4Q22 | FY 2022 Earnings Release

February 16th, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File Number: 001-39155

XP Inc.

(Exact name of registrant as specified in its charter)

Av. Chedid Jafet, 75, Torre Sul, 30th floor,

Vila Olímpia – São Paulo

Brazil 04551-065

+55 (11) 3075-0429

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F |

X |

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No |

X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No |

X |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| XP Inc. | |||||

| By: | /s/ Bruno Constantino Alexandre dos Santos | ||||

| Name: | Bruno Constantino Alexandre dos Santos | ||||

| Title: | Chief Financial Officer | ||||

Date: February 16, 2023

EXHIBIT INDEX

| Exhibit No. | Description |

| 99.1

|

Press Release dated February 16, 2023 - XP Inc. Reports Fourth Quarter and Full-Year 2022 Financial Results. |

| 99.2

|

XP Inc. - 4Q22 Earnings Presentation.

|

| 99.3 | XP Inc. – Consolidated Financial Statements for the years ended December 31, 2022, 2021 and 2020. |

Exhibit 99.1

|

4Q22 | FY 2022 Earnings Release February 16th, 2023

|

|

XP Inc. Reports Fourth Quarter and Full-Year 2022 Financial Results

São Paulo, Brazil, February 16, 2023 – XP Inc. (NASDAQ: XP) (“XP” or the “Company”), a leading tech-enabled platform and a trusted pioneer in providing low-fee financial products and services in Brazil, reported today its financial results for the fourth quarter and full-year 2022.

To our shareholders

Despite several challenges and uncertainties faced during 2022, the year was marked by important achievements and many lessons learned.

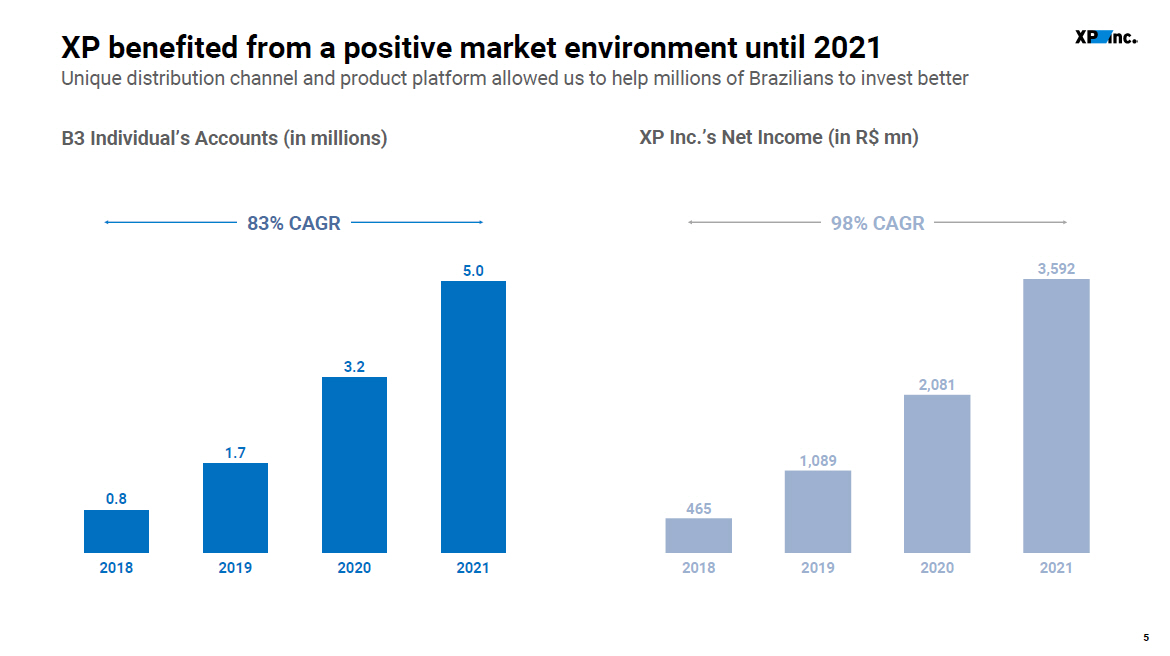

The recent bull market cycle ended in 2021, boosted capital markets and attracted Brazilian investors to more sophisticated investment products.

As the main investment platform in the country and with the largest specialized distribution network, XP Inc. benefited from this scenario and from its scalable and disruptive business model.

Between 2018 and 2021, our Client Assets, Gross Revenue and Net Income expanded by 59%, 58% and 98% per year, respectively, well above the most optimistic forecast by analysts and even ourselves at the IPO.

Over that period, proceeds from the IPO and earnings were mainly invested in: (i) preserving and developing the advisory channel; (ii) strategic acquisitions and (iii) new verticals that are complementing and improving customers' experience, as well as increasing our addressable market.

We have no doubt that these investments will create long-term value and gradually reduce the cyclicality of our business, which can already be seen in the new verticals’ reported results.

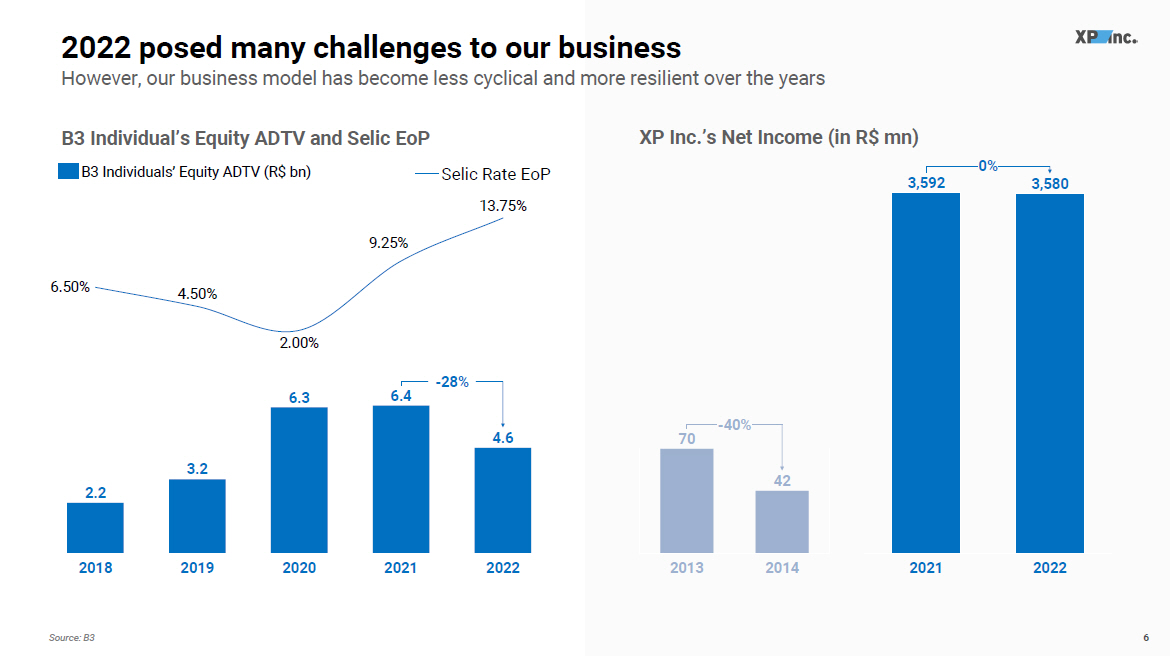

The last monetary tightening cycle in Brazil began in 2013 and took the overnight rate close to the current level of 13.75%. Although ten years ago our business was substantially smaller, going back in time allows us to clearly see the evolution of our company from a countercyclical point of view.

In 2014, XP’s net income fell 40% relative to 2013 as 80% of revenues derived from stock trading. With the market worsening, our main KPIs — net inflow and the addition of new clients and IFAs — were strongly affected too. The fact of the matter was that the company’s performance was almost perfectly correlated with the Brazilian stock market.

Returning to the present and analyzing 2022, which resembles 2014 for Brazil, the scenario for XP is quite different. Our revenue grew 10% compared to 2021 and, even amidst many challenges, our net income remained stable.

In short, we evolved from a single product to a diversified portfolio of complementary businesses: Equities, Fixed Income, Mutual Funds, Retirement Plans, International Investments, Structured Products, Insurance, Banking, Cards, Institutional, Corporate, Investment Banking, among others.

We are confident that we can grow consistently over the coming years, and, unlike other growing companies, we have always been profitable and able to overcome difficult times with resilient results.

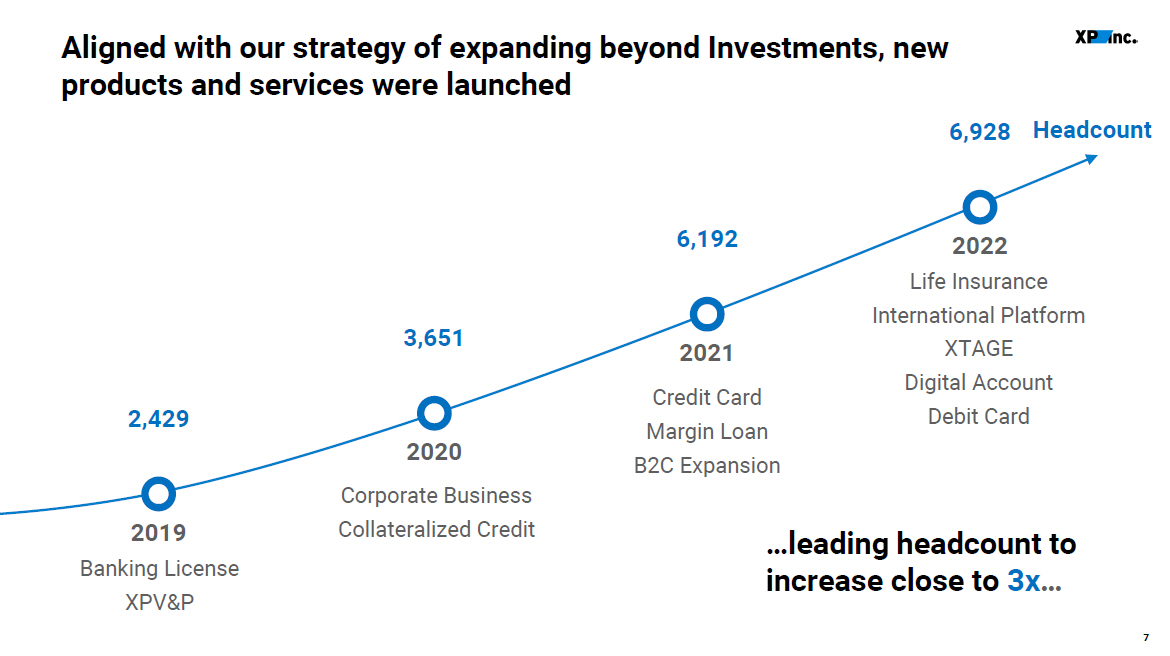

However, despite the relevant evolution of the business, we humbly recognize that the benign scenario of recent years has influenced the pace of our expansion, mainly in the increase of headcount, which was largely facilitated by the effects of the pandemic.

With a net addition of 1,200 employees in 2020 and 2,500 in 2021, we entered 2022 with a structure which was incompatible with the challenges we would face. The sharp increase in interest rates caused by persistent inflation slowed down client activity and the Retail overall business.

