UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 x

AMENDMENT NO. 2 x

CROWDSTREET REIT I, Inc.

(Exact Name of Registrant as Specified in its Charter)

98 San Jacinto Blvd, 4th Floor, Austin, TX 78701

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (971) 803-3110

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and Address of Agent for Service)

Copy to:

Shaun Reader

Curtis, Mallet-Prevost, Colt & Mosle LLP

101 Park Avenue

New York, New York 10178

(212) 696-6000

Check each box that appropriately characterizes the Registrant:

x Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)).

¨ Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act).

¨ Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

¨ A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

¨ Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act of 1933 (the “Securities Act”)).

¨ Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934.

¨ If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

x New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing).

This Registration Statement has been filed by Registrant pursuant to Section 8(b) of the Investment Company Act. However, shares in the Registrant are not being registered under the Securities Act since such shares will be issued solely in private placement transactions which do not involve any “public offering” within the meaning of Section 4(a)(2) of the Securities Act. Investment in the Registrant may be made only by individuals or entities which are “accredited investors” within the meaning of Regulation D under the Securities Act. This Registration Statement does not constitute an offer to sell, or the solicitation of an offer to buy, any share in the Registrant.

CrowdStreet REIT I, Inc.

Common Stock

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

APRIL 21, 2022

The Fund. CrowdStreet REIT I, Inc. (the “Fund”) is a newly organized Delaware corporation that is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”) as a non-diversified, closed-end management investment company. The Fund intends to be taxed as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”).

The Purpose. CrowdStreet, Inc. (“CrowdStreet”) launched in 2014 to make it easier for individual investors to participate in private commercial real estate investments through its online platform at www.crowdstreet.com (the “Marketplace”). Since then, it has become one of the nation’s largest online real estate investing platforms, enabling thousands of investors to research and select investments offered by real estate sponsors around the United States. For investors who prefer to have a professionally managed portfolio, CrowdStreet offers multi-asset funds through CrowdStreet Advisors, LLC (the “Investment Manager”), the investment adviser to the Fund. The Investment Manager is a wholly owned subsidiary of CrowdStreet and an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). Today, the Investment Manager manages a growing portfolio of over 20 private real estate investment funds. The Investment Manager formed this Fund to further expand access to private commercial real estate investments, by:

Investment Objective. The Fund invests in the real estate industry. The Fund’s primary investment objective is generating capital appreciation with a secondary objective of generating income to provide investors with attractive risk-adjusted returns.

Investment Strategy. The Fund will pursue its investment objective by investing at least 85% of its net assets in a portfolio of private commercial real estate investments. The Fund intends to invest in real estate projects with attractive risk-adjusted returns spread across sponsors, asset types and major cities to reduce portfolio risk. The real estate assets underlying the Fund’s equity investments may include multifamily, industrial, life science, healthcare, office and retail properties, as well as data centers, storage and student housing. The Fund’s investments primarily will be non-controlling equity ownership in entities formed by real estate sponsors to directly or indirectly purchase, develop, re-develop, manage, improve, hold or operate real estate property in the U.S.

The investment strategy seeks to take advantage of CrowdStreet’s substantial network of unaffiliated commercial real estate sponsors, selecting from what the Investment Manager’s investment committee believes to be the most attractive sectors, markets, and investment opportunities to construct the Fund’s portfolio. The Investment Manager will also leverage CrowdStreet’s experienced team of investment professionals and its extensive proprietary data, providing the Investment Manager with the advantage of real-time insights into underlying and unrecognized market trends, allowing for the investment committee’s timely identification of attractive investment opportunities.

The Offering. The Fund is conducting a private offering to sell common shares (the “Shares”) only to individuals and entities qualifying as “accredited investors” within the meaning of Regulation D under the Securities Act (each, an “Investor” or “you” and collectively, the “Investors”). The Fund is offering Shares at the initial closing of the Fund at $1,000 per Share, and thereafter each Share is offered at $1,000 plus a “make-up” amount calculated by applying an annualized rate of 3.0% to such Investor’s Subscription Amount applied over the period of time since the

initial closing of the Fund. The minimum subscription amount is $25,000 per investor, unless the Investment Manager accepts a lesser amount, in its sole discretion, (i) from employees, officers or trustees of the Fund, the Investment Manager or their respective affiliates, or (ii) as determined by the Board based on its consideration of the Investor’s overall relationship with the Investment Manager. The purchase price of Shares will be paid to and retained as assets of the Fund. The Fund will be offered primarily through the CrowdStreet Marketplace. The Fund will not pay CrowdStreet any commissions, fees, or other compensation for hosting the offering on the Marketplace.

Liquidity. The Fund is a private closed-end investment fund. The Shares are not redeemable and not registered under the Securities Act of 1933 (the “Securities Act”) or listed on any exchange. While the Fund is a Delaware corporation with a perpetual term, as a closed-ended fund, the Fund only intends to continue until all of its assets have completed their life cycle. The Fund seeks to structure its holdings such that the final asset liquidates within 5 to 7 years after the Initial Closing, but there can be no assurance this can be achieved.

Risks.

| · | An investment in the Fund is speculative with a substantial risk of loss, including risks typically associated with commercial real estate. |

| · | A prospective investor should invest in the Fund only if it can sustain a complete loss of its investment. |

| · | The Shares are not listed on any securities exchange, no secondary market for the Shares exists or is expected to develop. |

| · | Shares are subject to substantial restrictions. Shares will not be redeemable at a Shareholder’s option. As a result, an investor may not be able to sell or otherwise liquidate their Shares. |

| · | An investment in the Fund may not be suitable for investors who may need the money they invested in a specified timeframe. |

| · | The amount of distributions that the Fund may pay, if any, is uncertain. There is no assurance that distributions paid by the Fund will be maintained at a certain level or that dividends will be paid at all. |

| · | The Investment Manager and its affiliates sponsor and manage other funds and expect to form additional other funds in the future and may offer investment opportunities to persons other than the Fund or another fund, which may result in the Fund receiving a smaller allocation, or no allocation at all, of any such investment and the Fund may be left with less attractive investment opportunities as a result of this conflict. |

| · | There can be no assurance that the Fund will achieve its investment objectives or that its investment program will be successful, and an Investor could lose all of its investment in the Fund. |

SEE THE SECTION TITLED “RISK FACTORS AND CERTAIN CONFLICTS OF INTEREST” FOR SPECIAL CONSIDERATIONS RELEVANT TO AN INVESTMENT IN THE SHARES

Additional Information. This Confidential Private Placement Memorandum (this “Memorandum”) provides information that you should know about the Fund before you make a decision to invest. You should read this Memorandum and the referenced documents carefully. The Fund has agreed to provide, prior to the consummation of the transactions contemplated herein, to each offeree of the Shares the opportunity to ask questions of and receive answers from the Investment Manager, concerning the terms and conditions of this offering and to obtain any additional information, to the extent the Investment Manager possesses such information or can acquire it without unreasonable effort or expense, necessary to verify the accuracy of the information set forth herein. Prospective Investors and their professional advisors are invited to request any further information they may desire from the Investment Manager.

Please direct all inquiries regarding the Shares to:

CrowdStreet Advisors, LLC

98 San Jacinto Blvd, 4th Floor

Austin, TX 78701

(971) 803-3110

funds@crowdstreet.com

SEC Registration Statement on Form N-2. The Fund is a Delaware corporation registered under the Investment Company Act as a closed-end, non-diversified, management investment company. The Registration Statement on Form N-2 for the Fund, as well as each amendment thereto and certain other additional information about the Fund, is available on the SEC’s website at www.sec.gov. The Registration Statement on Form N-2 for the Fund, as well as each amendment thereto, is incorporated by reference into this Memorandum.

This Memorandum includes information required to be included in a prospectus and statement of additional information. You may request a free copy of the Registration Statement for the Fund, as well as this Memorandum, annual and quarterly reports to Investors when available, and other information about the Fund, and make inquiries by calling or writing to the Fund at the telephone number and address listed in “Additional Information” above.

