00008459822023FYfalseSmith & Nephew plctrue0.3020.2550.5980.3010.2550.5970.3020.2550.5980.3010.2550.5970.8280.8180.8090.8270.8160.808P20YP50YP3YP7YP3YP7YP2Y00000000000.2310.2310.2310.1440.1440.14400000845982snn:NotesDue2030Member2023-01-012023-12-310000845982snn:NotesDue2029Member2023-01-012023-12-310000845982dei:AdrMember2023-01-012023-12-310000845982ifrs-full:OrdinarySharesMember2023-01-012023-12-3100008459822023-12-310000845982dei:BusinessContactMember2023-01-012023-12-3100008459822023-01-012023-12-310000845982ifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember2023-01-012023-12-310000845982ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-01-012023-12-310000845982ifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember2023-01-012023-12-310000845982ifrs-full:CurrentMember2023-01-012023-12-310000845982snn:OtherTradingTransactionsMember2023-01-012023-12-310000845982snn:OtherTradingTransactionsMember2022-01-012022-12-310000845982snn:OtherTradingTransactionsMember2021-01-012021-12-310000845982ifrs-full:ReportableSegmentsMember2023-01-012023-12-310000845982ifrs-full:ReportableSegmentsMember2022-01-012022-12-310000845982ifrs-full:ReportableSegmentsMember2021-01-012021-12-310000845982snn:NotLaterThanTenYearsMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:USD2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:EUR2023-12-310000845982snn:SportsMedicineMember2023-01-012023-12-310000845982snn:EntMember2023-01-012023-12-310000845982snn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:SportsMedicineMember2022-01-012022-12-310000845982snn:OrthopaedicsMember2022-01-012022-12-310000845982snn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USsnn:TerminationOfUsPensionPlanMember2024-01-042024-01-0400008459822019-01-012019-12-310000845982snn:DefinedBenefitPensionPlansMember2023-12-310000845982snn:RestOfWorldExcludingUnitedKingdomAndUnitedStatesOfAmericaMember2023-12-310000845982country:US2023-12-310000845982country:GB2023-12-310000845982snn:RestOfWorldExcludingUnitedKingdomAndUnitedStatesOfAmericaMember2022-12-310000845982country:US2022-12-310000845982country:GB2022-12-310000845982snn:RestOfWorldExcludingUnitedKingdomAndUnitedStatesOfAmericaMember2021-12-310000845982country:US2021-12-310000845982country:GB2021-12-310000845982snn:CashAtBankMember2023-12-310000845982snn:BankOverdraftMember2023-12-310000845982snn:CashAtBankMember2022-12-310000845982snn:BankOverdraftMember2022-12-310000845982ifrs-full:InterestRateSwapContractMember2022-12-310000845982snn:CashAtBankMember2021-12-310000845982snn:BankOverdraftMember2021-12-310000845982snn:ShortTermBorrowingMember2020-12-310000845982snn:LongTermBorrowingMember2020-12-310000845982snn:CashAtBankMember2020-12-310000845982snn:BankOverdraftMember2020-12-310000845982ifrs-full:InterestRateSwapContractMember2020-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:WeightedAverageMemberifrs-full:FixedInterestRateMembercurrency:USD2023-01-012023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:WeightedAverageMemberifrs-full:FixedInterestRateMembercurrency:USD2022-01-012022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level2And3OfFairValueHierarchyMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level2And3OfFairValueHierarchyMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level2And3OfFairValueHierarchyMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level2And3OfFairValueHierarchyMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level2And3OfFairValueHierarchyMember2021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level2And3OfFairValueHierarchyMember2021-12-310000845982srt:ScenarioForecastMember2024-01-012024-12-310000845982snn:TreasurySharesExcludingEmployeeShareTrustMember2023-01-012023-12-310000845982snn:EmployeesShareTrustMember2023-01-012023-12-310000845982ifrs-full:TreasurySharesMember2023-01-012023-12-310000845982ifrs-full:TreasurySharesMember2021-01-012021-12-310000845982ifrs-full:InterestRateSwapContractMember2023-01-012023-12-310000845982ifrs-full:InterestRateSwapContractMember2022-01-012022-12-310000845982ifrs-full:InterestRateSwapContractMember2021-01-012021-12-310000845982snn:ShortTermBorrowingMember2023-01-012023-12-310000845982snn:CashAtBankMember2023-01-012023-12-310000845982snn:BankOverdraftMember2023-01-012023-12-310000845982ifrs-full:CurrencySwapContractMember2023-01-012023-12-310000845982snn:ShortTermBorrowingMember2022-01-012022-12-310000845982snn:CashAtBankMember2022-01-012022-12-310000845982snn:BankOverdraftMember2022-01-012022-12-310000845982ifrs-full:CurrencySwapContractMember2022-01-012022-12-310000845982snn:ShortTermBorrowingMember2021-01-012021-12-310000845982snn:CashAtBankMember2021-01-012021-12-310000845982snn:BankOverdraftMember2021-01-012021-12-310000845982ifrs-full:CurrencySwapContractMember2021-01-012021-12-310000845982ifrs-full:CurrencyRiskMembercurrency:USD2023-12-310000845982ifrs-full:CurrencyRiskMembercurrency:EUR2023-12-310000845982ifrs-full:CurrencyRiskMembercurrency:EUR2022-12-310000845982snn:ShortTermBorrowingMember2023-12-310000845982snn:LongTermBorrowingMember2023-12-310000845982snn:ShortTermBorrowingMember2022-12-310000845982snn:LongTermBorrowingMember2022-12-310000845982snn:ShortTermBorrowingMember2021-12-310000845982snn:LongTermBorrowingMember2021-12-310000845982ifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:USD2023-01-012023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:EUR2023-01-012023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:USD2022-01-012022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CurrencyRiskMembercurrency:EUR2022-01-012022-12-310000845982ifrs-full:InterestRateRiskMember2023-12-310000845982ifrs-full:InterestRateRiskMember2022-12-310000845982snn:CommittedBorrowingFacilitiesMember2022-12-310000845982snn:CommittedBorrowingFacilitiesMemberifrs-full:WeightedAverageMember2023-12-312023-12-310000845982ifrs-full:ForwardContractMember2023-01-012023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USsnn:TerminationOfUsPensionPlanMembersrt:ScenarioForecastMember2024-01-012024-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2023-12-012023-12-310000845982snn:ExtremityOrthopaedicsMember2023-01-012023-12-310000845982snn:EngageSurgicalMember2023-01-012023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:TopOfRangeMember2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMembersnn:OtherMember2023-12-310000845982snn:RetirementHealthcareMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-12-310000845982ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMembersnn:OtherMember2022-12-310000845982snn:RetirementHealthcareMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2022-12-310000845982ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2022-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembersnn:OtherMember2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembercountry:US2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembercountry:GB2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembersnn:OtherMember2022-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembercountry:US2022-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMembercountry:GB2022-12-310000845982snn:DefinedBenefitPensionPlansMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2022-12-310000845982snn:AcceleratedTaxDepreciationMember2023-01-012023-12-310000845982snn:LossesAndOtherTaxAttributesMember2022-01-012022-12-310000845982snn:AcceleratedTaxDepreciationMember2022-01-012022-12-310000845982ifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:ExtremityOrthopaedicsMember2021-01-042021-01-040000845982snn:LongTermBorrowingMember2023-01-012023-12-310000845982snn:LongTermBorrowingMember2022-01-012022-12-310000845982snn:LongTermBorrowingMember2021-01-012021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2023-06-012023-06-300000845982ifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember2023-12-310000845982ifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember2022-12-310000845982snn:PropertyPlantAndEquipmentOtherThanBuildingsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982snn:PropertyPlantAndEquipmentOtherThanBuildingsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:OrthopaedicInstrumentsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982snn:OrthopaedicInstrumentsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982ifrs-full:BuildingsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982ifrs-full:BuildingsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:ProductRelatedIntangibleAssetsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982snn:ProductRelatedIntangibleAssetsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982ifrs-full:ComputerSoftwareMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982ifrs-full:ComputerSoftwareMemberifrs-full:BottomOfRangeMember2023-01-012023-12-3100008459822021-01-012022-12-3100008459822022-01-012023-12-310000845982ifrs-full:AssociatesMember2023-01-012023-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMember2022-01-012022-12-310000845982snn:TraumaMembersnn:OrthopaedicsMember2023-01-012023-12-310000845982snn:SportsMedicineJointRepairMembersnn:SportsMedicineAndEntMember2023-01-012023-12-310000845982snn:OtherReconstructionMembersnn:OrthopaedicsMember2023-01-012023-12-310000845982snn:KneeImplantsMembersnn:OrthopaedicsMember2023-01-012023-12-310000845982snn:HipImplantsMembersnn:OrthopaedicsMember2023-01-012023-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2023-01-012023-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2023-01-012023-12-310000845982snn:EstablishedMarketsMembersnn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2023-01-012023-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2023-01-012023-12-310000845982snn:EmergingMarketsMembersnn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:EarNoseAndThroatMembersnn:SportsMedicineAndEntMember2023-01-012023-12-310000845982snn:ArthroscopicEnablingTechnologiesMembersnn:SportsMedicineAndEntMember2023-01-012023-12-310000845982snn:AdvancedWoundDevicesMembersnn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:AdvancedWoundCareMembersnn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:AdvancedWoundBioactivesMembersnn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:SportsMedicineAndEntMember2023-01-012023-12-310000845982snn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2023-01-012023-12-310000845982snn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2023-01-012023-12-310000845982snn:OrthopaedicsMember2023-01-012023-12-310000845982snn:AdvancedWoundManagementMember2023-01-012023-12-310000845982snn:AdvancedWoundManagementMember2023-01-012023-12-310000845982country:US2023-01-012023-12-310000845982country:GB2023-01-012023-12-310000845982country:CH2023-01-012023-12-310000845982snn:TraumaMembersnn:OrthopaedicsMember2022-01-012022-12-310000845982snn:SportsMedicineJointRepairMembersnn:SportsMedicineAndEntMember2022-01-012022-12-310000845982snn:OtherReconstructionMembersnn:OrthopaedicsMember2022-01-012022-12-310000845982snn:KneeImplantsMembersnn:OrthopaedicsMember2022-01-012022-12-310000845982snn:HipImplantsMembersnn:OrthopaedicsMember2022-01-012022-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2022-01-012022-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2022-01-012022-12-310000845982snn:EstablishedMarketsMembersnn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2022-01-012022-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2022-01-012022-12-310000845982snn:EmergingMarketsMembersnn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:EarNoseAndThroatMembersnn:SportsMedicineAndEntMember2022-01-012022-12-310000845982snn:ArthroscopicEnablingTechnologiesMembersnn:SportsMedicineAndEntMember2022-01-012022-12-310000845982snn:AdvancedWoundDevicesMembersnn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:AdvancedWoundCareMembersnn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:AdvancedWoundBioactivesMembersnn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:SportsMedicineAndEntMember2022-01-012022-12-310000845982snn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2022-01-012022-12-310000845982snn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2022-01-012022-12-310000845982snn:OrthopaedicsMember2022-01-012022-12-310000845982snn:AdvancedWoundManagementMember2022-01-012022-12-310000845982snn:AdvancedWoundManagementMember2022-01-012022-12-310000845982country:US2022-01-012022-12-310000845982country:GB2022-01-012022-12-310000845982country:CH2022-01-012022-12-310000845982snn:TraumaMembersnn:OrthopaedicsMember2021-01-012021-12-310000845982snn:SportsMedicineJointRepairMembersnn:SportsMedicineAndEntMember2021-01-012021-12-310000845982snn:OtherReconstructionMembersnn:OrthopaedicsMember2021-01-012021-12-310000845982snn:KneeImplantsMembersnn:OrthopaedicsMember2021-01-012021-12-310000845982snn:HipImplantsMembersnn:OrthopaedicsMember2021-01-012021-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2021-01-012021-12-310000845982snn:EstablishedMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2021-01-012021-12-310000845982snn:EstablishedMarketsMembersnn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2021-01-012021-12-310000845982snn:EmergingMarketsMembersnn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2021-01-012021-12-310000845982snn:EmergingMarketsMembersnn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:EarNoseAndThroatMembersnn:SportsMedicineAndEntMember2021-01-012021-12-310000845982snn:ArthroscopicEnablingTechnologiesMembersnn:SportsMedicineAndEntMember2021-01-012021-12-310000845982snn:AdvancedWoundDevicesMembersnn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:AdvancedWoundCareMembersnn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:AdvancedWoundBioactivesMembersnn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:SportsMedicineAndEntMember2021-01-012021-12-310000845982snn:OrthopaedicsSportsMedicineAndEntAndAdvancedWoundManagementMember2021-01-012021-12-310000845982snn:OrthopaedicsSportsMedicineAndEarNoseAndThroatMember2021-01-012021-12-310000845982snn:OrthopaedicsMember2021-01-012021-12-310000845982snn:AdvancedWoundManagementMember2021-01-012021-12-310000845982snn:AdvancedWoundManagementMember2021-01-012021-12-310000845982country:US2021-01-012021-12-310000845982country:GB2021-01-012021-12-310000845982country:CH2021-01-012021-12-310000845982snn:PrivatePlacementDebtMember2023-01-012023-12-310000845982snn:OsirisTherapeuticsMemberifrs-full:TopOfRangeMember2023-01-012023-12-310000845982snn:OsirisTherapeuticsMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:ArthrocareMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310000845982snn:HealthpointMember2023-01-012023-12-310000845982ifrs-full:TradingEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2022-01-012022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:EquityInvestmentsMember2022-01-012022-12-310000845982snn:EmployeesShareTrustMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:InstrumentsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LandAndBuildingsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:InstrumentsMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:LandAndBuildingsMember2023-12-310000845982snn:InstrumentsMember2023-12-310000845982ifrs-full:OtherPropertyPlantAndEquipmentMember2023-12-310000845982ifrs-full:LandMember2023-12-310000845982ifrs-full:LandAndBuildingsMember2023-12-310000845982ifrs-full:ConstructionInProgressMember2023-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:InstrumentsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LandAndBuildingsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:InstrumentsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:LandAndBuildingsMember2022-12-310000845982snn:InstrumentsMember2022-12-310000845982ifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310000845982ifrs-full:LandMember2022-12-310000845982ifrs-full:LandAndBuildingsMember2022-12-310000845982ifrs-full:ConstructionInProgressMember2022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:InstrumentsMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LandAndBuildingsMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:InstrumentsMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:LandAndBuildingsMember2021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2023-01-012023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2022-01-012022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2022-01-012022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2021-01-012021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2021-01-012021-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMember2021-12-310000845982ifrs-full:RestructuringProvisionMember2023-12-310000845982ifrs-full:RestructuringProvisionMember2022-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2021-12-310000845982ifrs-full:RestructuringProvisionMember2021-12-310000845982ifrs-full:LegalProceedingsProvisionMember2021-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2023-12-310000845982ifrs-full:LegalProceedingsProvisionMember2023-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2022-12-310000845982ifrs-full:LegalProceedingsProvisionMember2022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CashFlowHedgesMemberifrs-full:CurrencyRiskMember2023-01-012023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CashFlowHedgesMemberifrs-full:CurrencyRiskMember2022-01-012022-12-310000845982ifrs-full:OtherReservesMember2023-01-012023-12-310000845982ifrs-full:OtherReservesMember2022-01-012022-12-310000845982ifrs-full:OtherReservesMember2021-01-012021-12-310000845982snn:TreasurySharesExcludingEmployeeShareTrustMember2023-12-310000845982snn:EmployeesShareTrustMember2023-12-310000845982snn:TreasurySharesExcludingEmployeeShareTrustMember2022-12-310000845982snn:EmployeesShareTrustMember2022-12-310000845982snn:TreasurySharesExcludingEmployeeShareTrustMember2021-12-310000845982snn:EmployeesShareTrustMember2021-12-310000845982snn:DeferredSharesMember2020-12-310000845982snn:DeferredSharesMember2023-12-310000845982snn:DeferredSharesMember2022-12-310000845982snn:DeferredSharesMember2021-12-310000845982snn:SyndicatedRevolvingCreditFacilityMember2023-12-310000845982ifrs-full:ForwardContractMember2023-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:InterestRateRiskMember2022-12-310000845982ifrs-full:ForwardContractMember2022-12-310000845982snn:FinancialAssetsCashMemberifrs-full:CreditRiskMember2023-12-310000845982ifrs-full:DerivativesMemberifrs-full:CreditRiskMember2023-12-310000845982snn:FinancialAssetsCashMemberifrs-full:CreditRiskMember2022-12-310000845982ifrs-full:DerivativesMemberifrs-full:CreditRiskMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:PlanAssetsMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:PresentValueOfDefinedBenefitObligationMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:PlanAssetsMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:PresentValueOfDefinedBenefitObligationMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:PlanAssetsMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMember2023-12-310000845982ifrs-full:PresentValueOfDefinedBenefitObligationMember2023-12-310000845982ifrs-full:PlanAssetsMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:PlanAssetsMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:PlanAssetsMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:PlanAssetsMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMember2022-12-310000845982ifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310000845982ifrs-full:PlanAssetsMember2022-12-310000845982ifrs-full:PresentValueOfDefinedBenefitObligationMember2021-12-310000845982ifrs-full:PlanAssetsMember2021-12-310000845982snn:AcquisitionConsiderationLiabilityMemberifrs-full:Level3OfFairValueHierarchyMember2023-12-310000845982snn:AcquisitionConsiderationLiabilityMemberifrs-full:Level3OfFairValueHierarchyMember2022-12-310000845982snn:AcquisitionConsiderationLiabilityMemberifrs-full:Level3OfFairValueHierarchyMember2021-12-310000845982ifrs-full:KeyManagementPersonnelOfEntityOrParentMember2023-01-012023-12-310000845982ifrs-full:KeyManagementPersonnelOfEntityOrParentMember2022-01-012022-12-310000845982ifrs-full:KeyManagementPersonnelOfEntityOrParentMember2021-01-012021-12-310000845982ifrs-full:SharePremiumMember2022-01-012022-12-310000845982ifrs-full:SharePremiumMember2021-01-012021-12-310000845982ifrs-full:AssociatesMember2023-12-310000845982ifrs-full:AggregatedIndividuallyImmaterialAssociatesMember2023-12-310000845982ifrs-full:AssociatesMember2022-12-310000845982ifrs-full:AggregatedIndividuallyImmaterialAssociatesMember2022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:ProductRelatedIntangibleAssetsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:IntangibleAssetsUnderDevelopmentMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CustomerrelatedIntangibleAssetsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:ProductRelatedIntangibleAssetsMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:CustomerrelatedIntangibleAssetsMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:ComputerSoftwareMember2023-12-310000845982snn:ProductRelatedIntangibleAssetsMember2023-12-310000845982snn:OsirisTherapeuticsMember2023-12-310000845982snn:HealthpointMember2023-12-310000845982snn:ArthrocareMember2023-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMember2023-12-310000845982ifrs-full:IntangibleAssetsUnderDevelopmentMember2023-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMember2023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:ProductRelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:IntangibleAssetsUnderDevelopmentMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CustomerrelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:ProductRelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:CustomerrelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:ComputerSoftwareMember2022-12-310000845982snn:ProductRelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310000845982ifrs-full:IntangibleAssetsUnderDevelopmentMember2022-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:ProductRelatedIntangibleAssetsMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:IntangibleAssetsUnderDevelopmentMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CustomerrelatedIntangibleAssetsMember2021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:ProductRelatedIntangibleAssetsMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:TechnologybasedIntangibleAssetsMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:CustomerrelatedIntangibleAssetsMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:ComputerSoftwareMember2021-12-310000845982ifrs-full:GrossCarryingAmountMember2021-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310000845982ifrs-full:ComputerSoftwareMemberifrs-full:ConstructionInProgressMember2023-01-012023-12-310000845982ifrs-full:ComputerSoftwareMemberifrs-full:ConstructionInProgressMember2022-01-012022-12-310000845982snn:ComputerSoftwareAndIntangibleAssetsUnderDevelopmentMemberifrs-full:ConstructionInProgressMember2023-01-012023-12-310000845982snn:ComputerSoftwareAndIntangibleAssetsUnderDevelopmentMemberifrs-full:ConstructionInProgressMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-01-012022-12-310000845982snn:LossesAndOtherTaxAttributesMember2023-01-012023-12-310000845982snn:InventoryProvisionsAndOtherDifferencesMember2023-01-012023-12-310000845982snn:IntangiblesMember2023-01-012023-12-310000845982snn:IntangiblesMember2022-01-012022-12-310000845982ifrs-full:ActuarialAssumptionOfMortalityRatesMembersnn:DefinedBenefitPensionPlansMembercountry:US2023-12-310000845982ifrs-full:ActuarialAssumptionOfMortalityRatesMembersnn:DefinedBenefitPensionPlansMembercountry:GB2023-12-310000845982ifrs-full:ActuarialAssumptionOfExpectedRatesOfInflationMembersnn:DefinedBenefitPensionPlansMembercountry:GB2023-12-310000845982ifrs-full:ActuarialAssumptionOfDiscountRatesMembersnn:DefinedBenefitPensionPlansMembercountry:US2023-12-310000845982ifrs-full:ActuarialAssumptionOfDiscountRatesMembersnn:DefinedBenefitPensionPlansMembercountry:GB2023-12-310000845982snn:RetirementBenefitObligationMember2023-01-012023-12-310000845982snn:RetirementBenefitObligationMember2022-01-012022-12-310000845982snn:OrthopaedicsMember2023-01-012023-12-310000845982snn:EngageMember2023-01-012023-12-310000845982snn:EngageMember2023-01-012023-12-310000845982ifrs-full:AssociatesMember2022-01-012022-12-310000845982snn:EngageSIntangibleAssetsMember2023-01-012023-12-310000845982snn:ImmaterialProductAssetsMember2022-01-012022-12-310000845982snn:EngageSurgicalMembersnn:ProductRelatedIntangibleAssetsMember2022-01-180000845982snn:ExtremityOrthopaedicsMembersnn:ProductRelatedIntangibleAssetsMember2021-01-040000845982snn:ExtremityOrthopaedicsMemberifrs-full:CustomerrelatedIntangibleAssetsMember2021-01-040000845982snn:EurCorporateBondMemberifrs-full:HedgesOfNetInvestmentInForeignOperationsMemberifrs-full:CurrencyRiskMember2023-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:FairValueHedgesMemberifrs-full:InterestRateRiskMember2022-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:FairValueHedgesMemberifrs-full:InterestRateRiskMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