AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR DATED JANUARY 22, 2021

BOXABL, INC.

6120 N. Hollywood Blvd. #104

Las Vegas, NV 89115

UP TO 62,658,228 SHARES OF NON-VOTING SERIES A-1 PREFERRED STOCK AND UP TO 62,658,228 SHARES OF COMMON STOCK INTO WHICH THE NON-VOTING SERIES A-1 PREFERRED STOCK MAY CONVERT

AND

UP TO 3,571,429 SHARES OF NON_VOTING SERIES A PREDERRED STOCK AND UP TO 3,571,429 SHARES OF COMMON STOCK INTO WHICH THE NON-VOTING SERIES A PREFERRED STOCK MAY CONVERT

SEE “SECURITIES BEING OFFERED” AT PAGE 36

Series A-1 Preferred Stock

| Price to Public

| Underwriting discount and commissions(1)

| Proceeds to issuer(2)

| Proceeds to other persons

|

Per share

| $0.79

| $0.055

| $0.735

| N/A

|

Total Minimum

| $1,000,000

| $70,000

| $930,000

| N/A

|

Total Maximum

| $49,500,000

| $2,980,000

| $46,520,000

| N/A

|

(1) We have not engaged any placement agent or underwriter in connection with this offering. To the extent that we do so, we will file a supplement to the Offering Statement of which this Offering Circular is a part. The company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to perform administrative and compliance related functions in connection with this offering, but not for underwriting or placement agent services. Dalmore will receive a 1% commission, in addition to the one-time set-up fee and consulting fee payable by the company to Dalmore. In addition, we have engaged OpenDeal Broker LLC to assist with processing of investments through the online investment platform at www.republic.co maintained by OpenDeal Inc. (“Republic”). OpenDeal Broker LLC will perform substantially the same services as Dalmore, but only for those subscriptions received through Republic. As compensation, the company will pay to OpenDeal Broker LLC a commission equal to 2% of the funds raised through Republic, as well as offering set-up and processing fees equal to

1

5% of the amount raised through Republic for aggregate investments up to $1,000,000, and 4% of the amount raised over $1,000,000, with a minimum fee of $10,000. While we anticipate most sales will be processed by Dalmore, we are reflecting the higher commission to be received by OpenDeal Broker LLC in this table.

See “Plan of Distribution and Selling Security Holders” for details.

(2) Not including legal and accounting expenses of this Offering, which are estimated at approximately $85,000 for a fully-subscribed offering, not including state filing fees.

Series A Preferred Stock

| Price to Public

| Underwriting discount and commissions(1)

| Proceeds to issuer(2)

| Proceeds to other persons

|

Per share/unit

| $0.14

| $0.0014

| $0.138

| N/A

|

Total Maximum

| $500,000

| $5,000

| $495,000

| N/A

|

(1) Sales of Series A Preferred Stock will only be conducted through Dalmore, which will perform administrative and technology related functions in connection with this offering, but not underwriting or placement agent services. Dalmore will receive a 1% commission, in addition to the one-time set-up fee and consulting fee payable by the company to Dalmore. The one-time set-up and consulting fees are not reflected in this table. See “Plan of Distribution and Selling Security Holders” for details.

(2) Not including legal and accounting expenses of this Offering, which are estimated at approximately $5,000 for a fully-subscribed offering, not including state filing fees.

We have engaged Prime Trust, LLC as an escrow agent (the “Escrow Agent”) to hold funds tendered by investors. We may hold a series of closings at which we receive the funds from the Escrow Agent and issue the shares to investors. This Offering will terminate at the earlier of (i) the date at which the maximum offering amount has been sold; (ii) three years from the date of qualification of this Offering Statement or (iii) the date at which the Offering is earlier terminated by the company at its sole discretion. However, if a new offering statement is filed with the United States Securities and Exchange Commission (the “Commission”) prior to the termination of this Offering, this Offering may continue to be offered and sold until the earlier of the qualification of the new offering statement or three years and 180 days from the date of qualification of this Offering Statement. At least every 12 months after this Offering has been qualified by the Commission, the company will file a post-qualification amendment to include its recent financial statements. The Offering is being conducted on a best-efforts basis with a minimum raise of $1,000,000 (the “Minimum Target”). Provided the company reaches the minimum target, we may undertake one or more closings on a rolling basis, if we do so, we anticipate after the initial closing to hold closing at least on a monthly basis. After each closing, funds tendered by investors will be available to the Company. After the initial closing of the Offering, we expect to hold closings on at least a monthly basis.

The shares being sold in this offering include contractual restrictions on transfer. Pursuant to Article III of the Stockholders Agreement, investors will not be allowed to transfer shares acquired in this offering, except under limited circumstance following approval of the Board of Directors of the Company and satisfaction of the provisions of a right of first refusal granted to Paolo Tiramani and Galiano Tiramani.

Paolo Tiramani and Galiano Tiramani will receive a contractual call right to reacquire shares sold in this offering. Investors should be aware that should this call right be exercised, they would be required to sell their shares at the fair market price established by a valuation service. Investors may disagree with this valuation, but will be compelled to sell their shares nonetheless.

2

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 7.

Sales of these securities will commence on approximately February [_], 2021

The company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Summary -- Implications of Being an Emerging Growth Company.”

3

TABLE OF CONTENTS

In this Offering Circular, the term “Boxabl” or “the company” refers to Boxabl, Inc.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

4

SUMMARY

The Company

Boxabl is on a mission to bring building construction in line with modern manufacturing processes, creating a superior residential and commercial building that could be completed in half the time for half the cost of traditional construction.

The core product that we offer is the “Building Box", which consists of room modules that ship to site at a low cost and are stacked and connected to build most any shape and style of finished buildings. We are currently evaluating market demand, but anticipate that available dimensions will be 20x20 ft., 20x30 ft., 20x40 ft., and 20x60 ft. Our first product available for sale is our Casita Box, an accessory dwelling unit featuring a full-size kitchen, bathroom, and living area.

The Offering

Securities offered by us:

|

| Maximum of 62,658,228 shares of Non-Voting Series A-1 Preferred Stock and 62,658,228 shares of Common Stock into which the Non-Voting Series A-1 Preferred Stock may convert.

