false2023FYfalsetrue0001748797WI 0001748797 2023-01-31 0001748797 2022-01-31 0001748797 2022-02-01 2023-01-31 0001748797 2021-02-01 2022-01-31 0001748797 2022-02-16 0001748797 2021-05-04 0001748797 2022-06-14 0001748797 2019-01-31 0001748797 2022-12-13 0001748797 2021-02-16 0001748797 2022-12-08 0001748797 2021-01-31 0001748797 dooo:TrademarkMember dooo:BombardierIncMember 2021-02-01 2022-01-31 0001748797 dooo:BombardierIncMember ifrs-full:GoodwillMember 2021-02-01 2022-01-31 0001748797 dooo:BusinessCombinationAfter2003Member dooo:TrademarkMember 2021-02-01 2022-01-31 0001748797 dooo:BusinessCombinationAfter2003Member ifrs-full:GoodwillMember 2021-02-01 2022-01-31 0001748797 dooo:NormalCourseIssuerBidMember 2021-02-01 2022-01-31 0001748797 ifrs-full:TopOfRangeMember 2021-02-01 2022-01-31 0001748797 dooo:SubordinateVotingSharesMember 2021-02-01 2022-01-31 0001748797 country:CA 2021-02-01 2022-01-31 0001748797 dooo:ForeignMember 2021-02-01 2022-01-31 0001748797 dooo:ToolingMember 2021-02-01 2022-01-31 0001748797 dooo:Equipments1Member 2021-02-01 2022-01-31 0001748797 ifrs-full:BuildingsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:LandMember 2021-02-01 2022-01-31 0001748797 country:US 2021-02-01 2022-01-31 0001748797 dooo:NonUsMember 2021-02-01 2022-01-31 0001748797 dooo:MultipleVotingSharesMember 2021-02-01 2022-01-31 0001748797 dooo:PowersportSegmentMember 2021-02-01 2022-01-31 0001748797 dooo:MarineSegmentsMember 2021-02-01 2022-01-31 0001748797 dooo:InterSegmentEliminationsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:InterestRateRiskMember ifrs-full:TopOfRangeMember 2021-02-01 2022-01-31 0001748797 ifrs-full:BottomOfRangeMember ifrs-full:InterestRateRiskMember 2021-02-01 2022-01-31 0001748797 dooo:DealerAndDistributorFinancingArrangementsMember 2021-02-01 2022-01-31 0001748797 dooo:EuroCADMember 2021-02-01 2022-01-31 0001748797 dooo:OtherCurrenciesMember 2021-02-01 2022-01-31 0001748797 dooo:AutomaticSharePurchasePlanMember 2021-02-01 2022-01-31 0001748797 dooo:TermFacilityMember 2021-02-01 2022-01-31 0001748797 dooo:TermLoansMember 2021-02-01 2022-01-31 0001748797 ifrs-full:PensionDefinedBenefitPlansMember country:CA 2021-02-01 2022-01-31 0001748797 dooo:ForeignMember ifrs-full:PensionDefinedBenefitPlansMember 2021-02-01 2022-01-31 0001748797 dooo:PensionPlansFairValueOfAssetsMember country:CA 2021-02-01 2022-01-31 0001748797 dooo:ForeignMember dooo:PensionPlansFairValueOfAssetsMember 2021-02-01 2022-01-31 0001748797 dooo:YearRoundProductsMember 2021-02-01 2022-01-31 0001748797 dooo:SeasonalProductsMember 2021-02-01 2022-01-31 0001748797 dooo:PowerSportsPaAAndOemEnginesmemberMember 2021-02-01 2022-01-31 0001748797 dooo:MarineMember 2021-02-01 2022-01-31 0001748797 dooo:ResearchAndDevelopmentMember 2021-02-01 2022-01-31 0001748797 dooo:OperatingIncomeExpenseMember 2021-02-01 2022-01-31 0001748797 dooo:ResearchAndDevelopmentExpenseAndOtherElementsOfOperatingIncomeMember 2021-02-01 2022-01-31 0001748797 dooo:CostPricePropertyPlantAndEquipmentMember 2021-02-01 2022-01-31 0001748797 dooo:CostPriceOfIntangiblesMember 2021-02-01 2022-01-31 0001748797 dooo:USDCADMember 2021-02-01 2022-01-31 0001748797 ifrs-full:GoodwillMember 2021-02-01 2022-01-31 0001748797 dooo:TrademarkMember 2021-02-01 2022-01-31 0001748797 dooo:SoftwareAndLicensesMember 2021-02-01 2022-01-31 0001748797 dooo:PatentsMember 2021-02-01 2022-01-31 0001748797 dooo:DealerNetworkMember 2021-02-01 2022-01-31 0001748797 dooo:CustomerRelationshipMember 2021-02-01 2022-01-31 0001748797 dooo:GeneralAndAdministrativeExpensesMember 2021-02-01 2022-01-31 0001748797 dooo:TermLoansMember dooo:TrancheOneMember 2021-02-01 2022-01-31 0001748797 dooo:TermLoansMember ifrs-full:BottomOfRangeMember 2021-02-01 2022-01-31 0001748797 dooo:TermLoansMember ifrs-full:TopOfRangeMember 2021-02-01 2022-01-31 0001748797 srt:EuropeMember 2021-02-01 2022-01-31 0001748797 srt:AsiaPacificMember 2021-02-01 2022-01-31 0001748797 country:MX 2021-02-01 2022-01-31 0001748797 country:AT 2021-02-01 2022-01-31 0001748797 dooo:OtherCountriesMember 2021-02-01 2022-01-31 0001748797 ifrs-full:RetainedEarningsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:EquityAttributableToOwnersOfParentMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember 2021-02-01 2022-01-31 0001748797 dooo:TranslationOfForeignOperationsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:CashFlowHedgesMember 2021-02-01 2022-01-31 0001748797 dooo:AustrianGovernmentProgramsMember dooo:TermLoansMember 2021-02-01 2022-01-31 0001748797 dooo:CapitalStockMember 2021-02-01 2022-01-31 0001748797 dooo:ContributedSurplusMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsSeventeenMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsEighteenMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsNineteenMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsTwentyMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsTwentyOneMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsTwentyTwoMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsOneMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsTwoMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsThreeMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFourMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFiveMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsSixMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsSevenMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsEightMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsNineMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTenMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsElevenMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwelveMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsThirteenMember ifrs-full:NotLaterThanOneYearMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFourteenMember 2021-02-01 2022-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFifteenMember 2021-02-01 2022-01-31 0001748797 dooo:ContractsSixteenMember ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:LandAndBuildingsMember 2021-02-01 2022-01-31 0001748797 dooo:EquipmentMember 2021-02-01 2022-01-31 0001748797 ifrs-full:OtherAssetsMember 2021-02-01 2022-01-31 0001748797 ifrs-full:LeaseLiabilitiesMember 2021-02-01 2022-01-31 0001748797 ifrs-full:Level3OfFairValueHierarchyMember dooo:NoncontrollingInterestLiabilityMember 2021-02-01 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:InterestRateCapMember 2021-02-01 2022-01-31 0001748797 ifrs-full:Level1OfFairValueHierarchyMember dooo:TermFacilityMember 2021-02-01 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:TermLoansMember 2021-02-01 2022-01-31 0001748797 dooo:RangeFourteenMember 2021-02-01 2022-01-31 0001748797 dooo:RangeThirteenMember 2021-02-01 2022-01-31 0001748797 dooo:RangeTenMember 2021-02-01 2022-01-31 0001748797 dooo:RangeNineMember 2021-02-01 2022-01-31 0001748797 dooo:RangeEightMember 2021-02-01 2022-01-31 0001748797 dooo:RangeSevenMember 2021-02-01 2022-01-31 0001748797 dooo:RangeSixMember 2021-02-01 2022-01-31 0001748797 dooo:RangeFiveMember 2021-02-01 2022-01-31 0001748797 dooo:RangeFourMember 2021-02-01 2022-01-31 0001748797 dooo:RangeThreeMember 2021-02-01 2022-01-31 0001748797 dooo:EmployeeStockOptionsMember 2021-02-01 2022-01-31 0001748797 dooo:RestrictedInvestmentMember ifrs-full:Level2OfFairValueHierarchyMember 2021-02-01 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:FavourableForwardExchangeContractsMember 2021-02-01 2022-01-31 0001748797 dooo:FirstQuarterlyDividendMember 2021-02-01 2022-01-31 0001748797 dooo:SecondQuarterlyDividendMember 2021-02-01 2022-01-31 0001748797 dooo:ThirdQuarterlyDividendMember 2021-02-01 2022-01-31 0001748797 dooo:FourthQuarterlyDividendMember 2021-02-01 2022-01-31 0001748797 dooo:BombardierIncMember dooo:TrademarkMember 2022-02-01 2023-01-31 0001748797 ifrs-full:GoodwillMember dooo:BombardierIncMember 2022-02-01 2023-01-31 0001748797 dooo:TrademarkMember dooo:BusinessCombinationAfter2003Member 2022-02-01 2023-01-31 0001748797 dooo:BusinessCombinationAfter2003Member ifrs-full:GoodwillMember 2022-02-01 2023-01-31 0001748797 dooo:TelwaterPtyLtdMember 2022-02-01 2023-01-31 0001748797 dooo:BrpCommerceAndTradeCoLtdMember 2022-02-01 2023-01-31 0001748797 dooo:PinionGmbhMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember 2022-02-01 2023-01-31 0001748797 dooo:SubordinateVotingSharesMember 2022-02-01 2023-01-31 0001748797 