UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Aggregate market value of registrant's common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant's common stock on June 30, 2022 (the last business day of the registrant's most recently completed second quarter) as reported by Nasdaq Global Market on that date was $

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of February 9, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2023 Annual Meeting of Stockholders, which is to be filed with the Securities and Exchange Commission within 120 days of the registrant’ fiscal year ended December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

3 |

|

Item 1A. |

22 |

|

Item 1B. |

61 |

|

Item 2. |

61 |

|

Item 3. |

61 |

|

Item 4. |

61 |

|

|

|

|

PART II |

|

|

Item 5. |

62 |

|

Item 6. |

63 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 |

Item 7A. |

74 |

|

Item 8. |

75 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

104 |

Item 9A. |

104 |

|

Item 9B. |

104 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

104 |

|

|

|

PART III |

|

|

Item 10. |

105 |

|

Item 11. |

105 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

105 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

105 |

Item 14. |

105 |

|

|

|

|

PART IV |

|

|

Item 15. |

106 |

|

Item 16 |

106 |

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this Annual Report) contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this Annual Report are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements about:

The forward-looking statements in this Annual Report are only predictions and are based largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Such risks and uncertainties include those described throughout this Annual Report, including in the sections titled “Risk Factors” under Part I, Item 1A below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Part II, Item 7 below.

The forward-looking statements in this Annual Report are based upon information available to us as of the date of this Annual Report and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These forward-looking statements, like all statements in this Annual Report, speak only as of their date, and except as required by applicable law, we undertake no obligation to update or revise these statements, whether as a

1

result of any new information, future developments or otherwise. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Unless the context requires otherwise, all references in this Annual Report to “we,” “us,” “our,” “Outset” and “the “Company” refer to Outset Medical, Inc.

We have proprietary rights to trademarks, trade names and service marks appearing in this Annual Report that are important to our business. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this Annual Report are without the ® and ™ symbols, but such references are not intended to indicate that we will not assert our rights or the rights of the applicable licensors in these trademarks, service marks and trade names. All trademarks, trade names and service marks appearing in this Annual Report are the property of their respective owners.

2

PART I

Item 1. Business.

