UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 6, 2023

SILVER STAR PROPERTIES REIT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 000-53912 | | 26-3455189 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | |

| 2909 Hillcroft, Suite 420, Houston, Texas | | 77057 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (713) 467-2222

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| o | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | None | None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of Southern Star Self-Storage Investment Company

On April 6, 2023, the Executive Committee (the “Committee”) of the Board of Directors of Silver Star Properties REIT, Inc. (the “Company”) approved of the Equity Interest Purchase Agreement (the “Purchase Agreement”) to purchase all of the equity interests in Southern Star Self-Storage Investment Company, a Texas corporation, (“Southern Star”) for approximately $3,000,000 in cash and 301,659 restricted stock units of the Company’s Common Stock (the “Acquisition”). The Company expects to close the transaction within thirty days.

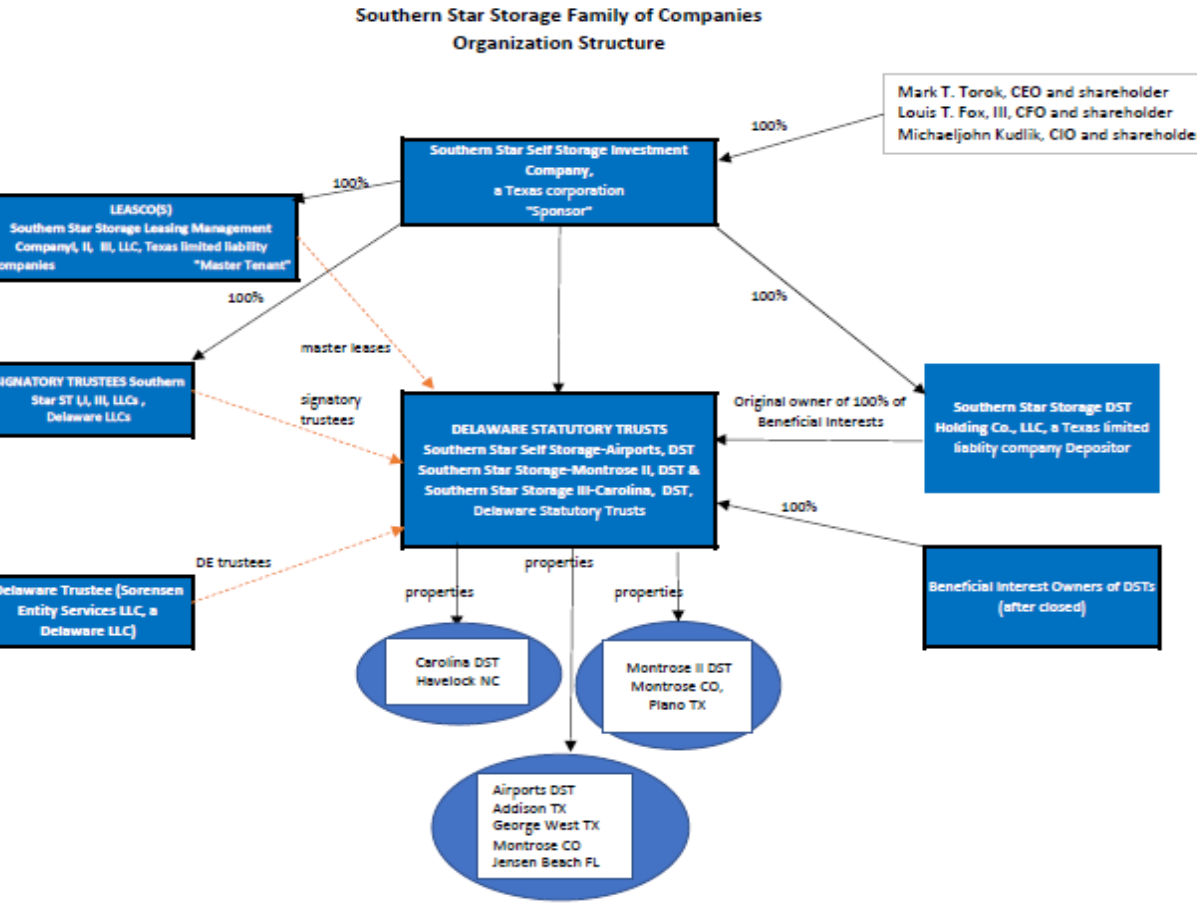

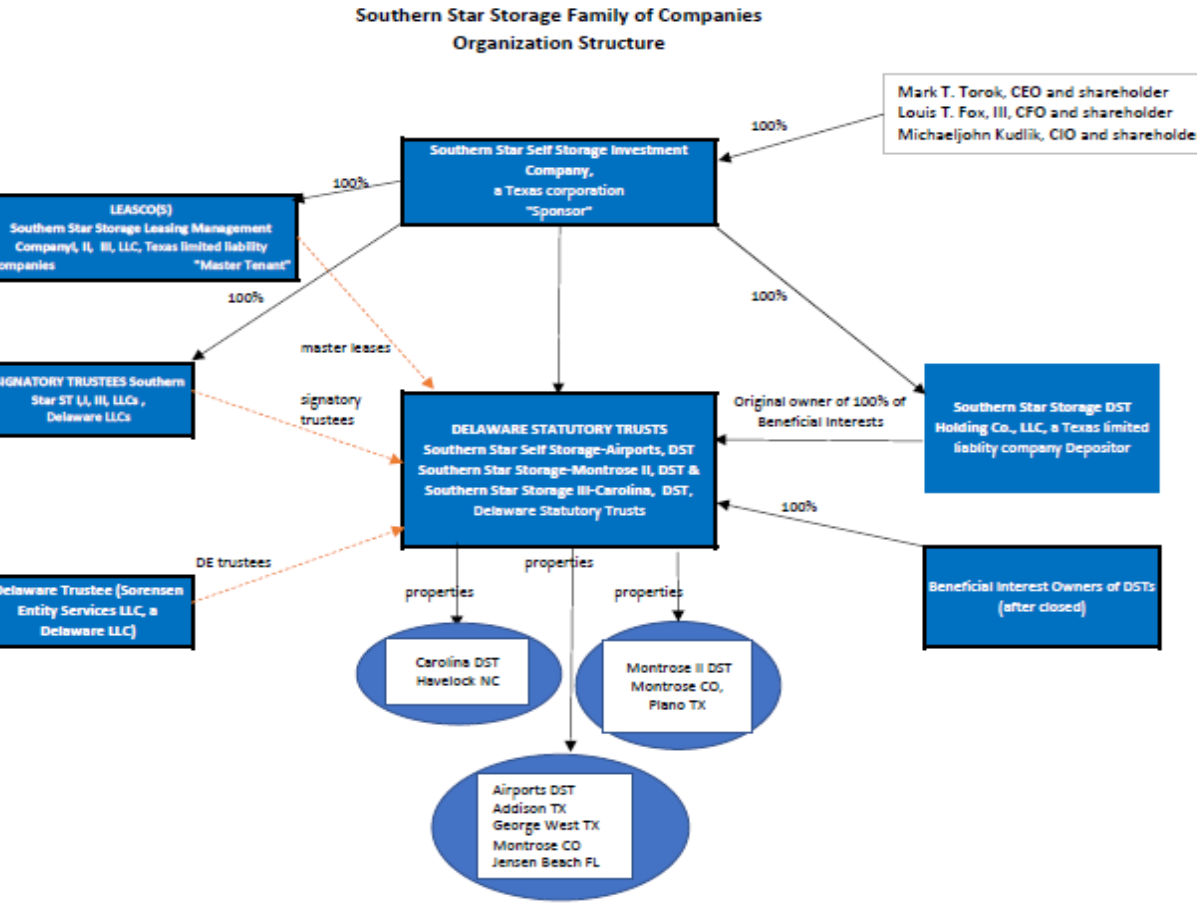

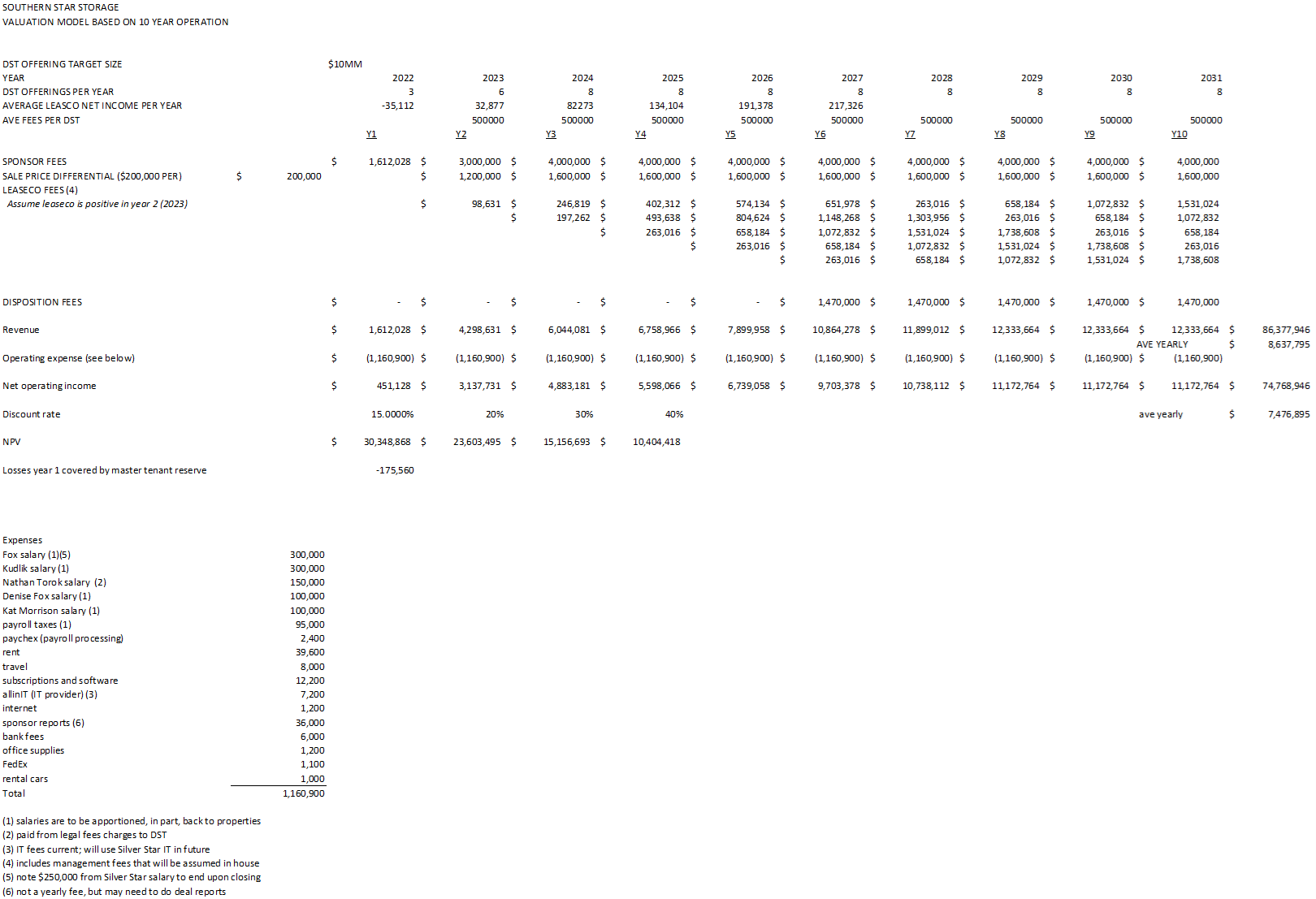

Southern Star is a privately held real estate company that specializes in the sponsorship and management of DST investments in self-storage properties. Established in 2019, the company currently operates a portfolio of nine properties, which together comprise 321,291 net rentable square feet (“NRSF”) spread across 2,526 units. Additionally, the company has two facilities, totaling 208,220 NRSF and 703 units, under contract that are expected to close by June 1, 2023. Most of the facilities also have parking for boats, RV’s and autos. The facilities generally contain both climate and non-climate-controlled units and are located predominantly in secondary and tertiary markets in Texas, Florida, North Carolina, and Colorado.

The Company expects to benefit from Southern Star’s experienced self-storage operating capabilities and investment prowess through its management team. Southern Star will use its expertise in developing assets with DSTs and operate as a "Sister" company alongside a subsidiary of the Company’s current operations.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is attached as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Employment Agreement with Mr. Torok

In conjunction with the Acquisition, on April 6, 2023, Mark T. Torok executed a three-year employment agreement (the “Employment Agreement”) with the Company to serve as the Company’s Chief Executive Officer. Under the Employment Agreement, Mr. Torok will receive a base salary for the first annual period equal to $550,000 and thereafter any increase will be determined by the Executive Committee with input from the Company’s compensation consultant and 1,263,642 Performance Units, as further described below. The Employment Agreement may be terminated by us at any time and for any reason (or no reason), and with or without cause, provided if the agreement is terminated without cause, we are required to provide Mr. Torok with all accrued benefits and his base salary rate until the earlier of twelve months following the termination date or the end of the term of the Employment Agreement.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the Employment Agreement, a copy of which is attached as Exhibit 10.2 to this Form 8-K and is incorporated herein by reference.

Adoption of the 2023 Incentive Award Plan