As permitted by SEC regulations, paper copies of the Fund’s shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Neither the SEC nor any state securities commission has approved or disapproved the offering of Shares or determined if this Memorandum is truthful or complete. Any representation to the contrary is a criminal offense.

The Shares will be issued solely in private placement transactions which do not involve any “public offering” within the meaning of Section 4(a)(2) of the Securities Act. The Shares are being offered pursuant to exemptions from registration. Investment in the Fund may be made only by individuals or entities that are “accredited investors” within the meaning of Regulation D under the Securities Act.

Shares are not deposits or obligations of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and Shares are not insured by the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System or any other government agency.

You should not construe the contents of this Memorandum as legal, tax or financial advice. You should consult your own professional advisers as to legal, tax, financial or other matters relevant to the suitability of an investment in the Fund.

| SUMMARY OF KEY TERMS | 6 |

| SUMMARY OF FUND EXPENSES | 21 |

| THE FUND | 23 |

| CROWDSTREET AND THE PLATFORM | 24 |

| THE OFFERING | 28 |

| RISK FACTORS AND CERTAIN CONFLICTS OF INTEREST | 30 |

| MANAGEMENT OF THE FUND | 54 |

| CODES OF ETHICS | 61 |

| PROXY VOTING POLICIES AND PROCEDURES | 62 |

| FEES AND EXPENSES | 63 |

| RESTRICTIONS ON OWNERSHIP AND TRANSFER | 65 |

| DISTRIBUTION POLICY | 68 |

| NO RIGHT OF REDEMPTION | 69 |

| CALCULATION OF NET ASSET VALUE | 69 |

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 71 |

| ERISA CONSIDERATIONS | 86 |

| ADDITIONAL INFORMATION | 87 |

| FINANCIAL STATEMENTS | 87 |

| PART C | C-1 |

SUMMARY OF KEY TERMS

This summary does not contain all of the information you should consider before investing in the Shares. You should review the more detailed information contained in this Confidential Private Placement Memorandum (this “Memorandum”), especially the information set forth under the heading Risk Factors and Certain Conflicts of Interest. The following summary is qualified entirely by the detailed information appearing elsewhere in this Memorandum and by the terms and conditions of the Fund’s Bylaws, as amended and restated from time to time (the “Bylaws”), which should be read carefully and retained for future reference.

An investment in the Fund is illiquid, Shares cannot be voluntarily redeemed. Accordingly, an investment in the Fund entails substantial risks and a prospective investor should invest in the Fund only if it can sustain a complete loss of its investment. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest, including the subsections titled Risks Associated with the Fund’s Structure and Terms; Risks Generally Associated with Investments in Securities and Private Investment Funds; and Risks Related to Third Parties

| The Fund |

CrowdStreet REIT I, Inc. (the “Fund”) is a newly organized Delaware corporation that is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund intends to elect to be taxed as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). |

| The Offering |

The Fund is seeking to raise up to approximately $200 million of subscription amounts (“Subscription Amounts,” and such target amount, the “Target Capitalization”) from prospective investors; provided that, the Investment Manager (as defined below) may accept a greater or lesser amount of aggregate Subscription Amounts in its sole discretion. The Fund is offering Shares at the Initial Closing (as defined below) at $1,000.00 per Share, and thereafter each Share is offered at $1,000 plus a “make-up” amount calculated by applying an annualized rate of 3.0% to such Investor’s Subscription Amount applied over the period of time since the Initial Closing. For example, if the Fund holds a second closing three months after the date of the Initial Closing, the “make up” amount is $7.50 ($1,000 x 0.75% (the annualized rate of 3.0%) = $7.50) and each Share will be offered at a purchase price equal to $1,007.50 ($1,000 + $7.50 = $1,007.50). The minimum Subscription Amount is $25,000 per Investor, unless the Investment Manager accepts a lesser amount, in its sole discretion, (i) from employees, officers or trustees of the Fund, the Investment Manager or their respective affiliates, or (ii) as determined by the Board based on its consideration of the Investor’s overall relationship with the Investment Manager. The purchase price of Shares will be paid to and retained as assets of the Fund. The Fund will be offered primarily through the CrowdStreet Marketplace. |

| Investment Manager |

The investment adviser of the Fund will be CrowdStreet Advisors, LLC, a Delaware limited liability company (the “Investment Manager”). The Investment Manager will have exclusive control over the management and operations of the Fund, including in making investment and divestment decisions on behalf of the Fund, subject to the oversight of the Board. The Investment Manager is registered as an investment adviser under the Investment Advisors Act of 1940, as amended (the “Advisers Act”). |

| 6 |

|

The Fund has entered into an Investment Management Agreement with the Investment Manager. The Investment Management Agreement may be terminated on sixty (60) days’ prior written notice to the Investment Manager or the Fund. | |

| Investment Objective |

The Fund invests in the real estate industry. The Fund’s primary investment objective is generating capital appreciation with a secondary objective of generating income to provide investors with attractive risk-adjusted returns. The Fund will target private equity investments in 20 to 25 entities that own U.S. commercial real estate, directly or indirectly (each such investment, a “Portfolio Company”). The Fund intends to invest in Portfolio Companies with attractive risk-adjusted returns spread across sponsors, asset types and major markets to take advantage of attractive opportunities and reduce portfolio risk. Asset types may include multifamily, industrial, life science, healthcare, office and retail properties, as well as data centers, storage and student housing. The investment strategy seeks to take advantage of the substantial network of commercial real estate sponsors developed by CrowdStreet, Inc. (“CrowdStreet”), a Delaware corporation and parent of the Investment Manager, by selecting from what the Investment Manager believes to be the most attractive sectors and markets to construct the Fund’s portfolio. The Fund will also leverage CrowdStreet’s experienced team of investment professionals and its extensive proprietary data, providing the investment committee with the advantage of real-time insights into underlying and unrecognized market trends, allowing for timely identification of attractive investment opportunities. The Fund cannot assure you that it will achieve its investment objectives or that the Fund’s investment program will be successful, and you could lose all of your investment in the Fund. The Fund will not control the Portfolio Companies. The real estate developers and operators who form the Portfolio Company and manage the underlying real estate projects are referred to herein as “Project Sponsors”. Project Sponsors are not affiliated with the Fund, the Investment Manager, or their affiliates. In addition to the Fund’s investment, Project Sponsors will capitalize the underlying real estate projects with other equity sources as well as secured debt and potentially unsecured debt. The Fund will not use leverage in connection with its investment activities. The Portfolio Companies in which the Fund invests may or may not also be offered on the investing platform (the “Marketplace”) maintained by CrowdStreet. |

| Investment Strategy |

The Fund’s investment strategy will follow the Investment Manager’s investment thesis, which is focused on three key areas: (1) thematic trends, (2) middle markets, and (3) growth markets. With thematic investing, the Investment Manager will seek projects supported by demographic and social trends that it believes are long-term drivers of demand. This includes an aging demographic, shift to e-commerce, housing shortages, and population migration to sun belt cities. With an emphasis on the middle market, which tend to be less competitive, the Investment Manager intends pursue attractive projects with smaller asset values that larger institutional investors are unable to participate in. Finally, the Investment Manager will focus on growth markets that it has identified, which includes secondary metropolitan areas . |

| 7 |

|

experiencing strong market fundamentals supported by above-average employment and population expansion, offering attractive risk-adjusted investment opportunities. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Associated with the Investment Strategy. | |