Maximum of 3,571,429 shares of Non-Voting Series A Preferred Stock and 3,571,429 shares of Common Stock into which the Non-Voting Series A Preferred Stock may convert.

|

|

|

|

Securities outstanding before the offering as of December 31, 2020:

|

|

|

Common Stock:

|

| 300,000,000 shares

|

Series A-1 Preferred Stock:

|

| 0 shares

|

Series A Preferred Stock:

|

| 16,680,269 shares

|

|

|

|

Series A-1 Preferred Stock outstanding after the offering (assuming a fully subscribed offering):

|

| 62,827,004 (1)

|

Series A Preferred Stock outstanding after the offering (assuming a fully subscribed offering):

|

| 20,251,698

|

|

|

|

(1) Includes 168,776 shares of Series A-1 Preferred Stock issued upon the mandatory conversion of convertible notes issued by the company, with $100,000 of such notes outstanding as of the date of this Offering Circular.

5

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ●

| We have a limited operating history with a history of losses and we may not achieve or maintain profitability in the future.

|

| ●

| If we cannot raise sufficient funds, we will not succeed.

|

| ●

| Our future success is dependent on the continued service of our senior management and in particular our Founder and Chief Executive Officer Paolo Tiramani.

|

| ●

| We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business and operating results.

|

| ●

| Decreased demand in the housing industry would adversely affect our business.

|

| ●

| If we do not protect our brand and reputation for quality and reliability, or if consumers associate negative impressions of our brand, our business will be adversely affected.

|

| ●

| We depend upon our patents and trademarks licensed from a related party. Any failure to protect those intellectual property rights, or any claims that our technology infringes upon the rights of others may adversely affect our competitive position and brand equity.

|

| ●

| We do not yet have a suitable manufacturing facility to begin production as the scale necessary to make the business viable.

|

| ●

| We have accepted deposits for a product we are not yet able to produce at scale.

|

| ●

| We will rely on third-party builders to construct our Boxes on site as well as we intend to rely on third-party franchisees. The failure of those builders to properly construct homes and franchisee manufacturers to properly manufacture Boxes could damage our reputation, result in costly litigation and materially impact our ability to succeed.

|

| ●

| If an unknown defect was detected in our Boxes or Box designs, our business would suffer and we may not be able to stay in business.

|

| ●

| The housing industry is highly competitive and many of our competitors have greater financial resources than we do. Increased competition may make it difficult for us to operate and grow our business.

|

| ●

| Government regulations may cause project delay, increase our expenses, or increase the costs to our customers which could have a negative impact on our operations.

|

| ●

| Increases in the cost of raw materials, or supply disruptions, could have a material adverse effect on our business.

|

| ●

| You will not have significant influence on the management of the company.

|

| ●

| We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses.

|

| ●

| Our Articles of Incorporation includes a forum selection provision, which could result in less favorable outcomes to the plaintiff(s) in any action against our company.

|

Implications of Being an Emerging Growth Company

We are not subject to the ongoing reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) because we are not registering our securities under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

·annual reports (including disclosure relating to our business operations for the preceding three fiscal years, or, if in existence for less than three years, since inception, related party transactions, beneficial ownership of the issuer’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the issuer’s liquidity, capital resources, and results of operations, and two years of audited financial statements),

·semiannual reports (including disclosure primarily relating to the issuer’s interim financial statements and MD&A) and

·current reports for certain material events.

6

In addition, at any time after completing reporting for the fiscal year in which our offering statement was qualified, if the securities of each class to which this offering statement relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

·will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

·will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”);

·will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

·will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

·may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and

·will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the Commission’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

RISK FACTORS

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as cyber-attacks and the ability to prevent those attacks). Additionally, early-stage companies are inherently more risky than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

7

Risks Related to our Business

We have a limited operating history with a history of losses and we may not achieve or maintain profitability in the future. The company has operated at a loss since inception and historically relied on contributions from its owners to meet its growth needs. Further we have yet to receive any revenue from the sale of Boxes, our sole intended product. We expect to make significant future investments in order to develop and expand our business, which we believe will result in additional capital expenses, marketing and general and administrative expenses that will require raising funds in these offerings to cover these additional costs until we are able to generate significant revenue.

If we cannot raise sufficient funds, we will not succeed. We are offering shares of our Non-Voting Series A-1 Preferred Stock to raise up to $49,500,000 in this Offering, plus up to $500,000 of our Non-Voting Series A Preferred Stock. Even if the maximum amount is raised, we are likely to need additional funds in the future in order to continue to grow, and if we cannot raise those funds for whatever reason, including reasons relating to the company itself or to the broader economy, the company may not survive. If we raise a substantially lesser amount than our aggregate $50,000,000 goal, we will have to find other sources of funding for some of the plans outlined in “Plan of Operations”.

The company has realized significant operating losses to date and expects to incur losses in the future. The company has operated at a loss since inception, and these losses are likely to continue. Boxabl’s net loss for 2019 was $707,547 and its net loss for 2018 was $110,768, and for the six month period ended June 30, 2020, Boxabl experienced a net loss of $335,117. Until the company achieves profitability, it will have to seek other sources of capital in order to continue operations.

The company’s auditor has prepared its audit report on the basis of the company continuing to operate as a going concern. The company’s auditor has issued a “going concern” opinion on the company’s financial statements. The company incurred a net loss of $707,547 during the year ended December 31, 2019, and has limited revenues, which creates substantial doubt about its ability to continue as a going concern.

Our future success is dependent on the continued service of our senior management and in particular our Founder and Chief Executive Officer Paolo Tiramani. Any loss of key members of our executive team could have a negative impact on our ability to manage and grow our business effectively. This is particularly true of our Founder and Chief Executive Officer Paolo Tiramani, who designed and patented our core intellectual property. The experience, technical skills and commercial relationships of our key personnel provide us with a competitive advantage, particularly as we are building our brand recognition and reputation.

We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business and operating results. We have received substantial interest in our Casita Boxes and will strive to meet that demand. This will require significant scaling up of operations, including acquiring facilities space, and skilled labor. To date, we do not have any experience manufacturing our products at a commercial scale. If we are unable to effectively manage our scaling up in operations, we could face unanticipated slowdowns and problems and costs that harm our ability to meet production demands.