CashFlowHedgesMemberifrs-full:CurrencyRiskMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:CashFlowHedgesMemberifrs-full:CurrencyRiskMember2022-12-310000845982ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMember2023-12-310000845982ifrs-full:LaterThanThreeYearsAndNotLaterThanFourYearsMember2023-12-310000845982ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2023-12-310000845982ifrs-full:LaterThanFourYearsAndNotLaterThanFiveYearsMember2023-12-310000845982ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMember2022-12-310000845982ifrs-full:LaterThanThreeYearsAndNotLaterThanFourYearsMember2022-12-310000845982ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2022-12-310000845982ifrs-full:LaterThanFourYearsAndNotLaterThanFiveYearsMember2022-12-310000845982snn:AcquisitionConsiderationLiabilityMemberifrs-full:Level3OfFairValueHierarchyMember2023-01-012023-12-310000845982snn:AcquisitionConsiderationLiabilityMemberifrs-full:Level3OfFairValueHierarchyMember2022-01-012022-12-310000845982ifrs-full:TradingEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2023-01-012023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:EquityInvestmentsMember2023-01-012023-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:TradeAndOtherPayablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:PrivatePlacementDebtNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:CorporateBondNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:CorporateBondInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:BankOverdraftsLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:BankLoansMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:AcquisitionConsiderationMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMembercurrency:USD2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMembercurrency:USD2023-12-310000845982snn:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembersnn:AcquisitionConsiderationMemberifrs-full:AtFairValueMember2023-12-310000845982snn:TradeAndOtherPayablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:PrivatePlacementDebtNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:OtherFinancialLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialLiabilitiesTotalMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMember2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMember2023-12-310000845982snn:FinancialLiabilitiesTotalMembercurrency:USD2023-12-310000845982snn:FinancialLiabilitiesLongTermDebtMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialLiabilitiesLongTermDebtMembercurrency:USD2023-12-310000845982snn:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:AtFairValueMember2023-12-310000845982snn:CorporateBondNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:CorporateBondInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:BankOverdraftsLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:BankLoansMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:CurrencySwapContractMembersrt:OtherCurrencyMember2023-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:CurrencySwapContractMembercurrency:USD2023-12-310000845982snn:PrivatePlacementDebtMember2023-12-310000845982snn:FinancialLiabilitiesTotalMember2023-12-310000845982snn:FinancialLiabilitiesLongTermDebtMember2023-12-310000845982snn:EurCorporateBondMember2023-12-310000845982snn:CorporateBondsMember2023-12-310000845982ifrs-full:CurrencySwapContractMember2023-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:TradeAndOtherPayablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:PrivatePlacementDebtNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:CorporateBondNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:CorporateBondInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:BankOverdraftsLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMembersnn:AcquisitionConsiderationMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:InterestRateSwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMembercurrency:USD2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMembercurrency:USD2022-12-310000845982snn:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembersnn:AcquisitionConsiderationMemberifrs-full:AtFairValueMember2022-12-310000845982snn:TradeAndOtherPayablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:PrivatePlacementDebtNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:OtherFinancialLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:AtFairValueMember2022-12-310000845982snn:FinancialLiabilitiesTotalMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FloatingInterestRateMember2022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:FixedInterestRateMember2022-12-310000845982snn:FinancialLiabilitiesTotalMembercurrency:USD2022-12-310000845982snn:FinancialLiabilitiesLongTermDebtMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialLiabilitiesLongTermDebtMembercurrency:USD2022-12-310000845982snn:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:AtFairValueMember2022-12-310000845982snn:CorporateBondNotInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:CorporateBondInHedgeRelationshipMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:BankOverdraftsLiabilitiesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:AcquisitionConsiderationMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:InterestRateSwapContractMembersrt:OtherCurrencyMember2022-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:CurrencySwapContractMembersrt:OtherCurrencyMember2022-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:CurrencySwapContractMembercurrency:USD2022-12-310000845982snn:PrivatePlacementDebtMember2022-12-310000845982snn:FinancialLiabilitiesTotalMember2022-12-310000845982snn:FinancialLiabilitiesLongTermDebtMember2022-12-310000845982snn:EurCorporateBondMember2022-12-310000845982snn:CorporateBondsMember2022-12-310000845982ifrs-full:InterestRateSwapContractMember2022-12-310000845982ifrs-full:CurrencySwapContractMember2022-12-310000845982snn:FinancialAssetsInvestmentsMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialAssetsInvestmentsMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:Level2OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMemberifrs-full:AtFairValueMember2022-12-310000845982snn:HedgingInstrumentsFairValueMembersnn:TradeAndOtherReceivablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:InterestRateSwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMembercurrency:USD2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembersnn:FinancialAssetsInvestmentsMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:ContingentConsiderationMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtAmortisedCostCategoryMembersnn:FinancialAssetsCashMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:TradeAndOtherReceivablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialAssetsTotalMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMember2023-12-310000845982snn:FinancialAssetsTotalMembercurrency:USD2023-12-310000845982snn:FinancialAssetsInvestmentsMemberifrs-full:AtFairValueMember2023-12-310000845982snn:FinancialAssetsCashMembersrt:OtherCurrencyMember2023-12-310000845982snn:FinancialAssetsCashMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982snn:FinancialAssetsCashMembercurrency:USD2023-12-310000845982ifrs-full:InterestRateSwapContractMembersrt:OtherCurrencyMember2023-12-310000845982ifrs-full:InterestRateSwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:EquityInvestmentsMember2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:FinancialAssetsAtAmortisedCostCategoryMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982ifrs-full:CurrencySwapContractMembersrt:OtherCurrencyMember2023-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:CurrencySwapContractMembercurrency:USD2023-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:AtFairValueMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:TradeReceivablesMember2023-12-310000845982snn:FinancialAssetsTotalMember2023-12-310000845982snn:FinancialAssetsCashMember2023-12-310000845982ifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2023-12-310000845982ifrs-full:InterestRateSwapContractMember2023-12-310000845982ifrs-full:CurrencySwapContractMember2023-12-310000845982ifrs-full:AtFairValueMember2023-12-310000845982snn:HedgingInstrumentsFairValueMembersnn:TradeAndOtherReceivablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2022-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMembercurrency:USD2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembersnn:FinancialAssetsInvestmentsMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:ContingentConsiderationMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtAmortisedCostCategoryMembersnn:FinancialAssetsCashMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:TradeAndOtherReceivablesMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:HedgingInstrumentsFairValueMemberifrs-full:AtFairValueMember2022-12-310000845982snn:FinancialAssetsTotalMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialAssetsTotalMemberifrs-full:FloatingInterestRateMember2022-12-310000845982snn:FinancialAssetsTotalMembercurrency:USD2022-12-310000845982snn:FinancialAssetsInvestmentsMemberifrs-full:AtFairValueMember2022-12-310000845982snn:FinancialAssetsCashMembersrt:OtherCurrencyMember2022-12-310000845982snn:FinancialAssetsCashMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982snn:FinancialAssetsCashMembercurrency:USD2022-12-310000845982ifrs-full:ForwardContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:EquityInvestmentsMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtAmortisedCostCategoryMemberifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982ifrs-full:CurrencySwapContractMembersrt:OtherCurrencyMember2022-12-310000845982ifrs-full:CurrencySwapContractMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:CurrencySwapContractMembercurrency:USD2022-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:TradeReceivablesMember2022-12-310000845982snn:FinancialAssetsTotalMember2022-12-310000845982snn:FinancialAssetsCashMember2022-12-310000845982ifrs-full:NotMeasuredAtFairValueInStatementOfFinancialPositionButForWhichFairValueIsDisclosedMember2022-12-310000845982ifrs-full:CurrencySwapContractMember2022-12-310000845982ifrs-full:AtFairValueMember2022-12-310000845982ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:EquityInvestmentsMember2021-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:TradeReceivablesMember2021-12-310000845982snn:ResearchAndDevelopmentExpensesMember2023-01-012023-12-310000845982ifrs-full:CostOfSalesMember2023-01-012023-12-310000845982snn:ResearchAndDevelopmentExpensesMember2022-01-012022-12-310000845982ifrs-full:CostOfSalesMember2022-01-012022-12-310000845982snn:ResearchAndDevelopmentExpensesMember2021-01-012021-12-310000845982ifrs-full:CostOfSalesMember2021-01-012021-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2023-01-012023-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2021-01-012021-12-310000845982ifrs-full:TopOfRangeMember2023-12-310000845982ifrs-full:BottomOfRangeMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2023-01-012023-12-310000845982snn:RetainedEarningsAndOtherReservesMember2023-12-310000845982ifrs-full:TreasurySharesMember2023-12-310000845982ifrs-full:SharePremiumMember2023-12-310000845982ifrs-full:RetainedEarningsMember2023-12-310000845982ifrs-full:OtherReservesMember2023-12-310000845982ifrs-full:OrdinarySharesMember2023-12-310000845982ifrs-full:IssuedCapitalMember2023-12-310000845982ifrs-full:CapitalRedemptionReserveMember2023-12-310000845982snn:RetainedEarningsAndOtherReservesMember2022-12-310000845982ifrs-full:TreasurySharesMember2022-12-310000845982ifrs-full:SharePremiumMember2022-12-310000845982ifrs-full:RetainedEarningsMember2022-12-310000845982ifrs-full:OtherReservesMember2022-12-310000845982ifrs-full:OrdinarySharesMember2022-12-310000845982ifrs-full:IssuedCapitalMember2022-12-310000845982ifrs-full:CapitalRedemptionReserveMember2022-12-310000845982snn:RetainedEarningsAndOtherReservesMember2021-12-310000845982ifrs-full:TreasurySharesMember2021-12-310000845982ifrs-full:SharePremiumMember2021-12-310000845982ifrs-full:RetainedEarningsMember2021-12-310000845982ifrs-full:OtherReservesMember2021-12-310000845982ifrs-full:OrdinarySharesMember2021-12-310000845982ifrs-full:IssuedCapitalMember2021-12-310000845982ifrs-full:CapitalRedemptionReserveMember2021-12-310000845982ifrs-full:TreasurySharesMember2020-12-310000845982ifrs-full:SharePremiumMember2020-12-310000845982ifrs-full:RetainedEarningsMember2020-12-310000845982ifrs-full:OtherReservesMember