On April 6, 2023, the Committee and Managing General Partner of Hartman XX Limited Partnership ("Operating Partnership") approved and adopted the Silver Star Properties REIT, Inc. and Hartman XX Limited Partnership 2023 Incentive Award Plan (the “Plan”) to promote the success and enhance the value of the Company by retaining personnel that have the knowledge vision and ability not only with the Company but also in the capital markets. The Plan recognizes that the entire Acquisition and the New Direction Plans, as defined below, were set up by the work and effort of the Chief Executive Officer and the Committee. The Plan further serves to incentivize and retain the Chief Executive Officer and the Committee, together, to execute the New Direction Plans and enable the Company and its shareholders to realize the value created by the New Direction Plans. Going forward, considering the Committee and the Chief Executive Officer, with their knowledge of the existing operations of the company, their working relationship with management and their vision along with management as to the manner in which the New Direction Plans should be carried out, it is essential that the Committee and the Chief Executive Officer be

retained in a fashion and in the totality for the benefit of the shareholders and all constituents including management, creditors and others to be fulfilled to the fullest extent possible.

The Plan allows for grants of performance units (“Performance Units”) which are intended to constitute profits interests units in the Operating Partnership, of which the general partner is a wholly-owned subsidiary of the Company, convertible into Partnership Common Units of the Operating Partnership at the election of the participant which may be later exchanged for Common Stock of the Company based on a 1:1 ratio. The participant is also able to cause the redemption of the Performance Units, or the applicable Partnership Common Units received as a result of conversion, after three years from the Grant Date. The Plan includes a three-year vesting that is intended to ensure that the Committee and the Chief Executive Officer will stay in place and provide continued services to the Company.

The foregoing description of the Plan does not purport to be complete and is qualified in its entirety by reference to the Plan, a copy of which is attached as Exhibit 10.3 to this Form 8-K and is incorporated herein by reference.

Grants of Performance Units to Mr. Torok and the Executive Committee

On April 6, 2023, pursuant to the Plan, the Committee approved grants of founders’ Performance Units to retain and incentivize the following executive officers and members of the Committee in carrying out the New Direction Plans, as defined below: Mark T. Torok, the Company’s Chief Executive Officer (1,263,642 Performance Units), Gerald Haddock, member of the Committee, (1,053,035 Performance Units), Jack Tompkins, member of the Committee, (1,053,035 Performance Units), and James Still, member of the Committee, (1,053,035 Performance Units). Performance Units vest 1/3 of the grant per year, and the term of each Performance Unit is ten (10) years from the date of grant.

The foregoing description of the grants does not purport to be complete and is qualified in its entirety by reference to the Form of AO LTIP Unit Award Agreement, a copy of which is attached as Exhibit 10.4 to this Form 8-K and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information contained in Item 1.01 above is incorporated by reference into this Item 5.02.

Item 7.01. Regulation FD Disclosure.

On April 6, 2023, the Company issued a press release announcing the approval by the Committee of the New Direction Plans, as defined below, to pivot the company’s assets into the self-storage asset class, the acquisition of Southern Star Self-Storage Investment Company, and the three-year employment agreement with Mr. Torok and also operating changes for the Company, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information provided pursuant to this Item 7.01, including Exhibit 99.1 in Item 9.01, are “furnished” and shall not be deemed to be “filed” with the Securities and Exchange Commission or incorporated by reference in any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filings. The furnishing of the remarks is not intended to constitute a representation that such furnishing is required by Regulation FD or that the remarks include material investor information that is not otherwise publicly available. In addition, the Company does not assume any obligation to update such information in the future. The attached prepared remarks contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Item 8.01. Other Events.

