false0001115055NASDAQNASDAQ00011150552025-07-242025-07-240001115055us-gaap:CommonStockMember2025-07-242025-07-240001115055pnfp:DepositarySharesEachRepresentingA140thInterestInAShareOf675FixedRateNonCumulativePerpetualPreferredStockSeriesBMember2025-07-242025-07-24

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2025

|

PINNACLE FINANCIAL PARTNERS, INC.

|

|

(Exact name of registrant as specified in charter)

|

|

Tennessee

|

000-31225

|

62-1812853

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

21 Platform Way South, Suite 2300, Nashville, Tennessee 37203

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (615) 744-3700

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Exchange on which Registered

|

|

Common Stock par value $1.00

|

|

PNFP

|

|

The Nasdaq Stock Market LLC

|

|

Depositary Shares (each representing a 1/40th interest in a share of 6.75% Fixed-Rate Non-Cumulative Perpetual Preferred Stock, Series B)

|

|

PNFPP

|

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17

CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure.

|

On July 24, 2025, Pinnacle Financial Partners, Inc., a Tennessee corporation (“Pinnacle”), and Synovus Financial Corp., a Georgia corporation

(“Synovus”), issued a joint press release announcing the execution of the Agreement and Plan of Merger (the “Merger Agreement”), dated as of July 24, 2025, by and among Synovus, Pinnacle, and Steel Newco Inc. (“Newco”), a newly formed Georgia

corporation jointly owned by Pinnacle and Synovus, pursuant to which, upon the terms and subject to the conditions set forth therein, each of Pinnacle and Synovus will simultaneously merge with and into Newco (collectively, the “Merger”), with

Newco continuing as the surviving corporation in the Merger. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In connection with the announcement of the Merger Agreement, Pinnacle and Synovus intend to provide supplemental information regarding the proposed

transaction in connection with presentations to analysts and investors. A copy of the joint investor presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 7.01 of this report, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information contained in Item 7.01 of this report, including Exhibit 99.1 and Exhibit 99.2, shall not

be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before, on, or after the date hereof, regardless of any general incorporation language in such filing, unless expressly

incorporated by specific reference to such filing.

| tem 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

Joint Press Release of Pinnacle Financial Partners, Inc. and Synovus Financial Corp., dated July 24, 2025.

|

|

|

Investor presentation of Pinnacle Financial Partners, Inc. and Synovus Financial Corp., dated July 24, 2025.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

⸸ Furnished, not filed.

Forward-Looking Statements

This Current Report on Form 8-K contains statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of,

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements

include, but are not limited to, statements about the benefits of the proposed transaction between Synovus Financial Corp. (“Synovus”) and Pinnacle Financial Partners, Inc. (“Pinnacle”), including future financial and operating results (including

the anticipated impact of the proposed transaction on Synovus’ and Pinnacle’s respective earnings and tangible book value), statements related to the expected timing of the completion of the proposed transaction, the combined company’s plans,

objectives, expectations and intentions, and other statements that are not historical facts. You can identify these forward-looking statements through the use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,”

“should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’, Pinnacle’s or combined company’s

future businesses and financial performance and/or the performance of the banking industry and economy in general.

Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks

and uncertainties which may cause the actual results, performance or achievements of Synovus, Pinnacle or the combined company to be materially different from the future results, performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus or Pinnacle and are subject to significant risks and uncertainties. Actual results may differ materially

from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this Current Report on Form 8-K. Many of these factors are

beyond Synovus’, Pinnacle’s or the combined company’s ability to control or predict. These factors include, among others, (1) the risk that the cost savings and synergies from the proposed transaction may not be fully realized or may take longer

than anticipated to be realized, (2) disruption to Synovus’ business and to Pinnacle’s business as a result of the announcement and pendency of the proposed transaction, (3) the risk that the integration of Pinnacle’s and Synovus’ respective

businesses and operations will be materially delayed or will be more costly or difficult than expected, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approvals by the shareholders of Synovus or

Pinnacle, (5) the amount of the costs, fees, expenses and charges related to the transaction, (6) the ability by each of Synovus and Pinnacle to obtain required governmental approvals of the proposed transaction on the timeline expected, or at all,

and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction, (7)

reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the proposed, (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing

the proposed transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (9) the dilution caused by the issuance of shares of the combined company’s common stock in the

transaction, (10) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (11) risks related to management and oversight of the expanded business and

operations of the combined company following the closing of the proposed transaction, (12) the possibility the combined company is subject to additional regulatory requirements as a result of the proposed transaction or expansion of the combined

company’s business operations following the proposed transaction, (13) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Synovus, Pinnacle or the

combined company and (14) general competitive, economic, political and market conditions and other factors that may affect future results of Synovus and Pinnacle including changes in asset quality and credit risk; the inability to sustain revenue

and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; and capital management activities. Additional

factors which could affect future results of Synovus and Pinnacle can be found in Synovus’ or Pinnacle’s filings with the Securities and Exchange Commission (the “SEC”), including in Synovus’ Annual Report on Form 10-K for the year ended December

31, 2024, under the captions “Forward-Looking Statements” and “Risk Factors,” and Synovus’ Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and Pinnacle’s Annual Report on Form 10-K for the year ended December 31, 2024, under the

captions “Forward-Looking Statements” and “Risk Factors,” and in Pinnacle’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Undue reliance should not be placed on any forward-looking statements, which are based on current

expectations and speak only as of the date that they are made. Synovus and Pinnacle do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be

required by law.

Important Information About the Merger and Where to Find It

Steel Newco Inc. (“Newco”) intends to file a registration statement on Form S-4 with the SEC to register the shares of Newco common stock that

will be issued to Pinnacle shareholders and Synovus shareholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Synovus and Pinnacle that also constitutes a prospectus of Newco. The

definitive joint proxy statement/prospectus will be sent to the shareholders of each of Synovus and Pinnacle in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY

STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT

INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Synovus, Pinnacle or Newco through the website maintained by the

SEC at http://www.sec.gov or by contacting the investor relations department of Synovus or Pinnacle at:

| |

Synovus Financial Corp.

|

Pinnacle Financial Partners, Inc.

|

| |

33 West 14th Street

|

21 Platform Way South

|

| |

Columbus, GA 31901

|

Nashville, TN 37203

|

| |

Attention: Investor Relations

|

Attention: Investor Relations

|

| |

InvestorRelations@synovus.com

|

investor.relations@pnfp.com

|

| |

(706) 641-6500 |

(615) 743-8219 |

Before making any voting or investment decision, investors and security holders of Synovus and Pinnacle are urged to read carefully the

entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be

obtained as described above.

Participants in Solicitation

Synovus and Pinnacle and their respective directors and executive officers and other members of management and employees may be deemed to be

participants in the solicitation of proxies from Synovus’ shareholders and Pinnacle’s shareholders in respect of the proposed transaction under the rules of the SEC. Information regarding Synovus’ directors and executive officers is available in

Synovus’ proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 12, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000057/syn-20250312.htm) (the “Synovus 2025 Proxy”),

under the headings “Corporate Governance and Board Matters,” “Director Compensation,” “Proposal 1 Election of Directors,” “Executive Officers,” “Stock Ownership of Directors and Named Executive Officers,” “Executive Compensation,” “Compensation

and Human Capital Committee Report,” “Summary Compensation Table,” and “Certain Relationships and Related Transactions,” and in Synovus’ Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 21, 2025 (and

available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000049/syn-20241231.htm), and in other documents subsequently filed by Synovus with the SEC, which can be obtained free of charge through the website maintained by

the SEC at http://www.sec.gov. Any changes in the holdings of Synovus’ securities by Synovus’ directors or executive officers from the amounts described in the Synovus 2025 Proxy have been or will be reflected on Initial Statements of Beneficial

Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Synovus 2025 Proxy and are available at the SEC’s website at www.sec.gov. Information regarding Pinnacle’s

directors and executive officers is available in Pinnacle’s proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 3, 2025 (and available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000063/pnfp-20250303.htm) (the “Pinnacle 2025 Proxy”), under the headings “Environmental, Social and Corporate Governance,” “Proposal 1 Election of Directors,” “Information About

Our Executive Officers,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Transactions,” and in Pinnacle’s Annual Report on Form 10-K for the year ended December 31,

2024, filed with the SEC on February 25, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000042/pnfp-20241231.htm), and in other documents subsequently filed by Pinnacle with the SEC, which can be obtained

free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of Pinnacle’s securities by Pinnacle’s directors or executive officers from the amounts described in the Pinnacle 2025 Proxy have been or

will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Pinnacle 2025 Proxy and are available at the SEC’s

website at www.sec.gov. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC.

No Offer or Solicitation

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

I

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

PINNACLE FINANCIAL PARTNERS, INC. |

| |

By:

|

/s/Harold R. Carpenter

|

| |

Name:

|

Harold R. Carpenter

|

| |

Title:

|

Executive Vice President and Chief Financial Officer

|

| |

|

|

| Date: July 24, 2025 |

|

|

Exhibit 99.1

Pinnacle Financial Partners and Synovus to Combine to Create the Southeast Growth Champion

Builds Fastest-Growing, Highest-Return Regional Bank

Positioned to Remain Employer of Choice, with Industry-Leading Customer Service and Deep Roots in Local Communities

Complete Alignment on Strategy, Leadership, Brand and Operating Model to Continue Long Track Record of Profitable Growth

Compelling Financial Profile with 20+% EPS Accretion and Earnback Period of 2.6 Years

Companies to Host Joint Conference Call Today at 5:30 p.m. ET

Nashville, TN and Columbus, GA — July 24, 2025 — Pinnacle Financial Partners

(Nasdaq/NGS: PNFP) and Synovus Financial Corp. (NYSE: SNV) today announced that they have entered into a definitive agreement to combine in an all-stock transaction valued at $8.6 billion based on the unaffected closing prices of the two companies

as of July 21, 2025. This transaction creates the highest-performing regional bank focused on the fastest-growth markets in the Southeast.

The combined company, which will operate under the Pinnacle Financial Partners and Pinnacle Bank name and brand, will be led by a highly experienced team with a shared

growth mindset. Kevin Blair, Chairman, Chief Executive Officer and President of Synovus, will serve as President and Chief Executive Officer of the combined company, and Terry Turner, President and Chief Executive Officer of Pinnacle, will serve as

Chairman of the Board of Directors of the combined company.

Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, the shares of Synovus and Pinnacle shareholders will

be converted into shares of a new Pinnacle parent company based on a fixed exchange ratio of 0.5237 Synovus shares per Pinnacle share. This exchange ratio represents a Synovus per share value of $61.18, a transaction value of $8.6 billion and an

approximate 10% premium to Synovus on an unaffected basis.

1 Following the close of the transaction,

Synovus shareholders will own approximately 48.5% and Pinnacle shareholders will own approximately 51.5% of

the combined company.

The transaction is expected to be approximately 21% accretive to Pinnacle’s estimated operating EPS in 2027,2 with a rapid tangible book value per share

earnback period of 2.6 years. The transaction is expected to be tax-free to shareholders of both companies.

“Over the last 25 years, we have attracted extraordinary talent to a bank that closely partners with its clients, developing ‘raving fans’ and delivering industry-leading

growth,” said Mr. Turner. “We are pleased to join forces with Synovus in a combination that prioritizes client experience and inspires associates. By combining Pinnacle’s operating model, which is anchored in a disciplined entrepreneurial spirit,

with Synovus’ talented team and strong presence in attractive and fast-growing Southeastern markets, we will extend our legacy of building share in the most attractive markets nationally. I have tremendous admiration for Kevin and look forward to partnering with him and the rest of the Synovus team to bring our two banks together seamlessly.”

“We are two high-performing institutions with one powerful future,” said Mr. Blair. “Our belief in the success of this merger is grounded in a decade of strong results

and proven execution from both companies, each delivering top-tier earnings and total shareholder returns. Building on a rich tradition of service and accelerating momentum, Synovus is well-positioned for growth. Together with Terry and the

Pinnacle team, we are primed for continued outperformance, as we are not just combining forces – we are multiplying our impact.”

1 As of July 21, 2025, the last trading day prior to media reports regarding a potential transaction involving Synovus.

2 Includes fully phased-in cost savings and assumed LFI expenses.

To position the combined company for continued market share gains, growth and shareholder value creation following the transaction close and over the long term, Pinnacle and Synovus have already aligned on all key elements of the go-forward operating

model, including Board mix, executive management, regional leadership teams, brand, headquarters, operating and recruiting models, compensation structure and community commitments. As a result, the companies are well-positioned to move swiftly on

integration planning and, following the close, integration execution.

Compelling Strategic Rationale

|

• |

High-growth footprint anchored in two capitals of the South: This

transaction creates the largest bank holding company in Georgia and the largest bank in Tennessee, with Pinnacle Financial Partners headquartered in Atlanta and Pinnacle Bank headquartered in Nashville. The combined company is positioned to

win in the most attractive and high-growth markets in the U.S. These markets have a deposit-weighted projected household growth of 4.6% (2025-2030), which is the highest among peers and approximately 170% of

the national average. Pinnacle and Synovus together have meaningful scale at the market level, including the top-5 position in 10 of our top-15 Southeastern metropolitan statistical areas, with significant room to grow and capture

additional share.

|

|

• |

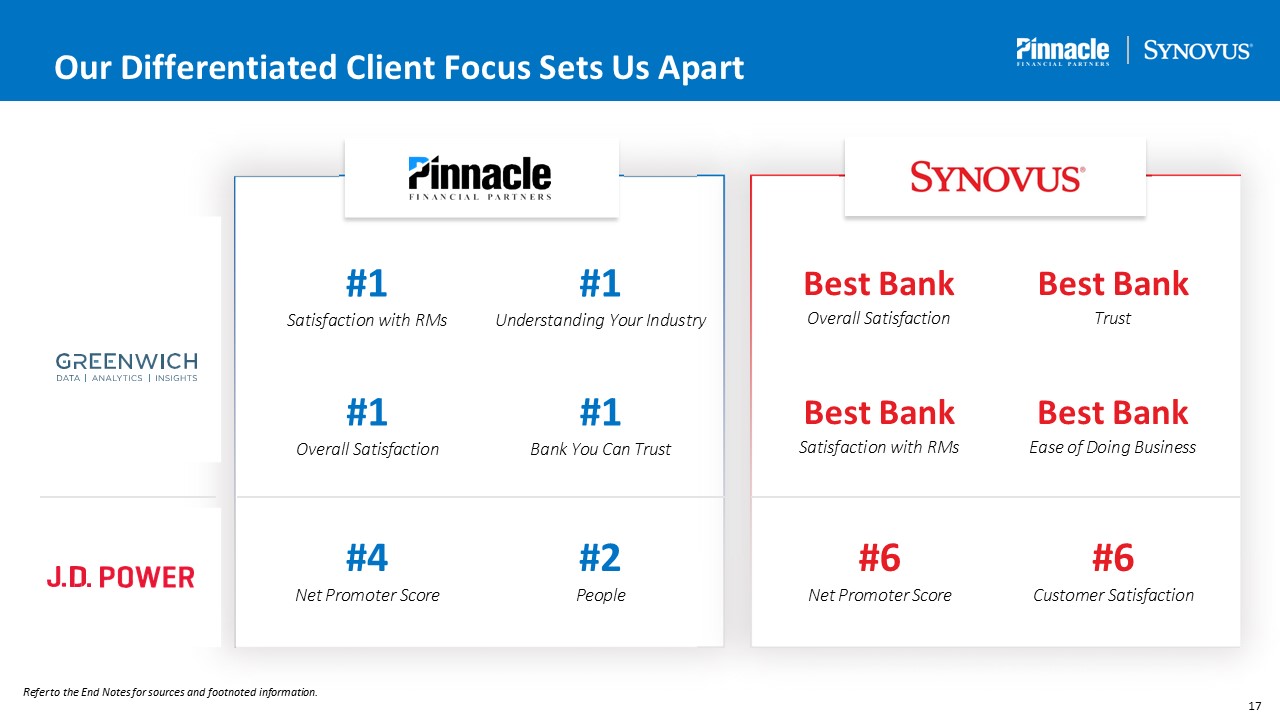

Great place to work, great place to bank: Synovus and Pinnacle rank #1 and #2,

respectively, in Associate Satisfaction on Glassdoor among peers. They both have been consistently recognized as top workplaces, including by Forbes, Fortune and Great Place to Work,® as well as by local publications in the communities they serve. This culture of professional excellence delivers extraordinary client service, and both companies have long ranked among the top performers for customer

satisfaction by J.D. Power and Coalition Greenwich. Collectively, Pinnacle and Synovus received a total of 45 Coalition Greenwich Best Bank Awards in 2025.

|

|

• |

Simple, highly aligned operating model: By aligning operating models within a geographic

focus where local leaders are empowered to make decisions and associates are engaged at every level, as well as providing clients access to specialized expertise, the combined company is well-positioned to continue driving peer-leading loan

and deposit growth, strong credit discipline and operating efficiency across its expanded footprint.

|

|

• |

Leadership team with significant large financial institution experience: Synovus’

management team has significant experience in leadership positions at larger financial institutions in critical areas, including enterprise risk, compliance, finance, technology and operations, favorably positioning the combined company to

transition to a $100+ billion asset institution.

|

Leadership, Governance, Headquarters and Community Benefits

The combined company’s leadership will reflect the strengths and capabilities of both Pinnacle and Synovus. This proven team has more than 120 years of combined

experience in the financial services industry and has successfully executed a number of significant transactions.