2020-12-310000845982ifrs-full:OrdinarySharesMember2020-12-310000845982ifrs-full:IssuedCapitalMember2020-12-310000845982ifrs-full:CapitalRedemptionReserveMember2020-12-310000845982ifrs-full:OrdinarySharesMembersnn:InterimDividendsMember2023-01-012023-12-310000845982ifrs-full:OrdinarySharesMembersnn:FinalDividendsMember2023-01-012023-12-310000845982ifrs-full:OrdinarySharesMembersnn:InterimDividendsMember2022-01-012022-12-310000845982ifrs-full:OrdinarySharesMembersnn:FinalDividendsMember2022-01-012022-12-310000845982ifrs-full:OrdinarySharesMembersnn:InterimDividendsMember2021-01-012021-12-310000845982ifrs-full:OrdinarySharesMembersnn:FinalDividendsMember2021-01-012021-12-310000845982ifrs-full:RetainedEarningsMember2023-01-012023-12-310000845982ifrs-full:OrdinarySharesMember2021-01-012021-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-01-012023-12-310000845982snn:SportsMedicineMemberifrs-full:WeightedAverageMember2023-12-310000845982snn:OrthopaedicsMemberifrs-full:WeightedAverageMember2023-12-310000845982snn:EntMemberifrs-full:WeightedAverageMember2023-12-310000845982snn:AdvancedWoundManagementMemberifrs-full:WeightedAverageMember2023-12-310000845982snn:SportsMedicineMemberifrs-full:WeightedAverageMember2022-12-310000845982snn:OrthopaedicsMemberifrs-full:WeightedAverageMember2022-12-310000845982snn:AdvancedWoundManagementMemberifrs-full:WeightedAverageMember2022-12-310000845982snn:SportsMedicineMember2023-12-310000845982snn:EntMember2023-12-310000845982snn:AdvancedWoundManagementMember2023-12-310000845982snn:SportsMedicineMember2022-12-310000845982snn:AdvancedWoundManagementMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:InstrumentsMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:LandAndBuildingsMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:InstrumentsMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:LandAndBuildingsMember2022-01-012022-12-310000845982snn:ProductRelatedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMember2023-01-012023-12-310000845982snn:ProductRelatedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:TechnologybasedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:CustomerrelatedIntangibleAssetsMember2022-01-012022-12-310000845982snn:InventoryProvisionsAndOtherDifferencesMember2022-01-012022-12-310000845982snn:RetirementBenefitObligationMember2023-12-310000845982snn:LossesAndOtherTaxAttributesMember2023-12-310000845982snn:IntangiblesMember2023-12-310000845982snn:AcceleratedTaxDepreciationMember2023-12-310000845982snn:RetirementBenefitObligationMember2022-12-310000845982snn:LossesAndOtherTaxAttributesMember2022-12-310000845982snn:IntangiblesMember2022-12-310000845982snn:AcceleratedTaxDepreciationMember2022-12-310000845982snn:RetirementBenefitObligationMember2021-12-310000845982snn:LossesAndOtherTaxAttributesMember2021-12-310000845982snn:InventoryProvisionsAndOtherDifferencesMember2021-12-310000845982snn:IntangiblesMember2021-12-310000845982snn:AcceleratedTaxDepreciationMember2021-12-310000845982snn:TradingTaxLossesMember2023-12-310000845982snn:InventoryProvisionsAndOtherDifferencesMember2023-12-310000845982snn:TradingTaxLossesMember2022-12-310000845982snn:InventoryProvisionsAndOtherDifferencesMember2022-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:TradeReceivablesMember2023-01-012023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:TradeReceivablesMember2022-01-012022-12-310000845982ifrs-full:RetainedEarningsMember2021-01-012021-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:LaterThanOneMonthMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember2023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CurrentMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMembersnn:LaterThanOneMonthMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMemberifrs-full:CurrentMember2023-12-310000845982srt:OtherCurrencyMember2023-12-310000845982ifrs-full:GrossCarryingAmountMember2023-12-310000845982ifrs-full:AccumulatedImpairmentMember2023-12-310000845982currency:USD2023-12-310000845982currency:GBP2023-12-310000845982currency:EUR2023-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:LaterThanOneMonthMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember2022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CurrentMember2022-12-310000845982srt:OtherCurrencyMember2022-12-310000845982ifrs-full:GrossCarryingAmountMember2022-12-310000845982ifrs-full:AccumulatedImpairmentMember2022-12-310000845982currency:USD2022-12-310000845982currency:GBP2022-12-310000845982currency:EUR2022-12-310000845982ifrs-full:ForeignCountriesMember2023-01-012023-12-310000845982ifrs-full:CountryOfDomicileMember2023-01-012023-12-310000845982ifrs-full:ForeignCountriesMember2022-01-012022-12-310000845982ifrs-full:CountryOfDomicileMember2022-01-012022-12-310000845982ifrs-full:ForeignCountriesMember2021-01-012021-12-310000845982ifrs-full:CountryOfDomicileMember2021-01-012021-12-310000845982snn:PrivatePlacementDebtMember2023-12-310000845982snn:BioventusLlcMember2023-12-310000845982snn:BioventusLlcMember2022-12-310000845982ifrs-full:PlanAssetsMember2023-01-012023-12-310000845982ifrs-full:PlanAssetsMember2022-01-012022-12-310000845982snn:AcquisitionConsiderationMember2023-01-012023-12-310000845982snn:BioventusLlcMember2023-01-012023-12-310000845982snn:BioventusLlcMember2022-01-012022-12-310000845982snn:CartihealLtdMemberifrs-full:MajorBusinessCombinationMember2024-01-0900008459822020-01-012020-12-310000845982snn:IfrsEquityMember2023-01-012023-12-310000845982snn:IfrsDebtMember2023-01-012023-12-310000845982snn:IfrsEquityMember2022-01-012022-12-310000845982snn:IfrsDebtMember2022-01-012022-12-310000845982snn:IfrsEquityMember2021-01-012021-12-310000845982snn:IfrsDebtMember2021-01-012021-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level1OfFairValueHierarchyMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:Level1OfFairValueHierarchyMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level1OfFairValueHierarchyMember2023-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level1OfFairValueHierarchyMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:Level1OfFairValueHierarchyMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level1OfFairValueHierarchyMember2022-12-310000845982snn:DefinedBenefitPensionPlansMembersnn:OtherMemberifrs-full:Level1OfFairValueHierarchyMember2021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:USifrs-full:Level1OfFairValueHierarchyMember2021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GBifrs-full:Level1OfFairValueHierarchyMember2021-12-3100008459822020-12-310000845982ifrs-full:ComputerSoftwareMember2023-12-310000845982ifrs-full:ComputerSoftwareMember2022-12-310000845982snn:TreasurySharesExcludingEmployeeShareTrustMember2022-01-012022-12-310000845982ifrs-full:TreasurySharesMember2022-01-012022-12-310000845982ifrs-full:RetainedEarningsMember2022-01-012022-12-310000845982ifrs-full:OrdinarySharesMember2022-01-012022-12-310000845982ifrs-full:IssuedCapitalMember2022-01-012022-12-310000845982ifrs-full:CapitalRedemptionReserveMember2022-01-012022-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:WeightedAverageMemberifrs-full:FixedInterestRateMembercurrency:USD2023-12-310000845982ifrs-full:WeightedAverageMemberifrs-full:FloatingInterestRateMember2023-12-310000845982snn:SeniorNotesMaturingNovember2024Member2023-12-310000845982snn:SeniorNotesMaturingJune2032Member2023-12-310000845982snn:SeniorNotesMaturingJune2030Member2023-12-310000845982snn:SeniorNotesMaturingJune2029Member2023-12-310000845982snn:SeniorNotesMaturingJune2028Member2023-12-310000845982snn:SeniorNotesMaturingJune2027Member2023-12-310000845982snn:SeniorNotesMaturingJanuary2026Member2023-12-310000845982snn:SeniorNotesMaturingJanuary2024Member2023-12-310000845982snn:CorporateBondMaturingOctober2030Member2023-12-310000845982snn:CorporateBondMaturingOctober2029Member2023-12-310000845982snn:FinancialLiabilitiesTotalMemberifrs-full:WeightedAverageMemberifrs-full:FixedInterestRateMembercurrency:USD2022-12-310000845982ifrs-full:WeightedAverageMemberifrs-full:FloatingInterestRateMember2022-12-310000845982snn:CorporateBondMaturingOctober2029Member2022-12-310000845982snn:CommittedBorrowingFacilitiesMember2023-12-310000845982ifrs-full:LaterThanFiveYearsMember2023-12-310000845982ifrs-full:LaterThanFiveYearsMember2022-12-310000845982ifrs-full:NotLaterThanOneYearMember2023-12-310000845982ifrs-full:NotLaterThanOneYearMember2022-12-3100008459822021-12-310000845982snn:RestOfWorldExcludingUnitedKingdomMember2023-01-012023-12-310000845982country:GB2023-01-012023-12-310000845982snn:RestOfWorldExcludingUnitedKingdomMember2022-01-012022-12-310000845982country:GB2022-01-012022-12-310000845982snn:RestOfWorldExcludingUnitedKingdomMember2021-01-012021-12-310000845982country:GB2021-01-012021-12-310000845982ifrs-full:TradingEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2023-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMember2023-12-310000845982ifrs-full:TradingEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2022-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMember2022-12-3100008459822022-12-310000845982ifrs-full:TradingEquitySecuritiesMemberifrs-full:Level3OfFairValueHierarchyMember2021-12-310000845982ifrs-full:ContingentConsiderationMemberifrs-full:Level3OfFairValueHierarchyMember2021-12-3100008459822023-04-012023-04-010000845982snn:OrthopaedicsMember2023-12-310000845982snn:OrthopaedicsMember2022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:ProductRelatedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:TechnologybasedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:CustomerrelatedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310000845982ifrs-full:SellingGeneralAndAdministrativeExpenseMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-01-012023-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembersnn:ProductRelatedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:CustomerrelatedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMemberifrs-full:ComputerSoftwareMember2022-01-012022-12-310000845982ifrs-full:SellingGeneralAndAdministrativeExpenseMember2022-01-012022-12-310000845982ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-01-012022-12-310000845982ifrs-full:SellingGeneralAndAdministrativeExpenseMember2021-01-012021-12-310000845982ifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-12-310000845982ifrs-full:LandAndBuildingsMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:InstrumentsMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LandAndBuildingsMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:LandAndBuildingsMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:ProductRelatedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:IntangibleAssetsUnderDevelopmentMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CustomerrelatedIntangibleAssetsMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMember2023-01-012023-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:IntangibleAssetsUnderDevelopmentMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:CustomerrelatedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2022-01-012022-12-310000845982ifrs-full:RestructuringProvisionMember2023-01-012023-12-310000845982ifrs-full:LegalProceedingsProvisionMember2023-01-012023-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2022-01-012022-12-310000845982ifrs-full:RestructuringProvisionMember2022-01-012022-12-310000845982ifrs-full:LegalProceedingsProvisionMember2022-01-012022-12-310000845982snn:MetalOnMetalHipClaimsProvisionMember2019-01-012019-12-310000845982ifrs-full:PresentValueOfDefinedBenefitObligationMember2023-01-012023-12-310000845982ifrs-full:PresentValueOfDefinedBenefitObligationMember2022-01-012022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2023-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2022-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:US2021-12-310000845982snn:DefinedBenefitPensionPlansMembercountry:GB2021-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:InstrumentsMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMembersnn:ProductRelatedIntangibleAssetsMember2022-01-012022-12-310000845982ifrs-full:GrossCarryingAmountMember2022-01-012022-12-310000845982snn:EngageSurgicalMember2022-01-180000845982snn:ExtremityOrthopaedicsMember2021-01-0400008459822022-01-012022-12-3100008459822021-01-012021-12-31iso4217:EURsnn:Optionssnn:segmentsnn:itemsnn:countrysnn:customeriso4217:GBPiso4217:USDxbrli:pureiso4217:CHFiso4217:USDiso4217:EURiso4217:USDiso4217:GBPiso4217:USDsnn:employeeiso4217:USDxbrli:sharesiso4217:GBPxbrli:sharesxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

