Annual Report

May 31, 2018

Elements U.S. Portfolio

Elements U.S. Small Cap Portfolio

Elements International Portfolio

Elements International Small Cap Portfolio

Elements Emerging Markets Portfolio

As filed with the Securities and Exchange Commission on XX

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22761

Stone Ridge Trust

(Exact name of registrant as specified in charter)

510 Madison Avenue, 21st Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Stone Ridge Asset Management LLC

510 Madison Avenue, 21st Floor

New York, NY 10022

(Name and address of agent for service)

(855) 609-3680

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2018

Date of reporting period: May 31, 2018

Item 1. Reports to Stockholders.

Annual Report

May 31, 2018

Elements U.S. Portfolio

Elements U.S. Small Cap Portfolio

Elements International Portfolio

Elements International Small Cap Portfolio

Elements Emerging Markets Portfolio

The shareholder letter below is reprinted from the Annual Report of the Stone Ridge Funds for the year ended October 31, 2017. The letter is dated December 2017 and speaks only as of its date. No updates have been made to, and no undertaking has been made to update, any data or other information contained in the letter.

The training of an instinct, of a truly fresh way of looking at the world, demands a kind of calm.

- Joshua Ramo, The Seventh Sense

December 2017

Dear Fellow Shareholder:

Stone Ridge launched its first funds five years ago. In the interim, we’ve become a global firm providing efficient access to a wide variety of uncorrelated risks, with responsibility for $14 billion of our investors’ life savings. One particularly wonderful aspect of the journey thus far: our footprints are indistinguishable from your footprints. We’re traveling together.

Together, we have explored Reinsurance, the Variance Risk Premium (VRP), and Alternative Lending. Together, we have changed the breadth of tools available for constructing portfolios and created a home for those seeking to innovate in finance. Together, we have breathed new life into certain investment structures originally conceived of by US regulators decades ago – and barely used until we dusted them off in 2013. Together, we have formed the Stone Ridge network of forward-thinking RIAs. Together, we are just getting started.

THE REAL POWER OF COMPOUNDING

If a high-priced management consultant analyzed our firm, I’m sure he’d tell us that we’re doing it all wrong. Looking externally, he’d tell us we should have a far more diversified client base, our products should be on every possible distribution platform, and we should do lots of press and advertising. Looking internally, he’d tell us we should have co-heads for every department, we should cull the bottom 5% of staff every year, and we should have a written succession plan for every employee. I count six too many “should’s”. We do none of those things. What the consultant would be missing is that when it comes to relationships, the power of compounding is far more potent than the power of diversification.

Think about the most important relationships in your life. They are almost certainly the ones that are the longest. Your parents, your spouse, your children, perhaps a couple of very old friends? Those relationships have benefitted the most from the power of compounding. The best shot Stone Ridge has to really matter to you – to be a true partner, not a vendor – is by practicing an extreme form of continuity. That’s why our RIA investors always see the same folks from Stone Ridge showing up in their offices, that’s why they see us a lot, and that’s why we don’t seek more diversification in our investor relationships. I’ll take compounding every time.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

1

Shareholder Letter

Viewed through that lens, perhaps it’s obvious why a key design principle of Stone Ridge since inception has been to have a smaller number of large relationships. This principle applies internally – let’s have a smaller number of phenomenally talented people, with virtually zero turnover. And it applies externally – let’s have a smaller number of large, forward thinking investors, who invest across the spectrum of Stone Ridge strategies. Indeed, 86% of the RIA firms we work with invest in multiple Stone Ridge funds, and in our last two product launches – $1.3 billion (18 months ago) and $2 billion (8 months ago), respectively – 100% of the firms at launch were existing Stone Ridge investors. We didn’t share those opportunities with any firm that wasn’t already an investor, and the trading profit for those products combined has been $610 million.

This compounding principle also applies to our partnerships with reinsurers. Many cynical industry participants assumed that in a hard market, reinsurers would share less risk with us and keep more of the higher-yielding business for themselves. Exactly the opposite has occurred. After a $100+ billion loss year for the industry, globally leading reinsurers – our core partners that we have been working with for years – made Stone Ridge their first post-event call.

While we hoped for and expected this behavior, post-event reactions were untested. That’s no longer true. Most important, our ecosystem of investors, reinsurers, and Stone Ridge funds proved to be Antifragile – the ultimate hedge against disasters. The bottom line is that the best of the reinsurance industry continues to grow with Stone Ridge, strategically leveraging our capital to extend their own lead in the market.

INTIMACY, INNOVATION, AND SERVICE

Given the extreme version of relationship continuity we practice, the resulting level of intimacy inside our firm gives us the freedom to innovate. Stone Ridge is comprised of makers and inventors. We’re ceaseless tinkerers, infected with ceaseless optimism. Our view of the world is unconcerned with things as they are – we focus on things as they might be, as they ought to be. Though each of our product launches have been “first of its kind” in the ’40 Act, we take no satisfaction in our firm being admired as creative. We just want to be left alone to actually be creative.

Our moat is our simplicity, dug deeper by our insight that charisma is as overrated as patience is underrated. I like things that take a long time.

Stone Ridge is also powered differently. We don’t build products just to sell them. Instead, we sell so we can build. The creative process is its own reward. The purity in our “sell to build, don’t build to sell” ethos inspires and untethers us. It’s extraordinarily attractive to be around. In many ways, it’s addictive.

We point our creativity towards product development, in service of our investors and our communities. In doing so, we serve our country and the broader world, the ultimate in socially responsible investing. Our Reinsurance funds enabled $1 billion to flow to the victims of the California wildfires, and Hurricanes Harvey/Irma/Maria, in their darkest hour. And every day, our Alternative Lending fund, LENDX, provides a nudge to economic growth in local neighborhoods across the United States. Finance is a powerful force for good.

AMERICA AND LENDX

Our country is blessed with limitless natural resources, giant oceans protecting us on the left and right, and friendly neighbors to the north and south. We’ve got a military that any other country would trade for theirs, a political class constrained by an ingenious system of checks and balances, and a built-in self-correcting mechanism of free elections.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

2

Shareholder Letter

Two hundred forty years later, it is easy to forget how uniquely successful the American experiment has been. One powerful cause of this success: America allows people to bet on themselves. No one is guaranteed success, but in America we can all try. And try again. And try again.