| Portfolio Companies |

The Fund will invest in securities of U.S. issuers. As a matter of fundamental policy, the Fund will normally invest at least 85% of its total assets in real estate investments. The Fund may invest in securities of companies with any market capitalization, including small, medium and large capitalizations. The Fund will invest primarily in illiquid investments (i.e., investments that the Fund reasonably expects cannot be sold or disposed of prior to liquidation or refinancing of the underlying real estate asset). For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Associated with the Investment Strategy. The Portfolio Companies will not be subsidiaries of the Fund or controlled by the Fund. For legal or tax purposes, the Fund may form a wholly owned subsidiary to execute the Fund’s investment in any Portfolio Company, but neither the Fund nor its subsidiary would hold a controlling interest in the Portfolio Company. In that event, the Fund will appropriately treat such subsidiary’s assets as assets of the Fund for purposes of determining compliance with various provisions of the Investment Company Act, applicable to the Fund, including those relating to investment policies (Section 8), affiliated transactions and custody (Section 17) and capital structure and leverage (Section 18). In addition, the Board (as defined below) will comply with the provisions of Section 15 of the Investment Company Act with respect to such a subsidiary’s investment advisory contracts. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest - The Investment Manager may organize, manage or otherwise engage in other investment funds or ventures while managing the Fund. |

| Board of Directors |

Subject to the requirements of the Investment Company Act, the business and affairs of the Fund with be managed under the direction of the board of directors of the Fund (the “Board”). The Board has delegated day-to-day operations to the Investment Manager (as defined below) and other service providers, subject to oversight by the Board. For additional information, please refer to the section titled Management of the Fund. The only standing committee of the Board is the Audit Committee. The current members of the Audit Committee are all of the Independent Directors. The function of the Fund’s Audit Committee is to, among other things, approve, prior to appointment, the engagement of the Fund’s independent registered public accounting firm and review the independent registered public accounting firm’s qualifications, independence and performance. Investors in the Fund will have no right to participate in the management of the Fund, to act for and on behalf of the Fund, or to vote on Fund matters except as specifically provided under applicable law or in the Bylaws. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms. |

| 8 |

| Term |

While the Fund is a Delaware corporation with a perpetual term, the Fund is structured as a closed-ended fund designated to continue until all Portfolio Companies have completed their life cycle. The Fund seeks to structure its holdings such that the final Portfolio Company liquidates within 5 to 7 years after the Initial Closing. The Fund seeks to invest in private real estate investments with an anticipated project term of 3 to 5 years. Thereafter, as each Portfolio Company completes its life cycle and liquidates its underlying real estate assets and distributes to the Fund, the Fund in turn distributes proceeds to Investors holding Shares, and the Fund winds down. The Fund does not anticipate that it will sell or dispose of a Portfolio Company prior to liquidation or refinancing of the underlying real estate asset, which may occur sooner or later than the business plan, projections, and other diligence materials associated with a Portfolio Company may indicate. Accordingly, the actual liquidation date for a Portfolio Company is ultimately outside of the control of the Investment Manager. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms – Term. The term of the Fund will continue until the Fund is dissolved in accordance with the Bylaws. The Fund’s Shares will not be registered with the SEC or listed on an exchange. The Fund’s Shares are designed for long-term investors. |

| Closings |

The Investment Manager will hold the fund’s first closing on the first date that the Fund admits prospective Investors into the Fund upon completion of the required properly executed subscription documents (the “Initial Closing”), which is anticipated to be April 1, 2022. The Investment Manager intends to hold one or more additional closings (each a “Subsequent Closing” and, collectively with the Initial Closing, the “Closings” or individually a “Closing”) through January 3, 2023. The Investment Manager may reject a subscription in whole or in part for any reason or no reason in its sole discretion. |

| Investor Qualifications | Shares are being sold only to “accredited investors” within the meaning of Regulation D under the Securities Act. Investors will be required to provide information verifying their status as accredited investors before purchasing any Shares. Shares will not be registered under the Securities Act or the securities laws of any state or any other jurisdiction, nor is any such registration contemplated. |

| Management Fee |

The Fund pays to the Investment Manager an annual “Management Fee,” quarterly in arrears. The Management Fee will be equal to an annual rate of 1.50% of the net asset value of the Fund (“NAV”); provided that to the extent the Fund accepts subscriptions from Investors after the Initial Closing, the Fund will pay to the Investment Manager the Management Fee that would have been paid had such Investors subscribed at the Initial Closing. |

| 9 |

|

The Management Fee may be paid out of current income, proceeds from the disposition of Portfolio Companies, and any other sources of cash available to the Fund, and payment may be deferred in the sole discretion of the Investment Manager for any reason or no reason at all. For additional information, please see the sections titled (i) Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms - Economic interest of the Investment Manager; (ii) Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest – The terms of the engagement by the Fund of the Investment Manager and its affiliates may not be negotiated at arm’s-length; and (iii) Investment Advisory Services—Investment Management Agreement. | |

| Investor Servicing Fee |

The Fund will pay a fee to the Investment Manager for administrative services (the “Investor Servicing Fee”) at an annual rate of 0.50% of the NAV; provided that to the extent the Fund accepts subscriptions from Investors after the Initial Closing, the Fund will pay to the Investment Manager the Investor Servicing Fee that would have been paid had such Investors subscribed at the Initial Closing. The administrative services provided by the Investment Manager include, without limitation, asset valuation and ongoing reporting to investors, engaging and coordinating service providers of the Fund, reviewing the adequacy and effectiveness of the Fund’s and certain services providers’ policies and procedures, managing distributions to Investors and maintain records of the Fund. The Investor Servicing Fee may be used by the Investment Manager to pay placement agent fees, commissions or other brokerage fees relating to the offering and sale of Shares. The Investor Servicing Fee will be charged quarterly in arrears. The Investor Servicing Fee may be paid out of current income, proceeds from the disposition of Portfolio Companies, and any other sources of cash available to the Fund, and payment may be deferred in the sole discretion of the Investment Manager for any reason or no reason at all. For additional information, please see the section titled (i) Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms - Economic interest of the Investment Manager; (ii) Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest – The terms of the engagement by the Fund of the Investment Manager and its affiliates may not be negotiated at arm’s-length; and (iii) Investment Advisory Services – Investment Management Agreement. |

| Other Services |

CrowdStreet Affiliates charge Project Sponsors technology and services fees, and may charge Project Sponsors placement fees in the future. All such services are provided at customary market rates negotiated with unaffiliated Project Sponsors. Project Sponsors may properly treat such fees as capital or operating expenses of the underlying real estate project, which may impact the Portfolio Company’s cash available for distributions to investors, including the Fund. For additional information, please see the section titled (i) Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest – Transactions with affiliates and payment of CrowdStreet Fees; (ii) Summary |

| 10 |

|

of Fund Expenses – Annual Expenses – Footnote (6); and (iii) Fees and Expenses – Other Services. | |

| Fund Expenses; Expense Limitation |

The Fund (and, thus, indirectly Investors) will bear all of its own expenses (“Fund Expenses”), whether incurred by the Fund, the Investment Manager, or any of their respective affiliates, associated with the formation, operation, dissolution, winding-up, or termination of the Fund. The Investment Management Agreement provides that the Investment Manager will waive its Management Fee and/or pay or reimburse the Fund for Operating Expenses (as defined below) in excess of 1.00% per annum of the Fund’s average quarterly NAV (“Operating Expense Limit”) for any calendar year or portion thereof during the term of the Investment Management Agreement. “Operating Expenses” are the ordinary annual operating expenses of the Fund, including, without limitation, third-party fees and expenses for accounting, administration, valuation, tax compliance, custody, banking, brokerage, depository, insurance premiums, reporting, Investor meetings, and preparation of tax returns and determinations, but excluding fees and expenses for legal, audit, taxes, indemnifications, litigations, interest, Management Fees, Investor Servicing Fees and Board fees, extraordinary or non-routine matters, and Organizational Expenses (as defined below). In the event that the Fund’s Operating Expenses are below the Operating Expense Limit in any fiscal year, the Investment Manager may be entitled to be reimbursed in whole or in part for fees or expenses waived or reduced by the Investment Manager during the prior three year-period pursuant to the Operating Expense Limit. The Investment Management Agreement provides that the Investment Manager will pay 100% of the Organizational Expenses. The Fund will reimburse the Investment Manager $250,000 of the Fund’s Organizational Expenses if and when the Fund accepts $60 million in Subscription Amounts, and the remainder if and when the Fund accepts $100 million in Subscription Amounts. As noted above, the Investment Management Agreement may be terminated on sixty (60) days’ prior written notice to the Investment Manager or the Fund. |