Decreased demand in the housing industry would adversely affect our business. Demand for new housing construction is tied to the broader economy and factors outside the company’s control. Should factors such as the COVID-19 pandemic result in continued loss of general economic activity, we could experience a slower growth in demand for our Boxes.

If we do not protect our brand and reputation for quality and reliability, or if consumers associate negative impressions of our brand, our business will be adversely affected. As a new entrant in the highly competitive home construction market, our ability to successfully grow our business is highly dependent on the reputation we establish for quality and reliability. To date, we have built a positive reputation based on our demonstration products for trade shows and conferences. As we expand operations to selling Boxes, we will need to deliver on the quality and reliability that is expected of us. If potential customers create a negative association about our brand, whether warranted or not, our business could be harmed.

We depend upon our patents and trademarks licensed from a related party. Any failure to protect those intellectual property rights, or any claims that our technology infringes upon the rights of others may adversely affect our competitive position and brand equity. Our future success depends significantly on the intellectual property created by our founder and which is owned by a related entity, Build IP LLC. If Build IP LLC is unable to protect that intellectual property from infringement, or if it is found to infringe on others our business would be materially harmed as competitors could utilize our same building and shipping designs.

8

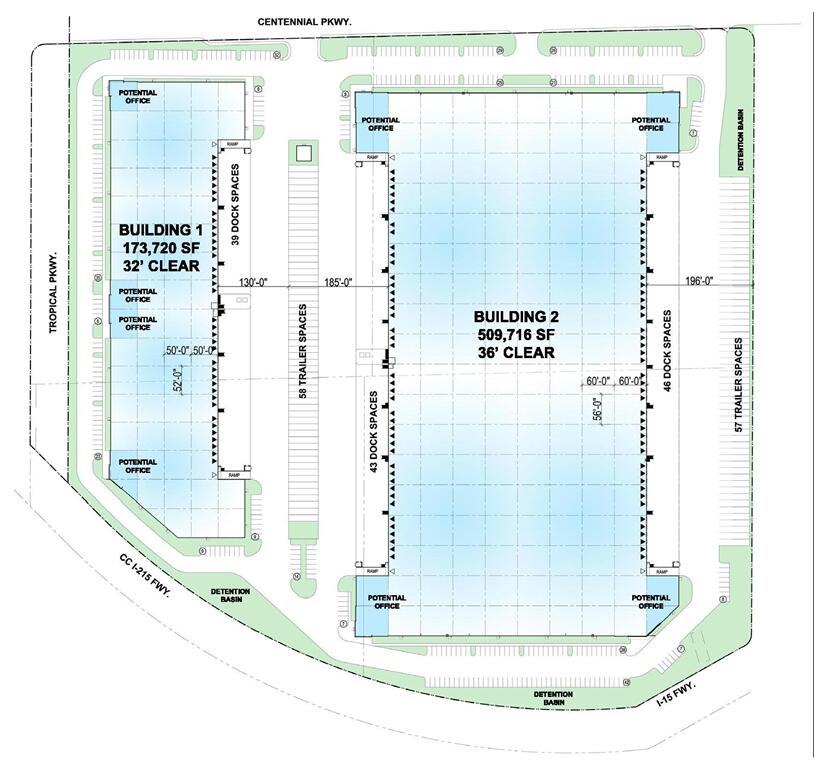

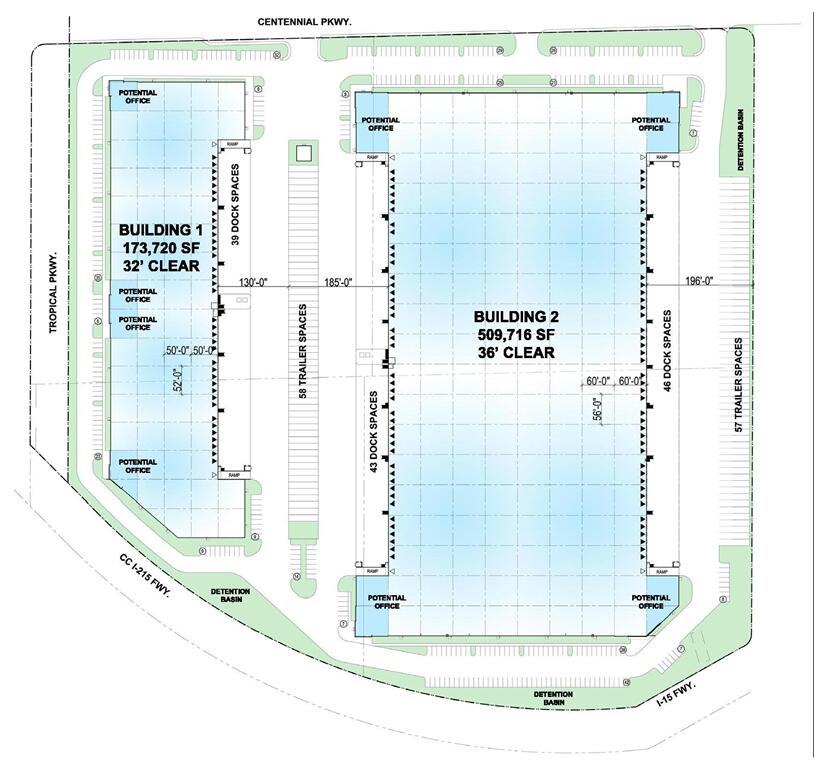

We do not yet have a suitable manufacturing facility to begin production as the scale necessary to make the business viable. Proceeds from this offering will be used to secure suitable manufacturing space in the Las Vegas area for our Boxes. Currently, we only have sufficient space to produce demonstration products. Our business relies on being able to produce our Boxes at scale, which can only be done once we have manufacturing space that is large enough for specialization of functions during the manufacturing process. If we are not able to obtain such manufacturing space in a timely manner, or on reasonable terms, our financial results may be negatively impacted.

We have accepted deposits for a product we are not yet able to produce at scale. As of the date of this offering circular, we have accepted deposits ranging from $100 to $1,200 from approximately 2,000 prospective customers. These deposits are being recorded as liabilities of the company and have not been maintained in a segregated account. As such, if the company is not able to deliver the requested product, we will be obligated to return the deposit, whether funds are available or not. If the prospective purchaser merely decides to not purchase a Box once they are available, they will forfeit their deposit.