Credit represents a powerful accelerant for those who want to bet on themselves. However, our current credit system is easily accessible and efficient only for subprime borrowers and very large borrowers. In contrast, small loans to prime and super-prime consumers, and especially to small businesses, are highly inefficient, too expensive, and often simply unavailable. This aspect of the credit formation process is largely broken, an unnecessary limiter to our country’s economic potential.

A recent Federal Reserve studyi of more than 10,000 small businesses across all 50 states revealed that “credit available for expansion” is the top financial challenge for business owners, and a staggering 59% use a credit card as their only source of borrowing. A related study by Paynetii showed that a typical small business underwriting process requires 28 separate tasks, 100 hours of work, and takes four to eight weeks, at an average cost of $6,555 per application. What if the small business only wants to borrow $5,000? Or $10,000?

LENDX is part of the solution. Since its inception in June 2016, LENDX has purchased 410,009 loans, $7 billion in all, and supported 77,749 small businesses. An incredible 92% of our small business loans have been under $10,000. These are loans to your local ice cream parlor, your local barber shop, your local gas station. Given the $6,555 average cost of loan origination via banks, it’s clear that these loans would simply not have been possible without you and LENDX.

Imagine if each of those 77,749 small businesses hired just one extra person? Maybe you even know that person. Maybe you are that person. How much does that add to your local economy, to your local neighborhood, to the fabric of your daily life?

In the context of asset allocation, the vast majority of our investors use LENDX as a substitute for traditional fixed income, which today suffers from a potentially toxic combination of low yield and high duration. LENDX is the opposite: high yield and low duration. Since inception, LENDX has materially outperformed the Barclays Aggregate benchmark, with no correlation.

And while LENDX has delivered, we’re just warming up. In this asset class, unlike most, size is not the enemy of performance. Towards the end of 2017, the fund’s size allowed us to significantly lower our already market leading borrowing costs and further reduce servicing fees from certain platforms we selected. We’ve also started accepting material investments into LENDX from some of the largest (re)insurance companies in the world – all partners in our reinsurance franchise – because as one (re)insurance CEO remarked to me, “We’re not built for zero interest rates.” No one is.

A NEW 60/40?

Since the financial crisis low in March 2009, the 60/40 portfolio has been remarkably, at times preposterously, and certainly unsustainably, good. To be precise, during this time period of almost 8 years, 60/40 has delivered annualized excess returns of 12.7%, annualized volatility of 6.9%, and a Sharpe Ratio of 1.8. To put this in perspective, the 90-year average for 60/40 is 5.0% annualized excess returns, with 12.0% annualized volatility, and a Sharpe Ratio of 0.4. So compared to the long-term average, post-crisis 60/40 has enjoyed 2.5x the annualized excess return, about 40% less volatility, and more than 4.5x the Sharpe Ratio. Wow. It’s not supposed to be this easy to make money.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

3

Shareholder Letter

Try the following thought experiment: holding volatility constant at the long-term average, what would annualized excess returns have to be over the next 10 and 20 years, for the post-crisis Sharpe Ratio to be equal to the long term average?

The answer: negative 2.6% annualized return for the next 10 years, and positive 1.2% annualized return for the next 20 years. Another “Wow.” Imagine making essentially no money on your investments for the next 10 or 20 years. No, really, stop and think about it for a moment. What would that mean for you?

Virtually no one today is thinking that a “lost decade or two” of returns is possible. Let’s be clear: it may not occur, but it certainly is possible. Just like the (re)insurance industry is not built for zero interest rates, today the world at large is not prepared for no returns to 60/40 for the next 10-20 years. Whether it’s pension funds, 401ks, or any individual investor’s retirement goals, extended periods of no returns are blissfully ignored in most everyone’s underwriting model.

So what to do? The good news is that markets have anticipated this challenge and a second wave of financial innovation is underway. The first wave “democratized investments” by making it possible for large numbers of investors to access the equity and bond markets via lower cost mutual funds and Exchange Traded Funds (ETFs). The second wave involves “democratizing balance sheets”, uncovering a much broader array of risks arising from financial intermediation – by banks, (re)insurance companies, and market makers – and making them available in cost-efficient structures.

In this second wave, we shift risk holding from a tiny number of gigantic balance sheets to a gigantic number of tiny balance sheets. We unlock profitable business lines historically buried within financial institutions. We de-risk the financial system. And we empower investors to access valuable P&L streams that can diversify 60/40. The alternative risk premiums Stone Ridge currently provides are just the start.

PRINCIPALS VS. AGENTS

To actually break free from 60/40, investors will need to find new managers that can provide both sufficient diversification to protect their wealth and sufficient return potential to grow their wealth. As part of new manager diligence, investors will need to ask different questions. Better questions. In fact, the quality of investor questions will determine the quality of investor performance.

Again, good news. Here is a necessary and sufficient set of diligence questions for managers:

Are the Portfolio Managers (PMs) and all employees required to invest in the funds? Do they pay full fees? Do the Independent Trustees of the Fund Board take all of their compensation in fund shares? Does the manager strictly limit when investors can purchase shares? Has the manager ever returned capital to investors?

If investors ask these questions, they never even have to meet with managers. If the answers are all yes, you are aligned. If not, be careful. The advice I have for manager selection is the same advice I have for my teenage daughter about teenage boy selection: ignore everything they say and only pay attention to what they do.

At Stone Ridge, we are principals, not agents. All PMs, indeed all employees, are required to invest in all strategies at full fees. Our Board elects to take 100% of their compensation in fund shares, not cash. We strictly limit when investors can give us money. All of this has been true since the firm began. And at the end of 2016, we returned $300 million of capital to investors when we determined that one of our funds was about to get too big, relative to the opportunity set.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

4

Shareholder Letter

Health warning: what we do is very risky. Do not get lulled into a false sense of security when looking at the consistency of our past results. In future years, there will be tragic earthquakes and hurricanes causing industry losses far worse than those this year. There will be market crashes and credit crises.

However, we’re unafraid to lead by example. The firm and employees together have over $400 million directly invested in our own funds. We’re proud of this alignment with our investors. It’s possible to go forward with no 60/40 at all. It may even be necessary.

OUR PARTNERSHIP

Stone Ridge is most proud of the 50/50 partnership we have with you, our clients. We are on the path together. You contribute the capital necessary to sustain and propel groundbreaking product development. We contribute our collective careers’ worth of experience in sourcing, structuring, execution, and risk management. Together, it works. In that spirit, I offer my deepest gratitude to you for sharing responsibility for your wealth with us this year. We look forward to serving you again in 2018.

