| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the fiscal year ended | ||||||||

or | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the transition period from __________ to __________ | ||||||||

| (Exact name of registrant as specified in its charter) | ||

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |||||||||||||

| incorporation or organization) | ||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(Registrant’s telephone number, including area code) | ||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

| Page | ||||||||||||||

Item 1. | ||||||||||||||

Item 1A. | ||||||||||||||

Item 1B. | ||||||||||||||

Item 2. | ||||||||||||||

Item 3. | ||||||||||||||

Item 4. | ||||||||||||||

Item 5. | ||||||||||||||

Item 7. | ||||||||||||||

| Item 7A. | ||||||||||||||

Item 8. | ||||||||||||||

Item 9. | ||||||||||||||

Item 9A. | ||||||||||||||

Item 9B. | ||||||||||||||

| Item 9C. | ||||||||||||||

Item 10. | ||||||||||||||

Item 11. | ||||||||||||||

Item 12. | ||||||||||||||

Item 13. | ||||||||||||||

Item 14. | ||||||||||||||

Item 15. | ||||||||||||||

Item 16. | ||||||||||||||

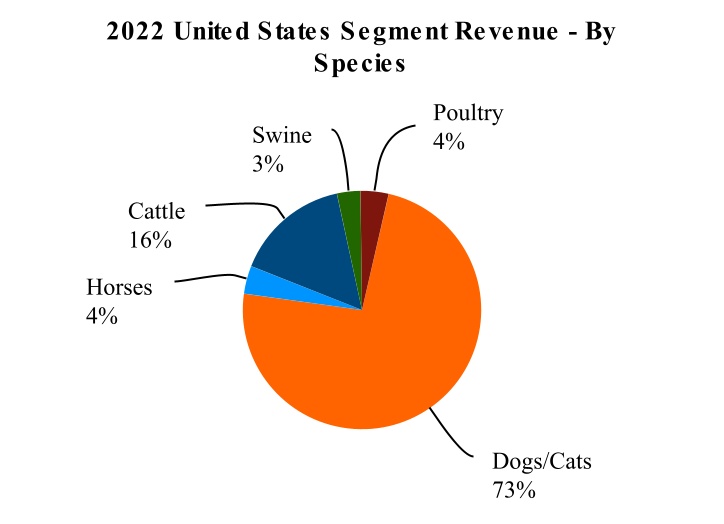

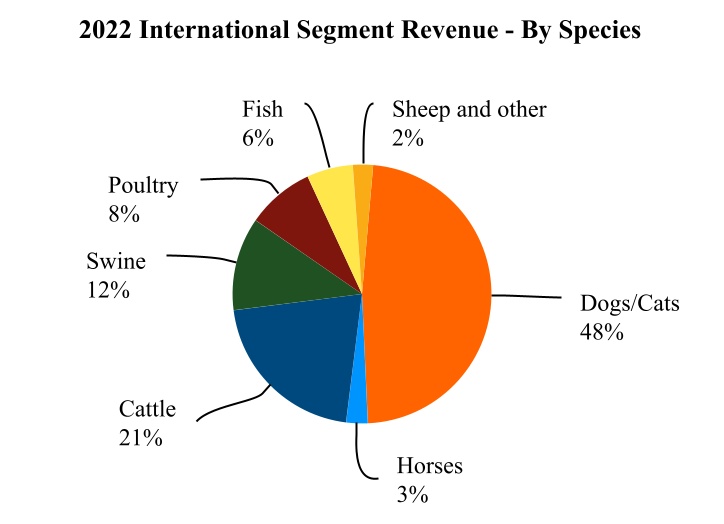

| (MILLIONS OF DOLLARS) | Revenue | Companion Animal | Livestock | ||||||||

| United States | $4,313 | 77% | 23% | ||||||||

| Total International | $3,681 | 51% | 49% | ||||||||

| Australia | $289 | 46% | 54% | ||||||||

| Brazil | $330 | 36% | 64% | ||||||||

| Canada | $238 | 61% | 39% | ||||||||

| Chile | $141 | 13% | 87% | ||||||||

| China | $382 | 66% | 34% | ||||||||

| France | $126 | 60% | 40% | ||||||||

| Germany | $176 | 73% | 27% | ||||||||

| Italy | $111 | 72% | 28% | ||||||||

| Japan | $173 | 68% | 32% | ||||||||

| Mexico | $136 | 32% | 68% | ||||||||

| Spain | $118 | 57% | 43% | ||||||||

| United Kingdom | $235 | 73% | 27% | ||||||||

| Other Developed | $468 | 48% | 52% | ||||||||

| Other Emerging | $758 | 38% | 62% | ||||||||

| Product / product line | Description | Primary species | ||||||||||||

| Vaccines | ||||||||||||||

Vanguard® L4 (4-way Lepto) / Vanguard® line | Helps protect against leptospirosis caused by Leptospira canicola, L. grippotyphosa, L. icterohaemorrhagiae and L. pomona. Aids in preventing canine distemper caused by canine distemper virus; infectious canine hepatitis caused by canine adenovirus type 1; respiratory disease caused by canine adenovirus type 2; canine parainfluenza caused by canine parainfluenza virus; canine parvoviral enteritis caused by canine parvovirus; Lyme disease and subclinical arthritis associated with Borrelia burgdorferi, the causative agent of Lyme disease. Vanguard Rapid Resp is a group of three vaccines combating infections in dogs caused by Bordetella bronchiseptica, canine parainfluenza and canine adenovirus; canine influenza vaccines; and an oral vaccine for Bordatella bronchiseptica | Dogs | ||||||||||||

| Anti-infectives | ||||||||||||||

Clavamox® / Synulox® | A broad-spectrum antibiotic and the first potentiated penicillin approved for use in dogs and cats | Cats, dogs | ||||||||||||

Convenia® | Anti-infective for the treatment of common bacterial skin infections that provides a course of treatment in a single injection | Cats, dogs | ||||||||||||

| Parasiticides | ||||||||||||||

ProHeart® | Prevents heartworm infestation; also for treatment of existing larval and adult hookworm infections | Dogs | ||||||||||||

Revolution® / Revolution® Plus / Stronghold® line | An antiparasitic for protection against fleas, heartworm disease and ear mites in cats and dogs; sarcoptic mites and American dog tick in dogs and roundworms and hookworms for cats | Cats, dogs | ||||||||||||

Simparica®/ Simparica Trio® | A monthly chewable tablet for dogs to control fleas and ticks; Simparica Trio, also a monthly chewable tablet, is a triple combination parasiticide that delivers all-in-one protection from fleas and ticks, as well as heartworm disease, roundworms and hookworms | Dogs | ||||||||||||

| Other Pharmaceutical Products | ||||||||||||||

Cerenia® | A medication that prevents and treats acute vomiting in dogs, treats acute vomiting in cats and prevents vomiting due to motion sickness in dogs | Cats, dogs | ||||||||||||

Librela® | An injectable monthly antibody therapy to alleviate osteoarthritis pain in dogs | Dogs | ||||||||||||

Rimadyl® | For the relief of pain and inflammation associated with osteoarthritis and for the control of postoperative pain associated with soft tissue and orthopedic surgeries | Dogs | ||||||||||||

| Dermatology | ||||||||||||||

Apoquel® | A selective inhibitor of the Janus Kinase 1 enzyme that controls pruritus associated with allergic dermatitis and control of atopic dermatitis in dogs at least 12 months of age | Dogs | ||||||||||||

Cytopoint® | An injectable to help reduce the clinical signs such as itching of atopic dermatitis in dogs of any age | Dogs | ||||||||||||

| Animal Health Diagnostics | ||||||||||||||

VetScan® | A portfolio of benchtop and handheld diagnostic instruments, rapid tests and associated consumables | Cats, dogs | ||||||||||||

| Product / product line | Description | Primary species | ||||||||||||

| Vaccines | ||||||||||||||

Improvac® / Improvest® / Vivax® | Reduces boar taint, as an alternative to surgical castration and suppression of estrus in gilts | Swine | ||||||||||||

Rispoval® / Bovishield® line | Aids in preventing three key viruses involved with pneumonia in cattle (BRSV, PI3 virus and BVD), as well as other respiratory diseases, depending on formulation | Cattle | ||||||||||||

Suvaxyn® / Fostera® | Aids in preventing or controlling diseases associated with major pig pathogens such as porcine circovirus type 2 (PCV2), porcine reproductive and respiratory syndrome virus (PRRSv) and Mycoplasma hyopneumoniae (M. hyo), depending on formulation | Swine | ||||||||||||

| Anti-infectives | ||||||||||||||

| Ceftiofur injectable line | Broad-spectrum cephalosporin antibiotic active against gram-positive and gram-negative bacteria, including ß-lactamase-producing strains, with some formulations producing a single course of therapy in one injection | Cattle, sheep, swine | ||||||||||||

Draxxin® / Draxxin KP | Single-dose low-volume antibiotic for the treatment and prevention of bovine and swine respiratory disease, infectious bovine keratoconjunctivitis and bovine foot rot. This franchise also includes Draxxin KP/Draxxin Plus, an injectable for the treatment of bovine respiratory disease that combines the antimicrobial properties of Draxxin with the anti-inflammatory, analgesic and antipyretic properties of the non-steroidal Ketoprofen to rapidly reduce fever in a single dose | Cattle, sheep, swine | ||||||||||||