Approval of the New Direction Plans

On April 6, 2023, the Committee, after receiving support from certain major shareholders, announced that it has completed its review and approval the plan, developed by Mark T. Torok and the Committee, to reposition the Company’s assets into the self-storage asset class to maximize shareholder value (the “New Direction Plans”). With this plan, the Company will shift our predominantly out of favor office assets into the stable, recession-resilient, and growing self-storage real estate asset class.

Item 9.01. Financial Statements and Exhibits.

(a) Exhibits

| | | | | |

Exhibit Number | Exhibit Description |

| |

| |

| |

| |

| |

Forward-Looking Statements

This report contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this report, other than statements of historical fact, are "forward-looking statements" for purposes of these provisions, including statements regarding the Company's plans to acquire the equity interests of Southern Star, the timing of the closing and the expected results of the New Direction Plans. These statements involve risks and uncertainties that could cause actual results to differ materially depending on a variety of important factors, and there can be no assurance that the Company will be able to consummate the acquisition on the terms described or at all. Factors that might cause or contribute to such differences include, but are not limited to, the failure of the Company and Southern Star to satisfy the closing condition and the risk factors detailed in the Company's annual reports on Form 10-K and quarterly reports on Form 10-Q that the Company files with the Securities Exchange Commission (“SEC”) from time to time. The Company's SEC filings are available from the Company and are also available at the SEC's website at http://www.sec.gov. In addition, factors that the Company is not currently aware of could harm the Company's future operating results. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report. The Company undertakes no obligation to make any revisions to the forward-looking statements or to reflect events or circumstances after the date of this report.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| SILVER STAR PROPERTIES REIT, INC. |

| (Registrant)

|

| Date: April 10, 2023 | By: | /s/ Michael Racusin |

| Michael Racusin |

| General Counsel and Corporate Secretary

|

EQUITY INTEREST PURCHASE AGREEMENT

This EQUITY INTEREST PURCHASE AGREEMENT (“Agreement”) is made and entered into as of April 6, 2023 (“Effective Date”), by and among the equity owners listed on Exhibit A attached hereto (each, a “Seller” and together, the “Sellers”), Southern Star Self-Storage Investment Company, a Texas corporation (the “Company”), and Silver Star Properties REIT, Inc., a Maryland corporation (“Buyer”). The Sellers have included on Exhibit A all of the entities directly or indirectly involved in any manner with the business of the Company and owned in whole or in part by the Company or the Sellers (“Company Affiliates”).

RECITALS

WHEREAS, Sellers owns all of the issued and outstanding stock of the Company (the “Company Interests”), and the term Company Interests shall include the equity interests of any Company Affiliate owned by any or all of the Sellers;

WHEREAS, Buyer desires to acquire from Sellers, and Sellers desire to sell to Buyer on the Closing Date, all of the Company Interests, upon the terms and subject to the conditions set forth in this Agreement, as a result of which, the Company and all Company Affiliates will, at the Closing, become, direct or indirect, wholly-owned subsidiaries of Buyer;

WHEREAS, It is the intent of the Parties to operate Silver Star and Southern Star as separately as possible and management of each company shall take all reasonable actions for that purpose. and

WHEREAS, capitalized terms used but not defined in the context of the section in which such terms first appear shall have the meanings set forth in Section 1.1.

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants and agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE I.

DEFINITION

Section 1.1 Definitions. For purposes of this Agreement, the following terms have the definitions set forth below:

“Affiliate” means, with respect to any Person: (i) any manager, director, officer, employee, member, stockholder, partner or principal of that Person; (ii) any other Person of which that Person is a manager, director, officer, employee, member, stockholder, partner or principal; (iii) any Person who directly or indirectly controls or is controlled by, or is under common control with, that Person; and (iv) with respect to any Person described above who is a natural person, any spouse and any relative (by blood, adoption or marriage) within the third degree of consanguinity of the Person.

“Agreement” has the meaning set forth in the preamble.

"Business Day" means any day on which national banks are open for business in the city of Houston, Texas.

“Buyer” has the meaning set forth in the preamble.

“Buyer Indemnitee” has the meaning set forth in Section 7.2.

“Closing” has the meaning set forth in Section 6.1.

“Closing Date” has the meaning set forth in Section 6.1.

“Closing Purchase Price” has the meaning set forth in Section 2.2.

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” has the meaning set forth in the preamble.

“Company Affiliates” has the meaning set forth in the preamble.

“Company Interests” has the meaning set forth in the recitals.

“Control” means, with respect to any Person, the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise.

“Employee Plans” has the meaning set forth in Section 3.9.

“Environmental Laws” has the meaning set forth in Section 3.13.

“ERISA” has the meaning set forth in Section 3.9.

“Exchange Act” means the Securities and Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Executive Committee” means the executive committee of the board of directors of the Buyer.

“FCPA” has the meaning set forth in Section 3.18.

“Fundamental Representations” has the meaning set forth in Section 7.5.

“GAAP” means the United States generally accepted accounting principles in effect from time to time.

“Governmental Authority” means any national, state or local, domestic or foreign or international, government or any judicial, legislative, executive, administrative or regulatory authority, tribunal, agency, body, entity or commission or other governmental, quasi-governmental or regulatory authority or agency, domestic or foreign or international.

“Hazardous Substance” has the meaning set forth in Section 3.13.

“Indemnitee” has the meaning set forth in Section 7.3.

“Indemnitor” has the meaning set forth in Section 7.3.

“Intellectual Property” has the meaning set forth in Section 3.14

“IRS” means the U.S. Internal Revenue Service.

"Knowledge" of Sellers or Company with respect to any fact or matter means the actual knowledge, after due inquiry and reasonable investigation, of Sellers or the Company's officers (as applicable) listed in Section 1.1 of the Disclosure Schedule.

“Law” has the meaning set forth in Section 3.13.

“Lien” has the meaning set forth in Section 2.1.

“Leased Real Property” has the meaning set forth in Section 3.16.

“Losses” has the meaning set forth in Section 7.1.

"Material Adverse Effect" means any state of facts, change, development, event, effect, condition, occurrence, action or omission that, individually or in the aggregate, is reasonably expected to result in a material adverse effect on the business, prospects, assets, properties, financial condition, results of operations or prospects of the Company and Company Affiliates, taken as a whole, or prevent, materially impede or materially delay the consummation by the Company of the transactions contemplated by this Agreement.

“Order” has the meaning set forth in Section 3.13.

“Owned Real Property” has the meaning set forth in Section 3.16.

“Permits” has the meaning set forth in Section 3.13.

"Person" means any individual, corporation, limited liability company, partnership, association, trust, estate or other entity or organization.

“Proceeding” has the meaning set forth in Section 7.3.

“Purchase Price” has the meaning set forth in Section 2.2.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Sellers” has the meaning set forth in the preamble.

“Seller Indemnitee” has the meaning set forth in Section 7.1.

“Tax” or Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance,

environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Tax Returns” has the meaning set forth in Section 3.12.

Section 1.2. Interpretation. The words describing the singular number shall include the plural and vice versa, words denoting either gender shall include both genders and words denoting natural Persons shall include all Persons and vice versa. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the parties and no presumption or burden of proof shall arise favoring or disfavoring any Person by virtue of the authorship of any provision of this Agreement.

ARTICLE II

PURCHASE AND SALE OF COMPANY INTERESTS

Section 2.1. Purchase and Sale of Interests. Upon the terms and subject to the conditions set forth in this Agreement, on the Closing Date, Sellers shall sell, transfer, assign and convey to Buyer, and Buyer shall purchase and accept from Sellers, all of Sellers’ rights, title and interest in and to the Company Interests, free and clear of all liens, claims and encumbrances of any nature whatsoever (collectively, “Liens”).

Section 2.2. Purchase Price. The purchase price for purchase of the Company Interests (“Purchase Price”) shall be equal to (i) $3,000,000 (“Cash Purchase Price”), plus (ii) 301,659 restricted stock units (“Incentive Units”) in the Buyer (“Equity Purchase Price”). The Cash Purchase Price shall be paid when the Buyer is in a reasonable position to make such payment, in whole or in part, as reasonably determined by the Executive Committee, provided, however, if cash is available, a payment of $1,500,000 shall be made on or before December 31, 2023 (the “Initial Payment Date”) and a second payment of $1,500,000 shall be made on or before June 30, 2024. Buyer shall ensure that any net income of the Company available on or after the above payment dates is distributed to Buyer to be used to pay the Cash Purchase Price until it is paid in full.