Sincerely,

Ross Stevens

Founder, CEO

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

5

Shareholder Letter

| 1 | Federal Reserve Bank of New York, 2016 Small Business Credit Survey (April 2017). |

| 1 | Paynet, “Rediscovering C&I Lending in 2017”. |

Return on Equity (ROE): a measure of a corporations profitability.

Sharpe Ratio: a portfolio’s excess return divided by its volatility.

RIA: stands for “Registered Investment Advisor”

60/40: stands for a portfolio comprised of 60% stocks and 40% bonds

P&L: stands for “profit and loss”

The Barclays Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. It is not possible to invest in an index.

RISK DISCLOSURES

The Stone Ridge Funds consist of the Stone Ridge High Yield Reinsurance Risk Premium Fund (“SHRIX”), the Stone Ridge Reinsurance Risk Premium Interval Fund (“SRRIX”), the Stone Ridge Post-Event Reinsurance Fund (“SRPEX” and, together with SHRIX and SRRIX, the “Reinsurance Funds”), the Stone Ridge U.S. Large Cap Variance Risk Premium Fund (the “U.S. Large Cap VRP Fund”), the Stone Ridge U.S. Small Cap Variance Risk Premium Fund (the “U.S. Small Cap VRP Fund”), the Stone Ridge U.S. Variance Risk Premium Master Fund (the “U.S. VRP Master Fund” and, together with the U.S. Large Cap VRP Fund and the U.S. Small Cap VRP Fund, the “U.S. VRP Funds”), the Stone Ridge International Developed Markets Variance Risk Premium Fund (the “Developed Markets VRP Fund”), the Stone Ridge Global Equity Variance Risk Premium Master Fund (the “Global VRP Master Fund” and, together with the Developed Markets VRP Fund, the “International VRP Funds”), the Stone Ridge All Asset Variance Risk Premium Fund (“AVRPX” and, together with the U.S. VRP Funds and the International VRP Funds, the “VRP Funds”) and the Stone Ridge Alternative Lending Risk Premium Fund (“LENDX” and, together with the Reinsurance Funds and the VRP Funds, the “Funds”).

The Portfolios consist of the Elements U.S. Portfolio, Elements U.S. Small Cap Portfolio, Elements International Portfolio, Elements International Small Cap Portfolio, and Elements Emerging Markets Portfolio (collectively, the “Portfolios”, and each a “Portfolio”).

The Funds and the Portfolios are generally sold to (i) institutional investors, including registered investment advisers (“RIAs”), that meet certain qualifications and have completed an educational program provided by Stone Ridge Asset Management LLC (the “Adviser”); (ii) clients of such institutional investors; and (iii) certain other eligible investors (as described in the relevant prospectus). Investors should carefully consider the Funds’ and the Portfolios’ risks and investment objectives, as an investment in the Funds and/or the Portfolios may not be appropriate for all investors and the Funds and the Portfolios are not designed to be a complete investment program. There can be no assurance that the Funds and/or the Portfolios will achieve their investment objectives. An investment in the Funds and/or the Portfolios involves a high degree of risk. It is possible that investing in a Fund and/or a Portfolio may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment. Before investing in a Fund and/or a Portfolio, an investor should read the discussion of the risks of investing in the Fund and/or the Portfolio in the relevant prospectus.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

6

Shareholder Letter

Holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security.

Investing in funds involves risks, as does all investing. Principal loss is possible.

The VRP Funds may invest in a variety of derivatives, including put and call options, futures contracts, options on futures contracts, swaps, swaptions, and other exchange-traded and over-the-counter derivatives contracts. The VRP Funds may invest in derivatives to generate income from premiums, for investment purposes, and for hedging and risk management purposes. A VRP Fund’s use of derivatives as part of its principal investment strategy to sell protection against the volatility of various underlying references involves the risk that, if the volatility of the underlying references is greater than expected, the VRP Fund will bear losses to the extent of its obligations under the relevant derivative contracts, which may not be outweighed by the amount of any premiums received for the sale of such derivative instruments. The use of derivatives involves risks that are in addition to, and potentially greater than, the risks of investing directly in securities and other more traditional assets. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, and credit risk.

Direct or indirect investments in securities of foreign issuers involve risks not ordinarily associated with exposure to securities and instruments of U.S. issuers, including differences in accounting, auditing and financial standards; less government supervision and regulation; currency risk; risks of expropriation, confiscatory taxation, political or social instability or diplomatic developments; less publicly available information; less volume in foreign markets; and increased costs of transacting in foreign markets. These risks are heightened in emerging markets.

The reinsurance industry relies on risk modeling to analyze potential risks in a single transaction and in a portfolio of transactions. The models are based on probabilistic simulations that generate thousands or millions of potential events based on historical data, scientific and meteorological principles and extensive data on current insured properties. Sellers of reinsurance-related securities typically provide a set of risk analytics and statistics at the time of trade that include models.

Event-linked bonds, catastrophe bonds and other reinsurance-related securities carry large uncertainties and major risk exposures to adverse conditions. If a trigger event, as defined within the terms of the bond, involves losses or other metrics exceeding a specific magnitude in the geographic region and time period specified therein, a Fund may lose a portion or all of its investment in such security. Such losses may be substantial. The reinsurance-related securities in which the Funds invest are considered “high yield” or “junk bonds.”

SHRIX and SRRIX may invest in reinsurance-related securities issued by foreign sovereigns and foreign entities that are corporations, partnerships, trusts or other types of business entities. Because the majority of reinsurance-related security issuers are domiciled outside the United States, each of SHRIX and SRRIX will normally invest significant amounts of its assets in non-U.S. entities. Accordingly, each of them may invest without limitation in securities issued by non-U.S. entities, including those in emerging market countries. Foreign issuers could be affected by factors not present in the U.S., including expropriation, confiscatory taxation, lack of uniform accounting and auditing standards, less publicly available financial and other information, potential difficulties in enforcing contractual obligations, and increased costs to enforce applicable contractual obligations outside the U.S.. These risks are greater in emerging markets.