country:CA 2022-02-01 2023-01-31 0001748797 dooo:ForeignMember 2022-02-01 2023-01-31 0001748797 dooo:ToolingMember 2022-02-01 2023-01-31 0001748797 dooo:Equipments1Member 2022-02-01 2023-01-31 0001748797 ifrs-full:BuildingsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:LandMember 2022-02-01 2023-01-31 0001748797 country:US 2022-02-01 2023-01-31 0001748797 dooo:NonUsMember 2022-02-01 2023-01-31 0001748797 dooo:NormalCourseIssuerBidTransactionOneMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember 2022-02-01 2023-01-31 0001748797 country:AT 2022-02-01 2023-01-31 0001748797 dooo:NormalCourseIssuerBidMember 2022-02-01 2023-01-31 0001748797 ifrs-full:InterestRateRiskMember 2022-02-01 2023-01-31 0001748797 ifrs-full:InterestRateRiskMember ifrs-full:TopOfRangeMember 2022-02-01 2023-01-31 0001748797 dooo:MultipleVotingSharesMember 2022-02-01 2023-01-31 0001748797 dooo:PowersportSegmentMember 2022-02-01 2023-01-31 0001748797 dooo:MarineSegmentsMember 2022-02-01 2023-01-31 0001748797 dooo:InterSegmentEliminationsMember 2022-02-01 2023-01-31 0001748797 dooo:TrademarkMember ifrs-full:BottomOfRangeMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:TrademarkMember 2022-02-01 2023-01-31 0001748797 ifrs-full:InterestRateRiskMember ifrs-full:BottomOfRangeMember 2022-02-01 2023-01-31 0001748797 dooo:DealerAndDistributorFinancingArrangementsMember 2022-02-01 2023-01-31 0001748797 dooo:USDCADMember 2022-02-01 2023-01-31 0001748797 dooo:EuroCADMember 2022-02-01 2023-01-31 0001748797 dooo:OtherCurrenciesMember 2022-02-01 2023-01-31 0001748797 dooo:AutomaticSharePurchasePlanMember 2022-02-01 2023-01-31 0001748797 dooo:ProductRelatedProvisionsMember 2022-02-01 2023-01-31 0001748797 dooo:OtherProvisionMember 2022-02-01 2023-01-31 0001748797 dooo:TermFacilityMember 2022-02-01 2023-01-31 0001748797 dooo:TermLoansMember 2022-02-01 2023-01-31 0001748797 country:CA ifrs-full:PensionDefinedBenefitPlansMember 2022-02-01 2023-01-31 0001748797 dooo:ForeignMember ifrs-full:PensionDefinedBenefitPlansMember 2022-02-01 2023-01-31 0001748797 dooo:PensionPlansFairValueOfAssetsMember country:CA 2022-02-01 2023-01-31 0001748797 dooo:ForeignMember dooo:PensionPlansFairValueOfAssetsMember 2022-02-01 2023-01-31 0001748797 dooo:YearRoundProductsMember 2022-02-01 2023-01-31 0001748797 dooo:SeasonalProductsMember 2022-02-01 2023-01-31 0001748797 dooo:PowerSportsPaAAndOemEnginesmemberMember 2022-02-01 2023-01-31 0001748797 dooo:MarineMember 2022-02-01 2023-01-31 0001748797 dooo:ResearchAndDevelopmentMember 2022-02-01 2023-01-31 0001748797 dooo:OperatingIncomeExpenseMember 2022-02-01 2023-01-31 0001748797 dooo:ResearchAndDevelopmentExpenseAndOtherElementsOfOperatingIncomeMember 2022-02-01 2023-01-31 0001748797 dooo:CostPricePropertyPlantAndEquipmentMember 2022-02-01 2023-01-31 0001748797 dooo:CostPriceOfIntangiblesMember 2022-02-01 2023-01-31 0001748797 dooo:TermFacilityBOneMember 2022-02-01 2023-01-31 0001748797 dooo:GeneralAndAdministrativeExpensesMember ifrs-full:NoncontrollingInterestsMember dooo:PinionMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember dooo:GeneralAndAdministrativeExpensesMember dooo:KaShawiniganMember 2022-02-01 2023-01-31 0001748797 dooo:SubstantialIssuerBidOfferMember 2022-02-01 2023-01-31 0001748797 ifrs-full:GoodwillMember 2022-02-01 2023-01-31 0001748797 dooo:TrademarkMember 2022-02-01 2023-01-31 0001748797 dooo:SoftwareAndLicensesMember 2022-02-01 2023-01-31 0001748797 dooo:PatentsMember 2022-02-01 2023-01-31 0001748797 dooo:DealerNetworkMember 2022-02-01 2023-01-31 0001748797 dooo:CustomerRelationshipMember 2022-02-01 2023-01-31 0001748797 dooo:GeneralAndAdministrativeExpensesMember 2022-02-01 2023-01-31 0001748797 dooo:TermLoansMember dooo:TrancheOneMember 2022-02-01 2023-01-31 0001748797 dooo:TermLoansMember dooo:TrancheTwoMember 2022-02-01 2023-01-31 0001748797 dooo:TermLoansMember ifrs-full:BottomOfRangeMember 2022-02-01 2023-01-31 0001748797 dooo:TermLoansMember ifrs-full:TopOfRangeMember 2022-02-01 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember 2022-02-01 2023-01-31 0001748797 srt:EuropeMember 2022-02-01 2023-01-31 0001748797 srt:AsiaPacificMember 2022-02-01 2023-01-31 0001748797 country:MX 2022-02-01 2023-01-31 0001748797 dooo:OtherCountriesMember 2022-02-01 2023-01-31 0001748797 dooo:CapitalStockMember 2022-02-01 2023-01-31 0001748797 dooo:ContributedSurplusMember 2022-02-01 2023-01-31 0001748797 ifrs-full:RetainedEarningsMember 2022-02-01 2023-01-31 0001748797 dooo:TranslationOfForeignOperationsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:CashFlowHedgesMember 2022-02-01 2023-01-31 0001748797 ifrs-full:EquityAttributableToOwnersOfParentMember 2022-02-01 2023-01-31 0001748797 dooo:AustrianGovernmentProgramsMember dooo:TermLoansMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsSeventeenMember 2022-02-01 2023-01-31 0001748797 dooo:ContractsEighteenMember ifrs-full:NotLaterThanOneYearMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsNineteenMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwentyMember 2022-02-01 2023-01-31 0001748797 dooo:ContractsTwentyOneMember ifrs-full:NotLaterThanOneYearMember 2022-02-01 2023-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsTwentyTwoMember 2022-02-01 2023-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsThirteenMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsNineMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTenMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsElevenMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwelveMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsOneMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwoMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsThreeMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFourMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsFiveMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsSixMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsSevenMember 2022-02-01 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:ContractsEightMember 2022-02-01 2023-01-31 0001748797 ifrs-full:LandAndBuildingsMember 2022-02-01 2023-01-31 0001748797 dooo:EquipmentMember 2022-02-01 2023-01-31 0001748797 ifrs-full:OtherAssetsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:LeaseLiabilitiesMember 2022-02-01 2023-01-31 0001748797 dooo:NoncontrollingInterestLiabilityMember ifrs-full:Level3OfFairValueHierarchyMember 2022-02-01 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:InterestRateCapMember 2022-02-01 2023-01-31 0001748797 dooo:TermFacilityMember ifrs-full:Level1OfFairValueHierarchyMember 2022-02-01 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:TermLoansMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:ToolingMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:ToolingMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:EquipmentMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:EquipmentMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember ifrs-full:BuildingsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember ifrs-full:BuildingsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:SoftwareAndLicensesMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:SoftwareAndLicensesMember 2022-02-01 2023-01-31 0001748797 dooo:PatentsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:DealerNetworkMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:DealerNetworkMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:CustomerRelationshipMember 2022-02-01 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:CustomerRelationshipMember 2022-02-01 2023-01-31 0001748797 dooo:NonAdjustingEventMember 2022-02-01 2023-01-31 0001748797 dooo:RangeElevenMember 2022-02-01 2023-01-31 0001748797 dooo:RangeTwelveMember 2022-02-01 2023-01-31 0001748797 dooo:RangeFourteenMember 2022-02-01 2023-01-31 0001748797 dooo:RangeThirteenMember 2022-02-01 2023-01-31 0001748797 dooo:RangeTenMember 2022-02-01 2023-01-31 0001748797 dooo:RangeNineMember 2022-02-01 2023-01-31 0001748797 dooo:RangeEightMember 2022-02-01 2023-01-31 0001748797 dooo:RangeSevenMember 2022-02-01 2023-01-31 0001748797 dooo:RangeSixMember 2022-02-01 2023-01-31 0001748797 dooo:RangeFiveMember 2022-02-01 2023-01-31 0001748797 dooo:RangeFourMember 2022-02-01 2023-01-31 0001748797 dooo:RangeThreeMember 2022-02-01 2023-01-31 0001748797 dooo:EmployeeStockOptionsMember 2022-02-01 2023-01-31 0001748797 dooo:TermFacilityBTwoMember 