Deloitte & Touche LLP

Harborside Plaza 10, Suite 400

Jersey

City, NJ 07311

USA

Tel: +1 212 937 8200

Fax: +1 212 937 8298

www.deloitte.com

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM ABS-15G

ASSET-BACKED SECURITIZER

REPORT PURSUANT TO SECTION 15G OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box to indicate the filing obligation to which this form is intended to satisfy:

[_] Rule 15Ga-1 under the Exchange Act (17 CFR 240.15Ga-1) for the reporting period

_______________ to ______________

Date of Report (Date of earliest event reported) ________________

Commission File Number of securitizer: ________________

Central Index Key Number of securitizer: ________________

Name and telephone number, including area code, of

the person to

contact in connection with this filing

Indicate by check mark whether the securitizer has no activity to report for the initial period pursuant to Rule 15Ga-1(c)(1) [_]

Indicate by check mark whether the securitizer has no activity to report for the quarterly period pursuant to Rule 15Ga-1(c)(2)(i) [_]

Indicate by check mark whether the securitizer has no activity to report for the annual period pursuant to Rule 15Ga-1(c)(2)(ii) [_]

[X] Rule 15Ga-2 under the Exchange Act (17 CFR 240.15Ga-2)

Central Index Key Number of depositor: 0001952528

Osprey Securitization I, LLC

(Exact name of issuing entity as specified in its charter)

Central Index Key Number of issuing entity (if applicable): Not

applicable

Central Index Key Number of underwriter (if applicable): Not applicable

James Hutson, (518) 949 0165

Name and telephone number, including area

code, of the person to

contact in connection with this filing

PART II: FINDINGS AND CONCLUSIONS OF THIRD-PARTY DUE DILIGENCE REPORTS

Item 2.01: Findings and Conclusions of a Third Party Due Diligence Report Obtained by the Issuer

The disclosures required by Rule 15Ga-2 (17 CFR 240.15Ga-2) are attached as Exhibits to this Form ABS-15G. Please see Exhibit 99.1 and Exhibit 99.2 for the related information.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the reporting entity has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| OSPREY SECURITIZATION HOLDINGS I, LLC (Depositor) | |||

| By: | /s/ James Hutson | ||

| Name: | James Hutson | ||

| Title: | Vice President | ||

Date: November 10, 2022

EXHIBIT INDEX

| Exhibit 99.1 | Independent Accountants’ Report on Applying Agreed-Upon Procedures, dated November 8, 2022. |

| Exhibit 99.2 | Solar Portfolio Securitization - Technical Due Diligence Report, dated November 5, 2022. |

Exhibit 99.1

|

Deloitte & Touche LLP Harborside Plaza 10, Suite 400 Jersey

City, NJ 07311

Tel: +1 212 937 8200 Fax: +1 212 937 8298 www.deloitte.com |

|

Distributed Solar Development, LLC 200 Harborside Drive, Suite 200 Schenectady, New York 12305 |

|

Independent Accountants’ Report

on Applying Agreed-Upon Procedures

We have performed the procedures described below, related to certain information with respect to a portfolio of renewable energy assets in connection with the proposed offering of Osprey Securitization I, LLC Series 2022-1. Distributed Solar Development, LLC (the “Company”) is responsible for the information provided to us, including the information set forth in the Data File (as defined herein).

The Company has agreed to the procedures and acknowledged that the procedures performed are appropriate to meet the intended purpose of evaluating the accuracy of certain information set forth in the Data File. Additionally, Credit Suisse Securities (USA) LLC (together with the Company, the “Specified Parties”) has agreed to the procedures and acknowledged that the procedures performed are appropriate for their purposes. This report may not be suitable for any other purpose. The procedures performed may not address all of the items of interest to a user of the report and may not meet the needs of all users of the report and, as such, users are responsible for determining whether the procedures performed are appropriate for their purposes. Consequently, we make no representations regarding the appropriateness of the procedures described below either for the purpose for which this report has been requested or for any other purpose.

We performed certain procedures on earlier versions of the Data File and communicated differences prior to being provided the final Data File which was subjected to the procedures described below.

Agreed-Upon Procedures

On November 8, 2022, representatives of the Company provided us with a computer-generated data file (the “Data File”) and related record layout containing data, as represented to us by the Company, as of the close of business September 30, 2022, with respect to 116 renewable energy assets (the “Assets”).

At the Company’s instruction, we performed certain comparisons and recomputations for each of the Assets relating to the renewable energy asset characteristics (the “Characteristics”) set forth on the Data File and indicated below.

Member of Deloitte Touche Tohmatsu Limited |

Characteristics

| 1. | Tax Equity Partnership | 43. | Ongoing Subscriber Manager |

| 2. | State | 44. | Ongoing Subscriber Management Escalator |

| 3. | Configuration / Technology | 45. | Operator |

| 4. | Battery Energy Storage System? (BESS) | 46. | Interconnecting Utility / Distribution Company; |

| 5. | Battery (kW) | 47. | Battery Equipment: Manufacturer |

| 6. | Battery (kWh) | 48. | Credit Banking Period for Community Solar Assets |

| 7. | Substantial Completion (COD) Date | 49. | PBI Type |

| 8. | Front of Meter (FTM) or Behind the Meter (BTM) | 50. | PBI Obligor |

| 9. | Project Contract Term (years) | 51. | PBI End Date |

| 10. | Contract Type | 52. | PBI Rate ($/kWh) |

| 11. | C&I Offtake (%) | 53. | Frequency of PBI Payments |

| 12. | Residential Community Solar Offtake (%) | 54. | Offtaker 1 |

| 13. | Guaranteed Output if applicable (kWh) | 55. | Offtaker 2 |

| 14. | Frequency of Customer Payments (days) | 56. | Offtaker 3 |

| 15. | Termination for Convenience Provision? | 57. | Offtaker 4 |

| 16. | C&I Contract Price ($/kWh) | 58. | Offtaker 5 |

| 17. | C&I Contract Escalator % | 59. | Offtaker 1 Concentration of Project (% of kW DC) |

| 18. | System Capacity (kWdc) | 60. | Offtaker 2 Concentration of Project (% of kW DC) |

| 19. | Year 1 Production Estimate (kWh) | 61. | Offtaker 3 Concentration of Project (% of kW DC) |

| 20. | Inverter: Manufacturer | 62. | Offtaker 4 Concentration of Project (% of kW DC) |

| 21. | Panel: Manufacturer | 63. | Offtaker 5 Concentration of Project (% of kW DC) |

| 22. | Racking: Manufacturer | 64. | Offtaker 1 S&P Rating |

| 23. | BESS Incentive Amount ($) | 65. | Offtaker 1 Moody's Rating |

| 24. | BESS Incentive Payment Frequency | 66. | Offtaker 1 Minimum Rating |

| 25. | BESS Incentive Payment End Date | 67. | Offtaker 2 S&P Rating |

| 26. | Remaining NYSERDA Incentive Amount | 68. | Offtaker 2 Moody's Rating |

| 27. | NYSERDA Incentive Payment Frequency | 69. | Offtaker 2 Minimum Rating |

| 28. | NYSERDA Incentive Payment End Date | 70. | Offtaker 3 S&P Rating |

| 29. | Hedged SREC Counterparty | 71. | Offtaker 3 Moody's Rating |

| 30. | Hedged SREC Quantity | 72. | Offtaker 3 Minimum Rating |

| 31. | Frequency of SREC Payments | 73. | Offtaker 4 S&P Rating |

| 32. | REC / SREC / L&ZREC Price ($/MWh) | 74. | Offtaker 4 Moody's Rating |

| 33. | REC / SREC / L&ZREC Term (years) | 75. | Offtaker 4 Minimum Rating |

| 34. | REC / SREC / L&ZREC Start Date | 76. | Offtaker 5 S&P Rating |

| 35. | REC / SREC / L&ZREC End Date | 77. | Offtaker 5 Moody's Rating |

| 36. | 20-Year Contractual REC Expense ($/MWh) | 78. | Offtaker 5 Minimum Rating |

| 37. | Land Lease Payment ($/kWdc) | 79. | Guaranteed Output Percentage (%) |

| 38. | Lease Termination Date | 80. | O&M Expense (During Contract) Escalator |

| 39. | Lease Extension Option | 81. | Asset Management Escalator |

| 40. | Lease Rent Rate (per year) | 82. | O&M Expense - During Contract ($/kWdc) |

| 41. | Lease Rent Rate annual escalator | 83. | Asset Management ($/kWdc) |

| 42. | Ongoing Subscription Management ($/kWdc) |

We compared Characteristic 1. to the corresponding information set forth on the “Register of Members.”