The value of LENDX’s investments in whole loans and other alternative lending-related securities, such as shares, certificates, notes or other securities representing an interest in and the right to receive principal and interest payments due on whole loans or fractions of whole loans, is entirely dependent on the

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

7

Shareholder Letter

borrowers’ continued and timely payments. If a borrower is unable or fails to make payments on a loan for any reason, LENDX may be greatly limited in its ability to recover any outstanding principal or interest due, as (among other reasons) LENDX may not have direct recourse against the borrower or may otherwise be limited in its ability to directly enforce its rights under the loan, whether through the borrower or the platform through which such loan was originated, the loan may be unsecured or under-collateralized and/or it may be impracticable to commence a legal proceeding against the defaulting borrower. LENDX generally will need to rely on the efforts of the platforms, servicers or their designated collection agencies to collect on defaulted loans and there is no guarantee that such parties will be successful in their efforts to collect on loans. Even if a loan in which LENDX has investment exposure is secured, there can be no assurance that the collateral will, when recovered and liquidated, generate sufficient (or any) funds to offset any losses associated with the defaulting loan. Although LENDX conducts diligence on the platforms, LENDX generally does not have the ability to independently verify, and will not independently diligence or confirm the truthfulness of, the information provided by the platforms, other than payment information regarding loans and other alternative lending-related securities owned by LENDX, which LENDX will observe directly as payments are received. The default history for alternative lending borrowing arrangements is limited and future defaults may be higher than historical defaults.

In general, the value of a debt security is likely to fall as interest rates rise. LENDX may invest in below-investment grade securities, which are often referred to as “junk,” or in securities that are unrated but that have similar characteristics to junk bonds. Such instruments have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and illiquid. LENDX’s investments in securitization vehicles or other special purpose entities that hold alternative lending-related securities (asset-backed securities) may involve risks that differ from or are greater than risks associated with other types of investments. The risks and returns for investors like LENDX in asset-backed securities depend on the tranche in which the investor holds an interest, and the value of an investment in LENDX may be more volatile and other risks tend to be compounded if and to the extent that LENDX is exposed to asset-backed securities directly or indirectly.

LENDX may invest directly or indirectly in the alternative lending-related securities of foreign issuers. Such investments may involve risks not ordinarily associated with exposure to alternative lending-related securities of U.S. issuers. The foreign alternative lending industry may be subject to less governmental supervision and regulation than exists in the U.S.; conversely, foreign regulatory regimes applicable to the alternative lending industry may be more complex and more restrictive than those in the U.S., resulting in higher costs associated with such investments, and such regulatory regimes may be subject to interpretation or change without prior notice to investors, such as LENDX. Foreign platforms may not be subject to accounting, auditing, and financial reporting standards and practices comparable to those in the U.S. Due to difference in legal systems, there may be difficulty in obtaining or enforcing a court judgment outside the U.S.

Some Funds (or their subsidiaries) may obtain financing to make investments and may obtain leverage through derivative instruments that afford the Fund economic leverage. Therefore, such Funds are subject to leverage risk. Leverage magnifies a Fund’s exposure to declines in the value of one or more underlying reference instruments or creates investment risk with respect to a larger pool of assets than the Fund would otherwise have and may be considered a speculative technique. The value of an investment in a Fund will be more volatile and other risks tend to be compounded if and to the extent the Fund borrows or uses derivatives or other investments that have embedded leverage. This risk is enhanced for SHRIX and SRRIX because they invest substantially all their assets in reinsurance-related securities. Reinsurance-related securities can quickly lose all or much of their value if a triggering event occurs. Thus, to the extent assets subject to a triggering event are leveraged, the losses could substantially outweigh SHRIX’s or SRRIX’s investment and result in significant losses to the relevant Fund.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

8

Shareholder Letter

Economic, political, and issuer-specific events will cause the value of securities, and the Portfolio that owns them, to rise or fall. Because the value of your investment in a Portfolio will fluctuate, you may lose money, even over the long term. Securities of smaller companies are often less liquid than those of larger companies, and smaller companies are generally more vulnerable to adverse business or economic developments and may have more limited resources. Foreign securities prices may decline or fluctuate because of economic or political actions of foreign governments and/or less regulated or liquid securities markets and may give rise to foreign currency risk. Securities of companies that exhibit other factors such as value, momentum or quality may be riskier than securities of companies that do not exhibit those factors, and may perform differently from the market as a whole. If a Portfolio uses derivatives, such Portfolio will be directly exposed to the risks of that derivative, including the risk that the counterparty is unable or unwilling to perform its obligations. Derivatives are subject to a number of additional risks, including risks associated with liquidity, interest rates, market movements and valuation. Securities lending and similar transactions involve the risk that the counterparty may fail to return the securities in a timely manner or at all and that the value of collateral securing a securities loan or similar transaction falls.

The Funds and the Portfolios may invest in illiquid or restricted securities, which may be difficult or impossible to sell at a time that a Fund or Portfolio would like or at the price that a Fund or Portfolio believes the security is currently worth.

Each Fund and each Portfolio intends to qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code. A Fund’s or a Portfolio’s investment strategy will potentially be limited by its intention to qualify for treatment as a RIC. The tax treatment of certain of the Funds’ and certain of the Portfolios’ investments under one or more of the qualification or distribution tests applicable to RICs is not certain. An adverse determination or future guidance by the IRS might affect a Fund’s or a Portfolio’s ability to qualify for such treatment.

If, in any year, a Fund or a Portfolio were to fail to qualify for treatment as a RIC under the Internal Revenue Code for any reason, and were unable to cure such failure, the Fund or the Portfolio would be subject to tax on its taxable income at corporate rates, and all distributions from earnings and profits, including any distributions of net tax-exempt income and net long-term capital gains, would be taxable to shareholders as ordinary income.

For additional risks, please refer to the relevant prospectus and statement of additional information.

Each of the Reinsurance Funds, the Portfolios, AVRPX and LENDX is classified as non-diversified under the 1940 Act. Accordingly, each such Fund or Portfolio may invest a greater portion of its assets in the securities of a single issuer than if it were a diversified fund, which may subject such Fund or Portfolio to a higher degree of risk associated with and developments affecting that issuer than a fund that invests more widely.

Each of AVRPX, SRRIX and LENDX has an interval fund structure pursuant to which each Fund, subject to applicable law, conducts quarterly repurchase offers of the Fund’s outstanding shares at net asset value (“NAV”), subject to approval of the Board of Trustees. In all cases, such repurchases will be for at least 5% and not more than 25% of the relevant Fund’s outstanding shares. Repurchase offers are currently expected to be 5% for SRRIX and LENDX and 10% for AVRPX. In connection with any given repurchase offer, it is possible that a Fund may offer to repurchase only the minimum amount of 5% of its outstanding shares. It is possible that a repurchase offer may be oversubscribed, with the result that shareholders may only be able to have a portion of their shares repurchased. There is no assurance that you will be able to tender your Shares when or in the amount that you desire. The Funds’ shares are not listed and the Funds do not currently intend to list their shares for trading on any national securities exchange; the shares are, therefore, not marketable, and you should consider the shares to be illiquid.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

9

Shareholder Letter

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund or a Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-609-3680. Performance over one year is annualized except where otherwise specified.

