REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

☒ | |||

Post-Effective Amendment No. 15 |

||||

and |

||||

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

☒ | |||

| ☐ | immediately upon filing pursuant to paragraph (b) of Rule 485 |

| ☒ | on May 1, 2023 pursuant to paragraph (b) of Rule 485 |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) of Rule 485 |

| ☐ | on (date) pursuant to paragraph (a)(1) of Rule 485 |

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

VARIABLE ANNUITY PROSPECTUS |

Securities Act of 1933 File No. 333-187762 | |

May 1, 2023 |

1 |

||||

3 |

||||

7 |

||||

16 |

||||

17 |

||||

17 |

||||

18 |

||||

19 |

||||

19 |

||||

19 |

||||

20 |

||||

21 |

||||

22 |

||||

23 |

||||

23 |

||||

24 |

||||

27 |

||||

32 |

||||

32 |

||||

32 |

||||

33 |

||||

33 |

||||

36 |

||||

40 |

||||

42 |

||||

46 |

||||

47 |

||||

49 |

||||

51 |

||||

59 |

||||

59 |

||||

59 |

||||

62 |

||||

72 |

||||

72 |

||||

73 |

||||

73 |

||||

73 |

||||

76 |

||||

76 |

||||

76 |

||||

77 |

||||

SPECIAL TERMS USED IN THIS PROSPECTUS |

PROSPECTUS |

1 |

2 |

PROSPECTUS | SPECIAL TERMS USED IN THIS PROSPECTUS |

Fees and Expenses |

Location in Prospectus | |||||||||||||

Charges for Early Withdrawals (Deferred Sales surrender charge) |

If you withdraw money during the first 1 . For example, if you make an early withdrawal, you could pay a surrender charge of up to $ |

Financial Information – Contract Costs and Expenses | ||||||||||||

Transaction Charges |

Financial Information – Contract Costs and Expenses | |||||||||||||

Ongoing Fees and Expenses (annual charges) |

The table below describes the fees and expenses that you may pay each year , depending on the options you choose. Please refer to your contract specifications page for information about the specific fees you will pay each year other options you have elected. Contracts issued in conjunction with applications signed before May 1, 2017: |

Financial Information – Contract Costs and Expenses | ||||||||||||

Annual Fee |

Minimum |

Maximum |

||||||||||||

Base Contract 1 |

||||||||||||||

Underlying Fund options (fund fees and expenses) 2 |

||||||||||||||

Optional benefits (if elected) 3 |

||||||||||||||

1 |

||||||||||||||

2 |

||||||||||||||

3 |

||||||||||||||

Contracts issued in conjunction with applications signed on or after May 1, 2017: |

||||||||||||||

Annual Fee |

Minimum |

Maximum |

||||||||||||

Base contract 1 |

. |

|||||||||||||

Investment options 2 (Portfolio Company fees and expenses) |

||||||||||||||

Optional benefit available for an additional charge 3 |

||||||||||||||

1 |

||||||||||||||

2 |

||||||||||||||

3 |

||||||||||||||

IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT |

PROSPECTUS |

3 |

Fees and Expenses |

Location in Prospectus | |||||||||||

Contracts issued in conjunction with applications signed on or after May 1, 2023: |

||||||||||||

Annual Fee |

Minimum |

Maximum |

||||||||||

Base contract 1 |

. |

|||||||||||

Investment options 2 (Portfolio Company fees and expenses) |

||||||||||||

Optional benefit available for an additional charge 3 |

||||||||||||

1 |

||||||||||||

2 |

||||||||||||

3 |

||||||||||||

Because your contract is customizable, the choices you make affect how much you will pay. To help you understand the cost of owning your contract, the following table shows the lowest and highest cost you could pay each year, based on current charges. This estimate assumes that you do not take withdrawals from the contract, which could add surrender charges that substantially increase costs. |

||||||||||||

Lowest Annual Cost $ |

Highest Annual Cost $ |

|||||||||||

Assumes: |

Assumes: |

|||||||||||

• Investment of $100,000 |

• Investment of $ 100,000 |

|||||||||||

• 5% annual appreciation |

• 5% annual appreciation |

|||||||||||

• Least expensive Contract and fund fees and expenses |

• Most expensive combination of Contract, optional benefits and fund fees and expenses |

|||||||||||

• No optional benefits |

||||||||||||

• No sales charges |

• No sales charges |

|||||||||||

• No additional purchase payments, transfers, or withdrawals |

• No additional purchase payments, transfers, or withdrawals |

|||||||||||

Risks |

Location in Prospectus | |||||||||||||

Risk of Loss |

Principal Risks | |||||||||||||

Not a Short-Term Investment |

This contract is not a short-term investment and is not appropriate for an investor who needs ready access to cash. Surrender charges may apply for the first 7 years following your last premium payment to your contract. Surrender charges will reduce the value of your contract if you withdraw money during that time. Tax deferral is generally more beneficial to investors with a long time horizon. |

Principal Risks | ||||||||||||

4 |

PROSPECTUS | IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT |

Risks |

Location in Prospectus | |||||||||||

Risks Associated with Investments |

An investment in this contract is subject to the risk of poor investment performance and can vary based on the investment options available under the contract. Each investment option, has its own unique risks. You should review the prospectuses for the available funds before making an investment decision. |

Principal Risks | ||||||||||

Insurance Company Risks |

1-888-GUARDIAN (1-888-482-7342). |

Principal Risks | ||||||||||

Restrictions |

Location in Prospectus | |||||||||||

Investments |

We reserve the right to remove or substitute the Variable Investment Options that are available as investment options under the contract. You may only invest in up to 25 Variable Investment Options at any one time. The number of transfer you make among the Variable Investment Options are limited to 15 per year, 5 per quarter and 3 per month. We may further limit transfer based on frequent trading. |

The Accumulation Period Financial Information – Contract Costs and Expenses | ||||||||||

Optional Benefits |

Other Contract Features | |||||||||||

Taxes |

Location in Prospectus | |||||||||||

Tax Implications |

You should consult with a tax professional to determine the tax implications of an investment in and payments received under this contract. If you purchase the contract through a tax-qualified plan or individual retirement account, you do not get any additional tax deferral.You will generally not be taxed on increases in the value of the contract until they are withdrawn. Withdrawals will be subject to ordinary income tax, and may be subject to tax penalties if you take a withdrawal before age 59 1 ⁄2 . |

Financial Information – Federal tax matters | ||||||||||

Conflict of Interest |

Location in Prospectus | |||||||||||

Investment Professional Compensation |

e.g. non-cash compensation. This conflict of interest may influence your investment professional to recommend this contract over another investment for which the investment professional is not compensated or compensated less. |

Your rights and responsibilities – Distribution of the contract | ||||||||||

Contract Exchanges |

Buying a contract | |||||||||||

IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT |

PROSPECTUS |

5 |

6 |

PROSPECTUS | IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT |

Charge | ||

Sales Load Imposed on Purchase Payments |

||

Surrender Charge 1 |

||

Transfer Fee (per transfer) |

Number of full years completed since premium payment was made |

Surrender charge percentage |

|||

0 |

8% | |||

1 |

7.5% | |||

2 |

6.5% | |||

3 |

5.5% | |||

4 |

5% | |||

5 |

4% | |||

6 |

3% | |||

7 |

0% | |||

FEE TABLE |

PROSPECTUS |

7 |

Charge |

||||

Administration Expenses |

||||

Base Contract Expenses (as a percentage of average Subaccount daily net assets) |

||||

Optional Benefit Expenses (as a percentage of Accumulation Value) (You will incur an additional fee for selecting one of these benefits) |

||||

– Highest Anniversary Value Death Benefit Rider (HAVDB) |

||||

– Return of Premium Death Benefit Basic Rider (ROPDB Basic) |

||||

– Return of Premium Death Benefit Plus Rider (ROPDB Plus) |

||||

– Combination HAVDB & ROPDB Plus |

Charge |

||||

Administration Expenses |

||||

Base Contract Expenses (as a percentage of average Subaccount daily net assets) |

||||

Optional Benefit Expenses (as a percentage of Accumulation Value) (You will incur an additional fee for selecting one of these benefits) |

||||

– Highest Anniversary Value Death Benefit Rider (HAVDB) |

||||

– Return of Premium Death Benefit Basic Rider (ROPDB Basic) |

||||

– Return of Premium Death Benefit Plus Rider (ROPDB Plus) |

||||

– Combination HAVDB & ROPDB Plus |

Minimum |

Maximum | |||

* |

8 |

PROSPECTUS | FEE TABLE |

Example 1: |

Basic Contract with both the Highest Anniversary Value Death Benefit and Return of Premium Death Benefit Plus riders, and maximum and minimum underlying mutual fund expenses on a gross basis.* |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

EXPENSE EXAMPLES |

PROSPECTUS |

9 |

Example 2: |

Basic Contract without any riders and maximum and minimum underlying mutual fund expenses on a gross basis.** |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

10 |

PROSPECTUS | EXPENSE EXAMPLES |

Example 1: |

Basic Contract with both the Highest Anniversary Value Death Benefit and Return of Premium Death Benefit Plus riders, and maximum and minimum underlying mutual fund expenses on a gross basis.* |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