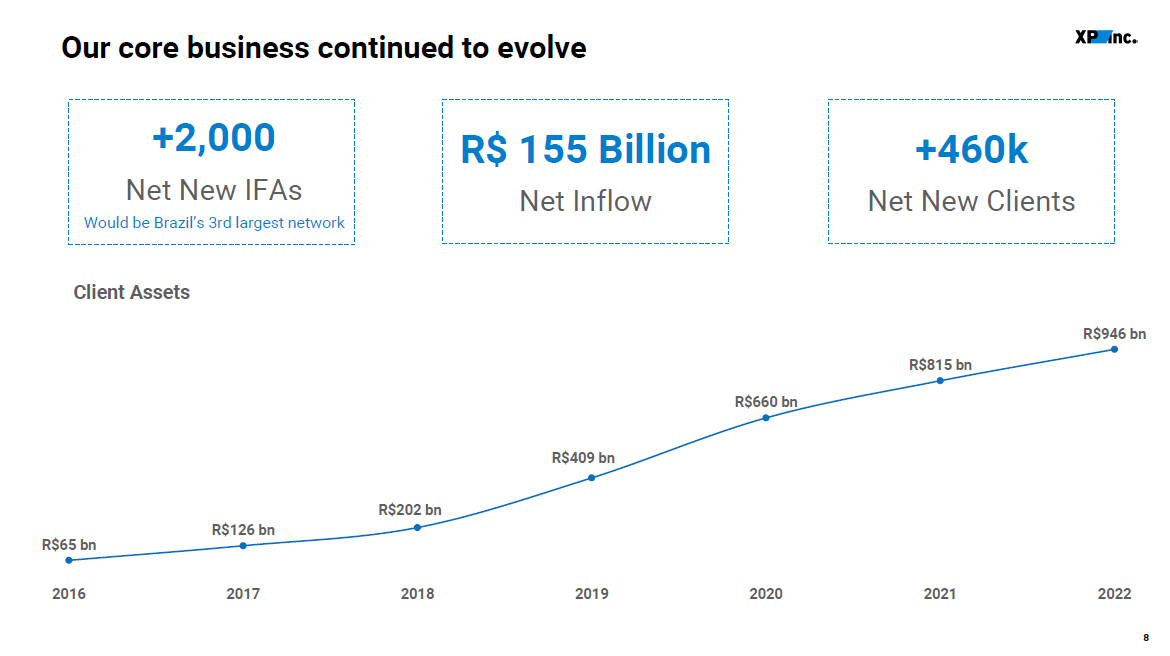

While our main KPIs expanded healthily for such hard year — R$155 billion net inflow and addition of 462 thousand new customers and 2 thousand IFAs — the reduction in hiring and expense adjustments made throughout the year did not prevent margin compression in 2022.

2

|

Hence, in the fourth quarter, we began a comprehensive adjustment of our cost structure. This adjustment was made possible by the corporate transformation process initiated in 2021 and which involved the formation of business units. The main positive effects of this process are increased agility to respond clients’ demands, more autonomy to managers and, consequently, maximizing the use of XP's resources.

Therefore, a substantially leaner cost structure will be seen in coming quarters and, more importantly, its implementation won’t compromise service quality nor the execution of our strategic plan.

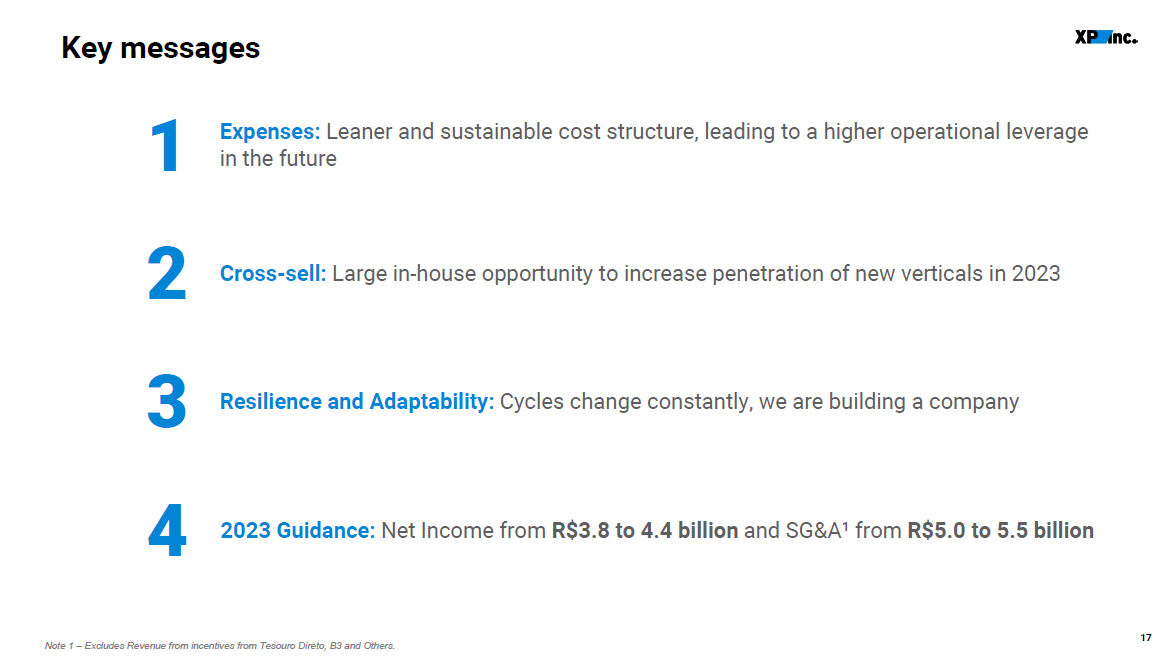

Such changes are aligned with the EBT margin guidance of 26% to 32% for 2023 to 2025, which is expected to converge from the lower end to the top over the period.

In summary, we don't know how long the current monetary cycle will last. However, we are adapting to the new scenario, staying close to our clients and teams, and learning from headwinds.

We started 2023 with a lot of energy and confidence. Brazil still has one of the most concentrated financial systems in the world, and we believe that with resilience, discipline, and a long-term vision, we will continue to gain market share from banks and move towards building the largest and best investment company in Brazil.

In the next paragraphs an update on expenses and return to shareholders will be provided.

Expenses

On the personnel front, we ended 2022 with 6,928 employees. At the end of January 2023, the total number of employees was 6,549, a decrease of 5.5% compared to December.

Adjusted SG&A expenses1 for 2023 are expected to be in the range of R$5.0 billion to R$5.5 billion, comparable to R$5.6 billion for 2022.

Return to Shareholders

Throughout 2022, 18 million shares were repurchased, equivalent to R$1.8 billion, including blocks from Itaú and Itaúsa. The numbers represent 3.2% of total shares and 51% of 2022 Net Income, respectively. In January 2023, another 3 million shares were repurchased.

In 2023, the current buyback program will continue and upon its conclusion a minimum return for shareholders in the form of buyback and/or dividends will be announced.

Conclusion

Finally, I would like to express my gratitude to our executive partners and collaborators.

We know that we have the right people and culture to continue our journey of transforming the Brazilian financial industry and building a better future for our existing and potential clients.

To our shareholders, clients, and business partners, thank you for your trust and always keep in mind that XP is our lifetime project.

Thiago Maffra, CEO

1 - Excludes Revenue from incentives from Tesouro Direto, B3 and others

3

|

Summary

| Operating Metrics (unaudited) | 4Q22 | 4Q21 | YoY | 3Q22 | QoQ | 2022 | 2021 | YoY | |

| Total Client Assets (in R$ bn) | 946 | 815 | 16% | 925 | 2% | 946 | 815 | 16% | |

| Total Net Inflow (in R$ bn) | 31 | 48 | -36% | 35 | -11% | 155 | 230 | -33% | |

| Annualized Retail Take Rate | 1.22% | 1.49% | -28 bps | 1.33% | -11 bps | 1.29% | 1.44% | -15 bps | |

| Active clients (in '000s) | 3,877 | 3,416 | 14% | 3,805 | 2% | 3,877 | 3,416 | 14% | |

| Headcount (EoP) | 6,928 | 6,192 | 12% | 6,948 | 0% | 6,928 | 6,192 | 12% | |

| IFAs (in '000s) | 12.3 | 10.3 | 20% | 11.6 | 6% | 12.3 | 10.3 | 20% | |

| Retail DATs (in mn) | 2.7 | 2.5 | 8% | 2.3 | 16% | 2.4 | 2.7 | -11% | |

| Retirement Plans Client Assets (in R$ bn) | 61 | 48 | 27% | 58 | 4% | 61 | 48 | 27% | |

| Card's TPV (in R$ bn) | 8.2 | 4.4 | 86% | 6.6 | 24% | 24.9 | 10.4 | 140% | |

| Credit Portfolio (in R$ bn) | 17.1 | 10.2 | 67% | 16.3 | 5% | 17.1 | 10.2 | 67% | |

| Financial Metrics (in R$ mn) | 4Q22 | 4Q21 | YoY | 3Q22 | QoQ | 2022 | 2021 | YoY | |

| Gross revenue | 3,337 | 3,447 | -3% | 3,811 | -12% | 14,036 | 12,799 | 10% | |

| Retail | 2,549 | 2,678 | -5% | 2,629 | -3% | 10,157 | 9,793 | 4% | |

| Institutional | 357 | 326 | 10% | 577 | -38% | 1,919 | 1,277 | 50% | |

| Corporate and Issuer Services | 275 | 333 | -17% | 436 | -37% | 1,295 | 1,213 | 7% | |

| Other | 156 | 110 | 42% | 170 | -8% | 666 | 516 | 29% | |

| Net Revenue | 3,177 | 3,260 | -3% | 3,620 | -12% | 13,348 | 12,077 | 11% | |

| Gross Profit | 2,067 | 2,363 | -13% | 2,615 | -21% | 9,382 | 8,555 | 10% | |

| Gross Margin | 65.1% | 72.5% | -743 bps | 72.2% | -716 bps | 70.3% | 70.8% | -54 bps | |

| EBT | 738 | 1,121 | -34% | 983 | -25% | 3,445 | 3,815 | -10% | |

| EBT Margin | 23.2% | 34.4% | -1,114 bps | 27.2% | -391 bps | 25.8% | 31.6% | -578 bps | |