| Fund Administration, Custodian | The Fund intends to engage third parties to serve as the administrator and the custodian. |

| Reinvestment of Capital | Proceeds received by the Fund from Portfolio Companies, whether current income or proceeds from a sale or disposition of Portfolio Companies and their underlying real estate, may be reinvested by the Fund in new Portfolio Companies until the second anniversary of the Initial Closing, and in current Portfolio Companies at any time. |

| Distributions |

Distributions from the Fund will be made in cash or in-kind (as discussed more fully below) at such times after the final Closing and in such amounts as determined by the Investment Manager in its sole discretion, subject to the Bylaws. For additional information, please refer to the section titled Summary of Key Terms – Closings, above. The Investment Manager may withhold from distributions amounts necessary, in its sole discretion, to create reserves for the payment of accrued or future Management Fees, Investor Servicing Fees and other Fund Expenses, for investment in future Portfolio Companies (subject to the |

| 11 |

|

Investment Limitations below), and for the payment of actual or anticipated liabilities. For additional information, please see the sections titled (i) Risk Factors and Certain Conflicts of Interest – Risks Generally Associated with Investments in Securities and Private Investment Funds – There are risks of Investors not receiving any distributable cash and (ii) Risk Factors and Certain Conflicts of Interest – Risks related to Compliance, Regulation, and Certain Tax Matters - Cost of complying with regulations may affect the Fund’s ability to make payments or distributions to Investors. | |

| Short-Term Investments | The Fund will be permitted to invest idle cash, pending investment, usage for expenses or fees, or distribution by the Fund, in high-quality liquid securities on a short-term basis, including money market instruments (“Short-Term Investments”). |

| REIT Status |

The Fund intends to elect to be taxed as and to qualify for treatment each year as a REIT under the Code. Qualification as a REIT for tax purposes involves the application of highly technical and complex Code provisions for which only a limited number of judicial or administrative interpretations exist. Notwithstanding the availability of cure provisions in the Code, various compliance requirements could be failed and could jeopardize the Fund’s REIT status. Failure to qualify for taxation as a REIT would cause the Fund to be taxed as a regular corporation, which would substantially reduce funds available for distributions to Investors. In addition, complying with the requirements to maintain its REIT status may cause the Funds to forego otherwise attractive opportunities or to liquidate otherwise attractive investments, adversely affect the Fund’s liquidity and force the Fund to borrow funds during unfavorable market conditions, and/or limit the Fund’s ability to hedge effectively and cause the Fund to incur tax liabilities.

Shares are not publicly offered. An investment in Shares generally differs from an investment in a listed REIT in various ways, including, without limitation:

· shares of listed REITs are priced by the trading market, which is influenced generally by numerous factors, not all of which are related to the underlying value of the entity’s real estate assets and liabilities; · the estimated value of the Fund's real estate assets and liabilities, rather than the trading market, will be used to determine its NAV; · an investment in the Fund has no liquidity whereas an investment in a listed REIT is a liquid investment, as shares can be sold on an exchange at any time; · listed REITs may be reasonable alternatives to an investment in the Fund and may be less costly and less complex with fewer and/or different risks than an investment in the Fund; · transactions for listed securities often involve nominal or no commissions; and · listed REITs are subject to the governance requirements of the exchange on which its stock is traded, including requirements relating to its board of directors, audit committee, independent director oversight of executive compensation and the director nomination process, code of conduct, shareholder meetings, related party transactions, shareholder approvals, and voting rights.. |

| 12 |

|

Although the Fund may follow many of these same governance guidelines, there is no requirement that it follows any of them. | |

| Reports; Electronic Delivery of Information |

Investors will receive: (a) quarterly reports briefly summarizing the business activities and financial status of the Fund, including financial information on Portfolio Companies of the Fund; (b) annual audited financial statements; (c) information reasonably necessary for the preparation of income tax returns annually; and (d) other such periodic reporting as provided for in the Bylaws. By executing the subscription agreement, Investors will agree to receive electronically all documents, communications, notices, contracts, and agreements relating to the Fund. |

| Transfers of Shares and Redemptions |

An investment in the Fund is illiquid. Shares are generally freely transferable by Investors subject to certain restrictions imposed by applicable securities laws or regulations, compliance with the transfer provisions of the Bylaws related to REIT compliance ownership limits and analogous regulatory compliance and receipt of appropriate documentation. The Bylaws generally prohibit any person from transferring the Shares if such transfer would result in Shares being owned by fewer than 100 persons. The transfer of any Shares in violation of the Bylaws will be deemed invalid, null and void, and of no force or effect. Any person to whom Shares are attempted to be transferred in violation of the Bylaws will not be entitled to vote on matters coming before the Investors, receive distributions from the Fund or have any other rights in or with respect to the Shares. The Fund will not have the ability to reject a transfer of Shares where all applicable transfer requirements, including those imposed under the transfer provisions of the Bylaws, are satisfied. Investors generally may not voluntarily redeem their Shares. The Bylaws also contain restrictions on the number and value of Shares that any one person may own. The Bylaws provide that generally no person may own either more than 9.8% in value or in number of Shares, whichever is more restrictive, or more than 9.8% in value or in number of the Fund’s total shares, whichever is more restrictive. Attempts to acquire Shares in excess of these 9.8% limits would not be effective without an exemption from these limits (prospectively or retroactively) by the Board. These limits may be further reduced if the Board waives these limits for certain Investors. These restrictions are designed, among other purposes, to enable the Fund to comply with ownership restrictions imposed on REITs by the Code. Attempted acquisitions in excess of these restrictions will, pursuant to the Bylaws, be void from the outset. For additional information, please see the section titled Risks Related to Compliance, Regulation, and Certain Tax Matters – The Fund may be restricted from acquiring, transferring or redeeming certain amounts of the Fund’s Shares. |

| ERISA |

Employee benefit plans and other plans subject to Employee Retirement Income Security Act of 1974, as amended (“ERISA”), or the Code, including corporate savings and 401(k) plans, IRAs and Keogh Plans (each, an “ERISA Plan”) may purchase Shares. Because the Fund is registered as an investment company under the Investment Company Act, the underlying assets of the Fund will not be considered to be “plan assets” of any ERISA Plan investing in the Fund for purposes of the fiduciary responsibility and prohibited |

| 13 |

|

transaction rules under Title I of ERISA or Section 4975 of the Code. Thus, neither the Fund or the Investment Manager will be a fiduciary within the meaning of ERISA or Section 4975 of the Code with respect to the assets of any ERISA Plan that becomes an Investor, solely as a result of the ERISA Plan’s investment in the Fund. The provisions of ERISA are subject to extensive and continuing administrative and judicial interpretation and review. The discussion of ERISA contained herein is, of necessity, general and may be affected by future publication of regulations and rulings. Potential investors should consult their legal advisers regarding the consequences under ERISA of an investment in the Fund through an ERISA Plan. For additional information, please see the section titled ERISA Considerations. | |

| Legal Counsel | Curtis, Mallet-Prevost, Colt & Mosle LLP will serve as counsel to the Investment Manager and the Fund. No separate counsel has been engaged by the Fund, the Investment Manager, or any of their respective affiliates to represent any current or prospective Investors of the Fund with respect to an investment in the Fund, or the Investors as a whole. For additional information, please see the section titled Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest - Legal counsel to the Fund and the Investment Manager does not also represent the Investors. |

| U.S. Federal Income Tax Considerations | The Fund intends to elect to be taxed as a REIT for U.S. federal income tax purposes commencing with the Fund’s taxable year ending December 31, 2022. The Fund believes that it is organized, and expects to operate, in such a manner to qualify for taxation as a REIT. The Fund’s qualification for taxation as a REIT will depend upon its ability to meet on a continuing basis, through actual operating results, distribution levels, and diversity of Shares and asset ownership, the various and complex REIT qualification tests imposed under the Code. No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. If the Fund qualifies for taxation as a REIT, it generally will be allowed to deduct dividends paid to its Investors and, as a result, it generally will not be subject to U.S. federal income tax on that portion of its ordinary income and net capital gain that it annually distributes to its Investors, as long as the Fund meets the minimum distribution requirements under the Code. The Fund intends to make distributions to its Investors on a regular basis as necessary to avoid material U.S. federal income tax and to comply with the REIT distribution requirements. For additional information, please see the section titled Certain U.S. Federal Income Tax Considerations. |

