Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| W.W. Grainger, Inc. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

| W.W. GRAINGER, INC. 100 GRAINGER PARKWAY LAKE FOREST, ILLINOIS 60045-5201 (847) 535-1000 |

March 15, 2018

Dear Grainger Shareholders:

We are pleased to invite you to attend the 2018 annual meeting of shareholders of W.W. Grainger, Inc. on Wednesday, April 25, 2018, at 10 a.m. Central Daylight Time. This year's annual meeting will be held at our headquarters located at 100 Grainger Parkway in Lake Forest, Illinois.

At the meeting, we will report on our operations and other matters of current interest. Shareholders will also vote on the matters described in the accompanying Notice of Annual Meeting and Proxy Statement and any other matters properly brought before the meeting.

As in prior years, we have elected to deliver our proxy materials to the majority of our shareholders over the Internet. This delivery process allows us to provide shareholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. The Notice of Annual Meeting of Shareholders on the following page contains instructions on how to:

Please take the time to carefully read the Notice of Annual Meeting and Proxy Statement that follow. Whether or not you plan to attend the meeting, please ensure that your shares are represented by giving us your proxy. You can do so by telephone, by Internet, or by signing and dating the enclosed proxy form and returning it promptly in the envelope provided.

We look forward to seeing you at the meeting.

| Sincerely, | ||

D.G. Macpherson Chairman of the Board and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| |

Proposal |

Board Recommendation |

For more information |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| 1. | to elect 11 directors for the ensuing year | FOR (all nominees) |

Page 9 | |||||||

2. |

to ratify the appointment of Ernst & Young LLP as independent auditor for the year ending December 31, 2018; and |

FOR |

Page 35 |

|||||||

3. |

to hold an advisory vote on the compensation of Grainger's Named Executive Officers |

FOR |

Page 76 |

|||||||

| | | | | | | | | | | |

We will also consider any other matters that may properly be brought before the Meeting (and any postponements or adjournments of the Meeting). As of the date of this proxy statement, we have not received notice of any such matters.

Shareholders of Grainger, as of the record date, are entitled to vote, as follows:

|

|

|

|

||||

| Internet | Telephone | |||||

| www.proxyvote.com for beneficial ownership |

1-800-690-6903 for beneficial ownership |

Mark, sign and date your proxy card and return it in the pre-addressed postage-paid envelope we have provided or return it to: | ||||

| www.investorvote.com/GWW for registered ownership up until 1:00 am CDT on April 25, 2018 |

or 1-800-652-8683 for registered ownership up until 1:00 am CDT, on April 25, 2018 |

For beneficial ownership: Vote Processing c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 |

For registered ownership: Proxy Services C/O Computershare Investor Services PO BOX 505008 Louisville, KY 40233-9814 |

|||

Regardless of whether you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote your shares in person, over the Internet or via a toll-free telephone number. If you received a paper copy of a proxy or voting instruction card by mail, you also may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. For specific instructions on voting, please refer to the section, Questions and Answers—Voting Information / page 79.

This Notice of Annual Meeting, Proxy Statement and Form of Proxy are being distributed and made available around March 15, 2018.

By order of the Board of Directors.

Hugo Dubovoy, Jr.

Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 25, 2018

Our Proxy Statement and Annual Report on Form 10-K are available in the 2018 Annual Shareholder Meeting/Proxy Information section of Grainger's website at http://www.grainger.com/investor, and also may be obtained free of charge on written request to the Corporate Secretary at Grainger's headquarters, 100 Grainger Parkway, Lake Forest, Illinois 60045-5201.

TABLE OF CONTENTS |

|

CEO Pay Ratio Disclosure |

75 |

|

| | | |

Proposal 3: Say on Pay |

76 |

|

| | | |

Equity Compensation Plans |

77 |

|

| | | |

Transactions with Related Persons |

78 |

|

| | | |

QUESTIONS AND ANSWERS |

79 |

|

| | | |

Proxy Materials |

79 |

|

| | | |

Voting Information |

79 |

|

| | | |

APPENDIX A—CATEGORICAL STANDARDS FOR DIRECTOR INDEPENDENCE |

A-1 |

|

| | | |

| C | orporate Governance | |

| | | |

The Board of Directors of the Company (the Board) acts as the steward of the Company for the benefit of the Company's shareholders. Our Directors bring to the Board a wealth of business experience and a track record of good business judgment in various situations relevant to the Company's operations. Our Directors exercise their business judgment in the best interests of the Company consistent with their fiduciary duties, and in alignment with shareholder value.

Our Board recognizes the importance of ensuring that our overall business strategy is designed to create long-term value for Grainger's shareholders. The Board maintains an active role in formulating, planning and overseeing the implementation of Grainger's strategy. It has a robust annual strategic planning process during which key elements of our business and financial plans, strategies and near- and long-term initiatives are developed and reviewed. This process culminates with a full-day Board session with our senior leadership team to review Grainger's overall strategy, opportunities, challenges, and capabilities, and helps shape the strategic content presented at the Company's annual Analyst Meeting. In addition to business strategy, the Board reviews Grainger's short-term and long-term financial plans, which serve as the basis for the annual operating and capital plans for the upcoming year. The Board evaluates progress made, as well as related challenges and risks, with respect to our strategy and plans throughout the year.

Operating Principles of the Board of Directors

The Board recognizes that defining its role under the Company's operating principles is an evolving process. In 1995, the Board established the W.W. Grainger, Inc. Operating Principles for the Board of Directors (the Operating Principles). The principles are not intended to cover all issues that may arise, but rather to provide a general framework of reference to assist the Board in the performance of its duties and responsibilities. Each year, the Board reviews and revises the Operating Principles, as appropriate, to address emerging needs and practices. The Operating Principles may be found in the Governance section of our website at http://www.grainger.com/investor.

Our Board of Directors is committed to excellence in its governance practices, including Board composition. Of our Board, 10 of 11 Directors are independent. The Board has adopted "categorical standards" to assist it in making independence determinations of director nominees. The categorical standards are intended to help, for example, the Board determine whether certain relationships between nominees and Grainger are "material relationships" for purposes of the New York Stock Exchange (the NYSE) independence standards. The categorical standards adopted by the Board have more restrictive thresholds than the NYSE's bright line revenue test for non-independence. The categorical standards adopted by the Board are set forth in Appendix A to this proxy statement and are also available in the Governance section of Grainger's website at http://www.grainger.com/investor.

Grainger's Board has 10 independent Directors and one management Director. The Board considered a variety of factors, including related party transactions and charitable donations, in assessing the

Proxy

Statement

![]() 1

1

| |

Corporate Governance |

independence of the Directors involved against the NYSE's independence standards and Grainger's categorical standards. In addition to ordinary course business transactions and charitable donations by the Company, the Board considered two contributions directed under the Company's matching charitable gift program to a tax-exempt organization where a Director serves as an officer and board member. The Board determined that none of the Directors had any direct or indirect material interest in any transactions or donations. Similar transactions and donations are likely to occur in the future and are not expected to impair the independence of the directors involved. Mr. Macpherson is a Grainger employee and, accordingly, is not considered "independent." However, the Board has determined that each of Mses. Hailey and Perez, and Messrs. Adkins, Anderson, Levenick, Novich, Roberts, Santi, Slavik, and Watson has no material relationship with Grainger within the meaning of the NYSE independence standards and Grainger's categorical standards and is, therefore, independent.

