DEF 14Afalse000153592900015359292022-01-012022-12-3100015359292020-01-012020-12-3100015359292021-01-012021-12-310001535929voya:TotalEquityCAPMemberecd:NonPeoNeoMember2020-01-012020-12-310001535929voya:GrantDateFairValueOfStockAwardsReportedInSCTMemberecd:NonPeoNeoMember2020-01-012020-12-310001535929voya:GrantDateFairValueOfStockAwardsReportedInSCTMemberecd:NonPeoNeoMember2021-01-012021-12-310001535929ecd:PeoMembervoya:TotalEquityCAPMember2020-01-012020-12-310001535929ecd:PeoMembervoya:TotalEquityCAPMember2021-01-012021-12-310001535929ecd:PeoMembervoya:TotalEquityCAPMember2022-01-012022-12-310001535929ecd:PeoMembervoya:GrantDateFairValueOfStockAwardsReportedInSCTMember2021-01-012021-12-310001535929voya:GrantDateFairValueOfStockAwardsReportedInSCTMemberecd:PeoMember2020-01-012020-12-310001535929voya:GrantDateFairValueOfStockAwardsReportedInSCTMemberecd:PeoMember2022-01-012022-12-310001535929voya:YearEndFairValueOfNewAwardsMemberecd:PeoMember2022-01-012022-12-310001535929ecd:PeoMembervoya:YearEndFairValueOfNewAwardsMember2021-01-012021-12-310001535929ecd:PeoMembervoya:YearEndFairValueOfNewAwardsMember2020-01-012020-12-310001535929voya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMemberecd:PeoMember2022-01-012022-12-310001535929voya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMemberecd:PeoMember2021-01-012021-12-310001535929ecd:PeoMembervoya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMember2020-01-012020-12-310001535929ecd:PeoMembervoya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMember2022-01-012022-12-310001535929ecd:PeoMembervoya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMember2021-01-012021-12-310001535929voya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMemberecd:PeoMember2020-01-012020-12-310001535929voya:TotalEquityCAPMemberecd:NonPeoNeoMember2022-01-012022-12-310001535929voya:TotalEquityCAPMemberecd:NonPeoNeoMember2021-01-012021-12-310001535929voya:GrantDateFairValueOfStockAwardsReportedInSCTMemberecd:NonPeoNeoMember2022-01-012022-12-310001535929voya:YearEndFairValueOfNewAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310001535929voya:YearEndFairValueOfNewAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310001535929voya:YearEndFairValueOfNewAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310001535929voya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310001535929voya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310001535929voya:ChangeInFairValueOfOutstandingUnvestedAwardsFromPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310001535929voya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001535929voya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001535929voya:ChangeInFairValueOfAwardsThatVestedInApplicableYearMemberecd:NonPeoNeoMember2022-01-012022-12-31000153592942022-01-012022-12-31000153592932022-01-012022-12-31000153592912022-01-012022-12-31000153592962022-01-012022-12-31000153592952022-01-012022-12-31000153592922022-01-012022-12-31iso4217:USDxbrli:pure

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under to Section 240.14a-12

|

Voya Financial, Inc.

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☑

|

|

|

No fee required.

|

|

☐

|

|

|

Fee paid previously with preliminary materials:

|

|

☐

|

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

TABLE OF CONTENTS

April 11, 2023

Dear Fellow Shareholders:

On behalf of the Voya Financial, Inc. (the “Company” or “Voya”) Board of Directors

(the “Board”), you are cordially invited to attend the 2023 Annual Meeting of Shareholders on Thursday, May 25, 2023.

Continuing to Execute and Achieve Further Growth

I would like to begin by sharing how energized I am to serve as Voya’s Chief Executive

Officer, representing our talented people who work together to make a positive impact in the lives of our customers, colleagues and communities every day. We are at a moment of great momentum for Voya as we begin the second year of the

three-year growth plan that we shared with you at Voya’s Investor Day in 2021. In 2022, we grew adjusted operating earnings per share by 24 percent, well above our annual growth target of 12 to 17 percent. We also carried out transformative

acquisitions throughout 2022 that have positioned Voya for strong growth in the years ahead and — across every business — we demonstrated our ability to execute last year despite the challenging macro-economic environment.

|

▪

|

Our acquisitions of Allianz Global Investors’ U.S. asset management business added

scale and diversification to Voya Investment Management, and is already delivering strong financial results.

|

|

▪

|

Our acquisition of Benefitfocus, we added a highly strategic business that provides

the capabilities we need to fully capitalize on our workplace strategy. Voya now serves the workplace benefits and savings needs of approximately 38 million individuals — or roughly one in 10 Americans — presenting an even greater

opportunity to positively impact the lives of our customers.

|

As we look toward the future, I’m enthusiastic about Voya’s prospects as we continue to

execute on our strategic and financial objectives. We will be guided by the same set of principles that have served Voya and our shareholders so well over the years — careful stewardship of shareholder capital, skillful management of expenses,

and a focus on profitable growth. My goal is to work closely with our experienced management team to build on these strengths as we write the next chapter of Voya’s growth story. In doing so, we will continue to lean on the strong leadership of

our Board, which continues to provide us with valuable and diverse perspectives and counsel.

Voya is a purpose-driven organization with a clear vision and strategy

By living our purpose — Together we fight for everyone’s opportunity for a better

financial future — we have grown our Company, created long-term value for our shareholders, and distinguished the Voya brand and our award-winning culture among our peers. For example, last month Voya was recognized by Ethisphere® as one of the

World’s Most Ethical Companies®, marking the 10th consecutive year that Voya has received this honor. We have earned this recognition every year that we have been eligible and, in 2023, were one of only seven honorees in the financial services

industry.

We are committed to positively impacting society through the solutions that we provide,

the corporate responsibility that we demonstrate, and the impact that we make in the communities in which we live and work. As a continuation of our evolution, earlier this year, we announced our bold, new vision — “Clearing your path to

financial confidence and a more fulfilling life.” Our vision defines what we aspire to do:

|

▪

|

By clearing your path, we fight to remove obstacles and barriers.

|

|

▪

|

Focusing on financial confidence means delivering guidance and tools to help

individuals to make informed and valuable choices throughout their journey.

|

|

▪

|

So that ultimately, people have the opportunity to achieve a more fulfilling life by

helping improve their financial, physical and emotional well-being.

|

Our vision bridges our purpose and strategy — helping to guide our decision-making and

focus our strategic actions. By bringing our vision and purpose to life though our strategy, we will continue to positively impact our customers, our colleagues and our communities and create long-term value for our shareholders.

|

Voya 2023 Proxy Statement

|

|

|

2

|

TABLE OF CONTENTS

In a few weeks, Voya will mark the 10-year anniversary of its initial public offering.

Over the past decade, Voya has achieved a financial, operational and cultural transformation that has positioned our Company to execute on our strategy and achieve even greater growth. This was accomplished under the leadership of our Executive

Chairman, Rodney O. Martin, Jr., whose commitment to our many stakeholders has been nothing short of extraordinary. Thanks to Rod’s leadership, and the incredible work performed by so many across our Company, Voya serves as an inspirational

success story — with more chapters to be written through the dedication, commitment and caring of our people.

In addition to Rod’s leadership, Voya has had the benefit of receiving strong guidance and

diverse perspectives from each director on our Board. We are proud to have a diverse Board of Directors and, therefore, input and direction informed by a number of important angles and factors for us to consider as we advance our strategy. I

would be remiss if I did not – on behalf of myself and Rod – take this opportunity to thank Byron Pollitt, who will be retiring from the Board upon the conclusion of his term at our Annual Shareholder Meeting in May. Since joining our Board in

2015, Byron has helped us create strong guiding principles for the work that we do every day. He has had a valuable impact on many functions and areas at Voya through his role as a director, including serving as chair of the Board’s audit

committee. I know I speak for everyone on our management team when I express my sincere appreciation for all he has done for us, our company and our shareholders.

On behalf of the Board and our management team, I would like to thank you for your

continued support of Voya.

