As filed with the Securities and Exchange Commission on July

24, 2020

File Nos. 033-31894

811-05954

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Post-Effective

Amendment No. 117 |

☒

|

and

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

THE CHARLES SCHWAB FAMILY OF FUNDS

(Exact Name of Registrant as Specified in Charter)

211 Main Street

San Francisco, California 94105

(Address of Principal Executive Offices)

(800) 648-5300

(Registrant’s Telephone Number, including Area Code)

David J. Lekich, Esq.

211 Main Street

San Francisco, California 94105

(Name and Address of Agent for Service)

Copies of communications to:

Douglas

P. Dick, Esq.

Dechert LLP

1900 K Street, N.W.

Washington, DC 20006 |

John M.

Loder, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, MA 02199-3600 |

It is proposed that this filing will become effective (check

appropriate box):

□ Immediately upon filing

pursuant to paragraph (b)

□ On (date) pursuant to

paragraph (b)

□ 60 days after filing pursuant to

paragraph (a)(1)

☒ On September 24, 2020 pursuant

to paragraph (a)(1)

□ 75 days after filing

pursuant to paragraph (a)(2)

□ On (date) pursuant

to paragraph (a)(2) of Rule 485

If appropriate, check

the following box:

□ This post-effective amendment

designates a new effective date for a previously filed post-effective amendment.

The information in this Prospectus is not complete and

may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

Prospectus | September

24, 2020

Schwab Funds®

Schwab® Money Funds

| Schwab

® Government Money Fund |

|

| Ultra

Shares |

[ ]

|

| Schwab

® Treasury Obligations Money Fund |

|

| Ultra

Shares |

[ ]

|

| Schwab

® U.S. Treasury Money Fund |

|

| Ultra

Shares |

[ ]

|

New

Notice Regarding Shareholder Report Delivery Options

Beginning on January 1, 2021, paper copies

of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a fund or from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made

available on a fund’s website www.schwabfunds.com/schwabfunds_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access

the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically.

If you would like to continue to receive a

fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request:

| • |

If you invest through

Charles Schwab & Co, Inc. (broker-dealer), by calling 1-866-345-5954 and using the unique identifier attached to this mailing; |

| • |

If you invest through

another financial intermediary (such as a bank or broker-dealer) by contacting them directly; or |

| •

|

If owned

directly through a fund by calling 1-800-407-0256. |

If you already receive shareholder reports

and other fund documents electronically, you will not be affected by this change and you need not take any action.

As with all mutual funds, the Securities and Exchange

Commission (SEC) has not approved these securities or passed on whether the information in this prospectus is adequate and accurate. Anyone who indicates otherwise is committing a federal crime.

Schwab® Government Money Fund

| Ticker

Symbol: |

Ultra Shares: [ ] |

Investment Objective

The fund’s goal is to seek the highest current income

consistent with stability of capital and liquidity.

Fund

Fees and Expenses

This table describes the fees and expenses you may pay if

you buy and hold shares of the fund. This table does not reflect any brokerage fees or commissions you may incur when buying or selling fund shares.

| Shareholder

Fees (fees paid directly from your investment) |

| |

Ultra

Shares |

| |

None

|

| Annual

Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) |

| Management

fees |

[ ]

|

| Distribution

(12b-1) fees |

None

|

| Other

expenses1 |

[ ]

|

| Total

annual fund operating expenses |

[ ]

|

| Less

expense reduction |

([ ])

|

| Total

annual fund operating expenses after expense reduction2 |

[ ]

|

| 1 |

“Other expenses”

is an estimate based on the expenses the fund’s Ultra Shares expects to incur for its first full fiscal year. |

|

2 |

The

investment adviser and its affiliates have agreed to limit the total annual fund operating expenses (excluding interest, taxes and certain non-routine expenses) of the Ultra Shares to 0.19% for so long as the investment adviser serves as the adviser

to the fund (contractual expense limitation agreement). This contractual expense limitation agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of

investing in the fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those time periods. The example also assumes

that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The figures are based on total annual fund operating expenses after any expense reduction. The example does not reflect any brokerage fees

or commissions you may incur when buying or selling fund shares. Your actual costs may be higher or lower.

| Expenses

on a $10,000 Investment |

| |

1

Year |

3

Years |

5

Years |

10

Years |

| Ultra

Shares |

$[ ]

|

$[ ]

|

$[ ]

|

$[ ]

|

Principal Investment Strategies

To pursue its goal, the fund invests in U.S. government

securities, such as:

| • |

U.S. Treasury bills and

notes |

| • |

other obligations that are

issued by the U.S. government, its agencies or instrumentalities, including obligations that are not fully guaranteed by the U.S. Treasury, such as those issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan

Mortgage Corporation (Freddie Mac) and the Federal Home Loan Banks |

| • |

repurchase agreements that

are collateralized fully by cash and/or U.S. government securities |

| •

|

obligations

that are issued by private issuers that are guaranteed as to principal or interest by the U.S. government, its agencies or instrumentalities |

The fund intends to operate as a government money market fund

under the regulations governing money market funds. The fund will invest at least 99.5% of its total assets in cash, U.S. government securities and/or repurchase agreements that are collateralized fully by cash and/or U.S. government securities;

under normal circumstances, at least 80% of the fund’s net assets (including, for this purpose, any borrowings for investment purposes) will be invested solely in U.S. government securities including repurchase agreements that are

collateralized fully by U.S. government securities (excluding cash). With respect to the 80% policy, the fund will notify its shareholders at least 60 days before changing the policy.

In choosing securities, the fund’s manager seeks to

maximize current income within the limits of the fund’s investment objective and credit, maturity and diversification policies. Some of these policies may be stricter than the federal regulations that apply to all money market funds.

The investment adviser’s credit research department

analyzes and monitors the securities that the fund owns or is considering buying. The manager may adjust the fund’s holdings or its average maturity based on actual or anticipated changes in credit quality or market dynamics, such as interest

rates. To preserve its investors’ capital, the fund seeks to maintain a stable $1.00 share price.

For temporary defensive purposes during unusual market

conditions, the fund may invest up to 100% of its assets in cash, cash equivalents or other high quality short-term investments.

As a government money market fund, the fund’s Board of

Trustees (the Board) has determined not to subject the fund to a liquidity fee and/or a redemption gate on fund redemptions. Please note that

Schwab Government Money Fund | Fund Summary1

the Board has reserved its ability to change this determination with respect

to liquidity fees and/or redemption gates, but only after providing appropriate prior notice to shareholders.

