| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| (State or other jurisdiction of | (I.R.S. Employer | |||||||

| incorporation or organization) | Identification No.) | |||||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| Page | ||||||||

| Part I | ||||||||

| Item 1. | ||||||||

| Supplementary Item. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Segment | Competitors | ||||

| Signal and Power Solutions | • Amphenol Corporation | ||||

| • Draexlmaier Automotive | |||||

| • Lear Corporation | |||||

| • Leoni AG | |||||

| • Molex Inc. (a subsidiary of Koch Industries, Inc.) | |||||

| • Sumitomo Corporation | |||||

| • TE Connectivity, Ltd. | |||||

| • Yazaki Corporation | |||||

| Advanced Safety and User Experience | • Bosch Group | ||||

| • Continental AG | |||||

| • Denso Corporation | |||||

| • Harman International (a subsidiary of Samsung Electronics) | |||||

| • Hyundai Mobis | |||||

| • Magna International | |||||

| • Panasonic Corporation | |||||

| • Valeo | |||||

| • Veoneer, Inc. | |||||

| • Visteon Corporation | |||||

| • ZF Friedrichshafen AG | |||||

| Customer | Percentage of Net Sales | ||||

| General Motors Company | 9% | ||||

| Stellantis N.V. | 9% | ||||

| Ford Motor Company | 8% | ||||

| Volkswagen Group | 8% | ||||

| Tesla, Inc. | 5% | ||||

| Geely Automobile Holdings Limited | 5% | ||||

| Mercedes-Benz Group AG | 4% | ||||

| SAIC General Motors Corporation Limited | 3% | ||||

| Bayerische Motoren Werke AG | 2% | ||||

| Toyota Motor Corporation | 2% | ||||

| Tata Motors Limited | 2% | ||||

| North America | Europe, Middle East & Africa | Asia Pacific | South America | Total | |||||||||||||||||||||||||

| Signal and Power Solutions | 45 | 37 | 33 | 5 | 120 | ||||||||||||||||||||||||

| Advanced Safety and User Experience | 2 | 5 | 4 | — | 11 | ||||||||||||||||||||||||

| Total | 47 | 42 | 37 | 5 | 131 | ||||||||||||||||||||||||

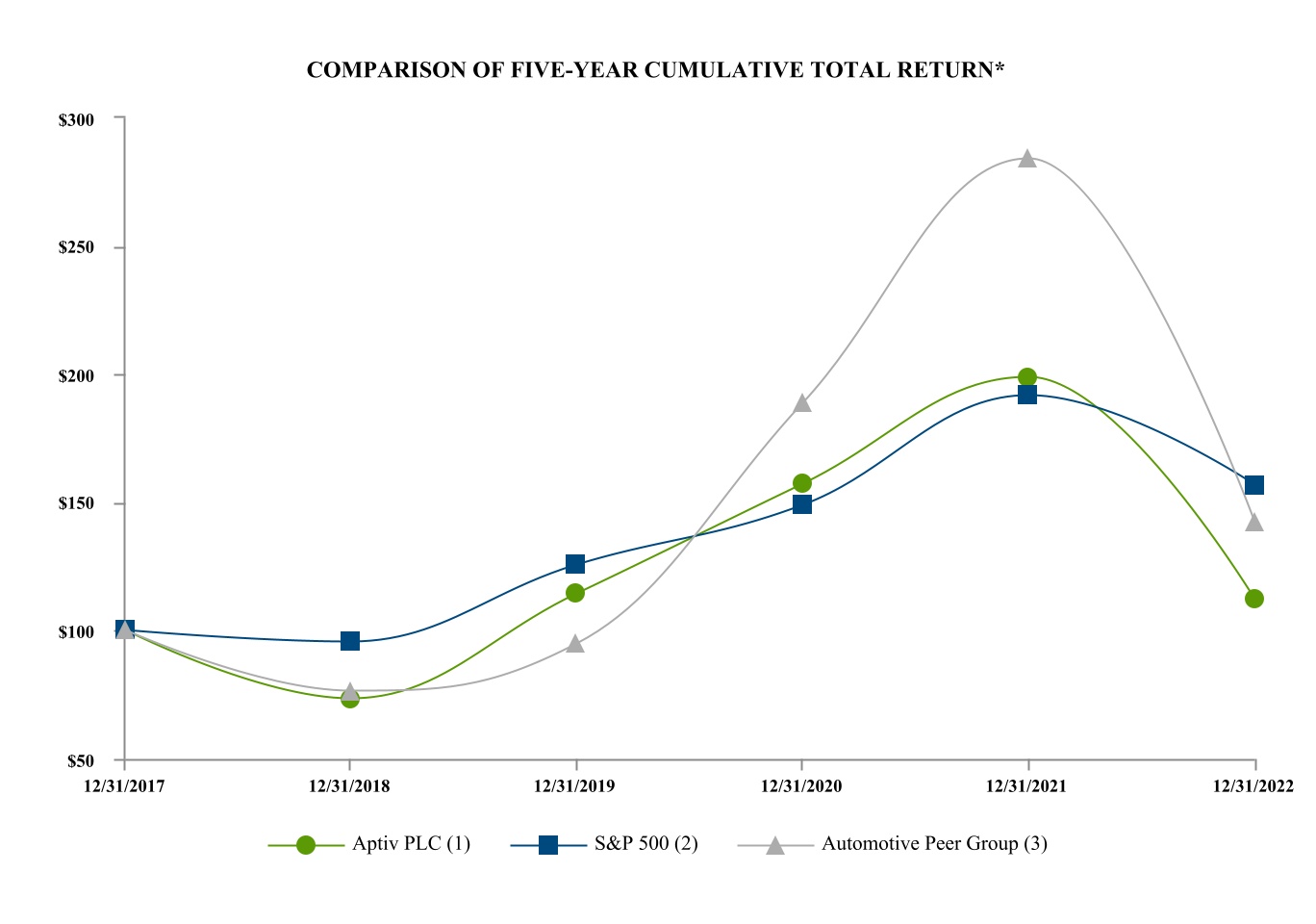

| Company Index | December 31, 2017 | December 31, 2018 | December 31, 2019 | December 31, 2020 | December 31, 2021 | December 31, 2022 | ||||||||||||||||||||||||||||||||

| Aptiv PLC (1) | $ | 100.00 | $ | 73.29 | $ | 114.25 | $ | 157.12 | $ | 198.92 | $ | 112.31 | ||||||||||||||||||||||||||

| S&P 500 (2) | 100.00 | 95.62 | 125.72 | 148.85 | 191.58 | 156.89 | ||||||||||||||||||||||||||||||||

| Automotive Peer Group (3) | 100.00 | 76.47 | 94.74 | 188.76 | 284.00 | 141.98 | ||||||||||||||||||||||||||||||||

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) (c) | ||||||||||||||||||||||||||

Equity compensation plans approved by security holders | 1,566,458 | (1) | $ | — | (2) | 12,742,596 | (3) | ||||||||||||||||||||||