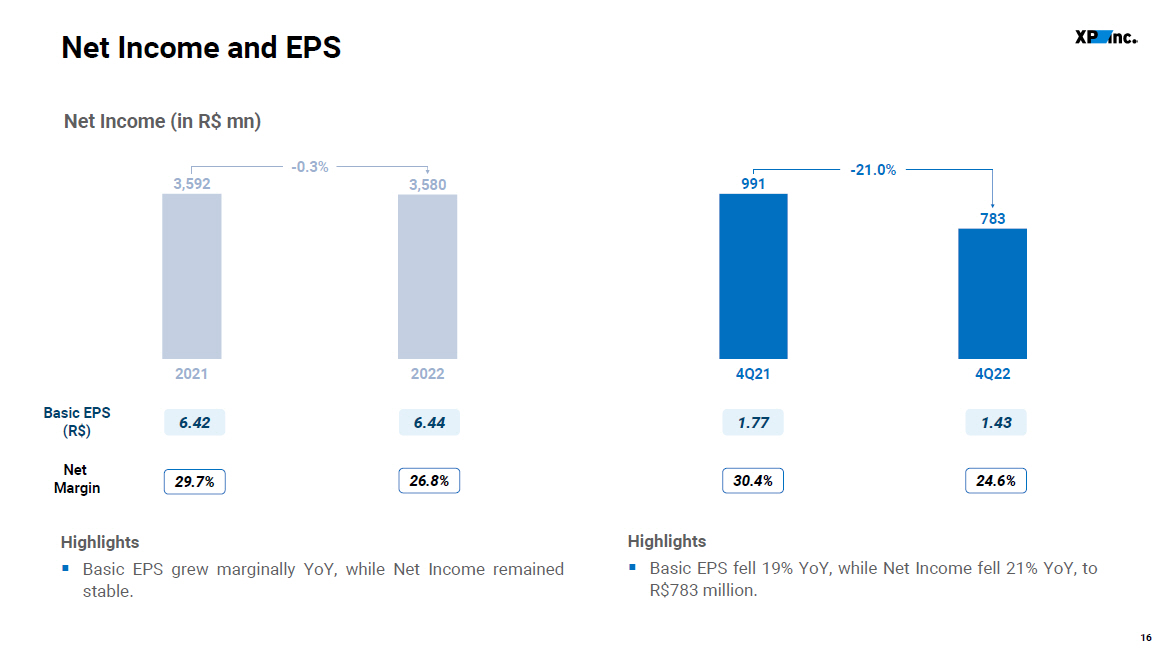

| Net Income | 783 | 991 | -21% | 1,031 | -24% | 3,580 | 3,592 | 0% | |

| Net Margin | 24.6% | 30.4% | -576 bps | 28.5% | -384 bps | 26.8% | 29.7% | -292 bps | |

| Basic EPS (in R$) | 1.43 | 1.77 | -19% | 1.85 | -23% | 6.44 | 6.42 | 0% | |

| Diluted EPS (in R$) | 1.39 | 1.71 | -19% | 1.80 | -23% | 6.25 | 6.26 | 0% | |

| ROAE¹ | 18.1% | 28.5% | -1032 bps | 24.4% | -629 bps | 22.8% | 28.4% | -562 bps | |

| ROAA² | 2.4% | 4.5% | -210 bps | 3.3% | -93 bps | 3.2% | 4.6% | -143 bps |

1 – Annualized Return on Average Equity.

2 – Annualized Return on Average Adjusted Assets. Adjusted Assets excludes Retirement Plans Liabilities and Float Balance.

4

|

Discussion of Results

Total Gross Revenue

2022 vs 2021

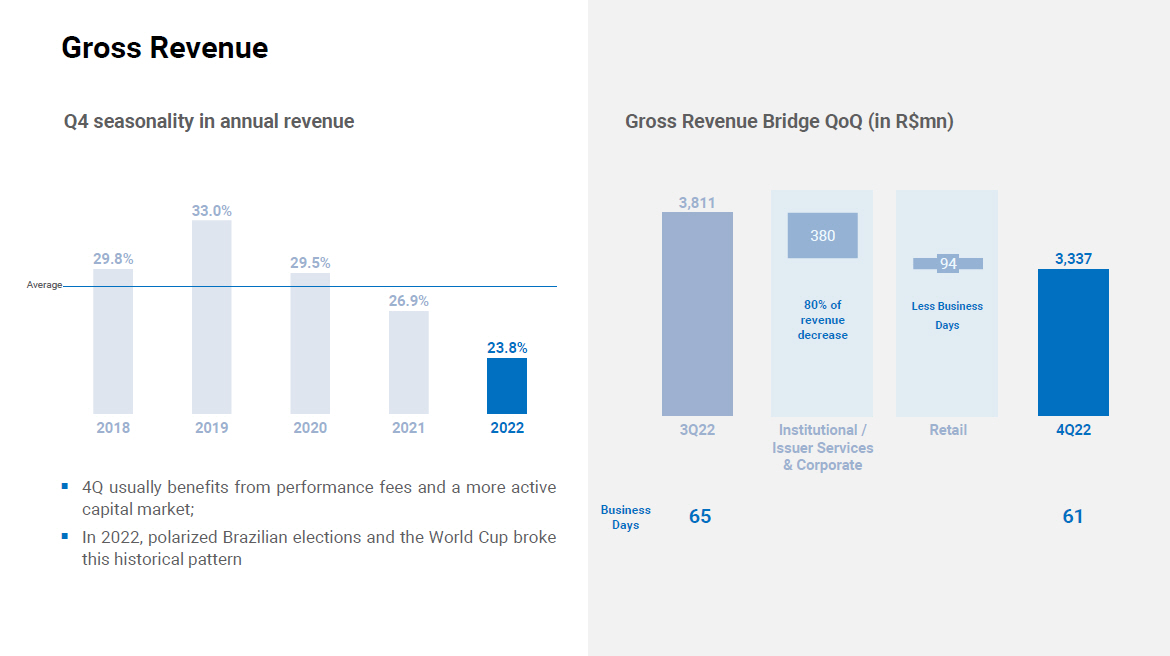

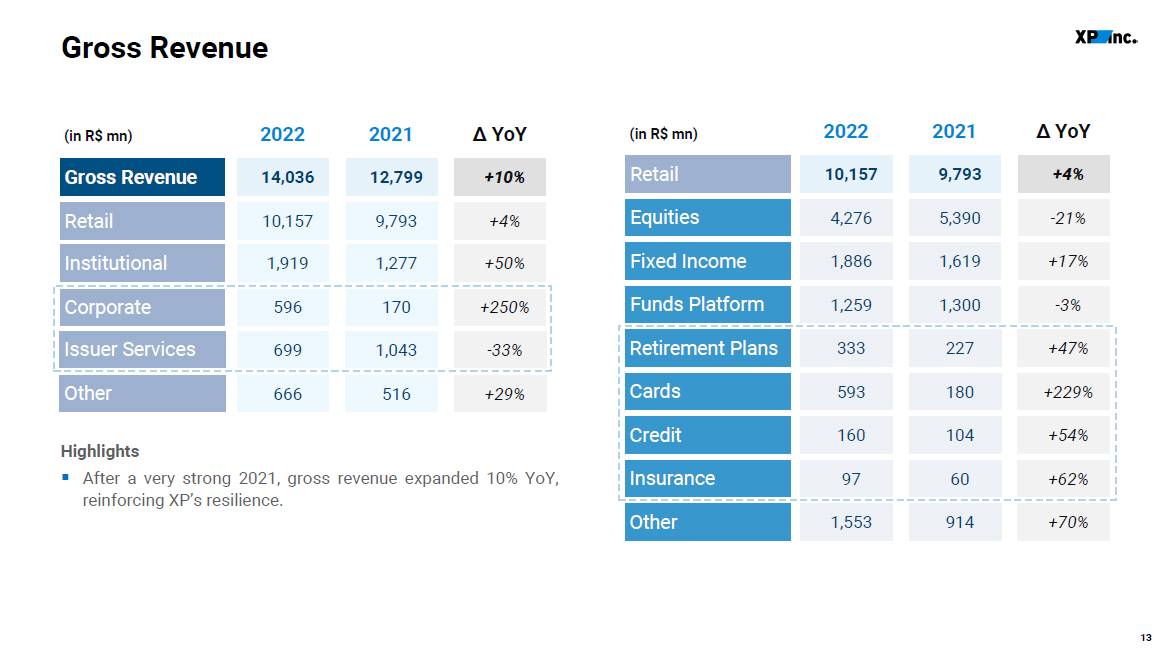

Gross Revenue totaled R$14 billion in 2022, up 10% versus 2021 and reinforcing the increased resilience of our business model. In a challenging scenario for Retail Equity and Issuer Services revenues, the main positive drivers were (i) Institutional, (ii) Corporate and (iii) Fixed Income, Float and Cards within Retail.

4Q22

Following an all-time high total gross revenue on 3Q22, the 12% sequential decrease was mainly driven by lower Institutional and Corporate & Issuer Services revenues. These lines, which together accounted for 80% of the decline, both had record performance on the previous quarter and benefited from anticipated deal flow and traded volume ahead of the Brazilian elections.

Retail Revenue

2022 vs 2021

While our main KPIs continued to expand, Retail revenue reached R$10.2 billion in 2022. Annual 4% growth was primarily driven by the growth of Fixed Income and Float, benefiting from higher rates, and Cards, in line with higher TPV. These factors compensated for the 21% decline in Equity revenue mostly associated with the 4.5% Selic rate hike during the year.

4Q22

It is important to highlight that, given the key relationship aspect of our advisory business, periods like the last quarter of 2022 pose several headwinds to the performance of Investments (Equity, Fixed Income and Funds).

With high rates, which already make investors less inclined to seek better returns, additional factors such as post-election uncertainty, World Cup, and holidays, further reduced advisor-client interactions recently. Hence, despite the persistence of an adverse scenario in the short term, Retail is expected to improve throughout 2023.

Retail revenue was R$2.5 billion in 4Q22, down 3% QoQ. The main negative drivers offsetting Float and Cards revenue growth were: (i) Equity, with lower Structured Notes revenue and less trading days than 3Q22 (61 vs 65) and (ii) Fixed Income, with lower distribution fees as a relevant part of DCM deals was underwritten by banks rather than distributed to investors.

Retail-related revenues represented 80% in 4Q22 and 71% in 2022 of consolidated Net Income from Financial Instruments, as per the Accounting Income Statement.

Take Rate

Annualized Retail Take Rate was 1.22% on 4Q22 and 1.29% for the full year of 2022. The former was impacted by the dysfunctional environment for Retail, similarly to 1Q22, while the latter comprises the more benign scenarios of 2Q22 and 3Q22.

5

|

Institutional Revenue

2022 vs 2021

In 2022, Institutional revenue grew 50% versus 2021 mainly due to (i) ongoing investments and focus on expanding our Institutional franchise to better serve global and Brazilian clients with a complete suite of services and (ii) FICC results on 1Q22 and 3Q22, which were boosted by increased volatility and traded volumes due to war in Eastern Europe and elections, respectively.

4Q22

Institutional revenue was R$357 million, down 38% from a record 3Q22.

Institutional revenue accounted for 6% in 4Q22 and 14% in 2022 of consolidated Net Income from Financial Instruments, as per the Accounting Income Statement.

Corporate & Issuer Services Revenue

2022 vs 2021

In 2022, revenue totaled R$1.3 billion, growing 7% YoY on the back of the Corporate business, which expanded more than 3x and compensated for Issuer Services contraction of 33% amidst a weaker deal flow across the board, but especially for ECM, when compared to 2021.

4Q22

Revenue totaled R$275 million in 4Q22, down 17% YoY and 37% QoQ. After a strong 3Q22 for capital market and corporate transactions ahead of elections, companies were less active on 4Q22. Also, as previously mentioned, average DCM distributed volume fell 35% in October-November vs 3Q22, according to Anbima. With a relevant underwritten volume, XP’s market share fell given our distribution leadership and limited balance sheet usage.

Corporate and Issuer Services related revenues represented 5% in 4Q22 and 7% in 2022 of consolidated Net Income from Financial Instruments, as per the Accounting Income Statement.

Other Revenue

2022 vs 2021

Other revenue, representing less than 5% of Total Gross Revenue, totaled R$666 million in 2022, growing 29% versus 2021 mainly due to the higher average Selic.