BOARD QUALIFICATIONS, ATTRIBUTES, SKILLS AND BACKGROUND

In addition to independence, the Board and its Board Affairs and Nominating Committee believe that a diverse, experienced and vibrant board also is of utmost importance for reaching sound decisions that drive shareholder value. As evidence of this commitment to a diversity of perspectives, our Board is currently comprised of 11 directors of varying experience and background, including two new directors appointed in 2017.

We determined that Board experience and diversity benefit us most when they are aligned with our global business needs, reflective of our strong corporate governance practices, and consistent with our corporate social responsibility goals. As a result of the Board's ongoing refreshment efforts, we added directors with expertise in the technology and digital space, as well as in leading corporate social responsibility initiatives for a global business. Our three newest directors, Rodney Adkins, Beatriz Perez and Lucas Watson, have enhanced the diversity of our Board in addition to bringing their valuable perspectives and experiences.

A breadth of Board perspectives supports our business as a broad line, business-to-business distributor of maintenance, repair and operating (MRO) supplies and other related products and services. Grainger's management operates its business through a network of highly integrated websites, distribution centers and branches with nearly 25,000 employees primarily in the United States and Canada, and with a presence in Europe, Asia and Latin America. More than 5,000 suppliers provide Grainger with less than 1.7 million products stocked in Grainger's distribution centers and branches worldwide. Approximately 3.5 million businesses and institutions worldwide rely on Grainger to keep their operations running and their people safe.

2

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

The following table highlights specific experience, qualifications, attributes, skills, and background information that the Board considered for each director. A particular director may possess additional experience, qualifications, attributes, or skills, even if not expressly indicated below.

| Director Qualifications, Attributes and Skills |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Operational | | | | | | | | | | | | |||||||||||

| Experience developing and implementing operating plans and business strategy | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

| Finance/Capital Allocation | | | | | | | | | | | | |||||||||||

| Knowledge of finance or financial reporting; experience with debt and capital market transactions; and/or mergers and acquisitions | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | ✓ | | ✓ | | ✓ | | |||

| Supply Chain/Logistics | | | | | | | | | | | | |||||||||||

| Experience in supply chain management encompassing the planning and management of all activities involved in sourcing and procurement, conversion, and all logistics management activities | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | |

| Digital/eCommerce | | | | | | | | | | | | |||||||||||

| Experience implementing digital and omni-channel strategies and/or operating an eCommerce business | | | | ✓ | | ✓ | | ✓ | | | ✓ | | | | | ✓ | ||||||

| Marketing/Sales & Brand Management | | | | | | | | | | | | |||||||||||

| Experience managing a marketing/sales function, and in increasing the perceived value of a product line or brand over time in the market | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

| Human Resources/Compensation | | | | | | | | | | | | |||||||||||

| Experience managing a human resources/compensation function; experience with executive compensation and broad-based incentive planning | | ✓ | | | | ✓ | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ||||

| Public Company/Leadership | | | | | | | | | | | | |||||||||||

| "C-Suite" experience with a public company; leadership experience as a division president or functional leader within a complex organization | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

| Corporate Governance/Public Company Experience | | | | | | | | | | | | |||||||||||

| Experience serving as a public company director; demonstrated understanding of current corporate governance standards and best practices in public companies | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | |

| International | | | | | | | | | | | | |||||||||||

| Experience overseeing a complex global organization | | ✓ | | | | | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | | | ✓ |

| Risk Assessment & Risk Management | | | | | | | | | | | | |||||||||||

| Experience overseeing complex risk management matters | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | ✓ | | ✓ | | ✓ | | ||

| Technology/Cyber security | | | | | | | | | | | | |||||||||||

| Experience implementing technology strategies and managing/mitigating cyber security risks | | ✓ | | | | | | | | ✓ | | ✓ | | | | ✓ | | ✓ | | | | ✓ |

Proxy

Statement

![]() 3

3

| |

Corporate Governance |

| Director Qualifications, Attributes and Skills (continued) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Government/Public Policy | | | | | | | | | | | | |||||||||||

| Experience overseeing complex regulatory matters that are integral to a business | | ✓ | | | ✓ | | ✓ | | ✓ | | | ✓ | | ✓ | | ✓ | | | ||||

| Real Estate | | | | | | | | | | | | |||||||||||

| Experience overseeing complex real estate matters that are integral to a business | | ✓ | | | | ✓ | | | | | | | | | | ✓ | | | | ✓ | | |

| Business Ethics/Corporate Social Responsibility | | | | | | | | | | | | |||||||||||

| Track record of integrity, uncompromising moral principles and strength of character; informed on company issues related to corporate social responsibility, sustainability and philanthropy while monitoring emerging issues potentially affecting the reputation of the business | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

| Director Tenure, Gender, Age and Race/Ethnicity | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Board Tenure | ||||||||||||||||||||||

| Years | 4 | 19 | 12 | 12 | 2 | 19 | 1 | 12 | 8 | 31 | 0 | |||||||||||

| Gender | ||||||||||||||||||||||

| Male | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| Female | ✓ | ✓ | ||||||||||||||||||||

| Age | ||||||||||||||||||||||

| Years Old | 59 | 67 | 67 | 65 | 50 | 63 | 48 | 67 | 56 | 65 | 47 | |||||||||||

| Race/Ethnicity | ||||||||||||||||||||||

| African American/Black | ✓ | ✓ | ||||||||||||||||||||

| Asian, Hawaiian, or Pacific Islander | ||||||||||||||||||||||

| Caucasian /White | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

| Hispanic/Latino | ✓ | |||||||||||||||||||||

| Native American | ||||||||||||||||||||||

| Other | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

The Board believes that a fully engaged Board is a strategic asset of the Company, and fresh viewpoints and perspectives are important for informed decision-making. At the same time, the Company believes that directors develop a deeper understanding of the Company over time, which provides significant shareholder value, and that year-over-year director continuity is beneficial to shareholders.

Even before Board vacancies arise, the Board periodically evaluates whether its Directors collectively has the right mix of skills, experience, attributes and diverse viewpoints necessary for it to be a good steward for the Company's shareholders. The results of these evaluations are used to identify desirable skill sets for potential Board nominees and to screen director candidates. In 2017, the Board codified this practice into the Board Affairs and Nominating Committee's charter.

4

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

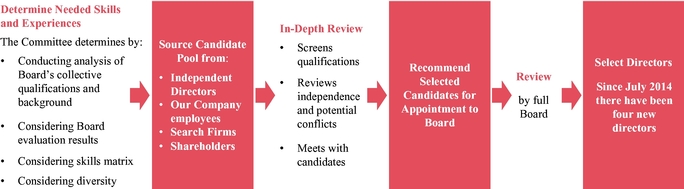

Also part of the planning for Board refreshment and director succession, the Board Affairs and Nominating Committee periodically considers potential director candidates. As a result of these ongoing reviews, in the last four years, the Board appointed four new directors.

The Board previously disclosed its membership expectations in the Company's Criteria for Membership on the Board of Directors (the Criteria). The Board's Criteria list the various factors that the Board Affairs and Nominating Committee should consider in reviewing candidates for the Board. For example, the Criteria insures turnover by generally prescribing a retirement age of 72 for non-employee director candidates. Within the last two years, two of our Directors did not stand for re-election based on retirement age. Separately, a third Director, the Company's former Chairman, retired in October 2017.