Very truly yours,

Heather Lavallee

Chief Executive Officer

|

Voya 2023 Proxy Statement

|

|

|

3

|

TABLE OF CONTENTS

Notice of 2023 Annual

Meeting of Shareholders

You are cordially invited to attend the Annual Meeting of Shareholders of Voya Financial,

Inc. (the “Company” or “Voya”), on Thursday, May 25, 2023, at 11:00 a.m., Eastern Time. The meeting will be held as a virtual meeting only, accessible at the following website address: www.virtualshareholdermeeting.com/VOYA2023. The proxy

statement describes the items of business that we will conduct at the meeting in more detail, and also provides you with important information about our Company, including our practices in the areas of corporate governance and executive

compensation. I strongly encourage you to read these materials and then vote your shares. Additional details regarding how to attend the meeting, submit questions and what to do in the event of technical difficulties are included in the proxy

statement.

|

Time and Date

11:00 a.m., Eastern Time

Thursday, May 25, 2023

|

|

Items of Business

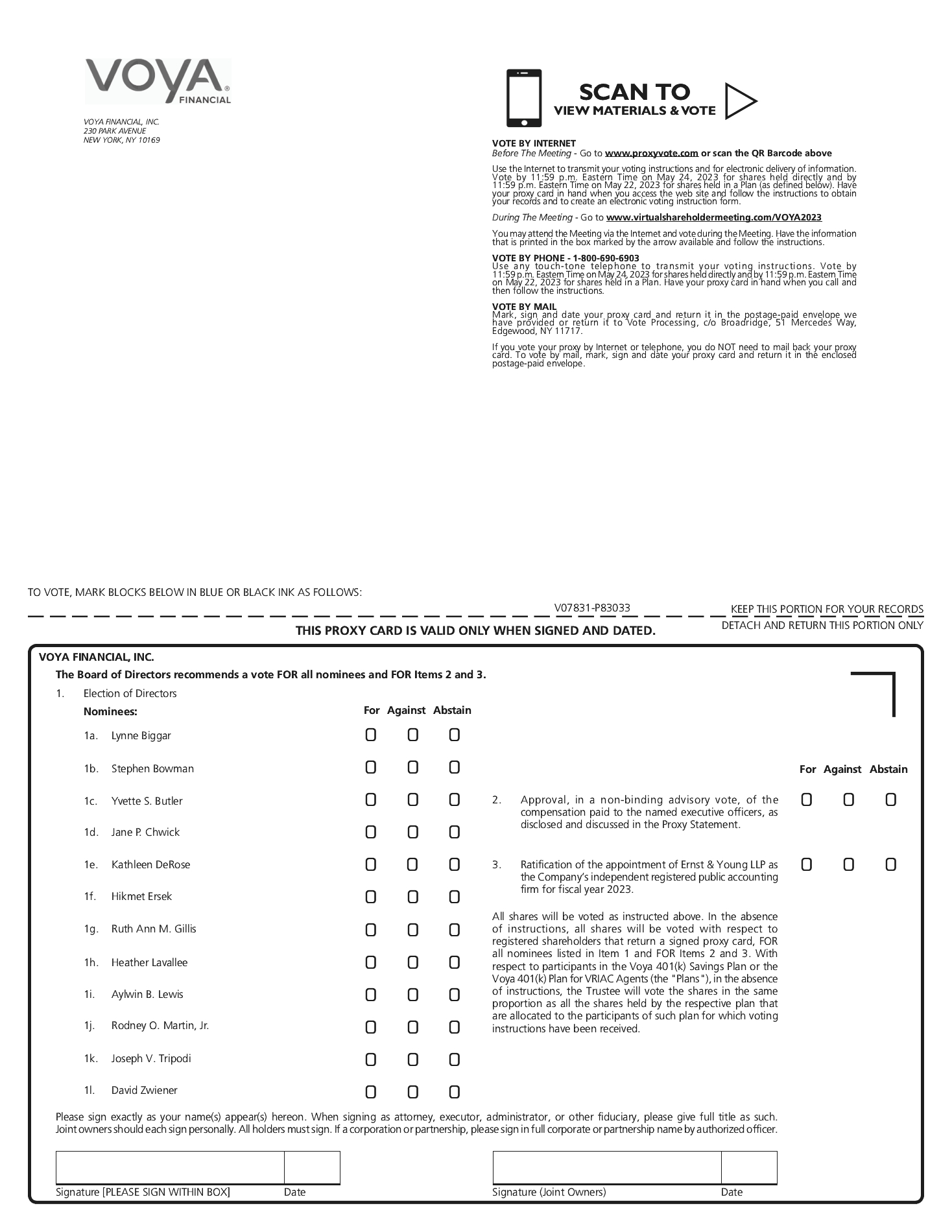

1 Election of twelve directors to our Board for one-year terms

2

Advisory vote to approve executive compensation

3

Ratification of appointment of Ernst & Young LLP as

our independent registered public accounting firm for

2023

4

Transaction of such other business as may properly

come before our 2023 Annual Meeting of Shareholders

|

|

Meeting website address

www.virtualshareholdermeeting.com/VOYA2023

|

|

Record Date

The record date for the determination of the shareholders entitled to vote at

our Annual Meeting of Shareholders, or any adjournments or postponements thereof, was the close of business on March 29, 2023.

|

Your vote is important to us. Please exercise your right to vote.

Important Notice Regarding the Availability of Proxy Materials for our

Annual Meeting to be held on May 25, 2023. Our Proxy Statement, 2022 Annual Report to Shareholders and other materials are available at www.proxyvote.com.

By Order of the Board of Directors,

My Chi To

Executive Vice

President, Chief Legal Officer

and Corporate Secretary

April 11, 2023

|

Voya 2023 Proxy Statement

|

|

|

4

|

TABLE OF CONTENTS

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE OF CONTENTS

This summary highlights certain information contained elsewhere in our proxy statement. You

should read the entire proxy statement carefully before voting.

Shareholders will be asked to vote on the following matters at the 2023 Annual Meeting:

|

Election of Directors

|

|

|

FOR each Director

Nominee

|

|

|

|

|

Advisory Vote on Approval of Executive Compensation

|

|

|

FOR approval

|

|

|

|

|

Ratification of Ernst & Young LLP as our Independent

Registered Public

Accounting Firm

|

|

|

FOR approval

|

|

|

|

Our proxy statement contains information about the matters to be voted on at our 2023 Annual

Meeting of Shareholders (which we refer to in this proxy statement as the “Annual Meeting”), as well as information about our corporate governance practices, the compensation we pay our executives, and other information about the Company. Our

principal executive offices are located at 230 Park Avenue, New York, New York 10169.

Please note that we are furnishing proxy materials to our shareholders via the Internet,

instead of mailing printed copies of those materials to each shareholder. By doing so, we save costs and reduce our impact on the environment. A Notice of Internet Availability of Proxy Materials, which contains instructions about how to access

our proxy materials and vote online or by mail, will be mailed to our shareholders beginning on or about April 11, 2023.

|

Your vote is important. Please exercise your right to vote.

|

|

Voya 2023 Proxy Statement

|

|

|

6

|

TABLE OF CONTENTS

Environmental, Social and

Governance (ESG) Highlights

|

|

|

87%

|

|

|

219%

|

|

|

77%

|

|

|

97%

|

|

Waste Diverted

from Landfill

|

|

|

Electricity Use Offset

|

|

|

Total Energy Reduction2

|

|

|

Paper Reduction2

|

|

Enhancing our

Governance Model

■ Voya established and staffed an ESG Center of Excellence whose goal is to further advance Voya’s ESG strategy and better integrate and manage

identified priorities.

■ The team supports our ESG Steering Committee, which is comprised of our Chief Financial Officer, Chief Legal Officer, Chief Risk Officer, and

Investment Management Chief Risk Officer. The ESG Steering Committee reports to our CEO and is responsible for ESG enterprise management and reporting, which is guided by our fiduciary obligations to our clients and shareholders and our

corporate purpose: Together, we fight for everyone's opportunity for a better financial future.

Staying Carbon Neutral

■ We manage our operational eco-efficiency by measuring and analyzing the decrease in our total waste, energy use, paper consumption and greenhouse gas

emissions, and the increase of our recycling.

■ While the majority of our employees worked from home in 2022, we took the opportunity to reduce office space and renovate additional space to better

serve a hybrid work model and reduce our carbon footprint.

■ Voya was named to the U.S. Environmental Protection Agency's 2022 Green Power Partnership list for the 15th consecutive year for achieving 100% or

more renewable energy.

■ Voya has been named to the 2022 Dow Jones Sustainability Index (DJSI), earning recognition as a top-performing sustainability company for the sixth

consecutive year.

Confirming our Commitment to Sustainable Development

■ In 2021, a more formalized process to qualitatively assess and identify climate-related risks across Voya’s businesses and operations was

established. As we expand our climate risk management process and leverage disclosure frameworks, our climate strategy will continue to evolve and support our commitment to minimize our impact on our environment.

■ In 2022, Voya joined the UN Global Compact to advance our sustainable development work and learn with other like-minded companies as we continue to

take responsible business actions that make meaningful and positive differences in the world.

|

|

|

|

|

Voya 2023 Proxy Statement

|

|

|

7

|

TABLE OF CONTENTS

Environmental, Social and

Governance (ESG) Highlights (continued)

|

|

|

48%

|

|

|

100%

|

|

|

99%

|

|

|

64%

|

|

AVPs and Above Hired From

Underrepresented Groups

|

|

|

Senior Executives Required to

Have Diversity Action Plans

|

|

|

Employees Completed

Ally Training

|

|

|

DEI Task Force Members

Are People of Color

|

Focusing on Colleagues, Clients and Community

Each member of the executive committee (EC) and their direct reports are required to have a

Diversity Action Plan that focuses on five areas that strengthen and reinforce the overall DEI strategy for our enterprise based on colleagues, clients and community.