We compared Characteristics 2. through 7. to the corresponding information set forth on or derived from site plans, engineering reports or construction drawings set forth in the Company records (collectively, the “Site Plans”).

With respect to Characteristic 8., for Assets with a Contract Type (as set forth on derived from the related Agreement) (i) of “power purchase agreement,” we observed “BTM” on the Data file and (ii) not “power purchase agreement,” we observed “FTM;”

We compared Characteristics 9. through 15. and 54. through 63. to the corresponding information set forth on or derived from the "Power Purchase Agreement", "Credit Purchase Agreement" or "Master Services Agreement" (collectively, the “Agreement”).

We compared Characteristics 16. and 17. to the corresponding information set forth on or derived from the Power Purchase Agreement or the “Statement of Qualification.”

We compared Characteristics 18. and 19. to the corresponding information set forth on or derived from the “PVsyst – Simulation Report.”

We compared Characteristics 20. through 22. to the corresponding information set forth on or derived from the "Warranty Certificate" or PVsyst - Simulation Report.

We compared Characteristics 23. through 25. to the corresponding information set forth on or derived from the "Conditional Reservation Letter" or "Summary of PPA Provisions."

We compared Characteristics 26. through 28. to the corresponding information set forth on or derived from the "NYSERDA Incentive Confirmation Letter."

We compared Characteristics 29. through 33. to the corresponding information set forth on or derived from the “REC Agreement.”

We compared Characteristics 34. and 35. to the corresponding information set forth on or derived from the “Independent Engineers Certificate.”

We compared Characteristic 36. to the corresponding information set forth on the "Solar Rewards Community Producer Agreement."

We compared Characteristics 37. through 41. to the corresponding information set forth on or derived from the Solar Land Lease, Land Lease Agreement or any amendments thereto (collectively the "Land Lease Agreement").

We compared Characteristic 42. through 44. to the corresponding information set forth on or derived from the "Community Solar Customer Management Agreement."

We compared Characteristic 45. to the corresponding information set forth on or derived from the Power Purchase Agreement or "Subscription Agreement."

We compared Characteristic 46. to the corresponding information set forth on or derived from the "Assignment and Assumption Agreement."

We compared Characteristic 47. to the corresponding information set forth on the “EPC Site Addenda.”

We compared Characteristic 48. to the corresponding information set forth on the "Community Solar Market Banked Credits Overview."

We compared Characteristics 49. through 53. to the corresponding information set forth on or derived from the Power Purchase Agreement, "Statement of Qualification," "TREC Approval" or "Conditional Reservation."

We compared Characteristics 54. through 58. to the corresponding information set forth on or derived from the “Offtaker Agreement”.

We compared Characteristics 59. through 63. to the corresponding information set forth on or derived from schedules provided to us by the Company (the “Offtaker Concentration Schedules”).

We compared Characteristics 64. through 78. to the corresponding information set forth on or derived from screen shots from the respective credit rating agency website (the “Credit Rating Screen Shots”).

With respect to our comparison of Characteristic 79. we recomputed the guaranteed output percentage as the quotient of (i) the Guaranteed Output (as set forth on or derived from on the Agreement) and (ii) the Year 1 Production Estimate (as set forth on or derived from the PVsyst Simulation Report). We compared such recomputed information to the corresponding information set forth on the Data File.

With respect to our comparison of Characteristics 80. and 81. we observed a value of 2% for the O&M Expense (During Contract) Escalator and Asset Management Escalator on the Data File.

With respect to our comparison of Characteristics 82. and 83. using certain methodologies and assumptions provided to us by representatives of the Company we recomputed the O&M expense - During Contract ($/kWdc) and Asset Management ($/kWdc). We compared such recomputed information to the corresponding information set forth on the Data File.

For purposes of our procedures and at your instruction:

| · | with respect to our comparison of Characteristic 18., differences of 1 kWdc or less are deemed to be in agreement; and |

| · | with respect to our comparison of Characteristics 7., 25., 28., 34., 35., 38. and 51., differences of 30 days or less are deemed to be in agreement. |

The renewable energy asset documents described above and any other related documents used in support of the Characteristics were provided to us by representatives of the Company and are collectively referred to hereinafter as the “Asset Documents.” We were not requested to perform, and we did not perform, any procedures with respect to the preparation or verification of any of the information set forth on the Asset Documents and we make no representations concerning the accuracy or completeness of any of the information contained therein. In certain instances, our procedures were performed using data imaged facsimiles or photocopies of the Asset Documents. In addition, we make no representations as to whether the Asset Documents are comprehensive or valid instruments or reflect the current prevailing terms with respect to the corresponding Assets.

Agreed-Upon Procedures’ Findings

The results of the foregoing procedures indicated that the Characteristics set forth on the Data File were found to be in agreement with the above mentioned Asset Documents.

******

We make no representations as to the (i) actual characteristics or existence of the underlying documents or data comprising the assets or underlying documentation underlying the Data File or the conformity of their characteristics with those assumed for purposes of the procedures described herein, (ii) existence or ownership of the assets or (iii) reasonableness of any of the aforementioned assumptions, information or methodologies.

It should be understood that we make no representations as to questions of legal interpretation or as to the sufficiency for your purposes of the procedures enumerated in the preceding paragraphs. Also, such procedures would not necessarily reveal any material misstatement of the information referred to above. We have no responsibility to update this report for events or circumstances that occur subsequent to the date of this report.

We were engaged by the Company to perform this agreed-upon procedures engagement and conducted our engagement in accordance with attestation standards established by the American Institute of

Certified Public Accountants (“AICPA”). An agreed-upon procedures engagement involves the practitioner performing specific procedures that the engaging party has agreed to and acknowledged to be appropriate for the purpose of the engagement and reporting on findings based on the procedures performed. We were not engaged to conduct, and did not conduct, an (i) audit conducted in accordance with generally accepted auditing standards or (ii) examination or a review engagement conducted in accordance with attestation standards established by the AICPA, the objective of which would be the expression of an opinion or conclusion, respectively, on the Data File. Accordingly, we do not express such an opinion or conclusion, or any other form of assurance, including reasonable assurance. Had we performed additional procedures, other matters might have come to our attention that would have been reported to you.

We are required to be independent of the Company and to meet our other ethical responsibilities, as applicable for agreed-upon procedures engagements set forth in the Preface: Applicable to All Members and Part 1 – Members in Public Practice of the Code of Professional Conduct established by the AICPA. Independence requirements for agreed-upon procedure engagements are less restrictive than independence requirements for audit and other attestation services.