INFORMATION FOR SHAREHOLDERS (Mark One)

| |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-14978

Smith & Nephew

(Exact name of Registrant as specified in its charter)

|

England and Wales (Jurisdiction of incorporation or organization) |

Building 5, Croxley Park, Hatters Lane, Watford, Hertfordshire WD18 8YE

(Address of principal executive offices)

Helen Barraclough, +44-1923-477340, helen.barraclough@smith-nephew.com

Building 5, Croxley Park, Hatters Lane, Watford, Hertfordshire WD18 8YE

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | |

| | | | |

Title of each class | | Trading Symbol | | Name on each exchange on which registered |

American Depositary Shares Ordinary Shares of 20¢ each 2.032% Notes due 2030 4.565% Notes due 2029 | | SNN SNN 30 SNLN | | New York Stock Exchange New York Stock Exchange* New York Stock Exchange New York Stock Exchange |

* Not for trading, but only in connection with the first registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer’s class of capital or common stock as of the close of the period covered by the annual report: 877,672,643 Ordinary Shares of 20¢ each

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ⌧ No ◻

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | |

Large Accelerated Filer ⌧ | Accelerated Filer ◻ | Non-accelerated filer ◻ |

Emerging growth company ☐ | | |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ◻

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

◻ U.S. GAAP | | ⌧ International Financial Reporting Standards as issued by the International Accounting Standards Board |

