Post-Qualification Offering Circular Amendment No. 1

File No. 024-11748

Explanatory Note

This Post-Qualification Offering Circular Amendment No. 1 to Offering Circular (this “Amendment”) replaces and supersedes in its entirety our original Offering Circular, dated January 28, 2022 (filed February 1, 2022), as previously supplemented by the Supplement thereto, dated January 30, 2023 (the “Supplement”).

THIS AMENDMENT IS DATED MARCH 31, 2023

We are amending our Offering Circular to report our entering into a placement agent agreement with a broker-dealer, Entoro Securities, LLC, a Delaware limited liability company (“Entoro”), who will assist us in the Offering. In connection with our entering into the placement agent agreement with Entoro, we have also updated the terms of our Subscription Agreement, a copy of which is attached as Exhibit 4.1 to this Amendment. A copy of the placement agent agreement with Entoro is attached as Exhibit 1.1 to this Offering Circular.

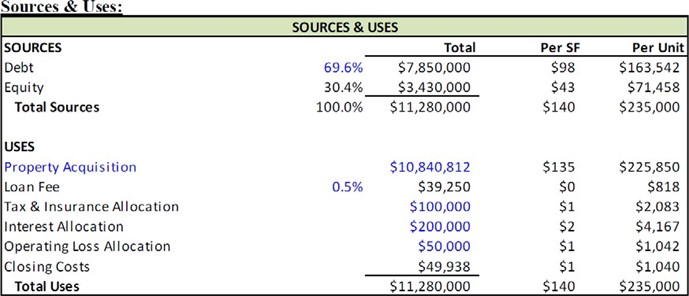

We are amending our Offering Circular to report the closing of NY1’s acquisition of an approximately $7.9 million multi-unit residential real estate property in Sackets Harbor, New York (the “NY1 Acquisition”). In the Supplement, the acquisition was described as being anticipated.

In the Supplement, we disclosed that we expected that (i) VBRE would contribute $100,000 to Holdings in exchange for 10,000 Class C Units of Holdings; (ii) Holdings would contribute $100,000 to NY1; and (iii) NY1 would incur approximately $100,000 in closing costs in connection with the NY1 Acquisition. In fact, NY1 incurred approximately $300,000 in closing costs and/or other working capital requirements, so VBRE contributed $300,000 to Holdings in exchange for 30,000 Class C Units, and Holdings contributed $300,000 to NY1. We have revised the Second Amendment to Limited Liability Company Agreement of Holdings accordingly. A copy of the revised Second Amendment to Limited Liability Company Agreement of Holdings is attached as Exhibit 6.4 to this Amendment. Likewise, the pro forma financial statements showing the impact of the NY1 Acquisition have been revised accordingly as well.

We identified some additional marketing terms that we plan to use on page 32.

Finally, we are amending our Offering Circular to extend the term of our Offering until two years after the qualification of this Amendment.

Capitalized terms used but not defined in this Explanatory Note have the meanings given to such terms in this Amendment below.

As submitted to the Securities and Exchange Commission on March 31, 2023

PART II – OFFERING CIRCULAR

Preliminary Offering Circular dated March 31, 2023

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

VictoryBase Corporation

a Delaware corporation

Up to $75,000,000 in Class A Common Stock

PO Box 617

Roanoke, TX 76262

469-694-2707

www.VictoryBase.com

This Offering Circular relates to a public offering (the “Offering”) of securities to be issued by VictoryBase Corporation, a Delaware corporation (the “Company”). We are offering up to 7,500,000 shares of our Class A common stock, par value $0.001 (“Class A Common Stock”), at an offering price of $10.00 per share (the “Shares”) on a continuous basis. Except as the context requires otherwise, as used in this Offering Circular, the terms “we,” “us,” or “our” refer to the Company, and where applicable, our direct and indirect subsidiaries.

This Offering will be available to any investor meeting the qualifications described in this Offering Circular.

These securities are speculative securities. Investment in our stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 3 of this Offering Circular.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

Generally, no sale may be made to you in this Offering if the aggregate annual purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

i

This Offering Circular follows the Offering Circular disclosure format.

The date of this Offering Circular is March 31, 2023

See “The Offering” section on page 1 and “Securities Being Offered” on page 53 for further details.

The Company (directly and through our broker-dealer) is the only party selling Shares in this Offering. None of the securities offered are being sold by our present security holders.

This Offering commenced within two calendar days of qualification of this Offering by the Securities and Exchange Commission on March 9, 2022, and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

The Shares in this Offering will be offered through Entoro as our broker-dealer and by us, affiliates of ours, and employees of ours or of our affiliates, in reliance upon the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934. Entoro is not required to sell any specific number or dollar amount of Shares but will use its “reasonable best efforts” to sell the Shares offered.

Because these securities are being offered on a “best efforts” basis, the following disclosures are hereby made:

| Price to Public (1) | Commissions (2) | Proceeds to Company (3) | Proceeds to Other Persons (4) | |||||||||||

| Per Share: | $ | 10.00 | $0.50 | $ | 9.50 | N/A | ||||||||

| Total Minimum: | N/A | N/A | N/A | N/A | ||||||||||

| Total Maximum: | $ | 75,000,000.00 | $3,750,000.00 | $ | 71,250,000.00 | N/A | ||||||||

| (1) | The price per Share shown was arbitrarily determined by our Board of Directors. The sales price per share bears no relationship to our book value or any other measure of our current value or worth. |

| (2) | We will pay Entoro a commission equal to 1% of gross offering proceeds during the term of our placement agent agreement with Entoro, except in cases that Entoro has facilitated the sale of Shares, in which case we will pay Entoro a commission equal to 5% of the gross offering proceeds. See “PLAN OF DISTRIBUTION.” |

| (3) | Does not reflect payment of expenses of this Offering, which are estimated to not exceed $5,000,000 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, administrative services, transfer agent fees, technology expenses, other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares. Over the next six months, we anticipate incurring approximately $362,000 in marketing expenses, $250,000 in broker-dealer expenses, $3,600 in transfer agent expenses, and $5,970 in technology expenses, in connection with the Offering. This amount represents the proceeds of this Offering to the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.” |

| (4) | There are no finder’s fees or other fees being paid to third parties from the proceeds, other than commissions payable to our broker-dealer. See “PLAN OF DISTRIBUTION.” |