At Voya, we believe we are stronger because of our differences: race, color, sex, national

origin, religion, age, disability, veteran status, sexual orientation, gender identity, genetic information, marital status, creed, citizenship status, as well as perspective of thoughts, beliefs, education, background and experiences.

We are committed to a diverse and inclusive workforce where all of these differences are

purposefully brought together and are dedicated to ensuring that historically marginalized and/or underserved communities have an opportunity for a better financial future including, but not limited to, African American/Black, Asian,

Hispanic/Latino, Indigenous Peoples, LGBTQ+, People with Disabilities, Veterans, Women, and Millennials and Gen Z populations.

|

|

|

|

DEI Task Force Focus Areas

|

|

|

|

Driving Change Through DEI Task Force

Voya’s DEI Task Force is tasked with increasing equity and inclusion and is comprised of 60+

professionals who are 58% female and 64% people of color and aligns to the strategic focus areas of Colleagues, Clients and Communities.

|

|

|

Colleagues

■ Benefits & Policies

■ Pay Equity

■ Development & Training

■ Recruitment & Hiring

|

|

|

|

|

|

Clients

■ Client Engagement

■ Business Generation

■ Marketing & Brand

|

|

|

|

|

|

Communities

■ Financial Wellness

■ Advocacy & Partnerships

|

|

|

|

1

|

As of December 31, 2022.

|

|

Voya 2023 Proxy Statement

|

|

|

8

|

TABLE OF CONTENTS

Environmental, Social and

Governance (ESG) Highlights (continued)

Advocating Through External Coalition

|

▪

|

Since 2020, Voya has been a member of the CEO Action for Racial Equity Fellowship

Program which seeks to advance racial equity by focusing on four key areas: economic empowerment, education, health care and public safety.

|

|

▪

|

Voya has served and/or partnered with over 3,000+ unique nonprofit organizations.

|

|

|

|

10 of 12

|

|

|

6 of 12

|

|

|

3 of 6

|

|

Director Nominees Are Independent

|

|

|

Director Nominees

Are Women

|

|

|

Standing Board Committees

Are Chaired by Women

|

Embedding Corporate Governance

|

▪

|

Corporate governance is a business imperative woven throughout our enterprise and we

have an unwavering commitment to conduct business in a way that is ethically, economically, socially and environmentally responsible.

|

|

▪

|

We report publicly in our annual impact report and on our website progress on our ESG

commitments and disclose related data to investors on an ongoing basis.

|

|

▪

|

For the past 10 years we have been recognized by Ethisphere, a global leader in

defining and advancing the standards of ethical business practices, as one of the World’s Most Ethical Companies.

|

Board Diversity

|

▪

|

The importance of DEI at Voya is reinforced at the highest level. Our Board comprises a

highly skilled group of individuals representing a diversity of experiences, backgrounds, tenure, gender, and ethnicity.

|

|

▪

|

At Voya, we believe that the Board needs to draw upon a range of experiences in

understanding opportunities, anticipating challenges and assessing risks to have effective corporate governance with a robust decision-making process.

|

Cybersecurity and Privacy

|

▪

|

Cybersecurity is a critical part of our risk management. The Technology, Innovation and

Operations Committee of the Board is responsible for reviewing the Company's risk exposure and coordinates with the Risk, Investment and Finance Committee to mitigate cybersecurity risks.

|

|

▪

|

Voya fosters a culture of respect for privacy rights and celebrates “Data Privacy Week”

annually.

|

Driving Changes in How we Recruit

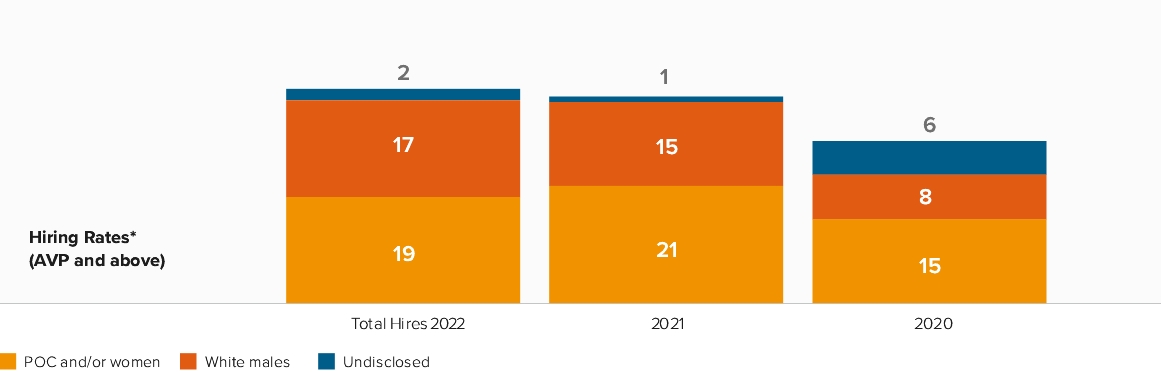

We have improved our rate of hiring underrepresented talent by mitigating bias in job

descriptions, expanding sources for candidates and requiring diverse slates and interview panels.

Talent Acquisition drives performance through an approach that focuses on three areas:

|

▪

|

Multi-Channel Talent Engagement

|

|

Voya 2023 Proxy Statement

|

|

|

9

|

TABLE OF CONTENTS

Environmental, Social and

Governance (ESG) Highlights (continued)

In 2022, Voya hired employees to fill 38 leadership roles, of which 50% were diverse hires.

Voya Employees1 2 (All)

|

68%

|

|

|

13%

|

|

|

10%

|

|

|

7%

|

|

|

2%

|

|

|

52%

|

|

|

3%

|

|

|

3%

|

|

|

2%

|

|

62%

|

|

|

13%

|

|

|

12%

|

|

|

13%

|

|

|

0%

|

|

|

54%

|

|

|

6%

|

|

|

5%

|

|

|

8%

|

|

⯀ Voya Financial Employees

|

|

|

⯀ 2020 Disability Equality Index

|

|

|

⯀ Bureau of

Labor Statistics, U.S. Department of Labor, Employment Situation of Veteran’s Summary, 2019 (U.S. Population)

|

|

⯀

Diversity Best Practices Data, as Disclosed by Member Organizations

|

|

|

⯀ How the

LGBTQ Community Fares in the Workplace, McKinsey & Company, June 23, 2020

|

|

Voya Leaders1 2 (AVP and above)

|

82%

|

|

|

5%

|

|

|

10%

|

|

|

2%

|

|

|

1%

|

|

|

36%

|

|

81%

|

|

|

4%

|

|

|

10%

|

|

|

4%

|

|

|

1%

|

|

|

29%

|

|

⯀ Voya Financial Employees

|

|

|

⯀

Diversity Best Practices Data, as Disclosed by Member Organizations

|

|

|

|

|

1

|

Demographics as voluntarily self-disclosed and metrics are as of December 31, 2022.

|

|

2

|

Third party statistics have not been reviewed by Voya for accuracy.

|

|

Total Number of Directors

|

|

|

10

|

|

Part I: Self-Identified Gender Identity

|

|

|

Female

|

|

|

Male

|

|

|

Non-Binary

|

|

|

Did Not Disclose Gender

|

|

Directors

|

|

|

5

|

|

|

5

|

|

|

—

|

|

|

—

|

|

Part II: Self-Identified Demographic Background

|

|

African American or Black

|

|

|

1

|

|

|

1

|

|

|

—

|

|

|

—

|

|

White

|

|

|

4

|

|

|

4

|

|

|

—

|

|

|

—

|

|

Two or More Races or Ethnicities

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

LGBTQ+

|

|

|

—

|

|

Disabled Veteran

|

|

|

—

|

|

Did Not Disclose Demographic Background

|

|

|

—

|

|

*

|

The chart reflects the data for those directors serving on date of survey, June 10, 2022.

|

|

Voya 2023 Proxy Statement

|

|

|

10

|

TABLE OF CONTENTS

Corporate Governance Highlights

Snapshot of Our Director Nominees

We believe that our director nominees bring a well-rounded variety of skills, qualifications

and experiences, and represent an effective mix of deep company knowledge and fresh perspectives. Our Board believes that our nominees’ varying tenures, breadth of experience and mix of attributes strengthen our Board’s independent leadership and

effective oversight of management given Voya’s, businesses, the operating environment in our industries, and our Company’s long-term strategy.

|

|

|

|

Lynne Biggar

Director

|

|

|

Yes

|

|

|

2014

|

|

|

|

|

Stephen

Bowman

Director

|

|

|

Yes

|

|

|

2023

|

|

|

|

|

Yvette S. Butler

Director

|

|

|

Yes

|

|

|

2021

|

|

|

|

|

Jane P. Chwick

Director

|

|

|

Yes

|

|

|

2014

|

|

|

|

|

Kathleen DeRose

Director

|

|

|

Yes

|

|

|

2019

|

|

|

|

|

Hikmet

Ersek

Director

|

|

|

Yes

|

|

|

2023

|

|

|

|

|

Ruth Ann M. Gillis

Director

|

|

|

Yes

|

|

|

2015

|

|

|

|

|

Heather Lavallee

President and

Chief Executive Officer

|

|

|

No

|

|

|

2022

|

|

|

|

|

Aylwin B. Lewis

Director

|

|

|

Yes

|

|

|

2020

|

|

|

|

|

Rodney O. Martin, Jr.