Following the close of the transaction:

|

• |

Mr. Turner will become Chairman of the combined company’s Board of Directors;

|

|

• |

Mr. Blair will serve as President and Chief Executive Officer of the combined company;

|

|

• |

Jamie Gregory, Chief Financial Officer of Synovus, will serve as Chief Financial Officer of the combined company;

|

|

• |

Rob McCabe, Chairman of Pinnacle, will become Vice Chairman and Chief Banking Officer of the combined company; and

|

|

• |

The combined company’s Board mix will comprise 15 directors, eight of whom will be from the Pinnacle Board and seven of whom will be from the Synovus Board.

|

In addition, the following individuals will serve as regional leaders of their respective markets under Mr. McCabe:

|

• |

Georgia: Charlie Clark, President of the Community Bank at Synovus;

|

|

• |

Tennessee and Kentucky: Bryan Bean, Senior Lending Officer at Pinnacle;

|

|

• |

Alabama: Chris Abele, Executive Director, Middle Market Banking at Synovus;

|

|

• |

The Carolinas and Virginia: Rick Callicutt, Chairman of the Carolinas and Virginia at Pinnacle;

|

|

• |

North and Central Florida: Scott Keith, Regional President at Pinnacle; and

|

|

• |

South Florida: Mike Walker, Executive Director, Middle Market Banking at Synovus.

|

The combined company will operate with a sustained commitment to associates and local communities, including Columbus, Georgia, through philanthropic giving and other

impactful initiatives. Its common stock will trade on the New York Stock Exchange under the ticker symbol PNFP.

Both Pinnacle and Synovus have strong track records of making significant positive impacts on their communities, and that commitment will be maintained with this

transaction. In addition to retaining strong local presences across the Southeast, the combined company will continue its significant employment and philanthropic commitments in Columbus, Nashville, Atlanta and across the Southeast, as well as

its strong community development initiatives focused on affordable housing, small business support and economic prosperity, among other worthwhile causes.

Timing and Approvals

The transaction is expected to close in the first quarter of 2026, subject to the receipt of required regulatory approvals, approval by Pinnacle and Synovus

shareholders and the satisfaction of other customary closing conditions.

Conference Call and Additional Materials

Pinnacle and Synovus will host a joint conference call and webcast today at 5:30 p.m. ET to discuss the transaction. A live webcast of the conference call and

associated presentation materials will be available on the investor relations section of each company’s website at https://investors.pnfp.com/ and https://investor.synovus.com/corporate-profile/default.aspx.

Advisors

Centerview Partners LLC is serving as lead financial advisor to Pinnacle and Sullivan & Cromwell LLP is serving as lead legal advisor, assisted by Bass, Berry

& Sims, PLC.

Piper Sandler & Co. also served as financial advisor to Pinnacle.

Morgan Stanley & Co. LLC is serving as lead financial advisor to Synovus and Wachtell, Lipton, Rosen & Katz is serving as legal advisor. Keefe, Bruyette &

Woods, a Stifel Company, also served as financial advisor to Synovus.

About Pinnacle

Pinnacle Financial Partners provides a full range of banking, investment, trust, mortgage and insurance products and services designed for businesses and their owners

and individuals interested in a comprehensive relationship with their financial institution. The firm is the No. 1 bank in the Nashville-Murfreesboro-Franklin MSA, according to 2024 deposit data from the FDIC. Pinnacle is No. 9 on FORTUNE

magazine’s 2025 list of 100 Best Companies to Work For® in the U.S., its ninth consecutive appearance and was recognized by American Banker as one of America’s Best Banks to Work For 12 years in a row and No. 1 among banks with more than $10

billion in assets in 2024.

The firm began operations in a single location in downtown Nashville, TN in October 2000 and has since grown to approximately $54.8 billion in assets as of June 30, 2025. As the second-largest bank holding company headquartered in Tennessee, Pinnacle

operates in several primarily urban markets across the Southeast.

Additional information concerning Pinnacle, which is included in the Nasdaq Financial-100 Index, can be accessed at www.pnfp.com.

Synovus Financial Corp. is a financial services company based in Columbus, Georgia, with approximately $61 billion in assets. Synovus provides commercial and consumer

banking and a full suite of specialized products and services, including wealth services, treasury management, mortgage services, premium finance, asset-based lending, structured lending, capital markets and international banking. As of June 30,

2025, Synovus has 244 branches in Georgia, Alabama, Florida, South Carolina and Tennessee. Synovus is a Great Place to Work-Certified Company. Learn more about Synovus at

synovus.com.

Forward-Looking Statements

This communication contains statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements include, but are

not limited to, statements about the benefits of the proposed transaction between Synovus Financial Corp. (“Synovus”) and Pinnacle Financial Partners, Inc. (“Pinnacle”), including future financial and operating results (including the anticipated

impact of the proposed transaction on Synovus’ and Pinnacle’s respective earnings and tangible book value), statements related to the expected timing of the completion of the proposed transaction, the combined company’s plans, objectives,

expectations and intentions, and other statements that are not historical facts. You can identify these forward-looking statements through the use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,”

“predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’, Pinnacle’s or combined company’s future

businesses and financial performance and/or the performance of the banking industry and economy in general.

Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks

and uncertainties which may cause the actual results, performance or achievements of Synovus, Pinnacle or the combined company to be materially different from the future results, performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus or Pinnacle and are subject to significant risks and uncertainties. Actual results may differ materially

from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this communication. Many of these factors are beyond

Synovus’, Pinnacle’s or the combined company’s ability to control or predict. These factors include, among others, (1) the risk that the cost savings and synergies from the proposed transaction may not be fully realized or may take longer than

anticipated to be realized, (2) disruption to Synovus’ business and to Pinnacle’s business as a result of the announcement and pendency of the proposed transaction, (3) the risk that the integration of Pinnacle’s and Synovus’ respective businesses

and operations will be materially delayed or will be more costly or difficult than expected, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approvals by the shareholders of Synovus or Pinnacle, (5)

the amount of the costs, fees, expenses and charges related to the transaction, (6) the ability by each of Synovus and Pinnacle to obtain required governmental approvals of the proposed transaction on the timeline expected, or at all, and the risk

that such approvals may result in the imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction, (7) reputational

risk and the reaction of each company’s customers, suppliers, employees or other business partners to the proposed, (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the proposed

transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (9) the dilution caused by the issuance of shares of the combined company’s common stock in the transaction,

(10) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (11) risks related to management and oversight of the expanded business and operations of

the combined company following the closing of the proposed transaction, (12) the possibility the combined company is subject to additional regulatory requirements as a result of the proposed transaction or expansion of the combined company’s

business operations following the proposed transaction, (13) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Synovus, Pinnacle or the combined

company and (14) general competitive, economic, political and market conditions and other factors that may affect future results of Synovus and Pinnacle including changes in asset quality and credit risk; the inability to sustain revenue and

earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; and capital management activities. Additional

factors which could affect future results of Synovus and Pinnacle can be found in Synovus’ or Pinnacle’s filings with the Securities and Exchange Commission (the “SEC”), including in Synovus’ Annual Report on Form 10-K for the year ended December

31, 2024, under the captions “Forward-Looking Statements” and “Risk Factors,” and Synovus’ Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and Pinnacle’s Annual Report on Form 10-K for the year ended December 31, 2024, under the

captions “Forward-Looking Statements” and “Risk Factors,” and in Pinnacle’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Undue reliance should not be placed on any forward-looking statements, which are based on current

expectations and speak only as of the date that they are made. Synovus and Pinnacle do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be

required by law.

Important Information About the Merger and Where to Find It

Steel Newco Inc. (“Newco”) intends to file a registration statement on Form S-4 with the SEC to register the shares of Newco common stock that will be

issued to Pinnacle shareholders and Synovus shareholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Synovus and Pinnacle that also constitutes a prospectus of Newco. The

definitive joint proxy statement/prospectus will be sent to the shareholders of each of Synovus and Pinnacle in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY

STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT

INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Synovus, Pinnacle or Newco through the website maintained by the

SEC at http://www.sec.gov or by contacting the investor relations department of Synovus or Pinnacle at:

| |

Synovus Financial Corp.

|

Pinnacle Financial Partners, Inc.

|

| |

33 West 14th Street

|

21 Platform Way South

|

| |

Columbus, GA 31901

|

Nashville, TN 37203

|

| |

Attention: Investor Relations

|

Attention: Investor Relations

|

| |

InvestorRelations@synovus.com

|

investor.relations@pnfp.com

|

| |

(706) 641-6500

|

(615) 743-8219

|

Before making any voting or investment decision, investors and security holders of Synovus and Pinnacle are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any

amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

Participants in Solicitation

Synovus and Pinnacle and their respective directors and executive officers and other members of management and employees may be deemed to be participants

in the solicitation of proxies from Synovus’ shareholders and Pinnacle’s shareholders in respect of the proposed transaction under the rules of the SEC. Information regarding Synovus’ directors and executive officers is available in Synovus’ proxy

statement for its 2025 annual meeting of shareholders, filed with the SEC on March 12, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000057/syn-20250312.htm) (the “Synovus 2025 Proxy”), under the

headings “Corporate Governance and Board Matters,” “Director Compensation,” “Proposal 1 Election of Directors,” “Executive Officers,” “Stock Ownership of Directors and Named Executive Officers,” “Executive Compensation,” “Compensation and Human

Capital Committee Report,” “Summary Compensation Table,” and “Certain Relationships and Related Transactions,” and in Synovus’ Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 21, 2025 (and available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000049/syn-20241231.htm), and in other documents subsequently filed by Synovus with the SEC, which can be obtained free of charge through the website maintained by the SEC at

http://www.sec.gov. Any changes in the holdings of Synovus’ securities by Synovus’ directors or executive officers from the amounts described in the Synovus 2025 Proxy have been or will be reflected on Initial Statements of Beneficial Ownership of

Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Synovus 2025 Proxy and are available at the SEC’s website at www.sec.gov. Information regarding Pinnacle’s directors and

executive officers is available in Pinnacle’s proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 3, 2025 (and available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000063/pnfp-20250303.htm) (the “Pinnacle 2025 Proxy”), under the headings “Environmental, Social and Corporate Governance,” “Proposal 1 Election of Directors,” “Information About

Our Executive Officers,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Transactions,” and in Pinnacle’s Annual Report on Form 10-K for the year ended December 31,

2024, filed with the SEC on February 25, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000042/pnfp-20241231.htm), and in other documents subsequently filed by Pinnacle with the SEC, which can be obtained

free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of Pinnacle’s securities by Pinnacle’s directors or executive officers from the amounts described in the Pinnacle 2025 Proxy have been or

will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Pinnacle 2025 Proxy and are available at the SEC’s

website at www.sec.gov. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Synovus Contacts

Investors

Jennifer H. Demba, CFA

Senior Director, Investor Relations

jenniferdemba@synovus.com

Media

Audria Belton

Director, External Communications

media@synovus.com

Pinnacle Contacts

Investors

Harold Carpenter

Chief Financial Officer

harold.carpenter@pnfp.com

Media

Joe Bass

Director of External Relations

joe.bass@pnfp.com

Tim Lynch / Aura Reinhard / Haley Salas

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Exhibit 99.2

Pinnacle and Synovus to Combine: Building The Southeast Growth Champion July

24, 2025

Forward‐Looking Statements 2 Forward‐Looking Statements This communication

contains statements that constitute “forward‐looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact are forward‐looking statements. These forward‐looking statements include, but are not limited to, statements about the benefits of the proposed transaction between Synovus

Financial Corp. (“Synovus”) and Pinnacle Financial Partners, Inc. (“Pinnacle”), including future financial and operating results (including the anticipated impact of the proposed transaction on Synovus’ and Pinnacle’s respective earnings and

tangible book value), statements related to the expected timing of the completion of the proposed transaction, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. You can

identify these forward‐looking statements through the use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,”

“potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’, Pinnacle’s or combined company’s future businesses and financial performance and/or the performance of the banking industry and

economy in general. Prospective investors are cautioned that any such forward‐looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance

or achievements of Synovus, Pinnacle or the combined company to be materially different from the future results, performance or achievements expressed or implied by such forward‐looking statements. Forward‐looking statements are based on the

information known to, and current beliefs and expectations of, Synovus or Pinnacle and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward‐looking statements. A

number of factors could cause actual results to differ materially from those contemplated by the forward‐looking statements in this communication. Many of these factors are beyond Synovus’, Pinnacle’s or the combined company’s ability to

control or predict. These factors include, among others, (1) the risk that the cost savings and synergies from the proposed transaction may not be fully realized or may take longer than anticipated to be realized, (2) disruption to Synovus’

business and to Pinnacle’s business as a result of the announcement and pendency of the proposed transaction, (3) the risk that the integration of Pinnacle’s and Synovus’ respective businesses and operations will be materially delayed or will

be more costly or difficult than expected, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approvals by the shareholders of Synovus or Pinnacle, (5) the amount of the costs, fees, expenses and

charges related to the transaction, (6) the ability by each of Synovus and Pinnacle to obtain required governmental approvals of the proposed transaction on the timeline expected, or at all, and the risk that such approvals may result in the

imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction, (7) reputational risk and the reaction of each

company’s customers, suppliers, employees or other business partners to the proposed, (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the proposed transaction or the

occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (9) the dilution caused by the issuance of shares of the combined company’s common stock in the transaction, (10) the

possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (11) risks related to management and oversight of the expanded business and operations of the

combined company following the closing of the proposed transaction, (12) the possibility the combined company is subject to additional regulatory requirements as a result of the proposed transaction or expansion of the combined company’s

business operations following the proposed transaction, (13) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Synovus, Pinnacle or the

combined company and (14) general competitive, economic, political and market conditions and other factors that may affect future results of Synovus and Pinnacle including changes in asset quality and credit risk; the inability to sustain

revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; and capital management activities.