Principal Risks

The fund is subject to risks, any of which could cause an

investor to lose money. The fund’s principal risks include:

Market Risk. Financial markets

rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the

occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. These events could reduce consumer demand or economic output; result in market closures,

low or negative interest rates, travel restrictions or quarantines; and significantly adversely impact the economy. Governmental and quasi-governmental authorities and regulators throughout the world have in the past often responded to serious

economic disruptions with a variety of significant fiscal and monetary policy changes which could have an unexpected impact on financial markets and the fund’s investments. As with any investment whose performance is tied to these markets, the

value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Investment Risk. You

could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any

time.

Interest Rate Risk. Interest rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low or there are negative

interest rates, the fund’s yield (and total return) also could be low or even negative. In addition, the fund may be unable to pay expenses out of fund assets or maintain a stable $1.00 share price. Also, a change in a central

bank’s monetary policy or economic conditions may result in a change in interest rates, which could have sudden and unpredictable effects on the markets. Volatility in the market may decrease liquidity in the money market securities markets,

making it more difficult for the fund to sell its money market investments at a time when the investment adviser might wish to sell such investments. Decreased market liquidity also may make it more difficult to value some or all of the fund’s

money market securities holdings.

Stable Net Asset

Value Risk. If the fund or another money market fund fails to maintain a stable net asset value (or such perception exists in the market place), the fund could experience increased redemptions, which may adversely

impact the fund’s share price.

The fund is permitted, among other things, to reduce or withhold any income

and/or gains generated from its portfolio to maintain a stable $1.00 share price.

Repurchase Agreements Risk.

When the fund enters into a repurchase agreement, the fund is exposed to the risk that the other party (i.e., the counterparty) will not fulfill its contractual obligation. In a repurchase agreement, there exists the risk that, when the fund buys a

security from a counterparty that agrees to repurchase the security at an agreed upon price (usually higher) and time, the counterparty will not repurchase the security.

Credit Risk. A decline in the

credit quality of an issuer, guarantor or liquidity provider of a portfolio investment or a counterparty could cause the fund to lose money or underperform. The fund could lose money if, due to a decline in credit quality, the issuer, guarantor or

liquidity provider of a portfolio investment or a counterparty fails to make, or is perceived as being unable or unwilling to make, timely principal or interest payments or otherwise honor its obligations. Even though the fund’s

investments in repurchase agreements are collateralized at all times, there is some risk to the fund if the other party should default on its obligations and the fund is delayed or prevented from recovering or disposing of the collateral. The credit

quality of the fund’s portfolio holdings can change rapidly in certain market environments and any downgrade or default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Certain U.S. government securities that the fund invests in

are not backed by the full faith and credit of the U.S. government, which means they are neither issued nor guaranteed by the U.S. Treasury. Although maintained in conservatorship by the Federal Housing Finance Agency (FHFA) since September 2008,

Fannie Mae and Freddie Mac maintain only lines of credit with the U.S. Treasury. Additionally, the FHFA recently announced plans to begin removing Fannie Mae and Freddie Mac from conservatorship. The Federal Home Loan Banks maintain limited access

to credit lines from the U.S. Treasury. Other securities, such as obligations issued by the Federal Farm Credit Banks Funding Corporation, are supported solely by the credit of the issuer. There can be no assurance that the U.S. government will

provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the fund owns do not extend to the shares of the fund itself.

Management Risk. Any

actively managed mutual fund is subject to the risk that its investment adviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s

investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment adviser’s maturity decisions will

also affect the fund’s yield, and potentially could affect its share price. To the extent that the investment adviser anticipates interest rate trends imprecisely, the fund’s yield at times could lag the yields of other money

market funds.

2Schwab Government Money Fund | Fund Summary

Redemption Risk. The fund may

experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemptions by a few large investors in the

fund may have a significant adverse effect on the fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money market funds, including the fund, could face a

market-wide risk of increased redemption pressures, potentially jeopardizing the stability of their $1.00 share prices.

Money Market Fund Risk. The

fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term performance than stock or bond investments.

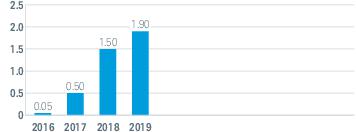

Performance

The bar chart below shows how the fund’s Investor

Shares investment results have varied from year to year, and the following table shows the fund’s Investor Shares average annual total returns for various periods. This information provides some indication of the risks of investing in the

fund. All figures assume distributions were reinvested. No performance is shown for the fund’s Ultra Shares because the Ultra Shares had not commenced operations prior to the date of this prospectus. The Investor Shares and the Ultra Shares of

the fund would have substantially similar performance because they invest in the same portfolio of securities and the annual returns would differ only to the extent that the Ultra Shares has lower expenses. Keep in mind that future performance may

differ from past performance. For current performance information, please see www.schwabfunds.com/schwabfunds_prospectus or call toll-free 1-877-824-5615 for the fund’s current seven-day yield.

Annual Total Returns (%) as of

12/31

Best Quarter: 0.53% Q2 2019

Worst Quarter: 0.00% Q1 2016

Year-to-date performance as of 6/30/20: 0.30%

| Average

Annual Total Returns as of 12/31/19 |

| |

1

Year |

Since

Inception

(1/21/15) |

| Investor

Shares |

1.90%

|

0.80%

|

| Ultra

Shares |

-

|

-

|

Investment Adviser

Charles Schwab Investment Management, Inc.

Purchase and Sale of Fund Shares

The fund is open for business each day that the New York

Stock Exchange (NYSE) is open except when the following federal holidays are observed: Columbus Day and Veterans Day. If the NYSE is closed due to weather or other extenuating circumstances on a day it would typically be open for business, or the

NYSE has an unscheduled early closing on a day it has opened for business, the fund reserves the right to treat such day as a business day and accept purchase and redemption orders and calculate its share price, as of the normally scheduled close of

regular trading on the NYSE for that day.

Eligible

Investors (as determined by the fund) may only invest in the fund through an account at Charles Schwab & Co., Inc. (Schwab) or another financial intermediary. When you place orders to purchase, exchange or redeem fund shares through Schwab or

another financial intermediary, you must follow Schwab’s or the other financial intermediary’s transaction procedures. Shareholders who previously purchased fund shares through the fund’s transfer agent and continue to hold such

shares directly through the fund’s transfer agent may make additional purchases and place exchange and redemption orders through the fund’s transfer agent by contacting the transfer agent by phone or in writing as noted below:

| • |

by telephone at

1-800-407-0256; or |

| •

|

by mail

to DST Asset Manager Solutions, Inc., Attn: Schwab Funds, P.O. Box 219647, Kansas City, MO 64121-9647. |

Set forth below are the investment minimums for the

fund’s Ultra Shares. The minimums may be waived for certain investors or in the fund’s sole discretion.

| |

Minimum

Initial

Investment |

Minimum

Additional

Investment |

| Ultra

Shares |

$1,000,000

|

$1

|

Tax Information

Distributions received from the fund will generally be

taxable as ordinary income or capital gains, unless you are investing through an IRA, 401(k) or other tax-advantaged account.

