| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

| PART I | Page | |||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||||||||||||

| Truckload | $ | 1,561,310 | $ | 1,280,629 | $ | 1,071,873 | $ | 1,348,878 | $ | 1,445,916 | |||||||||||||||||||

| LTL | 632,116 | 523,365 | 457,290 | 477,348 | 471,275 | ||||||||||||||||||||||||

| Ocean | 729,839 | 711,223 | 350,094 | 308,367 | 312,952 | ||||||||||||||||||||||||

| Air | 198,166 | 225,286 | 151,443 | 106,777 | 120,540 | ||||||||||||||||||||||||

| Customs | 107,691 | 100,539 | 87,095 | 91,828 | 88,515 | ||||||||||||||||||||||||

| Other Logistics Services | 251,547 | 210,958 | 195,159 | 149,664 | 154,546 | ||||||||||||||||||||||||

| Total | $ | 3,480,669 | $ | 3,052,000 | $ | 2,312,954 | $ | 2,482,862 | $ | 2,593,744 | |||||||||||||||||||

| North America | Europe | Asia | Oceania | South America | Total | |||||||||||||||||||||||||||||||||

| Network employees | 10,357 | 1,664 | 1,835 | 472 | 350 | 14,678 | ||||||||||||||||||||||||||||||||

| Shared services employees | 1,919 | 457 | 278 | 32 | 35 | 2,721 | ||||||||||||||||||||||||||||||||

Total Employees | 12,276 | 2,121 | 2,113 | 504 | 385 | 17,399 | ||||||||||||||||||||||||||||||||

| Contingent workers | 1,404 | 19 | 333 | 54 | 216 | 2,026 | ||||||||||||||||||||||||||||||||

| Women in Workforce | 48 | % | |||

| Management Positions Held by Women | 46 | % | |||

| Leadership Positions Held by Women | 27 | % | |||

| U.S. Racial and Ethnic Minorities in Workforce | 29 | % | |||

| Management Positions Held by U.S. Racial and Ethnic Minorities | 23 | % | |||

| Leadership Positions Held by U.S. Racial and Ethnic Minorities | 11 | % | |||

| External Hires - Women | 49 | % | |||

| External Hires - U.S. Racial and Ethnic Minorities | 42 | % | |||

| Name | Age | Position | ||||||||||||

| Scott P. Anderson | 56 | Interim Chief Executive Officer | ||||||||||||

| Ben G. Campbell | 57 | Chief Legal Officer and Secretary | ||||||||||||

| Angela K. Freeman | 55 | Chief Human Resources and ESG Officer | ||||||||||||

| Mac Pinkerton | 49 | President of NAST | ||||||||||||

| Arun Rajan | 54 | Chief Operating Officer | ||||||||||||

| Michael J. Short | 52 | President of Global Freight Forwarding | ||||||||||||

| Michael P. Zechmeister | 56 | Chief Financial Officer | ||||||||||||

Total Number of Shares Purchased (1) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs (2) | ||||||||||||||||||||

| October 2022 | 2,673,287 | $ | 95.94 | 2,665,000 | 9,089,110 | ||||||||||||||||||

| November 2022 | 1,572,887 | 93.55 | 1,564,812 | 7,524,298 | |||||||||||||||||||

| December 2022 | 117,903 | 94.48 | 115,100 | 7,409,198 | |||||||||||||||||||

| Fourth quarter 2022 | 4,364,077 | $ | 95.04 | 4,344,912 | 7,409,198 | ||||||||||||||||||

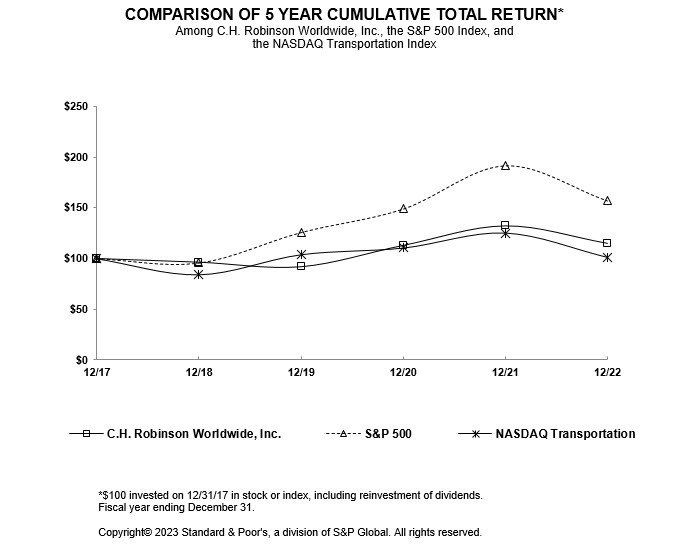

| December 31, | |||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||||||||||||

C.H. Robinson Worldwide, Inc. | $ | 100.00 | $ | 96.39 | $ | 91.85 | $ | 112.99 | $ | 132.40 | $ | 115.06 | |||||||||||||||||||||||

S&P 500 | 100.00 | 95.62 | 125.72 | 148.85 | 191.58 | 156.89 | |||||||||||||||||||||||||||||

Nasdaq Transportation | 100.00 | 84.30 | 103.87 | 110.40 | 125.06 | 101.32 | |||||||||||||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Transportation | $ | 23,516,384 | $ | 22,046,574 | $ | 15,147,562 | |||||||||||||||||||||||||||||

| Sourcing | 1,180,241 | 1,055,564 | 1,059,544 | ||||||||||||||||||||||||||||||||

| Total revenues | 24,696,625 | 23,102,138 | 16,207,106 | ||||||||||||||||||||||||||||||||

| Costs and expenses: | |||||||||||||||||||||||||||||||||||

| Purchased transportation and related services | 20,035,715 | 18,994,574 | 12,834,608 | ||||||||||||||||||||||||||||||||

| Purchased products sourced for resale | 1,067,733 | 955,475 | 960,241 | ||||||||||||||||||||||||||||||||

| Direct internally developed software amortization | 25,487 | 20,208 | 16,634 | ||||||||||||||||||||||||||||||||

| Total direct costs | 21,128,935 | 19,970,257 | 13,811,483 | ||||||||||||||||||||||||||||||||

| Gross profit / Gross profit margin | 3,567,690 | 14.4 | % | 3,131,881 | 13.6 | % | 2,395,623 | 14.8 | % | ||||||||||||||||||||||||||

| Plus: Direct internally developed software amortization | 25,487 | 20,208 | 16,634 | ||||||||||||||||||||||||||||||||

| Adjusted gross profits / Adjusted gross profit margin | $ | 3,593,177 | 14.5 | % | $ | 3,152,089 | 13.6 | % | $ | 2,412,257 | 14.9 | % | |||||||||||||||||||||||

| Twelve Months Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Total revenues | $ | 24,696,625 | $ | 23,102,138 | $ | 16,207,106 | ||||||||||||||

| Operating income | 1,266,782 | 1,082,108 | 673,268 | |||||||||||||||||

| Operating margin | 5.1 | % | 4.7 | % | 4.2 | % | ||||||||||||||

| Adjusted gross profit | $ | 3,593,177 | $ | 3,152,089 | $ | 2,412,257 | ||||||||||||||

| Operating income | 1,266,782 | 1,082,108 | 673,268 | |||||||||||||||||

| Adjusted operating margin | 35.3 | % | 34.3 | % | 27.9 | % | ||||||||||||||

| Twelve Months Ended December 31, | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % change | 2020 | % change | ||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Transportation | $ | 23,516,384 | $ | 22,046,574 | 6.7 | % | $ | 15,147,562 | 45.5 | % | ||||||||||||||||||||||

| Sourcing | 1,180,241 | 1,055,564 | 11.8 | % | 1,059,544 | (0.4) | % | |||||||||||||||||||||||||

Total revenues | 24,696,625 | 23,102,138 | 6.9 | % | 16,207,106 | 42.5 | % | |||||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||||||||

| Purchased transportation and related services | $ | 20,035,715 | $ | 18,994,574 | 5.5 | % | $ | 12,834,608 | 48.0 | % | ||||||||||||||||||||||

| Purchased products sourced for resale | 1,067,733 | 955,475 | 11.7 | % | 960,241 | (0.5) | % | |||||||||||||||||||||||||

| Personnel expenses | 1,722,980 | 1,543,610 | 11.6 | % | 1,242,867 | 24.2 | % | |||||||||||||||||||||||||

| Other selling, general, and administrative expenses | 603,415 | 526,371 | 14.6 | % | 496,122 | 6.1 | % | |||||||||||||||||||||||||