Total Annual Fund Operating Expenses before fee waiver and/or expense reimbursement / (recoupment): for VRLIX=1.55%; for VRSIX=1.77%; for VRFIX=2.07%; for VRGIX=2.05%; for SHRIX=1.81%; for AVRPX=2.76%; for LENDX=4.56%. Total Annual Fund Operating Expenses after fee waiver and/or expense reimbursement / (recoupment): for VRLIX=1.57%; for VRSIX=1.64%; for VRFIX=1.87%; for VRGIX=1.95%; for SHRIX=1.77%; for AVRPX=2.78%; for LENDX=4.57%. Total Annual Fund Operating Expenses for VRPIX=1.65%; for SRRIX=2.40%.

Standardized returns as of most recent quarter-end (06/30/18): for VRLIX 1Yr=2.09%, 5Yr=7.07%, since inception(5/1/2013)=6.90%; for VRSIX 1Yr=6.60%, 5Yr=6.04%, since inception(5/1/2013)=6.31%; for VRFIX 1Yr=2.47%, since inception(2/11/14)=3.17%; for VRGIX 1Yr=3.14%, since inception(11/14/2014)=3.63%; for VRPIX 1Yr=3.49%, 5Yr=6.59%, since inception(5/22/2013)=6.36%; for SHRIX 1Yr=-2.10%, 5Yr=5.45%, since inception(2/1/2013)=5.04%; for SRRIX 1Yr=-12.67%, since inception(12/9/2013)=2.98%; for AVRPX 1Yr=0.01%, since inception(4/2/2015)=4.65%; for LENDX 1Yr=5.98%, since inception(6/1/2016)=8.61%; for ELUSX 1Yr=14.30%, since inception (3/31/17)=13.19%; for ELSMX 1Yr=16.32%, since inception (3/31/17)=13.53%; for ELINX 1Yr=6.53%, since inception(4/28/17)=8.61%; for ELISX 1Yr=8.52%, since inception (4/28/17)=11.44%; for ELMMX 1Yr=6.63%, since inception (5/31/17)=7.21%. As of 06/30/18, 30-day SEC yield: SHRIX 5.09%; SRRIX 0.00%; LENDX 9.32% (net), 9.39% (gross of subsidized expenses). Results for the Funds reflect the reinvestment of dividends and other earnings and are net of fees and expenses. As a result of economic incentives received from platforms that may not be repeated, early LENDX performance was unusually strong for the period shown and should not be extrapolated to future periods. Results for the Portfolios reflect the reinvestment of all dividends, are net of fees and expenses, and reflect waivers of all of the Portfolios’ investment management fees and partial reimbursement of expenses. The Adviser has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolios to 0.15% (for ELUSX and ELSMX) or 0.20% (for ELINX, ELISX and ELMMX) for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued in whole or in part after that date. In the absence of fee waivers and reimbursements, returns for the Portfolios would have been lower. Portfolio returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total annual fund operating expenses for the Portfolios as disclosed in the most recent prospectus: for ELUSX, 0.45%; for ELSMX, 0.65%; for ELINX, 0.62%; for ELISX, 0.73%; for ELMMX, 0.86%.

Information furnished by others, upon which all or portions of the information contained herein are based, are from sources believed to be reliable. Stone Ridge makes no representation as to the accuracy, adequacy or completeness of such information and it has accepted the information without further verification.

The information provided herein should not be construed in any way as tax, capital, accounting, legal or regulatory advice. Investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Opinions expressed are subject to change at any time, and are not guaranteed and should not be considered investment advice.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

10

Shareholder Letter

The Funds’ and Portfolios’ investment objectives, risks, charges and expenses must be considered carefully before investing. The relevant prospectus contains this and other important information about the investment company. You can obtain an additional copy of the Funds’ and the Portfolios’ most recent periodic reports and certain other regulatory filings by calling 855-609-3860 or visiting www.stoneridgefunds.com for the Funds and www.elementsfunds.com for the Portfolios. The Funds’ and the Portfolios’ prospectuses, which include a statement of additional information, can be found by visiting:

Stone Ridge High Yield Reinsurance Risk Premium Fund1: Prospectus and SAI

Stone Ridge Reinsurance Risk Premium Interval Fund2: Prospectus and SAI

Stone Ridge Post-Event Reinsurance Fund2: Prospectus and SAI

Stone Ridge U.S. Large Cap Variance Risk Premium Fund, Stone Ridge U.S. Small Cap Variance Risk Premium Fund, Stone Ridge U.S. Variance Risk Premium Master Fund, Stone Ridge International Developed Markets Variance Risk Premium Fund, and Stone Ridge Global Equity Variance Risk Premium Master Fund1: Prospectus and SAI

Stone Ridge All Asset Variance Risk Premium Fund2: Prospectus and SAI

Stone Ridge Alternative Lending Risk Premium Fund2: Prospectus and SAI

Elements Portfolios1: Prospectus and SAI

1Open-end fund, 2Closed-end interval fund

The prospectuses should be read carefully before investing.

The Stone Ridge Funds and the Portfolios are distributed by ALPS Distributors, Inc. SRG000565

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

11

| ELEMENTS U.S. PORTFOLIO |

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge Asset Management LLC (“Stone Ridge”). Stone Ridge has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolio to 0.15% for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Russell 1000 Index is an unmanaged index that measures the performance of the stocks of the large-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2018) | ||||||||

| 1-year period ended 5/31/18 |

Since Commencement of Operations (4/3/17) |

|||||||

| Elements U.S. Portfolio |

14.02% | 13.12% | ||||||

| Russell 1000 Index |

14.60% | 14.71% | ||||||

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

12

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| PERFORMANCE DATA (Unaudited) |