None of the engagement, procedures or report was intended to address, nor did they address, the (i) conformity of the origination of the assets to stated underwriting or credit extension guidelines, standards, criteria or other requirements, (ii) value of collateral securing such assets or (iii) compliance of the originator of the assets with federal, state, and local laws and regulations.

None of the engagement, procedures or report were intended to satisfy, nor did they satisfy, any criteria for due diligence published by a nationally recognized statistical rating organization.

This report is intended solely for the information and use of the Specified Parties identified above and is not intended to be and should not be used by anyone other than these Specified Parties.

Yours truly,

/s/ Deloitte & Touche LLP

November 8, 2022

Exhibit 99.2

Distributed Solar Development, LLC |

Solar Portfolio Securitization | FINAL |

|

Solar Portfolio Securitization

Technical Due Diligence Report B&V PROJECT NO. 412545

|

|

Distributed Solar Development, LLC 5 November 2022 |

| BLACK & VEATCH | SN-1 |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

Special Notice

Acceptance of this report, or use of any information contained in this report, by any party receiving this report (each a “Recipient”) shall constitute an acknowledgement and acceptance by such Recipient of, and agreement by such Recipient to be bound by, the following:

(1) This report was prepared for Distributed Solar Development, LLC (“Client”) by Black & Veatch Management Consulting, LLC (“Black & Veatch”) and is based on information not within the control of Black & Veatch. In preparing this report, Black & Veatch has assumed that the information, both verbal and written, provided by others is complete and correct. Black & Veatch does not guarantee the accuracy of the information, data or opinions contained in this report and does not represent or warrant that the information contained in this report is sufficient or appropriate for any purpose.

(2) This report should not be construed as an invitation or inducement to any Recipient or other party to engage or otherwise participate in the proposed or any other transaction, to provide any financing, or to make any investment. Recipient acknowledges and agrees that it is not reasonably feasible for Black & Veatch to conduct a comprehensive investigation and make definitive determinations for the compensation provided and without thorough verification of the information upon which the Services were performed, and therefore Black & Veatch can offer no guarantee or assurances that any facts, observations, analysis, projections, opinions, or other matters contained in the report will be more accurate, either at the time the report is issued or at any other time.

(3) Recipient is not entitled to make any copies of any portion of this report, use extracts therefrom or transmit any part thereof to any other party in any form, including without limitation electronic or printed media of any kind.

(4) TO THE FULLEST EXTENT PERMITTED BY LAW, BLACK & VEATCH S TOTAL LIABILITY, ON A CUMULATIVE AND AGGREGATE BASIS, TO CLIENT AND ALL RECIPIENTS AND OTHER PARTIES, RESULTING FROM BLACK & VEATCH’S ACTIONS IN RELATION TO THE CREATION AND DISSEMINATION OF THIS REPORT, WILL BE LIMITED TO THE AMOUNT OF COMPENSATION (EXCLUSIVE OF THE REIMBURSEMENT OF COSTS AND EXPENSES) ACTUALLY RECEIVED BY BLACK & VEATCH FROM CLIENT FOR THE CREATION OF THIS REPORT UNDER THE IESA. Recipient hereby waives any right to seek or collect damages in excess thereof and releases Black & Veatch from any and all damages or losses which, if required to be paid to Recipient, would result in Black & Veatch paying total damages to any and all parties, including Client and all Recipients, in an amount that would exceed the limit set forth in the previous sentence.

The exclusive venue for any claim, cause of action, legal proceeding, or lawsuit relating to this report shall be the state and federal courts located in New York City, Borough of Manhattan, State of New York. Recipient and any other party irrevocably waive each argument, objection, defense, assertion, or claim that venue is improper for any reason in the state and federal courts in New York City, Borough of Manhattan, State of New York for any claim, cause of action, legal proceeding, or lawsuit brought in said courts or that such claims have been brought in an inconvenient forum.

The above terms and conditions are governed by and shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to the conflicts of laws principles thereof other than Sections 5-1401 and 5-1402 of the General Obligations Law of the State of New York.

IF ANY RECIPIENT IS NOT WILLING TO ACKNOWLEDGE AND ACCEPT, OR AGREE TO, THE TERMS SET FORTH ABOVE, IT MUST RETURN THIS REPORT TO BLACK & VEATCH IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE (INCLUDING DISCLOSURE) THEREOF. A RECIPIENT’S FAILURE SO TO RETURN THIS REPORT SHALL CONSTITUTE ITS ACKNOWLEDGEMENT AND ACCEPTANCE OF AND AGREEMENT TO THE TERMS SET FORTH ABOVE.

| BLACK & VEATCH | SN-2 |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

Table of Contents

| Special Notice | 2 |

| 1.0 Portfolio Overview and Summary | 1-1 |

| 1.1 Introduction | 1-1 |

| 1.2 Scope of Work | 1-1 |

| 1.3 Approach and Methodology | 1-2 |

| 1.4 Principal Assumptions | 1-2 |

| 1.5 Summary of Conclusions | 1-3 |

| 1.5.1 Developer Experience and Qualifications | 1-3 |

| 1.5.2 EPC and Quality Assurance | 1-3 |

| 1.5.3 Operational Performance of Portfolio | 1-3 |

| 1.5.4 Financial Model | 1-4 |

| 2.0 Developer Experience and Qualifications | 2-1 |

| 2.1 Developer Experience | 2-1 |

| 2.2 Conclusions | 2-2 |

| 3.0 EPC, Quality Assurance, and Major Equipment | 3-1 |

| 3.1 Engineering, Procurement and Construction | 3-1 |

| 3.1.1 Site Selection | 3-1 |

| 3.1.2 Engineering Process | 3-2 |

| 3.1.3 Procurement and Major Equipment Selection | 3-5 |

| 3.1.4 Construction | 3-16 |

| 3.2 Quality Assurance and Quality Control | 3-20 |

| 4.0 Operating Performance of Operational Projects | 4-21 |

| 4.1 Assessment Methodology | 4-21 |

| 4.2 Availability and Irradiance Adjusted Historical Production | 4-21 |

| 4.2.1 Conclusions | 4-25 |

| 5.0 Portfolio Effect Benefit Analysis | 5-26 |

| 5.1.1 Methodology | 5-27 |

| 5.1.2 Conclusions | 5-28 |

| 6.0 Financial Model | 6-29 |

| 6.1 Performacne Assumptions | 6-29 |

| 6.2 Energy Generation | 6-29 |

| 6.3 Operating Expenses | 6-30 |

| 6.3.1 Solar PV System O&M Cost | 6-30 |

| 6.3.2 O&M Inverter Replacement | 6-32 |

| Appendix A. | A-1 |

| BLACK & VEATCH | Table of Contents | i |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