The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The Shares will only be issued to purchasers who satisfy the requirements set forth in Regulation A. This Offering is expected to expire on the first of: (i) all of the Shares offered are sold; or (ii) two years from the date of qualification of this Amendment by the Securities and Exchange Commission, unless sooner terminated or extended by us.

ii

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein contain forward-looking statements and are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Form 1-A, Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give our current reasonable expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

The forward-looking statements contained in this Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein are based on reasonable assumptions we have made in light of our industry experience, perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. As you read and consider this Form 1-A, Offering Circular, and any documents incorporated by reference, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond our control) and assumptions. You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | The speculative nature of the business we intend to develop; |

| ● | Our reliance on suppliers, customers and investors; |

| ● | Our dependence upon external sources for the financing of our operations; |

| ● | Our ability to effectively execute our business plan; |

| ● | Our ability to manage our expansion, growth and operating expenses; |

| ● | Our ability to finance our businesses; |

| ● | Our ability to promote our businesses; |

| ● | Our ability to compete and succeed in highly competitive and evolving businesses; |

| ● | Our ability to respond and adapt to changes in technology and customer behavior; and |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance strong brands. |

Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize or should any of these assumptions prove incorrect or change, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements. Any forward-looking statement made by us in this Form 1-A, Offering Circular or any documents incorporated by reference herein speaks only as of the date of this Form 1-A, Offering Circular or any documents incorporated by reference herein. Factors or events that could cause our actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

iii

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A). As a Tier 2 offering pursuant to Regulation A, this Offering will be exempt from state law “blue sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Shares offered hereby are offered and sold only to “qualified purchasers” or at a time when our Shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D, and (ii) all other investors so long as their investment in our Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

| 1. | an individual net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or |

| 2. | earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. |

If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings, and automobiles.

iv

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in this Form 1-A and Offering Circular. We have not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents. We will provide the opportunity to ask questions of and receive answers from our management concerning terms and conditions of this Offering, the Company, or any other relevant matters and any additional reasonable information to any prospective investor prior to the consummation of the sale of the Shares. This Form 1-A and Offering Circular do not purport to contain all of the information that may be required to evaluate this Offering and any recipient hereof should conduct its own independent analysis. The statements of ours contained in this Offering Circular are based on information we believe to be reliable. No warranty can be made as to the accuracy of any forward-looking estimates we may have made or that circumstances have not changed since the date of this Form 1-A and Offering Circular. We do not expect to update or otherwise revise this Form 1-A, Offering Circular or other materials supplied herewith. The delivery of this Form 1-A and Offering Circular at any time does not imply that the information contained herein is correct as of any time subsequent to the date of this Form 1-A and Offering Circular. This Form 1-A and Offering Circular are submitted in connection with this Offering described herein and may not be reproduced or used for any other purpose.

v

vi

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular. For full Offering details, please (1) thoroughly review this Form 1-A filed with the Securities and Exchange Commission, (2) thoroughly review this Offering Circular, and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A and Offering Circular.

| Type of Stock Offering: | Class A Common Stock |

| Price Per Share: | $10.00 |

| Minimum Investment: | Generally $500, but we reserve the right to accept purchases of less than $500 in our sole discretion. |

| Maximum Offering Amount: | $75,000,000.00. We will not accept investments greater than the Maximum Offering Amount. |