Our Company

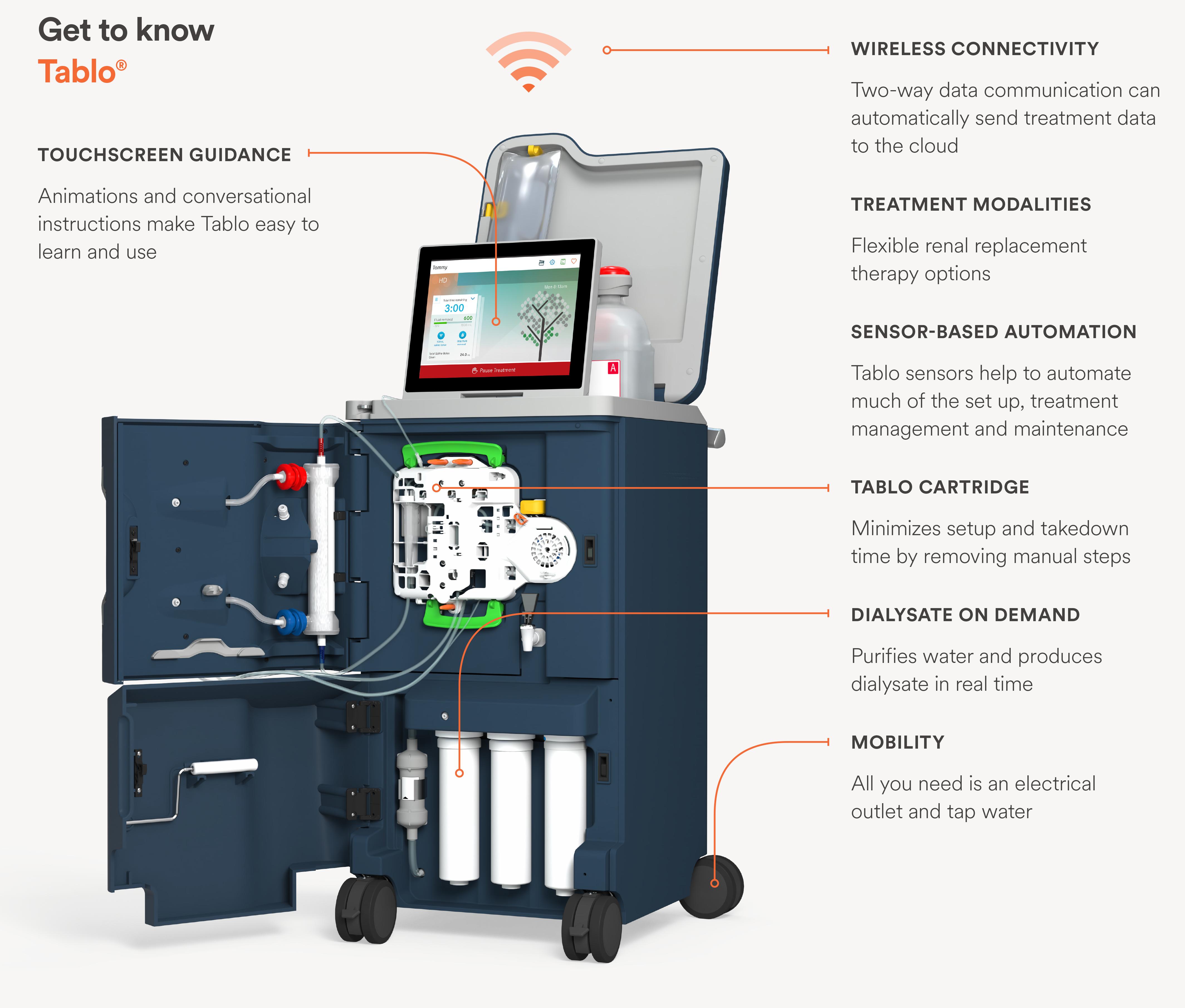

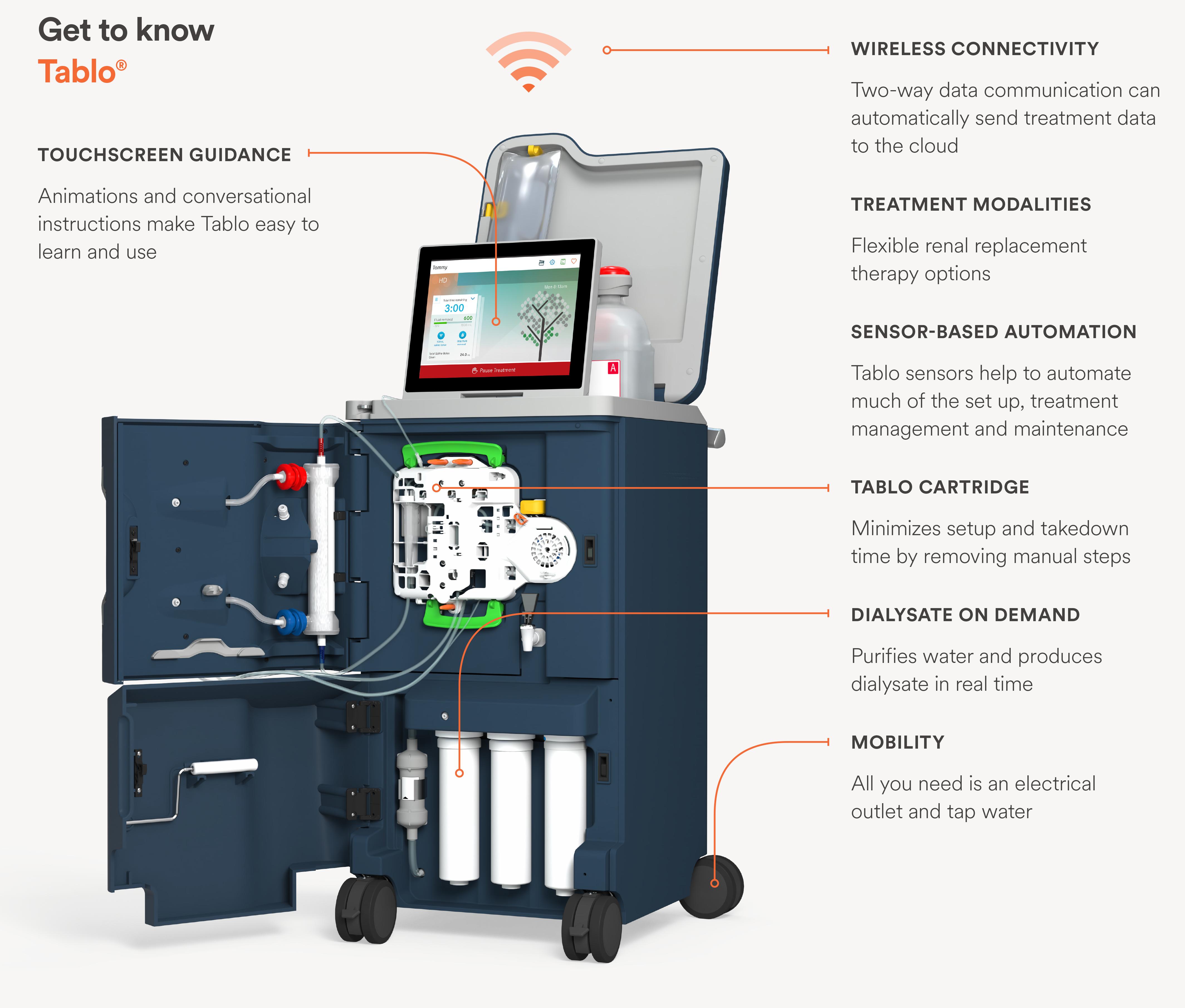

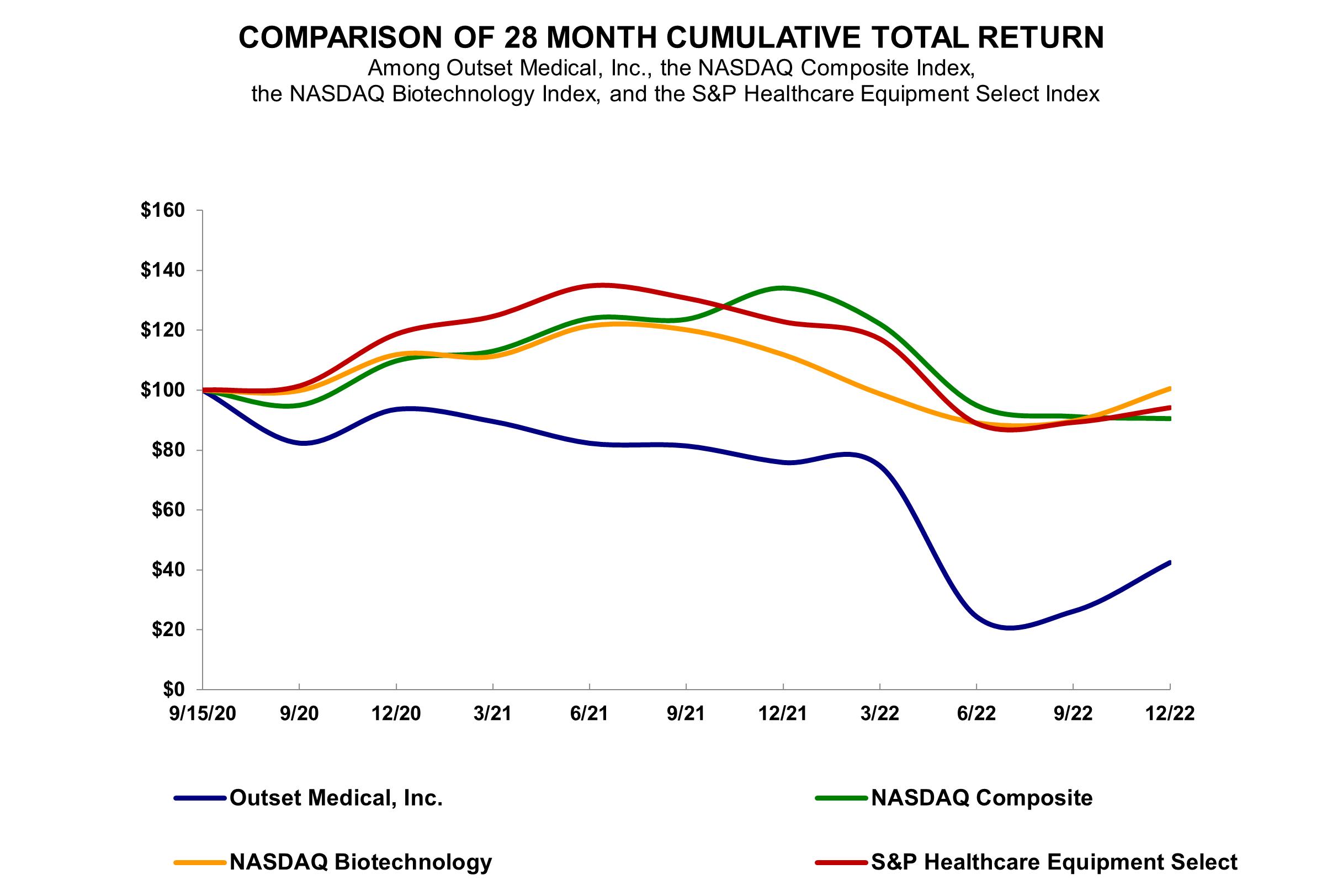

Outset is a medical technology company pioneering a first-of-its-kind technology to reduce the cost and complexity of dialysis. We believe the Tablo® Hemodialysis System represents a significant technological advancement that transforms the dialysis experience for patients and operationally simplifies it for providers. We designed Tablo from the ground up to be a single enterprise solution that can be utilized across the continuum of care, allowing dialysis to be delivered anytime, anywhere and by virtually anyone. Tablo is currently cleared by the U.S. Food and Drug Administration (FDA) for use in the hospital, clinic or home setting. Our technology is designed to elevate the dialysis experience for patients, and help providers overcome traditional care delivery challenges. Our focus on flexibility, ease of use and user experience translates to meaningfully reduced training times and fixed infrastructure requirements. Requiring only an electrical outlet and tap water to operate, Tablo frees patients and providers from the burdensome infrastructure required to operate traditional dialysis machines. The integration of water purification and on-demand dialysate production in a single 35-inch compact console enables Tablo to serve as a dialysis clinic on wheels. Tablo leverages cloud technology, making it possible for providers to monitor devices and treatments remotely, perform patient and population analytics and automate clinical recordkeeping. With a simple-to-use touchscreen interface, two-way wireless data transmission and a proprietary data analytics platform, Tablo is a new holistic approach to dialysis care. Unlike traditional hemodialysis machines, which have limited clinical versatility across care settings, Tablo can be used seamlessly across multiple care settings and a wide range of clinical applications.

We have generated meaningful evidence to demonstrate that providers can realize significant operational efficiencies, including reducing the cost of their dialysis programs by up to 80% in the intensive care unit (ICU). In addition, Tablo has been shown to deliver robust clinical care. In studies and surveys we have conducted, patients have reported quality of life benefits on Tablo compared to other dialysis machines. We believe Tablo empowers patients, who have traditionally been passive recipients of care, to regain agency and ownership of their treatment.

Kidney failure can be temporary and occur spontaneously due to an underlying medical condition, as is the case in acute kidney injury (AKI), or can worsen gradually over time, as is the case in chronic kidney disease (CKD), which may result in end-stage renal disease (ESRD). Kidney failure is commonly managed with hemodialysis, a procedure by which waste products and excess fluid are directly removed from a patient’s blood using an external dialysis machine. ESRD patients require complex management and the cost burden of administering dialysis is significant. Hemodialysis can be performed in multiple care settings, including the hospital, clinic or the patient’s home. Typically, different types of dialysis machines are used in different care settings and for different clinical needs. Tablo is an enterprise dialysis solution that allows providers to standardize to a single technology platform.

