| The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. |  | ||||

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 | |||||

| __________________ | |||||

FORM | |||||

| __________________ | |||||

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☒ | ||||

| Pre-Effective Amendment No. | ☐ | ||||

| Post-Effective Amendment No. 69 | ☒ | ||||

| and/or | |||||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | ☒ | ||||

| Amendment No. 71 | ☒ | ||||

| (Check appropriate box or boxes.) | |||||

| __________________ | |||||

(Exact Name of Registrant as Specified in Charter) | |||||

| __________________ | |||||

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 (Address of Principal Executive Offices) (Zip Code) | |||||

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (816) 531-5575 | |||||

JOHN PAK 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 (Name and Address of Agent for Service) | |||||

| Approximate Date of Proposed Public Offering: February 1, 2023 | |||||

| It is proposed that this filing will become effective (check appropriate box) | |||||

| ☐ | immediately upon filing pursuant to paragraph (b) | ||||

| ☒ | on February 1, 2023, at 8:30 a.m. Central pursuant to paragraph (b) | ||||

| ☐ | 60 days after filing pursuant to paragraph (a)(1) | ||||

| ☐ | on (date) pursuant to paragraph (a)(1) | ||||

| ☐ | 75 days after filing pursuant to paragraph (a)(2) | ||||

| ☐ | on (date) pursuant to paragraph (a)(2) of rule 485. | ||||

| If appropriate, check the following box: | |||||

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. | ||||

| The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. |  | ||||

| Fund Summary | 2 | ||||

| Investment Objective | 2 | ||||

| Fees and Expenses | 2 | ||||

| Principal Investment Strategies | 2 | ||||

| Principal Risks | 3 | ||||

| Fund Performance | 4 | ||||

| Portfolio Management | 5 | ||||

| Purchase and Sale of Fund Shares | 5 | ||||

| Tax Information | 5 | ||||

| Payments to Broker-Dealers and Other Financial Intermediaries | 5 | ||||

| Objectives, Strategies and Risks | 6 | ||||

| Management | 8 | ||||

| Investing Directly with American Century Investments | 10 | ||||

| Investing Through a Financial Intermediary | 12 | ||||

| Additional Policies Affecting Your Investment | 14 | ||||

| Share Price and Distributions | 18 | ||||

| Taxes | 20 | ||||

| Multiple Class Information | 22 | ||||

| Financial Highlights | 23 | ||||

| Investor | Advisor | |||||||

| Maximum Annual Account Maintenance Fee (waived if eligible investments total at least $10,000) | $ | |||||||

| Investor | Advisor | |||||||

| Management Fee | ||||||||

| Distribution and Service (12b-1) Fees | ||||||||

| Other Expenses | ||||||||

| Total Annual Fund Operating Expenses | ||||||||

| 1 year | 3 years | 5 years | 10 years | |||||||||||

| Investor Class | $ | $ | $ | $ | ||||||||||

| Advisor Class | $ | $ | $ | $ | ||||||||||

The fund’s anticipated growth rate is an estimate of the annualized rate of growth of the fund that an investor may expect from the purchase date to the fund’s weighted average maturity date. | ||||||||

The anticipated value at maturity is an estimate of the fund’s net asset value as of the fund’s weighted average maturity date. It is based on the maturity values of the zero-coupon securities held by the fund. | ||||||||

For the calendar year ended December 31, 2022 | 1 year | 5 years | 10 years | ||||||||

| - | |||||||||||

| - | - | - | |||||||||

| - | |||||||||||

| - | |||||||||||

| - | |||||||||||

Bloomberg U.S. 1-5 Year Treasury | - | ||||||||||

A fund’s anticipated growth rate is an estimate of the annualized rate of growth of the fund that an investor may expect from the purchase date to the fund’s weighted average maturity date. | ||||||||

The anticipated value at maturity is an estimate of a fund’s net asset value as of the fund’s weighted average maturity date. It is based on the maturity values of the zero-coupon securities held by the fund. | ||||||||

| Anticipated Values at Maturity | |||||||||||||||||

| 9/30/2018 | 9/30/2019 | 9/30/2020 | 9/30/2021 | 9/30/2022 | |||||||||||||

| Zero Coupon 2025 | $116.23 | $116.22 | $116.15 | $116.11 | $116.14 | ||||||||||||

| This table is designed to show the narrow ranges in which the fund’s AVM varies over time. There is no guarantee that a fund’s AVM will fluctuate as little in the future. | ||||||||

| Management Fees Paid by the Funds to the Advisor as a Percentage of Average Net Assets for the Most Recent Fiscal Year Ended September 30, 2022 | Investor Class | Advisor Class | ||||||

| Zero Coupon 2025 | 0.53% | 0.53% | ||||||

Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts, IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee, but you may be subject to other fees. | ||||||||

Financial intermediaries include banks, broker-dealers, insurance companies, plan sponsors and financial professionals. | ||||||||

| Broker-dealer sponsored wrap program accounts and/or fee-based advisory accounts | No minimum | ||||

| Coverdell Education Savings Account and IRAs | $1,0001,2 | ||||

Employer-sponsored retirement plans | No minimum | ||||

The net asset value, or NAV, of each class of the fund is the current value of the class’s assets, minus any liabilities, divided by the number of shares of the class outstanding. | ||||||||

Capital gains are increases in the values of capital assets, such as stocks or bonds, from the time the assets are purchased. | ||||||||

Qualified dividend income is a dividend received by a fund from the stock of a domestic or qualifying foreign corporation, provided that the fund has held the stock for a required holding period and the stock was not on loan at the time of the dividend. | ||||||||

| For a Share Outstanding Throughout the Years Ended September 30 (except as noted) | ||||||||||||||||||||||||||||||||||||||||||||

| Per-Share Data | Ratios and Supplemental Data | |||||||||||||||||||||||||||||||||||||||||||

| Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | ||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net Investment Income | Net Realized Gains | Total Distributions | Reverse Share Split | Net Asset Value, End of Period | Total Return(2) | Operating Expenses | Net Investment Income (Loss) | Portfolio Turnover Rate | Net Assets, End of Period (in thousands) | |||||||||||||||||||||||||||||||

| Investor Class | ||||||||||||||||||||||||||||||||||||||||||||

| 2022 | $113.92 | 3.81 | (14.33) | (10.52) | (3.34) | (0.36) | (3.70) | 3.70 | $103.40 | (9.24)% | 0.54% | 3.50% | 10% | $138,654 | ||||||||||||||||||||||||||||||

| 2021 | $116.13 | 3.40 | (5.61) | (2.21) | (3.03) | (1.42) | (4.45) | 4.45 | $113.92 | (1.91)% | 0.54% | 2.96% | 13% | $150,321 | ||||||||||||||||||||||||||||||

| 2020 | $107.31 | 3.78 | 5.04 | 8.82 | (3.71) | (0.45) | (4.16) | 4.16 | $116.13 | 8.23% | 0.55% | 3.38% | 19% | $148,086 | ||||||||||||||||||||||||||||||

| 2019 | $96.41 | 3.65 | 7.25 | 10.90 | (3.50) | (1.71) | (5.21) | 5.21 | $107.31 | 11.31% | 0.55% | 3.60% | 21% | $133,717 | ||||||||||||||||||||||||||||||

| 2018 | $99.63 | 3.57 | (6.79) | (3.22) | (3.19) | (1.05) | (4.24) | 4.24 | $96.41 | (3.24)% | 0.55% | 3.66% | 15% | $120,676 | ||||||||||||||||||||||||||||||

| Advisor Class | ||||||||||||||||||||||||||||||||||||||||||||

| 2022 | $107.53 | 3.33 | (13.51) | (10.18) | (3.06) | (0.36) | (3.42) | 3.42 | $97.35 | (9.47)% | 0.79% | 3.25% | 10% | $1,919 | ||||||||||||||||||||||||||||||

| 2021 | $109.89 | 2.94 | (5.30) | (2.36) | (2.74) | (1.42) | (4.16) | 4.16 | $107.53 | (2.15)% | 0.79% | 2.71% | 13% | $2,549 | ||||||||||||||||||||||||||||||

| 2020 | $101.79 | 3.30 | 4.80 | 8.10 | (3.44) | (0.45) | (3.89) | 3.89 | $109.89 | 7.96% | 0.80% | 3.13% | 19% | $2,524 | ||||||||||||||||||||||||||||||

| 2019 | $91.68 | 3.23 | 6.88 | 10.11 | (3.26) | (1.71) | (4.97) | 4.97 | $101.79 | 11.03% | 0.80% | 3.35% | 21% | $1,496 | ||||||||||||||||||||||||||||||