| Maximum Shares Offered: | 7,500,000 Shares of our Class A Common Stock |

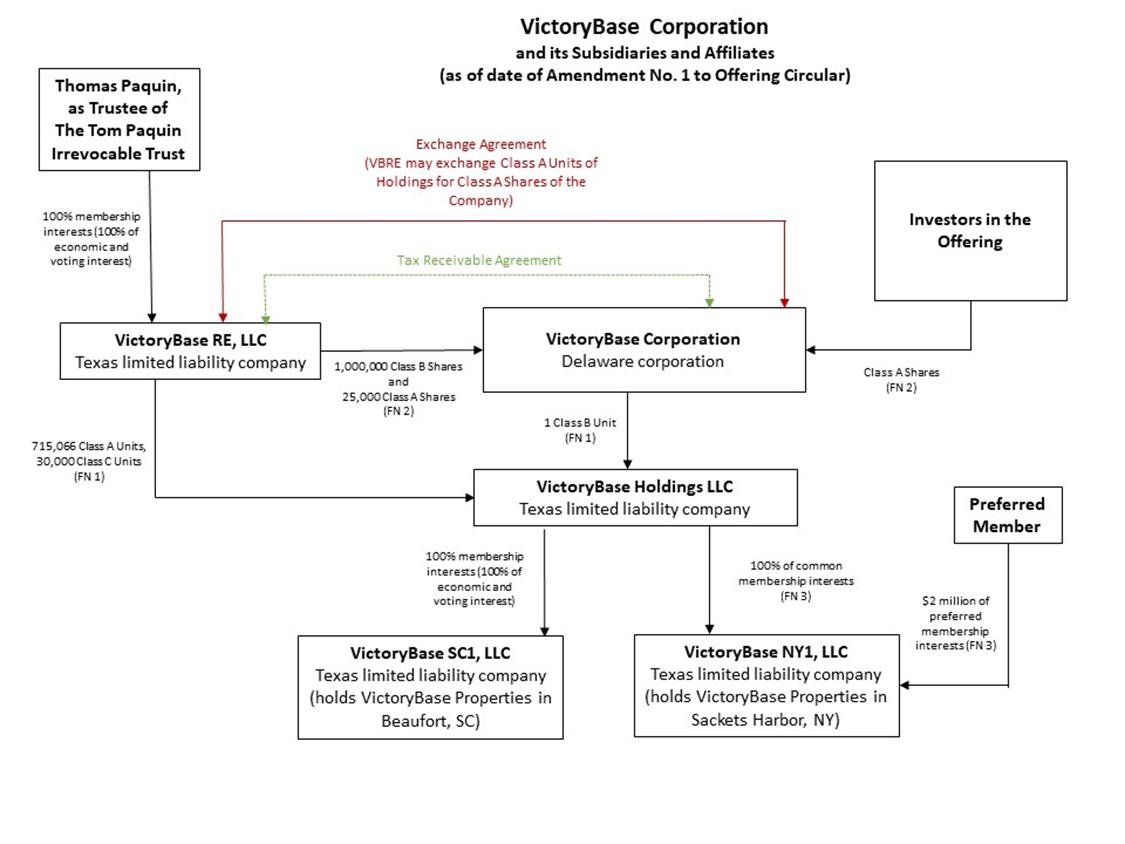

| Use of Proceeds: | We will use the proceeds of this Offering to (i) purchase Class B Units of VictoryBase Holdings LLC, a Texas limited liability company (“Holdings”), our subsidiary, and (ii) for general working capital. Holdings will use the proceeds of the sale of Class B Units to acquire (directly and indirectly) VictoryBase Properties and for general working capital. See also the description in section entitled “USE OF PROCEEDS TO ISSUER.” |

| Voting Rights: | The Shares have full voting rights; however, shares of our Class B Common Stock have super-voting rights as described in “SECURITIES BEING OFFERED.” |

| Length of Offering: | Shares will be offered on a continuous basis until either (1) the maximum number of Shares or sold; (2) two years from the date of qualification of this Amendment by the Commission, or (3) we in our sole discretion withdraw this Offering. |

| Class A Common Stock Outstanding (1)(2) | 25,030 Shares |

| Class A Common Stock in this Offering (2) | 7,500,000 Shares |

| Class A Common Stock to be outstanding after this Offering (3) | 7,525,000 Shares |

| (1) | We have authorized 10,000,000 shares of our Class A Common Stock and 1,000,000 shares of Class B Common Stock. We had issued 1,000,000 shares of our Class A Common Stock to VBRE, but VBRE subsequently surrendered 975,000 shares of Class A Common Stock back to the Company. As of the date of this Offering Circular, the Company has 25,000 shares of Class A Common Stock outstanding and held by VictoryBase RE, LLC (“VBRE”) and 30 shares of Class A Common Stock outstanding and held by an individual EquityBase Investor, for a total of 25,030 Class A Common Stock outstanding. We have issued 1,000,000 shares of Class B Common Stock to VBRE. Each share of Class B Common Stock is entitled to 1,000,000 votes, giving VBRE voting control of the Company. As of the date of this Offering Circular, Thomas Paquin is the trustee of The Tom Paquin Irrevocable Trust, the sole owner of VBRE. No Class B Common Stock is being sold in this Offering. Shares of our Class B Common Stock have no economic rights. In addition, VBRE, as the holder of Class A membership interests (“Class A Units”) of Holdings, has the right to exchange such Class A Units for shares of the Company’s Class A common stock such that immediately after the exchange, the indirect percentage ownership interest in Holdings represented by such newly issued Class A shares will equal the same percentage ownership as the Class A Units of Holdings as the forfeited Class A Units represented in Holdings immediately prior to the exchange. See “SECURITIES BEING OFFERED.” |

| (2) | Includes 30 Shares of Class A Common Stock previously sold as part of this Offering. |

| (3) | The total number of Shares of our Class A Common Stock assumes that the maximum number of Shares are sold in this Offering. |

-1-

We may not be able to sell the Maximum Offering Amount. We will conduct one or more closings on a rolling basis as funds are received from investors.

The net proceeds of this Offering will be the gross proceeds of the Shares sold minus the expenses of this Offering.

Restrictions on Resale

We are not currently listed on any stock exchange nor are we quoted on any quotation service, and our ability to list our stock or have our stock quoted for trading in the future is uncertain. Investors should not assume that the Shares will be listed or quoted. A public trading market for the Shares may never develop. We have no current plans to list or obtain quotation of the Shares. Accordingly, the investor must be willing to hold the Shares for an indefinite period of time. In order to sell the Shares, the investor will need to independently locate a buyer, and any such sales must comply with any applicable state blue sky laws and regulations which often restrict the offer or sale of shares.

Potential Future Share Repurchase Program

In the future, we plan to adopt a share repurchase program which may permit you to sell Shares back to the Company. Prior to adopting such any share repurchase program, we plan to seek an exemptive letter from the Division of Trading and Markets of the Securities and Exchange Commission (the “SEC”), seeking to exempt us from restrictions on repurchases of shares during an offering of securities under the provisions of Regulation M promulgated by the SEC. Unless and until we receive such an exemptive letter, we do not plan to adopt any share repurchase program. We may never obtain such an exemptive letter. Thus, we may never adopt a share repurchase program.

As used in this Offering Circular, we will use the following terms which have the meanings set forth below.

| ● | Base Agreement is an agreement between one of our customers and a VB Property Company that allows the customer to reside in a VictoryBase Property. |

| ● | Base Payment is a monthly payment made by our customers to occupy VictoryBase Properties under the terms of a Base Agreement. |

| ● | Control Agreement is a master control and contribution agreement among Holdings, a VB Property Company, and the owner of such VB Property Company. Under a Control Agreement, (i) the VB Property Company grants to Holdings (i) the right to elect to control and occupy (and permit third parties to control and occupy) one or more VictoryBase Properties, (ii) the right to require the owner of the VB Property Company to contribute its ownership of such VB Property Company to Holdings in exchange for membership interests of Holdings. A form of Control Agreement is attached as an exhibit to this Offering Circular. |

| ● | EquityBase Program is a marketing term we give to our program that allows a person to elect both to reside in VictoryBase Properties and to invest in shares of our stock. Regardless of whether a VictoryBase Property resident elects to enter into a subscription agreement or an investor elects to enter into a Base Agreement, in neither case would there be any change to the rights, privileges, or responsibilities of the customer under the Base Agreement or the rights, privileges, or responsibilities of the investor under the subscription agreement. We plan to offer discounted Base Payments to EquityBase Investors that meet the criteria that we might establish from time to time. See “Potential Future Discount Program” under “Plan of Distribution” below. |