Spectramast® | Treatment of subclinical or clinical mastitis in dry or lactating dairy cattle, delivered via intramammary infusion; same active ingredient as the ceftiofur line | Cattle | ||||||||||||

| Parasiticides | ||||||||||||||

Dectomax® | Injectable or pour-on endectocide, characterized by extended duration of activity, for the treatment and control of internal and external parasite infections | Cattle, swine | ||||||||||||

| Medicated Feed Additives | ||||||||||||||

| Lincomycin line | Controls necrotic enteritis; treatment of dysentery (bloody scours), control of ileitis and treatment/reduction in severity of mycoplasmal pneumonia | Swine, poultry | ||||||||||||

| Site | Location | Site | Location | |||||||||||||||||

| Buellton | California, U.S. | Overhalla | Norway | |||||||||||||||||

| Campinas | Brazil | Rathdrum | Ireland | |||||||||||||||||

| Catania | Italy | Rutherford | Australia | |||||||||||||||||

| Charles City | Iowa, U.S. | Salisbury | Maryland, U.S. | |||||||||||||||||

| Chicago Heights | Illinois, U.S. | San Diego | California, U.S. | |||||||||||||||||

| Durham | North Carolina, U.S. | Suzhou (Bio) | China | |||||||||||||||||

| Eagle Grove | Iowa, U.S. | Suzhou (MFA) | China | |||||||||||||||||

| Farum | Denmark | Tallaght | Ireland | |||||||||||||||||

| Kalamazoo | Michigan, U.S. | Tullamore | Ireland | |||||||||||||||||

| Klofta | Norway | Union City | California, U.S. | |||||||||||||||||

| Lincoln | Nebraska, U.S. | Weibern | Austria | |||||||||||||||||

| Louvain-la-Neuve | Belgium | Wellington | New Zealand | |||||||||||||||||

| Medolla | Italy | White Hall | Illinois, U.S. | |||||||||||||||||

| Melbourne | Australia | Willow Island | West Virginia, U.S. | |||||||||||||||||

| Olot | Spain | |||||||||||||||||||

| Issuer Purchases of Equity Securities | ||||||||||||||

Total Number of Shares Purchased(a) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under Plans or Programs | |||||||||||

| October 1 - October 31, 2022 | 385,234 | $148.78 | 384,955 | $2,934,545,331 | ||||||||||

| November 1 - November 30, 2022 | 807,282 | $143.37 | 806,710 | $2,818,883,845 | ||||||||||

| December 1 - December 31, 2022 | 1,523,900 | $151.67 | 1,523,758 | $2,587,042,238 | ||||||||||

| Total | 2,716,416 | $148.80 | 2,715,423 | $2,587,042,238 | ||||||||||

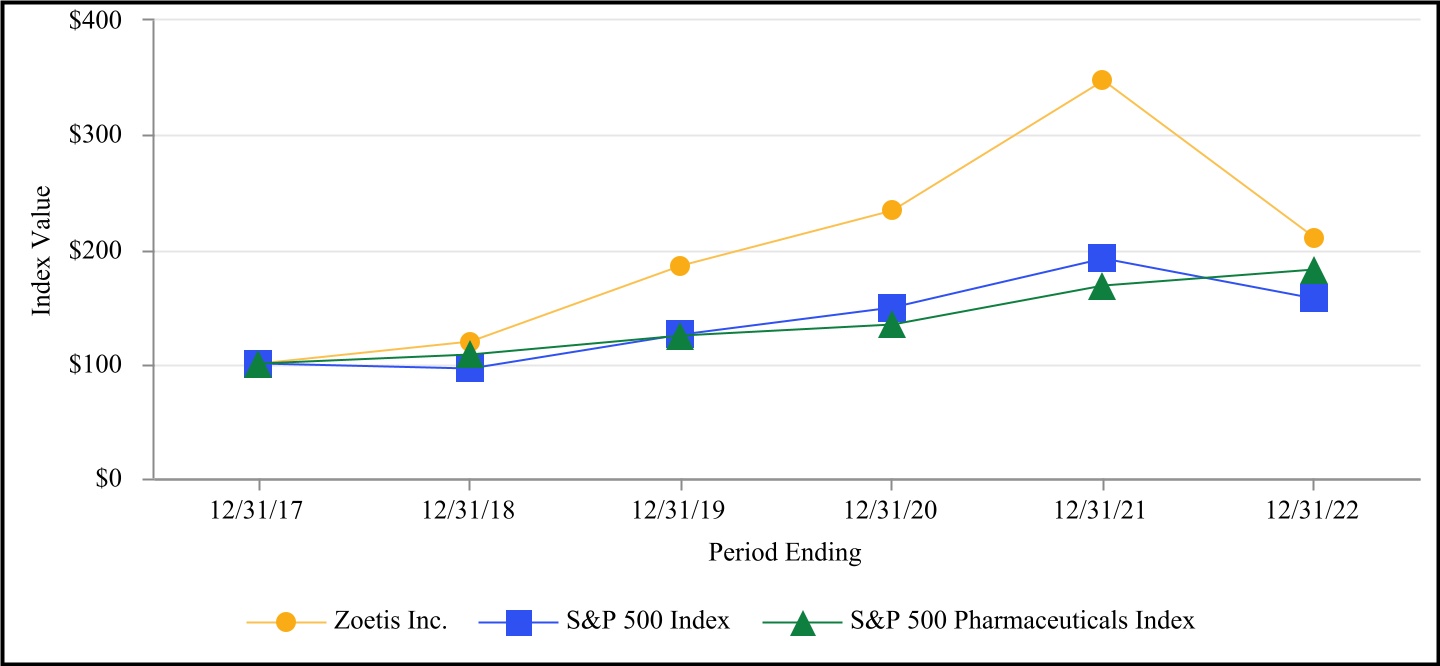

| December 31, 2017 | December 31, 2018 | December 31, 2019 | December 31, 2020 | December 31, 2021 | December 31, 2022 | |||||||||||||||

| Zoetis Inc. | $100 | $119.45 | $185.99 | $233.91 | $346.80 | $209.79 | ||||||||||||||

| S&P 500 Index | $100 | $95.62 | $125.72 | $148.85 | $191.58 | $156.88 | ||||||||||||||

| S&P 500 Pharmaceuticals Index | $100 | $108.09 | $124.40 | $133.76 | $168.21 | $182.43 | ||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Revenue | $ | 8,080 | $ | 7,776 | $ | 6,675 | 4 | 16 | ||||||||||||||||||||||||

| Net income attributable to Zoetis | 2,114 | 2,037 | 1,638 | 4 | 24 | |||||||||||||||||||||||||||

Adjusted net income(a) | 2,297 | 2,240 | 1,844 | 3 | 21 | |||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Revenue | $ | 8,080 | $ | 7,776 | $ | 6,675 | 4 | 16 | ||||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||||||||

Cost of sales(a) | 2,454 | 2,303 | 2,057 | 7 | 12 | |||||||||||||||||||||||||||

| % of revenue | 30.4 | % | 29.6 | % | 30.8 | % | ||||||||||||||||||||||||||

Selling, general and administrative expenses(a) | 2,009 | 2,001 | 1,726 | 0 | 16 | |||||||||||||||||||||||||||

| % of revenue | 25 | % | 26 | % | 26 | % | ||||||||||||||||||||||||||

Research and development expenses(a) | 539 | 508 | 463 | 6 | 10 | |||||||||||||||||||||||||||

| % of revenue | 7 | % | 7 | % | 7 | % | ||||||||||||||||||||||||||

Amortization of intangible assets(a) | 150 | 161 | 160 | (7) | 1 | |||||||||||||||||||||||||||

| Restructuring charges and certain acquisition-related costs | 11 | 43 | 25 | (74) | 72 | |||||||||||||||||||||||||||

| Interest expense, net of capitalized interest | 221 | 224 | 231 | (1) | (3) | |||||||||||||||||||||||||||

Other (income)/deductions—net | 40 | 48 | 17 | (17) | * | |||||||||||||||||||||||||||

| Income before provision for taxes on income | 2,656 | 2,488 | 1,996 | 7 | 25 | |||||||||||||||||||||||||||

| % of revenue | 33 | % | 32 | % | 30 | % | ||||||||||||||||||||||||||

| Provision for taxes on income | 545 | 454 | 360 | 20 | 26 | |||||||||||||||||||||||||||

| Effective tax rate | 20.5 | % | 18.2 | % | 18.0 | % | ||||||||||||||||||||||||||

| Net income before allocation to noncontrolling interests | 2,111 | 2,034 | 1,636 | 4 | 24 | |||||||||||||||||||||||||||

| Less: Net loss attributable to noncontrolling interests | (3) | (3) | (2) | — | 50 | |||||||||||||||||||||||||||

| Net income attributable to Zoetis | $ | 2,114 | $ | 2,037 | $ | 1,638 | 4 | 24 | ||||||||||||||||||||||||

| % of revenue | 26 | % | 26 | % | 25 | % | ||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| U.S. | $ | 4,313 | $ | 4,042 | $ | 3,557 | 7 | 14 | ||||||||||||||||||||||||

| International | 3,681 | 3,652 | 3,035 | 1 | 20 | |||||||||||||||||||||||||||

| Total operating segments | 7,994 | 7,694 | 6,592 | 4 | 17 | |||||||||||||||||||||||||||

| Contract manufacturing & human health | 86 | 82 | 83 | 5 | (1) | |||||||||||||||||||||||||||

| Total Revenue | $ | 8,080 | $ | 7,776 | $ | 6,675 | 4 | 16 | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Companion animal | $ | 5,203 | $ | 4,689 | $ | 3,652 | 11 | 28 | ||||||||||||||||||||||||

| Livestock | 2,791 | 3,005 | 2,940 | (7) | 2 | |||||||||||||||||||||||||||

| Contract manufacturing & human health | 86 | 82 | 83 | 5 | (1) | |||||||||||||||||||||||||||

| Total Revenue | $ | 8,080 | $ | 7,776 | $ | 6,675 | 4 | 16 | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