Section 2.3. Incentive Units. The Incentive Units will have cliff vesting after three years and will be subject to forfeiture in a manner that is typical for such Incentive Units. The Incentive Units shall be allocated to the owners and management of the Company, the Company Affiliates and any other individuals as determined by Mark T. Torok (“Torok”). The Incentive Units will be included in a separate agreement to be executed at Closing in a form substantially similar as is attached as Exhibit G, as part of a plan adopted by the Executive Committee.

Section 2.4. Other Assets. In addition to the Company Interests, the Sellers shall transfer any and all rights, not already held or owned by the Company or a Company Affiliate, with respect to any and all master leases used in connection with any Delaware statutory trust (“DST”) sponsored or managed by Company or any Company Affiliate to the Company or an appropriate Company Affiliate or to another entity as directed by Buyer. The Sellers shall also have all fees, including, without limitation, any current or future fees, associated with any DST,

not already payable to the Company or a Company Affiliate, made payable to Buyer, or any entity directed by Buyer, so that after the Closing all such fees shall be paid to a wholly owned direct or indirect subsidiary of Buyer. The Sellers shall also transfer or cause to be transferred to Buyer, or as directed by Buyer, all other assets and entities, owned or controlled by one or more Sellers, in any type or form used in, associated with, related to or part of the business of the Company and all Company Affiliates, including, without limitation, the self-storage business and all activities with respect to the DSTs, and this shall include all revenue streams of any form to any Seller or any family member of Sellers from the Company, any Company Affiliate, any DST or any lease. The Company will receive legal fee reimbursements received from the funding of pending DSTs under contract for properties in Rockport, Texas, Big Spring, Texas and Montgomery, Texas, and the Company will pay a proportionate salary to the attorney at a rate of $150,000 annually. Future compensation to all related parties will be subject to the review and approval of the Executive Committee. In addition, any other fees with respect to such DSTs shall be paid to the Company or a Company Affiliate and the lesser of (a) $900,000 or (b) the aggregate fees earned solely with respect to the acquisition, formation and funding of the DSTs referred to above shall be paid from the applicable Company or Company Affiliate as a bonus for the successful completion of the sale of the applicable properties to a DST. The bonus referred to above shall be paid to the individuals and in the amounts determined by Torok. The excess of any such fees will be taken into account by the Executive Committee in structuring compensation plans for 2023 with advice from the compensation advisors of the Executive Committee.

Section 2.5. Management. If any management members of the Company or any Company Affiliate continue employment with the Company or any Company Affiliate after the Closing, the executives, management and employees of the Company shall receive all of their compensation and any equity incentives solely from the Company and based upon the economic results from operations of the Company, excluding the Incentive Units. Compensation will be determined in a manner that is similar to the compensation of the management of the Buyer and its Affiliates, however, it shall be determined on a stand-alone basis for the Company and any applicable Company Affiliate. Louis T Fox III and Michaeljohn Kudlik shall be offered an employment agreement for three years at a salary of least $300,000 per year. Any such determinations shall be reviewed by and subject to the approval of the Executive Committee.

Section 2.6. Payment of Dividends or Distributions. Sellers shall cause the Company and the Company Affiliates to pay to Buyer, or as directed by Buyer, all fees, funds or other receipts received in excess of amounts necessary to operate the Company on a quarterly basis. Nothing herein shall be construed to prevent payments or transfers on a more frequent basis as may be determined by the Executive Committee. For the period beginning with the Closing and ending June 30, 2024, all available cash in excess of reasonable working capital requirements shall be distributed by the Company and all Company Affiliates to Buyer or as directed by Buyer.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLERS AND THE COMPANY.

Sellers and the Company hereby represent and warrant to Buyer as follows:

Section 3.1. Organization and Power. The Company is a corporation duly formed, validly existing and in good standing under the laws of the State of Texas and has all power and authority necessary to own or lease its properties and assets and to carry on its business as currently conducted. The Company is duly qualified or licensed to do business and is in good standing in each of the jurisdictions in which the character of the properties owned or held under lease by it or the nature of the business transacted by it makes such qualification necessary.

Section 3.2. Capitalization. All of the outstanding Company Interests are owned and held of record by Sellers. The Company Interests constitute 100% of the total issued and outstanding forms of equity interests of the Company and any applicable Company Affiliates. There are no options, restricted interests, convertible debt, exchangeable interests, profits interests, warrants, or other equity rights of any kind or in any form issued or outstanding from or by the Company or any Company Affiliate. The foregoing representation also applies to each Company Affiliate as if given directly from each Company Affiliate.

Section 3.3. Company Affiliates. The Company Affiliates listed on Exhibit A are all entities owned or controlled by the Company and one or more of the Sellers that are involved in the business of the Company or any Company Affiliate. Exhibit A sets forth a complete and correct list of each Company Affiliate, its place and form of organization, its address and each jurisdiction in which it is authorized to conduct or actually conducts business. Each Company Affiliate is a limited liability company or other business entity duly formed, incorporated or organized (as applicable), validly existing and in good standing under the laws of its jurisdiction of formation, incorporation or organization and has all corporate or other organizational powers required to carry on its business as currently conducted. Each such Company Affiliate is duly qualified to do business and is in good standing in each jurisdiction where such qualification is necessary. All the outstanding shares of capital stock of, or other equity or voting interests in each such Company Affiliate are owned by the Sellers, the Company, by one or more wholly owned Company Affiliates or by the Company and one or more wholly owned Company Affiliate, free and clear of all pledges, claims, liens, charges, options, security interests or other encumbrances of any kind, except for transfer restrictions imposed by applicable securities laws, and are duly authorized, validly issued, fully paid and non-assessable. Except for the capital stock of, or other equity or voting interests in, its Company Affiliates, the Company does not own, directly or indirectly, any capital stock of, or other equity or voting interests in, any Person.

Section 3.4. Authorization. Each of Sellers and the Company has the requisite power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby and to perform its obligations hereunder. The execution, delivery and performance by Sellers and the Company of this Agreement, and the consummation by Sellers and the Company of the transactions contemplated hereby, have been duly and validly authorized by the Sellers, the Company and no other proceedings on the part of Sellers and the Company are necessary to authorize this Agreement or to consummate the transactions contemplated hereby or to perform the respective obligations of Sellers and Company hereunder. This Agreement has been duly and validly executed and delivered by Sellers and the Company and, assuming this Agreement constitutes the legal, valid and binding agreement of Buyer, constitutes a legal, valid and binding agreement of Sellers and the Company, enforceable against Sellers and the Company in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and similar Laws, now or hereafter in effect, affecting creditors' rights generally and by general principles of equity. The

foregoing in this Section is applicable to each Company Affiliate and such representation is included in the representation given by Sellers and the Company in this Section.

Section 3.5. Non-Contravention; Filings and Consents. The execution, delivery and performance by Sellers and the Company of this Agreement and the consummation by Sellers, the Company, and all Company Affiliates of the transactions contemplated hereby do not and will not (with or without notice or lapse of time, or both), (a) contravene, conflict with, or result in any violation or breach of any provision of the certificate of formation or operating agreement of the Company or any Company Affiliate, (b) contravene, conflict with or result in a violation or breach of any provision of any applicable Law or Order, (c) require any consent or approval under, violate, conflict with, result in any breach of or any loss of any benefit under, or constitute a change of control or default under, or result in termination or give to others any right of termination, vesting, amendment, acceleration or cancellation of any contract to which the Company or any Company Affiliate is a party, or by which they or any of their respective properties or assets may be bound or affected or any Governmental Authority affecting, or relating in any way to, the property, assets or business of the Company or any Company Affiliate, or (d) result in the creation or imposition of any Lien on any asset of the Company or any Company Affiliate. The execution, delivery and performance of this Agreement by Sellers and the Company and the consummation of the transactions contemplated hereby by Sellers and the Company do not and will not require any consent, approval, authorization or permit of, action by, filing with or notification to, any Governmental Authority.

Section 3.6. Financial Statements. Since the Company and many of the Company Affiliates have limited operating histories, the Sellers and the Company have delivered certain unaudited financial information, but the Buyer is primarily relying upon the projections provided for the operations of the Company and the Company Affiliates and attached hereto as Exhibit F (“Projections”). The financial information given for prior periods present fairly in all material respects the financial condition of the Company as at the end of the covered periods and the results of its operations and its cash flows for the covered periods. The Projections are based upon reasonable and good faith assumptions and estimates for the future operations of the Company and the Company Affiliates. The Company and all Company Affiliates have no debt or other obligations other than those disclosed to the Buyer in writing before the Effective Date.