| ● | Holdings is VictoryBase Holdings LLC, a Texas limited liability company, a subsidiary of the Company. |

| ● | Holdings Tracking Units are membership interests of Holdings that track the value of one or more subsidiaries or other assets or operations of Holdings. |

| ● | NY1 is VictoryBase NY1, LLC, a Texas limited liability company, a subsidiary of Holdings. |

| ● | SC1 is VictoryBase SC1, LLC, a Texas limited liability company, a subsidiary of Holdings. |

| ● | Value Add is an adjective we use to describe a VictoryBase Property that we believe has net operating income that we can improve over time by implementing efficient management procedures and/or capital improvement programs. Generally, we consider a VictoryBase Property to no longer be “Value Add” when the efficient management procedures and/or capital improvement programs have been implemented and the net operating income has increased and is stabilized. |

| ● | VB Property Company is a company that owns one or more VictoryBase Properties. |

| ● | VictoryBase Property is a residential real property, such as single-family homes, townhomes, multi-family units or other residential real property within our network available for potential occupancy by one of our customers. |

-2-

The purchase of Shares of our Class A Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by us constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those risks associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on our business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You should consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company in forward-looking statements. We have attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results may differ from our current expectations.

Before investing, you should carefully read and carefully consider the following risk factors:

Risks relating to the Company and our Business

We have limited operating history.

We have a limited operating history and have suffered losses and our proposed plan of business may not be realized in the manner contemplated, and, if it cannot be, stockholders may lose all or a substantial part of their investment. We may not generate significant operating revenues and our operations may not be profitable.

We are dependent upon our management, key personnel and consultants to execute our business plan.

Our success is heavily dependent upon the continued active participation of our current executive officers as well as other key personnel and consultants. Loss of the services of one or more of these individuals could have a material adverse effect upon our business, financial condition, or results of operations. Further, our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the residential real estate industry is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on it. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on our business, financial condition or results of operations.

Although dependent upon key personnel, we do not have any key man life insurance policies on any such persons.

We are dependent upon management in order to conduct our operations and execute our business plan; however, we have not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of these key personnel, management or founders die or become disabled, we will not receive any compensation that would assist with such person’s absence. The loss of such person could negatively affect us and our operations.

-3-

We are not subject to Sarbanes-Oxley regulations, and we lack financial controls and safeguards required of public companies.

We do not have the internal infrastructure necessary, and we are not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. We may have significant deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses and diversion of management’s time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

We have engaged and intend to continue to engage in transactions with related persons.

We will routinely be engaged in transactions and contractual relationships with related parties. For example, each time VBRE contributes a new asset or a new entity to Holdings and/or one of its subsidiaries, the fair market value of such contribution will be determined by us and not by arms-length negotiation. Likewise, when the Company contributes cash to Holdings, the value of Holding’s existing assets, and therefore the number of Class B membership interests (“Class B Units”) of Holdings to be issued to the Company in exchange for such contribution will be based upon fair market value determined by us rather than by arms-length negotiation. Please see the section of this Offering Circular entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements.”

Changes in employment laws or regulation could harm our performance.

Various federal and state labor laws govern our relationship with our employees and affect operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

Our bank accounts will not be fully insured.

Our regular bank accounts each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in one or more of our accounts may exceed those limits at times. In the event that any of our banks should fail, we may not be able to recover all amounts deposited in these bank accounts.

Our business plan is speculative.

Our present business and planned business are speculative and subject to numerous risks and uncertainties. We may not generate significant revenues or profits.

We will likely incur debt.

We have incurred debt and expect to incur future debt in order to fund operations. Complying with obligations under such indebtedness may have a material adverse effect on us and on your investment.

Our expenses could increase without a corresponding increase in revenues.

Our operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on our consolidated financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

-4-

We will be reliant on key suppliers.

We intend to enter into agreements with key suppliers and will be reliant on positive and continuing relationships with such suppliers. Termination of those agreements, variations in their terms, or the failure of a key supplier to comply with its obligations under these agreements (including if a key supplier were to become insolvent), could have a material adverse effect on our consolidated financial results and on your investment.

Increased costs could affect us.

An increase in the cost of raw materials or energy could affect our profitability. Commodity and other price changes may result in unexpected increases in the cost of raw materials used by us. We may also be adversely affected by shortages of raw materials. In addition, energy cost increases could result in higher transportation, freight and other operating costs. We may not be able to increase our prices to offset these increased costs without suffering reduced volume, sales and operating profit, and this could have an adverse effect on your investment.

We may not be able to maintain and enhance our product image.

It is important that we maintain and enhance the image of our existing and new products. The image and reputation of our products may be impacted for various reasons including litigation or complaints from customers, investors or regulatory bodies resulting from quality failure. Such concerns, even when unsubstantiated, could be harmful to our image and the reputation of our products. From time to time, we may receive complaints from customers regarding products or services purchased from us. We may receive correspondence from customers requesting reimbursement. Dissatisfied customers may threaten legal action against us if no reimbursement is made. We may become subject to lawsuits from customers alleging injury because of a purported defect in VictoryBase Properties, claiming substantial damages and demanding payments from us. These claims may not be covered by our insurance policies. Any resulting litigation could be costly for us, divert our management’s attention, and could result in increased costs of doing business, or otherwise have a material adverse effect on our business, results of operations, or financial condition. Any negative publicity generated as a result of customer or investor complaints about our products could damage our reputation and diminish the value of our brand, which could have a material adverse effect on our business, results of operations, and financial condition, as well as your investment. Deterioration in our brand equity (brand image, reputation and product quality) may have a material adverse effect on our consolidated financial results as well as your investment.

If we are unable to protect our intellectual property effectively, we may not be able to operate our business, which would impair our ability to compete.

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. As we currently do not have any registered intellectual property with the USPTO, the names and/or logos of our brands (whether owned by us or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest trademark applications by us for our brands. Similarly, domains owned and used by us may be challenged by others who contest the ability of us to use the domain name or URL. Such challenges could have a material adverse effect on our consolidated financial results as well as your investment.

Computer, website or information system breakdown could affect our business.