Payments to Financial Intermediaries

If you purchase shares of the fund through a broker-dealer

or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other financial intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Schwab Government Money Fund | Fund Summary3

Schwab® Treasury Obligations Money Fund

| Ticker

Symbol: |

Ultra Shares: [ ] |

Investment Objective

The fund’s goal is to seek current income consistent

with stability of capital and liquidity. The fund’s investment objective is not fundamental and therefore may be changed by the fund’s Board of Trustees without shareholder approval.

Fund Fees and Expenses

This table describes the fees and expenses you may pay if

you buy and hold shares of the fund. This table does not reflect any brokerage fees or commissions you may incur when buying or selling fund shares.

| Shareholder

Fees (fees paid directly from your investment) |

| |

Ultra

Shares |

| |

None

|

| Annual

Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) |

| Management

fees |

[ ]

|

| Distribution

(12b-1) fees |

None

|

| Other

expenses1 |

[ ]

|

| Total

annual fund operating expenses |

[ ]

|

| Less

expense reduction |

([ ])

|

| Total

annual fund operating expenses after expense reduction2 |

[ ]

|

| 1 |

“Other expenses”

is an estimate based on the expenses the fund’s Ultra Shares expects to incur for its first full fiscal year. |

|

2 |

The

investment adviser and its affiliates have agreed to limit the total annual fund operating expenses (excluding interest, taxes and certain non-routine expenses) of the Ultra Shares to 0.19% for so long as the investment adviser serves as the adviser

to the fund (contractual expense limitation agreement). This contractual expense limitation agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of

investing in the fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those time periods. The example also assumes

that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The figures are based on total annual fund operating expenses after any expense reduction. The example does not reflect any brokerage fees

or commissions you may incur when buying or selling fund shares. Your actual costs may be higher or lower.

| Expenses

on a $10,000 Investment |

| |

1

Year |

3

Years |

5

Years |

10

Years |

| Ultra

Shares |

$[ ]

|

$[ ]

|

$[ ]

|

$[ ]

|

Principal Investment Strategies

To pursue its goal, the fund typically invests in securities

backed by the full faith and credit of the U.S. government and repurchase agreements backed by such investments. The fund intends to operate as a government money market fund under the regulations governing money

market funds. The fund will invest at least 99.5% of its total assets in cash, government securities and/or repurchase agreements that are collateralized fully by cash and/or government securities; under normal circumstances, at least 80% of the

fund’s net assets (including, for this purpose, any borrowings for investment purposes) will be invested solely in U.S. Treasury obligations or repurchase agreements backed by such obligations (excluding cash). With respect to the 80% policy,

the fund will notify its shareholders at least 60 days before changing the policy. The full faith and credit backing is the strongest backing offered by the U.S. government, and traditionally is considered by investors to be the highest degree of

safety as far as the payment of principal and interest.

Based on the fund manager’s view of market conditions

for U.S. Treasury securities, the fund may invest up to 20% of its net assets in: (i) obligations that are issued by the U.S. government, its agencies or instrumentalities, including obligations that are not fully guaranteed by the U.S. Treasury,

such as those issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal Home Loan Banks, and repurchase agreements backed by such obligations; and (ii) obligations that

are issued by private issuers that are guaranteed as to principal or interest by the U.S. government, its agencies or instrumentalities. Obligations that are issued by private issuers that are guaranteed as to principal or interest by the U.S.

government, its agencies or instrumentalities are considered U.S. government securities under the rules that govern money market funds.

In choosing securities, the fund’s manager seeks to

maximize current income within the limits of the fund’s investment objective and credit, maturity and diversification policies. By investing primarily in full faith and credit U.S. government investments and repurchase agreements backed by

such investments, the fund seeks to provide safety as to its assets. The portfolio manager may adjust the fund’s holdings or its average maturity based on actual or anticipated changes in credit quality or market dynamics, such as interest

rates. To preserve its investors’ capital, the fund seeks to maintain a stable $1.00 share price.

For temporary defensive purposes during unusual market

conditions, the fund may invest up to 100% of its assets in cash, cash equivalents or other high quality short-term investments.

4Schwab Treasury Obligations Money Fund | Fund Summary

As a government money market fund, the fund’s Board of

Trustees (the Board) has determined not to subject the fund to a liquidity fee and/or a redemption gate on fund redemptions. Please note that the Board has reserved its ability to change this determination with respect to liquidity fees and/or

redemption gates, but only after providing appropriate prior notice to shareholders.

Principal Risks

The fund is subject to risks, any of which could cause an

investor to lose money. The fund’s principal risks include:

Market Risk. Financial markets

rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the

occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. These events could reduce consumer demand or economic output; result in market closures,

low or negative interest rates, travel restrictions or quarantines; and significantly adversely impact the economy. Governmental and quasi-governmental authorities and regulators throughout the world have in the past often responded to serious

economic disruptions with a variety of significant fiscal and monetary policy changes which could have an unexpected impact on financial markets and the fund’s investments. As with any investment whose performance is tied to these markets, the

value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Investment Risk. You

could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any

time.

Interest Rate Risk. Interest rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low or there are negative

interest rates, the fund’s yield (and total return) also could be low or even negative. In addition, the fund may be unable to pay expenses out of fund assets or maintain a stable $1.00 share price. Also, a change in a central

bank’s monetary policy or economic conditions may result in a change in interest rates, which could have sudden and unpredictable effects on the markets. Volatility in the market may decrease liquidity in the money market securities markets,

making it more difficult for the fund to sell its money market investments at a time when the investment adviser might wish to sell such investments. Decreased market liquidity also may make it more difficult to value some or all of the fund’s

money market securities holdings.