4Q22

Other revenue grew 42% YoY also due to Selic.

Other revenue accounted for 9% in both 4Q22 and 2022 of consolidated Net Income from Financial Instruments, as per the Accounting Income Statement.

6

|

Costs of Goods Sold and Gross Margin

2022 vs 2021

COGS reached R$4.0 billion in 2022, up 13% relative to 2021, while Gross Margin fell 50bps mainly because of the positive performance of Cards revenue and its associated investback charge.

4Q22

Gross Margin was 65.1% in 4Q22 versus 72.5% in 4Q21 and 72.2% in 3Q22. Compression was mostly due to (i) sequential mix change, with higher share of Retail driving increase in proportionate commissions, (ii) R$27 million impact of criteria change on interchange fee recognition. As of 4Q22, interchange fees on installment purchases are fully recognized at the time of the transaction, in line with other players in the credit card industry and (iii) Prepaid Expenses write-off of R$35 million regarding contract termination with IFA operations. A R$74 million payment associated to the end of these contracts was recognized in Other Operating Income.

Despite possible quarterly volatility, we expect Gross Margin to remain stable in 2023 vs 2022.

SG&A Expenses

2022 vs 2021

SG&A expenses reached R$5.3 billion in 2022, growing 22% versus 2021. The expansion is mostly associated with the 33% YoY increase in average headcount and its effect on Salary & Taxes and Data Processing, which increased 31% and 52%, respectively.

In 2022, Revenue from incentives from Tesouro Direto, B3 and others, within Other Operating Income, totaled R$285 million. Despite being recurring, this line has components that depend on several and uncorrelated variables. Hence, we prefer to analyze SG&A Expenses excluding the incentives.

Adjusted SG&A expenses are estimated between R$5.0 billion and R$5.5 billion in 2023 versus R$5.6 billion in 2022.

4Q22

SG&A expenses totaled R$1.1 billion in 4Q22, down 22% QoQ, reflecting the ongoing adjustment our cost structure and the positive R$242 million amount on Other Administrative Income, which is related to incentives from Tesouro Direto, B3 and others, and payments received from contract termination with IFA operations.

Net Income and EPS

2022 vs 2021

Net Income and basic EPS were R$3.6 billion and R$6.44, virtually stable relative to 2021. On a diluted basis, EPS for 2022 was R$6.25.

Management estimates Net Income between R$3.8 billion and R$4.4 billion in 2023.

4Q22

In 4Q22, Net Income was R$783 million, down 21% YoY and 24% QoQ. Basic and diluted EPS were R$1.49 and R$1.43, respectively.

7

|

Other Information

Webcast and Conference Call Information

The Company will host a webcast to discuss its second quarter financial results on Thursday, February 16th, 2023, at 5:00 pm ET (7:00 pm BRT). To participate in the earnings webcast please subscribe at 4Q22 Earnings Web Meeting. The replay will be available on XP’s investor relations website at https://investors.xpinc.com/

Investor Relations Contact

ir@xpi.com.br

Important Disclosure

In reviewing the information contained in this release, you are agreeing to abide by the terms of this disclaimer. This information is being made available to each recipient solely for its information and is subject to amendment. This release is prepared by XP Inc. (the “Company,” “we” or “our”), is solely for informational purposes. This release does not constitute a prospectus and does not constitute an offer to sell or the solicitation of an offer to buy any securities. In addition, this document and any materials distributed in connection with this release are not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction.

This release was prepared by the Company. Neither the Company nor any of its affiliates, officers, employees or agents, make any representation or warranty, express or implied, in relation to the fairness, reasonableness, adequacy, accuracy or completeness of the information, statements or opinions, whichever their source, contained in this release or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. The information and opinions contained in this release are provided as at the date of this release, are subject to change without notice and do not purport to contain all information that may be required to evaluate the Company. The information in this release is in draft form and has not been independently verified. The Company and its affiliates, officers, employees and agents expressly disclaim any and all liability which may be based on this release and any errors therein or omissions therefrom. Neither the Company nor any of its affiliates, officers, employees or agents makes any representation or warranty, express or implied, as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any.

The information contained in this release does not purport to be comprehensive and has not been subject to any independent audit or review. Certain of the financial information as of and for the periods ended of December 31, 2021 and December 31, 2020, 2019, 2018 and 2017 has been derived from audited financial statements and all other financial information has been derived from unaudited interim financial statements. A significant portion of the information contained in this release is based on estimates or expectations of the Company, and there can be no assurance that these estimates or expectations are or will prove to be accurate. The Company’s internal estimates have not been verified by an external expert, and the Company cannot guarantee that a third party using different methods to assemble, analyze or compute market information and data would obtain or generate the same results.

Statements in the release, including those regarding the possible or assumed future or other performance of the Company or its industry or other trend projections, constitute forward-looking statements. These statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. By their nature, forward-looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements and there can be no assurance that such forward-looking statements will prove to be correct. These risks and uncertainties include factors relating to: (1) general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business; (2) fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future; (3) competition in the financial services industry; (4) our ability to implement our business strategy; (5) our ability to adapt to the rapid pace of technological changes in the financial services industry; (6) the reliability, performance, functionality and quality of our products and services and the investment performance of investment funds managed by third parties or by our asset managers; (7) the availability of government authorizations on terms and conditions and within periods acceptable to us; (8) our ability to continue attracting and retaining new appropriately-skilled employees; (9) our capitalization and level of indebtedness; (10) the interests of our controlling shareholders; (11) changes in government regulations applicable to the financial services industry in Brazil and elsewhere; (12) our ability to compete and conduct our business in the future; (13) the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors; (14) changes in consumer demands regarding financial products, customer experience related to investments and technological advances, and our ability to innovate to respond to such changes; (15) changes in labor, distribution and other operating costs; (16) our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us; (17) other factors that may affect our financial condition, liquidity and results of operations. Accordingly, you should not place undue reliance on forward-looking statements. The forward-looking statements included herein speak only as at the date of this release and the Company does not undertake any obligation to update these forward-looking statements. Past performance does not guarantee or predict future performance.

8

|

Moreover, the Company and its affiliates, officers, employees and agents do not undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of the release. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented and we do not intend to update any of these forward-looking statements.

Market data and industry information used throughout this release are based on management’s knowledge of the industry and the good faith estimates of management. The Company also relied, to the extent available, upon management’s review of industry surveys and publications and other publicly available information prepared by a number of third-party sources. All of the market data and industry information used in this release involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although the Company believes that these sources are reliable, there can be no assurance as to the accuracy or completeness of this information, and the Company has not independently verified this information.

The contents hereof should not be construed as investment, legal, tax or other advice and you should consult your own advisers as to legal, business, tax and other related matters concerning an investment in the Company. The Company is not acting on your behalf and does not regard you as a customer or a client. It will not be responsible to you for providing protections afforded to clients or for advising you on the relevant transaction.

This release includes our Float, Adjusted Gross Financial Assets, Net Asset Value, and Adjustments to Reported Net Income, which are non-GAAP financial information. We believe that such information is meaningful and useful in understanding the activities and business metrics of the Company’s operations. We also believe that these non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting the Company’s business. Further, investors regularly rely on non-GAAP financial measures to assess operating performance and such measures may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS. We also believe that certain non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in the Company’s industry, many of which present these measures when reporting their results. The non-GAAP financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements. The non-GAAP measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results. As other companies may determine or calculate this non-GAAP financial information differently, the usefulness of these measures for comparative purposes is limited. A reconciliation of such non-GAAP financial measures to the nearest GAAP measure is included in this release.

For purposes of this release:

“Active Clients” means the total number of retail clients served through our XP Investimentos, Rico, Clear, XP Investments and XP Private (Europe) brands, with Client Assets above R$100.00 or that have transacted at least once in the last thirty days. For purposes of calculating this metric, if a client holds an account in more than one of the aforementioned entities, such client will be counted as one “active client” for each such account. For example, if a client holds an account in each of XP Investimentos and Rico, such client will count as two “active clients” for purposes of this metric.

“Client Assets” means the market value of all client assets invested through XP’s platform and that is related to reported Retail Revenue, including equities, fixed income securities, mutual funds (including those managed by XP Gestão de Recursos Ltda., XP Advisory Gestão de Recursos Ltda. and XP Vista Asset Management Ltda., as well as by third-party asset managers), pension funds (including those from XP Vida e Previdência S.A., as well as by third-party insurance companies), exchange traded funds, COEs (Structured Notes), REITs, and uninvested cash balances (Float Balances), among others. Although Client Assets includes custody from Corporate Clients that generate Retail Revenue, it does not include custody from institutional clients (asset managers, pension funds and insurance companies).

Rounding

We have made rounding adjustments to some of the figures included in this release. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

9

|

Unaudited Managerial Income Statement (in R$ mn) 4

| Managerial Income Statement | 4Q22 | 4Q21 | YoY | 3Q22 | QoQ | 2022 | 2021 | YoY | |

| Total Gross Revenue | 3,337 | 3,447 | -3% | 3,811 | -12% | 14,036 | 12,799 | 10% | |

| Retail | 2,549 | 2,678 | -5% | 2,629 | -3% | 10,157 | 9,793 | 4% | |

| Equities | 995 | 1,296 | -23% | 1,120 | -11% | 4,276 | 5,390 | -21% | |

| Fixed Income | 393 | 484 | -19% | 489 | -20% | 1,886 | 1,619 | 17% | |

| Funds Platform | 311 | 332 | -6% | 282 | 11% | 1,259 | 1,300 | -3% | |

| Retirement Plans | 93 | 74 | 26% | 85 | 10% | 333 | 227 | 47% | |

| Cards | 234 | 86 | 172% | 146 | 61% | 593 | 180 | 229% | |

| Credit | 47 | 36 | 32% | 40 | 18% | 160 | 104 | 54% | |

| Insurance | 31 | 18 | 78% | 21 | 51% | 97 | 60 | 62% | |

| Other | 443 | 353 | 26% | 447 | -1% | 1,553 | 914 | 70% | |

| Institutional | 357 | 326 | 10% | 577 | -38% | 1,919 | 1,277 | 50% | |

| Issuer Services & Corporate | 275 | 333 | -17% | 436 | -37% | 1,295 | 1,213 | 7% | |

| Issuer Services | 140 | 270 | -48% | 228 | -39% | 699 | 1,043 | -33% | |

| Corporate | 135 | 63 | 115% | 207 | -35% | 596 | 170 | 250% | |

| Other | 156 | 110 | 42% | 170 | -8% | 666 | 516 | 29% | |

| Net Revenue | 3,177 | 3,260 | -3% | 3,620 | -12% | 13,348 | 12,077 | 11% | |

| COGS | (1,110) | (896) | 24% | (1,005) | 10% | (3,965) | (3,523) | 13% | |

| Gross Profit | 2,067 | 2,363 | -13% | 2,615 | -21% | 9,382 | 8,555 | 10% | |

| Gross Margin | 65.1% | 72.5% | -7.43 p.p | 72.2% | -7.16 p.p | 70.3% | 70.8% | -0.54 p.p | |