| 2018 | $94.98 | 3.17 | (6.47) | (3.30) | (2.94) | (1.05) | (3.99) | 3.99 | $91.68 | (3.48)% | 0.80% | 3.41% | 15% | $1,297 | ||||||||||||||||||||||||||||||

| Notes to Financial Highlights | ||

American Century Investments americancentury.com | |||||

| Retail Investors P.O. Box 419200 Kansas City, Missouri 64141-6200 1-800-345-2021 or 816-531-5575 | Financial Professionals P.O. Box 419385 Kansas City, Missouri 64141-6385 1-800-345-6488 | ||||

| This statement of additional information adds to the discussion in the fund’s prospectus dated February 1, 2023 but is not a prospectus. The statement of additional information should be read in conjunction with the fund’s current prospectus. If you would like a copy of the prospectus, please contact us at the address or telephone numbers listed on the back cover or visit American Century Investments’ website at americancentury.com. | |||||

| This statement of additional information incorporates by reference certain information that appears in the fund’s annual report, which is delivered to all investors. You may obtain a free copy of the fund’s annual report by calling 1-800-345-2021. |  | ||||

| The Fund’s History | 2 | ||||

| Fund Investment Guidelines | 2 | ||||

| Fund Investments and Risks | 2 | ||||

| Investment Strategies and Risks | 2 | ||||

| Investment Policies | 6 | ||||

| Temporary Defensive Measures | 8 | ||||

| Portfolio Turnover | 8 | ||||

| Disclosure of Portfolio Holdings | 8 | ||||

| Management | 12 | ||||

| Board of Trustees | 12 | ||||

| Officers | 17 | ||||

| Code of Ethics | 18 | ||||

| Proxy Voting Policies | 18 | ||||

| The Funds’ Principal Shareholders | 18 | ||||

| Service Providers | 18 | ||||

| Investment Advisor | 19 | ||||

| Portfolio Managers | 20 | ||||

| Transfer Agent and Administrator | 23 | ||||

| Sub-Administrator | 23 | ||||

| Distributor | 23 | ||||

| Custodian Bank | 23 | ||||

| Securities Lending Agent | 23 | ||||

| Independent Registered Public Accounting Firm | 24 | ||||

| Brokerage Allocation | 24 | ||||

| Regular Broker-Dealers | 25 | ||||

| Information About Fund Shares | 25 | ||||

| Fund Liquidations | 26 | ||||

| Multiple Class Structure | 26 | ||||

| Valuation of a Fund’s Securities | 27 | ||||

| Taxes | 28 | ||||

| Federal Income Tax | 28 | ||||

| State and Local Taxes | 29 | ||||

| Financial Statements | 29 | ||||

| Appendix A – Principal Shareholders | A-1 | ||||

| Appendix B – Payments to Dealers | B-1 | ||||

| Appendix C – Buying and Selling Fund Shares | C-1 | ||||

| Appendix D – Explanation of Fixed-Income Securities Ratings | D-1 | ||||

| Appendix E – Proxy Voting Policies | E-1 | ||||

| Fund | Ticker Symbol | Inception Date | ||||||

| Zero Coupon 2025 Fund | ||||||||

| Investor Class | BTTRX | 02/15/1996 | ||||||

| Advisor Class | ACTVX | 06/01/1998 | ||||||

| AVM | = | NAV | ( | 1+AGR 2 | ) | 2T | ||||||||||||||||||||

| Anticipated Growth Rate | 9/30/2018 | 9/30/2019 | 9/30/2020 | 9/30/2021 | 9/30/2022 | ||||||||||||

| Zero Coupon 2025 | 2.66% | 1.31% | 0.002% | 0.46% | 3.76% | ||||||||||||

| Anticipated Value at Maturity | 9/30/2018 | 9/30/2019 | 9/30/2020 | 9/30/2021 | 9/30/2022 | ||||||||||||

| Zero Coupon 2025 | $116.23 | $116.22 | $116.15 | $116.11 | $116.14 | ||||||||||||

| Subject | Policy | ||||

| Senior Securities | A fund may not issue senior securities, except as permitted under the Investment Company Act. | ||||

| Borrowing | A fund may not borrow money, except that a fund may borrow for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33⅓% of the fund’s total assets (including the amount borrowed) less liabilities (other than borrowings). | ||||

| Lending | A fund may not lend any security or make any other loan if, as a result, more than 33⅓% of the fund’s total assets would be lent to other parties, except (i) through the purchase of debt securities in accordance with its investment objective, policies and limitations or (ii) by engaging in repurchase agreements with respect to portfolio securities. | ||||

| Real Estate | A fund may not purchase or sell real estate unless acquired as a result of ownership of securities or other instruments. This policy shall not prevent a fund from investing in securities or other instruments backed by real estate or securities of companies that deal in real estate or are engaged in the real estate business. | ||||

| Concentration | A fund may not concentrate its investments in securities of issuers in a particular industry (other than securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities). | ||||

| Underwriting | A fund may not act as an underwriter of securities issued by others, except to the extent that the fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities. | ||||

| Commodities | A fund may not purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments, provided that this limitation shall not prohibit the fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities. | ||||

| Control | A fund may not invest for purposes of exercising control over management. | ||||

| Subject | Policy | ||||

| Leveraging | A fund may not purchase additional investment securities at any time during which outstanding borrowings exceed 5% of the total assets of the fund. | ||||

| Liquidity | A fund may not purchase any security or enter into a repurchase agreement if, as a result, more than 15% of its net assets would be invested in illiquid securities. Illiquid securities include repurchase agreements not entitling the holder to payment of principal and interest within seven days, and securities that are illiquid by virtue of legal or contractual restrictions on resale or the absence of a readily available market. | ||||

| Short Sales | A fund may not sell securities short, unless it owns or has the right to obtain securities equivalent in kind and amount to the securities sold short, and provided that transactions in futures contracts, options, and other derivative instruments are not deemed to constitute selling securities short. | ||||

| Margin | A fund may not purchase securities on margin, except to obtain such short-term credits as are necessary for the clearance of transactions, and provided that margin payments and other deposits in connection with transactions involving futures, options (puts, calls, etc.), swaps, short sales, forward contracts, commitment agreements, and other similar investment techniques shall not be deemed to constitute purchasing securities on margin. | ||||

Name (Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years | ||||||||||||

Independent Trustees | |||||||||||||||||

Tanya S. Beder (1955) | Trustee and Board Chair | Since 2011 (Board Chair since 2022) | Chairman and CEO, SBCC Group Inc. (independent advisory services) (2006 to present) | 32 | Kirby Corporation; Nabors Industries Ltd. | ||||||||||||

Jeremy I. Bulow (1954) | Trustee | Since 2011 | Professor of Economics, Stanford University, Graduate School of Business (1979 to present) | 76 | None | ||||||||||||

| Jennifer Cabalquinto (1968) | Trustee | Since 2021 | Chief Financial Officer, 2K (interactive entertainment) (2021 to present); Special Advisor, GSW Sports, LLC (2020 to 2021); Chief Financial Officer, GSW Sports, LLC (2013 to 2020) | 32 | Sabio Holdings Inc. | ||||||||||||

Anne Casscells (1958) | Trustee | Since 2016 | Co-Chief Executive Officer and Chief Investment Officer, Aetos Alternatives Management (investment advisory firm) (2001 to present); Lecturer in Accounting, Stanford University, Graduate School of Business (2009 to 2017) | 32 | None | ||||||||||||

Jonathan D. Levin (1972) | Trustee | Since 2016 | Philip H. Knight Professor and Dean, Graduate School of Business, Stanford University (2016 to present) Professor, Stanford University (2000 to present) | 32 | None | ||||||||||||

Peter F. Pervere (1947) | Trustee | Since 2007 | Retired | 32 | None | ||||||||||||

John B. Shoven (1947) | Trustee | Since 2002 | Charles R. Schwab Professor of Economics, Stanford University (1973 to present, emeritus since 2019) | 32 | Cadence Design Systems; Exponent; Financial Engines | ||||||||||||