Cost of sales | $ | 2,454 | $ | 2,303 | $ | 2,057 | 7 | 12 | ||||||||||||||||||||||||

| % of revenue | 30.4 | % | 29.6 | % | 30.8 | % | ||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

Selling, general and administrative expenses | $ | 2,009 | $ | 2,001 | $ | 1,726 | 0 | 16 | ||||||||||||||||||||||||

| % of revenue | 25 | % | 26 | % | 26 | % | ||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

Research and development expenses | $ | 539 | $ | 508 | $ | 463 | 6 | 10 | ||||||||||||||||||||||||

| % of revenue | 7 | % | 7 | % | 7 | % | ||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Amortization of intangible assets | $ | 150 | $ | 161 | $ | 160 | (7) | 1 | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

Restructuring charges and certain acquisition-related costs | $ | 11 | $ | 43 | $ | 25 | (74) | 72 | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Interest expense, net of capitalized interest | $ | 221 | $ | 224 | $ | 231 | (1) | (3) | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Other (income)/deductions—net | $ | 40 | $ | 48 | $ | 17 | (17) | * | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Provision for taxes on income | $ | 545 | $ | 454 | $ | 360 | 20 | 26 | ||||||||||||||||||||||||

| Effective tax rate | 20.5 | % | 18.2 | % | 18.0 | % | ||||||||||||||||||||||||||

| % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| 22/21 | 21/20 | ||||||||||||||||||||||||||||||||||||||||||||||

| Related to | Related to | ||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Foreign Exchange | Foreign Exchange | |||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | Total | Operational | Total | Operational | ||||||||||||||||||||||||||||||||||||||||

| U.S. | |||||||||||||||||||||||||||||||||||||||||||||||

| Companion animal | $ | 3,341 | $ | 2,990 | $ | 2,391 | 12 | — | 12 | 25 | — | 25 | |||||||||||||||||||||||||||||||||||

| Livestock | 972 | 1,052 | 1,166 | (8) | — | (8) | (10) | — | (10) | ||||||||||||||||||||||||||||||||||||||

| 4,313 | 4,042 | 3,557 | 7 | — | 7 | 14 | — | 14 | |||||||||||||||||||||||||||||||||||||||

| International | |||||||||||||||||||||||||||||||||||||||||||||||

| Companion animal | 1,862 | 1,699 | 1,261 | 10 | (9) | 19 | 35 | 5 | 30 | ||||||||||||||||||||||||||||||||||||||

| Livestock | 1,819 | 1,953 | 1,774 | (7) | (7) | — | 10 | 2 | 8 | ||||||||||||||||||||||||||||||||||||||

| 3,681 | 3,652 | 3,035 | 1 | (8) | 9 | 20 | 3 | 17 | |||||||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Companion animal | 5,203 | 4,689 | 3,652 | 11 | (3) | 14 | 28 | 1 | 27 | ||||||||||||||||||||||||||||||||||||||

| Livestock | 2,791 | 3,005 | 2,940 | (7) | (5) | (2) | 2 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| Contract manufacturing & human health | 86 | 82 | 83 | 5 | (2) | 7 | (1) | — | (1) | ||||||||||||||||||||||||||||||||||||||

| $ | 8,080 | $ | 7,776 | $ | 6,675 | 4 | (4) | 8 | 16 | 1 | 15 | ||||||||||||||||||||||||||||||||||||

| % Change | |||||||||||||||||||||||||||||||||||

| 22/21 | 21/20 | ||||||||||||||||||||||||||||||||||

| Related to | Related to | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Foreign Exchange | Foreign Exchange | |||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | Total | Operational | Total | Operational | ||||||||||||||||||||||||||||

| U.S. | $ | 2,763 | $ | 2,569 | $ | 2,239 | 8 | — | 8 | 15 | — | 15 | |||||||||||||||||||||||

| International | 1,990 | 1,948 | 1,547 | 2 | (10) | 12 | 26 | 5 | 21 | ||||||||||||||||||||||||||

| Total reportable segments | 4,753 | 4,517 | 3,786 | 5 | (5) | 10 | 19 | 2 | 17 | ||||||||||||||||||||||||||

| Other business activities | (424) | (406) | (372) | 4 | 9 | ||||||||||||||||||||||||||||||

| Reconciling Items: | |||||||||||||||||||||||||||||||||||

| Corporate | (1,073) | (1,052) | (879) | 2 | 20 | ||||||||||||||||||||||||||||||

| Purchase accounting adjustments | (160) | (175) | (198) | (9) | (12) | ||||||||||||||||||||||||||||||

| Acquisition-related costs | (5) | (12) | (18) | (58) | (33) | ||||||||||||||||||||||||||||||

| Certain significant items | (56) | (73) | (43) | (23) | 70 | ||||||||||||||||||||||||||||||

| Other unallocated | (379) | (311) | (280) | 22 | 11 | ||||||||||||||||||||||||||||||

| Income before income taxes | $ | 2,656 | $ | 2,488 | $ | 1,996 | 7 | 25 | |||||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| GAAP reported net income attributable to Zoetis | $ | 2,114 | $ | 2,037 | $ | 1,638 | 4 | 24 | ||||||||||||||||||||||||

| Purchase accounting adjustments—net of tax | 120 | 136 | 142 | (12) | (4) | |||||||||||||||||||||||||||

| Acquisition-related costs—net of tax | 4 | 10 | 19 | (60) | (47) | |||||||||||||||||||||||||||

| Certain significant items—net of tax | 59 | 57 | 45 | 4 | 27 | |||||||||||||||||||||||||||

Non-GAAP adjusted net income(a) | $ | 2,297 | $ | 2,240 | $ | 1,844 | 3 | 21 | ||||||||||||||||||||||||

| Year Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 22/21 | 21/20 | ||||||||||||||||||||||||||||

Earnings per share—diluted(a): | ||||||||||||||||||||||||||||||||

| GAAP reported EPS attributable to Zoetis—diluted | $ | 4.49 | $ | 4.27 | $ | 3.42 | 5 | 25 | ||||||||||||||||||||||||

| Purchase accounting adjustments—net of tax | 0.26 | 0.29 | 0.30 | (10) | (3) | |||||||||||||||||||||||||||

| Acquisition-related costs—net of tax | 0.01 | 0.02 | 0.04 | (50) | (50) | |||||||||||||||||||||||||||

| Certain significant items—net of tax | 0.12 | 0.12 | 0.09 | — | 33 | |||||||||||||||||||||||||||

| Non-GAAP adjusted EPS—diluted | $ | 4.88 | $ | 4.70 | $ | 3.85 | 4 | 22 | ||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Interest expense, net of capitalized interest | $ | 221 | $ | 224 | $ | 231 | ||||||||||||||

| Interest income | (50) | (6) | (12) | |||||||||||||||||

| Income taxes | 583 | 511 | 413 | |||||||||||||||||

| Depreciation | 266 | 236 | 202 | |||||||||||||||||

| Amortization | 40 | 37 | 40 | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Purchase accounting adjustments: | ||||||||||||||||||||

| Amortization and depreciation | $ | 160 | $ | 175 | $ | 198 | ||||||||||||||

| Total purchase accounting adjustments—pre-tax | 160 | 175 | 198 | |||||||||||||||||

Income taxes(a) | 40 | 39 | 56 | |||||||||||||||||

| Total purchase accounting adjustments—net of tax | 120 | 136 | 142 | |||||||||||||||||

| Acquisition-related costs: | ||||||||||||||||||||

| Integration costs | 4 | 10 | 17 | |||||||||||||||||

| Transaction costs | 1 | — | — | |||||||||||||||||

| Restructuring costs | — | 2 | 1 | |||||||||||||||||

| Total acquisition-related costs—pre-tax | 5 | 12 | 18 | |||||||||||||||||

Income taxes(a) | 1 | 2 | (1) | |||||||||||||||||

| Total acquisition-related costs—net of tax | 4 | 10 | 19 | |||||||||||||||||

| Certain significant items: | ||||||||||||||||||||

Operational efficiency initiative(b) | — | — | (18) | |||||||||||||||||

Other restructuring charges and cost-reduction/productivity initiatives(c) | 8 | 24 | 11 | |||||||||||||||||