Section 3.7. Undisclosed Liabilities; Indebtedness. Neither the Company nor any of the Company Affiliates have any liabilities that would have been required to be reflected on the balance sheet or in the notes thereto in accordance with GAAP and were not so reflected, other than (i) as disclosed in, set forth on, or reflected or reserved against in the Company financial statements, (ii) those incurred in the ordinary course of business since the financial information described in Section 3.6, (iii) those that are repaid, terminated, forgiven, settled, cancelled or otherwise extinguished at Closing, or (iv) those that would not have, individually or in the aggregate, a Material Adverse Effect.

Section 3.8. Absence of Certain Changes. Since January 1, 2023 through the date of this Agreement, (a) there has not been a Material Adverse Effect with respect to the Company or any Company Affiliate, (b) the Company and Company Affiliates have conducted their respective businesses only in the ordinary course of business consistent with past practice, and (c) neither the Company nor any Company Affiliate has taken any action that, if taken after the date hereof without the consent of Buyer, would constitute a breach of this Agreement.

Section 3.9. Employee Benefit Plans. Neither the Company nor any Company Affiliate sponsors or otherwise pays for any employee plan as defined in the Employee Retirement Income Security Act of 1974 (93 P.L. 406), as amended (“ERISA”). Neither the Company nor any Company Affiliate has any plan or commitment to establish any new Employee Plan.

Section 3.10. Labor and Employment Matters. Neither the Company nor any Company Affiliate is a party to, bound by, subject to, or is currently negotiating in connection with entering into, any collective bargaining agreement or understanding with a labor union or organization. None of the employees of the Company nor of any Company Affiliate is represented by any union with respect to his or her employment by the Company or any Company Affiliate. There is no claim or grievance pending or, to the Knowledge of Sellers or the Company, threatened against the Company or any Company Affiliate relating to terms and conditions of employment or unfair labor practices, including charges of unfair labor practices or harassment complaints. To the Knowledge of Sellers and the Company there is no activity or proceeding by a labor union or representative thereof to organize any employees of the Company or any Company Affiliate, nor have there been any strikes, slowdowns, work stoppages or threats thereof by or with respect to such employees. There are no liabilities, and no liabilities will be incurred or generated with respect to any labor matter as a result of the transactions included in this Agreement by the Company or any Company Affiliate.

Section 3.11. Litigation. Except as provided in Exhibit C, there is no complaint, claim, action, suit, litigation, proceeding or governmental or administrative investigation pending or, to the knowledge of Sellers or the Company, threatened against or affecting Sellers, the Company or any Company Affiliate with respect to the operations or ownership of the Company or any Company Affiliate. Neither the Company nor any Company Affiliate is subject to any outstanding Order that would interfere or prohibit the ordinary business of the Company or any Company Affiliate or that would otherwise restrict their business.

Section 3.12. Tax Matters. The Company and each Company Affiliate have timely filed all federal, state, local and foreign Tax returns, estimates, information statements and reports relating to any and all Taxes of the Company or any Company Affiliate or their respective operations (the “Tax Returns”) required to be filed by Law by the Company and each Company Affiliate as of the date hereof. All such Tax Returns are true, correct and complete, and Sellers, the Company and each Company Affiliate have timely paid all Taxes attributable to the Company or any Company Affiliate that were due and payable by them as shown on such Tax Returns. As of the date of this Agreement, there is no written claim or assessment pending or, to the Knowledge of the Company, threatened against Sellers, the Company or any Company Affiliate for any alleged deficiency in Taxes of the Company or any Company Affiliate, and there is no audit or investigation with respect to any liability of the Company or any Company Affiliate for Taxes. Neither the Company nor any Company Affiliate has waived any statute of limitations with respect to material Taxes or agreed to any extension of time with respect to a material Tax assessment or deficiency. The Company and each Company Affiliate have withheld from their employees (and timely paid to the appropriate Governmental Authority) proper and accurate amounts for all periods through the date hereof in compliance with all Tax withholding provisions of applicable federal, state, local and foreign Laws (including, without limitation, income, social security, and employment Tax withholding for all types of compensation). There are no deferred tax liabilities and no obligations or amounts that are due

or would become due as a result of the transactions herein under any provision of any applicable tax Law.

Section 3.13. Compliance with Laws; Permits. Neither the Company nor any Company Affiliate is or has been in conflict with, in default or, with notice, lapse of time or both, would be in default, with respect to or in violation of any (i) statute, law, ordinance, rule, regulation or requirement of a Governmental Authority (each, a “Law”) or (ii) order, judgment, writ, decree or injunction issued by any court, agency or other Governmental Authority (each, an “Order”) applicable to the Company or any Company Affiliate or by which any property or asset of the Company or any Company Affiliate is bound or affected. Neither Sellers, the Company nor any Company Affiliate has received any written notice of any violation or potential violation of any Law. The Company and each Company Affiliate have all permits, licenses, authorizations, consents, approvals and franchises from Governmental Authority required to conduct their businesses as currently conducted (“Permits”) and such Permits are valid and in full force and effect. The Company and each Company Affiliate are in compliance with the terms of such Permits and, as of the date of this Agreement, neither the Company nor any Company Affiliate has received written notice from any Governmental Authority threatening to revoke, or indicating that it is investigating whether to revoke, any such Permit.

Section 3.14. Environmental Matters. The Company and Company Affiliates have complied at all times with all applicable Environmental Laws. No property currently or formerly owned or operated by the Company, or any Company Affiliate has been contaminated with any Hazardous Substance in a manner that could reasonably be expected to require remediation or other action pursuant to any Environmental Law. Except as provided in Exhibit D, neither Sellers, the Company nor any Company Affiliate has received any written notice, demand, letter, claim or request for information alleging that the Company or any Company Affiliate is in violation of or liable under any Environmental Law. Neither the Company nor any Company Affiliate is subject to any order, decree or injunction with any Governmental Authority or agreement with any third party concerning liability under any Environmental Law or relating to Hazardous Substances. For purposes of this Agreement, "Environmental Law" means any federal, state or local statute, Law, regulation, order, decree, permit or authorization relating to: (i) the protection of health and safety or the environment or (ii) the handling, use, transportation, disposal, release or threatened release of any Hazardous Substance; and "Hazardous Substance" means any substance that is: (i) listed, classified, regulated or defined pursuant to any Environmental Law or (ii) any petroleum product or by-product, asbestos-containing material, polychlorinated biphenyls or radioactive material.

Section 3.15. Intellectual Property. The Company and Company Affiliates own, have a valid license or otherwise have the right to use all patents, inventions, copyrights, software, trademarks, service marks, domain names, trade dress, trade secrets and all other intellectual property rights of any kind or nature ("Intellectual Property") used in their business as currently conducted. The Intellectual Property used by the Company and Company Affiliates does not infringe, misappropriate or otherwise violate the Intellectual Property of any third party. None of Sellers, the Company or any Company Affiliate has received any written charge, complaint, claim, demand or notice alleging any such infringement, misappropriation or other violation (including any claim that the Company or any Company Affiliate must license or refrain from using any Intellectual Property of any third party). To Sellers' and the Company's knowledge no third party has infringed upon, misappropriated or otherwise violated any Intellectual Property of

the Company or any Company Affiliate. The Company and Company Affiliates use their respective best efforts to protect and maintain their Intellectual Property.

Section 3.16. Properties. The Company and each Company Affiliate have good and marketable title to, or in the case of leased property and leased tangible assets, valid leasehold interests in, all of the real property, personal property, and tangible assets used in the conduct of its business and all such property and assets, other than real property and assets in which the Company or any Company Affiliate has leasehold interests, are free and clear of all Liens, except for Liens disclosed to and approved by Buyer. Exhibit B attached hereto sets forth a complete and correct list of all real property and interests in real property currently owned by the Company or any Company Affiliate (each an “Owned Real Property”) and leased by the Company or any Company Affiliate (each a “Leased Real Property”), including the terms of each lease. Each Owned Real Property and Leased Real Property is in good condition and has been maintained in good repair in a manner consistent with standards generally followed with respect to similar properties, and satisfactorily serves the purposes for which it is used in the business of the Company and Company Affiliates. The Owned Real Property and the Leased Real Property constitute all of such property currently used in the business of the Company and the Company Affiliates.

