| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| (State of incorporation) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | |||||||||||||

| Smaller reporting company | Emerging growth company | ||||||||||||||||

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenue by geography | |||||||||||||||||

| North America | 71 | % | 69 | % | 83 | % | |||||||||||

| International | 29 | % | 31 | % | 17 | % | |||||||||||

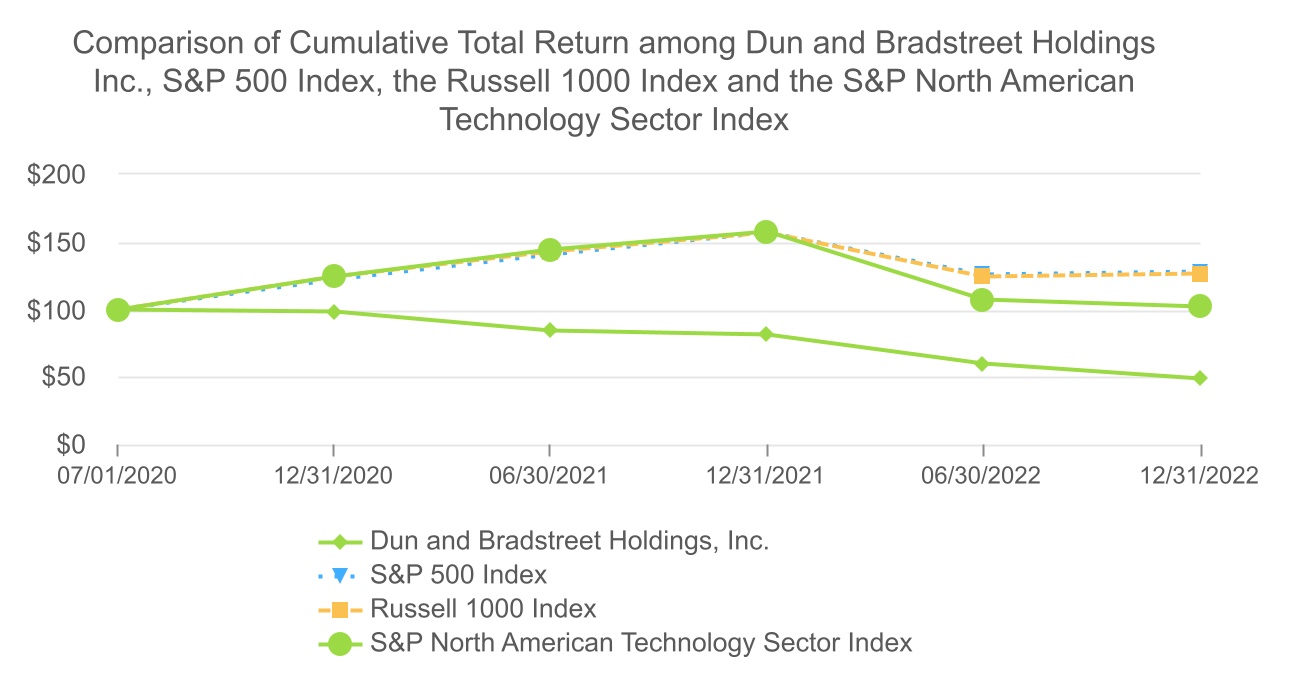

| 07/01/2020 | 12/31/2020 | 06/30/2021 | 12/31/2021 | 06/30/2022 | 12/31/2022 | |||||||||||||||

| Dun & Bradstreet Holdings, Inc. | $100 | $98 | $84 | $81 | $59 | $49 | ||||||||||||||

| S&P 500 Index | $100 | $122 | $140 | $156 | $125 | $128 | ||||||||||||||

| Russell 1000 Index | $100 | $124 | $142 | $157 | $124 | $127 | ||||||||||||||

| S&P North American Technology Sector | $100 | $124 | $144 | $157 | $107 | $102 | ||||||||||||||

| Long-Term Rate of Return | Discount Rate | |||||||||||||||||||||||||

| 25 Basis Points | 25 Basis Points | |||||||||||||||||||||||||

| Increase | Decrease | Increase | Decrease | |||||||||||||||||||||||

| Increase (decrease) in pension cost | $ | (3.6) | $ | 3.6 | $ | 0.7 | $ | (1.3) | ||||||||||||||||||

| Increase (decrease) in pension obligation | $ | — | $ | — | $ | (33.9) | $ | 35.4 | ||||||||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Revenue | $ | 2,224.6 | $ | 2,165.6 | |||||||

| Cost of services (exclusive of depreciation and amortization) | 721.4 | 664.3 | |||||||||

| Selling and administrative expenses | 745.6 | 714.7 | |||||||||

| Depreciation and amortization | 587.2 | 615.9 | |||||||||

| Restructuring charge | 20.5 | 25.1 | |||||||||

| Operating costs | 2,074.7 | 2,020.0 | |||||||||

| Operating income (loss) | 149.9 | 145.6 | |||||||||

| Interest income | 2.2 | 0.7 | |||||||||

| Interest expense | (193.2) | (206.4) | |||||||||

| Other income (expense) - net | 13.9 | 14.9 | |||||||||

| Non-operating income (expense) - net | (177.1) | (190.8) | |||||||||

| Income (loss) before provision (benefit) for income taxes and equity in net income of affiliates | (27.2) | (45.2) | |||||||||

| Less: provision (benefit) provision for income taxes | (28.8) | 23.4 | |||||||||

| Equity in net income of affiliates | 2.5 | 2.7 | |||||||||

| Net income (loss) | 4.1 | (65.9) | |||||||||

| Less: net (income) loss attributable to the non-controlling interest | (6.4) | (5.8) | |||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | (2.3) | $ | (71.7) | |||||||

Net income (loss) margin (1) | (0.1) | % | (3.3) | % | |||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Non - GAAP Financial Measures | |||||||||||

| Adjusted revenue (a) | $ | 2,224.6 | $ | 2,170.2 | |||||||

| Organic revenue (a) | $ | 2,242.6 | $ | 2,166.4 | |||||||

| Adjusted EBITDA (a) | $ | 863.5 | $ | 847.1 | |||||||

| Adjusted EBITDA margin (a) | 38.8 | % | 39.0 | % | |||||||

| Adjusted net income (a) | $ | 472.4 | $ | 471.1 | |||||||

| Adjusted earnings per share (a) | $ | 1.10 | $ | 1.10 | |||||||

| (a) Including impact of deferred revenue purchase accounting adjustments | $ | — | $ | (0.2) | |||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| GAAP revenue | $ | 2,224.6 | $ | 2,165.6 | |||||||

| Revenue adjustment due to the Bisnode acquisition close timing | — | 4.6 | |||||||||

| Adjusted revenue (a) | 2,224.6 | 2,170.2 | |||||||||

| Foreign currency impact | 69.5 | 3.1 | |||||||||

| Adjusted revenue before the effect of foreign currency | $ | 2,294.1 | $ | 2,173.3 | |||||||

| Net revenue from acquisition and divestiture - before the effect of foreign currency | (51.5) | (6.9) | |||||||||

| Organic revenue - before the effect of foreign currency (a) | $ | 2,242.6 | $ | 2,166.4 | |||||||

| North America | $ | 1,587.1 | $ | 1,499.4 | |||||||

| International | 637.5 | 671.0 | |||||||||

| Segment revenue | 2,224.6 | 2,170.4 | |||||||||

| Corporate and other | — | (0.2) | |||||||||

| Foreign currency impact | 69.5 | 3.1 | |||||||||

| Adjusted revenue before the effect of foreign currency | $ | 2,294.1 | $ | 2,173.3 | |||||||

| Net revenue from acquisition and divestiture - before the effect of foreign currency | (51.5) | (6.9) | |||||||||

| Organic revenue - before the effect of foreign currency (a) | $ | 2,242.6 | $ | 2,166.4 | |||||||

| (a) Including impact of deferred revenue purchase accounting adjustments | $ | — | $ | (0.2) | |||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | (2.3) | $ | (71.7) | |||||||

| Depreciation and amortization | 587.2 | 615.9 | |||||||||

| Interest expense - net | 191.0 | 205.7 | |||||||||

| (Benefit) provision for income tax - net | (28.8) | 23.4 | |||||||||

| EBITDA | 747.1 | 773.3 | |||||||||

| Other income (expense) - net | (13.9) | (14.9) | |||||||||

| Equity in net income of affiliates | (2.5) | (2.7) | |||||||||

| Net income (loss) attributable to non-controlling interest | 6.4 | 5.8 | |||||||||