| | ◻ Other |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ◻ Item 18 ◻

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ⌧

| Life Unlimited

Annual Report 2023 |

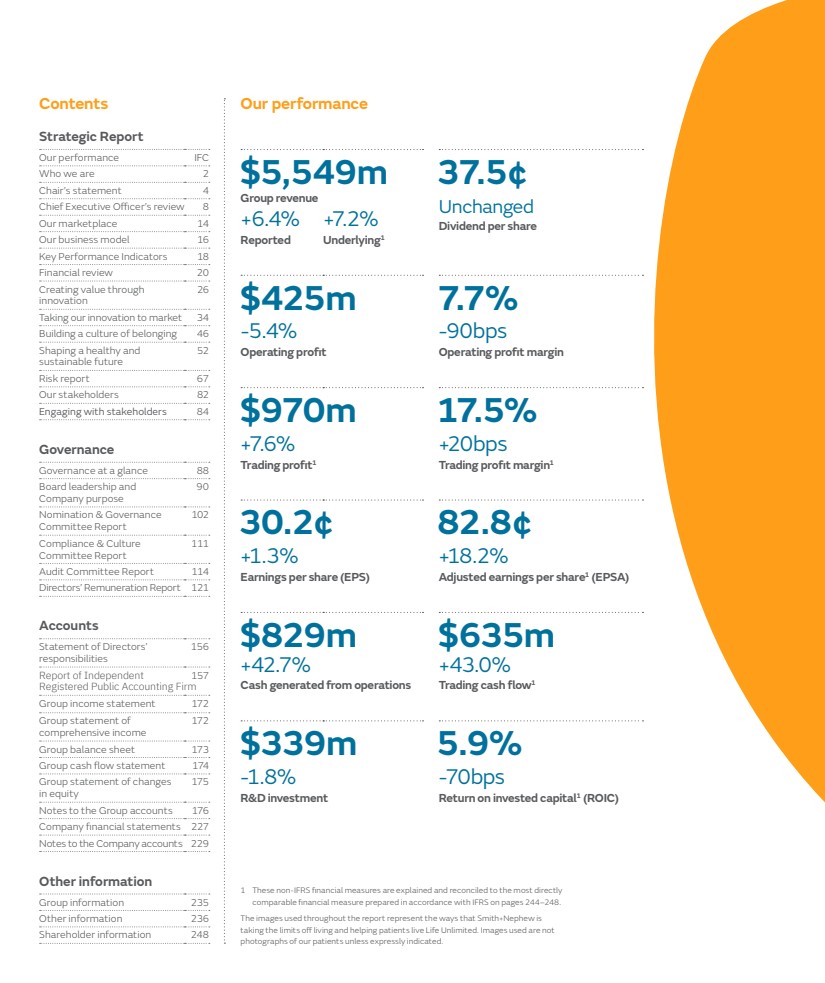

| Contents Our performance

Strategic Report

Our performance IFC

Who we are 2

Chair’s statement 4

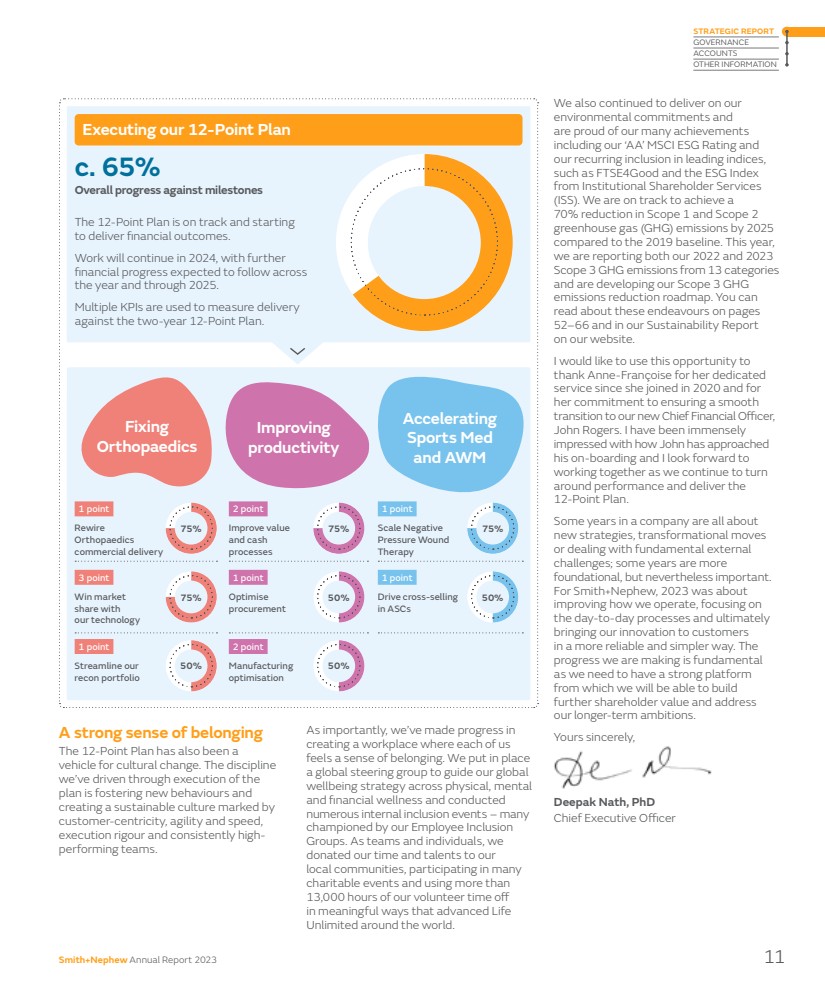

Chief Executive Officer’s review 8

Our marketplace 14

Our business model 16

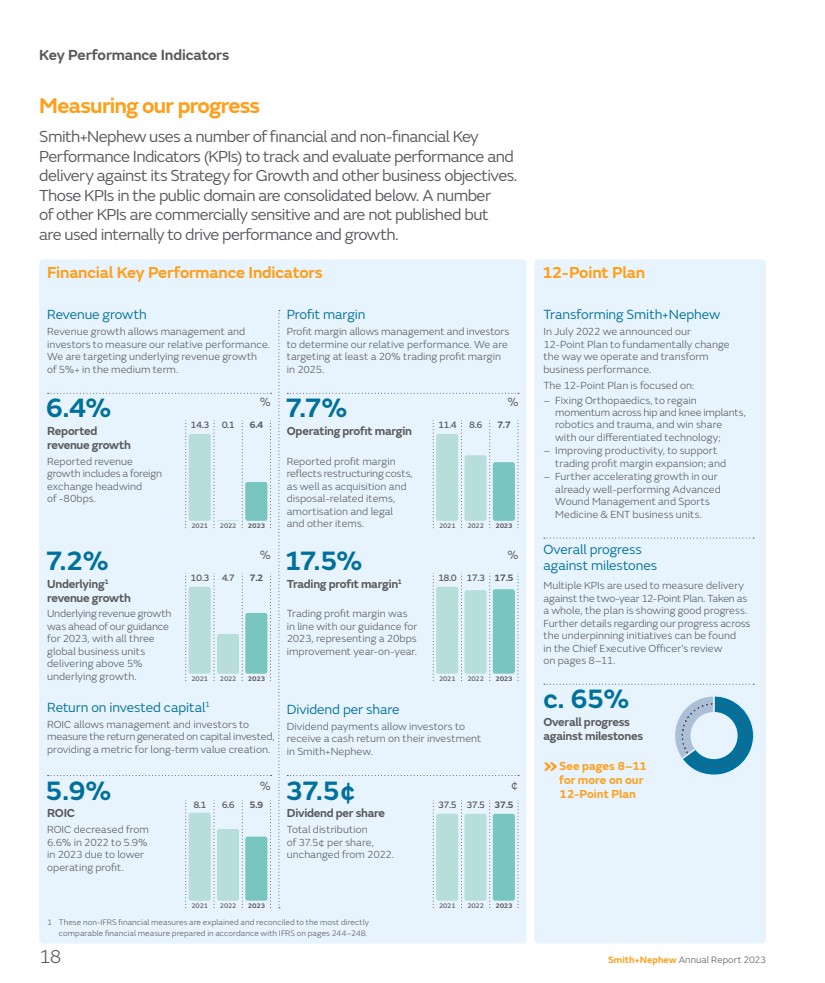

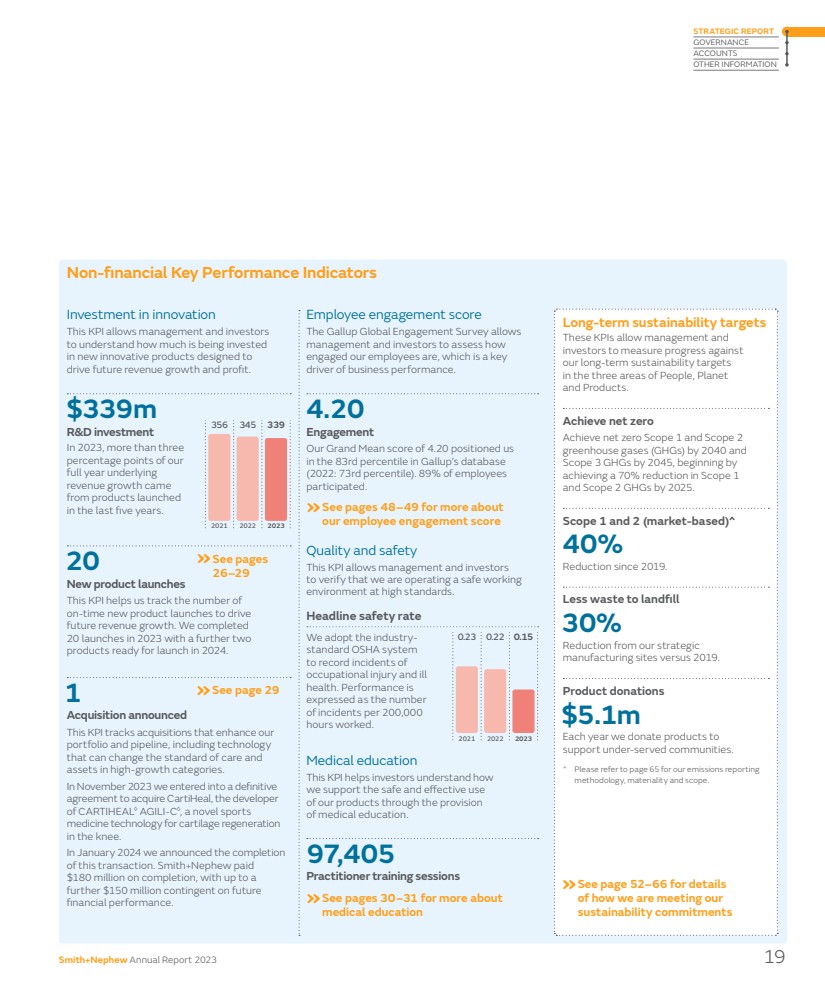

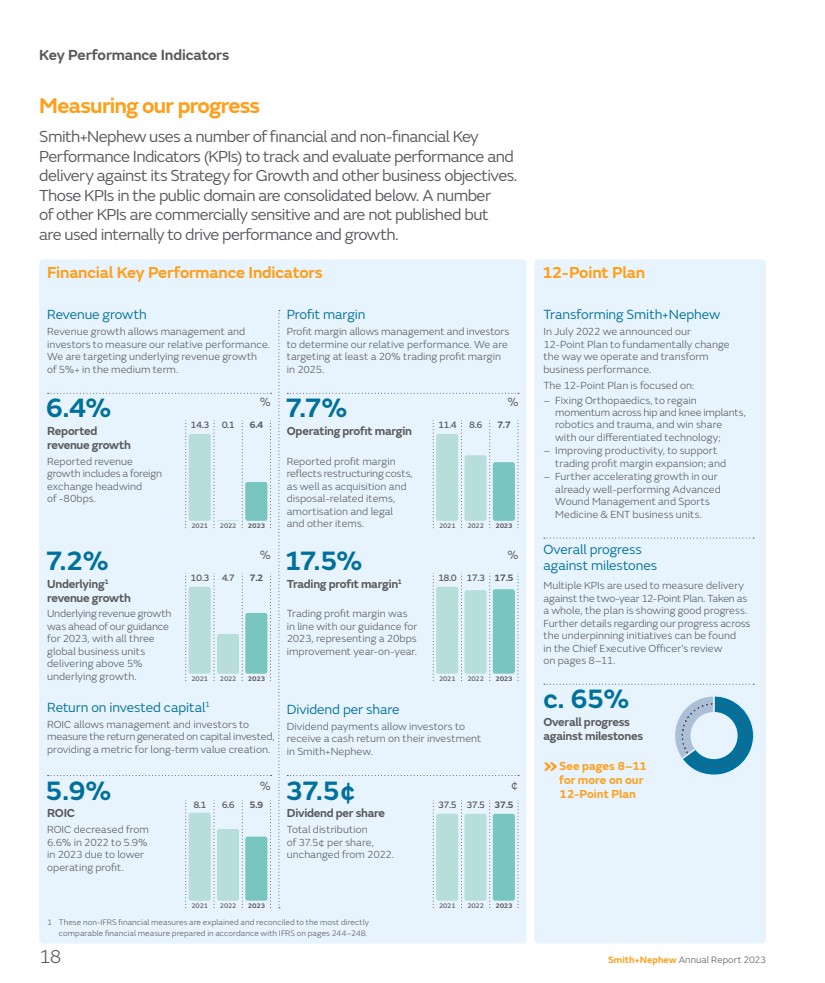

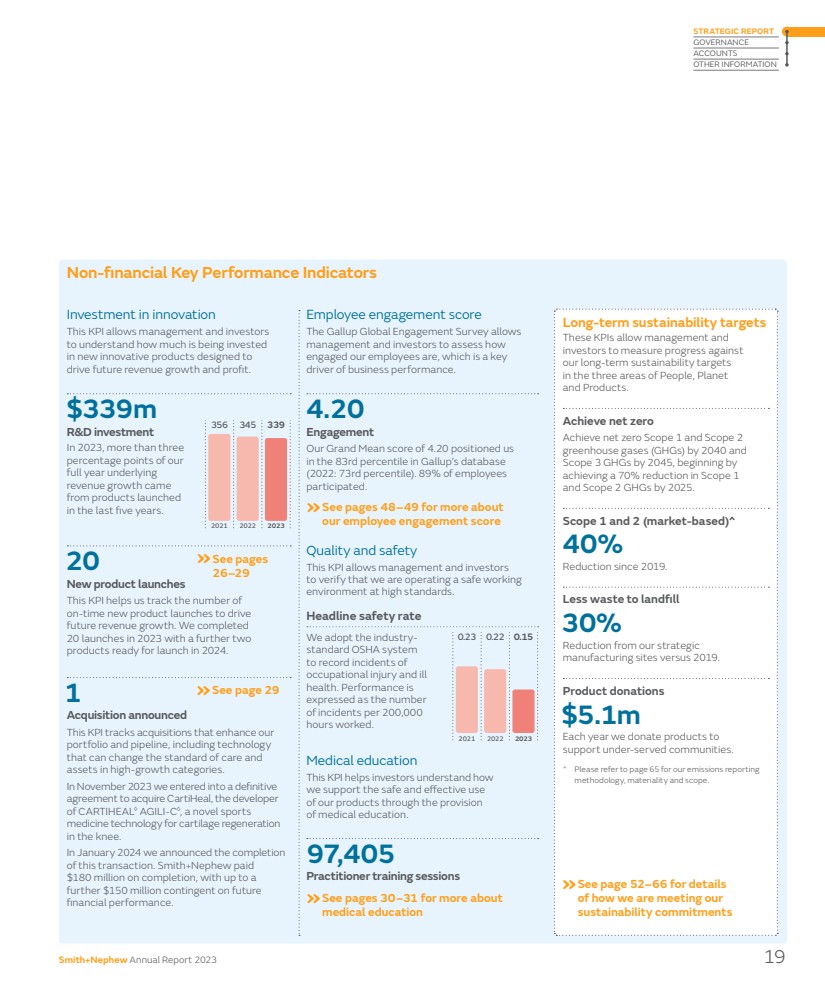

Key Performance Indicators 18

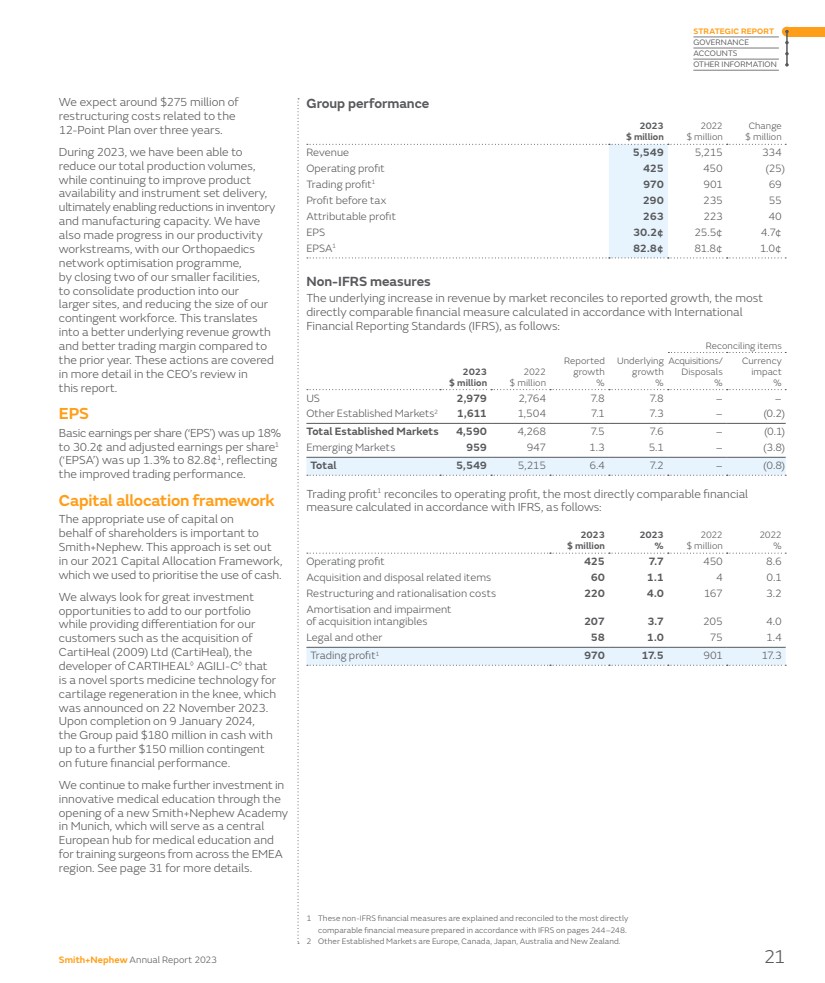

Financial review 20

Creating value through

innovation

26

Taking our innovation to market 34

Building a culture of belonging 46

Shaping a healthy and

sustainable future

52

Risk report 67

Our stakeholders 82

Engaging with stakeholders 84

Governance

Governance at a glance 88

Board leadership and

Company purpose

90

Nomination & Governance

Committee Report

102

Compliance & Culture

Committee Report

111

Audit Committee Report 114

Directors’ Remuneration Report 121

Accounts

Statement of Directors’

responsibilities

156

Report of Independent

Registered Public Accounting Firm

157

Group income statement 172

Group statement of

comprehensive income

172

Group balance sheet 173

Group cash flow statement 174

Group statement of changes

in equity

175

Notes to the Group accounts 176

Company financial statements 227

Notes to the Company accounts 229

Other information

Group information 235

Other information 236

Shareholder information 248

1 These non-IFRS financial measures are explained and reconciled to the most directly

comparable financial measure prepared in accordance with IFRS on pages 244–248.

The images used throughout the report represent the ways that Smith+Nephew is

taking the limits off living and helping patients live Life Unlimited. Images used are not

photographs of our patients unless expressly indicated.