Age |

0-50 | 51-59 | 60+ | |||

| | | | | | | |

Number of Directors |

3 | 2 | 6 |

The Board believes that it has the appropriate mix of relatively new directors and those with longer service to and financial interest in the Company. One longstanding director, Mr. Slavik, is the beneficial owner of approximately 6.6% of the Company's shares as of March 5, 2018. Mr. Slavik's beneficial ownership of Company shares pre-dates Grainger's initial public offering in 1967.

As a group, the average tenure of the 2018 nominees for election to Grainger's Board of Directors is approximately 11 years, with 40% of the non-employee nominees having Board tenure of less than five years. See Board Qualifications, Attributes, Skills and Background / pages 3-4 of this proxy statement for a matrix reflecting tenure for each nominee.

Years of Service |

0-5 | 6-10 | 10+ | |||

| | | | | | | |

Number of Directors |

4 | 1 | 6 |

In addition to relevant business experience, qualifications, attributes, skills, and the willingness to become involved with Grainger, the Board's Criteria also enumerate personal characteristics that the Board should consider, including reputation for ethics and integrity, common sense and judgment, independent and objective thought, and the consideration of diverse opinions.

Regarding diversity, the Criteria specify that consideration shall be given to candidates without regard to race, color, religion, gender or national origin. To ensure that the Board benefits from diverse perspectives, it proactively seeks qualified nominees from a variety of backgrounds, including candidates of gender, age, and racial diversity. In any retained search for Board candidates, Grainger specifies that the Board is seeking candidates with gender and racial diversity. We have established a standing relationship with a nationally recognized third party search firm to assist us in identifying potential new directors. In all searches, we specify that we will entertain a slate that includes only gender and racially diverse candidates. Our Board's diversity is set forth, below.

Gender |

Female | Male | ||

| | | | | |

Number of Directors |

2 | 9 |

Race/Ethnicity |

|

African American/Black |

|

Caucasian / White |

|

Hispanic/Latino |

|

Other | |||||

| | | | | | | | | | | | | | |

Number of Directors |

2 | 8 | 1 | — |

Proxy

Statement

![]() 5

5

| |

Corporate Governance |

Grainger's directors are elected each year at the annual meeting of shareholders. As set forth in the Operating Principles for the Board of Directors, Grainger expects all directors and nominees to attend annual meetings. At the 2017 annual meeting, all of the persons serving as directors at the time were in attendance. In addition, during 2017, all directors attended at least 75% of Board and Committee meetings.

Eleven directors, all current Board members, have been nominated by the Board for election at this year's annual meeting of shareholders. All directors are elected for a one-year term. Each director will, therefore, serve until the 2019 annual meeting of shareholders.

As required under Illinois law, majority voting and cumulative voting apply to all Grainger director elections. Under our majority voting standard, directors are elected by the votes of a majority of the shares of Grainger common stock represented in person or by proxy at the meeting and entitled to vote. Under cumulative voting, shareholders have the right to cumulate their votes in the election of directors. This means that you have a number of votes in the election equal to the number of shares you own multiplied by the number of directors being elected. You can cast those votes for the nominees as you choose. For example, you may cast all your votes for one nominee or you may apportion your votes among two or more nominees. In any matter other than the election of directors, each of your shares is entitled to one vote.

A shareholder directing to withhold authority for re-election of a director will have the same effect as votes against the election of that director. Assuming a quorum is present, broker non-votes will not affect the outcome of the vote. If any of the nominees for director mentioned below should be unavailable for election, a circumstance that is not expected, the person or persons voting your proxy may exercise discretion to vote for a substitute nominee selected by the Board.

CANDIDATES FOR BOARD MEMBERSHIP

The Board Affairs and Nominating Committee (the Committee) recommends to the Board candidates for Board and committee membership.

Before recommending candidates to the Board, the Committee reviews the results of the Board evaluation process and its skills matrix in determining the desired skill set for potential new candidates. The Committee then determines the position description for potential Board nominees by periodically evaluating whether the Board members collectively have the right mix of skills, experience, attributes and diverse viewpoints necessary for the Board to be a good steward for the Company's shareholders.

The Committee screens Board candidates based on a number of criteria, including ethical standards, judgment, independence and objectivity, strategic perspective, record of accomplishment, business knowledge, experience applicable to Grainger's goals, and diversity.

The Committee is assisted with its recruitment efforts by a nationally recognized third party search firm, which helps identify candidates that satisfy the Board's criteria. In addition to Board candidates

6

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

recommended by the Committee, suggestions as to nominees are received from employees, search firms, shareholders, and others.

The proxy access provisions of our By-laws permit a qualifying shareholder or group of up to 20 qualifying shareholders who have maintained continuous qualifying ownership of 3% or more of our outstanding common stock for at least the previous three years to nominate and include in our proxy materials qualifying director nominees constituting up to the greater of two directors or 20% of the directors then serving on the Board at the time of the nomination, provided that the shareholder(s) and nominee(s) satisfy the requirements specified in our By-laws.

Any shareholder who would like the Committee to consider a candidate for Board membership should send a letter of recommendation containing the name and address of the proposing shareholder and of the proposed candidate and setting forth the business, professional, and educational background of the proposed candidate, as well as a description of any agreement or relationship between the proposing shareholder and proposed candidate. A written consent of the proposed candidate to be identified as a nominee and to serve as a director if elected must also be provided. The communication should be sent by mail or other delivery service to the attention of the Corporate Secretary at Grainger's headquarters.

NOMINEES AND DIRECTOR EXPERIENCE AND QUALIFICATIONS

The nominees have provided the following information about themselves, including their ages as of March 15, 2018. Each nominee has provided information on his or her relevant background that includes the nominee's experience for at least the past five years.

Grainger's directors and nominees have varied experience, qualifications, attributes, skills, and backgrounds that assist them in providing guidance and oversight to Grainger's management as it operates the business through a network of highly integrated websites, distribution centers and branches with nearly 25,000 employees primarily in the United States and Canada, and with a presence in Europe, Asia, and Latin America. Businesses and institutions worldwide rely on our Company, a broad line distributor of maintenance, repair and operating (MRO) supplies and other related products and services, with 2017 sales of $10.4 billion, to keep their operations running and their people safe.

The Board has identified experience, qualifications, attributes, skills, and backgrounds that, in light of Grainger's business, structure and challenges, are relevant to service on the Board of Directors. The Board considers nominees who have demonstrated integrity and accomplishment in their business and professional careers and who possess the necessary experience and background to contribute to the Board and Grainger. In addition, the nominees have engaged in continuing education and other programs to remain current in their particular areas of expertise, to further their understanding of corporate governance, and in other matters relevant to Grainger.

Proxy

Statement

![]() 7

7

| |

Corporate Governance |

The Board believes each of the current nominees qualifies for service on the Board of Directors. Moreover, each of the current nominees has significant leadership experience in large, multifaceted organizations. This leadership experience includes developing and executing corporate strategy, overseeing operations, and managing risks in organizations similar in size or complexity to Grainger.

The summaries, provided below, are not a comprehensive statement of each nominee's background, but are provided to describe the primary experience, qualifications, attributes, skills, and background that led the Board to nominate each individual.

