11827321P90DP90DP90D659296441143901900016510522022FYP3YP3YP7YP3YP7Yfalse65320124P90DP90DP90DP90DP90DP90DP90DP90DP90DP90DP90D0.00501.000001651052us-gaap:CommonClassBMember2022-08-012022-08-310001651052us-gaap:CommonClassBMember2022-05-012022-05-310001651052us-gaap:CommonClassAMember2022-11-012022-11-300001651052us-gaap:CommonClassAMember2022-08-012022-08-310001651052us-gaap:CommonClassAMember2022-05-012022-05-310001651052us-gaap:CommonClassAMember2022-03-012022-03-310001651052us-gaap:CommonClassBMember2022-11-012022-11-300001651052us-gaap:CommonClassBMember2022-04-012022-04-300001651052us-gaap:CommonClassBMember2022-02-012022-02-280001651052us-gaap:RetainedEarningsMember2022-12-310001651052us-gaap:ParentMember2022-12-310001651052us-gaap:NoncontrollingInterestMember2022-12-310001651052us-gaap:AdditionalPaidInCapitalMember2022-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001651052us-gaap:RetainedEarningsMember2021-12-310001651052us-gaap:ParentMember2021-12-310001651052us-gaap:NoncontrollingInterestMember2021-12-310001651052us-gaap:AdditionalPaidInCapitalMember2021-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001651052us-gaap:RetainedEarningsMember2020-12-310001651052us-gaap:ParentMember2020-12-310001651052us-gaap:NoncontrollingInterestMember2020-12-310001651052us-gaap:AdditionalPaidInCapitalMember2020-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001651052us-gaap:RetainedEarningsMember2019-12-310001651052us-gaap:ParentMember2019-12-310001651052us-gaap:NoncontrollingInterestMember2019-12-310001651052us-gaap:AdditionalPaidInCapitalMember2019-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001651052focs:SharePriceUseIsEqualToOrLessThan33.00Memberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-310001651052focs:SharePriceUseIs110.00Memberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2022-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2021-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2020-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2019-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2022-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2021-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2021-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2020-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2020-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2019-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2021-01-012021-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2020-01-012020-12-310001651052focs:MarketConditionBasedAwardsMemberus-gaap:CommonClassAMember2018-07-012018-07-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2022-01-012022-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2021-01-012021-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2020-01-012020-12-310001651052srt:MaximumMemberus-gaap:EmployeeStockOptionMemberfocs:OmnibusIncentivePlan2018Memberus-gaap:CommonClassAMember2018-07-300001651052focs:IncentiveUnitsMemberfocs:HurdleRate9.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate7.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate6.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate58.50Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate5.50Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate44.71Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate43.50Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate43.07Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate37.59Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate36.64Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate33.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate30.48Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate28.50Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate27.90Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate27.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate26.26Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate23.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate22.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate21.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate19.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate17.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate16.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate14.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate13.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate12.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate11.00Member2022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate1.42Member2022-12-310001651052focs:TimeBasedIncentiveUnitsMember2021-01-012021-12-310001651052focs:TimeBasedAwardsMember2021-01-012021-12-310001651052focs:TimeBasedIncentiveUnitsMember2020-01-012020-12-310001651052focs:TimeBasedAwardsMember2020-01-012020-12-310001651052focs:ThirdAnniversaryOfCompanySIpoScenarioTwoMember2021-07-310001651052focs:ThirdAnniversaryOfCompanySIpoScenarioOneMember2021-07-310001651052focs:IndividualsOtherThanCertainOfficersMemberfocs:IncentiveUnitsMember2021-02-280001651052focs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-02-280001651052focs:ThirdAnniversaryOfCompanySIpoScenarioTwoMember2021-07-012021-07-310001651052focs:ThirdAnniversaryOfCompanySIpoScenarioOneMember2021-07-012021-07-310001651052focs:SharePriceUseIsEqualToOrLessThan33.00Memberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:SharePriceUseIs110.00Memberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasLessThan42Member2021-02-012021-02-280001651052focs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasBetweenThan42And63Member2021-02-012021-02-280001651052focs:TimeBasedAwardsMember2022-01-012022-12-310001651052focs:FocusLLCRestrictedCommonUnitsMember2022-01-012022-12-310001651052us-gaap:NonUsMember2022-01-012022-12-310001651052focs:WealthManagementServicesMember2022-01-012022-12-310001651052focs:OtherServicesMember2022-01-012022-12-310001651052country:US2022-01-012022-12-310001651052us-gaap:NonUsMember2021-01-012021-12-310001651052focs:WealthManagementServicesMember2021-01-012021-12-310001651052focs:OtherServicesMember2021-01-012021-12-310001651052country:US2021-01-012021-12-310001651052us-gaap:NonUsMember2020-01-012020-12-310001651052focs:WealthManagementServicesMember2020-01-012020-12-310001651052focs:OtherServicesMember2020-01-012020-12-310001651052country:US2020-01-012020-12-310001651052srt:ChiefExecutiveOfficerMember2022-01-012022-12-310001651052srt:ChiefExecutiveOfficerMember2021-01-012021-12-310001651052srt:ChiefExecutiveOfficerMember2020-01-012020-12-310001651052srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001651052srt:MinimumMemberus-gaap:EquipmentMember2022-01-012022-12-310001651052srt:MinimumMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310001651052srt:MinimumMemberus-gaap:ContractBasedIntangibleAssetsMember2022-01-012022-12-310001651052srt:MinimumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310001651052srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001651052srt:MaximumMemberus-gaap:EquipmentMember2022-01-012022-12-310001651052srt:MaximumMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310001651052srt:MaximumMemberus-gaap:ContractBasedIntangibleAssetsMember2022-01-012022-12-310001651052srt:MaximumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310001651052us-gaap:LeaseholdsAndLeaseholdImprovementsMember2022-12-310001651052us-gaap:FurnitureAndFixturesMember2022-12-310001651052focs:ComputersSoftwareDevelopmentAndEquipmentMember2022-12-310001651052us-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-12-310001651052us-gaap:FurnitureAndFixturesMember2021-12-310001651052focs:ComputersSoftwareDevelopmentAndEquipmentMember2021-12-310001651052us-gaap:RetainedEarningsMember2022-01-012022-12-310001651052us-gaap:RetainedEarningsMember2021-01-012021-12-310001651052us-gaap:RetainedEarningsMember2020-01-012020-12-310001651052focs:WealthManagementBusinessMemberus-gaap:SubsequentEventMember2023-01-012023-02-160001651052focs:FirstLienTermLoanTrancheMember2021-01-012021-07-310001651052focs:CertainHoldersOfClassCommonStockAndClassBCommonStockMemberfocs:FirstLienTermLoanMember2022-01-012022-12-310001651052focs:FirstLienRevolvingCreditFacilityMember2022-01-012022-12-310001651052focs:CertainHoldersOfClassCommonStockAndClassBCommonStockMemberfocs:FirstLienTermLoanMember2021-01-012021-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001651052us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001651052focs:FirstLienRevolvingCreditFacilityMember2022-11-012022-11-300001651052focs:FirstLienRevolverStepDownTwoMember2022-11-012022-11-300001651052focs:FirstLienRevolverStepDownOneMember2022-11-012022-11-300001651052focs:FirstLienTermLoanBTrancheBMember2022-11-012022-11-300001651052focs:FirstLienRevolvingCreditFacilityMember2022-11-300001651052us-gaap:StandbyLettersOfCreditMember2022-01-012022-12-310001651052us-gaap:StandbyLettersOfCreditMember2021-01-012021-12-310001651052us-gaap:StandbyLettersOfCreditMember2022-12-310001651052us-gaap:StandbyLettersOfCreditMember2021-12-310001651052focs:PrepaidExpensesAndOtherAssetsMemberus-gaap:InterestRateSwapMember2022-12-310001651052focs:ContingentConsiderationAndOtherLiabilitiesMemberus-gaap:InterestRateSwapMember2021-12-310001651052focs:FirstLienTermLoanBAndFirstLienTermLoanMember2022-01-012022-12-310001651052us-gaap:OtherIntangibleAssetsMember2022-12-310001651052us-gaap:CustomerRelationshipsMember2022-12-310001651052us-gaap:ContractBasedIntangibleAssetsMember2022-12-310001651052us-gaap:OtherIntangibleAssetsMember2021-12-310001651052us-gaap:CustomerRelationshipsMember2021-12-310001651052us-gaap:ContractBasedIntangibleAssetsMember2021-12-310001651052focs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-310001651052focs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-310001651052us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-02-280001651052us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001651052us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001651052focs:RestrictedCommonUnitsMember2022-01-012022-12-310001651052us-gaap:RestrictedStockUnitsRSUMember2022-12-310001651052us-gaap:EmployeeStockOptionMember2022-12-310001651052focs:RestrictedCommonUnitsMember2022-12-310001651052us-gaap:InterestRateSwapMember2022-11-300001651052us-gaap:InterestRateSwapMember2022-12-310001651052us-gaap:InterestRateSwapMember2021-12-310001651052us-gaap:InterestRateSwapMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-12-310001651052us-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLiborSwapRateMember2021-12-310001651052focs:CompensationAndRelatedExpensesMember2022-01-012022-12-310001651052focs:CompensationAndRelatedExpensesMember2021-01-012021-12-310001651052focs:CompensationAndRelatedExpensesMember2020-01-012020-12-310001651052focs:ThenExistingFirstLienTermLoanBTrancheMember2022-11-300001651052focs:FirstLienTermLoanBTrancheMember2021-12-310001651052focs:FirstLienTermLoanBTrancheBMember2021-12-310001651052focs:FirstLienRevolvingCreditFacilityMember2021-12-310001651052focs:FirstLienTermLoanTrancheMemberus-gaap:FairValueInputsLevel2Member2022-12-310001651052focs:FirstLienTermLoanTrancheBMemberus-gaap:FairValueInputsLevel2Member2022-12-310001651052focs:FirstLienTermLoanTrancheMemberus-gaap:FairValueInputsLevel2Member2021-12-310001651052focs:FirstLienTermLoanTrancheBMemberus-gaap:FairValueInputsLevel2Member2021-12-310001651052focs:FirstLienTermLoanBTrancheMember2022-12-310001651052focs:FirstLienTermLoanBTrancheBMember2022-12-310001651052focs:FirstLienTermLoanBMember2022-12-310001651052focs:FirstLienRevolvingCreditFacilityMember2022-12-310001651052focs:FirstsLienTermLoanMember2022-11-300001651052focs:FirstLienTermLoanBTrancheMember2022-11-300001651052focs:FirstsLienTermLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstsLienTermLoanMemberus-gaap:BaseRateMember2022-11-012022-11-300001651052focs:FirstLienTermLoanBTrancheMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstLienTermLoanBTrancheMemberus-gaap:BaseRateMember2022-11-012022-11-300001651052focs:FirstLienTermLoanBTrancheBMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstLienTermLoanBTrancheBMemberus-gaap:BaseRateMember2022-11-012022-11-300001651052focs:FirstLienRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstLienRevolverStepDownTwoMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstLienRevolverStepDownTwoMemberus-gaap:BaseRateMember2022-11-012022-11-300001651052focs:FirstLienRevolverStepDownOneMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-012022-11-300001651052focs:FirstLienRevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-10-012022-12-310001651052focs:FirstLienRevolverStepDownOneMemberus-gaap:BaseRateMember2022-10-012022-10-310001651052us-gaap:MemberUnitsMember2022-12-310001651052us-gaap:CommonClassBMember2021-12-310001651052us-gaap:CommonClassAMember2021-12-3100016510522019-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:CustomerRelationshipsMember2022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:CustomerRelationshipsMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:CustomerRelationshipsMember2020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2020-12-310001651052srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMember2022-12-310001651052srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMember2022-12-310001651052srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMember2021-12-310001651052srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMember2021-12-310001651052us-gaap:FairValueInputsLevel3Member2022-12-310001651052us-gaap:FairValueInputsLevel3Member2021-12-310001651052focs:FocusFinancialPartnersLLCMemberus-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberus-gaap:CommonClassAMember2021-01-012021-12-310001651052focs:FocusFinancialPartnersLLCMemberus-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-12-310001651052us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2022-12-310001651052us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2021-12-310001651052focs:FirstsLienTermLoanMember2022-12-012022-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2022-01-012022-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2021-01-012021-12-310001651052us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-01-012021-12-310001651052us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2020-01-012020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:CustomerRelationshipsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMemberus-gaap:ContractBasedIntangibleAssetsMember2020-01-012020-12-310001651052focs:CertainHoldersOfClassCommonStockAndClassBCommonStockMember2021-01-012021-12-310001651052us-gaap:CommonClassBMember2022-03-012022-03-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-01-012020-12-310001651052us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIsEqualToOrLessThan33.00Memberfocs:MarketBasedStockOptionsMember2022-01-012022-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIs110Memberfocs:MarketBasedStockOptionsMember2022-01-012022-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIsEqualToOrLessThan33.00Memberfocs:MarketBasedStockOptionsMember2021-01-012021-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIs110Memberfocs:MarketBasedStockOptionsMember2021-01-012021-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIsEqualToOrLessThan33.00Memberfocs:MarketBasedStockOptionsMember2020-01-012020-12-310001651052focs:ShareBasedCompensationArrangementSharePriceUsedInChangeOfControlTransactionIs110Memberfocs:MarketBasedStockOptionsMember2020-01-012020-12-310001651052focs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:MarketBasedStockOptionsMember2022-01-012022-12-310001651052focs:MarketBasedStockOptionsMember2021-01-012021-12-310001651052focs:MarketBasedStockOptionsMember2020-01-012020-12-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs80OrLessMemberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs80OrLessMemberfocs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs110OrMoreMemberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs110OrMoreMemberfocs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs80OrLessMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2022-01-012022-12-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs110OrMoreMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2022-01-012022-12-310001651052srt:MinimumMemberfocs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasBetweenThan42And63Member2021-02-012021-02-280001651052srt:MaximumMemberfocs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasBetweenThan42And63Member2021-02-012021-02-280001651052srt:MinimumMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasBetweenThan42And63Member2021-02-012021-02-280001651052srt:MaximumMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasBetweenThan42And63Member2021-02-012021-02-280001651052focs:IncentiveUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasGreaterThan63Member2021-02-012021-02-280001651052us-gaap:ShareBasedPaymentArrangementNonemployeeMemberfocs:ShareBasedPaymentArrangementVestingConditionsIfWeightedAveragePricePerShareWasLessThan42Member2021-02-012021-02-280001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs80OrLessMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2021-01-012021-12-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs110OrMoreMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2021-01-012021-12-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs80OrLessMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2020-01-012020-12-310001651052focs:ShareBasedCompensationArrangementHighest90DayVwapIs110OrMoreMemberfocs:MarketBasedStockOptionsMemberus-gaap:IPOMember2020-01-012020-12-310001651052focs:MarketConditionBasedAwardsMember2018-07-012018-07-310001651052us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-02-012021-02-280001651052focs:IncentiveUnitsMember2020-01-012020-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate9.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate7.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate6.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate58.50Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate5.50Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate44.71Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate43.50Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate43.07Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate37.59Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate36.64Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate33.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate30.48Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate28.50Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate27.90Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate27.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate26.26Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate23.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate22.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate21.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate19.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate17.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate16.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate14.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate13.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate12.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate11.00Member2022-01-012022-12-310001651052focs:IncentiveUnitsMemberfocs:HurdleRate1.42Member2022-01-012022-12-310001651052focs:IncentiveUnitsMember2019-12-310001651052focs:IncentiveUnitsMember2022-12-310001651052focs:IncentiveUnitsMember2021-12-310001651052focs:IncentiveUnitsMember2020-12-310001651052focs:IncentiveUnitsMember2021-01-012021-12-310001651052focs:TimeBasedIncentiveUnitsMember2022-01-012022-12-310001651052focs:IncentiveUnitsMember2022-01-012022-12-310001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingDateOfVestingMemberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingDateOfVestingMemberfocs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ZeroToSixtyDaysFromClosingDateMemberfocs:FirstsLienTermLoanMember2022-11-012022-11-300001651052focs:SixtyOneDaysToOneHundredTwentyDaysFromClosingDateMemberfocs:FirstsLienTermLoanMember2022-11-012022-11-300001651052focs:AfterOneHundredTwentyOneDaysOfClosingDateMemberfocs:FirstsLienTermLoanMember2022-11-012022-11-300001651052srt:MaximumMemberus-gaap:EmployeeStockOptionMemberfocs:OmnibusIncentivePlan2018Memberus-gaap:CommonClassAMember2018-07-302018-07-3000016510522023-02-012023-02-280001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2022-12-310001651052us-gaap:CommonClassBMember2022-12-310001651052us-gaap:CommonClassAMember2022-12-3100016510522020-03-3100016510522018-07-310001651052focs:FirstLienTermLoanBTrancheMember2022-11-012022-11-300001651052us-gaap:CommonClassAMember2022-01-012022-12-310001651052us-gaap:CommonClassAMember2021-01-012021-12-310001651052us-gaap:CommonClassAMember2020-01-012020-12-310001651052focs:MarketBasedIncentiveUnitsMember2018-07-012018-07-310001651052us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-01-012020-12-310001651052srt:MaximumMemberus-gaap:LineOfCreditMember2022-01-012022-12-3100016510522020-12-310001651052focs:InterestRateSwapTwoMember2022-11-300001651052focs:InterestRateSwapThreeMember2022-11-300001651052focs:InterestRateSwapOneMember2022-11-300001651052focs:InterestRateSwapTwoMember2022-12-310001651052focs:InterestRateSwapThreeMember2022-12-310001651052focs:InterestRateSwapOneMember2022-12-310001651052us-gaap:InterestRateSwapMemberus-gaap:LondonInterbankOfferedRateLiborSwapRateMember2022-11-300001651052focs:FirstsLienTermLoanMember2022-12-310001651052focs:FirstsLienTermLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-300001651052focs:FirstLienTermLoanBTrancheMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-300001651052focs:FirstLienTermLoanBTrancheBMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-11-300001651052focs:FirstsLienTermLoanMember2022-11-012022-11-300001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingSecondAnniversaryOfDateOfVestingInJuly2026Memberfocs:MarketConditionBasedAwardsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingSecondAnniversaryOfDateOfVestingInJuly2026Memberfocs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingFirstAnniversaryOfDateOfVestingInJuly2025Memberfocs:MarketBasedIncentiveUnitsMemberus-gaap:IPOMember2022-03-012022-03-310001651052focs:ShareBasedCompensationArrangementExercisesOnAndFollowingFirstAnniversaryOfDateOfVestingInJuly2025Memberfocs:MarketConditionBasedAwardsMember2022-03-012022-03-310001651052us-gaap:LineOfCreditMember2021-01-012021-12-310001651052focs:FocusFinancialPartnersLLCMember2022-11-012022-11-300001651052focs:FocusFinancialPartnersLLCMember2022-08-012022-08-310001651052focs:FocusFinancialPartnersLLCMember2022-05-012022-05-310001651052focs:FocusFinancialPartnersLLCMember2022-03-012022-03-310001651052focs:FocusFinancialPartnersLLCMember2022-12-310001651052focs:FocusFinancialPartnersLLCMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-01-012020-12-310001651052focs:WealthManagementBusinessMemberus-gaap:SubsequentEventMember2023-02-160001651052focs:ContingentConsiderationAndOtherLiabilitiesMember2022-12-310001651052focs:ContingentConsiderationAndOtherLiabilitiesMember2021-12-310001651052srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMember2022-12-310001651052srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMember2022-12-310001651052srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMember2021-12-310001651052srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMember2021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2022-01-012022-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2021-01-012021-12-310001651052us-gaap:SeriesOfIndividuallyImmaterialAssetAcquisitionsMember2020-01-012020-12-310001651052focs:ManagementAgreementMember2022-01-012022-12-3100016510522022-12-3100016510522021-12-310001651052us-gaap:ParentMember2022-01-012022-12-310001651052us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001651052us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001651052us-gaap:ParentMember2021-01-012021-12-310001651052us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001651052us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001651052us-gaap:ParentMember2020-01-012020-12-310001651052us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001651052us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-3100016510522020-01-012020-12-3100016510522021-01-012021-12-310001651052us-gaap:LineOfCreditMember2022-01-012022-12-3100016510522022-06-300001651052us-gaap:CommonClassBMember2023-02-130001651052us-gaap:CommonClassAMember2023-02-1300016510522022-01-012022-12-31xbrli:sharesiso4217:USDxbrli:pureiso4217:USDxbrli:sharesfocs:itemfocs:agreementfocs:Votefocs:segment