Certain asset impairment charges(d) | 47 | 46 | 37 | |||||||||||||||||

| Net loss on sale of assets | — | 3 | — | |||||||||||||||||

Other(e) | 1 | — | 13 | |||||||||||||||||

| Total certain significant items—pre-tax | 56 | 73 | 43 | |||||||||||||||||

Income taxes(a) | (3) | 16 | (2) | |||||||||||||||||

| Total certain significant items—net of tax | 59 | 57 | 45 | |||||||||||||||||

| Total purchase accounting adjustments, acquisition-related costs, and certain significant items—net of tax | $ | 183 | $ | 203 | $ | 206 | ||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Cost of sales: | ||||||||||||||||||||

| Purchase accounting adjustments | $ | 6 | $ | 6 | $ | 8 | ||||||||||||||

| Inventory write-offs | 4 | 2 | 15 | |||||||||||||||||

| Other | 4 | 6 | 4 | |||||||||||||||||

| Total Cost of sales | 14 | 14 | 27 | |||||||||||||||||

| Selling, general & administrative expenses: | ||||||||||||||||||||

| Purchase accounting adjustments | 29 | 30 | 54 | |||||||||||||||||

| Other | — | — | 13 | |||||||||||||||||

| Total Selling, general & administrative expenses | 29 | 30 | 67 | |||||||||||||||||

| Research & development expenses: | ||||||||||||||||||||

| Purchase accounting adjustments | 1 | 1 | 1 | |||||||||||||||||

| Total Research & development expenses | 1 | 1 | 1 | |||||||||||||||||

| Amortization of intangible assets: | ||||||||||||||||||||

| Purchase accounting adjustments | 124 | 138 | 135 | |||||||||||||||||

| Total Amortization of intangible assets | 124 | 138 | 135 | |||||||||||||||||

| Restructuring charges and certain acquisition-related costs: | ||||||||||||||||||||

| Integration costs | 4 | 10 | 17 | |||||||||||||||||

| Transaction costs | 1 | — | — | |||||||||||||||||

| Employee termination costs | 3 | 17 | 8 | |||||||||||||||||

| Asset impairments | 2 | 13 | — | |||||||||||||||||

| Exit costs | 1 | 3 | — | |||||||||||||||||

| Total Restructuring charges and certain acquisition-related costs | 11 | 43 | 25 | |||||||||||||||||

| Other (income)/deductions—net: | ||||||||||||||||||||

| Net loss/(gain) on sale of assets | — | 3 | (18) | |||||||||||||||||

| Asset impairments | 41 | 31 | 22 | |||||||||||||||||

| Other | 1 | — | — | |||||||||||||||||

| Total Other (income)/deductions—net | 42 | 34 | 4 | |||||||||||||||||

| Provision for taxes on income | 38 | 57 | 53 | |||||||||||||||||

| Total purchase accounting adjustments, acquisition-related costs, and certain significant items—net of tax | $ | 183 | $ | 203 | $ | 206 | ||||||||||||||

| Year Ended December 31, | $ Change | |||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 22/21 | 21/20 | |||||||||||||||||||||||||||

| Net cash provided by (used in): | ||||||||||||||||||||||||||||||||

| Operating activities | $ | 1,912 | $ | 2,213 | $ | 2,126 | $ | (301) | $ | 87 | ||||||||||||||||||||||

| Investing activities | (883) | (458) | (572) | (425) | 114 | |||||||||||||||||||||||||||

| Financing activities | (904) | (1,862) | 123 | 958 | (1,985) | |||||||||||||||||||||||||||

| Effect of exchange-rate changes on cash and cash equivalents | (29) | (12) | (7) | (17) | (5) | |||||||||||||||||||||||||||

| Net increase/(decrease) in cash and cash equivalents | $ | 96 | $ | (119) | $ | 1,670 | $ | 215 | $ | (1,789) | ||||||||||||||||||||||

| December 31, | |||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | |||||||||

| Cash and cash equivalents | $ | 3,581 | $ | 3,485 | |||||||

Accounts receivable, net(a) | 1,215 | 1,133 | |||||||||

| Short-term borrowings | 2 | — | |||||||||

| Current portion of long-term debt | 1,350 | — | |||||||||

| Long-term debt | 6,552 | 6,592 | |||||||||

| Working capital | 4,339 | 5,133 | |||||||||

| Ratio of current assets to current liabilities | 2.37:1 | 3.86:1 | |||||||||

| Description | Principal Amount | Interest Rate | Terms | ||||||||

| 2015 Senior Notes due 2025 | $750 million | 4.500% | Interest due semi annually, not subject to amortization, aggregate principal due on November 13, 2025 | ||||||||

| 2022 Senior Notes due 2025 | $600 million | 5.400% | Interest due semi annually, not subject to amortization, aggregate principal due on November 14, 2025 | ||||||||

| 2017 Senior Notes due 2027 | $750 million | 3.000% | Interest due semi annually, not subject to amortization, aggregate principal due on September 12, 2027 | ||||||||

| 2018 Senior Notes due 2028 | $500 million | 3.900% | Interest due semi annually, not subject to amortization, aggregate principal due on August 20, 2028 | ||||||||

| 2020 Senior Notes due 2030 | $750 million | 2.000% | Interest due semi annually, not subject to amortization, aggregate principal due on May 15, 2030 | ||||||||

| 2022 Senior Notes due 2032 | $750 million | 5.600% | Interest due semi annually, not subject to amortization, aggregate principal due on November 16, 2032 | ||||||||

| 2013 Senior Notes due 2043 | $1,150 million | 4.700% | Interest due semi annually, not subject to amortization, aggregate principal due on February 1, 2043 | ||||||||

| 2017 Senior Notes due 2047 | $500 million | 3.950% | Interest due semi annually, not subject to amortization, aggregate principal due on September 12, 2047 | ||||||||

| 2018 Senior Notes due 2048 | $400 million | 4.450% | Interest due semi annually, not subject to amortization, aggregate principal due on August 20, 2048 | ||||||||

| 2020 Senior Notes due 2050 | $500 million | 3.000% | Interest due semi annually, not subject to amortization, aggregate principal due on May 15, 2050 | ||||||||

| Commercial Paper | Long-term Debt | Date of Last Action | ||||||||||||||||||||||||

| Name of Rating Agency | Rating | Rating | Outlook | |||||||||||||||||||||||

| Moody’s | P-2 | Baa1 | Stable | August 2017 | ||||||||||||||||||||||

| S&P | A-2 | BBB | Stable | December 2016 | ||||||||||||||||||||||

| Page | |||||

Audited Consolidated Financial Statements of Zoetis Inc. and Subsidiaries: | |||||

Reports of Independent Registered Public Accounting Firm | |||||

Consolidated Statements of Income for the Years Ended December 31, 2022, 2021 and 2020 | |||||

Consolidated Statements of Comprehensive Income for the Years Ended December 31, 2022, 2021 and 2020 | |||||

Consolidated Balance Sheets as of December 31, 2022 and 2021 | |||||

Consolidated Statements of Equity for the Years Ended December 31, 2022, 2021 and 2020 | |||||

Consolidated Statements of Cash Flows for the Years Ended December 31, 2022, 2021 and 2020 | |||||

Notes to Consolidated Financial Statements | |||||

Schedule II—Valuation and Qualifying Accounts | |||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS AND SHARES, EXCEPT PER SHARE DATA) | 2022 | 2021 | 2020 | |||||||||||||||||

| Revenue | $ | $ | $ | |||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||

Cost of sales(a) | ||||||||||||||||||||

Selling, general and administrative expenses(a) | ||||||||||||||||||||

Research and development expenses(a) | ||||||||||||||||||||

| Amortization of intangible assets | ||||||||||||||||||||

| Restructuring charges and certain acquisition-related costs | ||||||||||||||||||||

| Interest expense, net of capitalized interest | ||||||||||||||||||||

| Other (income)/deductions––net | ||||||||||||||||||||

| Income before provision for taxes on income | ||||||||||||||||||||

| Provision for taxes on income | ||||||||||||||||||||

| Net income before allocation to noncontrolling interests | ||||||||||||||||||||

| Less: Net loss attributable to noncontrolling interests | ( | ( | ( | |||||||||||||||||

| Net income attributable to Zoetis Inc. | $ | $ | $ | |||||||||||||||||

| Earnings per share attributable to Zoetis Inc. stockholders: | ||||||||||||||||||||

| Basic | $ | $ | $ | |||||||||||||||||

| Diluted | $ | $ | $ | |||||||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||||||||

| Basic | ||||||||||||||||||||

| Diluted | ||||||||||||||||||||

| Dividends declared per common share | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Net income before allocation to noncontrolling interests | $ | $ | $ | |||||||||||||||||

| Other comprehensive loss, net of tax and reclassification adjustments: | ||||||||||||||||||||

Unrealized gains/(losses) on derivatives for cash flow hedges, net of tax of $ | ( | |||||||||||||||||||

Unrealized gains/(losses) on derivatives for net investment hedges, net of tax of $ | ( | |||||||||||||||||||