Credit Risk. A decline in the

credit quality of an issuer, guarantor or liquidity provider of a portfolio investment or a counterparty could cause the fund to lose money or underperform. The fund could lose money if, due to a decline in credit quality, the issuer, guarantor or

liquidity provider of a portfolio investment or a counterparty fails to make, or is perceived as being unable or unwilling to make, timely principal or interest payments or otherwise honor its obligations. Even though the fund’s

investments in repurchase agreements are collateralized at all times, there is some risk to the fund if the other party should default on its obligations and the fund is delayed or prevented from recovering or disposing of the collateral. The credit

quality of the fund’s portfolio holdings can change rapidly in certain market environments and any downgrade or default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Certain U.S. government securities that the fund invests in

are not backed by the full faith and credit of the U.S. government, which means they are neither issued nor guaranteed by the U.S. Treasury. Although maintained in conservatorship by the Federal Housing Finance Agency (FHFA) since September 2008,

Fannie Mae and Freddie Mac maintain only lines of credit with the U.S. Treasury. Additionally, the FHFA recently announced plans to begin removing Fannie Mae and Freddie Mac from conservatorship. The Federal Home Loan Banks maintain limited access

to credit lines from the U.S. Treasury. Other securities, such as obligations issued by the Federal Farm Credit Banks Funding Corporation, are supported solely by the credit of the issuer. There can be no assurance that the U.S. government will

provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the fund owns do not extend to the shares of the fund itself.

Stable Net Asset Value Risk.

If the fund or another money market fund fails to maintain a stable net asset value (or such perception exists in the market place), the fund could experience increased redemptions, which may adversely impact the fund’s share price. The fund

is permitted, among other things, to reduce or withhold any income and/or gains generated from its portfolio to maintain a stable $1.00 share price.

Repurchase Agreements Risk.

When the fund enters into a repurchase agreement, the fund is exposed to the risk that the other party (i.e., the counterparty) will not fulfill its contractual obligation. In a repurchase agreement, there exists the risk that when the fund buys a

security from a counterparty that agrees to repurchase the security at an agreed upon price (usually higher) and time, the counterparty will not repurchase the security.

Management Risk. Any

actively managed mutual fund is subject to the risk that its investment adviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s

investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment adviser’s maturity decisions will

also affect

Schwab

Treasury Obligations Money Fund | Fund Summary5

the fund’s yield, and potentially could affect its share price. To the

extent that the investment adviser anticipates interest rate trends imprecisely, the fund’s yield at times could lag the yields of other money market funds.

Redemption Risk. The fund may

experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemptions by a few large investors in the

fund may have a significant adverse effect on the fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money market funds, including the fund, could face a

market-wide risk of increased redemption pressures, potentially jeopardizing the stability of their $1.00 share prices.

Money Market Fund Risk. The

fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term performance than stock or bond investments.

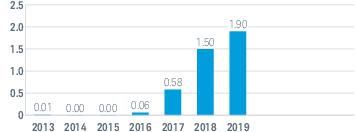

Performance

The bar chart below shows how the fund’s Investor

Shares investment results have varied from year to year, and the following table shows the fund’s Investor Shares average annual total returns for various periods. This information provides some indication of the risks of investing in the

fund. All figures assume distributions were reinvested. No performance is shown for the fund’s Ultra Shares because the Ultra Shares had not commenced operations prior to the date of this prospectus. The Investor Shares and the Ultra Shares of

the fund would have substantially similar performance because they invest in the same portfolio of securities and the annual returns would differ only to the extent that the Ultra Shares has lower expenses. Keep in mind that future performance may

differ from past performance. For current performance information, please see www.schwabfunds.com/schwabfunds_prospectus or call toll-free 1-877-824-5615 for the fund’s current seven-day yield.

Annual Total Returns (%) as of

12/31

Best Quarter: 0.52% Q2 2019

Worst Quarter: 0.00% Q1 2016

Year-to-date performance as of 6/30/20: 0.27%

| Average

Annual Total Returns as of 12/31/19 |

| |

1

Year |

5

Years |

Since

Inception

(4/24/12) |

| Investor

Shares |

1.90%

|

0.80%

|

0.52%

|

| Ultra

Shares |

-

|

-

|

-

|

Investment Adviser

Charles Schwab Investment Management, Inc.

Purchase and Sale of Fund Shares

The fund is open for business each day that the New York

Stock Exchange (NYSE) is open except when the following federal holidays are observed: Columbus Day and Veterans Day. If the NYSE is closed due to weather or other extenuating circumstances on a day it would typically be open for business, or the

NYSE has an unscheduled early closing on a day it has opened for business, the fund reserves the right to treat such day as a business day and accept purchase and redemption orders and calculate its share price, as of the normally scheduled close of

regular trading on the NYSE for that day.

Eligible

Investors (as determined by the fund) may only invest in the fund through an account at Charles Schwab & Co., Inc. (Schwab) or another financial intermediary. When you place orders to purchase, exchange or redeem fund shares through Schwab or

another financial intermediary, you must follow Schwab’s or the other financial intermediary’s transaction procedures. Shareholders who previously purchased fund shares through the fund’s transfer agent and continue to hold such

shares directly through the fund’s transfer agent may make additional purchases and place exchange and redemption orders through the fund’s transfer agent by contacting the transfer agent by phone or in writing as noted below:

| • |

by telephone at

1-800-407-0256; or |

| •

|

by mail

to DST Asset Manager Solutions, Inc., Attn: Schwab Funds, P.O. Box 219647, Kansas City, MO 64121-9647. |

Set forth below are the investment minimums for the

fund’s Ultra Shares. The minimums may be waived for certain investors or in the fund’s sole discretion.

| |

Minimum

Initial

Investment |

Minimum

Additional

Investment |

| Ultra

Shares |

$1,000,000

|

$1

|

Tax Information

Distributions received from the fund will generally be

taxable as ordinary income or capital gains, unless you are investing through an IRA, 401(k) or other tax-advantaged account.

Payments to Financial Intermediaries

If you purchase shares of the fund through a broker-dealer

or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares

6Schwab Treasury Obligations Money Fund | Fund Summary

and related services. These payments may create a conflict of interest by

influencing the broker-dealer or other financial intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Schwab Treasury Obligations Money Fund | Fund Summary7

Schwab® U.S. Treasury Money Fund

| Ticker

Symbol: |

Ultra Shares: [ ] |

Investment Objective

The fund’s goal is to seek the highest current income

that is consistent with stability of capital and liquidity.