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 001-38604

Focus Financial Partners Inc.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 47-4780811 |

(State or Other Jurisdiction

of Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

| |

875 Third Avenue, 28th Floor

New York, NY | 10022 |

(Address of Principal Executive Offices) | (Zip Code) |

(646) 519-2456

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.01 per share | | FOCS | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S -T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b -2 of the Exchange Act): ☐ Yes ☒ No

The aggregate market value of the Class A common stock held by non-affiliates was $1,963,340,301 on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter.

As of February 13, 2023, the registrant had 65,935,962 shares of Class A common stock and 11,827,321 shares of Class B common stock outstanding.

Documents incorporated by reference:

The registrant’s definitive proxy statement relating to the annual meeting of shareholders (to be held May 24, 2023) will be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year ended December 31, 2022 and is incorporated by reference in Part III to the extent described herein.

FOCUS FINANCIAL PARTNERS INC.

INDEX TO FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2022

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this Annual Report on Form 10-K (this “Annual Report”) may contain forward-looking statements. Forward-looking statements give our current expectations, contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential,” “continue,” “will” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under “Part I, Item 1A, Risk Factors.” Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| ● | fluctuations in wealth management fees; |

| ● | our reliance on our partner firms and the principals who manage their businesses; |

| ● | our ability to make successful acquisitions; |

| ● | unknown liabilities of or poor performance by acquired businesses; |

| ● | our inability to facilitate smooth succession planning at our partner firms; |

| ● | our inability to compete; |

| ● | our reliance on key personnel and principals; |

| ● | our inability to attract, develop and retain talented wealth management professionals; |

| ● | our inability to retain clients following an acquisition; |

| ● | our reliance on key vendors; |

| ● | write down of goodwill and other intangible assets; |

| ● | our failure to maintain and properly safeguard an adequate technology infrastructure; |

| ● | cyber-attacks and other disruptions; |

| ● | our inability to recover from business continuity problems; |

| ● | inadequate insurance coverage; |

| ● | the termination of management agreements by management companies; |

| ● | our inability to generate sufficient cash to service all of our indebtedness or our ability to access additional capital; |

| ● | the failure of our partner firms to comply with applicable U.S. and non-U.S. regulatory requirements and the highly regulated nature of our business; |

| ● | worsening economic conditions, including inflation, in the United States or internationally; |

| ● | wars or other geopolitical conflict; |

| ● | changes to laws and regulations; |

| ● | legal proceedings, governmental inquiries; and |

| ● | other factors discussed in this Annual Report. |

All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the date of this Annual Report or as of the date as of which they are made. Except as required by applicable law, including federal securities laws, we do not intend to update or revise any forward-looking statements.

GLOSSARY

The following terms are used throughout this Annual Report:

Base Earnings. This is a percentage of the estimated operating cash flow earnings before partner compensation (i.e., Target Earnings) upon which we apply a multiple to determine acquisition prices. We retain a preferred position in Base Earnings.

Commission-based. Commission-based revenue is derived from commissions paid by clients or payments from third parties for sales of investment or insurance products.

Fee-based. Fee-based services are those for which a partner firm primarily charges a fee directly to the client for wealth management services, recordkeeping and administration services and other services rather than being primarily compensated through commissions from clients or from third parties for recommending financial products.

Fiduciary Duty. A fiduciary duty is a legal duty to act in another party’s interests, with utmost good faith, to make full and fair disclosure of all material facts and to exercise all reasonable care to avoid misleading clients.

GAAP. Accounting principles generally accepted in the United States of America.

High Net Worth. High net worth individuals are generally defined in the financial industry as those with liquid financial assets, excluding primary residence, in excess of $1 million.

Lift Out. The circumstance when a group of wealth management professionals, already working as a team, seeks to leave their current employer and join another employer or start their own registered investment advisor firm.

Open-architecture. An investment platform that grants clients access to a wide range of investment funds and products offered by third parties. By contrast, a closed architecture is an investment platform that grants clients access only to proprietary investment funds and products.

Partnership. The term we use to refer to our business and relationship with our partner firms. It is not intended to describe a particular form of legal entity or a legal relationship.

Target Earnings. The estimated operating cash flow earnings before partner compensation.

Ultra-High Net Worth. Ultra-high net worth individuals are generally defined in the financial industry as those with liquid financial assets, excluding primary residence, in excess of $30 million.

Wealth Management. Comprehensive professional services that combine investment advice, financial and tax planning, consulting, tax return preparation, family office services and other services that help clients achieve their objectives regarding accumulation, preservation and distribution of long-term wealth.

Wirehouse. Brokerage firm that provides a full range of investment, research, trading and wealth management services to clients. The term originated prior to the advent of modern wireless communications, when brokerage firms were connected to their branches primarily through telephone and telegraph wires.

PART I

Unless otherwise indicated or the context requires, all references to “we,” “us,” “our,” the “Company,” and “Focus Inc,” refer to Focus Financial Partners Inc. and its consolidated subsidiaries. “Focus LLC” refers to Focus Financial Partners, LLC, a Delaware limited liability company and a consolidated subsidiary of ours.

The term “partner firms” refers to our consolidated subsidiaries engaged in wealth management and related services, the businesses of which are typically managed by the principals. The term “principals” refers to the wealth management professionals who manage the businesses of our partner firms pursuant to the relevant management agreement. The term “our partnership” refers to our business and relationship with our partner firms and is not intended to describe a particular form of legal entity or a legal relationship.

Item 1. Business

Corporate Structure

Focus Inc. is a holding company whose most significant asset is a membership interest in Focus LLC. Focus LLC directly or indirectly owns all of the outstanding equity interests in our partner firms. Focus Inc. is the sole managing member of Focus LLC and is responsible for all operational, management and administrative decisions of Focus LLC. Subject to certain restrictions, unitholders of Focus LLC (other than Focus Inc. and any of its subsidiaries) may receive shares of our Class A common stock pursuant to the exercise of an exchange right or a call right.

Our Company

We are a leading partnership of independent, fiduciary wealth management firms operating in the highly fragmented registered investment adviser (“RIA”) industry, with a footprint of over 85 partner firms primarily in the United States. We have achieved this market leadership by positioning ourselves as the partner of choice for many firms in an industry where a number of secular trends are driving consolidation. Our partner firms primarily service ultra-high net worth and high net worth individuals and families by providing highly differentiated and comprehensive wealth management services. Our partner firms benefit from our intellectual and financial resources, operating as part of a scaled business model with aligned economic interests, while retaining their entrepreneurial culture and independence.

Our partnership is built on the following principles, which enable us to attract and retain high-quality wealth management firms and accelerate their growth:

| |

Entrepreneurship: | Maintain the entrepreneurial spirit, independence and unique culture of each partner firm. |

| |

Fiduciary Standard: | Partner with wealth management firms that are held to the fiduciary standard in serving their clients. |

| |

Alignment of Interests: | Align principals’ interests with our interests through our differentiated partnership and economic model. |

| |

Value-Add Services: | Empower our partner firms through collaboration on strategy, growth and acquisition opportunities, marketing, technology and operational expertise, access to best practices and access to cash and credit, insurance, trust and valuation solutions. Provide access to world class intellectual resources and capital to fund expansion and acquisitions. |

We were founded by entrepreneurs and began revenue-generating and acquisition activities in 2006. Since that time, we have:

| ● | created a partnership of over 85 partner firms, the substantial majority of which are RIAs registered with the Securities and Exchange Commission (the “SEC”) pursuant to the Investment Advisers Act of 1940 (the “Advisers Act”); |

| ● | built a business with revenues in excess of $2.1 billion for the year ended December 31, 2022; |

| ● | increased revenues at a compound annual growth rate of 32.3% since 2006; |

| ● | established an attractive revenue model whereby in excess of 95% of our revenues for the year ended December 31, 2022 were fee-based and recurring in nature; |

| ● | built a partnership currently comprised of over 5,800 wealth management-focused principals and employees; and |