Additional factors which could affect future results of Synovus and Pinnacle can be found in Synovus’ or Pinnacle’s filings with the Securities and Exchange Commission (the “SEC”), including in Synovus’ Annual Report on Form 10‐K for the year

ended December 31, 2024, under the captions “Forward‐Looking Statements” and “Risk Factors,” and Synovus’ Quarterly Reports on Form 10‐Q and Current Reports on Form 8‐K, and Pinnacle’s Annual Report on Form 10‐K for the year ended December

31, 2024, under the captions “Forward‐Looking Statements” and “Risk Factors,” and in Pinnacle’s Quarterly Reports on Form 10‐Q and Current Reports on Form 8‐K. Undue reliance should not be placed on any forward‐looking statements, which are

based on current expectations and speak only as of the date that they are made. Synovus and Pinnacle do not assume any obligation to update any forward‐looking statements as a result of new information, future developments or otherwise,

except as otherwise may be required by law.

Important Information About the Merger 2 Important Information About the

Merger and Where to Find It Steel Newco Inc. (“Newco”) intends to file a registration statement on Form S‐4 with the SEC to register the shares of Newco common stock that will be issued to Pinnacle shareholders and Synovus shareholders in

connection with the proposed transaction. The registration statement will include a joint proxy statement of Synovus and Pinnacle that also constitutes a prospectus of Newco. The definitive joint proxy statement/prospectus will be sent to the

shareholders of each of Synovus and Pinnacle in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY

OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION AND

RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Synovus, Pinnacle or Newco through the website maintained by the SEC at http://www.sec.gov or by contacting

the investor relations department of Synovus or Pinnacle at: Synovus Financial Corp. 33 West 14th Street Columbus, GA 31901 Attention: Investor Relations InvestorRelations@synovus.com (706) 641‐6500 Pinnacle Financial Partners, Inc. 21

Platform Way South Nashville, TN 37203 Attention: Investor Relations investorrelations@pnfp.com (615) 743‐8219 Before making any voting or investment decision, investors and security holders of Synovus and Pinnacle are urged to read

carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of

these documents may be obtained as described above.

Additional Statements 2 Participants in Solicitation Synovus and Pinnacle and

their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Synovus’ shareholders and Pinnacle’s shareholders in respect of the proposed

transaction under the rules of the SEC. Information regarding Synovus’ directors and executive officers is available in Synovus’ proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 12, 2025 (and available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000057/syn‐20250312.htm) (the “Synovus 2025 Proxy”), under the headings “Corporate Governance and Board Matters,” “Director Compensation,” “Proposal 1 Election of

Directors,” “Executive Officers,” “Stock Ownership of Directors and Named Executive Officers,” “Executive Compensation,” “Compensation and Human Capital Committee Report,” “Summary Compensation Table,” and “Certain Relationships and Related

Transactions,” and in Synovus’ Annual Report on Form 10‐K for the year ended December 31, 2024, filed with the SEC on February 21, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000049/syn‐

20241231.htm), and in other documents subsequently filed by Synovus with the SEC, which can be obtained free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of Synovus’ securities by

Synovus’ directors or executive officers from the amounts described in the Synovus 2025 Proxy have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form

4 filed with the SEC subsequent to the filing date of the Synovus 2025 Proxy and are available at the SEC’s website at www.sec.gov. Information regarding Pinnacle’s directors and executive officers is available in Pinnacle’s proxy statement

for its 2025 annual meeting of shareholders, filed with the SEC on March 3, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000063/pnfp‐20250303.htm) (the “Pinnacle 2025 Proxy”), under the headings

“Environmental, Social and Corporate Governance,” “Proposal 1 Election of Directors,” “Information About Our Executive Officers,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain

Relationships and Related Transactions,” and in Pinnacle’s Annual Report on Form 10‐K for the year ended December 31, 2024, filed with the SEC on February 25, 2025 (and available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000042/pnfp‐20241231.htm), and in other documents subsequently filed by Pinnacle with the SEC, which can be obtained free of charge through the website maintained by the SEC

at http://www.sec.gov. Any changes in the holdings of Pinnacle’s securities by Pinnacle’s directors or executive officers from the amounts described in the Pinnacle 2025 Proxy have been or will be reflected on Initial Statements of Beneficial

Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Pinnacle 2025 Proxy and are available at the SEC’s website at www.sec.gov. Additional information

regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. No Offer or Solicitation This communication does not constitute an offer to sell or

the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

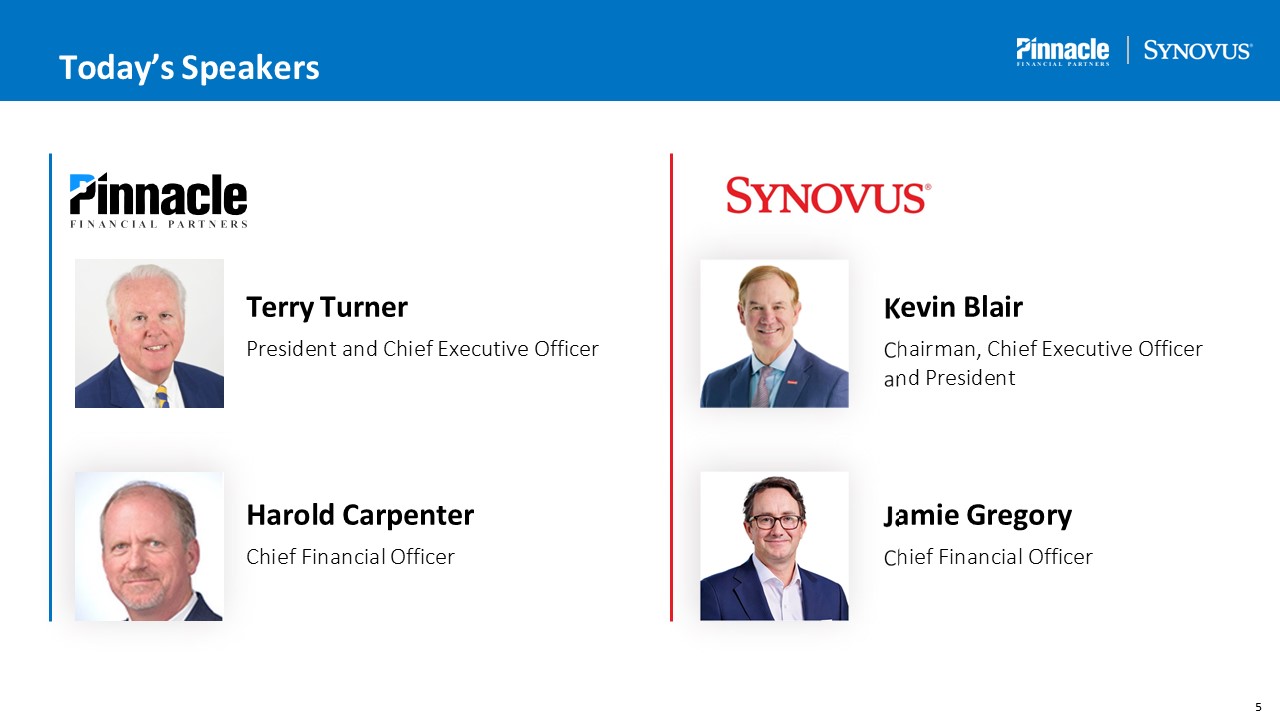

Terry Turner President and Chief Executive Officer K C a evin

Blair hairman, Chief Executive Officer nd President J C amie Gregory hief Financial Officer Harold Carpenter Chief Financial Officer Today’s Speakers 2

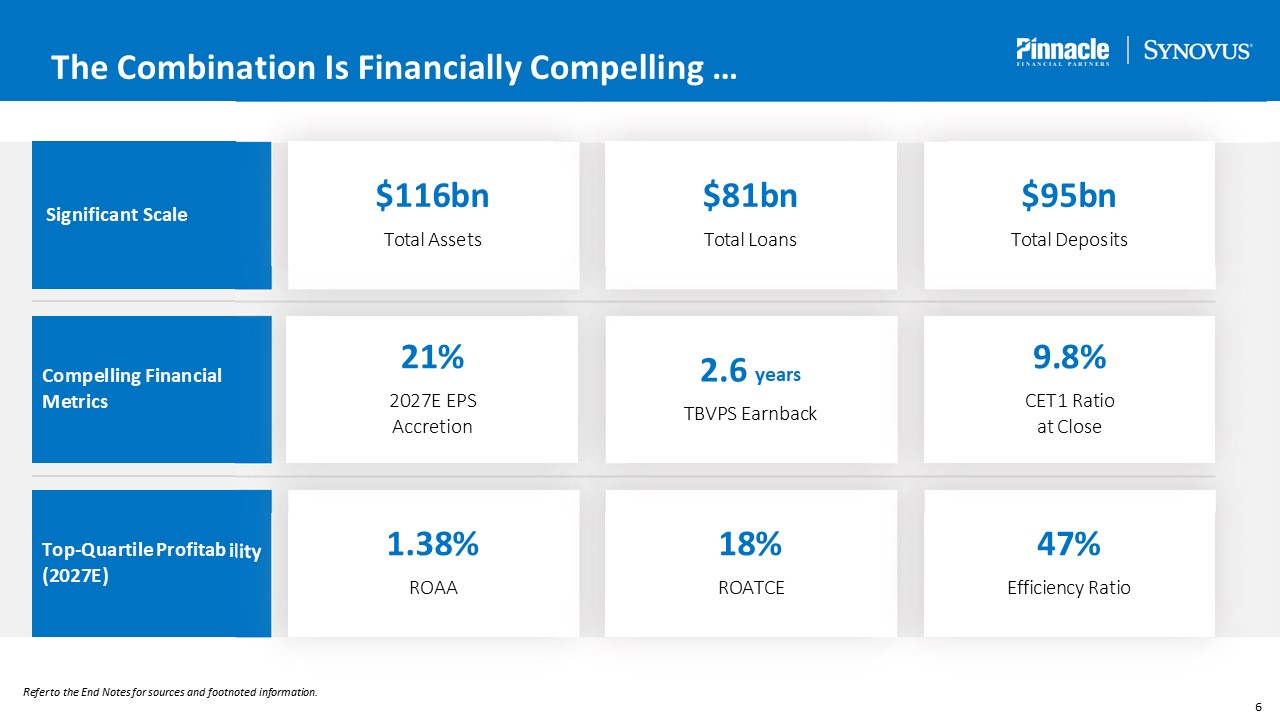

The Combination Is Financially Compelling … Significant

Scale ility Top‐Quartile Profitab (2027E) Compelling Financial Metrics 1.38% ROAA 18% ROATCE $116bn Total Assets $95bn Total Deposits 2.6 years TBVPS Earnback $81bn Total Loans 47% Efficiency Ratio 21% 2027E

EPS Accretion Refer to the End Notes for sources and footnoted information. 6 9.8% CET1 Ratio at Close

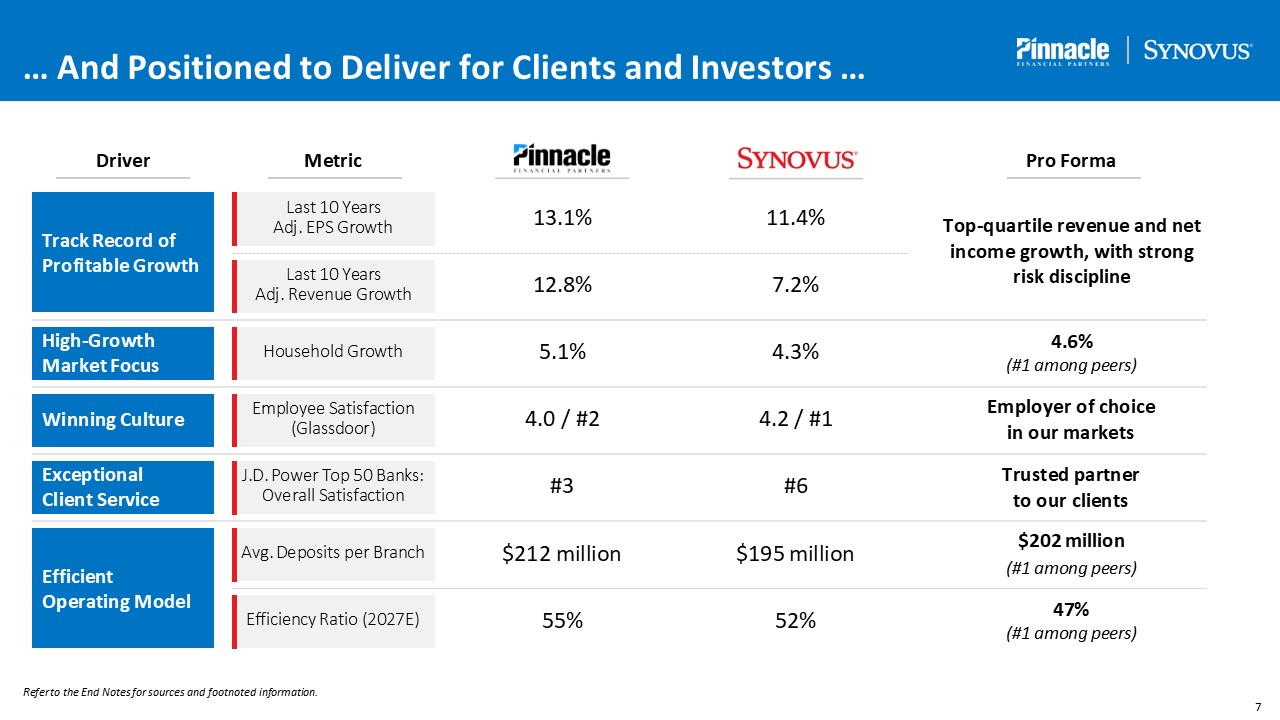

… And Positioned to Deliver for Clients and Investors … High‐Growth Market

Focus Winning Culture Exceptional Client Service Track Record of Profitable Growth Efficient Operating Model Driver Pro Forma 5.1% 4.3% 4.6% (#1 among peers) 4.0 / #2 4.2 / #1 Employer of choice in our markets #3 #6 $212

million $195 million 13.1% 11.4% Top‐quartile revenue and net income growth, with strong risk discipline Trusted partner to our clients $202 million (#1 among peers) 55% 52% 47% (#1 among peers) 12.8% 7.2% Metric Last 10 Years