Name (Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years | ||||||||||||

Interested Trustee | |||||||||||||||||

Jonathan S. Thomas (1963) | Trustee | Since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Director, ACC and other ACC subsidiaries | 140 | None | ||||||||||||

| Name of Trustee | Total Compensation for Service as Trustee of the Fund1 | Total Compensation for Service as Directors/Trustees for the American Century Investments Family of Funds2 | ||||||

| Tanya S. Beder | $1,188 | $373,750 | ||||||

| Jeremy I. Bulow | $926 | $386,250 | ||||||

| Anne Casscells | $959 | $302,500 | ||||||

| Jennifer Cabalquinto | $947 | $298,750 | ||||||

Ronald J. Gilson3 | $294 | $112,500 | ||||||

Frederick L.A. Grauer3 | $222 | $73,750 | ||||||

| Jonathan D. Levin | $947 | $298,750 | ||||||

| Peter F. Pervere | $990 | $312,500 | ||||||

| John B. Shoven | $959 | $302,500 | ||||||

| Name of Trustee | |||||||||||||||||

| Jonathan S. Thomas | Tanya S. Beder | Jeremy I. Bulow | Jennifer Cabalquinto | Anne Casscells | |||||||||||||

| Dollar Range of Equity Securities in the Funds: | |||||||||||||||||

| Zero Coupon 2025 | A | A | A | A | A | ||||||||||||

Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Trustees in Family of Investment Companies | E | E | C | A | E | ||||||||||||

| Jonathan D. Levin | Peter F. Pervere | John B. Shoven | |||||||||

| Dollar Range of Equity Securities in the Funds: | |||||||||||

| Zero Coupon 2025 | A | A | A | ||||||||

| Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Trustees in Family of Investment Companies | A | E | E | ||||||||

Name (Year of Birth) | Offices with the Fund | Principal Occupation(s) During the Past Five Years | ||||||

| Patrick Bannigan (1965) | President since 2019 | Executive Vice President and Director, ACC (2012 to present); Chief Financial Officer, Chief Accounting Officer and Treasurer, ACC (2015 to present). Also serves as President, ACS; Vice President, ACIM; Chief Financial Officer, Chief Accounting Officer and/or Director, ACIM, ACS and other ACC subsidiaries | ||||||

| R. Wes Campbell (1974) | Chief Financial Officer and Treasurer since 2018 | Vice President, ACS (2020 to present); Investment Operations and Investment Accounting, ACS (2000 to present) | ||||||

| Amy D. Shelton (1964) | Chief Compliance Officer and Vice President since 2014 | Chief Compliance Officer, American Century funds, (2014 to present); Chief Compliance Officer, ACIM (2014 to present); Chief Compliance Officer, ACIS (2009 to present). Also serves as Vice President, ACIS | ||||||

| John Pak (1968) | General Counsel and Senior Vice President since 2021 | General Counsel and Senior Vice President, ACC (2021 to present); Also serves as General Counsel and Senior Vice President, ACIM, ACS and ACIS. Chief Legal Officer of Investment and Wealth Management, The Bank of New York Mellon (2014 to 2021) | ||||||

| C. Jean Wade (1964) | Vice President since 2012 | Senior Vice President, ACS (2017 to present); Vice President, ACS (2000 to 2017) | ||||||

| Robert J. Leach (1966) | Vice President since 2006 | Vice President, ACS (2000 to present) | ||||||

| David H. Reinmiller (1963) | Vice President since 2000 | Attorney, ACC (1994 to present). Also serves as Vice President, ACIM and ACS | ||||||

| Ward D. Stauffer (1960) | Secretary since 2005 | Attorney, ACC (2003 to present) | ||||||

| Investment Category Fee Schedule for Zero Coupon 2025 | |||||

| Category Assets | Fee Rate | ||||

| First $1 billion | 0.3600% | ||||

| Next $1 billion | 0.3080% | ||||

| Next $3 billion | 0.2780% | ||||

| Next $5 billion | 0.2580% | ||||

| Next $15 billion | 0.2450% | ||||

| Next $25 billion | 0.2430% | ||||

| Thereafter | 0.2425% | ||||

| Complex Fee Schedule | |||||

| Complex Assets | Fee Rate Investor and Advisor Classes | ||||

| First $2.5 billion | 0.3100% | ||||

| Next $7.5 billion | 0.3000% | ||||

| Next $15 billion | 0.2985% | ||||

| Next $25 billion | 0.2970% | ||||

| Next $25 billion | 0.2870% | ||||

| Next $25 billion | 0.2800% | ||||

| Next $25 billion | 0.2700% | ||||

| Next $25 billion | 0.2650% | ||||

| Next $25 billion | 0.2600% | ||||

| Next $25 billion | 0.2550% | ||||

| Thereafter | 0.2500% | ||||

| Unified Management Fees | |||||||||||

| Fund | 2022 | 2021 | 2020 | ||||||||

| Zero Coupon 2025 | $773,129 | $840,509 | $733,161 | ||||||||

| Accounts Managed (As of September 30, 2022) | ||||||||||||||

Registered Investment Companies (e.g., American Century Investments funds and American Century Investments- subadvised funds) | Other Pooled Investment Vehicles (e.g., commingled trusts and 529 education savings plans) | Other Accounts (e.g., separate accounts and corporate accounts, including incubation strategies and corporate money) | ||||||||||||

| Miguel Castillo | Number of Accounts | 11 | 1 | 2 | ||||||||||

| Assets | $11.5 billion(1) | $48.6 million | $455.8 million | |||||||||||

| Robert V. Gahagan | Number of Accounts | 14 | 0 | 2 | ||||||||||

| Assets | $19.2 billion(1) | N/A | $455.8 million | |||||||||||

| James E. Platz | Number of Accounts | 17 | 0 | 2 | ||||||||||

| Assets | $19.4 billion(1) | N/A | $455.8 million | |||||||||||

| Fund | Benchmarks | Peer Group | ||||||

| Zero Coupon 2025 | 11/15/2025 STRIPS Issue | N/A | ||||||

| Ownership of Securities | ||||||||

| Aggregate Dollar Range of Securities in Fund | ||||||||

| Zero Coupon 2025 Fund | ||||||||

| Miguel Castillo | A | |||||||

| James E. Platz | A | |||||||

| Robert V. Gahagan | A | |||||||

| Zero Coupon 2025 | $5,702 | ||||

| Fund/Class | Shareholder | Percentage of Outstanding Shares Owned Of Record | ||||||

| Zero Coupon 2025 | ||||||||

| Investor Class | ||||||||

| National Financial Services LLC Jersey City, New Jersey | 18% | |||||||

| Charles Schwab & Co. Inc. San Francisco, California | 15% | |||||||

| Pershing LLC Jersey City, New Jersey | 6% | |||||||

| Advisor Class | ||||||||

| Pershing LLC Jersey City, New Jersey | 37% | |||||||

Mid Atlantic Trust Company Pittsburgh, Pennsylvania Includes 14.58% registered for the benefit of The New York Preparatory 401k Profit Sharing Plan & Trust | 16% | |||||||

| M L P F & S Jacksonville, Florida | 10% | |||||||

| National Financial Services LLC Jersey City, New Jersey | 8% | |||||||

| Vanguard Brokerage Services El Paso, Texas | 8% | |||||||

| Ameritrade Inc. FEBO Omaha, Nebraska | 7% | |||||||

| Ratings of Corporate and Municipal Debt Securities | |||||

| Standard & Poor’s Long-Term Issue Credit Ratings* | |||||

| Category | Definition | ||||

| AAA | An obligation rated ‘AAA’ has the highest rating assigned by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is extremely strong. | ||||

| AA | An obligation rated ‘AA’ differs from the highest-rated obligations only to a small degree. The obligor’s capacity to meet its financial commitment on the obligation is very strong. | ||||

| A | An obligation rated ‘A’ is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor’s capacity to meet its financial commitment on the obligation is still strong. | ||||

| BBB | An obligation rated ‘BBB’ exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. | ||||

| BB;B; CCC; CC; and C | Obligations rated ‘BB’, ‘B’, ‘CCC’, ‘CC’, and ‘C’ are regarded as having significant speculative characteristics. ‘BB’ indicates the least degree of speculation and ‘C’ the highest. While such obligations will likely have some quality and protective characteristics, these may be outweighed by large uncertainties or major exposures to adverse conditions. | ||||

| BB | An obligation rated ‘BB’ is less vulnerable to nonpayment than other speculative issues. However, it faces major ongoing uncertainties or exposure to adverse business, financial, or economic conditions which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation. | ||||

| B | An obligation rated ‘B’ is more vulnerable to nonpayment than obligations rated ‘BB’, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation. | ||||

| CCC | An obligation rated ‘CCC’ is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation. | ||||

| CC | An obligation rated ‘CC’ is currently highly vulnerable to nonpayment. The ‘CC’ rating is used when a default has not yet occurred, but Standard & Poor’s expects default to be a virtual certainty, regardless of the anticipated time to default. | ||||