2022-02-01 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:RestrictedInvestmentMember 2022-02-01 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:FavourableForwardExchangeContractsMember 2022-02-01 2023-01-31 0001748797 ifrs-full:BusinessCombinationsMember 2022-02-01 2023-01-31 0001748797 dei:BusinessContactMember 2022-02-01 2023-01-31 0001748797 dooo:FirstQuarterlyDividendMember 2022-02-01 2023-01-31 0001748797 dooo:SecondQuarterlyDividendMember 2022-02-01 2023-01-31 0001748797 dooo:ThirdQuarterlyDividendMember 2022-02-01 2023-01-31 0001748797 dooo:FourthQuarterlyDividendMember 2022-02-01 2023-01-31 0001748797 dooo:Equipments1Member ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 dooo:Equipments1Member dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 dooo:Equipments1Member 2022-01-31 0001748797 ifrs-full:BuildingsMember ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 ifrs-full:BuildingsMember dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 ifrs-full:BuildingsMember 2022-01-31 0001748797 ifrs-full:LandMember ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 ifrs-full:LandMember dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 ifrs-full:LandMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:ToolingMember 2022-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:ToolingMember 2022-01-31 0001748797 dooo:ToolingMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 dooo:CanadianEquitySecuritiesMember 2022-01-31 0001748797 dooo:ForeignEquitySecuritiesMember 2022-01-31 0001748797 dooo:BombardierIncMember 2022-01-31 0001748797 dooo:TrademarkMember 2022-01-31 0001748797 dooo:SkidooMember 2022-01-31 0001748797 dooo:SeadooMember 2022-01-31 0001748797 dooo:AlumacraftMember 2022-01-31 0001748797 dooo:ManitouMember 2022-01-31 0001748797 dooo:QuintrexMember 2022-01-31 0001748797 dooo:StacerMember 2022-01-31 0001748797 dooo:DealerAndDistributorFinancingArrangementsMember 2022-01-31 0001748797 dooo:MaterialsAndWorkInProgressMember 2022-01-31 0001748797 dooo:FinishedGoodsMember 2022-01-31 0001748797 dooo:PartsAccessoriesAndApparelMember 2022-01-31 0001748797 country:CA ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember 2022-01-31 0001748797 dooo:ForeignMember ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember 2022-01-31 0001748797 country:CA ifrs-full:WhollyUnfundedDefinedBenefitPlansMember 2022-01-31 0001748797 ifrs-full:WhollyUnfundedDefinedBenefitPlansMember dooo:ForeignMember 2022-01-31 0001748797 country:CA 2022-01-31 0001748797 dooo:ForeignMember 2022-01-31 0001748797 dooo:ProductRelatedProvisionsMember 2022-01-31 0001748797 dooo:OtherProvisionMember 2022-01-31 0001748797 ifrs-full:TradeReceivablesMember 2022-01-31 0001748797 ifrs-full:TradeReceivablesMember dooo:NotPastDueMember 2022-01-31 0001748797 ifrs-full:TradeReceivablesMember ifrs-full:LaterThanOneMonthAndNotLaterThanTwoMonthsMember 2022-01-31 0001748797 ifrs-full:LaterThanTwoMonthsAndNotLaterThanThreeMonthsMember ifrs-full:TradeReceivablesMember 2022-01-31 0001748797 ifrs-full:LaterThanThreeMonthsMember ifrs-full:TradeReceivablesMember 2022-01-31 0001748797 dooo:NormalCourseIssuerBidMember 2022-01-31 0001748797 ifrs-full:GoodwillMember ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 ifrs-full:GoodwillMember dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 ifrs-full:GoodwillMember 2022-01-31 0001748797 dooo:TrademarkMember ifrs-full:GrossCarryingAmountMember 2022-01-31 0001748797 dooo:TrademarkMember dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 dooo:TrademarkMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:SoftwareAndLicensesMember 2022-01-31 0001748797 dooo:SoftwareAndLicensesMember dooo:AccumulatedDepreciationMember 2022-01-31 0001748797 dooo:SoftwareAndLicensesMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:PatentsMember 2022-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:PatentsMember 2022-01-31 0001748797 dooo:PatentsMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:DealerNetworkMember 2022-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:DealerNetworkMember 2022-01-31 0001748797 dooo:DealerNetworkMember 2022-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:CustomerRelationshipMember 2022-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:CustomerRelationshipMember 2022-01-31 0001748797 dooo:CustomerRelationshipMember 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember 2022-01-31 0001748797 currency:CAD 2022-01-31 0001748797 country:US currency:USD 2022-01-31 0001748797 country:CA currency:CAD 2022-01-31 0001748797 dooo:AustraliaAndNewZealandMember currency:AUD 2022-01-31 0001748797 currency:EUR srt:EuropeMember 2022-01-31 0001748797 dooo:DerivativeFinancialInstrumentsMember ifrs-full:Level2OfFairValueHierarchyMember dooo:FavourableForwardExchangeContractsMember 2022-01-31 0001748797 dooo:RestrictedInvestmentMember ifrs-full:Level2OfFairValueHierarchyMember 2022-01-31 0001748797 dooo:TermLoansMember dooo:TrancheOneMember 2022-01-31 0001748797 dooo:TermLoansMember ifrs-full:BottomOfRangeMember 2022-01-31 0001748797 dooo:TermLoansMember ifrs-full:TopOfRangeMember 2022-01-31 0001748797 dooo:RangeThreeMember 2022-01-31 0001748797 dooo:RangeFourMember 2022-01-31 0001748797 dooo:RangeFiveMember 2022-01-31 0001748797 dooo:RangeSixMember 2022-01-31 0001748797 dooo:RangeSevenMember 2022-01-31 0001748797 dooo:RangeEightMember 2022-01-31 0001748797 dooo:RangeNineMember 2022-01-31 0001748797 dooo:RangeTenMember 2022-01-31 0001748797 dooo:RangeThirteenMember 2022-01-31 0001748797 dooo:RangeFourteenMember 2022-01-31 0001748797 dooo:AustrianGovernmentProgramsMember dooo:TermLoansMember 2022-01-31 0001748797 country:US 2022-01-31 0001748797 srt:EuropeMember 2022-01-31 0001748797 srt:AsiaPacificMember 2022-01-31 0001748797 country:MX 2022-01-31 0001748797 country:AT 2022-01-31 0001748797 dooo:OtherCountriesMember 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:TermLoansMember 2022-01-31 0001748797 ifrs-full:Level1OfFairValueHierarchyMember dooo:TermFacilityMember 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:UnfavourableForwardExchangeContractsMember 2022-01-31 0001748797 ifrs-full:Level3OfFairValueHierarchyMember dooo:NoncontrollingInterestLiabilityMember 2022-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:InterestRateCapMember 2022-01-31 0001748797 dooo:TermLoansMember 2022-01-31 0001748797 dooo:HedgingForeignExchangeContractsMember dooo:ContractsSeventeenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:HedgingForeignExchangeContractsMember dooo:ContractsEighteenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:HedgingForeignExchangeContractsMember dooo:ContractsNineteenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:HedgingForeignExchangeContractsMember dooo:ContractsTwentyMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ContractsTwentyOneMember dooo:HedgingForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsTwentyTwoMember dooo:HedgingForeignExchangeContractsMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsOneMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsTwoMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsThreeMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsFourMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsFiveMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsSixMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsSevenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsEightMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsNineMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsTenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsElevenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsTwelveMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsThirteenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsFourteenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 dooo:ForeignExchangeContractsMember dooo:ContractsFifteenMember ifrs-full:NotLaterThanOneYearMember 2022-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ForeignExchangeContractsMember dooo:ContractsSixteenMember 2022-01-31 0001748797 dooo:RestrictedInvestmentMember 2022-01-31 0001748797 dooo:DerivativeFinancialInstrumentsMember 2022-01-31 0001748797 dooo:AdvancesToSuppliersRelatedToPropertyPlantAndEquipmentMember 2022-01-31 0001748797 dooo:OtherFinancialAssetMember 2022-01-31 0001748797 dooo:Equipments1Member ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 