| Equity-based compensation | 66.0 | 33.3 | |||||||||

| Restructuring charges | 20.5 | 25.1 | |||||||||

| Merger and acquisition-related operating costs | 23.4 | 14.1 | |||||||||

| Transition costs | 24.4 | 11.6 | |||||||||

Other adjustments (1) | (7.9) | 1.5 | |||||||||

| Adjusted EBITDA | $ | 863.5 | $ | 847.1 | |||||||

| North America | $ | 718.0 | $ | 715.3 | |||||||

| International | 202.2 | 194.1 | |||||||||

| Corporate and other (a) | (56.7) | (62.3) | |||||||||

| Adjusted EBITDA (a) | $ | 863.5 | $ | 847.1 | |||||||

| (a) Including impact of deferred revenue purchase accounting adjustments | $ | — | $ | (0.2) | |||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | (2.3) | $ | (71.7) | |||||||

| Incremental amortization of intangible assets resulting from the application of purchase accounting | 494.0 | 535.7 | |||||||||

| Equity-based compensation | 66.0 | 33.3 | |||||||||

| Restructuring charges | 20.5 | 25.1 | |||||||||

| Merger and acquisition-related operating costs | 23.4 | 14.1 | |||||||||

| Transition costs | 24.4 | 11.6 | |||||||||

| Merger and acquisition-related non-operating (gain) costs | 3.7 | 2.2 | |||||||||

| Debt refinancing and extinguishment costs | 24.3 | 43.0 | |||||||||

| Non-recurring pension charges | 2.1 | — | |||||||||

Other adjustments (1) | (7.9) | 1.5 | |||||||||

| Tax impact of non-GAAP adjustments | (156.1) | (165.2) | |||||||||

| Other tax effect adjustments | (19.7) | 41.5 | |||||||||

| Adjusted net income (loss) attributable to Dun & Bradstreet Holdings, Inc. (a) | $ | 472.4 | $ | 471.1 | |||||||

| Adjusted diluted earnings (loss) per share of common stock | $ | 1.10 | $ | 1.10 | |||||||

| Weighted average number of shares outstanding - diluted | 430.0 | 429.8 | |||||||||

| (a) Including impact of deferred revenue purchase accounting adjustments | $ | — | $ | (0.2) | |||||||

| Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | $ Increase (Decrease) | % Increase (Decrease) | ||||||||||||||||||||

| North America: | |||||||||||||||||||||||

| Finance & Risk | $ | 866.9 | $ | 834.7 | $ | 32.2 | 3.9 | % | |||||||||||||||

| Sales & Marketing | 720.2 | 664.7 | 55.5 | 8.3 | % | ||||||||||||||||||

| Total North America | $ | 1,587.1 | $ | 1,499.4 | $ | 87.7 | 5.8 | % | |||||||||||||||

| International: | |||||||||||||||||||||||

| Finance & Risk | $ | 419.1 | $ | 430.3 | $ | (11.2) | (2.6) | % | |||||||||||||||

| Sales & Marketing | 218.4 | 240.7 | (22.3) | (9.2) | % | ||||||||||||||||||

| Total International | $ | 637.5 | $ | 671.0 | $ | (33.5) | (5.0) | % | |||||||||||||||

| Corporate and other: | |||||||||||||||||||||||

| Finance & Risk | $ | — | $ | (2.2) | $ | 2.2 | ** | ||||||||||||||||

| Sales & Marketing | — | (2.6) | 2.6 | ** | |||||||||||||||||||

| Total Corporate and other | $ | — | $ | (4.8) | $ | 4.8 | ** | ||||||||||||||||

| Total Revenue: | |||||||||||||||||||||||

| Finance & Risk | $ | 1,286.0 | $ | 1,262.8 | $ | 23.2 | 1.8 | % | |||||||||||||||

| Sales & Marketing | 938.6 | 902.8 | 35.8 | 4.0 | % | ||||||||||||||||||

| Total Revenue | $ | 2,224.6 | $ | 2,165.6 | $ | 59.0 | 2.7 | % | |||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | $ Increase (Decrease) | % Increase (Decrease) | ||||||||||||||||||||

| Cost of services (exclusive of depreciation and amortization) | $ | 721.4 | $ | 664.3 | $ | 57.1 | 8.6 | % | |||||||||||||||

| Selling and administrative expenses | 745.6 | 714.7 | 30.9 | 4.3 | % | ||||||||||||||||||

| Depreciation and amortization | 587.2 | 615.9 | (28.7) | (4.7) | % | ||||||||||||||||||

| Restructuring charges | 20.5 | 25.1 | (4.6) | (18.1) | % | ||||||||||||||||||

| Operating costs | $ | 2,074.7 | $ | 2,020.0 | $ | 54.7 | 2.7 | % | |||||||||||||||

| Operating income (loss) | $ | 149.9 | $ | 145.6 | $ | 4.3 | 2.9 | % | |||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | $ Increase (Decrease) | % Increase (Decrease) | ||||||||||||||||||||

| North America: | |||||||||||||||||||||||

| Adjusted EBITDA | $ | 718.0 | $ | 715.3 | $ | 2.7 | 0.4 | % | |||||||||||||||

| Adjusted EBITDA margin | 45.2 | % | 47.7 | % | (250) | bps | |||||||||||||||||

| International: | |||||||||||||||||||||||

| Adjusted EBITDA | $ | 202.2 | $ | 194.1 | $ | 8.1 | 4.2 | % | |||||||||||||||

| Adjusted EBITDA margin | 31.7 | % | 28.9 | % | 280 | bps | |||||||||||||||||

| Corporate and other: | |||||||||||||||||||||||

| Adjusted EBITDA | $ | (56.7) | $ | (62.3) | $ | 5.6 | 9.1 | % | |||||||||||||||

| Consolidated total: | |||||||||||||||||||||||

| Adjusted EBITDA | $ | 863.5 | $ | 847.1 | $ | 16.4 | 1.9 | % | |||||||||||||||

| Adjusted EBITDA margin | 38.8 | % | 39.0 | % | (20) | bps | |||||||||||||||||

| Net income (loss) margin | (0.1) | % | (3.3) | % | 320 | bps | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | $ Change | % Change | ||||||||||||||||||||

| Interest income | $ | 2.2 | $ | 0.7 | $ | 1.5 | 205.9 | % | |||||||||||||||

| Interest expense | (193.2) | (206.4) | 13.2 | 6.4 | % | ||||||||||||||||||

| Interest income (expense) – net | $ | (191.0) | $ | (205.7) | $ | 14.7 | 7.1 | % | |||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | $ Change | % Change | ||||||||||||||||||||

| Non-operating pension income (expense) | $ | 42.2 | $ | 53.7 | $ | (11.5) | (21) | % | |||||||||||||||

| Debt redemption premium | (16.3) | (29.5) | 13.2 | 45 | % | ||||||||||||||||||

| Miscellaneous other income (expense) – net | (12.0) | (9.3) | (2.7) | (29) | % | ||||||||||||||||||

| Other income (expense) – net | $ | 13.9 | $ | 14.9 | $ | (1.0) | (6) | % | |||||||||||||||

| Effective tax rate for the year ended December 31, 2020 | 49.6 | % | |||

| Impact of uncertain tax positions | 1.5 | ||||

Impact of income earned in non-U.S. jurisdictions (1) | 19.6 | ||||

| Impact of non-deductible charges | (12.7) | ||||

| Impact of non-deductible change in fair value of make-whole derivative liability for the Series A Preferred Stock | 3.0 | ||||

