6 billion (EUR 1 billion) in bonds to meet its disbursement needs. 3.5. Leadership in innovation and digitalisation of capital markets The EIB spearheads certain market developments supporting innovation and digitalisation of capital markets. Following the issuance of the Bank’s first digital bonds in April 2021, which primarily focused on the execution of a transaction using a public blockchain infrastructure, the EIB has engaged in further debt capital market digitalisation projects. In November 2022, the EIB launched its second EUR-denominated digital bond issue and its first using private blockchain technology. 2022 Currency Amount in EUR billion equivalent Australian dollar (AUD) 2.04 Pound sterling (GBP) 1.64 Canadian dollar (CAD) 0.98 Polish złoty (PLN) 0.97 Norwegian krone (NOK) 0.30 New Zealand dollar (NZD) 0.29 Chinese yuan (CNY) 0.23 Mexican peso (MXN) 0.17 South African rand (ZAR) 0.16 Swedish krona (SEK) 0.14 Czech koruna (CZK) 0.05 Egyptian pound (EGP) 0.05 Brazilian real (BRL) 0.04 Indonesian rupiah (IDR) 0.04 Hungarian forint (HUF) 0.04 Total 7.14 14% 29% 23% 14% 4% 4% 3% 2% 7% 2022 AUD GBP CAD PLN NOK NZD CNY Others MXN 42% 21% 10% 10% 6% 2% 2% 1% 6% 2021 GBP AUD PLN CAD NOK BRL SEK MXN Others 21 |

| Overview The EUR 100 million 2-year digital bond was issued, recorded and settled using private blockchain-based technology. Terms and conditions of the digital bond are governed by the laws of the Grand Duchy of Luxembourg. The settlement was facilitated by central bank digital currency tokens issued by Banque de France and Banque Centrale du Luxembourg. With its second digital bond issue, the EIB is continuing to set an example for markets in the field of blockchain technology. 3.6. EIB’s sustainability funding in the context of the European Union’s Sustainability Agenda In 2022, the year that marked the 15th anniversary of the world’s first green bond issued by the EIB in 2007, a record of EUR 19.9 billion or 45% of the Bank’s funding programme was issued in Climate and Sustainability Awareness Bonds (CABs and SABs) format (EUR 11.5 billion or 21% in 2021). This impressive growth of sustainability funding is the result of different factors: the gradual extension of eligibilities for CAB/SAB allocations, in the context of the Climate Bank Roadmap implementation; the increase in the volume of eligible disbursements; and the performance attractiveness of certain Climate Awareness Bonds and Sustainability Awareness Bonds in the secondary market. The EIB’s sustainability funding instruments are allocated exclusively to lending activities that contribute substantially to sustainability objectives. Climate Awareness Bonds focus on climate change mitigation, while Sustainability Awareness Bonds focus on other EU objectives for environmental and social sustainability. In 2022, the Climate Awareness Bonds framework was extended to further EU Taxonomy Regulation-eligible low-carbon activities in transport, manufacturing, waste and energy sectors. Climate Awareness Bonds Sustainability Awareness Bonds During 2022, the EIB issued EUR 13.6 billion34 of Climate Awareness Bonds. In the course of the year, EUR 12.7 billion of disbursements were found eligible for allocation of proceeds from CAB issuance and EUR 12.7 billion of CAB proceeds were allocated to such disbursements following the EIB’s allocation procedures. The balance of unallocated CAB proceeds in the treasury CAB portfolio amounted to EUR 0.0 billion at the beginning of the year and to EUR 0.9 billion at the end of the year. During 2022, the EIB issued EUR 5.9 billion35 of Sustainability Awareness Bonds. In the course of the year, EUR 4.2 billion of disbursements were found eligible for allocation of proceeds from SAB issuance and EUR 4.2 billion of SAB proceeds were allocated to such disbursements following the EIB’s allocation procedures. The balance of unallocated SAB proceeds in the treasury SAB portfolio amounted to EUR 0.3 billion at the beginning of the year and to EUR 2.0 billion at the end of the year. 4. TREASURY ACTIVITIES In the general context of uncertainty in the global financial markets, the EIB continues to maintain a robust liquidity position and flexibility to access the necessary liquidity resources under a prudent approach to liquidity management. 4.1. High-quality assets Treasury management fills the dual roles of ensuring that the Bank has the capacity to continually meet its financial commitments and of implementing the Bank’s asset and liability policy. Funds are invested in designated portfolios with defined criteria based on a low-risk strategy of diversification. The Bank’s portfolio management must at all times comply with the guidelines, prudential limits and indicators laid down by the EIB’s governing bodies. 34. Data are preliminary and based on net proceeds from Climate Awareness Bonds. 35. Data are preliminary and based on net proceeds from Sustainability Awareness Bonds. 22 |

| 2022 FINANCIAL REPORT At the end of 2022, the operational treasury included the following portfolios: • Treasury Monetary Portfolio (TMP), designed for daily liquidity management. At the end of the year, the bulk of these assets (92%) was held in the Treasury Monetary Portfolio invested in short-term instruments with a maturity of up to one year. • Securities Liquidity Portfolio (SLP), which invests in EUR, GBP and USD and aims to provide diversification while enhancing the return on treasury assets. Operating under the constraint of holding 65% in ECB-eligible assets, the SLP also serves as an additional line of liquidity. • Long-Term High Quality Liquid Assets Portfolio (LTHP), which originated from the previous long-term hedge portfolio. The LTHP portfolio is managed with the objective of constituting a core long-term liquidity reserve for the Bank in EUR and USD composed of highly rated liquid bonds. For a breakdown of the credit exposure of the treasury portfolio, please refer to Note B of the Statutory Financial Statements. 4.2. Prudent liquidity management Treasury activities are conducted with the primary objective of protecting the capital invested and ensuring that the Bank can meet its payment obligations on time and in full. Liquidity is consistently maintained within the set prudential limits to cater for the EIB’s operating environment. In the general context of uncertainty in the global financial markets, the EIB continues to maintain a robust liquidity position and flexibility to access all necessary liquidity resources, under a prudent approach to liquidity management. In 2022, all the Bank's liquidity risk indicators have constantly remained well above their respective limits. At the end of 2022, total treasury assets amounted to EUR 77.5 billion (EUR 105.6 billion in 2021) and the Bank’s total liquidity ratio stood at 95.4% (117.2% in 2021), in excess of the minimum liquidity requirement of 25%.36 The liquidity coverage ratio (LCR) stood at 348.0% at the end of 2022 (564.9% in 2021), while the net stable funding ratio (NSFR) amounted to 124.6% at the end of the year (130.0% in 2021). Both LCR and NSFR ratios remained comfortably above their regulatory limit of 100% during 2022. As an eligible counterparty in the Eurosystem’s monetary policy operations, the EIB also benefits from access to the monetary policy operations of the European Central Bank (ECB). The Bank has access to the Eurosystem’s open market operations and standing facilities through Banque Centrale du Luxembourg. The ability to reuse ECB-eligible collateral in repo transaction adds substantially to the operational liquidity resilience of the EIB. As of the end of 2022, the total value of securities held in the EIB’s inventory, which are eligible to be reused within the Eurosystem at Banque Centrale du Luxembourg, stood at EUR 20.1 billion, composed by proprietary assets for EUR 14.5 billion and reusable received collateral for EUR 5.6 billion. By comparison, in 2021, the total value of securities held in the EIB’s inventory stood at EUR 28.7 billion, of which EUR 16.3 billion was EIB-owned assets and EUR 12.4 billion was eligible reusable collateral received. The overnight placement with Banque Centrale du Luxembourg amounted to EUR 53.9 billion at the end of 2022 (EUR 56.7 billion at the end of 2021). 36. The minimum liquidity ratio is 25% of the forecast net cash outflows for the following 12 months. 23 |