dooo:Equipments1Member dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 dooo:Equipments1Member 2023-01-31 0001748797 ifrs-full:BuildingsMember ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 ifrs-full:BuildingsMember dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 ifrs-full:BuildingsMember 2023-01-31 0001748797 ifrs-full:LandMember ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 ifrs-full:LandMember dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 ifrs-full:LandMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:ToolingMember 2023-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:ToolingMember 2023-01-31 0001748797 dooo:ToolingMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 country:CA 2023-01-31 0001748797 country:AT 2023-01-31 0001748797 dooo:CanadianEquitySecuritiesMember 2023-01-31 0001748797 dooo:ForeignEquitySecuritiesMember 2023-01-31 0001748797 ifrs-full:ActuarialAssumptionOfDiscountRatesMember 2023-01-31 0001748797 ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMember 2023-01-31 0001748797 ifrs-full:ActuarialAssumptionOfLifeExpectancyAfterRetirementMember 2023-01-31 0001748797 dooo:BombardierIncMember 2023-01-31 0001748797 dooo:PinionGmbhMember 2023-01-31 0001748797 dooo:TrademarkMember 2023-01-31 0001748797 dooo:SkidooMember 2023-01-31 0001748797 dooo:SeadooMember 2023-01-31 0001748797 dooo:AlumacraftMember 2023-01-31 0001748797 dooo:ManitouMember 2023-01-31 0001748797 dooo:QuintrexMember 2023-01-31 0001748797 dooo:StacerMember 2023-01-31 0001748797 dooo:PinionMember 2023-01-31 0001748797 dooo:DealerAndDistributorFinancingArrangementsMember 2023-01-31 0001748797 ifrs-full:LiquidityRiskMember ifrs-full:NotLaterThanOneYearMember 2023-01-31 0001748797 ifrs-full:LiquidityRiskMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:TrademarkMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:TrademarkMember 2023-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanThreeYearsMember ifrs-full:LiquidityRiskMember 2023-01-31 0001748797 ifrs-full:LaterThanFourYearsAndNotLaterThanFiveYearsMember ifrs-full:LiquidityRiskMember 2023-01-31 0001748797 ifrs-full:LaterThanFiveYearsMember ifrs-full:LiquidityRiskMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:DealerAndDistributorFinancingArrangementsMember 2023-01-31 0001748797 dooo:MaterialsAndWorkInProgressMember 2023-01-31 0001748797 dooo:FinishedGoodsMember 2023-01-31 0001748797 dooo:PartsAccessoriesAndApparelMember 2023-01-31 0001748797 ifrs-full:GoodwillMember dooo:KonsbergMember 2023-01-31 0001748797 ifrs-full:GoodwillMember dooo:PinionMember dooo:KonsbergMember 2023-01-31 0001748797 dooo:PinionMember 2023-01-31 0001748797 dooo:KaShawiniganMember 2023-01-31 0001748797 country:CA ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember 2023-01-31 0001748797 dooo:ForeignMember ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember 2023-01-31 0001748797 country:CA ifrs-full:WhollyUnfundedDefinedBenefitPlansMember 2023-01-31 0001748797 ifrs-full:WhollyUnfundedDefinedBenefitPlansMember dooo:ForeignMember 2023-01-31 0001748797 dooo:ForeignMember 2023-01-31 0001748797 dooo:ProductRelatedProvisionsMember 2023-01-31 0001748797 dooo:OtherProvisionMember 2023-01-31 0001748797 ifrs-full:TradeReceivablesMember 2023-01-31 0001748797 ifrs-full:TradeReceivablesMember dooo:NotPastDueMember 2023-01-31 0001748797 ifrs-full:LaterThanOneMonthAndNotLaterThanTwoMonthsMember ifrs-full:TradeReceivablesMember 2023-01-31 0001748797 ifrs-full:LaterThanTwoMonthsAndNotLaterThanThreeMonthsMember ifrs-full:TradeReceivablesMember 2023-01-31 0001748797 ifrs-full:LaterThanThreeMonthsMember ifrs-full:TradeReceivablesMember 2023-01-31 0001748797 dooo:PinionMember dooo:PatentsMember 2023-01-31 0001748797 dooo:KaShawiniganMember dooo:PatentsMember 2023-01-31 0001748797 dooo:PatentsMember 2023-01-31 0001748797 dooo:PinionMember dooo:TrademarkMember 2023-01-31 0001748797 dooo:AccumulatedDepreciationMember ifrs-full:GoodwillMember 2023-01-31 0001748797 ifrs-full:GoodwillMember 2023-01-31 0001748797 dooo:TrademarkMember ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:TrademarkMember 2023-01-31 0001748797 dooo:TrademarkMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:SoftwareAndLicensesMember 2023-01-31 0001748797 dooo:SoftwareAndLicensesMember dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 dooo:SoftwareAndLicensesMember 2023-01-31 0001748797 dooo:PatentsMember ifrs-full:GrossCarryingAmountMember 2023-01-31 0001748797 dooo:PatentsMember dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 dooo:PatentsMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:DealerNetworkMember 2023-01-31 0001748797 dooo:AccumulatedDepreciationMember dooo:DealerNetworkMember 2023-01-31 0001748797 dooo:DealerNetworkMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember dooo:CustomerRelationshipMember 2023-01-31 0001748797 dooo:CustomerRelationshipMember dooo:AccumulatedDepreciationMember 2023-01-31 0001748797 dooo:CustomerRelationshipMember 2023-01-31 0001748797 ifrs-full:GrossCarryingAmountMember ifrs-full:GoodwillMember 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:SecuredOvernightFinancingRateMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:SecuredOvernightFinancingRateMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:USBaseRatePlusInterestMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:USBaseRatePlusInterestMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:USPrimeRatePlusInterestMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:USPrimeRatePlusInterestMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:BankersAcceptancesPlusInterestRateMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:BankersAcceptancesPlusInterestRateMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:CanadianPrimeRatePlusMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:CanadianPrimeRatePlusMember 2023-01-31 0001748797 ifrs-full:BottomOfRangeMember dooo:EuroLiborPlusMember 2023-01-31 0001748797 ifrs-full:TopOfRangeMember dooo:EuroLiborPlusMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:SecuredOvernightFinancingRateMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:USBaseRatePlusInterestMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:USPrimeRatePlusInterestMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:BankersAcceptancesPlusInterestRateMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:CanadianPrimeRatePlusMember 2023-01-31 0001748797 dooo:RevolvingCreditFacilitiesMember dooo:EuroLiborPlusMember 2023-01-31 0001748797 dooo:TermFacilityBOneMember dooo:LIBORMember 2023-01-31 0001748797 dooo:TermFacilityBOneMember dooo:USBaseRatePlusInterestMember 2023-01-31 0001748797 dooo:TermFacilityBOneMember dooo:USPrimeRatePlusInterestMember 2023-01-31 0001748797 dooo:TermFacilityBTwoMember dooo:SecuredOvernightFinancingRateMember 2023-01-31 0001748797 currency:CAD 2023-01-31 0001748797 country:US currency:USD 2023-01-31 0001748797 country:CA currency:CAD 2023-01-31 0001748797 dooo:AustraliaAndNewZealandMember currency:AUD 2023-01-31 0001748797 currency:EUR srt:EuropeMember 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:RestrictedInvestmentMember 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:FavourableForwardExchangeContractsMember 2023-01-31 0001748797 dooo:TermLoansMember dooo:TrancheOneMember 2023-01-31 0001748797 dooo:TermLoansMember dooo:TrancheTwoMember 2023-01-31 0001748797 dooo:TermLoansMember ifrs-full:BottomOfRangeMember 2023-01-31 0001748797 dooo:TermLoansMember ifrs-full:TopOfRangeMember 2023-01-31 0001748797 dooo:RangeThreeMember 2023-01-31 0001748797 dooo:RangeFourMember 2023-01-31 0001748797 dooo:RangeFiveMember 2023-01-31 0001748797 dooo:RangeSixMember 2023-01-31 0001748797 dooo:RangeSevenMember 2023-01-31 0001748797 dooo:RangeEightMember 2023-01-31 0001748797 dooo:RangeNineMember 2023-01-31 0001748797 dooo:RangeTenMember 2023-01-31 0001748797 dooo:RangeThirteenMember 2023-01-31 0001748797 dooo:RangeFourteenMember 2023-01-31 0001748797 dooo:RangeElevenMember 2023-01-31 0001748797 dooo:RangeTwelveMember 2023-01-31 0001748797 dooo:AustrianGovernmentProgramsMember dooo:TermLoansMember 2023-01-31 0001748797 country:US 2023-01-31 0001748797 srt:EuropeMember 2023-01-31 0001748797 srt:AsiaPacificMember 2023-01-31 0001748797 country:MX 2023-01-31 0001748797 dooo:OtherCountriesMember 2023-01-31 0001748797 dooo:TermLoansMember