Equity compensation plans not approved by security holders | — | — | — | ||||||||||||||||||||||||||

| Total | 1,566,458 | $ | — | 12,742,596 | |||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (dollars in millions) | |||||||||||||||||

| Net sales | $ | 17,489 | $ | 15,618 | $ | 1,871 | |||||||||||

| Cost of sales | 14,854 | 13,182 | (1,672) | ||||||||||||||

| Gross margin | 2,635 | 15.1% | 2,436 | 15.6% | 199 | ||||||||||||

| Selling, general and administrative | 1,138 | 1,075 | (63) | ||||||||||||||

| Amortization | 149 | 148 | (1) | ||||||||||||||

| Restructuring | 85 | 24 | (61) | ||||||||||||||

| Operating income | 1,263 | 1,189 | 74 | ||||||||||||||

| Interest expense | (219) | (150) | (69) | ||||||||||||||

| Other expense, net | (54) | (129) | 75 | ||||||||||||||

| Income before income taxes and equity loss | 990 | 910 | 80 | ||||||||||||||

| Income tax expense | (121) | (101) | (20) | ||||||||||||||

| Income before equity loss | 869 | 809 | 60 | ||||||||||||||

| Equity loss, net of tax | (279) | (200) | (79) | ||||||||||||||

| Net income | 590 | 609 | (19) | ||||||||||||||

| Net (loss) income attributable to noncontrolling interest | (3) | 19 | (22) | ||||||||||||||

| Net loss attributable to redeemable noncontrolling interest | (1) | — | (1) | ||||||||||||||

| Net income attributable to Aptiv | 594 | 590 | 4 | ||||||||||||||

| Mandatory convertible preferred share dividends | (63) | (63) | — | ||||||||||||||

| Net income attributable to ordinary shareholders | $ | 531 | $ | 527 | $ | 4 | |||||||||||

| Year Ended December 31, | Variance Due To: | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | Volume, net of contractual price reductions | FX | Commodity pass- through | Other | Total | |||||||||||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total net sales | $ | 17,489 | $ | 15,618 | $ | 1,871 | $ | 2,458 | $ | (676) | $ | 45 | $ | 44 | $ | 1,871 | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Variance Due To: | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | Volume (a) | FX | Operational performance | Other | Total | |||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of sales | $ | 14,854 | $ | 13,182 | $ | (1,672) | $ | (1,481) | $ | 588 | $ | (620) | $ | (159) | $ | (1,672) | ||||||||||||||||||||||||||||||||||

| Gross margin | $ | 2,635 | $ | 2,436 | $ | 199 | $ | 977 | $ | (88) | $ | (620) | $ | (70) | $ | 199 | ||||||||||||||||||||||||||||||||||

| Percentage of net sales | 15.1 | % | 15.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (dollars in millions) | |||||||||||||||||

| Selling, general and administrative expense | $ | 1,138 | $ | 1,075 | $ | (63) | |||||||||||

| Percentage of net sales | 6.5 | % | 6.9 | % | |||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (in millions) | |||||||||||||||||

| Amortization | $ | 149 | $ | 148 | $ | (1) | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (dollars in millions) | |||||||||||||||||

| Restructuring | $ | 85 | $ | 24 | $ | (61) | |||||||||||

| Percentage of net sales | 0.5 | % | 0.2 | % | |||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (in millions) | |||||||||||||||||

| Interest expense | $ | 219 | $ | 150 | $ | (69) | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (in millions) | |||||||||||||||||

| Other expense, net | $ | 54 | $ | 129 | $ | 75 | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (in millions) | |||||||||||||||||

| Income tax expense | $ | 121 | $ | 101 | $ | (20) | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | |||||||||||||||

| (in millions) | |||||||||||||||||

| Equity loss, net of tax | $ | 279 | $ | 200 | $ | (79) | |||||||||||

| Signal and Power Solutions | Advanced Safety and User Experience | Total | |||||||||||||||

| (in millions) | |||||||||||||||||

| For the Year Ended December 31, 2022: | |||||||||||||||||

| Adjusted operating income | $ | 1,441 | $ | 144 | $ | 1,585 | |||||||||||

| Amortization | (139) | (10) | (149) | ||||||||||||||

| Restructuring | (30) | (55) | (85) | ||||||||||||||

| Other acquisition and portfolio project costs | (15) | (11) | (26) | ||||||||||||||

| Asset impairments | (8) | — | (8) | ||||||||||||||

| Other charges related to Ukraine/Russia conflict (1) | (54) | — | (54) | ||||||||||||||

| Operating income | $ | 1,195 | $ | 68 | 1,263 | ||||||||||||

| Interest expense | (219) | ||||||||||||||||

| Other expense, net | (54) | ||||||||||||||||

| Income before income taxes and equity loss | 990 | ||||||||||||||||

| Income tax expense | (121) | ||||||||||||||||

| Equity loss, net of tax | (279) | ||||||||||||||||

| Net income | 590 | ||||||||||||||||

| Net loss attributable to noncontrolling interest | (3) | ||||||||||||||||

| Net loss attributable to redeemable noncontrolling interest | (1) | ||||||||||||||||

| Net income attributable to Aptiv | $ | 594 | |||||||||||||||

| Signal and Power Solutions | Advanced Safety and User Experience | Total | |||||||||||||||

| (in millions) | |||||||||||||||||

| For the Year Ended December 31, 2021: | |||||||||||||||||

| Adjusted operating income | $ | 1,225 | $ | 153 | $ | 1,378 | |||||||||||

| Amortization | (141) | (7) | (148) | ||||||||||||||

| Restructuring | (8) | (16) | (24) | ||||||||||||||

| Other acquisition and portfolio project costs | (11) | (4) | (15) | ||||||||||||||

| Asset impairments | (1) | (1) | (2) | ||||||||||||||

| Operating income | $ | 1,064 | $ | 125 | 1,189 | ||||||||||||

| Interest expense | (150) | ||||||||||||||||

| Other expense, net | (129) | ||||||||||||||||

| Income before income taxes and equity loss | 910 | ||||||||||||||||

| Income tax expense | (101) | ||||||||||||||||

| Equity loss, net of tax | (200) | ||||||||||||||||

| Net income | 609 | ||||||||||||||||

| Net income attributable to noncontrolling interest | 19 | ||||||||||||||||

| Net income attributable to Aptiv | $ | 590 | |||||||||||||||

| Year Ended December 31, | Variance Due To: | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | Volume, net of contractual price reductions | FX | Commodity Pass-through | Other | Total | |||||||||||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||

Signal and Power Solutions | $ | 12,943 | $ | 11,598 | $ | 1,345 | $ | 1,908 | $ | (626) | $ | 45 | $ | 18 | $ | 1,345 | ||||||||||||||||||||||||||||||||||

Advanced Safety and User Experience | 4,587 | 4,056 | 531 | 558 | (53) | — | 26 | 531 | ||||||||||||||||||||||||||||||||||||||||||

| Eliminations and Other | (41) | (36) | (5) | (8) | 3 | — | — | (5) | ||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 17,489 | $ | 15,618 | $ | 1,871 | $ | 2,458 | $ | (676) | $ | 45 | $ | 44 | $ | 1,871 | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Signal and Power Solutions | 17.2 | % | 17.6 | % | |||||||

| Advanced Safety and User Experience | 8.9 | % | 9.8 | % | |||||||

| Total | 15.1 | % | 15.6 | % | |||||||

| Year Ended December 31, | Variance Due To: | |||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Favorable/ (unfavorable) | Volume, net of contractual price reductions | Operational performance | Other | Total | ||||||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||||||

| Signal and Power Solutions | $ | 1,441 | $ | 1,225 | $ | 216 | $ | 712 | $ | (304) | $ | (192) | $ | 216 | ||||||||||||||||||||||||||||||

Advanced Safety and User Experience | 144 | 153 | (9) | 265 | (316) | 42 | (9) | |||||||||||||||||||||||||||||||||||||

| Total | $ | 1,585 | $ | 1,378 | $ | 207 | $ | 977 | $ | (620) | $ | (150) | $ | 207 | ||||||||||||||||||||||||||||||

| December 31, 2022 | |||||

| (in millions) | |||||

| Cash and cash equivalents | $ | 1,531 | |||

| Revolving Credit Facility, unutilized portion (1) | 2,000 | ||||

| Committed European accounts receivable factoring facility, unutilized portion (2) | 482 | ||||

| Total available liquidity | $ | 4,013 | |||

| Total number of shares repurchased | 1,059,075 | ||||

| Average price paid per share | $ | 53.73 | |||

| Total (in millions) | $ | 57 | |||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||

| LIBOR plus | ABR plus | LIBOR plus | ABR plus | ||||||||||||||||||||

| Revolving Credit Facility | 1.06 | % | 0.06 | % | 1.10 | % | 0.10 | % | |||||||||||||||

| Tranche A Term Loan | 1.105 | % | 0.105 | % | 1.125 | % | 0.125 | % | |||||||||||||||

| Borrowings as of | |||||||||||||||||

| December 31, 2022 | Rates effective as of | ||||||||||||||||

| Applicable Rate | (in millions) | December 31, 2022 | |||||||||||||||

| Tranche A Term Loan | LIBOR plus 1.105% | $ | 309 | 5.48 | % | ||||||||||||

| Aggregate Principal Amount (in millions) | Stated Coupon Rate | Issuance Date | Maturity Date | Interest Payment Date | ||||||||||||||||||||||