Foreign currency translation adjustments, net | ( | ( | ||||||||||||||||||

Benefit plans: Actuarial gain, net of tax of $ | ||||||||||||||||||||

| Total other comprehensive loss, net of tax | ( | ( | ( | |||||||||||||||||

| Comprehensive income before allocation to noncontrolling interests | ||||||||||||||||||||

| Less: Comprehensive loss attributable to noncontrolling interests | ( | ( | ( | |||||||||||||||||

| Comprehensive income attributable to Zoetis Inc. | $ | $ | $ | |||||||||||||||||

| December 31, | December 31, | |||||||||||||

| (MILLIONS OF DOLLARS, EXCEPT PER SHARE DATA) | 2022 | 2021 | ||||||||||||

| Assets | ||||||||||||||

Cash and cash equivalents(a) | $ | $ | ||||||||||||

Accounts receivable, less allowance for doubtful accounts of $ | ||||||||||||||

| Inventories | ||||||||||||||

| Other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

Property, plant and equipment, less accumulated depreciation of $ | ||||||||||||||

| Operating lease right of use assets | ||||||||||||||

| Goodwill | ||||||||||||||

| Identifiable intangible assets, less accumulated amortization | ||||||||||||||

| Noncurrent deferred tax assets | ||||||||||||||

| Other noncurrent assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and Equity | ||||||||||||||

| Short-term borrowings | $ | $ | ||||||||||||

| Current portion of long-term debt | ||||||||||||||

| Accounts payable | ||||||||||||||

| Dividends payable | ||||||||||||||

| Accrued expenses | ||||||||||||||

| Accrued compensation and related items | ||||||||||||||

| Income taxes payable | ||||||||||||||

| Other current liabilities | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Long-term debt, net of discount and issuance costs | ||||||||||||||

| Noncurrent deferred tax liabilities | ||||||||||||||

| Operating lease liabilities | ||||||||||||||

| Other taxes payable | ||||||||||||||

| Other noncurrent liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Commitments and contingencies (Note 18) | ||||||||||||||

| Stockholders' equity: | ||||||||||||||

Common stock, $ | ||||||||||||||

Treasury stock, at cost, | ( | ( | ||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

| Total Zoetis Inc. equity | ||||||||||||||

| Equity attributable to noncontrolling interests | ( | |||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | $ | $ | ||||||||||||

| Zoetis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional | Other | Attributable to | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS, EXCEPT SHARE DATA) | Common Stock | Treasury Stock | Paid-in | Retained | Comprehensive | Noncontrolling | Total | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Earnings | Loss | Interests | Equity | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2019 | $ | $ | ( | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income/(loss) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Consolidation of a noncontrolling interest(a) | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

Share-based compensation awards(b) | — | ( | ( | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

Treasury stock acquired(c) | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Employee benefit plan contribution from Pfizer Inc.(d) | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | ( | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income/(loss) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Share-based compensation awards(b) | — | ( | — | ( | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

Treasury stock acquired(c) | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Employee benefit plan contribution from Pfizer Inc.(d) | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | ( | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income/(loss) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Share-based compensation awards(b) | — | — | ( | ( | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

Treasury stock acquired(c) | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Employee benefit plan contribution from Pfizer Inc.(d) | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | ( | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Operating Activities | ||||||||||||||||||||

| Net income before allocation to noncontrolling interests | $ | $ | $ | |||||||||||||||||

| Adjustments to reconcile net income before noncontrolling interests to net cash provided by operating activities: | ||||||||||||||||||||

| Depreciation and amortization expense | ||||||||||||||||||||

| Share-based compensation expense | ||||||||||||||||||||

| Asset write-offs and asset impairments | ||||||||||||||||||||

| Net loss/(gain) on sales of assets | ( | |||||||||||||||||||

| Provision for losses on inventory | ||||||||||||||||||||

| Deferred taxes | ( | ( | ( | |||||||||||||||||

| Settlement of derivative contracts | ( | |||||||||||||||||||

| Employee benefit plan contribution from Pfizer Inc. | ||||||||||||||||||||

| Other non-cash adjustments | ( | |||||||||||||||||||

| Other changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||

| Accounts receivable | ( | ( | ||||||||||||||||||

| Inventories | ( | ( | ( | |||||||||||||||||

| Other assets | ( | ( | ||||||||||||||||||

| Accounts payable | ( | ( | ||||||||||||||||||

| Other liabilities | ( | |||||||||||||||||||

| Other tax accounts, net | ( | |||||||||||||||||||

| Net cash provided by operating activities | ||||||||||||||||||||

| Investing Activities | ||||||||||||||||||||

| Capital expenditures | ( | ( | ( | |||||||||||||||||

| Acquisitions, net of cash acquired | ( | ( | ( | |||||||||||||||||

| Purchase of investments | ( | ( | ||||||||||||||||||

| Proceeds from/(payments of) derivative instrument activity, net | ( | |||||||||||||||||||

| Net proceeds from sale of assets | ||||||||||||||||||||

| Other investing activities | ( | |||||||||||||||||||

| Net cash used in investing activities | ( | ( | ( | |||||||||||||||||

| Financing Activities | ||||||||||||||||||||

| Increase/(decrease) in short-term borrowings, net | ( | |||||||||||||||||||

| Principal payments on long-term debt | ( | ( | ||||||||||||||||||

| Proceeds from issuance of long-term debt—senior notes, net of discount | ||||||||||||||||||||

| Payment of debt issuance costs | ( | ( | ||||||||||||||||||

| Payment of consideration related to previous acquisitions | ( | ( | ( | |||||||||||||||||

| Share-based compensation-related proceeds, net of taxes paid on withholding shares | ( | ( | ||||||||||||||||||

| Purchases of treasury stock | ( | ( | ( | |||||||||||||||||

| Cash dividends paid | ( | ( | ( | |||||||||||||||||

| Acquisition of a noncontrolling interest, net of cash acquired | ||||||||||||||||||||

| Net cash (used in)/provided by financing activities | ( | ( | ||||||||||||||||||

| Effect of exchange-rate changes on cash and cash equivalents | ( | ( | ( | |||||||||||||||||

| Net increase/(decrease) in cash and cash equivalents | ( | |||||||||||||||||||

| Cash and cash equivalents at beginning of period | ||||||||||||||||||||

| Cash and cash equivalents at end of period | $ | $ | $ | |||||||||||||||||

| Supplemental cash flow information | ||||||||||||||||||||

| Cash paid during the period for: | ||||||||||||||||||||

| Income taxes | $ | $ | $ | |||||||||||||||||

| Interest, net of capitalized interest | ||||||||||||||||||||

| Non-cash transactions: | ||||||||||||||||||||

| Capital expenditures | $ | $ | $ | |||||||||||||||||

| Dividends declared, not paid | ||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| United States | $ | $ | $ | |||||||||||||||||

| Australia | ||||||||||||||||||||

| Brazil | ||||||||||||||||||||

| Canada | ||||||||||||||||||||

| Chile | ||||||||||||||||||||

| China | ||||||||||||||||||||

| France | ||||||||||||||||||||

| Germany | ||||||||||||||||||||

| Italy | ||||||||||||||||||||

| Japan | ||||||||||||||||||||

| Mexico | ||||||||||||||||||||

| Spain | ||||||||||||||||||||

| United Kingdom | ||||||||||||||||||||

| Other developed markets | ||||||||||||||||||||

| Other emerging markets | ||||||||||||||||||||

| Contract manufacturing & human health | ||||||||||||||||||||

| Total Revenue | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| U.S. | ||||||||||||||||||||

| Companion animal | $ | $ | $ | |||||||||||||||||

| Livestock | ||||||||||||||||||||

| International | ||||||||||||||||||||

| Companion animal | ||||||||||||||||||||

| Livestock | ||||||||||||||||||||

| Total | ||||||||||||||||||||

| Companion animal | ||||||||||||||||||||

| Livestock | ||||||||||||||||||||

| Contract manufacturing & human health | ||||||||||||||||||||

| Total Revenue | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Companion Animal: | ||||||||||||||||||||

| Dogs and Cats | $ | $ | $ | |||||||||||||||||

| Horses | ||||||||||||||||||||

| Livestock: | ||||||||||||||||||||

| Cattle | ||||||||||||||||||||

| Swine | ||||||||||||||||||||

| Poultry | ||||||||||||||||||||

| Fish | ||||||||||||||||||||

| Sheep and other | ||||||||||||||||||||

| Contract manufacturing & human health | ||||||||||||||||||||

| Total Revenue | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Parasiticides | $ | $ | $ | |||||||||||||||||

| Vaccines | ||||||||||||||||||||

| Dermatology | ||||||||||||||||||||

| Anti-infectives | ||||||||||||||||||||

| Other pharmaceuticals | ||||||||||||||||||||

| Medicated feed additives | ||||||||||||||||||||

| Animal health diagnostics | ||||||||||||||||||||

| Other non-pharmaceuticals | ||||||||||||||||||||

| Contract manufacturing & human health | ||||||||||||||||||||

| Total Revenue | $ | $ | $ | |||||||||||||||||

| (MILLIONS OF DOLLARS) | Amounts | ||||

| Cash and cash equivalents | $ | ||||

| Accounts receivable | |||||

Inventories(a) | |||||

| Other current assets | |||||

Property, plant and equipment(b) | |||||

Identifiable intangible assets(c) | |||||

| Other noncurrent assets | |||||

| Accounts payable | |||||

| Other current liabilities | |||||

| Other noncurrent liabilities | |||||

| Total net assets acquired | |||||

Goodwill(d) | |||||

| Total consideration | $ | ||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Restructuring charges and certain acquisition-related costs: | ||||||||||||||||||||

Integration costs(a) | $ | $ | $ | |||||||||||||||||

Transaction costs(b) | ||||||||||||||||||||

Restructuring charges(c)(d): | ||||||||||||||||||||

| Employee termination costs | ||||||||||||||||||||

| Asset impairment charges | ||||||||||||||||||||

| Exit costs | ||||||||||||||||||||

Total Restructuring charges and certain acquisition-related costs | $ | $ | $ | |||||||||||||||||

| Employee | Asset | |||||||||||||||||||||||||

| Termination | Impairment | Exit | ||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | Costs | Charges | Costs | Accrual | ||||||||||||||||||||||

| Balance, December 31, 2019 | $ | $ | — | $ | $ | |||||||||||||||||||||

| Provision | ||||||||||||||||||||||||||

Utilization and other(a) | ( | — | ( | |||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | — | $ | $ | |||||||||||||||||||||

| Provision | ||||||||||||||||||||||||||

| Non-cash activity | ( | ( | ||||||||||||||||||||||||

Utilization and other(a) | ( | — | ( | ( | ||||||||||||||||||||||

Balance, December 31, 2021(b) | $ | $ | — | $ | $ | |||||||||||||||||||||

| Provision | ||||||||||||||||||||||||||

| Non-cash activity | ( | ( | ||||||||||||||||||||||||

Utilization and other(a) | ( | — | ( | ( | ||||||||||||||||||||||

Balance, December 31, 2022(b)(c) | $ | $ | — | $ | $ | |||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Royalty-related income | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Interest income | ( | ( | ( | |||||||||||||||||