Impact of tax credits and deductions (2) | 23.7 | ||||

Impact of GILTI Inclusion (2) | (43.4) | ||||

Impact of change in state tax (3) | (63.7) | ||||

| Impact of valuation allowance | (2.7) | ||||

| Impact of CARES Act | (25.5) | ||||

| Other | (1.2) | ||||

| Effective tax rate for the year ended December 31, 2021 | (51.8) | % | |||

| Impact of uncertain tax positions | (4.3) | ||||

Impact of income earned in non-U.S. jurisdictions (1) | 42.5 | ||||

Impact of non-deductible charges (4) | (30.5) | ||||

| Impact of tax credits and deductions | 2.2 | ||||

| Impact of GILTI Inclusion | (29.3) | ||||

Impact of change in state tax (3) | 181.1 | ||||

| Impact of valuation allowance | 0.5 | ||||

| Other | (4.4) | ||||

| Effective tax rate for the year ended December 31, 2022 | 106.0 | % | |||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net cash provided by (used in) operating activities | $ | 537.1 | $ | 503.7 | |||||||

| Net cash provided by (used in) investing activities | (210.5) | (1,078.7) | |||||||||

| Net cash provided by (used in) financing activities | (281.1) | 400.1 | |||||||||

| Total cash provided during the period before the effect of exchange rate changes | $ | 45.5 | $ | (174.9) | |||||||

| Total | Payment due within one year | |||||||||||||

| Contractual obligations | ||||||||||||||

Short-term and long-term debt (1) | $ | 4,648.0 | $ | 298.0 | ||||||||||

Operating leases (2) | $ | 68.7 | $ | 20.5 | ||||||||||

Commitments to purchase obligations (3) | $ | 2,091.1 | $ | 356.7 | ||||||||||

Pension and other postretirement benefits payments/contributions (4) | $ | 144.2 | $ | 6.6 | ||||||||||

| Tax liabilities related to the 2017 Act | $ | 44.5 | $ | 5.2 | ||||||||||

| At December 31, 2022 | At December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Maturity | Principal amount | Debt issuance costs and discount | Carrying value | Principal amount | Debt issuance costs and discount | Carrying value | |||||||||||||||||||||||||||||||||||

| Debt maturing within one year: | |||||||||||||||||||||||||||||||||||||||||

| 2026 Term loan | February 8, 2026 | $ | 28.1 | $ | — | $ | 28.1 | $ | 28.1 | $ | — | $ | 28.1 | ||||||||||||||||||||||||||||

| 2029 Term loan | January 18, 2029 | 4.6 | — | 4.6 | — | — | — | ||||||||||||||||||||||||||||||||||

| Total short-term debt | $ | 32.7 | $ | — | $ | 32.7 | $ | 28.1 | $ | — | $ | 28.1 | |||||||||||||||||||||||||||||

| Debt maturing after one year: | |||||||||||||||||||||||||||||||||||||||||

| 2026 Term loan | February 8, 2026 | $ | 2,651.7 | $ | 49.2 | $ | 2,602.5 | $ | 2,754.8 | $ | 64.5 | $ | 2,690.3 | ||||||||||||||||||||||||||||

| 2029 Term loan | January 18, 2029 | 451.9 | 6.5 | 445.4 | — | — | — | ||||||||||||||||||||||||||||||||||

| Revolving facility | September 11, 2025 | 50.3 | — | 50.3 | 160.0 | — | 160.0 | ||||||||||||||||||||||||||||||||||

| 5.000% Senior unsecured notes | December 15, 2029 | 460.0 | 6.0 | 454.0 | 460.0 | 6.8 | 453.2 | ||||||||||||||||||||||||||||||||||

| 6.875% Senior secured notes | Fully paid off in January 2022 | — | — | — | 420.0 | 6.8 | 413.2 | ||||||||||||||||||||||||||||||||||

| Total long-term debt | $ | 3,613.9 | $ | 61.7 | $ | 3,552.2 | $ | 3,794.8 | $ | 78.1 | $ | 3,716.7 | |||||||||||||||||||||||||||||

| Total debt | $ | 3,646.6 | $ | 61.7 | $ | 3,584.9 | $ | 3,822.9 | $ | 78.1 | $ | 3,744.8 | |||||||||||||||||||||||||||||

| Page | |||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenue | $ | $ | $ | ||||||||||||||

| Cost of services (exclusive of depreciation and amortization) | |||||||||||||||||

| Selling and administrative expenses | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Restructuring charges | |||||||||||||||||

| Operating costs | |||||||||||||||||

| Operating income (loss) | |||||||||||||||||

| Interest income | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Other income (expense) - net | ( | ||||||||||||||||

| Non-operating income (expense) - net | ( | ( | ( | ||||||||||||||

| Income (loss) before provision (benefit) for income taxes and equity in net income of affiliates | ( | ( | ( | ||||||||||||||

| Less: provision (benefit) for income taxes | ( | ( | |||||||||||||||

| Equity in net income of affiliates | |||||||||||||||||

| Net income (loss) | ( | ( | |||||||||||||||

| Less: net (income) loss attributable to the non-controlling interest | ( | ( | ( | ||||||||||||||

| Less: Dividends allocated to preferred stockholders | ( | ||||||||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | |||||||||||

| Basic earnings (loss) per share of common stock: | |||||||||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | |||||||||||

| Diluted earnings (loss) per share of common stock: | |||||||||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | |||||||||||

| Weighted average number of shares outstanding-basic | |||||||||||||||||

| Weighted average number of shares outstanding-diluted | |||||||||||||||||

| Other comprehensive income (loss), net of income taxes: | |||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | ( | ||||||||||||

| Foreign currency adjustments: | |||||||||||||||||

Foreign currency translation adjustments, net of tax (1) | $ | ( | $ | ( | $ | ||||||||||||

Net investment hedge derivative, net of tax (2) | |||||||||||||||||

Cash flow hedge derivative, net of tax expense (benefit) (3) | |||||||||||||||||

| Defined benefit pension plans: | |||||||||||||||||

Prior service credit (cost), net of tax expense (benefit) (4) | ( | ( | ( | ||||||||||||||

Net actuarial gain (loss), net of tax expense (benefit) (5) | ( | ( | |||||||||||||||

| Total other comprehensive income (loss), net of tax | $ | ( | $ | $ | ( | ||||||||||||

| Comprehensive income (loss), net of tax | $ | ( | $ | ( | $ | ( | |||||||||||

| Less: comprehensive (income) loss attributable to the non-controlling interest | ( | ( | |||||||||||||||

| Comprehensive income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | |||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Accounts receivable, net of allowance of $ | |||||||||||

| Prepaid taxes | |||||||||||

| Other prepaids | |||||||||||

| Other current assets (Notes 4 and 14) | |||||||||||

| Total current assets | |||||||||||

| Non-current assets | |||||||||||

Property, plant and equipment, net of accumulated depreciation of $ | |||||||||||

Computer software, net of accumulated amortization of $ | |||||||||||

| Goodwill (Notes 17 and 18) | |||||||||||

| Deferred income tax (Note 10) | |||||||||||

| Other intangibles (Notes 17 and 18) | |||||||||||

| Deferred costs (Note 4) | |||||||||||

| Other non-current assets (Note 17) | |||||||||||

| Total non-current assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued payroll | |||||||||||

| Short-term debt (Note 6) | |||||||||||

| Deferred revenue (Note 4) | |||||||||||

| Other accrued and current liabilities (Note 17) | |||||||||||

| Total current liabilities | |||||||||||

| Long-term pension and postretirement benefits (Note 11) | |||||||||||

| Long-term debt (Note 6) | |||||||||||

| Deferred income tax (Note 10) | |||||||||||

| Other non-current liabilities (Note 17) | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Notes 9 and 20) | |||||||||||

| Equity | |||||||||||

Common Stock, $ | |||||||||||

| Capital surplus | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

Treasury Stock, | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total stockholder equity | |||||||||||

| Non-controlling interest | |||||||||||

| Total equity | |||||||||||

| Total liabilities and stockholder equity | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Cash flows provided by (used in) operating activities: | |||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | ( | ||||||||||||

| Reconciliation of net income (loss) to net cash provided by (used in) operating activities: | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Amortization of unrecognized pension loss (gain) | ( | ( | |||||||||||||||

| Debt early redemption premium expense | |||||||||||||||||

| Amortization and write off of deferred debt issuance costs | |||||||||||||||||

| Pension settlement charge | |||||||||||||||||

| Equity-based compensation expense | |||||||||||||||||

| Restructuring charge | |||||||||||||||||

| Restructuring payments | ( | ( | ( | ||||||||||||||

| Change in fair value of make-whole derivative liability | |||||||||||||||||

| Changes in deferred income taxes | ( | ( | ( | ||||||||||||||

Changes in operating assets and liabilities: (1) | |||||||||||||||||

| (Increase) decrease in accounts receivable | ( | ( | |||||||||||||||

| (Increase) decrease in prepaid taxes, other prepaids and other current assets | ( | ( | |||||||||||||||

| Increase (decrease) in deferred revenue | |||||||||||||||||

| Increase (decrease) in accounts payable | ( | ( | |||||||||||||||

| Increase (decrease) in accrued payroll | ( | ||||||||||||||||

| Increase (decrease) in other accrued and current liabilities | ( | ( | ( | ||||||||||||||

| (Increase) decrease in other long-term assets | ( | ( | ( | ||||||||||||||

| Increase (decrease) in long-term liabilities | ( | ( | ( | ||||||||||||||

| Net, other non-cash adjustments | ( | ||||||||||||||||

| Net cash provided by (used in) operating activities | |||||||||||||||||

| Cash flows provided by (used in) investing activities: | |||||||||||||||||

| Acquisitions of businesses, net of cash acquired | ( | ( | ( | ||||||||||||||

| Cash settlements of foreign currency contracts and net investment hedge | |||||||||||||||||