EXPENSE EXAMPLES |

PROSPECTUS |

11 |

Example 2: |

Basic Contract without any riders and maximum and minimum underlying mutual fund expenses on a gross basis.** |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

12 |

PROSPECTUS | EXPENSE EXAMPLES |

Example 1: |

Basic Contract with both the Highest Anniversary Value Death Benefit and Return of Premium Death Benefit Plus riders, and maximum and minimum underlying mutual fund expenses on a gross basis.* |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

EXPENSE EXAMPLES |

PROSPECTUS |

13 |

Example 2: |

Basic Contract without any riders and maximum and minimum underlying mutual fund expenses on a gross basis.** |

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

Years | ||||||||

1 |

3 |

5 |

10 | |||||

If you surrender your contract at the end of the applicable time period: |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

If you annuitize or you do not surrender your contract at the end of the applicable time |

||||||||

Maximum: |

$ |

$ |

$ |

$ | ||||

Minimum: |

$ |

$ |

$ |

$ | ||||

14 |

PROSPECTUS | EXPENSE EXAMPLES |

EXPENSE EXAMPLES |

PROSPECTUS |

15 |

16 |

PROSPECTUS | EXPENSE EXAMPLES |

BUYING A CONTRACT |

PROSPECTUS |

17 |

18 |

PROSPECTUS | BUYING A CONTRACT |

ACCUMULATION PERIOD |

PROSPECTUS |

19 |

20 |

PROSPECTUS | ACCUMULATION PERIOD |

| • | deregistering the Separate Account under the 1940 Act, |

| • | operating the Separate Account as a management investment company, or in another permissible form, |

| • | creating new separate accounts, |

| • | combining two or more separate accounts or investment divisions, |

| • | transferring assets among investment divisions, or into another separate account, or into GIAC’s general account, |

| • | modifying the contracts where necessary to preserve the favorable tax treatment that Owners of variable annuities currently receive under the Internal Revenue Code, |

| • | eliminating the shares of any of the Funds and substituting shares of another appropriate Fund (which may have different fees and expenses or may be available/closed to certain purchasers), and |

| • | adding, closing or removing investment divisions of the Separate Account to allocations of Net Premiums or transfers of Accumulation Value, or both, with respect to some or all contracts. |

ACCUMULATION PERIOD |

PROSPECTUS |

21 |

22 |

PROSPECTUS | ACCUMULATION PERIOD |

| • | You are limited to 15 transfers per year; |

| • | You are limited to no more than 5 transfers within a quarter; |

| • | You are limited to no more than 3 transfers within a month; |

| • | You can choose up to 25 of the available Variable Investment Options at any one time. |

| • | There are no initial sales charges on the premium payments. |

| • | All of the dividends and capital gains distributions that are payable to Variable Investment Options are reinvested in shares of the applicable Fund at the current net asset value. |

| • | When the annuity period of the contract begins, we will apply your Accumulation Value to a payment option in order to make Annuity Payments to you. |

| • | You can arrange to transfer your investments among the Variable Investment Options or change your future allocations by notifying us in writing at our Mailing Address, electronically or by telephone at our Customer Service Contact Center. We reserve the right to limit the number of transactions or otherwise restrict transaction privileges. Please see the Transfers |

| • | You can change Beneficiaries as long as the Annuitant is living. |

ACCUMULATION PERIOD |

PROSPECTUS |

23 |

24 |

PROSPECTUS | ACCUMULATION PERIOD |

| • | requiring you to make your transfer requests in writing through the U.S. Postal Service, or otherwise restricting electronic or telephone transaction privileges; |

| • | refusing to act on instructions of an agent acting under a power of attorney on your behalf; |

| • | refusing or otherwise restricting any transaction request that we believe alone, or with a group of transaction requests, may have a harmful effect; |

| • | impose a holding period between transfers; or |

| • | implementing and imposing on you any redemption fee imposed by an underlying Fund. |

ACCUMULATION PERIOD |

PROSPECTUS |

25 |

26 |

PROSPECTUS | ACCUMULATION PERIOD |

| • | A $100,000 initial premium payment is made on January 1, 2021 |

| • | A $30,000 DIA transfer is made on January 15, 2023 |

| • | A $10,000 gain from January 1, 2021 to January 15, 2023 |

Event |

Accumulation Value |

DIA Transfer |

Chargeable Premium |

Surrender Charge (on full surrender of Basic Contract) |

Cost Basis Allocated to Basic Contract |

Cost Basis Allocated to DIA Transfer | ||||||

Contract Issue |

$100,000 | $100,000 | $8,000 | $100,000* | $ 0 | |||||||

| Second Contract Anniversary | $110,000 | $100,000 | $6,500 | $100,000* | $ 0 | |||||||

DIA Transfer |

$30,000 | |||||||||||

| Values January 15, 2023 prior to transfer | $110,000 | $100,000 | $6,500 | $100,000* | $ 0 | |||||||

| Values January 16, 2023 after transfer | $ 80,000 | $80,000 | $5,200 | $73,000** | $27,000** |

| * | At contract issue and any point in time prior to the DIA transfer, the full cost basis is allocated to the Basic Contract. |

| ** | When the $30,000 transfer is made to the DIA rider from the Basic Contract, the partial annuitization rules will apply and a pro rata portion of the cost basis of the Basic Contract will be apportioned between the Basic Contract and the DIA rider. The cost basis apportioned to the DIA rider is equal to the amount of the Accumulation Value transferred from the Basic Contract to the DIA rider divided by the Accumulation Value of the Basic Contract immediately prior to the transfer, and multiplying that result by the cost basis of the Basic Contract. In this example, a $30,000 transfer is made from the Basic Contract to the DIA rider on January 15, 2023 Therefore, $30,000 is divided by $110,000 and multiplied by $100,000. Accordingly, the cost basis allocated to the DIA rider is approximately $27,000. The $27,000 is subtracted from the $100,000 premium equaling a cost basis of $73,000 remaining with the Basic Contract. |

ACCUMULATION PERIOD |

PROSPECTUS |

27 |

| • | from earnings, which, on any Valuation Date equals the Accumulation Value on that date, less Note, however: |

| • | from Net Premiums that are no longer subject to a surrender charge; |

| • | from the Free Withdrawal Amount; and |

| • | from Chargeable Premiums on a first-in-first-out |

28 |

PROSPECTUS | ACCUMULATION PERIOD |

| • | If you surrender the contract and Chargeable Premiums exceed Accumulation Value, then we will calculate the surrender charge based on the full amount of Chargeable Premiums. |

| • | If the contract has been continued under spousal continuation or is a contract that has been issued pursuant to an internal 1035 exchange of certain contracts, then all Net Premiums made before after |

| • | no premium payments are made for 2 consecutive years; |

| • | the Accumulation Value on or after the end of such 2 year period is less than $2,000; |

| • | the total amount of premium payments made, less |

ACCUMULATION PERIOD |

PROSPECTUS |

29 |

| • | we notified you in writing that this contract is inactive and 6 months after the date of such notice, you have not made any premium payments to bring either your total premium payments less withdrawals or your Accumulation Value to $2,000. |

30 |

PROSPECTUS | ACCUMULATION PERIOD |

ACCUMULATION PERIOD |

PROSPECTUS |

31 |

| • | the table in your contract reflecting the gender and age of the Annuitant at the birthday nearest the date Annuity Payments are to begin, and |

| • | the annuity payout option you choose. |

| • | Proceeds of less than $2,000 will be paid to you in a single payment and the contract will be cancelled. |

| • | A Payment frequency where the Annuity Payments are $20 or less will not be permitted. |

32 |

PROSPECTUS | ANNUITY PERIOD |

| • | any surviving Owner or Joint Owner; if none, then |

| • | any surviving primary Beneficiary; and, if none, then |

| • | any surviving Contingent Beneficiary. |

| • | elect to be paid the present value of any remaining payments in a lump sum; |

| • | withdraw a portion of the present value of any remaining Annuity Payments; |

| • | name or change any contingent or concurrent Beneficiaries; or |

| • | change the annuity payout option in effect at the time of the death of the Contract Owner and/or Annuitant. |

ANNUITY PERIOD |

PROSPECTUS |

33 |

34 |

PROSPECTUS | ANNUITY PERIOD |

| • | Option F-6 may not satisfy minimum required distribution requirements for qualified contracts, and |

| • | Option F-6 will in most circumstances be subject to the 10% penalty tax for distributions made before age 591/2. |

ANNUITY PERIOD |

PROSPECTUS |

35 |

Name of Benefit |

Purpose |

Standard or Optional |

Maximum Annual Fee |

Brief Description of Restrictions / Limitations | ||||

For Contracts issued in conjunction with applications signed prior to May 1, 2017: For contracts issued in conjunction with applications signed on or after May 1, 2017: |

• Can only be elected at contract issue. • Owners must be age 75 or younger. • Withdrawals will proportionately reduce the benefit, and such reductions could be significant. • Date for a benefit to be payable. |

36 |

PROSPECTUS | OTHER CONTRACT FEATURES |

Name of Benefit |

Purpose |

Standard or Optional |

Maximum Annual Fee |

Brief Description of Restrictions / Limitations | ||||

• Can only be elected at contract issue. • For contracts issued in conjunction with applications signed on or after May 1, 2017, Owners must be age 85 or younger. • Withdrawals may reduce the benefit, and such reductions could be significant. | ||||||||