Total costs and expenses | 23,429,843 | 22,020,030 | 6.4 | % | 15,533,838 | 41.8 | % | |||||||||||||||||||||||||

Income from operations | 1,266,782 | 1,082,108 | 17.1 | % | 673,268 | 60.7 | % | |||||||||||||||||||||||||

| Interest and other expense | (100,017) | (59,817) | 67.2 | % | (44,937) | 33.1 | % | |||||||||||||||||||||||||

Income before provision for income taxes | 1,166,765 | 1,022,291 | 14.1 | % | 628,331 | 62.7 | % | |||||||||||||||||||||||||

| Provision for income taxes | 226,241 | 178,046 | 27.1 | % | 121,910 | 46.0 | % | |||||||||||||||||||||||||

Net income | $ | 940,524 | $ | 844,245 | 11.4 | % | $ | 506,421 | 66.7 | % | ||||||||||||||||||||||

Diluted net income per share | $ | 7.40 | $ | 6.31 | 17.3 | % | $ | 3.72 | 69.6 | % | ||||||||||||||||||||||

Average employee headcount | 17,601 | 15,761 | 11.7 | % | 15,119 | 4.2 | % | |||||||||||||||||||||||||

Adjusted gross profit margin percentage(1) | ||||||||||||||||||||||||||||||||

| Transportation | 14.8% | 13.8% | 100 bps | 15.3% | (150 bps) | |||||||||||||||||||||||||||

| Sourcing | 9.5% | 9.5% | - bps | 9.4% | 10 bps | |||||||||||||||||||||||||||

| Total adjusted gross profit margin | 14.5% | 13.6% | 90 bps | 14.9% | (130 bps) | |||||||||||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||

| (dollars in thousands) | 2022 | 2021 | % change | 2020 | % change | ||||||||||||||||||||||||

| Total revenues | $ | 15,827,467 | $ | 14,507,917 | 9.1 | % | $ | 11,312,553 | 28.2 | % | |||||||||||||||||||

| Costs and expenses: | |||||||||||||||||||||||||||||

| Purchased transportation and related services | 13,630,763 | 12,714,964 | 7.2 | % | 9,795,462 | 29.8 | % | ||||||||||||||||||||||

| Personnel expenses | 844,472 | 779,435 | 8.3 | % | 624,358 | 24.8 | % | ||||||||||||||||||||||

| Other selling, general, and administrative expenses | 518,930 | 428,167 | 21.2 | % | 384,258 | 11.4 | % | ||||||||||||||||||||||

Total costs and expenses | 14,994,165 | 13,922,566 | 7.7 | % | 10,804,078 | 28.9 | % | ||||||||||||||||||||||

| Income from operations | $ | 833,302 | $ | 585,351 | 42.4 | % | $ | 508,475 | 15.1 | % | |||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||

| 2022 | 2021 | % change | 2020 | % change | |||||||||||||||||||||||||

Average employee headcount | 7,365 | 6,764 | 8.9 | % | 6,811 | (0.7) | % | ||||||||||||||||||||||

| Service line volume statistics | |||||||||||||||||||||||||||||

| Truckload | 0.5 | % | 2.5 | % | |||||||||||||||||||||||||

| LTL | (2.0) | % | 8.0 | % | |||||||||||||||||||||||||

Adjusted gross profits(1) | |||||||||||||||||||||||||||||

| Truckload | $ | 1,463,363 | $ | 1,192,644 | 22.7 | % | $ | 981,420 | 21.5 | % | |||||||||||||||||||

| LTL | 626,744 | 517,500 | 21.1 | % | 452,033 | 14.5 | % | ||||||||||||||||||||||

| Other | 106,597 | 82,809 | 28.7 | % | 83,638 | (1.0) | % | ||||||||||||||||||||||

| Total adjusted gross profits | $ | 2,196,704 | $ | 1,792,953 | 22.5 | % | $ | 1,517,091 | 18.2 | % | |||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||

| (dollars in thousands) | 2022 | 2021 | % change | 2020 | % change | ||||||||||||||||||||||||

| Total revenues | $ | 6,812,008 | $ | 6,729,790 | 1.2 | % | $ | 3,100,525 | 117.1 | % | |||||||||||||||||||

| Costs and expenses: | |||||||||||||||||||||||||||||

| Purchased transportation and related services | 5,728,535 | 5,656,249 | 1.3 | % | 2,471,537 | 128.9 | % | ||||||||||||||||||||||

| Personnel expenses | 414,690 | 368,563 | 12.5 | % | 281,048 | 31.1 | % | ||||||||||||||||||||||

| Other selling, general, and administrative expenses | 219,419 | 194,222 | 13.0 | % | 172,427 | 12.6 | % | ||||||||||||||||||||||

Total costs and expenses | 6,362,644 | 6,219,034 | 2.3 | % | 2,925,012 | 112.6 | % | ||||||||||||||||||||||

| Income from operations | $ | 449,364 | $ | 510,756 | (12.0) | % | $ | 175,513 | 191.0 | % | |||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||

| 2022 | 2021 | % change | 2020 | % change | |||||||||||||||||||||||||

Average employee headcount | 5,712 | 5,071 | 12.6 | % | 4,708 | 7.7 | % | ||||||||||||||||||||||

| Service line volume statistics | |||||||||||||||||||||||||||||

| Ocean | (0.5) | % | 17.0 | % | |||||||||||||||||||||||||

| Air | (9.0) | % | 45.5 | % | |||||||||||||||||||||||||

| Customs | 3.5 | % | 13.5 | % | |||||||||||||||||||||||||

Adjusted gross profits(1) | |||||||||||||||||||||||||||||

| Ocean | $ | 729,453 | $ | 710,845 | 2.6 | % | $ | 349,868 | 103.2 | % | |||||||||||||||||||

| Air | 195,191 | 221,906 | (12.0) | % | 146,056 | 51.9 | % | ||||||||||||||||||||||

| Customs | 107,691 | 100,540 | 7.1 | % | 87,092 | 15.4 | % | ||||||||||||||||||||||

| Other | 51,138 | 40,250 | 27.1 | % | 45,972 | (12.4) | % | ||||||||||||||||||||||

| Total adjusted gross profits | $ | 1,083,473 | $ | 1,073,541 | 0.9 | % | $ | 628,988 | 70.7 | % | |||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||||||||||||||

| (dollars in thousands) | 2022 | 2021 | % change | 2020 | % change | ||||||||||||||||||||||||

| Total revenues | $ | 2,057,150 | $ | 1,864,431 | 10.3 | % | $ | 1,794,028 | 3.9 | % | |||||||||||||||||||

| Loss from operations | (15,884) | (13,999) | N/M | (10,720) | N/M | ||||||||||||||||||||||||

Adjusted gross profits(1) | |||||||||||||||||||||||||||||

| Robinson Fresh | 121,639 | 107,543 | 13.1 | % | 105,700 | 1.7 | % | ||||||||||||||||||||||

| Managed Services | 115,094 | 105,064 | 9.5 | % | 94,828 | 10.8 | % | ||||||||||||||||||||||

| Other Surface Transportation | 76,267 | 72,988 | 4.5 | % | 65,650 | 11.2 | % | ||||||||||||||||||||||

| Total adjusted gross profits | $ | 313,000 | $ | 285,595 | 9.6 | % | $ | 266,178 | 7.3 | % | |||||||||||||||||||

| Description | Carrying Value as of December 31, 2022 | Borrowing Capacity | Maturity | |||||||||||||||||

| Revolving credit facility | $ | — | $ | 1,000,000 | November 2027 | |||||||||||||||

| 364-day revolving credit facility | 379,000 | 500,000 | May 2023 | |||||||||||||||||

| Senior Notes, Series A | 175,000 | 175,000 | August 2023 | |||||||||||||||||

| Senior Notes, Series B | 150,000 | 150,000 | August 2028 | |||||||||||||||||

| Senior Notes, Series C | 175,000 | 175,000 | August 2033 | |||||||||||||||||

Receivables Securitization Facility(1) | 499,655 | 500,000 | November 2023 | |||||||||||||||||