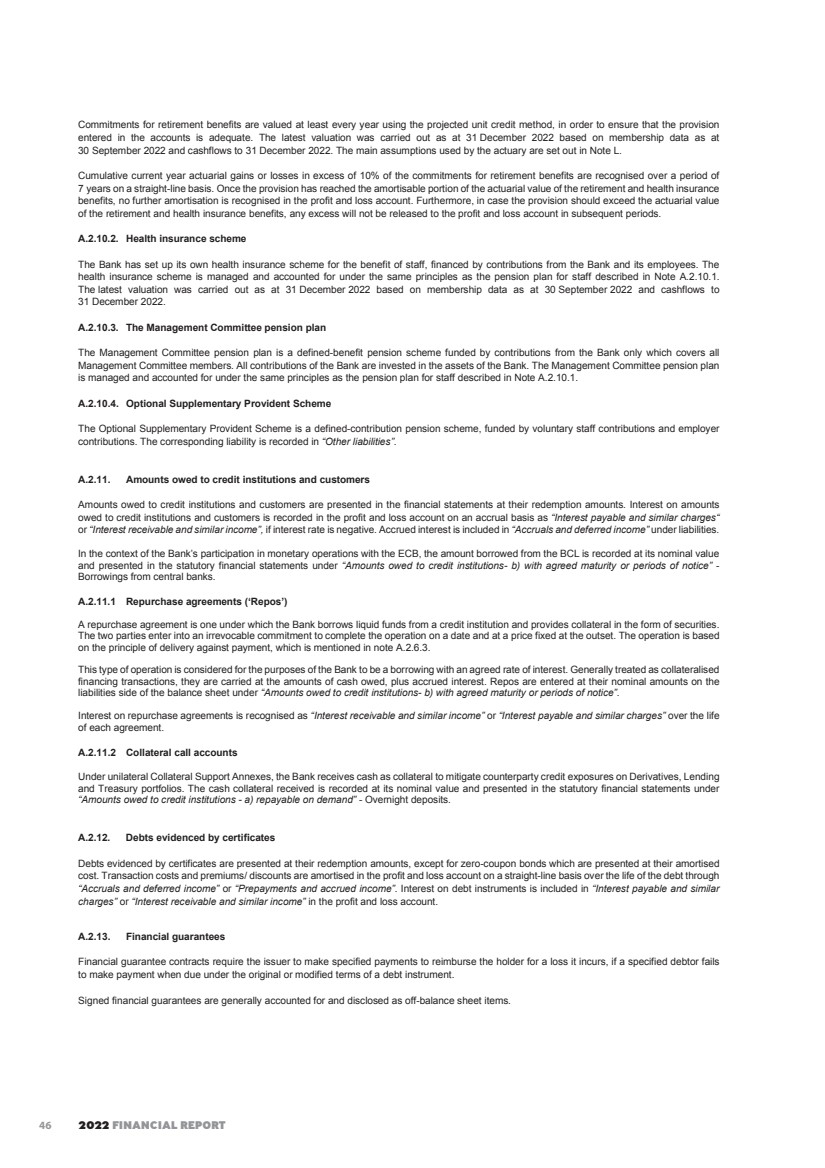

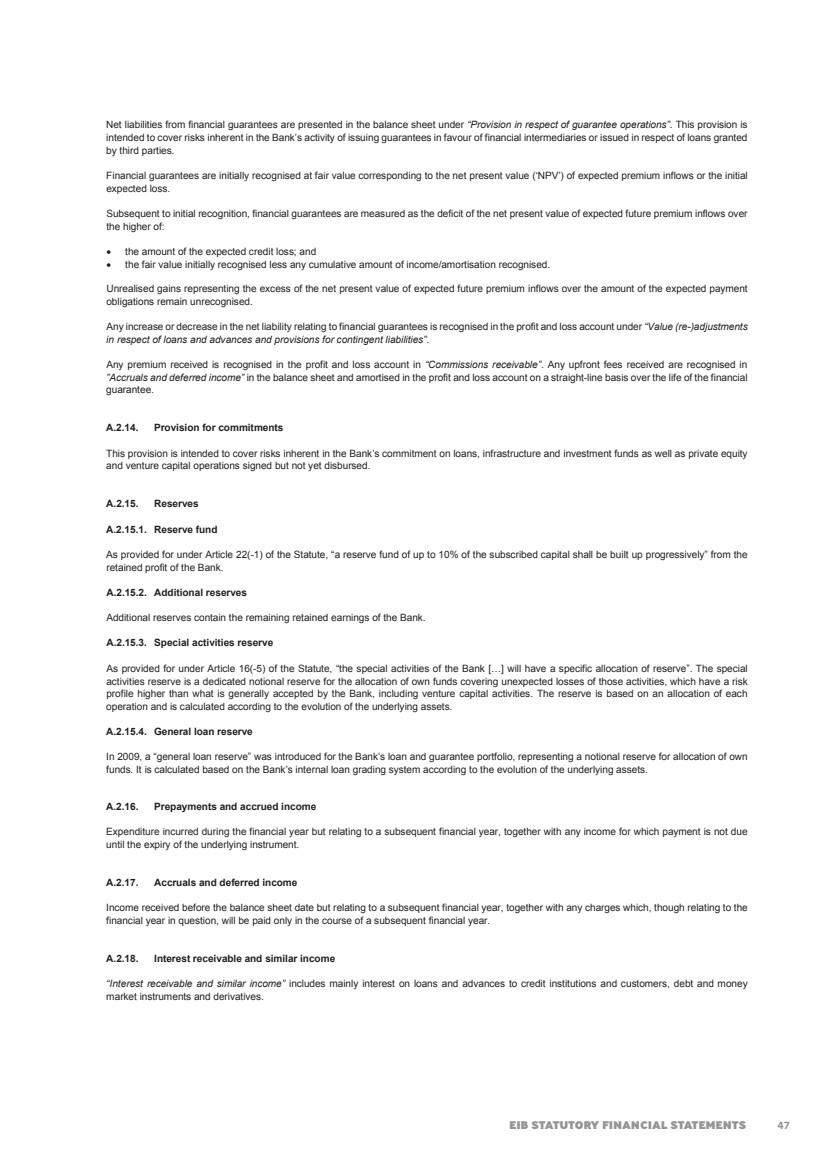

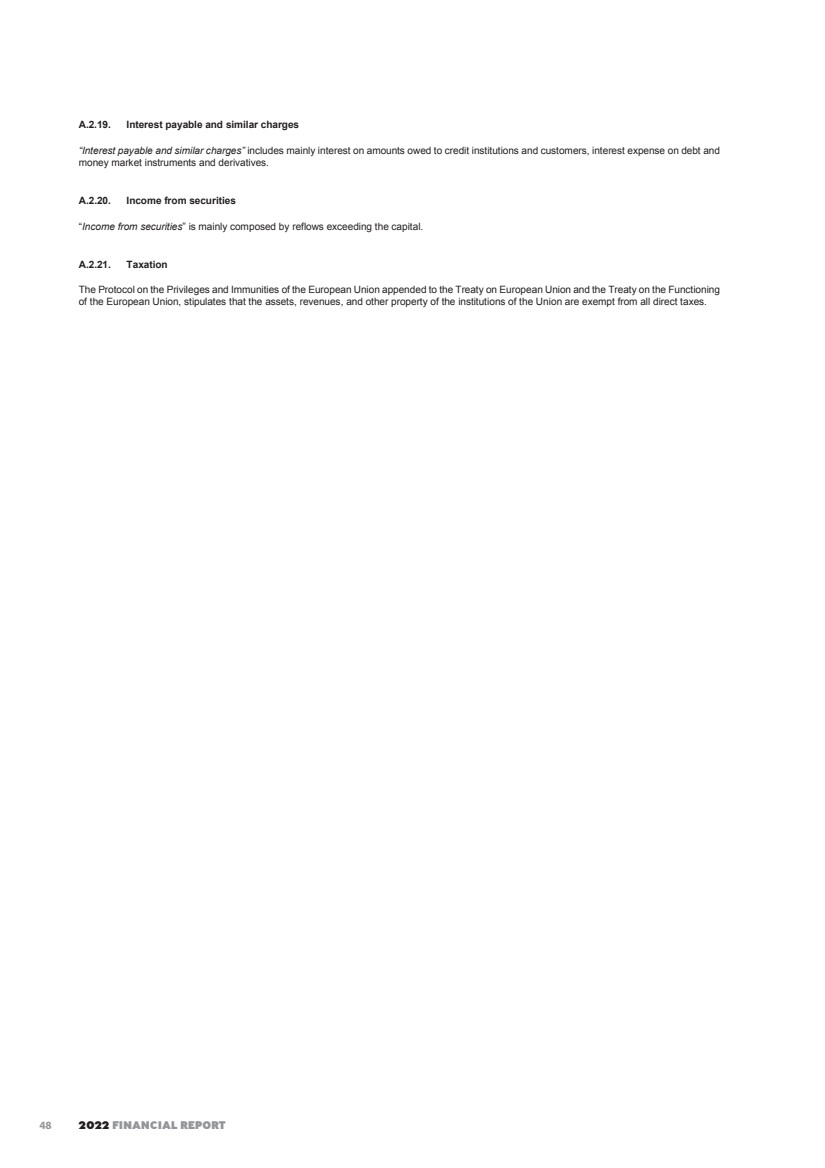

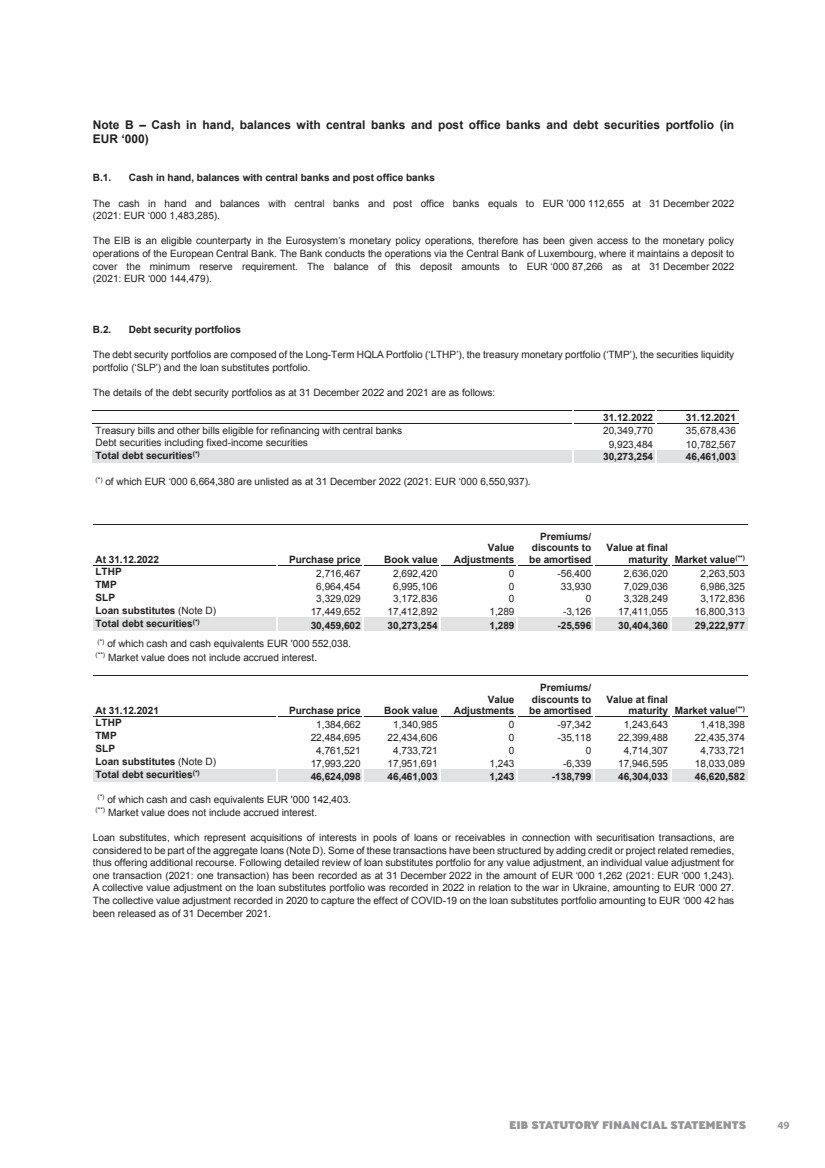

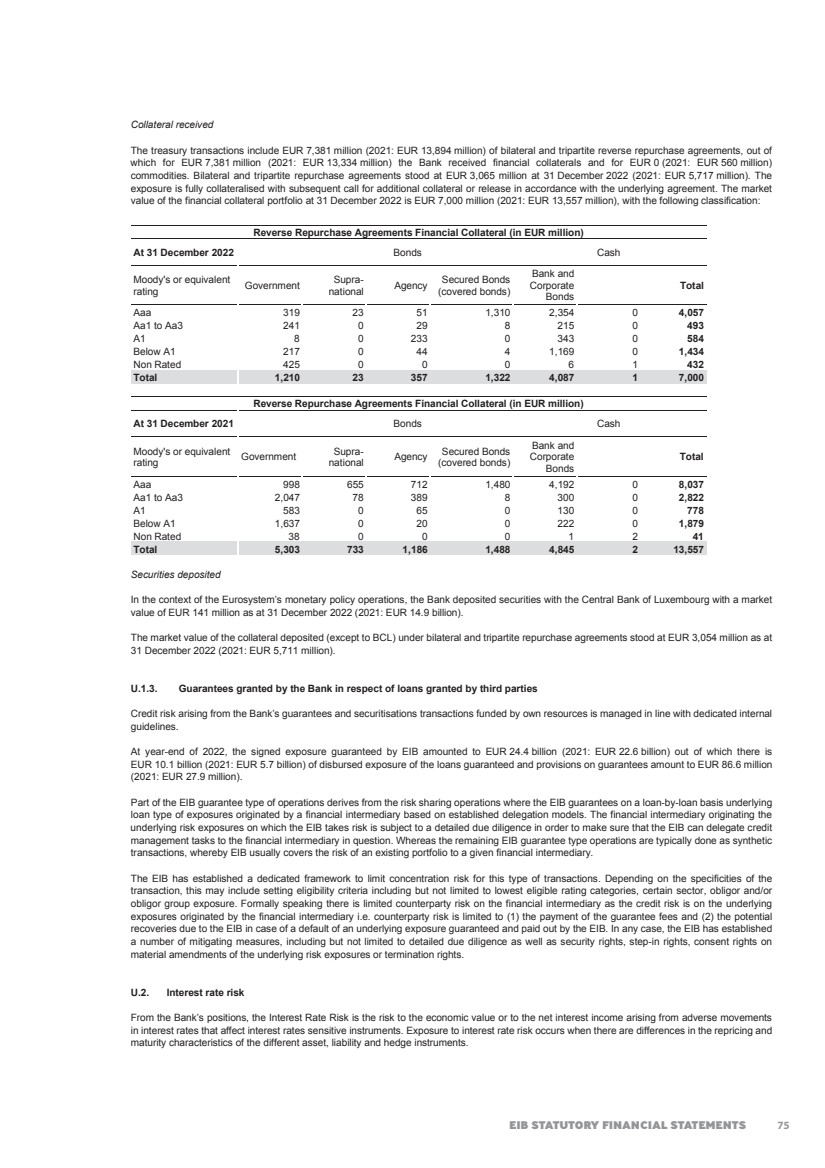

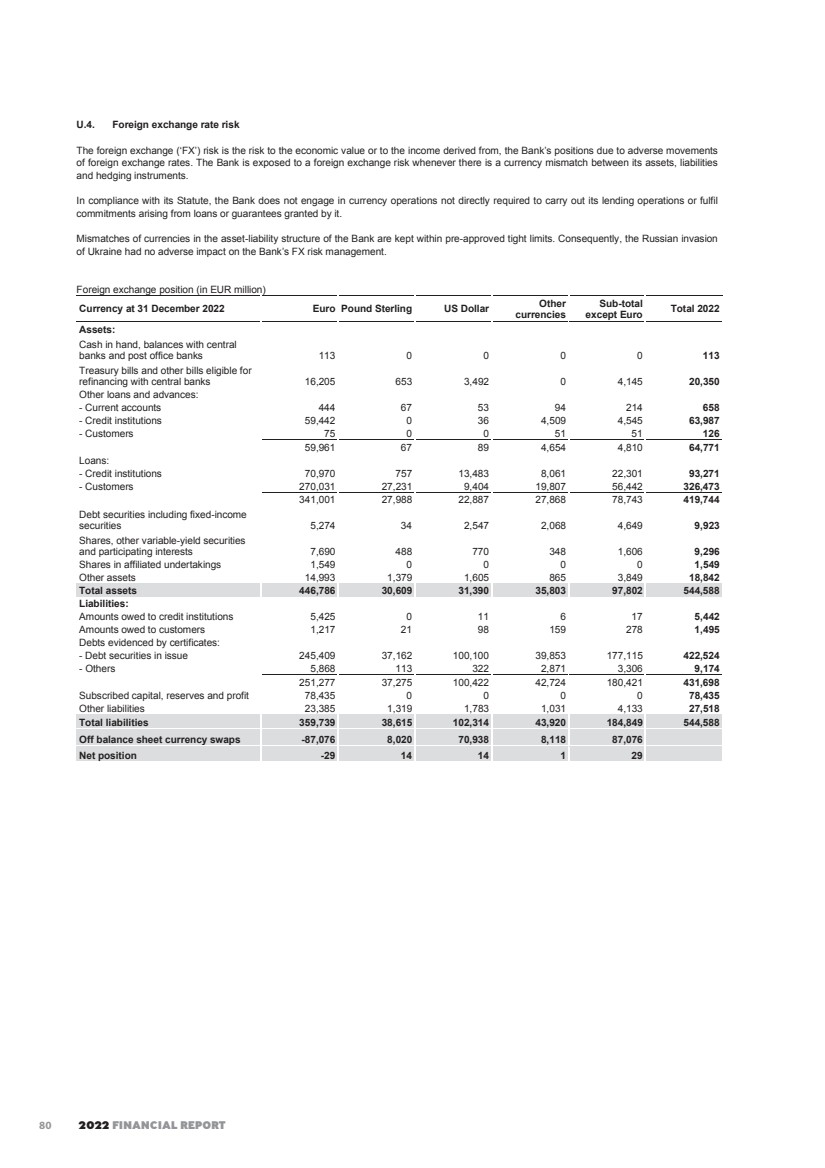

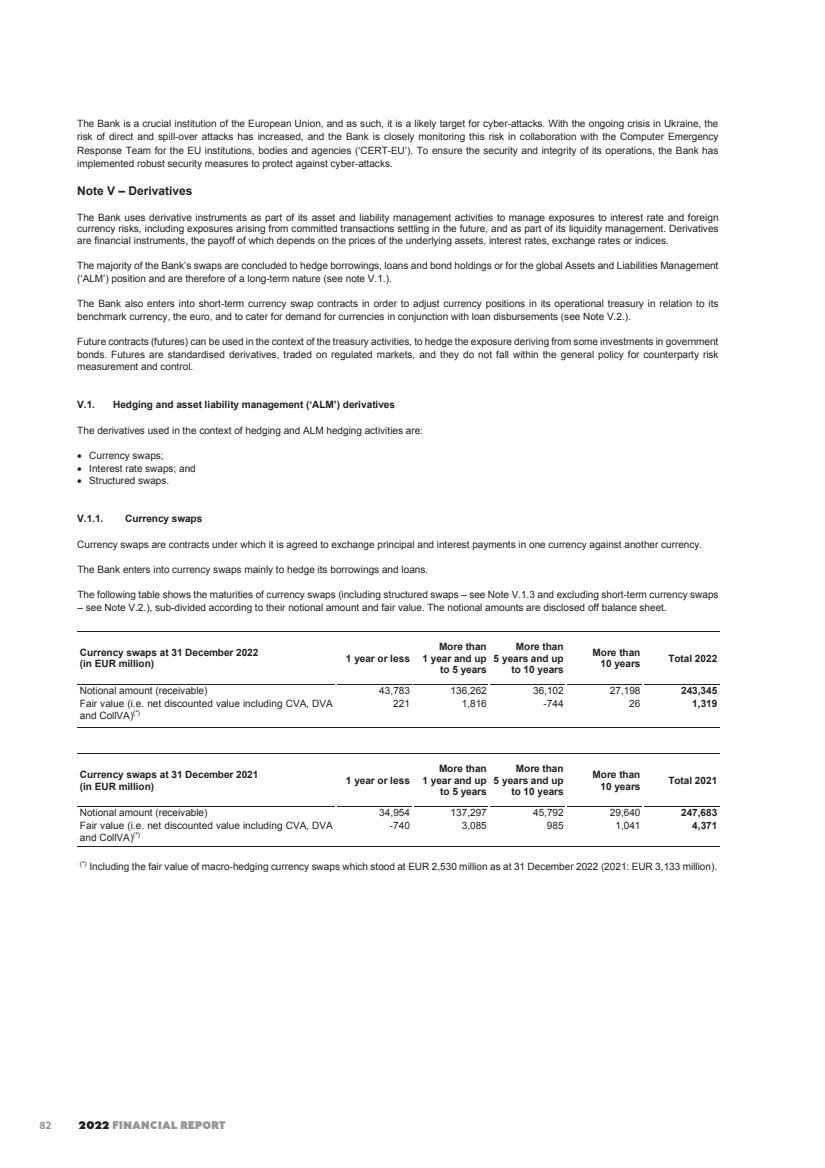

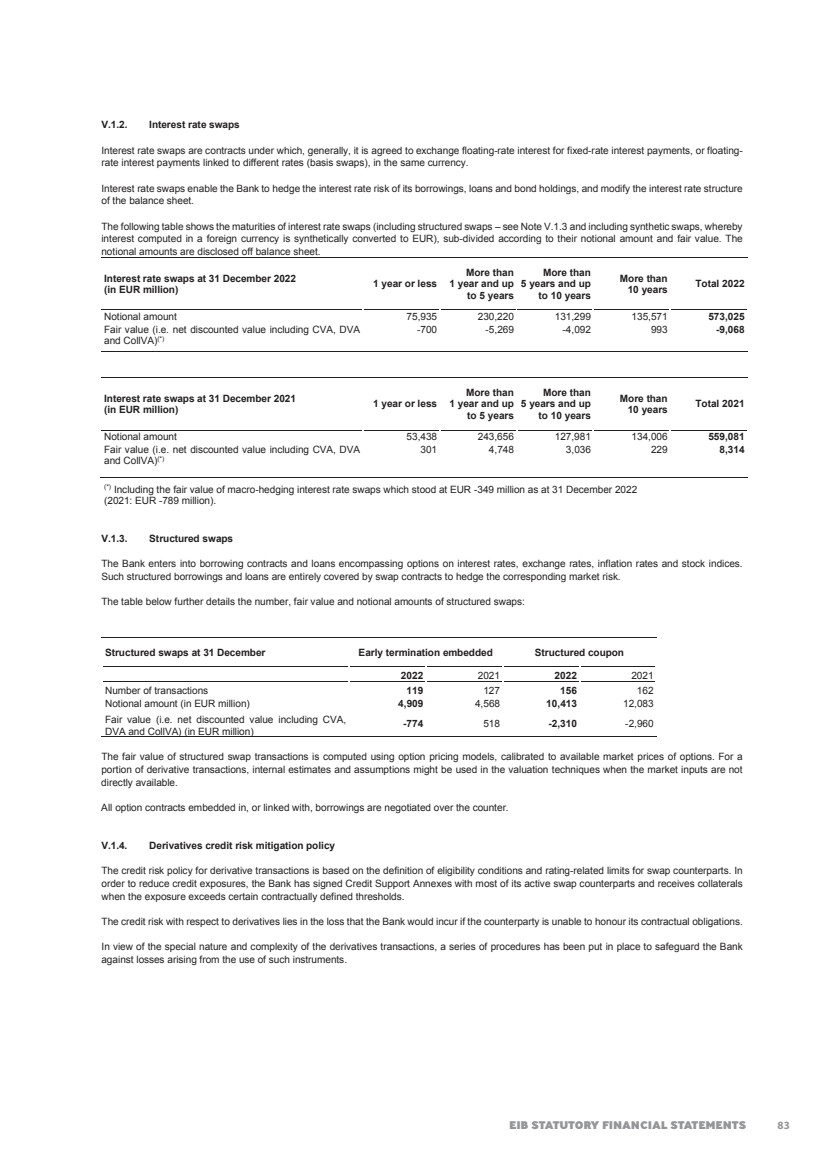

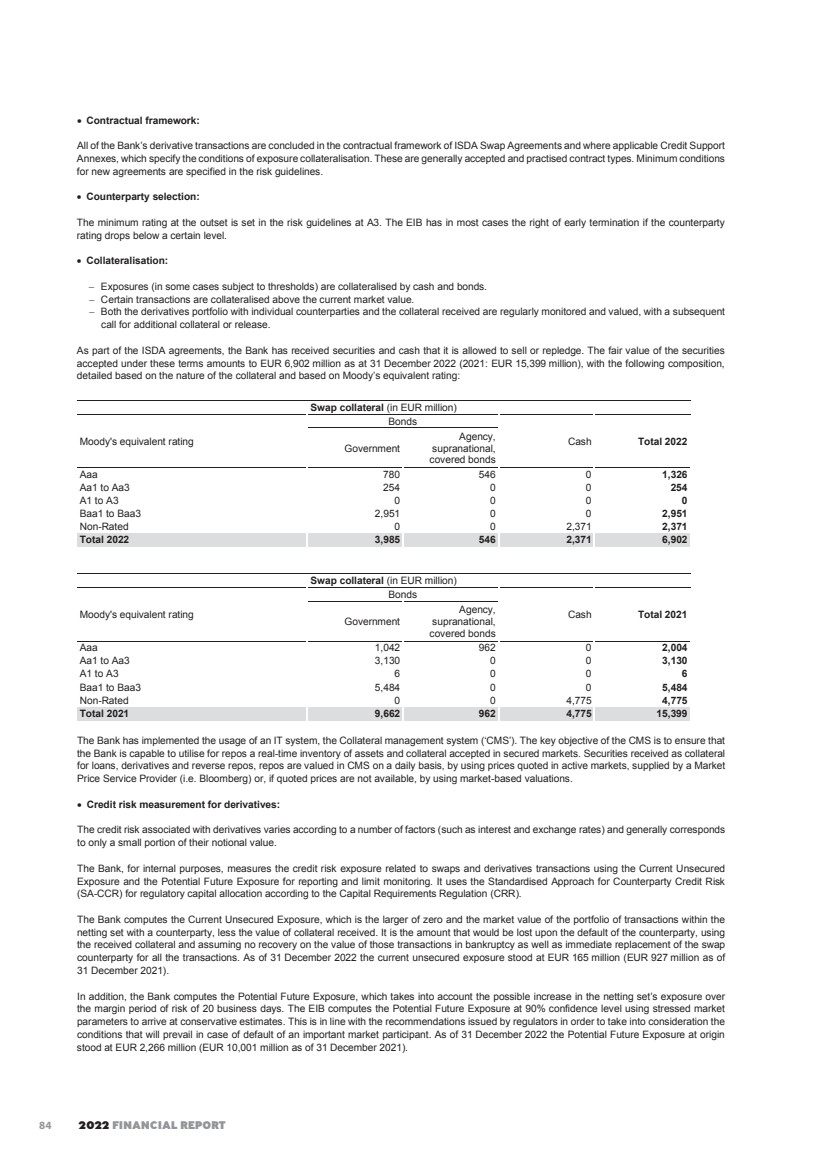

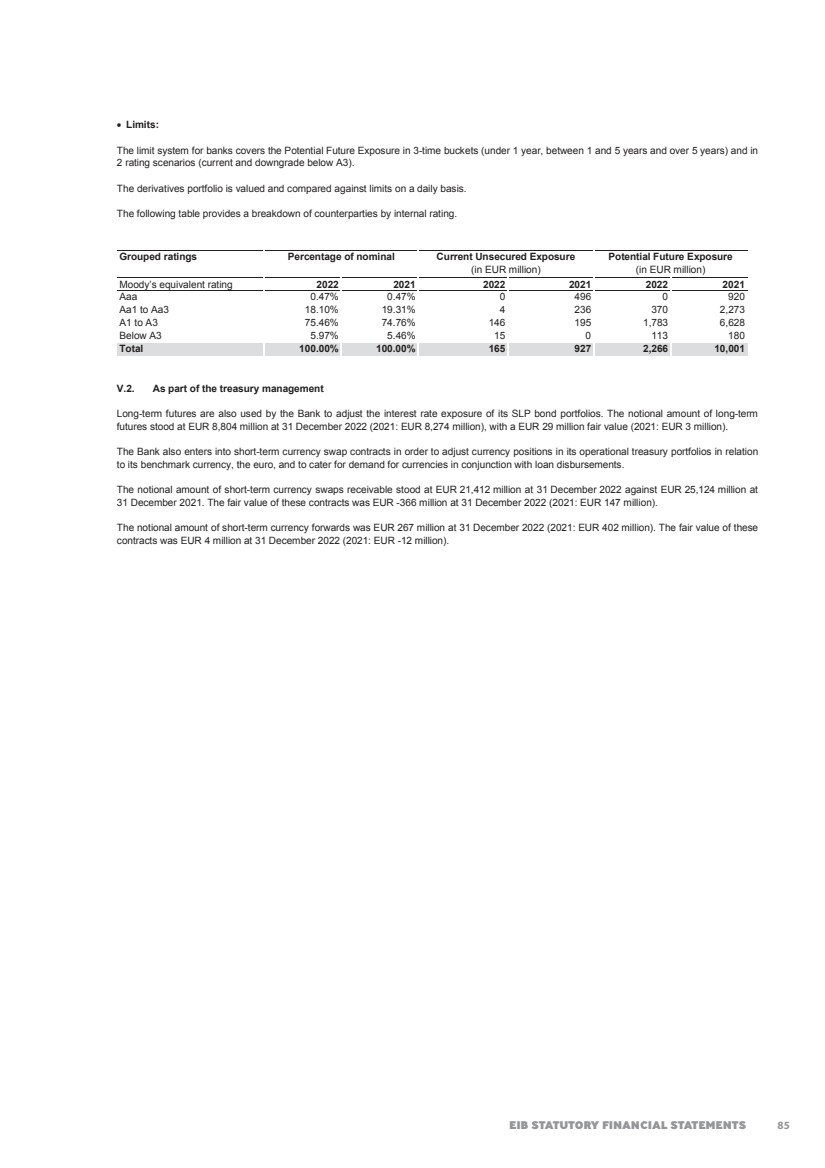

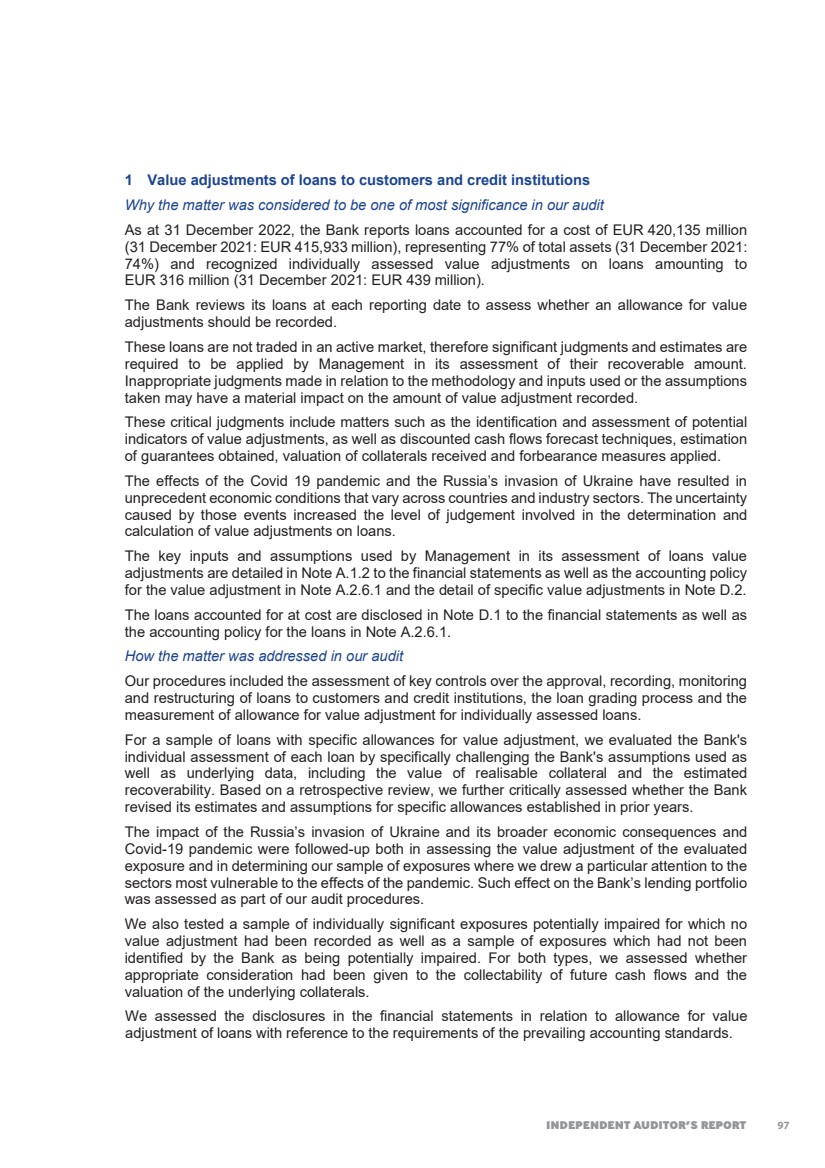

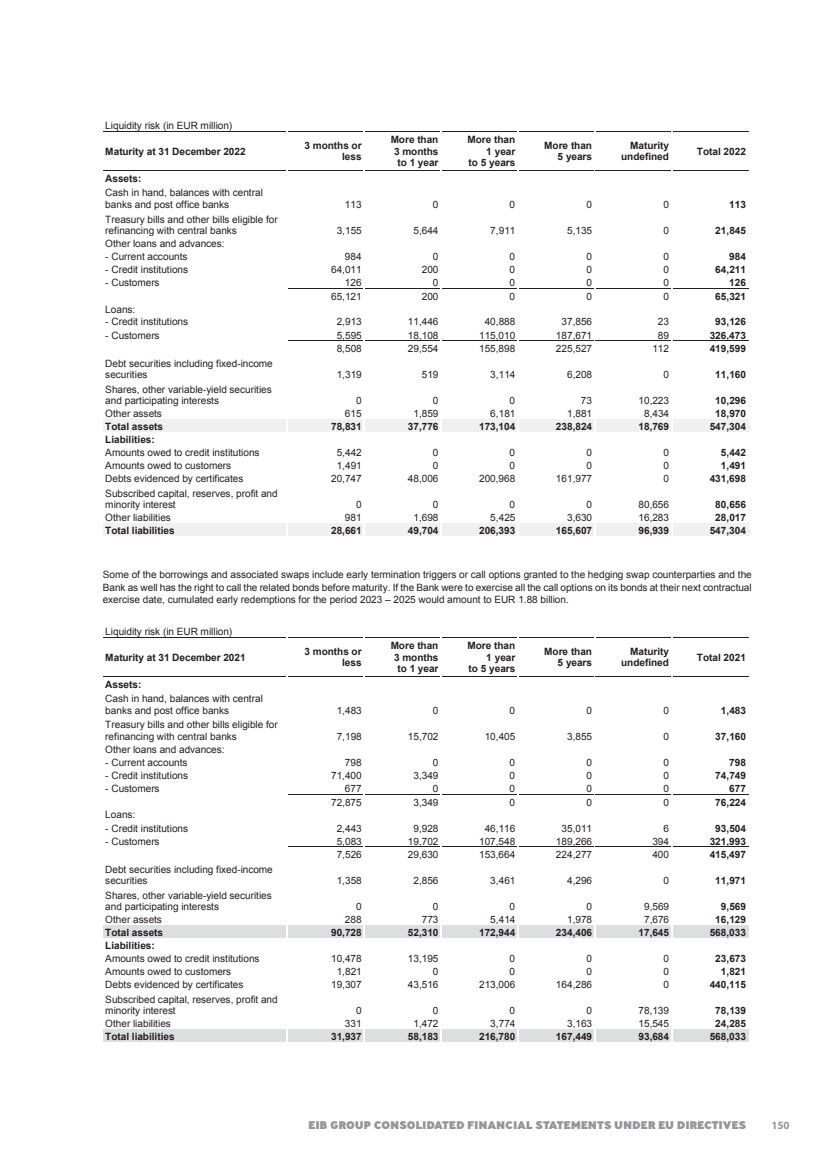

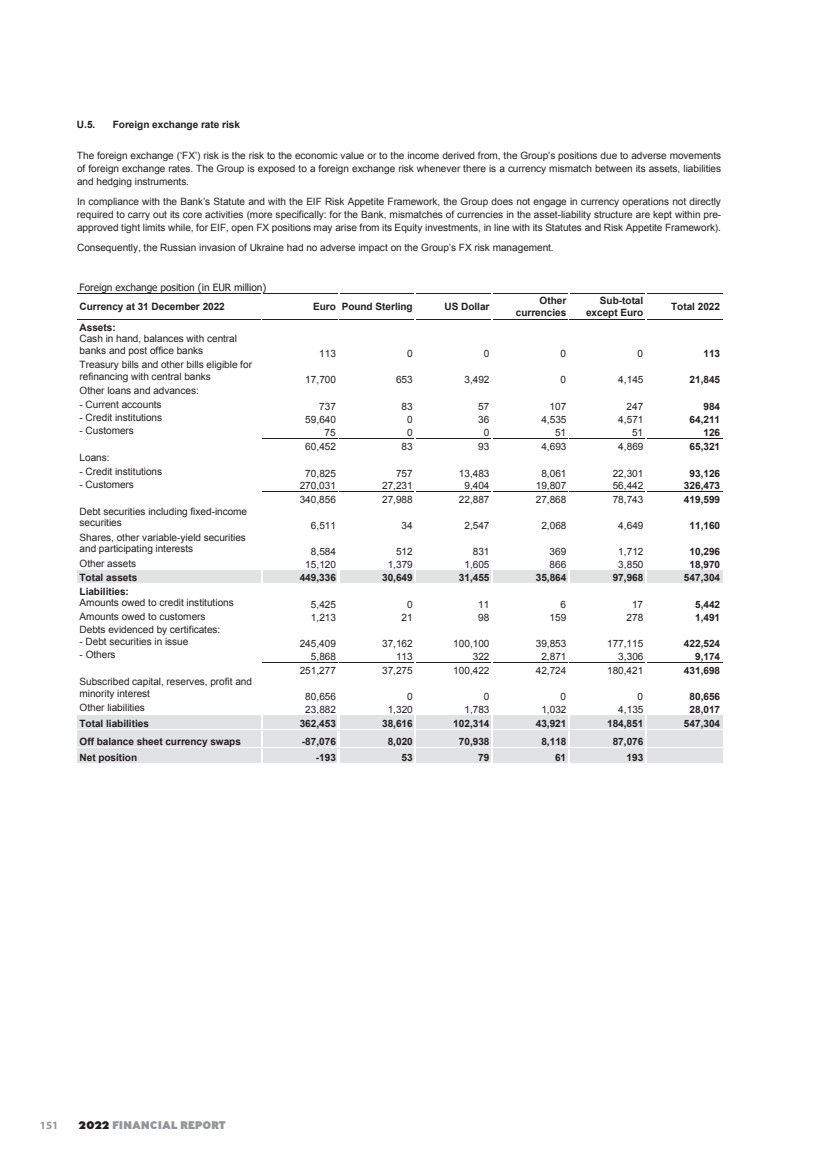

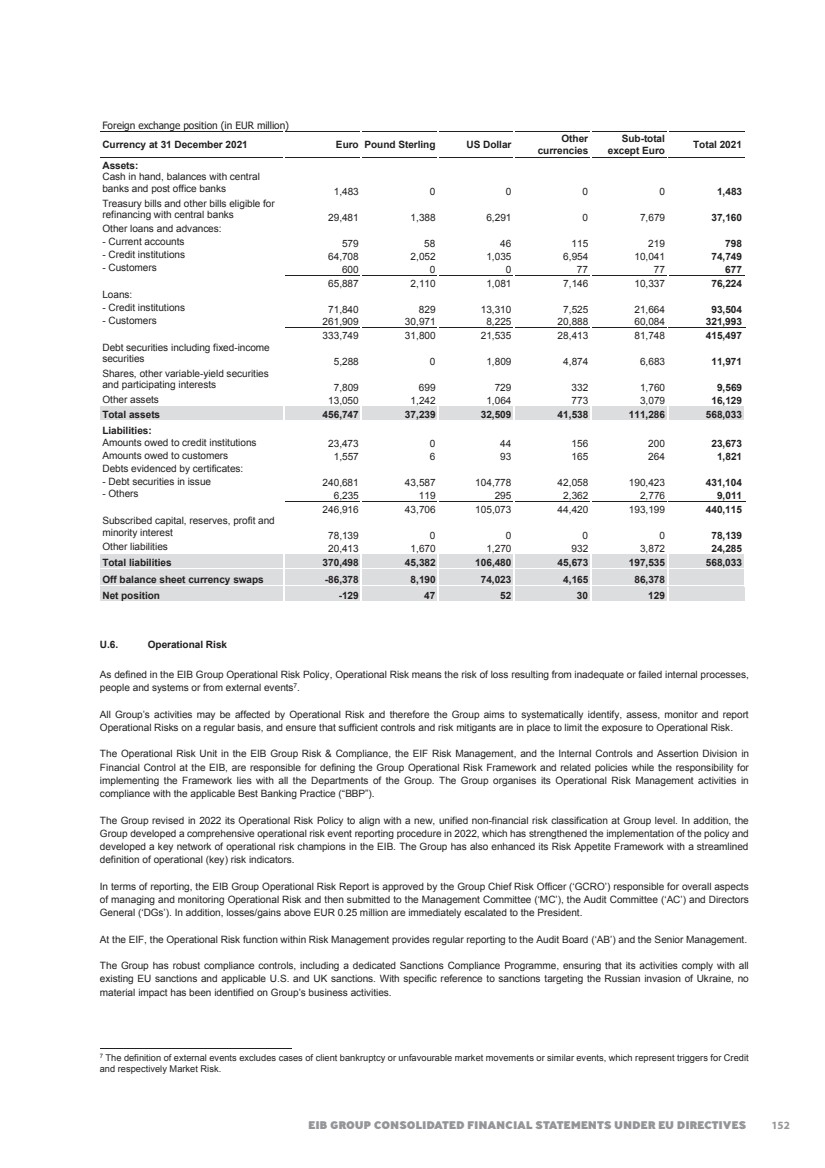

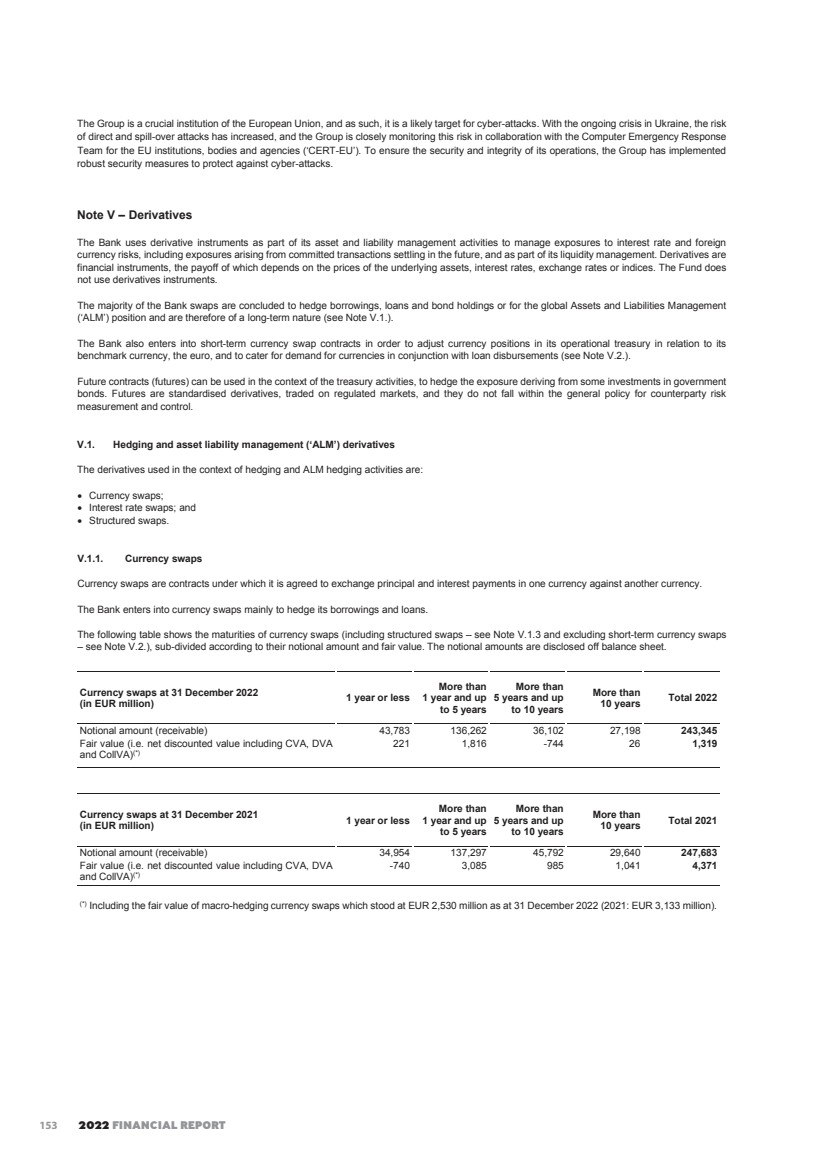

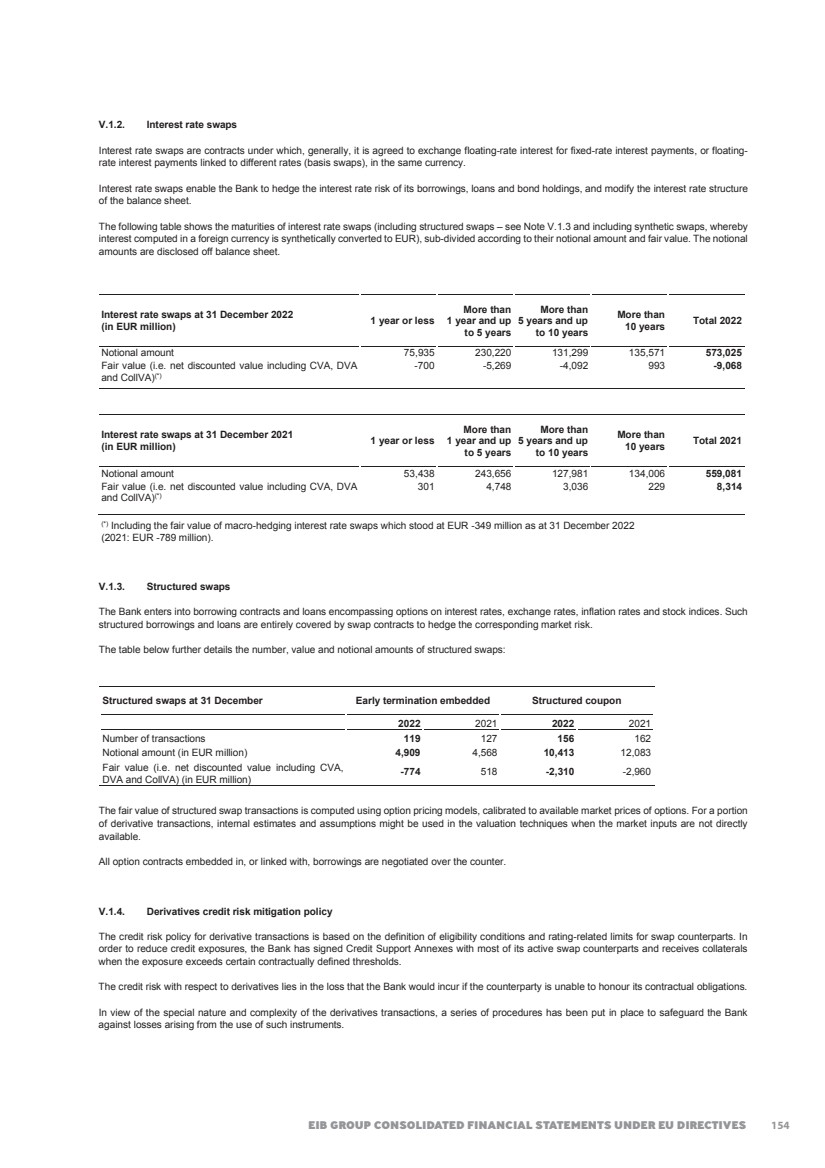

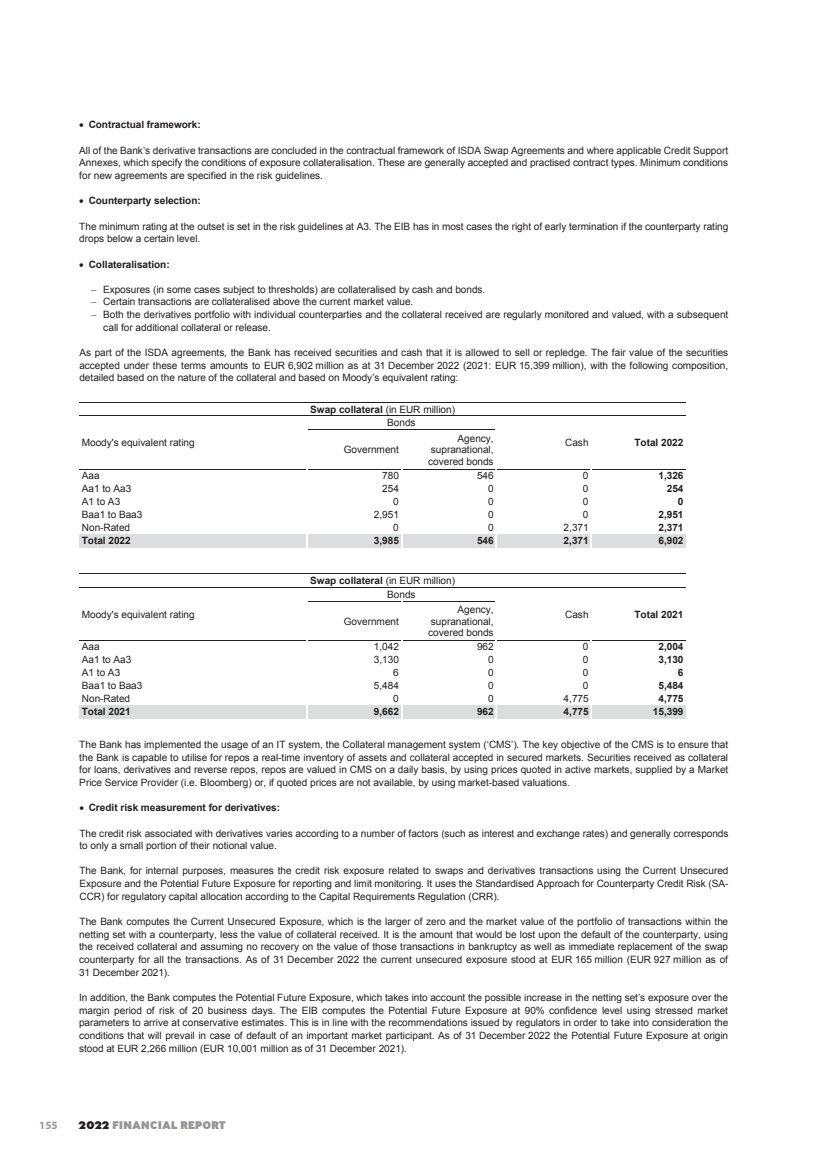

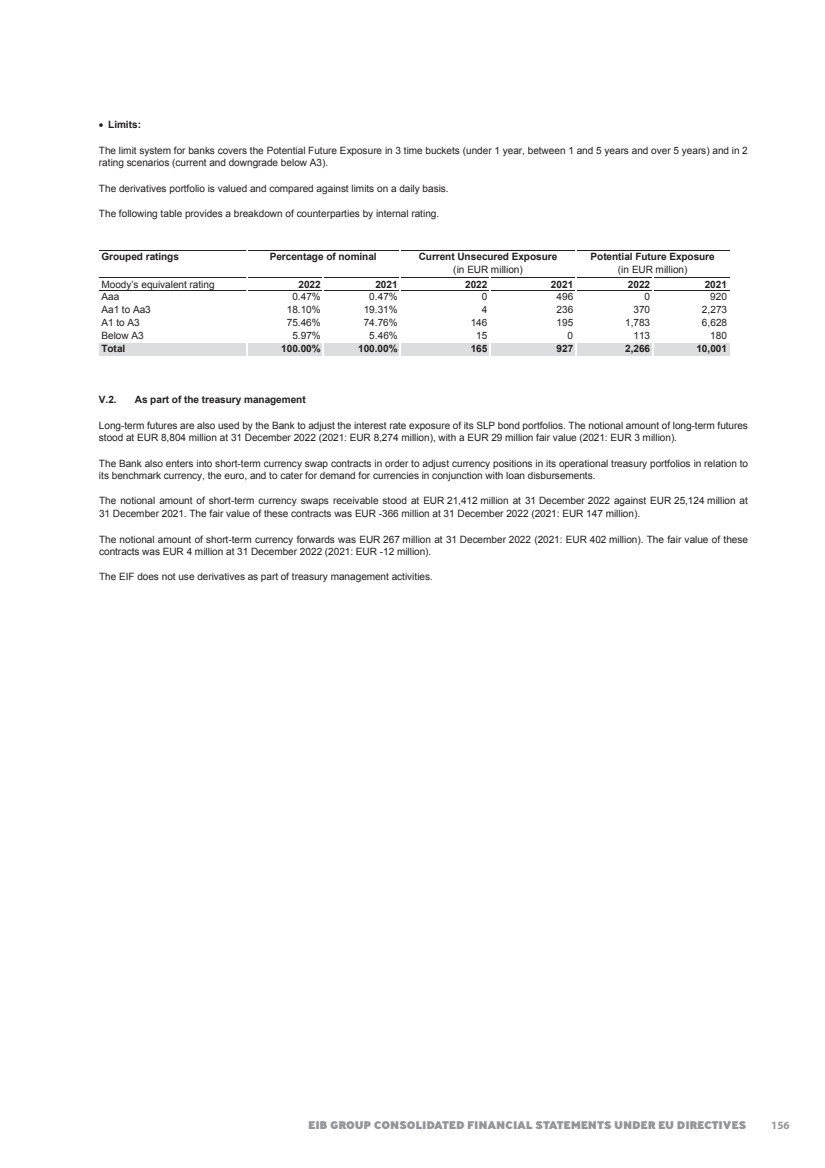

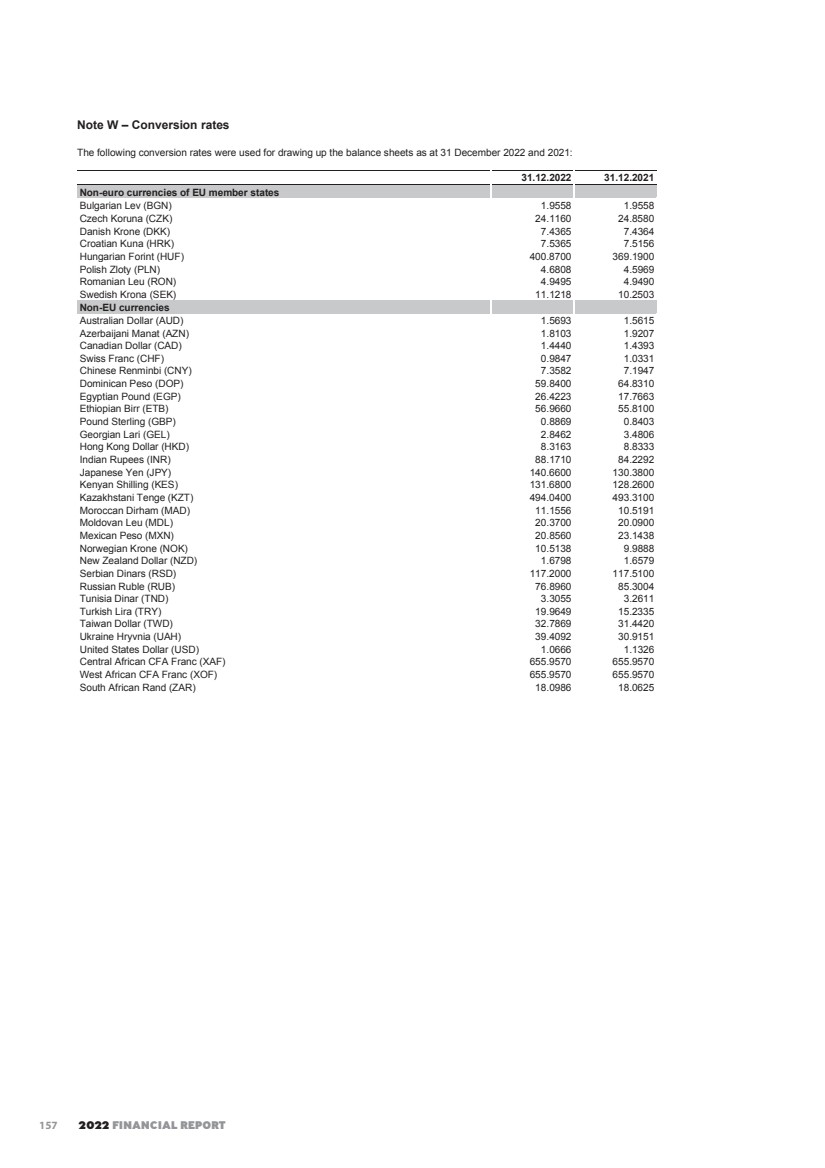

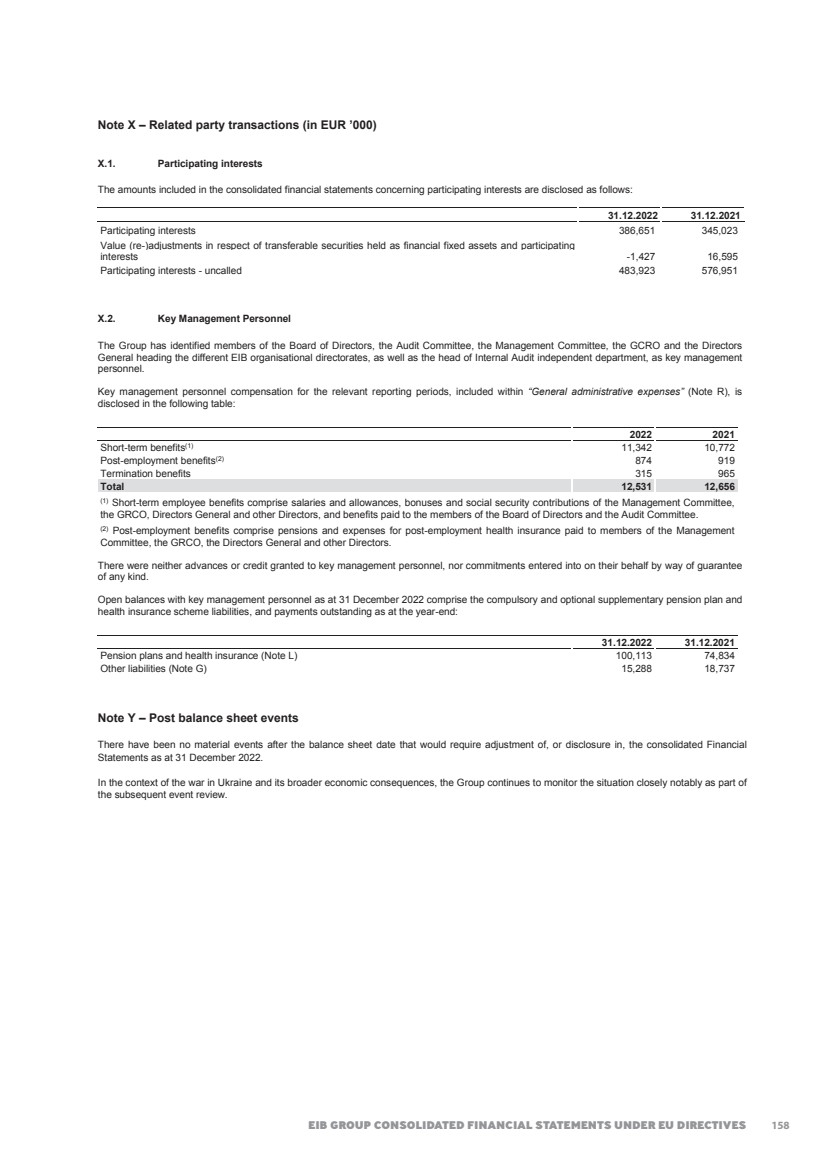

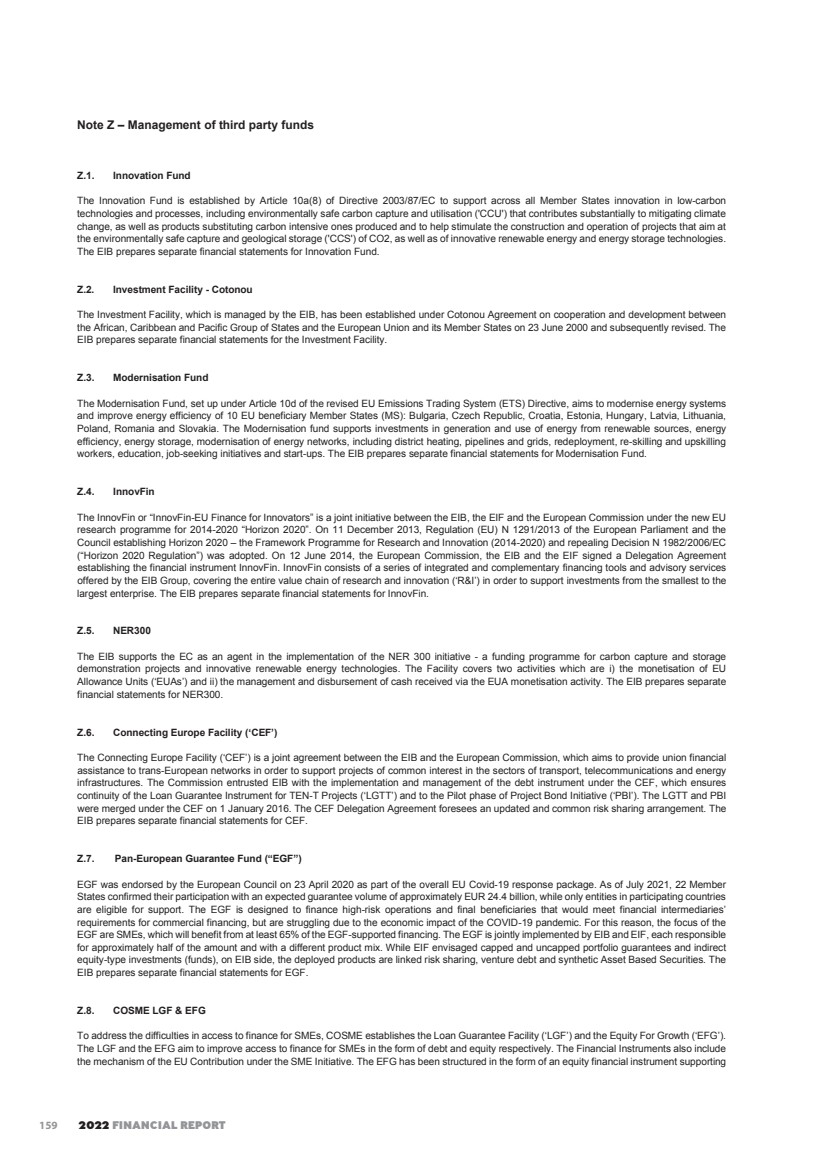