Executive

Chairman

|

|

|

No

|

|

|

2011

|

|

Voya 2023 Proxy Statement

|

|

|

11

|

TABLE OF CONTENTS

Corporate Governance Highlights (continued)

Snapshot of Our Director Nominees (continued)

|

|

|

|

Joseph V. Tripodi

Director

|

|

|

Yes

|

|

|

2015

|

|

|

|

|

David Zwiener

Operating

Executive, The Carlyle Group

|

|

|

Yes

|

|

|

2013

|

2023 Board Nominee Statistics

|

|

50%

|

|

Independent Directors

are Women

|

|

|

|

|

16%

|

|

Independent

Directors are People of Color

|

|

|

|

|

10 of 12

|

|

Directors Are Independent

|

|

|

|

|

|

5.4 years1

|

|

Average Director Tenure

|

|

|

|

|

|

3 of 6

|

|

Standing Board Committees

are Chaired by Women

|

|

1

|

As of the Annual Meeting of Shareholders.

|

|

Voya 2023 Proxy Statement

|

|

|

12

|

TABLE OF CONTENTS

Corporate Governance Highlights (continued)

Corporate Governance Best Practices and Accountability

We believe that strong and sustainable corporate governance is essential to the effective

oversight of the Company. As such, we periodically review and strive to improve our corporate governance practices. We list below our current key corporate governance practices:

|

✔ Annual election of directors

✔ Majority voting for directors

✔ Annual advisory vote on executive

compensation

✔ Annual board and committee

self-evaluations

✔ Oversight of political

contributions

|

|

|

✔ Proactive shareholder engagement

plan

✔

Independent directors meet regularly in executive sessions, including with our external auditors

✔ Stock

ownership requirements for directors and executive officers

✔ No poison pill

✔ Director orientation and

continuing education

✔

Anti-hedging and anti-pledging policies for directors and employees (including officers)

✔ 98% Board and Committee

Attendance

✔ 100%

independent standing Board Committees (with the exception of the Executive Committee)

✔ Board oversight of ESG issues and

priorities

|

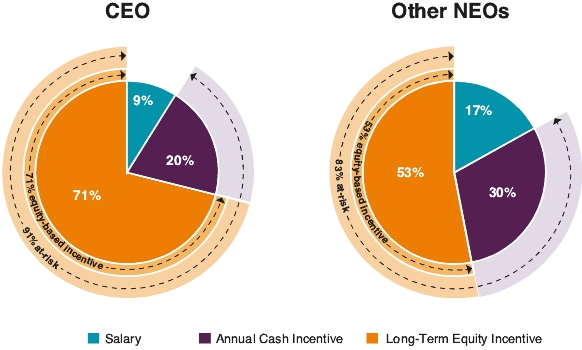

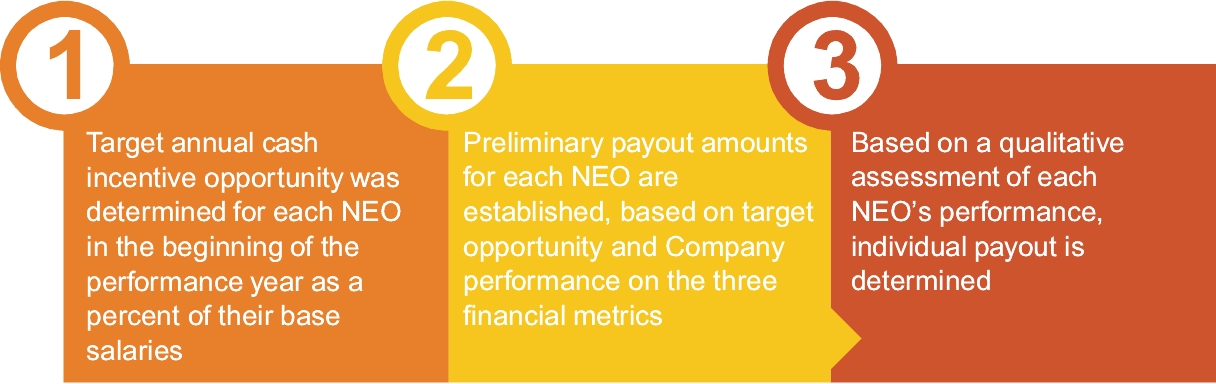

Executive Compensation Highlights

Below are the key elements related to our Executive Compensation in 2022:

|

✔

Awards in our annual cash incentive program are based on key financial measures set at the beginning of the year that we use to determine the success of our business as part of our approved budget process.

✔

Performance objectives for each named executive officers (NEO) are set at the beginning of the year and the results are assessed following the conclusion of each year.

✔

Performance assessment of the Chief Executive Officer (CEO) is conducted by the Compensation, Benefits and Talent Management Committee with input from all independent directors and advice from the independent compensation consultant.

✔ A

majority of long-term incentive equity grants to our NEOs are in the form of performance share units (PSUs) and performance-based options.

✔ The

Compensation, Benefits and Talent Management Committee’s independent compensation consultant performs services only for the Committee.

✔

Executive perquisites are limited and do not include tax gross-ups.

✔

Executives are subject to claw backs, including no-fault claw backs in the case of a financial restatement.

|

|

|

❖ No single trigger vesting of

change in control benefits.

❖ No

liberal share recycling for shares used to satisfy tax withholding requirements or tendered in payment of an option exercise price.

❖ No excise tax gross-up

provisions.

❖ No

re-pricing of stock options permitted without shareholder approval.

|

|

Voya 2023 Proxy Statement

|

|

|

13

|

TABLE OF CONTENTS

Corporate Governance Highlights (continued)

Business Highlights

Recorded full-year 2022 after-tax adjusted operating earnings of $835 million, or $7.58 per

diluted share, compared with $1,053 million, or $8.37 per diluted share in full-year 2021.

|

▪

|

For full-year 2022 (and compared with full-year 2021), Wealth Solutions full service

recurring deposits grew 10.3% to $13.3 billion; Health Solutions annualized in-force premiums grew 10.8% to $2.8 billion; and Investment Management generated positive net flows of $1.1 billion, which included positive net flows from the

U.S. asset management business that Voya acquired from Allianz Global Investors in July 2022.

|

|

▪

|

During 2022, Voya deployed $1.2 billion of excess capital, including $750 million of

shares repurchased; approximately $360 million of debt extinguished; and $80 million of dividends paid.

|

|

▪

|

As of Dec. 31, 2022, Voya had approximately $0.9 billion of excess capital, which

includes fourth quarter 2022 capital generation above the Company's target range of 90% to 100% of adjusted operating earnings. Full-year 2022 capital generation was in line with the target, excluding impacts from the Company’s annual

assumption update, deferred policy acquisition cost (DAC) unlocking, and fourth quarter tax adjustments, in each case which are non-cash in nature.

|

|

▪

|

On Jan. 24, 2023, Voya completed its acquisition of Benefitfocus, Inc., an

industry-leading benefits administration company that serves employers, health plans and brokers. The transaction accelerates Voya’s workplace-centered strategy and increases the Company’s capacity to meet the growing demand for

comprehensive benefits and savings solutions at the workplace.

|

|

▪

|

Voya was named to the 2022 Dow Jones Sustainability Index — earning recognition as a

sustainability top-performing company for the seventh consecutive year — and was recognized by Newsweek as

one of “America’s Greatest Workplaces 2023 for Diversity.” Voya Investment Management was named to Pensions

& Investments magazine’s “2022 Best Places to Work in Money Management” list for the eighth consecutive year. In addition, Voya was recognized by Ethisphere, a global leader in defining and advancing the standards of ethical

business practices, as one of the World's Most Ethical Companies for its 10th consecutive year.

|

Our Culture and the Character of Our Brand Are a Differentiator

Third-party awards and/or rankings about entities within the Voya family of companies are

given based upon various criteria and methodologies. Awards and/or rankings are not representative of actual client experiences or outcomes, and are not indicative of any future performance. For certain awards/rankings, Voya pays a fee to be

considered.

|

Voya 2023 Proxy Statement

|

|

|

14

|

TABLE OF CONTENTS

Part I: Corporate Governance

Proposal 1: Election of Directors

Our Board consists of 12 directors, who are elected annually by our shareholders for

one-year terms - independent directors, the Executive Chairman of our Board and former Chief Executive Officer (CEO), Rodney O. Martin, Jr. and our current President and CEO, Heather Lavallee.