| C | An obligation rated ‘C’ is currently highly vulnerable to nonpayment,and the obligation is expected to have lower relative seniority or lower ultimate recovery compared to obligations that are rated higher. | ||||

| D | An obligation rated ‘D’ is in default or in breach of an imputed promise. For non-hybrid capital instruments, the ‘D’ rating category is used when payments on an obligation are not made on the date due, unless Standard & Poor’s believes that such payments will be made within five business days in the absence of a stated grace period or within the earlier of the stated grace period or 30 calendar days. The ‘D’ rating also will be used upon the filing of a bankruptcy petition or the taking of similar action and where default on an obligation is a virtual certainty, for example due to automatic stay provisions. An obligation’s rating is lowered to ‘D’ if it is subject to a distressed exchange offer. | ||||

| NR | This indicates that no rating has been requested, or that there is insufficient information on which to base a rating, or that Standard & Poor’s does not rate a particular obligation as a matter of policy. | ||||

| Moody’s Investors Service, Inc. Global Long-Term Rating Scale | |||||

| Category | Definition | ||||

| Aaa | Obligations rated Aaa are judged to be of the highest quality, subject to the lowest level of credit risk. | ||||

| Aa | Obligations rated Aa are judged to be of high quality and are subject to very low credit risk. | ||||

| A | Obligations rated A are judged to be upper-medium grade and are subject to low credit risk. | ||||

| Baa | Obligations rated Baa are judged to be medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics. | ||||

| Ba | Obligations rated Ba are judged to be speculative and are subject to substantial credit risk. | ||||

| B | Obligations rated B are considered speculative and are subject to high credit risk. | ||||

| Caa | Obligations rated Caa are judged to be speculative of poor standing and are subject to very high credit risk. | ||||

| Ca | Obligations rated Ca are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest. | ||||

| C | Obligations rated C are the lowest rated and are typically in default, with little prospect for recovery of principal or interest. | ||||

| Fitch Investors Service, Inc. Long-Term Ratings | |||||

| Category | Definition | ||||

| AAA | Highest credit quality. ‘AAA’ ratings denote the lowest expectation of credit risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments. This capacity is highly unlikely to be adversely affected by foreseeable events. | ||||

| AA | Very High credit quality. ‘AA’ ratings denote expectations of very low credit risk. They indicate very strong capacity for payment of financial commitments. This capacity is not significantly vulnerable to foreseeable events. | ||||

| A | High credit quality. ‘A’ ratings denote expectations of low credit risk. The capacity for payment of financial commitments is considered strong. This capacity may, nevertheless, be more vulnerable to adverse business or economic conditions than is the case for higher ratings. | ||||

| BBB | Good credit quality. ‘BBB’ ratings indicate that expectations of credit risk are currently low. The capacity for payment of financial commitments is considered adequate but adverse business or economic conditions are more likely to impair this capacity. | ||||

| BB | Speculative. ‘BB’ ratings indicate an elevated vulnerability to credit risk, particularly in the event of adverse changes in business or economic conditions over time; however, business or financial alternatives may be available to allow financial commitments to be met. | ||||

| B | Highly speculative. ‘B’ ratings indicate that material credit risk is present. | ||||

| CCC | Substantial credit risk. ‘CCC’ ratings indicate that substantial credit risk is present. | ||||

| CC | Very high levels of credit risk. ‘CC’ ratings indicate very high levels of credit risk. | ||||

| C | Exceptionally high levels of credit risk. ‘C’ indicates exceptionally high levels of credit risk. | ||||

| Standard & Poor’s Corporate Short-Term Note Ratings | |||||

| Category | Definition | ||||

| A-1 | A short-term obligation rated ‘A-1’ is rated in the highest category by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is strong. Within this category, certain obligations are designated with a plus sign (+). This indicates that the obligor’s capacity to meet its financial commitment on these obligations is extremely strong. | ||||

| A-2 | A short-term obligation rated ‘A-2’ is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher rating categories. However, the obligor’s capacity to meet its financial commitment on the obligation is satisfactory. | ||||

| A-3 | A short-term obligation rated ‘A-3’ exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. | ||||

| B | A short-term obligation rated ‘B’ is regarded as vulnerable and has significant speculative characteristics. The obligor currently has the capacity to meet its financial commitments; however, it faces major ongoing uncertainties which could lead to the obligor’s inadequate capacity to meet its financial commitments. | ||||

| C | A short-term obligation rated ‘C’ is currently vulnerable to nonpayment and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. | ||||

| D | A short-term obligation rated ‘D’ is in default or in breach of an imputed promise. For non-hybrid capital instruments, the ‘D’ rating category is used when payments on an obligation are not made on the date due, unless Standard & Poor’s believes that such payments will be made within any stated grace period. However, any stated grace period longer than five business days will be treated as five business days. The ‘D’ rating also will be used upon the filing of a bankruptcy petition or the taking of a similar action and where default on an obligation is a virtual certainty, for example due to automatic stay provisions. An obligation’s rating is lowered to ‘D’ if it is subject to a distressed exchange offer. | ||||

| Moody’s Global Short-Term Rating Scale | |||||

| Category | Definition | ||||

| P-1 | Issuers (or supporting institutions) rated Prime-1 have a superior ability to repay short-term debt obligations. | ||||

| P-2 | Issuers (or supporting institutions) rated Prime-2 have a strong ability to repay short-term debt obligations. | ||||

| P-3 | Issuers (or supporting institutions) rated Prime-3 have an acceptable ability to repay short-term obligations. | ||||

| NP | Issuers (or supporting institutions) rated Not Prime do not fall within any of the Prime rating categories. | ||||

| Fitch Investors Service, Inc. Short-Term Ratings | |||||

| Category | Definition | ||||

| F1 | Highest short-term credit quality. Indicates the strongest intrinsic capacity for timely payment of financial commitments; may have an added “+” to denote any exceptionally strong credit feature. | ||||

| F2 | Good short-term credit quality. Good intrinsic capacity for timely payment of financial commitments. | ||||

| F3 | Fair short-term credit quality. The intrinsic capacity for timely payment of financial commitments is adequate. | ||||

| B | Speculative short-term credit quality. Minimal capacity for timely payment of financial commitments, plus heightened vulnerability to near term adverse changes in financial and economic conditions. | ||||

| C | High short-term default risk. Default is a real possibility. | ||||

| RD | Restricted default. Indicates an entity that has defaulted on one or more of its financial commitments, although it continues to meet other financial obligations. Typically applicable to entity ratings only. | ||||

| D | Default Indicates a broad-based default event for an entity, or the default of a short-term obligation. | ||||

| Standard & Poor’s Municipal Short-Term Note Ratings | |||||

| Category | Definition | ||||

| SP-1 | Strong capacity to pay principal and interest. An issue determined to possess a very strong capacity to pay debt service is given a plus (+) designation. | ||||

| SP-2 | Satisfactory capacity to pay principal and interest, with some vulnerability to adverse financial and economic changes over the term of the notes. | ||||

| SP-3 | Speculative capacity to pay principal and interest. | ||||

| Moody’s US Municipal Short-Term Debt Ratings | |||||

| Category | Definition | ||||

| MIG 1 | This designation denotes superior credit quality. Excellent protection is afforded by established cash flows, highly reliable liquidity support, or demonstrated broad-based access to the market for refinancing. | ||||

| MIG 2 | This designation denotes strong credit quality. Margins of protection are ample, although not as large as in the preceding group. | ||||

| MIG 3 | This designation denotes acceptable credit quality. Liquidity and cash-flow protection may be narrow, and market access for refinancing is likely to be less well-established. | ||||

| SG | This designation denotes speculative-grade credit quality. Debt instruments in this category may lack sufficient margins of protection. | ||||

| Moody’s Demand Obligation Ratings | |||||

| Category | Definition | ||||

| VMIG 1 | This designation denotes superior credit quality. Excellent protection is afforded by the superior short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price upon demand. | ||||

| VMIG 2 | This designation denotes strong credit quality. Good protection is afforded by the strong short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price upon demand. | ||||

| VMIG 3 | This designation denotes acceptable credit quality. Adequate protection is afforded by the satisfactory short-term credit strength of the liquidity provider and structural and legal protections that ensure the timely payment of purchase price upon demand. | ||||

| SG | This designation denotes speculative-grade credit quality. Demand features rated in this category may be supported by a liquidity provider that does not have an investment grade short-term rating or may lack the structural and/or legal protections necessary to ensure the timely payment of purchase price upon demand. | ||||