ifrs-full:Level2OfFairValueHierarchyMember 2023-01-31 0001748797 dooo:TermFacilityMember ifrs-full:Level1OfFairValueHierarchyMember 2023-01-31 0001748797 dooo:InterestRateCapMember dooo:DerivativeFinancialInstrumentsMember ifrs-full:Level2OfFairValueHierarchyMember 2023-01-31 0001748797 ifrs-full:Level3OfFairValueHierarchyMember dooo:NoncontrollingInterestLiabilityMember 2023-01-31 0001748797 ifrs-full:Level2OfFairValueHierarchyMember dooo:DerivativeFinancialInstrumentsMember dooo:UnfavourableForwardExchangeContractsMember 2023-01-31 0001748797 dooo:TermLoansMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsEightMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsSevenMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsSixMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsFiveMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsFourMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsThreeMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwoMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsOneMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsTwelveMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsElevenMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsTenMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember dooo:ContractsNineMember 2023-01-31 0001748797 dooo:ForeignExchangeContractsMember ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsThirteenMember 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:HedgingForeignExchangeContractsMember dooo:ContractsSeventeenMember 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:HedgingForeignExchangeContractsMember dooo:ContractsEighteenMember 2023-01-31 0001748797 dooo:ContractsNineteenMember dooo:HedgingForeignExchangeContractsMember ifrs-full:NotLaterThanOneYearMember 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:HedgingForeignExchangeContractsMember dooo:ContractsTwentyMember 2023-01-31 0001748797 ifrs-full:NotLaterThanOneYearMember dooo:HedgingForeignExchangeContractsMember dooo:ContractsTwentyOneMember 2023-01-31 0001748797 ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember dooo:ContractsTwentyTwoMember dooo:HedgingForeignExchangeContractsMember 2023-01-31 0001748797 dooo:SubordinateVotingSharesMember 2023-01-31 0001748797 dooo:MultipleVotingSharesMember 2023-01-31 0001748797 dooo:RestrictedInvestmentMember 2023-01-31 0001748797 dooo:DerivativeFinancialInstrumentsMember 2023-01-31 0001748797 dooo:AdvancesToSuppliersRelatedToPropertyPlantAndEquipmentMember 2023-01-31 0001748797 dooo:OtherFinancialAssetMember 2023-01-31 0001748797 dooo:DealersMember 2023-01-31 0001748797 dooo:IndividualDealerMember 2023-01-31 0001748797 dooo:DealerAndDistributorFinancingArrangementsTransactionsMember dooo:PersonalWatercraftMember dooo:SeasonalProductsDealersMember 2023-01-31 0001748797 dooo:NormalCourseIssuerBidMember 2023-01-31 0001748797 dooo:TermFacilityMember 2021-02-16 2021-02-16 0001748797 dooo:TermFacilityBOneMember 2021-02-16 2021-02-16 0001748797 dooo:TermFacilityBTwoMember 2021-02-16 2021-02-16 0001748797 dooo:TermFacilityBOneMember 2021-02-16 0001748797 dooo:AustrianGovernmentCovid19ProgramMember dooo:TermLoansMember 2022-05-05 2022-05-05 0001748797 dooo:DealerAndDistributorFinancingArrangementsTransactionsMember dooo:SnowmobilesMember dooo:SeasonalProductsDealersMember 2023-04-30 0001748797 dooo:DealerAndDistributorFinancingArrangementsTransactionsMember dooo:DealersMember 2024-01-31 0001748797 dooo:SubstantialIssuerBidOfferMember 2021-07-27 2021-07-27 0001748797 dooo:SubstantialIssuerBidOfferMember dooo:BeaudierGroupMember 2021-07-27 2021-07-27 0001748797 dooo:SubstantialIssuerBidOfferMember 2022-05-11 2022-05-11 0001748797 dooo:SubstantialIssuerBidOfferMember dooo:BeaudierGroupMember 2022-05-11 2022-05-11 0001748797 dooo:TermFacilityBTwoMember dooo:SecuredOvernightFinancingRateMember 2023-01-01 2023-12-31 0001748797 dooo:DealersMember dooo:DealerAndDistributorFinancingArrangementsTransactionsMember 2024-04-30 0001748797 dooo:NormalCourseIssuerBidMember 2022-11-30 2022-11-30 0001748797 dooo:NormalCourseIssuerBidMember 2021-12-01 2021-12-01 0001748797 dooo:TermFacilityMember 2022-06-10 2022-06-10 0001748797 dooo:TermFacilityBTwoMember 2022-12-13 2022-12-13 0001748797 dooo:TermFacilityMember 2022-12-13 2022-12-13 0001748797 dooo:PinionGmbhMember 2022-08-05 0001748797 dooo:KaShawiniganMember 2022-10-03 0001748797 dooo:ToolingMember 2021-01-31 0001748797 dooo:Equipments1Member 2021-01-31 0001748797 ifrs-full:BuildingsMember 2021-01-31 0001748797 ifrs-full:LandMember 2021-01-31 0001748797 dooo:SubordinateVotingSharesMember 2021-01-31 0001748797 dooo:MultipleVotingSharesMember 2021-01-31 0001748797 country:CA dooo:PensionPlansFairValueOfAssetsMember 2021-01-31 0001748797 dooo:ForeignMember dooo:PensionPlansFairValueOfAssetsMember 2021-01-31 0001748797 ifrs-full:PensionDefinedBenefitPlansMember country:CA 2021-01-31 0001748797 ifrs-full:PensionDefinedBenefitPlansMember dooo:ForeignMember 2021-01-31 0001748797 dooo:TermFacilityMember 2021-01-31 0001748797 dooo:TermLoansMember 2021-01-31 0001748797 ifrs-full:GoodwillMember 2021-01-31 0001748797 dooo:TrademarkMember 2021-01-31 0001748797 dooo:SoftwareAndLicensesMember 2021-01-31 0001748797 dooo:PatentsMember 2021-01-31 0001748797 dooo:DealerNetworkMember 2021-01-31 0001748797 dooo:CustomerRelationshipMember 2021-01-31 0001748797 dooo:SubordinateVotingSharesMember 2022-01-31 0001748797 dooo:MultipleVotingSharesMember 2022-01-31 0001748797 dooo:TermFacilityMember 2022-01-31 0001748797 dooo:EmployeeStockOptionsMember 2021-01-31 0001748797 dooo:ContributedSurplusMember 2021-01-31 0001748797 ifrs-full:RetainedEarningsMember 2021-01-31 0001748797 ifrs-full:EquityAttributableToOwnersOfParentMember 2021-01-31 0001748797 dooo:CapitalStockMember 2021-01-31 0001748797 dooo:TranslationOfForeignOperationsMember 2021-01-31 0001748797 ifrs-full:CashFlowHedgesMember 2021-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember 2021-01-31 0001748797 country:CA dooo:PensionPlansFairValueOfAssetsMember 2022-01-31 0001748797 dooo:PensionPlansFairValueOfAssetsMember dooo:ForeignMember 2022-01-31 0001748797 ifrs-full:PensionDefinedBenefitPlansMember country:CA 2022-01-31 0001748797 ifrs-full:PensionDefinedBenefitPlansMember dooo:ForeignMember 2022-01-31 0001748797 ifrs-full:LandAndBuildingsMember 2021-01-31 0001748797 dooo:EquipmentMember 2021-01-31 0001748797 ifrs-full:OtherAssetsMember 2021-01-31 0001748797 ifrs-full:LeaseLiabilitiesMember 2021-01-31 0001748797 dooo:EmployeeStockOptionsMember 2022-01-31 0001748797 ifrs-full:LandAndBuildingsMember 2022-01-31 0001748797 dooo:EquipmentMember 2022-01-31 0001748797 ifrs-full:OtherAssetsMember 2022-01-31 0001748797 ifrs-full:LeaseLiabilitiesMember 2022-01-31 0001748797 dooo:CapitalStockMember 2022-01-31 0001748797 dooo:ContributedSurplusMember 2022-01-31 0001748797 ifrs-full:RetainedEarningsMember 2022-01-31 0001748797 dooo:TranslationOfForeignOperationsMember 2022-01-31 0001748797 ifrs-full:CashFlowHedgesMember 2022-01-31 0001748797 ifrs-full:EquityAttributableToOwnersOfParentMember 2022-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember 2022-01-31 0001748797 dooo:TermFacilityMember 2023-01-31 0001748797 country:CA dooo:PensionPlansFairValueOfAssetsMember 2023-01-31 0001748797 dooo:ForeignMember dooo:PensionPlansFairValueOfAssetsMember 2023-01-31 0001748797 country:CA ifrs-full:PensionDefinedBenefitPlansMember 2023-01-31 0001748797 dooo:ForeignMember ifrs-full:PensionDefinedBenefitPlansMember 2023-01-31 0001748797 dooo:EmployeeStockOptionsMember 2023-01-31 0001748797 ifrs-full:LandAndBuildingsMember 2023-01-31 0001748797 dooo:EquipmentMember 2023-01-31 0001748797 ifrs-full:OtherAssetsMember 2023-01-31 0001748797 ifrs-full:LeaseLiabilitiesMember 2023-01-31 0001748797 dooo:CapitalStockMember 2023-01-31 0001748797 dooo:ContributedSurplusMember 2023-01-31 0001748797 ifrs-full:RetainedEarningsMember 2023-01-31 0001748797 dooo:TranslationOfForeignOperationsMember 2023-01-31 0001748797 ifrs-full:CashFlowHedgesMember 2023-01-31 0001748797 ifrs-full:EquityAttributableToOwnersOfParentMember 2023-01-31 0001748797 ifrs-full:NoncontrollingInterestsMember 2023-01-31 iso4217:CAD xbrli:pure xbrli:shares iso4217:EUR utr:Month utr:Year iso4217:USD iso4217:GBP iso4217:SEK iso4217:NOK iso4217:MXN iso4217:NZD iso4217:AUD iso4217:JPY iso4217:CAD xbrli:shares dooo:Segments dooo:Dividends iso4217:USD xbrli:shares utr:Y