We will rely on third-party builders to construct our Boxes on site as well as we intend to rely on third-party franchisees. The failure of those builders to properly construct homes and franchisee manufacturers to properly manufacture Boxes could damage our reputation, result in costly litigation and materially impact our ability to succeed. We sell our Boxes to Boxabl trained and certified builders, who are then responsible for on-site building and assembly. Purchasers can also order directly from us, and they will need to engage their own builders. We may discover that builders are engaging in improper construction practices, negatively impacting the reliability of our Boxes. Further, we not only intend to manufacturer the Boxes at our own factories but also to rely on third-party franchisees to manufacture our Boxes. To the extent that we do, we cannot be certain that any such franchisees will act in a manner consistent with our standards and requirements and produce Boxes in accordance with our quality standards. We may discover that our franchisees do not end up operating their franchises in accordance with our standards or applicable law. The occurrence of such events by the builders or franchisees could result in liability to us, or reputational damage.

If an unknown defect was detected in our Boxes or Box designs, our business would suffer and we may not be able to stay in business. In the ordinary course of our business, we could be subject to home warranty and construction defect claims. Defect claims may arise a significant period of time after a building with our Boxes has been completed. Although we maintain general liability insurance that we believe is adequate and may be reimbursed for losses by subcontractors that we engage to assemble our homes, an increase in the number of warranty and construction defect claims could have a material adverse effect on our results of operations. Furthermore, any design defect in our components may require us to correct the defect in all of the projects sold up until that time. Depending on the nature of the defect, we may not have the financial resources to do so and would not be able to stay in business. Even a defect that is relatively minor could be extremely costly to correct in every home and could impair our ability to operate profitably.

The housing industry is highly competitive and many of our competitors have greater financial resources than we do. Increased competition may make it difficult for us to operate and grow our business. The housing industry is highly competitive and we compete with traditional custom builders, manufactured and modular home builders, and other innovative entrants. In addition, we compete with existing homes that are offered for sale, which can reduce the interest in new construction. Many of our competitors have significantly greater resources than we do, a greater ability to obtain financing and the ability to accept more risk than we can prudently manage. If we are unable to compete effectively in this environment, we may not be able to continue to operate our business or achieve and maintain profitability.

Government regulations may cause project delay, increase our expenses, or increase the costs to our customers which could have a negative impact on our operations. We are subject to state modular home building codes, and projects are subject to permitting processes at the local level. If we encounter difficulties with obtaining state modular home approvals, we could experience increased costs in obtaining those approvals. Until state approvals are obtained, we would be limited in our ability to access that state market. Further, modular home codes may change over time, potentially increasing our costs, which we may not be able to pass on to customers, negatively impact our sales and profitability.

Increases in the cost of raw materials, or supply disruptions, could have a material adverse effect on our business. Our raw materials consist of steel, foams, and plastics, which primarily are sourced from, or dependent on materials sourced domestic vendors who may source their material from overseas. The costs of these materials may increase due to increased tariffs or shipping costs or reduced supply availability of these materials more generally. Further, global or local natural disruptions, including the COVID-19 pandemic, may impact the supply chain, including limiting work in factories producing the materials into useable forms or impacts on the supply chain. Disruptions in supply could result in delays in our production line, delaying delivery of products. Further, we may not be able to pass through any increased material costs to our customers which could

9

have a material adverse effect on our ability to achieve profitability. To the extent that we are able to pass through increased costs, it may lessen any competitive advantage that we have based on price.

The company has broad discretion in the use of proceeds in this Offering. The company has broad discretion on how to allocate the proceeds received as a result of this Offering and may use the proceeds in ways that differ from the proposed uses discussed in this offering circular. If the company fails to spend the proceeds effectively, its business and financial condition could be harmed and there may be the need to seek additional financing sooner than expected.

Risks Related to the Offering and to the Securities being Offered

Any valuation at this stage is difficult to assess. The valuation for this offering was established by the company based on the best estimates of management, and is not based on historical financial results. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially early stage companies, is difficult to assess and you may risk overpaying for your investment.

We include projections of future plans and performance in this offering circular. Projections rely on the occurrence of stated assumptions and should not assumptions not be correct or not occur, then the stated projections may be inaccurate. We include projected timelines in our “Plan of Operations” and include projected cost comparisons on our offering page. Those projections will only be achieved if the assumptions they are based on are correct. There are many reasons why the assumptions could be inaccurate, including customer acceptance, competition, general economic conditions and our own inability to execute our plans. Potential investors should take the assumptions in consideration when reading those projections, and consider whether they think they are reasonable.

You will not have significant influence on the management of the company. The day-to-day management, as well as big picture decisions will be made exclusively by our executive officers and directors. You will have a very limited ability, if at all, to vote on issues of company management and will not have the right or power to take part in the management of the company and will not be represented on the board of directors of the company. Accordingly, no person should purchase our stock unless he or she is willing to entrust all aspects of management to our executive officers and directors.

This investment is illiquid. There is no currently established market for reselling these securities and the company currently has no plans to list any of its shares on any over-the-counter (OTC) or similar exchange. If you decide that you want to resell these securities in the future, you may not be able to find a buyer. You should assume that you may not be able to liquidate your investment for some time, or be able to pledge these shares as collateral.

We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses. In order to fund future growth and development, we will likely need to raise additional funds in the future through offering equity or debt that converts into equity, which would dilute the ownership percentage of investors in this offering. See “Dilution.” Furthermore, if we raise capital through debt, the holders of our debt would have priority over holders of equity, including the Series Seed Preferred Stock, and we may be required to accept terms that restrict our ability to incur more debt. We cannot assure you that the necessary funds will be available on a timely basis, on favorable terms, or at all, or that such funds if raised, would be sufficient. The level and timing of future expenditures will depend on a number of factors, many of which are outside our control. If we are not able to obtain additional capital on acceptable terms, or at all, we may be forced to curtail or abandon our growth plans, which could adversely impact our business, development, financial condition, operating results or prospects.