| U.S. Tax-Exempt Investors | U.S. Tax-Exempt Investors may recognize “unrelated business taxable income” (“UBTI”) if they invest in the Fund. U.S. TAX-EXEMPT INVESTORS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS PRIOR TO MAKING AN INVESTMENT IN THE FUND. |

| Non-U.S. Persons | Non-U.S. Persons (as defined for federal income tax purposes) are not eligible to invest in the Fund. For additional information, please see the section titled Certain U.S. Federal Income Tax Considerations. |

| Principal Risks |

There can be no assurance that any Investor will achieve its investment objective or avoid substantial losses by investing in the Fund. Investments in commercial real estate entail a high degree of risk, and Investors may lose |

| 14 |

|

some or all of their investment in the Fund. A potential Investor should invest in the Fund only if able to withstand a total loss of investment. Potential Investors are urged to consult with their personal investment, legal and tax advisors before investing in the Fund. Additional risks involved in investing in the Fund include: General Risks ▪ There is no guarantee that the Fund will return capital, and you may lose all or a portion of your investment in the Fund. ▪ You will not be able to redeem any of your Shares and any transfer of your Shares is subject to certain restrictions imposed by applicable securities laws or regulations, compliance with the transfer provisions of the Bylaws related to REIT compliance ownership limits and analogous regulatory compliance. ▪ No public market for the Shares exists, and none is expected to develop in the future, and any distributions you receive may not be received for several years after your initial investment in the Fund.

Risks Related to Fund Management and CrowdStreet Operations ▪ Shares will be offered and sold to prospective investors, and the Fund may invest in Portfolio Companies, through the Marketplace operated and controlled by CrowdStreet. ▪ The Investment Manager is controlled by CrowdStreet, and the Fund’s investment program relies substantially on the ongoing maintenance of a relationship with CrowdStreet and its affiliates. ▪ CrowdStreet and its affiliates are expected to share common management with the Investment Manager, which may subject one or more of the members of the professional staff of the Investment Manager to certain fiduciary or other duties, including responsibilities with respect to other funds and accounts managed and advised by the Investment Manager, the exercise of which duties may not be in the Fund’s best interests. ▪ The administration of the Fund and the Fund’s investment program will rely on the satisfactory performance, reliability and availability of the CrowdStreet website and the systems supporting the CrowdStreet website and other electronic infrastructure. ▪ If any of the confidential information stored on the CrowdStreet website or supporting systems is compromised, Investors’ confidential information and other investors’ confidential information may be stolen.

Risks Associated with the Investment Strategy ▪ The Fund’s investments will be subject to the risks typically associated with real estate. ▪ The Fund’s investment portfolio will be impacted by the performance of the commercial real estate market, including: general and local economic conditions and negative developments in the business economy, the supply and demand for properties, and the financial resources of tenants; changes in building, environmental, zoning, and other laws; changes in real property tax rates; changes in interest rates and the availability of mortgage funds; environmental cleanup costs and other liabilities from hazardous waste, mold, or indoor air pollution; uninsured casualties, acts of God (such as earthquake, tsunami, hurricane, wind, flood, epidemic), war, terrorism, nuclear accident, labor dispute, riot, and other factors that are beyond the control of the Fund and may not be insurable at . |

| 15 |

|

reasonable cost to the full extent needed to protect the real estate or its revenue-generating capacity; development, redevelopment, and construction delays and cost overruns. ▪ Construction and renovation is subject to risks. ▪ The investment strategy includes investments in special situation and distressed assets that involve significant risks. ▪ The Fund may participate in investments with highly leveraged capital structures, which may increase the risk of loss of such assets. ▪ Automated analytical processes used in connection with the operation of the Fund may fail to perform as intended. ▪ Debt incurred by a Portfolio Company increases risk. ▪ Equity investments in a Portfolio Company will be subordinate to existing and future indebtedness of a Portfolio Company. ▪ Investments with third parties in Portfolio Companies may involve risks not present in investments where a third party is not involved, including, among other things, the possibility that a third-party partner may have financial difficulties resulting in a negative impact on such Portfolio Company, may have economic or business interests or goals which are inconsistent with those of the Fund, may cause reputational risk or harm to the Fund, or may be in a position to take (or block) action in a manner contrary to the Fund’s investment objectives, or the increased possibility of default by, diminished liquidity or insolvency of, the third party, due to a sustained or general economic downturn. ▪ The Fund is subject to risks of expedited transactions. ▪ The Fund may lack appropriate diversification. ▪ Real estate valuation is inherently inexact. ▪ No guarantee of distributions of current income. ▪ Returns and loss rates on underlying investments may be uncertain. ▪ The Fund’ investments may be subject to indirect or direct environmental risks.

Risks Associated with the Fund’s Structure and Terms ▪ Investors in the Fund will be relying on the Investment Manager to identify, structure, and implement investments consistent with the Fund’s investment objectives and policies and to conduct the business of the Fund as contemplated by this Memorandum and the Bylaws. ▪ The Fund is newly formed with no operating history, and past investment performance is not indicative of the Fund’s future investments. ▪ The Fund’s investments will be illiquid, long-term investments with limited transferability. ▪ Shares in the Fund will be subject to transfer restrictions. ▪ Economic interest of the Investment Manager; the Investment Manager generally will benefit from Management Fees and Investor Servicing Fees paid by the Fund even if the Fund is not profitable. ▪ Because the Investment Manager will not receive a percentage of the profits of the Fund and will not make a capital contribution to the Fund, the Investment Manager may lack the financial incentive or risk aversion that the Investment Manager would have if it received allocations and distributions on a basis identical to that of the Investor. ▪ The Fund will have no set term; the Investment Manager will have complete discretion regarding when to dispose of the Fund’s assets and begin its liquidation and winding-down period, subject to the |

| 16 |

|

completion of a Portfolio Company’s life cycle. The Fund seeks to deploy the net proceeds of the Fund’s offering within twelve months of the final closing. The Fund seeks to structure its holdings such that the final asset is liquidated within 5 to 7 years after the Initial Closing, but there can be no assurance that this can be achieved. The risk factors described in the Memorandum, such as market conditions and natural disasters, can materially delay the Fund’s ability to deploy capital during the expected time frame and can materially delay a Project Sponsor’s ability to complete the Portfolio Company’s life cycle. The Fund will not have control over the Portfolio Company's operations or decisions and will not be able to force a the sale of the underlying real estate assets. If the Fund is unable to fully realize all of its investments during the anticipated Fund term, the Fund may be unable to sell the Portfolio Company or distribute its interest among the Investors. In that event, the Fund may be required to continue its term beyond the expected period. ▪ In managing the Fund, the Investment Manager will establish reserves for operating expenses, Fund liabilities, and other matters and inadequate or excessive reserves could have a material adverse effect upon the investment returns to the Investors of the Fund. ▪ The Investment Manager retains the discretion to make distributions of securities in kind to the Investors to the extent permitted under applicable law.

Risks Generally Associated with Investments in Securities and Private Investment Funds ▪ Investment in the Fund is suitable only for those persons who, either alone or together with their duly designated representative, have such knowledge and experience in financial and business matters that they are capable of evaluating the merits and risks of their proposed investment, who can afford to bear the economic risk of their investment, who are able to withstand a total loss of their investment and who have no need for liquidity in their investment and no need to dispose of their Shares to satisfy current financial needs and contingencies or existing or contemplated undertakings or indebtedness. ▪ Investors will lack control of the Fund and will have limited voting rights. ▪ There is no assurance that the Fund will be able to achieve its investment objectives, as a result of which you may lose some or all of your investment. ▪ Failure to raise enough capital to execute the investment program. ▪ There are risks of Investors not receiving any distributable cash. ▪ The Fund’s investments will be subject to risks from general economic and market conditions. ▪ The Fund is subject to risks related to pandemic.