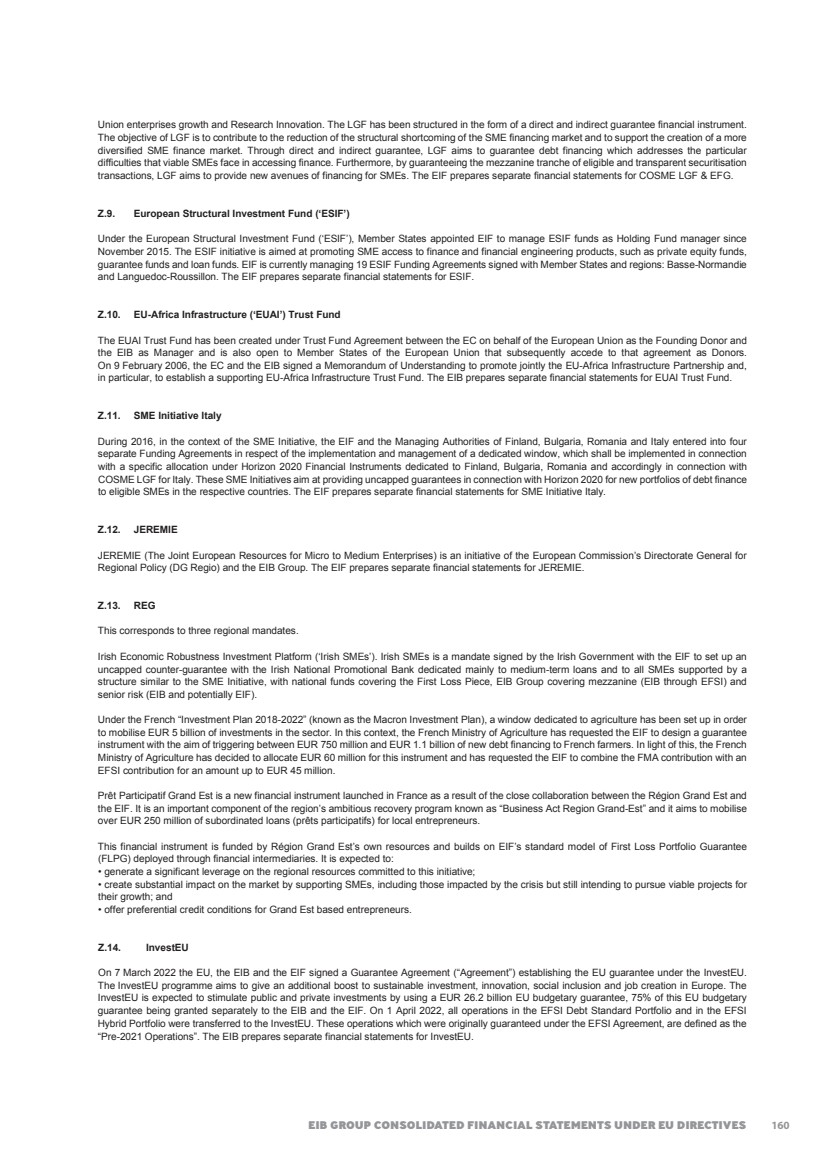

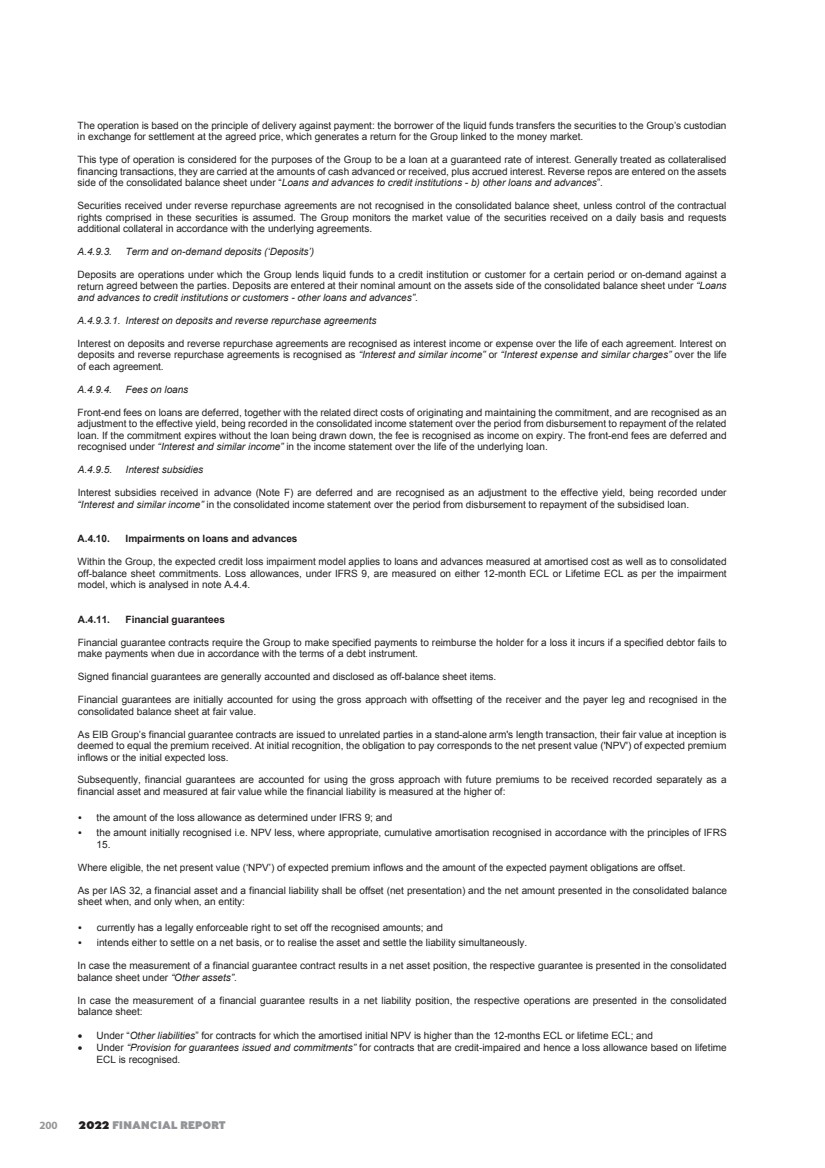

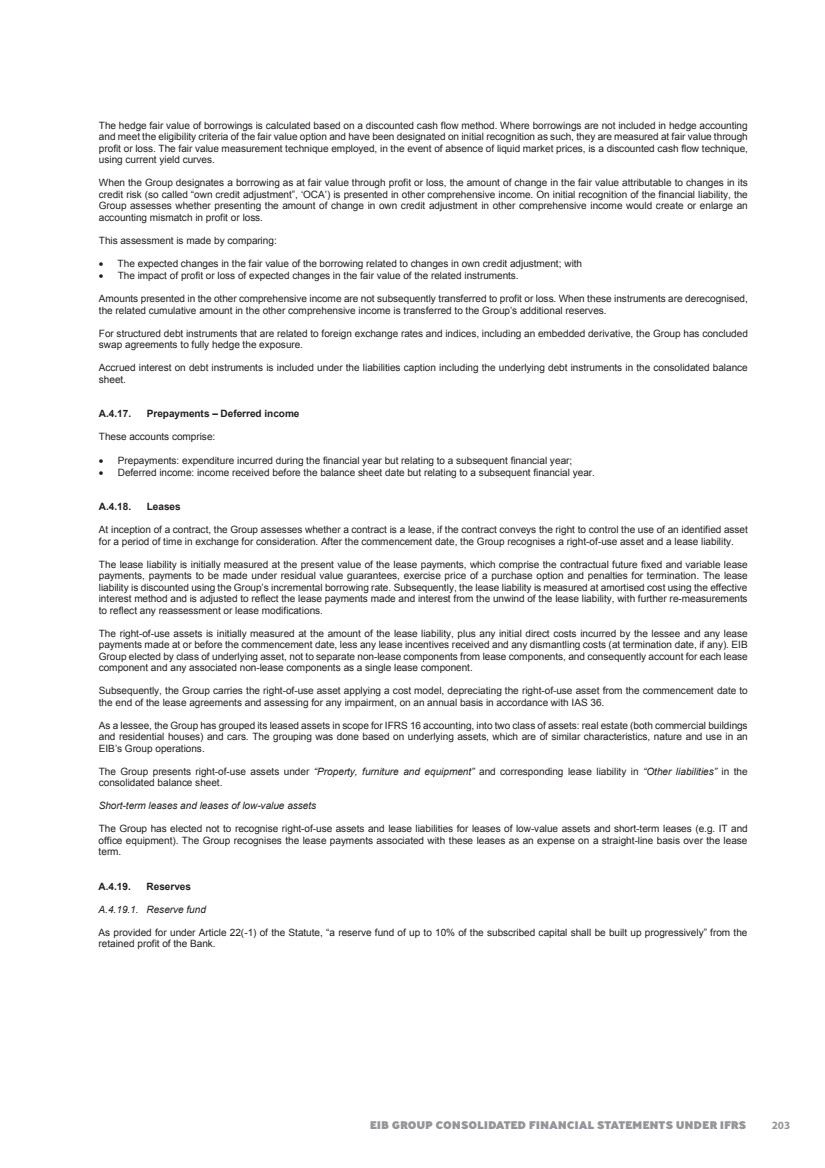

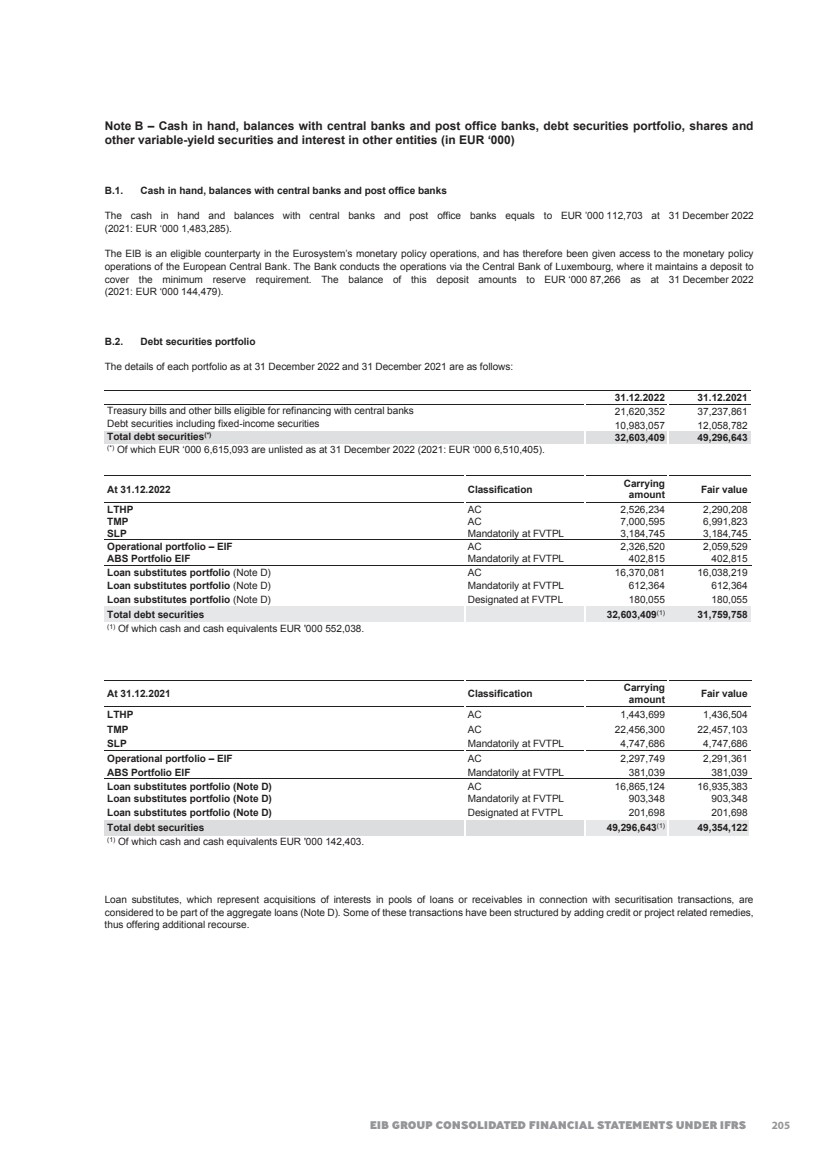

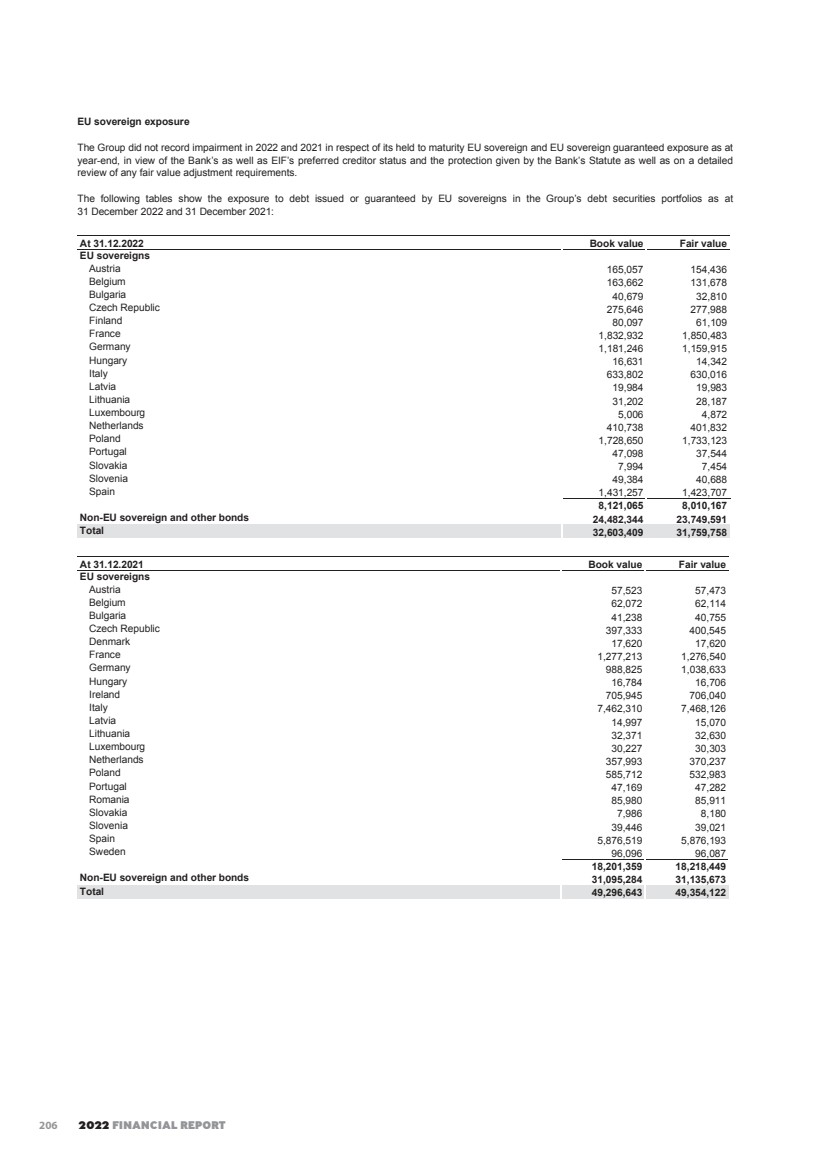

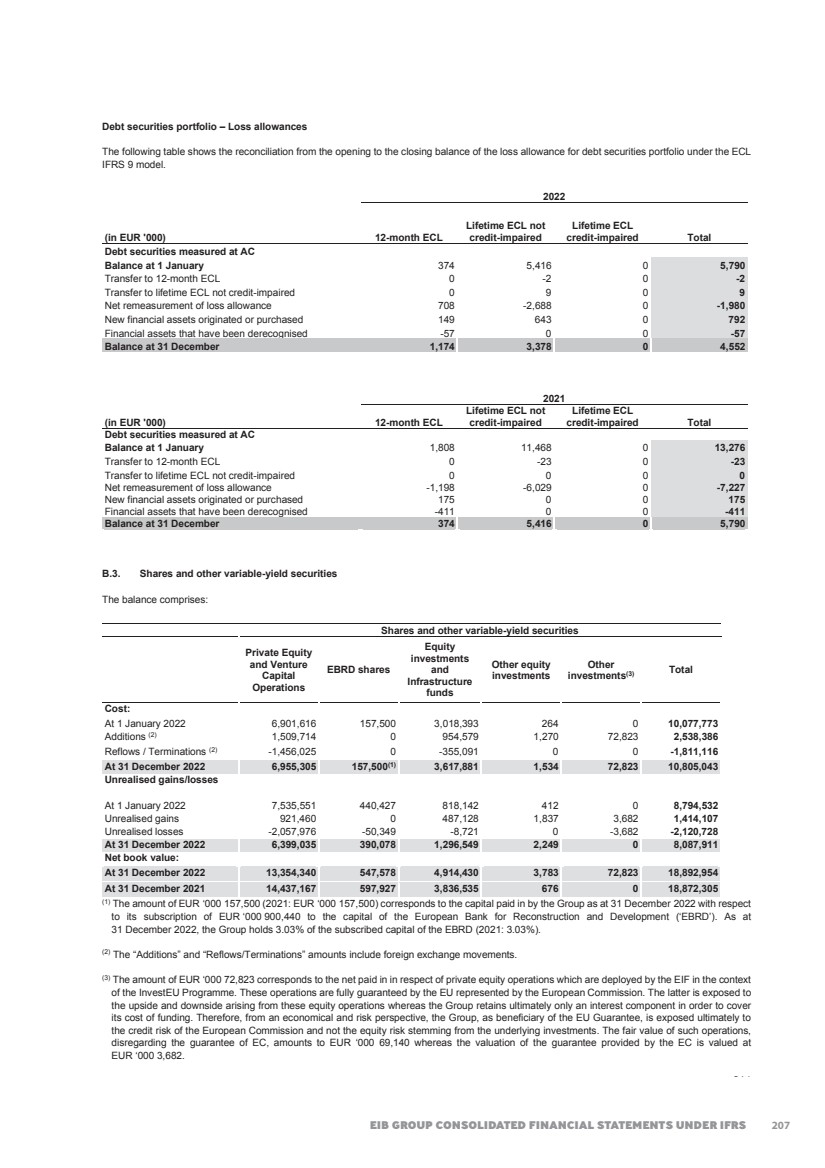

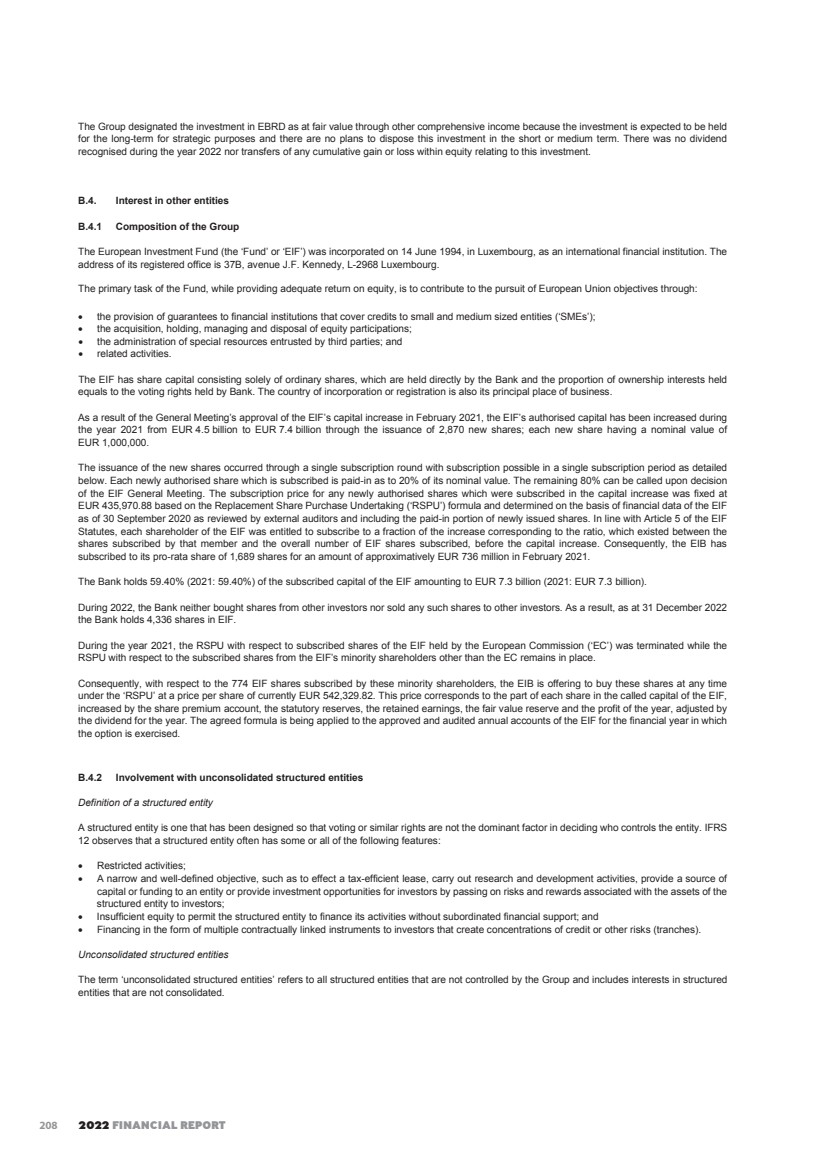

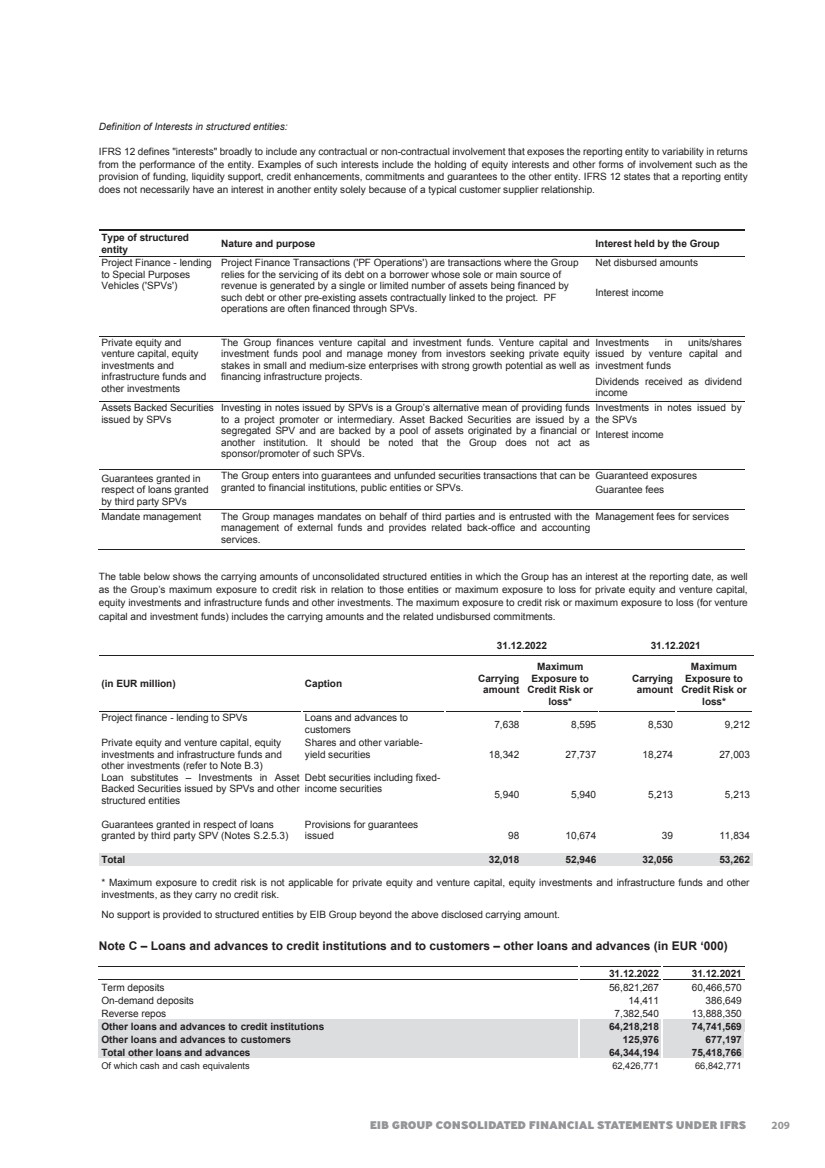

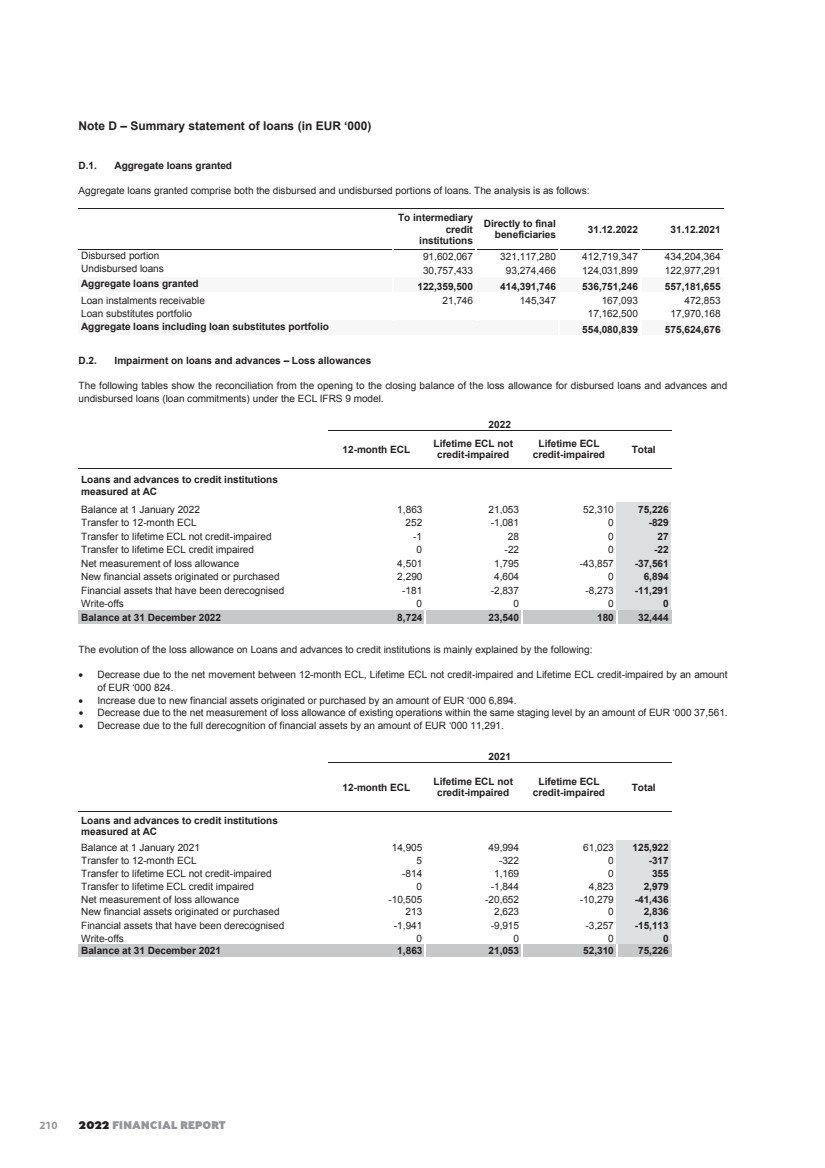

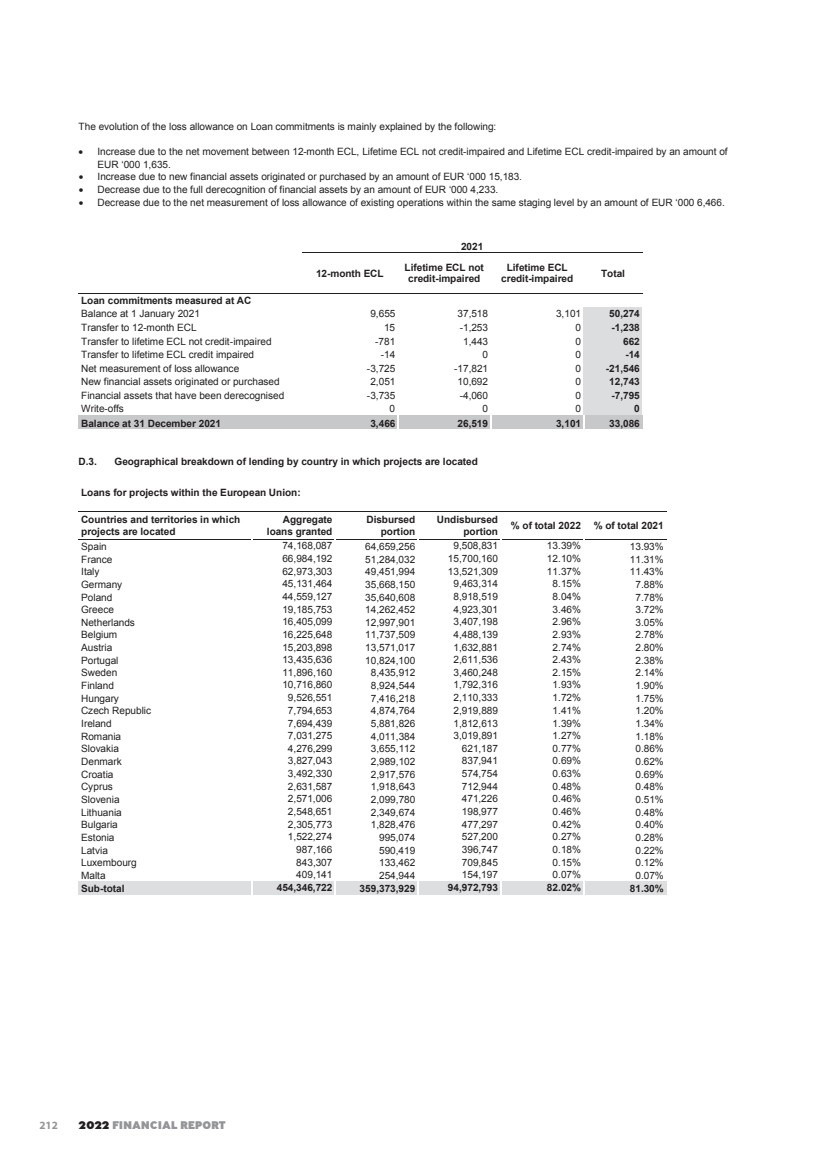

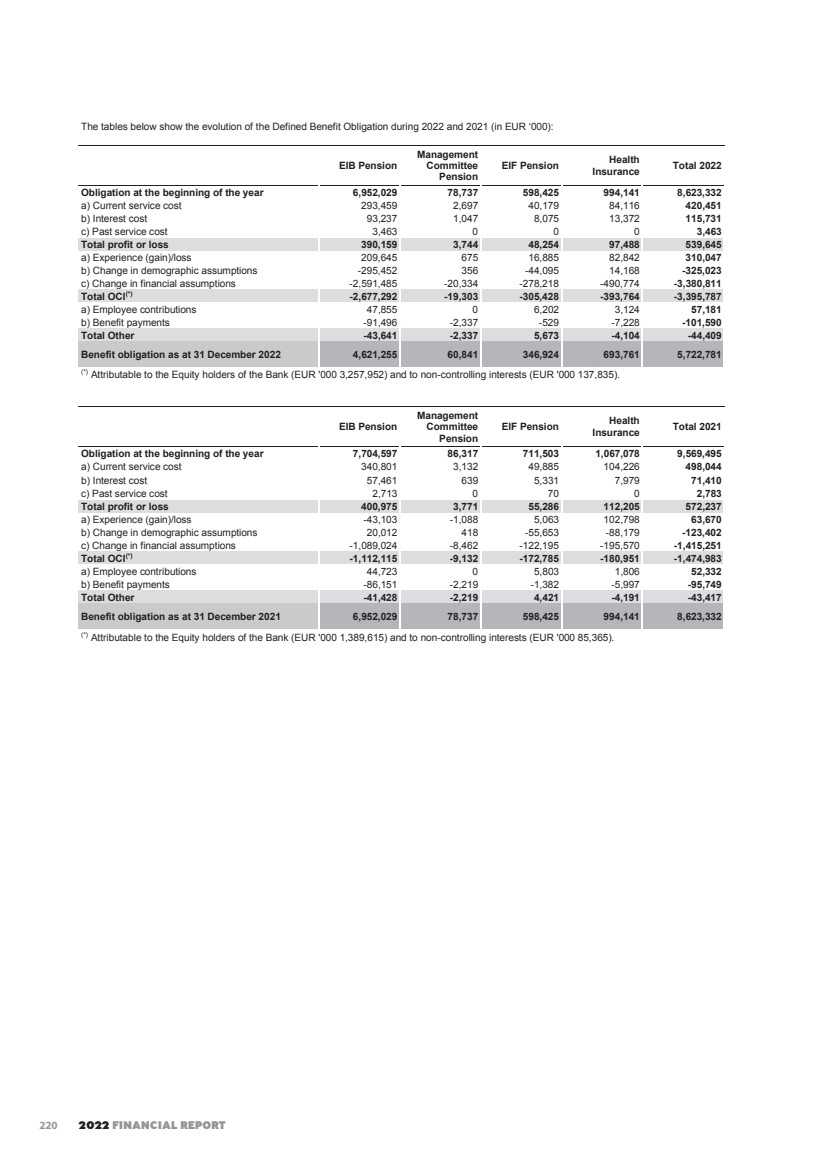

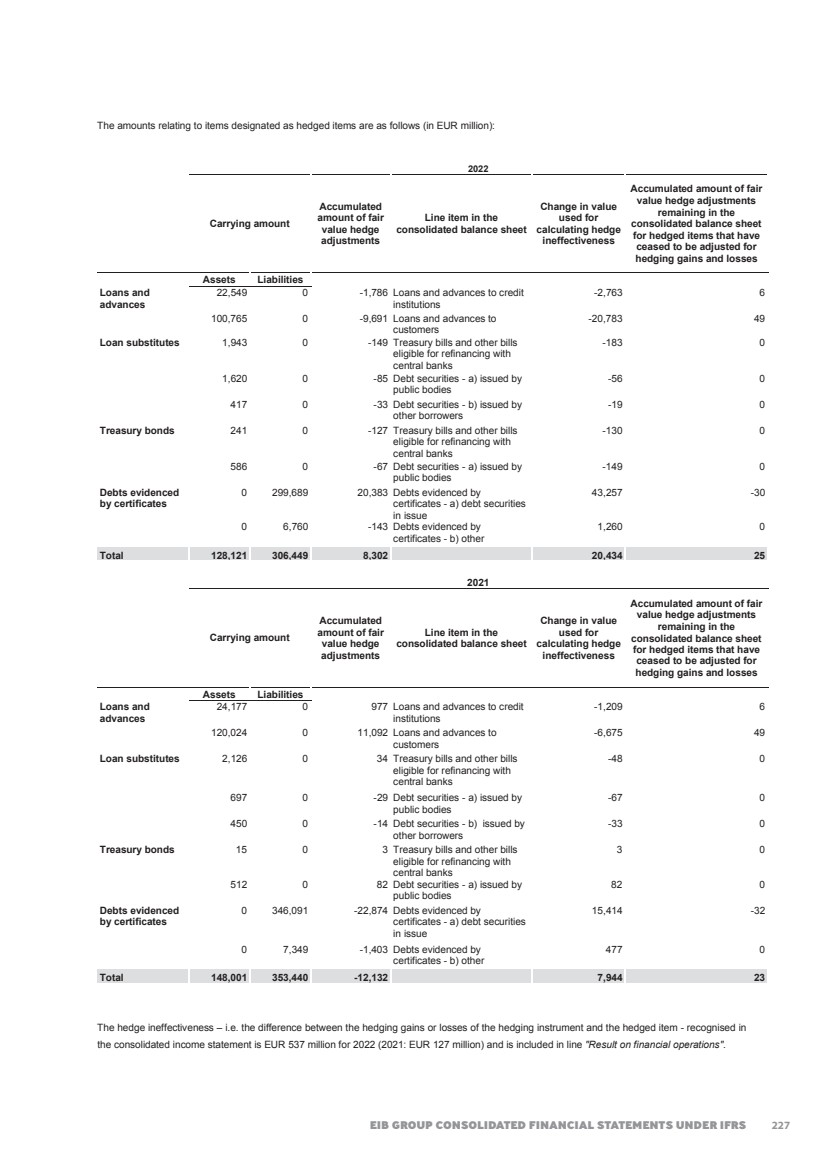

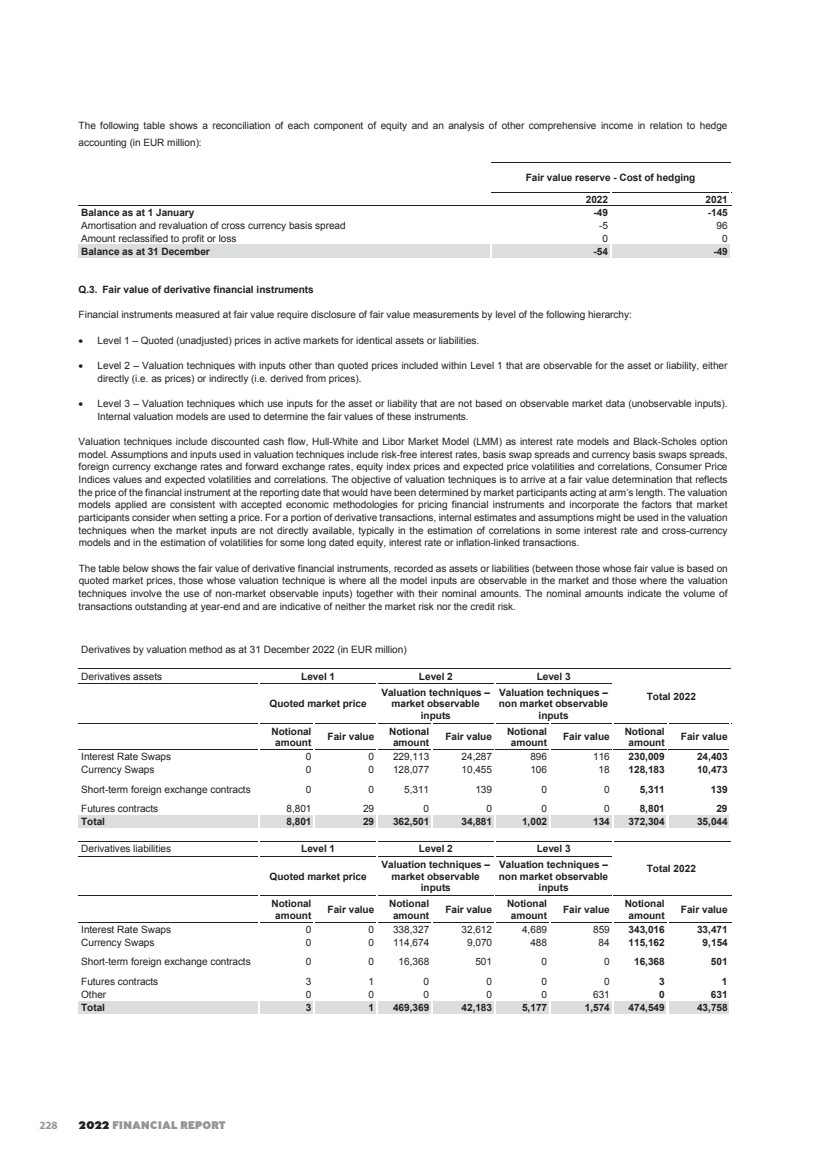

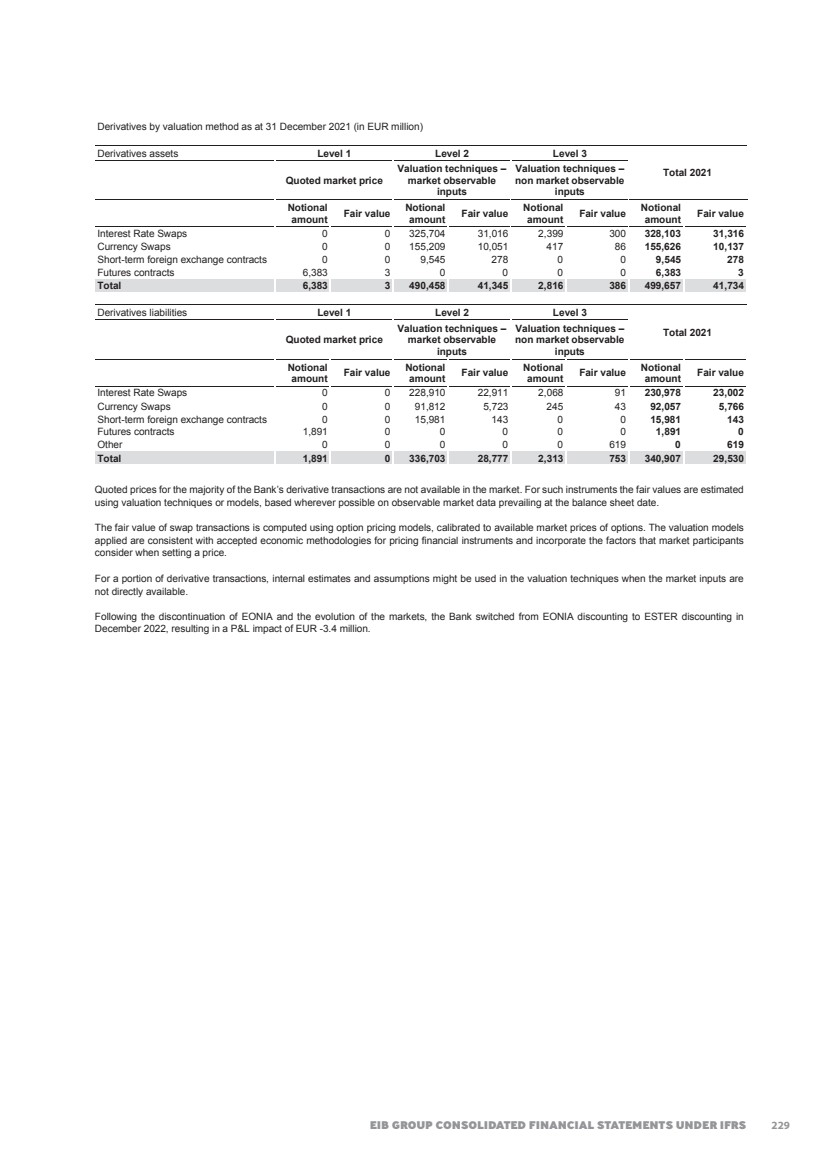

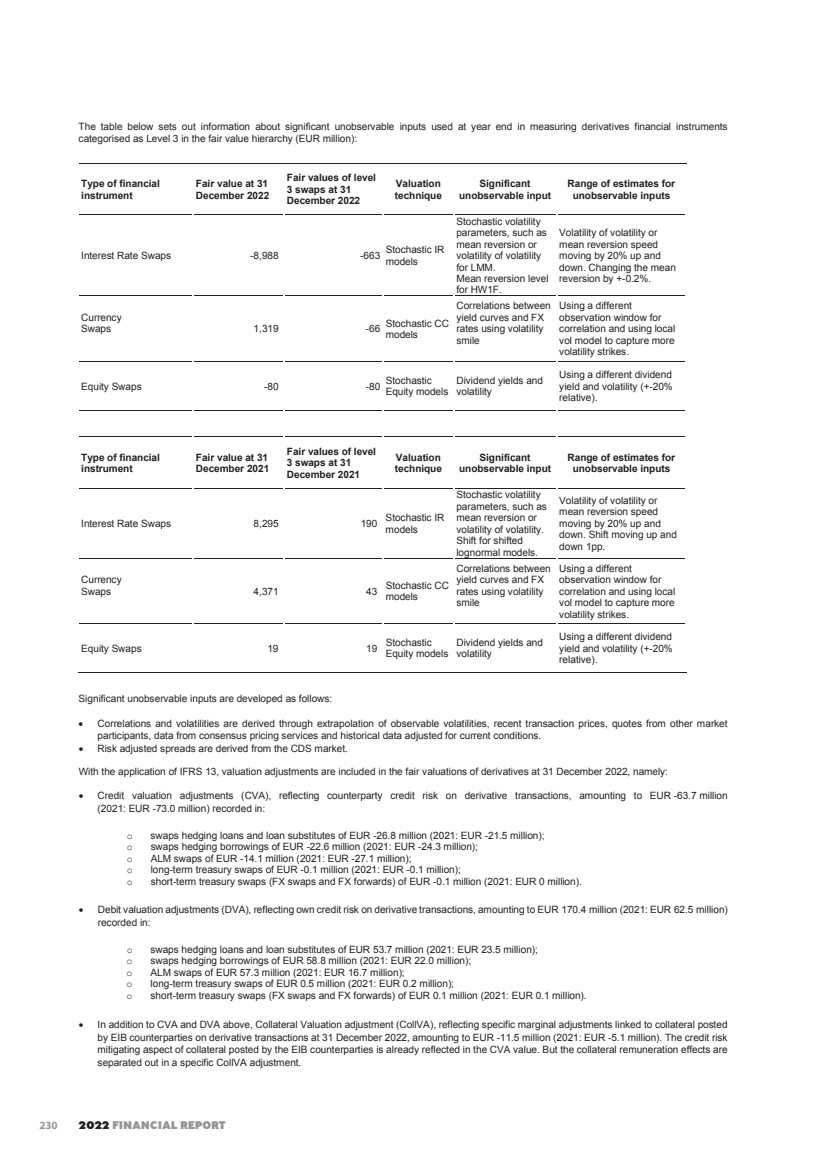

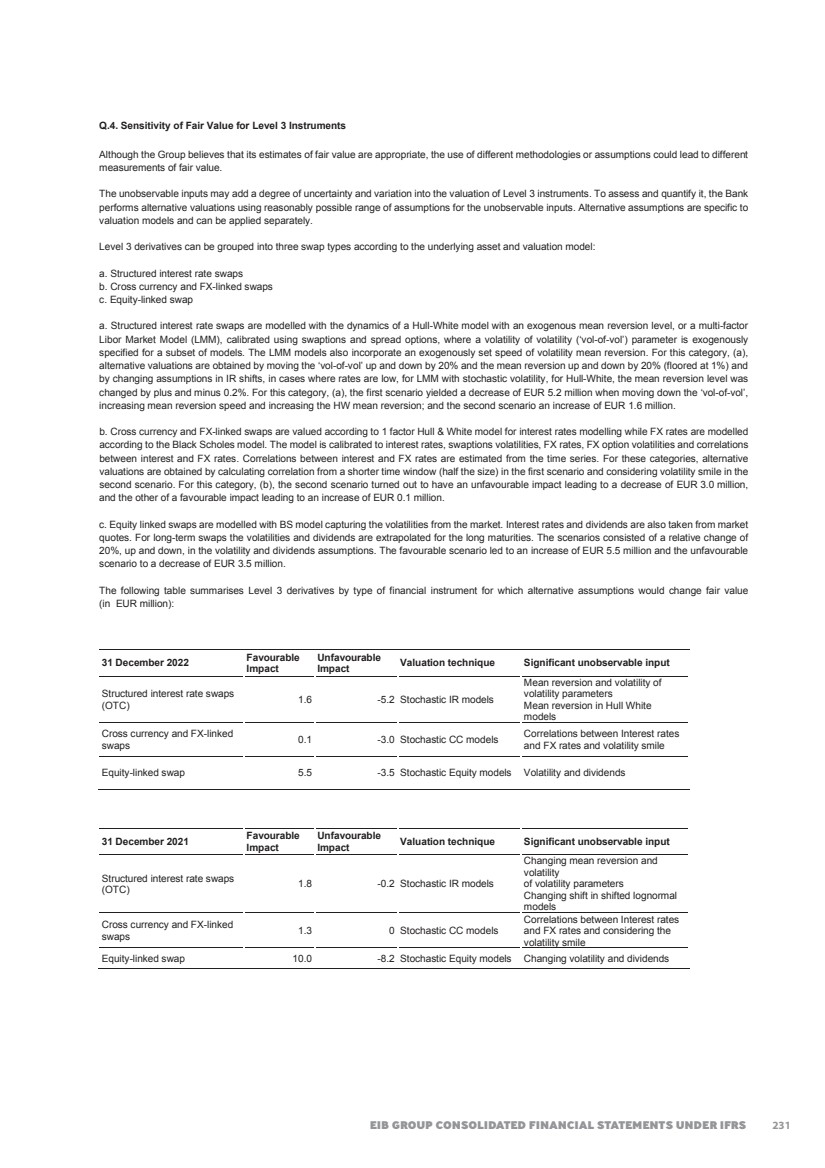

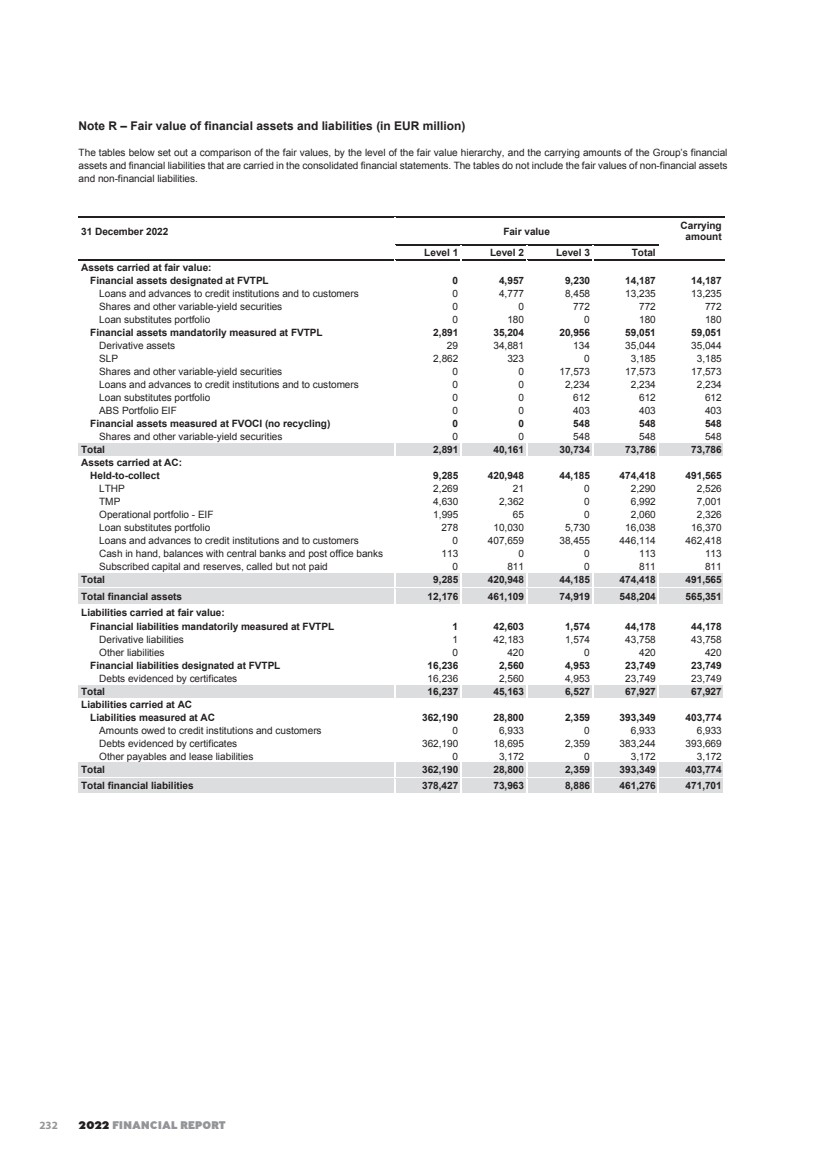

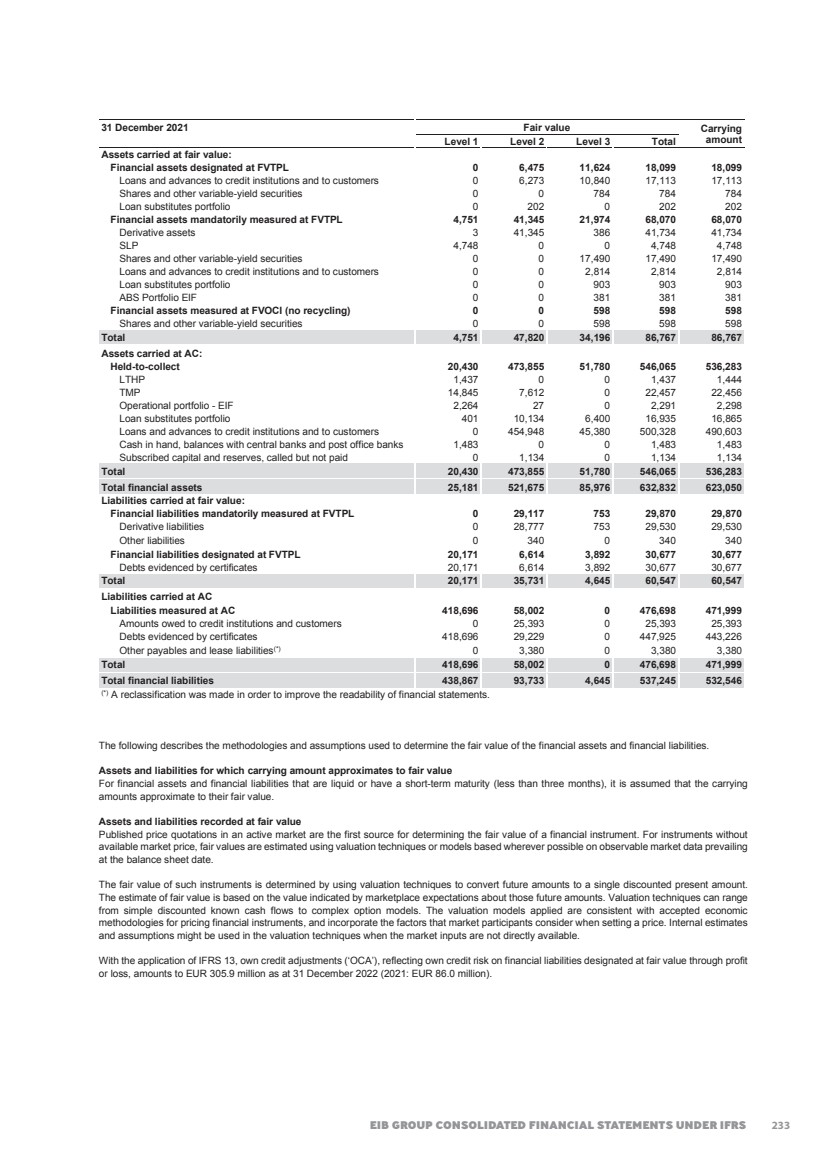

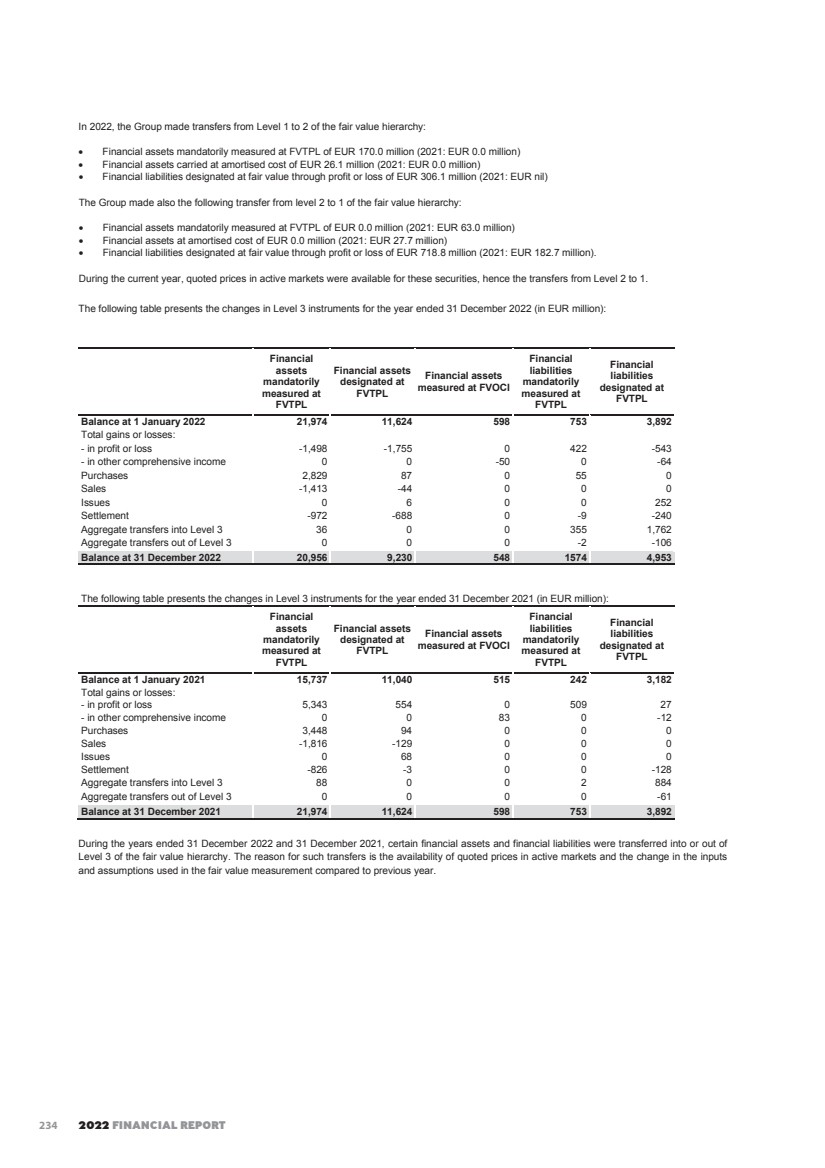

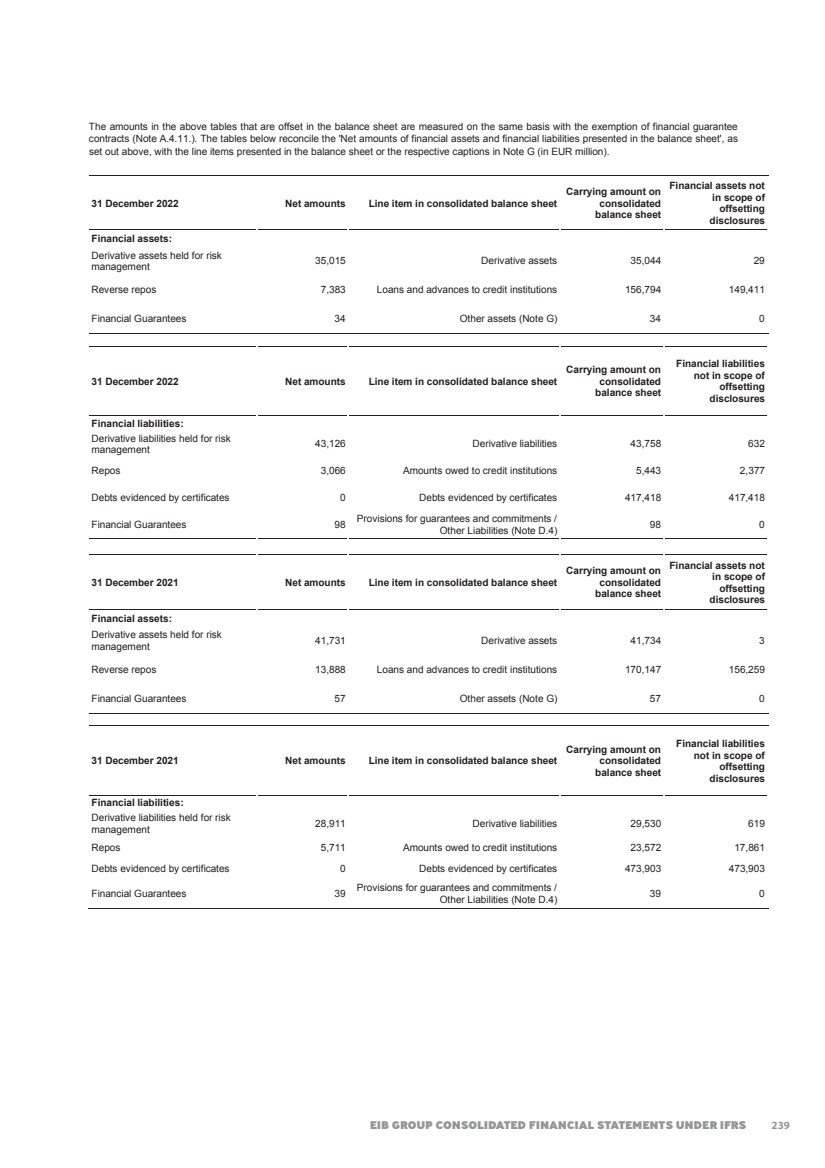

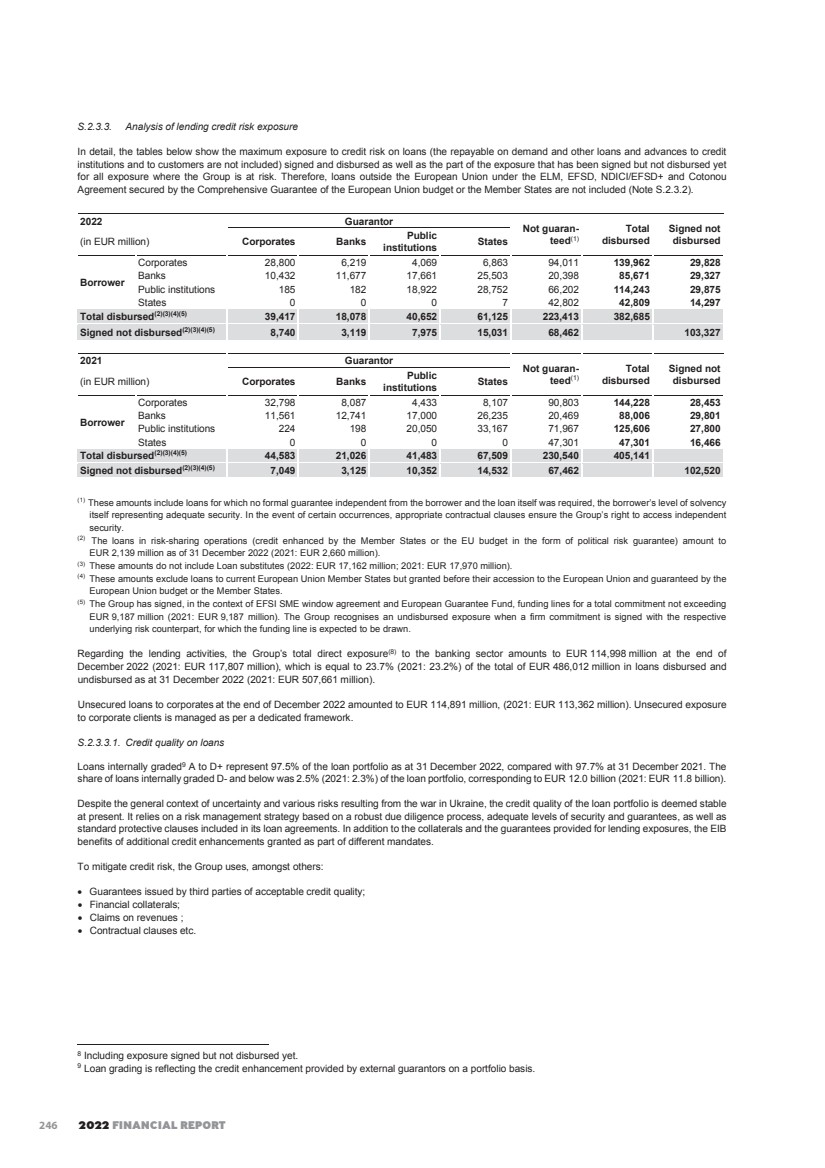