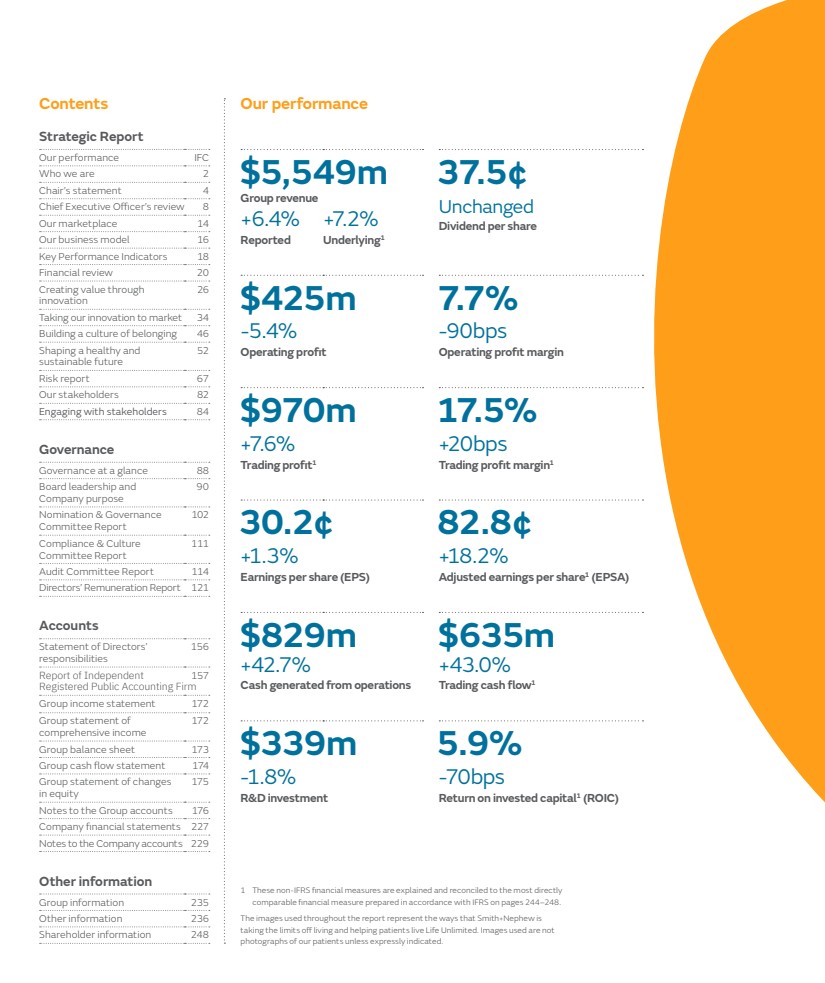

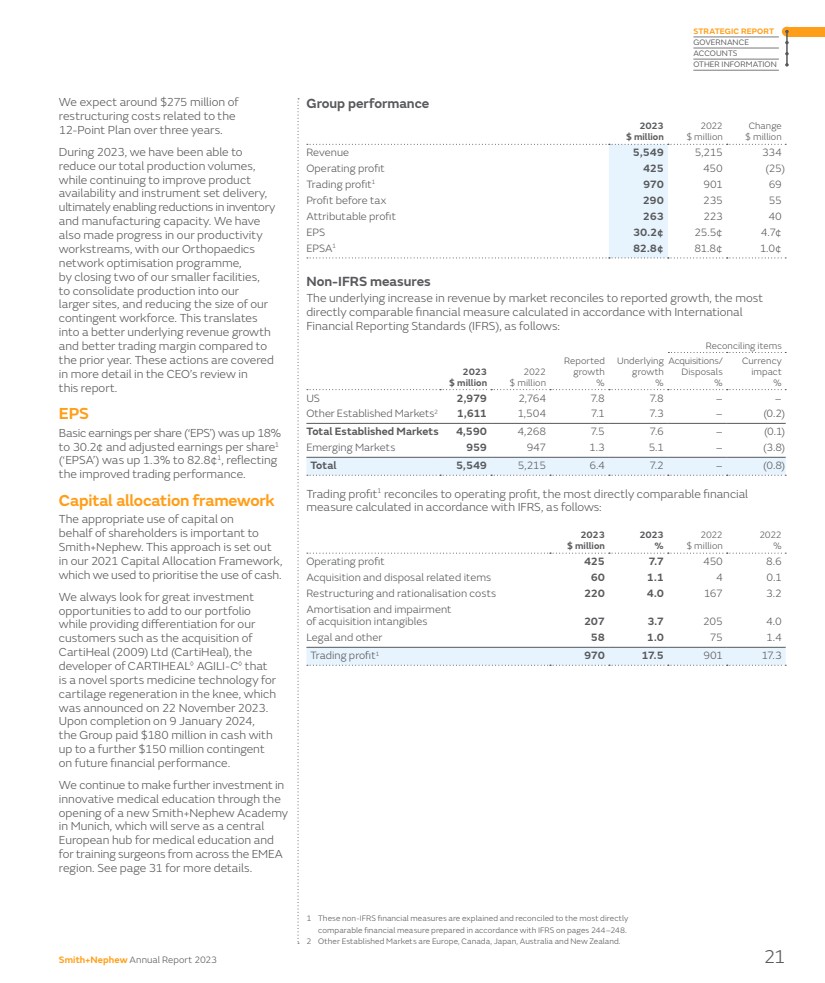

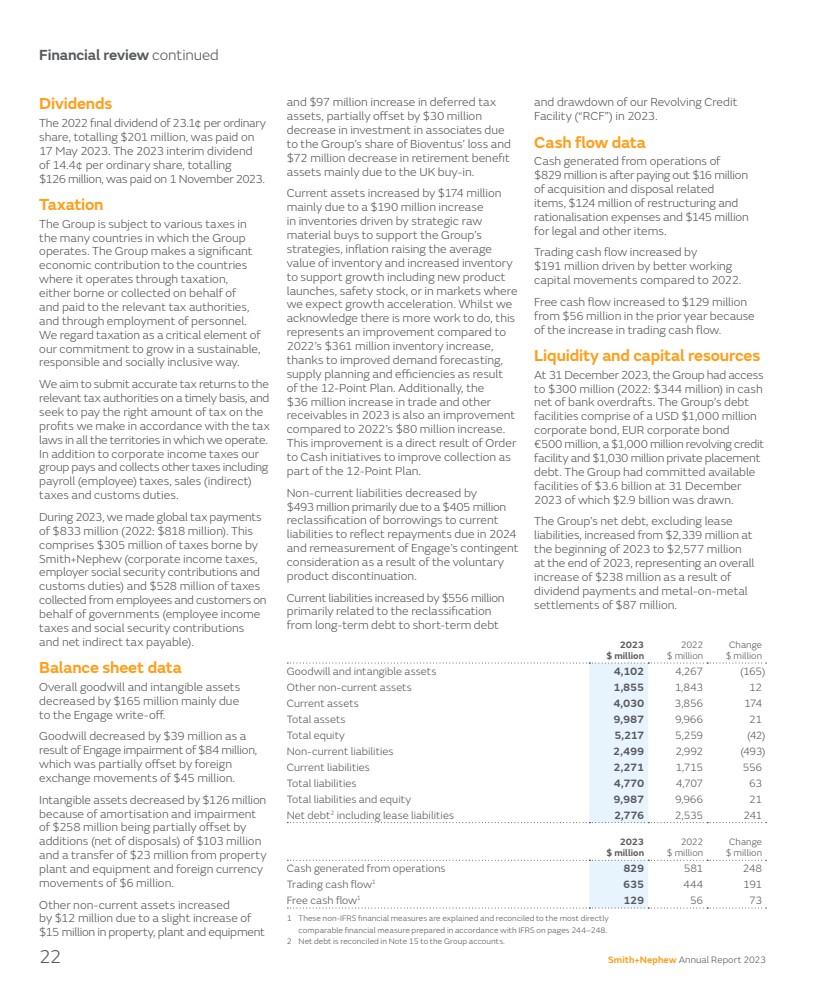

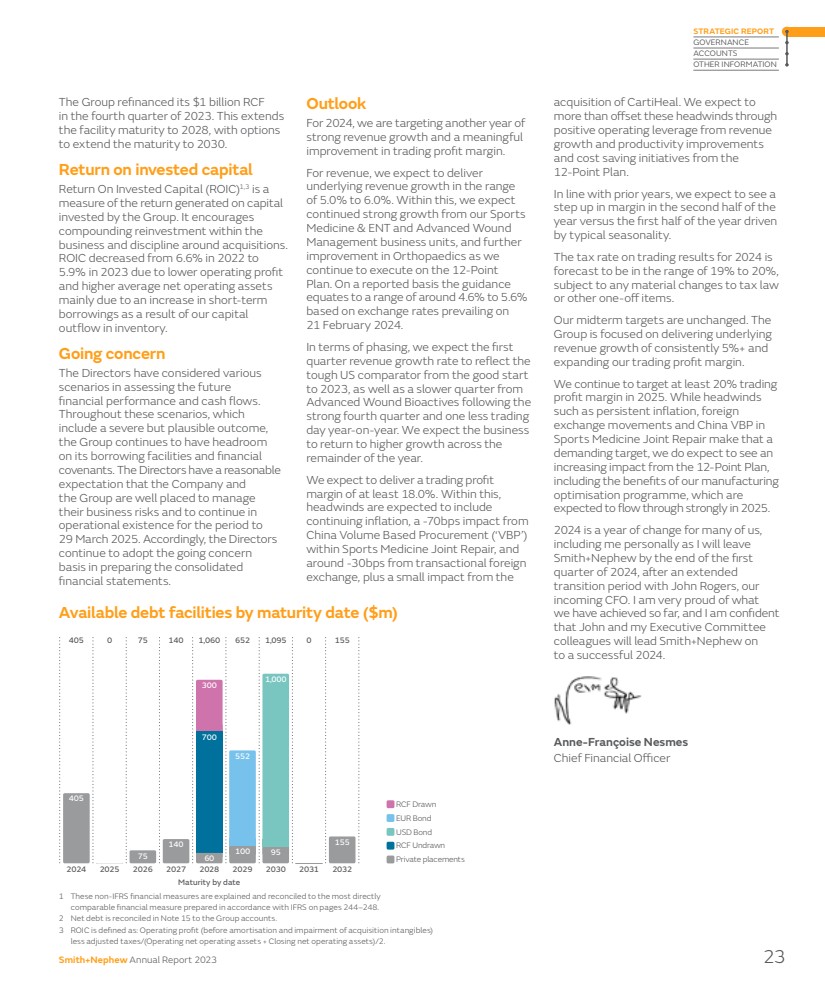

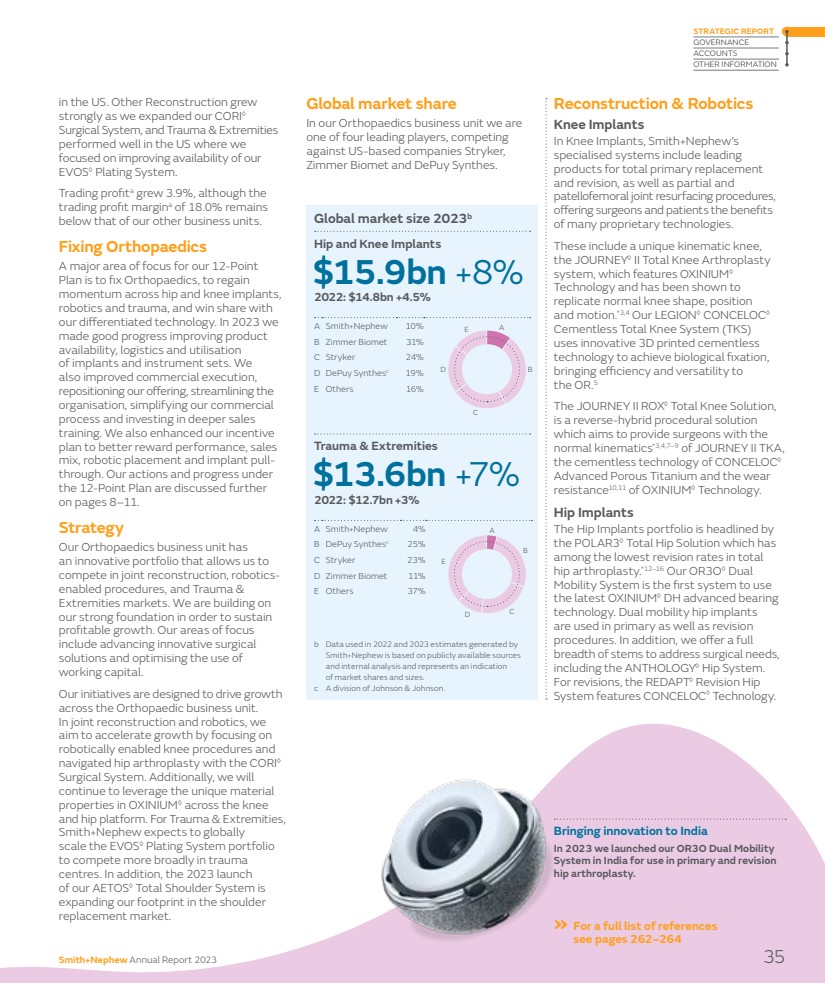

$5,549m

Group revenue

37.5¢

Unchanged +6.4% Dividend per share

Reported

+7.2%

Underlying1

$425m

-5.4%

Operating profit

7.7%

-90bps

Operating profit margin

$970m

+7.6%

Trading profit1

17.5%

+20bps

Trading profit margin1

30.2¢

+1.3%

Earnings per share (EPS)

82.8¢

+18.2%

Adjusted earnings per share1 (EPSA)

$829m

+42.7%

Cash generated from operations

$635m

+43.0%

Trading cash flow1

$339m

-1.8%

R&D investment

5.9%

-70bps

Return on invested capital1 (ROIC) |

| Physical health is never just about