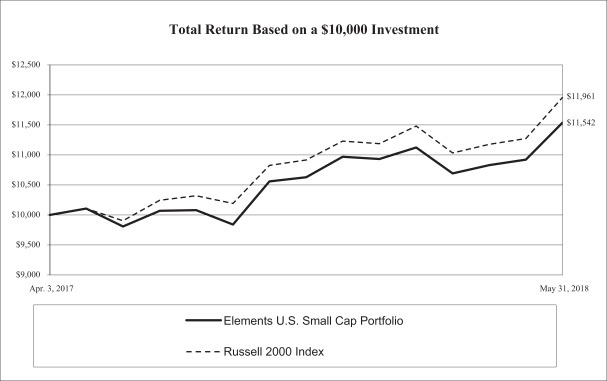

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolio to 0.15% for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2018) | ||||||||

| 1-year period ended 5/31/18 |

Since Commencement of Operations (4/3/17) |

|||||||

| Elements U.S. Small Cap Portfolio |

17.65% | 13.14% | ||||||

| Russell 2000 Index |

20.76% | 16.66% | ||||||

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

13

| ELEMENTS INTERNATIONAL PORTFOLIO |

| PERFORMANCE DATA (Unaudited) |

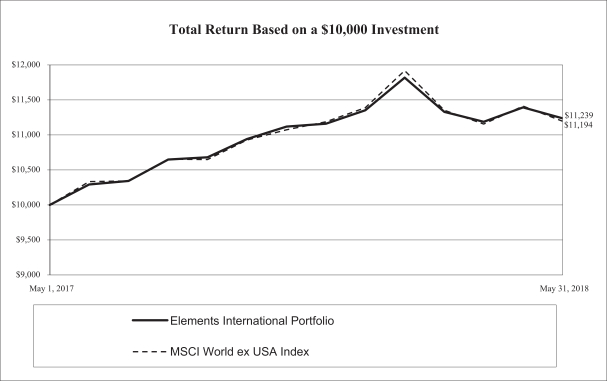

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolio to 0.20% for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The MSCI World ex USA Index is a free-float adjusted index which captures large- and mid-cap representation across 22 of 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2018) | ||||||||

| 1-year period ended 5/31/18 |

Since Operations |

|||||||

| Elements International Portfolio |

9.22% | 11.37% | ||||||

| MSCI World ex USA Index |

8.33% | 10.96% | ||||||

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

14

| ELEMENTS INTERNATIONAL SMALL CAP PORTFOLIO |

| PERFORMANCE DATA (Unaudited) |

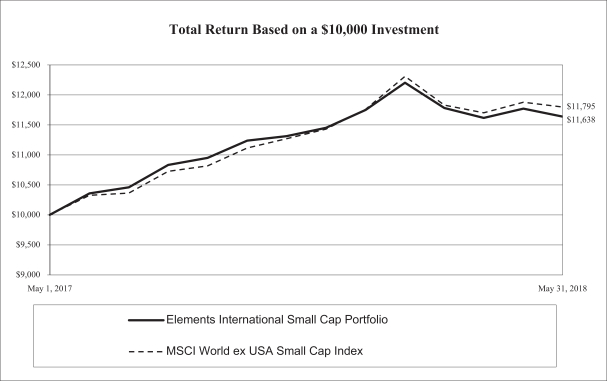

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolio to 0.20% for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The MSCI World ex USA Small Cap Index is a free-float adjusted index which captures small-cap representation across 22 or 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2018) | ||||||||

| 1-year period ended 5/31/18 |

Since Operations |

|||||||

| Elements International Small Cap Portfolio |

12.34% | 15.01% | ||||||

| MSCI World ex USA Small Cap Index |

14.20% | 16.44% | ||||||

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

15

| ELEMENTS EMERGING MARKETS PORTFOLIO |

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on June 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee and reimburse expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolio to 0.20% for the fiscal year ended May 31, 2018 and for the period from June 1, 2018 through September 27, 2018. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The MSCI Emerging Markets Index is a free float weighted equity index which captures large and mid-cap representation across Emerging Markets countries, as determined by MSCI. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2018) | ||||

| Since Commencement of Operations (6/1/17) |

||||

| Elements Emerging Markets Portfolio |

13.46% | |||

| MSCI Emerging Markets Index |

13.66% | |||

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

16

| Management’s Discussion of Fund Performance |

The Elements U.S. Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on U.S. companies, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2018, total returns were 14.02% for the Portfolio and 14.60% for the Russell 1000 Index.2 Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium or factors emphasized are positive for U.S. companies. The performance of the Portfolio was primarily driven by the broad trend of the market for U.S. companies as illustrated by the Russell 1000 Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed negatively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements U.S. Small Cap Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on small capitalization U.S. companies, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2018, total returns were 17.65% for the Portfolio and 20.76% for the Russell 2000 Index.3 Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium or factors emphasized are positive for U.S. small capitalization companies. The performance of the Portfolio was primarily driven by the broad trend of the market for small capitalization U.S. companies as illustrated by the Russell 2000 Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed negatively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements International Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on companies associated with countries with developed markets, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2018, total returns were 9.22% for the Portfolio and 8.33% for the MSCI World ex USA Index4 (net dividends). Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium, factors emphasized, or relevant currencies performances versus the U.S. dollar are positive for developed markets companies. The performance of the Portfolio was primarily driven by the broad trend of the market for developed markets companies as illustrated by the MSCI World ex USA Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed positively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements International Small Cap Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on small capitalization companies associated with countries with developed markets, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2018, total returns were 12.34% for the Portfolio and 14.20% for the MSCI World ex USA Small Cap Index5 (net dividends). Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium, factors emphasized, or relevant currencies performances versus the U.S. dollar are positive for small capitalization developed markets companies. The performance of the Portfolio was primarily driven by the broad trend of the market for small capitalization developed markets companies as illustrated by the MSCI World ex USA Small Cap Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed negatively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

| 1 | The “equity risk premium” is positive if investment returns for equity securities exceed the risk-free rate, on average and over time. The “risk-free rate” is the rate of return that can be earned on high quality, short-term government debt securities. |

| 2 | The Russell 1000 Index consists of the largest 1000 companies in the Russell 3000 Index. |

| 3 | The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index. |

| 4 | The MSCI World ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries — excluding the United States. |

| 5 | The MSCI World ex USA Small Cap Index captures small cap representation across 22 of 23 Developed Markets countries — excluding the United States. |

Past performance does not guarantee future results. Indices are not investable and do not reflect any fees or transaction costs.

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

17

| Management’s Discussion of Fund Performance |

The Elements Emerging Markets Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives associated with countries with emerging markets, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2018, total returns were 13.46% for the Portfolio and 13.66% for the MSCI Emerging Markets Index6 (net dividends). Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium, factors emphasized, or relevant currencies performances versus the U.S. dollar are positive for emerging markets companies. The performance of the Portfolio was primarily driven by the broad trend of the market for emerging markets companies as illustrated by the MSCI Emerging Markets Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed negatively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

Investors should carefully consider the risks and investment objectives of the Elements U.S. Portfolio, Elements U.S. Small Cap Portfolio, Elements International Portfolio, Elements International Small Cap Portfolio and Elements Emerging Markets Portfolio (collectively, the “Portfolios”), as an investment in a Portfolio may not be appropriate for all investors and the Portfolios are not designed to be a complete investment program. An investment in a Portfolio involves a high degree of risk. It is possible that investing in a Portfolio may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment. Before investing in a Portfolio, an investor should read the discussion of the risks of investing in the Portfolio in the prospectus.