For Contracts issued in conjunction with applications signed prior to May 1, 2017: For contracts issued in conjunction with applications signed on or after May 1, 2017: |

• Can only be elected at contract issue. • For contracts issued in conjunction with applications signed on or after May 1, 2017, Owners must be age 60 or younger. • Withdrawals may reduce the benefit, and such reductions could be significant. | |||||||

For Contracts issued in conjunction with applications signed prior to May 1, 2017: For contracts issued in conjunction with applications signed on or after May 1, 2017: |

• Can only be elected at contract issue. • For contracts issued in conjunction with applications signed on or after May 1, 2017, Owners must be age 60 or younger. • Withdrawals will proportionately reduce the benefit, and such reductions could be significant. | |||||||

• Can only be elected at Contract Issue age 80 or under for a non-qualified contract, or age 65 or under for a qualified contract.• This rider may not be available in your state |

OTHER CONTRACT FEATURES |

PROSPECTUS |

37 |

Name of Benefit |

Purpose |

Standard or Optional |

Maximum Annual Fee |

Brief Description of Restrictions / Limitations | ||||

• You may not transfer any Accumulation Value to the DIA rider on or after the second Contract Anniversary. • Only amounts not subject to a surrender charge may be transferred to the DIA rider. • You may only make DIA transfers for a non-qualified contract if Owner/Annuitant is age 83 or younger; for a qualified contract if Owner/ Annuitant is age 70 or younger; and, if choosing a life only DIA Payout option, if Owner/Annuitant is age 70 or younger.• The initial DIA transfer is a minimum of $5,000, and subsequent transfers must be at least $1,000. • Transfers in any year cannot exceed the lesser of $100,000 or the total value of the transfers you made in the year you made your initial transfer. • Total transfers are capped at $1,000,000. • The number of transfer per month, quarter and year are limited. |

38 |

PROSPECTUS | OTHER CONTRACT FEATURES |

Name of Benefit |

Purpose |

Standard or Optional |

Maximum Annual Fee |

Brief Description of Restrictions / Limitations | ||||

• After the initial DIA transfer, you may not change the Annuitant(s), DIA commencement date (unless the Changing the DIA Commencement Date provision is exercised), or the DIA payout option. • Once a DIA transfer has been made and the cancellation period has expired, the amounts transferred can not be withdrawn. • All DIA transfers will be treated as withdrawals under the Basic Contract except that the DIA transfer will reduce the amount of any Premium still subject to a Surrender Charge. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

39 |

Monthly Contract Anniversary from Issue Date |

Percentage of Fixed DCA Account transferred | |

1 |

33 1 ⁄3 % | |

2 |

50% | |

3 |

100% |

40 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | the Valuation Date that all amounts have been transferred out of the Fixed DCA Account; |

| • | the Annuity Commencement Date; |

| • | the date a transfer or change in allocation instructions under the Basic Contract is received at our Mailing Address; |

| • | the date the Basic Contract is surrendered or terminated; or |

| • | the date on which you request that all amounts in the Fixed DCA Account be transferred out of the Fixed DCA Account to the then current allocation options. |

| • | the New York Stock Exchange is closed other than for customary week-end and holiday closings or restricts trading, |

| • | the SEC determines that an emergency exists as a result of which sales of securities or determination of the fair value of a Variable Investment Options’s assets is not reasonably practicable, or |

| • | the SEC, by order, permits us to postpone in order to protect Contract Owners remaining in the Variable Investment Options. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

41 |

| • | any surviving Owner, if none, then |

| • | any surviving primary Beneficiary, if none, then, |

| • | any surviving Contingent Beneficiary, if none then |

| • | to the last surviving Owner’s estate. |

| • | the date we receive Due Proof of Death in Good Order at our Mailing Address; or |

| • | the 15th day after the date of death. |

| • | the Accumulation Value as of the end of the Valuation Date on which we receive Due Proof of Death in Good Order, less |

| • | the amount of any death benefit provided by an enhanced death benefit rider. |

42 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | Non-qualified Contracts |

| • | Qualified Contracts |

OTHER CONTRACT FEATURES |

PROSPECTUS |

43 |

| • | Qualified Contracts continued |

| • | any surviving Owner, if none then |

| • | any surviving primary Beneficiary, if none then |

| • | any surviving Contingent Beneficiary, if none then |

| • | the last surviving Owner’s estate. |

44 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | Non-qualified Contracts |

| • | Qualified Contracts |

| • | If the Beneficiary (or the sole surviving joint Contract Owner) is not your spouse, and you die before the date Annuity Payments begin, then we must distribute all of your interest in the contract within five years of your death. These distribution requirements will be satisfied if any portion of the deceased Contract Owner’s interest: is payable to, or for the benefit of, any new Contract Owner, and will be distributed over the new Contract Owner’s life, or over a period not extending beyond the life expectancy of any new Contract Owner. |

| • | If your spouse is the only primary Beneficiary (or the sole surviving joint Owner) when you die, then your surviving spouse may be able to elect (or may be deemed to have elected) to continue the contract. For more information, see Spousal continuation |

| • | If a Beneficiary is not a natural person, the Beneficiary must elect that the entire death benefit be distributed within five years of your death. |

| • | In California, if any Owner who is not the Death Benefit Covered Person dies prior to the Annuity Commencement Date, we must distribute all of the Owner’s interest in the contract in a lump sum. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

45 |

46 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| (i) | any Owner, or in California the Death Benefit Covered Person; |

| (ii) | a surviving spouse who has continued the Basic Contract in accordance with the spousal continuation provision and who on the effective date of the spousal continuation is 75 or younger. |

| • | the death benefit under the contract without any optional riders (i.e., the Basic Contract); or |

| • | the highest anniversary value enhanced death benefit, |

OTHER CONTRACT FEATURES |

PROSPECTUS |

47 |

| • | the date that a death benefit is paid under a death benefit rider or under the Basic Contract, if the Basic Contract is not continued by an eligible spouse; |

| • | the date that a death benefit is paid under this rider or under the Basic Contract upon death of the surviving spouse who has continued the Basic Contract and this rider; |

| • | the date the Accumulation Value under the Basic Contract equals zero; |

| • | the Annuity Commencement Date; or |

48 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | upon a change in Owner (or, if Owner is a non-natural person, a change in Annuitant), including spousal continuation, and the new Owner is age 76 or older. |

| • | The dollar amount of the withdrawal, including any applicable Surrender Charges; or |

| • | The ROPDB Basic death benefit immediately before the withdrawal multiplied by (a) divided by (b) where (a) is the amount of the withdrawal, including any applicable Surrender Charges and (b) is the Accumulation Value immediately before the withdrawal. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

49 |

| • | The Accumulation Value immediately after the withdrawal; or |

| • | The total premiums paid under the Basic Contract less the total amount of withdrawals. |

| • | The dollar amount of the withdrawal (including any surrender charges) in excess of the dollar amount in the ROPDB Plus Interest Account; or |

| • | The ROPDB Plus death benefit immediately before the withdrawal multiplied by (a) divided by (b) where (a) is the dollar amount of the withdrawal in excess of the dollar amount in the ROPDB Plus Interest Account and (b) is the Accumulation Value immediately prior to the |

50 |

PROSPECTUS | OTHER CONTRACT FEATURES |

withdrawal reduced by the dollar amount withdrawn from the ROPDB Plus Interest Account. |

| • | the date a death benefit is paid under a death benefit rider or under the Basic Contract upon proof of death in Good Order; or |

| • | the date the Accumulation Value under the Basic Contract equals zero; or |

| • | the Basic Contract’s Annuity Commencement Date. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

51 |

52 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | the age of the Annuitant at the time the DIA transfer request is received at our Mailing Address in Good Order; |

| • | the DIA commencement date; |

| • | the DIA payout option chosen; |

| • | for non-qualified contracts, the sex of the Annuitant; and |

| • | the current interest rate environment. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

53 |

54 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | the DIA rider is in effect and payments thereunder have begun; |

| • | the request is made after the DIA commencement date; |

| • | The Owner is at least age 59 1 ⁄2 ; |

| • | the frequency of DIA payments is monthly; and |

| • | there are at least six months of payments remaining in any guaranteed or refund certain period. |

OTHER CONTRACT FEATURES |

PROSPECTUS |

55 |

56 |

PROSPECTUS | OTHER CONTRACT FEATURES |

OTHER CONTRACT FEATURES |

PROSPECTUS |

57 |

58 |

PROSPECTUS | OTHER CONTRACT FEATURES |

| • | At the end of the Valuation Period we add together the net asset value of a Fund share and its portion of dividends and distributions made by the Fund during the period. |

| • | We divide this total by the net asset value of the particular Fund share calculated at the end of the preceding Valuation Period. |

| • | Finally we add up the daily charges (contract charges and the enhanced death benefit rider(s) where applicable) and subtract them from the above total. |