| Payments for real estate purchase | ( | ||||||||||||||||

| Capital expenditures | ( | ( | ( | ||||||||||||||

| Additions to computer software and other intangibles | ( | ( | ( | ||||||||||||||

| Other investing activities, net | |||||||||||||||||

| Net cash provided by (used in) investing activities | ( | ( | ( | ||||||||||||||

| Cash flows provided by (used in) financing activities: | |||||||||||||||||

Proceeds from issuance of common stock in the IPO transaction and Private Placement, net (2) | |||||||||||||||||

| Payment for the redemption of Cumulative Series A Preferred Stock | ( | ||||||||||||||||

| Payment for make-whole liability | ( | ||||||||||||||||

| Payment for debt early redemption premiums | ( | ( | ( | ||||||||||||||

Payments of dividends (3) | ( | ( | |||||||||||||||

| Payment of long term debt | ( | ( | ( | ||||||||||||||

| Proceeds from borrowings on Credit Facility | |||||||||||||||||

| Proceeds from issuance of Senior Notes | |||||||||||||||||

| Proceeds from borrowings on Term Loan Facility | |||||||||||||||||

| Payments of borrowings on Credit Facility | ( | ( | ( | ||||||||||||||

| Payments of borrowing on Term Loan Facility | ( | ( | ( | ||||||||||||||

| Payments of borrowings on Bridge Loan | ( | ||||||||||||||||

| Payment of debt issuance costs | ( | ( | ( | ||||||||||||||

| Payment for purchase of non-controlling interests | ( | ||||||||||||||||

Other financing activities, net (4) | ( | ( | ( | ||||||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ( | |||||||||||||||

| Increase (decrease) in cash and cash equivalents | ( | ||||||||||||||||

| Cash and Cash Equivalents, Beginning of Period | |||||||||||||||||

| Cash and Cash Equivalents, End of Period | $ | $ | $ | ||||||||||||||

| Supplemental Disclosure of Cash Flow Information: | |||||||||||||||||

| Cash Paid for: | |||||||||||||||||

| Income taxes payment (refund), net | $ | $ | $ | ||||||||||||||

| Interest | $ | $ | $ | ||||||||||||||

| Noncash Investing and Financing activities: | |||||||||||||||||

| Fair value of acquired assets | $ | $ | $ | ||||||||||||||

| Cash paid for acquired businesses | ( | ( | ( | ||||||||||||||

| Unpaid purchase price accrued in "Other accrued and current liabilities" | ( | ||||||||||||||||

| ( | |||||||||||||||||

| Assumed liabilities from acquired businesses including non-controlling interest | $ | $ | $ | ||||||||||||||

| Noncash additions to computer software | $ | $ | $ | ||||||||||||||

| Noncash additions to property, plant and equipment | $ | $ | $ | ||||||||||||||

| Common stock | Capital surplus | (Accumulated deficit) retained earnings | Treasury stock | Cumulative translation adjustment | Defined benefit postretirement plans | Cash flow hedging derivative | Total stockholder equity (deficit) | Non-controlling interest | Total equity (deficit) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2020 | $ | $ | $ | ( | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | ( | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

Accretion - Series A Preferred Stock (1) | — | ( | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of Class A Common Stock in IPO and Private Placement, net of issuance costs | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Equity-based compensation plans (2) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Pension adjustments, net of tax benefit of $ | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Change in cumulative translation adjustment, net of tax expense of $ | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash flow hedge derivative, net of tax expense of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred dividend (1) | — | ( | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Payment to non-controlling interest | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | ( | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2021 | $ | $ | $ | ( | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | ( | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued for Bisnode acquisition | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation plans | — | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Pension adjustments, net of tax expense of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Change in cumulative translation adjustment, net of tax benefit of $ | — | — | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

Cash flow hedge derivative, net of tax expense of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment to non-controlling interest | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| Common stock | Capital surplus | (Accumulated deficit) retained earnings | Treasury stock | Cumulative translation adjustment | Defined benefit postretirement plans | Cash flow hedging derivative | Total stockholder equity (deficit) | Non-controlling interest | Total equity (deficit) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase of non-controlling interest (3) | — | ( | — | — | — | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of cumulative translation adjustment related to the purchase of non-controlling interest | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation plans | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends declared (4) | — | ( | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Pension adjustments, net of tax benefit of $ | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Change in cumulative translation adjustment, net of tax benefit of $ | — | — | — | — | ( | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Net investment hedge derivative, net of tax expense of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash flow hedge derivative, net of tax expense of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment to non-controlling interest | — | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| Gross proceeds | $ | ||||

| Less: | |||||

| Underwriter fees | |||||

IPO related expenses (a) | |||||

Redemption of Series A Preferred Stock (b) | |||||

Make-whole payment on redemption of Series A Preferred Stock (b) | |||||

Partial redemption of | |||||

Call premium on partial redemption of | |||||

Partial redemption of | |||||

Call premium on partial redemption of | |||||

| Cash to balance sheet | $ | ||||

| Weighted average amortization period (years) | ||||||||

| Intangible assets: | ||||||||

| Reacquired right | ||||||||

| Database | ||||||||

| Customer relationships | ||||||||

| Technology | ||||||||

| Partnership agreements | ||||||||

| Trademark | ||||||||

| Level Input | Input Definition | ||||

| Level I | Observable inputs utilizing quoted prices (unadjusted) for identical assets or liabilities in active markets at the measurement date. | ||||

| Level II | Inputs other than quoted prices included in Level I that are either directly or indirectly observable for the asset or liability through corroboration with market data at the measurement date. | ||||

| Level III | Unobservable inputs for the asset or liability in which little or no market data exists, therefore requiring management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. | ||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | |||||||||||||||||||||||||||||||||||

| Future revenue | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenue recognized at a point in time | $ | $ | $ | ||||||||||||||

| Revenue recognized over time | |||||||||||||||||

| Total revenue recognized | $ | $ | $ | ||||||||||||||

| At December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Accounts receivable, net | $ | $ | $ | ||||||||||||||

Short-term contract assets (1) | $ | $ | $ | ||||||||||||||

Long-term contract assets (2) | $ | $ | $ | ||||||||||||||

| Short-term deferred revenue | $ | $ | $ | ||||||||||||||

Long-term deferred revenue (3) | $ | $ | $ | ||||||||||||||

| Severance and termination | Contract termination and other exit costs | Total | |||||||||||||||

| Balance remaining as of December 31, 2019 | $ | $ | $ | ||||||||||||||

Charge taken during 2020 (1) | |||||||||||||||||

| Payments made during 2020 | ( | ( | ( | ||||||||||||||

| Balance remaining as of December 31, 2020 | $ | $ | $ | ||||||||||||||

Charge taken during 2021 (1) | |||||||||||||||||

| Payments made during 2021 | ( | ( | ( | ||||||||||||||

| Balance remaining as of December 31, 2021 | $ | $ | $ | ||||||||||||||

Charge taken during 2022 (1) | |||||||||||||||||

| Payments made during 2022 | ( | ( | ( | ||||||||||||||

| Balance remaining as of December 31, 2022 | $ | $ | $ | ||||||||||||||

| At December 31, 2022 | At December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Maturity | Principal amount | Debt issuance costs and discount* | Carrying value | Principal amount | Debt issuance costs and discount* | Carrying value | |||||||||||||||||||||||||||||||||||

| Debt maturing within one year: | |||||||||||||||||||||||||||||||||||||||||

2026 Term loan (1) | February 8, 2026 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

2029 Term Loan (1) | January 18, 2029 | ||||||||||||||||||||||||||||||||||||||||

| Total short-term debt | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Debt maturing after one year: | |||||||||||||||||||||||||||||||||||||||||