Risks Related to Conflicts of Interest ▪ There may be occasions when the Fund and its affiliates will encounter potential conflicts of interest in connection with the Fund’s activities. ▪ Project Sponsors will provide compensation to CrowdStreet and its affiliates. ▪ The Investment Manager and its affiliates are entitled to significant compensation and affiliates of the Investment Manager may provide |

| 17 |

|

services to Portfolio Companies and their affiliates and receive fees in connection with those services. ▪ Fees paid by Project Sponsors to access the Marketplace may present conflicts of interest. ▪ The Investment Manager and its affiliates sponsor and manage other funds and expect to form additional other funds in the future and may offer investment opportunities to persons other than the Fund or another fund, which may result in the Fund receiving a smaller allocation, or no allocation at all, of any such investment and the Fund may be left with less attractive investment opportunities as a result of this conflict. ▪ The terms of the engagement by the Fund of the Investment Manager and its affiliates may not be negotiated at arm’s-length. ▪ The Investment Manager may organize, manage or otherwise engage in other investment funds or ventures while managing the Fund. ▪ Employees, investment consultants, partners and affiliates, officers, and directors affiliated with CrowdStreet, the Investment Manager, and the Fund will be entitled to certain rights of exculpation and indemnification for liabilities incurred in connection with the affairs of the Fund. ▪ Legal counsel to the Fund and the Investment Manager does not also represent the Investors.

Risks Related to Third Parties ▪ The success of the Fund is dependent on the performance of the Project Sponsors and other third parties over which the Fund has no control. ▪ Portfolio Companies may depend on third parties with limited to no operating history. ▪ The Investment Manager relies on information provided by third parties. ▪ Investors do not have recourse against Project Sponsors, other managers or owners of Portfolio Companies, or third-party service providers of Portfolio Companies. ▪ Portfolio Companies may rely on third-party property managers and leasing agents for effective operations. ▪ Investments with third parties in Portfolio Companies may involve risks not present in investments where a third party is not involved, including, among other things, the possibility that a third-party partner may have financial difficulties resulting in a negative impact on such Portfolio Company, may have economic or business interests or goals which are inconsistent with those of the Fund, may cause reputational risk or harm to the Fund, or may be in a position to take (or block) action in a manner contrary to the Fund’s investment objectives, or the increased possibility of default by, diminished liquidity or insolvency of, the third party, due to a sustained or general economic downturn.

Risks Related to Compliance, Regulation, and Certain Tax Matters ▪ CrowdStreet and the Fund’s business is subject to extensive government regulation, supervision, examination and enforcement, which could adversely affect CrowdStreet or the Fund’s business, results of operations and financial condition. ▪ The Investment Manager is subject to regulation as an investment adviser under the Investment Advisers Act. |

| 18 |

|

▪ Changes in regulation of financial institutions may affect our business. ▪ Changes in regulation of internet commerce may affect the Fund. ▪ Cost of complying with regulations may affect the Fund’s ability to make payments or distributions to Investors. ▪ Laws intended to prohibit money laundering may require CrowdStreet or the Fund to disclose investor information to regulatory authorities. ▪ Your investment may have adverse tax consequences. ▪ An investors who uses a self-directed IRA to make illiquid investments, such as an investment in the Fund, faces significant additional risks, including but not limited to liquidity risk, the risk of loss of all capital, and the risk that the investor’s advisor and/or custodian does not adequately account for suitability or tax consequences of an investment in the Fund with respect to an IRA. ▪ There may be Unrelated Business Taxable Income for U.S. tax-exempt Investors. ▪ The Fund is required to make distributions sufficient to satisfy the requirements for qualification as a REIT for U.S. federal income tax purposes, but there can be no assurance that the Fund will achieve investment results that will allow the Fund to make a specified level of cash distributions or maintain certain levels of cash distributions. ▪ The Fund intends to elect to be taxed as and to qualify for treatment each year as a REIT under the Code, which involves the application of highly technical and complex Code provisions for which only a limited number of judicial or administrative interpretations exist; failure to qualify for taxation as a REIT would cause the Fund to be taxed as a regular corporation, which would substantially reduce funds available for distributions to Investors and complying with the requirements to maintain its REIT status may cause the Funds to forego otherwise attractive opportunities or to liquidate otherwise attractive investments, and/or cause the Fund to incur tax liabilities. ▪ Even if the Fund qualifies and maintains its tax status as a REIT, it may become subject to U.S. federal income taxes and related state and local taxes, which would reduce the Fund’s cash flows. ▪ REIT distribution requirements could adversely affect the Fund’s liquidity and may force the Fund to borrow funds during unfavorable market conditions. ▪ If the Fund fails to invest a sufficient amount of the net proceeds from selling the Shares in real estate assets within one year from the receipt of the proceeds, the Fund could fail to maintain its REIT status. ▪ If the Fund forms a TRS, the Fund’s overall tax liability could increase. ▪ Failure to comply with limits on the Fund’s ability to own and engage in transactions with TRSs would jeopardize the Fund’s REIT qualification and may result in the application of a 100% excise tax. ▪ Dividends payable by funds that qualify for taxation as REITs generally do not qualify for reduced tax rates under current law. ▪ In order to maintain the Fund’s REIT status, Investors may be restricted from acquiring or transferring certain amounts of the Fund’s Shares. ▪ The IRS may take the position that gains from sales of property are subject to a 100% prohibited transaction tax. ▪ Legislative or regulatory action related to federal income tax laws could adversely affect Fund’s Investors and/or the Fund’s business. |

| 19 |

|

▪ A portion of the Fund’s distributions may be treated as a return of capital for U.S. federal income tax purposes, which could reduce the basis of an Investor’s investment in the Fund’s Shares and may trigger taxable gain. ▪ The Investment Manager and its affiliates have limited experience managing a portfolio of assets owned by a fund that qualifies for taxation as REIT.

For a discussion of the U.S. federal income tax consequences of an investment in the Fund, see the section titled Certain U.S. Federal Income Tax Considerations. There are many additional risks that relate to an investment in the securities described in this Summary. For additional risk disclosure, please refer to the section titled Risk Factors and Certain Conflicts of Interest. |

| 20 |

SUMMARY OF FUND EXPENSES

The following table illustrates the expenses and fees that the Fund expects to incur and that Investors can expect to bear directly or indirectly, by investing in the Fund. This fee table is based on estimated expenses of the Fund for the fiscal year ending December 31, 2022, and assumes that the Fund will raise $200 million in total from Investors during such fiscal year.