FINANCIAL INFORMATION |

PROSPECTUS |

59 |

| • | Guardian Life, its subsidiaries or any of their separate accounts |

| • | present or retired directors, officers, employees, general agents, or field representatives of Guardian Life or its subsidiaries |

| • | present or retired directors or officers of any of the Funds |

| • | present and retired directors, trustees, officers, partners, registered representatives and employees of broker-dealer firms that have written sales agreements with Park Avenue Securities LLC |

| • | immediate family members of the individuals named above, based on their status at the time the contract was purchased, limited to their: |

| – | spouses |

| – | children and grandchildren |

| – | parents and grandparents |

| – | brothers and sisters |

| • | trustees or custodians of any employee benefit plan, IRA, Keogh plan or trust established for the benefit of persons named in the second and third bullets above |

| • | clients of broker-dealers, financial institutions and registered investment advisors that have entered into an agreement with GIAC to participate in fee-based wrap accounts or similar programs to purchase contracts |

60 |

PROSPECTUS | FINANCIAL INFORMATION |

| • | For contracts issued in conjunction with applications signed on or after May 1, 2017, the annual charge is 0.75%. |

| • | For contracts issued in conjunction with applications signed prior to May 1, 2017, the annual charge is 1.00%. |

FINANCIAL INFORMATION |

PROSPECTUS |

61 |

62 |

PROSPECTUS | FINANCIAL INFORMATION |

FINANCIAL INFORMATION |

PROSPECTUS |

63 |

64 |

PROSPECTUS | FINANCIAL INFORMATION |

| • | made on or after the taxpayer reaches age 59 1 ⁄2 |

| • | made from an immediate annuity contract |

| • | made on or after the death of an Owner |

| • | attributable to the taxpayer’s becoming disabled, or |

| • | made as part of a series of substantially equal periodic payments for the life – or life expectancy – of the taxpayer or the joint lives (or life expectancies) of the taxpayer and a Beneficiary. |

FINANCIAL INFORMATION |

PROSPECTUS |

65 |

| • | if distributed in a lump sum, they are taxed in the same manner as a surrender of the contract |

| • | if distributed under a payout option, they are generally taxed in the same way as Annuity Payments. |

66 |

PROSPECTUS | FINANCIAL INFORMATION |

FINANCIAL INFORMATION |

PROSPECTUS |

67 |

| • | made on or after the taxpayer reaches age 59 1 ⁄2 |

| • | made on or after the death of an Owner |

| • | attributable to the taxpayer’s becoming disabled |

| • | made as part of a series of substantially equal periodic payments for the life or life expectancy of the taxpayer. |

68 |

PROSPECTUS | FINANCIAL INFORMATION |

FINANCIAL INFORMATION |

PROSPECTUS |

69 |

70 |

PROSPECTUS | FINANCIAL INFORMATION |

FINANCIAL INFORMATION |

PROSPECTUS |

71 |

72 |

PROSPECTUS | YOUR RIGHTS AND RESPONSIBILITIES |

| • | the difference between the gross premiums you paid (including contract charges, premium taxes and other charges) and the amounts we allocated to the Variable Investment Options you chose; and |

| • | the Accumulation Value of the contract on the date we receive your cancellation. |

YOUR RIGHTS AND RESPONSIBILITIES |

PROSPECTUS |

73 |

74 |

PROSPECTUS | YOUR RIGHTS AND RESPONSIBILITIES |

YOUR RIGHTS AND RESPONSIBILITIES |

PROSPECTUS |

75 |

76 |

PROSPECTUS | OTHER INFORMATION |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

% |

- |

% |

% |

|||||||||||||

American Funds Insurance Series ® Asset Allocation Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

American Funds Insurance Series ® The Bond Fund of America (Class 4) |

% |

- |

% |

% |

||||||||||||

American Funds Insurance Series ® Capital World Growth and Income Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

American Funds Insurance Series ® Global Growth Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

American Funds Insurance Series ® Growth Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

American Funds Insurance Series ® Growth-Income Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

APPENDIX |

PROSPECTUS |

77 |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

(1) |

% |

|||||||||||||||

(1) |

|

% |

||||||||||||||

(2) Other investment advisers serve as sub-advisers for the fund. |

% |

% |

% |

|||||||||||||

% |

- |

% |

||||||||||||||

% |

||||||||||||||||

% |

||||||||||||||||

(1) |

This Fund is not available as an investment allocation option in New York |

(2) |

There is no assurance that this Fund will be able to maintain a stable net asset value per share. In addition, during extended periods of low interest rates, and partly as a result of asset-based separate account charges, the yield on this investment account may become low and possibly negative. |

78 |

PROSPECTUS | APPENDIX |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

% |

- |

% |

- |

% |

||||||||||||

% |

- |

% |

% |

|||||||||||||

% |

||||||||||||||||

% |

- |

% |

||||||||||||||

% |

- |

% |

% |

|||||||||||||

% |

- |

% |

% |

|||||||||||||

% |

- |

% |

% |

|||||||||||||

Schroder Investment Management North America Inc. (“SIMNA”) Schroder Investment Management North America Limited (“SIMNA Ltd.”) |

% |

- |

% |

- |

% |

|||||||||||

APPENDIX |

PROSPECTUS |

79 |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

% |

- |

% |

% |

|||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

|||||||||||||

| |

% |

- |

% |

|||||||||||||

| |

% |

|||||||||||||||

80 |

PROSPECTUS | APPENDIX |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

|||||||||||||

| Guardian Small-Mid Cap Core VIP Fund |

% |

- |

% |

|||||||||||||

| |

% |

- |

% |

|||||||||||||

| |

% |

- |

% |

|||||||||||||

| |

% |

- |

% |

|||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

APPENDIX |

PROSPECTUS |

81 |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

- |

% |

|||||||||||

| |

% |

% |

% |

|||||||||||||

| (i) |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® Asset Allocation Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® The Bond Fund of America (Class 4) |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® Capital World Growth and Income Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® Global Growth Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

82 |

PROSPECTUS | APPENDIX |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| American Funds Insurance Series ® Growth Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® Growth-Income Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

| American Funds Insurance Series ® U.S. Government Securities Fund (Class 4) |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| (ii) Fidelity Management & Research Company and its affiliates Other investment advisers serve as sub-advisers for the fund. |

% |

% |

% |

|||||||||||||

% |

||||||||||||||||

| |

% |

- |

% |

- |

% |

|||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

APPENDIX |

PROSPECTUS |

83 |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

% |

||||||||||||

| Schroder Investment Management North America Inc. (“SIMNA”) Schroder Investment Management North America Limited (“SIMNA Ltd.”) |

% |

- |

% |

- |

% |

|||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

84 |

PROSPECTUS | APPENDIX |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

% |

- |

% |

||||||||||||||

| |

% |

- |

% |

|||||||||||||

% |

- |

% |

||||||||||||||

| (i) |

% |

- |

% |

% |

||||||||||||

| (i) |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

APPENDIX |

PROSPECTUS |

85 |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

% |

% |

|||||||||||||

Morgan Stanley Variable Insurance Fund, Inc. Emerging Markets Equity Portfolio (Class II) |

% |

- |

% |

- |

% |

|||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

86 |

PROSPECTUS | APPENDIX |

As of December 31, 2022 | ||||||||||||||||

Investment Objective |

Portfolio Company And Adviser/SubAdviser |

Current Expenses |

1 Year Average Annual Total Return |

5 Year Average Annual Total Return |

10 Year Average Annual Total Return | |||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

- |

% |

% |

||||||||||||

| |

% |

% |

% |

|||||||||||||

Virtus Duff & Phelps Real Estate Securities Series Virtus Investment Advisers, Inc. |

% |

- |

% |

% |

||||||||||||

(i) |

This Fund is only available for investment under your contract if your contract was issued in conjunction with an application dated before May 1, 2017 and you have contract value allocated to the Fund, or premium allocation instructions, dollar cost averaging instructions or rebalancing instructions that include the Fund (collectively “Allocation Instructions”), as of April 30, 2017. If at any time after April 30, 2017, you no longer have Contract Value allocated to the Fund and no Allocation Instructions that include the Fund, the Fund will no longer be available as an investment allocation option under your contract. |

(ii) |

There is no assurance that this Fund will be able to maintain a stable net asset value per share. In addition, during extended periods of low interest rates, and partly as a result of asset-based separate account charges, the yield on this investment account may become low and possibly negative. |

APPENDIX |

PROSPECTUS |

87 |

INDIVIDUAL FLEXIBLE PREMIUM

DEFERRED VARIABLE

ANNUITY CONTRACT

Issued Through The Guardian Separate Account R of

The Guardian Insurance & Annuity Company, Inc.

Statement of Additional Information dated May 1, 2023

This Statement of Additional Information is not a prospectus but should be read in conjunction with the current Prospectus for The Guardian Separate Account R (marketed under the name “Guardian Investor ProFreedom Variable AnnuitySM (B Share)”) dated May 1, 2023.

The financial statements for The Guardian Separate Account R and The Guardian Insurance & Annuity Company, Inc. are incorporated by reference in this Statement of Additional Information.

A free Prospectus is available upon request by writing:

The Guardian Insurance & Annuity Company, Inc.

Individual Markets, Annuities

P. O. Box 981592

El Paso, TX 79998-1592

or calling:

The Guardian Insurance & Annuity Company, Inc.