| SG&A | (1,135) | (1,122) | 1% | (1,463) | -22% | (5,317) | (4,364) | 22% | |

| People | (892) | (952) | -6% | (1,057) | -16% | (3,943) | (3,427) | 15% | |

| Non-People | (243) | (170) | 43% | (405) | -40% | (1,374) | (937) | 47% | |

| D&A | (46) | (52) | -13% | (44) | 4% | (206) | (232) | -11% | |

| EBIT | 886 | 1,189 | -25% | 1,109 | -20% | 3,859 | 3,959 | -3% | |

| Interest expense on debt | (150) | (57) | 162% | (128) | 17% | (402) | (136) | 196% | |

| Share of profit or (loss) in joint ventures and associates | 1 | (11) | -113% | 1 | -180% | (12) | (8) | 58% | |

| EBT | 738 | 1,121 | -34% | 983 | -25% | 3,445 | 3,815 | -10% | |

| EBT Margin | 23.2% | 34.4% | -11.1 p.p | 27.2% | -3.9 p.p | 25.8% | 31.6% | -5.8 p.p | |

| Tax Expense (Accounting) | 44 | (130) | -134% | 48 | -7% | 136 | (223) | -161% | |

| Tax expense (Tax Witholding in Funds)¹ | (192) | (157) | 22% | (190) | 1% | (754) | (567) | 33% | |

| Effective tax rate (Normalized) | (15.8%) | (22.5%) | 6.6 p.p | (12.1%) | -3.7 p.p | (14.7%) | (18.0%) | 3.3 p.p | |

| Net Income | 783 | 991 | -21% | 1,031 | -24% | 3,580 | 3,592 | 0% | |

| Net Margin | 24.6% | 30.4% | -5.8 p.p | 28.5% | -3.8 p.p | 26.8% | 29.7% | -2.9 p.p | |

| Adjustments | 110 | 95 | 16% | 118 | -7% | 494 | 411 | 20% | |

| Adjusted Net Income² | 893 | 1,086 | -18% | 1,149 | -22% | 4,075 | 4,003 | 2% | |

| Adjusted Net Margin | 28.1% | 33.3% | -5.2 p.p | 31.7% | -3.6 p.p | 30.5% | 33.1% | -2.6 p.p |

1 – Tax adjustments are related to tax withholding expenses that are recognized net in gross revenue.

2 – See appendix for a reconciliation of Adjusted Net Income.

10

|

Accounting Income Statement (in R$ mn)

| Accounting Income Statement | 4Q22 | 4Q21 | YoY | 3Q22 | QoQ | 2022 | 2021 | YoY | |

| Net revenue from services rendered | 1,565 | 1,552 | 1% | 1,558 | 0% | 5,940 | 6,196 | -4% | |

| Brokerage commission | 544 | 541 | 1% | 498 | 9% | 2,103 | 2,465 | -15% | |

| Securities placement | 361 | 493 | -27% | 525 | -31% | 1,631 | 1,917 | -15% | |

| Management fees | 412 | 381 | 8% | 361 | 14% | 1,581 | 1,490 | 6% | |

| Insurance brokerage fee | 47 | 33 | 42% | 35 | 35% | 153 | 133 | 15% | |

| Educational services | 6 | 11 | -41% | 6 | 0% | 27 | 71 | -62% | |

| Commission Fees | 237 | 77 | 207% | 135 | 75% | 564 | 193 | 192% | |

| Other services | 102 | 165 | -38% | 143 | -29% | 449 | 532 | -16% | |

| Sales Tax and contributions on Services | (145) | (149) | -3% | (145) | 0% | (568) | (605) | -6% | |

| Net income from financial instruments at amortized cost and at fair value through other comprehensive income | 14 | (543) | n.a. | 563 | -97% | 1,145 | (1,559) | n.a. | |

| Net income from financial instruments at fair value through profit or loss | 1,598 | 2,250 | -29% | 1,499 | 7% | 6,262 | 7,440 | -16% | |

| Total revenue and income | 3,177 | 3,260 | -3% | 3,620 | -12% | 13,347 | 12,077 | 11% | |

| Operating costs | (1,071) | (866) | 24% | (977) | 10% | (3,871) | (3,430) | 13% | |

| Selling expenses | (48) | (64) | -25% | (33) | 46% | (139) | (227) | -39% | |

| Administrative expenses | (1,368) | (1,344) | 2% | (1,503) | -9% | (5,641) | (4,693) | 20% | |

| Other operating revenues (expenses), net | 235 | 233 | 1% | 29 | n.a. | 257 | 324 | -21% | |

| Expected credit losses | (38) | (30) | 26% | (28) | 35% | (94) | (93) | 2% | |

| Interest expense on debt | (150) | (57) | 162% | (128) | 17% | (402) | (136) | 196% | |

| Share of profit or (loss) in joint ventures and associates | 1 | (11) | n.a. | 1 | 4% | (12) | (8) | 58% | |

| Income before income tax | 738 | 1,121 | -34% | 983 | -25% | 3,445 | 3,815 | -10% | |

| Income tax expense | 44 | (130) | n.a. | 48 | -7% | 136 | (223) | n.a. | |

| Net income for the period | 783 | 991 | -21% | 1,031 | -24% | 3,580 | 3,592 | 0% |

11

|

Balance Sheet (in R$ mn)

| Assets | 4Q22 | 3Q22 | |||

| Cash | 3,553 | 2,601 | |||

| Financial assets | 177,682 | 172,585 | |||

| Fair value through profit or loss | 96,730 | 89,157 | |||

| Securities | 87,513 | 73,101 | |||

| Derivative financial instruments | 9,217 | 16,056 | |||

| Fair value through other comprehensive income | 34,479 | 40,238 | |||

| Securities | 34,479 | 40,238 | |||

| Evaluated at amortized cost | 46,473 | 43,190 | |||

| Securities | 9,272 | 8,060 | |||

| Securities purchased under agreements to resell | 7,604 | 8,047 | |||

| Securities trading and intermediation | 3,271 | 3,983 | |||

| Accounts receivable | 598 | 568 | |||

| Loan Operations | 22,211 | 20,411 | |||

| Other financial assets | 3,517 | 2,121 | |||

| Other assets | 5,761 | 5,509 | |||

| Recoverable taxes | 163 | 165 | |||

| Rights-of-use assets | 258 | 261 | |||

| Prepaid expenses | 4,240 | 4,196 | |||

| Other | 1,099 | 887 | |||

| Deferred tax assets | 1,612 | 1,509 | |||

| Investments in associates and joint ventures | 2,272 | 2,415 | |||

| Property and equipment | 311 | 308 | |||

| Goodwill & Intangible assets | 844 | 815 | |||

| Total Assets | 192,035 | 185,742 |

12

|

| Liabilities | 4Q22 | 3Q22 | |||

| Financial liabilities | 127,709 | 124,490 | |||

| Fair value through profit or loss | 22,135 | 24,145 | |||

| Securities | 13,529 | 9,469 | |||

| Derivative financial instruments | 8,605 | 14,675 | |||

| Evaluated at amortized cost | 105,574 | 100,345 | |||

| Securities sold under repurchase agreements | 31,790 | 31,429 | |||

| Securities trading and intermediation | 16,063 | 15,374 | |||

| Financing instruments payable | 43,684 | 41,416 | |||

| Accounts payables | 617 | 561 | |||

| Borrowings | 1,866 | 1,901 | |||

| Other financial liabilities | 11,554 | 9,663 | |||

| Other liabilities | 47,169 | 43,664 | |||

| Social and statutory obligations | 968 | 628 | |||

| Taxes and social security obligations | 365 | 249 | |||

| Private pension liabilities | 45,734 | 42,714 | |||

| Provisions and contingent liabilities | 44 | 38 | |||

| Other | 58 | 35 | |||

| Deferred tax liabilities | 111 | 120 | |||

| Total Liabilities | 174,989 | 168,274 | |||

| Equity attributable to owners of the Parent company | 17,039 | 17,465 | |||

| Issued capital | 0 | 0 | |||

| Capital reserve | 19,160 | 15,459 | |||

| Other comprehensive income | (134) | (109) | |||

| Treasury | (1,987) | (681) | |||

| Retained earnings | - | 2,796 | |||

| Non-controlling interest | 6 | 3 | |||

| Total equity | 17,046 | 17,468 | |||

| Total liabilities and equity | 192,035 | 185,742 | |||

13

|

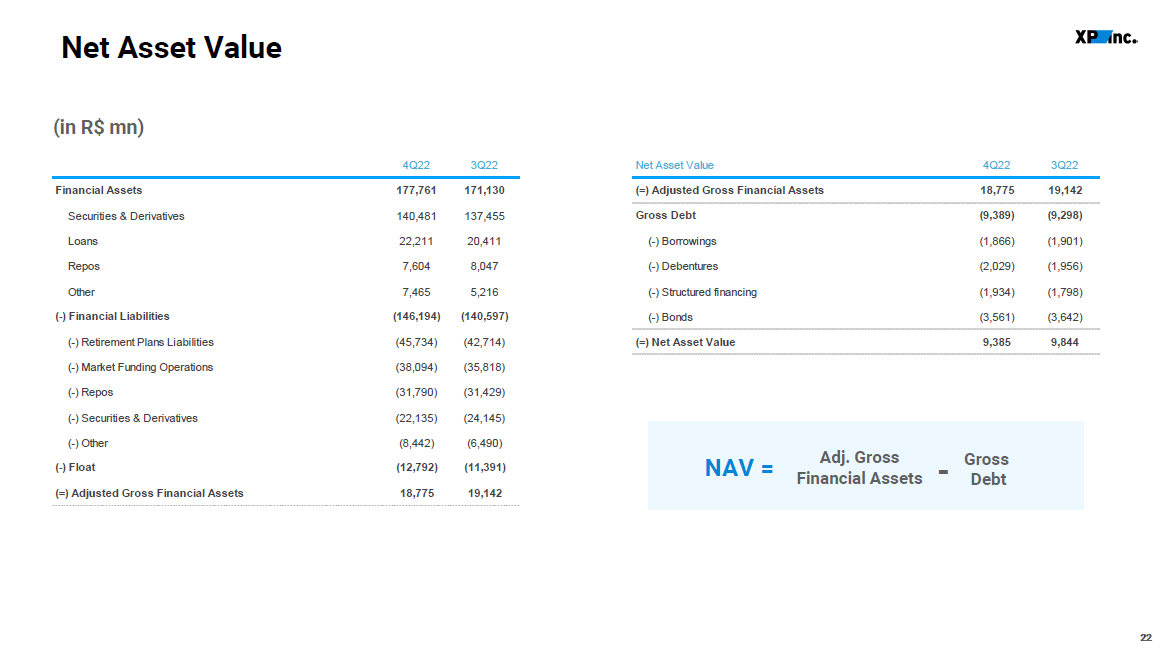

Float, Adjusted Gross Financial Assets and Net Asset Value

(in R$ mn)

We present Adjusted Gross Financial Assets because we believe this metric captures the liquidity that is, in fact, available to us, net of the portion of liquidity that is related to our Float Balance (and therefore attributable to clients). We calculate Adjusted Gross Financial Assets as the sum of (1) Cash and Financial Assets (comprised of Cash plus Securities – Fair value through profit or loss, plus Securities – Fair value through other comprehensive income, plus Securities – Evaluated at amortized cost, plus Derivative financial instruments, plus Securities (purchased under agreements to resell), plus Loans and Foreign exchange portfolio (assets) less (2) Financial Liabilities (comprised of the sum of Securities loaned, Derivative financial instruments, Securities sold under repurchase agreements and Private pension liabilities), Deposits, Structured Operation Certificates (COE), Financial Bills, Foreign exchange portfolio (liabilities), Credit cards operations and (3) less Float Balance.