SECURITIES AND EXCHANGE COMMISSION

| |

|

URSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR

| |

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR |

|

|

|

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

|

For the fiscal year ended |

|

|

|

Commission File Number: |

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English (if applicable))

(Province or other jurisdiction of incorporation or organization)

(Primary Standard Industrial Classification Code Number (if applicable))

(I.R.S. Employer Identification Number (if applicable))

(Address and telephone number of Registrant’s principal executive offices)

(Name, address (including zip code) and telephone number

(including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Subordinate Voting Shares |

|

|

|

The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

(Title of Class)

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

[

] Annual information

] Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

36,522,508

Subordinate Voting Shares and

42,384,200

Multiple Voting Shares

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

Registrant

was required to submit such files).

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

12b-2

of the Exchange Act.

Emerging growth company

[ ]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [

x

]

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. [ ]

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of

incentive

-based compensation received by any of the registrant’s executive officers during the relevant recovery period

pursuant

to

|

|

|

|

|

| Auditor Firm Id: 1208 |

|

Auditor Name: Deloitte LLP |

|

Auditor Location: Montreal, Canada |

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report on Form 40-F:

A. Annual Information Form

The Registrant’s Annual Information Form for the year ended January 31, 2023 is attached as Exhibit 99.1 to this Annual Report on Form 40-F and is incorporated by reference herein.

B. Audited Annual Financial Statements

The Registrant’s audited annual consolidated financial statements for the year ended January 31, 2023, including the report of the independent registered public accounting firm with respect thereto, are attached as Exhibit 99.2 to this Annual Report on Form 40-F and are incorporated by reference herein.

C. Management’s Discussion and Analysis

The Registrant’s Management’s Discussion and Analysis for the year ended January 31, 2023 is attached as Exhibit 99.3 to this Annual Report on Form 40-F and is incorporated by reference herein.

CONTROLS AND PROCEDURES

The Company’s President and Chief Executive Officer and the Chief Financial Officer are responsible for establishing and maintaining the Company’s disclosure controls and procedures as well as its internal control over financial reporting, as those terms are defined in National Instrument 52-109 – Certification of Disclosure in Issuers’ Annual and Interim Filings of the Canadian securities regulatory authorities and Rule 13a-15(e) and Rule 15d-15(e) under the U.S. Securities Exchange Act of 1934, as amended.

Disclosure controls and procedures

The President and Chief Executive Officer and the Chief Financial Officer have designed, or caused to be designed under their supervision, disclosure controls and procedures in order to provide reasonable assurance that:

| |

• |

|

material information relating to the Company has been made known to them; and |

| |

• |

|

information required to be disclosed in the Company’s filings is recorded, processed, summarized and reported within the time periods specified in securities legislation. |

An evaluation of the design and effectiveness of the Company’s disclosure controls and procedures was carried out under the supervision of the President and Chief Executive Officer and the Chief Financial Officer. Based on this evaluation, the President and Chief Executive Officer and the Chief Financial Officer concluded, as of January 31, 2023, that the Company’s disclosure controls and procedures were effective.

Management’s Report on Internal Control over Financial Reporting

The President and Chief Executive Officer and the Chief Financial Officer have designed, or caused to be designed under their supervision, such internal control over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Management’s projections of any evaluation of the effectiveness of internal control over financial reporting as to future periods are subject to the risks that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

An evaluation of the design and effectiveness of the Company’s internal controls over financial reporting was carried out under the supervision of the President and Chief Executive Officer and the Chief Financial Officer. In making this evaluation, the President and Chief Executive Officer and the Chief Financial Officer used the criteria set forth by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO) Internal Control – Integrated Framework (2013). Based on this evaluation, the President and Chief Executive Officer and the Chief Financial Officer concluded, as of January 31, 2023, that the Company’s internal controls over financial reporting were effective.

Our internal control over financial reporting as of January 31, 2023 has been audited by Deloitte LLP, independent registered public accounting firm, who also audited our consolidated financial statements for the year ended January 31, 2023. Deloitte LLP issued an unqualified opinion, as stated in their report, on the effectiveness of our internal control over financial reporting as of January 31, 2023.

Changes in internal control over financial reporting

There were no changes in the Company’s internal control over financial reporting during the three- and twelve-month periods ended January 31, 2023, that have materially affected, or are reasonably likely to materially affect the Company’s internal control over financial reporting.

Attestation report of registered public accounting firm

The attestation report of Deloitte LLP on management’s internal control over financial reporting is filed as Exhibit 99.2 to this annual report on Form 40-F, and is incorporated herein by reference.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Registrant sent during the year ended January 31, 2023 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE FINANCIAL EXPERT

The Registrant’s board of directors (the “Board of Directors”) has determined that it has at least one audit committee financial expert (as such term is defined in item 8(a) of General Instruction B to Form 40-F) serving on its audit committee (the “Audit Committee”). Michael Ross has been determined by the Board of Directors to be such audit committee financial expert and is independent (as such term is defined by the Nasdaq Stock Market’s corporate governance standards applicable to the Registrant).