American Century Investments americancentury.com | |||||

| Retail Investors P.O. Box 419200 Kansas City, Missouri 64141-6200 1-800-345-2021 or 816-531-5575 | Financial Professionals P.O. Box 419385 Kansas City, Missouri 64141-6385 1-800-345-6488 | ||||

Name and Principal Business Address* | Positions and Offices With Underwriter | Positions and Offices With Registrant | ||||||

| Joe Schultz | Director, President and Chief Executive Officer | none | ||||||

| Karen Heath-Wade | Director and Senior Vice President | none | ||||||

| Mark Najarian | Director and Senior Vice President | none | ||||||

| Gary P. Kostuke | Senior Vice President | none | ||||||

| Richard T. Luchinsky | Senior Vice President | none | ||||||

| John Pak | Senior Vice President and General Counsel | Senior Vice President and General Counsel | ||||||

| Wayne Park | Senior Vice President | none | ||||||

| Brian Schappert | Senior Vice President | none | ||||||

| Erik Schneberger | Senior Vice President | none | ||||||

| Richard Smith | Senior Vice President | none | ||||||

| Elizabeth A. Young | Chief Privacy Officer, Senior AML Officer and Vice President | none | ||||||

| Ward D. Stauffer | Secretary | Secretary | ||||||

| Brian L. Brogan | Assistant Secretary | Assistant Vice President | ||||||

| Otis H. Cowan | Assistant Secretary | Assistant Vice President and Assistant Secretary | ||||||

| David H. Reinmiller | Assistant Secretary | Vice President | ||||||

| Robert Allen | Vice President | none | ||||||

| Xavier Allen | Vice President | none | ||||||

| Ryan Ander | Vice President | none | ||||||

| Paul Ardekani | Vice President | none | ||||||

| Matthew Auer | Vice President | none | ||||||

| Julia Bartlett | Vice President | none | ||||||

| Stacey L. Belford | Vice President | none | ||||||

| Michael Bell | Vice President | none | ||||||

| Stacy Bernstein | Vice President | none | ||||||

| Andrew M. Billingsley | Vice President | none | ||||||

Name and Principal Business Address* | Positions and Offices With Underwriter | Positions and Offices With Registrant | ||||||

| James D. Blythe | Vice President | none | ||||||

| Don Bonder | Vice President | none | ||||||

| Karyn Bostick | Vice President | none | ||||||

| Scott Boughton | Vice President | non | ||||||

| Michael Boutureira | Vice President | none | ||||||

| Emily Brockmeier | Vice President | none | ||||||

| Bruce W. Caldwell | Vice President | none | ||||||

| Donell Chisolm | Vice President | none | ||||||

| Matthew Cobb | Vice President | none | ||||||

| Douglas Comer | Vice President | none | ||||||

| Chatten Cowherd | Vice President | none | ||||||

| Nicolas D’Alessandro | Vice President | none | ||||||

| Jesse Daniels | Vice President | none | ||||||

| Terry Daugherty | Vice President | none | ||||||

| Mario Davila | Vice President | none | ||||||

| Mark Davis | Vice President | none | ||||||

| Shane Dawe | Vice President | none | ||||||

| Ellen DeNicola | Vice President | none | ||||||

| Glenn Dial | Vice President | none | ||||||

| David P. Donovan | Vice President | none | ||||||

| Gabriel Dorman | Vice President | none | ||||||

| Ryan C. Dreier | Vice President | none | ||||||

| John Dudgeon | Vice President | none | ||||||

| Courtney Dunne | Vice President | none | ||||||

| Megan Ekleberry | Vice President | none | ||||||

| Kevin G. Eknaian | Vice President | none | ||||||

| John Ellspermann | Vice President | none | ||||||

| Lee Ellwood | Vice President | none | ||||||

Name and Principal Business Address* | Positions and Offices With Underwriter | Positions and Offices With Registrant | ||||||

| Sean Ensminger | Vice President | none | ||||||

| Gregg Erdman | Vice President | none | ||||||

| Christopher Van Evans | Vice President | none | ||||||

| Jill A. Farrell | Vice President | none | ||||||

| Alex Fishman | Vice President | none | ||||||

| Peter Foley | Vice President | none | ||||||

| Michael C. Galkoski | Vice President | none | ||||||

| Diane Gallagher | Vice President | none | ||||||

| Glenn Godin | Vice President | none | ||||||

| Stephen Gongola | Vice President | none | ||||||

| Wendy Goodyear | Vice President | none | ||||||

| Timothy R. Guay | Vice President | none | ||||||

| Brett G. Hart | Vice President | none | ||||||

| Juliana Hastings | Vice President | none | ||||||

| Marcela Holder | Vice President | none | ||||||

| Tom Horning | Vice President | none | ||||||

| Robert O. Houston | Vice President | none | ||||||

| Jennifer Ison | Vice President | none | ||||||

| Michael A. Jackson | Vice President | none | ||||||

| Amanda Jacobi | Vice President | none | ||||||

| Angela Johnson | Vice President | none | ||||||

| Wylie Kain | Vice President | none | ||||||

| Delia Kiely | Vice President | none | ||||||

| Matthew S. Kives | Vice President | none | ||||||

| Matthew Kobata | Vice President | none | ||||||

| Joshua Kurtz | Vice President | none | ||||||

| Kyle Langan | Vice President | none | ||||||

| Jeffrey Leone | Vice President | none | ||||||

| Dennis Logan | Vice President | none | ||||||

| Robert Macchi | Vice President | none | ||||||

Name and Principal Business Address* | Positions and Offices With Underwriter | Positions and Offices With Registrant | ||||||

| Chris Marra | Vice President | none | ||||||

| Brian Mayfield | Vice President | none | ||||||

| Evan Mayhew | Vice President | none | ||||||

| Walter McGhee | Vice President | none | ||||||

| Alastair McKibbin | Vice President | none | ||||||

| Tod McMichael | Vice President | none | ||||||

| Ariella Menegon | Vice President | none | ||||||

| Marek Michejada | Vice President | none | ||||||

| Roger Miller | Vice President | none | ||||||

| Erin Molle | Vice President | none | ||||||

| Nate Morris | Vice President | none | ||||||

| Susan M. Morris | Vice President | none | ||||||

| Jennifer Mulrooney | Vice President | none | ||||||

| Michael Nelligan | Vice President | none | ||||||

| Andrew Nepomuceno | Vice President | none | ||||||

| Kelly A. Ness | Vice President | none | ||||||

| Krisha Newham | Vice President | none | ||||||

| John E. O’Connor | Vice President | none | ||||||

| Brad O’Neill | Vice President | none | ||||||

| Edward Panko | Vice President | none | ||||||

| Scott Pawlich | Vice President | none | ||||||

| Christy A. Poe | Vice President | none | ||||||

| Nathaniel Proctor | Vice President | none | ||||||

| Blake Reardon | Vice President | none | ||||||

| Cheryl Redline | Vice President and Treasurer | none | ||||||

| Daniel K. Richardson | Vice President | none | ||||||

| Gerald M. Rossi | Vice President | none | ||||||

| Brian Schweisberger | Vice President | none | ||||||

Name and Principal Business Address* | Positions and Offices With Underwriter | Positions and Offices With Registrant | ||||||

| Matthew Sennet | Vice President | none | ||||||

| Paul Shahrokhi | Vice President | none | ||||||

| Tracey L. Shank | Vice President | none | ||||||

| Amy D. Shelton | Vice President and Chief Compliance Officer | Vice President and Chief Compliance Officer | ||||||

| Steven Silverman | Vice President | none | ||||||

| Michael T. Sullivan | Vice President | none | ||||||

| Adam Tabor | Vice President | none | ||||||

| Noah Tenenhaus | Vice President | none | ||||||

| Francis Tighe | Vice President | none | ||||||

| David Tondreault | Vice President | none | ||||||

| Ryan VanSickle | Vice President | none | ||||||

| Susan Waldron | Vice President | none | ||||||

| Byron Walker | Vice President | none | ||||||

| Sean Walker | Vice President | none | ||||||

| Todd Williams | Vice President | none | ||||||

| John Brereton Young | Vice President | none | ||||||

| John Zimmerman | Vice President | none | ||||||

| American Century Target Maturities Trust | |||||

| (Registrant) | |||||

By: * ___________________________________ Patrick Bannigan President | |||||

| SIGNATURES | TITLE | DATE | ||||||

* _________________________________ Patrick Bannigan | President (principal executive officer) | January 27, 2023 | ||||||

* _________________________________ R. Wes Campbell | Chief Financial Officer and Treasurer (principal financial officer and principal accounting officer) | January 27, 2023 | ||||||

* _________________________________ Jonathan S. Thomas | Trustee | January 27, 2023 | ||||||