Section 3.17. Material Contracts. There are no contracts with the Company or any Company Affiliate that would limit, in any manner, any activity of the Buyer, any entity owned or controlled by the Buyer, the Company, or any Company Affiliate with respect to current or future operations or business practices. For example, there are no non-compete, non-solicitation or similar provisions in any contract of the Sellers, Company or any Company Affiliate that would apply to the Sellers, the Company, Company Affiliates, Buyer or any entity owned or controlled by Buyer with respect to the business of the Company and Company Affiliates. Except for the payments described in Section 2.4, the agreements referred to in Section 2.5, and the employment agreement between the Buyer and Mark Torok to be executed contemporaneously herewith, no Seller or Seller Affiliate has any other contract or agreement with the Company or any Company Affiliate, and no other employment or material contracts exist with any other Person.

Section 3.18. Anticorruption. The Company and Company Affiliates have no foreign operations and have made no payments to foreign Persons in violation of any applicable Law.

Section 3.19. Insurance. The Company and Company Affiliates maintain policies of insurance, including property, fire, workers' compensation, products liability, directors' and officers' liability and other casualty and liability insurance, that is in form and amount as customary for the Company's and Company Affiliates' types of business and as may be additionally required under the terms of any contract or agreement. Each insurance policy and bond is in full force and effect, all premiums due and payable thereon have been paid, and the Company and Company Affiliates are in full compliance with the terms of such policies and bonds. There is no claim pending under any of such policies or bonds as to which coverage has been questioned, denied or disputed. There is no threatened termination of, or pending material premium increase with respect to, any such policies or bonds.

Section 3.20. Brokers; Certain Expenses. No agent, broker, investment banker, financial advisor or other firm or Person, other than those whose fees and expenses shall be paid

entirely by Sellers, is or shall be entitled to receive any brokerage, finder's, financial advisor's, transaction or other fee or commission in connection with this Agreement or the transactions contemplated hereby based upon agreements made by or on behalf of Sellers, the Company or any Company Affiliate.

Section 3.21. Privacy and Data Security. Each of Company and each Company Affiliate materially complies with applicable privacy and security laws, and with privacy and information security obligations to which it is subject under contract, privacy policy, or online terms of use. The Company maintains policies and procedures that materially comply with (i) applicable privacy and security laws and (ii) privacy and information security obligations to its customers and investors, data subjects or other persons, under contract, privacy policy, or online terms of use. To the best of Company’s knowledge, neither Company nor any Company Affiliates has received any written notice from any governmental authority that it is under investigation for a material violation of any of the applicable privacy and security laws. All computer systems, including the Software, firmware, hardware, networks, interfaces, and related systems owned or licensed by the Company or Company Affiliates (collectively, the “Business Systems”) are sufficient for the needs of their business as currently conducted. To the Company’s knowledge, in the last eighteen (18) months, there has been (i) no material disruption, interruption or outage to any material Business System, (ii) no material part of the Business Systems has been prone to material malfunction or error and (iii) no unauthorized material breaches of the security of the Business Systems. The Company and Company Affiliates have safeguarded their Business Systems with information security controls, and disaster recovery and business continuity practices.

Section 3.22. Delaware Statutory Trusts. All DSTs have been properly formed and the Sellers, Company and all Company Affiliates have complied fully with all applicable Laws with respect to such DSTs, including, without limitation, applicable securities laws. The Sellers have included in this transaction all of the rights to fees, leases, operations or otherwise in such DSTs owned or held by or for the Sellers, Company and Company Affiliates. The Sellers, Company and all Company Affiliates have the power and authority to transfer all such rights, including, without limitation, any applicable master lease so that all of such items will be owned and controlled by the Buyer either directly or through a subsidiary of the Buyer. For example, Sellers, Company or Company Affiliates own or control all aspects of Southern Star Self Storage – Airports, DST, and all items (e.g., fees, leases, future fees, operations etc) shall be transferred so that Buyer or an entity owned or controlled by Buyer owns any and all rights with respect to such DST and will receive all future revenue streams of any kind in such DST.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER.

Buyer represents and warrants to Sellers as follows:

Section 4.1. Organization. Buyer is a corporation duly formed, validly existing, and in good standing under the laws of the jurisdiction of its formation and has the requisite power to carry on its business as now conducted.

Section 4.2. Authority. Buyer has all necessary power and authority to enter into this Agreement and to consummate the transactions contemplated by this Agreement. This

Agreement has been duly executed and delivered by Buyer and, assuming due authorization, execution and delivery of this Agreement by Sellers and the Company, constitutes a legal, valid and binding agreement of Buyer, enforceable in accordance with its terms against Buyer, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to creditors' rights generally and by general principles of equity.

Section 4.3. Consents and Approvals. The execution and delivery of this Agreement by Buyer and the consummation by Buyer of the transactions contemplated hereby require no consent, approval, authorization or filing with or notice to any Governmental Authority.

Section 4.4. Non-Contravention. The execution, delivery and performance of this Agreement by Buyer and the consummation of the transactions contemplated by this Agreement do not and will not (with or without notice or lapse of time or both) contravene, conflict with, or result in any violation or breach of any provision of the articles of incorporation or bylaws of Buyer; or contravene, conflict with or result in a violation or breach of any Law or Order; or require any consent or approval under, violate, conflict with, result in any breach of any loss of any benefit under, or constitute a change of control or default under, or result in termination or give to others any right of termination, vesting, amendment, acceleration or cancellation of any contract to which Buyer is a party, or by which its properties or assets may be bound or affected.

ARTICLE V

COVENANTS.

Section 5.1. Conduct of Business of the Company Pending the Closing. Sellers and the Company each covenant and agree that, during the period from the date of this Agreement until the Closing Date, the business of the Company and Company Affiliates shall be conducted in the ordinary course of business consistent with past practice and the Company and Company Affiliates shall comply with all applicable Laws. Without limiting the generality of the foregoing, from the date of this Agreement until the Closing Date, except with the prior written consent of Buyer, the Sellers and the Company will not and will not permit any change in the structure or ownership of the Company and Company Affiliates, and the Sellers and the Company will not allow any borrowings, distributions, legal settlements, extraordinary payments, liens on property, transfers of property or any similar matters by the Company or any Company Affiliate.

Section 5.2. Non-Competition and Non-Solicitation. Each Seller shall execute the agreement attached hereto as Exhibit E (“Non-Competition Agreement”). For each Seller who continues in the management of the Company or a Company Affiliate, such Seller may execute an appropriate employment agreement with a generally accepted non-competition and non-solicitation clauses along with other generally accepted restrictive clauses, provided, however, that any such agreement must, at a minimum, contain substantially similar provisions as the Non-competition Agreement. Torok shall also have an employment agreement with similar clauses.

Section 5.3. Access to Information. Sellers, Company and Company Affiliates shall provide to Buyer and its representatives such documents, financial, tax and operating data and other information as Buyer and its representatives may reasonably request.

Section 5.4. Best Efforts; Government Filings. Each Seller, the Company and Buyer shall use their reasonable best efforts to take, or cause to be taken, all actions and to do, or cause to be done, and to assist and cooperate with the other parties in doing, all things necessary, proper or advisable under applicable Law to consummate transactions contemplated by this Agreement.

Section 5.5. Press Releases. Buyer and Sellers shall consult with each other before issuing any press release or making any other public statement with respect to this Agreement or the transactions contemplated hereby and shall not issue any such press release or make any such other public statement without the consent of the other party, which shall not be unreasonably withheld, except as such release, filing or statement may be required by applicable Law or any listing agreement with or rule of any national securities exchange.

Section 5.6. Notification of Certain Matters. Sellers shall promptly notify Buyer in writing of any inaccuracy of any representation or warranty contained in this Agreement and any notices received by any Seller, the Company or any Company Affiliate from any Governmental Authority with respect to the Company or any Company Affiliate.

Section 5.7. Future Operations. The Company and all Company Affiliates shall each provide to the Executive Committee, on a quarterly basis, a statement of net operating income, a balance sheet, a statement of funds flow from operations, a statement of current and proposed or planned capital expenditures, a sources and uses of funds statement with a projection for the next quarter, and any other statement or schedule requested by the Executive Committee. In addition to the foregoing, the Company and the Company Affiliates shall each provide annual budgets to the Executive Committee for its approval on or before November 30 of each year. Statements showing the expected distributions to the Buyer shall be prepared for the Company and each Company Affiliate and given to the Executive Committee on a quarterly basis, and shall show the projected distributions for the next 12 months. The Company and Company Affiliates shall report any material change in forecasts, projections or estimates, including without limitation the Projections, to the Executive Committee as soon as reasonable after discovery. Buyer intends to apply the foregoing to all of its subsidiaries and affiliates.

Section 5.8. Tax Returns and Audits.