By executing the subscription agreement in this offering, investors will join as Stockholders under our Stockholders Agreement. The company has established a Stockholders Agreement between itself, Paolo Tiramani, Galiano Tiramani, and each new stockholder to the company. The agreement provides for among, other items, control of the directorships of the company by Paolo Tiramani and Galiano Tiramani, restrictions on transfer of the securities in this offering, and a right for either Paolo Tiramani or Galiano Tiramani to call for the acquisition of securities issued to investors in this offering as a fair market value established by a valuation service.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement or Stockholders Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements. Investors in this offering will be bound by the subscription agreement and Stockholders Agreement, both of which include a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to these agreements. By signing these agreements, the investor warrants that the investor has reviewed this

10

waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel.

If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Nevada, which governs the subscription agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement.

If you bring a claim against the company in connection with matters arising under the subscription agreement or Stockholders Agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against us. If a lawsuit is brought against us under one of these agreements, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement or Stockholders Agreement with a jury trial. No condition, stipulation or provision of the subscription agreement or Stockholders Agreement serves as a waiver by any holder of our shares or by us of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

Our Articles of Incorporation, Stockholders Agreement, and subscription agreement each include a forum selection provision, which could result in less favorable outcomes to the plaintiff(s) in any action against our company.

Articles of Incorporation

Our Articles of Incorporation includes a forum selection provision that requires any claims against us by stockholders involving, with limited exceptions:

·brought in the name or right of the Corporation or on its behalf;

·asserting a claim for breach of any fiduciary duty owed by any director, officer, employee or agent of the company to the company or the company’s stockholders;

·arising or asserting a claim arising pursuant to any provision of Chapters 78 or 92A of the Nevada Revised Statutes or any provision of these Articles of Incorporation (including any Preferred Stock designation) or the bylaws;

·to interpret, apply, enforce or determine the validity of these Articles of Incorporation (including any Preferred Stock designation) or the bylaws; or

·asserting a claim governed by the internal affairs doctrine.

Any of the above actions are required to be brought in the Eighth Judicial District Court of Clark County, Nevada. If the Eighth Juridical District Court of Clark County does not have jurisdiction, then the matter may be adjudicated in another state district court in the State of Nevada, or in federal court located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Note, this provision does not apply to any suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or to any claim for which the federal courts have exclusive jurisdiction.

Stockholders Agreement

Our Stockholders Agreement includes a forum selection provision that requires any suit, action, or proceeding based in contract or tort arising from the Stockholders Agreement be brought in the Eighth Judicial District Court of Clark County, Nevada. If the Eighth Juridical District Court of Clark County does not have jurisdiction, then the matter may be adjudicated in another state district court in the State of Nevada, or in federal court located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts

11

over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision may not be used to bring actions in state courts for suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

Subscription Agreement

Our subscription agreement for each manner of investing and class of security includes a forum selection provision that requires any suit, action, or proceeding arising from the subscription agreement be brought in a state of federal court of competent jurisdiction located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision may not be used to bring actions in state courts for suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

The Stockholders Agreement places limitations on the transferability of our securities. Pursuant to Article III of the Stockholders Agreement, investors will not be allowed to transfer shares acquired in this offering, except under limited circumstance following approval of the Board of Directors of the Company and satisfaction of the provisions of a right of first refusal granted to Paolo Tiramani and Galiano Tiramani. Investors should note that these restrictions on transferability are in addition to any restrictions provided by statute or regulation.

The Stockholders Agreement includes a contractual call right for Paolo Tiramani or Galiano Tiramani to repurchase the shares of investors in this offering. Investors should be aware that should this call right be exercised, they would be required to sell their shares at the fair market price established by an independent valuation service or investment bank. This fair market price may be less than what investors will pay in this offering. Investors may disagree with this valuation, but will be compelled to sell their shares nonetheless.

Using a credit card to purchase shares may impact the return on your investment. Investors in this offering have the option of paying for their investment with a credit card. Transaction fees charged by your credit card company (which can reach 5% of transaction value if considered a cash advance) and interest charged on unpaid card balances (which can reach almost 25% in some states) add to the effective purchase price of the shares you buy. See “Plan of Distribution and Selling Securityholders.” The cost of using a credit card may also increase if you do not make the minimum monthly card payments and incur late fees. These increased costs may reduce the return on your investment.

DILUTION

Dilution means a reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares.

12

The following table (as of December 31, 2020) demonstrates the price that new investors are paying for their shares with the effective cash price paid by existing stockholders. This method gives investors a better picture of what they will pay for their investment compared to the company’s insiders and earlier investors. The share numbers and amounts in this table assume (1) conversion of all issued shares of Preferred Stock into shares of Common Stock and (2) conversion of all outstanding convertible notes into shares of Common Stock at their discounted conversion price.

Class of Securities

| Dates Issued

| Issued Shares

| Potential Shares

| Total Issued and Potential Shares

| Effective cash price per share at issuance or potential conversion

|

|

|

|

|

|

|

Common Stock

| 2020

| 300,000,000

|

| 300,000,000

| $0.00

|

Series A Preferred Stock

| 2020

| 16,680,269

|

| 18,680,269

| $0.14

|

Series A-1 Preferred Stock

| 2021

|

|

| 0

|

|

|

|

|

|

|

|

Convertible Notes

| 2020

|

| 168,776

| 168,776

| $0.59

|

|

|

|

|

|

|

Total Common Share Equivalents

|

| 318,680,269

| 168,776

| 318,849,045

| $0.01

|

|

|

|

|

|

|

Investors in this Offering (Assuming fully subscribed offering)

|

|

|

|

Series A Preferred Stock

|

|

| 3,571,429

| 3,571,429

| $0.14

|

Series A-1 Preferred Stock

|

|

| 62,658,228

| 62,658,228

| $0.79

|

|

|

|

|

|

|

Total after inclusion of this offering

| 316,680,269

| 66,398,433

| 383,078,702

|

|

The following table demonstrates the dilution that new investors for the company’s Series A-1 Preferred Stock will experience upon investment in the company. We chose to focus on the Series A-1 Preferred Stock to illustrate the effects of dilution as we anticipate the vast majority of new investment will be in exchange for our Series A-1 Preferred Stock. This table uses the company’s unaudited net tangible book value as of June 30, 2020 of $(234,511) which is derived from the net equity of the Company in the June 30, 2020 interim financial statements. The offering costs assumed in the following table includes up to $2,980,000 in commissions payable to OpenDeal Broker LLC, as well as up to $85,000 for legal, accounting, and EDGARization fees incurred for this Offering. We expect most sales to take place through Dalmore at a 1% commission, but are including the percentage commissions and fees payable to OpenDeal Broker LLC to illustrate dilution as that amount is higher. If all sales were made through Dalmore, the commissions payable would be up to $495,000. The table presents three scenarios for the convenience of the reader: a $5,000,000 raise from this offering, a $20,000,000 raise from this offering, a $35,000,000, and a fully subscribed $49,500,000 raise from this offering (the maximum offering for the Series A-1 Preferred Stock).