| $ | 700 | 2.396% | February 2022 | February 2025 | February 18 and August 18 | |||||||||||||||||||||

| 749 | 1.50% | March 2015 | March 2025 | March 10 | ||||||||||||||||||||||

| 535 | 1.60% | September 2016 | September 2028 | September 15 | ||||||||||||||||||||||

| 300 | 4.35% | March 2019 | March 2029 | March 15 and September 15 | ||||||||||||||||||||||

| 800 | 3.25% | February 2022 | March 2032 | March 1 and September 1 | ||||||||||||||||||||||

| 300 | 4.40% | September 2016 | October 2046 | April 1 and October 1 | ||||||||||||||||||||||

| 350 | 5.40% | March 2019 | March 2049 | March 15 and September 15 | ||||||||||||||||||||||

| 1,500 | 3.10% | November 2021 | December 2051 | June 1 and December 1 | ||||||||||||||||||||||

| 1,000 | 4.15% | February 2022 | May 2052 | May 1 and November 1 | ||||||||||||||||||||||

| Obligor Group | |||||

| Year Ended December 31, 2022 | (in millions) | ||||

| Net sales | $ | — | |||

| Gross margin | $ | — | |||

| Operating loss | $ | (67) | |||

| Net loss | $ | (299) | |||

| Net loss attributable to Aptiv | $ | (299) | |||

| As of December 31, 2022 | |||||

| Current assets (1) | $ | 5,340 | |||

| Long-term assets (2) | $ | 516 | |||

| Current liabilities (3) | $ | 7,372 | |||

| Long-term liabilities (3) | $ | 6,668 | |||

| Noncontrolling interest | $ | — | |||

| As of December 31, 2021 | |||||

| Current assets (1) | $ | 6,432 | |||

| Long-term assets | $ | 14 | |||

| Current liabilities (3) | $ | 6,572 | |||

| Long-term liabilities (3) | $ | 4,276 | |||

| Noncontrolling interest | $ | — | |||

| Payments due by Period | |||||||||||||||||||||||||||||

| Total | 2023 | 2024 & 2025 | 2026 & 2027 | Thereafter | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Debt and finance lease obligations (excluding interest) | $ | 6,581 | $ | 31 | $ | 1,501 | $ | 264 | $ | 4,785 | |||||||||||||||||||

| Estimated interest costs related to debt and finance lease obligations | 3,868 | 217 | 407 | 344 | 2,900 | ||||||||||||||||||||||||

| Operating lease obligations | 514 | 121 | 173 | 114 | 106 | ||||||||||||||||||||||||

| Contractual commitments for capital expenditures | 253 | 253 | — | — | — | ||||||||||||||||||||||||

| Other contractual purchase commitments, including information technology | 421 | 259 | 147 | 10 | 5 | ||||||||||||||||||||||||

| Total | $ | 11,637 | $ | 881 | $ | 2,228 | $ | 732 | $ | 7,796 | |||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Signal and Power Solutions | $ | 573 | $ | 434 | $ | 355 | |||||||||||

| Advanced Safety and User Experience | 196 | 124 | 173 | ||||||||||||||

| Other (1) | 75 | 53 | 56 | ||||||||||||||

| Total capital expenditures | $ | 844 | $ | 611 | $ | 584 | |||||||||||

| North America | $ | 312 | $ | 218 | $ | 235 | |||||||||||

| Europe, Middle East & Africa | 271 | 233 | 212 | ||||||||||||||

| Asia Pacific | 249 | 149 | 129 | ||||||||||||||

| South America | 12 | 11 | 8 | ||||||||||||||

| Total capital expenditures | $ | 844 | $ | 611 | $ | 584 | |||||||||||

| Pension Benefits | |||||||||||||||||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Weighted-average discount rate | 5.20 | % | 1.90 | % | 5.95 | % | 3.09 | % | |||||||||||||||

| Weighted-average rate of increase in compensation levels | N/A | N/A | 2.82 | % | 2.47 | % | |||||||||||||||||

| Pension Benefits | |||||||||||||||||||||||||||||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Weighted-average discount rate | 1.90 | % | 1.20 | % | 2.40 | % | 3.09 | % | 2.21 | % | 2.87 | % | |||||||||||||||||||||||

| Weighted-average rate of increase in compensation levels | N/A | N/A | N/A | 2.47 | % | 3.64 | % | 3.69 | % | ||||||||||||||||||||||||||

Weighted-average expected long-term rate of return on plan assets | N/A | N/A | N/A | 4.46 | % | 4.29 | % | 4.68 | % | ||||||||||||||||||||||||||

| Change in Assumption | Impact on Pension Expense | Impact on PBO | ||||||||||||

25 basis point (“bp”) decrease in discount rate | Less than + $1 million | ‘+ $16 million | ||||||||||||

25 bp increase in discount rate | ‘- $1 million | ‘- $15 million | ||||||||||||

25 bp decrease in long-term expected return on assets | ‘+ $1 million | — | ||||||||||||

25 bp increase in long-term expected return on assets | ‘- $1 million | — | ||||||||||||

| Credit Agreement | ||||||||

| Change in Rate | (impact to annual interest expense, in millions) | |||||||

| 25 bps decrease | - $1 | |||||||

| 25 bps increase | +$1 | |||||||

| Uncertain Tax Positions | |||||

| Description of the Matter | As described in Notes 2 and 14, the Company establishes reserves for uncertain tax positions for positions that are taken on their income tax returns that might not be sustained upon examination by the taxing authorities. At December 31, 2022, the Company has recorded approximately $224 million relating to uncertain tax positions. In determining whether an uncertain tax position exists, the Company determines, based solely on its technical merits, whether the tax position is more likely than not to be sustained upon examination, and if so, a tax benefit is measured on a cumulative probability basis that is more likely than not to be realized upon the ultimate settlement. The Company identifies its certain and uncertain tax positions and then evaluates the recognition and measurement steps to determine the amount that should be recognized. The Company then evaluates uncertain tax positions in subsequent periods for recognition, de-recognition or re-measurement if changes have occurred, or when effective settlement or expiration of the statute of limitations occurs. | ||||

| Auditing the uncertain tax positions is complex because of the judgmental nature of the tax accruals and various other tax return positions that might not be sustained upon review by taxing authorities. The Company files tax returns in multiple jurisdictions and is subject to examination by taxing authorities throughout the world due to its complex global footprint. Taxing jurisdictions significant to Aptiv include Barbados, China, Germany, Ireland, Luxembourg, Mexico, South Korea, the U.K. and the U.S. | |||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design, and tested the operating effectiveness of controls related to the recognition, measurement and the evaluation of changes in uncertain tax positions. This included testing controls over management’s review of the tax positions, their evaluation of whether they met the measurement threshold and then recalculating the amounts recognized based upon a cumulative probability assessment performed by management. Our audit procedures to test the Company’s uncertain tax positions included, among others, involvement of our tax professionals, including transfer pricing professionals. This included evaluating tax opinions and third-party transfer pricing studies obtained by the Company and assessing the Company’s correspondence with the relevant tax authorities. We analyzed the Company’s assumptions and data used to determine the amount of tax benefit to recognize and tested the accuracy of the calculations. Our testing also included the evaluation of the ongoing positions and consideration of changes, the recording of penalties and interest and the ultimate settlement and payment of certain tax matters. | ||||