Senior Notes (1) | 595,049 | 600,000 | April 2028 | |||||||||||||||||

| Total debt | $ | 1,973,704 | $ | 3,100,000 | ||||||||||||||||

| Twelve months ended December 31, | 2022 | 2021 | % change | 2020 | % change | ||||||||||||||||||||||||

| Sources (uses) of cash: | |||||||||||||||||||||||||||||

| Cash provided by operating activities | $ | 1,650,171 | $ | 94,955 | 1,637.8 | % | $ | 499,191 | (81.0) | % | |||||||||||||||||||

| Capital expenditures | (128,497) | (70,922) | (54,009) | ||||||||||||||||||||||||||

| Acquisitions, net of cash acquired | — | (14,750) | (223,230) | ||||||||||||||||||||||||||

| Sale of property and equipment | 63,579 | — | 5,525 | ||||||||||||||||||||||||||

| Cash used for investing activities | (64,918) | (85,672) | (24.2) | % | (271,714) | (68.5) | % | ||||||||||||||||||||||

| Repurchase of common stock | (1,459,900) | (581,756) | (177,514) | ||||||||||||||||||||||||||

| Cash dividends | (285,317) | (277,321) | (209,956) | ||||||||||||||||||||||||||

| Net borrowings (repayments) on debt | 54,000 | 822,701 | (143,000) | ||||||||||||||||||||||||||

| Other financing activities | 71,671 | 43,949 | 89,803 | ||||||||||||||||||||||||||

| Net cash (used for) provided by financing activities | (1,619,546) | 7,573 | NM | (440,667) | NM | ||||||||||||||||||||||||

| Effect of exchange rates on cash and cash equivalents | (5,638) | (3,239) | 9,128 | ||||||||||||||||||||||||||

| Net change in cash and cash equivalents | $ | (39,931) | $ | 13,617 | $ | (204,062) | |||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | |||||||||||||||||||||||||||||||||||

| Borrowings under credit agreements | $ | 878,655 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 878,655 | |||||||||||||||||||||||||||

Senior notes(1) | 25,200 | 25,200 | 25,200 | 25,200 | 25,200 | 607,350 | 733,350 | ||||||||||||||||||||||||||||||||||

Long-term notes payable(1) | 196,388 | 14,440 | 14,440 | 14,440 | 14,440 | 379,690 | 633,838 | ||||||||||||||||||||||||||||||||||

Maturity of lease liabilities(2) | 85,930 | 77,868 | 64,308 | 53,098 | 42,757 | 113,678 | 437,639 | ||||||||||||||||||||||||||||||||||

Purchase obligations(3) | 167,484 | 44,799 | 6,252 | 3,906 | 1,251 | — | 223,692 | ||||||||||||||||||||||||||||||||||

| Total | $ | 1,353,657 | $ | 162,307 | $ | 110,200 | $ | 96,644 | $ | 83,648 | $ | 1,100,718 | $ | 2,907,174 | |||||||||||||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Receivables, net of allowance for credit loss of $ | |||||||||||

| Contract assets, net of allowance for credit loss | |||||||||||

| Prepaid expenses and other | |||||||||||

Total current assets | |||||||||||

| Property and equipment | |||||||||||

| Accumulated depreciation and amortization | ( | ( | |||||||||

| Net property and equipment | |||||||||||

| Goodwill | |||||||||||

Other intangible assets, net of accumulated amortization of $ | |||||||||||

| Right-of-use lease assets | |||||||||||

| Deferred tax assets | |||||||||||

| Other assets | |||||||||||

Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ INVESTMENT | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Outstanding checks | |||||||||||

| Accrued expenses: | |||||||||||

| Compensation | |||||||||||

| Transportation expense | |||||||||||

| Income taxes | |||||||||||

| Other accrued liabilities | |||||||||||

| Current lease liabilities | |||||||||||

| Current portion of debt | |||||||||||

Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Noncurrent lease liabilities | |||||||||||

| Noncurrent income taxes payable | |||||||||||

| Deferred tax liabilities | |||||||||||

| Other long-term liabilities | |||||||||||

Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Stockholders’ investment: | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

Treasury stock at cost ( | ( | ( | |||||||||

Total stockholders’ investment | |||||||||||

Total liabilities and stockholders’ investment | $ | $ | |||||||||

| For the years ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenues: | |||||||||||||||||

| Transportation | $ | $ | $ | ||||||||||||||

| Sourcing | |||||||||||||||||

Total revenues | |||||||||||||||||

| Costs and expenses: | |||||||||||||||||

| Purchased transportation and related services | |||||||||||||||||

| Purchased products sourced for resale | |||||||||||||||||

| Personnel expenses | |||||||||||||||||

| Other selling, general, and administrative expenses | |||||||||||||||||

Total costs and expenses | |||||||||||||||||

| Income from operations | |||||||||||||||||

| Interest and other expenses | ( | ( | ( | ||||||||||||||

| Income before provision for income taxes | |||||||||||||||||

| Provision for income taxes | |||||||||||||||||

| Net income | |||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||

Comprehensive income | $ | $ | $ | ||||||||||||||

Basic net income per share | $ | $ | $ | ||||||||||||||

Diluted net income per share | $ | $ | $ | ||||||||||||||

Basic weighted average shares outstanding | |||||||||||||||||

Dilutive effect of outstanding stock awards | |||||||||||||||||

Diluted weighted average shares outstanding | |||||||||||||||||

| Common Shares Outstanding | Amount | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Treasury Stock | Total Stockholders’ Investment | |||||||||||||||||||||||||||||||||||

| Balance December 31, 2019 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||||||||||||||

Foreign currency adjustments | |||||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | ( | ( | |||||||||||||||||||||||||||||||||||||||

Stock issued for employee benefit plans | ( | ||||||||||||||||||||||||||||||||||||||||

| Issuance of restricted stock | ( | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | |||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||

| Balance December 31, 2020 | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||||||||||||||

Foreign currency adjustments | ( | ( | |||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Stock issued for employee benefit plans | ( | ||||||||||||||||||||||||||||||||||||||||

| Issuance of restricted stock | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | |||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||

| Balance December 31, 2021 | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||||||||||||||

| Foreign currency adjustments | ( | ( | |||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Stock issued for employee benefit plans | ( | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | |||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||

| For the year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| OPERATING ACTIVITIES | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Provision for credit losses | ( | ||||||||||||||||

| Stock-based compensation | |||||||||||||||||

| Deferred income taxes | ( | ( | ( | ||||||||||||||

| Excess tax benefit on stock-based compensation | ( | ( | ( | ||||||||||||||

| Other operating activities | ( | ||||||||||||||||

| Changes in operating elements, net of effects of acquisitions: | |||||||||||||||||

| Receivables | ( | ( | |||||||||||||||

| Contract assets | ( | ( | |||||||||||||||

| Prepaid expenses and other | ( | ( | |||||||||||||||

| Accounts payable and outstanding checks | ( | ||||||||||||||||

| Accrued compensation | |||||||||||||||||

| Accrued transportation expense | ( | ||||||||||||||||

| Accrued income taxes | ( | ||||||||||||||||

| Other accrued liabilities | |||||||||||||||||

| Other assets and liabilities | ( | ||||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| INVESTING ACTIVITIES | |||||||||||||||||

| Purchases of property and equipment | ( | ( | ( | ||||||||||||||

| Purchases and development of software | ( | ( | ( | ||||||||||||||

| Acquisitions, net of cash acquired | ( | ( | |||||||||||||||

| Proceeds from sale of property and equipment | |||||||||||||||||

| Net cash used for investing activities | ( | ( | ( | ||||||||||||||

| FINANCING ACTIVITIES | |||||||||||||||||

| Proceeds from stock issued for employee benefit plans | |||||||||||||||||

| Stock tendered for payment of withholding taxes | ( | ( | ( | ||||||||||||||

| Repurchase of common stock | ( | ( | ( | ||||||||||||||

| Cash dividends | ( | ( | ( | ||||||||||||||

| Proceeds from long-term borrowings | |||||||||||||||||

| Payments on long-term borrowings | ( | ||||||||||||||||

| Proceeds from short-term borrowings | |||||||||||||||||

| Payments on short-term borrowings | ( | ( | ( | ||||||||||||||

| Net cash (used for) provided by financing activities | ( | ( | |||||||||||||||

| Effect of exchange rates on cash and cash equivalents | ( | ( | |||||||||||||||