Adj. EPS Growth Last 10 Years Adj. Revenue Growth Household Growth Employee Satisfaction (Glassdoor) J.D. Power Top 50 Banks: Overall Satisfaction Avg. Deposits per Branch Efficiency Ratio (2027E) Refer to the End Notes for sources and

footnoted information. 6

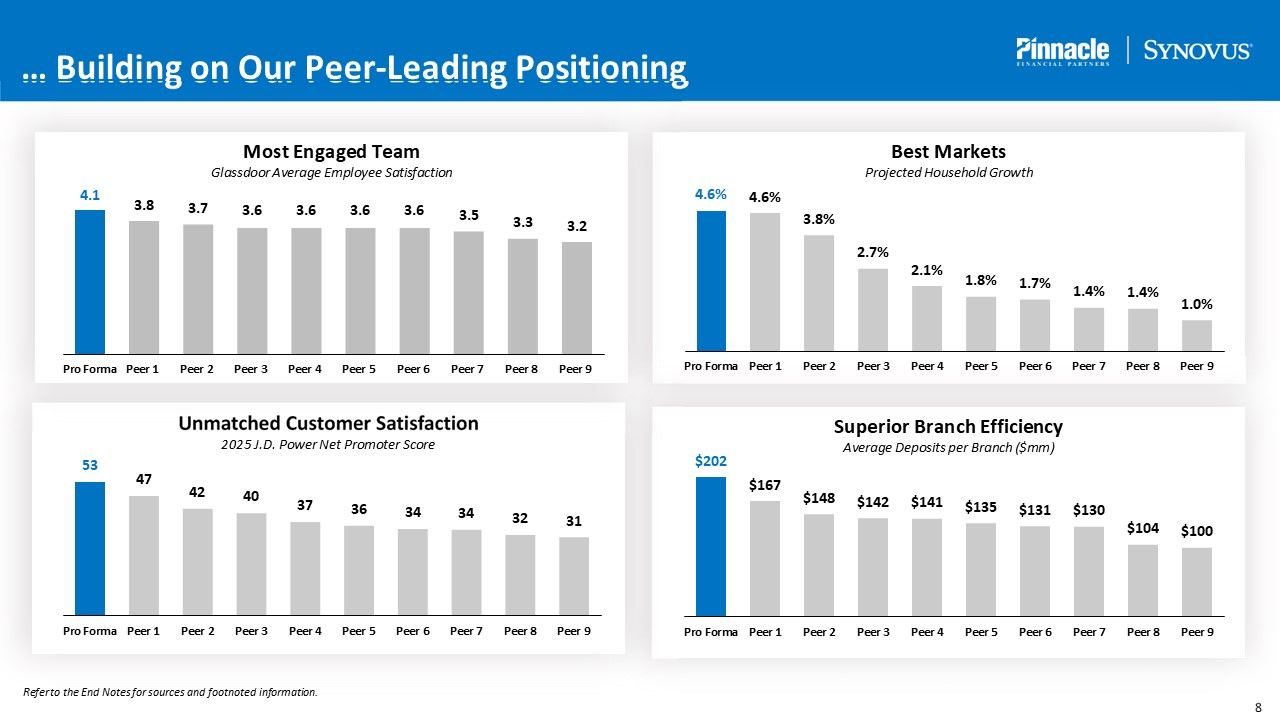

8 … Building on Our Peer‐Leading Positioning Superior Branch

Efficiency Average Deposits per Branch ($mm) Best Markets Projected Household Growth Unmatched Customer Satisfaction 2025 J.D. Power Net Promoter Score 4.1 3.8 3.7 Most Engaged Team Glassdoor Average Employee Satisfaction 3.6 3.6

3.6 3.6 3.5 3.3 3.2 Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 4.6% 4.6% 3.8% 2.7% 2.1% 1.8% 1.7% 1.4% 1.4% 1.0% Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer

9 53 47 42 40 37 36 34 34 32 31 Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 $202 $167 $148 $142 $141 $135 $131 $130 $104 $100 Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer

6 Peer 7 Peer 8 Peer 9 Refer to the End Notes for sources and footnoted information.

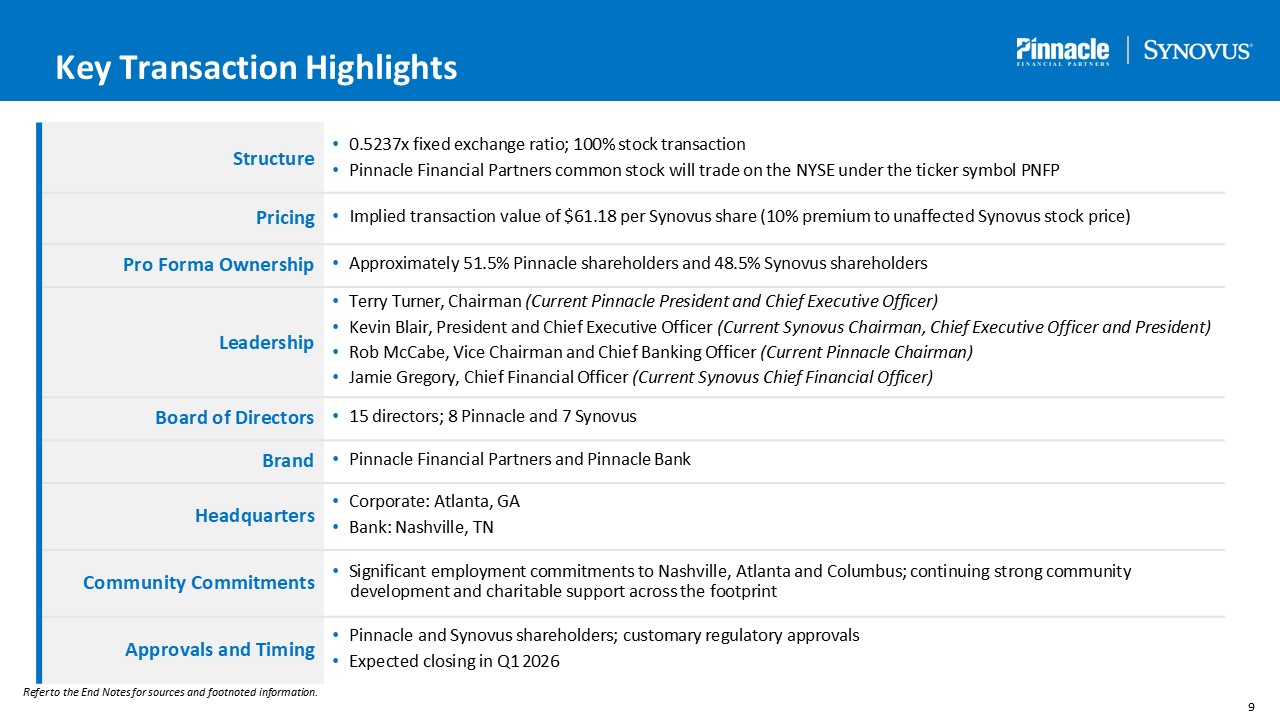

Structure 0.5237x fixed exchange ratio; 100% stock transaction Pinnacle

Financial Partners common stock will trade on the NYSE under the ticker symbol PNFP Pricing Implied transaction value of $61.18 per Synovus share (10% premium to unaffected Synovus stock price) Pro Forma Ownership Approximately 51.5%

Pinnacle shareholders and 48.5% Synovus shareholders Leadership Terry Turner, Chairman (Current Pinnacle President and Chief Executive Officer) Kevin Blair, President and Chief Executive Officer (Current Synovus Chairman, Chief Executive

Officer and President) Rob McCabe, Vice Chairman and Chief Banking Officer (Current Pinnacle Chairman) Jamie Gregory, Chief Financial Officer (Current Synovus Chief Financial Officer) Board of Directors 15 directors; 8 Pinnacle and 7

Synovus Brand Pinnacle Financial Partners and Pinnacle Bank Headquarters Corporate: Atlanta, GA Bank: Nashville, TN Community Commitments Significant employment commitments to Nashville, Atlanta and Columbus; continuing strong

community development and charitable support across the footprint Approvals and Timing Pinnacle and Synovus shareholders; customary regulatory approvals Expected closing in Q1 2026 Refer to the End Notes for sources and footnoted

information. 10 Key Transaction Highlights

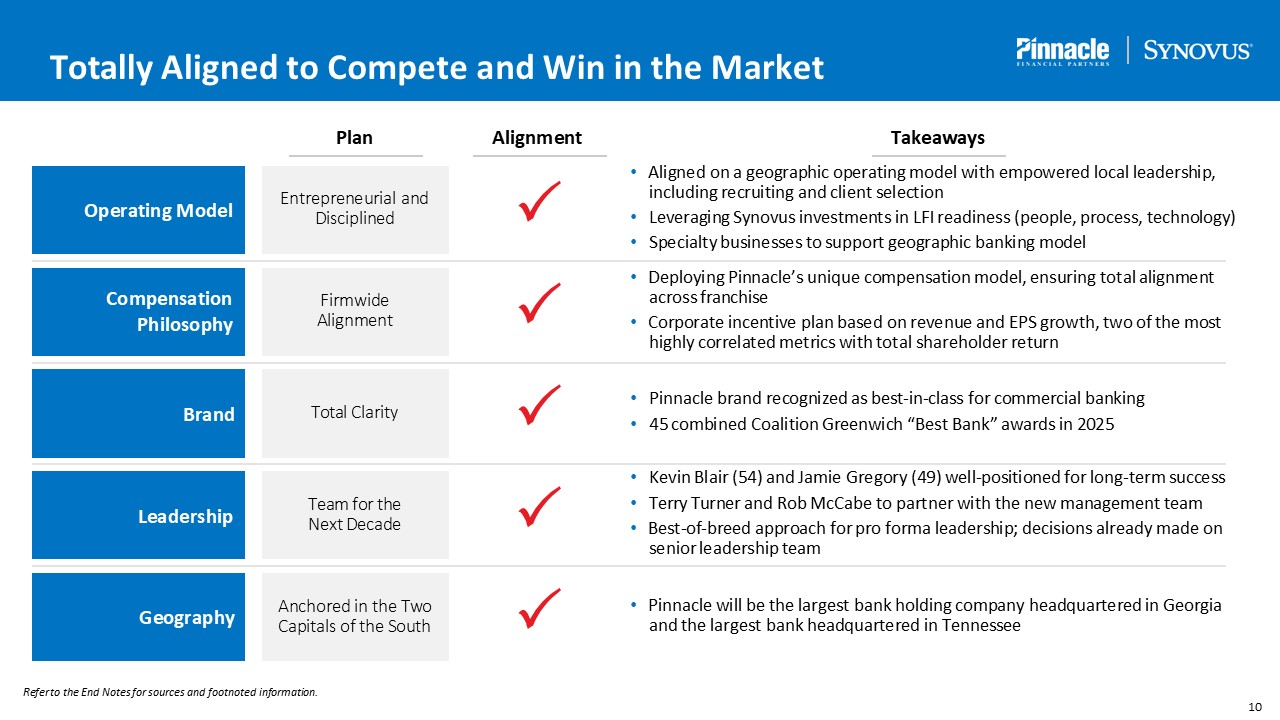

Totally Aligned to Compete and Win in the Market Operating Model Compensation

Philosophy Brand Leadership Geography Plan Alignment Takeaways Entrepreneurial and Disciplined Firmwide Alignment Total Clarity Team for the Next Decade Anchored in the Two Capitals of the South Aligned on a

geographic operating model with empowered local leadership, including recruiting and client selection Leveraging Synovus investments in LFI readiness (people, process, technology) Specialty businesses to support geographic banking

model Deploying Pinnacle’s unique compensation model, ensuring total alignment across franchise Corporate incentive plan based on revenue and EPS growth, two of the most highly correlated metrics with total shareholder return Pinnacle

brand recognized as best‐in‐class for commercial banking 45 combined Coalition Greenwich “Best Bank” awards in 2025 Kevin Blair (54) and Jamie Gregory (49) well‐positioned for long‐term success Terry Turner and Rob McCabe to partner with

the new management team Best‐of‐breed approach for pro forma leadership; decisions already made on senior leadership team Pinnacle will be the largest bank holding company headquartered in Georgia and the largest bank headquartered in

Tennessee Refer to the End Notes for sources and footnoted information. 10

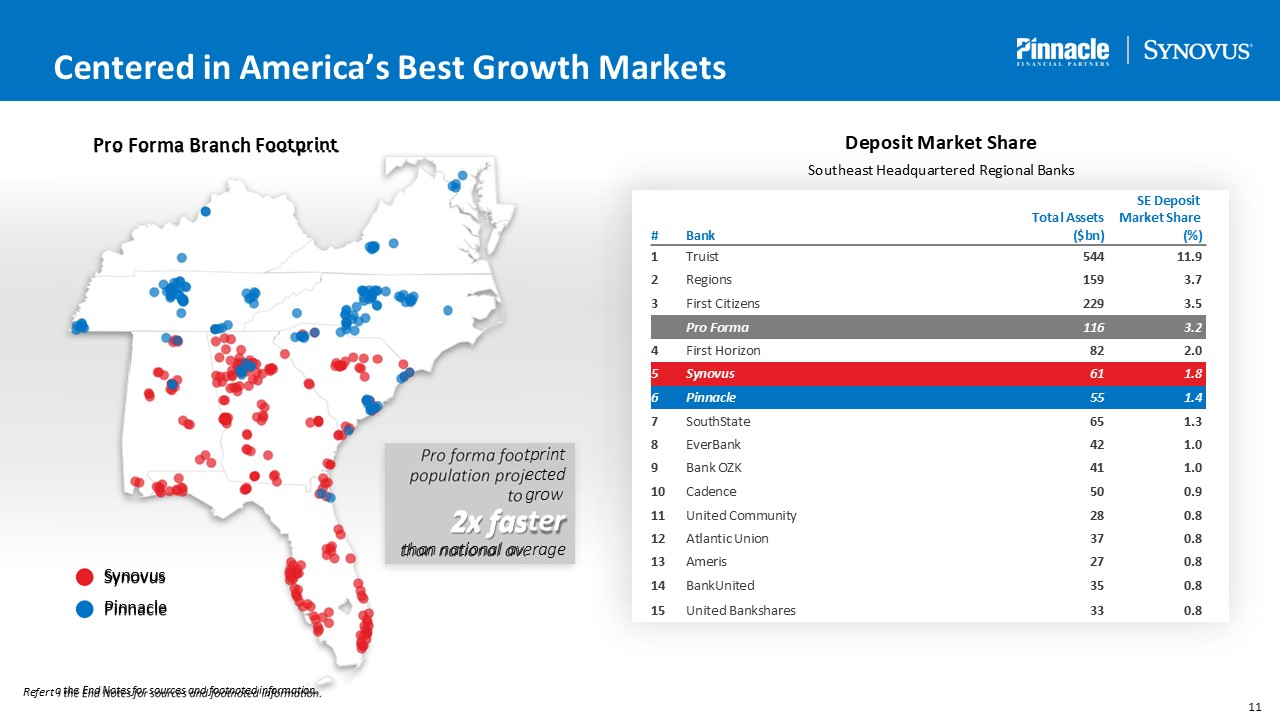

Pro Forma Branch Footprint Deposit Market Share Southeast Headquartered

Regional Banks Pro forma foo population proj to tprint ected grow ter erage Total Assets SE Deposit Market Share # Bank ($bn) (%) 1 Truist 544 11.9 2 Regions 159 3.7 3 First Citizens 229 3.5 Pro