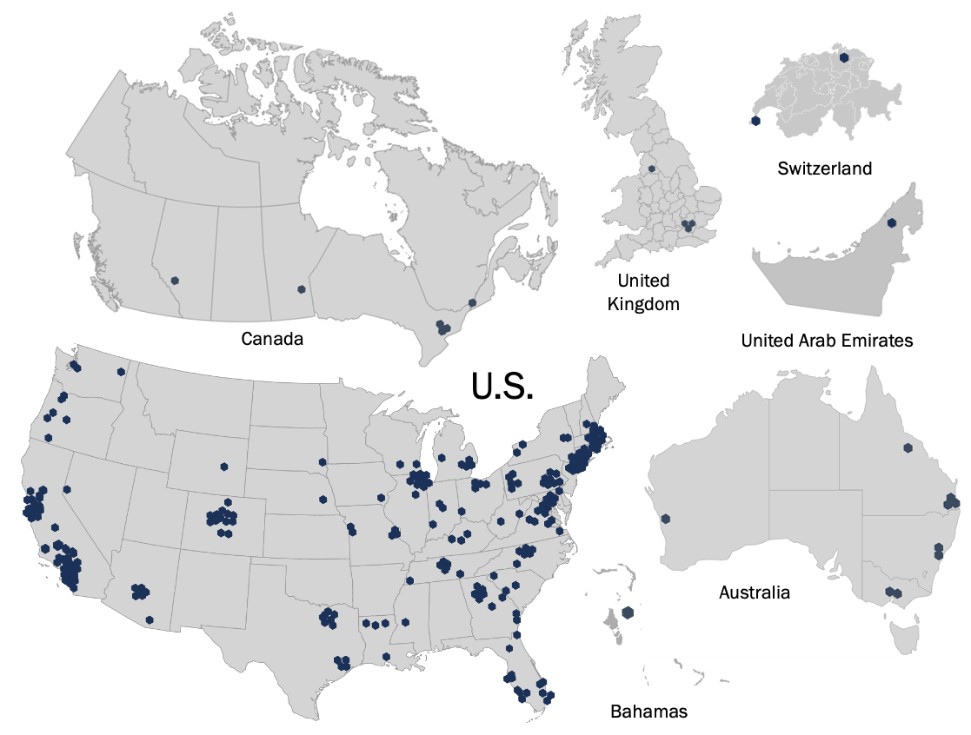

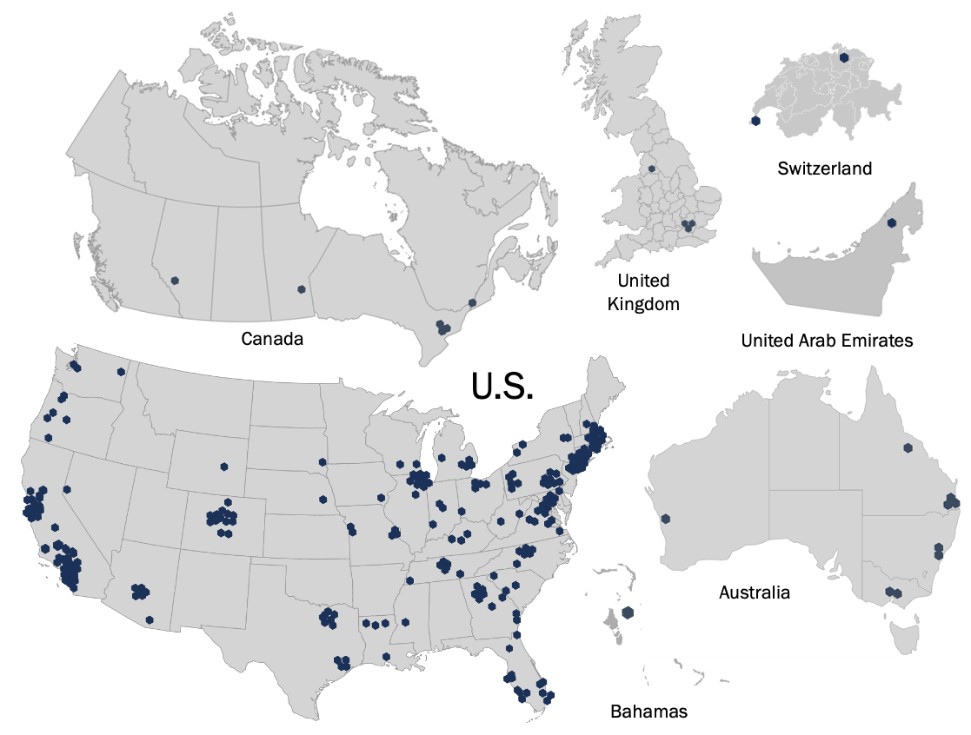

| ● | established a national footprint across the United States and an international presence with partner firms primarily in Australia, Canada, Switzerland and the United Kingdom. |

We are in the midst of a fundamental shift in the growing wealth management services industry. The delivery of wealth management services is moving from traditional brokerage, commission-based platforms to a fiduciary, open-architecture and fee-based structure. This shift has resulted in a significant transfer of client assets and wealth management professionals from traditional brokerage, commission-based platforms to independent wealth management practices. We believe that our leading partnership of independent, fiduciary wealth management firms positions us to benefit from these trends.

The independent wealth management industry, including RIAs, is highly fragmented, which we believe enables us to continue our growth strategy of acquiring high-quality independent wealth management firms, directly and through acquisitions by our partner firms. We have a track record of enhancing the competitive position of our partner firms by providing them with access to the intellectual expertise, resources and network benefits of our large organization. Our scale enables us to help our partner firms achieve operational efficiencies and ensure organizational continuity. Additionally, our scale, resources and value-added services increase our partner firms’ ability to achieve growth through a variety of tactical, operational and strategic initiatives, as well as the consummation of their own acquisitions.

Our partnership is composed of trusted professionals providing comprehensive wealth management services through a largely recurring, fee-based model, which differentiates our partner firms from the traditional brokerage platforms whose revenues are largely derived from commissions. We derive a substantial majority of our revenues from wealth management fees for investment advice, financial and tax planning, consulting, tax return preparation, family office services and other services. We also generate other revenues from recordkeeping and administration service fees, commissions and distribution fees and outsourced services.

Recent Development

On February 2, 2023, we announced that we had entered into an exclusivity agreement for a limited period with Clayton, Dubilier & Rice, LLC ("CD&R"), a private investment firm, to engage in negotiations regarding the terms and definitive agreements whereby CD&R may potentially acquire us for $53 per share in cash. A Special Committee of our Board of Directors approved the exclusivity agreement.

Funds managed by Stone Point Capital LLC (together with its affiliates, “Stone Point”) are considering retaining a portion of their investment in us and providing new equity financing as part of the proposed transaction, subject to negotiation with CD&R of definitive agreements on mutually agreeable terms.

Negotiations regarding definitive terms and agreements are ongoing and there is no certainty that final terms of any transaction will be agreed upon or, if agreed upon, completed. Any transaction would be subject to the completion of due diligence, Board and stockholder approval, regulatory approvals and other customary conditions. We will cease to be a publicly traded company if such a transaction is consummated.

See also Part I, Item 1A. Risk Factors – Risk Related to Possible Transaction.

Our Growth Strategy

We believe we are well-positioned to take advantage of favorable trends in the wealth management industry, including the migration of wealth management professionals from traditional brokerage, commission-based platforms to a fiduciary, open-architecture and fee-based structure. We plan to grow our business through the growth of our existing partner firms and the expansion of our partnership.