13

| $5 Million Raise

|

| $20 Million Raise

|

| $35 Million Raise

|

| $49.5 Million Raise

|

Price per Share

| $0.79

|

| $0.79

|

| $0.79

|

| $0.79

|

Shares Issued

| 6,329,114

|

| 25,316,456

|

| 44,303,797

|

| 62,658,228

|

Capital Raised

| $ 5,000,000

|

| $ 20,000,000

|

| $ 35,000,000

|

| $ 49,500,000

|

Less: Offering Costs

| $ 395,000

|

| $ 1,295,000

|

| $ 2,195,000

|

| $ 3,065,000

|

Net Offering Proceeds

| $ 4,605,000

|

| $ 18,705,000

|

| $ 32,805,000

|

| $ 46,435,000

|

Net Tangible Book Value Pre-financing at June 30, 2020

| ($234,511)

|

| ($234,511)

|

| ($234,511)

|

| ($234,511)

|

Net Tangible Book Value Post-financing

| $ 4,370,489

|

| $ 18,470,489

|

| $ 32,570,489

|

| $ 46,200,489

|

|

|

|

|

|

|

|

|

Shares issued and outstanding pre-financing

| 316,680,269

|

| 316,680,269

|

| 316,680,269

|

| 316,680,269

|

Total Post-Financing Shares Issued and Outstanding

| 323,009,383

|

| 341,996,725

|

| 360,984,066

|

| 379,338,497

|

Net tangible book value per share prior to offering

| $ (0.001)

|

| $ (0.001)

|

| $ (0.001)

|

| $ (0.001)

|

Increase/(Decrease) per share attributable to new investors

| $ 0.014

|

| $ 0.055

|

| $ 0.091

|

| $ 0.123

|

Net tangible book value per share after offering

| $ 0.014

|

| $ 0.054

|

| $ 0.090

|

| $ 0.122

|

Dilution per share to new investors ($)

| $ 0.776

|

| $ 0.736

|

| $ 0.7000

|

| $ 0.668

|

Dilution per share to new investors (%)

| 98.29%

|

| 93.16%

|

| 88.58%

|

| 84.58%

|

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

14

●In June 2019 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million.

●In December the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000.

●In June 2020 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660.

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the amount of convertible notes that the company has issued (and may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

The company is offering a maximum of 62,658,228 shares of its Non-Voting Series A-1 Preferred Stock at a price of $0.79 per share on a “best-efforts” basis, as well as up to 3,571,429 shares of its Non-Voting Series A Preferred Stock at a price of $0.14 per share. The company has set a minimum of $1,000,000 in gross proceeds to be received prior to the occurrence of any closing for the Series A-1 Preferred Stock. There is no minimum for the Series A Preferred Stock.

The Non-Voting Series A Preferred Stock will only be available to a select group of investors who made commitments or indications of interest during our previous offering under Regulation Crowdfunding, but were not able to make that investment because we had reached our maximum offering size of $1.07 million. The company will contact those prospective investors directly regarding their eligibility to subscribe for our Non-Voting Series A Preferred Stock in this offering. These investors will then have the opportunity to make a new investment decision in accordance with the subscription procedures described below.

For each class of shares, the minimum investment per investor is $1000.

For our Non-Voting Series A-1 Preferred Stock, we plan to market the securities in this offering both through online and offline means. Online marketing may take the form of contacting potential investors through electronic media and posting our Offering Circular or “testing the waters” materials on an online investment platform.

The offering will terminate at the earliest of: (1) the date at which the maximum offering amount has been sold, (2) the date which is three years from this offering being qualified by the Commission, and (3) the date at which the offering is earlier terminated by us at our sole discretion.

Provided the company has received the minimum offering amount for the Series A-1 Preferred Stock, the company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to the company. If the minimum amount is not reached, any funds tendered by investors will be promptly returned.

15

Broker-Dealer Agreement

The company has engaged Dalmore Group, LLC (“Dalmore”) a broker-dealer registered with the SEC and a member of FINRA, to perform the following administrative and compliance related functions in connection with this offering, but not for underwriting or placement agent services. The services performed include:

| ●

| Review investor information, including KYC (“Know Your Customer”) data, AML (“Anti Money Laundering”) and other compliance background checks, and provide a recommendation to the company whether or not to accept investor as a customer;

|

| ●

| Review each investors subscription agreement to confirm such investors participation in the offering and provide a determination to the company whether or not to accept the use of the subscription agreement for the investor’s participation;

|

| ●

| Contact and/or notify the company, if needed, to gather additional information or clarification on an investor;

|

| ●

| Not provide any investment advice nor any investment recommendations to any investor;

|

| ●

| Keep investor details and data confidential and not disclose to any third-party except as required by regulators or pursuant to the terms of the agreement (e.g. as needed for AML and background checks); and

|

| ●

| Coordinate with third party providers to ensure adequate review and compliance.

|

As compensation for the services listed above, the company has agreed to pay Dalmore a commission equal to 1% of the amount raised in the offering to support the offering on all newly invested funds after the issuance of a No Objection Letter by FINRA. In addition, the company has paid Dalmore a one-time advance set up fee of $5,000 to cover reasonable out-of-pocket accountable expenses actually anticipated to be incurred by Dalmore, such as, among other things, preparing the FINRA filing. Dalmore will refund any fee related to the advance to the extent it is not used, incurred or provided to the company. In addition, the company will pay a $20,000 consulting fee that will be due after FINRA issues a No Objection Letter and the Commission qualifies the offering. The company estimates that total fees due to pay Dalmore would be $525,000 for a fully subscribed offering. These assumptions were used in estimating the expenses of this offering.