Driving adoption of Tablo in the acute setting has been our primary focus since Tablo’s clearance by the FDA for use in an acute or chronic care facility in September 2014. We have invested in growing our economic and clinical evidence, built veteran field service, sales and clinical support teams with significant expertise, and implemented a comprehensive training and customer experience program. Our experience in the acute market has demonstrated Tablo’s clinical flexibility and operational versatility, while also delivering meaningful cost savings to the providers. We plan to continue leveraging our commercial infrastructure, including our sales, field service and marketing teams, to broaden our installed base in the acute care market, as well as driving utilization and fleet expansion with our existing customers.

Tablo is also utilized for home-based dialysis. In March 2020, Tablo was cleared by the FDA for patient use in the home. We believe our ability to reduce training time, patient dropout, and supplies and infrastructure required to deliver dialysis in the home can drive efficiency and economic improvements to the home care model. In our home investigational device exemption (IDE) trial, patients reported specific quality of life improvements compared to their experience on the incumbent home dialysis machine. To penetrate this market successfully, we continue to make investments in, and focus on refining our home distribution, logistics, service and support systems to help ensure they continue to scale. We are also working with providers, patients and payors to increase awareness and adoption of transitional care units (TCUs) as a bridge to home based therapy. To demonstrate the cost advantages of Tablo in the home setting, we are continuing to collect additional patient clinical experience and outcomes data.

The Tablo Hemodialysis System (Tablo)

Tablo is an FDA-cleared single enterprise solution for hemodialysis, comprised of a compact console with integrated water purification, on-demand dialysate production and advanced software and connectivity capabilities. We designed Tablo from the ground up to be a single enterprise solution that can be utilized across the continuum of care, allowing dialysis to be delivered anytime, anywhere, and by virtually anyone. Unlike traditional hemodialysis machines, Tablo can be used seamlessly across multiple

3

care settings and a wide range of clinical applications, all with the benefit of remote system management, monitoring and maintenance through two-way wireless data transmission capabilities.

The Tablo system is comprised of the following components:

4

Tablo Data Ecosystem

Tablo's two-way wireless data transmission and connectedness help reduce maintenance costs and enable ongoing system improvements. This is all made possible by our growing team of experienced software, data science, and machine learning engineers.

Tablo leverages cloud technology to make it possible for providers to monitor devices and treatments remotely, perform patient and population analytics, and automate clinical recordkeeping. Due to Tablo’s wireless connectivity, we can release new features and enhancements through over-the-air (OTA) updates, without requiring hardware changes or interventions from field service engineers (FSEs). We also release user trainings this way, which means that customers can train and upgrade their device on their own schedule. We have used these OTA updates to add important new features designed to extend Tablo’s clinical applicability in addition to updates designed to enhance device uptime by enabling remote diagnostics and support. We believe these OTA updates help Tablo get smarter over time.

Tablo’s connectedness also allows it to continually stream to the cloud over 500,000 device performance data points after every treatment. We use this data, in conjunction with our diagnostic and predictive algorithms, to determine failure types and, in some instances, predict failures before they occur. Equipped with this information, our FSEs can visit sites knowing they have the correct parts and consumables to address the issues reported, and those that are yet to come. In effect, this contributes to a reduction in service hours and an increase in device uptime.

The above functionality is enabled through the following key platforms: TabloHub®, a customer-facing portal; MyTablo, a patient-facing portal; and TabloDash, an internal data analytics platform.

TabloHub

TabloHub is designed to be a one-stop shop for providers that allows customers to monitor treatments in real-time across their fleet, visualize historical treatment records and statistics, see system disinfection and service records, search documentation, read news about Tablo, and perform various trainings. It is accessible from virtually anywhere, using a smart phone, tablet, or a web browser.

Through the Tablo application programming interface (API), providers can integrate Tablo with their Electronic Medical Records (EMR) to receive treatment data and flowsheets automatically to reduce manual record keeping, which in turn, helps reduce record-entry errors and auditing risks. Tablo’s two-way wireless transmission delivers data intended to be compliant with the federal Health Insurance Portability and Accountability Act (HIPAA) to the provider without any need for additional equipment. It connects to the cloud using a standard Ethernet or Wi-Fi connection. TabloHub strengthens care, simplifies meeting documentation requirements, and makes system management easy.

MyTablo

MyTablo is a version of TabloHub designed for patients who are dialyzing at home or performing self-care at a clinic. Through the MyTablo portal, patients have the ability to access training materials and download their own treatment reports.

TabloDash

TabloDash is a powerful data analytics platform used by Outset team members to analyze diagnostic data produced by connected devices across all fleets, data from our customer relationship management system, and various other sources. Tablo captures more than 500,000 machine performance data points during every treatment, which is then used to fuel data analytics and machine learning algorithms that drive our research and development pipeline.

Through TabloDash, data can be visualized, graphed, aggregated, and queried to answer complex business intelligence questions, and build performance monitoring dashboards. For example, our service team uses TabloDash to analyze field response times, categorize failures by types, diagnose specific device issues, and monitor customer fleet performance.

The real-time nature of TabloDash allows our FSEs to troubleshoot and adjust a device remotely during a call with a customer and avoid the need to send FSEs to a site unnecessarily. If it is necessary to dispatch an FSE, we can use TabloDash to help ensure they arrive with the correct parts to complete the repair, and are also able to address any preventive maintenance predicted by our algorithms, all during the same visit.

TabloDash is the linchpin that helps us optimize the cost of service while increasing the quality of service by reducing unnecessary visits, time spent on-site, and device downtime.

With the above features and benefits in mind, we believe the Tablo Hemodialysis System is well-positioned as a differentiated, all-in-one solution enabling transformational dialysis across the continuum of care, from hospital to home, in one of the largest, most expensive, least changed areas of healthcare.

5

Competition

There are a number of dialysis machine manufacturers in the United States, Europe and Asia. Notable competitors in the United States include Fresenius Medical Care AG & Co. KGaA (Fresenius), Baxter International, Inc. (Baxter) and B. Braun. Medical Inc. (B. Braun). In addition, Quanta Dialysis Technologies Ltd’s (Quanta) dialysis system received FDA 510(k) clearance for use in acute and/or chronic settings. Of these competitors, Fresenius is the largest, and is vertically integrated, both manufacturing dialysis products and operating dialysis clinics along with providing inpatient dialysis services to hospitals and health systems. Additionally, companies with dialysis machine development programs include Medtronic plc (Medtronic). With the exception of Quanta, our competitors are significantly larger than us with greater financial, marketing, sales and personnel resources, greater brand recognition and longer operating histories. We believe our ability to compete effectively will be dependent on our ability to build the commercial infrastructure necessary to effectively demonstrate the value of Tablo, maintain and improve product quality and feature functionality, build the infrastructure to support the operating needs of the business and achieve cost reductions.

Acute Care

While historically customers in this market have focused on machine functionality and price, we believe they are increasingly focused on the total cost of patient care, which favors technology that can provide clinical versatility and improve operational efficiency. In the acute care setting, the dialysis machine manufacturers that we compete with include Fresenius, Baxter and B. Braun. We compete primarily on the basis that Tablo is designed to drive operational efficiency through ease of use and cost reduction by reducing infrastructure and supplies cost.

Further, hospital customers in this market have generally outsourced their dialysis services to third party providers, for example, Fresenius, rather than offering on-site inpatient dialysis services on their own. We may also compete against these outsourced dialysis providers. In such instances, we believe our ability to compete effectively will depend on our ability to demonstrate Tablo’s economic, clinical, compliance and operational benefits relative to outsourcing dialysis services.