our body. It’s our mind, feelings and

ambitions. When something holds

us back, it’s our whole life on hold.

We’re here to change that, to use

technology to take the limits off living,

and help other medical professionals

do the same.

So that patients can stare down

fear, see that anything is possible,

then go on stronger. Inspired by a

simple promise. Two words that

bring together all we do…

Life Unlimited

To learn more about our purpose visit

www.smith-nephew.com

Smith+Nephew Annual Report 2023 1

STRATEGIC REPORT

GOVERNANCE

ACCOUNTS

OTHER INFORMATION |

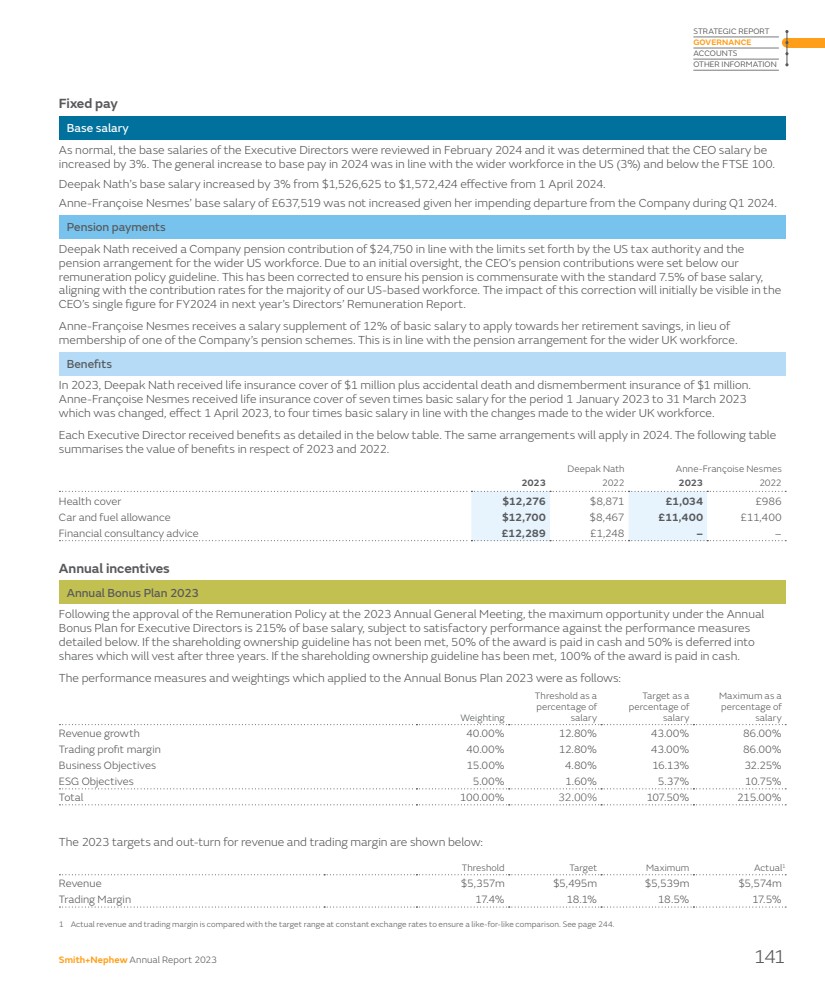

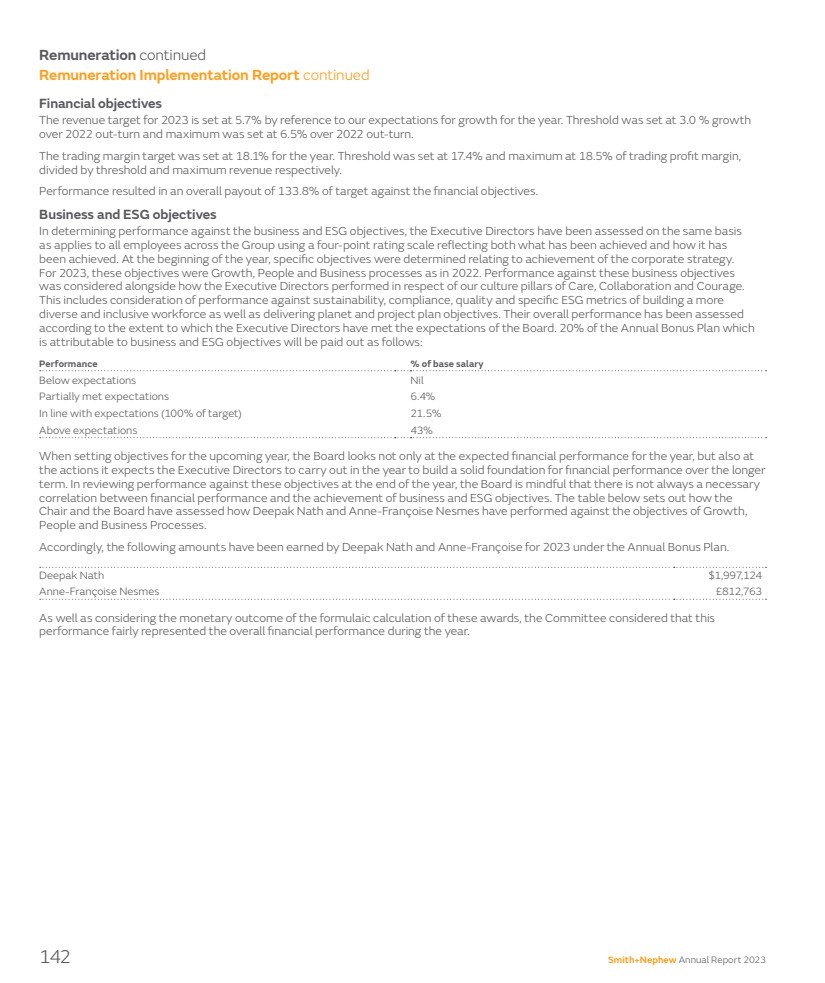

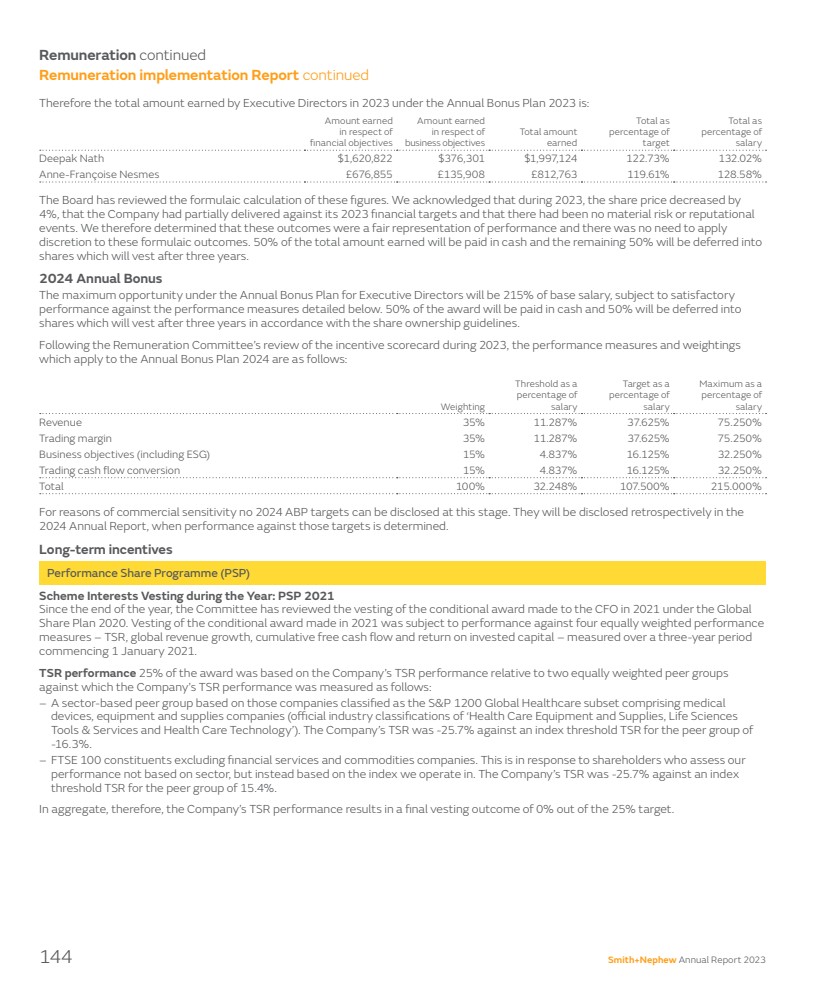

| Who we are