List of Tables

| Table 1-1 Portfolio Projects: Location | 1-1 |

| Table 2-1 DSD Completed Projects: Location | 2-1 |

| Table 2-2 DSD Development Projects: Pipeline | 2-2 |

| Table 3-1 Preferred Warranty Terms | 3-5 |

| Table 3-2 Tesla Megapack Technical Specifications | 3-14 |

| Table 3-3 Tesla Megpack Inverter Specification | 3-15 |

| Table 3-4 Tesla Megapack Regulatory Summary | 3-15 |

| Table 4-1 Black & Veatch’s Weather Adjusted Expected Production (2021) | 4-23 |

| Table 4-2 Black & Veatch’s Weather Adjusted Production Ratios | 4-24 |

| Table 5-1 Contributions to Overall Uncertainty in the Expected Energy Production | 5-27 |

| Table 5-2 Portfolio Effect Benefit | 5-27 |

| Table 6-1 Energy Yield Assumptions | 6-29 |

| Table 6-2 O&M Costs | 6-31 |

| Table 6-3 Full Portfolio Site List | A-1 |

| Table 6-4 Weather Adjusted Expected Production | A-7 |

List of Figures

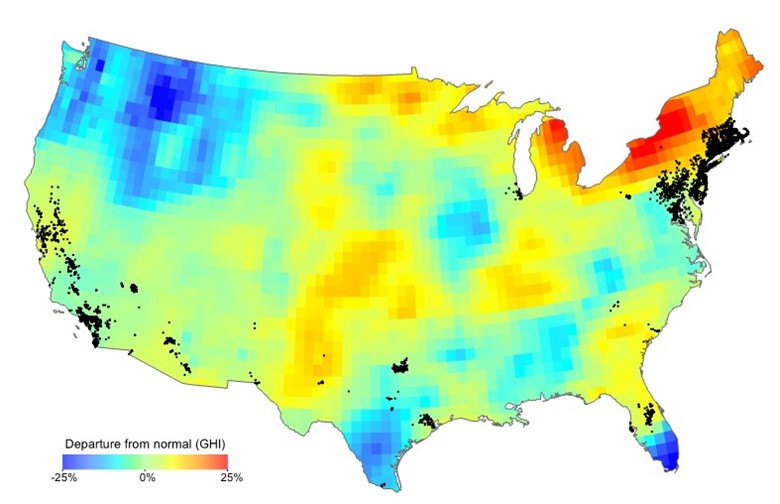

| Figure 4-1 Irradiance Anomalies Compared to Long-Term Average for June 2020 | 4-22 |

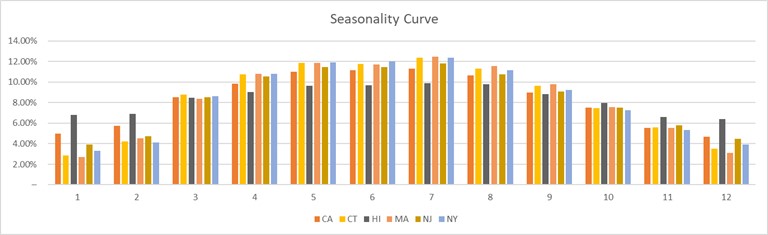

| Figure 4-2 Seasonality Curve | 4-23 |

| BLACK & VEATCH | Table of Contents | ii |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| 1.0 | Portfolio Overview and Summary |

| 1.1 | Introduction |

Black & Veatch Management Consulting LLC (Black & Veatch) was retained by Distributed Solar Development, LLC (DSD) to provide technical due diligence services in connection with DSD’s efforts to securitize operating distributed solar PV assets (“Portfolio”).

As listed in Table 1-1, The Portfolio consists of 111 operating assets spread across eleven different states, ranging in size from approximately 20.8 kW to over 7.5 MW for an aggregate DC capacity between 132.81 MWdc. Ten projects in the Portfolio are equipped with energy storage systems (ESS).

Table 1-1 Portfolio Projects: Location

| Project Location | Number of Projects | Total Capacity (MWDC) |

| CA | 35 | 21.27 |

| CO | 5 | 9.89 |

| CT | 3 | 1.88 |

| HI | 2 | 2.02 |

| MA | 12 | 9.56 |

| MD | 2 | 7.76 |

| MN | 3 | 0.40 |

| NJ | 21 | 10.21 |

| NY | 26 | 67.33 |

| PA | 1 | 1.91 |

| RI | 1 | 0.57 |

| 111 | 132.81 |

| 1.2 | Scope of Work |

To conduct the assessment of the Portfolio, and the processes associated with the technical and commercial aspects of the Portfolio, Black & Veatch conducted the following:

n Data collection and informational calls with DSD,

n Review of DSD experience and qualifications,

n On-site review of representative DSD solar PV sites previously completed,

n Review of the engineering design methodology for the Projects,

n Assessment of performance at the Operating Projects,

n Review of technical assumptions to the financial model.

| BLACK & VEATCH | Portfolio Overview and Summary | 1-1 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

In addition, Black & Veatch (1) discussed with, and posed questions to DSD that Black & Veatch, in its sole judgment, chose to ask about the Portfolio; and (2) reviewed certain technical reports prepared by others as identified in this report. The conclusions and findings that resulted from this review are summarized in this report (Report).

The conclusions and findings that resulted from this review are summarized in this Report. The Report was prepared in accordance with the Management Consulting Services Agreement between DSD and Black & Veatch with effective date of May 22, 2019 (MCSA), and task order dated May 11, 2022 and the information contained herein was developed based on the needs of DSD. The level of information included in the Report reflects the knowledge of issues gained by Black & Veatch during the course of the review. The Report was prepared with respect to the potential financing of the Portfolio and is solely for use of DSD. The Report should not be relied upon by any other party or for any other purpose.

Certain statements made in this Report are forward looking. The achievement of certain events, results or performance contained in such forward-looking statements involve known and unknown risks and uncertainties that may cause actual events, results or performance to be materially different than originally intended. Black & Veatch does not plan to update or revise any forward-looking statements when such events, results, or performance occur.

| 1.3 | Approach and Methodology |

The Black & Veatch team, which included project management specialists, financial analysis experts, solar PV technology specialists, and supporting engineers, gathered available data from the electronic data room to assess the status of the Portfolio. Data requests for additional or updated documentation were submitted as necessary.

Black & Veatch reviewed operating data for representative operating projects included in the Portfolio, provided by DSD. Black & Veatch also reviewed the methodology for DSD’s energy production estimates. The operating Projects were analyzed to determine the historical performance of DSD projects which may be indicative of the future performance of the Portfolio.

| 1.4 | Principal Assumptions |

In the assessment of the Portfolio, Black & Veatch has used and relied upon certain information provided by representatives of DSD, and Black & Veatch assumes the information provided is true and correct and reasonable for the purposes of this Report. In preparing this Report and the opinions presented herein, Black & Veatch has made certain assumptions with respect to conditions that may exist, or events that may occur in the future. Black & Veatch believes that the use of the information and assumptions is reasonable for purposes of this Report. However, some events may occur or circumstances change that cannot be foreseen or controlled by Black & Veatch and that may render these assumptions incorrect. To the extent the actual future conditions differ from those assumed herein or provided to Black & Veatch by others, the actual results will differ from those that have been forecast in this Report.

In discussing the Portfolio, unless noted otherwise, Black & Veatch considers the equipment, systems, and interconnections to be typical of those found in solar PV facilities of similar size and nature. Black & Veatch has provided recommendations, where appropriate, based on previous experience and inspections of similar facilities. When necessary, Black & Veatch identifies those areas considered to have design or operational deficiencies that are critical to reliable operation of the facilities.

| BLACK & VEATCH | Portfolio Overview and Summary | 1-2 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

Throughout this Report, Black & Veatch has stated assumptions and reported information provided by others, all of which were relied upon in the development of the conclusions of this Report. Following is a summary of principal considerations and assumptions made in developing the opinions expressed herein:

n The Portfolio are being operated and maintained in accordance with good industry practices, required renewals and replacements will be made in a timely manner, and the equipment is not being operated in a manner to cause it to exceed equipment manufacturer’s recommendations.

n All licenses permits and approvals, and permit modifications (if necessary) have been obtained and/or renewed on a timely basis.

n All contracts, agreements, rules, and regulations are fully enforceable in accordance with their terms and that all parties will comply with the provisions of the respective agreements.