* _________________________________ Tanya S. Beder | Chair and Trustee | January 27, 2023 | ||||||

* _________________________________ Jeremy I. Bulow | Trustee | January 27, 2023 | ||||||

* _________________________________ Jennifer Cabalquinto | Trustee | January 27, 2023 | ||||||

* _________________________________ Anne Casscells | Trustee | January 27, 2023 | ||||||

* _________________________________ Jonathan D. Levin | Trustee | January 27, 2023 | ||||||

* _________________________________ Peter F. Pervere | Trustee | January 27, 2023 | ||||||

* _________________________________ John B. Shoven | Trustee | January 27, 2023 | ||||||

*By: /s/ Evan C. Johnson Evan C. Johnson Attorney in Fact (pursuant to Power of Attorney dated September 21, 2022) | ||||||||

| EXHIBIT NUMBER | DESCRIPTION OF DOCUMENT | ||||

| EXHIBIT (j)(1) | |||||

| EXHIBIT (j)(2) | |||||

| EXHIBIT – 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document | |||||||

| EXHIBIT – 101.SCH | XBRL Taxonomy Extension Schema Document | |||||||

| EXHIBIT – 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document | |||||||

| EXHIBIT – 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | |||||||

| EXHIBIT – 101.LAB | XBRL Taxonomy Extension Label Linkbase Document | |||||||

| Label | Element | Value |

|---|---|---|

| Risk/Return: | rr_RiskReturnAbstract | |

| Document Type | dei_DocumentType | 485BPOS |

| Document Period End Date | dei_DocumentPeriodEndDate | Sep. 30, 2022 |

| Registrant Name | dei_EntityRegistrantName | American Century Target Maturities Trust |

| Central Index Key | dei_EntityCentralIndexKey | 0000757928 |

| Amendment Flag | dei_AmendmentFlag | false |

| Document Creation Date | dei_DocumentCreationDate | Jan. 27, 2023 |

| Document Effective Date | dei_DocumentEffectiveDate | Feb. 01, 2023 |

| Prospectus Date | rr_ProspectusDate | Feb. 01, 2023 |

| Entity Inv Company Type | dei_EntityInvCompanyType | N-1A |

| Label | Element | Value | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Risk/Return [Heading] | rr_RiskReturnHeading | Zero Coupon 2025 Fund | ||||||||||||||||||||||||||||||||||||

| Objective [Heading] | rr_ObjectiveHeading | Investment Objective | ||||||||||||||||||||||||||||||||||||

| Objective, Primary [Text Block] | rr_ObjectivePrimaryTextBlock | The fund seeks the highest return consistent with investment in U.S. Treasury securities. | ||||||||||||||||||||||||||||||||||||

| Expense [Heading] | rr_ExpenseHeading | Fees and Expenses | ||||||||||||||||||||||||||||||||||||

| Expense Narrative [Text Block] | rr_ExpenseNarrativeTextBlock | The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and example below. | ||||||||||||||||||||||||||||||||||||

| Shareholder Fees Caption [Text] | rr_ShareholderFeesCaption | Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||

| Operating Expenses Caption [Text] | rr_OperatingExpensesCaption | Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||

| Portfolio Turnover [Heading] | rr_PortfolioTurnoverHeading | Portfolio Turnover | ||||||||||||||||||||||||||||||||||||

| Portfolio Turnover [Text Block] | rr_PortfolioTurnoverTextBlock | The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 10% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||

| Portfolio Turnover, Rate | rr_PortfolioTurnoverRate | 10.00% | ||||||||||||||||||||||||||||||||||||

| Expense Example [Heading] | rr_ExpenseExampleHeading | Example | ||||||||||||||||||||||||||||||||||||

| Expense Example Narrative [Text Block] | rr_ExpenseExampleNarrativeTextBlock | The example below is intended to help you compare the costs of investing in the fund with the costs of investing in other mutual funds. | ||||||||||||||||||||||||||||||||||||

| Expense Example by, Year, Caption [Text] | rr_ExpenseExampleByYearCaption | The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods, that you earn a 5% return each year, and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||||||||

| Strategy [Heading] | rr_StrategyHeading | Principal Investment Strategies | ||||||||||||||||||||||||||||||||||||

| Strategy Narrative [Text Block] | rr_StrategyNarrativeTextBlock | Under normal circumstances, the fund will invest at least 80% of the value of its net assets in zero-coupon securities. Typically, other than during the fund’s target maturity year, the fund intends to exceed this 80% requirement and be fully invested in zero-coupon securities. The fund invests primarily in zero-coupon U.S. Treasury securities and their equivalents (including certain zero-coupon U.S. government agency securities), and may invest up to 20% of its assets in other zero-coupon U.S. government agency securities that are AAA-rated. Zero-coupon securities make no periodic interest or principal payments. Instead, they trade at a deep discount to their face value and all of the interest and principal is paid when the securities mature. The fund is managed to mature in the year 2025 and will be liquidated near the end of its target maturity year. If shares of the fund are held until the fund is liquidated and all distributions are reinvested, the fund’s performance should be similar to an investment in a zero-coupon U.S. Treasury security with the same term to maturity as the fund. The advisor expects that shareholders who hold their shares until the fund is liquidated and reinvest all distributions will realize an investment return and maturity value that do not differ significantly from the anticipated growth rate (AGR) and anticipated value at maturity (AVM) calculated on the day the shares were purchased.

As of the fund’s most recent fiscal year end, September 30, 2022, the fund’s Investor Class AGR was 3.76% and its AVM was $116.14. The AGR and AVM for the Advisor Class will differ from that of the Investor Class, depending on the expenses of that class. When determining whether to buy or sell a security, the portfolio managers consider, among other things, the fund’s average maturity, current and anticipated changes in interest rates, current valuation relative to alternatives in the market, general market conditions and any other factors deemed relevant by the portfolio managers. Securities issued or guaranteed by the U.S. Treasury and certain U.S. government agencies or instrumentalities are supported by the full faith and credit of the U.S. government. Zero-coupon U.S. government agency securities that are ultimately backed by securities or payment obligations of the U.S. Treasury and are considered by the market to be of comparable credit quality, such as Resolution Funding Corporation (REFCORP) bonds, are considered to be zero-coupon U.S. Treasury equivalents by the fund’s managers. Securities issued or guaranteed by other U.S. government agencies or instrumentalities, such as the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac), and the Federal Home Loan Bank, are not guaranteed by the U.S. Treasury or supported by the full faith and credit of the U.S. government. However, these agencies or instrumentalities are authorized to borrow from the U.S. Treasury to meet their obligations.

|

||||||||||||||||||||||||||||||||||||

| Strategy Portfolio Concentration [Text] | rr_StrategyPortfolioConcentration | Under normal circumstances, the fund will invest at least 80% of the value of its net assets in zero-coupon securities. | ||||||||||||||||||||||||||||||||||||

| Risk [Heading] | rr_RiskHeading | Principal Risks | ||||||||||||||||||||||||||||||||||||

| Risk Narrative [Text Block] | rr_RiskNarrativeTextBlock | •Interest Rate Risk – Investments in debt securities are sensitive to interest rate changes and zero coupon securities are more sensitive to interest rate changes than traditional coupon-bearing securities. Generally, when interest rates rise, the fund’s share value will decline. The opposite is true when interest rates decline. Funds with longer weighted average maturities are more sensitive to interest rate changes. A period of rising interest rates may negatively affect the fund’s performance. Additionally, in extreme low interest rate environments, the fund’s expenses may exceed the yields on the securities in which the fund invests, resulting in a negative anticipated growth rate (AGR). You may lose money as a result of holding fund shares with a negative AGR. •Unanticipated Capital Gains or Losses – When shareholders redeem their shares before the target maturity date, the fund may need to liquidate holdings to meet these redemptions and unanticipated capital gains or losses may result. The fund will distribute these capital gains or losses to all shareholders. •Zero-Coupon U.S. Treasury Correlation – Although the fund’s investment policies are designed to provide an investment that is similar to investing in a zero-coupon U.S. Treasury security that matures in the year 2025, a precise forecast of the fund’s final maturity value and yield to maturity is not possible. •Market Risk – The value of the securities owned by the fund may go up and down, sometimes rapidly or unpredictably. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economics and markets generally. •Public Health Emergency Risk - A pandemic, caused by the infectious respiratory illness COVID-19, is causing market disruption and other economic impacts. Markets have experienced volatility, reduced liquidity, and increased trading costs. These events may continue to impact the fund and its underlying investments. •Principal Loss – At any given time your shares may be worth less than the price you paid for them. In other words, it is possible to lose money by investing in the fund. An investment in the fund is not a bank deposit, and it is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

|

||||||||||||||||||||||||||||||||||||

| Risk Lose Money [Text] | rr_RiskLoseMoney | Principal Loss – At any given time your shares may be worth less than the price you paid for them. In other words, it is possible to lose money by investing in the fund. | ||||||||||||||||||||||||||||||||||||

| Risk Not Insured Depository Institution [Text] | rr_RiskNotInsuredDepositoryInstitution | An investment in the fund is not a bank deposit, and it is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. | ||||||||||||||||||||||||||||||||||||

| Bar Chart and Performance Table [Heading] | rr_BarChartAndPerformanceTableHeading | Fund Performance | ||||||||||||||||||||||||||||||||||||