Identifiable intangible asset impairment charges(a) | ||||||||||||||||||||

Net loss/(gain) on sale of assets(b) | ( | |||||||||||||||||||

| Impairment of an equity investment | ||||||||||||||||||||

| Other asset impairment charges | ||||||||||||||||||||

Foreign currency loss(c) | ||||||||||||||||||||

| Other, net | ( | |||||||||||||||||||

| Other (income)/deductions—net | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| United States | $ | $ | $ | |||||||||||||||||

| International | ||||||||||||||||||||

Income before provision for taxes on income | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| United States: | ||||||||||||||||||||

| Current income taxes: | ||||||||||||||||||||

| Federal | $ | $ | $ | |||||||||||||||||

| State and local | ||||||||||||||||||||

| Deferred income taxes: | ||||||||||||||||||||

| Federal | ( | ( | ( | |||||||||||||||||

| State and local | ( | ( | ( | |||||||||||||||||

Total U.S. tax provision | ||||||||||||||||||||

| International: | ||||||||||||||||||||

| Current income taxes | ||||||||||||||||||||

| Deferred income taxes | ( | ( | ||||||||||||||||||

| Total international tax provision | ||||||||||||||||||||

| Provision for taxes on income | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| U.S. statutory income tax rate | % | % | % | |||||||||||||||||

State and local taxes, net of federal benefits | ||||||||||||||||||||

Unrecognized tax benefits and tax settlements and resolution of certain tax positions(a) | ||||||||||||||||||||

| Foreign Derived Intangible Income | ( | ( | ||||||||||||||||||

| U.S. Research and Development Tax Credit | ( | ( | ( | |||||||||||||||||

| Share-based payments | ( | ( | ( | |||||||||||||||||

Non-deductible / non-taxable items | ||||||||||||||||||||

| Taxation of non-U.S. operations | ( | ( | ( | |||||||||||||||||

| All other—net | ( | ( | ||||||||||||||||||

| Effective tax rate | % | % | % | |||||||||||||||||

| As of December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

(MILLIONS OF DOLLARS) | Assets (Liabilities) | |||||||||||||

| Prepaid/deferred items | $ | $ | ||||||||||||

| Inventories | ||||||||||||||

| Capitalized R&D for tax | ||||||||||||||

| Identifiable intangible assets | ( | ( | ||||||||||||

| Property, plant and equipment | ( | ( | ||||||||||||

| Employee benefits | ||||||||||||||

| Restructuring and other charges | ||||||||||||||

| Legal and product liability reserves | ||||||||||||||

| Net operating loss/credit carryforwards | ||||||||||||||

| Unremitted earnings | ( | ( | ||||||||||||

| All other | ||||||||||||||

| Subtotal | ( | |||||||||||||

| Valuation allowance | ( | ( | ||||||||||||

Net deferred tax asset/(liability)(a)(b) | $ | $ | ( | |||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Balance, January 1 | $ | ( | $ | ( | $ | ( | ||||||||||||||

Increases based on tax positions taken during a prior period(a) | ( | ( | ( | |||||||||||||||||

Decreases based on tax positions taken during a prior period(a) | ||||||||||||||||||||

Increases based on tax positions taken during the current period(a) | ( | ( | ( | |||||||||||||||||

| Settlements | ||||||||||||||||||||

Lapse in statute of limitations(a) | ||||||||||||||||||||

Balance, December 31(b) | $ | ( | $ | ( | $ | ( | ||||||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| $ | $ | |||||||||||||

3.000% 2020 senior notes due 2050 | ||||||||||||||

| Unamortized debt discount / debt issuance costs | ( | ( | ||||||||||||

| Less current portion of long-term debt | ||||||||||||||

| Cumulative fair value adjustment for interest rate swap contracts | ( | |||||||||||||

| Long-term debt, net of discount and issuance costs | $ | $ | ||||||||||||

| After | ||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2023 | 2024 | 2025 | 2026 | 2027 | 2027 | Total | |||||||||||||||||||||||||||||||||||||

| Maturities | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Interest payments | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| Notional | ||||||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS) | 2022 | 2021 | ||||||||||||

| Derivatives not Designated as Hedging Instruments | ||||||||||||||

| Foreign currency forward-exchange contracts | $ | $ | ||||||||||||

| Derivatives Designated as Hedging Instruments | ||||||||||||||

| Foreign exchange derivative instruments (in foreign currency): | ||||||||||||||

| Euro | ||||||||||||||

| Danish krone | ||||||||||||||

| Swiss franc | ||||||||||||||

| Forward-starting interest rate swaps | $ | $ | ||||||||||||

| Fixed-to-floating interest rate swap contracts | $ | $ | ||||||||||||

| Fair Value of Derivatives | ||||||||||||||||||||

| As of December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | Balance Sheet Location | 2022 | 2021 | |||||||||||||||||

| Derivatives Not Designated as Hedging Instruments: | ||||||||||||||||||||

| Foreign currency forward-exchange contracts | Other current assets | $ | $ | |||||||||||||||||

| Foreign currency forward-exchange contracts | Other current liabilities | ( | ( | |||||||||||||||||

| Total derivatives not designated as hedging instruments | ||||||||||||||||||||

| Derivatives Designated as Hedging Instruments: | ||||||||||||||||||||

| Forward-starting interest rate swap contracts | Other non-current assets | $ | $ | |||||||||||||||||

| Forward-starting interest rate swap contracts | Other non-current liabilities | ( | ||||||||||||||||||

| Foreign exchange derivative instruments | Other current assets | |||||||||||||||||||

| Foreign exchange derivative instruments | Other non-current assets | |||||||||||||||||||

| Foreign exchange derivative instruments | Other current liabilities | ( | ( | |||||||||||||||||

| Foreign exchange derivative instruments | Other non-current liabilities | ( | ||||||||||||||||||

| Fixed-to-floating interest rate swap contracts | Other non-current assets | |||||||||||||||||||

| Fixed-to-float interest rate swap contracts | Other non-current liabilities | ( | ||||||||||||||||||

| Total derivatives designated as hedging instruments | ||||||||||||||||||||

| Total derivatives | $ | $ | ||||||||||||||||||

| Year Ended December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Foreign currency forward-exchange contracts | $ | ( | $ | ( | ||||||||||

| Year Ended December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Forward starting interest rate swap contracts | $ | ( | $ | |||||||||||

| Foreign exchange derivative instruments | $ | $ | ||||||||||||

| Year Ended December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Foreign exchange derivative instruments | $ | $ | ||||||||||||

| As of December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS, EXCEPT LEASE TERM AND DISCOUNT RATE AMOUNTS) | 2022 | 2021 | ||||||||||||||||||

| Supplemental Balance Sheet information for operating leases | ||||||||||||||||||||

| Operating lease right of use assets | $ | $ | ||||||||||||||||||

| Operating lease liabilities | ||||||||||||||||||||

| $ | $ | |||||||||||||||||||

| Operating lease liabilities - noncurrent | ||||||||||||||||||||

| Total operating lease liabilities | $ | $ | ||||||||||||||||||

| Weighted-average remaining lease term—operating leases (years) | ||||||||||||||||||||

| Weighted-average discount rate—operating leases | % | % | ||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Supplemental Income Statement information for operating leases | ||||||||||||||||||||

| Operating lease expense | $ | $ | $ | |||||||||||||||||

| Variable lease payments not included in the measurement of lease liabilities | ||||||||||||||||||||

| Short-term lease payments not included in the measurement of lease liabilities | ||||||||||||||||||||

| Supplemental Cash Flow information for operating leases | ||||||||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities | $ | $ | $ | |||||||||||||||||

| Lease obligations obtained in exchange for right-of-use assets (non-cash) | ||||||||||||||||||||

| Total | Less: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After | Lease | Imputed | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2023 | 2024 | 2025 | 2026 | 2027 | 2027 | Payments | Interest | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Maturities | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Finished goods | $ | $ | ||||||||||||

| Work-in-process | ||||||||||||||

| Raw materials and supplies | ||||||||||||||

| Inventories | $ | $ | ||||||||||||

| Useful Lives | As of December 31, | |||||||||||||||||||

| (MILLIONS OF DOLLARS) | (Years) | 2022 | 2021 | |||||||||||||||||

| Land | — | $ | $ | |||||||||||||||||

| Buildings | 33 1/3 - | |||||||||||||||||||

| Machinery, equipment and fixtures | ||||||||||||||||||||

| Construction-in-progress | — | |||||||||||||||||||

| Less: Accumulated depreciation | ||||||||||||||||||||

Property, plant and equipment | $ | $ | ||||||||||||||||||

| (MILLIONS OF DOLLARS) | U.S. | International | Total | |||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | |||||||||||||||||

| Adjustments | ( | |||||||||||||||||||

Other(b) | ( | ( | ||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | |||||||||||||||||