At our Annual Meeting, our shareholders will be asked to elect 12 nominees to our Board

(collectively, the “Director Nominees”).

Board Recommendation: Our Board unanimously recommends that our

shareholders elect each of our Director Nominees described below under “Our Director Nominees”.

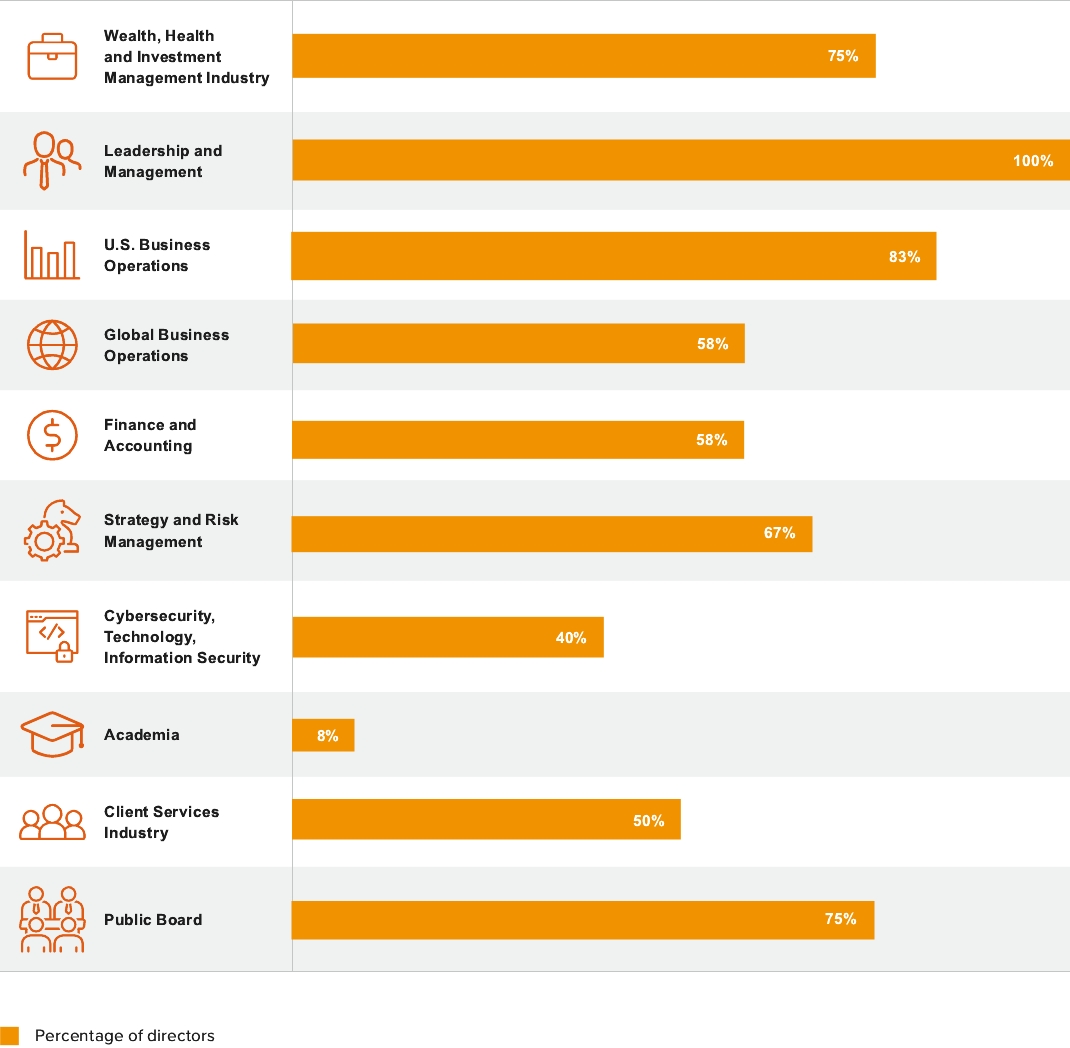

Director Skills and Qualifications

We believe that our director nominees bring a well-rounded variety of skills, qualifications

and experiences, and represent an effective mix of deep company knowledge and fresh perspectives. Our Board believes that our Director Nominees' varying tenures, breadth of experience and mix of attributes strengthen our Board's independent

leadership and effective oversight of management given Voya's businesses, the operating environment in our industries, and the Company's long-term strategy.

Our Director Nominees have significant skills and experience in the following areas:

|

Voya 2023 Proxy Statement

|

|

|

15

|

TABLE OF CONTENTS

Director Nomination and Re-Nomination

The Nominating, Governance and Social Responsibility Committee is responsible for identifying

individuals believed to be qualified to become Board members, consistent with criteria approved by our Board, and to select, or recommend to the Board, the nominees to stand for election as directors at the annual meeting of shareholders or, if

applicable, at a special meeting of shareholders. The Committee does not set specific minimum qualifications that directors must meet in order to recommend them to our Board, but specific characteristics considered by the Committee when

evaluating candidates for the Board include:

|

|

|

Diversity of background,

including gender, ethnicity,

race, culture and geography

|

|

|

|

Financial literacy or other

professional business experience

relevant to an understanding of

our business

|

|

|

|

Significant leadership

experience

|

|

|

|

Independence for purposes of

the New York Stock

Exchange (NYSE) listing rules

|

|

|

|

Accomplishments and

reputation in the business community

|

|

|

|

Strong character

and integrity

|

We also appreciate the importance of critically evaluating individual directors and their

contributions to our Board in connection with re-nomination decisions. In considering whether to recommend re-nomination of a director for election at our annual meeting, the Nominating, Governance and Social Responsibility Committee considers

factors such as:

|

|

|

The extent to which the Board

is diverse as a whole and

responds to shareholder views

|

|

|

|

Shareholder feedback, including

the support received by director

nominees at our last annual meeting

|

|

|

|

The extent to which the director’s skills, qualifications and

experience continue to contribute

to the success of our Board

|

|

|

|

Independence for purposes of

the NYSE listing rules

|

|

|

|

Attendance and participation

at, and preparation for, Board

and Committee meetings

|

|

Voya 2023 Proxy Statement

|

|

|

16

|

TABLE OF CONTENTS

Consideration of Shareholder Nominees

It is the policy of the Nominating, Governance and Social Responsibility Committee to

consider candidates recommended by shareholders in the same manner as other candidates. Shareholders wishing to submit potential director candidates for consideration should submit the names of their nominees, a description of their

qualifications and background and the signed consent of the nominee to be so considered, to our Nominating, Governance and Social Responsibility Committee, care of the Corporate Secretary, Voya Financial, Inc., 230 Park Avenue, New York, New York

10169. For more information on how and when to submit a nomination, see “Part V: Other information — Frequently Asked Questions About our Annual Meeting — How do I submit a shareholder proposal or director nominations for the 2024 Annual

Meeting?”.

If elected by our shareholders, the 12 Director Nominees, all of whom are currently members

of our Board, will serve for a one-year term expiring at our 2024 Annual Meeting of Shareholders. Each duly elected director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or

removal.

Each of our Director Nominees has been approved and nominated for election by our Board. All

of our directors are elected by a majority vote of our shareholders, excluding abstentions.

Below is biographical information about our Director Nominees. This information is current

as of the date of this proxy statement and has been confirmed by each of the Director Nominees for inclusion in this proxy statement.

|

|

|

Lynne Biggar

Age: 60

Director Since: 2014-2021, 2022 to current

|

|

|

Experience

Ms. Biggar is

currently a Senior Advisor at Boston Consulting Group and an independent public and private board director. Prior to joining BCG in April 2022, she served as the Executive Vice President and Global Chief Marketing Officer of Visa Inc.

until March 2022. Prior to joining Visa in February 2016, Ms. Biggar served as the Executive Vice President of Consumer Marketing + Revenue at Time Inc. from November 2013 to January 2016. Prior to that, Ms. Biggar served as Executive

Vice President & General Manager of International Card Products + Experiences for American Express from January 2012 to November 2013 and was a member of the company’s Global Management Team. From August 2009 to January 2012, Ms.