It is a measure that we track internally daily, and it more intuitively reflects the effect of the operational profits we generate and the variations between working capital assets and liabilities (cash flows from operating activities), investments in fixed and intangible assets and investments in the IFA Network (cash flows from investing activities) and inflows and outflows related to equity and debt securities in our capital structure (cash flows from financing activities). Our management treats all securities and financial instrument assets, net of financial instrument liabilities, as balances that compose our total liquidity, with subline items (such as, for example, “securities at fair value through profit and loss” and “securities at fair value through other comprehensive income”) expected to fluctuate substantially from quarter to quarter as our treasury manages and allocates our total liquidity to the most suitable financial instruments.

In order to explain how we measure our cash position or generation internally, we are introducing the Net Asset Value concept. Since we are a financial institution, we hold several types of financial instruments with different characteristics, hence the definition of net cash that makes more sense from a business perspective is the Net Asset Value. It is basically the adjusted gross financial assets net of debt instruments.

14

|

| Adjusted Gross Financial Assets | 4Q22 | 3Q22 | |||

| Assets | 177,761 | 171,130 | |||

| (+) Cash | 3,553 | 2,601 | |||

| (+) Securities - Fair value through profit or loss | 87,513 | 73,101 | |||

| (+) Securities - Fair value through other comprehensive income | 34,479 | 40,238 | |||

| (+) Securities - Evaluated at amortized cost | 9,272 | 8,060 | |||

| (+) Derivative financial instruments | 9,217 | 16,056 | |||

| (+) Securities purchased under agreements to resell | 7,604 | 8,047 | |||

| (+) Loans and credit card operations | 22,211 | 20,411 | |||

| (+) Foreign exchange portfolio | 2,145 | 1,130 | |||

| (+) Energy | 647 | 619 | |||

| (+) Compulsory | 1,119 | 866 | |||

| Liabilities | (146,194) | (140,597) | |||

| (-) Securities | (13,529) | (9,469) | |||

| (-) Derivative financial instruments | (8,605) | (14,675) | |||

| (-) Securities sold under repurchase agreements | (31,790) | (31,429) | |||

| (-) Retirement Plans Liabilities | (45,734) | (42,714) | |||

| (-) Deposits | (20,262) | (21,205) | |||

| (-) Structured Operations | (12,110) | (11,026) | |||

| (-) Financial Bills | (5,676) | (3,566) | |||

| (-) Foreign exchange portfolio | (2,405) | (1,420) | |||

| (-) Credit card operations | (4,987) | (3,996) | |||

| (-) Commitments subject to possible redemption | (1,049) | (1,074) | |||

| (-) Promissory Note | (47) | (20) | |||

| (-) Float | (12,792) | (11,391) | |||

| (=) Adjusted Gross Financial Assets | 18,775 | 19,142 |

| Net Asset Value | 4Q22 | 3Q22 | |||

| (=) Adjusted Gross Financial Assets | 18,775 | 19,142 | |||

| Gross Debt | (9,389) | (9,298) | |||

| (-) Borrowings | (1,866) | (1,901) | |||

| (-) Debentures | (2,029) | (1,956) | |||

| (-) Structured financing | (1,934) | (1,798) | |||

| (-) Bonds | (3,561) | (3,642) | |||

| (=) Net Asset Value | 9,385 | 9,844 |

| Float (=net uninvested clients' deposits) | 4Q22 | 3Q22 | |||

| Assets | (3,271) | (3,983) | |||

| (-) Securities trading and intermediation | (3,271) | (3,983) | |||

| Liabilities | 16,063 | 15,374 | |||

| (+) Securities trading and intermediation | 16,063 | 15,374 | |||

| (=) Float | 12,792 | 11,391 |

15

|

Reconciliation of Adjusted Net Income (in R$ mn)

| Adjusted Net Income | 4Q22 | 4Q21 | YoY | 3Q22 | QoQ | 2022 | 2021 | YoY | |

| Net Income | 783 | 991 | -21% | 1,031 | -24% | 3,580 | 3,592 | 0% | |

| (+) Share Based Compensation | 181 | 149 | 22% | 186 | -3% | 793 | 658 | 21% | |

| (+/-) Taxes | (71) | (54) | 30% | (68) | 4% | (299) | (247) | 21% | |

| Adj. Net Income | 893 | 1,086 | -18% | 1,149 | -22% | 4,075 | 4,003 | 2% |

16

Exhibit 99.2

1

2 Important Disclosure IN REVIEWING THE INFORMATION CONTAINED IN THIS PRESENTATION, YOU ARE AGREEING TO ABIDE BY THE TERMS OF THIS DISCLAIMER . THIS INFORMATION IS BEING MADE AVAILABLE TO EACH RECIPIENT SOLELY FOR ITS INFORMATION AND IS SUBJECT TO AMENDMENT . This presentation is prepared by XP Inc . (the “Company,” “we” or “our”), is solely for informational purposes . This presentation does not constitute a prospectus and does not constitute an offer to sell or the solicitation of an offer to buy any securities . In addition, this document and any materials distributed in connection with this presentation are not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction . This presentation was prepared by the Company . Neither the Company nor any of its affiliates, officers, employees or agents, make any representation or warranty, express or implied, in relation to the fairness, reasonableness, adequacy, accuracy or completeness of the information, statements or opinions, whichever their source, contained in this presentation or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information . The information and opinions contained in this presentation are provided as at the date of this presentation, are subject to change without notice and do not purport to contain all information that may be required to evaluate the Company . The information in this presentation is in draft form and has not been independently verified . The Company and its affiliates, officers, employees and agents expressly disclaim any and all liability which may be based on this presentation and any errors therein or omissions therefrom . Neither the Company nor any of its affiliates, officers, employees or agents makes any representation or warranty, express or implied, as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any . The information contained in this presentation does not purport to be comprehensive and has not been subject to any independent audit or review . Certain of the financial information as of and for the periods ended December 31 , 2019 , 2018 and 2017 has been derived from audited financial statements and all other financial information has been derived from unaudited interim financial statements . A significant portion of the information contained in this presentation is based on estimates or expectations of the Company, and there can be no assurance that these estimates or expectations are or will prove to be accurate . The Company’s internal estimates have not been verified by an external expert, and the Company cannot guarantee that a third party using different methods to assemble, analyze or compute market information and data would obtain or generate the same results . Statements in the presentation, including those regarding the possible or assumed future or other performance of the Company or its industry or other trend projections, constitute forward - looking statements . These statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others . By their nature, forward - looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company . Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward - looking statements and there can be no assurance that such forward - looking statements will prove to be correct . These risks and uncertainties include factors relating to : ( 1 ) general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business ; ( 2 ) fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future ; ( 3 ) competition in the financial services industry ; ( 4 ) our ability to implement our business strategy ; ( 5 ) our ability to adapt to the rapid pace of technological changes in the financial services industry ; ( 6 ) the reliability, performance, functionality and quality of our products and services and the investment performance of investment funds managed by third parties or by our asset managers ; ( 7 ) the availability of government authorizations on terms and conditions and within periods acceptable to us ; ( 8 ) our ability to continue attracting and retaining new appropriately - skilled employees ; ( 9 ) our capitalization and level of indebtedness ; ( 10 ) the interests of our controlling shareholders ; ( 11 ) changes in government regulations applicable to the financial services industry in Brazil and elsewhere ; ( 12 ) our ability to compete and conduct our business in the future ; ( 13 ) the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors ; ( 14 ) changes in consumer demands regarding financial products, customer experience related to investments and technological advances, and our ability to innovate to respond to such changes ; ( 15 ) changes in labor, distribution and other operating costs ; ( 16 ) our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us ; ( 17 ) the negative impacts of the COVID - 19 pandemic on global, regional and national economies and the related market volatility and protracted economic downturn ; and ( 18 ) other factors that may affect our financial condition, liquidity and results of operations . Accordingly, you should not place undue reliance on forward - looking statements . The forward - looking statements included herein speak only as at the date of this presentation and the Company does not undertake any obligation to update these forward - looking statements . Past performance does not guarantee or predict future performance . Moreover, the Company and its affiliates, officers, employees and agents do not undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward - looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation . You are cautioned not to unduly rely on such forward - looking statements when evaluating the information presented and we do not intend to update any of these forward - looking statements . Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management . The Company also relied, to the extent available, upon management’s review of industry surveys and publications and other publicly available information prepared by a number of third party sources . All of the market data and industry information used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . Although the Company believes that these sources are reliable, there can be no assurance as to the accuracy or completeness of this information, and the Company has not independently verified this information . The contents hereof should not be construed as investment, legal, tax or other advice and you should consult your own advisers as to legal, business, tax and other related matters concerning an investment in the Company . The Company is not acting on your behalf and does not regard you as a customer or a client . It will not be responsible to you for providing protections afforded to clients or for advising you on the relevant transaction . This presentation also includes certain non - GAAP financial information . We believe that such information is meaningful and useful in understanding the activities and business metrics of the Company’s operations . We also believe that these non - GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting the Company’s business . Further, investors regularly rely on non - GAAP financial measures to assess operating performance and such measures may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS . We also believe that certain non - GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in the Company’s industry, many of which present these measures when reporting their results . The non - GAAP financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements . The non - GAAP measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results . As other companies may determine or calculate this non - GAAP financial information differently, the usefulness of these measures for comparative purposes is limited . A reconciliation of such non - GAAP financial measures to the nearest GAAP measure is included in this presentation . For purposes of this presentation : “Active Clients” means the total number of retail clients served through our XP Investimentos, Rico, Clear, XP Investments and XP Private (Europe) brands, with Client Assets above R $ 100 . 00 or that have transacted at least once in the last thirty days . For purposes of calculating this metric, if a client holds an account in more than one of the aforementioned entities, such client will be counted as one “active client” for each such account . For example, if a client holds an account in each of XP Investimentos and Rico, such client will count as two “active clients” for purposes of this metric . “Client Assets” means the market value of all client assets invested through XP’s platform, including equities, fixed income securities, mutual funds (including those managed by XP Gestão de Recursos Ltda . , XP Advisory Gestão Recursos Ltda . and XP Vista Asset Management Ltda . , as well as by third - party asset managers), pension funds (including those from XP Vida e Previdência S . A . , as well as by third - party insurance companies), exchange traded funds, COEs (Structured Notes), REITs, and uninvested cash balances (Floating Balances), among others .