Our business operations plan to rely heavily on technology and electronic communications. We plan to conduct a substantial portion of our business through our website or mobile app. Computer, website, mobile app, or information system breakdowns as well as cyber security attacks could impair our ability to service customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on our consolidated financial results as well as your investment. Furthermore, we do not currently have insurance protections against cyber attack or system breakdowns or malfunctions.

-5-

Changes in the economy could have a detrimental impact on us.

Changes in the general economic climate could have a detrimental impact on consumer expenditure and therefore on our revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, inflation, higher unemployment and tax increases) may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on our consolidated financial results and on your investment.

The amount of capital we are attempting to raise in this Offering is not enough to sustain our current business plan.

In order to achieve our near and long-term goals, we will need to procure funds in addition to the amount raised in this Offering. We may not be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause you to lose all or a portion of your investment.

Additional financing may be necessary for the implementation of our growth strategy.

We may require additional debt and/or equity financing to pursue our growth and business strategies. These include, but are not limited to, enhancing our operating infrastructure and otherwise respond to competitive pressures. Given our limited operating history and existing losses, additional financing may not be available, or, if available, may not be available upon terms acceptable to us. Lack of additional funding could force us to curtail substantially our growth plans. Furthermore, the issuance by us of any additional securities pursuant to any future fundraising activities undertaken by us would dilute the ownership of existing stockholders and may reduce the price of our Shares.

Our employees, executive officers, directors and insider stockholders beneficially own or control a substantial portion of our outstanding shares.

Thomas Paquin, our founder, sole director, and an officer, serves as the trustee of The Tom Paquin Irrevocable Trust, which owns and controls VBRE, which controls all of our Class B Common Stock, which controls the Company. Control of the Company by one person will limit your ability and the ability of our other stockholders, whether acting alone or together, to propose or direct the management or overall direction of the Company. Additionally, this concentration of ownership could discourage or prevent a potential takeover of the Company that might otherwise result in an investor receiving a premium over the market price for his Shares. Because Mr. Paquin indirectly controls the Company, he will have the power to control the election of our directors and the approval of actions for which the approval of our stockholders is required. If you acquire our Shares, you will have no effective voice in the management of the Company. Such concentrated control of the Company may adversely affect the price of the Shares. Our principal stockholder may be able to control matters requiring approval by our stockholders, including the election of directors, mergers or other business combinations. Such concentrated control may also make it difficult for our stockholders to receive a premium for their Shares in the event that we merge with a third party or enter into different transactions, which require stockholder approval. These provisions could also limit the price that investors might be willing to pay in the future for our Shares.

-6-

Our operating plan relies in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our forecasted results.

Whether actual operating results and business developments will be consistent with our expectations and assumptions as reflected in our forecast depends on a number of factors, many of which are outside our control, including, but not limited to:

| ● | whether we can obtain sufficient capital to sustain and grow our business; |

| ● | our ability to manage our growth; |

| ● | whether we can manage relationships with key vendors and advertisers; |

| ● | demand for our products and services; |

| ● | the timing and costs of new and existing marketing and promotional efforts; |

| ● | competition; |

| ● | four ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel; |

| ● | our ability to adequately insure our assets and protect against liabilities; |

| ● | the overall strength and stability of domestic and international economies; |

| ● | the impact of inflation; and |

| ● | consumer spending habits. |

Unfavorable changes in any of these or other factors, most of which are beyond our control, could materially and adversely affect our business, consolidated results of operations and consolidated financial condition.

To date, we have had operating losses, and we may not be initially profitable for at least the foreseeable future, and we cannot predict when we might become profitable.

We have been operating at a loss since our inception. We may not be able to generate significant revenues in the future. In addition, we expect to incur substantial operating expenses in order to fund the expansion of our business. As a result, we expect to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, we might become profitable.

We may be unable to manage our growth or implement our expansion strategy.

We may not be able to expand our product and service offerings, our markets, or implement the other features of our business strategy at the rate or to the extent presently planned. Our projected growth will place a significant strain on our administrative, operational and financial resources. If we are unable to successfully manage our future growth, establish and continue to upgrade our operating and financial control systems, recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, our consolidated financial condition and consolidated results of operations could be materially and adversely affected.

We rely upon trade secret protection to protect our intellectual property. It may be difficult and costly to protect our proprietary rights and we may not be able to ensure their protection.

We currently rely on trade secrets. While we use reasonable efforts to protect these trade secrets, our employees, consultants, contractors or advisors may, unintentionally or willfully, disclose our trade secrets to competitors or other third parties. Moreover, our competitors may independently develop equivalent knowledge, methods and know-how. If we are unable to defend our trade secrets from others use, or if our competitors develop equivalent knowledge, it could have a material adverse effect on our business. Any infringement of our proprietary rights could result in significant litigation costs, and any failure to adequately protect our proprietary rights could result in our competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenue. Existing patent, copyright, trademark and trade secret laws afford only limited protection. Therefore, we may not be able to protect our proprietary rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using our trade secrets could be expensive and time consuming, and the outcome of such a claim is unpredictable. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. This litigation could result in substantial costs and diversion of resources and could materially adversely affect our future operating results.

-7-

Our business model is evolving.

Our business model is unproven and is likely to continue to evolve. Accordingly, our current business model may not be successful and may need to be changed. Our ability to generate significant revenues will depend, in large part, on our ability to successfully market our products to potential users who may not be convinced of the need for our products and services or who may be reluctant to rely upon third parties to develop and provide these products. We intend to continue to develop our business model as our market continues to evolve.

We need to increase brand awareness.

Due to a variety of factors, our opportunity to achieve and maintain a significant market share may be limited. Developing and maintaining awareness of our brand name, among other factors, is critical. Further, the importance of brand recognition will increase as competition in our market increases. Successfully promoting and positioning our brand, products and services will depend largely on the effectiveness of our marketing efforts. Therefore, we may need to increase our financial commitment to creating and maintaining brand awareness. If we fail to successfully promote our brand name or if we incur significant expenses promoting and maintaining our brand name, it would have a material adverse effect on our consolidated results of operations.