Investor Transaction Expenses

| Make-Up Amount(1) | 3.00 | % |

Annual Expenses

| As a Percentage of Average Net Assets | |||

| Management Fee(2) | 1.50 | % | |

| Investor Servicing Fee(3) | 0.50 | % | |

| Other Expenses(4) | 0.89 | % | |

| Organizational Expenses 0.26% | |||

| Operating Expenses(5) 0.59% | |||

| Audit Expenses 0.02% | |||

| Independent Director Fees 0.03% | |||

| Total Annual Expenses(6),(7) | 2.89 | % |

| (1) | Each Investor participating in a Subsequent Closing will purchase each Share at a price equal to $1,000 plus a “make-up” amount calculated by applying an annualized rate of 3.0% to $1,000 applied over the period of time since the Initial Closing. For example, if the Fund holds a second closing three months after the date of the Initial Closing, the “make up” amount is $7.50 ($1,000 x 0.75% (the annualized rate of 3.0%) = $7.50) and each Share will be offered at a purchase price equal to $1,007.50 ($1,000 + $7.50 = $1007.50). The entire purchase price, including such “make-up” amount, is paid into the capital of the Fund. For additional information, please see the sections titled The Offering – Subscription Procedures. | |

| (2) | The Management Fee will be equal to 1.50% per annum of the NAV, paid quarterly in arrears; provided that to the extent the Fund accepts subscriptions from Investors after the Initial Closing, the Fund will pay to the Investment Manager the Management Fee that would have been paid had such Investors subscribed at the Initial Closing. The Investment Manager intends to defer collection of its Management Fee in the Fund's first year of operations, and may continue to defer some or all of such fees potentially subsequent years, to maximize the Fund's investable assets in its first year. For additional information, please see the sections titled (i) Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms - Economic interest of the Investment Manager; (ii) Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest – The terms of the engagement by the Fund of the Investment Manager and its affiliates may not be negotiated at arm’s-length; and (iii) Investment Advisory Services—Investment Management Agreement. |

| 21 |

| (3) | The Investor Servicing Fee will be equal to 0.50% per annum of the NAV, paid quarterly in arrears; provided that to the extent the Fund accepts subscriptions from Investors after the Initial Closing, the Fund will pay to the Investment Manager the Investor Servicing Fee that would have been paid had such Investors subscribed at the Initial Closing. The Investor Servicing Fee may be used by the Investment Manager to pay placement agent fees, commissions or other brokerage fees relating to the offering and sale of Shares. The Investment Manager intends to defer collection of the Investor Servicing Fee in the Fund's first year of operations, and may continue to defer some or all of such fees potentially subsequent years, to maximize the Fund's investable assets in its first year. For additional information, please see the section titled (i) Risk Factors and Certain Conflicts of Interest – Risks Associated with the Fund’s Structure and Terms - Economic interest of the Investment Manager; (ii) Risk Factors and Certain Conflicts of Interest – Risks Related to Conflicts of Interest – The terms of the engagement by the Fund of the Investment Manager and its affiliates may not be negotiated at arm’s-length; and (iii) Investment Advisory Services—Investment Management Agreement. |

| (4) | “Other Expenses" reflect an estimate of all expected ordinary operating expenses for the Fund for the fiscal year ending December 31, 2022, plus one-time organizational and offering expenses. The table reflects the Fund’s expenses and does not reflect the expenses of the Portfolio Company or its underlying real estate. The Portfolio Companies are not Fund affiliates or subsidiaries and are not controlled by the Fund so no Acquired Fund fees have been estimated. The Investment Manager will pay 100%, of the Organizational Expenses and the Fund will reimburse the Investment Manager $250,000 for Organizational Expenses if and when the Fund accepts $60 million in Subscription Amounts and the remainder when the Fund accepts $100 million in Subscription Amounts. |

| (5) | Operating Expenses include the ordinary annual operating expenses of the Fund, including without limitation, third-party fees and expenses for accounting, administration, valuation, tax compliance, custody, banking, brokerage, insurance premiums, reporting, investor meetings, and preparation of tax returns and determinations. The Investment Manager has agreed to limit such Operating Expenses to 1.0% of the Fund's average quarterly NAV. | |

| (6) |

Total annual expenses will increase or decrease over time based on the Fund’s total Shares purchased, asset level and other factors. However, the portion of annual expenses that are “Other Expenses” generally include fixed amounts that will not proportionally increase or decrease based on the Fund’s total Shares purchased. For example, if the Fund were to raise only $100 million from Investors during the fiscal year ending December 31, 2022 (which the Investment Manager believes unlikely), keeping all other assumptions the same, the Fund’s total Other Expense ratios, as set forth in the fee table, would almost double and the amounts in the example below would increase significantly. If the Fund were to raise less than $200 million in total from Investors during the fiscal year ending December 31, 2022, the Fund’s total Other Expense ratio would be higher than that presented above. As previously noted, the Investment Manager intends to defer collection of its Management Fee and Investor Servicing Fee in the Fund's first year of operations, and may continue to defer some or all of such fees potentially subsequent years, to maximize the Fund's investable assets in its first year. Further, the Investment Manager will waive the Management Fee to the extent that Operating Expenses are in excess of 1.00% per annum of the Fund’s average quarterly NAV (the “Operating Expense Limit”) for any calendar year or portion there during the term of the Investment Management Agreement; provided, however, that in the event that the Operating Expenses are below the Operating Expense Limit in any fiscal year, the Investment Manager may be entitled to be reimbursed in whole or in part for fees or expenses waived or reduced by the Investment Manager during the prior three year-period pursuant to the Operating Expense Limit. Further, the Investment Management Agreement provides that the Investment Manager will pay 100% of the Organizational Expenses; the Fund will reimburse the Investment Manager $250,000 of the Fund’s Organizational Expenses if and when the Fund accepts $60 million in Subscription Amounts, and the remainder if and when the Fund accepts $100 million in Subscription Amounts. As noted above, the Investment Management Agreement may be terminated on sixty (60) days’ prior written notice to the Investment Manager or the Fund. |

| 22 |

| (7) | CrowdStreet Affiliates charge Project Sponsors technology and services fees, and may charge Project Sponsors placement fees in the future (collectively, “CrowdStreet Fees”). All such services are provided at customary market rates negotiated with unaffiliated Project Sponsors. The Project Sponsors may capitalize or expense some or all of the CrowdStreet Fees, as well as fees charged by other service providers who are not affiliated with CrowdStreet, in the real estate project underlying the Portfolio Company. CrowdStreet Fees and other service provider fees increase a Portfolio Company’s expenses, which may reduce cash available for distributions to investors, including the Fund. The net impact of CrowdStreet Fees on the expenses of the Portfolio Company will vary based on numerous factors, as will the impact on the Fund’s performance, which the Fund estimates to range from 0.0% to 1.0% of Average Net Assets (annualized). In the unlikely event that a CrowdStreet Affiliate charges a Project Sponsor fees for services that overlap with services to be provided by the Investment Manager to the Fund in connection with the Investment Manager’s fees, the Investment Manager will reduce the amount of the Investor Servicing Fees charged to the Fund by an amount equal to the CrowdStreet Fees paid by the Project Sponsor for such overlapping services. |

The purpose of the table above and the example below is to assist you in understanding the various costs and expenses you will bear directly or indirectly as an Investor in the Fund. For a more complete description of the various costs and expenses of the Fund, see the section titled Fees and Expenses.

|

Example: |

1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| You would pay the following expenses on a $1,000 fully invested purchase, assuming a 5% annual return: | $ | 30 | $ | 87 | $ | 147 | $ | 308 |

The example is based on the fees and expenses set forth in the table above. The example should not be considered a representation of future expenses. Actual Fund expenses may be greater or less than those shown. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example. The example assumes that the Fund will raise $200 million.