3 Index 1. Introduction 2. FY22 KPIs and Financials 3. Q&A

1 Introduction

5 0.8 2020 2018 2019 2021 1.7 3.2 5.0 465 1,089 3,592 2018 2021 2019 2020 2,081 B3 Individual’s Accounts (in millions) XP Inc.’s Net Income (in R$ mn) 83% CAGR 98% CAGR XP benefited from a positive market environment until 2021 Unique distribution channel and product platform allowed us to help millions of Brazilians to invest better

6 2022 posed many challenges to our business Source: B3 B3 Individuals’ Equity ADTV (R$ bn) 6.5 0 % 4.5 0 % 2.0 0 % 9.2 5 % Selic Rate EoP 13.75% 2018 2019 2020 2021 2022 2.2 6.4 3.2 6.3 4.6 - 28% 70 42 2013 2014 - 40% 3,592 2021 2022 3,580 0% However, our business model has become less cyclical and more resilient over the years B3 Individual’s Equity ADTV and Selic EoP XP Inc.’s Net Income (in R$ mn)

7 Aligned with our strategy of expanding beyond Investments, new products and services were launched 2019 Banking License XPV&P 2020 Corporate Business Collateralized Credit 2021 Credit Card Margin Loan B2C Expansion 2022 Life Insurance International Platform XTAGE Digital Account Debit Card 2,429 3,651 6,192 6,928 Headcount …leading headcount to increase close to 3x …

8 Our core business continued to evolve R$ 155 Billion Net Inflow +460k Net New Clients 2016 2017 2018 2019 2020 2021 2022 R$65 bn R$660 bn R$126 bn R$202 bn R$815 bn R$409 bn R$946 bn Client Assets +2,000 Net New IFAs Would be Brazil’s 3rd largest network

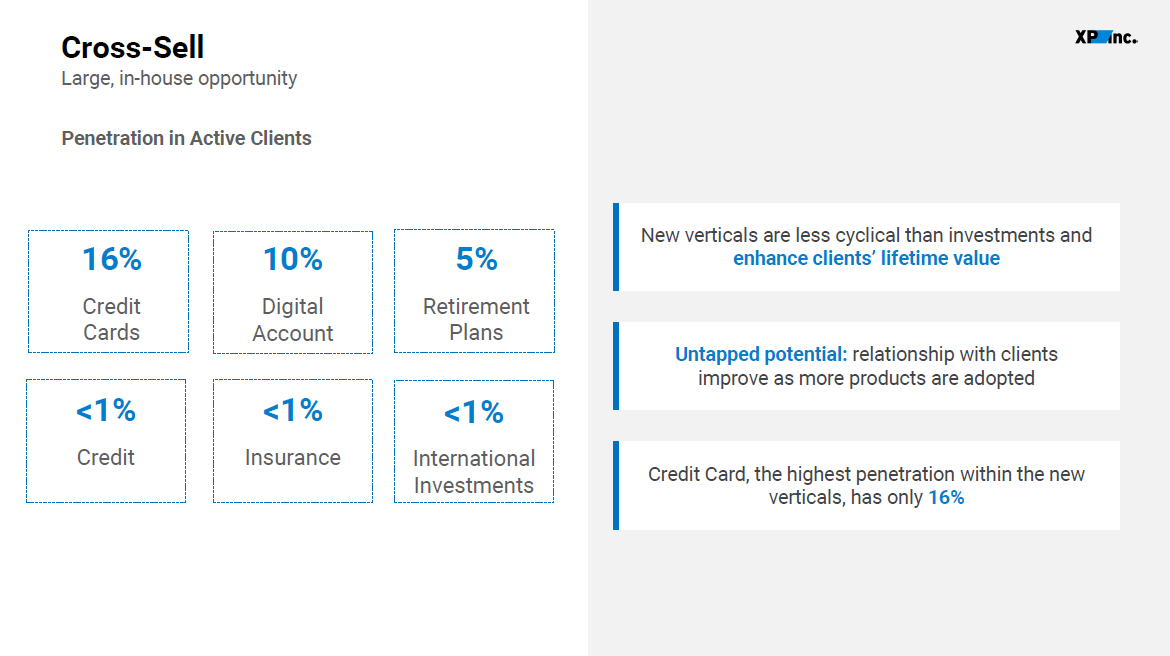

9 Credit Card, the highest penetration within the new verticals, has only 16% New verticals are less cyclical than investments and enhance clients’ lifetime value Cross - Sell Large, in - house opportunity Penetration in Active Clients Untapped potential: relationship with clients improve as more products are adopted 16% Credit Cards 5% Retire m ent Plans <1% Inte r national Investments <1% Credit <1% Insurance 10% Digital Account

10 SG&A Expenses 2023 GUIDANCE SG&A¹ between R$5.0 - 5.5 billion vs FY22 SG&A¹ of R$5.6 billion Adjustments to cost structure with no impact on service level nor strategic plan 2019 2018 3.2 2021 2020 4.7 2022 1.3 1.9 5.6 Note 1 – Excludes Revenue from incentives from Tesouro Direto, B3 and Others. Corporate transformation process allowed for resource optimization and increased efficiency Total SG&A (in R$ bn)¹ Leaner and sustainable cost structure from 2023 onwards 42 . 6 % 37 . 1 % 42 . 0 % 39 . 1 % 39 . 2 % SG&A¹ Expense Ratio (SG&A¹/Net Revenue)

2 FY22 KPIs and Financials

12 Gross Revenue 29.8% 33.0% 29.5% 26.9% 23.8% 2022 2018 2019 2021 2020 Q4 seasonality in annual revenue ▪ 4Q usually benefits from performance fees and a more active capital market; ▪ In 2022, polarized Brazilian elections and the World Cup broke this historical pattern Average 3,811 3,337 380 3Q22 Institutional / Issuer Services & Corporate Retail 4Q22 Bus i ness Days Gross Revenue Bridge QoQ (in R$mn) 80 % of revenue decr e a s e 94 Less Business Days 61 65

13 Gross Revenue (in R$ mn) 2022 2021 Δ YoY Gross Revenue 14,036 12,799 +10% Retail 10,157 9,793 +4% Institutional 1,919 1,277 +50% Corporate 596 170 +25 0 % Issuer Services 699 1,043 - 33% Other 666 516 +29% Highlights ▪ After a very strong 2021, gross revenue expanded 10% YoY, reinforcing XP’s resilience. (in R$ mn) 2022 2021 Δ YoY Retail 10,157 9,7 9 3 +4% Equities 4,276 5,390 - 21% Fixed Income 1,886 1,619 +17% Funds Platform 1,259 1,300 - 3% Retirement Plans 333 227 +47% Cards 593 180 +229% Credit 160 104 +54% Insurance 97 60 +62% Other 1,553 914 +70%

14 Gross Margin 72.2% 65.1% 2.6% 1.1% 1.5% 1.9% 3Q22 Prepaid E x pense Write - off Com m iss ionabl e Revenue Mix Credit Cards Ot h er 4Q22 Gross Margin YoY Gross Margin Bridge QoQ Highlights ▪ Despite possible quarterly volatility, Gross Margin for 2023 is expected to be in line with 2021 and 2022. 70.8% 2021 2022 70.3% - 0.8 bps Highlights ▪ Gros s Mar g in c o mpre s si o n m a in l y led by i t e m s t h a t a r e expected to normalize going forward.

15 SG&A Expenses 5,500 5,000 425 1,377 1,377 485 Peo p le Non - People 0% 952 892 2021 2022 2023E 4Q21 4Q22 31.6% 25.8% 26 - 32% 34.4% 23.2% Note 1 – Excludes Revenue from incentives from Tesouro Direto, B3 and Others Highlights ▪ SG&A¹ expenses were flat YoY and fell 8% QoQ reflecting the ongoing adjustment of our cost structure. Total SG&A Expenses 1 (in R$ mn) 5,602 4,730 EBT Margin Highlights ▪ SG&A ¹ e x pense s e s tim a t e d be t w e en R $ 5 . 0 bi l l i on and R $ 5 . 5 billion in 2023, versus R$5.6 billion in 2022.

16 Net Income and EPS 991 4Q21 - 21.0% 783 2021 2022 3,580 29.7% 26.8% Net Income (in R$ mn) - 0.3% 3,592 30.4% Net Mar g in 6.42 6.44 1.77 Basic EPS (R$) 4Q22 1.43 24.6% Highlights ▪ Basic EPS fell 19% YoY, while Net Income fell 21% YoY, to R$783 million. Highlights ▪ Ba s ic E P S gr ew margin a l l y YoY, w h i le Net I nc o m e r emained stable.

17 Key messages 1 Expenses: Leaner and sustainable cost structure, leading to a higher operational leverage in the future Resilience and Adaptability: Cycles change constantly, we are building a company Cross - sell: Large in - house opportunity to increase penetration of new verticals in 2023 2 3 4 2023 Guidance: Net Income from R$3.8 to 4.4 billion and SG&A¹ from R$5.0 to 5.5 billion Note 1 – Excludes Revenue from incentives from Tesouro Direto, B3 and Others.

Q&A

19 Investor Relations ir@xpi.com.br https://investors.xpinc.com/

Appendix

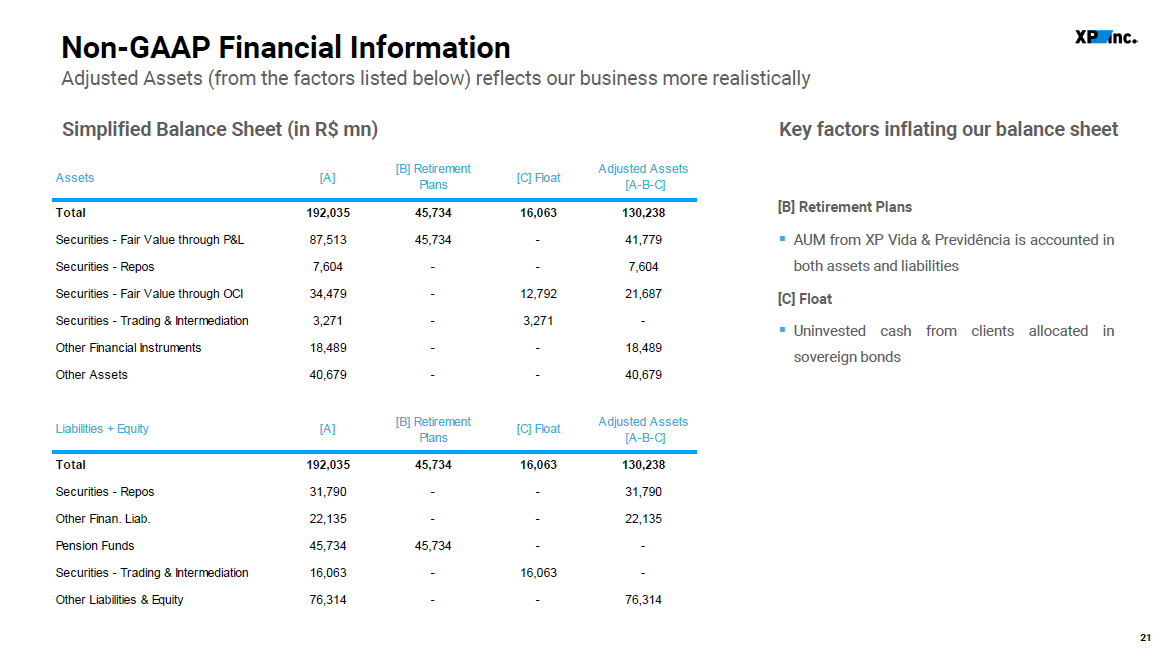

21 Non - GAAP Financial Information Adjusted Assets (from the factors listed below) reflects our business more realistically [B] Retirement Plans ▪ AUM from XP Vida & Previdência is accounted in both assets and liabilities f r o m c l ie n t s allo c at ed in [C] Float ▪ Uninv e st e d c ash sovereign bonds Simplified Balance Sheet (in R$ mn) Key factors inflating our balance sheet Assets [ A ] Plans [ A - B - C ] Total 192,035 45,734 16,063 130 , 23 8 Securities - Fair Value through P&L 87,513 45,734 - 41,779 Securities - Repos 7,604 - - 7,604 Securities - Fair Value through OCI 34,479 - 12,792 21,687 Securities - Trading & Intermediation 3,271 - 3,271 - Other Financial Instruments 18,489 - - 18,489 Other Assets 40,679 - - 40,679 [C] Float [B] Retirement Adjusted Assets Liabilities + Equity [ A ] [B] Retirement Plans [ A - B - C ] Total 192,035 45,734 16,063 130 , 23 8 Securities - Repos 31,790 - - 31,790 Other Finan. Liab. 22,135 - - 22,135 Pension Funds 45,734 45,734 - - Securities - Trading & Intermediation 16,063 - 16,063 - Other Liabilities & Equity 76,314 - - 76,314 [C] Float Adjusted Assets