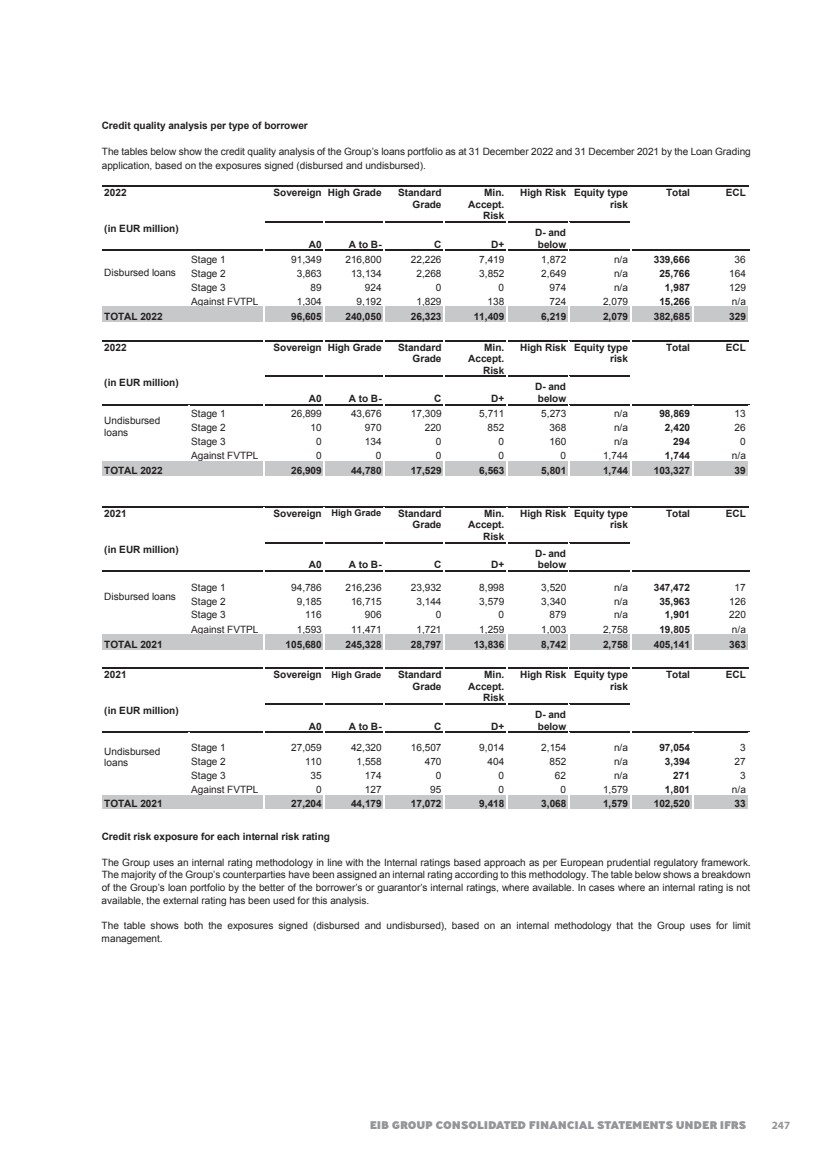

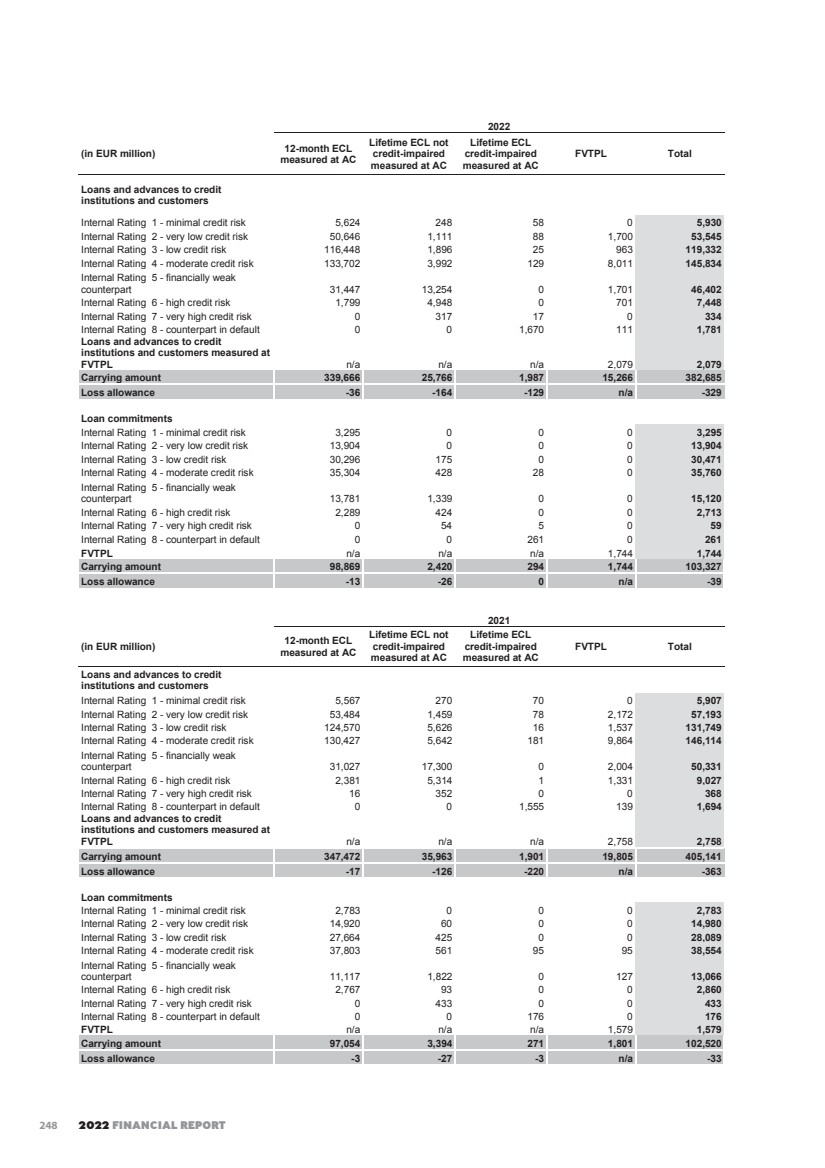

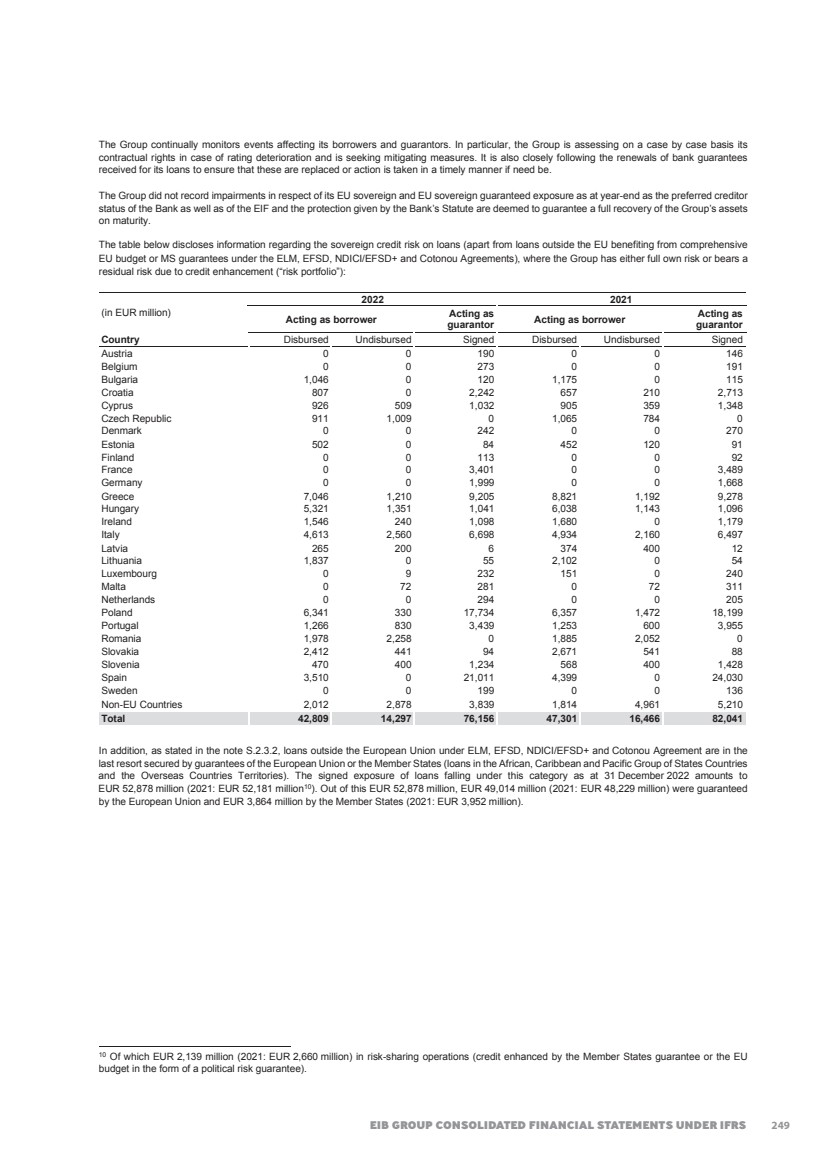

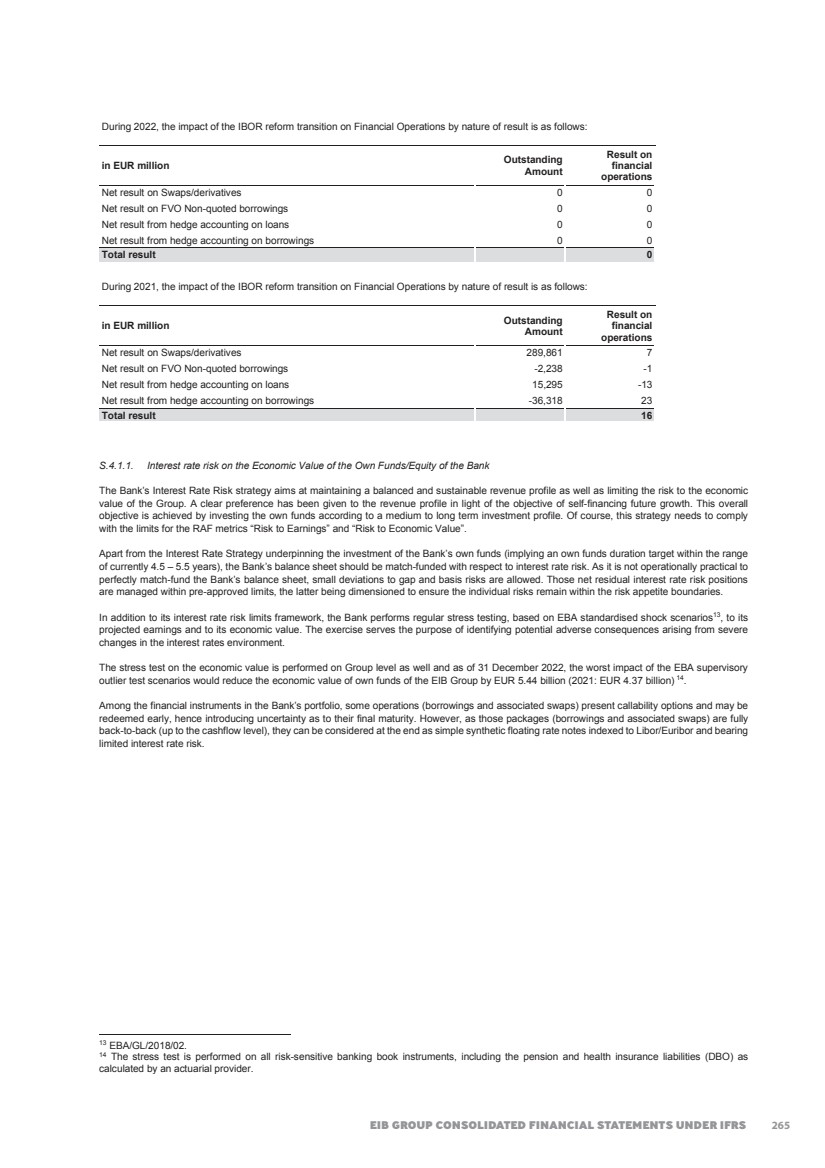

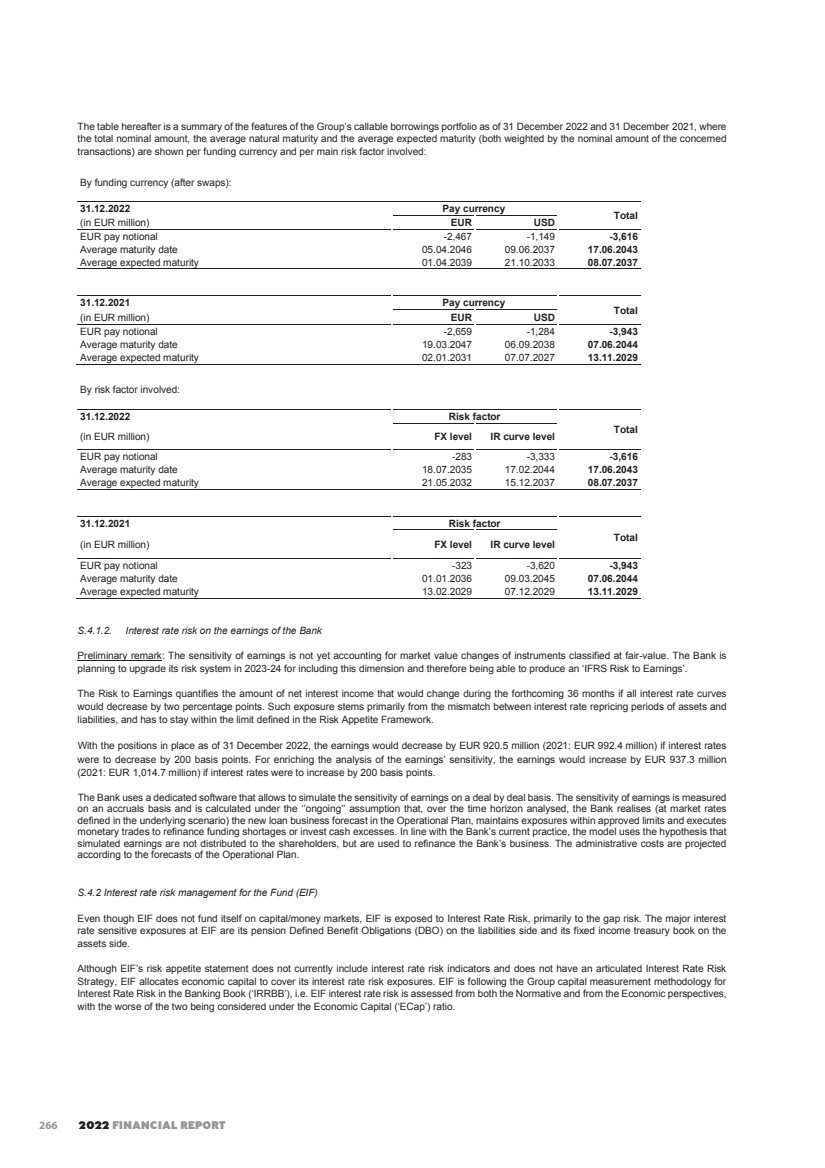

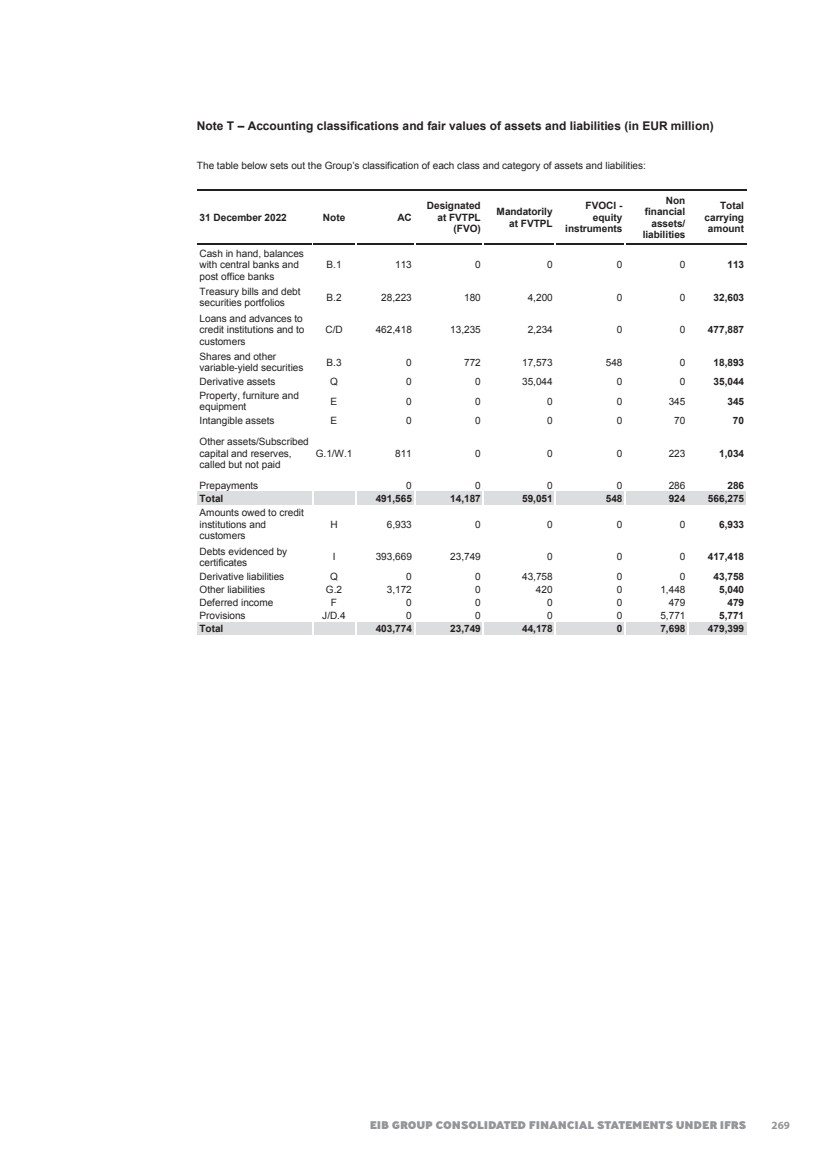

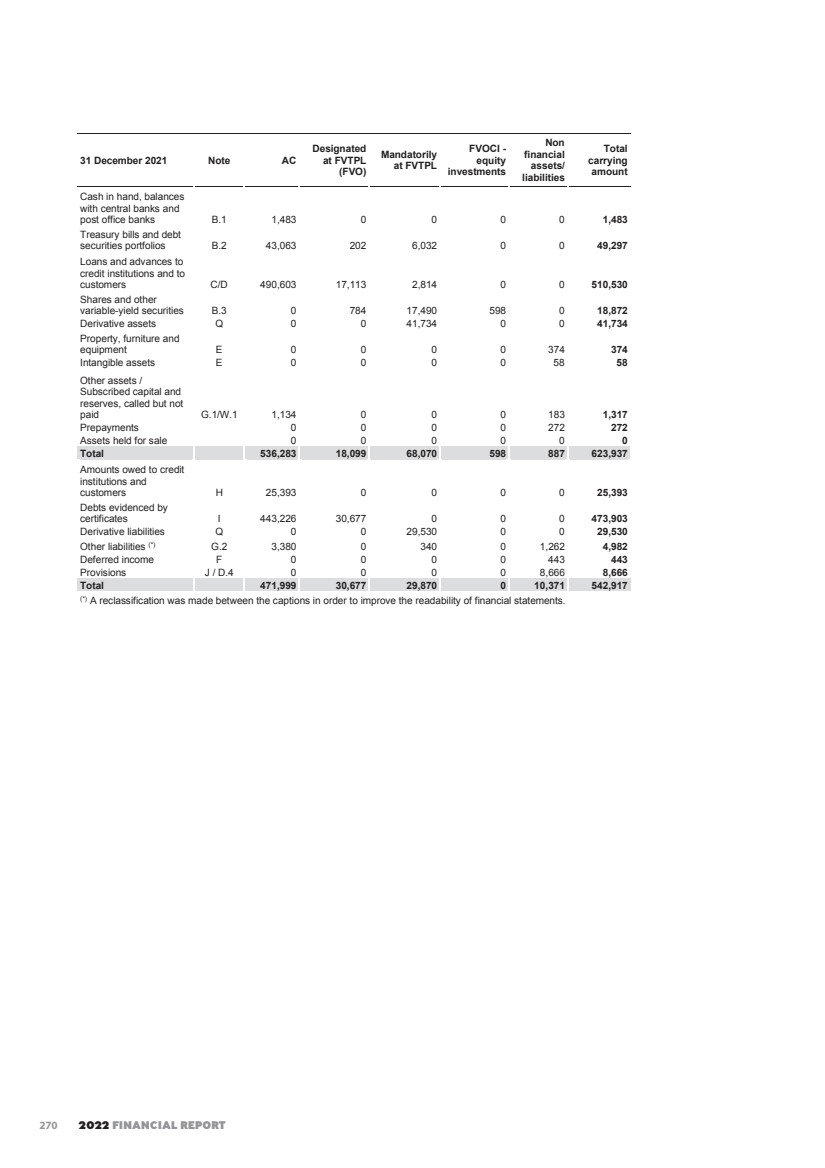

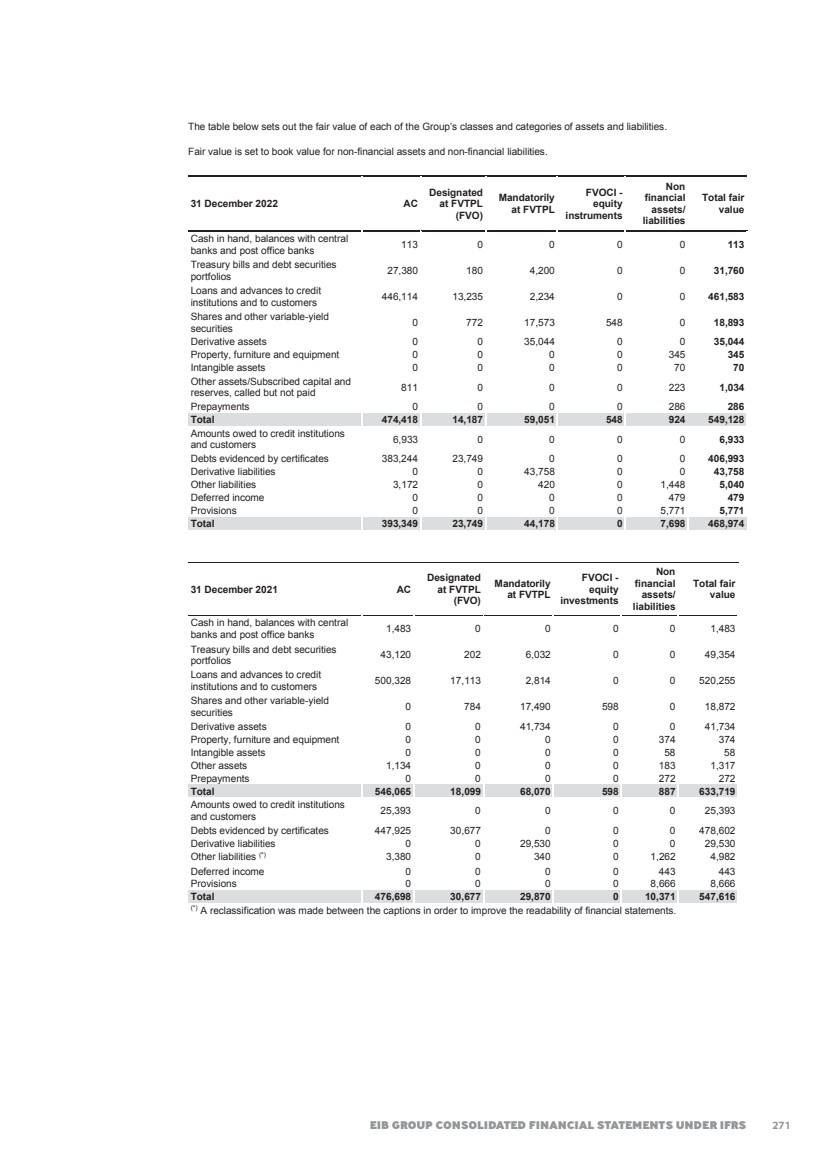

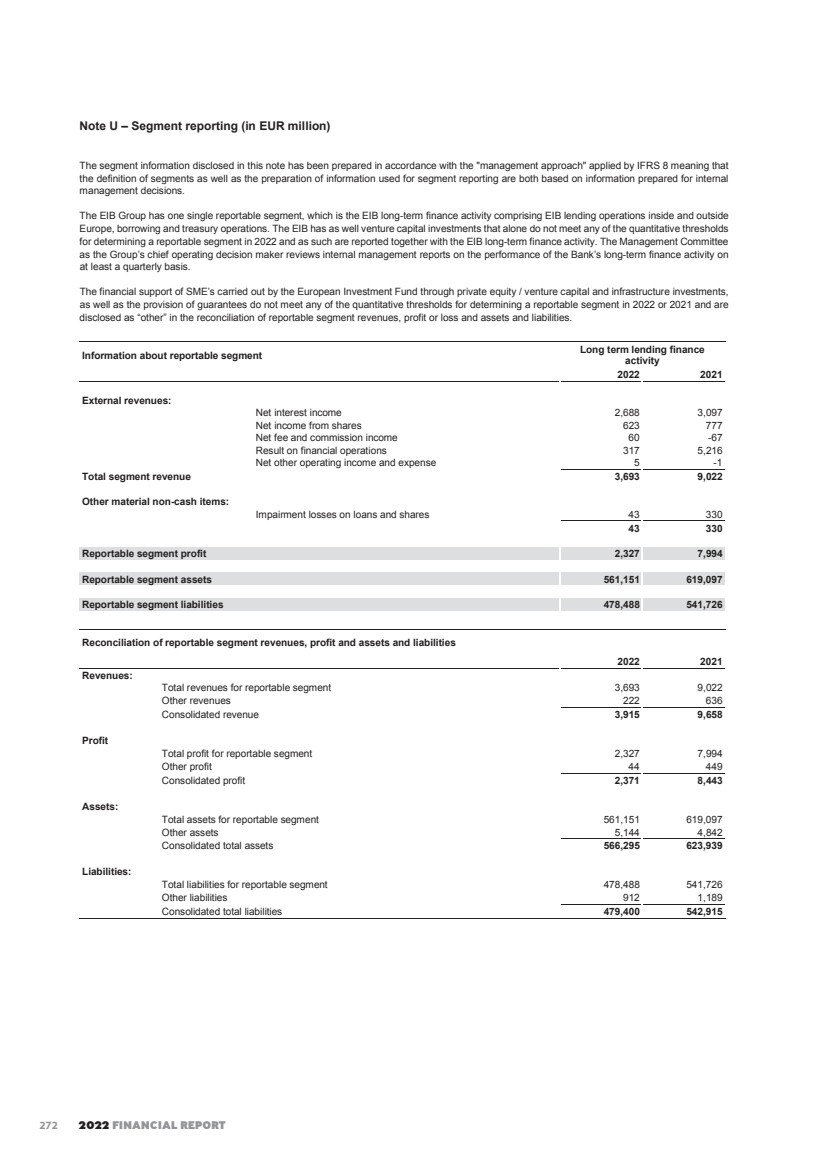

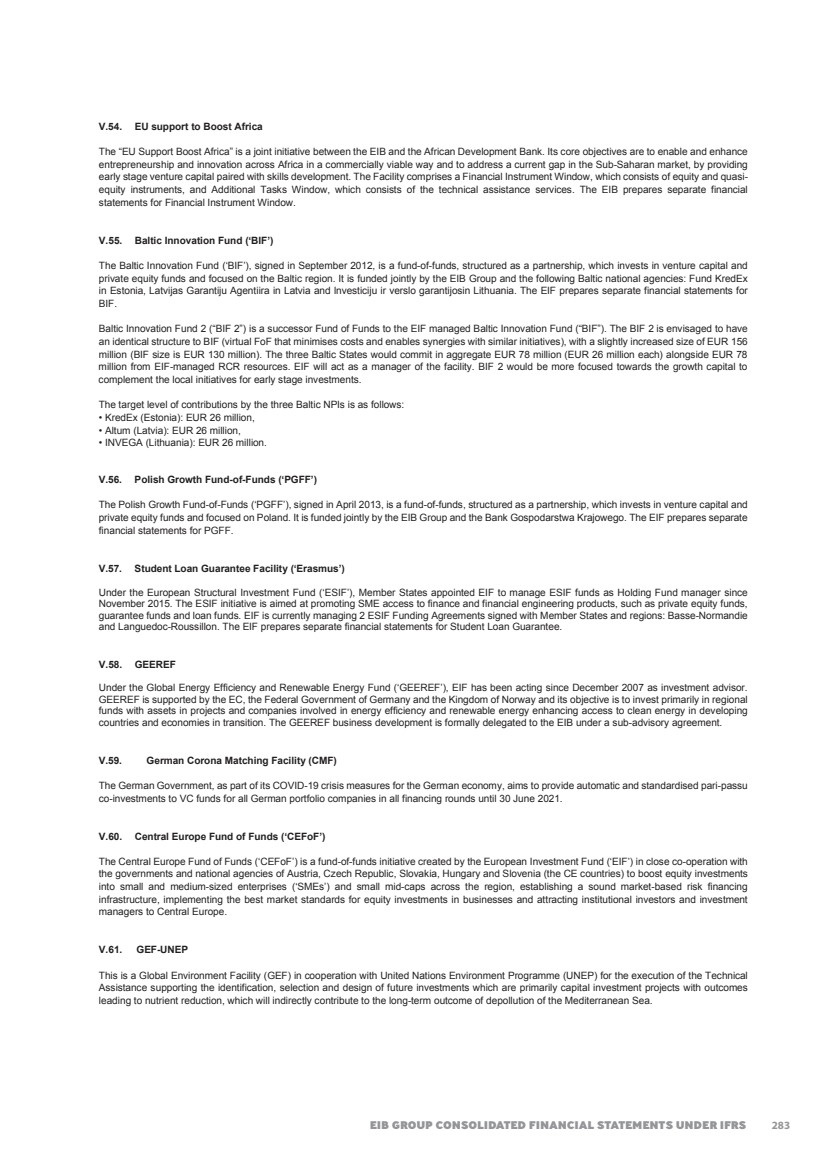

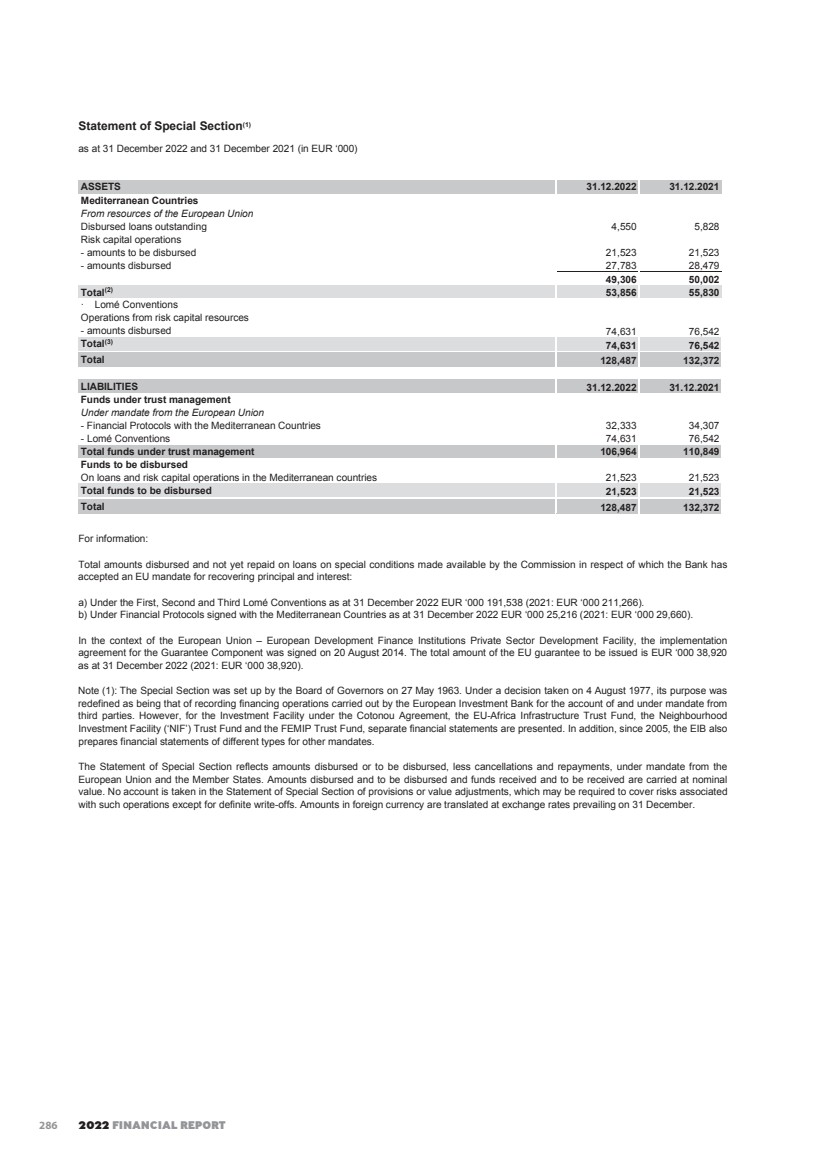

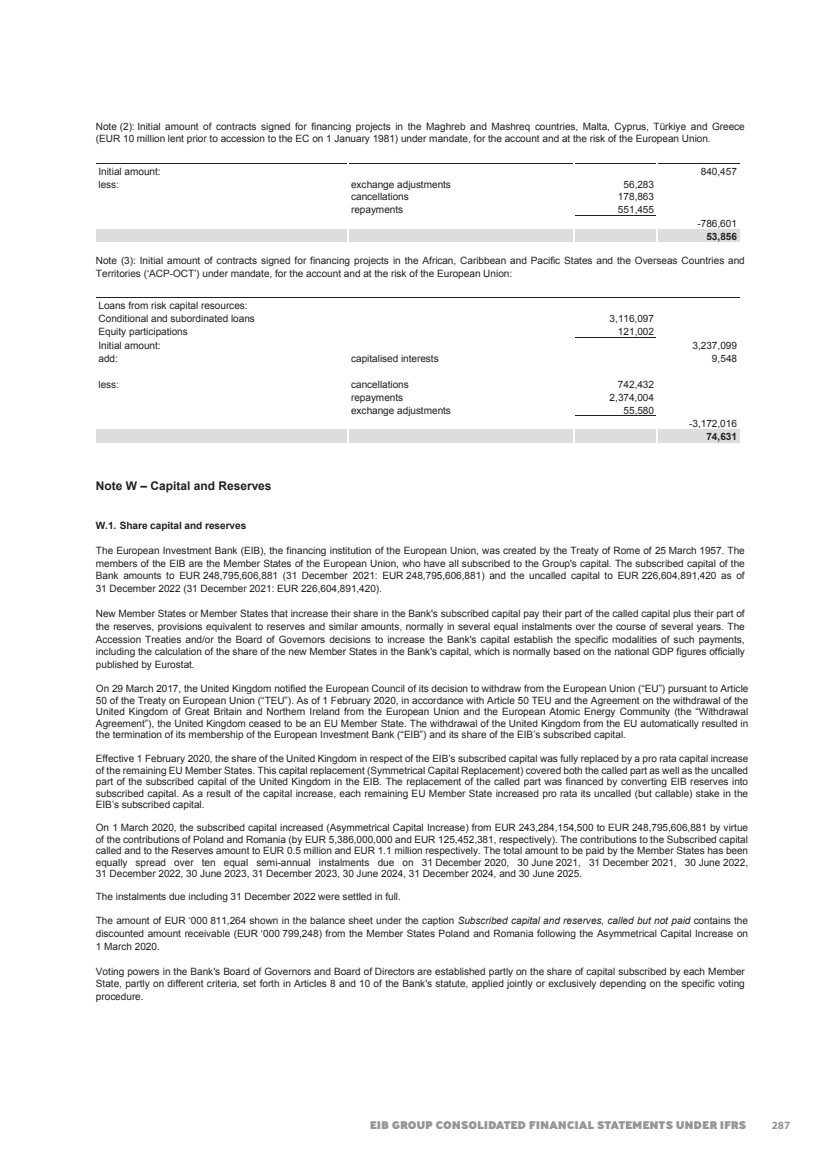

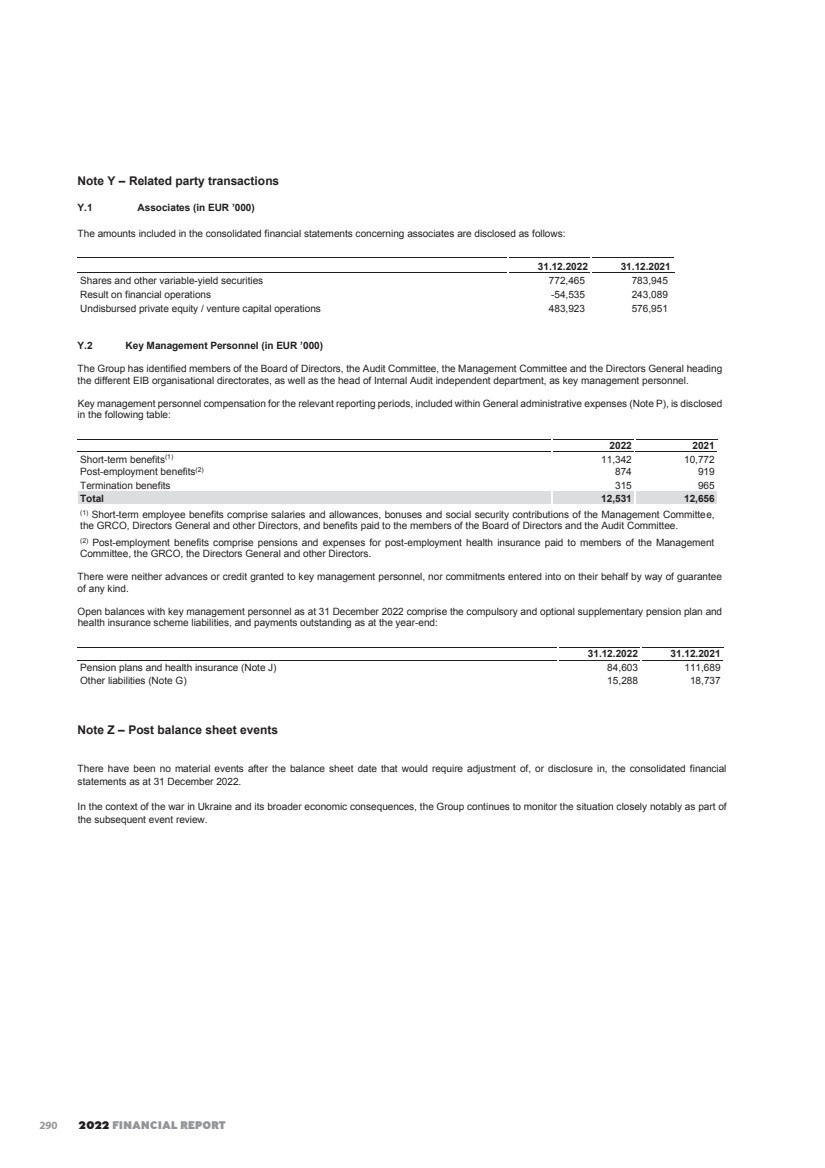

| Overview 4.3. Treasury financial result in 2022 The financial result from the EIB's treasury portfolios for the year was EUR 431.6 million (EUR -165.2 million in 2021). This figure reflects a gross result, mainly the interests received by the treasury, which started to turn positive in the second half of the year, hence benefiting overall the results of