Net change in cash and cash equivalents | ( | ( | |||||||||||||||

Cash and cash equivalents, beginning of year | |||||||||||||||||

Cash and cash equivalents, end of year | $ | $ | $ | ||||||||||||||

| Supplemental cash flow disclosures | |||||||||||||||||

| Cash paid for income taxes | $ | $ | $ | ||||||||||||||

| Cash paid for interest | |||||||||||||||||

| Accrued share repurchases held in other accrued liabilities | |||||||||||||||||

| 2022 | $ | |||||||

| 2021 | ||||||||

| 2020 | ||||||||

| 2022 | 2021 | ||||||||||

| Furniture, fixtures, and equipment | $ | $ | |||||||||

Buildings(1) | |||||||||||

Corporate aircraft(1) | |||||||||||

| Leasehold improvements | |||||||||||

| Land | |||||||||||

| Construction in progress | |||||||||||

| Less: accumulated depreciation and amortization | ( | ( | |||||||||

| Net property and equipment | $ | $ | |||||||||

| 2022 | $ | |||||||

| 2021 | ||||||||

| 2020 | ||||||||

| 2022 | 2021 | ||||||||||

| Purchased software | $ | $ | |||||||||

| Internally developed software | |||||||||||

| Less accumulated amortization | ( | ( | |||||||||

| Net software | $ | $ | |||||||||

| NAST | Global Forwarding | All Other and Corporate | Total | ||||||||||||||||||||

| December 31, 2020 balance | $ | $ | $ | $ | |||||||||||||||||||

| Acquisitions | |||||||||||||||||||||||

| Foreign currency translation | ( | ( | ( | ( | |||||||||||||||||||

| December 31, 2021 balance | |||||||||||||||||||||||

| Foreign currency translation | ( | ( | ( | ( | |||||||||||||||||||

| December 31, 2022 balance | $ | $ | $ | $ | |||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||

| Cost | Accumulated Amortization | Net | Cost | Accumulated Amortization | Net | ||||||||||||||||||||||||||||||

| Finite-lived intangibles | |||||||||||||||||||||||||||||||||||

| Customer relationships | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

| Total finite-lived intangibles | ( | ( | |||||||||||||||||||||||||||||||||

| Indefinite-lived intangibles | |||||||||||||||||||||||||||||||||||

| Trademarks | — | — | |||||||||||||||||||||||||||||||||

| Total intangibles | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

| 2022 | $ | ||||

| 2021 | |||||

| 2020 | |||||

| NAST | Global Forwarding | All Other and Corporate | Total | ||||||||||||||||||||

| 2023 | $ | $ | $ | $ | |||||||||||||||||||

| 2024 | |||||||||||||||||||||||

| 2025 | |||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||

| Thereafter | |||||||||||||||||||||||

| Total | $ | ||||||||||||||||||||||

| Average interest rate as of | Carrying value as of | |||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | Maturity | December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||

| Revolving credit facility | % | % | November 2027 | $ | $ | |||||||||||||||||||||||||||

| 364-day revolving credit facility | % | % | May 2023 | |||||||||||||||||||||||||||||

| Senior Notes, Series A | % | % | August 2023 | |||||||||||||||||||||||||||||

| Senior Notes, Series B | % | % | August 2028 | |||||||||||||||||||||||||||||

| Senior Notes, Series C | % | % | August 2033 | |||||||||||||||||||||||||||||

Receivables Securitization Facility (1) | % | % | November 2023 | |||||||||||||||||||||||||||||

Senior Notes(1) | % | % | April 2028 | |||||||||||||||||||||||||||||

| Total debt | ||||||||||||||||||||||||||||||||

| Less: Current maturities and short-term borrowing | ( | ( | ||||||||||||||||||||||||||||||

| Long-term debt | $ | $ | ||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Domestic | $ | $ | $ | ||||||||||||||

| Foreign | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Unrecognized tax benefits, beginning of period | $ | $ | $ | ||||||||||||||

| Additions based on tax positions related to the current year | |||||||||||||||||

| Additions for tax positions of prior years | |||||||||||||||||

| Reductions for tax positions of prior years | ( | ( | ( | ||||||||||||||

| Lapse in statute of limitations | ( | ( | ( | ||||||||||||||

| Settlements | ( | ( | |||||||||||||||

| Unrecognized tax benefits, end of the period | $ | $ | $ | ||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Tax provision: | |||||||||||||||||

| Federal | $ | $ | $ | ||||||||||||||

| State | |||||||||||||||||

| Foreign | |||||||||||||||||

| Deferred provision (benefit): | |||||||||||||||||

| Federal | ( | ( | ( | ||||||||||||||

| State | ( | ( | ( | ||||||||||||||

| Foreign | ( | ( | ( | ||||||||||||||

| ( | ( | ( | |||||||||||||||

| Total provision | $ | $ | $ | ||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Federal statutory rate | % | % | % | ||||||||||||||

| State income taxes, net of federal benefit | |||||||||||||||||

| Share-based payment awards | ( | ( | ( | ||||||||||||||

| Excess foreign tax credits | ( | ( | ( | ||||||||||||||

| Other U.S. tax credits and incentives | ( | ( | ( | ||||||||||||||

| Foreign | ( | ||||||||||||||||

| Other | |||||||||||||||||

| Effective income tax rate | % | % | % | ||||||||||||||

| 2022 | 2021 | ||||||||||

| Deferred tax assets: | |||||||||||

| Lease liabilities | $ | $ | |||||||||

| Compensation | |||||||||||

| Accrued expenses | |||||||||||

| Foreign affiliate prepayment | |||||||||||

| Long-lived assets | |||||||||||

| Other | |||||||||||

| Deferred tax liabilities: | |||||||||||

| Right-of-use assets | ( | ( | |||||||||

| Intangible assets | ( | ( | |||||||||

| Accrued revenue | ( | ||||||||||

| Prepaid assets | ( | ( | |||||||||

| Long-lived assets | ( | ||||||||||

| Foreign withholding tax | ( | ( | |||||||||

| Other | ( | ( | |||||||||

| Net deferred tax assets | $ | $ | |||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Stock options | $ | $ | $ | ||||||||||||||

| Stock awards | |||||||||||||||||

| Company expense on ESPP discount | |||||||||||||||||

| Total stock-based compensation expense | $ | $ | $ | ||||||||||||||

| Options | Weighted Average Exercise Price | Aggregate Intrinsic Value (in thousands) | Average Remaining Life (years) | ||||||||||||||||||||

| Outstanding as of December 31, 2021 | $ | $ | |||||||||||||||||||||

| Exercised | ( | ||||||||||||||||||||||

| Forfeitures | ( | ||||||||||||||||||||||

| Outstanding as of December 31, 2022 | $ | $ | |||||||||||||||||||||

| Vested as of December 31, 2022 | $ | ||||||||||||||||||||||

| Exercisable as of December 31, 2022 | $ | ||||||||||||||||||||||

| 2022 | $ | ||||

| 2021 | |||||

| 2020 | |||||

| First Vesting Date | Last Vesting Date | Options Granted, Net of Forfeitures | Weighted Average Grant Date Fair Value(1) | Unvested Options | ||||||||||||||||||||||

| December 31, 2019 | December 31, 2023 | $ | ||||||||||||||||||||||||

| December 31, 2020 | December 31, 2024 | |||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| 2020 Grants | 2019 Grants | ||||||||||

| Weighted-average risk-free interest rate | |||||||||||

| Expected dividend yield | |||||||||||

| Weighted-average volatility | |||||||||||

| Expected term (in years) | |||||||||||

| Weighted average fair value per option | $ | $ | |||||||||

| Number of Restricted Shares and Restricted Stock Units | Weighted Average Grant Date Fair Value | ||||||||||

| Unvested as of December 31, 2021 | $ | ||||||||||

Granted(1) | |||||||||||

Performance-based grant adjustment(2) | |||||||||||

| Vested | ( | ||||||||||

| Forfeitures | ( | ||||||||||

| Unvested as of December 31, 2022 | $ | ||||||||||

| First Vesting Date | Last Vesting Date | Performance Shares and Stock Units Granted, Net of Forfeitures | Weighted Average Grant Date Fair Value (1) | Unvested Performance Shares and Restricted Stock Units | ||||||||||||||||||||||