Net Asset Value 2 2 2 2 Adj. G Financial Assets NAV = Debt - ( - ) Float ( 12 , 792 ) (11,391) (=) Adjusted Gross Financial Assets 18 , 77 5 19,142 (in R$ mn) 4 Q 2 2 3Q22 Net Asset Value 4Q22 3Q22 Financial Assets 177 , 76 1 171,130 (=) Adjusted Gross Financial Assets 18,775 19,142 Securities & Derivatives 140 , 48 1 137,455 Gross Debt (9,389) (9,298) Loans 22 , 21 1 20,411 ( - ) Borrowings (1,866) (1,901) Repos 7 , 60 4 8,047 ( - ) Debentures (2,029) (1,956) Other 7 , 46 5 5,216 ( - ) Structured financing (1,934) (1,798) ( - ) Financial Liabilities ( 146 , 194 ) (140,597) ( - ) Bonds (3,561) (3,642) ( - ) Retirement Plans Liabilities ( 45 , 734 ) (42,714) (=) Net Asset Value 9 , 38 5 9,844 ( - ) Market Funding Operations ( 38 , 094 ) (35,818) ( - ) Repos ( 31 , 790 ) (31,429) ( - ) Securities & Derivatives ( 22 , 135 ) (24,145) ( - ) Other ( 8 , 442 ) (6,490) ross Gross

Ŷ

Exhibit 99.3

|

XP Inc. Consolidated financial statements at |

Independent auditor's report

To the Board of Directors and Shareholders

XP Inc.

Opinion

We have audited the accompanying consolidated financial statements of XP Inc. (the "Company") and its subsidiaries, which comprise the consolidated balance sheets as at December 31, 2022 and the consolidated statements of income and of comprehensive income, of changes in equity and of cash flows for the year then ended, and notes to the financial statements, including significant accounting policies and other explanatory information.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of XP Inc. and its subsidiaries as at December 31, 2022, and their financial performance and their cash flows for the year then ended, in accordance with the International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the "Auditor's responsibilities for the audit of the financial statements" section of our report. We are independent of the Company and its subsidiaries in accordance with the ethical requirements established in the Code of Professional Ethics and Professional Standards issued by the Brazilian Federal Accounting Council, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Key Audit Matters

Key Audit Matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current year. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. |

|

PricewaterhouseCoopers Auditores Independentes Ltda., Avenida Brigadeiro Faria Lima, 3732, Edifício B32, 16o

São Paulo, SP, Brasil, 04538-132

T: +55 (11) 4004-8000, www.pwc.com.br

| Why it is a Key Audit Matter | How the matter was addressed in the audit |

| Information technology environment | |

|

The processing of transactions, operations development and business

continuity processes

The inherent risks in information technology, associated with eventual deficiencies in the controls that support the processing and operation, logical accesses, systems change management in the existing technology environments, can, eventually, cause incorrect processing of critical transactions, improper accesses to systems and data, and consequently processing of unauthorized transactions and errors in automated controls of application systems. For this reason, this was considered as a focal area in our audit.

|

With the support of professionals with specialized skill and knowledge, we understood the information technology environment and tested general technology controls. During our planning activities, we considered tests related to systemic development and change management, access, security to programs, systems and data, systems operation/processing and physical security of the data processing center.

We tested automated and technology-dependent controls related to applications in the relevant XP business processes.

Considering the results obtained in the procedures described above and in order to obtain necessary and sufficient evidence in our financial statements audit, it was necessary to carry out additional documental testing in order to assess the integrity and accuracy of the information generated by systems and automated reports and, when necessary, the application of procedures using analytical databases, which allowed us to apply a wider spectrum of testing and evidence gathering.

We also performed unpredictability tests and review procedures for specific access to accounting entries, in addition to the procedures already applied to address the risk of management override of controls.

The results of these procedures provided us with appropriate and sufficient audit evidence considering the consolidated financial statements taken as a whole. |

| Revenue from services rendered (Notes 3(xxii.1) and 28(a)) |

|

|

XP Inc. and its subsidiaries' revenue is substantially comprised of brokerage commission, securities placement and management fees.

These revenues are recognized according to contractual terms that consider the commission percentage for services provided. Revenue recognition requires management

|

We understood the internal controls environment regarding revenue recognition processes.

We also performed a tie-out between analytical information extracted from operational systems and revenue recorded in the accounting ledger. On a sample basis, we inspected supporting evidence of revenue in the accounting ledger and confronted its subsequent financial settlement |

3

|

controls to ensure proper recognition at a certain point in time.

Considering the relevance of these revenues in the consolidated financial statements, associated with eventual deficiencies in the controls, this area was considered as a focus area of our audit. |

with bank statements. In addition, we recalculated selected revenue transactions recognized in the accounting ledger.

Therefore, our audit procedures provided us with appropriate and sufficient audit evidence in the consolidated financial statements taken as a whole. |

Responsibilities of management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with the International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the financial reporting process of the Company and its subsidiaries.

Auditor's responsibilities for the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and International Standards on Auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| • | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| • | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control of the Company and its subsidiaries. |

4

| • | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| • | Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the ability of the Company to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Company to cease to continue as a going concern. |

| • | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether these financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| • | Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the Key Audit Matters. We describe these matters in our auditor's report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

São Paulo, February 16, 2023

/s/ PricewaterhouseCoopers

Auditores Independentes Ltda.

PricewaterhouseCoopers

Auditores Independentes Ltda.

CRC 2SP000160/O-5

/s/ Tatiana Fernandes Kagohara Gueorguiev

Tatiana Fernandes Kagohara Gueorguiev

Contadora CRC 1SP245281/O-6

5

XP Inc. and its subsidiaries Consolidated balance sheets at December 31, 2022 and 2021 In thousands of Brazilian Reais |  |

| Assets | Note | 2022 | 2021 | |

| Cash | 3,553,126 | 2,485,641 | ||

| Financial assets | 177,681,987 | 127,745,263 | ||

| Fair value through profit or loss | 96,730,159 | 69,123,669 | ||

| Securities | 7 | 87,513,004 | 58,179,955 | |

| Derivative financial instruments | 8 | 9,217,155 | 10,943,714 | |

| Fair value through other comprehensive income | 34,478,668 | 32,332,377 | ||

| Securities | 7 | 34,478,668 | 32,332,377 | |

| Evaluated at amortized cost | 46,473,160 | 26,289,217 | ||

| Securities | 7 | 9,272,103 | 2,238,807 | |

| Securities purchased under agreements to resell | 6 | 7,603,820 | 8,894,531 | |

| Securities trading and intermediation | 18 | 3,271,000 | 1,405,651 | |

| Accounts receivable | 11 | 597,887 | 469,086 | |

| Loan operations | 10 | 22,211,161 | 12,819,627 | |

| Other financial assets | 20 | 3,517,189 | 461,515 | |

| Other assets | 5,760,811 | 4,688,125 | ||

| Recoverable taxes | 12 | 163,248 | 153,316 | |

| Rights-of-use assets | 16 | 258,491 | 284,509 | |

| Prepaid expenses | 13 | 4,240,107 | 3,982,750 | |

| Other | 1,098,965 | 267,550 | ||

| Deferred tax assets | 24 | 1,611,882 | 1,273,069 | |

| Investments in associates and joint ventures | 15 | 2,271,731 | 2,013,365 | |

| Property and equipment | 16 | 310,894 | 313,964 | |

| Goodwill and Intangible assets | 16 | 844,182 | 820,975 | |

| Total assets | 192,034,613 | 139,340,402 |

The accompanying notes are an integral part of these consolidated financial statements.

1 OF 76

XP Inc. and its subsidiaries Consolidated balance sheets at December 31, 2022 and 2021 In thousands of Brazilian Reais |  |

| Liabilities and equity | Note | 2022 | 2021 | |

| Financial liabilities | 127,708,578 | 91,358,151 | ||

| Fair value through profit or loss | 22,134,674 | 14,573,385 | ||

| Securities | 7 | 13,529,265 | 2,665,202 | |

| Derivative financial instruments | 8 | 8,605,409 | 11,908,183 | |

| Evaluated at amortized cost | 105,573,904 | 76,784,766 | ||

| Securities sold under repurchase agreements | 6 | 31,790,091 | 26,281,345 | |

| Securities trading and intermediation | 18 | 16,062,697 | 15,597,555 | |

| Financing instruments payable | 17 | 43,683,629 | 24,429,086 | |

| Accounts payables | 617,394 | 867,526 | ||

| Borrowings | 19 | 1,865,880 | 1,928,782 | |

| Other financial liabilities | 20 | 11,554,213 | 7,680,472 | |

| Other liabilities | 47,172,782 | 33,533,688 | ||

| Social and statutory obligations | 21 | 968,119 | 1,022,212 | |

| Taxes and social security obligations | 22 | 365,419 | 549,651 | |

| Retirement plans liabilities | 23 | 45,733,815 | 31,921,400 | |

| Provisions and contingent liabilities | 27 | 43,541 | 29,308 | |

| Other | 61,888 | 11,117 | ||

| Deferred tax liabilities | 24 | 111,043 | 28,934 | |

| Total liabilities | 174,992,403 | 124,920,773 | ||

| Equity attributable to owners of the Parent company | 17,035,735 | 14,416,836 | ||

| Issued capital | 24 | 23 | ||

| Capital reserve | 19,156,382 | 14,923,315 | ||

| Other comprehensive income | (133,909) | (334,563) | ||

| Treasury shares | (1,986,762) | (171,939) | ||

| Non-controlling interest | 6,475 | 2,793 | ||

| Total equity | 25 | 17,042,210 | 14,419,629 | |

| Total liabilities and equity | 192,034,613 | 139,340,402 |

The accompanying notes are an integral part of these consolidated financial statements.

2 OF 76

XP Inc. and its subsidiaries Consolidated statements of income and of comprehensive income for the years ended December 31, 2022, 2021 and 2020 In thousands of Brazilian Reais, except earnings per share |  |

Consolidated statements of income and of comprehensive income of income

| Note |

2022 |

2021 |

2020 |

|||||

| Net revenue from services rendered | 28 | 5,940,456 | 6,196,465 | 5,016,488 | ||||

| Net income (loss) from financial instruments at amortized cost and at fair value through other comprehensive income | 28 | 1,145,395 | (1,559,464) | 183,393 | ||||

| Net income from financial instruments at fair value through profit or loss | 28 | 6,261,539 | 7,440,111 | 2,951,724 | ||||

| Total revenue and income | 13,347,390 | 12,077,112 | 8,151,605 | |||||

| Operating costs | 29 | (3,871,096) | (3,430,109) | (2,645,359) | ||||

| Selling expenses | 30 | (138,722) | (227,483) | (134,915) | ||||