| 1.5 | Summary of Conclusions |

Based on the reviews and analyses described in this Report, Black & Veatch is of the opinion that:

| 1.5.1 | Developer Experience and Qualifications |

n Black & Veatch is of the opinion that DSD has an organization of the experience and size conducive to developing, owning, and operating solar PV sites (including PV sites coupled with BESS equipment). The DSD team has completed over 240 similar solar PV projects previously.

| 1.5.2 | EPC and Quality Assurance |

n DSD’s EPC practices are consistent with accepted industry practices.

n DSD’s processes for assessing project conditions, selecting suppliers and subcontractors, and the quality assurance program through the project lifecycle, appear consistent with accepted industry practices.

n Black & Veatch is of the opinion that the major equipment suppliers listed for potential use in the Portfolio have demonstrated proven equipment supply track records for other solar PV projects or energy storage systems.

| 1.5.3 | Operational Performance of Portfolio |

n Based on actual operating energy and availability data provided for 2021, Black & Veatch estimates downward impact of 1.3% on expected production adjusted for weather for the portfolio.

n Based on geographic locations and distribution of projects withing the portfolio, Black & Veatch expects a benefit of 0.7% (at P90 confidence interval) for the overall portfolio.

| 1.5.4 | Financial Model |

| n | The major technical assumptions, including energy yield, degradation rate, and useful life in the Financial Model are found to be consistent with industry benchmarks. |

| BLACK & VEATCH | Portfolio Overview and Summary | 1-3 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| n | The P50 production estimates used for revenue projections in the Financial Model assumes an availability of 99.2 percent for the Projects, consistent with the availability guarantee included in the master SSA. |

| n | The capital cost, O&M cost, and inverter replacement assumptions are generally within the range observed in the market for solar projects of similar size and technology. |

| BLACK & VEATCH | Portfolio Overview and Summary | 1-4 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| 2.0 | Developer Experience and Qualifications |

Black & Veatch reviewed DSD as a solar PV project developer, to assess their capabilities to execute the development of the Portfolio.

DSD is wholly owned by BlackRock Real Assets, and was previously operated under GE Solar, LLC since 2014. DSD is focused on DG solar projects ranging from 300 kW to 10 MW across rooftop, carport, and ground-mounted systems in the Northeast, Mid-Atlantic, Midwest, and California regions of the US. DSD targets development sites in municipal, university, schools, and hospital (MUSH) host locations. DSD provides full development, EPC, financing and O&M services.

| 2.1 | Developer Experience |

DSD has successfully reached COD on over 200 distributed PV solar projects, representing a total solar PV DC capacity of over 180 MW and a total BESS capacity of approaching 11 MW. DSD’s first project after its evolution from GE Solar, LLC was completed in 2019, and the developer is actively developing and acquiring additional sites.

An overview of DSD’s historical track record of completed projects is presented in Table 2-1 and Table 2-2.

Table 2-1 DSD Completed Projects: Location

| Project Location | Number of Projects | Total Capacity (MWDC) | Total BESS Capacity (MW) |

| Georgia | 4 | 2.0 | 0.00 |

| Maryland | 22 | 15.5 | 0.00 |

| New Jersey | 48 | 26.8 | 0.00 |

| New York | 29 | 84.5 | 10.00 |

| California | 69 | 27.2 | 0.38 |

| Massachusetts | 20 | 19.3 | 0.45 |

| Colorado | 5 | 9.9 | 0.00 |

| Minnesota | 6 | 1.5 | 0.00 |

| Florida | 3 | 4.4 | 0.00 |

| Connecticut | 21 | 14.5 | 0.00 |

| South Carolina | 3 | 5.9 | 0.00 |

| Nevada | 1 | 1.0 | 0.00 |

| Vermont | 3 | 3.6 | 0.00 |

| Delaware | 1 | 0.9 | 0.00 |

| New Hampshire | 1 | 0.8 | 0.00 |

| North Carolina | 2 | 2.0 | 0.00 |

| Wisconsin | 1 | 1.3 | 0.00 |

| District of Columbia | 1 | 0.6 | 0.00 |

| Hawaii | 1 | 0.9 | 0.00 |

| Rhode Island | 1 | 0.6 | 0.00 |

| Total | 242 | 223.2 | 10.82 |

| BLACK & VEATCH | Developer Experience and Qualifications | 2-1 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

Table 2-2 DSD Development Projects: Pipeline

| Project Location | Number of Projects | Total Capacity (MWDC) | Total BESS Capacity (MW) |

| Massachusetts | 28 | 68.55 | 27.76 |

| New Jersey | 43 | 57.78 | 1.88 |

| Minnesota | 7 | 11.28 | 0.00 |

| California | 67 | 53.67 | 13.15 |

| New York | 24 | 92.67 | 11.41 |

| Maryland | 6 | 14.53 | 0.00 |

| Connecticut | 9 | 7.98 | 0.00 |

| Arizona | 1 | 2.17 | 0.00 |

| Maine | 2 | 11.80 | 0.00 |

| Virginia | 2 | 3.17 | 0.00 |

| Pennsylvania | 1 | 1.28 | 0.00 |

| Ohio | 1 | 2.68 | 0.00 |

| District of Columbia | 2 | 0.62 | 0.00 |

| Total | 193 | 328.18 | 54.21 |

| 2.2 | Conclusions |

Black & Veatch is of the opinion that DSD has an organization of the experience and size conducive to developing, owning and operating solar PV sites (including PV sites coupled with BESS equipment). The DSD team has completed over 240 similar solar PV projects previously.

| BLACK & VEATCH | Developer Experience and Qualifications | 2-2 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| 3.0 | EPC, Quality Assurance, and Major Equipment |

Black & Veatch has reviewed the process by which DSD develops and designs a project from initial site qualification through final design for construction, for the purpose of identifying any significant discrepancies from accepted industry practice. Additionally, Black & Veatch has reviewed the Quality Assurance and Quality Control (QA/QC) processes DSD follows to ensure quality design and construction. Lastly, Black & Veatch has reviewed the DSD process for strategic acquisitions of DG solar PV sites from developers.

| 3.1 | Engineering, Procurement and Construction |

The following sections provide an overview of DSD’s strategy for engineering, procurement, and construction (EPC) of the projects originated by DSD. DSD has an established project development process from the origination at the point of award through notice to procced (NTP)/initial construction funding. The stages of development include diligence, real estate, interconnection, incentives, engineering, and permitting.

DSD has a development team of project management professionals who have core competencies in natural resource management, civil engineering, land use planning, federal, state, and local permitting, interconnection processes and incentive management. The DSD development team is responsible for managing development budgets, schedules, and resources to achieve funding and development NTP on all projects and providing a risk and opportunity analysis through the development process.

| 3.1.1 | Site Selection |

All areas of DSD’s organization coordinate on process with customer engagement, after which DSD negotiates a letter of intent (LOI) with potential hosts. During the LOI negotiation process, DSD performs a desktop feasibility study and preliminary energy production modeling for prospective sites. Site selection for the projects is primarily based on host requirements and cost analysis on business case studies. DSD initially performs a desktop site diligence, including check of site locations by Google Earth or ArcGIS, analysis of wetland status using National Wetlands Inventory, flood zone analysis with Federal Emergency Management Agency (FEMA), interconnection analysis, and topography analysis using resources on the U.S. Geological Survey's (USGS) website and information from Authority Having Jurisdiction (AHJ) building and planning department. DSD then performs analysis with two dimensions (2D) and three dimensions (3D) modeling to identify areas with less than 15 percent slope and areas with potential shading and incorporates the site analysis findings to system design.