Home Care

We believe competition in the home setting is based on a system’s clinical performance, its cost efficiency, its ease of use and patient preference. In the home hemodialysis setting, competitors include Fresenius (through its acquisition of NxStage). We believe through Tablo’s unique advantages it is easier and faster for patients to learn, and simpler for patients to operate at home, which may position us well against existing competitors. We believe these factors will reduce patient burn-out, thereby extending patient retention, increasing home hemodialysis growth and improving associated margin for providers. We do not consider peritoneal dialysis (PD) to be competitive to our products given the differences in treatment modality, that PD is clinically limited due to patients with certain pre-existing conditions such as congestive heart failure and obesity and that PD is regarded as a “temporary” modality since approximately 80% of patients are on the therapy for less than three years.

Intellectual Property

Our success depends in part on our ability to protect our proprietary technology and intellectual property rights. We rely on a combination of federal, state, common law and international rights, as well as contractual restrictions, to protect our intellectual property.

We seek patent protection for certain of our key innovations, processes and other inventions. We pursue the registration of our trademarks, service marks and domain names in the United States and in certain other locations. We control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with third parties. Our intellectual property includes specific algorithms for the Tablo console, including those related to pressure sensors, blood leakage and pump control loops.

Patents

As of December 31, 2022, we had 21 issued U.S. patents, as well as 10 pending U.S. patent applications. We had an aggregate of 39 issued patents in Australia, Canada, China, France, Germany, Hong Kong, Japan, Spain, Sweden and the United Kingdom, as well as 19 pending patent applications in Australia, Brazil, Canada, China, the European Patent Office, Hong Kong, Japan, and under the Patent Cooperation Treaty. Some of our patents and other intellectual property cover aspects of Tablo that enable it to be used by anyone, including the patient, through the automation of functions formerly performed by dialysis center technicians using traditional dialysis systems. Our proprietary data ecosystem provides what we believe is a unique way of connecting providers and patients for real-time treatment monitoring, automated treatment documentation, and simplified compliance and record-keeping.

Our patents expire between October 2025 and December 2039. The term of individual patents depends upon the legal term for patents in the countries in which they are granted. In most countries, including the United States, the patent term is 20 years from the earliest claimed filing date of a non-provisional patent application in the applicable country. In the United States, a patent’s term may, in certain cases, be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the United

6

States Patent and Trademark Office (USPTO) in examining and granting a patent, or it may be shortened if a patent is terminally disclaimed over a commonly owned patent or a patent naming a common inventor and having an earlier expiration date. We cannot be sure that our pending patent applications or future patent applications will result in issued patents or that any patents that have issued or might issue in the future will protect our current or future products, provide us with any competitive advantage or will not be challenged, invalidated, or circumvented.

Various aspects of Tablo, including, without limitation, sensor technology, connectivity, automation, analytics and interface are covered by software, algorithms, processes, trade secret or other proprietary rights. We protect our trade secrets through a variety of measures, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to our proprietary information. Trade secrets and proprietary information can be difficult to protect, however. While we have confidence in the measures we take to protect and preserve our trade secrets and proprietary information, such measures can be breached, and we may not have adequate remedies for any such breach. In addition, our trade secrets and proprietary information may otherwise become known or be independently discovered by competitors.

There is no active patent litigation involving any of our patents, and we have not received any notices claiming that our activities infringe a third party’s patent.

Manufacturing, Supply Chain and Logistics

We direct the manufacturing and supporting supply chain, distribution and logistics for the Tablo console, the Tablo cartridge and other consumables (electrolyte concentrates and plastic tubing that transports the concentrates into Tablo to enable on-demand dialysate production). We partner with several different contract manufacturers in the assembly and testing of our products and operate under a Quality Management System that has been certified to ISO 13485 Medical Device Quality Management System standard.

Tablo Console

We established a manufacturing facility in Tijuana, Mexico, which enabled us to fully insource Tablo console manufacturing during 2021. We are operating in Mexico in collaboration with TACNA Services (TACNA), a well-known outsourced business administration service provider that provides all the back-office and facility infrastructure support, allowing us to focus on our core competencies – design and high-volume manufacturing for reliability and cost reduction. Tablo consoles manufactured in our Mexico facility are tested at the facility using an integrated system testing protocols designed by us, and then direct-shipped to our distribution centers, using a network of short-haul and long-haul freight forwarders optimized for time and cost efficiency.

Pursuant to the terms of our manufacturing services agreement with TACNA (the TACNA Agreement), TACNA provides support services in connection with our manufacturing activities in Mexico. Under the TACNA Agreement, TACNA hires employees as requested by us and is responsible for human resource functions including maintenance of employee files and reports. TACNA is also responsible for performing internal statutory accounting and payroll services, as well as payables processing. Additional services that TACNA is obligated to provide under the TACNA Agreement include interfacing with both Mexican and U.S. governmental agencies, preparing import-export documentation, coordinating shipment of equipment, raw materials and finished products, and obtaining necessary permits and licenses required in Mexico. Under the TACNA Agreement, TACNA’s services are generally performed under a pass-through cost model under which costs incurred are approved by us. We are also obligated to pay TACNA fees based on the number of employees under the TACNA Agreement. The TACNA Agreement has an initial three-year term and will continue thereafter until terminated by us or TACNA in accordance with the terms of the TACNA Agreement.

The number of suppliers required for Tablo console production is in excess of 200 worldwide. We consider a discrete number of these suppliers, located in the United States, Mexico, Europe and Asia, as critical providers of components such as pumps, motors, valves and PCBA boards. We are currently undertaking a second source qualification process for the majority of these critical components. Where second sourcing is unavailable or infeasible and likely to remain so, we have sought to mitigate supply interruption risks with increased levels of safety stock.

Tablo Cartridge

Until recently, the Tablo cartridge was manufactured exclusively by our two contract manufacturing partners. During 2022, we moved production of a majority of Tablo cartridges to a manufacturing site in Tijuana, Mexico in partnership with Providien Medical (Providien), in order to help us achieve cost reductions through lower freight costs and mitigate against global supply chain interruption. Providien, part of Carlisle Companies Incorporated, offers expertise in high volume disposable assembly services. Tablo cartridges produced at this facility undergo sterilization using electronic beam (e-beam) technology, which is an environmentally friendly sterilization method for which we received 510(k) clearance from the FDA in November 2021.

During 2022, we also continued to produce a portion of Tablo cartridges through Infus Medical Co. Ltd. (Infus), a contract manufacturer with two facilities in Thailand. As part of this arrangement, we direct the oversight of the raw materials sourcing, selection and planning while Infus takes receipt of the Tablo cartridge components, and performs assembly, testing and Ethylene

7

Oxide sterilization before shipment. Tablo cartridges produced through Infus have shipped primarily via ocean freight, though in times of peak demand or other supply chain constraints, we have shipped by air freight. Our team inspects the product before releasing it for shipment.

More recently, we also initiated production of Tablo cartridges in-house at our manufacturing facility in Tijuana, Mexico that we operate in collaboration with TACNA. We intend to increase the quantity of Tablo cartridges produced at this facility as we ramp our cartridge manufacturing capabilities during the remainder of the year, while continuing to rely on one or more of our contract manufacturers as additional sources for cartridge production. We expect that insourcing Tablo cartridges will ultimately further our long-term gross margin expansion and supply continuity strategies and improve the flexibility of our operations. Tablo cartridges produced at our facility are sterilized using e-beam technology.

The various components for the Tablo cartridge are manufactured by approximately 30 different single-source suppliers located in various countries including the United States, Mexico, Europe and Asia.

In addition to the Tablo cartridge, each treatment requires a concentrated container of bicarbonate and a concentrated container of acid, and two small plastic straws that draw the appropriate amount of the concentrates into the Tablo console in order to produce dialysate on demand.