8

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

| | | |

| Rodney C. Adkins | ||

Independent Director

Age: 59

Director Since: 2014

Grainger Board Committees:

BANC

CCOB

President of 3RAM Group LLC, a privately held company specializing in capital investments, business consulting services and property management

| Current Public Company Boards |

• Avnet, Inc. (audit committee; corporate governance committee) |

• PPL Corporation (audit committee; finance committee) |

• United Parcel Service, Inc. (Chair, risk committee; compensation committee) |

• PayPal Holdings, Inc. (audit committee; risk and compliance committee) |

Prior Public Company Boards |

• Pitney Bowes Inc. (2007-2013) (audit committee; executive compensation committee) |

Qualifications: |

| Prior Business and Other Experience |

• Senior Vice President of International Business Machines Corporation (IBM), a leading manufacturer of information technologies (2007-2014), where he held numerous development and management roles, including Senior Vice President of Corporate Strategy (2013-2014); Senior Vice President of Systems and Technology Group (2009-2013); Senior Vice President of Development & Manufacturing (2007-2009; Vice President of Development of IBM Systems and Technology Group (2003-2007) |

Other Key Qualifications |

| Mr. Adkins served as the senior vice president of IBM, a global information technology and innovation-focused public company and held senior positions responsible for development,

management and strategy. Over the course of 30 years with IBM, he developed deep product development and brand management experience. He also gained significant experience managing and understanding corporate finance, financial statements and

accounting through his many operational roles with the company. Additionally, Mr. Adkins managed IBM's supply chain and procurement, giving him direct insight into global trade and supply chains, and the role of distributors in those efforts.

Mr. Adkins has extensive experience in corporate governance matters. |

Proxy

Statement

![]() 9

9

| |

Corporate Governance |

| | | |

| Brian P. Anderson | ||

Independent Director

Age: 67

Director Since: 1999

Grainger Board Committees:

Audit

BANC

Former Executive Vice President of Finance and Chief Financial Officer of OfficeMax Incorporated, a distributor of business to business and retail office products, having served in that position until January 2005

| Current Public Company Boards |

• James Hardie Industries plc (Chair, audit committee; remuneration committee) |

• Pulte Group, Inc. (Chair, audit committee; nominating and governance committee) |

• Stericycle, Inc. (Chair, audit committee). |

Prior Public Company Boards |

• A.M. Castle & Co. (2005-2016), Chairman of the Board (Chair, audit committee) |

Qualifications: |

| Prior Business and Other Experience |

• Senior Vice President and Chief Financial Officer of Baxter International Inc., a position he assumed in 1998 |

Other Key Qualifications |

| Mr. Anderson served as the chief financial officer of OfficeMax Incorporated and Baxter International Inc., held finance positions including corporate controller and vice president of audit and was an audit partner at an international public accounting firm. As a result, Mr. Anderson has in-depth knowledge of accounting and finance as well as familiarity in risk management and risk assessment and the application of the Committee of Sponsoring Organizations of the Treadway Commission internal controls framework. Mr. Anderson also has in-depth experience in corporate governance matters as the former chairman of the board of A.M. Castle & Co., and as a member of the governance committee of Pulte Group, Inc. In addition, he is a director and Chairman of The Nemours Foundation, a non-profit children's health organization, and a member of the Governing Board of the Center for Audit Quality's (CAQ) Governing Board. Mr. Anderson is an "audit committee financial expert." See "Audit Committee" below for the Board's determination concerning Mr. Anderson's service on more than three public company audit committees. |

| | | |

| V. Ann Hailey | ||

Independent Director

Age: 67

Director Since: 2006

Grainger Board Committees:

Audit

BANC

Former Executive Vice President and Chief Financial Officer of L Brands, Inc. (formerly, Limited Brands, Inc.) (1997-2006), a retail apparel, personal care and beauty products company

| Current Public Company Boards |

• Realogy Holdings Corp. (Chair, audit committee; nominating and corporate governance committee) |

• TD Ameritrade Holdings, Inc. (audit committee; risk committee; outside independent director's committee) |

Prior Public Company Boards |

• Avon Products, Inc. (audit committee; finance committee) (2008-2016) |

• Federal Reserve Bank of Cleveland (Chair, audit committee) (2004-2008) |

Qualifications: |

| Prior Business and Other Experience |

• Former Executive Vice President, Corporate Development with L Brands Inc. (2006-2007); and, former board member (2001-2006) |

• President, Chief Executive Officer and Chief Financial Officer of Famous Yard Sale, Inc. (2012-2014) |

• Various leadership roles at PepsiCo., Inc.; Vice President, Headquarters Finance, Pepsi Cola Company; Vice President, Finance and Chief Financial Officer of Pepsi Cola Fountain Beverage and USA Divisions (13 years) |

• Chief Financial Officer, Gilt Groupe, Inc. (2009-2010) |

• Leadership roles at Pillsbury Company |

• Leadership roles at RJR Nabisco Foods, Inc. |

Other Key Qualifications |

| Ms. Hailey has spent her career in consumer businesses, such as L Brands, Inc., PepsiCo., Inc., Pillsbury Company, and RJR Nabisco Foods, Inc., and brings key financial and operations experience to the Company. In particular, Ms. Hailey possesses broad expertise in finance, strategic planning, branding and marketing, retail goods and sales and distribution on a global scale. Ms. Hailey's positions as chief financial officer, her current and prior service on the audit committees of other companies and as Audit Chair of the Cleveland Federal Reserve Bank and her accounting and financial knowledge, also impart significant expertise to the Board, including an understanding of financial statements, corporate finance, accounting and capital markets. Through her experiences at Gilt Groupe Inc. and Famous Yard Sale, Ms. Hailey has added experience in Internet site development and selling as well as new venture management and funding. Ms. Hailey is an "audit committee financial expert." |

10

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

| | | |

| Stuart Levenick | ||

Independent Director

Lead Director

Age: 65

Director Since: 2005

Grainger Board Committees:

Chair, BANC

CCOB

Retired Group President of Caterpillar Inc., a manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines

| Current Public Company Boards |

• Lead Director of Entergy Corporation (former Chair, finance committee; governance committee; executive committee) |

• Finning International Inc. (Chair, audit committee; corporate governance committee) |

Prior Public Company Boards |

• None |

Qualifications: |

| Prior Business and Other Experience |

• Vice President, Caterpillar Inc. |

• Chairman of Shin Caterpillar Mitsubishi Ltd. (2000-2004) and Vice President, Asia Pacific Division (2001-2004) |

Other Key Qualifications |

| Mr. Levenick has served as the group president of a division of Caterpillar Inc., a public multinational manufacturing company and has had extensive international operations experience including positions outside the United States in numerous countries for more than 20 years. Mr. Levenick also had operational responsibility for supply chain and logistics and responsibility for the global parts and product support business as well as global marketing of his previous employer. In addition, he had led his former employer's global human resources function and had responsibility for that company's enterprise risk assessment. |

| | | |

| D.G. Macpherson | ||

Chairman of the Board

Age: 50

Director Since: 2016

Chairman (2017-present) and Chief Executive Officer (2016-present) of W.W. Grainger, Inc.