Upon the execution of LOI, DSD engages a broader project management team and initiates high-level engineering, interconnection, and project development. DSD’s engineering team performs an onsite evaluation to collect information on preliminary project and interconnection configurations. DSD as the EPC provider is responsible for the permits and approvals for interconnection with the local electric utility. Potential shading concerns to be incorporated into the production estimate model are also assessed at this time.

For rooftop projects, DSD discusses the roof warranty with representatives of the manufacturer (Carlisle, Firestone, etc.) and the requirements for maintaining the warranty (including pre-install and post-install inspections). DSD engages a third- party licensed structural professional engineering firm to perform a site structural evaluation to determine the structural capacity available for the additional load of the proposed

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-1 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

PV system. In some cases, re-roofing of the facility is considered in conjunction with the installation of the PV system (may be paid for by DSD depending on the expected commercial terms of the PPA).

A site-specific geotechnical investigation is always performed for ground-mounted solar canopies because the bearing capacity of the soil must be capable of resisting the forces or reactions at the base of the canopy columns through the engineered foundation.

For garage top canopies, no geotechnical investigation is required, since the canopy columns tie to the existing concrete structure via anchor bolts or connection brackets. Instead, a third-party structural firm is engaged to assess garage top canopies to confirm there is sufficient capacity in the concrete (sometimes steel) structure to resist the forces imparted by the addition of the solar canopy, and is also typically engaged to approve the structural design of the carport. DSD has a carport design group in-house which is utilized for most of the engineering design for single-tilt, ‘Y’ tilt, and ‘W’ tilt carport projects. DSD has also indicated that they hold IP related to ‘W’ carport topology and associated drainage systems which can be used in conjunction with the solar array.

For ground-mount projects, DSD performs a topographic survey in order to determine the project design and evaluate the proximity to utility infrastructure and interconnection feasibility.

DSD has a development engineering checklist for the deliverables required at the development phase, which includes items provided by offtaker/host, site walk deliverables, rooftop inspection findings (as applicable), site and environmental diligence list, CAD details, list of assumptions and customer feedback, and preliminary CAD layout, and preliminary PVsyst report. Black & Veatch holds the opinion that the development engineering list is in line with accepted industry practice.

| 3.1.2 | Engineering Process |

The DSD engineering team works with the finance team to determine the cost to build for each system to ensure that each project meets the technical and financial criteria. The finance team will confirm with the engineering team regarding the finalized production estimates prior to contract negotiation with off-takers. Detailed engineering design commences upon the execution of PPA. DSD adheres to an internal standard design methodology and utilizes DSD’s standard loss assumptions for each system design, ensuring that the project is capable of meeting the energy production estimates defined within the PPA.

The DSD engineering team consists two functional teams, development engineering and project engineering. The development engineering team supports evaluation and bidding of projects until the projects are awarded. The development engineering team utilizes a standardized, high volume, low overhead structure. The project engineering team provides design management and oversight to the third-party EPC contractor who is performing engineering or, in the case of DSD acting as EPC, manages the design process to create the final design and construction documents. When beneficial, DSD employs local or component-specific expertise as engineering resources for specific portions of the overall design.

Under DSD's typical development process, DSD completes 30 percent design in-house, and engages third party engineers for the issued-for-permit (IFP) and issued-for-construction (IFC) design sets. The project engineering team steps in post award and manages the design process through construction and commissioning of the projects. Once a project is awarded, a resource from the project engineering team is assigned to manage the design process for the creation of final design and construction

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-2 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

documentations. Third party engineering resources are engaged as appropriate. The project engineering team sets the overall basis of the design and coordinates with third parties to create the final construction plan to ensure adherence to the project needs and DSD design standards and specifications. DSD's internal design standards for all projects involve a complete review of site conditions, property boundaries & easements, existing electrical configurations, site topography and civil/structural considerations as necessary depending on the type of PV system. System size or annual energy production are typically requested to be maximized in order to lower the total cost per kWh. Helioscope and SunDat iterations are performed initially to quickly evaluate options, and subsequently a detailed PVSyst report with annual hourly data is generated once the optimal configuration is derived. Black & Veatch reviewed DSD design requirements and technical specification for the EPC of solar projects, which specify the design and equipment requirements for the components and systems of the projects, and the industry standards that the systems are to be designed, constructed, and tested.

The following guidance is used for engagement of third parties to support different disciplines:

| n | Racking layout and structural engineering is generally provided by selected equipment providers to ensure compliance with local structural and foundational codes, except for canopies. The structural engineering for canopies is conducted in-house, with racking system manufactured by steel providers according to DSD specifications. For canopy projects, the AHJ confirms the applicable code cycles and roof design snow loads, wind speeds and seismic criteria. DSD’s canopy team applies current IBC code and local codes in structural design of canopies, which is typically based on ASCE 7-16. Site specific wind, snow and seismic design parameters are extracted from the ASCE database and verified by the local AHJ to ensure compliance to local code design loads mandate, which is sometimes more stringent. DSD's internal team optimizes the structural design to deliver the optimal system size and annual energy production based on feasible configurations and develops a bid document with confirmed design criteria for steel fabricators to propose a canopy structure. The steel vendors optimize the steel member sizing and provide reactions at the base of the canopy columns. The forces that are imparted to either the ground or the existing concrete garage structure are used to design the foundations or connections. A site-specific geotechnical report is used for drilled pier and/or spread footing designs including concrete mix, dimensions and rebar configurations specified for ground canopies because the bearing capacity of the soil must be capable of resisting the forces or reactions at the base of the canopy columns through the engineered foundation. For garage top canopies projects, no geotechnical investigation is required because the canopy columns tie to the existing concrete structure via anchor bolts or connection brackets. Connection engineering and structural adequacy checks using the reactions are used to determine anchor bolt or connection brackets design. In connection brackets, analysis of the existing structure is performed to confirm there is sufficient capacity in the concrete (sometimes steel) structure to resist the forces imparted by the addition of the solar canopy. |

| n | Electrical design is generally developed in-house and may include a stamp from a third party in jurisdictions where DSD does not carry the proper license. The DSD design requirements and technical specification specify the requirements for combiner box, inverter, medium voltage and pad mounted transformers, panelboard, electrical raceway, grounding, power and control wiring in accordance with applicable ANSI, NEMA, UL, NEC, NESC, IEEE, and local code, and design baseline of DC to AC ratio and wiring losses. |

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-3 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| n | Civil engineering for the project sites, particularly for ground-mount and canopy projects, is provided by a local or regional engineering firm to ensure AHJ compliance with environmental and code requirements such as grading, set-backs, stormwater management, and landscaping. Oversight for this portion of scope is managed by DSD’s in-house civil engineering resources. The DSD design requirements and technical specification specify the requirements on general site civil engineering, including grading and drainage plan, access road construction and other road surfacing, pads for proposed substation and control house building (as applicable), security fencing, hydrology study and geotechnical reports. DSD follows a low impact development approach related to stormwater, attempting to maintain existing flow paths and not creating point discharge where possible. Generally, maintaining the pre-construction peak flow and volume for the post construction scenario using 10-year, 50-year, or 100-year, depending on local AHJ requirements. The site is revegetated with hearty vegetation that promote infiltration and filters all sediment from any runoff leaving the site. A full hydrology study is only conducted for larger sites that exceed 1 acre of impervious area, panels are not considered imperious or where required by the local AHJ. For site partially in a floodplain, DSD refers to FEMA FIRM maps for base flood elevation (BFE). If the project includes zone A (undefined BFE), DSD works with the local flood plain administrator who will either define the BFE or require analysis by a civil engineer to determine the BFE. |

| n | Disconnect switches are typically placed as close to the POI as possible. Weather stations are likewise typically placed as close to the POI as possible. The data acquisition system (DAS), including the weather station, is preferred to be powered by the power source from the host building or regular distribution grid, so that if there is a solar plant trip the DAS will still be able to supply information. |

Black & Veatch is of the opinion that DSD design requirements and technical specifications are in line with accepted industry practice.