Government Regulation

United States Food and Drug Administration

In the United States, our products are subject to regulation by the FDA as medical devices pursuant to the Federal Food Drug and Cosmetic Act (FDCA). The FDA regulates the development, design, non-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, adverse event reporting, advertising, promotion, marketing and distribution, and import and export of medical devices to ensure that medical devices distributed domestically are safe and effective for their intended uses and otherwise meet the requirements of the FDCA.

FDA Premarket Clearance and Approval Requirements

Unless an exemption applies, each medical device commercially distributed in the United States requires either FDA clearance of a 510(k) premarket notification, approval of a de novo application, or approval of a premarket approval (PMA). Under the FDCA, medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to ensure its safety and effectiveness. Class I includes devices with the lowest risk to the patient and are those for which safety and effectiveness can be assured by adherence to the FDA’s General Controls for medical devices, which include compliance with the applicable portions of the Quality System Regulation (QSR) facility registration and product listing, reporting of adverse medical events, and truthful and non-misleading labeling, advertising, and promotional materials. Class II devices are subject to the FDA’s General Controls, and special controls as deemed necessary by the FDA to ensure the safety and effectiveness of the device. These special controls can include performance standards, post-market surveillance, patient registries and FDA guidance documents.

While most Class I devices are exempt from the 510(k) premarket notification requirement, manufacturers of most Class II devices are required to submit to the FDA a premarket notification under Section 510(k) of the FDCA requesting permission to commercially distribute the device. The FDA’s permission to commercially distribute a device subject to a 510(k) premarket notification is generally known as 510(k) clearance. Devices deemed by the FDA to pose the greatest risks, such as life sustaining, life supporting or some implantable devices, or devices that have a new intended use, or use advanced technology that is not substantially equivalent to that of a legally marketed device, are placed in Class III, requiring approval of a PMA. Some pre-amendment devices are unclassified, but are subject to FDA’s premarket notification and clearance process in order to be commercially distributed. Tablo is a Class II device subject to 510(k) clearance.

510(k) Clearance Marketing Pathway

To obtain 510(k) clearance, we must submit to the FDA a premarket notification submission demonstrating that the proposed device is “substantially equivalent” to a predicate device already on the market. A predicate device is a legally marketed device that is not subject to PMA, i.e., a device that was legally marketed prior to May 28, 1976 (pre-amendments device) and for which a PMA is not required, a device that has been reclassified from Class III to Class II or I, or a device that was found substantially equivalent through the 510(k) process. The FDA’s 510(k) clearance process usually takes from three to twelve months, but often takes longer. The FDA may require additional information, including clinical data, to make a determination regarding substantial equivalence. In addition, the FDA collects user fees for certain medical device submissions and annual fees for medical device establishments.

If the FDA agrees that the device is substantially equivalent to a predicate device currently on the market, it will grant 510(k) clearance to commercially market the device. If the FDA determines that the device is “not substantially equivalent” to a previously cleared device, the device is automatically designated as a Class III device. The device sponsor must then fulfill more rigorous PMA

8

requirements, or can request a risk-based classification determination for the device in accordance with the “de novo” process, which is a route to market for novel medical devices that are low to moderate risk and are not substantially equivalent to a predicate device. If a de novo request is granted, the device may be legally marketed and a new classification is established. If the device is classified as Class II, the device may serve as a predicate for future 510(k) submissions. If the device is not approved through de novo review, then it must go through the standard PMA process for Class III devices.

After a device receives 510(k) marketing clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change or modification in its intended use, will require a new 510(k) clearance or, depending on the modification, PMA approval. The FDA requires each manufacturer to determine whether the proposed change requires submission of a 510(k) or a PMA in the first instance, but the FDA can review any such decision and disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination, the FDA can require the manufacturer to cease marketing and/or request the recall of the modified device until 510(k) marketing clearance or PMA approval is obtained. Also, in these circumstances, the manufacturer may be subject to significant regulatory fines or penalties.

PMA Approval Pathway

Class III devices require approval of a PMA before they can be marketed, although some pre-amendment Class III devices for which the FDA has not yet required a PMA are cleared through the 510(k) process. The PMA process is more demanding than the 510(k) premarket notification process. In a PMA application, the manufacturer must demonstrate that the device is safe and effective, and the PMA application must be supported by extensive data, including data from preclinical studies and human clinical trials. The PMA application must also contain a full description of the device and its components, a full description of the methods, facilities, and controls used for manufacturing, and proposed labeling. Following receipt of a PMA application, the FDA determines whether the application is sufficiently complete to permit a substantive review. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review of a PMA application, although in practice, the FDA’s review often takes significantly longer, and can take up to several years. An advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA may or may not accept the panel’s recommendation. In addition, the FDA will generally conduct a pre-approval inspection of the applicant or its third-party manufacturers’ or suppliers’ manufacturing facility or facilities to ensure compliance with the QSR. PMA devices are also subject to the payment of user fees.

The FDA will approve the new device for commercial distribution if it determines that the data and information in the PMA application constitute valid scientific evidence and that there is reasonable assurance that the device is safe and effective for its intended use(s). A PMA may include post-approval conditions intended to ensure the safety and effectiveness of the device, including, among other things, restrictions on labeling, promotion, sale and distribution, and collection of long-term follow-up data from patients in the clinical study that supported the PMA or requirements to conduct additional clinical studies post-approval. The FDA may condition PMA approval on some form of post-market surveillance when deemed necessary to protect the public health or to provide additional safety and efficacy data for the device in a larger population or for a longer period of use. In such cases, the manufacturer might be required to follow certain patient groups for a number of years and to make periodic reports to the FDA on the clinical status of those patients. Failure to comply with the conditions of approval can result in material adverse enforcement action, including withdrawal of the approval.

Certain changes to an approved device, such as changes in manufacturing facilities, methods, or quality control procedures, or changes in the design performance specifications, which affect the safety or effectiveness of the device, require submission of a PMA supplement. PMA supplements often require submission of the same type of information as a PMA, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA and may not require as extensive clinical data or the convening of an advisory panel. Certain other changes to an approved device require the submission of a new PMA, such as when the design change causes a different intended use, mode of operation, and technical basis of operation, or when the design change is so significant that a new generation of the device will be developed, and the data that were submitted with the original PMA are not applicable for the change in demonstrating a reasonable assurance of safety and effectiveness. None of our products are currently marketed pursuant to a PMA.

De novo Classification

Medical device types that the FDA has not previously classified as Class I, II or III are automatically classified into Class III regardless of the level of risk they pose. To market low to moderate risk medical devices that are automatically placed into Class III due to the absence of a predicate device, a manufacturer may request a de novo down-classification. This procedure allows a manufacturer whose novel device is automatically classified into Class III to request classification of its medical device into Class I or Class II on the basis that the device presents low or moderate risk, rather than requiring the submission and approval of a PMA application. A medical device may be eligible for de novo classification if the manufacturer first submitted a 510(k) premarket notification and received a determination from the FDA that the device was not substantially equivalent or a manufacturer may request

9

de novo classification directly without first submitting a 510(k) premarket notification to the FDA and receiving a not substantially equivalent determination. The FDA is required to classify the device within 120 calendar days following receipt of the de novo application, although in practice, the FDA’s review may take significantly longer. During the pendency of the FDA’s review, the FDA may issue an additional information letter, which places the de novo request on hold and stops the review clock pending receipt of the additional information requested. In the event the de novo requestor does not provide the requested information within 180 calendar days, the FDA will consider the de novo request to be withdrawn. If the manufacturer seeks reclassification into Class II, the manufacturer must include a draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and effectiveness of the medical device. In addition, the FDA may reject the de novo request for classification if it identifies a legally marketed predicate device that would be appropriate for a 510(k) or determines that the device is not low to moderate risk or that general controls would be inadequate to control the risks and special controls cannot be developed. In the event the FDA determines the data and information submitted demonstrate that general controls or general and special controls are adequate to provide reasonable assurance of safety and effectiveness, the FDA will grant the de novo request for classification. When the FDA grants a de novo request for classification, the device is granted marketing authorization and further can serve as a predicate for future devices of that type, through a 510(k) premarket notification.