Fund Fees and Expenses

This table describes the fees and expenses you may pay if

you buy and hold shares of the fund. This table does not reflect any brokerage fees or commissions you may incur when buying or selling fund shares.

| Shareholder

Fees (fees paid directly from your investment) |

| |

Ultra

Shares |

| |

None

|

| Annual

Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) |

| Management

fees |

[ ]

|

| Distribution

(12b-1) fees |

None

|

| Other

expenses1 |

[ ]

|

| Total

annual fund operating expenses |

[ ]

|

| Less

expense reduction |

([ ])

|

| Total

annual fund operating expenses after expense reduction2 |

[ ]

|

| 1 |

“Other expenses”

is an estimate based on the expenses the fund’s Ultra Shares expects to incur for its first full fiscal year. |

|

2 |

The

investment adviser and its affiliates have agreed to limit the total annual fund operating expenses (excluding interest, taxes and certain non-routine expenses) of the Ultra Shares to 0.19% for so long as the investment adviser serves as the adviser

to the fund (contractual expense limitation agreement). This contractual expense limitation agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of

investing in the fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those time periods. The example also assumes

that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The figures are based on total annual fund operating expenses after any expense reduction. The example does not reflect any brokerage fees

or commissions you may incur when buying or selling fund shares. Your actual costs may be higher or lower.

| Expenses

on a $10,000 Investment |

| |

1

Year |

3

Years |

5

Years |

10

Years |

| Ultra

Shares |

$[ ]

|

$[ ]

|

$[ ]

|

$[ ]

|

Principal Investment Strategies

To pursue its goal, the fund typically invests in securities

backed by the full faith and credit of the U.S. government. The fund intends to operate as a government money market fund under the regulations governing money market funds. The fund will invest at least 99.5% of

its total assets in cash and/or government securities (including bills and notes); under normal circumstances, at least 80% of the fund’s net assets (including, for this purpose, any borrowings for investment purposes) will be invested solely

in U.S. Treasury securities (excluding cash). With respect to the 80% policy, the fund will notify its shareholders at least 60 days before changing the policy. The full faith and credit backing is the strongest backing offered by the U.S.

government, and traditionally is considered by investors to be the highest degree of safety as far as the payment of principal and interest.

Based on the fund manager’s view of market conditions

for U.S. Treasury securities, the fund may invest up to 20% of its net assets in: (i) obligations that are issued by the U.S. government, its agencies or instrumentalities, including obligations that are not fully guaranteed by the U.S. Treasury,

such as those issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal Home Loan Banks; and (ii) obligations that are issued by private issuers that are guaranteed as

to principal or interest by the U.S. government, its agencies or instrumentalities. Obligations that are issued by private issuers that are guaranteed as to principal or interest by the U.S. government, its agencies or instrumentalities are

considered U.S. government securities under the rules that govern money market funds.

In choosing securities, the fund’s manager seeks to

maximize current income within the limits of the fund’s investment objective and credit, maturity and diversification policies. By investing primarily in full faith and credit U.S. government investments, the fund seeks to provide maximum

safety as to its assets. The fund is distinct from certain other types of government money market funds in that it does not invest in repurchase agreements. The portfolio manager may adjust the fund’s holdings or its average maturity based on

actual or anticipated changes in credit quality or market dynamics, such as interest rates. To preserve its investors’ capital, the fund seeks to maintain a stable $1.00 share price.

Because the income from U.S. Treasury securities is exempt

from state and local income taxes, the fund generally expects that the majority of the dividends it pays will be exempt from those taxes as well. (Dividends still will be subject to federal income tax.) However, the fund may invest up to 20% of its

net assets in non-U.S. Treasury investments that are not exempt from state and

8Schwab U.S. Treasury Money Fund | Fund Summary

local income taxes. Further, during unusual market conditions, the fund may

invest a greater portion of its assets in investments that are not exempt from state and local income taxes as a temporary defensive measure. When the fund engages in such activities, it may not achieve its investment goal.

For temporary defensive purposes during unusual market

conditions, the fund may invest up to 100% of its assets in cash, cash equivalents or other high quality short-term investments.

As a government money market fund, the fund’s Board of

Trustees (the Board) has determined not to subject the fund to a liquidity fee and/or a redemption gate on fund redemptions. Please note that the Board has reserved its ability to change this determination with respect to liquidity fees and/or

redemption gates, but only after providing appropriate prior notice to shareholders.

Principal Risks

The fund is subject to risks, any of which could cause an

investor to lose money. The fund’s principal risks include:

Market Risk. Financial markets

rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the

occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. These events could reduce consumer demand or economic output; result in market closures,

low or negative interest rates, travel restrictions or quarantines; and significantly adversely impact the economy. Governmental and quasi-governmental authorities and regulators throughout the world have in the past often responded to serious

economic disruptions with a variety of significant fiscal and monetary policy changes which could have an unexpected impact on financial markets and the fund’s investments. As with any investment whose performance is tied to these markets, the

value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Investment Risk. You

could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any

time.

Interest Rate Risk. Interest rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low or there are negative

interest rates, the fund’s yield (and total return) also could be low or even negative. In addition, the fund may be unable to pay expenses out of fund assets or maintain a stable $1.00 share price. Also, a change in a central

bank’s monetary policy or economic conditions may result in a

change in interest rates, which could have sudden and unpredictable effects

on the markets. Volatility in the market may decrease liquidity in the money market securities markets, making it more difficult for the fund to sell its money market investments at a time when the investment adviser might wish to sell such

investments. Decreased market liquidity also may make it more difficult to value some or all of the fund’s money market securities holdings.

Stable Net Asset Value Risk.

If the fund or another money market fund fails to maintain a stable net asset value (or such perception exists in the market place), the fund could experience increased redemptions, which may adversely impact the fund’s share price. The fund

is permitted, among other things, to reduce or withhold any income and/or gains generated from its portfolio to maintain a stable $1.00 share price.

Credit Risk. A decline in the

credit quality of an issuer, guarantor or liquidity provider of a portfolio investment or a counterparty could cause the fund to lose money or underperform. The fund could lose money if, due to a decline in credit quality, the issuer, guarantor or

liquidity provider of a portfolio investment or a counterparty fails to make, or is perceived as being unable or unwilling to make, timely principal or interest payments or otherwise honor its obligations. The credit quality of the fund’s

portfolio holdings can change rapidly in certain market environments and any downgrade or default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Certain U.S. government securities that the fund invests in

are not backed by the full faith and credit of the U.S. government, which means they are neither issued nor guaranteed by the U.S. Treasury. Although maintained in conservatorship by the Federal Housing Finance Agency (FHFA) since September 2008,

Fannie Mae and Freddie Mac maintain only lines of credit with the U.S. Treasury. Additionally, the FHFA recently announced plans to begin removing Fannie Mae and Freddie Mac from conservatorship. The Federal Home Loan Banks maintain limited access

to credit lines from the U.S. Treasury. Other securities, such as obligations issued by the Federal Farm Credit Banks Funding Corporation, are supported solely by the credit of the issuer. There can be no assurance that the U.S. government will

provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the fund owns do not extend to the shares of the fund itself.

Management Risk. Any

actively managed mutual fund is subject to the risk that its investment adviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s

investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment adviser’s maturity decisions will

also affect the fund’s yield, and potentially could affect its share price. To the extent that the investment adviser anticipates interest rate trends

Schwab

U.S. Treasury Money Fund | Fund Summary9

imprecisely, the fund’s yield at times could lag the yields of other

money market funds.