2026 Term loan (1) | February 8, 2026 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

2029 Term Loan (1) | January 18, 2029 | ||||||||||||||||||||||||||||||||||||||||

Revolving facility (1) (2) | September 11, 2025 | ||||||||||||||||||||||||||||||||||||||||

| December 15, 2029 | |||||||||||||||||||||||||||||||||||||||||

| Fully paid off in January 2022 | |||||||||||||||||||||||||||||||||||||||||

| Total long-term debt | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Total debt | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | |||||||||||||||||||||||||||||||||||

| Debt principal outstanding as of December 31, 2022 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| Interest associated with debt outstanding as of December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Total debt and interest | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| $ | $ | ||||||||||

| $ | $ | ||||||||||

| $ | $ | ||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Operating lease costs | $ | $ | $ | ||||||||||||||

| Variable lease costs | |||||||||||||||||

| Short-term lease costs | |||||||||||||||||

| Sublease income | ( | ( | ( | ||||||||||||||

| Total lease costs | $ | $ | $ | ||||||||||||||

| December 31, 2022 | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Undiscounted cash flows | |||||

| Less imputed interest | |||||

| Total operating lease liabilities | $ | ||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Weighted average remaining lease term (in years) | |||||||||||

| Weighted average discount rate | % | % | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| U.S. | $ | ( | $ | ( | $ | ( | |||||||||||

| Non-U.S | |||||||||||||||||

| Income (loss) before provision for income taxes and equity in net income of affiliates | $ | ( | $ | ( | $ | ( | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Current tax provision: | |||||||||||||||||

| U.S. Federal | $ | $ | $ | ( | |||||||||||||

| State and local | |||||||||||||||||

| Non-U.S. | |||||||||||||||||

| Total current tax provision | $ | $ | $ | ||||||||||||||

| Deferred tax provision: | |||||||||||||||||

| U.S. Federal | $ | ( | $ | ( | $ | ( | |||||||||||

| State and local | ( | ( | |||||||||||||||

| Non-U.S. | ( | ( | ( | ||||||||||||||

| Total deferred tax provision | $ | ( | $ | ( | $ | ( | |||||||||||

| Provision (benefit) for income taxes | $ | ( | $ | $ | ( | ||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Statutory tax rate | % | % | % | ||||||||||||||

State and local taxes, net of U.S. Federal tax benefits (1) | ( | ||||||||||||||||

Nondeductible charges (2) | ( | ( | ( | ||||||||||||||

Change in fair value of make-whole derivative liability (3) | ( | ||||||||||||||||

| U.S. taxes on foreign income | ( | ( | ( | ||||||||||||||

Non-U.S. taxes (5) | |||||||||||||||||

| Valuation allowance | ( | ( | ( | ||||||||||||||

| Interest | ( | ( | |||||||||||||||

Tax credits and deductions (5) | |||||||||||||||||

| Tax contingencies related to uncertain tax positions | ( | ( | |||||||||||||||

GILTI tax (5) | ( | ( | ( | ||||||||||||||

CARES Act (4) | |||||||||||||||||

| Other | ( | ( | |||||||||||||||

| Effective tax rate | % | ( | % | % | |||||||||||||

| December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Deferred tax assets: | ||||||||||||||

| Operating losses | $ | $ | ||||||||||||

| Interest expense carryforward | ||||||||||||||

| Bad debts | ||||||||||||||

| Accrued expenses | ||||||||||||||

| Capital loss and credit carryforwards | ||||||||||||||

| Pension and postretirement benefits | ||||||||||||||

| Foreign exchange | ||||||||||||||

ASC 842 - Lease liability (1) | ||||||||||||||

| Equity Compensation | ||||||||||||||

| Other | ||||||||||||||

| Total deferred tax assets | $ | $ | ||||||||||||

| Valuation allowance | ( | ( | ||||||||||||

| Net deferred tax assets | $ | $ | ||||||||||||

| Deferred tax liabilities: | ||||||||||||||

| Intangibles | $ | ( | $ | ( | ||||||||||

| Commission Assets | ( | ( | ||||||||||||

| Fixed assets | ( | ( | ||||||||||||

ASC 842 - ROU asset (1) | ( | ( | ||||||||||||

| Other | ( | ( | ||||||||||||

| Total deferred tax liabilities | $ | ( | $ | ( | ||||||||||

| Net deferred tax (liabilities) assets | $ | ( | $ | ( | ||||||||||

| Gross unrecognized tax benefits as of December 31, 2019 | $ | |||||||

Additions for current year’s tax positions | ||||||||

Increase in prior years’ tax positions | ||||||||

Reduction due to expired statute of limitations (1) | ( | |||||||

| Gross unrecognized tax benefits as of December 31, 2020 | $ | |||||||

Additions for current year’s tax positions | ||||||||

Increase in prior years’ tax positions | ||||||||

| Settlements with taxing authority | ( | |||||||

Reduction due to expired statute of limitations (2) | ( | |||||||

| Gross unrecognized tax benefits as of December 31, 2021 | $ | |||||||

Additions for current year’s tax positions | ||||||||

Increase in prior years’ tax positions | ||||||||

| Settlements with taxing authority | ( | |||||||

Reduction due to expired statute of limitations (3) | ( | |||||||

| Gross unrecognized tax benefits as of December 31, 2022 | $ | |||||||

| Pension plans | Postretirement benefit obligations | |||||||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Change in benefit obligation: | ||||||||||||||||||||||||||

| Benefit obligation at beginning of year | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Service cost | ( | ( | ||||||||||||||||||||||||

| Interest cost | ( | ( | ||||||||||||||||||||||||

| Benefits paid | ||||||||||||||||||||||||||

| Acquisitions | ( | |||||||||||||||||||||||||

| Plan amendment | ||||||||||||||||||||||||||

| Settlement | ||||||||||||||||||||||||||

| Plan participants' contributions | ( | ( | ||||||||||||||||||||||||

| Actuarial (loss) gain | ||||||||||||||||||||||||||

| Effect of changes in foreign currency exchange rates | ||||||||||||||||||||||||||

| Benefit obligation at end of year | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Change in plan assets: | ||||||||||||||||||||||||||

| Fair value of plan assets at beginning of year | $ | $ | $ | $ | ||||||||||||||||||||||

| Actual return on plan assets | ( | |||||||||||||||||||||||||

| Acquisitions | ||||||||||||||||||||||||||

| Employer contributions | ||||||||||||||||||||||||||

| Plan participants' contributions | ||||||||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | ||||||||||||||||||||||

| Settlement | ( | |||||||||||||||||||||||||

| Effect of changes in foreign currency exchange rates | ( | ( | ||||||||||||||||||||||||

| Fair value of plan assets at end of year | $ | $ | $ | $ | ||||||||||||||||||||||

| Net funded status of plan | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Pension plans | Postretirement benefit obligations | ||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Amounts recorded in the consolidated balance sheets: | |||||||||||||||||||||||

Prepaid pension assets (1) | $ | $ | $ | $ | |||||||||||||||||||

Short-term pension and postretirement benefits (2) | ( | ( | ( | ( | |||||||||||||||||||

Long-term pension and postretirement benefits (3) | ( | ( | ( | ( | |||||||||||||||||||

| Net amount recognized | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Accumulated benefit obligation | $ | $ | N/A | N/A | |||||||||||||||||||

| Amount recognized in accumulated other comprehensive loss consists of: | |||||||||||||||||||||||

| Actuarial loss (gain) | $ | $ | $ | ( | $ | ||||||||||||||||||

| Prior service cost (credit) | ( | ( | ( | ||||||||||||||||||||

| Total amount recognized - pretax | $ | $ | $ | ( | $ | ( | |||||||||||||||||

| December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Accumulated benefit obligation | $ | $ | ||||||||||||

| Fair value of plan assets | ||||||||||||||

| Unfunded accumulated benefit obligation | $ | $ | ||||||||||||

| Projected benefit obligation | $ | $ | ||||||||||||

| Pension plans | Postretirement benefit obligations | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Components of net periodic cost (income): | |||||||||||||||||||||||||||||||||||

| Service cost | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Interest cost | |||||||||||||||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of prior service cost (credit) | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of actuarial loss (gain) | |||||||||||||||||||||||||||||||||||

| Net periodic cost (income) | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||

| Pension plans | Postretirement benefit obligations | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Other changes in plan assets and benefit obligations recognized in other comprehensive income (loss) | |||||||||||||||||||||||||||||||||||

Actuarial (loss) gain arising during the year, before tax benefit (expense) of $ | $ | ( | $ | $ | ( | $ | $ | $ | ( | ||||||||||||||||||||||||||

Prior service credit (cost) arising during the year, before tax benefit (expense) of less than $ | $ | $ | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||||||||

Amortization of actuarial (loss) gain, before tax benefit (expense) of less than $ | $ | ( | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||

Amortization of prior service (cost) credit, before tax benefit (expense) of $( | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Pension plans | Postretirement benefit obligations | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Discount rate for determining projected benefit obligation at December 31 | % | % | % | % | % | % | |||||||||||||||||||||||||||||

| Discount rate in effect for determining service cost | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Discount rate in effect for determining interest cost | % | % | % | % | % | % | |||||||||||||||||||||||||||||

| Weighted average expected long-term return on plan assets | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Rate of compensation increase for determining projected benefit obligation at December 31 | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Rate of compensation increase for determining net pension cost | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