Forma 116 3.2 4 First Horizon 82 2.0 5 Synovus 61 1.8 6 Pinnacle 55 1.4 7 SouthState 65 1.3 8 EverBank 42 1.0 9 Bank OZK 41 1.0 10 Cadence 50 0.9 11 United Community 28 0.8 12 Atlantic

Union 37 0.8 13 Ameris 27 0.8 14 BankUnited 35 0.8 15 United Bankshares 33 0.8 Centered in America’s Best Growth Markets 2x fas than national av Synovus Pinnacle o the End Notes for sources and footnoted

information. Refer t 11

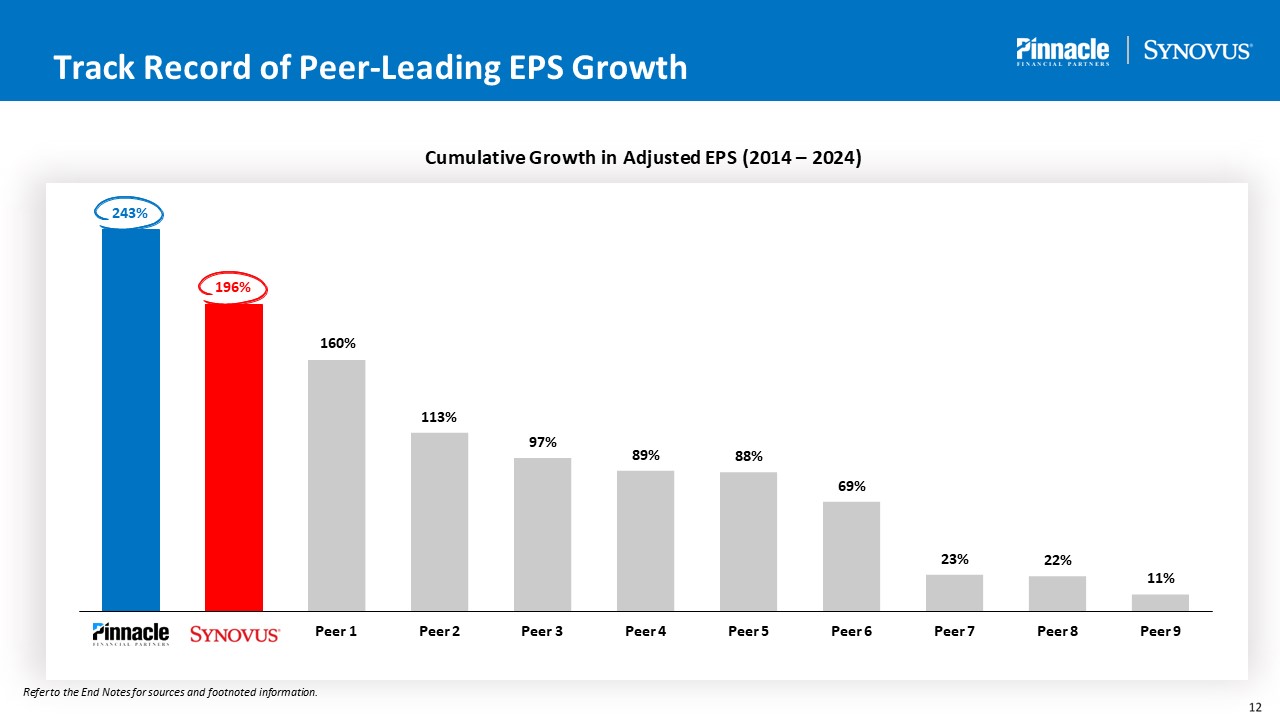

12 Cumulative Growth in Adjusted EPS (2014 – 2024) Refer to the End Notes for

sources and footnoted information. Track Record of Peer‐Leading EPS Growth 243% 196% 160% 113% 97% 89% 88% 69% 23% 22% 11% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9

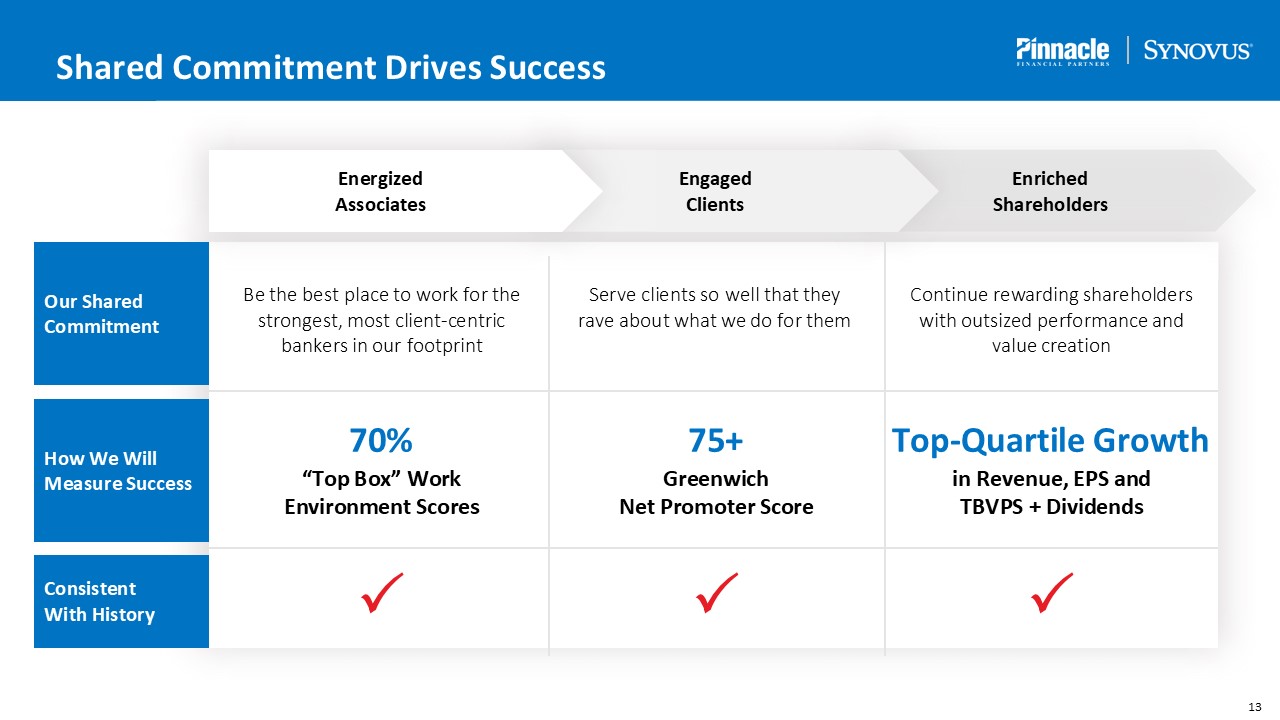

Shared Commitment Drives Success Be the best place to work for the strongest,

most client‐centric bankers in our footprint 70% “Top Box” Work Environment Scores Serve clients so well that they rave about what we do for them 75+ Greenwich Net Promoter Score Continue rewarding shareholders with outsized

performance and value creation Top‐Quartile Growth in Revenue, EPS and TBVPS + Dividends Energized Associates Engaged Clients Enriched Shareholders How We Will Measure Success 13 Consistent With History Our Shared Commitment

Relentless Focus on Serving Clients in Our Markets Commercial Real Estate

Banking Private Banking / Private Wealth Services Retail Banking Specialty Businesses Specialty Commercial Lending Treasury & Payment Solutions Capital Markets Mortgage Wealth (Brokerage, Trust) Commercial Sponsorship Specialty

Deposit Verticals Rob McCabe (Chief Banking Officer) Charlie Cl Geo ark Comme Georgia Bryan Be Tenness Kentuck graphic Market ee / y an rcial and Middle M Chris Ab Alabam Leadership a ele arket Banking Rick

Callic nd utt Carolinas a Virginia Scott Keit North / Central Flo rida h Mike Walker South Florida 13

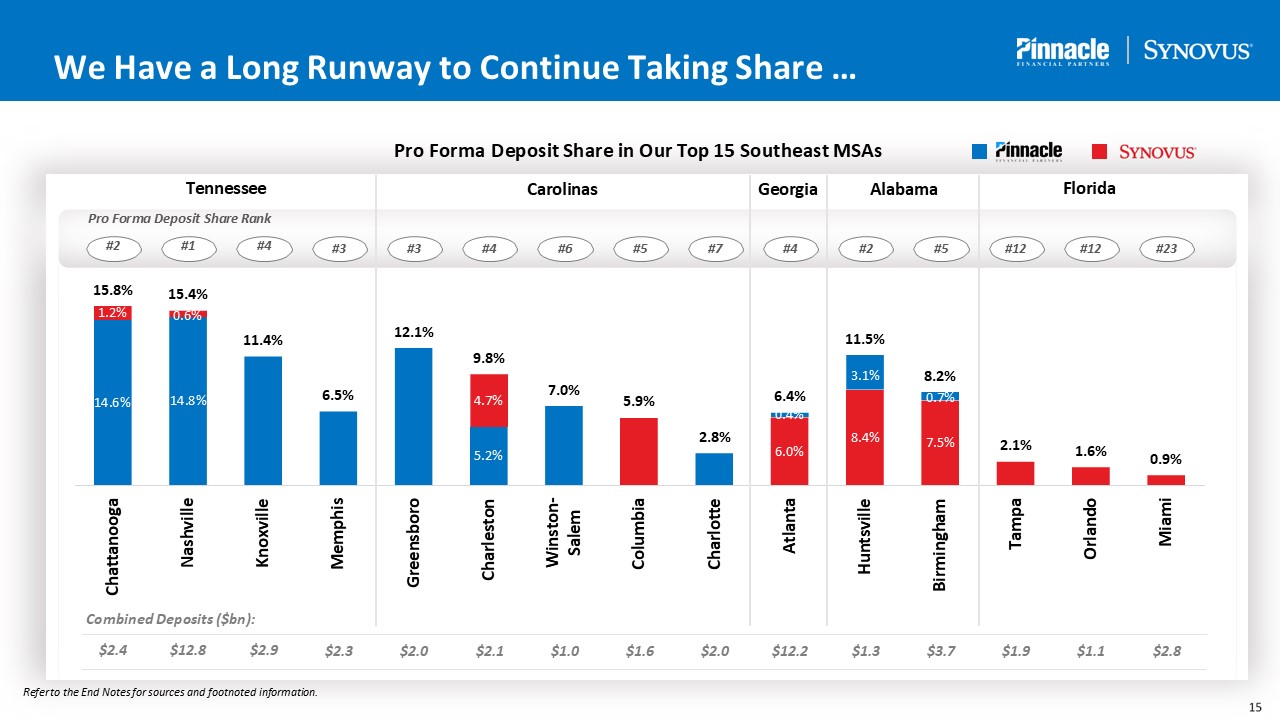

15 We Have a Long Runway to Continue Taking Share … Florida Pro Forma Deposit

Share in Our Top 15 Southeast MSAs Carolinas Georgia Alabama Tennessee Pro Forma Deposit Share Rank #2 #1

#4 #3 #3 #4 #6 #5 #7 #2 #5 #12 #12 #23 #4 14.6% 14.8% 5.2% 6.0% 8.4% 7.5% 1.2% 0.6% 4.7% 3.1% 0.7% 15.8% 15.4% 11.4% 6.5% 12.1% 9.8% 7.0% 5.9% 2.8% 6.4% 0.4% 11.5% 8.2% 2.1% 1.6% 0.9% Chattanooga Nashville Knoxville Memphis Greensboro Charleston Winston‐ Salem Columbia Charlotte Atlanta Huntsville Birmingham Tampa Orlando Miami Combined

Deposits ($bn): $2.4 $12.8 $2.9 $2.3 $2.0 $2.1 $1.0 $1.6 $2.0 $12.2 $1.3 $3.7 $1.9 $1.1 $2.8 Refer to the End Notes for sources and footnoted information.

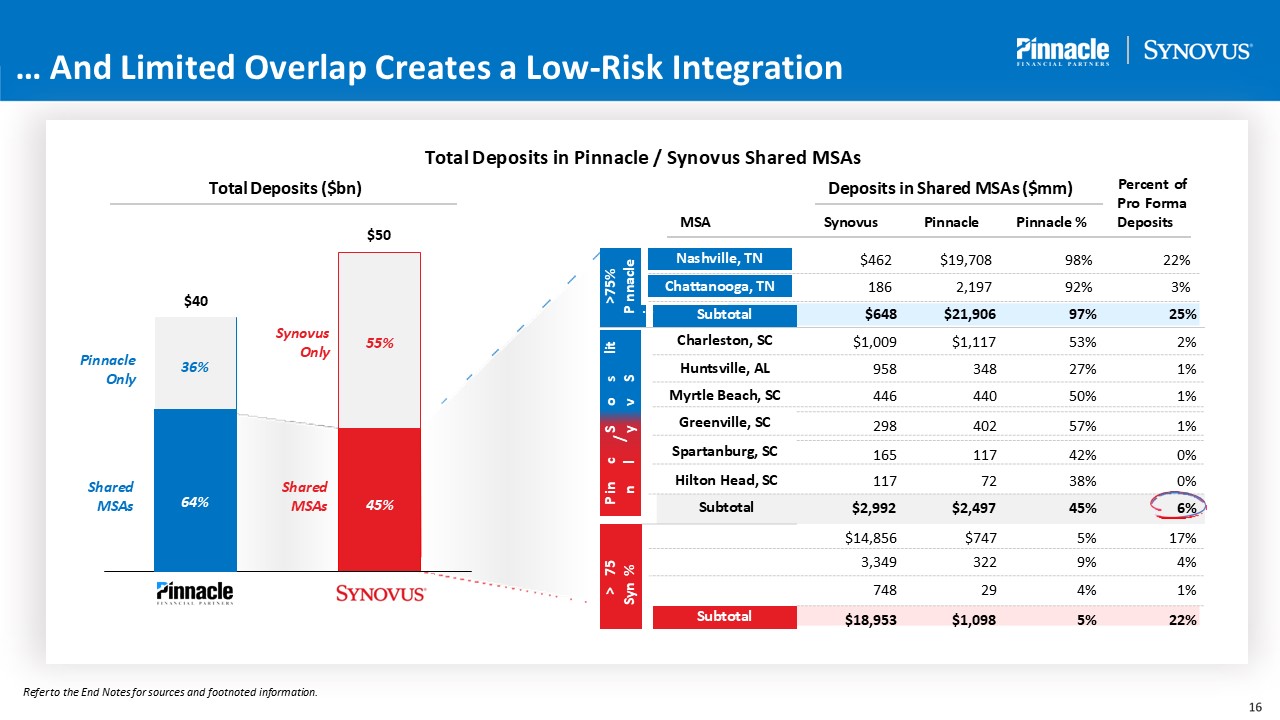

16 $40 $50 … And Limited Overlap Creates a Low‐Risk

Integration >75% nnacle / Nashville, TN Chattanooga, TN Percent of Pro Forma Deposits Total Deposits in Pinnacle / Synovus Shared MSAs Deposits in Shared MSAs ($mm) MSA Synovus Pinnacle Pinnacle % Total Deposits ($bn) Shared

MSAs Pinnacle Only Shared MSAs Synovus Only 64% 36% 22% $462 $19,708 98% 186 2,197 92% 3% Pi Subtotal $648 $21,906 97% 25% 55% lit Charleston, SC $1,009 $1,117 53% 2% s Sp Huntsville,

AL 958 348 27% 1% ovu Myrtle Beach, SC 446 440 50% 1% Syn Greenville, SC 298 402 57% 1% cle Spartanburg, SC 165 117 42% 0% inna Hilton Head, SC 117 72 38% 0% 45% P Subtotal $2,992 $2,497 45% 6% Atlanta,

GA $14,856 $747 5% 17% 75% ovus Birmingham, AL 3,349 322 9% 4% > Syn Jacksonville, FL 748 29 4% 1% Subtotal $18,953 $1,098 5% 22% Refer to the End Notes for sources and footnoted information.