Customer Service Office Contact Center

1-888-GUARDIAN (1-888-482-7342)

or visiting our website: https://guardianlife.onlineprospectus.net/guardianlife/ProFreedomB index.html?where=eengine.goToDocument(%22Product%20Prospectus%22)

Read the Prospectus before you invest. Terms used in this Statement of Additional Information shall have the same meaning as in the Prospectus.

| B-1 |

EB-017000 5/2017

| B-2 |

SERVICES TO THE SEPARATE ACCOUNT

The Guardian Insurance & Annuity Company, Inc. (“GIAC”) maintains the books and records of The Guardian Separate Account R (the “Separate Account”). GIAC, a wholly owned subsidiary of The Guardian Life Insurance Company of America, acts as custodian of the assets of the Separate Account. GIAC bears all expenses incurred in the operations of the Separate Account, except the mortality and expense risk charge and the administrative charge (as described in the Prospectus), which are borne by the Contract Owner.

GIAC issues variable annuity contracts and variable life insurance policies through several separate accounts all of which are registered as unit investment trusts under the 1940 Act (“Separate Accounts”). Park Avenue Securities LLC (PAS), serves as principal underwriter for the Separate Accounts pursuant to a distribution and service agreement between GIAC and PAS. Prior to December 30, 2019 PAS was a wholly owned subsidiary of GIAC. Effective December 31, 2019, Park Avenue Securities LLC (PAS), became a wholly owned subsidiary of The Guardian Life Insurance Company of America. PAS serves as principal underwriter for the Separate Accounts pursuant to a distribution and service agreement between GIAC and PAS. The contracts are offered continuously and are sold by GIAC insurance agents who are registered representatives of either PAS or of other broker-dealers which have selling agreements with PAS and GIAC. GIAC paid an aggregate amount of commissions to PAS of $14,717,034 in 2020, $16,379,266 in 2021, and $14,356,514 in 2022. Of those aggregate amounts, PAS retained $3,365,479 in 2020, $3,725,794 in 2021, and $3,100,071 in 2022.

ANNUITY PAYMENTS

The objective of the contracts is to provide benefit payments (known as Annuity Payments) which will increase at a rate sufficient to maintain purchasing power at a constant level. For this to occur, the actual net investment return must exceed the assumed investment return by an amount equal to the rate of inflation. Of course, no assurance can be made that this objective will be met. If the assumed interest return were to be increased, benefit payments would start at a higher level but would increase more slowly or decrease more rapidly. Likewise, a lower assumed interest return would provide a lower initial payment with greater increases or lesser decreases in subsequent Annuity Payments.

Value of an Annuity Unit: The value of an annuity unit is determined independently for each of the Variable Investment Options. For any Valuation Period, the value of an annuity unit is equal to the value for the immediately preceding Valuation Period multiplied by the annuity change factor for the current Valuation Period. The annuity unit value for a Valuation Period is the value determined as of the end of such period. The annuity change factor is equal to the net investment factor for the same Valuation Period adjusted to neutralize the assumed investment return used in determining the Annuity Payments. The net investment factor is reduced by (a) the contract charge, (b) administrative expenses and (c) if applicable, any optional death benefit rider charge on an annual basis during the life of the contract. The dollar amount of any payment due after the first payment under a Variable Investment Option will be determined by multiplying the number of annuity units by the value of an annuity unit for the Valuation Period ending ten (10) days prior to the Valuation Period in which the payment is due.

Determination of the First Annuity Payment: At the time Annuity Payments begin, the value of the Contract Owner’s account is determined by multiplying the Accumulation Unit value on the Valuation Period ten (10) days before the date the first annuity payment is due by the corresponding number of accumulation units credited to the Contract Owner’s account as of the date the first annuity payment is due, less any applicable premium taxes not previously deducted.

The contracts contain tables reflecting the dollar amount of the first monthly payment which can be purchased with each $1,000 of value accumulated under the contract. The amounts depend on the fixed annuity payout option selected, the mortality table used under the contract (the 1983 Individual Mortality Table projected using Scale G) and the nearest age of the Annuitant. The first annuity payment is determined by multiplying the benefit per $1,000 of value shown in the contract tables by the number of thousands of dollars of value accumulated under the contract. Currently, we are using annuity purchase rates we believe to be more favorable to you than those in your contract. We may change these rates from time to time, but the rate will never be less favorable to you than those guaranteed in your contract.

DIA TRANSFERS

| A. | At the time you submit a transfer request we will inform you of the following: |

| 1. | That amounts used to purchase deferred income payments are not liquid. |

| 2. | That payments made pursuant to the DIA rider are subject to the credit risk of the insurance company. |

| B-3 |

| 3. | The DIA payment amount that you receive from the Company may be higher or lower than the amount you might receive if you purchased a similar product offered by us or by another company. When making a DIA transfer, you should consider, in consultation with your financial adviser, payment amounts for similar products, as well as your future income needs, contract terms, the claims paying ability of the insurance company and your tax situation. |

| 4. | The DIA payment amount is based on various factors disclosed in your prospectus. The confirmation we send you will provide you with the DIA payment amount for the amount you have transferred. |

| B. | Upon completion of the transfer you will receive a confirmation which will inform you of the following: |

| 1. | The amount of the DIA payment purchased. |

| 2. | The lack of liquidity of amounts transferred to the DIA rider. |

| 3. | A notice that the Contract Owner has the ability to consider other products and cancel within a specific period of time. |

| 4. | Any compensation paid to the broker/dealer or any other person as a result of a DIA transfer. |

CALCULATION OF YIELD QUOTATIONS FOR THE FIDELITY VIP GOVERNMENT MONEY MARKET PORTFOLIO INVESTMENT DIVISION

The yield of the Investment Division of the Separate Account investing in the Fidelity VIP Government Money Market Portfolio represents the net change, exclusive of gains and losses realized by the Investment Division of the Fidelity VIP Government Money Market Portfolio and unrealized appreciation and depreciation with respect to the Fidelity VIP Government Money Market Portfolios’ portfolio of securities, in the value of a hypothetical pre-existing contract that is credited with one Accumulation Unit at the beginning of the period for which yield is determined (the “base period”). The base period generally will be a seven-day period. The current yield for a base period is calculated by dividing (1) the net change in the value of the contract for the base period (see “Accumulation Period” in the Prospectus) by (2) the value of the contract at the beginning of the base period and multiplying the result by 365/7. Deductions from purchase payments (for example, any applicable premium taxes) and any applicable contingent deferred sales charge assessed at the time of withdrawal or annuitization are not reflected in the computation of current yield of the Investment Division. The determination of net change in contract value reflects all deductions that are charged to a contract Owner, in proportion to the length of the base period and the Investment Division’s average contract size.

Yield also may be calculated on an effective or compound basis, which assumes continual reinvestment by the Investment Division throughout an entire year of net income earned by the Investment Division at the same rate as net income is earned in the base period.

The effective or compound yield for a base period is calculated by (1) dividing (i) the net change in the value of the contract for the base period by (ii) the value of the contract as of the beginning of the base period, (2) adding 1 to the result, (3) raising the sum to a power equal to 365 divided by the number of days in the base period, and (4) subtracting 1 from the result.

The current and effective yields of the Fidelity VIP Government Money Market Portfolio Investment Division will vary depending on prevailing interest rates, the operating expenses and the quality, maturity and type of instruments held in the Fidelity VIP Government Money Market Portfolio. Consequently, no yield quotation should be considered as representative of what the yield of the Investment Division may be for any specified period in the future. The yield is subject to fluctuation and is not guaranteed.

VALUATION OF ASSETS OF THE SEPARATE ACCOUNT

The value of Fund shares held in each Investment Division at the time of each valuation is the redemption value of such shares at such time. If the right to redeem shares of a Fund has been suspended, or payment of redemption value has been postponed for the sole purpose of computing Annuity Payments, the shares held in the Separate Account (and corresponding annuity units) may be valued at fair value as determined in good faith by GIAC’s Board of Directors.

| B-4 |

QUALIFIED PLAN TRANSFERABILITY RESTRICTIONS

Where a contract is owned in conjunction with a retirement plan qualified under the Code, a tax-sheltered annuity program or individual retirement account, and notwithstanding any other provisions of the contract, the contract Owner may not change the ownership of the contract nor may the contract be sold, assigned or pledged as collateral for a loan or as security for the performance of an obligation or for any other purpose to any person other than GIAC unless the contract Owner is the trustee of an employee trust qualified under the Code, the custodian of a custodial account treated as such, or the employer under a qualified non-trusteed pension plan.