| Current Public Company Boards |

• None |

Prior Public Company Boards |

• None |

Qualifications: |

| Prior Business and Other Experience |

• Chief Operating Officer of Grainger (2015-2016); Senior Vice President and Group President, Global Supply Chain and International (2013-2015); Senior Vice President and President, Global Supply Chain and Corporate Strategy (2012-2013); Senior Vice President, Global Supply Chain (2008-2012) |

• The Boston Consulting Group, Partner and Managing Director (2002-2008) |

Other Key Qualifications |

| Mr. Macpherson has served Grainger in many capacities over his nearly 10 years with the Company, including developing Company strategy, overseeing the launch of Grainger's U.S. single channel business, Zoro Tools, Inc., building the Company's supply chain capabilities globally and realigning the U.S. business to create greater value for customers of all sizes. Mr. Macpherson also has extensive experience in strategic planning, development and execution. Mr. Macpherson joined Grainger in 2008 after working closely with Grainger for six years as a partner and managing director at The Boston Consulting Group, a global management consulting firm, where he was a member of the Industrial Goods Leadership Team. |

Proxy

Statement

![]() 11

11

| |

Corporate Governance |

| | | |

| Neil Novich | ||

Independent Director

Age: 63

Director Since: 1999

Grainger Board Committees:

Audit

BANC

Former Chairman, President and Chief Executive Officer of Ryerson Inc. (1996-2007), a public multinational metal distributor and fabricator

| Current Public Company Boards |

• Analog Devices, Inc. (Chair, compensation committee) |

• Beacon Roofing Supply, Inc. (Chair, compensation committee; former Chair, audit committee) |

• Hillenbrand, Inc. (Chair, compensation and management development committee; mergers and acquisitions committee; nominating and corporate governance committee) |

Prior Public Company Boards |

• Ryerson Inc., Chairman of the Board (1999-2007) |

Qualifications: |

| Prior Business and Other Experience |

• Trustee of The Field Museum of Natural History |

• Member of the Dean's Counsel of the Physical Sciences Division, University of Chicago |

Other Key Qualifications |

| Mr. Novich has served as the chief executive officer and chairman of the board of Ryerson Inc., where he was deeply engaged in that company's distribution operations on a domestic and international basis, and also in the leadership development and human resources functions. He was also a consultant for a management consulting firm for over 10 years developing strategies for its clients. As a result, Mr. Novich has in-depth operational experience in supply chain, distribution and logistics and experience in developing strategy across a variety of industries. Mr. Novich is an "audit committee financial expert." |

| | | |

| Beatriz R. Perez | ||

Independent Director

Age: 48

Director Since: 2017 Grainger Board Committees:

BANC

CCOB

Senior Vice President and Chief Public Affairs, Communications and Sustainability Officer of The Coca-Cola Company (March 2017-present), a global beverage company

| Current Public Company Boards |

• Primerica, Inc. (compensation committee) |

Prior Public Company Boards |

• HSBC North America Holdings and the HSBC Finance Corporation (nominating and governance; risk & compliance committee; audit committee) (2008-2014) |

Qualifications: |

| Prior Business and Other Experience |

• Prior to assuming her position in March 2017, Ms. Perez has held several positions at The Coca-Cola Company, including her most recent as the Company's first Chief Sustainability Officer, announced July 2011. Prior to that she held various roles of increasing responsibility at The Coca-Cola Company in the North America Operating Division, including Chief Marketing Officer, Senior Vice President Integrated Marketing, and multiple field operating roles. |

Other Key Qualifications |

| Ms. Perez is a senior vice president and named executive officer of The Coca-Cola Company, a public multinational beverage company, where she leads a team across public affairs and communications, sustainability and partnerships to support that company's growth model and strategic initiatives. In this role, Ms. Perez aligns a diverse portfolio of work against critical business objectives to support brands, communities, consumers and partners worldwide. During her tenure of more than two decades at that company, she has held several leadership roles while garnering significant experience in marketing and sustainability programs. Ms. Perez also is a strong advocate for community service, serving on various non-profit boards, including The Coca-Cola Foundation. |

12

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

| | | |

| Michael J. Roberts | ||

Independent Director

Age: 67

Director Since: 2006

Grainger Board Committees:

BANC

Chair, CCOB

Former Global President and Chief Operating Officer of McDonald's Corporation (2004-2006), a public multinational food service company

| Current Public Company Boards |

• CenturyLink, Inc. (human resources and compensation committee; nominating and corporate governance committee) |

Prior Public Company Boards |

• Qwest Communications International, Inc. (prior to its acquisition by CenturyLink) (2009-2011) (compensation and human resources committee) • SP Plus Corporation (formerly, Standard Parking Corporation) (2010-2013) (audit committee; compensation committee; executive committee) |

Qualifications: |

| Prior Business and Other Experience |

• Chief Executive Officer—McDonald's USA (2004); President—McDonald's USA (2001-2004); President, West Division—McDonald's USA (1997-2001) |

Other Key Qualifications |

| Mr. Roberts served as president and chief operating officer of McDonald's Corporation, a public multinational food-service company, and in this capacity had extensive management and profit and loss responsibilities. He also was responsible for the marketing and international operations of that company. In addition, Mr. Roberts has significant human resources experience and previously served on the compensation committees of Qwest Communications International, Inc. and SP Plus Corporation. |

| | | |

| E. Scott Santi | ||

Independent Director

Age: 56

Director Since: 2010

Grainger Board Committees:

Chair, Audit

BANC

Chairman (2015-present) and Chief Executive Officer (2012-present) of Illinois Tool Works Inc. (ITW), a worldwide manufacturer of engineered components and systems

| Current Public Company Boards |

• Illinois Tool Works Inc. (2015) |

Prior Public Company Boards |

• None |

Qualifications: |

| Prior Business and Other Experience |

• Acting Chief Executive Officer of ITW (2012); Vice Chairman of ITW (2008-2012); Executive Vice President (2004-2008) |

Other Key Qualifications |

| Mr. Santi is the chief executive officer of ITW, a worldwide manufacturer of engineered components and systems. Prior to assuming this position, he served in various management roles for ITW including positions requiring significant operational and financial responsibility. During his tenure he has had extensive international responsibility including operating responsibility for a business with annual international revenues of several billion dollars. Mr. Santi has significant experience with mergers and acquisitions and with integrating acquired companies. He has also had significant strategic marketing responsibilities and human resource experience including compensation policy, leadership development and succession planning. Mr. Santi is an "audit committee financial expert." |

Proxy

Statement

![]() 13

13

| |

Corporate Governance |

| | | |

| James D. Slavik | ||

Independent Director

Age: 65

Director Since: 1987

Grainger Board Committees:

BANC

CCOB

Chairman and a director of Mark IV Capital, Inc. (2003-present), a private commercial real estate development and investment company; in addition, he serves as Chief Executive Officer and President of Emerald Bay Ventures II, LLC, a private investment company which invests in real estate and venture capital

| Current Public Company Boards |

• None |

Prior Public Company Boards |

• None |

Qualifications: |

| Prior Business and Other Experience |

• Mark IV Capital, Inc.'s Chairman and Chief Executive Officer (1990-2003) |

Other Key Qualifications |

| Mr. Slavik has expansive knowledge in investments, financing and real estate. Mr. Slavik also worked at multiple commercial brokerage companies as an investment properties broker and led the marketing programs for clients' commercial properties. He also serves on the Advisory Board for the Cove Fund, a seed capital fund affiliated with UCI Applied Innovation (formerly the Institute for Innovation) at the University of California at Irvine and is a Founding Director for UCI Applied Innovation. Mr. Slavik is also a director of the Hoag Hospital Foundation and is a member of its investment and nominating committees. |

| | | |

| Lucas E. Watson | ||

Independent Director

Age: 47

Director Since: 2017

Grainger Board Committees:

Audit

BANC

Executive Vice President and Chief Marketing and Sales Officer of Intuit, Inc. (2016-present), a global provider of business and financial management solutions

| Current Public Company Boards |

• None |

Prior Public Company Boards |

• None |

Qualifications: |

| Prior Business and Other Experience |

• Vice President, Global Brand Solutions, Google, Inc., a global technology company (2011-2016) |

• Various roles in sales, marketing and digital business at Procter & Gamble Company(1994-2011) |

Other Key Qualifications |

| Mr. Watson is Executive Vice President and Chief Marketing and Sales Officer at Intuit, where he leads the company's global sales and go-to-market efforts that bring Intuit's financial management solutions to market across a variety of channels while focusing on global brand expansion, market share growth and strengthening brand equity. As Vice President, Global Brand Solutions at Google, he led the company's brand advertising business, working with some of the world's leading companies to build stronger and more trusted brands. At Procter & Gamble, a global consumer products company, he held a variety of roles across the globe, including driving Procter & Gamble's digital initiatives for 75 brands across 200 countries. During his tenure of more than two decades at these three multinational public companies, Mr. Watson has held several leadership roles while acquiring a deep understanding of sales, marketing, technology and digital business. |

14

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

BOARD MEETINGS AND COMMITTEE MEMBERSHIP

The Company's Operating Principles for the Board of Directors (the Operating Principles) provide for the Board's Committees and the process for selecting Committee leadership. The Board Affairs and Nominating Committees' recommendations are considered by the Board following each annual meeting of shareholders. The Committees are appointed by the Board based on recommendations of the Board Affairs and Nominating Committee. As required by each Committee's charter, all members of each Committee must be "independent" directors.

Five meetings of the Board were held in 2017. Committee members have the opportunity to meet in closed session, without management present, during each Committee meeting. Accordingly, each Board meeting included at least one executive session, during which only independent directors were present. The Committees report regularly to the full Board on their activities and actions.

The Board has delegated certain responsibilities and authority to its standing Committees, as described below.

Independent Directors' Committee Assignments

| Audit Committee |

Board Affairs & Nominating Committee |

Compensation Committee | ||||

| | | | | | | |

| Rodney C. Adkins |

|

|

||||

Brian P. Anderson |

|

|||||

V. Ann Hailey |

||||||

Stuart L. Levenick |

|

|||||

Neil S. Novich |

||||||

Beatriz R. Perez |

|

|||||

Michael J. Roberts |

||||||

E. Scott Santi |

|

|||||

James D. Slavik |

||||||

Lucas E. Watson |

|

|||||

| | | | | | | |

![]() Chairperson

Chairperson

![]() Member

Member

![]() Lead Director

Lead Director

Each Committee has a charter that it reviews annually and then makes recommendations to our Board for charter revisions that may be needed to reflect evolving best practices. Copies of each Committee charter may be found in the Governance section of our website at http://www.grainger.com/investor.

Proxy

Statement

![]() 15

15

| |

Corporate Governance |

AUDIT COMMITTEE |

Number of Meetings Held in Fiscal 2017: 5 |

The Audit Committee of the Board (the Audit Committee) met five times in 2017. The Board has determined that each of the members of the Audit Committee is "independent," as that term is defined in the independence requirements for audit committee members contained in the applicable rules of the U.S. Securities and Exchange Commission (the SEC) and in the listing standards of the NYSE. The Board has determined that each of Mr. Santi, Mr. Anderson, Mr. Novich, and Ms. Hailey is an "audit committee financial expert," as that term is defined in the applicable rules of the SEC. Further, in accordance with applicable NYSE listing standards, the Board has considered Mr. Anderson's simultaneous service on the audit committees of more than three public companies, namely the audit committees of Grainger, PulteGroup Inc., James Hardie Industries plc, and Stericycle, Inc., and has determined that this service will not impair his ability to serve effectively on the Company's Audit Committee.

The Audit Committee assists the Board in its oversight responsibility with respect to the following:

16

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

BOARD AFFAIRS AND NOMINATING COMMITTEE |

Number of Meetings Held in Fiscal 2017: 5 |

The Board Affairs and Nominating Committee of the Board (the Board Affairs and Nominating Committee) met five times in 2017. The Board has determined that each of the members of the Board Affairs and Nominating Committee is "independent," as defined in the independence requirements for members of nominating committees contained in the applicable listing standards of the NYSE.

The Board Affairs and Nominating Committee assists the Board in its oversight responsibility as follows:

Proxy

Statement

![]() 17

17

| |

Corporate Governance |

COMPENSATION COMMITTEE |

Number of Meetings Held in Fiscal 2017: 7 |

The Compensation Committee of the Board (the Compensation Committee) met seven times in 2017. The Board has determined that each member of the Compensation Committee is "independent," as defined in the independence requirements for members of compensation committees in the applicable rules of the SEC, the listing standards of the NYSE, and under the Internal Revenue Code.

The Compensation Committee oversees Grainger's compensation and benefits, policies and programs (generally for all employees and specifically with respect to executives), makes decisions on executive compensation, and reviews and recommends other compensation matters to be submitted to the Board and/or shareholders for approval. The general responsibilities of the Compensation Committee are to oversee that:

The Compensation Committee annually reviews and approves CEO compensation, as follows:

The Compensation Committee also reviews and recommends to the Board for approval the compensation paid to the CEO's direct reports, including the other Named Executive Officers.

In overseeing the Company's compensation programs, the Compensation Committee develops programs based on its own deliberations, programs and recommendations from management, and compensation and benefits consultants, including its independent compensation consultant. After a review of the factors prescribed by the SEC and the NYSE rules and regulations, the Compensation Committee determined that Deloitte Consulting LLP is independent and has retained Deloitte Consulting as its independent compensation consultant.

18

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

The independent compensation consultant is solely hired by, and reports directly to, the Compensation Committee. The Compensation Committee routinely meets with the independent compensation consultant in executive session, without management present, following each Compensation Committee meeting. The Compensation Committee has sole authority to retain and terminate the independent compensation consultant, including sole authority to approve the consultant's fees. At the Compensation Committee's direction, the independent compensation consultant:

Members of management (including some of the Named Executive Officers) assist the Compensation Committee in providing recommendations for the design of Grainger's compensation program for its Named Executive Officers, other officers, and employees. Management also recommends salary and award levels, except those related to the Chairman of the Board and Chief Executive Officer. Salaries and awards related to the Chairman of the Board and Chief Executive Officer are reviewed by the Compensation Committee, together with the other independent directors (as directed by the Board), in executive session without members of management present. On issues of Chairman and Chief Executive Officer compensation, the independent directors of the Compensation Committee, in their sole discretion, determine the appropriate compensation design and level.