17 #6 Customer Satisfaction #6 Net Promoter Score #2 People #4 Net

Promoter Score Best Bank Ease of Doing Business Best Bank Satisfaction with RMs #1 Bank You Can Trust #1 Overall Satisfaction Best Bank Trust Best Bank Overall Satisfaction #1 Understanding Your Industry #1 Satisfaction with

RMs Our Differentiated Client Focus Sets Us Apart Refer to the End Notes for sources and footnoted information.

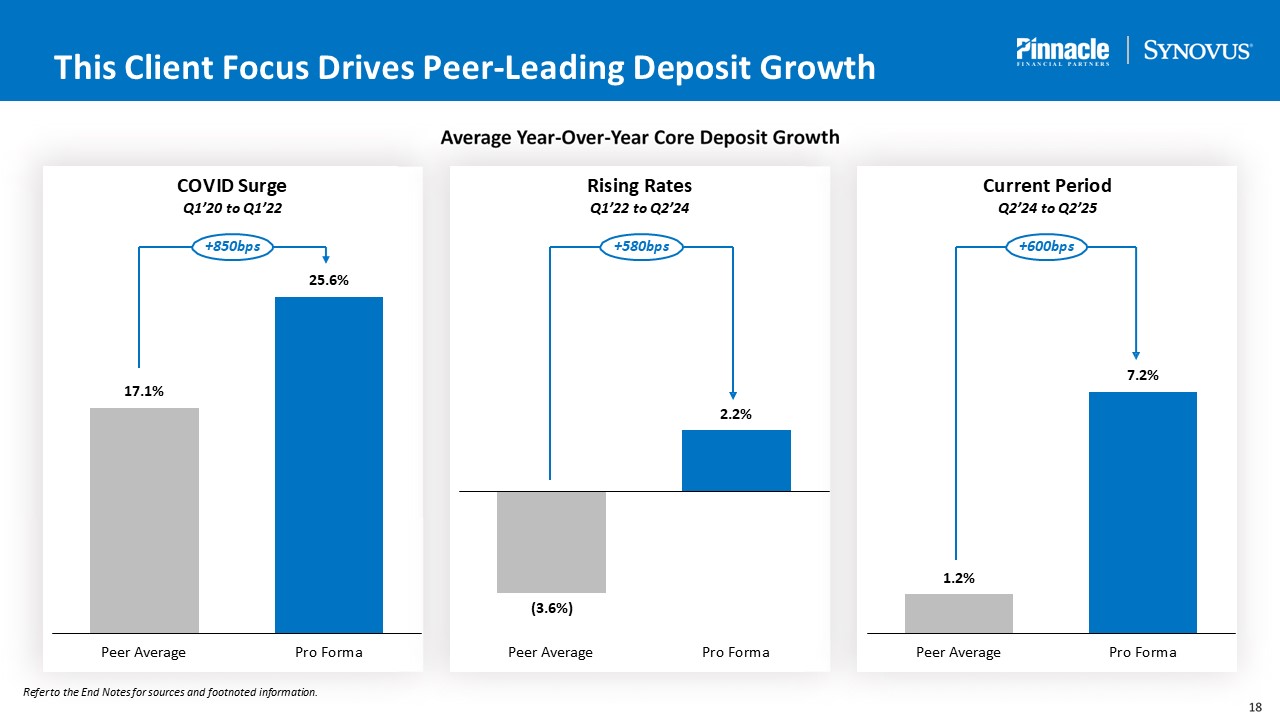

18 COVID Surge Q1’20 to Q1’22 This Client Focus Drives Peer‐Leading Deposit

Growth Average Year‐Over‐Year Core Deposit Growth Rising Rates Q1’22 to Q2’24 Current Period Q2’24 to Q2’25 +850bps +580bps +600bps 25.6% 17.1% 2.2% (3.6%) Pro Forma Peer Average 7.2% 1.2% Pro Forma Peer Average Peer

Average Pro Forma Refer to the End Notes for sources and footnoted information.

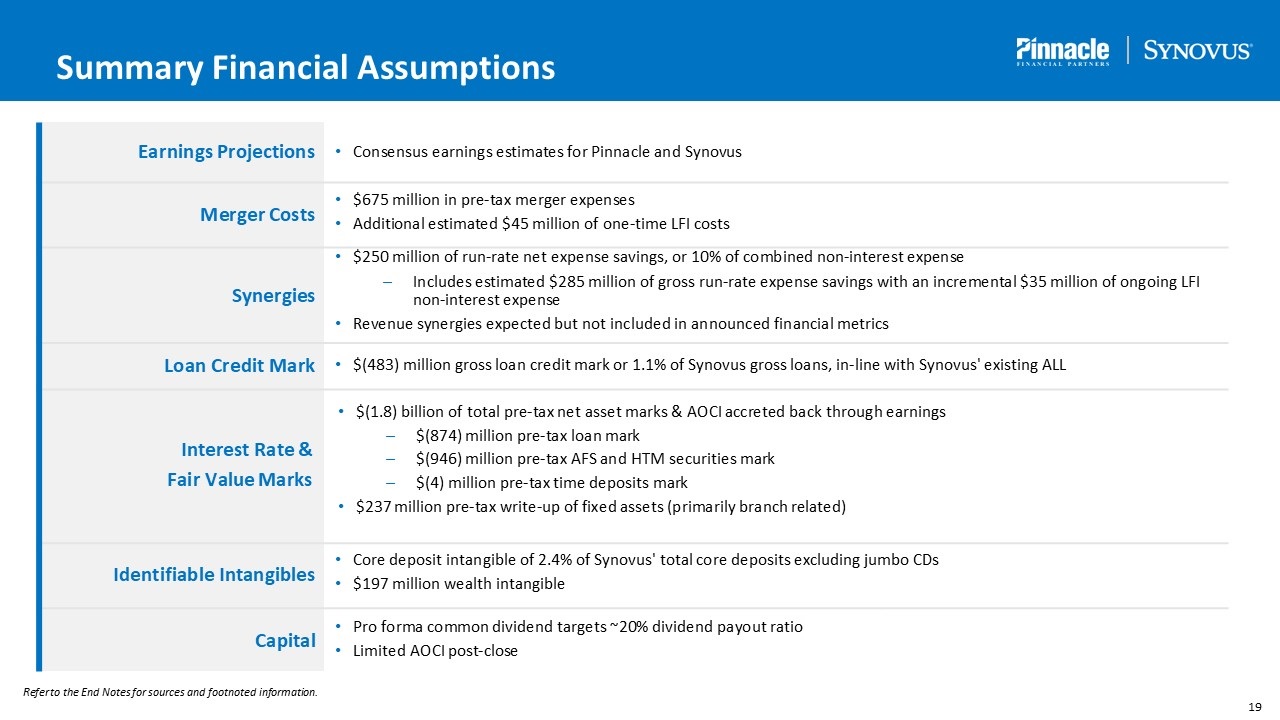

Earnings Projections Consensus earnings estimates for Pinnacle and

Synovus Merger Costs $675 million in pre‐tax merger expenses Additional estimated $45 million of one‐time LFI costs Synergies $250 million of run‐rate net expense savings, or 10% of combined non‐interest expense ‒ Includes estimated

$285 million of gross run‐rate expense savings with an incremental $35 million of ongoing LFI non‐interest expense Revenue synergies expected but not included in announced financial metrics Loan Credit Mark $(483) million gross loan credit

mark or 1.1% of Synovus gross loans, in‐line with Synovus' existing ALL Interest Rate & Fair Value Marks $(1.8) billion of total pre‐tax net asset marks & AOCI accreted back through earnings ‒ $(874) million pre‐tax loan mark ‒

$(946) million pre‐tax AFS and HTM securities mark ‒ $(4) million pre‐tax time deposits mark $237 million pre‐tax write‐up of fixed assets (primarily branch related) Identifiable Intangibles Core deposit intangible of 2.4% of Synovus'

total core deposits excluding jumbo CDs $197 million wealth intangible Capital Pro forma common dividend targets ~20% dividend payout ratio (GAAP NI) Limited AOCI post‐close 19 Summary Financial Assumptions Refer to the End Notes for

sources and footnoted information.

2 High‐Conviction, No‐Regrets Expense Savings … $250 million of run‐rate net

expense savings; additional investments for LFI readiness ($35 million) netted against gross synergies ($285 million) Limited front line impact and branch overlap Only ~5% of combined workforce expected to be impacted Synergies developed

through a bottom‐up detailed review of staffing, technology and real estate needs Conservative approach to cost savings; focus on preserving combined growth profile Primarily leveraging Synovus' technology stack 0

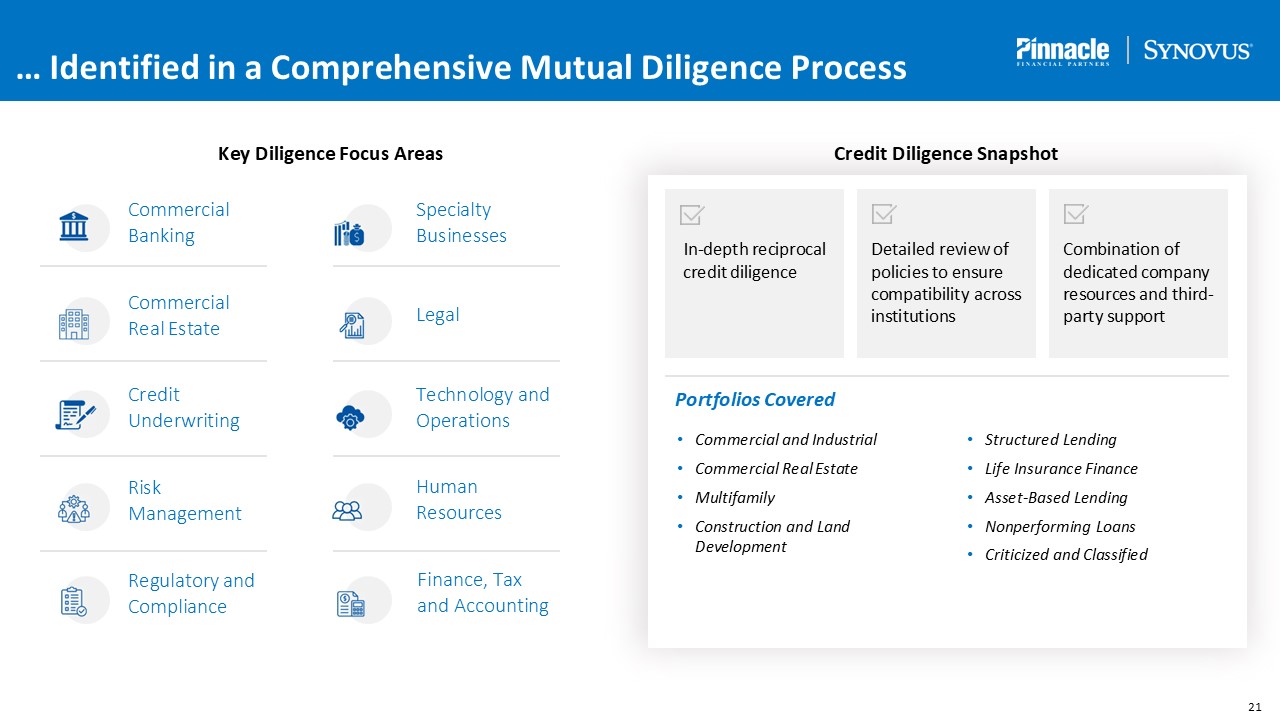

Commercial Banking … Identified in a Comprehensive Mutual Diligence

Process Key Diligence Focus Areas Specialty Businesses Commercial Real Estate Credit Underwriting Legal Risk Management Technology and Operations Regulatory and Compliance Finance, Tax and Accounting Human Resources Credit

Diligence Snapshot In‐depth reciprocal credit diligence Detailed review of policies to ensure compatibility across institutions Combination of dedicated company resources and third‐ party support Portfolios Covered Commercial and

Industrial Commercial Real Estate Multifamily Construction and Land Development Structured Lending Life Insurance Finance Asset‐Based Lending Nonperforming Loans Criticized and Classified 22

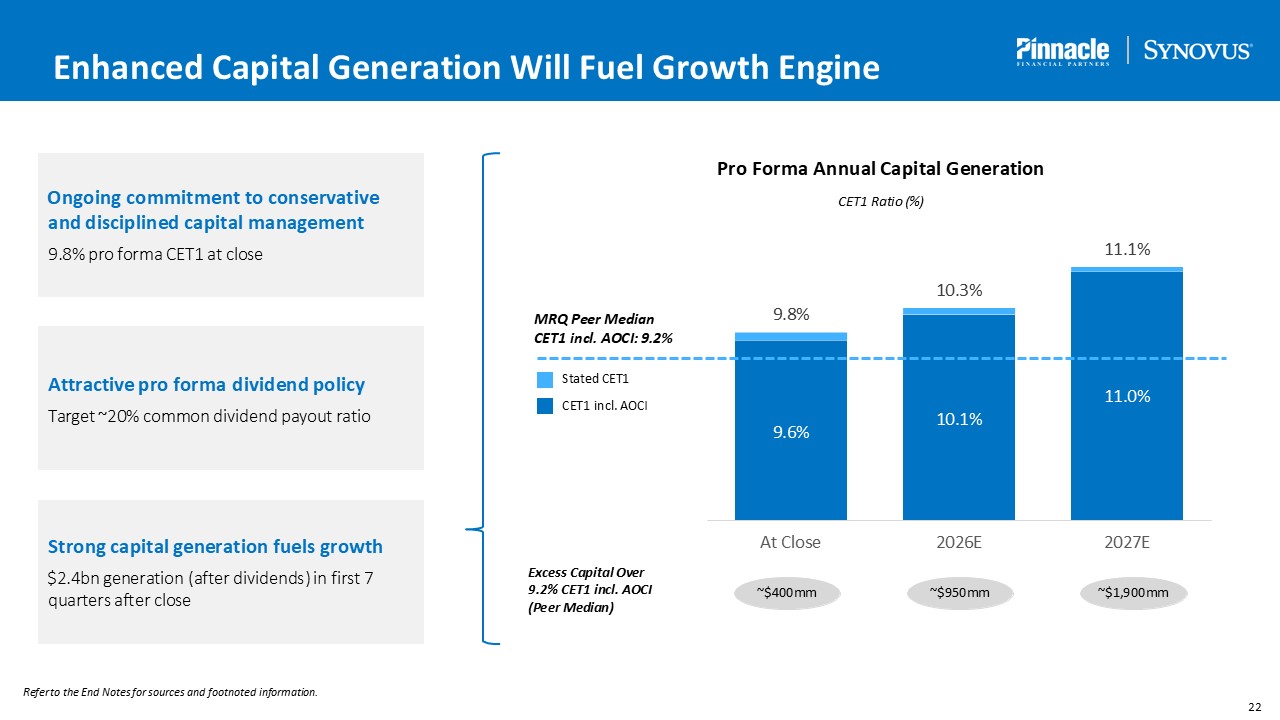

Enhanced Capital Generation Will Fuel Growth Engine Ongoing commitment to

conservative and disciplined capital management 9.8% pro forma CET1 at close Pro Forma Annual Capital Generation CET1 Ratio (%) Stated CET1 Excess Capital Over 9.2% CET1 incl. AOCI (Peer Median) ~$400mm ~$950mm ~$1,900mm Attractive

pro forma dividend policy Target ~20% common dividend payout ratio Strong capital generation fuels growth $2.4bn generation (after dividends) in first 7 quarters after close 9.6% 10.1% 11.0% 9.8% 10.3% 11.1% At