Redemption Risk. The fund may experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets.

Redemptions by a few large investors in the fund may have a significant adverse effect on the fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money

market funds, including the fund, could face a market-wide risk of increased redemption pressures, potentially jeopardizing the stability of their $1.00 share prices.

Money Market Fund Risk. The

fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term performance than stock or bond investments.

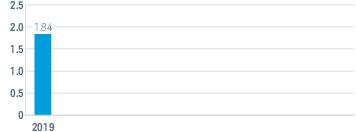

Performance

The bar chart below shows the fund’s Investor Shares

investment results for the prior calendar year, and the following table shows the fund’s Investor Shares average annual total returns for various periods. This information provides some indication of the risks of investing in the fund. All

figures assume distributions were reinvested. No performance is shown for the fund’s Ultra Shares because the Ultra Shares had not commenced operations prior to the date of this prospectus. The Investor Shares and the Ultra Shares of the fund

would have substantially similar performance because they invest in the same portfolio of securities and the annual returns would differ only to the extent that the Ultra Shares has lower expenses. Keep in mind that future performance may differ

from past performance. For current performance information, please see www.schwabfunds.com/schwabfunds_prospectus or call toll-free 1-877-824-5615 for the fund’s current seven-day yield.

Annual Total Returns (%) as of

12/31

Best Quarter: 0.51% Q2 2019

Worst Quarter: 0.37% Q4 2019

Year-to-date performance as of 6/30/20: 0.27%

| Average

Annual Total Returns as of 12/31/19 |

| |

1

Year |

Since

Inception

(1/17/18) |

| Investor

Shares |

1.84%

|

1.65%

|

| Ultra

Shares |

-

|

-

|

Investment Adviser

Charles Schwab Investment Management, Inc.

Purchase and Sale of Fund Shares

The fund is open for business each day that the New York

Stock Exchange (NYSE) is open except when the following federal holidays are observed: Columbus Day and Veterans Day. If the NYSE is closed due to weather or other extenuating circumstances on a day it would typically be open for business, or the

NYSE has an unscheduled early closing on a day it has opened for business, the fund reserves the right to treat such day as a business day and accept purchase and redemption orders and calculate its share price, as of the normally scheduled close of

regular trading on the NYSE for that day.

Eligible

Investors (as determined by the fund) may only invest in the fund through an account at Charles Schwab & Co., Inc. (Schwab) or another financial intermediary. When you place orders to purchase, exchange or redeem fund shares through Schwab or

another financial intermediary, you must follow Schwab’s or the other financial intermediary’s transaction procedures. Shareholders who previously purchased fund shares through the fund’s transfer agent and continue to hold such

shares directly through the fund’s transfer agent may make additional purchases and place exchange and redemption orders through the fund’s transfer agent by contacting the transfer agent by phone or in writing as noted below:

| • |

by telephone at

1-800-407-0256; or |

| •

|

by mail

to DST Asset Manager Solutions, Inc., Attn: Schwab Funds, P.O. Box 219647, Kansas City, MO 64121-9647. |

Set forth below are the investment minimums for the

fund’s Ultra Shares. The minimums may be waived for certain investors or in the fund’s sole discretion.

| |

Minimum

Initial

Investment |

Minimum

Additional

Investment |

| Ultra

Shares |

$1,000,000

|

$1

|

Tax Information

Distributions received from the fund will generally be

taxable as ordinary income or capital gains, unless you are investing through an IRA, 401(k) or other tax-advantaged account, although dividends paid by the fund from income earned on U.S. Treasury securities are exempt from state and local taxes in

most states.

10Schwab U.S. Treasury Money Fund | Fund Summary

Payments to Financial Intermediaries

If you purchase shares of the fund through a broker-dealer

or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other financial intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Schwab U.S. Treasury Money Fund | Fund Summary11

Fund Details

The funds invest exclusively in money market instruments.

There can be no assurance that the funds will achieve their investment objectives. Except as explicitly described otherwise, the strategies and policies of the funds may be changed without shareholder approval. In addition, the investment objective

of the Schwab Treasury Obligations Money Fund may be changed without shareholder approval.

Money Fund Regulations

Money market funds in the United States are subject to rules

governing their operation:

| • |

Credit quality: money market

funds must invest exclusively in high-quality securities. |

| • |

Diversification:

requirements for diversification limit a fund’s exposure to any given issuer, guarantor or liquidity provider. |

| • |

Maturity: money market funds

must maintain a dollar-weighted average portfolio maturity of no more than 60 days and a dollar-weighted average life to maturity of no more than 120 days. In addition, money market funds cannot invest in any security whose effective maturity is

longer than 397 days (approximately 13 months). |

| •

|

Liquidity: taxable

money market funds are subject to a minimum liquidity requirement that prohibits a fund from acquiring certain types of securities, if immediately after the acquisition, the fund’s investments in daily or weekly liquid assets would be

below 10% or 30%, respectively, of the fund’s total assets. |

Portfolio Holdings

A description of the funds’ policies and procedures with

respect to the disclosure of each fund’s portfolio securities is available in the funds’ Statement of Additional Information (SAI). Each fund posts on its website at

www.schwabfunds.com/schwabfunds_prospectus a list of the securities held by each fund as of the last business day of the most recent month. This list is updated within 5 business days after the end of each

month and will remain available online for at least 6 months after the initial posting. In addition, not later than 5 business days after the end of each calendar month, each fund will file a schedule of information regarding its portfolio holdings

and other information about the fund as of the last day of that month with the SEC on Form N-MFP. These filings will be publicly available immediately upon filing on the SEC’s website at www.sec.gov. A

link to each fund’s Form N-MFP filings on the SEC’s website will also be available at www.schwabfunds.com/schwabfunds_prospectus.