We face competition in our markets from a number of large and small companies, some of which have greater financial, research and development, production and other resources than us.

In many cases, our competitors have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical and marketing resources. Our ability to compete depends, in part, upon a number of factors outside our control, including the ability of our competitors to develop alternatives that are superior. If we fail to successfully compete in our markets, or if we incur significant expenses in order to compete, it would have a material adverse effect on our consolidated results of operations.

A data security breach could expose us to liability and protracted and costly litigation and could adversely affect our reputation and operating revenues.

To the extent that our activities involve the storage and transmission of confidential information, we and/or third-party processors will receive, transmit and store confidential customer and investor and other information. Encryption software and the other technologies used to provide security for storage, processing and transmission of confidential customer and investor and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to our or these third parties’ systems or databases could result in the theft, publication, deletion or modification of confidential customer and investor and other information. A data security breach of the systems on which sensitive account information is stored could lead to fraudulent activity involving our products and services, reputational damage, and claims or regulatory actions against us. If we are sued in connection with any data security breach, we could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, we might be forced to pay damages and/or change our business practices or pricing structure, any of which could have a material adverse effect on our operating revenues and profitability. We would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

We depend on third-party providers for a reliable internet infrastructure and the failure of these third parties, or the internet in general, for any reason would significantly impair our ability to conduct our business.

We will outsource some or all of our online presence and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, our business would be significantly damaged. As has occurred with many businesses that rely upon the internet, we may be subject to “denial-of-service” attacks in which unknown individuals bombard our computer servers with requests for data, thereby degrading the servers’ performance. We may not be successful in quickly identifying and neutralizing these attacks. If a third-party facility failed, or our ability to access the internet was interfered with because of the failure of internet equipment in general or if we become subject to malicious attacks of computer intruders, our business and operating results will be materially adversely affected.

-8-

Our employees may engage in misconduct or improper activities.

We, like any business, are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with laws or regulations, provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose unauthorized activities to us. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and serious harm to our reputation.

Our directors enjoy limitations on their liability.

We may provide for the indemnification of our directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability our directors and our stockholders for monetary damages for breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling ours pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

The number of active-duty US military personnel may decrease in size or the location of US military bases may change.

Our business model is highly dependent upon US military servicepersons as a significant portion of our investor and customer base. Significant changes in deployment patterns or the size and scope of the US military personnel or the size or location of US military bases could have material adverse effect on our business and the results of our operations.

The market may not embrace our business concept.

Our business concept is somewhat novel, and our potential customers may not be aware of our business concept. Even after becoming aware of our business offerings, our potential customers may not embrace our business concept and may choosing instead to rent or purchase homes rather than do business with us.

Due to the unpredictability of deployment orders, our client base may terminate their Base Agreements early in certain circumstances, which could negatively affect our revenue.

A significant portion of our client base will be active duty and Reserve/National Guard service members. Those service members frequently move or receive orders to active duty that require them to deploy outside the United States. If either of these things occurs, the service member may terminate his or her Base Agreement early without penalty under certain circumstances as set forth in the Servicemembers Civil Relief Act and under the terms of the applicable Base Agreement. A significant number of early terminations of Base Agreements could have a material adverse effect on our business and results of our operations.

COVID-19 may have unpredictable effects on the global economy and our business.

The global pandemic caused by the spread of COVID-19 may have a substantial impact on the global economy, the residential real estate market, and our business in ways that are difficult to predict or react to. Although we believe our business model is well positioned to weather the storm of the pandemic and the economic devastation that we expect will be left in the pandemic’s wake, we may not be able to adapt our business model to effectively compete in these uncertain times.

-9-

COVID-19 or other global, national, or reginal pandemics may cause a change in business operations.

A pandemic and any other internal or external condition can cause face-to-face meeting to be cancelled, operations to change in various and unpredictable ways, operations to reduced or even ceased, additional cost could be incurred to sanitize or provide other use other methods to mediate risks, both physical and other, have an negative impact on our ability to hire or retain employees, provide alternate solutions to customers if we are unable to perform any portion of our agreements, or other unknown and unpredictable negative impacts on the business.

Environmentally hazardous conditions may adversely affect our financial condition, cash flows and operating results.

Under various federal, state and local laws, as well as local ordinances and regulations, an owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous substances at, on, under or in such property, as well as certain other potential costs relating to hazardous or toxic substances. Such laws often impose such liability without regard to whether the owner knew of, or was responsible for, the presence of such hazardous substances. A conveyance of the property, therefore, does not relieve the owner or operator from liability. As a current or former owner and operator of real estate, we may be required by law to investigate and clean up hazardous substances released at or from the properties we currently own or operate or have in the past owned or operated. We may also be liable to the government or to third parties for property damage, investigation costs and cleanup costs. In addition, some environmental laws create a lien on the contaminated site in favor of the government for damages and costs the government incurs in connection with the contamination. Contamination may adversely affect our ability to sell or lease real estate, or to make properties available for residents, or to borrow using the real estate as collateral. Persons who arrange for the disposal or treatment of hazardous substances also may be liable for the costs of removal or remediation of such substances at a disposal or treatment facility owned or operated by another person. In addition, certain environmental laws impose liability for the management and disposal of asbestos-containing materials and for the release of such materials into the air. These laws may provide for third parties to seek recovery from owners or operators of real properties for personal injury associated with asbestos-containing materials. In connection with the ownership, operation, management, and development of real properties, we may be considered an owner or operator of such properties and, therefore, are potentially liable for removal or remediation costs, and may be liable for governmental fines and injuries to persons and property. When we arrange for the treatment or disposal of hazardous substances at landfills or other facilities owned by other persons, we may be liable for the removal or remediation costs at such facilities. We are not aware of any environmental liabilities relating to our investment properties that would have a material adverse effect on our business, assets, or results of operations. However, environmental liabilities may arise in the future and such liabilities may have a material adverse effect on our business, assets or results of operation.

Losses in excess of our insurance coverage or uninsured losses could adversely affect our cash flow, including without limitation as a result of hurricanes, earthquakes, hail, tornados, and other natural disasters.