| December 31, 2021 | December 31, 2023 | $ | ||||||||||||||||||||||||

| December 31, 2022 | December 31, 2024 | |||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| Number of Restricted Shares and Stock Units | Weighted Average Grant Date Fair Value | ||||||||||

| Unvested as of December 31, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeitures | ( | ||||||||||

| Unvested as of December 31, 2022 | $ | ||||||||||

| 2022 | $ | ||||

| 2021 | |||||

| 2020 | |||||

| Shares Purchased By Employees | Aggregate Cost to Employees | Expense Recognized By the Company | |||||||||||||||

| 2022 | $ | $ | |||||||||||||||

| 2021 | |||||||||||||||||

| 2020 | |||||||||||||||||

| Shares Repurchased | Total Value of Shares Repurchased | ||||||||||

| 2022 Repurchases | $ | ||||||||||

| 2021 Repurchases | |||||||||||

| 2020 Repurchases | |||||||||||

| 2022 | $ | ||||

| 2021 | |||||

| 2020 | |||||

| Estimated Life (years) | |||||||||||

| Customer relationships | $ | ||||||||||

| Current assets | $ | ||||

| Property and equipment | |||||

| Right-of-use lease assets | |||||

| Other intangible assets | |||||

| Goodwill | |||||

| Total assets | |||||

| Current liabilities | |||||

| Lease liabilities | |||||

| Deferred tax liabilities | |||||

| Net assets acquired | $ | ||||

| Estimated Life (years) | |||||||||||

| Customer relationships | $ | ||||||||||

| NAST | Global Forwarding | All Other and Corporate | Consolidated | ||||||||||||||||||||

| Twelve Months Ended December 31, 2022 | |||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | |||||||||||||||||||

| Income (loss) from operations | ( | ||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

Total assets(1) | |||||||||||||||||||||||

| Average employee headcount | |||||||||||||||||||||||

| NAST | Global Forwarding | All Other and Corporate | Consolidated | ||||||||||||||||||||

| Twelve Months Ended December 31, 2021 | |||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | |||||||||||||||||||

| Income (loss) from operations | ( | ||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

Total assets(1) | |||||||||||||||||||||||

| Average employee headcount | |||||||||||||||||||||||

| NAST | Global Forwarding | All Other and Corporate | Consolidated | ||||||||||||||||||||

| Twelve Months Ended December 31, 2020 | |||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | |||||||||||||||||||

| Income (loss) from operations | ( | ||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

Total assets(1) | |||||||||||||||||||||||

| Average employee headcount | |||||||||||||||||||||||

| For the year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Total revenues | |||||||||||||||||

| U.S. | $ | $ | $ | ||||||||||||||

| Other locations | |||||||||||||||||

| Total revenues | $ | $ | $ | ||||||||||||||

| As of December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Long-lived assets | |||||||||||||||||

| U.S. | $ | $ | $ | ||||||||||||||

| Other locations | |||||||||||||||||

| Total long-lived assets | $ | $ | $ | ||||||||||||||

| Twelve Months Ended December 31, 2022 | |||||||||||||||||||||||

| NAST | Global Forwarding | All Other and Corporate | Total | ||||||||||||||||||||

| Major service lines: | |||||||||||||||||||||||

Transportation and logistics services(1) | $ | $ | $ | $ | |||||||||||||||||||

Sourcing(2) | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| Twelve Months Ended December 31, 2021 | |||||||||||||||||||||||

| NAST | Global Forwarding | All Other and Corporate | Total | ||||||||||||||||||||

| Major service lines: | |||||||||||||||||||||||

Transportation and logistics services(1) | $ | $ | $ | $ | |||||||||||||||||||

Sourcing(2) | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| Twelve Months Ended December 31, 2020 | |||||||||||||||||||||||

| NAST | Global Forwarding | All Other and Corporate | Total | ||||||||||||||||||||

| Major service lines: | |||||||||||||||||||||||

Transportation and logistics services(1) | $ | $ | $ | $ | |||||||||||||||||||

Sourcing(2) | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||

| Lease Costs | 2022 | 2021 | 2020 | ||||||||||||||

| Operating lease expense | $ | $ | $ | ||||||||||||||

| Short-term lease expense | |||||||||||||||||

| Total lease expense | $ | $ | $ | ||||||||||||||

| Twelve Months Ended December 31, | |||||||||||||||||

| Other Lease Information | 2022 | 2021 | 2020 | ||||||||||||||

| Operating cash outflows from operating leases | $ | $ | $ | ||||||||||||||

Right-of-use lease assets obtained in exchange for new lease liabilities(1) | |||||||||||||||||

| As of December 31, | |||||||||||

| Lease Term and Discount Rate | 2022 | 2021 | |||||||||

Weighted average remaining lease term (in years)(1) | |||||||||||

| Weighted average discount rate | % | % | |||||||||

| Maturity of Lease Liabilities | Operating Leases | |||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total lease payments | ||||||||

| Less: Interest | ( | |||||||

| Present value of lease liabilities | $ | |||||||

| Balance, December 31, 2020 | $ | ||||

| Provision | |||||

| Write-offs | ( | ||||

| Balance, December 31, 2021 | |||||

| Provision | ( | ||||

| Write-offs | ( | ||||

| Balance, December 31, 2022 | $ | ||||

| Twelve Months Ended December 31, | |||||

| 2022 | |||||

Severance(1) | $ | ||||

Other selling, general, and administrative expenses(2) | |||||

Other personnel expenses(1) | |||||

| Total | $ | ||||

| NAST | Global Forwarding | All Other and Corporate | Consolidated | ||||||||||||||||||||

| Personnel expenses | $ | $ | $ | $ | |||||||||||||||||||

| Other selling, general, and administrative expenses | |||||||||||||||||||||||

| Accrued Severance and Other Personnel Expenses | Other Selling, General, and Administrative Expenses | Total | |||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | ||||||||||||||

| Restructuring charges | |||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||

| Settled non-cash | ( | ( | |||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ||||||||||||||

| Plan Category | Number of Securities to Be Issued Upon Exercise of Outstanding Options, Warrants, and Rights(1) | Weighted Average Exercise Price of Outstanding Options, Warrants, and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in the First Column) (2) | |||||||||||||||||

Equity compensation plans approved by security holders | 5,358,796 | $ | 77.93 | 6,492,529 | ||||||||||||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||||||||||

| Total | 5,358,796 | $ | 77.93 | 6,492,529 | ||||||||||||||||

| Number | Description | ||||||||||

| 3.1 | |||||||||||

| 3.2 | |||||||||||

| 4.1 | |||||||||||

| 4.2 | |||||||||||

| 4.3 | |||||||||||

| 4.4 | |||||||||||

| †10.1 | |||||||||||

| †10.2 | |||||||||||

| †10.3 | |||||||||||

| 10.4 | |||||||||||

| 10.5 | |||||||||||

| 10.6 | |||||||||||

| 10.7 | |||||||||||

| 10.8 | |||||||||||

| 10.9 | |||||||||||

| 10.10 | |||||||||||

| 10.11 | |||||||||||

| 10.12 | |||||||||||

| 10.13 | |||||||||||

| †10.14 | |||||||||||

| †10.15 | |||||||||||

| †10.16 | |||||||||||

| †10.17 | |||||||||||

| †10.18 | |||||||||||

| †10.19 | |||||||||||

| †10.20 | |||||||||||

| †10.21 | |||||||||||

| †10.22 | |||||||||||

| †10.23 | |||||||||||

| †10.24 | |||||||||||

| †10.25 | |||||||||||

| †10.26 | |||||||||||

| †10.27 | |||||||||||

| †10.28 | |||||||||||

| †10.29 | |||||||||||

| †10.30 | |||||||||||

| †10.31 | |||||||||||

| *21 | |||||||||||

| *23.1 | |||||||||||

| *24 | |||||||||||

| *31.1 | |||||||||||

| *31.2 | |||||||||||

| *32.1 | |||||||||||

| *32.2 | |||||||||||

| *101 | The following financial statements from our Annual Report on Form 10-K for the year ended December 31, 2022, filed on February 17, 2023, formatted in Inline XBRL: (i) Consolidated Statements of Operations and Comprehensive Income for the years ended December 31, 2022, 2021, and 2020, (ii) Consolidated Balance Sheets as of December 31, 2022 and 2021, (iii) Consolidated Statements of Cash Flows for the years ended December 31, 2022, 2021, and 2020, (iv) Consolidated Statements of Stockholders’ Investment for the years ended 2022, 2021, and 2020, and (v) the Notes to the Consolidated Financial Statements, tagged as blocks of text. | ||||||||||