Revenue Recognition | |||||

| Description of the Matter | As described in Notes 2 and 24, Aptiv occasionally enters into pricing agreements with its customers that provide for price reductions, some of which are conditional upon achieving certain joint cost saving targets. In addition, from time to time, Aptiv makes payments to customers in conjunction with ongoing business. Revenue is recognized based on the agreed-upon price at the time of shipment, and sales incentives, allowances and certain customer payments are recognized as a reduction to revenue at the time of the commitment to provide such incentives or make these payments. Certain other customer payments or upfront fees are considered to be a cost to obtain a contract as they are directly attributable to a contract, are incremental and management expects the payments to be recoverable. In these cases, the customer payment is capitalized and amortized to revenue based on the transfer of goods and services to the customer for which the upfront payment relates. As of December 31, 2022, Aptiv has recorded $78 million related to these capitalized upfront payments. Auditing the accounting for and completeness of arrangements containing elements such as sales incentives, allowances and customer payments, including the appropriate timing and presentation of adjustments to revenue as well as costs to obtain a contract is judgmental due to the unique facts and circumstances involved in each revenue arrangement, as well as on-going commercial negotiations with customers. | ||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the review of customer contracts. This included testing controls over management’s process to identify and evaluate customer contracts that contain sales incentives, allowances and customer payments that impact revenue recognition. Our audit procedures to test the completeness of the Company’s identification of such contracts included, among others, interviewing sales representatives who are responsible for negotiations with customers and testing cash payments and credit memos issued to customers. To test management’s assessment of customer contracts containing sales incentives, allowances and customer payments, our procedures included, among others, selecting a sample of customer agreements, obtaining and reviewing source documentation, including master agreements, and other documents that were part of the agreement, and evaluating the contract terms to determine the appropriateness of the accounting treatment. | ||||

| Acquisition of Wind River - Valuation of Intangible Assets | |||||

| Description of the Matter | As described in Note 20, Aptiv completed the acquisition of Wind River Systems, Inc. (“Wind River”) on December 23, 2022, for total consideration of approximately $3.5 billion. The acquisition was accounted for as a business combination and, as such, the Company measured the assets acquired and liabilities assumed at their acquisition-date fair values, including the estimated fair values of the technology-related and customer-based intangible assets of $750 million and $630 million, respectively. The estimated fair value of these assets was based on third-party valuations and management’s estimates, generally utilizing income and market approaches. Auditing the Company's valuation of technology-related and customer-based intangible assets was complex and required significant auditor judgment due to the high degree of subjectivity in evaluating certain assumptions required to estimate the fair value of these intangible assets. The fair value measurement was sensitive to underlying assumptions including discount rates, and management’s estimate of projected revenue growth rates and profit margins. These assumptions relate to the future performance of the acquired business, are forward-looking and could be affected by future economic and market conditions. | ||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the valuation of the technology-related and customer-based intangible assets. This included testing controls over management’s review of the significant assumptions and other inputs used in the valuation of these intangible assets, and review of the valuation model. Our audit procedures to test the estimated fair value of the acquired technology-related and customer-based intangible assets included, among others, evaluating the Company's use of valuation methodologies, evaluating the prospective financial information and testing the completeness and accuracy of the underlying data supporting the significant assumptions and estimates. We involved our valuation specialists to review the valuation model and assist in testing the significant assumptions used to value the technology-related and customer-based intangible assets. Our testing also included comparing significant management assumptions to current industry and market trends, historical results of the acquired business and to other relevant factors. We also performed sensitivity analyses of the significant assumptions to evaluate the change in the fair value resulting from changes in the assumptions. | ||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Net sales | $ | $ | $ | ||||||||||||||

| Operating expenses: | |||||||||||||||||

| Cost of sales | |||||||||||||||||

| Selling, general and administrative | |||||||||||||||||

| Amortization | |||||||||||||||||

Restructuring (Note 10) | |||||||||||||||||

Gain on autonomous driving joint venture (Note 20) | ( | ||||||||||||||||

| Total operating expenses | |||||||||||||||||

| Operating income | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

Other expense, net (Note 19) | ( | ( | |||||||||||||||

| Income before income taxes and equity loss | |||||||||||||||||

| Income tax expense | ( | ( | ( | ||||||||||||||

| Income before equity loss | |||||||||||||||||

| Equity loss, net of tax | ( | ( | ( | ||||||||||||||

| Net income | |||||||||||||||||

| Net (loss) income attributable to noncontrolling interest | ( | ||||||||||||||||

| Net loss attributable to redeemable noncontrolling interest | ( | ||||||||||||||||

| Net income attributable to Aptiv | |||||||||||||||||

Mandatory convertible preferred share dividends (Note 15) | ( | ( | ( | ||||||||||||||

| Net income attributable to ordinary shareholders | $ | $ | $ | ||||||||||||||

| Basic net income per share: | |||||||||||||||||

| Basic net income per share attributable to ordinary shareholders | $ | $ | $ | ||||||||||||||

| Weighted average number of basic shares outstanding | |||||||||||||||||

Diluted net income per share (Note 15): | |||||||||||||||||

| Diluted net income per share attributable to ordinary shareholders | $ | $ | $ | ||||||||||||||

| Weighted average number of diluted shares outstanding | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Other comprehensive (loss) income: | |||||||||||||||||

| Currency translation adjustments | ( | ( | |||||||||||||||

Net change in unrecognized gain (loss) on derivative instruments, net of tax (Note 17) | ( | ||||||||||||||||

Employee benefit plans adjustment, net of tax (Note 12) | ( | ||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||

| Comprehensive income | |||||||||||||||||

| Comprehensive (loss) income attributable to noncontrolling interest | ( | ||||||||||||||||

| Comprehensive income attributable to redeemable noncontrolling interest | |||||||||||||||||

| Comprehensive income attributable to Aptiv | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $ | |||||||||||

Inventories (Note 3) | |||||||||||

Other current assets (Note 4) | |||||||||||

| Total current assets | |||||||||||

| Long-term assets: | |||||||||||

Property, net (Note 6) | |||||||||||

Operating lease right-of-use assets (Note 25) | |||||||||||

Investments in affiliates (Note 5) | |||||||||||

Intangible assets, net (Note 7) | |||||||||||

Goodwill (Note 7) | |||||||||||

Other long-term assets (Note 4) | |||||||||||

| Total long-term assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

Short-term debt (Note 11) | $ | $ | |||||||||

| Accounts payable | |||||||||||

Accrued liabilities (Note 8) | |||||||||||

| Total current liabilities | |||||||||||

| Long-term liabilities: | |||||||||||

Long-term debt (Note 11) | |||||||||||

Pension benefit obligations (Note 12) | |||||||||||

Long-term operating lease liabilities (Note 25) | |||||||||||

Other long-term liabilities (Note 8) | |||||||||||

| Total long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (Note 13) | |||||||||||

Redeemable noncontrolling interest (Note 2) | |||||||||||

| Shareholders’ equity: | |||||||||||

Preferred shares, $ | |||||||||||

Ordinary shares, $ | |||||||||||

| Additional paid-in-capital | |||||||||||

| Retained earnings | |||||||||||

Accumulated other comprehensive loss (Note 16) | ( | ( | |||||||||

| Total Aptiv shareholders’ equity | |||||||||||

| Noncontrolling interest | |||||||||||

| Total shareholders’ equity | |||||||||||

| Total liabilities, redeemable noncontrolling interest and shareholders’ equity | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||

| Depreciation | |||||||||||||||||

| Amortization | |||||||||||||||||

| Amortization of deferred debt issuance costs | |||||||||||||||||

| Restructuring expense, net of cash paid | ( | ( | |||||||||||||||

| Deferred income taxes | ( | ( | ( | ||||||||||||||

| Pension and other postretirement benefit expenses | |||||||||||||||||

| Loss from equity method investments, net of dividends received | |||||||||||||||||

| Loss on modification of debt | |||||||||||||||||

| Loss on extinguishment of debt | |||||||||||||||||

| Loss on sale of assets | |||||||||||||||||

| Share-based compensation | |||||||||||||||||

| Gain on autonomous driving joint venture, net | ( | ||||||||||||||||

| Other charges related to Ukraine/Russia conflict | |||||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||

| Accounts receivable, net | ( | ( | |||||||||||||||

| Inventories | ( | ( | ( | ||||||||||||||

| Other assets | |||||||||||||||||

| Accounts payable | |||||||||||||||||

| Accrued and other long-term liabilities | ( | ||||||||||||||||

| Other, net | ( | ( | |||||||||||||||

| Pension contributions | ( | ( | ( | ||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||

| Capital expenditures | ( | ( | ( | ||||||||||||||

| Proceeds from sale of property | |||||||||||||||||

| Cost of business acquisitions and other transactions, net of cash acquired | ( | ( | ( | ||||||||||||||