12Schwab

Money Funds | Fund Details

Financial Highlights

This section provides further details about the financial

history of each fund and its respective share classes (none of which are offered in this prospectus), for the past five years or, if shorter, for its period of operations. No financial highlights are presented for the Ultra Shares for each fund

because the Ultra Shares for each respective fund had not commenced operations prior to the date of this prospectus. Certain information reflects financial results for a single fund share. “Total return” shows the percentage that an

investor in a fund would have earned or lost during a given period, assuming all distributions were reinvested. This information has been audited (except for the period ended June 30, 2020, which is unaudited) by [ ], an

independent registered public accounting firm. [ ]’s full report is included in each fund’s annual report (see back cover). Each fund’s unaudited financial statements for the semiannual period ended June 30,

2020 is included in each fund’s semiannual report (see back cover). [ ] resigned as the funds’ independent registered public accounting firm effective June 8, 2020. The funds’ Board of Trustees appointed

[ ] beginning June 9, 2020 to act as the funds’ independent registered public accounting firm. [TO BE UPDATED BY AMENDMENT]

Schwab Government Money Fund

| Sweep

Shares |

1/1/20–

6/30/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/17 |

1/1/16–

12/31/16 |

1/1/15–

12/31/15 |

| Per-Share

Data |

| Net

asset value at beginning of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

| Income

(loss) from investment operations: |

|

|

|

|

|

|

| Net

investment income (loss)1 |

[ ]

|

0.02

|

0.01

|

0.00

2 |

0.00

2 |

—

|

| Net

realized and unrealized gains (losses) |

[ ]

|

—

|

0.00

2 |

0.00

2 |

0.00

2 |

(0.00)

2 |

| Total

from investment operations |

[ ]

|

0.02

|

0.01

|

0.00

2 |

0.00

2 |

(0.00)

2 |

| Less

distributions: |

|

|

|

|

|

|

| Distributions

from net investment income |

[ ]

|

(0.02)

|

(0.01)

|

(0.00)

2 |

(0.00)

2 |

—

|

| Distributions

from net realized gains |

[ ]

|

—

|

(0.00)

2 |

(0.00)

2 |

—

|

—

|

| Total

distributions |

[ ]

|

(0.02)

|

(0.01)

|

(0.00)

2 |

(0.00)

2 |

—

|

| Net

asset value at end of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

| Total

return |

[ ]%

|

1.65%

|

1.23%

|

0.26%

|

0.01%

|

—

|

| Ratios/Supplemental

Data |

| Ratios

to average net assets: |

|

|

|

|

|

|

| Net

operating expenses |

[ ]%

|

0.59%

|

0.62%

|

0.63%

3,4 |

0.39%

3 |

0.14%

3 |

| Gross

operating expenses |

[ ]%

|

0.59%

|

0.62%

|

0.68%

|

0.71%

|

0.72%

|

| Net

investment income (loss) |

[ ]%

|

1.64%

|

1.12%

|

0.25%

|

0.01%

|

0.00%

|

| Net

assets, end of period (x 1,000,000) |

$[ ]

|

$12,450

|

$11,325

|

$25,324

|

$32,377

|

$23,017

|

| 1 |

Calculated based on the

average shares outstanding during the period. |

| 2 |

Per-share amount was less

than $0.005. |

| 3 |

Reflects the effect of a

voluntary yield waiver in excess of the contractual expense limitation. |

|

4 |

Effective

October 3, 2017, the contractual expense limitation changed. The ratio presented for period ended December 31, 2017 is a blended ratio. |

Schwab Money Funds | Financial

Highlights13

Schwab Government Money Fund

| Investor

Shares |

1/1/20–

6/30/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/171 |

1/1/16–

12/31/16 |

1/21/15

2–

12/31/15 |

| Per-Share

Data |

| Net

asset value at beginning of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

| Income

(loss) from investment operations: |

|

|

|

|

|

|

| Net

investment income (loss)3 |

[ ]

|

0.02

|

0.02

|

0.00

4 |

0.00

4 |

—

|

| Net

realized and unrealized gains (losses) |

[ ]

|

—

|

0.00

4 |

0.00

4 |

0.00

4 |

(0.00)

4 |

| Total

from investment operations |

[ ]

|

0.02

|

0.02

|

0.00

4 |

0.00

4 |

(0.00)

4 |

| Less

distributions: |

|

|

|

|

|

|

| Distributions

from net investment income |

[ ]

|

(0.02)

|

(0.02)

|

(0.00)

4 |

(0.00)

4 |

—

|

| Distributions

from net realized gains |

[ ]

|

—

|

(0.00)

4 |

(0.00)

4 |

—

|

—

|

| Total

distributions |

[ ]

|

(0.02)

|

(0.02)

|

(0.00)

4 |

(0.00)

4 |

—

|

| Net

asset value at end of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

| Total

return |

[ ]%

|

1.90%

|

1.51%

|

0.50%

|

0.05%

|

—

5 |

| Ratios/Supplemental

Data |

| Ratios

to average net assets: |

|

|

|

|

|

|

| Net

operating expenses |

[ ]%

|

0.35%

|

0.35%

|

0.40%

6,7 |

0.33%

|

0.20%

8 |

| Gross

operating expenses |

[ ]%

|

0.47%

|

0.48%

|

0.53%

|

0.55%

|

0.57%

8 |

| Net

investment income (loss) |

[ ]%

|

1.84%

|

1.66%

|

0.51%

|

0.09%

|

0.00%

8 |

| Net

assets, end of period (x 1,000,000) |

$[ ]

|

$13,436

|

$7,871

|

$1,362

|

$

939 |

$

100 |

| 1 |

Effective October 3, 2017,

the share class name of Purchased Shares was changed to Investor Shares. |

| 2 |

Commencement of operations.

|

| 3 |

Calculated based on the

average shares outstanding during the period. |

| 4 |

Per-share amount was less

than $0.005. |

| 5 |

Not annualized. |

| 6 |

Reflects the effect of a

voluntary yield waiver in excess of the contractual expense limitation. |

| 7 |

Effective October 3, 2017,

the contractual expense limitation changed. The ratio presented for period ended December 31, 2017 is a blended ratio. |

|

8 |

Annualized.

|

14Schwab

Money Funds | Financial Highlights

Schwab Treasury Obligations Money Fund

| Investor

Shares |

1/1/20–

6/30/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/171 |

1/1/16–

12/31/16 |

1/1/15–

12/31/15 |

| Per-Share

Data |

| Net

asset value at beginning of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$1.00

|

| Income

(loss) from investment operations: |

|

|

|

|

|

|

| Net

investment income (loss)2 |

[ ]

|

0.02

|

0.02

|

0.01

|

0.00

3 |

—

|

| Net

realized and unrealized gains (losses) |

[ ]

|

0.00

3 |

(0.01)

4 |

0.00

3 |

(0.00)

3 |

0.00

3 |

| Total

from investment operations |

[ ]

|

0.02

|

0.01

|

0.01

|

0.00

3 |

0.00

3 |

| Less

distributions: |

|

|

|

|

|

|

| Distributions

from net investment income |

[ ]

|

(0.02)

|

(0.01)

|

(0.01)

|

(0.00)

3 |

—

|

| Distributions

from net realized gains |

[ ]

|

(0.00)

3 |

—

|

(0.00)

3 |

—

|

—

|

| Total

distributions |

[ ]

|

(0.02)

|

(0.01)

|

(0.01)

|

(0.00)