EXPERTS

The financial statements of The Guardian Insurance & Annuity Company, Inc. and each of the subaccounts of The Guardian Separate Account R included in Form N-VPFS dated April 17, 2023 have been so incorporated in reliance on the reports of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

FINANCIAL STATEMENTS

(1) The Guardian Separate Account R:

Statement of Assets and Liabilities as of December 31, 2022

Statement of Operations for the Year Ended December 31, 2022

Statements of Changes in Net Assets for the Years Ended December 31, 2022 and 2021

Notes to Financial Statements

Report of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm

(2) The Guardian Insurance & Annuity Company, Inc.:

Statutory Basis Balance Sheets as of December 31, 2022 and 2021

Statutory Basis Statements of Operations for the Years Ended December 31, 2022 and 2021

Statutory Basis Statements of Changes in Surplus for the Years Ended December 31, 2022 and 2021

Statutory Basis Statements of Cash Flows for the Years Ended December 31, 2022 and 2021

Notes to Statutory Basis Statements

Report of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm

| B-5 |

The Guardian Separate Account R

PART C. OTHER INFORMATION

| Item 27. | Exhibits |

| (1) | Incorporated by reference to the Registration Statement on Form N-4 (Reg. No. 333-187762) as initially filed on April 4, 2013. |

| (2) | Incorporated by reference to the Pre-Effective Amendment No. 1 to Registration Statement on Form N-4 (Reg. No. 333-187762) as initially filed on June 21, 2013. |

| (3) | Incorporated by reference to the Pre-Effective Amendment No. 3 to Registration Statement on Form N-4 (Reg. No.333-187762 as filed on December 9, 2013. |

| (4) | Incorporated by reference to the Post-Effective Amendment No. 2 to Registration Statement on Form N-4 (Reg. No. 333-187762) as filed on April 27, 2015. |

| (5) | Not Applicable |

| (6) | Incorporated by reference to Pre-Effective Amendment No. 1 to the Registration Statement on Form N-6 filed by the Registrant on August 1, 2008 (File No. 333-151073; Accession No. 0001193125-08-163928) |

| (7) | Incorporated by reference to Pre-Effective Amendment No. 2 to the Registration Statement on Form N-6 filed by the Registrant on August 26, 2008 (File No. 333-151073; Accession No. 0001193125-08-184460) |

| (8) | Incorporated by reference to Post-Effective Amendment No. 2 to the Registration Statement on Form N-6 filed by the Registrant on April 27, 2010 (File No. 333-151073; Accession No. 0001193125-10-094621) |

| (9) | Incorporated by reference to Post-Effective Amendment No. 3 to the Registration Statement on Form N-6 filed by the Registrant on April 27, 2011 (File No. 333-151073; Accession No. 0001193125-11-111532) |

| (10) | Incorporated by reference to the Registration Statement on Form N-6 filed by the Registrant on May 2, 2013 (File No. 333-188304; Accession No. 0001193125-13-196448) |

| (11) | Incorporated by reference to Pre-Effective Amendment No. 2 on Form N-6 filed by the Registrant on September 27, 2013 (File No. 333-188304; Accession No. 0001193125-13-382543) |

| (12) | Incorporated by reference Post-Effective Amendment No. 2 to the Registration statement on Form N-6 filed by the Registrant on April 24, 2015 (File No. 333-188304; Accession No. 0001193125-15-146150) |

| (13) | Incorporated by reference Post-Effective Amendment No. 4 to the Registration statement on Form N-6 filed by the Registrant on April 25, 2016 (File No. 333-188304; Accession No. 0001193125-16-553860) |

| (14) | Incorporated by reference to Post-Effective Amendment No. 5 to the Registration statement on Form N-6 filed by the Registrant on April 25, 2017 (File No. 333-188304; Accession No. 0001193125-17-136515) |

| (15) | Incorporated by reference to Post-Effective Amendment No. 1 to the Registration Statement on Form N-6 filed by the Registrant on April 26, 2019 (File No. 333-222952; Accession Number 0001193125-19-122119) |

| (16) | Incorporated by reference to the Post-Effective Amendment No. 10 to Registration Statement on Form N-4 (Reg. No. 333-187762) as filed on February 26, 2021. |

| (17) | Incorporated by reference to the Post-Effective Amendment No. 12 to Registration Statement on Form N-4 (Reg. No. 333-187762) as filed on April 28, 2021. |

| (18) | Incorporated by reference to the Post-Effective Amendment No. 14 to Registration Statement on Form N-4 filed on April 28, 2022. (Reg. No. 333-187762 Accession No. 0001193125-22-127444) |

| (19) | Filed herewith |

C-1

| Item 28. | Directors and Officers of the Depositor |

The following is a list of directors and principal officers of The Guardian Insurance & Annuity Company, Inc. (“GIAC”), the depositor of the Registrant.

THE GUARDIAN INSURANCE & ANNUITY COMPANY, INC.