Mr. Ross is a corporate director. He was Chief Financial Officer of Sesami Cash Management Technologies Corporation (“Sesami”) from 2022 to 2023. In this role, he was responsible for all financial activities, corporate development, and strategic planning. Prior to joining Sesami, Mr. Ross was Chief Financial Officer of Dollarama Inc. for over a decade. Prior to that, Mr. Ross was CFO of Sanimax Industries, a rendering services company, and spent over 20 years in senior financial roles in the television and broadcasting industry. He began his career as an auditor with Ernst & Young. Mr. Ross is a member of the board of directors of Pixcom Inc., the Fondation CHU Saint Justine and FEI – Quebec Chapter. He was previously a member of the board of directors of Investissement Québec, la Fondation Marie-Vincent, Fondation Dr Clown and Muscular Dystrophy Canada. Mr. Ross holds a Bachelor’s Degree in commerce and a graduate diploma in accounting from Concordia University. He received the Fellow of the Order distinction (FCPA) in 2012.

The SEC has indicated that the designation of Michael Ross as an audit committee financial expert does not make him an “expert” for any purpose, impose on him any duties, obligations or liability that are greater than the duties, obligations or liability imposed on him as a member of the Audit Committee and the Board of Directors in absence of such designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

CODE OF ETHICS

The Registrant has adopted a Code of Ethics that applies to all directors, officers and employees of the Registrant and its subsidiaries (collectively, “covered persons”). On December 5, 2022, the Registrant amended its Code of Ethics to, among other things, (i) offer real-life examples of common scenarios that covered persons may face and guidance for how to handle such scenarios, (ii) enhance the Registrant’s standards regarding, among other matters, ethical conduct and compliance with certain applicable governmental laws, rules or regulations, and (iii) include hyperlinks to the Registrant’s more detailed policies. A copy of the Code of Ethics, as amended, is filed as Exhibit 99.7 to this annual report on Form 40-F and can be obtained, free of charge, on the Registrant’s website (www.brp.com) or by contacting the Registrant at (450) 532-6154.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table sets out the fees billed to the Registrant by Deloitte LLP for professional services rendered for the fiscal period ended January 31, 2023 and January 31, 2022. During this period, Deloitte LLP was the Registrant’s only external auditor.

|

|

|

|

|

|

|

|

|

| (in Canadian dollars) |

|

Year ended

January 31, 2023 |

|

|

Year ended

January 31, 2022 |

|

| Audit Fees(1) |

|

$ |

4,541,500 |

|

|

$ |

4,521,837 |

|

| Audit-Related Fees(2) |

|

|

772,597 |

|

|

|

603,274 |

|

| Tax Fees(3) |

|

|

126,429 |

|

|

|

122,774 |

|

| All Other Fees(4) |

|

|

- |

|

|

|

- |

|

| Total Fees Paid |

|

$ |

5,440,526 |

|

|

$ |

5,247,885 |

|

Notes:

| |

1. |

“Audit Fees” include fees necessary to perform the annual audit or reviews of the consolidated financial statements. |

| |

2. |

“Audit-Related Fees” include fees for assurance and related services by the independent auditor that are reasonably related to the performance of statutory audit or review of the Company’s financial statements other than those included in “Audit Fees,” such as consultation on accounting and reporting matters. |

| |

3. |

“Tax Fees” include fees for all tax services other than those included in “Audit Fees” and “Audit-Related Fees.” This category includes fees for tax compliance, tax advice and tax planning. |

| |

4. |

“Other Fees” include fees for products and services provided by the independent auditor other than those included above, including consulting services. |

The Registrant’s Audit Committee is responsible for pre-approval of all audit services and permitted non-audit services provided to the Registrant or its subsidiaries by Deloitte LLP. The Audit Committee has delegated to the Chair of the Audit Committee, who is independent, the authority to act on behalf of the Audit Committee with respect to the pre-approval of all audit and permitted non-audit services provided by its external auditors from time to time. Any approvals by the Chair are reported to the full Audit Committee at its next meeting. All of the services described in footnotes 2, 3 and 4 under “Principal Accountant Fees and Services” above were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Registrant has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Ernesto M. Hernández, Katherine Kountze, Estelle Métayer, Nicholas Nomicos and Michael Ross.

CORPORATE GOVERNANCE

The Registrant is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and its Subordinate Voting Shares are listed on the Toronto Stock Exchange (“TSX”) and The Nasdaq Global Select Market (“Nasdaq”). Nasdaq Listing Rule 5615(a)(3) permits a foreign private issuer to follow its home country practices in lieu of certain requirements in the Nasdaq Listing Rules. The following is a summary of the significant ways in which the Registrant’s corporate governance practices differ from those required to be followed by U.S. domestic issuers under Nasdaq’s corporate governance standards. In addition, the Registrant is currently a “controlled company” as defined in the Nasdaq Listing Rules. Upon ceasing to be a “controlled company”, as a foreign private issuer, the Registrant intends to continue to follow Canadian corporate governance practices and TSX rules in lieu of the corporate governance requirements of Nasdaq. Except as described below, the Registrant is in compliance with the Nasdaq corporate governance standards in all significant respects.

| |

• |

|

Quorum Requirements. Rule 5620(c) of the Nasdaq Listing Rules requires that the minimum quorum requirement for a meeting of shareholders is 33.33% of the outstanding shares of its common voting stock. In addition, Rule 5620(c) requires that an issuer listed on Nasdaq state its quorum requirement in its by-laws. The Registrant follows the requirements of the Canada Business Corporations Act with respect to quorum requirements. The quorum requirement for a meeting of shareholders is set forth in the Registrant’s by-laws, which require not less than 25% of the issued and outstanding shares entitled to vote at the meeting to be present in person or represented by proxy and at least two persons entitled to vote at the meeting actually present. |

| |

• |

|

Shareholder Approval. Sections 5635(a) through (d) of the Nasdaq Listing Rules require an issuer to obtain |

| |

shareholder approval prior to certain issuances of securities, including (i) the acquisition of the stock or assets of another company; (ii) equity-based compensation of officers, directors, employees or consultants; (iii) a change of control; and (iv) private placements. The Registrant does not follow this rule. Instead, the Registrant complies with applicable TSX rules. Such rules require issuers to obtain shareholder approval prior to a distribution of common shares (other than in respect of public offerings) that involve the sale of more than 25% of the issuer’s outstanding common shares prior to the transaction. In addition, under TSX rules (1) the creation of, or certain material amendments to, equity compensation plans require shareholder approval and (2) the sale of common shares at a discount to officers and directors requires shareholder approval in specified circumstances. |

| |

• |

|

Compensation Committee. The Registrant follows applicable Canadian laws with respect to compensation consultants, legal counsel and other advisers to our Human Resources & Compensation Committee. Applicable Canadian securities legislation does not specifically require consideration of potential conflicts of interest on the part of compensation consultants, legal counsel and other advisers to the compensation committee, but best practices dictate disclosure of any such conflicts in the Registrant’s management information circular. |

| |

• |

|

Independent Directors. Nasdaq Listing Rule 5605(b) requires that a majority of a listed issuer’s board of directors be independent directors as defined in Nasdaq Listing Rule 5605(a)(2) for companies that are not controlled. Applicable TSX rules require only that listed issuers have at least two independent directors. Although the Registrant is a “controlled company” under Nasdaq rules, we follow applicable TSX requirements with respect to director independence. |

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F, the securities in relation to which the obligation to file an annual report on Form 40-F arises, or transactions in said securities.

B. Consent to Service of Process

The Registrant has previously filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X in connection with its Subordinate Voting Shares.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BRP INC. |

|

|

|

|

|

|

|

| Date: March 23, 2023 |

|

|

|

By: |

|

/s/ Sébastien Martel |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Sébastien Martel |

|

|

|

|

|

|

Title: |

|

Chief Financial Officer |

|

|

EXHIBIT INDEX

|

|

|

| No. |

|

Document |

| 99.1 |

|

Annual Information Form of the Registrant for the year ended January 31, 2023 |

| 99.2 |

|

Audited consolidated financial statements of the Registrant as at January 31, 2023 and 2022 and for the years ended January 31, 2023 and 2022. |

| 99.3 |

|

Management’s discussion and analysis of the Registrant for the year ended January 31, 2023. |

| 99.4 |

|

Fifth Amendment to Fourth Amended and Restated Term Loan Credit Agreement, dated as of June 10, 2022 among the Registrant, Bombardier Recreational Products Inc., the guarantors party thereto, Bank of Montreal, as administrative agent, and the lenders from time to time party thereto. |

| 99.5 |

|

Sixth Amendment to Fourth Amended and Restated Term Loan Credit Agreement, dated as of December 13, 2022 among the Registrant, Bombardier Recreational Products Inc., the guarantors party thereto, Bank of Montreal, as administrative agent, and the lenders from time to time party thereto. |

| 99.6 |

|

Seventh Amendment to Fourth Amended and Restated Term Loan Credit Agreement, dated as of March 10, 2023 among the Registrant, Bombardier Recreational Products Inc., the guarantors party thereto, Bank of Montreal, as administrative agent, and the lenders from time to time party thereto. |

| 99.7 |

|

Code of Ethics. |

| 23.1 |

|

Consent of Deloitte LLP. |

| 31.1 |

|

Certification of Chief Executive Officer pursuant to Rule 13(a)-14(a) or 15(d)-14 of the Securities Exchange Act of 1934. |

| 31.2 |

|

Certification of Chief Financial Officer pursuant to Rule 13(a)-14(a) or 15(d)-14 of the Securities Exchange Act of 1934. |

| 32.1 |

|

Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 32.2 |

|

Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101 |

|

Interactive Data File. |

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

Exhibit 99.1

BRP INC. ANNUAL INFORMATION FORM March 22, 2023 Fiscal year ended January 31, 2023