Close 2026E 2027E CET1 incl. AOCI MRQ Peer Median CET1 incl. AOCI: 9.2% Refer to the End Notes for sources and footnoted information. 22

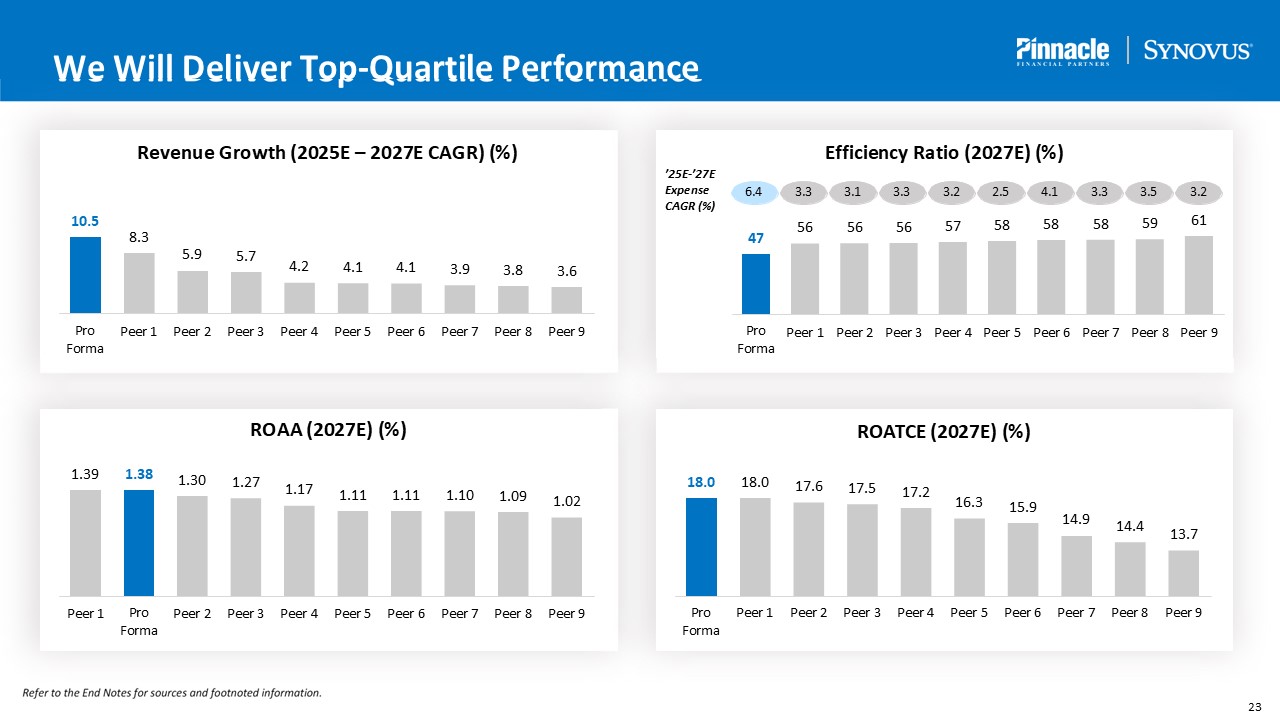

We Will Deliver Top‐Quartile Performance Refer to the End Notes for sources and

footnoted information. 10.5 8.3 5.9 5.7 4.2 4.1 4.1 3.9 3.8 3.6 Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 47 56 58 59 61 Pro Forma Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer

7 Peer 8 Peer 9 1.39 1.38 1.30 1.27 1.17 1.11 1.11 1.10 1.09 1.02 Peer 1 Pro Forma Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 18.0 18.0 17.6 17.5 17.2 16.3 15.9 14.9 14.4 13.7 Pro Peer 1 Peer 2 Peer 3

Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Forma Revenue Growth (2025E – 2027E CAGR) (%) ROAA (2027E) (%) ROATCE (2027E) (%) ’25E‐’27E Expense CAGR (%) 6.4 3.3 Efficiency Ratio (2027E) (%) 3.1 3.3 3.2 2.5 4.1 56 56 57 58

58 3.3 3.5 3.2 22

We Are Completely Aligned on Our Shared Vision … Compelling Strategic and

Financial Rationale Execution‐Ready with Key Decisions Made Highly compatible leadership and corporate cultures Most economically vibrant footprint in the country Financially compelling transaction with strong EPS accretion, achievable

cost savings and reasonable TBV earnback Further diversifies revenue mix while maintaining balance sheet and capital strength Deep leadership team with LFI experience Brand Name Leadership Operating model and core system Recruiting model

and compensation structure Holding company, bank headquarters and community commitments 22

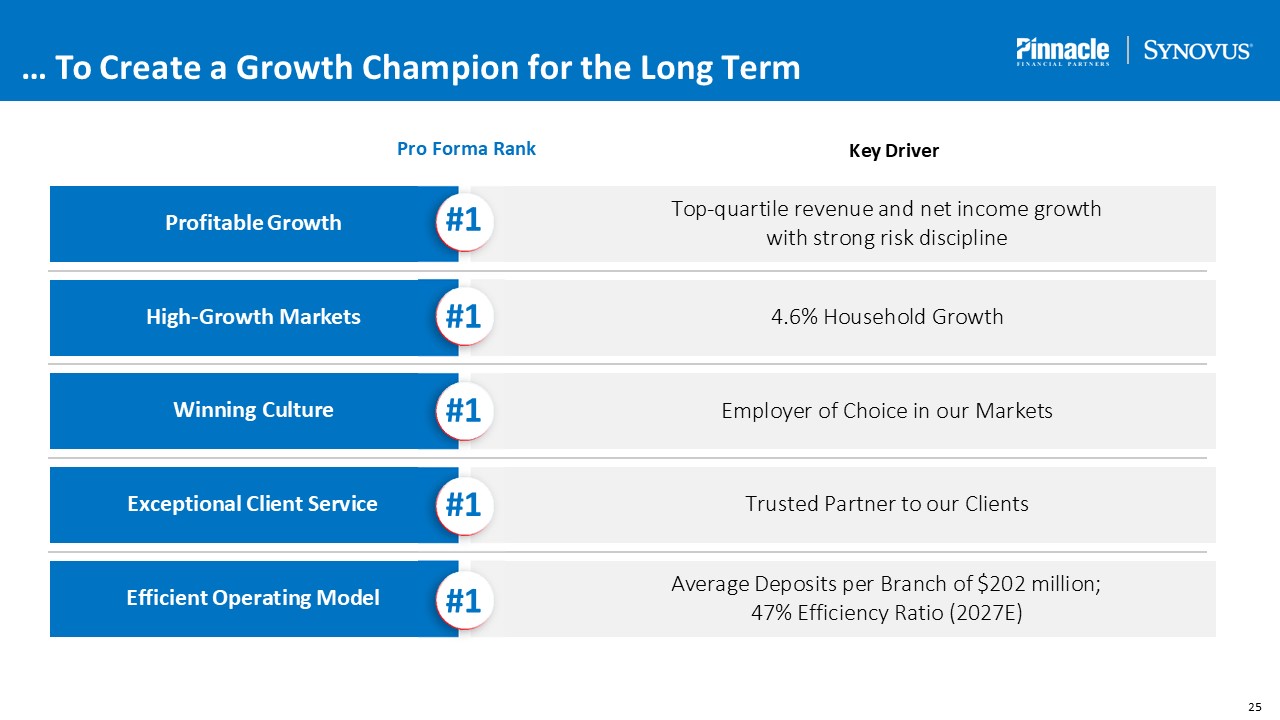

… To Create a Growth Champion for the Long Term High‐Growth Markets Winning

Culture Exceptional Client Service Profitable Growth Efficient Operating Model 4.6% Household Growth Employer of Choice in our Markets Top‐quartile revenue and net income growth with strong risk discipline Trusted Partner to our

Clients Average Deposits per Branch of $202 million; 47% Efficiency Ratio (2027E) Pro Forma Rank Key Driver #1 22 #1 #1 #1 #1

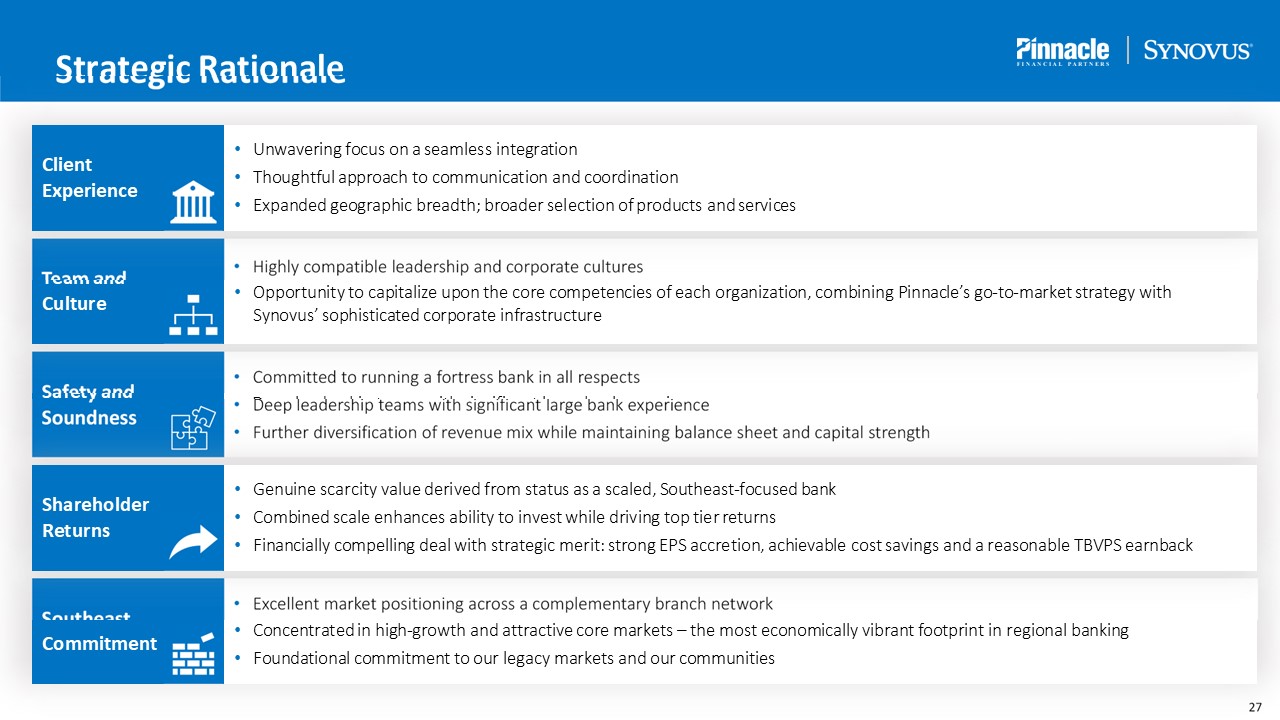

27 Strategic Rationale Concentrated in high‐growth and attractive core markets

– the most economically vibrant footprint in regional banking Foundational commitment to our legacy markets and our communities • Excellent market positioning across a complementary branch network Southeast Commitment • Committed to

running a fortress bank in all respects Safety and • Deep leadership teams with significant large bank experience Soundness • Further diversification of revenue mix while maintaining balance sheet and capital strength Genuine scarcity

value derived from status as a scaled, Southeast‐focused bank Combined scale enhances ability to invest while driving top tier returns Financially compelling deal with strategic merit: strong EPS accretion, achievable cost savings and a

reasonable TBVPS earnback Shareholder Returns • Highly compatible leadership and corporate cultures Opportunity to capitalize upon the core competencies of each organization, combining Pinnacle’s go‐to‐market strategy with Synovus’

sophisticated corporate infrastructure Team and Culture Unwavering focus on a seamless integration Thoughtful approach to communication and coordination Expanded geographic breadth; broader selection of products and services Client

Experience

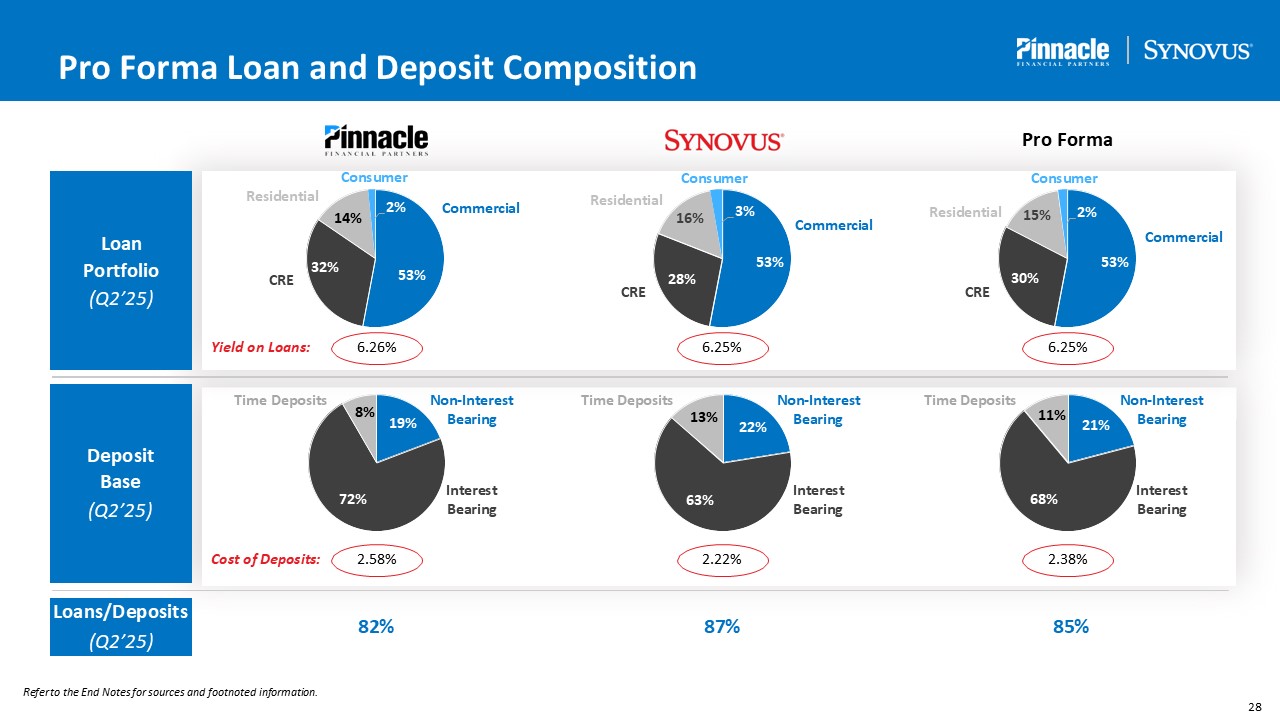

Pro Forma Loan and Deposit Composition Loan Portfolio (Q2’25) Deposit

Base (Q2’25) Loans/Deposits (Q2’25) CRE Commercial Non‐Interest Bearing Interest Bearing Time Deposits 82% 87% 85% Consumer Yield on Loans: 6.26% 6.25% 6.25% Residential CRE Residential CRE Residential Non‐Interest