Breakthrough Device Program

The FDA has implemented a Breakthrough Device Program that is intended to help patients receive more timely access to breakthrough medical technologies that have the potential to provide more effective treatment or diagnosis for life-threatening or irreversibly debilitating diseases or conditions. A device also must meet one of the following criteria: (i) it represents breakthrough technology; (ii) there is no approved or cleared alternative; (iii) it offers significant advantages over existing cleared or approved devices; or (iv) availability of the device is in the best interest of patients. Under the program, we are eligible to receive priority review and interactive communications from the FDA regarding device development and clinical trial protocols, all the way through to commercialization decisions.

Clinical Trials

Clinical trials are almost always required to support a PMA and are sometimes required to support a 510(k) submission. All clinical investigations of devices to determine safety and effectiveness must be conducted in accordance with the FDA’s IDE regulations which govern investigational device labeling, prohibit promotion of the investigational device, and specify an array of recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. If the device presents a “significant risk,” to human health, as defined by the FDA, the FDA requires the device sponsor to submit an IDE application to the FDA, which must become effective prior to commencing human clinical trials. A significant risk device is one that presents a potential for serious risk to the health, safety or welfare of a patient and either is implanted, used in supporting or sustaining human life, substantially important in diagnosing, curing, mitigating or treating disease or otherwise preventing impairment of human health, or otherwise presents a potential for serious risk to a subject. An IDE application must be supported by appropriate data, such as animal and laboratory test results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. The IDE will automatically become effective 30 days after receipt by the FDA unless the FDA notifies the company that the investigation may not begin. If the FDA determines that there are deficiencies or other concerns with an IDE for which it requires modification, the FDA may permit a clinical trial to proceed under a conditional approval.

In addition, the study must be approved by, and conducted under the oversight of, an Institutional Review Board (IRB) for each clinical site. The IRB is responsible for the initial and continuing review of the IDE study, and may pose additional requirements for the conduct of the study. If an IDE application is approved by the FDA and one or more IRBs, human clinical trials may begin at a specific number of investigational sites with a specific number of patients, as approved by the FDA. If the device presents a non-significant risk to the patient, a sponsor may begin the clinical trial after obtaining approval for the trial by one or more IRBs without separate approval from the FDA, but must still follow abbreviated IDE requirements, such as monitoring the investigation, ensuring that the investigators obtain informed consent, and labeling and record-keeping requirements. Acceptance of an IDE application for review does not guarantee that the FDA will allow the IDE to become effective and, if it does become effective, the FDA may or may not determine that the data derived from the trials support the safety and effectiveness of the device or warrant the continuation of clinical trials. An IDE supplement must be submitted to, and approved by, the FDA before a sponsor or investigator may make a change to the investigational plan that may affect its scientific soundness, study plan or the rights, safety or welfare of human subjects.

During a study, the sponsor is required to comply with the applicable FDA requirements, including, for example, trial monitoring, selecting clinical investigators and providing them with the investigational plan, ensuring IRB review, adverse event reporting, record keeping and prohibitions on the promotion of investigational devices or on making safety or effectiveness claims for them. The clinical investigators in the clinical study are also subject to FDA regulations and must obtain patient informed consent, rigorously follow the investigational plan and study protocol, control the disposition of the investigational device, and comply with all reporting and recordkeeping requirements. Additionally, after a trial begins, we, the FDA or the IRB could suspend or terminate a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the anticipated benefits.

10

Post-market Regulation

After a device is cleared or approved for marketing, numerous and pervasive regulatory requirements continue to apply. These include:

Quality Systems Regulation Requirements

Our manufacturing processes are required to comply with the applicable portions of the QSR, which cover the methods and the facilities and controls for the design, manufacture, testing, production, processes, controls, quality assurance, labeling, packaging, distribution, installation and servicing of finished devices intended for human use. The QSR requires that each manufacturer establish a quality systems program by which the manufacturer monitors the manufacturing process and maintains records that show compliance with FDA regulations and the manufacturer’s written specifications and procedures relating to the devices. The QSR also requires, among other things, maintenance of records and certain documentation, a device master file, device history file, and complaint files. QSR compliance is necessary to receive and maintain FDA clearance or approval to market new and existing products. As a manufacturer, we are subject to periodic scheduled or unscheduled audits or inspections by the FDA. Our failure to maintain compliance with the QSR requirements could result in the shut-down of, or restrictions on, our manufacturing operations and the recall or seizure of our products, which would have a material adverse effect on our business. The discovery of previously unknown problems with any of our products, including unanticipated adverse events or adverse events of increasing severity or frequency, whether resulting from the use of the device within the scope of its clearance or off-label by a physician in the practice of medicine, could result in restrictions on the device, including the removal of the product from the market or voluntary or mandatory device recalls.

The FDA has broad regulatory compliance and enforcement powers. If the FDA determines that we failed to comply with applicable regulatory requirements, it can take a variety of compliance or enforcement actions, which may result in any of the following sanctions:

11

The FDA can also publish Safety Communications or Letters to Health Care Providers when the agency becomes aware of new issues involving a specific product or, or more broadly, a product family. These communications are posted on the FDA’s website and describe the FDA’s analysis of a current issue and provide specific regulatory approaches and clinical recommendations for patient management.

Current FDA Regulatory Status

We currently have regulatory clearances required to market the Tablo Hemodialysis System in the U.S. for use in patients with acute and/or chronic renal failure, with or without ultrafiltration, in an acute or chronic care facility. The Tablo Hemodialysis System is also indicated for use in the home and observed by a trained individual. The Tablo Hemodialysis System is not cleared by the FDA for Continuous Renal Replacement Therapy (CRRT), a subtype of hemodialysis intended to be performed without interruption at lower flow and ultrafiltration rates for hemodynamically unstable patients who may not tolerate higher flow or ultrafiltration rates typically associated with conventional dialysis. Treatments must be administered under a physician’s prescription and observed by a trained individual who is considered competent in the use of the device. The FDA’s authorizations for the Tablo System and Tablo Cartridge have thus far been granted as 510(k) clearances.

Since Tablo’s original clearance by the FDA for home use in March 2020, we have made certain changes to the device over time and, where appropriate, have submitted 510(k) applications for certain modifications to the Tablo. In May 2021, we submitted a 510(k) application to the FDA covering the design changes for patient use in the home. In May 2022, after further discussions with the FDA and receiving indications that the clearance of this 510(k) application would be delayed beyond our original expectations, we implemented a shipment hold on the distribution and marketing of Tablo for use in the home environment pending the FDA’s review and clearance of this 510(k) application. In late July 2022, the FDA cleared this 510(k) application of Tablo for patient use in the home and we resumed marketing and shipping Tablo for home use.

The FDA previously issued to us a post-market surveillance order under Section 522 of the FDCA which required that we conduct a human factors study, as well as conduct a detailed analysis of adverse events and complaints from home users. While the FDA recently placed this 522 study requirement on hold because the original order specifically pertained to a prior version of Tablo, the FDA may decide to issue a new 522 order applicable to the current version of Tablo or extend the requirements of the prior 522 study order to apply to the version of Tablo that is the subject of the recently cleared 510(k) application. If the FDA does require us to run a 522 study with the version of Tablo that is the subject of the July 2022 clearance, we would need to submit and obtain the FDA’s approval of an updated 522 study protocol for the current version of Tablo before we could commence, conduct and complete the study. Should the FDA decide that the use of the Tablo System in the home environment identifies new concerns related to the safety and effectiveness of the product, or if the FDA determines that the requirements of the 522 order are otherwise unmet, we may be required to make changes to our Tablo System or its labeling for which we may need to submit new marketing authorization applications and obtain clearance, we may need to temporarily suspend shipment of Tablo, withdraw or recall the Tablo System from the market, and we may be subject to other enforcement actions, any of which could materially and adversely harm our business.