DSD selects engineering design contractors based on the track record and company qualification. The contractors are required to meet the DSD's design requirement and technical specification for the project and should be capable of meeting all the code and design requirements of the AHJ for each project. DSD has identified preferred contractors in each jurisdiction that the Projects are located to support the engineering design. Although DSD will also work with other contractors, these preferred contractors have been previously vetted and have successfully completed previous projects. Details on the preferred contractors are summarized in the Appendix B.

DSD’s engineering team has a set of standard deliverables to be completed by each subcontractor. All drawings and reports are required to be approved by DSD in-house personnel. DSD has a standard scope of work for engineering services, including conceptual design, 90 percent design set, IFP set, IFC set, and as-built drawings. The scope of work also includes requirements on design parameters. Black & Veatch considers the standard deliverable list to be in line with accepted industry practice.

Overall, the approach to have an established in-house engineering team with support from third parties as appropriate allows DSD to integrate engineering with estimating, construction, and project financing, and improve overall efficiency from project development to O&M and asset management.

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-4 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| 3.1.3 | Procurement and Major Equipment Selection |

DSD’s procurement of equipment is coordinated among the construction, engineering, and accounting functions of the organization under the direction of the Chief Operation Officer (COO). The role of the procurement team is to maintain established relationships with module manufactures for forward looking pricing and technology efficiency and provide such information to internal design and budgeting teams, and engineering team when technical evaluation is required. The COO also provides direct negotiation support on master supply agreements for modules and inverters. Initial pricing for inverters for inverter selection is managed by the engineering team. Final procurement of equipment and onboarding is primarily managed by project managers in the construction team upon receipt of equipment specifications from the engineering team.

DSD procures modules and inverters with manufacturers directly and procures most racking systems and common balance of plant materials from contracting partners. The contracting partners are also responsible for site logistics for module and inverter deliveries, as coordinated by the project manager and operations administrators.

DSD selects and approves suppliers of PV equipment, including PV modules, inverters, trackers, and energy storage systems through an internal selection process. DSD maintains an approved vendor list based on project experiences and feedback collected. In general, DSD selects module suppliers that are included on Bloomberg New Energy Finance “Tier 1” manufacturer list. In addition, DSD has preferred warranty terms for each type of major equipment, as listed in Table 3-1. Any material deviation from the preferred warranty terms requires review by an independent engineer.

Table 3-1 Preferred Warranty Terms

| Major Equipment | Preferred Warranty Terms |

| Modules |

10 to 25-year limited product warranty 25-year limited peak power warranty |

| Inverters | 10 to 12-year limited product warranty (materials and workmanship) |

| Batteries | 10 to 20 years of operation |

| Racking | 20 to 25-year limited product warranty |

DSD also established the following criteria for major equipment supplier selection:

| n | Proven and consistent record of providing high quality and high efficiency products to the US market, with very few (if any) warranty claims or start-up issues based on DSD’s direct experience. |

| n | Well established US based support staff for technical support, warranty claims and logistics. |

| n | Consistent power output and field performance. |

| n | Those with a historically high “say-do” ratio that operate with integrity in the US market (never cancelled a PO after it was already confirmed, equipment consistently shows up as scheduled, stands behind their warranty, etc.). |

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-5 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| n | Favorable contractual terms and conditions. |

As an operating practice, DSD only selects equipment vendors that are well-established and well-recognized in the solar PV industry. To be considered for use by DSD, all vendors are required to have appropriate certifications and quality/warranty track records to be regarded as top-tier manufacturers. It is common in industry for developers to work with a variety of equipment vendors. This allows them to be able to negotiate for best pricing and also diversify the technical makeup of an operating Portfolio.

Black & Veatch reviewed the key major equipment suppliers expected to be utilized in the Portfolio.

| 3.1.3.1 | Modules |

| 3.1.3.1.1 | Hanwha |

Hanwha, a subsidiary of Hanwha Group, is a Fortune Global 500 Firm and a Top-Ten business enterprise in South Korea. As of 2021, the Hanwha Group has 25 affiliates in North America and 469 global networks within the manufacturing and construction, finance, and services and leisure sectors. Hanwha engages in downstream development and EPC business, as well as PV module manufacturing. Hanwha is one of the world’s largest solar cell and photovoltaic manufacturers with total annual module production capacity of 11.3 GW as of May 2020. One of its affiliates, Hanwha Q CELLS has built a production facility in the US in 2019, with an annual module manufacturing capacity 1.7 GW.

Hanwha offers a 12-year limited product warranty and a 25-year limited performance warranty for crystalline Q Cells series monofacial modules. The limited product warranty warrants that the modules will be free from defects in materials and workmanship under normal application, installation, use, and service conditions. The limited peak power warranty warrants that the power output measured at STC will not be less than 98.0 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 85 percent at the end of the 25th year, with annual degradation no more than 0.54 percent. In the event of a valid warranty claim, Hanwha will either repair the module(s) or provide replacement module(s).

| 3.1.3.1.2 | JA Solar |

JA Solar Technology Co. Ltd. (JA Solar) is a manufacturer headquartered in Beijing and was incorporated in 2005 for the commercial production of solar cells in China. JA Solar has been listed on the Shenzhen Stock Exchange since 2019. In 2009, JA Solar expanded its business to silicon wafer and module manufacturing in addition of solar cell manufacturing. JA Solar has 12 manufacturing and research and development facilities, with a total module manufacturing capacity of 11 GW, silicon wafer manufacturing capacity of 11.5 GW, and solar cell manufacturing capacity of 16 GW as of 2020. JA Solar reported a total module shipment of 63 GW as of the fourth quarter of 2020.

JA Solar offers a 12-year limited product warranty and a 30-year limited peak power warranty for its monocrystalline and polycrystalline modules. The limited product warranty warrants that the modules will be free from defects in materials and workmanship under normal application, installation, use, and service conditions. The limited peak power warranty for monocrystalline modules warrants that the power output measured at STC will not be less than 97.0 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 82.5 percent at the end of the 30th year, with annual degradation no more than 0.5 percent. The limited peak power warranty for polycrystalline modules warrants that the power output measured at STC will not be less than 97.5

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-6 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 83.0 percent at the end of the 30th year, with annual degradation no more than 0.5 percent. In the event of a valid warranty claim, Hanwha will either repair the module(s) or provide replacement module(s).

| 3.1.3.1.3 | LG |

LG Electronics was established in 1958 in South Korea and is a large multinational producer of consumer electronics, mobile communications devices and home appliances. LG is a publicly traded company, listed on the Korea Stock Exchange. The company has reportedly been involved in the research and development of solar PV technology dating back to 1985. In the mid-2000s, LG Chemical (LG Chem) formed a solar cell research team which formally integrated with LG in 2008. In 2009, LG constructed multiple PV cell and module ISO 9001 certified factories in Gumi, Korea. Mass production began in 2010 leading to 400 MW accumulated production supply and sales in 32 countries in 2012. In 2019, LG opened a solar module manufacturing facility in Huntsville, Alabama, with an annual manufacturing capacity of 550 MW.