We generally maintain insurance policies related to our business, including casualty, general liability and other policies covering business operations, employees and assets. However, we may be required to bear all losses that are not adequately covered by insurance. In addition, there are certain losses that are not generally insured because it is not economically feasible to insure against them, including losses due to riots or acts of war. If an uninsured loss or a loss in excess of insured limits occurs with respect to one or more of our properties, then we could lose the capital we invested in the properties, as well as the anticipated profits and cash flow from the properties and, in the case of debt that carries recourse to us, we would remain obligated for any mortgage debt or other financial obligations related to the properties. Although we believe that our insurance programs are adequate, we may incur losses in excess of its insurance coverage, or we may not be able to obtain insurance in the future at acceptable levels and reasonable cost.

-10-

The market value of our VictoryBase Properties could decline, thereby reducing the value of the Company and the Shares.

The value of residential real property in our portfolio of VictoryBase Properties may fluctuate. Market and economic conditions in the markets in which we operate may impact occupancy or rental rates. Occupancy and rental rates, in turn, may impact the amount of Base Payments we are able to obtain from residents, and thus our revenues, and if our communities do not generate cash flow sufficient to meet our operating expenses, including debt service and capital expenditures, current cash flow and ability to pay or refinance our debt obligations could be adversely affected. We are exposed to the risks of downturns in the local economy or other local real estate market conditions that could adversely affect occupancy rates, rental rates, Base Payment rates, and property values in these markets. Other factors that may affect the value of our assets include:

| ● | the national and local economic climate, which may be adversely affected by, among other factors, plant closings, and industry slowdowns; |

| ● | local real estate market conditions such as the oversupply of residential real property in an area; |

| ● | the number of repossessed homes in a particular market; |

| ● | the rental market which may limit the extent to which Base Payment rates may be increased to meet increased expenses without decreasing occupancy rates; |

| ● | the safety, convenience and attractiveness of our properties and the neighborhoods where they are located; |

| ● | zoning or other regulatory restrictions; |

| ● | competition from other available housing communities and alternative forms of housing; |

| ● | our ability to provide adequate management, maintenance and insurance; |

| ● | increased operating costs, including insurance premiums, real estate taxes and utilities; and |

| ● | the enactment of rent control laws or laws taxing the owners of residential homes. |

The quality of our VictoryBase Properties may not be adequate, and there will be only limited guarantees from the builder of our VictoryBase Properties.

We will seek to acquire or construct VictoryBase Properties that have satisfactory levels of quality to satisfy consumer demands and to provide for reasonable maintenance expenses. We will seek to obtain warranties from our builders, and we will seek to use only reputable builders for our homes. However, we may not be successful in selecting only reputable builders and all builders’ warranties are limited to varying degrees. VictoryBase Properties that we acquire or construct may turn out to lack the quality that we expect. Lack of quality in any one property could result in a decline in confidence in our brand which would negatively impact the value or perceived value of our VictoryBase Properties nationwide. Thus, if any of our VictoryBase Properties ends up inferior quality, it could have a negative impact on our business and our results of operations.

Increased interest rates may have a negative impact on cash flows of the Company and limit our ability to continue operations without seeking addition financing.

Interest rate increases can have a negative impact on all aspects of the business. An increase in interest rates can increase interest payments on any indebtedness that we incur. The increase can create increased cash flow requirements, which we may not be able to support. Increase interest rates could also decreases the affordability of our home in the event we attempt to resell them or use the homes as collateral. If we elect to use financial hedging instruments, such as interest rate swaps, we may suffer losses on and increase or decrease in interest rates, depending on our short or long position.

The costs of our Base Agreement discount program may exceed its benefits.

We plan to implement a Base Agreement discount program as outlined in “Potential Future Discount Program” under “PLAN OF DISTRIBUTION” below. Under our anticipated discount program, EquityBase Investors may obtain discounted Base Payments under their Base Agreements if they also purchase Shares in this Offering. We anticipate that this discount program will lower our operating costs by encouraging our residents to have an ownership mentality, which we also may refer to as an ownership mindset. The discount program may not result in the development of such ownership mentality in our residents. Any such ownership mindset may not result in lowering our operating costs by the amount of the Base Payment discounts or at all. There is no limit to the amount of discount we may elect to offer, but we anticipate that the amount of the discount will be less than half of the amount of the applicable Base Payment.

-11-

Risks relating to this Offering and investment

We may undertake additional equity or debt financing that may dilute the Shares in this Offering.

We may undertake further equity or debt financing, which may be dilutive to existing stockholders, including you, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing stockholders, including you, and also reducing the value of Shares subscribed for under this Offering.

An investment in our Shares could result in a loss of your entire investment.

An investment in the Shares offered in this Offering involves a high degree of risk, and you should not purchase the Shares if you cannot afford the loss of your entire investment. You may not be able to liquidate your investment for any reason in the near future.

The Shares are offered on a “best efforts” basis, and we may not raise the maximum amount being offered.

Since we are offering the Shares on a “best efforts” basis, we may not sell enough Shares to meet our capital needs. If you purchase Shares in this Offering, we may not raise enough money to satisfy the full “Use of Proceeds To Issuer” which we have outlined in this Offering Circular or to meet our working capital needs.

We have not paid dividends in the past and do not expect to pay dividends in the future, so any return on your investment may be limited to the value of the Shares.

We have never paid cash dividends on shares of our stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on the Shares will depend on earnings, financial condition and other business and economic factors affecting it at such time that management may consider relevant. If we do not pay dividends, the Shares may be less valuable because a return on your investment will only occur if our stock price appreciates.

We may not be able to obtain additional financing.

Even if we are successful in selling the maximum number of Shares in this Offering, we may require additional funds to continue and grow our business. We may not be able to obtain additional financing as needed, on acceptable terms, or at all, which would force us to delay our plans for growth and implementation of our strategy which could seriously harm our business, financial condition and results of operations. If we need additional funds, we may seek to obtain them primarily through additional equity or debt financings. Those additional financings could result in dilution to our current stockholders, and to you if you invest in this Offering.