Interest credit rates for cash balance (1) | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||

| Asset category | Quoted prices in active markets for identical assets (Level I) | Significant other observable inputs (Level II) | Significant unobservable inputs (Level III) | Total | ||||||||||||||||||||||

| Short-term investment funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Aon Collective Investment Trust Funds: | ||||||||||||||||||||||||||

| Equity funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Fixed income funds | ||||||||||||||||||||||||||

| Real estate funds | ||||||||||||||||||||||||||

| Total Aon Collective Investment Trust Funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| Other Investments Measured at Net Asset Value | ||||||||||||||||||||||||||

| Aon Collective Investment Trust Funds | $ | |||||||||||||||||||||||||

| Aon Alternative Investment Funds: | ||||||||||||||||||||||||||

| Fixed income funds | $ | |||||||||||||||||||||||||

| Venture Capital Fund | ||||||||||||||||||||||||||

| Other Non-U.S. commingled equity and fixed income | ||||||||||||||||||||||||||

| Total other investments measured at net asset value | $ | |||||||||||||||||||||||||

| Total investments at fair value | $ | |||||||||||||||||||||||||

| Asset category | Quoted prices in active markets for identical assets (Level I) | Significant other observable inputs (Level II) | Significant unobservable inputs (Level III) | Total | ||||||||||||||||||||||

| Short-term investment funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Aon Collective Investment Trust Funds: | ||||||||||||||||||||||||||

| Equity funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Fixed income funds | ||||||||||||||||||||||||||

| Real estate funds | ||||||||||||||||||||||||||

| Total Aon Collective Investment Trust Funds | $ | $ | $ | $ | ||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| Other Investments Measured at Net Asset Value | ||||||||||||||||||||||||||

| Aon Collective Investment Trust Funds | $ | |||||||||||||||||||||||||

| Aon Alternative Investment Funds: | ||||||||||||||||||||||||||

| Fixed income funds | $ | |||||||||||||||||||||||||

| Venture Capital Fund | ||||||||||||||||||||||||||

| Other Non-U.S. commingled equity and fixed income | ||||||||||||||||||||||||||

| Total other investments measured at net asset value | $ | |||||||||||||||||||||||||

| Total investments at fair value | $ | |||||||||||||||||||||||||

| Asset allocations | Target asset allocations | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Return-seeking assets | % | % | % | % | ||||||||||||||||||||||

| Liability-hedging assets | % | % | % | % | ||||||||||||||||||||||

| Total | % | % | % | % | ||||||||||||||||||||||

| Pension plans | Postretirement benefit plans | |||||||||||||

| 2023 | $ | $ | ||||||||||||

| 2024 | $ | $ | ||||||||||||

| 2025 | $ | $ | ||||||||||||

| 2026 | $ | $ | ||||||||||||

| 2027 | $ | $ | ||||||||||||

| 2028 - 2032 | $ | $ | ||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Stock-based compensation expense: | ||||||||||||||||||||

Restricted stock and restricted stock units (1) | $ | $ | $ | |||||||||||||||||

| Stock options | ||||||||||||||||||||

| Incentive units | ||||||||||||||||||||

| Total compensation expense | $ | $ | $ | |||||||||||||||||

| Expected tax benefit: | ||||||||||||||||||||

| Restricted stock and restricted stock units | $ | $ | $ | |||||||||||||||||

| Stock options | ||||||||||||||||||||

| Total compensation expense | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

Expected dividend yield (1) | % | N/A | % | |||||||||||||||||

Expected stock price volatility (2) | % | N/A | % | |||||||||||||||||

Risk-free interest rate (3) | % | N/A | % | |||||||||||||||||

Expected life of options (in years) (4) | N/A | |||||||||||||||||||

| Weighted average grant date fair value | $ | N/A | $ | |||||||||||||||||

| Stock options | |||||||||||||||||||||||

| Number of options | Weighted-average exercise price | Weighted average remaining contractual term (in years) | Aggregate intrinsic value (in millions) | ||||||||||||||||||||

| Balances, December 31, 2021 | $ | $ | |||||||||||||||||||||

| Granted | $ | ||||||||||||||||||||||

| Forfeited | ( | $ | |||||||||||||||||||||

| Exercised | $ | ||||||||||||||||||||||

| Balances, December 31, 2022 | $ | $ | |||||||||||||||||||||

| Expected to vest as of December 31, 2022 | $ | $ | |||||||||||||||||||||

| Exercisable as of December 31, 2022 | $ | $ | |||||||||||||||||||||

| Restricted stock and Restricted stock units | |||||||||||||||||||||||

| Number of shares | Weighted-average grant date fair value | Weighted average remaining contractual term (in years) | Aggregate intrinsic value | ||||||||||||||||||||

| Balances, December 31, 2021 | $ | $ | |||||||||||||||||||||

| Granted | $ | ||||||||||||||||||||||

| Forfeited | ( | $ | |||||||||||||||||||||

| Vested | ( | $ | |||||||||||||||||||||

| Balances, December 31, 2022 | $ | $ | |||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Fair value of shares vested | $ | $ | N/A | |||||||||||||||||

| Tax benefit realized upon vesting | $ | $ | N/A | |||||||||||||||||

| Number of common units/restricted shares | Weighted-average grant date fair value | Weighted average remaining contractual term (in years) | Aggregate intrinsic value (in millions) | ||||||||||||||||||||

| Outstanding, December 31, 2021 | $ | $ | |||||||||||||||||||||

| Distribution | ( | $ | |||||||||||||||||||||

| Forfeited | ( | $ | |||||||||||||||||||||

| Outstanding, December 31, 2022 | $ | $ | |||||||||||||||||||||

| Expected to vest, December 31, 2022 | $ | $ | |||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Fair value of shares vested | $ | $ | $ | |||||||||||||||||

| Tax benefit realized upon vesting | $ | $ | $ | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Weighted average number of shares outstanding-basic | ||||||||||||||||||||

| Weighted average number of shares outstanding-diluted | ||||||||||||||||||||

| Earnings (loss) per share of common stock: | ||||||||||||||||||||

| Basic | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Diluted | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Common Shares | Treasury Shares (1) | Common Shares Outstanding | ||||||||||||||||||

| Shares as of December 31, 2020 | ( | |||||||||||||||||||

| Shares issued for the year ended December 31, 2021 | ||||||||||||||||||||

| Shares forfeited for the year ended December 31, 2021 | ( | ( | ( | |||||||||||||||||

| Shares as of December 31, 2021 | ( | |||||||||||||||||||

| Shares issued for the year ended December 31, 2022 | N/A | |||||||||||||||||||

| Shares forfeited for the year ended December 31, 2022 | ( | ( | ( | |||||||||||||||||

| Shares as of December 31, 2022 | ( | |||||||||||||||||||

| Declaration Date | Record Date | Payment Date | Dividends Per Share | |||||||||||||||||

| July 28, 2022 | September 1, 2022 | September 22, 2022 | $ | |||||||||||||||||

| October 27, 2022 | December 1, 2022 | December 15, 2022 | $ | |||||||||||||||||

| Asset derivatives | Liability derivatives | ||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||

| Balance sheet location | Fair value | Balance sheet location | Fair value | Balance sheet location | Fair value | Balance sheet location | Fair value | ||||||||||||||||||||||||||||||||||||||||

| Derivatives designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash flow hedge derivative: | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate swaps | Other current assets | $ | Other current assets | $ | Other accrued & current liabilities | $ | Other accrued & current liabilities | $ | |||||||||||||||||||||||||||||||||||||||

| Net investment hedge derivative: | |||||||||||||||||||||||||||||||||||||||||||||||

| Cross-currency swaps | Other current assets | Other current assets | Other accrued & current liabilities | Other accrued & current liabilities | |||||||||||||||||||||||||||||||||||||||||||

| Total derivatives designated as hedging instruments | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange forward contracts | Other current assets | $ | Other current assets | $ | Other accrued & current liabilities | $ | Other accrued & current liabilities | $ | |||||||||||||||||||||||||||||||||||||||

| Total derivatives not designated as hedging instruments | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

| Total derivatives | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

| Amount of pre-tax gain or (loss) recognized in OCI on derivative | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| Derivatives designated as hedging instruments | 2022 | 2021 | 2020 | ||||||||||||||

| Cash flow hedge derivative: | |||||||||||||||||

| Interest rate swaps | $ | $ | $ | ||||||||||||||

| Net investment hedge derivative: | |||||||||||||||||

| Cross-currency swaps | $ | $ | $ | ||||||||||||||

| Amount of gain or (loss) reclassified from accumulated OCI into income | |||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| Derivatives designated as hedging instruments | Location of gain or (loss) reclassified from accumulated OCI into income | 2022 | 2021 | 2020 | |||||||||||||||||||