The Compensation Committee approves annual grants of equity awards (including, stock options, restricted stock units (RSUs), and performance shares) to Named Executive Officers, other officers and employees under approved shareholder plans. Also, the Compensation Committee has delegated to management limited authority to grant "off-cycle" awards of stock options and RSUs to non-officer employees. Awards under this authority are granted under terms and conditions approved by the Compensation Committee. The pool of shares available to management under this delegation is refreshed annually by the Compensation Committee. Management informs the Compensation Committee of the awarded grants at the Compensation Committee's next meeting. The Compensation Committee may terminate this delegation of authority at its discretion.

Proxy

Statement

![]() 19

19

| |

Corporate Governance |

The Board carefully considered its leadership structure and believes that a combined Chairman/CEO position represents the best long-term leadership structure for Grainger. In the Board's view, having a single individual serving as both the Chairman and CEO assists in the timely flow of relevant information, which supports effective Board decision-making and provides a useful connection between the Board and management so that Board actions are appropriately and efficiently executed. The Board's Lead Director structure helps assure these functions are properly and timely performed. The Board does not believe that separating the role of the Chairman and CEO would result in strengthening Grainger's corporate governance or in creating or enhancing long-term value for our shareholders.

The Board has strong governance structures and processes in place to ensure the independence of the Board. These established structures and processes, which are reflected in the Operating Principles for the Board of Directors (the Operating Principles) and the Committee charters, allow for the independent directors to effectively exercise the Board's authority in overseeing critical matters of strategy, operations, enterprise risk management, and financial reporting. Duties specifically performed by the independent directors, either collectively or through committees comprised solely of independent directors, include selecting the Chairman and CEO and evaluating his or her performance and setting his or her compensation. In deciding that a combined Chairman and CEO position is the appropriate long-term leadership structure for Grainger, the Board also recognizes the need for independent leadership and oversight. Since 1995, the Operating Principles provide for a leadership role to the independent director serving as Chair of the Board Affairs and Nominating Committee. Over time, this lead director has been responsible for facilitating Board involvement on major issues and/or proposals, reviewing meeting agenda and information to be provided to the Board, consulting with directors, the CEO, and management and presiding at executive sessions of the Board.

The Board believes that given Grainger's corporate governance structures and processes, a combined Chairman and CEO position in conjunction with an independent Lead Director provides effective oversight of management by the Board and results in a high level of management accountability to shareholders.

In 2010, the Board revised its Operating Principles and By-laws to create the leadership position of Lead Director, to be elected by and from the Board's independent directors. The current Lead Director, Mr. Stuart L. Levenick, was appointed to serve in this capacity after the April 2014 annual meeting of shareholders. Among the duties assigned to the Lead Director is the responsibility for:

20

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

BOARD, COMMITTEE AND DIRECTOR EVALUATIONS

The Board recognizes that a rigorous evaluation process is an essential component of strong corporate governance practices and promoting ongoing Board effectiveness. Each year, the Board conducts a three-part evaluation process coordinated by the Lead Director and the Committee Chairs: full Board evaluation, Committee evaluations, and director self-assessment. These evaluations, which are annually reviewed by an external corporate governance expert, ask directors to rate how the Board performs and seek feedback on more open-ended topics, including Board and Committee processes and effectiveness, including for example:

Proxy

Statement

![]() 21

21

| |

Corporate Governance |

The results of the evaluations are compiled anonymously and include responses and comments. The results of the completed Board evaluations and individual director self-assessments are furnished to the Lead Director, while the results of the completed evaluations for the Committees are furnished to the corresponding Committee Chairs, and then discussed at the Board and Committee meetings, respectively. Below is an overview of the key steps in the annual evaluation process:

The information gained through this process helps shape the content of educational presentations to the Board as well as identify the skill sets desirable in director searches conducted by the Board from time-to-time.

As a result of the Board's 2017 evaluation process and related follow up, the Board identified the need for director candidates with proven track records of strategic thinking and experience in eCommerce. In 2017, a new independent director with experience in each of these areas was added to the Board.

22

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

The Board oversees its management to, among other things, encourage management communication with our shareholders, ensure effective succession planning to maximize long-term corporate performance, evaluate management's performance against its goals, to help management assess long-term strategies for, and oversee risk management processes and policies of, the Company, and to evaluate the Company's commitment to social responsibility.

Board's Role in Shareholder Engagement

The Board believes it is important that the Company's strategy is effectively communicated to its shareholders, and that shareholders' perspectives are understood and considered by the Board. During 2017, the Board's Lead Director met with a variety of institutional investors to explain the Company's corporate governance practices and policies as part of a corporate governance roadshow.

As part of its oversight role, the Board routinely receives reports and briefings from the Company's Investor Relations team. Grainger has a comprehensive shareholder engagement program. Each November, the Company hosts an annual Analyst Meeting where senior management discusses the Company strategy and expectations for the upcoming year. In 2017, more than 90 investors and analysts attended the event, with more than a hundred participating via webcast.

Throughout 2017, management participated in 10 investor conferences and met with over 410 unique firms and more than 650 unique investors. Our investor outreach includes both existing and potential shareholders, and we aim to meet with a majority of our largest investors each year. Grainger's management met with 64% of our top 25 investors, excluding index and exchange-traded funds, between January and April to discuss their perspectives and feedback.

Succession Planning and Management Development

Our Board recognizes that it has an important duty to ensure senior leadership continuity by overseeing the development of executive talent and planning for the efficient succession of the CEO and other key leadership positions. Our Board has delegated primary oversight responsibility for succession planning and management development to the Board Affairs and Nominating Committee. The Committee reports on its activities to the full Board, which routinely addresses succession planning during executive sessions.

Our Board generally conducts, at least once a year, an in-depth review of senior leader development and succession planning, including emergency succession scenarios. This review addresses the Company's management development initiatives, assesses senior management resources, and identifies individuals who should be considered as potential future senior executives. To ensure that the succession planning and management development process supports and enhances Grainger's strategic objectives, the Board and the Board Affairs and Nominating Committee also regularly consult with the Chairman of the Board and CEO on the Company's organizational needs, the leadership potential and related development plans for key managers, and plans for future development and emergency situations.

Proxy

Statement

![]() 23

23

| |

Corporate Governance |

Board's Role in Risk Oversight

The Board has overall responsibility for risk oversight. Its role is to oversee risk assessment and risk management processes and policies used by Grainger to identify, assess, monitor and address potential financial, compensation, operational, strategic and legal risks on an enterprise-wide basis. The risks monitored include threats to information technology systems and other issues of cyber security. Both the Board and the Audit Committee regularly review Grainger's risk assessment and risk management processes and policies, including receiving regular reports from the Company's Chief Information Security Officer, and the members of Grainger's management who are responsible for risk assessment and risk management on the effectiveness of Grainger's Enterprise Risk Management (ERM) initiatives. As part of its oversight responsibility, the Compensation Committee assesses the relationship between potential risk created by Grainger's compensation programs and their impact on long-term shareholder value.

We will continue to engage with our shareholders on a regular basis to understand their perspectives and, as appropriate, incorporate their feedback on our performance, business strategies, executive compensation programs and corporate governance practices.