| 104 | The cover page from the Current Report on Form 10-K formatted in Inline XBRL | ||||||||||

| * | Filed herewith | ||||

| † | Management contract or compensatory plan or arrangement required to be filed as an exhibit to Form 10-K pursuant to Item 15(c) of the Form 10-K Report | ||||

| C.H. ROBINSON WORLDWIDE, INC. | ||||||||

| By: | /s/ BEN G. CAMPBELL | |||||||

| Ben G. Campbell | ||||||||

| Chief Legal Officer and Secretary | ||||||||

| Signature | Title | |||||||

| /s/ SCOTT P. ANDERSON | Interim Chief Executive Officer (Principal Executive Officer) | |||||||

| Scott P. Anderson | ||||||||

| /s/ MICHAEL P. ZECHMEISTER | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | |||||||

| Michael P. Zechmeister | ||||||||

| * | Chair of the Board | |||||||

| Jodee A. Kozlak | ||||||||

| * | Director | |||||||

| James J. Barber, Jr. | ||||||||

| * | Director | |||||||

| Kermit R. Crawford | ||||||||

| * | Director | |||||||

| Timothy C. Gokey | ||||||||

| * | Director | |||||||

| Mark A. Goodburn | ||||||||

| * | Director | |||||||

| Mary J. Steele Guilfoile | ||||||||

| * | Director | |||||||

| Henry J. Maier | ||||||||

| * | Director | |||||||

| James B. Stake | ||||||||

| * | Director | |||||||

| Paula C. Tolliver | ||||||||

| * | Director | |||||||

| Henry W. Winship | ||||||||

| *By: | /s/ BEN G. CAMPBELL | |||||||

| Ben G. Campbell | ||||||||

| Attorney-in-Fact | ||||||||

| The following is a list of subsidiaries of the Company as of December 31, 2022, omitting some subsidiaries which, considered in aggregate, would not constitute a significant subsidiary. | |||||

Legal Entity Name | Where incorporated | ||||

C.H. Robinson Worldwide Argentina, S.A. | Argentina | ||||

CH. Robinson Trade Management Holding Pty. Ltd | Australia | ||||

C.H. Robinson (Australia) Pty Ltd | Australia | ||||

C.H. Robinson Trade Management Pty. Ltd. (fka APC Trade) | Australia | ||||

C.H. Robinson Worldwide (AU) Pty. Ltd (fka APC Logistics Pty) | Australia | ||||

C.H. Robinson Worldwide (Australia) Pty. Ltd. | Australia | ||||

C.H. Robinson Worldwide (Oceania) Pty. Ltd. (fka AJ Considine) | Australia | ||||