(a) Sellers shall be responsible for filing all Tax Returns for the tax periods ending on or before the Closing Date. Any such Tax Returns shall be given to Buyer for review and if any position is disputed the parties will try to resolve it, but if no resolution the parties shall have an independent CPA resolve the issue. Sellers shall be solely responsible for all Taxes with respect to such Tax Returns. With respect to any Tax Returns that include periods before and after the Closing Date, the Buyer shall prepare and file such Tax Returns and the applicable Tax, if any, shall be Buyer shall be obligated to prepare, file, and pay any applicable Tax for any Tax Returns for any Tax period beginning on or after the Closing Date. Sellers and Buyer agree in good faith to resolve any disputes, provided that in the event that they are unable to resolve such disputes prior to the applicable filing deadline, Buyer shall be entitled to file such Tax Returns in accordance with its reasonable determination. Sellers shall timely remit (or cause to be timely remitted) to Buyer any Taxes shown due on any Tax Returns filed by Buyer.

(b) Sellers shall be responsible and shall indemnify Buyer for any and all of Taxes of the Company and Company Affiliates arising out of or attributable to any Pre-Closing Period. Buyer shall be responsible, and indemnify Sellers, for any and all of Taxes of the Company and Company Affiliates for any Post-Closing Period.

(c) If after the Closing Date, Buyer, the Company or any Company Affiliate receives a refund of any Tax of the Company or any Company Affiliate or a credit against any Tax of the Company or any Company Affiliate attributable to a Pre-Closing Period (whether received in cash, or as a credit against other Taxes), Buyer shall pay to Sellers within fifteen (15) Business days after such receipt an amount equal to such refund or credit, together with any interest received or credited thereon, regardless of the nature of or reason for the refund or reduction in Taxes payable.

(d) Following the Closing, Buyer shall control all Contests (as defined below) relating to Taxes of the Company or any Company Affiliate. In the case of a Contest that relates solely and exclusively to Pre-Closing Periods or for which Buyer may otherwise seek indemnification from Sellers under this Agreement; provided, that Sellers shall have acknowledged its obligation to indemnify Buyer under this Section, Sellers shall have the right, at Sellers’ expense, to control the conduct of such Contest, and Buyer shall have the right, at its expense, to participate in such Contest. In the case of a Contest that relates to Pre-Closing Periods and Post-Closing Periods, Buyer shall have the right, bearing its own expenses, to conduct such Contest with respect to such Contest. Sellers, at their own cost, may participate in such Contest. The Party controlling a Contest for a Pre-Closing Period shall in any event keep the other Party informed of the progress of such Contest, shall promptly provide the other Party with copies of all material documents (including material notices, protests, briefs, written rulings and determinations and correspondence) pertaining to such audit or proceeding and shall not settle such Contest without the other Party’s advance written consent, which consent shall not be unreasonably withheld, conditioned or delayed. For purposes of this Agreement, a “Contest” is any audit, administrative or judicial proceeding or other dispute with respect to any Tax matter that affects the Company or any of its Subsidiaries, as the case may be.

(e) If Buyer discovers an error in a Pre-Closing Period Tax Return, Buyer shall have the exclusive right to file (or cause to be filed) an amended Tax Returns with respect to such Pre-Closing Periods. Upon the request of Sellers, Buyer shall file (or caused to be filed) any amended Tax Return described in the preceding sentence and shall execute any powers of attorney or similar documents that may be required for such filing. If such amended Tax Returns would have an effect on a Tax liability of Buyer, the Company or any Company Affiliate for a Post-Closing Period, such amended Tax Returns shall not be filed without Buyer’s written consent (not to be unreasonably withheld or delayed). Prior to the filing of any such amended Tax Return, Sellers shall remit to Buyer the entire amount of tax, interest and additions to tax due in connection with such amended Tax Return.

(f) After the Closing Date, Buyer and Sellers shall (and shall cause their respective Affiliates to) (i) assist the other Party in preparing any Tax Returns which such other Party is responsible for preparing and filing herein, and in connection therewith provide the other Party necessary powers of attorney, (ii) cooperate fully in preparing for and conducting any audits of, or disputes with Taxing Authorities regarding, any Tax Returns of the Company or any Company Affiliate, and (iii) make available to the other Party and to any Taxing Authority as reasonably requested all information, records, and documents relating to Taxes of the Company or any Company Affiliate.

(g) Notwithstanding anything to the contrary in this Agreement, any amounts payable pursuant to the obligations under this Section shall be paid without duplication. The Parties shall treat any indemnity payments made pursuant to this Section as adjustments to the Purchase Price for Tax purposes unless applicable Tax Law causes such payment not to be so treated.

(h) If requested by Buyer and to the extent the purchase herein is qualified, Sellers shall cooperate fully in making an election under Section 338(h)(10) of the Code and the Treasury Regulations and any corresponding or similar elections under state, local or foreign Tax Law (collectively, the “Section 338(h)(10) Elections”) with respect to the Company and Company Affiliates. Sellers and Buyer shall mutually agree on the allocation of the “Aggregate Deemed Sale Price” which shall be prepared in accordance with Section 338(h)(10) and Section 1060 of the Code and the Treasury Regulations promulgated thereunder. Buyer shall be responsible for the preparation and filing of all forms and documents required to effectuate the Section 338(h)(10) Elections.

ARTICLE VI

CLOSING AND CLOSING CONDITIONS.

Section 6.1. Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place within thirty (30) days from the Effective Date in a manner reasonably determined by the parties, which can be remotely by the electronic exchange of documents and signatures (or their electronic counterparts). The date on and time at which the Closing occurs is referred to in this Agreement as the “Closing Date.”

Section 6.2. Conditions Precedent to Obligations of Buyer. The obligations of Buyer under this Agreement to proceed with the Closing shall be subject to the satisfaction by Sellers and the Company on or prior to the Closing Date of each of the following conditions precedent:

(a) Accuracy of Representations and Warranties. The representations and warranties of Sellers and the Company set forth in this Agreement shall be true and correct on and as of the Closing Date with the same force and effect as though made on and as of that date (other than representations and warranties that are made as of a specific date, which representations and warranties shall have been true and correct on and as of such date).

(b) Performance and Compliance. Sellers and the Company shall have performed or complied in all material respects with each covenant and agreement to be performed or complied with by them under this Agreement on or prior to the Closing Date.

(c) Consents and Approvals. Sellers and the Company shall have obtained or made each consent, authorization, approval, exemption, filing, registration or qualification, required to be obtained or made by any of them in connection with the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated by this Agreement.

(d) Litigation. There shall be no pending or threatened action by or before any Governmental Authority or arbitrator (i) seeking to restrain, prohibit or invalidate any of the transactions contemplated by this Agreement or (ii) seeking monetary relief against Buyer by reason of the consummation of these transactions, and there shall not be in effect any order, writ, judgment, injunction or decree issued by any Governmental Authority by which Buyer or any of its properties or assets is bound that has that effect.

(e) Material Adverse Effect. No event shall have occurred and no condition shall exist that constitutes or, with the giving of notice or the passage of time or both, is likely to have a Material Adverse Effect.

(f) Closing Certificate. Sellers and the Company shall have delivered to Buyer a certificate containing their respective execution, dated the Closing Date and certifying that each of the conditions specified in subsections (a), (b), (c), (d) and (e) above have been met.

(g) Secretary's Certificate. The Company shall have delivered to Buyer a certificate of its Secretary, dated the Closing Date and certifying: (i) that correct and complete copies of the Company's charter and by-laws are attached to the certificate; and (ii) that correct and complete copies of each resolution of the Company approving this Agreement and authorizing the execution of this Agreement and the consummation of the transactions contemplated by this Agreement are attached to the certificate.

Section 6.3. Conditions Precedent to Obligations of Sellers. The obligations of Sellers under this Agreement to proceed with the Closing shall be subject to the satisfaction by Buyer on or prior to the Closing Date of each of the following conditions precedent:

(a) Accuracy of Representations and Warranties. The representations and warranties of Buyer set forth in this Agreement shall be true and correct on and as of the Closing Date with the same force and effect as though made on and as of that date.

(b) Performance and Compliance. Buyer shall have performed or complied in all material respects with each covenant and agreement to be performed or complied with by it under this Agreement on or prior to the Closing Date.

(c) Consents and Approvals. Buyer shall have obtained or granted each consent, authorization, approval, exemption, filing, registration or qualification required to be obtained or granted by it in connection with the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated by this Agreement.