In October 2022,we submitted a 510(k) notification to the FDA seeking clearance of a new software version intended to offer new commercial features and enhancements designed to improve the reliability and serviceability of Tablo, as well as other previously implemented modifications. We have received, and are in the process of responding to, a request for additional information regarding some of the modifications included in the 510(k). At this time, this 510(k) application is pending at the FDA. Based on the results of the FDA’s review, we may be required to take additional actions, which may include reverting Tablo back to its prior, un-modified configuration.

In May 2022, the FDA published a Letter to Healthcare Providers entitled "Potential Risk of Exposure to Toxic Compounds When Using Certain Hemodialysis Machines Manufactured by Fresenius Medical Care – Letter to Health Care Providers." In that communication, the agency stated that it is evaluating the potential risk of exposure to non-dioxin-like (NDL) polychlorinated biphenyl acids (PCBAs) and NDL polychlorinated biphenyls (PCBs) with certain hemodialysis machines marketed in the United States. The FDA stated that the source of the NDL PCBAs and NDL PCBs is from the silicone tubing used as a part of the hydraulics in those machines and the dialysate lines. Although the Tablo Hemodialysis System was not the subject of the FDA’s Letter to Healthcare Providers, the FDA reached out to Outset regarding the tubing used in the Tablo. In a series of discussions with the FDA, the agency requested that we conduct a targeted analysis and a screening analysis on the tubing used in the Tablo Hemodialysis System. The FDA is requesting data on three specific compounds of PCB / PCBA as well as screening for other toxins and PCB/PCBAs. We are cooperating fully with the agency and are in the process of finalizing testing and screening protocols for submission to the FDA, and plan to perform the analysis in the first half of 2023. Based on the results of this testing, Outset may be required to take additional actions including submission of a 510(k) application for modified silicone tubing, if necessary.

12

We continue to seek opportunities for product improvements and feature enhancements, which will, from time to time, require FDA clearance or approval before commercial launch.

In the first quarter of 2023, the FDA conducted their first quality system inspection of our San Jose, California facility. At completion, the FDA issued a Form FDA-483 identifying four inspectional observations, relating to: (i) a single medical device report (MDR) that was not submitted within the required time period, (ii) completeness of software validation documentation, (iii) procedures defining escalation of nonconforming product to Corrective and Preventive Action (CAPA), and (iv) procedures connecting actions in customer complaints and the CAPA system. We intend to provide a complete response to the FDA and to implement a corrective action plan to address these observations within the requisite timeframe. Although we believe we are in material compliance with the QSR and will be able to address the observations identified in the Form-483 in a timely manner, there is no guarantee that subsequent inspections of our facility by the FDA or other regulatory authorities will not result in similar observations with respect to our quality system, which could adversely affect our business. The observations do not affect our ability to serve patients in both the home and acute end markets, and we intend to expeditiously and effectively address them in a way that strengthens our quality system.

Healthcare Fraud and Abuse Laws

Certain U.S. federal healthcare fraud and abuse laws apply by virtue of the fact that our customers will submit claims for our products and services that are reimbursed, in whole or in part, by Medicare, Medicaid, or other federal healthcare programs (as that term is defined at 42 U.S.C. § 1320a- 7b(f)). The principal federal fraud and abuse laws that apply in these circumstances are discussed below.

The U.S. federal Anti-Kickback Statute is a broad criminal statute that prohibits, among other things, the knowing and willful offer, solicitation, receipt, or payment of any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, for the purpose of inducing or rewarding the order, purchase, use or recommendation of items or services that may be paid for, or reimbursed by, in whole or in part, a federal healthcare program, such as Medicare or Medicaid. This includes products, like Tablo, that are not directly reimbursed but are purchased and used in a service paid for by such programs. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. Further, the term “remuneration” has been broadly interpreted to include anything of value. The Affordable Care Act (ACA) healthcare reform legislation specified that any claims submitted as a result of a violation of the federal Anti-Kickback Statute constitute false claims and are subject to enforcement under the federal False Claims Act, which is discussed in more detail below. Government officials continue to focus their enforcement efforts on the federal Anti-Kickback Statute and the sales and marketing activities of medical device manufacturers and other healthcare companies, and routinely bring cases against individuals or entities who allegedly offer unlawful inducements to potential or existing customers in an attempt to procure their business. Judgments and settlements of these cases by healthcare companies have involved significant fines and, in some instances, criminal pleas and convictions. Conviction under the federal Anti-Kickback Statue results in mandatory exclusion from participation in the federal healthcare programs, meaning that federal healthcare programs will not reimburse (directly or indirectly) for products or services furnished by the excluded entity or individuals. Violators are subject to, among other things, imprisonment and significant criminal fines for each violation under the Anti-Kickback Statute, plus up to three times the remuneration involved and other civil penalties under the False Claims Act, as discussed in more detail below.

Given the breadth of the federal Anti-Kickback Statute, and to allow innocuous or beneficial arrangements that may otherwise implicate the law, there are statutory exceptions and regulatory safe harbors that protect certain arrangements from liability under the law when all elements of an applicable exception or safe harbor are met. However, these exceptions and safe harbors are narrowly drawn, and there is no exception or safe harbor for many common business activities like educational grants or reimbursement support programs. Given that the Anti-Kickback Statute is an intent-based law, the failure of a transaction or arrangement to fit precisely within an exception or safe harbor does not necessarily mean that it is illegal or that prosecution will be pursued.

The federal civil False Claims Act (FCA) imposes civil penalties against individuals or entities for, among other things, knowingly presenting, or causing to be presented, claims for payment of government funds that are false or fraudulent, or knowingly making, using, or causing to be made or used a false record or statement material to an obligation to pay money to the government, or knowingly concealing or knowingly and improperly avoiding, decreasing, or concealing an obligation to pay money to the federal government. This statute also permits a private individual acting as a “qui tam whistleblower” to bring actions on behalf of the federal government alleging violations of the FCA and to share in any monetary recovery. FCA liability is potentially significant in the healthcare industry because the statute provides for treble damages and mandatory penalties for each false claim submitted or statement made. Government enforcement agencies and private whistleblowers have investigated medical device manufacturers for, or asserted liability under, the FCA for a variety of alleged inappropriate promotional and marketing activities, including those involving the provision of free product or other items of value to customers, certain financial arrangements with healthcare providers, the provision of billing, coding, and reimbursement advice, and purported “off-label” promotion of products, among other things.

Another key federal healthcare law is the federal healthcare fraud statute, which was added by HIPAA. The federal healthcare fraud statute imposes liability for, among other things, knowingly and willfully executing, or attempting to execute, a

13

scheme to defraud any healthcare benefit program, or knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement, in connection with the delivery of, or payment for healthcare benefits, items or services by a healthcare benefit program, which includes both government and privately funded benefits programs. Similar to the U.S. federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate them in order to have committed a violation.

The Physician Payments Sunshine Act (Sunshine Act) requires us to track and report annually certain data on payments and other transfers of value we make to teaching hospitals and U.S.-licensed physicians, physician assistants, nurse practitioners, clinical nurse specialists, certified nurse anesthetists, anesthesiology assistants, and certified nurse-midwives. Manufacturers are also required to report ownership and investment interests held by the physicians described above and their immediate family members. The data are sent to the Center for Medicare and Medicaid Services (CMS) for public disclosure on the Open Payments website. Failure to timely report information in accordance with the Sunshine Act may result in significant financial penalties.

In addition to these federal laws, there are often state laws and regulations, including state anti-kickback and false claims laws, that may apply to our business practices, including but not limited to: research, sales and marketing arrangements; claims involving healthcare items or services reimbursed by any third- party payor, including private insurers; state laws that require medical device companies to comply with the medical device industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the U.S. federal government, or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; and state laws and regulations that require drug and device manufacturers to file reports relating to pricing and marketing information, which requires tracking gifts and other remuneration and items of value provided to healthcare professionals and entities. In some states, applicable state anti-kickback laws apply with respect to all payors, including commercial health insurance companies.