the investments. Taking into consideration the cost of funding used to finance the treasury assets, the net treasury result remained positive in 2022, reaching EUR 115.5 million (EUR 96.6 million in 2021). The positive net treasury result reflects better placement rates on investments over the internal transfer price. The average rate of return on the Bank’s treasury was 0.4% in 2022 (-0.3% in 2021), in a market environment characterised by rising EU interest rates, which encouraged investments predominantly focused on very short tenors. 4.4. Asset and liability management The interest rate, foreign exchange and basis risk positions of the Bank’s assets and liabilities are managed within prescribed limits. This involves rebalancing the various risk profiles using standard derivative instruments to achieve a target exposure of the managed risk factors. The Interest Rate Risk Strategy aims to ensure the self-sustainability of the Bank’s business and the growth of its own funds. 5. CONSERVATIVE RISK MANAGEMENT ALIGNED WITH BEST BANKING PRACTICE In order to clarify and reinforce the EIB’s best banking practice (BBP) framework, the Bank’s Board of Governors approved the BBP Guiding Principles. The BBP Guiding Principles is a high-level document, defining the overall principles and the general scope of the banking rules and guidelines applicable to the EIB as best practice. It also sets forth assessment criteria aimed at identifying the relevant rules and considers specificities of the EIB’s business model by way of general adjustments. The document is regularly reviewed by the Bank’s governing bodies and is available on its website. The Audit Committee, an independent body that reports directly to the EIB’s Board of Governors, is statutorily tasked with