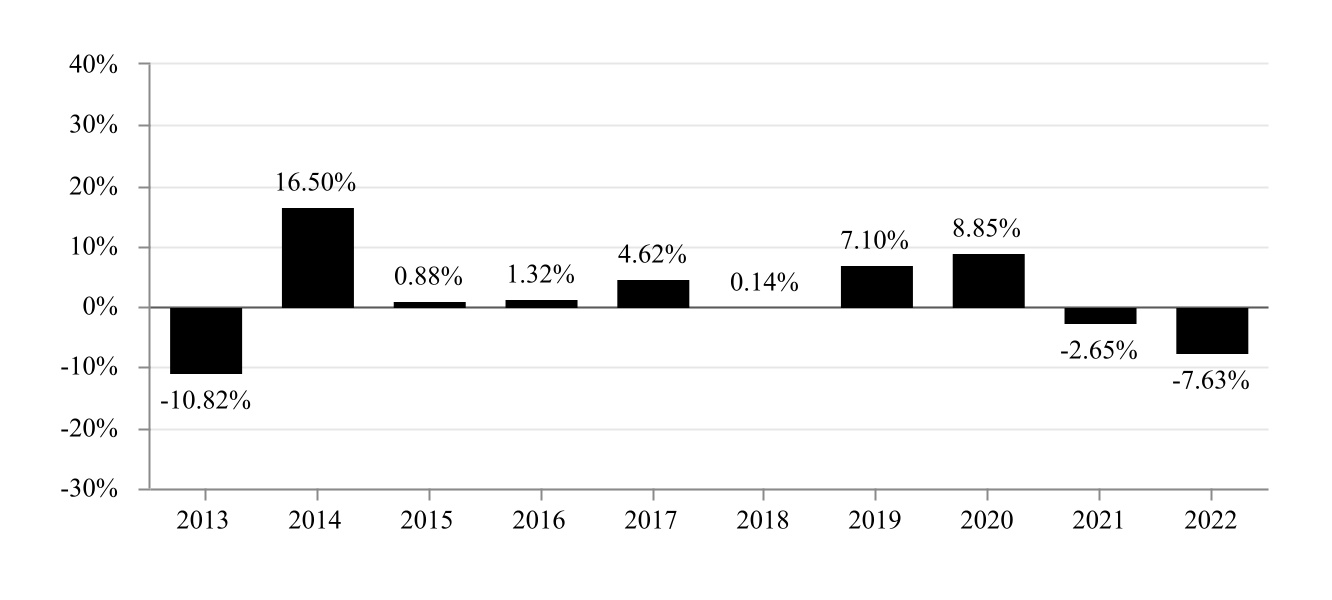

| Performance Narrative [Text Block] | rr_PerformanceNarrativeTextBlock | The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the fund’s performance from year to year for Investor Class shares. The table shows how the fund’s average annual returns for the periods shown compared with those of a broad measure of market performance. The table also shows results for a U.S. Treasury zero-coupon security (STRIPS Issue) with a maturity date similar to the fund. The fund’s past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. For current performance information, including yields, please visit americancentury.com. Sales charges and account fees, if applicable, are not reflected in the bar chart. If those charges were included, returns would be less than those shown.

|

||||||||||||||||||||||||||||||||||||

| Performance Information Illustrates Variability of Returns [Text] | rr_PerformanceInformationIllustratesVariabilityOfReturns | The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the fund’s performance from year to year for Investor Class shares. The table shows how the fund’s average annual returns for the periods shown compared with those of a broad measure of market performance. | ||||||||||||||||||||||||||||||||||||

| Performance Additional Market Index [Text] | rr_PerformanceAdditionalMarketIndex | The table also shows results for a U.S. Treasury zero-coupon security (STRIPS Issue) with a maturity date similar to the fund. | ||||||||||||||||||||||||||||||||||||

| Performance Availability Website Address [Text] | rr_PerformanceAvailabilityWebSiteAddress | americancentury.com | ||||||||||||||||||||||||||||||||||||

| Performance Past Does Not Indicate Future [Text] | rr_PerformancePastDoesNotIndicateFuture | The fund’s past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. | ||||||||||||||||||||||||||||||||||||

| Bar Chart [Heading] | rr_BarChartHeading | Calendar Year Total Returns | ||||||||||||||||||||||||||||||||||||

| Bar Chart Does Not Reflect Sales Loads [Text] | rr_BarChartDoesNotReflectSalesLoads | Sales charges and account fees, if applicable, are not reflected in the bar chart. If those charges were included, returns would be less than those shown. | ||||||||||||||||||||||||||||||||||||

| Bar Chart Closing [Text Block] | rr_BarChartClosingTextBlock | Highest Performance Quarter (1Q 2020): 6.49% Lowest Performance Quarter (4Q 2016): -6.90% | ||||||||||||||||||||||||||||||||||||

| Performance Table Heading | rr_PerformanceTableHeading | Average Annual Total ReturnsFor the calendar year ended December 31, 2022 | ||||||||||||||||||||||||||||||||||||

| Performance Table Uses Highest Federal Rate | rr_PerformanceTableUsesHighestFederalRate | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. | ||||||||||||||||||||||||||||||||||||

| Performance Table Not Relevant to Tax Deferred | rr_PerformanceTableNotRelevantToTaxDeferred | Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or IRAs. | ||||||||||||||||||||||||||||||||||||

| Performance Table One Class of after Tax Shown [Text] | rr_PerformanceTableOneClassOfAfterTaxShown | The after-tax returns are shown only for Investor Class shares. After-tax returns for other share classes will vary. | ||||||||||||||||||||||||||||||||||||

| Performance Table Closing [Text Block] | rr_PerformanceTableClosingTextBlock | The after-tax returns are shown only for Investor Class shares. After-tax returns for other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or IRAs. | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | 11/15/2025 STRIPS Issue | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Index No Deduction for Fees, Expenses, Taxes [Text] | rr_IndexNoDeductionForFeesExpensesTaxes | (reflects no deduction for fees, expenses or taxes) | ||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | 11/15/2025 STRIPS Issue (reflects no deduction for fees, expenses or taxes) | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (7.30%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 1.49% | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 1.88% | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | Bloomberg U.S. 1-5 Year Treasury | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Index No Deduction for Fees, Expenses, Taxes [Text] | rr_IndexNoDeductionForFeesExpensesTaxes | (reflects no deduction for fees, expenses or taxes) | ||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | Bloomberg U.S. 1-5 Year Treasury (reflects no deduction for fees, expenses or taxes) | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (5.47%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 0.62% | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 0.68% | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | INVESTOR CLASS | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Trading Symbol | dei_TradingSymbol | BTTRX | ||||||||||||||||||||||||||||||||||||

| Maximum Account Fee | rr_MaximumAccountFee | $ 25 | ||||||||||||||||||||||||||||||||||||

| Management Fees (as a percentage of Assets) | rr_ManagementFeesOverAssets | 0.53% | ||||||||||||||||||||||||||||||||||||

| Distribution and Service (12b-1) Fees | rr_DistributionAndService12b1FeesOverAssets | none | ||||||||||||||||||||||||||||||||||||

| Other Expenses (as a percentage of Assets): | rr_OtherExpensesOverAssets | 0.01% | ||||||||||||||||||||||||||||||||||||

| Expenses (as a percentage of Assets) | rr_ExpensesOverAssets | 0.54% | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 55 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 173 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 302 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 678 | ||||||||||||||||||||||||||||||||||||

| Annual Return 2013 | rr_AnnualReturn2013 | (10.82%) | ||||||||||||||||||||||||||||||||||||