Growth of Our Existing Partner Firms

High-Quality, Growth-Oriented Partner Firms

Our goal has been and continues to be to acquire high-quality, entrepreneurial wealth management firms that have built their businesses through a proven track record of growth. We believe that our partner firms will continue to take advantage of the shift in client assets to the RIA space and grow organically through acquisitions of wealth management practices and customer relationships, by attracting new clients, adding new wealth management professionals, increasing client assets from existing clients and through financial market appreciation over time. The economic arrangements put in place at the time of acquisition through our management agreements incentivize the principals of our partner firms to continue executing on their growth plans.

Value-Added Services

We have a team of over 100 professionals who support our partner firms by providing value added services, including marketing and business development support; human resources support, including adviser coaching and development and structuring compensation and incentive models, career path planning and succession planning advice, recruiting and talent management, operational and technology expertise, cash and credit solutions, trust services, insurance solutions, valuation solutions, legal and regulatory support and providing negotiating leverage with vendors. Our value added services also include access to our M&A expertise, which facilitates acquisition opportunities for our partner firms through a proactive outreach program, structuring, executing and funding transactions and providing guidance to partner firms to facilitate their integration into our partnership as well as integration of mergers they execute. We assign a relationship leader to each partner firm who is responsible for coordinating our value added services to assist that partner firm in accelerating its growth. Our partner firms also have access to our intellectual expertise and partner firm network, which ultimately enhance their operations, enabling them to better serve their clients.

Some of our key value-added services are described in detail below.

Marketing and Business Development. We offer marketing and business development coaching to our partner firms on topics including referral programs, revenue enhancement measures, communications, website and social media, brand strategy and public relations support. Our marketing team works closely with each of our partner firms to understand their unique value proposition and help them better market themselves to their clients and their centers of influence, including accounting and law firms who serve as potential referral sources. To further support our partner firms, we hold a minority investment in Financial Insight Technology, Inc. (known as SmartAsset), a New York-based fintech company that connects prospective clients with financial advisers and provides tools to help individuals make more informed financial decisions.

Talent Management. We support the mentoring of next generation talent at each of our partner firms through continuous coaching programs that we organize and execute. These programs emphasize key learnings gained from observing top talent across our organization, allowing our firms to benefit from best practices across our talent pool. We also help our partner firms recruit new talent, helping them to grow and enhance their businesses through the addition of experienced advisors and other professionals.

Compensation Structures and Succession Planning. We help our partner firms align their compensation models to further incentivize their teams. We also facilitate wealth management professional career path planning and advise on

principal promotions to the respective management company. These services allow our partner firms to attract and retain the highest quality wealth management professionals. Our acquisition structure facilitates succession planning by maintaining the partner firm and management company as separate entities, thereby allowing for the principals owning the management company to transition over time without disrupting client relationships at the partner firm.

Operations and Technology. We assist partner firms in selecting and implementing third-party technology solutions that strengthen each firm’s operational performance. Our partner firms can request that our operations team conduct detailed operational assessments to determine their staffing and operating efficiency. Additionally, our operations team provides partner firms negotiating leverage with vendors and cost-efficient access to third-party technology.

Cash and Credit Solutions. Through Focus Treasury & Credit Solutions we have created a network of third-party banks and non-bank lenders to provide a competitive array of cash and credit solutions. These alternatives enable our partner firms to proactively help their clients achieve higher yields on cash, as well as unlock home equity and business opportunities through refinancing, commercial lending and other options.

Insurance Solutions. Through Focus Risk Solutions we have created a network of third-party insurance brokers who can facilitate a competitive array of insurance solutions through their relationships with established insurance carriers. These solutions enable our partner firms to proactively help their clients with risk management in various lines of insurance, including life, health, and property and casualty.

Trust Services. Through Focus Fiduciary Solutions we have created a network of third-party advisor-coordinated, independent trustees who have the scale and expertise to meet the diverse needs of our partners firms’ clients and can do so at highly competitive pricing. We work on a consultative basis with our partners to help them explore and develop service offerings for their clients.

Valuation Services. Through Focus Valuation Solutions, we have created a network of third-party valuation firms that can help clients value a wide variety of business interests and financial assets. Valuation solutions are important for ultra-high net worth and high net worth individuals with unique and hard to value assets, such as closely held businesses, real estate and life insurance.

Legal and Regulatory Support. We have an experienced team of legal professionals in place to help support our partner firms in fulfilling their regulatory responsibilities by providing subject matter guidance and expertise. We also assist our partner firms in negotiating and drafting acquisition and other agreements. We also have relationships with numerous high quality law firms and compliance consultants that can assist our partner firms create, implement and maintain a robust compliance environment.

Sharing of Best Practices / Collaboration with Other Partner Firms. Our partner firms have access to networking opportunities, best practices roundtable discussions and training seminars. We offer offsite and virtual meetings, seminars and other forums for partner firms to learn and adopt best practices. We host partners meetings where wealth management professionals from our partner firms have opportunities to collaborate and share ideas. In addition, we host periodic summits for chief investment officers, chief compliance officers, chief operating officers, chief financial officers and chief marketing officers, where our partner firms can share specialized expertise and business development practices. Our partner firms are also encouraged to share best practices regularly in order to enhance their collective ability to better serve their clients.

Expansion of Our Partnership

Our Acquisition Models

We are a source of permanent capital and buy substantially all of the assets or equity of the firms we acquire. We utilize three models for acquisitions: (1) direct acquisitions of wealth management practices who become partner firms of Focus but operate on an autonomous basis, (2) acquisitions of wealth management practices and customer relationships on behalf of our partner firms to accelerate the growth of their businesses, and (3) acquisitions of wealth

management practices on behalf of Connectus Wealth Advisers (“Connectus”), one of our partner firms. Firms that join Connectus manage their client relationships and retain their brand identity post-acquisition, but rely on a shared infrastructure and other services provided by Connectus.

Acquisitions of New Partner Firms

Since inception, a fundamental aspect of our growth strategy has been the acquisition of high-quality, independent wealth management firms to expand our partnership. We believe that there are approximately 1,000 firms in the United States that are high-quality targets for future acquisitions. While most of our acquisitions have taken place in the United States, we also see opportunities in several countries where market and regulatory trends toward the fiduciary standard and open-architecture access mirror those occurring in the United States. We have already begun expansion primarily into Australia, Canada, Switzerland and the United Kingdom.

Our unique value proposition, differentiated partnership model and track record have allowed us to grow and enhance our leadership position in the independent wealth management industry.

We are highly selective in choosing our partner firms and conduct extensive financial, legal, regulatory, tax, operational and business due diligence. We evaluate a variety of criteria including the quality of the wealth management professionals, client characteristics, historical revenues and cash flows, the recurring nature of the revenues, compliance policies and procedures and the alignment of interests between the wealth management professionals and their clients. We focus on firms with owners who are committed to the long-term management and growth of their businesses.