Republic Agreement

In addition, the company has engaged OpenDeal Broker LLC (CRD #297797) to assist with processing of investments through the online investment platform at www.republic.co maintained by OpenDeal Inc. (“Republic”). OpenDeal Broker LLC will perform substantially the same services as Dalmore, but only for those subscriptions received through Republic. These services include:

| ●

| Provide a landing page on the Republic platform for our offering of the Shares and perform related services;

|

| ●

| Review investor information, including KYC (“Know Your Customer”) data, AML (“Anti Money Laundering”) and other compliance background checks, and provide a recommendation to the company whether or not to accept investor as a customer;

|

| ●

| Provide technical services to allow us to execute and deliver evidence of the executed subscription agreement to the investor, and

|

| ●

| Provide services that allow an investor to send consideration for the Shares to the Escrow Agent.

|

The company does not intend to actively promote the offering on Republic, and OpenDeal Broker LLC will not act as an underwriter or placement agent for this offering. Only our shares of Series A-1 Preferred Stock will be available through Republic.

As compensation, the company will pay to OpenDeal Broker LLC a commission equal to 2% of the funds raised through Republic, as well as offering set-up and processing fees equal to 5% of the amount raised through Republic for aggregate investments up to $1,000,000, and 4% of the amount raised over $1,000,000, with a minimum fee of $10,000.

Investors’ Tender of Funds

Provided we have reached our minimum investment of $1,000,000 received by the Escrow Agent, we will conduct multiple closings on investments (so not all investors will receive their shares on the same date). The funds tendered by potential investors will be held in a segregated deposit account controlled by the company and will be transferred to our operating account at each closing in this offering.

16

Process of Subscribing

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation by the investor to the effect that, if you are not an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth (excluding your principal residence).

If you decide to subscribe for either the Non-Voting Series A-1 or Series A Preferred Stock in this offering, you should complete the following steps:

1.Go to invest.boxabl.com, click on the "Invest Now" button;

2.Complete the online investment form;

3.Deliver funds directly by check, wire, debit or credit card, or electronic funds transfer via ACH to the specified account;

4.Once funds or documentation are received an automated AML check will be performed to verify the identity and status of the investor;

5.Once AML is verified, investor will electronically receive, review, execute and deliver to us a subscription agreement.

Any potential investor will have ample time to review the subscription agreement, along with their counsel, prior to making any final investment decision. Dalmore will review all subscription agreements completed by the investor. After Dalmore has completed its review of a subscription agreement for an investment in the company, the funds may be released by the escrow agent.

If the subscription agreement is not complete or there is other missing or incomplete information, the funds will not be released until the investor provides all required information. In the case of a debit card payment, provided the payment is approved, Dalmore will have up to three days to ensure all the documentation is complete. Dalmore will generally review all subscription agreements on the same day, but not later than the day after the submission of the subscription agreement.

All funds tendered (by check, wire, debit or credit card, or electronic funds transfer via ACH to the specified account) by investors will be deposited into an escrow account at the Escrow Agent for the benefit of the company. All funds received by wire transfer will be made available immediately while funds transferred by ACH will be restricted for a minimum of three days to clear the banking system prior to deposit into an account at the Escrow Agent. Credit card transactions will be processed through a payment processing platform integrated with the Escrow Agent.

The company maintains the right to accept or reject subscriptions in whole or in part, for any reason or for no reason, including, but not limited to, in the event that an investor fails to provide all necessary information, even after further requests, in the event an investor fails to provide requested follow up information to complete background checks or fails background checks, and in the event the offering is oversubscribed in excess of the maximum offering amount.

In the interest of allowing interested investors as much time as possible to complete the paperwork associated with a subscription, there is no maximum period of time to decide whether to accept or reject a subscription. If a subscription is rejected, funds will not be accepted by wire transfer or ACH, and payments made by debit card or check will be returned to subscribers within 30 days of such rejection without deduction or interest. Upon acceptance of a subscription, the company will send a confirmation of such acceptance to the subscriber.

Dalmore has not investigated the desirability or advisability of investment in the shares nor approved, endorsed or passed upon the merits of purchasing the shares. Dalmore is not participating as an underwriter and under no circumstance will it solicit any investment in the company, recommend the company’s securities or provide investment advice to any prospective investor, or make any securities recommendations to investors. Dalmore is not distributing any offering circulars or making any oral representations concerning this Offering Circular or this offering. Based upon Dalmore’s anticipated limited role in this offering, it has not and will not conduct extensive due diligence of this offering and no investor should rely on the involvement of Dalmore in this offering as any basis for a belief that it has done extensive due diligence. Dalmore does not expressly or

17

impliedly affirm the completeness or accuracy of the Offering Statement and/or Offering Circular. All inquiries regarding this offering should be made directly to the company.

Upon confirmation that an investor’s funds have cleared, the company will instruct the Transfer Agent to issue shares to the investor. The Transfer Agent will notify an investor when shares are ready to be issued and the Transfer Agent has set up an account for the investor.

Republic Subscription Process

Investors investing through OpenDeal Broker LLC may also access the company’s offering through an offering page hosted on Republic. Investors may follow the instructions provided through Republic to review the company’s offering materials, including the offering circular and subscription agreement, as well as submit payment which will be deposited into an escrow account at the Escrow Agent for the benefit of the company. Credit card transactions will be processed through a payment processing platform integrated with the Escrow Agent as well.

OpenDeal Broker LLC has not investigated the desirability or advisability of investment in the shares nor approved, endorsed or passed upon the merits of purchasing the shares. OpenDeal Broker LLC is not participating as an underwriter and under no circumstance will it solicit any investment in the company, recommend the company’s securities or provide investment advice to any prospective investor, or make any securities recommendations to investors. OpenDeal Broker LLC is not distributing any offering circulars or making any oral representations concerning this Offering Circular or this offering. Based upon OpenDeal Broker LLC’s anticipated limited role in this offering, it has not and will not conduct extensive due diligence of this offering and no investor should rely on the involvement of OpenDeal Broker LLC in this offering as any basis for a belief that it has done extensive due diligence. OpenDeal Broker LLC does not expressly or impliedly affirm the completeness or accuracy of the Offering Statement and/or Offering Circular. All inquiries regarding this offering should be made directly to the company.