| Cash flow hedge derivative: | |||||||||||||||||||||||

| Interest rate swaps | Interest expense | $ | $ | ( | $ | ( | |||||||||||||||||

| Amount of gain or (loss) recognized in income on derivative | |||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| Derivatives designated as hedging instruments | Location of gain or (loss) reclassified from accumulated OCI into income | 2022 | 2021 | 2020 | |||||||||||||||||||

| Cash flow hedge derivative: | |||||||||||||||||||||||

| Interest rate swaps | Interest expense | $ | $ | ( | $ | ( | |||||||||||||||||

| Amount of gain (loss) recognized in income on derivatives | ||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments | Location of gain or (loss) recognized in income on derivatives | 2022 | 2021 | 2020 | ||||||||||||||||||||||

| Make-whole derivative liability | Non-operating income (expenses) – net | $ | $ | $ | ( | |||||||||||||||||||||

| Foreign exchange collar | Non-operating income (expenses) – net | $ | $ | ( | $ | |||||||||||||||||||||

| Foreign exchange forward contracts | Non-operating income (expenses) – net | $ | ( | $ | $ | |||||||||||||||||||||

| Quoted prices in active markets for identical assets (Level I) | Significant other observable inputs (Level II) | Significant unobservable inputs (Level III) | Balance at December 31, 2022 | ||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

Cash equivalents (1) | $ | $ | $ | $ | |||||||||||||||||||

| Other current assets: | |||||||||||||||||||||||

Foreign exchange forwards (2) | $ | $ | $ | $ | |||||||||||||||||||

Interest rate swap arrangements (3) | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Other accrued and current liabilities: | |||||||||||||||||||||||

Foreign exchange forwards (2) | $ | $ | $ | $ | |||||||||||||||||||

Cross-currency swap arrangements (3) | $ | $ | $ | $ | |||||||||||||||||||

| Quoted prices in active markets for identical assets (Level I) | Significant other observable inputs (Level II) | Significant unobservable inputs (Level III) | Balance at December 31, 2021 | ||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

Cash equivalents (1) | $ | $ | $ | $ | |||||||||||||||||||

| Other current assets: | |||||||||||||||||||||||

Foreign exchange forwards (2) | $ | $ | $ | $ | |||||||||||||||||||

Interest rate swap arrangements (3) | $ | $ | $ | $ | |||||||||||||||||||

| Other accrued and current liabilities: | |||||||||||||||||||||||

Foreign exchange forwards (2) | $ | $ | $ | $ | |||||||||||||||||||

| December 31, | |||||||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||

| Carrying amount | Fair value | Carrying amount | Fair value | ||||||||||||||||||||

Long-term debt (1) | $ | $ | $ | $ | |||||||||||||||||||

| Revolving facility | $ | $ | $ | $ | |||||||||||||||||||

Term loan facility (2) | $ | $ | $ | $ | |||||||||||||||||||

| Foreign currency translation adjustments | Net investment hedge derivative | Defined benefit pension plans | Cash flow hedge derivative | Total | ||||||||||||||||||||||||||||

| Balance, January 1, 2020 | $ | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | |||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss), net of tax | ( | |||||||||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | |||||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss), net of tax | ||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | |||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss), net of tax | ( | ( | ||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||

| Amount reclassified from accumulated other comprehensive income (loss) | ||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||

| Details about accumulated other comprehensive income (loss) components | Affected line item in the statement where net income (loss) is presented | 2022 | 2021 | 2020 | ||||||||||||||||||||||

| Defined benefit pension plans: | ||||||||||||||||||||||||||

| Amortization of prior service costs | Other income (expense)- net | $ | $ | ( | $ | ( | ||||||||||||||||||||

| Amortization of actuarial gain/loss | Other income (expense)- net | |||||||||||||||||||||||||

| Derivative financial instruments: | ||||||||||||||||||||||||||

| Interest contracts | Interest expense | ( | ||||||||||||||||||||||||

| Total before tax | ( | |||||||||||||||||||||||||

| Tax benefit (expense) | ( | ( | ||||||||||||||||||||||||

| Total reclassifications for the period, net of tax | $ | ( | $ | $ | ||||||||||||||||||||||

| Amortization life (years) | Initial purchase price allocation at December 31, 2022 | Measurement Period Adjustments | Final Purchase Price Allocation at December 31, 2022 | |||||||||||||||||||||||

| Cash | $ | $ | $ | |||||||||||||||||||||||

| Accounts receivable | ||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||

| Total current assets | ||||||||||||||||||||||||||

| Intangible assets: | ||||||||||||||||||||||||||

| Customer relationships | ||||||||||||||||||||||||||

| Technology | ||||||||||||||||||||||||||

| Trademark | ||||||||||||||||||||||||||

| Goodwill | Indefinite | |||||||||||||||||||||||||

| Total assets acquired | $ | $ | $ | |||||||||||||||||||||||

| Deferred tax liability | ||||||||||||||||||||||||||

| Other liabilities | ||||||||||||||||||||||||||

| Total liabilities assumed | ||||||||||||||||||||||||||

| Total purchase price | $ | $ | $ | |||||||||||||||||||||||

| Amortization life (years) | Initial purchase price allocation at December 31, 2021 | Measurement Period Adjustments | Final Purchase Price Allocation at December 31, 2022 | |||||||||||||||||||||||

| Cash | $ | $ | $ | |||||||||||||||||||||||

| Accounts receivable | ||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||

| Total current assets | ||||||||||||||||||||||||||

| Intangible assets: | ||||||||||||||||||||||||||

| Customer relationships | ||||||||||||||||||||||||||

| Technology | ||||||||||||||||||||||||||

| Trademark | ||||||||||||||||||||||||||

| Database | ||||||||||||||||||||||||||

| Goodwill | Indefinite | |||||||||||||||||||||||||

| Total assets acquired | $ | $ | $ | |||||||||||||||||||||||

| Total liabilities assumed | ||||||||||||||||||||||||||

| Total purchase price | $ | $ | $ | |||||||||||||||||||||||

| Weighted average amortization period (years) | Initial purchase price allocation at March 31, 2021 | Measurement period adjustment | Final purchase price allocation at December 31, 2021 | |||||||||||||||||||||||

| Cash | $ | $ | $ | |||||||||||||||||||||||

| Accounts receivable | ||||||||||||||||||||||||||

| Other current assets | ||||||||||||||||||||||||||

| Total current assets | ||||||||||||||||||||||||||

| Property, plant & equipment | ||||||||||||||||||||||||||

| Intangible assets: | ||||||||||||||||||||||||||

| Reacquired right | ( | |||||||||||||||||||||||||

| Database | ( | |||||||||||||||||||||||||

| Customer relationships | ||||||||||||||||||||||||||

| Technology | ( | |||||||||||||||||||||||||

| Goodwill | Indefinite | |||||||||||||||||||||||||

| Right of use asset | ||||||||||||||||||||||||||

| Other | ( | |||||||||||||||||||||||||

| Total assets acquired | $ | $ | $ | |||||||||||||||||||||||

| Accounts payable | $ | $ | $ | |||||||||||||||||||||||

Deferred revenue (1) | ||||||||||||||||||||||||||

| Accrued payroll | ||||||||||||||||||||||||||

| Accrued income tax and other tax liabilities | ||||||||||||||||||||||||||

| Short-term lease liability | ||||||||||||||||||||||||||

| Other current liabilities | ||||||||||||||||||||||||||

| Total current liabilities | ||||||||||||||||||||||||||

| Long-term pension and postretirement obligations | ||||||||||||||||||||||||||

| Deferred tax liability | ||||||||||||||||||||||||||

| Long-term lease liability | ||||||||||||||||||||||||||

| Other liabilities | ||||||||||||||||||||||||||

| Total liabilities assumed | $ | $ | $ | |||||||||||||||||||||||

| Total consideration | $ | $ | $ | |||||||||||||||||||||||

| Year Ended December 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| Reported revenue | $ | $ | |||||||||

| Pro forma adjustments: | |||||||||||

| Pre-acquisition revenue: | |||||||||||

| Bisnode | |||||||||||

| Eyeota | |||||||||||

| NetWise | |||||||||||

| Adjustments to Bisnode's pre-acquisition revenue related to revenue received from Dun & Bradstreet Holdings, Inc. | ( | ||||||||||

| Adjustments to Dun & Bradstreet's revenue related to revenue received from Bisnode | ( | ||||||||||