Our partner firm acquisitions have been structured as acquisitions of substantially all of the assets or equity of the firm we chose to partner with but only a portion of the underlying economics in order to align the principals’ interests with our own objectives. To determine the acquisition price, we first estimate the operating cash flow of the business based on current and projected levels of revenue and expense, before compensation and benefits to the selling principals or other individuals who become principals. We refer to the operating cash flow of the business as Earnings Before Partner Compensation (“EBPC”), and to this EBPC estimate as Target Earnings (“Target Earnings”). In economic terms, we typically purchase 40% to 60% of the partner firm’s EBPC. The purchase price is a multiple of the corresponding percentage of Target Earnings and may consist of cash or a combination of cash and equity, and the right to receive contingent consideration. We refer to the corresponding percentage of Target Earnings on which we base the purchase price as Base Earnings (“Base Earnings”). Under a management agreement between our operating subsidiary and the management company and the principals, the management company is entitled to management fees typically consisting of all future EBPC of the acquired wealth management firm in excess of Base Earnings up to Target Earnings, plus a percentage of any EBPC in excess of Target Earnings. Through the management agreement, we create downside earnings protection for ourselves by retaining a preferred position in Base Earnings.

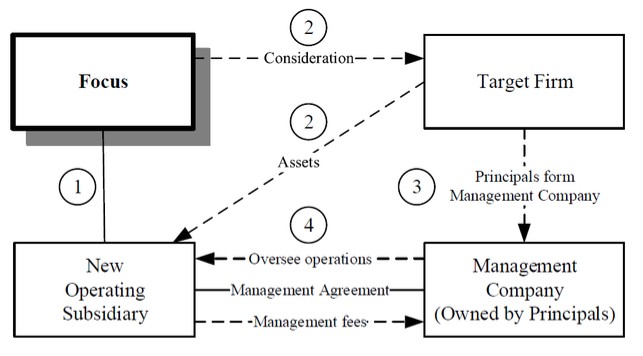

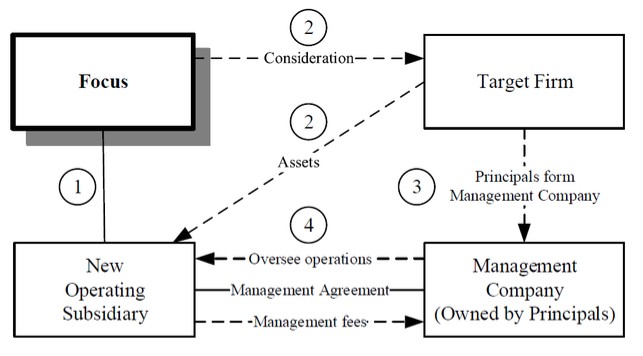

Since 2006, when we began revenue-generating and acquisition activities, we have grown to a partnership with over 85 partner firms. Acquisitions of partner firms to date have been structured as illustrated below, with limited exceptions. Subsidiary mergers at the partner firm level and acquisitions in foreign jurisdictions have been structured differently, and we expect some differences in the future depending on legal and tax considerations.

| (1) | Focus LLC forms a wholly owned subsidiary. |

| (2) | In exchange for cash or a combination of cash and equity and the right to receive contingent consideration, the new operating subsidiary acquires substantially all of the assets or equity of the target firm, which is owned by the selling principals, and becomes the new operating subsidiary of Focus. |

| (3) | The selling principals form a management company. In addition to the selling principals, the management company may include non-selling principals who become newly admitted in connection with the acquisition or thereafter. |

| (4) | The new operating subsidiary, the principals and the management company enter into a management agreement which typically has an initial term of six years subject to automatic renewals for consecutive one-year terms, unless earlier terminated by either the management company or us in certain limited situations. Under the management agreement, the management company is entitled to management fees typically consisting of all future EBPC of the new operating subsidiary in excess of Base Earnings up to Target Earnings, plus a percentage of any EBPC in excess of Target Earnings. Pursuant to the management agreement, the management company provides the personnel who lead the day-to-day operations of the new operating subsidiary. Through the management agreement, we create downside protection for ourselves by retaining a preferred position in each partner firm’s Base Earnings. |

In connection with a typical acquisition, we enter into an acquisition agreement with the target firm and its selling principals pursuant to which we purchase substantially all of the assets or equity of the target firm. The purchase price is a multiple of Base Earnings, which is a percentage of Target Earnings. The purchase price is comprised of a base purchase price and a right to receive contingent consideration in the form of earn out payments. The contingent consideration for acquisitions of new partner firms is generally paid over a six-year period upon the satisfaction of specified growth thresholds in years three and six. These growth thresholds are typically tied to the compound annual growth rate (“CAGR”) of the partner firm’s earnings. Such growth thresholds can be set annually or for different time frames as well, for example, annually over a six-year period. The contingent consideration for acquisitions made by our partner firms is paid upon the satisfaction of specified financial thresholds. These thresholds are typically tied to revenue as adjusted for certain criteria or other operating metrics, based on the retention or growth of the business acquired. These arrangements may result in the payment of additional purchase price consideration to the sellers for periods

following the closing of an acquisition. Contingent consideration payments are typically payable in cash and, in some cases, equity.

The acquisition agreements contain customary representations and warranties of the parties, and closing is generally conditioned on the delivery of certain ancillary documents, including an executed management agreement, a confidentiality and non-solicitation agreement, a non-competition agreement and, when required, confirmation that clients have consented at agreed-upon levels to the assignment of their advisory agreements to our subsidiary.

In connection with the acquisition, management companies and selling principals agree to non-competition and non-solicitation provisions of the management agreement, as well as standalone non-competition and non-solicitation agreements required by the acquisition agreement. Such non-competition and non-solicitation agreements typically have five-year terms. The non-competition and non-solicitation provisions of the management agreement continue during the term of the management agreement and for a period of two years thereafter.

Our partner firms are primarily overseen by the principals who own the management company formed concurrently with the acquisition. Our operating subsidiary, the management company and the principals enter into a long-term management agreement pursuant to which the management company provides the personnel responsible for overseeing the day-to-day operations of the partner firm. The term of the management agreement is generally six years subject to automatic renewals for consecutive one-year terms, unless earlier terminated by either the management company or us in certain limited situations. Subject to applicable cure periods, we may terminate the management agreement upon the occurrence of an event of cause, which may include willful misconduct by the management company or any principal that is reasonably likely to result in a material adverse effect, the failure of the management company to comply with regulatory or other governmental compliance procedures or a material breach of the agreement by the management company or the principals. In some cases, we may have the right to terminate the agreement if any principal ceases to be involved on a full-time basis in the management of the management company or the performance of services under the agreement. Generally, the management company may terminate the management agreement upon a material breach of the agreement by us and the expiration of the applicable cure period.

This ownership and management structure allows the principals to maintain their entrepreneurial spirit through autonomous day-to-day decision making, while gaining access to our extensive resources and preserving the principals’ long-term economic incentive to continue to grow the business. The management company structure provides both flexibility to us and stability to our partner firms by permitting the principals to continue to build equity value in the management company as the partner firm grows and to control their internal economics and succession plans within the management company.

The following table provides an illustrative example of our economics, including management fees earned by the management company, for periods of projected revenues, +10% growth in revenues and −10% growth in revenues. This example assumes (i) Target Earnings of $3.0 million; (ii) Base Earnings acquired of 60% of Target Earnings or $1.8 million; and (iii) a percentage of earnings in excess of Target Earnings retained by the management company of 40%.