Escrow Agent

After an investor executes a subscription agreement, those funds will be irrevocable and will remain in a subscription escrow account established for the Offering. The company has engaged Prime Trust, LLC as the escrow agent (the “Escrow Agent”) for the Offering. If a subscription is rejected or if a rescission is requested, all funds will be returned to subscribers within thirty days of such rejection without deduction or interest. Upon acceptance by us of a subscription, a confirmation of such acceptance will be sent to the subscriber. The Escrow Agent has not investigated the desirability or advisability of investment in the Shares nor approved, endorsed or passed upon the merits of purchasing the securities.

The funds tendered by potential investors will be held by the Escrow Agent, and will be transferred to the company upon closing or returned to the investors as discussed above. We may undertake one or more closings on a rolling basis (so not all investors will receive their units on the same date) after reaching the minimum offering amount. After each closing, funds tendered by investors will be available to us. Upon each closing, investors will receive a notification regarding their Shares and funds tendered by investors will be made available to the company. The Escrow Agreement can be found in Exhibit 8 to the Offering Statement of which this Offering Circular is a part.

Transfer Agent

Colonial Stock Transfer will serve as transfer agent to maintain stockholder information on a book-entry basis. We will not issue shares in physical or paper form. Instead, our shares will be recorded and maintained on our stockholder register.

Selling Securityholders

There are no selling securityholders in this offering.

Provisions of Note in our Subscription Agreement

Forum Selection Provision

The subscription agreement that investors will execute in connection with the offering includes a forum selection provision that requires any claims against the company based on the agreement to be brought in a state or federal court of competent jurisdiction in the State of Nevada, for the purpose of any suit, action or other proceeding arising out of or based upon the

18

subscription agreement. Although we believe the provision benefits us by providing increased consistency in the application of Nevada law in the types of lawsuits that may be brought to enforce contractual rights and obligations under the subscription agreement and in limiting our litigation costs, to the extent it is enforceable, the forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. The company has adopted the provision to limit the time and expense incurred by its management to challenge any such claims. As a company with a small management team, this provision allows its officers to not lose a significant amount of time travelling to any particular forum so they may continue to focus on operations of the company. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision may not be used to bring actions in state courts for suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

Jury Trial Waiver

The subscription agreement that investors will execute in connection with the offering provides that subscribers waive the right to a jury trial of any claim they may have against us arising out of or relating to the agreement, including any claim under federal securities laws. By signing the subscription agreement an investor will warrant that the investor has reviewed this waiver with the investor’s legal counsel, and knowingly and voluntarily waives his or her jury trial rights following consultation with the investor’s legal counsel. If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable given the facts and circumstances of that case in accordance with applicable case law. In addition, by agreeing to the provision, subscribers will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations promulgated thereunder.

USE OF PROCEEDS TO ISSUER

The company estimates that if it sells the maximum amount of $50,000,000 from the sale of its Non-Voting Series A-1 and Series A Preferred Stock, which represents the value of shares available to be offered as of the date of this offering circular out of the rolling 12-month maximum offering amount of $50,000,000 under Tier 2 of Regulation A, the net proceeds to the issuer in this offering would be approximately $46,910,000, after deducting the estimated fixed offering expenses of $85,000 and commissions due to OpenDeal Broker, LLC for all sales of the Non-Voting Series A-1 Preferred Stock and commissions due to Dalmore for sales of the Non-Voting Series A Preferred Stock. As stated above, we expect that most sales will be conducted through Dalmore, but are including the higher commission due to OpenDeal Broker LLC for the calculations below.

We are also setting out our estimated use of proceeds based on four other scenarios, including the minimum raise of $1,000,000, as well as receiving gross proceeds of $10,000,000, $25,000,000, and $50,000,000. The values are estimates and actual expenses may differ in order to serve the best interests of the company. Our current priority is to raise sufficient funds to build out our manufacturing facilities space, purchase capital equipment, and raw materials to deliver on placed orders as they arrive, as well as to meet the demand we anticipate from purchasers that have expressed interest and placed deposits. For further discussion, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Plan of Operations.”

| $1M Offering

| $10M Offering

| $25M Offering

| $50M Offering

|

Offering Proceeds

|

|

|

|

|

Gross Proceeds

| $ 1,000,000

| $ 10,000,000

| $ 25,000,000

| $ 50,000,000

|

Offering Expenses

| $ 155,000

| $ 695,000

| $ 1,595,000

| $ 3,090,000

|

|

|

|

|

|

Total Proceeds Available for Use

| $ 845,000

| $ 9,305,000

| $ 23,405,000

| $ 46,910,000

|

|

|

|

|

|

Estimated Expenses

|

|

|

|

|

Sales & Marketing

| -

| $ 300,000

| $ 550,000

| $ 2,000,000

|

Purchase of Capital Equipment

| $ 160,000

| $ 3,300,000

| $ 8,130,000

| $ 8,330,000

|

19

Facility Lease

| $ 631,838

| $ 840,000

| $ 1,600,000

| $ 1,600,000

|

Raw Materials

| $ 50,000

| $ 1,910,000

| $ 3,010,000

| $ 3,010,000

|

General & Administrative

| -

| $ 1,150,000

| $ 7,960,000

| $ 8,750,000

|

Testing & Certification

| -

| $ 1,800,000

| $ 2,100,000

| $ 2,100,000

|

Research & Development

| -

| -

| -

| $ 11,000,000

|

|

|

|

|

|

Total Expenditures

| $ 841,838

| $ 9,300,000

| $ 23,350,000

| $ 36,790,000

|

|

|

|

|

|

Working Capital Reserves

| $ 3,162

| $ 5,000

| $ 55,000

| $ 10,120,000

|

The company reserves the right to change the above use of proceeds if management believes it is in the best interests of the company.

THE COMPANY’S BUSINESS

Boxabl Overview

Boxabl is on a mission to bring building construction in line with modern manufacturing processes, creating a superior residential and commercial building that could be completed in half the time for half the cost of traditional construction.