Biggar served as Executive Vice President & General Manager of the Membership Rewards and Strategic Card Services group at American Express. Prior to that, Ms. Biggar led American Express’ consumer travel business from January 2005

to July 2009. Before joining American Express in 1992, Ms. Biggar held various positions in international strategy and marketing. Ms. Biggar has been recognized by Forbes as one of the World’s Most Influential CMOs three years in a row (2019–2021), by Business

Insider as one of the 25 Most Innovative CMOs in the World (2020), by Adweek’s Top 50 and 30 Most Powerful Women in Sports (2018–2020), and Most Tech Savvy CMOs (2018). Brand Innovators also named her on its “Top 100” Women in Brand Marketing list for five consecutive years.

Board Memberships and Other Positions

■ Finastra

■ Independent member of the Leading Hotels of the World Executive Committee

|

|

Voya 2023 Proxy Statement

|

|

|

17

|

TABLE OF CONTENTS

|

|

|

Stephen Bowman

Age: 59

Director Since: 2023

|

|

|

Experience

Mr. Bowman

served as Chief Financial Officer of The Northern Trust Corporation from 2014 until his retirement in 2020. As CFO, Mr. Bowman was responsible for the company’s Global Finance function including Controller’s group, Financial Planning

and Analysis, Tax, Investor Relations, Treasury, Capital Adequacy, Business Unit Finance, Corporate Real Estate, Procurement, Fee Billing and Finance Technology. Prior to his CFO role, Mr. Bowman served in various leadership positions

at The Northern Trust Corporation, including Chief Human Resources Officer and CEO or Northern Trust’s European and North American region. Mr. Bowman is a National Trustee of Miami University and serves as the Chair of the Investment

Subcommittee. Mr. Bowman has also served as the Chairman of the Lincoln Park Zoo and Glenwood Academy. Mr. Bowman is a graduate of Miami University and earned a MBA from DePaul University.

Board Memberships and Other Positions

■ First Interstate Bank (a public company)

■ FNZ Trust Co.

|

|

|

|

|

Yvette S. Butler

Age: 57

Director Since: 2021

|

|

|

Experience

Ms. Butler is

founder and CEO of Hive Wealth, a community-driven mobile app aimed at helping people build financial wealth. Ms. Butler previously was President of SVB Private Bank & Wealth Management from June 2018 to May 2022. Prior to joining

SVB, Ms. Butler was the Executive Vice President of Capital One Investing from April 2013 to March 2018. Prior to joining Capital One, Ms. Butler served as Managing Director for Wells Fargo Advisors heading up the direct business teams,

including WFA Solutions and WellsTrade. Ms. Butler also led investor marketing for E*Trade and launched Merrill Lynch’s Financial Advisory Center which later became MerrillEdge. In 2001, she moved to Merrill Lynch as Retirement Group

Director. Ms. Butler’s early career included Merrill Lynch investment banking, Charles Schwab and McKinsey.

Board Memberships and Other Positions

■ Synctera

■ Hillcrest Finance

|

|

Voya 2023 Proxy Statement

|

|

|

18

|

TABLE OF CONTENTS

|

|

|

|

Jane P. Chwick

Age: 60

Director Since: 2014

|

|

|

Experience

Ms. Chwick

retired as the Co-Chief Operating Officer of Technology for The Goldman Sachs Group, Inc. in 2013, where she was employed in increasingly senior positions from 1983 until 2013. Ms. Chwick was a partner at Goldman Sachs Group, Inc.,

where she had a 30-year career in technology, most recently as the co-chief operating officer of the Technology Division. In that role, she was responsible for financial and business planning, setting the technical strategy and the

management of an 8,000-person organization within the firm. While at Goldman, Ms. Chwick served on many governance committees, including the firm’s Finance Committee, the Firm Wide New Activity Committee and the Technology Risk

Committee, and was co-chair of the Technology Division Operating Committee. Ms. Chwick was also the co-founder and co-CEO of Trewtec, Inc., providing corporate directors, chief executive officers and chief technology officers with the

information they need to improve their oversight of a company’s technology function. Ms. Chwick previously served on the board of directors of Essent Group (a public company) and The Queens College Foundation, both until December 31,

2021.

Board Memberships and Other Positions

■ M&T Bank (a public company)

■ MarketAxess Holdings, Inc. (a public company)

■ ThoughtWorks Inc. (a public company)

|

|

|

|

|

|

|

|

Kathleen DeRose

Age: 62

Director Since: 2019

|

|

|

Experience

Ms. DeRose is a

Clinical Professor of Finance at the New York University Leonard N. Stem School of Business, where she leads the FinTech curriculum and is the Director of the Fubon Center for Technology, Business, and Innovation. Ms. DeRose was the

Managing Director, Head of Business Strategy and Solutions, Investment Strategy and Research at Credit Suisse Group AG, from 2013 to 2015, and the Managing Director, Head of Global Investment Process, Asset Management at Credit Suisse

from 2010 to 2013. Prior to that, Ms. DeRose was the Managing Partner, Head of Portfolio Management and Research at Hagin Investment Management from 2006 to 2010, and the Managing Director, Head of Large Cap Equities at Bessemer Trust

from 2003 to 2006. Prior to 2003, Ms. DeRose also held a number of roles at Deutsche Bank, from 1991 to 2003, where she became the Managing Director of the bank, and at JP Morgan Chase (formerly Chase Manhattan Bank), from 1983 to 1991.

Board Memberships and Other Positions

■ The London Stock Exchange (a public company)

■ Enfusion, Inc. (a public company)

■ Experian, Inc. (a public company)

|

|

Voya 2023 Proxy Statement

|

|

|

19

|

TABLE OF CONTENTS

|

|

|

|

Hikmet Ersek

Age: 62

Director Since: 2023

|

|

|

Experience

Mr. Ersek has

more than 38 years of executive experience in Global Financial Services. Mr. Ersek is currently a Supervisory Board Member of Erste Bank Holding (EBS.VI). With his investment vehicle, Ersek Enterprises LLC, he is also advising and

investing in privately held companies. Additionally, since 2015 he has been serving as the Austrian Honorary Consul in the USA, responsible for Colorado, Wyoming, and New Mexico. Mr. Ersek began his global career in financial services

in Europe when he joined Europay/MasterCard in Austria in 1986. A decade later in 1996, he joined General Electric (GE) Capital as Business Development executive, and he also represented the GE Corporation as the National Executive for

Austria and Slovenia.

Mr. Ersek

joined Western Union (NYSE: WU) in 1999 and until 2010 was responsible for international expansion of Western Union in Europe, Africa, and Asia. From 2010-2021 he was the CEO and Director of the company. Founded more than 170 years ago,

Western Union has become under Mr. Ersek’s leadership one of the world’s largest companies, serving more than 150 million customers in 200 countries, with 12,000 employees speaking more than 75 languages. Mr. Ersek successfully

diversified and evolved Western Unions business portfolio to become a global digital payments company.

Board Memberships and Other Positions

■ Erste Group Bank (EBS.VI)

■ Special Advisor to Waterdrop

|

|

|

|

|

|

|

|

|

|

|

|

|

Ruth Ann M.

Gillis

Age: 68

Director Since: 2015

|

|

|

Experience

From 2008 until

her retirement in 2014, Ms. Gillis served as Executive Vice President and Chief Administrative Officer of Exelon Corporation, a publicly-held Fortune 100 diversified energy company, and President of Exelon Business Services Company, a

subsidiary of Exelon Corporation. Ms. Gillis also served as Chief Diversity Officer and as Chief Financial Officer of Exelon Corporation. Prior to her time at Exelon Corporation, Ms. Gillis served as Chief Financial Officer of the

University of Chicago Hospitals and Health System and, from 1977 to 1996, Ms. Gillis held various senior management and lending positions at First Chicago Corporation. Ms. Gillis has extensive finance, banking, risk management,

financial reporting, operations and information technology, human capital management, and regulatory expertise acquired in highly regulated and complex industries with a history of accomplishment and executive capability. Ms. Gillis

qualifies as an “audit committee financial expert” as defined by the Securities and Exchange Commission and has been recognized as a National Association of Corporate Directors Board Leadership Fellow since 2017.