3 |

—

|

| Net

asset value at end of period |

$[ ]

|

$

1.00 |

$

1.00 |

$

1.00 |

$

1.00 |

$1.00

|

| Total

return |

[ ]%

|

1.89%

|

1.51%

|

0.58%

|

0.06%

|

—

|

| Ratios/Supplemental

Data |

| Ratios

to average net assets: |

|

|

|

|

|

|

| Net

operating expenses |

[ ]%

|

0.35%

|

0.35%

|

0.33%

5,6 |

0.30%

5 |

0.12%

5 |

| Gross

operating expenses |

[ ]%

|

0.48%

|

0.49%

|

0.54%

|

0.58%

|

0.59%

|

| Net

investment income (loss) |

[ ]%

|

1.86%

|

1.57%

|

0.65%

|

0.11%

|

0.00%

|

| Net

assets, end of period (x 1,000,000) |

$[ ]

|

$10,820

|

$7,545

|

$3,125

|

$

692 |

$

51 |

| 1 |

Effective October 3, 2017,

the share class name of Value Advantage Shares was changed to Investor Shares. |

| 2 |

Calculated based on the

average shares outstanding during the period. |

| 3 |

Per-share amount was less

than $0.005. |

| 4 |

The per share amount does not

accord with the change in aggregate gains and losses in securities during the period because of the timing of fund transactions in relation to fluctuating market values. |

| 5 |

Reflects the effect of a

voluntary yield waiver in excess of the contractual expense limitation. |

|

6 |

Effective

October 3, 2017, the contractual expense limitation changed. The ratio presented for period ended December 31, 2017 is a blended ratio. |

Schwab Money Funds | Financial

Highlights15

Schwab U.S. Treasury Money Fund

| Investor

Shares |

1/1/20–

6/30/20 |

1/1/19–

12/31/19 |

1/17/18

1–

12/31/18 |

|

|

|

| Per-Share

Data |

| Net

asset value at beginning of period |

$[ ]

|

$

1.00 |

$

1.00 |

|

|

|

| Income

(loss) from investment operations: |

|

|

|

|

|

|

| Net

investment income (loss)2 |

[ ]

|

0.02

|

0.02

|

|

|

|

| Net

realized and unrealized gains (losses) |

[ ]

|

0.00

3 |

(0.01)

4 |

|

|

|

| Total

from investment operations |

[ ]

|

0.02

|

0.01

|

|

|

|

| Less

distributions: |

|

|

|

|

|

|

| Distributions

from net investment income |

[ ]

|

(0.02)

|

(0.01)

|

|

|

|

| Distributions

from net realized gains |

[ ]

|

(0.00)

3 |

(0.00)

3 |

|

|

|

| Total

distributions |

[ ]

|

(0.02)

|

(0.01)

|

|

|

|

| Net

asset value at end of period |

$[ ]

|

$

1.00 |

$

1.00 |

|

|

|

| Total

return |

[ ]%

|

1.84%

|

1.40%

5 |

|

|

|

| Ratios/Supplemental

Data |

| Ratios

to average net assets: |

|

|

|

|

|

|

| Net

operating expenses |

[ ]%

|

0.35%

|

0.35%

6 |

|

|

|

| Gross

operating expenses |

[ ]%

|

0.49%

|

0.49%

6 |

|

|

|

| Net

investment income (loss) |

[ ]%

|

1.77%

|

1.64%

6 |

|

|

|

| Net

assets, end of period (x 1,000,000) |

$[ ]

|

$7,517

|

$3,414

|

|

|

|

| 1 |

Commencement of operations.

|

| 2 |

Calculated based on the

average shares outstanding during the period. |

| 3 |

Per-share amount was less

than $0.005. |

| 4 |

The per share amount does not

accord with the change in aggregate gains and losses in securities during the period because of the timing of fund transactions in relation to fluctuating market values. |

| 5 |

Not annualized. |

|

6 |

Annualized.

|

16Schwab

Money Funds | Financial Highlights

Fund Management

The investment adviser for the funds is Charles Schwab

Investment Management, Inc. (CSIM), 211 Main Street, San Francisco, CA 94105. CSIM was founded in 1989 and as of July 31, 2020, managed approximately $[ ] billion in assets.

As the investment adviser, CSIM oversees the asset management

and administration of the funds. As compensation for these services, CSIM receives a management fee from each fund. For the 12 months ended December 31, 2019, these fees were 0.31% for the Schwab Government Money Fund, 0.32% for the Schwab Treasury

Obligations Money Fund and 0.33% for the Schwab U.S. Treasury Money Fund. These figures, which are expressed as a percentage of each fund’s average daily net assets, represent the actual amounts paid, including the effects of reductions.

Reductions include any contractual or voluntary waivers or reimbursements. Any applicable contractual expense limitation is described in the Fund Summaries section.

A discussion regarding the basis for the Board of

Trustees’ approval of the funds’ investment advisory agreement is available in each fund’s 2020 semiannual report, which covers the period from January 1, 2020 through June 30, 2020.

Schwab Money Funds |

Fund Management17

Investing in the Funds

In this section, you will find information on buying, selling

and exchanging shares. Eligible Investors may only invest in a fund through an intermediary by placing orders through your brokerage account at Schwab or an account with another broker/dealer, investment adviser, 401(k) plan, employee benefit plan,

administrator, bank, or other financial intermediary (intermediary) that is authorized to accept orders on behalf of the fund (intermediary orders). No new accounts can be opened directly with the funds’ transfer agent. Eligible Shareholders

(as described herein) who purchased fund shares prior to October 2, 2017 directly from, and continue to hold such shares directly through, the funds’ transfer agent may continue to place additional purchase, exchange or redemption orders

through the funds’ transfer agent (direct orders). You also will see how to choose a distribution option for your investment. These pages include helpful information on taxes as well.

The funds generally are not registered for sale in

jurisdictions outside the United States and are intended for purchase by persons residing in the United States. A person is considered resident in the United States if at the time of the investment (i) the account has an address of record in the

United States or a U.S. territory (including APO/FPO/DPO) and (ii) all account owners are resident in the United States or a U.S. territory and have a valid U.S. taxpayer identification number. If an existing account is updated to reflect a non-U.S.

address, the account may be restricted from making additional investments.

Investing Through a Financial Intermediary

Placing Orders Through Your Intermediary

When you place orders through Schwab or other intermediary,

you are not placing your orders directly with a fund, and you must follow Schwab’s or the other intermediary’s transaction procedures. Your intermediary may impose different or additional conditions than the funds on purchases,

redemptions and exchanges of fund shares. These differences may include initial and subsequent investment requirements, exchange policies, fund choices, and cut-off times for investment and trading restrictions. Your intermediary may independently