Additions(a) | ||||||||||||||||||||

Other(b) | ( | ( | ||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | |||||||||||||||||

| As of December 31, 2022 | As of December 31, 2021 | |||||||||||||||||||||||||||||||||||||

| Identifiable | Identifiable | |||||||||||||||||||||||||||||||||||||

| Gross | Intangible Assets, | Gross | Intangible Assets, | |||||||||||||||||||||||||||||||||||

| Carrying | Accumulated | Less Accumulated | Carrying | Accumulated | Less Accumulated | |||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | Amount | Amortization | Amortization | Amount | Amortization | Amortization | ||||||||||||||||||||||||||||||||

| Finite-lived intangible assets: | ||||||||||||||||||||||||||||||||||||||

| Developed technology rights | $ | $ | ( | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| Brands and tradenames | ( | ( | ||||||||||||||||||||||||||||||||||||

| Other | ( | ( | ||||||||||||||||||||||||||||||||||||

| Total finite-lived intangible assets | ( | ( | ||||||||||||||||||||||||||||||||||||

| Indefinite-lived intangible assets: | ||||||||||||||||||||||||||||||||||||||

| Brands and tradenames | — | — | ||||||||||||||||||||||||||||||||||||

| In-process research and development | — | — | ||||||||||||||||||||||||||||||||||||

| Product rights | — | — | ||||||||||||||||||||||||||||||||||||

| Total indefinite-lived intangible assets | — | — | ||||||||||||||||||||||||||||||||||||

| Identifiable intangible assets | $ | $ | ( | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||||||||||||||

| Amortization expense | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| As of and for the | ||||||||||||||

| Year Ended December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Change in benefit obligation: | ||||||||||||||

| Projected benefit obligation, beginning | $ | $ | ||||||||||||

| Service cost | ||||||||||||||

| Interest cost | ||||||||||||||

| Changes in actuarial assumptions and other | ( | ( | ||||||||||||

| Settlements and curtailments | ( | ( | ||||||||||||

| Benefits paid | ( | ( | ||||||||||||

| Adjustments for foreign currency translation | ( | ( | ||||||||||||

| Other––net | ( | ( | ||||||||||||

| Benefit obligation, ending | ||||||||||||||

| Change in plan assets: | ||||||||||||||

| Fair value of plan assets, beginning | ||||||||||||||

| Actual return on plan assets | ( | |||||||||||||

| Company contributions | ||||||||||||||

| Settlements and curtailments | ( | ( | ||||||||||||

| Benefits paid | ( | ( | ||||||||||||

| Adjustments for foreign currency translation | ( | ( | ||||||||||||

| Other––net | ( | ( | ||||||||||||

| Fair value of plan assets, ending | ||||||||||||||

Funded status—Projected benefit obligation in excess of plan assets at end of year(a) | $ | ( | $ | ( | ||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Pension plans with an accumulated benefit obligation in excess of plan assets: | ||||||||||||||

| Fair value of plan assets | $ | $ | ||||||||||||

| Accumulated benefit obligation | ||||||||||||||

| Pension plans with a projected benefit obligation in excess of plan assets: | ||||||||||||||

| Fair value of plan assets | ||||||||||||||

| Projected benefit obligation | ||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Service cost | $ | $ | $ | |||||||||||||||||

| Interest cost | ||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | |||||||||||||||||

| Amortization of net losses | ||||||||||||||||||||

| Net periodic benefit cost | $ | $ | $ | |||||||||||||||||

| As of December 31, | ||||||||||||||||||||

| (PERCENTAGES) | 2022 | 2021 | 2020 | |||||||||||||||||

| Weighted average assumptions used to determine benefit obligations: | ||||||||||||||||||||

| Discount rate | % | % | % | |||||||||||||||||

| Rate of compensation increase | % | % | % | |||||||||||||||||

| Cash balance credit interest rate | % | % | % | |||||||||||||||||

| Weighted average assumptions used to determine net benefit cost for the year ended December 31: | ||||||||||||||||||||

| Discount rate | % | % | % | |||||||||||||||||

| Expected return on plan assets | % | % | % | |||||||||||||||||

| Rate of compensation increase | % | % | % | |||||||||||||||||

| Cash balance credit interest rate | % | % | % | |||||||||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Equity securities: Equity commingled funds | ||||||||||||||

| Debt securities: Government bonds | ||||||||||||||

| Other investments | ||||||||||||||

Total(a) | $ | $ | ||||||||||||

| As of December 31, | ||||||||||||||||||||

| Target allocation | ||||||||||||||||||||

| percentage | Percentage of Plan Assets | |||||||||||||||||||

| (PERCENTAGES) | 2022 | 2022 | 2021 | |||||||||||||||||

| Cash and cash equivalents | % | % | ||||||||||||||||||

| Equity securities | % | % | ||||||||||||||||||

| Debt securities | % | % | ||||||||||||||||||

| Other investments | % | % | ||||||||||||||||||

| Total | % | % | ||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Stock options / stock appreciation rights | $ | $ | $ | |||||||||||||||||

| RSUs / DSUs | ||||||||||||||||||||

| PSUs | ||||||||||||||||||||

Share-based compensation expense—total(a) | $ | $ | $ | |||||||||||||||||

| Tax benefit for share-based compensation expense | ( | ( | ( | |||||||||||||||||

| Share-based compensation expense, net of tax | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

Expected dividend yield(a) | % | % | % | |||||||||||||||||

Risk-free interest rate(b) | % | % | % | |||||||||||||||||

Expected stock price volatility(c) | % | % | % | |||||||||||||||||

Expected term(d) (years) | ||||||||||||||||||||

| Weighted-Average | ||||||||||||||||||||||||||

| Remaining | Aggregate | |||||||||||||||||||||||||

| Weighted-Average | Contractual Term | Intrinsic Value(a) | ||||||||||||||||||||||||

| Shares | Exercise Price | (Years) | (Millions) | |||||||||||||||||||||||

| Outstanding, December 31, 2021 | $ | |||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Exercised | ( | |||||||||||||||||||||||||

| Forfeited | ( | |||||||||||||||||||||||||

| Outstanding, December 31, 2022 | $ | $ | ||||||||||||||||||||||||

| Exercisable, December 31, 2022 | $ | $ | ||||||||||||||||||||||||

| Year Ended/As of December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS, EXCEPT PER STOCK OPTION AMOUNTS) | 2022 | 2021 | 2020 | |||||||||||||||||

| Weighted-average grant date fair value per stock option | $ | $ | $ | |||||||||||||||||

| Aggregate intrinsic value on exercise | ||||||||||||||||||||

| Cash received upon exercise | ||||||||||||||||||||

| Tax benefits realized related to exercise | ||||||||||||||||||||

| Weighted-Average | ||||||||||||||

| RSUs | Grant Date Fair Value | |||||||||||||

| Nonvested, December 31, 2021 | $ | |||||||||||||

Granted | ||||||||||||||

Vested | ( | |||||||||||||

Reinvested dividend equivalents | ||||||||||||||

Forfeited | ( | |||||||||||||

| Nonvested, December 31, 2022 | $ | |||||||||||||

| Weighted-Average | ||||||||||||||

| PSUs | Grant Date Fair Value | |||||||||||||

| Nonvested, December 31, 2021 | $ | |||||||||||||

Granted | ||||||||||||||

Vested | ( | |||||||||||||

Reinvested dividend equivalents | ||||||||||||||

Forfeited | ( | |||||||||||||

| Nonvested, December 31, 2022 | $ | |||||||||||||

Shares issued, December 31, 2022 | $ | |||||||||||||

| Currency Translation Adjustments | Benefit Plans | Accumulated Other | ||||||||||||||||||||||||||||||

| Cash Flow | Net Investment | Other Currency | Actuarial | Comprehensive | ||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | Hedges | Hedges | Translation Adj | (Losses)/Gains | Loss | |||||||||||||||||||||||||||

| Balance, December 31, 2019 | $ | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||

| Other comprehensive (loss)/gain, net of tax | ( | ( | ( | |||||||||||||||||||||||||||||

| Balance, December 31, 2020 | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||

| Other comprehensive gain/(loss), net of tax | ( | ( | ||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | ( | ( | ( | |||||||||||||||||||||||||||||

| Other comprehensive gain/(loss), net of tax | ( | ( | ||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (MILLIONS OF DOLLARS AND SHARES, EXCEPT PER SHARE DATA) | 2022 | 2021 | 2020 | |||||||||||||||||

| Numerator | ||||||||||||||||||||

| Net income before allocation to noncontrolling interests | $ | $ | $ | |||||||||||||||||

| Less: net loss attributable to noncontrolling interests | ( | ( | ( | |||||||||||||||||

| Net income attributable to Zoetis Inc. | $ | $ | $ | |||||||||||||||||

| Denominator | ||||||||||||||||||||

| Weighted-average common shares outstanding | ||||||||||||||||||||

| Common stock equivalents: stock options, RSUs, DSUs and PSUs | ||||||||||||||||||||

| Weighted-average common and potential dilutive shares outstanding | ||||||||||||||||||||

| Earnings per share attributable to Zoetis Inc. stockholders—basic | $ | $ | $ | |||||||||||||||||

| Earnings per share attributable to Zoetis Inc. stockholders—diluted | $ | $ | $ | |||||||||||||||||

| Earnings | Depreciation and Amortization(a) | |||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||

| U.S. | ||||||||||||||||||||||||||||||||||||||

| Revenue | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Cost of Sales | ||||||||||||||||||||||||||||||||||||||

| Gross Profit | ||||||||||||||||||||||||||||||||||||||

| Gross Margin | % | % | % | |||||||||||||||||||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||||||||||||||||

| Other (income)/deductions-net | ( | |||||||||||||||||||||||||||||||||||||

| U.S. Earnings | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| International | ||||||||||||||||||||||||||||||||||||||