Board Memberships and Other Positions

■ Snap-On Incorporated (a public company)

■ KeyCorp (a public company)

■ Life trustee of the Goodman Theatre and Life director of the Lyric Opera of Chicago

|

|

Voya 2023 Proxy Statement

|

|

|

20

|

TABLE OF CONTENTS

|

|

|

|

Heather Lavallee

President and Chief Executive Officer

Age: 53

Director Since: 2022

|

|

|

Experience

With 30 years

of experience in the financial services industry, Ms. Lavallee is a collaborative leader who excels in building high-performing businesses. Prior to assuming her current roles as president and CEO, Lavallee served as the Company’s

president and CEO-elect, overseeing Voya’s Workplace Solutions and Investment Management businesses, as well as Voya’s technology and data organizations, strategy and risk teams. Previously at Voya, Ms. Lavallee served as CEO of Voya’s

Wealth Solutions business where she led its customer experience and profitable growth. Ms. Lavallee also served as the president of the Company’s Tax-Exempt Markets business, and was responsible for all aspects of that business,

including product, distribution, financial management, strategy and operational performance. Under her leadership, Voya’s Tax-Exempt Markets business achieved significant client growth, including Voya becoming the largest retirement

plan provider in the government market in 2020. Prior to that, Lavallee was president of Employee Benefits (now Health Solutions), where she oversaw all aspects of the group and voluntary insurance business — including strategy, product

development, underwriting, actuarial, distribution and marketing.

Board Memberships and Other Positions

■ National Down Syndrome Society

■ Junior Achievement of Southwest New England, Inc.

|

|

|

|

|

Aylwin B. Lewis

Director Since: 2020

Age: 69

|

|

|

Experience

Mr. Lewis

served as Chairman, Chief Executive Officer and President of Potbelly Corporation, a franchisor of quick service restaurants, from June 2008 until his retirement in November 2017. From September 2005 to February 2008, Mr. Lewis was

President and Chief Executive Officer of Sears Holdings Corporation and Chief Executive Officer of Kmart and Sears Retail following Sears’ acquisition of Kmart Holding Corporation in March 2005. Mr. Lewis also served as Chief

Multi-Branding and Operating Officer of YUM! Brands, Inc., a franchisor and licensor of quick service restaurants including KFC, Long John Silvers, Pizza Hut, Taco Bell and A&W, from 2003 until October 2004, Chief Operating Officer

of YUM! Brands from 2000 until 2003 and Chief Operating Officer of Pizza Hut from 1996 to 1997.

Mr. Lewis

previously served on the board of directors of Red Robin Gourmet Burgers, Inc., The Walt Disney Company and Starwood Hotels, each a public company.

Board Memberships and Other Positions

■ Marriott International, Inc. (a public company)

■ Chef’s Warehouse (a public company)

|

|

|

|

|

Voya 2023 Proxy Statement

|

|

|

21

|

TABLE OF CONTENTS

|

|

|

|

Rodney O. Martin,

Jr.

Executive Chairman of the Board of Directors and

Chairman of the Board’s Executive Committee

Age: 70

Director Since: 2011

|

|

|

Experience

Mr. Martin is

Executive Chairman of the Board of Directors and a veteran of the retirement, insurance and financial services industries with more than 40 years of high-profile experience. He joined Voya as CEO in 2011 and served as the Company’s

chairman and CEO for more than a decade before assuming the role of Executive Chairman. As Voya’s CEO, Mr. Martin advanced a significant financial, operational and cultural transformation and evolved the business portfolio to one

focused on delivering health, wealth and investment solutions that enabled Voya’s approximately 14.7 million individual, workplace and institutional clients to achieve their financial wellness goals with confidence.

Prior to

joining Voya, Mr. Martin held several leadership roles of increasing responsibility during a 10-year tenure at AIG. He served as COO of AIG Worldwide Life Insurance; chairman and CEO of American Life Insurance Company (Alico); chairman

of American International Assurance (AIA); and chairman of AIG’s international life and retirement services businesses. Mr. Martin previously was president and CEO of American General Life Companies prior to its acquisition by AIG in

2001. He began his career in 1975 as an agent with Connecticut Mutual Life Insurance Company, where he served more than 20 years, ultimately becoming president of Connecticut Mutual Insurance Services.

Board Memberships and Other Positions

■ Junior Achievement, USA.

■ Founding partner of the National Down Syndrome Society CEO Commission for Disability Employment

|

|

|

|

|

|

|

|

|

|

|

Joseph V. Tripodi

Age: 67

Director Since: 2015

|

|

|

Experience

Mr. Tripodi has

significant global and functional experience in numerous diverse industries. Mr. Tripodi was the Chief Marketing Officer of The Subway Corporation from December 2016 to 2019. Prior to that, Mr. Tripodi was the Executive Vice President

and Chief Marketing & Commercial Officer of The Coca-Cola Company from 2007 to 2015. Prior to joining The Coca-Cola Company in 2007, Mr. Tripodi was Senior Vice President and Chief Marketing Officer of Allstate Insurance Company

from 2003 to 2007. Mr. Tripodi also previously served as Chief Marketing Officer for The Bank of New York in 2002 and Seagram Spirits & Wine from 1999 to 2002. Prior to joining Seagram, Mr. Tripodi held several marketing roles at

MasterCard International, including serving as its Executive Vice President, Global Marketing, Products and Services from 1989 to 1998.

Board Memberships and Other Positions

■ Newman’s Own

■ Playfly Sports, LLC.

|

|

|

|

|

Voya 2023 Proxy Statement

|

|

|

22

|

TABLE OF CONTENTS

|

|

|

|

David Zwiener

Lead Director

Age: 68

Director Since: 2013

|

|

|

Experience

Since March

2016, Mr. Zwiener has served as an Operating Executive of The Carlyle Group. From January 2015 to March 2016, Mr. Zwiener was Interim CEO at PartnerRe Ltd. Mr. Zwiener was a Principal in Dowling Capital Partners from 2010 to 2015. Prior

to joining Dowling Capital Partners, Mr. Zwiener was Chief Financial Officer of Wachovia Corporation. From 2007 to 2008, he was Managing Director and Co-Head of the Financial Institutions Group at The Carlyle Group. From 1995 to 2007,

Mr. Zwiener served in increasingly responsible positions at The Hartford, rising to President and Chief Operating Officer-Property & Casualty.

Board Memberships and Other Positions

■ Previously served as a director of The Bank of N.T. Butterfield & Son Limited, Partner Re, Ltd., CNO Financial Group, The Hartford, Sheridan

Healthcare, Inc., the Hartford Hospital and a trustee of the New Britain Museum of American Art

|

|

Voya 2023 Proxy Statement

|

|

|

23

|

TABLE OF CONTENTS

The Board does not have a policy on whether the offices of the Chairperson of the Board

(“Chairperson”) and the Chief Executive Officer (CEO) should be separate or combined. The Board believes that it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairperson and the CEO in such a

manner as the Board considers in the best interests of the Company at the time, after considering all relevant circumstances. The Board will periodically consider the advantages of having an independent Chairperson or having a combined

Chairperson and CEO and is open to different structures as circumstances may warrant. Following the appointment of Heather Lavallee as president and CEO-elect, our Nominating, Governance and Social Responsibility Committee considered the

leadership structure of our Board and recommended the separation of the Chairperson and CEO roles to the Board as being in the best interest of the Company at this time. Our Board adopted the Committee's recommendation.

The separate roles for the Chairperson and CEO allow the Chairperson to focus on leading the

Board in its oversight and governance responsibilities and allows the CEO to focus on setting and executing the Company’s strategic plans and initiatives, and on leading the operations of the Company. It is the policy of our Board that, during

any period where the Chairperson is not “independent” for purposes of the NYSE listing rules, the Board will appoint a Lead Director who is an independent director. David Zwiener currently serves as our Lead Director.

We believe that effective independent board leadership is a key component of good corporate

governance and long-term value creation. As such, our Board believes that an effective Lead Director must:

|

▪

|

Be a good communicator: since the role requires facilitating discussions among board

members, between directors and the CEO/management and engaging with other stakeholders, strong communications skills are necessary;

|

|

▪

|

Have the required time commitment: given the key functions of the position, the role

requires a significant time commitment to execute responsibilities effectively;

|

|

▪

|

Have relevant industry expertise: the Lead Director acts as a sounding board to our CEO

and we believe that relevant industry expertise enhances the effectiveness of the role; and

|

|

▪

|

Have personal effectiveness: the ability to earn support of other directors and

management and exercise sound judgment and leadership are key to the effectiveness of the role.