(d) Litigation. There shall be no pending or threatened action by or before any Governmental Authority or arbitrator seeking to restrain, prohibit or invalidate any of the transactions contemplated by this Agreement, and there shall not be in effect any Governmental Order that has that effect.

(e) Officer's Certificate. Buyer shall have delivered to Sellers a certificate of its President, dated the Closing Date and certifying that each of the conditions specified in subsections (a), (b), u and (d) above have been met.

Section 6.4. Closing Deliverables.

(a) At the Closing, Sellers shall deliver to Buyer:

(1) a duly executed certificate of non-foreign status conforming to the form of the sample certification set forth in Treasury Regulation Section 1.1445-2(b)(2)(iv);

(2) the closing certificate described in Section 6.2(f); and

(3) the certificate or certificates evidencing the Company Interests, duly endorsed in blank or accompanied by another proper instrument of assignment endorsed in blank in proper form for transfer.

(b) At the Closing, the Company shall deliver to Buyer:

(1) a duly executed certificate of non-foreign status conforming to the form of the sample certification set forth in Treasury Regulation Section 1.1445-2(b)(2)(iv); and

(2) the closing certificate described in Section 6.2(f); and

(3)the certificate described in Section 6.2(g).

(c) At the Closing, Buyer shall deliver to Sellers and the Company, the closing certificate described in Section 6.3(e); and the applicable agreement for the Incentive Units.

ARTICLE VII

INDEMNIFICATION.

Section 7.1. Indemnification by Sellers. From and after the Closing, Sellers shall defend, indemnify and hold harmless Buyer, all entities directly or indirectly owned or controlled by Buyer, the Company, Company Affiliates and their respective members, shareholders,

directors, managers, officers, employees and agents (each a “Seller Indemnitee”) from and against any and all liabilities, obligations, claims, contingencies, Taxes, fines, deficiencies, demands, assessments, losses (including diminution in value), damages (including incidental and consequential damages), costs and expenses, including, without limitation, all corrective and remedial actions, all court costs and reasonable attorneys’ fees, and all reasonable amounts paid in investigation, defense or settlement of the foregoing (collectively, “Losses”) that constitute, or arise out of or in connection with: (a) any misrepresentation or breach of warranty under Article III; or (b) any default by Sellers, the Company or any Company Affiliate in the performance or observance of any of their covenants or agreements under this Agreement.

Section 7.2. Indemnification by Buyer. From and after the Closing, Buyer shall defend, indemnify and hold harmless Sellers (each a “Buyer Indemnitee”) from and against any Losses that constitute, or arise out of or in connection with: (a) any misrepresentation or breach of warranty under Article IV; or (b) any default by Buyer in the performance or observance of any of its covenants or agreements under this Agreement.

Section 7.3. Representation, Settlement and Cooperation. If any investigation, action or other proceeding (each a “Proceeding”) is initiated against any Seller Indemnitee or Buyer Indemnitee (each, an “Indemnitee”) and the Indemnitee intends to seek indemnification from Sellers or Buyer (each an “Indemnitor”), as applicable, under this Article VII. on account of the Indemnitee's involvement in the Proceeding, then the Indemnitee shall give prompt notice to the applicable Indemnitor; provided, however, that the failure to so notify the Indemnitor shall not relieve the Indemnitor of its obligations under this Article VII. but instead shall reduce those obligations by the amount of damages or increased costs and expenses attributable to the failure to give notice. Upon receipt of notice of a Proceeding for which indemnification is available under this Article VII, the Indemnitor shall diligently defend against the Proceeding on behalf of the Indemnitee at the Indemnitor's own expense using counsel reasonably acceptable to the Indemnitee; provided, however, that if the Indemnitor shall fail or refuse to conduct the defense, or if the Indemnitee has been advised by counsel that it may have defenses available to it which are different from or in addition to those available to the Indemnitor or that its interests in the Proceeding are adverse to the Indemnitor's interests, then the Indemnitee may defend against the Proceeding at the Indemnitor's expense. The Indemnitor or Indemnitee, as applicable, may participate in any Proceeding being defended against by the other at its own expense and shall not settle any Proceeding without the prior consent of the other, which consent shall not be unreasonably withheld. The Indemnitor and Indemnitee shall cooperate with each other in the conduct of any Proceeding.

Section 7.4. Notice and Satisfaction of Indemnification Claims. No indemnification claim shall be deemed to have been asserted until the applicable Indemnitor has been given notice by the Indemnitee of the amount of the claim and the facts on which the claim is based (including evidence supporting the amount of the claim). For purposes of this Article VII, notice of an indemnification claim shall be deemed to cover claims arising out of or in connection with all related Proceedings so long as, in the case of Proceedings instituted by third parties, the Indemnitee complies with Section 7.3. Indemnification claims shall be paid within 30 days after the Indemnitor's receipt of the notice described in this Section 7.4 (including the required evidence of the amount of the claim). Evidence of (a) the amount of the claims for which the Indemnitee seeks indemnification, and (b) the Indemnitor's liability shall be in form and content reasonably satisfactory to the Indemnitor.

Section 7.5. Survival. All representations and warranties made in this Agreement shall survive the Closing until the second anniversary of the Closing Date, other than (a) the representations and warranties set forth in Section 3.1 (Organization and Power), Section 3.2 (Capitalization), Section 3.3 (Subsidiaries), Section 3.4 (Authorization), Section 3.5 (Non-Contravention; Filings and Consents), Section 3.20 (Brokers), and Article IV (Buyer Representations and Warranties), which shall survive indefinitely (collectively, the “Fundamental Representations”), and (b) the representations and warranties set forth in Section 3.6 (Financial Statements), Section 3.9 (Employee Benefit Plans), Section 3.12 (Tax Matters), Section 3.14 (Environmental Matters), Section 3.15 (Intellectual Property), Section 3.21 (Privacy and Data Security), and Section 3.22 (Delaware Statutory Trusts), which shall survive until sixty (60) days following the expiration of the applicable statute of limitations. Each of the covenants and agreements made in this Agreement to be performed prior to the Closing shall survive the Closing for a period of twenty-four (24) months following the Closing Date, and each of the covenants and agreements made in this Agreement to be performed following the Closing shall survive the Closing until they are fully performed or terminate in accordance with their respective terms.

Section 7.6. Effect of Investigation. Buyer’s right to indemnification or any other remedy based on the inaccuracy of, breach of, non-performance of, or non-compliance with any representation, warranty, or obligation in this Agreement, or otherwise with respect to this Agreement, will not be affected by any investigation conducted (or capable of being conducted) with respect to, or any knowledge acquired (or capable of being acquired) at any time (whether on, before, or after the Closing Date) with respect to any fact or matter, including with respect to the inaccuracy of, breach of, non-performance of, or non-compliance with any representation, warranty, or obligation in this Agreement. The waiver of any condition based on the inaccuracy of, breach of, non-performance of, or non-compliance with any representation, warranty, or obligation in this Agreement will not affect the Buyer’s right to indemnification or any other remedy based on the inaccuracy of, performance of, or compliance with such representation, warranty, or obligation, or otherwise with respect to this Agreement.

ARTICLE VIII

MISCELLANEOUS.

Section 8.1. Entire Agreement; Assignment; Amendments. This Agreement constitutes the entire agreement and supersedes all oral agreements and understandings and all written agreements prior to the date hereof between or on behalf of the parties with respect to the subject matter hereof. This Agreement shall not be assigned by any party by operation of law or otherwise without the prior written consent of the other parties hereto. This Agreement may be amended only by a writing signed by each of the parties, and any amendment shall be effective only to the extent specifically set forth in that writing.

Section 8.2. Severability; Expenses; Further Assurances. If any term, condition or other provision of this Agreement is determined by a court of competent jurisdiction to be invalid, illegal or incapable of being enforced by any rule of Law or public policy, all other terms, conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated by this Agreement is not affected in any manner materially adverse to any party. Upon such

determination that any term or other provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to affect the original intent of the parties as closely as possible in a mutually acceptable manner in order that the transactions contemplated by this Agreement be consummated as originally contemplated to the fullest extent possible. Except as otherwise specifically provided in this Agreement, each party shall be responsible for the expenses it may incur in connection with the negotiation, preparation, execution, delivery, performance and enforcement of this Agreement. The parties shall from time to time do and perform any additional acts and execute and deliver any additional documents and instruments that may be required by applicable Governmental Rules or reasonably requested by any party to establish, maintain or protect its rights and remedies under, or to affect the intents and purposes of, this Agreement.

Section 8.3. Enforcement of the Agreement; Jurisdiction; No Jury Trial.