Revenue(b) | ||||||||||||||||||||||||||||||||||||||

| Cost of Sales | ||||||||||||||||||||||||||||||||||||||

| Gross Profit | ||||||||||||||||||||||||||||||||||||||

| Gross Margin | % | % | % | |||||||||||||||||||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||||||||||||||||

| Other (income)/deductions-net | ( | ( | ||||||||||||||||||||||||||||||||||||

| International Earnings | ||||||||||||||||||||||||||||||||||||||

| Total operating segments | ||||||||||||||||||||||||||||||||||||||

Other business activities | ( | ( | ( | |||||||||||||||||||||||||||||||||||

| Reconciling Items: | ||||||||||||||||||||||||||||||||||||||

Corporate | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Purchase accounting adjustments | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Acquisition-related costs | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Certain significant items(c) | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Other unallocated | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Total Earnings(d) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| As of December 31, | ||||||||||||||

| (MILLIONS OF DOLLARS) | 2022 | 2021 | ||||||||||||

| U.S. | $ | $ | ||||||||||||

| International | ||||||||||||||

| Property, plant and equipment, less accumulated depreciation | $ | $ | ||||||||||||

| Balance, | Balance, | |||||||||||||||||||||||||

| Beginning of | End of | |||||||||||||||||||||||||

| (MILLIONS OF DOLLARS) | Period | Additions | Deductions | Period | ||||||||||||||||||||||

| Year Ended December 31, 2022 | ||||||||||||||||||||||||||

| Allowance for doubtful accounts | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Year Ended December 31, 2021 | ||||||||||||||||||||||||||

| Allowance for doubtful accounts | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Year Ended December 31, 2020 | ||||||||||||||||||||||||||

| Allowance for doubtful accounts | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to Zoetis Inc.'s Current | ||||||||

| Report on Form 8-K filed on May 20, 2022 (File No. 001-35797)) | ||||||||

| By-laws of the Registrant, amended and restated as of December 8, 2022 (incorporated by reference to Exhibit 3.2 to Zoetis | ||||||||

| Inc.’s Current Report on Form 8-K filed on December 8, 2022 (File No. 001-35797)) | ||||||||

| Specimen Common Stock Certificate (incorporated by reference to Exhibit 4.1 to Zoetis Inc.'s Annual Report on Form 10-K | ||||||||

| filed on February 15, 2022 (File No. 001-35797)) | ||||||||

Indenture, dated as of January 28, 2013, between Zoetis Inc. and Deutsche Bank Trust Company Americas, as trustee | ||||||||

(incorporated by reference to Zoetis Inc.'s registration statement on Form S-1 (File No. 333-183254)) | ||||||||

First Supplemental Indenture, dated as of January 28, 2013, between Zoetis Inc. and Deutsche Bank Trust Company | ||||||||

Americas, as trustee (incorporated by reference to Exhibit 4.3 of Zoetis Inc.'s registration statement on Form S-1 | ||||||||

(File No. 333-183254)) | ||||||||

| Second Supplemental Indenture, dated November 13, 2015, between Zoetis Inc. and Deutsche Bank Trust Company | ||||||||

| Americas, as trustee (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K filed on | ||||||||

| November 13, 2015 (File No. 001-35797)) | ||||||||

| Third Supplemental Indenture, dated September 12, 2017, between Zoetis Inc. and Deutsche Bank Trust Company Americas, | ||||||||

as trustee (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K filed on September 12, 2017 | ||||||||

(File No. 001-35797)) | ||||||||

Fourth Supplemental Indenture, dated August 20, 2018, between Zoetis Inc. and Deutsche Bank Trust Company Americas, | ||||||||

as trustee (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K filed on August 20, 2018 | ||||||||

(File No. 001-35797)) | ||||||||

| Fifth Supplemental Indenture, dated May 12, 2020, between Zoetis Inc. and Deutsche Bank Trust Company Americas, | ||||||||

| as trustee (incorporated by reference to Exhibit 4.2 to Zoetis Inc.'s Current Report on Form 8-K filed on May 12, 2020 | ||||||||

(File No. 001-35797)) | ||||||||

| Sixth Supplemental Indenture, dated November 16, 2022, between Zoetis Inc. and Deutsche Bank Trust Company Americas, | ||||||||

| as trustee (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K filed on November 16, 2022 | ||||||||

| (File No. 001-35797)) | ||||||||

Form of 3.250% Senior Notes due 2023 (incorporated by reference to Exhibit 4.3 of Zoetis Inc.'s registration statement on | ||||||||

Form S-1 (File No. 333-183254)) | ||||||||

Form of 4.500% Senior Notes due 2025 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on | ||||||||

Form 8-K filed on November 13, 2015 (File No. 001-35797)) | ||||||||

Form of 4.700% Senior Notes due 2043 (incorporated by reference to Exhibit 4.3 of Zoetis Inc.'s registration statement on | ||||||||

Form S-1 (File No. 333-183254)) | ||||||||

Form of 3.000% Senior Notes due 2027 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

filed on September 12, 2017 (File No. 001-35797)) | ||||||||

| Form of 3.950% Senior Notes due 2027 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

filed on September 12, 2017 (File No. 001-35797)) | ||||||||

Form of 3.900% Senior Notes due 2028 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

filed on August 20, 2018 (File No. 001-35797)) | ||||||||

Form of 4.450% Senior Notes due 2048 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

filed on August 20, 2018 (File No. 001-35797)) | ||||||||

| Form of 2.000% Senior Notes due 2030 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

| filed on May 12, 2020 (File No. 001-35797)) | ||||||||

| Form of 3.000% Senior Notes due 2050 (incorporated by reference to Exhibit 4.2 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

| filed on May 12, 2020 (File No. 001-35797)) | ||||||||

| Form of 5.400% Senior Notes due 2025 (incorporated by reference to Exhibit 4.3 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

| filed on November 16, 2022 (File No. 001-35797)) | ||||||||

| Form of 5.600% Senior Notes due 2032 (incorporated by reference to Exhibit 4.4 to Zoetis Inc.’s Current Report on Form 8-K | ||||||||

| filed on November 16, 2022 (File No. 001-35797)) | ||||||||

Description of the Registrant’s Securities † | ||||||||

Global Separation Agreement, dated February 6, 2013, by and between Zoetis Inc. and Pfizer Inc. (incorporated by reference to | ||||||||

| Exhibit 10.1 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on March 28, 2013 (File No. 001-35797)) | ||||||||

Tax Matters Agreement, dated February 6, 2013, by and between Zoetis Inc. and Pfizer Inc. (incorporated by reference to | ||||||||

| Exhibit 10.3 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on March 28, 2013 (File No. 001-35797)) | ||||||||

| Research and Development Collaboration and License Agreement, dated February 6, 2013, by and between Zoetis Inc. | ||||||||

| and Pfizer Inc. (incorporated by reference to Exhibit 10.4 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on | ||||||||

March 28, 2013 (File No. 001-35797)) | ||||||||

| Pfizer Inc. 2004 Stock Plan, as amended and restated (incorporated by reference to Exhibit 10.6 of Zoetis Inc.'s registration | ||||||||

| statement on Form S-1 (File No. 333-183254))* | ||||||||

| Patent and Know-How License Agreement (Zoetis as licensor), dated February 6, 2013, by and between Zoetis Inc. and | ||||||||

| Pfizer Inc. (incorporated by reference to Exhibit 10.8 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on | ||||||||

| March 28, 2013 (File No. 001-35797)) | ||||||||

| Patent and Know-How License Agreement (Pfizer as licensor), dated February 6, 2013, by and between Zoetis Inc. and | ||||||||

| Pfizer Inc. (incorporated by reference to Exhibit 10.9 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on | ||||||||

| March 28, 2013 (File No. 001-35797)) | ||||||||

| Trademark and Copyright License Agreement, dated February 6, 2013, by and between Zoetis Inc. and Pfizer Inc. | ||||||||

| (incorporated by reference to Exhibit 10.10 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on March 28, 2013 | ||||||||

| (File No. 001-35797)) | ||||||||

| Environmental Matters Agreement, dated February 6, 2013, by and between Zoetis Inc. and Pfizer Inc. (incorporated by | ||||||||

| reference to Exhibit 10.13 to Zoetis Inc.’s 2012 Annual Report on Form 10-K filed on March 28, 2013) (File No. 001-35797)) | ||||||||

| Zoetis Inc. 2013 Equity and Incentive Plan, as amended and restated as of May 19, 2022 (incorporated by reference to Exhibit | ||||||||

| 10.1 to Zoetis Inc.’s Quarterly Report on Form 10-Q filed on August 4, 2022 (File No. 001-35797))* | ||||||||

| Sale of Business Severance Plan (incorporated by reference to Exhibit 10.17 to Zoetis Inc.’s 2012 Annual Report on | ||||||||

| Form 10-K filed on March 28, 2013 (File No. 001-35797))* | ||||||||

| Revolving Credit Agreement, dated as of December 21, 2022, among Zoetis Inc., the lenders party thereto and JPMorgan | ||||||||