Mutual fund investing involves risk. Principal loss is possible.

Economic, political, and issuer-specific events will cause the value of securities, and the Portfolio that owns them, to rise or fall. Because the value of your investment in a Portfolio will fluctuate, you may lose money, even over the long term. Securities of smaller companies are often less liquid than those of larger companies, and smaller companies are generally more vulnerable to adverse business or economic developments and may have more limited resources. Foreign securities prices may decline or fluctuate because of economic or political actions of foreign governments and/or less regulated or liquid securities markets and may give rise to foreign currency risk. Securities of companies that exhibit other factors such as value, momentum or quality may be riskier than securities of companies that do not exhibit those factors, and may perform differently from the market as a whole. If a Portfolio uses derivatives, such Portfolio will be directly exposed to the risks of that derivative, including the risk that the counterparty is unable or unwilling to perform its obligations. Derivatives are subject to a number of additional risks, including risks associated with liquidity, interest rates, market movements and valuation. Securities lending and similar transactions involve the risk that the counterparty may fail to return the securities in a timely manner or at all and that the value of collateral securing a securities loan or similar transaction falls. Please see the prospectus for a complete list of risks.

Each Portfolio is classified as non-diversified under the 1940 Act. Each Portfolio is an open-end management investment company.

The Portfolios’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Portfolios. You can obtain an additional copy of the Portfolios’ most recent periodic reports and certain other regulatory filings by calling 855-609-3680 or visiting www.elementsfunds.com. The Portfolios’ prospectus, which includes a statement of additional information, can be found by visiting www.elementsfunds.com. The prospectus should be read carefully before investing.

The Elements Portfolios are distributed by ALPS Distributors, Inc. SRG000566

| 6 | The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets countries. |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

18

Past performance does not guarantee future results. Indices are not investable and do not reflect any fees or transaction costs.

| ALLOCATION OF PORTFOLIO HOLDINGS AT MAY 31, 2018 (Unaudited) |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

20

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

22

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

23

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

24

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

25

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

26

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

27

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

Open Futures Contracts

| DESCRIPTION | NUMBER OF CONTRACTS PURCHASED |

NOTIONAL VALUE |

VALUE/ UNREALIZED DEPRECIATION |

|||||||||

| FUTURES CONTRACTS PURCHASED | ||||||||||||

| S&P 500 E-Mini Index, June 2018 Settlement |

894 | $ | 120,935,850 | $ | (1,120,367) | |||||||

|

|

|

|

|

|||||||||

| TOTAL FUTURES CONTRACTS PURCHASED |

$ | 120,935,850 | $ | (1,120,367) | ||||||||

|

|

|

|

|

|||||||||

Total Return Swaps

| COUNTERPARTY (a) | REFERENCE ENTITY | PAY/RECEIVE RETURN

ON |

BASE FINANCING RATE (b) |

TERMINATION DATE |

PAYMENT FREQUENCY |

NOTIONAL VALUE |

NUMBER OF UNITS |

UNREALIZED APPRECIATION (DEPRECIATION) |

||||||||||||||||||

| A |

Affiliated Managers Group, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | $ | 449,020 | 2,750 | $ | 10,842 | ||||||||||||||||

| A |

Alphabet, Inc. — Class A | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 177,409 | 172 | (11,445) | ||||||||||||||||||

| A |

Alphabet, Inc. — Class A | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 3,810,924 | 3,600 | (143,880) | ||||||||||||||||||

| A |

Amazon.com, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 501,666 | 319 | (17,207) | ||||||||||||||||||

| A |

Amazon.com, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 5,095,648 | 3,200 | (112,189) | ||||||||||||||||||

| A |

Apple, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 2,204,134 | 11,847 | (15,358) | ||||||||||||||||||

| B |

Arconic, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,301,306 | 104,700 | 452,483 | ||||||||||||||||||

| A |

Arrow Electronics, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 508,217 | 6,769 | 7,191 | ||||||||||||||||||

| A |

Berkshire Hathaway, Inc. — Class B | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 471,577 | 2,391 | 14,546 | ||||||||||||||||||

| A |

Best Buy Co., Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 105,853 | 1,374 | 12,283 | ||||||||||||||||||

| B |

Biogen, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 1,926,599 | 7,430 | (252,866) | ||||||||||||||||||

| A |

Broadcom, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 155,497 | 668 | (12,583) | ||||||||||||||||||

| B |

Broadcom, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,093,446 | 13,251 | (239,254) | ||||||||||||||||||

| A |

CA, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 577,567 | 16,712 | (23,194) | ||||||||||||||||||

| A |

CBRE Group, Inc. — Class A | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 609,585 | 13,115 | 4,634 | ||||||||||||||||||

| B |

Choice Hotels International, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,352,735 | 29,100 | 20,085 | ||||||||||||||||||

| A |

Church & Dwight Co., Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 403,891 | 8,462 | 5,311 | ||||||||||||||||||

| B |

Cisco Systems, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,101,660 | 70,094 | 115,444 | ||||||||||||||||||

| A |

Citigroup, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 85,410 | 1,238 | 2,617 | ||||||||||||||||||

| A |

Dell Technologies, Inc. — Class V | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 155,262 | 2,138 | (16,887) | ||||||||||||||||||