The offering price has been arbitrary determined, and we may in the future elect to change the price of the Shares for this Offering or the purchase price for shares of our Class A Common Stock in future offerings arbitrarily.

We have arbitrarily established the offering price of the Shares based upon our present and anticipated financing needs, and the offering price of the Shares bears no relationship to our present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the Shares may not be indicative of the value of the Shares or the Company, now or in the future. From time to time in the future, we may arbitrarily adjust the purchase price for the Shares in this Offering and/or the purchase price for shares of our Class A Common Stock in future offerings. Any such future offering price of the Shares may not bear any relationship to our then present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria.

-12-

Our management has broad discretion in application of proceeds of this Offering.

Our management has broad discretion to adjust the application and allocation of the net proceeds of this Offering in order to address changed circumstances and opportunities. As a result of the foregoing, our success will be substantially dependent upon the discretion and judgment of our management with respect to the application and allocation of the net proceeds hereof.

We may not be able to pay distributions to our stockholders, and we may never adopt a share repurchase program.

While we may choose to pay distributions at some point in the future to our stockholders, cash flow and profits may not allow such distributions to ever be made. In addition, the amount of cash available for distributions may be limited due to repurchases of our shares if we ever adopt a share repurchase program. If we adopt a share repurchase program, our board of directors will have flexibility to determine the allocation of available cash available as between the payment of distributions and repurchase of our shares. We may never adopt a share repurchase program.

There is no public trading market for our Shares.

At present, shares of our Class A Common Stock are not listed or quoted any exchange or quotation service. There is no consistent and active trading market for our securities and a consistent trading market may not develop. Although we hope to have the Shares listed for trading in the future or have the Shares quoted for trading on an electronic quotation service, such listing or quotation may never occur.

You may not be legally permitted to sell the Shares.

Any resale of the Shares must comply with any applicable federal securities laws and state blue sky laws. You may not be able to resell the Shares in one or more states under their applicable state blue sky laws, unless the resale of the shares is registered or you are able to qualify for an applicable exemption from registration requirements under such state blue sky laws. We have no current plans to register the Shares for resale with any state securities regulator. Moreover, although we plan to adopt a share repurchase program in the future, we may never adopt a share repurchase plan. And if we do adopt a share repurchase plan, we expect that it will include numerous restrictions that may limit your ability to sell your Shares to us, including provisions that (i) our Board of Directors may reject any request for repurchase of Shares at any time in its sole discretion, and (ii) our Board of Directors may suspend (in whole or in part), amend (in whole or in part), or terminate our share repurchase program at any time. Therefore, it may be difficult for you to sell your Shares promptly or at all. If you are able to sell your Shares, you may have to sell them at a discount to the price you paid for the Shares. It is likely that your Shares would not be accepted as the primary collateral for a loan. You should purchase the Shares only as a long-term investment because of the illiquid nature of the Shares.

We may never adopt a future share repurchase program; if we adopt such a program, the repurchases price may be less than the offering price in this Offering and less than our then-current offering price.

We do not expect that a secondary market for resale of our Class A Common Stock will develop. We plan to request from the SEC an exemptive letter exempting a potential share repurchase program from Regulation M promulgated by the SEC. If we obtain such an exemptive letter, we plan to adopt a stock repurchase plan for stockholders who wish to sell their shares. We may never obtain an exemptive letter from the SEC, and even if we obtain such a letter, we may never adopt a share repurchase plan. Our ability to repurchase Shares depends upon the levels of our cash reserves, availability under any line of credit that we might have, the pace of new Share sales, and our ability to sell properties and other investments. If we must sell properties or other investments in order to honor repurchase requests, the repurchase of Shares offered for repurchase could be delayed until we have sold sufficient properties or investments to honor such requests. We will have no obligation to sell any properties in order repurchase Shares. We expect that the property sale process, if undertaken to honor repurchase requests, could take several months, and we may never raise sufficient capital from property sales and other sources to honor all such requests. If we adopt a share repurchase program, we expect to honor such repurchase requests in the order they are received. If we adopt a share repurchase program, we may not repurchase Shares if such repurchase would materially impair our capital or operations as determined by our Board of Directors. We may never adopt a share repurchase program, and if we do adopt such as program, our Board of Directors may suspend (in part or in whole), amend (in part or in whole) or terminate our share repurchase program at any time.

-13-

Furthermore, if we adopt a share repurchase program in the future, the repurchase price is likely to be based upon a discount to our then-current net asset value. If we adopt such a share repurchase program, there could be a significant difference in your repurchase price and our current offering price and our offering price at the time of any such repurchase. Likewise, our net asset value for purposes of determining the repurchase price as part of a future share repurchase program may be less than the current offering price and the offering price at the time of repurchase, even prior to applying any discounts under the terms of any such share repurchase plan. We may never adopt a share repurchase plan.

Sales of a substantial number of shares of our type of stock may cause the price of our type of stock to decline.

If our stockholders sell substantial amounts of shares of our Class A Common Stock, shares sold may cause the price to decrease below the current offering price. These sales may also make it more difficult for us to sell equity or equity-related securities at a time and price that we deem reasonable or appropriate.

We have made assumptions in our projections and in “forward-looking statements” that may not be accurate.

The discussions and information in this Offering Circular may contain both historical and “forward-looking statements” which can be identified by the use of forward-looking terminology including the terms “believes,” “anticipates,” “continues,” “expects,” “intends,” “may,” “will,” “would,” “should,” or, in each case, their negative or other variations or comparable terminology. You should not place undue reliance on forward-looking statements. These forward-looking statements include matters that are not historical facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking statements contained in this Offering Circular, based on past trends or activities, should not be taken as a representation that such trends or activities will continue in the future. To the extent that this Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance, reduction of consumer demand, unexpected costs and operating deficits, lower sales and revenues than forecast, default on Base Agreements or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain investors or customers, loss of investors or customers, and failure to obtain new investors or customers, the risk of litigation and administrative proceedings involving the Company or our employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of our operating results and financial condition, adverse publicity and news coverage, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be referred to in this Offering Circular or in other reports issued by us or by third-party publishers.

Investment in the Shares offered in this Offering is a long-term investment.