| Proceeds from sale of technology investments | |||||||||||||||||

| Cost of technology investments | ( | ( | ( | ||||||||||||||

| Settlement of derivatives | ( | ( | |||||||||||||||

| Net cash used in investing activities | ( | ( | ( | ||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||

| Net repayments under other short-term debt agreements | ( | ( | ( | ||||||||||||||

| Net repayments under other long-term debt agreements | ( | ( | ( | ||||||||||||||

| Repayment of senior notes | ( | ||||||||||||||||

| Proceeds from issuance of senior notes, net of issuance costs | |||||||||||||||||

| Fees related to modification of debt agreements | ( | ( | |||||||||||||||

| Proceeds from the public offering of ordinary shares, net of issuance costs | |||||||||||||||||

| Proceeds from the public offering of preferred shares, net of issuance costs | |||||||||||||||||

| Contingent consideration payments | ( | ||||||||||||||||

| Dividend payments of consolidated affiliates to minority shareholders | ( | ( | |||||||||||||||

| Repurchase of ordinary shares | ( | ||||||||||||||||

| Distribution of mandatory convertible preferred share cash dividends | ( | ( | ( | ||||||||||||||

| Distribution of ordinary share cash dividends | ( | ||||||||||||||||

| Taxes withheld and paid on employees’ restricted share awards | ( | ( | ( | ||||||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||||||||

| Effect of exchange rate fluctuations on cash, cash equivalents and restricted cash | ( | ( | |||||||||||||||

| (Decrease) increase in cash, cash equivalents and restricted cash | ( | ||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of the year | |||||||||||||||||

| Cash, cash equivalents and restricted cash at end of the year | $ | $ | $ | ||||||||||||||

| Reconciliation of cash, cash equivalents and restricted cash and cash classified as assets held for sale: | |||||||||||||||||

| December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Cash, cash equivalents and restricted cash | $ | $ | $ | ||||||||||||||

| Cash classified as assets held for sale | |||||||||||||||||

| Total cash, cash equivalents and restricted cash | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ordinary Shares | Preferred Shares | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Redeemable Noncontrolling Interest | Number of Shares | Amount of Shares | Number of Shares | Amount of Shares | Additional Paid in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Total Aptiv Shareholders’ Equity | Noncontrolling Interest | Total Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2022 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss attributable to noncontrolling interest | ( | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income attributable to noncontrolling interest | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividend payments of consolidated affiliates to minority shareholders | — | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mandatory convertible preferred share cumulative dividends | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes withheld on employees’ restricted share award vestings | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Acquired redeemable noncontrolling interest (Note 20) | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2021 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mandatory convertible preferred share cumulative dividends | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes withheld on employees’ restricted share award vestings | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ordinary Shares | Preferred Shares | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Redeemable Noncontrolling Interest | Number of Shares | Amount of Shares | Number of Shares | Amount of Shares | Additional Paid in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Total Aptiv Shareholders’ Equity | Noncontrolling Interest | Total Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2020 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income attributable to noncontrolling interest | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends on ordinary shares | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividend payments of consolidated affiliates to minority shareholders | — | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mandatory convertible preferred share cumulative dividends | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes withheld on employees’ restricted share award vestings | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of ordinary shares | — | ( | — | — | — | ( | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of mandatory convertible preferred shares | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustment for recently adopted accounting pronouncements | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percentage of Total Net Sales | Accounts Receivable | |||||||||||||||||||||||||||||||

| Year Ended December 31, | December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||||

| GM | % | % | % | $ | $ | |||||||||||||||||||||||||||

| Stellantis (1) | % | % | % | |||||||||||||||||||||||||||||

| Ford | % | % | % | |||||||||||||||||||||||||||||

| VW | % | % | % | |||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| (in millions) | |||||||||||

| Productive material | $ | $ | |||||||||

| Work-in-process | |||||||||||

| Finished goods | |||||||||||

| Total | $ | $ | |||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| (in millions) | |||||||||||

| Value added tax receivable | $ | $ | |||||||||

| Prepaid insurance and other expenses | |||||||||||

| Reimbursable engineering costs | |||||||||||

| Notes receivable | |||||||||||

| Income and other taxes receivable | |||||||||||

| Deposits to vendors | |||||||||||

| Derivative financial instruments (Note 17) | |||||||||||

| Capitalized upfront fees (Note 24) | |||||||||||

| Contract assets (Note 24) | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| (in millions) | |||||||||||

| Deferred income taxes, net (Note 14) | $ | $ | |||||||||

| Unamortized Revolving Credit Facility debt issuance costs | |||||||||||

| Income and other taxes receivable | |||||||||||

| Reimbursable engineering costs | |||||||||||

| Value added tax receivable | |||||||||||

| Equity investments (Note 5) | |||||||||||

| Derivative financial instruments (Note 17) | |||||||||||

| Capitalized upfront fees (Note 24) | |||||||||||

| Contract assets (Note 24) | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Current assets | $ | $ | |||||||||

| Non-current assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Current liabilities | $ | $ | |||||||||

| Non-current liabilities | |||||||||||

| Shareholders’ equity | |||||||||||

| Total liabilities and shareholders’ equity | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Net sales | $ | $ | $ | ||||||||||||||

| Gross loss | ( | ( | ( | ||||||||||||||

| Net loss | ( | ( | ( | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Sales to affiliates | $ | $ | $ | ||||||||||||||

| Purchases from affiliates | |||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Receivables due from affiliates | $ | $ | |||||||||

| Payables due to affiliates | |||||||||||

| December 31, | ||||||||||||||||||||

| Investment Name | Segment | 2022 | 2021 | |||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Equity investments without readily determinable fair values: | ||||||||||||||||||||

| StradVision, Inc. | Advanced Safety and User Experience | $ | $ | |||||||||||||||||

| LeddarTech, Inc. | Advanced Safety and User Experience | |||||||||||||||||||

| Quanergy Systems, Inc (1) | Advanced Safety and User Experience | |||||||||||||||||||

| Other investments | Various | |||||||||||||||||||

| Total equity investments without readily determinable fair values | ||||||||||||||||||||

| Publicly traded equity securities: | ||||||||||||||||||||

| Smart Eye AB | Advanced Safety and User Experience | |||||||||||||||||||

| Otonomo Technologies Ltd. | Advanced Safety and User Experience | |||||||||||||||||||

| Valens Semiconductor Ltd. | Signal and Power Solutions | |||||||||||||||||||

| Total publicly traded equity securities | ||||||||||||||||||||

| Total investments | $ | $ | ||||||||||||||||||

| Estimated Useful Lives | December 31, | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| (Years) | (in millions) | ||||||||||||||||

| Land | — | $ | $ | ||||||||||||||

| Land and leasehold improvements | |||||||||||||||||

| Buildings | |||||||||||||||||

| Machinery, equipment and tooling | |||||||||||||||||

| Furniture and office equipment | |||||||||||||||||

| Construction in progress | — | ||||||||||||||||

| Total | |||||||||||||||||

| Less: accumulated depreciation | ( | ( | |||||||||||||||

| Total property, net | $ | $ | |||||||||||||||

| As of December 31, 2022 | As of December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Estimated Useful Lives | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | |||||||||||||||||||||||||||||||||||

| (Years) | (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||

| Amortized intangible assets: | |||||||||||||||||||||||||||||||||||||||||

| Patents and developed technology | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Customer relationships | |||||||||||||||||||||||||||||||||||||||||

| Trade names | |||||||||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||||||||

| Unamortized intangible assets: | |||||||||||||||||||||||||||||||||||||||||

| In-process research and development | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Trade names | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Goodwill | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Year Ending December 31, | |||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Estimated amortization expense | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Balance at January 1 | $ | $ | |||||||||

| Acquisitions (1) | |||||||||||

| Foreign currency translation and other | ( | ( | |||||||||

| Balance at December 31 | $ | $ | |||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Balance at January 1 | $ | $ | |||||||||

| Amortization | |||||||||||

| Foreign currency translation and other | ( | ( | |||||||||

| Balance at December 31 | $ | $ | |||||||||

| Signal and Power Solutions | Advanced Safety and User Experience | Total | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance at January 1, 2021 | $ | $ | $ | ||||||||||||||