| 23 |

THE FUND

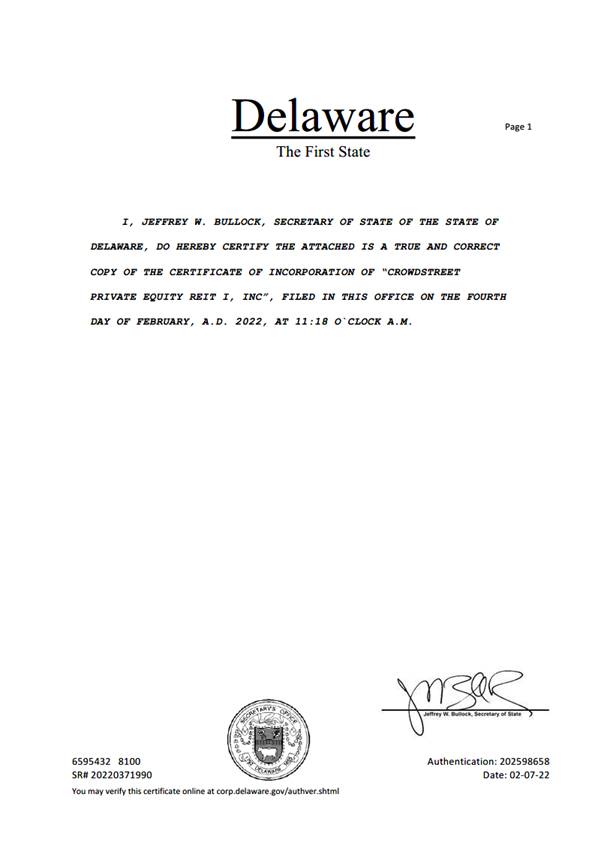

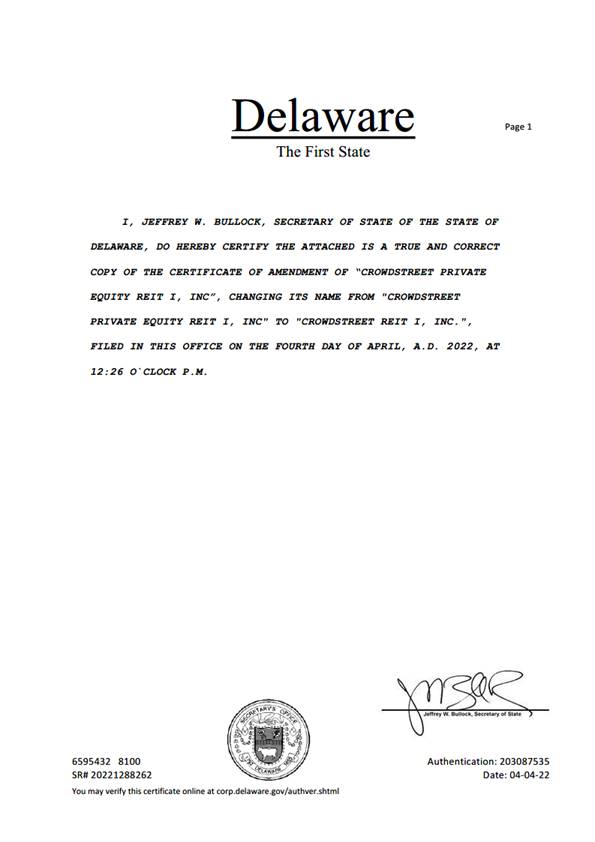

CrowdStreet REIT I, Inc. (the “Fund”) is a newly organized non-diversified, closed-end management investment company that is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Fund was organized as a Delaware corporation on February 4, 2022. As a newly organized entity, the Fund has no operating history. The Fund intends to elect to be taxed as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s principal office is located at 98 San Jacinto Blvd, 4th Floor, Austin, TX 78701 and its telephone number is (971) 803-3110.

The Fund is a specialized investment vehicle that incorporates features of both a private investment fund that is not registered under the Investment Company Act and a closed-end investment company that is registered under the Investment Company Act. Private investment funds (such as private equity limited partnership funds) are collective asset pools that typically offer their securities privately, without registering them under the Securities Act of 1933, as amended (the “Securities Act”). Registered closed-end investment companies, such as the Fund, are typically managed more conservatively than private investment funds because of the requirements and restrictions imposed on them by the Investment Company Act. By combining certain features from non-registered and registered funds, the Investment Manager believes it can offer “accredited investors” access to the long-term investment return benefits of private equity real estate opportunities at a much lower investment minimum and with the convenience of Form 1099-DIV tax reporting.

At the time of the Initial Closing, the Fund will not have selected any of its investments and will not have any specified properties or investments when Investors are admitted to the Fund. As a result, prospective Investors in the Fund may not have an opportunity to evaluate information on all Portfolio Companies to be made by the Fund and, accordingly, will be dependent upon the judgment and ability of the Investment Manager to source and execute on potential Portfolio Companies. See the section titled Risk Factors and Certain Conflicts of Interest – Risks Related to Fund Management and CrowdStreet Operations.

Investment Objective and Strategy

The Fund invests in the real estate industry. The Fund’s primary investment objective is generating capital appreciation with a secondary objective of generating income to provide Investors with attractive risk-adjusted returns. The Fund will hold non-controlling equity interests in unaffiliated entities that own real estate assets, directly or indirectly. The Fund seeks to take advantage of CrowdStreet’s platform, which provides access to a substantial and growing open network of over 280 third-party real estate sponsors for attractive investment opportunities. CrowdStreet’s ability to review and monitor a high volume of real estate projects across markets provides it with extensive proprietary, real-time data to evaluate opportunities and make timely investment decisions. As of January 31, 2022, CrowdStreet has reviewed thousands of real estate transactions, enabling its network of investors to invest over $2.8bn in equity across more than 590 projects.

The Fund will target 20 to 25 direct private equity investments in U.S. commercial real estate projects. The Fund intends to invest in real estate projects with attractive risk-adjusted returns spread across sponsors, asset types and major markets to take advantage of attractive opportunities and reduce portfolio risk. Asset types may include multifamily, industrial, life science, healthcare, office and retail properties, as well as data centers, storage and student housing. The investment strategy seeks to take advantage of CrowdStreet’s substantial network of commercial real estate sponsors, selecting from what the Investment Manager believes to be the most attractive sectors, markets and individual opportunities to construct the Fund’s portfolio. The Fund will also leverage CrowdStreet’s experienced team of investment professionals and its extensive proprietary data, providing it with the advantage of real-time insights into underlying and unrecognized market trends, allowing for timely identification of attractive investment opportunities.

As a matter of fundamental policy, the Fund will normally invest at least 85% of its total assets in real estate investments. The Fund’s investment strategy will follow the Investment Manager’s investment thesis focused on three key areas: (1) thematic trends, (2) middle markets, and (3) growth markets. With thematic investing, the Investment Manager will seek projects supported by demographic and social trends that it believes are long-term drivers of demand. This includes an aging demographic, shift to e-commerce, housing shortages, and population migration to sun belt cities. With an emphasis on the middle market segment of real estate, a sector that is generally less competitive, the Investment Manager intends pursue attractive projects with smaller asset values that larger

| 24 |

institutional investors are unable to participate in. Finally, the Investment Manager will focus on growth markets that it has identified, which includes secondary metropolitan areas experiencing strong market fundamentals supported by above-average employment and population expansion, offering attractive risk-adjusted investment opportunities.

CROWDSTREET AND THE PLATFORM

Overview

CrowdStreet launched in 2014 to make it easier for individual investors to participate in the $19bn commercial real estate asset class, enabling a large and rapidly growing community of investors to access a major asset class. CrowdStreet’s online marketplace provides investors with direct access to a diverse range of institutional-quality commercial real estate opportunities that have historically been unavailable to individuals. CrowdStreet developed its industry-leading financial technology platform to source, evaluate, negotiate, structure, and monitor investment opportunities from experienced commercial real estate sponsors and offer them to qualified investors through its online marketplace that provides a streamlined service and digital experience. CrowdStreet’s growing team of experienced professionals currently consists of over 200 employees, most of which are dedicated to capital markets, due diligence, portfolio management and fund management, investor relations, technology and transaction management.

The CrowdStreet Marketplace

CrowdStreet’s award-winning marketplace (the “Marketplace”) is one of the largest online real estate investing platforms in the U.S. and was named Best Overall Real Estate CrowdFunding Site by Investopedia for 2021 and 2022. CrowdStreet makes its screened menu of real estate opportunities easily accessible to its investor community through its Marketplace. With tens of thousands of individual investor members, CrowdStreet has invested over $2.9bn in equity for projects with a total capitalization of over $24bn. These investments have been made across more than 590 commercial real estate opportunities sponsored and managed by over 280 experienced, institutional real estate operators and developers. Projects to date have included new developments, value-add capital improvement projects, stabilized properties, and special situations in growing cities across the U.S.

The Investment Manager

CrowdStreet provides investment advice and premium investment services, including a separately managed account service (“Privately Managed Accounts” or “PMA”) and investment funds through CrowdStreet Advisors, LLC (the “Investment Manager”), a wholly owned subsidiary of CrowdStreet and a registered investment advisor. As of January 31, 2022, the Investment Manager had assets under management of approximately $300 million across PMA and 20 private investment funds.