Corporate Social Responsibility

Grainger is committed to being a responsible corporate citizen and strives to integrate environmental, social and governance (ESG) principles into the daily operation of its business. Grainger's Corporate Social Responsibility (CSR) platform includes our commitment to operating responsibly, valuing our people, serving our communities and sustaining our environment. These commitments shape our focus on corporate citizenship and fuel our determination to make a positive difference today and in the future. In 2017, we participated in the Dow Jones Sustainability Index and established an emissions intensity target in accordance with the Global Reporting Initiative (GRI). The Board receives routine reports on these and other ESG efforts. Grainger publishes an annual CSR report that is periodically updated and, while it is available on our website at http://www.GraingerCSR.com, it is not being incorporated by reference into this proxy statement.

OTHER COMMUNICATIONS WITH DIRECTORS

Grainger has established a process by which shareholders and other interested parties may communicate with the Board, its Committees, and/or individual directors on matters of interest. Such communications should be sent in writing to:

[Name(s)

of director(s)]

or

[Non-management directors]

or

[Board of Directors]

W.W. Grainger, Inc.

P.O. Box 66

Lake Forest, Illinois 60045-0066

If the matter is confidential in nature, please mark the correspondence accordingly. Additional information concerning this process is available in the Governance section of Grainger's website at http://www.grainger.com/investor.

24

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

All the documents below are available to shareholders are available in the Governance section of Grainger's website at www.grainger.com/investor or in print, free of charge, upon request to the Corporate Secretary at Grainger's headquarters, 100 Grainger Parkway, Lake Forest, Illinois 60045-5201.

Grainger has adopted Business Conduct Guidelines for directors, officers, and employees, which incorporates the Code of Ethics required by the SEC to apply to a company's chief executive officer, chief financial officer, and chief accounting officer or controller. Our Business Conduct Guidelines are posted in the Governance section on our website at http://www.grainger.com/investor.

Operating Principles for the Board of Directors

Grainger also has adopted Operating Principles for the Board of Directors, which represent its corporate governance guidelines. The Operating Principles are available in the Governance section of Grainger's website at http://www.grainger.com/investor.

Available in the Governance section of our website at http://www.grainger.com/investor, are the charters, as amended from time to time, of the Audit Committee, the Board Affairs and Nominating Committee, and the Compensation Committee, which were adopted by the Board.

Corporate Social Responsibility

Grainger publishes an annual CSR report that is periodically updated and, while it is available in the Corporate Social Responsibility section of our website at http://www.GraingerCSR.com, it is not being incorporated by reference into our proxy statement.

Proxy

Statement

![]() 25

25

| |

Corporate Governance |

Grainger's non-employee directors each receive an annual cash retainer of $85,000 and an annual deferred stock grant of $145,000. Directors serving as Committee Chairs receive an additional annual cash retainer.

Grainger's non-employee directors are compensated at a level that approximates median market practice. In benchmarking director pay, Grainger uses the same compensation comparator group that is used to benchmark compensation for Grainger's executives as described in the Compensation Discussion and Analysis / page 47. The Compensation Committee's independent compensation consultant periodically reviews and updates the comparator group as well as comparative compensation information and advises on director compensation.

The directors' compensation program, which was last adjusted in April 2015, consists of the following:

| | Compensation for | | Value | | ||||

| | | | | | | | | |

| Annual Cash Retainer for each Director | $85,000 | |||||||

| | | | | | | | | |

| Annual Retainer for the Lead Director | | $25,000 | | |||||

| | | | | | | | | |

| Deferred Stock Unit Grant for each Director | $145,000 | |||||||

| | | | | | | | | |

| | Chair Retainers: | | | | ||||

| | Audit Committee | | $20,000 | | ||||

| | Compensation Committee | | $15,000 | | ||||

| | Board Affairs and Nominating Committee | | $10,000 | | ||||

| | | | | | | | | |

All non-employee directors receive an annual deferred stock unit grant worth $145,000. The number of shares covered by each grant is equal to $145,000 divided by the 200-day average stock price through January 31 (a methodology consistent with the calculation used for equity awards to Grainger executives), rounded up to the next ten-share increment. The deferred stock units are settled in shares upon termination of service as a director. Directors may defer their annual cash retainers, lead director retainer, committee chair retainers (as applicable), and meeting fees into a deferred stock unit account.

Stock ownership guidelines applicable to non-employee directors were established in 1998. These guidelines provide that within five years after election, a director must own Grainger common stock and common stock equivalents having a value of at least five times the annual cash retainer fee for serving on the Board. The pledging of Company shares by directors or executive officers is prohibited by Company policy (see Hedging and Pledging Prohibition / page 55). No directors have pledged any of the shares beneficially owned by them and all directors are currently in compliance with the ownership guidelines.

Grainger matches directors' charitable contributions on a three-to-one basis up to a maximum Company contribution of $7,500 annually and provides discounts on product purchases, both on the same basis as provided to U.S. Grainger employees.

Mr. Macpherson, who is an employee of Grainger, does not receive any compensation for serving as a director.

26

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

|

Name |

|

Fees Earned or Paid in Cash (1) |

|

Stock Awards (2) |

|

All Other Compensation (3) |

| Total | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Rodney C. Adkins |

$85,000 | $123,750 | $7,500 | $216,250 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Brian P. Anderson |

| $85,000 | | $123,750 | | $750 | | $209,500 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

V. Ann Hailey |

$85,000 | $123,750 | $0 | $208,750 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Stuart L. Levenick |

| $120,000 | | $123,750 | | $0 | | $243,750 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Neil S. Novich |

$85,000 | $123,750 | $7,500 | $216,250 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Beatriz R. Perez (4) |

| $63,750 | | $80,102 | | $0 | | $143,852 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Michael J. Roberts |

$100,000 | $123,750 | $0 | $223,750 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

E. Scott Santi |

| $105,000 | | $123,750 | | $7,500 | | $236,250 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

James D. Slavik |

$85,000 | $123,750 | $7,500 | $216,250 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Lucas E. Watson (5) |

| $28,305 | | $49,179 | | $0 | | $77,484 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Proxy

Statement

![]() 27

27

| |

Corporate Governance |

Security Ownership of Certain Beneficial Owners

The following table sets forth information, as of December 31, 2017, concerning any person known to Grainger to beneficially own more than 5% of Grainger's common stock, as reported on Schedule 13G or Schedule 13G/A. The information in the table and the related notes is based on statements filed by the respective beneficial owners with the SEC pursuant to Sections 13(d) and 13(g) under the Securities Exchange Act of 1934, as amended.

Name and Address of Beneficial Owner |

|

Amount and Nature of Beneficial Ownership (1) |

| Percent of Class | ||||

| | | | | | | | | |

BlackRock, Inc. |

3,516,122(2) | 6.2% | ||||||

| | | | | | | | | |

James D. Slavik |

| 3,669,085(3) | | 6.44% | ||||

| | | | | | | | | |

State Street Corporation |

3,401,698(4) | 5.97% | ||||||

| | | | | | | | | |

Susan Slavik Williams |

| 4,822,643(5) | | 8.5% | ||||

| | | | | | | | | |

The Vanguard Group |

5,884,588(6) | 10.32% | ||||||

| | | | | | | | | |

28

![]() www.grainger.com

www.grainger.com

|

Corporate Governance | | ||

|

|

|

|

power, and shared dispositive power with respect to all 3,401,698 of the shares. The Schedule 13G certifies that the securities were acquired in the ordinary course of business and not with the purpose of changing or influencing the control of Grainger.

Proxy

Statement

![]() 29

29

| |

Corporate Governance |

Security Ownership of Management