| Acquisitions (1) | |||||||||||||||||

| Foreign currency translation and other | ( | ( | |||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ||||||||||||||

| Acquisitions (2) | $ | $ | $ | ||||||||||||||

| Foreign currency translation and other | ( | ( | |||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| (in millions) | |||||||||||

| Payroll-related obligations | $ | $ | |||||||||

| Employee benefits, including current pension obligations | |||||||||||

| Income and other taxes payable | |||||||||||

| Warranty obligations (Note 9) | |||||||||||

| Restructuring (Note 10) | |||||||||||

| Customer deposits | |||||||||||

| Accrued interest | |||||||||||

| MCPS dividends payable | |||||||||||

| Contract liabilities (Note 24) | |||||||||||

| Operating lease liabilities (Note 25) | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| (in millions) | |||||||||||

| Environmental (Note 13) | $ | $ | |||||||||

| Extended disability benefits | |||||||||||

| Warranty obligations (Note 9) | |||||||||||

| Restructuring (Note 10) | |||||||||||

| Payroll-related obligations | |||||||||||

| Accrued income taxes | |||||||||||

| Deferred income taxes, net (Note 14) | |||||||||||

| Contract liabilities (Note 24) | |||||||||||

| Derivative financial instruments (Note 17) | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Accrual balance at beginning of year | $ | $ | |||||||||

| Provision for estimated warranties incurred during the year | |||||||||||

| Changes in estimate for pre-existing warranties | |||||||||||

| Settlements made during the year (in cash or in kind) | ( | ( | |||||||||

| Foreign currency translation and other | ( | ( | |||||||||

| Accrual balance at end of year | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Signal and Power Solutions | $ | $ | $ | ||||||||||||||

| Advanced Safety and User Experience | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

| Employee Termination Benefits Liability | Other Exit Costs Liability | Employee Termination Benefits | |||||||||||||||

| (in millions) | |||||||||||||||||

| Accrual balance at January 1, 2021 | $ | $ | $ | ||||||||||||||

| Provision for estimated expenses incurred during the year | |||||||||||||||||

| Payments made during the year | ( | ( | |||||||||||||||

| Foreign currency and other | ( | ( | |||||||||||||||

| Accrual balance at December 31, 2021 | $ | $ | $ | ||||||||||||||

| Provision for estimated expenses incurred during the year | $ | $ | $ | ||||||||||||||

| Payments made during the year | ( | ( | |||||||||||||||

| Foreign currency and other | |||||||||||||||||

| Accrual balance at December 31, 2022 | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| $ | $ | ||||||||||

Tranche A Term Loan, due 2026 (net of $ | |||||||||||

| Finance leases and other | |||||||||||

| Total debt | |||||||||||

| Less: current portion | ( | ( | |||||||||

| Long-term debt | $ | $ | |||||||||

| Debt and Finance Lease Obligations | |||||

| (in millions) | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Total | $ | ||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||

| LIBOR plus | ABR plus | LIBOR plus | ABR plus | ||||||||||||||||||||

| Revolving Credit Facility | % | % | % | % | |||||||||||||||||||

| Tranche A Term Loan | % | % | % | % | |||||||||||||||||||

| Borrowings as of | |||||||||||||||||

| December 31, 2022 | Rates effective as of | ||||||||||||||||

| Applicable Rate | (in millions) | December 31, 2022 | |||||||||||||||

| Tranche A Term Loan | LIBOR plus 1.105% | $ | % | ||||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Benefit obligation at beginning of year | $ | $ | |||||||||

| Actuarial gain | ( | ||||||||||

| Benefits paid | ( | ( | |||||||||

| Benefit obligation at end of year | $ | $ | |||||||||

| Change in plan assets: | |||||||||||

| Fair value of plan assets at beginning of year | $ | $ | |||||||||

| Aptiv contributions | |||||||||||

| Benefits paid | ( | ( | |||||||||

| Fair value of plan assets at end of year | $ | $ | |||||||||

| Underfunded status | $ | ( | $ | ( | |||||||

| Amounts recognized in the consolidated balance sheets consist of: | |||||||||||

| Current liabilities | $ | ( | $ | ( | |||||||

| Long-term liabilities | ( | ( | |||||||||

| Total | $ | ( | $ | ( | |||||||

| Amounts recognized in accumulated other comprehensive loss consist of (pre-tax): | |||||||||||

| Actuarial loss | $ | $ | |||||||||

| Total | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Benefit obligation at beginning of year | $ | $ | |||||||||

| Service cost | |||||||||||

| Interest cost | |||||||||||

| Actuarial gain | ( | ( | |||||||||

| Benefits paid | ( | ( | |||||||||

| Impact of curtailments | ( | ||||||||||

| Exchange rate movements and other | ( | ( | |||||||||

| Benefit obligation at end of year | $ | $ | |||||||||

| Change in plan assets: | |||||||||||

| Fair value of plan assets at beginning of year | $ | $ | |||||||||

| Actual return on plan assets | ( | ||||||||||

| Aptiv contributions | |||||||||||

| Benefits paid | ( | ( | |||||||||

| Exchange rate movements and other | ( | ( | |||||||||

| Fair value of plan assets at end of year | $ | $ | |||||||||

| Underfunded status | $ | ( | $ | ( | |||||||

| Amounts recognized in the consolidated balance sheets consist of: | |||||||||||

| Long-term assets | $ | $ | |||||||||

| Current liabilities | ( | ( | |||||||||

| Long-term liabilities | ( | ( | |||||||||

| Total | $ | ( | $ | ( | |||||||

| Amounts recognized in accumulated other comprehensive loss consist of (pre-tax): | |||||||||||

| Actuarial loss | $ | $ | |||||||||

| Total | $ | $ | |||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in millions) Plans with ABO in Excess of Plan Assets | |||||||||||||||||||||||

| PBO | $ | $ | $ | $ | |||||||||||||||||||

| ABO | |||||||||||||||||||||||

| Fair value of plan assets at end of year | |||||||||||||||||||||||

| Plans with Plan Assets in Excess of ABO | |||||||||||||||||||||||

| PBO | $ | $ | $ | $ | |||||||||||||||||||

| ABO | |||||||||||||||||||||||

| Fair value of plan assets at end of year | |||||||||||||||||||||||

| Total | |||||||||||||||||||||||

| PBO | $ | $ | $ | $ | |||||||||||||||||||

| ABO | |||||||||||||||||||||||

| Fair value of plan assets at end of year | |||||||||||||||||||||||

| U.S. Plans | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Amortization of actuarial losses | $ | $ | $ | ||||||||||||||

| Net periodic benefit cost | $ | $ | $ | ||||||||||||||

| Non-U.S. Plans | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Service cost | $ | $ | $ | ||||||||||||||

| Interest cost | |||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ||||||||||||||

| Settlement loss | |||||||||||||||||

| Curtailment loss | |||||||||||||||||

| Amortization of actuarial losses | |||||||||||||||||

| Other | |||||||||||||||||

| Net periodic benefit cost | $ | $ | $ | ||||||||||||||

| Pension Benefits | |||||||||||||||||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Weighted-average discount rate | % | % | % | % | |||||||||||||||||||

| Weighted-average rate of increase in compensation levels | N/A | N/A | % | % | |||||||||||||||||||

| Pension Benefits | |||||||||||||||||||||||||||||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Weighted-average discount rate | % | % | % | % | % | % | |||||||||||||||||||||||||||||

Weighted-average rate of increase in compensation levels | N/A | N/A | N/A | % | % | % | |||||||||||||||||||||||||||||

Weighted-average expected long-term rate of return on plan assets | N/A | N/A | N/A | % | % | % | |||||||||||||||||||||||||||||

| Change in Assumption | Impact on Pension Expense | Impact on PBO | ||||||||||||