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

28

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| COUNTERPARTY (a) | REFERENCE ENTITY | PAY/RECEIVE RETURN

ON |

BASE FINANCING RATE (b) |

TERMINATION DATE |

PAYMENT FREQUENCY |

NOTIONAL VALUE |

NUMBER OF UNITS |

UNREALIZED APPRECIATION (DEPRECIATION) |

||||||||||||||||||

| A |

Duke Energy Corp. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | $ | 158,263 | 1,966 | $ | 5,125 | ||||||||||||||||

| A |

Electronic Arts, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 483,171 | 3,900 | (26,719) | ||||||||||||||||||

| A |

Exelixis, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 421,742 | 19,462 | 18,869 | ||||||||||||||||||

| A |

Express Scripts Holdings Co. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 162,141 | 2,100 | 3,255 | ||||||||||||||||||

| A |

Exxon Mobil Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 3,592,140 | 46,000 | (177,723) | ||||||||||||||||||

| A |

Facebook, Inc. — Class A | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 182,270 | 1,050 | (18,745) | ||||||||||||||||||

| A |

Fidelity National Financial, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 565,315 | 15,019 | 10,984 | ||||||||||||||||||

| A |

Flir Systems, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 734,584 | 13,327 | 15,128 | ||||||||||||||||||

| A |

Fortune Brands Home & Security, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 527,543 | 9,519 | (8,324) | ||||||||||||||||||

| A |

Gilead Sciences, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 169,213 | 2,291 | 15,129 | ||||||||||||||||||

| B |

Gilead Sciences, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,102,499 | 41,920 | 284,592 | ||||||||||||||||||

| A |

Home Depot, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 3,700,800 | 20,000 | (45,755) | ||||||||||||||||||

| A |

HP, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 655,001 | 29,827 | (1,195) | ||||||||||||||||||

| A |

IBM Common Stock | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 271,281 | 1,852 | 7,195 | ||||||||||||||||||

| B |

Ingersoll-Rand PLC | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 1,031,092 | 12,384 | (50,511) | ||||||||||||||||||

| A |

Intel Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 4,783,796 | 89,200 | (133,522) | ||||||||||||||||||

| A |

Johnson & Johnson | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 426,683 | 3,480 | 7,855 | ||||||||||||||||||

| A |

JP Morgan Chase & Co. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 140,579 | 1,285 | 3,345 | ||||||||||||||||||

| B |

Kar Auction Services, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,289,472 | 43,100 | 20,620 | ||||||||||||||||||

| B |

Keysight Technologies, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,369,562 | 44,200 | (221,171) | ||||||||||||||||||

| A |

Kohls Corp. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 59,463 | 954 | (4,101) | ||||||||||||||||||

| A |

L3 Technologies, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 116,802 | 592 | (856) | ||||||||||||||||||

| B |

Laboratory Corp. of America Holdings | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,756,928 | 16,600 | (234,380) | ||||||||||||||||||

| A |

Lear Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 728,813 | 3,808 | (24,177) | ||||||||||||||||||

| A |

Leidos Holdings Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 533,650 | 8,673 | 13,477 | ||||||||||||||||||

| A |

Lincoln National Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 520,866 | 7,615 | 16,778 | ||||||||||||||||||

| A |

LKQ Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 490,831 | 16,077 | (19,266) | ||||||||||||||||||

| B |

Lockheed Martin Corp. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,868,800 | 8,000 | 343,416 | ||||||||||||||||||

| A |

Manpower Group, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 466,943 | 4,865 | 24,816 | ||||||||||||||||||

| B |

McDonald’s Corp. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,091,243 | 19,443 | (12,358) | ||||||||||||||||||

| B |

MGM Resorts International | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,099,697 | 85,698 | 411,989 | ||||||||||||||||||

| B |

Micron Technology, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,083,897 | 62,911 | (531,691) | ||||||||||||||||||

| A |

Microsoft Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 2,209,283 | 23,059 | (76,542) | ||||||||||||||||||

| B |

Mondelex International, Inc. — Class A | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,014,145 | 74,700 | 87,963 | ||||||||||||||||||

| A |

Monsanto Co. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 219,623 | 1,756 | (3,770) | ||||||||||||||||||

| B |

Norwegian Cruise Line Holdings Ltd. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 4,216,809 | 74,305 | 337,880 | ||||||||||||||||||

| A |

Park Hotels & Resorts, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 542,122 | 18,192 | (43,286) | ||||||||||||||||||

| A |

PG&E Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 453,362 | 10,600 | (5,318) | ||||||||||||||||||

| A |

Pinnacle West Capital Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 563,134 | 7,192 | (8,654) | ||||||||||||||||||

| A |

Proctor & Gamble Co. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 430,890 | 5,918 | (1,292) | ||||||||||||||||||

| A |

Robert Half International, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 730,213 | 11,635 | (12,966) | ||||||||||||||||||

| A |

Rockwell Collins, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 121,828 | 916 | (4,196) | ||||||||||||||||||

| B |

Royal Caribbean Cruises Ltd. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 3,098,454 | 25,883 | 388,748 | ||||||||||||||||||

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

29

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. PORTFOLIO |

| COUNTERPARTY (a) | REFERENCE ENTITY | PAY/RECEIVE RETURN

ON |

BASE FINANCING RATE (b) |

TERMINATION DATE |

PAYMENT FREQUENCY |

NOTIONAL VALUE |

NUMBER OF UNITS |

UNREALIZED APPRECIATION (DEPRECIATION) |

||||||||||||||||||

| A |

Schlumberger, Inc. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | $ | 4,677,956 | 67,270 | $ | 64,902 | ||||||||||||||||

| B |

Spirit Aerosystems Holdings — Class A | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,030,616 | 25,200 | (99,166) | ||||||||||||||||||

| A |

Torchmark Corp. | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 593,664 | 6,981 | 2,275 | ||||||||||||||||||

| B |

Tyson Foods, Inc. — Class A | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 2,399,617 | 34,100 | 94,306 | ||||||||||||||||||

| A |

Universal Health Services, Inc. — Class B | Pay | 1-Month LIBOR USD | 6/13/2018 | Term | 662,306 | 5,712 | 5,872 | ||||||||||||||||||

| B |

Valmont Industries, Inc. | Pay | 1-Month LIBOR USD | 7/25/2018 | Term | 343,320 | 2,400 | (6,632) | ||||||||||||||||||

| A |

Waste Management, Inc. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 83,205 | 1,011 | (253) | ||||||||||||||||||

| A |

Western Digital Corp. | Pay | 1-Month LIBOR USD | 6/4/2018 | Term | 152,863 | 1,890 | (4,673) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||

| $ | 98,215,896 | $ | 207,850 | |||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||

| (a) | See Note 2. |

| (b) | The swaps accrue financing fees according to the relevant base financing rate, which resets periodically, plus a fixed spread. |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

30

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

32

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

33

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

34

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

35

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

36

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

37

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

38

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

39

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

40

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

41

| Schedule of Investments | as of May 31, 2018 |

| ELEMENTS U.S. SMALL CAP PORTFOLIO |

| The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | (Continued) |

| Elements Portfolios | Annual Report | May 31, 2018 | ||||||||||||||

42

| Schedule of Investments | as of May 31, 2018 |