TABLE OF CONTENTS

|

|

|

|

|

| EXPLANATORY NOTES |

|

|

1 |

|

|

|

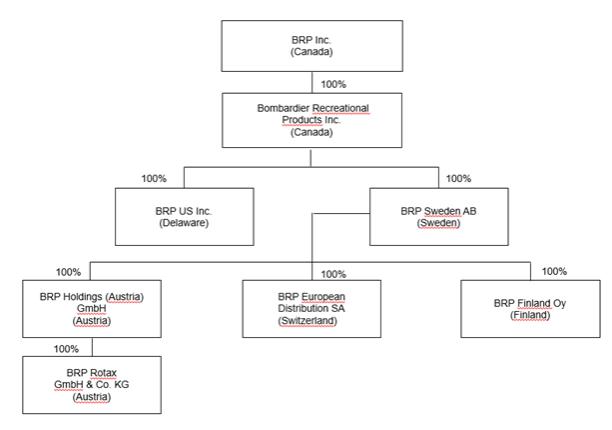

| CORPORATE STRUCTURE |

|

|

6 |

|

|

|

| GENERAL DEVELOPMENT OF THE BUSINESS |

|

|

7 |

|

|

|

| BUSINESS OF THE COMPANY AND ITS INDUSTRY |

|

|

9 |

|

|

|

| RISK FACTORS |

|

|

29 |

|

|

|

| DIVIDENDS |

|

|

57 |

|

|

|

| DESCRIPTION OF THE CAPITAL STRUCTURE |

|

|

57 |

|

|

|

| MARKET FOR SECURITIES AND TRADING PRICE AND VOLUME |

|

|

63 |

|

|

|

| DIRECTORS AND OFFICERS |

|

|

64 |

|

|

|

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

|

|

77 |

|

|

|

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

|

|

77 |

|

|

|

| INDEPENDENT AUDITOR, TRANSFER AGENT AND REGISTRAR |

|

|

78 |

|

|

|

| MATERIAL CONTRACTS |

|

|

78 |

|

|

|

| INTEREST OF EXPERTS |

|

|

80 |

|

|

|

| AUDIT COMMITTEE |

|

|

80 |

|

|

|

| ADDITIONAL INFORMATION |

|

|

83 |

|

|

|

| GLOSSARY OF TERMS |

|

|

83 |

|

|

|

| APPENDIX A CHARTER OF THE AUDIT COMMITTEE |

|

|

A-1 |

|

EXPLANATORY NOTES

The information in this annual

information form (the “Annual Information Form”) is stated as at January 31, 2023, unless otherwise indicated.

Unless

otherwise noted or required by the context, the “Company” and “BRP” refer to BRP Inc. and its direct and indirect subsidiaries and predecessors or other entities controlled by them.

Unless otherwise indicated, all references to “$” or “dollars” are to Canadian dollars, references to “US$” or

“U.S. dollars” are to United States dollars and references to “AUD$” are to Australian dollars. Amounts are stated in Canadian dollars unless indicated to the contrary.

All references to “Fiscal 2023” are to the Company’s fiscal year ended January 31, 2023, to “Fiscal 2022” are to

the Company’s fiscal year ended January 31, 2022 and to “Fiscal 2021” are to the Company’s fiscal year ended January 31, 2021.

All references to “season” throughout this Annual Information Form have different meanings depending on the applicable type of

vehicle and region. Please refer to the following table for a description of such meanings:

|

|

|

| Australia |

|

|

| Boats |

|

12 months ended September 30 |

|

| All other Regions and Territories |

|

|

| ATVs and SSVs |

|

12 months ended June 30 |

|

|

| Three-wheeled on-road vehicles |

|

12 months ended October 31 |

|

|

| Snowmobiles |

|

12 months ended March 31 |

|

|

| PWCs and pontoons |

|

12 months ended September 30 |

|

|

| Outboard engines |

|

12 months ended July 31 |

|

|

| Boats |

|

12 months ended July 31 |

Any references to seasonal data for multiple products refer to each product’s respective season for the

specific year indicated.

Certain capitalized terms and phrases used in this Annual Information Form are defined in the “Glossary of

Terms” beginning on page 83.

Forward-Looking Statements

Certain statements in this Annual Information Form about the Company’s current and future plans, including statements relating to its 5-year plan referred to as “Mission 2025”, prospects, expectations, anticipations, estimates and intentions, results, levels of activity, performance, objectives, targets, goals, achievements, including

the Company’s environmental, social and governance (“ESG”) targets, goals and initiatives set forth under its CSR25 program and announced intention to electrify its existing product lines and launch new electric product lines,

priorities and strategies, financial position, market position, capabilities, competitive strengths and beliefs, the prospects and trends of the industries in which the Company operates, the expected growth in demand for products and services in the

markets in which the Company competes, research and product development activities, including projected design, characteristics, capacity or performance of future products and their expected scheduled entry to market, expected financial requirements

and the availability of capital resources and liquidities, or any other future events or developments and other statements in this Annual Information Form that are not historical facts constitute forward-looking statements within the meaning of

applicable securities laws. The words “may”, “will”, “would”, “should”, “could”, “expects”, “forecasts”, “plans”, “intends”, “trends”,

“indications”, “anticipates”, “believes”, “estimates”, “outlook”, “predicts”, “projects”, “likely” or “potential” or the negative or other variations of these

words or other comparable words or phrases, are intended to identify forward-looking statements.

1

2023 Annual Information Form

Forward-looking statements are presented for the purpose of assisting readers in

understanding certain key elements of the Company’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of the Company’s business and anticipated operating environment.

Readers are cautioned that such information may not be appropriate for other purposes; readers should not place undue reliance on forward-looking statements contained herein. Forward-looking statements, by their very nature, involve inherent risks

and uncertainties and are based on a number of assumptions, both general and specific. The Company cautions that its assumptions may not materialize and that global economic and political conditions, combined with one or more of the risks and

uncertainties discussed herein, may render such assumptions, although believed reasonable at the time they were made, inaccurate. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks,

uncertainties and other factors which may cause the actual results or performance of the Company or the industry to be materially different from the outlook or any future results or performance implied by such statements.

In addition, many factors could cause the Company’s actual results, level of activity, performance or achievements or future events or

developments to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the following factors, which are discussed in greater detail under the heading “Risk Factors” of this

Annual Information Form: the impact of adverse economic conditions including in the context of recent significant increases of interest and inflation rates; any decline in social acceptability of the Company and its products, including in connection

with the broader adoption of electrical or low-emission products; fluctuations in foreign currency exchange rates; high levels of indebtedness; any unavailability of additional capital; any supply problems,

termination or interruption of supply arrangements or increases in the cost of materials, including as a result of the military conflict between Russia and Ukraine; the inability to attract, hire and retain key employees, including members of the

Company’s management team or employees who possess specialized market knowledge and technical skills; any failure of information technology systems, security breach or cyber-attack, or difficulties with the implementation of new systems,

including the Company’s new ERP; the Company’s reliance on international sales and operations; the Company’s inability to successfully execute its growth strategy; unfavourable weather conditions and climate change more generally; the

Company’s seasonal nature of its business and some of its products; the Company’s reliance on a network of independent dealers and distributors; any inability of dealers and distributors to secure adequate access to capital; any inability

to comply with product safety, health, environmental and noise pollution laws; the Company’s large fixed cost base; any failure to compete effectively against competitors or any failure to meet consumers’ evolving expectations; any failure