Less than + $ | ‘+ $ | |||||||||||||

‘- $ | ‘- $ | |||||||||||||

‘+ $ | — | |||||||||||||

‘- $ | — | |||||||||||||

| Projected Pension Benefit Payments | |||||||||||

| U.S. Plans | Non-U.S. Plans | ||||||||||

| (in millions) | |||||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| 2028 – 2032 | |||||||||||

| Fair Value Measurements at December 31, 2022 | ||||||||||||||||||||||||||

| Asset Category | Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | ||||||||||||||||||||||

| Time deposits | ||||||||||||||||||||||||||

| Equity mutual funds | ||||||||||||||||||||||||||

| Bond mutual funds | ||||||||||||||||||||||||||

| Real estate trust funds | ||||||||||||||||||||||||||

| Private debt funds | ||||||||||||||||||||||||||

| Insurance contracts | ||||||||||||||||||||||||||

| Debt securities | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| Fair Value Measurements at December 31, 2021 | ||||||||||||||||||||||||||

| Asset Category | Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | ||||||||||||||||||||||

| Time deposits | ||||||||||||||||||||||||||

| Equity mutual funds | ||||||||||||||||||||||||||

| Bond mutual funds | ||||||||||||||||||||||||||

| Real estate trust funds | ||||||||||||||||||||||||||

| Hedge funds | ||||||||||||||||||||||||||

| Insurance contracts | ||||||||||||||||||||||||||

| Debt securities | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) | |||||||||||||||||||||||

| Real Estate Trust Fund | Hedge Funds | Insurance Contracts | Private Lending Funds | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Beginning balance at January 1, 2021 | $ | $ | $ | $ | |||||||||||||||||||

| Actual return on plan assets: | |||||||||||||||||||||||

| Relating to assets still held at the reporting date | |||||||||||||||||||||||

| Purchases, sales and settlements | ( | ( | |||||||||||||||||||||

| Foreign currency translation and other | ( | ||||||||||||||||||||||

| Ending balance at December 31, 2021 | $ | $ | $ | $ | |||||||||||||||||||

| Actual return on plan assets: | |||||||||||||||||||||||

| Relating to assets still held at the reporting date | $ | $ | $ | $ | ( | ||||||||||||||||||

| Purchases, sales and settlements | ( | ||||||||||||||||||||||

| Foreign currency translation and other | ( | ( | ( | ||||||||||||||||||||

| Ending balance at December 31, 2022 | $ | $ | $ | $ | |||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| U.S. income (loss) | $ | $ | ( | $ | ( | ||||||||||||

| Non-U.S. income | |||||||||||||||||

| Income before income taxes and equity loss | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Current income tax expense (benefit): | |||||||||||||||||

| U.S. federal | $ | $ | $ | ( | |||||||||||||

| Non-U.S. | |||||||||||||||||

| U.S. state and local | |||||||||||||||||

| Total current | |||||||||||||||||

| Deferred income tax expense (benefit), net: | |||||||||||||||||

| U.S. federal | ( | ( | ( | ||||||||||||||

| Non-U.S. | ( | ( | ( | ||||||||||||||

| U.S. state and local | ( | ( | |||||||||||||||

| Total deferred | ( | ( | ( | ||||||||||||||

| Total income tax provision | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Notional U.S. federal income taxes at statutory rate | $ | $ | $ | ||||||||||||||

| Income taxed at other rates | ( | ( | ( | ||||||||||||||

| Change in valuation allowance | ( | ( | |||||||||||||||

| Other change in tax reserves | |||||||||||||||||

| Intragroup reorganizations | ( | ( | |||||||||||||||

| Withholding taxes | |||||||||||||||||

| Tax credits | ( | ( | ( | ||||||||||||||

| Change in tax law | ( | ( | |||||||||||||||

| Other adjustments | ( | ( | |||||||||||||||

| Total income tax expense | $ | $ | $ | ||||||||||||||

| Effective tax rate | % | % | % | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Deferred tax assets: | |||||||||||

| Pension | $ | $ | |||||||||

| Employee benefits | |||||||||||

| Net operating loss carryforwards | |||||||||||

| Warranty and other liabilities | |||||||||||

| Operating lease liabilities | |||||||||||

| Capitalized R&D | |||||||||||

| Other | |||||||||||

| Total gross deferred tax assets | |||||||||||

| Less: valuation allowances | ( | ( | |||||||||

| Total deferred tax assets (1) | $ | $ | |||||||||

| Deferred tax liabilities: | |||||||||||

| Fixed assets | $ | $ | |||||||||

| Tax on unremitted profits of certain foreign subsidiaries | |||||||||||

| Intangibles | |||||||||||

| Operating lease right-of-use assets | |||||||||||

| Total gross deferred tax liabilities | |||||||||||

| Net deferred tax (liabilities) assets | $ | ( | $ | ||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Long-term assets | $ | $ | |||||||||

| Long-term liabilities | ( | ( | |||||||||

| Total deferred tax (liability) asset | $ | ( | $ | ||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance at beginning of year | $ | $ | $ | ||||||||||||||

| Additions related to current year | |||||||||||||||||

| Additions related to prior years | |||||||||||||||||

| Reductions related to prior years | ( | ( | ( | ||||||||||||||

| Reductions due to expirations of statute of limitations | ( | ( | ( | ||||||||||||||

| Settlements | ( | ( | |||||||||||||||

| Balance at end of year | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions, except per share data) | |||||||||||||||||

| Numerator, basic: | |||||||||||||||||

| Net income attributable to ordinary shareholders | $ | $ | $ | ||||||||||||||

| Numerator, diluted: | |||||||||||||||||

| Net income attributable to Aptiv | $ | $ | $ | ||||||||||||||

| MCPS dividends (1) | ( | ( | |||||||||||||||

| Numerator, diluted | $ | $ | $ | ||||||||||||||

| Denominator: | |||||||||||||||||

| Weighted average ordinary shares outstanding, basic | |||||||||||||||||

Dilutive shares related to RSUs | |||||||||||||||||

| Weighted average MCPS converted shares (1) | |||||||||||||||||

Weighted average ordinary shares outstanding, including dilutive shares | |||||||||||||||||

| Net income per share attributable to ordinary shareholders: | |||||||||||||||||

| Basic | $ | $ | $ | ||||||||||||||

| Diluted | $ | $ | $ | ||||||||||||||

| Total number of shares repurchased | |||||

| Average price paid per share | $ | ||||

| Total (in millions) | $ | ||||

| Dividend | Amount | ||||||||||

| Per Share | (in millions) | ||||||||||

| 2022: | |||||||||||

| Fourth quarter | $ | $ | |||||||||

| Third quarter | |||||||||||

| Second quarter | |||||||||||

| First quarter | |||||||||||

| Total | $ | $ | |||||||||

| 2021: | |||||||||||

| Fourth quarter | $ | $ | |||||||||

| Third quarter | |||||||||||

| Second quarter | |||||||||||

| First quarter | |||||||||||

| Total | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (in millions) | |||||||||||||||||

| Foreign currency translation adjustments: | |||||||||||||||||

| Balance at beginning of year | $ | ( | $ | ( | $ | ( | |||||||||||

| Aggregate adjustment for the year (1) | ( | ( | |||||||||||||||

| Balance at end of year | ( | ( | ( | ||||||||||||||

| Gains (losses) on derivatives: | |||||||||||||||||

| Balance at beginning of year | $ | ( | $ | $ | |||||||||||||

Other comprehensive income before reclassifications (net tax effect of $ | |||||||||||||||||

Reclassification to income (net tax effect of $ | ( | ( | |||||||||||||||

| Balance at end of year | ( | ||||||||||||||||

| Pension and postretirement plans: | |||||||||||||||||

| Balance at beginning of year | $ | ( | $ | ( | $ | ( | |||||||||||

Other comprehensive income (loss) before reclassifications (net tax effect of $( | ( | ||||||||||||||||