C.H. Robinson Austria GmbH | Austria | ||||

C.H. Robinson Belgium BVBA | Belgium | ||||

C.H. Robinson Worldwide Logistica Do Brasil Ltda | Brazil | ||||

C.H. Robinson Company (Canada) Ltd. | Canada | ||||

C.H. Robinson Project Logistics Ltd. (Canada) | Canada | ||||

C.H. Robinson Worldwide Canada, Ltd. (fka Milgram & Company) | Canada | ||||

Accelerated Global Insurance Company PSC | Cayman Islands | ||||

C.H. Robinson Worldwide Chile SA | Chile | ||||

Robinson Fresh Chile SA | Chile | ||||

C.H. Robinson Freight Services (China) Ltd. | China | ||||

C.H. Robinson Worldwide Logistics (Dalian) Co. Ltd. | China | ||||

C.H. Robinson International Trading (Shanghai) Co. Ltd. | China | ||||

C.H. Robinson International Colombia S.A.S. (fka Space Cargo) | Colombia | ||||

C.H. Robinson Worldwide Costa Rica, SA | Costa Rica | ||||

C.H. Robinson Czech Republic, sro | Czech Republic | ||||

| C.H. Robinson Freight Services Middle East DMCC | Dubai | ||||

C.H. Robinson France SAS | France | ||||

C.H. Robinson Worldwide GmbH | Germany | ||||

C.H. Robinson Freight Services (Hong Kong) Limited | Hong Kong | ||||

C.H. Robinson Worldwide (Hong Kong) Ltd. | Hong Kong | ||||

CHR Holdings (Hong Kong) Limited | Hong Kong | ||||

C.H. Robinson Hungaria Szallitmanyozasi Kft | Hungary | ||||

C.H. Robinson International (India) Private Ltd. | India | ||||

C.H. Robinson Worldwide Freight India Pvt. Ltd. | India | ||||

PT CH Robinson Global Forwarding Indonesia | Indonesia | ||||

C.H. Robinson Freight Services (Ireland) Limited | Ireland | ||||

CH Robinson Cork Technology Center (Ireland) Limited | Ireland | ||||

C.H. Robinson International Italy, SRL | Italy | ||||

Dema Service S.p.A. | Italy | ||||

| C.H. Robinson Freight Services Africa Limited | Kenya | ||||

C.H. Robinson Freight Services (Korea) Ltd. | Korea | ||||

C.H. Robinson Global Holding S.à r.l. | Luxembourg | ||||

C.H. Robinson Investments S.à r.l. | Luxembourg | ||||

Legal Entity Name | Where incorporated | ||||

C.H. Robinson LATAM Holding S.a.r.l. | Luxembourg | ||||

C.H. Robinson Luxembourg Finance S.à r.l. | Luxembourg | ||||

C.H. Robinson Luxembourg Holding S.à r.l. | Luxembourg | ||||

C.H. Robinson Freight Services (Malaysia) Sdn. Bhd. | Malaysia | ||||

| C. H. Robinson Holding (Malta) Limited | Malta | ||||

C.H. Robinson de Mexico S.A. de C.V. | Mexico | ||||

C.H. Robinson Global Forwarding Mexico S.A. de C.V. | Mexico | ||||

C.H. Robinson Worldwide S.A. de C.V. | Mexico | ||||

Robinson Fresh de Mexico S.A. de C.V. | Mexico | ||||

C.H. Robinson TMC Mexico S.A. de C.V. | Mexico | ||||

SPC LATAM SA de CV | Mexico | ||||

C.H. Robinson Europe BV | Netherlands | ||||

CH Robinson Worldwide BV | Netherlands | ||||

Robinson Fresh BV | Netherlands | ||||

C.H. Robinson Worldwide (NZ) Ltd. (fka APC Logistics (NZ) | New Zealand | ||||

C.H. Robinson Worldwide Peru SA | Peru | ||||

C.H. Robinson Polska S.A. | Poland | ||||

C.H. Robinson International Puerto Rico, Inc. | Puerto Rico | ||||

C.H. Robinson Worldwide Romania, SRL | Romania | ||||

C.H. Robinson Freight Services (Singapore) Pte. Ltd. | Singapore | ||||

C.H. Robinson Worldwide Singapore Pte. Ltd. | Singapore | ||||

C.H. Robinson International Singapore Pte. Ltd | Singapore | ||||

C.H. Robinson Iberica SL | Spain | ||||

C.H. Robinson International Spain, SAU | Spain | ||||

C.H. Robinson Freight Services Lanka (Private) Limited | Sri Lanka | ||||

C.H. Robinson Worldwide Freight Lanka (Private) Limited | Sri Lanka | ||||

C.H. Robinson Sweden AB | Sweden | ||||

C.H. Robinson Freight Services (Taiwan) Ltd. | Taiwan | ||||

C.H. Robinson Freight Services (Thailand) Ltd. | Thailand | ||||

C.H. Robinson Logistics and Transport Services Limited (Turkey) | Turkey | ||||

C.H. Robinson Worldwide (UK) Ltd. | United Kingdom | ||||

C.H. Robinson Worldwide Uruguay S.A. | Uruguay | ||||

C.H. Robinson Freight Services (Vietnam) Company Limited | Vietnam | ||||

C.H. Robinson Company, LLC. | United States | ||||

C.H. Robinson Company, Inc. | United States | ||||

Robinson Holding Company | United States | ||||

C.H. Robinson Worldwide, Inc. | United States | ||||

C.H. Robinson International, Inc. | United States | ||||

Freightquote.com, Inc. | United States | ||||

Freightview, Inc. | United States | ||||

Enterprise TMS LLC | United States | ||||

FQ Real Estate Holdings LLC | United States | ||||

M.O.T. Intermodal Shipping USA, Inc. | United States | ||||

C.H. Robinson Project Logistics, Inc. | United States | ||||

Legal Entity Name | Where incorporated | ||||

C.H. Robinson Operations, Inc. | United States | ||||

CHR Holdings, Inc. | United States | ||||

C.H. Robinson Receivables LLC | United States | ||||

C.H. Robinson Shared Service, Inc. | United States | ||||

C.H. Robinson Freight Services, Ltd. | United States | ||||

C.H. Robinson Technology LLC | United States | ||||

C.H. Robinson Shared Services, LLC | United States | ||||

Prime Distribution Services, Inc. | United States | ||||

| C. H. Robinson Renewables LLC | United States | ||||

| C. H. Robinson Automation, LLC | United States | ||||

| Signature | Date | |||||||

| /s/ James J. Barber, Jr. | February 7, 2023 | |||||||

| James J. Barber, Jr. | ||||||||

| /s/ Kermit Crawford | February 7, 2023 | |||||||

| Kermit Crawford | ||||||||

| /s/ Timothy C. Gokey | February 7, 2023 | |||||||

| Timothy C. Gokey | ||||||||

| /s/ Mark A. Goodburn | February 7, 2023 | |||||||

| Mark A. Goodburn | ||||||||

| /s/ Mary J. Steele Guilfoile | February 7, 2023 | |||||||

| Mary J. Steele Guilfoile | ||||||||

| /s/ Jodee A. Kozlak | February 7, 2023 | |||||||

| Jodee A. Kozlak | ||||||||

| /s/ Henry J. Maier | February 7, 2023 | |||||||

| Henry J. Maier | ||||||||

| /s/ James B. Stake | February 7, 2023 | |||||||

| James B. Stake | ||||||||

| /s/ Paula C. Tolliver | February 7, 2023 | |||||||

| Paula C. Tolliver | ||||||||

| /s/ Henry W. Winship | February 7, 2023 | |||||||

| Henry W. Winship | ||||||||

| Signature: | /s/ Scott P. Anderson | |||||||

| Name: | Scott P. Anderson | |||||||

| Title: | Interim Chief Executive Officer | |||||||

| Signature: | /s/ Michael P. Zechmeister | |||||||

| Name: | Michael P. Zechmeister | |||||||

| Title: | Chief Financial Officer | |||||||

| /s/ Scott P. Anderson | |||||||||||

| Scott P. Anderson | |||||||||||

| Interim Chief Executive Officer | |||||||||||

/s/ Michael P. Zechmeister | ||||||||

| Michael P. Zechmeister | ||||||||

| Chief Financial Officer | ||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Audit Information [Abstract] | |

| Auditor Name | Deloitte & Touche LLP |

| Auditor Firm ID | 34 |

| Auditor Location | Minneapolis, Minnesota |

CONSOLIDATED BALANCE SHEETS (Parenthetical) - USD ($) $ in Thousands |

Dec. 31, 2022 |

Dec. 31, 2021 |

|---|---|---|

| Statement of Financial Position [Abstract] | ||

| Receivables, allowance for doubtful accounts | $ 28,749 | $ 41,542 |

| Other intangible assets, accumulated amortization | $ 106,932 | $ 88,302 |

| Preferred stock, par value (in dollars per share) | $ 0.10 | $ 0.10 |

| Preferred stock, authorized (in shares) | 20,000,000 | 20,000,000 |

| Preferred stock, issued (in shares) | 0 | 0 |

| Preferred stock, outstanding (in shares) | 0 | 0 |

| Common stock, par value (in dollars per share) | $ 0.10 | $ 0.10 |

| Common stock, authorized (in shares) | 480,000,000 | 480,000,000 |

| Common stock, issued (in shares) | 179,204,000 | 179,206,000 |

| Common stock, outstanding (in shares) | 116,323,000 | 129,186,000 |

| Treasury stock (in shares) | 62,881,000 | 50,020,000 |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME - USD ($) shares in Thousands, $ in Thousands |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Revenues: | |||

| Total revenues | $ 24,696,625 | $ 23,102,138 | $ 16,207,106 |

| Costs and expenses: | |||

| Personnel expenses | 1,722,980 | 1,543,610 | 1,242,867 |

| Other selling, general, and administrative expenses | 603,415 | 526,371 | 496,122 |

| Total costs and expenses | 23,429,843 | 22,020,030 | 15,533,838 |

| Income from operations | 1,266,782 | 1,082,108 | 673,268 |

| Interest and other expenses | (100,017) | (59,817) | (44,937) |

| Income before provision for income taxes | 1,166,765 | 1,022,291 | 628,331 |

| Provision for income taxes | 226,241 | 178,046 | 121,910 |

| Net income | 940,524 | 844,245 | 506,421 |

| Other comprehensive (loss) income | (27,726) | (15,136) | 30,151 |

| Comprehensive income | $ 912,798 | $ 829,109 | $ 536,572 |

| Basic net income per share (in dollars per share) | $ 7.48 | $ 6.37 | $ 3.74 |

| Diluted net income per share (in dollars per share) | $ 7.40 | $ 6.31 | $ 3.72 |

| Basic weighted average shares outstanding (in shares) | 125,743 | 132,482 | 135,532 |

| Dilutive effect of outstanding stock awards (in shares) | 1,407 | 1,352 | 641 |

| Diluted weighted average shares outstanding (in shares) | 127,150 | 133,834 | 136,173 |

| Transportation | |||

| Revenues: | |||

| Total revenues | $ 23,516,384 | $ 22,046,574 | $ 15,147,562 |

| Costs and expenses: | |||

| Purchased services and products | 20,035,715 | 18,994,574 | 12,834,608 |

| Sourcing | |||

| Revenues: | |||

| Total revenues | 1,180,241 | 1,055,564 | 1,059,544 |

| Costs and expenses: | |||

| Purchased services and products | $ 1,067,733 | $ 955,475 | $ 960,241 |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' INVESTMENT (Parenthetical) - $ / shares |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Statement of Stockholders' Equity [Abstract] | |||