LG offers a 12-year limited product warranty and a 25-year limited peak power warranty, commencing on the date of original purchase for Mono X plus and NeON™ 2 modules. The limited product warranty warrants that the modules will be free from defects in materials and workmanship under normal application, installation, use, and service conditions. The limited peak power warranty for Mono X, NeON™ 2 and NeON BiFacial modules warrants that the power output measured at STC will not be less than 98 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 84.8 percent at the end of the 25th year, with annual degradation no more than 0.55 percent. The test for underperformance includes a measurement tolerance of 3.0 percent. In the event of a valid warranty claim, LG will either repair the module(s) or provide additional module(s) and provide shipment to the initial delivery location.

| 3.1.3.1.4 | Astronergy (Chint) |

Astronergy Solar (Astronergy) was established in 2006 and is headquartered in Zhejiang, China. The company is a part of the Chint Group, which was founded in 1984 in Wenzhou, China. The Chint Group currently employs over 25,000 global employees and has reported a revenue of $5.10 billion in 2020. The subsidiary is engaged in the PV power station development and PV module production. Astronergy reports an annual production capacity of approximately 8 GW, with projects developed in Thailand, Spain, the United States, India, Bulgaria, Romania, South Africa, and Japan. The company’s primary manufacturing facilities are located in China, Thailand, Malaysia, and Germany.

Astronergy offers a 10-year limited product warranty and a 25-year limited peak power warranty, commencing on the date of delivery of the modules. The limited product warranty warrants that the modules will be free from defects in materials and workmanship under normal application, installation, use, and service conditions. The limited peak power warranty for the modules warrants that the power output measured at STC will not be less than 97.5 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 83.0 percent at the end of the 25th year, with annual degradation no more than 0.7 percent. In the event of a valid warranty claim, Astronergy will either repair the module(s) or provide additional module(s) and provide shipment to the initial delivery location.

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-7 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

| 3.1.3.1.5 | ZNShine Solar |

ZNShine Solar (ZNShine) (NEEQ Stock Code: 838463) was founded in 1998 and is currently headquartered in Jin Tan, Jiangsu, China. ZNShine is a solar solution manufacturer and also provides EPC services and works on projects development and operation. ZNShine currently has projects in Japan, India, Germany, Italy, Switzerland, the UK, the USA, Canada, Chile, Australia, and Africa.

ZNShine reported an annual PV production of 6 GW in 2021. As of 2021, ZNShine employs over 1,200 employees worldwide.

ZNShine solar modules are backed by a 12-year product workmanship and 25-year linear power output warranty. Warranty start date occurs when the module is delivered to the buyer. ZNShine warrants that modules will be free from defects in material and workmanship. The warranty covers mechanical and electrical integrity and stability according to approved operation methods and provided there are no localized impacts or external forces. If there are any warranty claims, ZNShine can opt to either repair or replace faulty modules or provide a refund at residual market value of the equipment. For output warranty, with polycrystalline modules, first year loss is 2.5 percent and subsequent years are 0.7 percent through the twenty-fifth year for a nominal output value of 80.7 percent at the end of the power output warranty period.

| 3.1.3.1.6 | LONGi Solar |

LONGi Solar (LONGi) is a wholly-owned subsidiary of LONGi Green Energy Technology Co., Ltd (LONGi Green Energy), the largest supplier of mono-crystalline silicon wafers in the world for utility, commercial, and residential systems. LONGi was founded in 2000 and is headquartered in Xi’an, Shanxi, China, with US headquarters in San Jose, California. LONGi operates globally with branches in Japan, Europe, North America, India, Malaysia, Australia, and Africa. The company is a pure-play manufacturer of mono-crystalline solar cells and modules. Production of mono-crystalline silicon is completed at several locations in China and Malaysia by LONGi Silicon, a wholly-owned subsidiary of LONGi Green Energy.

As of the first quarter of 2021, LONGi reported a module shipment of 24.5 GW annually and a module capacity of 50 GW. In 2020, LONGi’s annual revenue was reported at $8.41 billion. LONGi reported total assets exceeding $14.2 billion through Q1 2021.

The product warranty has a 10-year term, commencing on the date of purchase by the original end use purchaser or six months after the modules are shipped out of the production plant. The limited product warranty warrants that the modules will be free from defects in materials and workmanship under normal application, installation, use, and service conditions. In the event of a valid product warranty claim, LONGi will, at its sole option, repair or replace the module(s).

LONGi Solar also offers a twenty-five-year linear performance warranty, warranting the power output measured at STC will not be less than 97.0 percent of the labeled power output at the end of the first year after the warranty start date; thereafter 0.7 percent per year degradation; and will be no less than 80.2 percent at the end of the twenty-fifth year.

| 3.1.3.1.7 | Trina Solar |

Trina Solar Co. Ltd. (Trina Solar) is headquartered in Changzhou, Jiangsu Province, China, and was founded in 1997 for the manufacturing, selling, research, and development of PV products, EPC, O&M, smart

| BLACK & VEATCH | EPC, Quality Assurance, and Major Equipment | 3-8 |

| Acceptance or use of this Report constitutes an acknowledgement and acceptance of, and agreement to be bound by, the terms of the Special Notice set forth on the cover page of this Report (the “Special Notice”). If the Recipient is not willing to accept and acknowledge, or to agree to be bound by, the terms set forth in the Special Notice, it must return the Report to Black & Veatch immediately without making any copies thereof, extracts there from or use (including disclosure) thereof. |

| Distributed Solar Development, LLC | | Solar Portfolio Securitization | 5 November 2022 |

|

micro-grid, multi-energy complementary systems, and energy cloud-platform operations. Trina Solar has been listed on the STAR Market of the Shanghai Stock Exchange since June 2020. In the last quarter of 2021, the company reported total revenue of 13.23 billion CNY and net income of 719.96 million CNY. As of December 31, 2020, its total assets were worth $6.99 billion.

As of June 30, 2021, Trina Solar delivered more than 80GW of solar modules worldwide and ranked on the list of "Top 500 Private Enterprises in China”. Trina Solar has connected over 5.5GW of solar power plants to the grid worldwide. The company has over 19,000 employees and provides services to over 100 customers globally, with regional headquarters in Singapore, Tokyo, Zurich, Dubai, Fremont, and Miami, global sales and office centers in Spain, Mexico, Chile, Italy, Germany, Australia, United Arab Emirates, France, Columbia, Brazil, India and production bases in Vietnam and Thailand.

Trina Solar offers a 10-year limited product warranty and a 25-year limited peak power warranty for its polycrystalline and monocrystalline modules. The limited product warranty warrants that the modules will be free from defects in design, material, workmanship, or manufacture that materially impedes the functioning of the module(s) and that the module(s) will conform to the specifications and the drawings applicable. The limited peak power warranty for polycrystalline modules warrants that the power output measured at STC will not be less than 97.5 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 80.7 percent at the end of the 25th year, with annual degradation no more than 0.7 percent. The limited peak power warranty for monocrystalline modules warrants that the power output measured at STC will not be less than 97.0 percent of the nameplate power output at the end of the first year after the warranty start date and will be no less than 80.68 percent at the end of the 25th year, with annual degradation no more than 0.68 percent. In the event of a valid warranty claim, Trina Solar will either refund the salvage value of the module(s), repair the module(s), or provide replacement module(s).

| 3.1.3.1.8 | VSUN Solar |

Headquartered in Tokyo, Japan, VSUN Solar is an affiliate with FUJI Solar Co., Ltd. VSUN Solar is a solar solution provider, with research and development base in Tokyo, sales offices in the US. Germany, China and production bases for solar modules located in Bac Giang province in Vietnam and Zhengjiang province in China. VSUN Solar reported an annual production of 2.1 GW in 2020.

VSUN solar modules are backed by a 10 year product workmanship and 25 year linear power output warranty.