Reclassification to income (net tax effect of $( | |||||||||||||||||

| Balance at end of year | ( | ( | ( | ||||||||||||||

| Accumulated other comprehensive loss, end of year | $ | ( | $ | ( | $ | ( | |||||||||||

| Reclassification Out of Accumulated Other Comprehensive Income (Loss) | ||||||||||||||||||||||||||

| Details About Accumulated Other Comprehensive Income Components | Year Ended December 31, | Affected Line Item in the Statement of Operations | ||||||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Foreign currency translation adjustments: | ||||||||||||||||||||||||||

| Liquidation of foreign subsidiary (1) | $ | ( | $ | $ | Other expense, net | |||||||||||||||||||||

| ( | Income before income taxes | |||||||||||||||||||||||||

| Income tax expense | ||||||||||||||||||||||||||

| ( | Net income | |||||||||||||||||||||||||

| Net (loss) income attributable to noncontrolling interest | ||||||||||||||||||||||||||

| $ | ( | $ | $ | Net income attributable to Aptiv | ||||||||||||||||||||||

| Gains (losses) on derivatives: | ||||||||||||||||||||||||||

| Commodity derivatives | $ | ( | $ | $ | ( | Cost of sales | ||||||||||||||||||||

| Foreign currency derivatives | ( | ( | Cost of sales | |||||||||||||||||||||||

| ( | Income before income taxes | |||||||||||||||||||||||||

| ( | Income tax expense | |||||||||||||||||||||||||

| ( | Net income | |||||||||||||||||||||||||

| Net (loss) income attributable to noncontrolling interest | ||||||||||||||||||||||||||

| $ | $ | $ | ( | Net income attributable to Aptiv | ||||||||||||||||||||||

| Pension and postretirement plans: | ||||||||||||||||||||||||||

| Actuarial loss | $ | ( | $ | ( | $ | ( | Other expense, net (2) | |||||||||||||||||||

| Curtailment loss | ( | Other expense, net (2) | ||||||||||||||||||||||||

| ( | ( | ( | Income before income taxes | |||||||||||||||||||||||

| Income tax expense | ||||||||||||||||||||||||||

| ( | ( | ( | Net income | |||||||||||||||||||||||

| Net (loss) income attributable to noncontrolling interest | ||||||||||||||||||||||||||

| $ | ( | $ | ( | $ | ( | Net income attributable to Aptiv | ||||||||||||||||||||

| Total reclassifications for the year | $ | ( | $ | $ | ( | |||||||||||||||||||||

| Commodity | Quantity Hedged | Unit of Measure | Notional Amount (Approximate USD Equivalent) | |||||||||||||||||

| (in thousands) | (in millions) | |||||||||||||||||||

| Copper | pounds | $ | ||||||||||||||||||

| Foreign Currency | Quantity Hedged | Unit of Measure | Notional Amount (Approximate USD Equivalent) | |||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Mexican Peso | MXN | $ | ||||||||||||||||||

| Chinese Yuan Renminbi | RMB | |||||||||||||||||||

| Euro | EUR | |||||||||||||||||||

| Polish Zloty | PLN | |||||||||||||||||||

| Hungarian Forint | HUF | |||||||||||||||||||

| Asset Derivatives | Liability Derivatives | Net Amounts of Assets and (Liabilities) Presented in the Balance Sheet | |||||||||||||||||||||||||||

| Balance Sheet Location | December 31, 2022 | Balance Sheet Location | December 31, 2022 | December 31, 2022 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

Derivatives designated as cash flow hedges: | |||||||||||||||||||||||||||||

| Commodity derivatives | Other current assets | $ | Accrued liabilities | $ | |||||||||||||||||||||||||

| Foreign currency derivatives* | Other current assets | Other current assets | $ | ||||||||||||||||||||||||||

| Commodity derivatives | Other long-term assets | Other long-term liabilities | |||||||||||||||||||||||||||

| Foreign currency derivatives* | Other long-term assets | Other long-term assets | |||||||||||||||||||||||||||

| Foreign currency derivatives* | Other long-term liabilities | ||||||||||||||||||||||||||||

| Derivatives designated as net investment hedges: | |||||||||||||||||||||||||||||

| Foreign currency derivatives | Other current assets | Accrued liabilities | |||||||||||||||||||||||||||

| Total derivatives designated as hedges | $ | $ | |||||||||||||||||||||||||||

| Derivatives not designated: | |||||||||||||||||||||||||||||

| Foreign currency derivatives* | Other current assets | $ | $ | ||||||||||||||||||||||||||

| Total derivatives not designated as hedges | $ | $ | |||||||||||||||||||||||||||

| Asset Derivatives | Liability Derivatives | Net Amounts of Assets and (Liabilities) Presented in the Balance Sheet | |||||||||||||||||||||||||||

| Balance Sheet Location | December 31, 2021 | Balance Sheet Location | December 31, 2021 | December 31, 2021 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

Derivatives designated as cash flow hedges: | |||||||||||||||||||||||||||||

| Commodity derivatives | Other current assets | $ | Accrued liabilities | $ | |||||||||||||||||||||||||

| Foreign currency derivatives* | Other current assets | Other current assets | $ | ||||||||||||||||||||||||||

| Foreign currency derivatives* | Accrued liabilities | Accrued liabilities | ( | ||||||||||||||||||||||||||

| Commodity derivatives | Other long-term assets | Other long-term liabilities | |||||||||||||||||||||||||||

| Foreign currency derivatives* | Other long-term assets | Other long-term assets | |||||||||||||||||||||||||||

| Foreign currency derivatives* | Other long-term liabilities | Other long-term liabilities | ( | ||||||||||||||||||||||||||

Derivatives designated as net investment hedges: | |||||||||||||||||||||||||||||

| Foreign currency derivatives | Other current assets | Accrued liabilities | |||||||||||||||||||||||||||

| Total derivatives designated as hedges | $ | $ | |||||||||||||||||||||||||||

| Derivatives not designated: | |||||||||||||||||||||||||||||

| Commodity derivatives | Other current assets | $ | Accrued liabilities | $ | |||||||||||||||||||||||||

| Foreign currency derivatives* | Accrued liabilities | ( | |||||||||||||||||||||||||||

| Total derivatives not designated as hedges | $ | $ | |||||||||||||||||||||||||||

| Year Ended December 31, 2022 | (Loss) Gain Recognized in OCI | (Loss) Gain Reclassified from OCI into Income | |||||||||

| (in millions) | |||||||||||

| Derivatives designated as cash flow hedges: | |||||||||||

| Commodity derivatives | $ | ( | $ | ( | |||||||

| Foreign currency derivatives | |||||||||||

| Derivatives designated as net investment hedges: | |||||||||||

| Foreign currency derivatives | |||||||||||

| Total | $ | $ | |||||||||

| Loss Recognized in Income | |||||

| (in millions) | |||||

| Derivatives not designated: | |||||

| Foreign currency derivatives | $ | ( | |||

| Total | $ | ( | |||

| Year Ended December 31, 2021 | Gain (Loss) Recognized in OCI | Gain (Loss) Reclassified from OCI into Income | |||||||||

| (in millions) | |||||||||||

| Derivatives designated as cash flow hedges: | |||||||||||

| Commodity derivatives | $ | $ | |||||||||

| Foreign currency derivatives | ( | ( | |||||||||

| Derivatives designated as net investment hedges: | |||||||||||

| Foreign currency derivatives | ( | ||||||||||

| Total | $ | $ | |||||||||

| Gain (Loss) Recognized in Income | |||||

| (in millions) | |||||

| Derivatives not designated: | |||||

| Commodity derivatives | $ | ||||

| Foreign currency derivatives | ( | ||||

| Total | $ | ( | |||

| Year Ended December 31, 2020 | Gain (Loss) Recognized in OCI | Loss Reclassified from OCI into Income | |||||||||

| (in millions) | |||||||||||

| Derivatives designated as cash flow hedges: | |||||||||||

| Commodity derivatives | $ | $ | ( | ||||||||

| Foreign currency derivatives | ( | ( | |||||||||

| Derivatives designated as net investment hedges: | |||||||||||

| Foreign currency derivatives | ( | ||||||||||

| Total | $ | $ | ( | ||||||||

| Gain Recognized in Income | |||||

| (in millions) | |||||

| Derivatives not designated: | |||||

| Foreign currency derivatives | $ | ||||

| Total | $ | ||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Fair value at beginning of year | $ | $ | |||||||||

| Additions | |||||||||||

| Payments | ( | ||||||||||

| Fair value at end of year | $ | $ | |||||||||

| Total | Quoted Prices in Active Markets Level 1 | Significant Other Observable Inputs Level 2 | Significant Unobservable Inputs Level 3 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| As of December 31, 2022 | |||||||||||||||||||||||