| Total pro forma revenue | $ | $ | |||||||||

Reported net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | |||||||

| Pro forma adjustments - net of tax effect: | |||||||||||

| Pre-acquisition net income: | |||||||||||

| Bisnode | |||||||||||

| Eyeota | ( | ( | |||||||||

| NetWise | ( | ||||||||||

| Intangible amortization - net of tax benefits | ( | ( | |||||||||

| Write off related to pre-existing relationship - net of tax benefits | ( | ||||||||||

| Transaction costs - net of tax benefits | |||||||||||

| Pro forma net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | |||||||

| Amortization life (years) | Initial purchase price allocation at March 31, 2020 | Measurement period adjustments | Final purchase price allocation at December 31, 2020 | |||||||||||||||||||||||

| Cash | $ | $ | $ | |||||||||||||||||||||||

| Accounts receivable | ||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||

| Total current assets | ||||||||||||||||||||||||||

| Intangible assets: | ||||||||||||||||||||||||||

| Customer relationships | ||||||||||||||||||||||||||

| Technology | ||||||||||||||||||||||||||

| Goodwill | Indefinite | |||||||||||||||||||||||||

| Deferred tax asset | ||||||||||||||||||||||||||

| Total assets acquired | $ | $ | $ | |||||||||||||||||||||||

| Total liabilities assumed | ||||||||||||||||||||||||||

| Total purchase price | $ | $ | $ | |||||||||||||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

Right of use assets (1) | $ | $ | |||||||||

Prepaid pension assets (2) | |||||||||||

| Investments | |||||||||||

| Other non-current assets | |||||||||||

| Total | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Accrued operating costs | $ | $ | |||||||||

| Accrued interest expense | |||||||||||

Short-term lease liability (1) | |||||||||||

| Accrued income tax | |||||||||||

Accrued liability related to the purchase of non-controlling interest (2) | |||||||||||

Other accrued liabilities (3) | |||||||||||

| Total | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Deferred revenue - long term | $ | $ | |||||||||

| U.S. tax liability associated with the 2017 Act | |||||||||||

Long-term lease liability (1) | |||||||||||

| Liabilities for unrecognized tax benefits | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Land | $ | $ | |||||||||

| Building and building improvement | $ | $ | |||||||||

| Less: accumulated depreciation | |||||||||||

| Net building and building improvement | $ | $ | |||||||||

| Furniture and equipment | $ | $ | |||||||||

| Less: accumulated depreciation | |||||||||||

| Net furniture and equipment | $ | $ | |||||||||

| Leasehold improvements | $ | $ | |||||||||

| Less: accumulated depreciation | |||||||||||

| Net leasehold improvements | $ | $ | |||||||||

| Property, plant and equipment - net | $ | $ | |||||||||

| Weighted average amortization period (years) | Purchase price allocation | ||||||||||

| Land | Indefinite | $ | |||||||||

| Building | |||||||||||

| Site improvements | |||||||||||

| Tenant improvements | |||||||||||

In place lease intangibles (1) | |||||||||||

| Total | $ | ||||||||||

| Computer software | Goodwill | |||||||||||||

| December 31, 2020 | $ | $ | ||||||||||||

Acquisition (3) | ||||||||||||||

Additions at cost (1) (6) | — | |||||||||||||

| Amortization | ( | — | ||||||||||||

| Impairment / Write-off | ( | |||||||||||||

Other (2) | ( | ( | ||||||||||||

| December 31, 2021 | $ | $ | ||||||||||||

Acquisition (3) | ||||||||||||||

Additions at cost (1) (6) | — | |||||||||||||

| Amortization | ( | — | ||||||||||||

| Impairment / Write-off | ( | |||||||||||||

Other (2) | ( | ( | ||||||||||||

| December 31, 2022 | $ | $ | ||||||||||||

| Customer relationships | Reacquired rights | Database | Other indefinite-lived intangibles (8) | Other intangibles | Total | |||||||||||||||||||||||||||||||||

December 31, 2020 (4) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

Acquisitions (3) | — | |||||||||||||||||||||||||||||||||||||

Additions at cost (5) | ||||||||||||||||||||||||||||||||||||||

| Amortization | ( | ( | ( | — | ( | ( | ||||||||||||||||||||||||||||||||

WWN Relationship transfer (7) | — | — | — | ( | ||||||||||||||||||||||||||||||||||

Other (2) | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||

December 31, 2021 (4) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

Additions at cost (1) | ||||||||||||||||||||||||||||||||||||||

| Amortization | ( | ( | ( | — | ( | ( | ||||||||||||||||||||||||||||||||

Other (2) | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||

December 31, 2022 (4) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | |||||||||||||||||||||||||||||||||||

| Computer software | |||||||||||||||||||||||||||||||||||||||||

| Customer relationships | |||||||||||||||||||||||||||||||||||||||||

| Reacquired rights | |||||||||||||||||||||||||||||||||||||||||

| Database | |||||||||||||||||||||||||||||||||||||||||

| Other intangibles | |||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| December 31, 2019 | $ | |||||||

| Additions charged to costs and expenses | ||||||||

| Write-offs | ( | |||||||

| Recoveries | ||||||||

| Other | ( | |||||||

| December 31, 2020 | $ | |||||||

| Additions charged to costs and expenses | ||||||||

| Write-offs | ( | |||||||

| Recoveries | ||||||||

| Other | ( | |||||||

| December 31, 2021 | $ | |||||||

| Additions charged to costs and expenses | ||||||||

| Write-offs | ( | |||||||

| Recoveries | ||||||||

| Other | ( | |||||||

| December 31, 2022 | $ | |||||||

| January 1, 2020 | $ | |||||||

| Additions charged (credited) to costs and expenses | ||||||||

| Additions charged (credited) due to foreign currency fluctuations | ||||||||

| Additions charged (credited) to other accounts | ||||||||

| December 31, 2020 | $ | |||||||

| Additions charged (credited) to costs and expenses | ||||||||

| Additions charged (credited) due to foreign currency fluctuations | ( | |||||||

| Additions charged (credited) to other accounts | ||||||||

| December 31, 2021 | $ | |||||||

| Additions charged (credited) to costs and expenses | ||||||||

| Additions charged (credited) due to foreign currency fluctuations | ( | |||||||

| Additions charged (credited) to other accounts | ||||||||

| December 31, 2022 | $ | |||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

Non-operating pension income (expense) (1) | $ | $ | $ | ||||||||||||||

Change in fair value of make-whole derivative liability (2) | ( | ||||||||||||||||

Debt redemption premium (3) | ( | ( | ( | ||||||||||||||

Miscellaneous other income (expense) – net (4) | ( | ( | |||||||||||||||

| Other income (expense) – net | $ | $ | $ | ( | |||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenue: | |||||||||||||||||

| North America | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

Corporate and other (1) | ( | ( | |||||||||||||||

| Consolidated total | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Adjusted EBITDA: | |||||||||||||||||

| North America | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

Corporate and other (1) | ( | ( | ( | ||||||||||||||

| Consolidated total | $ | $ | $ | ||||||||||||||

| Depreciation and amortization | ( | ( | ( | ||||||||||||||

| Interest expense - net | ( | ( | ( | ||||||||||||||

| Dividends allocated to preferred stockholders | ( | ||||||||||||||||

| Benefit (provision) for income taxes | ( | ||||||||||||||||

| Other income (expense) - net | ( | ||||||||||||||||

| Equity in net income of affiliates | |||||||||||||||||

| Net income (loss) attributable to non-controlling interest | ( | ( | ( | ||||||||||||||

| Equity-based compensation | ( | ( | ( | ||||||||||||||

| Restructuring charges | ( | ( | ( | ||||||||||||||

| Merger and acquisition-related operating costs | ( | ( | ( | ||||||||||||||

| Transition costs | ( | ( | ( | ||||||||||||||

Other adjustments (2) | ( | ||||||||||||||||

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | ( | $ | ( | $ | ( | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Depreciation and amortization: | |||||||||||||||||

| North America | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

| Total segments | |||||||||||||||||

Corporate and other (1) | |||||||||||||||||

| Consolidated total | $ | $ | $ | ||||||||||||||

| Capital expenditures: | |||||||||||||||||

North America (2) | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

| Total segments | |||||||||||||||||

| Corporate and other | |||||||||||||||||

| Consolidated total | $ | $ | $ | ||||||||||||||

| Additions to computer software and other intangibles: | |||||||||||||||||

North America (3) | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

| Total segments | |||||||||||||||||

| Corporate and other | |||||||||||||||||

| Consolidated total | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Assets: | |||||||||||