verifying that the Bank’s activities conform to best banking practice. As part of this role, the Audit Committee has implemented an internal review and evaluation process (EIB REP). Since March 2021, this process is framed by the EIB’s Review and Evaluation Guiding Principles, which were subsequently detailed by the EIB REP implementing rules and a review and evaluation methodology specific to the EIB Group. Globally, this framework is based on the European Banking Authority’s Guidelines on the Supervisory Review and Evaluation Process, while considering the EIB’s specific nature, policy mission, specific tasks and governance structure. The EIB REP supports the Audit Committee in its role to ensure that the Bank complies with applicable best banking practice. The approach to determining annual operational targets and orientations takes into account the Bank’s objective of maintaining a robust credit standing, the long-term nature of its lending business and the granularity of its portfolio. The Bank has defined a set of indicators (such as comprehensive risk appetite metrics) to monitor the credit, liquidity, market and operational risks inherent in its activities including, among others, minimum capital requirements, and the credit quality distribution of the Bank’s loan portfolio, risk concentration measures and liquidity measures. The EIB’s lending policies establish minimum credit quality criteria for both borrowers and guarantors in lending operations and identify the acceptable transaction structure. In analysing risks, the Bank applies an internal loan grading system and assigns internal ratings to counterparties. Diversification of the loan portfolio is supported by a counterparty limit framework and sector limits for its key industries. 24 |