| Dividends declared per share (in dollars per share) | $ 2.26 | $ 2.08 | $ 2.04 |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES BASIS OF PRESENTATION. C.H. Robinson Worldwide, Inc., and our subsidiaries (“the company,” “we,” “us,” or “our”) are a global provider of transportation services and logistics solutions through a network of offices operating in North America, Europe, Asia, Oceania, and South America. The consolidated financial statements include the accounts of C.H. Robinson Worldwide, Inc., and our majority owned and controlled subsidiaries. Our minority interests in subsidiaries are not significant. All intercompany transactions and balances have been eliminated in the consolidated financial statements. USE OF ESTIMATES. The preparation of financial statements, in conformity with accounting principles generally accepted in the U.S., requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates have been prepared on the basis of the most current and best information available, and our actual results could differ materially from those estimates. REVENUE RECOGNITION. At contract inception, we assess the goods and services promised in our contracts with customers and identify our performance obligations to provide distinct goods and services to our customers. We have determined that the following distinct goods and services represent our primary performance obligations. Transportation and Logistics Services - As a global logistics provider, our primary performance obligation under our customer contracts is to utilize our relationships with a wide variety of transportation companies to efficiently and cost-effectively transport our customers’ freight. Revenue is recognized for these performance obligations as they are satisfied over the contract term, which generally represents the transit period. The transit period can vary based upon the method of transport, generally a number of days for over the road, rail, and air transportation, or several weeks in the case of an ocean shipment. Determining the transit period and how much of it has been completed as of the reporting date may require management to make judgments that affect the timing of revenue recognized. When the customer’s freight reaches its intended destination our performance obligation is complete. Pricing for our services is generally a fixed amount and is typically due within 30 days upon completion of our performance obligation, but can vary based on the nature of the service provided and certain other factors. We also provide certain value-added logistics services, such as customs brokerage, fee-based managed services, warehousing services, small parcel, and supply chain consulting and optimization services. These services may include one or more performance obligations, which are generally satisfied over the service period as we perform our obligations. The service period may be a very short duration, in the case of customs brokerage and small parcel, or it may be longer in the case of warehousing, managed services, and supply chain consulting and optimization services. Pricing for our services is established in the customer contract and is dependent upon the specific needs of the customer but may be agreed upon at a fixed fee per transaction, labor hour, or service period. Payment is typically due within 30 days upon completion of our performance obligation, but can vary based on the nature of the service provided and certain other factors. Sourcing Services - We contract with grocery retailers, restaurants, foodservice distributors, and produce wholesalers to provide sourcing services under the trade name Robinson Fresh® (“Robinson Fresh”). Our primary service obligation under these contracts is the buying, selling, and/or marketing of produce including fresh fruits, vegetables, and other value-added perishable items. Revenue is recognized when our performance obligations under these contracts are satisfied at a point in time, generally when the produce is received by our customer. Pricing under these contracts is generally a fixed amount and is typically due within 20 to 30 days upon completion of our performance obligation, but can vary based on the nature of the service provided and certain other factors. In many cases, as additional performance obligations, we contract to arrange logistics and transportation of the products we buy, sell, and/or market. These performance obligations are satisfied over the contract term consistent with our other transportation and logistics services. The contract period is typically less than one year. Pricing for our services is generally a fixed amount and is typically due within 30 days upon completion of our performance obligation, but can vary based on the nature of the service provided and certain other factors. Total revenues represent the total dollar value of revenue recognized from contracts with customers for the goods and services we provide. Substantially all of our revenues are attributable to contracts with our customers. Our adjusted gross profits are our total revenues less purchased transportation and related services, including contracted motor carrier, rail, ocean, air, and other costs, and the purchase price and services related to the products we source. Most transactions in our transportation and sourcing businesses are recorded at the gross amount we charge our customers for the services we provide and goods we sell. In these transactions, we are primarily responsible for fulfilling the promise to provide the specified good or service to our customers and we have discretion in establishing the price for the specified good or service. Additionally, in our sourcing business, in some cases, we take inventory risk before the specified good has been transferred to our customer. Customs brokerage, managed services, freight forwarding, and sourcing managed procurement transactions are recorded at the net amount we charge our customers for the services we provide because many of the factors stated above are not present. CONTRACT ASSETS. Contract assets represent amounts for which we have the right to consideration for the services we have provided while a shipment is still in-transit but for which we have not yet completed our performance obligations or have not yet invoiced our customer. Upon completion of our performance obligations, which can vary in duration based upon the method of transport, and billing our customer, these amounts become classified within accounts receivable and are then typically due within 30 days. ACCRUED TRANSPORTATION EXPENSE. Accrued transportation expense represents amounts we owe to vendors, primarily transportation providers, for the services they have provided while a shipment is still in-transit as of the reporting date. ALLOWANCE FOR CREDIT LOSSES. Accounts receivable and contract assets are reduced by an allowance for expected credit losses. We determine our allowance for expected credit losses by evaluating two approaches that consider our past credit loss experience, our customers' credit ratings, and other customer-specific and macroeconomic factors. The first approach is pooling our customers by credit rating and applying an expected loss ratio based upon credit rating and number of days the receivable has been outstanding (i.e., aging approach). The second approach is to compute an expected loss ratio for each credit rating pool based upon our historical write-off experience and apply it to our accounts receivable (i.e., loss ratio approach). These two approaches are evaluated in consideration of other known information and customer-specific and macroeconomic factors, including the price of diesel fuel, for purposes of determining the expected credit loss allowance. FOREIGN CURRENCY. Most balance sheet accounts of foreign subsidiaries are remeasured at the current exchange rate as of the end of the year and translated to our U.S. Dollar reporting currency. Translation adjustments are recorded in other comprehensive (loss) income. Statement of operations items are translated at the average exchange rate during the year. CASH AND CASH EQUIVALENTS. Cash and cash equivalents consist primarily of bank deposits and highly liquid investments with an original maturity of three months or less from the time of purchase. Cash and cash equivalents held outside the U.S. totaled $204.7 million and $217.1 million as of December 31, 2022 and 2021, respectively. Approximately half of our cash and cash equivalents balance is denominated in U.S. Dollars although these balances are frequently held in locations where the U.S. Dollar is not the functional currency. PREPAID EXPENSES AND OTHER. Prepaid expenses and other includes items such as software maintenance contracts, prepaid insurance premiums, other prepaid operating expenses, and inventories, consisting primarily of produce and related products held for resale. RIGHT-OF-USE LEASE ASSETS. Right-of-use lease assets are recognized upon lease commencement and represent our right to use an underlying asset for the lease term. LEASE LIABILITIES. Lease liabilities are recognized at commencement date and represent our obligation to make the lease payments arising from a lease, measured on a discounted basis. PROPERTY AND EQUIPMENT. Property and equipment are recorded at cost. Maintenance and repair expenditures are charged to expense as incurred. Depreciation is computed using the straight-line method over the estimated life of the asset. Amortization of leasehold improvements is computed over the shorter of the lease term or the estimated useful life of the improvement. We recognized the following depreciation expense (in thousands):

A summary of our property and equipment as of December 31 is as follows (in thousands):

________________________________ (1) Our corporate aircraft and an office building in Kansas City, Missouri, were reclassified as held-for-sale assets as of December 31, 2021. These held-for-sale assets of $35.0 million were sold in 2022 and were included within Prepaid expenses and other current assets in our Consolidated Balance Sheets as of December 31, 2021. The fair value of the assets that were held for sale was $64.0 million. GOODWILL. Goodwill represents the excess of the cost of acquired businesses over the net of the fair value of identifiable tangible assets and identifiable intangible assets purchased and liabilities assumed. Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating segment) on an annual basis (November 30 for us) and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. See Note 2, Goodwill and Other Intangible Assets. OTHER INTANGIBLE ASSETS. Other intangible assets include definite-lived customer lists, trademarks, non-competition agreements, and indefinite-lived trademarks. The definite-lived intangible assets are being amortized using the straight-line method over their estimated lives. Definite-lived intangible assets are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. The indefinite-lived trademarks are not amortized. Indefinite-lived intangible assets are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable, or annually, at a minimum. See Note 2, Goodwill and Other Intangible Assets. OTHER ASSETS. Other assets consist primarily of purchased and internally developed software. We amortize software when it is put into service using the straight-line method over three years. We recognized the following amortization expense of purchased and internally developed software (in thousands):

A summary of our purchased and internally developed software as of December 31, is as follows (in thousands):

INCOME TAXES. Income taxes are accounted for using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences of temporary differences between the carrying amounts and tax bases of assets and liabilities using enacted rates. Annual tax provisions include amounts considered sufficient to pay assessments that may result from examination of prior year tax returns; however, the amount ultimately paid upon resolution of issues raised may differ from the amounts accrued. The financial statement benefits of an uncertain income tax position are recognized when more likely than not, based on the technical merits, the position will be sustained upon examination. Unrecognized tax benefits are, more likely than not, owed to a taxing authority, and the amount of the contingency can be reasonably estimated. Uncertain income tax positions are included in “Accrued income taxes” or “Noncurrent income taxes payable” in the consolidated balance sheets. COMPREHENSIVE INCOME (LOSS). Comprehensive income (loss) consists primarily of foreign currency translation adjustments. It is presented on our consolidated statements of operations and comprehensive income. STOCK-BASED COMPENSATION. We have issued stock awards, including stock options, performance-based restricted shares, performance-based restricted stock units, and time-based restricted stock units to certain key employees. The awards vest over to five years, either based on the company’s earnings or adjusted gross profits growth or the passage of time. The related compensation expense for each award is recognized over the appropriate vesting period. The fair value of each share-based payment award is established on the date of grant. For grants of restricted shares and restricted stock units, the fair value is established based on the market price on the date of the grant, discounted for post-vesting holding restrictions. The discounts on outstanding grants vary from 12 percent to 24 percent and are calculated using the Black-Scholes option pricing model-protective put method. Changes in expected volatility and risk-free interest rates are the primary reason for changes in the discount. For grants of stock options, we use the Black-Scholes option pricing model to estimate the fair value of these share-based payment awards. The determination of the fair value of stock options is affected by our stock price and a number of assumptions, including expected volatility, expected term, risk-free interest rate, and dividend yield.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GOODWILL AND OTHER INTANGIBLE ASSETS |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and Intangible Assets Disclosure [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOODWILL AND OTHER INTANGIBLE ASSETS | GOODWILL AND OTHER INTANGIBLE ASSETS The change in the carrying amount of goodwill is as follows (in thousands):