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | Projected | | +10% Growth | | −10% Growth | |

| | | Revenues | | in Revenues | | in Revenues | |

|

| | | (in thousands) | |

| New Partner Firm | | | | | | | | | | |

| New partner firm revenues | | $ | 5,000 | | $ | 5,500 | | $ | 4,500 | |

| Less: | | | | | | | | | | |

| Operating expenses (excluding management fees) | | | (2,000) | | | (2,000) | | | (2,000) | |

| EBPC | | $ | 3,000 | | $ | 3,500 | | $ | 2,500 | |

| Base Earnings to Focus Inc. (60%) | | | 1,800 | | | 1,800 | | | 1,800 | |

| Management fees to management company (40%) | | | 1,200 | | | 1,200 | | | 700 | |

| EBPC in excess of Target Earnings: | | | | | | | | | | |

| To Focus Inc. (60%) | | | — | | | 300 | | | — | |

| To management company as management fees (40%) | | | — | | | 200 | | | — | |

| Focus Inc. | | | | | | | | | | |

| Focus Inc. revenues | | $ | 5,000 | | $ | 5,500 | | $ | 4,500 | |

| Less: | | | | | | | | | | |

| Operating expenses (excluding management fees) | | | (2,000) | | | (2,000) | | | (2,000) | |

| Less: | | | | | | | | | | |

| Management fees to management company | | | (1,200) | | | (1,400) | | | (700) | |

| Operating income | | $ | 1,800 | | $ | 2,100 | | $ | 1,800 | |

| | | | | | | | | | | |

In certain circumstances, the structure of our relationship with partner firms may differ from the typical structure described above. For example, the economic structure in some non-U.S. partner firms differs from the way in which we own our U.S. partner firms. We expect some differences in the structure of our future international acquisitions as well.

Acquisitions by Our Partner Firms

We are instrumental to, and support the acquisition of, wealth management practices and customer relationships by our partner firms to further expand their businesses. Partner firms pursue acquisitions for a variety of reasons, including geographic expansion, acquisition of new talent and/or specific expertise and succession planning. Acquisitions by our partner firms allow them to add new talent and services to better support their client base while simultaneously capturing synergies from the acquired businesses. We believe there are approximately 5,000 firms in the United States that are suitable targets for our partner firms. We have an experienced team of professionals with deep industry relationships to assist in identifying potential acquisition targets for our partner firms. Through our proprietary in-house sourcing effort, we frequently identify acquisition opportunities for our partner firms. Additionally, many of our partner firms are well known in the industry and have developed extensive relationships. In recent years, principals and employees of our partner firms have identified attractive merger candidates, and we believe this trend will continue as our partner firms continue to build scale.

In addition to sourcing opportunities, we are actively involved through each stage of the process to provide legal, financial, tax, compliance and operational expertise to guide our partner firms through the acquisition due diligence process and execution. We provide the funding for acquisitions in the same manner that a parent company would typically fund acquisitions by its subsidiaries.

Our partner firms typically acquire substantially all of the assets or equity of a target firm for cash or a combination of cash and equity and the right to receive contingent consideration. In certain situations, when the acquisition involves a merger with a corporation, and the consideration includes our Class A common stock, Focus Inc. may purchase all of the equity of a target firm and then contribute the assets to our partner firm. In certain instances, our partner firms may acquire only the customer relationships. At the time a partner firm consummates an acquisition, we typically amend our management agreement with the partner firm to adjust Base Earnings and Target Earnings to reflect the projected post acquisition EBPC of the partner firm.

Our partner firms completed 18 transactions in 2020 (including 4 transactions completed by Connectus), 24 transactions in 2021 (including 8 transactions completed by Connectus) and 19 transactions in 2022 (including 1 transaction completed by Connectus). With our approval and support, our partner firms may choose to merge with each other as well. Consolidation of our existing partner firms leads to efficiencies and incremental growth in our cash flows.

Acquisitions Through Connectus

Connectus has wealth advisory subsidiaries in the United States, Australia, Canada and the United Kingdom. It was launched through a partner firm that joined us in 2007 and subsequently expanded in the United States, Australia, Canada and the United Kingdom. Connectus completed 4 transactions in 2020, 8 transactions in 2021 and 1 transaction in 2022. We expect that Connectus’ international footprint will expand further. Connectus is designed for founders and teams of wealth management practices who want to continue managing their client relationships and maintaining their boutique cultures under their own brand names, while gaining the operational efficiencies of shared infrastructure and other services provided by Connectus. Connectus offers integrated technology, investment support and centralized services, including compliance, accounting and talent management. Connectus also provides marketing capabilities to support business expansion through lead generation and organic growth programs. Through us, Connectus advisers gain a strategic growth partner with specialized capabilities. They benefit from our global scale and extensive network of partner firms, continuity planning expertise and client solutions.

In connection with a typical Connectus acquisition, we enter into an acquisition agreement with the target firm and its selling principals pursuant to which Connectus purchases substantially all of the assets or equity of the target firm for cash. Because of Connectus’ unique structure, Focus in most cases retains 100% of post-acquisition profitability and the selling principals and advisers of the target firm receive market-based compensation and growth-based economics generally based on the growth of revenues.

Lift Outs of Established Wealth Management Professionals

From time to time, partner firms hire individuals or wealth management teams from traditional brokerage firms and wirehouses, or through Focus Independence, we offer such individuals or teams the opportunity to establish their own independent wealth management firms and ultimately join our partnership as a new partner firm. If joining as a new partner firm, we typically enter into an option agreement, which provides us with the option to acquire substantially all of the assets of a new wealth management firm that such teams managed after their resignation from the brokerage firm or wirehouse approximately 12 to 13 months from such resignation date.

Our Partner Firms

Our partner firms provide comprehensive wealth management services to ultra-high net worth and high net worth individuals and families, as well as business entities, under a largely recurring, fee-based model. Our partner firms provide these services across a diverse range of investment styles, asset classes and clients. The substantial majority of our partner firms are RIAs, and certain of our partner firms also have affiliated broker-dealers and/or insurance brokers. Several of our partner firms and their principals have been recognized as leading wealth management firms and advisers by financial publications such as Barron’s, The Financial Times and Forbes.

Our partner firms derive a substantial majority of their revenues from wealth management fees, which are composed of fees earned from wealth management services, including investment advice, financial and tax planning, consulting, tax return preparation, family office services and other services. Fees are primarily based either on a

contractual percentage of the client’s assets based on the market value of the client’s assets on the predetermined billing date, a flat fee, an hourly rate based on predetermined billing rates or a combination of such fees and are billed either in advance or arrears on a monthly, quarterly or semiannual basis. In certain cases, such wealth management fees may be subject to minimum fee levels depending on the services performed. We also generate other revenue from recordkeeping and administration service fees, commissions and distribution fees and outsourced services.

We currently have over 85 partner firms. All of our partner firm acquisitions have been paid for with cash or a combination of cash and equity and the right to receive contingent consideration. We have to date, with limited exceptions, acquired substantially all of the assets or equity of the firms we choose to partner with and have assumed only post-closing contractual obligations, not any material existing liabilities.

The following is a list of our partner firms as of February 16, 2023:

| | | | | | | |

|---|

| | | | | Joined through | | Acquisition(s) |

|---|

| | | Partner | | Focus | | Completed by |

|---|

| Partner Firm | | Firm Since | | Independence | | Partner Firm |

|---|

| | | 2006 | | | | |