|

|

Voya 2023 Proxy Statement

|

|

|

24

|

TABLE OF CONTENTS

Key Functions and Responsibilities of our Lead Director

The following table outlines the key functions and responsibilities of our Lead Director:

|

Board Leadership

|

|

|

Leads independent directors and acts as a liaison between independent directors and

the Executive Chairman/CEO/senior executives

|

|

|

•

|

|

|

Acts as liaison between independent directors and the Executive Chairman CEO

|

| |

•

|

|

|

Acts as a sounding board and advisor to the CEO

|

| |

•

|

|

|

Has the authority to call meetings of the independent directors

|

| |

•

|

|

|

Leads meetings of independent directors, including executive sessions

|

| |

•

|

|

|

Participates in CEO succession planning

|

|

Board Oversight of Strategy

|

|

|

Ensures Board ownership of strategy and provides guidance to the CEO on execution of

the strategy, when needed

|

|

|

•

|

|

|

Ensures that the Board periodically reviews our long-term strategy

|

| |

•

|

|

|

Ensures that the Board oversees management’s execution of the long-term strategy

|

| |

•

|

|

|

Assists in aligning governance structures and Company culture with the long-term

strategy

|

| |

•

|

|

|

Provides guidance to the CEO on executing the long-term strategy

|

|

Board Culture

|

|

|

Fosters an environment of open dialogue and constructive feedback

|

|

|

•

|

|

|

Encourages director participation by fostering an environment of open dialogue and

constructive feedback among independent directors

|

| |

•

|

|

|

Helps ensure efficient and effective Board performance and functioning

|

|

Board Meetings

|

|

|

Reviews and approves Board meeting agendas; follows up on meeting outcomes

|

|

|

•

|

|

|

Consults on and approves Board meeting agendas with input from other directors

|

| |

•

|

|

|

Consults on and approves Board meeting schedules to ensure sufficient time for

discussion on all agenda items

|

| |

•

|

|

|

Advises the Executive Chairman/CEO of the Board’s information needs and ensure the

timeliness of information provided to the Board

|

| |

•

|

|

|

Follows up on Board meeting outcomes

|

BOARD CONTINUING EDUCATION

Our Corporate Governance Guidelines encourage directors to attend director continuing

education courses by providing reimbursement of such courses sponsored by recognized organizations for up to $15,000 per year per director. In addition to such reimbursement, we provide directly, and with the assistance of outside advisors,

presentations to the Board on current issues or topics relevant to the Board, including corporate governance trends and practices, cybersecurity, enterprise risk management, remote work and external perspectives and views of analysts and

investors. For new directors, we provide a half-day orientation where senior management provides detailed presentations on our strategies and operations.

|

Voya 2023 Proxy Statement

|

|

|

25

|

TABLE OF CONTENTS

BOARD ROLE IN RISK OVERSIGHT

Our Board carries out its risk oversight function through its regularly scheduled meetings,

through its committees (including the Audit Committee, which, consistent with NYSE rules, has a central role in risk oversight), and through informal interactions and discussions between our directors and our senior management. In particular, the

Committees of our Board focus on overseeing the following risks:

|

Model Risk

Operational Risk:

• Internal Fraud

• External Fraud

• Employment

Practices &

Workplace Safety

• Clients, Products &

Business Practices

Strategic/Business Risk:

• Regulatory

• Financial

Reporting Risk

|

|

|

Strategic/Business Risk:

• Compensation and

Benefits Risk

• Talent Risk

|

|

|

Strategic/Business Risk:

• Environmental and

Social Risk

• CEO Succession

Risk

|

|

|

Credit and Counterparty Risk

ESG Risk

Insurance Risk

Liquidity Risk

Market Risk

Operational Risk:

• Issues with Material

Effect on the Capital

Plan

Strategic/Business Risk:

• Ratings

• Product Distribution

• Expense Risk

|

|

|

Technology and

Operational Risk:

• Cybersecurity Risk

• Execution, Delivery

& Process

Management

(Includes

Outsourcing Risk

and Third-Party

Vendor Risk)

• Technology &

Infrastructure

Management

(Includes IT Risk)

• Information Risk

• Privacy Risk

• Natural

Disasters & Public Safety

|

|

|

Strategic Business Risk:

• Emerging Risk

• Global Economy

• Strategic Risk

• Product Pricing

• Investor Risk

• Suitability Risk

• Reputational Risk

Any other Risk as appropriate

|

The Board receives regular reports from the Risk, Investment and Finance Committee, the

management risk committee of the Company and the Company’s Chief Risk Officer on the Company’s ongoing adherence to the Board’s risk-related policies and the status of the Company’s risk management programs.

|

Cybersecurity Risk Oversight:

Cybersecurity is a critical part of risk management at Voya. Voya is continuously evolving and adapting its cybersecurity program to stay ahead of threats. Voya employs 100+ information security professionals and has a

multi-disciplined triage team comprised of fraud experts responsible for end-to-end action from prevention to customer care. Voya has also implemented a highly adaptive, risk-based monitoring process tailored to prevent cybersecurity

threats and protect participant account assets, as well as invested in technology to identify fraudulent activity across all contact points, including artificial intelligence, intelligence and behavior-based analytics models, event-based

red flag monitoring and industry watch-lists.

The Technology, Innovation and Operations Committee is responsible for reviewing

the risk exposure of the Company and the steps taken to monitor such exposures, and coordinates with our Risk, Investment and Finance Committee to mitigate cybersecurity risks.

|

Our directors are actively engaged inside and outside of Board meetings.

Actively Engaged Board and Outstanding Attendance

|

8

Board Meetings

in 2022

|

|

|

35

Standing Committee

Meetings in 2022

|

|

|

34

Executive Sessions

in 2022

|

|

Voya 2023 Proxy Statement

|

|

|

26

|

TABLE OF CONTENTS

No directors attended fewer than 75% of the aggregate number of meetings of the Board and of

the Committees on which the director served during 2022, which is the threshold for disclosure under SEC rules. In 2022, our directors attended 98% of the combined total meetings of the full Board and Committees on which they served. In addition,

we encourage our directors to attend each of our annual meetings and, in 2022, 6 of 10 directors serving at the time attended the Annual Meeting of Shareholders.

Discussions and Communications Outside of Board Meetings

The chairs of our Committees meet and speak regularly with members of our management between

Board meetings. The chairs of our Committees have regular meetings with our management prior to Committee meetings to review meeting agendas, time allocated to each agenda item and meeting materials, and to discuss specific agenda items in order

to ensure that the meeting will sufficiently fulfill the information needs of Committee members and that the Committees are carrying out in full the responsibilities set forth in their charters. After each meeting and on an ad hoc basis as

needed, Committee chairs provide feedback to management in preparation for future meetings. Our Lead Director conducts similar meetings with our Executive Chairman and our CEO with respect to Board meetings. In addition, directors have

discussions with each other and our senior management team and other key employees outside of Board meetings as needed.

Our directors also receive weekly analyst reports on the Company and its peers, and, on a

quarterly basis, they receive feedback from senior management on our meetings and interactions with investors.

Board and Committee Self-Assessments

Our Board is committed to enhancing its performance. Pursuant to NYSE requirements, our

Corporate Governance Guidelines and the Committee charters, the Board, and each of its Committees, are required to conduct a self-evaluation on annual basis. To meet this requirement, the Nominating, Governance and Social Responsibility Committee

solicits feedback using a written questionnaire and through one-on-one discussions with each director.

|

The Corporate Secretary initiates the feedback process by developing and

circulating a written questionnaire to directors for completion in advance of the Board’s evaluation discussion.

|

|

|

|

|

|

The Corporate Secretary then gathers the directors’ input and feedback. Summaries of

the feedback are prepared and shared with each Committee and the full Board, and then discussed in executive sessions of each Committee and the full Board.

|

|

|

|

|

|

The chair of each Committee and the Lead Director share the results of the

discussions with management to address any requests or enhancements in practices that may be warranted.

|

|

|

|

Our processes enable directors to provide confidential feedback on topics including:

|

▪

|

Board/Committee information and materials;

|

|

▪

|

Board/Committee meeting mechanics and structure;

|

|

▪

|

Board/Committee composition;

|

|

▪

|

Board/Committee responsibilities and accountability;

|

|

▪

|

Board meeting content and conduct; and

|

|

▪

|

Overall performance of Board members.

|

While this formal self-evaluation is conducted on an annual basis, directors share

perspectives, feedback and suggestions with management and each other year-round.

As required by NYSE rules, our Board considers annually whether each of its members is

“independent” for purposes of NYSE rules. Those rules provide that a director is “independent” if our Board determines that the director does not have any direct or indirect material relationship with Voya.

|

Voya 2023 Proxy Statement

|

|

|

27

|

TABLE OF CONTENTS

Our Board has determined that each of Mses. Biggar, Butler, Chwick, DeRose and Gillis, and

Messrs. Bowman, Ersek, Lewis, Tripodi and Zwiener are independent. This determination was based, in part, on detailed information that each director provided our Board regarding his or her business and professional relationships, and those of his

or her family members, with Voya and those entities with which we have significant business or financial interactions.

In making its independence determinations, our Board considered both the “bright line”

independence criteria set forth in NYSE rules, as well as other relationships that, although not expressly inconsistent with independence under NYSE rules, may nevertheless have been determined to constitute a “material direct or indirect