Bearing Interest Bearing Time Deposits Non‐Interest Bearing Interest Bearing Time Deposits Cost of Deposits: 2.58% 2.22% 2.38% Pro

Forma Commercial Commercial Consumer Consumer 53% 32% 14% 2% 53% 28% 16% 3% 53% 30% 15% 2% 19% 72% 8% 22% 63% 13% 21% 68% 11% Refer to the End Notes for sources and footnoted information. 28

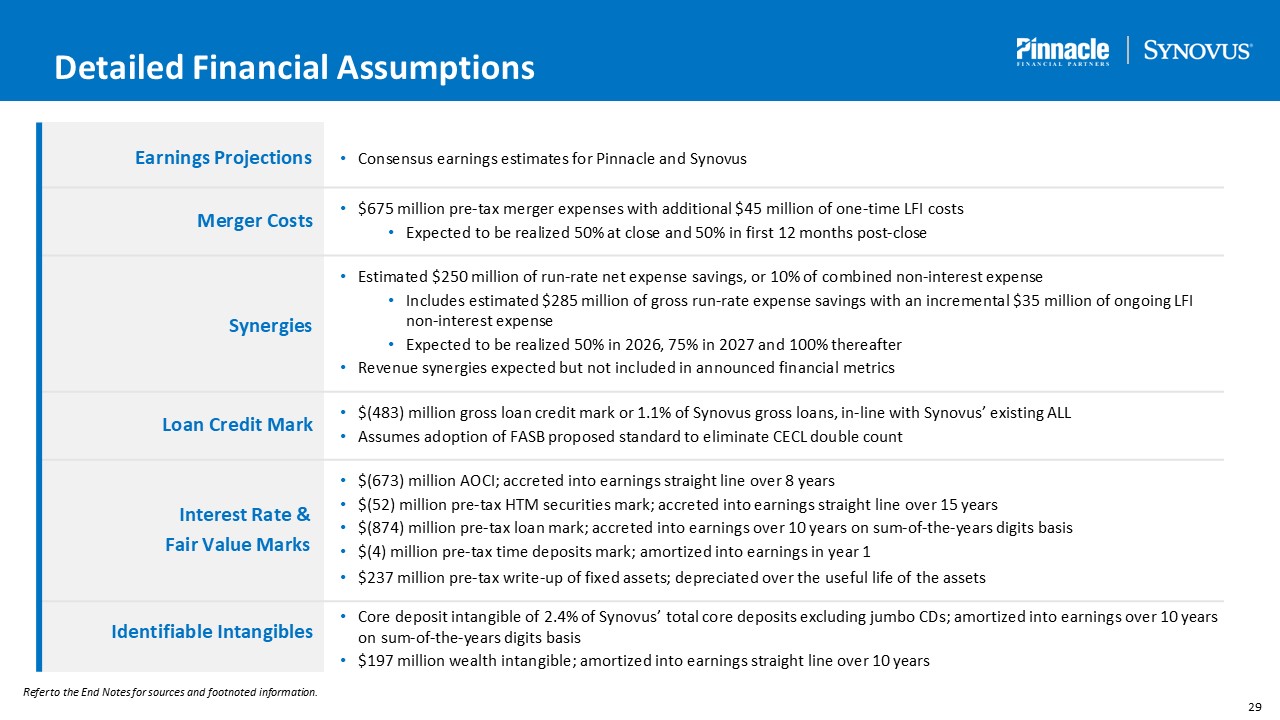

Earnings Projections Consensus earnings estimates for Pinnacle and

Synovus Merger Costs $675 million pre‐tax merger expenses with additional $45 million of one‐time LFI costs Expected to be realized 50% at close and 50% in first 12 months post‐close Synergies Estimated $250 million of run‐rate net

expense savings, or 10% of combined non‐interest expense Includes estimated $285 million of gross run‐rate expense savings with an incremental $35 million of ongoing LFI non‐interest expense Expected to be realized 50% in 2026, 75% in 2027

and 100% thereafter Revenue synergies expected but not included in announced financial metrics Loan Credit Mark $(483) million gross loan credit mark or 1.1% of Synovus gross loans, in‐line with Synovus’ existing ALL Assumes adoption of

FASB proposed standard to eliminate CECL double count Interest Rate & Fair Value Marks $(673) million AOCI; accreted into earnings straight line over 8 years $(52) million pre‐tax HTM securities mark; accreted into earnings straight

line over 15 years $(874) million pre‐tax loan mark; accreted into earnings over 10 years on sum‐of‐the‐years digits basis $(4) million pre‐tax time deposits mark; amortized into earnings in year 1 $237 million pre‐tax write‐up of fixed

assets; depreciated over the useful life of the assets Identifiable Intangibles Core deposit intangible of 2.4% of Synovus’ total core deposits excluding jumbo CDs; amortized into earnings over 10 years on sum‐of‐the‐years digits

basis $197 million wealth intangible; amortized into earnings straight line over 10 years Refer to the End Notes for sources and footnoted information. 28 Detailed Financial Assumptions

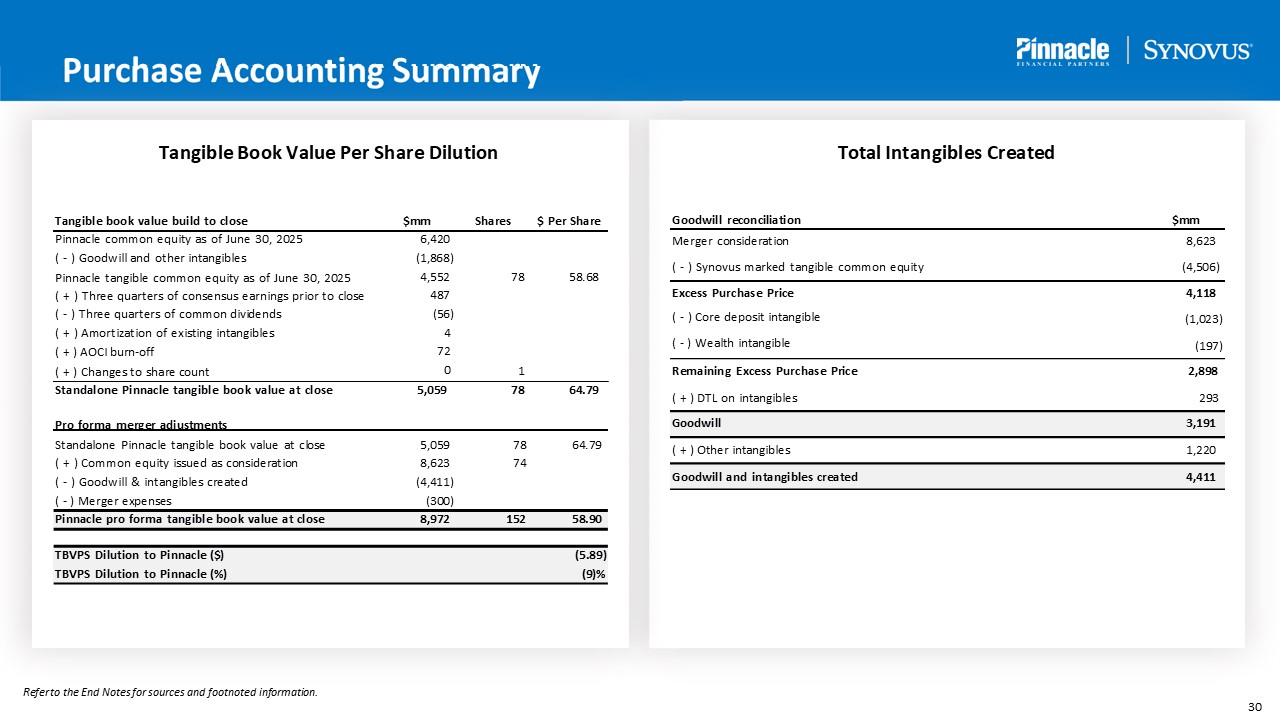

Purchase Accounting Summary Tangible Book Value Per Share Dilution Total

Intangibles Created Tangible book value build to close $mm Shares $ Per Share 78 58.68 Pinnacle common equity as of June 30, 2025 ( ‐ ) Goodwill and other intangibles Pinnacle tangible common equity as of June 30, 2025 ( + ) Three

quarters of consensus earnings prior to close ( ‐ ) Three quarters of common dividends ( + ) Amortization of existing intangibles ( + ) AOCI burn‐off ( + ) Changes to share count 6,420 (1,868) 4,552 487 (56) 4 72 0 1 Standalone

Pinnacle tangible book value at close 5,059 78 64.79 Pro forma merger adjustments Standalone Pinnacle tangible book value at close 5,059 78 64.79 ( + ) Common equity issued as consideration 8,623 74 ( ‐ ) Goodwill & intangibles

created (4,411) ( ‐ ) Merger expenses (300) Pinnacle pro forma tangible book value at close 8,972 152 58.90 TBVPS Dilution to Pinnacle ($) (5.89) TBVPS Dilution to Pinnacle (%) (9)% Goodwill reconciliation $mm Merger

consideration 8,623 ( ‐ ) Synovus marked tangible common equity (4,506) Excess Purchase Price 4,118 ( ‐ ) Core deposit intangible ( ‐ ) Wealth intangible (1,023) (197) Remaining Excess Purchase Price ( + ) DTL on

intangibles 2,898 293 Goodwill 3,191 ( + ) Other intangibles 1,220 Goodwill and intangibles created 4,411 Refer to the End Notes for sources and footnoted information. 28

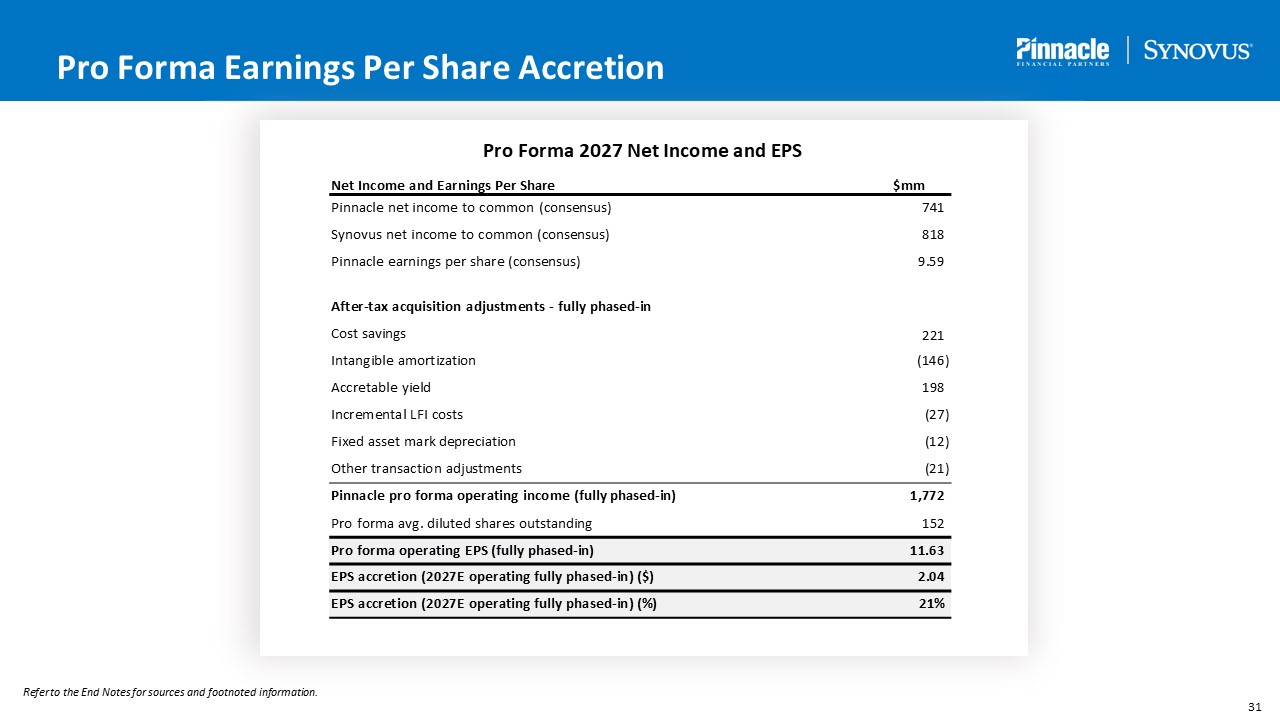

Pro Forma Earnings Per Share Accretion Pro Forma 2027 Net Income and EPS Net

Income and Earnings Per Share $mm Pinnacle net income to common (consensus) 741 Synovus net income to common (consensus) 818 Pinnacle earnings per share (consensus) 9.59 After‐tax acquisition adjustments ‐ fully phased‐in Cost

savings 221 Intangible amortization (146) Accretable yield 198 Incremental LFI costs (27) Fixed asset mark depreciation (12) Other transaction adjustments (21) Pinnacle pro forma operating income (fully phased‐in) 1,772 Pro

forma avg. diluted shares outstanding 152 Pro forma operating EPS (fully phased‐in) 11.63 EPS accretion (2027E operating fully phased‐in) ($) 2.04 EPS accretion (2027E operating fully phased‐in) (%) 21% Refer to the End Notes for

sources and footnoted information. 28

End Notes 32 Peers listed include CFG, FITB, HBAN, KEY, MTB, PNC, RF, TFC and

USB. Page 6 – The Combination is Financially Compelling … Scale figures represent a simple summation as of June 30, 2025 and exclude purchase accounting adjustments. EPS accretion and profitability metrics presented as of 2027E and include

fully phased‐in cost savings. Reflects operating efficiency ratio including accretable yield. Page 7 –… And Positioned to Deliver for Clients and Investors … Source: S&P Capital IQ Pro, FDIC, J.D. Power and Coalition Greenwich. FDIC

deposit data as of June 30, 2024 and capped at $5 billion per branch. EPS Growth and Revenue Growth reflect 2014‐2024 Adjusted EPS CAGR and 2014‐2024 Adjusted Total Revenue per share CAGR, respectively. Household growth reflects estimated

2025‐2030 (not annualized); growth rate reflects deposit‐weighted average based on MSA‐level deposits. Employee satisfaction reflects Glassdoor average employee satisfaction (out of 5 stars) as of June 27, 2025. J.D. Power rankings reflect