| Annual Return 2014 | rr_AnnualReturn2014 | 16.50% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2015 | rr_AnnualReturn2015 | 0.88% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2016 | rr_AnnualReturn2016 | 1.32% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2017 | rr_AnnualReturn2017 | 4.62% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2018 | rr_AnnualReturn2018 | 0.14% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2019 | rr_AnnualReturn2019 | 7.10% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2020 | rr_AnnualReturn2020 | 8.85% | ||||||||||||||||||||||||||||||||||||

| Annual Return 2021 | rr_AnnualReturn2021 | (2.65%) | ||||||||||||||||||||||||||||||||||||

| Annual Return 2022 | rr_AnnualReturn2022 | (7.63%) | ||||||||||||||||||||||||||||||||||||

| Highest Quarterly Return, Label | rr_HighestQuarterlyReturnLabel | Highest Performance Quarter | ||||||||||||||||||||||||||||||||||||

| Highest Quarterly Return, Date | rr_BarChartHighestQuarterlyReturnDate | Mar. 31, 2020 | ||||||||||||||||||||||||||||||||||||

| Highest Quarterly Return | rr_BarChartHighestQuarterlyReturn | 6.49% | ||||||||||||||||||||||||||||||||||||

| Lowest Quarterly Return, Label | rr_LowestQuarterlyReturnLabel | Lowest Performance Quarter | ||||||||||||||||||||||||||||||||||||

| Lowest Quarterly Return, Date | rr_BarChartLowestQuarterlyReturnDate | Dec. 31, 2016 | ||||||||||||||||||||||||||||||||||||

| Lowest Quarterly Return | rr_BarChartLowestQuarterlyReturn | (6.90%) | ||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | Investor Class Return Before Taxes | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (7.63%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 0.98% | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 1.55% | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | INVESTOR CLASS | After Taxes on Distributions | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | Return After Taxes on Distributions | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (8.93%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | (0.53%) | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | (0.13%) | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | INVESTOR CLASS | After Taxes on Distributions and Sales | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | Return After Taxes on Distributions and Sale of Fund Shares | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (4.51%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 0.21% | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 0.56% | ||||||||||||||||||||||||||||||||||||

| American Century Target Maturities Trust | ZERO COUPON 2025 FUND | ADVISOR CLASS | ||||||||||||||||||||||||||||||||||||||

| Prospectus [Line Items] | rr_ProspectusLineItems | |||||||||||||||||||||||||||||||||||||

| Trading Symbol | dei_TradingSymbol | ACTVX | ||||||||||||||||||||||||||||||||||||

| Maximum Account Fee | rr_MaximumAccountFee | none | ||||||||||||||||||||||||||||||||||||

| Management Fees (as a percentage of Assets) | rr_ManagementFeesOverAssets | 0.53% | ||||||||||||||||||||||||||||||||||||

| Distribution and Service (12b-1) Fees | rr_DistributionAndService12b1FeesOverAssets | 0.25% | ||||||||||||||||||||||||||||||||||||

| Other Expenses (as a percentage of Assets): | rr_OtherExpensesOverAssets | 0.01% | ||||||||||||||||||||||||||||||||||||

| Expenses (as a percentage of Assets) | rr_ExpensesOverAssets | 0.79% | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 1 Year | rr_ExpenseExampleYear01 | $ 81 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 3 Years | rr_ExpenseExampleYear03 | 253 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 5 Years | rr_ExpenseExampleYear05 | 439 | ||||||||||||||||||||||||||||||||||||

| Expense Example, with Redemption, 10 Years | rr_ExpenseExampleYear10 | $ 978 | ||||||||||||||||||||||||||||||||||||

| Label | rr_AverageAnnualReturnLabel | Advisor Class Return Before Taxes | ||||||||||||||||||||||||||||||||||||

| 1 Year | rr_AverageAnnualReturnYear01 | (7.85%) | ||||||||||||||||||||||||||||||||||||

| 5 Years | rr_AverageAnnualReturnYear05 | 0.73% | ||||||||||||||||||||||||||||||||||||

| 10 Years | rr_AverageAnnualReturnYear10 | 1.30% | ||||||||||||||||||||||||||||||||||||

{

"instance": {

"ck0000757928-20220930.htm": {

"axisCustom": 0,

"axisStandard": 4,

"baseTaxonomies": {

"http://xbrl.sec.gov/dei/2022": 10,

"http://xbrl.sec.gov/rr/2022": 95

},

"contextCount": 8,

"dts": {

"calculationLink": {

"local": [

"ck0000757928-20220930_cal.xml"

]

},

"definitionLink": {

"local": [

"ck0000757928-20220930_def.xml"

]

},

"inline": {

"local": [

"ck0000757928-20220930.htm"

]

},

"labelLink": {

"local": [

"ck0000757928-20220930_lab.xml"

]

},

"presentationLink": {

"local": [

"ck0000757928-20220930_pre.xml"

]

},

"schema": {

"local": [

"ck0000757928-20220930.xsd"

],

"remote": [

"http://www.xbrl.org/2003/xbrl-instance-2003-12-31.xsd",

"http://www.xbrl.org/2003/xbrl-linkbase-2003-12-31.xsd",

"http://www.xbrl.org/2003/xl-2003-12-31.xsd",

"http://www.xbrl.org/2003/xlink-2003-12-31.xsd",

"http://www.xbrl.org/2005/xbrldt-2005.xsd",

"http://www.xbrl.org/lrr/role/negated-2009-12-16.xsd",

"http://www.xbrl.org/lrr/role/net-2009-12-16.xsd",

"https://www.xbrl.org/dtr/type/2020-01-21/types.xsd",

"https://xbrl.sec.gov/dei/2022/dei-2022.xsd",

"https://xbrl.sec.gov/rr/2022/rr-2022.xsd"

]

}

},

"elementCount": 212,

"entityCount": 1,

"hidden": {

"http://xbrl.sec.gov/dei/2022": 4,

"http://xbrl.sec.gov/rr/2022": 10,

"total": 14

},

"keyCustom": 0,

"keyStandard": 74,

"memberCustom": 6,

"memberStandard": 2,

"nsprefix": "ck0000757928",

"nsuri": "http://www.americancentury.com/20220930",

"report": {

"R1": {

"firstAnchor": {

"ancestors": [

"span",

"div",

"td",

"tr",

"table",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "iab69fe30874c479cac3fc99711784534_D20230201-20230201",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:EntityRegistrantName",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

},

"groupType": "document",

"isDefault": "false",

"longName": "0000001 - Document - Document and Entity Information {Elements}",

"menuCat": "",

"order": "1",

"role": "http://www.americancentury.com/role/DocumentandEntityInformationElements",

"shortName": "Document and Entity Information",

"subGroupType": "",

"uniqueAnchor": {

"ancestors": [

"span",

"div",

"td",

"tr",

"table",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "iab69fe30874c479cac3fc99711784534_D20230201-20230201",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:EntityRegistrantName",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

}

},

"R2": {

"firstAnchor": {

"ancestors": [

"span",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "i362287d2841041d49f9ecd9b36a16cc4_D20230201-20230201",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "rr:RiskReturnHeading",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

},

"groupType": "disclosure",

"isDefault": "false",

"longName": "0000002 - Disclosure - Risk/Return Detail Data {Elements}",

"menuCat": "",

"order": "2",

"role": "http://www.americancentury.com/role/RiskReturnDetailDataElements",

"shortName": "Risk/Return Detail Data",

"subGroupType": "",

"uniqueAnchor": {

"ancestors": [

"span",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "i362287d2841041d49f9ecd9b36a16cc4_D20230201-20230201",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "rr:RiskReturnHeading",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

}

},

"S1": {

"firstAnchor": {

"ancestors": [

"span",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "iab69fe30874c479cac3fc99711784534_D20230201-20230201",

"decimals": null,

"lang": "en-US",

"name": "dei:DocumentCreationDate",

"reportCount": 1,

"unitRef": null,

"xsiNil": "false"

},

"groupType": "RR_Summaries",

"isDefault": "true",

"longName": "000009643 - Disclosure - Document and Entity Information",

"section": 0,

"shortName": "Document and Entity Information",

"subGroupType": "",

"uniqueAnchor": {

"ancestors": [

"span",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "iab69fe30874c479cac3fc99711784534_D20230201-20230201",

"decimals": null,

"lang": "en-US",

"name": "dei:DocumentCreationDate",

"reportCount": 1,

"unitRef": null,

"xsiNil": "false"

}

},

"S2": {

"firstAnchor": {

"ancestors": [

"span",

"div",

"body",

"html"

],

"baseRef": "ck0000757928-20220930.htm",

"contextRef": "i362287d2841041d49f9ecd9b36a16cc4_D20230201-20230201",

"decimals": null,

"lang": "en-US",