Through our compliance efforts, we strive to design our business operations and relationships with our customers to comply with all applicable law. However, many of the laws and regulations applicable to us are broad in scope and may be interpreted or applied by prosecutorial, regulatory or judicial authorities or whistleblowers in ways that we cannot predict. Thus, it is possible that governmental entities or other parties could interpret these laws differently or assert non-compliance with respect to one or more of our business operations and relationships. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, and/or exclusion from government funded healthcare programs, such as Medicare and Medicaid. In addition, we may become subject to additional oversight and reporting requirements under a corporate integrity agreement as part of a settlement to resolve allegations of non-compliance with these laws (even if we do not admit violations). We may also need to curtail or restructure our operations as a result of being found to violate these laws, having such violations asserted against us, or based on enforcement actions instituted with respect to comparable practices by others. Any of these outcomes could have an adverse effect on our financial condition and ability to conduct our operations.

Privacy and Security

In the course of performing our business we obtain personally identifiable information (PII), including health-related information. Numerous federal and state laws and regulations, including HIPAA, govern the collection, dissemination, security, use and confidentiality of patient-identifiable health information or personal information. Such laws and regulations relating to privacy, data protection, and consumer protection are evolving and subject to potentially differing interpretations. These requirements may be interpreted and applied in a manner that varies from one jurisdiction to another and/or may conflict with other laws or regulations. HIPAA establishes a set of national privacy and security standards for the protection of individually identifiable health information, including protected health information (PHI) for certain covered entities, including healthcare providers that submit certain covered transactions electronically, as well as their ‘‘business associates,’’ which are persons or entities that perform a function or provide certain services for, or on behalf of, a covered entity that involve creating, receiving, maintaining or transmitting PHI. HIPAA also imposes breach reporting obligations on such covered entities and their respective business associates. Penalties for failure to comply with a requirement of HIPAA vary significantly depending on the failure and could include civil monetary or criminal penalties. HIPAA also authorizes state attorneys general to file suit under HIPAA on behalf of state residents. Courts can award damages, costs and attorneys’ fees related to violations of HIPAA in such cases. While HIPAA does not create a private right of action allowing individuals to sue us in civil court for HIPAA violations, its standards have been used as the basis for a duty of care claim in state civil suits such as those for negligence or recklessness in the misuse or breach of PHI. The Department of Health and Human Services Office for Civil Rights (OCR) has recently increased its enforcement efforts on compliance with HIPAA, including the security regulations (Security Rule), bringing actions against entities which have failed to implement security measures sufficient to reduce risks to electronic protected health information or to conduct an accurate and thorough risk analysis, among other violations. HIPAA enforcement actions may lead to monetary penalties and costly and burdensome corrective action plans. We are also required to report known breaches of PHI consistent with applicable breach reporting requirements set forth in applicable laws and regulations. Finally, on December 10, 2020, OCR issued proposed revisions to the Privacy Rule aimed at reducing regulatory burdens that may exist in discouraging coordination of care, including creating an exception to the minimum necessary standard for healthcare coordination, and other proposals to increase patient access to their health information, among other changes. While a final rule has not yet been issued,

14

if adopted, these proposed changes may require us to update our HIPAA policies and procedures to comply with the new requirements.

In addition, various federal and state legislative and regulatory bodies, or self-regulatory organizations, may expand current laws or regulations, enact new laws or regulations or issue revised rules or guidance regarding privacy, data protection and consumer protection. For instance, the California Consumer Privacy Act (CCPA) became effective on January 1, 2020. The CCPA gives California residents new rights to access and delete their personal information, opt out of certain personal information sharing and receive detailed information about how their personal information is used by requiring covered companies to provide new disclosures to California consumers (as that term is broadly defined) and provide such consumers new ways to opt-out of certain sales of personal information. The CCPA provides for civil penalties for violations, as well as a private right of action for data breaches that is expected to increase data breach litigation. Although there are limited exemptions for PHI and the CCPA’s implementation standards and enforcement practices are likely to remain uncertain for the foreseeable future, the CCPA may increase our compliance costs and potential liability. Additionally, a California ballot initiative, the California Privacy Rights Act (CPRA), passed in November 2020, and the majority of the provisions took effect on January 1, 2023. The CPRA amendments to the CCPA impose additional data protection obligations on companies doing business in California, including additional consumer rights processes, limitations on data uses, new audit requirements for higher risk data, and opt outs for certain uses of sensitive data. The amendments also created a new California data protection agency authorized to issue substantive regulations and could result in increased privacy and information security enforcement. Additional compliance investment and potential business process changes may be required. Laws similar to the California laws have passed in Virginia, Colorado, Connecticut, and Utah and have been proposed in other states and at the federal level. To the extent these laws apply to our operations, they may ultimately have conflicting requirements that would further complicate compliance. Further, new health information standards, whether implemented pursuant to HIPAA, congressional action or otherwise, could have a significant effect on the manner in which we handle health-related information, and the cost of complying with these standards could be significant. If we do not comply with existing or new laws and regulations related to patient health information, we could be subject to criminal or civil sanctions.

Additionally, the Federal Trade Commission (FTC) and many state attorneys general are interpreting existing federal and state consumer protection laws to impose evolving standards for the online collection, use, dissemination and security of health-related and other personal information. Courts may also adopt the standards for fair information practices promulgated by the FTC, which concern consumer notice, choice, security and access. Consumer protection laws require us to publish statements that describe how we handle personal information and choices individuals may have about the way we handle their personal information. If such information that we publish is considered untrue, we may be subject to government claims of unfair or deceptive trade practices, which could lead to significant liabilities and consequences. Furthermore, according to the FTC, violating consumers’ privacy rights or failing to take appropriate steps to keep consumers’ personal information secure may constitute unfair or deceptive acts or practices in violation of Section 5 of the FTC Act. The FTC expects a company’s data security measures to be reasonable and appropriate in light of the sensitivity and volume of consumer information it holds, the size and complexity of its business, and the cost of available tools to improve security and reduce vulnerabilities. Individually identifiable health information is considered sensitive data that merits stronger safeguards. The FTC’s guidance for appropriately securing consumers’ personal information is similar to what is required by the HIPAA Security Rule. Enforcement by the FTC under the FTC Act can result in civil penalties or enforcement actions.

We may also be subject to laws and regulations in foreign countries covering data privacy and other protection of health and employee information that may be more onerous than corresponding U.S. laws. These regulations may require that we obtain individual consent before we collect or process personal data, restrict our use or transfer of personal data, impose technical and organizational measures to ensure the security of personal data, add obligations to our data analytics services, and require that we notify regulatory agencies, individuals or the public about any data security breaches. As we expand our international operations, we may be required to expend significant time and resources to put in place additional mechanisms to ensure compliance with multiple robust and evolving data privacy laws as they become applicable to our business.

Our business relies on secure and continuous processing of information and the availability of our Information technology (IT) networks and IT resources, as well as critical IT vendors that support our technology and data processing operations. Security breaches, computer malware and computer hacking attacks have become more prevalent across industries and may occur on our systems or those of our third-party service providers. Attacks upon information technology systems are increasing in their frequency, levels of persistence, sophistication, and intensity, and are being conducted by sophisticated and organized groups and individuals with a wide range of motives and expertise. We may face increased cybersecurity risks due to our reliance on internet technology and the increased frequency of employees working remotely, which may create additional opportunities for cybercriminals to exploit vulnerabilities. OCR, in partnership with the Healthcare and Public Health Sector Coordinating Council, issued cybersecurity guidelines for healthcare organizations that reflect consensus-based, voluntary practices to cost-effectively reduce cybersecurity risks for organizations of varying sizes. Although these Department of Health and Human Services (HHS)-backed guidelines, entitled “Health Industry Cybersecurity Practices: Managing Threats and Protecting Patients,” are voluntary, they are likely to serve as an important reference point for the healthcare industry, and may cause us to invest additional resources in technology, personnel and programmatic cybersecurity controls as the cybersecurity risks we face continue to evolve.

15