DIRECTOR & OFFICER ROSTER

| Name and Principal Business Address: |

Positions and Offices with Depositor | |

| Dominique Baede 10 Hudson Yards, New York, NY 10001 |

Director and President | |

| Michael Ferik 100 First Stamford Place, West Stamford, CT 06902 |

Director | |

| Kevin Molloy 10 Hudson Yards, New York, NY 10001 |

Director | |

| Michael Slipowitz 10 Hudson Yards, New York, NY 10001 |

Director & Corporate Chief Actuary | |

| Nicholas Liolis 10 Hudson Yards, New York, NY 10001 |

Chief Investment Officer | |

| Kermitt Brooks 10 Hudson Yards, New York, NY 10001 |

Chief Legal Officer | |

| Harris Oliner 10 Hudson Yards, New York, NY 10001 |

Associate General Counsel, Corporate Secretary | |

| Kim Sellers 10 Hudson Yards, New York, NY 10001 |

Chief Tax Officer | |

| Carl Desrochers 700 South Street, Pittsfield, MA 01201 |

Head of IM Finance and Actuarial | |

| Jeff Butscher 6255 Sterner’s Way, Bethlehem, PA 18017 |

Chief Compliance Officer Rule 38a-1 Chief Compliance Officer | |

| Stuart Carlisle 100 Great Meadow Road, Wethersfield, CT 06109 |

Head of Product Fund Management | |

| Kimberly Delaney Geissel 6255 Sterner’s Way, Bethlehem, PA 18017 |

Strategic Initiatives Executive | |

| Debra Udicious 10 Hudson Yards, New York, NY 10001 |

Corporate Treasurer | |

| John H. Walter 10 Hudson Yards, New York, NY 10001 |

Head of Asset Management Accounting & Mutual Fund Treasurer | |

| Nahulan Ethirveerasingam 10 Hudson Yards, New York, NY 10001 |

Head of Annuity Product Management | |

| Alex D. Borress 101 Crawfords Corner Rd. Holmdel, NJ 07733 |

Senior Lead Actuary, Head of Life & Annuity Pricing | |

| Shawn P. McGrath 700 South Street, Pittsfield, MA 01201 |

Individual Markets Controller | |

| Christian Mele 6255 Sterner’s Way, Bethlehem, PA 18017 |

Head of Annuity & PAS Operations and Customer Service | |

| Mariana Slepovitch 10 Hudson Yards, New York, NY 10001 |

Senior Actuary, Corporate | |

| Brian Hagan 10 Hudson Yards, New York, NY 10001 |

Interim Anti-Money Laundering Officer | |

| John J. Monahan 6255 Stemer’s Way, Bethlehem, PA 18017 |

Compliance Lead, Individual Markets |

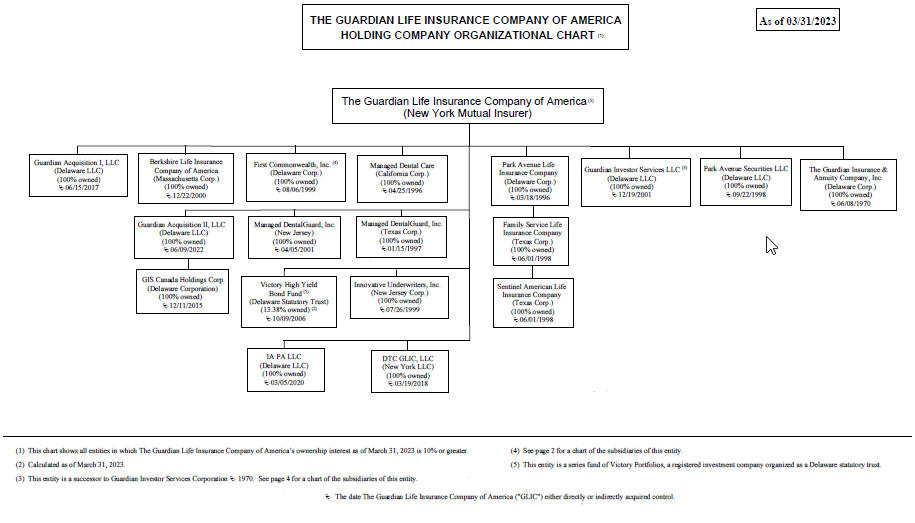

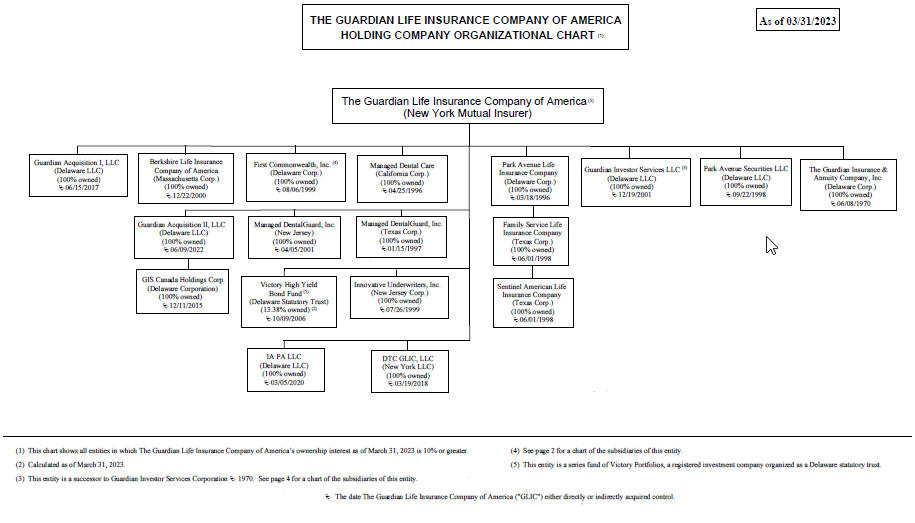

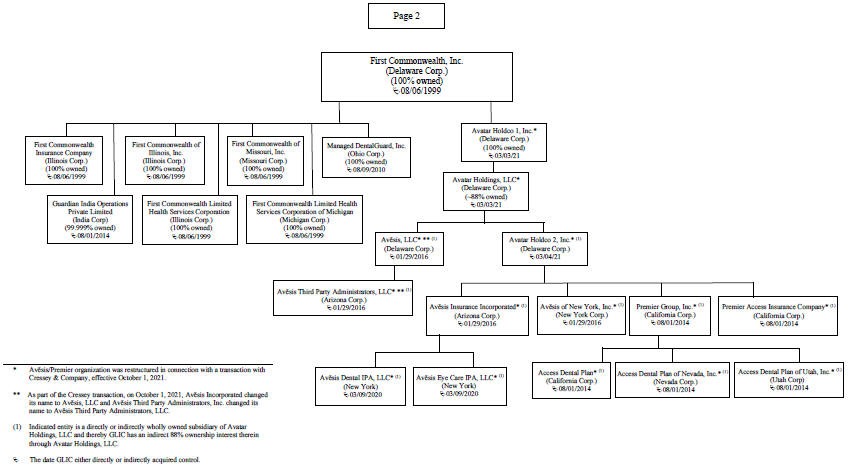

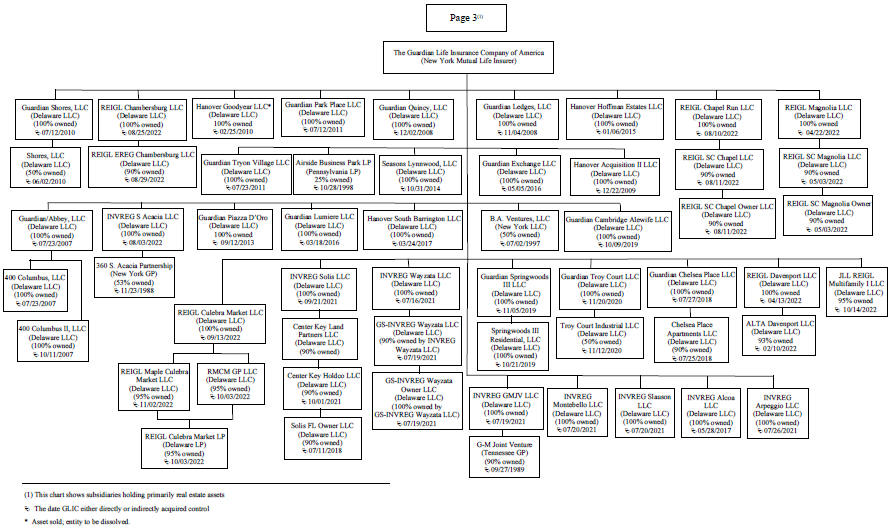

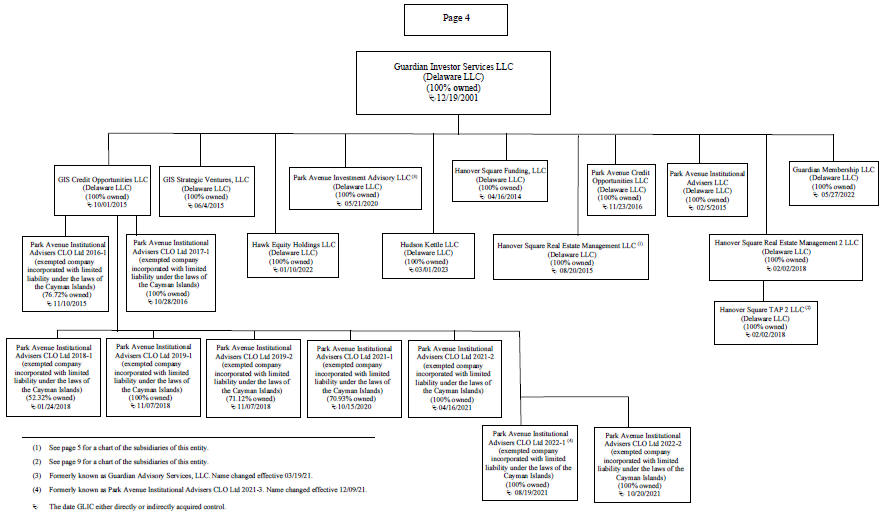

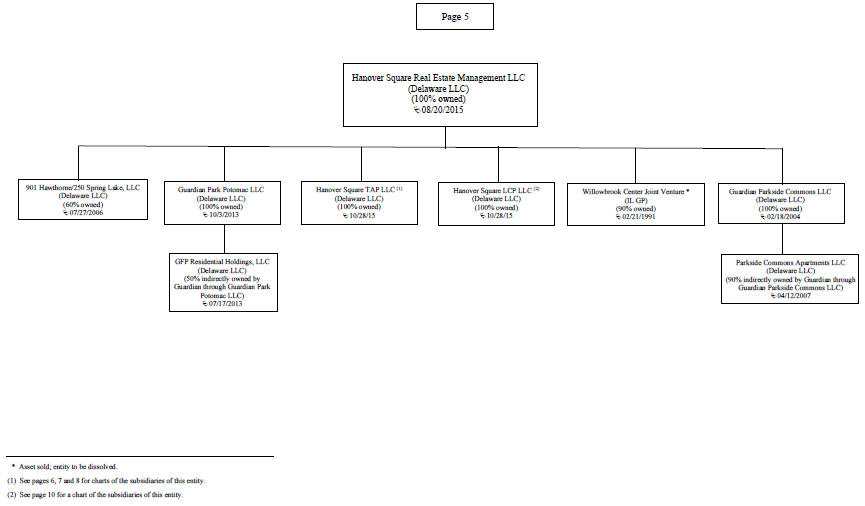

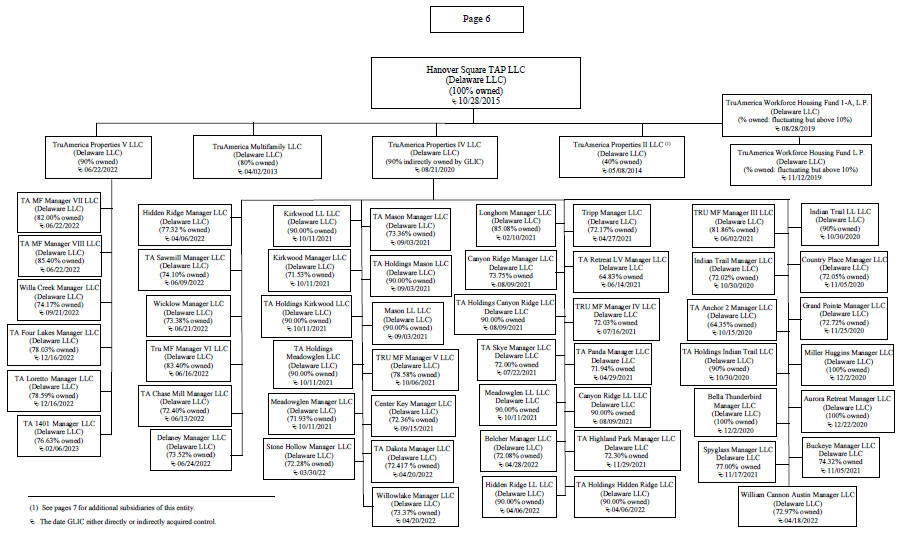

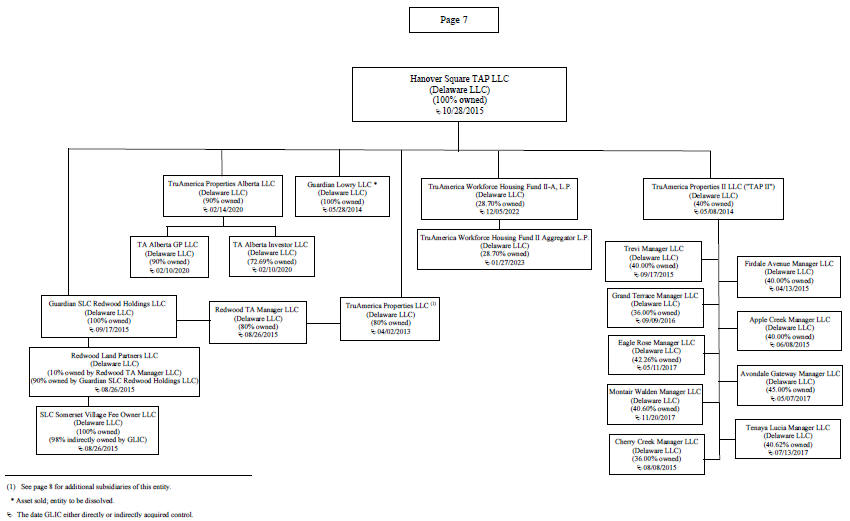

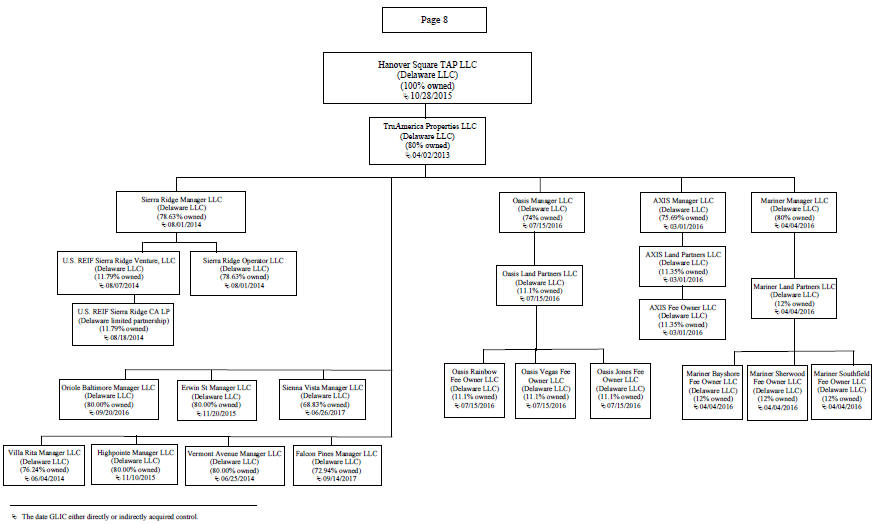

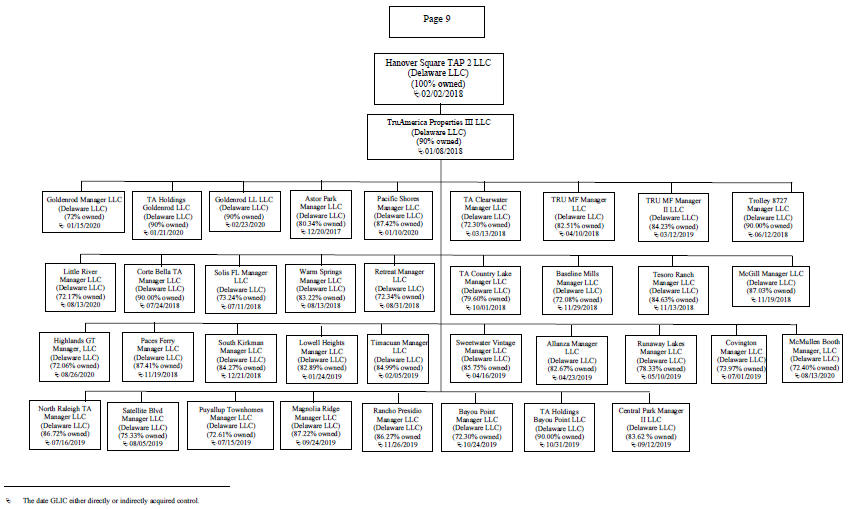

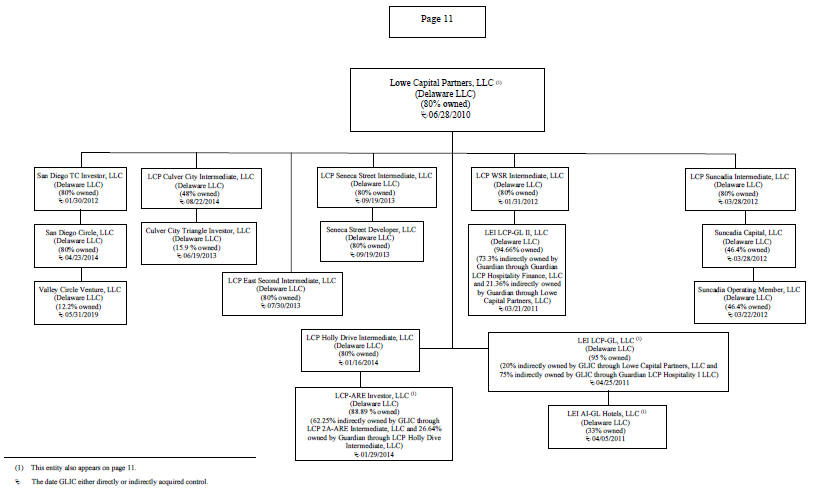

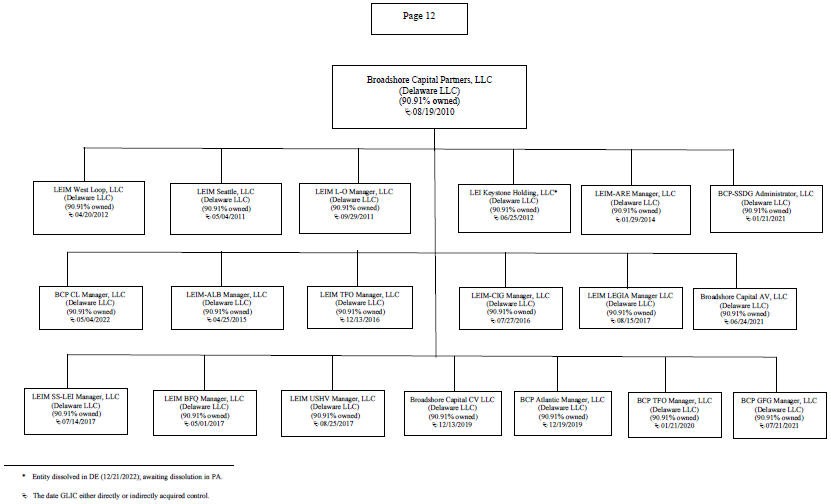

| Item 29. | Persons Controlled by or under Common Control with Registrant |

The following list sets forth the persons directly controlled by The Guardian Life Insurance Company of America (“Guardian Life”), the parent company of GIAC, the Registrant’s depositor.

C-2

| Item 30. | Indemnification |

The By-Laws of The Guardian Insurance & Annuity Company, Inc. provide that the Company shall, to the fullest extent legally permissible under the General Corporation Law of the State of Delaware, indemnify and hold harmless officers and directors of the Corporation for certain liabilities reasonably incurred in connection with such person’s capacity as an officer or director.

The Certificate of Incorporation of the Corporation includes the following provision:

No director of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director except for liability (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law; (iii) under Section 164 of the Delaware General Corporation Law, or (iv) for any transaction for which the director derived an improper personal benefit.

Insofar as indemnification for liability arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel, the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

| Item 31. | Principal Underwriters |

(a) Park Avenue Securities LLC (“PAS”) is the principal underwriter of the Registrant’s variable annuity contracts.

In addition, PAS is the distributor of variable annuity and variable life insurance contracts currently offered by GIAC through its separate accounts, The Guardian/Value Line Separate Account, The Guardian Separate Account A, The Guardian Separate Account B, The Guardian Separate Account C, The Guardian Separate Account D, The Guardian Separate Account E, The Guardian Separate Account F, The Guardian Separate Account K, The Guardian Separate Account M, The Guardian Separate Account N, The Guardian Separate Account Q, Separate Account 1 and Separate Account 2 which are all registered as unit investment trusts under the 1940 Act.

(b) The following is a list of each director and officer of PAS.

PARK AVENUE SECURITIES LLC

MANAGER & OFFICER ROSTER

| OFFICER |

OFFICER TITLE | |

| Marianne Caswell | Board Manager & President | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Michael Ferik | Board Manager | |

| 100 First Stamford Place, West Stamford, CT 06902 | ||

| Leyla Lesina | Board Manager | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Kevin Molloy | Board Manager | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Harris Oliner | Associate General Counsel, Corporate Secretary | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Carly Maher | Head of Wealth Management Strategy and Business Operations | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Joseph Fuschillo | Head of Wealth Management Business Development | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Michael Kryza | Head of Corporate Development | |

| 100 First Stamford Place | ||

| Stamford, CT 06902 | ||

| Joshua Hergan | Assistant General Counsel | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Thomas Drogan | Chief Compliance Officer | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Shawn McGrath | Individual Markets Controller | |

| 700 South Street, Pittsfield, MA 01201 | ||

| Allen Boggs | Head of Supervision and Business Risk | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Michael Ryniker | Head of Operations | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Kyle Hooper | Senior Counsel, Assistant Corporate Secretary | |

| 8 Lands End Drive, Greensboro, NC 27514 |

||

| Tyla Reynolds 10 Hudson Yards, New York, NY 10001 |

Associate General Counsel, Assistant Corporate Secretary | |

| Robert D. Grauer 10 Hudson Yards, New York, NY 10001 |

Associate General Counsel, Assistant Corporate Secretary | |

| Rose Burachio | Assistant Corporate Secretary | |

| 10 Hudson Yards, New York, NY 10001 | ||

| Brian Hagan | Anti-Money Laundering Compliance Officer | |

| 101 Crawfords Corner Rd, Holmdel, PA 07733 | ||

C-3

(c) PAS, as the principal underwriter of the Registrant’s variable annuity contracts received, either directly or indirectly, the following commissions or other compensation from the Registrant during the last fiscal year.

| Net Underwriting Discounts and Commissions |